UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-07923

City National Rochdale Funds

(Exact name of registrant as specified in charter)

400 North Roxbury Drive

Beverly Hills, California 90210

(Address of principal executive offices) (Zip code)

Leigh Muniz, Esq.

400 North Roxbury Drive

Beverly Hills, CA 90210

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-888-889-0799

Date of fiscal year end: September 30, 2019

Date of reporting period: March 31, 2019

Item 1. Reports to Stockholders.

The registrant’s schedules as of the close of the reporting period, as set forth in §§ 210.12-12 through 210.12-14 of Regulation S-X [17 CFR §§ 210-12.12-12.14], are attached hereto.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund, if you hold your shares directly with the Fund, or from your financial intermediary, such as a broker-dealer or bank, if you hold your shares through a financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you hold your shares directly with a Fund, you may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at (866) 209-1967 or, if you hold your shares through a financial intermediary, contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. If you hold your shares directly with a Fund, you can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at (866) 209-1967 or, if you hold your shares through a financial intermediary, by contacting your financial intermediary. Your election to receive reports in paper will apply to all of the City National Rochdale Funds you hold directly or through your financial intermediary, as applicable.

TABLE OF CONTENTS

| | City National Rochdale Funds Semi-Annual Report |

| | |

2 | Schedule of Investments/Consolidated Schedule of Investments |

115 | Statements of Assets and Liabilities/Consolidated Statement of Assets and Liabilities |

118 | Statements of Operations/Consolidated Statement of Operations |

122 | Statements of Changes in Net Assets/Consolidated Statements of Changes in Net Assets |

126 | Consolidated Statement of Cash Flows |

128 | Financial Highlights/Consolidated Financial Highlights |

131 | Notes to Financial Statements/Consolidated Notes to Financial Statements |

145 | Disclosure of Fund Expenses |

148 | Board Approval of Advisory and Sub-Advisory Agreements |

The Funds file their complete schedules of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within 60 days after the end of the period. The Funds’ Form N-Q filings are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The most current Form N-Q filing is also available on the Funds’ website at www.citynationalrochdalefunds.com and without charge, upon request, by calling 1-888-889-0799. After April 1, 2019, the Funds will begin submitting their complete schedules of portfolio holdings on Form N-PORT with the Commission for each month in a fiscal quarter within 60 days after the end of that fiscal quarter, and the Funds will no longer utilize Form N-Q.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to the Funds’ portfolio securities, and information on how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available (1) without charge, upon request, by calling 1-888-889-0799, (2) on the Funds’ website at www.citynationalrochdalefunds.com, and (3) on the Commission’s website at www.sec.gov.

CITY NATIONAL ROCHDALE FUNDS | PAGE 1

schedule of investments |

March 31, 2019 (Unaudited) |

City National Rochdale Government Money Market Fund |

Description | | Face Amount (000) | | | Value (000) | |

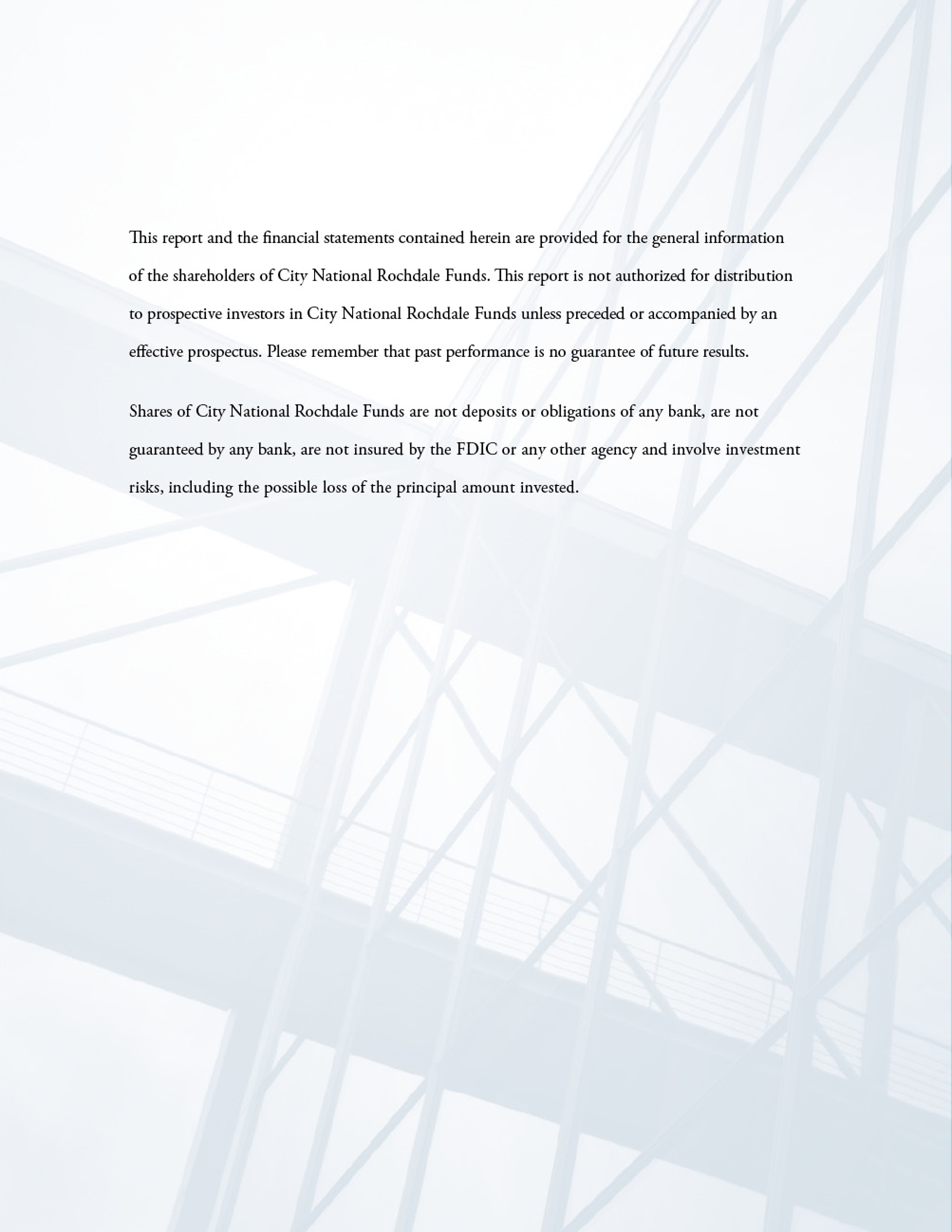

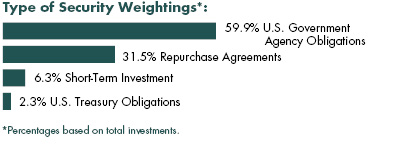

U.S. Government Agency Obligations [59.9%] |

FAMC, MTN | | | | | | | | |

2.436%, VAR ICE LIBOR USD 1 Month+-0.050%, 06/25/19 | | $ | 50,000 | | | $ | 50,000 | |

FFCB | | | | | | | | |

2.385%, VAR US Federal Funds Effective Rate+-0.025%, 04/25/19 | | | 50,000 | | | | 50,000 | |

2.500%, VAR US Treasury 3 Month Bill Money Market Yield+0.075%, 11/01/19 | | | 50,000 | | | | 49,998 | |

2.446%, VAR ICE LIBOR USD 1 Month+-0.040%, 06/25/20 | | | 56,000 | | | | 55,987 | |

FHLB | | | | | | | | |

2.491%, 05/24/19 | | | 50,000 | | | | 50,003 | |

2.396%, VAR ICE LIBOR USD 1 Month+-0.100%, 05/28/19 | | | 50,000 | | | | 50,000 | |

2.356%, VAR ICE LIBOR USD 1 Month+-0.125%, 06/07/19 | | | 50,000 | | | | 50,000 | |

2.396%, VAR ICE LIBOR USD 1 Month+-0.090%, 07/25/19 | | | 50,000 | | | | 50,000 | |

2.449%, VAR ICE LIBOR USD 3 Month+-0.245%, 08/16/19 | | | 50,000 | | | | 50,000 | |

2.411%, VAR ICE LIBOR USD 1 Month+-0.075%, 10/25/19 | | | 50,000 | | | | 50,000 | |

2.436%, VAR ICE LIBOR USD 1 Month+-0.060%, 10/28/19 | | | 100,000 | | | | 100,000 | |

2.419%, VAR ICE LIBOR USD 1 Month+-0.080%, 11/13/19 | | | 11,000 | | | | 11,000 | |

2.495%, VAR United States Secured Overnight Financing Rate+0.065%, 11/15/19 | | | 20,000 | | | | 20,000 | |

2.395%, VAR ICE LIBOR USD 1 Month+-0.095%, 01/02/20 | | | 50,000 | | | | 50,000 | |

2.417%, VAR ICE LIBOR USD 1 Month+-0.065%, 02/05/20 | | | 50,000 | | | | 50,000 | |

2.493%, VAR ICE LIBOR USD 3 Month+-0.200%, 02/14/20 | | | 50,000 | | | | 50,000 | |

2.423%, VAR ICE LIBOR USD 1 Month+-0.065%, 02/20/20 | | | 50,000 | | | | 50,000 | |

2.475%, VAR ICE LIBOR USD 1 Month+-0.015%, 06/04/20 | | | 50,000 | | | | 50,000 | |

FHLB DN (A) | | | | | | | | |

2.437%, 04/10/19 | | | 100,000 | | | | 99,940 | |

2.414%, 04/17/19 | | | 98,000 | | | | 97,895 | |

2.423%, 04/22/19 | | | 150,000 | | | | 149,789 | |

2.420%, 04/24/19 | | | 150,000 | | | | 149,769 | |

2.421%, 04/26/19 | | | 100,000 | | | | 99,833 | |

2.437%, 05/03/19 | | | 150,000 | | | | 149,677 | |

2.466%, 05/10/19 | | | 114,000 | | | | 113,698 | |

2.472%, 05/15/19 | | | 100,000 | | | | 99,700 | |

2.516%, 05/17/19 | | | 50,000 | | | | 49,841 | |

5.522%, 05/22/19 | | | 50,000 | | | | 49,824 | |

2.527%, 05/24/19 | | | 100,000 | | | | 99,633 | |

2.484%, 05/29/19 | | | 100,000 | | | | 99,604 | |

2.442%, 05/31/19 | | | 50,000 | | | | 49,798 | |

2.542%, 06/05/19 | | | 28,000 | | | | 27,873 | |

2.435%, 06/07/19 | | | 100,000 | | | | 99,550 | |

2.512%, 06/19/19 | | | 15,000 | | | | 14,918 | |

FNMA | | | | | | | | |

2.530%, VAR United States Secured Overnight Financing Rate+0.100%, 04/30/20 | | | 40,000 | | | | 40,000 | |

2.450%, VAR United States Secured Overnight Financing Rate+0.060%, 07/30/20 | | | 25,000 | | | | 25,000 | |

