© 2022 Valmont® Industries, Inc. Valmont Industries, Inc. Second Quarter 2022 Earnings Presentation July 21, 2022

Disclosure Regarding Forward-Looking Statements July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation2 These slides contain (and the accompanying oral discussion will contain) “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such statements, including general economic and business conditions, conditions affecting the industries served by the Company and its subsidiaries including the continuing and developing effects of COVID-19 including the effects of the outbreak on the general economy and the specific economic responses to the Company’s products and services, the overall market acceptance of such products and services, the integration of acquisitions and other factors disclosed in the Company’s periodic reports filed with the Securities and Exchange Commission, as well as future economic and market circumstances, industry conditions, company performance and financial results, operating efficiencies, availability and price of raw materials, availability and market acceptance of new products, product pricing, domestic and international competitive environments, geopolitical risks and actions and policy changes of domestic and foreign governments. Consequently, such forward-looking statements should be regarded as the Company’s current plans, estimates and beliefs. The Company does not undertake and specifically declines any obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect any future events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

STEVE KANIEWSKI PRESIDENT & CHIEF EXECUTIVE OFFICER July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation3

2Q 2022 Summary July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation4 • Higher volumes driven by strong broad-based market demand • Maintaining pricing strategy and discipline to capture value delivered • Seventh consecutive quarter of double digit, year-over-year sales growth • Record global backlog of $2.0 billion, reflecting strong market demand TOTAL 2Q 2022 SALES $1,135.5M; +27% Y/Y AGRICULTURE $377.8M; +34% Y/Y 33% of Sales • Strength in all regions, notably in North America, Brazil and Western Europe, on robust market demand for irrigation equipment and ag solar solutions • Growth of connected crop management and advanced analytics through higher technology sales • Geopolitical events raising food security concerns, leading to higher demand for irrigation, solar and technology solutions INFRASTRUCTURE $765.0M; +24% Y/Y 67% of Sales • Strong underlying demand across global markets, along with favorable pricing and higher volumes • Ongoing electrification of power infrastructure continues to lead grid investments; expect benefit from renewable energy funding and the U.S. infrastructure bill • More than 45% sales growth in the Telecommunications product line

July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation5 Adds Fast Growing Company in 5G Infrastructure and PIM Mitigation Solutions to Portfolio Strategic Rationale • The acquisition advances Valmont’s strategy to provide concealment, PIM and radio frequency solutions in the telecommunication sector • Leverages our engineering expertise and global manufacturing footprint to enhance our access to markets and carriers around the world • Accelerates expansion in telecom markets in partnership with industry-leader Ericsson, who remains a minority owner ConcealFab Overview • ConcealFab is a leader in the 5G infrastructure and passive intermodulation (PIM) mitigation solutions for telecommunications • Early innovator in 5G and small cell infrastructure • First-to-market innovative solutions, customer-centric strategy, and established partnerships with wireless operators, utilities, and major OEMs ConcealFab Acquisition Expands Presence in Global Telecom Market

Conserving Resources, Improving Life® July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation6 Demonstrating ESG is Good For Business Committed to 2025 environmental goals and four aligned United Nations Sustainability Development Goals Sustainable Manufacturing Expansion New spun concrete manufacturing facility in Bristol, Indiana to create highly engineered low carbon transmission poles, with planned installation of a 500kW solar array • Creates northern U.S. concrete utility market presence • Builds grid resiliency and will support growing demand for transmission poles • Solar field is expected to fully offset the site’s electricity consumption • Net metering agreement allows for generated energy to be sold back at retail price Better Projects Award Recipient Awarded the annual Better Projects Award for the Alternative Energy-Mobile Source project • Replaced 100 gasoline vehicles with electrical vehicles at the Valley, NE campus • Reduced Valley’s Scope I GHG emissions by ~130 metric tons annually with an associated annual fuel cost savings • Model project for creation of future sustainability program called the “Green Fleet Initiative” Bristol, Indiana

AVNER APPLBAUM EVP & CHIEF FINANCIAL OFFICER July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation7

July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation8 Diluted EPS GAAP Adjusted1 +22.1% +20.9% Sales ($M) +26.9% Operating Income ($M) GAAP Adjusted1 +43.7% +35.2% 2Q 2022 Financial Summary • Higher volumes and a relentless focus on pricing strategies, improved fixed-cost leverage and the realization of strong demand across the portfolio • Operating income margin improved to 10.5% (10.8% adjusted1) of net sales • EPS growth driven by higher operating income, partially offset by higher tax expense due to changes in the geographic mix of earnings and an incremental UK tax benefit in 2021 that did not repeat this year 1 Please see Reg G reconciliation to GAAP measures at end of document. $82.6 $118.7 $90.9 $122.9 2021 2022 2021 2022 $894.6 $1,135.5 2021 2022 $2.89 $3.53 $3.06 $3.70 2021 2022 2021 2022

