Fourth Quarter 2016 Financial Results Supplement February 16, 2017 Exhibit 99.2

Table of contents Financial Results 3 – Annual Financial Results 4 – Quarterly Financial Results 5 – Market-Related Items 6 – Segment Financial Results 7 – Treasury Draw Requests and Dividend Payments Housing Market 8 – National Home Prices 9 – Home Price Performance by State: December 2015 to December 2016 10 – Housing Market Support Segment Business Information 11 – Single-Family New Funding Volume 12 – Single-Family Guarantee Fees Charged on New Acquisitions 13 – Single-Family Credit Risk Transfer Transactions 14 – Single-Family Transferred Credit Risk 15 – Single-Family Credit Quality – Credit Guarantee Portfolio 16 – Single-Family Mortgage Market and Freddie Mac Delinquency Rates 17 – Multifamily Business Volume and Portfolio Composition 18 – Multifamily Percentage of Affordable Units Financed 19 – Multifamily Securitization Volume 20 – Multifamily Market and Freddie Mac Delinquency Rates 21 – Investments – Purchase Agreement Portfolio Limits 22 – Investments – Mortgage-Related Investments Portfolio Composition 23 – Investments – Mortgage-Related Investments Portfolio Composition, Continued 24 – Interest-Rate Risk Measures 25 – Safe Harbor Statements

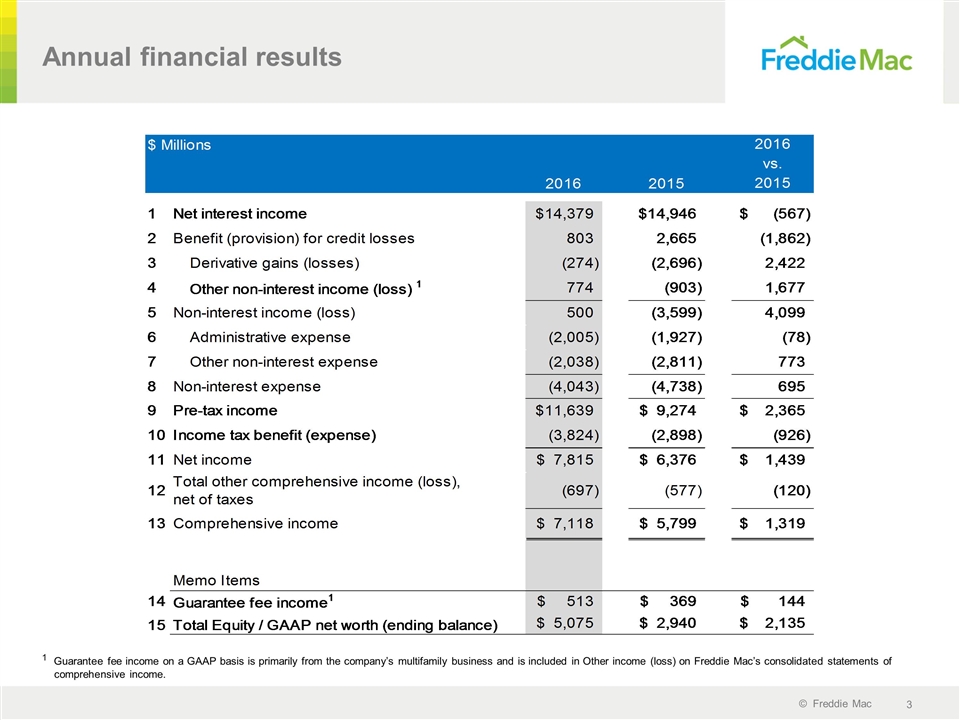

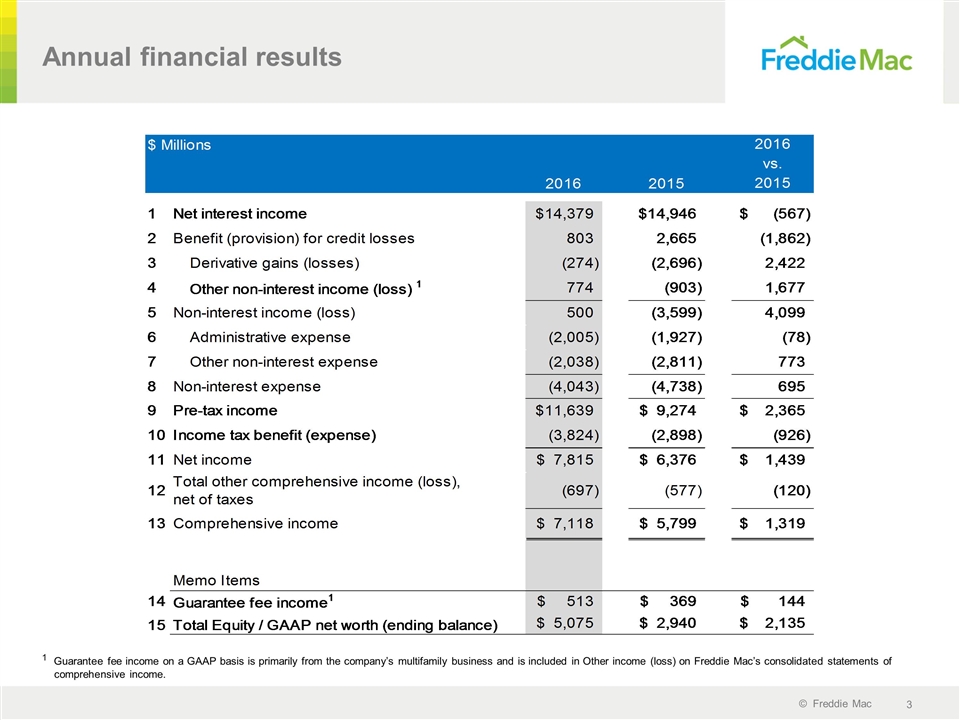

Annual financial results 1 Guarantee fee income on a GAAP basis is primarily from the company’s multifamily business and is included in Other income (loss) on Freddie Mac’s consolidated statements of comprehensive income.

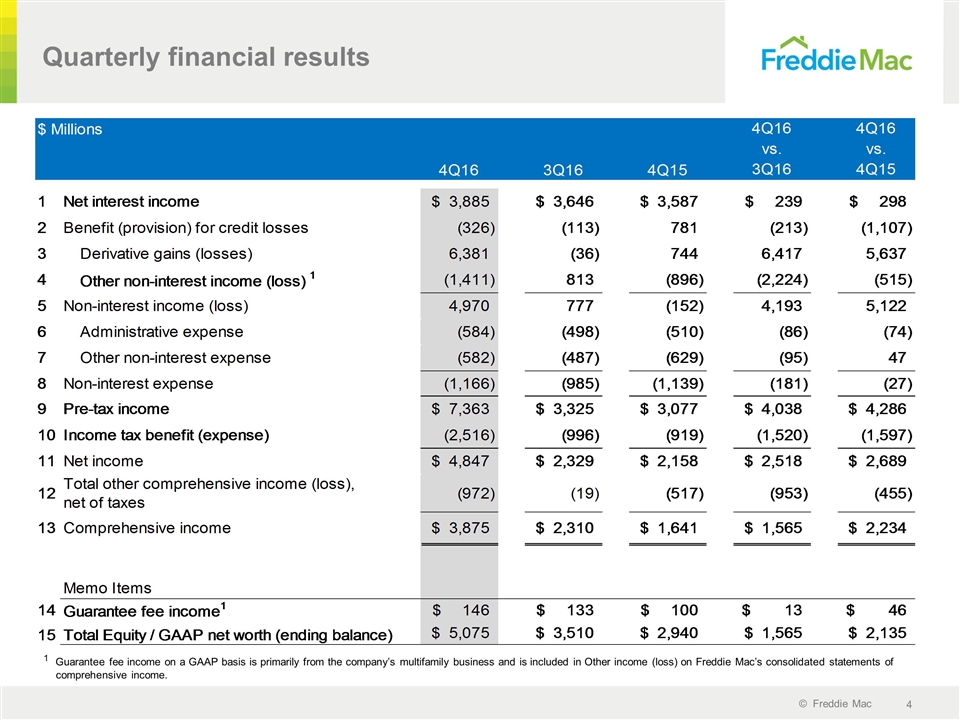

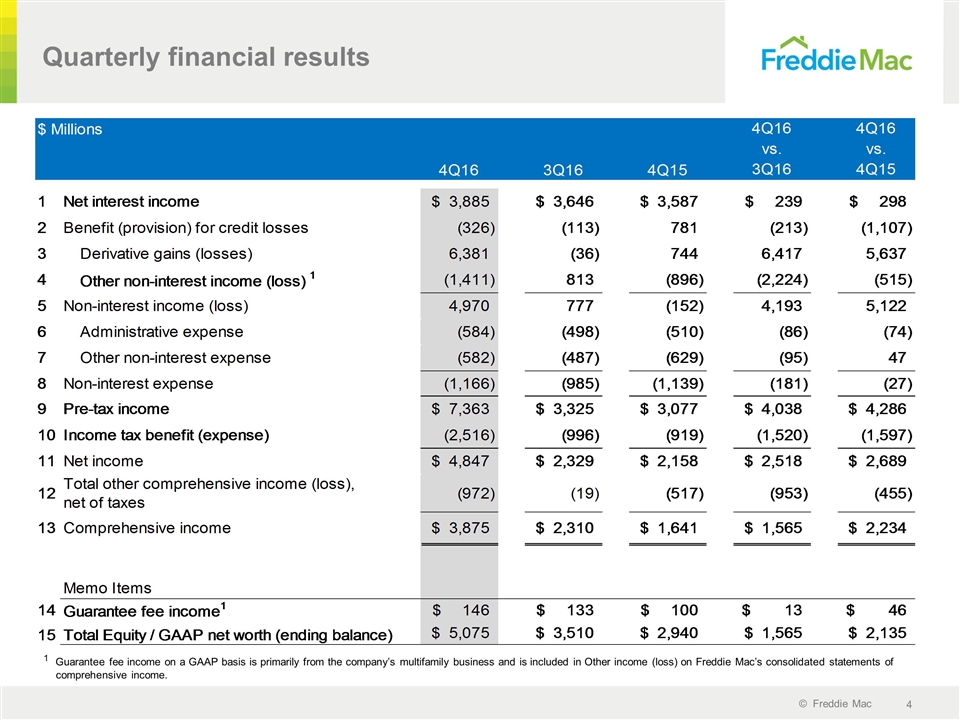

Quarterly financial results 1 Guarantee fee income on a GAAP basis is primarily from the company’s multifamily business and is included in Other income (loss) on Freddie Mac’s consolidated statements of comprehensive income.

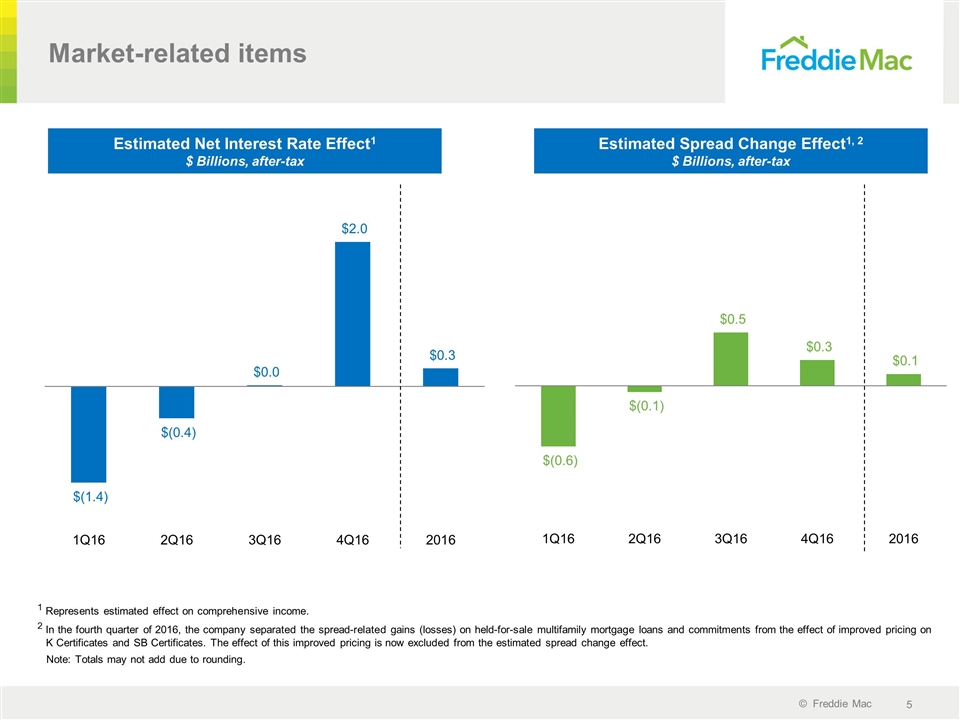

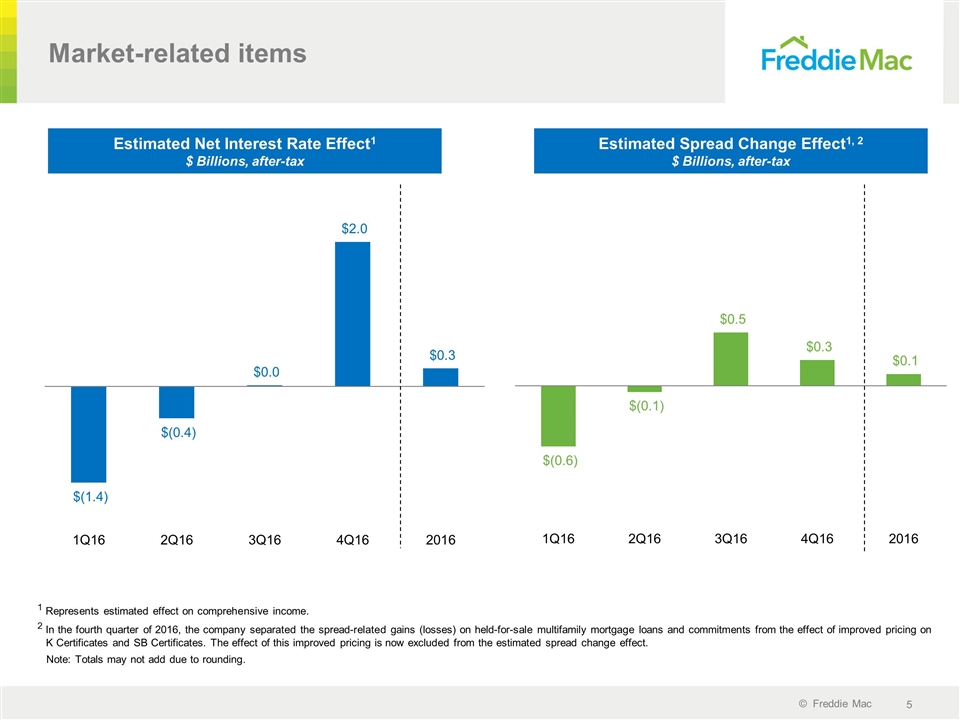

Market-related items Estimated Net Interest Rate Effect1 $ Billions, after-tax Estimated Spread Change Effect1, 2 $ Billions, after-tax 1 Represents estimated effect on comprehensive income. 2 In the fourth quarter of 2016, the company separated the spread-related gains (losses) on held-for-sale multifamily mortgage loans and commitments from the effect of improved pricing on K Certificates and SB Certificates. The effect of this improved pricing is now excluded from the estimated spread change effect. Note: Totals may not add due to rounding.

