SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material Pursuant to §240.14a-12 |

Amegy Bancorporation, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | |

| | | Filed by: Amegy Bancorporation, Inc. |

| | | Pursuant to Rule 14a-12 |

| | | under the Securities Exchange Act of 1934 |

| |

| | | Subject Company: Amegy Bancorporation, Inc. |

| | | Commission File No. 000-22007 |

On August 31, 2005, Amegy Bancorporation, Inc. issued the following communication:

| | |

| | VOLUME 1 ISSUE 8 ~ AUGUST 2005 Equipment Leasing &

Finance Contest, page 2 2Q Earnings, page 3 Blitz Winners, page 4 |

NOTABLE NEWS

Amegy Increases Prime Rate

Effective August 9, the Bank increased its Prime Rate from 6.25% to 6.50%. This follows a similar increase by the Federal Reserve Bank of .25 percent in its target for federal funds rate.

Higher 12-Month CD Rate

On August 12th, the Bank increased its promotional 1 year/12-Month CD /IRA to 4.00% APY. This promotion is available for CDs and IRAs in all of Amegy banking centers to all customers who have or are opening a checking or savings account. Customers may use existing Amegy funds to open this promotional CD/IRA (Risable Rate Option available).

New Humble Banking Center Opening

On Monday, August 15, the new Amegy Humble banking center opened its doors for business! The banking center is located on the FM 1960 Bypass near the Humble Wal-Mart. A ribbon cutting ceremony for this location will be held at 10:30 a.m. on September 9, followed by a Grand Opening week, running from September 12 - 17.

2005 Annual Code of Conduct and Ethics Re-Certification

It’s time to review the revised Code of Conduct and Ethics (“the Code”) on PeopleSoft. Your annual certification is an essential part of the Bank’s ongoing corporate governance practices and is required by law. If you have not been certified in 2005, you are required to do so by September 30, 2005. If you have questions about the Code, please contact the Human Resources Department at x21052.

Oil Prices Reach Record Highs

Oil prices have soared to a new record high of $68 a barrel the week of August 25th. Rising concern a tropical storm could hit production sites in the Gulf of Mexico as well as a U.S. government energy report released this week showing a decline in the country’s gasoline supply are factors related to this price increase. However, current prices adjusted for inflation are still below the level oil prices hit in the late 1970s and early 1980s.

Business Wins Continue

Throughout the Bank, Amegy’s bankers are leading by example when they say, “It is business as usual around here.”

Within the last few weeks, Commercial Lender Sloan Evans has closed a $5 million loan to consolidate existing debt for one of his service industry clients. In the east/southeast region, Commercial Lender Russell Lindsey and Treasury Management Sales Officer Angela Tellez recently closed significant credit, treasury management, and depository business. Meanwhile, Larry Jensen and Abbey Moore are hard at work to win a revolving credit facility and treasury management business from a manufacturing prospect.

Community Lender John Kelley has spent the last month putting the finishing touches on a $5 million loan for a church’s facility expansion. “It is business as usual around here. Obviously, the most important thing clients care about is that we are taking care of their needs and that our pricing and terms are competitive,” says Kelley. “Everything else becomes a distraction only when you let it.”

In Dallas, Corporate Lender Melinda Jackson has just closed a $15 million participation in a syndicated deal for an equipment manufacturer and supplier. The company is considering moving some of its interest rate hedging business to Amegy as well (see Hedging article on page 2).

Many Retail bankers are having the same experience. Vicki Mackey, Sterling Ridge Banking Center Manager, is one of 18 bankers in the Retail business line recently recognized for new business efforts during a Retail blitz. “I have developed many relationships with building contractors in the region, which are a great referral source for Home Improvement Loans. And just asking for referrals from current clients is a proven formula for winning new business,” says Mackey.

In the Dallas Operations Center, Credit Analyst Tom Caughlin and Corporate Lender Melinda Jackson worked together to close a recent deal.

It’s business as usual for customers as well. James Prickett in LaPorte has been asking for the personal business of one of his largest commercial clients for years. “Within a week after the merger announcement, he walked into our banking center and said, ‘I have been promising you my personal accounts,’” recalls Prickett. “He then opened three accounts for his wife and himself.”

