As filed with the Securities and Exchange Commission on June 24, 2005

Registration No. 333-119560

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE

AMENDMENT NO. 1 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

JWH GLOBAL TRUST

(Exact name of registrant as specified in its charter)

Delaware |

| 6799 |

| 36-4113382 |

(State of Organization) |

| (Primary Standard Industrial |

| (IRS Employer |

c/o CIS Investments, Inc.

233 South Wacker Drive

Suite 2300

Chicago, Illinois 60606

(312) 460-4000

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

Annette Cazenave

c/o CIS Investments, Inc.

233 South Wacker Drive

Suite 2300

Chicago, Illinois 60606

(312) 460-4000

(Name, address, including zip code, and telephone number, including area code,

of agent for service)

Copies to:

Kenneth Rosenzweig

Peter Schultz

Mayer, Brown, Rowe & Maw LLP

71 South Wacker Drive

Chicago, Illinois 60606

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 (the “Securities Act”) check the following box. ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Pursuant to the provisions of Rule 429 under the Securities Act, this Registration Statement relates to Registration Statement No. 333-105282 filed by the Registrant. The prospectus forming part of this Registration Statement shall serve the purpose specified in said Rule 429.

[This page intentionally left blank]

JWH GLOBAL TRUST

$545,167,627

Units of Beneficial Interest

The Trust

The Trust trades in the U.S. and international futures and forward markets in currencies, interest rates, energy and agricultural products, metals and stock indices.

The primary objective of the Trust is substantial capital appreciation over time by applying trend-following strategies.

It seeks to reduce volatility and risk of loss by participating in broadly diversified global markets and implementing risk control policies.

An investment in the Trust offers a potentially valuable means of diversifying a traditional portfolio.

The Trading Advisor

John W. Henry & Company, Inc. (JWH®) is one of the largest professional managed futures advisors in terms of assets under management in the managed futures industry.

The Trust utilizes the Trading Advisor’s Financial and Metals Portfolio, JWH GlobalAnalytics® Family of Programs, the International Foreign Exchange Program and the Global Financial and Energy Portfolio.

Managing Owner

CIS Investments, Inc. (CISI) is the Managing Owner and sponsor of the Trust.

The Managing Owner is a subsidiary of Cargill Investor Services, Inc. (CIS). CIS is a subsidiary of Cargill, Incorporated, one of the largest private companies in the United States.

The Units

The Units are available for subscription on the last day of each month at the Net Asset Value per Unit.

As of May 31, 2005, the Net Asset Value per Unit had increased from $100 as of June 2, 1997, when the Trust began trading, to $128.75. Past performance is not necessarily indicative of future results.

Subscriptions as received will be deposited in escrow at JP Morgan Trust Company, NA until being invested in the Units as of the last day of the month. All interest actually earned on an investor’s subscription while held in escrow will be used to purchase additional Units for such investor.

The Units are offered on a best efforts basis by a number of selling agents. CIS Securities, Inc. is the Lead Selling Agent of the Units. There is no minimum number of Units which must be sold as of the beginning of any particular month.

The Risks

Before you decide whether to invest, read this entire prospectus carefully and consider “The Risks You Face” beginning on page 11.

• You could lose all or substantially all of your investment in the Trust.

• The Trust is speculative and it takes positions with total values that are bigger than the total amount of the Trust’s assets. The face value of the Trust’s positions typically range from three to fifteen times its aggregate Net Assets.

• Performance has been volatile. The Net Asset Value per Unit has fluctuated over 21% in a single month.

• The use of a single advisor applying a limited number of generally similar trading programs decreases diversification relative to a fund using multiple advisors and increases risk.

• Substantial expenses, totaling about 9.63% per annum, must be offset by trading profits and interest income.

• The Trust trades to a substantial degree on non-U.S. markets which are not subject to the same degree of regulation as U.S. markets.

• There is no market for the Units. Units may only be redeemed as of the end of a calendar month subject to a 3% redemption charge through the end of the eleventh month after issuance.

• Investors are required to make representations and warranties in connection with their investment.

• Each prospective investor is encouraged to discuss the investment with his/her individual financial, legal and tax adviser.

Minimum Investments |

|

|

| |

First-time investors: |

| $ | 5,000 |

|

IRAs, other tax-exempt accounts: |

| $ | 2,000 |

|

Existing investors: |

| $ | 1,000 |

|

This prospectus is in two parts: a disclosure document and a statement of additional

information. These parts are bound together, and both contain important information.

Neither the Securities and Exchange Commission nor any state securities commission has approved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE

MERITS OF PARTICIPATING IN THIS POOL NOR HAS THE COMMISSION PASSED ON THE

ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT.

CIS INVESTMENTS, INC.

Managing Owner

August 1, 2005

COMMODITY FUTURES TRADING COMMISSION

RISK DISCLOSURE STATEMENT

YOU SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE AWARE THAT FUTURES AND OPTIONS TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS GAINS. SUCH TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND CONSEQUENTLY THE VALUE OF YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS ON REDEMPTIONS MAY AFFECT YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE POOL.

FURTHER, COMMODITY POOLS MAY BE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT, ADVISORY AND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS. THIS DISCLOSURE DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF EACH EXPENSE TO BE CHARGED THIS POOL AT PAGES 33 TO 34 AND A STATEMENT OF THE PERCENTAGE RETURN NECESSARY TO BREAKEVEN, THAT IS, TO RECOVER THE AMOUNT OF YOUR INITIAL INVESTMENT, AT PAGE 4.

THIS BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO EVALUATE YOUR PARTICIPATION IN THIS COMMODITY POOL. THEREFORE, BEFORE YOU DECIDE TO PARTICIPATE IN THIS COMMODITY POOL, YOU SHOULD CAREFULLY STUDY THIS DISCLOSURE DOCUMENT, INCLUDING A DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF THIS INVESTMENT, AT PAGES 11 TO 16.

YOU SHOULD ALSO BE AWARE THAT THIS COMMODITY POOL MAY TRADE FOREIGN FUTURES OR OPTIONS CONTRACTS. TRANSACTIONS ON MARKETS LOCATED OUTSIDE THE UNITED STATES, INCLUDING MARKETS FORMALLY LINKED TO A UNITED STATES MARKET, MAY BE SUBJECT TO REGULATIONS WHICH OFFER DIFFERENT OR DIMINISHED PROTECTION TO THE POOL AND ITS PARTICIPANTS. FURTHER, UNITED STATES REGULATORY AUTHORITIES MAY BE UNABLE TO COMPEL THE ENFORCEMENT OF THE RULES OF REGULATORY AUTHORITIES OR MARKETS IN NON-UNITED STATES JURISDICTIONS WHERE TRANSACTIONS FOR THE POOL MAY BE EFFECTED.

Please see the important Privacy Policy Statement on Page 77.

This prospectus does not include all of the information or exhibits in the Trust’s Registration Statement. You can read and copy the entire Registration Statement at the public reference facilities maintained by the SEC in Washington, D.C.

The Trust files quarterly and annual reports with the SEC. You can read and copy these reports at the SEC public reference facilities in Washington D.C. at 100 F Street, N.E., Washington D.C. 20549. Please call the SEC at 1-202-942-8090, or toll free at 1-800-SEC-0330, for further information.

The Trust’s filings are posted at the SEC website at http://www.sec.gov.

CIS INVESTMENTS, INC.

Managing Owner

233 South Wacker Drive

Suite 2300

Chicago, Illinois 60606

(888) 292-9399

JWH GLOBAL TRUST

Contents

PART ONE |

| |

|

| |

| ||

| ||

| ||

| ||

| ||

| ||

Quantitative and Qualitative Disclosures About the Trust’s Market Risk |

| |

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

|

| |

| ||

|

| |

| ||

| ||

| ||

|

| |

Exhibit A — Sixth Amended and Restated Declaration and Agreement of Trust |

| |

| ||

| ||

General

JWH Global Trust is a Delaware statutory trust which trades in a wide range of U.S. and international futures and forward markets. CIS Investments, Inc. (“CISI”) is the Trust’s Managing Owner. John W. Henry & Company, Inc. (“JWH®”) is its Trading Advisor.

