AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON MARCH 21, 2014

SECURITIES ACT FILE NO. 333-191513

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM N-14

REGISTRATION STATEMENT

UNDER THE

SECURITIES ACT OF 1933

PRE-EFFECTIVE AMENDMENT NO. 3

POST-EFFECTIVE AMENDMENT NO. [ ]

CITY NATIONAL ROCHDALE FUNDS

(FORMERLY CNI CHARTER FUNDS)

(Exact Name of Registrant as Specified in Charter)

400 North Roxbury Drive

Beverly Hills, California 90210

(Address of Principal Executive Offices) (Zip Code)

(800) 708-8881

(Registrant’s Area Code and Telephone Number)

William J. Souza, Esq.

400 North Roxbury Drive

Beverly Hills, California 90210

(Name and Address of Agent for Service)

With Copies To:

Michael Glazer

Bingham McCutchen LLP

355 South Grand Avenue

Los Angeles, California 90071

Approximate Date of Proposed Public Offering: As soon as practicable after the effective date of this Registration Statement.

The Registrant hereby amends this Registration Statement under the Securities Act of 1933 on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with the provisions of Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Title of Securities Being Registered: Class N shares.

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940.

CITY NATIONAL ROCHDALE ALTERNATIVE TOTAL RETURN FUND LLC

570 Lexington Avenue

New York, New York 10022

1-800-245-9888

[ ], 2014

Dear Shareholder:

We are seeking your approval of the proposed reorganization of your fund, City National Rochdale Alternative Total Return Fund LLC, into City National Rochdale Fixed Income Opportunities Fund. City National Rochdale, LLC (“CNR”) is the investment adviser for both funds.

The Board of Managers of your fund has called a Special Meeting of Shareholders (the “Meeting”) to be held on _________, 2014, at the offices of CNR, 570 Lexington Avenue, New York, New York 10022 at 10:00 a.m. Eastern Time in order to vote on the proposed reorganization.

CNR has informed your fund’s Board of Managers that it believes that shareholders would benefit from an allocation to life settlement investments through a multi-strategy portfolio which includes other more liquid sources of investment return rather than obtaining dedicated investment exposure to the asset class through a separate pooled investment vehicle. After considering the viability of and alternatives for your fund in light of CNR’s decision, your fund’s current size and the need to continue to make premium payments on the life insurance policies held by your fund, CNR recommended the proposed reorganization to your fund’s Board of Managers.

If the proposed reorganization is approved by shareholders, on the closing date of the reorganization your fund will transfer all of its assets to the acquiring fund and the acquiring fund will assume all of the liabilities of your fund. On that date, you will receive shares of the acquiring fund equal in aggregate net asset value to the value of your shares of your fund.

Enclosed are various materials, including a Combined Prospectus and Proxy Statement and proxy ballot for the Meeting. The materials will provide you with detailed information about the proposed reorganization. After careful consideration, the Board of Managers of your fund has determined that the reorganization is in the best interests of your fund and the existing investors of your fund will not be diluted as a result of the reorganization. The Board of Managers of your fund recommends you vote in favor of the proposed reorganization.

Your vote is important. Please take a moment now to sign and return your proxy card in the enclosed postage paid return envelope. If we do not hear from you after a reasonable amount of time you may receive a telephone call from us, reminding you to vote your shares.

Sincerely,

/s/ Garrett R. D’Alessandro

Garrett R. D’Alessandro

President & Chief Executive Officer

CITY NATIONAL ROCHDALE ALTERNATIVE TOTAL RETURN FUND LLC

570 Lexington Avenue

New York, New York 10022

1-800-245-9888

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

A Special Meeting of Shareholders of the City National Rochdale Alternative Total Return Fund LLC (the “Target Fund”) will be held on _________, 2014, at 10:00 a.m. Eastern Time, at the offices of City National Rochdale, LLC, 570 Lexington Avenue, New York, New York 10022. The meeting will be held for the following purposes:

1. Reorganization of the Target Fund. For the shareholders of the Target Fund to consider and vote on a proposed reorganization of the Target Fund into the City National Rochdale Fixed Income Opportunities Fund, a series of City National Rochdale Funds, and the subsequent dissolution of the Target Fund.

2. Other Business. To consider and act upon such other business as may properly come before the meeting or any adjournments or postponements thereof.

The appointed proxies will vote in their discretion on any other business as may properly come before the special meeting or any adjournments or postponements thereof.

The Board of Managers of the Target Fund has unanimously approved the proposed reorganization. Please read the accompanying Combined Prospectus and Proxy Statement for a more complete discussion of the proposal.

Shareholders of the Target Fund of record as of the close of business on _________, 2014 are entitled to notice of, and to vote at, the special meeting or any adjournments or postponements thereof.

You are invited to attend the special meeting. If you cannot do so, please complete and return the accompanying proxy in the enclosed postage paid return envelope as promptly as possible. This is important for the purpose of ensuring a quorum at the special meeting. You may revoke your proxy at any time before it is exercised by signing and submitting a revised proxy, by giving written notice of revocation to the Target Fund at any time before the proxy is exercised, or by voting in person at the special meeting.

By Order of the Board of Managers,

/s/ Garrett R. D’Alessandro

Garrett R. D’Alessandro

President & Chief Executive Officer

__________, 2014

PROSPECTUS FOR:

CITY NATIONAL ROCHDALE FUNDS

City National Rochdale Fixed Income Opportunities Fund

400 North Roxbury Drive

Beverly Hills, California 90210

1-800-708-8881

PROXY STATEMENT FOR:

CITY NATIONAL ROCHDALE ALTERNATIVE TOTAL RETURN FUND LLC

570 Lexington Avenue

New York, New York, 10022-6837

1-800-245-9888

COMBINED PROSPECTUS AND PROXY STATEMENT

Dated _________, 2014

The Board of Managers of City National Rochdale Alternative Total Return Fund LLC (the “Target Fund”) is soliciting the enclosed proxies in connection with a special meeting (the “Meeting”) of shareholders1 of the Target Fund.

The Meeting will be held on _________, 2014 at 10:00 a.m. Eastern Time at the offices of City National Rochdale, LLC (“CNR”), 570 Lexington Avenue, New York, New York 10022. The Meeting is being called to consider the proposed reorganization of the Target Fund into the City National Rochdale Fixed Income Opportunities Fund (the “Acquiring Fund”), a series of City National Rochdale Funds (the “Trust”), and to transact such other business as may properly come before the meeting or any adjournments or postponement thereof. Each of the Target Fund and the Acquiring Fund is referred to herein as a “Fund” and collectively they are referred to as the “Funds.” Shareholders of record of the Target Fund as of _________, 2014 will be entitled to vote at the Meeting.

| 1 | The Target Fund, a Delaware limited liability company, offers units of interests and not shares. For ease of reference, the proxy materials refer to unitholders and members as shareholders and to units as shares. |

The Target Fund is a closed-end management investment company organized as a Delaware limited liability company on November 18, 2010. The Target Fund’s offices are located at 570 Lexington Avenue, New York, New York 10022. The Target Fund’s phone number is 1-800-245-9888. The Trust is an open-end management investment company (referred to generally as a “mutual fund”) organized as a Delaware statutory trust on October 28, 1996. The Trust’s offices are located at 400 North Roxbury Drive, Beverly Hills, California 90210. The Trust’s phone number is 1-888-889-0799. The same Board members comprise the Board of Managers of the Target Fund (the “Board” or the “Target Fund Board”) and the Board of Trustees of the Trust (the “Acquiring Fund Board”).

This Combined Prospectus and Proxy Statement (the “Prospectus/Proxy Statement”) is furnished to the shareholders of the Target Fund on behalf of the Target Fund Board in connection with the solicitation of voting instructions for the Meeting. It is being mailed to shareholders of the Target Fund on or about _________, 2014. The prospectus for the Acquiring Fund accompanies and is incorporated into this Prospectus/Proxy Statement. This Prospectus/Proxy Statement sets forth concisely the information about the Acquiring Fund and the proposed reorganization that Target Fund shareholders should know before voting on the reorganization. You should retain them for future reference.

