- VMI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Valmont Industries (VMI) DEF 14ADefinitive proxy

Filed: 22 Mar 02, 12:00am

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /x/ | ||

| Filed by a Party other than the Registrant / / | ||

Check the appropriate box: | ||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to §240.14a-12 | |

Valmont Industries, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| /x/ | No fee required | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| / / | Fee paid previously with preliminary materials. | |||

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

![]()

Proxy Statement

For The

April 29, 2002

Annual Shareholders' Meeting

Dear Shareholder:

You are cordially invited to attend Valmont's Annual Meeting of Shareholders on Monday, April 29, 2002 at 2:00 P.M. The meeting will be held in the Lecture Hall of the Joslyn Art Museum at 2200 Dodge Street in Omaha. You may enter the building through the atrium entrance on the east side.

The formal meeting of Shareholders will be followed by a review of Valmont's business operations for 2001 and the first quarter of 2002, as well as our outlook for the future. Following the meeting, you are invited to an informal reception where you can visit with the Directors and Officers about the activities of the Company.

If you cannot attend the meeting in person, please vote your shares by proxy. Please complete, sign and date the enclosed proxy card and return it in the postage paid envelope. Your prompt return of the card will help your Company avoid additional solicitation costs. Your vote is important, either in person or by proxy.

I look forward to seeing you at our Annual Meeting.

Sincerely, | ||

Mogens C. Bay Chairman and Chief Executive Officer |

Valmont Industries, Inc.

Notice of Annual Meeting

of Shareholders

Notice is hereby given that the Annual Meeting of Shareholders of Valmont Industries, Inc., a Delaware corporation, will be held at the Joslyn Art Museum, 2200 Dodge St., Omaha, Nebraska 68102, on Monday, April 29, 2002 at 2:00 p.m. local time for the purpose of:

Shareholders of record at the close of business on March 1, 2002 are entitled to vote at this meeting. If you do not expect to be present at the Annual Meeting and wish your shares to be voted, please complete, sign, date and mail the enclosed proxy form.

By Order of the Board of Directors | ||

P. Thomas Pogge Secretary One Valmont Plaza Omaha, Nebraska 68154 March 22, 2002 |

3

To Our Shareholders:

The Board of Directors of Valmont Industries, Inc. solicits your proxy in the form enclosed for use at the Annual Meeting of Shareholders to be held on Monday, April 29, 2002, or at any adjournments thereof.

At the close of business on March 1, 2002, the record date for shareholders entitled to notice of and to vote at the meeting, there were outstanding 24,026,860 shares of the Company's common stock. There were no preferred shares outstanding. All holders of common stock are entitled to one vote for each share of stock held by them.

Shares of common stock represented by a properly signed and returned proxy, including shares represented by broker non-votes or abstaining from voting, will be treated as present at the meeting for the purpose of determining a quorum. Directors are elected by a favorable vote of a plurality of the shares of voting stock present and entitled to vote, in person or by proxy, at the Annual Meeting. Accordingly, abstentions or broker non-votes will not affect the election of Directors.

The proposals to approve the Valmont 2002 Stock Plan and to ratify the appointment of the accountants requires the affirmative vote of a majority of shares present in person or represented by proxy. Abstentions will have the same effect as a vote against these proposals. Broker non-votes on these proposals are treated as shares for which voting power has been withheld by the beneficial holders of those shares and therefore will not be counted as votes for or against these proposals.

Any shareholder giving a proxy may revoke it before the meeting by mailing a signed instrument revoking the proxy to: Corporate Secretary, Valmont Industries, Inc., One Valmont Plaza, Omaha, Nebraska 68154-5215. To be effective, the revocation must be received by the Secretary before the date of the meeting. A shareholder may attend the meeting in person and at that time withdraw the proxy and vote in person.

The cost of solicitation of proxies, including the cost of reimbursing banks and brokers for forwarding proxies and proxy statements to their principals, shall be borne by the Company. This proxy statement and proxy card are being mailed to shareholders on or about March 22, 2002.

4

The following table sets forth, as of March 1, 2002, the number of shares beneficially owned by (i) persons known to the Company to be beneficial owners of more than 5% of the Company's outstanding common stock, (ii) directors and named executive officers and (iii) all directors and executive officers as a group.

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership March 1, 2002(1) | Percent of Class(2) | |||

|---|---|---|---|---|---|

| Robert B. Daugherty Ocean Reef Key Largo, FL 33037 | 7,131,568 | 29.7 | % | ||

| J.P. Morgan Chase & Co. (3) 270 Park Ave. New York, NY 10017 | 1,425,134 | 5.9 | % | ||

| Mogens C. Bay | 1,128,665 | 4.7 | % | ||

| John E. Jones | 50,000 | ||||

| Thomas F. Madison | 65,230 | ||||

| Charles D. Peebler, Jr. | 44,000 | ||||

| Bruce Rohde | 38,000 | ||||

| Walter Scott, Jr. | 92,000 | ||||

| Kenneth E. Stinson | 52,000 | ||||

| Terry J. McClain | 267,318 | 1.1 | % | ||

| E. Robert Meaney | 117,185 | ||||

| Mark E. Treinen | 94,079 | ||||

| Mark C. Jaksich | 41,428 | ||||

| All Executive Officers and Directors As Group (15 persons) | 9,127,882 | 38.0 | % |

5

The Company's Board of Directors currently consists of eight members and is divided into three classes. Each class serves for three years on a staggered term basis. Of the Directors of the Company, only Mr. Bay is an employee of the Company.

Three Directors have terms of office that expire at the 2002 Annual Meeting. They have been nominated by the Board of Directors for re-election to three-year terms. These nominees are:

| Mogens C. Bay John E. Jones Walter Scott, Jr. |

Unless authority to vote for directors is withheld, the shares represented by the enclosed proxy will be voted for the election of the nominees named above. In the event any of such nominees becomes unavailable for election, the proxy holders will have discretionary authority to vote the proxies for a substitute. The Board of Directors has no reason to believe that any such nominee will be unavailable to serve.

Nominees for Election—Terms Expire 2005:

Mogens C. Bay, Age 53, Chairman and Chief Executive Officer of the Company since January 1997. Director, ConAgra Foods, Inc., Peter Kiewit Sons', Inc. and Level 3 Communications, Inc.

Served as Director of Company continuously since October 1993.

Valmont Stock: 1,128,665 shares

John E. Jones, Age 67, Retired Chairman, President and Chief Executive Officer of CBI Industries, Inc. (industrial construction). Director, Amsted Industries Incorporated, NICOR Inc. and BWAY Corp.

