UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

| | |

| Core Molding Technologies, Inc. |

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| þ | No fee required. |

| o | Fee paid previously with preliminary materials. |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

CORE MOLDING TECHNOLOGIES, INC.

800 Manor Park Drive

Columbus, Ohio 43228

(614) 870-5000

April 8, 2022

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Core Molding Technologies, Inc. to be held at 800 Manor Park Drive, Columbus, Ohio, on May 12, 2022, at 9:00 a.m., Eastern Daylight Savings Time. Further information about the meeting and the matters to be considered is contained in the formal Notice of Annual Meeting of Stockholders and Proxy Statement on the following pages.

This has been an eventful year with much progress made on our strategic objectives of achieving profitable revenue growth and diversification of processes, customers and industries.

•Record sales of $307 million in 2021.

•Signed over $75 million of net new business wins which will launch through 2023.

•Diversified and transformed customer base from 91% heavy duty truck in 2011 to 41% in 2021 with the Company serving many new industries and customers.

•$15 billion total addressable market enabled by our technical solutions providing engineered material capability to convert other materials to composites providing for future growth.

These accomplishments are key to growing our long-term shareholder value.

I would like to thank the Company leadership and the whole team for these accomplishments and for all of the hard work and creativity in overcoming the global supply chain and labor challenges in 2021. Core continues to grow and develop its culture focused on people and their development.

The Board is committed to the execution of our environmental, social, and governance (“ESG”) strategy. Our Board has one diverse member and will add another diverse member in 2022 to better represent where the Company operates. Please see the “Corporate Responsibility” section of this proxy for additional information on ESG.

It is important that your shares be represented at this meeting. Whether or not you plan to attend, we hope that you vote using one of the available voting options outlined on your proxy card.

Sincerely,

Thomas R. Cellitti

Chairman of the Board

TABLE OF CONTENTS

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| 38 |

| |

| 39 |

| |

| 39 |

| |

| 39 |

| |

| 40 |

| |

| 40 |

| |

| 41 |

| |

| |

| |

| PROPOSAL NO. 2 ADVISORY VOTE ON FREQUENCY OF VOTES ON EXECUTIVE COMPENSATION | 42 |

| |

| 43 |

| |

PROPOSAL NO. 4 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 44 |

| |

| 45 |

| |

| VOTE CARD | 46 |

| |

| APPENDIX A | |

CORE MOLDING TECHNOLOGIES, INC.

800 Manor Park Drive

Columbus, Ohio 43228

(614) 870-5000

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

May 12, 2022

To Our Stockholders:

Core Molding Technologies, Inc. (the "Company") will hold its 2022 Annual Meeting of Stockholders on May 12, 2022 at 9:00 a.m., Eastern Daylight Savings Time, at 800 Manor Park Drive, Columbus, OH, for the following purposes:

| | | | | |

| 1. | to elect seven (7) directors to comprise the Board of Directors of the Company; |

| |

| 2. | to hold an advisory vote on the frequency of votes on executive compensation; |

| |

| 3. | to hold an advisory vote relating to the compensation of our named executive officers; |

| |

| 4. | to ratify the appointment of Crowe LLP as the independent registered public accounting firm for the Company for the year ending December 31, 2022; and |

| |

| 5. | to consider and act upon other business as may properly come before the meeting and any adjournments or postponements of the meeting. |

The foregoing matters are described in more detail in the Proxy Statement, which is attached to this notice. Only stockholders of record at the close of business on March 25, 2022, the record date, are entitled to receive notice of and to vote at the meeting.

We desire to have maximum representation at the meeting and respectfully request that you date, execute and promptly mail the enclosed proxy in the postage-paid envelope provided. You may revoke a proxy by notice in writing to the Secretary of the Company at any time prior to its use.

BY ORDER OF THE BOARD OF DIRECTORS

John P. Zimmer

Executive Vice President, Secretary, Treasurer, and Chief Financial Officer

April 8, 2022

CORE MOLDING TECHNOLOGIES, INC.

800 Manor Park Drive

Columbus, Ohio 43228

(614) 870-5000

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

May 12, 2022

GENERAL INFORMATION

Solicitation

The Board of Directors of the Company (the "Board of Directors" or "Board" and individually, a "director" or "directors") is soliciting the enclosed proxy. In addition to the use of the mail, directors and officers of the Company may solicit proxies, personally or by telephone. The Company will not pay its directors and officers any additional compensation for the solicitation.

Broadridge Financial Solutions, Inc. will conduct proxy distribution and tabulation on behalf of the Company. The Company will reimburse Broadridge Financial Solutions, Inc. for reasonable expenses incurred for these services. The Company will make arrangements with brokerage firms and other custodians, nominees and fiduciaries for the forwarding of proxy distribution material to beneficial owners of the common stock of the Company. The Company will reimburse those brokerage firms, custodians, nominees and fiduciaries for their reasonable expenses.

The Company will pay all expenses of the proxy distribution and tabulation. Except as otherwise provided, the Company will not use specially engaged employees or other paid solicitors to conduct any proxy solicitation.

Voting Rights and Votes Required

Holders of shares of the common stock of the Company at the close of business on March 25, 2022, the record date for the annual meeting, are entitled to notice of, and to vote at, the annual meeting. On the record date, the Company had 8,702,109 shares of common stock issued.

Each outstanding share of common stock on the record date is entitled to one vote on all matters presented at the annual meeting. The presence, in person or by proxy, of holders of a majority of the shares of common stock entitled to vote at the annual meeting on any matter will constitute a quorum for the transaction of business at the annual meeting with respect to such matter. No business with respect to a matter, other than adjournment, can be conducted at the annual meeting unless a quorum is present in person or by proxy with respect to such matter.

Abstentions will count as shares present and entitled to vote in determining the presence of a quorum for a particular matter, and will have the effect of a vote "against" such matter. Broker non-votes are shares held of record by brokers or other nominees that are present in person or by proxy at the meeting, but are not voted because instructions have not been received from the beneficial owner with respect to a particular matter over which the broker or nominee does not have discretionary authority to vote. If you do not return a proxy card and your shares are held in "street name," your broker may be permitted, under applicable rules of the self-regulatory organizations of which it is a member, to vote your shares in its discretion on certain matters that are deemed to be routine, such as ratification of the appointment of our independent registered public accounting firm. Proposals 1, 2 and 3 as referenced in the Company's Notice of Annual Meeting of Stockholders are considered to be non-routine, and Proposal 4 is considered to be routine. Accordingly, if you do not provide voting instructions to your brokerage firm or other entity holding your shares, your brokerage firm or other entity holding your shares will not be permitted to vote your shares on Proposals 1, 2 and 3 and will be permitted to vote your shares on Proposal 4, at its discretion. Broker non-votes will not count as shares entitled to vote on the applicable matters in the establishment of a quorum for Proposal 1, 2 or 3 and will have no effect on such proposals. Accordingly, the Company requests that you

promptly provide your broker or other nominee with voting instructions if you want your shares voted for non-routine matters and to carefully follow the instructions your broker gives you pertaining to their procedures.

The Board of Directors has adopted a plurality plus voting policy (the "Voting Policy"). Pursuant to the Voting Policy, any nominee for director in an uncontested election who receives a greater number of votes "withheld" from his or her election than votes "for'' such election shall submit his or her offer of resignation for consideration by the Board within 90 days from the date of the election, and shall recuse himself or herself from all deliberations on his or her resignation. The Board shall consider all of the relevant facts and circumstances in its consideration of the action to be taken with respect to such offer of resignation. To the extent that any resignation is accepted, the Board will consider whether to fill such vacancy or vacancies or to reduce the size of the Board. Therefore, each of the seven directors will be elected in accordance with the Voting Policy by a plurality plus standard of votes cast by stockholders of record on the record date and present at the annual meeting, in person or by proxy. Cumulative voting in the election of directors will not be permitted.

