NovaStar Financial

(NYSE-NFI)

www.novastarmortgage.com

2005 Fourth Quarter Earnings

Conference Call

February 28, 2006

Safe Harbor Statement

Certain matters discussed in this release constitute forward-looking statements within the meaning of the

federal securities laws. Forward-looking statements are those that predict or describe future events and that do

not relate solely to historical matters. Forward-looking statements are subject to risks and uncertainties and

certain factors can cause actual results to differ materially from those anticipated. Some important factors that

could cause actual results to differ materially from those anticipated include: our ability to generate sufficient

liquidity on favorable terms; the size and frequency of our securitizations; interest rate fluctuations on our

assets that differ from our liabilities; increases in prepayment or default rates on our mortgage assets; changes

in assumptions regarding estimated loan losses and fair value amounts; changes in origination and resale

pricing of mortgage loans; our compliance with applicable local, state and federal laws and regulations or

opinions of counsel relating thereto and the impact of new local, state or federal legislation or regulations or

opinions of counsel relating thereto or court decisions on our operations; the initiation of margin calls under

our credit facilities; the ability of our servicing operations to maintain high performance standards and

maintain appropriate ratings from rating agencies; our ability to expand origination volume while maintaining

an acceptable level of overhead; our ability to adapt to and implement technological changes; the stability of

residual property values; the outcome of litigation or regulatory actions pending against us or other legal

contingencies; the impact of losses resulting from natural disasters; the impact of general economic conditions;

and the risks that are from time to time included in our filings with the SEC, including our Quarterly Report on

Form 10-Q, for the period ending September 30, 2005. Other factors not presently identified may also cause

actual results to differ. This document speaks only as of its date and we expressly disclaim any duty to update

the information herein.