Served as Director of Company continuously since April 1993.

Valmont Stock: 50,000 shares

Walter Scott, Jr., Age 70, Chairman of Level 3 Communications, Inc. (communications and information services) since March 1998. Previously, Chairman of the Board and President of Peter Kiewit Sons', Inc. Director, Berkshire Hathaway, Inc., Commonwealth Telephone Enterprises, Inc., MidAmerican Energy Holdings Company, Peter Kiewit Sons', Inc., Burlington Resources and RCN Corporation.

Served as Director of Company continuously since April 1981.

Valmont Stock: 92,000 shares

Continuing Directors—Terms Expire 2004:

Thomas F. Madison, Age 66, President of MLM Partners (consulting and small business investment) since January 1993; Previously Chairman of Communications Holdings, Inc., President—Markets of U S WEST Communications and Vice Chairman and Office of CEO of Minnesota Mutual Life Insurance Company; Director, ACI Telecentrics, Delaware Group of Mutual Funds, Digital River, Inc., and Rimage Corporation.

Served as Director of Company continuously since June 1987.

Valmont Stock: 65,230 shares

Bruce Rohde, Age 53, Chairman and CEO of ConAgra Foods, Inc. (food processor and producer) since September 1998. President, Vice Chairman and Chief Executive Officer of ConAgra Foods, Inc.

6

from September 1997 to September 1998. President and Vice Chairman of ConAgra Foods, Inc. from August 1996 to September 1997. Director, ConAgra Foods, Inc.

Served as Director of Company continuously since February 1999.

Valmont Stock: 38,000 shares

Continuing Directors—Terms Expire 2003:

Robert B. Daugherty, Age 80, Chairman Emeritus of the Company since December 1996; Chairman of the Board of the Company from March 1947 to December 1996.

Served as Director of Company continuously since March 1947.

Valmont Stock: 7,131,568 shares

Charles D. Peebler, Jr., Age 65, Retired Chairman Emeritus of True North Communications, Inc. and Managing Director of Plum Holdings, L.P. (venture capital firm concentrating on media content investments). Previously, President of True North Communications, Inc. and Chairman and Chief Executive Officer of True North Diversified Companies; Director, American Tool Companies, Inc., EOS International, Inc. and AvalonBay Communities, Inc.

Served as Director of Company continuously since February 1999.

Valmont Stock: 44,000 shares

Kenneth E. Stinson, Age 59, Chairman and Chief Executive Officer of Peter Kiewit Sons', Inc. (construction and mining) since March 1998. Chairman and CEO of Kiewit Construction Group, Inc. from August 1994 until March 1998. Director, ConAgra Foods, Inc., Level 3 Communications, Inc. and Peter Kiewit Sons', Inc.

Served as Director of Company continuously since December 1996.

Valmont Stock: 52,000 shares

Messrs. Scott (Chairman), Jones and Peebler are members of the Audit Committee, which met four times during the last fiscal year. The Audit Committee, composed of directors who are not employees of the Company, assists the Board by reviewing (1) the financial statements of the Company, (2) the independence and performance of the Company's independent auditors, and (3) the compliance by the Company with legal and regulatory requirements. The Audit Committee also recommends selection of the independent auditors; reviews matters pertaining to the audit, systems of internal control and accounting policies and procedures; has approval authority with respect to services provided by the independent auditors; and directs and supervises investigations into matters within the scope of its duties.

The Company does not have a standing Nominating Committee.

7

to U.S. Government bonds, compounded monthly. Mr. Bay does not receive director or meeting fees.

The following Summary Compensation Table provides information on the annual and long-term compensation for services paid by the Company to the Chief Executive Officer and the four highest paid executive officers for the three fiscal years ended December 29, 2001.

Summary Compensation Table

| | | | | Long-Term Compensation | | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | Awards | Payouts | | ||||||

| | | Annual Compensation | | |||||||||

| Name and Principal Position | | Number of Options (#) | LTIP Payouts ($) | All Other Comp. ($)(1) | ||||||||

| Year | Salary ($) | Bonus ($) | ||||||||||

| Mogens C. Bay Chairman and Chief Executive Officer | 2001 2000 1999 | 650,000 650,000 624,000 | 0 909,091 661,600 | 100,000 100,000 200,000 | 251,944 351,938 0 | 40,587 107,244 70,683 | ||||||

Terry J. McClain Sr. Vice President and Chief Financial Officer | 2001 2000 1999 | 281,750 245,000 229,900 | 0 297,727 222,425 | 30,000 25,000 50,000 | 61,882 86,438 0 | 15,463 35,885 24,660 | ||||||

E. Robert Meaney Sr. Vice President — International | 2001 2000 1999 | 247,500 225,000 218,400 | 0 204,545 163,800 | 30,000 25,000 20,000 | 58,787 82,133 0 | 13,783 29,324 21,447 | ||||||

Mark E. Treinen Vice President, Business Development | 2001 2000 1999 | 157,500 150,000 130,000 | 0 119,091 98,000 | 10,000 10,000 15,000 | 29,160 40,738 0 | 8,400 17,960 12,642 | ||||||

Mark C. Jaksich Vice President, Corporate Controller | 2001 2000 1999 | 140,000 110,000 87,000 | 0 80,000 40,625 | 10,000 10,000 7,500 | 0 0 0 | 6,300 10,990 5,743 | ||||||

8

Stock Option Grants In Fiscal Year 2001

The following table provides information on fiscal year 2001 stock option grants to executive officers named in the Summary Compensation Table. No stock appreciation rights were granted during fiscal 2001.

