Midwest Super Community Bank Conference Kevin Eichner, CEO

Frank Sanfilippo, CFO

FORWARD LOOKING STATEMENTS

It should be noted that in addition to the historical information contained herein, this presentation contains forward-looking statements which are inherently subject to risks and uncertainties that could cause actual results to differ materially from those contemplated from such statements. Factors that could cause or contribute to such differences include, but are not limited to, burdens imposed by federal and state regulations of banks, credit risk, exposure to local economic conditions, risks associated with rapid increase or decrease in prevailing interest rates and competition from banks and other financial institutions, as well as those risks described in Enterprise Financial’s 2003 Annual Report or Form 10-K.

OUR BUSINESS MODEL

Enterprise Financial Services Corp is a high growth bank holding company in two lines of business, focused on private businesses and their owner families, currently operating in two urban markets.

MISSION

Our mission is to guide our clients to a lifetime of financial success.

VISION

Our vision is to build an exceptional company that clients love, shareholders prize and associates are proud to serve.

We expect Enterprise to be one of the very highest performing growth companies in the industry.

BUSINESS LINE STRATEGY

Our two primary lines of business are commercial banking and wealth management. We compete with full product lines in each line of business.

LOCATING EFSC WITHIN A

PEER GROUP

Enterprise is an emerging public company most properly benchmarked over time against companies like CoBiz, Private Bancorp, Boston Private and other high performing business banks with strong wealth management franchises.

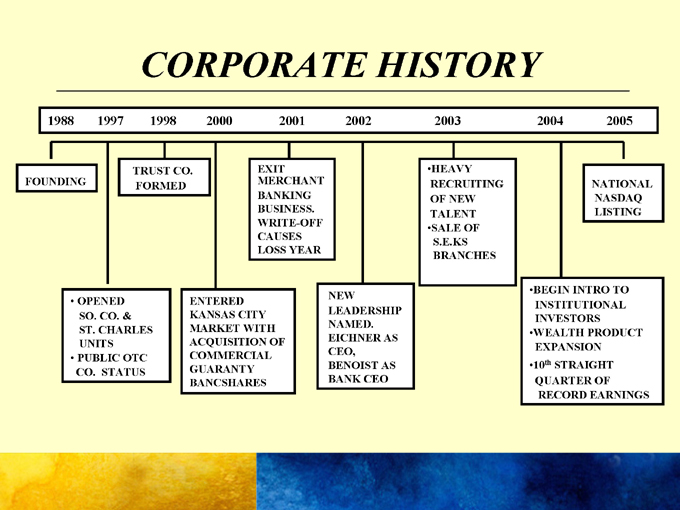

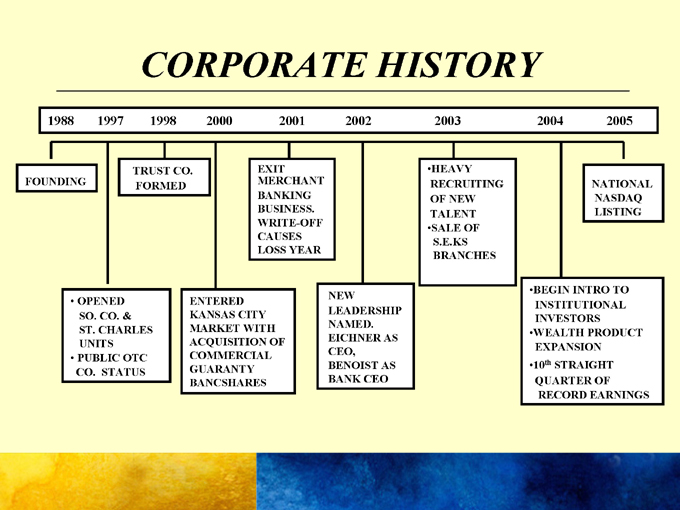

CORPORATE HISTORY

1988 1997 1998 2000 2001 2002 2003 2004 2005

FOUNDING

TRUST CO. FORMED

EXIT MERCHANT BANKING BUSINESS. WRITE-OFF CAUSES LOSS YEAR

HEAVY RECRUITING OF NEW TALENT SALE OF S.E.KS BRANCHES

NATIONAL NASDAQ LISTING

OPENED SO. CO. & ST. CHARLES UNITS

PUBLIC OTC CO. STATUS

ENTERED KANSAS CITY MARKET WITH ACQUISITION OF COMMERCIAL GUARANTY BANCSHARES

NEW

LEADERSHIP NAMED. EICHNER AS CEO, BENOIST AS BANK CEO

BEGIN INTRO TO INSTITUTIONAL INVESTORS WEALTH PRODUCT EXPANSION

10th STRAIGHT QUARTER OF

RECORD EARNINGS

OVERVIEW: BANKING LINE OF BUSINESS

$1.1 billion of banking assets growing at 15% CAGR Diverse loan portfolio with business owners we know Sophisticated credit quality management Exceptional core deposit base with 21% DDA and less than 10% brokered deposits Highly efficient, multi-faceted distribution system “Franchise Player” banking talent deployed in each market

OVERVIEW: WEALTH MANAGEMENT LINE OF BUSINESS

Enterprise Trust has grown to $1.3 billion in assets in just six years – one of fastest growing Trust companies in U.S. Much more than money management with family office for business owners and other high net worth individuals Non-proprietary, open architecture platform Wealth Products and Business Consulting units augment Trust income and fill product voids LOB an excellent differentiator and now emerging as significant contributor to earnings lift Outstanding talent with full complement of attorneys, CFA’s, CPA’s, and other professionals

ST. LOUIS MARKET

St. Louis MSA is 18th largest in U.S. – Stable, diverse economic base A target-rich environment with nearly 60,000 privately held businesses 80,286 households with investible assets of $1 million or more

(Source: Investment News 12/04)

EFSC now largest and fastest growing billion dollar public bank holding company headquartered in St. Louis

KANSAS CITY MARKET

Another rich private company market with over 48,000 businesses 54,316 households with investible assets of at least $1 million Enterprise has grown nearly 4x in just four years to $200 million One of fastest growing banks in the market

DIFFERENTIATORS

Our primary marketing differentiators are:

Holistic view of personal and business needs Name brand talent with outstanding reputations Exceptional service – top to bottom Sophisticated technology-enabled platform Narrow-cast marketing (e.g., Enterprise University)

ORGANIZATIONAL STRATEGIES

Enfranchisement recruiting model Fewer, but better people

Strong reward systems tied directly to annual and long-term performance contracts Very invested in assessment, training, and continuous development of talent Supportive, enjoyable culture High performance expectations with emphasis on disciplined execution

