UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(MARK ONE)

| | | | | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-12675 (Kilroy Realty Corporation)

Commission file number 000-54005 (Kilroy Realty, L.P.)

KILROY REALTY CORPORATION

KILROY REALTY, L.P.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Kilroy Realty Corporation | Maryland | 95-4598246 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

| Kilroy Realty, L.P. | Delaware | 95-4612685 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

12200 W. Olympic Boulevard, Suite 200, Los Angeles, California, 90064

(Address of principal executive offices) (Zip Code)

(310) 481-8400

| | |

| (Registrant’s telephone number, including area code) |

| | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: | |

| Registrant | Title of each class | Name of each exchange on which registered | Ticker Symbol |

| Kilroy Realty Corporation | Common Stock, $.01 par value | New York Stock Exchange | KRC |

Securities registered pursuant to Section 12(g) of the Act:

| | | | | |

| Registrant | Title of each class |

| Kilroy Realty, L.P. | Common Units Representing Limited Partnership Interests |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Kilroy Realty Corporation Yes ☒ No ☐ Kilroy Realty, L. P. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Kilroy Realty Corporation Yes ☐ No ☒ Kilroy Realty, L. P. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Kilroy Realty Corporation Yes ☒ No ☐ Kilroy Realty, L. P. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Kilroy Realty Corporation Yes ☒ No ☐ Kilroy Realty, L. P. Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | |

| Kilroy Realty Corporation |

| ☒ | Large accelerated filer | ☐ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company |

| ☐ | Emerging growth company If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o |

| | | | | | | |

| Kilroy Realty, L.P. |

| ☐ | Large accelerated filer | ☐ | Accelerated filer | ☒ | Non-accelerated filer | ☐ | Smaller reporting company |

| ☐ | Emerging growth company If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o |

Indicate by check mark whether the registrant has filed a report on and attestation to management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Kilroy Realty Corporation ☒ Kilroy Realty, L. P. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Kilroy Realty Corporation ☐ Kilroy Realty, L. P. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

Kilroy Realty Corporation ☐ Kilroy Realty, L. P. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Kilroy Realty Corporation Yes ☐ No ☒ Kilroy Realty, L. P. Yes ☐ No ☒

The aggregate market value of the voting and non-voting shares of common stock held by non-affiliates of Kilroy Realty Corporation was approximately $3,649,816,084 based on the quoted closing price on the New York Stock Exchange for such shares on June 30, 2024.

There is no public trading market for the common units of limited partnership interest of Kilroy Realty, L.P. As a result, the aggregate market value of the common units of limited partnership interest held by non-affiliates of Kilroy Realty, L.P. cannot be determined.

As of February 7, 2025, 118,136,676 shares of Kilroy Realty Corporation’s common stock, par value $.01 per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Kilroy Realty Corporation’s Proxy Statement with respect to its 2025 Annual Meeting of Stockholders to be filed not later than 120 days after the end of the registrant’s fiscal year are incorporated by reference into Part III of this Form 10-K.

EXPLANATORY NOTE

This report combines the annual reports on Form 10-K for the year ended December 31, 2024 of Kilroy Realty Corporation and Kilroy Realty, L.P. Unless stated otherwise or the context otherwise requires, references to “Kilroy Realty Corporation” or the “Company,” “we,” “our,” and “us” mean Kilroy Realty Corporation, a Maryland corporation, and its controlled and consolidated subsidiaries, and references to “Kilroy Realty, L.P.” or the “Operating Partnership” mean Kilroy Realty, L.P., a Delaware limited partnership, and its controlled and consolidated subsidiaries.

The Company is a real estate investment trust, or REIT, and the general partner of the Operating Partnership. As of December 31, 2024, the Company owned an approximate 99.0% common general partnership interest in the Operating Partnership. The remaining approximate 1.0% common limited partnership interests are owned by non-affiliated investors and a former executive officer and director. As the sole general partner of the Operating Partnership, the Company exercises exclusive and complete discretion over the Operating Partnership’s day-to-day management and control and can cause it to enter into certain major transactions, including acquisitions, dispositions, and refinancings, and cause changes in its line of business, capital structure, and distribution policies.

There are a few differences between the Company and the Operating Partnership that are reflected in the disclosures in this Form 10-K. We believe it is important to understand the differences between the Company and the Operating Partnership in the context of how the Company and the Operating Partnership operate as an interrelated, consolidated company. The Company is a REIT, the only material asset of which is the partnership interests it holds in the Operating Partnership. As a result, the Company generally does not conduct business itself, other than acting as the sole general partner of the Operating Partnership, issuing equity from time to time and guaranteeing certain debt of the Operating Partnership. The Company itself is not directly obligated under any indebtedness, but generally guarantees all of the debt of the Operating Partnership. The Operating Partnership owns substantially all of the assets of the Company either directly or through its subsidiaries, conducts the operations of the Company’s business, and is structured as a limited partnership with no publicly traded equity. Except for net proceeds from equity issuances by the Company, which the Company generally contributes to the Operating Partnership in exchange for units of partnership interest, the Operating Partnership generates the capital required by the Company’s business through the Operating Partnership’s operations, by the Operating Partnership’s incurrence of indebtedness, or through the issuance of units of partnership interest.

Noncontrolling interests, stockholders’ equity and partners’ capital are the main areas of difference between the consolidated financial statements of the Company and those of the Operating Partnership. The common limited partnership interests in the Operating Partnership are accounted for as partners’ capital in the Operating Partnership’s financial statements and, to the extent not held by the Company, as noncontrolling interests in the Company’s financial statements. The differences between stockholders’ equity, partners’ capital, and noncontrolling interests result from the differences in the equity issued by the Company and the Operating Partnership.

We believe combining the annual reports on Form 10-K of the Company and the Operating Partnership into this single report results in the following benefits:

•Combined reports better reflect how management and the analyst community view the business as a single operating unit;

•Combined reports enhance investors’ understanding of the Company and the Operating Partnership by enabling them to view the business as a whole and in the same manner as management;

•Combined reports are more efficient for the Company and the Operating Partnership and result in savings in time, effort, and expense; and

•Combined reports are more efficient for investors by reducing duplicative disclosure and providing a single document for their review.

To help investors understand the significant differences between the Company and the Operating Partnership, this report presents the following separate sections for each of the Company and the Operating Partnership:

•Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations:

◦—Liquidity and Capital Resources of the Company; and

◦—Liquidity and Capital Resources of the Operating Partnership;

•consolidated financial statements;

•the following notes to the consolidated financial statements:

◦Note 9, Secured and Unsecured Debt of the Company;

◦Note 10, Secured and Unsecured Debt of the Operating Partnership;

◦Note 12, Noncontrolling Interests on the Company’s Consolidated Financial Statements;

◦Note 13, Noncontrolling Interests on the Operating Partnership’s Consolidated Financial Statements;

◦Note 14, Stockholders’ Equity of the Company;

◦Note 15, Partners’ Capital of the Operating Partnership;

◦Note 21, Net Income Available to Common Stockholders Per Share of the Company;

◦Note 22, Net Income Available to Common Unitholders Per Unit of the Operating Partnership;

◦Note 23, Supplemental Cash Flows Information of the Company; and

◦Note 24, Supplemental Cash Flows Information of the Operating Partnership.

