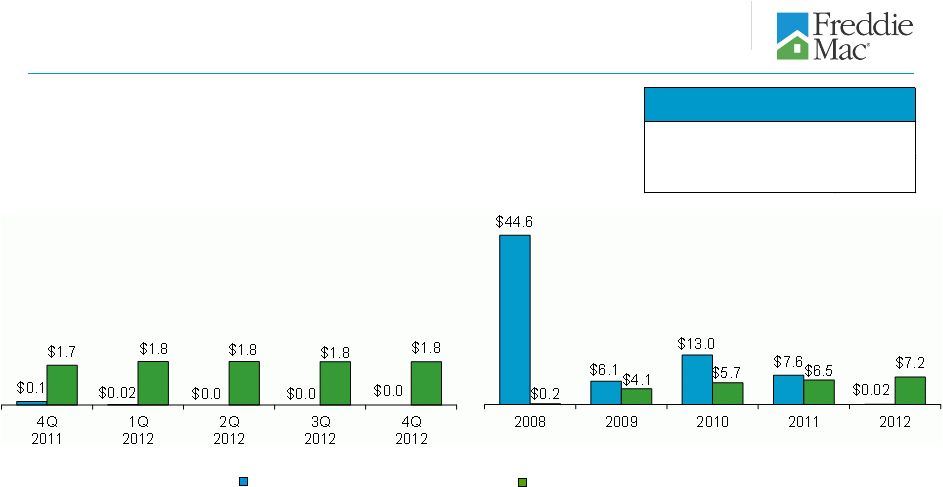

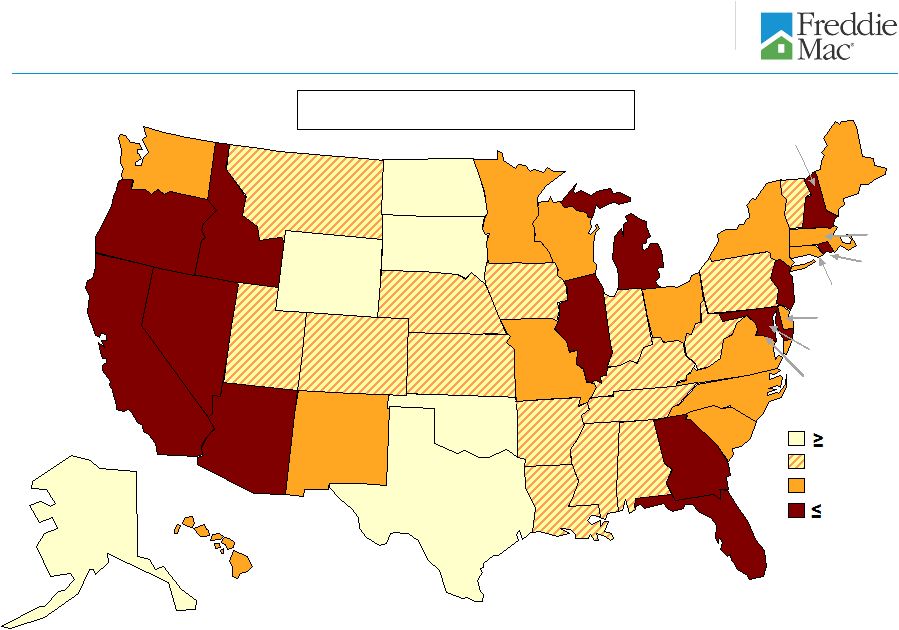

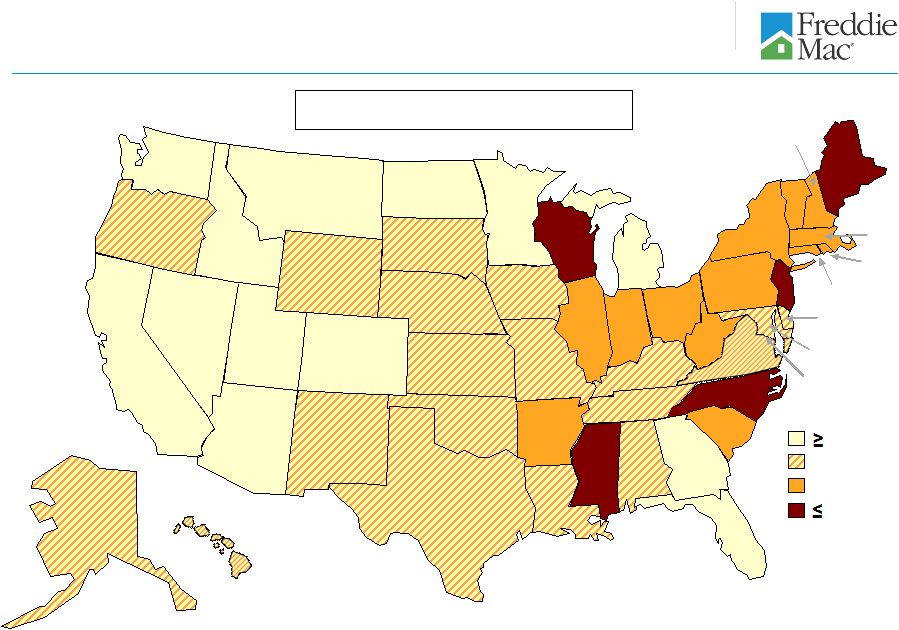

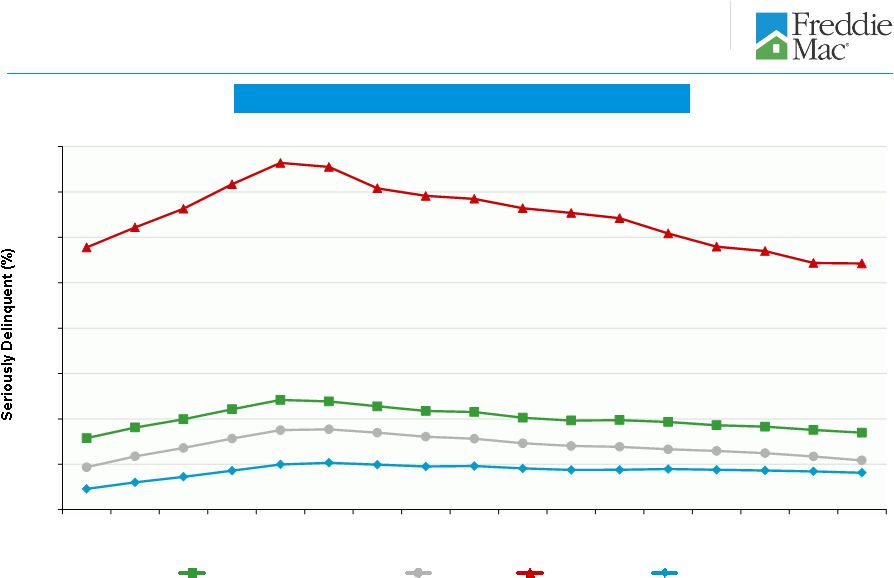

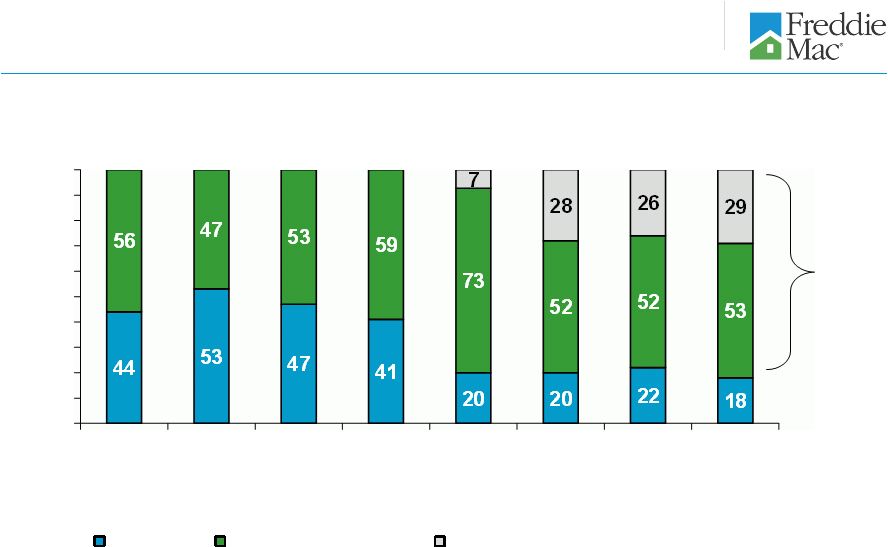

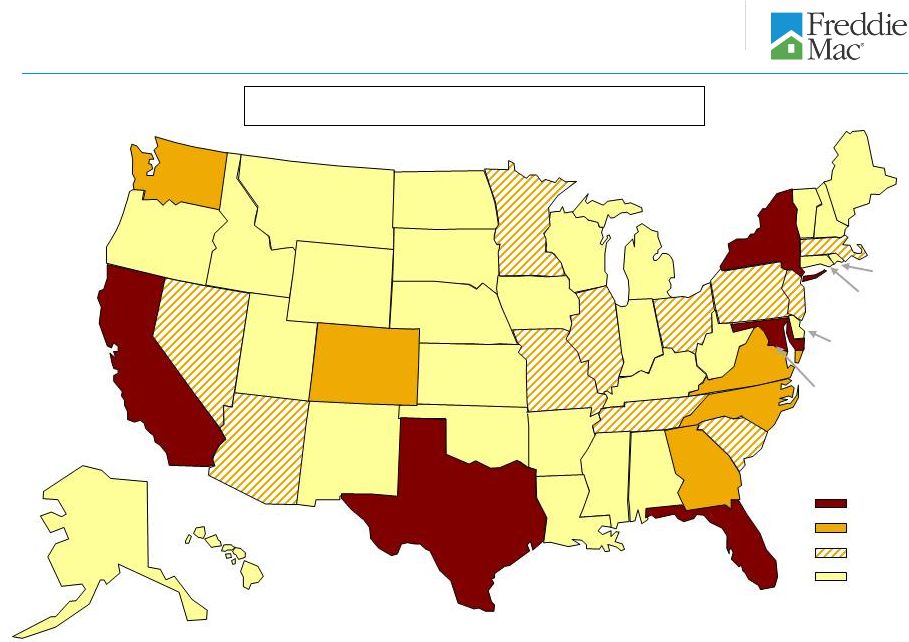

26 Single-family 4Q 2012 credit losses and REO by region and state 1 Based on the unpaid principal balance (UPB) of the single-family credit guarantee portfolio at December 31, 2012. 2 UPB amounts exclude Other Guarantee Transactions with ending balances of $553 million since these securities are backed by non-Freddie Mac issued securities for which loan characteristic data was not available. 3 Based on the number of loans that are three monthly payments or more past due or in the process of foreclosure. 