- KRC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Kilroy Realty (KRC) DEF 14ADefinitive proxy

Filed: 9 Apr 21, 4:36pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement | ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

☒ |

Definitive Proxy Statement | |||||

☐ |

Definitive Additional Materials | |||||

☐ |

Soliciting Material under §240.14a-12 |

KILROY REALTY CORPORATION

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, If Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒

| No fee required.

| |||

☐

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| |||

(1) | Title of each class of securities to which transaction applies: | |||

| ||||

(2) | Aggregate number of securities to which transaction applies: | |||

| ||||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| ||||

(4) | Proposed maximum aggregate value of transaction: | |||

| ||||

(5) | Total fee paid: | |||

| ||||

☐ |

Fee paid previously with preliminary materials. | |||

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) |

Amount Previously Paid: | |||

| ||||

(2) | Form, Schedule or Registration Statement No.: | |||

| ||||

(3) | Filing Party: | |||

| ||||

(4) | Date Filed: | |||

| ||||

KILROY PROXY STATEMENT Kilroy Realty Corporation April 2021

ON THE COVER

| Located in Seattle’s South Lake Union, 333 Dexter is an iconic destination built for people first, and designed to inspire. The city’s once-industrial lakeside neighborhood has been revitalized as a nexus for innovation and creativity, providing a platform for the growth of local talent and imagination. Dexter provides customizable spaces within a community of artful architecture, innovative amenities, and superior convenience, meticulously designed with details to invite interaction and foster discovery. The development consists of two 12-story towers totaling 635,000 SF of creative office space, unique retail, and a mid-block connection with over 19,000 SF of vibrant outdoor public space at ground level.

| |||

ABOUT KILROY

| Kilroy Realty is a place where innovation works. We have made it our mission to provide creative work environments that spark inspiration and productivity for the country’s very best thinkers and doers. Home to approximately 250 employees, we are planning, building and managing millions of square feet of innovative and sustainable properties across the Pacific Northwest, San Francisco Bay Area, Greater Los Angeles and Greater San Diego; spaces that redefine life for the better.

| |||

KILROY REALTY CORPORATION

12200 W. Olympic Boulevard, Suite 200

Los Angeles, California 90064

April 9, 2021

To Our Fellow Stockholders:

On behalf of the entire Board of Directors of Kilroy Realty Corporation (NYSE: KRC), we are pleased to present you with KRC’s 2021 Proxy Statement and invite you to attend KRC’s 2021 annual meeting of stockholders to be held virtually on May 20, 2021 at 8:00 a.m. local (Pacific) time.

First and foremost, we continue to send our thoughts to those impacted by the COVID-19 virus, both globally and in the communities in which we live, work and operate. While the virus outbreak has been a challenging and unpredictable period, we believe that we have navigated the period of uncertainty well and are well-positioned to weather the challenges that the virus outbreak may continue to present. In 2020, despite shelter in place restrictions, we ended the year with our stabilized portfolio 94.3% leased. We also completed construction on $1.3 billion of office space and 371 residential units, which was an annual record for the company. Finally, we strengthened an already strong balance sheet.

Our actions in response to the pandemic translated to solid financial results, including ending the year with $1.5 billion of total liquidity that fully funds our under-construction development, and annualized net debt to EBITDA of 5.8x. We increased our common dividend by 3.1% on an annualized basis, being one of only two office REITs to do so during 2020. We also increased Same Store Cash NOI by 8.3%, which was driven by higher rental rates.

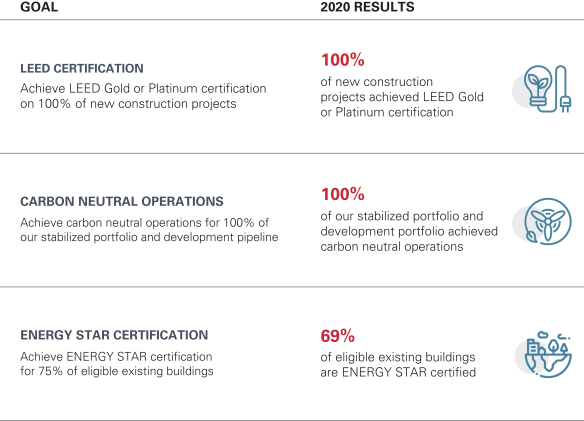

Overall, we aim to have a resilient portfolio that minimizes environmental and social impacts related to the development and operations of our buildings while maximizing the health and productivity of our tenants, employees and communities, as well as our financial returns. Our commitment to and leadership position in sustainability continues to be recognized by various industry groups and government agencies across the world and is more important now than ever. Last year, KRC proudly achieved:

| • | Our goal of carbon neutral operations by year-end 2020, a timeframe that exceeded both California and Federal standards by multiple decades; and |

| • | LEED-certification for 68% of its existing properties (with 100% of new developments designed to be LEED Gold or Platinum) and Fitwel certifications for 39% of its existing properties, a key measure of how workplaces support human health. |

For seven years running, KRC has been chosen as the North American listed office leader in sustainability by GRESB, the most widely recognized standard for sustainability practices in our industry. KRC has also been awarded the EPA’s highest ENERGY STAR honor, Partner of the Year Sustained Excellence, for the past six years and NAREIT’s Leader in Light award in the Office Sector for the past seven years. KRC has also been included in the Dow Jones Sustainability World Index for four years and on Newsweek’s list of America’s Most Responsible Companies for the past two years, and in 2020 was named the #1 Most Sustainable U.S. REIT by Calvert Research & Management.

In 2020, we also continued to focus our attention on diversity, equity and inclusion in our workplaces through expanded training programs, and to community engagement in our operations through our philanthropic and charitable endeavors. We were recognized for our work through our inclusion in Bloomberg’s 2020 Gender Equality Index for the second year in a row.

The annual meeting on May 20, 2021 will be held in a virtual-only meeting format, via live audio webcast at www.virtualshareholdermeeting.com/KRC2021. Although you will not be able to attend the annual meeting in person, the virtual-only meeting format will provide stockholders with the ability to participate in the annual meeting, vote their shares and ask questions.

To be admitted to the virtual-only annual meeting, log on to the annual meeting at www.virtualshareholdermeeting.com/KRC2021 at the appropriate time and enter your unique 16-digit control number, which may be found on the proxy card, voting instruction form or Notice of Internet Availability of Proxy Materials, as applicable. Stockholders are encouraged to access the virtual-only annual meeting prior to its start time. Online access will begin at 7:50 a.m. local (Pacific) time.

The accompanying proxy materials contain detailed information about the matters on which you are being asked to vote at the annual meeting. We encourage you to submit your vote as soon as possible, whether or not you expect to attend the annual meeting. We urge you to read the materials carefully and vote in accordance with the Board’s recommendations. Your vote is very important to us.

Sincerely,

|

John Kilroy |

Chairman of the Board, |

Chief Executive Officer |

KILROY REALTY CORPORATION

12200 W. Olympic Boulevard, Suite 200

Los Angeles, California 90064

April 9, 2021

To Our Fellow Stockholders:

On behalf of the Board, I would like to thank you for your investment in KRC. The Board is steadfast in its commitment to building and protecting the long-term value of the company, particularly during this period of global uncertainty. We take seriously our oversight responsibilities, including overseeing KRC’s strategy as well as KRC’s operating, financial and liquidity risks. Our long-standing commitment to maintaining a conservative balance sheet and focusing on long-term success, as well as diversity, sustainability, best-in-class governance, and linking compensation for our executive leadership team to performance, continue, as we believe this is the best way to handle the recent turbulence in the market and drive long-term value for stockholders. We further believe that KRC’s strong long-term financial performance and solid performance in 2020 are testaments to our strategy and the performance of the KRC team during a time when the need for effective leadership within organizations has never been greater.

Since KRC’s 2020 annual meeting of stockholders, we reached out to stockholders who together own approximately 62% of KRC’s outstanding common stock and requested meetings to solicit their input on key items of stockholder interest, including our executive compensation program and sustainability initiatives. We met with each of those stockholders who accepted such request and I personally led the meetings. Feedback from these meetings helped inform key Board discussions and decisions for 2021.

Our Executive Compensation Committee made changes to the KRC executive compensation structure for 2020 based on feedback received from stockholders in 2019 and at the start of 2020, which were in addition to previous changes to the executive compensation structure for 2019 based on feedback received from stockholders after the 2018 annual meeting. As discussed in more detail in this Proxy Statement, these included changes to the executive annual cash incentive program to make it simpler and more objective and modifying John Kilroy’s 2020 annual equity award opportunity to be entirely linked to Company performance and stockholder returns.

During these challenging times, our values as a company matter more than ever and we maintain our focus on ensuring that we are a leader in environmental, social and governance issues. We were recognized by GRESB as the North American Listed Office leader for the seventh year in a row. We further deepened our focus on building a more sustainable enterprise by proudly achieving carbon neutral operations by year-end 2020 after having been the first North American REIT to commit to doing so. Additionally, we continued our significant emphasis on our human capital initiatives, including our focus on enhancing employee growth, satisfaction and wellness while maintaining a diverse and thriving culture despite the fact that a majority of our employees were working remotely.

