Filed pursuant to Rule 424(b)(3)

Registration Statement No. 333-146177

PART I – DISCLOSURE DOCUMENT

RJO GLOBAL TRUST

981,819.90468 Units of Beneficial Interest

The Trust

The RJO Global Trust is a Delaware statutory trust that trades in the U.S. and international futures and forward markets in equities, fixed income, currencies, interest rates, energy and agricultural products, metals, commodities indices, and stock indices. The primary objective of the trust is capital appreciation. R.J. O’Brien Fund Management, LLC, the managing owner of the trust, pursues this objective by allocating the trust’s assets to a diverse group of experienced trading advisors. The managing owner seeks to reduce volatility and risk of loss by participating in broadly diversified global markets and implementing risk control policies. An investment in the trust offers a means of diversifying a traditional portfolio of equities and debt.

The Managing Owner

R.J. O’Brien Fund Management, LLC, a registered commodity pool operator, is the managing owner and sponsor of the trust.

Minimum Subscription Amounts

| First-time investors (initial subscription) | | $ | 5,000 | |

| Existing investors (additional subscription minimums) | | $ | 1,000 | |

| IRAs, tax-exempt accounts | | $ | 2,000 | |

The Trading Advisors

The following trading advisors trade the trust’s assets:

| | · | Global Advisors (Jersey) Limited; |

| | · | Haar Capital Management LLC; |

| | · | John W. Henry & Company, Inc.; and |

| | · | NuWave Investment Management, LLC |

The managing owner may add, remove or replace any trading advisor without the consent of or advance notice to investors. Investors will be notified of any material change in the basic investment policies or structure of the trust.

The Units

Units are available for subscription on the last business day of each month at the current net asset value per unit. As of January 31, 2010, the net asset value per unit for Class A units was $100.90 and $103.10 for Class B units. The units are offered in two classes. Class A units are subject to a selling commission. Class B units are not charged a selling commission, and will only be offered to certain qualified investors participating in a program through certain financial advisors.

The Offering

Subscriptions will initially be deposited in a subscription account at JP Morgan Chase. Upon acceptance of an investor’s subscription agreement by the managing owner, 100% of the subscription amount will be invested in the trust as of the first business day of the following month at which time it will immediately be allocated to the trading advisors. The units are offered on a continuous basis. There is no scheduled termination date for the offering of units. R.J. O’Brien Securities, LLC is the lead selling agent of the units. Additional selling agents retained by the lead selling agent will use their best efforts to sell the units offered. There is no minimum number of units which must be sold during a particular month.

THE RISKS YOU FACE

Before you decide whether to invest, you should read this entire prospectus carefully and consider “The Risks You Face” beginning on page11 and “Conflicts of Interest” beginning on page 70.

| · | These are speculative securities. You could lose all or substantially all of your investment in the trust. |

| · | The trust’s futures, forward and options trading is speculative and trading performance has been, and is expected to be, volatile. |

| · | The trust takes positions with total values that are bigger than the total amount of the trust’s assets. The face value of the trust’s positions typically range from two to fifteen times its aggregate net assets. |

| · | Past performance is not necessarily indicative of future results. |

| · | The trust is subject to substantial charges and must generate trading profits, after taking into account estimated interest income of 0.56%, of 6.99% to 7.34% with respect to the Class A units (4.99% to 5.34% with respect to Class B units) after one year to cover its expenses and break even. |

| · | Some assets of the trust are traded on non-U.S. markets that are not subject to the same degree of regulation as U.S. markets. |

| · | You will be taxed on your share of the trust’s income even though the trust does not intend to make any distributions. |

| · | There is no secondary market for the units and none is expected to develop. Units may only be redeemed as of the end of a calendar month subject to a 1.5% redemption charge through the end of the eleventh month after issuance. |

Before you invest, you will be required to represent and warrant that you meet applicable state minimum financial suitability standards. You are encouraged to discuss the investment with your financial, legal, and tax advisors before you invest in the trust.

This prospectus is in two parts: a disclosure document and a statement of additional information. These parts are bound together, and both contain important information.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THIS POOL NOR HAS THE COMMISSION PASSED ON THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT.

R.J. O’Brien Fund Management, LLC

Managing Owner

The date of this prospectus is April 30, 2010.

COMMODITY FUTURES TRADING COMMISSION

RISK DISCLOSURE STATEMENT

YOU SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE AWARE THAT FUTURES AND OPTIONS TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS GAINS. SUCH TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND CONSEQUENTLY THE VALUE OF YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS ON REDEMPTIONS MAY AFFECT YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE POOL.

FURTHER, COMMODITY POOLS MAY BE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT, AND ADVISORY AND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS. THIS DISCLOSURE DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF EACH EXPENSE TO BE CHARGED THIS POOL AT PAGES 24 TO 28 AND A STATEMENT OF THE PERCENTAGE RETURN NECESSARY TO BREAKEVEN, THAT IS, TO RECOVER THE AMOUNT OF YOUR INITIAL INVESTMENT, AT PAGE 7.

THIS BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO EVALUATE YOUR PARTICIPATION IN THIS COMMODITY POOL. THEREFORE, BEFORE YOU DECIDE TO PARTICIPATE IN THIS COMMODITY POOL, YOU SHOULD CAREFULLY STUDY THIS DISCLOSURE DOCUMENT, INCLUDING A DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF THIS INVESTMENT, AT PAGES 11 TO 19.

YOU SHOULD ALSO BE AWARE THAT THIS COMMODITY POOL MAY TRADE FOREIGN FUTURES OR OPTIONS CONTRACTS. TRANSACTIONS ON MARKETS LOCATED OUTSIDE THE UNITED STATES, INCLUDING MARKETS FORMALLY LINKED TO A UNITED STATES MARKET, MAY BE SUBJECT TO REGULATIONS WHICH OFFER DIFFERENT OR DIMINISHED PROTECTION TO THE POOL AND ITS PARTICIPANTS. FURTHER, UNITED STATES REGULATORY AUTHORITIES MAY BE UNABLE TO COMPEL THE ENFORCEMENT OF THE RULES OF REGULATORY AUTHORITIES OR MARKETS IN NON-UNITED STATES JURISDICTIONS WHERE TRANSACTIONS FOR THE POOL MAY BE EFFECTED.

RJO GLOBAL TRUST

PART ONE DISCLOSURE DOCUMENT |

| | |

| Summary | 2 |

| Organizational Chart | 10 |

| The Risks You Face | 11 |

| How the Trust Works | 20 |

| Performance of the Trust | 22 |

| Charges | 23 |

| Interest Income | 27 |

| The Managing Owner | 27 |

| The Trading Advisors | 29 |

| Brokerage Arrangements | 67 |

| Redemptions; Net Asset Value | 68 |

| Conflicts of Interest | 69 |

| Fiduciary Duty and Remedies | 71 |

| The Trust and the Trustee | 72 |

| Tax Consequences | 75 |

| Benefit Plan Investors | 80 |

| Plan of Distribution | 82 |

| Lawyers | 84 |

| Accountants | 84 |

| Privacy Policy | 84 |

| |

PART TWO STATEMENT OF ADDITIONAL INFORMATION |

| |

| Managed Futures Funds in General | 86 |

| The Role of Managed Futures in Your Portfolio | 88 |

| Futures Markets and Trading Methods | 94 |

| Exhibit A — Eighth Amended and Restated Declaration and Agreement of Trust | A-1 |

| Exhibit B — Subscription Requirements | B-1 |

| Exhibit C-A — Class A Units Subscription Agreement and Power of Attorney | C-A-1 |

| Exhibit C-B — Class B Units Subscription Agreement and Power of Attorney | C-B-1 |

| Exhibit D – Request for Redemption | D-1 |

SUMMARY

This summary highlights certain information contained elsewhere in this prospectus. Before you decide to invest in the trust, you should read the entire prospectus, the statement of additional information, the information incorporated by reference herein, and the exhibits.

