UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07899 and 811-07885

Name of Fund: BlackRock Index Funds, Inc.

BlackRock International Index Fund

BlackRock Small Cap Index Fund

Quantitative Master Series LLC

Master Small Cap Index Series

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Index Funds, Inc. and Quantitative Master Series LLC, 55 East 52nd Street, New York, NY 10055

Registrants’ telephone number, including area code: (800) 441-7762

Date of fiscal year end: 12/31/2016

Date of reporting period: 12/31/2016

Item 1 – Report to Stockholders

DECEMBER 31, 2016

| | | | |

ANNUAL REPORT | | | |  |

BlackRock Index Funds, Inc.

| Ø | BlackRock International Index Fund |

| Ø | BlackRock Small Cap Index Fund |

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

| | | | | | |

| | | | | | | |

| 2 | | BLACKROCK INDEX FUNDS, INC. | | DECEMBER 31, 2016 | | |

Dear Shareholder,

The year 2016 started on a fraught note with worries about slowing growth in China, plunging oil prices and sliding share prices. Then reflationary expectations in the United States helped drive a second-half global growth pick-up and big market reversals. As such, higher-quality asset classes such as Treasury bonds, municipals and investment grade credit prevailed in the first half of the year, only to struggle in the second. In contrast, risk assets sold off at the start of the year and rebounded in the latter half, with some asset classes posting strong year-end returns.

A key takeaway from 2016’s market performance is that economics can trump politics. The global reflationary theme — governments taking policy action to support growth — was the dominant driver of 2016 asset returns, outweighing significant political upheavals and uncertainty. This trend accelerated after the U.S. election on expectations for an extra boost to U.S. growth via fiscal policy.

Markets were remarkably resilient during the year. Spikes in equity volatility after big surprises such as the U.K.’s vote to leave the European Union and the outcome of the U.S. presidential election were short-lived. Instead, political surprises and initial sell-offs were seized upon as buying opportunities. We believe this reinforces the case for taking the long view rather than reacting to short-term market noise.

Asset returns varied widely in 2016. Perceived safe assets such as government bonds and low-volatility shares underperformed the higher-risk areas of the market. And the reversal of longstanding trends created opportunities, such as in the recovery of value stocks and commodities.

We expect some of these trends to extend into 2017 and see the potential for more flows into risk assets this year. Learn more by reading our market insights at blackrock.com.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of December 31, 2016 | |

| | | 6-month | | | 12-month | |

U.S. large cap equities

(S&P 500® Index) | | | 7.82 | % | | | 11.96 | % |

U.S. small cap equities

(Russell 2000® Index) | | | 18.68 | | | | 21.31 | |

International equities

(MSCI Europe, Australasia, Far East Index) | | | 5.67 | | | | 1.00 | |

Emerging market equities (MSCI Emerging Markets Index) | | | 4.49 | | | | 11.19 | |

3-month Treasury bills

(BofA Merrill Lynch 3-Month U.S. Treasury Bill Index) | | | 0.18 | | | | 0.33 | |

U.S. Treasury securities

(BofA Merrill Lynch 10-Year U.S. Treasury Index) | | | (7.51 | ) | | | (0.16 | ) |

U.S. investment grade bonds

(Bloomberg Barclays U.S. Aggregate Bond Index) | | | (2.53 | ) | | | 2.65 | |

Tax-exempt municipal bonds (S&P Municipal Bond Index) | | | (3.43 | ) | | | 0.77 | |

U.S. high yield bonds

(Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index) | | | 7.40 | | | | 17.13 | |

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | | | |

| | | | | | | |

| | THIS PAGE NOT PART OF YOUR FUND REPORT | | | | 3 |

| | | | |

| Fund Summary as of December 31, 2016 | | BlackRock International Index Fund |

BlackRock International Index Fund’s (the “Fund”) investment objective is to match the performance of the MSCI EAFE Index (Europe, Australasia, Far East) (the “MSCI EAFE Index”) in U.S. dollars with net dividends as closely as possible before the deduction of Fund expenses. On May 19, 2016, the Board approved the conversion of the Fund, a series of BlackRock Index Funds, Inc., from a “master-feeder” structure into a stand-alone mutual fund effective August 1, 2016.

| | |

| Portfolio Management Commentary | | |

How did the Fund perform?

| • | | For the 12-month period ended December 31, 2016, the Fund’s Institutional Shares returned 0.99%, Investor A Shares returned 0.78% and Class K Shares returned 1.03%. The benchmark MSCI EAFE Index returned 1.00% for the same period. The MSCI EAFE Index is a free float-adjusted, market-capitalization weighted index designed to measure equity performance of developed markets, excluding the United States and Canada. |

| • | | Returns for the Fund’s respective share classes differ from the benchmark index based on individual share-class expenses. |

Describe the market environment.

| • | | The year had its worst monthly start since 2008 as the markets struggled with weakness in China and plunging oil prices. Performance declined early in the reporting period as concerns about the slowing global economy rattled developed markets globally. Oil price stability toward the end of the first quarter helped decrease global volatility and fuel the recovery as well. |

| • | | Performance of equity indexes was mixed in the second quarter amid recovering oil prices, uncertainty about a potential Federal Reserve (the “Fed”) rate hike and the U.K.’s referendum on European Union (“EU”) membership. The U.K.’s decision to leave the EU shocked investors globally and resulted in a sharp two-day selloff, after which developed markets rallied into the end of the month and recovered much of the losses. |

| • | | Global equity markets broadly rallied during the third quarter as the Fed kept rates unchanged, Japan announced additional fiscal and monetary stimulus, and the Bank of England cut rates. However, weak macro data out of China, a terrorist attack in Thailand, flooding in Louisiana, and a more hawkish tone from Fed officials hindered some performance for the quarter. |

| • | | Developed markets rallied in the last quarter of the year as global investors embraced the results of the U.S. election and strong macro data, although a stronger U.S. dollar subdued gains for U.S. investors. The year ended with a global equity rally as strong global economic data and continued optimism around president-elect Trump’s reflationary policies outweighed the effects of the European Central Bank’s decision to reduce the pace of its asset purchases and diplomatic tensions between the United States and other major powers. |

Describe recent portfolio activity.

| • | | During the period, as changes were made to the composition of the MSCI EAFE Index, the Fund purchased and sold securities to maintain its objective of replicating the risks and return of the benchmark index. |

Describe portfolio positioning at period end.

| • | | The Fund remains positioned to match the risk characteristics of its benchmark index, irrespective of the future direction of international markets. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | |

| Ten Largest Holdings | | Percent of

Net Assets | |

Nestlé SA, Registered Shares | | | 2 | % |

Novartis AG, Registered Shares | | | 1 | |

HSBC Holdings PLC | | | 1 | |

Roche Holding AG | | | 1 | |

Toyota Motor Corp. | | | 1 | |

Royal Dutch Shell PLC, Class A | | | 1 | |

BP PLC | | | 1 | |

TOTAL SA | | | 1 | |

Royal Dutch Shell PLC, Class B | | | 1 | |

British American Tobacco PLC | | | 1 | |

| | | | |

| Geographic Allocation | | Percent of

Net Assets | |

Japan | | | 23 | % |

United Kingdom | | | 15 | |

France | | | 10 | |

Germany | | | 9 | |

Switzerland | | | 9 | |

Australia | | | 7 | |

Netherlands | | | 5 | |

Hong Kong | | | 3 | |

Spain | | | 3 | |

Sweden | | | 3 | |

Italy | | | 2 | |

Denmark | | | 2 | |

Other1 | | | 6 | |

Other Assets Less Liabilities | | | 3 | |

| | 1 | | Includes holdings within countries that are 1% or less of net assets. Please refer to the Schedule of Investments for such countries. |

| | | | | | |

| | | | | | | |

| 4 | | BLACKROCK INDEX FUNDS, INC. | | DECEMBER 31, 2016 | | |

| | |

| | | BlackRock International Index Fund |

| | |

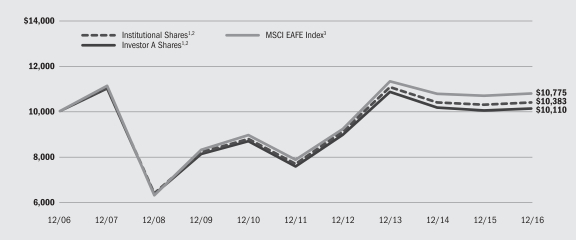

| Total Return Based on a $10,000 Investment |

| | 1 | | Assuming transaction costs and other operating expenses, including administration fees, if any. |

| | 2 | | Prior to August 1, 2016, the Fund invested all of its assets in the Master International Index Series, a series of Quantative Master Series, LLC. The Master International Index Series invested in a statistically selected sample of equity securities included in the MSCI EAFE Index and in derivative instruments linked to the MSCI EAFE Index. |

| | 3 | | A free-float adjusted, market-capitalization weighted index designed to measure equity performance of developed markets, excluding the United States and Canada. |

| | | | | | | | |

| Performance Summary for the Period Ended December 31, 2016 |

| | | | | | | | | | | | | | | | |

| | | 6-Month

Total Returns | | | Average Annual Total Returns4 | |

| | | | 1 Year | | | 5 Years | | | 10 Years | |

Institutional | | | 4.53 | % | | | 0.99 | % | | | 6.24 | % | | | 0.38 | % |

Investor A | | | 4.42 | | | | 0.78 | | | | 5.98 | | | | 0.11 | |

Class K | | | 4.57 | | | | 1.03 | | | | 6.30 | | | | 0.42 | |

MSCI EAFE Index | | | 5.67 | | | | 1.00 | | | | 6.53 | | | | 0.75 | |

| | 4 | | See “About Fund Performance” on page 8 for a detailed description of share classes, including any related fees. |

| | | | Past performance is not indicative of future results. |

| | | | Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | Hypothetical7 | | | | |

| | | Beginning

Account Value

July 1, 2016 | | | Ending

Account Value

December 31, 2016 | | | Expenses Paid

During the Period6 | | | Beginning

Account Value

July 1, 2016 | | | Ending

Account Value

December 31, 2016 | | | Expenses Paid

During the Period5 | | | Annualized

Expense Ratio | |

Institutional | | $ | 1,000.00 | | | $ | 1,045.30 | | | $ | 0.57 | | | $ | 1,000.00 | | | $ | 1,024.58 | | | $ | 0.56 | | | | 0.11 | % |

Investor A | | $ | 1,000.00 | | | $ | 1,044.20 | | | $ | 1.90 | | | $ | 1,000.00 | | | $ | 1,023.28 | | | $ | 1.88 | | | | 0.37 | % |

Class K | | $ | 1,000.00 | | | $ | 1,045.70 | | | $ | 0.36 | | | $ | 1,000.00 | | | $ | 1,024.78 | | | $ | 0.36 | | | | 0.07 | % |

| | 6 | | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period shown). Because the Fund invested all of its assets in Master International Index prior to August 1, 2016, the expense example reflects the net expenses of both the Fund and Master International Index. |

| | 7 | | Hypothetical 5% return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 366. |

| | | | See “Disclosure of Expenses” on page 8 for further information on how expenses were calculated. |

| | | | | | |

| | | | | | | |

| | BLACKROCK INDEX FUNDS, INC. | | DECEMBER 31, 2016 | | 5 |

| | |

| Fund Summary as of December 31, 2016 | | BlackRock Small Cap Index Fund |

BlackRock Small Cap Index Fund’s (the “Fund”) investment objective is to match the performance of the Russell 2000® Index as closely as possible before the deduction of Fund expenses.