Additionally, the Board is focused on best practices around gender and ethnic diversity, equity and inclusion. In 2020, we appointed a new female independent director, Louisa Ritter, to our Board as part of our ongoing board refreshment and diversity efforts, and we are currently searching for another new female director and a new director who is ethnically diverse.

We greatly value the feedback we receive from you, our stockholders. Our practice of regularly engaging with stockholders will continue, as we want to ensure that your voice is heard. We encourage you to reach out with any questions or concerns that you have whether or not you expect to attend the annual meeting.

Our commitment to our stockholders remains as strong as ever. Thank you for your trust and continued support. We look forward to your participation at the annual meeting.

Sincerely,

|

Edward Brennan, PhD |

Lead Independent Director |

CONTENTS

| 54 | ||||

| 54 | ||||

| 55 | ||||

| 57 | ||||

| 69 | ||||

| 72 | ||||

| COMPENSATION COMMITTEE MATTERS | 75 | |||

| 75 | ||||

| 75 | ||||

| NAMED EXECUTIVE OFFICER COMPENSATION TABLES | 76 | |||

| 76 | ||||

| 81 | ||||

| 82 | ||||

| 84 | ||||

| 87 | ||||

| 88 | ||||

| 90 | ||||

| 96 | ||||

| CEO PAY-RATIO DISCLOSURE | 100 | |||

| EQUITY COMPENSATION PLAN INFORMATION | 101 | |||

CONTENTS

This Proxy Statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on our current expectations, beliefs and assumptions, and are not guarantees of future performance. Forward-looking statements are generally identified through the inclusion of words such as “believe,” “expect,” “goals” and “target” or similar statements or variations of such terms and other similar expressions. Numerous factors could cause actual future performance, results and events to differ materially from those indicated in the forward-looking statements, including, among others: global market and general economic conditions and their effect on our liquidity and financial conditions and those of our tenants; adverse economic or real estate conditions generally, and specifically, in the States of California and Washington; risks associated with our investment in real estate assets, which are illiquid, and with trends in the real estate industry; defaults on or non-renewal of leases by tenants; any significant downturn in tenants’ businesses; our ability to re-lease property at or above current market rates; costs to comply with government regulations, including environmental remediation; the availability of cash for distribution and debt service and exposure to risk of default under debt obligations; increases in interest rates and our ability to manage interest rate exposure; the availability of financing on attractive terms or at all, which may adversely impact our future interest expense and our ability to pursue development, redevelopment and acquisition opportunities and refinance existing debt; a decline in real estate asset valuations, which may limit our ability to dispose of assets at attractive prices or obtain or maintain debt financing, and which may result in write-offs or impairment charges; significant competition, which may decrease the occupancy and rental rates of properties; potential losses that may not be covered by insurance; the ability to successfully complete acquisitions and dispositions on announced terms; the ability to successfully operate acquired, developed and redeveloped properties; the ability to successfully complete development and redevelopment projects on schedule and within budgeted amounts; delays or refusals in obtaining all necessary zoning, land use and other required entitlements, governmental permits and authorizations for our development and redevelopment properties; increases in anticipated capital expenditures, tenant improvement and/or leasing costs; defaults on leases for land on which some of our properties are located; adverse changes to, or enactment or implementations of, tax laws or other applicable laws, regulations or legislation, as well as business and consumer reactions to such changes; risks associated with joint venture investments, including our lack of sole decision-making authority, our reliance on co-venturers’ financial condition and disputes between us and our co-venturers; environmental uncertainties and risks related to natural disasters; our ability to maintain our status as a REIT; and uncertainties regarding the impact of the COVID-19 pandemic, and restrictions intended to prevent its spread, on our business and the economy generally. These factors are not exhaustive and additional factors could adversely affect our business and financial performance. For a discussion of additional factors that could materially adversely affect our business and financial performance, see the factors included under the caption “Risk Factors” in our most recent annual report on Form 10-K and subsequent reports on Forms 10-Q and 8-K. All forward-looking statements are based on currently available information, and speak only as of the dates on which they are made. We assume no obligation to update any forward-looking statement that becomes untrue because of subsequent events, new information or otherwise, except to the extent we are required to do so in connection with our ongoing requirements under federal securities laws.

OF STOCKHOLDERS

| Date and Time: | Thursday, May 20, 2021 at 8:00 a.m. local (Pacific) time | |||

| Place: | Live audio webcast at www.virtualshareholdermeeting.com/KRC2021 | |||

You will not be able to attend the 2021 annual meeting of stockholders (the “Annual Meeting”) in person. | ||||

Items of Business: | 1. | Elect as directors the seven nominees named in the attached Proxy Statement. | ||

2. | Approve, on an advisory basis, the compensation of our named executive officers. | |||

3. | Approve the amendment and restatement of our bylaws to remove Independent Committee | |||

approval requirement separately governed by our related party transactions policy. | ||||

4. | Ratify the appointment of Deloitte & Touche LLP as our independent auditor for the year | |||

ending December 31, 2021. | ||||

| Record Date: | The Board of Directors has fixed the close of business on March 8, 2021 as the record date for determining the stockholders entitled to receive notice of and to vote at the Annual Meeting, or any adjournment(s) or postponement(s) thereof. | |||

| Proxy Voting: | Your vote is very important to us. Whether or not you plan to attend the Annual Meeting, we urge you to submit your proxy or voting instructions as soon as possible to ensure your shares are represented at the Annual Meeting. If you vote at the Annual Meeting, your proxy or voting instructions will not be used. | |||

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF | By Order of the Board of Directors, | |

| PROXY MATERIALS | ||

The Notice of Annual Meeting, Proxy Statement and our 2020 Annual Report on Form 10-K are available at www.proxyvote.com. Copies of these proxy materials are also available in the Investors — Financial Reports section of our website at http://www.kilroyrealty.com. You are encouraged to access and review all of the important information contained in our proxy materials before voting. |

Tyler Rose | |

| President and Secretary | ||

| April 9, 2021 :: Los Angeles, California |

| KILROY REALTY | PROXY STATEMENT | 1 |

The Annual Meeting will be held in a virtual-only meeting format, via live audio webcast that will provide stockholders with the ability to participate in the Annual Meeting, vote their shares and ask questions. We are implementing a virtual-only meeting format in order to protect the health and safety of all attendees, particularly in light of the COVID-19 pandemic, as well as leverage technology to enhance stockholder access to the Annual Meeting by enabling attendance and participation from any location around the world by visiting www.virtualshareholdermeeting.com/KRC2021. We believe that the virtual-only meeting format will give stockholders the opportunity to exercise the same rights as if they had attended an in-person meeting and believe that these measures will enhance stockholder access and encourage participation and communication with our Board of Directors and management.

BENEFITS OF A VIRTUAL ANNUAL MEETING

| • | We believe a virtual-only meeting format facilitates stockholder attendance and participation by enabling all stockholders to participate fully, equally and without cost, using an Internet-connected device from any location around the world. In addition, the virtual-only meeting format increases our ability to engage with all stockholders, regardless of size, resources or physical location and enables us to protect the health and safety of all attendees, particularly in light of the COVID-19 pandemic. |

| • | Stockholders of record and beneficial owners as of March 8, 2021, the record date, will have the ability to submit questions directly to our management and Board of Directors and vote electronically at the Annual Meeting via the virtual-only meeting platform. |

ATTENDANCE AT THE VIRTUAL ANNUAL MEETING

| • | Attendance at the Annual Meeting is open to the public online at www.virtualshareholdermeeting.com/KRC2021, but you are entitled to participate in the Annual Meeting by voting or asking questions only if you were a stockholder of record or beneficial owner as of March 8, 2021, the record date. |

| • | To participate in the Annual Meeting by voting or asking questions, you will need the 16-digit control number included on your proxy card, voting instruction form or Notice of Internet Availability of Proxy Materials, as applicable. |

| • | If you were a stockholder as of March 8, 2021, the record date, you may vote shares held in your name as the stockholder of record or shares for which you are the beneficial owner but not the stockholder of record electronically during the Annual Meeting through the online virtual annual meeting platform by following the instructions provided when you log in to the online virtual annual meeting platform. |

| • | On the day of the Annual Meeting, Thursday, May 20, 2021, stockholders may begin to log in to the virtual-only Annual Meeting beginning at 7:50 a.m. local (Pacific) time, and the Annual Meeting will begin promptly at 8:00 a.m. local (Pacific) time. Please allow ample time for online login. |

| • | We will have technicians ready to assist you with any technical difficulties you may have accessing the Annual Meeting. If you encounter any difficulties accessing the virtual-only Annual Meeting platform, including any difficulties with your 16-digit control number or submitting questions, you may call the technical support number that will be posted on the Annual Meeting log-in page. |

QUESTIONS AT THE VIRTUAL ANNUAL MEETING

| • | Stockholders will have the opportunity to submit questions during the Annual Meeting by following the instructions on the virtual-only Annual Meeting platform. |

| • | Following the presentation of all proposals at the Annual Meeting, we will answer as many stockholder-submitted questions as time permits. Any questions that we are unable to address during the Annual Meeting will be answered on our website at http://investors.kilroyrealty.com following the Annual Meeting. If we receive substantially similar questions, we will group the questions together and provide a single response to avoid repetition. |

| • | We will not answer any questions that are irrelevant to the purpose of the Annual Meeting or our business or that contain inappropriate or derogatory references which are not in good taste. |

YOU WILL NOT BE ABLE TO ATTEND THE ANNUAL MEETING IN PERSON

| 2 | PROXY STATEMENT | KILROY REALTY |

This section highlights information about Kilroy Realty Corporation (“we,” “our,” “us” or the “Company”) and our Board of Directors (the “Board”) that is contained elsewhere in this Proxy Statement. This section does not contain all of the information that you should consider and you should read the entire Proxy Statement before voting.