Additional information about the Target Fund is included in its Offering Memorandum and Statement of Additional Information dated January 10, 2011, as amended and/or supplemented, which are incorporated by reference herein. Additional information about the Acquiring Fund is included in its Prospectus and Statement of Additional Information dated January 31, 2014, as amended and/or supplemented. Additional information is also set forth in the Statement of Additional Information dated ________, 2014 relating to this Prospectus/Proxy Statement, which is also incorporated by reference herein. The Target Fund will furnish you, at your request and without charge, a copy of the Offering Memorandum, Statement of Additional Information and/or the most recent annual or semi-annual report for the Target Fund. You can request copies by calling 1-800-245-9888. As described herein, additional information about the Target Fund and the Trust has been filed with the SEC.

The SEC has not approved or disapproved these securities or passed on the adequacy of this Prospectus/Proxy Statement. Any representation to the contrary is a criminal offense.

Dated: ________, 2014

TABLE OF CONTENTS

| | Page |

SUMMARY OF PROSPECTUS/PROXY STATEMENT | 1 |

| REASONS FOR THE PROPOSED REORGANIZATION | 48 |

| CAPITALIZATION | 52 |

| VOTING AND MEETING PROCEDURES | 53 |

| GENERAL INFORMATION | 55 |

| FINANCIAL HIGHLIGHTS AND FINANCIAL STATEMENTS | 56 |

| INFORMATION FILED WITH THE SECURITIES AND EXCHANGE COMMISSION | 57 |

| APPENDIX A - AGREEMENT AND PLAN OF REORGANIZATION | A-1 |

SUMMARY OF PROSPECTUS/PROXY STATEMENT

Proposed Reorganization

The Board has called the Meeting to allow shareholders of the Target Fund to consider and vote on the proposed reorganization of the Target Fund into the Acquiring Fund (the “Reorganization”).

CNR has informed the Board that it believes that shareholders would benefit from an allocation to life settlement investments through a multi-strategy portfolio which includes other more liquid sources of investment return, to ensure portfolio diversification and the availability of assets to pay premiums on life settlement investments when due without the need to sell current life settlement investments to do so, rather than obtaining dedicated investment exposure to the asset class through a separate pooled investment vehicle. After considering the viability of and alternatives for the Target Fund in light of CNR’s decision, the Fund’s current size ($55.9 million as of July 31, 2013) and the need to continue to make premium payments on the insurance policies held by the Target Fund, CNR recommended the proposed Reorganization to the Board.

In the proposed Reorganization, Target Fund shareholders would become shareholders of a much larger ($752.4 million as of July 31, 2013) mutual fund offering daily liquidity. Today, as a shareholder of the Target Fund, a privately offered closed-end fund that is not exchange-listed, you have no redemption rights and are holding an illiquid investment. The Target Fund has conducted no tender offers to repurchase its shares from shareholders to date and has no current plans to conduct any tender offers.

If the Reorganization is completed, Target Fund shareholders would pay a lower investment advisory fee (0.50% rather than 1.75% plus a performance allocation) and lower total expenses (1.10% rather than 2.40% based on expenses of the Target Fund and combined Acquiring Fund as of July 31, 2013). Target Fund shareholders would also be able to exchange their shares for shares of other series of City National Rochdale Funds. Target Fund shareholders have no exchange rights today.

Target Fund shareholders would lose dedicated exposure to life insurance policies if the Reorganization is consummated. However, Target Fund shareholders would be obtaining interests in a diversified fund that may invest up to 15% of its net assets in life insurance policies.

The proposed Reorganization is intended to be a taxable transaction. The tax consequences of the Reorganization will be substantially similar to those of a liquidation of the Target Fund, which is treated as a partnership for federal income tax purposes. The exchange of the Target Fund’s assets for shares of the Acquiring Fund will be a taxable exchange, on which the Target Fund will recognize gains and losses. Target Fund shareholders will be subject to tax on their allocable shares of gains and losses recognized by the Target Fund. Target Fund shareholders may also recognize gain or loss on the distribution of Acquiring Fund shares in liquidation of the Target Fund.

Pursuant to the terms of the proposed Agreement and Plan of Reorganization between the Target Fund and the Trust on behalf of the Acquiring Fund (the “Reorganization Agreement”), the Reorganization would involve the transfer of all of the assets of the Target Fund to the Acquiring Fund in exchange for the assumption of all of the liabilities of Target Fund by Acquiring Fund and the issuance of Class N shares of the Acquiring Fund having an aggregate net asset value equal to the aggregate net asset value of the shares of the Target Fund. The net asset value per share of the Target Fund and the Acquiring Fund will be determined in accordance with the regular practices of each Fund. The Board and the Acquiring Fund Board have approved the same fair valuation methodology and procedures to price life insurance policy holdings. Shares of the Acquiring Fund will be distributed to shareholders of the Target Fund and the Target Fund will be dissolved.

CNR serves as the investment adviser for each Fund. CNR engages Federated Investment Management Company, GML Capital LLP, Seix Investment Advisors LLC and Alcentra Limited to each sub-advise a portion of the Acquiring Fund’s portfolio. The Acquiring Fund is a diversified series of the Trust, an open-end management investment company, which means that the Acquiring Fund is limited as to amounts of issuers it may own with respect to 75% of its assets. The Acquiring Fund’s shares are registered under the Securities Act of 1933, as amended (the “1933 Act”) and the Investment Company Act of 1940, as amended (the “1940 Act”) and are publicly offered on a continuous basis. Investors may purchase or redeem shares of the Acquiring Fund on any business day. The Target Fund is a non-diversified closed-end management investment company. The shares of the Target Fund are registered under the 1940 Act, but are not registered under the 1933 Act, are issued solely in private placement transactions, are not exchange listed and are continuously offered. The Target Fund is an illiquid investment and shareholders have no right to require the Fund to redeem their shares. The Target Fund has conducted no tender offers since its launch on January 4, 2011 and has no current plans to conduct any tender offers.

CNR will bear the costs of the proposed Reorganization, including legal, accounting and transfer agent costs.

For the reasons set forth below in “Reasons for the Proposed Reorganization and Board Considerations,” the Board of the Target Fund, including all of the Board members who are not “interested persons” of the Target Fund (the “Independent Board Members”) under the 1940 Act, concluded that the Reorganization is in the best interests of the Target Fund and its shareholders and that the interests of the Target Fund’s existing shareholders will not be diluted as a result of the proposed Reorganization. After careful consideration, the Board of the Target Fund unanimously approved the Reorganization and is recommending that shareholders of the Target Fund vote “FOR” the Reorganization. The members of the Board of the Target Fund, in their capacities as the Acquiring Fund Board, have also approved the Reorganization on behalf of the Acquiring Fund after concluding that the Reorganization is in the best interests of the Acquiring Fund and its shareholders and that the interests of the Acquiring Fund’s existing shareholders will not be diluted as a result of the Reorganization.