| | |

| Portfolio Management Commentary | | |

How did the Fund perform?

| • | | For the 12-month period ended December 31, 2016, the Fund’s Institutional Shares returned 21.33%, Investor A Shares returned 21.04% and Class K Shares returned 21.32%. The benchmark Russell 2000® Index returned 21.31% for the same period. |

| • | | The Fund invests all of its assets in Master Small Cap Index Series (the “Series”), a series of Quantative Master Series LLC. |

Describe the market environment.

| • | | The year started with U.S. stock prices falling due to fears of a global economic slowdown, oil prices cratering, and terrorist attacks in Istanbul, Jakarta and Pakistan. Domestic equity markets rebounded in the second quarter of 2016, despite increased volatility in June from the “Brexit”, i.e., the U.K.’s vote to leave the European Union. |

| • | | U.S. equities capitalized on the upward momentum from their second quarter rally, which continued through the second half of the reporting period, driven by a dovish Federal Reserve (the “Fed”) that kept rates unchanged and stronger-than-expected earnings releases versus analyst expectations. The U.S. economy continued to strengthen into the fourth |

| | | quarter as seen by strong macro data and tightening of the U.S. labor market. As such, the Fed’s decision to raise rates by 25 basis points at the end of the reporting period did not come as a big surprise. |

| • | | The U.S. election and the Fed were front and center in 2016. The year started with an increase in volatility as investors prepared for a possible Fed rate increase, and weighed probable outcomes of the U.S. election. While many people were shocked by the Trump win, markets did not experience the same type of volatility seen after the Brexit vote, with major U.S. indexes posting solid gains in November. |

Describe recent portfolio activity.

| • | | During the period, as changes were made to the composition of the Russell 2000® Index, the Series purchased and sold securities to maintain its objective of replicating the risks and return of the benchmark index. |

Describe portfolio positioning at period end.

| • | | The Series remains positioned to match the risk characteristics of its benchmark index, irrespective of the market’s future direction. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| | | | | | | |

| 6 | | BLACKROCK INDEX FUNDS, INC. | | DECEMBER 31, 2016 | | |

| | |

| | | BlackRock Small Cap Index Fund |

| | |

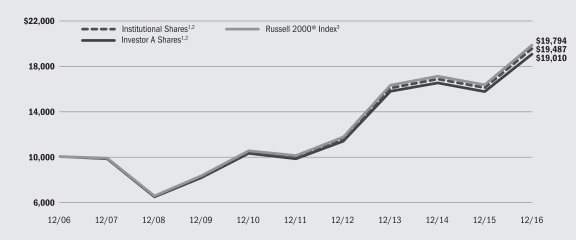

| Total Return Based on a $10,000 Investment | | |

| | 1 | | Assuming transaction costs and other operating expenses, including administration fees, if any. |

| | 2 | | The Fund invests all of its assets in the Series. The Series may invest in a statistically selected sample of the stocks included in the Russell 2000® Index and in derivative instruments linked to the Russell 2000® Index. |

| | 3 | | An unmanaged index that is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. |

| | |

| Performance Summary for the Period Ended December 31, 2016 | | |

| | | | | | | | | | | | | | | | |

| | | 6-Month Total Returns | | | Average Annual Total Returns4 | |

| | | | 1 Year | | | 5 Years | | | 10 Years | |

Institutional | | | 18.62 | % | | | 21.33 | % | | | 14.44 | % | | | 6.90 | % |

Investor A | | | 18.49 | | | | 21.04 | | | | 14.18 | | | | 6.63 | |

Class K | | | 18.61 | | | | 21.32 | | | | 14.51 | | | | 6.96 | |

Russell 2000® Index | | | 18.68 | | | | 21.31 | | | | 14.46 | | | | 7.07 | |

| | 4 | | See “About Fund Performance” on page 8 for a detailed description of share classes, including related fees, if any. |

| | | | Past performance is not indicative of future results. |

| | | | Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | Hypothetical7 | | | | |

| | | Beginning Account Value July 1, 2016 | | | Ending

Account Value December 31, 2016 | | | Expenses Paid

During the Period6 | | | Beginning

Account Value

July 1, 2016 | | | Ending

Account Value

December 31, 2016 | | | Expenses Paid

During the Period5 | | | Annualized

Expense Ratio | |

Institutional | | $ | 1,000.00 | | | $ | 1,186.20 | | | $ | 0.71 | | | $ | 1,000.00 | | | $ | 1,024.48 | | | $ | 0.66 | | | | 0.13 | % |

Investor A | | $ | 1,000.00 | | | $ | 1,184.90 | | | $ | 2.14 | | | $ | 1,000.00 | | | $ | 1,023.18 | | | $ | 1.98 | | | | 0.39 | % |

Class K | | $ | 1,000.00 | | | $ | 1,186.10 | | | $ | 0.49 | | | $ | 1,000.00 | | | $ | 1,024.68 | | | $ | 0.46 | | | | 0.09 | % |

| | 6 | | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period shown). Because the Fund invests all of its assets in the Series, the expense example reflects the net expenses of both the Fund and the Series. |

| | 7 | | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 366. |

| | | | See “Disclosure of Expenses” on page 8 for further information on how expenses were calculated. |

| | | | | | |

| | | | | | | |

| | BLACKROCK INDEX FUNDS, INC. | | DECEMBER 31, 2016 | | 7 |

| • | | Institutional and Class K Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors. Prior to March 31, 2011, Class K Shares’ performance results are those of Institutional Shares restated to reflect Class K Shares’ fees. |

| • | | Investor A Shares are not subject to any sales charge and bear no ongoing distribution fee. These shares are subject to an ongoing service fee of 0.25% per year. These shares are generally available through financial intermediaries. |

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures

shown in the performance tables on the previous pages assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager and/or Administrator”), the Funds’ investment adviser and/or administrator, has contractually agreed to waive and/or reimburse a portion of the Funds’ expenses. Without such waiver and/or reimbursement, the Funds’ performance would have been lower. The Manager and/or administrator is under no obligation to continue waiving and/or reimbursing its fees after the applicable termination date of such agreement. See Note 4 of the Notes to Financial Statements for additional information on waivers and/or reimbursements.

Shareholders of these Funds may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, administration fees, service fees, including 12b-1 fees, acquired fund fees and expenses and other fund expenses. The expense examples on the previous pages (which are based on a hypothetical investment of $1,000 invested on July 1, 2016 and held through December 31, 2016) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

|

| Derivative Financial Instruments |

International Index Fund and the Series may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other asset without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the

counterparty to the transaction or illiquidity of the instrument. The Fund’s and Series’ successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Fund or Series can realize on an investment and/or may result in lower distributions paid to shareholders. The Fund’s and Series’ investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| 8 | | BLACKROCK INDEX FUNDS, INC. | | DECEMBER 31, 2016 | | |

| | |

Schedule of Investments December 31, 2016 | | BlackRock International Index Fund (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Australia — 7.1% | | | | | | | | |

AGL Energy Ltd. | | | 269,419 | | | $ | 4,286,578 | |

Alumina Ltd. | | | 784,345 | | | | 1,025,605 | |

Amcor Ltd. | | | 457,153 | | | | 4,920,255 | |

AMP Ltd. | | | 1,197,023 | | | | 4,341,413 | |

APA Group (a) | | | 443,354 | | | | 2,736,962 | |

Aristocrat Leisure Ltd. | | | 205,692 | | | | 2,294,822 | |

ASX Ltd. | | | 73,533 | | | | 2,634,324 | |

Aurizon Holdings Ltd. | | | 765,573 | | | | 2,783,483 | |

AusNet Services | | | 804,849 | | | | 916,240 | |

Australia & New Zealand Banking Group Ltd. | | | 1,154,945 | | | | 25,283,102 | |

Bank of Queensland Ltd. | | | 132,943 | | | | 1,136,135 | |

Bendigo & Adelaide Bank Ltd. | | | 159,193 | | | | 1,456,259 | |

BGP Holdings PLC (b) | | | 783,183 | | | | 8 | |

BHP Billiton Ltd. | | | 1,267,630 | | | | 22,709,374 | |

Boral Ltd. | | | 482,878 | | | | 1,879,882 | |

Brambles Ltd. | | | 619,174 | | | | 5,525,557 | |

Caltex Australia Ltd. | | | 101,701 | | | | 2,229,861 | |

Challenger Ltd. | | | 196,281 | | | | 1,585,932 | |

CIMIC Group Ltd. | | | 29,853 | | | | 751,135 | |

Coca-Cola Amatil Ltd. | | | 260,065 | | | | 1,896,644 | |

Cochlear Ltd. | | | 21,942 | | | | 1,936,613 | |

Commonwealth Bank of Australia | | | 672,012 | | | | 39,866,478 | |

Computershare Ltd. | | | 159,385 | | | | 1,430,013 | |

Crown Resorts Ltd. | | | 127,577 | | | | 1,063,270 | |

CSL Ltd. | | | 176,694 | | | | 12,778,476 | |

Dexus Property Group | | | 396,875 | | | | 2,753,198 | |

Domino’s Pizza Enterprises Ltd. | | | 21,754 | | | | 1,017,288 | |

DUET Group (a) | | | 1,064,603 | | | | 2,102,412 | |

Flight Centre Travel Group Ltd. | | | 14,458 | | | | 325,834 | |

Fortescue Metals Group Ltd. | | | 606,249 | | | | 2,533,514 | |

Goodman Group | | | 759,504 | | | | 3,900,528 | |

GPT Group | | | 747,674 | | | | 2,710,722 | |

Harvey Norman Holdings Ltd. | | | 199,302 | | | | 738,463 | |

Healthscope Ltd. | | | 572,674 | | | | 944,025 | |

Incitec Pivot Ltd. | | | 699,652 | | | | 1,810,409 | |

Insurance Australia Group Ltd. | | | 899,481 | | | | 3,878,856 | |

Lend Lease Group (a) | | | 212,775 | | | | 2,235,956 | |

Macquarie Group Ltd. | | | 117,228 | | | | 7,343,397 | |

Medibank Pvt Ltd. | | | 1,167,386 | | | | 2,371,733 | |

Mirvac Group | | | 1,395,790 | | | | 2,143,504 | |

National Australia Bank Ltd. | | | 1,050,126 | | | | 23,195,685 | |

Newcrest Mining Ltd. | | | 307,028 | | | | 4,402,489 | |

Oil Search Ltd. | | | 510,559 | | | | 2,627,725 | |

Orica Ltd. | | | 133,041 | | | | 1,690,835 | |

Origin Energy Ltd. | | | 691,591 | | | | 3,272,089 | |

Qantas Airways Ltd. | | | 159,123 | | | | 381,184 | |

QBE Insurance Group Ltd. | | | 561,273 | | | | 5,014,835 | |

Ramsay Health Care Ltd. | | | 52,761 | | | | 2,594,080 | |

REA Group Ltd. | | | 22,709 | | | | 902,458 | |

Rio Tinto Ltd. | | | 163,715 | | | | 7,013,729 | |

Santos Ltd. | | | 691,335 | | | | 1,991,483 | |

Scentre Group | | | 2,178,120 | | | | 7,291,217 | |

Seek Ltd. | | | 139,458 | | | | 1,493,616 | |

Sonic Healthcare Ltd. | | | 165,002 | | | | 2,539,379 | |

South32 Ltd. | | | 2,143,612 | | | | 4,219,812 | |

Stockland | | | 880,404 | | | | 2,908,573 | |

Suncorp Group Ltd. | | | 510,643 | | | | 4,972,196 | |

Sydney Airport (a) | | | 455,980 | | | | 1,968,211 | |

Tabcorp Holdings Ltd. | | | 376,311 | | | | 1,303,730 | |

Tatts Group Ltd. | | | 575,404 | | | | 1,854,164 | |

Telstra Corp. Ltd. | | | 1,656,327 | | | | 6,086,468 | |

TPG Telecom Ltd. | | | 123,145 | | | | 604,539 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Australia (continued) | | | | | | | | |