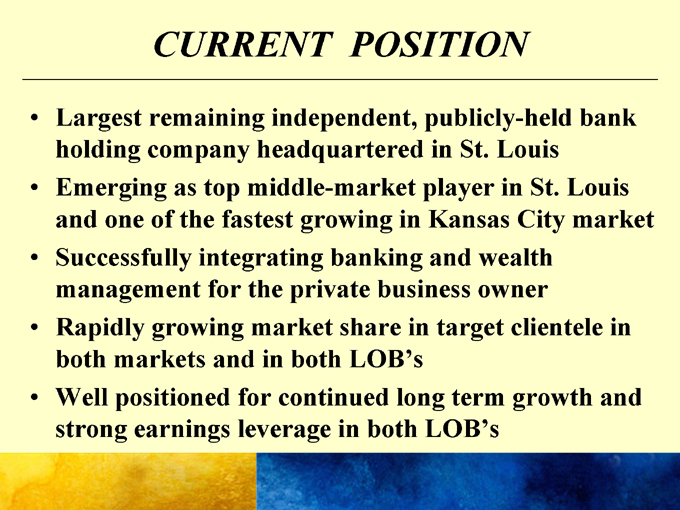

CURRENT POSITION

Largest remaining independent, publicly-held bank holding company headquartered in St. Louis Emerging as top middle-market player in St. Louis and one of the fastest growing in Kansas City market Successfully integrating banking and wealth management for the private business owner Rapidly growing market share in target clientele in both markets and in both LOB’s Well positioned for continued long term growth and strong earnings leverage in both LOB’s

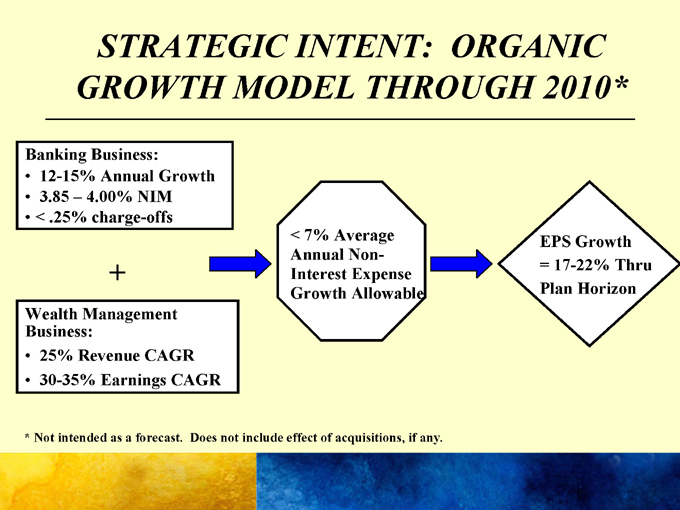

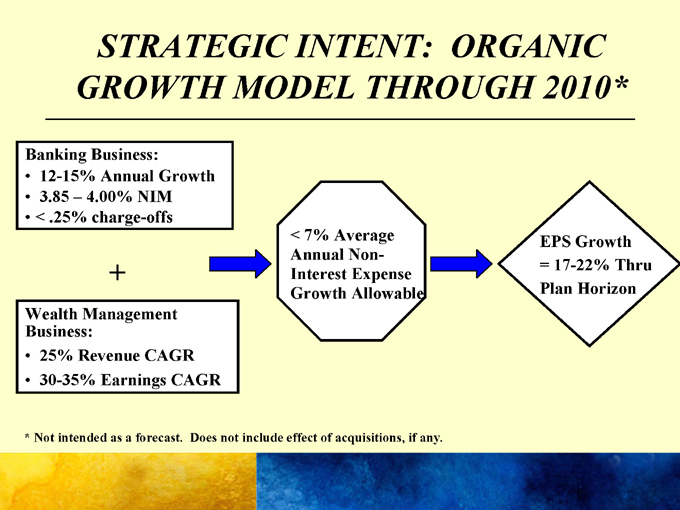

STRATEGIC INTENT: ORGANIC GROWTH MODEL THROUGH 2010*

Banking Business:

12-15% Annual Growth 3.85 – 4.00% NIM < .25% charge-offs

Wealth Management Business:

25% Revenue CAGR 30-35% Earnings CAGR

< 7% Average Annual Non-Interest Expense Growth Allowable

EPS Growth = 17-22% Thru Plan Horizon

* Not intended as a forecast. Does not include effect of acquisitions, if any.

+

STRATEGIC IMPERATIVES

Retain “pure play” market focus Grow share in St. Louis and Kansas City Continue to attract, retain and deploy top talent Drive major gains in productivity Protect core funding advantages Increase company visibility Explore other markets and strategic acquisitions Broaden shareholder base