2

Opening Comments

Scott Hartman, CEO

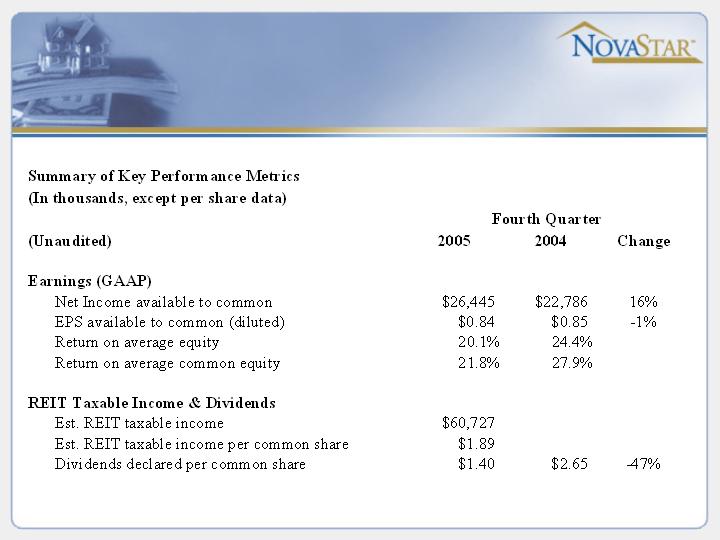

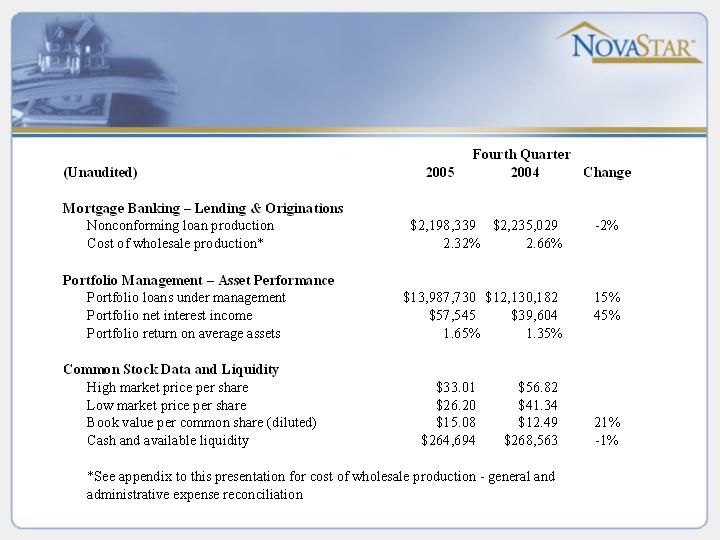

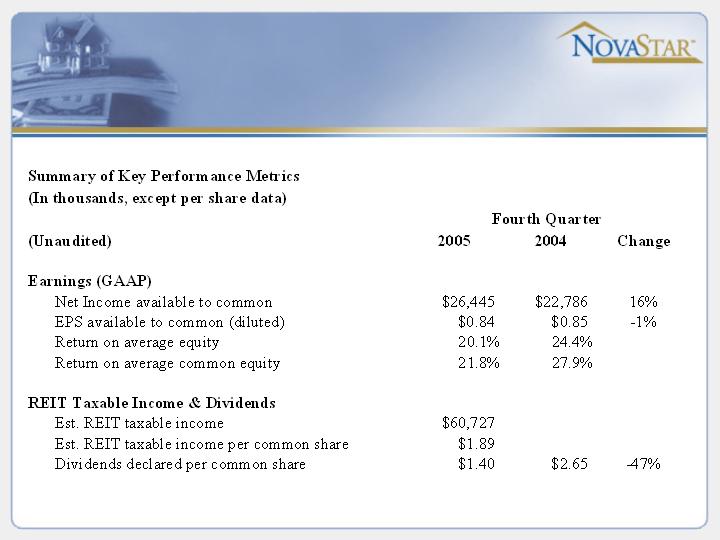

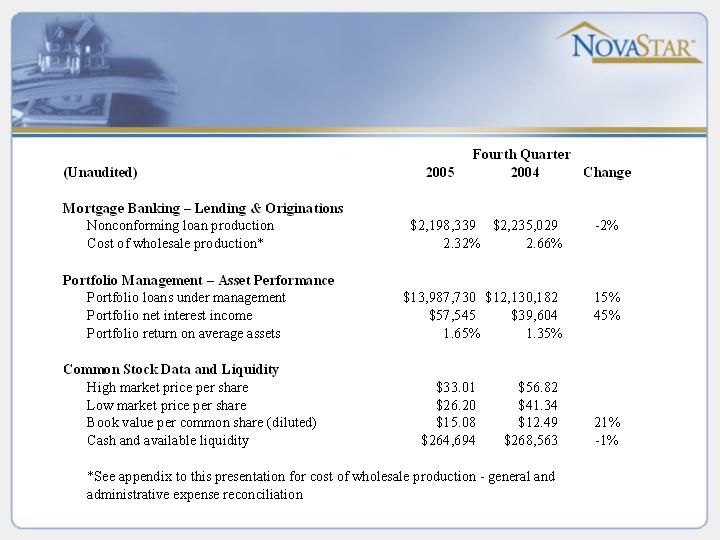

Key Performance Metrics

4

Key Performance Metrics

5

Historical

EPS and Dividends

6

2006 Dividend Guidance

2006 Common Dividend of at Least $5.60 per Share

7

