NYSE: FCF NYSE: FCF Acquisition of DCB Financial Corporation October 3, 2016

NYSE: FCF Forward‐looking Statements This presentation contains “forward‐ looking statements” within the meaning of the Private Securities Litigation Reform Act, relating to present or future trends or factors affecting the banking industry and, specifically, the financial operations, markets and products of First Commonwealth and DCB Financial. Forward‐looking statements are typically identified by words such as “believe”, “plan”, “expect”, “anticipate”, “intend”, “outlook”, “estimate”, “forecast”, “will”, “should”, “project”, “goal”, and other similar words and expressions. These forward‐looking statements involve certain risks and uncertainties. In addition to factors previously disclosed in First Commonwealth Financial Corporation and DCB Financial Corp. reports filed with the SEC and those identified elsewhere in this presentation or today’s press release, the following factors among others, could cause actual results to differ materially from forward‐ looking statements or historical performance: ability to obtain regulatory approvals in a timely manner and without significant expense or other burdens; ability to meet other closing conditions to the merger, including approval by DCB Financial Corp. shareholders; delay in closing the Merger; difficulties and delays in integrating the businesses of DCB Financial Corp. and First Commonwealth Financial Corporation or fully realizing cost savings and other benefits; business disruption following the Merger; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of First Commonwealth products and services; customer borrowing, repayment, investment and deposit practices; customer disintermediation; the introduction, withdrawal, success and timing of business initiatives; competitive conditions; the inability to realize anticipated cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions and divestitures; economic conditions; and the impact, extent and timing of technological changes, capital management activities, and the actions and policies of the federal and state bank regulatory authorities and legislative and regulatory actions and reforms. First Commonwealth Financial Corporation undertakes no obligation to revise these forward‐looking statements or to reflect events or circumstances after the date of this presentation.

