SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of February, 2005

IMSA GROUP

(Translation of Registrant’s name into English)

GRUPO IMSA, S.A. DE C.V.

Ave. Batallón de San Patricio No. 111, Piso 26

Fracc. Valle Oriente

San Pedro Garza García, N.L. 66269, México

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-Fx Form 40-F¨

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes¨ Nox

TABLE OF CONTENTS

| 1. | Press Release issued on February 16, 2005, announcing results for the fourth quarter of 2004. |

| | |

| | Fourth Quarter 2004 |

| | | NYSE BMW |

GRUPO IMSA ANNOUNCES FOURTH QUARTER 2004 RESULTS

Sales Grow 33.8% and Operating Income 139.6% in year 2004

Monterrey, Mexico, February 16, 2005 - Grupo Imsa, S.A. de C.V. (BMV: IMSA) (NYSE: IMY) today announced results for the fourth quarter of 2004.1

FOURTH QUARTER 2004 HIGHLIGHTS

| • | | Accumulated 2004 and fourth quarter revenues of all three business segments rose. In peso terms, total 2004 sales grew 33.8% toPs 37,075, while fourth quarter sales totaledPs 9,624, an increase of 30.5% year-over-year. In dollar terms, revenues rose 36.5% in 2004, reachingUS$3,234, and for the quarter grew 37.9% compared with the fourth quarter of 2003 toUS$850. |

| • | | Operating income in pesos increased 139.6% in 2004 toPs 3,669 and 156.9% in the fourth quarter compared with fourth quarter 2003 toPs 822. In dollar terms, operating income grew 139.1% for the year toUS$317 and 160.8% for the fourth quarter compared with fourth quarter 2003 toUS$70. |

| • | | 2004 primary cash flow (EBITDA) in peso terms totaledPs 5,182, 84.6% above that of 2003, while fourth quarter EBITDA totaledPs 1,252, an increase of 89.4% compared to the same quarter of the previous year. In dollar terms, EBITDA grew 85.3% in 2004 toUS$449, while it reachedUS$108 in the fourth quarter of 2004, a growth of 94.4% compared to the fourth quarter of 2003. |

| • | | Net interest coverage – defined as EBITDA divided by net interest expense – was 18.3 times for the past twelve months, while leverage – defined as total debt divided by EBITDA – was 0.9 times. |

| • | | IMSA ACERO acquired the assets of Polymer Coil Coaters, mainly comprising a continuous industrial steel painting line to supply the construction industry in the southeastern United States. |

| • | | IMSA ACERO, in conjunction with an international consortium of companies, signed a ten-year off-take agreement to purchase slab from the Corus Group. |

| • | | Grupo Imsa’s shares were included in the Mexican Stock Market Index for the period of February 2005 to January 2006. |

| • | | The Stockholders’ General Assembly approved a proposal to delist Grupo Imsa’s American Depositary Shares from the New York Stock Exchange to concentrate the Company’s float in the Mexican Stock Exchange. |

| 1 | Unless otherwise stated, all figures are presented in millions of December 31, 2004 pesos (Ps), or in millions of nominal U.S. dollars (US$). |

Please refer to the last page of this document for definitions of terms, U.S. dollar conversion methodology and other disclosures.

Page 1 of 16

Consolidated Financial Results

Mr. Eugenio Clariond Reyes, Grupo Imsa’s Chief Executive Officer, stated: “2004 was a very important year for Grupo Imsa. We consolidated our competitive position and posted unprecedented results in sales and profits, while making progress with our continuous improvement programs, consolidating our portfolio of businesses and further strengthening our financial position.” Mr. Clariond continued: “Additionally, during the past weeks, we have taken concrete steps to generate even more value for our stockholders. IMSA ACERO signed a long-term contract to supply approximately 20% of its steel slab needs and acquired an industrial steel paining plant in the southeastern United States. Moreover, our shares became part of the Mexican Stock Market Index; the stockholders approved the delisting of our ADRs from the New York Stock Exchange to concentrate stock transactions in the Mexican Stock Market; and the credit rating of our debt was upgraded.”

SALES

In dollar terms, Grupo Imsa’s revenues for 2004 grew 36.5% to US$3,234, and in peso terms increased 33.8% to Ps 37,075. For the fourth quarter of 2004 (4Q04), sales in dollar terms reached US$850, an increase of 37.9% over fourth quarter 2003 (4Q03) but a decline of 3.7% compared to third quarter 2004 (3Q04). In peso terms, net sales for 4Q04 totaled Ps 9,624, an upswing of 30.5% over 4Q03 but a reduction of 3.9% vs. 3Q04. The year-over-year revenue growth was a result of an increase in prices in most businesses which partially offset a rise in the cost of main inputs, as well as growth in sales volumes for IMSALUM and certain IMSATEC businesses. The quarter-over-quarter decline in sales reflects the third quarter being seasonally stronger than the fourth.

For 4Q04, domestic sales amounted to Ps 5,146, 52.4% above 4Q03 and 8.3% more than 3Q04. Foreign sales for 4Q04 totaled Ps 4,478, an increase of 12.0% over 4Q03 but a reduction of 14.9% compared to 3Q04. Foreign sales for the quarter represented 47% of total net sales.

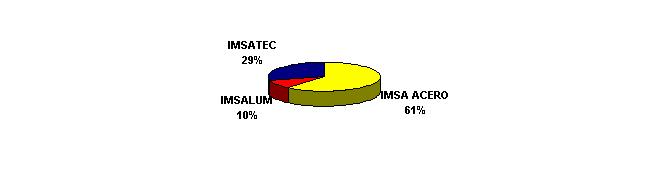

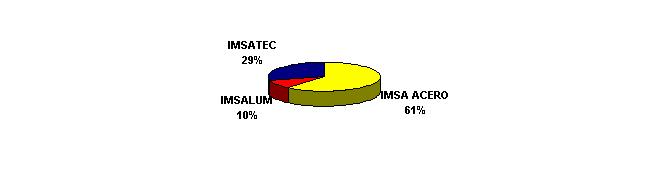

The following is a breakdown by business segment for the quarter:

Please refer to the last page of this document for definitions of terms, U.S. dollar conversion methodology and other disclosures.