Individual Grants

| | | | | | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(2) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | % of Total Options Granted to Employees In Fiscal Year | | | |||||||||

| Name | Date Granted | Options Granted | Exercise Price ($) Per Share | Expiration Date | ||||||||||

| 5% ($) | 10% ($) | |||||||||||||

| Mogens C. Bay(1) | 1/02/01 | 100,000 | 19.2% | 17.58 | 01/01/11 | 1,105,214 | 2,800,609 | |||||||

| Terry J. McClain(1) | 12/16/01 | 30,000 | 5.8% | 13.91 | 12/17/11 | 262,347 | 664,786 | |||||||

| E. Robert Meaney(1) | 12/16/01 | 30,000 | 5.8% | 13.91 | 12/17/11 | 262,347 | 664,786 | |||||||

| Mark E. Treinen(1) | 12/16/01 | 10,000 | 1.9% | 13.91 | 12/17/11 | 87,449 | 221,595 | |||||||

| Mark C. Jaksich(1) | 12/16/01 | 10,000 | 1.9% | 13.91 | 12/17/11 | 87,449 | 221,595 | |||||||

All Shares Outstanding(3) | 230,286,078 | 583,590,135 | ||||||||||||

8

Options Exercised in Fiscal Year 2001 and Fiscal Year End Values

The following table provides information on the exercise of stock options during fiscal 2001 and the status of unexercised stock options at the end of the year for the executive officers named in the Summary Compensation Table.

| | | | Number of Unexercised Options at FY-End (#) | Value of Unexercised In-The-Money Options at FY-End ($)(2) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Shares Acquired On Exercise (#) | Value Realized ($)(1) | ||||||||||

| | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||

| Mogens C. Bay | 0 | 0 | 746,668 | 233,332 | 1,593,634 | 67,416 | ||||||

| Terry J. McClain | 0 | 0 | 152,256 | 83,332 | 0 | 31,500 | ||||||

| E. Robert Meaney | 0 | 0 | 77,531 | 59,998 | 19,448 | 31,500 | ||||||

| Mark E. Treinen | 0 | 0 | 41,869 | 21,666 | 24,680 | 10,500 | ||||||

| Mark C. Jaksich | 1,000 | 5,865 | 35,334 | 19,166 | 76,525 | 10,500 | ||||||

Long-Term Incentive Plans—Awards in Fiscal Year 2001

The following table provides information on the long-term incentive program awards granted to the executive officers named in the Summary Compensation Table during fiscal year 2001.

| | | | Estimated Future Payouts under Non-Stock Price-Based Plans | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | Performance or Other Period Until Maturation or Payout | ||||||||

| | Number Of Shares, Units or Other Rights (#) | |||||||||

| | Threshold ($) | Target ($) | Maximum ($) | |||||||

| Mogens C. Bay | 1 Unit | (1) | 195,000 | 390,000 | 858,000 | |||||

| Terry J. McClain | 1 Unit | (1) | 42,263 | 84,525 | 185,955 | |||||

| E. Robert Meaney | 1 Unit | (1) | 37,125 | 74,250 | 163,350 | |||||

| Mark E. Treinen | 1 Unit | (1) | 19,688 | 39,375 | 86,625 | |||||

| Mark C. Jaksich | 1 Unit | (1) | 17,500 | 35,000 | 77,000 | |||||

See "Compensation Committee Report on Executive Compensation—Long-Term Performance Incentives" for a description of the award program.

9

Compensation Committee Report

On Executive Compensation

Valmont's executive compensation policies and practices are approved by the Compensation Committee of the Board of Directors (the "Committee"). The Committee during 2001 consisted of two Directors who are not employees of the Company. The Committee's determinations on compensation of the Chief Executive Officer and other executive officers are reviewed with the Board of Directors.

The Committee has implemented compensation policies, plans and programs that seek to enhance shareholder value by aligning the financial interests of the executive officers with those of the Company's shareholders. Annual base salaries are generally set at competitive median levels. The Company relies on annual and long-term incentive compensation and stock options to attract, retain, motivate and reward executive officers and other key employees. Incentive compensation is variable and tied to corporate, business unit and individual performance. The plans are designed to provide an incentive to management to grow earnings, provide quality returns on investments, enhance shareholder value and contribute to the long-term growth of the Company. All incentive compensation plans are reviewed at least annually to assure their linkage to the current strategies and needs of the business. The Company's programs have been designed so that compensation paid to named executive officers in 2001 will be deductible under the Internal Revenue Code's compensation limits for deductibility.

Valmont's executive compensation is based on four components, each of which is intended to support the overall compensation philosophy.

Base Salary. Base salary is targeted at median level for industrial manufacturing companies of similar characteristics such as sales volume, capitalization and financial performance. Salaries for executive officers are reviewed by the Committee on an annual basis and may be changed based on the individual's performance or a change in competitive pay levels in the marketplace.

The Committee reviews with the Chief Executive Officer an annual salary plan for the Company's executive officers (other than the Chief Executive Officer). The salary plan is modified as deemed appropriate and approved by the Committee. The annual salary plan is developed by the Company's human resources staff, under the ultimate direction of the Chief Executive Officer, and is based on peer group and national surveys of industrial manufacturing organizations with similar characteristics and on performance judgments as to the past and expected future contributions of the individual executive. In addition, the Committee annually reviews information provided by independent compensation consultants concerning salary competitiveness. The Committee reviews and establishes the base salary of the Chief Executive Officer based on similar competitive compensation data and the Committee's assessment of his past performance, his leadership in establishing performance standards in the conduct of the Company's business, and its expectation as to his future contribution in directing the long-term success of the Company and its businesses.

The Committee maintained the Chief Executive Officer's base salary of $650,000 during 2001. The decision to maintain the salary reflected the Committee's desire to direct more of the Chief Executive Officer's total compensation to incentive based programs.

Annual Incentives. The Company's short-term incentive plans are paid pursuant to programs established under the stockholder approved Executive Incentive Plan. The Committee believes that the annual bonus of key employees, including executive officers, should be based on optimizing profits and prudent management of the capital employed in the business. Accordingly, the programs provide for target performance levels based upon the Company's earnings per share or the respective business unit's net operating income after tax less a cost of capital. A minimum threshold level must be met before any awards are earned. Individual award targets are based on a pre-determined percentage of beginning of the year base salary considering the individual's position and the Committee's assessment

10

of the individual's expected contribution in such position. Participants, thresholds and specific performance levels are established by the Committee at the beginning of each fiscal year.

The Committee approved participation, including executive officers, in the programs for 2001. Based on performance levels achieved during 2001, the Committee approved aggregate bonus payments of $4,207,461. No annual incentive was paid to the Chief Executive Officer or the other executive officers named in the Summary Compensation Table for 2001.

Long-term Performance Incentives. Long-term performance incentives for senior management employees are provided through long-term performance share programs ("Programs") established under the stockholder approved Executive Incentive Plan and through the 1988, 1996 and 1999 Stock Plans. The current programs operate on three-year award cycles. The Committee selects participants, establishes target awards, and determines a performance matrix (based on return on equity, return on invested capital, net earnings and other selected factors) at the beginning of each award cycle. The performance matrix provides for the performance shares to be increased or decreased in number based on greater or lesser levels of performance. Earned performance shares are then valued at the Company's stock price at the end of the performance period. The Committee approves the number of performance shares to be paid following a review of results at the end of each performance cycle. Awards may be paid in cash or in shares of common stock or any combination of cash and stock.