BUSINESS HIGHLIGHTS

Despite the challenges presented by the global pandemic, in 2020 we strengthened our balance sheet, delivered a record year of developments, raised our dividend, and increased Same Store Cash NOI. Our highly experienced leadership team, led by John Kilroy (who brings over 50 years of experience to the organization), continued to effectively manage a state of the art portfolio by navigating the rapidly evolving business environment defensively. Overall, the Company’s executive management team has an average tenure of 29 years in the real estate industry.

SAME STORE CASH NOI GROWTH(1) | DIVIDEND GROWTH | 4Q 2020 NET DEBT / EBITDA(2) | YEAR-END LIQUIDITY(3) | |||

| 8.3% | 43% | 5.8x | $1.5B | |||

Second Highest Growth in Past Decade |

Cumulative Increase Over Five-Year Period |

Decreased by 1.2x from 4Q 2019 |

Cash on Hand Fully Funds Under-Construction & Tenant Improvement Development(4) | |||

CONSTRUCTION COMPLETED(5) | CARBON NEUTRAL OPERATIONS(6) | |||||

| $1.3B | Achieved | |||||

Office Space & 371 Residential Units |

Year-End 2020 | |||||

Despite shelter in place restrictions, we executed over 731,000 square feet of leases, including on development properties, with average rental rates that were up 36.5% on a GAAP basis and 18.4% on a cash basis as compared to prior leases. We fully stabilized The Exchange on 16th, a $585.0 million, 750,000 square foot office development project located in the Mission Bay district of San Francisco. The office component is 100% leased to Dropbox, Inc. and we recently announced that we signed a definitive agreement to sell the property for a purchase price of $1.08 billion or approximately $1,440 per square foot, which closed at the end of March 2021. Additionally, we achieved our goal of carbon neutral operations by year-end 2020 and continued to be recognized as a leader within the industry for sustainability. More information on the Company’s 2020 performance is detailed on pages 52–54.

| (1) | See Appendix A for the definition of “net operating income” (“NOI”) and a reconciliation of net income available to common stockholders computed in accordance with GAAP to net operating income, for the definition of “Same Store NOI (on a GAAP and cash basis)” and a reconciliation of net income available to common stockholders computed in accordance with GAAP to Same Store NOI (on a GAAP and cash basis), and for the definition of “adjusted net income available to stockholders” and a reconciliation of net income available to common stockholders computed in accordance with GAAP to adjusted net income available to common stockholders. Increases are reported as 2020 performance above 2019 levels. |

| (2) | The debt to earnings before interest, taxes, depreciation and amortization (“EBITDA”) ratio is calculated as the Company’s consolidated debt balance for the applicable period, divided by the Company’s annualized EBITDA, for such period. See Appendix A for a definition of EBITDA and a reconciliation of net income available to common stockholders computed in accordance with GAAP to net income available to common stockholders computed in accordance with GAAP to EBITDA, in each case presented on an annualized basis for the applicable period. The Company’s annualized EBITDA reflects our pro rata share of joint ventures. Debt is net of cash. |

| (3) | Liquidity is comprised of approximately $732.0 million of cash and cash equivalents on hand and full availability under the Company’s $750.0 million revolving credit facility. |

| (4) | Development consists of projects in the tenant improvement phase and under construction. |

| (5) | Core and shell completion for office properties. |

| (6) | Carbon neutral operations is zero Scope 1 and Scope 2 market-based greenhouse gas emissions. Scope 1 emissions represent those produced by consuming onsite natural gas procured by the Company. Scope 2 emissions represent those produced by consuming onsite electricity procured by the Company. |

| KILROY REALTY | PROXY STATEMENT | 3 |

EXTENSIVE STOCKHOLDER ENGAGEMENT AND RESPONSIVENESS

Since our 2020 annual meeting of stockholders, we reached out to stockholders who collectively own approximately 62% of our outstanding common stock and requested meetings to solicit their input on a variety of topics, including market conditions, executive compensation, corporate strategy and corporate governance practices. We met with each of those stockholders who accepted such request. Our Lead Independent Director and Chair of the Executive Compensation Committee (the “Compensation Committee”) personally led the meetings. The following actions were taken based on stockholder feedback we have received: |

62% Reached out to Stockholders Holding Approximately 62% of our Common Stock |

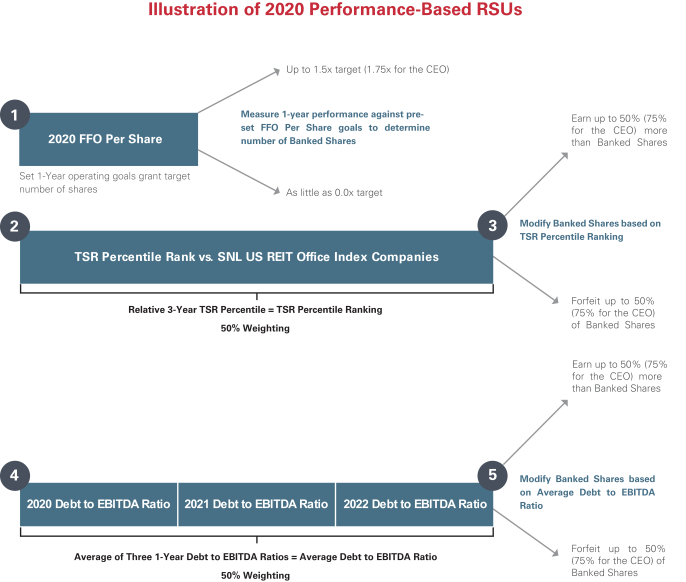

| • | Enhanced the Performance-Based Component of our NEOs’ Equity Awards. To further enhance the performance-based nature of our NEOs’ long-term equity compensation opportunities, our CEO’s entire 2020 annual equity award is subject to performance-based vesting requirements and three-fourths of the 2020 annual equity awards for our other NEOs are subject to performance-based vesting requirements (other than with respect to Ms. Ngo, who was not an Executive Vice President or more senior officer at the time our 2020 annual equity awards were granted). |

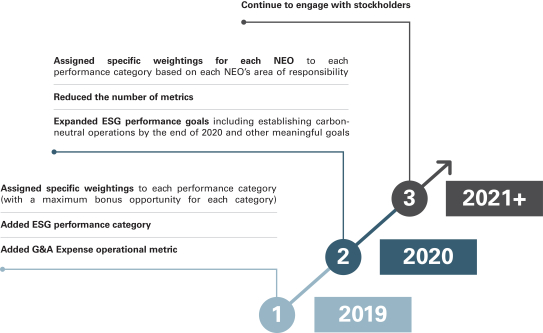

| • | Simplified Our Annual Cash Incentive Program. We also received feedback from certain stockholders that they would like to see more clarity, simplicity and objectivity in our annual cash incentive program for NEOs. In designing our 2020 annual cash incentive program for NEOs, the Compensation Committee simplified the number of metrics to be used in evaluating performance to promote a focused alignment of financial goals with Company strategy, with goal weightings varying between the NEOs based on each executive’s area of responsibility. In addition, in an effort to remain aligned with stockholder focus on ESG issues, we again included an ESG-focused category in the 2020 annual cash incentive program metrics with expanded goals, including establishment of carbon neutral operations by the end of 2020, achievement of LEED certifications on new development, annual progress on human capital initiatives (including employee engagement, talent development and diversity), and implementation and efficacy of in-season and off-season stockholder outreach. (See pages 61-62 for additional details.) |

