Exhibit 99.2 Second Quarter 2019 Financial Results Supplement July 31, 2019

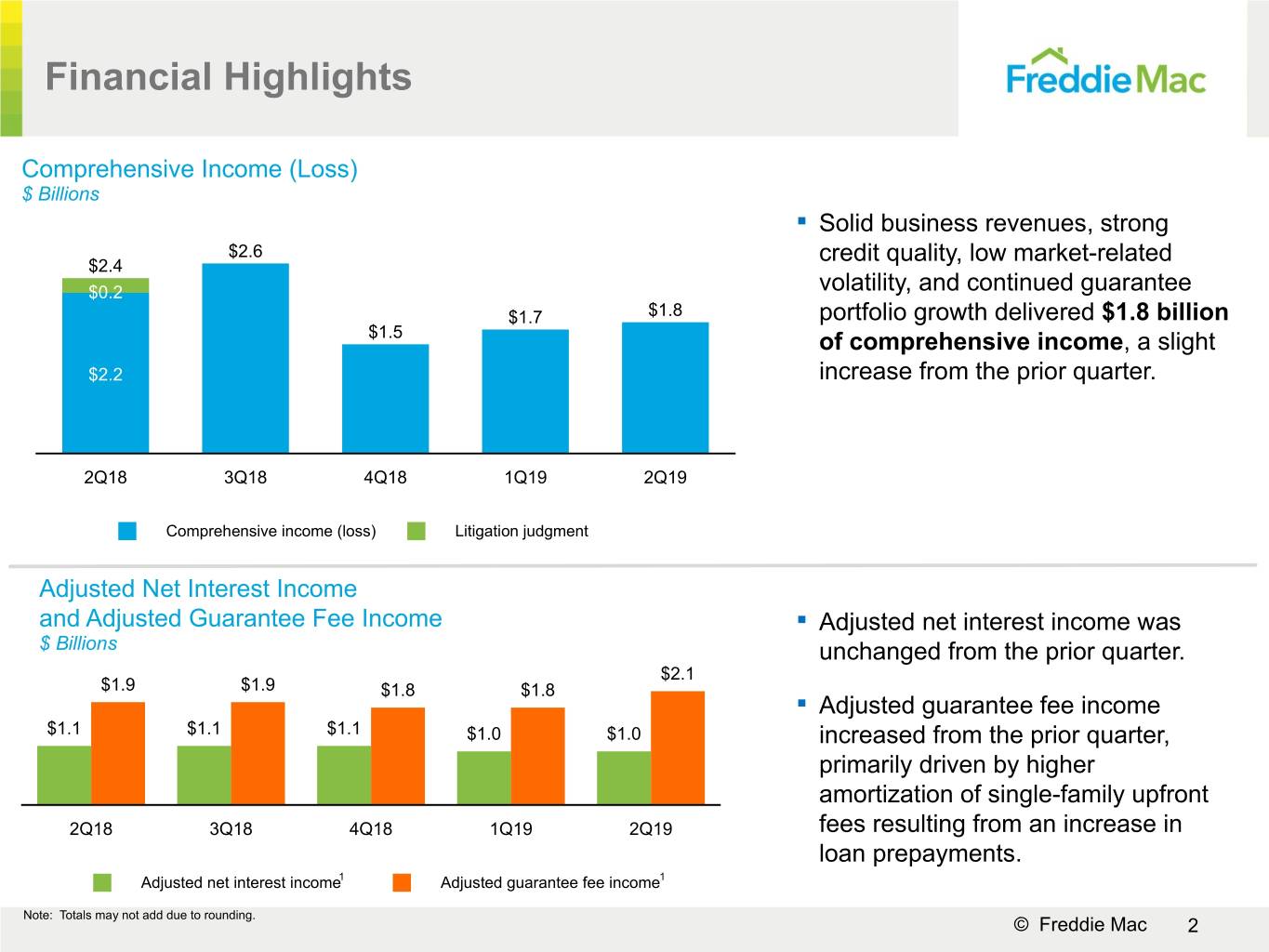

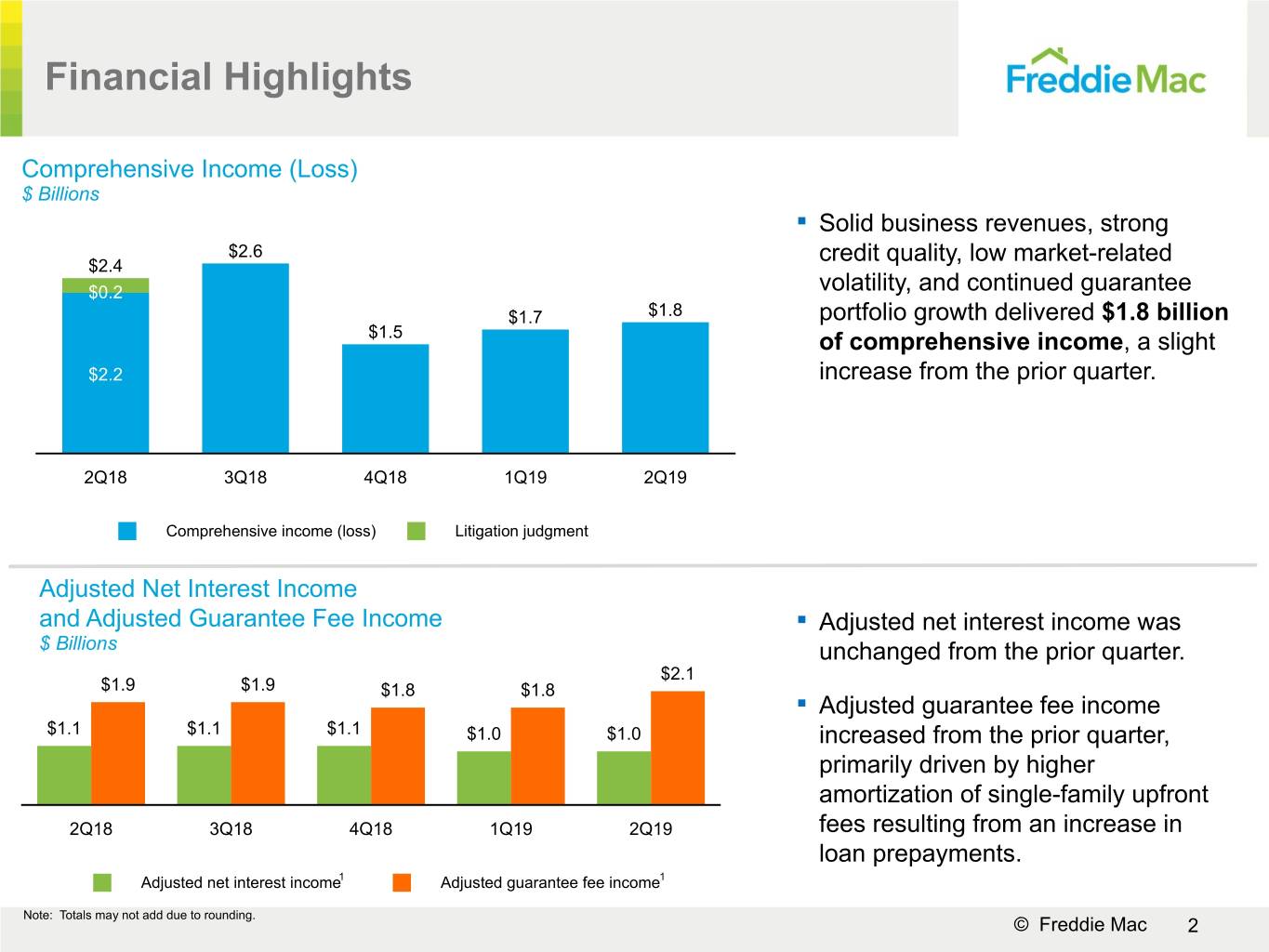

Financial Highlights Comprehensive Income (Loss) $ Billions ▪ Solid business revenues, strong $2.6 credit quality, low market-related $2.4 $0.2 volatility, and continued guarantee $1.7 $1.8 portfolio growth delivered $1.8 billion $1.5 of comprehensive income, a slight $2.2 increase from the prior quarter. 2Q18 3Q18 4Q18 1Q19 2Q19 Comprehensive income (loss) Litigation judgment Adjusted Net Interest Income and Adjusted Guarantee Fee Income ▪ Adjusted net interest income was $ Billions unchanged from the prior quarter. $2.1 $1.9 $1.9 $1.8 $1.8 ▪ Adjusted guarantee fee income $1.1 $1.1 $1.1 $1.0 $1.0 increased from the prior quarter, primarily driven by higher amortization of single-family upfront 2Q18 3Q18 4Q18 1Q19 2Q19 fees resulting from an increase in loan prepayments. Adjusted net interest income1 Adjusted guarantee fee income1 Note: Totals may not add due to rounding. © Freddie Mac 2