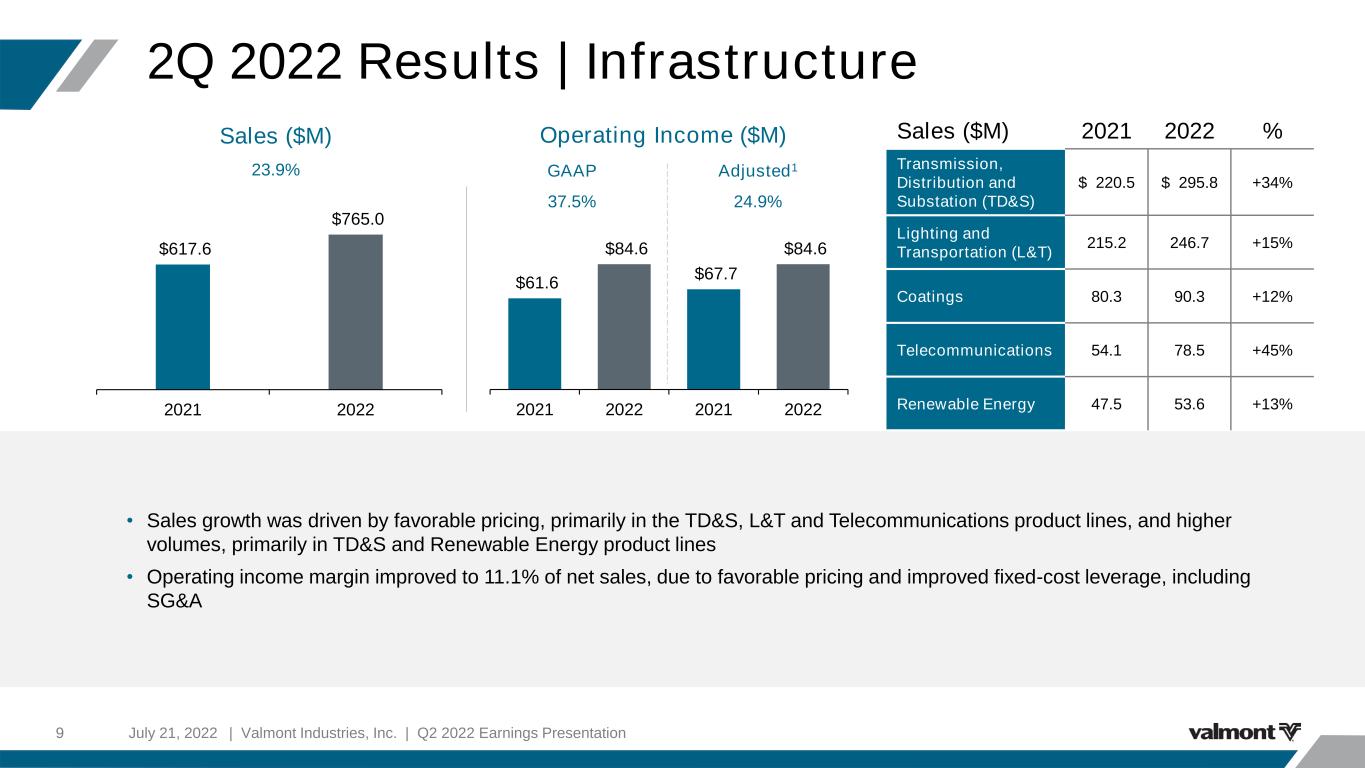

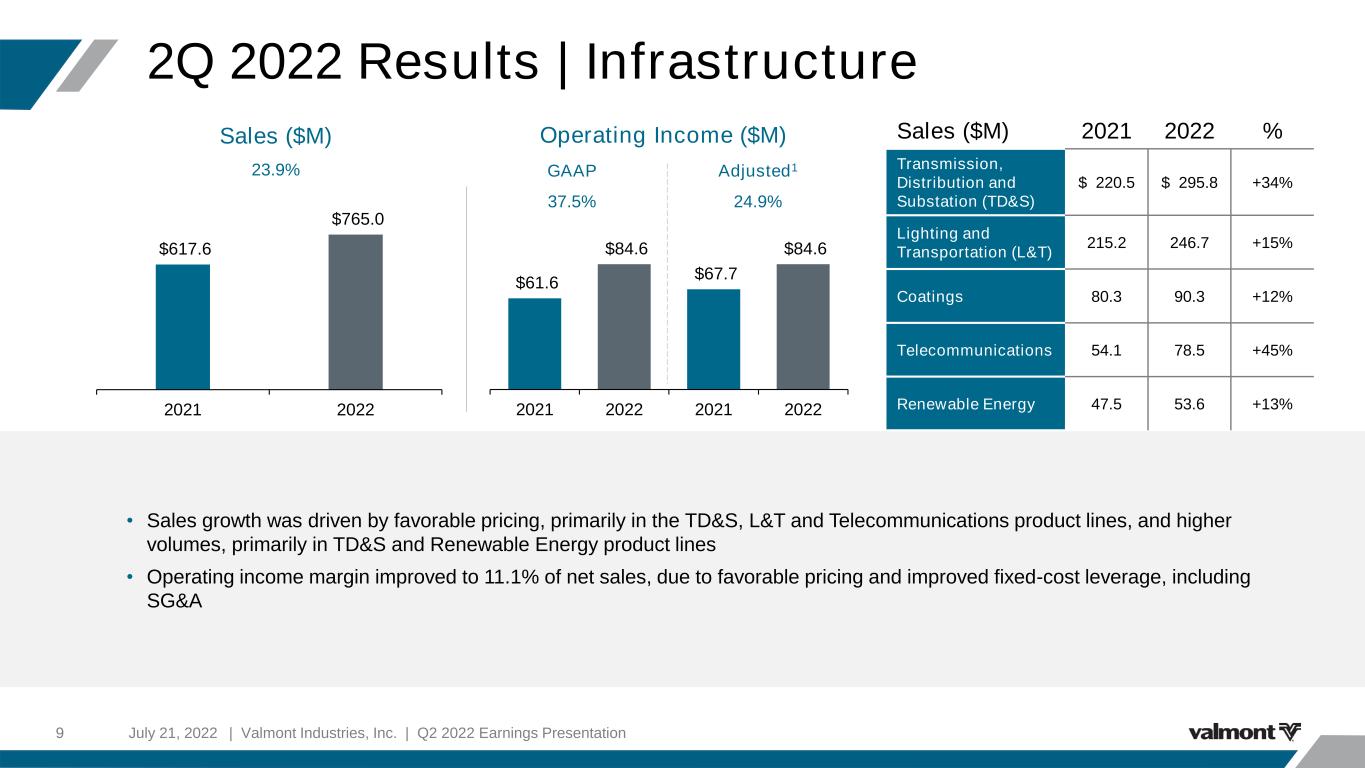

July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation9 Sales ($M) 23.9% 2Q 2022 Results | Infrastructure • Sales growth was driven by favorable pricing, primarily in the TD&S, L&T and Telecommunications product lines, and higher volumes, primarily in TD&S and Renewable Energy product lines • Operating income margin improved to 11.1% of net sales, due to favorable pricing and improved fixed-cost leverage, including SG&A Sales ($M) 2021 2022 % Transmission, Distribution and Substation (TD&S) $ 220.5 $ 295.8 +34% Lighting and Transportation (L&T) 215.2 246.7 +15% Coatings 80.3 90.3 +12% Telecommunications 54.1 78.5 +45% Renewable Energy 47.5 53.6 +13% $617.6 $765.0 2021 2022 Operating Income ($M) GAAP Adjusted1 37.5% 24.9% $61.6 $84.6 $67.7 $84.6 2021 2022 2021 2022

July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation10 Operating Income ($M) GAAP Adjusted1 38.3% 45.0% Sales ($M) 34.0% 2Q 2022 Results | Agriculture 1 Please see Reg G reconciliation to GAAP measures at end of document. 2Agricultural Technology sales are reported as a subset of total Agriculture segment sales $282.0 $377.8 2021 2022 • Sales increased due to higher average selling prices of irrigation equipment globally, and higher volumes specifically in North America and Brazil • In Brazil, revenues nearly doubled growing more than $40.0 million year-over-year demonstrating robust market demand for irrigation equipment and ag solar products • Operating income margin improved to 15.5% of net sales (16.6% adjusted1) due to favorable pricing and additional volume leverage, partially offset by higher SG&A expense, including incremental R&D expense for technology investments Sales ($M) 2021 2022 % North American Irrigation $ 156.0 $ 203.5 +30% International Irrigation 125.9 174.3 +38% Agricultural Technology2 28.5 30.2 +6% $42.0 $58.0 $42.9 $62.2 2021 2022 2021 2022

July 21, 202211 2Q 2022 Cash Flow Highlights ($M) YTD 6/25/2022 Net Cash Flows from Operating Activities $ 68.0 Net Cash Flows from Investing Activities (87.8) Net Cash Flows from Financing Activities 0.6 Net Cash Flows from Operating Activities $ 68.0 Purchase of Property, Plant & Equipment (49.7) Free Cash Flows $ 18.3 Full-Year Operating Cash Flows Expected To Exceed Net Earnings in 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation

July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation12 Balanced Approach to Capital Allocation GROWING OUR BUSINESS RETURNING CASH TO SHAREHOLDERS $50M $39M $10M $22M Capital Expenditures Acquisitions Share Repurchases Dividends • In line with expected 2022 FY CapEx of $110 - $120M • Investments to support strategic growth initiatives and Industry 4.0 advanced manufacturing • Acquired ConcealFab to expand 5G infrastructure presence; will be accretive in year one • Strategic fit + market expansion • Returns exceeding cost of capital within 3 years • Opportunistic approach, supported by free cash flow • ~$112M remains on current authorization • 10% dividend increase announced February 2022 • Payout ratio target: 22% of earnings • Current payout: ~15% 2022 YTD Capital Deployment: $122M

July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation13 Strong Balance Sheet and Liquidity Cash $154.6M Total Long-Term Debt $995.6M Shareholders’ Equity $1,553.2M Total Debt to Adj. EBITDA1 1.8x Available Credit under Revolving Credit Facility2 $534.4M Cash $154.6M Total Available Liquidity $689.0M As of June 25, 2022 ► Long-term debt of $995.6M, mostly fixed-rate, with long-dated maturities to 2044 and 2054 ► Total Debt to Adjusted EBITDA remains within our desired range of 1.5 to 2.5 times ► Capital allocation strategy has not changed, and the primary focus is to maintain liquidity to support operations 1See slide 31 for calculation of Adjusted EBITDA and Leverage Ratio. 2 $800M Total Revolver less borrowings and Standby LC’s of $266M.