Transurban Group (a) | | | 785,110 | | | $ | 5,843,022 | |

Treasury Wine Estates Ltd. | | | 303,772 | | | | 2,336,804 | |

Vicinity Centres | | | 1,248,117 | | | | 2,691,585 | |

Vocus Communications Ltd. | | | 237,370 | | | | 661,010 | |

Wesfarmers Ltd. | | | 435,821 | | | | 13,228,004 | |

Westfield Corp. | | | 783,860 | | | | 5,300,019 | |

Westpac Banking Corp. | | | 1,315,164 | | | | 30,872,024 | |

Woodside Petroleum Ltd. | | | 298,850 | | | | 6,693,723 | |

Woolworths Ltd. | | | 490,330 | | | | 8,510,966 | |

| | | | | | | | |

| | | | | | | | 348,743,914 | |

Austria — 0.2% | | | | | | | | |

Andritz AG | | | 24,967 | | | | 1,251,190 | |

Erste Group Bank AG (b) | | | 114,141 | | | | 3,337,159 | |

Immoeast (b) | | | 30,711 | | | | — | |

OMV AG | | | 57,180 | | | | 2,015,805 | |

Raiffeisen Bank International AG (b) | | | 39,292 | | | | 716,253 | |

Voestalpine AG | | | 46,828 | | | | 1,831,124 | |

| | | | | | | | |

| | | | | | | | 9,151,531 | |

Belgium — 1.1% | | | | | | | | |

Ageas | | | 73,375 | | | | 2,900,279 | |

Anheuser-Busch InBev SA | | | 302,627 | | | | 32,031,252 | |

Colruyt SA | | | 22,252 | | | | 1,099,804 | |

Groupe Bruxelles Lambert SA | | | 30,636 | | | | 2,566,743 | |

KBC Group NV | | | 97,074 | | | | 5,997,987 | |

Proximus | | | 67,796 | | | | 1,948,918 | |

Solvay SA | | | 28,104 | | | | 3,285,543 | |

Telenet Group Holding NV (b) | | | 25,183 | | | | 1,395,810 | |

UCB SA | | | 45,997 | | | | 2,942,932 | |

Umicore SA | | | 39,651 | | | | 2,255,801 | |

| | | | | | | | |

| | | | | | | | 56,425,069 | |

Denmark — 1.6% | | | | | | | | |

A.P. Moeller — Maersk A/S, Class A | | | 1,425 | | | | 2,150,493 | |

A.P. Moeller — Maersk A/S, Class B | | | 2,558 | | | | 4,077,358 | |

Carlsberg A/S, Class B | | | 38,881 | | | | 3,348,787 | |

Chr Hansen Holding A/S | | | 40,637 | | | | 2,247,443 | |

Coloplast A/S, Class B | | | 44,607 | | | | 3,004,663 | |

Danske Bank A/S | | | 271,383 | | | | 8,210,352 | |

DONG Energy A/S (b)(c) | | | 32,538 | | | | 1,230,800 | |

DSV A/S | | | 77,597 | | | | 3,446,101 | |

Genmab A/S (b) | | | 23,884 | | | | 3,956,445 | |

ISS A/S | | | 62,602 | | | | 2,109,868 | |

Novo Nordisk A/S, Class B | | | 753,443 | | | | 27,027,645 | |

Novozymes A/S, Class B | | | 85,953 | | | | 2,957,808 | |

Pandora A/S | | | 43,754 | | | | 5,711,646 | |

TDC A/S (b) | | | 292,491 | | | | 1,499,417 | |

Tryg A/S | | | 37,209 | | | | 671,940 | |

Vestas Wind Systems A/S | | | 89,018 | | | | 5,765,209 | |

William Demant Holding A/S (b) | | | 44,366 | | | | 770,613 | |

| | | | | | | | |

| | | | | | | | 78,186,588 | |

Finland — 0.9% | | | | | | | | |

Elisa OYJ | | | 49,941 | | | | 1,621,157 | |

Fortum OYJ | | | 184,321 | | | | 2,817,561 | |

Kone OYJ, Class B | | | 133,486 | | | | 5,964,631 | |

Metso OYJ | | | 37,252 | | | | 1,059,779 | |

Neste Oil OYJ | | | 50,850 | | | | 1,945,905 | |

Nokia OYJ | | | 2,280,655 | | | | 10,938,392 | |

Nokian Renkaat OYJ | | | 39,688 | | | | 1,475,515 | |

Orion OYJ, Class B | | | 45,244 | | | | 2,010,274 | |

Sampo OYJ, Class A | | | 173,916 | | | | 7,774,504 | |

| | |

| ADR | | American Depositary Receipts |

| REIT | | Real Estate Investment Trust |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | BLACKROCK INDEX FUNDS, INC. | | DECEMBER 31, 2016 | | 9 |

| | |

Schedule of Investments (continued) | | BlackRock International Index Fund |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Finland (continued) | | | | | | | | |

Stora Enso OYJ, Class R | | | 241,099 | | | $ | 2,579,034 | |

UPM-Kymmene OYJ | | | 214,163 | | | | 5,237,474 | |

Wartsila OYJ | | | 55,993 | | | | 2,510,523 | |

| | | | | | | | |

| | | | | | | | 45,934,749 | |

France — 9.8% | | | | | | | | |

Accor SA | | | 68,090 | | | | 2,536,534 | |

Aeroports de Paris | | | 11,308 | | | | 1,210,938 | |

Air Liquide SA | | | 153,350 | | | | 17,052,325 | |

Airbus Group SE | | | 227,080 | | | | 14,998,331 | |

Alstom SA (b) | | | 51,884 | | | | 1,426,737 | |

ArcelorMittal (b) | | | 718,999 | | | | 5,282,856 | |

Arkema SA | | | 27,637 | | | | 2,701,535 | |

AtoS SE | | | 36,393 | | | | 3,835,733 | |

AXA SA | | | 760,031 | | | | 19,159,460 | |

BNP Paribas SA | | | 417,454 | | | | 26,565,902 | |

Bollore SA | | | 354,110 | | | | 1,246,849 | |

Bouygues SA | | | 82,799 | | | | 2,964,148 | |

Bureau Veritas SA | | | 109,522 | | | | 2,119,721 | |

Cap Gemini SA | | | 63,122 | | | | 5,317,972 | |

Carrefour SA | | | 217,354 | | | | 5,233,007 | |

Casino Guichard-Perrachon SA | | | 23,687 | | | | 1,134,952 | |

Christian Dior SE | | | 21,662 | | | | 4,538,444 | |

Cie Generale des Etablissements Michelin | | | 70,786 | | | | 7,868,485 | |

CNP Assurances | | | 70,636 | | | | 1,307,423 | |

Compagnie de Saint-Gobain | | | 200,322 | | | | 9,318,450 | |

Credit Agricole SA | | | 459,797 | | | | 5,691,681 | |

Danone SA | | | 234,467 | | | | 14,836,733 | |

Dassault Aviation SA | | | 883 | | | | 985,530 | |

Dassault Systemes SA | | | 51,722 | | | | 3,936,873 | |

Edenred | | | 73,835 | | | | 1,461,971 | |

Eiffage SA | | | 19,690 | | | | 1,371,438 | |

Electricite de France SA | | | 128,170 | | | | 1,304,112 | |

Engie SA | | | 588,499 | | | | 7,490,971 | |

Essilor International SA | | | 82,788 | | | | 9,340,823 | |

Eurazeo | | | 12,896 | | | | 753,921 | |

Eutelsat Communications SA | | | 66,765 | | | | 1,291,078 | |

Fonciere Des Regions | | | 13,150 | | | | 1,146,555 | |

Gecina SA | | | 17,273 | | | | 2,385,711 | |

Groupe Eurotunnel SE, Registered Shares | | | 154,181 | | | | 1,464,708 | |

Hermes International | | | 10,463 | | | | 4,292,106 | |

ICADE | | | 15,620 | | | | 1,113,275 | |

Iliad SA | | | 11,019 | | | | 2,116,168 | |

Imerys SA | | | 14,357 | | | | 1,087,716 | |

Ingenico Group SA | | | 24,107 | | | | 1,923,397 | |

JCDecaux SA | | | 23,090 | | | | 678,935 | |

Kering | | | 29,420 | | | | 6,599,011 | |

Klepierre | | | 81,313 | | | | 3,190,604 | |

L’Oreal SA | | | 99,468 | | | | 18,129,563 | |

Lagardere SCA | | | 51,741 | | | | 1,436,093 | |

Legrand SA | | | 103,321 | | | | 5,861,935 | |

LVMH Moet Hennessy Louis Vuitton SE | | | 108,146 | | | | 20,620,372 | |

Natixis SA | | | 341,634 | | | | 1,923,865 | |

Orange SA | | | 772,557 | | | | 11,715,027 | |

Pernod Ricard SA | | | 80,632 | | | | 8,725,999 | |

Peugeot SA (b) | | | 176,805 | | | | 2,879,653 | |

Publicis Groupe SA | | | 74,265 | | | | 5,117,197 | |

Remy Cointreau SA | | | 7,151 | | | | 609,534 | |

Renault SA | | | 74,108 | | | | 6,582,035 | |

Rexel SA | | | 126,208 | | | | 2,073,582 | |

Safran SA | | | 120,431 | | | | 8,661,866 | |

Sanofi | | | 454,848 | | | | 36,781,373 | |

Schneider Electric SE | | | 217,551 | | | | 15,112,930 | |

SCOR SE | | | 72,714 | | | | 2,509,415 | |

SEB SA | | | 8,737 | | | | 1,183,897 | |

SES SA | | | 134,167 | | | | 2,952,048 | |

SFR Group SA (b) | | | 42,483 | | | | 1,197,709 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