The advisory vote on executive compensation and the advisory vote on the frequency of voting on executive compensation require the approval of a majority of the shares of the common stock present at the annual meeting, in person or by proxy, and entitled to vote thereon.

The Company is seeking stockholder ratification of the appointment of its independent registered public accounting firm. While ratification is not required by law, the affirmative vote of a majority of the shares of the common stock present at the annual meeting, in person or by proxy, and entitled to vote thereon would ratify the selection of Crowe LLP ("Crowe") as the independent registered public accounting firm for the current year.

Voting of Proxies

Shares of common stock represented by all properly executed proxies received prior to the annual meeting will be voted in accordance with the choices specified in the proxy. Unless contrary instructions are indicated on the proxy, the shares will be voted:

•FOR the election as directors of the nominees named in this Proxy Statement until their successors are elected and qualified;

•FOR the resolution to hold an advisory vote on the approval of the compensation of the named executive officers every 1 year;

•FOR the resolution to approve the advisory vote for 2021 compensation of the named executive officers; and

•FOR the ratification of the appointment of Crowe LLP ("Crowe") as the independent registered public accounting firm for the Company for the year ending December 31, 2022.

Management of the Company and the Board of Directors of the Company know of no matters to be brought before the annual meeting other than as set forth in this Proxy Statement. If, however, any other matter is properly presented to the stockholders for action, it is the intention of the holders of the proxies to vote at their discretion on all matters on which the shares of common stock represented by proxies are entitled to vote.

Revocability of Proxy

A stockholder who signs and returns a proxy in the accompanying form may revoke it at any time before the authority granted by the proxy is exercised. A stockholder may revoke a proxy by delivering a written statement to the Secretary of the Company that the proxy is revoked.

Annual Report

The Annual Report on Form 10-K for the year ended December 31, 2021 of the Company, which includes financial statements and information concerning the operations of the Company, accompanies this Proxy Statement. The Annual Report is not to be regarded as proxy solicitation materials.

Stockholder Proposals

Any stockholder who desires to present a proposal for consideration at the 2023 annual meeting of stockholders must submit the proposal in writing to the Company. If the proposal is received by the Company prior to the close of business on December 9, 2022, and otherwise meets the requirements of applicable state and federal law, the Company will include the proposal in the proxy statement and form of proxy relating to the 2023 annual meeting of

stockholders. The Company may confer on the proxies for the 2023 annual meeting of stockholders discretionary authority to vote on any proposal, if the Company does not receive notice of the proposal by February 22, 2023.

Stockholder Director Nominees

Any stockholder who desires to present nomination for a director must do so pursuant to the deadlines and procedures and in the manner as stated in the Corporate Governance section under the Nominating and Corporate Governance Committee section of the Board Meetings and Committees subsection thereunder.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on May 12, 2022

The Proxy Statement, proxy card, and Annual Report to stockholders, which includes the Form 10-K for the year ended December 31, 2021, are available at http://colsec.coremt.com.

CORPORATE RESPONSIBILITY

Commitment to Sustainability

The Board and Management are dedicated to being socially and environmentally responsible in both our business strategy and the decisions we make every day. We understand and appreciate that global society, governments and stockholders are expecting increased commitment to sustainable value creation, and we embrace the opportunities that this can bring to our company and the communities in which we participate. Our approach to sustainability focuses on three areas: (i) environmental, (ii) social issues and (iii) governance ("ESG").

Environmental Highlights

Environmental stewardship is an essential component of the Company's strategic planning to do our part in creating a sustainable future. Highlights of our environmental practices include:

•ISO 14001 certified environmental management system locations.

•Third party audit of Company's compliance with environmental regulations.

•Over 50% of our products sold are produced with recyclable materials.

•Dedicated Sustainability Leader to drive the Company's sustainability initiatives.

•Formal Enterprise Risk Management system to identify and act upon environmental risks with direct oversight by the Board.

•Partnership with the Ohio Soy Council to develop bio-based thermoset resins for the thermoset industry.

•Energy reduction initiates throughout the organization including more efficient boilers and air compressor systems, low energy lighting and thermoset scrap reduction.

•Partnership with National Oceanic and Atmospheric Administration ("NOAA") to develop and conduct field trials with engineered plastic fish traps for harvesting invasive lionfish commercially; reducing their harmful effect on our coral reel ecosystems.

Social Highlights

The Company is committed to being an employer of choice and a socially responsible partner in our communities. We provide employees with a culture focused on a safe environment, with growth opportunities, and a competitive total rewards package. Highlights of our social practices include:

•Organizational and leadership development systems that embeds a culture that is based on our foundational values of transparency for trust, mutual respect, courage to challenge and being a learning organization.

•Year-long leadership development program for high-potential employees.

•Total rewards program, including a redesigned short-term incentive plan, focused on performance and expanded benefits programs.

•Increased diversity representation on our Board of Directors and leadership teams through intentional focus on diversity and inclusion initiatives.

•Semi-annual all employee feedback-action surveys focused on improving workplace culture and retention.

•Comprehensive talent and succession program to ensure a sustainable pipeline for long-term success.

•Partnership with local community groups such as community food banks, children charity groups for sick children, at-risk youth groups; providing food, school supplies and toys to children in local neighborhoods.

Corporate Governance Highlights

We are committed to creating strong corporate governance practices that promote independence, transparency and accountability for all of our stockholders. Highlights of our corporate governance practices include:

•Declassified Board in which all directors stand for reelection each year

•All director nominees other than our CEO are independent

•100% independent key board committees

•Independent Chairman

•Annual elections for directors with "plurality plus" voting standard

•Ability for stockholders to call a special meeting

•Strong risk oversight at the Board and committee levels

•Anti-hedging and anti-pledging policies

•Independent compensation consultant

•A formal Board approved Code of Conduct and Ethics

•Board oversight of sustainability focused on product, environmental and social matters

The Board of Directors - Independence

Of the directors who presently serve on the Company's Board of Directors, the Board has affirmatively determined that Members Cellitti, Crowley, Hellmold, Jauchius, Kowaleski and Smith meet the standards of independence under NYSE American LLC exchange listing standards. In making this determination, the Board of Directors considered all facts and circumstances the Board of Directors deemed relevant from the standpoint of each of the directors and from that of persons or organizations with which each of the directors has an affiliation, including commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships among others. In making this determination, the Board of Directors has relied upon both information provided by the directors and information developed internally by the Company in evaluating these facts.

Board Leadership Structure

The Chairman of the Board (the “Chairman”) is a director and presides at meetings of the Board. The Chairman is elected on an annual basis by at least a majority vote of the remaining directors. Historically, the offices of Chairman of the Board and Chief Executive Officer have been separated. Such separation enables the Chairman to devote his time to managing the Board and the Chief Executive Officer to focus on the operations of the Company. The Company has no fixed policy with respect to separation of the offices of the Chairman of the Board and Chief Executive Officer; however, the Board believes it is in the best interests of the Company and its stockholders to separate these positions. Thomas R. Cellitti has served as the Company's Chairman of the Board since June 15, 2020.

Risk Oversight

The Board has an active role, as a whole and at the committee level, in overseeing the management of the Company's risks. The Company has adopted an enterprise risk management assessment process to identify, assess and prepare for potential events which may affect the Company’s operations. The risk assessment is regularly reviewed by the Board of Directors. The Board reviews information regarding the Company's operations and liquidity, as well as the related risks. The Board reviews and approves the Company's annual operating and capital plans. The Compensation Committee reviews the Company's incentive compensation arrangements to determine whether they encourage excessive risk taking, reviews the relationship between risk management policies and compensation, and evaluates compensation policies that could mitigate any such risk. The Audit Committee oversees the management of financial risks. The Nominating and Corporate Governance Committee manages risks associated with the independence of the Board of Directors and overall corporate governance. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board of Directors is regularly informed about risks through committee minutes and reports at Board meetings. The entire Board manages risks associated with environmental and social matters.