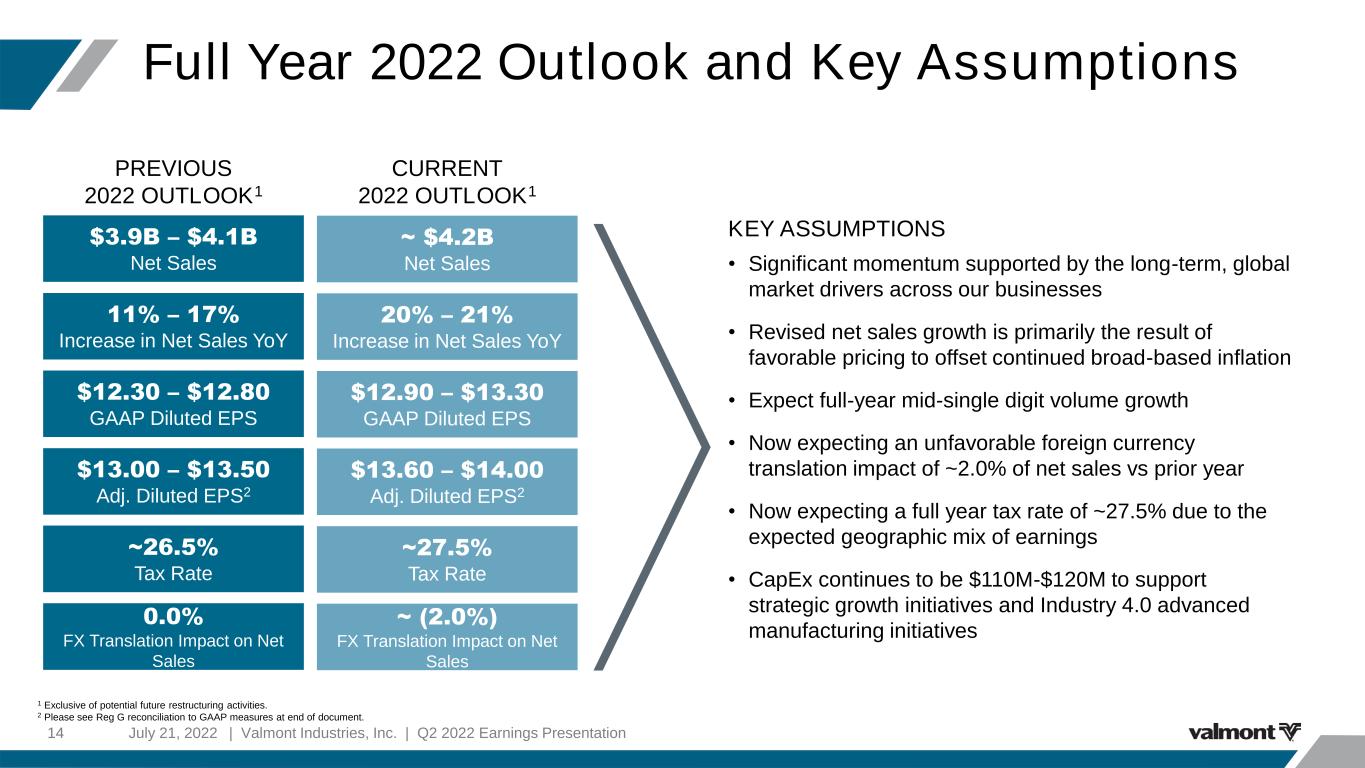

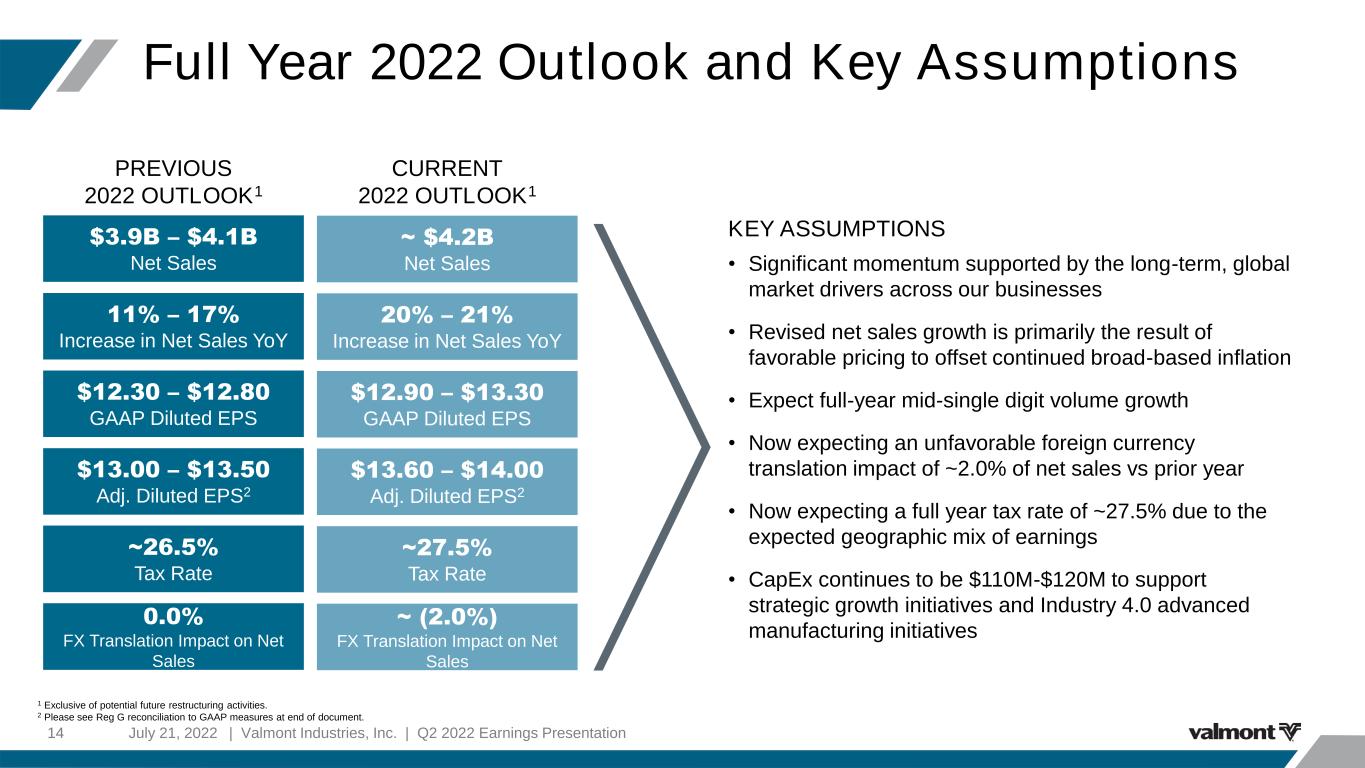

July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation14 Full Year 2022 Outlook and Key Assumptions KEY ASSUMPTIONS • Significant momentum supported by the long-term, global market drivers across our businesses • Revised net sales growth is primarily the result of favorable pricing to offset continued broad-based inflation • Expect full-year mid-single digit volume growth • Now expecting an unfavorable foreign currency translation impact of ~2.0% of net sales vs prior year • Now expecting a full year tax rate of ~27.5% due to the expected geographic mix of earnings • CapEx continues to be $110M-$120M to support strategic growth initiatives and Industry 4.0 advanced manufacturing initiatives PREVIOUS 2022 OUTLOOK1 CURRENT 2022 OUTLOOK1 1 Exclusive of potential future restructuring activities. 2 Please see Reg G reconciliation to GAAP measures at end of document. 11% – 17% Increase in Net Sales YoY 0.0% FX Translation Impact on Net Sales $13.00 – $13.50 Adj. Diluted EPS2 $12.30 – $12.80 GAAP Diluted EPS ~26.5% Tax Rate $3.9B – $4.1B Net Sales 20% – 21% Increase in Net Sales YoY ~ (2.0%) FX Translation Impact on Net Sales $13.60 – $14.00 Adj. Diluted EPS2 $12.90 – $13.30 GAAP Diluted EPS ~27.5% Tax Rate ~ $4.2B Net Sales