France (continued) | | | | | | | | |

Societe BIC SA | | | 9,961 | | | $ | 1,353,467 | |

Societe Generale SA | | | 297,795 | | | | 14,647,585 | |

Sodexo SA | | | 35,068 | | | | 4,026,274 | |

Suez | | | 128,047 | | | | 1,886,706 | |

Technip SA | | | 41,306 | | | | 2,942,299 | |

Thales SA | | | 42,583 | | | | 4,125,471 | |

TOTAL SA | | | 882,679 | | | | 45,274,461 | |

Unibail-Rodamco SE | | | 38,126 | | | | 9,088,245 | |

Valeo SA | | | 93,377 | | | | 5,360,569 | |

Veolia Environnement SA | | | 185,322 | | | | 3,148,964 | |

Vinci SA | | | 195,925 | | | | 13,327,723 | |

Vivendi SA | | | 443,880 | | | | 8,419,031 | |

Wendel SA | | | 11,895 | | | | 1,431,380 | |

Zodiac Aerospace | | | 81,835 | | | | 1,876,557 | |

| | | | | | | | |

| | | | | | | | 481,265,944 | |

Germany — 8.8% | | | | | | | | |

adidas AG | | | 73,403 | | | | 11,576,987 | |

Allianz SE, Registered Shares | | | 179,868 | | | | 29,685,034 | |

Axel Springer AG | | | 22,539 | | | | 1,092,889 | |

BASF SE | | | 360,662 | | | | 33,424,857 | |

Bayer AG, Registered Shares | | | 324,934 | | | | 33,852,737 | |

Bayerische Motoren Werke AG | | | 127,409 | | | | 11,866,366 | |

Bayerische Motoren Werke AG, Preference Shares | | | 21,253 | | | | 1,623,094 | |

Beiersdorf AG | | | 37,520 | | | | 3,178,239 | |

Brenntag AG | | | 58,093 | | | | 3,220,026 | |

Commerzbank AG | | | 428,017 | | | | 3,258,835 | |

Continental AG | | | 42,615 | | | | 8,210,069 | |

Covestro AG (c) | | | 24,935 | | | | 1,706,742 | |

Daimler AG, Registered Shares | | | 379,258 | | | | 28,146,847 | |

Deutsche Bank AG, Registered Shares (b) | | | 545,713 | | | | 9,898,871 | |

Deutsche Boerse AG (b) | | | 75,627 | | | | 6,154,193 | |

Deutsche Lufthansa AG, Registered Shares | | | 105,061 | | | | 1,354,313 | |

Deutsche Post AG, Registered Shares | | | 377,530 | | | | 12,381,110 | |

Deutsche Telekom AG, Registered Shares | | | 1,295,928 | | | | 22,234,497 | |

Deutsche Wohnen AG, Bearer Shares | | | 137,073 | | | | 4,299,498 | |

E.ON SE | | | 792,718 | | | | 5,576,725 | |

Evonik Industries AG | | | 62,158 | | | | 1,852,857 | |

Fraport AG Frankfurt Airport Services Worldwide | | | 16,908 | | | | 997,706 | |

Fresenius Medical Care AG & Co. KGaA | | | 83,548 | | | | 7,061,554 | |

Fresenius SE & Co. KGaA | | | 159,232 | | | | 12,421,819 | |

Fuchs Petrolub SE, Preference Shares | | | 28,016 | | | | 1,173,571 | |

GEA Group AG | | | 67,017 | | | | 2,689,421 | |

Hannover Rueck SE | | | 23,099 | | | | 2,495,325 | |

HeidelbergCement AG | | | 57,591 | | | | 5,360,568 | |

Henkel AG & Co. KGaA | | | 41,294 | | | | 4,297,607 | |

Henkel AG & Co. KGaA, Preference Shares | | | 68,766 | | | | 8,185,891 | |

Hochtief AG | | | 9,393 | | | | 1,311,385 | |

Hugo Boss AG | | | 30,553 | | | | 1,865,231 | |

Infineon Technologies AG | | | 441,865 | | | | 7,643,147 | |

Innogy SE (b)(c) | | | 50,940 | | | | 1,770,063 | |

K+S AG, Registered Shares | | | 71,063 | | | | 1,692,796 | |

Lanxess AG | | | 37,568 | | | | 2,460,074 | |

Linde AG | | | 72,331 | | | | 11,865,002 | |

MAN SE | | | 12,440 | | | | 1,234,748 | |

Merck KGaA | | | 50,677 | | | | 5,276,532 | |

Metro AG | | | 74,504 | | | | 2,476,299 | |

Muenchener Rueckversicherungs AG, Registered Shares | | | 62,585 | | | | 11,820,926 | |

OSRAM Licht AG | | | 38,507 | | | | 2,016,434 | |

Porsche Automobil Holding SE, Preference Shares | | | 56,618 | | | | 3,075,488 | |

ProSiebenSat.1 Media AG, Registered Shares | | | 98,234 | | | | 3,781,221 | |

RWE AG (b) | | | 181,576 | | | | 2,253,112 | |

SAP SE | | | 386,001 | | | | 33,391,035 | |

Schaeffler AG | | | 78,399 | | | | 1,156,872 | |

Siemens AG, Registered Shares | | | 299,996 | | | | 36,731,493 | |

Symrise AG | | | 45,972 | | | | 2,793,153 | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| 10 | | BLACKROCK INDEX FUNDS, INC. | | DECEMBER 31, 2016 | | |

| | |

Schedule of Investments (continued) | | BlackRock International Index Fund |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Germany (continued) | | | | | | | | |

Telefonica Deutschland Holding AG | | | 325,977 | | | $ | 1,393,357 | |

ThyssenKrupp AG | | | 140,800 | | | | 3,344,741 | |

TUI AG | | | 198,867 | | | | 2,847,207 | |

United Internet AG, Registered Shares | | | 42,689 | | | | 1,665,829 | |

Volkswagen AG | | | 13,486 | | | | 1,935,578 | |

Vonovia SE | | | 179,507 | | | | 5,828,118 | |

Zalando SE (b)(c) | | | 30,213 | | | | 1,150,941 | |

| | | | | | | | |

| | | | | | | | 432,059,030 | |

Hong Kong — 3.1% | | | | | | | | |

AIA Group Ltd. | | | 4,745,000 | | | | 26,580,727 | |

ASM Pacific Technology Ltd. | | | 106,704 | | | | 1,128,437 | |

Bank of East Asia Ltd. | | | 464,932 | | | | 1,774,931 | |

BOC Hong Kong Holdings Ltd. | | | 1,451,400 | | | | 5,169,240 | |

Cathay Pacific Airways Ltd. | | | 704,263 | | | | 924,233 | |

Cheung Kong Infrastructure Holdings Ltd. | | | 264,500 | | | | 2,100,760 | |

Cheung Kong Property Holdings Ltd. | | | 1,065,939 | | | | 6,509,680 | |

CK Hutchison Holdings Ltd. | | | 1,045,439 | | | | 11,801,396 | |

CLP Holdings Ltd. | | | 638,687 | | | | 5,857,325 | |

First Pacific Co., Ltd. | | | 585,250 | | | | 408,272 | |

Galaxy Entertainment Group Ltd. | | | 875,000 | | | | 3,789,730 | |

Hang Lung Group, Ltd. | | | 342,000 | | | | 1,186,704 | |

Hang Lung Properties Ltd. | | | 909,000 | | | | 1,916,762 | |

Hang Seng Bank Ltd. | | | 301,353 | | | | 5,588,463 | |

Henderson Land Development Co., Ltd. | | | 410,742 | | | | 2,176,924 | |

HK Electric Investments & HK Electric Investments Ltd. (a)(c) | | | 1,282,000 | | | | 1,056,891 | |

HKT Trust & HKT Ltd. (a) | | | 928,560 | | | | 1,137,348 | |

Hong Kong & China Gas Co., Ltd. | | | 3,057,162 | | | | 5,399,535 | |

Hong Kong Exchanges & Clearing Ltd. | | | 447,502 | | | | 10,524,519 | |

Hongkong Land Holdings Ltd. | | | 437,300 | | | | 2,754,875 | |

Hysan Development Co., Ltd. | | | 206,791 | | | | 852,814 | |

Jardine Matheson Holdings Ltd. | | | 98,500 | | | | 5,435,007 | |

Kerry Properties Ltd. | | | 190,500 | | | | 515,155 | |

Li & Fung Ltd. | | | 2,261,980 | | | | 991,332 | |

Link REIT | | | 871,914 | | | | 5,652,682 | |

Melco Crown Entertainment Ltd. — ADR | | | 83,947 | | | | 1,334,757 | |

MGM China Holdings Ltd. | | | 440,000 | | | | 908,880 | |

MTR Corp. Ltd. | | | 541,000 | | | | 2,622,893 | |

New World Development Co., Ltd. | | | 2,230,968 | | | | 2,350,563 | |

NWS Holdings Ltd. | | | 704,223 | | | | 1,144,772 | |

PCCW Ltd. | | | 1,747,000 | | | | 944,398 | |

Power Assets Holdings Ltd. | | | 549,500 | | | | 4,833,988 | |

Sands China Ltd. | | | 997,000 | | | | 4,301,231 | |

Shangri-La Asia Ltd. | | | 729,905 | | | | 768,628 | |

Sino Land Co., Ltd. | | | 1,173,263 | | | | 1,749,391 | |

SJM Holdings Ltd. | | | 538,000 | | | | 419,819 | |

Sun Hung Kai Properties Ltd. | | | 563,324 | | | | 7,093,645 | |

Swire Pacific Ltd., Class A | | | 223,077 | | | | 2,122,749 | |

Swire Properties Ltd. | | | 456,600 | | | | 1,256,970 | |

Techtronic Industries Co., Ltd. | | | 526,500 | | | | 1,884,068 | |

WH Group Ltd. (c) | | | 3,031,500 | | | | 2,443,682 | |

Wharf Holdings Ltd. | | | 562,357 | | | | 3,725,038 | |

Wheelock & Co., Ltd. | | | 284,000 | | | | 1,593,877 | |

Wynn Macau Ltd. | | | 694,400 | | | | 1,097,721 | |

Yue Yuen Industrial Holdings Ltd. | | | 252,285 | | | | 914,459 | |

| | | | | | | | |

| | | | | | | | 154,745,271 | |

Ireland — 0.7% | | | | | | | | |

Bank of Ireland (b) | | | 10,455,168 | | | | 2,560,649 | |

CRH PLC | | | 324,873 | | | | 11,205,693 | |

DCC PLC | | | 36,689 | | | | 2,727,128 | |

Experian PLC | | | 371,888 | | | | 7,200,354 | |

James Hardie Industries PLC | | | 180,685 | | | | 2,852,191 | |

Kerry Group PLC, Class A | | | 63,157 | | | | 4,514,144 | |

Paddy Power Betfair PLC | | | 33,210 | | | | 3,533,770 | |

Ryanair Holdings PLC (b) | | | 9,354 | | | | 142,824 | |

| | | | | | | | |

| | | | | | | | 34,736,753 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Israel — 0.7% | | | | | | | | |

Azrieli Group Ltd. | | | 20,626 | | | $ | 895,176 | |

Bank Hapoalim BM | | | 385,846 | | | | 2,290,195 | |

Bank Leumi Le-Israel BM (b) | | | 516,361 | | | | 2,122,027 | |

Bezeq The Israeli Telecommunication Corp. Ltd. | | | 802,855 | | | | 1,522,875 | |