This report also includes separate sections under Item 9A. Controls and Procedures and separate Exhibit 31 and Exhibit 32 certifications for the Company and the Operating Partnership to establish that the Chief Executive Officer and the Chief Financial Officer of each entity have made the requisite certifications and that the Company and Operating Partnership are compliant with Rule 13a-15 or Rule 15d-15 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and 18 U.S.C. §1350.

TABLE OF CONTENTS

| | | | | | | | | | | |

| | | Page |

| | PART I | |

| Item 1. | | | |

| Item 1A. | | | |

| Item 1B. | | | |

| Item 1C. | | | |

| Item 2. | | | |

| Item 3. | | | |

| Item 4. | | | |

| | PART II | |

| Item 5. | | | |

| | | |

| Item 7. | | | |

| Item 7A. | | | |

| Item 8. | | | |

| Item 9. | | | |

| Item 9A. | | | |

| Item 9B. | | | |

| Item 9C. | | | |

| | PART III | |

| Item 10. | | | |

| Item 11. | | | |

| Item 12. | | | |

| Item 13. | | | |

| Item 14. | | | |

| | PART IV | |

| Item 15. | | | |

| Item 16. | | | |

| | | |

PART I

This document contains certain “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, among other things, statements or information concerning our plans, objectives, capital resources, portfolio performance, results of operations, projected future occupancy and rental rates, lease expirations, debt maturities, potential investments, strategies such as capital recycling, development and redevelopment activity, projected construction costs, projected construction commencement and completion dates, projected square footage of space that could be constructed on undeveloped land that we own, projected rentable square footage of or number of units in properties under construction or in the development pipeline, anticipated proceeds from capital recycling activity or other dispositions and anticipated dates of those activities or dispositions, projected increases in the value of properties, dispositions, future executive incentive compensation, pending, potential, or proposed acquisitions, plans to grow our net operating income and funds from operations, our ability to re-lease properties at or above current market rates, anticipated market conditions, demographics and other forward-looking financial data, as well as the discussion in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Factors That May Influence Future Results of Operations.” Forward-looking statements are based on our current expectations, beliefs and assumptions, and are not guarantees of future performance. Forward-looking statements are inherently subject to uncertainties, risks, changes in circumstances, trends and factors that are difficult to predict, many of which are outside of our control. Accordingly, actual performance, results and events may vary materially from those indicated or implied in the forward-looking statements, and you should not rely on the forward-looking statements as predictions of future performance, results, or events. All forward-looking statements are based on information that was available and speak only as of the dates on which they were made. We assume no obligation to update any forward-looking statement that becomes untrue because of subsequent events, new information or otherwise, except to the extent we are required to do so in connection with our ongoing requirements under federal securities laws.

In addition, this report contains information and statistics regarding, among other things, the industry, markets, submarkets, and sectors in which we operate, whether our leases are above or below applicable market rents and the number of square feet of office and other space that could be developed from specific parcels of undeveloped land. We obtained this information and these statistics from various third-party sources and our own internal estimates. We believe that these sources and estimates are reliable but have not independently verified them and cannot guarantee their accuracy or completeness.

ITEM 1. BUSINESS

The Company

Kilroy Realty Corporation (the “Company”) is a self-administered real estate investment trust (“REIT”) active in premier office, life science, and mixed-use property types in the United States. The Company’s approach to modern business environments is designed to drive creativity and productivity for some of the world’s leading technology, entertainment, life science, and business services companies, and we have been consistently recognized for our leadership in sustainability and building operations. The Company owns, develops, acquires, and manages real estate assets, consisting primarily of premier properties in Los Angeles, San Diego, the San Francisco Bay Area, Seattle, and Austin, which we believe have strategic advantages and strong barriers to entry. The Company qualifies as a REIT under the Internal Revenue Code of 1986, as amended (the “Code”). We own our interests in all of our real estate assets through Kilroy Realty, L.P. (the “Operating Partnership”) and generally conduct substantially all of our operations through the Operating Partnership.

Our stabilized portfolio of operating properties was comprised of the following properties at December 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Number of

Buildings | | Rentable

Square Feet | | Number of

Tenants | | Percentage Occupied (1) | | |

Stabilized Office Properties (2) | 123 | | | 17,142,721 | | | 428 | | | 82.8 | % | | |

________________________(1)Represents economic occupancy for space where we have achieved revenue recognition for the associated lease agreements.

(2)Includes stabilized life science and retail space.

| | | | | | | | | | | | | | | | | | | |

| Number of

Properties | | Number of

Units | | 2024 Average Occupancy | | |

| Stabilized Residential Properties | 3 | | | 1,001 | | | 92.5 | % | | |

Our stabilized portfolio includes all of our properties with the exception of development and redevelopment properties currently committed for construction, under construction, or in the tenant improvement phase, undeveloped land, and real estate assets held for sale. We define redevelopment properties as those properties for which we expect to spend significant development and construction costs pursuant to a formal plan to change its use, the intended result of which is a higher economic return on the property. We define a property in the tenant improvement phase as a development or redevelopment property where the project has reached “cold shell condition” and is ready for tenant improvements, which may require additional major base building modifications before being placed in service. Projects in the tenant improvement phase are moved into our stabilized portfolio once the project reaches the earlier of 95% occupancy or one year from the date of the cessation of major base building construction activities. Costs capitalized to construction in progress for development and redevelopment properties are transferred to land and improvements, buildings and improvements, and deferred leasing costs on our consolidated balance sheets as the projects or phases of projects are placed in service.

We did not have any properties or undeveloped land held for sale at December 31, 2024. As of December 31, 2024, the following properties were excluded from our stabilized portfolio:

| | | | | | | | | | | |

| Number of

Properties/Projects | | Estimated Rentable

Square Feet (1) |

| | | |

| In-process redevelopment projects - tenant improvement | 2 | | 100,000 |

| In-process development projects - under construction | 1 | | 875,000 |

________________________

(1)Estimated rentable square feet upon completion.

Our stabilized portfolio also excludes our future development pipeline, which, as of December 31, 2024, was comprised of eight future development sites, representing approximately 64 gross acres of undeveloped land.

As of December 31, 2024, all of our properties and development and redevelopment projects, and all of our business was conducted in the state of California, with the exception of ten stabilized office properties and one future development project located in the state of Washington, and one stabilized office property and one future

development project located in Austin, Texas. All of our properties and development and redevelopment projects are 100% owned, excluding four office properties owned by three consolidated property partnerships. Two of the three consolidated property partnerships, 100 First Street Member, LLC (“100 First LLC”) and 303 Second Street Member, LLC (“303 Second LLC”), each owned one office property in San Francisco, California through subsidiary REITs. As of December 31, 2024, the Company owned a 56% common equity interest in both 100 First LLC and 303 Second LLC. The third consolidated property partnership, Redwood City Partners, LLC (“Redwood LLC”), owned two office properties in Redwood City, California. As of December 31, 2024, the Company owned an approximate 93% common equity interest in Redwood LLC. The remaining interests in all three property partnerships were owned by unrelated third parties.