The Trust

The RJO Global Trust is a Delaware statutory trust (formed in November 1996) that trades in the U.S. and international futures and forward markets in equities, fixed income, currencies, interest rates, energy and agricultural products, metals, commodities indices, and stock indices. The primary objective of the trust is capital appreciation. R.J. O’Brien Fund Management, LLC (“RJOFM”), the managing owner of the trust, pursues this objective by allocating the trust’s assets to a diverse group of experienced trading advisors. The managing owner seeks to reduce volatility and risk of loss by participating in broadly diversified global markets and implementing risk control policies. An investment in the trust offers a means of diversifying a traditional portfolio of equities and debt. Investing in the trust poses risks to investors and you are encouraged to read “The Risk You Face” beginning on page 11.

The office of the trust is located at c/o R.J. O’Brien Fund Management, LLC, 222 South Riverside Plaza, Suite 900, Chicago, Illinois 60606; telephone (312) 373-5000.

The Managing Owner

R.J. O’Brien Fund Management, LLC, a registered commodity pool operator, is the managing owner and sponsor of the trust. The managing owner is a subsidiary of RJO Holdings, Corp. The managing owner was originally incorporated in Illinois in 2006 and was reformed as a limited liability company in Delaware in July 2007. The managing owner has been registered with the Commodity Futures Trading Commission (the CFTC) as a commodity pool operator since December 1, 2006, and has been a member of the National Futures Association (the NFA) in such capacity since December 1, 2006. As of January 31, 2010, the managing owner was managing approximately $57.8 million in client assets. The managing owner maintains its principal office at 222 South Riverside Plaza, Suite 900, Chicago, Illinois 60606; telephone (312) 373-5000. See the organizational chart of the trust at page 10.

As of January 31, 2010, the trust’s capitalization was approximately $57,859,878, the net asset value per unit for Class A was $100.90, the net asset value per unit for Class B was $103.10, and the trust had approximately 3,391 unitholders.

The Trading Advisors

The trust was originally established and operated as a single-advisor commodity pool. As of November 1, 2008, the trust became a multi-advisor commodity pool, adding four trading advisors. As of July 1, 2009, the trust reallocated its assets to the current six trading advisors: Abraham Trading, L.P., Global Advisors (Jersey) Limited, John W. Henry & Company, Inc., NuWave Investment Management, LLC, Conquest Capital, LLC, and Haar Capital Management LLC. As of January 31, 2010, the net assets available for trading were allocated to the same six trading advisors, with the approximate percentage allocation to each trading advisor as indicated below:

| | · | Abraham Trading, L.P. – Trading Diversified – 16.66% |

| | · | Conquest Capital, LLC – Macro – 16.66% |

| | · | Global Advisors (Jersey) Limited – Commodity Systematic – 16.66% |

| | · | Haar Capital Management LLC – Discretionary Commodity Trading Program – 16.66% |

| | · | John W. Henry & Company, Inc. – Diversified Plus – 16.66% |

| | · | NuWave Investment Management, LLC – Combined Futures Portfolio (2x) – 16.66% |

The managing owner is responsible for selecting, monitoring, and replacing trading advisors. The managing owner may change the allocation to each advisor, add, remove or replace any trading advisor without the consent of or advance notice to investors. Investors will be notified of any material change in the basic investment policies or structure of the trust.

The Trust and Its Investment Objectives

The primary objective of the trust is substantial capital appreciation through trading directed by a diverse group of trading advisors. At the same time, the trading advisors will attempt to reduce volatility and risk of loss by participating in diversified markets and applying risk control policies.

Through an investment in the trust, investors have the opportunity to participate in markets not typically represented in an individual’s portfolio, and the potential to profit from rising as well as falling prices. The success of the trading advisors’ trading is not dependent upon favorable economic conditions, national or international. Indeed, periods of economic uncertainty can augment the profit potential of the trust by increasing the likelihood of significant movements in commodity prices, the exchange rates between various countries, world stock prices and interest rates. The trust’s assets are rebalanced at the end of each quarter among the trading advisors in accordance with the percentages above.

Below is a brief description of each trading program utilized by the trading advisors on behalf of the trust.

Abraham Trading, L.P. – Trading Diversified: Abraham Trading was founded in 1988. Abraham’s trading approach consists of five strategies with fifteen sub-systems with independent entry and exit points, a trade filter and enhanced risk management applications. The portfolio presently monitors and trades sixty markets including thirty-four commodity interests and twenty-six financial futures markets. The holding periods generally range from just a few days to four months. For a complete description of Abraham’s trading program, please see “The Trading Advisors – Abraham Trading, L.P.” beginning on page 33.

Conquest Capital, LLC – Macro: Conquest Capital was founded in 2001. Conquest’s trading program is primarily a short-term, systematic trading strategy with a trend-following bias that concentrates on many of the markets that would react strongly to national or global systemic shocks. Conquest’s Macro trading program currently trades in 31 markets, including: currency pairs, fixed-income, stock indices, energies, and metals. New positions are based on total portfolio equity. For a complete description of Conquest’s trading program, please see “The Trading Advisors – Conquest Capital, LLC” beginning on page 39.

Global Advisors (Jersey) Limited – Commodity Systematic: The operations now conducted by Global Advisors (Jersey) Limited (“GAJL”) began in 1999. GAJL operates a systematic quantitative trading and portfolio management tool that has been developed specifically for the commodities futures markets. GAJL describes its system’s core trading style as a “breakout follower” because it tends to have a low correlation with pure trend following approaches. The suite of models has been designed by GAJL to offer diversification within the commodity niche, by trading inter and intra-commodity spreads as well as outright commodities. Trades are structured to minimize the effects of transactions costs and to increase capacity within its markets. The program trades energy, base metals, precious metals, agricultural markets and commodity indices. No financial markets are traded. For a complete description of GAJL’s trading program, please see “The Trading Advisors – Global Advisors (Jersey) Limited” beginning on page 43.

Haar Capital Management LLC – Discretionary Commodity Trading Program: Haar was formed in 2005. Haar’s trading program is a primarily fundamental strategy that is designed to achieve the capital appreciation of its client’s assets through the speculation in financial and commodity futures and options contracts in market sectors including, without limitation, currencies, metals, financials, energies, softs, livestock, grains, and equity indices. Haar seeks to achieve profit from longer-term trends that develop due to certain changing fundamental factors behind commodity price changes. In addition to outright long and short positions, trading strategies may include inter and intra-market spread positions and the use of commodity options. For a complete description of Haar’s trading program, please see “The Trading Advisors – Haar Capital Management LLC” beginning on page 49.

John W. Henry & Company, Inc. – JWH Diversified Plus: John W. Henry & Company Inc. (“JWH”) began trading assets for clients in 1982. JWH’s trading program utilized by the trust is a broadly diversified program that combines three separate two-phase reversal systems with a dynamic sizing of individual market positions based on volatility. The three trend-following models utilize different time horizons to permit multiple entry and exit points. Portfolio exposure will vary based on the relative positions (long or short) of the three models used. For a complete description of John W. Henry’s trading program, please see “The Trading Advisors – John W. Henry & Company, Inc.” beginning on page 53.