Total Portfolio Balances 2 Total guarantee portfolio Portfolio balance highlights $ Billions +5% YoY increase ▪ Total guarantee portfolio: • Single-family - grew $80 billion, or 4%, year-over- $2,133 $2,157 $2,184 $2,075 $2,101 year. $243 $249 $220 $226 $237 • Multifamily - grew $29 billion, or 13%, year-over- year. $1,855 $1,875 $1,896 $1,914 $1,935 ▪ Total investments portfolio: 6/30/2018 9/30/2018 12/31/2018 3/31/2019 6/30/2019 • Mortgage-related investments portfolio - decreased $17 billion, or 7%, year-over-year. Single-family credit guarantee portfolio Multifamily guarantee portfolio3 Total investments portfolio 4,5 Purchase Agreement Total debt outstanding 2019 Debt Cap $300B $ Billions $ Billions 3.0 2.9 2.9 2.6 2.6 -3% YoY decrease $279 $281 $273 $280 $310 $311 $296 $302 $256 $281 11% 10% 10% 12% 10% $74 $83 $63 $77 $83 36% 36% 37% 34% 32% FHFA 2019 Limit 40% 39% 42% 37% 45% $236 $228 $218 $219 $219 $225B* 13% 15% 11% 17% 13% 6/30/2018 9/30/2018 12/31/2018 3/31/2019 6/30/2019 6/30/2018 9/30/2018 12/31/2018 3/31/2019 6/30/2019 Discount notes Callable debt Mortgage-related investments portfolio2,4 Non-callable debt Other Other investments portfolio Weighted average maturity in years Note: Totals may not add due to rounding. *FHFA limit, which pertains to the mortgage-related investments portfolio only, was $260 billion in 2018 © Freddie Mac 3 and decreased to $225 billion as of December 31, 2018.