We own our interests in all of our real estate assets through the Operating Partnership and generally conduct substantially all of our operations through the Operating Partnership, of which we owned an approximate 99.0% common general partnership interest as of December 31, 2024. The remaining approximate 1.0% common limited partnership interest in the Operating Partnership as of December 31, 2024 was owned by non-affiliated investors and a former executive officer and director. With the exception of the Operating Partnership and our consolidated property partnerships, all of our subsidiaries are wholly-owned.

Available Information; Website Disclosure; Corporate Governance Documents

Kilroy Realty Corporation was incorporated in the state of Maryland on September 13, 1996 and Kilroy Realty, L.P. was organized in the state of Delaware on October 2, 1996. Our principal executive offices are located at 12200 W. Olympic Boulevard, Suite 200, Los Angeles, California 90064. Our telephone number at that location is (310) 481-8400. Our website is www.kilroyrealty.com. The information found on, or otherwise accessible through, our website is not incorporated into, and does not form a part of, this annual report on Form 10-K or any other report or document we file with or furnish to the SEC. All reports we will file with the SEC are available free of charge via EDGAR through the SEC website at www.sec.gov. All reports that we will file with the SEC will also be available free of charge on our website at www.kilroyrealty.com as soon as reasonably practicable after we file those materials with, or furnish them to, the SEC.

We use our website as a routine channel of distribution of company information, including press releases, presentations, and supplemental information, as a means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor our website in addition to following press releases, SEC filings, and public conference calls and webcasts. Investors and others can receive notifications of new information posted on our investor relations website in real time by signing up for email alerts.

The following documents relating to corporate governance are also available on our website under “Investors —Overview —Governance Documents” and available in print to any security holder upon request:

•Corporate Governance Guidelines;

•Code of Business Conduct and Ethics;

•Policies and Procedures Concerning Consideration of Director Candidates;

•Audit Committee Charter;

•Executive Compensation Committee Charter;

•Nominating / Corporate Governance Committee Charter; and

•Corporate Social Responsibility and Sustainability Committee Charter.

You may request copies of any of these documents by writing to:

Attention: Investor Relations

Kilroy Realty Corporation

12200 West Olympic Boulevard, Suite 200

Los Angeles, California 90064

We intend to disclose on our website under “Investors —Overview —Governance Documents” any amendment to, or waiver of, any provisions of our Code of Business Conduct and Ethics applicable to the directors and/or officers of the Company that would otherwise be required to be disclosed under the rules of the Securities and Exchange Commission or the New York Stock Exchange.

Business and Growth Strategies

Growth Strategies. We believe that a number of strategies will enable us to continue to achieve our objectives of long-term sustainable growth in Net Operating Income (defined below) and FFO (defined below), and the maximization of long-term stockholder value, including:

•Operating strategies

•Development and redevelopment strategies

•Capital recycling strategies

•Financing strategies

•Sustainability strategies

“Net Operating Income” is defined as consolidated operating revenues (rental income and other property income) less consolidated operating expenses (property expenses, real estate taxes and ground leases). “FFO” is Funds From Operations available to common stockholders and common unitholders calculated in accordance with the 2018 Restated White Paper on FFO approved by the Board of Governors of the National Association of Real Estate Investment Trusts (“Nareit”). (See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations —Results of Operations” and “—Non-GAAP Supplemental Financial Measures: Funds From Operations” for a reconciliation of these measures to generally accepted accounting principles (“GAAP”) net income available to common stockholders.)

Operating Strategies. We focus on enhancing our long-term sustainable growth in Net Operating Income and FFO from our properties by:

•maximizing cash flows through new and renewal leasing activity;

•managing portfolio credit risk through effective underwriting, including the use of credit enhancements to mitigate individual tenant credit risks;

•maintaining and developing long-term relationships with industry-leading companies in our markets;

•managing operating expenses through the efficient use of internal property management, leasing, marketing, financing, accounting, legal, and construction and development management functions;

•investing in capital improvements to enhance the competitive advantages of our properties in their respective markets and integrating technology, including building management systems, security operation centers, and tenant experience solutions to provide a premium experience to our tenant base while reducing operating costs; and

•attracting and retaining motivated employees to meet our operating and financial goals.

Development and Redevelopment Strategies. We and our predecessors have developed office properties primarily located in California since 1947. As of December 31, 2024, we had two redevelopment projects in the tenant improvement phase totaling approximately 100,000 square feet and one development project under construction totaling approximately 875,000 square feet of office and life science space. Our future development pipeline was comprised of eight potential development sites representing approximately 64 gross acres of undeveloped land on which we believe could develop over 6.0 million square feet of office, life science, residential, and retail space. We execute on our development and redevelopment strategies by:

•developing or redeveloping assets in highly populated, amenity rich, supply-constrained locations that are attractive to a broad array of tenants;

•being the premier provider of modern and collaborative office, life science, and mixed-use projects on the West Coast and in Austin, Texas, with a focus on design and environment;

•maintaining a disciplined approach and commencing development only when appropriate based on market conditions, focusing on pre-leasing, developing in stages / phasing, and cost control;

•self-funding our development and redevelopment activities primarily through internally generated free cash flows and/or selective disposition activity;

We may engage in the additional development and redevelopment of office, life science, and mixed-use properties when market conditions support a favorable risk-adjusted return on such projects. We expect that our significant working relationships with tenants, municipalities, and landowners on the West Coast and in Austin, Texas will give us further access to additional opportunities in the future.

Capital Recycling Strategies. We believe we are well-positioned to acquire and/or dispose of properties due to our extensive experience and proven track record of capital allocation. Against the backdrop of market volatilities, we intend to evaluate opportunities based on:

•submarket dynamics for the property being evaluated, which may include job growth of companies or industries located in that area and/or current or future competitive supply;

•physical characteristics of the property, which help determine the revenue growth potential over time, as well as the capital required to maintain and/or grow that revenue; and

•investment returns, including both the in-place income and the future income, factoring in projections of occupancy and rents over time.

Financing Strategies. Our financing policies and objectives are determined by our board of directors. Our goal is to maintain significant liquidity and a conservative leverage ratio. Our financing strategies include:

•maintaining financial flexibility, including a significant unencumbered asset base;

•maximizing our ability to access a variety of public and private capital sources;

•maintaining a staggered debt maturity schedule to limit risk exposure at any particular point in the capital and credit market cycles;

•completing financing in advance of capital needs;

•managing interest rate exposure by primarily financing on a fixed-rate basis; and

•maintaining an investment grade credit rating.

We utilize multiple sources of capital, including borrowings under our unsecured revolving credit facility and our unsecured term loan facility, proceeds from the issuance of public or private debt or equity securities, and other bank and/or institutional borrowings, and our capital recycling program. There can be no assurance that we will be able to obtain capital as needed on terms favorable to us or at all. (See the discussion under the caption “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations —Factors That May Influence Future Results of Operations” and “Item 1A. Risk Factors.”)