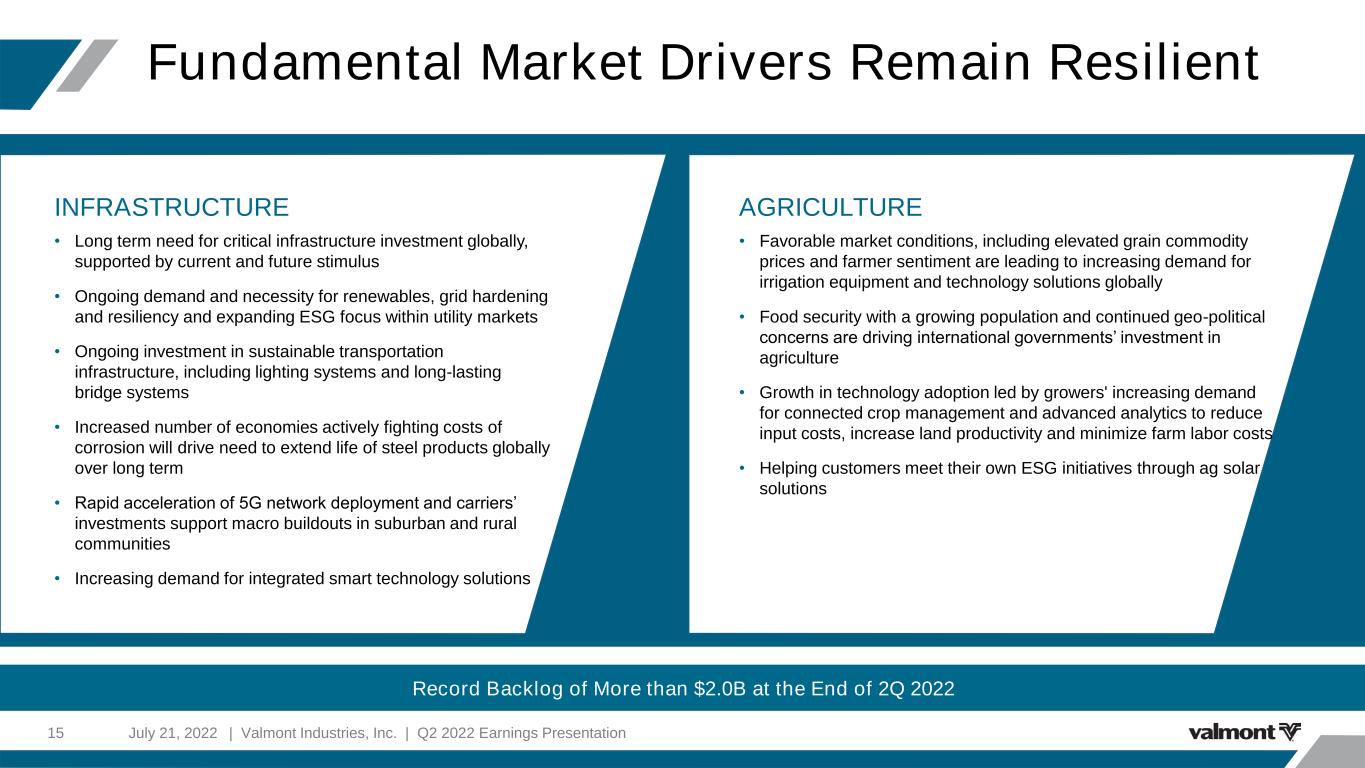

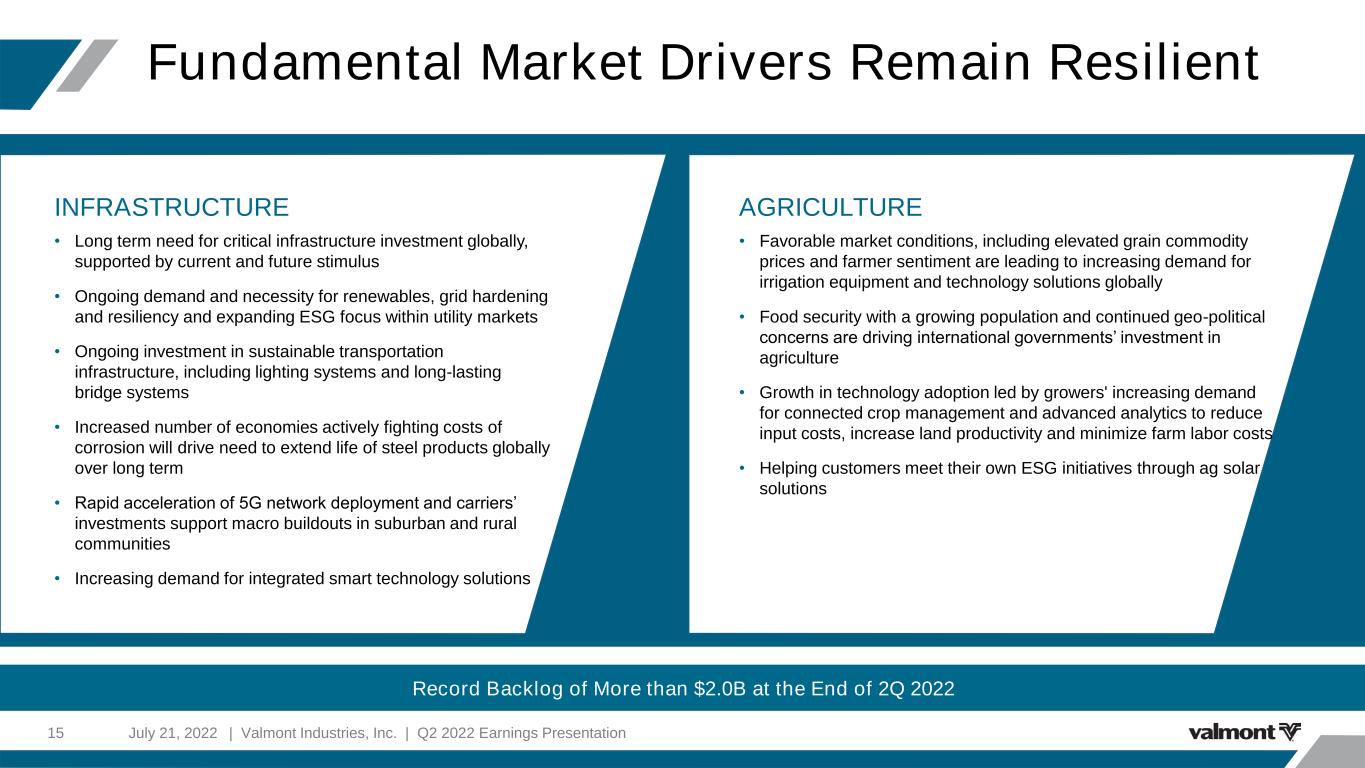

July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation15 Fundamental Market Drivers Remain Resilient Record Backlog of More than $2.0B at the End of 2Q 2022 INFRASTRUCTURE • Long term need for critical infrastructure investment globally, supported by current and future stimulus • Ongoing demand and necessity for renewables, grid hardening and resiliency and expanding ESG focus within utility markets • Ongoing investment in sustainable transportation infrastructure, including lighting systems and long-lasting bridge systems • Increased number of economies actively fighting costs of corrosion will drive need to extend life of steel products globally over long term • Rapid acceleration of 5G network deployment and carriers’ investments support macro buildouts in suburban and rural communities • Increasing demand for integrated smart technology solutions AGRICULTURE • Favorable market conditions, including elevated grain commodity prices and farmer sentiment are leading to increasing demand for irrigation equipment and technology solutions globally • Food security with a growing population and continued geo-political concerns are driving international governments’ investment in agriculture • Growth in technology adoption led by growers' increasing demand for connected crop management and advanced analytics to reduce input costs, increase land productivity and minimize farm labor costs • Helping customers meet their own ESG initiatives through ag solar solutions

July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation16 Summary Ability to grow sales through innovation and execution while adapting and responding quickly to meet customer needs Financial strength and flexibility by executing on our pricing strategies and advancing operational excellence across our footprint Our diversified markets are supported by strong drivers that are independent of the general economy Investing in our employees and technology to drive new products and services, and build upon the strength of our operations Poised and Well Positioned to Capture Growth and Drive Stakeholder Value in the Future Disciplined capital allocation allocating capital to high-growth strategic investments while returning capital to shareholders through dividends and share repurchases