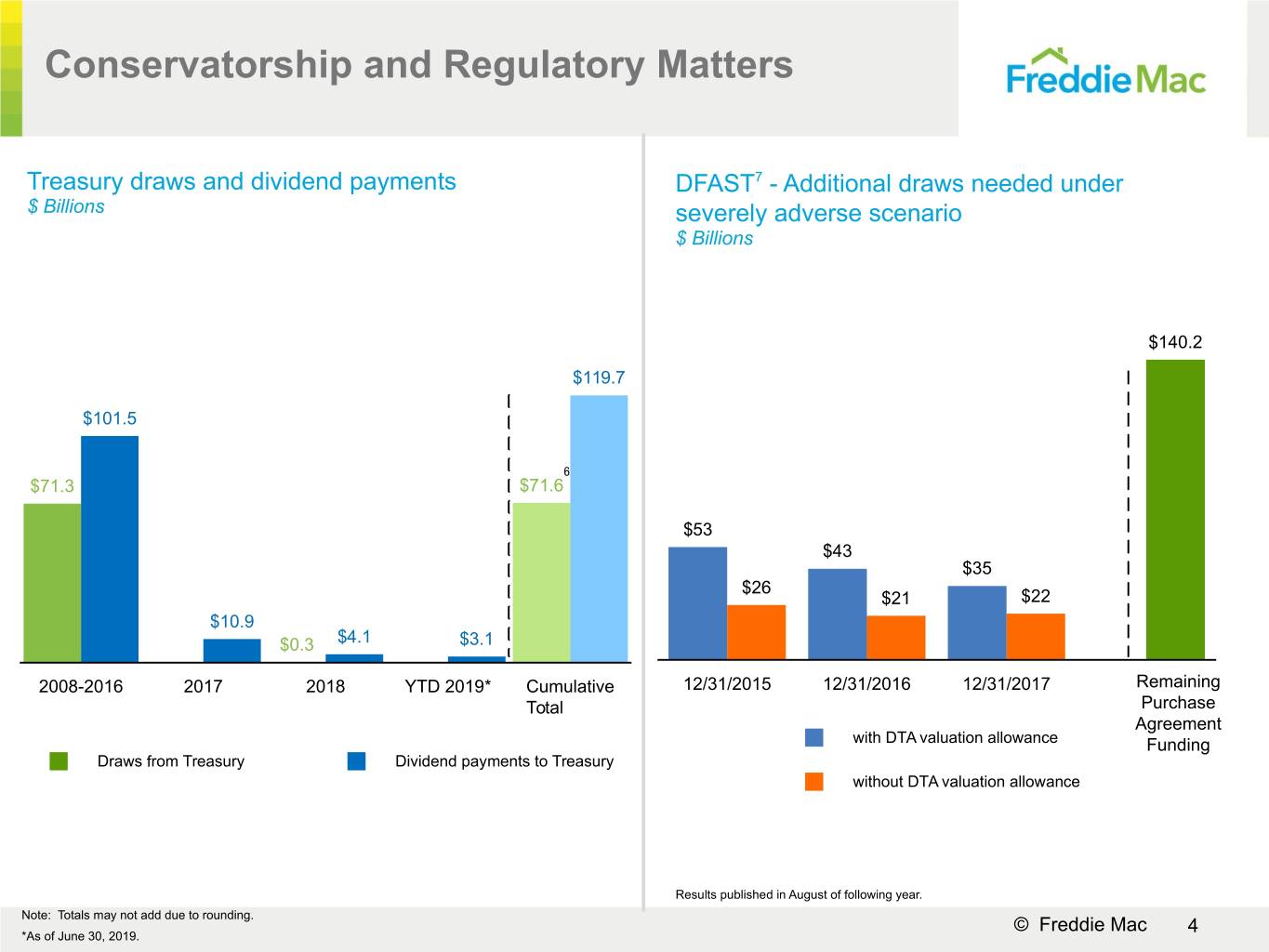

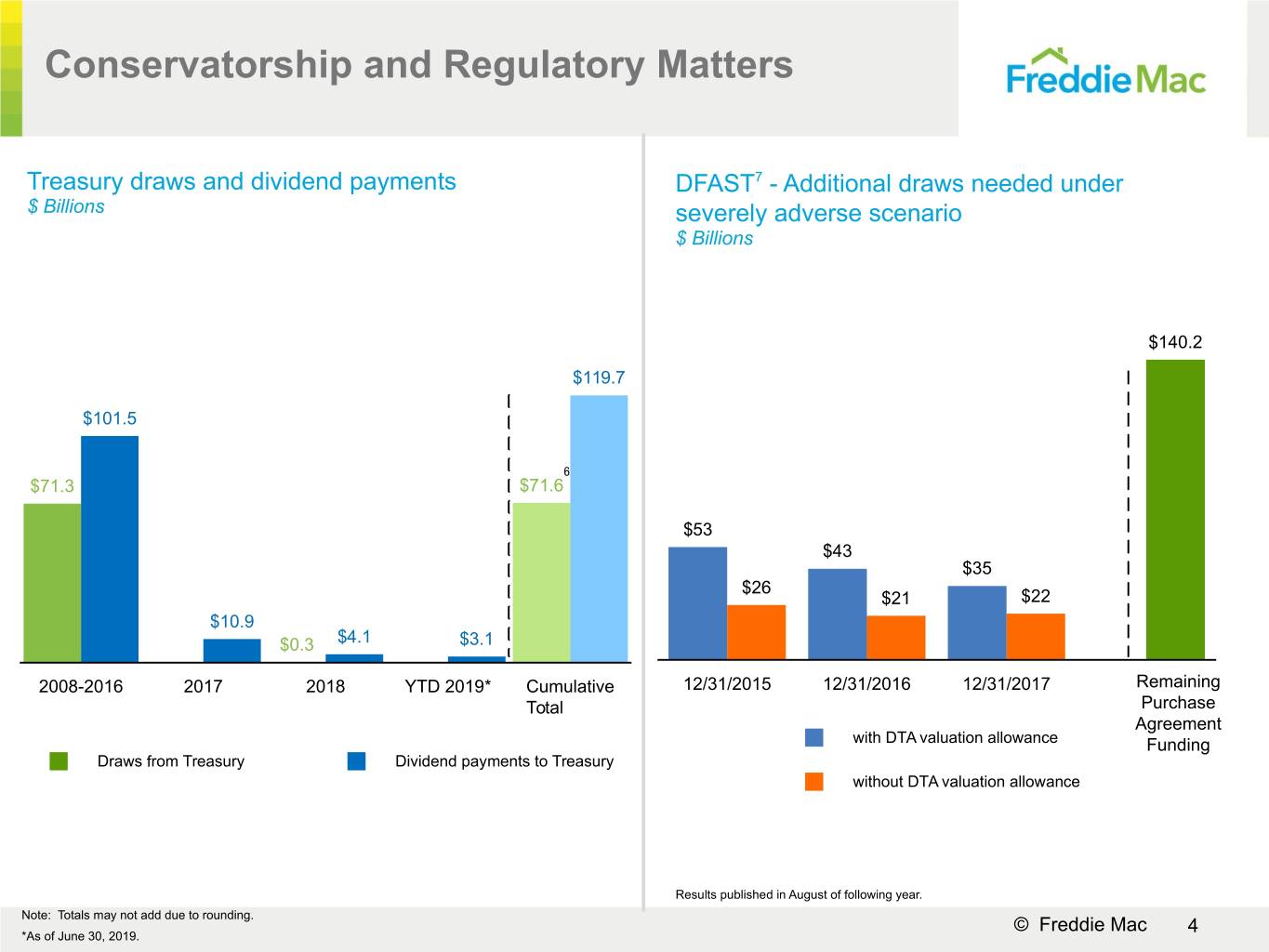

Conservatorship and Regulatory Matters Treasury draws and dividend payments DFAST7 - Additional draws needed under $ Billions severely adverse scenario $ Billions $140.2 $119.7 $101.5 6 $71.3 $71.6 $53 $43 $35 $26 $21 $22 $10.9 $0.3 $4.1 $3.1 2008-2016 2017 2018 YTD 2019* Cumulative 12/31/2015 12/31/2016 12/31/2017 Remaining Total Purchase Agreement with DTA valuation allowance Funding Draws from Treasury Dividend payments to Treasury without DTA valuation allowance Results published in August of following year. Note: Totals may not add due to rounding. © Freddie Mac 4 *As of June 30, 2019.

Interest-Rate Risk Measures GAAP Adverse Scenario8 (Before-Tax) PVS-Level9 and Average Duration Gap10 $ Billions $275 ($0.2) ($0.2) ($0.5) ($0.5) $(0.8) $23 $18 $11 $15 ($2.1) 2Q18 3Q18 4Q18 1Q19 2Q19 ($2.7) ($3.4) ($3.3) PVS-L (50 bps) ($ Millions) $(4.6) 93% 86% 89% 85% 82% 2.2 0 0 0 0 2Q18 3Q18 4Q18 1Q19 2Q19 Average duration gap (Months) 6/30/2018 9/30/2018 12/31/2018 3/31/2019 6/30/2019 Before hedge accounting After hedge accounting In April 2019, the company updated its interest-rate risk measures to include upfront fees (including buy-downs) related to single-family credit guarantee activity as the company changed its strategy to incorporate upfront fees into its asset and liability interest-rate risk management strategy and % Change definition. The company hedged the upfront fees interest-rate risk over several weeks resulting in temporarily higher than normal duration gap and PVS-L levels. These levels returned to historical averages by the end of 2Q19 as the company completed its hedging of upfront fees interest-rate risk. The inclusion of upfront fees increased the company's derivative volume resulting in a larger effect of derivatives on its PVS-L (50 bps). © Freddie Mac 5

Key Economic Indicators National home prices increased by an average of 3.7% Quarterly ending interest rates over the past year 4.55% 4.72% 4.55% 4.06% 3.73% 3.11% 2.93% 2.72% 2.41% 1.96% 6/30/2018 9/30/2018 12/31/2018 3/31/2019 6/30/2019 30-year PMMS 10-year LIBOR Unemployment rate and job creation 4.0% 3.7% 3.9% 3.8% 3.7% National home prices have surpassed the 2006 peak 243,000 233,000 189,000 174,000 171,000 196 168 (2006 Peak) 2Q18 3Q18 4Q18 1Q19 2Q19 Freddie Mac House Price Index (December 2000 = 100) Average monthly net new jobs (non-farm) 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 National unemployment rate (as of the last month in United States (Not Seasonally Adjusted) each quarter) © Freddie Mac 6