Sustainability Strategies. Our longstanding leadership in sustainability in real estate is globally recognized, and our commitment to sustainable operations remains strong. Our vision is a resilient portfolio that minimizes the environmental impact of our buildings while maximizing the health and productivity of our tenants, employees, and communities, while also delivering compelling returns to stockholders. Our board of directors, through the Corporate Social Responsibility and Sustainability Committee (the “CSR&S Committee”) in conjunction with management, currently oversee and advance the Company’s corporate social responsibility and sustainability initiatives. The CSR&S Committee recognizes that community engagement and sustainable operations benefit our investors, tenants, and other stakeholders and are key to preserving our Company’s value and credibility.

As a result of our commitment to sustainability, we have consistently received high rankings in sustainability performance by the Global Real Estate Sustainability Benchmark (“GRESB”). In 2024, we were proud to earn the highly competitive GRESB 5 Star designation for both our standing assets and development portfolio. We have been recognized with the U.S. EPA ENERGY STAR® Partner of the Year Sustained Excellence Award for the last nine years, and the U.S. EPA’s National Top 100 list of largest green power users. We have also been included on Newsweek’s list of America’s Most Responsible Companies since 2020, and in 2024 Kilroy was awarded the Green Lease Leader of the Decade award.

We manage our properties to offer the maximum degree of utility and operational efficiency to our tenants. Reducing energy use year over year is an ongoing aspect of our operational strategy. We pursue a variety of strategies to drive energy efficiency across the portfolio, such as utility use monitoring, systematic energy auditing, mechanical, lighting, and other building upgrades, optimizing operations and engaging tenants. We collaborate with our tenants on efforts to reduce their energy and water consumption and increase recycling diversion and compost rates. Many of our existing and prospective tenants have ambitious sustainability targets of their own, and we engage with tenants on a range of sustainability topics throughout each year. We aim to incorporate green lease language into all of our new leases, and the majority of our leases also include a cost recovery clause for resource-efficiency related capital expenditures. Green leases (also known as aligned leases, high performance leases or energy efficient leases) aim to align the financial and energy incentives of building owners and tenants so they can work together to save money, conserve resources, and ensure the efficient operation of buildings. We have received the Institute for Market Transformation’s (“IMT’s”) Green Lease Leaders award for 11 consecutive years.

We build our new development and redevelopment projects to Leadership in Energy and Environmental Design (“LEED”) specifications. All of our office and life science new development projects pursue LEED certification, at the Platinum or Gold level. We are actively pursuing LEED Gold certification for one approximately 875,000 square foot office and life science project under construction.

We identify climate change as a risk to our Company, its tenants, and our other stakeholders. These risks may include transitional risks such as policy, market, technology, and reputational concerns, as well as physical risks, and are a focus area for the board of directors and management. Climate-related risks are governed by the board of directors through the CSR&S Committee and by management through a newly established ESG Steering Committee which includes members from Asset Management, Development & Construction, Finance, Accounting, Human Resources, Investments, Leasing, Legal, and Sustainability. We are proud to have achieved carbon neutral operations since 2020. This means that the entirety of our Scope 1 and Scope 2 emissions, and scope 3 downstream leased assets emissions are offset through a combination of energy efficiency measures, onsite and offsite renewables, renewable energy credits (RECs), and verified carbon offsets. Our annual sustainability report includes additional detail on our carbon neutral operations strategy, other voluntary sustainability goals, as well as portfolio-wide energy, carbon, water, and waste data which are subject to a limited assurance process conducted by an independent third party.

Significant Tenants

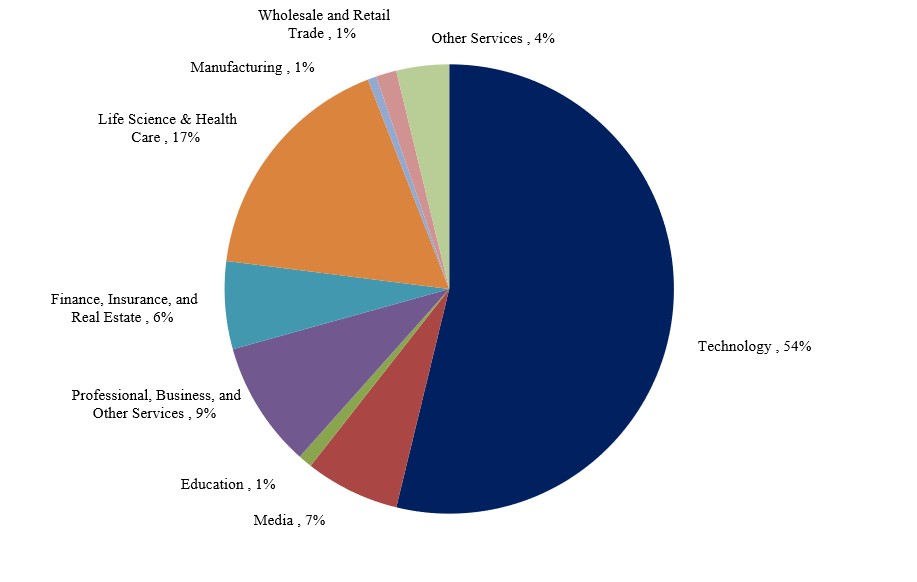

As of December 31, 2024, our 20 largest tenants in terms of annualized base rental revenues represented approximately 53.6% of our total annualized base rental revenues, defined as annualized monthly contractual rents from existing tenants as of December 31, 2024. Annualized base rental revenue includes the impact of straight-lining rent escalations and the amortization of free rent periods and excludes the impact of the following: amortization of deferred revenue related to tenant-funded tenant improvements, amortization of above/below market rents, amortization for lease incentives due under existing leases, and expense reimbursement revenue.

For further information on our 20 largest tenants and the composition of our tenant base, see “Item 2. Properties —Significant Tenants.”

Competition

We compete with other developers, owners, operators, and acquirers of office and life science properties, undeveloped land, and other commercial real estate, including mixed-use, and residential real estate, many of which own properties similar to ours in the same submarkets in which our properties are located. For further discussion of the potential impact of competitive conditions on our business, see “Item 1A. Risk Factors.”

Segment and Geographic Financial Information

During 2024 and 2023, we had one reportable segment. See Note 26 “Segments” to our consolidated financial statements included in this report for information regarding our reportable segment. For information, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations —Results of Operations.”

As of December 31, 2024, all of our properties and development and redevelopment projects were owned and all of our business was conducted in the state of California with the exception of ten stabilized office properties and one future development project located in the state of Washington and one stabilized office property and one future development project located in Austin, Texas. As of December 31, 2024, all of our properties and development and redevelopment projects were 100% owned, excluding four office properties owned by three consolidated property partnerships.

