UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File No. 811-07909

CREDIT SUISSE SMALL CAP GROWTH FUND, INC.

(Exact Name of Registrant as Specified in Charter)

466 Lexington Avenue, New York, New York 10017-3140

(Address of Principal Executive Offices) (Zip Code)

J. Kevin Gao, Esq.

Credit Suisse Small Cap Growth Fund, Inc.

466 Lexington Avenue

New York, New York 10017-3140

Registrant’s telephone number, including area code: (212) 875-3500

Date of fiscal year end: October 31

Date of reporting period: November 1, 2005 to April 30, 2006

Item 1. Reports to Stockholders.

CREDIT SUISSE FUNDS

Semiannual Report

April 30, 2006

(unaudited)

n CREDIT SUISSE

CAPITAL APPRECIATION FUND

n CREDIT SUISSE

MID-CAP GROWTH FUND

n CREDIT SUISSE

SMALL CAP GROWTH FUND

The Funds' investment objectives, risks, charges and expenses (which should be considered carefully before investing), and more complete information about the the Funds, are provided in the Prospectus, which should be read carefully before investing. You may obtain additional copies by calling 800-927-2874 or by writing to Credit Suisse Funds, P.O. Box 55030, Boston, MA 02205-5030.

Credit Suisse Asset Management Securities, Inc., Distributor, is located at 466 Lexington Ave., New York, NY 10017-3140. Credit Suisse Funds are advised by Credit Suisse Asset Management, LLC.

Investors in the Credit Suisse Funds should be aware that they may be eligible to purchase Common Class and/or Advisor Class shares (where offered) directly or through certain intermediaries. Such shares are not subject to a sales charge but may be subject to an ongoing service and distribution fee of up to 0.50% of average daily net assets. Investors in the Credit Suisse Funds should also be aware that they may be eligible for a reduction or waiver of the sales charge with respect to Class A, B or C shares. For more information, please review the relevant prospectuses or consult your financial representative.

The views of the Funds' management are as of the date of the letter and Fund holdings described in this document are as of April 30, 2006; these views and Fund holdings may have changed subsequent to these dates. Nothing in this document is a recommendation to purchase or sell securities.

Fund shares are not deposits or other obligations of Credit Suisse Asset Management, LLC ("Credit Suisse") or any affiliate, are not FDIC-insured and are not guaranteed by Credit Suisse or any affiliate. Fund investments are subject to investment risks, including loss of your investment.

Credit Suisse Capital Appreciation Fund

Semiannual Investment Adviser's Report

April 30, 2006 (unaudited)

May 31, 2006

Dear Shareholder:

Performance Summary

11/01/05 – 04/30/06

| Fund & Benchmark | | Performance | |

| Common1 | | | 6.95 | % | |

| Advisor1 | | | 6.66 | % | |

| Class A1,2 | | | 6.80 | % | |

| Class B1,2 | | | 6.44 | % | |

| Class C1,2 | | | 6.44 | % | |

| Russell 1000® Growth Index3 | | | 7.06 | % | |

Performance for the Fund's Class A, Class B and Class C Shares is without the maximum sales charge of 5.75%, 4.00% and 1.00%, respectively.2

Market Overview: GDP rebounds, market moves upward

The period was an overall positive one for US equities, supported by economic expansion and optimism over corporate earnings. While fourth quarter 2005 GDP growth was modest compared with earlier quarters, as the economy absorbed a severe hurricane season, growth rebounded: First quarter 2006 GDP rose at its highest quarterly rate in more than two years. Notwithstanding the period immediately following this report, investors' appetite for risk taking remained, in general, healthy during the semiannual period ended April 30, 2006. This occurred during a period of high energy costs, steadily rising interest rates and ongoing political tensions in the Middle East.

Most sectors of the market advanced, led by economically sensitive areas such as energy, materials and producer durables companies. In the large-capitalization area, value stocks outperformed growth stocks. Small-capitalization stocks outpaced larger cap stocks in general, extending a long period of small cap outperformance.

Strategic Review: Focus on company fundamentals

Stocks that aided the Fund's performance in the period included its producer durables, materials and consumer staples holdings. However, this was offset by underperformance from the Fund's health care stocks, including UnitedHealth Group in the managed care area. We decided to eliminate this position in the period, based on concerns about profitability catalysts as well as management compensation issues.

1

Credit Suisse Capital Appreciation Fund

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Our noteworthy recent portfolio activity included establishing a position in Autodesk (0.7% of the Fund's net assets as of April 30, 2006), a provider of software and multimedia tools used in mechanical design and other applications. We believe that the company is entering an upgrade cycle, from two-dimensional to three-dimensional products, that could support sales and income growth for an extended period.

In addition to UnitedHealth, our other sales included American International Group, a globally oriented financial services company specializing in insurance. We believe that the stock price had risen to fully reflect the company's emergence from previous difficulties.

Going forward, we will continue to adhere to our general strategy of seeking sectors and companies with the potential to outperform the overall market. We look for stocks available at a reasonable price relative to projected growth, while employing themes or patterns associated with growth companies, such as significant fundamental changes, generation of large free cash flows or company share-buyback programs.

Marian U. Pardo

Jeffrey T. Rose

The value of investments generally will fluctuate in response to market movements.

In addition to historical information, this report contains forward-looking statements, which may concern, among other things, domestic and foreign market, industry and economic trends and developments and government regulation and their potential impact on the Fund's investment portfolio. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future and their impact on the Fund could be materially different from that projected, anticipated or implied. The Fund has no obligation to update or revise forward-looking statements.

2

Credit Suisse Capital Appreciation Fund

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Average Annual Returns as of March 31, 20061

| | | 1 Year | | 5 Years | | 10 Years | | Since

Inception | | Inception

Date | |

| Common Class | | | 12.80 | % | | | (2.20 | )% | | | 7.05 | % | | | 9.38 | % | | 08/17/87 | |

| Advisor Class | | | 12.24 | % | | | (2.68 | )% | | | 6.53 | % | | | 9.06 | % | | 04/04/91 | |

Class A Without

Sales Charge | | | 12.48 | % | | | — | | | | — | | | | (0.34 | )% | | 11/30/01 | |

Class A With Maximum

Sales Charge | | | 6.00 | % | | | — | | | | — | | | | (1.69 | )% | | 11/30/01 | |

| Class B Without CDSC | | | 11.67 | % | | | — | | | | — | | | | (1.07 | )% | | 11/30/01 | |

| Class B With CDSC | | | 7.67 | % | | | — | | | | — | | | | (1.07 | )% | | 11/30/01 | |

| Class C Without CDSC | | | 11.68 | % | | | — | | | | — | | | | (1.08 | )% | | 11/30/01 | |

| Class C With CDSC | | | 10.68 | % | | | — | | | | — | | | | (1.08 | )% | | 11/30/01 | |

Average Annual Returns as of April 30, 20061

| | | 1 Year | | 5 Years | | 10 Years | | Since

Inception | | Inception

Date | |

| Common Class | | | 14.45 | % | | | (3.82 | )% | | | 6.89 | % | | | 9.32 | % | | 08/17/87 | |

| Advisor Class | | | 13.89 | % | | | (4.31 | )% | | | 6.37 | % | | | 8.98 | % | | 04/04/91 | |

Class A Without

Sales Charge | | | 14.21 | % | | | — | | | | — | | | | (0.40 | )% | | 11/30/01 | |

Class A With Maximum

Sales Charge | | | 7.65 | % | | | — | | | | — | | | | (1.72 | )% | | 11/30/01 | |

| Class B Without CDSC | | | 13.30 | % | | | — | | | | — | | | | (1.14 | )% | | 11/30/01 | |

| Class B With CDSC | | | 9.30 | % | | | — | | | | — | | | | (1.14 | )% | | 11/30/01 | |

| Class C Without CDSC | | | 13.30 | % | | | — | | | | — | | | | (1.14 | )% | | 11/30/01 | |

| Class C With CDSC | | | 12.30 | % | | | — | | | | — | | | | (1.14 | )% | | 11/30/01 | |

Returns represent past performance and include change in share price and reinvestment of dividends and capital gains. Past performance cannot guarantee future results. The current performance of the Fund may be lower or higher than the figures shown. Returns and share price will fluctuate, and redemption value may be less than original cost. The performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance information current to the most recent month-end is available at www.credit-suisse.com/us.

1 Fee waivers and/or expense reimbursements may reduce expenses for the Fund, without which performance would be lower. Waivers may be discontinued at any time.

2 Total return for the Fund's Class A Shares for the reporting period, based on offering price (with maximum sales charge of 5.75%), was 0.63%. Total return for the Fund's Class B Shares for the reporting period, based on redemption value (including maximum contingent deferred sales charge of 4%), was 2.44%. Total return for the Fund's Class C Shares for the reporting period, based on redemption value (including maximum contingent deferred sales charge of 1%), was 5.44%.

3 The Russell 1000® Growth Index measures the performance of those companies in the Russell 1000® Index with higher price-to-book ratios and higher forecasted growth values. It is an unmanaged index of common stocks that includes reinvestment of dividends and is compiled by Frank Russell Company. Investors cannot invest directly in an index.

3

Credit Suisse Capital Appreciation Fund

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Information About Your Fund's Expenses

As an investor of the Fund, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Fund expenses. Examples of transaction costs include sales charges (loads), redemption fees and account maintenance fees, which are not shown in this section and which would result in higher total expenses. The following table is intended to help you understand your ongoing expenses of investing in the Fund and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The table is based on an investment of $1,000 made at the beginning of the six month period ended April 30, 2006.

The table illustrates your Fund's expenses in two ways:

• Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses paid on a $1,000 investment in the Fund using the Fund's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

• Hypothetical 5% Fund Return. This helps you to compare your Fund's ongoing expenses with those of other mutual funds using the Fund's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs had been included, your costs would have been higher. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expenses of owning different funds.