The Committee previously selected the participants, including executive officers, for participation in the award cycle ending in 2001. Based on performance goals previously established by the Committee, payments of $523,929 were approved for the 1999-2001 plan. The long-term performance incentive of $251,944 paid to the Chief Executive Officer for the 1999-2001 plan was based on pre-established performance goals. During 2001, the Committee selected the participants and established the performance goals for the 2002-2004 award cycle. The performance goals for the cycles ending in 2002, 2003 and 2004 are based on the company's return on invested capital.

Stock Incentives. Long-term stock incentives are provided through grants of stock options and restricted stock to executive officers and other key employees pursuant to the stockholder approved 1988, 1996 and 1999 Stock Plans (all referenced as the "Plan"). The stock component of compensation is intended to retain and motivate employees to improve long-term shareholder value. Stock options are granted at the prevailing market value and have value only if the Company's stock price increases. Stock options granted during 2001 vest beginning on the first anniversary of the grant in equal amounts over three years. Employees must be employed by the Company at the time of vesting in order to exercise the options. The Committee believes this element of the total compensation program directly links the participant's interests with those of the shareholders and the long-term performance of the Company.

The Committee establishes the number and terms of the options granted under the Plan. The Committee encourages executives to build a substantial ownership investment in the Company's common stock. The Options Exercised on page 9 reflect the shares acquired by certain executive officers in 2001. The table on page 5 reflects the ownership position of the directors and executive officers at March 1, 2002. Outstanding performance by an individual executive officer is recognized through larger option grants. The Committee, in determining grants of stock options under the Plan, also reviews and considers the executive's history of retaining shares previously obtained through the exercise of prior options.

The Committee granted options for an aggregate of 491,800 shares to 105 employees during 2001, including options for an aggregate of 192,000 shares to the executive officers. The Chief Executive Officer was granted non-qualified options in January 2001 to acquire 100,000 shares. The number of options awarded in the 2001 grant was equal to the standard grant in the prior three years and recognizes Mr. Bay's performance in leading the growth of the Company.

11

Restricted stock grants are also part of the Company's long-term stock incentives. Restricted stock awards will be issued when performance results and the strategic needs of the business so warrant. There were no restricted stock awards during the period of 1997 through 2001 to executive officers.

The Committee believes that the programs described above provide compensation that is competitive with comparable manufacturing companies, links executive and shareholder interests and provides the basis for the Company to attract and retain qualified executives. The Committee will continue to monitor the relationship among executive compensation, the Company's performance and shareholder value.

COMPENSATION COMMITTEE Thomas F. Madison, Chairman Charles D. Peebler, Jr. |

12

During fiscal 2000, Valmont's Board of Directors adopted a written charter setting out the functions to be performed by the Audit Committee (the "Committee") of the Board of Directors. The Committee members listed below are all independent for purposes of the National Association of Securities Dealers' listing standards.

The Committee reviewed Valmont's audited financial statements for fiscal 2001 and met with both management and Deloitte & Touche LLP ("Deloitte"), the Company's independent accountants, to discuss the financial statements. The Committee received from and discussed with Deloitte the written disclosures and the letter required by Independence Standards Board Standard No. 1 relating to that firm's independence from the Company. The Committee also discussed with Deloitte any matters required to be discussed by Statement on Auditing Standards No. 61 relating to communications between the audit committee and the independent accountants. Based on these reviews and discussions, the Committee recommended to the Board of Directors that the Company's audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 29, 2001.

The Committee performed other functions pursuant to the charter of the Audit Committee. The Committee has considered whether the provision of non-audit services by Deloitte (see "Ratification of Appointment of Independent Auditors") is compatible with maintaining such firm's independence.

Audit Committee | ||

Walter Scott, Jr., Chairman Charles D. Peebler, Jr. John E. Jones |

13

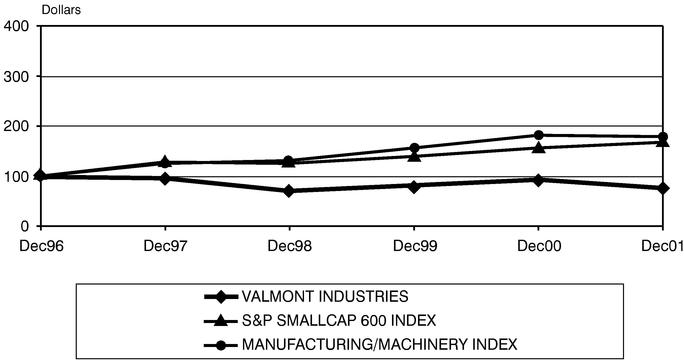

Shareholder Return Performance Graphs

The graph below compares the yearly change in the cumulative total shareholder return on the Company's common stock with the cumulative total returns of the S&P Small Cap 600 Index and an index consisting of a combination of the S&P Manufacturing (Diversified) and Machinery (Diversified) indexes for the five year period ended December 29, 2001. The graph assumes that the value of the investment in Valmont Common Stock and each index was $100 on December 31, 1996 and that all dividends were reinvested.

14

APPROVAL OF THE VALMONT 2002 STOCK PLAN

General

Valmont's Board of Directors has adopted the Valmont 2002 Stock Plan (the "Plan"), subject to stockholder approval. The Board of Directors recognizes the value of stock incentives in assisting Valmont in the hiring and retaining of management personnel and in enhancing the long-term mutuality of interest between Valmont stockholders and its directors, officers and employees. Since only 449,621 shares of common stock remain available for grant under Valmont's current stock plans, the Board of Directors has approved the Plan which authorizes the issuance of up to 1,700,000 shares of Valmont common stock.

Under the Plan, the Compensation Committee (the "Committee") of the Board may grant stock options, stock appreciation rights, restricted stock and certain stock bonuses to officers and other employees of Valmont and its subsidiaries. The number of grantees may vary from year to year. The number of employees eligible to participate in the Plan is estimated to be approximately 200. The Committee administers the Plan and its determinations are binding upon all persons participating in the Plan.