The Trust began trading on June 2, 1997 with an initial capitalization of $13,027,103 and a Net Asset Value per Unit of $100. As of May 31, 2005, the Trust’s capitalization was approximately $301 million, the Net Asset Value per Unit was $128.75, and the Trust had a total of 13,993 Unitholders.

The Trust and Its Objectives

The primary objective of the Trust is substantial capital appreciation through trading directed by JWH. At the same time, JWH will attempt to reduce volatility and risk of loss by participating in diversified markets and applying risk control policies.

Through an investment in the Trust, investors have the opportunity to participate in markets not typically represented in an individual’s portfolio, and the potential to profit from rising as well as falling prices. The success of JWH’s trading is not dependent upon favorable economic conditions, national or international. Indeed, periods of economic uncertainty can augment the profit potential of the Trust by increasing the likelihood of significant movements in commodity prices, the exchange rates between various countries, world stock prices and interest rates.

The Trust allocates 30% of its assets to JWH’s Financial and Metals Portfolio, 30% to the JWH GlobalAnalytics® Family of Programs, 20% to the International Foreign Exchange Program and 20% to the Global Financial and Energy Portfolio. JWH rebalances the Trust’s assets at the end of each quarter among these four trading programs in accordance with the preceding percentages.

2

The Managing Owner

The Managing Owner and Commodity Pool Operator of the Trust is CISI. CISI was incorporated in Delaware in 1983 and is a subsidiary of CIS, the Trust’s futures broker. In addition to the Trust, CISI currently operates two public commodity pools jointly with IDS Futures Corporation. As of May 31, 2005, the aggregate capitalization of the funds managed by CISI was approximately $328 million. CISI maintains its principal office at 233 South Wacker Drive, Suite 2300, Chicago, Illinois 60606; telephone (312) 460-4000.

See the organizational chart of the Trust at page 10 and “Transactions Between the CIS Group and the Trust” at page 69.

JWH

JWH has been the sole Trading Advisor for the Trust since inception. JWH manages capital in commodities, financial futures and foreign exchange markets for international banks, brokerage firms, pension funds, institutions and high net worth individuals. JWH trades on a 24-hour basis in a wide range of futures and forward contracts — more than seventy markets as of the date of this prospectus — in the United States, Europe and Asia. JWH is one of the largest managed futures advisors in terms of assets under management, trading approximately $2.6 billion in client capital as of April 30, 2005.

The Offering

Units are available for subscription at the Net Asset Value per Unit as of the close of business on the last business day of each calendar month. CIS Securities, Inc. is the Lead Selling Agent of the Units and the Units are offered on a best efforts basis by a number of additional selling agents.

In order to purchase Units, an investor must complete, execute and deliver to a Selling Agent an original of the Subscription Agreement and Power of Attorney Signature Page which accompanies this prospectus. Subscription documents must be received no later than the fifth business day prior to the month-end of investment (including the last business day of the month) in order to be accepted as of the last day of the month.

The minimum initial investment is $5,000; $2,000 for trustees or custodians of eligible employee benefit plans and individual retirement accounts. Subscriptions in excess of these minimums are permitted in $100 increments. Additional subscriptions by existing Unitholders are permitted in $1,000 minimums with $100 increments. There is no minimum number of Units which must be sold as of the beginning of any particular month.

Subscriptions as received will be deposited in escrow at JP Morgan Trust Company, NA until being invested in the Units as of the last day of the month. All interest actually earned on an investor’s subscription while held in escrow will be used to purchase additional Units for such investor.

Major Risks of the Trust

The Trust is a speculative investment. It is not possible to predict how the Trust will perform over either the long or short term.

Investors must be prepared to lose all or substantially all of their investment in the Units.

There can be no assurance that the past performance of either the Trust or JWH is indicative of how they will perform in the future.

The Trust is a single-advisor fund, which is likely to involve higher risk than multi-advisor funds.

To date, the performance of the Trust has been volatile. The Net Asset Value per Unit has varied by more than 21% in a single month.

The Trust could incur large losses over short periods.

The Trust typically takes positions with a face value of three to fifteen times its total Net Assets.

Positive correlation among the trading programs (because they trade in some of the same markets and are all technical, trend-following programs) reduces diversification and increases the risk of loss.

The performance of the JWH trading programs is dependent upon market trends of the type

3

that JWH’s models are designed to identify. Trendless periods are frequent, and during such periods the Trust is unlikely to be profitable.

Trading on foreign contract markets involves additional risks, including the risks of inadequate or lack of regulation, exchange-rate fluctuations, expropriation, credit and investment controls and counterparty insolvency.

There can be no assurance of the continued availability of JWH or its key principals.

Because its performance is entirely unpredictable, there is no way of telling when is a good time to invest in the Trust. Investors have no means of knowing whether they are buying Units at a time when profitable periods are ending, beginning, or not in progress.

The Units are not transferable and may only be redeemed once a month. Because investors must submit subscriptions as well as redemption notices by the fifth business day prior to month-end, they cannot know the Net Asset Value at which they will acquire or redeem Units. Investors cannot control the maximum losses on their Units because they cannot be sure of the redemption value of their Units.

As Unitholders, investors have no voice in the operation of the Trust; they are entirely dependent on the management of CISI and JWH for the success of their investment.

Redemptions

You can redeem Units at their month-end Net Asset Value at the end of each month. CISI must receive your redemption request no later than the fifth business day prior to the month-end of redemption. A redemption charge of 3% of the Net Asset Value of the Units redeemed applies to Units redeemed on or before the eleventh month-end from the date Units are issued.

Fees and Expenses

The Incentive Fee payable to JWH is calculated on a quarterly basis and could be substantial even in a breakeven or losing year. The Trust’s other significant expenses are its Brokerage and Management Fees. If the Trust’s Net Asset Value increases, the absolute dollar amount of these percentage-of-assets fees will also, but they will have the same effect on the Trust’s rate of return. The following breakeven table indicates the approximate amount of trading profit the Trust must earn during the first twelve months after a Unit is purchased to offset the costs of the Trust.

Breakeven Table

Expenses |

| Twelve-Month |

| Twelve-Month |

| |

Brokerage Fees |

| 6.00 | % | $ | 300.00 |

|

Management Fee |

| 2.00 | % | $ | 100.00 |

|

Incentive Fee* |

| 1.00 | % | $ | 50.00 |

|

Administrative Expenses* |

| 0.13 | % | $ | 6.50 |

|

Ongoing Offering Costs |

| 0.50 | % | $ | 25.00 |

|

Less Interest Income* |

| (2.00 | )% | $ | (100.00 | ) |

Return on $5,000 Initial Investment Required For “Breakeven” If Units Held At Least Twelve Months** |

| 7.63 | % | $ | 381.50 |

|

* Estimated. The Incentive Fee is 20% of New Trading Profits and is paid quarterly; consequently, an Incentive Fee could be paid in a breakeven or losing year. Interest Income is estimated at 2% (variable based on current interest rates).

‡ Assumes a constant $5,000 Net Asset Value.

** A redeeming Unitholder pays redemption charges equal to 3% of the redemption proceeds to CIS through the end of the eleventh month after the redeemed Unit was purchased. Redemption charges, if applicable, reduce the redemption proceeds otherwise payable to investors.

See “Charges” at page 33.

JWH’s Programs

JWH currently offers 11 investment programs in four categories: Broadly Diversified; Financial; Foreign Exchange; and Multiple Style. Broadly Diversified programs invest in a broad spectrum of worldwide financial and nonfinancial futures and forward markets including currencies, interest rates, non-U.S. stock indices, metals, energies and agricultural commodities. Financial programs invest in worldwide financial futures and forward markets including currencies, interest rates and stock indices in addition to the metals and energies markets.