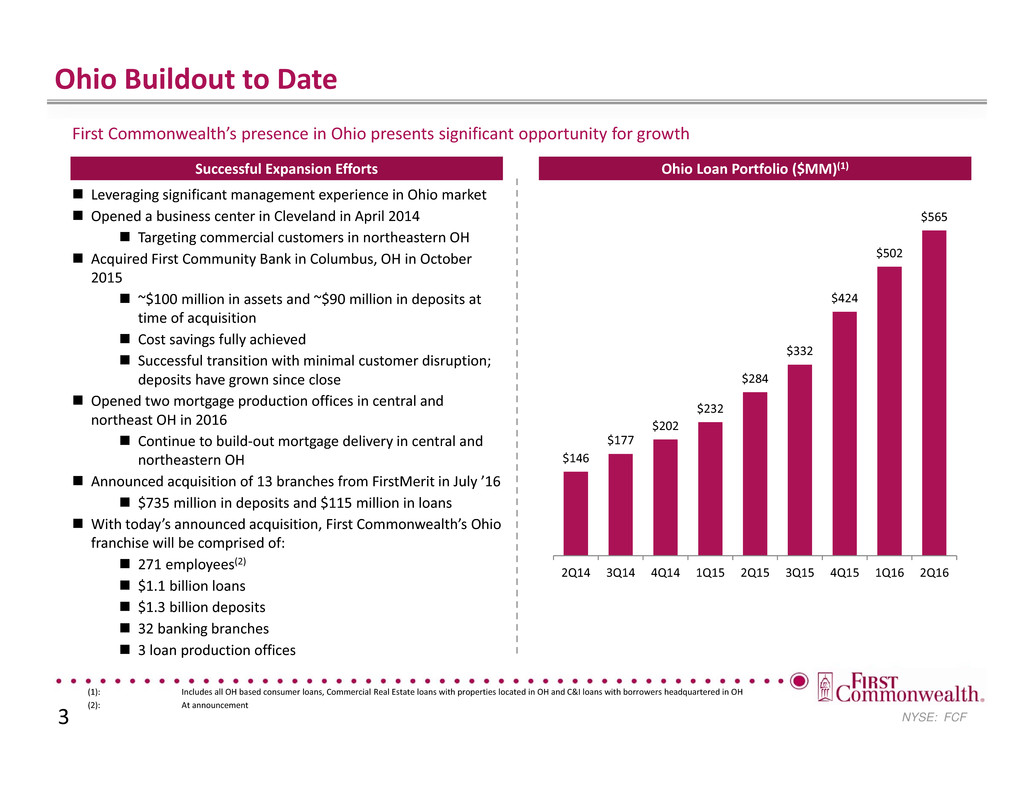

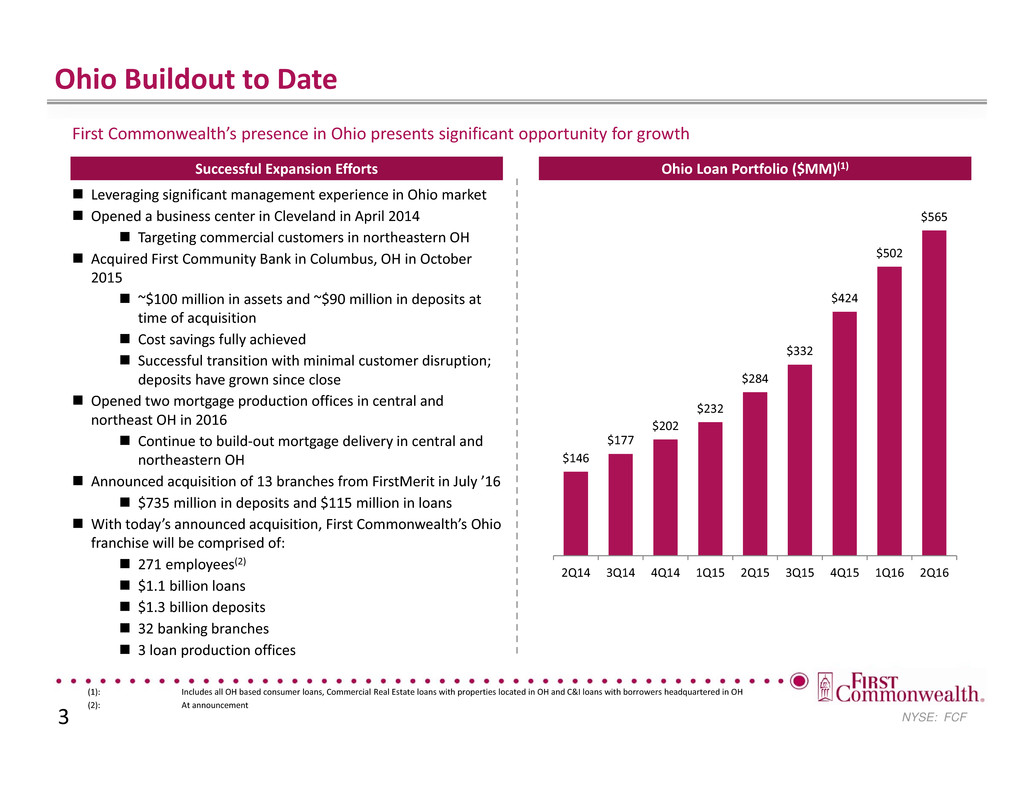

NYSE: FCF Ohio Buildout to Date 3 Successful Expansion Efforts Leveraging significant management experience in Ohio market Opened a business center in Cleveland in April 2014 Targeting commercial customers in northeastern OH Acquired First Community Bank in Columbus, OH in October 2015 ~$100 million in assets and ~$90 million in deposits at time of acquisition Cost savings fully achieved Successful transition with minimal customer disruption; deposits have grown since close Opened two mortgage production offices in central and northeast OH in 2016 Continue to build‐out mortgage delivery in central and northeastern OH Announced acquisition of 13 branches from FirstMerit in July ’16 $735 million in deposits and $115 million in loans With today’s announced acquisition, First Commonwealth’s Ohio franchise will be comprised of: 271 employees(2) $1.1 billion loans $1.3 billion deposits 32 banking branches 3 loan production offices Ohio Loan Portfolio ($MM)(1) First Commonwealth’s presence in Ohio presents significant opportunity for growth (1): Includes all OH based consumer loans, Commercial Real Estate loans with properties located in OH and C&I loans with borrowers headquartered in OH (2): At announcement $146 $177 $202 $232 $284 $332 $424 $502 $565 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