Comparison of Investment Objectives and Principal Strategies

The investment objective and principal strategies of each Fund are set forth in the following table. The investment objective for each Fund is not fundamental and may be changed by the respective Board without shareholder approval.

| Investment Objectives |

| Target Fund | Acquiring Fund |

| The Fund’s investment objective is to seek long-term capital appreciation through the purchase of life insurance policies at a discount to face value. The Fund is expected to have low volatility and low correlation with the U.S. equity markets. | The Fund seeks a high level of current income. |

| Principal Strategies |

| Target Fund | Acquiring Fund |

The Fund will normally pursue its investment objective by investing substantially all of its assets in life insurance policies and interests related thereto purchased through life settlement transactions (collectively, “Policies”). The Adviser has wide discretion in determining the Policies in which the Fund will invest. Policies may include, without limitation, whole, universal, variable universal, term, variable term, survivorship, group, and other types of life insurance policies. While it is anticipated that the Fund will endeavor to purchase complete ownership interests in each Policy in which it invests, the Fund may also purchase partial ownership interests in any particular Policy when the Adviser believes that such a purchase is appropriate. The Fund may also purchase interests in pools of Policies issued by third parties and/or purchase Policies directly from third parties. For purposes of the Fund’s investment objective, “low volatility” means expected monthly net asset value fluctuations (after consideration for distributions of principal and interest) of Units that are no greater than the annualized monthly ups and downs of 30% of the average annual return of the Standard & Poor’s 500-stock index over a three-year rolling period. | Under normal conditions, the Fund invests at least 80% of its net assets (plus any borrowing for investment purposes) in fixed income securities. The Fund will invest in both fixed rate and floating rate fixed income securities and may invest in fixed income securities of any credit rating. The Fund seeks to invest its net assets across a spectrum of income yielding securities and primarily focuses on investments in high yield bonds (commonly known as “junk” bonds) issued by corporate and municipal issuers, in fixed and floating rate loans made to U.S. and foreign borrowers, and in domestic and foreign corporate bonds including asset backed securities and bank loans. The Fund’s foreign investments include investments in companies that are operating principally in emerging market or frontier market countries. The Fund considers a company to be operating principally in an emerging market or frontier market if (i) the company is incorporated or has its principal business activities in an emerging market or frontier market country, respectively; or (ii) the company derives 50% or more of its revenues from, or has 50% or more of its assets in, an emerging market or frontier market country, respectively. The Fund considers a country to be an emerging market country if it has been determined by an international organization, such as the World Bank, to have a low to middle income economy. The Fund considers a country to be a frontier market country if it is included in the MSCI Frontier Markets Index. |

| Target Fund | Acquiring Fund |

A “life settlement” is the transfer of the beneficial interest in a Policy by the underlying insured person to a third party (in this case, the Fund). The Policy owner transfers his or her Policy at a discount to its face value (i.e., the payment amount set forth in the Policy that is payable on the death of the insured or upon maturity of the Policy) in return for an immediate cash settlement. The purchaser of the Policy is then responsible for premiums payable on the Policy and will be entitled to receive the full face value from the insurance company upon maturation (i.e., upon the death of the insured). The Adviser expects the Fund’s portfolio to include no less than 90% (measured as of the time the Fund’s assets are fully invested in Policies) of its Policies (or fractional interests in Policies, if applicable) where the issuing insurance company is rated B+ or better for financial stability by AMBEST and/or BB+ or better from S&P (or a rating of similar quality or better if rated by a different nationally recognized statistical ratings organization, i.e. investment grade). The Adviser also expects to generally select only Policies within the life settlement marketplace that are issued by U.S. life insurance companies, where the insured is over the age of 65. | The Fund also invests in other income-producing securities consisting of preferred stocks, high dividend paying stocks, securities issued by other investment companies (including exchange traded funds (“ETFs”) and money market funds), and money market instruments. Up to 100% of the Fund’s assets may be held in instruments that are rated below investment grade by either by Standard & Poor’s Ratings Services (“Standard & Poor’s”) or Moody’s Investors Service, Inc. (“Moody’s”) or in unrated securities determined by City National Rochdale, LLC (the “Adviser”), the Fund’s investment adviser, or a Fund sub-adviser to be of equal quality. The Fund may invest in income producing securities and other instruments without regard to the maturity of any instrument or the average maturity or duration of the Fund as a whole. In selecting the Fund’s investments, the Adviser or the relevant sub-adviser analyzes an issuer’s financial condition, business product strength, competitive position and management experience. The Fund may continue to own a security as long as the dividend or interest yields satisfy the Fund’s objective, the credit quality meets the Adviser’s or sub-adviser’s fundamental criteria and the Adviser or sub-adviser believes the valuation is attractive and industry trends remain favorable. |

| Target Fund | Acquiring Fund |

Prior to investing in any Policy, the Adviser will perform a due diligence review of the insured owner of the Policy. Such review will include, but not limited to: confirmation that the Policy is past its contestability period; that the Policy was issued after a full medical evaluation of the insured; that the Fund will be able to obtain unencumbered ownership of the Policy (for example, that the Policy is not pledged as collateral nor are there loans outstanding on the Policy); that the current medical condition of the insured is available; and generally that a family medical history – in particular of the parents of the insured – is available. The Adviser will then have a life expectancy evaluation of the insured performed by one or more independent life evaluation expectancy firms, in addition to the Adviser’s own evaluation. In addition, the Adviser will take into consideration various economic factors with respect to the purchase of the Policy, including, without limitation, the existence of any cash value in the Policy, the face amount/death benefit of the Policy, estimated future premium payment liability and a discounted present value of the Policy based on an acceptable target internal rate of return. The life expectancy of the insureds’ covered by the Policies held by the Fund is expected to range from 1 to 10 years. The weighted average life expectancy of the Policies in the Fund are not expected to exceed 8 years. The Adviser will strive to purchase Policies from multiple insurance companies in an effort to mitigate risk to the Fund due to deterioration in the claims paying ability of any particular insurance company. | The Fund may also invest up to 15% of its net assets in life insurance policies and interests related thereto purchased through life settlement transactions. The Fund may invest in life insurance policies and related interests directly or through a wholly-owned subsidiary of the Fund organized under the laws of Ireland (the “Subsidiary”). |

| Target Fund | Acquiring Fund |

The Fund is non-diversified. The Fund’s investments will be concentrated in the life insurance industry. The Fund will be required to make ongoing premium payments for Policies in which it invests and will incur operating and other expenses. The Fund may have income from the maturity of the Policies to provide liquidity to help the Fund meet a portion of the estimated future Policy premium payments and the costs associated with the management of the Fund. In order to address the Fund’s future liquidity needs, it is currently expected that the Fund will need to make future offerings of Units, preferred units and/or debt securities in order to meet all or a portion of its estimated future Policy premium payments and/or to make distributions (if any). The Fund may also set aside a portion of its net asset to be used to make future Policy premium payments. Accordingly, a portion of the Fund’s net assets may be invested in cash, cash equivalent securities or short-term debt securities, repurchase agreements and money market instruments. Depending upon a number of factors, including valuation changes relating to Policies, increased life expectancies requiring increased premium reserves, and potentially other circumstances which may create additional liquidity needs, the Fund may invest, subject to its ability to liquidate its portfolio of Policies, up to 30% of its assets in cash and high quality, short-term debt securities. However, the Fund does not intend to regularly invest a significant portion of its total assets in money market instruments and expects to fund future premium payments through the maturity proceeds of the Policies and/or through additional sales of Units. | |

| Target Fund | Acquiring Fund |

The investment objective of the Fund is not fundamental and may be changed by the Board without the approval of the Unitholders. The Fund may also use other strategies and invest in other securities that are described, along with their risks, in the SAI. However, the Fund might not use all of the strategies and techniques or invest in all of the types of securities described in this Offering Memorandum or in the SAI. Consistent with its investment limitations, the Fund may invest in new types of securities and instruments. The Fund intends to use leverage. The Fund may borrow, issue debt securities or issue preferred shares for leveraging purposes or for other specific purposes up to the amount permitted under the 1940 Act. | |

Comparison of Principal Investment Risks

The principal risks to which investments in each Fund are subject are set forth in the following table.