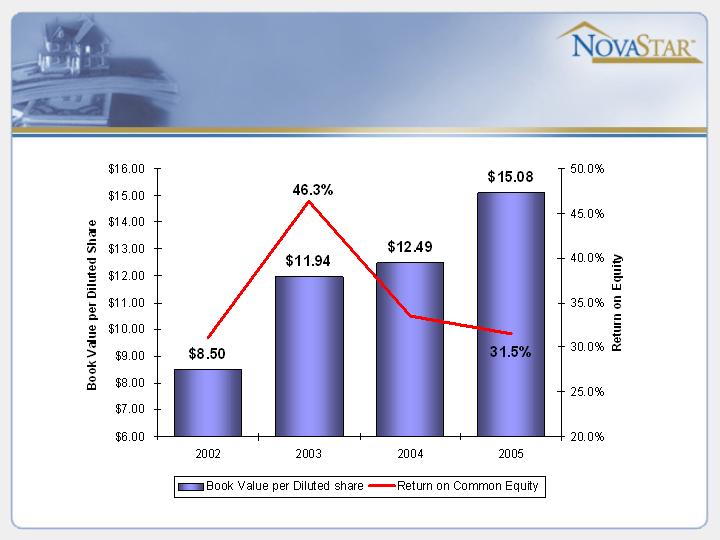

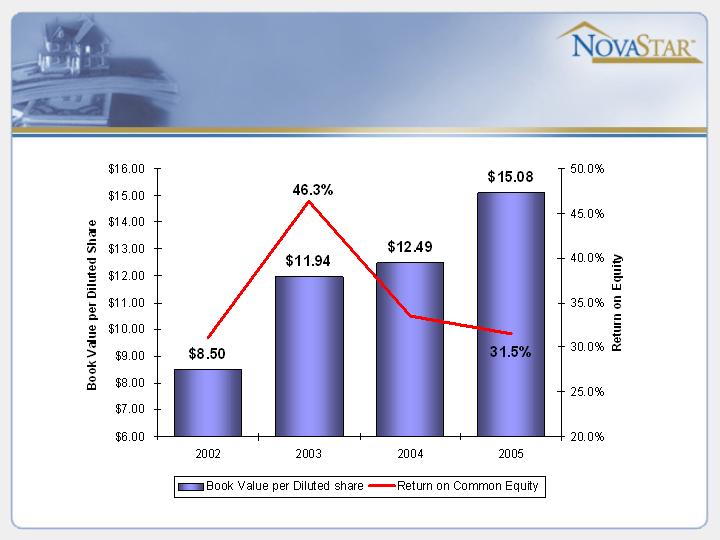

Historical

Book Value & ROE

8

Mortgage Banking

Production

Production down

2% Yr/Yr, down

21% Sequentially

10

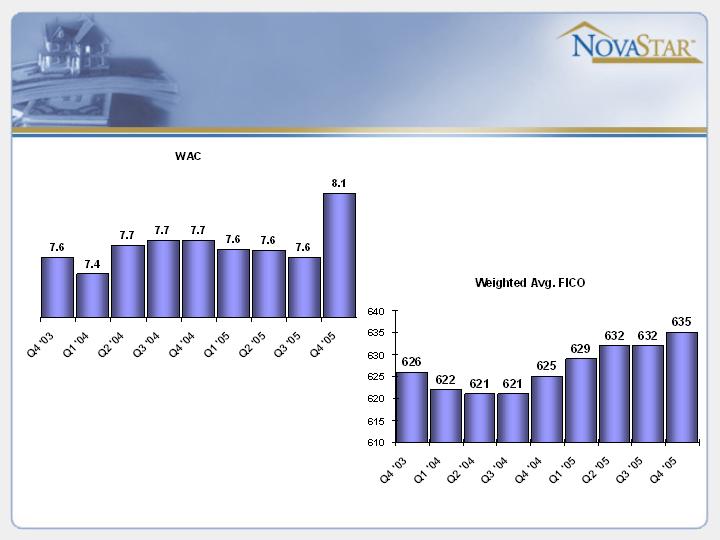

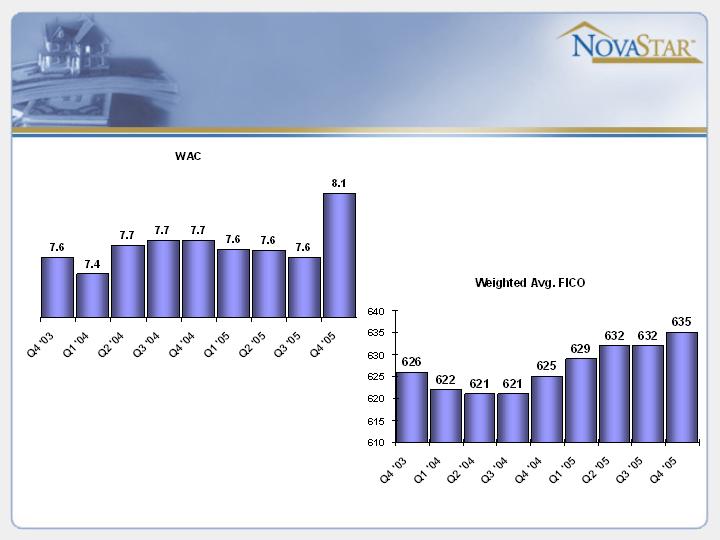

Production

Credit Characteristics

11

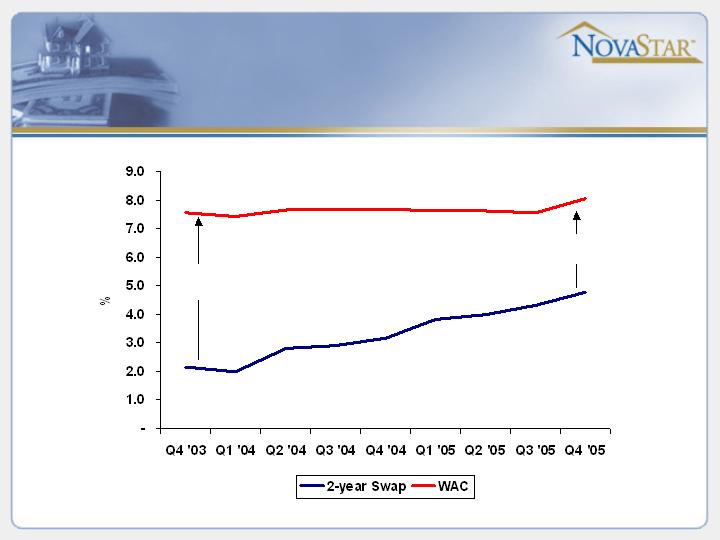