Tennessee Valley Authority DN (A) | | | | | | | | |

2.412%, 04/02/19 | | | 100,000 | | | | 99,994 | |

2.423%, 04/09/19 | | | 100,000 | | | | 99,946 | |

| | | | | | | | | |

Total U.S. Government Agency Obligations |

(Cost $2,603,270) | | | 2,603,270 | |

| | | | | | | | | |

U.S. Treasury Obligation [2.3%] |

United States Treasury Bill, 2.371%(A) | | | 100,000 | | | | 99,993 | |

| | | | | | | | | |

Total U.S. Treasury Obligation |

(Cost $99,993) | | | 99,993 | |

| | | | | | | | | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 2

schedule of investments |

March 31, 2019 (Unaudited) |

City National Rochdale Government Money Market Fund(concluded) |

Description | | Shares/Face Amount (000) | | | Value (000) | |

Short-Term Investment [6.3%] |

Morgan Stanley Institutional Liquidity Funds - Government Portfolio, 2.290%** | | | 275,581,441 | | | $ | 275,582 | |

| | | | | | | | | |

Total Short-Term Investment |

(Cost $275,582) | | | 275,582 | |

| | | | | | | | | |

Repurchase Agreements [31.5%] |

Daiwa (B) | | | | | | | | |

2.500%, dated 3/29/19, repurchased on 4/1/19, repurchase price $60,012,000 (collateralized by various U.S. Government obligations, par values ranging from $20,400 to $14,161,000, 0.000% - 6.000%, 4/30/19 - 3/20/49; with a total market value of $61,393,360) | | $ | 60,000 | | | | 60,000 | |

Barclays (B) | | | | | | | | |

2.550%, dated 3/29/19, repurchased on 4/1/19, repurchase price $75,015,000 (collateralized by U.S. Government obligations, par value $66,133,500, 3.625%, 2/15/44; with a total market value of $76,500,111) | | | 75,000 | | | | 75,000 | |

Barclays (B) | | | | | | | | |

2.400%, dated 3/29/19, repurchased on 4/1/19, repurchase price $457,091,400 (collateralized by various U.S. Government obligations, par values ranging from $133,220,700 to $309,140,300, 3.000%, 9/30/25 - 2/15/47; with a total market value of $466,140,022) | | | 457,000 | | | | 457,000 | |

Goldman Sachs (B) | | | | | | | | |

2.510%, dated 3/29/19, repurchased on 4/1/19, repurchase price $125,026,146 (collateralized by various U.S. Government obligations, par values ranging from $2 to $100,000,000, 0.000% - 6.250%, 6/22/21 - 11/16/37; with a total market value of $127,500,000) | | | 125,000 | | | | 125,000 | |

| | | | | | | |

Description | | Face Amount (000) | | | Value (000) | |

Wells Fargo (B) | | | | | | | | |

2.610%, dated 3/29/19, repurchased on 4/1/19, repurchase price $650,130,000 (collateralized by various U.S. Government obligations, par values ranging from $1,000 to $250,748,226, 0.000% - 6.000%, 4/5/19 - 4/1/49; with a total market value of $663,000,000) | | $ | 650,000 | | | | 650,000 | |

| | | | | | | | | |

Total Repurchase Agreements |

(Cost $1,367,000) | | | 1,367,000 | |

| | | | | | | | | |

Total Investments [100.0%] |

(Cost $4,345,845) | | $ | 4,345,845 | |

Percentages are based on net assets of $4,343,975 (000).

** | The rate reported is the 7-day effective yield as of March 31, 2019. |

(A) | Zero coupon security. The rate reported is the effective yield at time of purchase. |

(B) | Tri-party Repurchase Agreement. |

DN — Discount Note

FAMC — Federal Agriculture Mortgage Corporation

FFCB — Federal Farm Credit Bank

FHLB — Federal Home Loan Bank

FNMA — Federal National Mortgage Association

ICE — Intercontinental Exchange

LIBOR — London Interbank Offered Rates

MTN — Medium Term Note

USD — U.S. Dollar

VAR — Variable

The following is a list of the inputs used as of March 31, 2019, in valuing the Fund’s investments carried at value (000):

Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

U.S. Government Agency Obligations | | $ | — | | | $ | 2,603,270 | | | $ | — | | | $ | 2,603,270 | |

U.S. Treasury Obligation | | | — | | | | 99,993 | | | | — | | | | 99,993 | |

Short-Term Investment | | | 275,582 | | | | — | | | | — | | | | 275,582 | |

Repurchase Agreements | | | — | | | | 1,367,000 | | | | — | | | | 1,367,000 | |

Total Investments in Securities | | $ | 275,582 | | | $ | 4,070,263 | | | $ | — | | | $ | 4,345,845 | |

For the period ended March 31, 2019, there have been no transfers between any of the fair value hierarchy levels. Transfers between levels are recognized at period end.

Amounts designated as “—” are either $0 or have been rounded to $0.

For more information on valuation inputs, see Note 2 – Significant Accounting Policies in the Notes to Financial Statements.

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 3

schedule of investments |

March 31, 2019 (Unaudited) |

City National Rochdale Government Bond Fund |

Description | | Face Amount (000) | | | Value (000) | |

U.S. Treasury Obligations [42.8%] |

U.S. Treasury Inflation Indexed Bonds | | | | | | | | |

0.125%, 04/15/20 | | $ | 830 | | | $ | 888 | |

U.S. Treasury Notes | | | | | | | | |

2.375%, 12/31/20 | | | 1,655 | | | | 1,657 | |

2.000%, 11/30/20 | | | 2,500 | | | | 2,486 | |

1.875%, 05/31/22 | | | 4,365 | | | | 4,317 | |

1.875%, 08/31/24 | | | 2,805 | | | | 2,749 | |

1.500%, 01/31/22 | | | 5,500 | | | | 5,388 | |

1.375%, 10/31/20 | | | 1,500 | | | | 1,477 | |

| | | | | | | | | |

Total U.S. Treasury Obligations |

(Cost $19,145) | | | 18,962 | |

| | | | | | | | | |

U.S. Government Agency Obligations [34.3%] |

FFCB | | | | | | | | |

2.678%, VAR ICE LIBOR USD 1 Month+0.190%, 09/20/19 | | | 4,900 | | | | 4,905 | |

FHLB | | | | | | | | |

3.375%, 09/08/23 | | | 1,585 | | | | 1,658 | |

3.125%, 09/09/22 | | | 1,610 | | | | 1,654 | |

1.375%, 09/13/19 | | | 2,095 | | | | 2,085 | |

FNMA | | | | | | | | |

1.250%, 08/17/21 | | | 5,000 | | | | 4,878 | |

| | | | | | | | | |

Total U.S. Government Agency Obligations |

(Cost $15,261) | | | 15,180 | |

| | | | | | | | | |

U.S. Government Mortgage-Backed Obligations [21.8%] |

FHLMC, Ser 2016-4635, Cl EG, Pool FHR 4635 EG | | | | | | | | |

2.500%, 12/15/46 | | | 2,175 | | | | 2,154 | |

FNMA | | | | | | | | |

2.625%, 09/06/24 | | | 1,400 | | | | 1,420 | |

FNMA, Pool AL5866 | | | | | | | | |

2.669%, 08/01/22 | | | 1,740 | | | | 1,749 | |

FNMA, Pool AS4877 | | | | | | | | |

3.000%, 04/01/30 | | | 1,610 | | | | 1,625 | |

FNMA, Pool FN0004 | | | | | | | | |

3.619%, 12/01/20 | | | 2,453 | | | | 2,494 | |

Description | | Face Amount (000)/Shares | | | Value (000) | |

FNMA ARM, Pool 766620 | | | | | | | | |

4.214%, VAR ICE LIBOR USD 12 Month+1.650%, 03/01/34 | | $ | 71 | | | $ | 74 | |

GNMA, Pool 329656 | | | | | | | | |

8.000%, 08/15/22 | | | 2 | | | | 2 | |

GNMA, Pool 376533 | | | | | | | | |

7.500%, 06/15/24 | | | — | | | | 1 | |

GNMA, Pool 398660 | | | | | | | | |

7.500%, 05/15/26 | | | 1 | | | | 1 | |

GNMA, Pool 497411 | | | | | | | | |

6.000%, 01/15/29 | | | 2 | | | | 3 | |

GNMA ARM, Pool G2 81318 | | | | | | | | |

3.625%, VAR US Treas Yield Curve Rate T Note Const Mat 1 Yr+1.500%, 04/20/35 | | | 100 | | | | 104 | |

GNMA ARM, Pool G2 81447 | | | | | | | | |

3.750%, VAR US Treas Yield Curve Rate T Note Const Mat 1 Yr+1.500%, 08/20/35 | | | 25 | | | | 26 | |

| | | | | | | | | |

Total U.S. Government Mortgage-Backed Obligations |

(Cost $9,702) | | | 9,653 | |

| | | | | | | | | |

Short-Term Investment** [1.2%] |

SEI Daily Income Trust Government Fund, Cl F, 2.220% | | | 536,093 | | | | 536 | |

| | | | | | | | | |

Total Short-Term Investment |

(Cost $536) | | | 536 | |

| | | | | | | | | |

Total Investments [100.1%] |

(Cost $44,644) | | $ | 44,331 | |

| | | | | | | | | |

Percentages are based on net assets of $44,275 (000).

** | The rate reported is the 7-day effective yield as of March 31, 2019. |

ARM — Adjustable Rate Mortgage

Cl — Class

FFCB — Federal Farm Credit Bank

FHLB — Federal Home Loan Bank

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

GNMA — Government National Mortgage Association

ICE — Intercontinental Exchange

LIBOR — London Interbank Offered Rate

Ser — Series

USD — U.S. Dollar

VAR — Variable

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 4

schedule of investments |

March 31, 2019 (Unaudited) |

City National Rochdale Government Bond Fund(concluded) |

The following is a list of the inputs used as of March 31, 2019, in valuing the Fund’s investments carried at value (000):

Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

U.S. Treasury Obligations | | $ | — | | | $ | 18,962 | | | $ | — | | | $ | 18,962 | |

U.S. Government Agency Obligations | | | — | | | | 15,180 | | | | — | | | | 15,180 | |

U.S. Government Mortgage-Backed Obligations | | | — | | | | 9,653 | | | | — | | | | 9,653 | |

Short-Term Investment | | | 536 | | | | — | | | | — | | | | 536 | |

Total Investments in Securities | | $ | 536 | | | $ | 43,795 | | | $ | — | | | $ | 44,331 | |

For the period ended March 31, 2019, there have been no transfers between any of the fair value hierarchy levels. Transfers between levels are recognized at period end.

Amounts designated as “—” are $0 or have been rounded to $0.

For more information on valuation inputs, see Note 2 – Significant Accounting Policies in the Notes to Financial Statements.