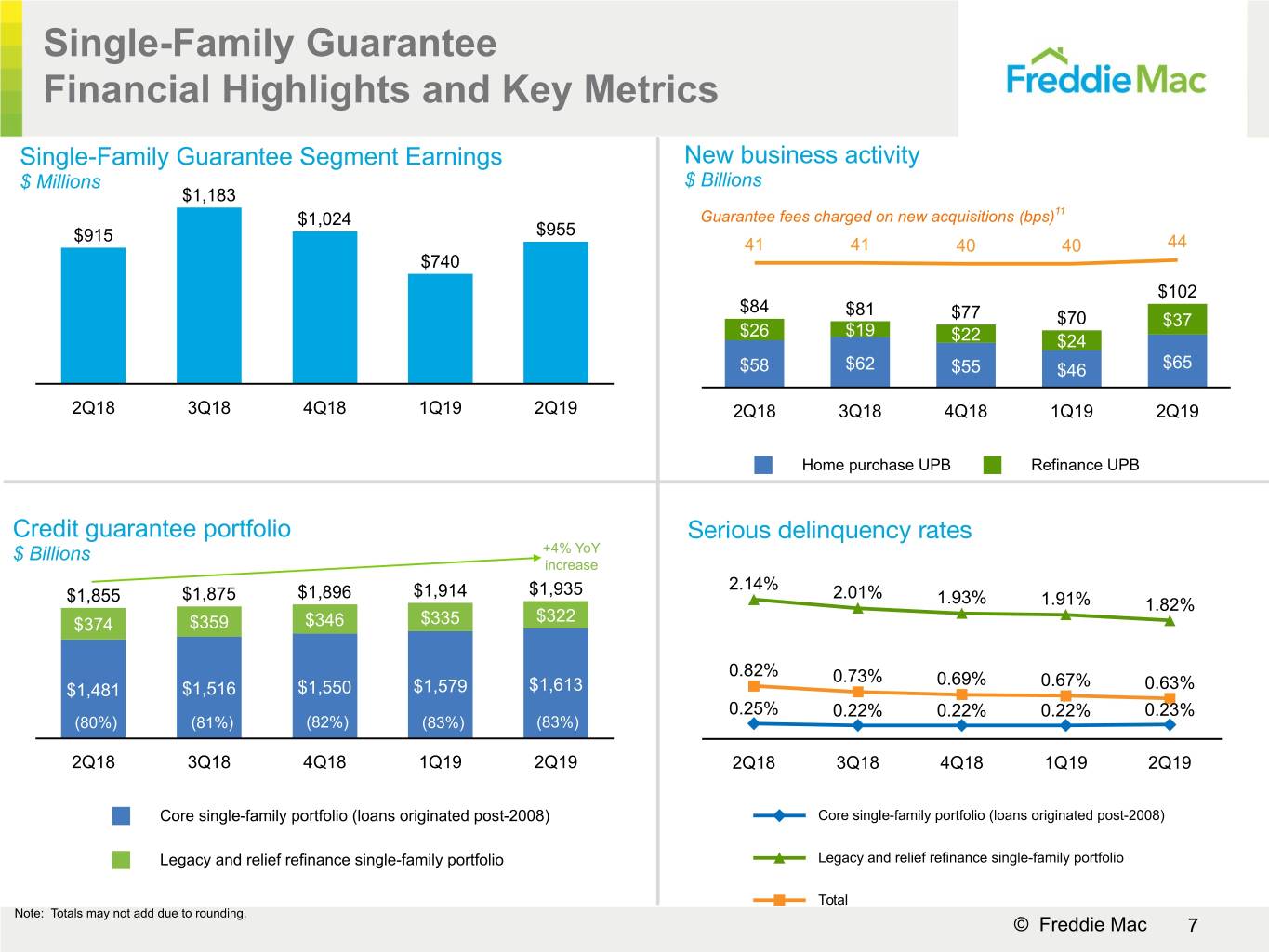

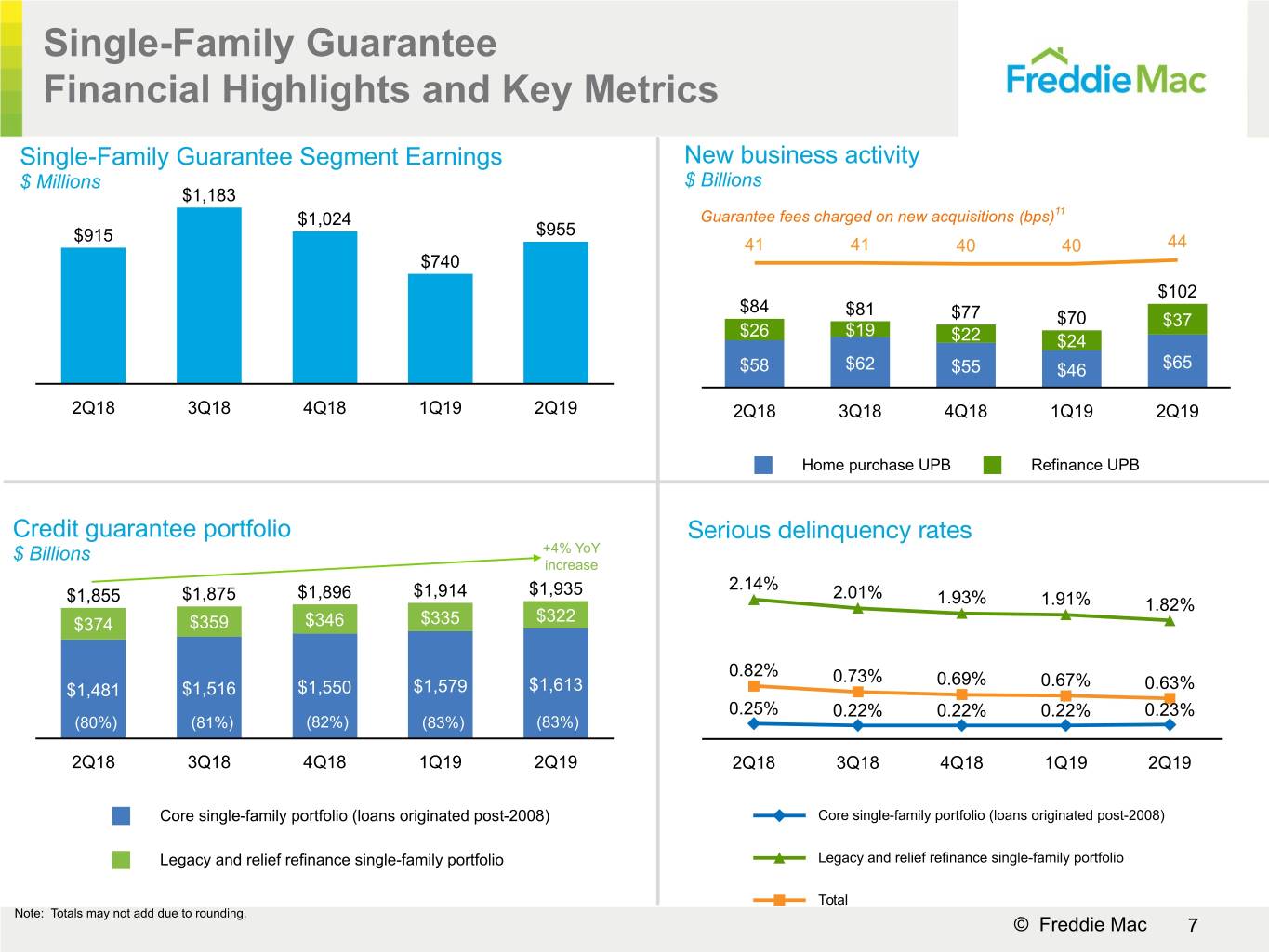

Single-Family Guarantee Financial Highlights and Key Metrics Single-Family Guarantee Segment Earnings New business activity $ Millions $ Billions $1,183 $1,024 Guarantee fees charged on new acquisitions (bps)11 $915 $955 41 41 40 40 44 $740 $102 $84 $81 $77 $70 $37 $26 $19 $22 $24 $58 $62 $55 $46 $65 2Q18 3Q18 4Q18 1Q19 2Q19 2Q18 3Q18 4Q18 1Q19 2Q19 Home purchase UPB Refinance UPB Credit guarantee portfolio Serious delinquency rates $ Billions +4% YoY increase 2.14% $1,855 $1,875 $1,896 $1,914 $1,935 2.01% 1.93% 1.91% 1.82% $322 $374 $359 $346 $335 0.82% 0.73% 0.69% 0.67% $1,481 $1,516 $1,550 $1,579 $1,613 0.63% 0.25% 0.22% 0.22% 0.22% 0.23% (80%) (81%) (82%) (83%) (83%) 2Q18 3Q18 4Q18 1Q19 2Q19 2Q18 3Q18 4Q18 1Q19 2Q19 Core single-family portfolio (loans originated post-2008) Core single-family portfolio (loans originated post-2008) Legacy and relief refinance single-family portfolio Legacy and relief refinance single-family portfolio Total Note: Totals may not add due to rounding. © Freddie Mac 7

Single-Family Guarantee Loan Purchase Credit Characteristics Weighted average original loan-to-value ratio (OLTV) Weighted average credit score 745 746 747 747 750 78% 79% 77% 77% 77% 746 746 747 747 750 78% 79% 77% 77% 77% 712 711 67% 66% 65% 62% 64% 707 707 706 2Q18 3Q18 4Q18 1Q19 2Q19 2Q18 3Q18 4Q18 1Q19 2Q19 Relief refinance (includes HARP) Relief refinance (includes HARP) All other All other Total purchases and guarantees Total purchases and guarantees New business activity with debt-to-income ratio > 45 % Loan purpose 12% 9% 11% 15% 18% 18% 18% 19% 15% 18% 17% 16% 20% 18% 14% 69% 76% 71% 65% 64% 2Q18 3Q18 4Q18 1Q19 2Q19 2Q18 3Q18 4Q18 1Q19 2Q19 Home purchase Cash-out refinance Other refinance © Freddie Mac 8