The maximum number of shares of Valmont's common stock that may be issued under the Plan is 1,700,000. Any shares of common stock subject to an award which for any reasons are cancelled, terminated or otherwise settled without the issuance of any common stock are again available for awards under the Plan. If payment for an award or the satisfaction of related withholding tax liabilities is effected through the surrender of common stock or the withholding of common stock, the number of shares of common stock available for awards under the Plan shall be increased by the number of shares of common stock so surrendered or withheld. The maximum number of shares of common stock which may be issued under the Plan to any one employee shall not exceed 40% of the aggregate number of shares of common stock that may be issued under the Plan. A maximum of 20% of the shares of stock available under the Plan may be issued as restricted stock or stock bonuses. In addition, a maximum of 50,000 shares may be issued to non-employee consultants.

The shares may be unissued shares or treasury stock. If there is a stock split, stock dividend, recapitalization, spinoff, exchange or other similar corporate transaction or event affecting Valmont's common stock, appropriate adjustments shall be made by the Committee in the number of shares issuable in the future and in the number of shares and price under all outstanding grants made before the event.

Grants Under The Plan

Stock Options for Employees: The Committee may grant employees nonqualified options and options qualifying as incentive stock options. The option price of either a nonqualified stock option or an incentive stock option will be the fair market value of the common stock on the date of grant. Options qualifying as incentive stock options must meet certain requirements of the Internal Revenue Code. To exercise an option, an employee may pay the option price in cash, or if permitted by the Committee, by withholding shares otherwise issuable on exercise of the option or by delivering other shares of common stock, if such shares have been owned by the optionee for at least six months. The term of each option will be fixed by the Committee but may not exceed ten years from the date of grant. The Committee will determine the time or times when each option is exercisable. Options may be made exercisable in installments, and the exercisability of options may be accelerated by the Committee. All outstanding options become immediately exercisable in the event of a change-in-control (as defined in the Plan) of Valmont.

Replacement Options: The Committee may grant a replacement option to any employee who exercises all or part of an option using "qualifying stock." A replacement option grants to the employee

15

the right to purchase, at fair market value as of the date of said exercise and grant, the number of shares of stock used by the employee in payment of the purchase price for the option or in connection with applicable withholding taxes on the option exercise. A replacement option may not be exercised for six months following the date of grant, and expires on the same date as the option which it replaces. "Qualifying stock" is stock which has been owned by the employee for at least six months prior to the date of exercise and has not been used in a stock-for-stock swap transaction within the preceding six months.

Stock Appreciation Rights: The Committee may grant a stock appreciation right (a "SAR") in conjunction with an option granted under the Plan or separately from any option. Each SAR granted in tandem with an option may be exercised only to the extent that the corresponding option is exercised, and such SAR terminates upon termination or exercise of the corresponding option. Upon the exercise of a SAR granted in tandem with an option, the corresponding option will terminate. SAR's granted separately from options may be granted on such terms and conditions as the Committee establishes. If an employee exercises a SAR, the employee will generally receive a payment equal to the excess of the fair market value at the time of exercise of the shares with respect to which the SAR is being exercised over the price of such shares as fixed by the Committee at the time the SAR was granted. Payment may be made in cash, in shares of Valmont common stock, or any combination of cash and shares as the Committee determines.

Restricted Stock: The Committee may grant awards of restricted stock to employees under the Plan. The restrictions on such shares shall be established by the Committee, which may include restrictions relating to continued employment and Valmont financial performance. The Committee may issue such restricted stock awards without any cash payment by the employee, or with such cash payment as the Committee may determine. All restrictions lapse in the event of a change-in-control (as defined in the Plan) of Valmont. The Committee intends that all restricted stock grants shall have a restriction period of one year on performance-based restricted stock and three years on tenure-based restricted stock. The Committee has the right to accelerate the vesting of restricted shares and to waive any restrictions. The Committee intends to grant acceleration or waiver of restricted stock provisions only in the case of special circumstances.

Stock Bonuses: The Committee may grant a bonus in shares of Valmont common stock to employees under the Plan. Such stock bonuses shall only be granted in lieu of cash compensation otherwise payable to such employee.

Director Participation: Each non-employee director will receive under the Plan (1) an annual award of 2,000 shares of common stock and (2) an annual award of a nonqualified stock option for 4,000 shares of common stock exercisable at the fair market value of Valmont's common stock on the date of grant. These awards shall be made annually on the date of and following completion of Valmont's annual stockholders' meeting, commencing with the 2002 annual stockholders' meeting. Directors currently receive similar grants under the 1999 Stock Plan. Following stockholder approval of the 2002 Stock Plan, directors will receive such grants only pursuant to the 2002 Stock Plan. The common stock award will be forfeited if the director's services terminate for any reason other than death, retirement from the board at mandatory retirement age, or resignation or failure to stand for re-election, in any such case without the prior approval of the board.

Tax Withholding: The Committee may permit an employee to satisfy applicable federal, state and local tax withholding requirements through the delivery to Valmont of previously-acquired shares of common stock or by having shares otherwise issuable under the Plan withheld by Valmont.

Other Information: Except as permitted by the Committee, awards under the Plan are not transferable except by will or under the laws of descent and distribution. The Board may terminate the Plan at any time but such termination shall not affect any stock options, SAR's, restricted stock or

16

stock bonuses then outstanding under the Plan. Unless terminated by action of the Board, the Plan will continue in effect until December 31, 2012, but awards granted prior to such date will continue in effect until they expire in accordance with their original terms. The Board may also amend the Plan as it deems advisable. Amendments which (1) materially modify the requirements for participation in the 2002 Stock Plan, (2) increase the number of shares of Valmont common stock subject to issuance under the 2002 Stock Plan, or (3) change the minimum exercise price for stock options as provided in the Plan, must be submitted to stockholders for approval.

Federal Income Tax Consequences

With respect to incentive stock options, if the holder of an option does not dispose of the shares acquired upon exercise of the option within one year from the transfer of such shares to such employee, or within two years from the date the option to acquire such shares is granted, then for federal income tax purposes (1) the optionee will not recognize any income at the time of exercise of the option; (2) the excess of the fair market value of the shares as of the date of exercise over the option price will constitute an "item of adjustment" for purposes of the alternative minimum tax; and (3) the difference between the option price and the amount realized upon the sale of the shares by the optionee will be treated as a long-term capital gain or loss. Valmont will not be allowed a deduction for federal income tax purposes in connection with the granting of an incentive stock option or the issuance of shares thereunder.

With respect to the grant of options which are not incentive stock options, the person receiving an option will recognize no income on receipt thereof. Upon the exercise of the option, the optionee will recognize ordinary income in the amount of the difference between the option price and the fair market value of the shares on the date the option is exercised. Valmont generally will receive an equivalent deduction at that time.