4

Credit Suisse Capital Appreciation Fund

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Expenses and Value of a $1,000 Investment

for the six month period ended April 30, 2006

| Actual Fund Return | | Common

Class | | Advisor

Class | | Class A | | Class B | | Class C | |

Beginning Account

Value 11/1/05 | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending Account

Value 4/30/06 | | $ | 1,069.50 | | | $ | 1,066.60 | | | $ | 1,068.00 | | | $ | 1,064.40 | | | $ | 1,064.40 | | |

| Expenses Paid per $1,000* | | $ | 6.36 | | | $ | 8.92 | | | $ | 7.64 | | | $ | 11.47 | | | $ | 11.47 | | |

Hypothetical 5%

Fund Return | |

Beginning Account

Value 11/1/05 | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending Account

Value 4/30/06 | | $ | 1,018.65 | | | $ | 1,016.17 | | | $ | 1,017.41 | | | $ | 1,013.69 | | | $ | 1,013.69 | | |

| Expenses Paid per $1,000* | | $ | 6.21 | | | $ | 8.70 | | | $ | 7.45 | | | $ | 11.18 | | | $ | 11.18 | | |

| | Common

Class | | Advisor

Class | | Class A | | Class B | | Class C | |

| Annualized Expense Ratios* | | | 1.24 | % | | | 1.74 | % | | | 1.49 | % | | | 2.24 | % | | | 2.24 | % | |

* Expenses are equal to the Fund's annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year period, then divided by 365.

The "Expenses Paid per $1,000" and the "Annualized Expense Ratios" in the tables are based on actual expenses paid by the Fund during the period, net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Fund's actual expenses would have been higher.

For more information, please refer to the Fund's prospectus.

5

Credit Suisse Capital Appreciation Fund

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

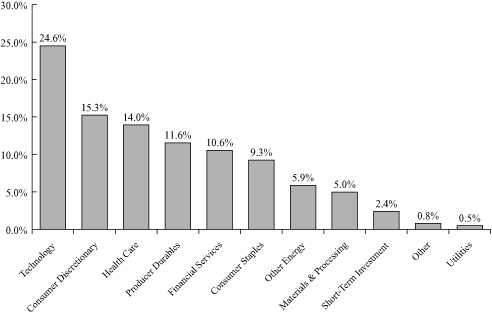

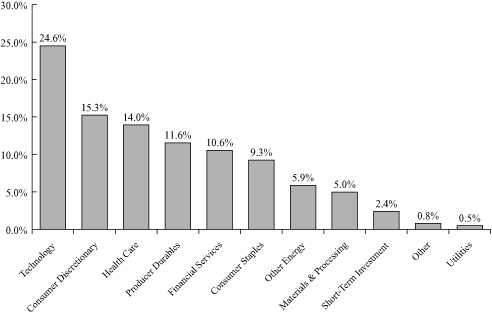

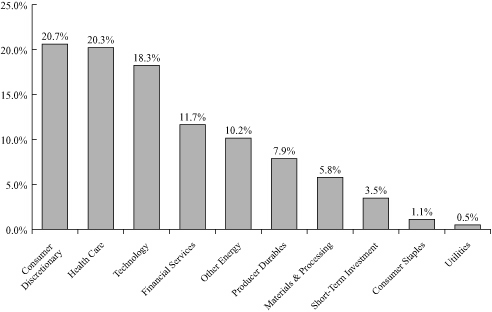

SECTOR BREAKDOWN*

* Expressed as a percentage of total investments (excluding security lending collateral) and may vary over time.

6

Credit Suisse Mid-Cap Growth Fund

Semiannual Investment Adviser's Report

April 30, 2006 (unaudited)

May 31, 2006

Dear Shareholder:

Performance Summary

11/01/05 – 04/30/06

| Fund & Benchmark | | Performance | |

| Common1 | | | 11.02 | % | |

| Advisor1 | | | 10.77 | % | |

| Class A1,2 | | | 10.90 | % | |

| Class B1,2 | | | 10.51 | % | |

| Class C1,2 | | | 10.51 | % | |

| Russell 2500(TM) Growth Index3 | | | 19.12 | % | |

| Russell Midcap® Growth Index4 | | | 15.50 | % | |

Performance for the Fund's Class A, Class B and Class C Shares is without the maximum sales charge of 5.75%, 4.00% and 1.00%, respectively.2

Market Overview: GDP rebounds, market moves upward

The period was an overall positive one for US equities, supported by economic expansion and optimism over corporate earnings. While fourth quarter 2005 GDP growth was modest compared with earlier quarters, as the economy absorbed a severe hurricane season, growth rebounded: First quarter 2006 GDP rose at its highest quarterly rate in more than two years. Notwithstanding the period immediately following this report, investors' appetite for risk taking remained, in general, healthy during the semiannual period ended April 30, 2006. This occurred during a period of high energy costs, steadily rising interest rates and ongoing political tensions in the Middle East.

Most sectors of the market advanced, led by economically sensitive areas such as energy, materials and producer durables companies. Small and mid-capitalization stocks outperformed large-cap stocks, and performance among smaller-cap growth stocks was especially robust.

Strategic Review: Focus on company fundamentals

The Fund participated in the strong rally among mid-cap growth stocks, though it underperformed its benchmarks, in part because smaller companies in the benchmarks outperformed and we had more emphasis on relatively large companies. Stocks that hindered the Fund's performance included its health care holdings, in particular a pharmaceutical company that fell sharply on disappointing results. We opted to eliminate this position in the period, based on our view of its growth prospects going forward. The Fund's technology and

7

Credit Suisse Mid-Cap Growth Fund

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

financial services holdings, while positive in absolute terms, underperformed their respective components within the Fund's benchmarks. On the positive side in terms of relative return, the Fund was aided by good stock selection in the producer durables and energy sectors.

With regard to recent portfolio activity, noteworthy purchases we made included American Tower (1.7% of the Fund's net assets as of April 30, 2006), an owner/operator of cell-phone towers. We think that the company is well positioned to benefit from consolidation and growth within the cell-phone industry, factors that could drive space-leasing rates higher over time. Our late-period sales included Chemtura, due to our concerns regarding integration difficulties as the company merged with Great Lakes Chemical.

Going forward, we will continue to seek to identify companies with attractive capital-growth potential. Our stock-selection process emphasizes companies we believe to have accelerating earnings, improving fundamentals, competent management and compelling business models, including companies still in their developmental stage as well as older companies that appear to be entering a new stage of growth.

The Credit Suisse Mid-Cap Growth Team

Marian U. Pardo

Leo M. Bernstein

Calvin E. Chung

Eric M. Wiegand

Investing in small to medium-sized companies may be more volatile and less liquid than investments in larger companies.

In addition to historical information, this report contains forward-looking statements, which may concern, among other things, domestic and foreign market, industry and economic trends and developments and government regulation and their potential impact on the Fund's investment portfolio. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future and their impact on the Fund could be materially different from that projected, anticipated or implied. The Fund has no obligation to update or revise forward-looking statements.

8

Credit Suisse Mid-Cap Growth Fund

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Average Annual Returns as of March 31, 20061

| | |

1 Year | | 5 Years | | 10 Years | | Since

Inception | | Inception

Date | |

| Common Class | | | 15.65 | % | | | 6.34 | % | | | 5.19 | % | | | 10.94 | % | | 01/21/88 | |

| Advisor Class | | | 15.07 | % | | | 5.80 | % | | | 4.69 | % | | | 9.26 | % | | 04/04/91 | |

Class A Without

Sales Charge | | | 15.35 | % | | | — | | | | — | | | | 7.03 | % | | 11/30/01 | |

Class A With Maximum

Sales Charge | | | 8.72 | % | | | — | | | | — | | | | 5.58 | % | | 11/30/01 | |

| Class B Without CDSC | | | 14.50 | % | | | — | | | | — | | | | 8.14 | % | | 02/27/04 | |

| Class B With CDSC | | | 10.50 | % | | | — | | | | — | | | | 7.25 | % | | 02/27/04 | |

| Class C Without CDSC | | | 14.54 | % | | | — | | | | — | | | | 8.14 | % | | 02/27/04 | |

| Class C With CDSC | | | 13.54 | % | | | — | | | | — | | | | 8.14 | % | | 02/27/04 | |

Average Annual Returns as of April 30, 20061

| | | 1 Year | | 5 Years | | 10 Years | | Since

Inception | | Inception

Date | |

| Common Class | | | 19.88 | % | | | 3.80 | % | | | 4.32 | % | | | 10.87 | % | | 01/21/88 | |

| Advisor Class | | | 19.29 | % | | | 3.28 | % | | | 3.83 | % | | | 9.18 | % | | 04/04/91 | |

Class A Without

Sales Charge | | | 19.61 | % | | | — | | | | — | | | | 6.83 | % | | 11/30/01 | |

Class A With Maximum

Sales Charge | | | 12.74 | % | | | — | | | | — | | | | 5.41 | % | | 11/30/01 | |

| Class B Without CDSC | | | 18.69 | % | | | — | | | | — | | | | 7.66 | % | | 02/27/04 | |

| Class B With CDSC | | | 14.69 | % | | | — | | | | — | | | | 6.81 | % | | 02/27/04 | |

| Class C Without CDSC | | | 18.78 | % | | | — | | | | — | | | | 7.66 | % | | 02/27/04 | |

| Class C With CDSC | | | 17.78 | % | | | — | | | | — | | | | 7.66 | % | | 02/27/04 | |

Returns represent past performance and include change in share price and reinvestment of dividends and capital gains. Past performance cannot guarantee future results. The current performance of the Fund may be lower or higher than the figures shown. Returns and share price will fluctuate, and redemption value may be less than original cost. The performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance information current to the most recent month-end is available at www.credit-suisse.com/us.

1 Fee waivers and/or expense reimbursements may reduce expenses for the Fund, without which performance would be lower. Waivers may be discontinued at any time.

2 Total return for the Fund's Class A Shares for the reporting period, based on offering price (with maximum sales charge of 5.75%), was 4.52%. Total return for the Fund's Class B Shares for the reporting period, based on redemption value (including maximum contingent deferred sales charge of 4%), was 6.51%. Total return for the Fund's Class C Shares for the reporting period, based on redemption value (including maximum contingent deferred sales charge of 1%), was 9.51%.