As always, executive management is available to make calls. CEO Paul Murphy has been on several calls with lenders from The Woodlands to Fort Bend County in an effort to move more business across the finish line. “This is one of my favorite things to do, but as a public company, Scott, Randy and I would have to devote significant time meeting with the investment analyst community. I expect the number of calls we can go on to increase meaningfully once the integration is complete. If anyone has a prospect that they need a little extra help with, call one of us and let’s see what we can do!”

Amegy Mortgage:

Announcing Online Pre-Approvals

After receiving an online pre-approval, potential clients are referred to a Residential Loan Officer such as Jennifer Goodwin of Amegy Mortgage.

When beginning the home buying process, the first question a potential buyer hears from a realtor is often, “have you been pre-approved?”

“We have made the home buying process easier with our new online pre-approval system,” said Mike Holtkamp, SVP Residential Lending. “This new functionality has the ability to pre-approve customers. If pre-approved, a customer instantly receives a pre-approval letter that they can print and use when looking at properties with their realtor.”

See PRE-APPROVALS on page 4

Job Fairs Continue for Retail Bank

While much of Human Resources’ attention has been devoted to the job mapping process with Zions, the group remains focused on preparing the Bank for the future. This was evident at the first of four Retail Job Fairs where more than 30 pre-screened applicants interviewed for positions within the Retail business line.

The Fairs are being held at the FM 1960, League City Historic, Galleria and Rollingbrook banking centers to build a pipeline for future job openings.

Advertisements in the Houston Chronicle and community newspapers are being used to publicize the events and direct candidates to submit their resumes at www.amegybank.com. If candidates meet the requirements, they are invited to the Job Fair to begin the selection process.

Employees are reminded that they can receive $1000 for referring individuals who are subsequently hired to work at the Bank.

STOCK BOX

| | | | | | | | | | | |

Stock Close on 07/29/05

| | % Change

From

Previous

Month

| | | July Avg.

Daily

Volume

| | YTD%

Change

| | | 12-Month

Total

Return

| |

$22.78 | | 1.79 | % | | 2,344,604 | | -2.19 | % | | 12.6397 | % |

From The Desk Of…

Getting Back to Business as Usual

The last month and a half has been filled with excitement and buzz about the Zions/Amegy merger. As Amegy employees, it is inevitable that you have been somewhat distracted by all of the hype… and, that’s normal in a merger environment. As Walter, Scott and I have said before, we believe this merger is the best decision for our shareholders, customers, and employees. But, for this to be true, we have to continue to perform… we must get back to business as usual.

I know it’s difficult to focus when you have unanswered questions about the merger. But, I assure you in time, as we have the information, all necessary merger communication will be released.

Back in April, I wrote to you about the importance of growing deposits. Let me remind you of this message. All of the many products and services a banker offers are driven by three things –making loans, growing deposits, and selling our fee services products. Don’t forget about the many programs at the Bank like the Commercial and Retail Blitzes, the Equipment Leasing Contest, (see articles in thisAmegy Newsedition) and Everyone’s A Prospect that make gaining business an easy and rewarding process.

Use the merger to your advantage with both your customers and colleagues. Communicate that this opportunity will allow Amegy to preserve the heritage of a community bank with the efficiencies of a larger company.

From the recent success stories I have heard, many of you have been doing this already. When Dallas Energy Lender Don Drake emailed a mid-size compressor company about the merger, the company immediately called Don to schedule a lunch for the following week. Don was quick to get back to business after hearing about the merger, and he used the news of the merger to win more business. Don was excited about the merger, so his customer responded positively.

Since the news of the merger was released, our message to our customers has been that they will continue to experience the same proactive, local service that they have grown to expect. Let’s keep our promise and continue to serve our customers with dedication and enthusiasm as we always have. Remember, without the efforts of our hardworking employees, this service is not possible.

Equipment Leasing & Financing Group Summer Incentive Contest

Situation:An Amegy Banker is leaving the doctor’s office and notices the doctor’s computer and other IT equipment.

The A Banker asks:Are you planning to acquire any capital equipment in the next 6 months to a year?

The doctor’s likely answer:Yes.

A Banker’s follow up:Would you be interested discussing a proposal with our Equipment Leasing & Finance Group?

The doctor’s probable answer:Sure, I’d be happy to visit with one of them.

If the simplicity of the scenario described above isn’t enough motivation to refer prospects and customers to the Equipment Leasing & Financing Group, all Amegy bankers are eligible for the Summer Leasing Incentive Contest. The contest will run until September 30.