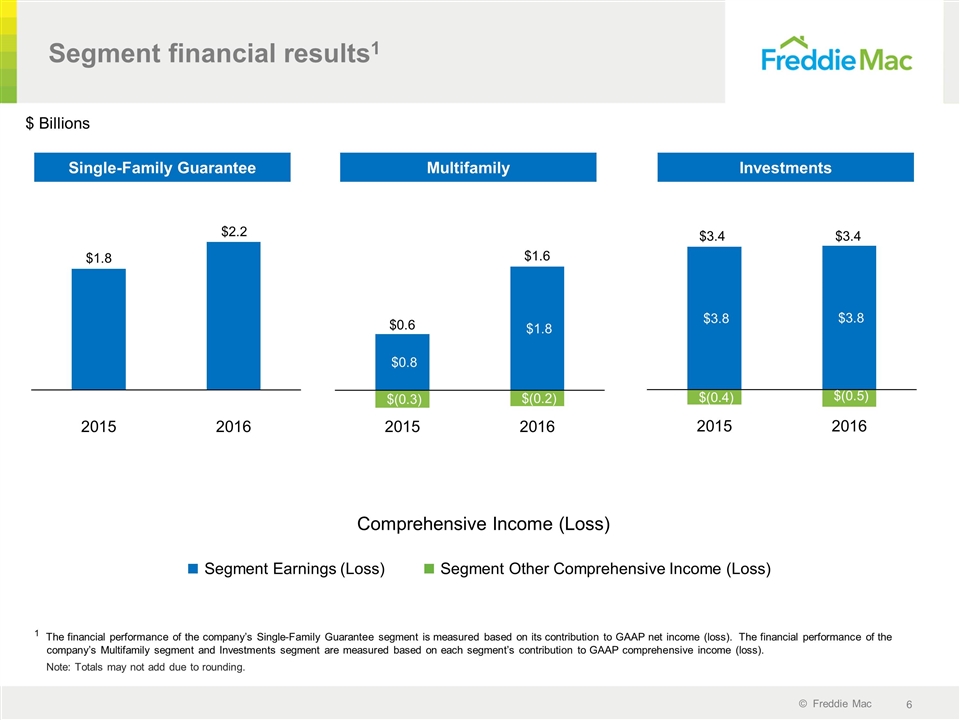

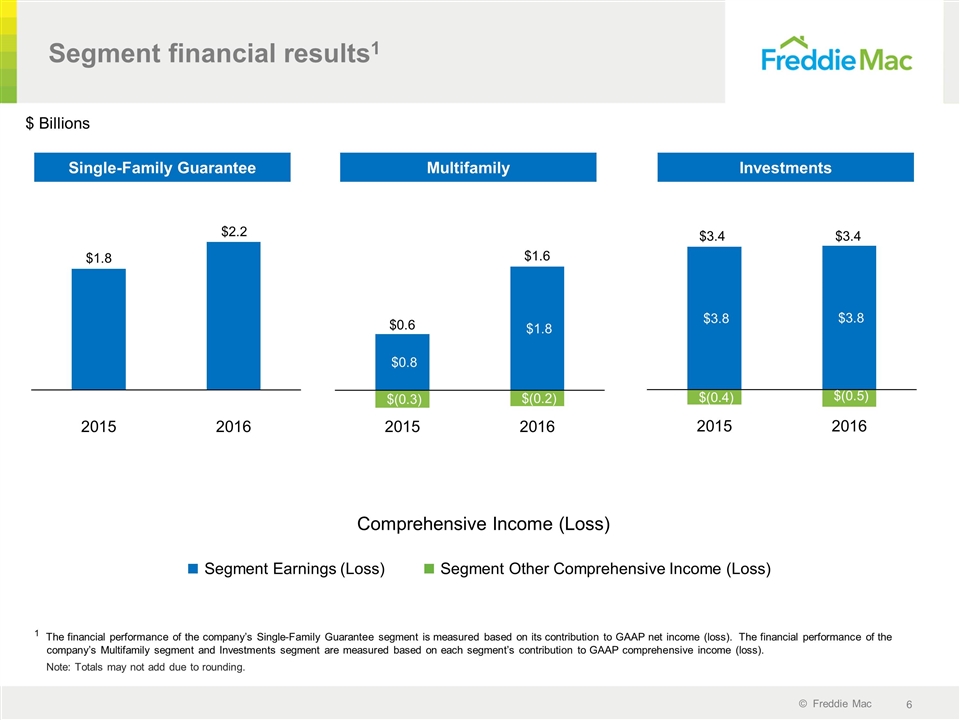

Segment financial results1 1 The financial performance of the company’s Single-Family Guarantee segment is measured based on its contribution to GAAP net income (loss). The financial performance of the company’s Multifamily segment and Investments segment are measured based on each segment’s contribution to GAAP comprehensive income (loss). Note: Totals may not add due to rounding. Investments Comprehensive Income (Loss) Segment Earnings (Loss) Segment Other Comprehensive Income (Loss) Single-Family Guarantee Multifamily $3.4 $0.6 $ Billions $1.8 $2.2 $1.6 $3.4

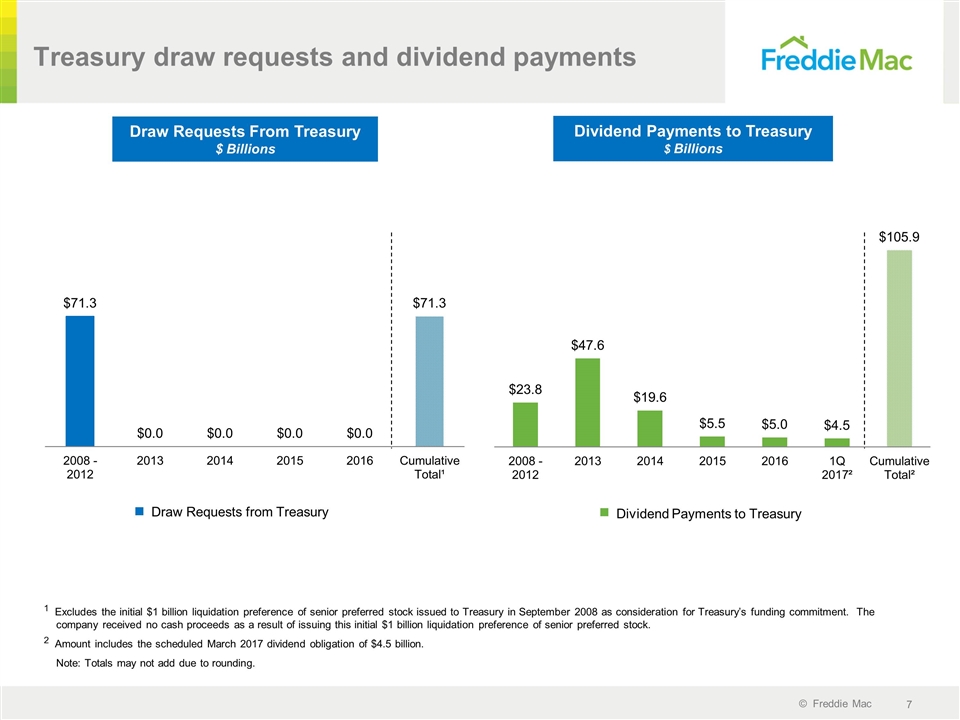

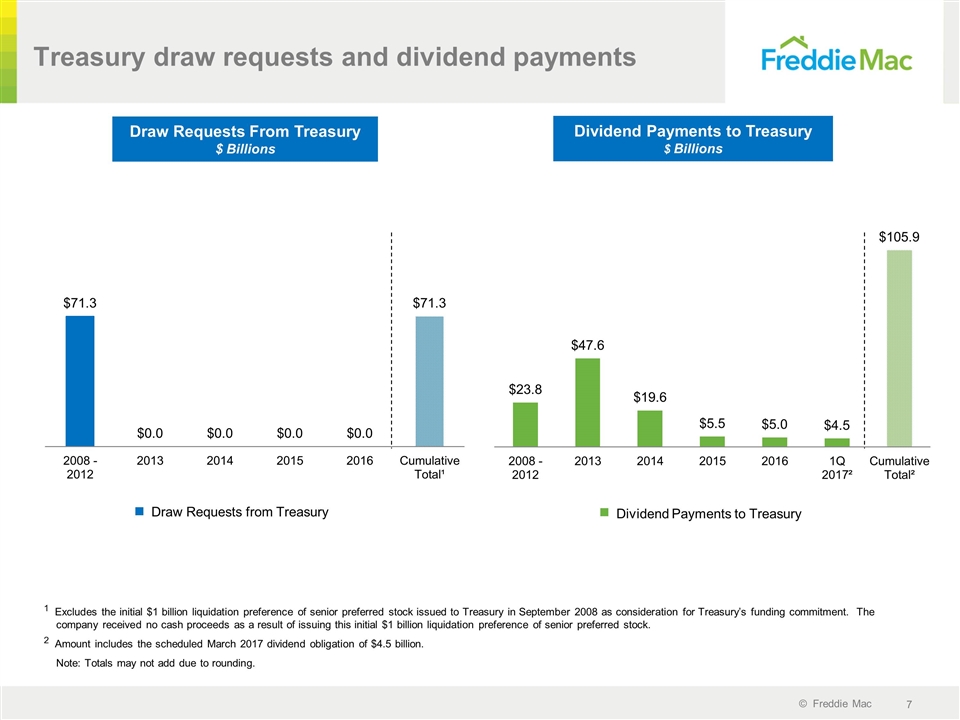

Dividend Payments to Treasury Draw Requests from Treasury Treasury draw requests and dividend payments 1 Excludes the initial $1 billion liquidation preference of senior preferred stock issued to Treasury in September 2008 as consideration for Treasury’s funding commitment. The company received no cash proceeds as a result of issuing this initial $1 billion liquidation preference of senior preferred stock. 2 Amount includes the scheduled March 2017 dividend obligation of $4.5 billion. Note: Totals may not add due to rounding. Draw Requests From Treasury $ Billions Dividend Payments to Treasury $ Billions

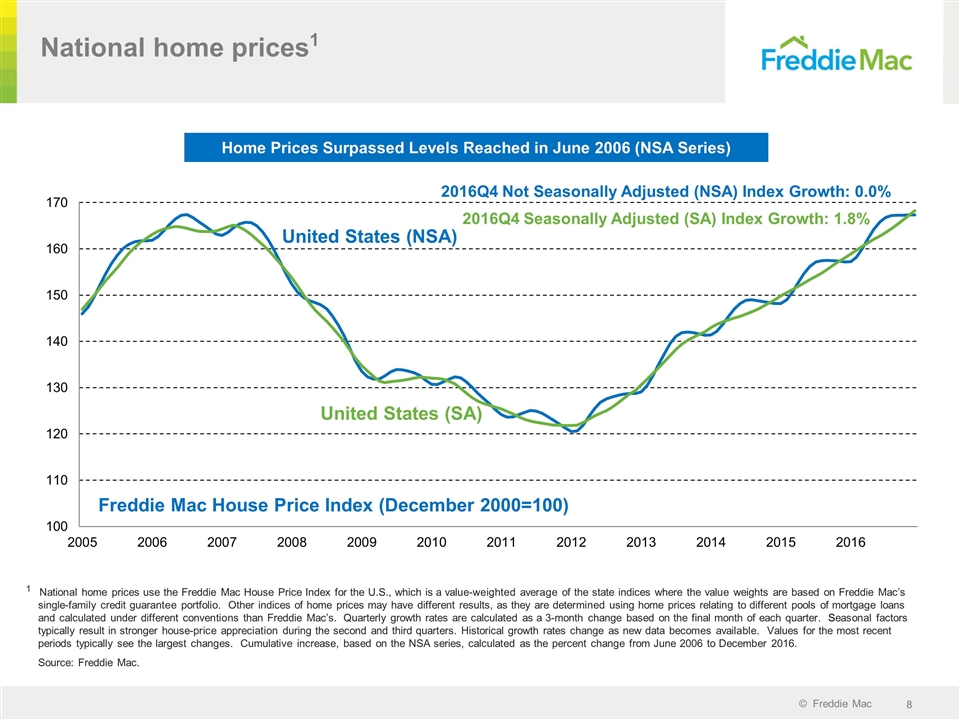

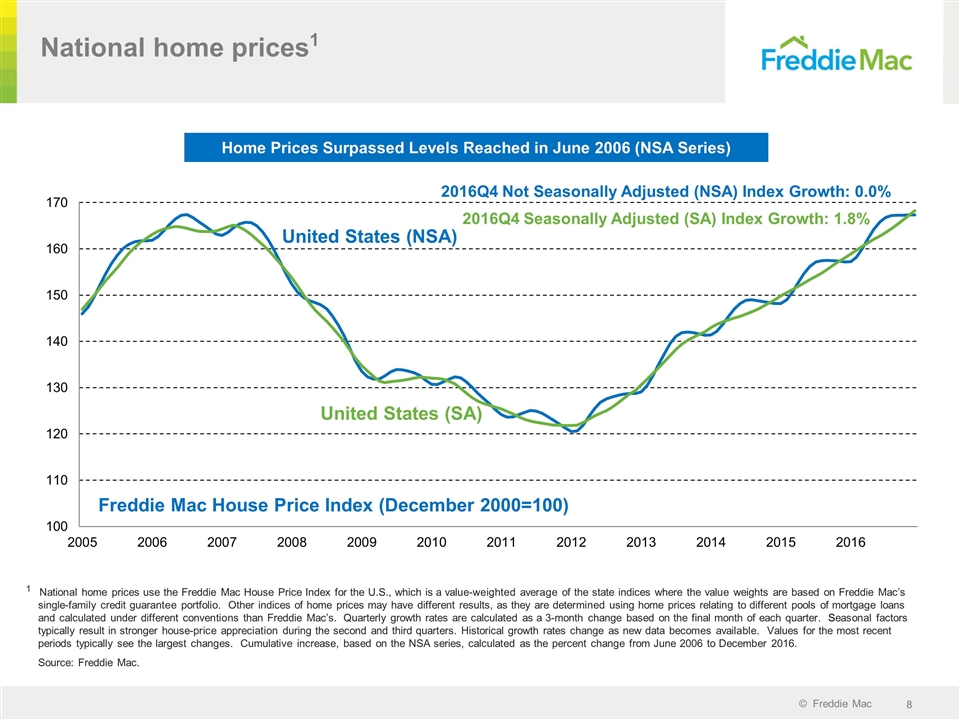

1 National home prices use the Freddie Mac House Price Index for the U.S., which is a value-weighted average of the state indices where the value weights are based on Freddie Mac’s single-family credit guarantee portfolio. Other indices of home prices may have different results, as they are determined using home prices relating to different pools of mortgage loans and calculated under different conventions than Freddie Mac’s. Quarterly growth rates are calculated as a 3-month change based on the final month of each quarter. Seasonal factors typically result in stronger house-price appreciation during the second and third quarters. Historical growth rates change as new data becomes available. Values for the most recent periods typically see the largest changes. Cumulative increase, based on the NSA series, calculated as the percent change from June 2006 to December 2016. Source: Freddie Mac. National home prices1 Home Prices Surpassed Levels Reached in June 2006 (NSA Series) Freddie Mac House Price Index (December 2000=100)