SELECTED FINANCIALS

FRANK SANFILIPPO

CFO

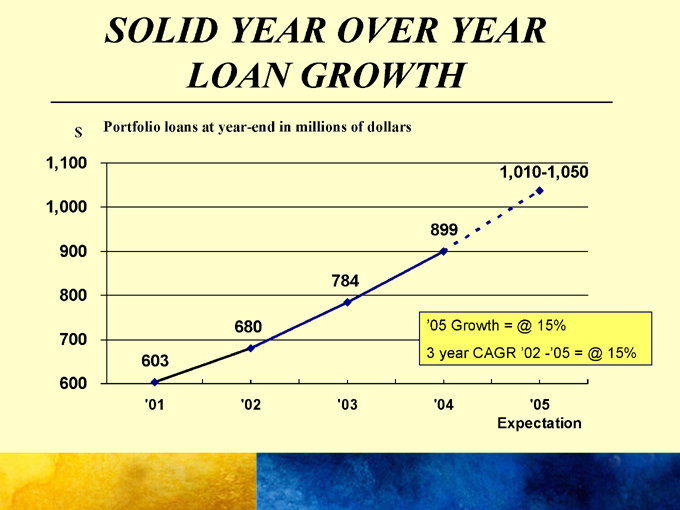

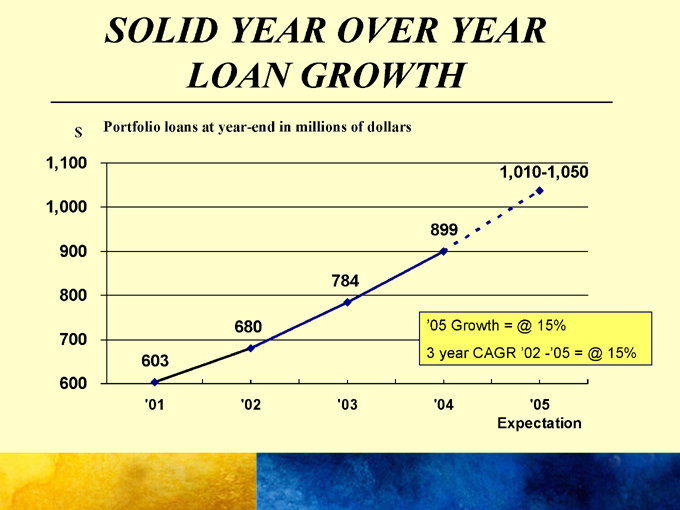

SOLID YEAR OVER YEAR

LOAN GROWTH

Portfolio loans at year-end in millions of dollars $

1,100 1,000 900 800 700 600

603

680

784

899

1,010-1,050

‘05 Growth = @ 15%

3 year CAGR ‘02 -‘05 = @ 15%

‘01 ‘02 ‘03 ‘04 ‘05 Expectation

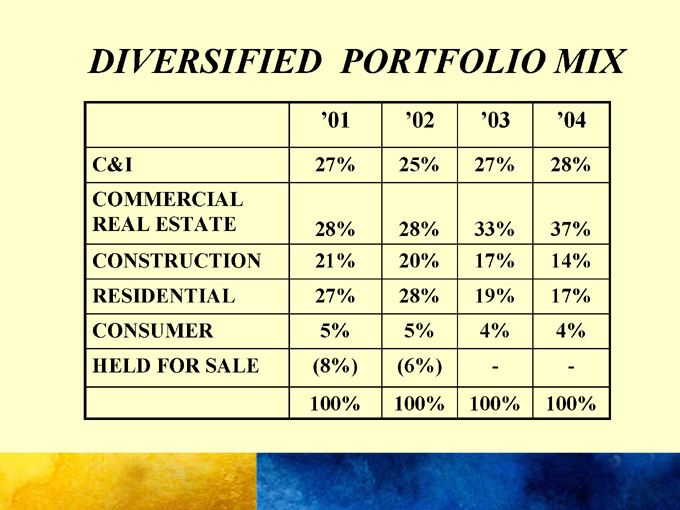

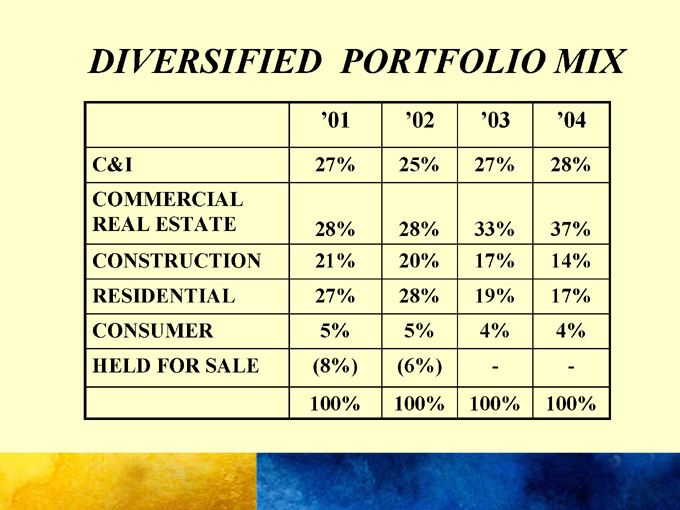

DIVERSIFIED PORTFOLIO MIX

‘01 ‘02 ‘03 ‘04

C&I 27% 25% 27% 28%

COMMERCIAL

REAL ESTATE 28% 28% 33% 37%

CONSTRUCTION 21% 20% 17% 14%

RESIDENTIAL 27% 28% 19% 17%

CONSUMER 5% 5% 4% 4%

HELD FOR SALE (8%) (6%) - -

100% 100% 100% 100%

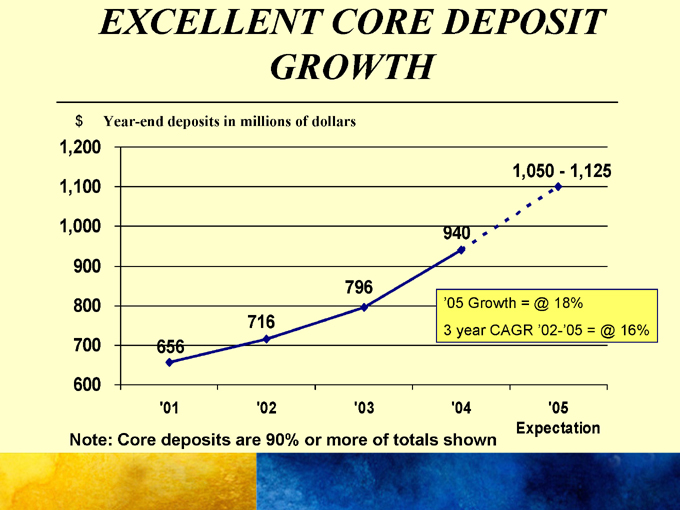

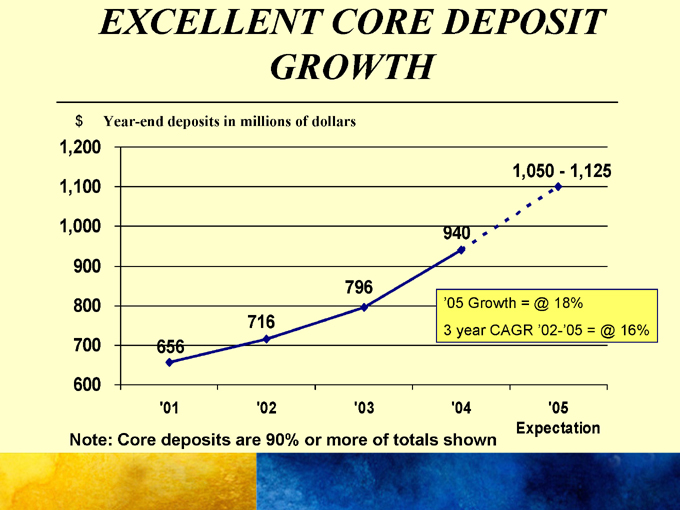

EXCELLENT CORE DEPOSIT

GROWTH

Year-end deposits in millions of dollars $

1,200 1,100 1,000 900 800 700 600

656

716

796

940

1,050-1,125

‘05 Growth = @ 18%