The Compensation Committee, consisting of Board Members Hellmold, Cellitti, Kowaleski and Smith, recommends to the Board of Directors compensation policies as they relate to the Company's named executive officers and directors, and also considers the overall policies and practices utilized by senior management with respect to establishing compensation for all other employees. The Compensation Committee considers the risk assessments of the Company's Chief Executive Officer and Chief Financial Officer as part of its duties to review and recommend the current compensation packages to the Board. The Compensation Committee believes that the Company’s policies and practices with respect to compensation are not reasonably likely to have a material adverse effect on the Company. In reaching the foregoing conclusions, both the Compensation Committee and the Chief Executive Officer and Chief Financial Officer assessed the risks associated with the Company’s compensation policies and practices. The basis for these conclusions included: (i) a consideration of the Company's existing compensation programs, and the allocation between each primary component of compensation (base salary, annual short-term incentives, bonus, and long-term equity based compensation); and (ii) a consideration of the risks associated with the Company's business, and whether the Company's compensation policies and practices increased those risks. Based on the foregoing, the Compensation Committee recommended, and all of the independent members of the Board approved, the Company's compensation programs, and in connection with such approval concluded that the risks associated with the Company's compensation policies and practices are not reasonably likely to have a material adverse effect on the Company.

Responsiveness to Stockholder Feedback

The Board values and appreciates stockholder feedback and seeks to maintain open lines of communication with all of our stockholders. The Company spoke to a majority of our largest shareholders during 2021.

Board Meetings and Committees

The Board of Directors met eight times during the year ended December 31, 2021. During that period, all directors except Mr. Jauchius attended 100% of the total number of meetings of the Board of Directors and the total number of meetings of all committees of the Board of Directors on which each director served. Mr. Jauchius attended all but one of the meetings of the Board of Directors and all committee meetings of the Board of which he serves.

Compensation Committee

The Company has a Compensation Committee, which consists of Board Members Hellmold (Committee Chair), Cellitti, Kowaleski and Smith, who are all deemed independent directors under NYSE American LLC listing standards. The Compensation Committee is governed by a charter. A copy is available on the Company's website at www.coremt.com. In accordance with its written charter, the Compensation Committee performs the duty of reviewing, evaluating and making recommendations to the Board concerning the form and amount of compensation paid to the executive officers and directors of the Company, with a majority of directors, who are independent under NYSE American LLC listing standards, required to effect a decision.

All of the Compensation Committee members are familiar with the standard compensation levels in similar industries, and are knowledgeable regarding the current trends for compensating executive officers. The Compensation Committee may also obtain analysis and advice from an external compensation consultant to assist with the performance of its duties under its charter. The Compensation Committee retained Pearl Meyer & Partners (“Pearl Meyer”), a leading advisor on executive compensation, to assist in reviewing appropriate 2021 compensation programs. In this regard, Pearl Meyer compiled competitive data for base salaries, non-equity compensation, and equity incentive awards from a peer group of companies to be used to benchmark the appropriateness and competitiveness of our executive compensation. During 2021, there were no fees paid to Pearl Meyer for services that were not related exclusively to executive or director compensation. The Compensation Committee has assessed the independence of Pearl Meyer pursuant to Securities and Exchange Commission ("SEC") rules and determined that Pearl Meyer is independent and its work for the Compensation Committee does not raise any conflict of interest.

The Compensation Committee makes all recommendations regarding the executive officers' compensation, subject to ratification by the independent members of the Board, after consulting with its advisors, in executive session where no management employees are present. While the Chief Executive Officer and Chief Financial Officer attend Compensation Committee meetings regularly by invitation, all final deliberations are held and all final recommendations are made by the Compensation Committee in executive session, where no management employees are present. For additional information regarding the operation of the Compensation Committee, see "Compensation Discussion and Analysis" within this proxy statement. The Compensation Committee held three meetings during 2021.

Audit Committee

The Company has an Audit Committee, which consists of Board Members Jauchius (Committee Chair), Crowley, Hellmold, and Smith, each of whom are "independent" as that term is defined under NYSE American LLC listing standards. The Board has determined that Jauchius, Crowley, Hellmold, and Smith each qualify as an "audit committee financial expert" as defined in Item 407(d)(5)(ii) of Regulation S-K (17 CFR §229.407(d)(5)(ii)) as promulgated by the SEC. The principal function of the Audit Committee is to review and approve the scope of the annual audit undertaken by the independent registered public accounting firm of the Company and to meet with them to review and inquire as to audit functions and other financial matters and to review the interim, quarterly financial statements and year-end audited financial statements. For a more detailed description of the role of the Audit Committee, see "Audit Committee Report" below. The Audit Committee discussed the interim financial information contained in quarterly earnings announcements with both management and the independent auditors prior to the public release of quarterly information. The Audit Committee is governed by a charter as most recently reaffirmed by the Board of Directors on March 3, 2022. A copy of the Audit Committee Charter is available on the Company's website at www.coremt.com. In accordance with its written charter, the Audit Committee assists the Board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Company. The Audit Committee met four times during the year ended December 31, 2021.

Nominating and Corporate Governance Committee

The Company has a Nominating and Corporate Governance Committee consisting of Board Members Crowley (Committee Chair), Cellitti, Hellmold, and Jauchius each of whom are independent under NYSE American LLC listing standards. The principal function of the Nominating and Corporate Governance Committee is to recommend candidates for membership on the Board of Directors and to oversee corporate governance. A copy of the Nominating and Corporate Governance Committee Charter is available on the Company's website at www.coremt.com. The Nominating and Corporate Governance Committee held three meetings during 2021.

In identifying and evaluating nominees for director, the Nominating and Corporate Governance Committee seeks to ensure that the Board possesses, in the aggregate, the strategic, managerial and financial skills and experience necessary to fulfill its duties and to achieve its objectives, and seeks to ensure that the Board is comprised of directors who possess knowledge in areas that are of importance to the Company. In addition, the Nominating and Corporate Governance Committee believes it is important that at least one director have the requisite experience and expertise to be designated as an "audit committee financial expert." The Nominating and Corporate Governance Committee looks at each nominee on a case-by-case basis regardless of who recommended the nominee. At times, the Committee will retain an executive search firm to assist in identifying candidates with the required expertise. The Board values diversity and is committed to identifying nominees with diverse perspectives and having an inclusive environment. The Nominating and Corporate Governance Committee evaluates and measures those skills and accomplishments which should be possessed by a prospective member of the Board, including contribution of a diverse frame of reference that will enhance the quality of the Board's deliberations and decisions. In addition, the Nominating and Corporate Governance Committee considers, among other factors, ethical values, personal integrity and business reputation of the candidate, financial acumen, reputation for effective exercise of sound business judgment, strategic planning capability, indicated interest in providing attention to the duties of a member of the Board, personal skills in marketing, manufacturing processes, technology or in other areas where such person’s talents may contribute to the effective performance by the Board of its responsibilities.