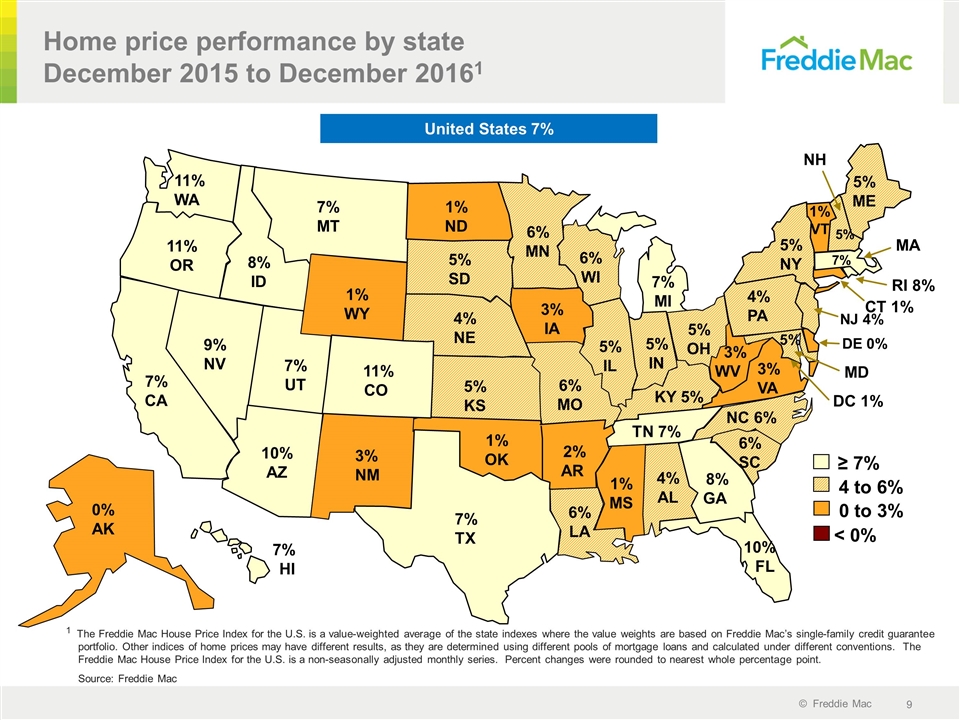

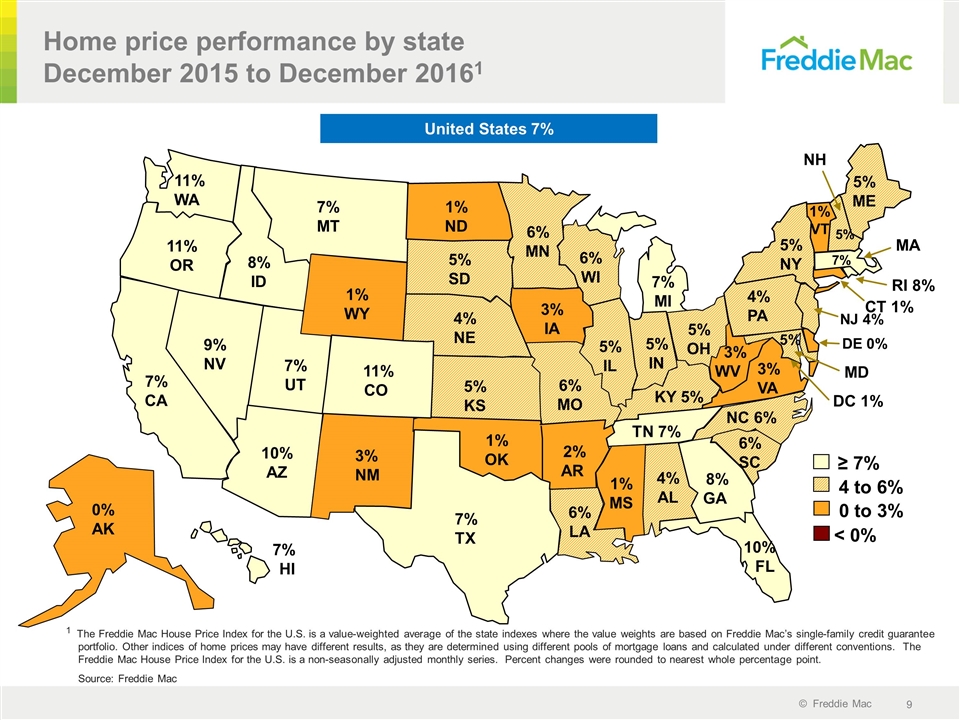

Home price performance by state December 2015 to December 20161 United States 7% 1 The Freddie Mac House Price Index for the U.S. is a value-weighted average of the state indexes where the value weights are based on Freddie Mac’s single-family credit guarantee portfolio. Other indices of home prices may have different results, as they are determined using different pools of mortgage loans and calculated under different conventions. The Freddie Mac House Price Index for the U.S. is a non-seasonally adjusted monthly series. Percent changes were rounded to nearest whole percentage point. Source: Freddie Mac 4% AL 0% AK ≥ 7% 4 to 6% ˂ 0% 0 to 3% 2% AR 10% AZ 7% CA 11% CO CT 1% DC 1% DE 0% 10% FL 8% GA 7% HI 3% IA 8% ID 5% IL 5% IN 5% KS KY 5% 6% LA 5% 5% ME 7% MI 6% MN 6% MO 1% MS 7% MT NC 6% 1% ND 4% NE NJ 4% 3% NM 9% NV 5% NY 5% OH 1% OK 11% OR 4% PA 6% SC 5% SD TN 7% 7% TX 7% UT 3% VA 11% WA 6% WI 3% WV 1% WY 5% 7% MD MA NH 1% VT RI 8%

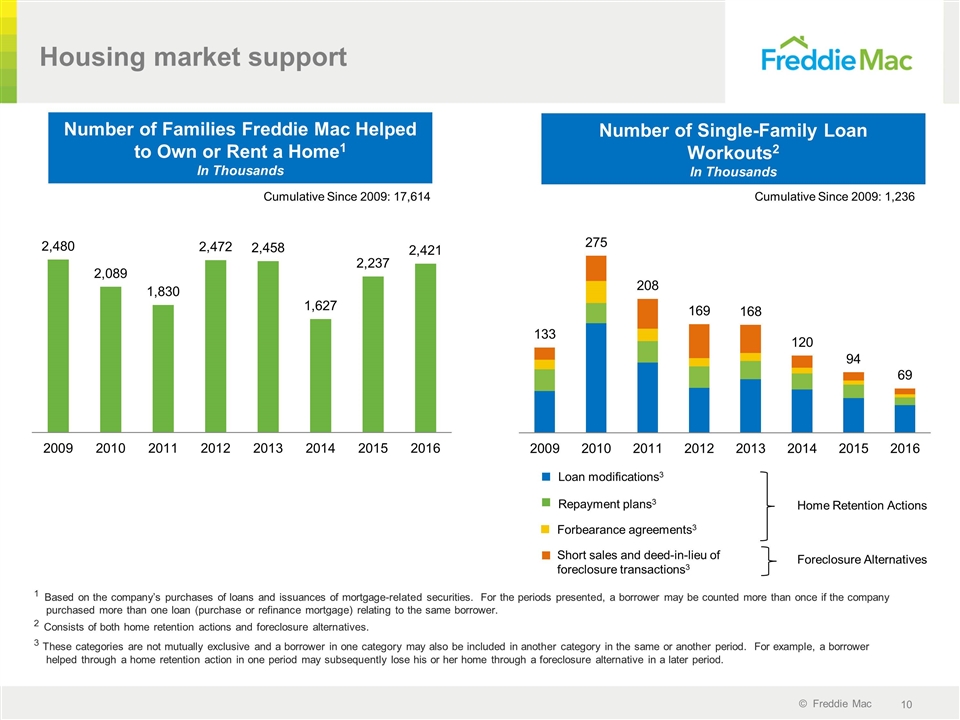

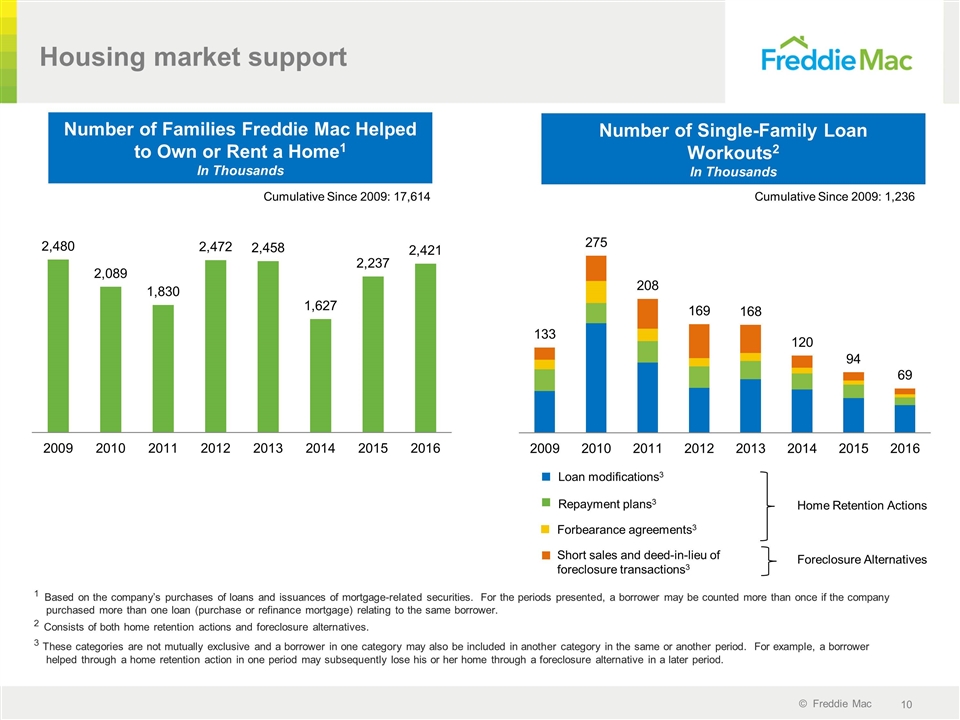

Housing market support Number of Families Freddie Mac Helped to Own or Rent a Home1 In Thousands Number of Single-Family Loan Workouts2 In Thousands 1 Based on the company’s purchases of loans and issuances of mortgage-related securities. For the periods presented, a borrower may be counted more than once if the company purchased more than one loan (purchase or refinance mortgage) relating to the same borrower. 2 Consists of both home retention actions and foreclosure alternatives. 3 These categories are not mutually exclusive and a borrower in one category may also be included in another category in the same or another period. For example, a borrower helped through a home retention action in one period may subsequently lose his or her home through a foreclosure alternative in a later period. Repayment plans3 Loan modifications3 Forbearance agreements3 Short sales and deed-in-lieu of foreclosure transactions3 Home Retention Actions Foreclosure Alternatives Cumulative Since 2009: 17,614 Cumulative Since 2009: 1,236

