The Directors submit their report and audited financial statements for the year ended 31 December 2005. For the purposes of this report, “Company” means COLT Telecom Group plc and “Group” means the Company and its subsidiary undertakings.

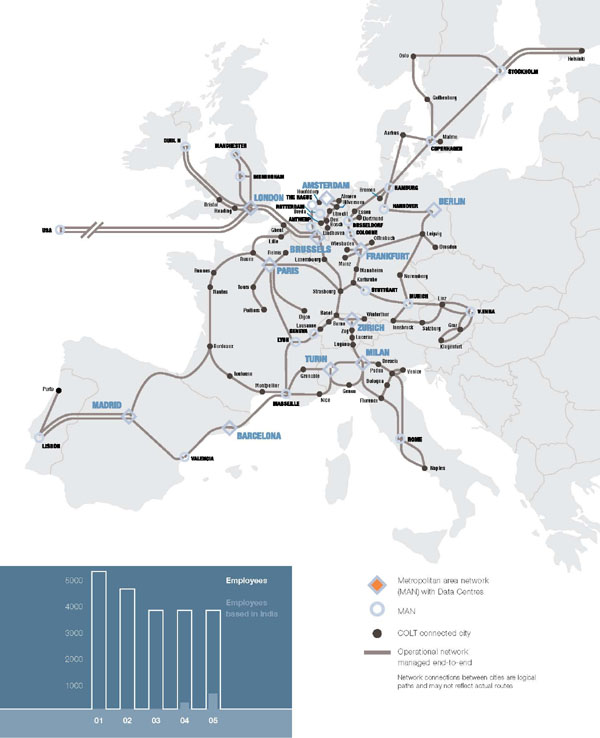

The Company is the holding company for the Group. The principal activity of the Group is the provision of business communications solutions and services within Europe.

The Chairman’s Overview, the Chief Executive Officer’s Review of Operations and the Financial Review contain details of the development of the Group’s business during 2005, the position at the end of 2005, events in 2006 up to the date of this report and likely future developments.

The Group Income Statement for 2005 is set out on page 35 and the Financial Review is set out on pages 12 to 17. The Directors are not recommending the payment of a dividend.

On 23 February 2006, the Company will announce a substantial programme to strengthen the foundations of its corporate structure with its intention to raise £300m of new equity, move its domicile to mainland Europe and cancel its US registration and NASDAQ listing.

The tenth Annual General Meeting of the Company (the “AGM”) is to be held at The London Capital Club, 15 Abchurch Lane, London, EC4N 7BW, UK on Thursday 27 April 2006, starting at 11:00 a.m. The notice convening the meeting is in a separate document sent to shareholders. All proposals in the notice of the meeting to be considered at the AGM will be decided by a poll

of shareholders.

The Directors of the Company are listed with their biographical details on pages 20 and 21. Richard Walsh was appointed as a new Director on 1 June 2005. As advised in the 2004 Annual Report Gene Gabbard was appointed a Director on 6 January 2005. In accordance with the Articles of Association all the current Directors will retire at the AGM. All of the retiring Directors, being eligible, are standing for re-election or, in the case of Richard Walsh, the Director appointed since the last Annual General Meeting, for election, as a Director.

The interests of the current Directors in the Company’s ordinary shares at 1 January 2005 or if later, their date of appointment,

There was no change in these interests between 31 December 2005 and 22 February 2006.

Details of the Directors’ interests in options over the Company’s ordinary shares are set out on page 32. Details of the Directors’ service agreements are set out on page 31.

PricewaterhouseCoopers LLP are the external auditors of the Company. Their reappointment as the Company’s auditors, together with authority for the Directors to fix their remuneration, will be proposed at the AGM.

Details of the changes in the number of the Company’s ordinary shares in issue are set out in note 14 of the Financial Statements on page 51. The Directors have shareholder authority to allot ordinary shares in the Company and to dis-apply statutory pre-emption rights. The renewal of these authorities will be proposed at the AGM.

The Company has shareholder authority to purchase its own shares. No shares have been purchased and no contract has been entered into under this authority. The renewal of this authority will be proposed at the AGM.

Annual Report 2005 23

Shareholders

Two trusts are set up for facilitating the holding of shares in the Company by employees and the executive Directors. Details of these trusts, including the number of the Company’s ordinary shares held by them, are given in note 14 of the Financial Statements on pages 51 to 54.

As at 22 February 2006, the following shareholders have notified the Company of their interest in 3% or more of the Company’s issued ordinary shares:

Shareholder | Number of Ordinary Shares |

FMR Corp.1 | 471,089,421 |

Fidelity Investors Limited Partnership2 | 313,073,111 |

Orbis Investment Management Limited3 | 136,707,504 |

Fidelity International Limited4 | 107,906,957 |

Amvescap plc5 | 67,684,889 |

1 FMR Corp.’s (82 Devonshire Street, Boston, Massachusetts 02109 USA) interest is held through:

(a) an indirect wholly owned subsidiary, Colt, Inc., that holds 13,681,198 ordinary shares;

(b) a wholly owned subsidiary, that as trustee holds 77,000,000 ordinary shares for The Colt, Inc. 2004 Annuity Trust, 172,215,436 ordinary shares for The Colt, Inc. 2003 Annuity Trust, 82,723,580 ordinary shares for The Colt, Inc. 2002 Annuity Trust, 60,016,438 ordinary shares for The Colt, Inc. 2001 Annuity Trust and 1,575,038 ordinary shares for The Colt, Inc. 2001 Charitable Trust;

(c) a wholly-owned subsidiary, Strategic Advisers, Inc., that as manager of three charitable foundations has sole voting power over 9,715,293 ordinary shares for the Edward C. Johnson Fund, 9,810,218 ordinary shares for the Fidelity Foundation and 43,687,020 ordinary shares for the Fidelity Non-Profit Management Foundation; and

(d) the COLT Incentive Share Plan Trust, of which Colt, Inc. is the joint trustee, that holds 665,200 ordinary shares.

2 Fidelity Investors Limited Partnership (82 Devonshire Street, Boston, Massachusetts 02109 USA) is a Delaware limited partnership.

3 Orbis Investment Management Limited (LPG Building, 34 Bermudiana Road, Hamilton HM 11, Bermuda) is a Bermuda company.

4 Fidelity International Limited (Pembroke Hall, 42 Crow Lane, Pembroke, Bermuda HM-19) is a Bermuda company.

5 Amvescap plc (30 Finsbury Square, London, EC2A 1AG) is a fund manager whose interest is a non-beneficial interest held either directly or through its subsidiary companies.

Fidelity Relationship Agreement

In December 1996, the Company entered into a Relationship Agreement with FMR Corp., COLT Inc., Fidelity Investors Limited Partnership, FIL Bank and Trust Company Limited (now FIL Trust Company Limited) and Fidelity International Limited (“Fidelity”). Under the Agreement, Fidelity, and where appropriate its affiliates, have agreed that more than half of the Directors of the Company will be non-Fidelity related Directors, that Fidelity will not compete with the Group without the consent of the non-Fidelity related Directors, that any agreements between Fidelity and the Group will be on an arm’s length basis and subject to the consent of the non-Fidelity related Directors, and that Fidelity will not acquire ordinary shares of the Company if less than 25% of the shares would as a result be in public hands. The Agreement continues in force while Fidelity or its affiliates hold at least 30% of the issued ordinary shares of the Company.

The current Fidelity related Directors under the Agreement are Barry Bateman, Jean-Yves Charlier, Timothy Hilton, John Remondi and Richard Walsh. Details of transactions with Fidelity and its affiliates in 2005 are given in note 23 of the Financial Statements on page 63.

Corporate and social responsibility

The Corporate and Social Responsibility Review on pages 18 and 19 sets out the charitable and political donations made by the Group, the employment policies of the Group and action taken to involve employees in the business of the Group.

Creditors and supplier payment policy

Where goods or services have been supplied in accordance with terms agreed with a supplier, it is the policy of the Group that the supplier is paid in accordance with those terms. The Company is a holding company and has no trade creditors. At 31 December 2005, the number of days of annual purchases represented by year end creditors for the Group was 29 days (2004: 30 days).

Approved by the Board of Directors and signed on its behalf by

Caroline Griffin Pain

Company Secretary, 22 February 2006

24 COLT Telecom Group plc

Corporate governance statement

The Board recognises that good corporate governance is in the best interests of all shareholders. This statement describes the Company’s corporate governance arrangements.

The Combined Code on Corporate Governance

The Combined Code on Corporate Governance (the “Combined Code”) was issued in its amended form by the UK Financial Reporting Council in July 2003 and is annexed to the Listing Rules of the UK Listing Authority. During the year ended 31 December 2005, the Company complied with the provisions of Section 1 of the Combined Code in all respects save only for the matters described in this statement. These matters at 31 December 2005 were as follows:

The Board has not appointed a Senior Independent Director. The Board is satisfied that because the Company maintains an active relationship with its shareholders, as described in the Relations with Shareholders section below, there is no necessity for a Senior Independent Director within the Company, but will keep this under review.