Changes to Annual Cash Incentive Plan Since 2019

Continue to engage with stockholders Assigned specific weightings for each NEO to each performance category based on each NEO's area of responsibility Reduced the number of metrics Expanded ESG performance goals including establishing carbon-neutral operations by the end of 2020 and other meaningful goals Assigned specific weightings to each performance category (with a maximum bonus opportunity for each category) Added ESG performance category Added G&A Expense operational metric 1 2 3 2019 2020 2021+

| • | Diversity. Several stockholders asked about diversity on the Board and within the Company. In 2020, we appointed a new female independent director, Louisa Ritter, to our Board as part of our ongoing Board refreshment and diversity efforts, and we are currently searching for another new female director and a new director who is ethnically diverse, or a single new director who is both female and ethnically diverse. In addition, among our workforce, we have numerous women in key leadership roles within the Company, as further discussed on page 8, women make up more than half of our workforce, and approximately 45% of our workforce is diverse. |

| 4 | PROXY STATEMENT | KILROY REALTY |

| • | Jeffrey Hawken Employment Agreement. We also received feedback from stockholders in 2020 that they voted against our 2020 Say-on-Pay vote because in January 2020 we extended our employment agreement with Jeffrey Hawken, who was serving as our Executive Vice President and Chief Operating Officer at the time of such extension. However, severance benefits would have been triggered under Mr. Hawken’s agreement had we failed to extend the term of the agreement upon substantially the same (or better) compensation and other terms for Mr. Hawken. This was a legacy provision in Mr. Hawken’s employment agreement that has not been included in any of the Company’s other employment agreements that are currently in effect, and we do not plan on including this provision in any new employment agreements in the future. In July 2020, the Company notified Mr. Hawken that his employment was being terminated without cause in connection with a restructuring of the Company’s management team and the Company entered into a Separation Agreement (the “Separation Agreement”) with Mr. Hawken pursuant to which Mr. Hawken’s employment with the Company ended on July 13, 2020 (the “Separation Date”). The severance benefits provided to Mr. Hawken under the Separation Agreement are generally consistent with the severance benefits that Mr. Hawken would have been entitled to receive had the Company failed to extend the term of his employment agreement (on substantially the same (or better) compensation and other terms for Mr. Hawken) earlier in the year. Mr. Hawken’s Separation Agreement is discussed in “Compensation Discussion and Analysis — Employment and Separation Agreements with Jeffrey Hawken” and “Named Executive Officer Compensation Tables — Potential Payments Upon Termination or Change in Control” below. |

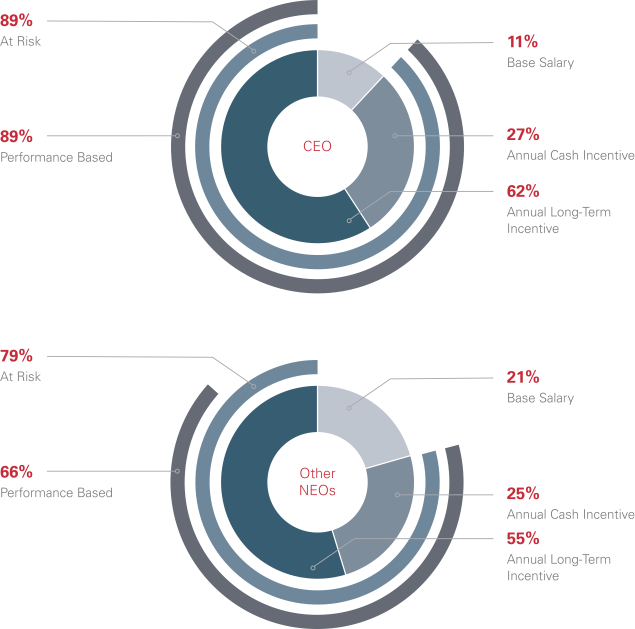

COMPENSATION HIGHLIGHTS

The Compensation Committee approved the 2020 compensation arrangements for our NEOs. Below are highlights of our 2020 compensation arrangements for our NEOs from the Compensation Discussion and Analysis (the “CD&A”) section of this Proxy Statement:

Enhanced Operating and Financial Goals that Were Not Adjusted for the Impact of COVID-19

| • | The 2020 short-term incentives (annual cash bonuses) for our NEOs were significantly less than the 2019 short-term incentives for our NEOs, with our CEO’s 2020 short-term incentive being approximately 30% less than his 2019 short-term incentive. |

| • | Key operating and financial goals used to determine 2020 short-term incentives for our NEOs were generally set at levels above the performance goals used for 2019. See the discussion on page 59. |

| • | The Adjusted FFO per share target used in the 2020 performance-based long-term incentive awards for our NEOs was set above the Adjusted FFO per share target used for 2019. |

| • | Our 2020 short-term incentive goals and methodology, as well as our 2020 performance-based long-term incentive award goals were established before the full impact of the COVID-19 pandemic was known. The Compensation Committee considered the impact of the COVID-19 pandemic on us and on the commercial real estate market in 2020 and determined that the goals, methodology and structure of our executive incentive programs would not be adjusted for the impact of the pandemic. |

| • | Vesting for the 2020 performance-based long-term incentive awards is also contingent on our total stockholder return (“TSR”)(7) compared to other office-focused REITs over a three-year period (for 50% of the performance-based awards) and our average ratio of debt to EBITDA over that period (for the remaining 50% of the performance-based awards). |

Continued Emphasis on Long-Term Incentive Awards and Performance-Based Compensation

| • | Long-term equity compensation, tied to three-year vesting periods, is the largest component of each NEO’s total compensation opportunity. |

| • | The entire 2020 annual equity award for our CEO is subject to performance-based vesting requirements and includes a performance measure indexed to our relative TSR. |

| • | Three-fourths of the 2020 annual equity awards for our other NEOs are subject to performance-based vesting requirements and include a performance measure based on our relative TSR (other than with respect to Ms. Ngo, as discussed previously). |

| (7) | For purposes of this Proxy Statement, TSR is calculated assuming dividend reinvestment. |

| KILROY REALTY | PROXY STATEMENT | 5 |

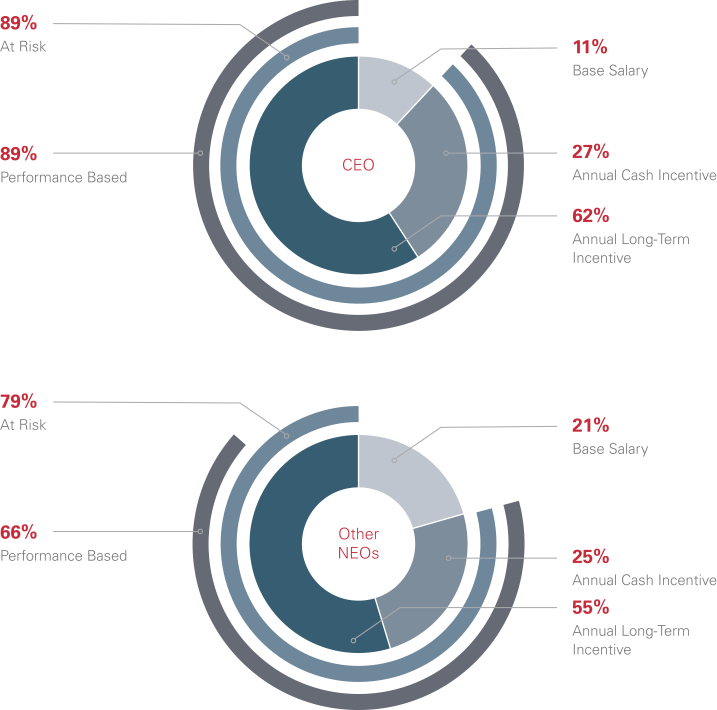

| • | Approximately 89% of our CEO’s target TDC(8) for 2020 was not guaranteed but rather was tied to metrics related to Company performance and/or stock price, and therefore meaningfully “at risk.” |

| • | Approximately 79% of our other NEOs’ target TDC for 2020 was not guaranteed but rather was tied to metrics related to Company performance and/or stock price, and therefore meaningfully “at risk” (Ms. Ngo is excluded for purposes of this illustration as she was not an Executive Vice President or more senior officer when we structured our 2020 executive compensation program). |

2020 Target

Total Direct Compensation

89% At Risk 89% Performance Based 79% At Risk 66% Performance Based 11% Base Salary 27% Annual Cash Incentive 62% Annual Long-Term Incentive 21% Base Salary 25% Annual Cash Incentive 55% Annual Long-Term Incentive CEO Other NEOs

| (8) | As used in this Proxy Statement, “target TDC” means target total direct compensation, which is the executive’s base salary, target annual cash incentive and grant date fair value (based on the value approved by the Compensation Committee and used to determine the number of shares subject to the award) of annual long-term incentive awards granted to the executive in 2020. |

| 6 | PROXY STATEMENT | KILROY REALTY |

CORPORATE SOCIAL RESPONSIBILITY AND SUSTAINABILITY HIGHLIGHTS

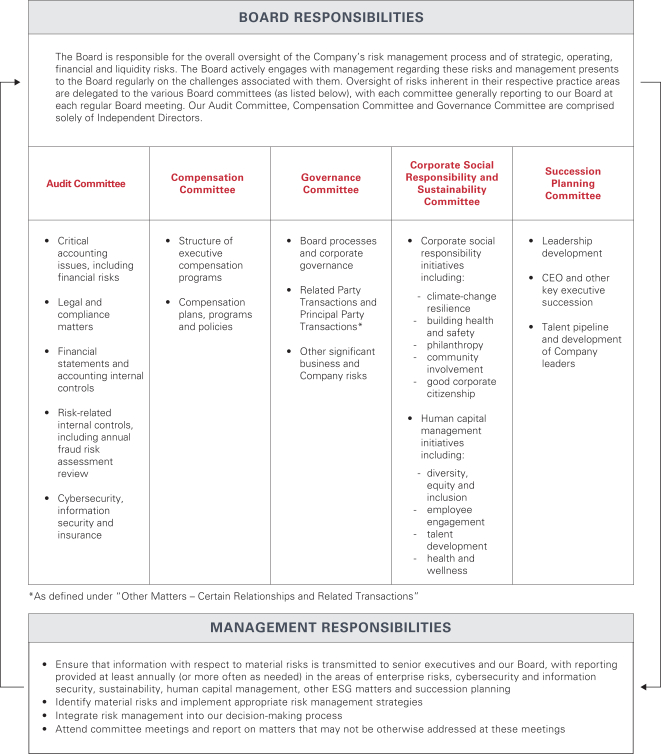

The Company and its Board maintain a focus on corporate social responsibility and sustainability. Through the Corporate Social Responsibility and Sustainability Committee (the “CSR&S Committee”) of our Board, we continuously look for new and better ways to foster a diverse and inclusive work environment, improve employee health and safety, engage our surrounding communities and minimize our environmental impact, all while creating value for our stockholders. These efforts were of particular importance to the Company during 2020, as our employees, tenants and communities in which we operate faced challenges resulting from the COVID-19 pandemic, climate change and social injustices. Below are some recent highlights of our human capital, diversity and sustainability initiatives. For additional information, see “Corporate Governance — Board Composition and Governance — Corporate Social Responsibility and Sustainability” beginning on page 34. (References to our employees in this Proxy Statement include individuals employed through our operating partnership, Kilroy Realty, L.P., as well as through Kilroy Realty TRS, Inc.)