17 Q&A July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation

18 APPENDIX July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation

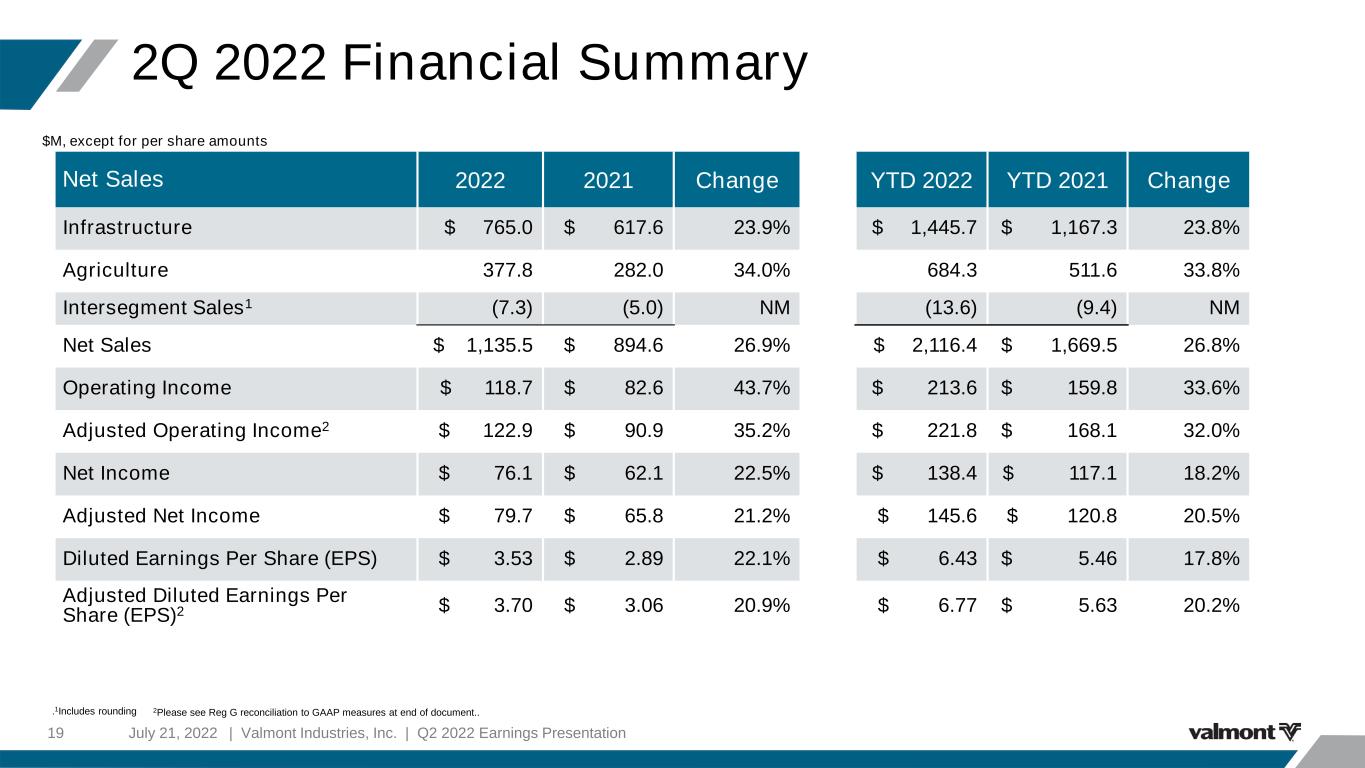

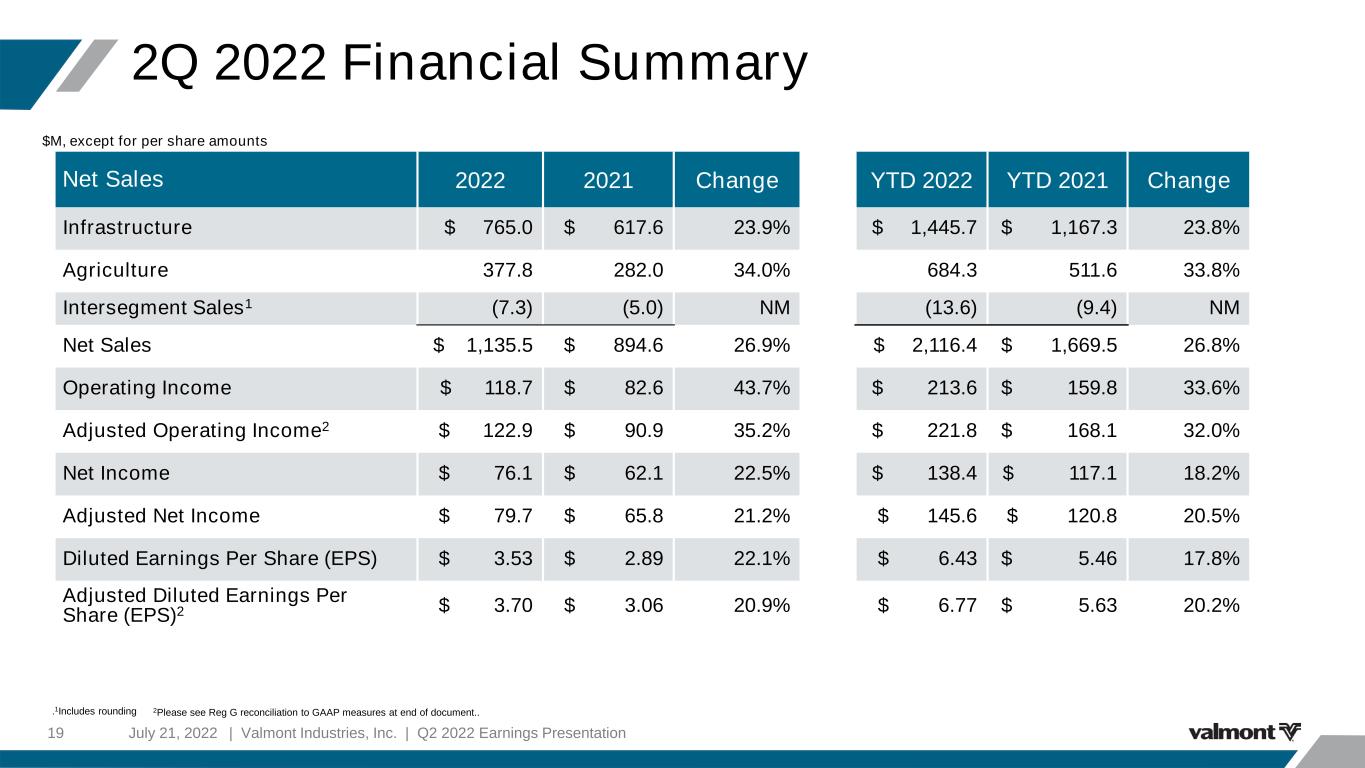

July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation19 2Q 2022 Financial Summary $M, except for per share amounts .1Includes rounding 2Please see Reg G reconciliation to GAAP measures at end of document.. Net Sales 2022 2021 Change YTD 2022 YTD 2021 Change Infrastructure $ 765.0 $ 617.6 23.9% $ 1,445.7 $ 1,167.3 23.8% Agriculture 377.8 282.0 34.0% 684.3 511.6 33.8% Intersegment Sales1 (7.3) (5.0) NM (13.6) (9.4) NM Net Sales $ 1,135.5 $ 894.6 26.9% $ 2,116.4 $ 1,669.5 26.8% Operating Income $ 118.7 $ 82.6 43.7% $ 213.6 $ 159.8 33.6% Adjusted Operating Income2 $ 122.9 $ 90.9 35.2% $ 221.8 $ 168.1 32.0% Net Income $ 76.1 $ 62.1 22.5% $ 138.4 $ 117.1 18.2% Adjusted Net Income $ 79.7 $ 65.8 21.2% $ 145.6 $ 120.8 20.5% Diluted Earnings Per Share (EPS) $ 3.53 $ 2.89 22.1% $ 6.43 $ 5.46 17.8% Adjusted Diluted Earnings Per Share (EPS)2 $ 3.70 $ 3.06 20.9% $ 6.77 $ 5.63 20.2%