4

Foreign Exchange programs invest in a wide range of world currencies primarily traded in the interbank market. Multiple Style programs involve the selection and allocation of assets among the other types of JWH investment programs on a discretionary basis.

JWH’s Programs Used for the Trust

Effective August 1, 2005, the Trust allocates its assets among JWH’s Financial and Metals Portfolio, JWH GlobalAnalytics® Family of Programs, the International Foreign Exchange Program and the Global Financial and Energy Portfolio. The Financial and Metals Portfolio, which began trading client funds in October 1984, is one of the longest established JWH programs. The JWH GlobalAnalytics® Family of Programs has been trading client capital since June 1997. The International Foreign Exchange Program has been trading client capital since August 1986. The Global Financial and Energy Portfolio has been trading client capital since June 1994. From January 1, 2000 through July 31, 2005, the Trust allocated its assets among JWH’s Financial and Metals Portfolio, G-7 Currency Portfolio and JWH GlobalAnalytics Family of Programs.

The JWH programs used by the Trust may change materially over time. The Trust has employed other JWH programs in the past and may do so in the future without notice to investors.

Past performance is not necessarily indicative of future results.

Financial and Metals Portfolio

Markets Traded:

Interest Rates

Global Stock Indices

Currencies

Precious Metals

The Financial and Metals Portfolio began trading client capital in October 1984. The Financial and Metals Portfolio seeks to identify and capitalize on intermediate-term price movements in four worldwide market sectors: interest rates, currencies, global stock indices and metals. This program takes a market position when trends are identified but may take a neutral stance or liquidate open positions in non-trending markets. As of April 30, 2005, JWH had approximately $392 million under management pursuant to the Financial and Metals Portfolio.

JWH GlobalAnalytics® Family of Programs

Markets Traded:

Interest Rates

Global Stock Indices

Currencies

Energies

Softs

Grains

Fiber

Precious and Base Metals

Introduced in June 1997, JWH GlobalAnalytics® Family of Programs is the result of extensive research and testing by JWH. The program invests in a broad spectrum of worldwide financial and non-financial futures markets, including interest rate, global stock index, currency, metal, energy and agricultural contracts. Unlike other JWH programs, which invest in intermediate or long-term price movements, JWH GlobalAnalytics® Family of Programs invests in both long- and short-term price movements. JWH GlobalAnalytics® Family of Programs uses a combination of two investment styles, one of which always maintains a market position — long or short — and the other of which takes a market position when trends are identified but may take a neutral stance or liquidate open positions in non-trending markets. As of April 30, 2005, JWH had approximately $248 million under management in the JWH GlobalAnalytics® Family of Programs.

International Foreign Exchange Program

Markets Traded:

Currencies

The International Foreign Exchange Program seeks to identify and capitalize on intermediate-term price movements in a broad range of both major and minor currencies, primarily trading in the interbank market. Positions are taken outright against the U.S. dollar or as non-dollar cross rates. This program uses the three-phase forex investment style. As of April 30, 2005, JWH had approximately $184 million under management pursuant to the International Foreign Exchange Program.

5

Global Financial and Energy Portfolio

Markets Traded:

Currencies

Energies

Global Stock Indices

Interest Rates

Precious and Base Metals

The Global Financial and Energy Portfolio seeks to identify and capitalize on long-term price movements in five worldwide market sectors: currencies, energies, global stock indices, interest rates, and metals. This program uses the two-phase investment style. Beginning in April 1995, the position size in relation to account equity in this program was reduced approximately 50%. Since the change was implemented, the Global Financial and Energy Portfolio has experienced lower volatility. In 1997, the sector allocation for the program was expanded to include metals. The quantitative model underlying the program was not changed. As of April 30, 2005, JWH had approximately $25 million under management pursuant to the Global Financial and Energy Portfolio.

Past performance is not necessarily indicative of future results.

Allocation Among JWH Programs

The Managing Owner has the discretion, subject to JWH’s agreement, from time to time, to alter the allocation of the Trust’s assets among the JWH trading programs, to delete a trading program or to add other JWH programs. In deciding whether to delete or add a JWH program, the Managing Owner will consider, among other things, recent and/or expected economic and market conditions, the performance of each trading program and the trading programs combined, the performance of other JWH programs, and the market sector concentration of the trading programs currently being used by the Trust as well as the other JWH programs. If the Trust’s trading programs become concentrated in the same market sectors, or if the recent performance of a trading program appears incompatible with the Trust’s objectives, the Managing Owner and JWH might agree to terminate the use of that program and possibly replace it with another. The following pie charts show the historical allocations made by the Trust to the various JWH programs since the Trust’s inception.

Legend:

F&M: Financial and Metals Portfolio

G-7: G-7 Currency Portfolio

GA: JWH GlobalAnalytics® Family of Programs

Original: Original Investment Program

GFE: Global Financial and Energy Portfolio

FX: International Foreign Exchange Program

The JWH Programs Are Technical and Trend-Following, Computerized Systems

The mathematical models used by the JWH programs are technical systems, generating trading signals on the basis of statistical research into past market prices. JWH does not attempt to analyze underlying economic factors, identify mispricings in the market or predict future prices. Its analysis focuses exclusively on past price movements.

As a trend-following advisor, JWH’s objective is to participate in major price trends — sustained price movements either up or down. Such price trends may be relatively infrequent. Trend-following advisors anticipate that over half of their positions will be unprofitable. Their strategy is based on making sufficiently large profits from the trends which they identify and follow to generate overall profits despite the more numerous but, hopefully, smaller losses incurred on the majority of their positions.

6

Markets Traded

The Financial and Metals Portfolio, the JWH GlobalAnalytics® Family of Programs, the International Foreign Exchange Program and the Global Financial and Energy Portfolio emphasize trading in currencies, energies, global stock indices, interest rates, agricultural and the metals sectors. This participation may include the following:

Currencies

Australian Dollar

Brazilian Real

British Pound

Canadian Dollar

Chilean Peso

Czech Koruna

Danish Krone

Euro

Hong Kong Dollar

Japanese Yen

Korean Won

Mexican Peso

New Zealand Dollar

Norwegian Krone

Polish Zloty

Singapore Dollar

South African Rand

Swedish Krona

Swiss Franc

Taiwan Dollar

Thai Baht

U.S. Dollar

Indices

DAX (German)

DJ EuroStoxx 50

Goldman Sachs Commodity Index

FTSE 100 (UK)

Nasdaq 100

Nasdaq 100 E-Mini

Nikkei 225 Index

SFE SPI 200

S&P 500® Stock Index

Metals

Aluminum

Copper

Copper, High Grade

Gold

Lead

Nickel

Palladium

Platinum

Silver

Tin

Zinc

Energies

Brent Crude Oil

Crude Oil

Natural Gas

Heating Oil

Unleaded Gasoline

London Gasoil

Financial Instruments

Australian (90-day) Bank Bills

Australian (3-year and 10-year) Treasury Bonds

Canadian Bank Bills

Canadian Government Bonds

Euribor

Eurobund

Eurodollar

Euroswiss

Euroyen

Euro BOBL (5 year)

Euro Shatz (2 year)

Japanese Government Bond

U.K. Long “Gilt”

U.K. Short Sterling

U.S. 5- and 10-year Treasury Note

U.S. 30-year Bond

U.S. 2-year Note

Agricultural Products

Cocoa

Coffee

Corn

Cotton

Live Cattle

Soybeans

Soybean Meal

Soybean Oil

Sugar

Wheat

These markets are traded if and when contract liquidity, legal constraints, market conditions and data reliability standards meet JWH’s specifications.

As of May 31, 2005, the Trust had the approximate market sector commitments as shown in the pie chart below. Also shown on the following page are the approximate average market sector weightings of each JWH program currently used by the Trust for the three-year period ending May 31, 2005. The market sector weightings of the Trust and the JWH programs may vary significantly over time.

