February 27, 2012

VIA HARD COPY AND EDGAR

Mr. John Cash

Accounting Branch Chief

Securities and Exchange Commission

100 F Street NE

Washington, D.C. 20549

Re: The Valspar Corporation

Form 10-K for the fiscal year ended October 28, 2011

Filed December 21, 2011

File No. 1-03011

Dear Mr. Cash,

This letter responds on behalf of The Valspar Corporation (the “Company”) to your comment letter to Ms. Lori A. Walker dated February 2, 2012 with respect to the filing listed above. Included below are your comments and the corresponding responses supplied by the Company:

Form 10-K for the fiscal year ended October 28, 2011

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 12

Critical Accounting Policies and Estimates, page 20

Valuation of Goodwill and Indefinite-Lived Intangible Assets, page 20

1. We note that you recorded impairment charges to goodwill and intangible assets in two of your reporting units in the fourth quarter of FY 2011. With a view to enhanced disclosures in future filings, please provide us the following information:

• a description of each of your five reporting units in FY 2010, including the amount of goodwill allocated to each reporting unit, summarized historical financial information for each reporting unit, and the material assumptions used in the FY 2010 impairment analysis of each reporting unit;

The table below describes our fiscal year 2010 reporting units. For purposes of our goodwill impairment testing model, in addition to the reporting units shown in the table, all other smaller product lines comprising a nominal amount (less than 2%) of our total goodwill were aggregated to reconcile the sum of our reporting unit fair values to the Company’s overall enterprise value. Therefore, “All Other” was considered a separate reporting unit in fiscal year 2010, as disclosed in our 2010 Form 10-K. SeeAppendix I for the amount of goodwill allocated to each reporting unit as of October 29, 2010 and summarized historical financial information (net sales and earnings before interest and taxes (EBIT)) for each reporting unit.

Mr. John Cash

February 27, 2012

Page 2

| Reportable Segment | Paints | Coatings |

| Operating Segment / Reporting Unit | Consumer | Automotive | Packaging | Industrial |

| Reporting Unit Description | Branded products sold globally to either a wholesale or retail distributor such as home improvement or hardware stores or other retail paint distributors. | Branded products sold globally to either wholesale or retail automotive refinish distributors. | Technology driven coatings sold to global OEM customers, primarily in the food and packaging markets. | Technology driven coatings sold to global OEM customers, primarily in construction, transportation and agriculture equipment, commercial and residential construction, and appliance and housing markets. |

Goodwill (in millions) | Refer toAppendix I for reporting unit goodwill amounts as of October 29, 2010. |

Net Sales (in millions) | Refer toAppendix I for net sales by reporting unit for the fiscal years ended October 29, 2010, October 30, 2009 and October 31, 2008. |

EBIT (in millions) | Refer toAppendix I for EBIT by reporting unit for the fiscal years ended October 29, 2010, October 30, 2009 and October 31, 2008. |

We used the following three material assumptions in our fiscal year 2010 impairment analysis: (i) discount rate; (ii) sales growth; and (iii) operating margin improvement, as disclosed in the “Critical Accounting Policies and Estimates” section of Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our fiscal year 2010 Form 10-K (page 19).Appendix I lists the specific assumptions used for each reporting unit in our fiscal year 2010 impairment analysis. The discount rates varied by reporting unit from 10 – 11% and were determined using a weighted average cost of capital (WACC) for our peer group, adjusted for risk based on the industry/market in which the reporting unit operates. Sales growth and operating margin improvement assumptions by reporting unit ranged from 2 – 6% and from 0.5 – 3.5 ppt, respectively, and were obtained from the five-year strategic plan approved by our Board of Directors in the fourth quarter of the fiscal year.

We performed a sensitivity analysis on each of our material assumptions, as disclosed in our 2010 Form 10-K (Item 7, page 19). Based on the results of these analyses, none of our reporting units would have been at risk of failing “step 1” with a carrying value in excess of its fair value as of October 29, 2010, even if the discount rate increased by 10% or if no sales growth occurred in forecasted periods or if costs remained at 2010 spending levels with no cost savings realized in future periods.

