Banco Santander Chile Management Commentary 4Q24 As of December 31, 2024

Important information Banco Santander Chile cautions that this document contains forward looking statements within the meaning of the US Private Securities Litigation Reform Act of 1995. These forward looking statements are found in various places throughout this presentation and include, without limitation, statements concerning our future business development and economic performance. While these forward looking statements represent our judgment and future expectations concerning the development of our business, a number of risks, uncertainties and other important factors could cause actual developments and results to differ materially from our expectations. These factors include, but are not limited to: (1) general market, macro-economic, governmental and regulatory trends; (2) movements in local and international securities markets, currency exchange rates, and interest rates; (3) competitive pressures; (4) technological developments; and (5) changes in the financial position or credit worthiness of our customers, obligors and counterparties. The risk factors and other key factors that we have indicated in our past and future filings and reports, including those with the Securities and Exchange Commission of the United States of America, could adversely affect our business and financial performance. Note: This document was approved for disclosure by the Bank’s Audit Committee on January 27, 2025. This report is presented according to accounting rules and instructions as issued by the Financial Markets Commission for banks in Chile which are similar to IFRS, but there are some differences. Please refer to our 2023 20-F filed with the SEC for an explanation of the main differences between accounting rules and instructions as issued by the Financial Markets Commission and IFRS. Nevertheless, the consolidated accounts are prepared on the basis of generally accepted accounting principles in Chile. Please note that this information is provided for comparative purposes only and that this restatement may undergo further changes during the year and, therefore, historical figures, including financial ratios, presented in this report may not be entirely comparable to future figures presented by the Bank.

Contents Important information 2 Contents 3 Section 1: Key information 4 Section 2: Business environment 9 Section 3: Segment information 16 Section 4: Balance sheet and results 25 Section 5: Guidance 42 Section 6: Risks 43 Section 7: Credit risk ratings 54 Section 8: Stock performance 55 Annex 1: Strategy and responsible banking 57 Annex 2: Balance sheet 73 Annex 3: Income statement YTD 74 Annex 4: Quarterly income statement 75 Annex 5: Quarterly evolution of key ratios and other information 76 3