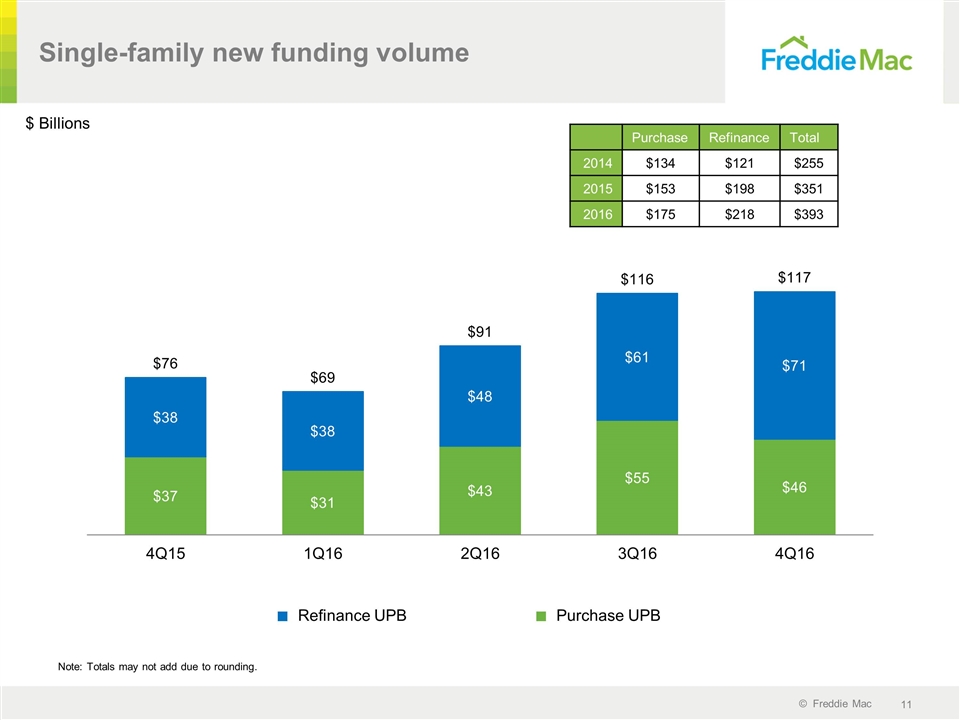

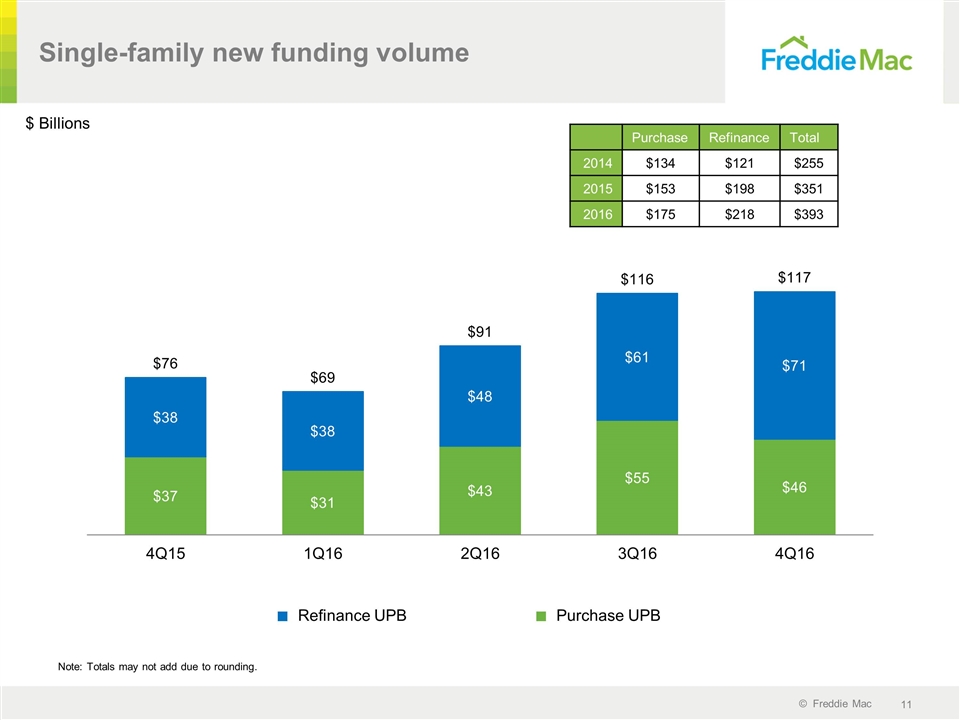

Single-family new funding volume Refinance UPB Purchase UPB Purchase Refinance Total 2014 $134 $121 $255 2015 $153 $198 $351 2016 $175 $218 $393 $ Billions Note: Totals may not add due to rounding.

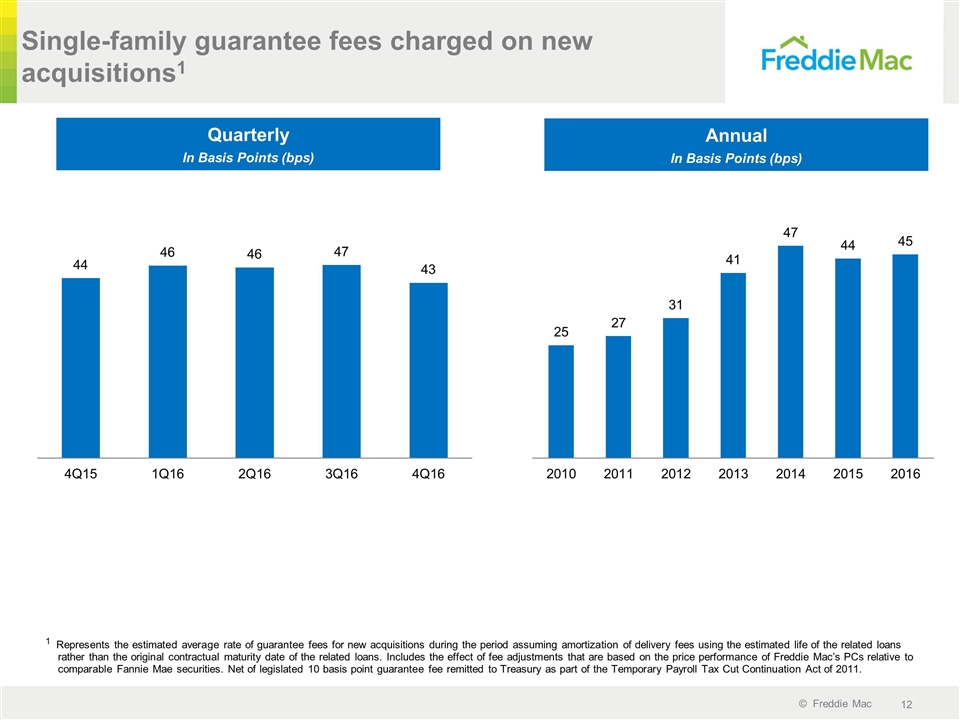

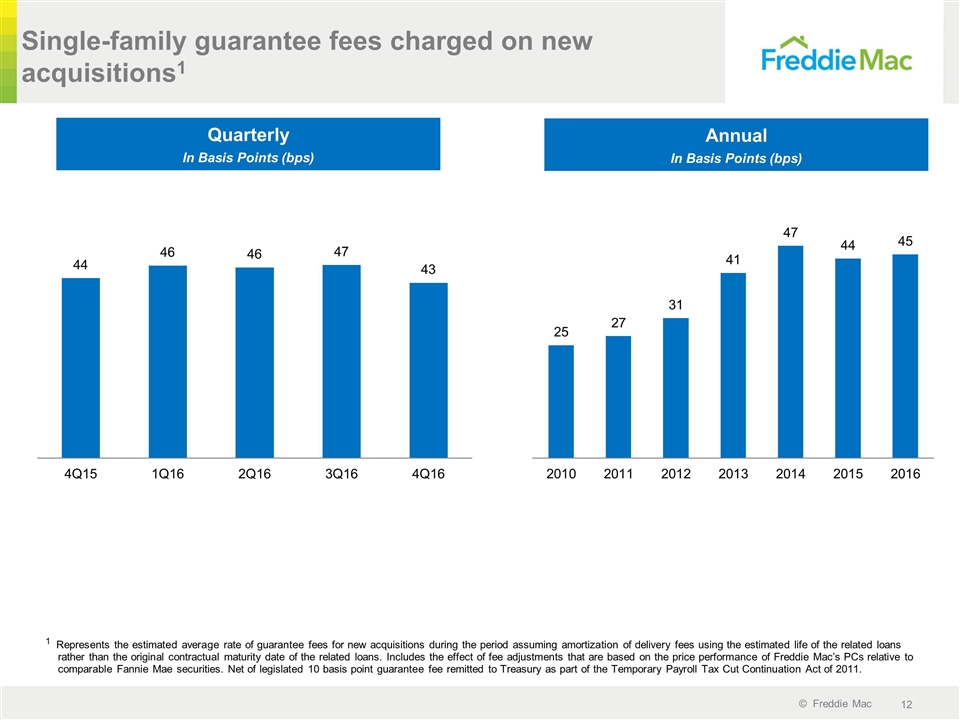

Single-family guarantee fees charged on new acquisitions1 1 Represents the estimated average rate of guarantee fees for new acquisitions during the period assuming amortization of delivery fees using the estimated life of the related loans rather than the original contractual maturity date of the related loans. Includes the effect of fee adjustments that are based on the price performance of Freddie Mac’s PCs relative to comparable Fannie Mae securities. Net of legislated 10 basis point guarantee fee remitted to Treasury as part of the Temporary Payroll Tax Cut Continuation Act of 2011. Quarterly In Basis Points (bps) Annual In Basis Points (bps)

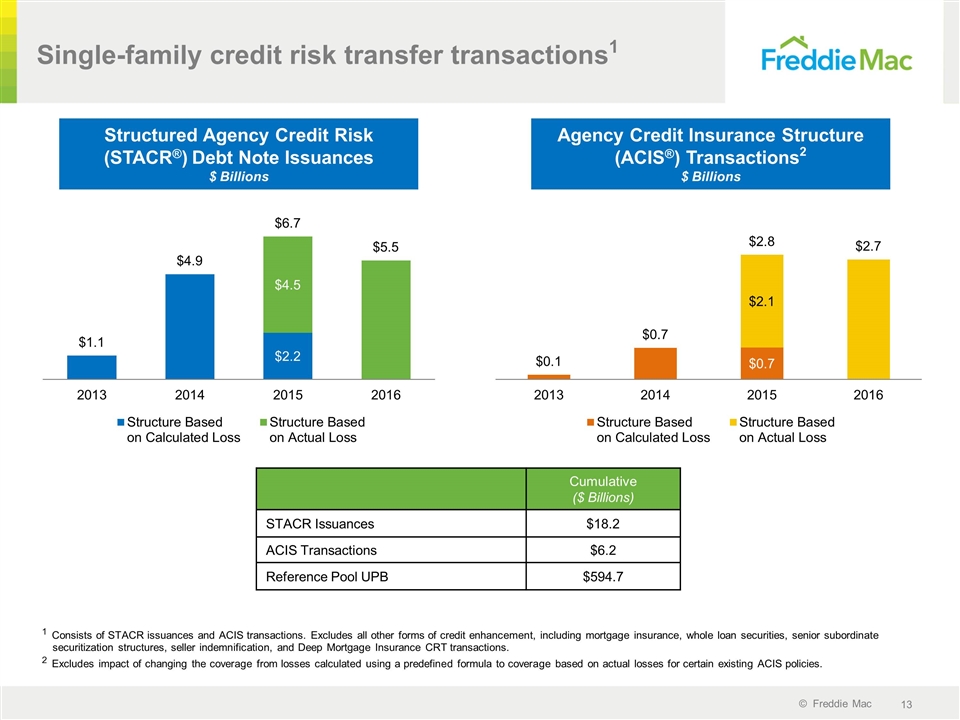

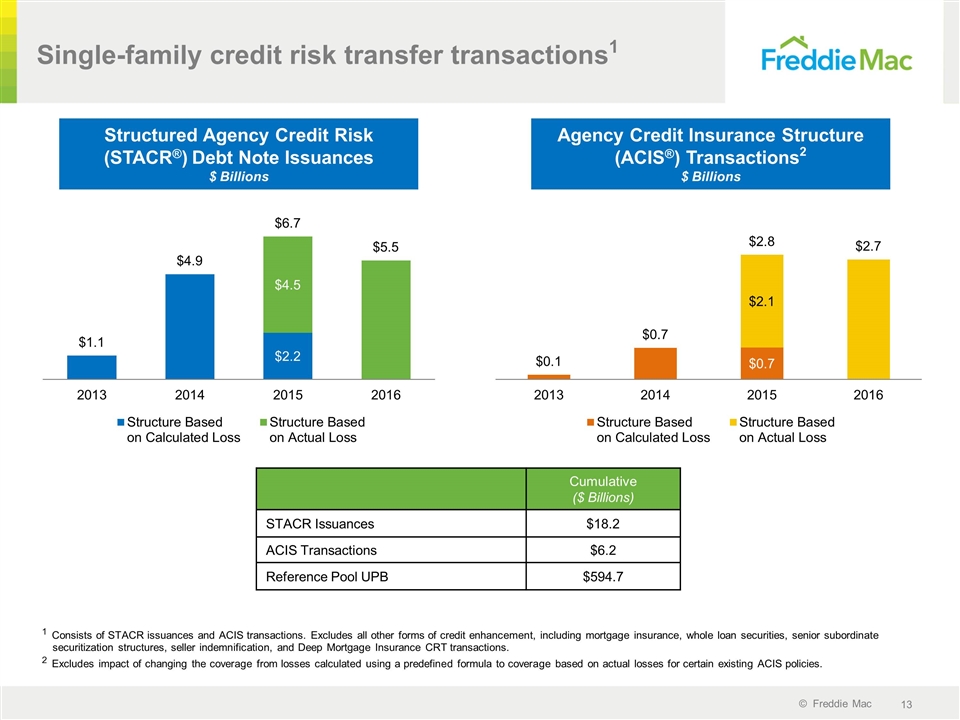

Single-family credit risk transfer transactions1 Structured Agency Credit Risk (STACR®) Debt Note Issuances $ Billions Agency Credit Insurance Structure (ACIS®) Transactions2 $ Billions 1 Consists of STACR issuances and ACIS transactions. Excludes all other forms of credit enhancement, including mortgage insurance, whole loan securities, senior subordinate securitization structures, seller indemnification, and Deep Mortgage Insurance CRT transactions. 2 Excludes impact of changing the coverage from losses calculated using a predefined formula to coverage based on actual losses for certain existing ACIS policies. Cumulative ($ Billions) STACR Issuances $18.2 ACIS Transactions $6.2 Reference Pool UPB $594.7