The table below summarizes the specific qualification, attributes, skills and experience of each director nominee that led our Board of Directors to conclude that the nominee is qualified to serve on our Board of Directors. While each director nominee is generally knowledgeable in each of these areas, an "X" in the chart below indicates that the item is a specific qualification, attribute, skill or experience that the nominee brings to our Board of Directors. The lack of an "X" for a particular item does not mean that the nominee does not possess that qualification, attribute, skill or experience.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director | Manufacturing | Industry (Truck, Auto, Marine) | Management (CEO/CFO Group or Division Head) | Marketing | Finance, Accounting & Budgeting | Mergers & Acquisitions | Strategy | Corporate Governance |

| Thomas R. Cellitti | X | X | X | | X | | X | |

| James F. Crowley | | | X | | X | X | X | X |

| David L. Duvall | X | X | X | | X | X | X | |

| Ralph O. Hellmold | | | X | | X | X | | X |

| Matthew E. Jauchius | | X | X | X | X | | X | |

| Sandra L. Kowaleski | X | | X | | X | X | X | |

| Andrew O. Smith | X | | X | | X | | X | |

Our Board currently has one diverse member and is undertaking an active search to add another diverse member during 2022 to better represent where the Company operates.

The Nominating and Corporate Governance Committee will consider persons recommended by stockholders to become nominees for election as directors and subject to the procedural requirements set forth below, such

recommendations will be evaluated in the same manner as other potential nominees. Recommendations for consideration by the Nominating and Corporate Governance Committee should be sent to the Secretary of the Company in writing together with appropriate biographical information concerning each proposed nominee as detailed in Article III.D of the Nominating and Corporate Governance Committee Charter.

The Bylaws of the Company set forth procedural requirements pursuant to which stockholders may make nominations to the Board of Directors. The Board of Directors or the Nominating and Corporate Governance Committee may not accept recommendations for nominations to the Board of Directors in contravention of these procedural requirements.

In order for a stockholder to nominate a person for election to the Board of Directors, the stockholder must give written notice of the stockholder's intent to make the nomination either by personal delivery or by United States mail, postage prepaid, to the Secretary of the Company not less than fifty nor more than seventy-five days prior to the meeting at which directors will be elected. In the event that less than sixty days prior notice or prior public disclosure of the date of the meeting is given or made to stockholders, the Company must receive notice not later than the close of business on the tenth day following the day on which notice of the date of the meeting was mailed or public disclosure was made, whichever occurred first.

The notice must set forth:

•the name and address of record of the stockholder who intends to make the nomination;

•a representation that the stockholder is a holder of record of shares of the capital stock of the Company entitled to vote at the meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice;

•the name, age, business and residence address and principal occupation or employment of each proposed nominee;

•a description of all arrangements or understandings between the stockholder and each proposed nominee and any other person or persons, naming such person or persons, pursuant to which the nomination or nominations are to be made by the stockholder;

•other information regarding each proposed nominee as would be required to be included in a proxy statement filed pursuant to the proxy rules of the SEC; and

•the written consent of each proposed nominee to serve as a director of the Company if elected.

The Company may require any proposed nominee to furnish other information as it may reasonably require to determine the eligibility of the proposed nominee to serve as a director. The presiding officer of the meeting of stockholders may, if the facts warrant, determine that a stockholder did not make a nomination in accordance with the foregoing procedure. If the presiding officer makes such a determination, the officer shall declare such determination at the meeting and the defective nomination will be disregarded.

Board Policies Regarding Communication with the Board of Directors and Attendance at Annual Meetings Stockholders may communicate with the full Board of Directors, non-management directors as a group or individual directors, including the Chairman of the Board, by submitting such communications in writing to the Company's Secretary, c/o the Board of Directors (or, at the stockholder's option, c/o a specific director or directors), 800 Manor Park Drive, Columbus, Ohio 43228. Such communications will be delivered directly to the Board.

The Company does not have a policy regarding Board member attendance at the annual meeting of stockholders; however, all directors of the Company attended the 2021 annual meeting of stockholders.

Code of Ethics

The Company has adopted a Code of Conduct and Business Ethics which applies to all employees and directors of the Company, including the Company's principal executive officer, principal financial officer and principal accounting officer or persons performing similar functions. The Company's Board believes that the Code of Conduct and Business Ethics complies with the code of ethics required by the rules and regulations of the SEC. A

copy of the Company's Code of Conduct and Business Ethics is available on the Company's website at www.coremt.com.

Securities Trading Policy

The Company has adopted an Insider Trading Policy, which applies to all employees and directors of the Company including the Company’s principal executive officer, principal financial officer and principal accounting officer or persons performing similar functions, as well as to each director. The Board believes that the Insider Trading Policy is designed to ensure compliance with all applicable insider trading rules.

Anti-Hedging and Anti-Pledging Policy

The Company's Insider Trading Policy includes an anti-hedging policy, which states that directors, executives and all other employees are not permitted to (a) pledge the Company's securities as collateral for a loan or other obligation, (b) purchase, sell or trade in options (including puts or calls) to purchase or sell the Company's securities, (c) purchase the Company's securities on margin, (d) engage in "short sales", (e) hold the Company's securities in an account that is subject to a margin-call or (f) otherwise deal in derivative securities, which are based upon the Company’s securities.

Compensation Committee Interlocks and Insider Participation

Our Compensation Committee consisted of Board Members Hellmold, Cellitti, Kowaleski and Smith none of whom, during 2021, was an officer or employee of the Company, nor had a relationship requiring disclosure under Item 404 of Regulation S-K (17 CFR §229.404). The Company did not have any compensation committee interlocks in 2021, which generally means that no executive officer of the Company served as a director or member of the compensation committee of another entity, one of whose executive officers served as a director or member of the Compensation Committee of the Company.

DIRECTORS AND EXECUTIVE OFFICERS OF CORE MOLDING TECHNOLOGIES, INC.

| | | | | | | | | | | | | | |

| Board of Directors |

| | | | |

| Name | | Age | | Title |

| | | | |

| Thomas R. Cellitti | | 70 | | Director, Chairman of the Board |

| James F. Crowley | | 75 | | Director |

| David L. Duvall | | 53 | | President, Chief Executive Officer and Director |

| Ralph O. Hellmold | | 81 | | Director |

| Matthew E. Jauchius | | 52 | | Director |

| | | | |

| Sandra L. Kowaleski | | 58 | | Director |

| | | | |

| Andrew O. Smith | | 59 | | Director |

Thomas R. Cellitti

Chairman of the Board

Independent

Director Since: 2000

Age: 70

Education: Loyola University, Chicago (Master’s degree in Business Administration), Marquette University (Bachelor’s degree in Business Administration)

Thomas R. Cellitti was elected Chairman of the Board in June of 2020 and has served as a director of the Company since February 10, 2000. Mr. Cellitti previously was Chairman of the Nominating and Corporate Governance Committee and Chairman of the Executive Resource Committee. Prior to his retirement from Navistar Inc. (“Navistar”) in 2013, Mr. Cellitti was the Senior Vice President of Integrated Reliability and Quality, for Navistar since 2008. Prior to such time, Mr. Cellitti served as Vice President and General Manager, Medium Truck Division from 2004 to 2008, as well as Vice President and General Manager, Bus Vehicle Division from 1991 to 2004 for Navistar, where he led developing and implementing the business strategies. Prior to this time, Mr. Cellitti held positions in Manufacturing and Finance. Mr. Cellitti has also served on the board of various industry and nonprofit organizations as well as private corporations. Mr. Cellitti’s experience includes leadership in developing and implementing business strategies for profitable growth. Mr. Cellitti has a Master’s degree in Business Administration with a specialization in Finance from Loyola University of Chicago and a Bachelor’s degree in Business Administration from Marquette University.

Board Qualifications: As a result of these and other professional experiences, the Board of Directors has concluded that Mr. Cellitti should serve as a director because of his in-depth insight and knowledge about manufacturing operations, quality, and business strategy as well as his extensive background in the powertrain, bus, and truck industries.

