Exhibit 99.1

Exhibit 99.1

Investor/Analyst Presentation – Bellevue, Washington October 10, 2011

Disclaimer

Statements made in this presentation may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements relate to, without limitation, Kilroy Realty Corporation’s (the “Company”) and Kilroy Realty, L.P.’s (the “Operating Partnership”) future economic performance, plans and objectives for future operations, and projections of revenue and other selected financial information. Forward-looking statements can be identified by the use of words such as “may,” “will,” “plan,” “could,” “should,” “expect,” “anticipate,” “outlook,” “estimate,” “projected,” “target,” “continue” “intend,” “believe,” “seek,” or “assume,” and variations of such words and similar expressions are intended to identify such forward looking statements. Forward-looking statements are not guarantees of future performance and are inherently subject to risks, uncertainties and assumptions, many of which are beyond the control of the Company and the Operating

Partnership. Although we believe that the expectations reflected in such forward-looking statements are based upon reasonable assumptions at the time made, we cannot assure you that such expectations will be achieved, and future events and actual results, financial and otherwise, may differ materially from the results discussed in the forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements and are advised to consider the risks detailed in the Company’s and the Operating Partnership’s Annual Report on Form 10-K for the year ended December 31, 2010, as supplemented by the Company’s and the Operating Partnership’s Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. All Company and Operating Partnership financial data as of and for the period ending September 30, 2011 included in this presentation is based on preliminary results of operations, and the historical financial condition and results of operations as of and for the periods ended September 30, 2011, when reported, may differ. The Company and the Operating Partnership assume no obligation to update and supplement forward-looking statements that become untrue because of subsequent events, new information or otherwise.

This presentation includes information with respect to letters of intent (“LOIs”) that we have entered into with respect to space that we are proposing to lease to certain tenants. There can be no assurance if or when the leases contemplated by these LOIs will be entered into or, if entered into that the terms will not differ substantially from those described in this presentation. An LOI is not a definitive agreement and one or more of the leases contemplated by LOIs may not result in a signed lease. In addition, this presentation contains information regarding properties under contract. We cannot assure you that these transactions will close or, if they do, that the terms will not differ from those described in this presentation. Accordingly, you should not rely on the information in this presentation regarding LOIs and properties under contract as a prediction of future leasing or acquisition activity.

In this presentation, we rely on and refer to information and statistical data regarding the industry and the sectors in which we operate, including information relating to projected employment growth, occupancy rates, rent growth and leasing demand. This information and statistical data is based on information obtained from various third-party sources (including the Bureau of Labor Statistics, U.S. Census Bureau, The Center for Measuring University Performance and established, well-known real estate brokerage and advisory companies), and, in some cases, on our own internal estimates. We believe that these sources and estimates are reliable, but have not independently verified them and cannot guarantee their accuracy or completeness.

1

Program

I. Tyler Rose II. John Kilroy III. Eli Khouri IV. Mike Shields V. Tyler Rose VI. John Kilroy VII. Q&A VIII. Property Tour

Introduction

Company Overview

Acquisitions, Dispositions and Seattle Overview

Eastside Market and KRC Properties

Financial Update

Key Takeaways

Overlake Office Center, Redmond

Key Center, Bellevue

Plaza Yarrow Bay, Kirkland

2

John Kilroy

President

Chief Executive Officer

Company Overview

3

Making Progress on All Fronts

Strong leasing performance year-to-date

Four consecutive quarters of positive same-store NOI

Company now 93% occupied and 93% leased

More than 1.1 million square feet of in-place letters of intent as of September 30, 2011 Closed acquisition of 201 3rd Street in San Francisco in September

Acquired $516 million of properties year-to-date

Three pending acquisitions totaling $163 million

Closed $24 million of dispositions in San Diego

Additional dispositions totaling $175 million currently in the market Full availability of credit line

Continued focus on core portfolio growth

4

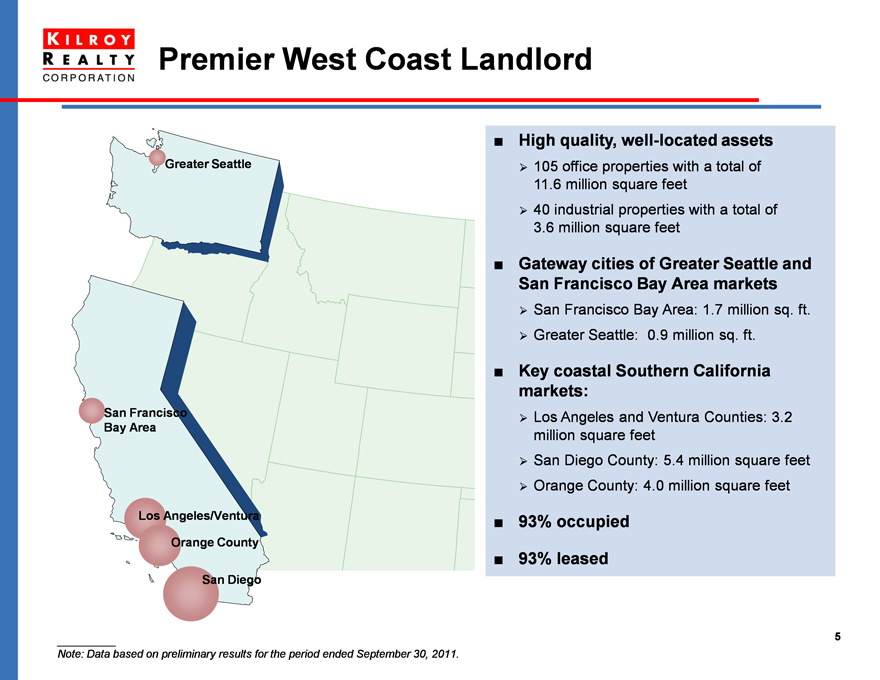

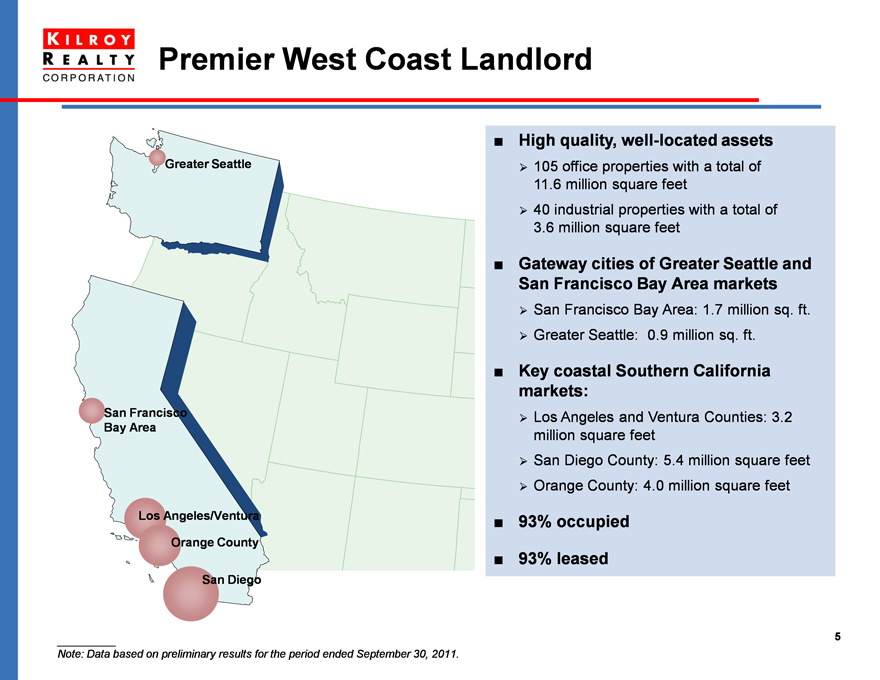

Premier West Coast Landlord

High quality, well-located assets

105 office properties with a total of 11.6 million square feet

40 industrial properties with a total of 3.6 million square feet

Gateway cities of Greater Seattle and San Francisco Bay Area markets

San Francisco Bay Area: 1.7 million sq. ft.

Greater Seattle: 0.9 million sq. ft.

Key coastal Southern California markets:

Los Angeles and Ventura Counties: 3.2 million square feet

San Diego County: 5.4 million square feet

Orange County: 4.0 million square feet

93% occupied

93% Leased

Note: Data based on preliminary results for the period ended September 30, 2011.

5

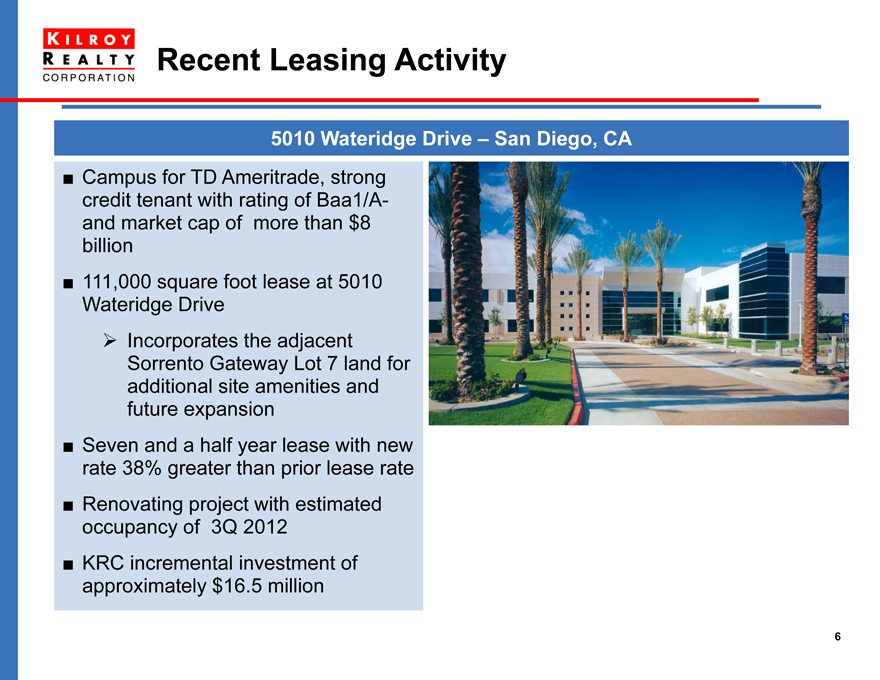

Recent Leasing Activity

5010 Wateridge Drive – San Diego, CA

Campus for TD Ameritrade, strong credit tenant with rating of Baa1/A-and market cap of more than $8 billion 111,000 square foot lease at 5010 Wateridge Drive

Incorporates the adjacent Sorrento Gateway Lot 7 land for additional site amenities and future expansion Seven and a half year lease with new rate 38% greater than prior lease rate

Renovating project with estimated occupancy of 3Q 2012 KRC incremental investment of approximately $16.5 million

6

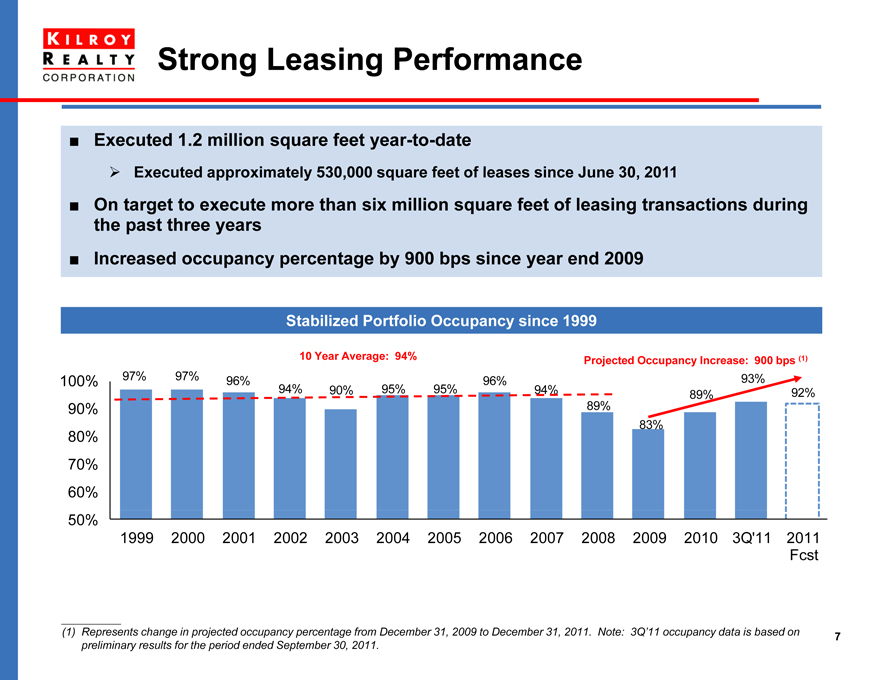

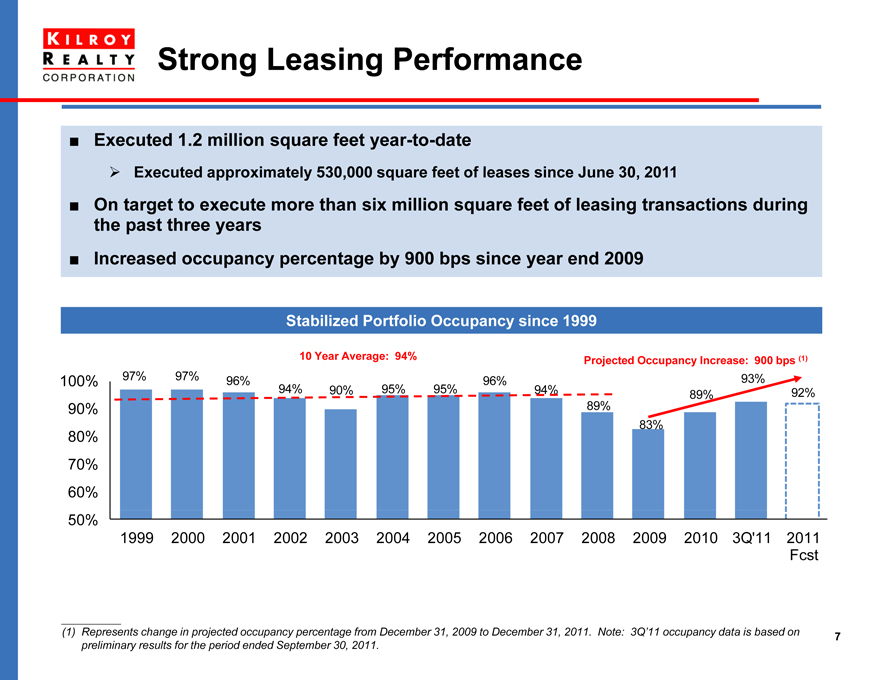

Strong Leasing Performance

Executed 1.2 million square feet year-to-date

Executed approximately 530,000 square feet of leases since June 30, 2011

On target to execute more than six million square feet of leasing transactions during the past three years Increased occupancy percentage by 900 bps since year end 2009

Stabilized Portfolio Occupancy since 1999

10 Year Average: 94%

Projected Occupancy Increase: 900 bps (1)

97% 97% 96%

94%

90% 95% 95%

96%

94%

89%

83%

89%

93%

92%

100% 90% 80% 70% 60% 50%

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 3Q’11 2011

Fcst

(1) Represents change in projected occupancy percentage from December 31, 2009 to December 31, 2011. Note: 3Q’11 occupancy data is based on preliminary results for the period ended September 30, 2011.

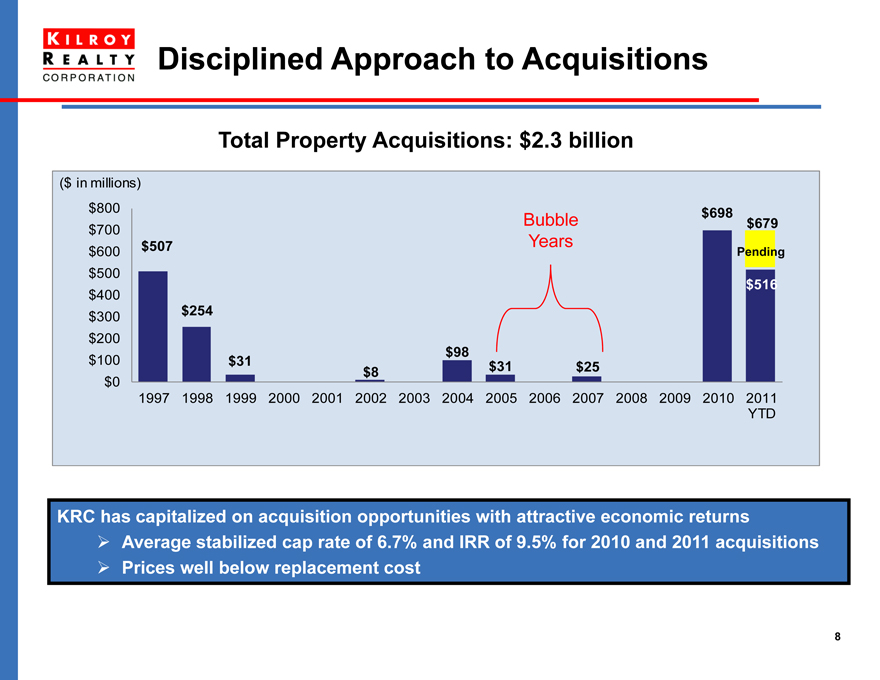

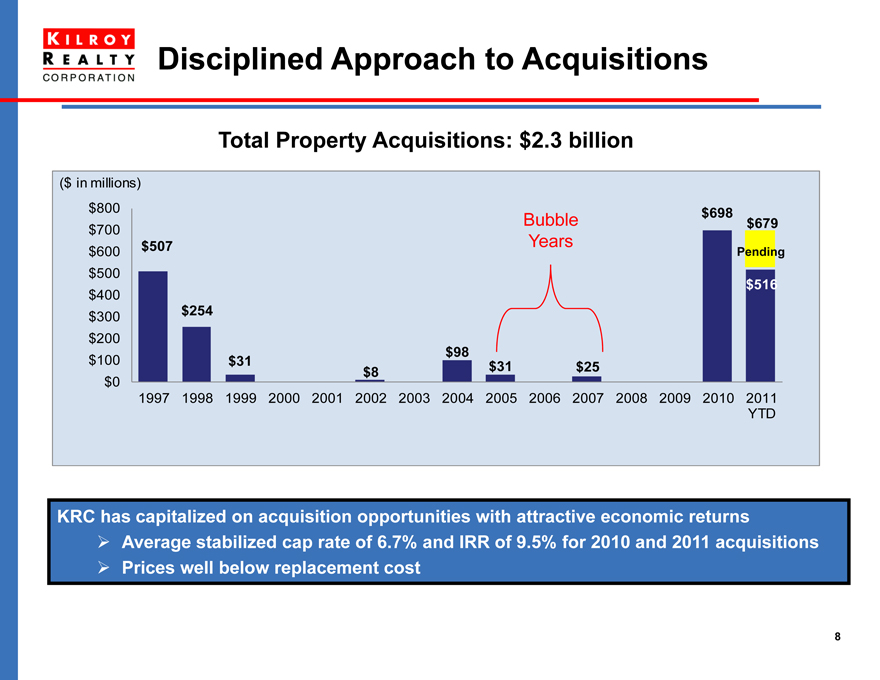

Disciplined Approach to Acquisitions

Total Property Acquisitions: $2.3 billion

($ in millions)