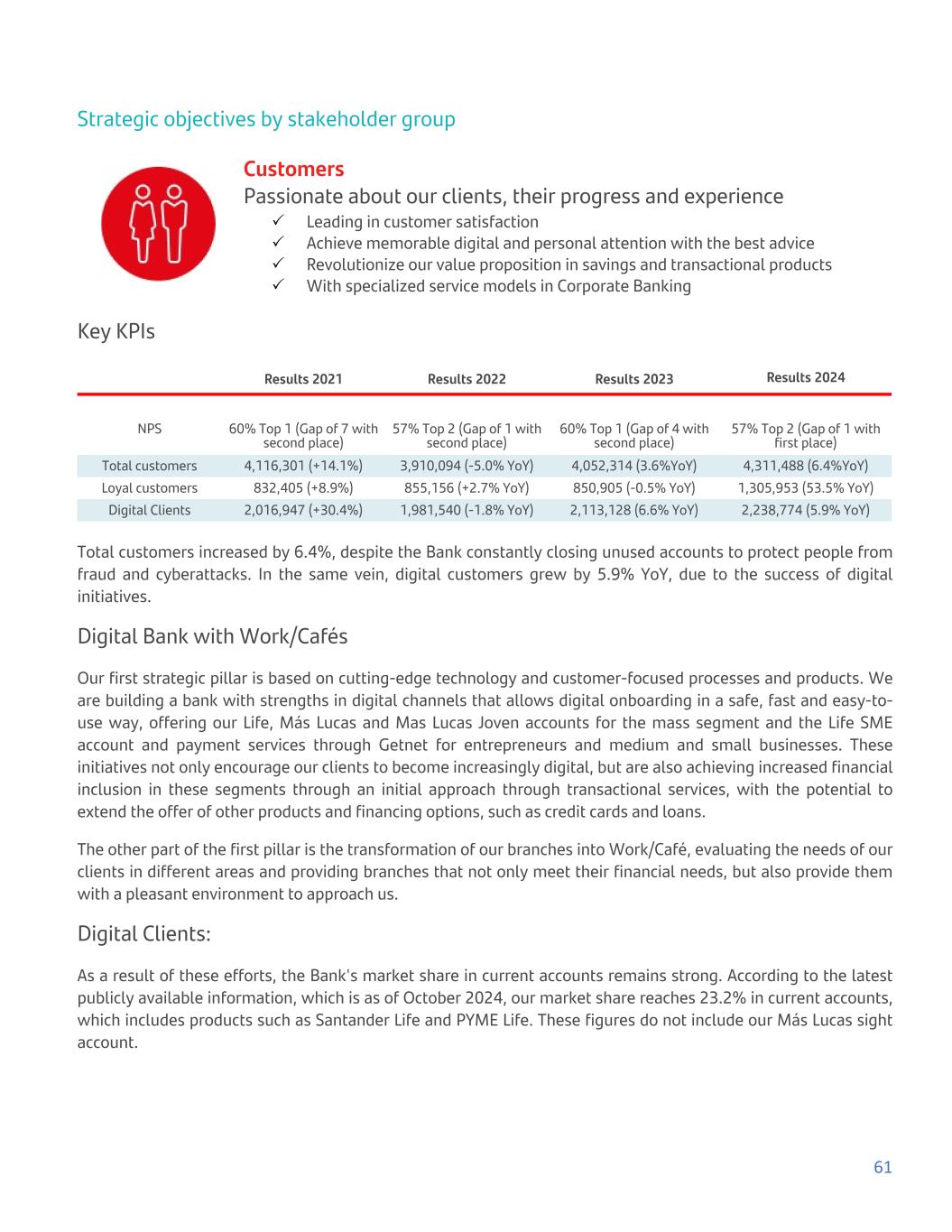

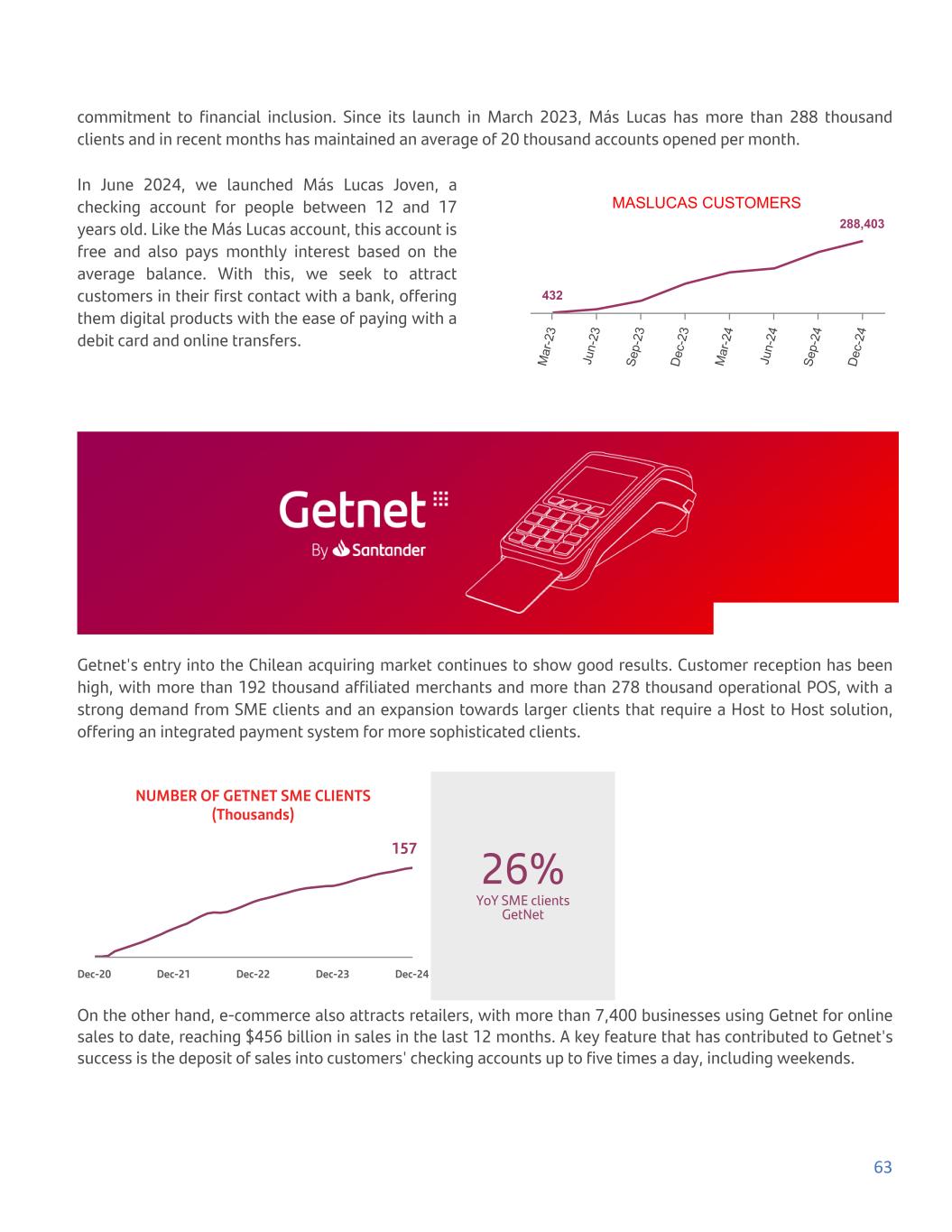

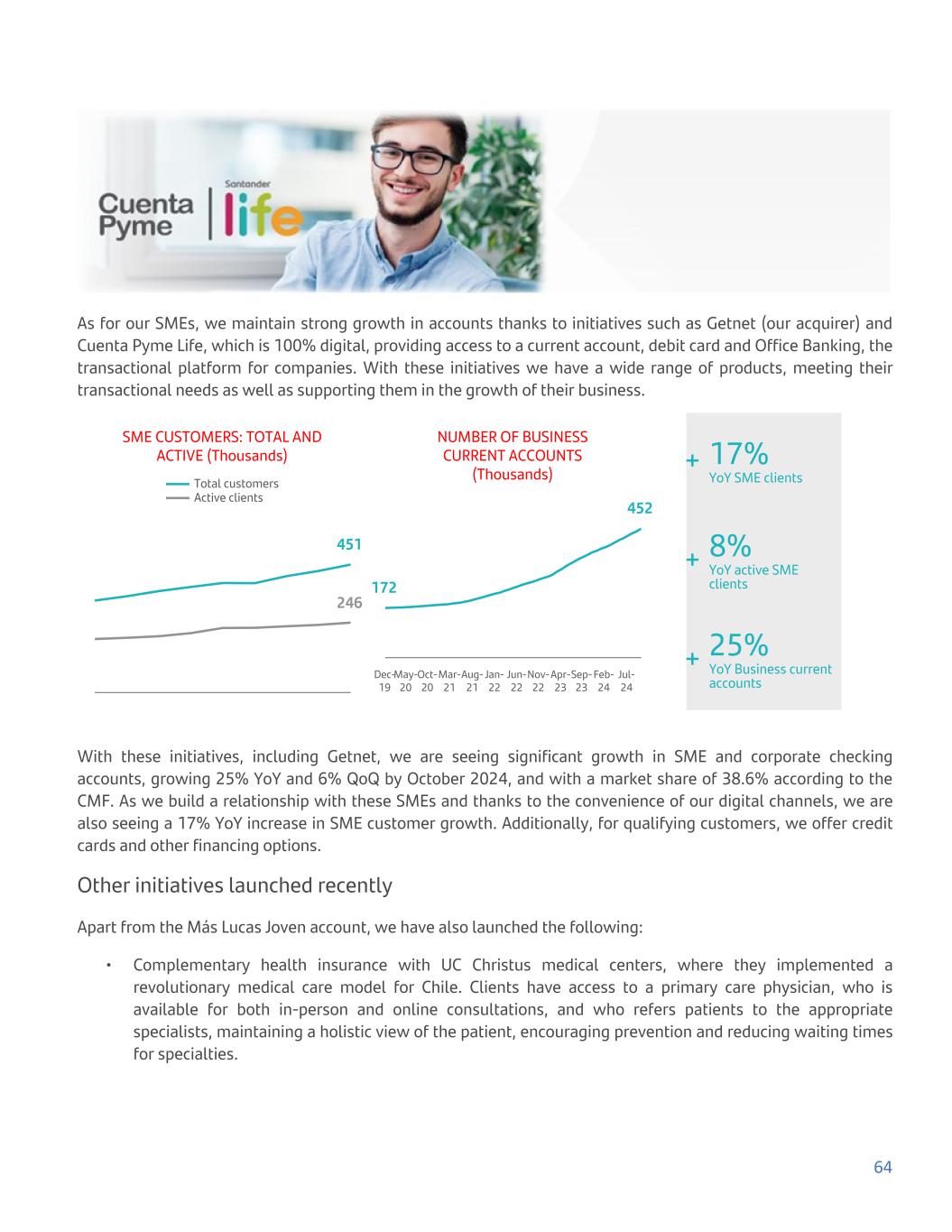

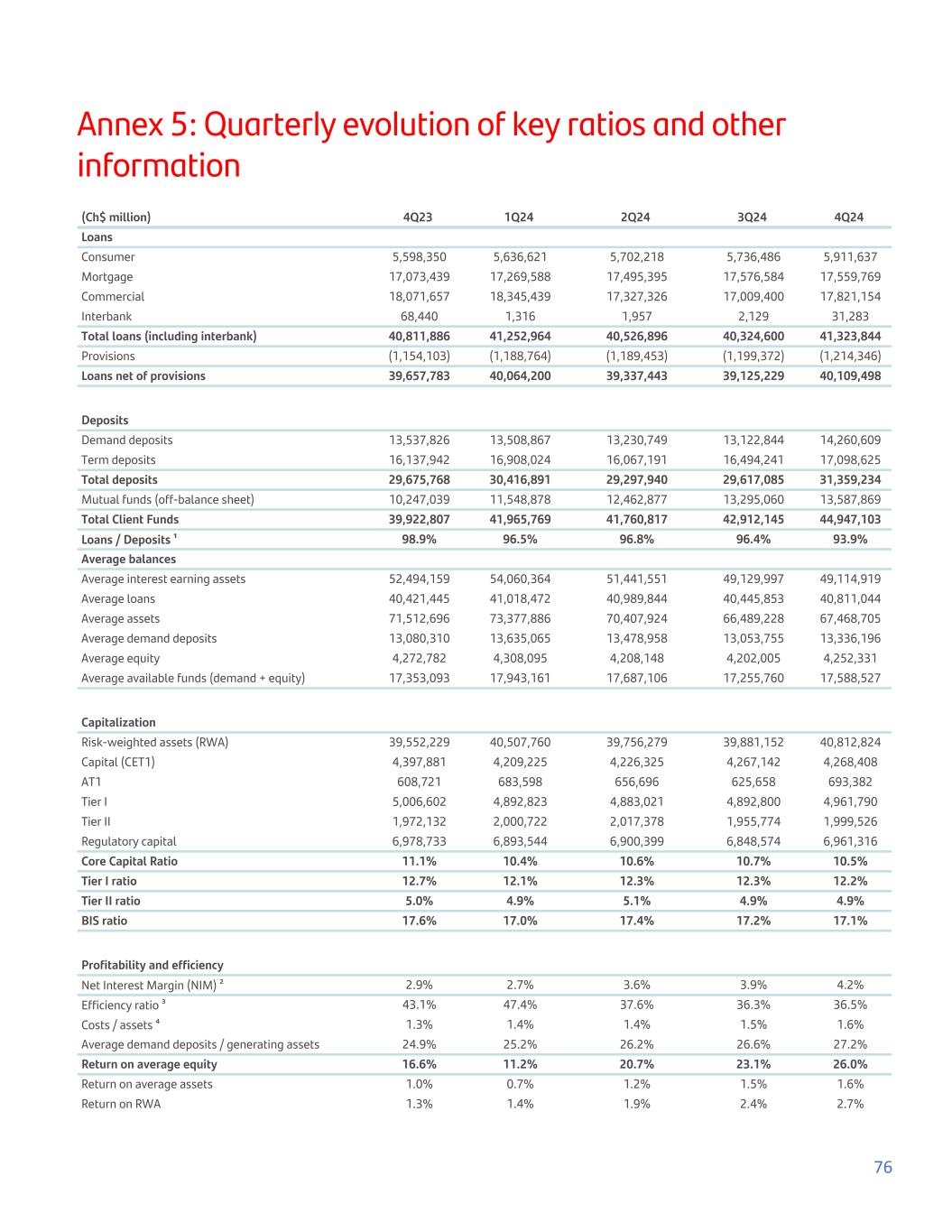

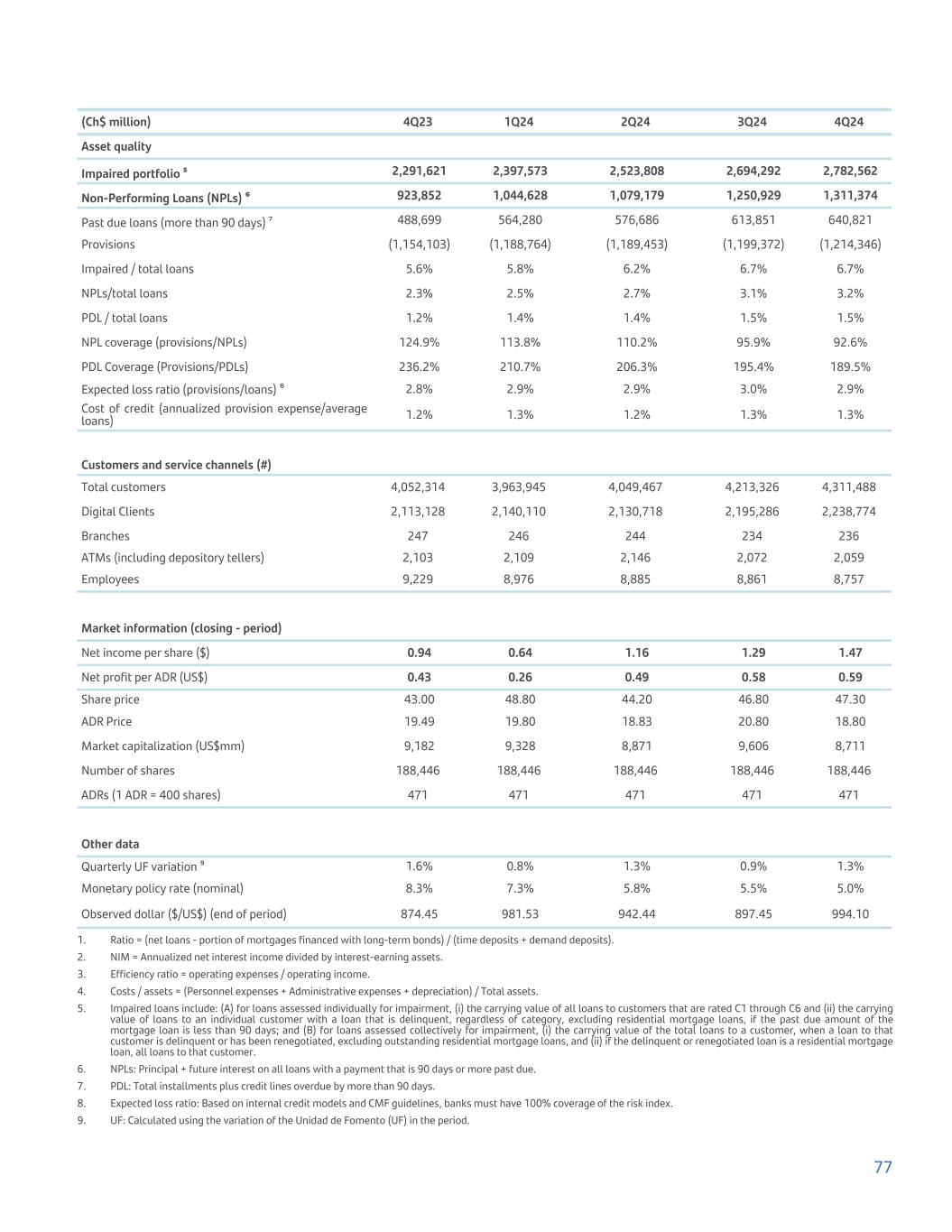

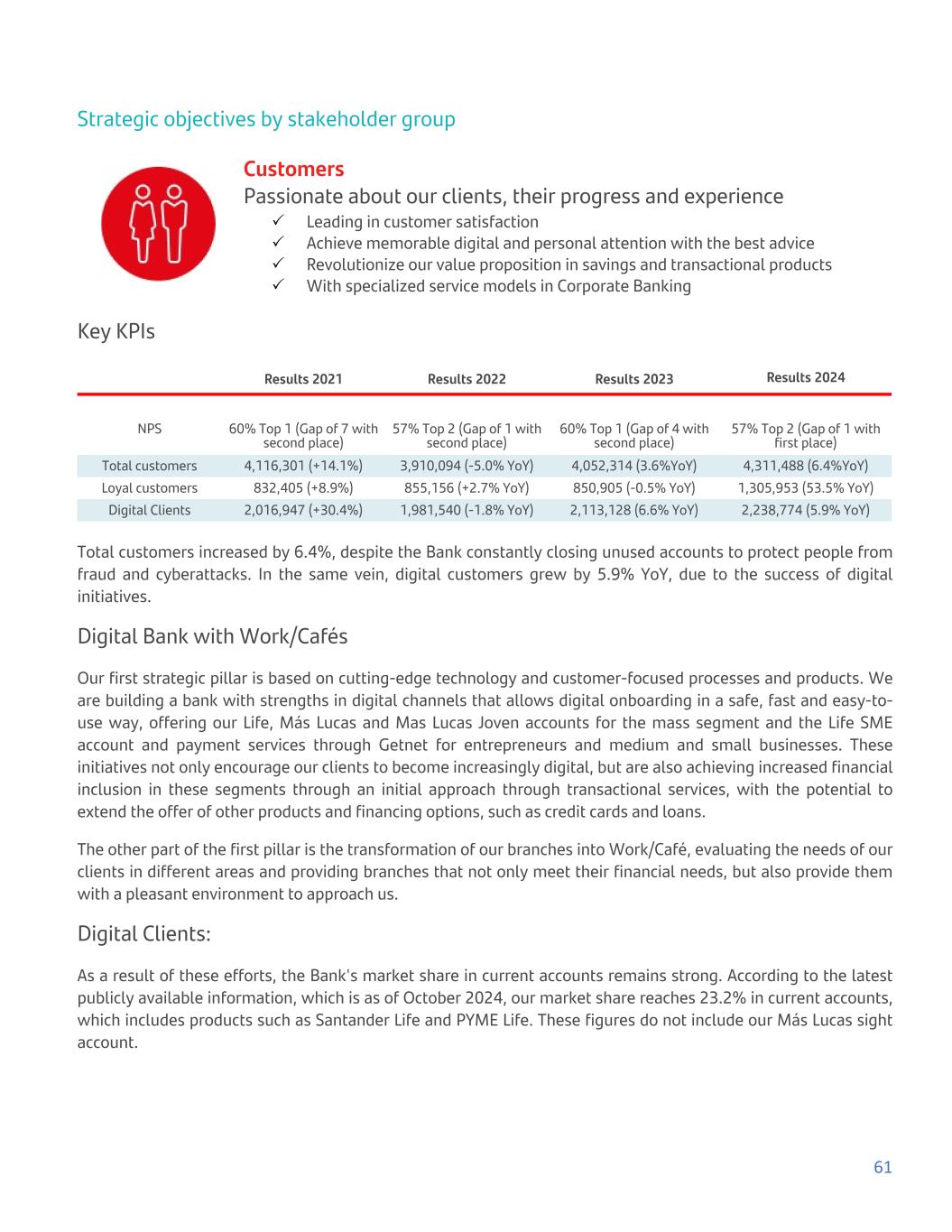

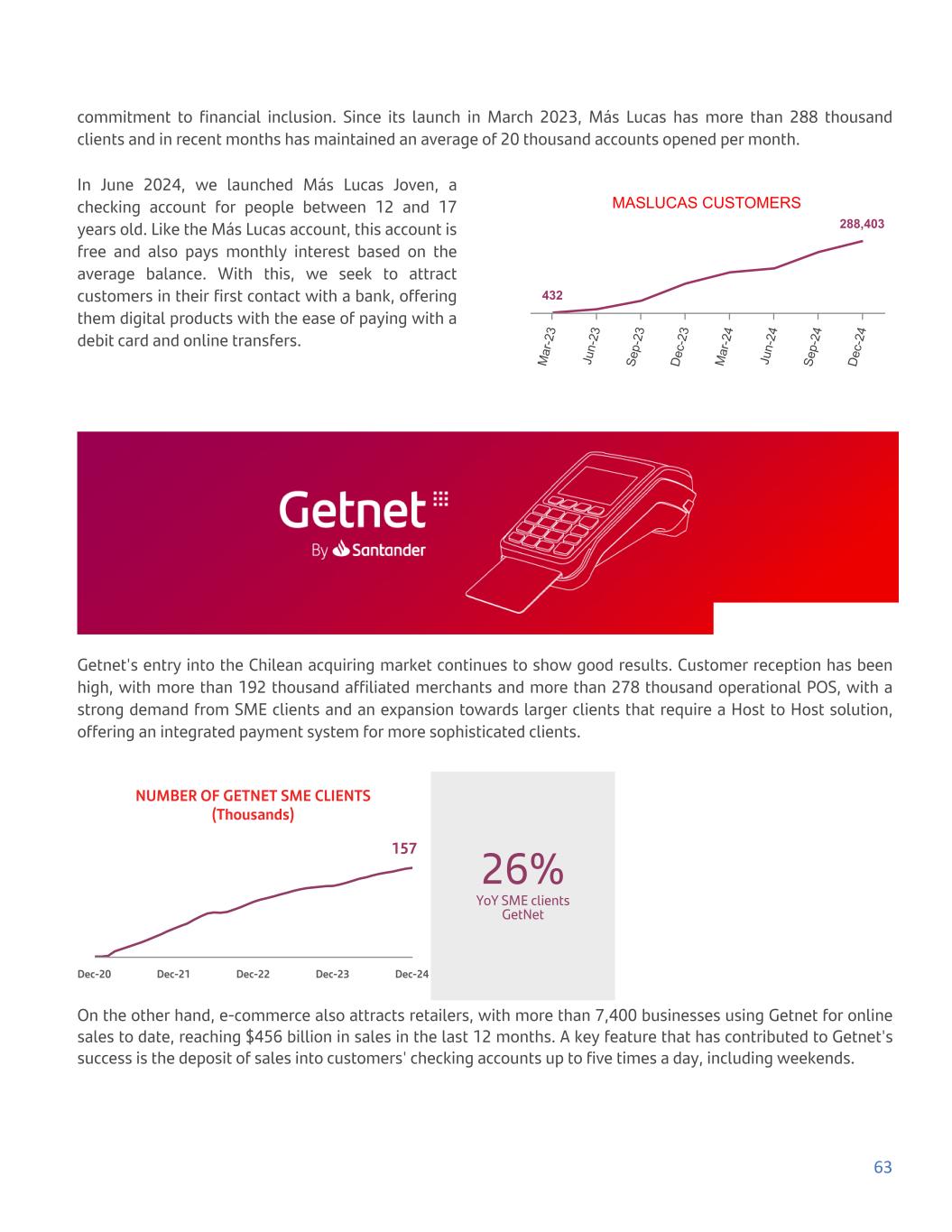

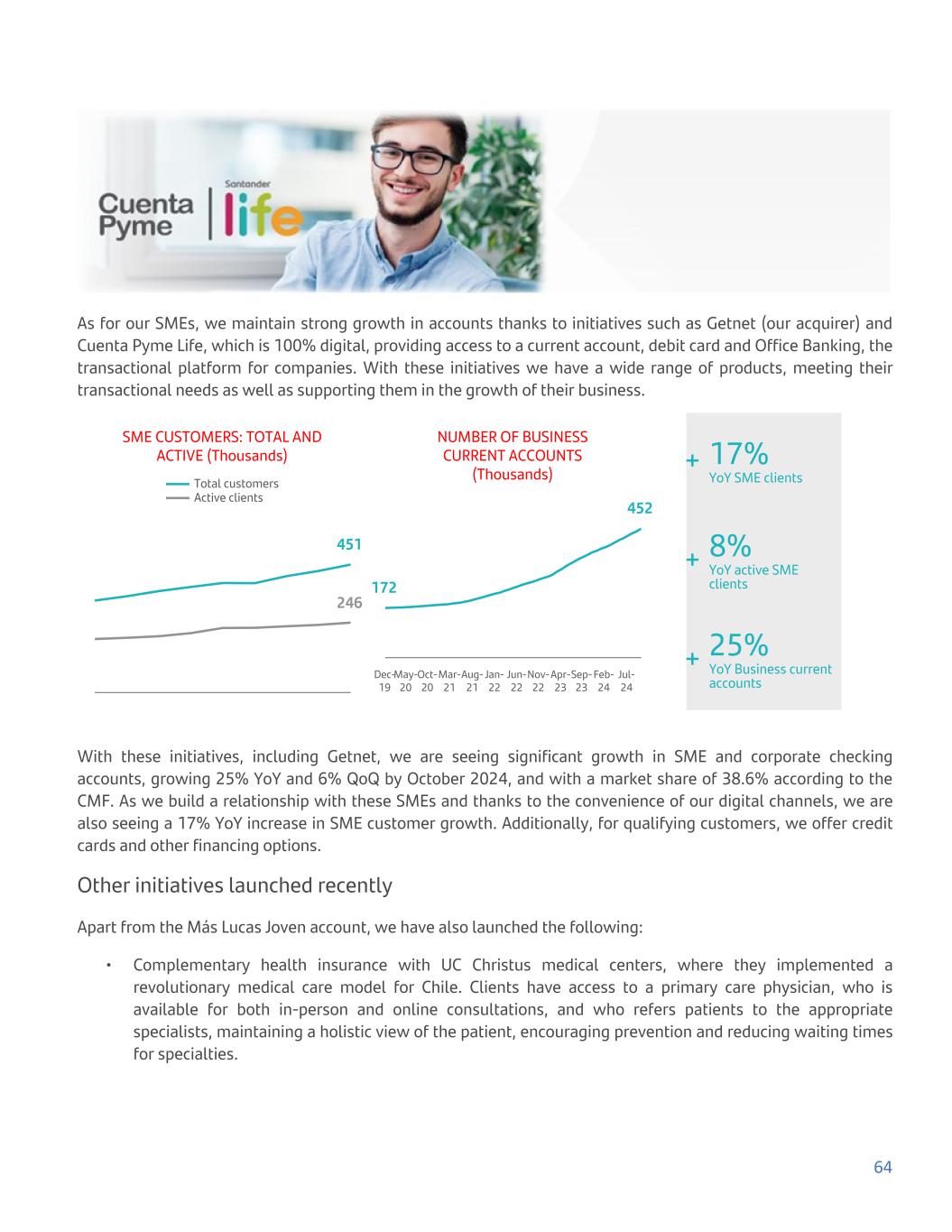

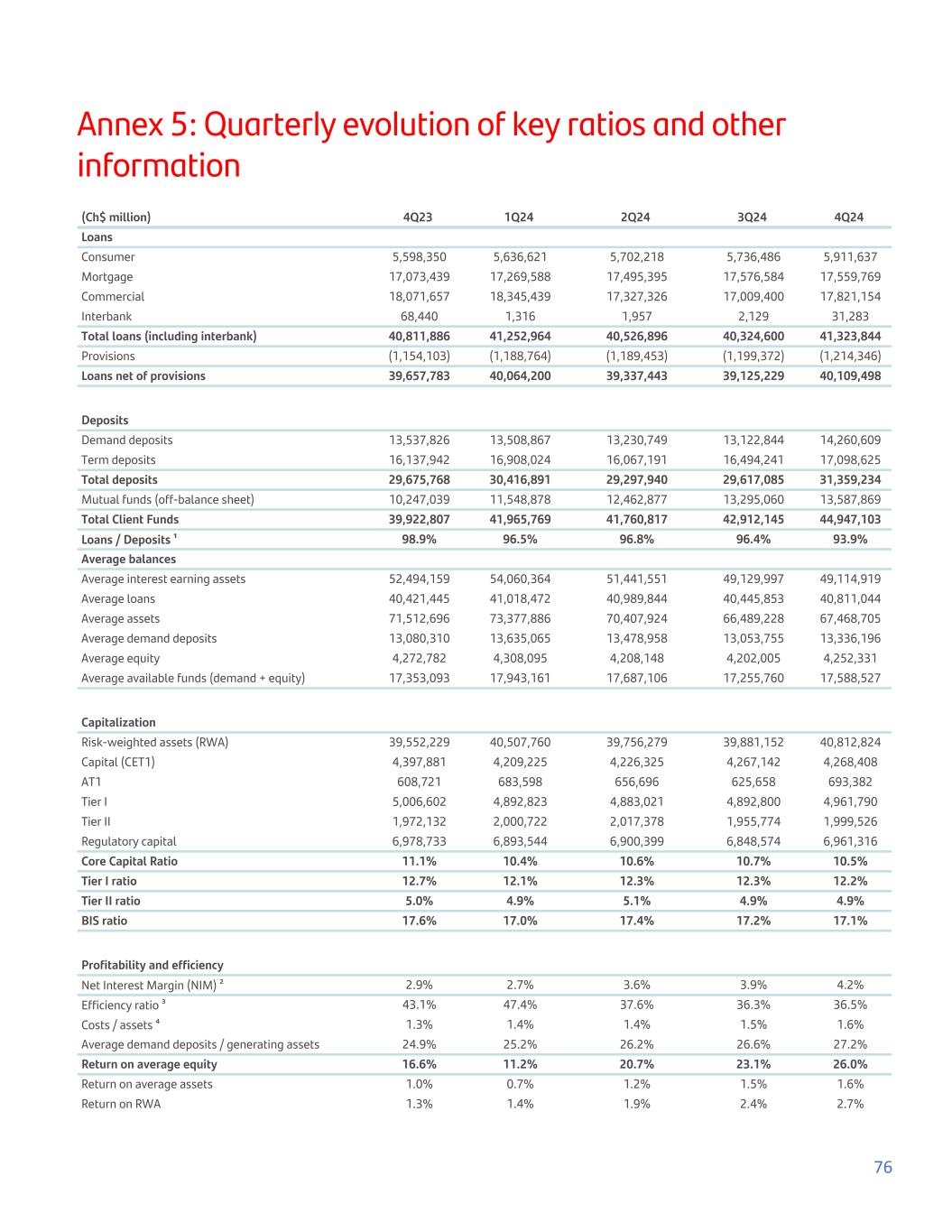

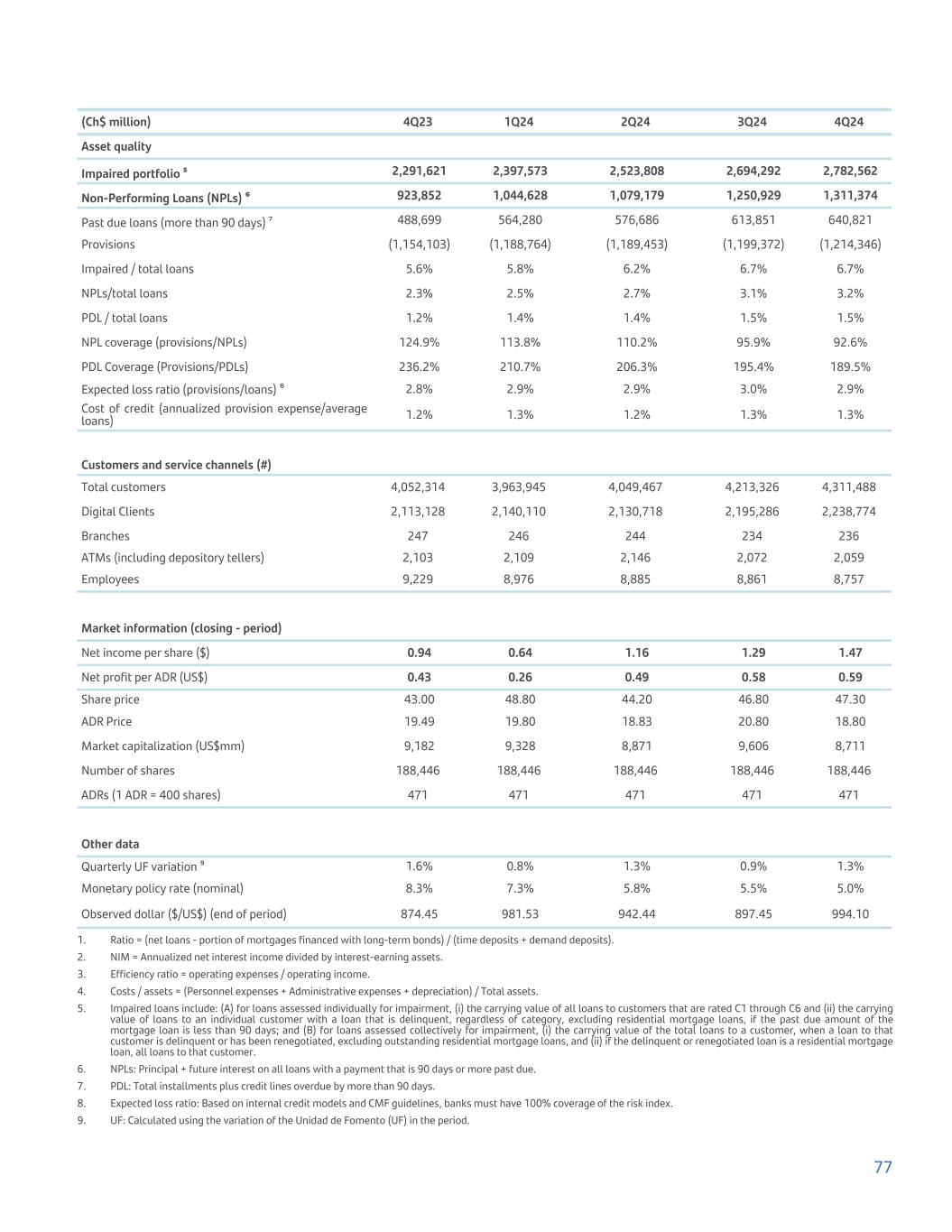

Section 1: Key information Summary of results Strong financial performance with ROAE1 of 26.0% in 4Q242 and 20.2% in 12M243 As of December 31, 2024, the Bank's net income attributable to shareholders totaled $858 billion ($4.55 per share and US$1.83 per ADR), marking a 72.8% increase compared to the same period of the previous year and with an ROAE of 20.2%. In 4Q24, net income attributable to shareholders of the Bank totaled $277 billion, increasing 13.7% in the quarter with a quarterly ROAE of 26.0%, this marks the third consecutive quarter with an ROAE above 20%. The improvement in results is explained by an increase in the Bank's main revenue lines. Operating income increased by 34.5% YoY, supported by a stronger interest margin and readjustments.4 Robust NIM5 recovery, reaching 3.6% in 2024, and 4.2% in 4Q24 Net interest and readjustment income (NII) for the year ended December 31, 2024 increased by 62.1% compared to the same period in 2023. This growth was primarily due to higher net interest income, resulting from a lower monetary policy rate that reduced our funding costs from 6.8% to 4.7% in 12M24. This was partially offset by lower readjustment income due to a smaller variation in the UF compared to the previous year. Consequently, the NIM improved from 2.2% in 2023 to 3.6% in 2024, and further to 4.2% in 4Q24. Continued expansion of customer base continued with a 6.4% YoY increase in total customers and a 5.9% YoY increase in digital customers Our strategy to enhance digital products has led to a continued growth in our customer base reaching approximately 4.3 million customers, with over 2.2 million digital customers (88% of our active customers). The Bank's market share in current accounts remains robust at 23.2% as of October 2024, driven by