Human Capital Development

| CULTURE OF INCLUSION

Continued cultivation of diverse culture of inclusion at the Company and on the Board |  | TRAINING AND EDUCATION

Required an unconscious bias training for all employees in 2020 |  | EMPLOYEE SATISFACTION

Conducted an employee satisfaction survey in 2020 and took actions to address feedback | |||||||||

The Company is committed to enhancing employee growth, satisfaction and wellness while maintaining a diverse and thriving culture. Our human capital development initiatives include the following:

| • | Diversity. We believe cultivating a diverse culture of inclusion that makes a positive difference in our employees’ lives is vital to the success of our Company, and we have developed targeted training to improve workplace diversity, equity and inclusion, as further discussed below. |

| • | Training and Education. We support the development of our employees through various training and education programs throughout their tenure at the Company, from providing initial onboarding to offering specific skill building opportunities and leadership development through workshops, online training and Company-sponsored executive coaching services for certain members of management. |

| — | In early 2021, we launched a dedicated online onboarding site to share resources and tools for new hires, and to acclimate new employees to our Company culture. |

| — | We conducted several corporate trainings in 2020, including an unconscious bias training, which all employees were required to take, and a COVID-19 workplace preparedness training. |

| — | We conduct annual performance and career development reviews for all employees, and revamped our process in 2020, including refreshing the core competencies against which employees are evaluated and adding a new self-review element. |

| • | Employee Health. The mental and physical health and wellness of our employees is of central importance to our culture. We evaluate our group health and ancillary benefits annually as we seek to provide a robust benefits package. We also conduct an annual wellness survey to help us better tailor our employee health and wellness programs. |

| — | We offer our employees programs such as paid parental and medical leave, fertility services (including egg freezing), discounted gym passes, an enhanced employee assistance program to provide support and assistance with various life and family matters, commuter benefits, subsidized medical, dental, vision and life insurance, and parental leave coaching. |

| — | In 2020, we expanded our offerings to include both a health and a dependent care flexible spending account (FSA). |

| • | Fostering Company Culture and Providing Support to Employees During COVID-19 Pandemic. Maintaining a thriving company culture is of utmost importance to the Company. In accordance with local and state government guidance and social distancing recommendations, almost all of our corporate employees have worked remotely since March 2020, and our team has worked hard to protect and foster the Company’s culture during the COVID-19 pandemic. |

| — | During 2020, we formed an inter-regional and inter-departmental taskforce and worked with the Company’s Culture Crew to organize teambuilding events and activities, virtual exercise classes, a virtual library of self-care resources and other remote programming to keep our employees connected while working from home. |

| KILROY REALTY | PROXY STATEMENT | 7 |

| — | As we prepare for a broader re-entry to the workplace, the taskforce is focused on ensuring that our employees feel safe and comfortable, and is working with the Culture Crew to develop programming to help employees connect and engage with one another as they transition back to the workplace. |

| — | We conducted two employee surveys during 2020 — one focused on work from home/re-entering the workplace and a more general employee satisfaction survey. We have taken actions to address the feedback received in the surveys and are committed to conducting employee surveys on a regular basis to monitor employee engagement and satisfaction. |

Diversity at the Company

We strive to have a workforce that reflects the diversity of qualified talent that is available in the markets that we serve.

| • | Gender Diversity. We have numerous women in key leadership roles, including our EVP, Chief Administrative Officer, our SVP, Chief Financial Officer and Treasurer, our SVP, Chief Accounting Officer and Controller, our SVP, Corporate Counsel and multiple other Senior Vice Presidents. Several women in the Company have received awards for their leadership in the real estate industry and/or the local business regions in which we operate, as further described in our annual sustainability report on our website located at the address below. In addition, women make up more than half of our workforce. |

BLOOMBERG GENDER EQUALITY INDEX

Member 2020 - 2021; Listed for Superior Diversity, Equity and Inclusion Programs and Results(9)

EMPLOYEES BY CATEGORY Overall Workforce Supervisors VPs & Above 2020 Promotions 2021 Promotions to Date 2020 Hires FEMALE MALE 59% 41% 56% 44% 29% 71% 46% 54% 58% 42% 72% 28%

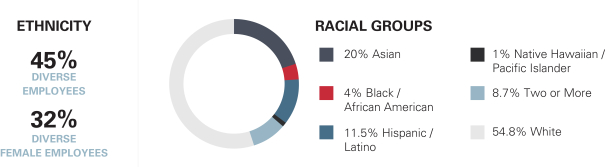

| • | Ethnic Diversity. Approximately 45% of our employees are diverse. We recently launched a Company-wide diversity initiative to bolster our diversity, equity and inclusion efforts and communicated regularly with our employees throughout 2020 regarding the events that occurred around social and racial injustice, and important holidays such as Juneteenth, Black History Month and Women’s History Month, sharing resources, virtual events and other opportunities for learning around such topics. |

ETHNICITY 45% DIVERSE EMPLOYEES 32% DIVERSE FEMALE EMPLOYEES RACIAL GROUPS 20% Asian 4% Black / African American 11.5% Hispanic / Latino 1% Native Hawaiian / Pacific Islander 8.7% Two or More 54.8% White

| (9) | The Gender Equality Index (GEI) measures gender equality across five pillars: female leadership and talent pipeline, equal pay and gender pay parity, inclusive culture, sexual harassment policies, and pro-women brand. |

| 8 | PROXY STATEMENT | KILROY REALTY |

Diversity on the Board

Our Nominating/Corporate Governance Committee (the “Governance Committee”) and the Board understand the importance of bringing diverse experience and perspectives to the Board and as such: | ||

• In 2020, we appointed a new female independent director, Louisa Ritter, to our Board as part of our ongoing board refreshment and diversity efforts. Currently, two of our seven directors (or 29%) are female, with one serving as the Chair of the Company’s CSR&S Committee. |

29%

| |

• In addition to our recent efforts to increase gender diversity on the Board and in response to stockholder feedback, our Board is also committed to appointing a new female director and a new director who is ethnically diverse, or a single new director who is both female and ethnically diverse, and our Governance Committee has initiated a search for such director candidates. | ||

• Our Corporate Governance Guidelines and Board Membership Criteria include diversity as a criteria considered by the Governance Committee and the Board in considering Board nominations. The Governance Committee and the Board consider diversity, in its broadest sense, reflecting, but not limited to, profession, geography, gender, ethnicity, skills and experience. |  | |

• Our Governance Committee and Board will continue to endeavor to include women and individuals from minority groups in the qualified pool from which new director candidates are selected when the Board undergoes any future Board refreshment. | ||

More information regarding our human capital development goals and initiatives can be found in our annual sustainability report on our website located at http://kilroyrealty.com/commitment-sustainability.

| KILROY REALTY | PROXY STATEMENT | 9 |

Sustainability

We remain a committed leader in the effort to building and operating environmentally sound properties, which has resulted in wide recognition amongst our peers and by industry organizations around the world.

| 100%

LEED GOLD OR PLATINUM

certification for new construction project(10)

|

ENERGY STAR

Partner of the Year 2014 - 2020; Sustained Excellence |

GRESB

Green Star 2013 - 2020; #1 Ranking in the Americas Listed 2020; Global Sector Leader Global Sector Leader |

NAREIT

Leader in the Light Award Office Sector 2014 - 2020; Leader in the Light Award, Most Innovative | |||