$800 $700 $600 $500 $400 $300 $200 $100 $0

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

YTD

$507

$254

$31

$8

$98

$31

$25

Bubble Years

$698

$679

Pending

$516

KRC has capitalized on acquisition opportunities with attractive economic returns

Average stabilized cap rate of 6.7% and IRR of 9.5% for 2010 and 2011 acquisitions

Prices well below replacement cost

8

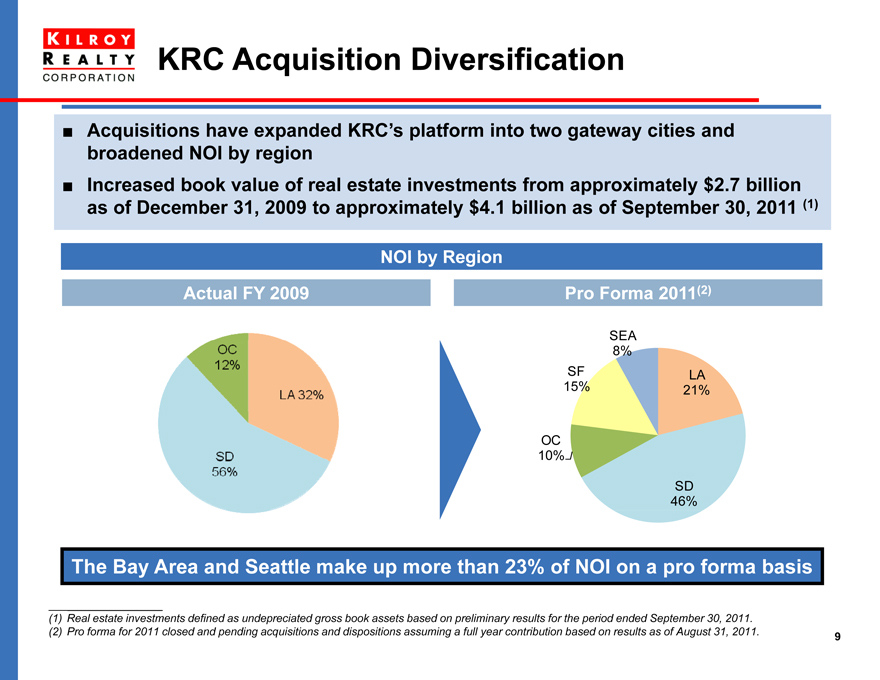

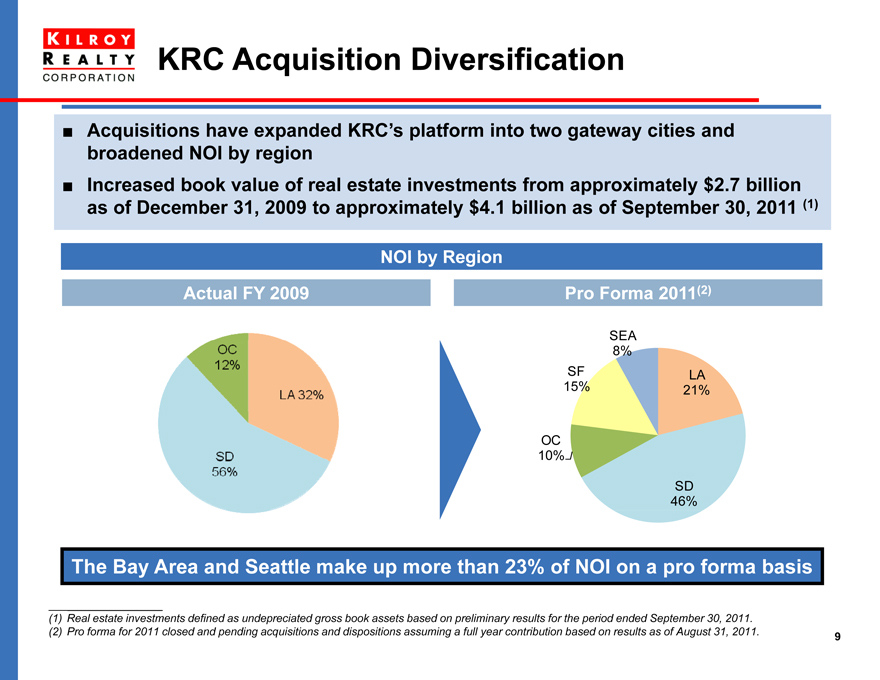

KRC Acquisition Diversification

Acquisitions have expanded KRC’s platform into two gateway cities and broadened NOI by region Increased book value of real estate investments from approximately $2.7 billion as of December 31, 2009 to approximately $4.1 billion as of September 30, 2011 (1)

NOI by Region

Actual FY 2009

OC 12% SD 56% LA 32%

SEA 8%

SF 15%

OC 10%

SD 46% LA21%

The Bay Area and Seattle make up more than 23% of NOI on a pro forma basis

(1) Real estate investments defined as undepreciated gross book assets based on preliminary results for the period ended September 30, 2011. (2) Pro forma for 2011 closed and pending acquisitions and dispositions assuming a full year contribution based on results as of August 31, 2011.

9

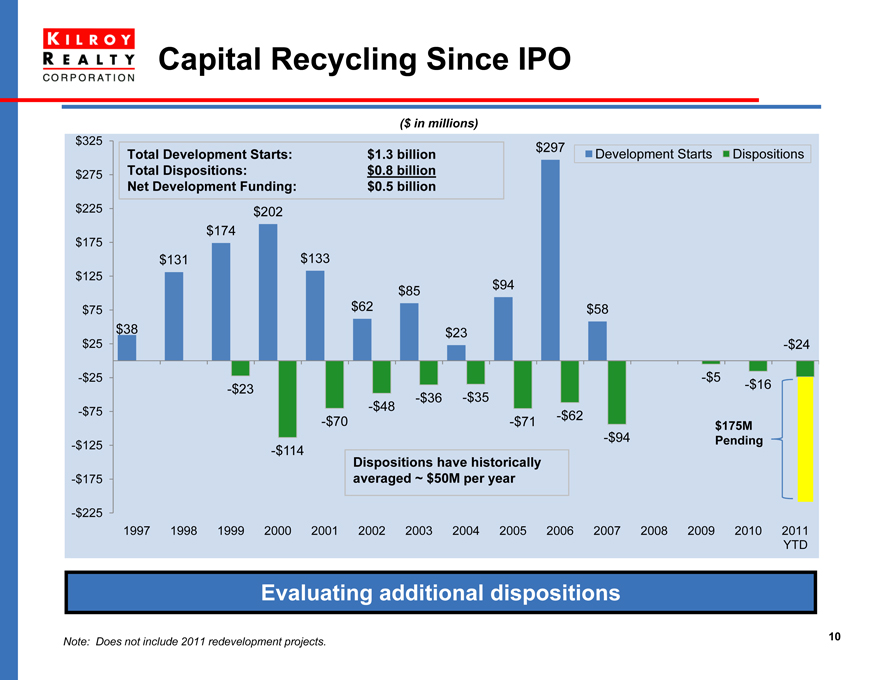

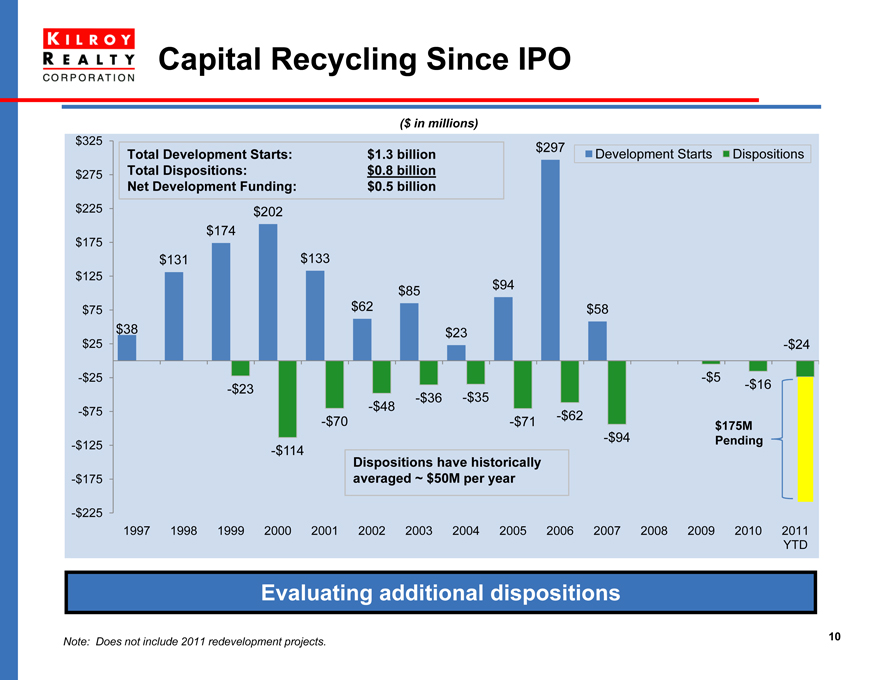

Capital Recycling Since IPO

($ in millions)

$325 $275 $225 $175 $125 $75 $25

-$25 -$75 -$125 -$175 -$225

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

YTD

Total Development Starts: Total Dispositions: Net Development Funding:

$1.3 billion $0.8 billion $0.5 billion

Development Starts Dispositions

$38 $131 $174 $202 $133 $62 $85 $23 $94 $297 $58 -$24 -$23 -$114 -$70 -$48 -$36 -$35 -$71 -$62 -$94 -$5 -$16

$175M Pending

Evaluating additional dispositions

Note: Does not include 2011 redevelopment projects.

10

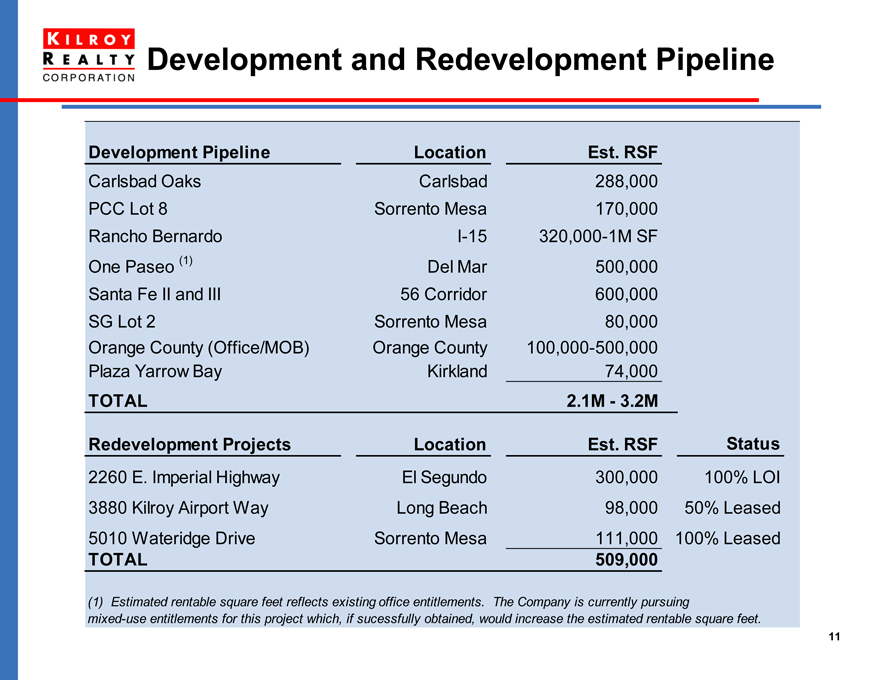

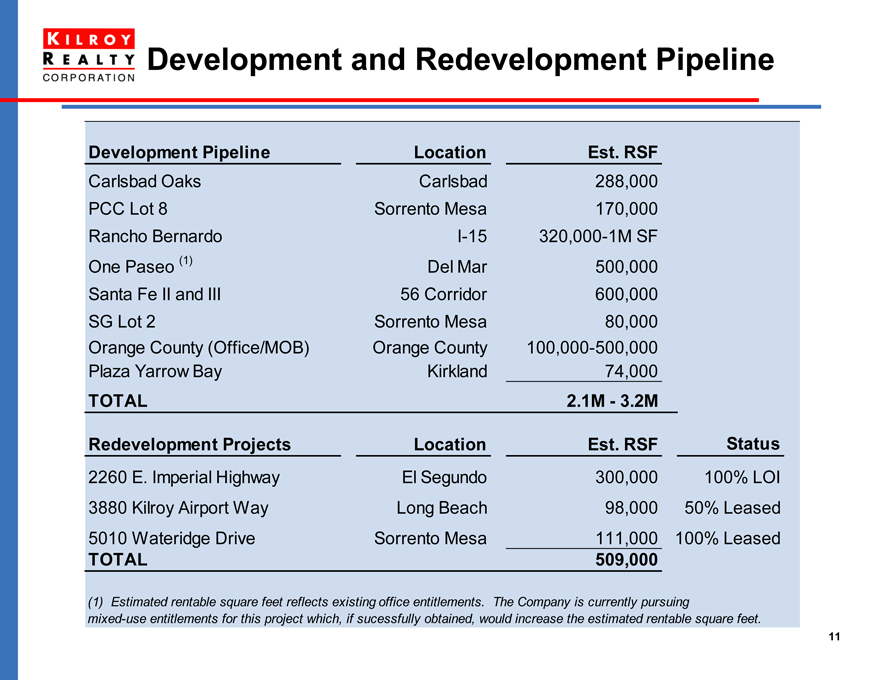

Development and Redevelopment Pipeline

Development Pipeline Location Est. RSF

Carlsbad Oaks Carlsbad 288,000

PCC Lot 8 Sorrento Mesa 170,000

Rancho Bernardo I-15 320,000-1M SF

One Paseo (1) Del Mar 500,000

Santa Fe II and III 56 Corridor 600,000

SG Lot 2 Sorrento Mesa 80,000

Orange County (Office/MOB) Orange County 100,000-500,000

Plaza Yarrow Bay Kirkland 74,000

TOTAL 2.1M-3.2M

Redevelopment Projects Location Est. RSF Status

2260 E. Imperial Highway El Segundo 300,000 100% LOI

3880 Kilroy Airport Way Long Beach 98,000 50% Leased

5010 Wateridge Drive Sorrento Mesa 111,000 100% Leased

TOTAL 509,000

(1) Estimated rentable square feet reflects existing office entitlements. The Company is currently pursuing mixed-use entitlements for this project which, if sucessfully obtained, would increase the estimated rentable square feet.

11

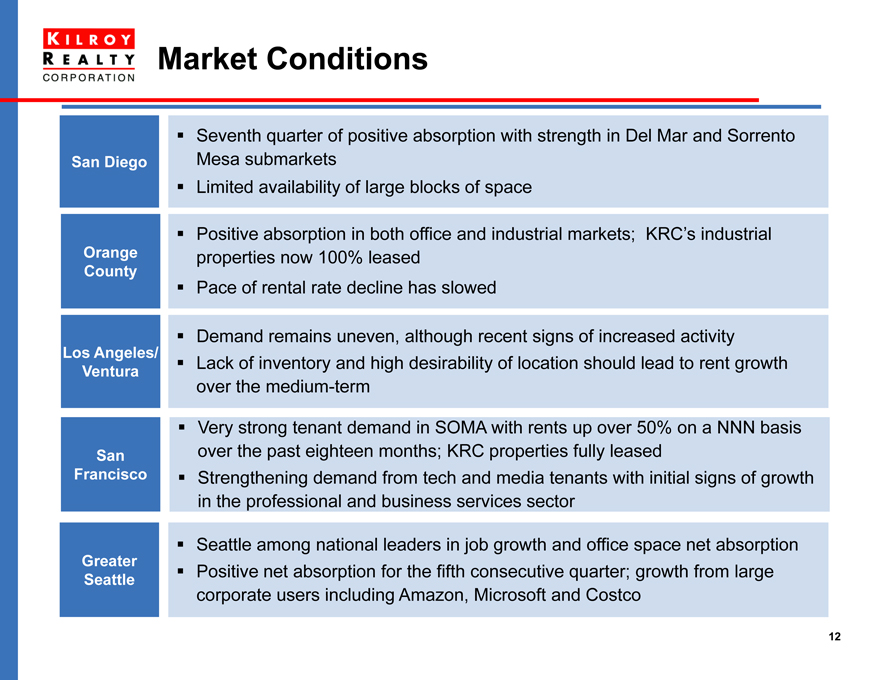

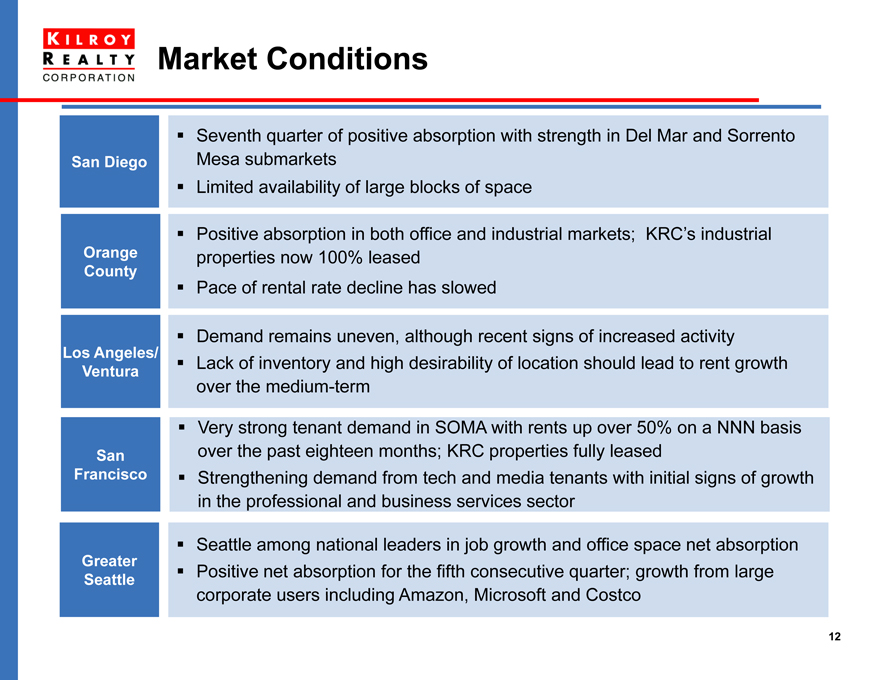

Market Conditions

San Diego

Orange County

Los Angeles/ Ventura

San Francisco

Greater Seattle

Seventh quarter of positive absorption with strength in Del Mar and Sorrento Mesa submarkets Limited availability of large blocks of space