NuWave Investment Management, LLC – Combined Futures Portfolio (2x): NuWave Investment Management, LLC is engaged in the business of providing trading advisory services to customers with respect to futures contracts, forward contracts, and other futures-related interests on United States and foreign exchanges and markets. NuWave Investment Management, LLC’s “Combined Futures Portfolio (2x)” program is a broadly diversified trading program designed to capture directional price movement in both bull and bear market cycles. The program actively manages directional positions according to the output of proprietary pattern recognition models that identify repetitive market tendencies without relying on traditional “trend” definitions. For a complete description of NuWave Investment Management, LLC’s trading program, please see “The Trading Advisors – NuWave Investment Management, LLC” beginning on page 62.

The Offering

Units are available for subscription on the last business day of each month at the current net asset value per unit. As of January 31, 2010, the net asset value per unit for Class A units was $100.90 and $103.10 for Class B units. R.J. O’Brien Securities, LLC (“RJOS”) is the lead selling agent of the units and has retained additional selling agents to offer the units on a reasonable efforts basis. The units are offered in two classes. Class A units are subject to a selling commission. Class B units are not charged a selling commission, and will only be offered to certain qualified investors participating in a program through certain financial advisors.

In order to purchase units, an investor must complete, execute and deliver a subscription agreement and power of attorney, which accompanies this prospectus. A signed subscription agreement must be received by the trust’s administrator, ACS Securities Services, Inc., no later than the fifth business day prior to the month-end of investment (including the last business day of the month) in order to be received and approved by the managing owner in time for the subscriber to be accepted as an investor as of the last business day of the month.

The minimum initial investment is $5,000 for individuals and $2,000 for trustees or custodians of eligible employee benefit plans and individual retirement accounts. Subscriptions in excess of these minimums are permitted in $100 increments. Additional subscriptions by existing unitholders are permitted in $1,000 minimums in $100 increments. There is no minimum number of units that must be sold during a particular month. There is no maximum aggregate subscription amount for the trust.

Subscriptions will initially be deposited in a subscription account at JP Morgan Chase. Upon acceptance of an investor’s subscription agreement by the managing owner, 100% of the subscription amount will be invested in the trust as of the first business day of the month at which time it will immediately be allocated to the trading advisors. The units are offered on a continuous basis. There is no scheduled termination date for the offering of units. The managing owner may, in its sole discretion, reject any subscription in whole or in part.

A unitholder cannot lose more than his or her investment in the trust plus undistributed profits, and in no event shall any obligations of the trust subject a unitholder to any liability in excess of the capital contributed by such unitholder, his or her share of undistributed profits and assets and the amount of any distributions wrongfully distributed to such unitholder.

Major Risks of the Trust

| | · | The trust is a speculative investment and its performance is expected to be volatile. It is not possible to predict how the trust will perform over the long or short term. |

| | · | Investors must be prepared to lose all or substantially all of their investment in the units. |

| | · | There can be no assurance that the past performance of either the trust or the trading advisors is indicative of how they will perform in the future. |

| | · | To date, the performance of the trust has been volatile. The net asset value per unit has varied by more than 16.01% in a single month. |

| | · | The trust could incur large losses over short periods. |

| | · | The trust is subject to substantial charges and must generate trading profits, after taking into account estimated interest income of 0.56%, of 6.99% to 7.34% with respect to the Class A units (4.99% to 5.34% with respect to the Class B units) after one year to cover its expenses and break even. |

| | · | The trust typically takes positions with a face value of two to fifteen times its total net assets. |

| | · | Trading on foreign contract markets involves additional risks, including the risks of inadequate or lack of regulation, exchange-rate fluctuations, expropriation, credit and investment controls and counterparty insolvency. |

| | · | There can be no assurance of the continued availability of a trading advisor or its key principals. |

| | · | Units may only be redeemed as of the end of a calendar month, subject to a 1.5% redemption charge through the end of the eleventh month after issuance. Because investors must submit subscriptions as well as redemption notices by the fifth business day prior to month-end, investors will not know the net asset value at the time they acquire or redeem units. |

| | · | Unitholders may not transfer or assign units without providing prior written notice to the managing owner. No assignee may become a substitute unitholder except with the consent of the managing owner. |

| | · | As unitholders, investors have no discretion in the operation of the trust; they are entirely dependent on the managing owner and the trading advisors for the success of their investment in the trust. |

| | · | Profits earned by the trust will be taxable to an investor even though the managing owner does not intend to make any distributions. |

| | · | The trust is subject to conflicts of interest. See “Conflicts of Interest” beginning on page 70. |

Please see “The Risks You Face” beginning on page 11 for a more detailed list of relevant risks to an investment in the trust.

Redemptions

You may redeem units at their month-end net asset value at the end of each month. ACS Securities Services, Inc., the trust’s administrator, must receive your redemption request no later than the fifth business day prior to the month-end of redemption. Requests for partial redemptions must be for at least a number of units amounting to the minimum equivalent of $1,000, and a minimum balance of $1,000 must be maintained in such instances. A redemption charge of 1.5% of the net asset value of the units redeemed will be assessed on units redeemed on or before the eleventh month-end from the date units are issued.

Distributions

The managing owner currently does not intend to make any distributions of trust profits.

Fees and Expenses of the Trust

The trust pays substantial fees and expenses that must be offset by trading gains in order to avoid depletion of the trust’s assets. A brief description of such fees is described below. Please see “Charges” beginning on page 24 for additional information.

| Fee | | Description |

| | | |

| Brokerage Fee | | 4.65% to 5.0% of the trust’s month-end assets on an annual basis (0.3875% to 0.417% monthly) with respect to Class A units and 2.65% to 3.0% of the trust’s month-end assets on an annual basis (0.221% to 0.25% monthly) with respect to Class B units, payable as follows: managing owner fee of 0.75% annually; selling commission of 2.35% annually (2.0% is paid to the selling agents and 0.35% is paid to the managing owner for underwriting expenses); clearing, NFA and exchange fees (including fees related to foreign currency transactions and other off-exchange transactions) (paid as incurred and estimated at 1.22% to 1.42% annually and capped at 1.57%); and 0.33% to the trust’s consultant, Liberty Funds Group. Class B units will not be charged the 2.0% selling commission payable to the selling agents. |

| | | |

| Management Fees | | The trust pays each trading advisor a monthly rate of up to 0.167% (2.0% annually) of the portion of net assets managed by each trading advisor. |

| | | |

| Incentive Fees | | The trust pays each trading advisor a quarterly incentive fee equal to 20.0% of new trading profits earned on the portion of the trust’s net assets managed by such trading advisor. |

| | | |

| Ongoing offering costs | | The trust pays ongoing offering costs as they are incurred up to a maximum of 0.5% of the trust’s average month-end net assets each fiscal year. |

| | | |

| Administrative expenses | | The trust pays administrative expenses as they are incurred, currently at 0.40% of net assets per year. |

| | | |

| Redemption fee | | 1.5% of the net asset value per unit will be charged on all units redeemed if the redemption is effected during the first eleven months after issuance. |

Breakeven Table

Following is a table that sets forth the fees and expenses that you would incur on an initial investment of $5,000 in the Class A units and the Class B units of the trust and the amount that your investment must earn, after taking into account estimated interest income, in order to breakeven after one year.

| | | | | | | |

| | | | | | | | | | | | |

| | | | | | $ | | | % | | | $ | |

Brokerage Fee2 | | | 5.00 | | | | 250.00 | | | | 3.00 | | | | 150.00 | |

Management Fee3 | | | 2.00 | | | | 100.00 | | | | 2.00 | | | | 100.00 | |

Incentive Fee4 | | | — | | | | — | | | | — | | | | — | |

| Ongoing Offering Costs | | | 0.50 | | | | 25.00 | | | | 0.50 | | | | 25.00 | |

| Administrative Expenses | | | 0.40 | | | | 20.00 | | | | 0.40 | | | | 20.00 | |

