American Securitization Forum

Las Vegas, Nevada

January 29 – February 1, 2006

Forward looking disclosure

Certain matters discussed in this presentation may constitute forward-looking statements within the meaning of

the federal securities laws that inherently include certain risks and uncertainties. Actual results and the timing

of certain events could differ materially from those projected in or contemplated by the forward-looking

statements due to a number of factors, including our ability to generate sufficient liquidity on favorable terms;

the size and frequency of our securitizations; interest rate fluctuations on our assets that differ from our

liabilities; increases in prepayment or default rates on our mortgage assets; changes in assumptions regarding

estimated loan losses and fair value amounts; changes in origination and resale pricing of mortgage loans; our

compliance with applicable local, state and federal laws and regulations and the impact of new local, state or

federal legislation or regulations or court decisions on our operations; the initiation of margin calls under our

credit facilities; the ability of our servicing operations to maintain high performance standards and maintain

appropriate ratings from rating agencies; our ability to expand origination volume while maintaining an

acceptable level of overhead; our ability to adapt to and implement technological changes; the stability of

residential property values; the outcome of litigation or regulatory actions pending against us; the impact of

general economic conditions; and other risk factors that are from time to time included in our filings with the

SEC, including our 2005 Quarterly Report on Form 10-Q. Other factors not presently identified may also cause

actual results to differ. Management continuously updates and revises these estimates and assumptions based

on actual conditions experienced. It is not practicable to publish all revisions and, as a result, no one should

assume that results projected in or contemplated by the forward-looking statements will continue to be accurate

in the future. This presentation contains statistics and other data that in some cases have been obtained from,

or compiled from, information made available by service providers or included in publicly filed reports of other

entities. Although we believe this information to be reliable, we are not able to independently verify t

he accuracy thereof.

2

Overview

Founded: June, 1996

IPO: October, 1997 (NYSE: NFI)

$1.0 billion market cap; $564 million of GAAP equity

Top 20 residential mortgage ABS issuer

Current production run rate of $700-$900 million per month

Cost to originate historically in the 2.00%-2.50% range

Servicer rating of “Strong” by S&P

Completed 31 ABS transactions, total issuance over $26 billion

Disciplined underwriting approval through automated system

manages to a 3.5-5.0% (pre- MI) loss under normal market

conditions.

3

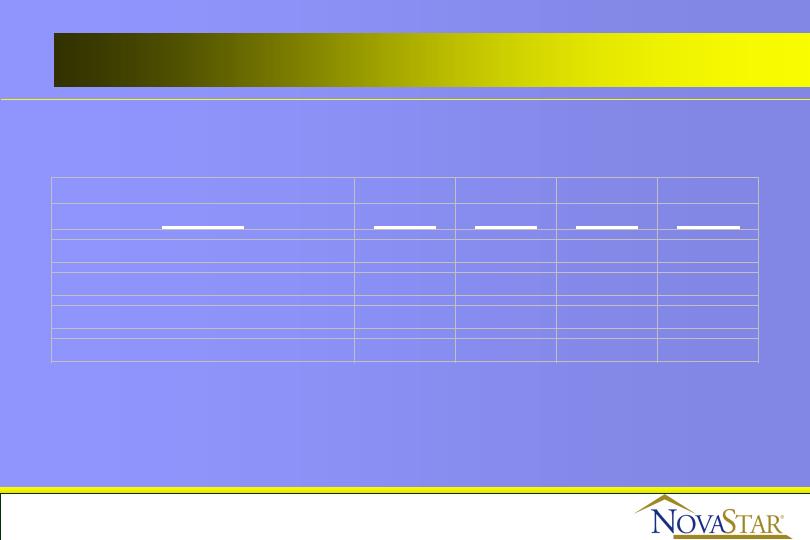

9/30/2005 Subprime Market Rankings

(in millions)