“Many companies can benefit from Leasing Equipment because it’s often more attractive financing than taking out a loan,” says Rodger Garrison, Equipment Leasing Manager. “To understand the types of capital equipment that can be financed through leasing, employees should think outside the box. Wallpaper, napkins, IT equipment for doctors’ offices, and office furniture are just a few examples of equipment that could potentially be leased.”

See CONTEST on page 4

We’re Not Hedging on This…

New Interest Rate Swap Product Gets the Job Done

In today’s rising interest rate environment, many customers prefer a fixed rate on their loans. On the flip side, it’s natural for the Bank to prefer floating rate loans when rates are increasing. This situation led Trust & Investments Manager Dave Farries and Chief Lending Officer Joe Argue to look into hedging products for Amegy Bank. Debuting in June 2005, the Bank’s new interest rate swap product allows bankers to accommodate a customer’s request for fixed pricing while maintaining a profitable relationship for the Bank.

An interest rate swap is an agreement between two parties who exchange interest payments, based on a notional principal amount, over an agreed period of time.

This new functionality is a high-return and low-risk way to protect against rising rates.

See INTEREST RATE SWAP on page 4

Interest Rate Swap 101

In the swap process, the loan and the hedge are two separate transactions. Interest rate hedges for loans allow customers to separate the borrowing rate decision from the interest rate exposure decision. For example, suppose a company who has borrowed on a variable interest rate basis speculates that interest rates are likely to rise. They elect to pay a fixed rate for the remaining term of the loan using an interest rate swap, while their underlying borrowing remains variable, but hedged. In this case, the two variable cash flows offset each other, which achieves a fixed rate for the borrower.

Over 14,000 Cross-selling Opportunities

Small Business Team Has Big Plans!

While serving small business owners has been a backbone of the Bank since its inception, a business line was formalized in early 2004 to focus on the needs of clients that are independently owned and operated and have annual revenues up to $5 million. In its inaugural year, Amegy’s Small Business group already has proven to be a success, and it has big plans for the future.

Small Business team members (left to right) Craig Wessels, Rick Ulloa, Maggie Hicks, Shirley Kwan, and Chuck Bowman.

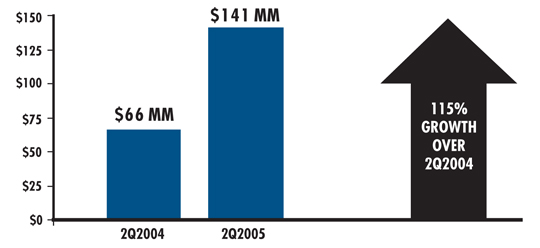

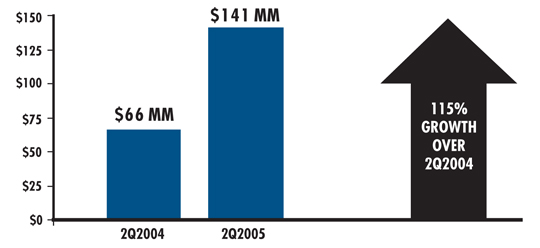

Since the Small Business group’s formation in the second quarter of 2004 through the second quarter of 2005, retail Small Business deposits have increased by $76 million, or 115%, and Small Business loans have increased by $13.5 million, or 461%.

Small Business Manager Chuck Bowman joined Amegy Bank last spring and since then, he has added four Small Business Regional Managers: Shirley Kwan (Southwest), Rick Ulloa (East/Southeast), Maggie Hicks (East/Southeast), and Craig Wessels (North). Chuck oversees the Central area.

There are more than 14,000 Small Business accounts in Amegy banking centers. Rick Ulloa explains: “We’ve identified an abundance of Amegy small business customers, but 76% of them only have single product accounts. This means we have a huge opportunity to cross-sell other products to them.”

See STRATEGY on page 4

Second Quarter Earnings

Core Growth Continues

Amegy Bank’s strategy to build its core businesses proved successful in the second quarter.

Loans and deposits increased at relatively similar rates in the second quarter. Average loans grew by 23% and deposits grew by 20%. Annualized on a linked quarter basis, deposits grew 14%, a significant improvement over the first quarter.

Net income was $19.2 million and total revenue was $94 million, a year-to-year increase of 18% and 22%, respectively. Earnings per share were 27 cents, which is a 13% increase versus the linked quarter.