Less: Interest Income5 | | | (0.56 | ) | | | (28.00 | ) | | | (0.56 | ) | | | (28.00 | ) |

Trading profit that units must earn to recoup an initial investment of $5,0006 | | | — | | | | 367.00 | | | | — | | | | 267.00 | |

Trading profit as a percentage of net assets that units must earn to recoup an initial investment of $5,0006 | | | 7.34 | | | | — | | | | 5.34 | | | | — | |

| (1) | The breakeven analysis assumes that the units have a constant month-end net asset value and assumes a $5,000 investment. |

| The brokerage fee ranges from an annual rate of 4.65% to 5.0% of the trusts’ month-end net assets for Class A units and 2.65% to 3.0% for Class B units. For purposes of calculating the break-even point, the highest possible brokerage fee rate was used for each class of units. The brokerage fee includes: any applicable sales commissions, all transaction fees, and a fee payable to the trust’s consultant, Liberty Funds Group. |

| For purposes of calculating the breakeven amount, the highest possible management fee, equal to 2.0% of the net assets on an annual basis, has been used. |

| Incentive fees are paid to trading advisors only on new trading profits earned by the trading advisor on the portion of the trust’s net assets that it manages. New trading profits are determined after deducting advisor management fees and the brokerage fee and do not include interest income. Therefore, incentive fees will be zero at the breakeven point on the assets managed by the trading advisors. |

| The trust is paid interest on the average daily U.S. dollar balances on deposit with R.J. O’Brien & Associates, LLC at a rate equal to the average four-week Treasury Bill rate. With respect to non-U.S. dollar deposits, the current rate of interest is equal to a rate of one-month LIBOR less 1.0%. The rate of interest used for this calculation was 0.56%, which is an estimated average. |

| A redeeming unitholder pays redemption charges equal to 1.5% of the redemption proceeds to R.J. O’Brien Fund Management, LLC through the end of the eleventh month after the redeemed unit was purchased. Redemption charges, if applicable, reduce the redemption proceeds otherwise payable to investors. |

Principal Tax Aspects of Owning Units

As long as the trust is treated as a partnership for U.S. federal income tax purposes and is not treated as a publicly traded partnership that is taxable as a corporation, taxable U.S. investors are subject to U.S. federal income tax (and applicable state income taxes) each year on their allocable shares of any income and gains recognized by the trust whether or not they redeem any units or receive any distributions from the trust.

Under current law, 40% of any trading profits on Section 1256 Contracts will be taxable as short-term capital gains at the individual investor’s ordinary income tax rate, while 60% of such gains will be taxable as long-term capital gain at a 15% maximum rate for individuals. The trust’s trading gains from other contracts will be primarily short-term capital gain. This tax treatment applies regardless of how long an investor holds units. If, on the other hand, an individual investor held a stock or bond for more than twelve months, all the gain realized on its sale would generally be taxed as long-term capital gain, generally at a 15% maximum rate through 2010.

Losses on the units may be deducted against capital gains, and, in the case of individuals, any losses in excess of capital gains may only be deducted against ordinary income to the extent of $3,000 per year. Consequently, investors could pay tax on the trust’s interest income even though they have lost money on their units. See “Tax Consequences” beginning at page 76.

Is the Trust a Suitable Investment for You?

You should consider investing in the trust if you are interested in its potential to produce enhanced returns over the long-term that are generally unrelated to the returns of the traditional debt and equity markets and you are prepared to risk significant or total losses of your investment. An investment in the trust is a diversification opportunity and is not intended to be a complete investment program. Only the risk capital portion of your investment portfolio should be considered for an investment in the trust.

To invest, you must have, at a minimum (i) a net worth of at least $250,000 (exclusive of home, furnishings and automobiles) or (ii) an annual gross income of at least $70,000 and a net worth (similarly calculated) of at least $70,000, in accordance with the North American Securities Administrators Association, Inc. Guidelines for the Registration of Commodity Pool Programs, as amended and adopted on May 7, 2007. A number of states in which the units are offered impose additional or higher suitability standards. Please see the suitability standards in Exhibit B attached to this prospectus.

These standards are regulatory minimums only, and just because you meet the minimum standard does not necessarily mean the units are a suitable investment for you. See the “Subscription Requirements” in Exhibit B for specific information about state requirements.

Investors are cautioned not to invest more than 10% of their readily marketable assets in the trust. Investors should be aware that they may lose all of their investments in the trust.

An Investment in the Units Should be Considered as a Three to Five Year Commitment

The market conditions in which the trust is likely to recognize significant profits occur infrequently. An investor should plan to hold units for long enough to have a realistic opportunity for a number of such trends to develop. The managing owner believes that investors should consider the units at least a three- to five-year commitment.

Important Information About This Prospectus

This prospectus is part of a registration statement that was filed with the Securities and Exchange Commission (“SEC”) on behalf of the trust by its managing owner. Before purchasing any units, you should carefully read this prospectus, together with the additional information incorporated by reference into this prospectus, as described under the heading “Incorporation of Certain Information by Reference,” or information described under the heading “Where You Can Find More Information.”

You should rely only on the information contained in or incorporated by reference into this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The trust will not make an offer to sell units in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus, as well as information that was previously filed with the SEC and incorporated by reference hereto, is accurate as of the date of such document. The trust’s performance, financial condition, results of operations and prospects may have changed since that date.

Incorporation of Certain Information by Reference

The SEC allows the trust to “incorporate by reference” into this prospectus certain information that it has filed with the SEC. This means that the trust can disclose important information to you by referring you to those documents without restating that information in this document. The information incorporated by reference into this prospectus is considered to be part of this prospectus. We incorporate by reference into this prospectus the documents listed below, including their exhibits, except to the extent information in those documents differs from information contained in this prospectus:

| | (a) | The trust’s Annual Report on Form 10-K for the year ended December 31, 2009, as filed with the SEC on March 31, 2010; |

| | (b) | The trust’s current report on Form 8-K filed on April 6, 2010. |

We will provide to any beneficial owner to whom a copy of this prospectus is delivered, a copy of any or all of the information that we have incorporated by reference into this prospectus contained in the registration statement, but not delivered with this prospectus. We will provide this information upon written or oral request and at no cost to the requester. You may request this information by contacting the managing owner at: R.J. O’Brien Fund Management, LLC, 222 South Riverside Plaza, Suite 900, Chicago, Illinois 60606; Attention: Annette Cazenave, Senior Vice President, or by calling (312) 373-5000. You may also access these documents at the managing owner’s website at http://www.rjobrien.com/FundManagement/.

Where You Can Find More Information

The trust filed its registration statement relating to this offering of units with the SEC. This prospectus is part of the registration statement, but the registration statement includes additional information. The trust also files an annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to these reports with the SEC. You may read and copy any of the materials the trust has filed with the SEC at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549 on official business days during the hours of 10:00 a.m. to 3:00 p.m. For further information on the Public Reference Room, please call the SEC at 1-800-SEC-0330. These materials are also available to the public from the SEC’s web site at http://www.sec.gov.

RJO GLOBAL TRUST

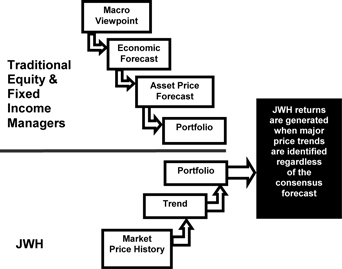

The following is an organizational chart that shows the relationship among the various parties involved with this offering. Other than the trading advisors and the trustee, all of the entities indicated in the organizational chart are affiliates of RJO Holdings, Corp. See “Conflicts of Interest” beginning at page 70.