Check Point Software Technologies Ltd. (b) | | | 48,849 | | | | 4,125,786 | |

Elbit Systems Ltd. | | | 9,098 | | | | 919,071 | |

Frutarom Industries, Ltd. | | | 14,827 | | | | 756,803 | |

Israel Chemicals Ltd. | | | 165,989 | | | | 677,664 | |

Mizrahi Tefahot Bank Ltd. | | | 47,961 | | | | 700,453 | |

Mobileye NV (b) | | | 70,038 | | | | 2,669,849 | |

NICE Ltd. | | | 22,742 | | | | 1,560,385 | |

Taro Pharmaceutical Industries Ltd. (b) | | | 6,231 | | | | 655,937 | |

Teva Pharmaceutical Industries Ltd. — ADR | | | 366,780 | | | | 13,295,775 | |

| | | | | | | | |

| | | | | | | | 32,191,996 | |

Italy — 1.8% | | | | | | | | |

Assicurazioni Generali SpA | | | 454,599 | | | | 6,738,228 | |

Atlantia SpA | | | 170,669 | | | | 3,993,029 | |

Enel SpA | | | 2,979,468 | | | | 13,096,840 | |

Eni SpA | | | 984,518 | | | | 15,960,094 | |

Ferrari NV | | | 47,660 | | | | 2,774,785 | |

Intesa Sanpaolo SpA | | | 5,456,989 | | | | 13,727,525 | |

Leonardo-Finmeccanica SpA (b) | | | 99,828 | | | | 1,398,118 | |

Luxottica Group SpA | | | 71,810 | | | | 3,859,531 | |

Mediobanca SpA | | | 206,008 | | | | 1,681,706 | |

Poste Italiane SpA (c) | | | 185,431 | | | | 1,230,698 | |

Prysmian SpA | | | 69,483 | | | | 1,780,872 | |

Saipem SpA (b) | | | 2,143,978 | | | | 1,199,153 | |

Snam SpA | | | 1,006,314 | | | | 4,138,819 | |

Telecom Italia SpA (b) | | | 4,174,325 | | | | 3,685,670 | |

Telecom Italia SpA, Non-Convertible Savings Shares (b) | | | 2,263,286 | | | | 1,642,677 | |

Tenaris SA | | | 183,350 | | | | 3,272,894 | |

Terna — Rete Elettrica Nazionale SpA | | | 581,991 | | | | 2,661,644 | |

UniCredit SpA | | | 2,086,974 | | | | 5,993,224 | |

UnipolSai SpA | | | 560,158 | | | | 1,194,774 | |

| | | | | | | | |

| | | | | | | | 90,030,281 | |

Japan — 23.3% | | | | | | | | |

ABC-Mart, Inc. | | | 9,600 | | | | 543,088 | |

Acom Co., Ltd. (b) | | | 204,600 | | | | 893,428 | |

Aeon Co., Ltd. | | | 275,200 | | | | 3,889,564 | |

AEON Financial Service Co., Ltd. | | | 41,000 | | | | 726,197 | |

Aeon Mall Co., Ltd. | | | 33,350 | | | | 468,661 | |

Air Water, Inc. | | | 61,000 | | | | 1,098,836 | |

Aisin Seiki Co., Ltd. | | | 72,400 | | | | 3,132,705 | |

Ajinomoto Co., Inc. | | | 219,500 | | | | 4,416,899 | |

Alfresa Holdings Corp. | | | 83,600 | | | | 1,380,818 | |

Alps Electric Co., Ltd. | | | 68,000 | | | | 1,633,901 | |

Amada Holdings Co., Ltd. | | | 127,600 | | | | 1,421,536 | |

ANA Holdings, Inc. | | | 453,000 | | | | 1,218,582 | |

Aozora Bank Ltd. | | | 507,000 | | | | 1,791,360 | |

Asahi Glass Co., Ltd. | | | 413,100 | | | | 2,802,739 | |

Asahi Group Holdings Ltd. | | | 152,500 | | | | 4,801,475 | |

Asahi Kasei Corp. | | | 474,000 | | | | 4,124,400 | |

Ashikaga Holdings Co., Ltd. | | | 357,200 | | | | 1,320,186 | |

Asics Corp. | | | 64,300 | | | | 1,281,364 | |

Astellas Pharma, Inc. | | | 833,500 | | | | 11,563,438 | |

Bandai Namco Holdings, Inc. | | | 81,600 | | | | 2,246,037 | |

Bank of Kyoto Ltd. | | | 106,000 | | | | 785,731 | |

Benesse Holdings, Inc. | | | 19,000 | | | | 522,025 | |

Bridgestone Corp. | | | 262,200 | | | | 9,434,156 | |

Brother Industries Ltd. | | | 107,700 | | | | 1,936,167 | |

Calbee, Inc. | | | 26,800 | | | | 838,334 | |

Canon, Inc. | | | 414,900 | | | | 11,684,488 | |

Casio Computer Co., Ltd. | | | 84,700 | | | | 1,193,687 | |

Central Japan Railway Co. | | | 55,300 | | | | 9,079,683 | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | BLACKROCK INDEX FUNDS, INC. | | DECEMBER 31, 2016 | | 11 |

| | |

Schedule of Investments (continued) | | BlackRock International Index Fund |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Japan (continued) | | | | | | | | |

Chiba Bank Ltd. | | | 295,000 | | | $ | 1,808,388 | |

Chubu Electric Power Co., Inc. | | | 279,500 | | | | 3,889,349 | |

Chugai Pharmaceutical Co., Ltd. | | | 82,700 | | | | 2,372,170 | |

Chugoku Bank Ltd. | | | 58,000 | | | | 831,813 | |

Chugoku Electric Power Co., Inc. | | | 105,900 | | | | 1,239,518 | |

Concordia Financial Group Ltd. | | | 483,000 | | | | 2,324,254 | |

Credit Saison Co., Ltd. | | | 61,200 | | | | 1,089,108 | |

CYBERDYNE, Inc. (b)(d) | | | 29,900 | | | | 421,621 | |

Dai Nippon Printing Co., Ltd. | | | 219,000 | | | | 2,160,796 | |

Dai-ichi Life Insurance Co., Ltd. | | | 415,900 | | | | 6,914,951 | |

Daicel Corp. | | | 128,600 | | | | 1,413,834 | |

Daiichi Sankyo Co., Ltd. | | | 237,700 | | | | 4,853,650 | |

Daikin Industries Ltd. | | | 90,200 | | | | 8,263,121 | |

Daito Trust Construction Co., Ltd. | | | 26,300 | | | | 3,953,881 | |

Daiwa House Industry Co., Ltd. | | | 219,800 | | | | 5,994,026 | |

Daiwa House REIT Investment Corp. | | | 464 | | | | 1,176,313 | |

Daiwa Securities Group, Inc. | | | 622,000 | | | | 3,830,105 | |

DeNA Co., Ltd. | | | 40,900 | | | | 893,872 | |

Denso Corp. | | | 188,900 | | | | 8,171,144 | |

Dentsu, Inc. | | | 80,413 | | | | 3,781,284 | |

Don Quijote Holdings Co., Ltd. | | | 41,300 | | | | 1,524,188 | |

East Japan Railway Co. | | | 129,949 | | | | 11,204,034 | |

Eisai Co., Ltd. | | | 97,100 | | | | 5,564,544 | |

Electric Power Development Co., Ltd. | | | 50,000 | | | | 1,147,578 | |

FamilyMart UNY Holdings Co., Ltd. | | | 28,900 | | | | 1,923,007 | |

FANUC Corp. | | | 75,600 | | | | 12,647,455 | |

Fast Retailing Co., Ltd. | | | 20,400 | | | | 7,283,348 | |

Fuji Electric Co., Ltd. | | | 260,800 | | | | 1,346,692 | |

Fuji Heavy Industries Ltd. | | | 247,700 | | | | 10,092,390 | |

FUJIFILM Holdings Corp. | | | 167,800 | | | | 6,353,877 | |

Fujitsu Ltd. | | | 744,000 | | | | 4,119,935 | |

Fukuoka Financial Group, Inc. | | | 331,000 | | | | 1,467,978 | |

Hachijuni Bank Ltd. | | | 186,400 | | | | 1,078,577 | |

Hakuhodo DY Holdings, Inc. | | | 101,700 | | | | 1,252,250 | |

Hamamatsu Photonics KK | | | 49,800 | | | | 1,308,011 | |

Hankyu Hanshin Holdings, Inc. | | | 90,800 | | | | 2,907,490 | |

Hikari Tsushin, Inc. | | | 9,100 | | | | 847,101 | |

Hino Motors Ltd. | | | 114,900 | | | | 1,167,390 | |

Hirose Electric Co., Ltd. | | | 13,800 | | | | 1,706,586 | |

Hiroshima Bank Ltd. | | | 218,000 | | | | 1,015,840 | |

Hisamitsu Pharmaceutical Co., Inc. | | | 21,600 | | | | 1,078,854 | |

Hitachi Chemical Co., Ltd. | | | 35,600 | | | | 888,087 | |

Hitachi Construction Machinery Co., Ltd. | | | 39,000 | | | | 843,137 | |

Hitachi High-Technologies Corp. | | | 23,400 | | | | 941,158 | |

Hitachi Ltd. | | | 1,926,000 | | | | 10,385,262 | |

Hitachi Metals Ltd. | | | 89,400 | | | | 1,203,629 | |

Hokuriku Electric Power Co. | | | 77,700 | | | | 869,077 | |

Honda Motor Co., Ltd. | | | 633,600 | | | | 18,498,137 | |

Hoshizaki Corp. | | | 20,000 | | | | 1,583,383 | |

Hoya Corp. | | | 156,400 | | | | 6,557,760 | |

Hulic Co., Ltd. | | | 121,900 | | | | 1,081,545 | |

Idemitsu Kosan Co., Ltd. | | | 41,500 | | | | 1,100,801 | |

IHI Corp. (b) | | | 624,000 | | | | 1,616,096 | |

Iida Group Holdings Co., Ltd. | | | 65,000 | | | | 1,232,220 | |

Inpex Corp. | | | 353,800 | | | | 3,536,516 | |

Isetan Mitsukoshi Holdings Ltd. | | | 141,805 | | | | 1,526,905 | |

Isuzu Motors Ltd. | | | 226,000 | | | | 2,857,660 | |

ITOCHU Corp. | | | 599,700 | | | | 7,940,480 | |

J. Front Retailing Co., Ltd. | | | 95,500 | | | | 1,285,782 | |

Japan Airlines Co., Ltd. | | | 47,480 | | | | 1,385,503 | |

Japan Airport Terminal Co., Ltd. (d) | | | 15,200 | | | | 549,237 | |

Japan Exchange Group, Inc. | | | 192,900 | | | | 2,751,194 | |

Japan Post Bank Co., Ltd. | | | 173,200 | | | | 2,075,550 | |

Japan Post Holdings Co., Ltd. | | | 171,800 | | | | 2,139,164 | |

Japan Prime Realty Investment Corp. | | | 351 | | | | 1,384,804 | |

Japan Real Estate Investment Corp. | | | 497 | | | | 2,714,265 | |

Japan Retail Fund Investment Corp. | | | 1,057 | | | | 2,142,766 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Japan (continued) | | | | | | | | |