| Target Fund | Acquiring Fund |

Liquidity of Units; Limitations on Transfer. The Fund does not intend to list its Units for trading on any national securities exchange. There is no secondary trading market for the Units, and none is expected to develop. The Units are, therefore, not readily marketable. Because the Fund is a closed-end investment company with an indefinite term, its Units will not be redeemable at the option of a Member and the Units will not be exchangeable for interests of any other fund. Liquidity may be provided to Members through (i) repurchase offers made from time to time by the Fund and/or (ii) direct sales of a Member’s Units to other clients of the Adviser that are coordinated by the Adviser. There is no assurance that a Member tendering a Unit for repurchase in connection with a repurchase offer made by the Fund will have that Unit repurchased in that repurchase offer or that the Adviser will be able to facilitate a sale of a Member’s Units to its other clients. Subject to the transfer restrictions, Members may be able to sell Units if they are able to find a Qualified Investor willing to purchase the Units, and in conformity with any Board procedures regarding transfer. The transferability of Units will also be subject to certain restrictions contained in the Operating Agreement and imposed under applicable securities laws. The Fund is designed primarily for long-term investors with 5 to 8 year investment horizons. You should not invest in the Fund if you need a liquid investment. | The Effect of Interest Rates – The Fund’s yield typically moves in the same direction as movements in short-term interest rates, although it does not do so as quickly. Market Risk of Fixed Income Securities – The prices of fixed income securities respond to economic developments, particularly interest rate changes, as well as to perceptions about the creditworthiness of individual issuers, including governments. Generally, fixed income securities decrease in value if interest rates rise and increase in value if interest rates fall, with lower rated and longer-maturity securities more volatile than higher rated and shorter-maturity securities. Additionally, especially during periods of declining interest rates, borrowers may pay back principal before the scheduled due date, requiring the Fund to replace a particular loan or bond with another, lower-yield security. Issuers – The Fund may be adversely affected if the issuers of securities that the Fund holds do not make their principal or interest payments on time. |

| Target Fund | Acquiring Fund |

Portfolio Liquidity. The market for Policies is less liquid than the equity and bond markets, and no active trading market currently exists for the Policies. The Policies are thus not considered liquid. Liquidity relates to the ability of the Fund to sell an investment in a timely manner at a price approximately equal to its value on the Fund’s books. The limited liquidity of the Policies may impair the Fund’s ability to realize the full value of its assets in the event of a voluntary or involuntary liquidation of such assets. Because of the lack of an active trading market, Policies will be priced using fair value procedures adopted by the Fund's Board. The risks of illiquidity are particularly important when the Fund’s operations require cash, and may in certain circumstances require that the Fund raise cash, additional equity, preferred stock or debt to meet the premium payments on the Policies. The substantial portion of the Fund’s assets invested in Policies may restrict the ability of the Fund to dispose of its investments in a timely fashion and at a fair price, and could result in capital losses to the Fund and Unitholders. | Market Risk of Equity Securities – By investing directly or indirectly in stocks, the Fund may expose you to a sudden decline in the share price of a particular portfolio holding or to an overall decline in the stock market. In addition, the Fund’s principal market segment may underperform other segments or the market as a whole. The value of your investment in the Fund will fluctuate daily and cyclically based on movements in the stock market and the activities of individual companies in the Fund’s portfolio. Common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value as market confidence in and perceptions of their issuers change. Preferred stock is subject to the risk that the dividend on the stock may be changed or omitted by the issuer, and that participation in the growth of the issuer may be limited. Preferred stock typically has “preference” over common stock in the payment of distributions and the liquidation of a company’s assets, but is subordinated to bonds and other debt instruments. In addition, preferred stock holders generally do not have voting rights with respect to the issuing company. |

| Target Fund | Acquiring Fund |

Performance Compensation. The Adviser will generally be entitled to receive performance-based compensation. This performance based compensation could create an incentive for the Adviser to make investment decisions on behalf of the Fund that are riskier and more speculative than would be the case in the absence of a performance allocation. An investment in the Fund is speculative in nature due to, among other things, the uncertainty associated with estimating life expectancies. In addition, because the Performance Allocation is calculated on a basis that includes unrealized appreciation of the Fund’s assets, the Performance Allocation may be greater than if it were based solely on realized gains. Concentration of Investments. Because the Fund concentrates its investments in the life insurance industry, a development adversely affecting that industry would have a greater adverse effect on the Fund than it would if the Fund invested in a number of different industries. Non-Diversification. The Fund has registered as a “non-diversified” investment company. This means it may invest a larger percentage of its assets in one issuer than a diversified fund. If the Fund invests a relatively high percentage of its assets in obligations of a limited number of issuers, the Fund will be more at risk to any single corporate, economic, political or regulatory event that impacts one or more of those issuers. | Prepayments – As a general rule, prepayments of principal of loans underlying asset-backed or other pass-through securities increase during a period of falling interest rates and decrease during a period of rising interest rates. In periods of declining interest rates, as a result of prepayments the Fund may be required to reinvest its assets in securities with lower interest rates. In periods of increasing interest rates, the securities subject to prepayment risk held by the Fund may exhibit price characteristics of longer-term debt securities.

Extension – Rising interest rates can cause the average maturity of the Fund’s holdings of asset-backed and other pass-through securities to lengthen unexpectedly due to a drop in prepayments. This would increase the sensitivity of the Fund to rising rates and the potential for price declines of portfolio securities. Management – The Fund’s performance depends on the Adviser’s and sub-advisers' skill in making appropriate investments. As a result, the Fund may underperform the markets in which it invests or similar funds. Sub-Adviser Allocation – The Fund’s performance is affected by the Adviser’s decisions concerning how much of the Fund’s portfolio to allocate for management by each of the Fund’s sub-advisers or to retain for management by the Adviser. |

| Target Fund | Acquiring Fund |

Inability to Make Premium Payments. Premium payments are required to keep Policies in force. If the Fund is unable to make premium payments on a Policy due to liquidity issues or for any other reason, the Policy will lapse, and the Fund will lose its ownership interest in the Policy. It is currently expected that the Fund will need to make future offerings of Units, preferred units and/or debt securities or borrow capital in order to meet at least a portion of its estimated future Policy premium payments. There is no assurance that these offerings will be successful in raising sufficient assets or that the Fund will be able to borrow capital to meet the Policy’s premium payments. Leverage. Leverage risk is the risk associated with the use of the Fund’s borrowings, outstanding preferred units or debt securities, if issued in the future. There can be no assurance that the Fund’s leveraging strategy will be successful. The Fund intends to use leverage, subject to the limitations of the 1940 Act (or any more restrictive terms imposed by lenders). | Credit – Changes in the credit quality rating of a security or changes in an issuer’s financial condition can affect the Fund. A default on a security held by the Fund could cause the value of your investment in the Fund to decline. Investments in bank loans and lower rated debt securities involve higher credit risks. There is a relatively higher risk that the issuer of such loans or debt securities will fail to make timely payments of interest or principal, or go bankrupt. Credit risk may be high for the Fund because it invests in lower rated investment quality fixed income securities. Liquidity – Bank loans, high yield bonds, floating rate securities and lower rated securities may experience illiquidity, particularly during certain periods of financial or economic distress, causing the value of the Fund’s investments to decline. It may be more difficult for the Fund to sell its investments when illiquid or the Fund may receive less than it expects to receive if the security were sold. Additionally, one or more of the instruments in which the Fund invests may be permanently illiquid in nature and market prices for these instruments are unlikely to be readily available at any time. In the absence of readily available market prices or, as is expected to be the case for certain illiquid asset-backed investments, the absence of any pricing service or observable pricing inputs, the valuation process will depend on the evaluation of factors such as prevailing interest rates, creditworthiness of the issuer, the relative value of the cash flows represented by the underlying assets and other factors. The sales price the Fund may receive for an illiquid security may differ from the Fund’s valuation of the illiquid security. |