“I am once again grateful for the contributions our talented employees have made to our results,” said Paul Murphy, CEO. “Our core growth is excellent. Loans, deposits, and fee income all look good and the pipeline for new business is attractive.

However, expense structure and the net interest margin were two areas where we faced the same challenges we have been facing since the third quarter of last year. I believed that those challenges were not going away and were becoming a distraction. Joining Zions will enable us to realize efficiencies by adding capital and even more great products.”

Added Scott McLean, President: “Zions has made a significant investment and they clearly expect us to continue to build out the franchise in Texas. Maintaining our focus on Everyone’s A Prospect and the Community Banking business model are two immediate ways everyone can help. Our goal of becoming the state champ is very much alive and well.”

Customersin the Community

Customers Go Beyond

With a mission to be a strong community partner, Amegy Bank is a natural fit for companies that also work to make a difference. Two Amegy private banking and commercial clients, Ray Solcher of Grocery Services and Mark Brumback of Hearing Aid Express, have exhibited this giving spirit by going beyond their communities to other countries to help those in need.

On a fishing trip in Chile, Ray Solcher and his son visited a school for hearing impaired children in Vina del Mar where the shortage of hearing aids in the region immediately became apparent to them.

Having a hearing impaired son, Ray was well aware of the impact that being hearing impaired can have on a child. He also knew how much the simple gift of a hearing aid can change a child’s life.

As a result of this trip, Ray’s son gave him the idea to form Hearing Aid for Latin America, an organization dedicated to granting the gift of hearing to underprivileged children in Latin America. Ray contacted Mark Brumback to help him with his endeavor. Mark entered the hearing aid industry in 1991 when he purchased the rights to Hearing Aid Express, a company located in Houston and Dallas that offers in-office assembly of hearing aids to its patients.

In 2002, Ray and Mark set out on their first mission to Latin America to fit children for hearing aids. Mark told his relationship officer, Private Banker Missy Krantz, “If you catch it early enough, with the correct hearing aid, hearing impaired children may learn how to speak.” When they showed up, children were lined up to receive the hearing aids. Mark and Ray immediately knew this organization would be a success.

See CUSTOMERS GO BEYOND on page 4

Amegy Makes the Grade with its Bank at School Programs

Amegy Bank of Texas has launched a new Bank at School program with two Houston-area middle schools, Edison Middle School and Ortiz Middle School. The Bank created this program to promote the importance of savings and financial literacy. Through this program, students will be given the opportunity to open an Amegy Young Savers account and, once a week, they will make deposits at their school “banks.”

With the help of Amegy bankers, the students from Edison and Ortiz will run their in-school banks by acting as tellers, bookkeepers, and bank managers. To help facilitate this project, Amegy has partnered with The After-School-All-Stars of Greater Houston (ASAS). In addition to staffing the in-school banks, the students in these after-school classes will learn fundamental math and savings skills. All students at Edison and Ortiz will also receive banking education through their classes.

An estimated 1,000 students from each middle school will participate in the Bank at School program. Six Amegy banking centers are involved in this project: South Shaver, Red Bluff, Pasadena, North Loop East, Galleria, and Amegy’s upcoming Lawndale location.

Several employees throughout the Bank are helping launch this new program:

Pat Moretti

Nelda Sullivan

Katrina Henderson

Sarah Petrie

April Timmons

Olga Galvan

Alvaro Perales

Gabriel Perez

Rick Helton

Gayle Guidry

Linh Doan

Mark Washington

Michele Fregia

Amegy’s Bank at School Banking Center at Edison Middle School. Edison students created the mosaic artwork for the banking center.

Customer Centric Committee Rewards Service Achievement Winners

As a drive thru teller at the Galleria Motor Bank, Joshua Flores doesn’t do a lot of heavy lifting and his customer interactions usually occur from a distance. That changed last month when he was processing a deposit for a customer and noticed her right front tire was flat. In the July heat, Joshua acted quickly and changed the customer’s tire. A customer in the next car captured the moment best when he said, “If you were at XYZ Bank, no one would appear to help.”

LaPorte Personal Banker Tommy Clark knows when to move fast as well. A customer received an erroneous letter stating that a Home Improvement loan payment was late and that the Bank would take action if it wasn’t paid. Tommy told the customer he didn’t know why that had happened, but that he would take care of it.

The customer stated, “True to his word, he took care of this and quickly called back to let us know that everything was fine.” The customer commented that at the time of the original loan processing, Tommy had come in on his day off to work around the customer’s schedule.