Japan Tobacco, Inc. | | | 436,700 | | | $ | 14,334,080 | |

JFE Holdings, Inc. | | | 208,700 | | | | 3,156,050 | |

JGC Corp. | | | 91,700 | | | | 1,661,264 | |

JSR Corp. | | | 66,200 | | | | 1,042,011 | |

JTEKT Corp. | | | 77,400 | | | | 1,234,204 | |

JX Holdings, Inc. | | | 786,760 | | | | 3,324,389 | |

Kajima Corp. | | | 376,800 | | | | 2,602,600 | |

Kakaku.com, Inc. | | | 58,700 | | | | 969,906 | |

Kamigumi Co., Ltd. | | | 74,000 | | | | 704,800 | |

Kaneka Corp. | | | 87,000 | | | | 707,651 | |

Kansai Electric Power Co., Inc. (b) | | | 278,500 | | | | 3,036,109 | |

Kansai Paint Co., Ltd. | | | 77,700 | | | | 1,429,186 | |

Kao Corp. | | | 198,600 | | | | 9,400,703 | |

Kawasaki Heavy Industries Ltd. | | | 622,000 | | | | 1,946,963 | |

KDDI Corp. | | | 728,900 | | | | 18,406,892 | |

Keihan Holdings Co., Ltd. | | | 199,000 | | | | 1,305,323 | |

Keikyu Corp. | | | 208,000 | | | | 2,409,300 | |

Keio Corp. | | | 250,000 | | | | 2,053,547 | |

Keisei Electric Railway Co., Ltd. | | | 59,000 | | | | 1,428,618 | |

Keyence Corp. | | | 17,792 | | | | 12,174,169 | |

Kikkoman Corp. | | | 65,000 | | | | 2,073,906 | |

Kintetsu Group Holdings Co., Ltd. | | | 675,000 | | | | 2,572,212 | |

Kirin Holdings Co., Ltd. | | | 328,100 | | | | 5,325,463 | |

Kobe Steel Ltd. (b) | | | 132,100 | | | | 1,256,031 | |

Koito Manufacturing Co., Ltd. | | | 45,900 | | | | 2,423,978 | |

Komatsu Ltd. | | | 357,400 | | | | 8,095,160 | |

Konami Holdings Corp. | | | 32,300 | | | | 1,303,572 | |

Konica Minolta, Inc. | | | 158,400 | | | | 1,569,854 | |

Kose Corp. | | | 9,500 | | | | 787,627 | |

Kubota Corp. | | | 405,400 | | | | 5,777,278 | |

Kuraray Co., Ltd. | | | 152,200 | | | | 2,282,324 | |

Kurita Water Industries Ltd. | | | 48,700 | | | | 1,071,433 | |

Kyocera Corp. | | | 124,100 | | | | 6,152,940 | |

Kyowa Hakko Kirin Co., Ltd. | | | 95,000 | | | | 1,310,371 | |

Kyushu Electric Power Co. Inc. | | | 198,600 | | | | 2,151,526 | |

Kyushu Financial Group, Inc. | | | 168,300 | | | | 1,140,317 | |

Lawson, Inc. | | | 27,900 | | | | 1,958,350 | |

LINE Corp. (b) | | | 16,800 | | | | 573,530 | |

Lion Corp. | | | 93,000 | | | | 1,524,397 | |

LIXIL Group Corp. | | | 101,300 | | | | 2,295,991 | |

M3, Inc. | | | 72,900 | | | | 1,832,780 | |

Mabuchi Motor Co., Ltd. | | | 20,100 | | | | 1,044,478 | |

Makita Corp. | | | 41,300 | | | | 2,759,619 | |

Marubeni Corp. | | | 621,700 | | | | 3,516,381 | |

Marui Group Co., Ltd. | | | 85,100 | | | | 1,239,875 | |

Maruichi Steel Tube Ltd. | | | 16,500 | | | | 536,187 | |

Mazda Motor Corp. | | | 213,580 | | | | 3,477,931 | |

McDonald’s Holdings Co. Japan Ltd. | | | 20,700 | | | | 541,489 | |

Medipal Holdings Corp. | | | 60,200 | | | | 948,277 | |

Meiji Holdings Co., Ltd. | | | 42,700 | | | | 3,340,346 | |

Minebea Co., Ltd. | | | 118,300 | | | | 1,103,883 | |

Miraca Holdings, Inc. | | | 18,800 | | | | 840,848 | |

MISUMI Group, Inc. | | | 106,300 | | | | 1,746,159 | |

Mitsubishi Chemical Holdings Corp. | | | 500,900 | | | | 3,238,648 | |

Mitsubishi Corp. | | | 584,600 | | | | 12,416,109 | |

Mitsubishi Electric Corp. | | | 758,000 | | | | 10,543,144 | |

Mitsubishi Estate Co., Ltd. | | | 482,000 | | | | 9,574,772 | |

Mitsubishi Gas Chemical Co., Inc. | | | 59,000 | | | | 1,005,326 | |

Mitsubishi Heavy Industries Ltd. | | | 1,258,200 | | | | 5,719,829 | |

Mitsubishi Logistics Corp. | | | 31,000 | | | | 437,048 | |

Mitsubishi Materials Corp. | | | 37,900 | | | | 1,159,255 | |

Mitsubishi Motors Corp. | | | 238,700 | | | | 1,356,917 | |

Mitsubishi Tanabe Pharma Corp. | | | 103,700 | | | | 2,030,435 | |

Mitsubishi UFJ Financial Group, Inc. | | | 5,008,574 | | | | 30,889,486 | |

Mitsubishi UFJ Lease & Finance Co., Ltd. | | | 157,100 | | | | 810,280 | |

Mitsui & Co., Ltd. | | | 684,900 | | | | 9,384,712 | |

Mitsui Chemicals, Inc. | | | 390,000 | | | | 1,747,410 | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| 12 | | BLACKROCK INDEX FUNDS, INC. | | DECEMBER 31, 2016 | | |

| | |

Schedule of Investments (continued) | | BlackRock International Index Fund |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Japan (continued) | | | | | | | | |

Mitsui Fudosan Co., Ltd. | | | 359,000 | | | $ | 8,311,028 | |

Mitsui OSK Lines Ltd. | | | 534,000 | | | | 1,473,876 | |

Mixi, Inc. | | | 14,600 | | | | 531,995 | |

Mizuho Financial Group, Inc. | | | 9,583,664 | | | | 17,198,216 | |

MS&AD Insurance Group Holdings, Inc. | | | 196,370 | | | | 6,081,098 | |

Murata Manufacturing Co., Ltd. | | | 76,200 | | | | 10,175,498 | |

Nabtesco Corp. | | | 50,600 | | | | 1,172,958 | |

Nagoya Railroad Co., Ltd. | | | 393,000 | | | | 1,897,479 | |

NEC Corp. | | | 998,000 | | | | 2,639,634 | |

Nexon Co., Ltd. | | | 61,100 | | | | 882,967 | |

NGK Insulators Ltd. | | | 109,400 | | | | 2,117,640 | |

NGK Spark Plug Co., Ltd. | | | 70,700 | | | | 1,567,048 | |

NH Foods Ltd. | | | 64,000 | | | | 1,726,499 | |

Nidec Corp. | | | 92,000 | | | | 7,920,340 | |

Nikon Corp. | | | 143,700 | | | | 2,231,723 | |

Nintendo Co., Ltd. | | | 44,400 | | | | 9,229,667 | |

Nippon Building Fund, Inc. | | | 516 | | | | 2,860,532 | |

Nippon Electric Glass Co., Ltd. | | | 205,500 | | | | 1,108,766 | |

Nippon Express Co., Ltd. | | | 331,000 | | | | 1,777,228 | |

Nippon Paint Holdings Co., Ltd. | | | 69,000 | | | | 1,872,986 | |

Nippon Prologis REIT, Inc. | | | 531 | | | | 1,085,826 | |

Nippon Steel & Sumitomo Metal Corp. | | | 311,000 | | | | 6,888,292 | |

Nippon Telegraph & Telephone Corp. | | | 269,300 | | | | 11,336,220 | |

Nippon Yusen KK | | | 646,000 | | | | 1,196,319 | |

Nissan Chemical Industries Ltd. | | | 47,700 | | | | 1,590,020 | |

Nissan Motor Co., Ltd. | | | 940,300 | | | | 9,432,282 | |

Nisshin Seifun Group, Inc. | | | 69,840 | | | | 1,046,475 | |

Nissin Foods Holdings Co., Ltd. | | | 19,900 | | | | 1,043,829 | |

Nitori Holdings Co., Ltd. | | | 30,200 | | | | 3,443,250 | |

Nitto Denko Corp. | | | 66,310 | | | | 5,076,765 | |

NOK Corp. | | | 30,900 | | | | 624,971 | |

Nomura Holdings, Inc. | | | 1,463,400 | | | | 8,651,859 | |

Nomura Real Estate Holdings, Inc. | | | 57,800 | | | | 980,863 | |

Nomura Real Estate Master Fund, Inc. | | | 1,513 | | | | 2,289,969 | |

Nomura Research Institute Ltd. | | | 45,870 | | | | 1,394,063 | |

NSK Ltd. | | | 196,600 | | | | 2,270,626 | |

NTT Data Corp. | | | 52,400 | | | | 2,531,528 | |

NTT Docomo, Inc. | | | 536,200 | | | | 12,196,012 | |

Obayashi Corp. | | | 247,300 | | | | 2,361,059 | |

Obic Co., Ltd. | | | 27,700 | | | | 1,208,162 | |

Odakyu Electric Railway Co., Ltd. | | | 120,500 | | | | 2,381,075 | |

Oji Holdings Corp. | | | 278,000 | | | | 1,130,515 | |

Olympus Corp. | | | 116,100 | | | | 4,000,196 | |

Omron Corp. | | | 73,600 | | | | 2,812,621 | |

Ono Pharmaceutical Co., Ltd. | | | 166,600 | | | | 3,630,983 | |

Oracle Corp. Japan | | | 12,100 | | | | 608,680 | |

Oriental Land Co., Ltd. | | | 86,800 | | | | 4,899,136 | |

ORIX Corp. | | | 522,000 | | | | 8,124,538 | |

Osaka Gas Co., Ltd. | | | 739,000 | | | | 2,835,586 | |

Otsuka Corp. | | | 23,400 | | | | 1,091,476 | |

Otsuka Holdings Co., Ltd. | | | 153,600 | | | | 6,690,876 | |

Panasonic Corp. | | | 848,200 | | | | 8,602,574 | |

Park24 Co., Ltd. | | | 33,300 | | | | 901,742 | |

Pola Orbis Holdings, Inc. | | | 7,000 | | | | 577,102 | |

Rakuten, Inc. | | | 370,300 | | | | 3,628,142 | |

Recruit Holdings Co., Ltd. | | | 145,300 | | | | 5,823,097 | |

Resona Holdings, Inc. | | | 902,756 | | | | 4,626,639 | |

Ricoh Co., Ltd. | | | 284,600 | | | | 2,404,238 | |

Rinnai Corp. | | | 11,700 | | | | 941,424 | |

Rohm Co., Ltd. | | | 32,300 | | | | 1,853,146 | |

Ryohin Keikaku Co., Ltd. | | | 10,100 | | | | 1,976,906 | |

Sankyo Co., Ltd. | | | 13,200 | | | | 425,590 | |

Santen Pharmaceutical Co., Ltd. | | | 142,600 | | | | 1,739,908 | |

SBI Holdings, Inc. | | | 71,440 | | | | 907,712 | |

Secom Co., Ltd. | | | 82,100 | | | | 5,998,563 | |

Sega Sammy Holdings, Inc. | | | 77,132 | | | | 1,146,183 | |

Seibu Holdings, Inc. | | | 60,100 | | | | 1,076,023 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Japan (continued) | | | | | | | | |