1

Ameriquest

$63,670

1

Ameriquest

$40,181

2

New Century

$39,553

2

New Century

$27,556

3

Countrywide

$32,457

3

Lehman Bros

$27,306

4

Option One

$30,190

4

Countrywide

$25,351

5

Fremont

$26,616

5

Option One

$18,350

6

WAMU

$26,314

6

Bear Stearns

$15,421

7

Wells Fargo

$22,770

7

CSFB

$15,370

8

First Franklin

$22,278

8

RBS/Greenwich

$14,641

9

HSBC

$17,990

9

WAMU

$14,399

10

GMAC-RFC

$15,339

10

WMC

$14,269

11

CitiFinancial

$13,571

11

First Franklin

$14,246

20

NovaStar Mortgage

$7,085

17

NovaStar Mortgage

$6,428

Source: Inside B&C Lending

Source: Inside B&C Lending

Originations

MBS Issuers

4

NovaStar Organizational Structure

NovaStar Financial, Inc. (NFI)

REIT

NFI Holding Corp.

Taxable REIT Subsidiary

NovaStar Mortgage, Inc. (NMI)

NovaStar Capital, Inc. (NCI)

Mortgage Banking

Servicing

Warehouse Lending

5

NovaStar Operating Strategy

NovaStar is structured as a REIT

Parent company does not pay corporate taxes

Focus is on being a portfolio investor vs. pure mortgage banking

Originate high margin, non-conforming residential mortgages

Service our own collateral (no third party servicing)

Use technology to be an efficient originator and servicer

Create mortgage securities with good risk-adjusted returns

from our loans through securitization

Use capital markets to price and manage risks

Interest rate risks hedged with swaps / caps

Credit risk managed through the purchase of deep MI

6

Origination Strategy

Primarily an A- wholesale lender

Vertical integration

Originator and end investor

Whole loan portfolio exceeding $14 billion

Centralized origination operation

Strive to be a low cost producer - cost to originate 2.00%-2.25%

Better risk controls - over 40% appraisal reviews

Manage underwriting - 100% prefunding audits

Diversify credit risk - deep MI

Focus on developing competitive advantages in every

channel in which we choose to operate

7

Distribution Channels

Wholesale

Production centers located in Cleveland, OH and Lake Forest, CA

400 person inside & outside sales force located in 40 states call on a

customer base of over 16,400 independent retail brokers

Compete on service, primarily a price taker

Correspondent

Sales force dedicated solely to the sourcing of closed loans

Focus is on the development of correspondent flow relationships and

purchase of mini bulk pools ($1-$20 million)