Positive absorption in both office and industrial markets; KRC’s industrial properties now 100% leased

Pace of rental rate decline has slowed

Demand remains uneven, although recent signs of increased activity

Lack of inventory and high desirability of location should lead to rent growth over the medium-term

Very strong tenant demand in SOMA with rents up over 50% on a NNN basis over the past eighteen months; KRC properties fully leased ?Strengthening demand from tech and media tenants with initial signs of growth in the professional and business services sector

Seattle among national leaders in job growth and office space net absorption Positive net absorption for the fifth consecutive quarter; growth from large corporate users including Amazon, Microsoft and Costco

12

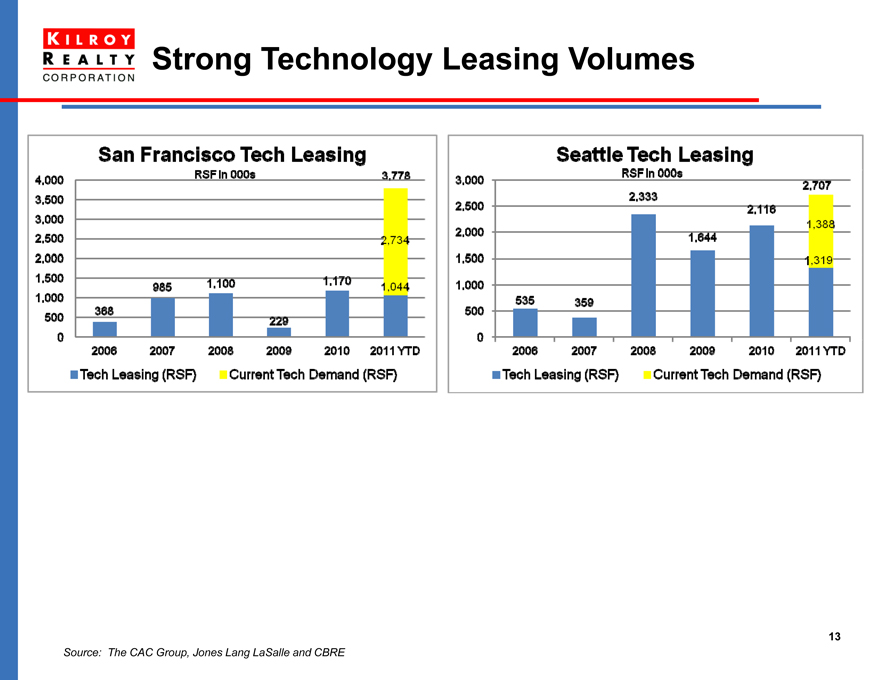

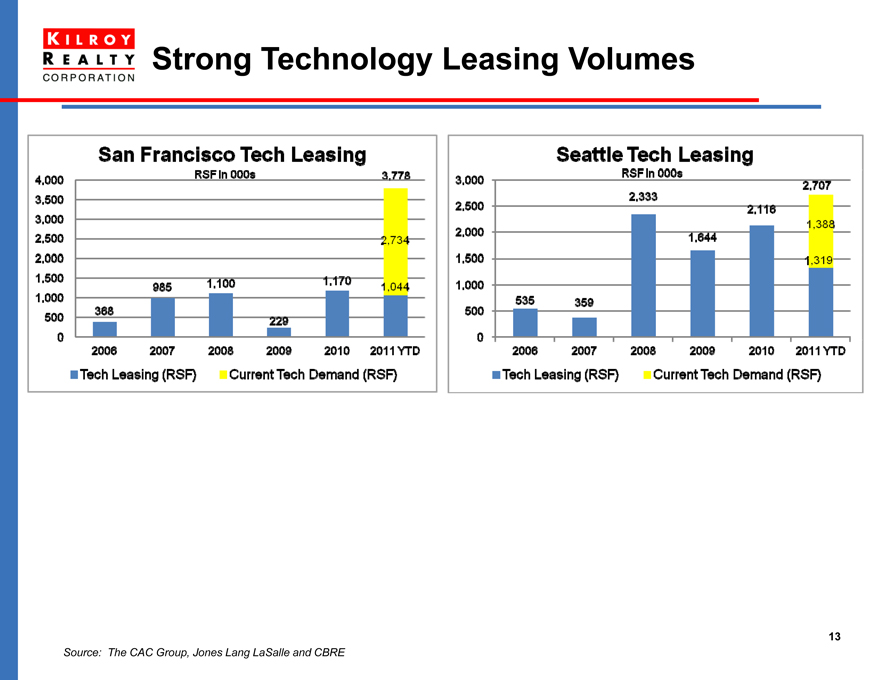

Strong Technology Leasing Volumes

San Francisco Tech leasing

RSF in 000s

4,000 3,500 3,000 2,500 2000 1,500 1,000 500 0

2006 2007 2008 2009 2010 2011 YTD

368 985 1,100 229 1,170 3,778 2,734 1,044

Tech Leasing (RSF)

Current Tech Demand (RSF)

Seattle Tech Leasing

RSF in 000s

3,000 2,500 2000 1,500 1,000 500 0

2006 2007 2008 2009 2010 2011 YTD

535 359 2,333 1,644 2,118 2,707 1,388 1,319

Tech Leasing (RSF)

Current Tech Demand (RSF)

Source: The CAC Group, Jones Lang LaSalle and CBRE

13

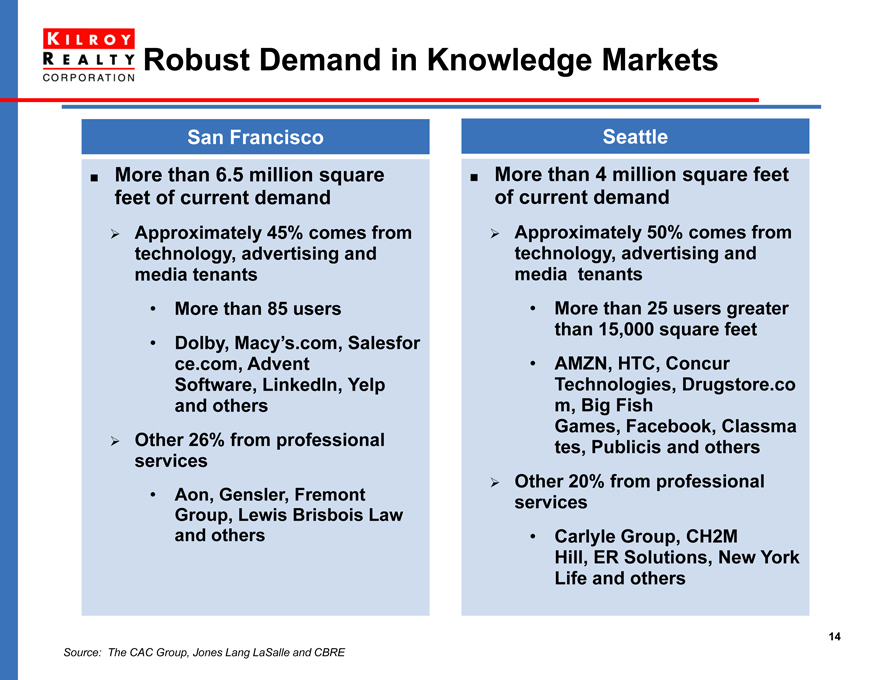

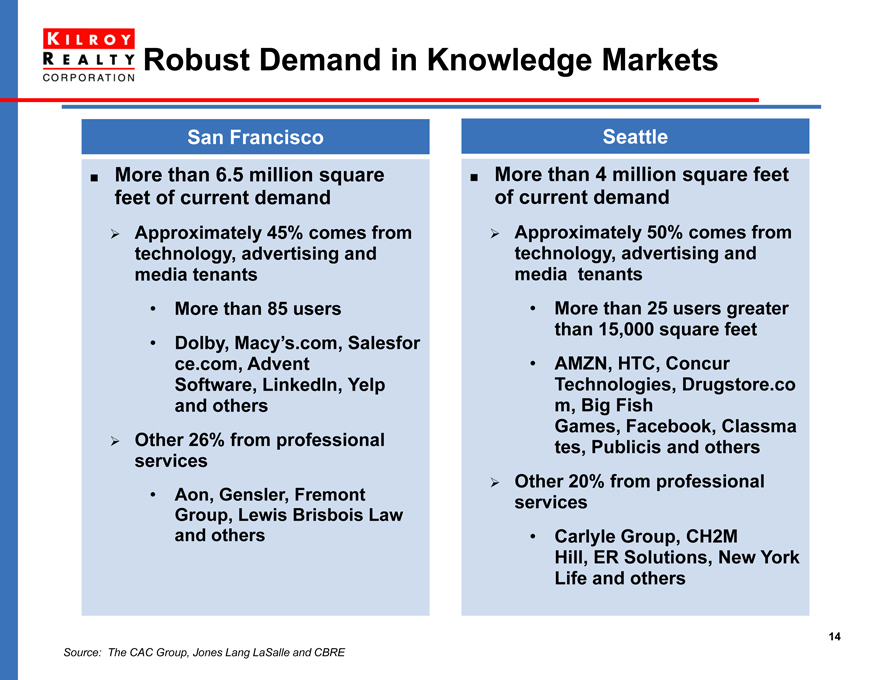

Robust Demand in Knowledge Markets

San Francisco

More than 6.5 million square feet of current demand

Approximately 45% comes from technology, advertising and media tenants

More than 85 users

Dolby, Macy’s.com, Salesforce.com, Advent Software, LinkedIn, Yelp and others

Other 26% from professional services

Aon, Gensler, Fremont Group, Lewis Brisbois Law and others

Seattle

More than 4 million square feet of current demand

Approximately 50% comes from technology, advertising and media tenants

More than 25 users greater than 15,000 square feet

AMZN, HTC, Concur Technologies, Drugstore.com, Big Fish Games, Facebook, Classmates, Publicis and others

Other 20% from professional services

Carlyle Group, CH2M Hill, ER Solutions, New York Life and others

Source: The CAC Group, Jones Lang LaSalle and CBRE

14

2011 Outlook

Market volatility hasn’t impacted leasing traction

Anticipate continued KRC occupancy improvements

Executing capital recycling program Cautiously evaluating growth opportunities along the West Coast Bolstered management team Maintaining top credit profile

Flexibility/agility/discipline will be the key in uncertain times

15

Eli Khouri

Chief Investment Officer

Acquisitions, Dispositions and Seattle Overview

16

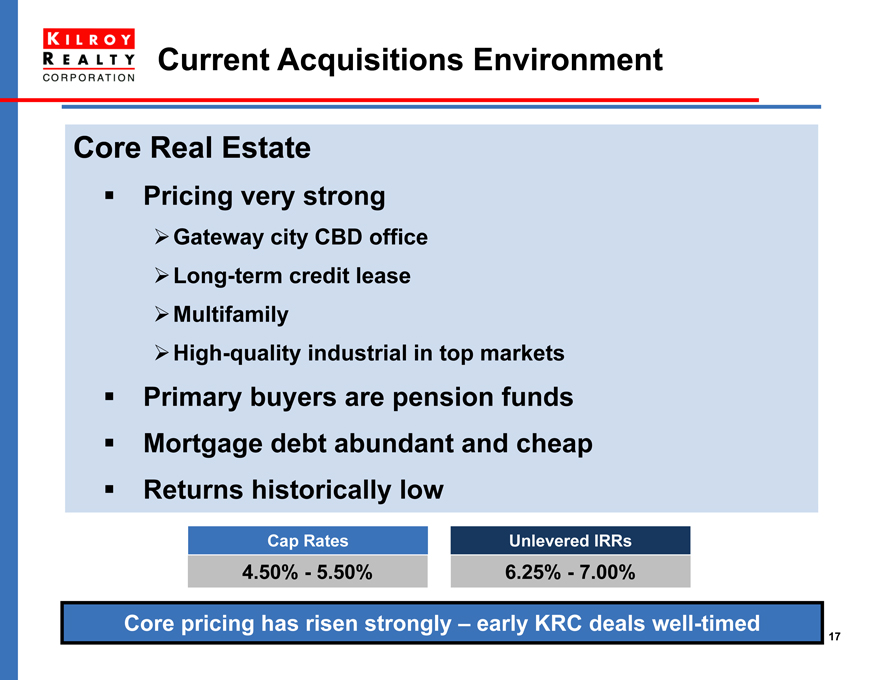

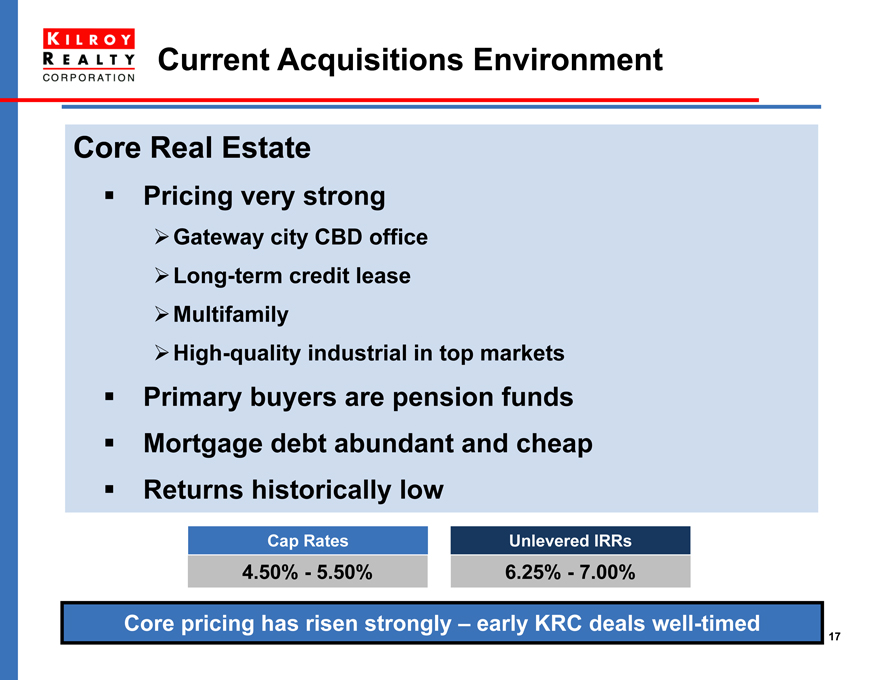

Current Acquisitions Environment

Core Real Estate

Pricing very strong

Gateway city CBD office

Long-term credit lease

Multifamily

High-quality industrial in top markets

Primary buyers are pension funds Mortgage debt abundant and cheap Returns historically low

Cap Rates Unlevered IRRs

4.50% - 5.50% 6.25% - 7.00%

Core pricing has risen strongly – early KRC deals well-timed

17

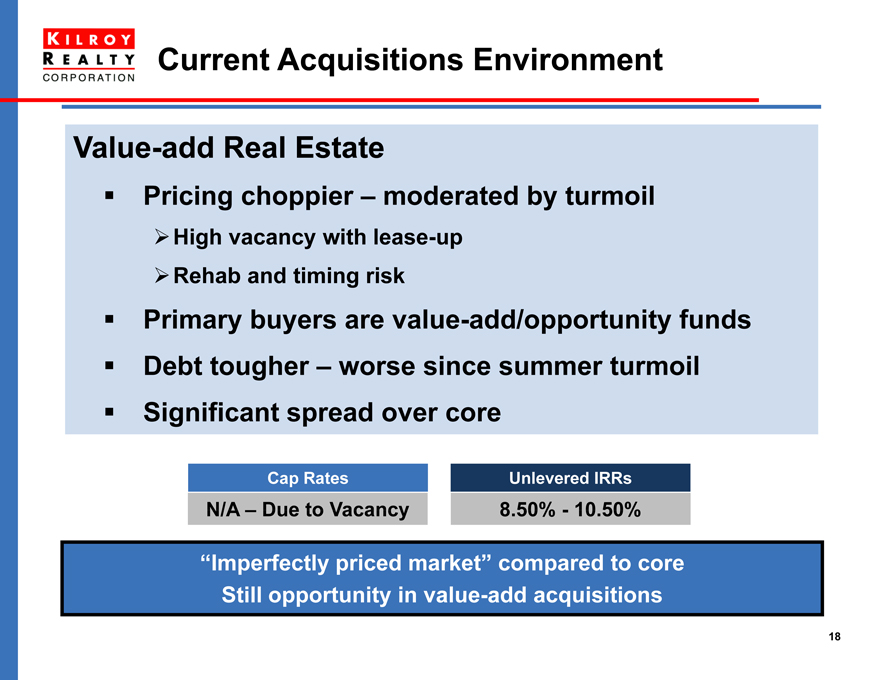

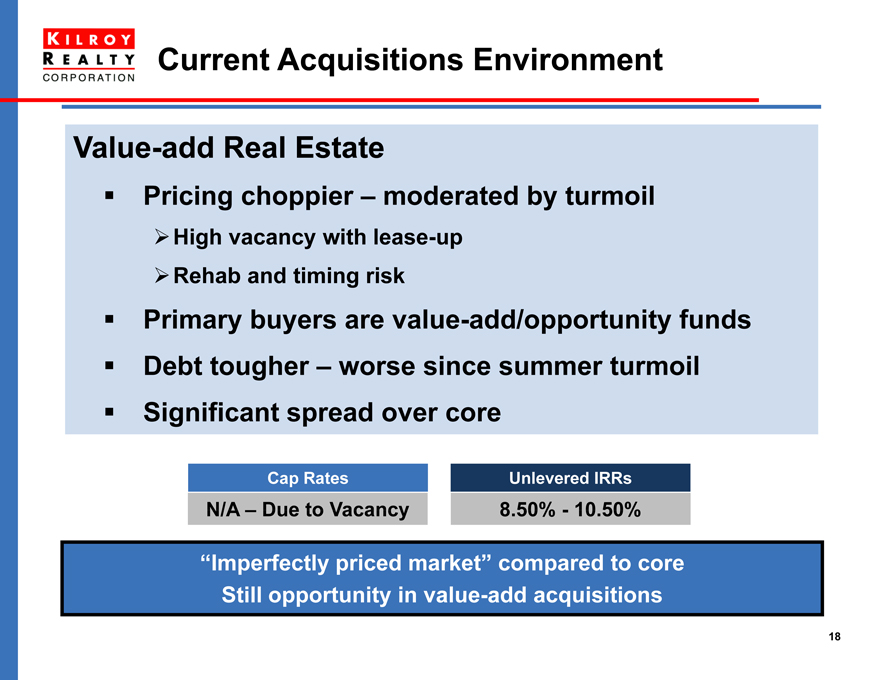

Current Acquisitions Environment

Value-add Real Estate

Pricing choppier – moderated by turmoil

High vacancy with lease-up

Rehab and timing risk

Primary buyers are value-add/opportunity funds Debt tougher – worse since summer turmoil Significant spread over core