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 5

schedule of investments |

March 31, 2019 (Unaudited) |

City National Rochdale Corporate Bond Fund |

Description | | Face Amount (000) | | | Value (000) | |

Corporate Bonds [74.1%] |

Automotive [7.6%] |

American Honda Finance, MTN | | | | | | | | |

1.700%, 09/09/21 | | $ | 2,500 | | | $ | 2,441 | |

Daimler Finance North America | | | | | | | | |

3.128%, VAR ICE LIBOR USD 3 Month+0.430%, 02/12/21(A) | | | 2,500 | | | | 2,489 | |

General Motors Financial | | | | | | | | |

5.250%, 03/01/26 | | | 1,250 | | | | 1,290 | |

Hyundai Capital America, MTN | | | | | | | | |

3.615%, VAR ICE LIBOR USD 3 Month+1.000%, 09/18/20(A) | | | 1,000 | | | | 1,003 | |

Toyota Motor Credit, MTN | | | | | | | | |

2.250%, 10/18/23 | | | 3,000 | | | | 2,941 | |

| | | | | | | | | |

Total Automotive | | | 10,164 | |

| | | | | | | | | |

Banks [11.9%] |

Bank of Montreal, MTN | | | | | | | | |

3.231%, VAR ICE LIBOR USD 3 Month+0.630%, 09/11/22 | | | 1,200 | | | | 1,202 | |

BPCE | | | | | | | | |

4.000%, 04/15/24 | | | 1,800 | | | | 1,852 | |

Cooperatieve Rabobank UA | | | | | | | | |

3.263%, VAR ICE LIBOR USD 3 Month+0.480%, 01/10/23 | | | 2,500 | | | | 2,481 | |

Mizuho Financial Group | | | | | | | | |

3.481%, VAR ICE LIBOR USD 3 Month+0.880%, 09/11/22 | | | 2,600 | | | | 2,611 | |

National Australia Bank | | | | | | | | |

4.375%, 12/10/20(A) | | | 751 | | | | 770 | |

PNC Bank | | | | | | | | |

2.700%, 11/01/22 | | | 2,500 | | | | 2,487 | |

Svenska Handelsbanken | | | | | | | | |

2.955%, VAR ICE LIBOR USD 3 Month+0.360%, 09/08/20 | | | 2,000 | | | | 2,001 | |

Wells Fargo Bank, MTN | | | | | | | | |

2.910%, VAR United States Secured Overnight Financing Rate+0.480%, 03/25/20 | | | 2,500 | | | | 2,503 | |

| | | | | | | | | |

Total Banks | | | 15,907 | |

| | | | | | | | | |

Broadcasting & Cable [3.9%] |

CBS | | | | | | | | |

4.300%, 02/15/21 | | | 1,400 | | | | 1,430 | |

Comcast | | | | | | | | |

3.700%, 04/15/24 | | | 1,500 | | | | 1,549 | |

Comcast Cable Communications Holdings | | | | | | | | |

9.455%, 11/15/22 | | | 1,800 | | | | 2,211 | |

| | | | | | | | | |

Total Broadcasting & Cable | | | 5,190 | |

| | | | | | | | | |

Computer System Design & Services [1.2%] |

Apple | | | | | | | | |

3.450%, 05/06/24 | | | 1,500 | | | | 1,548 | |

| | | | | | | | | |

Drugs [0.7%] |

AbbVie | | | | | | | | |

2.500%, 05/14/20 | | | 1,000 | | | | 997 | |

| | | | | | | | | |

Food, Beverage & Tobacco [0.9%] |

Molson Coors Brewing | | | | | | | | |

1.450%, 07/15/19 | | | 1,250 | | | | 1,245 | |

| | | | | | | | | |

Insurance [1.5%] |

Berkshire Hathaway | | | | | | | | |

2.750%, 03/15/23 | | | 2,000 | | | | 2,012 | |

| | | | | | | | | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 6

schedule of investments |

March 31, 2019 (Unaudited) |

City National Rochdale Corporate Bond Fund(continued) |

Description | | Face Amount (000) | | | Value (000) | |

Investment Bank/Broker-Dealer [1.0%] |

Jefferies Group | | | | | | | | |

5.125%, 01/20/23 | | $ | 1,300 | | | $ | 1,377 | |

| | | | | | | | | |

Machinery [1.9%] |

Caterpillar Financial Services, MTN | | | | | | | | |

3.198%, VAR ICE LIBOR USD 3 Month+0.590%, 06/06/22 | | | 2,500 | | | | 2,508 | |

| | | | | | | | | |

Medical Products & Services [1.9%] |

Gilead Sciences | | | | | | | | |

3.700%, 04/01/24 | | | 2,500 | | | | 2,581 | |

| | | | | | | | | |

Medical-HMO [2.3%] |

UnitedHealth Group | | | | | | | | |

2.875%, 03/15/23 | | | 3,000 | | | | 3,017 | |

| | | | | | | | | |

Multi-line Insurance [0.6%] |

MetLife | | | | | | | | |

4.750%, 02/08/21 | | | 794 | | | | 823 | |

| | | | | | | | | |

Petroleum & Fuel Products [7.9%] |

BP Capital Markets | | | | | | | | |

3.814%, 02/10/24 | | | 2,500 | | | | 2,599 | |

Shell International Finance BV | | | | | | | | |

3.400%, 08/12/23 | | | 2,500 | | | | 2,570 | |

Sunoco Logistics Partners Operations | | | | | | | | |

4.650%, 02/15/22 | | | 1,300 | | | | 1,351 | |

Total Capital International | | | | | | | | |

2.875%, 02/17/22 | | | 4,000 | | | | 4,033 | |

| | | | | | | | | |

Total Petroleum & Fuel Products | | | 10,553 | |

| | | | | | | | | |

Real Estate [2.0%] |

Prologis | | | | | | | | |

4.250%, 08/15/23 | | | 2,500 | | | | 2,642 | |

| | | | | | | | | |

Real Estate Investment Trusts [2.3%] |

HCP | | | | | | | | |

3.150%, 08/01/22 | | | 1,000 | | | | 1,001 | |

Simon Property Group | | | | | | | | |

3.375%, 10/01/24 | | | 2,000 | | | | 2,045 | |

| | | | | | | | | |

Total Real Estate Investment Trusts | | | 3,046 | |

| | | | | | | | | |

Regional Authority [1.5%] |

Province of Ontario Canada | | | | | | | | |

4.400%, 04/14/20 | | | 2,000 | | | | 2,037 | |

| | | | | | | | | |

Retail [3.3%] |

AutoZone | | | | | | | | |

4.000%, 11/15/20 | | | 1,400 | | | | 1,417 | |

Costco Wholesale | | | | | | | | |

2.150%, 05/18/21 | | | 3,000 | | | | 2,989 | |

| | | | | | | | | |

Total Retail | | | 4,406 | |

| | | | | | | | | |

Security Brokers & Dealers [16.7%] |

Bank of Nova Scotia | | | | | | | | |

2.450%, 03/22/21 | | | 2,500 | | | | 2,488 | |

Citigroup | | | | | | | | |

4.056%, VAR ICE LIBOR USD 3 Month+1.430%, 09/01/23 | | | 1,000 | | | | 1,017 | |

Credit Suisse Group Funding Guernsey | | | | | | | | |

3.450%, 04/16/21 | | | 1,250 | | | | 1,263 | |

Deutsche Bank, MTN | | | | | | | | |

2.850%, 05/10/19 | | | 1,450 | | | | 1,450 | |

Goldman Sachs Group, MTN | | | | | | | | |

3.951%, VAR ICE LIBOR USD 3 Month+1.300%, 11/23/24 | | | 2,700 | | | | 2,703 | |

HSBC Holdings | | | | | | | | |

3.400%, 03/08/21 | | | 2,500 | | | | 2,522 | |

JPMorgan Chase | | | | | | | | |

3.300%, 04/01/26 | | | 3,000 | | | | 3,004 | |

Macquarie Group | | | | | | | | |

6.000%, 01/14/20(A) | | | 2,000 | | | | 2,045 | |

Morgan Stanley, MTN | | | | | | | | |

3.750%, 02/25/23 | | | 2,000 | | | | 2,051 | |

Royal Bank of Scotland Group | | | | | | | | |

4.519%, VAR ICE LIBOR USD 3 Month+1.550%, 06/25/24 | | | 1,250 | | | | 1,278 | |

Sumitomo Mitsui Financial Group | | | | | | | | |

2.846%, 01/11/22 | | | 2,500 | | | | 2,502 | |

| | | | | | | | | |

Total Security Brokers & Dealers | | | 22,323 | |

| | | | | | | | | |

Telephones & Telecommunications [5.0%] |

America Movil | | | | | | | | |

5.000%, 03/30/20 | | | 2,600 | | | | 2,651 | |

AT&T | | | | | | | | |

3.600%, 02/17/23 | | | 2,000 | | | | 2,039 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 7

schedule of investments |

March 31, 2019 (Unaudited) |

City National Rochdale Corporate Bond Fund(continued) |

Description | | Face Amount (000) | | | Value (000) | |

Verizon Communications | | | | | | | | |

3.784%, VAR ICE LIBOR USD 3 Month+1.100%, 05/15/25 | | $ | 2,000 | | | $ | 2,000 | |

| | | | | | | | | |

Total Telephones & Telecommunications | | | 6,690 | |

| | | | | | | | | |

Total Corporate Bonds |

(Cost $98,774) | | | 99,066 | |

| | | | | | | | | |

Municipal Bonds [9.7%] |

California [4.0%] |

California State, Various Purpose, GO | | | | | | | | |

3.500%, 04/01/28 | | | 3,700 | | | | 3,886 | |

University of California, Ser AX, GO | | | | | | | | |

Callable 04/01/25 @ 100 | | | | | | | | |

3.063%, 07/01/25 | | | 1,400 | | | | 1,425 | |

| | | | | | | | | |

Total California | | | 5,311 | |

| | | | | | | | | |

New York [5.7%] |

New York City, Build America Bonds, GO | | | | | | | | |

5.424%, 03/01/25 | | | 2,500 | | | | 2,835 | |

New York State, Urban Development, RB | | | | | | | | |

3.100%, 03/15/24 | | | 3,500 | | | | 3,556 | |

New York State, Urban Development, RB | | | | | | | | |

2.790%, 03/15/21 | | | 1,205 | | | | 1,212 | |

| | | | | | | | | |

Total New York | | | 7,603 | |

| | | | | | | | | |

Total Municipal Bonds |

(Cost $12,531) | | | 12,914 | |

| | | | | | | | | |

Commercial Paper [5.6%] |

CME Group | | | | | | | | |

2.463%, 04/09/19 | | | 3,000 | | | | 2,998 | |

NASDAQ | | | | | | | | |

2.731%, 04/02/19 | | | 2,000 | | | | 1,999 | |

Nissan Motor Acceptance Corp | | | | | | | | |

2.782%, 05/28/19 | | | 2,500 | | | | 2,490 | |

| | | | | | | | | |

Total Commercial Paper |

(Cost $7,487) | | | 7,487 | |

| | | | | | | | | |

Description | | Face Amount (000)/Shares | | | Value (000) | |

Mortgage-Backed Security [2.7%] |

Carmax Auto Owner Trust, Ser 2018-4, Cl A3 | | | | | | | | |

3.360%, 09/15/23 | | $ | 3,500 | | | $ | 3,559 | |

| | | | | | | | | |

Total Mortgage-Backed Security |

(Cost $3,500) | | | 3,559 | |

| | | | | | | | | |

Affiliated Registered Investment Company [2.1%] |

City National Rochdale Fixed Income Opportunities Fund, Cl N | | | 116,460 | | | | 2,847 | |

| | | | | | | | | |

Total Affiliated Registered Investment Company |

(Cost $3,000) | | | 2,847 | |

| | | | | | | | | |

Asset-Backed Security [1.5%] |

Ford Credit Floorplan Master Owner Trust A, Ser 2016-3, Cl A1 | | | | | | | | |

1.550%, 07/15/21 | | | 2,000 | | | | 1,993 | |

| | | | | | | | | |

Total Asset-Backed Security |

(Cost $2,000) | | | 1,993 | |

| | | | | | | | | |

Closed-End Fund [1.0%] |

Stone Ridge Reinsurance Risk Premium Interval Fund | | | 172,288 | | | | 1,411 | |

| | | | | | | | | |

Total Closed-End Fund |

(Cost $1,744) | | | 1,411 | |

| | | | | | | | | |

Short-Term Investment** [2.9%] |

SEI Daily Income Trust Government Fund, Cl F, 2.220% | | | 3,851,771 | | | | 3,852 | |

| | | | | | | | | |

Total Short-Term Investment |

(Cost $3,852) | | | 3,852 | |

| | | | | | | | | |

Total Investments [99.6%] |

(Cost $132,888) | | $ | 133,129 | |

| | | | | | | | | |

Percentages are based on net assets of $133,624 (000).