100%

CARBON NEUTRAL

operations(6)(10)

|

GREEN LEASE

Leader 2014 - 2020; Gold Level 2018 - 2020 |

NEWSWEEK

America’s Most |

CENTER FOR

Best in Building Health, | |||

69%

ENERGY STAR

certified(10)

|

S&P

Yearbook Member |

CLIMATE REGISTRY AND CENTER FOR CLIMATE & ENERGY SOLUTIONS

Climate Leadership Award 2020 |

DOW JONES

Member 2017 - 2020; One of Only Seven North American Real Estate | |||

CALVERT RESEARCH & MANAGEMENT’S TOP 10 MOST SUSTAINABLE US REITS

Sector Leader 2021 | ||||||

Climate Resilience. We identify climate change as a risk to our business, an opportunity for long-term value creation and a key driver of long-term strategic business decisions. In 2020, under the oversight of our Board, we conducted analyses of our modeled financial losses due to climate change aligned with the Task Force for Climate-Related Financial Disclosures (TCFD) using The Climate Service’s Climanomics® platform. In connection with these analyses, we have updated various Company policies and procedures, including those related to our operations and acquisitions to address these results. In addition, we have incorporated these analyses into our development strategy. We intend to continue to be proactive in managing climate-related risks. More information about our climate resilience work, including our climate change scenario analysis, can be found in our annual sustainability report on our website located at the address above.

| (10) | As of December 31, 2020. |

| 10 | PROXY STATEMENT | KILROY REALTY |

CORPORATE GOVERNANCE HIGHLIGHTS

The Company is committed to good corporate governance, which promotes the long-term interests of stockholders, strengthens accountability of the Board and helps build public trust in the Company. Highlights include the following:

Independent Board Leadership and Practices

|

Lead Independent Director with a well-defined role and robust responsibilities |

Majority of directors are independent (6 out of 7 current directors) |

Dedicated CSR&S Committee responsible for overseeing Company objectives related to sustainability, human capital matters, including diversity, equity and inclusion, health and wellness, philanthropy and community involvement, good corporate citizenship and other non-financial issues that are of significance to the Company and its stockholders |

Commitment to include women and individuals from minority groups in the qualified pool from which new director candidates are selected |

Continued commitment to Board refreshment with one new independent director in the last year and a majority of the Board appointed since 2014 |

Average independent director tenure of 8.4 years |

Comprehensive risk oversight practices, including cybersecurity and insurance |

Regular strategic updates from the CEO |

Regular executive sessions of independent directors |

Regular Board and committee self-evaluations |

Succession Planning Committee oversees regular succession planning efforts |

CEO may only serve on the board of directors of one other public company |

All standing Board committees are composed solely of independent directors |

Robust Stockholder Rights

|

Stockholder proxy access aligns with best practices and reflects stockholder feedback |

Majority voting for directors in uncontested elections |

Annual director elections (declassified Board) |

Annual Say-on-Pay voting |

Stockholder right to call a special meeting |

Stockholder right to amend Bylaws by a majority vote |

No stockholder rights plan |

| KILROY REALTY | PROXY STATEMENT | 11 |

Best Practices Compensation and Governance Practices

|

Independent compensation consultant |

Robust stock ownership guidelines for executives and non-employee directors |

Stock holding requirements |

Anti-hedging policy |

Anti-pledging policy |

Clawback policy |

Related party transactions policy |

No single trigger change in control provisions |

No excise tax gross-ups |

No repricing of underwater stock options without stockholder approval |

Regular engagement with investors; since our 2020 annual meeting of stockholders, we reached out to stockholders who together own approximately 62% of our outstanding common stock and requested meetings to solicit their input. Our Lead Independent Director and Chair of the Compensation Committee personally led meetings with all stockholders who accepted such request |

| 12 | PROXY STATEMENT | KILROY REALTY |

VOTING MATTERS AND BOARD RECOMMENDATIONS

Our Board is soliciting your proxy to vote on the following matters at our Annual Meeting to be held at 8:00 a.m. local (Pacific) time on Thursday, May 20, 2021 via live audio webcast at www.virtualshareholdermeeting.com/KRC2021, and any adjournments or postponements of the Annual Meeting:

| Vote Required | Vote Required | Board

| Page | |||||

Proposal No. 1 |

Election of Seven Director Nominees |

Majority of Votes Cast

|

For | 14

| ||||

Proposal No. 2 |

Advisory Approval of Compensation of NEOs |

Majority of Votes Cast |

For | 25

| ||||

Proposal No. 3 |

Approval of Amendment and Restatement of Bylaws to Remove Independent Committee Approval Requirement Separately Governed by Our Related Party Transactions Policy

|

Majority of Votes Entitled to be Cast |

For | 27

| ||||

Proposal No. 4 |

Ratification of Appointment of Deloitte & Touche LLP as Independent Auditor for 2021 |

Majority of Votes Cast |

For | 29

|

HOW TO CAST YOUR VOTE

| INTERNET | PHONE | DURING THE MEETING | ||||

Follow the instructions provided in the notice or separate proxy card or voting instruction form you received. | Follow the instructions provided in the separate proxy card or voting instruction form you received. | Send your completed and signed proxy card or voting instruction form to the address on your proxy card or voting instruction form. | Follow the instructions provided in the notice or separate proxy card or voting instruction form you received. | |||

On April 9, 2021, the proxy materials for our Annual Meeting, including this Proxy Statement and our 2020 Annual Report on Form 10-K (the “2020 Annual Report”), were first sent or made available to our stockholders entitled to vote at the Annual Meeting.

|

| KILROY REALTY | PROXY STATEMENT | 13 |

| PROPOSAL 1 – |

| ELECTION OF DIRECTORS |

The Board presently consists of seven directors. Each director is serving a term that continues until the Annual Meeting and until his or her successor is duly elected and qualified. As further described below, our Board has selected all seven of our incumbent directors for election at the Annual Meeting.

NOMINEES FOR DIRECTOR

Upon the recommendation of the Governance Committee, the Board nominated John Kilroy, Edward Brennan, PhD, Jolie Hunt, Scott Ingraham, Louisa Ritter, Gary Stevenson and Peter Stoneberg for election to the Board for a term continuing until the annual meeting of stockholders to be held in 2022 and until their respective successors are duly elected and qualified. All of our director nominees are currently directors of the Company and, other than Ms. Ritter, were previously elected to serve on the Board by our stockholders. In this Proxy Statement, references to “John Kilroy” or our CEO are to John B. Kilroy, Jr.

Ms. Ritter is standing for election to the Board for the first time after being appointed to the Board in October 2020 as part of our ongoing Board refreshment process. Ms. Ritter is currently the President of Pisces, Inc., a San Francisco-based asset management firm. Prior to joining Pisces in 2016, Ms. Ritter worked at Goldman Sachs for 14 years.

At the request of the Governance Committee and in connection with the Governance Committee’s consideration of new, diverse director candidates, Korn Ferry (“Korn Ferry”) assessed Ms. Ritter’s candidacy. As part of its assessment, a representative of Korn Ferry interviewed Ms. Ritter, made

multiple reference calls with her prior employers and conducted an extensive background check. The Board then reviewed the results of Korn Ferry’s evaluation and screening, received a presentation from Korn Ferry and discussed the potential director candidate. Each of the Board members also met and interviewed Ms. Ritter. Following these interviews, the Board then met, discussed and approved Ms. Ritter’s appointment to the Board. Ms. Ritter was initially identified as a potential nominee by Mr. Stoneberg, the Chair of our Governance Committee.

Except as otherwise instructed, proxies solicited by this Proxy Statement will be voted “FOR” the election of each of the nominees to the Board. The nominees have consented to be named in this Proxy Statement and to serve as directors if elected. If any nominee of the Board is unable to serve, or for good cause will not serve, as a director at the time of the Annual Meeting, the persons who are designated as proxies intend to vote, in their discretion, for any other persons that may be designated by the Board. As of the date of this Proxy Statement, the Board has no reason to believe that any of the director nominees named above will be unable or unwilling to stand as a nominee or to serve as a director if elected.

| 14 | PROXY STATEMENT | KILROY REALTY |

BOARD COMPOSITION

Board Snapshot

The following provides a snapshot of our seven director nominees:

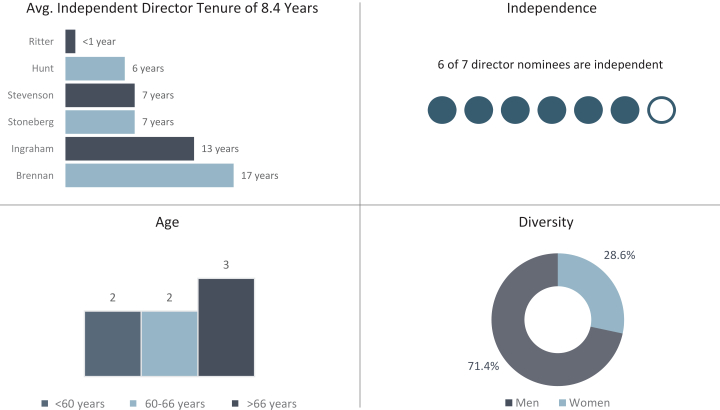

Avg. Independent Director Tenure of 8.4 Years Ritter Hunt Stevenson Stoneberg Ingraham Brennan 1 year 6 years 7 years 7 years 13 years 17 years Independence 6 of 7 director nominees are independent Age 3 2 2 <60 years 60-66 years >66 years Diversity 28.6% 71.4% Men Women

Avg. Independent Director Tenure of 8.4 Years Ritter Hunt Stevenson Stoneberg Ingraham Brennan 1 year 6 years 7 years 7 years 13 years 17 years Independence 6 of 7 director nominees are independent Age 3 2 2 <60 years 60-66 years >66 years Diversity 28.6% 71.4% Men Women