The Chairman of the Company is a member of the Compensation Committee. His contact with executives provides an important contribution to the work of this Committee. Moreover, the Board believes that it is important that Fidelity, as the major shareholder, is represented on the Compensation Committee.

The Board

The Board has twelve members and it comprises the Chairman, the Chief Executive, one other executive Director and nine non-executive Directors. Biographical details of the Directors are set out on pages 20 and 21.

Five members of the board are employed by Fidelity, the Company’s major shareholder. These are the Chairman, the Chief Executive, and three of the non-executive Directors: Timothy Hilton, John Remondi and Richard Walsh. The appointment of Directors representing a company’s major shareholder is common and the Fidelity related non-executive Directors, although not independent under the provisions of the Combined Code, are independent of management and accordingly exercise their judgement in the interests of all shareholders. The Company is also able to carry on its business independently of its major shareholder and the Fidelity Relationship Agreement, details of which are set out in the Report of the Board of Directors on page 23, requires that any agreements between Fidelity and the Group will be on an arm’s length basis and subject to the consent of the non-Fidelity related Directors.

The Board considers each of the remaining six non-executive Directors: Andreas Barth, Vincenzo Damiani, Hans Eggerstedt, Gene Gabbard, Robert Hawley and Frans van den Hoven to be independent, notwithstanding the following relationships or circumstances.

Vincenzo Damiani, Robert Hawley and Frans van den Hoven hold share options, details of which are set out on page 32. They were granted their options on joining the Board as an appropriate means by which they could acquire shares in the Company and align their interests with shareholders, and at a time when this was permitted under then applicable corporate governance provisions. Options have not been granted to any non-executive Director since 2002. There is no intention to grant options to non-executive Directors in the forthcoming twelve months. The estimated values of the outstanding options based on a Black-Scholes model are less than £11,000, £700 and £100 respectively. In the circumstances, the Board does not consider that these historical options compromise the independence of these Directors.

Frans van den Hoven is an independent non-executive director of three funds managed by Fidelity International Limited. His role in this capacity involves the oversight of Fidelity International Limited on behalf of the funds’ shareholders. As he is independent of Fidelity management, the Board does not consider that these external directorships compromise his independence. Whilst Frans van den Hoven has been a non-executive Director for nine years, the Board does not consider this to compromise his independence as the composition of the Board as a whole, including the

Annual Report 2005 25

executive Directors, has changed significantly over this time. The Board has given particular consideration to the Combined Code’s requirement that determination of independence and re-appointment for members serving for more than nine years should be subject to a rigorous review and are satisfied that Mr van den Hoven continues to make a valued contribution as an independent non-executive Director.

There is a division of responsibility between the Chairman, Barry Bateman, and the Chief Executive, Jean-Yves Charlier. The Chairman, whose commitments other than to the Group are set out on page 20 and which have not changed during the year, is responsible for keeping the strategic direction of the Group under review and for ensuring that the Board functions effectively. The Chief Executive is responsible for the operation and development of the Group’s business.

On appointment, Directors undertake an induction process which is designed to develop their knowledge and understanding of the Group’s business through visits to various operating sites, presentations on relevant technology, product demonstrations, briefings from management and a familiarisation with investor perceptions of the Group. The Directors’ knowledge and understanding of the Group’s business is refreshed throughout the year and with briefings as necessary on corporate governance and regulatory compliance. The training needs of the Directors are periodically reviewed by the Board.

The Board has evaluated its performance and that of its Committees during 2005 and their continuing ability to act as effective bodies. The non-executive Directors have assessed the Chairman’s performance. A series of questionnaires were used to facilitate the evaluation process, which was conducted without external consultants. The Chairman has assessed whether each Director contributed effectively to the Board and demonstrated commitment to the role.

Where a Director has been unable to attend all meetings of the Board or Board committees of which he is a member, the Director has confirmed that he remains committed to the role and has the requisite time available to perform the role.

Under the Company’s Articles of Association, at each Annual General Meeting all Directors appointed since the previous Annual General Meeting retire and seek election, and all other Directors retire and seek re-election. This means that no Director can hold office for more than one year unless re-elected by shareholders.

Operation of the Board

The Board met six times in 2005. The attendance of each of the Directors at the meetings held in 2005 while a Director was:

Director | Meetings

held | Meetings

attended | Percentage

attended |

| | | |

Andreas Barth | 6 | 6 | 100% |

Barry Bateman | 6 | 6 | 100% |

Tony Bates | 6 | 6 | 100% |

Jean-Yves Charlier | 6 | 6 | 100% |

Vincenzo Damiani | 6 | 6 | 100% |

Hans Eggerstedt | 6 | 5 | 83% |

Gene Gabbard | 6 | 6 | 100% |

Robert Hawley | 6 | 6 | 100% |

Timothy Hilton | 6 | 5 | 83% |

John Remondi | 6 | 6 | 100% |

Frans van den Hoven | 6 | 6 | 100% |

Richard Walsh | 4 | 4 | 100% |

The Board is scheduled to meet five times in 2006. Additional meetings will be held as required.

During 2005, the non-executive Directors and the Chairman met without the executive Directors present and it is intended that this will happen at least once in 2006.

The Board is primarily responsible for decisions on Group strategy, including approval of strategic plans, annual budgets, interim and full year financial statements and reports, accounting policies and all material capital projects, investments and disposals. There is a schedule of matters reserved for approval by the Board.

Each Director is provided with monthly reports which include financial information and information on revenue streams and the Company’s support functions. In the months when there is a Board meeting, this information is circulated to the Directors in advance of the meeting, together with details of all other business to be considered at the meeting. The Directors are encouraged to supplement this information through direct contact with the Group’s senior management. Each of the Directors can take independent advice at the expense of the Company.

26 COLT Telecom Group plc

Corporate governance statement

continued

Board Committees

The Board has delegated specific responsibilities to three standing Committees of the Board. The membership of these Committees and a summary of their main duties under their terms of reference are set out below. The full terms of reference may be viewed on the Company’s website, www.colt.net.

The Committees are provided with the resources required to undertake their duties and they are able to take independent advice at the expense of the Company. The Company Secretary acts as secretary to each of these Committees.

In addition to the standing Committees, the Board occasionally delegates specific tasks to ad-hoc Committees of the Board.

Audit Committee

Hans Eggerstedt is the Chairman of the Audit Committee and is also the Committee member identified as having recent and relevant financial experience. The other members of the Committee are Vincenzo Damiani, Gene Gabbard and Robert Hawley. Gene Gabbard was appointed to the Committee on 20 July 2005 replacing Frans van den Hoven.

The Chief Administrative and Financial Officer, the Chief Executive Officer, the Group Financial Controller, the Senior Director of Audit, Risk and Security and representatives from the external auditors, usually attend meetings of the Committee in advisory capacities.

The Committee met four times in 2005. The attendance of each of the Directors at the meetings held in 2005 while a committee member was:

Director | Meetings

held | Meetings

attended | Percentage

attended |

|

| | | |

Vincenzo Damiani | 4 | 4 | 100% |

Hans Eggerstedt | 4 | 4 | 100% |

Gene Gabbard | 1 | 1 | 100% |

Robert Hawley | 4 | 4 | 100% |

Frans van den Hoven | 3 | 3 | 100% |

| | | |

|

During 2005, the Committee met the Company’s external auditors, PricewaterhouseCoopers LLP, without any Company management present and it is intended that this will continue in 2006.

The duties of the Committee are to review the integrity of the financial statements, to review the effectiveness of the internal control policies, to review the procedures for managing risks, to oversee the internal audit function, to consider the appointment and relationship with the external auditors, and to review procedures for handling allegations from whistle-blowers.

During 2005, the Committee considered, among other matters, compliance with the provisions of the Combined Code and with the requirements of the US Sarbanes-Oxley Act of 2002, accounting developments, the financial control environment and risk management and control.

To guard against the objectivity of and the independence of the external auditors being compromised, the Committee has adopted a policy under which any service provided by the external auditors must be approved by the Committee or within a category pre-approved by the Committee, and within the maximum charge set by the Committee.

Annual Report 2005 27

Compensation Committee

Robert Hawley is the Chairman of the Compensation Committee and the other members are Andreas Barth, Barry Bateman and Vincenzo Damiani. Fidelity related Directors abstain from voting on the remuneration of any other Fidelity related Director.