Human Capital Resources

As of December 31, 2024, we employed 229 people through the Operating Partnership. We believe our people are our greatest resource and managing and developing talent is our most important responsibility. Our human capital development goals and initiatives demonstrate our commitment to enhancing employee growth, satisfaction, and wellness while maintaining a collaborative and inclusive culture. Our approach is designed to, among other things, attract, retain, develop, and incentivize talented and experienced individuals in the highly competitive employment and commercial real estate markets in which we operate. Several of our human capital development initiatives include the following:

Talent Acquisition and Retention. We are committed to fostering a performance-based culture. As a result, we focus on recruiting and retaining talent based on merit without discrimination on the basis of any legally protected characteristic. We strive to cultivate a culture of engagement and inclusion, and we believe this commitment will allow us to attract and retain a highly qualified workforce to better serve our stakeholders. To emphasize this commitment, we have developed programming to promote workplace diversity and inclusion, and we continue to require mandatory unconscious bias training for all employees. As of December 31, 2024, our workforce was 56% female and 46% was ethnically diverse. In December 2023, we announced the appointment of Angela M. Aman as our new Chief Executive Officer and a director on our Board, effective January 22, 2024. Following her appointment, three of our eight directors (or 38%) are women. In addition, in May 2024, we announced the appointment of Daryl J. Carter as a member of our Board, resulting in 12.5% of our directors being racially or ethnically diverse.

Training and Education. We support the continual growth and development of our employees through various training and education programs throughout their tenure at the Company, offering a portfolio of learning experiences in various modalities to elevate their knowledge, skills, and abilities. During 2024, across all teams and regions, employees participated in various training and developmental opportunities, including virtual workshops, self-paced training, in-person sessions, “lunch and learns,” online webinars, and conferences. We also conducted annual competency-based performance assessments and talent development plans for all employees.

Employee Health and Wellness. The physical and mental health and well-being of our employees is of central importance to our culture. We evaluate our health and ancillary benefits annually to ensure our benefits package is robust and competitive. We are proud to offer a comprehensive health benefits program that provides employees and their families with care and coverage built around their total health. Our offerings include a medical HDHP and two-PPO plans, dental, and vision, with over 90% of the premiums absorbed by the Company. Employees have the option to participate in an HSA with a generous Company contribution, and we offer medical FSA and dependent care FSA options. Our package also includes Company paid group LTD, Life & AD&D, with voluntary employee paid buy-up options. We periodically conduct wellness surveys to help us better tailor our employee health and wellness programs and, during 2024, we added a new fitness reimbursement benefit meant to offset the costs associated with a gym membership or fitness class participation. Our enhanced Employee Assistance Program helps support mental health and wellness and we continue to focus on providing a variety of programming in this area. In addition to offering a 401(k) plan with matching contributions and immediate vesting after 90-days of employment, in 2024, we focused on employee financial wellness by offering a variety of educational events, web workshops, and financial tips, all aimed at helping our employees improve their overall financial well-being.

Competitive Benefits and Compensation. While many companies leverage a mix of competitive salaries and ancillary benefits to attract and retain their people, we have gone beyond those traditional structures and placed more emphasis on offering an expanded comprehensive benefits program as noted above. Additional benefits include enhanced paid pregnancy and parental leave benefits, parental leave coaching, and well-being programming and activities, coordinated by the Company, that align with our core values of Belong, Connect, and Progress.

Strong Communities and Healthy Planet. We are deeply aware that our buildings are part of the larger community and that we thrive when the communities around us thrive. We are proud to make these communities better places to live and work through our volunteerism and philanthropy initiatives. For the second year in a row, our transformed “Month of Service” program delivered a more robust effort dedicated to giving back to the communities in which we operate. The company-wide initiative gave our team enhanced opportunities to connect with local organizations and meaningful causes in the spirit of community enrichment and employee volunteerism. Over 152 employees assisted 18 organizations, dedicating more than 1,200 hours, a 17% increase in number of volunteer hours provided versus 2023.

Environmental Regulations and Potential Liabilities

Government Regulations Relating to the Environment. Many laws and governmental regulations relating to the environment are applicable to our properties, and changes in these laws and regulations, or their interpretation by agencies and the courts, occur frequently and may adversely affect us.

Existing conditions at some of our properties. Independent environmental consultants have conducted Phase I or similar environmental site assessments on all of our properties. We generally obtain these assessments prior to the acquisition of a property and may later update them as required for subsequent financing of the property, if a property is slated for disposition, or as requested by a tenant. Consultants are required to perform Phase I assessments to American Society for Testing and Materials standards then-existing for Phase I site assessments and typically include a historical review, a public records review, a visual inspection of the surveyed site, and the issuance of a written report. These assessments do not generally include any soil or groundwater sampling or subsurface investigations; however, if a Phase I does recommend that soil or groundwater samples be taken or other subsurface investigations take place, we generally perform such recommended actions. Depending on the age of the property, the Phase I may have included an assessment of asbestos-containing materials or a separate hazardous materials survey may have been conducted. For properties where asbestos-containing materials were identified or suspected, an operations and maintenance plan was generally prepared and implemented.

Historical operations at or near some of our properties, including the presence of underground or above ground storage tanks, various sites uses that involved hazardous substances, the landfilling of hazardous substances and solid waste, and migration of contamination from other sites, may have caused soil or groundwater contamination. In some instances, (i) the prior owners of the affected properties conducted remediation of known contamination in the soils on our properties, (ii) we are required to conduct further environmental clean-up and environmental closure activities at certain properties, or (iii) residual contamination could pose environmental, health, and safety risks if not appropriately addressed. We may need to investigate or remediate contaminated soil, soil gas, landfill gas, and groundwater, and we may also need to conduct landfill closure and post-closure activities, including, for example, the implementation of groundwater and methane monitoring systems and impervious cover, and the costs of such work could exceed projected or budgeted amounts. To protect the health and safety of site occupants and others, we may be required to implement and operate safeguards, including, for example, vapor intrusion mitigation systems and building protection systems to address methane. We may need to modify our methods of construction or face increased construction costs as a result of environmental conditions, and we may face obligations under agreements with governmental authorities with respect to the management of such environmental conditions. If releases from our sites migrate offsite, or if our site redevelopment activities cause or contribute to a migration of hazardous substances, neighbors or others could make claims against us, such as for property damage, personal injury, or cost recovery.

As of December 31, 2024, we had accrued environmental remediation liabilities of approximately $72.0 million recorded on our consolidated balance sheets in connection with certain of our in-process and future development projects. The accrued environmental remediation liabilities represent the remaining costs we estimate we will incur prior to and during the development process. These estimates, which we developed with the assistance of third-party experts, consist primarily of the removal of contaminated soil, treatment of contaminated groundwater in connection with dewatering efforts, performance of environmental closure activities, construction of remedial systems and other related costs that are necessary when we develop new buildings. It is possible that we could incur additional environmental remediation costs in connection with these development projects. However, potential additional environmental costs cannot be reasonably estimated at this time and certain changes in estimates could occur as the site conditions, final project timing, design elements, actual soil conditions, and other aspects of the projects, which may depend upon municipal and other approvals beyond the control of the Company, are determined. See Note 19 “Commitments and Contingencies” to our consolidated financial statements included in this report for additional information.