James F. Crowley

Chairman of the Nominating and Corporate Governance Committee

Independent

Director Since: 1998

Age: 75

Education: Wharton Graduate School of Business at the University of Pennsylvania (Master's degree in Business Administration), Villanova University (Bachelor's degree in Business Administration), Harvard Business School (Corporate Governance Certificate)

James F. Crowley has served as a director of the Company since May 28, 1998, and is Chairman of the Nominating & Corporate Governance Committee. Mr. Crowley is a private investor and Chairman and Managing Partner of Old Strategic LLC, headquartered in Connecticut. From October 2008 to September 2021, Mr. Crowley had served as a Director of Green Plains and was Chairman of its audit committee. Mr. Crowley retired in 2021. From 1993 to 2006, Mr. Crowley was a founding partner and Chairman of the Strategic Research Institute LLC. From 1984 to 1992, Mr. Crowley served in various capacities with Prudential Securities, Inc., including President of Global Investment & Merchant Banking. Prior to joining Prudential Securities, Inc., Mr. Crowley was a First Vice President and Partner at Smith Barney, Harris Upham & Co. in its Investment Bank and Capital Markets Division. Mr. Crowley has also served on the board of various not-for-profit and private organizations and universities. Mr. Crowley has a Master’s degree in Business Administration from the Wharton Graduate School of Business at the University of Pennsylvania and a Bachelors of Science degree in Business Administration from Villanova University. In addition, Mr. Crowley has attended corporate governance courses at Harvard, Stanford and Northwestern Universities. In 2019, Mr. Crowley was awarded the Harvard Business School Certificate in Corporate Governance.

Board Qualifications: As a result of these and other professional experiences, the Board of Directors has concluded that Mr. Crowley should serve as a director because of his extensive business, investment banking, finance and corporate management experience, as well as his in-depth understanding of the financial markets and insight into the role of serving as Chair of the Company’s Nominating & Corporate Governance Committee.

David L. Duvall

President and Chief Executive Officer

Director Since: 2018

Age: 53

Education: Stanford University (Master of Science in Mechanical Engineering), Purdue University (Bachelor of Science in Mechanical Engineering)

David Duvall joined the Company on October 22, 2018, as Chief Executive Officer and President. Mr. Duvall came to the Company from Signode Industrial Group, a Carlyle Group company, where he served as Group President of the Global Equipment & Tools division, from January 2017 to October 2018, when Signode was sold to Crown Holdings Inc. Prior to Signode, Mr. Duvall served as Senior Vice President and General Manager of Danfoss’ Global Hydrostatics Division from 2012 to 2017, based out of Germany. From 2008 to 2012 Mr. Duvall was Vice President and General Manager for the Global Valves business at Danfoss and led the carve-out of that business to form a stand-alone business within the Danfoss structure. Mr. Duvall has held various senior management roles in both the industrial and automotive sectors, including Americas General Manager for Fuel Tanks at TI Automotive (2005-2008) and Vice President of Operations with VITEC LLC (2003-2005). Mr. Duvall has a Master’s of Science in Mechanical Engineering from Stanford University and a Bachelor of Science in Mechanical Engineering from Purdue University.

Board Qualifications: As a result of these and other professional experiences, the Board of Directors has concluded that Mr. Duvall should serve as a director because of his corporate management skills and experience, in-depth global operations insight, and strategy and business development knowledge.

Ralph O. Hellmold

Chairman of Compensation Committee

Independent

Director Since: 1996

Age: 81

Education: Columbia University (Master’s degree in International Relations), Harvard College (Bachelor of Arts)

Ralph O. Hellmold has served as a director of the Company since its formation on December 31, 1996, and is Chairman of the Compensation Committee. He was Managing Member of Hellmold & Co., LLC, an investment banking boutique specializing in mergers and acquisitions and working with troubled companies or their creditors until 2012, and is currently an investor. Prior to forming Hellmold & Co., LLC in 2004, Mr. Hellmold was president of Hellmold Associates which was formed in 1990 and Chairman of The Private Investment Banking Company which was formed in 1999. Prior to 1990, Mr. Hellmold was a Managing Director at Prudential-Bache Capital Funding, where he served as co-head of the Corporate Finance Group, co-head of the Investment Banking Committee and head of the Financial Restructuring Group. Prior to 1987, Mr. Hellmold was a partner at Lehman Brothers and its successors, where he worked in Corporate Finance since 1974 and co-founded Lehman’s Financial Restructuring Group. Mr. Hellmold is a Chartered Financial Analyst and has served as director, and on the audit committee, of other public corporations in the past. Mr. Hellmold has a Master’s degree in International Relations from Columbia University and a Bachelor of Arts degree from Harvard College.

Board Qualifications: As a result of these and other professional experiences, the Board of Directors has concluded that Mr. Hellmold should serve as a director because of his extensive business, investment banking, finance and corporate management experience, as well as his in-depth understanding of the financial markets and a strong background in mergers and acquisitions, which also supports his role of serving as Chair of the Company’s Compensation Committee.

Matthew E. Jauchius

Chairman of Audit Committee

Independent

Director Since: 2013

Age: 52

Education: University of Michigan (Master’s degree in Business Administration), The Ohio State University (Bachelor’s degree in Business Administration)

Matthew E. Jauchius has served as a director of the Company since January 1, 2013, and is Chairman of the Audit Committee. Mr. Jauchius is currently a Lecturer in Marketing at the Fisher College of Business at The Ohio State University, President of Buckwolf LLC, a marketing and strategy consultancy, President of J5 Alpha LLC, a small business focused on fitness services, and a venture investor. Mr. Jauchius previously served as the Executive Vice President and Chief Marketing Officer at Fifth Third Bancorp, where he directed a substantial integrated marketing program from 2017 to 2021. From 2015 to 2016, Mr. Jauchius served as Executive Vice President and Chief Marketing Officer of Hertz Global Holdings, and from 2010 to 2015 Mr. Jauchius served as Executive Vice President and Chief Marketing Officer at Nationwide Mutual Insurance Company. Mr. Jauchius also served previously as Senior Vice President and Chief Strategy Officer at Nationwide. Prior to Nationwide, Mr. Jauchius served as Associate Principal at McKinsey & Company, Risk Advisor at Bank One (now Chase), and Senior Accountant at Ernst & Young. Mr. Jauchius’ experience includes strategy and growth, marketing and sales, company turnarounds, audit/risk management, and operational cost improvements, which includes support to the automotive, agriculture and other manufacturing industries. Mr. Jauchius has a Master’s degree in Business Administration from the University of Michigan and a Bachelor’s degree in Business Administration from The Ohio State University. Mr. Jauchius is a Certified Public Accountant (inactive) in the State of Ohio.

Board Qualifications: As a result of these and other professional experiences, the Board of Directors has concluded that Mr. Jauchius should serve as a director and Chair of the Company’s Audit Committee because of his in-depth insight and experience in marketing, strategy and business development.

Sandra L. Kowaleski

Director

Independent

Director Since: 2020

Age: 58

Education: The Ohio State University (Bachelor’s degree in Chemical Engineering)

Sandra L. Kowaleski has served as a director of the Company since September 21, 2020. Ms. Kowaleski is current VP Operations at Stanley Black and Decker. She is responsible for manufacturing locations supporting the Outdoor Business Unit and providing operational leadership to the integration activities and electrification strategy post acquisition of MTD Products. From 2015 to 2020, Ms. Kowaleski served as a Global Operations Leader of Momentive Performance Materials, a global leader in silicones and advanced materials serving the aerospace, automotive, transportation, electronics, and semiconductors industries. In her career, she has also held several executive-level operations and business leadership positions, including Vice President - Global Operations for Minerals Technologies and Vice President, General Manager - Functional Coatings & Manufacturing Operations for OMNOVA Solutions/GenCorp. Ms. Kowaleski's experience includes global operational and manufacturing system optimization, leading business and culture transformations, multi-national business leadership, and strengthening financial results in multi-site businesses. Prior board experience includes Board of Trustees for the OMNOVA Foundation and Advisory Board Member for the Industrial Systems & Welding Engineering department of The Ohio State University. She was also a Managing Director for GmbH. Ms. Kowaleski has a Bachelor's Degree in Chemical Engineering from The Ohio State University.