The Managing Director, Human Resources, normally attends meetings of the Committee in an advisory capacity. The Compensation Committee met six times in 2005. The attendance of each of the Directors at the meetings held in 2005 while a committee member was:

Director | Meetings

held | Meetings

attended | Percentage

attended |

|

| | | |

Andreas Barth | 6 | 6 | 100% |

Barry Bateman | 6 | 6 | 100% |

Vincenzo Damiani | 6 | 6 | 100% |

Robert Hawley | 6 | 6 | 100% |

| | | |

|

The duties of the Committee are to review the compensation policy, to determine the remuneration of executive Directors and to exercise discretion on behalf of the Board in relation to employee benefit schemes. The Directors’ Remuneration Report on pages 29 to 33 provides details of how the Committee has discharged its duties in 2005.

Nomination Committee

Barry Bateman is the Chairman of the Nomination Committee and the other members are Vincenzo Damiani and Robert Hawley.

Fidelity related Directors abstain from voting on the appointment of any other Fidelity related Director.

The Nomination Committee met three times in 2005. The attendance of each of the Directors at the meetings held in 2005 while a committee member was:

Director | Meetings

held | Meetings

attended | Percentage

attended |

|

| | | |

Barry Bateman | 3 | 3 | 100% |

Vincenzo Damiani | 3 | 3 | 100% |

Robert Hawley | 3 | 2 | 67% |

| | | |

|

The duties of the Committee are to recommend to the Board a preferred candidate for appointment to the Board or to a specific position or role on the Board or Board Committee and to recommend to the Board the continuation in office of non-executive Directors.

During 2005, the Committee considered the appointment of two non-executive Directors. As stated in the last Annual Report, open advertising was not necessary in the search for Gene Gabbard because given his known extensive telecom and high technology experience he was well suited to the role. Assistance was taken from external consultants, A.T. Kearney during the appointment process. Richard Walsh is a Fidelity related Director and for this reason neither an external search consultancy nor open advertising were used when appointing him.

28 COLT Telecom Group plc

Corporate governance statement

continued

Relations with shareholders

The Company utilises its website, www.colt.net, to communicate a wide range of information about the Group.

The Company has a policy of maintaining an active dialogue with institutional shareholders through individual meetings with senior management and participation in conference calls. The views of shareholders expressed during these meetings and calls are reported to the Board and analysts and brokers briefings are circulated to the Board so that an understanding of the views of major shareholders can be developed.

The Board recognises that one of the main opportunities for non-institutional shareholders to question the Board is at the Annual General Meeting and for this reason it is the practice that each of the Directors attend the meeting whenever possible. Any shareholder is free to contact the Company’s Head of Investor Relations at any time.

Statement of Directors’ responsibilities

Directors are required by the Companies Act 1985 to prepare financial statements for each financial year which give a true and fair view of the state of affairs of the Company, including its subsidiary companies, as at the end of the financial year, and of the profit or loss of the Company for that relevant period. In preparing those financial statements, the Directors are required to select suitable accounting policies and apply them consistently, supported by judgements and estimates that are reasonable and prudent and to state whether applicable accounting standards have been followed, subject to any material departures disclosed and explained in the financial statements.

The Directors are also responsible for keeping proper accounting records, which disclose with reasonable accuracy, the financial position of the Company and they are also responsible for safeguarding the assets of the Company and for preventing and detecting fraud and other irregularities.

The financial statements are published on the Company website. The maintenance and integrity of the website is the responsibility of the Directors. Legislation in the UK governing the preparation and dissemination of financial statements may differ from legislation in other jurisdictions.

Going concern

The Directors, after making appropriate enquiries and taking into account expected and anticipated facilities including the ability of the Company to access capital markets, have a reasonable expectation that the Company has adequate resources to continue in operational existence for the foreseeable future. For this reason, the Directors continue to adopt the going concern basis in preparing the financial statements.

Internal control

The Board has overall responsibility for the Company’s system of internal controls and for reviewing its effectiveness. The system of internal control is designed to manage, rather than eliminate, risk of failure to achieve business objectives and can only provide reasonable and not absolute assurance against material misstatement or loss. Throughout 2005, and up until the date of this report, there has been an ongoing process for identifying, evaluating and managing the material risks faced by the Company. The effectiveness of the internal control system and risk management process is kept under review by the Audit Committee and reviewed annually by the Board.

The Group’s senior management, supported by the Senior Director of Audit, Risk and Security, identify the key risks facing the Group. These risks and how they are being managed are reported to the Audit Committee. The key risks are selected from the Group risk register which details the risks identified, the impact if those risks were to occur and the actions that will be taken to manage those risks most appropriately. The Audit Committee conducts regular reviews of risk assessment and management process.

The Company operates a management structure with clear delegated authority levels and clear functional reporting lines and accountability. The Company operates a comprehensive budgeting and financial reporting system, which compares actual performance to budget on a monthly basis. All capital expenditure and all other purchases are subject to appropriate authorisation procedures. This together with the internal controls and risk management process allows management to monitor financial and operational performance and compliance controls on a continuing basis and to identify and respond to business risks as they arise.

Annual Report 2005 29

Directors’ remuneration report

The Directors’ Remuneration Report sets out the Company’s policy on remuneration. The report also sets out for each Director the remuneration earned in 2005, their interests in share options and other long-term incentive plans and their contractual relationship with the Company.

The Directors’ Remuneration Report, which has been approved and adopted by the Board of Directors, will be put to shareholders at the Annual General Meeting for approval. The report complies with the Directors’ Remuneration Report Regulations 2002 and sets out how the principles in Section 1.B of the Combined Code have been applied.

Compensation Committee

The Compensation Committee consists of independent non-executive Directors and the Company Chairman. Robert Hawley is the Chairman of the Committee and the other members are Andreas Barth, Barry Bateman and Vincenzo Damiani.

The Combined Code on Corporate Governance section of the Corporate Governance Statement on page 24 gives the reasons why the Board considers it appropriate for the Company Chairman to remain a member of the Committee. The statement also sets out the number of meetings, attendance and duties of the Committee.

Normally attending meetings of the Committee, in an advisory capacity, is the Managing Director, Human Resources. The Committee also appointed and received advice from Inbucon, Monks Partnership and Watson Wyatt on salary, benefits and other compensation trend data which the Committee has used when considering the appropriate level of compensation for its executive Directors. In addition, Slaughter and May have provided guidance about the rules of the share option plans.

Compensation policy

The Company’s policy is to place a significant emphasis on performance related elements of total compensation for executive Directors and senior executive officers and to align their interests with those of shareholders.

Base salary reflects an executive’s experience, responsibility and market value. Performance bonuses are subject to upper limits that normally range between 50% and 200% of salary or, where appropriate, a specified amount. Each year, performance targets are set for bonuses that link 50% to the Company’s financial targets and the balance to personal business goals such as quality of service, revenue success, process improvements and the introduction of new technologies.

The Company believes that it is important to encourage an ownership mentality amongst all employees. Share and share option schemes are designed to offer employees an opportunity to participate in the Company’s future success.

The policies relating to each of the components of total compensation are subject to regular review in order to ensure that they remain competitive, stimulating and challenging. The package is geared towards driving exceptional effort through the variable elements of the total package. The ability to have an impact on shareholder value will influence the mix of the total reward package with, at less senior levels, there being greater emphasis on the base salary portion of the total package. Base salaries and performance bonuses are benchmarked regularly against other appropriate sectors, in particular, telecommunications operators and technology companies.

Elements of compensation for executive Directors

Executive Directors receive base salary, performance bonus, long-term incentives, defined contribution pensions and other usual benefits. Payment of bonus and vesting of long-term incentives is dependent upon the achievement of performance targets that are set beforehand by the Committee.

30 COLT Telecom Group plc

Directors’ remuneration report

continued

Salary and bonus

Base salary for the executive Directors is set when they are appointed to the role and reflects their experience, responsibility and market value and are not normally reviewed annually.

Bonus amounts are based upon demanding financial targets and the achievement of personal predetermined business objectives. Bonuses are subject to upper limits of 200% of salary for Jean-Yves Charlier and 150% of salary for Tony Bates. Annual bonuses do not form part of pensionable earnings. Current executive Director performance bonus payments for the year were in the range of 65% to 68% of maximum bonus potential.

Proportion of fixed and variable remuneration

The table below shows the approximate targeted proportion of fixed and variable remuneration for the executive Directors. The long-term incentives proportion is based on the estimated value of the awards using a Black-Scholes model which takes into account the likelihood that performance conditions are met at the end of the relevant performance periods. The annual cash bonus plan supports financial and operational performance, whilst the long-term incentive element is reward for superior performance over the longer term and the numbers in the table take into account the likelihood of payment.