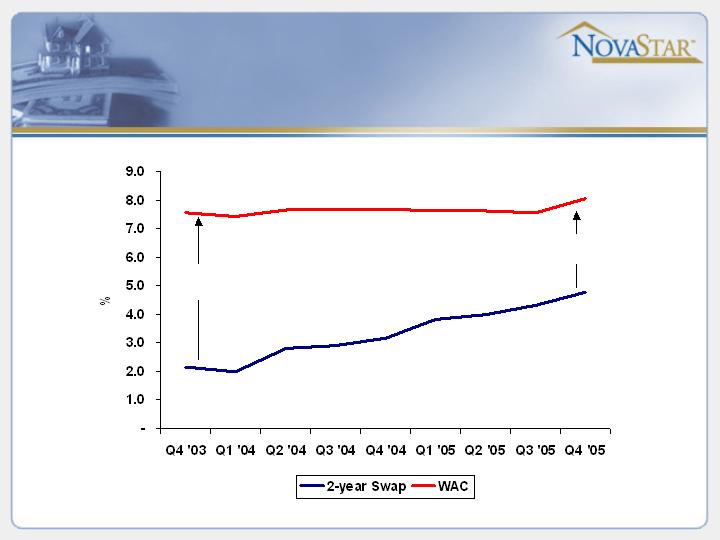

Spreads

*Excluding MTA

7.6%

2.2%

540 bps

327 bps

8.1%*

4.8%

12

Mortgage Lending

Financials

13

Mortgage Banking

Environment

Intensely competitive

Pricing at or below cost to originate

Smaller players won’t survive

Volumes flat to down for many

Many are originating and “hoping” to make money

Race to lower costs (continues from 2005)