4 Based on the UPB of loans at the time of REO acquisition. 5 Consist of the aggregate amount of charge-offs, net of recoveries, and REO operations expense for 4Q 2012. 6 Region designation: West (AK, AZ, CA, GU, HI, ID, MT, NV, OR, UT, WA); Northeast (CT, DE, DC, MA, ME, MD, NH, NJ, NY, PA, RI, VT, VA, WV); Southeast (AL, FL, GA, KY, MS, NC, PR, SC, TN, VI); North Central (IL, IN, IA, MI, MN, ND, OH, SD, WI); and Southwest (AR, CO, KS, LA, MO, NE, NM, OK, TX, WY). ($ Billions) % of Total UPB 2 ($ Millions) % of Total Serious Delinquency Rate 3 (%) 4Q 2012 Acquisitions ($ Millions) REO Inventory ($ Millions) % of Total Inventory ($ Millions) % of Total Region 6 1 West $456 28% $14,961 24% 2.79% $667 $1,402 19% $958 40% 2 Northeast 420 25 18,926 30 3.77% 283 944 12 219 9 3 North Central 293 18 8,402 14 2.52% 766 2,839 37 521 22 4 Southeast 277 17 16,703 27 4.97% 786 1,693 22 610 25 5 Southwest 192 12 3,270 5 1.69% 293 755 10 88 4 6 Total $1,638 100% $62,262 100% 3.25% $2,795 $7,633 100% $2,396 100% State 7 California $264 16% $7,325 12% 2.34% $340 $725 10% $572 24% 8 Florida 95 6 11,968 19 9.87% 385 785 10 433 18 9 Illinois 83 5 4,095 7 4.08% 254 1,005 13 237 10 10 Ohio 46 3 1,244 2 2.73% 118 335 4 76 3 11 Michigan 47 3 916 1 1.88% 150 683 9 97 4 12 Arizona 40 2 1,170 2 2.45% 129 216 3 154 7 13 Nevada 17 1 1,782 3 8.14% 29 57 1 126 5 14 All other 1,046 64 33,762 54 2.77% 1,390 3,827 50 701 29 15 Total $1,638 100% $62,262 100% 3.25% $2,795 $7,633 100% $2,396 100% Total Portfolio UPB 1 Credit Losses 5 REO Acquisitions & Balance 4 Seriously Delinquent Loans |