Cap Rates Unlevered IRRs

N/A – Due to Vacancy 8.50% - 10.50%

“Imperfectly priced market” compared to core Still opportunity in value-add acquisitions

18

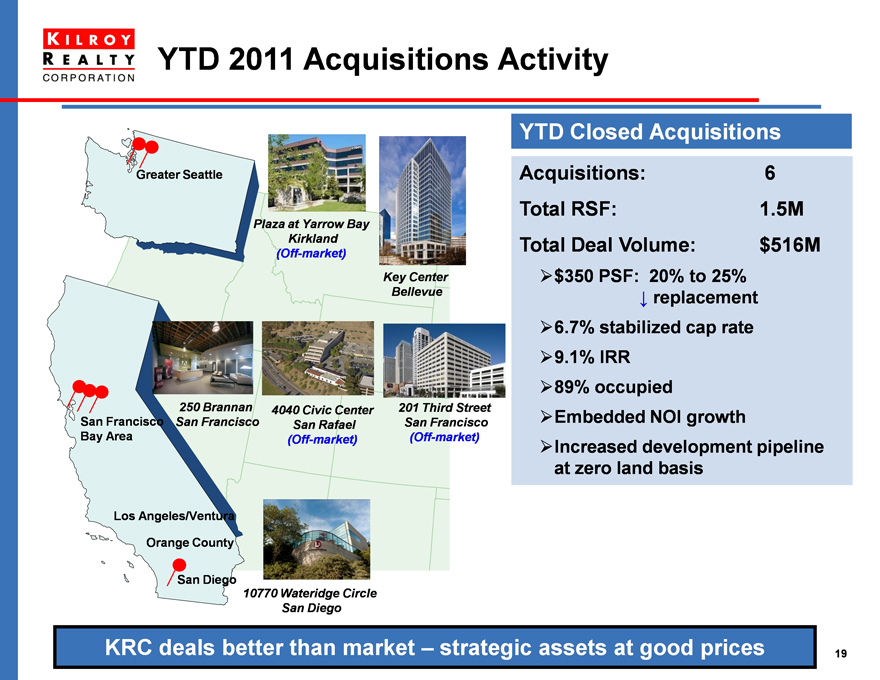

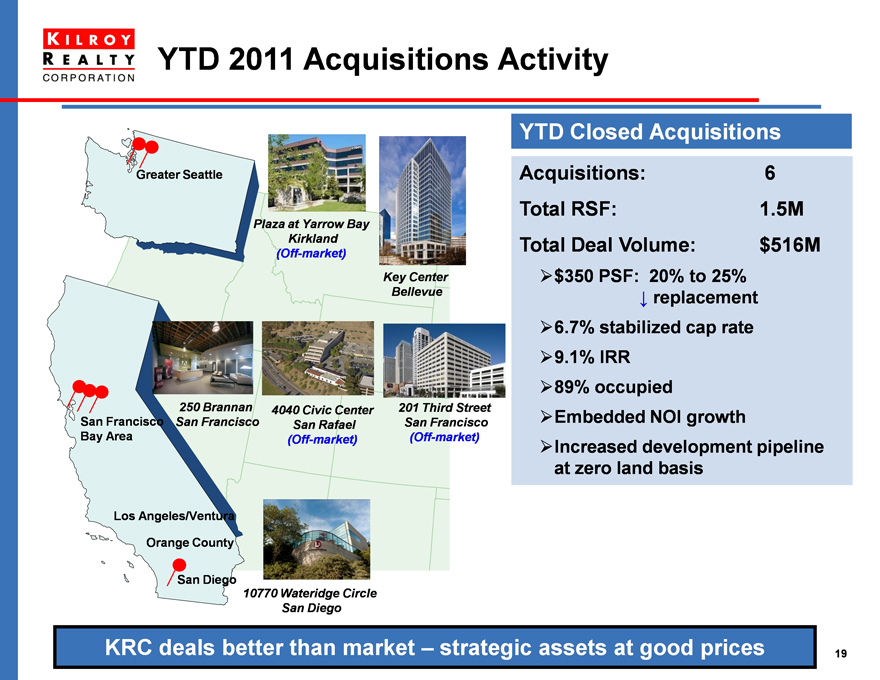

YTD 2011 Acquisitions Activity

YTD Closed Acquisitions Acquisitions: 6 Total RSF: 1.5M Total Deal Volume: $516M

$350 PSF: 20% to 25% replacement

6.7% stabilized cap rate

9.1% IRR

89% occupied

Embedded NOI growth

Increased development pipeline at zero land basis

Greater Seattle

Plaza at Yarrow Bay Kirkland

(Off-market)

Key Center

Bellevue

San Francisco Bay Area

250 Brannan 4040 Civic Center San Francisco San Rafael (Off-market)

201 Third Street San Francisco (Off-market)

San Diego

10770 Wateridge Circle San Diego

KRC deals better than market – strategic assets at good prices

19

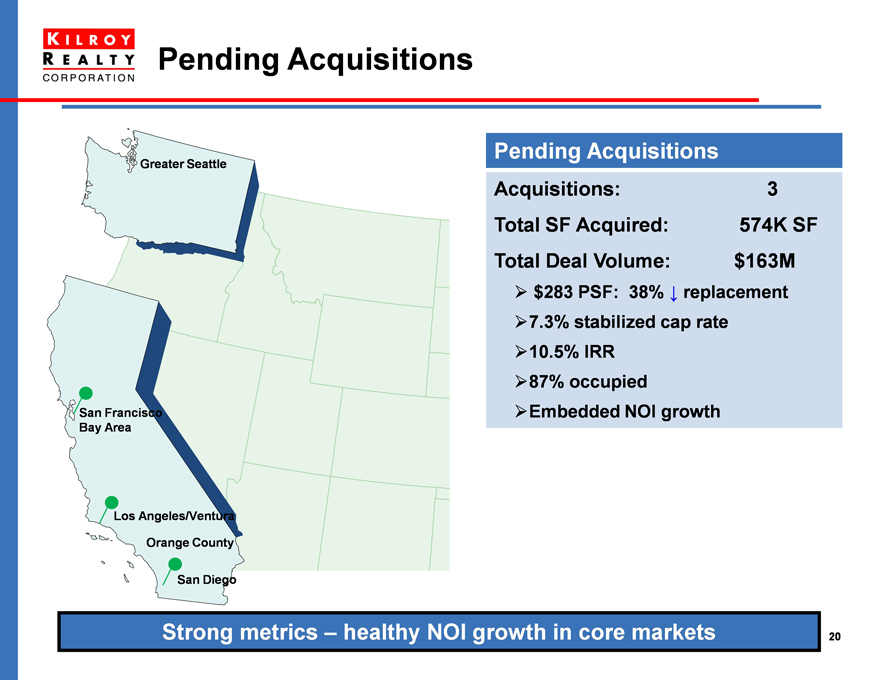

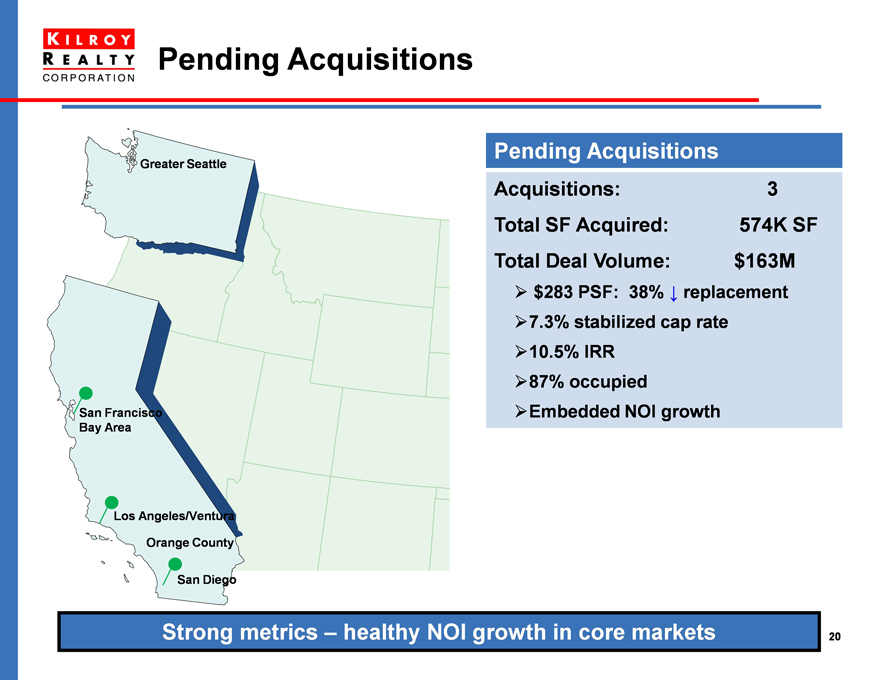

Pending Acquisitions

Greater Seattle

San Francisco Bay Area

Los Angeles/Ventura

Orange County

San Diego

Pending Acquisitions Acquisitions: 3 Total SF Acquired: 574K SF Total Deal Volume: $163M