Each month, the Customer Centric Committee votes on service moments like these and awards the banker with $100 cash and a service certificate. Tommy and Joshua were the winners for July and August.

“Moments like these occur throughout the Bank every day, and we want to make sure they do not go unnoticed,” said Christy Watson, Customer Service Advocate. “Anyone with a service moment that they think should be rewarded is encouraged to send an email to Customer Centric.”

Honorable Mention

JULY 2005

| | |

| Operations Center: | | Joe Alvarez (Customer Service Rep) |

| |

| Porter: | | Holly Miller (Personal Banker) |

| |

| Old Town Spring: | | Connie Taylor (Banking Center Mgr) Phyl Butler (Operations, Loan Services) |

AUGUST 2005

| | |

| Galleria: | | Blake Stoehr (Commercial Lending) Betty Cunningham (Commercial Lending) Graciela Garcia (International Banking) Kim Pillow (Treasury Management Implementation Supervisor) |

| |

| Conroe: | | Ashley Blackwell (Personal Banker) |

| |

| Coles Crossing: | | Andrew Walker (Associate Banking Center Manager) |

Members of the Customer Centric Committee with service winner Joshua Flores

Service Winner, Tommy Clark, receives his cash prize and certificate from Sandra Bornstein

INTEREST RATE SWAP

Continued from page 2

“The swap enabled my client to secure an attractive fixed rate for a longer term while eliminating interest rate risk for Amegy,” says Energy Lender Ross Bartley, whose customer is one of the first to have taken advantage of the capability. “It enhanced the relationship by providing the client with certainty of funds for the duration of the deal. This is an example of a pricing option we couldn’t offer before we added the ability to provide interest rate derivative products.”

Ross adds: “This is a true ‘win-win.’ The client received a more attractive rate option while the bank reduced risk and increased its profitability.”

In addition, there is an incentive plan in place where the referring banker gets 5% of the net revenue with a cap of $10,000 per transaction. To date, Amegy has conducted four swaps in the amount of $38.5 million for clients of Ross Bartley, J Carr, Sloan Evans, Laif Afseth, and Carmen Jordan. Each of the officers will receive referral fees for this product.

STRATEGY

Continued from page 2

Evidence of the cross-selling opportunities is seen in the recent referral Lane Ward made to Rick. The prospect, the owner of a windows installation company, wasn’t ready to move his business to Amegy after the initial meeting.

“One day, the gentleman called and wanted Amegy to finance a new delivery truck,” recalls Rick. “We knew this was our chance. They were so impressed with our tenacity and quick turnaround on the truck loan that, at loan closing, we won the operating account and the additional financing for debt consolidation and possibly its merchant services account.” Not only that, but the manager recently told Rick that he will be moving his second company’s accounts to Amegy Bank as well as all of his personal accounts.

The Small Business team is spending time educating banking center personnel to increase the number of customers with multiple accounts. “Retail bankers sit down with current Small Business customers every day, and all they need to do is ask the customer the right questions about their business to cross-sell more products,” says Chuck. “We’re integrating Small Business into the Retail business model and teaching Retail bankers how to make effective Small Business calls because they have a big opportunity right at their doorstep.”

Potential customers include manufacturers, wholesalers, doctors, attorneys, service companies, auto retailers, and home builders. Loan requests up to $250,000 are processed through the Small Business Loan Center, which offers lines of credit, term loans, and small business credit cards.

“Because of Amegy’s size, we can offer sophisticated business products and advanced technology that can save small business owners time and money,” explains Chuck. “At the same time, we can make local decisions so the customer gets speedy service.”