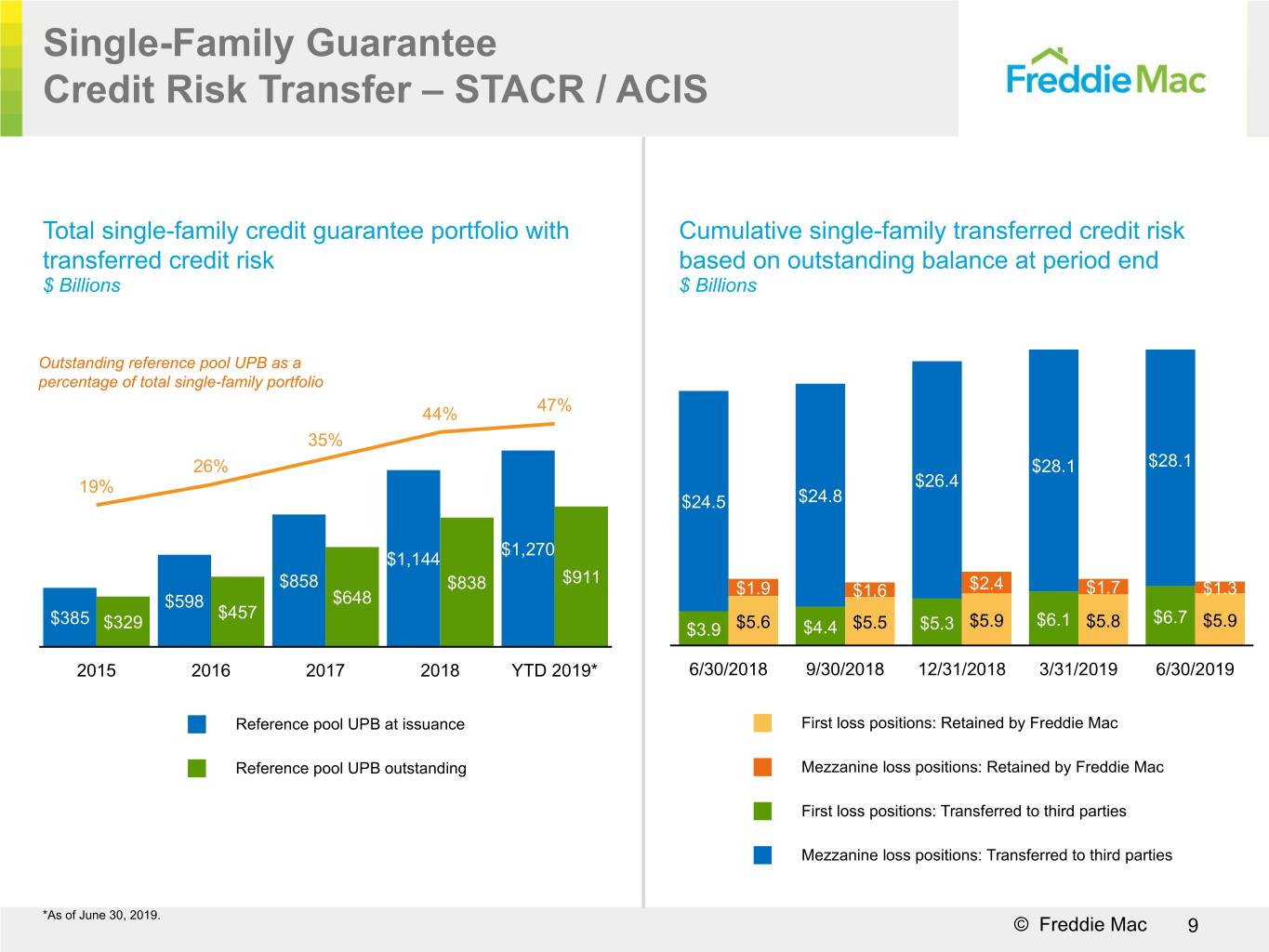

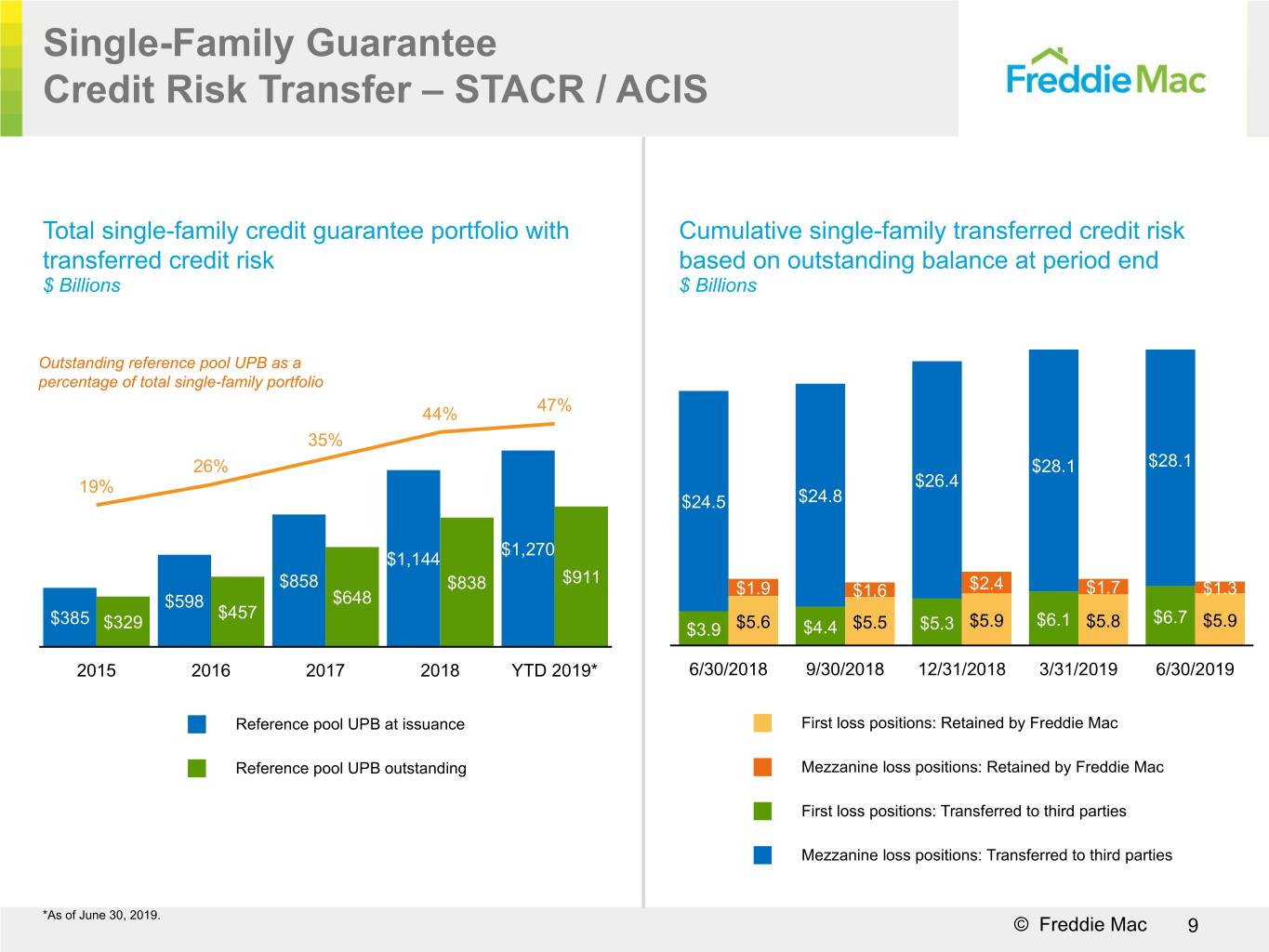

Single-Family Guarantee Credit Risk Transfer – STACR / ACIS Total single-family credit guarantee portfolio with Cumulative single-family transferred credit risk transferred credit risk based on outstanding balance at period end $ Billions $ Billions Outstanding reference pool UPB as a percentage of total single-family portfolio 44% 47% 35% 26% $28.1 $28.1 19% $26.4 $24.5 $24.8 $1,270 $1,144 $858 $911 $838 $1.9 $1.6 $2.4 $1.7 $1.3 $598 $648 $385 $457 $5.9 $6.1 $6.7 $5.9 $329 $3.9 $5.6 $4.4 $5.5 $5.3 $5.8 2015 2016 2017 2018 YTD 2019* 6/30/2018 9/30/2018 12/31/2018 3/31/2019 6/30/2019 Reference pool UPB at issuance First loss positions: Retained by Freddie Mac Reference pool UPB outstanding Mezzanine loss positions: Retained by Freddie Mac First loss positions: Transferred to third parties Mezzanine loss positions: Transferred to third parties *As of June 30, 2019. © Freddie Mac 9

Multifamily Financial Highlights and Key Metrics Multifamily comprehensive income (loss) Multifamily acquisitions of units by area median $ Millions income (% of eligible units acquired) 6% 6% 9% 7% 6% $526 $505 $395 $440 94% 94% 91% 93% 94% $(199) 2Q18 3Q18 4Q18 1Q19 2Q19 2015 2016 2017 2018 YTD 2019* ≤120% AMI >120% AMI +35% increase Multifamily market and Freddie Mac delinquency Total portfolio since 2016 $ Billions rates (%) $280 $283 $288 $249 $36 $33 $33 $213 $39 $7 $7 $6 $42 $7 $13 1.11 $243 $249 1Q19 $203 $237 0.13 $158 0.03 (74%) (82%) (85%) (86%) (86%) 12/31/2016 12/31/2017 12/31/2018 3/31/2019 6/30/2019 2Q15 2Q16 2Q17 2Q18 2Q19 Guarantee portfolio Mortgage-related securities Freddie Mac (60+ day) FDIC insured institutions (90+ day) Unsecuritized loans and other MF CMBS market (60+ day) Note: Totals may not add due to rounding. *As of June 30, 2019. © Freddie Mac 10