** | The rate reported is the 7-day effective yield as of March 31, 2019. |

(A) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutions. On March 31, 2019, the value of these securities amounted to $6,307 (000), representing 4.7% of the net assets of the Fund. |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 8

schedule of investments |

March 31, 2019 (Unaudited) |

City National Rochdale Corporate Bond Fund(concluded) |

Cl — Class

GO — General Obligation

ICE— Intercontinental Exchange

LIBOR — London Inter-bank Offered Rate

MTN — Medium Term Note

RB — Revenue Bond

Ser — Series

USD — U.S. Dollar

VAR — Variable Rate

The following is a list of the inputs used as of March 31, 2019, in valuing the

Fund’s investments carried at value (000):

Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Corporate Bonds | | $ | — | | | $ | 99,066 | | | $ | — | | | $ | 99,066 | |

Municipal Bonds | | | — | | | | 12,914 | | | | — | | | | 12,914 | |

Commercial Paper | | | — | | | | 7,487 | | | | — | | | | 7,487 | |

Mortgage-Backed Security | | | — | | | | 3,559 | | | | — | | | | 3,559 | |

Affiliated Registered Investment Company | | | 2,847 | | | | — | | | | — | | | | 2,847 | |

Asset-Backed Security | | | — | | | | 1,993 | | | | — | | | | 1,993 | |

Closed-End Fund | | | 1,411 | | | | — | | | | — | | | | 1,411 | |

Short-Term Investment | | | 3,852 | | | | — | | | | — | | | | 3,852 | |

Total Investments in Securities | | $ | 8,110 | | | $ | 125,019 | | | $ | — | | | $ | 133,129 | |

For the period ended March 31, 2019, there have been no transfers between any of the fair value hierarchy levels. Transfers between levels are recognized at period end.

The following is a summary of the transactions with affiliates for the period ended March 31, 2019:

| | | City National

Rochdale

Fixed Income

Opportunities

Fund, Class N

(000) | |

Beginning balance as of 10/1/18 | | $ | 2,877 | |

Purchases at Cost | | | 0 | |

Unrealized Gain (Loss) | | | (30 | ) |

Ending balance as of 3/31/19 | | $ | 2,847 | |

Dividend Income | | $ | 2 | |

Amounts designated as “—” are $0 or have been rounded to $0.

For more information on valuation inputs, see Note 2 – Significant Accounting Policies in the Notes to Financial Statements.

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 9

schedule of investments |

March 31, 2019 (Unaudited) |

City National Rochdale California Tax Exempt Bond Fund |

Description | | Face Amount (000) | | | Value (000) | |

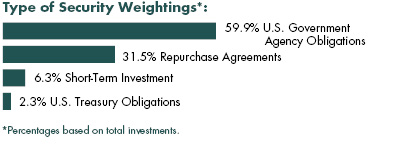

Municipal Bonds [94.5%] |

California [89.9%] |

Bay Area, Water Supply & Conservation Agency, Ser A, RB | | | | | | | | |

Callable 04/01/23 @ 100 | | | | | | | | |

5.000%, 10/01/23 | | $ | 600 | | | $ | 685 | |

Brea, Redevelopment Agency Successor, Redevelopment Project, TA | | | | | | | | |

5.000%, 08/01/20 | | | 500 | | | | 524 | |

Brea, Redevelopment Agency Successor, Redevelopment Project, TA | | | | | | | | |

Callable 08/01/23 @ 100 | | | | | | | | |

5.000%, 08/01/25 | | | 500 | | | | 573 | |

California State, Department of Water Resources, Ser AX, RB | | | | | | | | |

Callable 12/01/27 @ 100 | | | | | | | | |

5.000%, 12/01/29 | | | 500 | | | | 627 | |

California State, Educational Facilities Authority, Chapman University, RB | | | | | | | | |

Callable 04/01/25 @ 100 | | | | | | | | |

5.000%, 04/01/26 | | | 100 | | | | 119 | |

California State, Educational Facilities Authority, Chapman University, RB | | | | | | | | |

Callable 04/01/25 @ 100 | | | | | | | | |

5.000%, 04/01/27 | | | 100 | | | | 118 | |

California State, GO | | | | | | | | |

5.250%, 09/01/22 | | | 1,000 | | | | 1,124 | |

California State, GO | | | | | | | | |

5.000%, 11/01/19 | | | 1,000 | | | | 1,021 | |

California State, GO | | | | | | | | |

5.000%, 09/01/20 | | | 1,000 | | | | 1,050 | |

California State, GO | | | | | | | | |

5.000%, 12/01/21 | | | 1,000 | | | | 1,091 | |

California State, GO | | | | | | | | |

5.000%, 10/01/22 | | | 1,000 | | | | 1,118 | |

California State, GO | | | | | | | | |

Callable 11/01/20 @ 100 | | | | | | | | |

5.000%, 11/01/22 | | | 1,025 | | | | 1,083 | |

California State, GO | | | | | | | | |

5.000%, 11/01/24 | | | 1,000 | | | | 1,177 | |

California State, GO | | | | | | | | |

5.000%, 08/01/26 | | | 1,000 | | | | 1,220 | |

California State, GO | | | | | | | | |

Callable 12/01/23 @ 100 | | | | | | | | |

5.000%, 12/01/26 | | | 1,000 | | | | 1,147 | |

California State, GO | | | | | | | | |

Callable 11/01/23 @ 100 | | | | | | | | |

5.000%, 11/01/27 | | | 500 | | | | 571 | |

California State, GO | | | | | | | | |

5.000%, 04/01/32 | | | 500 | | | | 647 | |

California State, GO | | | | | | | | |

4.000%, 04/01/23 | | | 1,000 | | | | 1,094 | |

California State, Health Facilities Financing Authority, Ser A, RB | | | | | | | | |

Callable 11/15/22 @ 100 | | | | | | | | |

5.000%, 11/15/25 | | | 665 | | | | 740 | |

California State, Health Facilities Financing Authority, St. Joseph Health System, Ser D, RB | | | | | | | | |

5.000%, 07/01/43(A) | | | 975 | | | | 1,023 | |

California State, Infrastructure & Economic Development Bank, RB | | | | | | | | |

5.000%, 01/01/28 | | | 800 | | | | 989 | |

California State, Infrastructure & Economic Development Bank, Ser B, RB | | | | | | | | |

5.000%, 07/01/23 | | | 1,000 | | | | 1,137 | |

California State, Municipal Finance Authority, RB | | | | | | | | |

5.000%, 06/01/23 | | | 200 | | | | 230 | |

California State, Municipal Finance Authority, RB | | | | | | | | |

5.000%, 10/01/23 | | | 225 | | | | 255 | |

California State, Public Works Board, Department of Corrections and Rehab Project, Ser A, RB | | | | | | | | |

5.000%, 09/01/22 | | | 1,000 | | | | 1,114 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 10

schedule of investments |

March 31, 2019 (Unaudited) |

City National Rochdale California Tax Exempt Bond Fund(continued) |

Description | | Face Amount (000) | | | Value (000) | |

California State, Public Works Board, Department of Corrections-State Prisons, Ser A, RB, AMBAC | | | | | | | | |

5.000%, 12/01/19 | | $ | 230 | | | $ | 235 | |

California State, Public Works Board, Judicial Council, Ser B, RB | | | | | | | | |

5.000%, 10/01/23 | | | 475 | | | | 545 | |

California State, Public Works Board, RB | | | | | | | | |

5.000%, 09/01/25 | | | 1,500 | | | | 1,793 | |

California State, Public Works Board, Ser B, RB | | | | | | | | |

5.000%, 10/01/25 | | | 225 | | | | 269 | |

California State, Public Works Board, Ser C, RB | | | | | | | | |

Callable 03/01/27 @ 100 | | | | | | | | |

5.000%, 03/01/28 | | | 500 | | | | 612 | |

California State, Public Works Board, Ser S, RB | | | | | | | | |

Callable 04/01/27 @ 100 | | | | | | | | |

5.000%, 04/01/28 | | | 800 | | | | 980 | |

California State, Public Works Board, Various Capital Projects, Ser G1, RB | | | | | | | | |

Pre-Refunded @ 100 | | | | | | | | |

5.250%, 10/01/19(B) | | | 250 | | | | 255 | |

California State, Statewide Communities Development Authority, Cottage Health System, RB | | | | | | | | |

Callable 11/01/24 @ 100 | | | | | | | | |

5.000%, 11/01/25 | | | 350 | | | | 408 | |

California State, University Systemwide Revenue, Ser A, RB | | | | | | | | |

5.000%, 11/01/24 | | | 900 | | | | 1,072 | |

California State, University Systemwide Revenue, Ser A, RB | | | | | | | | |

Callable 05/01/26 @ 100 | | | | | | | | |

5.000%, 11/01/27 | | | 240 | | | | 294 | |

Chula Vista, Police Facility Project, COP | | | | | | | | |

5.000%, 10/01/21 | | | 360 | | | | 392 | |

Contra Costa, Transportation Authority, Ser A, RB | | | | | | | | |

5.000%, 03/01/27 | | | 420 | | | | 528 | |

East Bay, Municipal Utility District, Water System Revenue, Ser A, RB | | | | | | | | |

Callable 06/01/25 @ 100 | | | | | | | | |

5.000%, 06/01/29 | | | 850 | | | | 1,016 | |

Gilroy, Public Facilities Financing Authority, RB | | | | | | | | |

5.000%, 11/01/21 | | | 940 | | | | 1,027 | |

Golden State Tobacco Securitization, Ser A, RB | | | | | | | | |

5.000%, 06/01/19 | | | 1,000 | | | | 1,005 | |

Golden State Tobacco Securitization, Ser A, RB | | | | | | | | |

5.000%, 06/01/21 | | | 1,000 | | | | 1,070 | |

Inglewood, Redevelopment Agency Successor Agency, TA, BAM | | | | | | | | |

5.000%, 05/01/23 | | | 500 | | | | 565 | |

Jurupa, Unified School District, GO, AGM | | | | | | | | |

5.000%, 08/01/22 | | | 1,000 | | | | 1,120 | |

Long Beach, Harbor Revenue, Ser A, RB | | | | | | | | |

5.000%, 12/15/20 | | | 1,000 | | | | 1,061 | |

Long Beach, Harbor Revenue, Ser A, RB, AMT | | | | | | | | |

5.000%, 05/15/27 | | | 500 | | | | 612 | |

Long Beach, Unified School District, Election of 2008, Ser S, GO | | | | | | | | |

Pre-Refunded @ 100 | | | | | | | | |

5.250%, 08/01/19(B) | | | 2,010 | | | | 2,036 | |

Long Beach, Unified School District, GO | | | | | | | | |

5.000%, 08/01/26 | | | 1,000 | | | | 1,244 | |

Los Angeles County, Disney Parking Hall Project, COP | | | | | | | | |

5.000%, 09/01/22 | | | 500 | | | | 559 | |

Los Angeles County, Metropolitan Transportation Authority, Ser A, RB | | | | | | | | |

Callable 07/01/25 @ 100 | | | | | | | | |

5.000%, 07/01/26 | | | 500 | | | | 605 | |

Los Angeles, Department of Airports, RB, AMT | | | | | | | | |

Callable 05/15/26 @ 100 | | | | | | | | |

5.000%, 05/15/29 | | | 400 | | | | 474 | |

Los Angeles, Department of Airports, Ser C, RB | | | | | | | | |

5.000%, 05/15/25 | | | 550 | | | | 664 | |

Los Angeles, Department of Water & Power, Power System Project, Ser A, RB | | | | | | | | |