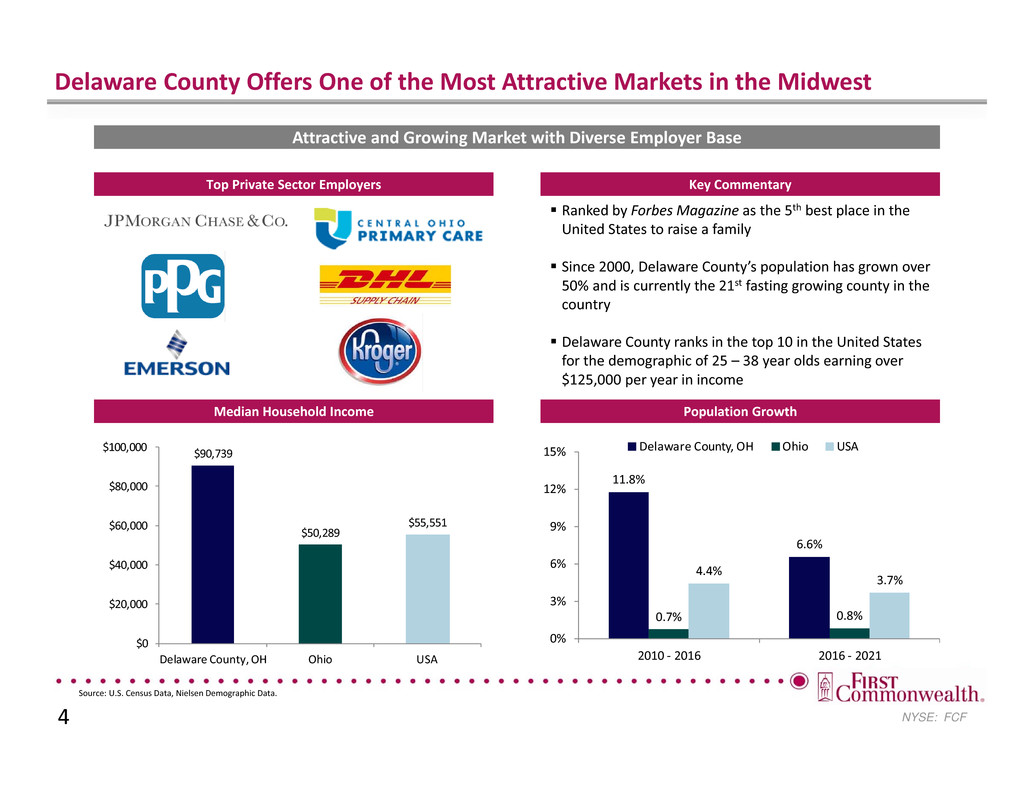

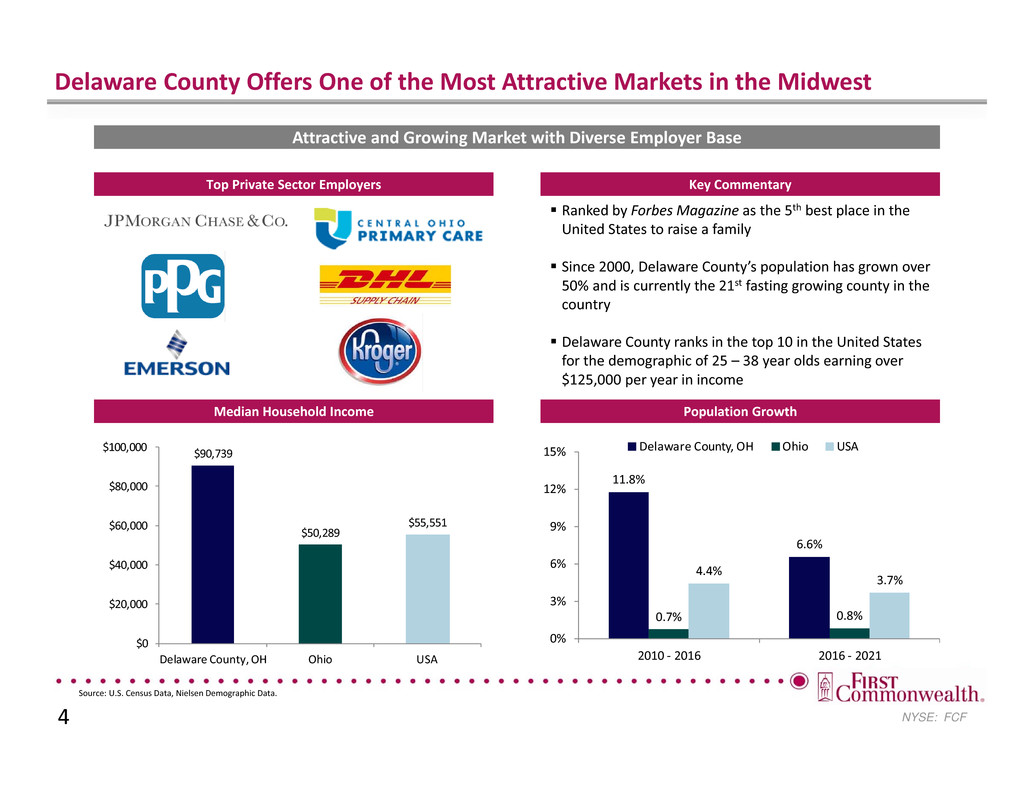

NYSE: FCF Delaware County Offers One of the Most Attractive Markets in the Midwest 4 Source: U.S. Census Data, Nielsen Demographic Data. Attractive and Growing Market with Diverse Employer Base Median Household Income Key CommentaryTop Private Sector Employers Population Growth Ranked by Forbes Magazine as the 5th best place in the United States to raise a family Since 2000, Delaware County’s population has grown over 50% and is currently the 21st fasting growing county in the country Delaware County ranks in the top 10 in the United States for the demographic of 25 – 38 year olds earning over $125,000 per year in income 11.8% 6.6% 0.7% 0.8% 4.4% 3.7% 0% 3% 6% 9% 12% 15% 2010 ‐ 2016 2016 ‐ 2021 Delaware County, OH Ohio USA $90,739 $50,289 $55,551 $0 $20,000 $40,000 $60,000 $80,000 $100,000 Delaware County, OH Ohio USA