Page 2 of 16

| | | | | | | | | | | | | | | |

Sales

| | 4Q04

| | 3Q04

| | 4Q03

| | 2004

| | 2003

|

IMSA ACERO | | Ps | 5,895 | | Ps | 6,138 | | Ps | 4,038 | | Ps | 22,778 | | Ps | 15,451 |

IMSATEC | | | 2,756 | | | 2,866 | | | 2,503 | | | 10,480 | | | 9,017 |

IMSALUM | | | 975 | | | 1,010 | | | 834 | | | 3,816 | | | 3,235 |

Total Net Sales1 | | Ps | 9,624 | | Ps | 10,016 | | Ps | 7,375 | | Ps | 37,075 | | Ps | 27,703 |

TOTAL US$ Average | | | 850 | | | 883 | | | 616 | | | 3,234 | | | 2,370 |

OPERATING INCOME

Operating income in nominal dollar terms for 2004 grew 139.1% to a total of US$317, and in peso terms increased 139.6% to Ps 3,669. Operating income in nominal dollar terms for 4Q04 amounted to US$70, an increase of 160.8% over 4Q03 but a reduction of 35.1% vs. 3Q04. Operating income for 4Q04 in peso terms was Ps 822, a growth of 156.9% vs. 4Q03 but a decline of 33.7% from 3Q04. Grupo Imsa’s operating margin for the quarter was 8.5%, compared to 4.3% for 4Q03 and 12.4% for 3Q04.

EBITDA

EBITDA in dollars grew 85.3% in 2004 to US$449, and in pesos increased 84.6% to Ps 5,182. EBITDA in dollars for 4Q04 totaled US$108, representing an increase of 94.4% year-over-year but a decline of 24.1% quarter-over-quarter. EBITDA for the quarter in peso terms was Ps 1,252, 89.4% above 4Q03 but 23.0% below 3Q04.

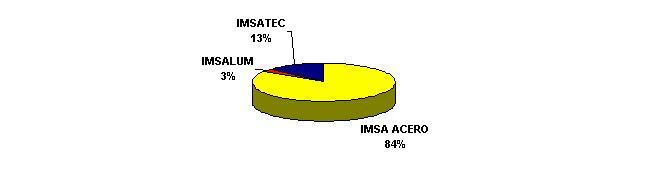

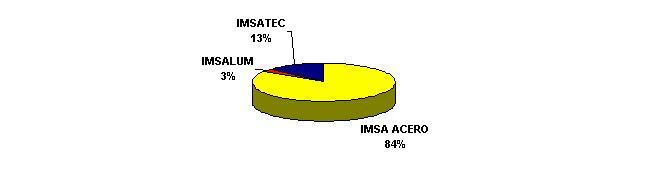

EBITDA contribution per business segment in 4Q04 was as follows:

| | | | | | | | | | | | | | | | | | | | |

EBITDA

| | 4Q04

| | | 3Q04

| | | 4Q03

| | | 2004

| | | 2003

| |

IMSA ACERO | | Ps | 1,098 | | | Ps | 1,388 | | | Ps | 524 | | | Ps | 4,414 | | | Ps | 2,230 | |

IMSATEC | | | 176 | | | | 191 | | | | 137 | | | | 636 | | | | 500 | |

IMSALUM | | | 33 | | | | 79 | | | | 45 | | | | 271 | | | | 248 | |

Corporate | | | (55 | ) | | | (31 | ) | | | (45 | ) | | | (139 | ) | | | (171 | ) |

TOTAL | | Ps | 1,252 | | | Ps | 1,627 | | | Ps | 661 | | | Ps | 5,182 | | | Ps | 2,807 | |

TOTAL US$ Avg. | | | 108 | | | | 142 | | | | 56 | | | | 449 | | | | 242 | |

EBITDA Margin | | | 13.0 | % | | | 16.2 | % | | | 9.0 | % | | | 14.0 | % | | | 10.1 | % |

| 1 | The sum of these amounts does not equal the consolidated net sales for the periods presented because Corporate and Other has been excluded. |

Please refer to the last page of this document for definitions of terms, U.S. dollar conversion methodology and other disclosures.

Page 3 of 16

INTEGRAL FINANCING COST (INCOME)

The integral financing income for 4Q04 was Ps 98, compared to costs of Ps 155 in 4Q03 and Ps 35 in 3Q04. The main reason for the change in integral financing result was a foreign exchange gain resulting from the appreciation of the Mexican pesos vs. the U.S. dollar in 4Q04.

Interest expense for 4Q04 was unchanged with respect to 4Q03, and fell 46% compared to 3Q04. The quarter-over-quarter decline was a result of a reduction in average debt in 4Q04 and of the fact that in 3Q04 the Company prepaid a significant part of its bank debt, so that the total expenses related to the placement of the unpaid debt was recognized in 3Q04 instead of being amortized over the remaining life of the debt.

| | | | | | | | | | | | | | | | | | | | |

Integral Financing Cost (Income)

| | 4Q04

| | | 3Q04

| | | 4Q03

| | | 2004

| | | 2003

| |

Interest expense | | Ps | 68 | | | Ps | 126 | | | Ps | 67 | | | Ps | 342 | | | Ps | 338 | |

Interest income | | | (11 | ) | | | (16 | ) | | | (13 | ) | | | (59 | ) | | | (35 | ) |

Foreign exchange loss (gain) | | | (68 | ) | | | 5 | | | | 230 | | | | 25 | | | | 736 | |

Gain from monetary position | | | (87 | ) | | | (80 | ) | | | (129 | ) | | | (291 | ) | | | (321 | ) |

Integral financing cost (income) | | Ps | (98 | ) | | Ps | 35 | | | Ps | 155 | | | Ps | 17 | | | Ps | 718 | |

MAJORITY NET INCOME

The Majority Net Income for 2004 totaled Ps 2,934, 268.6% above that of 2003. For 4Q04, the Majority Net Income was Ps 1,079, compared to incomes of Ps 244 for 4Q03 and Ps 775 for 3Q04. The 4Q04 figure includes an effect for deferred taxes reflecting a reduction in tax rates as of 2005 and therefore the recalculation of the liability for deferred taxes registered at the close of 2003. The corporate income tax rate is being slowly reduced in Mexico, decreasing from 33% in 2004 to 30% in 2005 and programmed to drop to 28% by 2007. The effect on deferred taxes, an increased operating income and a foreign exchange gain resulted in growth in Net Income compared to 4Q03. The upswing compared to 3Q04 is a result of the effect of the corporate tax rate on deferred taxes and the foreign exchange gain of 4Q04.