Whole loan prices seem like they are recovering a

little, but rates are up

14

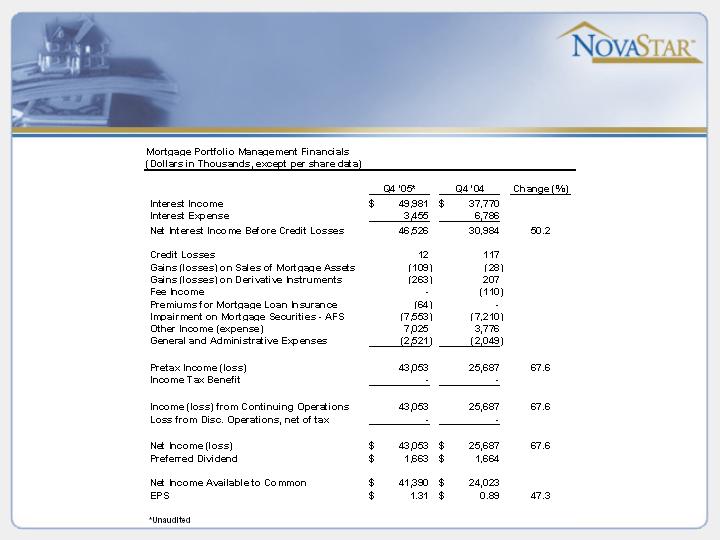

Portfolio Management

Portfolio Roll forward

16

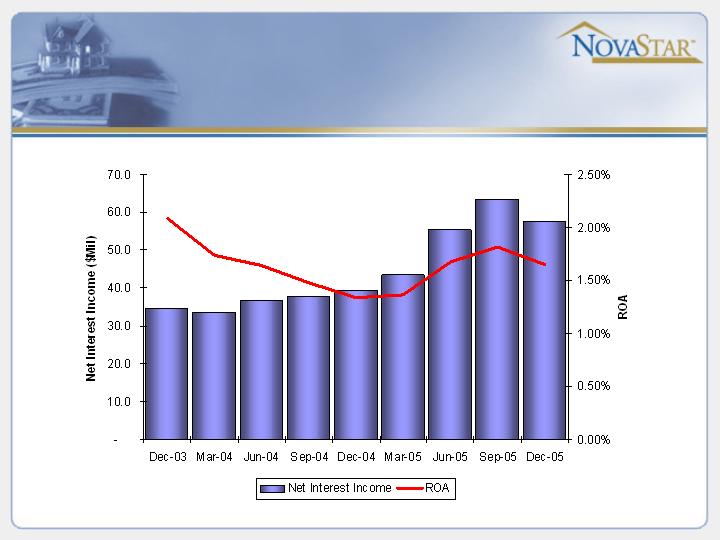

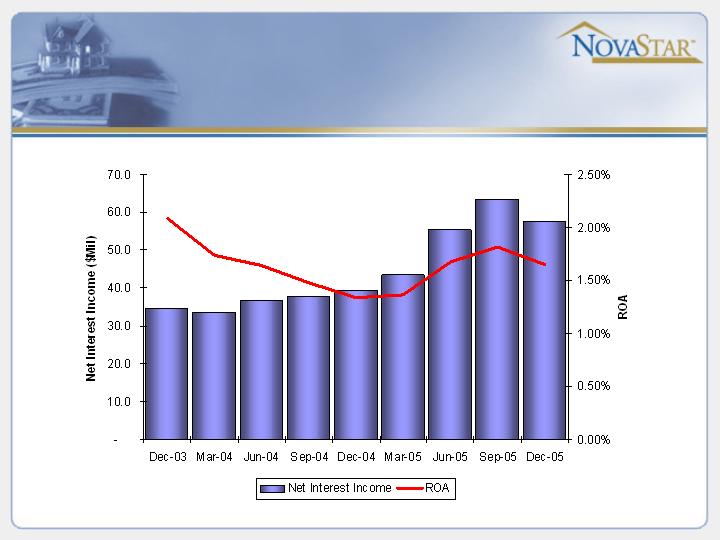

Portfolio ROA

17