Proportion of fixed and variable remuneration

| | | | | | |

| Fixed | Variable |

| Base

Pay | Pension | Benefits | Bonus | Long-term

Incentives | Total |

| (%) | (%) | (%) | (%) | (%) | (%) |

Tony Bates | 34 | 5 | 1 | 34 | 26 | 100 |

Jean-Yves Charlier | 30 | 4 | 1 | 40 | 25 | 100 |

Long-term incentives

The Company has two share option plans used for long-term incentives, the Group Share Plan and the Deferred Bonus Plan. Options over shares and stock appreciation rights granted under these Plans to Directors are set out in the table on pages 32 and 33. Further details of the plans are set out in note 14 on pages 51 to 54.

Group share plan (“Option Plan”)

The Option Plan is divided into two parts; the “Approved Part” approved by the UK Inland Revenue for the purposes of the Income and Corporation Taxes Act 1988 and the “Unapproved Part” which is not so approved. Options granted under the Approved Part will not normally be exercisable until the third anniversary of the date of grant. Options granted under the Unapproved Part may become exercisable earlier than the third anniversary.

There are two programmes now offered under the Option Plan, “Performance Options” and “Welcome Options”. Performance Options are awarded to high performing executives and, subject to meeting performance conditions, 100% of shares under option vest on the third anniversary of the date of grant. Welcome Options are awarded to senior employees to attract them to COLT and, subject to performance conditions, 50% of shares under option vest on the third anniversary and 25% of shares under option vest on each of the fourth and fifth anniversaries of the grant date. Options are granted at an option price which is not less than the market value of the ordinary shares on the date of grant.

For all grants of options made during 2005, a performance condition was applied based upon the achievement of a performance metric based on Profit Before Tax (“PBT”).

In 2005 a review of the competitiveness of the long-term incentives was undertaken. The review took into account the recent appointment of senior executives and the challenges facing the Company. The review concluded that the level of the long-term incentives was materially short of normal levels for organisations with similar challenges. It was decided that as a result of this review a special award should be made under the rules of the Group Share Plan to Jean-Yves Charlier and Tony Bates of 6 million and 4 million stock appreciation rights respectively; details are set out in the table titled Special Stock Plan on page 33. The performance criteria is a combination of PBT and share price which requires a very significant improvement in both share price and PBT before any stock appreciation rights vest (50% in year 4 and 50% in year 5). This was fully disclosed at the time of the grant via an announcement to the London Stock Exchange. It is not expected that such a special grant will take place again in the near future.

Deferred Bonus Plan

In 2004 Jean-Yves Charlier and Tony Bates purchased 500,000 and 100,000 shares respectively and were awarded matching awards of shares of 250,000 and 50,000 respectively under the provisions of the Deferred Bonus Plan. Subject to the same performance conditions as for their Option Plan options, the Deferred Bonus Plan shares will vest on the third anniversary of the grant date.

Annual Report 2005 31

Pension contributions and other benefits

Pension contributions are determined based on employee age and years of service and are made to defined contribution schemes. Benefits include, as appropriate, housing benefit, private health insurance and other similar benefits commensurate with market practice.

Savings-related share option scheme (“SAYE Scheme”)

Participation in the Company’s SAYE Scheme is open to all eligible employees and the executive Directors. Details of the participation of the executive Directors are set out on page 33. Under the SAYE Scheme, employees may save between £5 and £250 a month with a savings institution and are granted options to acquire shares in the Company. After a three year period, employees can use the proceeds of their savings account to exercise the options at a price established at the beginning of the three year period. The price established at the beginning of the three years is at the discretion of the Board of Directors and can be up to a 20% discount to the then market price of the Company’s shares.

Non-executive Directors

The compensation of non-executive Directors is reviewed periodically by the Board. The Company aligns this compensation with the interests of shareholders by delivering it in a mix of cash and shares acquired in the open market. In the last twelve months, the non-executive Directors have received no element of their compensation in the form of options, benefits or other incentives, nor is it the intention of the Board that this should occur within the forthcoming twelve months.

Directors’ service agreements

Jean-Yves Charlier’s services are provided under a secondment agreement with Fidelity International Limited and Fidelity Investment Management Limited. The secondment is for three years from 1 September 2004 but can be terminated by Fidelity International Limited and Fidelity Investment Management Limited or by the Company at any time. In the event of termination there is no right to compensation.

Tony Bates has an employment contract that can be terminated by him giving six months’ notice. The contract can be terminated by the Company giving twelve months’ notice. In the event of termination, he has the right to receive an amount which is equal to his salary and other benefits for the period of notice plus bonus equal to the average bonus percentage of salary achieved during the previous two years.

The Chairman and non-executive Directors are engaged on letters of appointment that set out their duties and responsibilities. The appointment of Barry Bateman, Gene Gabbard, John Remondi and Richard Walsh can be terminated by them or by the Company by giving three months’ notice. The appointment of Andreas Barth, Vincenzo Damiani, Hans Eggerstedt, Robert Hawley, Timothy Hilton and Frans van den Hoven can be terminated by them or by the Company at any time. In every case, there is no right to compensation in the event of termination.

COLT v MSCI Europe Telecom Services index

The following graph shows the Company’s share performance against the Morgan Stanley MSCI Europe Telecom Services index (both rebased to 100 as at 1 January 2001) which has been chosen because it is the principal index of European Telecom Service providers.

COLT Telecom Group plc totoal return index versus the total return index of MSCI Eurpoe telecom services index for the five financial years ending 31 December 2005 (rebased) as at 1 January 2001

32 COLT Telecom Group plc

Directors’ remuneration report

continued

AUDITED INFORMATION

Directors’ remuneration

The table below sets out details of the remuneration received by individuals during 2005 while they were a Director of the Company.

£000

Name | Salary/Fee | Bonus | Other Cash | Benefits1 | Total

2005 | Total

2004 | Pension

2005 | Pension 2004 |

|

| | | | | | | | |

Andreas Barth2 | 30.0 | – | – | – | 30.0 | 30.0 | – | – |

Barry Bateman3 | – | – | – | – | – | – | – | – |

Tony Bates | 325.0 | 316.9 | – | 2.6 | 644.5 | 758.2 | 58.5 | 39.0 |

Jean-Yves Charlier4 | 400.0 | 544.0 | – | 5.1 | 949.1 | 329.9 | 56.0 | 18.7 |

Vincenzo Damiani2 | 35.0 | – | – | – | 35.0 | 35.0 | – | – |

Hans Eggerstedt2 | 35.0 | – | – | – | 35.0 | 34.3 | – | – |

Gene Gabbard2 | 32.3 | – | – | – | 32.3 | – | – | – |

Robert Hawley2 | 40.0 | – | – | – | 40.0 | 35.0 | – | – |

Timothy Hilton3 | – | – | – | – | – | – | – | – |

John Remondi3 | – | – | – | – | – | – | – | – |

Frans van den Hoven2 | 32.7 | – | – | – | 32.7 | 35.0 | – | – |

Richard Walsh3 | – | – | – | – | – | – | – | – |

|

Total | 930.0 | 860.9 | – | 7.7 | 1,798.6 | 1,257.4 | 114.5 | 57.7 |

|

1 This figure includes, as appropriate, housing benefit, private health insurance and other similar benefits.

2 £15,000 of the fees paid to each non-executive Director was in the form of Company shares acquired in the open market.

3 Barry Bateman, Timothy Hilton, John Remondi and Richard Walsh are employed by Fidelity International Limited and FMR Corp. respectively. They receive no remuneration from Fidelity International Limited or FMR Corp. attributable to their duties for the Company and, as set out in their letters of appointment, receive no remuneration from the Company either.

4 Jean-Yves Charlier’s services as Chief Executive Officer are provided under a secondment agreement with Fidelity International Limited and Fidelity Investment Management Limited under which all the remuneration attributable to his duties to the Company as Chief Executive Officer is paid for by the Company.

Directors’ share options

The tables below set out details of options under each of the Company’s share option plans held by the Directors of the Company.

The closing mid-point price of the Company’s ordinary shares on 31 December 2005 was £0.56 per share and the range during the year was £0.46 to £0.67 per share.