• a description of each of your reporting units in FY 2011, including the amount of goodwill allocated to each reporting unit, summarized historical financial information for each reporting unit, and the material assumptions used in the FY 2011 impairment analysis of each reporting unit;

Mr. John Cash

February 27, 2012

Page 3

The table below describes our fiscal year 2011 reporting units. SeeAppendix II for the amount of goodwill allocated to each reporting unit (prior and subsequent to impairment) as of October 28, 2011 and summarized financial information (net sales and EBIT) for each reporting unit.

| Reportable Segment | Paints | Coatings | |

| Operating Segment | Consumer | Automotive | Packaging | Industrial | |

| Reporting Unit | Consumer | Automotive | Packaging | Industrial | Wood | Gelcoat |

| Reporting Unit Description | Branded products sold globally to either a wholesale or retail distributor such as home improvement or hardware stores or other retail paint distributors. | Branded products sold globally to either wholesale or retail automotive refinish distributors. | Technology driven coatings sold to global OEM customers, primarily in the food and packaging markets. | Technology driven coatings sold to global OEM customers, primarily in construction, transportation and agriculture equipment, commercial and residential construction, and appliance and housing markets. | Technology driven coatings sold to global OEM customers, primarily in new housing, furniture and cabinet markets. | Technology driven gel coatings sold to OEM customers, primarily in the marine, transportation and bath tub/shower markets. |

Goodwill (prior to impairment) | Refer toAppendix II for reporting unit goodwill amounts prior to impairment as of October 28, 2011. |

| Goodwill (subsequent to impairment) | Refer toAppendix II for reporting unit goodwill amounts subsequent to impairment as of October 28, 2011. |

Net Sales (in millions) | Refer toAppendix II for reporting unit net sales for the fiscal year ended October 28, 2011. |

EBIT (in millions) | Refer toAppendix II for EBIT amounts by reporting unit for the fiscal year ended October 28, 2011. |

In fiscal year 2011, we enhanced our goodwill impairment model to incorporate additional market participant assumptions and market comparables at a reporting unit level. We also used an outside provider to assist us in developing our model. As a result, we used the following four material assumptions in our fiscal year 2011 impairment analysis: (i) discount rate; (ii) long-term sales growth rates; (iii) forecasted operating margins; and (iv) market multiples, as disclosed in the “Critical Accounting Policies and Estimates” section of Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our 2011 Form 10-K (page 19).Appendix II lists the specific assumptions used for each reporting unit in our fiscal year 2011 impairment analysis.

The discount rate or WACC rate assigned to each reporting unit was determined using our peer group’s median debt to capital and equity to capital ratios, adjusted for the 20 year treasury risk-free rate, equity risk premiums, tax rates, size premiums and industry, market and forecast risk. Our risk-adjusted WACC rates ranged from 10 – 14%. Long-term sales growth rates by reporting unit ranged from 0 – 3%. Long-term sales growth rates were based on consideration of historical growth, economic data, industry forecasts and strategic growth initiatives. Operating margin improvement assumptions by reporting unit, excluding the gelcoat reporting unit which had a negative operating margin change, ranged from 0 – 6.1 ppt. Operating margin improvements were obtained from the five-year strategic plan approved by our Board of Directors in the fourth quarter of the fiscal year. Market multiple assumptions were a weighted average of forward revenue and earnings before interest, tax, depreciation and amortization (EBITDA) multiples derived from our peer group, and the multiples were adjusted for size, risk and growth of the individual reporting units. The adjusted market multiples ranged from 0.4 – 1.8 for revenue and 6.0 – 8.6 for EBITDA, excluding the gelcoat reporting unit.

Mr. John Cash

February 27, 2012

Page 4

We performed a sensitivity analysis on each of our material assumptions for the reporting units that did not fail “step 1” as disclosed in our 2011 Form 10-K (Item 7, page 19). Based on the results of these analyses, even if the discount rate increased by 10% or if the long-term growth rate declined to zero or if costs remained at 2011 spending levels with no cost savings realized in future periods, such reporting units would continue to have a fair value in excess of their carrying value as of October 28, 2011.