3 year CAGR ‘02-‘05 = @ 16%

‘01 ‘02 ‘03 ‘04 ‘05

Expectation

Note: Core deposits are 90% or more of totals shown

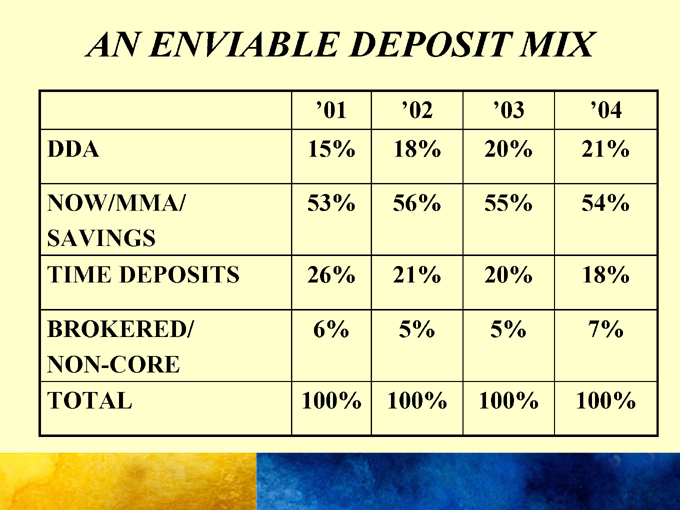

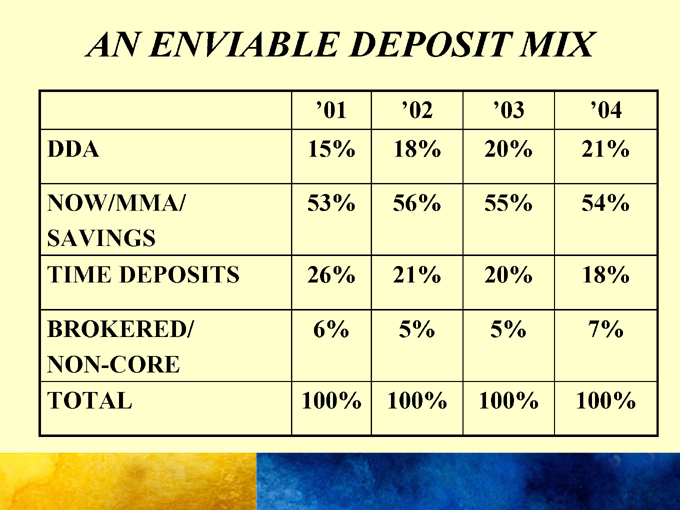

AN ENVIABLE DEPOSIT MIX

‘01 ‘02 ‘03 ‘04

DDA 15% 18% 20% 21%

NOW/MMA/ 53% 56% 55% 54%

SAVINGS

TIME DEPOSITS 26% 21% 20% 18%

BROKERED/ 6% 5% 5% 7%

NON-CORE

TOTAL 100% 100% 100% 100%

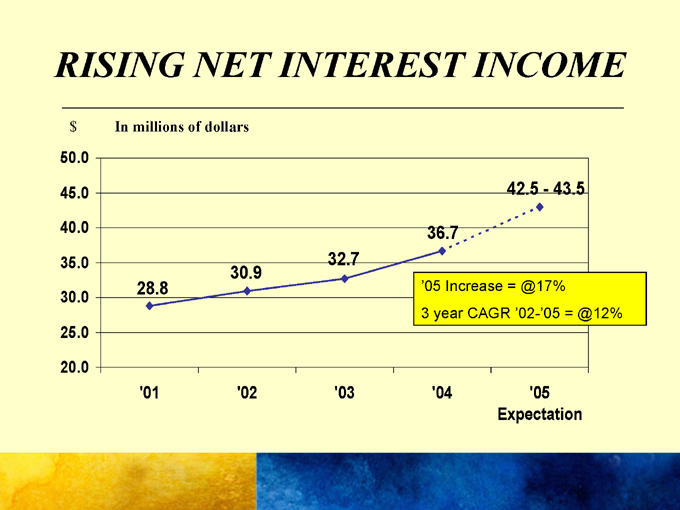

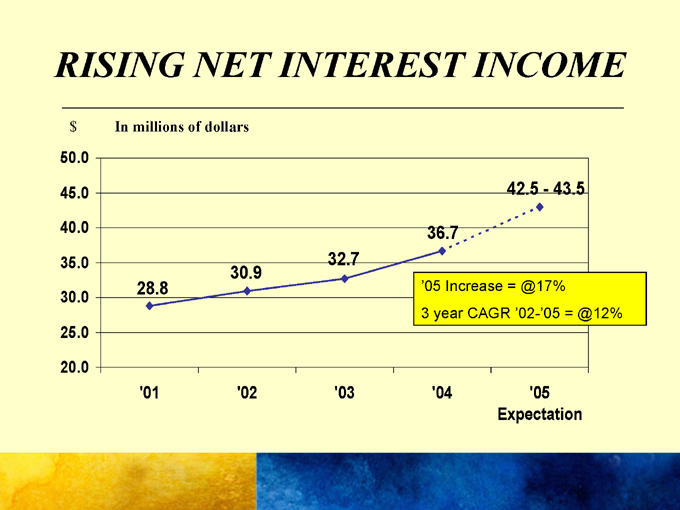

RISING NET INTEREST INCOME

In millions of dollars $

50.0 45.0 40.0 35.0 30.0 25.0 20.0

28.8

30.9

32.7

36.7

42.5-43.5

‘05 Increase = @17% 3 year CAGR ‘02-’05 = @12%

‘01 ‘02 ‘03 ‘04 ‘05 Expectation

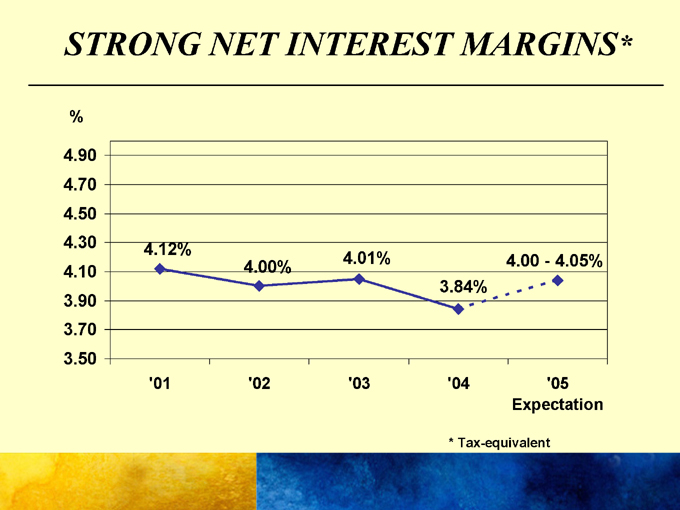

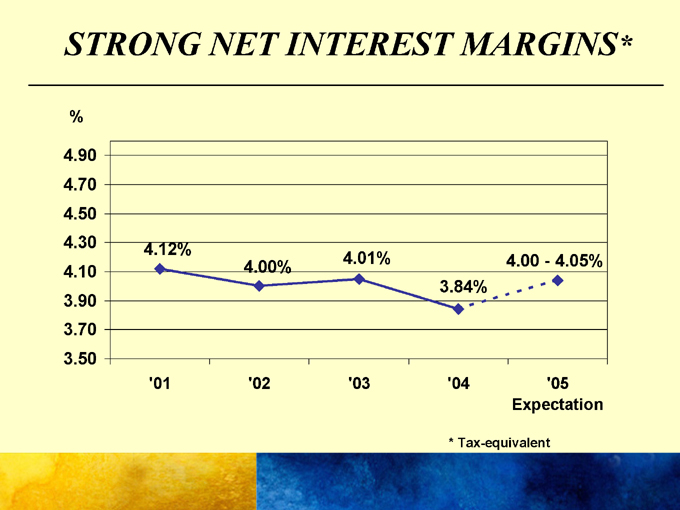

STRONG NET INTEREST MARGINS*

%

4.90 4.70 4.50

4.30 4.12%

4.01% 4.00 - 4.05% 4.10 4.00% 3.84% 3.90 3.70 3.50

‘01 ‘02 ‘03 ‘04 ‘05 Expectation

* Tax-equivalent