Board Qualifications: As a result of these and other professional experiences, the Board of Directors has concluded that Ms. Kowaleski should serve as a director because of her corporate management skills and experience, in-depth global operations insight, business development knowledge, and advanced materials and molding expertise.

Andrew O. Smith

Director

Independent

Director Since: 2015

Age: 59

Education: University of Chicago (Law degree and a Master’s degree in Business Administration), University of Pennsylvania (Bachelor’s degree in Engineering and a Bachelor’s degree in Finance)

Andrew O. Smith has served as a director of the Company since August 6, 2015. Since 2019, he has been the President and Chief Executive Officer for Yenkin-Majestic Paint Corporation/OPC Polymers (“YM/OPC”), a privately-held manufacturer of coatings resins, architectural paints, and industrial coatings serving customers primarily in North America. Before joining YM/OPC in 1995, Mr. Smith served as a principal in several entrepreneurial businesses, after beginning his career as a management consultant in the strategy practice of Booz · Allen & Hamilton, where he advised major industrial and financial corporations. In his current position, Mr. Smith oversees manufacturing, finance, information technology, legal, research and development and strategic planning. He also serves on the Board of YM/OPC, the Buckeye Institute for Public Policy Solutions, and several other non-profit organizations. Mr. Smith has extensive experience in manufacturing and materials development, knowledge of supply chain and logistics, and extensive experience analyzing financial statements. He is a member of the bar of the State of New York and active in professional organizations including the National Association of Manufacturers and the American Coatings Association. Mr. Smith has a law degree and a Master’s degree in Business Administration both from the University of Chicago and a Bachelor’s degree in Engineering from the School of Engineering and Applied Science and a Bachelor’s degree in Finance from the Wharton School of Business, both at the University of Pennsylvania.

Board Qualifications: As a result of these and other professional experiences, the Board of Directors has concluded that Mr. Smith should serve as a director because of his in-depth insight and knowledge about manufacturing, materials technology, and executive leadership.

| | | | | | | | | | | | | | |

| Executive Management |

| | | | |

| Name | | Age | | Position(s) Currently Held |

| | | | |

| Renee R. Anderson | | 58 | | Executive Vice President, Human Resources |

| David L. Duvall | | 53 | | President, Chief Executive Officer and Director |

| J. Christopher Highfield | | 55 | | Executive Vice President, Marketing and Sales |

| Eric L. Palomaki | | 40 | | Executive Vice President, Operations, Research and Development |

| John P. Zimmer | | 57 | | Executive Vice President, Secretary, Treasurer, and Chief Financial Officer |

Biographical information for David Duvall, who also serves as one of our directors, is provided above in this Proxy Statement.

Renee R. Anderson

Executive Officer Since: 2019

Age: 58

Education: Montreat College (Bachelor’s degree in Business Administration), Western Carolina University (Master’s degree in Human Resource Management)

Renee Anderson joined the Company on January 7, 2019 and was appointed Executive Vice President of Human Resources. Prior to joining CORE, from 2016 to 2018, Mrs. Anderson was President of Anderson Consulting Services, LLC, a Human Resources consulting practice specializing in helping organizations implement culture change initiatives which focus on: employee engagement, results-driven actions, conflict management, organizational effectiveness, leadership development and talent development/management. Prior to Anderson Consulting Services, from 2012 to 2016, Mrs. Anderson served as the Americas Human Resources Director for Draexlmaier, an automotive supplier with over 60,000 employees generating revenues of $3.7 billion annually. Before that, from 1997 to 2011, she held Human Resource leadership positions of increasing responsibility with Danfoss and Alcan Medical. Mrs. Anderson earned her bachelor’s degree from Montreat College in Business Administration and earned her Master’s degree from Western Carolina University in Human Resource Management.

J. Christopher Highfield

Executive Officer Since: 2020

Age: 55

Education: Cedarville University (Master of Business Administration), Wittenberg University (Bachelor in Business Administration)

J. Christopher Highfield joined the Company in June of 2015 serving as the Director of Truck & Bus Products. He was promoted to Vice President and Commercial Lead in August of 2018, and to Executive Vice President of Sales & Marketing in November of 2020. Prior to joining the Company, Mr. Highfield was employed by American Trim, a Tier 1 supplier of decorated metal products serving the appliance, automotive, heavy truck and industrial marketplace, from 2002 to 2015. He joined American Trim as the Director of Truck & Bus Products, and held several positions of increasing responsibility, advancing to the senior leader of the Sales & Marketing organization. Prior to American Trim, Mr. Highfield held various director, general manager and commercial leadership positions with top Tier 1 providers in the agriculture, appliance, automotive, lawn & garden, heavy truck, industrial and outdoor power markets. Mr. Highfield earned his MBA with a concentration in Operations & Finance from Cedarville University and his undergraduate degree in Business Administration from Wittenberg University.

Eric L. Palomaki

Executive Officer Since: 2018

Age: 40

Education: Jack Welch Management Institute (Master of Business Administration), Rensselaer Polytechnic Institute (Bachelor of Science in Mechanical Engineering)

Eric L. Palomaki joined the company on September 19, 2018, and was appointed to the position of Vice President of Operations. Mr. Palomaki was promoted to Executive Vice President of Operations, Research and Development in November, 2020. Prior to joining CORE, Mr. Palomaki was the Vice President of Advanced Manufacturing Engineering from 2013 to 2017 at Acuity Brands Lighting, a commercial lighting company with 12,000 employees generating $3.5 billion annually. Prior to Acuity Brands, Mr. Palomaki served in multiple roles in the automotive industry for North American Lighting in 2012 and 2013, and TRW Automotive from 2007 to 2012. Mr. Palomaki holds a Master of Business Administration from Jack Welch Management Institute, and a Bachelor’s of Science in Mechanical Engineering from Rensselaer Polytechnic Institute.

John P. Zimmer

Executive Officer Since: 2013

Age: 57

Education: The Ohio State University (Bachelor’s degree in Business Administration)

John P. Zimmer joined the Company on November 4, 2013 and was appointed to the position of Vice President, Treasurer, Secretary and Chief Financial Officer on November 5, 2013. Mr. Zimmer has more than 30 years of finance and accounting experience. Prior to joining the company, Mr. Zimmer was Chief Financial Officer of Parex Group USA, Inc., a division of Parex Group, a $1 billion manufacturer of construction materials, from 2010 to 2013. Mr. Zimmer also served as Chief Financial Officer of The Upper Deck Company, LLC from 2006 to 2010. Prior to that, Mr. Zimmer was Vice President of Finance for Cardinal Health Pyxis Products, and held senior management roles with SubmitOrder, Inc., Cardinal Health and Deloitte & Touche. Mr. Zimmer has a Bachelor’s degree in Business Administration from The Ohio State University, and is also a Certified Public Accountant (inactive) in the State of Ohio.

The Company is not aware of any family relationships among any of the following persons or any arrangements or understandings pursuant to which those persons have been, or are to be, selected as a director or executive officer of the Company, other than arrangements or understandings with directors or executive officers acting solely in their capacity as directors or executive officers.

EXECUTIVE COMPENSATION

Unless the context requires otherwise, in this Executive Compensation section, including the Compensation Discussion and Analysis and the tables which follow it, references to "we," "us," "our'' or similar terms are to the Company and our subsidiaries.