Attempt to create competitive advantages by offering small warehouse

lines and private labeling our origination system

Current production run rate of approx. $150-$200 million per quarter

8

Distribution Channels - Continued

Retail

Offices located in Columbia, MD and Kansas City, MO focusing

primarily on retention of existing portfolio

Total of 104 loan officers

Secondary focus on new business using primarily purchased leads

Also maintain a chain local branch in a few select markets

Current production run rate of approx. $350-$400 million per quarter

9

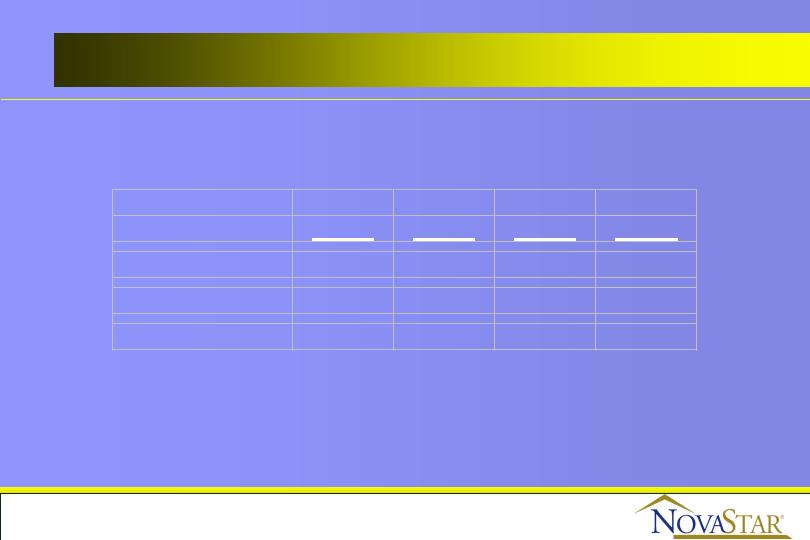

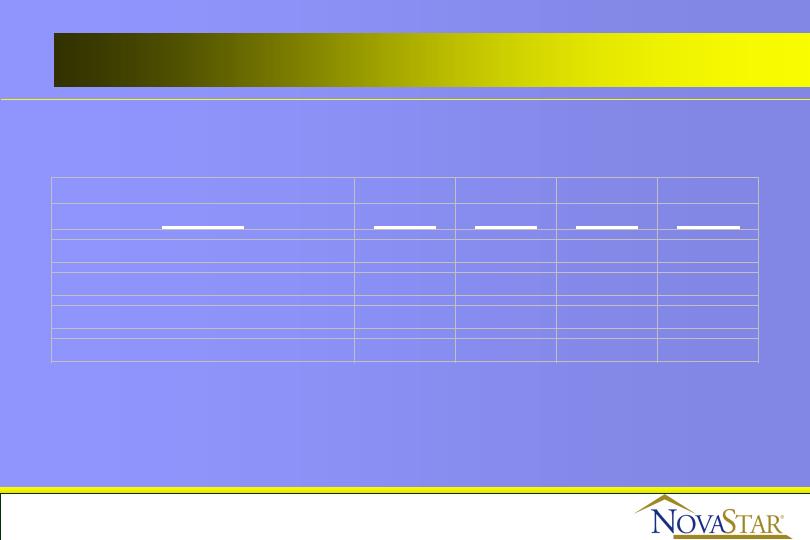

Production Mix by Channel

2002

2003

2004

2005

Channel

Actual

Actual

Actual

Actual

Independent Brokers

79%

67%

65%

75%

Retail

19%

28%

25%

16%

Correspondent

2%

5%

10%

9%

Total Nonconforming Production

$2.50 B

$5.25 B

$8.42 B

$9.28 B

10

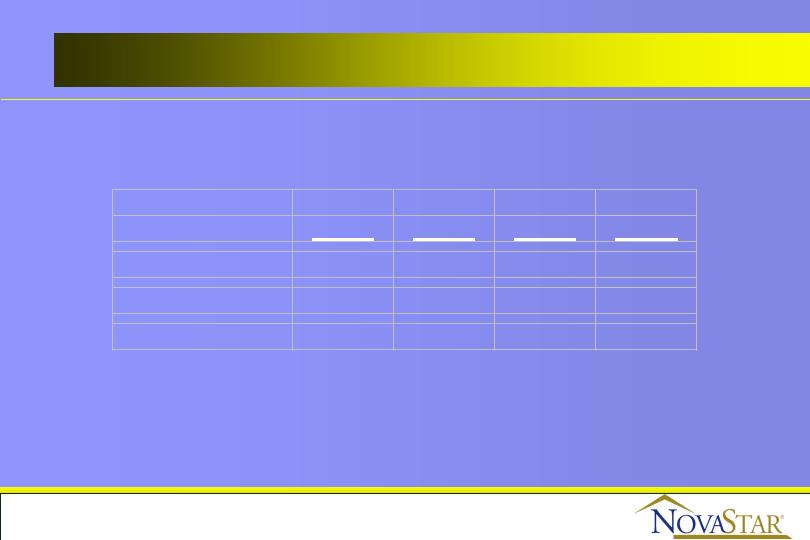

Securitization History

2002

2003

2004

2005

Actual

Actual

Actual

Actual

Production

$2.50 B

$5.25 B

$8.42 B

$9.28 B

Underlying Deals

3

4

4

4

Resecuritizations

1

1

3

1

11

Non-Conforming Production

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

Quarter

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

Principal Originated

Cost to Originate

12

NovaStar Origination Practices

100% Pre-funding Audit (100% DISSCO / 40% full QC audit)