| Target Fund | Acquiring Fund |

| The Fund may borrow money or issue preferred units or debt securities for any purpose deemed appropriate by the Adviser and approved by the Board; such purposes may include, but are not limited to, the purchase of Policies, making premium payments on Policies, making distributions, meeting repurchase requests pursuant to tender offers, and for operational or portfolio management purposes. Although leverage will increase investment return if the Fund earns a greater return on the investments purchased with borrowed funds than it pays for the use of those funds, the use of leverage will decrease investment return if the Fund fails to earn as much on investments purchased with borrowed funds as it pays for the use of those funds. The use of leverage will therefore magnify the extent of the changes in the value of the Fund. Because acquiring and maintaining Policies or other investments on margin or by the use of other leverage allows the Fund to acquire Policies or other investments worth more than its original capital investment in those investments, the amount that the Fund stands to lose in the event of adverse price movements will be increased in relation to the amount of its capital investment. In the event of a sudden, precipitous drop in value of the Fund’s net assets, the Adviser might not be able to liquidate assets quickly enough to pay off the Fund’s borrowing. Money borrowed for leveraging will be subject to interest costs that may or may not be recovered by return on the securities purchased. In order to maintain required asset coverage levels, the Fund may be required to alter the composition of its investment portfolio or take other actions, such as redeeming preferred shares, if any, or prepaying borrowings with the proceeds from the Fund’s investments, at what might be an inopportune time in the market. Such actions could reduce the net earnings or returns to Unitholders over time. The Fund also may be required to maintain minimum average balances in connection with its borrowings or to pay a commitment or other fee to maintain a line of credit, increasing the expenses of the Fund and reducing any net investment income. | Foreign Securities – Foreign investments tend to be more volatile than domestic securities, and are subject to risks that are not typically associated with domestic securities (e.g., changes in currency rates and exchange control regulations, unfavorable political and economic developments and the possibility of seizure or nationalization of companies, or the imposition of withholding taxes on income). There may be less government supervision of foreign markets. As a result, foreign issuers may not be subject to the uniform accounting, auditing, and financial reporting standards and practices applicable to domestic issuers, and there may be less publicly available information about foreign issuers. Emerging Markets Securities – Many of the risks with respect to foreign investments are more pronounced for investments in developing or emerging market countries. Emerging market countries may have government exchange controls, more volatile currency exchange rates, less market regulation, and less developed securities markets and legal systems. Their economies also depend heavily upon international trade and may be adversely affected by protective trade barriers and economic conditions of their trading partners. Frontier Markets Securities – Frontier market countries are a sub-set of emerging market countries the capital markets of which are less developed, generally less liquid and have lower market capitalization than those of the more developed, “traditional” emerging markets but which still demonstrate a relative market openness to and accessibility for foreign investors. Frontier market countries generally have smaller economies and even less developed capital markets with relatively newer and less tested regulatory and legal systems than traditional emerging markets, and, as a result, the risks discussed above with respect to emerging markets are magnified in frontier market countries. Securities issued by borrowers in frontier market countries are often subject to extreme price volatility and illiquidity and effects stemming from government ownership or control of parts of private sector and of certain companies; trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which frontier market countries trade; and relatively new and unsettled securities laws. |

| Target Fund | Acquiring Fund |

Valuation. The Adviser and the Board anticipate that market quotations will not be readily available for the Policies in which the Fund invests. Although the Fund will seek to use independent pricing services to assist in pricing Policies, it is therefore expected that a substantial portion of the Fund’s assets will be priced using fair value procedures adopted by the Board. Fair value of an asset is the amount, as determined by the Adviser in good faith, that the Fund might reasonably expect to receive upon a current sale of the asset. Many factors may influence the price at which the Fund could sell any particular Policy. The sales price may well differ - higher or lower - from the Fund’s last valuation, and such differences could be significant. Valuing assets using fair value methodologies involves greater reliance on judgment than valuing assets based on market quotations. The sales price the Fund could receive for any particular Policy may differ from the Fund’s valuation of the Policy. When the Fund employs its fair value methodologies, it may value those assets higher or lower than another fund using its own fair value methodologies to price the same assets. The value given to the Fund’s securities and Policies will be used to calculate the Adviser’s fees and the Performance Allocation. Therefore, a conflict may arise with respect to this responsibility given the Performance Allocation to be earned by the Adviser. | Financial Services Firms – The Fund invests in obligations of financial services firms, including those of banks. Changes in economic conditions and government regulations can significantly affect these issuers. Volatility – Because of the speculative nature of the income securities in which the Fund invests, the Fund may fluctuate in price more than other bond and income funds. High Yield (“Junk”) Bonds – High yield bonds involve greater risks of default, downgrade, or price declines and are more volatile than investment grade securities. Issuers of high yield bonds may be more susceptible than other issuers to economic downturns and are subject to a greater risk that the issuer may not be able to pay interest or dividends and ultimately to repay principal upon maturity. Discontinuation of these payments could have a substantial adverse effect on the market value of the security. Bank Loans – The Fund may invest in U.S. and non-U.S. bank loans. Bank loans are not traded on an exchange and purchasers and sellers of bank loans generally rely on market makers, typically the administrative agent under a bank loan, to effect private sales transactions. As a result bank loans may have relatively less liquidity than other types of fixed income assets, and the Fund may be more likely to incur losses on the sale of bank loans than on other, more liquid, investments. The Fund’s investments in non-U.S. bank loans are subject to additional risks including future unfavorable political and economic developments, possible withholding taxes on interest income, seizure or nationalization of foreign deposits, currency controls, interest limitations, or other governmental restrictions which might affect the payment of principal or interest on the bank loans held by the Fund. |

| Target Fund | Acquiring Fund |

Cash Management and Defensive Investing. The Fund may invest, for defensive purposes or otherwise, a portion of its assets in high quality fixed-income securities, money market instruments, and money market mutual funds, or hold cash or cash equivalents in such amounts as the Adviser deems appropriate under the circumstances. Money market instruments or short-term debt securities held by the Fund for cash management or defensive investing purposes can fluctuate in value. Like other fixed income securities, they are subject to risk, including market, interest rate and credit risk. If the Fund holds cash uninvested, the Fund will not earn income on the cash and the Fund’s yield will go down. If a significant amount of the Fund’s assets are used for cash management or defensive investing purposes, it will be more difficult for the Fund to achieve its objective. Other Risk Factors. Relying on life insurance companies to make payments on the Policies involves certain risks. These include the risk that the insurance companies will fail to meet their obligations under the Policies or fail to do so in a timely manner or become insolvent. The Fund’s ability to hedge or otherwise mitigate such risks is limited to its ability to sell the Policies to other investors. Although a market may develop for the Policies in the future, these instruments are generally considered illiquid. Valuation of such instruments requires that a good faith “fair value” be assigned to each instrument after careful examination of a range of tangible and intangible inputs and even when appropriate valuation methodologies are fully carried out, there can be no assurance that such instruments can be sold at the values at which they may be carried. Tax Risks. The Fund intends to operate as a partnership and not as an association or a publicly traded partnership taxable as a corporation for U.S. federal income tax purposes. The Fund should not be subject to U.S. federal income tax, and each Member will be required to report on the Member’s own annual tax return, to the extent required, the Member’s distributive share of the Fund’s tax items of income, gain, deduction and loss. If the Fund were determined to be an association or a publicly traded partnership taxable as a corporation, the taxable income of the Fund would be subject to corporate income tax and any distributions of profits from the Fund would be treated as dividends. Applicable Law and Regulatory Developments. The Fund is a closed-end management investment company registered under the 1940 Act. The Fund must comply with various legal requirements, including requirements imposed by the federal securities laws and tax laws. Should any of those laws change over the life of the Fund, the legal requirements to which the Fund may be subject could differ materially from current requirements. It is impossible to predict if future regulatory developments might adversely affect the Fund. Future regulations, if any, could have a material adverse impact on the Fund’s ability to conduct its business as described herein or even to continue doing business at all. If it were determined that Policies are not securities under the 1940 Act, the Fund may not be eligible to register as an investment company under the 1940 Act. If the Fund were required to deregister with the SEC, the Fund would no longer be subject to, and Unitholders would no longer benefit from, the investor protections of the 1940 Act. Time Risks. The primary risk and determinant of return on investments in Policies is time. The Fund will not receive a cash return on investment until the Policies in which it owns interests have matured (i.e., the insured has died and the life insurance company has paid out the death benefit). The rate of return on a Policy cannot be calculated before the insured dies. Advances in medical sciences may prolong the lives of insureds beyond that estimated. The longer the insured lives, the lower the rate of return on the related Policy will be. | Rating Agencies – A credit rating is not an absolute standard of quality, but rather a general indicator that reflects only the view of the originating rating agency. If a rating agency revises downward or withdraws its rating of a security in which the Fund invests, that security may become less liquid or may lose value. Underlying Funds – To the extent the Fund invests in other funds, the risks associated with investing in the Fund are closely related to the risks associated with the securities and other investments held by the underlying funds. The ability of the Fund to achieve its investment goal depends in part upon the ability of the underlying funds to achieve their investment goals. The underlying funds may not achieve their investment goals. In addition, by investing in the Fund, shareholders indirectly bear fees and expenses charged by the underlying funds in addition to the Fund’s direct fees and expenses. ETFs – ETFs typically trade on securities exchanges and their shares may, at times, trade at a premium or discount to their net asset values. In addition, an ETF may not replicate exactly the performance of the benchmark index or group of indices it seeks to track for a number of reasons, including transaction costs incurred by the ETF, the temporary unavailability of certain index securities in the secondary market or discrepancies between the ETF and the index with respect to the weighting of securities or the number of securities held. By investing in the Fund, shareholders indirectly bear fees and expenses charged by the ETFs in which the Fund invests, in addition to the Fund’s direct fees and expenses. Life Insurance Policies – The Fund may invest in beneficial interests in individual life insurance policies (“Policies”). The Policy owner transfers his or her Policy at a discount to its face value (the amount that is payable upon the death of the insured) in return for an immediate cash settlement. The ultimate purchaser of the Policy (in this case, the Fund) is responsible for premiums payable on the Policy and is entitled to receive the full face value from the insurance company upon the death of the insured. If the Fund is unable to make premium payments on a Policy, the Policy will lapse and the Fund will lose its ownership interest in the Policy. There is currently no established secondary market for Policies, and the Policies are not considered liquid investments by the Fund. If the Fund must sell Policies to meet redemption requests or other cash needs, the Fund may be forced to sell at a loss. In addition, market quotations will not be readily available for the Policies and the Policies will be priced using a fair value methodology adopted by the Trust’s Board. The sales price the Fund could receive for a Policy may differ from the Trust’s valuation of the Policy. There may be a mismatch of cash flows related to the Fund’s investment in Policies (e.g., the Subsidiary may not take in enough new investment and death benefits paid on maturing life settlements to cover premium payments on existing Policies held by the Subsidiary). The longer the insured lives, the lower the Fund’s rate of return on the related Policy will be. The underwriter’s estimate of the insured’s life expectancy may be incorrect. An insurance company may be unable or refuse to pay benefits on a Policy. In addition, the heirs of an insured may challenge the life insurance settlement. Although the Fund intends to only purchase Policies for which the applicable contestability period has expired, it is possible that a Policy may be subject to contest by the insurance company. A Policy is a liability of the issuing life insurance company, and if the life insurance company goes out of business, sufficient funds may not be available to pay that liability. |