2021 Updates to the Executive Compensation Program

In 2021, the Company completed its operations turnaround, which it began in the fourth quarter of 2018. In line with its updated business objectives, the Company adopted an executive compensation program designed to increase focus on growth and profitability. The Company adjusted components of its compensation program in 2021 as follows:

•Executive base pay adjustments were in line with market benchmarks.

•The annual short-term incentive plan was modified to focus on achieving earnings before interest and taxes ("EBIT") and free cash flows ("FCF") targets.

•Long-term stock based compensation awards were modified to be in line with Company historical targets.

The most significant compensation program changes related to the Short-term Incentive Plan ("STIP"). The 2021 STIP was a pay for performance plan which focused on growth and profitability of the Company by providing performance achievement goals related to earnings before interest and taxes ("EBIT") and free cash flows ("FCF"). The previous 2020 STIP was a pay for performance plan that focused on improving Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) which would provide cash flows to stabilize and improve the business during its turnaround and allow the Company to refinance its credit facility.

In 2021, the Company paid an annual incentive payout based on the Company's successful results and its ability to quickly adjust operations in the face of macro supply chain shortages and rapid inflation. The 2021 STIP payments were 68% and 55% of base salary for the CEO and NEOs, respectively, compared to 60% for both CEO and NEOs in 2020.

The Board granted Mr. Duvall $1,000,000 of restricted stock in 2021 in addition to his normal annual grant to recognize the successful turnaround of the Company and recognize Mr. Duvall's decision in prior years to waive guaranteed cash incentives in 2019 and 2020 of $550,000 each year. The restricted stock vests evenly over three years.

Compensation Discussion and Analysis

This compensation discussion and analysis describes the following aspects of our compensation system as it applies to our named executive officers (NEOs) as described in the summary compensation table set forth below:

•Our compensation philosophy and objectives;

•The means we employ to achieve our compensation objectives, including the establishment of total direct compensation and the mix within that compensation;

•The elements of compensation that are included within total direct compensation, as well as, other compensation items in addition to total direct compensation; and

•The reasons we have elected to pay these elements of compensation to achieve our compensation objectives and how we determine the amount of each element.

Compensation Philosophy and Objectives

Our compensation philosophy is focused on incentivizing executives primarily through the use of base salary, annual short-term cash incentives and long-term equity-based incentive compensation in order to attract, motivate, reward and retain executives.

The Board of Directors has established an articulated compensation philosophy with the following primary objectives:

•Attract, retain and encourage the development of highly qualified and motivated executives;

•Provide compensation that is competitive with our peers and defined marketplace;

•Provide compensation on both an annual and long-term basis and in a fashion that aligns the interests of executives with those of our stockholders in order to create long-term stockholder value; and

•Enhance the connection between our business results and the compensation of executives, linking a material portion of executive compensation with performance.

To this end, the objectives of our compensation philosophy put a strong emphasis on correlating the long-term growth of stockholder value with management’s most significant compensation opportunities.

Means of Achieving Our Compensation Objectives

The three primary components of compensation for our NEOs include base salary, annual cash incentive compensation and long-term equity-based incentive compensation. Our NEOs also participate in our 401(k) plan and receive medical, dental, vision, short-term disability, long-term disability and life insurance benefits consistent with those benefits for our other corporate salaried employees.

Determination of Compensation

Our Compensation Committee reviews, evaluates and recommends compensation policies for our NEOs. All of the Compensation Committee members are familiar with the standard compensation levels in similar industries, and are knowledgeable regarding the current trends for compensating executive officers. The Board of Directors is responsible for the formal determination concerning compensation of NEOs; provided, however, that the Chief Executive Officer (“CEO”) is not involved in, and abstains from, all discussions and decisions regarding his compensation as an executive officer. During 2021, the Compensation Committee retained Pearl Meyer & Partners LLC (“Pearl Meyer”) to assist in the review of 2021 compensation programs. In this regard, Pearl Meyer compiled competitive data for base salaries, non-equity compensation, and equity incentive awards from a peer group of companies to be used to benchmark the appropriateness and competitiveness of our executive compensation. During 2021, there were no fees paid to Pearl Meyer for services that were not related to executive or director compensation. The Compensation Committee has assessed the independence of Pearl Meyer pursuant to SEC rules and determined that Pearl Meyer is independent and its work for the Compensation Committee does not raise any conflict of interest. The Compensation Committee also considered each NEOs individual performance, the compensation objectives described above and peer group performance described below in determining compensation. Past stockholder advisory votes are considered by the Compensation Committee as affirmation by our stockholders of the Company's compensation policies and practices with respect to our NEOs.

As part of its duty to review executive officer compensation programs, the Compensation Committee reviews and evaluates the Company's equity incentive programs with consideration of the peer benchmark data and the Board's overall compensation objectives. Stock grants are typically considered after the Company's annual meeting, but may be awarded at other times. During 2021, the Board made stock grants to the NEOs under the Long-Term Equity Incentive Plan.

Peer Group Analysis

To help facilitate the compensation review and to establish appropriate levels of compensation for directors and NEOs, the Board retained Pearl Meyer, a leading advisor on executive compensation, to compile competitive data for base salaries, non-equity compensation, and equity incentive awards from a peer group of companies. Because our market for executive talent is national, competitive data is reflective of the compensation levels of executives at companies of comparable size and complexity on both the local and national level. In addition, the information that is collected relates to companies with comparable manufacturing operations or geographic representation. The companies reviewed were publicly traded in the United States and had median sales of approximately $256 million. The data reviewed for these peer companies was derived from the publicly available SEC filings of these organizations. The companies comprising the peer group reviewed for establishing 2021 compensation levels were as follows:

| | | | | | | | |

| CECO Environmental Corp | Universal Stainless & Alloy | Twin Disc, Incorporated |

| Douglas Dynamics Inc. | Commercial Vehicle Group | Compx International Inc. |

| Gentherm Incorporated | DMC Global Inc. | Dorman Product Inc. |

| Hurco Companies, Inc. | The Eastern Company | FreightCar America, Inc. |

| Motorcar Parts of America | Graham Corporation | Helios Technologies, Inc. |

| Sifco Industries, Inc. | Lydall, Inc. | Manitex International, Inc. |

| Synalloy Corp | PGT Innovations, Inc. | Strattec Security Corp. |

| UFP Technologies, Inc. | Stoneridge, Inc. | |

The Company removed Continental Materials Corp (delisted) and Shiloh Industries (acquired) from the peer group in 2021. No new companies were added to the peer group.

We used this competitive data to determine the applicable market median for executive compensation among the peer group, which serves as a benchmark for analyzing compensation for each of our executive positions. Non-equity compensation and equity awards can vary significantly from year to year in relation to the peer group, depending on the Company's performance in relation to that of the peer group. In years of higher profitability, the short-term incentive (non-equity compensation) and equity amounts awarded to our executive officers may exceed the corresponding market median amounts of our peer group. In contrast, during years of lower profitability the Company's short-term incentive and equity awards may fall below the corresponding market median amounts of our peer group.

We believe reviewing the approximate market median amounts from our peer group is an appropriate guide for establishing our executive compensation, because we expect to achieve at least median performance and that result balances the cost of the compensation program with the expected performance.

While we target total compensation at the market median, an executive's actual total compensation could vary significantly depending upon the relationship between our actual performance and the performance of our peer group, particularly in regard to non-equity compensation. If our results are well above the peer group performance, executives have the opportunity to earn compensation that is well above the relevant market median. Conversely, executives may earn compensation that is well below the relevant market median if our performance is well below peer group levels.