Other than the accrued environmental liabilities recorded in connection with certain of our development projects, we are not aware of any such condition, liability, or concern by any other means that would give rise to material environmental liabilities. However, our assessments may have failed to reveal all environmental conditions, liabilities, or compliance concerns; there may be material environmental conditions, liabilities, or compliance concerns that arose at a property after the review was completed; future laws, ordinances, or regulations may impose material additional environmental liability; and environmental conditions at our properties may be affected in the future by tenants, third parties, or the condition of land or operations near our properties, such as the presence of underground storage tanks or migrating plumes. We cannot be certain that costs of future environmental compliance will not have an adverse effect on our financial condition, results of operations, cash flows, the quoted trading price of our securities, and our ability to satisfy our debt service obligations, and to pay dividends and distributions to security holders.

Use of hazardous materials by some of our tenants. Some of our tenants handle hazardous substances and waste on our properties as part of their routine operations. Environmental laws and regulations may subject these tenants, and potentially us, to liability resulting from such activities. We generally require our tenants in their leases to comply with these environmental laws and regulations and to indemnify us for liabilities arising out of or related to their operations and any non-compliance with environmental laws. As of December 31, 2024, other than routine cleaning materials and chemicals used in routine office operations, approximately 1-2% of our tenants handled hazardous substances and/or wastes on approximately 4-5% of the aggregate square footage of our properties as part of their business operations. These tenants are primarily involved in the life sciences business. The hazardous substances and wastes are primarily comprised of diesel fuel for emergency generators and small quantities of lab and light manufacturing chemicals, including, but not limited to, alcohol, ammonia, carbon dioxide, cryogenic gases, dichlorophenol, methane, naturalyte acid, nitrogen, nitrous oxide, and oxygen which are routinely used by life science companies. We are not aware of any material noncompliance, liability, or claim relating to hazardous or

toxic substances or petroleum products in connection with any of our properties, and management does not believe that on-going activities by our tenants will have a material adverse effect on our operations.

Costs related to government regulation and private litigation over environmental matters. Under applicable environmental laws and regulations, we may be liable for the costs of removal, remediation, or disposal of certain hazardous or toxic substances present or released on our properties. These laws could impose liability without regard to whether we are otherwise responsible for, or even knew of, the presence or release of the hazardous materials. Government investigations and remediation actions may have substantial costs, and the presence or release of hazardous substances on a property could result in governmental clean-up actions, personal injury actions, or similar claims by private plaintiffs.

Potential environmental liabilities may exceed our environmental insurance coverage limits, transactional indemnities or holdbacks. We carry what we believe to be commercially reasonable environmental insurance. Our environmental insurance policies are subject to various terms, conditions, and exclusions. Similarly, in connection with some transactions we obtain environmental indemnities and holdbacks that may not be honored by the indemnitors, may be less than the resulting liabilities or may otherwise fail to address the liabilities adequately. Therefore, we cannot provide any assurance that our insurance coverage or transactional indemnities will be sufficient or that our liability, if any, will not have a material adverse effect on our financial condition, results of operations, cash flows, the quoted trading price of our securities, and our ability to satisfy our debt service obligations, and to pay dividends and distributions to security holders.

SUMMARY RISK FACTORS

The following section sets forth a summary of material factors that may adversely affect our business and operations. For a more extensive discussion of these factors, see “1A. Risk Factors” contained in this report.

•Global market, economic, and geopolitical conditions may adversely affect our business, results of operations, liquidity, and financial condition, and those of our tenants.

•Many of our costs, such as operating and general and administrative expenses, interest expense and real estate construction costs, as well as the value of our assets, could be adversely impacted by periods of heightened inflation.

•All of our properties are located in California, Seattle, Washington, and Austin, Texas and we may therefore be susceptible to adverse economic conditions and regulations, as well as natural disasters, in those areas.

•Potential casualty losses, such as earthquake losses, may adversely affect our financial condition, results of operations, and cash flows.

•Continuing uncertainty in the office leasing market could adversely affect our business, financial condition, results of operations, and cash flows.

•Our performance and the market value of our securities are subject to risks associated with our investments in real estate assets and with trends in the real estate industry.

•We depend upon significant tenants, and the loss of a significant tenant could adversely affect our financial condition, results of operations, ability to borrow funds, and cash flows.

•Downturns in tenants’ businesses may reduce our revenues and cash flows.

•A large percentage of our tenants operate in a concentrated group of industries and downturns in these industries could adversely affect our financial condition, results of operations, and cash flows.

•We may be unable to renew leases or re-lease available space.

•We are subject to governmental regulations that may affect the development, redevelopment, and use of our properties.

•Epidemics, pandemics or other outbreaks, and restrictions intended to prevent their spread, could adversely impact our business, financial condition, results of operations, cash flows, liquidity, and ability to satisfy our debt service obligations, and to pay dividends and distributions to security holders.

•We face significant competition, which may decrease the occupancy and rental rates of our properties.

•In order to maintain the quality of our properties and successfully compete against other properties, we must periodically spend money to maintain, repair, and renovate our properties, which reduces our cash flows.

•We may not be able to rebuild our existing properties to their existing specifications if we experience a substantial or comprehensive loss of such properties.

•Our business is subject to risks associated with climate change and our sustainability strategies.

•We are subject to environmental and health and safety laws and regulations, and any costs to comply with, or liabilities arising under, such laws and regulations could be material.

•We may be unable to complete acquisitions and successfully operate acquired properties.

•There are significant risks associated with property acquisitions as well as development and redevelopment.

•We face risks associated with the development and operation of mixed-use commercial properties.

•Joint venture investments could be adversely affected by our lack of sole decision-making authority, our reliance on co-venturers’ financial condition, and disputes between us and our co-venturers, and could expose us to potential liabilities and losses.

•We own certain properties subject to ground leases and other restrictive agreements that limit our uses of the properties, restrict our ability to sell or otherwise transfer the properties, and expose us to the loss of the properties if such agreements are breached by us, terminated, or not renewed.

•Real estate assets are illiquid, and we may not be able to sell our properties when we desire.

•We may invest in securities related to real estate, which could adversely affect our ability to pay dividends and distributions to our security holders.

•We face risks associated with short-term liquid investments.

•Our property taxes could increase due to reassessment or property tax rate changes.

•Our business could be adversely impacted if there are deficiencies in our disclosure controls and procedures or internal control over financial reporting.

•We face risks associated with perceived or actual security breaches through cyber attacks, cyber intrusions or otherwise, as well as other significant disruptions of our information technology (IT) networks and related systems or those of our service providers.

•We face risks associated with compliance with ever evolving federal and state laws relating to the handling of information about individuals, which involves significant expenditure and resources, and any failure by us or our vendors to comply may result in significant liability, negative publicity, and/or an erosion of trust, which could materially adversely affect our business, results of operations, and financial condition.

•The actual density of our undeveloped land holdings and/or any particular land parcel may not be consistent with our potential density estimates.

•Loss of key executive officers or our inability to successfully transition key executive officers could harm our operations and financial performance, and adversely affect the quoted trading price of our securities.

•We could be adversely affected by labor disputes, strikes, or other union job actions.

•We may not be able to meet our debt service obligations.

•The covenants in the agreements governing the Operating Partnership’s unsecured revolving credit facility, unsecured term loan facility, and note purchase agreements may limit our ability to make distributions to the holders of our common stock.

•A downgrade in our credit ratings could materially adversely affect our business and financial condition.