This section includes the principal risks that you will face with an investment in the trust. You should consider these risks when making your investment decision. You should not invest in the trust unless you can afford to lose your entire investment.

Possible Total Loss of an Investment in the Trust

You could lose all or substantially all of your investment in the trust. Neither the trust nor the trust’s trading advisors have any ability to control or predict market conditions. The investment approach utilized on behalf of the trust may not be successful, and there is no guarantee that the strategies employed by the trust’s trading advisors on behalf of the trust will be successful.

Specific Risks Associated with a Multi-Advisor Commodity Pool

The trust is a multi-advisor commodity pool. Each of the trust’s trading advisors makes trading decisions independent of the other trading advisors for the trust. Thus, it is possible that the trust could hold opposite positions in the same or similar futures, forwards, and options, thereby offsetting any potential for profit from these positions.

Investing in the Units Might Not Diversify an Overall Portfolio

One of the objectives of the trust is to add an element of diversification to a traditional securities or debt portfolio. While the trust may perform in a manner largely independent from the general equity and debt markets, there is no assurance it will do so. An investment in the trust could increase, rather than reduce, the overall portfolio losses of an investor during periods when the trust, as well as equities and debt markets, decline in value. There is no way of predicting whether the trust will lose more or less than stocks and bonds in declining markets. Investors must not rely on the trust as any form of protection against losses in their securities or debt portfolios.

Investors Must Not Rely on the Past Performance of the Trading Advisors or the Trust in Deciding Whether to Buy Units

The performance of the trust is entirely unpredictable, and the past performance of the trust, as well as of the trust’s trading advisors, is not necessarily indicative of their future results.

An influx of new market participants, changes in market regulation, international political developments, demographic changes and numerous other factors can contribute to once-successful strategies becoming outdated. Not all of these factors can be identified, much less quantified. There can be no assurance that the trust’s trading advisors will trade the trust’s assets in a profitable manner.

Volatile Performance History

The performance of the trust to date has been volatile. As of January 31, 2010, the trust has been experiencing a drawdown for the last 80 months for Class A units, which stood at (25.32%), and for the last 13 months for Class B units, which stood at (12.13%). Past performance of the trust is not necessarily indicative of future results.

The Trust’s Substantial Expenses Will Cause Losses for the Trust Unless Offset by Profits and Interest Income

The trust pays annual expenses of approximately 4.99% to 7.34% after taking into account estimated interest income of its average month-end assets. In addition to this annual expense level, the trust is subject to 20% quarterly incentive fees on any new trading profits. Because these incentive fees are calculated quarterly, they could represent a substantial expense to the trust even in a breakeven or unprofitable year. Additionally, investors who redeem units within the first eleven months after the units are issued would in effect pay 6.49% to 8.85% including the 1.5% redemption fee.

The trust’s expenses could, over time, result in significant losses. Except for the incentive fee, these expenses are not contingent and are payable whether or not the trust is profitable. Furthermore, some of the strategies and techniques employed by the trust’s trading advisors may require frequent trades to take place and, as a consequence, portfolio turnover and brokerage commissions may be greater than for other investment entities of similar size. Investors will sustain these losses if the trust is unable to generate sufficient trading profits to offset its fees and expenses. Please see the “Break-Even Table” and “Charges” on pages 7 and 23, respectively, for a more complete discussion of the fees to be charged to the trust.

Incentive Fees may be Paid Even Though Trading Losses are Sustained

The trust pays the trading advisors incentive fees based on the new trading profits they each generate for the trust with respect to the assets traded by such advisor. These new trading profits include unrealized appreciation on open positions. Accordingly, it is possible that the trust will pay an incentive fee on new trading profits that do not become realized. Also, each trading advisor will retain all incentive fees paid to it, even if it incurs a subsequent loss after payment of an incentive fee. Due to the fact that incentive fees are paid quarterly, it is possible that an incentive fee may be paid to a trading advisor during a year in which the assets allocated to the trading advisor suffer a loss for the year. Because each trading advisor receives an incentive fee based on the new net trading profits earned by the trading advisor, the trading advisors may have an incentive to make investments that are riskier than would be the case in the absence of such incentive fee being paid to the trading advisors based on new trading profits. In addition, as incentive fees are calculated on a trading-advisor-by-trading-advisor basis, it is possible that one or more trading advisors could receive incentive fees during periods when the trust has a negative return as a whole.

An Investment in the Trust is not Liquid

The units are not a liquid investment. There is no secondary market for the units. Investors may redeem units only as of the last day of each calendar month on five business days’ written notice. Partial redemptions must be in the amount of at least $1,000 of units and investors must maintain a balance of $1,000 of units. A redemption fee equal to 1.5% will apply to units redeemed within the first eleven months after their issuance.

The Trust is Subject to Market Fluctuations

Managed futures trading involves trading in various commodity interests. The market prices of futures contracts fluctuate rapidly. Prices of futures contracts traded by the trust’s trading advisors are affected generally, among other things, by (1) changing supply and demand relationships, (2) weather, agricultural, trade, fiscal, monetary and exchange control programs, (3) policies of governments and national and international political and economic events; and (4) changes in interest rates. The profitability of the trust depends entirely on capitalizing on fluctuations in market prices. If a trading advisor incorrectly predicts the direction of prices in futures, forwards, and options, large losses may occur. Often, the most unprofitable market conditions for the trust are those in which prices “whipsaw,” moving quickly upward, then reversing, then moving upward again, then reversing again.

Options Trading can be More Volatile and Expensive than Futures Trading

The trust may also trade options which, although options trading requires many of the same skills, has different risks than futures trading. Successful options trading requires a trader to assess accurately near-term market volatility because that volatility is immediately reflected in the price of outstanding options. Correct assessment of market volatility can therefore be of much greater significance in trading options than it is in many long-term futures strategies where volatility does not have as great an effect on the price of a futures contract.

Options are Volatile and Inherently Leveraged, and Sharp Movements in Prices Could Cause the Trust to Incur Large losses

Certain trading advisors may use options on futures contracts, forward contracts or commodities to generate premium income or speculative gains. Options involve risks similar to futures, because options are subject to sudden price movements and are highly leveraged, in that payment of a relatively small purchase price, called a premium, gives the buyer the right to acquire an underlying futures contract, forward contract or commodity that has a face value substantially greater than the premium paid. The buyer of an option risks losing the entire purchase price of the option. The writer, or seller, of an option risks losing the difference between the purchase price received for the option and the price of the futures contract, forward contract or commodity underlying the option that the writer must purchase or deliver upon exercise of the option. There is no limit on the potential loss. Specific market movements of the futures contracts, forward contracts or commodities underlying an option cannot accurately be predicted.

Cash Flow Needs May Cause Positions to be Closed which May Cause Substantial Losses

Certain trading advisors may trade options on futures. Futures contract gains and losses are marked-to-market daily for purposes of determining margin requirements. Option positions generally are not marked-to-market daily, although short option positions will require additional margin if the market moves against the position. Due to these differences in margin treatment between futures and options, there may be periods in which positions on both sides must be closed down prematurely due to short term cash flow needs of the trust. If this occurs during an adverse move in a spread or straddle relationship, then a substantial loss could occur.

The Large Size of the Trust’s Trading Positions Increases the Risk of Sudden, Major Losses

The trust takes positions with face values up to as much as approximately fifteen times its total equity. Consequently, even small price movements can cause major losses.