Option Plan

Name | 1 Jan 2005 | Granted | Exercised | Lapsed | 31 Dec 2005 | Date of exercise | Market value | Option exercise price per share | Usual date from which first exercisable 1,2 | Usual expiry date |

|

| |

Tony Bates | 500,000 | – | – | – | 500,000 | – | – | 0.7667 | 4 May 2007 to 4 May 2009 | 4 May 2014 |

| |

|

Jean-Yves Charlier | 800,000 | – | – | – | 800,000 | – | – | 0.3800 | 31 Aug 2007 to 31 Aug 2009 | 31 Aug 2014 |

| |

|

Vincenzo Damiani | 40,000 | – | – | – | 40,000 | – | – | 0.4800 | 29 Jul 2003 to 29 Jul 2007 | 29 Jul 2012 |

| |

|

Robert Hawley | 68,060 | – | – | – | 68,060 | – | – | 7.4940 | 25 Nov 1999 to 25 Nov 2003 | 25 Nov 2008 |

| |

|

Frans van den Hoven | 16,000 | – | – | – | 16,000 | – | – | 8.5000 | 17 Dec 1996 to 17 Dec 2000 | 17 Dec 2006 |

| 16,000 | – | – | – | 16,000 | – | – | 29.0000 | 17 Dec 1996 to 17 Dec 2000 | 17 Dec 2006 |

| 16,000 | – | – | – | 16,000 | – | – | 14.8600 | 17 Dec 1996 to 17 Dec 2000 | 17 Dec 2006 |

| |

|

| |

| 48,000 | – | – | – | 48,000 | | | | | |

Annual Report 2005 33

Special Stock Plan

Name | 1 Jan 2005 | Granted | Exercised | Lapsed | 31 Dec 2005 | Option

exercise

price per

share | Usual date

of vesting2 |

| | |

Tony Bates | – | 4,000,000 | – | – | 4,000,000 | 0.495 | 24 Mar 2010 |

| | |

Jean-Yves Charlier | – | 6,000,000 | – | – | 6,000,000 | 0.495 | 24 Mar 2010 |

| | |

To qualify for an award under the Special Stock Plan both Directors were required to purchase the following number of ordinary shares in the Company at market value:

Tony Bates | 160,000 shares |

Jean-Yves Charlier | 240,000 shares |

Such shares form part of their total holdings shown on page 22.

Deferred Bonus Plan

| | | | | | |

Name | 1 Jan 2005 | Granted | Exercised | Lapsed | 31 Dec 2005 | Usual date

of vesting2 |

| | |

Tony Bates | 50,000 | – | – | – | 50,000 | 26 Oct 2007 |

| | |

Jean-Yves Charlier | 250,000 | – | – | – | 250,000 | 31 Aug 2007 |

| | |

SAYE Scheme

There are no directors in the SAYE scheme.

1 In the case of options granted under the Option Plan before July 2003, usually 20% of the shares under option become exercisable on each of the five anniversaries following the grant date. In the case of options granted since July 2003, usually 50% of the shares under option become exercisable on the third anniversary of the grant date and 25% of the shares under option become exercisable on each of the fourth and fifth anniversaries of the grant date. In certain circumstances, including the death of the option holder, options may become exercisable earlier.

2 Usually an option over shares is exercisable, or vests, only if a performance condition is met. For all grants of options made during 2005, a performance condition was applied based upon the achievement of a performance metric based on Profit Before Tax.

Approved by the Board of Directors and signed on its behalf by

Dr R Hawley CBE, Chairman of the Compensation Committee

34 COLT Telecom Group plc

Independent auditors’ report to the members of COLT Telecom Group plc

We have audited the Group and Company financial statements (the “financial statements”) of COLT Telecom Group plc for the year ended 31 December 2005 which comprise the Consolidated Income Statement, the Consolidated Statement of Recognised Income and Expense, the Consolidated and Company Balance Sheets, the Consolidated Cash Flow Statement, and the related notes. These financial statements have been prepared under the accounting policies set out therein. We have also audited the information in the Directors’ Remuneration Report that is described as having been audited.

Respective responsibilities of Directors and auditors

The Directors’ responsibilities for preparing the Annual Report and the Group financial statements in accordance with applicable law and International Financial Reporting Standards (IFRS) as adopted for use in the European Union, and for preparing the Company financial statements and the Directors’ Remuneration Report in accordance with applicable law and UK Accounting Standards (UK Generally Accepted Accounting Practice) are set out in the Statement of Directors’ Responsibilities.

Our responsibility is to audit the financial statements and the part of the Directors’ Remuneration Report to be audited in accordance with relevant legal and regulatory requirements and International Standards on Auditing (UK and Ireland). This report, including the opinion, has been prepared for and only for the Company’s members as a body in accordance with Section 235 of the Companies Act 1985 and for no other purpose. We do not, in giving this opinion, accept or assume responsibility for any other purpose or to any other person to whom this report is shown or into whose hands it may come save where expressly agreed by our prior consent in writing.

We report to you our opinion as to whether the financial statements give a true and fair view and whether the financial statements and the part of the Directors’ Remuneration Report to be audited have been properly prepared in accordance with the Companies Act 1985 and whether, in addition, the Group financial statements have been properly prepared in accordance with Article 4 of the IAS Regulation. We also report to you if, in our opinion, the Report of the Board of Directors is not consistent with the financial statements, if the Company has not kept proper accounting records, if we have not received all the information and explanations we require for our audit, or if information specified by law regarding Directors’ remuneration and other transactions is not disclosed.

We review whether the Corporate Governance Statement reflects the Company’s compliance with the nine provisions of the 2003 FRC Combined Code specified for our review by the Listing Rules of the Financial Services Authority, and we report if it does not. We are not required to consider whether the Board’s statements on internal control cover all risks and controls, or form an opinion on the effectiveness of the Group’s corporate governance procedures or its risk and control procedures.

We read other information contained in the Annual Report and consider whether it is consistent with the audited financial statements. The other information comprises only the Chairman’s Overview, the Chief Executive Officer’s Review of Operations, the Corporate and Social Responsibility Review, the Financial Review, the Report of the Board of Directors, the Corporate Governance Statement and the unaudited part of the Directors’ Remuneration Report. We consider the implications for our report if we become aware of any apparent misstatements or material inconsistencies with the financial statements. Our responsibilities do not extend to any other information.

Basis of audit opinion

We conducted our audit in accordance with International Standards on Auditing (UK and Ireland) issued by the Auditing Practices Board. An audit includes examination, on a test basis, of evidence relevant to the amounts and disclosures in the financial statements and the part of the Directors’ Remuneration Report to be audited. It also includes an assessment of the significant estimates and judgments made by the Directors in the preparation of the financial statements, and of whether the accounting policies are appropriate to the Group’s and Company’s circumstances, consistently applied and adequately disclosed.

We planned and performed our audit so as to obtain all the information and explanations which we considered necessary in order to provide us with sufficient evidence to give reasonable assurance that the financial statements and the part of the Directors’ Remuneration Report to be audited are free from material misstatement, whether caused by fraud or other irregularity or error. In forming our opinion we also evaluated the overall adequacy of the presentation of information in the financial statements and the part of the Directors’ Remuneration Report to be audited.

Opinion

In our opinion:

| • | the Group financial statements give a true and fair view, in accordance with IFRS as adopted for use in the European Union, of the state of the Group’s affairs as at 31 December 2005 and of its loss and cash flows for the year then ended; |

| • | the Group financial statements have been properly prepared in accordance with the Companies Act 1985 and Article 4 of the IAS Regulation; |

| • | the Company financial statements give a true and fair view, in accordance with UK Generally Accepted Accounting Practice, of the state of the Company’s affairs as at 31 December 2005; and |

| • | the Company financial statements and the part of the Directors’ Remuneration Report to be audited have been properly prepared in accordance with the Companies Act 1985. |

PricewaterhouseCoopers LLP

Chartered Accountants and Registered Auditors

London

22 February 2006

Annual Report 2005 35

Consolidated income statement

| | | Year ended 31 December | |

| Notes | 2005 Before exceptional items £m | 2005 Exceptional items £m | 2005 After exceptional items £m | 2004 £m |

| | |

| | | | | |

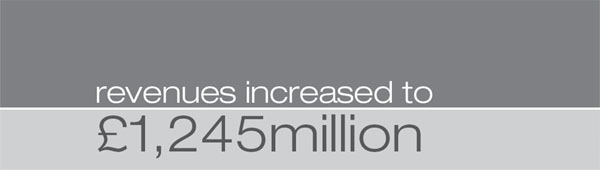

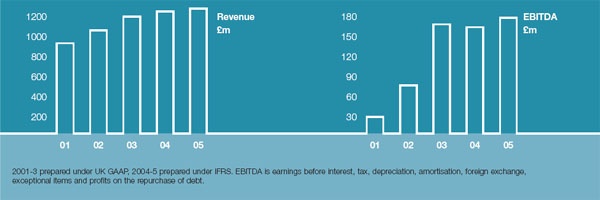

Revenue | 2 | 1,245.5 | – | 1,245.5 | 1,218.6 |

| | | | | |

Cost of sales | | | | | |

Interconnect and network | | (814.2) | – | (814.2) | (813.7) |

Network depreciation | | (195.2) | (229.7) | (424.9) | (192.0) |

| | |

| | (1,009.4) | (229.7) | (1,239.1) | (1,005.7) |

| | |

| | | | | |

Gross profit (loss) | | 236.1 | (229.7) | 6.4 | 212.9 |

| | | | | |

Operating expenses | | | | | |

Selling, general and administrative | | (257.9) | – | (257.9) | (248.7) |

Other depreciation and amortisation | | (32.3) | (17.5) | (49.8) | (28.5) |

| | |

| | (290.2) | (17.5) | (307.7) | (277.2) |

| | |

Operating loss | | (54.1) | (247.2) | (301.3) | (64.3) |

Other income (expense) | | | | | |

Interest receivable | | 11.6 | – | 11.6 | 21.0 |

Interest payable and similar charges | 6 | (46.2) | – | (46.2) | (66.8) |

Profit on repurchase of debt | | 0.3 | – | 0.3 | 0.2 |

Exchange loss | | (0.3) | – | (0.3) | – |

| | |

| | (34.6) | – | (34.6) | (45.6) |

| | |

Loss before taxation | 3 | (88.7) | (247.2) | (335.9) | (109.9) |

Taxation | 8 | – | – | – | – |

| | |

Loss for the year | | (88.7) | (247.2) | (335.9) | (109.9) |

| | |

Basic and diluted loss per share | 9 | £(0.06) | £(0.16) | £(0.22) | £(0.07) |

| | |

There is no difference between the loss before and after taxation for the years stated above and their historical cost equivalents.