•An increase in interest rates would increase our interest costs on variable rate debt and new debt and could adversely affect our ability to refinance existing debt, conduct development, redevelopment, and acquisition activity and recycle capital.

•Our growth depends on external sources of capital that are outside of our control and the inability to obtain capital on terms that are acceptable to us, or at all, could adversely affect our financial condition and results of operations.

•Our organizational structure includes approval rights for limited partners and restrictions that may delay, deter or prevent a change of control.

•We may issue additional common units and shares of capital stock without unitholder or stockholder approval, as applicable, which may dilute unitholder or stockholder investment and decrease the quoted trading price per share of the Company’s common stock.

•The board of directors may change investment and financing policies without stockholder or unitholder approval.

•Loss of the Company’s REIT status would have significant adverse consequences to us and the value of the Company’s common stock.

ITEM 1A. RISK FACTORS

The following section sets forth material factors that may adversely affect our business and operations. The following factors, as well as the factors discussed in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations —Factors That May Influence Future Results of Operations” and other information contained in this report, should be considered in evaluating us and our business.

Risks Related to our Business and Operations

Global market, economic, and geopolitical conditions may adversely affect our business, results of operations, liquidity, and financial condition, and those of our tenants. Our business may be adversely affected by global market, economic and geopolitical conditions, including general global economic and political uncertainty and dislocations in the credit markets. If these conditions become more volatile or worsen, our business, results of operations, liquidity and financial condition, and those of our tenants may be adversely affected as a result of the following consequences, among others:

•our ability to obtain financing on terms and conditions that we find acceptable, or at all, may be limited, which could reduce our ability to pursue acquisition and development opportunities and refinance existing debt, reduce our returns from our acquisition and development activities, and increase our future interest expense;

•the financial condition of our tenants, many of which are technology; life science and healthcare; finance, insurance and real estate; media and professional business, and other service firms, may be adversely affected, which may result in tenant defaults under leases due to bankruptcy, lack of liquidity, operational failures, or for other reasons;

•significant job losses in the technology; life science and healthcare; finance, insurance and real estate; media and professional business and other service firm industries may occur, which may decrease demand for our office space, causing market rental rates and property values to be negatively impacted;

•reduced values of our properties may limit our ability to dispose of assets at attractive prices or to obtain debt financing secured by our properties and may reduce the availability of unsecured loans; and

•one or more lenders under the Operating Partnership’s unsecured revolving credit facility could refuse to fund their financing commitment to us or could fail and we may not be able to replace the financing commitment of any such lenders on favorable terms, or at all.

Many of our costs, such as operating and general and administrative expenses, interest expense, and real estate construction costs, as well as the value of our assets, could be adversely impacted by periods of heightened inflation. While inflation has moderated in 2024, the consumer price index was at significantly elevated levels for most of the year. Federal policies, volatile commodity prices and geopolitical conflicts may have exacerbated, and may continue to exacerbate, increases in the consumer price index.

A sustained or further increase in inflation could have an adverse impact on our operating expenses incurred in connection with, among others, the property-related contracted services such as repairs and maintenance, janitorial, utilities, security, and insurance. Our operating expenses, with the exception of ground lease rental expenses, may be recoverable through our lease arrangements. In general, the office and life science properties are leased to tenants on a triple net, modified net, full service gross, or modified gross basis. Under a triple net lease, the tenants pay their proportionate share of real estate taxes, operating costs, and utility costs. A modified net lease is similar to a triple net lease, except the tenants are obligated to pay their proportionate share of certain operating expenses directly to the service provider. Under a full service gross lease, we are obligated to pay the tenant’s proportionate share of real estate taxes, insurance, and operating expenses up to the amount incurred during the “base year,” which is typically the tenant’s first year of occupancy. The tenant pays its proportionate share of increases in expenses above the base year. A modified gross lease is similar to a full service gross lease, except tenants are obligated to pay their proportionate share of certain operating expenses, usually electricity, directly to the service provider. At December 31, 2024, 46% of our properties were leased to tenants on a triple net basis, 27% were leased to tenants on a

modified gross basis, 21% of our properties were leased to tenants on a full service gross basis, and 6% of our properties were leased to tenants on a modified net basis, in each case as a percentage of our annualized base rental revenue.

During inflationary periods, we expect to recover some increases in operating expenses from our tenants through our existing lease structures. As a result, we do not believe that inflation would result in a material adverse effect on our net operating income and operating cash flows at the property level. However, there can be no assurance that our tenants would be able to absorb these expense increases and be able to continue to pay us their portion of operating expenses, capital expenditures, and rent. Also, due to rising costs, our tenants may be unable to continue operating their businesses altogether. Alternatively, our tenants may decide to relocate to areas with lower rent and operating expenses where we may not currently own properties, and our tenants may cease to lease properties from us. Such adverse impacts on our tenants may cause increased vacancies, which may add pressure to lower rents and increase our expenditures for re-leasing. If we are unable to retain our tenants or withstand increases in operating expenses, capital expenditures, and leasing costs, we may be unable to meet our financial expectations, which may adversely affect our business, financial condition, results of operations, cash flows, liquidity, and ability to satisfy our debt service obligations, and to pay dividends and distributions to security holders.

Our general and administrative expenses consist primarily of compensation costs, technology services, and professional service fees. Rising inflation rates may require us to provide compensation increases beyond historical annual increases, which may increase our compensation costs. Similarly, technology services and professional service fees are also subject to the impact of inflation and expected to increase proportionately with increasing market prices for such services. Consequently, inflation may increase our general and administrative expenses over time and may adversely impact our results of operations and cash flows.

Our exposure to increases in interest rates in the short term is limited to our variable-rate borrowings, which consist of borrowings under our unsecured revolving credit facility and unsecured term loan facility. As of December 31, 2024, we had no borrowings under our unsecured revolving credit facility and $200.0 million outstanding under our unsecured term loan facility. However, the increases in long-term interest rates has recently and may continue to increase our financing costs over time, as we incur new debt or refinance existing debt. Increases in interest rates increase our interest costs, which reduce our cash flows and impact our ability to make distributions to stockholders. For more information, see “Item 1A. Risk Factors—Risks Related to our Indebtedness—An increase in interest rates would increase our interest costs on variable rate debt and new debt and could adversely affect our ability to refinance existing debt, conduct development, redevelopment and acquisition activity and recycle capital.”

In addition, historically, during periods of increasing interest rates, real estate valuations have generally decreased as a result of rising capitalization rates, which tend to be positively correlated with interest rates. Consequently, prolonged periods of higher interest rates may negatively impact the valuation of our portfolio and result in the decline of the quoted trading price of our securities and market capitalization, as well as lower sales proceeds from future dispositions. Although the extent of any prolonged periods of higher interest rates remains unknown at this time, negative impacts to our cost of capital may adversely affect our future business plans and growth, including our development and redevelopment activities, at least in the near term.