Seiko Epson Corp. | | | 116,800 | | | $ | 2,465,947 | |

Sekisui Chemical Co., Ltd. | | | 156,100 | | | | 2,484,883 | |

Sekisui House Ltd. | | | 240,400 | | | | 3,994,077 | |

Seven & i Holdings Co., Ltd. | | | 292,000 | | | | 11,104,518 | |

Seven Bank Ltd. | | | 223,800 | | | | 639,928 | |

Sharp Corp. (b) | | | 692,000 | | | | 1,601,123 | |

Shimadzu Corp. | | | 95,000 | | | | 1,509,263 | |

Shimamura Co., Ltd. | | | 10,000 | | | | 1,246,828 | |

Shimano, Inc. | | | 30,700 | | | | 4,808,626 | |

Shimizu Corp. | | | 198,000 | | | | 1,807,337 | |

Shin-Etsu Chemical Co., Ltd. | | | 152,100 | | | | 11,770,856 | |

Shinsei Bank Ltd. | | | 712,000 | | | | 1,191,420 | |

Shionogi & Co., Ltd. | | | 115,900 | | | | 5,539,199 | |

Shiseido Co., Ltd. | | | 152,700 | | | | 3,859,337 | |

Shizuoka Bank Ltd. | | | 230,000 | | | | 1,930,283 | |

Showa Shell Sekiyu KK | | | 52,700 | | | | 489,606 | |

SMC Corp. | | | 22,500 | | | | 5,353,299 | |

Softbank Group Corp. | | | 379,100 | | | | 25,086,568 | |

Sohgo Security Services Co., Ltd. | | | 26,100 | | | | 1,001,815 | |

Sompo Japan Nipponkoa Holdings, Inc. | | | 144,675 | | | | 4,885,861 | |

Sony Corp. | | | 502,900 | | | | 14,051,992 | |

Sony Financial Holdings, Inc. | | | 80,400 | | | | 1,253,309 | |

Stanley Electric Co., Ltd. | | | 51,400 | | | | 1,400,273 | |

Start Today Co., Ltd. | | | 63,000 | | | | 1,085,256 | |

Sumitomo Chemical Co., Ltd. | | | 595,000 | | | | 2,820,494 | |

Sumitomo Corp. | | | 469,000 | | | | 5,505,783 | |

Sumitomo Dainippon Pharma Co., Ltd. | | | 55,600 | | | | 954,336 | |

Sumitomo Electric Industries Ltd. | | | 313,600 | | | | 4,515,624 | |

Sumitomo Heavy Industries Ltd. | | | 195,000 | | | | 1,252,126 | |

Sumitomo Metal Mining Co., Ltd. | | | 187,000 | | | | 2,385,687 | |

Sumitomo Mitsui Financial Group, Inc. | | | 522,650 | | | | 19,904,060 | |

Sumitomo Mitsui Trust Holdings, Inc. | | | 131,382 | | | | 4,700,678 | |

Sumitomo Realty & Development Co., Ltd. | | | 136,000 | | | | 3,610,438 | |

Sumitomo Rubber Industries Ltd. | | | 79,300 | | | | 1,254,712 | |

Sundrug Co., Ltd. | | | 14,800 | | | | 1,023,290 | |

Suntory Beverage & Food Ltd. | | | 53,100 | | | | 2,199,487 | |

Suruga Bank Ltd. | | | 59,200 | | | | 1,321,787 | |

Suzuken Co., Ltd. | | | 24,000 | | | | 783,901 | |

Suzuki Motor Corp. | | | 138,900 | | | | 4,876,622 | |

Sysmex Corp. | | | 66,200 | | | | 3,825,000 | |

T&D Holdings, Inc. | | | 216,200 | | | | 2,853,278 | |

Taiheiyo Cement Corp. | | | 439,000 | | | | 1,384,011 | |

Taisei Corp. | | | 406,000 | | | | 2,835,084 | |

Taisho Pharmaceutical Holdings Co., Ltd. | | | 12,300 | | | | 1,019,657 | |

Taiyo Nippon Sanso Corp. | | | 37,200 | | | | 429,737 | |

Takashimaya Co., Ltd. | | | 124,000 | | | | 1,020,735 | |

Takeda Pharmaceutical Co., Ltd. | | | 275,600 | | | | 11,433,546 | |

TDK Corp. | | | 45,600 | | | | 3,126,711 | |

Teijin Ltd. | | | 77,000 | | | | 1,555,838 | |

Terumo Corp. | | | 137,400 | | | | 5,065,291 | |

THK Co., Ltd. | | | 50,300 | | | | 1,110,802 | |

Tobu Railway Co., Ltd. | | | 344,000 | | | | 1,705,339 | |

Toho Co., Ltd. | | | 38,700 | | | | 1,091,686 | |

Toho Gas Co., Ltd. | | | 165,000 | | | | 1,340,102 | |

Tohoku Electric Power Co., Inc. | | | 175,900 | | | | 2,217,385 | |

Tokio Marine Holdings, Inc. | | | 266,800 | | | | 10,923,605 | |

Tokyo Electric Power Co. Holdings, Inc. (b) | | | 623,800 | | | | 2,510,612 | |

Tokyo Electron Ltd. | | | 61,800 | | | | 5,812,249 | |

Tokyo Gas Co., Ltd. | | | 769,000 | | | | 3,471,372 | |

Tokyo Tatemono Co., Ltd. | | | 98,100 | | | | 1,309,679 | |

Tokyu Corp. | | | 399,000 | | | | 2,927,927 | |

Tokyu Fudosan Holdings Corp. | | | 209,500 | | | | 1,233,863 | |

TonenGeneral Sekiyu KK | | | 102,000 | | | | 1,074,083 | |

Toppan Printing Co., Ltd. | | | 203,000 | | | | 1,935,646 | |

Toray Industries, Inc. | | | 578,700 | | | | 4,673,306 | |

Toshiba Corp. (b) | | | 1,581,000 | | | | 3,818,971 | |

Toto Ltd. | | | 59,100 | | | | 2,334,364 | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| | BLACKROCK INDEX FUNDS, INC. | | DECEMBER 31, 2016 | | 13 |

| | |

Schedule of Investments (continued) | | BlackRock International Index Fund |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Japan (continued) | | | | | | | | |

Toyo Seikan Kaisha Ltd. | | | 65,200 | | | $ | 1,212,441 | |

Toyo Suisan Kaisha Ltd. | | | 34,500 | | | | 1,248,186 | |

Toyoda Gosei Co., Ltd. | | | 28,900 | | | | 674,502 | |

Toyota Industries Corp. | | | 61,400 | | | | 2,919,277 | |

Toyota Motor Corp. | | | 1,046,288 | | | | 61,342,187 | |

Toyota Tsusho Corp. | | | 81,900 | | | | 2,128,761 | |

Trend Micro, Inc. | | | 41,400 | | | | 1,469,441 | |

Tsuruha Holdings, Inc. | | | 12,800 | | | | 1,211,425 | |

Unicharm Corp. | | | 151,300 | | | | 3,304,430 | |

United Urban Investment Corp. | | | 1,325 | | | | 2,021,237 | |

USS Co., Ltd. | | | 89,600 | | | | 1,423,364 | |

West Japan Railway Co. | | | 66,000 | | | | 4,042,890 | |

Yahoo! Japan Corp. | | | 548,400 | | | | 2,100,350 | |

Yakult Honsha Co., Ltd. | | | 41,200 | | | | 1,906,175 | |

Yamada Denki Co., Ltd. | | | 214,300 | | | | 1,153,887 | |

Yamaguchi Financial Group, Inc. | | | 99,000 | | | | 1,077,824 | |

Yamaha Corp. | | | 68,600 | | | | 2,091,789 | |

Yamaha Motor Co., Ltd. | | | 115,200 | | | | 2,526,226 | |

Yamato Holdings Co., Ltd. | | | 128,200 | | | | 2,598,742 | |

Yamazaki Baking Co., Ltd. | | | 51,100 | | | | 985,179 | |

Yaskawa Electric Corp. | | | 107,700 | | | | 1,669,883 | |

Yokogawa Electric Corp. | | | 80,800 | | | | 1,166,538 | |

Yokohama Rubber Co., Ltd. | | | 39,900 | | | | 713,222 | |

| | | | | | | | |

| | | | | | | | 1,148,914,278 | |

Luxembourg — 0.1% | | | | | | | | |

Eurofins Scientific SE | | | 4,242 | | | | 1,807,278 | |

RTL Group SA (b) | | | 14,198 | | | | 1,040,190 | |

| | | | | | | | |

| | | | | | | | 2,847,468 | |

Mexico — 0.0% | | | | | | | | |

Fresnillo PLC | | | 95,911 | | | | 1,424,698 | |

Netherlands — 5.0% | | | | | | | | |

ABN AMRO Group NV (c) | | | 106,910 | | | | 2,367,176 | |

Aegon NV | | | 682,760 | | | | 3,750,842 | |

AerCap Holdings NV (b) | | | 64,421 | | | | 2,680,558 | |

Akzo Nobel NV | | | 95,474 | | | | 5,965,862 | |

Altice NV Class A (b) | | | 129,723 | | | | 2,567,201 | |

Altice NV Class B (b) | | | 50,125 | | | | 997,382 | |

ASML Holding NV | | | 146,538 | | | | 16,422,570 | |

CNH Industrial NV | | | 393,676 | | | | 3,415,925 | |

EXOR NV | | | 40,614 | | | | 1,746,683 | |

Gemalto NV | | | 34,153 | | | | 1,972,529 | |

Heineken Holding NV | | | 39,946 | | | | 2,777,867 | |

Heineken NV | | | 89,178 | | | | 6,682,813 | |

ING Groep NV | | | 1,533,531 | | | | 21,590,198 | |

Koninklijke Ahold Delhaize NV | | | 501,778 | | | | 10,568,949 | |

Koninklijke Boskalis Westminster NV | | | 38,152 | | | | 1,323,572 | |

Koninklijke DSM NV | | | 75,752 | | | | 4,539,609 | |

Koninklijke KPN NV | | | 1,365,391 | | | | 4,037,628 | |

Koninklijke Philips NV | | | 367,067 | | | | 11,221,943 | |

Koninklijke Vopak NV | | | 23,924 | | | | 1,128,736 | |

NN Group NV | | | 117,296 | | | | 3,970,766 | |

NXP Semiconductor NV (b) | | | 114,835 | | | | 11,254,978 | |

QIAGEN NV (b) | | | 89,561 | | | | 2,509,799 | |

Randstad Holding NV | | | 48,608 | | | | 2,632,977 | |

Royal Dutch Shell PLC, Class A | | | 1,694,936 | | | | 46,786,185 | |

Royal Dutch Shell PLC, Class B | | | 1,467,524 | | | | 42,164,749 | |

Unilever NV CVA | | | 642,876 | | | | 26,408,583 | |

Wolters Kluwer NV | | | 120,701 | | | | 4,365,652 | |

| | | | | | | | |

| | | | | | | | 245,851,732 | |

New Zealand — 0.2% | | | | | | | | |

Auckland International Airport Ltd. | | | 398,759 | | | | 1,729,617 | |

Contact Energy Ltd. | | | 333,423 | | | | 1,078,190 | |

Fletcher Building Ltd. | | | 270,933 | | | | 1,990,749 | |

Mercury NZ Ltd. | | | 263,786 | | | | 541,911 | |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