• the carrying values of any remaining goodwill or intangible assets in the Wood Coating and Gelcoat reporting units after the impairment charges;

We valued our goodwill and intangible assets with the assistance of a third party valuation expert. There is no remaining goodwill for either the wood coatings or gelcoat reporting units. There is $58.9 million of intangible assets remaining for the wood coatings reporting unit, which relate to customer lists, technology and trademarks, primarily in our China wood coatings product line. No intangible assets remain in the gelcoat reporting unit.

• a comprehensive explanation of the changes in the structure of the reporting units used to conduct impairment testing;

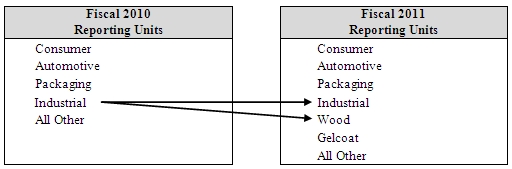

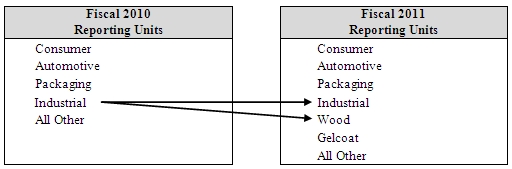

In performing our fiscal year 2011 impairment analysis, we reconsidered the appropriate reporting units as a result of: (i) the long-term financial outlook determined as part of our strategic planning process which occurs in the fourth quarter of our fiscal year; (ii) the current volatility in the markets in which we compete; and (iii) a change in our Chief Operating Decision Maker (CODM). The wood coatings product line is highly dependent on the U.S. new housing market, which is a key input for our internal forecasts and which serves as a basis for our strategic planning process. In previous fiscal years, we expected the U.S. new housing market to return to prior year levels. However, in 2011, we concluded for the foreseeable future that the U.S. new housing market will not be materially different from current conditions. In addition, we assigned a seasoned executive to evaluate the product line infrastructure. Despite restructuring actions taken in 2011, the long-term financial outlook for the wood coatings product line diverged from that of our other industrial product lines and no longer met the criteria for aggregation within our industrial reporting unit for purposes of impairment testing.

During our strategic planning process in the fourth quarter of 2011, the gelcoat product line was deemed non-strategic. We have restructured to improve its financial performance, but it is underperforming our expectations. As a result, gelcoat was viewed as a separate reporting unit for purposes of impairment testing.

Mr. John Cash

February 27, 2012

Page 5

The following chart depicts our fiscal year 2010 reporting units compared to fiscal year 2011.

• a comprehensive explanation of the changes in the forecasts for each reporting unit;

Our strategic planning process occurs in the fourth quarter of our fiscal year for all reporting units. During this period, the forecasts are reviewed and approved by executive management and the Board of Directors. As noted above, in fiscal year 2010, we forecasted sales growth of 2 – 6% and operating margin improvements of 0.5 – 3.5 ppt. In fiscal year 2011, we forecasted long-term sales growth of 0 – 3% and operating margin improvements of 0 – 6.1 ppt, excluding the gelcoat reporting unit which had a negative operating margin change. Although forecasts changed for all reporting units from 2010 to 2011, there was no material impact to our impairment analysis, other than for the wood coatings and gelcoat reporting units.

The industrial operating segment, which is made up of our general industrial, coil and wood product lines, was affected negatively at the beginning of the economic crisis of 2008. New business and a diversified geographical portfolio more than offset the market declines in our general industrial and coil product lines. However, our wood product line is more closely tied to the U.S. new housing market. During our 2010 planning process, we expected recovery in this market. As part of our 2011 strategic review process, however, we concluded that the current market conditions, which are substantially below recent historical levels, are not expected to materially change in the foreseeable future. Specifically, U.S. new housing starts have not recovered to expected levels of 1.1 million per year. They currently remain in the 500-600k range. In 2011, we assigned a seasoned executive to oversee the wood product line to ensure it was profitable and sized appropriately for the current and future market expectations. As part of this evaluation, a comprehensive restructuring plan was completed, including closing three U.S. plants and right-sizing the global headcount. Despite our restructuring initiatives to improve profitability of the product line, the market continues to decline, which resulted in a carrying value in excess of fair value of the wood coatings reporting unit.