We have long-term lease agreements with our tenants, and we believe that annual rent escalations within our long-term leases are generally sufficient to offset the effect of inflation on non-recoverable costs, such as general and administrative expenses and interest expense. However, the impact of the current elevated rate of inflation may not be adequately offset by some of our annual rent escalations, and it is possible that the resetting of rents from our renewal and re-leasing activities would not fully offset the impact of the current inflation rate. As a result, during inflationary periods in which the inflation rate exceeds the annual rent escalation percentages within our lease contracts, we may not adequately mitigate the impact of inflation, which may adversely affect our business, financial condition, results of operations, and cash flows.

Additionally, inflation may have a negative effect on the construction costs necessary to complete our development and redevelopment projects, including, but not limited to, costs of construction materials, labor, and services from third-party contractors and suppliers. We rely on a number of third-party suppliers and contractors to supply raw materials, skilled labor, and services for our construction projects. Certain increases in the costs of

construction materials can often be managed in our development and redevelopment projects through either general budget contingencies built into our overall construction costs estimates for each of our projects or guaranteed maximum price construction contracts, which stipulate a maximum price for certain construction costs and shift inflation risk to our construction general contractors. However, no assurance can be given that our budget contingencies would accurately account for potential construction cost increases given the current severity of inflation and variety of contributing factors or that our general contractors would be able to absorb such increases in costs and complete our construction projects timely, within budget, or at all.

We have not encountered significant difficulty collaborating with our third-party suppliers and contractors and obtaining materials and skilled labor, and we have not experienced significant delays or increases in overall project costs due to the factors discussed above. While we do not rely on any single supplier or vendor for the majority of our materials and skilled labor, we may experience difficulties obtaining necessary materials from suppliers or vendors whose supply chains might become impacted by economic or political changes, shortages of shipping containers and/or means of transportation, or difficulties obtaining adequate skilled labor from third-party contractors in a tightening labor market. It is uncertain whether we would be able to source the essential commodities, supplies, materials and skilled labor timely or at all without incurring significant costs or delays, particularly during times of economic uncertainty resulting from events outside of our control, including, but not limited to, federal policies and the ongoing or future geopolitical conflicts.

Higher construction costs could adversely impact our investments in real estate assets and expected yields on our development and redevelopment projects, which may make otherwise lucrative investment opportunities less profitable to us. Our reliance on a number of third-party suppliers and contractors may also make such investment opportunities unattainable if we are unable to sufficiently fund our projects due to significant cost increases, or are unable to obtain the resources and materials to do so reasonably due to disrupted supply chains. As a result, our business, financial condition, results of operations, cash flows, liquidity, and ability to satisfy our debt service obligations, and to pay dividends and distributions to security holders could be adversely affected over time.

All of our properties are located in California, Seattle, Washington, and Austin, Texas and we may therefore be susceptible to adverse economic conditions and regulations, as well as natural disasters, in those areas. Because all of our properties are concentrated in California, Seattle, Washington, and Austin, Texas, we may be exposed to greater economic risks than if we owned a more geographically dispersed portfolio. Further, within California, our properties are concentrated in Los Angeles, San Diego County, and the San Francisco Bay Area, exposing us to risks associated with those specific areas. We are susceptible to adverse developments in the economic and regulatory environments of California, Seattle, Washington, and Austin, Texas (such as periods of economic slowdown or recession, business layoffs or downsizing, industry slowdowns, relocations of businesses, increases in real estate and other taxes, costs of complying with governmental regulations or increased regulation, and other factors), as well as adverse weather conditions and natural disasters that occur in those areas (such as earthquakes, wind, landslides, droughts, fires, floods, and other events). For example, many of our assets are in zones that have been impacted by drought and, as such, face the risk of increased water costs and potential fines and/or penalties for high consumption. In addition, California is also regarded as more litigious and more highly regulated and taxed than many other states, which may reduce demand for office space in California.

Potential casualty losses, such as earthquake losses, may adversely affect our financial condition, results of operations, and cash flows. We carry comprehensive liability, fire, extended coverage, rental loss, and terrorism insurance covering all of our properties. Management believes the policy specifications and insured limits are appropriate given the relative risk of loss, the cost of the coverage, and industry practice. We do not carry insurance for generally uninsurable losses such as loss from riots or acts of God. In addition, all of our West Coast properties are located in earthquake-prone areas. We carry earthquake insurance on our properties in an amount and with deductibles that management believes are commercially reasonable. However, the amount of our earthquake insurance coverage may not be sufficient to cover losses from earthquakes. We may also discontinue earthquake insurance on some or all of our properties in the future if the cost of premiums for earthquake insurance exceeds the value of the coverage discounted for the risk of loss. If we experience a loss that is uninsured or which exceeds policy limits, we could lose the capital invested in the damaged properties as well as the anticipated future cash flows from those properties. Further, if the damaged properties are subject to recourse indebtedness, we would continue to be liable for the indebtedness, even if the properties were irreparable.

Any adverse developments in the economy or real estate market in California and the surrounding region, or in Seattle, Washington, or Austin, Texas or any decrease in demand for office space resulting from the California or Seattle, Washington, or Austin, Texas regulatory or business environment could impact our ability to generate revenues sufficient to meet our operating expenses or other obligations, which would adversely impact our financial condition, results of operations, cash flows, the quoted trading price of our securities, and our ability to satisfy our debt service obligations, and to pay dividends and distributions to our security holders.

Continuing uncertainty in the office leasing market could adversely affect our business, financial condition, results of operations, and cash flows. Office tenants are still active in the leasing markets but are more selective in making rental decisions, and both relocating and renewing tenants are pursuing space efficiencies, which may be accompanied by reductions in the amount of space they are leasing due to the impact of hybrid work and/or a desire to manage real estate expenses. As a result, we are experiencing longer lease negotiation periods prior to signing deals. Our office tenants may elect to not renew their leases, or to renew them for less space than they currently occupy or for shorter terms, which could increase vacancy, place downward pressure on occupancy, rental rates and income, and property valuations. The need to reconfigure leased office space, either in response to evolving tenant needs or for other reasons, may impact space requirements and also may require us to spend increased amounts for tenant improvements. If substantial reconfiguration of the tenant’s space is required, the tenant may find it more advantageous to relocate than to renew its lease and renovate the existing space. For more information, see “—We may be unable to renew leases or re-lease available space,” below. All of these factors could have a material adverse effect on our business, financial condition, results of operations, cash flows, ability to satisfy our debt service obligations, or make distributions to stockholders.

Our performance and the market value of our securities are subject to risks associated with our investments in real estate assets and with trends in the real estate industry. Our economic performance and the value of our real estate assets and, consequently the market value of the Company’s securities, are subject to the risk that our properties may not generate revenues sufficient to meet our operating expenses or other obligations. A deficiency of this nature would adversely impact our financial condition, results of operations, cash flows, the quoted trading price of our securities, and our ability to satisfy our debt service obligations, and to pay dividends and distributions to our security holders.

Events and conditions applicable to owners and operators of real estate that are beyond our control and could impact our economic performance and the value of our real estate assets may include:

•local oversupply or reduction in demand for office, mixed-use, or other commercial space, which may result in decreasing rental rates and greater concessions to tenants;

•inability to collect rent from tenants;

•vacancies or inability to rent space on favorable terms or at all;

•inability to finance property development and acquisitions on favorable terms or at all;