$283 PSF: 38% replacement

7.3% stabilized cap rate

10.5% IRR

87% occupied

Embedded NOI growth

Strong metrics – healthy NOI growth in core markets

20

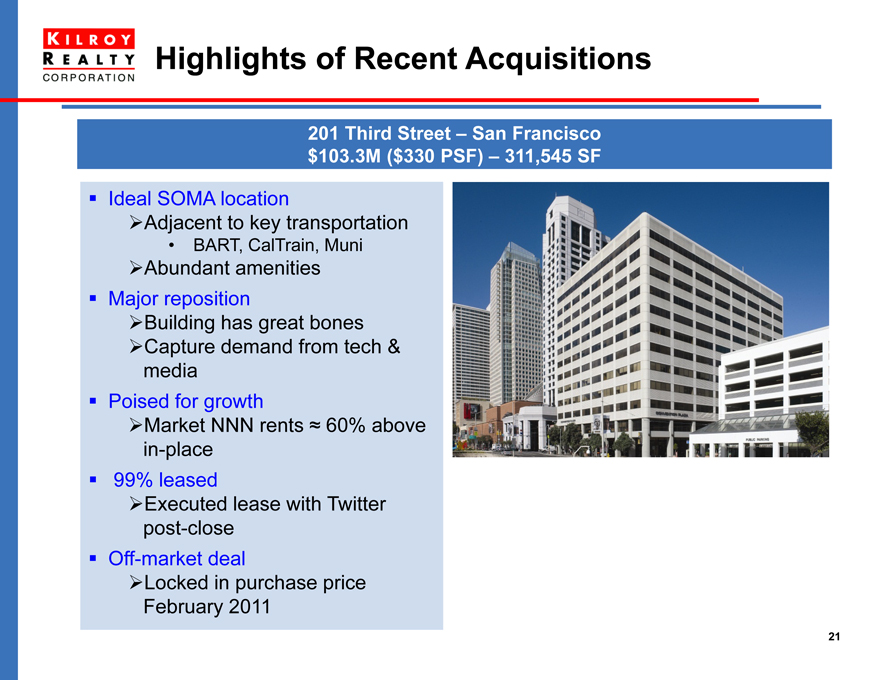

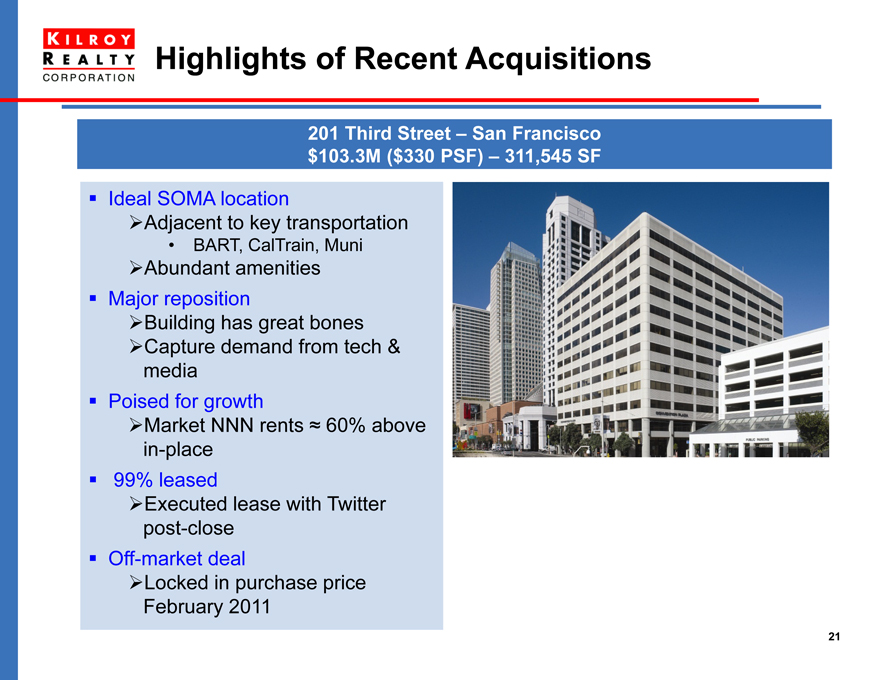

Highlights of Recent Acquisitions

201 Third Street – San Francisco $103.3M ($330 PSF) – 311,545 SF

Ideal SOMA location

Adjacent to key transportation

BART, CalTrain, Muni

Abundant amenities Major reposition

Building has great bones

Capture demand from tech & media Poised for growth

Market NNN rents 60% above in-place 99% leased

Executed lease with Twitter post-close Off-market deal

Locked in purchase price February 2011

21

Highlights of Recent Acquisitions: Repositioning Plans

Before

After

Similar to 303 Second – great opportunity, major transformation

22

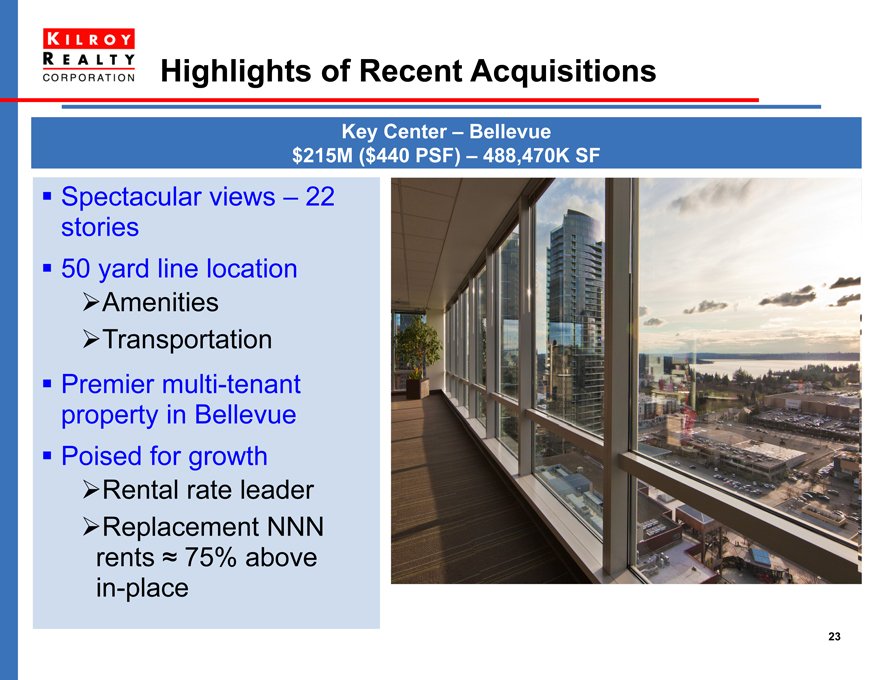

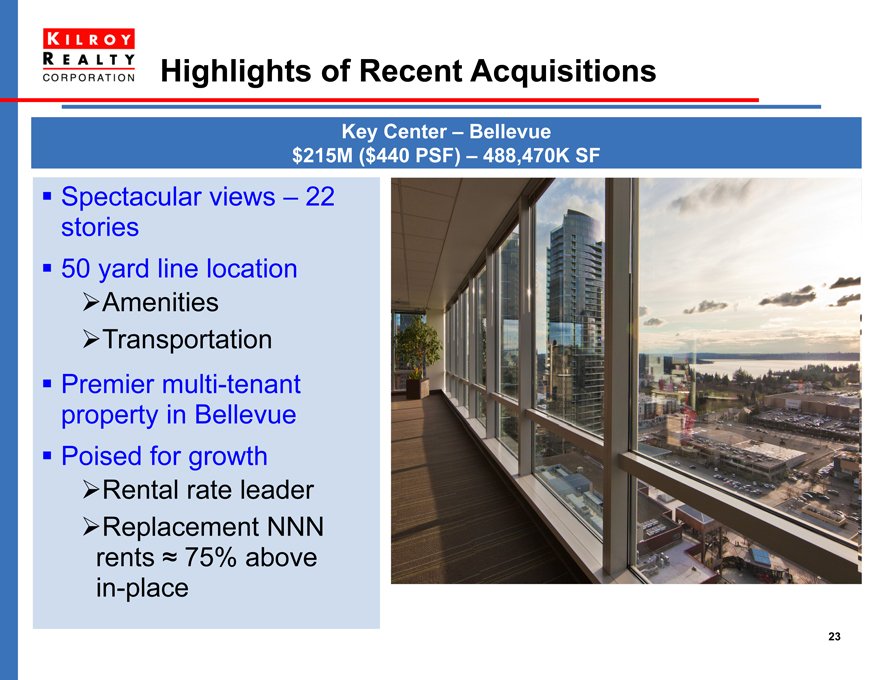

Highlights of Recent Acquisitions

Key Center – Bellevue $215M ($440 PSF) – 488,470K SF

Spectacular views – 22 stories 50 yard line location

Amenities

Transportation Premier multi-tenant property in Bellevue Poised for growth

Rental rate leader

Replacement NNN rents 75% above in-place

23

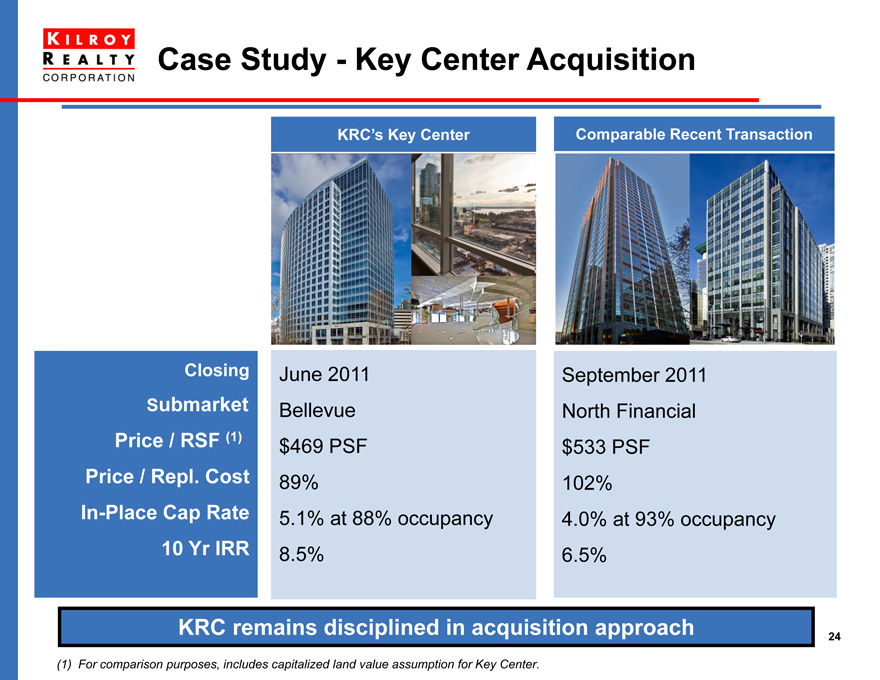

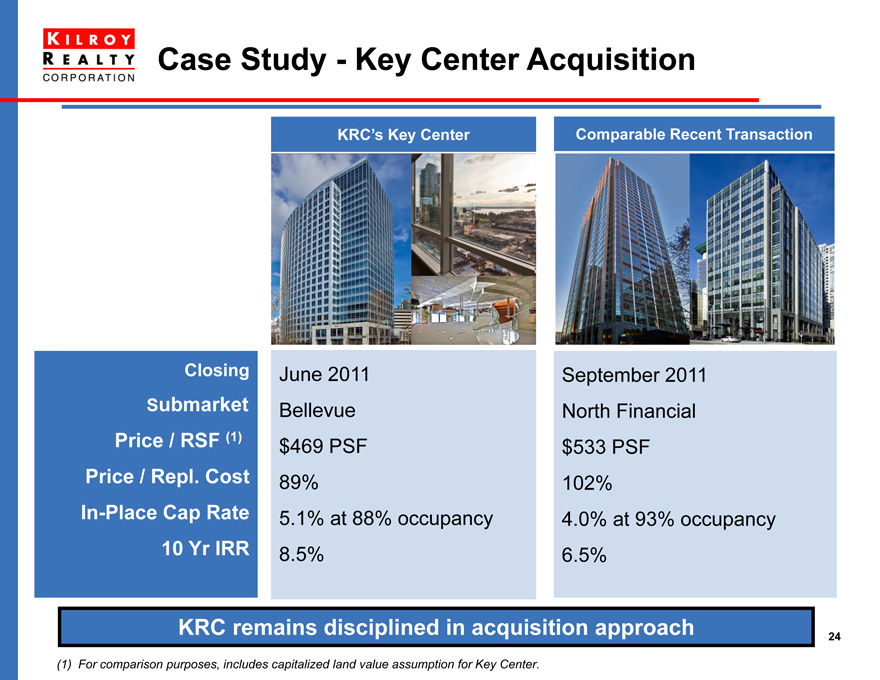

Case Study - Key Center Acquisition

Closing

Submarket

Price / RSF (1)

Price / Repl. Cost

In-Place Cap Rate

10 Yr IRR

KRC’s Key Center

June 2011 Bellevue $469 PSF 89%

5.1% at 88% occupancy 8.5%

Comparable Recent Transaction

September 2011 North Financial $533 PSF 102% 4.0% at 93% occupancy 6.5%

KRC remains disciplined in acquisition approach

(1) For comparison purposes, includes capitalized land value assumption for Key Center.

24

Highlights of Recent Acquisitions

201 Third Street – San Francisco $103.3M ($330 PSF) – 312K SF

Ideal SOMA location

Adjacent to key transportation

BART, CalTrain, Muni

Abundant amenities

Major reposition

Building has great bones

Capture demand from tech & media

Poised for growth

Market NNN rents 60% above in-place

99% leased

Executed lease with Twitter post-close

Off-market deal

Locked in purchase price Feb. 2011

Key Center – Bellevue $215M ($440 PSF) – 488K SF

Spectacular views – 22 stories 50 yard line location

Amenities

Transportation

Premier multi-tenant property in Bellevue Poised for growth

Rental rate leader

Replacement NNN rents 75% above in-place

KRC executes well-timed deals – core and value-add

25

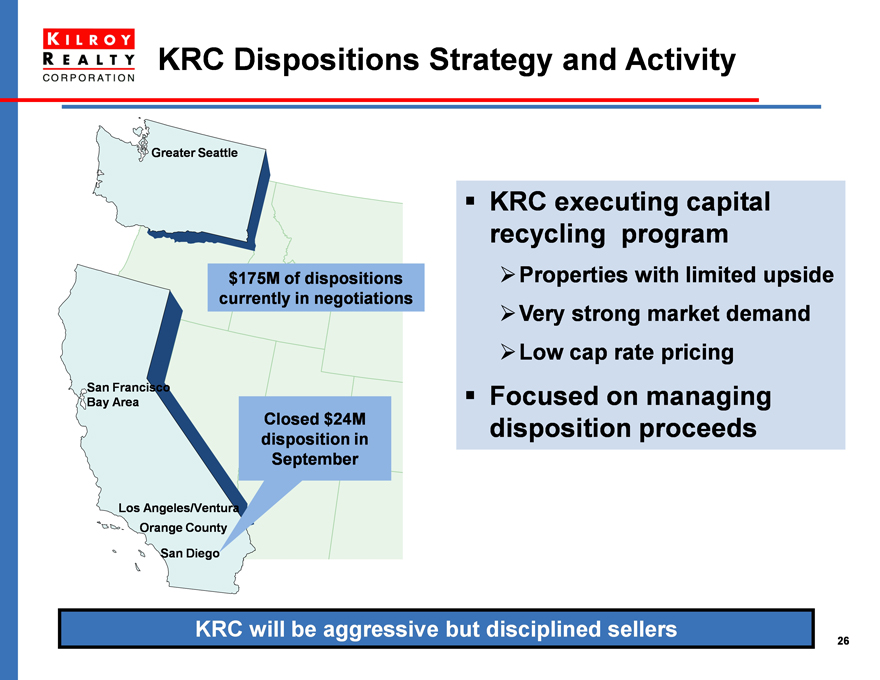

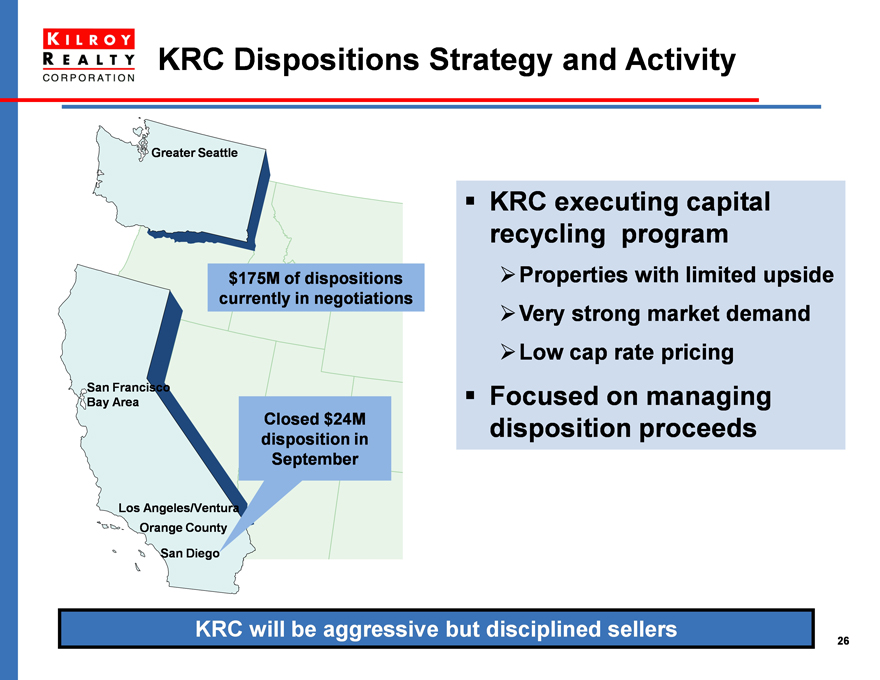

KRC Dispositions Strategy and Activity

Greater Seattle

San Francisco Bay Area

Los Angeles/Ventura

Orange County

San Diego

$175M of dispositions currently in negotiations

Closed $24M disposition in September

Los Angeles/Ventura Orange County

San Diego

KRC executing capital recycling program

Properties with limited upside

Very strong market demand

Low cap rate pricing

Focused on managing disposition proceeds

KRC will be aggressive but disciplined sellers

26

KRC Acquisitions Strategy and Activity

Focus on high-quality acquisitions in major West Coast markets

Core pricing aggressive in knowledge markets

Core plus & value-add offer more attractive opportunities

Key criteria

Value creation opportunity

Strong markets

Well located – proximity to transportation & amenities

Attractive fundamental characteristics

Discount to replacement cost

Attractive opportunities remain

KRC underwriting reflects moderated macro outlook

27

Why Seattle

Great Quality of Life Exceptional Workforce Critical Mass of Knowledge Companies

28

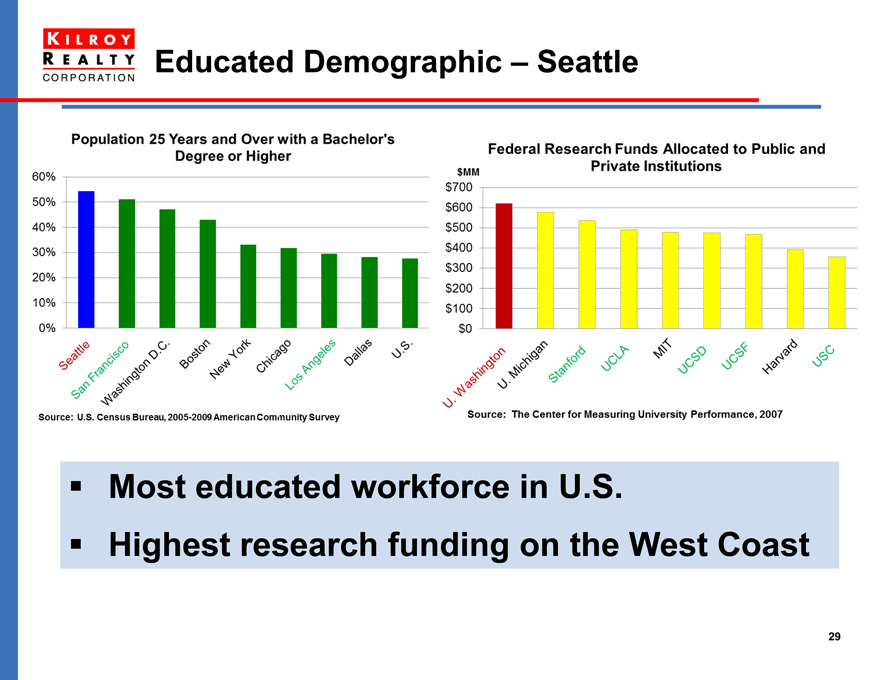

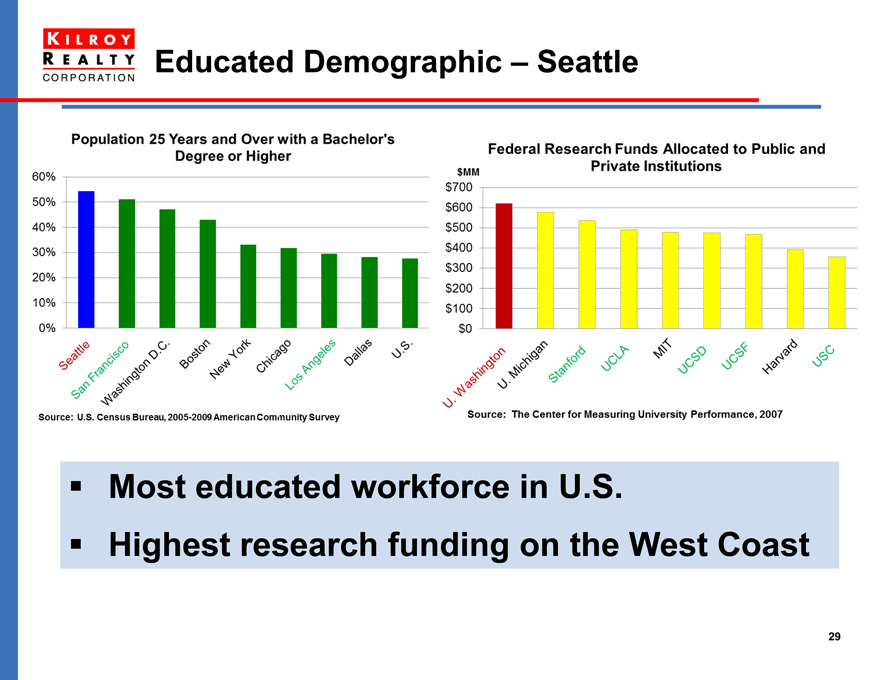

Educated Demographic – Seattle

Population 25 Years and Over with a Bachelor’s Degree or Higher

60% 50% 40% 30% 20% 10% 0%

Seattle San Francisco Washington D.C. Boston New York Chicago Los Angeles Dallas U.S.

Source: U.S. Census Bureau, 2005-2009 American Community Survey

Federal Research Funds Allocated to Public and Private Institutions

$MM

$700 $600 $500 $400 $300 $200 $100 $0

U. Washington U. Michigan Stanford UCLA MIT UCSD UCSF Harvard USC

Source: The Center for Measuring University Performance, 2007

Most educated workforce in U.S.

Highest research funding on the West Coast

29

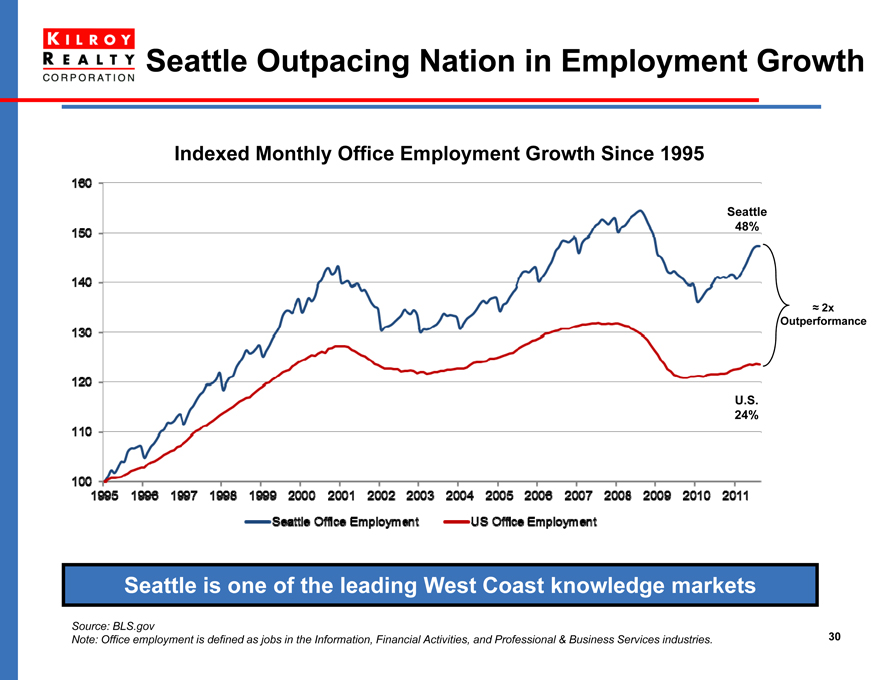

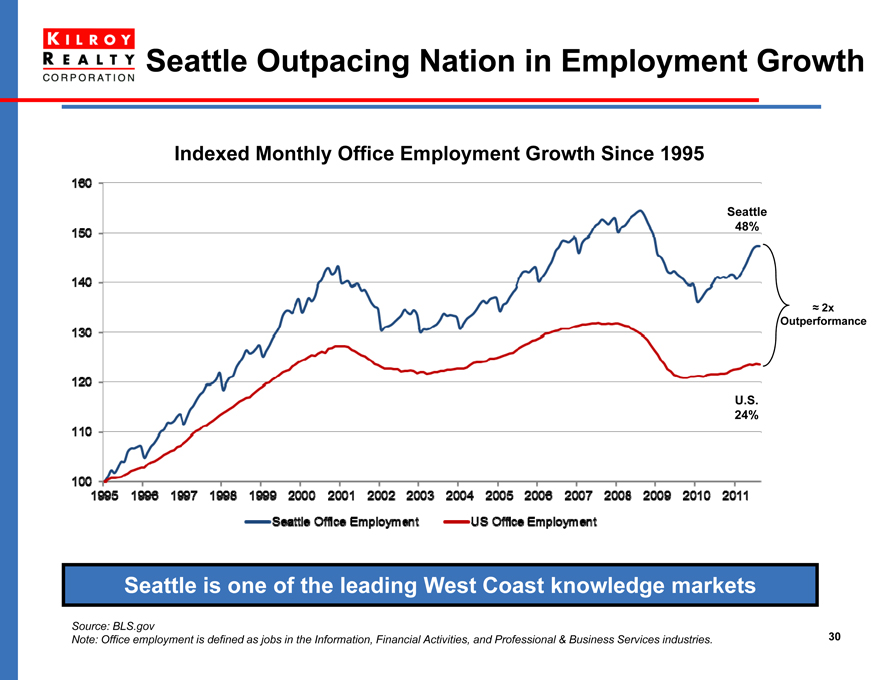

Seattle Outpacing Nation in Employment Growth

Indexed Monthly Office Employment Growth Since 1995

160 150 140 130 120 110 100

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Seattle 48%

≈2x Outperformance

U.S. 24%

Seattle Office Employment

US Office Employment

Seattle is one of the leading West Coast knowledge markets

Source: BLS.gov

Note: Office employment is defined as jobs in the Information, Financial Activities, and Professional & Business Services industries.