All of the Group’s activities are continuing.

Details of exceptional items are provided in note 7.

The accompanying notes are an integral part of the financial statements.

36 COLT Telecom Group plc

Consolidated statement of recognised income and expense

| | Year ended 31 December |

| | |

| Notes | 2005 £m | 2004 £m |

| | | |

Loss for the year | | (335.9) | (109.9) |

Net exchange adjustments offset in reserves | 14 | (9.6) | (0.8) |

Revaluation of warrants | 14 | (0.1) | (0.7) |

| | |

Total recognised loss for the year | | (345.6) | (111.4) |

| | |

The accompanying notes are an integral part of the financial statements.

Annual Report 2005 37

Consolidated balance sheet

| | At 31 December |

| Notes | 2005 £m | 2004 £m |

| | |

ASSETS | | | |

Non-current assets | | | |

Intangible assets | 10 | 38.9 | 65.8 |

Property, plant and equipment | 11 | 834.2 | 1,197.0 |

| | |

Total non-current assets | | 873.1 | 1,262.8 |

| | | |

Current assets | | | |

Trade and other receivables | 12 | 238.5 | 247.6 |

Cash and cash equivalents | 13 | 225.3 | 452.7 |

| | |

Total current assets | | 463.8 | 700.3 |

| | |

Total assets | | 1,336.9 | 1,963.1 |

| | |

| | | |

EQUITY | | | |

Capital and reserves | | | |

Share capital | | 2,355.7 | 2,354.4 |

Other reserves | | 23.7 | 31.0 |

Retained earnings | 14 | (2,039.5) | (1,703.6) |

| | |

Total equity | 14 | 339.9 | 681.8 |

| | | |

Liabilities | | | |

Non-current liabilities | | | |

Financial liabilities | | | |

Convertible debt | 21 | 224.0 | 382.3 |

Non-convertible debt | 21 | 351.8 | 363.4 |

Provisions | 16 | 35.7 | 48.7 |

| | |

Total non-current liabilities | | 611.5 | 794.4 |

| | |

Current liabilities | | | |

Financial liabilities | | | |

Non-convertible debt | 21 | – | 81.7 |

Loan finance | 21 | 10.3 | – |

Trade and other payables | 15 | 375.2 | 405.2 |

| | |

Total current liabilities | | 385.5 | 486.9 |

| | |

Total liabilities | | 997.0 | 1,281.3 |

| | |

Total equity and liabilities | | 1,336.9 | 1,963.1 |

| | |

The financial statements on pages 35 to 71 were approved by the Board of Directors on 22 February 2006 and were signed on its behalf by

Tony Bates, Chief Administrative and Financial Officer

The accompanying notes are an integral part of the financial statements.

38 COLT Telecom Group plc

Consolidated cash flow statement

| | Year ended 31 December |

| Notes | 2005 £m | 2004 £m |

| | |

Net cash generated from operating activities | 17 | 156.2 | 140.6 |

| | | |

Cash flows from investing activities | | | |

Purchase of non-current assets | | (126.3) | (129.4) |

Proceeds from the disposal of non-current assets | | 1.4 | 4.7 |

| | |

Net cash used in investing activitities | | (124.9) | (124.7) |

| | | |

Cash flows from financing activities | | | |

Interest paid, finance costs and similar charges | | (35.5) | (45.9) |

Interest received | | 11.2 | 20.5 |

Issue of ordinary shares | | 1.0 | 0.6 |

Loan finance | | 10.3 | – |

Redemption of debt | | (238.3) | (335.3) |

| | |

Net cash used in financing activities | | (251.3) | (360.1) |

| | |

Net movement in cash and cash equivalents | | (220.0) | (344.2) |

Cash and cash equivalents at beginning of period | | 452.7 | 802.4 |

| | |

Effect of exchange rate changes on cash and cash equivalents | | (7.4) | (5.5) |

Cash and cash equivalents at end of period | 13 | 225.3 | 452.7 |

| | |

The accompanying notes are an integral part of the financial statements.

Annual Report 2005 39

Notes to the financial statements

1 Basis of Presentation and Principal Accounting Policies

COLT Telecom Group plc (“COLT” or “the Company”) together with its subsidiaries is referred to as “the Group”. The Group financial statements consolidate the financial statements of the Company and its subsidiaries as at and for the year ended 31 December 2005.

Accounting policies for the year ended 31 December 2005

The principal accounting policies adopted in the preparation of these financial statements are set out below. These policies have been consistently applied to all the years presented, unless otherwise stated.

As permitted by paragraph 3 (3) of Schedule 4 of the Companies Act 1985, the Directors have adapted the prescribed income statement format in a manner appropriate to the nature of the Group’s business.

Basis of accounting

The financial statements of the Company have been prepared in accordance with UK GAAP and the Companies Act 1985. The financial statements of the Group have been prepared in accordance with International Financial Reporting Standards (“IFRS”) and IFRIC interpretations as endorsed by the EU and with those parts of the Companies Act 1985 applicable to companies reporting under IFRS. The Group’s previous Annual Report was presented under UK GAAP. The 2004 comparative information has, as permitted by IFRS 1, been restated taking advantage of the following transitional exemptions:

| • | Business combinations prior to the transition date of 1 January 2004 have not been restated. |

| • | The Company has elected to adopt recognition and measurement criteria requirements only to share based payments granted after 7 November 2002 that had not vested by 1 January 2005. |

| • | The Company has reset the cumulative translation differences for all foreign operations to £nil as at 1 January 2004. |

The Group has elected to comply with IAS 32 “Financial Instruments: Disclosure and Presentation” and IAS 39 “Financial Instruments: Recognition and Measurement” with effect from 1 January 2004.

Accounting policies and presentation applied are therefore not consistent with those applied in preparing the Group’s financial statements for the year ended 31 December 2004 due to the transition from UK GAAP to IFRS.

The preparation of financial statements in conformity with generally accepted accounting principles requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Although these estimates are based on management’s best knowledge of the amount, event or actions, actual results ultimately may differ from those estimates.

The financial statements have been prepared under the historical cost convention.

A summary of the more important Group accounting policies is set out below.

Basis of consolidation

The consolidated financial statements include those of the Company and all of its subsidiary undertakings. Subsidiary undertakings are those entities controlled directly or indirectly by the Company. Control arises when the Company has the ability to direct the financial and operating policies of an entity so as to obtain benefits from its activities.

Foreign currency transactions and translation

Transactions denominated in foreign currencies are translated in their functional currency at the exchange rate prevailing at the time of the transaction. Monetary assets and liabilities are translated at the period end rate and taken to the consolidated income statement. Exchange differences arising from the re-translation of the opening net assets of foreign subsidiaries, denominated in foreign currencies, and any related loans, together with the differences between income statements translated at average rates and rates ruling at the period end are taken directly to the translation reserve.

Revenue

Revenue represents amounts earned for telecommunication services provided to customers (net of value added tax and intercompany revenue).

Contracted income invoiced in advance for fixed periods is recognised as revenue in the period of actual service provision. Installation fees are recognised in the consolidated income statement over the expected length of the customer relationship period.

40 COLT Telecom Group plc

Notes to the financial statements

continued

Revenue attributable to infrastructure sales in the form of indefeasible rights-of-use (“IRUs”) with characteristics which qualify the transaction as an outright sale, or transfer of title agreements, are recognised at the time of delivery and acceptance by the customer. Proceeds from the sale of infrastructure qualify as revenue where the infrastructure was designated as built for resale at the outset and where the associated costs of construction have been classified as inventory for future sale. Where the infrastructure was not designated for resale and was classified as tangible non-current assets, the proceeds from these infrastructure sales are recorded net of costs as a gain or loss on the disposal of a non-current asset.