increased customer demand for US dollar current accounts which can be easily opened digitally by our customers. It also demonstrates the success of Getnet's strategy in encouraging cross-selling of other products such as the Cuenta Pyme Life. 4 1Annualized net income attributable to shareholders of the Bank divided by the average equity attributable to shareholders.2The fourth quarter of 2024.3The twelve months ending December 31, 2024.4Year over year4 5NIM: Net interest margin. Net interest income and annualized readjustments divided by interest-earning assets.

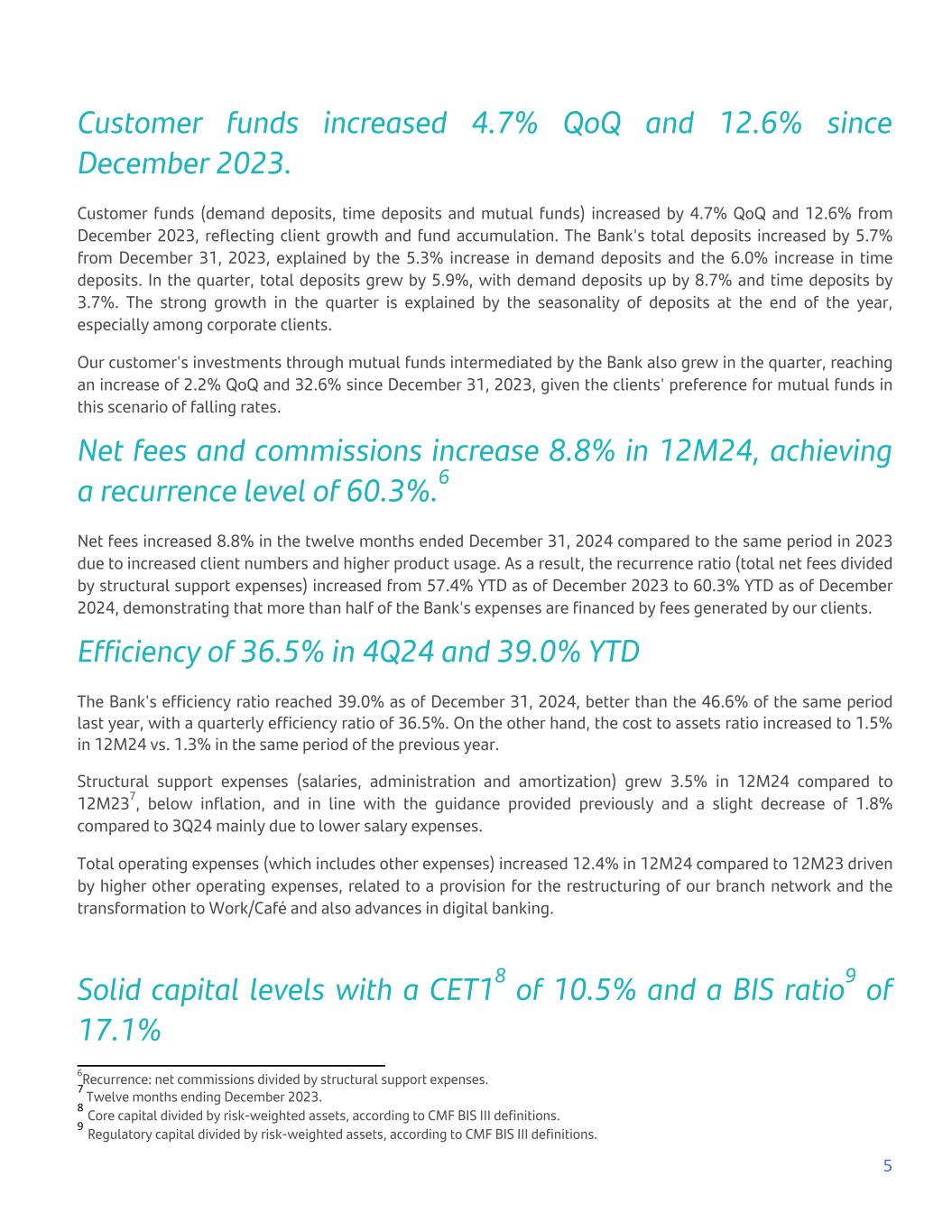

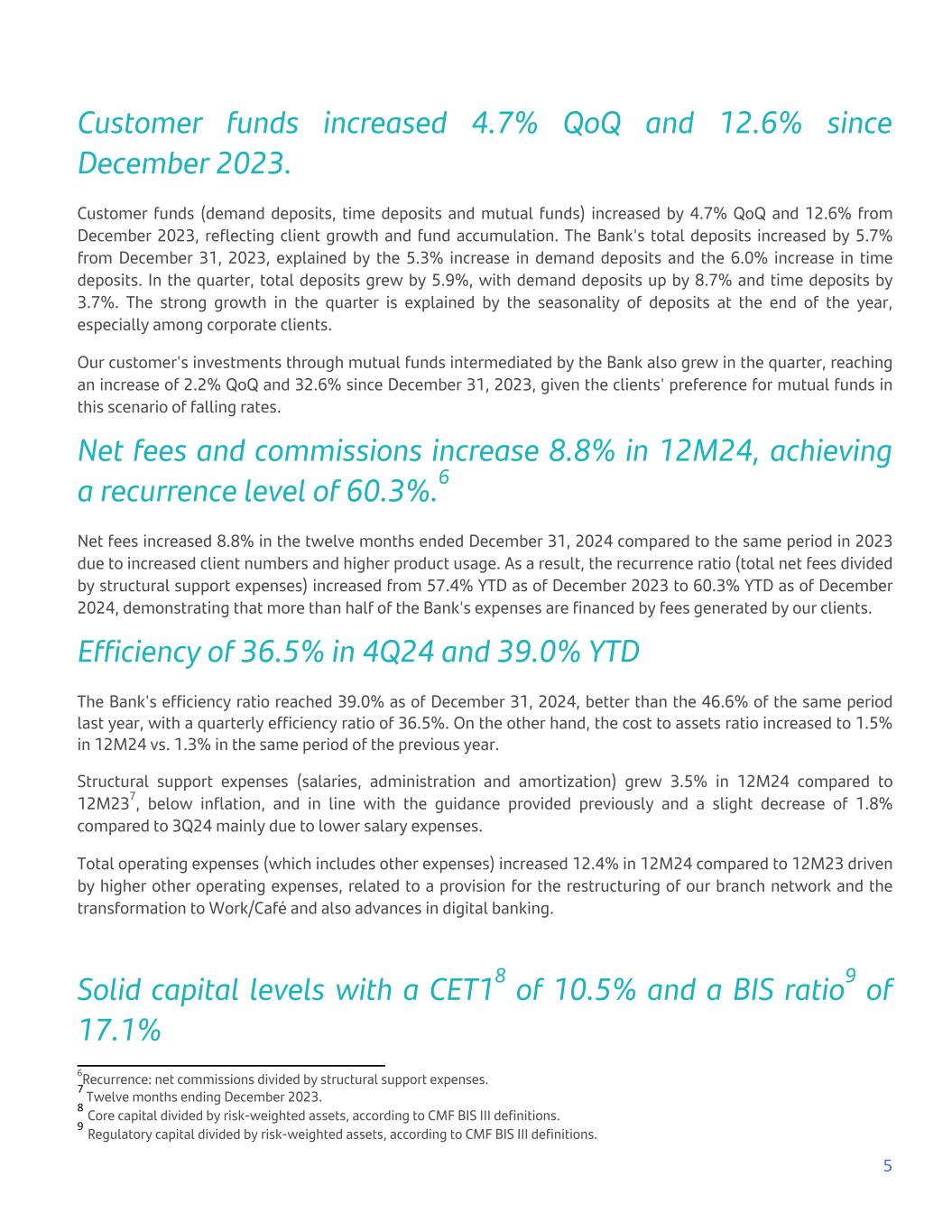

Customer funds increased 4.7% QoQ and 12.6% since December 2023. Customer funds (demand deposits, time deposits and mutual funds) increased by 4.7% QoQ and 12.6% from December 2023, reflecting client growth and fund accumulation. The Bank's total deposits increased by 5.7% from December 31, 2023, explained by the 5.3% increase in demand deposits and the 6.0% increase in time deposits. In the quarter, total deposits grew by 5.9%, with demand deposits up by 8.7% and time deposits by 3.7%. The strong growth in the quarter is explained by the seasonality of deposits at the end of the year, especially among corporate clients. Our customer's investments through mutual funds intermediated by the Bank also grew in the quarter, reaching an increase of 2.2% QoQ and 32.6% since December 31, 2023, given the clients' preference for mutual funds in this scenario of falling rates. Net fees and commissions increase 8.8% in 12M24, achieving a recurrence level of 60.3%.6 Net fees increased 8.8% in the twelve months ended December 31, 2024 compared to the same period in 2023 due to increased client numbers and higher product usage. As a result, the recurrence ratio (total net fees divided by structural support expenses) increased from 57.4% YTD as of December 2023 to 60.3% YTD as of December 2024, demonstrating that more than half of the Bank's expenses are financed by fees generated by our clients. Efficiency of 36.5% in 4Q24 and 39.0% YTD The Bank's efficiency ratio reached 39.0% as of December 31, 2024, better than the 46.6% of the same period