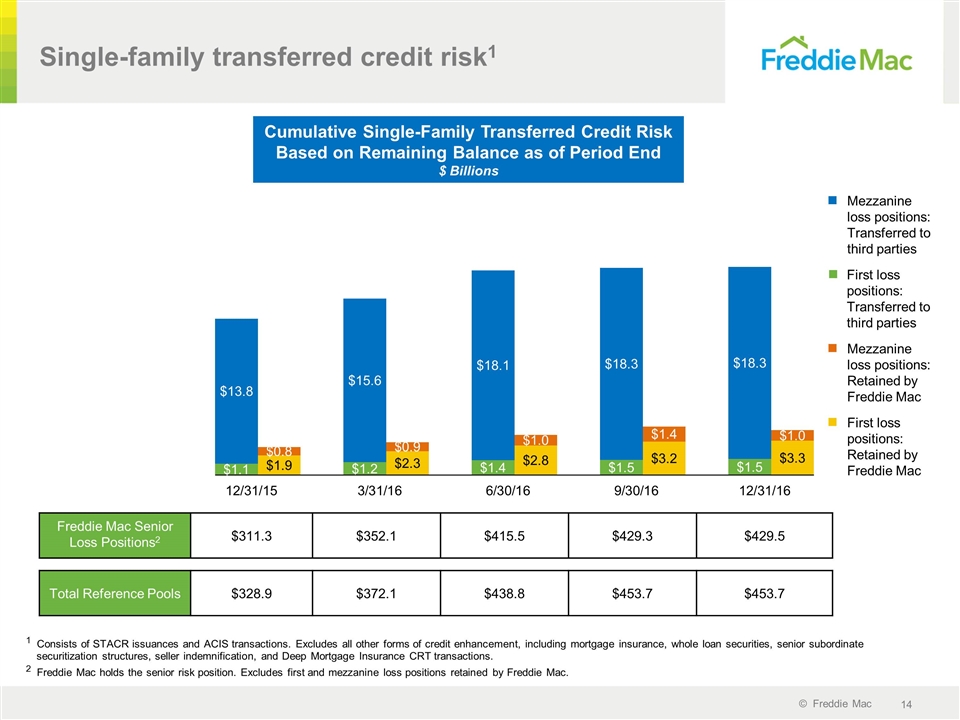

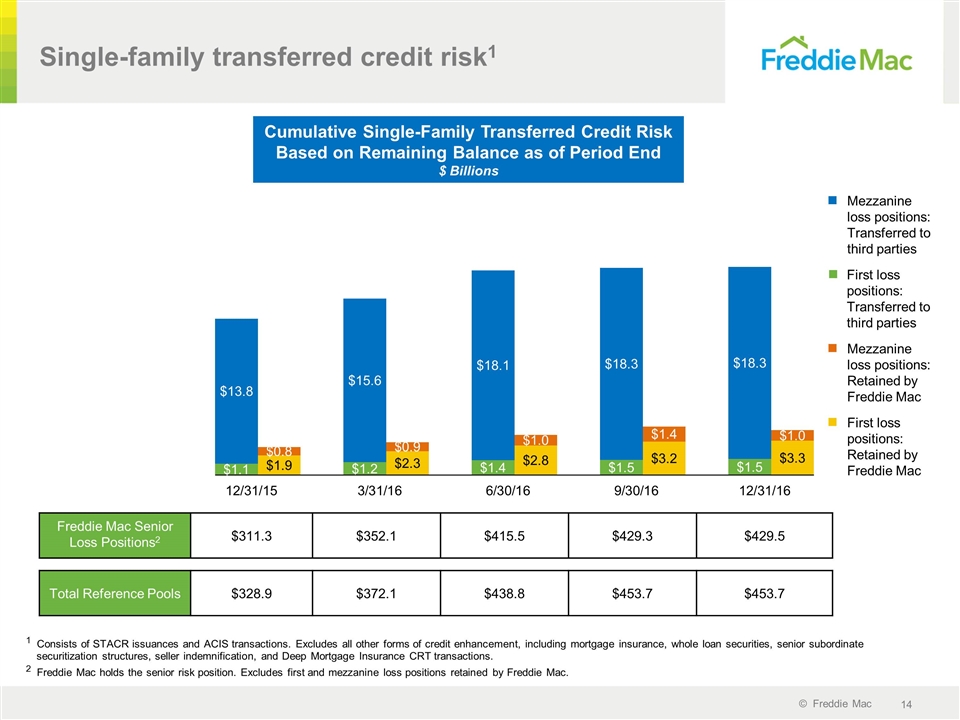

Cumulative Single-Family Transferred Credit Risk Based on Remaining Balance as of Period End $ Billions Single-family transferred credit risk1 1 Consists of STACR issuances and ACIS transactions. Excludes all other forms of credit enhancement, including mortgage insurance, whole loan securities, senior subordinate securitization structures, seller indemnification, and Deep Mortgage Insurance CRT transactions. 2 Freddie Mac holds the senior risk position. Excludes first and mezzanine loss positions retained by Freddie Mac. Freddie Mac Senior Loss Positions2 $311.3 $352.1 $415.5 $429.3 $429.5 Total Reference Pools $328.9 $372.1 $438.8 $453.7 $453.7 First loss positions: Retained by Freddie Mac Mezzanine loss positions: Retained by Freddie Mac Mezzanine loss positions: Transferred to third parties First loss positions: Transferred to third parties

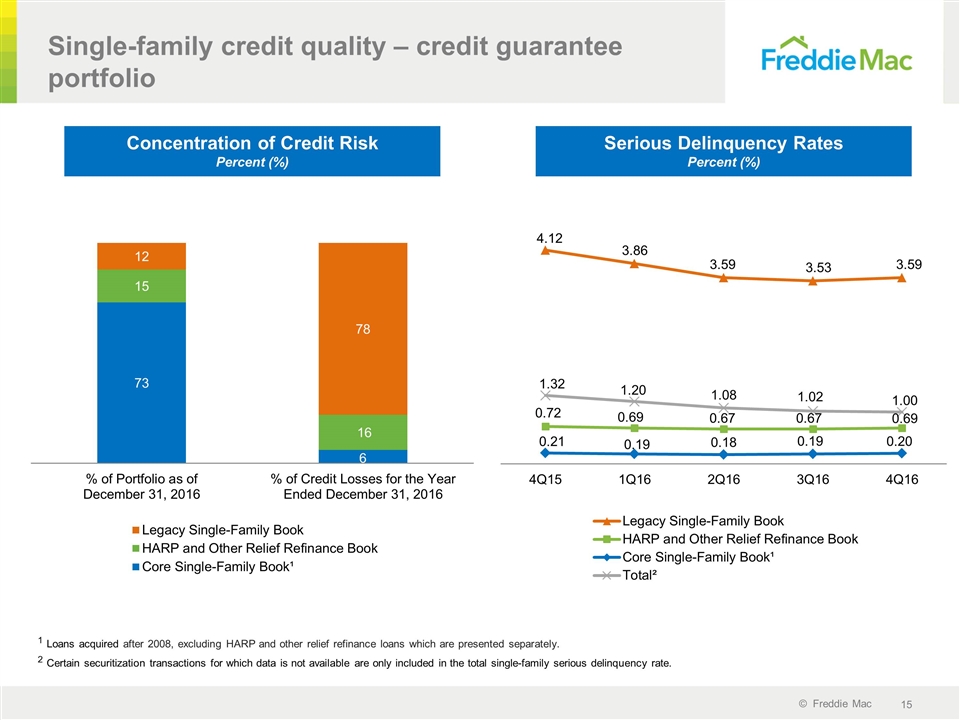

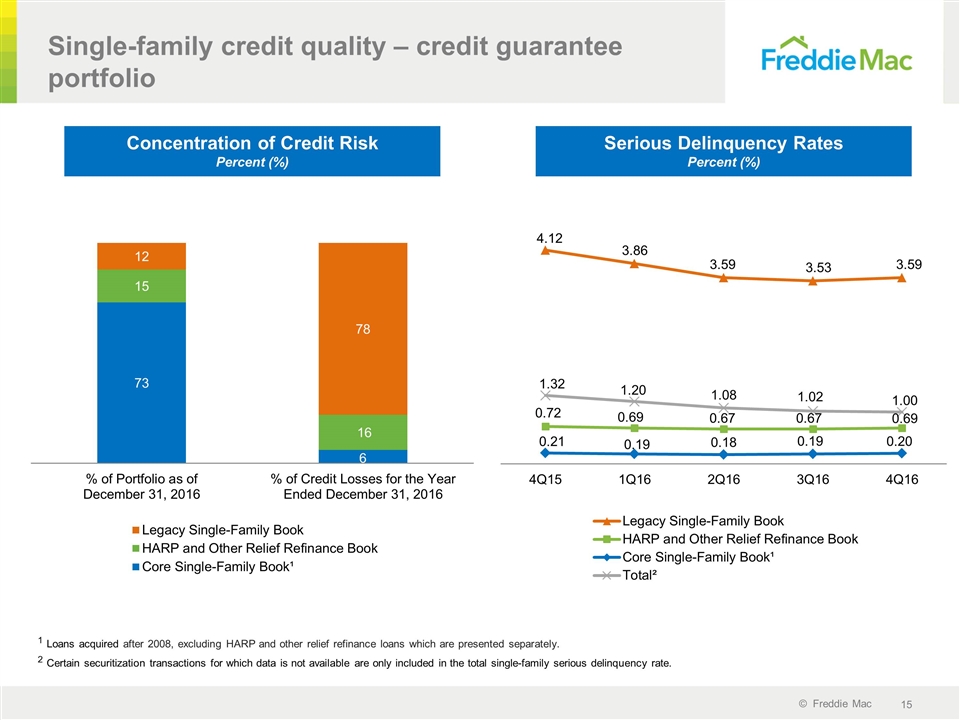

Single-family credit quality – credit guarantee portfolio 1 Loans acquired after 2008, excluding HARP and other relief refinance loans which are presented separately. 2 Certain securitization transactions for which data is not available are only included in the total single-family serious delinquency rate. Concentration of Credit Risk Percent (%) Serious Delinquency Rates Percent (%)

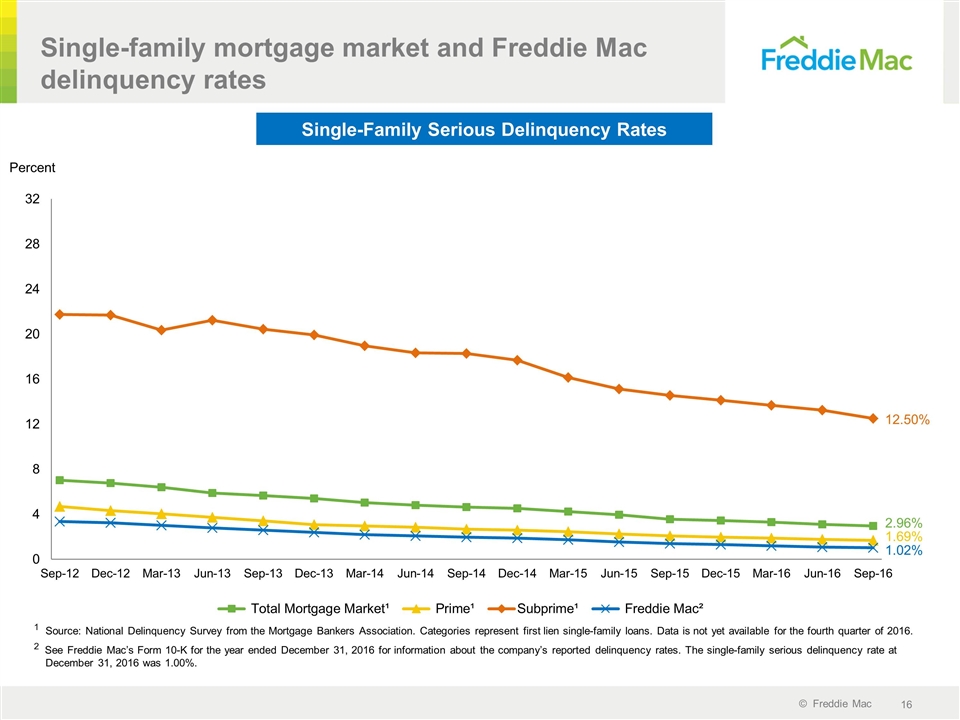

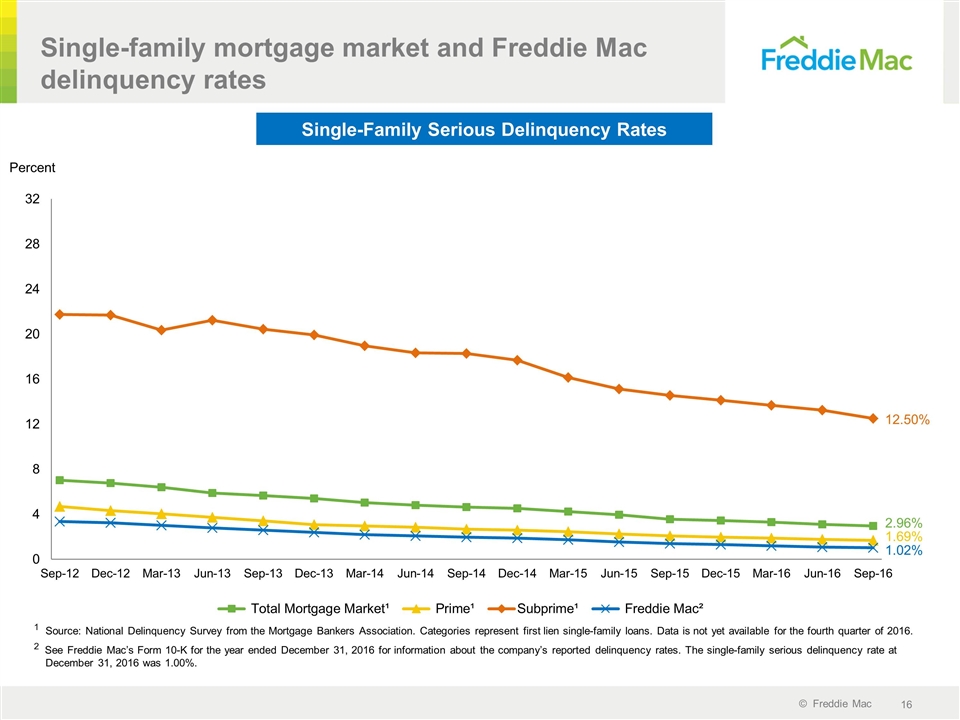

1 Source: National Delinquency Survey from the Mortgage Bankers Association. Categories represent first lien single-family loans. Data is not yet available for the fourth quarter of 2016. 2 See Freddie Mac’s Form 10-K for the year ended December 31, 2016 for information about the company’s reported delinquency rates. The single-family serious delinquency rate at December 31, 2016 was 1.00%. 12.50% 2.96% Single-Family Serious Delinquency Rates Single-family mortgage market and Freddie Mac delinquency rates Percent 1.69% 1.02%