With respect to restricted stock awards and bonuses of common stock, an amount equal to the fair market value of the Valmont shares distributed to the employee (in excess of any purchase price paid by the employee) will be includable in the employee's gross income at the time of receipt unless the award is not transferable and subject to a substantial risk of forfeiture as defined in Section 83 of the Internal Revenue Code (a "Forfeiture Restriction"). If an employee receives an award subject to a Forfeiture Restriction, the employee may elect to include in gross income the fair market value of the award. In the absence of such an election, the employee will include in gross income the fair market value of the award subject to a Forfeiture Restriction on the earlier of the date such restrictions lapse or the date the award becomes transferable. Valmont generally is entitled to a deduction at the time and in the amount that the income is included in the gross income of an employee.

With respect to stock appreciation rights, the amount of any cash (or the fair market value of any common stock) received upon the exercise of a stock appreciation right will be subject to ordinary income tax in the year of receipt and Valmont generally will be entitled to a deduction for such amount.

Vote Required

The favorable vote of the holders of a majority of the outstanding shares of Valmont's common stock present in person or represented by proxy at the meeting is required for approval of the Plan.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE

APPROVAL OF THE VALMONT 2002 STOCK PLAN.

17

Ratification of Appointment of Independent Auditors

The firm of Deloitte & Touche LLP and the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively "Deloitte") has been appointed by the Board of Directors to conduct the 2002 audit of the Company's financial statements. The same firm conducted the 2000 and 2001 audits. Fees billed by Deloitte to the Company for services during the fiscal year ended December 29, 2001 were:

Audit Fees. Deloitte billed the Company an aggregate of $198,340 for professional services rendered in connection with the audit of the Company's fiscal 2001 annual financial statements and Deloitte's review of the Company's quarterly financial statements during fiscal 2001.

Financial Information Systems Design and Implementation Fees. Deloitte performed no information technology services for the Company during fiscal 2001.

All Other Fees. Deloitte billed the Company an aggregate of $555,922 for all other services during fiscal 2001 including audit related services of approximately $52,510 and non-audit services of $503,412. Audit related services primarily included fees for employee benefit plan audits, consents related to Securities and Exchange Commission filings, agreed-upon procedures and consultation on accounting standards. Non-audit services primarily included fees for consultations related to tax planning and compliance and general business practices.

The Board of Directors requests that the shareholders ratify the appointment of Deloitte as independent public accountants to conduct the 2002 audit of the Company's financial statements. A representative from Deloitte will be present at the Shareholders' Meeting and will have the opportunity to respond to appropriate questions.

Shareholder proposals intended to be presented at the next annual meeting of shareholders must be received by the Company no later than November 25, 2002 in order to be considered for inclusion in the proxy statement for such meeting.

The Company's bylaws set forth certain procedures which shareholders must follow in order to nominate a director or present any other business at an annual shareholders' meeting. Generally, a shareholder must give timely notice to the Secretary of the Company. To be timely, such notice must be received by the Company at its principal executive offices not less than ninety nor more than one hundred twenty days prior to the meeting. The bylaws specify the information which must accompany such shareholder notice. Details of the provision of the bylaws may be obtained by any shareholder from the Secretary of the Company.

The Board of Directors does not know of any matter, other than those described above, that may be presented for action at the Annual Meeting of Shareholders. If any other matter or proposal should be presented and should properly come before the meeting for action, the persons named in the accompanying proxy will vote upon such matter and upon such proposal in accordance with their best judgment.

By Order of the Board of Directors | ||

P. Thomas Pogge Secretary Valmont Industries, Inc. |

17

PROXY

Valmont Industries, Inc.

Proxy for the Annual Meeting of Shareholders on April 29, 2002

The undersigned hereby constitutes and appoints Mogens C. Bay and Robert B. Daugherty, or any substitute appointed by them, the undersigned's agents, attorneys and proxies to vote, as designated below, the number of shares the undersigned would be entitled to vote if personally present at the Annual Meeting of the Shareholders of Valmont Industries, Inc., to be held at the Joslyn Art Museum, 2200 Dodge Street, Omaha, Nebraska 68102, on April 29, 2002 at 2:00 p.m. local time, or at any adjournments thereof.

| o | FOR all nominees listed below (except as designated to the contrary below). | o | WITHHOLD AUTHORITY to vote for all nominees listed below. |

Mogens C. Bay

John E. Jones

Walter Scott, Jr.

(Instruction: To withhold authority to vote for any individual nominee, write the nominee's name on the space provided below.)

| o FOR | o AGAINST | o ABSTAIN |

| o FOR | o AGAINST | o ABSTAIN |

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS. THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. IF PROPERLY EXECUTED AND NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED IN FAVOR OF ALL PROPOSALS.

| Dated this ___ day of _________, 2002. | Signature | ||

Signature | |||

| (When signing as attorney, executor, administrator, trustee, guardian or conservator, designate full title. All joint tenants must sign.) | |||

Note: Pursuant to Instruction 3 to Item 10 of Schedule 14A of the Securities Exchange Act of 1934, the following written plan document, which is not being mailed to stockholders with the proxy statement, is being filed in electronic format as an appendix to this proxy statement filing.

SECTION 1

NAME AND PURPOSE

1.1 Name. The name of the plan shall be the Valmont 2002 Stock Plan (the "Plan").

1.2. Purpose of Plan. The purpose of the Plan is to foster and promote the long-term financial success of the Company and increase stockholder value by (a) motivating superior performance by means of stock incentives, (b) encouraging and providing for the acquisition of an ownership interest in the Company by Employees and (c) enabling the Company to attract and retain the services of a management team responsible for the long-term financial success of the Company.

SECTION 2

DEFINITIONS

2.1 Definitions. Whenever used herein, the following terms shall have the respective meanings set forth below:

2.2 Gender and Number. Except when otherwise indicated by the context, words in the masculine gender used in the Plan shall include the feminine gender, the singular shall include the plural, and the plural shall include the singular.

SECTION 3

ELIGIBILITY AND PARTICIPATION

Except as otherwise provided in Sections 5.1 and 7.1, the only persons eligible to participate in the Plan shall be those Employees selected by the Committee as Participants.

SECTION 4

POWERS OF THE COMMITTEE

�� 4.1 Power to Grant. The Committee shall determine the Participants to whom Awards shall be granted, the type or types of Awards to be granted, and the terms and conditions of any and all such Awards. The Committee may establish different terms and conditions for different types of Awards, for different Participants receiving the same type of Awards, and for the same Participant for each Award such Participant may receive, whether or not granted at different times.