As a Result of Leverage, Small Changes in the Price of the Trading Advisors’ Positions May Result in Substantial Losses

Commodity interest contracts are typically traded on margin. This means that a small amount of capital can be used to invest in contracts of much greater total value. The resulting leverage means that a relatively small change in the market price of a contract can produce a substantial loss. Like other leveraged investments, any purchase or sale of a contract may result in losses in excess of the amount invested in that contract. The trust’s trading advisors may result in losses in excess of the amount invested in that contract. The trust’s trading advisors may lose more than their initial margin deposits on a trade.

The Trading Advisors’ Trading is Subject to Execution Risks

Market conditions may make it impossible for the trust’s trading advisors to execute a buy or sell order at the desired price, or to close out an open position. Daily price fluctuation limits are established by the exchanges and approved by the CFTC. When the market price of a contract reaches its daily price fluctuation limit, no trades can be executed outside the limit. The holder of a contract may therefore be locked into an adverse price movement for several days or more and lose considerably more than the initial margin put up to establish the position. Thinly-traded or illiquid markets also can make it difficult or impossible to execute trades.

Unit Values Are Unpredictable and Vary Significantly Month-to-Month

The net asset value per unit can vary significantly month-to-month. Investors cannot know at the time they submit a subscription or a redemption request what the subscription price or redemption value of their units will be.

The only way to take money out of the trust is to redeem units. You can only redeem units at month-end on five business days’ advance notice and subject to possible redemption charges and minimum balance and redemption request amounts. The restrictions imposed on redemptions limit your ability to protect yourself against major losses by redeeming units.

Transfers of units are subject to limitations as well, such as advance written notice of any intent to transfer and the consent of the managing owner prior to the acceptance of a substitute unitholder.

In addition, investors are unable to know whether they are subscribing for units after a significant upswing in the net asset value per unit — often a time when the trust has an increased probability of entering into a losing period.

Possible Effect of Redemptions on the Value of Units

Substantial redemptions of units could require the trust to liquidate investments more rapidly than otherwise desirable in order to raise the necessary cash to fund the redemptions and, at the same time, achieve a market position appropriately reflecting a smaller equity base. This could make it more difficult to recover losses or generate profits. Illiquidity in the markets could make it difficult to liquidate positions on favorable terms, and may result in losses.

Incentive-Based Compensation May Affect Trading Advisors’ Trading

The trading advisors are entitled to compensation based upon net trading gain in the value of the assets they manage. Incentive-based arrangements may give them incentives to engage in transactions that are more risky or speculative than they might otherwise make because speculative investments might result in higher profits in which the trading advisor would participate, resulting in higher incentive fees to them, while resulting in larger losses to the trust. The trading advisors will not return an incentive fee for a period in which there is net trading gain if, in a subsequent period, the investments under their management suffer a net trading loss. In addition, because the incentive fee for each trading advisor is based solely on its performance, and not the overall performance of the trust, the trust may indirectly pay an incentive fee to one or more trading advisors during periods when the trust is not profitable on an overall basis.

Disadvantages of Replacing or Switching Trading Advisors

A trading advisor generally is required to recoup previous trading losses before it can earn performance-based competition. However, the managing owner may elect to replace a trading advisor that has a “loss carry-forward.” In that case, the trust would lose the “free ride” of any potential recoupment of the prior losses of such trading advisor. In addition, the trading advisor would earn performance-based compensation on the first dollars of investment profits. The effect of the replacement of or the reallocation of assets away from a trading advisor, therefore, could be significant.

The Opportunity Costs of Rebalancing the Trading Programs

The quarterly rebalancing of the trust’s assets among its trading advisors and their trading programs may result in the liquidation of profitable positions, thereby foregoing greater profits which the trust would otherwise have realized, and the establishment of unprofitable positions, thereby incurring losses which the trust would otherwise have avoided had rebalancing not occurred.

Alteration of Trading Systems and Contracts and Markets Traded

The trust’s trading advisors may, in their discretion, change and adjust the trading programs, as well as the contracts and markets traded. These adjustments may result in foregoing profits which the trading programs would otherwise have captured, as well as incurring losses which they would otherwise have avoided. Neither the managing owner nor the unitholders are likely to be informed of any non-material changes in the trading programs.

Increased Competition from Other Trend-Following Traders Could Reduce the Trust’s Profitability

There has been a dramatic increase over the past twenty-five years in the amount of assets managed by trend-following trading systems like John W. Henry & Company, Inc.’s and Abraham Trading Company’s trading programs. In 1980, the amount of assets in the managed futures industry was estimated at approximately $300 million; by December 31, 2009, this estimate was approximately $213 billion. It is also estimated that over half of all managed futures trading advisors rely primarily on trend-following systems. Although the amount of trading in the futures industry as a whole has increased significantly during the same period of time, the increase in managed money increases trading competition. The more competition there is for the same positions, the more costly and harder they are to acquire.

Systematic Strategies Do Not Consider Fundamental Types of Data, or Minimally Consider Fundamental Types of Data, and Do Not Have the Benefit of Discretionary Decision Making

Portfolio managers like John W. Henry & Company, Inc., Abraham Trading Company, and Global Advisors (Jersey) Limited rely primarily on technical, systematic strategies that do not take into account factors external to the market itself (although certain of these strategies may have minor discretionary elements incorporated into their system strategy). The widespread use of technical trading systems frequently results in numerous managers attempting to execute similar trades at or about the same time, altering trading patterns and affecting market liquidity. Furthermore, the profit potential of trend-following systems may be diminished by the changing character of the markets, which may make historical price data (on which technical programs are based) only marginally relevant to future market patterns. Systematic strategies are developed on the basis of a statistical analysis of market prices. Consequently, any factor external to the market itself that dominates prices that a discretionary decision-maker may take into account may cause major losses for a systematic strategy. For example, a pending political or economic event may be very likely to cause a major price movement, but a systematic strategy may continue to maintain positions indicated by its trading method that might incur major losses if the event proved to be adverse.

Increasing the Level of Equity Under a Trading Advisor’s Management Could Lead to Diminished Returns

The rates of returns achieved by a trading advisor often diminish as the assets under its management increases. This can occur for many reasons, including the inability of the trading advisor to execute larger position sizes at desired prices and because of the need to adjust the trading advisor’s trading program to avoid exceeding speculative position limits. These are limits established by the CFTC and the exchanges on the number of speculative futures and options contracts in a commodity that one trader may own or control. The trading advisors have not agreed to limit the amount of additional assets that they will manage.

Illiquid Markets Could Make It Impossible for the Trust to Realize Profits or Limit Losses

In illiquid markets, the trust’s trading advisors could be unable to capitalize on the opportunities identified by it or to close out positions against which the market is moving. There are numerous factors which can contribute to market illiquidity, far too many for the trading advisors to predict when or where illiquid markets may occur. The trust attempts to limit its trading to highly liquid markets, but there can be no assurance that a market which has been highly liquid in the past will not experience periods of unexpected illiquidity.

Unexpected market illiquidity has caused major losses in recent years in such sectors as emerging markets, fixed income relative value strategies and mortgage-backed securities. There can be no assurance that the same will not happen to the trust at any time or from time to time. The large size of the positions which the trading advisors acquire for the trust increases the risk of illiquidity by both making its positions more difficult to liquidate and increasing the losses incurred while trying to do so.