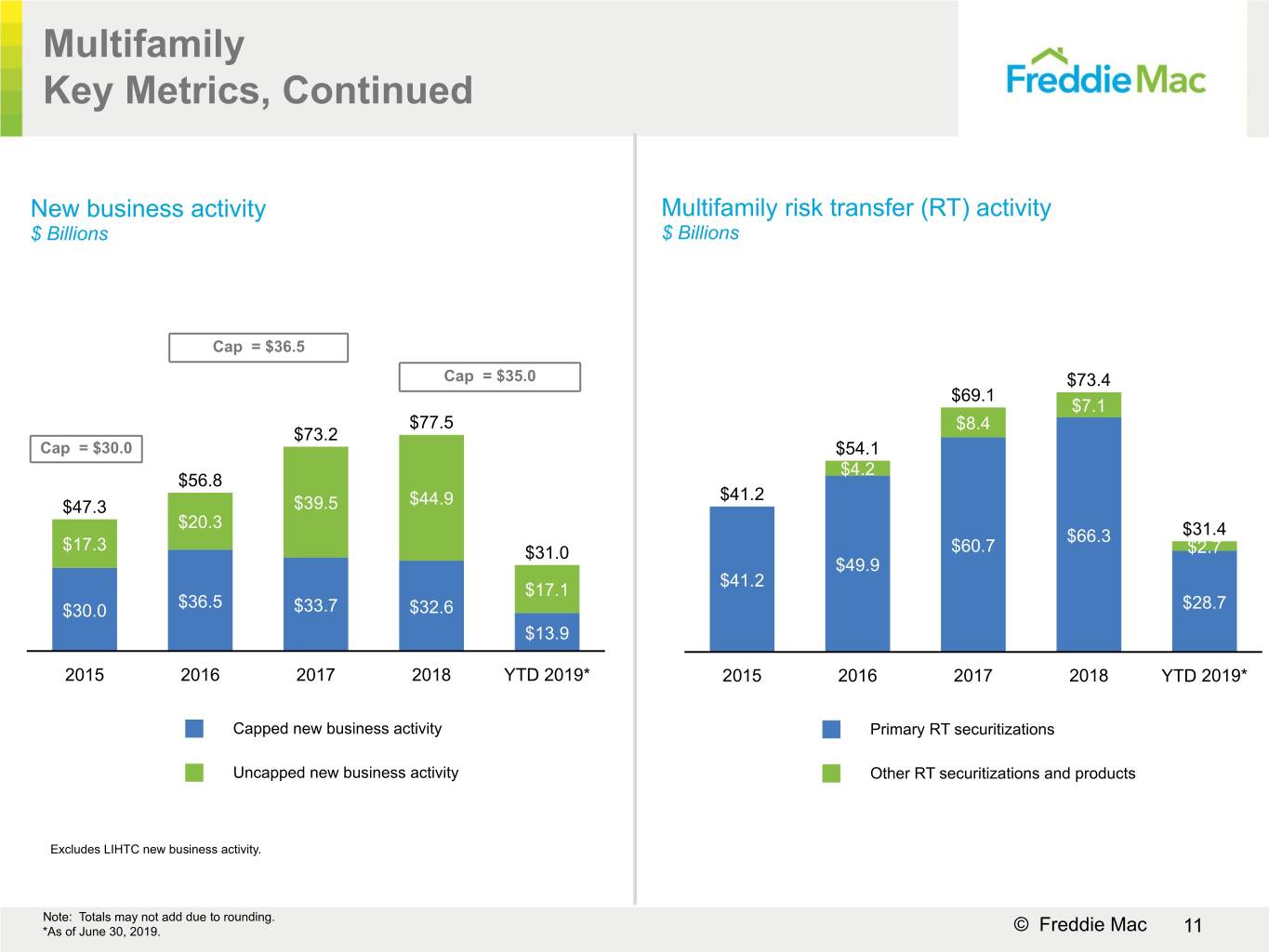

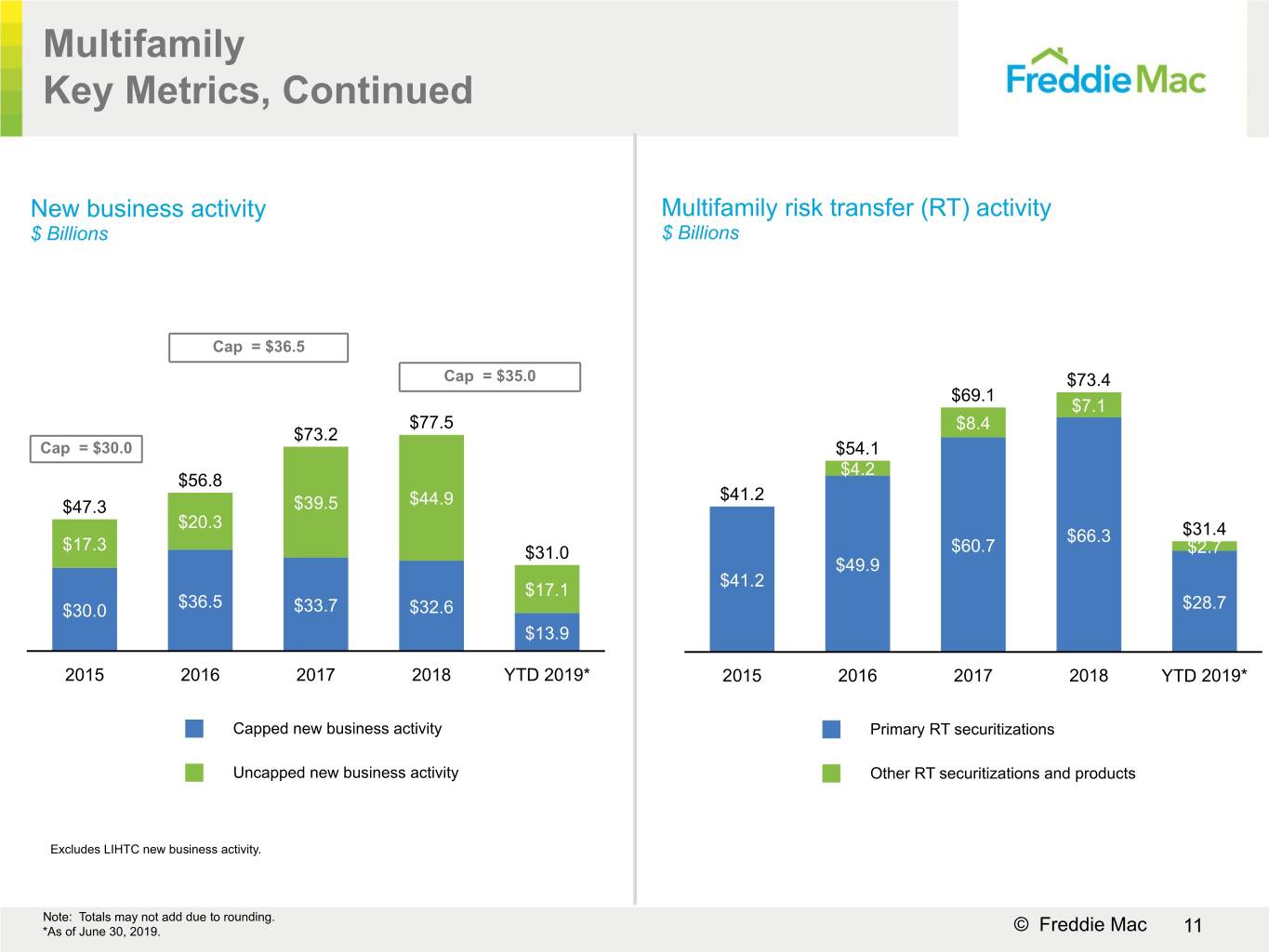

Multifamily Key Metrics, Continued New business activity Multifamily risk transfer (RT) activity $ Billions $ Billions Cap = $36.5 Cap = $35.0 $73.4 $69.1 $7.1 $77.5 $8.4 $73.2 Cap = $30.0 $54.1 $4.2 $56.8 $41.2 $47.3 $39.5 $44.9 $20.3 $66.3 $31.4 $17.3 $31.0 $60.7 $2.7 $49.9 $41.2 $17.1 $36.5 $30.0 $33.7 $32.6 $28.7 $13.9 2015 2016 2017 2018 YTD 2019* 2015 2016 2017 2018 YTD 2019* Capped new business activity Primary RT securitizations Uncapped new business activity Other RT securitizations and products Excludes LIHTC new business activity. Note: Totals may not add due to rounding. *As of June 30, 2019. © Freddie Mac 11