Avg. Independent Director Tenure of 7.6 Years Ritter Hunt Stevenson Stoneberg Ingraham Brennan 1 year 5 years 6 years 6 years 13 years 17 years Independence 6 of 7 director nominees are independent Age 3 2 2 <60 years 60-66 years >66 years Diversity 28.6% 71.4% Men Women

| KILROY REALTY | PROXY STATEMENT | 15 |

Director Nominee Skills, Experience and Background

We believe each of the seven director nominees possesses the professional and personal qualifications necessary for effective service as a director. In addition to each nominee’s specific experience, qualifications and skills, we believe that each nominee has a reputation for integrity, honesty and adherence to high ethical standards and has demonstrated business acumen and an ability to exercise sound business judgment. We believe all nominees have a commitment to the Company and to building long-term stockholder value. The following chart shows a summary of the director nominees’ skills and core competencies:

| Skill/Qualification

| Kilroy

| Brennan

| Hunt

| Ingraham

| Ritter

| Stevenson

| Stoneberg

| |||||||

Target Tenant Industry Experience

Knowledge and experience with the top five industries that make up the majority of our tenant base (Technology; Life Science & Healthcare; Media; and F.I.R.E. — Finance, Insurance and Real Estate)

| ● | ● | ● | ● | ● | ● | ● | |||||||

Executive Leadership

Leadership role as company CEO or President

| ● | ● | ● | ● | ● | ● | ● | |||||||

Public Company Board Service

Experience as a board member of another publicly traded company

| ● | ● | ● | |||||||||||

Investment Experience

Relevant investment, strategic and deal structuring experience

| ● | ● | ● | ● | ● | ● | ||||||||

Financial Literacy/Accounting Experience

Financial or accounting experience and an understanding of financial reporting, internal controls and compliance

| ● | ● | ● | ● | ● | |||||||||

Finance/Capital Markets Experience

Experience navigating our capital-raising needs

| ● | ● | ● | ● | ● | ● | ||||||||

Risk Management Experience

Experience overseeing and managing company risk

| ● | ● | ● | ● | ● | ● | ● | |||||||

Advanced Degree/Professional Accreditation

Possesses an advanced degree or other professional accreditation that brings additional perspective to our business and strategy

| ● | ● | ● | ● | ● |

| 16 | PROXY STATEMENT | KILROY REALTY |

DIRECTOR NOMINEE

| JOHN KILROY Chief Executive Officer and Chairman of the Board

| |||

Age: 72 Director Since: 1996 Race/Ethnicity: Caucasian |

Committees - CSR&S

| |||

John Kilroy was elected to serve as our Chairman of the Board (“Chairman”) in February 2013 and has been our CEO and a director since our incorporation in September 1996. Mr. Kilroy also served as our President from our incorporation in September 1996 until December 2020. Having led its private predecessor, Kilroy Industries, in a similar capacity, he became its President in 1981 and was elected CEO in 1991. Mr. Kilroy has been involved in all aspects of commercial real estate acquisition, entitlement, development, construction, leasing, financing and dispositions for the Company and its predecessor since 1967. With Mr. Kilroy’s expertise and guidance, the Company entered the San Francisco and Seattle markets in 2009 and 2010, respectively, very early in the cycle. Mr. Kilroy has actively led the Company to become one of the premier landlords on the West Coast with one of the largest LEED-certified portfolios, spanning some of the strongest markets in the country, from Seattle to San Diego.

Mr. Kilroy currently serves on the board of directors of MGM Resorts International (NYSE: MGM), the Policy Advisory Board for the Fisher Center for Real Estate and Urban Economics at the University of California, Berkeley and the Advisory Board of Governors of the National Association of Real Estate Investment Trusts (“NAREIT”), and is a member of The Real Estate Roundtable. Mr. Kilroy previously served on the board of New Majority California and as Chairman of New Majority Los Angeles. He is a past trustee of the El Segundo Employers Association, Viewpoint School, Jefferson Center for Character Education and the National Fitness Foundation. He was also a member of the San Francisco America’s Cup Organizing Committee. Mr. Kilroy attended the University of Southern California.

Specific Qualifications, Attributes, Skills and Experience:

Mr. Kilroy was nominated to serve on our Board because of his more than 50 years of experience with our Company and its predecessor, including 23 years as our President and CEO and approximately 17 and seven years as our predecessor’s President and CEO, respectively, as well as his experience in acquiring, owning, developing and managing real estate, and his service on the board of governors of a national real estate trade organization. | ||||

| KILROY REALTY | PROXY STATEMENT | 17 |

DIRECTOR NOMINEE

| EDWARD BRENNAN, PhD Lead Independent Director since 2014

| |||

Age: 69 Director Since: 2003 Race/Ethnicity: Caucasian |

Committees - Audit - Compensation (Chair) - Governance

| |||

Edward Brennan, PhD has been a member of our Board since July 2003 and our Lead Independent Director since March 2014. He is currently the acting CEO and a director of Abram Scientific, a privately held medical diagnostics company, and a Venture Partner with Treo Ventures, a venture capital partnership focused on medical devices and imbedded IT technologies. Until March 2014, Dr. Brennan was CEO of Nexus Dx, Inc. (“Nexus”), a medical diagnostics company located in San Diego, California. In November 2011, Nexus was acquired by Samsung Electronics Co., Ltd. from ITC Nexus Holding Company, where Dr. Brennan had been Chief Integration Officer following the merger of Nexus and International Technidyne Corporation. Previously, he was President and Chief Operating Officer of CryoCor, Inc. from March 2005 to February 2006 and Chief Executive Officer from February 2006 until June 2008, when the company was sold to Boston Scientific Corporation. From January 2004, he served as chairman of HemoSense Inc. until its sale to Inverness Medical Innovations in November 2007. While a director of HemoSense since 2000, he was also a Managing Partner of Perennial Ventures, a Seattle-based venture capital firm beginning in 2001. Prior to that time, he served as Vice President at Tredegar Investments. Dr. Brennan has participated in the development, management and financing of new medical technology ventures for over 30 years, including scientific and executive positions with Syntex, Inc., UroSystems, Inc., Medtronic Inc., DepoMed Systems, Inc. and CardioGenesis Corp. Dr. Brennan also works as a House Manager for the Center for the Performing Arts in the City of Mountain View, serves on the board of directors of several private companies and previously served on the Board of Trustees of Goucher College, Baltimore, Maryland. Dr. Brennan holds Bachelor’s degrees in Chemistry and Biology and a PhD in Biology from the University of California, Santa Cruz.

Specific Qualifications, Attributes, Skills and Experience:

Dr. Brennan was nominated to serve on our Board because of his executive management and board of directors experience with both public and private companies and specifically, his over 30 years of experience with companies in the health sciences and medical industries, which have historically been target tenants of the Company. | ||||

| 18 | PROXY STATEMENT | KILROY REALTY |

DIRECTOR NOMINEE

| JOLIE HUNT Independent Director

| |||

Age: 42 Director Since: 2015 Race/Ethnicity: Caucasian |

Committees - Compensation - Governance - CSR&S (Chair)

| |||

Jolie Hunt has been a member of our Board since May 2015. She is the CEO of Hunt & Gather, a marketing and communications agency that helps launch startup ventures, revive the strategic marketing and communications efforts of established brands and utilizes discreet influencer relations to pair like-minded people and places together where there is mutual benefit. Before founding Hunt & Gather in 2013, Ms. Hunt served as Chief Marketing & Communications Officer for AOL, Inc. from 2012 to 2013, and held the role of Senior Vice President, Global Head of Brand & Public Relations at Thomson Reuters from 2008 to 2012. Prior to that time, Ms. Hunt was the Global Director of Corporate & Business Affairs at IBM Corporation from 2006 to 2008 and served as Director of Public Relations for the Financial Times from 2002 to 2006. Ms. Hunt currently serves on the boards of The Lowline and the Civilian Public Affairs Council for West Point Military Academy. Ms. Hunt earned a Bachelor’s degree in Mass Communication from Boston University and completed the Global Executive Program at Dartmouth University Tuck School of Business and Spain’s IE Business School in 2010.

Specific Qualifications, Attributes, Skills and Experience:

Ms. Hunt was nominated to serve on our Board because of her significant marketing and communications experience, knowledge about trends in the media, entertainment and technology world and the use of technology to advance company brands, which she acquired through her experience working with multiple multinational corporations and as the founder and CEO of Hunt & Gather. The Board believes these positions and experience bring additional, unique skills, perspective and connections to our Board. | ||||

| KILROY REALTY | PROXY STATEMENT | 19 |

DIRECTOR NOMINEE

| SCOTT INGRAHAM Independent Director

| |||

Age: 67 Director Since: 2007 Race/Ethnicity: Caucasian |

Committees - Audit (Chair) - Governance

| |||

Scott Ingraham has been a member of our Board since June 2007. He is the co-owner of Zuma Capital, a firm engaged in private equity and angel investing. He was the co-founder (1999), Chairman and CEO of Rent.com, an Internet-based multi-family real estate site, before it was sold to eBay in 2005. Mr. Ingraham was also a co-founder and previously served as the President and CEO of Oasis Residential (“Oasis”), a public apartment REIT founded in 1992 that merged with Camden Property Trust (“Camden”) in 1998. In addition to serving on the Company’s Board, Mr. Ingraham serves on the board of trust managers of Camden (NYSE: CPT) (since 1998), the audit committee of Camden (for six years previously and beginning again in 2016), the board of directors of RealPage, Inc. (Nasdaq: RP) (since 2012) and the audit committee of Real Page, Inc. (since 2012). He also served on the board of directors of LoopNet (Nasdaq: LOOP) for six years before it was acquired by Co-Star in 2012. Prior to co-founding Oasis, Mr. Ingraham’s career was devoted to real estate finance, mortgage and investment banking. He holds a Bachelor’s degree in Business Administration from the University of Texas at Austin.