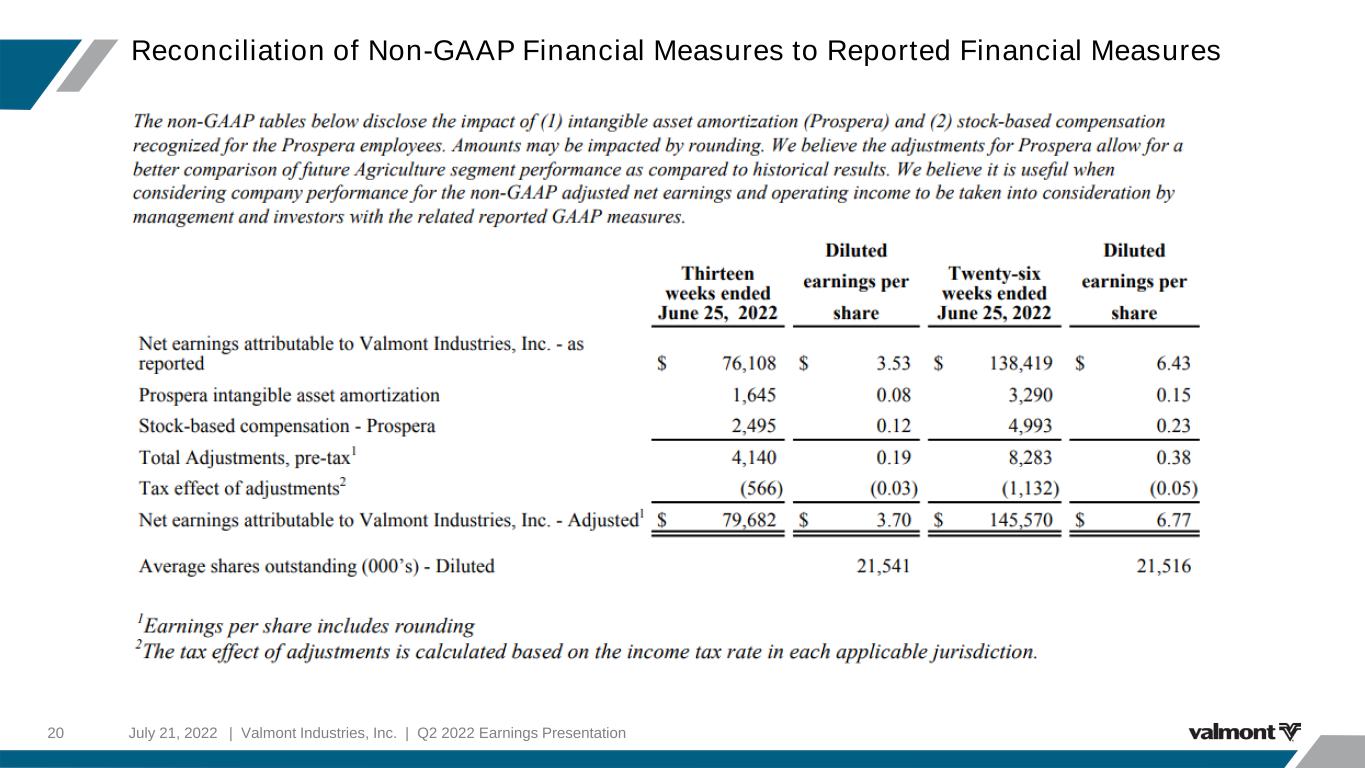

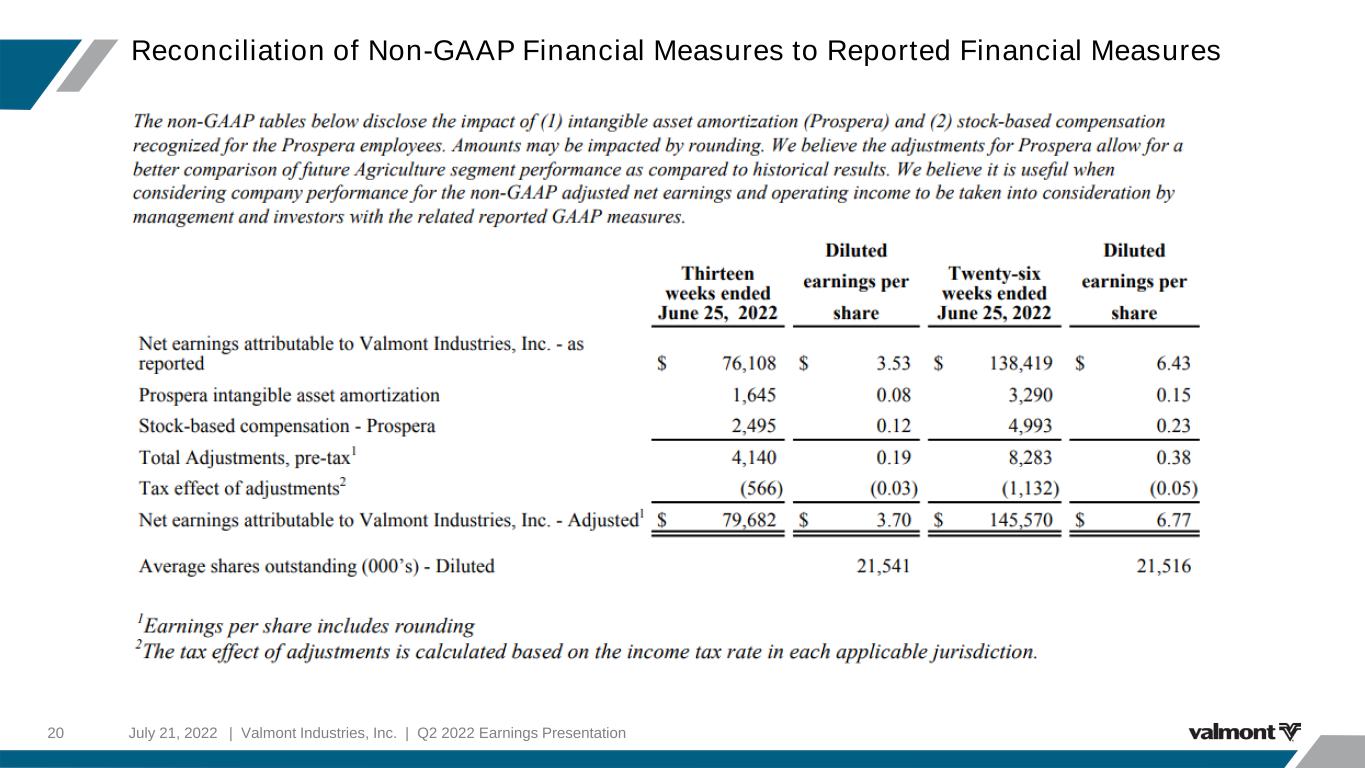

July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation20 Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures

July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation21 Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures

July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation22 Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures

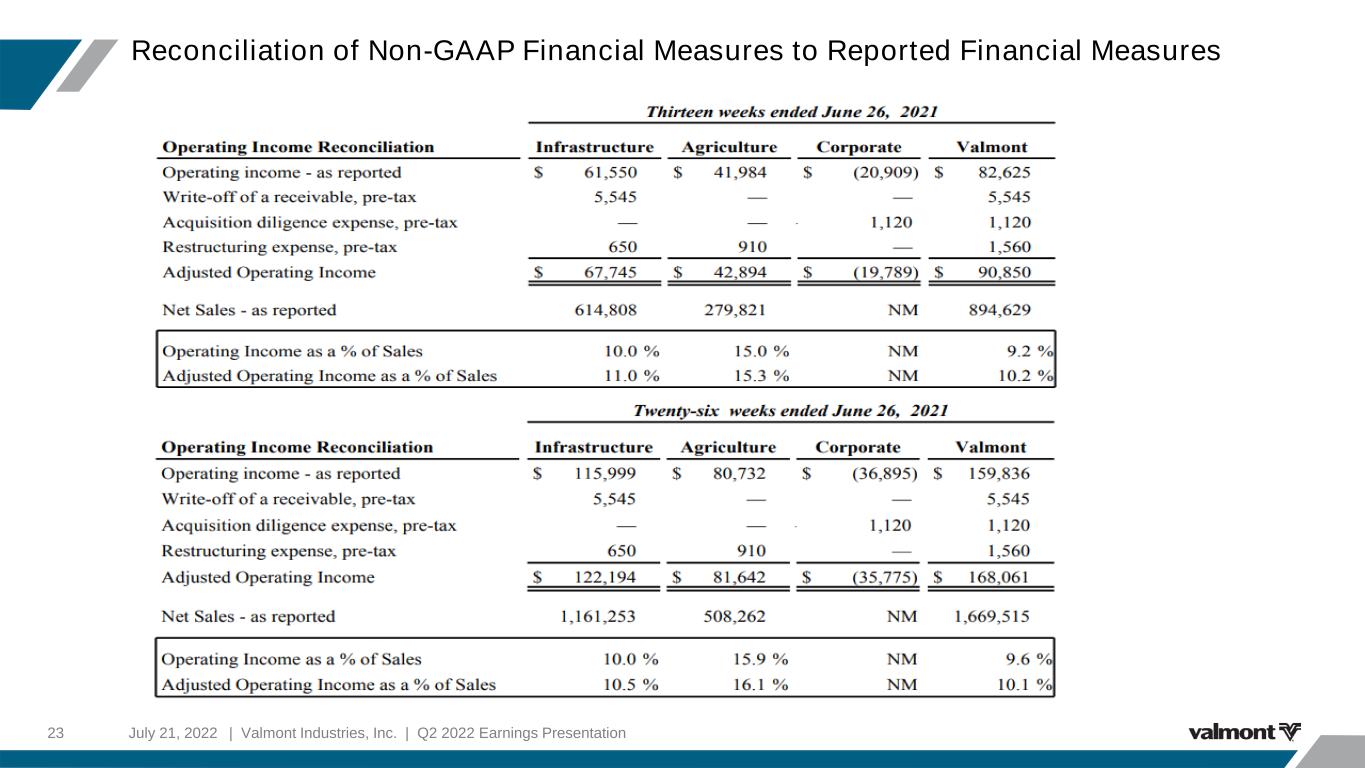

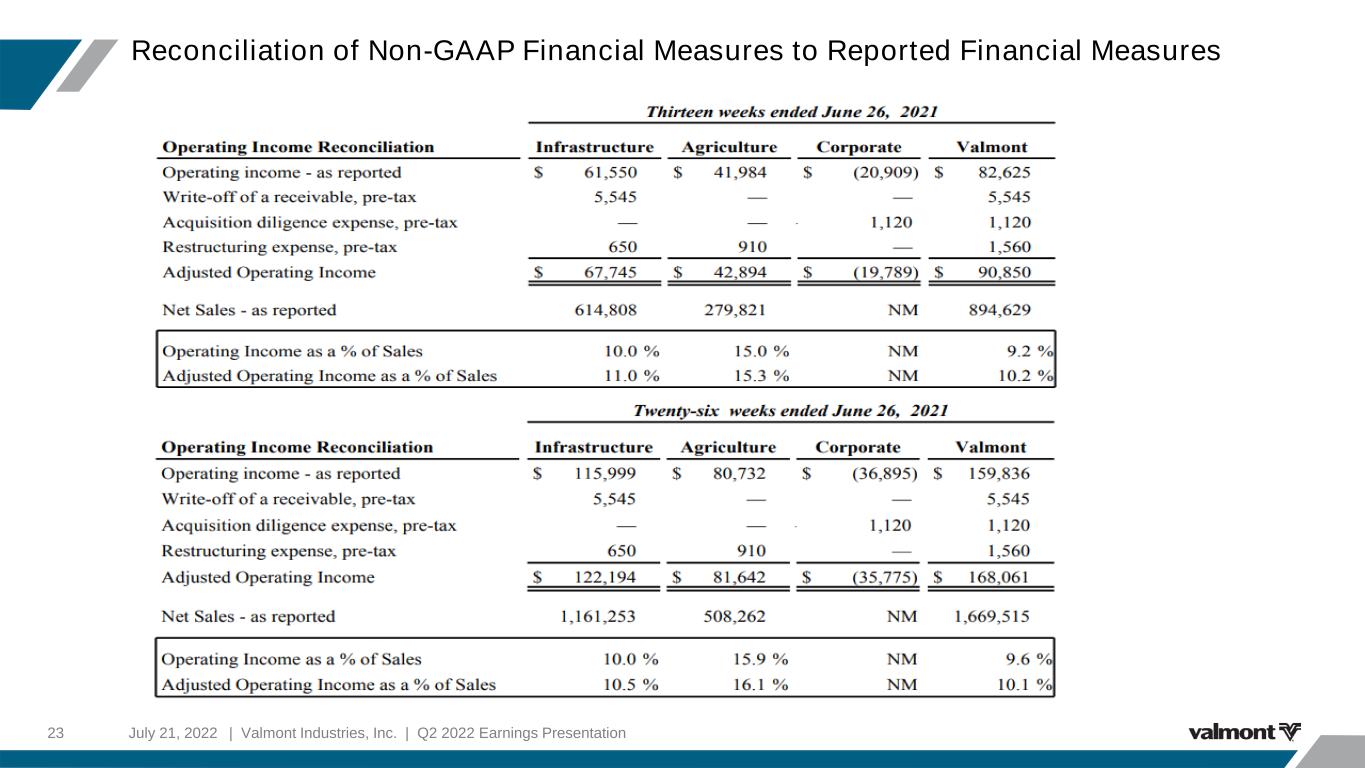

July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation23 Reconciliation of Non-GAAP Financial Measures to Reported Financial Measures

July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation24 Regulation G Reconciliation of Forecasted GAAP and Adjusted Earnings (Dollars in thousands, except per share amounts)

Historical Segment Financials July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation25 2020 Q1 Q2 Q3 Q4 FY FY Sales: Infrastructure segment 549,646$ 617,604$ 634,283$ 693,568$ 2,495,101$ 2,261,804$ Agriculture segment 229,664 281,965 240,331 276,757 1,028,717 645,831 Total 779,310 899,569 874,614 970,325 3,523,818 2,907,635 Intersegment Sales: Infrastructure segment (3,201) (2,796) (1,826) (2,753) (10,576) (6,541) Agriculture segment (1,223) (2,144) (4,006) (4,294) (11,667) (5,739) Total (4,424) (4,940) (5,832) (7,047) (22,243) (12,280) Net Sales: Infrastructure segment 546,445 614,808 632,457 690,815 2,484,525 2,255,263 Agriculture segment 228,441 279,821 236,325 272,463 1,017,050 640,092 Total 774,886$ 894,629$ 868,782$ 963,278$ 3,501,575$ 2,895,355$ Operating Income: Infrastructure segment 54,449 61,550 71,422 45,985 233,406 209,172 Agriculture segment 38,748 41,984 27,735 28,560 137,027 83,046 Corporate (15,986) (20,909) (22,962) (23,791) (83,648) (66,265) Total 77,211$ 82,625$ 76,195$ 50,754$ 286,785$ 225,953$ 2021

July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation26 Infrastructure Investment and Jobs Act (IIJA) Source:(7/15/2022): Grassley.senate.gov Infrastructure Investment and Jobs Act Spending Breakdown (In Order - Most to Least) Previously-Passed Transportation Funding | $650B Roads, Bridges and Related Programs | $111B Energy, Power and Electric Grid Reliability | $107.5B Freight and Passenger Rail | $66B Broadband | $65B Water and Wastewater Infrastructure | $55B Public Transportation | $39.2B Airports | $25B Natural Disaster Prevention and Mitigation | $23.3B Cleaning-Up Abandoned Sites | $21B Army Corps of Engineers | $16.7B Highway and Pedestrian Safety | $11B Ports and Coast Guard | $7.8B Cybersecurity and other Infrastructure Programs | $10.11B

July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation27 5G Adoption and Capex Spend Forecasts Source: GSM Association.

July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation28 U.S. Net Cash Farm Income by Year Source: USDA, American Farm Bureau Federation