5.000%, 07/01/19 | | | 500 | | | | 504 | |

Los Angeles, Department of Water & Power, Power System Project, Ser C, RB | | | | | | | | |

5.000%, 07/01/23 | | | 500 | | | | 575 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 11

schedule of investments |

March 31, 2019 (Unaudited) |

City National Rochdale California Tax Exempt Bond Fund(continued) |

Description | | Face Amount (000) | | | Value (000) | |

Los Angeles, Municipal Improvement Authority, Capital Equipment, Ser A, RB | | | | | | | | |

4.000%, 11/01/19 | | $ | 575 | | | $ | 584 | |

Los Angeles, Sanitation Districts Financing Authority, Ser A, RB | | | | | | | | |

Callable 10/01/25 @ 100 | | | | | | | | |

5.000%, 10/01/28 | | | 500 | | | | 600 | |

Los Angeles, Ser A, GO, ETM | | | | | | | | |

5.000%, 09/01/21 | | | 270 | | | | 294 | |

Los Angeles, Water & Power Resource Authority, Sub-Ser B-3, RB | | | | | | | | |

Callable 04/01/19 @ 100 | | | | | | | | |

1.310%, 07/01/34(A) | | | 2,000 | | | | 2,000 | |

Orange County, Redevelopment Agency Successor Agency, TA, AGM | | | | | | | | |

5.000%, 09/01/23 | | | 320 | | | | 369 | |

Redding, Electric System Revenue, RB | | | | | | | | |

5.000%, 06/01/24 | | | 600 | | | | 706 | |

Redding, Electric System Revenue, RB | | | | | | | | |

5.000%, 06/01/25 | | | 250 | | | | 301 | |

Riverside County, Infrastructure Financing Authority, Ser A, RB | | | | | | | | |

Callable 11/01/26 @ 100 | | | | | | | | |

4.000%, 11/01/29 | | | 500 | | | | 567 | |

Riverside County, Transportation Commission, Ser A, RB | | | | | | | | |

Pre-Refunded @ 100 | | | | | | | | |

5.250%, 06/01/23(B) | | | 500 | | | | 578 | |

Riverside, Electric System Revenue, Ser A | | | | | | | | |

5.000%, 10/01/23 | | | 1,000 | | | | 1,155 | |

Riverside, Public Financing Authority, Ser A, RB | | | | | | | | |

5.000%, 11/01/21 | | | 1,000 | | | | 1,089 | |

Sacramento County, Sanitation District Financing Authority, Sewer Revenue, Ser A, RB | | | | | | | | |

5.000%, 12/01/20 | | | 500 | | | | 531 | |

San Diego, Association of Governments South Bay Expressway Revenue, Ser A, RB | | | | | | | | |

Callable 07/01/27 @ 100 | | | | | | | | |

5.000%, 07/01/28 | | | 350 | | | | 431 | |

San Diego, Public Facilities Financing Authority, Sewer Revenue, RB | | | | | | | | |

5.000%, 05/15/25 | | | 1,000 | | | | 1,210 | |

San Francisco City & County, Airport Commission, RB, AMT | | | | | | | | |

5.000%, 05/01/27 | | | 2,000 | | | | 2,439 | |

San Francisco City & County, Airport Commission, Ser D, AMT | | | | | | | | |

5.000%, 05/01/21 | | | 1,000 | | | | 1,068 | |

San Francisco City & County, Public Utilities Commission, Water Revenue, Ser A, RB | | | | | | | | |

Callable 10/01/25 @ 100 | | | | | | | | |

5.000%, 10/01/27 | | | 1,000 | | | | 1,214 | |

San Francisco City & County, Public Utilities Commission, Water Revenue, Ser A, RB | | | | | | | | |

Callable 11/01/24 @ 100 | | | | | | | | |

5.000%, 11/01/28 | | | 500 | | | | 590 | |

San Francisco, State Building Authority, RB | | | | | | | | |

4.000%, 12/01/20 | | | 1,000 | | | | 1,043 | |

San Jose, International Airport, Ser A, RB, AMT | | | | | | | | |

5.000%, 03/01/24 | | | 500 | | | | 573 | |

San Leandro, Unified School District, GO, BAM | | | | | | | | |

5.000%, 08/01/24 | | | 325 | | | | 383 | |

San Mateo County, Joint Powers Financing Authority, Maple Street Correctional Center, RB | | | | | | | | |

Callable 06/15/24 @ 100 | | | | | | | | |

5.000%, 06/15/26 | | | 1,035 | | | | 1,214 | |

San Mateo County, Transportation Authority, Ser A, RB, NATL, ETM | | | | | | | | |

5.250%, 06/01/19 | | | 755 | | | | 760 | |

San Pablo County, Redevelopment Agency, Ser A, TA, AGM | | | | | | | | |

5.000%, 06/15/21 | | | 480 | | | | 516 | |

Santa Clara County, Financing Authority, Lease Revenue Capital Project, Ser A, RB | | | | | | | | |

5.000%, 02/01/20 | | | 500 | | | | 515 | |

Santa Clara Valley, Transportation Authority, Ser B, RB | | | | | | | | |

5.000%, 06/01/26 | | | 200 | | | | 248 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 12

schedule of investments |

March 31, 2019 (Unaudited) |

City National Rochdale California Tax Exempt Bond Fund(continued) |

Description | | Face Amount (000) | | | Value (000) | |

Southern California, Public Power Authority, Ser B, RB | | | | | | | | |

Callable 11/01/20 @ 100 | | | | | | | | |

1.750%, 07/01/40(A) | | $ | 3,000 | | | $ | 2,987 | |

Tahoe-Truckee, Unified School District, Ser B, GO | | | | | | | | |

Callable 08/01/26 @ 100 | | | | | | | | |

5.000%, 08/01/27 | | | 200 | | | | 247 | |

Tahoe-Truckee, Unified School District, Ser B, GO | | | | | | | | |

Callable 08/01/26 @ 100 | | | | | | | | |

5.000%, 08/01/28 | | | 200 | | | | 246 | |

Tustin, Unified School District, SPL Tax, BAM | | | | | | | | |

5.000%, 09/01/24 | | | 500 | | | | 588 | |

University of California, Regents of the University of California Medical Center Pooled Revenue, Ser J, RB | | | | | | | | |

Pre-Refunded @ 100 | | | | | | | | |

5.000%, 05/15/23(B) | | | 495 | | | | 565 | |

University of California, Regents of the University of California Medical Center Pooled Revenue, Ser J, RB | | | | | | | | |

Callable 05/15/23 @ 100 | | | | | | | | |

5.000%, 05/15/26 | | | 110 | | | | 125 | |

University of California, Revenues Limited Project, Ser E, RB | | | | | | | | |

Callable 05/15/20 @ 100 | | | | | | | | |

5.000%, 05/15/22 | | | 500 | | | | 520 | |

University of California, Ser AT, RB | | | | | | | | |

Callable 11/15/20 @ 100 | | | | | | | | |

1.400%, 05/15/46(A) | | | 2,500 | | | | 2,485 | |

University of California, Ser AY, RB | | | | | | | | |

Callable 05/15/27 @ 100 | | | | | | | | |

5.000%, 05/15/28 | | | 2,000 | | | | 2,509 | |

University of California, Ser G, RB | | | | | | | | |

Pre-Refunded @ 100 | | | | | | | | |

5.000%, 05/15/22(B) | | | 230 | | | | 256 | |

University of California, Ser G, RB | | | | | | | | |

Callable 05/15/22 @ 100 | | | | | | | | |

5.000%, 05/15/26 | | | 270 | | | | 299 | |

Description | | Face Amount (000)/Shares | | | Value (000) | |

Westlands, Water District, Ser A, RB, AGM | | | | | | | | |

Callable 09/01/26 @ 100 | | | | | | | | |

5.000%, 09/01/27 | | $ | 1,000 | | | $ | 1,218 | |

| | | | | | | | | |

Total California | | | 75,020 | |

| |

Colorado [1.2%] |

Colorado State, Housing & Finance Authority, Ser B-2, RB | | | | | | | | |

Callable 03/29/19 @ 100 | | | | | | | | |

2.430%, 11/01/44(A) | | | 1,000 | | | | 1,000 | |

| | | | | | | | | |

Florida [0.6%] |

Davie, Eastern University Project, RB | | | | | | | | |

5.000%, 04/01/25 | | | 400 | | | | 465 | |

| | | | | | | | | |

Illinois [2.8%] |

Illinois State, Ser A, RB | | | | | | | | |

5.000%, 10/01/21 | | | 1,000 | | | | 1,059 | |

Illinois State, Ser A, RB | | | | | | | | |

5.000%, 10/01/23 | | | 1,200 | | | | 1,300 | |

| | | | | | | | | |

Total Illinois | | | 2,359 | |

| | | | | | | | | |

Total Municipal Bonds |

(Cost $77,096) | | | 78,844 | |

| | | | | | | | | |

Short-Term Investment** [0.8%] |

SEI Daily Income Trust Government Fund, Cl F, 2.196% | | | 689,765 | | | | 690 | |

| | | | | | | | | |

Total Short-Term Investment |

(Cost $690) | | | 690 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 13

schedule of investments |

March 31, 2019 (Unaudited) |

City National Rochdale California Tax Exempt Bond Fund(concluded) |

Description | | Face Amount (000) | | | Value (000) | |

Repurchase Agreement [3.6%] |

Barclays (C) | | | | | | | | |

2.400%, dated 3/29/19, repurchased on 4/1/19, repurchase price $3,000,600 (collateralized by U.S. Government obligations, par value $3,003,400, 2.875%, 8/15/45; with a total market value of $3,060,019) | | $ | 3,000 | | | $ | 3,000 | |

| | | | | | | | | |

Total Repurchase Agreement |

(Cost $3,000) | | | 3,000 | |

| | | | | | | | | |

Total Investments [98.9%] |

(Cost $80,786) | | $ | 82,534 | |

| | | | | | | | | |

Percentages are based on net assets of $83,431 (000).

** | The rate reported is the 7-day effective yield as of March 31, 2019. |

(A) | Variable or floating rate security, the interest rate of which adjusts periodically based on prevailing interest rates. |

(B) | Pre-Refunded Security — The maturity date shown is the pre-refunded date. |

(C) | Tri-party Repurchase Agreement. |

AGM — Assured Guarantee Municipal

AMBAC — American Municipal Bond Assurance Company

AMT — Alternative Minimum Tax (subject to)

BAM — Build America Mutual

Cl — Class

COP — Certificate of Participation

ETM — Escrowed to Maturity

GO — General Obligation

NATL — National Public Finance Guarantee Corporation

RB — Revenue Bond

Ser — Series

SPL Tax — Special Tax

TA — Tax Allocation

The following is a list of the inputs used as of March 31, 2019, in valuing the Fund’s investments carried at value (000):

Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Municipal Bonds | | $ | — | | | $ | 78,844 | | | $ | — | | | $ | 78,844 | |

Short-Term Investment | | | 690 | | | | — | | | | — | | | | 690 | |

Repurchase Agreement | | | — | | | | 3,000 | | | | — | | | | 3,000 | |

Total Investments in Securities | | $ | 690 | | | $ | 81,844 | | | $ | — | | | $ | 82,534 | |

For the period ended March 31, 2019, there have been no transfers between any of the fair value hierarchy levels. Transfers between levels are recognized at period end.