| | | | | | | | | | | | | | | |

Majority Net Income

| | 4Q04

| | 3Q04

| | 4Q03

| | 2004

| | 2003

|

Majority net income | | Ps | 1,079 | | Ps | 775 | | Ps | 244 | | Ps | 2,934 | | Ps | 796 |

Majority net income per equity unit | | Ps | 1.92 | | Ps | 1.38 | | Ps | 0.43 | | Ps | 5.22 | | Ps | 1.41 |

Majority net income per ADS | | US$ | 1.54 | | US$ | 1.11 | | US$ | 0.32 | | US$ | 4.16 | | US$ | 1.10 |

As of December 31, 2004, Grupo Imsa had 2,809.1 million shares outstanding, equivalent to 561,815,458 equity units and 62,423,940 ADSs.

FINANCIAL POSITION

Net debt as of December 31, 2004 was US$387, an increase of US$28 compared to net debt presented in the balance sheet as of September 30, 2004 but a reduction of US$408 compared to net debt (including ENERMEX) as of yearend 2003. The quarter-over-quarter rise in net debt reflects the payment in October of a dividend of US$53, the acquisition in December of the assets of Polymer Coil Coaters for US$29 and a temporary increase in working capital. Total debt as of

Please refer to the last page of this document for definitions of terms, U.S. dollar conversion methodology and other disclosures.

Page 4 of 16

December 31, 2004 was US$419, US$453 below total debt (including ENERMEX) as of December 31, 2003, largely because of the sale of the battery business.

Net interest coverage defined as primary cash flow (EBITDA) divided by net interest expense was 18.3 times for the twelve months ended December 31, 2004, while interest coverage defined as EBITDA divided by gross interest expense was 15.2 times for the same period. The total debt to EBITDA ratio for the past twelve months was 0.9 times as of December 31, 2004.

Financial Results by Segment

IMSA ACERO

Sales

4Q04 sales volume was 541 thousand tonnes, a decline of 5.9% from 4Q03 and of 8.5% compared to 3Q04. Domestic shipments for the quarter totaled 391 thousand tonnes, 1.3% above 4Q03 and 0.3% more than 3Q04. Foreign volume amounted to 150 thousand tonnes for 4Q04, a decline of 20.8% from 4Q03 and of 25.5% versus 3Q04. The year-over-year and quarter-over-quarter declines in volume reflect excessive inventories in the markets where the company participates, which meant that steel consumers preferred to absorb their own inventories before making additional purchases. The decrease compared to 3Q04 also reflects the demand of the fourth quarter being seasonally lower than in the third.

Net sales for 4Q04 reached Ps 5,895, an increase of 46.0% over 4Q03 but a reduction of 4.0% compared to 3Q04. The year-over-year growth reflects increased prices for the company’s products and a change in the sales mix towards the domestic market. The quarter-over-quarter decline in net sales was a result of a reduction in sales volume.

Operating Income and EBITDA

Operating income was Ps 740, an increase of 171.1% over 4Q03 but a decline of 31.0% versus 3Q04. 4Q04 operating margin was 12.6%, compared to margins of 6.8% for 4Q03 and 17.5% for 3Q04. EBITDA for 4Q04 was Ps 1,089, a growth of 109.5% with respect to 4Q03 but a decline of 20.9% versus 3Q04. In dollar terms, EBITDA rose 114.8% year-over-year but declined 20.9% quarter-over-quarter to US$96.

The year-over-year increase in operating income was largely due to a continuation of the temporary rise in the margin between the cost of raw materials and the price of the company’s products, because of existing inventories and because, during this period in which steel prices continued to increase in the international marketplace, the company received raw materials at prices that had been contracted in advance. The quarter-over-quarter decline reflects a reduction in sales volume and a natural decline in margin because raw material costs continued to rise ahead of final product prices. The cost of raw materials is expected to continue rising in the first quarter of 2005, while product price increases will be limited, so IMSA ACERO’s margin will tend to fall.

Please refer to the last page of this document for definitions of terms, U.S. dollar conversion methodology and other disclosures.

Page 5 of 16

IMSATEC

Sales

IMSATEC’s 4Q04 revenues totaled Ps 2,756, representing an upswing of 10.1% over 4Q03 but a decline of 3.8% versus 3Q04. The year-over-year revenue growth reflects increased sales volumes for several IMSATEC businesses and higher prices of most of its products. Both in Mexico and the United States, the company’s businesses benefited from greater activity in the non-residential construction segment. In addition, most IMSATEC businesses were able to reflect an important part of the increase in raw material costs, such as those of steel and plastic, in their product prices. The quarter-over-quarter revenue reduction reflects the seasonality of IMSATEC’s operations, with the fourth quarter of the year being seasonally slower than the third in the construction industry.

Operating Income and EBITDA

Operating income totaled Ps 124 in 4Q04, an increase of 57.0% compared to 4Q03 but a decline of 10.8% vs. 3Q04. Operating margin for the quarter was 4.5%, compared to 3.2% for 4Q03 and 4.8% in 3Q04. EBITDA for the quarter was Ps 176, an increase of 28.5% vs. 4Q03 but a reduction of 7.9% with respect to 3Q04. In dollar terms, EBITDA grew year-over-year by 17.6% and declined quarter-over-quarter by 17.5% to US$14.

IMSATEC’s operating income rose year-over-year because of economies of scale resulting from increased sales and the company’s emphasis on continuous improvement programs to make its production and administrative processes more efficient, which resulted in a reduction in operating expenses as a percent of sales from 13.1% in 4Q03 to 10.5% in 4Q04. The quarter-over-quarter decline in operating income largely reflects the fourth quarter of the year being seasonally less active than the third.