Our gelcoat business is also highly influenced by the U.S. housing market. Due to the challenging economy, we completed several recent restructuring initiatives in an attempt to restore profitable growth. In 2011, we recognized that we could not overcome the market declines through additional actions, which resulted in a carrying value in excess of the fair value of the gelcoat reporting unit.

Mr. John Cash

February 27, 2012

Page 6

• a comprehensive explanation of the change in your CODM; and

We consider our Chief Executive Officer to be our Chief Operating Decision Maker (“CODM”), as defined by ASC 280-10-50, because he allocates resources to and assesses the performance of the operating segments identified within the Company as part of his regular reviews of operating results. As disclosed in our Form 8-K filed with the Commission on February 17, 2011, Mr. Gary E. Hendrickson was appointed President and Chief Executive Officer effective on June 1, 2011. Mr. Hendrickson replaced Mr. William L. Mansfield, who retired as Chief Executive Officer on June 1, 2011, during our third quarter of fiscal year 2011. Our strategic planning process and annual impairment testing began in the fourth quarter, shortly after this change in leadership. Subsequent to the transition, Mr. Hendrickson continues to review the same operating results, allocate resources to and assess performance of our operating segments at the same level as those reviewed by Mr. Mansfield, but Mr. Hendrickson has a different view on the growth outlook of the end markets that influence the wood coatings and gelcoat reporting units and the allocation of resources to those businesses.

• what, if any, disclosures you provided in your FY 2011 quarterly filings to alert investors to changing conditions that could materially impact the Wood Coating and Gelcoat reporting units.

From 2008 and forward, we have consistently disclosed in Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our Form 10-K that the U.S. housing market has been weak and the impact it has had on our wood business. Specifically in our 2011 Form 10-Qs, we alerted investors that the end markets served by our wood coatings product line have been struggling for several years and that we do not anticipate any significant changes in the near or medium term. As a result, in our wood coatings product line, we initiated restructuring actions to further rationalize our manufacturing capacity and reduce our overall global headcount. These actions began in the second quarter of 2011 and continued throughout the remainder of the year. This information was disclosed in our fiscal year 2011 Form 10-Qs in the “Overview” portion of our disclosures in “Item 2: Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as in our restructuring footnote (Note 14). Due to the small size of the gelcoat product line (less than 1% of total sales in fiscal year 2011), no specific disclosures were made about this product line.

In addition to our 2011 Form 10-Qs, during our second, third and fourth quarterly earnings calls, Mr. Hendrickson explained that the end markets served by the wood coatings product line had been struggling for years, as they are closely tied to new housing starts. He indicated that we do not expect to see significant changes in the near or medium term in these markets. As a result, we were closing two of our West Coast production facilities, but were confident that we would be able to accommodate future growth if and when it occurs with capacity at other facilities.

Mr. John Cash

February 27, 2012

Page 7

In addition, we acknowledge that:

• we are responsible for the adequacy and accuracy of the disclosures in the filing;

• staff comments or changes to disclosures in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and

• we may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

Thank you for your comments, and we look forward to discussing our responses with you.

Sincerely,

/s/Lori A. Walker

Lori A. Walker

| cc: | Julie Kunkel, Partner, Ernst & Young LLP |

| | Martin Rosenbaum, Partner, Maslon Edelman Borman & Brand LLP |

Mr. John Cash

February 27, 2012

Page 8

Appendix I

On behalf of The Valspar Corporation and pursuant to 17 C.F.R. Section 200.83 (Rule 83), confidential treatment has been requested for this Appendix and its contents, which is identified by Bates number VAL001 in the applicable FOIA Confidential Treatment Request.

Mr. John Cash

February 27, 2012

Page 9

Appendix II

On behalf of The Valspar Corporation and pursuant to 17 C.F.R. Section 200.83 (Rule 83), confidential treatment has been requested for this Appendix and its contents, which is identified by Bates number VAL002 in the applicable FOIA Confidential Treatment Request.