JWH Global Trust Sector Allocation

May 31, 2005

7

Average Sector Allocations (3-Year Average) as of May 31, 2005

Allocation to |

| JWH Program |

| Agriculture |

| Currencies |

| Energies |

| Global |

| Interest |

| Metals |

| |

30% |

|

| G-7 Currency Portfolio |

|

|

| 100.0 | % |

|

|

|

|

|

|

|

|

40% |

|

| Financial and Metals Portfolio |

|

|

| 32.4 | % |

|

| 21.3 | % | 38.8 | % | 7.5 | % |

30% |

|

| JWH GlobalAnalytics Family of Programs |

| 14.7 | % | 16.9 | % | 15.7 | % | 11.8 | % | 33.2 | % | 7.7 | % |

There is no way to predict which markets the Trust will trade or what its relative commitments to the different markets will be.

Varying the Size of the Trust’s Market Positions

JWH attempts to adjust the Trust’s position sizes and market exposure to meet its profit and risk-control objectives. Generally, only between 2% and 15% of the face value of a futures or forward position is required as margin to put on the position. Consequently, JWH has considerable flexibility to make significant changes in the size of the Trust’s open positions. For example, the margin requirement for the Treasury bond futures contract is only approximately 2% of the face value of each contract. This means that JWH could acquire, for each $100,000 of Trust capital, positions ranging from a single Treasury bond contract with a face value of $100,000 up to fifty such contracts with a face value of $5,000,000. The greater the market exposure of the Trust, the more profit or loss it will recognize as a result of the same price movement, and the greater its risk, profit potential and expected performance volatility.

Principal Tax Aspects of Owning Units

Investors are taxed each year on any gains recognized by the Trust whether or not they redeem any Units or receive any distributions from the Trust.

40% of any trading profits on U.S. exchange-traded contracts are taxed as short-term capital gains at the individual investor’s ordinary income tax rate, while 60% of such gains are taxed as long-term capital gain at a 15% maximum rate for individuals. The Trust’s trading gains from other contracts will be primarily short-term capital gain. This tax treatment applies regardless of how long an investor holds Units. If, on the other hand, an investor held a stock or bond for twelve months or longer, all the gain realized on its sale would generally be taxed at a 15% maximum rate.

Losses on the Units may be deducted against capital gains. Any losses in excess of capital gains may only be deducted against ordinary income to the extent of $3,000 per year. Consequently, investors could pay tax on the Trust’s interest income even though they have lost money on their Units. See “Tax Consequences” beginning at page 72.

An Investment in the Units Should be Considered as a Three to Five Year Commitment

The market conditions in which the Trust is likely to recognize significant profits occur infrequently. An investor should plan to hold Units for long enough to have a realistic opportunity for a number of such trends to develop.

CISI believes that investors should consider the Units at least a three- to five-year commitment.

(1) Effective August 1, 2005, the Trust ceased to allocate any of its assets to the G-7 Currency Portfolio. Effective August 1, 2005, the Trust allocates 30% of its assets to JWH’s Financial and Metals Portfolio, 30% to JWH GlobalAnalytics® Family of Programs, 20% to the International Foreign Exchange Program and 20% to the Global Financial and Energy Portfolio.

8

Is the Trust a Suitable Investment for You?

You should consider investing in the Trust if you are interested in its potential to produce enhanced returns over the long-term that are generally unrelated to the returns of the traditional debt and equity markets and you are prepared to risk significant losses. CISI offers the Trust only as a diversification opportunity for an investor’s entire investment portfolio, not as a complete investment program. No one should invest more than 10% of his or her readily marketable assets in the Trust.

Recent Development

On June 22, 2005, CIS and Refco Group Ltd., LLC, (“Refco”) a provider of execution and clearing services for exchange-traded derivatives and one of the world’s largest independent derivative brokers, announced that they had entered into a definitive agreement for Refco to acquire the global brokerage operations of CIS for $208 million in cash and future contingent cash payments of between $67 million and $192 million, based on performance of the acquired operations. As a result of the acquisition, Refco or one of its affiliates shall become the owner of the Managing Owner and an affiliate of Refco shall become the futures broker for the Trust. The transaction is expected to close following receipt of necessary regulatory clearances and satisfaction of contractual closing conditions. In the event the transaction closes, this prospectus will be amended to reflect that fact.

9

JWH GLOBAL TRUST

Organizational Chart

Other than JWH and the Trustee, all of the entities indicated in the Organizational Chart are Cargill, Incorporated affiliates.

For convenience, CISI and entities affiliated with it are sometimes collectively referred to as the “CIS Group.”

See “Conflicts of Interest” beginning at page 66 and “Transactions Between the CIS Group and the Trust” at page 69.

10

Possible Total Loss of an Investment in the Trust

You could lose all or substantially all of your investment in the Trust.

Specific Risks Associated with a Single-Advisor Fund

Even in the speculative area of managed futures, single-advisor funds are considered by some to be unusually high risk investments. Multi-advisor strategies are used by many “commodity pools” specifically for risk control purposes.

Investing in the Units Might Not Diversify an Overall Portfolio

One of the objectives of the Trust is to add an element of diversification to a traditional securities portfolio. While the Trust may perform in a manner largely independent from the general stock and bond markets, there is no assurance it will do so. An investment in the Trust could increase rather than reduce overall portfolio losses during periods when the Trust as well as stocks and bonds decline in value. There is no way of predicting whether the Trust will lose more or less than stocks and bonds in declining markets. Investors must not rely on the Trust as any form of hedge against losses in their core securities portfolios.

Prospective investors should consider whether diversification in itself is worthwhile even if the Trust is unprofitable.

Investors Must Not Rely on the Past Performance of Either JWH or the Trust in Deciding Whether to Buy Units

The performance of the Trust is entirely unpredictable, and the past performance of the Trust as well as of JWH is not necessarily indicative of their future results.

The price data which JWH has researched in developing its programs may not reflect the changing dynamics of future markets. If not, the JWH programs would have little chance of being profitable. An influx of new market participants, changes in market regulation, international political developments, demographic changes and numerous other factors can contribute to once-successful strategies becoming outdated. Not all of these factors can be identified, much less quantified. There can be no assurance that JWH will trade profitably.

Volatile JWH Trading History

JWH’s performance, even when successful, has been characterized by significant volatility. Since the inception of trading of the JWH programs, the largest “peak-to-valley” drawdown experienced by any single program was nearly 60% on a composite basis, and certain individual accounts managed pursuant to such program experienced even greater volatility. Moreover, certain programs have incurred losses of 10% or more in a single trading day. Even if the Trust is successful, it is likely to experience significant losses from time to time.

The performance of the Trust to date has been volatile.

The Similarities Among the JWH Programs Reduce Diversification, Increasing the Risk of Loss

The similarities among the programs reduce the Trust’s diversification. The less diversification, the higher the risk that the market will move against a large number of positions held by different programs at the same time, increasing losses.

Overlap of the Markets Traded by JWH Also Reduces Diversification, Increasing the Risk of Loss

The trading programs used by the Trust emphasize trading in the financial instrument and currency markets. The degree of market overlap changes with the program mix. However, in general, CISI expects the Trust will maintain a substantial concentration in these two sectors while the current programs continue to be used for the Trust. For example, the Trust may allocate more than 50% of its trading assets to a single market sector such as currencies. Market concentration increases the risk of major losses and unstable Unit values, as the same price movements adversely

11

affect many of the Trust’s concentrated positions at or about the same time.

As it is impossible to predict where price trends will occur, certain trend-following managers attempt to maximize the chance of exploiting such trends by taking positions in as many different markets and market sectors as feasible. The Trust does not follow this approach and, as a result, may not capture trends which would have been highly profitable.

Its Substantial Expenses Will Cause Losses for the Trust Unless Offset by Profits and Interest Income

The Trust pays fixed annual expenses of approximately 8.63% of its average month-end assets. In addition to this 8.63% annual expense level, the Trust is subject to 20% quarterly Incentive Fees on any New Trading Profits. Because these Incentive Fees are calculated quarterly, they could represent a substantial expense to the Trust even in a breakeven or losing year. Based on CISI’s experience with the Trust and its other funds, CISI expects that approximately 1% of the Trust’s average month-end assets might be paid out in Incentive Fees even during a losing year. Overall, investors must expect that the Trust will pay about 9.63% per year in expenses, 12.63% including the 3% redemption charge in effect for the first eleven months after a Unit is issued.