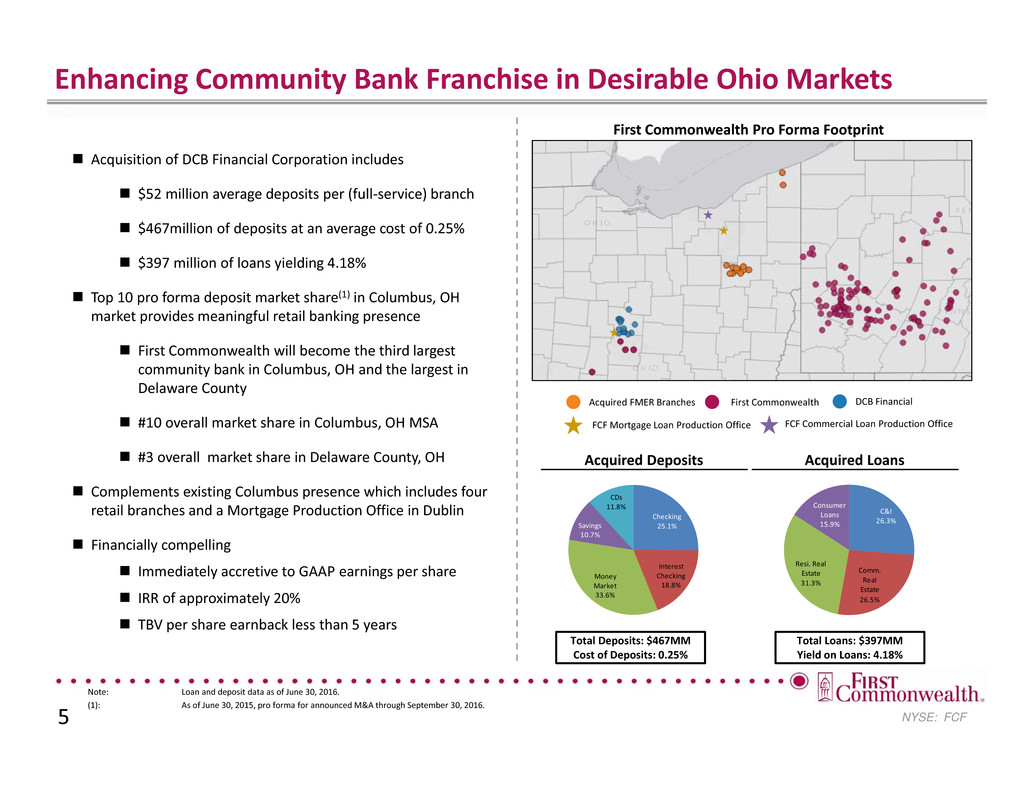

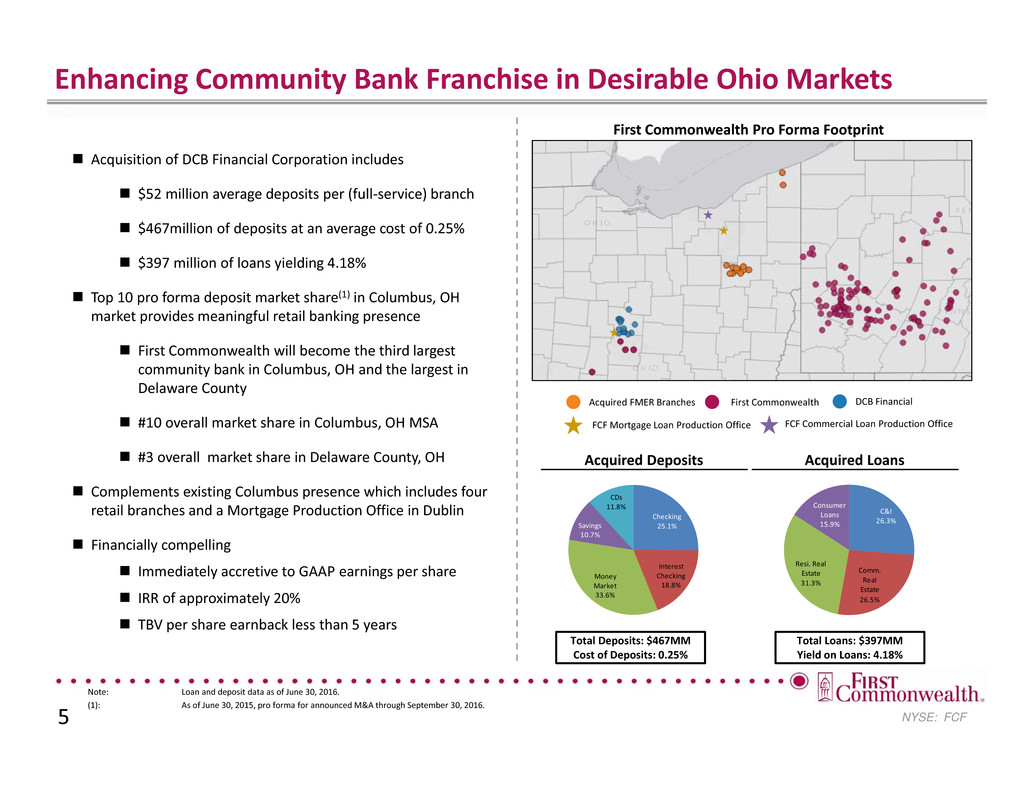

NYSE: FCF Checking 25.1% Interest Checking 18.8% Money Market 33.6% Savings 10.7% CDs 11.8% C&I 26.3% Comm. Real Estate 26.5% Resi. Real Estate 31.3% Consumer Loans 15.9% Enhancing Community Bank Franchise in Desirable Ohio Markets 5 Note: Loan and deposit data as of June 30, 2016. (1): As of June 30, 2015, pro forma for announced M&A through September 30, 2016. Acquisition of DCB Financial Corporation includes $52 million average deposits per (full‐service) branch $467million of deposits at an average cost of 0.25% $397 million of loans yielding 4.18% Top 10 pro forma deposit market share(1) in Columbus, OH market provides meaningful retail banking presence First Commonwealth will become the third largest community bank in Columbus, OH and the largest in Delaware County #10 overall market share in Columbus, OH MSA #3 overall market share in Delaware County, OH Complements existing Columbus presence which includes four retail branches and a Mortgage Production Office in Dublin Financially compelling Immediately accretive to GAAP earnings per share IRR of approximately 20% TBV per share earnback less than 5 years First Commonwealth Pro Forma Footprint Acquired Deposits Acquired Loans Total Deposits: $467MM Cost of Deposits: 0.25% Total Loans: $397MM Yield on Loans: 4.18% Acquired FMER Branches First Commonwealth DCB Financial FCF Commercial Loan Production OfficeFCF Mortgage Loan Production Office