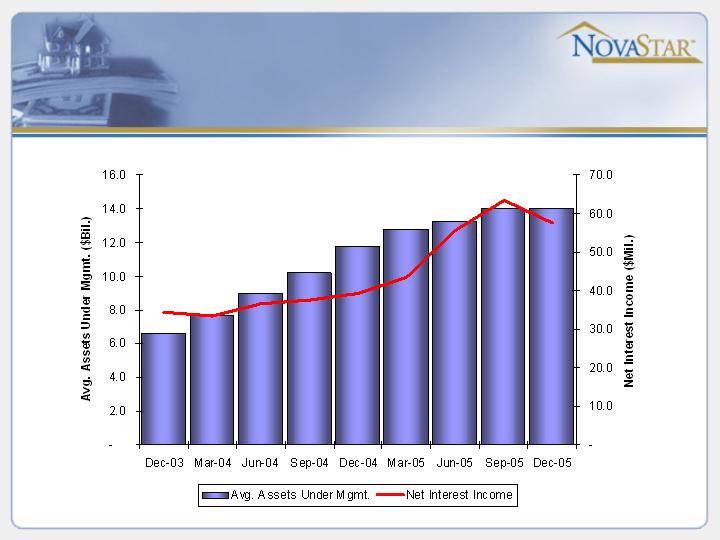

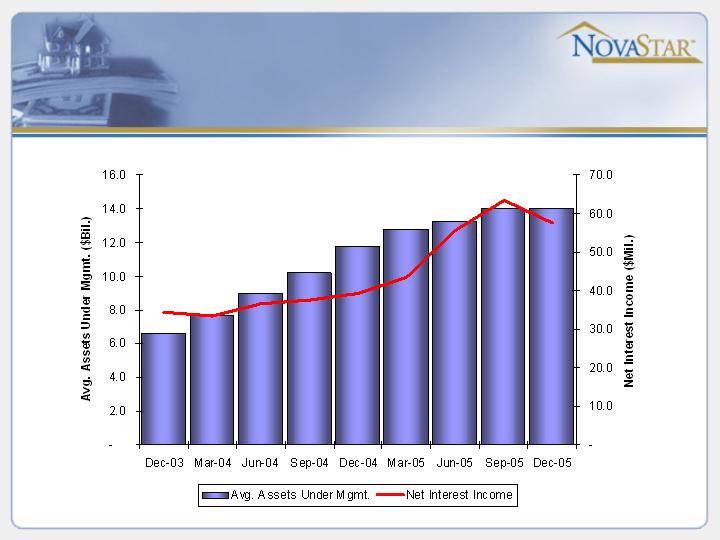

Portfolio

Net Interest Income

18

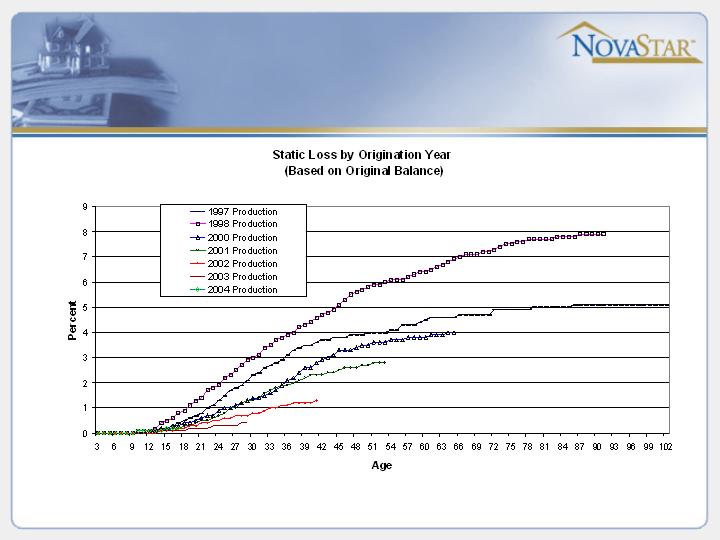

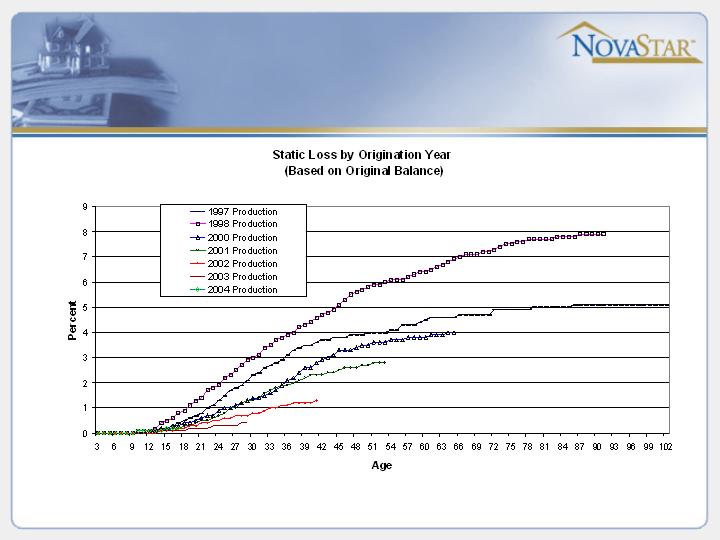

Static Pool

Delinquency Trends

19

Static Pool

Cumulative Losses

20

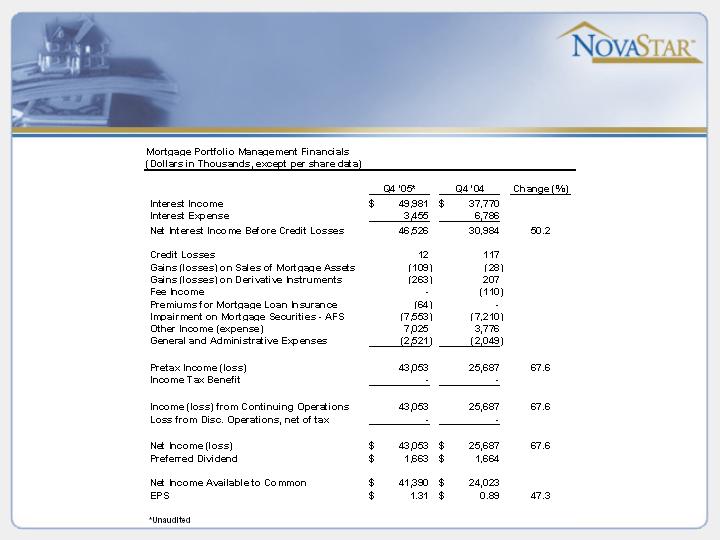