last year, with a quarterly efficiency ratio of 36.5%. On the other hand, the cost to assets ratio increased to 1.5% in 12M24 vs. 1.3% in the same period of the previous year. Structural support expenses (salaries, administration and amortization) grew 3.5% in 12M24 compared to 12M237, below inflation, and in line with the guidance provided previously and a slight decrease of 1.8% compared to 3Q24 mainly due to lower salary expenses. Total operating expenses (which includes other expenses) increased 12.4% in 12M24 compared to 12M23 driven by higher other operating expenses, related to a provision for the restructuring of our branch network and the transformation to Work/Café and also advances in digital banking. Solid capital levels with a CET18 of 10.5% and a BIS ratio9 of 17.1% 5 6Recurrence: net commissions divided by structural support expenses. 7 Twelve months ending December 2023. 8 Core capital divided by risk-weighted assets, according to CMF BIS III definitions. 9 Regulatory capital divided by risk-weighted assets, according to CMF BIS III definitions.

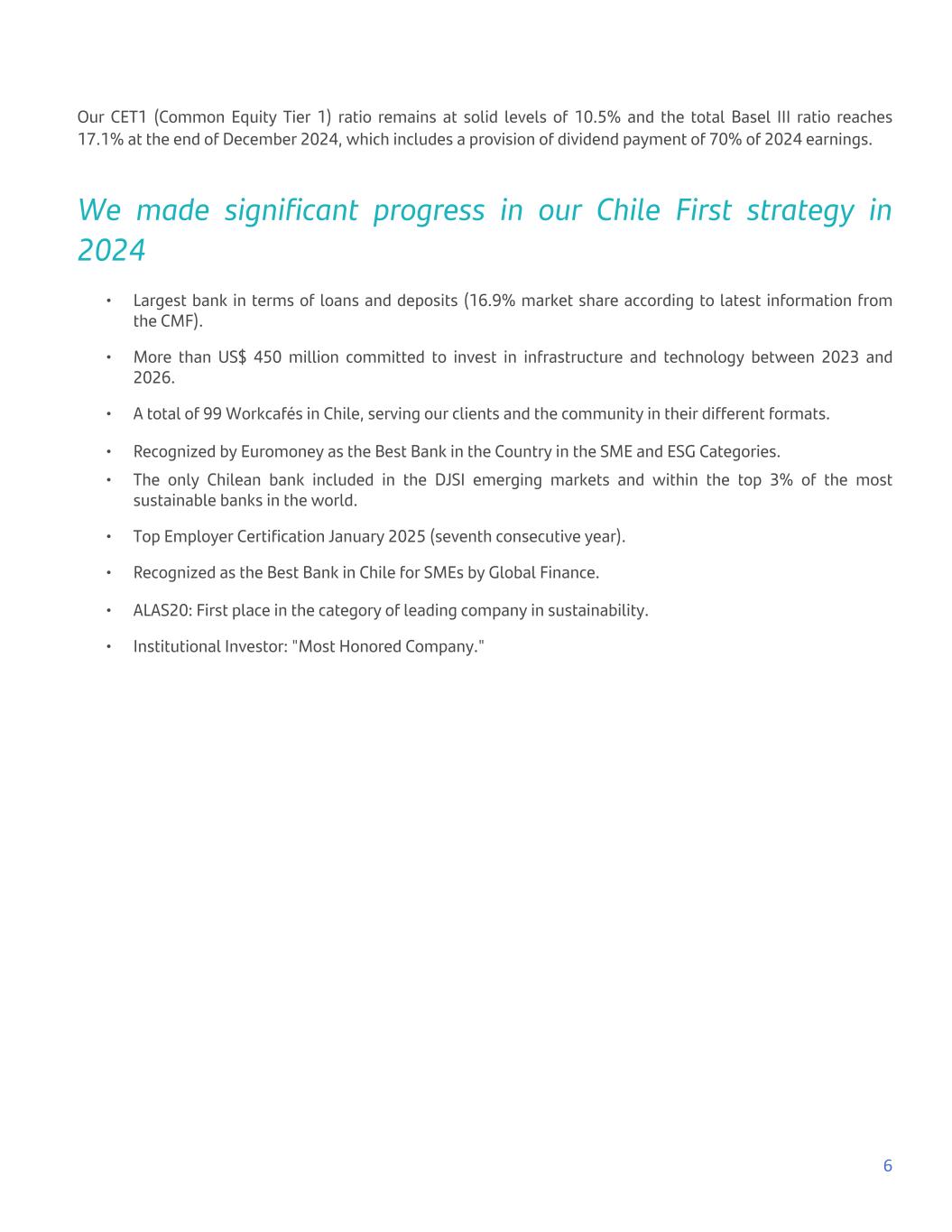

Our CET1 (Common Equity Tier 1) ratio remains at solid levels of 10.5% and the total Basel III ratio reaches 17.1% at the end of December 2024, which includes a provision of dividend payment of 70% of 2024 earnings. We made significant progress in our Chile First strategy in 2024 • Largest bank in terms of loans and deposits (16.9% market share according to latest information from the CMF). • More than US$ 450 million committed to invest in infrastructure and technology between 2023 and 2026. • A total of 99 Workcafés in Chile, serving our clients and the community in their different formats. • Recognized by Euromoney as the Best Bank in the Country in the SME and ESG Categories. • The only Chilean bank included in the DJSI emerging markets and within the top 3% of the most sustainable banks in the world. • Top Employer Certification January 2025 (seventh consecutive year). • Recognized as the Best Bank in Chile for SMEs by Global Finance. • ALAS20: First place in the category of leading company in sustainability. • Institutional Investor: "Most Honored Company." 6