The following is a summary of the transactions with affiliates for the period ended March 31, 2019:

| | | City National

Rochdale

Municipal High

Income Fund,

Class N

(000) | |

Beginning balance as of 10/1/18 | | $ | 992 | |

Purchases at Cost | | | — | |

Proceeds from Sales | | | (987 | ) |

Realized Gain (Loss) | | | (13 | ) |

Unrealized Gain (Loss) | | | 8 | |

Ending balance as of 3/31/19 | | $ | — | |

Dividend Income | | $ | 1 | |

Amounts designated as “—” are either $0 or have been rounded to $0.

For information on the Fund’s policy regarding valuation of investments and other significant accounting policies, please refer to the Fund’s most recent semi-annual or annual financial statements.

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 14

schedule of investments |

March 31, 2019 (Unaudited) |

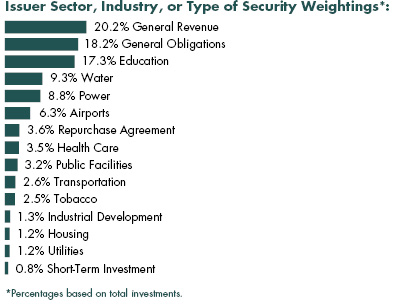

City National Rochdale Municipal High Income Fund |

Description | | Face Amount (000) | | | Value (000) | |

Municipal Bonds [93.2%] |

Alabama [1.4%] |

Alabama State, Southeast Gas Supply District, Ser A, RB | | | | | | | | |

Callable 03/01/24 @ 100 | | | | | | | | |

4.000%, 06/01/49(A) | | $ | 5,000 | | | $ | 5,377 | |

Jefferson County, Sewer Revenue, RB | | | | | | | | |

Callable 10/01/23 @ 105 | | | | | | | | |

0.826%, 10/01/23 | | | 2,500 | | | | 2,298 | |

Jefferson County, Sewer Revenue, Ser D, RB | | | | | | | | |

Callable 10/01/23 @ 105 | | | | | | | | |

6.000%, 10/01/42 | | | 9,000 | | | | 10,467 | |

| | | | | | | | | |

Total Alabama | | | 18,142 | |

| | | | | | | | | |

Alaska [0.9%] |

Northern Arkansas, Tobacco Securitization, Ser A, RB | | | | | | | | |

Callable 04/15/19 @ 100 | | | | | | | | |

5.000%, 06/01/46 | | | 12,500 | | | | 12,136 | |

| | | | | | | | | |

Arizona [1.1%] |

Arizona State, Industrial Development Authority, RB | | | | | | | | |

Callable 07/01/29 @ 100 | | | | | | | | |

5.000%, 01/01/54 | | | 375 | | | | 399 | |

Glendale, Industrial Development Authority, Glencroft Retirement Community, RB | | | | | | | | |

Callable 11/15/26 @ 100 | | | | | | | | |

5.250%, 11/15/46 | | | 1,000 | | | | 1,027 | |

Glendale, Industrial Development Authority, Glencroft Retirement Community, RB | | | | | | | | |

Callable 11/15/26 @ 100 | | | | | | | | |

5.250%, 11/15/51 | | | 1,850 | | | | 1,894 | |

Glendale, Industrial Development Authority, Glencroft Retirement Community, RB | | | | | | | | |

Callable 11/15/26 @ 100 | | | | | | | | |

5.000%, 11/15/36 | | | 600 | | | | 619 | |

Phoenix, Industrial Development Authority, Legacy Traditional School Projects, RB | | | | | | | | |

5.750%, 07/01/24(B) | | | 1,400 | | | | 1,496 | |

Phoenix, Industrial Development Authority, Legacy Traditional School Projects, RB | | | | | | | | |

Callable 07/01/25 @ 100 | | | | | | | | |

5.000%, 07/01/45(B) | | | 3,300 | | | | 3,387 | |

Pima County, Industrial Development Authority, Noah Webster School Project, RB | | | | | | | | |

Callable 12/15/23 @ 100 | | | | | | | | |

7.000%, 12/15/43 | | | 1,500 | | | | 1,623 | |

Tempe, Industrial Development Authority, Mirrabella at ASU Project, Ser A, RB | | | | | | | | |

Callable 10/01/27 @ 100 | | | | | | | | |

6.125%, 10/01/52(B) | | | 1,200 | | | | 1,317 | |

Yavapai County, Industrial Development Authority, Ser A, RB | | | | | | | | |

Callable 03/01/25 @ 100 | | | | | | | | |

5.000%, 09/01/34(B) | | | 2,015 | | | | 2,101 | |

| | | | | | | | | |

Total Arizona | | | 13,863 | |

| | | | | | | | | |

California [7.5%] |

Adelanto, Public Utility Authority, Utility System Project, Ser A, RB | | | | | | | | |

Pre-Refunded @ 100 | | | | | | | | |

6.750%, 07/01/19(C) | | | 6,500 | | | | 6,585 | |

California County, Tobacco Securitization Agency, Sub-Ser A, RB | | | | | | | | |

Callable 04/15/19 @ 18 | | | | | | | | |

6.542%, 06/01/46(D) | | | 10,000 | | | | 1,760 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 15

schedule of investments |

March 31, 2019 (Unaudited) |

City National Rochdale Municipal High Income Fund(continued) |

Description | | Face Amount (000) | | | Value (000) | |

California State, GO | | | | | | | | |

Callable 12/01/23 @ 100 | | | | | | | | |

5.000%, 12/01/31 | | $ | 1,500 | | | $ | 1,701 | |

California State, Health Facilities Financing Authority, Ser A, RB | | | | | | | | |

Callable 11/15/27 @ 100 | | | | | | | | |

4.000%, 11/15/40 | | | 5,000 | | | | 5,384 | |

California State, Municipal Finance Authority, California Baptist University, Ser A, RB | | | | | | | | |

Callable 11/01/25 @ 100 | | | | | | | | |

5.500%, 11/01/45(B) | | | 4,000 | | | | 4,527 | |

California State, Municipal Finance Authority, Ser A, RB | | | | | | | | |

Callable 11/01/26 @ 100 | | | | | | | | |

5.250%, 11/01/36 | | | 255 | | | | 285 | |

California State, Municipal Finance Authority, Ser A, RB | | | | | | | | |

Callable 11/01/26 @ 100 | | | | | | | | |

5.000%, 11/01/47 | | | 1,005 | | | | 1,079 | |

California State, Pollution Control Financing Authority, Calplant I Project, RB, AMT | | | | | | | | |

Callable 07/01/27 @ 100 | | | | | | | | |

8.000%, 07/01/39(B) | | | 5,000 | | | | 5,416 | |

California State, Public Works Board, Department of Corrections and Rehab Project, Ser A, RB | | | | | | | | |

Callable 09/01/24 @ 100 | | | | | | | | |

5.000%, 09/01/31 | | | 5,000 | | | | 5,730 | |

California State, Public Works Board, Various Capital Projects, Ser A, RB | | | | | | | | |

Callable 04/01/22 @ 100 | | | | | | | | |

5.000%, 04/01/37 | | | 1,000 | | | | 1,082 | |

California State, School Finance Authority, KIPP LA Project, Ser A, RB | | | | | | | | |

Callable 07/01/27 @ 100 | | | | | | | | |

5.000%, 07/01/47(B) | | | 500 | | | | 554 | |

California State, School Finance Authority, View Park Elementary & Middle School Project, Ser A, RB | | | | | | | | |

Callable 10/01/24 @ 100 | | | | | | | | |

6.000%, 10/01/49 | | | 1,120 | | | | 1,212 | |

California State, School Finance Authority, View Park Elementary & Middle School Project, Ser A, RB | | | | | | | | |

Callable 10/01/24 @ 100 | | | | | | | | |

5.875%, 10/01/44 | | | 1,000 | | | | 1,078 | |

California State, School Finance Authority, View Park Elementary & Middle School Project, Ser A, RB | | | | | | | | |

Callable 10/01/24 @ 100 | | | | | | | | |

5.625%, 10/01/34 | | | 575 | | | | 625 | |

California State, Statewide Communities Development Authority, RB | | | | | | | | |

Callable 06/01/25 @ 100 | | | | | | | | |

7.000%, 06/01/45(E) | | | 3,155 | | | | 1,902 | |

California State, Statewide Communities Development Authority, RB | | | | | | | | |

Callable 06/01/28 @ 100 | | | | | | | | |

5.250%, 12/01/43(B) | | | 500 | | | | 563 | |

California State, Statewide Communities Development Authority, RB | | | | | | | | |

Callable 06/01/28 @ 100 | | | | | | | | |

5.250%, 12/01/48(B) | | | 2,000 | | | | 2,244 | |

California State, Statewide Communities Development Authority, Ser A, RB | | | | | | | | |

Callable 06/01/26 @ 100 | | | | | | | | |

5.250%, 12/01/56(B) | | | 1,500 | | | | 1,640 | |

California State, Statewide Financing Authority, Ser C, RB | | | | | | | | |

Callable 04/15/19 @ 8 | | | | | | | | |

13.601%, 06/01/55(D) | | | 50,000 | | | | 2,334 | |

Central Basin, Municipal Water District, Ser A, RB | | | | | | | | |

Callable 08/01/28 @ 100 | | | | | | | | |

5.000%, 08/01/44 | | | 2,000 | | | | 2,230 | |

Folsom Ranch, Financing Authority, SPL Tax | | | | | | | | |

Callable 09/01/27 @ 100 | | | | | | | | |

5.000%, 09/01/37 | | | 1,435 | | | | 1,617 | |

Folsom Ranch, Financing Authority, SPL Tax | | | | | | | | |

Callable 09/01/27 @ 100 | | | | | | | | |

5.000%, 09/01/47 | | | 2,000 | | | | 2,214 | |

Golden State, Tobacco Securitization, Ser A-1, RB | | | | | | | | |

Callable 06/01/22 @ 100 | | | | | | | | |

5.000%, 06/01/47 | | | 7,000 | | | | 6,965 | |

Inland Empire, Tobacco Securitization Authority, RB | | | | | | | | |

Callable 04/15/19 @ 33 | | | | | | | | |

8.267%, 06/01/36(D) | | | 25,000 | | | | 7,895 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 16

schedule of investments |

March 31, 2019 (Unaudited) |

City National Rochdale Municipal High Income Fund(continued) |

Description | | Face Amount (000) | | | Value (000) | |

M-S-R, Energy Authority, Ser C, RB | | | | | | | | |

7.000%, 11/01/34 | | $ | 2,500 | | | $ | 3,689 | |

Northern California, Gas Authority No. 1, Ser B, RB | | | | | | | | |

2.594%, 07/01/27(A) | | | 5,000 | | | | 4,862 | |

Northern California, Tobacco Securitization Authority, Ser A-1, RB | | | | | | | | |

Callable 04/15/19 @ 100 | | | | | | | | |

5.375%, 06/01/38 | | | 4,650 | | | | 4,671 | |

Orange County, Community Facilities District, SPL Tax | | | | | | | | |

Callable 08/15/28 @ 100 | | | | | | | | |

5.000%, 08/15/47 | | | 1,000 | | | | 1,100 | |

Oroville City, RB | | | | | | | | |

Callable 04/01/29 @ 100 | | | | | | | | |

5.250%, 04/01/39 | | | 750 | | | | 855 | |

Oroville City, RB | | | | | | | | |

Callable 04/01/29 @ 100 | | | | | | | | |

5.250%, 04/01/49 | | | 3,000 | | | | 3,365 | |

Palomar Pomerado, Health Care District, COP | | | | | | | | |

Pre-Refunded @ 100 | | | | | | | | |

6.000%, 11/01/20(C) | | | 3,920 | | | | 4,198 | |

San Buenaventura, Community Memorial Health System Project, RB | | | | | | | | |

Callable 12/01/21 @ 100 | | | | | | | | |

7.500%, 12/01/41 | | | 1,000 | | | | 1,112 | |

San Buenaventura, Community Memorial Health System Project, RB | | | | | | | | |

Callable 12/01/21 @ 100 | | | | | | | | |

7.000%, 12/01/26 | | | 1,000 | | | | 1,111 | |

San Mateo, Community Facilities District, Community Facilities District No. 2008-1-Bay, SPL Tax | | | | | | | | |