3 The Russell 2500(TM) Growth Index measures the performance of those companies in the Russell 2500(TM) Index with higher price-to-book ratios and higher forecasted growth values. It is an unmanaged index of common stocks that includes reinvestment of dividends and is compiled by Frank Russell Company. Investors cannot invest directly in an index.

4 The Russell Midcap® Growth Index measures the performance of those companies in the Russell Midcap® Index with higher price-to-book ratios and higher forecasted growth values. The stocks are also members of the Russell 1000® Growth Index. It is an unmanaged index of common stocks that includes reinvestment of dividends and compiled by Frank Russell Company. Investors cannot invest directly in an index.

9

Credit Suisse Mid-Cap Growth Fund

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Information About Your Fund's Expenses

As an investor of the Fund, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Fund expenses. Examples of transaction costs include sales charges (loads), redemption fees and account maintenance fees, which are not shown in this section and which would result in higher total expenses. The following table is intended to help you understand your ongoing expenses of investing in the Fund and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The table is based on an investment of $1,000 made at the beginning of the six month period ended April 30, 2006.

The table illustrates your Fund's expenses in two ways:

• Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses paid on a $1,000 investment in the Fund using the Fund's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

• Hypothetical 5% Fund Return. This helps you to compare your Fund's ongoing expenses with those of other mutual funds using the Fund's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs had been included, your costs would have been higher. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expenses of owning different funds.

10

Credit Suisse Mid-Cap Growth Fund

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Expenses and Value of a $1,000 Investment

for the six month period ended April 30, 2006

| Actual Fund Return | | Common

Class | | Advisor

Class | | Class A | | Class B | | Class C | |

Beginning Account

Value 11/1/05 | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending Account

Value 4/30/06 | | $ | 1,110.20 | | | $ | 1,107.70 | | | $ | 1,109.00 | | | $ | 1,105.10 | | | $ | 1,105.10 | | |

| Expenses Paid per $1,000* | | $ | 7.32 | | | $ | 9.93 | | | $ | 8.63 | | | $ | 12.53 | | | $ | 12.53 | | |

Hypothetical 5%

Fund Return | |

Beginning Account

Value 11/1/05 | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending Account

Value 4/30/06 | | $ | 1,017.85 | | | $ | 1,015.37 | | | $ | 1,016.61 | | | $ | 1,012.89 | | | $ | 1,012.89 | | |

| Expenses Paid per $1,000* | | $ | 7.00 | | | $ | 9.49 | | | $ | 8.25 | | | $ | 11.98 | | | $ | 11.98 | | |

| | Common

Class | | Advisor

Class | | Class A | | Class B | | Class C | |

| Annualized Expense Ratios* | | | 1.40 | % | | | 1.90 | % | | | 1.65 | % | | | 2.40 | % | | | 2.40 | % | |

* Expenses are equal to the Fund's annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year period, then divided by 365.

The "Expenses Paid per $1,000" and the "Annualized Expense Ratios" in the tables are based on actual expenses paid by the Fund during the period, net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Fund's actual expenses would have been higher.

For more information, please refer to the Fund's prospectus.

11

Credit Suisse Mid-Cap Growth Fund

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

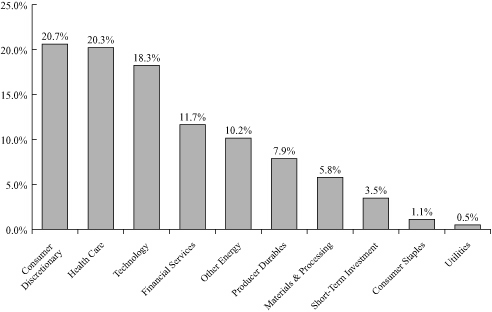

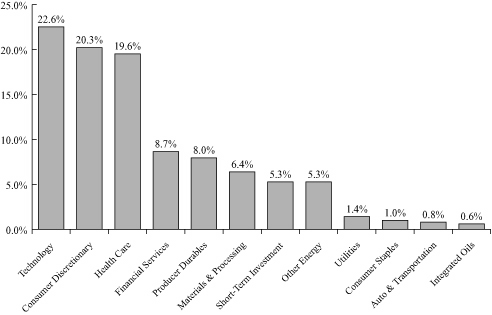

SECTOR BREAKDOWN*

* Expressed as a percentage of total investments (excluding security lending collateral) and may vary over time.

12

Credit Suisse Small Cap Growth Fund

Semiannual Investment Adviser's Report

April 30, 2006 (unaudited)

May 31, 2006

Dear Shareholder:

Performance Summary

11/01/05 – 04/30/06

| Fund & Benchmark | | Performance | |

| Common1 | | | 15.87 | % | |

| Advisor1 | | | 15.65 | % | |

| Class A1,2 | | | 15.87 | % | |

| Class B1,2 | | | 15.44 | % | |

| Class C1,2 | | | 15.54 | % | |

| Russell 2000® Growth Index3 | | | 20.31 | % | |

Performance for the Fund's Class A, Class B and Class C Shares is without the maximum sales charge of 5.75%, 4.00% and 1.00%, respectively.2

Effective April 5, 2006, Laura Granger is responsible for the day-to-day management of the Fund.

Market Overview: GDP rebounds, market moves upward

The period was an overall positive one for US equities, supported by economic expansion and optimism over corporate earnings. While fourth quarter 2005 GDP growth was modest compared with earlier quarters, as the economy absorbed a severe hurricane season, growth rebounded: First quarter 2006 GDP rose at its highest quarterly rate in more than two years. Notwithstanding the period immediately following this report, investors' appetite for risk taking remained, in general, healthy during the semiannual period ended April 30, 2006. This occurred during a period of high energy costs, steadily rising interest rates and ongoing political tensions in the Middle East.

Most sectors of the market advanced, led by economically sensitive areas such as energy, materials and producer durables companies. Smaller-capitalization stocks outperformed large-cap stocks, and performance among small-cap growth stocks was especially robust.

Strategic Review: Focus on company fundamentals

The Fund participated in the strong performance of small-cap growth stocks, though it trailed its benchmark, in part due to weakness in certain health care holdings. These included two pharmaceutical stocks that declined sharply in the period. We decided to eliminate our positions in both companies, based on their growth prospects over the intermediate term. Stocks that aided the Fund's

13

Credit Suisse Small Cap Growth Fund

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

absolute and relative return in the period included its consumer discretionary and financial services holdings.

Going forward, we will continue to seek to identify companies with attractive capital-growth potential. Our stock-selection process emphasizes companies we believe to have accelerating earnings, improving fundamentals, competent management and compelling business models, and includes companies still in their developmental stage as well as older companies that appear to be entering a new stage of growth. Our general strategy is focused on a company's longer-term prospects, though we also attempt to identify stocks we feel are poised to benefit from specific market catalysts over the nearer term.

Laura Granger

Portfolio Manager

Because of the nature of the Fund's investments in special-situation, start-up and other small companies, an investment in the fund may be more volatile and less liquid than investments in larger companies.

In addition to historical information, this report contains forward-looking statements, which may concern, among other things, domestic and foreign market, industry and economic trends and developments and government regulation and their potential impact on the Fund's investment portfolio. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future and their impact on the Fund could be materially different from that projected, anticipated or implied. The Fund has no obligation to update or revise forward-looking statements.

14

Credit Suisse Small Cap Growth Fund

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Average Annual Returns as of March 31, 20061

| | | 1 Year | | 5 Years | | Since

Inception | | Inception

Date | |

| Common Class | | | 18.20 | % | | | 7.57 | % | | | 9.92 | % | | 12/31/96 | |

| Advisor Class | | | 17.57 | % | | | — | | | | 7.55 | % | | 02/27/04 | |

Class A Without

Sales Charge | | | 18.14 | % | | | — | | | | 7.53 | % | | 11/30/01 | |

Class A With Maximum

Sales Charge | | | 11.37 | % | | | — | | | | 6.07 | % | | 11/30/01 | |

| Class B Without CDSC | | | 17.31 | % | | | — | | | | 7.30 | % | | 02/27/04 | |

| Class B With CDSC | | | 13.31 | % | | | — | | | | 6.41 | % | | 02/27/04 | |

| Class C Without CDSC | | | 17.52 | % | | | — | | | | 7.39 | % | | 02/27/04 | |

| Class C With CDSC | | | 16.52 | % | | | — | | | | 7.39 | % | | 02/27/04 | |

Average Annual Returns as of April 30, 20061

| | | 1 Year | | 5 Years | | Since

Inception | | Inception

Date | |

| Common Class | | | 23.93 | % | | | 4.29 | % | | | 9.58 | % | | 12/31/96 | |

| Advisor Class | | | 23.29 | % | | | — | | | | 6.19 | % | | 02/27/04 | |

Class A Without

Sales Charge | | | 23.86 | % | | | — | | | | 6.86 | % | | 11/30/01 | |

Class A With Maximum

Sales Charge | | | 16.77 | % | | | — | | | | 5.44 | % | | 11/30/01 | |

| Class B Without CDSC | | | 23.03 | % | | | — | | | | 5.95 | % | | 02/27/04 | |

| Class B With CDSC | | | 19.03 | % | | | — | | | | 5.09 | % | | 02/27/04 | |

| Class C Without CDSC | | | 23.19 | % | | | — | | | | 6.02 | % | | 02/27/04 | |

| Class C With CDSC | | | 22.19 | % | | | — | | | | 6.02 | % | | 02/27/04 | |

Returns represent past performance and include change in share price and reinvestment of dividends and capital gains. Past performance cannot guarantee future results. The current performance of the Fund may be lower or higher than the figures shown. Returns and share price will fluctuate, and redemption value may be less than original cost. The performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance information current to the most recent month-end is available at www.credit-suisse.com/us.

1 Fee waivers and/or expense reimbursements may reduce expenses for the Fund, without which performance would be lower. Waivers may be discontinued at any time.