| Target Fund | Acquiring Fund |

Inability to Predict the Life Expectancy of an Insured. Any estimate of life expectancy is based upon medical and actuarial data, and no one can predict with certainty when a particular insured will die. Unanticipated delays in the collection of a substantial number of Policies, caused by underestimating an insured’s life expectancy, could have a material adverse effect on the Fund’s financial results, which, in turn, may have a material adverse effect on the Fund’s ability to make distributions to its Members or meet its Policy premium obligations. Policies will mature earlier and/or later than estimated. If maturities occur later than estimated, it can reduce return or create a loss of principal. Inability to Make Premium Payments. If the Fund is unable to make premium payments on a Policy due to liquidity issues or for any other reason, the Policy will lapse, and the Fund will lose its ownership interest in the Policy. This can reduce return or create a loss of principal. Privacy Law. Privacy laws may limit the information available to the Adviser about insureds. Incomplete or inaccurate information regarding an insured can cause the Fund to hold a Policy at a different carrying value than would have been the case had the medical information been known to the Adviser. | Tax – To qualify for treatment as a regulated investment company (“RIC”) under the Internal Revenue Code of 1986, as amended (the “Code”), the Fund must meet certain requirements including requirements regarding the composition of its income. Any income the Fund derives from direct investments in Policies may be considered non-qualifying income and must be limited, along with investments in any other non-qualifying sources, to a maximum of 10% of the Fund’s gross income in any fiscal year. In addition, the Fund may invest in Policies through the Subsidiary. The Fund has not received a private letter ruling from the Internal Revenue Service (the “IRS”) confirming that income from the Subsidiary would be qualifying income for purposes of the Fund’s RIC status. However, the Fund has obtained an opinion of counsel, based on representations from the Fund and the Subsidiary, that actual distributions made to the Fund by the Subsidiary will, more likely than not, be treated as qualifying income. As a result either of direct investments in Policies or investments through the Subsidiary, the Fund might generate more non-qualifying income than anticipated, might not be able to generate qualifying income in a particular fiscal year at levels sufficient to limit its non-qualifying income to 10% of the Fund’s gross income, or might not be able to determine the percentage of qualifying income it derives for a taxable year until after year-end. If the Fund fails to meet this 10% requirement, the Fund might not be eligible for treatment as a RIC, in which case it would be subject to federal income tax on its net income at corporate rates. Alternatively, if the Fund fails to meet the 10% requirement, the Fund might be able to pay a tax equal to the amount of the non-qualifying income to the extent it exceeds one-ninth of the Fund’s qualifying income. |

| Target Fund | Acquiring Fund |

Volatility of Policies Market. The Policies market has experienced substantial growth, which may affect the availability of Policies. The market for the purchase of Policies is highly competitive. There are few substantial barriers to prevent new competitors from entering this market. The Adviser expects to face competition from existing competitors and new market entrants in the future. As a result, the Adviser may not be able to acquire Policies on behalf of the Fund on a commercially viable basis. Although the secondary insurance policy market is regulated, such market is not subject to government oversight, disclosure, accounting, auditing and financial standards that are equivalent to those the applicable to equities markets. Accordingly, there can be no certainty that such markets will always be active; this may result in difficulty purchasing or selling Policies at desired prices and in desired quantities. Government Regulation. The market for Policies may be subject to new government regulation that may impact the ability to purchase Policies. Refusal to Pay Benefits on Certain Policies. Although the Fund will perform extensive steps to insure the Fund’s rights to each Policy, insurers may refuse to pay benefits on certain Policies on the basis that there was no “insurable interest” on the part of the purchaser of a Policy at the time such Policy was issued. | Under current IRS guidance, Policy proceeds paid by a U.S. insurance company to a foreign corporation such as the Subsidiary are generally subject to U.S. federal income tax withholding at a 30% rate. The Subsidiary intends to qualify for benefits under the U.S.-Ireland income tax treaty which would include an exemption from such withholding. There is a risk, however, that a U.S. insurance company issuer may not respect the claimed treaty benefits and may withhold the 30% tax on the proceeds paid to the Subsidiary. In such a case, the Subsidiary may be able to obtain a refund from the IRS. The tax treatment of the Policies and the Fund’s investments in the Subsidiary may be adversely affected by future legislation, Treasury Regulations and/or guidance issued by the IRS that could, among other things, affect the character, timing and/or amount of the Fund’s taxable income or gains and of distributions made by the Fund. Any changes to the U.S.-Ireland tax treaty, U.S. or Ireland law, or the manner in which the treaty and such laws are applied to the Subsidiary or the Fund, may also have an adverse tax effect on the Subsidiary, the Fund and its shareholders. |