Charges to customers for services provided through the Group network where the Group is deemed to be acting as agent are reported net of service providers’ charges to the Group.

Cost of sales

Cost of sales includes payments made to other carriers, depreciation of network infrastructure and equipment, direct network costs and construction costs associated with infrastructure sales.

Operating leases

Costs in respect of operating leases are charged on a straight-line basis over the lease term. Operating lease incentives are recognised as a reduction in the rental expense over the lease term.

Intangible assets

Intangible assets are stated at cost less accumulated amortisation and any accumulated impairment losses. Goodwill was amortised to 1 January 2004 (being the date of transition to IFRS). From 1 January 2004 the amortisation was frozen and goodwill subject to an annual impairment review.

Goodwill

Goodwill arises on the purchase of subsidiary undertakings and represents the excess of the fair value of purchase consideration over the fair value of assets acquired.

Other intangible assets

Intangible assets purchased separately, such as software that does not form an integral part of related hardware, are capitalised at cost.

Amortisation is calculated to write off the cost of intangible fixed assets on a straight-line basis over their expected economic lives as follows:

Software assets | 20% – 33% per annum |

Goodwill is considered to have an indefinite life.

Property, plant and equipment

Property, plant and equipment is recorded at historical cost less accumulated depreciation and any accumulated impairment losses. Network infrastructure and equipment comprises assets purchased and built, at cost, together with capitalised labour which is directly attributable to the cost of construction.

Depreciation is calculated to write off the cost of tangible fixed assets on a straight-line basis over their expected economic lives as follows:

Network infrastructure and equipment | 5% – 20% per annum | |

Office computers, equipment, fixtures and fittings and vehicles | 10% – 33% per annum |

| | | |

Depreciation of network infrastructure and equipment commences from the date it becomes operational. Borrowing costs related to the purchase of fixed assets are not capitalised.

The assets’ useful lives are reviewed and adjusted if appropriate at each balance sheet date.

Impairment

Goodwill is allocated to cash-generating units for the purpose of impairment testing. The recoverable amount of the cash generating unit to which the goodwill relates is tested annually for impairment or when events or changes in circumstances indicate that it might be impaired. The carrying values of property, plant and equipment and intangible assets other than goodwill are reviewed for impairment only when events indicate the carrying value may be impaired.

In an impairment test, the recoverable amount of the cash-generating unit or asset is estimated to determine the extent of any impairment loss. The recoverable amount is the higher of fair value less costs to sell and the value in use to the Group. An impairment loss is recognised to the extent that the carrying value exceeds the recoverable amount.

Annual Report 2005 41

Notes to the financial statements

continued

Licences

Annual amounts payable for telecommunications licences have been expensed as incurred.

Deferred taxation

Deferred tax is provided on all timing differences that arise between the carrying amounts of assets and liabilities for financial reporting purposes and their tax base which result in an obligation at the balance sheet date, to pay more tax, or a right to pay less tax, at a future date, at rates that are expected to apply when the obligation crystallises, based on current tax rates and laws enacted or substantially enacted at the balance sheet date. Deferred tax assets and liabilities are recognised to the extent that it is regarded as probable that they will be recovered in the foreseeable future. Deferred tax is measured on a non-discounted basis.

Property provisions

The Group provides for obligations relating to excess leased space in its properties. The provisions represent the net present value of the future estimated costs and the unwinding of the discount is included within the interest charge for the year.

Financial instruments

Cash and cash equivalents

For the purpose of preparation of the cash flow statement, cash and cash equivalents includes cash at bank and in hand, and short-term deposits with a maturity period of five working days. Interest income receivable on cash and cash equivalents is recognised as it is earned.

Borrowings

Borrowings are recognised initially at fair value, net of transaction costs incurred. Borrowings are subsequently stated at amortised cost. Any difference between the proceeds, net of transaction costs, and the redemption value is recognised in the income statement over the period of the borrowings using the constant rate method.

The change in fair value of the Group’s Euro denominated borrowings relating to the movement of the Euro to Sterling exchange rate is treated as a hedge of net assets of the Group’s Euro denominated subsidiaries. Foreign exchange gains and losses on the Group’s Euro denominated borrowings are taken directly to the translation reserve to the extent that the hedge is effective.

Employee benefits

Pension schemes

The Group operates a number of defined contribution pension schemes through its subsidiaries. Pension costs are charged to the income statement on an accruals basis in the period in which contributions are payable to the schemes.

Share-based payments

The cost of share-based employee compensation arrangements, whereby employees receive remuneration in the form of shares or share options, is recognised as an employee benefit expense in the income statement.

The total expense is apportioned over the vesting period of the benefit and is determined by reference to the fair value at the grant date of the shares or share options awarded and the number that are expected to vest. The assumptions underlying the number of awards expected to vest are subsequently adjusted to reflect conditions prevailing at the balance sheet date. At the vesting date of an award, the cumulative expense is adjusted to take account of the awards that actually vest.

42 COLT Telecom Group plc

Notes to the financial statements

continued

2 Segmental reporting

Primary reporting format – geographic segments

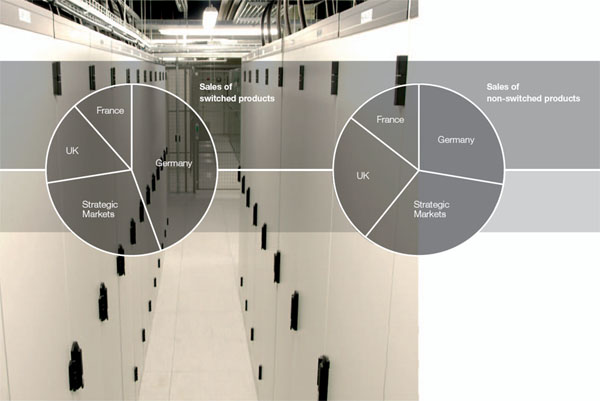

The Group operates in a single business segment, telecommunications, and in the geographical areas shown below. The reported segments are Germany, Strategic Markets, UK and France. Strategic Markets comprises Austria, Belgium, Denmark, Ireland, Italy, The Netherlands, Portugal, Spain, Sweden and Switzerland.

Revenue from the single business segment is attributed between geographical areas and is classified as Switched, Non-switched, and Other. Switched revenue comprises services including the transmission of voice, data or video through a switching centre. Non-switched revenue includes managed and non-managed network services, bandwidth services and voice traffic which is delivered in a digital form (IP Voice). Switched revenue has been voluntarily further split between carrier and non-carrier. Carrier revenue includes switched services provided wholesale to other licenced operators, and non-carrier revenue is all other switched revenue.

Additionally, the Group has voluntarily disclosed revenue split by Corporate and Wholesale customers. Wholesale turnover includes services to other telecommunications carriers, resellers and internet service providers (ISPs). Corporate turnover includes services to corporate and government accounts.

Inter-segment revenue transactions are carried out at an arm’s length price. Costs are allocated to segments using appropriate allocation factors.

The information in the table below is based on the location where the assets are located which is not materially different from the location of the customer.

Year ended 31 December 2005 | Germany

£m | Strategic

Markets

£m | UK

£m | France

£m | Corporate

and

eliminations

£m | Consolidated £m |

| | |

| | | | | | |

Revenue | | | | | | |

Carrier | 149.4 | 142.8 | 43.9 | 26.5 | (101.0) | 261.6 |

Non-carrier | 229.4 | 111.9 | 84.8 | 66.8 | – | 492.9 |

| | |

Total switched | 378.8 | 254.7 | 128.7 | 93.3 | (101.0) | 754.5 |

Non-switched | 143.9 | 191.7 | 125.7 | 77.0 | (48.6) | 489.7 |

Other | – | 1.3 | – | – | – | 1.3 |

Inter-segment sales | (50.5) | (72.8) | (15.2) | (11.1) | 149.6 | – |

| | |

Total revenue | 472.2 | 374.9 | 239.2 | 159.2 | – | 1,245.5 |

| | |

| | | | | | |

Result | | | | | | |

Operating loss before exceptional items | (21.2) | (12.8) | (17.7) | (2.4) | – | (54.1) |

Exceptional items (note 7) | – | (99.9) | (46.8) | (100.5) | – | (247.2) |

| | |

Operating loss after exceptional items | (21.2) | (112.7) | (64.5) | (102.9) | – | (301.3) |

Interest receivable | 0.6 | 0.7 | 0.1 | – | 10.2 | 11.6 |

Interest payable and similar charges | (1.0) | (0.6) | (0.3) | – | (44.3) | (46.2) |