The Trust’s expenses could, over time, result in significant losses. Except for the Incentive Fee, these expenses are not contingent and are payable whether or not the Trust is profitable.

JWH Analyzes Only Technical Market Data, Not Any Economic Factors External to Market Prices

The JWH programs focus exclusively on statistical analysis of market prices. Consequently, any factor external to the market itself which dominates prices is likely to cause major losses. For example, a pending political or economic event may be very likely to cause a major price movement, but JWH would continue to maintain positions that would incur major losses as a result of such movement, if its programs indicated that it should do so.

The likelihood of the Units being profitable could be materially diminished during periods when events external to the markets themselves have an important impact on prices. During such periods, JWH’s historical price analysis could establish positions on the wrong side of the price movements caused by such events.

Lack of Price Trends or of the Types of Price Trends Which JWH Programs Can Identify Will Cause Major Losses

The Trust cannot trade profitably unless major price trends occur in at least certain markets that it trades. Many markets are trendless most of the time, and in static markets the JWH programs are likely to incur losses. In fact, JWH expects more than half of its trades to be unprofitable; it depends on significant gains from a few major trends to offset these losses. It is not just any price trend, but price trends of the type which JWH’s systems have been designed to identify, which are necessary for the Trust to be profitable.

The Danger to the Trust of “Whipsaw” Markets

Often, the most unprofitable market conditions for the Trust are those in which prices “whipsaw,” moving quickly upward, then reversing, then moving upward again, then reversing again. In such conditions, the JWH programs may establish losing positions based on incorrectly identifying both the brief upward or downward price movements as trends.

The Large Size of the Trust’s Trading Positions Increases the Risk of Sudden, Major Losses

The Trust takes positions with face values up to as much as approximately fifteen times its total equity. Consequently, even small price movements can cause major losses.

Unit Values Are Unpredictable and Vary Significantly Month-to-Month

The Net Asset Value per Unit can vary significantly month-to-month. In June 2002, there was more than a 21% change in the value of a Unit. Investors cannot know at the time they submit a subscription or a redemption request what the

12

subscription price or redemption value of their Units will be.

The only way to take money out of the Trust is to redeem Units. You can only redeem Units at month-end on five business days’ advance notice and subject to possible redemption charges. The restrictions imposed on redemptions limit your ability to protect yourself against major losses by redeeming Units.

Transfers of Units are subject to limitations as well, such as advance written notice of any intent to transfer and the consent of CISI to such transfer.

In addition, investors are unable to know whether they are subscribing for Units after a significant upswing in the Net Asset Value per Unit — often a time when the Trust has an increased probability of entering into a losing period.

The Opportunity Costs of Rebalancing the JWH Programs

The quarterly rebalancing of the Trust’s assets among its JWH trading programs may result in the liquidation of profitable positions, thereby foregoing greater profits which the Trust would otherwise have realized, and the establishment of unprofitable positions, thereby incurring losses which the Trust would otherwise have avoided had rebalancing not occurred.

Alteration of Trading Systems and Contracts and Markets Traded

JWH may, in its discretion, change and adjust the trading programs, as well as the contracts and markets which they trade. These adjustments may result in foregoing profits which the trading programs would otherwise have captured, as well as incurring losses which they would otherwise have avoided. Neither the Managing Owner nor the Unitholders are likely to be informed of any non-material changes in the trading programs.

Increased Competition from Other Trend-Following Traders Could Reduce JWH’s Profitability

There has been a dramatic increase over the past twenty-five years in the amount of assets managed by trend-following trading systems like the JWH programs. In 1980, the amount of assets in the managed futures industry were estimated at approximately $300 million; by March 31, 2005, this estimate had risen to approximately $127 billion. It is also estimated that over half of all managed futures trading advisors rely primarily on trend-following systems. Although the amount of trading in the futures industry as a whole has increased significantly during the same period of time, the increase in managed money increases trading competition. The more competition there is for the same positions, the more costly and harder they are to acquire.

JWH’s High Level of Equity Under Management Could Lead to Diminished Returns

JWH has a significant amount of assets under management. As of January 1, 1990, JWH had approximately $197 million under management; as of April 30, 2005, this figure had risen to approximately $2.6 billion. The more money JWH manages, the more difficult it may be for JWH to trade profitably because of the difficulty of trading larger positions without adversely affecting prices and performance. Large trades result in more price slippage than do smaller orders.

Illiquid Markets Could Make It Impossible for JWH to Realize Profits or Limit Losses

In illiquid markets, JWH could be unable to capitalize on the opportunities identified by it or to close out positions against which the market is moving. There are numerous factors which can contribute to market illiquidity, far too many for JWH to predict when or where illiquid markets may occur. JWH attempts to limit its trading to highly liquid markets, but there can be no assurance that a market which has been highly liquid in the past will not experience periods of unexpected illiquidity.

Unexpected market illiquidity has caused major losses in recent years in such sectors as

13

emerging markets, fixed income relative value strategies and mortgage-backed securities. There can be no assurance that the same will not happen to the Trust at any time or from time to time. The large size of the positions which JWH acquires for the Trust increases the risk of illiquidity by both making its positions more difficult to liquidate and increasing the losses incurred while trying to do so.

JWH Trades Extensively in Foreign Markets; These Markets Are Less Regulated Than U.S. Markets and Are Subject to Exchange Rate, Market Practices and Political Risks

The trading programs used for the Trust trade a great deal outside the U.S. From time to time, as much as 30%-50% of the Trust’s overall market exposure could involve positions taken on foreign markets. Foreign trading involves risks — including exchange-rate exposure, possible governmental intervention and lack of regulation — which U.S. trading does not. In addition, the Trust may not have the same access to certain positions on foreign exchanges as do local traders, and the historical market data on which JWH bases its strategies may not be as reliable or accessible as it is in the United States. Certain foreign exchanges may also be in a more or less developmental stage so that prior price histories may not be indicative of current price dynamics. The rights of clients in the event of the insolvency or bankruptcy of a non-U.S. market or broker are also likely to be more limited than in the case of U.S. markets or brokers.

Unregulated Markets Lack Regulatory Protections of Exchanges

A substantial portion of the Trust’s trading — primarily its trading of spot and forward contracts in currencies — takes place in unregulated markets. It is impossible to determine fair pricing, prevent abuses such as “front-running” or impose other effective forms of control over such markets. The absence of regulation could expose the Trust in certain circumstances to significant losses which it might otherwise have avoided.

Electronic Trading

JWH may from time to time trade on electronic markets and use electronic order routing systems, which differ from traditional open outcry pit trading and manual order routing methods. Characteristics of electronic trading and order routing systems vary widely among the different electronic systems with respect to order matching procedures, opening and closing procedures and prices, error trade policies and trading limitations or requirements. There are also differences regarding qualifications for access and grounds for termination and limitations on the types of orders that may be entered into the system. Each of these matters may present different risk factors with respect to trading on or using a particular system. Each system may also present risks related to system access, varying response times and security. Trading through an electronic trading or order routing system also entails risks associated with system or component failure. In the event of system or component failure, it is possible that for a certain time period, it might not be possible to enter new orders, execute existing orders or modify or cancel orders that were previously entered. System or component failure may also result in loss of orders or order priority. Some contracts offered on an electronic trading system may be traded electronically and through open outcry during the same trading hours. Exchanges offering an electronic trading or order routing system and/or listing the contract may have adopted rules to limit their liability, the liability of futures brokers and software and communication system vendors and the amount that may be collected for system failures and delays. These limitation of liability provisions vary among the exchanges.