Callable 09/01/22 @ 100 | | | | | | | | |

5.500%, 09/01/44 | | | 1,000 | | | | 1,077 | |

Southern California, Tobacco Securitization Authority, Ser A-1, RB | | | | | | | | |

Callable 04/15/19 @ 100 | | | | | | | | |

5.000%, 06/01/37 | | | 3,000 | | | | 3,000 | |

Westminster School District, GO, BAM | | | | | | | | |

Callable 08/01/39 @ 100 | | | | | | | | |

1.803%, 08/01/34 (F) | | | 4,540 | | | | 2,904 | |

| | | | | | | | | |

Total California | | | 98,566 | |

| | | | | | | | | |

Colorado [8.0%] |

9th Avenue Metropolitan District No. 2, GO | | | | | | | | |

Callable 12/01/23 @ 103 | | | | | | | | |

5.000%, 12/01/48 | | | 1,000 | | | | 1,025 | |

Amber Creek, Metropolitan District, Ser A, GO | | | | | | | | |

Callable 12/01/22 @ 103 | | | | | | | | |

5.125%, 12/01/47 | | | 1,065 | | | | 1,074 | |

Amber Creek, Metropolitan District, Ser A, GO | | | | | | | | |

Callable 12/01/22 @ 103 | | | | | | | | |

5.000%, 12/01/37 | | | 750 | | | | 757 | |

Arkansas State, River Power Authority, Colorado Improvement Project, RB | | | | | | | | |

Callable 10/01/20 @ 100 | | | | | | | | |

6.125%, 10/01/40 | | | 2,500 | | | | 2,609 | |

Base Village Metropolitan District No. 2, Ser A, GO | | | | | | | | |

Callable 12/01/21 @ 103 | | | | | | | | |

5.750%, 12/01/46 | | | 3,055 | | | | 3,111 | |

Belleview Station Metropolitan District No. 2, GO | | | | | | | | |

Callable 12/01/21 @ 103 | | | | | | | | |

5.125%, 12/01/46 | | | 3,375 | | | | 3,466 | |

Belleview Station Metropolitan District No. 2, GO | | | | | | | | |

Callable 12/01/21 @ 103 | | | | | | | | |

5.000%, 12/01/36 | | | 1,500 | | | | 1,542 | |

Big Dry Creek Metropolitan District, Ser A, GO | | | | | | | | |

Callable 12/01/22 @ 103 | | | | | | | | |

5.750%, 12/01/47 | | | 2,910 | | | | 2,945 | |

Brighton Crossing Metropolitan District No. 4, Ser A, GO | | | | | | | | |

Callable 12/01/22 @ 103 | | | | | | | | |

5.000%, 12/01/37 | | | 525 | | | | 542 | |

Brighton Crossing Metropolitan District No. 4, Ser A, GO | | | | | | | | |

Callable 12/01/22 @ 103 | | | | | | | | |

5.000%, 12/01/47 | | | 1,720 | | | | 1,768 | |

Buffalo Highlands Metropolitan District, Ser A, GO | | | | | | | | |

Callable 12/01/23 @ 103 | | | | | | | | |

5.375%, 12/01/48 | | | 1,775 | | | | 1,802 | |

Canyons Metropolitan District No. 5, Ser A, GO | | | | | | | | |

Callable 12/01/22 @ 103 | | | | | | | | |

6.125%, 12/01/47 | | | 1,000 | | | | 1,019 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 17

schedule of investments |

March 31, 2019 (Unaudited) |

City National Rochdale Municipal High Income Fund(continued) |

Description | | Face Amount (000) | | | Value (000) | |

Canyons Metropolitan District No. 5, Ser A, GO | | | | | | | | |

Callable 12/01/22 @ 103 | | | | | | | | |

6.000%, 12/01/37 | | $ | 2,000 | | | $ | 2,049 | |

Castle Oaks, Metropolitan District No. 3, GO | | | | | | | | |

Pre-Refunded @ 100 | | | | | | | | |

6.250%, 12/01/20(C) | | | 2,860 | | | | 3,160 | |

Castle Oaks, Metropolitan District No. 3, GO | | | | | | | | |

Pre-Refunded @ 100 | | | | | | | | |

5.500%, 12/01/20(C) | | | 2,345 | | | | 2,562 | |

Clear Creek Station Metropolitan District No. 2, Ser A, GO | | | | | | | | |

Callable 12/01/22 @ 103 | | | | | | | | |

5.000%, 12/01/47 | | | 1,000 | | | | 1,021 | |

Colorado State, Educational & Cultural Facilities Authority, Aspen Ridge School Project, RB | | | | | | | | |

Callable 07/01/25 @ 100 | | | | | | | | |

5.250%, 07/01/46(B) | | | 1,930 | | | | 1,955 | |

Colorado State, Educational & Cultural Facilities Authority, Aspen Ridge School Project, RB | | | | | | | | |

Callable 07/01/25 @ 100 | | | | | | | | |

5.000%, 07/01/36(B) | | | 915 | | | | 929 | |

Colorado State, Educational & Cultural Facilities Authority, Charter School Preparatory School Project, RB | | | | | | | | |

Callable 04/01/25 @ 100 | | | | | | | | |

5.250%, 04/01/45(B) | | | 2,655 | | | | 2,690 | |

Colorado State, Educational & Cultural Facilities Authority, Charter School Preparatory School Project, RB | | | | | | | | |

Callable 04/01/25 @ 100 | | | | | | | | |

5.125%, 04/01/35(B) | | | 1,515 | | | | 1,546 | |

Colorado State, Health Facilities Authority, Sunny Vista Living Center, Ser A, RB | | | | | | | | |

Callable 12/01/25 @ 100 | | | | | | | | |

6.125%, 12/01/45(B) | | | 1,000 | | | | 1,046 | |

Colorado State, High Performance Transportation Enterprise, U.S. 36 & I-25 Managed Lanes Project, RB, AMT | | | | | | | | |

Callable 01/01/23 @ 100 | | | | | | | | |

5.750%, 01/01/44 | | | 2,000 | | | | 2,182 | |

Colorado State, Public Energy Authority, RB | | | | | | | | |

6.500%, 11/15/38 | | | 6,000 | | | | 8,739 | |

Denver County, Health & Hospital Authority, Ser A, RB | | | | | | | | |

Callable 12/01/27 @ 100 | | | | | | | | |

4.000%, 12/01/35(B) | | | 1,835 | | | | 1,901 | |

Denver County, Health & Hospital Authority, Ser A, RB | | | | | | | | |

Callable 12/01/27 @ 100 | | | | | | | | |

4.000%, 12/01/36(B) | | | 2,305 | | | | 2,386 | |

Denver, Regional Transportation District, Denver Transportation Partners Project, RB | | | | | | | | |

Callable 07/15/20 @ 100 | | | | | | | | |

6.000%, 01/15/41 | | | 1,000 | | | | 1,028 | |

Erie Highlands Metropolitan District No. 1, GO | | | | | | | | |

Callable 12/01/20 @ 103 | | | | | | | | |

5.750%, 12/01/45 | | | 2,000 | | | | 2,036 | |

Erie Highlands Metropolitan District No. 2, Ser A, GO | | | | | | | | |

Callable 12/01/23 @ 103 | | | | | | | | |

5.250%, 12/01/48 | | | 5,725 | | | | 5,826 | |

Flatiron Meadows Metropolitan District, GO | | | | | | | | |

Callable 12/01/21 @ 103 | | | | | | | | |

5.125%, 12/01/46 | | | 2,000 | | | | 1,990 | |

Great Western Park Metropolitan District No. 2, Ser A, GO | | | | | | | | |

Callable 12/01/21 @ 100 | | | | | | | | |

5.000%, 12/01/46 | | | 1,825 | | | | 1,837 | |

Green Gables Metropolitan District No. 1, Ser A, GO | | | | | | | | |

Callable 12/01/21 @ 103 | | | | | | | | |

5.300%, 12/01/46 | | | 2,500 | | | | 2,547 | |

Lewis Pointe, Metropolitan District, Ser A, GO | | | | | | | | |

Callable 12/01/20 @ 100 | | | | | | | | |

6.000%, 12/01/44 | | | 2,590 | | | | 2,604 | |

Leyden Rock Metropolitan District No. 10, Ser A, GO | | | | | | | | |

Callable 12/01/21 @ 103 | | | | | | | | |

5.000%, 12/01/45 | | | 2,500 | | | | 2,544 | |

Leyden Rock Metropolitan District No. 10, Ser A, GO | | | | | | | | |

Callable 12/01/21 @ 103 | | | | | | | | |

4.375%, 12/01/33 | | | 1,500 | | | | 1,505 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 18