2 Total return for the Fund's Class A Shares for the reporting period, based on offering price (with maximum sales charge of 5.75%), was 9.22%. Total return for the Fund's Class B Shares for the reporting period, based on redemption value (including maximum contingent deferred sales charge of 4%), was 11.44%. Total return for the Fund's Class C Shares for the reporting period, based on redemption value (including maximum contingent deferred sales charge of 1%), was 14.54%.

3 The Russell 2000® Growth Index measures the performance of those companies in the Russell 2000® Index with higher price-to-book ratios and higher forecasted growth values. It is an unmanaged index of common stocks that includes reinvestment of dividends and is compiled by Frank Russell Company. Investors cannot invest directly in an index.

15

Credit Suisse Small Cap Growth Fund

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Information About Your Fund's Expenses

As an investor of the Fund, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Fund expenses. Examples of transaction costs include sales charges (loads), redemption fees and account maintenance fees, which are not shown in this section and which would result in higher total expenses. The following table is intended to help you understand your ongoing expenses of investing in the Fund and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The table is based on an investment of $1,000 made at the beginning of the six month period ended April 30, 2006.

The table illustrates your Fund's expenses in two ways:

• Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses paid on a $1,000 investment in the Fund using the Fund's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

• Hypothetical 5% Fund Return. This helps you to compare your Fund's ongoing expenses with those of other mutual funds using the Fund's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs had been included, your costs would have been higher. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expenses of owning different funds.

16

Credit Suisse Small Cap Growth Fund

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

Expenses and Value of a $1,000 Investment

for the six month period ended April 30, 2006

| Actual Fund Return | | Common

Class | | Advisor

Class | | Class A | | Class B | | Class C | |

Beginning Account

Value 11/1/05 | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending Account

Value 4/30/06 | | $ | 1,158.70 | | | $ | 1,156.50 | | | $ | 1,158.70 | | | $ | 1,154.40 | | | $ | 1,155.40 | | |

| Expenses Paid per $1,000* | | $ | 7.49 | | | $ | 8.82 | | | $ | 7.49 | | | $ | 11.48 | | | $ | 11.49 | | |

Hypothetical 5%

Fund Return | |

Beginning Account

Value 11/1/05 | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending Account

Value 4/30/06 | | $ | 1,017.85 | | | $ | 1,016.61 | | | $ | 1,017.85 | | | $ | 1,014.13 | | | $ | 1,014.13 | | |

| Expenses Paid per $1,000* | | $ | 7.00 | | | $ | 8.25 | | | $ | 7.00 | | | $ | 10.74 | | | $ | 10.74 | | |

| | Common

Class | | Advisor

Class | | Class A | | Class B | | Class C | |

| Annualized Expense Ratios* | | | 1.40 | % | | | 1.65 | % | | | 1.40 | % | | | 2.15 | % | | | 2.15 | % | |

* Expenses are equal to the Fund's annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year period, then divided by 365.

The "Expenses Paid per $1,000" and the "Annualized Expense Ratios" in the tables are based on actual expenses paid by the Fund during the period, net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Fund's actual expenses would have been higher.

For more information, please refer to the Fund's prospectus.

17

Credit Suisse Small Cap Growth Fund

Semiannual Investment Adviser's Report (continued)

April 30, 2006 (unaudited)

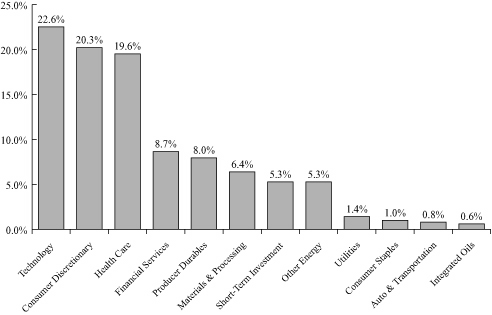

SECTOR BREAKDOWN*

* Expressed as a percentage of total investments (excluding security lending collateral) and may vary over time.

18

Credit Suisse Capital Appreciation Fund

Schedule of Investments

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS (98.0%) | |

| Aerospace & Defense (8.4%) | |

| Boeing Co. | | | 86,800 | | | $ | 7,243,460 | | |

| Lockheed Martin Corp. | | | 48,200 | | | | 3,658,380 | | |

| Precision Castparts Corp. | | | 94,600 | | | | 5,957,908 | | |

| United Technologies Corp. | | | 99,300 | | | | 6,237,033 | | |

| | | | | | | | 23,096,781 | | |

| Banks (3.8%) | |

| Hudson City Bancorp, Inc. | | | 227,000 | | | | 3,044,070 | | |

| Northern Trust Corp. | | | 63,300 | | | | 3,727,737 | | |

| Wells Fargo & Co. | | | 51,500 | | | | 3,537,535 | | |

| | | | | | | | 10,309,342 | | |

| Beverages (3.7%) | |

| Coca-Cola Co. | | | 104,300 | | | | 4,376,428 | | |

| PepsiCo, Inc. | | | 97,600 | | | | 5,684,224 | | |

| | | | | | | | 10,060,652 | | |

| Biotechnology (2.3%) | |

| Genentech, Inc.* | | | 44,000 | | | | 3,507,240 | | |

| Genzyme Corp.* | | | 44,400 | | | | 2,715,504 | | |

| | | | | | | | 6,222,744 | | |

| Chemicals (2.1%) | |

| Monsanto Co. | | | 68,700 | | | | 5,729,580 | | |

| Commercial Services & Supplies (0.8%) | |

| Avery Dennison Corp. | | | 33,500 | | | | 2,093,750 | | |

| Communications Equipment (9.2%) | |

| Cisco Systems, Inc.* | | | 329,700 | | | | 6,907,215 | | |

| Comverse Technology, Inc.* | | | 193,400 | | | | 4,380,510 | | |

| Corning, Inc.* | | | 340,900 | | | | 9,419,067 | | |

| Motorola, Inc. | | | 208,300 | | | | 4,447,205 | | |

| | | | | | | | 25,153,997 | | |

| Computers & Peripherals (3.7%) | |

| Apple Computer, Inc.* | | | 98,000 | | | | 6,898,220 | | |

| EMC Corp.* | | | 247,900 | | | | 3,349,129 | | |

| | | | | | | | 10,247,349 | | |

| Diversified Financials (5.2%) | |

| American Express Co. | | | 81,900 | | | | 4,407,039 | | |

| Morgan Stanley | | | 53,200 | | | | 3,420,760 | | |

| SLM Corp. | | | 64,900 | | | | 3,431,912 | | |

| TD Ameritrade Holding Corp. | | | 168,300 | | | | 3,123,648 | | |

| | | | | | | | 14,383,359 | | |

| Electrical Equipment (0.5%) | |

| Rockwell Automation, Inc. | | | 18,400 | | | | 1,333,264 | | |

See Accompanying Notes to Financial Statements.

19

Credit Suisse Capital Appreciation Fund

Schedule of Investments (continued)

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| Electronic Equipment & Instruments (2.8%) | |

| Broadcom Corp. Class A* | | | 94,950 | | | $ | 3,903,394 | | |

| Roper Industries, Inc.§ | | | 79,800 | | | | 3,787,308 | | |

| | | | | | | | 7,690,702 | | |

| Energy Equipment & Services (3.4%) | |

| Bonneville Pacific Corp.*^ | | | 16,883 | | | | 127 | | |

| Grant Prideco, Inc.* | | | 68,600 | | | | 3,512,320 | | |

| Halliburton Co. | | | 40,900 | | | | 3,196,335 | | |

| Weatherford International, Ltd.* | | | 48,200 | | | | 2,551,226 | | |

| | | | | | | | 9,260,008 | | |

| Food & Drug Retailing (1.7%) | |

| CVS Corp. | | | 157,000 | | | | 4,666,040 | | |

| Food Products (0.9%) | |

| Wm. Wrigley Jr. Co. | | | 42,600 | | | | 2,005,182 | | |

| Wm. Wrigley Jr. Co. Class B | | | 10,650 | | | | 501,615 | | |

| | | | | | | | 2,506,797 | | |

| Healthcare Equipment & Supplies (4.3%) | |

| Dade Behring Holdings, Inc. | | | 82,300 | | | | 3,209,700 | | |

| Hologic, Inc.* | | | 39,600 | | | | 1,887,732 | | |

| IMS Health, Inc. | | | 75,700 | | | | 2,057,526 | | |

| St. Jude Medical, Inc.* | | | 114,600 | | | | 4,524,408 | | |

| | | | | | | | 11,679,366 | | |

| Healthcare Providers & Services (1.9%) | |

| Aetna, Inc. | | | 67,100 | | | | 2,583,350 | | |

| Omnicare, Inc.§ | | | 48,400 | | | | 2,744,764 | | |

| | | | | | | | 5,328,114 | | |

| Hotels, Restaurants & Leisure (4.8%) | |

| Cheesecake Factory, Inc.* | | | 39,700 | | | | 1,252,932 | | |

| Harrah's Entertainment, Inc. | | | 51,900 | | | | 4,237,116 | | |

| Penn National Gaming, Inc.*§ | | | 86,700 | | | | 3,530,424 | | |

| Starbucks Corp.* | | | 112,900 | | | | 4,207,783 | | |

| | | | | | | | 13,228,255 | | |

| Household Products (2.1%) | |

| Procter & Gamble Co. | | | 98,800 | | | | 5,751,148 | | |

| Industrial Conglomerates (0.8%) | |

| 3M Co. | | | 27,300 | | | | 2,332,239 | | |

| Insurance (1.7%) | |

| Genworth Financial, Inc. Class A | | | 137,600 | | | | 4,568,320 | | |

| Internet & Catalog Retail (1.3%) | |

| eBay, Inc.* | | | 101,900 | | | | 3,506,379 | | |

| Internet Software & Services (2.2%) | |

| Google, Inc. Class A* | | | 8,700 | | | | 3,636,078 | | |

| Yahoo!, Inc.* | | | 76,700 | | | | 2,514,226 | | |

| | | | | | | | 6,150,304 | | |

See Accompanying Notes to Financial Statements.