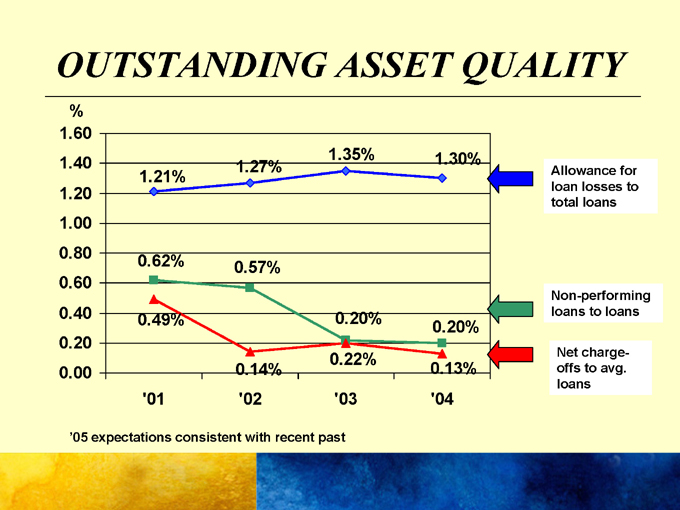

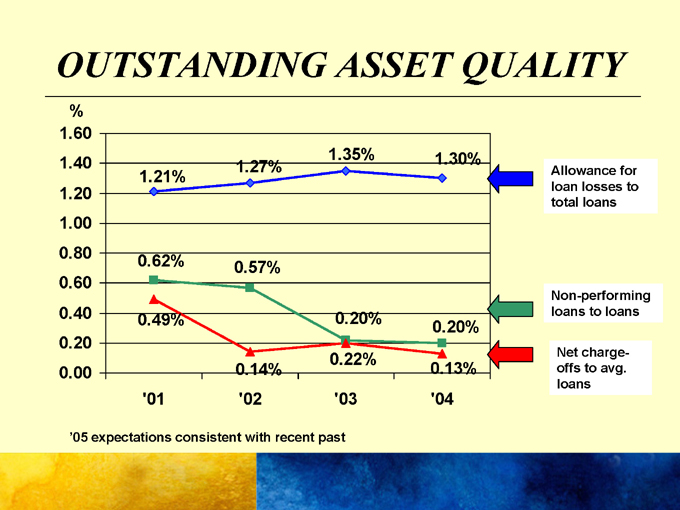

OUTSTANDING ASSET QUALITY

% 1.60

1.35% 1.30% 1.40 1.27% 1.21% 1.20 1.00 0.80 0.62% 0.57% 0.60 0.40 0.49% 0.20% 0.20% 0.20 0.22% 0.00 0.14% 0.13% ‘01 ‘02 ‘03 ‘04

Allowance for loan losses to total loans

Non-performing loans to loans

Net charge-offs to avg. loans

‘05 expectations consistent with recent past

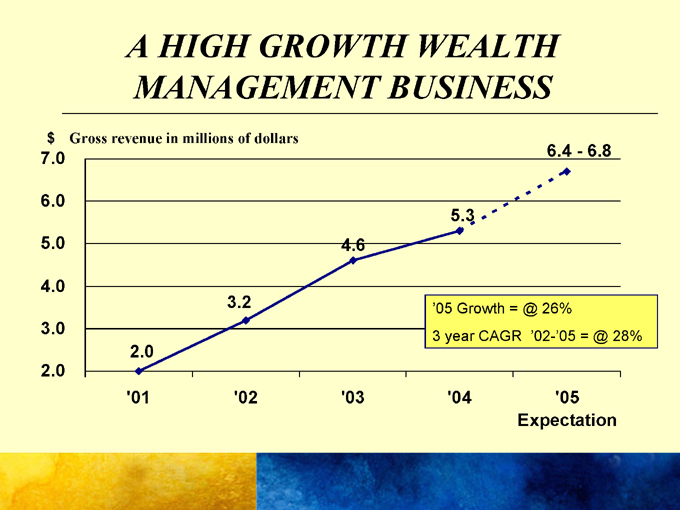

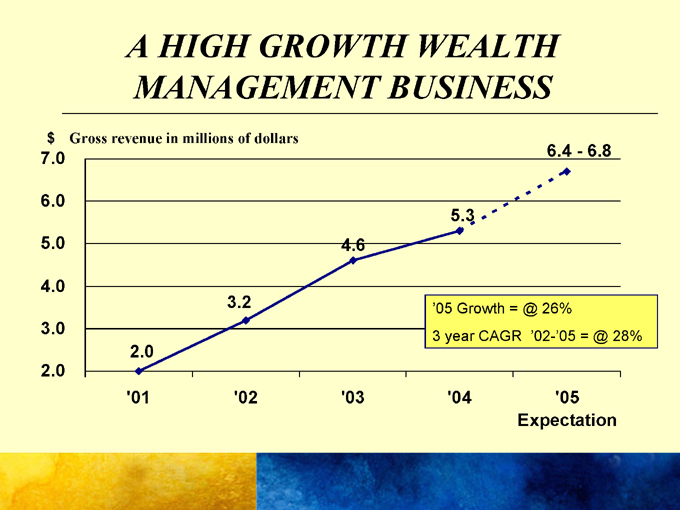

A HIGH GROWTH WEALTH MANAGEMENT BUSINESS

$ Gross revenue in millions of dollars

7.0 6.4-6.8 6.0 5.3 5.0 4.6

4.0

3.2 ‘05 Growth = @ 26%

3.0 3 year CAGR ‘02-’05 = @ 28%

2.0 2.0

‘01 ‘02 ‘03 ‘04 ‘05 Expectation

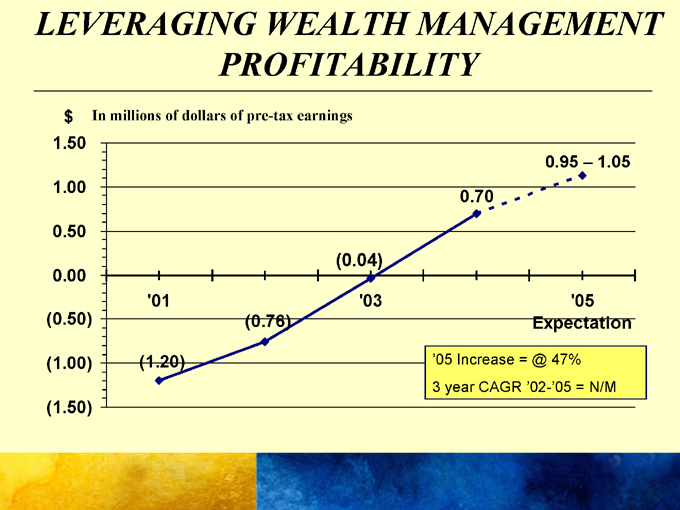

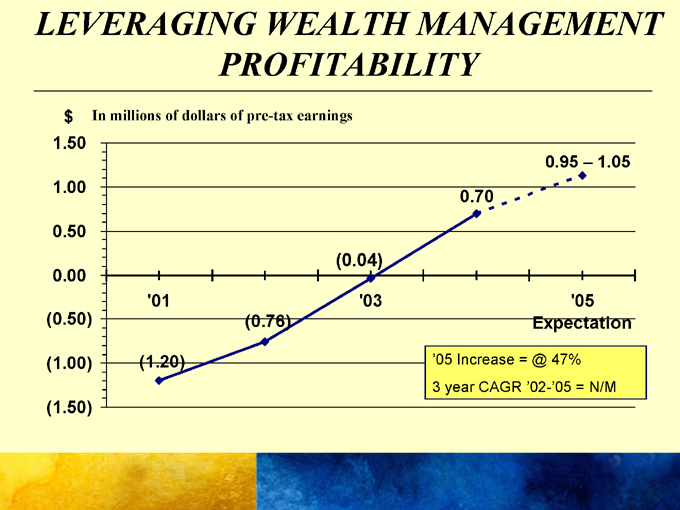

LEVERAGING WEALTH MANAGEMENT

PROFITABILITY

$ In millions of dollars of pre-tax earnings

1.50

0.95 – 1.05

1.00

0.70 0.50

(0.04)