In 2004, the market environment in the economies and industries in which the company participates improved slightly, resulting in an increase in sales and in greater flexibility for the company to reflect rising input costs in its product prices. Private, non-residential construction in the United States grew approximately 3% during the year, but the very significant rise in input costs limited IMSATEC’s financial results, with most of the reported growth reflecting increased sales and the company’s continuous improvement initiatives which resulted in lower costs and expenses. It is important to note that, despite the rise in IMSATEC’s raw material costs, operating income grew 53.4% in 2004.

IMSALUM

Sales

IMSALUM’s 4Q04 revenues totaled Ps 975, a growth of 16.9% over 4Q03 but a decline of 3.5% compared to 3Q04. The year-over-year upswing in revenues was due to the Mexican construction market remaining strong and the price of final products having risen to reflect part of the increase in the cost of aluminum. In addition, the economic recovery in the United States, combined with important contracts that the company began to supply in 2004, resulted in significant ladder sales growth in the U.S. market in 2004. The quarter-over-quarter decrease was due to the fact that the third quarter of the year is seasonally stronger than the fourth in the ladder business. During the past months, IMSALUM has redoubled its efforts to improve customer service, and this has

Please refer to the last page of this document for definitions of terms, U.S. dollar conversion methodology and other disclosures.

Page 6 of 16

resulted in increased sales and a growth in customer loyalty.

Operating Income and EBITDA

Operating income for 4Q04 was Ps 19, representing decreases of 42.4% from 4Q03 and of 71.6% vs. 3Q04. Operating margin for the quarter was 1.9%, compared to operating margins of 4.0% for 4Q03 and of 6.6% for 3Q04. IMSALUM’s 4Q04 EBITDA was Ps 33, 26.7% below that of 4Q03 and 58.2% below that of 3Q04. In dollar terms, EBITDA fell 27.3% year-over-year and 62.2% quarter-over-quarter to US$3.

The decline in operating income mainly reflects the average price of aluminum during 4Q04 being 7% more than in 3Q04 and 21% above that of 4Q03. IMSALUM’s businesses were affected by being unable to reflect the abrupt fourth quarter increase in the price of aluminum ingot and scrap in their prices. Quarter-over-quarter, IMSALUM was also affected by the normal seasonal reduction in activity in the fourth quarter. The company expects to recover a significant part of the margin lost in 4Q04 because it continues to raise its prices to reflect the new aluminum costs, and the price of aluminum remained stable during the first weeks of 2005.

In 4Q04, IMSALUM made changes in its organizational structure, moving from a business focus to a functional focus in order to take advantage of synergies and concentrate efforts on results.

Corporate Developments

Grupo Imsa becomes part of the Mexican Stock Market Index

Grupo Imsa’s shares became part of the Mexican Stock Market Index for the period of February 2005 to January 2006.

Mr. Marcelo Canales Clariond, Grupo Imsa’s CFO, stated: “We are very satisfied that our company’s shares have been included for the first time in the Mexican Stock Market Index. This is an important step in our objective of increasing the liquidity of our stock. We are committed to continue working to make Grupo Imsa a financial vehicle for creating value for our stockholders.”

Grupo Imsa in the process of delisting its ADSs from the New York Stock Exchange

The general extraordinary assembly of Grupo Imsa stockholders of January 27, 2005 approved a proposal to delist the Company’s American Depositary Shares (ADSs), corresponding to American Depositary Receipts, from the New York Stock Exchange, and to simultaneously terminate the Company’s American Depositary Receipt program with the Bank of New York (the Depositary), in order to concentrate the Company’s float in a single market – the Mexican Stock Exchange – and increase the stock’s liquidity.

A few days ago, the Company began the process of obtaining authorization from the Securities and Exchange Commission (SEC) and the New York Stock Exchange for the aforementioned delisting, which should take place in a period of approximately 30 days after the beginning of such procedures. Additionally, the Company advised the Bank of New York that at the end of the said period, Grupo Imsa’s ADR program with the bank would be formally terminated. During the said period, and within a period of 270 days after the termination of the depositary program, holders of Grupo Imsa ADRs who so wish may exchange these securities for BC equity units, so long as

Please refer to the last page of this document for definitions of terms, U.S. dollar conversion methodology and other disclosures.

Page 7 of 16

they have a financial intermediation contract with a stockbroker authorized to operate in Mexico. Grupo Imsa will pay the costs arising from the substitution of ADRs by BC equity units, so long as the said substitution is made on or after the date on which the aforementioned depositary program is terminated.

Marcelo Canales explained: “Grupo Imsa maintains its commitment to offering transparency and information as a publicly traded company, so we will continue to comply with our obligation to provide information to the corresponding authorities and with our efforts to increase relations with investors both at home and abroad, to provide the highest quality information and to continue operating with world-class corporate governance.”

Grupo Imsa’s credit rating upgraded

In January, Standard & Poor’s upgraded the Company’s global credit rating in local and foreign currency from BBB- to BBB and its domestic credit rating from mxAA to mxAA+. Fitch Mexico also increased Grupo Imsa’s domestic rating from AA(mex)(Double A) to AA+(mex)(Double A plus).

Marcelo Canales, Grupo Imsa’s CFO, explained: “Grupo Imsa follows a policy of maintaining a solid financial position that ensures the Company’s continuity for the benefit of our employees, stockholders and creditors. This change in rating reflects the strength of our business model and its capacity to generate cash.”

Grupo Imsa acquires industrial steel painting plant

Grupo Imsa, through IMSA ACERO, acquired the assets of Polymer Coil Coaters from Magnatrax Corporation for US$29. These assets mainly comprise a continuous industrial steel painting line in Fairfield, Alabama, which serves the construction industry in the southeastern United States. The plant has an annual production capacity of 135,000 tonnes of painted steel.

Santiago Clariond, CEO of IMSA ACERO, stated: “This plant will be integrated into our Steelscape operations, expanding our geographical coverage of the United States, which is currently concentrated on the west coast. One of our objectives for Steelscape is for it to grow in an orderly and profitable way to cover the entire U.S. and become the most important painted steel supplier to the U.S. construction industry.”

IMSA ACERO signs long-term steel slab supply agreement

IMSA ACERO, in conjunction with a consortium of international companies, signed a ten-year off-take agreement with the Corus Group to purchase steel slab at production cost from their plant in Teesside, England. During the ten years of the contract, IMSA ACERO will have access to 16% of the production of the Teesside Plant, estimated to be between 3.2 and 3.6 million tonnes of steel slab per year. The contracted amount represents approximately 20% of the company’s current and future slab needs. Grupo Imsa will pay a total estimated amount of US$46 over the ten-year period of the contract.