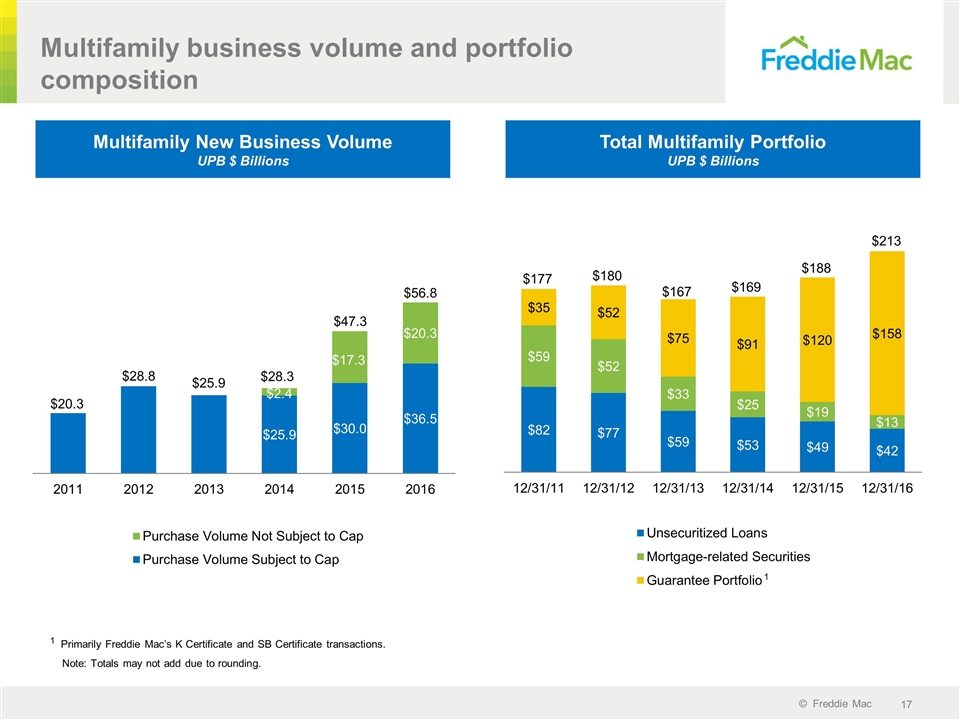

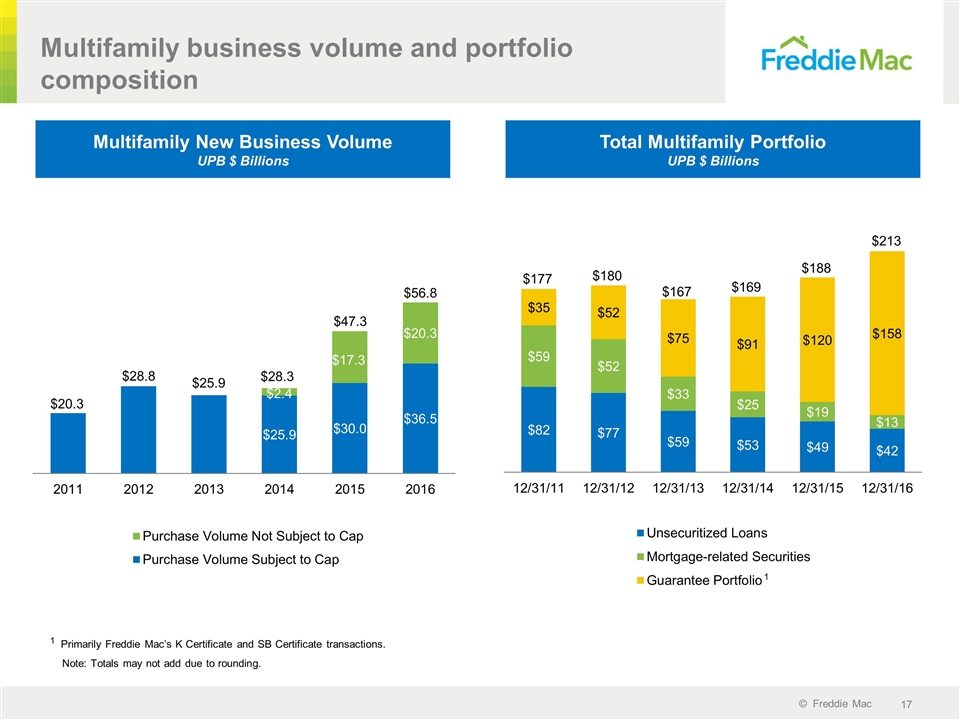

Total Multifamily Portfolio UPB $ Billions Multifamily business volume and portfolio composition Multifamily New Business Volume UPB $ Billions 1 Primarily Freddie Mac’s K Certificate and SB Certificate transactions. Note: Totals may not add due to rounding. $188 $177 $180 $167 $169 $20.3 $28.8 $25.9 $28.3 $47.3 1 $213 $56.8

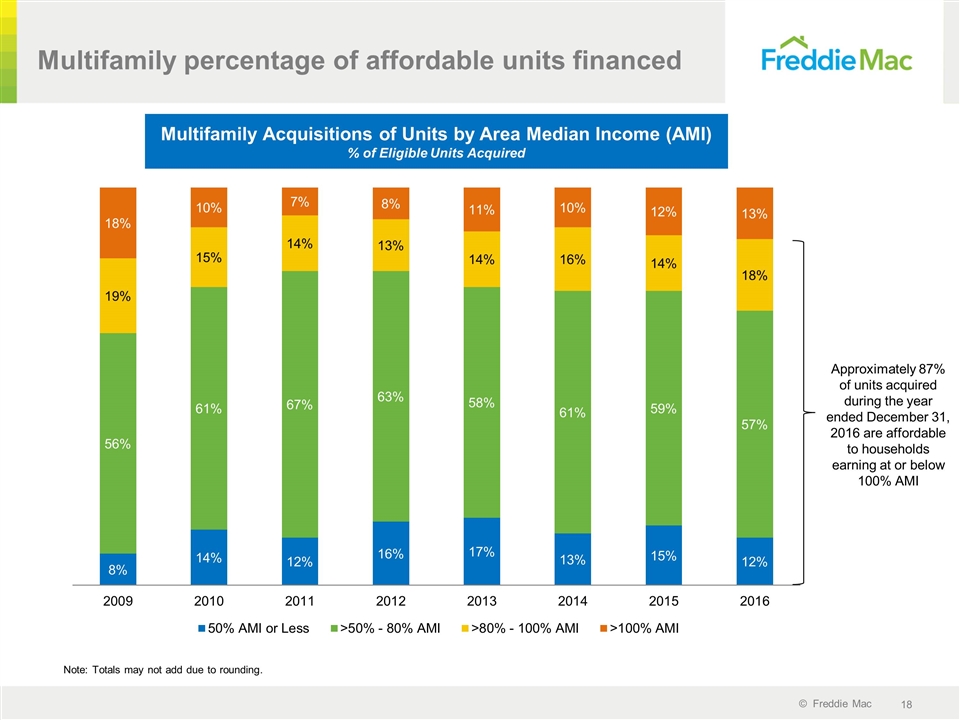

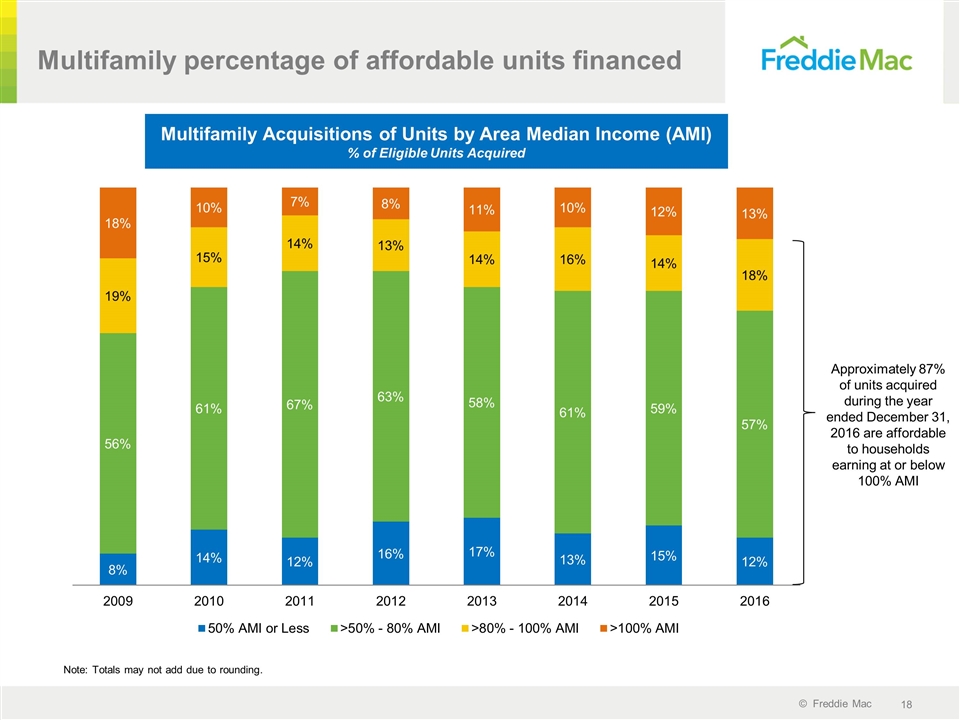

Note: Totals may not add due to rounding. Multifamily percentage of affordable units financed Multifamily Acquisitions of Units by Area Median Income (AMI) % of Eligible Units Acquired Approximately 87% of units acquired during the year ended December 31, 2016 are affordable to households earning at or below 100% AMI

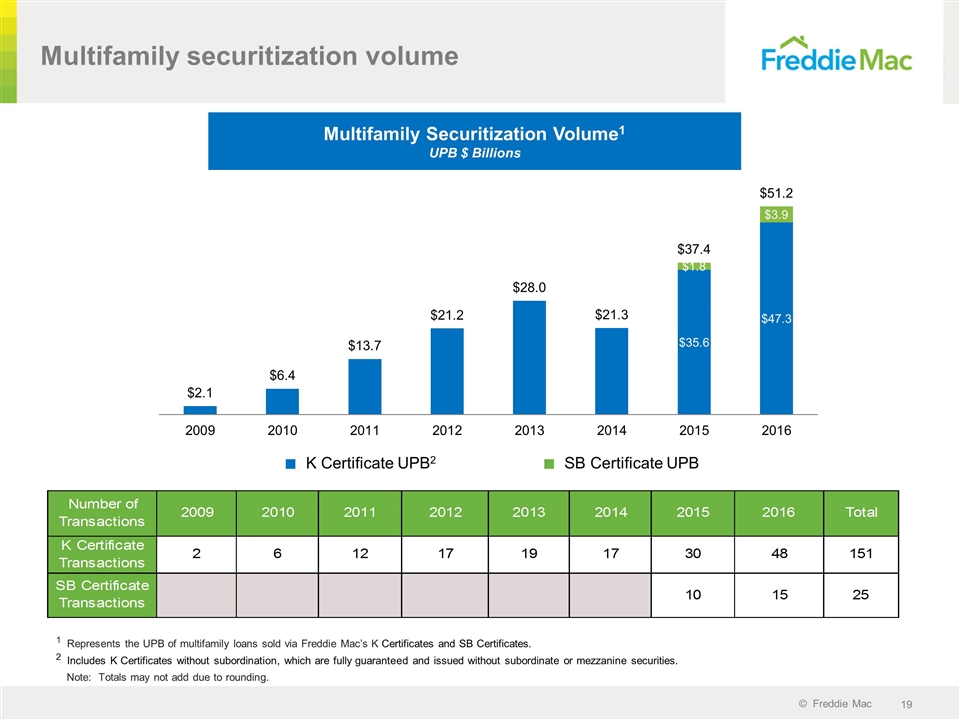

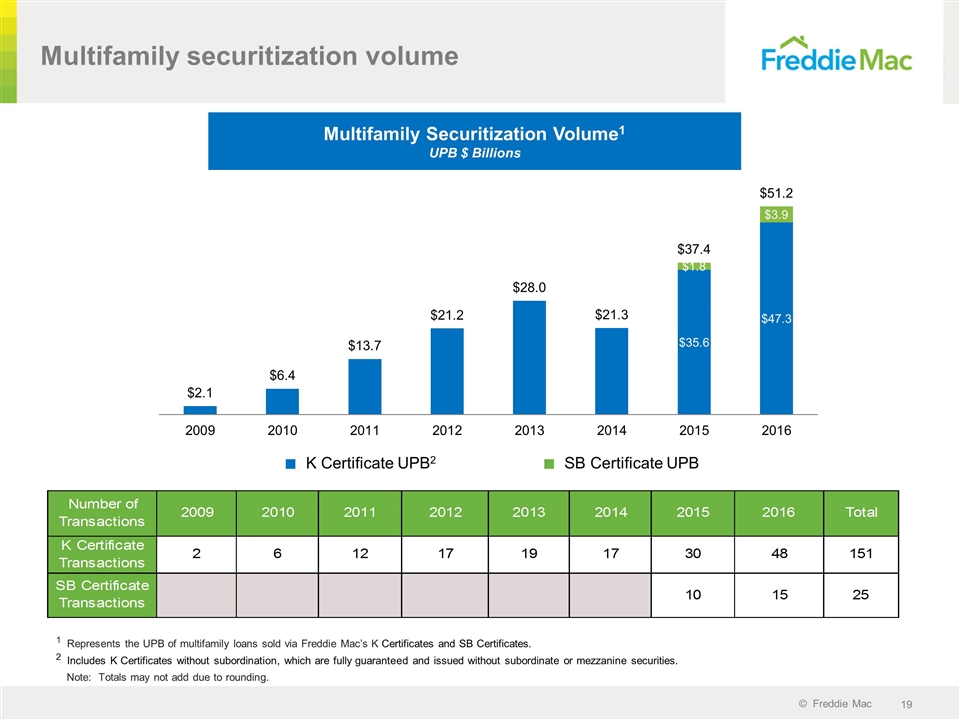

1 Represents the UPB of multifamily loans sold via Freddie Mac’s K Certificates and SB Certificates. 2 Includes K Certificates without subordination, which are fully guaranteed and issued without subordinate or mezzanine securities. Note: Totals may not add due to rounding. Multifamily Securitization Volume1 UPB $ Billions Multifamily securitization volume K Certificate UPB2 SB Certificate UPB