20

Credit Suisse Capital Appreciation Fund

Schedule of Investments (continued)

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| IT Consulting & Services (2.4%) | |

| CACI International, Inc. Class A*§ | | | 56,000 | | | $ | 3,502,240 | | |

| NAVTEQ Corp.* | | | 76,700 | | | | 3,184,584 | | |

| | | | | | | | 6,686,824 | | |

| Machinery (1.5%) | |

| Deere & Co. | | | 46,900 | | | | 4,116,882 | | |

| Media (1.7%) | |

| Univision Communications, Inc. Class A* | | | 127,700 | | | | 4,557,613 | | |

| Multiline Retail (1.7%) | |

| Kohl's Corp.* | | | 83,700 | | | | 4,673,808 | | |

| Oil & Gas (2.6%) | |

| Hugoton Royalty Trust | | | 6,661 | | | | 184,184 | | |

| Newfield Exploration Co.* | | | 47,500 | | | | 2,118,500 | | |

| XTO Energy, Inc. | | | 111,766 | | | | 4,733,290 | | |

| | | | | | | | 7,035,974 | | |

| Pharmaceuticals (5.5%) | |

| Barr Pharmaceuticals, Inc.* | | | 61,100 | | | | 3,699,605 | | |

| Forest Laboratories, Inc.* | | | 101,700 | | | | 4,106,646 | | |

| Medco Health Solutions, Inc.* | | | 53,200 | | | | 2,831,836 | | |

| Wyeth | | | 91,800 | | | | 4,467,906 | | |

| | | | | | | | 15,105,993 | | |

| Semiconductor Equipment & Products (1.2%) | |

| Applied Materials, Inc. | | | 73,100 | | | | 1,312,145 | | |

| Maxim Integrated Products, Inc. | | | 57,300 | | | | 2,020,398 | | |

| | | | | | | | 3,332,543 | | |

| Software (7.9%) | |

| Adobe Systems, Inc.* | | | 156,782 | | | | 6,145,854 | | |

| Autodesk, Inc.* | | | 48,500 | | | | 2,038,940 | | |

| Electronic Arts, Inc.* | | | 57,800 | | | | 3,283,040 | | |

| Microsoft Corp. | | | 313,500 | | | | 7,571,025 | | |

| Red Hat, Inc.*§ | | | 91,400 | | | | 2,686,246 | | |

| | | | | | | | 21,725,105 | | |

| Specialty Retail (2.4%) | |

| Best Buy Company, Inc. | | | 36,300 | | | | 2,056,758 | | |

| Home Depot, Inc. | | | 116,900 | | | | 4,667,817 | | |

| | | | | | | | 6,724,575 | | |

| Tobacco (1.0%) | |

| Altria Group, Inc. | | | 36,900 | | | | 2,699,604 | | |

| Wireless Telecommunication Services (2.5%) | |

| American Tower Corp. Class A* | | | 161,700 | | | | 5,520,438 | | |

| NII Holdings, Inc.* | | | 23,100 | | | | 1,383,690 | | |

| | | | | | | | 6,904,128 | | |

| TOTAL COMMON STOCKS (Cost $222,076,711) | | | | | | | 268,861,539 | | |

See Accompanying Notes to Financial Statements.

21

Credit Suisse Capital Appreciation Fund

Schedule of Investments (continued)

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| SHORT-TERM INVESTMENTS (6.2%) | |

| State Street Navigator Prime Portfolio§§ | | | 10,155,153 | | | $ | 10,155,153 | | |

| | | Par

(000) | | | |

| State Street Bank and Trust Co. Euro Time Deposit, 3.850%, 05/01/06 | | $ | 6,719 | | | | 6,719,000 | | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $16,874,153) | | | | | 16,874,153 | | |

| TOTAL INVESTMENTS AT VALUE (104.2%) (Cost $238,950,864) | | | | | 285,735,692 | | |

| LIABILITIES IN EXCESS OF OTHER ASSETS (-4.2%) | | | | | (11,408,263 | ) | |

| NET ASSETS (100.0%) | | | | $ | 274,327,429 | | |

* Non-income producing security.

^ Not readily marketable security; security is valued at fair value as determined in good faith by, or under the direction of, the Board of Trustees.

§ Security or a portion thereof is on loan.

§§ Represents security purchased with cash collateral received for securities on loan.

See Accompanying Notes to Financial Statements.

22

Credit Suisse Mid-Cap Growth Fund

Schedule of Investments

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS (96.7%) | |

| Aerospace & Defense (7.2%) | |

| Alliant Techsystems, Inc.*§ | | | 42,800 | | | $ | 3,423,572 | | |

| Goodrich Corp. | | | 96,600 | | | | 4,298,700 | | |

| L-3 Communications Holdings, Inc. | | | 51,700 | | | | 4,223,890 | | |

| Precision Castparts Corp. | | | 161,100 | | | | 10,146,078 | | |

| | | | | | | | 22,092,240 | | |

| Banks (4.7%) | |

| Hudson City Bancorp, Inc. | | | 307,700 | | | | 4,126,257 | | |

| Mellon Financial Corp. | | | 90,100 | | | | 3,390,463 | | |

| Mercantile Bankshares Corp. | | | 65,200 | | | | 2,450,216 | | |

| Northern Trust Corp. | | | 75,500 | | | | 4,446,195 | | |

| | | | | | | | 14,413,131 | | |

| Beverages (1.1%) | |

| Constellation Brands, Inc. Class A* | | | 140,800 | | | | 3,477,760 | | |

| Biotechnology (5.2%) | |

| Amylin Pharmaceuticals, Inc.*§ | | | 67,600 | | | | 2,943,980 | | |

| Celgene Corp.* | | | 82,700 | | | | 3,486,632 | | |

| Neurocrine Biosciences, Inc.*§ | | | 51,500 | | | | 2,954,040 | | |

| PDL BioPharma, Inc.*§ | | | 230,600 | | | | 6,636,668 | | |

| | | | | | | | 16,021,320 | | |

| Chemicals (1.7%) | |

| Monsanto Co. | | | 63,500 | | | | 5,295,900 | | |

| Commercial Services & Supplies (5.3%) | |

| Avery Dennison Corp. | | | 37,800 | | | | 2,362,500 | | |

| Brinks Co.§ | | | 101,800 | | | | 5,171,440 | | |

| Corporate Executive Board Co. | | | 33,300 | | | | 3,567,429 | | |

| Intermec , Inc.* | | | 81,500 | | | | 2,158,935 | | |

| Laureate Education, Inc.*§ | | | 62,400 | | | | 3,125,616 | | |

| | | | | | | | 16,385,920 | | |

| Communications Equipment (2.4%) | |

| Avaya, Inc.* | | | 238,100 | | | | 2,857,200 | | |

| Comverse Technology, Inc.* | | | 199,600 | | | | 4,520,940 | | |

| | | | | | | | 7,378,140 | | |

| Diversified Financials (3.4%) | |

| National Financial Partners Corp.§ | | | 49,000 | | | | 2,548,000 | | |

| Nuveen Investments, Inc. Class A§ | | | 90,400 | | | | 4,350,048 | | |

| TD Ameritrade Holding Corp. | | | 188,100 | | | | 3,491,136 | | |

| | | | | | | | 10,389,184 | | |

| Electrical Equipment (0.5%) | |

| Rockwell Automation, Inc. | | | 20,600 | | | | 1,492,676 | | |

| Electronic Equipment & Instruments (5.1%) | |

| Broadcom Corp. Class A* | | | 124,500 | | | | 5,118,195 | | |

| Intersil Corp. Class A | | | 93,400 | | | | 2,765,574 | | |

| Roper Industries, Inc. | | | 168,000 | | | | 7,973,280 | | |

| | | | | | | | 15,857,049 | | |

See Accompanying Notes to Financial Statements.

23

Credit Suisse Mid-Cap Growth Fund

Schedule of Investments (continued)

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| Energy Equipment & Services (4.2%) | |

| Grant Prideco, Inc.* | | | 35,600 | | | $ | 1,822,720 | | |

| National-Oilwell Varco, Inc.* | | | 103,300 | | | | 7,124,601 | | |

| Smith International, Inc. | | | 93,000 | | | | 3,927,390 | | |

| | | | | | | | 12,874,711 | | |

| Healthcare Equipment & Supplies (4.6%) | |

| Dade Behring Holdings, Inc. | | | 91,800 | | | | 3,580,200 | | |

| Hologic, Inc.* | | | 44,200 | | | | 2,107,014 | | |

| IMS Health, Inc. | | | 85,500 | | | | 2,323,890 | | |

| Intuitive Surgical, Inc.* | | | 12,700 | | | | 1,612,900 | | |

| Varian Medical Systems, Inc.* | | | 86,000 | | | | 4,504,680 | | |

| | | | | | | | 14,128,684 | | |

| Healthcare Providers & Services (6.0%) | |

| Covance, Inc.* | | | 109,000 | | | | 6,360,150 | | |

| Omnicare, Inc.§ | | | 152,323 | | | | 8,638,237 | | |

| Quest Diagnostics, Inc. | | | 63,800 | | | | 3,555,574 | | |

| | | | | | | | 18,553,961 | | |

| Hotels, Restaurants & Leisure (5.5%) | |

| Cheesecake Factory, Inc.* | | | 88,600 | | | | 2,796,216 | | |

| Penn National Gaming, Inc.* | | | 184,400 | | | | 7,508,768 | | |

| Starwood Hotels & Resorts Worldwide, Inc. | | | 116,500 | | | | 6,684,770 | | |

| | | | | | | | 16,989,754 | | |

| Household Durables (0.6%) | |

| Snap-On, Inc. | | | 41,700 | | | | 1,730,550 | | |

| Insurance (3.3%) | |

| Genworth Financial, Inc. Class A | | | 239,300 | | | | 7,944,760 | | |

| W.R. Berkley Corp. | | | 58,950 | | | | 2,205,909 | | |

| | | | | | | | 10,150,669 | | |

| Internet Software & Services (0.7%) | |

| Akamai Technologies, Inc.*§ | | | 60,500 | | | | 2,038,245 | | |

| IT Consulting & Services (5.5%) | |

| CACI International, Inc. Class A* | | | 127,500 | | | | 7,973,850 | | |

| NAVTEQ Corp.* | | | 100,900 | | | | 4,189,368 | | |

| SRA International, Inc. Class A*§ | | | 146,800 | | | | 4,700,536 | | |

| | | | | | | | 16,863,754 | | |

| Leisure Equipment & Products (1.9%) | |

| SCP Pool Corp.§ | | | 128,500 | | | | 6,003,520 | | |

| Media (2.4%) | |

| Lamar Advertising Co. Class A* | | | 44,700 | | | | 2,458,053 | | |

| Univision Communications, Inc. Class A* | | | 143,000 | | | | 5,103,670 | | |

| | | | | | | | 7,561,723 | | |

See Accompanying Notes to Financial Statements.