NYSE: FCF Strategic Rationale 6 Expands First Commonwealth Bank’s footprint and provides a broader geography for mortgage and small business lending growth in central Ohio o Opportunity to leverage FCF’s Columbus leadership talent already in place o Builds scale in demographically attractive Columbus region and allows for wider deposit gathering o Attractive loan and deposit mix o Branch network creates cross sale opportunities for Wealth, Mortgage and Small Business lending Both banks’ Mortgage operations are very similar and both continue to build scale in the region DCBF’s SBA team will expand and diversify FCF’s revenue streams DCBF is the third largest independent community bank remaining in the Columbus MSA DCBF’s relatively high efficiency ratio creates significant cost saving opportunities

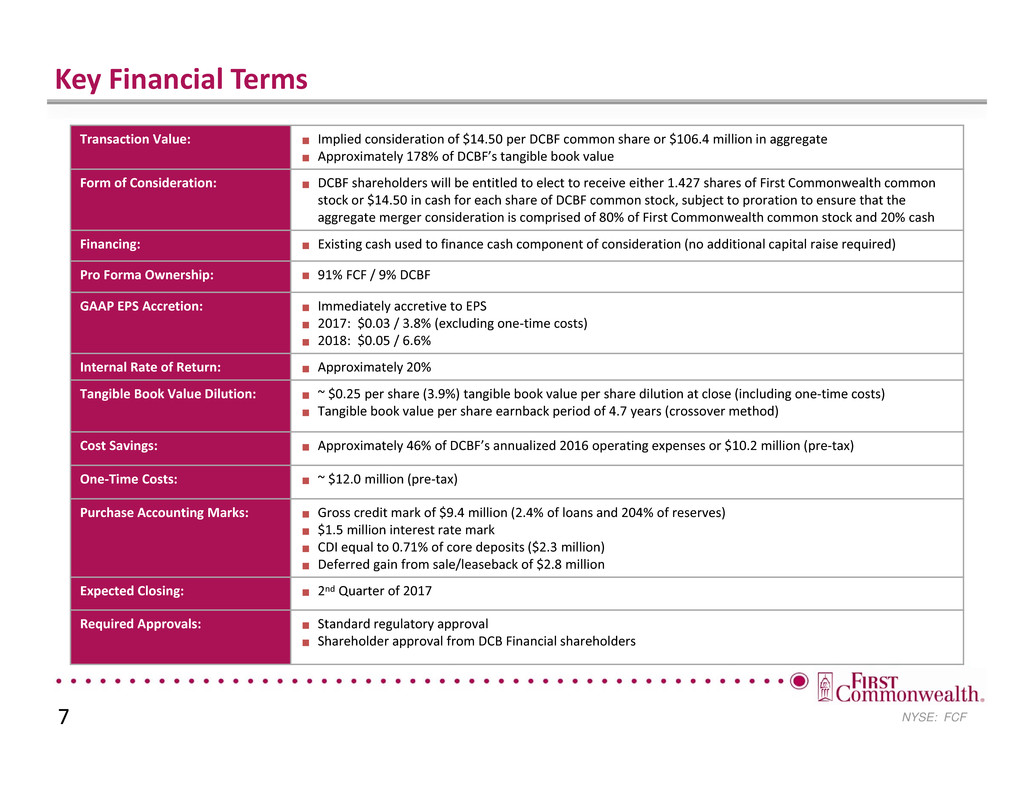

NYSE: FCF Key Financial Terms 7 Transaction Value: Implied consideration of $14.50 per DCBF common share or $106.4 million in aggregate Approximately 178% of DCBF’s tangible book value Form of Consideration: DCBF shareholders will be entitled to elect to receive either 1.427 shares of First Commonwealth common stock or $14.50 in cash for each share of DCBF common stock, subject to proration to ensure that the aggregate merger consideration is comprised of 80% of First Commonwealth common stock and 20% cash Financing: Existing cash used to finance cash component of consideration (no additional capital raise required) Pro Forma Ownership: 91% FCF / 9% DCBF GAAP EPS Accretion: Immediately accretive to EPS 2017: $0.03 / 3.8% (excluding one‐time costs) 2018: $0.05 / 6.6% Internal Rate of Return: Approximately 20% Tangible Book Value Dilution: ~ $0.25 per share (3.9%) tangible book value per share dilution at close (including one‐time costs) Tangible book value per share earnback period of 4.7 years (crossover method) Cost Savings: Approximately 46% of DCBF’s annualized 2016 operating expenses or $10.2 million (pre‐tax) One‐Time Costs: ~ $12.0 million (pre‐tax) Purchase Accounting Marks: Gross credit mark of $9.4 million (2.4% of loans and 204% of reserves) $1.5 million interest rate mark CDI equal to 0.71% of core deposits ($2.3 million) Deferred gain from sale/leaseback of $2.8 million Expected Closing: 2nd Quarter of 2017 Required Approvals: Standard regulatory approval Shareholder approval from DCB Financial shareholders