Capital Markets Financial Highlights and Key Metrics Capital Markets comprehensive income Capital Markets investments portfolio $ Billions $ Billions -3% YoY decrease $1.0 $261 $262$263 $254 $0.9 $229 $247 $73 $83 $76 $81 $0.6 $62 $0.5 $0.4 $188 $180 $167 $171 $173 2Q18 3Q18 4Q18 1Q19 2Q19 2Q18 3Q18 4Q18 1Q19 2Q19 Mortgage investments portfolio Other investments portfolio Capital Markets cash window securitization Capital Markets mortgage investments portfolio $ Billions $ Billions $45 -8% YoY $42 decrease $38 $38 $188 $180 $167 $171 $173 $30 $51 $50 $45 $42 $39 $13 $12 $9 $13 $16 $124 $118 $114 $116 $118 (66%) (66%) (68%) (68%) (68%) 2Q18 3Q18 4Q18 1Q19 2Q19 2Q18 3Q18 4Q18 1Q19 2Q19 Liquid Securitization pipeline Less liquid Note: Totals may not add due to rounding. © Freddie Mac 12

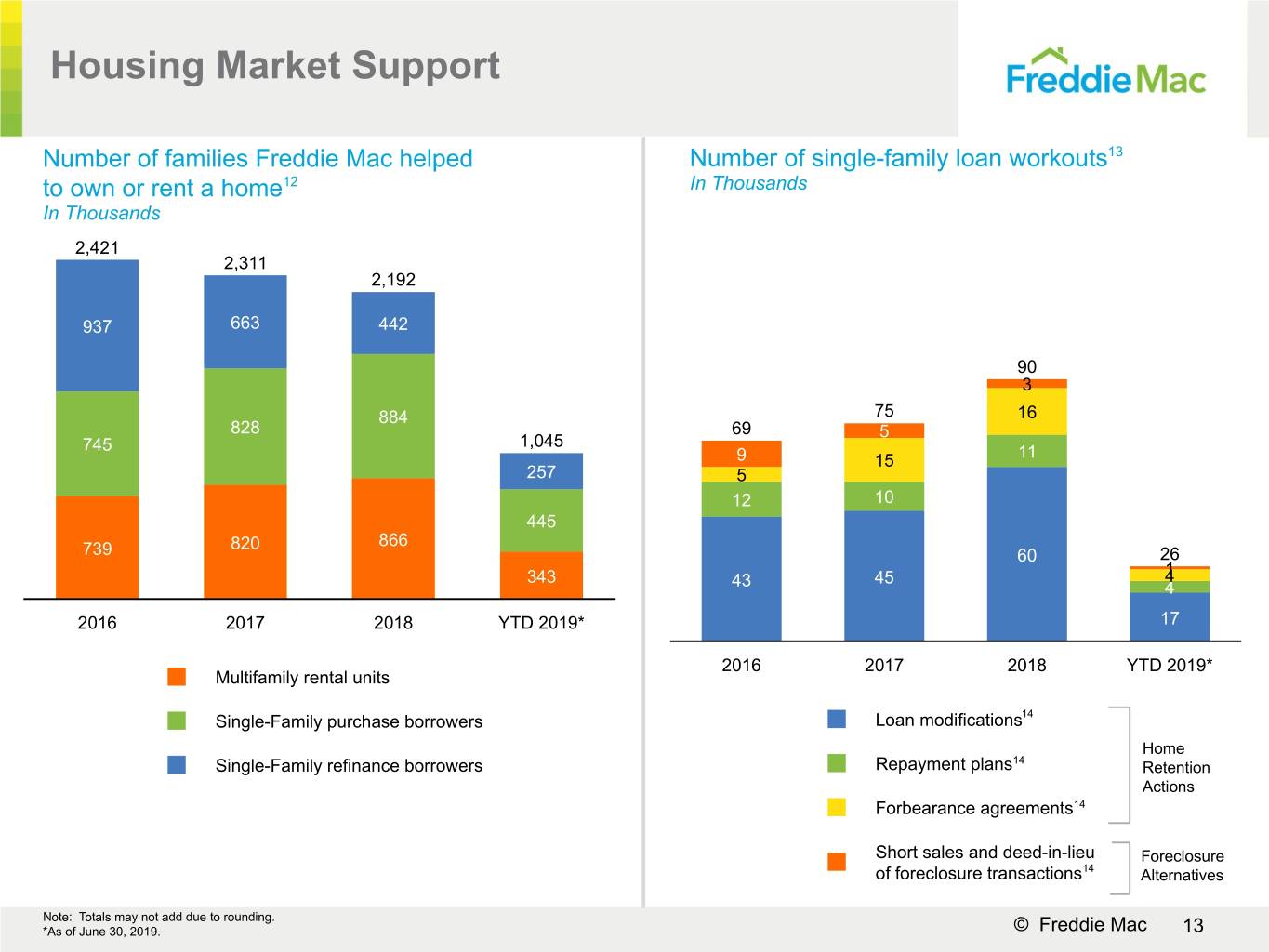

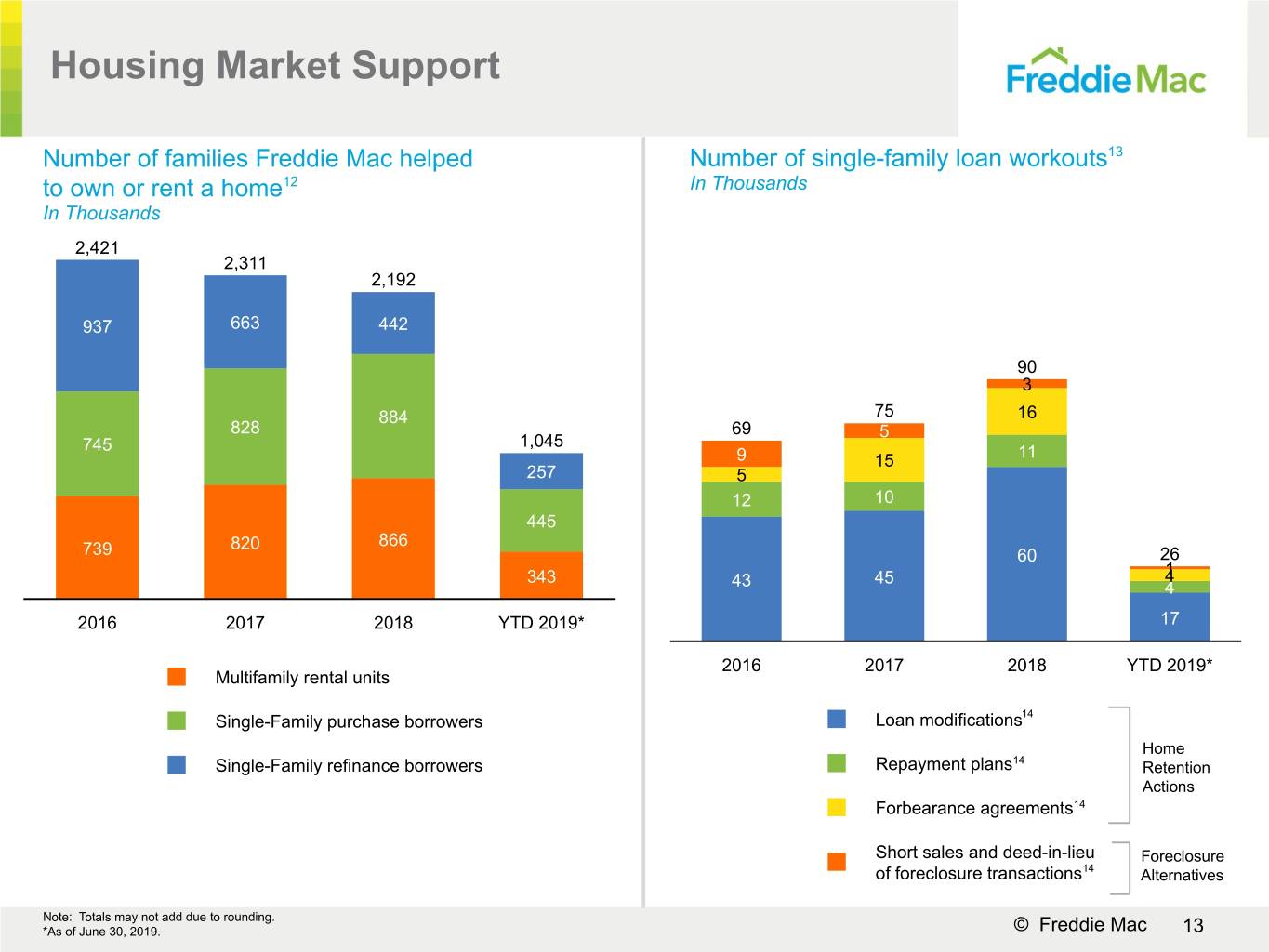

Housing Market Support Number of families Freddie Mac helped Number of single-family loan workouts13 to own or rent a home12 In Thousands In Thousands 2,421 2,311 2,192 937 663 442 90 3 884 75 16 828 69 5 745 1,045 9 15 11 257 5 12 10 445 820 866 739 60 26 343 45 41 43 4 2016 2017 2018 YTD 2019* 17 2016 2017 2018 YTD 2019* Multifamily rental units Single-Family purchase borrowers Loan modifications14 Home Single-Family refinance borrowers Repayment plans14 Retention Actions Forbearance agreements14 Short sales and deed-in-lieu Foreclosure of foreclosure transactions14 Alternatives Note: Totals may not add due to rounding. *As of June 30, 2019. © Freddie Mac 13

Endnotes 1 For additional information regarding Freddie Mac’s non-GAAP financial measures and reconciliations to the comparable amounts under GAAP, see the company’s Press Release for the quarter ended June 30, 2019. 2 Based on unpaid principal balances (UPB) of loans and securities. Excludes mortgage-related securities traded, but not yet settled. 3 Primarily Freddie Mac’s K Certificate and SB (Small Balance) Certificate transactions. 4 The company’s Purchase Agreement with Treasury limits the amount of mortgage assets the company can own and indebtedness it can incur. See the company’s Annual Report on Form 10-K for the year ended December 31, 2018 for more information. 5 Represents the company’s aggregate indebtedness for purposes of the Purchase Agreement debt cap and primarily includes the par value of other short-term and long-term debt used to fund its business activities. 6 Excludes the initial $1 billion liquidation preference of senior preferred stock issued to Treasury in September 2008 as consideration for Treasury’s funding commitment and the $3.0 billion increase in the aggregate liquidation preference of the senior preferred stock pursuant to the December 21, 2017 Letter Agreement. The company received no cash proceeds as a result of issuing the initial $1 billion liquidation preference of senior preferred stock or the $3.0 billion increase on December 31, 2017. 7 For additional information, see Regulation and Supervision / Federal Housing Finance Agency / Capital Standards in the company’s Annual Report on Form 10-K for the year ended December 31, 2018. (DFAST: Dodd-Frank Act Stress Test) 8 The company evaluates the potential benefits of fair value hedge accounting by evaluating a range of interest rate scenarios and identifying which of those scenarios produces the most adverse GAAP earnings outcome. At June 30, 2019, the GAAP adverse scenario before fair value hedge accounting was a parallel shift in which rates decrease by 100 basis points, while the adverse scenario after fair value hedge accounting was a non-parallel shift in which long-term rates decrease by 100 basis points. 9 Portfolio Value Sensitivity (PVS) is the company's estimate of the change in the value of our financial assets and liabilities from an instantaneous shock to interest rates, assuming spreads are held constant and no rebalancing actions are undertaken. PVS-L measures the estimated sensitivity of the portfolio value to a 50 basis point parallel movement in interest rates. 10 Duration gap measures the difference in price sensitivity to interest rate changes between our financial assets and liabilities and is expressed in months relative to the value of assets. 