Compensation Mix

We compensate our CEO and other NEOs through a combination of base salary, the opportunity for short-term incentive compensation and long-term equity-based incentive compensation. The amount of total direct compensation for our CEO and other NEOs is allocated among the various types of compensation in a manner designed to achieve our overall compensation objectives based on the peer group median as described above.

Elements of Direct Compensation | | | | | | | | |

| Direct Compensation Element | Description | Additional Details |

| Base Salary | Provide predictable level of current income for our NEOs | •Designed to attract and retain qualified executives

•Adjustments, if any, approved by the Board on an annual basis

|

| Short-term Incentive Program | Annual program for all salaried employees, including CEO and other NEOs, designed to align with stockholder interests by directly tying cash incentive payments to our overall financial performance | •In 2021 the Company adopted a short-term incentive plan based on EBIT and FCF targets.

•In 2020 the Company adopted a short-term incentive plan that was based on the successful turnaround of the Company. The plan targeted payout levels were lowered to recognize the current financial position of the Company and the need to conserve cash during the Company’s turnaround |

| Long-Term Stock-Based Compensation | |

| Restricted Stock | Granted to our CEO and other NEOs, directors and other key managers | •Vests in three equal installments over the next three years following the grant date

•No shares vest until a recipient’s third anniversary with the Company

•For participants 65 years of age and older, grants vest over a one year period

•Accelerated vesting upon death, disability or “change-in-control”

•Award based on percentage of recipient’s base salary

•Shares granted based on the award value divided by the Company's average of the high and low share price on the grant date

•In 2020, the targeted grants were reduced in consideration of the Company’s financial performance and low stock price. |

| | | | | | | | |

| Long-Term Stock-Based Compensation Continued | |

| Stock Appreciation Rights (SARs) | Granted to our CEO and other NEOs, directors and other key managers in 2019 | •Vests in three equal installments over the next three years following the grant date

•All SARs grants are fully time vested upon the date of the recipient's 65th birthday

•Accelerated vesting upon death, disability or “change-in-control”

•Based on the award value divided by the Black-Scholes price on the grant date

•SARs granted in 2019 as part of the Company’s turnaround plan to compensate for a successful turnaround. SARs were granted with a $10.00 strike price when the Company’s share price was $7.69. |

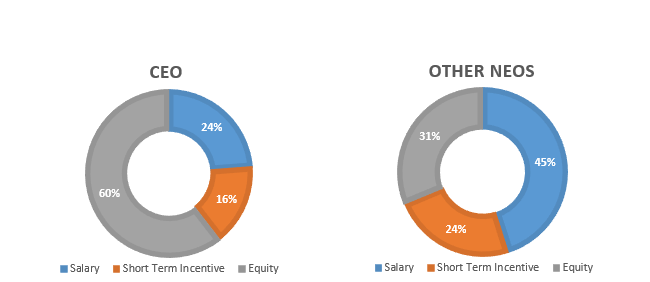

2021 Compensation Mix for CEO and NEOs

The annual short-term incentive and long-term equity-based incentive components (“Variable Compensation”) target was 65% and 60% of the CEO and other NEOs overall direct compensation, respectively, with the remaining 35% and 40% relating to base salary. In years of higher profitability, the short-term incentive and long-term equity amounts awarded to our executive officers could result in a compensation mix higher than our target. In contrast, during years of lower profitability our compensation mix of short-term incentive and long-term equity amounts could result in a compensation mix lower than our target.

The resulting compensation mix related to Variable Compensation for our CEO and other NEOs for 2021 was approximately 76% and 55%, respectively. Salary and other compensation for our CEO and other NEOs for 2021 was approximately 24% and 45%, respectively. The Board granted Mr. Duvall an additional $1,000,000 of restricted stock in 2021 to recognize the successful turnaround of the Company and recognize Mr. Duvall's prior decision to waive guaranteed cash incentives in 2019 and 2020 of $550,000 each year. The Board considered the resulting compensation mix reasonable and appropriate in light of the performance achieved and the market amounts from our peer group.

Base Salary

We use base salaries to provide predictable level of current income for our CEO and other NEOs. Our base salaries are designed to assist in attracting, retaining and encouraging the development of qualified executives. The amount of each executive's annual base salary is based on that executive’s position, skills and experience, individual performance and the salaries of executives with comparable positions and responsibilities at peer companies. When establishing base salaries for our CEO and other NEOs, we do not consider awards previously made, including equity-based awards under our long-term incentive or short-term incentives plans. Base salary adjustments are approved by the Board, based upon recommendations of the Compensation Committee and consider the CEO and other NEOs’ individual performance and pay relative to other peer group companies.

The Compensation Committee typically reviews officer compensation on an annual basis, or upon a new executive officer being appointed.

Base salaries for the CEO and other NEOs were adjusted in June 2021. As part of the Company’s turnaround plan the CEO and NEOs of the Company voluntarily reduced their base salary by 10% from January 1, 2020 through September 30, 2020. As a result of the success of the turnaround and the Company’s ability to refinance its defaulted debt facility, the CEO and NEOs salaries were reinstated to their approved levels as of October 1, 2020. No other adjustments to the CEO and NEOs’ salary was made in 2020.

Short-term Incentive Plan ("STIP")

2021 STIP

In 2021 the Company adopted a new STIP which reflected the Company's successful completed from its turnaround and the focus on growing the Company and increasing profitability. The STIP provides all salaried personnel with a target STIP percentage award of base pay based on an individual's position. The target STIP percentage for our CEO and other NEOs are as follows:

| | | | | | | | |

| Position | | STIP Target Percentage of Base Pay |

| CEO | | 100% |

| NEO | | 80% |

The actual STIP payment percentage can increase or decrease based on Company's actual performance compared to performance goals set by the Board. If the Company meets less than 80% of performance goals no payout related to that goal is made. If the Company exceeds a performance goal by 50% the STIP payment percentage reaches its maximum level of two times the target STIP percentage for the specific performance goal. The STIP payment percentage incrementally increases for performance achievement between 80% and 150% of performance targets.

The Board set the following performance goals for 2021 (in thousands):

| | | | | | | | | | | | | | |

| Measurement | | Goal Amount | | Weight |

EBIT (before STIP) (1) | | $17,517 | | 70% |

Free Cash Flow (2) | | $10,347 | | 30% |

(1) EBIT excluding the operations and closure costs of the Company's Batavia, Ohio facility.

(2) Free Cash Flows is defined as operating cash flows less capital expenditures, excluding capital expenditures for the addition of the Company's DFLT press expansion in Matamoros, Mexico.

The Company's full year achievement of the goals are as follows (in thousands):

| | | | | | | | | | | | | | |

| Measurement | | Goal Amount | | Actual Weight |

| EBIT (before STIP) | | $16,024 | | 91% |

| Free Cash Flow | | $5,986 | | 58% |

Based on performance, the Company achieved 51% of targeted STIP. In the second half of 2021 rapid global inflation and supply chain disruptions significantly changed the Company's operational focus for 2021. The Company's focus transitioned to supply chain stability and making sure that customer deliveries were uninterrupted and managing the impact on the Company's financial results of rapid inflation. The Board recognized that as a result of the macro events the ability of the Company to meet its STIP goals was severely impacted. The Board determined that STIP goal performance for the first half 2021 should be used to pay the full year STIP bonus. As a result, the Board adjusted the STIP performance to 68% of targeted STIP for all participants to partially reflect the effect of macro events and the Company's ability to quickly meet the macro challenges. Total STIP payments were $2.4 million and 33% being allocated to the NEOs.

The STIP Payout for our CEO and NEO are as follows:

| | | | | | | | | | | | | | | | | | | | |

| Position | | Target STIP | | Achievement | | Payout Level (as a percent of base salary) |

| CEO | | 100% | | 68% | | 68% |