New Hires

| | |

| Vice President | | |

| |

| Paula Alam | | Sr Banking Center Mgr |

| Ian Cushnie | | Corp FX Advisor III |

| Felix Fernandez-DeLaVega | | Sr Banking Center Mgr |

| Stephanie Flores | | Commercial Lender III |

| Glenn Johnson | | Audit Mgr II |

| Kelly Porter | | Retail Development Mgr |

| |

| Assistant Vice President | | |

| |

| Jacqueline Dipuccio | | Banking Center Mgr |

| Triakinna Dirden | | Banking Center Mgr |

| LaToya Graham | | Banking Center Mgr |

| Gail Murphy | | Banking Center Mgr |

| Linda Nichols | | Banking Center Mgr |

| Jorge Olivares | | Banking Center Mgr |

| |

| Officer | | |

| |

| Harriet Eisenstein | | Sr Personal Banker |

| Mavis Hadley | | Operations Analyst II |

| Sherry Hunyadi | | Software Developer III |

| Annie Martinez | | Client Relationship Associate |

| Dahlia Molina | | Foreign Exchange Ops Team Ldr |

| Arlene Potter | | Teller Services Mgr |

| |

| Promotions | | |

| |

| Senior Vice President | | |

| |

| Glenn Baird | | TM Sales Team Leader |

| Vicki Brandt | | Service & Quality Mgmt Mgr |

| Mark Edwards | | Trust RealEstate/Oil&Gas Mgr |

| |

| Assistant Vice President | | |

| |

| LauraCecil | | Mktg Research & Info Mgr |

| ScottChapa | | Retirement Plan Investment Anl |

| Kelcy Konstantin | | Retail Diverse Markets Dev Rep |

| Michael Londono | | Commercial Lender |

| Patricia Maxie | | IT Network Serv Implement Mgr |

| Jacqueline Nation | | Credit Risk Reviewer III |

| Bruce Neary | | 401k Enrollment Spec |

ONLINE PRE-APPROVALS

Continued from page 1

A pre-approval is a statement of willingness to make a mortgage loan for a loan amount based on a property purchase price and desired down payment. Even if a customer does not have a specific property in mind, they can still be pre-approved through this system for a specified loan amount.

Using the information a customer provides online, Amegy Mortgage orders a credit report and obtains an underwriting analysis. The customer’s information is then sent to a local Amegy Mortgage Loan Officer who follows up with them regarding the loan. Prospects can complete the online pre-approval at their own pace with the ability to save their information and come back later. A directory of Amegy Mortgage Loan Officers is also available online so customers can contact them directly with any questions they may have regarding the loan process.

For a limited time, Amegy Bank customers may submit an online pre-approval for FREE by using the special promo code 1002abk (a $35 savings). More than 50 customers have already taken advantage of our new online pre-approval system, which is available, 24-hours-a-day, at www.amegymortgage.com.

CONTEST

Continued from page 3

For each $250,000 in equipment financing that is approved and funded, the employee who made the referral will receive a $250 SIMON gift card that can be used at any of The Galleria Malls. The individual who originates the most volume will receive an additional $1,000 gift card. The loan or lease will be booked to the referring officer’s portfolio.

Last winter, Equipment Leasing held another incentive contest where the prize was a free ski trip to Utah. Joe Goyne, Amegy Bank President in the Dallas Region, won the trip last year. Joe explains: “It’s easy to find interested customers. If you are talking to a customer who wants to buy and finance some equipment, just ask the customer if he would like a proposal to see whether a loan or lease makes the best sense. Many times the equipment vendor has already asked the customer this question, so he has had time to give it some thought.”

Joe adds: “If you do not bring leasing up in the conversation, you may very well lose the transaction to their vendor, which is usually at a higher cost than Amegy’s equipment finance or lease and loan options.”

Amegy Bank is privileged to offer the contest at no cost to the Bank. Like last year’s winter promotion, it is being funded by the Leasing Group’s partner, Sentry Financial.

CUSTOMERS GO BEYOND

Continued from page 3

Every year, the members of Hearing Aid for Latin America visit a different Latin American country to supply hearing impaired children with hearing aids. To date, the group has been to Chile and Mexico twice and Nicaragua once. They have made 708 ear molds and fitted 708 aids on mostly children. In addition, they have provided thousands of batteries to help ensure the hearing aids will work.

“The numbers speak to the success of Latin American hearing aid project,” says Missy Krantz. “It’s great that Amegy can be involved in the organization’s mission which I know will only gain more success with time.”

In speaking to his relationship officer, Private Banker Kallie Armstrong, Ray says, “In September, we are returning to Chile where we will start training the Chileans to fit hearing aids. On this trip, we hope to begin planning the establishment of a permanent hearing clinic in Vina del Mar.

Hearing Aid for Latin America takes donations for new and used behind the ear hearing aids, and they continue to look for corporate sponsors to contribute to their cause. For more information on the organization and how you can help, please visit http://www.latinhearing.org.