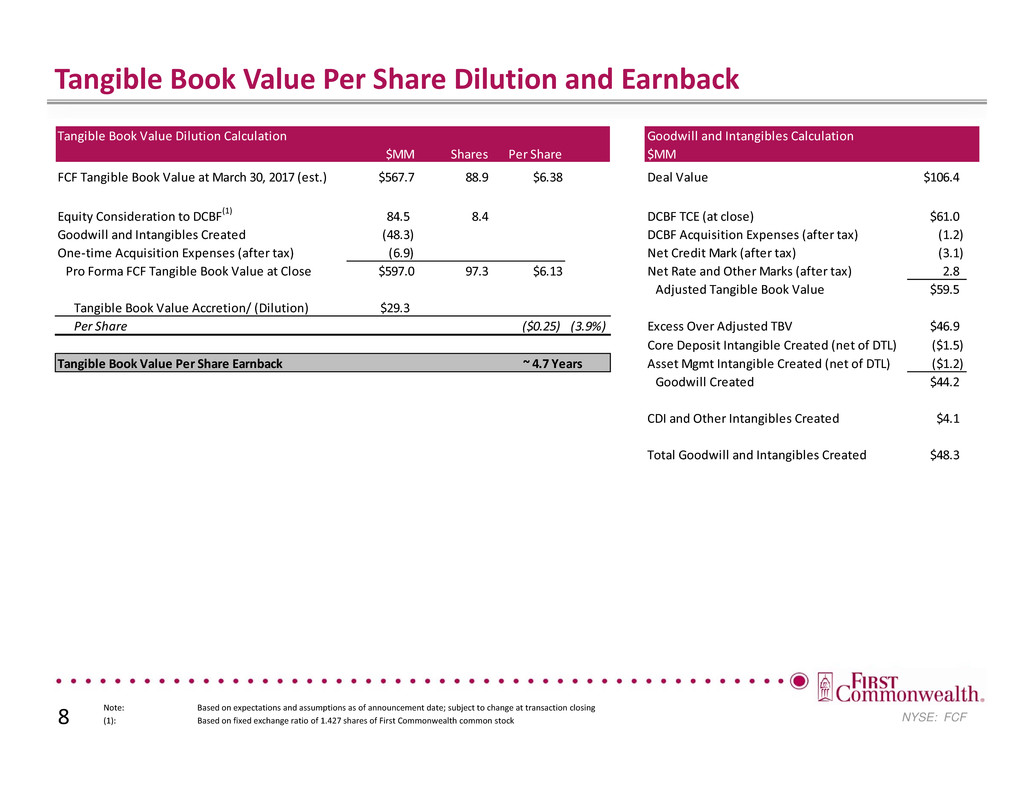

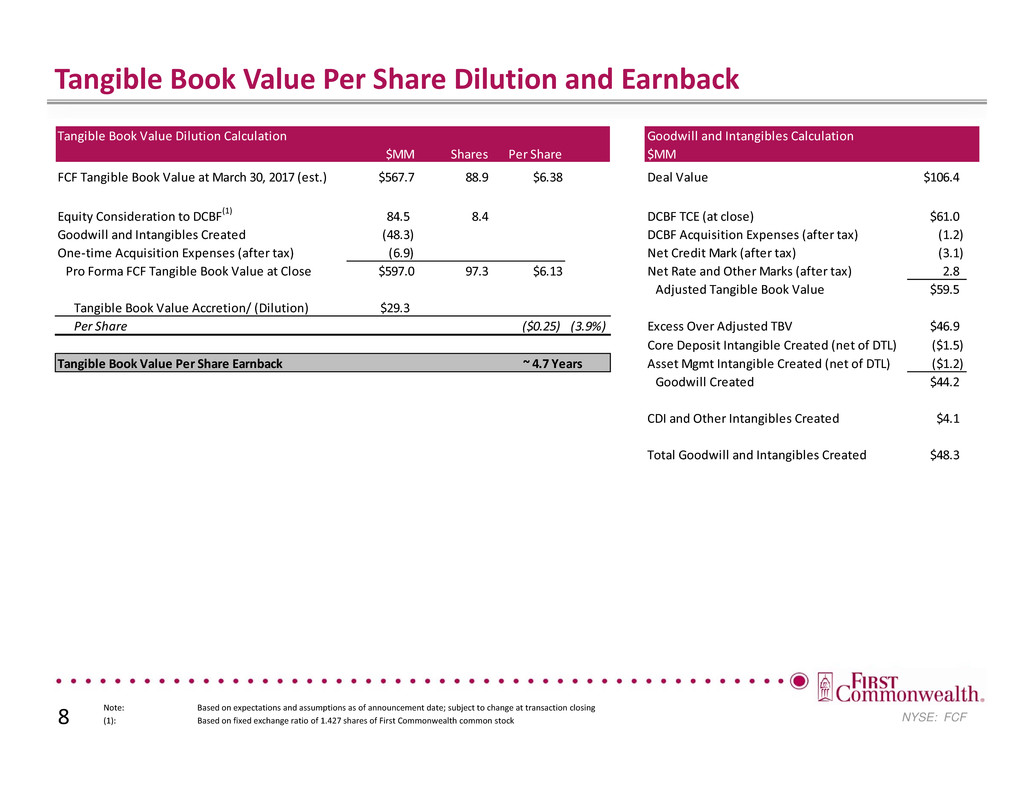

NYSE: FCF Tangible Book Value Per Share Dilution and Earnback 8 Note: Based on expectations and assumptions as of announcement date; subject to change at transaction closing (1): Based on fixed exchange ratio of 1.427 shares of First Commonwealth common stock Tangible Book Value Dilution Calculation Goodwill and Intangibles Calculation $MM Shares Per Share $MM FCF Tangible Book Value at March 30, 2017 (est.) $567.7 88.9 $6.38 Deal Value $106.4 Equity Consideration to DCBF(1) 84.5 8.4 DCBF TCE (at close) $61.0 Goodwill and Intangibles Created (48.3) DCBF Acquisition Expenses (after tax) (1.2) One‐time Acquisition Expenses (after tax) (6.9) Net Credit Mark (after tax) (3.1) Pro Forma FCF Tangible Book Value at Close $597.0 97.3 $6.13 Net Rate and Other Marks (after tax) 2.8 Adjusted Tangible Book Value $59.5 Tangible Book Value Accretion/ (Dilution) $29.3 Per Share ($0.25) (3.9%) Excess Over Adjusted TBV $46.9 Core Deposit Intangible Created (net of DTL) ($1.5) Tangible Book Value Per Share Earnback Asset Mgmt Intangible Created (net of DTL) ($1.2) Goodwill Created $44.2 CDI and Other Intangibles Created $4.1 Total Goodwill and Intangibles Created $48.3 ~ 4.7 Years

NYSE: FCF NYSE: FCF For more information, please contact: Ryan M. Thomas Vice President / Finance & Investor Relations First Commonwealth Financial Corporation 654 Philadelphia Street Indiana, Pennsylvania 15701 (724) 463‐1690 InvestorRelations@fcbanking.com