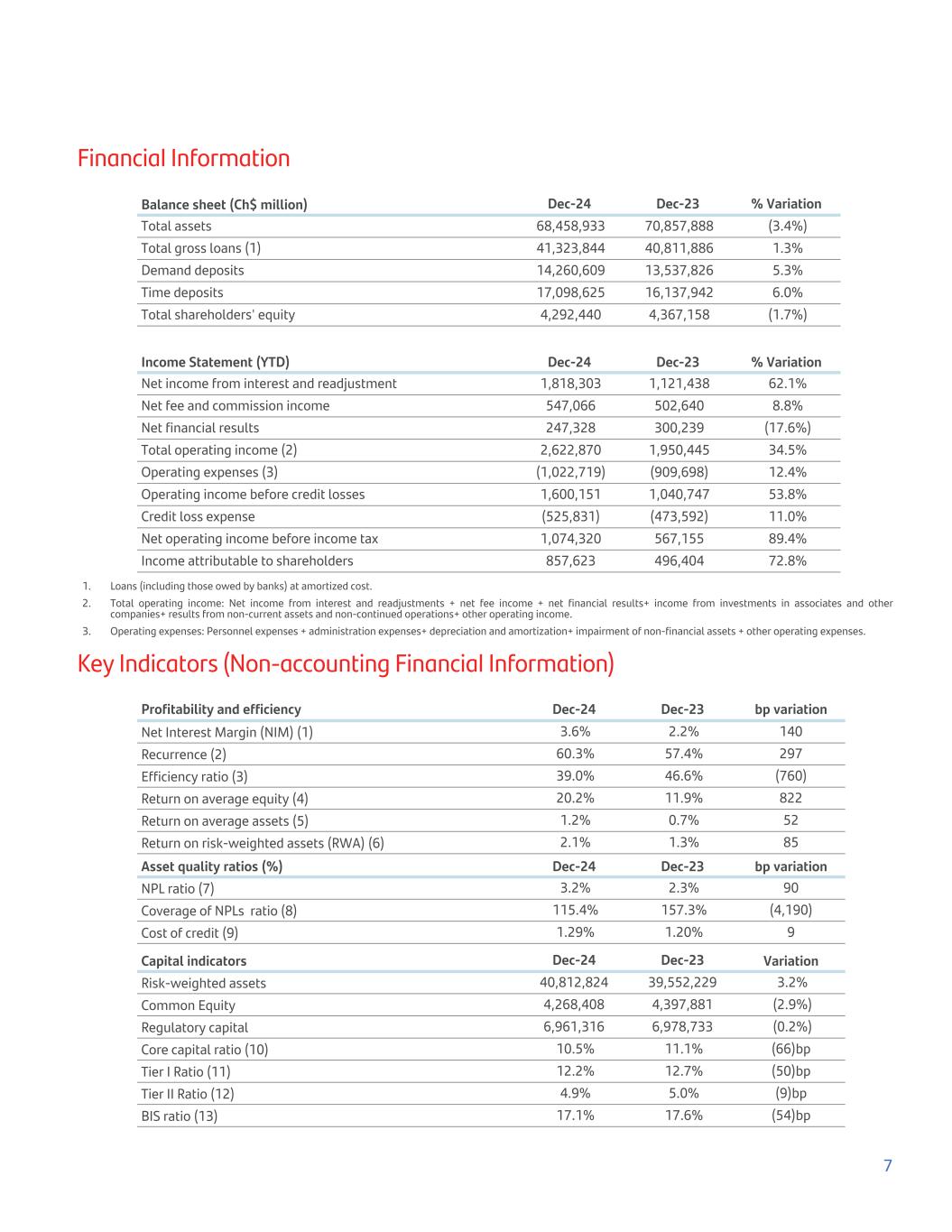

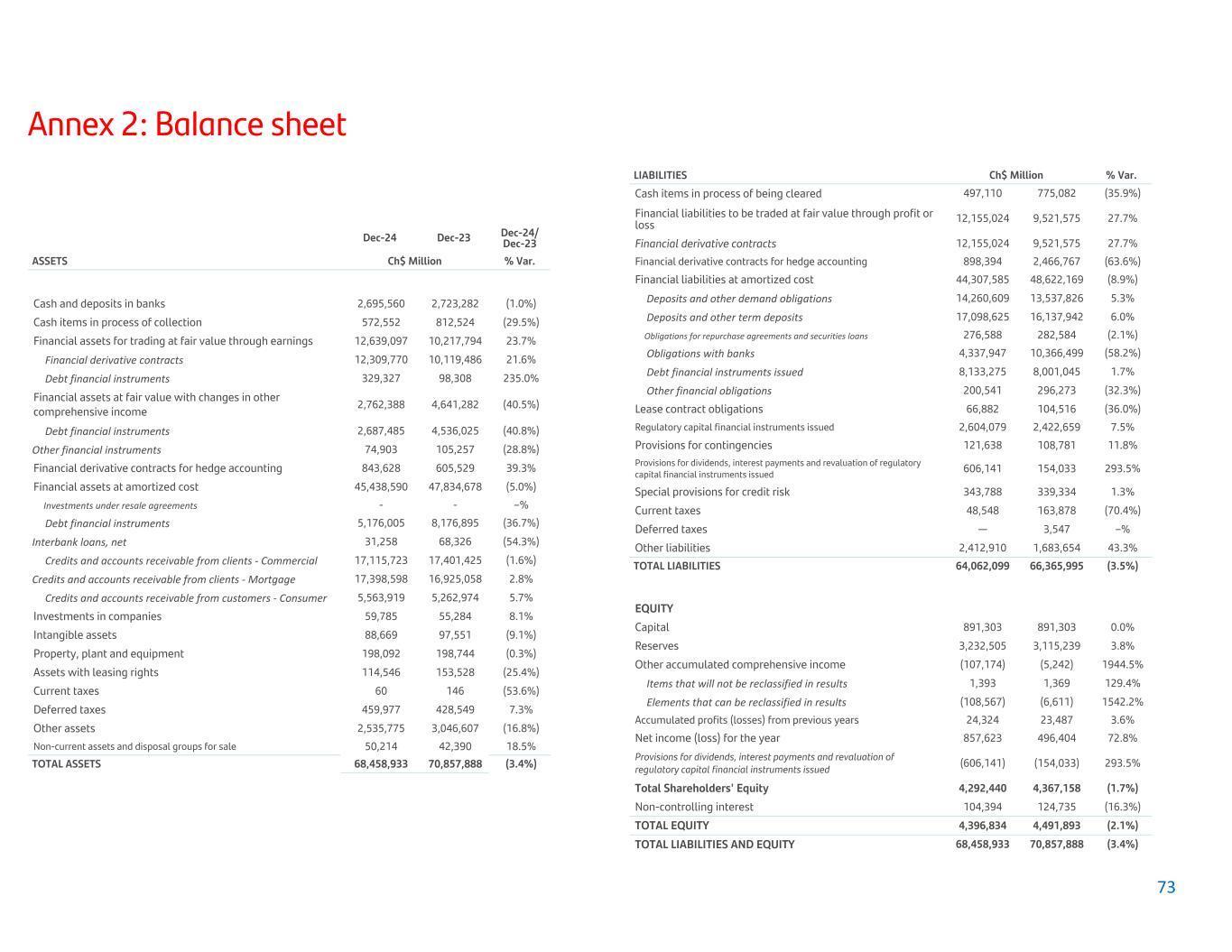

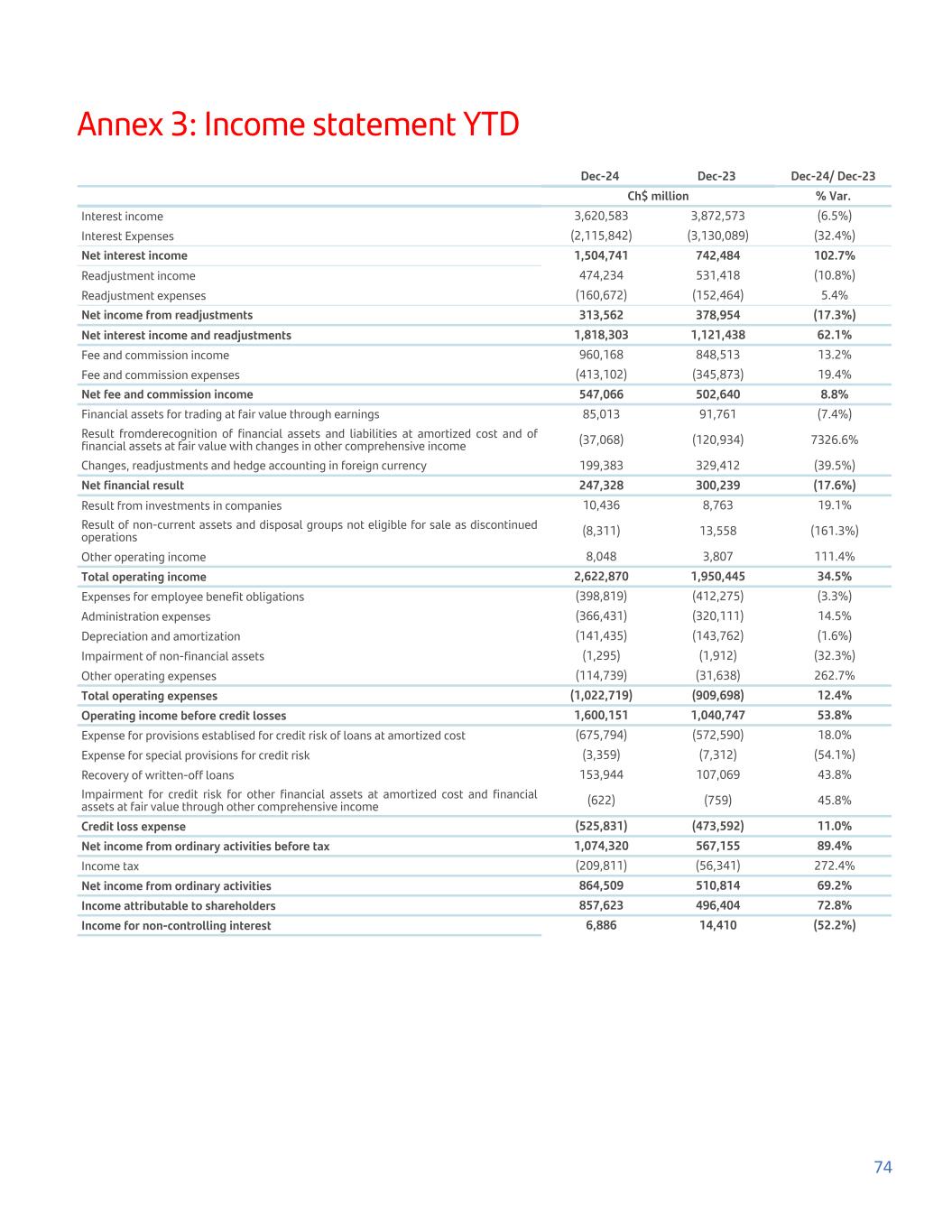

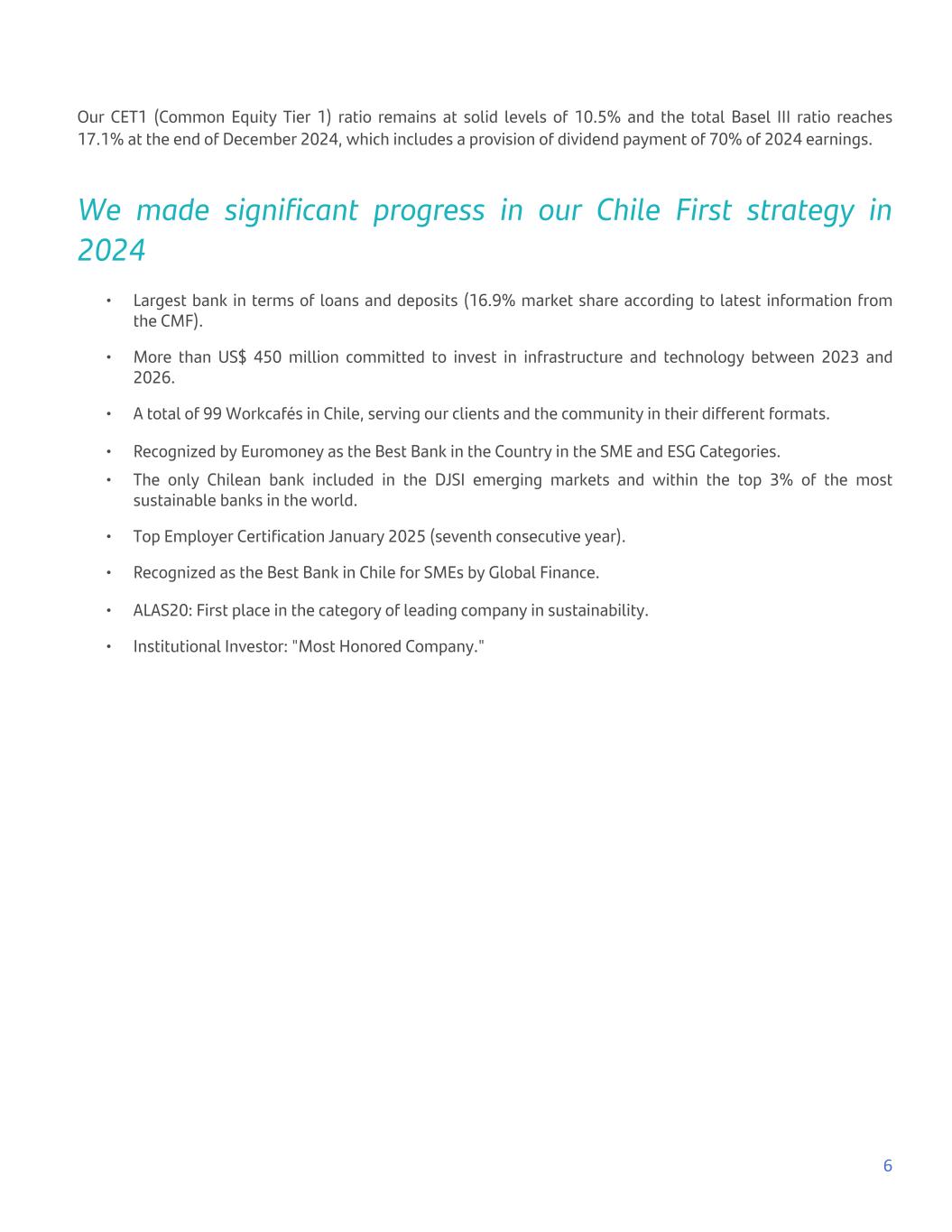

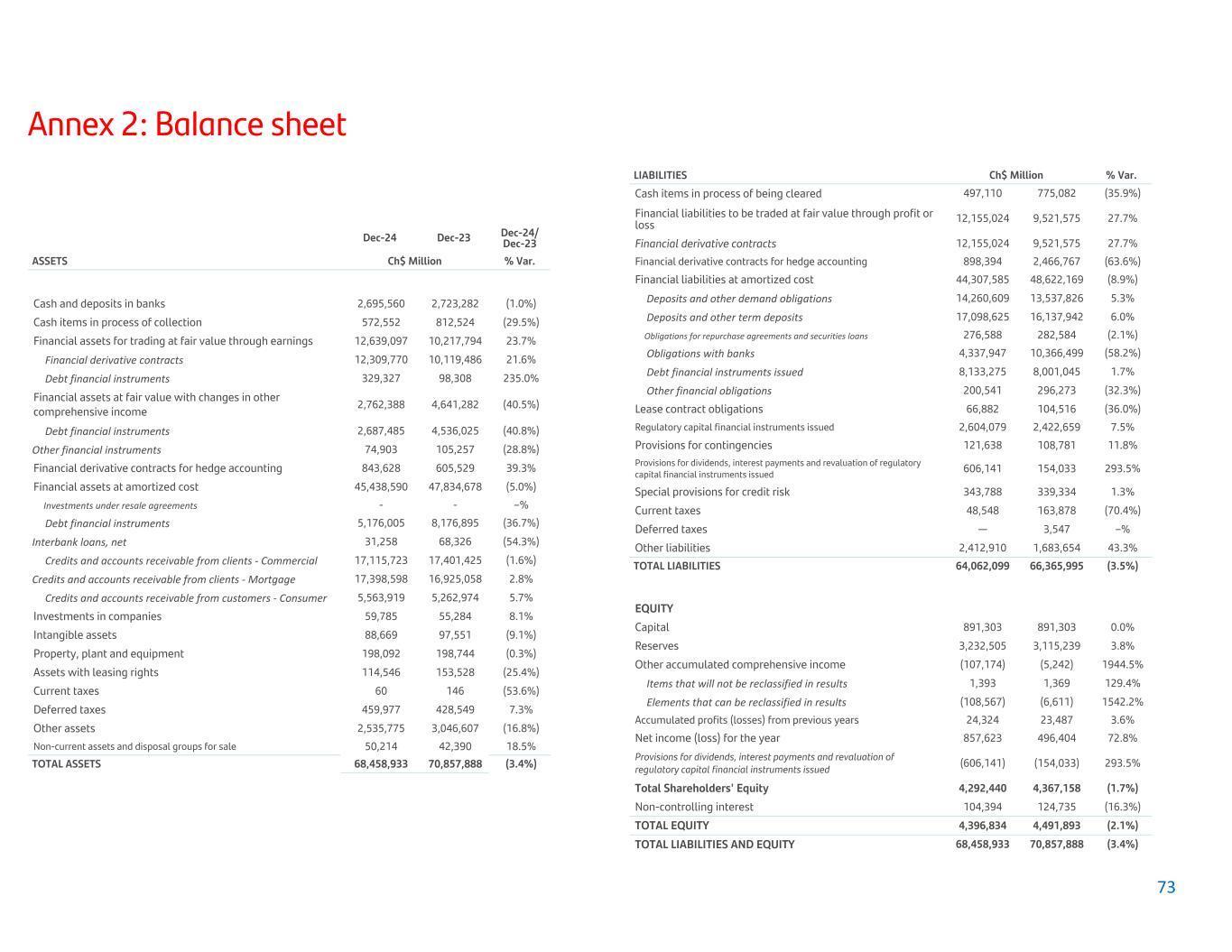

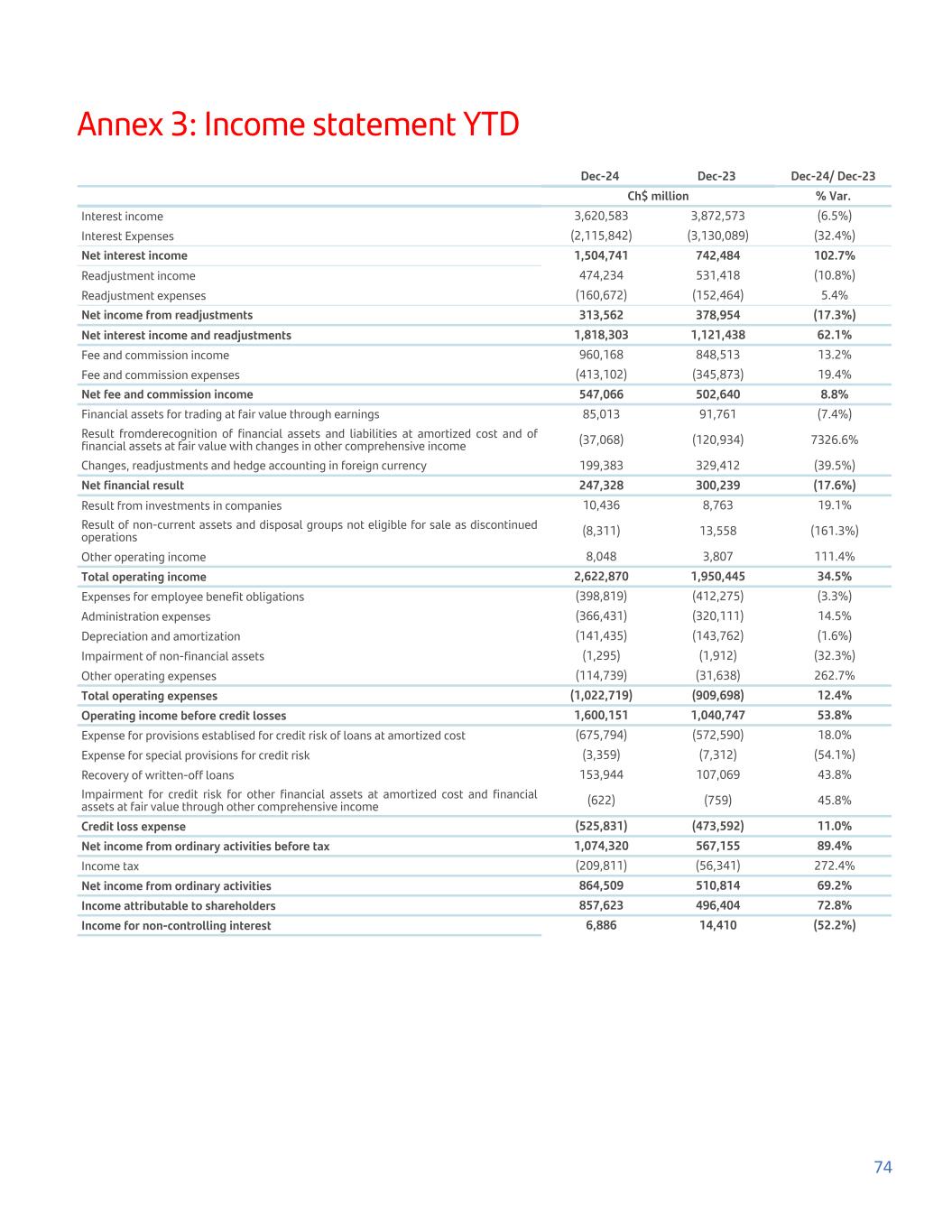

Financial Information Balance sheet (Ch$ million) Dec-24 Dec-23 % Variation Total assets 68,458,933 70,857,888 (3.4%) Total gross loans (1) 41,323,844 40,811,886 1.3% Demand deposits 14,260,609 13,537,826 5.3% Time deposits 17,098,625 16,137,942 6.0% Total shareholders' equity 4,292,440 4,367,158 (1.7%) Income Statement (YTD) Dec-24 Dec-23 % Variation Net income from interest and readjustment 1,818,303 1,121,438 62.1% Net fee and commission income 547,066 502,640 8.8% Net financial results 247,328 300,239 (17.6%) Total operating income (2) 2,622,870 1,950,445 34.5% Operating expenses (3) (1,022,719) (909,698) 12.4% Operating income before credit losses 1,600,151 1,040,747 53.8% Credit loss expense (525,831) (473,592) 11.0% Net operating income before income tax 1,074,320 567,155 89.4% Income attributable to shareholders 857,623 496,404 72.8% 1. Loans (including those owed by banks) at amortized cost. 2. Total operating income: Net income from interest and readjustments + net fee income + net financial results+ income from investments in associates and other companies+ results from non-current assets and non-continued operations+ other operating income. 3. Operating expenses: Personnel expenses + administration expenses+ depreciation and amortization+ impairment of non-financial assets + other operating expenses. Key Indicators (Non-accounting Financial Information) Profitability and efficiency Dec-24 Dec-23 bp variation Net Interest Margin (NIM) (1) 3.6% 2.2% 140 Recurrence (2) 60.3% 57.4% 297 Efficiency ratio (3) 39.0% 46.6% (760) Return on average equity (4) 20.2% 11.9% 822 Return on average assets (5) 1.2% 0.7% 52 Return on risk-weighted assets (RWA) (6) 2.1% 1.3% 85 Asset quality ratios (%) Dec-24 Dec-23 bp variation NPL ratio (7) 3.2% 2.3% 90 Coverage of NPLs ratio (8) 115.4% 157.3% (4,190) Cost of credit (9) 1.29% 1.20% 9 Capital indicators Dec-24 Dec-23 Variation Risk-weighted assets 40,812,824 39,552,229 3.2% Common Equity 4,268,408 4,397,881 (2.9%) Regulatory capital 6,961,316 6,978,733 (0.2%) Core capital ratio (10) 10.5% 11.1% (66)bp Tier I Ratio (11) 12.2% 12.7% (50)bp Tier II Ratio (12) 4.9% 5.0% (9)bp BIS ratio (13) 17.1% 17.6% (54)bp 7