24

Credit Suisse Mid-Cap Growth Fund

Schedule of Investments (continued)

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| Metals & Mining (2.0%) | |

| Peabody Energy Corp. | | | 97,800 | | | $ | 6,245,508 | | |

| Oil & Gas (4.0%) | |

| Hugoton Royalty Trust | | | 6,413 | | | | 177,318 | | |

| Newfield Exploration Co.* | | | 112,400 | | | | 5,013,040 | | |

| Noble Energy, Inc. | | | 59,400 | | | | 2,671,812 | | |

| XTO Energy, Inc. | | | 107,600 | | | | 4,556,860 | | |

| | | | | | | | 12,419,030 | | |

| Personal Products (0.5%) | |

| Alberto-Culver Co. | | | 36,800 | | | | 1,654,896 | | |

| Pharmaceuticals (3.9%) | |

| Barr Pharmaceuticals, Inc.* | | | 49,900 | | | | 3,021,445 | | |

| Endo Pharmaceuticals Holdings, Inc.* | | | 142,600 | | | | 4,484,770 | | |

| Forest Laboratories, Inc.* | | | 114,800 | | | | 4,635,624 | | |

| | | | | | | | 12,141,839 | | |

| Real Estate (0.4%) | |

| Host Hotels & Resorts, Inc. | | | 54,976 | | | | 1,155,586 | | |

| Semiconductor Equipment & Products (0.7%) | |

| Maxim Integrated Products, Inc. | | | 64,700 | | | | 2,281,322 | | |

| Software (5.7%) | |

| Activision, Inc.* | | | 231,166 | | | | 3,280,246 | | |

| Adobe Systems, Inc.* | | | 175,760 | | | | 6,889,792 | | |

| Autodesk, Inc.* | | | 54,700 | | | | 2,299,588 | | |

| Cerner Corp.*§ | | | 53,900 | | | | 2,137,135 | | |

| Red Hat, Inc.*§ | | | 103,100 | | | | 3,030,109 | | |

| | | | | | | | 17,636,870 | | |

| Specialty Retail (3.8%) | |

| Circuit City Stores, Inc. | | | 128,700 | | | | 3,700,125 | | |

| Michaels Stores, Inc. | | | 110,600 | | | | 4,183,998 | | |

| Williams-Sonoma, Inc. | | | 95,000 | | | | 3,977,650 | | |

| | | | | | | | 11,861,773 | | |

| Textiles & Apparel (1.1%) | |

| Coach, Inc.* | | | 100,800 | | | | 3,328,416 | | |

| Wireless Telecommunication Services (3.3%) | |

| American Tower Corp. Class A* | | | 152,900 | | | | 5,220,006 | | |

| Crown Castle International Corp.* | | | 101,800 | | | | 3,425,570 | | |

| NII Holdings, Inc.* | | | 26,100 | | | | 1,563,390 | | |

| | | | | | | | 10,208,966 | | |

| TOTAL COMMON STOCKS (Cost $240,052,339) | | | | | | | 298,633,097 | | |

| PREFERRED STOCK (0.0%) | |

| Telecommunications (0.0%) | |

| Celletra, Ltd. Series C*†† (Cost $7,000,000) | | | 1,102,524 | | | | 0 | | |

See Accompanying Notes to Financial Statements.

25

Credit Suisse Mid-Cap Growth Fund

Schedule of Investments (continued)

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| SHORT-TERM INVESTMENTS (15.1%) | |

| State Street Navigator Prime Portfolio§§ | | | 35,801,017 | | | $ | 35,801,017 | | |

| | | Par

(000) | | | |

| State Street Bank and Trust Co. Euro Time Deposit, 3.850%, 05/01/06 | | $ | 10,828 | | | | 10,828,000 | | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $46,629,017) | | | | | 46,629,017 | | |

| TOTAL INVESTMENTS AT VALUE (111.8%) (Cost $293,681,356) | | | | | 345,262,114 | | |

| LIABILITIES IN EXCESS OF OTHER ASSETS (-11.8%) | | | | | (36,367,749 | ) | |

| NET ASSETS (100.0%) | | | | $ | 308,894,365 | | |

* Non-income producing security.

†† Restricted security, not readily marketable; security is valued at fair value as determined in good faith, by or under the direction of, the Board of Directors.

§ Security or a portion thereof is on loan.

§§ Represents security purchased with cash collateral received for securities on loan.

See Accompanying Notes to Financial Statements.

26

Credit Suisse Small Cap Growth Fund

Schedule of Investments

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS (96.3%) | |

| Aerospace & Defense (0.8%) | |

| BE Aerospace, Inc.* | | | 25,000 | | | $ | 650,750 | | |

| Auto Components (0.8%) | |

| Keystone Automotive Industries, Inc.* | | | 16,700 | | | | 689,710 | | |

| Banks (1.8%) | |

| Boston Private Financial Holdings, Inc.§ | | | 32,900 | | | | 1,093,925 | | |

| UCBH Holdings, Inc.§ | | | 26,700 | | | | 472,323 | | |

| | | | | | | | 1,566,248 | | |

| Biotechnology (2.3%) | |

| LifeCell Corp.*§ | | | 52,500 | | | | 1,419,600 | | |

| Martek Biosciences Corp.*§ | | | 19,900 | | | | 591,030 | | |

| | | | | | | | 2,010,630 | | |

| Chemicals (1.6%) | |

| Airgas, Inc. | | | 34,500 | | | | 1,395,525 | | |

| Commercial Services & Supplies (3.5%) | |

| Home Solutions of America, Inc.* | | | 44,800 | | | | 426,496 | | |

| Huron Consulting Group, Inc.*§ | | | 19,900 | | | | 707,445 | | |

| Kforce, Inc.*§ | | | 77,300 | | | | 1,086,065 | | |

| VistaPrint, Ltd.* | | | 24,300 | | | | 777,114 | | |

| | | | | | | | 2,997,120 | | |

| Communications Equipment (1.7%) | |

| F5 Networks, Inc.*§ | | | 11,200 | | | | 655,872 | | |

| Symmetricom, Inc.*§ | | | 105,500 | | | | 854,550 | | |

| | | | | | | | 1,510,422 | | |

| Construction Materials (0.8%) | |

| U.S. Concrete, Inc.* | | | 47,400 | | | | 650,328 | | |

| Distributions & Wholesale (2.4%) | |

| Beacon Roofing Supply, Inc.*§ | | | 26,300 | | | | 973,100 | | |

| Brightpoint, Inc.*§ | | | 33,800 | | | | 1,131,624 | | |

| | | | | | | | 2,104,724 | | |

| Diversified Financials (4.7%) | |

| Affiliated Managers Group, Inc.*§ | | | 16,650 | | | | 1,686,645 | | |

| Bankrate, Inc.* | | | 9,500 | | | | 458,565 | | |

| National Financial Partners Corp.§ | | | 17,400 | | | | 904,800 | | |

| Texas Capital Bancshares, Inc.*§ | | | 42,700 | | | | 984,662 | | |

| | | | | | | | 4,034,672 | | |

| Electrical Equipment (0.8%) | |

| Energy Conversion Devices, Inc.*§ | | | 13,600 | | | | 680,136 | | |

| Electronic Equipment & Instruments (2.7%) | |

| Daktronics, Inc.§ | | | 16,700 | | | | 654,974 | | |

| FLIR Systems, Inc.*§ | | | 30,800 | | | | 753,060 | | |

| Itron, Inc.*§ | | | 13,800 | | | | 925,290 | | |

| | | | | | | | 2,333,324 | | |

See Accompanying Notes to Financial Statements.

