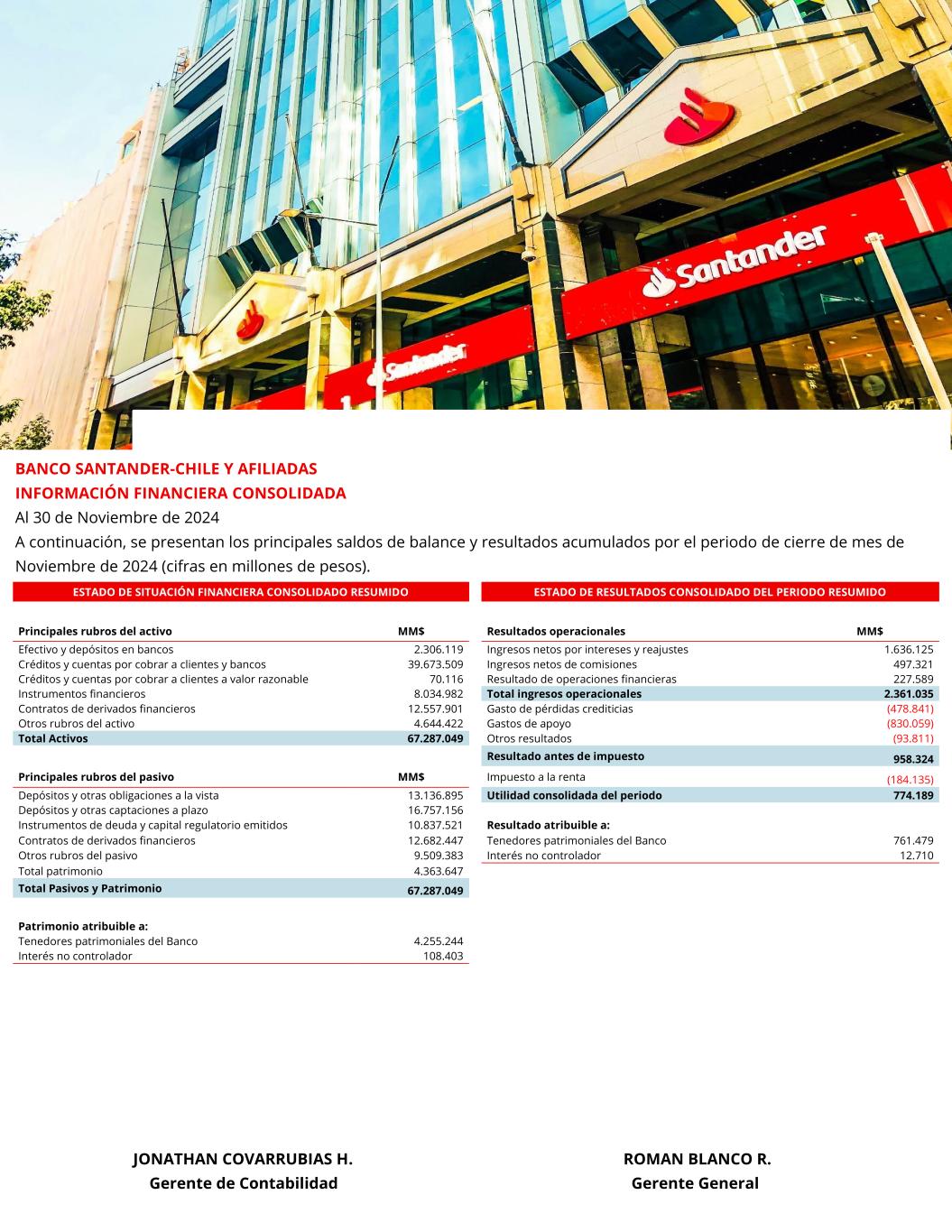

SUMMARIZED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION SUMMARIZED CONSOLIDATED STATEMENTS OF INCOME FOR THE PERIOD Principal assets MCh$ Operational results MCh$ Cash and deposits in banks 2,306,119 Net interest income 1,636,125 Loans and accounts receivables from customers and banks, net 39,673,509 Net fee and commission income 497,321 Loans and accounts receivables from customers at fair value, net 70,116 Result from financial operations 227,589 Financial instruments 8,034,982 Total operating income 2,361,035 Financial derivative contracts 12,557,901 Provision for loan losses (478,841) Other asset ítems 4,644,422 Support expenses (830,059) Total assets 67,287,049 Other results (93,811) Income before tax 958,324 Principal liabilities MCh$ Income tax expense (184,135) Deposits and other demand liabilities 13,136,895 Net income for the period 774,189 Time deposits and other time liabilities 16,757,156 Issued debt and regulatory capital instruments 10,837,521 Attributable to: Financial derivative contracts 12,682,447 Equity holders of the Bank 761,479 Other liabilities ítems 9,509,383 Non-controlling interest 12,710 Total equity 4,363,647 Total liabilities and Equity 67,287,049 Equity attributable to: Equity holders of the Bank 4,255,244 Non-controlling interest 108,403 BANCO SANTANDER-CHILE AND SUBSIDIARIES CONSOLIDATED FINANCIAL INFORMATION As of November 30, 2024 The principal balances and results accumulated for the period ending November 2024 (amounts in millions of Chilean pesos). JONATHAN COVARRUBIAS H. ROMAN BLANCO R. Chief Accounting Officer Chief Executive Officer

IMPORTANT NOTICE The unaudited financial information has been prepared in accordance with the Compendium of Accounting Standards for Banks effective from January 1, 2022 issued by the Financial Market Commission (FMC). The accounting principles issued by the FMC are substantially similar to IFRS but there are some exceptions. The FMC is the banking industry regulator according to article 2 of the General Banking Law. which by General Regulation establishes the accounting principles to be used by the banking industry. For those principles not covered by the Compendium of Accounting Standards for Banks, banks can use generally accepted accounting principles issued by the Chilean Accountant’s Association AG which coincide with International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB). If discrepancies exist between the accounting principles issued by the FMC (Compendium of Accounting Standards for Banks) and IFRS the Compendium of Accounting Standards for Banks will take precedence. ¿Qué podemos hacer por ti hoy?