0.00

‘01 ‘03 ‘05 (0.50) (0.76) Expectation

(1.00) (1.20) ‘05 Increase = @ 47% 3 year CAGR ‘02-’05 = N/M

(1.50)

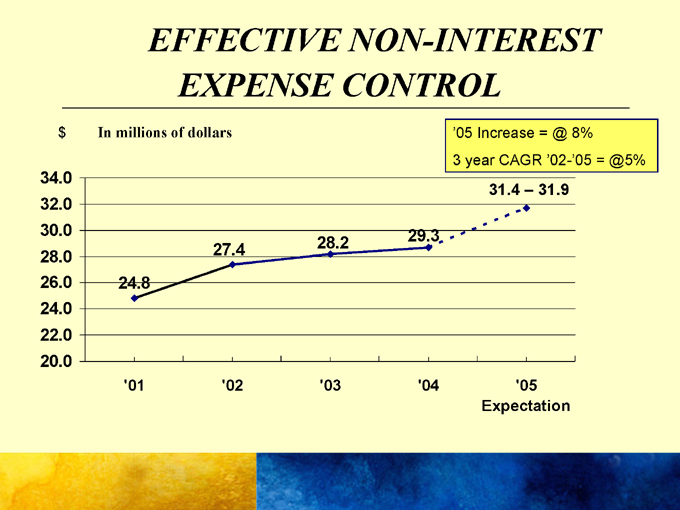

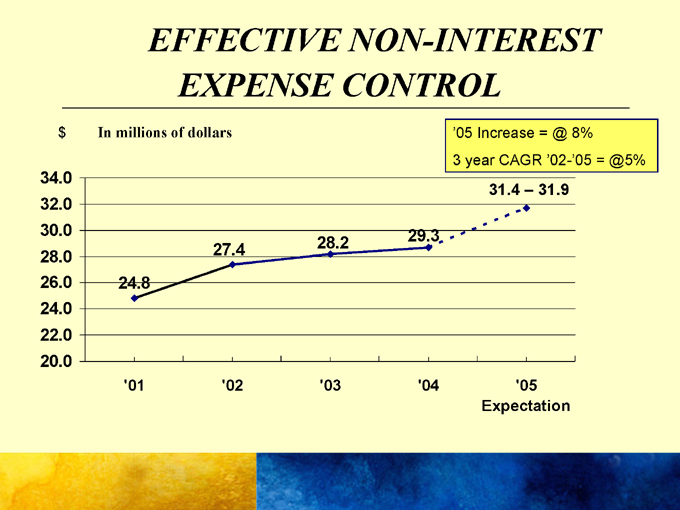

EFFECTIVE NON-INTEREST

EXPENSE CONTROL

$ In millions of dollars ‘05 Increase = @ 8% 3 year CAGR ‘02-’05 = @5%

34.0

31.4 – 31.9

32.0

30.0 29.3 27.4 28.2 28.0 26.0 24.8 24.0 22.0 20.0

‘01 ‘02 ‘03 ‘04 ‘05 Expectation

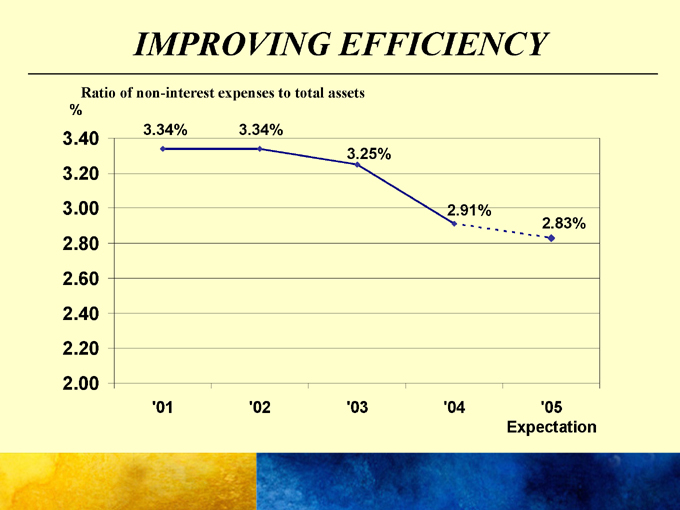

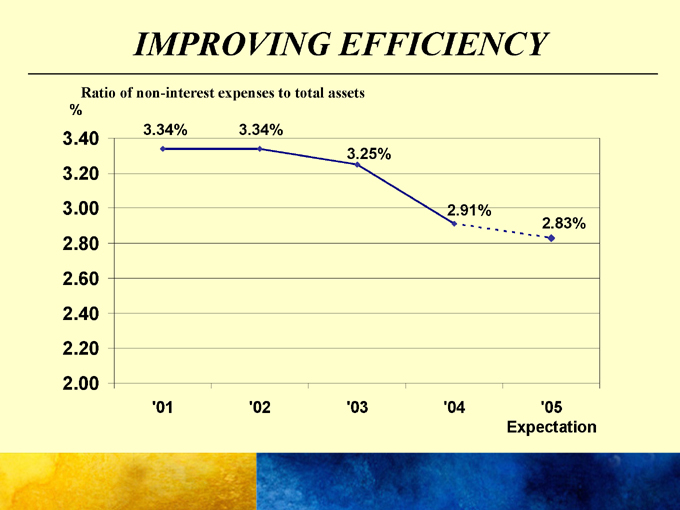

IMPROVING EFFICIENCY

Ratio of non-interest expenses to total assets

%

3.40 3.34% 3.34%

3.25%

3.20

3.00 2.91%

2.83%

2.80 2.60 2.40 2.20 2.00

‘01 ‘02 ‘03 ‘04 ‘05 Expectation

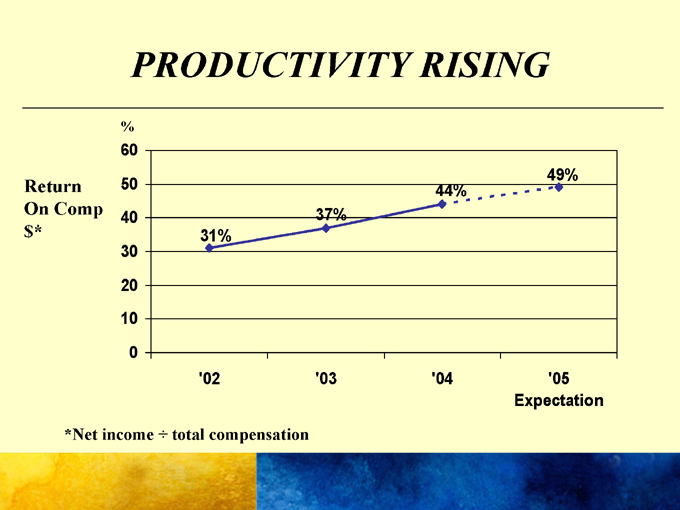

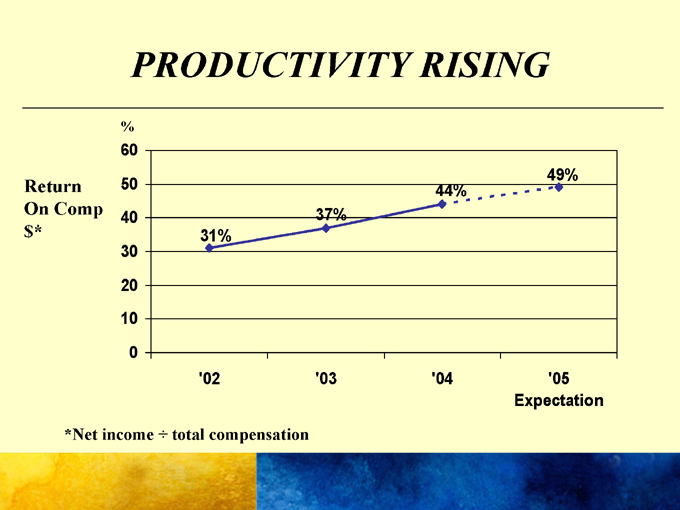

PRODUCTIVITY RISING

Return On Comp $*

%

60

49%

50 44%