schedule of investments |

March 31, 2019 (Unaudited) |

City National Rochdale Municipal High Income Fund(continued) |

Description | | Face Amount (000) | | | Value (000) | |

North Holly, Metropolitan District, Ser A, GO | | | | | | | | |

Callable 12/01/23 @ 103 | | | | | | | | |

5.500%, 12/01/48 | | $ | 1,755 | | | $ | 1,763 | |

Overlook Metropolitan District, GO | | | | | | | | |

Callable 12/01/21 @ 103 | | | | | | | | |

5.500%, 12/01/46 | | | 1,230 | | | | 1,206 | |

Serenity Ridge, Metropolitan District No. 2, Ser A, GO | | | | | | | | |

Callable 12/01/23 @ 103 | | | | | | | | |

5.125%, 12/01/37 | | | 550 | | | | 568 | |

Serenity Ridge, Metropolitan District No. 2, Ser A, GO | | | | | | | | |

Callable 12/01/23 @ 103 | | | | | | | | |

5.125%, 12/01/43 | | | 1,000 | | | | 1,026 | |

Sierra Ridge Metropolitan District No. 2, Ser A, GO | | | | | | | | |

Callable 12/01/21 @ 103 | | | | | | | | |

5.500%, 12/01/46 | | | 1,500 | | | | 1,541 | |

Solaris, Metropolitan District No. 3, Ser A, GO | | | | | | | | |

5.000%, 12/01/36 | | | 700 | | | | 721 | |

Solaris, Metropolitan District No. 3, Ser A, GO | | | | | | | | |

Callable 12/01/21 @ 103 | | | | | | | | |

5.000%, 12/01/46 | | | 2,530 | | | | 2,587 | |

Southglenn, Metropolitan District, GO | | | | | | | | |

Callable 12/01/21 @ 103 | | | | | | | | |

5.000%, 12/01/46 | | | 3,675 | | | | 3,715 | |

Southglenn, Metropolitan District, GO | | | | | | | | |

Callable 12/01/21 @ 103 | | | | | | | | |

3.500%, 12/01/26 | | | 1,750 | | | | 1,699 | |

Southlands, Metropolitan District No. 1, Ser A-1, GO | | | | | | | | |

Callable 12/01/27 @ 100 | | | | | | | | |

5.000%, 12/01/37 | | | 500 | | | | 539 | |

Southlands, Metropolitan District No. 1, Ser A-1, GO | | | | | | | | |

Callable 12/01/27 @ 100 | | | | | | | | |

5.000%, 12/01/47 | | | 3,000 | | | | 3,184 | |

Stone Creek Metropolitan District, Ser A, GO | | | | | | | | |

Callable 12/01/23 @ 103 | | | | | | | | |

5.625%, 12/01/47 | | | 2,000 | | | | 2,019 | |

Villas Metropolitan District, Ser A, GO | | | | | | | | |

Callable 12/01/23 @ 103 | | | | | | | | |

5.125%, 12/01/48 | | | 1,250 | | | | 1,259 | |

Water Valley, Metropolitan District No. 01, GO | | | | | | | | |

Callable 12/01/26 @ 100 | | | | | | | | |

5.250%, 12/01/40 | | | 300 | | | | 321 | |

Water Valley, Metropolitan District No. 01, GO | | | | | | | | |

Callable 12/01/26 @ 100 | | | | | | | | |

5.000%, 12/01/35 | | | 100 | | | | 106 | |

Water Valley, Metropolitan District No. 01, GO | | | | | | | | |

Callable 12/01/26 @ 100 | | | | | | | | |

4.000%, 12/01/33 | | | 375 | | | | 372 | |

Water Valley, Metropolitan District No. 02, GO | | | | | | | | |

Callable 12/01/26 @ 100 | | | | | | | | |

5.250%, 12/01/40 | | | 1,045 | | | | 1,118 | |

Water Valley, Metropolitan District No. 02, GO | | | | | | | | |

Callable 12/01/26 @ 100 | | | | | | | | |

4.000%, 12/01/33 | | | 250 | | | | 242 | |

Westcreek Metropolitan District No. 2, Ser A, GO | | | | | | | | |

Callable 06/01/24 @ 103 | | | | | | | | |

5.375%, 12/01/48(B) | | | 1,300 | | | | 1,303 | |

Whispering Pines Metropolitan District No. 1, Ser A, GO | | | | | | | | |

Callable 12/01/22 @ 103 | | | | | | | | |

5.000%, 12/01/37 | | | 1,685 | | | | 1,717 | |

Whispering Pines Metropolitan District No. 1, Ser A, GO | | | | | | | | |

Callable 12/01/22 @ 103 | | | | | | | | |

5.000%, 12/01/47 | | | 2,500 | | | | 2,530 | |

| | | | | | | | | |

Total Colorado | | | 105,279 | |

| | | | | | | | | |

Connecticut [0.4%] |

Tender Option Bond Trust Receipts/Certificates, Ser 2016-XM0449, RB | | | | | | | | |

Callable 06/01/26 @ 100 | | | | | | | | |

8.650%, 12/01/45(A) (B) (G) | | | 3,335 | | | | 4,647 | |

| | | | | | | | | |

Delaware [0.2%] |

Delaware State, Economic Development Authority, Indian River Power Project, RB | | | | | | | | |

Callable 10/01/20 @ 100 | | | | | | | | |

5.375%, 10/01/45 | | | 2,000 | | | | 2,077 | |

| | | | | | | | | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 19

schedule of investments |

March 31, 2019 (Unaudited) |

City National Rochdale Municipal High Income Fund(continued) |

Description | | Face Amount (000) | | | Value (000) | |

District of Columbia [0.3%] |

District of Columbia, Tobacco Settlement Financing, Ser A, RB | | | | | | | | |

Callable 04/29/19 @ 19 | | | | | | | | |

7.502%, 06/15/46(D) | | $ | 8,000 | | | $ | 1,251 | |

Metropolitan Washington, Airports Authority, Dulles Toll Road Revenue, Ser B, RB | | | | | | | | |

Callable 10/01/28 @ 100 | | | | | | | | |

6.500%, 10/01/44 | | | 2,000 | | | | 2,586 | |

| | | | | | | | | |

Total District of Columbia | | | 3,837 | |

| | | | | | | | | |

Florida [5.1%] |

Alachua County, Health Facilities Authority, East Ridge Retirement Village Project, RB | | | | | | | | |

Callable 11/15/24 @ 100 | | | | | | | | |

6.250%, 11/15/44 | | | 2,690 | | | | 2,345 | |

Alachua County, Health Facilities Authority, East Ridge Retirement Village Project, RB | | | | | | | | |

Callable 11/15/24 @ 100 | | | | | | | | |

6.000%, 11/15/34 | | | 2,500 | | | | 2,269 | |

Brevard County, Industrial Development Authority, TUFF Florida Tech Project, RB | | | | | | | | |

Callable 11/01/19 @ 100 | | | | | | | | |

6.750%, 11/01/39 | | | 960 | | | | 976 | |

Capital Trust Agency, RB | | | | | | | | |

Callable 01/01/29 @ 100 | | | | | | | | |

5.375%, 07/01/54(B) | | | 1,500 | | | | 1,520 | |

Capital Trust Agency, RB | | | | | | | | |

Callable 01/01/29 @ 100 | | | | | | | | |

5.125%, 07/01/39(B) | | | 1,500 | | | | 1,520 | |

Florida State, Capital Trust Agency, Silver Creek St. Augustine, RB | | | | | | | | |

Callable 04/29/19 @ 100 | | | | | | | | |

7.000%, 01/01/35(A) (E) | | | 815 | | | | 774 | |

Florida State, Capital Trust Agency, Silver Creek St. Augustine, RB | | | | | | | | |

Callable 04/29/19 @ 100 | | | | | | | | |

5.750%, 01/01/50(E) | | | 945 | | | | 898 | |

Florida State, Capital Trust Agency, Silver Creek St. Augustine, Ser A, RB | | | | | | | | |

Callable 01/01/21 @ 103 | | | | | | | | |

8.250%, 01/01/44(E) | | | 3,390 | | | | 2,373 | |

Florida State, Capital Trust Agency, Silver Creek St. Augustine, Ser A, RB | | | | | | | | |

Callable 01/01/21 @ 103 | | | | | | | | |

8.250%, 01/01/49(E) | | | 1,000 | | | | 700 | |

Florida State, Development Finance, Renaissance Charter School Project, RB | | | | | | | | |

Callable 06/15/25 @ 100 | | | | | | | | |

6.125%, 06/15/46(B) | | | 4,930 | | | | 5,129 | |

Florida State, Development Finance, Renaissance Charter School Project, Ser A, RB | | | | | | | | |

Callable 06/15/22 @ 100 | | | | | | | | |

6.125%, 06/15/43(B) | | | 1,000 | | | | 1,015 | |

Florida State, Development Finance, Renaissance Charter School Project, Ser A, RB | | | | | | | | |

Callable 06/15/24 @ 100 | | | | | | | | |

6.125%, 06/15/44 | | | 3,000 | | | | 3,181 | |

Florida State, Development Finance, Renaissance Charter School Project, Ser A, RB | | | | | | | | |

Callable 06/15/24 @ 100 | | | | | | | | |

6.000%, 06/15/34 | | | 2,110 | | | | 2,257 | |

Florida State, Village Community Development District No. 10, SAB | | | | | | | | |

Callable 05/01/23 @ 100 | | | | | | | | |

6.000%, 05/01/44 | | | 940 | | | | 1,064 | |

Florida State, Village Community Development District No. 12, SAB | | | | | | | | |

Callable 05/01/26 @ 100 | | | | | | | | |

3.875%, 05/01/47 | | | 2,965 | | | | 2,972 | |

Jacksonville, Jacksonville University Project, Ser B, RB | | | | | | | | |

Callable 06/01/28 @ 100 | | | | | | | | |

5.000%, 06/01/53(B) | | | 1,000 | | | | 1,054 | |

Lakewood Ranch, Stewardship District, SAB | | | | | | | | |

Callable 05/01/27 @ 100 | | | | | | | | |

5.250%, 05/01/37 | | | 1,815 | | | | 1,910 | |

Miami-Dade County, Educational Facilities Authority, Ser A, RB | | | | | | | | |

Callable 04/01/28 @ 100 | | | | | | | | |

4.000%, 04/01/53 | | | 1,500 | | | | 1,554 | |

Miami-Dade County, Industrial Development Authority, Pinecrest Academy Project, RB | | | | | | | | |

Callable 09/15/24 @ 100 | | | | | | | | |

5.250%, 09/15/44 | | | 4,300 | | | | 4,578 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 20

schedule of investments |

March 31, 2019 (Unaudited) |

City National Rochdale Municipal High Income Fund(continued) |

Description | | Face Amount (000) | | | Value (000) | |

Miami-Dade County, Industrial Development Authority, Youth CO-OP Charter Schools Project, Ser A, RB | | | | | | | | |

Callable 09/15/25 @ 100 | | | | | | | | |

5.750%, 09/15/35(B) | | $ | 1,605 | | | $ | 1,648 | |

Mid-Bay, Bridge Authority, Ser A, RB | | | | | | | | |

Pre-Refunded @ 100 | | | | | | | | |

7.250%, 10/01/21(C) | | | 5,200 | | | | 5,911 | |

Mid-Bay, Bridge Authority, Ser A, RB | | | | | | | | |

Callable 10/01/25 @ 100 | | | | | | | | |

5.000%, 10/01/35 | | | 5,000 | | | | 5,573 | |

Osceola County, Finance Authority, Poinciana Parkway Project, Ser A, RB | | | | | | | | |

Callable 10/01/24 @ 100 | | | | | | | | |

5.375%, 10/01/47 | | | 5,000 | | | | 5,385 | |

Palm Beach County, Health Facilities Authority, Sinai Residences Project, Ser A, RB | | | | | | | | |

Callable 06/01/22 @ 102 | | | | | | | | |

7.500%, 06/01/49 | | | 2,000 | | | | 2,257 | |

Palm Beach County, Health Facilities Authority, Sinai Residences Project, Ser A, RB | | | | | | | | |

Callable 06/01/22 @ 102 | | | | | | | | |

7.250%, 06/01/34 | | | 500 | | | | 561 | |

Saint Johns County, Industrial Development Authority, Presbyterian Retirement Project, Ser A, RB | | | | | | | | |

Pre-Refunded @ 100 | | | | | | | | |

6.000%, 08/01/20(C) | | | 3,000 | | | | 3,172 | |

Village Community Development District No. 12, SAB | | | | | | | | |

Callable 05/01/28 @ 100 | | | | | | | | |

4.250%, 05/01/43(B) | | | 2,500 | | | | 2,564 | |

Village Community Development District No. 12, SAB | | | | | | | | |

Callable 05/01/28 @ 100 | | | | | | | | |

4.000%, 05/01/33(B) | | | 1,500 | | | | 1,538 | |

| | | | | | | | | |

Total Florida | | | 66,698 | |

| | | | | | | | | |

Georgia [1.1%] |

Atlanta, Department of Aviation, Ser A, RB | | | | | | | | |

Callable 01/01/24 @ 100 | | | | | | | | |

5.000%, 01/01/31 | | | 2,500 | | | | 2,845 | |

DeKalb County, Hospital Authority, Dekalb Medical Center Project, RB | | | | | | | | |

Pre-Refunded @ 100 | | | | | | | | |

6.125%, 09/01/20(C) | | | 1,000 | | | | 1,062 | |

Gainesville & Hall County, Development Authority, Riverside Military Academy, RB | | | | | | | | |

Callable 03/01/27 @ 100 | | | | | | | | |

5.125%, 03/01/52 | | | 2,925 | | | | 3,085 | |

Gainesville & Hall County, Development Authority, Riverside Military Academy, RB | | | | | | | | |

Callable 03/01/27 @ 100 | | | | | | | | |