4.2 Administration. The Committee shall be responsible for the administration of the Plan. The Committee, by majority action thereof, is authorized to prescribe, amend, and rescind rules and regulations relating to the Plan, to provide for conditions deemed necessary or advisable to protect the interests of the Company, and to make all other determinations necessary or advisable for the administration and interpretation of the Plan in order to carry out its provisions and purposes. Determinations, interpretations, or other actions made or taken by the Committee pursuant to the provisions of the Plan shall be final, binding, and conclusive for all purposes and upon all persons.

2

SECTION 5

STOCK SUBJECT TO PLAN

5.1 Number. Subject to the provisions of Section 5.3, the number of shares of Stock subject to Awards (including Director Awards) under the Plan may not exceed 1,700,000 shares of Stock. The shares to be delivered under the Plan may consist, in whole or in part, of treasury Stock or authorized but unissued Stock, not reserved for any other purpose. The maximum number of shares of Stock with respect to which Awards may be granted to any one Employee under the Plan is 40% of the aggregate number of shares of Stock available for Awards under Section 5.1. A maximum of 20% of the shares of Stock available for issuance under the Plan may be issued as Restricted Stock or Stock Bonuses. In addition, a maximum of 50,000 shares available for issuance under the Plan may be issued to non-employee consultants.

5.2 Cancelled, Terminated or Forfeited Awards. Any shares of Stock subject to an Award which for any reason are cancelled, terminated or otherwise settled without the issuance of any Stock shall again be available for Awards under the Plan. In the event that an Award is exercised through the delivery of Stock or in the event that withholding tax liabilities arising from such Award are satisfied by the withholding of Stock by the Company, the number of shares available for Awards under the Plan shall be increased by the number of shares surrendered or withheld.

5.3 Adjustment in Capitalization. In the event of any Stock dividend or Stock split, recapitalization (including, without limitation, the payment of an extraordinary dividend), merger, consolidation, combination, spin-off, distribution of assets to stockholders, exchange of shares, or other similar corporate transaction or event, (i) the aggregate number of shares of Stock available for Awards under Section 5.1 and (ii) the number of shares and exercise price with respect to Options and the number, prices and dollar value of other Awards, shall be appropriately adjusted by the Committee, whose determination shall be conclusive. If, pursuant to the preceding sentence, an adjustment is made to the number of shares of Stock authorized for issuance under the Plan, a corresponding adjustment shall be made with respect to Director Awards granted pursuant to Section 7.1.

SECTION 6

STOCK OPTIONS

6.1 Grant of Options. Options may be granted to Participants at such time or times as shall be determined by the Committee. Options granted under the Plan may be of two types: (i) Incentive Stock Options and (ii) Nonstatutory Stock Options. The Committee shall have complete discretion in determining the number of Options, if any, to be granted to a Participant. Each Option shall be evidenced by an Option agreement that shall specify the type of Option granted, the exercise price, the duration of the Option, the number of shares of Stock to which the Option pertains, the exercisability (if any) of the Option in the event of death, retirement, disability or termination of employment, and such other terms and conditions not inconsistent with the Plan as the Committee shall determine. Options may also be granted in replacement of or upon assumption of options previously issued by companies acquired by the Company by merger or stock purchase, and any options so replaced or assumed may have the same terms including exercise price as the options so replaced or assumed.

6.2 Option Price. Nonstatutory Stock Options and Incentive Stock Options granted pursuant to the Plan shall have an exercise price which is not less than the Fair Market Value on the date the Option is granted.

6.3 Exercise of Options. Options awarded to a Participant under the Plan shall be exercisable at such times and shall be subject to such restrictions and conditions as the Committee may impose, subject to the Committee's right to accelerate the exercisability of such Option in its discretion.

3

Notwithstanding the foregoing, no Option shall be exercisable for more than ten years after the date on which it is granted.

6.4 Payment. The Committee shall establish procedures governing the exercise of Options, which shall require that written notice of exercise be given and that the Option price be paid in full in cash or cash equivalents, including by personal check, at the time of exercise or pursuant to any arrangement that the Committee shall approve. The Committee may, in its discretion, permit a Participant to make payment (i) by tendering, either by actual delivery of shares or by attestation, shares of Stock already owned by the Participant valued at its Fair Market Value on the date of exercise (if such Stock has been owned by the Participant for at least six months) or (ii) by electing to have the Company retain Stock which would otherwise be issued on exercise of the Option, valued at its Fair Market Value on the date of exercise. As soon as practicable after receipt of a written exercise notice and full payment of the exercise price, the Company shall deliver to the Participant a certificate or certificates representing the acquired shares of Stock. The Committee may permit a Participant to elect to pay the exercise price upon the exercise of an Option by irrevocably authorizing a third party to sell shares of Stock (or a sufficient portion of the shares) acquired upon exercise of the Option and remit to the Company a sufficient portion of the sale proceeds to pay the entire exercise price and any required tax withholding resulting from such exercise.

6.5 Incentive Stock Options. Notwithstanding anything in the Plan to the contrary, no term of this Plan relating to Incentive Stock Options shall be interpreted, amended or altered, nor shall any discretion or authority granted under the Plan be so exercised, so as to disqualify the Plan under Section 422 of the Code, or, without the consent of any Participant affected thereby, to cause any Incentive Stock Option previously granted to fail to qualify for the Federal income tax treatment afforded under Section 421 of the Code.

6.6 Replacement Options. The Committee may grant a replacement option (a "Replacement Option") to any Employee who exercises all or part of an option granted under this Plan using Qualifying Stock (as herein defined) as payment for the purchase price. A Replacement Option shall grant to the Employee the right to purchase, at the Fair Market Value as of the date of said exercise and grant, the number of shares of stock equal to the sum of the number of whole shares (i) used by the Employee in payment of the purchase price for the option which was exercised and (ii) used by the Employee in connection with applicable withholding taxes on such transaction. A Replacement Option may not be exercised for six months following the date of grant, and shall expire on the same date as the option which it replaces. Qualifying Stock is stock which has been owned by the Employee for at least six months prior to the date of exercise and has not been used in a stock-for-stock swap transaction within the preceding six months.