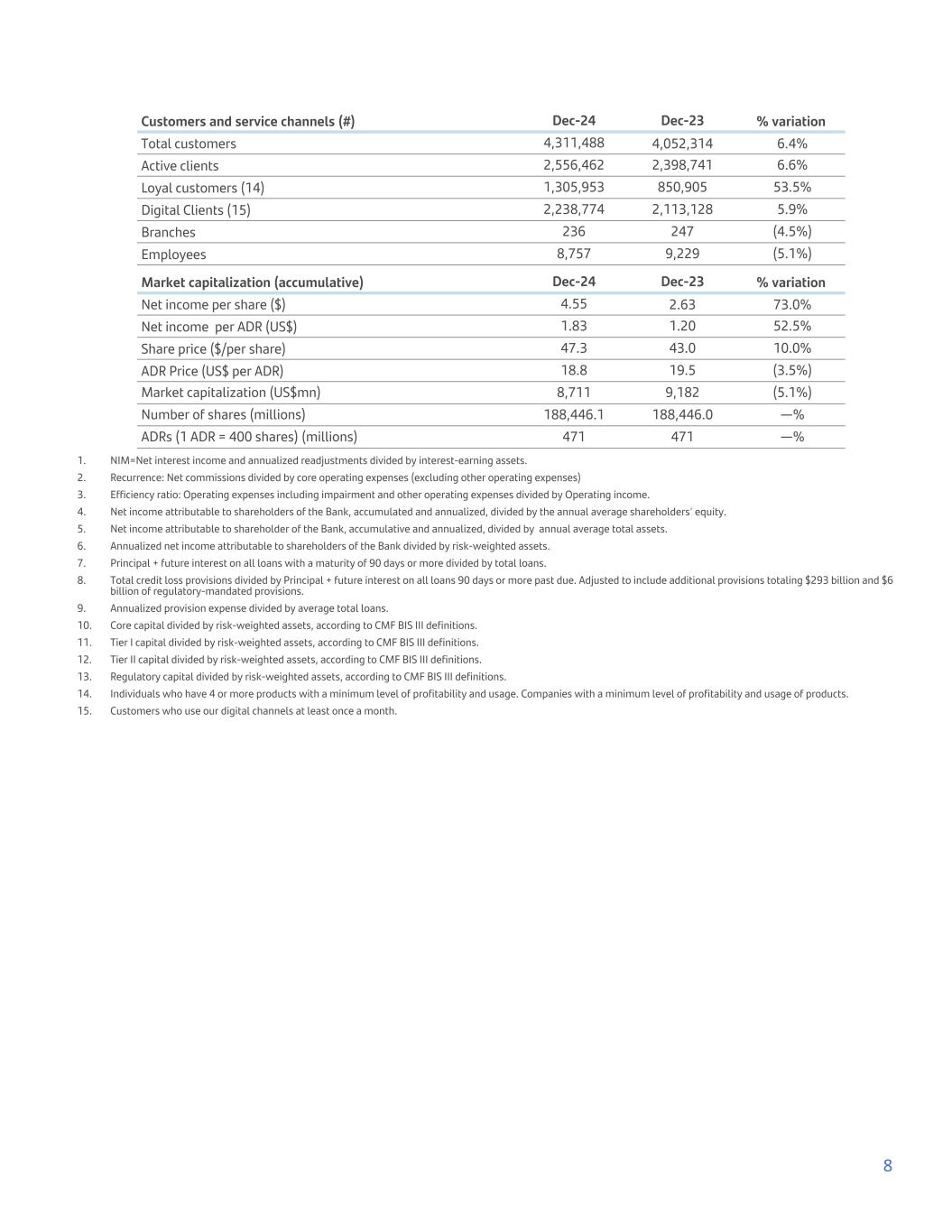

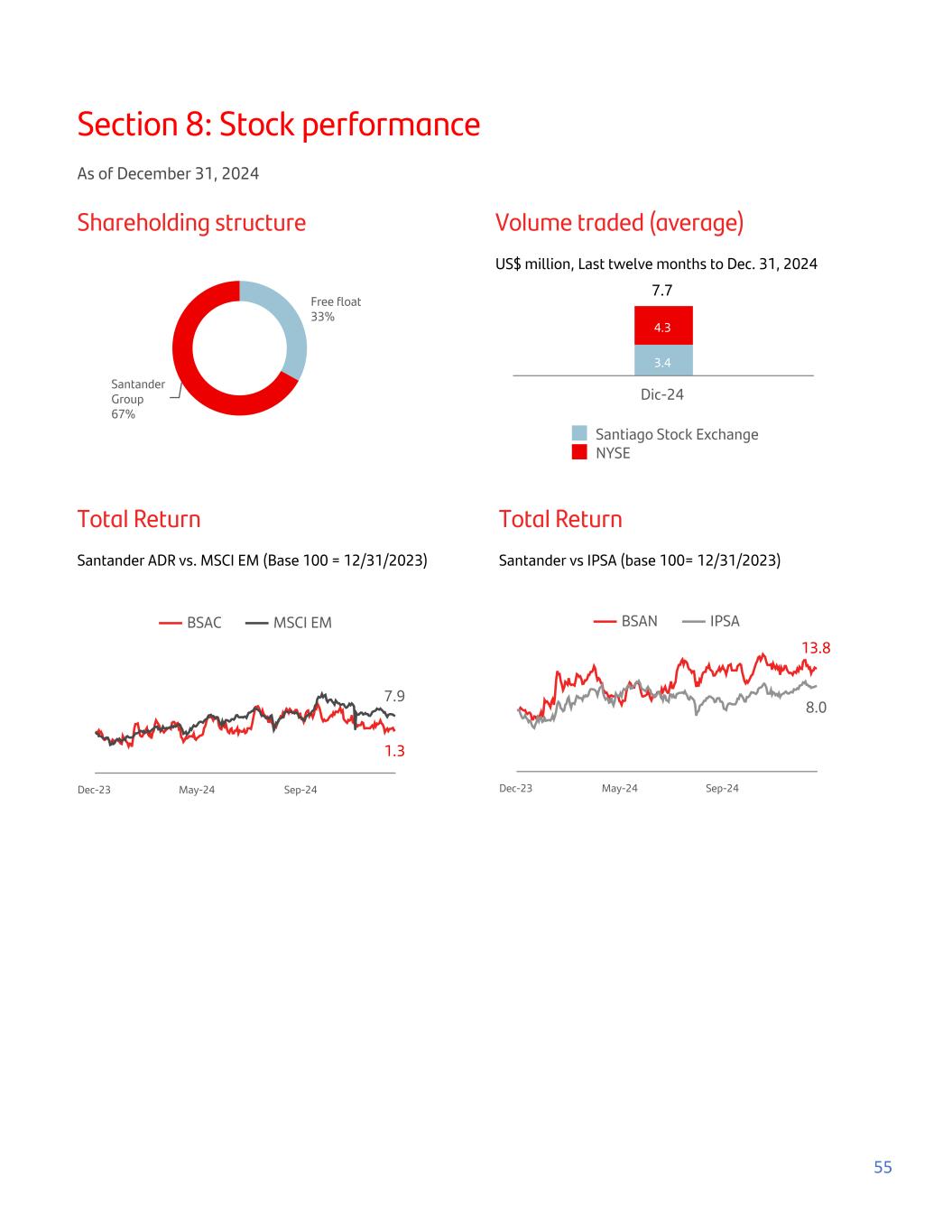

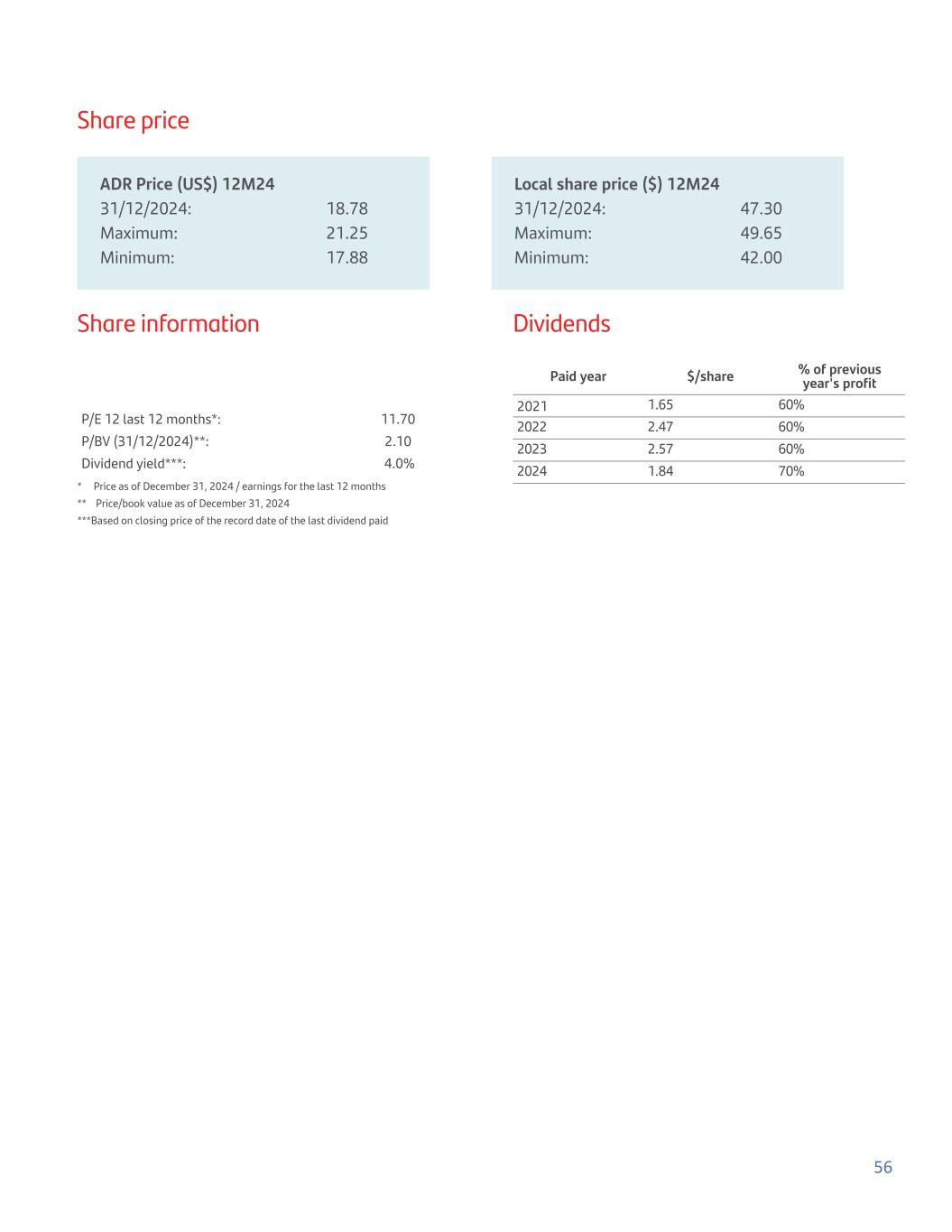

Customers and service channels (#) Dec-24 Dec-23 % variation Total customers 4,311,488 4,052,314 6.4% Active clients 2,556,462 2,398,741 6.6% Loyal customers (14) 1,305,953 850,905 53.5% Digital Clients (15) 2,238,774 2,113,128 5.9% Branches 236 247 (4.5%) Employees 8,757 9,229 (5.1%) Market capitalization (accumulative) Dec-24 Dec-23 % variation Net income per share ($) 4.55 2.63 73.0% Net income per ADR (US$) 1.83 1.20 52.5% Share price ($/per share) 47.3 43.0 10.0% ADR Price (US$ per ADR) 18.8 19.5 (3.5%) Market capitalization (US$mn) 8,711 9,182 (5.1%) Number of shares (millions) 188,446.1 188,446.0 —% ADRs (1 ADR = 400 shares) (millions) 471 471 —% 1. NIM=Net interest income and annualized readjustments divided by interest-earning assets. 2. Recurrence: Net commissions divided by core operating expenses (excluding other operating expenses) 3. Efficiency ratio: Operating expenses including impairment and other operating expenses divided by Operating income. 4. Net income attributable to shareholders of the Bank, accumulated and annualized, divided by the annual average shareholders' equity. 5. Net income attributable to shareholder of the Bank, accumulative and annualized, divided by annual average total assets. 6. Annualized net income attributable to shareholders of the Bank divided by risk-weighted assets. 7. Principal + future interest on all loans with a maturity of 90 days or more divided by total loans. 8. Total credit loss provisions divided by Principal + future interest on all loans 90 days or more past due. Adjusted to include additional provisions totaling $293 billion and $6 billion of regulatory-mandated provisions. 9. Annualized provision expense divided by average total loans. 10. Core capital divided by risk-weighted assets, according to CMF BIS III definitions. 11. Tier I capital divided by risk-weighted assets, according to CMF BIS III definitions. 12. Tier II capital divided by risk-weighted assets, according to CMF BIS III definitions. 13. Regulatory capital divided by risk-weighted assets, according to CMF BIS III definitions. 14. Individuals who have 4 or more products with a minimum level of profitability and usage. Companies with a minimum level of profitability and usage of products. 15. Customers who use our digital channels at least once a month. 8

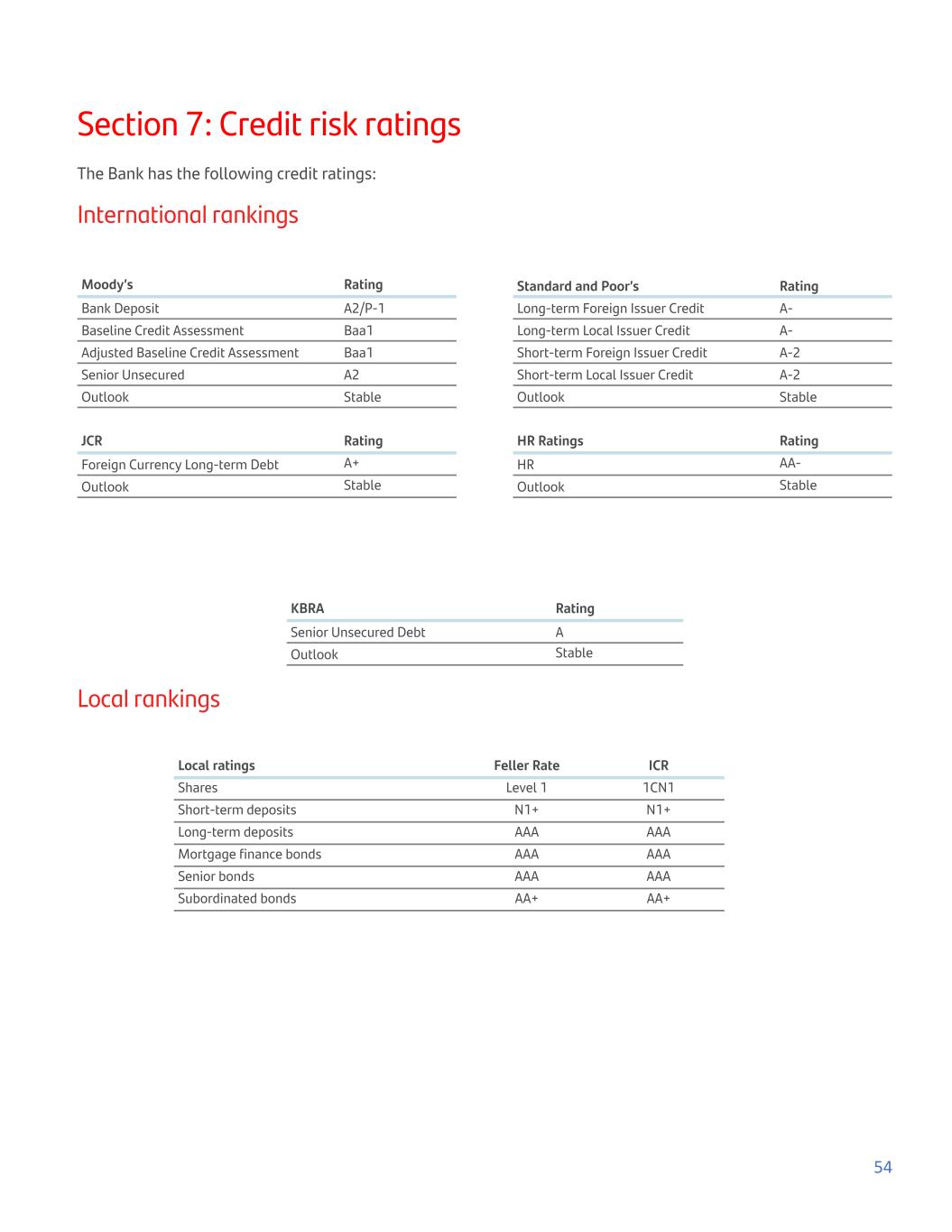

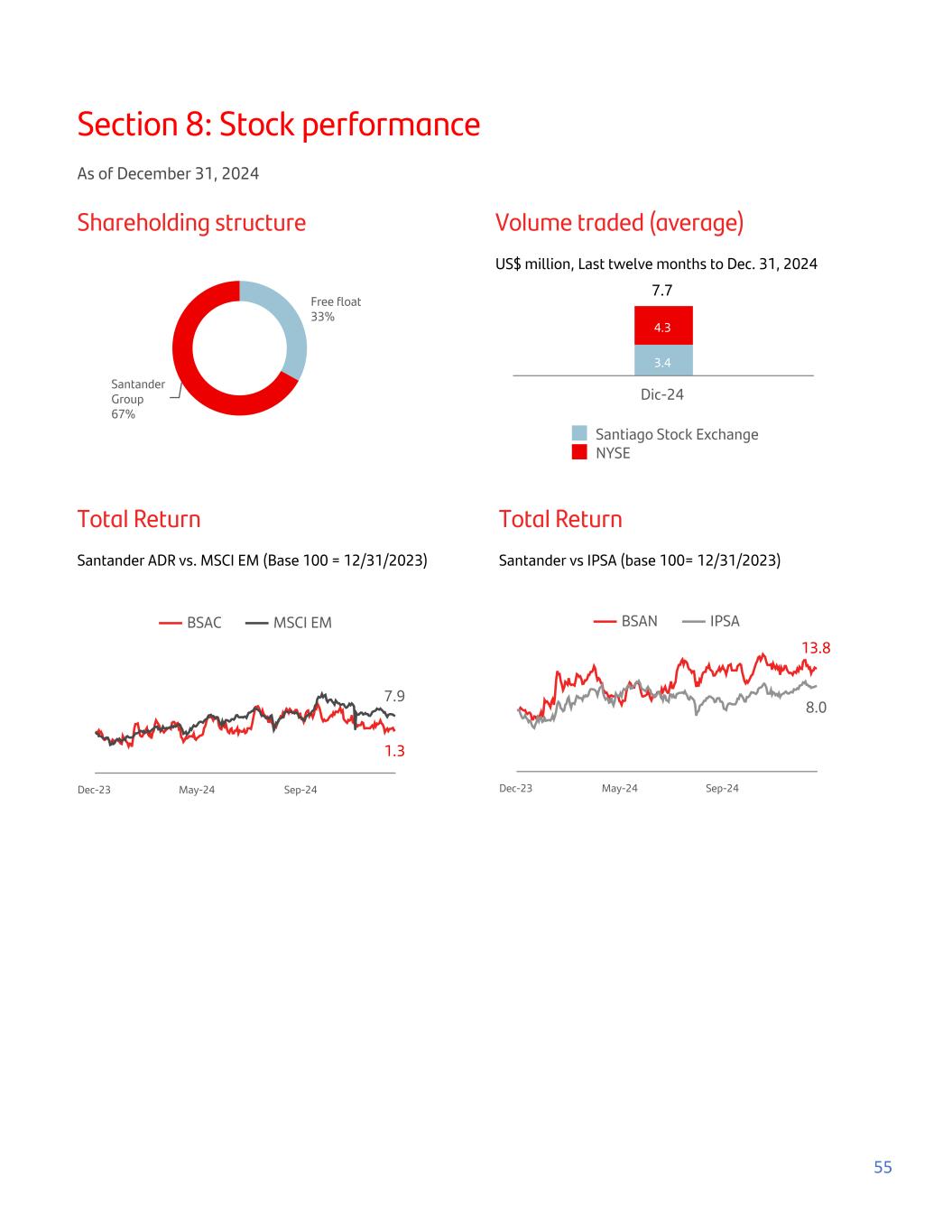

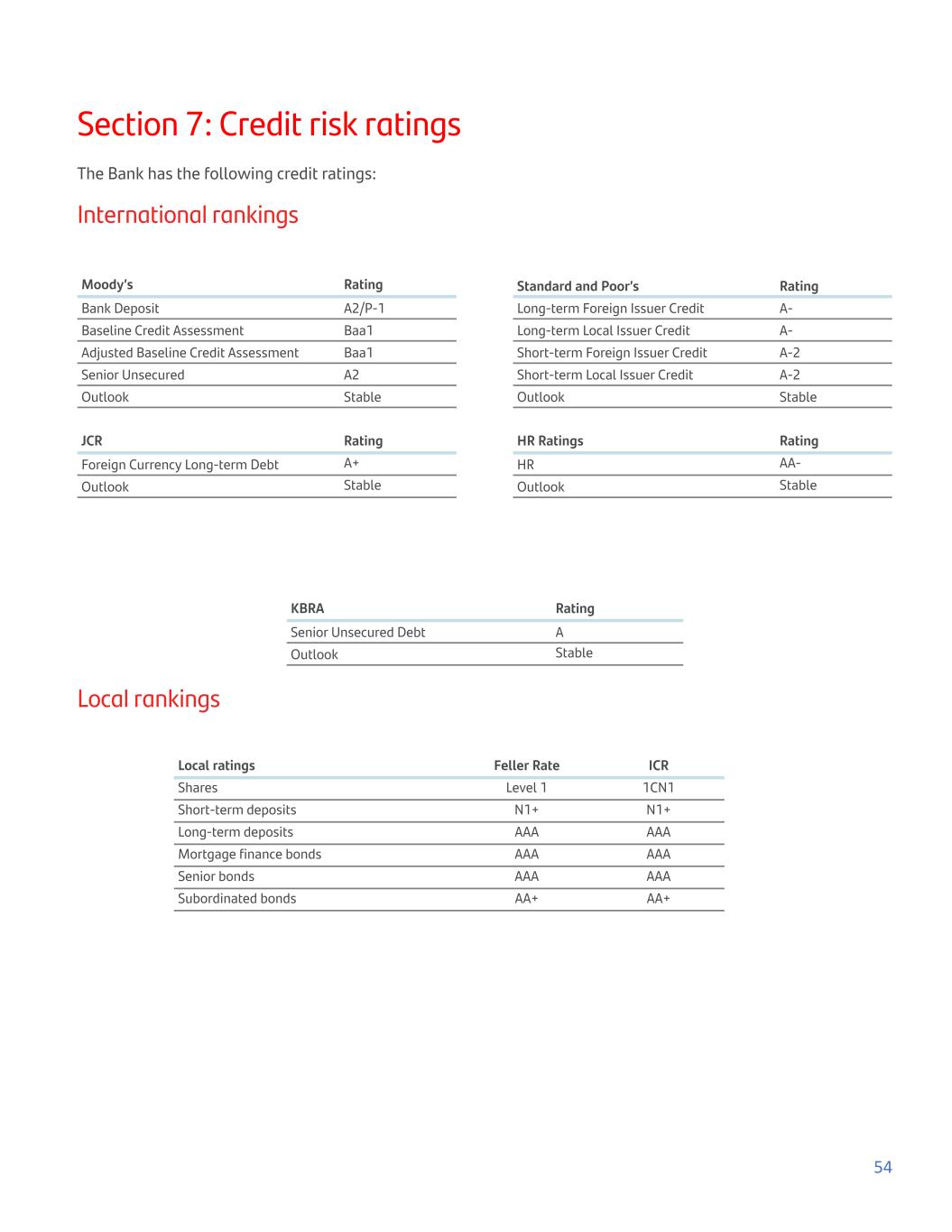

Section 2: Business environment Competitive position We are the largest bank in the Chilean market in terms of total loans (excluding loans held by subsidiaries of Chilean banks abroad) and the second largest bank in terms of total deposits (excluding deposits held by subsidiaries of Chilean banks abroad). We have a leading presence in all major business segments in Chile and a broad distribution network with national coverage that extends throughout the country. We offer unique transaction capabilities to clients through our 236 branches and digital platforms. Our headquarters are in Santiago and we operate in all major regions of Chile. Santander Chile provides a wide range of banking services to its customers, including commercial, consumer and mortgage loans, as well as current accounts, time deposits, savings accounts and other transactional products. In addition to its traditional banking operations, it offers financial services, including leasing, factoring, foreign trade services, financial advisory services, acquisition and brokerage of mutual funds, securities and insurance. Market Share (1) Santander Ranking (2) Total loans 17.1% 1 Commercial 14.0% 3 Mortgages 20.7% 1 Consumer 20.0% 1 Demand deposits 20.4% 3 Time deposits 14.9% 3 Current accounts (#) 23.2% 1 Credit card purchases ($) 23.9% 1 Branch offices (#) 16.0% 3 Employees (#) 15.5% 3 Indicators (1) November 2024 Efficiency 47.4% 4 ROAE 11.2% 5 ROAA 0.7% 6 1. Source: CMF as of November 2024. Current accounts, credit card purchases (last 12 months), branches and employees as of October 2024. 2. Competition: Banco de Chile, BCI, Banco Estado, Itaú and Scotiabank. Banco Santander Chile is one of the companies with the highest risk ratings in Latin America, with an A2 rating from Moody's, A- from Standard and Poor's, A+ from Japan Credit Rating Agency, AA- from HR Ratings and A from KBRA. All our ratings as of the date of this report have a stable outlook. As of December 31, 2024, the Bank has total assets of $68,458,933 million (US$68,865 million), total gross loans (including loans to banks) at amortized cost of $41,323,844 million (US$41,569 million), total deposits of $31,359,234 million (US$31,545 million) and shareholders' equity of $4,292,440 million (US$4,318 million). The BIS capital ratio was 17.1%, with a core capital ratio of 10.5%. As of December 31, 2024, Santander Chile employs 8,757 people and has 236 branches throughout Chile. For more information on the constitution of the business, please consult here or in the Bank's Integrated Report. 9