| Target Fund | Acquiring Fund |

Contestability of Policies. Although the Fund will perform extensive steps to insure against the contestability of the Fund’s rights to each Policy, Policies may be subject to contest by the issuing life insurance company. If the insurance company successfully contests a Policy, the Policy will be rescinded and declared void. Delays in Payment and Non-Payment of the Proceeds of Policies. Any delays in collecting a substantial amount of the proceeds of Policies could have a material adverse effect on the Fund’s returns and, therefore, on its ability to make distributions to Members or meet its Policy premium obligations. Missing Insureds. The Fund could incur substantial unplanned expenses in locating a missing insured and could experience substantial delays in collecting death benefits, which would affect the value of Policies. Pricing. The pricing of a Policy is dependent primarily upon the life expectancy of the insured, the net death benefit and the premium rate payable in respect of his or her Policy. While the Fund will seek to acquire Policies on the lives of insureds in respect of whom competent medical diagnoses have been made, such diagnoses will not always prove to have been correct. An error in pricing can reduce return or lead to the loss of principal. | Wholly-Owned Subsidiary – The Fund may invest in Policies by investing in the Subsidiary. The Subsidiary is not an investment company registered under the 1940 Act and, unless otherwise noted in this Prospectus and the Statement of Additional Information, is not subject to all of the investor protections of the 1940 Act and other U.S. regulations. Changes in the laws of the United States and/or Ireland could affect the ability of the Fund and/or the Subsidiary to operate as described in this Prospectus and the Statement of Additional Information and could negatively affect the Fund and its shareholders. The Subsidiary (unlike the Fund) may invest an unlimited portion of its net assets in Policies. However, the Subsidiary otherwise is subject to the Fund’s investment restrictions and other policies. |

| Target Fund | Acquiring Fund |

Credit Rating – Policy Providers. Credit ratings of insurance companies are not a guarantee of quality or a warranty, nor are they a recommendation by the rating agency to buy, sell or hold any financial obligations of such companies. A credit rating represents only the applicable rating agency’s opinion regarding financial strength and ability of the insurance company to meet its ongoing insurance policy and contract obligations. In determining a credit rating, rating agencies do not evaluate the risks of fluctuations in market value. As a result, a credit rating may not fully reflect the risks inherent in the relevant insurance company. Rating agencies may fail to make timely changes to credit ratings in response to subsequent events. Insurance Industry. Because the Policies represent insurance company obligations, Fund investors may be exposed to additional risks. The Fund may be more susceptible to adverse economic, political or regulatory occurrences affecting the insurance industry. For example, health care and insurance-related issuers may become subject to new government or third party payor reimbursement policies and national and state legislation which may affect the financial position of certain insurance companies. Insolvency. The Fund bears certain risks associated with the potential insolvency of insurance companies. If an insurance company were to seek protection under the federal bankruptcy or state insolvency laws, payments due to the Fund may be delayed or reduced, which would affect the value of the Policies and thus the Fund’s net asset value. | Defensive Investments – During unusual economic or market conditions, or for temporary defensive or liquidity purposes, the Fund may invest up to 100% of its assets in cash or cash equivalents that would not ordinarily be consistent with the Fund’s investment goal. |

Comparison of Fees and Expenses

The following table shows the fees and expenses for the Target Fund and Acquiring Fund, and the pro forma fees and expenses of the combined Acquiring Fund after giving effect to the Reorganization based on pro forma net assets as of July 31, 2013.

| | Target Fund | Acquiring Fund | Combined Acquiring Fund (Pro Forma) |

Annual Fund Operating Expenses (expenses that are deducted from Fund assets) | | | |

| Management Fee | 1.75% | 0.50% | 0.50% |

| Performance Allocation | 0.00%(1) | N/A | N/A |

| Distribution (12b-1) Fee | N/A | 0.25% | 0.25% |

| Other Expenses | | | |

Service Fee/Shareholder Servicing Fee(2) | 0.25% | 0.25% | 0.25% |

| Other Fund Expenses | 0.36% | 0.10% | 0.10% |

| Total Other Expenses | 0.61% | 0.35% | 0.35% |

| Acquired Fund Fees and Expenses | 0.04% | N/A(3) | N/A(3) |

| Total Annual Fund Operating Expenses | 2.40% | 1.10%(4) | 1.10%(4) |

| (1) | With respect to the Target Fund, CNR is generally entitled to a 20% performance allocation on net profits exceeding a 10% hurdle rate and a standard high-water mark. CNR has not taken its performance allocation to date. CNR would withdraw its performance allocation from the Target Fund immediately prior to the Reorganization. For more information about the performance allocation, please see section entitled “The Adviser” below. |

| (2) | In addition to the Management Fee, the Target Fund also pays CNR a Service Fee at an annual aggregate rate equal to 0.25% of the Fund’s month-end net assets for servicing holders of shares. Services provided include, but are not limited to, handling inquiries regarding the Fund ; assisting in the enhancement of relations and communications between shareholders and the Fund; assisting in the establishment and maintenance of shareholder accounts with the Fund; and assisting in the maintenance of Fund records containing shareholder information. With respect to the Acquiring Fund, the Fund pays a Shareholder Servicing Fee to an affiliate of CNR to provide or arrange for the provision of the following shareholder services: responding to shareholder inquiries; processing purchases and redemptions of the Fund’s shares, including reinvestment of dividends; assisting shareholders in changing dividend options, account designations, and addresses; transmitting proxy statements, annual reports, prospectuses, and other correspondence from the Fund to shareholders; and providing such other information and assistance to shareholders as may be reasonably requested by such shareholders. |

| (3) | Acquired fund fees and expenses of the Acquiring Fund do not reflect the expenses borne by the Acquiring Fund as the sole shareholder of the Subsidiary (as defined below). Investments in the Subsidiary did not begin until September 2013 and, therefore, the Acquiring Fund did not bear such expenses as of July 31, 2013. Acquired fund fees and expenses are estimated to be 0.02% for the current fiscal year. |

| (4) | CNR has voluntarily agreed to limit its fees or reimburse expenses to the extent necessary to keep total annual Fund operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses) at or below 1.09%. Any fee reductions or reimbursements may be repaid to CNR within three years after they occur if such repayments can be achieved within the Fund’s then current expense limit, if any, for that year and if certain other conditions are satisfied, including ratification by the Trust’s Board of Trustees. CNR may terminate its voluntary agreement to limit its fees at any time although it intends to continue this arrangement at least through January 31, 2015. |

The examples set forth below are intended to help you compare the cost of investing in the Target Fund, the Acquiring Fund, and on a pro forma basis, in the Acquiring Fund after giving effect to the Reorganization, and also to help you compare these costs with the cost of investing in other mutual funds. The examples assume that you invest $10,000 in the relevant Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The examples also assume that your investment has a 5% return each year, that all dividends and other distributions are reinvested and that total operating expenses for the Fund are those shown in the tables above. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| | 1 Year | 3 Years | 5 Years | 10 Years |

Target Fund: | $243 | $748 | $1,280 | $2,736 |

Acquiring Fund: | $112 | $350 | $606 | $1,340 |

Pro Forma Combined Acquiring Fund: | $112 | $350 | $606 | $1,340 |

Comparison of Performance Information

The following past performance information for each Fund is set forth below: (1) a bar chart showing changes in the Fund's performance from year to year for the past calendar year as well as since inception, and (2) a table detailing how the average annual total returns of the Fund compared to those of broad-based market indices. Returns are shown both before and after taxes for the Acquiring Fund. The after-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state or local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. As a closed-end fund, the Target Fund is not required to show after-tax returns.

The bar chart and the performance table that follow illustrate some of the risks and volatility of an investment in each Fund by showing changes in the Fund’s performance from year to year and by showing the Fund’s average annual total returns for 1 year and since inception. Of course, each Fund’s past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Call 1-800-245-9888 to obtain updated performance information.