Santiago Clariond stated: “This transaction is in line with our strategy of assuring a significant part of our steel needs in order to offer our customers improved service and have better control over our inputs. It also opens the door for us to explore opportunities to increase the production capacity of our hot-rolling mill.”

* * *

Please refer to the last page of this document for definitions of terms, U.S. dollar conversion methodology and other disclosures.

Page 8 of 16

Grupo Imsa, a holding company, dates back to 1936 and is today one of Mexico’s leading diversified industrial companies, operating in three core businesses: steel processed products; steel and plastic construction products; and aluminum and other related products. With manufacturing and distribution facilities in Mexico, the United States, Europe and throughout Central and South America, Grupo Imsa currently exports to all five continents. Grupo Imsa’s shares trade on the Mexican Stock Exchange (IMSA) and, in the United States, on the NYSE (IMY).

Contacts:

Adrian Fernandez, Corporate Finance Director, (52-81) 8153-8433

Jose Luis Fornelli, Investor Relations Manager, (52-81) 8153-8416

jose.fornelli@grupoimsa.com

TABLES TO FOLLOW

Please refer to the last page of this document for definitions of terms, U.S. dollar conversion methodology and other disclosures.

Page 9 of 16

GRUPO IMSA, S.A. DE C.V. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Millions of Mexican pesos of

purchasing power as of December 31, 2004)

| | | | | | |

| | | December

2004

| | | December

2003

| |

ASSETS | | | | | | |

| | |

Current: | | | | | | |

Cash and cash equivalents | | 359 | | | 875 | |

Accounts receivable-trade, net | | 4,929 | | | 3,839 | |

Inventories | | 10,272 | | | 5,804 | |

Other current assets | | 1,353 | | | 1,073 | |

Current assets of discontinued operations | | — | | | 1,838 | |

| | |

|

| |

|

|

| | | 16,913 | | | 13,429 | |

| | |

Investment in associated companies | | 108 | | | 119 | |

Property, plant and equipment | | 18,384 | | | 18,472 | |

Other assets | | 572 | | | 767 | |

Noncurrent assets of discontinued operations | | — | | | 2,576 | |

Excess of cost over fair value of net assets acquired of subsidiaries | | 869 | | | 999 | |

| | |

|

| |

|

|

TOTAL ASSETS | | 36,846 | | | 36,362 | |

| | |

|

| |

|

|

| | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | |

| | |

Current: | | | | | | |

Current portion of long-term debt | | 280 | | | 932 | |

Bank loans | | 306 | | | 304 | |

Accounts payable-trade | | 4,464 | | | 3,917 | |

Advances from clients | | 483 | | | 260 | |

Provisión para gastos | | | | | | |

Impuestos por pagar | | | | | | |

Other accounts payable and accrued liabilities | | 1,872 | | | 1,087 | |

Short-term liabilities of discontinued operations | | — | | | 1,715 | |

| | |

|

| |

|

|

| | | 7,405 | | | 8,215 | |

| | |

|

| |

|

|

Lont-term debt | | 4,130 | | | 7,616 | |

Deferred taxes | | 5,036 | | | 2,883 | |

Other long-term liabilities | | 432 | | | 250 | |

Long-term liabilities of discontinued operations | | — | | | 1,136 | |

| | |

|

| |

|

|

| | | 9,598 | | | 11,885 | |

| | |

|

| |

|

|

TOTAL LIABILITIES | | 17,003 | | | 20,100 | |

| | |

|

| |

|

|

Excess of fair value of net assets acquired over cost of subsidiaries | | 55 | | | 99 | |

| | |

Stockholder’s equity: | | | | | | |

Common stock | | 5,225 | | | 5,225 | |

Additional paid-in capital | | 3,064 | | | 3,064 | |

Reserve for repurchase of own shares | | 139 | | | 143 | |

Retained earnings | | 19,284 | | | 17,359 | |

Insufficiency in capital restatement | | (7,523 | ) | | (6,477 | ) |

Stockholders’ equity operation | | 3,346 | | | — | |

Initial effect of deferred taxes | | (3,822 | ) | | (3,822 | ) |

| | |

|

| |

|

|

Mayority interest | | 19,713 | | | 15,492 | |

Minority interest | | — | | | 948 | |

| | |

|

| |

|

|

TOTAL STOCKHOLDERS’ EQUITY | | 19,713 | | | 16,440 | |

| | |

|

| |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | | 36,771 | | | 36,639 | |

| | |

|

| |

|

|

Please refer to the last page of this document for definitions of terms, U.S. dollar conversion methodology and other disclosures.

Page 10 of 16

GRUPO IMSA, S.A. DE C.V. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Millions of Mexican pesos of purchasing power

as of December 31, 2004)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | % Change

| |

| | | 4Q04

| | | 3Q04

| | | 4Q03

| | | 2004

| | | 2003

| | | 4Q04/4Q03

| | | 4Q04/3Q04

| | | 2004 / 2003

| |

NET SALES | | 9,624 | | | 10,016 | | | 7,375 | | | 37,075 | | | 27,703 | | | 30.5 | % | | -3.9 | % | | 33.8 | % |

Domestic Sales | | 5,146 | | | 4,751 | | | 3,377 | | | 18,767 | | | 13,061 | | | 52.4 | % | | 8.3 | % | | 43.7 | % |

Foreign Sales | | 4,478 | | | 5,265 | | | 3,998 | | | 18,308 | | | 14,642 | | | 12.0 | % | | -14.9 | % | | 25.0 | % |

COST OF SALES | | 7,969 | | | 8,048 | | | 6,247 | | | 30,341 | | | 23,113 | | | 27.6 | % | | -1.0 | % | | 31.3 | % |

OPERATING EXPENSES | | 833 | | | 729 | | | 808 | | | 3,065 | | | 3,059 | | | 3.1 | % | | 14.3 | % | | 0.2 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| | | | | | | | | |

OPERATING INCOME | | 822 | | | 1,239 | | | 320 | | | 3,669 | | | 1,531 | | | 156.9 | % | | -33.7 | % | | 139.6 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| | | | | | | | | |