Profit on repurchase of debt | – | – | – | – | 0.3 | 0.3 |

Exchange loss | (0.3) | – | – | – | – | (0.3) |

| | |

Loss before and after taxation | (21.9) | (112.6) | (64.7) | (102.9) | (33.8) | (335.9) |

| | |

| | | | | | |

| | |

Segment assets | 481.6 | 295.5 | 245.1 | 113.4 | 201.3 | 1,336.9 |

| | |

| | | | | | |

Segment liabilities | 128.7 | 144.1 | 47.3 | 77.9 | 599.0 | 997.0 |

| | | | | | |

Other segment items | | | | | | |

Capital expenditure | | | | | | |

Intangible non-current assets | 0.1 | 1.2 | 1.1 | 0.3 | 15.4 | 18.1 |

Tangible non-current assets | 20.5 | 43.7 | 21.2 | 17.9 | 1.2 | 104.5 |

| | |

| 20.6 | 44.9 | 22.3 | 18.2 | 16.6 | 122.6 |

| | |

Depreciation | | | | | | |

Intangible non-current assets | 4.3 | 3.6 | 4.5 | 0.8 | 11.5 | 24.7 |

Tangible non-current assets | 68.0 | 50.9 | 54.0 | 27.8 | 2.1 | 202.8 |

| | |

| 72.3 | 54.5 | 58.5 | 28.6 | 13.6 | 227.5 |

| | |

Annual Report 2005 43

Notes to the financial statements

continued

Year ended 31 December 2004 | Germany

£m | Strategic

Markets

£m | UK

£m | France

£m | Corporate

and

eliminations

£m | Consolidated £m |

| | |

| | | | | | |

Revenue | | | | | | |

Carrier | 154.2 | 139.2 | 40.4 | 15.4 | (85.1) | 264.1 |

Non-carrier | 219.6 | 96.3 | 103.0 | 64.1 | – | 483.0 |

| | |

Total switched | 373.8 | 235.5 | 143.4 | 79.5 | (85.1) | 747.1 |

Non-switched | 140.7 | 176.2 | 121.2 | 75.0 | (44.6) | 468.5 |

Other | 1.3 | 1.7 | 0.1 | – | (0.1) | 3.0 |

Inter-segment sales | (40.9) | (62.9) | (18.0) | (8.0) | 129.8 | – |

| | |

Total revenue | 474.9 | 350.5 | 246.7 | 146.5 | – | 1,218.6 |

| | |

| | | | | | |

Result | | | | | | |

Operating loss by geographical segment | (23.0) | (19.7) | (18.5) | (3.1) | – | (64.3) |

Interest receivable | 0.6 | 0.5 | 0.6 | – | 19.3 | 21.0 |

Interest payable and similar charges | (0.7) | (0.6) | (0.2) | – | (65.3) | (66.8) |

Profit on repurchase of debt | – | – | – | – | 0.2 | 0.2 |

Exchange loss | (0.1) | (0.1) | 0.2 | – | – | – |

| | |

Loss before and after taxation | (23.2) | (19.9) | (17.9) | (3.1) | (45.8) | (109.9) |

| | |

| | | | | | |

Segment assets | 543.3 | 424.4 | 336.9 | 238.4 | 420.1 | 1,963.1 |

| | |

| | | | | | |

Segment liabilities | 130.5 | 154.5 | 103.9 | 52.8 | 839.6 | 1,281.3 |

| | |

Other segment items | | | | | | |

Capital expenditure | | | | | | |

Intangible non-current assets | 0.1 | 1.7 | 1.2 | 0.4 | 12.6 | 16.0 |

Tangible non-current assets | 31.9 | 41.0 | 29.0 | 13.6 | 1.6 | 117.1 |

| | |

| 32.0 | 42.7 | 30.2 | 14.0 | 14.2 | 133.1 |

| | |

Depreciation | | | | | | |

Intangible non-current assets | 3.8 | 2.1 | 2.7 | 1.4 | 7.3 | 17.3 |

Tangible non-current assets | 73.1 | 42.5 | 54.2 | 26.8 | 6.6 | 203.2 |

| | |

| 76.9 | 44.6 | 56.9 | 28.2 | 13.9 | 220.5 |

| | |

Voluntary disclosures

Segmental analysis by customer type for the year ended 31 December 2005:

| Corporate

£m | Wholesale

£m | Total

£m |

| | |

| | | |

Carrier | – | 261.6 | 261.6 |

Non-carrier | 325.6 | 167.3 | 492.9 |

| | |

Total switched | 325.6 | 428.9 | 754.5 |

Non-switched | 390.7 | 99.0 | 489.7 |

Other | 1.1 | 0.2 | 1.3 |

| | |

Total revenue | 717.4 | 528.1 | 1,245.5 |

| | |

Segmental analysis by customer type for the year ended 31 December 2004:

| Corporate

£m | Wholesale

£m | Total

£m |

| | | |

Carrier | – | 264.1 | 264.1 |

Non-carrier | 336.1 | 146.9 | 483.0 |

| | |

Total switched | 336.1 | 411.0 | 747.1 |

Non-switched | 363.0 | 105.5 | 468.5 |

Other | 2.9 | 0.1 | 3.0 |

| | |

Total revenue | 702.0 | 516.6 | 1,218.6 |

| | |

44 COLT Telecom Group plc

Notes to the financial statements

continued

3 Loss before taxation

The following items have been included in arriving at loss before taxation:

| Year ended 31 December |

| 2005

£m | 2004 £m |

| | |

| | |

Staff costs (note 5) | 221.2 | 210.6 |

Amortisation of intangible assets | 24.7 | 17.3 |

Depreciation of property, plant and equipment | 202.8 | 203.2 |

Impairment of intangible assets | 17.5 | – |

Impairment of property, plant and equipment | 229.7 | – |

Other operating lease rentals payable | | |

Property | 27.2 | 29.7 |

Plant and equipment | 75.2 | 73.0 |

| | |

Services provided by the Group’s auditors and network of firms:

| Year ended 31 December |

| 2005

£m | 2004 £m |

| | |

Audit services | | |

Statutory audit | 1.2 | 0.9 |

Other assurance services | 0.3 | 0.2 |

Tax services | | |

Compliance services | 0.4 | 0.6 |

Advisory services | 0.1 | 0.1 |

Other services not covered above | – | 0.2 |

| | |

| 2.0 | 2.0 |

| | |

Tax services – compliance services include all fees relating to ensuring that the Group is fully compliant with all aspects of tax legislation.

Tax services – advisory services includes all other tax fees. All tax fees were incurred in the UK in both 2004 and 2005.

4 Directors

| Year ended 31 December |

| 2005

£m | 2004 £m |

| | |

Aggregate emoluments | 1.9 | 1.9 |

| | |

| 1.9 | 1.9 |

| | |

The Directors consider that only the Board of Directors has the authority and responsibility for planning, directing and controlling the activities of the Group and therefore there are no other key management personnel.

Further details on Directors’ emoluments are set out in the Directors’ Remuneration Report on pages 29 to 33.

Annual Report 2005 45

Notes to the financial statements

continued

5 Employee information

Average monthly number of people (including executive Directors) employed by the Group:

| Year ended 31 December |

| 2005 | 2004 |

| | |

| | |

By category: | | |

Operations and technology | 2,524 | 2,527 |

Sales and marketing | 932 | 928 |

Administration | 614 | 580 |

| | |

| 4,070 | 4,035 |

| | |

| | |

| Year ended 31 December |

| 2005 | 2004 |

| | |

| | |

By geography: | | |

Germany | 1,021 | 1,165 |

Strategic Markets | 1,097 | 1,156 |

UK | 1,129 | 1,201 |

France | 422 | 459 |

India | 401 | 54 |

| | |

| 4,070 | 4,035 |

| | |

| | |

| Year ended 31 December |

| 2005

£m | 2004

£m |

| | |

| | |

Employee costs (for the above persons): | | |

Wages and salaries | 191.8 | 185.5 |

Share option charge | 2.7 | 2.1 |

Social security costs | 30.7 | 31.3 |

Other pension costs (note 22) | 11.9 | 9.7 |

| | |

| 237.1 | 228.6 |

Less: employee costs capitalised | (15.9) | (18.0) |

| | |

| 221.2 | 210.6 |

| | |

Capitalised employee costs are included in fixed asset additions within the appropriate asset category.

6 Interest payable and similar charges

| Year ended 31 December |

| 2005

£m | 2004

£m |

| | |

| | |

Interest and similar charges on convertible notes | 17.1 | 30.3 |

Interest and similar charges on non-convertible notes | 27.2 | 35.0 |

Other interest payable and similar charges | 1.9 | 1.5 |

| | |

| 46.2 | 66.8 |

| | |

46 COLT Telecom Group plc

Notes to the financial statements

continued

7 Exceptional items

The Group will continue to separately identify and disclose one off or unusual items (termed “exceptional items”). We believe this provides meaningful analysis of the trading results of the Group and aids readers’ understanding of the impact of such items. Exceptional items may not be comparable to similarly titled measures used by other companies.