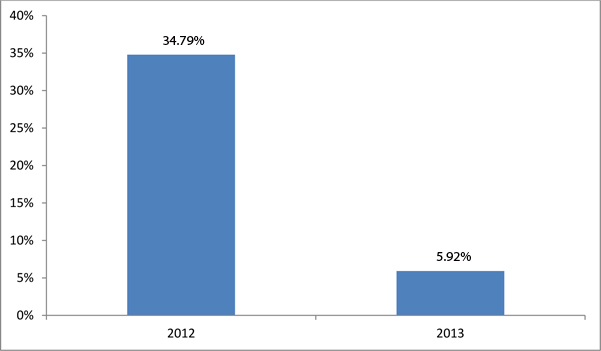

Target Fund Performance

This bar chart shows the performance of the Target Fund based on a calendar year.

| | Quarterly Return | Quarter End |

| Highest | 28.17% | 06/30/2012 |

| Lowest | | 09/30/2013 |

This table shows the average annual total returns of the Target Fund for the periods ended December 31, 2013. The table also shows how the Target Fund’s performance compares with the returns of a broad-based market index, as well as a comparison to a secondary index.

Average Annual Total Returns as of December 31, 2013

| | One Year | Since Inception(1) |

| Return Before Taxes | 5.92% | 14.03% |

S&P 500 Index (Reflects no deduction for fees, expenses or taxes) | 32.39% | 15.79% |

Barclays Intermediate Aggregate Bond Index + 500 bps (Reflects no deduction for fees, expenses or taxes) | 3.98% | 7.94% |

| (1) | The Target Fund commenced operations on January 4, 2011. |

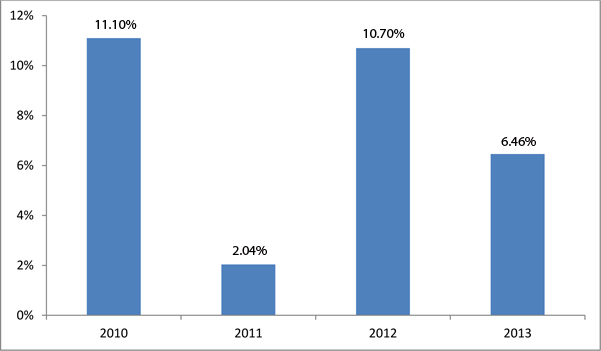

Acquiring Fund Performance

This bar chart shows the performance of the Acquiring Fund based on a calendar year.

| | Quarterly Return | Quarter End |

| Highest | 4.96% | 9/30/2010 |

| Lowest | (3.94)% | 9/30/2011 |

This table shows the average annual total returns of the Acquiring Fund for the periods ended December 31, 2013. The table also shows how the Acquiring Fund’s performance compares with the returns of a broad-based market index, as well as comparisons to secondary indices.

Average Annual Total Returns(1) as of December 31, 2013

| | One Year | Since Inception(2) |

| Return Before Taxes | 6.46% | 8.63% |

| Return After Taxes on Distributions | 3.82% | 6.23% |

| Return After Taxes on Distributions and Sale of Fund Shares | 3.71% | 5.82% |

| Credit Suisse Leveraged Loan Index (Reflects no deduction for fees, expenses or taxes) | 6.15% | 9.14% |

| Barclays U.S. Aggregate Bond Index (Reflects no deduction for fees, expenses or taxes) | (2.02)% | 4.50% |

| Barclays U.S. High Yield Bond Index (Reflects no deduction for fees, expenses or taxes) | 7.44% | 14.20% |

| (1) | On March 29, 2013, the Rochdale Fixed Income Opportunities Portfolio (the “Predecessor Fund”) reorganized into the Fund. The Acquiring Fund has adopted an investment objective and investment strategies and policies identical to those of the Predecessor Fund. The performance results reflect the performance of the Predecessor Fund. |

| (2) | The Predecessor Fund commenced operations on July 1, 2009. |

The Adviser

CNR is the investment adviser to each Fund. CNR is located at 570 Lexington Avenue, New York, New York, 10022-6837. As of December 31, 2013, CNR managed assets of approximately $22.1 billion for individual and institutional investors.

CNR is a wholly owned subsidiary of City National, a federally chartered commercial bank founded in the early 1950s. City National is itself a wholly owned subsidiary of City National Corporation, a New York Stock Exchange listed company. City National has provided trust and fiduciary services, including investment management services, to individuals and businesses for over 50 years. City National currently provides investment management services to individuals, pension and profit sharing plans, endowments and foundations. As of December 31, 2013, City National and its affiliates had approximately $64.7 billion in assets under management or administration.

Subject to the oversight of the Target Fund’s Board of Managers and the Trust’s Board of Trustees, CNR has complete discretion as to the purchase and sale of investments for the Target Fund and the Acquiring Fund, consistent with each Fund’s investment objective, policies and restrictions.

Target Fund

With respect to the Target Fund, for its advisory services to the Fund, CNR is entitled to an investment management fee equal to an annual aggregate rate equal to 1.75% of the Fund’s month-end net assets, including assets attributable to the Advisor (or its affiliates) and before giving effect to any repurchases of shares by the Fund. In addition, pursuant to a Service Agreement with the Target Fund, CNR is entitled to a service fee at an annual aggregate rate equal to 0.25% of the Fund’s month-end net assets, before giving effect to any repurchases of shares by the Fund, for servicing holders of shares.

The Target Fund will also allocate to CNR a performance allocation (the “Performance Allocation”) with respect to each shareholder as of the close of each Allocation Period as follows: if the “Positive Allocation Change” for such Allocation Period for a shareholder exceeds the “10% Hurdle” for such shareholder and the amount of any positive balance in such shareholder’s “High Watermark Account”, then the performance allocation will be equal to the sum of (i) 100% of the amount of such shareholder’s Positive Allocation Change for such Allocation Period until CNR receives an amount equal to the 10% Catch-Up Amount and (ii) 20% of the amount by which such shareholder’s Positive Allocation Change for such Allocation Period, if any, exceeds the sum of the amount of the Positive Allocation Change allocated to such shareholder to satisfy such shareholder’s 10% Hurdle (the “10% Priority Amount”) and the 10% Catch-Up Amount.

“10% Hurdle” means, with respect to each shareholder, calculated as of the end of any Allocation Period, the amount that such shareholder’s capital account would have earned as of the end of such Allocation Period if it had achieved a compounded, cumulative rate of return of 10% per annum calculated from the date such capital account was initially created (as adjusted for additional contributions and withdrawals of capital). For the avoidance of doubt, the 10% Hurdle will be aggregated from year to year.

“10% Catch-Up Amount” means, with respect to each shareholder, calculated as of the end of any Allocation Period, the amount equal to (i) the quotient of the 10% Priority Amount divided by eighty percent (80%), less (ii) the 10% Priority Amount.

“Allocation Period” means, with respect to each shareholder, the period commencing as of the date of admission of such shareholder to the Target Fund, and thereafter each period commencing as of the day following the last day of the preceding Allocation Period with respect to such shareholder, and ending at the close of business on the first to occur of the following: (i) the last day of a Fiscal Year; (ii) the day as of which the Target Fund repurchases the shares (or any portion thereof) of such shareholder; (iii) the day as of which the Target Fund admits as a substituted shareholder a person to whom the shares (or any portion thereof) of such shareholder have been transferred (unless there is no change of beneficial ownership); and (iv) the day as of which the Advisor is no longer entitled to receive the Performance Allocation.

“Allocation Change” means, with respect to each shareholder for each Allocation Period, the difference between:

(1) the sum of (a) the balance of such shareholder’s capital account as of the close of the Allocation Period (after giving effect to all allocations to be made to such shareholder’s capital account as of such date other than any Performance Allocation to be debited against such shareholder’s capital account), plus (b) any debits to such shareholder’s capital account during the Allocation Period to reflect any actual or deemed distributions or repurchases with respect to such shareholder’s shares plus (c) any debits to such shareholder’s capital account during the Allocation Period to reflect any items allocable to such shareholder’s capital account; and

(2) the sum of (a) the balance of such shareholder’s capital account as of the commencement of the Allocation Period, plus (b) any credits to such shareholder’s capital account during the Allocation Period to reflect any contributions made by such shareholder to the capital of the Target Fund.

If the amount specified in clause (1) exceeds the amount specified in clause (2), such difference will be a “Positive Allocation Change,” and if the amount specified in clause (2) exceeds the amount specified in clause (1), such difference will be a “Negative Allocation Change.”