New Zealand (continued) | | | | | | | | |

Meridian Energy Ltd. | | | 382,399 | | | $ | 689,824 | |

Ryman Healthcare Ltd. | | | 173,120 | | | | 974,777 | |

Spark New Zealand Ltd. | | | 619,457 | | | | 1,465,771 | |

| | | | | | | | |

| | | | | | | | 8,470,839 | |

Norway — 0.6% | | | | | | | | |

DNB ASA | | | 378,184 | | | | 5,614,253 | |

Gjensidige Forsikring ASA | | | 67,716 | | | | 1,073,543 | |

Marine Harvest ASA (b) | | | 152,278 | | | | 2,753,260 | |

Norsk Hydro ASA | | | 546,945 | | | | 2,610,420 | |

Orkla ASA | | | 305,174 | | | | 2,761,436 | |

Schibsted ASA, Class A | | | 36,434 | | | | 833,873 | |

Schibsted ASA, Class B | | | 44,513 | | | | 942,079 | |

Statoil ASA | | | 443,520 | | | | 8,094,982 | |

Telenor ASA | | | 271,727 | | | | 4,055,989 | |

Yara International ASA | | | 71,073 | | | | 2,795,945 | |

| | | | | | | | |

| | | | | | | | 31,535,780 | |

Portugal — 0.1% | | | | | | | | |

EDP — Energias de Portugal SA | | | 838,206 | | | | 2,551,119 | |

Galp Energia SGPS SA | | | 157,892 | | | | 2,353,891 | |

Jeronimo Martins SGPS SA | | | 119,702 | | | | 1,856,535 | |

| | | | | | | | |

| | | | | | | | 6,761,545 | |

Singapore — 1.2% | | | | | | | | |

Ascendas Real Estate Investment Trust | | | 957,546 | | | | 1,497,068 | |

CapitaLand Commercial Trust Ltd. | | | 1,029,200 | | | | 1,048,518 | |

CapitaLand Ltd. | | | 1,088,149 | | | | 2,261,295 | |

CapitaLand Mall Trust | | | 943,700 | | | | 1,224,029 | |

City Developments Ltd. | | | 148,635 | | | | 848,227 | |

ComfortDelGro Corp. Ltd. | | | 786,516 | | | | 1,336,505 | |

DBS Group Holdings Ltd. | | | 667,407 | | | | 7,962,726 | |

Genting Singapore PLC | | | 2,125,227 | | | | 1,322,737 | |

Global Logistic Properties Ltd. | | | 1,194,800 | | | | 1,809,184 | |

Golden Agri-Resources Ltd. | | | 3,277,251 | | | | 970,314 | |

Hutchison Port Holdings Trust | | | 1,842,900 | | | | 799,669 | |

Jardine Cycle & Carriage Ltd. | | | 33,956 | | | | 964,349 | |

Keppel Corp. Ltd. | | | 564,477 | | | | 2,246,585 | |

Oversea-Chinese Banking Corp. Ltd. | | | 1,217,198 | | | | 7,475,592 | |

SATS, Ltd. | | | 261,000 | | | | 874,115 | |

SembCorp Industries Ltd. | | | 550,790 | | | | 1,080,150 | |

Singapore Airlines Ltd. | | | 248,309 | | | | 1,654,208 | |

Singapore Exchange Ltd. | | | 311,000 | | | | 1,533,605 | |

Singapore Press Holdings Ltd. | | | 298,085 | | | | 724,898 | |

Singapore Technologies Engineering Ltd. | | | 605,913 | | | | 1,345,787 | |

Singapore Telecommunications Ltd. | | | 3,060,832 | | | | 7,677,896 | |

StarHub Ltd. | | | 299,257 | | | | 579,316 | |

Suntec Real Estate Investment Trust | | | 1,055,100 | | | | 1,200,674 | |

United Overseas Bank Ltd. | | | 501,947 | | | | 7,051,798 | |

UOL Group Ltd. | | | 244,199 | | | | 1,006,728 | |

Wilmar International Ltd. | | | 706,470 | | | | 1,745,304 | |

Yangzijiang Shipbuilding Holdings Ltd. | | | 1,357,383 | | | | 761,097 | |

| | | | | | | | |

| | | | | | | | 59,002,374 | |

Spain — 3.0% | | | | | | | | |

Abertis Infraestructuras SA | | | 283,236 | | | | 3,957,232 | |

ACS Actividades de Construccion y Servicios SA | | | 77,417 | | | | 2,443,094 | |

Aena SA (c) | | | 28,449 | | | | 3,875,923 | |

Amadeus IT Group SA | | | 174,738 | | | | 7,925,089 | |

Banco Bilbao Vizcaya Argentaria SA | | | 2,583,356 | | | | 17,409,042 | |

Banco de Sabadell SA | | | 2,070,906 | | | | 2,877,678 | |

Banco Popular Espanol SA | | | 1,297,836 | | | | 1,250,460 | |

Banco Santander SA | | | 5,746,410 | | | | 29,894,382 | |

Bankia SA | | | 1,975,057 | | | | 2,012,671 | |

Bankinter SA | | | 311,208 | | | | 2,406,715 | |

CaixaBank SA | | | 1,285,867 | | | | 4,237,929 | |

Distribuidora Internacional de Alimentacion SA | | | 267,745 | | | | 1,313,176 | |

Enagas SA | | | 21,783 | | | | 552,052 | |

See Notes to Financial Statements.

| | | | | | |

| | | | | | | |

| 14 | | BLACKROCK INDEX FUNDS, INC. | | DECEMBER 31, 2016 | | |

| | |

Schedule of Investments (continued) | | BlackRock International Index Fund |

| | | | | | | | |

| Common Stocks | | Shares | | | Value | |

Spain (continued) | | | | | | | | |

Endesa SA | | | 122,923 | | | $ | 2,599,584 | |

Ferrovial SA | | | 216,906 | | | | 3,868,355 | |

Gas Natural SDG SA | | | 135,535 | | | | 2,549,858 | |

Grifols SA | | | 119,482 | | | | 2,371,883 | |

Iberdrola SA | | | 2,092,844 | | | | 13,703,699 | |

Industria de Diseno Textil SA | | | 431,555 | | | | 14,701,339 | |

International Consolidated Airlines Group SA | | | 340,384 | | | | 1,833,696 | |

Mapfre SA | | | 452,406 | | | | 1,378,073 | |

Red Electrica Corp. SA | | | 65,428 | | | | 1,232,674 | |

Repsol SA | | | 440,148 | | | | 6,185,460 | |

Telefonica SA | | | 1,827,534 | | | | 16,872,444 | |

Zardoya Otis SA | | | 79,739 | | | | 672,902 | |

| | | | | | | | |

| | | | | | | | 148,125,410 | |

Sweden — 2.7% | | | | | | | | |

Alfa Laval AB | | | 130,565 | | | | 2,153,716 | |

Assa Abloy AB, Class B | | | 389,921 | | | | 7,214,954 | |

Atlas Copco AB, A Shares | | | 269,411 | | | | 8,173,000 | |

Atlas Copco AB, B Shares | | | 157,096 | | | | 4,271,037 | |

Boliden AB | | | 111,775 | | | | 2,903,354 | |

Electrolux AB, Class B | | | 92,205 | | | | 2,283,091 | |

Getinge AB, Class B | | | 69,458 | | | | 1,112,925 | |

Hennes & Mauritz AB, Class B | | | 372,006 | | | | 10,312,418 | |

Hexagon AB, Class B | | | 106,020 | | | | 3,776,001 | |

Husqvarna AB, Class B | | | 152,365 | | | | 1,182,215 | |

ICA Gruppen AB | | | 33,272 | | | | 1,012,728 | |

Industrivarden AB, Class C | | | 72,727 | | | | 1,352,556 | |

Investor AB, Class B | | | 173,616 | | | | 6,468,955 | |

Kinnevik AB | | | 100,329 | | | | 2,396,375 | |

L E Lundbergforetagen AB, -B Shares | | | 14,706 | | | | 900,353 | |

Lundin Petroleum AB (b) | | | 67,425 | | | | 1,461,209 | |

Millicom International Cellular SA | | | 22,529 | | | | 960,060 | |

Nordea Bank AB | | | 1,177,336 | | | | 13,045,616 | |

Sandvik AB | | | 423,411 | | | | 5,223,225 | |

Securitas AB, Class B | | | 111,648 | | | | 1,751,293 | |

Skandinaviska Enskilda Banken AB, Class A | | | 591,455 | | | | 6,180,814 | |

Skanska AB, Class B | | | 131,261 | | | | 3,090,457 | |

SKF AB, Class B | | | 146,220 | | | | 2,681,114 | |

Svenska Cellulosa AB, B Shares | | | 248,535 | | | | 6,995,393 | |

Svenska Handelsbanken AB, Class A | | | 589,127 | | | | 8,159,673 | |

Swedbank AB, Class A | | | 350,567 | | | | 8,446,726 | |

Swedish Match AB | | | 71,413 | | | | 2,265,791 | |

Tele2 AB, Class B | | | 129,728 | | | | 1,037,303 | |

Telefonaktiebolaget LM Ericsson, Class B | | | 1,214,574 | | | | 7,118,582 | |

TeliaSonera AB | | | 1,037,695 | | | | 4,168,620 | |

Volvo AB, Class B | | | 601,949 | | | | 7,007,896 | |

| | | | | | | | |

| | | | | | | | 135,107,450 | |

Switzerland — 8.8% | | | | | | | | |

ABB Ltd., Registered Shares (b) | | | 753,197 | | | | 15,848,552 | |

Actelion Ltd., Registered Shares (b) | | | 39,547 | | | | 8,546,439 | |

Adecco SA, Registered Shares | | | 61,435 | | | | 4,010,277 | |

Aryzta AG (b) | | | 30,407 | | | | 1,337,187 | |

Baloise Holding AG, Registered Shares | | | 20,462 | | | | 2,574,832 | |