Regulatory Changes Could Restrict the Trust’s Operations

The Trust implements a speculative, highly leveraged strategy. From time to time there is governmental scrutiny of these types of strategies and political pressure to regulate their activities.

Regulatory changes could adversely affect the Trust by restricting its markets, limiting its trading and/or increasing the taxes to which Unitholders are subject. As an example, the legality of EFP transactions come under periodic CFTC review. EFPs are a mechanism for converting a foreign currency forward into a futures contract. If

14

JWH could not trade EFPs for the Trust, the effect on the Trust could be material and adverse. CISI is not aware of any pending or threatened regulatory developments which might adversely affect the Trust. However, adverse regulatory initiatives could develop suddenly and without notice.

The Trust Could Lose Assets and Have Its Trading Disrupted Due to the Bankruptcy of CIS or Others

The Trust is subject to the risk of CIS, exchange or clearinghouse insolvency. Trust assets could be lost or impounded in such an insolvency during lengthy bankruptcy proceedings. Were a substantial portion of the Trust’s capital tied up in a bankruptcy, CISI might suspend or limit trading, perhaps causing the Trust to miss significant profit opportunities. No CISI fund has ever lost any assets due to the bankruptcy or default of a broker, exchange or clearinghouse, but there can be no assurance that this will not happen in the future.

Possibility of Termination of the Trust Before Expiration of Its Stated Term

As Managing Owner, CISI may withdraw from the Trust upon 120 days’ notice, which would cause the Trust to terminate unless a substitute managing owner were obtained. Other events, such as a long-term substantial loss suffered by the Trust, could also cause the Trust to terminate before the expiration of its stated term. This could cause you to liquidate your investments and upset the overall maturity and timing of your investment portfolio. If the registrations with the CFTC or memberships in NFA of JWH, CISI or CIS were revoked or suspended, such entity would no longer be able to provide services to the Trust.

The following are not risks but rather important tax features of investing in the Trust which all prospective investors should carefully consider before deciding whether to purchase Units.

Investors Are Taxed Every Year on Their Share of the Trust’s Profits — Not Only When They Redeem as Would Be the Case if They Held Stocks or Bonds

Investors are taxed each year on their investment in the Trust, irrespective of whether they redeem any Units.

All performance information included in this prospectus is presented on a pre-tax basis; the investors who experienced such performance had to pay the related taxes from other sources.

Over time, the compounding effects of the annual taxation of the Trust’s income are material to the economic consequences of investing in the Trust. For example, a 10% compound annual rate of return over five years would result in an initial $10,000 investment compounding to $16,105. However, if one factors in a 30% tax rate each year, the result would be $14,025.

The Trust’s Trading Gains Are Taxed at Higher Short-Term Capital Gains Rate

Investors are taxed on their share of any trading profits of the Trust at both short- and long-term capital gain rates depending on the mix of U.S. exchange-traded contracts and non-U.S. exchange-traded contracts traded. These tax rates are determined irrespective of how long an investor holds Units. Consequently, the tax rate on the Trust’s trading gains may be higher than those applicable to other investments held by an investor for a comparable period.

Tax Could Be Due From Investors on Their Share of the Trust’s Interest Income Despite Overall Losses

Investors may be required to pay tax on their allocable share of the Trust’s interest income, even though the Trust incurs overall losses. Trading losses can only be used by individuals to offset trading gains and $3,000 of interest income each year. Consequently, if an investor were allocated $5,000 of interest income and $10,000 of net trading losses, the investor would owe tax on $2,000 of interest income even though the investor would have a $5,000 economic loss for the year. The $7,000

15

capital loss would carry forward, but subject to the same limitation on its deductibility against interest income.

Buying Units

You buy Units as of the last business day of any month at Net Asset Value. Your subscription must be submitted by the fifth business day prior to the month-end of investment. Late subscriptions will be applied to Unit sales as of the end of the second month after receipt, unless revoked.

CISI has no present intention to terminate the offering, but may do so at any time.

Units are offered at Net Asset Value. Investors need to submit Subscription Agreements with each purchase of Units. The minimum purchase for first-time investors is $5,000; $2,000 for IRAs and other tax-exempt accounts. Existing investors may make additional investments in $1,000 minimums.

Use of Proceeds

100% of all subscription proceeds are invested directly into the Trust. Neither the Trust nor any subscriber pays any selling commissions. CIS pays all such commissions as part of the ongoing syndication costs of the Trust. In return, CIS receives substantial revenues from the Trust over time.

The Trust uses subscription proceeds to margin its speculative futures trading, as well as to pay trading losses and expenses. At the same time that the Trust’s assets are being used as margin, they are also available for active or passive cash management. To date, the Trust’s cash has been passively managed by placing it on deposit with CIS. Substantially all the cash management return earned on the Trust’s assets is paid to the Trust, although the CIS Group does retain certain economic benefits from possession of the Trust’s assets, as described in more detail under “Interest Income” beginning at page 63.

Redeeming Units

You can redeem Units monthly. To redeem at month-end, contact your financial advisor or CISI. Redemption requests must be received by CISI no later than the fifth business day prior to the month-end of redemption.

The proceeds of Units redeemed through the eleventh month from the date of issuance are reduced by a charge of 3% of their redemption date Net Asset Value. This charge is paid to CIS. If a Unitholder acquires Units at more than one closing, the Units purchased first by such investor and, accordingly, least likely to be subject to redemption charges, are assumed to be those first redeemed.

Uncertain Subscription and Redemption Value of Units

The Trust sells and redeems Units at subscription or redemption date Net Asset Value, not at the Net Asset Value as of the date that subscriptions or redemption requests are submitted. Investors must submit irrevocable subscriptions and redemption requests no later than the fifth business day prior to the effective date of subscription or redemption. Because of the volatility of Unit values, this delay means that investors cannot know the value at which they will purchase or redeem their Units.

Materially adverse changes in the Trust’s financial position could occur between the time an investor irrevocably commits to acquire or redeem Units and the time the purchase or redemption is made.

No Distributions Intended

The Trust does not anticipate making any distributions to investors. No distributions have been made to date.

16

The following are the monthly rates of return from January 1, 2000 through May 31, 2005. Through September 30, 2000, the Trust paid JWH a 4% Management Fee and a 15% Incentive Fee. As of October 1, 2000, the Trust began paying JWH a 2% Management Fee and a 20% Incentive Fee. Through July 1, 2003, the Trust paid CIS an annual Brokerage Fee of 6.5% of the Trust’s month-end assets. As of July 1, 2003, the Trust began paying CIS a reduced annual Brokerage Fee of 6.0% of the Trust’s month-end assets.

JWH GLOBAL TRUST

January 1, 2000 — May 31, 2005

Type of Pool: Publicly Offered; Single Advisor; Not Principal Protected

Aggregate Subscriptions: $456.7 million

Current Capitalization: $301.0 million

Worst Monthly Decline since January 1, 2000 (Month/Year): (13.27)% (11/01)

Worst Monthly Decline since Inception (Month/Year): (13.27)% (11/01)

Worst Peak-to-Valley Decline since January 1, 2000 (Month/Year): (29.87)% (5/03 – 8/04)

Worst Peak-to-Valley Decline since Inception (Month/Year): (29.87)% (5/03 - 8/04)