30

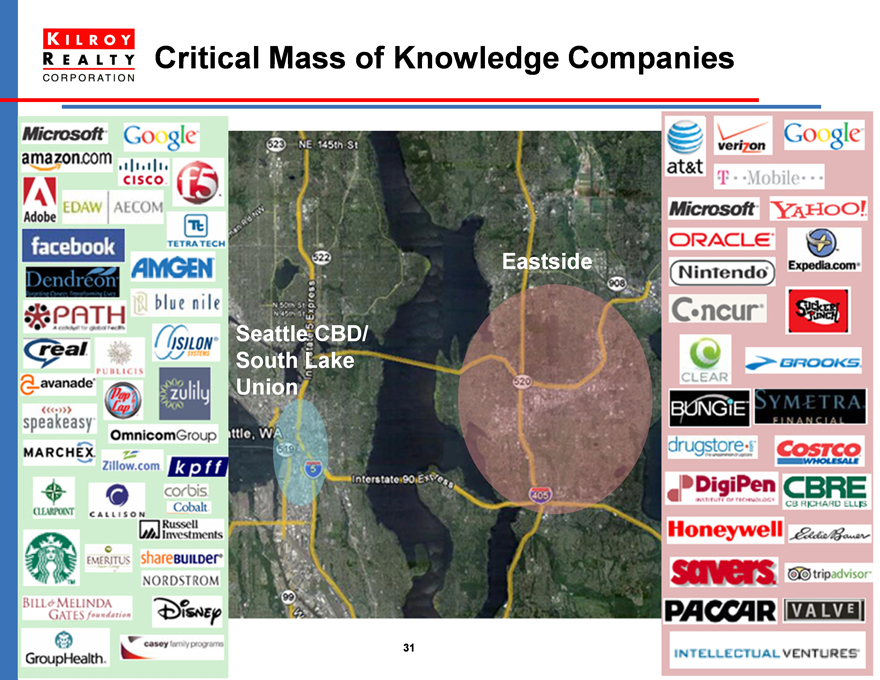

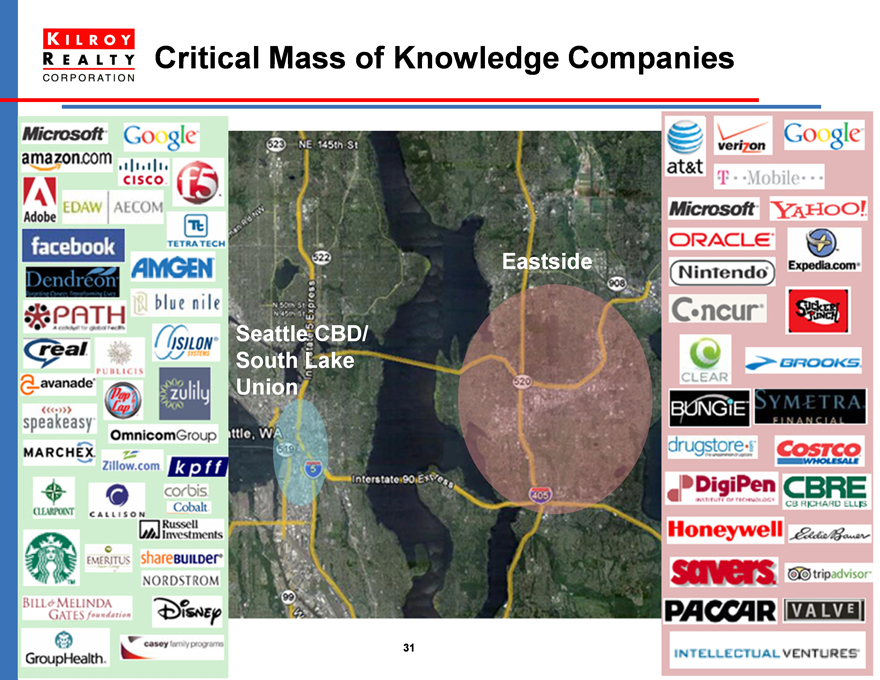

Critical Mass of Knowledge Companies

Seattle CBD/ South Lake Union

Eastside

31

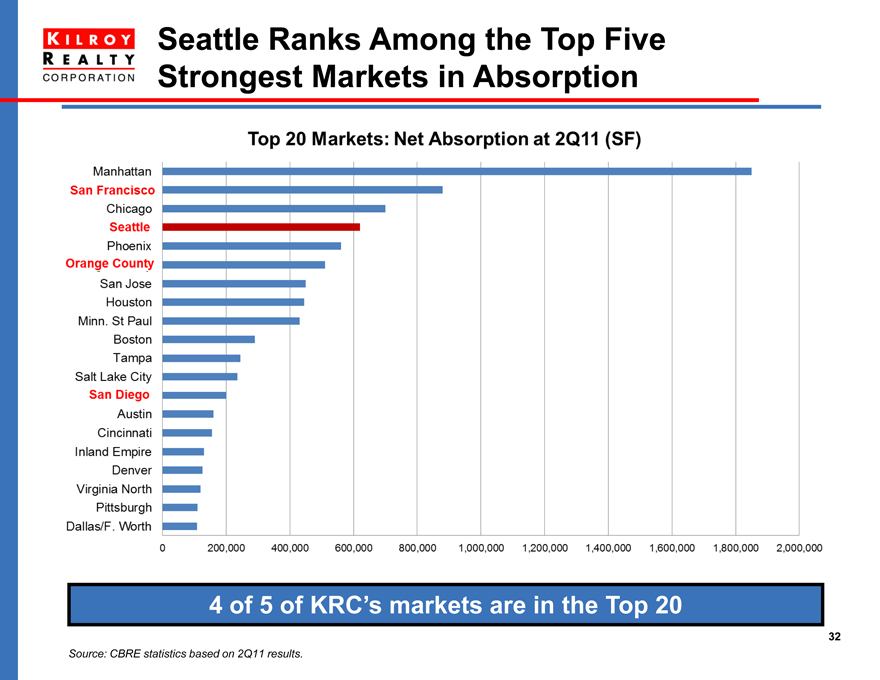

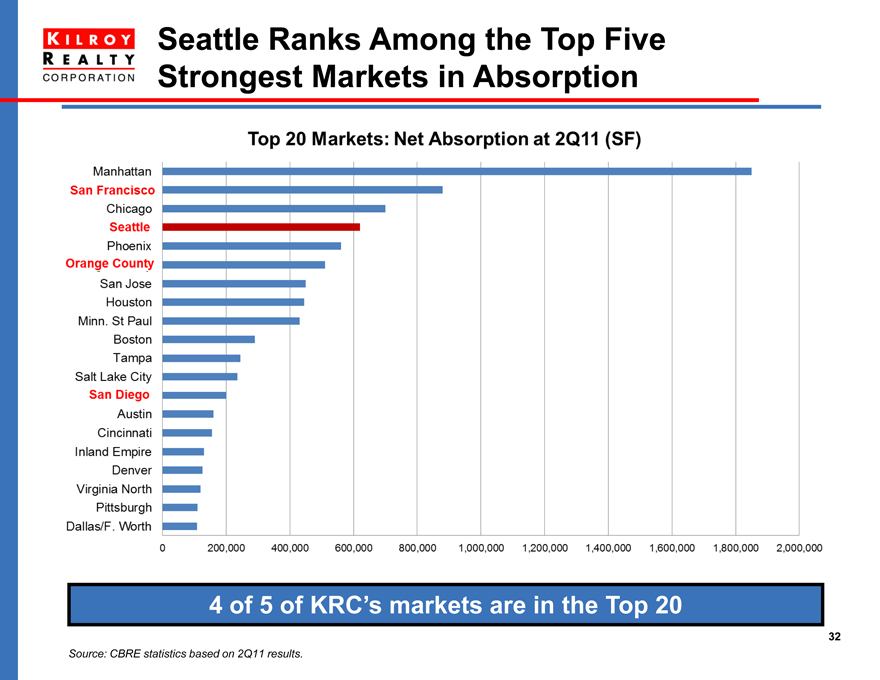

Seattle Ranks Among the Top Five Strongest Markets in Absorption

Top 20 Markets: Net Absorption at 2Q11 (SF)

Manhattan San Francisco Chicago Seattle Phoenix Orange County San Jose Houston Minn. St Paul Boston Tampa Salt Lake City San Diego Austin Cincinnati Inland Empire Denver Virginia North Pittsburg Dallas/F. Worth

0 200,000 400,000 600,000 800,000 1,000,000 1,200,000 1,400,000 1,600,000 1,800,000 2,000,000

4 of 5 of KRC’s markets are in the Top 20

Source: CBRE statistics based on 2Q11 results.

32

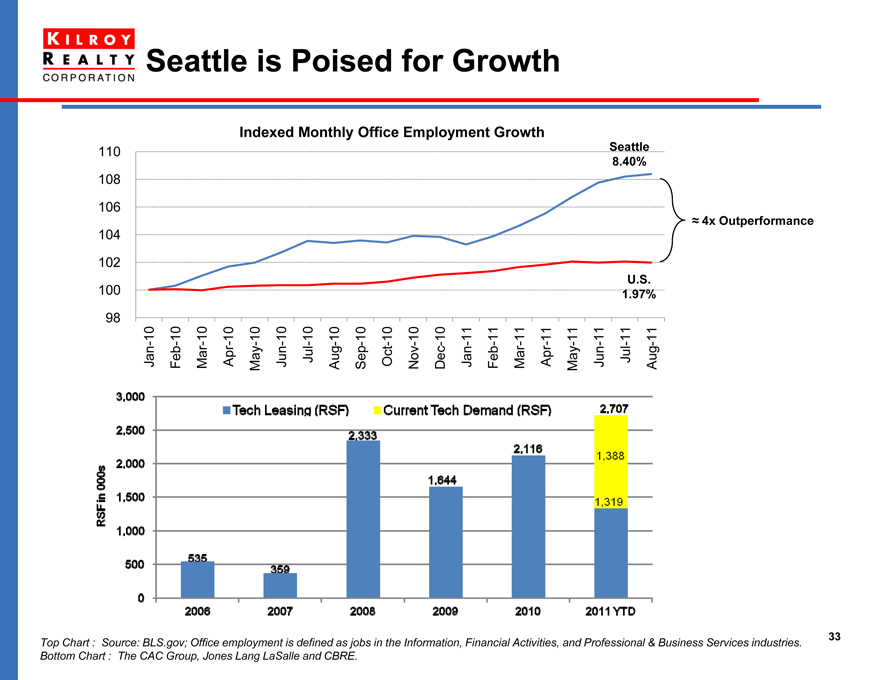

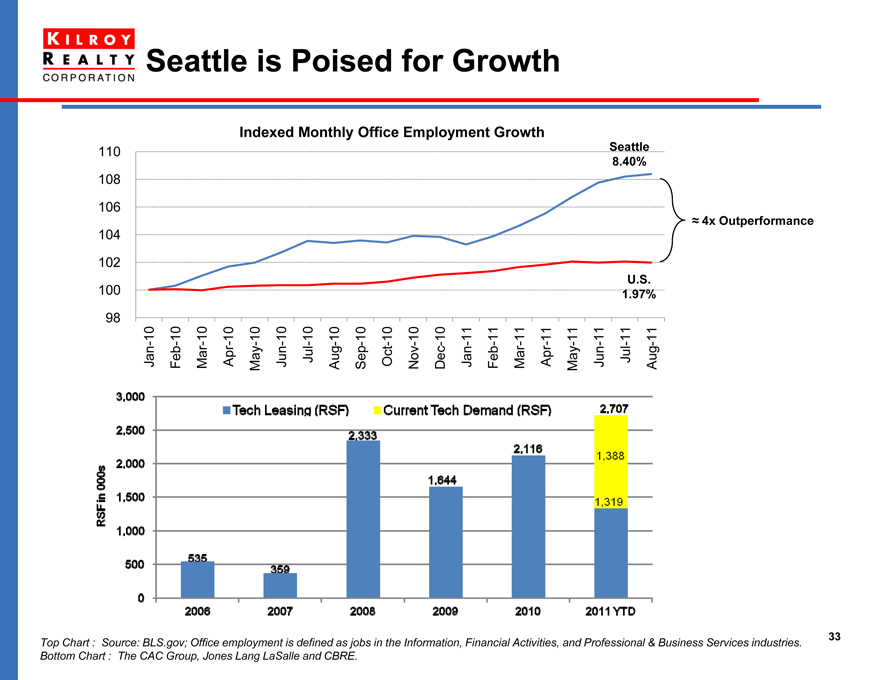

Seattle is Poised for Growth

Indexed Monthly Office Employment Growth

110

108 106 104

102 100

98

Seattle 8.40%

≈4x Outperformance

U.S. 1.97%

Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10 Oct-10 Nov-10 Dec-10 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11

RSF in 000s

3,000 2,500 2,000 1,500 1,000 500 0

Tech Leasing (RSF)

Current Tech Demand (RSF)

535 359 2,333 1,644 2,116 2,707 1,388 1,319

2006 2007 2008 2009 2010 2011 YTD Top Chart : Source: BLS.gov; Office employment is defined as jobs in the Information, Financial Activities, and Professional & Business Services industries. Bottom Chart : The CAC Group, Jones Lang LaSalle and CBRE.

33

KRC Outlook for Region

Seattle poised for growth

Has outpaced the nation in job growth since 1995

Quality of life attracts premier office employers

KRC well positioned to create value over time

Quality, well-leased assets in strong locations

Built sharpshooter platform

Significant local experience in operations, acquisitions and development

Seattle platform bolsters KRC’s West Coast franchise

34

Mike Shields

Vice President, Pacific Northwest

Eastside Market and KRC Properties

35

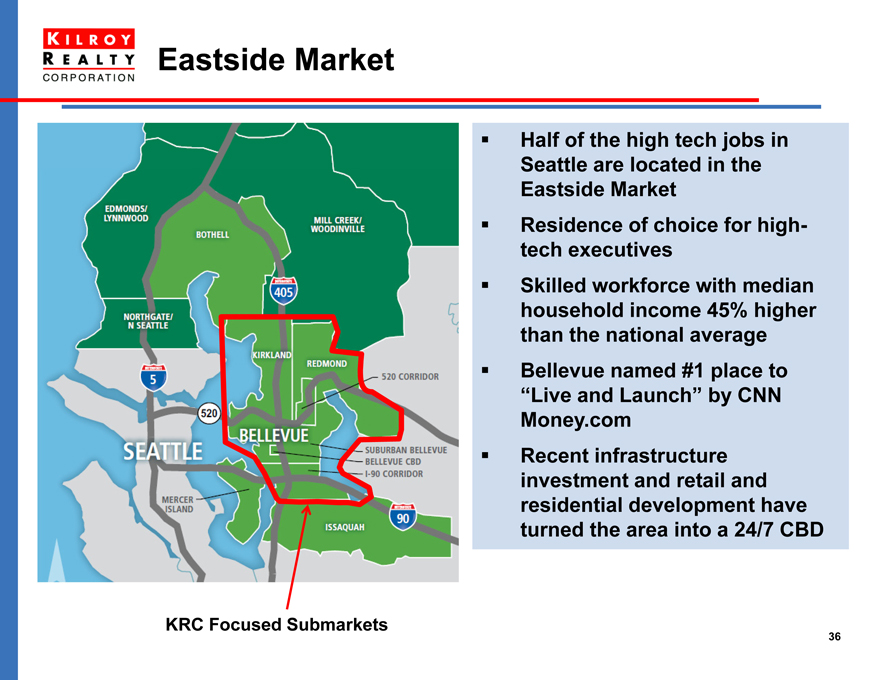

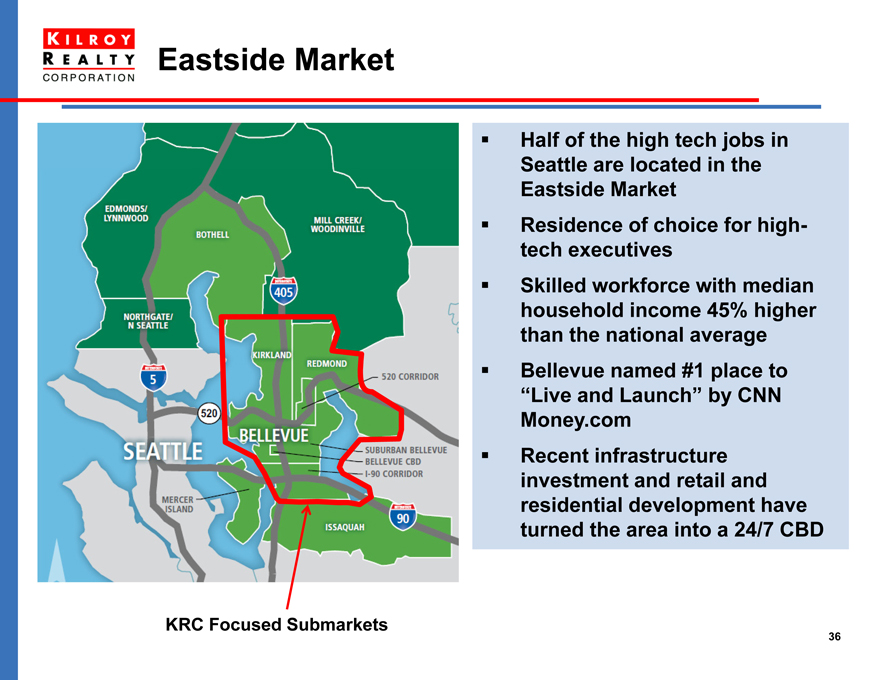

Eastside Market

Half of the high tech jobs in Seattle are located in the Eastside Market Residence of choice for high-tech executives Skilled workforce with median household income 45% higher than the national average Bellevue named #1 place to “Live and Launch” by CNN Money.com Recent infrastructure investment and retail and residential development have turned the area into a 24/7 CBD