Financial expenses | | 68 | | | 126 | | | 67 | | | 342 | | | 338 | | | 1.5 | % | | -46.0 | % | | 1.2 | % |

Interest income | | (11 | ) | | (16 | ) | | (13 | ) | | (59 | ) | | (35 | ) | | -15.4 | % | | -31.3 | % | | 68.6 | % |

Foreign exchange loss (gain) | | (68 | ) | | 5 | | | 230 | | | 25 | | | 736 | | | | | | | | | -96.6 | % |

Gain from monetary position | | (87 | ) | | (80 | ) | | (129 | ) | | (291 | ) | | (321 | ) | | -32.6 | % | | 8.7 | % | | -9.3 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| | | | | | | | | |

INTEGRAL FIN. COST, NET | | (98 | ) | | 35 | | | 155 | | | 17 | | | 718 | | | | | | | | | -97.6 | % |

| | | | | | | | |

Other income, net | | 72 | | | 18 | | | 40 | | | 161 | | | 200 | | | 80.0 | % | | 300.0 | % | | -19.5 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| | | | | | | | | |

INCOME BEFORE TAXES AND EMPLOYEE’S PROFIT SHARING | | 848 | | | 1,186 | | | 125 | | | 3,491 | | | 613 | | | 578.4 | % | | -28.5 | % | | 469.5 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| | | | | | | | | |

PROVISIONS FOR: Income taxes | | (145 | ) | | 398 | | | 38 | | | 753 | | | 166 | | | | | | | | | 353.6 | % |

Employees’ profit sharing | | (11 | ) | | 10 | | | (19 | ) | | 13 | | | 26 | | | -42.1 | % | | | | | -50.0 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| | | | | | | | | |

INCOME BEFORE DISCONTINUED OPERATIONS | | 1,004 | | | 778 | | | 106 | | | 2,725 | | | 421 | | | 847.2 | % | | 29.0 | % | | 547.3 | % |

| | | | | | | | |

Discontinued Operations | | 74 | | | (5 | ) | | 222 | | | 317 | | | 638 | | | -66.7 | % | | | | | -50.3 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| | | | | | | | | |

CONSOLIDATED NET INCOME | | 1,078 | | | 773 | | | 328 | | | 3,042 | | | 1,059 | | | 228.7 | % | | 39.5 | % | | 187.3 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| | | | | | | | | |

Net income of minority interest | | (1 | ) | | (2 | ) | | 84 | | | 108 | | | 263 | | | | | | -50.0 | % | | -58.9 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| | | | | | | | | |

Net income of majority interest | | 1,079 | | | 775 | | | 244 | | | 2,934 | | | 796 | | | 342.2 | % | | 39.2 | % | | 268.6 | % |

| | |

|

| |

|

| |

|

| |

|

| |

|

| | | | | | | | | |

Please refer to the last page of this document for definitions of terms, U.S. dollar conversion methodology and other disclosures.

Page 11 of 16

GRUPO IMSA, S.A. DE C.V. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN FINANCIAL POSITION

(Millions of Mexican pesos of

purchasing power as of December 31, 2004)

| | | | | | |

| | | December

2004

| | | December

2003

| |

OPERATING ACTIVITIES: | | | | | | |

CONSOLIDATED NET INCOME | | 3,042 | | | 1,059 | |

ITEMS NOT (GENERATING) REQUIRING RESOURCES: | | | | | | |

| | |

Depreciation and amortization | | 1,513 | | | 1,277 | |

Amoritzation of excess of fair value of net assets acquired over cost of subsidiaries | | 18 | | | 18 | |

Other | | 448 | | | 217 | |

| | |

|

| |

|

|

| | | 5,021 | | | 2,571 | |

| | |

|

| |

|

|

CHANGES IN CURRENT ASSETS AND LIABILITIES NET OF EFFECTS FROM PURCHASES OF BUSINESSES: | | | | | | |

Accounts receivable-trade | | (1,090 | ) | | (207 | ) |

Inventories | | (5,083 | ) | | (288 | ) |

Other current assets | | (280 | ) | | (416 | ) |

Accounts payable-trade | | 547 | | | 971 | |

Advances from clients | | 223 | | | 64 | |

Other accounts payable and accrued liabilities | | 786 | | | 172 | |

| | |

|

| |

|

|

| | | (4,897 | ) | | 296 | |

| | |

|

| |

|

|

RESOURCES GENERATED FROM OPERATING ACTIVITIES | | 124 | | | 2,867 | |

| | |

|

| |

|

|

FINANCING ACTIVITIES: | | | | | | |

Proceeds (Payments) of short-term bank loans | | (650 | ) | | 36 | |

Proceeds (Payments) from borrowings from banks and issuance of long-term debt | | (3,486 | ) | | 85 | |

Dividends paid | | (995 | ) | | (362 | ) |

Others | | 158 | | | (672 | ) |

| | |

|

| |

|

|

RESOURCES (USED IN) GENERATED FROM FINANCING ACTIVITIES | | (4,973 | ) | | (913 | ) |

| | |

|

| |

|

|

INVESTING ACTIVITIES: | | | | | | |

Acquisition of property, plant and equipment | | (1,238 | ) | | (1,555 | ) |

Acquisition of companies and minority interest | | 5,457 | | | — | |

Other assets | | 76 | | | (21 | ) |

| | |

|

| |

|

|

RESOURCES USED IN INVESTING ACTIVITIES | | 4,295 | | | (1,576 | ) |

| | |

|

| |

|

|

(DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS | | (554 | ) | | 378 | |

CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | | 913 | | | 493 | |

| | |

|

| |

|

|

CASH AND CASH EQUIVALENTS AT END OF PERIOD | | 359 | | | 871 | |

| | |

|

| |

|

|

Please refer to the last page of this document for definitions of terms, U.S. dollar conversion methodology and other disclosures.

