SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| ¨ | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| x | | Soliciting Material Pursuant to §240.14a-12 |

Amegy Bancorporation, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Filed by: Amegy Bancorporation, Inc.

Pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Amegy Bancorporation, Inc.

Commission File No. 000-22007

On August 31, 2005, Amegy Bancorporation, Inc. issued the following communication:

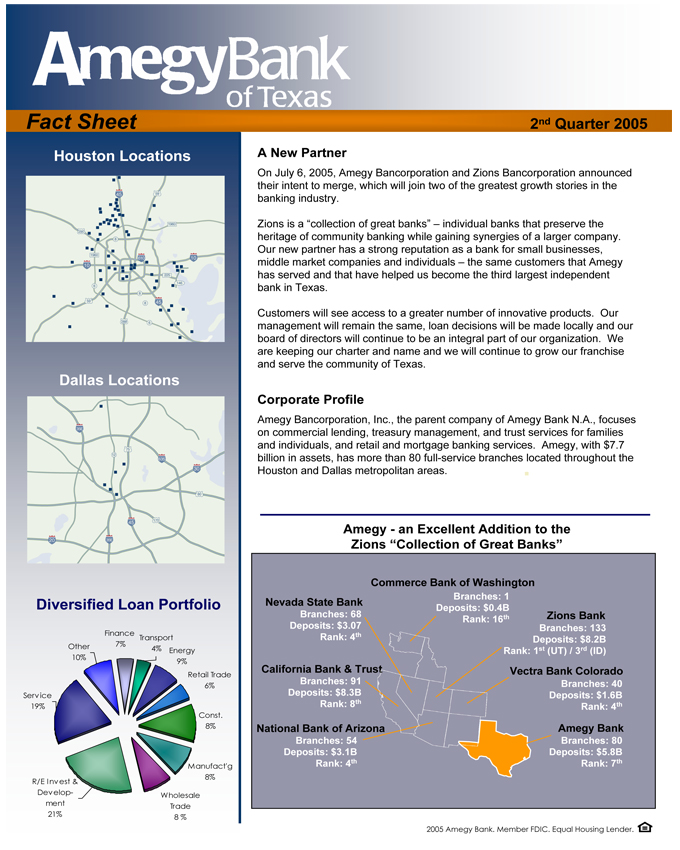

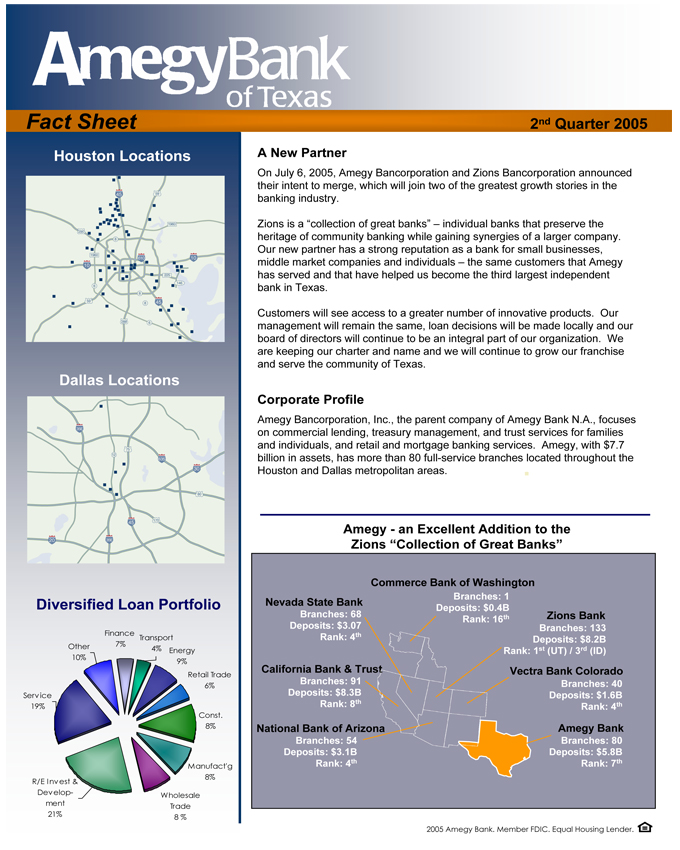

Fact Sheet

Houston Locations

Dallas Locations

Diversified Loan Portfolio

Service 19%

Other 10%

Finance 7%

Transport

4% Energy 9%

Retail Trade 6%

Const.

8%

Manufact’g 8%

Wholesale Trade 8%

R/E Invest & Development 21%

2nd Quarter 2005

A New Partner

On July 6, 2005, Amegy Bancorporation and Zions Bancorporation announced their intent to merge, which will join two of the greatest growth stories in the banking industry.

Zions is a “collection of great banks” – individual banks that preserve the heritage of community banking while gaining synergies of a larger company. Our new partner has a strong reputation as a bank for small businesses, middle market companies and individuals – the same customers that Amegy has served and that have helped us become the third largest independent bank in Texas.

Customers will see access to a greater number of innovative products. Our management will remain the same, loan decisions will be made locally and our board of directors will continue to be an integral part of our organization. We are keeping our charter and name and we will continue to grow our franchise and serve the community of Texas.

Corporate Profile

Amegy Bancorporation, Inc., the parent company of Amegy Bank N.A., focuses on commercial lending, treasury management, and trust services for families and individuals, and retail and mortgage banking services. Amegy, with $7.7 billion in assets, has more than 80 full-service branches located throughout the Houston and Dallas metropolitan areas.