27

Credit Suisse Small Cap Growth Fund

Schedule of Investments (continued)

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| Energy Equipment & Services (1.0%) | |

| Complete Production Services, Inc.* | | | 7,700 | | | $ | 203,511 | | |

| Dril-Quip, Inc.* | | | 9,200 | | | | 662,216 | | |

| | | | | | | | 865,727 | | |

| Food Products (1.1%) | |

| Peet's Coffee & Tea, Inc.*§ | | | 29,600 | | | | 921,744 | | |

| Healthcare Equipment & Supplies (9.4%) | |

| ArthroCare Corp.*§ | | | 22,500 | | | | 1,019,925 | | |

| Haemonetics Corp.* | | | 30,300 | | | | 1,651,350 | | |

| Hologic, Inc.*§ | | | 27,100 | | | | 1,291,857 | | |

| Immucor, Inc.* | | | 36,500 | | | | 1,060,325 | | |

| Integra LifeSciences Holdings*§ | | | 26,100 | | | | 1,095,156 | | |

| IntraLase Corp.*§ | | | 11,600 | | | | 249,168 | | |

| Mentor Corp. | | | 20,900 | | | | 905,597 | | |

| Neurometrix, Inc.* | | | 23,200 | | | | 875,104 | | |

| Spectranetics Corp.*§ | | | 1,800 | | | | 23,130 | | |

| | | | | | | | 8,171,612 | | |

| Healthcare Providers & Services (6.1%) | |

| Advisory Board Co.* | | | 20,800 | | | | 1,167,296 | | |

| PSS World Medical, Inc.*§ | | | 55,200 | | | | 995,808 | | |

| Psychiatric Solutions, Inc.*§ | | | 41,200 | | | | 1,362,072 | | |

| Sunrise Senior Living, Inc.*§ | | | 27,600 | | | | 1,026,720 | | |

| United Surgical Partners International, Inc.*§ | | | 23,400 | | | | 772,434 | | |

| | | | | | | | 5,324,330 | | |

| Hotels, Restaurants & Leisure (3.9%) | |

| California Pizza Kitchen, Inc.*§ | | | 18,500 | | | | 584,600 | | |

| Orient-Express Hotels, Ltd. Class A§ | | | 34,600 | | | | 1,418,600 | | |

| Shuffle Master, Inc.*§ | | | 36,400 | | | | 1,344,980 | | |

| | | | | | | | 3,348,180 | | |

| Household Durables (0.5%) | |

| Knoll, Inc. | | | 21,200 | | | | 461,100 | | |

| Industrial Conglomerates (1.4%) | |

| Chemed Corp.§ | | | 21,900 | | | | 1,193,331 | | |

| Internet & Catalog Retail (1.7%) | |

| Coldwater Creek, Inc.* | | | 23,700 | | | | 662,652 | | |

| Nutri/System, Inc.*§ | | | 12,300 | | | | 834,678 | | |

| | | | | | | | 1,497,330 | | |

| Internet Software & Services (6.2%) | |

| Allscripts Heathcare Solutions, Inc.*§ | | | 49,600 | | | | 844,688 | | |

| Digitas, Inc.*§ | | | 73,400 | | | | 1,035,674 | | |

| INVESTools, Inc.* | | | 34,200 | | | | 312,930 | | |

| Jupitermedia Corp.*§ | | | 44,400 | | | | 782,328 | | |

| Openwave Systems, Inc.* | | | 73,166 | | | | 1,361,619 | | |

| Opsware, Inc.*§ | | | 121,900 | | | | 1,031,274 | | |

| | | | | | | | 5,368,513 | | |

See Accompanying Notes to Financial Statements.

28

Credit Suisse Small Cap Growth Fund

Schedule of Investments (continued)

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| IT Consulting & Services (0.7%) | |

| Redback Networks, Inc.*§ | | | 27,000 | | | $ | 604,800 | | |

| Machinery (3.0%) | |

| CE Franklin, Ltd.* | | | 50,700 | | | | 900,939 | | |

| Ceradyne, Inc.*§ | | | 15,800 | | | | 837,400 | | |

| Kennametal, Inc. | | | 13,800 | | | | 853,530 | | |

| | | | | | | | 2,591,869 | | |

| Media (3.1%) | |

| aQuantive, Inc.*§ | | | 22,500 | | | | 563,850 | | |

| Central European Media Enterprises, Ltd. Class A* | | | 13,600 | | | | 875,976 | | |

| Lions Gate Entertainment Corp.*§ | | | 126,000 | | | | 1,231,020 | | |

| | | | | | | | 2,670,846 | | |

| Oil & Gas (4.9%) | |

| Comstock Resources, Inc.* | | | 33,500 | | | | 1,041,180 | | |

| Denbury Resources, Inc.* | | | 42,700 | | | | 1,392,020 | | |

| EXCO Resources, Inc.*§ | | | 3,800 | | | | 48,754 | | |

| KCS Energy, Inc.*§ | | | 17,000 | | | | 498,950 | | |

| Todco Class A*§ | | | 9,700 | | | | 444,939 | | |

| W&T Offshore, Inc.§ | | | 19,800 | | | | 845,262 | | |

| | | | | | | | 4,271,105 | | |

| Personal Products (0.2%) | |

| Medifast, Inc.* | | | 12,700 | | | | 150,114 | | |

| Pharmaceuticals (2.2%) | |

| Adolor Corp.*§ | | | 30,300 | | | | 712,656 | | |

| Durect Corp.*§ | | | 6,000 | | | | 29,160 | | |

| Nektar Therapeutics*§ | | | 54,500 | | | | 1,172,295 | | |

| | | | | | | | 1,914,111 | | |

| Real Estate (1.2%) | |

| Trammell Crow Co.* | | | 27,800 | | | | 1,082,254 | | |

| Semiconductor Equipment & Products (11.4%) | |

| Diodes, Inc.* | | | 13,500 | | | | 549,990 | | |

| FormFactor, Inc.*§ | | | 20,900 | | | | 871,321 | | |

| Integrated Device Technology, Inc.*§ | | | 42,900 | | | | 652,938 | | |

| Microsemi Corp.* | | | 30,500 | | | | 833,260 | | |

| Netlogic Microsystems, Inc.*§ | | | 26,100 | | | | 1,051,047 | | |

| ON Semiconductor Corp.*§ | | | 89,500 | | | | 641,715 | | |

| Photronics, Inc.*§ | | | 58,600 | | | | 1,053,042 | | |

| SiRF Technology Holdings, Inc.*§ | | | 35,700 | | | | 1,219,155 | | |

| Supertex, Inc.*§ | | | 16,200 | | | | 625,644 | | |

| Tessera Technologies, Inc.*§ | | | 63,400 | | | | 2,033,238 | | |

| Trident Microsystems, Inc.* | | | 14,500 | | | | 385,700 | | |

| | | | | | | | 9,917,050 | | |

See Accompanying Notes to Financial Statements.

29

Credit Suisse Small Cap Growth Fund

Schedule of Investments (continued)

April 30, 2006 (unaudited)

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| Software (7.2%) | |

| Cognos, Inc.*§ | | | 29,000 | | | $ | 1,080,830 | | |

| Gravity Company, Ltd. ADR*§ | | | 21,200 | | | | 185,076 | | |

| Informatica Corp.* | | | 66,600 | | | | 1,023,642 | | |

| THQ, Inc.*§ | | | 36,099 | | | | 925,217 | | |

| TradeStation Group, Inc.* | | | 65,300 | | | | 1,040,882 | | |

| Ultimate Software Group, Inc.*§ | | | 27,100 | | | | 692,947 | | |

| VeriFone Holdings, Inc.*§ | | | 29,000 | | | | 897,840 | | |

| Verint Systems, Inc.* | | | 12,800 | | | | 415,232 | | |

| | | | | | | | 6,261,666 | | |

| Specialty Retail (4.0%) | |

| Aaron Rents, Inc.§ | | | 37,900 | | | | 1,017,994 | | |

| Children's Place Retail Stores, Inc.*§ | | | 17,400 | | | | 1,074,972 | | |

| Citi Trends, Inc.*§ | | | 13,900 | | | | 674,845 | | |

| Zumiez, Inc.*§ | | | 21,400 | | | | 695,500 | | |

| | | | | | | | 3,463,311 | | |

| Textiles & Apparel (0.7%) | |

| dELiA*s, Inc.*§ | | | 57,677 | | | | 613,107 | | |

| Wireless Telecommunication Services (2.5%) | |

| NTELOS Holdings Corp.*§ | | | 90,000 | | | | 1,259,100 | | |

| SBA Communications Corp. Class A* | | | 36,200 | | | | 909,344 | | |

| | | | | | | | 2,168,444 | | |

| TOTAL COMMON STOCKS (Cost $71,134,047) | | | | | | | 83,484,133 | | |

| SHORT-TERM INVESTMENTS (34.2%) | |

| State Street Navigator Prime Portfolio§§ | | | 24,961,735 | | | | 24,961,735 | | |

| | | Par

(000) | | | |

| State Street Bank and Trust Co. Euro Time Deposit, 3.850%, 05/01/06 | | $ | 4,704 | | | | 4,704,000 | | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $29,665,735) | | | | | | | 29,665,735 | | |

| TOTAL INVESTMENTS AT VALUE (130.5%) (Cost $100,799,782) | | | | | | | 113,149,868 | | |

| LIABILITIES IN EXCESS OF OTHER ASSETS (-30.5%) | | | | | | | (26,430,802 | ) | |

| NET ASSETS (100.0%) | | | | | | $ | 86,719,066 | | |

INVESTMENT ABBREVIATION

ADR = American Depositary Receipt

* Non-income producing security.

§ Security or a portion thereof is on loan.

§§ Represents security purchased with cash collateral received for securities on loan.

See Accompanying Notes to Financial Statements.

30

Credit Suisse Funds

Statements of Assets and Liabilities

April 30, 2006 (unaudited)

| | | Capital

Appreciation Fund | | Mid-Cap

Growth Fund | | Small Cap

Growth Fund | |

| Assets | |

Investments at value, including collateral for securities

on loan of $10,155,153, $35,801,017 and $24,961,735,

respectively (Cost $238,950,864, $293,681,356 and

$100,799,782, respectively) (Note 2) | | $ | 285,735,6921 | | | $ | 345,262,1142 | | | $ | 113,149,8683 | | |

| Cash | | | 254 | | | | 487 | | | | 666 | | |

| Receivable for investments sold | | | 13,937,893 | | | | 8,708,720 | | | | 2,056,492 | | |

| Receivable for fund shares sold | | | 170,909 | | | | 124,518 | | | | 107,999 | | |

| Dividend and interest receivable | | | 289,876 | | | | 231,836 | | | | 13,402 | | |

| Prepaid expenses and other assets | | | 65,360 | | | | 60,348 | | | | 35,681 | | |

| Total Assets | | �� | 300,199,984 | | | | 354,388,023 | | | | 115,364,108 | | |

| Liabilities | |

| Advisory fee payable (Note 3) | | | 160,667 | | | | 218,940 | | | | 41,735 | | |

| Administrative services fee payable (Note 3) | | | 52,603 | | | | 58,839 | | | | 17,102 | | |

| Shareholder servicing/Distribution fee payable (Note 3) | | | 16,676 | | | | 47,737 | | | | 17,742 | | |