The Trust Trades in Foreign Markets; These Markets Are Less Regulated Than U.S. Markets and Are Subject to Exchange Rate, Market Practices and Political Risks

Some of the trading programs used for the trust trade outside the U.S. From time to time, as much as 20%–40% of the trust’s overall market exposure could involve positions taken on foreign markets. Foreign trading involves risks — including exchange-rate exposure, possible governmental intervention and lack of regulation — which U.S. trading does not. In addition, the trust may not have the same access to certain positions on foreign exchanges as do local traders, and the historical market data on which the trust’s commodity trading advisors base their strategies may not be as reliable or accessible as it is in the United States. Certain foreign exchanges may also be in a more or less developmental stage so that prior price histories may not be indicative of current price dynamics. The rights of traders or investors in the event of the insolvency or bankruptcy of a non-U.S. market or broker are also likely to be more limited than in the case of U.S. markets or brokers. Additionally, trading on U.S. exchanges is subject to CFTC regulation and oversight, including, for example, minimum capital requirements for commodity brokers, regulation of trading practices on the exchanges, prohibitions against trading ahead of customer orders, prohibitions against filling orders off exchanges, prescribed risk disclosure statements, testing and licensing of industry sales personnel and other industry professionals and record keeping requirements. Trading on non-U.S. exchanges is not regulated by the CFTC or any other U.S. governmental agency or instrumentality and may be subject to regulations that are different from those to which U.S. exchanges trading is subject, provide fewer protections to investors than trading on U.S. exchanges, and may be less vigorously enforced than regulations in the U.S.

Unregulated Markets, Particularly the Trading of Spot and Forward Contracts in Currency, Lack Regulatory Protections of Exchanges

A substantial portion of the trust’s trading — primarily its trading of spot and forward contracts in currencies — takes place in unregulated markets. It is impossible to determine fair pricing, prevent abuses such as “front-running” or impose other effective forms of control over such markets. The absence of regulation could expose the trust in certain circumstances to significant losses which it might otherwise have avoided. Because these contracts are not traded on an exchange, the performance of them is not guaranteed by an exchange or its clearinghouse, and the trust is at risk with respect to the ability of the counterparty to perform on the contract. Additionally, see the Risk Factor entitled “The Trust Trades in Foreign Markets; These Markets Are Less Regulated Than U.S. Markets and Are Subject to Exchange Rate, Market Practices and Political Risks” directly above.

Electronic Trading

The trust’s trading advisors may from time to time trade on electronic markets and use electronic order routing systems, which differ from traditional open outcry pit trading and manual order routing methods. Characteristics of electronic trading and order routing systems vary widely among the different electronic systems with respect to order matching procedures, opening and closing procedures and prices, error trade policies and trading limitations or requirements. There are also differences regarding qualifications for access and grounds for termination and limitations on the types of orders that may be entered into the system. Each of these matters may present different risk factors with respect to trading on or using a particular system. Each system may also present risks related to system access, varying response times and security. Trading through an electronic trading or order routing system also entails risks associated with system or component failure. In the event of system or component failure, it is possible that for a certain time period, it might not be possible to enter new orders, execute existing orders or modify or cancel orders that were previously entered. System or component failure may also result in loss of orders or order priority. Some contracts offered on an electronic trading system may be traded electronically and through open outcry during the same trading hours. Exchanges offering an electronic trading or order routing system and/or listing the contract may have adopted rules to limit their liability, the liability of futures brokers and software and communication system vendors and the amount that may be collected for system failures and delays. These limitations of liability provisions vary among the exchanges.

Regulatory Changes Could Restrict the Trust’s Operations

The trust implements a speculative, highly leveraged strategy. From time to time there is governmental scrutiny of these types of strategies and political pressure to regulate their activities.

Regulatory changes could adversely affect the trust by restricting its markets, limiting its trading and/or increasing the taxes to which unitholders are subject. Pending legislation may amend the regulation applicable to futures and over-the-counter derivatives markets. These amendments may alter the applicable requirements for trading in the futures, options and over-the-counter derivatives markets. Such changes may limit trading or restrict the ability of the managers to implement certain trading strategies. This pending legislation might adversely affect the trust. However, regulatory initiatives adversely affecting the trust could develop without notice.

The Trust Could Lose All of its Assets and Have Its Trading Disrupted Due to the Bankruptcy of the Managing Owner, the Trust’s Commodity Broker or Others

The trust is subject to the risk of insolvency of an exchange, clearinghouse, commodity broker, and counterparties with whom the trading advisors trade. Trust assets could be lost or impounded in such an insolvency during lengthy bankruptcy proceedings. Were a substantial portion of the trust’s capital tied up in a bankruptcy, the managing owner might suspend or limit trading, perhaps causing the trust to miss significant profit opportunities. The trust is subject to the risk of the inability or refusal to perform on the part of the counterparties with whom contracts are traded. In the event that the clearing broker is unable to perform its obligations, the trust’s assets are at risk and investors may only recover a pro rata share of their investment, or nothing at all.

Exchange-traded futures and futures-styled option contracts are marked to market on a daily basis, with variations in value credited or charged to the trust’s account on a daily basis. The clearing broker, as futures commission merchant for the trust’s exchange-traded contracts, is required, pursuant to CFTC regulations, to segregate from its own assets, and for the sole benefit of its commodity customers, all funds held by such clients with respect to exchange-traded futures and futures-styled options contracts, including an amount equal to the net unrealized gain on all open futures and futures-styled options contracts. Bankruptcy law applicable to all U.S. futures brokers requires that, in the event of the bankruptcy of such a broker, all property held by the broker, including certain property specifically traceable to the trust, will be returned, transferred, or distributed to the broker's customers only to the extent of each customer's pro rata share of the assets held by such futures broker.

With respect to transactions the trust enters into that are not traded on an exchange, there are no daily settlements of variations in value and there is no requirement to segregate funds held with respect to such accounts. Thus, the funds the trust invests in such transactions may not have the same protections as funds used as margin or to guarantee exchange-traded futures and options contracts. If the counterparty becomes insolvent and the trust has a claim for amounts deposited or profits earned on transactions with the counterparty, the trust's claim may not receive a priority. Without a priority, the trust is a general creditor and its claim will be paid, along with the claims of other general creditors, from any monies still available after priority claims are paid. Even funds of the trust that the counterparty keeps separate from its own operating funds may not be safe from the claims of other general and priority creditors. There are no limitations on the amount of allocated assets a portfolio manager can trade on foreign exchanges or in forward contracts.

Special Redemption in Event of 50% Decline in Net Assets; Limitation on Redemption Payments

If the trust experiences a decline in net asset value per unit as of the close of business on any business day to less than 50% of the net asset value per unit on the prior highest month-end net asset value, or to $50 or less, the managing owner will liquidate all open positions and suspend trading. Within ten days of such event, the managing owner shall declare a special redemption date and mail notice of such event to each unitholder. The right of a unitholder to receive a redemption payment, including in connection with this special notice, depends on the trust’s ability to obtain the necessary funds by liquidating commodity positions and obtaining payments from its commodity brokers, banks, or other persons or entities.

Possibility of Termination of the Trust Before Expiration of Its Stated Term

The managing owner may withdraw from managing the trust upon 120 days’ notice, which would cause the trust to terminate unless a substitute managing owner were obtained. Other events, such as a substantial decline in the aggregate net assets of the trust or the net asset value per unit, as described in the Eighth Amended and Restated Declaration and Agreement of Trust, could also cause the trust to terminate before the expiration of its stated term. This could cause you to liquidate your investments and upset the overall maturity and timing of your investment portfolio. If the registrations with the CFTC or memberships in the NFA of the managing owner or the trust’s trading advisors were revoked or suspended, such entity would no longer be able to provide services to the trust, which would cause the trust to terminate in 90 days unless a substitute managing owner were obtained.