40 37% 31% 30 20 10 0

‘02 ‘03 ‘04 ‘05 Expectation

*Net income ÷ total compensation

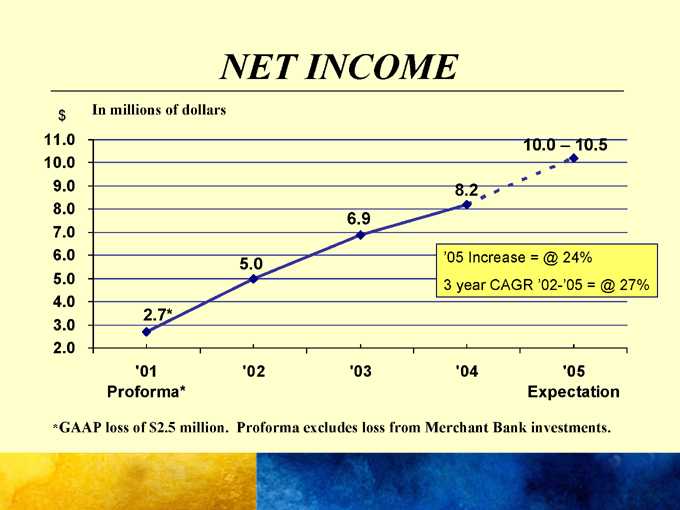

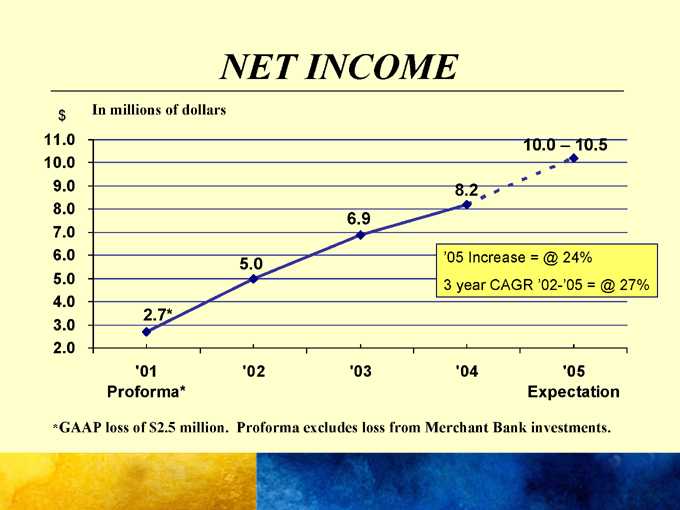

NET INCOME

In millions of dollars $

11.0 10.0 9.0 8.0 7.0 6.0 5.0 4.0 3.0 2.0

2.7*

5.0

6.9

8.2

10.0 – 10.5

‘05 Increase = @ 24% 3 year CAGR ‘02-’05 = @ 27%

‘01 ‘02 ‘03 ‘04 ‘05 Proforma* Expectation

*GAAP loss of $2.5 million. Proforma excludes loss from Merchant Bank investments.

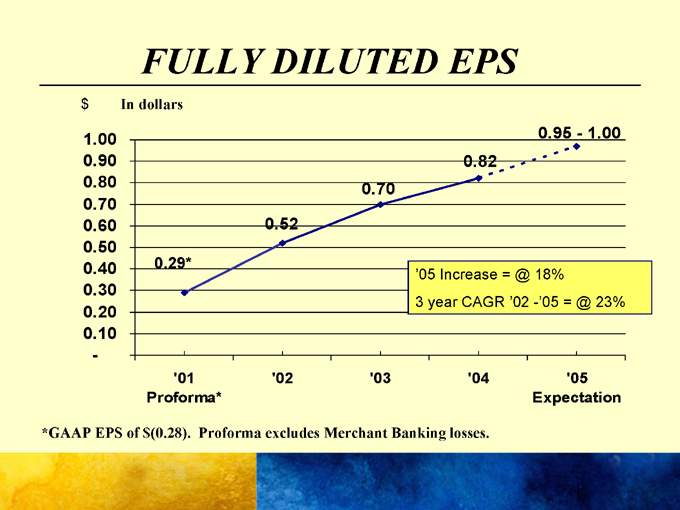

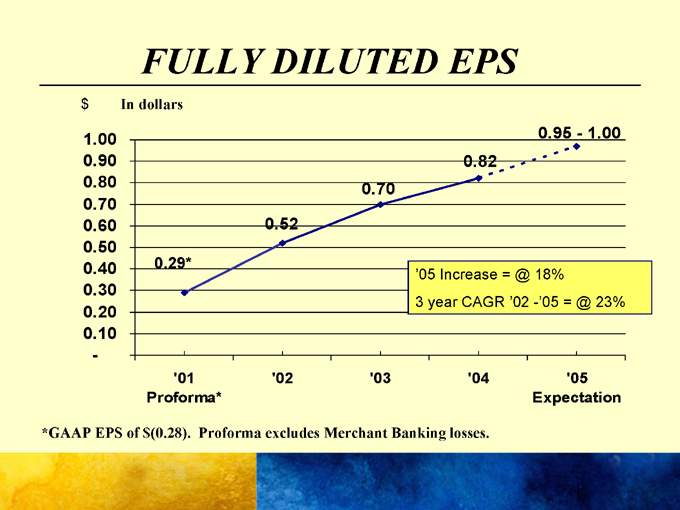

FULLY DILUTED EPS

$ In dollars

1.00 0.95-1.00 0.90 0.82 0.80 0.70 0.70 0.60 0.52 0.50 0.40 0.29*

‘05 Increase = @ 18%

0.30

3 year CAGR ‘02 -’05 = @ 23%

0.20 0.10 -

‘01 ‘02 ‘03 ‘04 ‘05 Proforma* Expectation

*GAAP EPS of $(0.28). Proforma excludes Merchant Banking losses.