Specific Qualifications, Attributes, Skills and Experience:

Mr. Ingraham was nominated to serve on our Board because he possesses extensive financial and real estate knowledge based on his experience as Chairman and CEO of Rent.com, President and CEO of Oasis, a member of the board of trustees and a member of the nominating and corporate governance committee, audit committee and compensation committee of Camden, a member of the board of directors and audit committee of LoopNet and a member of the board of directors and audit committee of RealPage, Inc. | ||||

| 20 | PROXY STATEMENT | KILROY REALTY |

DIRECTOR NOMINEE

| LOUISA RITTER Independent Director

| |||

Age: 57 Director Since: 2020 Race/Ethnicity: Caucasian |

Committees - Audit

| |||

Louisa Ritter has been a member of our Board since October 2020. Ms. Ritter is currently the President of Pisces, Inc. (“Pisces”), a San Francisco-based asset management firm. Prior to joining Pisces in 2016, Ms. Ritter worked at Goldman Sachs for 14 years, most recently serving as Managing Director in its Executive Office and President of Goldman Sachs Gives. Prior to leading Goldman Sachs Gives, Ms. Ritter led various businesses including serving as COO of West Region Investment Banking and Chief of Staff of Global Technology, Media and Telecomm Investment Banking. Prior to Goldman Sachs, she spent ten years at Montgomery Securities, which ultimately became Banc of America Securities, where she served as Co-COO of Global Corporate & Investment Banking.

Ms. Ritter has served on various non-profit boards including The Hamlin School, Marin Academy, the Management Board of the Stanford School of Business and The Global CO2 Initiative. She holds a Bachelor of Arts degree from Yale University and a Master’s degree in Business Administration from the Stanford University Graduate School of Business.

Specific Qualifications, Attributes, Skills and Experience:

Ms. Ritter was nominated to serve on our Board because she possesses extensive financial and investment knowledge based on her experiences handling a variety of matters as President at Pisces, and as a banker and corporate executive at a preeminent investment banking firm. She also has a broad range of experience through her non-profit service, having served on finance and governance committees, and having held an array of leadership roles including board chair, and chair of compensation, head search and personnel committees. | ||||

| KILROY REALTY | PROXY STATEMENT | 21 |

DIRECTOR NOMINEE

| GARY STEVENSON Independent Director

| |||

Age: 64 Director Since: 2014 Race/Ethnicity: Prefer Not to Disclose |

Committees - Compensation - Governance

| |||

Gary Stevenson has been a member of our Board since May 2014. Mr. Stevenson is currently the Deputy Commissioner of Major League Soccer and has been President and Managing Director of MLS Business Ventures of Major League Soccer since 2013. Prior to such time, Mr. Stevenson served as President of PAC-12 Enterprises (“Pac-12”) from 2011 to 2013, where he managed a diversified and integrated company, including the Pac-12 Networks and Pac-12 Properties. Before joining Pac-12, Mr. Stevenson was Chairman and CEO of OnSport Strategies, a sports and entertainment consulting company that he founded in 1997 and later sold to Wasserman Media Group in 2007. From 2007 to 2010, Mr. Stevenson served as Principal for Wasserman Media Group to help handle the integration of OnSport Strategies. Mr. Stevenson previously also served as President of NBA Properties, Marketing and Media for the National Basketball Association from 1995 to 1997, as Chief Operating Officer and Executive Vice President of the Golf Channel from 1994 to 1995 and as Executive Vice President, Business Affairs for PGA Tour from 1987 to 1994. Mr. Stevenson received his Bachelor’s degree from Duke University and his Master’s degree in Business Administration from George Washington University.

Specific Qualifications, Attributes, Skills and Experience:

Mr. Stevenson was nominated to serve on our Board because of his extensive business and operational experience, including his founding role at OnSport Strategies, and his roles as President of Pac-12 and currently as President and Managing Partner of MLS Business Ventures of Major League Soccer. The Board believes these positions and Mr. Stevenson’s entrepreneurship success bring a diverse set of skills, experiences and relationships to our Board. | ||||

| 22 | PROXY STATEMENT | KILROY REALTY |

DIRECTOR NOMINEE

| PETER STONEBERG Independent Director

| |||

Age: 65 Director Since: 2014 Race/Ethnicity: Caucasian |

Committees - Audit - Governance (Chair) - CSR&S

| |||

Peter Stoneberg has been a member of our Board since May 2014. Mr. Stoneberg is currently a Managing Partner of Velocity Ventures, LLC, a merchant banking and M&A advisory firm that he founded in 2000. Mr. Stoneberg is also currently a Managing Partner of Architect Partners, LLC, an investment banking firm that he joined in 2020. Mr. Stoneberg was recently a Managing Partner of Dresner Partners, LLC an investment banking firm that he joined in 2018. From 2000 to 2006, Mr. Stoneberg was with Bank of America Capital Investors (“BACI”), a private equity firm where he was an investment partner specializing in growth and buyout capital for public and private technology companies. Mr. Stoneberg also served as Senior Managing Director of Montgomery Securities, where he founded and led the Technology M&A group, beginning in 1994 until its acquisition by Bank of America in 1999. Previously, Mr. Stoneberg served in various other investment banking and management roles, including as Managing Director of Broadview Associates, Co-Founder and President of Data/Voice Solutions Corp and Product Marketing Manager for IBM and ROLM Corp. He was also an investor and on the board of directors of Cupertino Electric, Osprey Ventures, Historic Motorsports Productions, Saleslogix Corp. and Netcom Systems. Additionally, Mr. Stoneberg has served as a founder of the San Francisco America’s Cup Organizing Committee and Chair of the Investment Committee of the St. Francis Sailing Foundation. Mr. Stoneberg received his Bachelor’s degree in Business from the University of Colorado and has completed the Stanford Law School Directors’ College.

Specific Qualifications, Attributes, Skills and Experience:

Mr. Stoneberg was nominated to serve on our Board because of his significant relationships, experience with and knowledge of large and small companies in the high-technology industry, particularly those within the San Francisco Bay Area, which have become target tenants of the Company. Mr. Stoneberg also possesses extensive knowledge in the areas of raising equity and debt capital, and mergers and acquisitions based on his experience at BACI, Montgomery Securities and Velocity Ventures. Mr. Stoneberg also has experience as an active board member at three companies, including as a member of the audit and compensation committees of Netcom Systems and Cupertino Electric. | ||||

| KILROY REALTY | PROXY STATEMENT | 23 |

VOTE REQUIRED

Each director nominee will be elected at the Annual Meeting if he or she receives a majority of the votes cast with respect to his or her election (that is, the number of votes cast “FOR” the nominee must exceed the number of votes cast “AGAINST” the nominee). The majority voting standard does not apply, however, in a contested election where the number of director nominees exceeds the number of directors to be elected at an annual meeting of stockholders. In such circumstances, directors will instead be elected by a plurality of all the votes cast in the election of directors at the annual meeting at which a quorum is present. The election of directors at the Annual Meeting is not contested.

Under Maryland law, if an incumbent director is not re-elected at a meeting of stockholders at which he or she stands for re-election, then the incumbent director continues to serve in office as a holdover director until his or her successor is elected. To address this “holdover” issue, our Bylaws provide that if an incumbent director is not re-elected due to his or her failure to receive a majority of the votes cast in an uncontested election, the director will promptly tender his or her resignation as a director, subject to acceptance by the Board. The Governance Committee will then make a recommendation to our Board as to whether to accept or reject the tendered resignation, or whether other action should be taken. Our Board will act on the Governance Committee’s recommendation and publicly disclose its decision, along with its rationale, within 90 days after the date of the certification of the election results.

RECOMMENDATION

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE DIRECTOR NOMINEES.

| 24 | PROXY STATEMENT | KILROY REALTY |

ADVISORY APPROVAL OF OUR EXECUTIVE COMPENSATION

We are asking our stockholders to approve the compensation of our NEOs (as identified in the CD&A) as disclosed pursuant to the U.S. Securities and Exchange Commission (the “SEC”) executive compensation disclosure rules and set forth in this Proxy Statement (including in the compensation tables, the narratives accompanying those tables and the CD&A). This is commonly referred to as a “Say-on-Pay” vote.

Our executive compensation philosophy is designed to achieve the following objectives:

| • | To align executive compensation with the Company’s corporate strategies, business objectives and the creation of long-term value for our stockholders without encouraging unnecessary or excessive risk-taking; |