Quality/Fraud procedures for new and existing brokers

Watch list / Do not take list for 3rd party vendors

Quality Control - Identifies negative trends / provides feedback

5%-10% random review of all files within 30-45 days of funding

100% Appraisal Review

60% cleared by underwriter using AVMs or on-line data sources

(SiteXdata)

40% referred to on staff licensed appraisers

15% of those reviewed by staff appraisers have their value reduced

Predatory Lending Issues

We do not originate high cost loans (HOEPA or State High Cost loans)

Net tangible benefit test automated and performed on all eligible loans

Adhere to the FNMA fee test (5% max) on all loans where NovaStar acts

as the lender

13

Risks and Risk Management

Interest rate/prepayment

Hedging - match duration using swaps and caps

Prepayment/convexity - prepayment penalties

Portfolio is hedged within maximum exposure of 10% of equity

up/down 100 bps

Credit

Geographic diversification

Lender paid deep MI to 50-55% LTV

Common sense U/W and strong quality control

Servicing

Liquidity

$3.65 billion of borrowing capacity from 5 separate lenders

14

Servicing Overview

$14 billion portfolio representing 99,000 accounts

17th largest sub-prime servicer (as of 6/30/05; Source: Mortgage Servicing News)

Total staff of 260

17 years average experience among Management/Supervisors

Approved FHA, VA, Fannie Mae and Freddie Mac

seller/servicer

Rated by all three rating agencies

S&P: Strong

Moody’s: SQ2

Fitch: RSP3+

15

Servicing

$0

$2,500

$5,000

$7,500

$10,000

$12,500

$15,000

Quarter

0.00%

0.10%

0.20%

0.30%

0.40%

0.50%

Principal Serviced

Cost to Service

16

Summary of 9/30/2005 YTD Results

GAAP earnings of $106 million; $3.64 / share

$4.20 dividend / share (common)

$264 million of cash and available liquidity

Completed three whole loan Sr./Sub securitizations and

one NIM resecuritization backed by $6.5 billion of

collateral

17

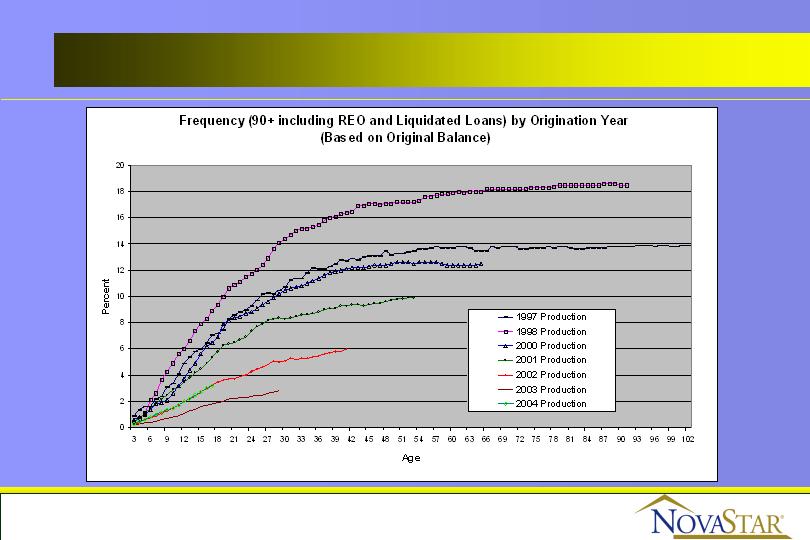

Collateral Performance

Pre-Mortgage Insurance

(All data as of December 31, 2005 unless stated otherwise)

Production Summary

Year

Average

Balance

WAC

LTV

CLTV

FICO

PPP

(% with)