Page 12 of 16

GRUPO IMSA S.A. DE C.V. AND SUBSIDIARIES

(Millions of Mexican pesos of purchasing power as of December 31, 2004)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 4Q04

| | | 3Q04

| | | 4Q03

| | | 2004

| | | 2003

| | | 4Q04/4Q03

| | | 4Q04/3Q04

| | | 2004/2003

| |

IMSA ACERO | | | | | | | | | | | | | | | | | | | | | | | | |

DOMESTIC SALES | | 4,120 | | | 3,813 | | | 2,465 | | | 15,016 | | | 9,683 | | | 67.1 | % | | 8.1 | % | | 55.1 | % |

FOREIGN SALES | | 1,775 | | | 2,325 | | | 1,573 | | | 7,762 | | | 5,768 | | | 12.8 | % | | -23.7 | % | | 34.6 | % |

% Export/Sales | | 30.1 | % | | 37.9 | % | | 39.0 | % | | 34.1 | % | | 37.3 | % | | | | | | | | | |

NET SALES | | 5,895 | | | 6,138 | | | 4,038 | | | 22,778 | | | 15,451 | | | 46.0 | % | | -4.0 | % | | 47.4 | % |

COST OF SALES | | 4,785 | | | 4,767 | | | 3,467 | | | 18,316 | | | 13,065 | | | 38.0 | % | | 0.4 | % | | 40.2 | % |

OPERATING EXPENSES | | 370 | | | 298 | | | 298 | | | 1,258 | | | 1,119 | | | 24.2 | % | | 24.2 | % | | 12.4 | % |

OPERATING INCOME | | 740 | | | 1,073 | | | 273 | | | 3,204 | | | 1,267 | | | 171.1 | % | | -31.0 | % | | 152.9 | % |

OPERATING MARGIN | | 12.6 | % | | 17.5 | % | | 6.8 | % | | 14.1 | % | | 8.2 | % | | | | | | | | | |

EBITDA | | 1,098 | | | 1,388 | | | 524 | | | 4,414 | | | 2,230 | | | 109.5 | % | | -20.9 | % | | 97.9 | % |

EBITDA MARGIN | | 18.6 | % | | 22.6 | % | | 13.0 | % | | 19.4 | % | | 14.4 | % | | | | | | | | | |

| | | | | | | | |

IMSATEC | | | | | | | | | | | | | | | | | | | | | | | | |

DOMESTIC SALES | | 558 | | | 504 | | | 481 | | | 2,003 | | | 1,786 | | | 16.0 | % | | 10.7 | % | | 12.2 | % |

FOREIGN SALES | | 2,198 | | | 2,362 | | | 2,022 | | | 8,477 | | | 7,231 | | | 8.7 | % | | -6.9 | % | | 17.2 | % |

% Export/Sales | | 79.8 | % | | 82.4 | % | | 80.8 | % | | 80.9 | % | | 80.2 | % | | | | | | | | | |

NET SALES | | 2,756 | | | 2,866 | | | 2,503 | | | 10,480 | | | 9,017 | | | 10.1 | % | | -3.8 | % | | 16.2 | % |

COST OF SALES | | 2,342 | | | 2,445 | | | 2,096 | | | 8,881 | | | 7,479 | | | 11.7 | % | | -4.2 | % | | 18.7 | % |

OPERATING EXPENSES | | 290 | | | 282 | | | 328 | | | 1,174 | | | 1,261 | | | -11.6 | % | | 2.8 | % | | -6.9 | % |

OPERATING INCOME | | 124 | | | 139 | | | 79 | | | 425 | | | 277 | | | 57.0 | % | | -10.8 | % | | 53.4 | % |

OPERATING MARGIN | | 4.5 | % | | 4.8 | % | | 3.2 | % | | 4.1 | % | | 3.1 | % | | | | | | | | | |

EBITDA | | 176 | | | 191 | | | 137 | | | 636 | | | 500 | | | 28.5 | % | | -7.9 | % | | 27.2 | % |

EBITDA MARGIN | | 6.4 | % | | 6.7 | % | | 5.5 | % | | 6.1 | % | | 5.5 | % | | | | | | | | | |

| | | | | | | | |

IMSALUM | | | | | | | | | | | | | | | | | | | | | | | | |

DOMESTIC SALES | | 470 | | | 431 | | | 432 | | | 1,747 | | | 1,593 | | | 8.8 | % | | 9.0 | % | | 9.7 | % |

FOREIGN SALES | | 505 | | | 579 | | | 402 | | | 2,069 | | | 1,642 | | | 25.6 | % | | -12.8 | % | | 26.0 | % |

% Export/Sales | | 51.8 | % | | 57.3 | % | | 48.2 | % | | 54.2 | % | | 50.8 | % | | | | | | | | | |

NET SALES | | 975 | | | 1,010 | | | 834 | | | 3,816 | | | 3,235 | | | 16.9 | % | | -3.5 | % | | 18.0 | % |

COST OF SALES | | 842 | | | 835 | | | 684 | | | 3,144 | | | 2,570 | | | 23.1 | % | | 0.8 | % | | 22.3 | % |

OPERATING EXPENSES | | 114 | | | 108 | | | 117 | | | 453 | | | 466 | | | -2.6 | % | | 5.6 | % | | -2.8 | % |

OPERATING INCOME | | 19 | | | 67 | | | 33 | | | 219 | | | 199 | | | -42.4 | % | | -71.6 | % | | 10.1 | % |

OPERATING MARGIN | | 1.9 | % | | 6.6 | % | | 4.0 | % | | 5.7 | % | | 6.2 | % | | | | | | | | | |

EBITDA | | 33 | | | 79 | | | 45 | | | 271 | | | 248 | | | -26.7 | % | | -58.2 | % | | 9.3 | % |

EBITDA MARGIN | | 3.4 | % | | 7.8 | % | | 5.4 | % | | 7.1 | % | | 7.7 | % | | | | | | | | | |

Please refer to the last page of this document for definitions of terms, U.S. dollar conversion methodology and other disclosures.