KRC Focused Submarkets

36

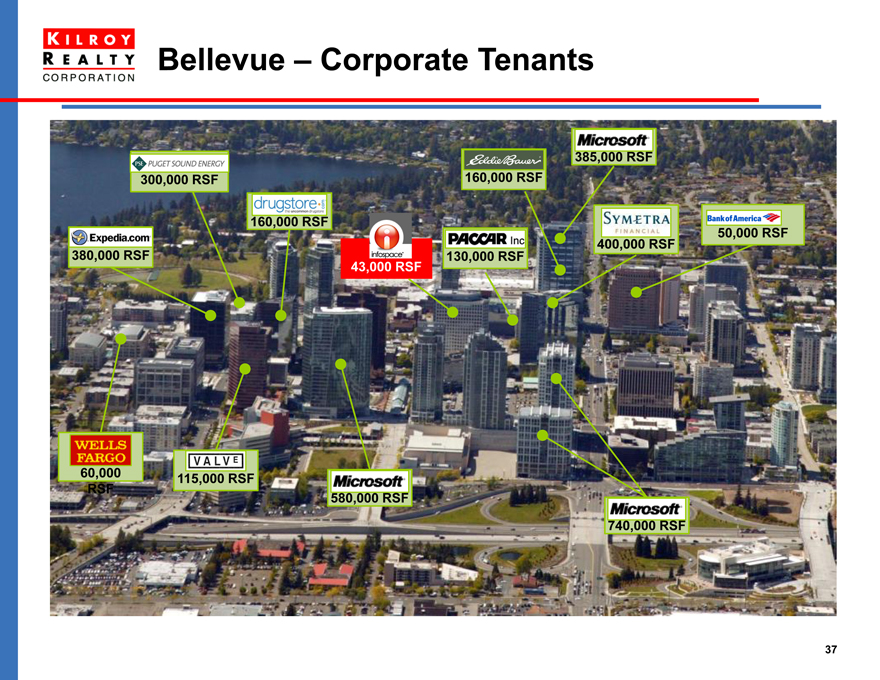

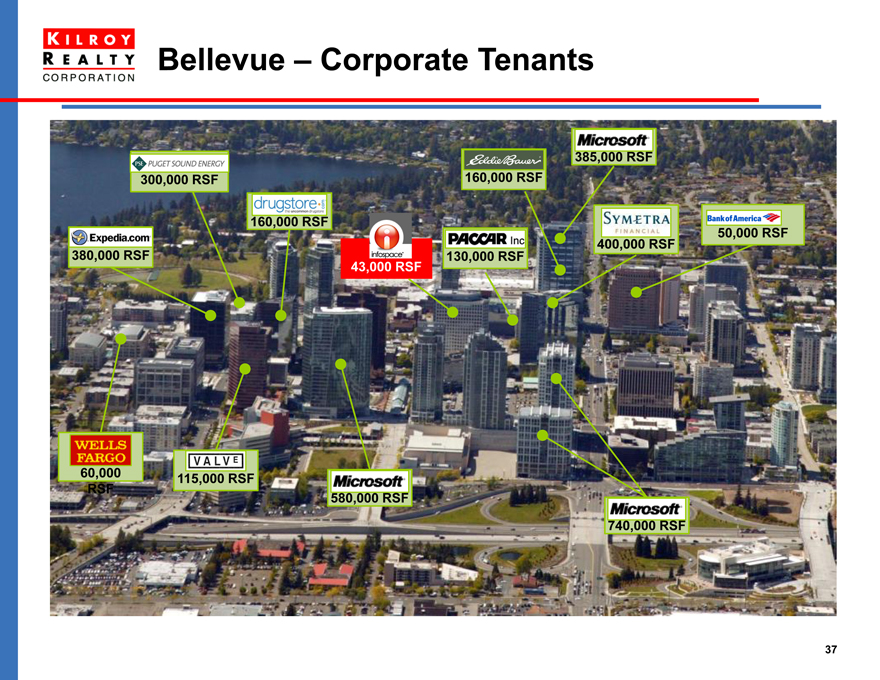

Bellevue - Corporate Tenants

300,000 RSF

380,000 RSF

160,000 RSF

60,000

115,000 RSF

580,000 RSF

130,000 RSF

160,000 RSF

385,000 RSF

400,000 RSF

50,000 RSF

740,000 RSF

43,000 RSF

37

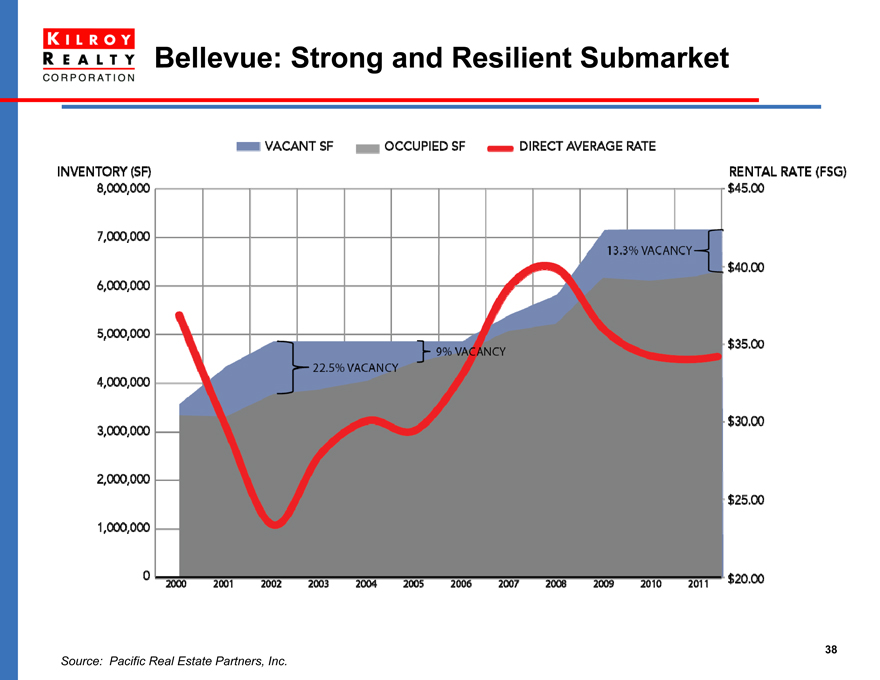

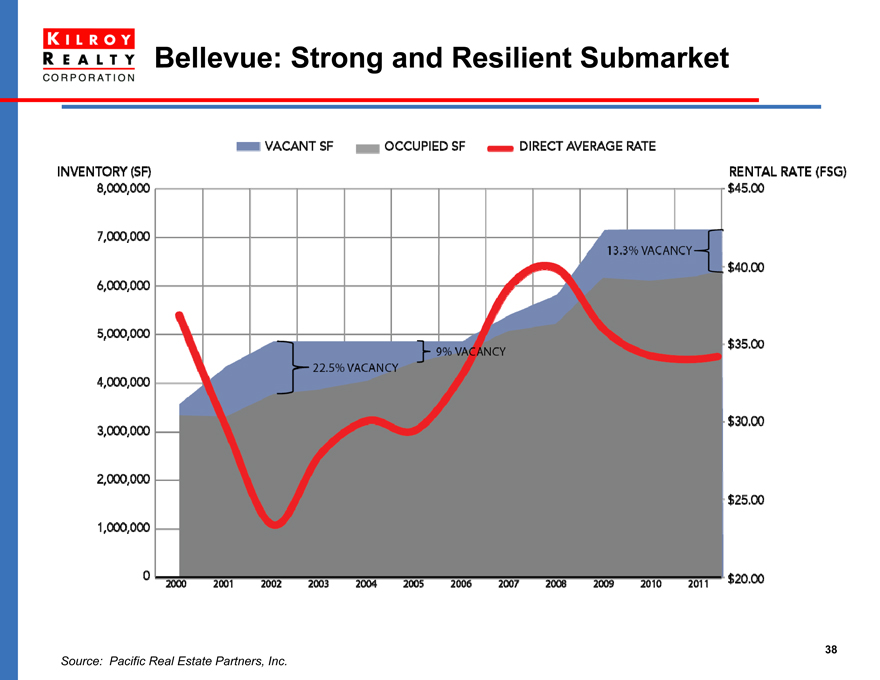

Bellevue: Strong and Resilient Submarket

INVENTORY (SF)

8,000,000 7,000,000 6,000,000 5,000,000 4,000,000 3,000,000 2,000,000 1,000,000 0

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

RENTAL RATE (FSG)

$20.00 $25.00 $30.00 $35.00 $40.00 $45.00

22.5% VACANCY 9% VACANCY 13.3% VACANCY

VACANT SF OCCUPIED SF

DIRECT AVERAGE RATE

Source: Pacific Real Estate Partners, Inc.

38

Microsoft Spurs Innovation and Growth

Over 300 local tech companies have grown from Microsoft roots

Microsoft encompasses 14 million square feet of leased and owned space in the Seattle region

39

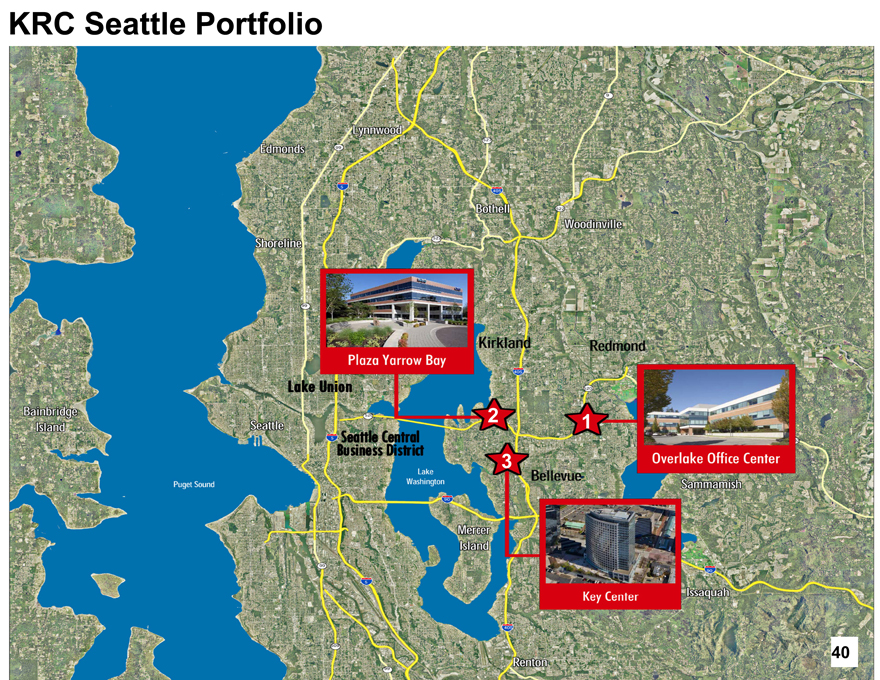

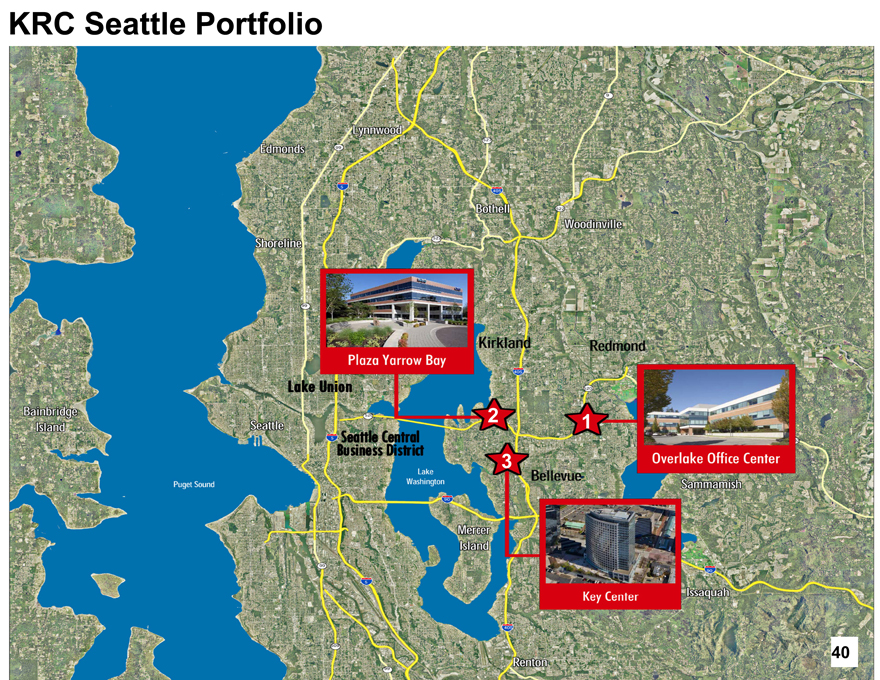

KRC Seattle Portfolio

40

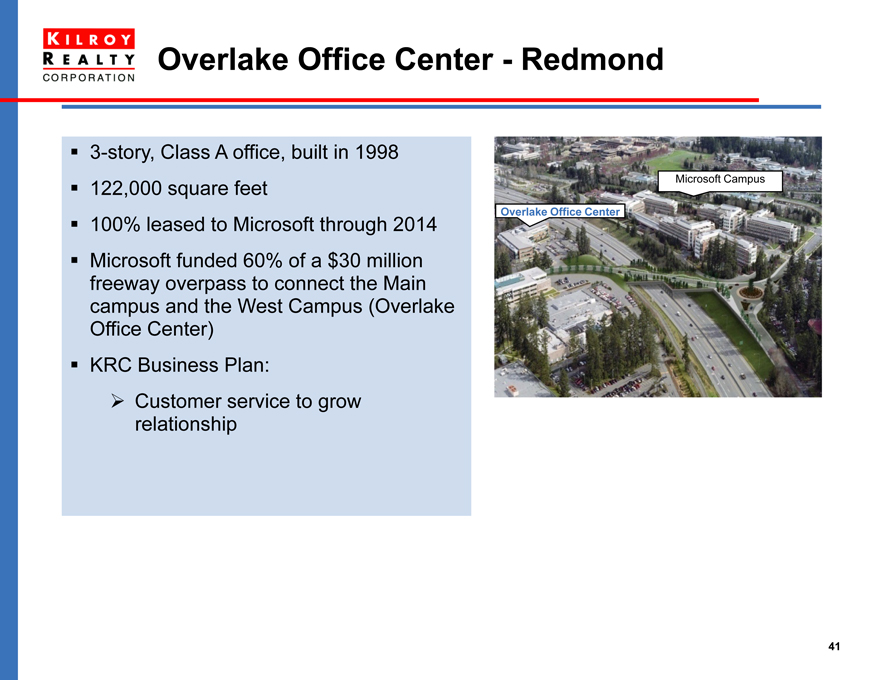

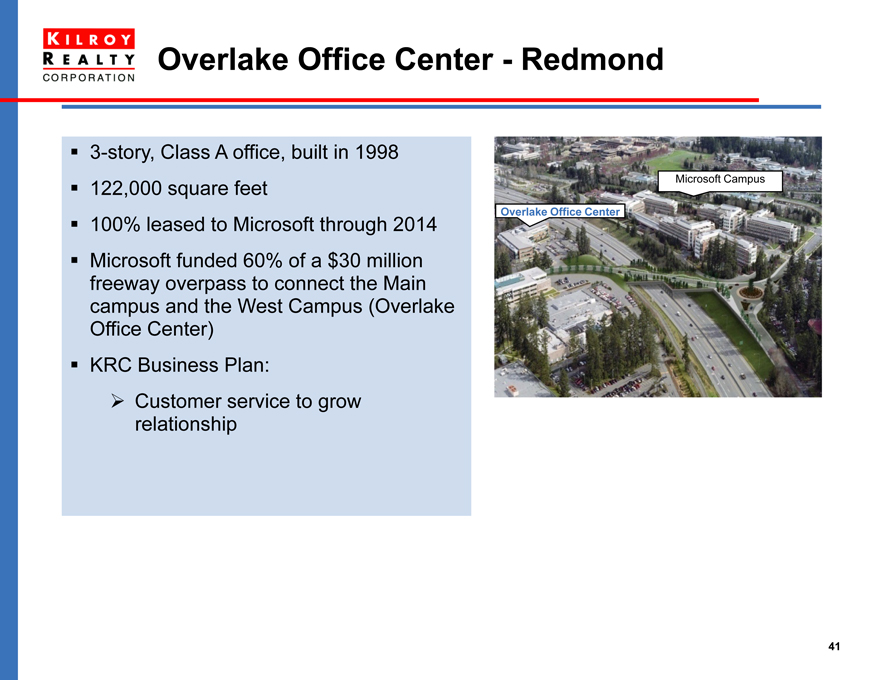

Overlake Office Center - Redmond

3-story, Class A office, built in 1998 122,000 square feet 100% leased to Microsoft through 2014 Microsoft funded 60% of a $30 million freeway overpass to connect the Main campus and the West Campus (Overlake Office Center) KRC Business Plan:

Customer service to grow relationship

Microsoft Campus

Overlake Office Center

41

Plaza Yarrow Bay - Kirkland

Four building, 279,900 SF campus 90% occupied by technology, legal, financial services and marketing industries Future development potential of approximately 74,000 SF

One of top Eastside suburban office projects KRC Business Plan:

Lease vacant space and grow rents

Upgrade exterior environment

Tenant retention

Approximately 67 acres of waterfront land was donated to City

42

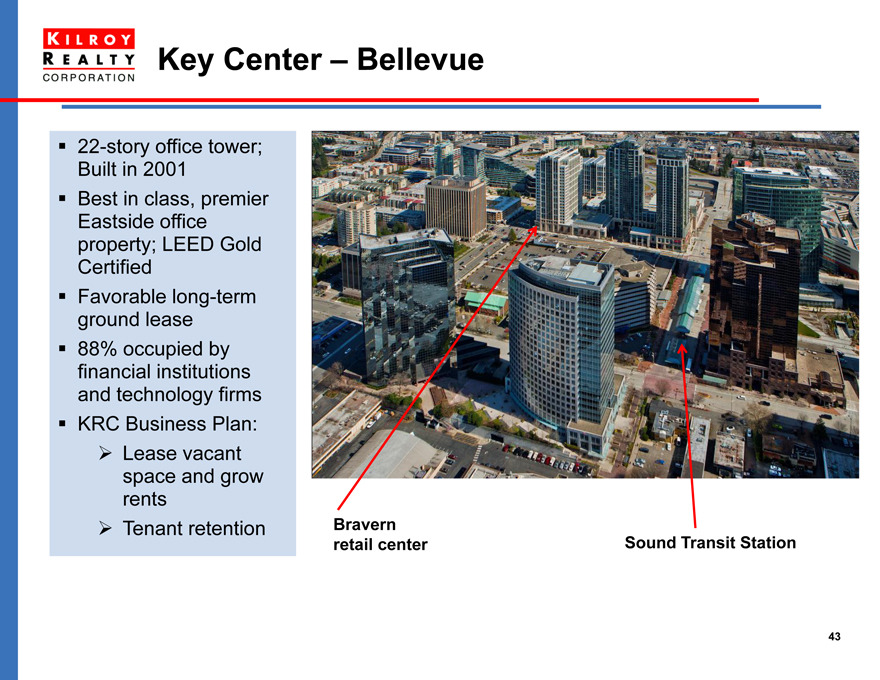

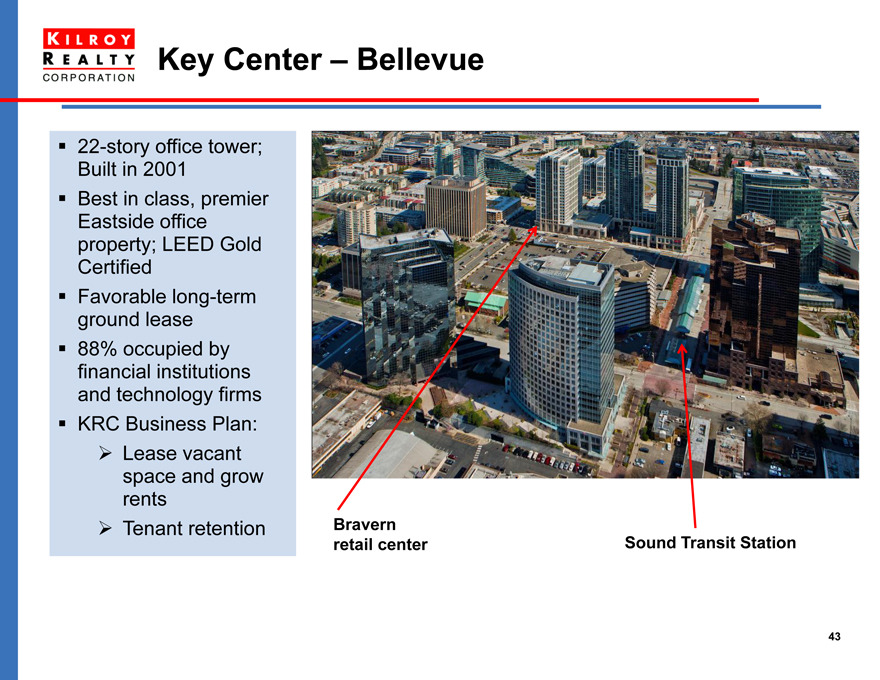

Key Center – Bellevue

22-story office tower;

Built in 2001

Best in class, premier Eastside office property; LEED Gold Certified Favorable long-term ground lease 88% occupied by financial institutions and technology firms KRC Business Plan:

Lease vacant space and grow rents

Tenant retention

Bravern retail center

Sound Transit Station

43

Tyler Rose

Chief Financial Officer

Financial Update

44

3Q 2011 Preliminary Results

2Q11 Conference Call Guidance

2011 FFO per share range of $2.22 to $2.29

Year-end occupancy of 92%

3Q 2011 preliminary results

3Q FFO per share of $0.56

2011 FFO per share in guidance range

Year-end occupancy forecast of 92%

45

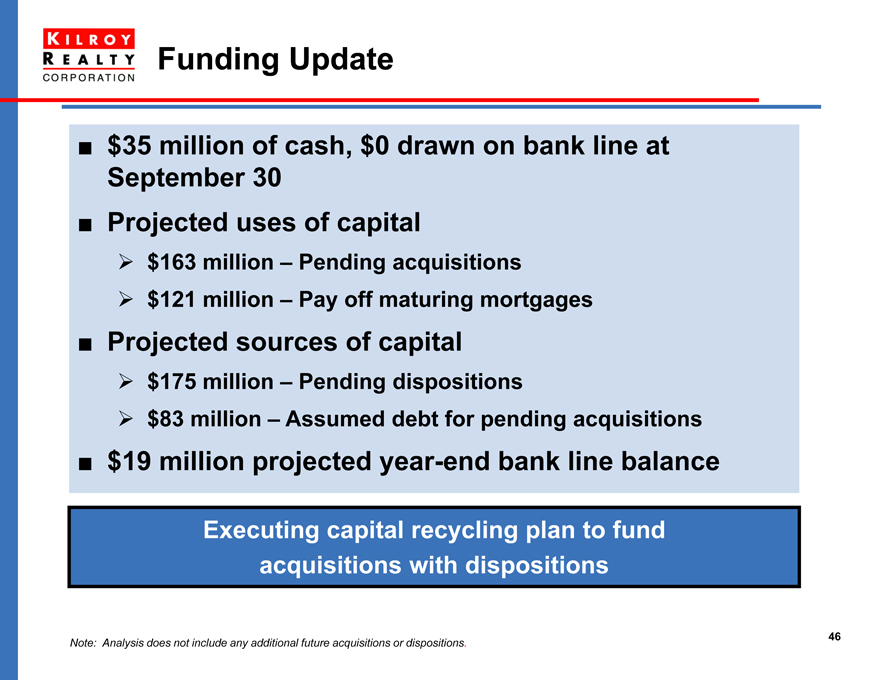

Funding Update

$35 million of cash, $0 drawn on bank line at September 30 Projected uses of capital

$163 million – Pending acquisitions

$121 million – Pay off maturing mortgages

Projected sources of capital

$175 million – Pending dispositions

$83 million – Assumed debt for pending acquisitions

$19 million projected year-end bank line balance

Executing capital recycling plan to fund acquisitions with dispositions

Note: Analysis does not include any additional future acquisitions or dispositions.

46

John Kilroy

President

Chief Executive Officer

Key Takeaways

47

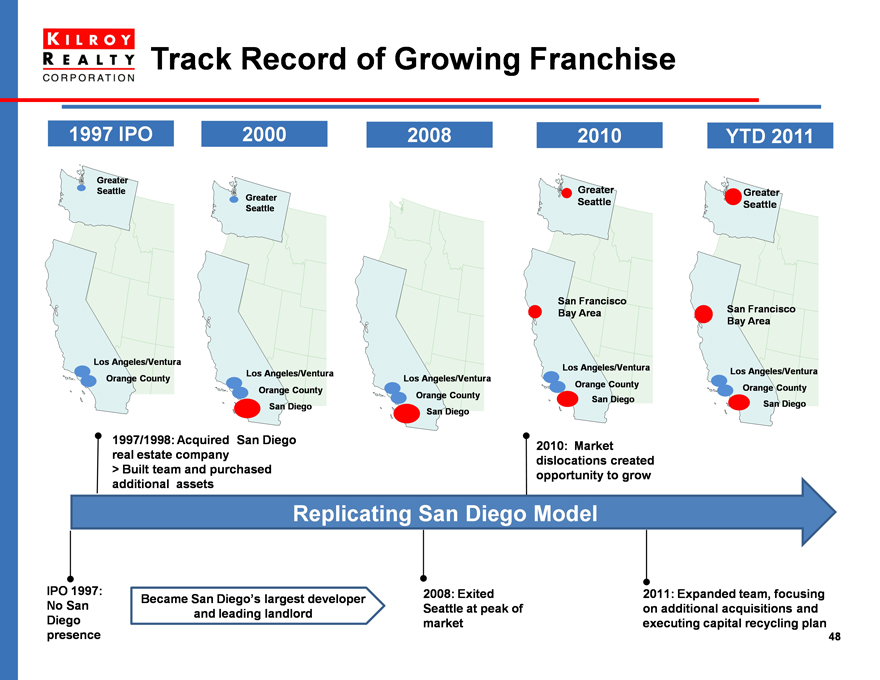

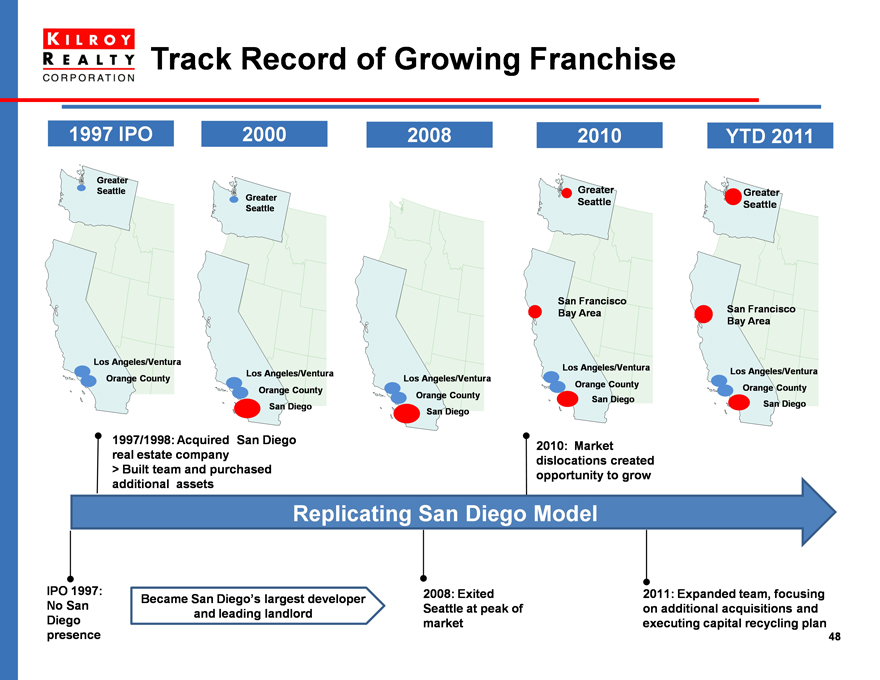

Track Record of Growing Franchise

1997 IPO 2000 2008 2010 YTD 2011

Greater Seattle

Los Angeles/Ventura Orange County

Greater Seattle

Los Angeles/Ventura Orange County San Diego

Los Angeles/Ventura Orange County San Diego

Greater Seattle San Francisco Bay Area

Los Angeles/Ventura Orange County San Diego

Greater Seattle San Francisco Bay Area

Los Angeles/Ventura Orange County San Diego

1997/1998: Acquired San Diego real estate company

> Built team and purchased additional assets

2010: Market dislocations created opportunity to grow

Replicating San Diego Model

IPO 1997: No San Diego presence

Became San Diego’s largest developer and leading landlord

2008: Exited Seattle at peak of market

2011: Expanded team, focusing on additional acquisitions and executing capital recycling plan

48

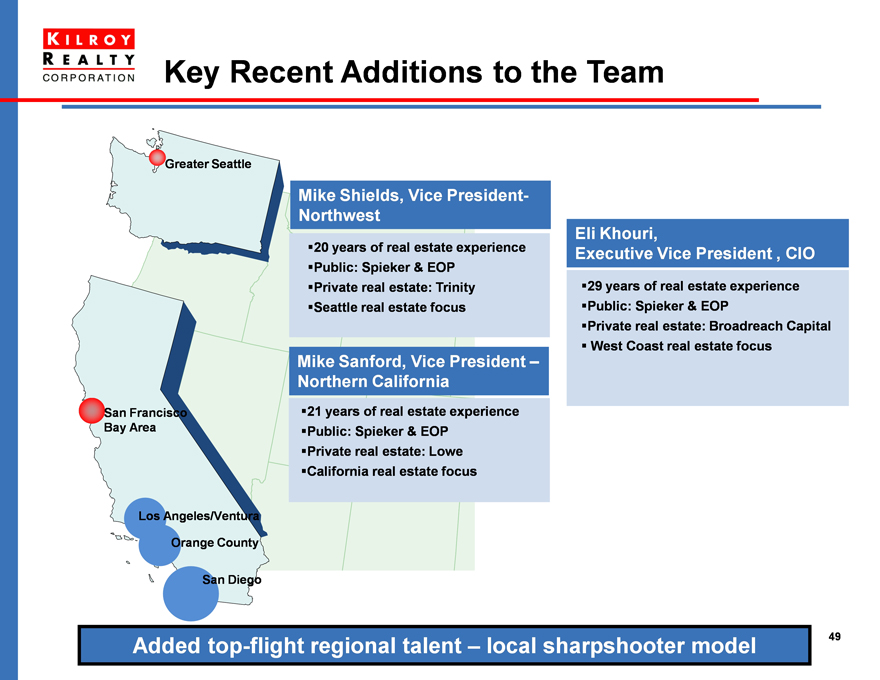

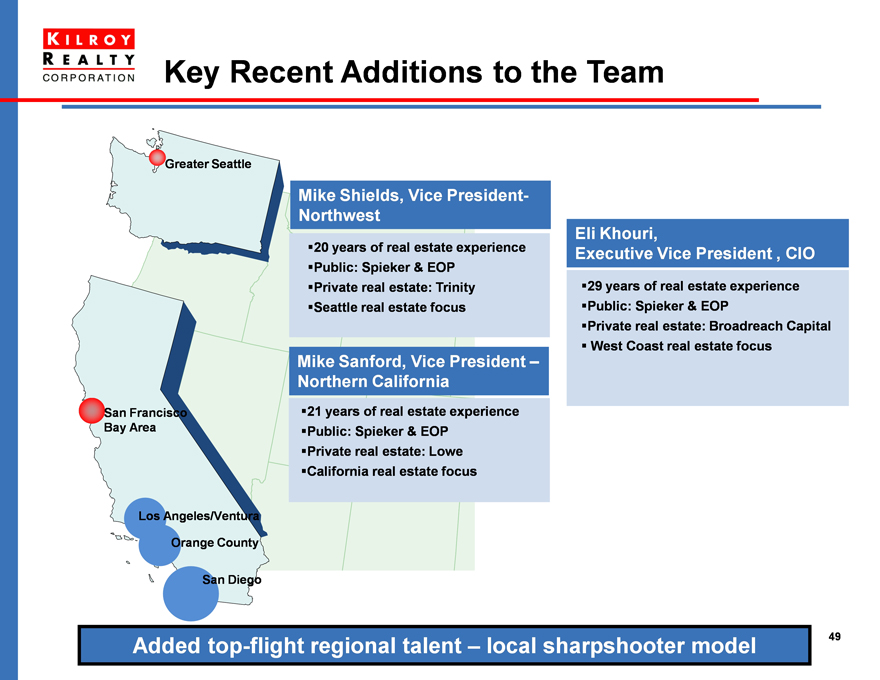

Key Recent Additions to the Team

Greater Seattle

San Francisco Bay Area

Los Angeles/Ventura

Orange County

San Diego

Mike Shields, Vice President-Northwest

Public: Spieker & EOP Private real estate: Trinity ??Seattle real estate focus

Mike Sanford, Vice President –Northern California

21 years of real estate experience Public: Spieker & EOP

Private real estate: Lowe California real estate focus

Eli Khouri,

Executive Vice President , CIO

29 years of real estate experience Public: Spieker & EOP

Private real estate: Broadreach Capital West Coast real estate focus

Added top-flight regional talent – local sharpshooter model

49

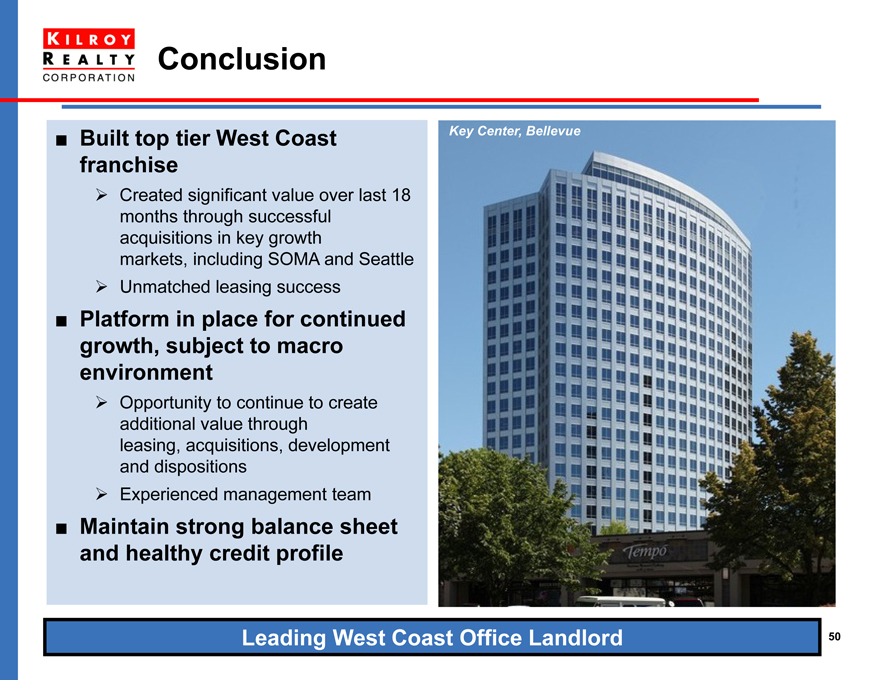

Conclusion

Built top tier West Coast franchise

Created significant value over last 18 months through successful acquisitions in key growth markets, including SOMA and Seattle

Unmatched leasing success

Platform in place for continued growth, subject to macro environment

Opportunity to continue to create additional value through leasing, acquisitions, development and dispositions

Experienced management team

Maintain strong balance sheet and healthy credit profile

KeyKey Center, Center, Bellevue Bellevue

Leading West Coast Office Landlord

50

Q&A

51