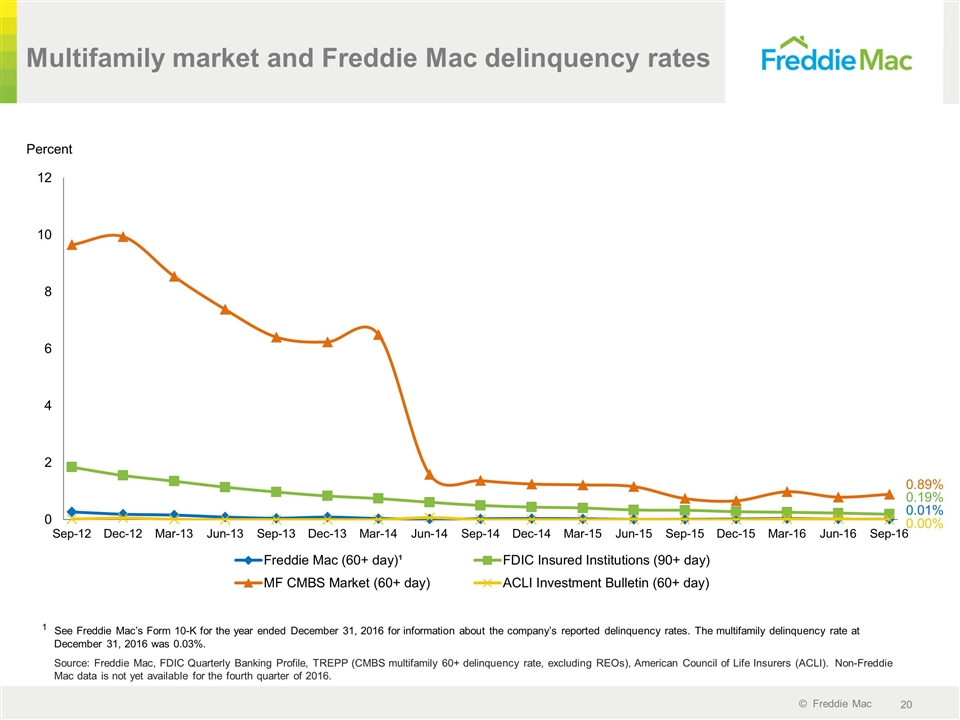

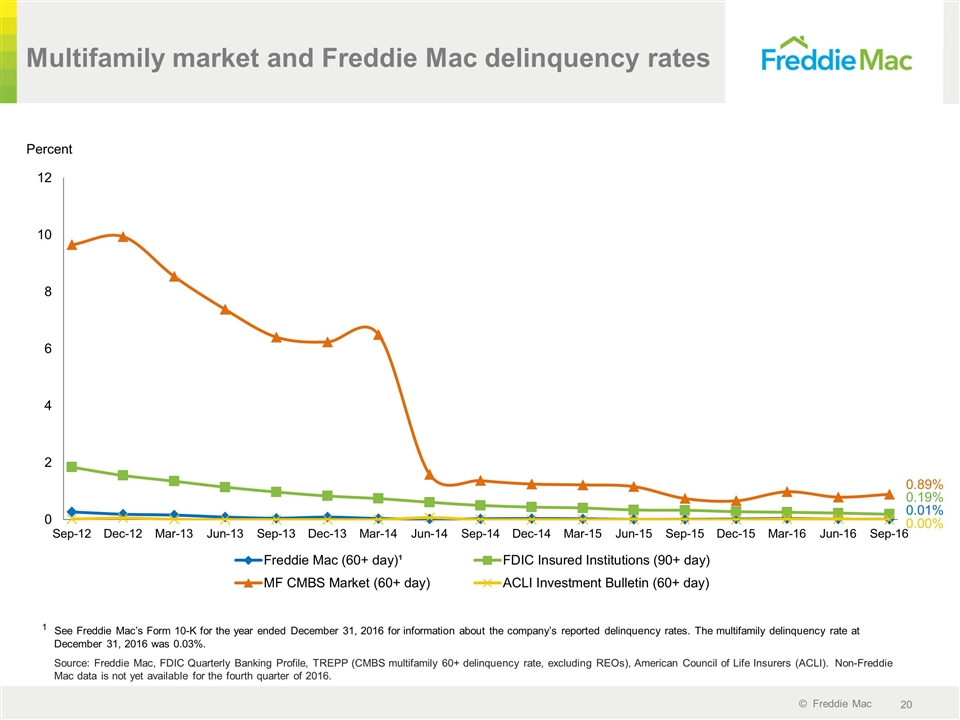

0.01% 0.00% Multifamily market and Freddie Mac delinquency rates Percent 1 See Freddie Mac’s Form 10-K for the year ended December 31, 2016 for information about the company’s reported delinquency rates. The multifamily delinquency rate at December 31, 2016 was 0.03%. Source: Freddie Mac, FDIC Quarterly Banking Profile, TREPP (CMBS multifamily 60+ delinquency rate, excluding REOs), American Council of Life Insurers (ACLI). Non-Freddie Mac data is not yet available for the fourth quarter of 2016. 0.89% 0.19%

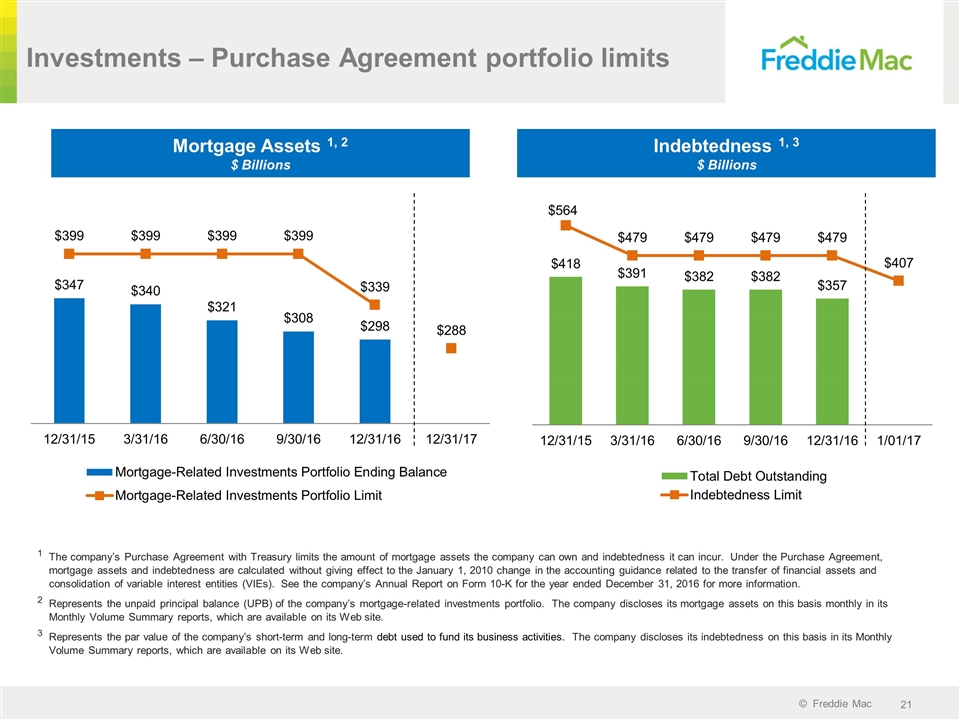

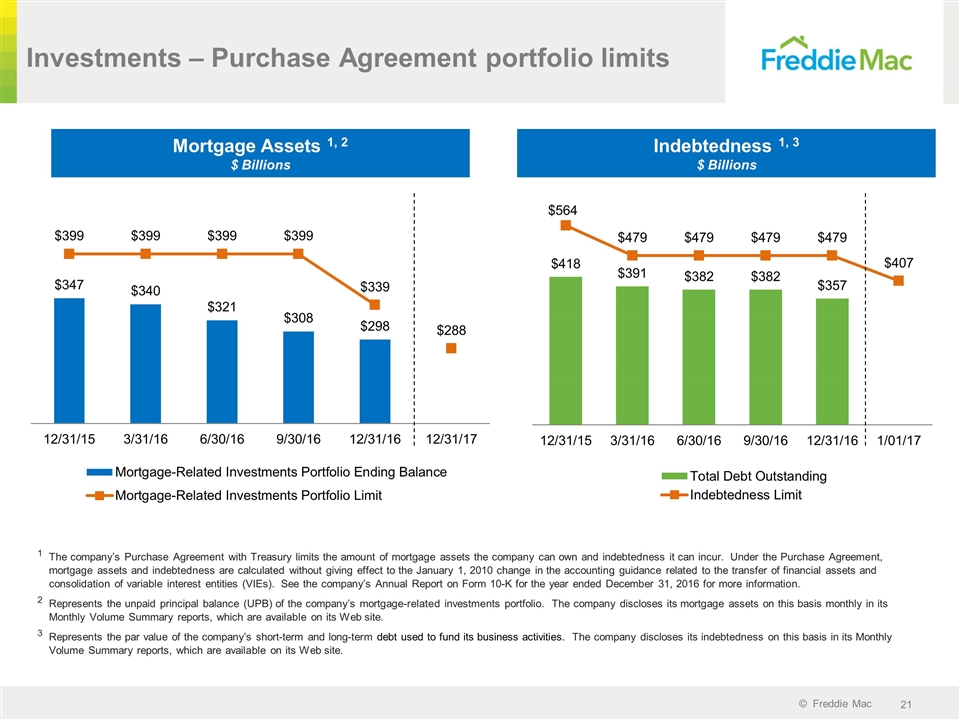

Investments – Purchase Agreement portfolio limits Indebtedness 1, 3 $ Billions Mortgage Assets 1, 2 $ Billions 1 The company’s Purchase Agreement with Treasury limits the amount of mortgage assets the company can own and indebtedness it can incur. Under the Purchase Agreement, mortgage assets and indebtedness are calculated without giving effect to the January 1, 2010 change in the accounting guidance related to the transfer of financial assets and consolidation of variable interest entities (VIEs). See the company’s Annual Report on Form 10-K for the year ended December 31, 2016 for more information. 2 Represents the unpaid principal balance (UPB) of the company’s mortgage-related investments portfolio. The company discloses its mortgage assets on this basis monthly in its Monthly Volume Summary reports, which are available on its Web site. 3 Represents the par value of the company’s short-term and long-term debt used to fund its business activities. The company discloses its indebtedness on this basis in its Monthly Volume Summary reports, which are available on its Web site.

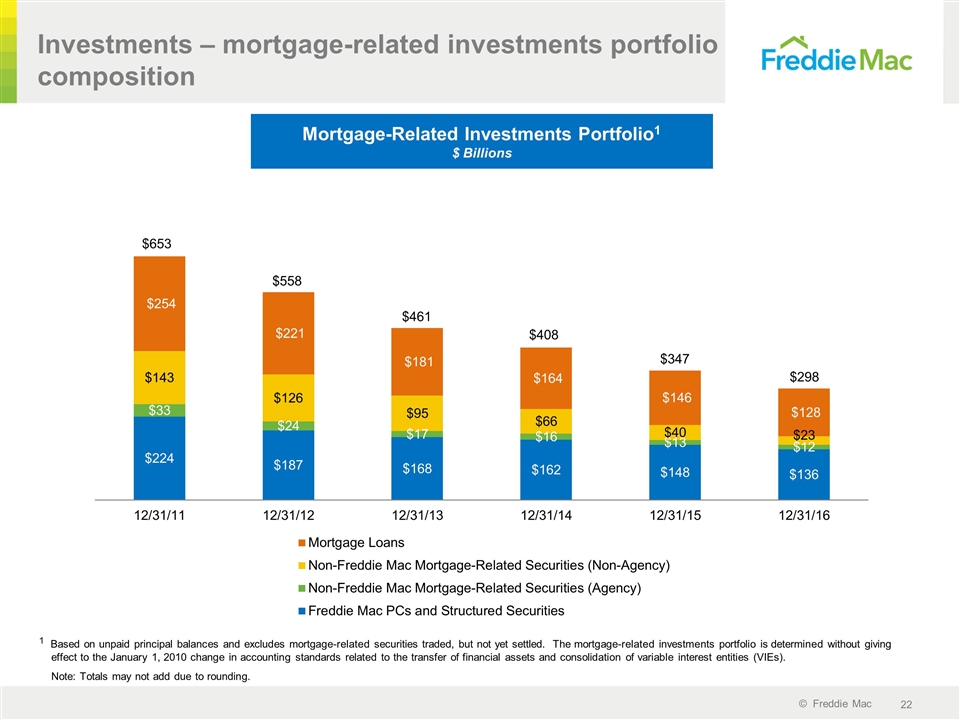

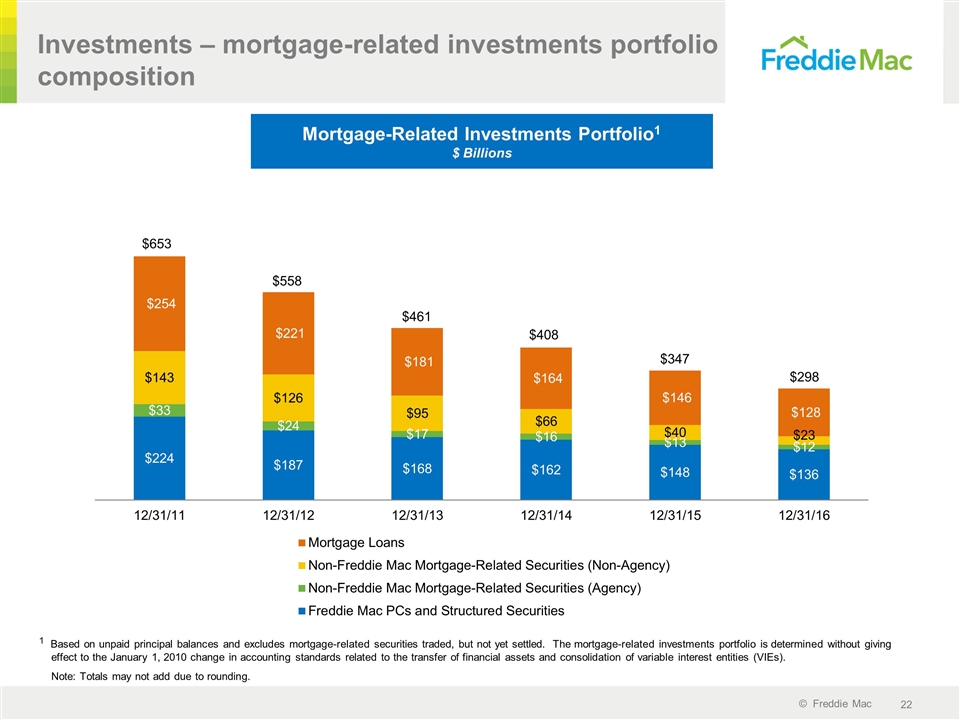

1 Based on unpaid principal balances and excludes mortgage-related securities traded, but not yet settled. The mortgage-related investments portfolio is determined without giving effect to the January 1, 2010 change in accounting standards related to the transfer of financial assets and consolidation of variable interest entities (VIEs). Note: Totals may not add due to rounding. Investments – mortgage-related investments portfolio composition Mortgage-Related Investments Portfolio1 $ Billions $653 $558 $461 $408 $347 $298