SECTION 7

DIRECTOR AWARDS

7.1 Amount of Award. Each Eligible Director shall receive a non-discretionary Award of 2,000 shares of stock each year; such Award shall be made annually on the date of and following completion of the Company's annual stockholders' meeting (commencing with the 2002 annual stockholders' meeting). Each Eligible Director shall be issued a common stock certificate for such number of shares. Termination of the director's services for any reason other than (i) death, (ii) retirement from the Board at mandatory retirement age, or (iii) resignation or failure to stand for re-election, in any such case with the prior approval of the Board, will result in forfeiture of the Stock. If the Stock is forfeited, the director shall return the number of forfeited shares of Stock, or equivalent value, to the Company. The number of shares of Stock awarded to an Eligible Director annually shall be appropriately adjusted in the event of any stock changes as described in Section 5.3. In addition, each Eligible Director shall receive a non-discretionary Award of a Nonqualified Stock Option for 4,000 shares of Stock exercisable

4

at the Fair Market Value of the Company's common stock on the date of grant; such Award shall be made annually on the date of and following completion of the Company's annual stockholders' meeting (commencing with the 2002 annual stockholders' meeting). The number of nonqualified options awarded to a director shall be appropriately adjusted in the event of any stock changes as described in Section 5.3.

7.2 No Other Awards. An Eligible Director shall not receive any other Award under the Plan.

SECTION 8

STOCK APPRECIATION RIGHTS

8.1 SAR's In Tandem with Options. Stock Appreciation Rights may be granted to Participants in tandem with any Option granted under the Plan, either at or after the time of the grant of such Option, subject to such terms and conditions, not inconsistent with the provisions of the Plan, as the Committee shall determine. Each Stock Appreciation Right shall only be exercisable to the extent that the corresponding Option is exercisable, and shall terminate upon termination or exercise of the corresponding Option. Upon the exercise of any Stock Appreciation Right, the corresponding Option shall terminate.

8.2 Other Stock Appreciation Rights. Stock Appreciation Rights may also be granted to Participants separately from any Option, subject to such terms and conditions, not inconsistent with the provisions of the Plan, as the Committee shall determine.

SECTION 9

RESTRICTED STOCK

9.1 Grant of Restricted Stock. The Committee may grant Restricted Stock to Participants at such times and in such amounts, and subject to such other terms and conditions not inconsistent with the Plan as it shall determine. Each grant of Restricted Stock shall be subject to such restrictions, which may relate to continued employment with the Company, performance of the Company, or other restrictions, as the Committee may determine. Each grant of Restricted Stock shall be evidenced by a written agreement setting forth the terms of such Award.

9.2 Removal of Restrictions. The Committee may accelerate or waive such restrictions in whole or in part at any time in its discretion.

SECTION 10

STOCK BONUSES

10.1 Grant of Stock Bonuses. The Committee may grant a Stock Bonus to a Participant at such times and in such amounts, and subject to such other terms and conditions not inconsistent with the Plan, as it shall determine.

SECTION 11

AMENDMENT, MODIFICATION, AND TERMINATION OF PLAN

11.1 General. The Board may from time to time amend, modify or terminate any or all of the provisions of the Plan, subject to the provisions of this Section 11.1. The Board may not change the Plan in a manner which would prevent outstanding Incentive Stock Options granted under the Plan from being Incentive Stock Options without the written consent of the optionees concerned. Furthermore, the Board may not make any amendment which would (i) materially modify the requirements for participation in the Plan, (ii) increase the number of shares of Stock subject to

5

Awards under the Plan or to any one Employee pursuant to Section 5.1, or (iii) change the minimum exercise price for stock options as provided in Section 6.2, in each case without the approval of a majority of the outstanding shares of Stock entitled to vote thereon. No amendment or modification shall affect the rights of any Employee with respect to a previously granted Award, nor shall any amendment or modification affect the rights of any Eligible Director pursuant to a previously granted Director Award.

11.2 Termination of Plan. No further Options shall be granted under the Plan subsequent to December 31, 2012, or such earlier date as may be determined by the Board.

SECTION 12

MISCELLANEOUS PROVISIONS

12.1 Nontransferability of Awards. Except as otherwise provided by the Committee, Awards under the Plan are not transferable, except by will or by the laws of descent and distribution.

12.2 Beneficiary Designation. Each Participant under the Plan may from time to time name any beneficiary or beneficiaries (who may be named contingent or successively) to whom any benefit under the Plan is to be paid or by whom any right under the Plan is to be exercised in case of his death. Each designation will revoke all prior designations by the same Participant shall be in a form prescribed by the Committee, and will be effective only when filed in writing with the Company. In the absence of any such designation, Awards outstanding at death may be exercised by the Participant's surviving spouse, if any, or otherwise by his estate.

12.3 No Guarantee of Employment or Participation. Nothing in the Plan shall interfere with or limit in any way the right of the Company or any Subsidiary to terminate any Participant's employment at any time, nor confer upon any Participant any right to continue in the employ of the Company or any Subsidiary. No Employee shall have a right to be selected as a Participant, or, having been so selected, to receive any future Awards.

12.4 Tax Withholding. The Company shall have the power to withhold, or require a Participant or Eligible Director to remit to the Company, an amount sufficient to satisfy federal, state, and local withholding tax requirements on any Award under the Plan, and the Company may defer issuance of Stock until such requirements are satisfied. The Committee may, in its discretion, permit a Participant to elect, subject to such conditions as the Committee shall impose, (i) to have shares of Stock otherwise issuable under the Plan withheld by the Company or (ii) to deliver to the Company previously acquired shares of Stock, in each case having a Fair Market Value sufficient to satisfy all or part of the Participant's estimated total federal, state and local tax obligation associated with the transaction.

12.5 Change of Control. On the date of a Change of Control, all outstanding options and stock appreciation rights shall become immediately exercisable and all restrictions with respect to Restricted Stock shall lapse. "Change of Control" shall mean:

6

12.6 Agreements with Company. An Award under the Plan shall be subject to such terms and conditions, not inconsistent with the Plan, as the Committee may, in its sole discretion, prescribe. The terms and conditions of any Award to any Participant shall be reflected in such form of written document as is determined by the Committee or its designee.

12.7 Company Intent. The Company intends that the Plan comply in all respects with Rule 16b-3 under the Act, and any ambiguities or inconsistencies in the construction of the Plan shall be interpreted to give effect to such intention.

12.8 Requirements of Law. The granting of Awards and the issuance of shares of Stock shall be subject to all applicable laws, rules, and regulations, and to such approvals by any governmental agencies or securities exchanges as may be required.

12.9 Effective Date. The Plan shall be effective upon its adoption by the Board subject to approval by the Company's stockholders at the 2002 annual stockholders' meeting.

12.10 Governing Law. The Plan, and all agreements hereunder, shall be construed in accordance with and governed by the laws of the State of Delaware.

7