Net Asset Value per Unit, May 31, 2005: $128.75

Number of Unitholders, May 31, 2005: 13,993

|

| 2005 |

| 2004 |

| 2003 |

| 2002 |

| 2001 |

| 2000 |

|

January |

| (9.54 | )% | 1.07 | % | 7.07 | % | (1.60 | )% | 1.70 | % | (2.81 | )% |

February |

| (5.63 | ) | 4.54 |

| 3.57 |

| (5.58 | ) | 0.09 |

| (3.24 | ) |

March |

| 0.50 |

| (4.64 | ) | (3.32 | ) | (5.97 | ) | 8.25 |

| (3.47 | ) |

April |

| (6.40 | ) | (9.38 | ) | 1.29 |

| (0.30 | ) | (6.96 | ) | 2.43 |

|

May |

| 7.95 |

| (6.21 | ) | 7.78 |

| 8.81 |

| 3.15 |

| (1.21 | ) |

June |

|

|

| (5.16 | ) | (5.74 | ) | 21.15 |

| (4.15 | ) | (5.15 | ) |

July |

|

|

| (3.31 | ) | (2.96 | ) | 5.72 |

| (4.26 | ) | (2.28 | ) |

August |

|

|

| (2.21 | ) | 1.02 |

| 1.07 |

| 4.24 |

| 0.88 |

|

September |

|

|

| 4.26 |

| (2.73 | ) | 4.41 |

| 1.33 |

| (4.54 | ) |

October |

|

|

| 11.97 |

| (1.06 | ) | (6.66 | ) | 1.93 |

| 6.61 |

|

November |

|

|

| 10.85 |

| (4.77 | ) | (6.64 | ) | (13.27 | ) | 5.80 |

|

December |

|

|

| 0.24 |

| 7.84 |

| 11.98 |

| 7.50 |

| 18.58 |

|

Compound Annual Rate of Return |

| (13.32 | )% | (0.39 | )% | 6.87 | % | 24.99 | % | (2.58 | )% | 9.65 | % |

Compound Annual Rates of Return for years prior to 2000 were (9.44%) (1999), 5.20% (1998) and 9.70% (June — December of 1997).

Until October 5, 1998, when the G-7 Currency Program was added to the Trust’s portfolio, the Trust used only two JWH programs, the Original Investment Program and the Financial and Metals Portfolio. Effective January 1, 2000, the Trust substituted the JWH GlobalAnalytics® Family of Programs for the Original Investment Program and changed the allocation of Trust assets among the three programs. Effective August 1, 2005 the Trust ceased to allocate any of its assets to the G-7 Currency Portfolio. Effective August 1, 2005, the Trust allocates 30% of its assets to the Financial and Metals Portfolio, 30% to JWH GlobalAnalytics® Family of Programs, 20% to the International Foreign Exchange Program and 20% to the Global Financial and Energy Portfolio.

Monthly Rate of Return is the net performance of the Trust during a month (including interest income) divided by the total equity of the Trust as of the beginning of the month. Performance information is calculated on an accrual basis in accordance with generally accepted accounting principles.

Worst Peak-to-Valley Decline is the largest decline in the Net Asset Value per Unit without such Net Asset Value per Unit being subsequently equaled or exceeded.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

17

Selected and Supplementary Financial Information

The following Selected Financial Information for the period ended March 31, 2005 is derived from the unaudited financial statements of the Trust for the period from January 1, 2005 to March 31, 2005. The Selected Financial Information for the years ended December 31, 2004, 2003, 2002, 2001 and 2000 is derived from the financial statements for the years ended December 31, 2004, 2003, 2002, 2001 and 2000, which have been audited by KPMG LLP. See “Financial Statements” at page 79.

Income Statement Data |

| Jan. 1, 2005 |

| Jan. 1, 2004 |

| Jan. 1, 2003 |

| Jan. 1, 2002 |

| Jan. 1, 2001 |

| Jan. 1, 2000 |

| ||||||

|

| (unaudited) |

|

|

|

|

|

|

|

|

|

|

| ||||||

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Realized (loss) gain on closed positions |

| $ | (28,523,529 | ) | $ | 21,176,837 |

| $ | 11,375,400 |

| $ | 15,033,511 |

| $ | 8,079,390 |

| $ | 740 |

|

Change in unrealized gain (loss) on open positions |

| (13,895,329 | ) | 12,110,774 |

| 4,341,361 |

| 3,792,911 |

| (5,446,646 | ) | 4,664,653 |

| ||||||

Interest income |

| 1,938,865 |

| 3,631,292 |

| 1,183,618 |

| 811,042 |

| 1,657,888 |

| 3,265,169 |

| ||||||

Foreign currency transaction (loss) gain |

| (546,345 | ) | (414,668 | ) | 302,525 |

| 103,274 |

| 139,504 |

| (483,085 | ) | ||||||

Total Revenues |

| $ | (41,026,338 | ) | $ | 36,504,235 |

| $ | 17,202,904 |

| $ | 19,740,738 |

| $ | 4,430,136 |

| $ | 7,447,477 |

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Commissions paid to CIS |

| 4,394,758 |

| 15,298,552 |

| 7,584,742 |

| 3,450,709 |

| 3,215,618 |

| 3,737,532 |

| ||||||

Exchange, clearing and NFA fees |

| 37,333 |

| 108,740 |

| 49,676 |

| 17,475 |

| 32,547 |

| 38,489 |

| ||||||

Management fees |

| 1,477,773 |

| 5,141,363 |

| 2,472,995 |

| 1,068,838 |

| 1,001,094 |

| 2,088,954 |

| ||||||

Incentive fees |

| — |

| 5,419,877 |

| 2,344,357 |

| 2,741,521 |

| 990,171 |

| — |

| ||||||

Amortization of prepaid initial organization and offering expenses* |

| — |

| — |

| — |

| 55,072 |

| 132,173 |

| 132,173 |

| ||||||

Ongoing organization and offering expenses |

| 367,249 |

| 1,271,788 |

| 611,094 |

| 263,456 |

| 248,048 |

| 288,770 |

| ||||||

Other operating expenses |

| 95,515 |

| 416,855 |

| 176,430 |

| 86,473 |

| 64,643 |

| 35,740 |

| ||||||

Total Expenses |

| 6,372,628 |

| 27,657,175 |

| 13,239,294 |

| 7,683,544 |

| 5,684,294 |

| 6,321,658 |

| ||||||

Net income (loss) |

| $ | (47,398,966 | ) | $ | 8,847,060 |

| $ | 3,963,610 |

| $ | 12,057,194 |

| $ | (1,254,158 | ) | $ | 1,125,819 |

|

Balance Sheet Data |

| March 31, 2005 |

| Dec. 31, 2004 |

| Dec. 31, 2003 |

| Dec. 31, 2002 |

| Dec. 31, 2001 |

| Dec. 31, 2000 |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Aggregate Net Asset Value |

| $ | 296,946,612 |

| $ | 332,040,409 |

| $ | 207,113,300 |

| $ | 64,130,526 |

| $ | 49,535,093 |

| $ | 50,129,734 |

|

Net Asset Value per Unit |

| $ | 127.43 |

| $ | 148.54 |

| $ | 149.12 |

| $ | 139.53 |

| $ | 111.63 |

| $ | 114.59 |

|

* The $650,000 of organizational and initial offering costs reimbursed to the Managing Owner by the Trust as of the commencement of trading were amortized over a sixty-month period, which ended on May 31, 2002.

18

The following Supplementary Financial Information presents the results of operations and other data for three-month periods ended March 31 of 2005, 2004 and 2003 and June 30, September 30 and December 31 of 2004 and 2003. This information has not been audited.