PPP

Years

ARM

NON-FULL

DOC

NOO

CASH OUT

1997-98

$104,540

10.04%

79.6%

81.3%

604

70%

2.2

68%

35.1%

5.9%

52.8%

1999

$100,837

9.90%

81.6%

82.9%

615

90%

3.2

64%

39.8%

7.7%

49.5%

2000

$116,009

10.55%

82.5%

84.9%

616

90%

2.9

77%

41.4%

6.1%

42.9%

2001

$128,925

9.76%

82.7%

85.5%

613

84%

2.5

74%

39.1%

4.5%

49.4%

2002

$146,642

8.21%

81.0%

83.3%

627

82%

2.4

70%

45.4%

3.7%

56.9%

2003

$153,639

7.22%

80.0%

82.6%

637

78%

2.3

69%

50.3%

3.6%

62.0%

2004

$157,076

7.57%

82.1%

84.0%

621

73%

1.9

85%

50.0%

4.2%

60.8%

2005

$176,450

7.53%

81.0%

84.8%

630

66%

1.6

86%

53.2%

4.8%

60.9%

19

Actual Loss Severity

Production

Principal

Average

Loss

Year

Loans

Liquidated

Balance

Severity

1997-1998

2,045

$203,728,981

$99,623

42.2%

2000

569

$64,006,314

$112,489

35.4%

2001

848

$99,288,932

$117,086

34.9%

2002

657

$90,228,821

$137,335

30.9%

2003

509

$66,971,806

$131,575

29.0%

2004

429

$61,033,211

$142,269

26.3%

2000-2005

3,012

$381,529,082

$126,670

31.6%

20

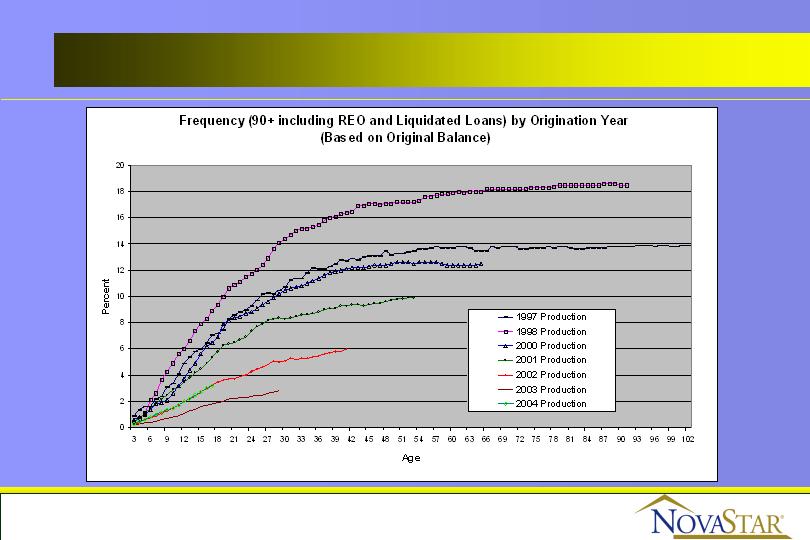

Production Performance

21

Production Performance

22

Early Performance Indicators

MBA method

OTS method

Early Payment

First Payment Default

First Payment Default

Default*

1997-1998

4.67%

2.05%

9.20%

2000

1.65%

0.80%

5.61%

2001

1.33%

0.66%

5.02%

2002

1.05%

0.45%

2.77%

2003

0.67%

0.25%

1.79%

2004

1.49%

0.54%

3.27%

2005

1.44%

0.49%

1.92%

2000-2005

1.26%

0.47%

2.64%

* Early payment default is defined as missing one payment in the first six payments.

23

Additional Data

Complete production and performance data can be found on

NovaStar’s websites:

http://www.novastarbondinvestors.com/

Static pool data

Offering documents

Bond remittance statements

http://www.novastarmortgage.com/corporate/

Monthly production reports

Mortgage insurance claim statistics

24