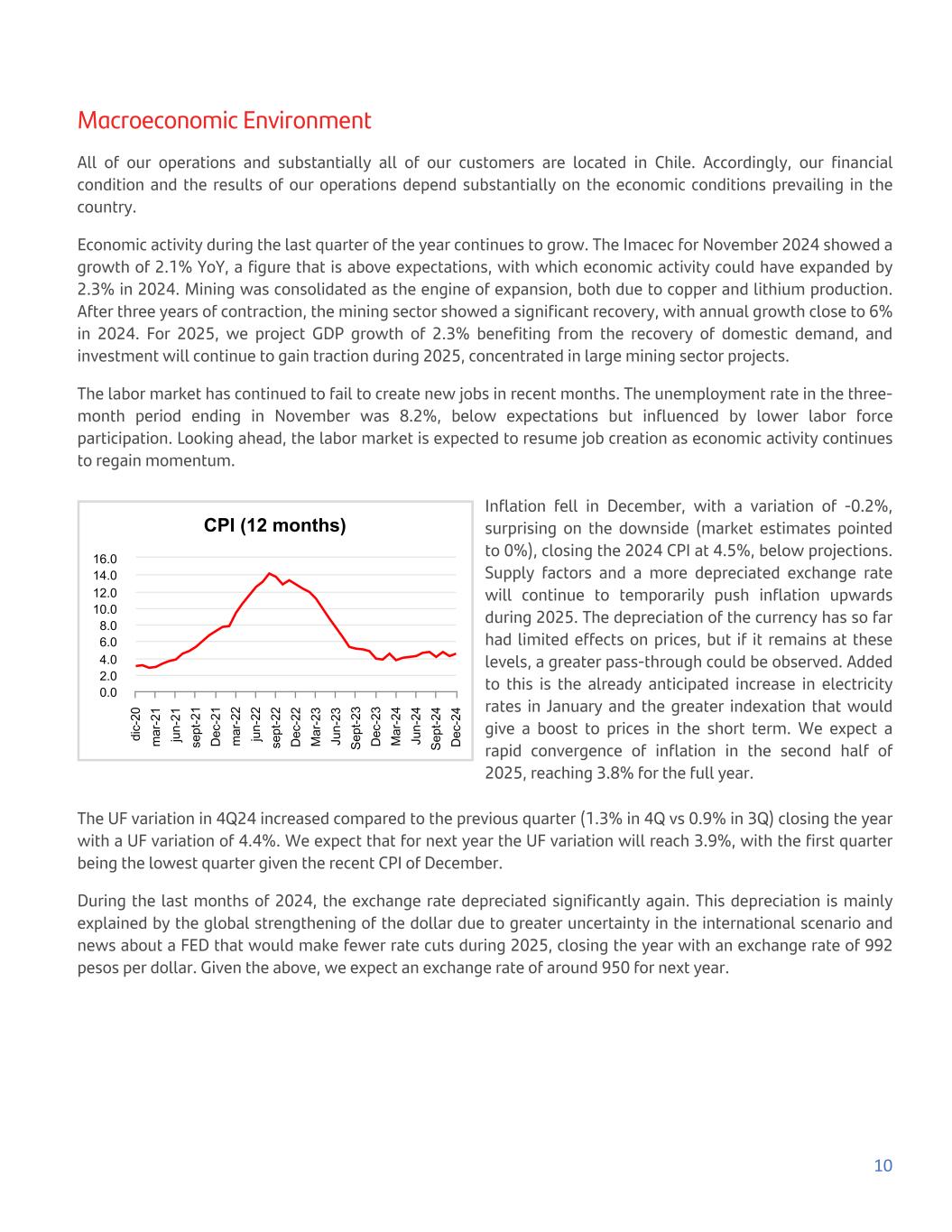

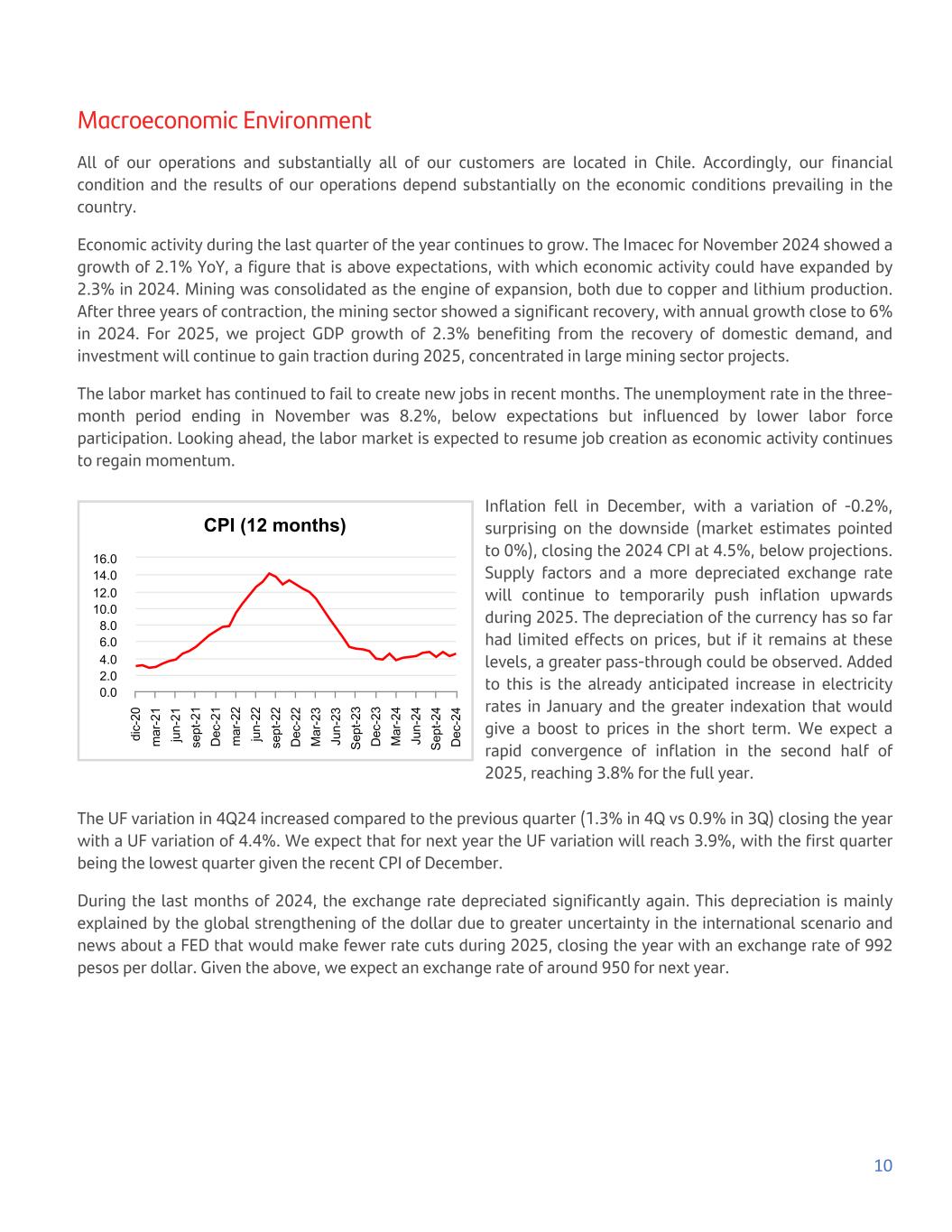

Macroeconomic Environment All of our operations and substantially all of our customers are located in Chile. Accordingly, our financial condition and the results of our operations depend substantially on the economic conditions prevailing in the country. Economic activity during the last quarter of the year continues to grow. The Imacec for November 2024 showed a growth of 2.1% YoY, a figure that is above expectations, with which economic activity could have expanded by 2.3% in 2024. Mining was consolidated as the engine of expansion, both due to copper and lithium production. After three years of contraction, the mining sector showed a significant recovery, with annual growth close to 6% in 2024. For 2025, we project GDP growth of 2.3% benefiting from the recovery of domestic demand, and investment will continue to gain traction during 2025, concentrated in large mining sector projects. The labor market has continued to fail to create new jobs in recent months. The unemployment rate in the three- month period ending in November was 8.2%, below expectations but influenced by lower labor force participation. Looking ahead, the labor market is expected to resume job creation as economic activity continues to regain momentum. CPI (12 months) di c- 20 m ar -2 1 ju n- 21 se pt -2 1 D ec -2 1 m ar -2 2 ju n- 22 se pt -2 2 D ec -2 2 M ar -2 3 Ju n- 23 S ep t-2 3 D ec -2 3 M ar -2 4 Ju n- 24 S ep t-2 4 D ec -2 4 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 Inflation fell in December, with a variation of -0.2%, surprising on the downside (market estimates pointed to 0%), closing the 2024 CPI at 4.5%, below projections. Supply factors and a more depreciated exchange rate will continue to temporarily push inflation upwards during 2025. The depreciation of the currency has so far had limited effects on prices, but if it remains at these levels, a greater pass-through could be observed. Added to this is the already anticipated increase in electricity rates in January and the greater indexation that would give a boost to prices in the short term. We expect a rapid convergence of inflation in the second half of 2025, reaching 3.8% for the full year. The UF variation in 4Q24 increased compared to the previous quarter (1.3% in 4Q vs 0.9% in 3Q) closing the year with a UF variation of 4.4%. We expect that for next year the UF variation will reach 3.9%, with the first quarter being the lowest quarter given the recent CPI of December. During the last months of 2024, the exchange rate depreciated significantly again. This depreciation is mainly explained by the global strengthening of the dollar due to greater uncertainty in the international scenario and news about a FED that would make fewer rate cuts during 2025, closing the year with an exchange rate of 992 pesos per dollar. Given the above, we expect an exchange rate of around 950 for next year. 10

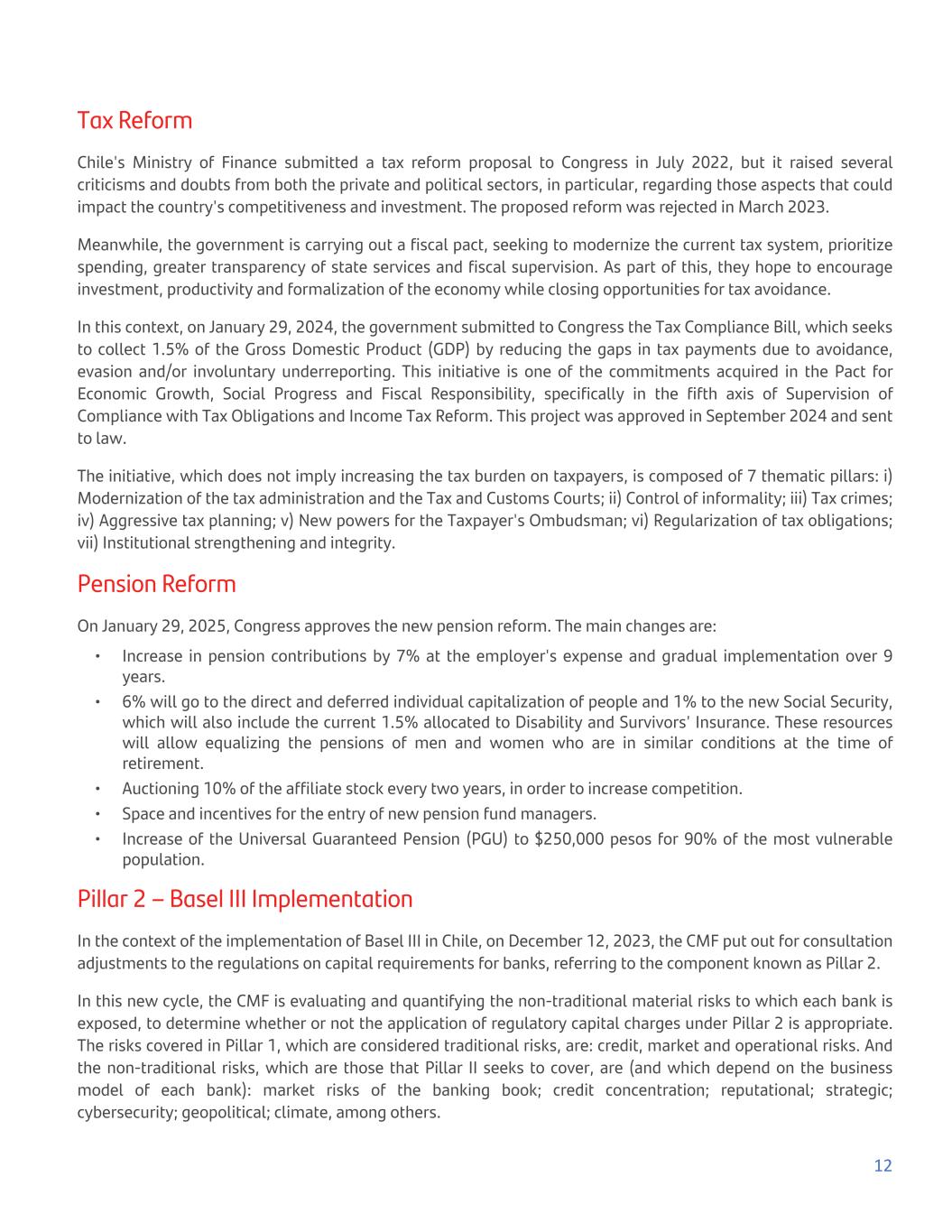

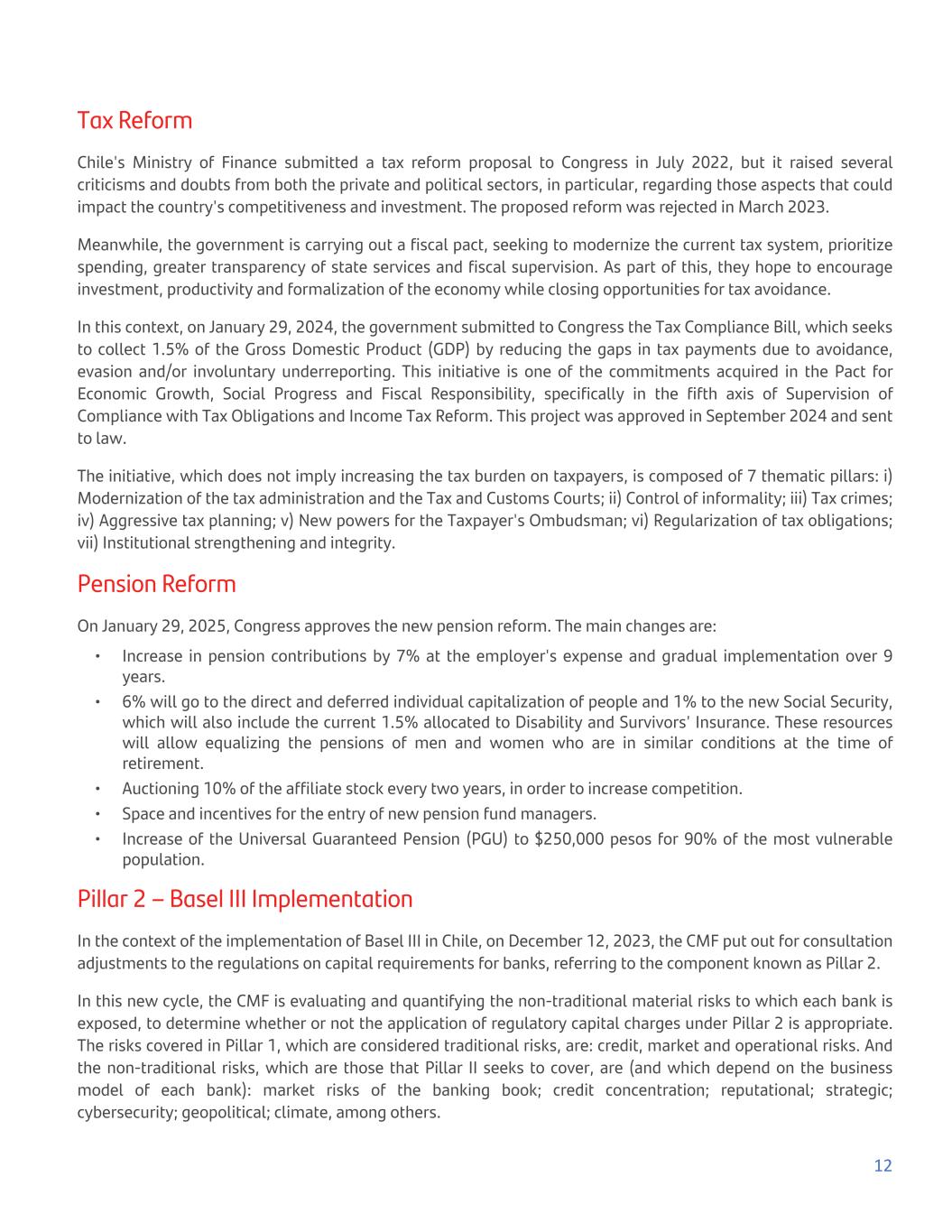

MPR D ec -2 02 2 Fe b- 20 23 M ar -2 02 3 A pr -2 02 3 M ay -2 02 3 Ju n- 20 23 Ju l-2 02 3 A ug -2 02 3 S ep -2 02 3 O ct -2 02 3 N ov -2 02 3 D ec -2 02 3 Ja n- 20 24 Fe b- 20 24 M ar -2 02 4 A pr -2 02 4 M ay -2 02 4 Ju n- 20 24 Ju l-2 02 4 A ug -2 02 4 S ep -2 02 4 O ct -2 02 4 N ov -2 02 4 D ec -2 02 4 0.0 2.0 4.0 6.0 8.0 10.0 12.0 The Central Bank began the rate cut process in July 2023 and continued with this trend in its subsequent meetings, closing 2023 at 8.25%. During 2024, the cuts have persisted, although more gradually. At the last meeting of the year in December, the Central Bank cut the rate by 25bp, to 5.0%, highlighting that the external sector remains the main source of identified risks. It also projects that the FED will continue with two rate cuts in 2025, leaving a narrower outlook. With this, we estimate that the Central Bank will continue implementing more cuts next year, to reach a neutral rate of 4.25% at the end of 2025. In the last meeting of the central bank in January, they maintained the MPR at 5.00%. Summary of estimated economic data: 2021 2022 2023 2024 (E) 2025 (E) National accounts GDP (real change % YoY) 11.7% 2.4% 0.2% 2.3% 2.3% Internal demand (real change % y/y) 21.7% 2.3% -4.2% 1.2% 2.7% Total consumption (actual change % y/y) 19.3% 3.1% -3.9% 1.6% 2.2% Private consumption (real change % YoY) 20.8% 2.9% -5.2% 1.1% 2.0% Public consumption (real change % y/y) 13.8% 4.1% 1.7% 3.4% 3.1% Gross fixed capital formation (real change % YoY) 15.7% 2.8% -1.1% -0.9% 5.1% Exports (real change % YoY) -1.4% 1.4% -0.3% 5.3% 3.8% Imports (real change % YoY) 31.8% 0.9% -12.0% 1.6% 5.3% Monetary and Foreign Exchange Market CPI inflation 7.2% 12.6% 3.9% 4.5% 3.8% UF inflation 6.6% 13.3% 4.8% 4.4% 3.9% CLP/US$ exchange rate (end of year) 852 875 879 992 950 Monetary policy rate (end of year) 4.0% 11.25% 8.25% 5.0% 4.25% Fiscal Policy Public expenditure 31.6% -24.0% 1.0% 3.5% 3.0% Central Government Balance (% GDP) -7.7% 1.3% -2.4% -2.7% -2.3% Estimates from the Research Department of Banco Santander Chile. 11