Portfolio Segment

Financials

21

Portfolio trends

Size of portfolio should be relatively stable

over the next year

Over time, ROA’s should come down to a

normalized range of 1.00% to 1.25%

Made a conscious decision to include more

MI in 2005 deals due to expected slowdown

in housing price appreciation

22

Questions

Appendix

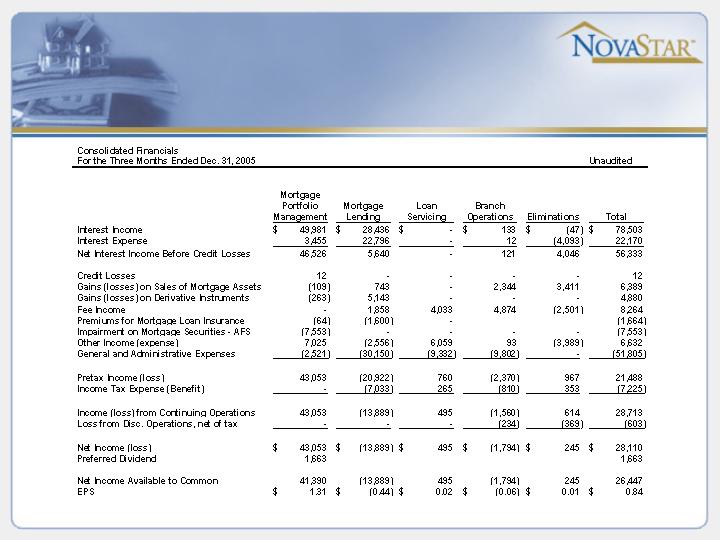

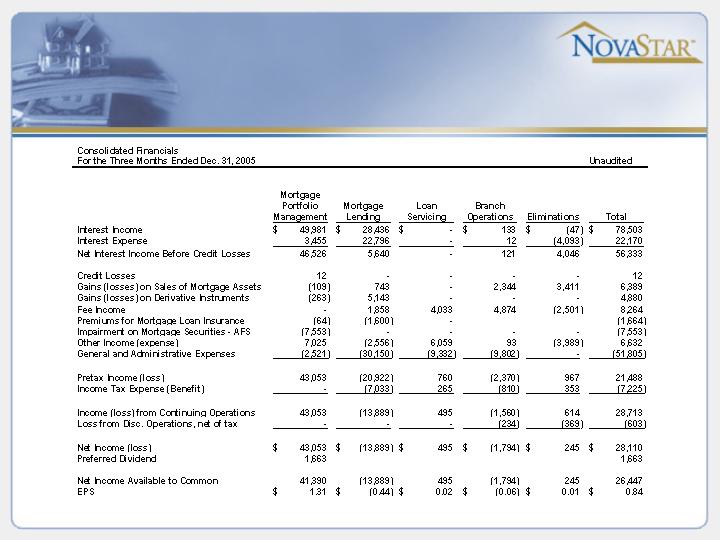

Consolidated Financials

25

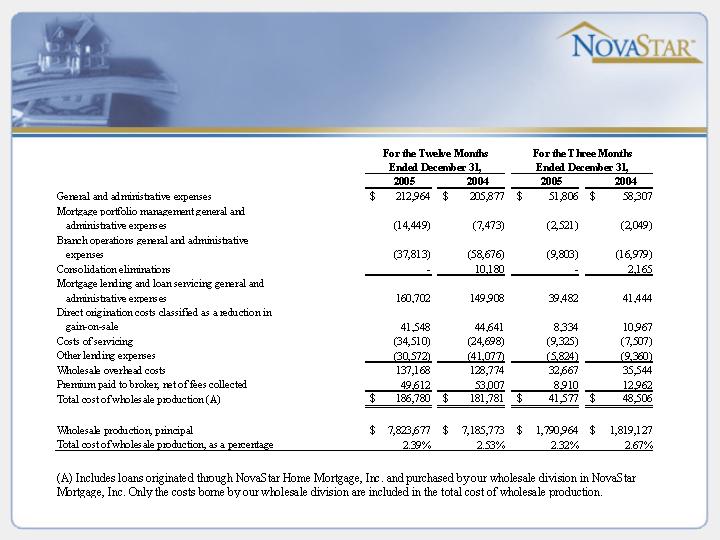

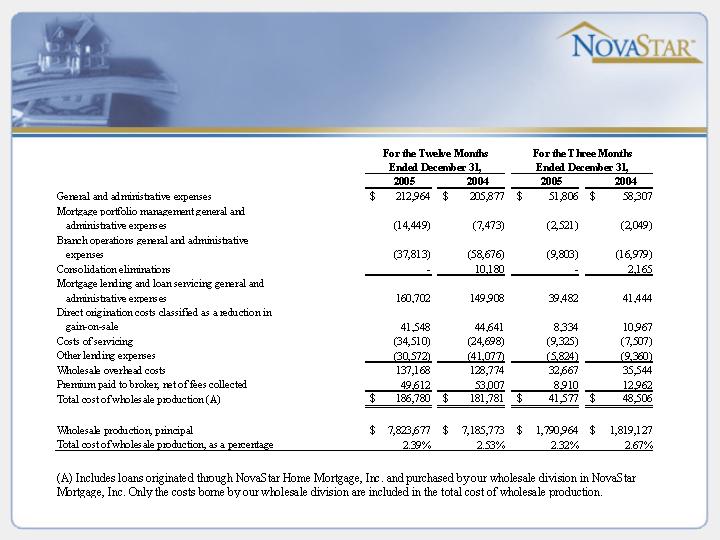

Cost of Wholesale

Production

26