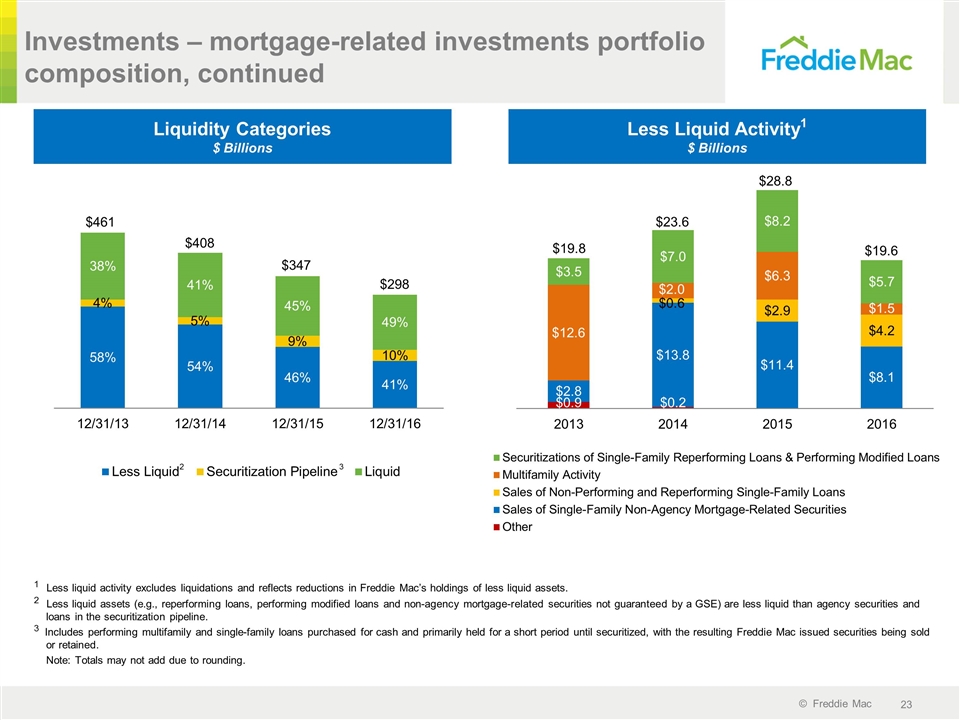

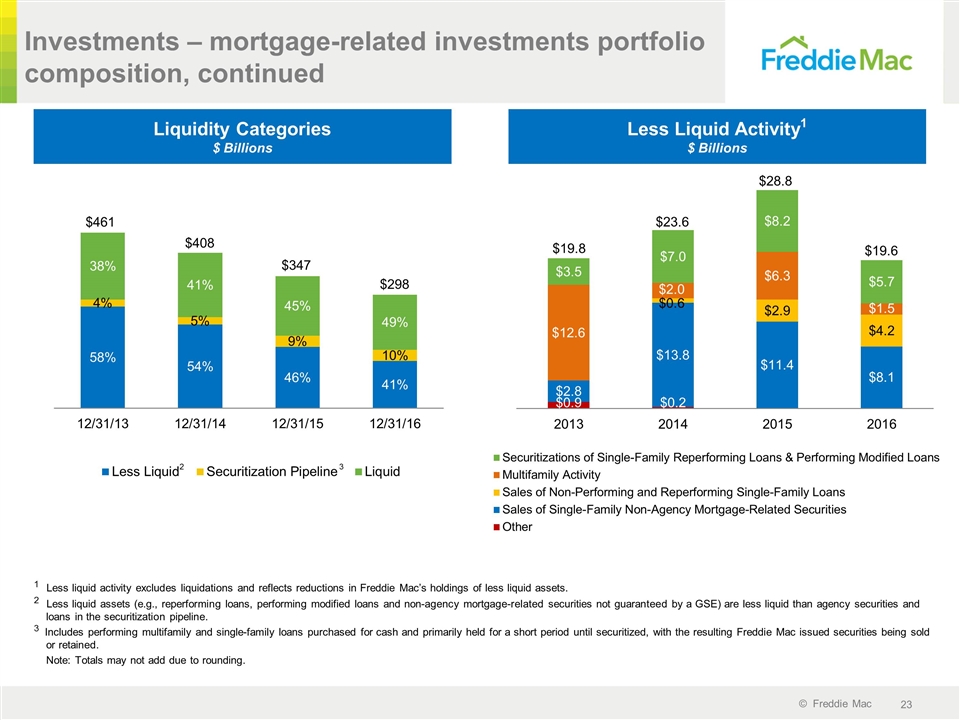

Investments – mortgage-related investments portfolio composition, continued Liquidity Categories $ Billions 1 Less liquid activity excludes liquidations and reflects reductions in Freddie Mac’s holdings of less liquid assets. 2 Less liquid assets (e.g., reperforming loans, performing modified loans and non-agency mortgage-related securities not guaranteed by a GSE) are less liquid than agency securities and loans in the securitization pipeline. 3 Includes performing multifamily and single-family loans purchased for cash and primarily held for a short period until securitized, with the resulting Freddie Mac issued securities being sold or retained. Note: Totals may not add due to rounding. Less Liquid Activity1 $ Billions $19.8 $23.6 $28.8 $408 $347 $461 2 $19.6 $298

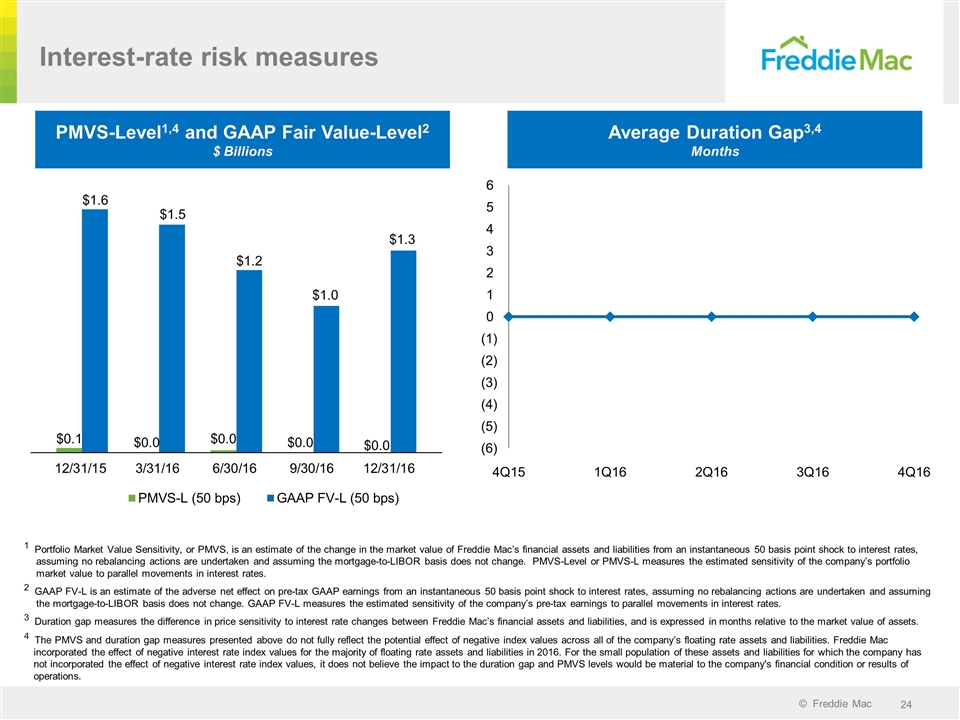

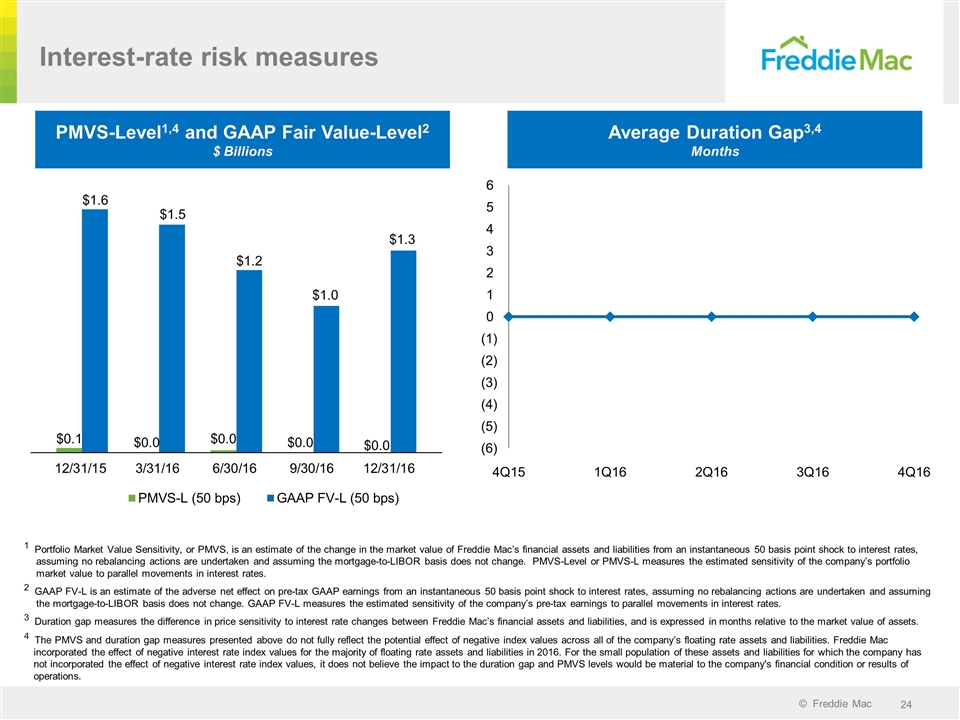

1 Portfolio Market Value Sensitivity, or PMVS, is an estimate of the change in the market value of Freddie Mac’s financial assets and liabilities from an instantaneous 50 basis point shock to interest rates, assuming no rebalancing actions are undertaken and assuming the mortgage-to-LIBOR basis does not change. PMVS-Level or PMVS-L measures the estimated sensitivity of the company’s portfolio market value to parallel movements in interest rates. 2 GAAP FV-L is an estimate of the adverse net effect on pre-tax GAAP earnings from an instantaneous 50 basis point shock to interest rates, assuming no rebalancing actions are undertaken and assuming the mortgage-to-LIBOR basis does not change. GAAP FV-L measures the estimated sensitivity of the company’s pre-tax earnings to parallel movements in interest rates. 3 Duration gap measures the difference in price sensitivity to interest rate changes between Freddie Mac’s financial assets and liabilities, and is expressed in months relative to the market value of assets. 4 The PMVS and duration gap measures presented above do not fully reflect the potential effect of negative index values across all of the company’s floating rate assets and liabilities. Freddie Mac incorporated the effect of negative interest rate index values for the majority of floating rate assets and liabilities in 2016. For the small population of these assets and liabilities for which the company has not incorporated the effect of negative interest rate index values, it does not believe the impact to the duration gap and PMVS levels would be material to the company's financial condition or results of operations. Interest-rate risk measures PMVS-Level1,4 and GAAP Fair Value-Level2 $ Billions Average Duration Gap3,4 Months $1.6 $1.5 $1.2 $1.0 $0.1 $0.0 $0.0 $0.0 $1.3 $0.0

Safe Harbor Statements Freddie Mac obligations Freddie Mac’s securities are obligations of Freddie Mac only. The securities, including any interest or return of discount on the securities, are not guaranteed by and are not debts or obligations of the United States or any federal agency or instrumentality other than Freddie Mac. No offer or solicitation of securities This presentation includes information related to, or referenced in the offering documentation for, certain Freddie Mac securities, including offering circulars and related supplements and agreements. Freddie Mac securities may not be eligible for offer or sale in certain jurisdictions or to certain persons. This information is provided for your general information only, is current only as of its specified date and does not constitute an offer to sell or a solicitation of an offer to buy securities. The information does not constitute a sufficient basis for making a decision with respect to the purchase or sale of any security. All information regarding or relating to Freddie Mac securities is qualified in its entirety by the relevant offering circular and any related supplements. Investors should review the relevant offering circular and any related supplements before making a decision with respect to the purchase or sale of any security. In addition, before purchasing any security, please consult your legal and financial advisors for information about and analysis of the security, its risks and its suitability as an investment in your particular circumstances. Forward-looking statements Freddie Mac's presentations may contain forward-looking statements, which may include statements pertaining to the conservatorship, the company’s current expectations and objectives for its Single-family Guarantee, Multifamily and Investments segments, its efforts to assist the housing market, liquidity and capital management, economic and market conditions and trends, market share, the effect of legislative and regulatory developments and new accounting guidance, credit quality of loans the company guarantees, the costs and benefits of the company’s credit risk transfer transactions, and results of operations and financial condition on a GAAP, Segment Earnings, non-GAAP and fair value basis. Forward-looking statements involve known and unknown risks and uncertainties, some of which are beyond the company’s control. Management’s expectations for the company’s future necessarily involve a number of assumptions, judgments and estimates, and various factors, including changes in market conditions, liquidity, mortgage spreads, credit outlook, actions by the U.S. government (including FHFA, Treasury and Congress), and the impacts of legislation or regulations and new or amended accounting guidance, could cause actual results to differ materially from these expectations. These assumptions, judgments, estimates and factors are discussed in the company’s Annual Report on Form 10-K for the year ended December 31, 2016, which is available on the Investor Relations page of the company’s Web site at www.FreddieMac.com/investors and the SEC’s Web site at www.sec.gov. The company undertakes no obligation to update forward-looking statements it makes to reflect events or circumstances occurring after the date of this presentation.