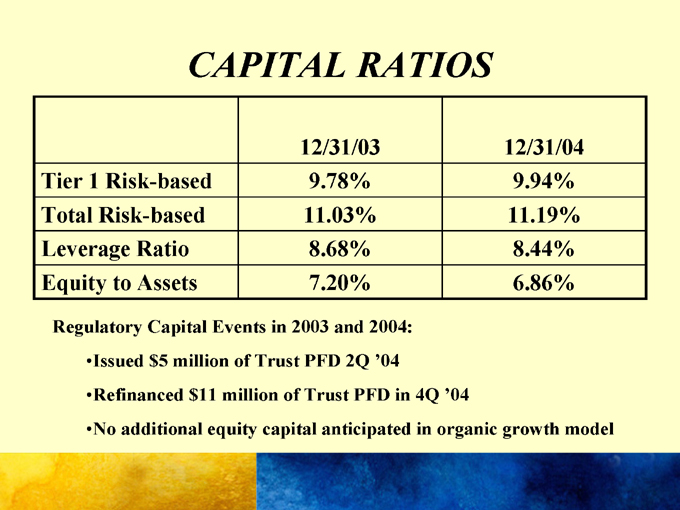

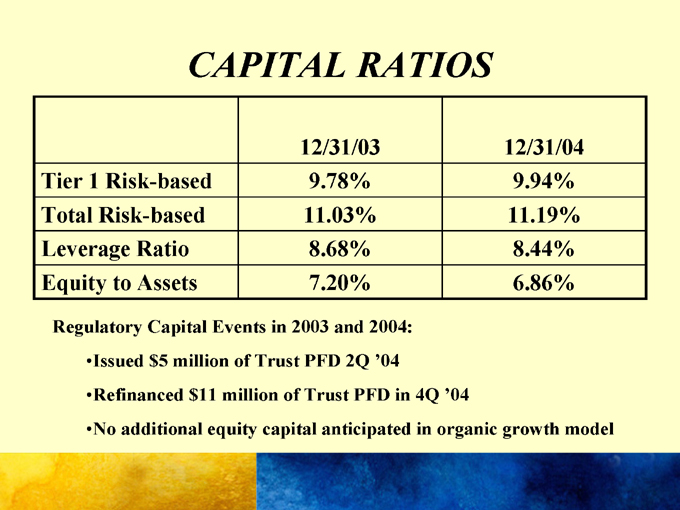

CAPITAL RATIOS

12/31/03 12/31/04

Tier 1 Risk-based 9.78% 9.94%

Total Risk-based 11.03% 11.19%

Leverage Ratio 8.68% 8.44%

Equity to Assets 7.20% 6.86%

Regulatory Capital Events in 2003 and 2004: Issued $5 million of Trust PFD 2Q ‘04 Refinanced $11 million of Trust PFD in 4Q ‘04

No additional equity capital anticipated in organic growth model

SUMMARY

KEVIN EICHNER

CEO

SUMMARY

Positioning EFSC stock as high growth, high performing winner in the small cap financial services space Compelling pure-play strategy well executed by experienced and passionate management team Strong competitive position in two urban markets with excellent business and high net worth client potential Largest remaining St. Louis headquartered public bank holding company in that market

SUMMARY (continued)

Achieving significant lift in EPS driven by:

Strong core banking growth Wealth management net fee income Non-interest expense control

Infrastructure and talent in place to support much larger business model Driving excellent shareholder returns with the prospect of continued long term growth Newly listed NASDAQ national market stock trading at just over 2.5x book with strong inside ownership

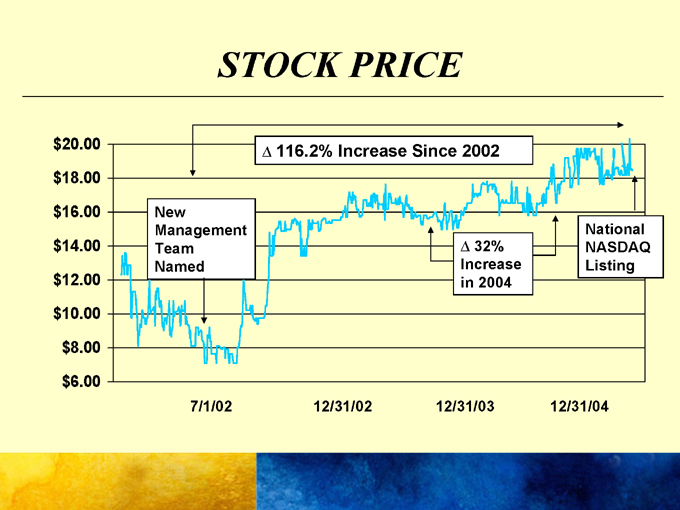

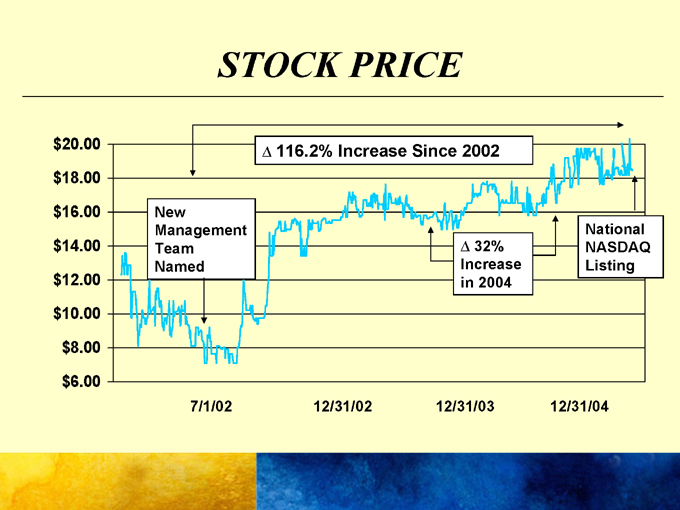

STOCK PRICE

$20.00 $18.00 $16.00 $14.00 $12.00 $10.00 $8.00 $6.00

New

Management Team Named

116.2% Increase Since 2002

32% Increase in 2004

National NASDAQ Listing

7/1/02 12/31/02 12/31/03 12/31/04

DISCUSSION