Trading Swaps Creates Distinctive Risks

Certain of the trading advisors may trade swaps. Swaps are not traded on exchanges and are not subject to the same type of government regulation as exchange markets. As a result, many of the protections afforded to participants on organized exchanges and in a regulated environment are not available in connection with these transactions. The swap markets are “principals’ markets,” in which performance with respect to a swap is the responsibility only of the counterparty to the contract, and not of any exchange or clearinghouse. The trust is subject to the risk of the inability or refusal to perform with respect to swaps on the part of the counterparties. There are no limitations on daily price movements in swaps. Speculative position limits are not applicable to swaps. Participants in the swap markets are not required to make continuous markets in the swaps they trade.

The regulation of swaps may be subject to substantial change under pending legislation. It is not known how such changes will impact existing swaps positions. These changes, if enacted, may alter the manner in which swaps are traded, whether they are required to be cleared by a clearinghouse and whether swaps will be subject to other regulatory requirements, such as speculative position limits.

Stop-loss Orders May not Prevent Large Losses

Certain of the trading advisors may use stop-loss orders. Such stop-loss orders may not effectively prevent substantial losses, and depending on market factors at the time, may not be able to be executed at such stop-loss levels. No risk control technique can assure that large losses will be avoided.

Off-exchange Foreign Currency Futures and Options

The trading advisors may engage in the trading of off-exchange foreign currency contracts on behalf of the trust. Such contracts are not traded on exchanges and are not guaranteed by a clearing house; rather, banks and dealers act as principals in these markets. Neither the CFTC nor any banking authority regulates trading in such off-exchange foreign currency contracts. In addition, there is no limitation on the daily price movements of off-exchange foreign currency contracts. Principals in the off-exchange foreign currency markets have no obligation to continue to make markets in the off-exchange foreign currency contracts traded. There have been periods during which certain banks or dealers have refused to quote prices for off-exchange foreign currency contracts or have quoted prices with an unusually wide spread between the price at which they are prepared to buy and that at which they are prepared to sell. The imposition of credit controls by governmental authorities might limit such off-exchange foreign currency trading to less than that which a trading advisor would otherwise recommend, to the possible detriment of the trust.

If a trading advisor engages in off-exchange foreign currency trading, the trust will be subject to the risk of the failure of, or the inability to perform with respect to its off-exchange foreign currency contracts by, the principals with which the trust trades. Trust funds on deposit with such principals will also generally not be protected by the same segregation requirements imposed on CFTC-regulated futures brokers with respect to customer funds on deposit with them. However, the trust intends to engage in off-exchange foreign currency trading only with large, well-capitalized banks and dealers. In addition, a trading advisor may order trades for the trust in such markets through agents. Accordingly, the insolvency or bankruptcy of such parties could also subject the trust to the risk of loss.

Investors Are Taxed Every Year on Their Share of the Trust’s Profits and Will Need To Fund such Taxes from Other Sources

The managing owner does not intend to make distributions to the unitholders, but intends to re-invest substantially all of the trust’s income and gains for the foreseeable future. As long as the trust is treated as a partnership for U.S. federal income tax purposes and is not treated as a publicly traded partnership that is taxable as a corporation, taxable U.S. investors are subject to U.S. federal income tax (and applicable state income taxes) each year on their allocable shares of any income and gain of the trust, even if they receive no distributions and irrespective of whether they redeem any units. Investors may need to pay this tax liability out of their other resources or by redeeming units from the trust.

All performance information included in this prospectus is presented on a pre-tax basis; the investors who experienced such performance had to pay the related taxes from other sources.

Over time, the compounding effects of the annual taxation of the trust’s income may be material to the economic consequences of investing in the trust. For example, a 10% compound annual rate of return over five years would result in an initial $10,000 investment compounding to $16,105. However, if one factors in a 30% tax rate each year, the result would be $14,025.

The Trust Generates Short-Term Capital Gains That Are Not Eligible for a Preferential Tax Rate

Investors are taxed on their share of any trading profits of the trust at both short- and long-term capital gain rates depending on the mix of U.S. exchange-traded contracts and non-U.S. exchange-traded contracts traded. These tax rates are determined irrespective of how long an investor holds units. Consequently, the tax rate on the trust’s trading gains may be higher than those applicable to other investments held by an investor for a comparable period.

Tax Could Be Due From Investors on Their Share of the Trust’s Interest Income Despite Overall Losses

Investors may be required to pay tax on their allocable share of the trust’s interest income, even though the trust incurs overall losses. Trading losses should be capital losses that can only be used by individuals to offset capital gains and $3,000 of ordinary income, such as interest income, each year. Consequently, if an investor were allocated $5,000 of interest income and $10,000 of net trading losses, the investor would owe tax on $2,000 of interest income even though the investor would have a $5,000 economic loss for the year. The $7,000 loss would carry forward, but subject to the same limitation on its deductibility against ordinary income.

Deductibility of Trust Expenses May Be Limited if Characterized as Investment Advisory Fees

How the Trust Works

Buying Units

You may buy units in the trust as of the last business day of any month at the current net asset value. Your subscription must be submitted to the trust’s administrator, ACS Securities Services, Inc., by the fifth business day prior to the month-end of the month preceding your subscription date. Late subscriptions will be applied to unit sales as of the end of the second month after receipt, unless revoked by the investor.

The managing owner has no present intention to terminate the offering, but may do so at any time in its sole discretion.

Units are offered at net asset value. Investors need to submit subscription agreements with each purchase of units. The minimum purchase for first-time investors is $5,000 for individuals and $2,000 for IRAs and other tax-exempt accounts. Existing investors may make additional investments in $1,000 minimums.

Use of Proceeds

100% of all subscription proceeds are invested directly into the trust.

The trust uses subscription proceeds to margin its speculative futures trading, as well as to pay trading losses and expenses. At the same time that the trust’s assets are being used as margin, the excess cash margin is available for active or passive cash management. The trust is paid interest on the average daily U.S. dollar balances on deposit with R.J. O’Brien & Associates, LLC at a rate equal to the average four-week Treasury Bill rate. With respect to non-U.S. dollar deposits, the current rate of interest is equal to a rate of one-month LIBOR less 1.0%. To the extent excess cash is not invested in securities, such cash will be subject to the creditworthiness of the institution where such funds are deposited. To the extent the trust trades in futures and options contracts on U.S. exchanges, the assets deposited by the trust with its clearing brokers as margin must be segregated pursuant to the regulations of the CFTC. Such funds, along with segregated funds of other customers in the accounts, may be invested by the commodity brokers, under applicable CFTC regulations, in general obligations of the U.S. and obligations fully guaranteed as to principal and interest by the U.S., general obligations of any State or political subdivision thereof, obligations issued by an enterprise sponsored by the U.S., certificates of deposit issued by a bank as defined in the Commodity Exchange Act or a domestic branch of a foreign bank insured by the FDIC, commercial paper, corporate notes or bonds, general obligations of a sovereign nation, and interests in money market mutual funds, subject to conditions and restrictions regarding marketability, investment quality and investment concentration. In addition, such investments may be bought and sold pursuant to designated repurchase and reverse repurchase agreements. Such funds are subject to being held as “customer segregated funds” under CFTC rules.

To the extent that the trust trades in futures, forward, options and related contracts on markets other than regulated U.S. futures exchanges, the assets deposited by the trust with its clearing brokers as margin may be invested by the commodity brokers, under applicable CFTC regulations, in the instruments described above for customer segregated funds and also in equity and debt securities traded on established securities markets in the U.S. Such funds are subject to being held as “secured amounts” rather than as “customer segregated funds” under CFTC rules.

Redeeming Units

You can redeem units monthly. To redeem at month-end, contact your financial advisor or the managing owner. Redemption requests must be received by the trust’s administrator, ACS Securities Services, Inc., no later than the fifth business day prior to the month-end of redemption.