Amegy—an Excellent Addition to the Zions “Collection of Great Banks”

Commerce Bank of Washington

Nevada State Bank

Branches: 68 Deposits: $3.07 Rank: 4th

California Bank & Trust

Branches: 91 Deposits: $8.3B

Rank: 8th

National Bank of Arizona

Branches: 54 Deposits: $3.1B

Rank: 4th

Branches: 1 Deposits: $0.4B

Rank: 16th Zions Bank

Branches: 133 Deposits: $8.2B

Rank: 1st (UT) / 3rd (ID)

Vectra Bank Colorado

Branches: 40 Deposits: $1.6B

Rank: 4th

Amegy Bank

Branches: 80 Deposits: $5.8B

Rank: 7th

2005 Amegy Bank. Member FDIC. Equal Housing Lender.

Dynamic Products

Retail Customers

Business Customers

IDEAL®

Image Data Extraction Archive Lockbox

Image and data lift technology

Automated integration and archival

Healthcare initiative with cross-industry mobility

Balance reporting

ACH originations

Tax payments

Wires (Domestic/ International)

Positive Pay Advantage

Lockbox Web Delivery

File Transfer

Institutional Custody Online • e-FX

LC Online

Headlines

“How Amegy Bank of Texas Fits With Zions’ Growth Plan” – American Banker (6-7-05) “Amegy, Anadarko create Tool for Oilfield Lease Payments” – Houston Business Journal (4-26-05)

“Midtier Finds an Edge in its Tech Expertise”

– American Banker (4-26-05)

Contacts

Sarah Peterson: 713-232-1115

Sarah.peterson@amegybank.com

Darren Craig: 713-232-1433

Darren.craig@amegybank.com

Strong Internal Growth ($ in billions)

Loans Deposits Assets

2.51 3.09 2.76 3.94 3.43 4.40 3.22 3.91 5.17 3.59 4.40 5.95 4.23 5.62 7.51 4.84 5.90 7.74

2000 2001 2002 2003 2004 2Q05

Consistent Noninterest Income Growth ($ in thousands)

Noninterest income Capital Markets and Investments

CAGR =24%

40,942 55,412 67,136 83,209 96,505 60,338

2000 2001 2002 2003 2004 YTD 2005

CAGR = 20%

6,017 7,244 9,302 9,712 12,682 8,247

2000 2001 2002 2003 2004 YTD 2005

Treasury Management Retail

CAGR=22%

9,126 11,718 16,304 18,429 20,473 8,213

2000 2001 2002 2003 2004 YTD 2005

CAGR = 44%

7,331 14,011 20,360 25,124 31,343 18,117

2000 2001 2002 2003 2004 YTD 2005

Additional Information and Where to Find it

Zions Bancorporation has filed a registration statement on Form S-4 (File No. 333-127636), which includes a proxy statement of Amegy Bancorporation, Inc.; both companies will also file other relevant documents concerning the proposed merger transaction with the Securities and Exchange Commission (SEC). INVESTORS ARE URGED TO READ THE FORM S-4 (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS TO IT) AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC BECAUSE THEY CONTAIN IMPORTANT INFORMATION. You may obtain the documents free of charge at the website maintained by the SEC at www.sec.gov. In addition, you may obtain documents filed with the SEC by Zions free of charge by contacting: Investor Relations, Zions Bancorporation, One South Main Street, Suite 1134, Salt Lake City, Utah 84111, (801) 524-4787. You may obtain documents filed with the SEC by Amegy free of charge by contacting: Controller, Amegy Bancorporation, Inc., 4400 Post Oak Parkway, Houston, Texas 77027, (713) 235-8800.

Participants in Solicitation

Zions Bancorporation, Amegy Bancorporation, Inc., and their respective directors and executive officers, may be deemed to be participants in the solicitation of proxies from Amegy’s shareholders in connection with the merger. Information about the directors and executive officers of Zions and their ownership of Zions stock is set forth in the proxy statement for Zions’ 2005 Annual Meeting of Shareholders. Information about the directors and executive officers of Amegy and their ownership of Amegy stock is set forth in the proxy statement for Amegy’s 2005 Annual Meeting of Shareholders. Investors may obtain additional information regarding the interests of such participants by reading the Form S-4 and proxy statement for the merger when they become available.

Investors should read the Form S-4 carefully before making any voting or investment decisions.

2005 Amegy Bank. Member FDIC. Equal Housing Lender.

Cautionary Language Concerning Forward-Looking Statements

Information set forth in this document contains financial estimates and other forward-looking statements that are subject to risks and uncertainties, and actual results might differ materially. Such statements include, but are not limited to, statements about the benefits of the business combination transaction involving Zions Bancorporation and Amegy Bancorporation, Inc., including future financial and operating results, the new company’s plans, objectives, expectations and intentions and other statements that are not historical facts. Such statements are based upon the current beliefs and expectations of Zions’ and Amegy’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements.

The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: the failure of Amegy shareholders to approve the transaction; the ability to obtain governmental approvals of the transaction on the proposed terms and schedule; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; competition and its effect on pricing, spending, third-party relationships and revenues. Additional factors that may affect future results are contained in Amegy’s filings with the Securities and Exchange Commission (“SEC”), which are available at the SEC’s Web site http://www.sec.gov. Amegy disclaims any obligation to update and revise statements contained in this presentation based on new information or otherwise.