| Payable for investments purchased | | | 14,943,950 | | | | 8,567,670 | | | | 3,488,378 | | |

| Payable upon return of securities loaned (Note 2) | | | 10,155,153 | | | | 35,801,017 | | | | 24,961,735 | | |

| Payable for fund shares redeemed | | | 330,516 | | | | 609,019 | | | | 34,603 | | |

| Trustees'/Directors' fee payable | | | 3,609 | | | | 3,718 | | | | 3,606 | | |

| Other accrued expenses payable | | | 209,381 | | | | 186,718 | | | | 80,141 | | |

| Total Liabilities | | | 25,872,555 | | | | 45,493,658 | | | | 28,645,042 | | |

| Net Assets | |

| Capital stock, $0.001 par value (Note 7) | | | 15,586 | | | | 8,837 | | | | 3,831 | | |

| Paid-in capital (Note 7) | | | 563,110,207 | | | | 417,218,412 | | | | 72,732,640 | | |

| Accumulated net investment loss | | | (526,637 | ) | | | (895,819 | ) | | | (342,302 | ) | |

| Accumulated net realized gain (loss) on investments | | | (335,056,555 | ) | | | (159,017,823 | ) | | | 1,974,811 | | |

| Net unrealized appreciation from investments | | | 46,784,828 | | | | 51,580,758 | | | | 12,350,086 | | |

| Net Assets | | $ | 274,327,429 | | | $ | 308,894,365 | | | $ | 86,719,066 | | |

| Common Shares | |

| Net assets | | $ | 266,887,815 | | | $ | 284,866,885 | | | $ | 85,131,230 | | |

| Shares outstanding | | | 15,147,779 | | | | 8,101,402 | | | | 3,761,253 | | |

Net asset value, offering price and redemption price

per share | | $ | 17.62 | | | $ | 35.16 | | | $ | 22.63 | | |

| Advisor Shares | |

| Net assets | | $ | 4,555,225 | | | $ | 23,128,214 | | | $ | 2,328 | | |

| Shares outstanding | | | 270,945 | | | | 709,697 | | | | 104 | | |

Net asset value, offering price and redemption price

per share | | $ | 16.81 | | | $ | 32.59 | | | $ | 22.39 | | |

See Accompanying Notes to Financial Statements.

31

Credit Suisse Funds

Statements of Assets and Liabilities (continued)

April 30, 2006 (unaudited)

| | | Capital

Appreciation Fund | | Mid-Cap

Growth Fund | | Small Cap

Growth Fund | |

| A Shares | |

| Net assets | | $ | 1,681,163 | | | $ | 793,140 | | | $ | 1,544,002 | | |

| Shares outstanding | | | 96,392 | | | | 22,858 | | | | 68,216 | | |

| Net asset value and redemption price per share | | $ | 17.44 | | | $ | 34.70 | | | $ | 22.63 | | |

Maximum offering price per share (net asset

value/(1-5.75%)) | | $ | 18.50 | | | $ | 36.82 | | | $ | 24.01 | | |

| B Shares | |

| Net assets | | $ | 765,374 | | | $ | 104,952 | | | $ | 40,370 | | |

| Shares outstanding | | | 45,357 | | | | 3,073 | | | | 1,812 | | |

| Net asset value and offering price per share | | $ | 16.87 | | | $ | 34.16 | | | $ | 22.28 | | |

| C Shares | |

| Net assets | | $ | 437,852 | | | $ | 1,174 | | | $ | 1,136 | | |

| Shares outstanding | | | 25,955 | | | | 34 | | | | 51 | | |

| Net asset value and offering price per share | | $ | 16.87 | | | $ | 34.16 | | | $ | 22.31 | | |

1 Including $9,923,968 of securities on loan.

2 Including $35,007,494 of securities on loan.

3 Including $24,339,809 of securities on loan.

See Accompanying Notes to Financial Statements.

32

Credit Suisse Funds

Statements of Operations

For the Six Months Ended April 30, 2006 (unaudited)

| | | Capital

Appreciation Fund | | Mid-Cap

Growth Fund | | Small Cap

Growth Fund | |

| Investment Income (Note 2) | |

| Dividends | | $ | 1,164,630 | | | $ | 1,165,298 | | | $ | 59,159 | | |

| Interest | | | 124,752 | | | | 208,703 | | | | 93,553 | | |

| Securities lending | | | 4,771 | | | | 20,036 | | | | 33,170 | | |

| Total investment income | | | 1,294,153 | | | | 1,394,037 | | | | 185,882 | | |

| Expenses | |

| Investment advisory fees (Note 3) | | | 1,020,084 | | | | 1,435,544 | | | | 377,215 | | |

| Administrative services fees (Note 3) | | | 244,418 | | | | 266,796 | | | | 68,356 | | |

| Shareholder servicing/Distribution fees (Note 3) | | | | | | | | | | | | | |

| Common Class | | | — | | | | — | | | | 92,598 | | |

| Advisor Class | | | 12,558 | | | | 62,507 | | | | 5 | | |

| Class A | | | 2,067 | | | | 898 | | | | 1,677 | | |

| Class B | | | 3,517 | | | | 368 | | | | 101 | | |

| Class C | | | 2,336 | | | | 5 | | | | 5 | | |

| Transfer agent fees (Note 3) | | | 375,733 | | | | 402,340 | | | | 87,127 | | |

| Registration fees | | | 41,159 | | | | 45,748 | | | | 47,440 | | |

| Printing fees (Note 3) | | | 38,270 | | | | 28,197 | | | | 20,562 | | |

| Audit and tax fees | | | 21,618 | | | | 20,314 | | | | 10,737 | | |

| Custodian fees | | | 21,514 | | | | 16,152 | | | | 10,308 | | |

| Trustees'/Directors' fees | | | 10,632 | | | | 10,741 | | | | 10,633 | | |

| Legal fees | | | 9,313 | | | | 9,169 | | | | 8,791 | | |

| Insurance expense | | | 4,760 | | | | 4,959 | | | | 2,379 | | |

| Commitment fees (Note 4) | | | 4,192 | | | | 4,327 | | | | 968 | | |

| Miscellaneous expense | | | 8,581 | | | | 8,174 | | | | 4,427 | | |

| Total expenses | | | 1,820,752 | | | | 2,316,239 | | | | 743,329 | | |

| Less: fees waived (Note 3) | | | — | | | | (26,383 | ) | | | (215,145 | ) | |

| Net expenses | | | 1,820,752 | | | | 2,289,856 | | | | 528,184 | | |

| Net investment loss | | | (526,599 | ) | | | (895,819 | ) | | | (342,302 | ) | |

| Net Realized and Unrealized Gain (Loss) from Investments | |

| Net realized gain from investments | | | 20,533,482 | | | | 21,722,462 | | | | 2,591,876 | | |

Net change in unrealized appreciation (depreciation)

from investments | | | 498,928 | | | | 13,030,513 | | | | 8,643,143 | | |

| Net realized and unrealized gain from investments | | | 21,032,410 | | | | 34,752,975 | | | | 11,235,019 | | |

| Net increase in net assets resulting from operations | | $ | 20,505,811 | | | $ | 33,857,156 | | | $ | 10,892,717 | | |

See Accompanying Notes to Financial Statements.

33

Credit Suisse Funds

Statements of Changes in Net Assets

| | | Capital Appreciation Fund | | Mid-Cap Growth Fund | |

| | | For the Six Months

Ended

April 30, 2006

(unaudited) | | For the Year

Ended

October 31, 2005 | | For the Six Months

Ended

April 30, 2006

(unaudited) | | For the Year

Ended

October 31, 2005 | |

| From Operations | |

| Net investment income (loss) | | $ | (526,599 | ) | | $ | 277,820 | | | $ | (895,819 | ) | | $ | (3,208,392 | ) | |

| Net realized gain from investments | | | 20,533,482 | | | | 30,354,928 | | | | 21,722,462 | | | | 41,439,467 | | |

| Net change in unrealized appreciation (depreciation) from investments | | | 498,928 | | | | 2,641,122 | | | | 13,030,513 | | | | 8,210,614 | | |

| Net increase in net assets resulting from operations | | | 20,505,811 | | | | 33,273,870 | | | | 33,857,156 | | | | 46,441,689 | | |

| From Dividends | |

Dividends from net investment income

Common Class Shares | | | (277,858 | ) | | | — | | | | — | | | | — | | |

| From Capital Share Transactions (Note 7) | |

| Proceeds from sale of shares | | | 17,026,757 | | | | 44,355,998 | | | | 12,703,432 | | | | 36,330,337 | | |

| Reinvestment of dividends | | | 273,440 | | | | — | | | | — | | | | — | | |

| Net asset value of shares redeemed | | | (62,363,772 | ) | | | (230,751,856 | ) | | | (53,771,801 | ) | | | (158,014,386 | ) | |

| Net increase (decrease) in net assets from capital share transactions | | | (45,063,575 | ) | | | (186,395,858 | ) | | | (41,068,369 | ) | | | (121,684,049 | ) | |

| Net increase (decrease) in net assets | | | (24,835,622 | ) | | | (153,121,988 | ) | | | (7,211,213 | ) | | | (75,242,360 | ) | |

| Net Assets | |

| Beginning of period | | | 299,163,051 | | | | 452,285,039 | | | | 316,105,578 | | | | 391,347,938 | | |

| End of period | | $ | 274,327,429 | | | $ | 299,163,051 | | | $ | 308,894,365 | | | $ | 316,105,578 | | |

| Accumulated net investment income (loss) | | $ | (526,637 | ) | | $ | 277,820 | | | $ | (895,819 | ) | | $ | — | | |

See Accompanying Notes to Financial Statements.

34

| | | Small Cap Growth Fund | |

| | | For the Six Months

Ended

April 30, 2006

(unaudited) | | For the Year

Ended

October 31, 2005 | |

| From Operations | |

| Net investment income (loss) | | $ | (342,302 | ) | | $ | (927,136 | ) | |

| Net realized gain from investments | | | 2,591,876 | | | | 9,417,899 | | |