11 Represents the estimated average rate of guarantee fees for new acquisitions during the period assuming amortization of upfront fees using the estimated life of the related loans rather than the original contractual maturity date of the related loans. Includes the effect of fee adjustments that are based on the price performance of Freddie Mac’s PCs relative to comparable Fannie Mae securities. Net of legislated 10 basis point guarantee fee remitted to Treasury as part of the Temporary Payroll Tax Cut Continuation Act of 2011. 12 Based on the company’s purchases of loans and issuances of mortgage-related securities. For the periods presented, a borrower may be counted more than once if the company purchased more than one loan (purchase or refinance mortgage) relating to the same borrower. 13 Consists of both home retention actions and foreclosure alternatives. 14 Categories are not mutually exclusive, and a borrower in one category may also be included in another category in the same or another period. For example, a borrower helped through a home retention action in one period may subsequently lose his or her home through a foreclosure alternative in a later period. © Freddie Mac 14

Safe Harbor Statements Freddie Mac obligations Freddie Mac’s securities are obligations of Freddie Mac only. The securities, including any interest or return of discount on the securities, are not guaranteed by and are not debts or obligations of the United States or any federal agency or instrumentality other than Freddie Mac. No offer or solicitation of securities This presentation includes information related to, or referenced in the offering documentation for, certain Freddie Mac securities, including offering circulars and related supplements and agreements. Freddie Mac securities may not be eligible for offer or sale in certain jurisdictions or to certain persons. This information is provided for your general information only, is current only as of its specified date, and does not constitute an offer to sell or a solicitation of an offer to buy securities. The information does not constitute a sufficient basis for making a decision with respect to the purchase or sale of any security. All information regarding or relating to Freddie Mac securities is qualified in its entirety by the relevant offering circular and any related supplements. Investors should review the relevant offering circular and any related supplements before making a decision with respect to the purchase or sale of any security. In addition, before purchasing any security, please consult your legal and financial advisors for information about and analysis of the security, its risks, and its suitability as an investment in your particular circumstances. Forward-looking statements Freddie Mac's presentations may contain forward-looking statements, which may include statements pertaining to the conservatorship, the company’s current expectations and objectives for its Single-family Guarantee, Multifamily, and Capital Markets segments, its efforts to assist the housing market, liquidity and capital management, economic and market conditions and trends, market share, the effect of legislative and regulatory developments and new accounting guidance, credit quality of loans the company owns or guarantees, the costs and benefits of the company’s credit risk transfer transactions, and results of operations and financial condition on a GAAP, Segment Earnings, non-GAAP, and fair value basis. Forward-looking statements involve known and unknown risks and uncertainties, some of which are beyond the company’s control. Management’s expectations for the company’s future necessarily involve a number of assumptions, judgments, and estimates, and various factors, including changes in market conditions, liquidity, mortgage spreads, credit outlook, actions by the U.S. government (including FHFA, Treasury, and Congress), and the impacts of legislation or regulations and new or amended accounting guidance, could cause actual results to differ materially from these expectations. These assumptions, judgments, estimates, and factors are discussed in the company’s Annual Report on Form 10-K for the year ended December 31, 2018, Quarterly Reports on Form 10-Q for the quarters ended March 31, 2019 and June 30, 2019, and Current Reports on Form 8-K, which are available on the Investor Relations page of the company’s website at www.freddiemac.com/investors and the SEC’s website at www.sec.gov. The company undertakes no obligation to update forward-looking statements it makes to reflect events or circumstances occurring after the date of this presentation. © Freddie Mac 15