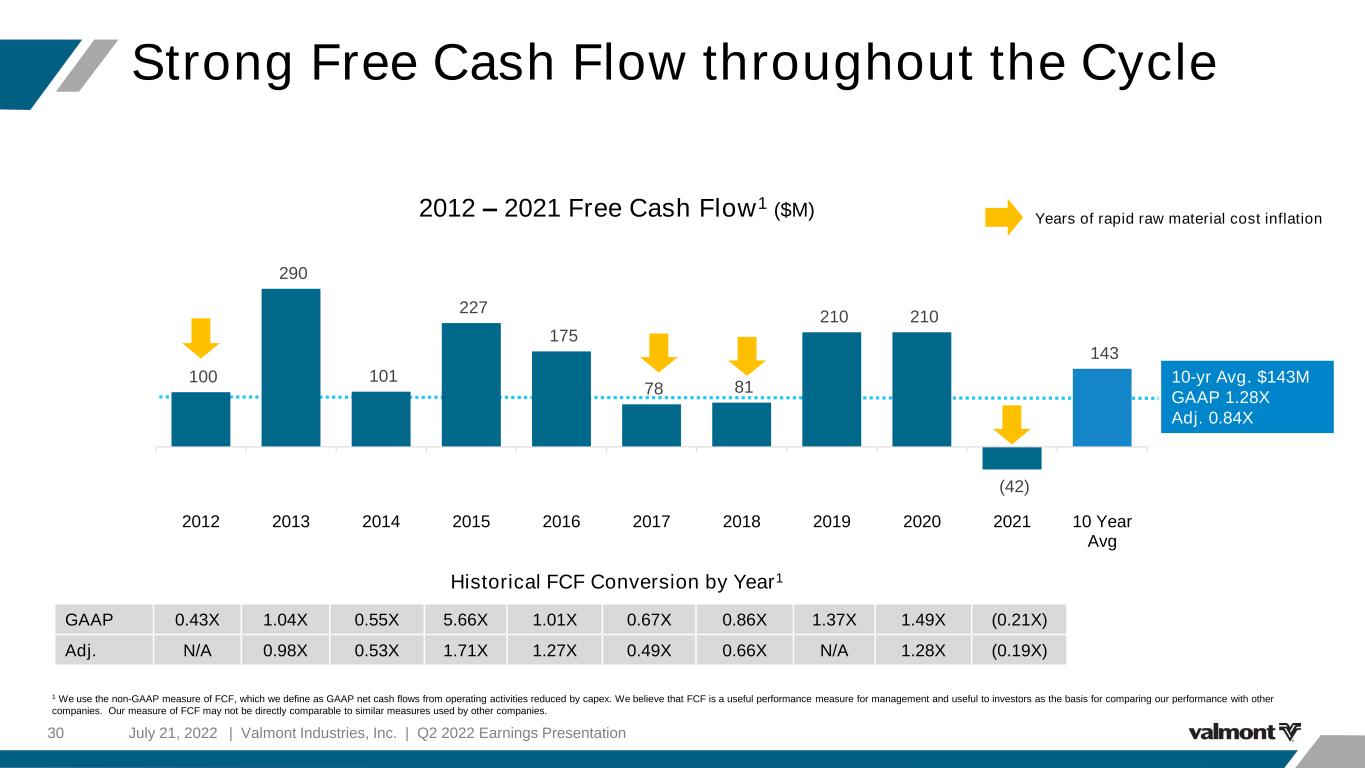

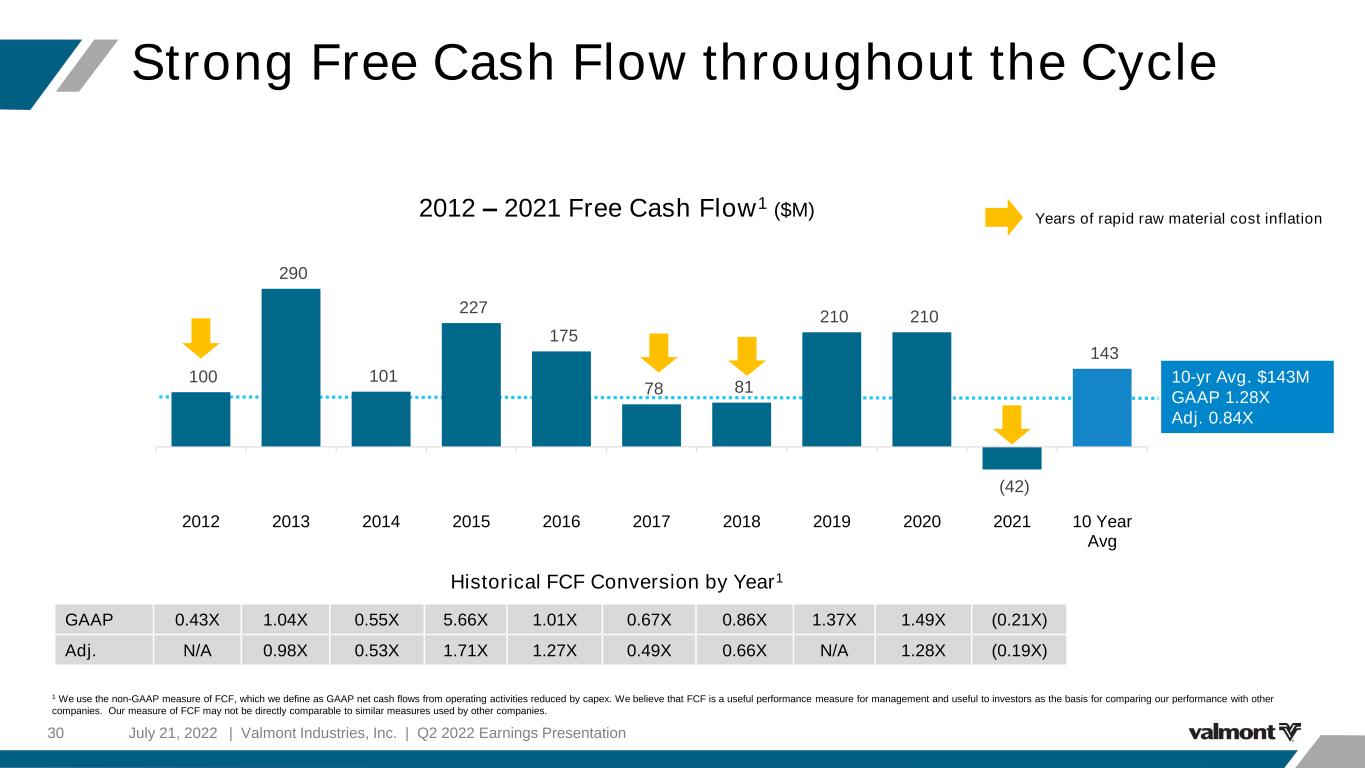

July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation29 2012-2021 Historical Free Cash Flow1 1 Adjusted earnings for purposes of calculating FCF conversion may not agree to the adjusted net earnings. The difference is due to cash restructuring, debt refinancing, or other non-recurring expenses which were settled in cash in the year of occurrence. ($M) 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Net cash flows from operating activities $ 197.1 $ 396.4 $ 174.1 $ 272.3 $ 232.8 $ 133.1 $ 153.0 $ 307.6 $ 316.3 $ 65.9 Net cash flows from investing activities (136.7) (131.7) (256.9) (48.2) (53.0) (49.6) (155.4) (168.1) (104.0) (417.3) Net cash flows from financing activities (16.4) (37.4) (136.8) (32.0) (95.2) (32.0) (162.1) (98.9) (173.8) 133.5 Net cash flows from operating activities $ 197.1 $ 396.4 $ 174.1 $ 272.3 $ 232.8 $ 133.1 $ 153.0 $ 307.6 $ 316.3 $ 65.9 Purchase of plant, property, and equipment (97.1) (106.8) (73.0) (45.5) (57.9) (55.3) (72.0) (97.4) (106.7) (107.8) Free Cash flows 100.0 289.7 101.1 226.8 174.9 77.8 81.0 210.2 209.6 (41.9) Net earnings attributed to Valmont Industries, Inc. $ 234.1 $ 278.5 $ 183.9 $ 40.1 $ 175.5 $ 120.5 $ 101.8 $ 146.4 $ 140.7 $ 195.6 Adjusted net earnings attributed to Valmont Industries, Inc. N/A $ 295.1 $ 187.7 $ 131.7 $ 139.9 $ 162.7 $ 130.4 N/A $ 159.8 $ 222.3 Free Cash Flow Conversion - GAAP 0.43 1.04 0.55 5.66 1.00 0.65 0.80 1.44 1.49 (0.21) Free Cash Flow Conversion - Adjusted N/A 0.98 0.53 1.71 1.25 0.48 0.62 N/A 1.31 (0.19) 1) Reconciliation of Net Earnings to Adjusted Figures Net earnings attributed to Valmont Industries, Inc. $ 234.1 $ 278.5 $ 183.9 $ 40.1 $ 175.5 $ 120.5 $ 101.8 $ 146.4 $ 140.7 $ 195.6 Change in valuation allowance against deferred tax assets - - - 7.1 (20.7) 41.9 - - - 5.0 Impairment of long-lived assets - 12.2 - 61.8 1.1 - 28.6 - 19.1 21.7 Reversal of contingent liability - - - (16.6) - - - - - Other non-recurring expenses (non-cash) - - - 18.1 - - - - Deconsolidation of Delta EMD, after-tax and NCI - 4.4 - - - - - - - - Noncash loss from Delta EMD shares - - 3.8 4.6 0.6 0.2 - - - - Adjusted net earnings attributed to Valmont Industries, Inc. $ 234.1 $ 295.1 $ 187.7 $ 131.7 $ 139.9 $ 162.7 $ 130.4 $ 146.4 $ 159.8 $ 222.3 10 Year Average FCF is $143M; Last 5 Years Has Averaged $107M

July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation30 Years of rapid raw material cost inflation GAAP 0.43X 1.04X 0.55X 5.66X 1.01X 0.67X 0.86X 1.37X 1.49X (0.21X) Adj. N/A 0.98X 0.53X 1.71X 1.27X 0.49X 0.66X N/A 1.28X (0.19X) 2012 – 2021 Free Cash Flow1 ($M) 100 290 101 227 175 78 81 210 210 (42) 143 (100) (50) - 50 100 150 200 250 300 350 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 10 Year Avg 10-yr Avg. $143M GAAP 1.28X Adj. 0.84X Historical FCF Conversion by Year1 Strong Free Cash Flow throughout the Cycle 1 We use the non-GAAP measure of FCF, which we define as GAAP net cash flows from operating activities reduced by capex. We believe that FCF is a useful performance measure for management and useful to investors as the basis for comparing our performance with other companies. Our measure of FCF may not be directly comparable to similar measures used by other companies.

July 21, 2022 | Valmont Industries, Inc. | Q2 2022 Earnings Presentation31 Calculation of Adjusted EBITDA and Leverage Ratio Certain of our debt agreements contain covenants that require us to maintain certain coverage ratios. Our Debt/Adjusted EBITDA may not exceed 3.5X Adjusted EBITDA (or 3.75X Adjusted EBITDA after certain material acquisitions) of the prior four quarters. See “Leverage Ratio “ below. TTM 25-Jun-22 Net earnings attributable to Valmont Industries, Inc. $ 216,925 Interest expense 44,826 Income tax expense 83,880 Stock-based compensation 39,355 Depreciation and amortization expense 96,527 EBITDA 481,513 Asset impairments 27,911 Adjusted EBITDA – last four quarters $ 509,424 Net indebtedness $ 1,003,093 Leverage Ratio 1.76 Interest-bearing debt $ 1,003,093 Less: Cash and cash equivalents in excess of $50 million 104,579 Net indebtedness $ 898,514 ($000s)