Way to go Blitz Winners!

| | | | |

| May Winners | | | | |

| | |

Division | | Officer | | Assistant |

| | |

| Comm’l/Corp | | Blake Stoehr | | Betty Cunningham |

| Specialty | | John Kelley | | Joani Conwell |

| Regional | | Tom Hill | | Frances Buitron |

| Private Bnk | | Jim Lykes | | Vickie Santellana |

| Treas Mgt | | Paige Mostyn | | Barbara Hernandez |

| Investments | | Natalie Aide | | Kitty Sullivan |

| CRA/SBA/Lease | | Eduardo Rios | | Elsa Huizar |

| | |

June Winners | | | | |

| | |

Division | | Officer | | Assistant |

| | |

| Comm’l/Corp | | Blake Stoehr | | Betty Cunningham |

| Specialty | | Jeremy Newsom | | Francine Taylor & Dawna Lisner |

| Regional | | Susan Leopold | | Erin Wright & Angela Sheffield |

| Private Banking | | Trina Fowlkes | | Karen Martinez |

| Treasury Management | | Kacy Karl | | Mary Jane Canales |

| Investments | | Natalie Aide | | Kitty Sullivan |

| CRA/SBA/Lease | | Michelle Wright | | Debra Kerschen |

| | |

July Winners | | | | |

| | |

Division | | Officer | | Assistant |

| | |

| Comm’l/Corp | | Blake Stoehr | | Betty Cunningham |

| Specialty | | John Kelley | | Joani Conwell |

| Regional | | John Shirley | | Tracy Goldenstein |

| Private Banking | | Trina Fowlkes | | Karen Martinez |

| Treasury Management | | Glenn Baird | | Mary Jane Canales |

| Investments | | Barbara Vilutis | | Kitty Sullivan |

| CRA/SBA/Lease | | John Hernandez | | Elsa Huizar |

Additional Information and Where to Find it

Zions Bancorporation has filed a registration statement on Form S-4 (File No. 333-127636), which includes a proxy statement of Amegy Bancorporation, Inc.; both companies will also file other relevant documents concerning the proposed merger transaction with the Securities and Exchange Commission (SEC). INVESTORS ARE URGED TO READ THE FORM S-4 (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS TO IT) AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC BECAUSE THEY CONTAIN IMPORTANT INFORMATION. You may obtain the documents free of charge at the website maintained by the SEC at www.sec.gov. In addition, you may obtain documents filed with the SEC by Zions free of charge by contacting: Investor Relations, Zions Bancorporation, One South Main Street, Suite 1134, Salt Lake City, Utah 84111, (801) 524-4787. You may obtain documents filed with the SEC by Amegy free of charge by contacting: Controller, Amegy Bancorporation, Inc., 4400 Post Oak Parkway, Houston, Texas 77027, (713) 235-8800.

Participants in Solicitation

Zions Bancorporation, Amegy Bancorporation, Inc., and their respective directors and executive officers, may be deemed to be participants in the solicitation of proxies from Amegy’s shareholders in connection with the merger. Information about the directors and executive officers of Zions and their ownership of Zions stock is set forth in the proxy statement for Zions’ 2005 Annual Meeting of Shareholders. Information about the directors and executive officers of Amegy and their ownership of Amegy stock is set forth in the proxy statement for Amegy’s 2005 Annual Meeting of Shareholders. Investors may obtain additional information regarding the interests of such participants by reading the Form S-4 and proxy statement for the merger when they become available.

Investors should read the Form S-4 carefully before making any voting or investment decisions.

Cautionary Language Concerning Forward-Looking Statements

Information set forth in this document contains financial estimates and other forward-looking statements that are subject to risks and uncertainties, and actual results might differ materially. Such statements include, but are not limited to, statements about the benefits of the business combination transaction involving Zions Bancorporation and Amegy Bancorporation, Inc., including future financial and operating results, the new company’s plans, objectives, expectations and intentions and other statements that are not historical facts. Such statements are based upon the current beliefs and expectations of Zions’ and Amegy’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements.

The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: the failure of Amegy shareholders to approve the transaction; the ability to obtain governmental approvals of the transaction on the proposed terms and schedule; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; competition and its effect on pricing, spending, third-party relationships and revenues. Additional factors that may affect future results are contained in Amegy’s filings with the Securities and Exchange Commission (“SEC”), which are available at the SEC’s Web site http://www.sec.gov. Amegy disclaims any obligation to update and revise statements contained in this presentation based on new information or otherwise.