|

| Period ending |

| |

Total Revenues |

| $ | (41,026,338 | ) |

Total Expenses |

| $ | 6,372,628 |

|

Gross Profit (Loss) |

| $ | (47,398,966 | ) |

Net Profit (Loss) |

| $ | (47,398,966 | ) |

Net Profit per Unit |

| $ | (21.11 | ) |

|

| Period ending |

| Period ending |

| Period ending |

| Period ending |

| ||||

Total Revenues |

| $ | 6,680,881 |

| $ | (47,458,520 | ) | $ | 2,195,583 |

| $ | 75,086,292 |

|

Total Expenses |

| $ | 5,774,450 |

| $ | 5,059,084 |

| $ | 5,259,942 |

| $ | 11,563,699 |

|

Gross Profit (Loss) |

| $ | 906,431 |

| $ | (52,517,604 | ) | $ | (3,064,359 | ) | $ | 63,522,593 |

|

Net Profit (Loss) |

| $ | 906,431 |

| $ | (52,517,604 | ) | $ | (3,064,359 | ) | $ | 63,522,593 |

|

Net Profit per Unit |

| $ | 1.14 |

| $ | (29.15 | ) | $ | (1.72 | ) | $ | 29.15 |

|

|

| Period ending |

| Period ending |

| Period ending |

| Period ending |

| ||||

Total Revenues |

| $ | 7,380,193 |

| $ | 5,374,923 |

| $ | (3,564,983 | ) | $ | 8,012,771 |

|

Total Expenses |

| $ | 2,961,837 |

| $ | 3,236,594 |

| $ | 2,972,388 |

| $ | 4,068,475 |

|

Gross Profit (Loss) |

| $ | 4,418,356 |

| $ | 2,138,329 |

| $ | (6,537,371 | ) | $ | 3,944,296 |

|

Net Profit (Loss) |

| $ | 4,418,356 |

| $ | 2,138,329 |

| $ | (6,537,371 | ) | $ | 3,944,296 |

|

Net Profit per Unit |

| $ | 10.06 |

| $ | 4.32 |

| $ | (7.16 | ) | $ | 2.37 |

|

There were no extraordinary, unusual or infrequently occurring items recognized in each full calendar quarter within the two most recent fiscal years, and the Trust has not disposed of any segments of its business. There have been no year-end adjustments that are material to the results of any fiscal quarter reported above.

Management’s Analysis of Operations

Results of Operations

General

JWH programs do not predict price movements. No fundamental economic supply or demand analysis is used in attempting to identify mispricings in the market, and no macroeconomic assessments of the relative strengths of different national economies or economic sectors is made. Instead, the programs apply proprietary computer models to analyze past market data, and from this data alone attempt to determine whether market prices are trending. Technical traders such as JWH base their strategies on the theory that market prices reflect the collective judgment of numerous different traders and are, accordingly, the best and most efficient indication of market movements. However, there are frequent periods during which fundamental factors external to the market dominate prices.

If JWH’s models identify a trend, they signal positions which follow it. When these models identify the trend as having ended or reversed, these positions are either closed out or reversed. Due to their trend-following character,

19

the JWH programs do not predict either the commencement or the end of a price movement. Rather, their objective is to identify a trend early enough to profit from it and to detect its end or reversal in time to close out the Trust’s positions while retaining most of the profits made from following the trend.

In analyzing the performance of JWH’s trend-following programs, economic conditions, political events, weather factors, etc., are not directly relevant because only market data has any input into JWH’s trading results. There is no direct connection between particular market conditions and price trends. There are so many influences on the markets that the same general type of economic event may lead to a price trend in some cases but not in others. The analysis is further complicated by the fact that the programs are designed to recognize only certain types of trends and to apply only certain criteria of when a trend has begun. Consequently, even though significant price trends may occur, if these trends are not comprised of the type of intra-period price movements which the programs are designed to identify, the Trust may miss the trend altogether.

The Trust’s success depends on JWH’s ability to recognize and capitalize on major price movements and other profit opportunities in different sectors of the world economy. Because of the speculative nature of its trading, operational or economic trends have little relevance to the Trust’s results, and its past performance is not necessarily indicative of its future results. The Managing Owner believes, however, that there are certain market conditions — for example, markets with major price movements — in which the Trust has a better opportunity of being profitable than in others.

The following performance summary outlines certain major price trends which the JWH programs have identified for the Trust during the last three fiscal years as well as the first fiscal quarter of 2005. The fact that certain trends were captured does not imply that others, perhaps larger and potentially more profitable trends, were not missed or that JWH will be able to capture similar trends in the future. Moreover, the fact that the programs were profitable in certain market sectors in the past does not mean that they will be so in the future.

The performance summary is an outline description of how the Trust performed in the past, not necessarily any indication of how it will perform in the future. Furthermore, the general causes to which certain trends are attributed may or may not in fact have caused such trends, as opposed to simply having occurred at about the same time.

While there can be no assurance that JWH will be profitable even in trending markets, markets in which substantial and sustained price movements occur offer the best profit potential for the Trust.

Performance Summary

2005

Fiscal Quarter Ended March 31, 2005

The Trust recorded a net loss of $47,398,966 or ($21.11) per unit in the first quarter of 2005. As of March 31, 2005, the Trust had gained 27.43% since its inception in June 1997.

On March 31, 2005, JWH was managing 100% of the Trust’s assets. Approximately 30% of the assets were allocated to each of the JWH GlobalAnalytics® Family of Programs and the G-7 Currency Portfolio. Approximately 40% of the Trust’s assets were allocated to JWH’s Financial and Metals Portfolio.

The Trust’s performance was negative in January. While both the fixed-income and agriculture sectors had gains for the month, they were not enough to offset the losses in other sectors. The Trust’s underperformance was driven by the strength of the US dollar, which rebounded from last year’s weakening trend. The dollar’s sudden turnaround was the dominant factor that drove most market sectors during the month, and therefore resulted in the overall loss for the program. The weak US dollar trend, which had dominated the markets during the second half of

20

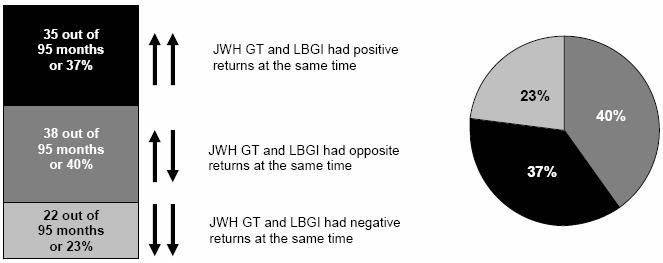

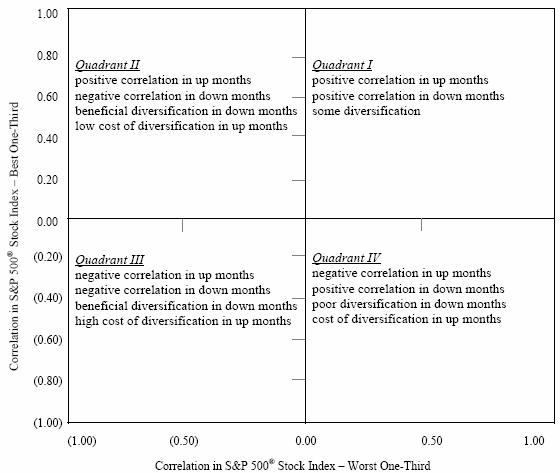

last year, began to reverse itself as market expectations of a Yuan revaluation by the Chinese central bank began to diminish. The Canadian dollar/Japanese yen cross was the only positive contributor to the month, while the largest loss was in the euro. Trading in both metals and indices was also negative during the month. The loss in metals was due to the weakening of both gold and aluminum. Gold, which has recently had a strong inverse relationship with the US dollar, came under pressure as the US dollar strengthened throughout the month. Aluminum also added to the Trust’s losses as supply increases in Shanghai put pressure on the market. The Trust’s returns in the indices sector further hindered performance. The loss in indices resulted from a sell off in world equity markets. The largest gain in the indices sector was achieved in the Eurostoxx 50, while the largest loss occurred in the Nasdaq e-mini. Higher prices in energies led to negative performance for the Trust in this sector. In addition to the events in the Middle East, weather dominated the sector’s price action. Brent crude was the only positive contributor of this sector, while the largest loss came from natural gas. The agricultural sector provided positive returns for the month of January. Wheat helped returns as prices fell to a 20-month low. Corn boosted returns slightly as prices fell to the lowest level since June 2001. The largest gain in the agricultural sector was achieved in wheat, while the largest loss occurred in cotton. The fixed income sector was also positive for the Trust for the month. Japanese Government bonds (JGBs) rose during the month after Japanese government reports showed household spending and industrial production fell. The largest gain was achieved in the JGBs, while the largest loss occurred in Australian 10-year bond. Although January underperformed, it is these types of markets that have provided the catalyst historically for long-term trends to emerge. Overall, the Trust recorded a loss of -9.54% for the month.