Page 13 of 16

SALES VOLUME

| | | | | | | | | | |

| | | 4Q04

| | 3Q04

| | 4Q03

| | 2004

| | 2003

|

STEEL PROCESSING IMSA ACERO (Tonnes) | | | | | | | | | | |

| | | | | |

Domestic Sales Volume | | 391,320 | | 390,113 | | 386,142 | | 1,628,637 | | 1,491,335 |

| | | | | |

Export and Foreign Subsidiaries | | 149,969 | | 201,412 | | 189,307 | | 716,341 | | 675,381 |

Sales Volume | | | | | | | | | | |

| | | | | |

TOTAL IMSA ACERO | | 541,289 | | 591,525 | | 575,449 | | 2,344,978 | | 2,166,716 |

| | | | | |

| | | 4Q04

| | 3Q04

| | 4Q03

| | 2004

| | 2003

|

IMSALUM Aluminum (Tonnes) | | | | | | | | | | |

| | | | | |

TOTAL ALUMINUM | | 14,755 | | 14,674 | | 12,965 | | 59,595 | | 49,799 |

Please refer to the last page of this document for definitions of terms, U.S. dollar conversion methodology and other disclosures.

Page 14 of 16

Selected Financial Information

Income Statement

US$ Millions(1)

| | | | | | | | | | |

| | | 4Q04

| | 3Q04

| | 4Q03

| | 2004

| | 2003

|

Net Sales | | | | | | | | | | |

IMSA ACERO | | 517 | | 540 | | 342 | | 1,984 | | 1,330 |

IMSATEC | | 247 | | 253 | | 204 | | 918 | | 764 |

IMSALUM | | 86 | | 90 | | 70 | | 333 | | 278 |

Grupo Imsa(2) | | 850 | | 883 | | 616 | | 3,234 | | 2,370 |

| | | | |

Export & Foreign Company Sales | | | | | | | | |

IMSA ACERO | | | | | | | | | | |

IMSATEC | | 9 | | 12 | | 7 | | 35 | | 24 |

IMSALUM | | 2 | | 6 | | 3 | | 19 | | 17 |

Grupo Imsa(2) | | 70 | | 108 | | 27 | | 317 | | 133 |

| | | | | |

EBITDA | | | | | | | | | | |

IMSA ACERO | | 96 | | 121 | | 45 | | 383 | | 193 |

IMSATEC | | 14 | | 17 | | 12 | | 54 | | 43 |

IMSALUM | | 3 | | 7 | | 4 | | 23 | | 21 |

Grupo Imsa(2) | | 108 | | 142 | | 56 | | 449 | | 242 |

| | | | | |

Majority Net Income | | | | | | | | | | |

Grupo Imsa | | 96 | | 69 | | 20 | | 260 | | 69 |

| (1) | Peso figures converted into dollars by dividing the monthly nominal pesos by the average monthly exchange rate. |

| (2) | The sum of these amounts does not equal the consolidated figures presented because Corporate and Other have been excluded. |

Please refer to the last page of this document for definitions of terms, U.S. dollar conversion methodology and other disclosures.

Page 15 of 16

Disclosures and Definitions

Methodology used for consolidation and presentation of results and other important disclosures

Grupo Imsa consolidates its results in Mexican pesos using Mexican generally accepted accounting principles (Mexican GAAP). Figures in this document are presented in millions of Mexican pesos as of December 31, 2004 (Ps), unless otherwise specified.

In compliance with Bulletin B-15, “Foreign Currency Translation of Foreign Currency Financial Statements,” the restatement factors applied to financial statements of prior periods are calculated on the basis of a weighted average index that takes into consideration the inflation rates of the countries in which Grupo Imsa’s subsidiaries operate and changes in the exchange rates of each country vis-à-vis the Mexican peso. The restatement factor for the twelve-month period of December 2003 – December 2004 was 1.04908; for the three-month period of September 2004 – December 2004, it was 1.00712.

For the convenience of the reader, this document contains U.S. dollar amounts for Grupo Imsa and its three business segments. The conversion from Mexican pesos to U.S. dollars is carried out by dividing nominal monthly peso amounts of the financial statements by the average Mexican peso – U.S. dollar exchange rate for that month, and then adding the results of the divisions into quarterly or accumulated figures. U.S. dollar (US$) figures in this document are presented in millions, unless otherwise specified.

Fourth quarter 2004 (4Q04) inflation was 1.8%, resulting in an inflation rate of 5.2% for the last twelve months. The Mexican peso appreciated 1.3% against the U.S. dollar during 4Q04 and depreciated 0.3% over the last twelve months. The exchange rate used as of December 31, 2004 was 11.2648 pesos per dollar. Since the price and cost structure of Grupo Imsa is mainly denominated in dollars, the performance of the Company is affected when financial information is expressed in real pesos.

The term EBITDA is used throughout this document because Grupo Imsa believes it is a widely accepted financial indicator of its ability to generate cash flow to operate, fund capital expenditures, pay taxes, service or incur debt, and pay dividends. EBITDA should not be considered as an indicator of Grupo Imsa’s financial performance, as a measure of liquidity or as a substitute for the statement of changes in financial position. EBITDA can be reconciled by adding operating income to depreciation and operating amortization, all of which are concepts accepted under Mexican GAAP.

Effective on July 1, 2004, Grupo Imsa, through its battery subsidiary Enermex, S.A. de C.V., divested its automotive battery business, ceding its interest to Johnson Controls, Inc., the company that had been its minority partner since 1998. According to the interpretation of the related accounting bulletins, this transaction was classified as a stockholders’ equity operation and therefore is presented as part of the stockholders’ equity. For purposes of analysis and comparability, the results of the divested companies are presented under a single heading in the Income Statement as “Discontinued operations”. Additionally, all prior years’ operations of such companies were restructured as “Discontinued operations” and are presented in the attached financial statements as such.

This document contains forward-looking statements relating to Grupo Imsa’s future performance or its current expectations or beliefs. These include statements regarding the intent, belief or current expectations of the Company and its management. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties pertaining to the industries in which the Company participates. Grupo Imsa does not intend, and does not assume any obligation, to update these forward-looking statements.

Definition of terms

EBITDA: Operating income plus depreciation and operating amortization

Net Debt: Total debt, minus cash and cash equivalents

Net Interest Coverage: EBITDA divided by (interest expense minus interest income)

Interest Coverage: EBITDA divided by interest expense

Page 16 of 16

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | | | | GRUPO IMSA, S.A. DE C.V. |

| | | | | (Registrant) |

| | | |

| Dated: February 16, 2005 | | | | By: | | /s/ MARCELO CANALES CLARIOND |

| | | | | | | Name: | | Marcelo Canales Clariond |

| | | | | | | Title: | | Chief Financial Officer |