Tax Reform Chile's Ministry of Finance submitted a tax reform proposal to Congress in July 2022, but it raised several criticisms and doubts from both the private and political sectors, in particular, regarding those aspects that could impact the country's competitiveness and investment. The proposed reform was rejected in March 2023. Meanwhile, the government is carrying out a fiscal pact, seeking to modernize the current tax system, prioritize spending, greater transparency of state services and fiscal supervision. As part of this, they hope to encourage investment, productivity and formalization of the economy while closing opportunities for tax avoidance. In this context, on January 29, 2024, the government submitted to Congress the Tax Compliance Bill, which seeks to collect 1.5% of the Gross Domestic Product (GDP) by reducing the gaps in tax payments due to avoidance, evasion and/or involuntary underreporting. This initiative is one of the commitments acquired in the Pact for Economic Growth, Social Progress and Fiscal Responsibility, specifically in the fifth axis of Supervision of Compliance with Tax Obligations and Income Tax Reform. This project was approved in September 2024 and sent to law. The initiative, which does not imply increasing the tax burden on taxpayers, is composed of 7 thematic pillars: i) Modernization of the tax administration and the Tax and Customs Courts; ii) Control of informality; iii) Tax crimes; iv) Aggressive tax planning; v) New powers for the Taxpayer's Ombudsman; vi) Regularization of tax obligations; vii) Institutional strengthening and integrity. Pension Reform On January 29, 2025, Congress approves the new pension reform. The main changes are: • Increase in pension contributions by 7% at the employer's expense and gradual implementation over 9 years. • 6% will go to the direct and deferred individual capitalization of people and 1% to the new Social Security, which will also include the current 1.5% allocated to Disability and Survivors' Insurance. These resources will allow equalizing the pensions of men and women who are in similar conditions at the time of retirement. • Auctioning 10% of the affiliate stock every two years, in order to increase competition. • Space and incentives for the entry of new pension fund managers. • Increase of the Universal Guaranteed Pension (PGU) to $250,000 pesos for 90% of the most vulnerable population. Pillar 2 – Basel III Implementation In the context of the implementation of Basel III in Chile, on December 12, 2023, the CMF put out for consultation adjustments to the regulations on capital requirements for banks, referring to the component known as Pillar 2. In this new cycle, the CMF is evaluating and quantifying the non-traditional material risks to which each bank is exposed, to determine whether or not the application of regulatory capital charges under Pillar 2 is appropriate. The risks covered in Pillar 1, which are considered traditional risks, are: credit, market and operational risks. And the non-traditional risks, which are those that Pillar II seeks to cover, are (and which depend on the business model of each bank): market risks of the banking book; credit concentration; reputational; strategic; cybersecurity; geopolitical; climate, among others. 12

On October 11, 2024, the CMF published a new version for consultation of the regulations on capital requirements for pillar 2. This new proposal considers that part of the changes will come into effect as of May 2025 and the remaining changes for the IAPE of 2026. Subsequently, on January 17, 2025, the CMF applied for the second time the current regulations on additional asset requirements according to Pillar II, where the Council resolved to apply said requirements to the same institutions as the previous year, these are: Banco Bice, Banco BTG Pactual Chile, Banco Consorcio, Banco de Chile, Banco del Estado de Chile, Banco Internacional, Banco Security, HSBC Bank (Chile) and Scotiabank Chile. The above decision is based on the capital self-assessment process through the Effective Asset Self-Assessment Report (IAPE) that all banks carry out annually in the month of April. In this report, the banks themselves determine their internal target of effective equity necessary to cover their material risks over a horizon of at least three years. And, in addition, from the IAPE corresponding to the year 2023, it also considers risks for which there is no measurement standard, such as market risk in the banking book and credit concentration risk. Exchange rates In February 2023, the Committee for the Setting of Exchange Rate Caps proposed new rate caps. These were approved at the end of April 2023 and will be implemented gradually. Card type Current rate First cut (Oct-23) Second cut (Oct-24) (Suspended) Debit 0.6% 0.5% 0.35% Credit 1.48% 1.14% 0.80% Prepaid 1.04% 0.94% 0.80% In order to assess the effects of the gradual implementation of the process of determining limits on interchange rates, the Committee agreed to carry out an impact study on: (i) the application of the preliminary rates; (ii) the first reduction established in this resolution; (iii) the evaluation of the potential effects, or those that are reasonably foreseeable, of the second reduction; and (iv) on all aspects of the market that are relevant to the fulfillment of the Committee's objectives established in the aforementioned law. This report has not yet been published. On September 30, the Committee indicated that it will begin a review process of the limits on the exchange rates, so it will maintain the limits in force at the time (the reduction scheduled for October 2024 is suspended). New regulations for consumer provisions During 2022, the CMF published a draft for a new standardized provisioning model for consumer loans for banks. The CMF estimated an impact for the entire industry of about US$1 billion and the Bank estimated an impact of an expense of between Ch$100 billion and Ch$150 billion. In October 2023, the CMF published a second draft for consultation for the same model, estimating an initial impact of US$487 million for the entire system. Finally, in March 2024, the CMF published the final regulations for this model, which will come into force in January 2025. The impact for the entire system is close to US$454 million and for the Bank it is approximately Ch$100 billion. As reported by the CMF, voluntary provisions already established in previous periods can be used to constitute this additional requirement. 13

Fraud Act In early April, improvements were approved to the Fraud Law No. 20,009 to combat the recent increase in cases of unknown bank transactions (better known as self-fraud) and other crimes associated with opportunistic behavior, which have strongly affected financial institutions. Certain aspects are modified, such as, for example, i) the repayment terms for an unknown transaction, ii) the requirement of a sworn statement from the user and a complaint to a criminal authority to make the fraud claim effective, iii) a new suspension procedure is created, regardless of the amount claimed, when the issuer has sufficient evidence of the existence of fraud or gross negligence on the part of the user, and then submits the background information to the respective local police court requesting authorization to maintain said suspension, among others. Consolidated debt In early June, the Consolidated Debt Law was approved, which creates a public and free Consolidated Debt Registry (Redec), which will be administered by the Financial Market Commission (CMF). The new law establishes that new institutions that did not do so before will be required to report to the CMF current loans granted to natural persons, such as the administrative agents of endorsable mortgage loans; family allowance compensation funds; credit card issuers (supervised by the CMF); securitization companies; credit advisory entities regulated by the Fintec Law; and any other entity supervised by the CMF, which it determines through a General Standard. Furthermore, it is made clear that the person is the owner of his/her data and is guaranteed the right to protection of said data, under the supervision of the CMF, by establishing his/her rights to update, rectify and cancel the information, along with defining severe sanctions for negligent or malicious access or use of Redec information. In order to access the registry information, reporters must have prior consent, which will be granted for the sole purpose of evaluating their commercial or credit risk for a specific operation and for a limited period. Fintech and Open Finance Law At the beginning of July, the Financial Market Commission (CMF) published the regulations governing the Open Finance System (SFA) or open finance of the Fintech Law, which will come into force in July 2026. The regulation establishes that institutions currently regulated in the financial system - such as banks, payment card issuers, insurance companies, fund managers, savings and credit cooperatives supervised by the CMF - must compulsorily join the SFA to provide the information that the user decides to share with other participating institutions, after giving their consent. In addition, the CMF established the rules for institutions that voluntarily decide to register with the SFA and thus offer financial services to users. The implementation period of the SFA will be gradual, depending on the role played by each participant within this scheme. The first stage has a 24-month period for its entry into force, a period that will be used for the adaptations required for implementation by each of the participants. In addition, during this period they will develop the technical manuals with the specifications. After this time, the standard contains an implementation schedule that begins with the progressive delivery of information that banks and payment card issuers must share within the following 18 months. Then, in the 18 consecutive months, the obligation will begin for savings and credit 14

cooperatives supervised by the CMF, insurance companies, fund managers and compensation funds, among others. Therefore, the total implementation of the standard is estimated to take five years. Regulation and supervision In Chile, only banks may maintain current accounts for their clients, conduct foreign trade transactions and, together with regulated non-bank financial institutions such as cooperatives, accept time deposits. The main authorities regulating financial institutions in Chile are the Financial Market Commission (CMF) and the Central Bank. Chilean banks are subject primarily to the General Banking Law, and secondarily, to the extent not inconsistent with this statute, to the provisions of the Chilean Corporations Law governing corporations, except for certain provisions that expressly exclude them. For more information about our Bank's regulation and supervision, please refer here. For more information on the General Banking Law click here. For more information about the CMF, please visit the following website: www.cmfchile.cl For more information about the Central Bank, please visit the following website: www.bcentral.cl 15

Section 3: Segment information Segment information is based on the Financial Information presented to senior management and the Board of Directors. The Bank has aligned the segment information consistently with the underlying information used internally for management reporting purposes and with that presented in other public documents of the Bank. The Bank's senior management has been determined to be primarily responsible for the Bank's operating decisions. The Bank's operating segments reflect the Bank's organizational and management structures. Senior management reviews internal information based on these segments to assess performance and allocate resources. During 2024, the Bank will maintain the general criteria applied in 2023, adding the opening of Retail (formerly Individuals and SMEs) in Retail and Wealth Management & Insurance. For comparative purposes, the 2023 data has been reworked including these modifications. Description of segments Retail Banking This segment comprises individuals and small companies with annual sales of less than 400,000 UF. This segment offers a variety of services to clients including consumer loans, credit cards, commercial loans, foreign trade, mortgage loans, debit cards, current accounts, savings products, mutual funds, stock brokerage and insurance. Additionally, SME clients are offered loans with state guarantee, leasing and factoring. Wealth Management & Insurance It comprises the Asset Management, Insurance and Private Banking businesses, also coordinating the distribution of the different investment products and services to the rest of the Grupo Santander Divisions in Chile. The Santander Insurance business offers both personal and corporate protection products, health insurance, life insurance, travel insurance, savings, personal protection, automobile insurance, unemployment insurance, among others; and finally, for high net worth clients, Santander Private Banking offers everything from transactional products and services (credits, cards, foreign trade, buying/selling shares) to sophisticated products and services such as international investment accounts, structured funds, alternative investment funds, asset management and open architecture. Middle-market This segment includes companies with annual sales of over 400,000 UF without a limit (for specialized sectors of the Metropolitan Region with annual sales of over 100,000 UF without a limit). It also includes institutional organizations such as universities, government agencies, municipalities and regional governments and companies in the real estate sector that execute projects to sell to third parties and all construction companies with annual sales of over 100,000 UF without a limit. A wide variety of products are offered to this segment, including commercial loans, leasing, factoring, foreign trade, credit cards, mortgage loans, current accounts, transactional services, treasury services, financial consulting, savings products, mutual funds and insurance. In addition, specialized services are offered to companies in the real estate sector for the financing of mainly residential projects, with the intention of increasing the sale of mortgage loans. 16

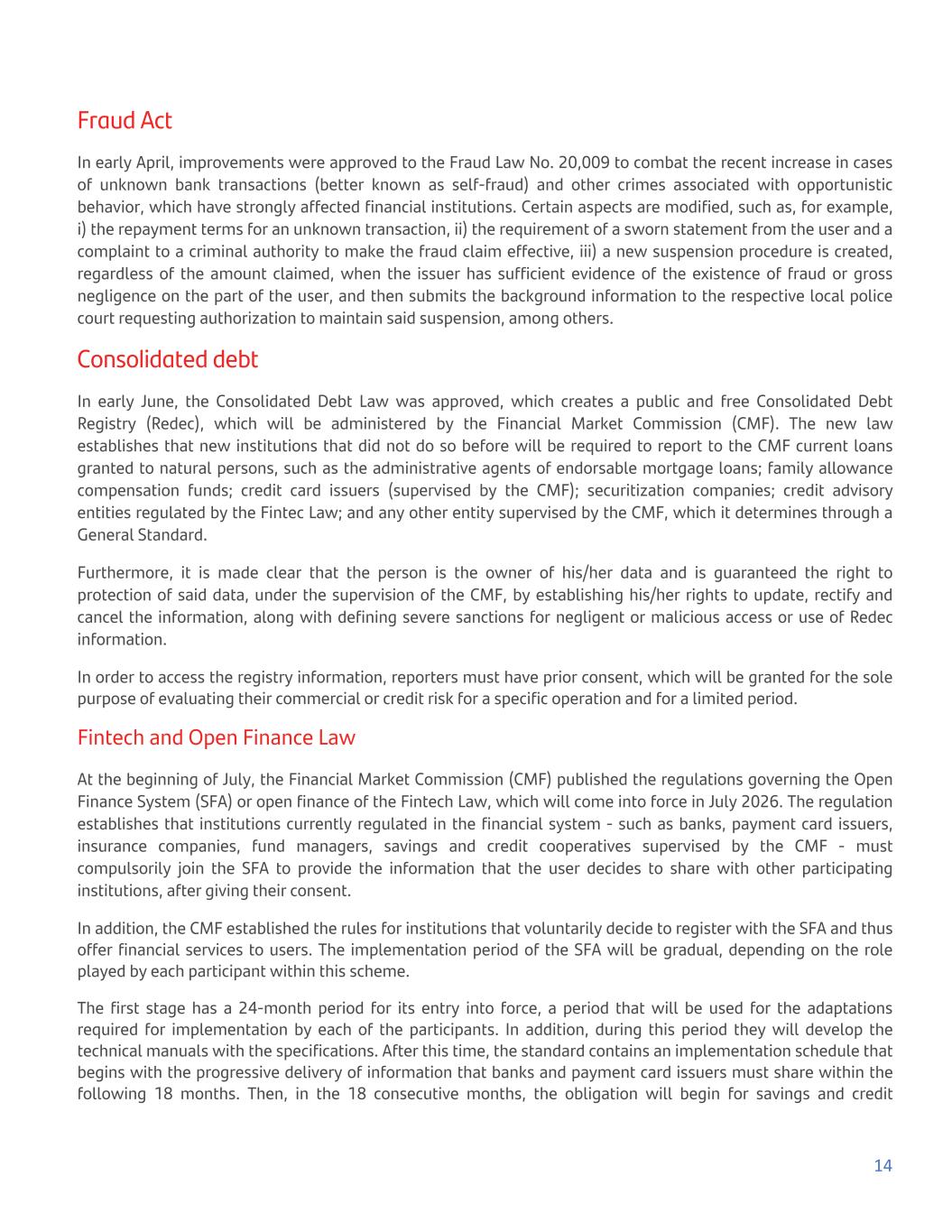

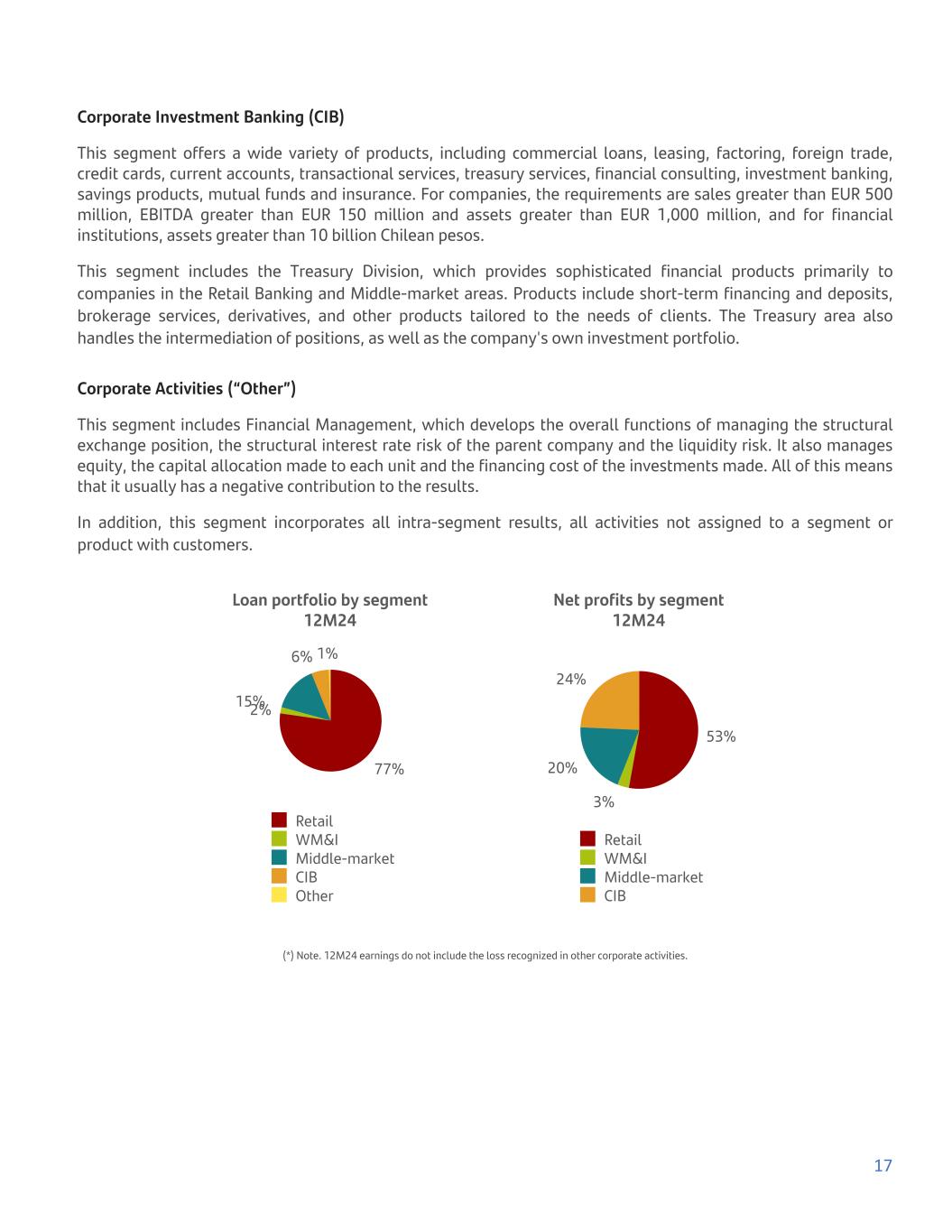

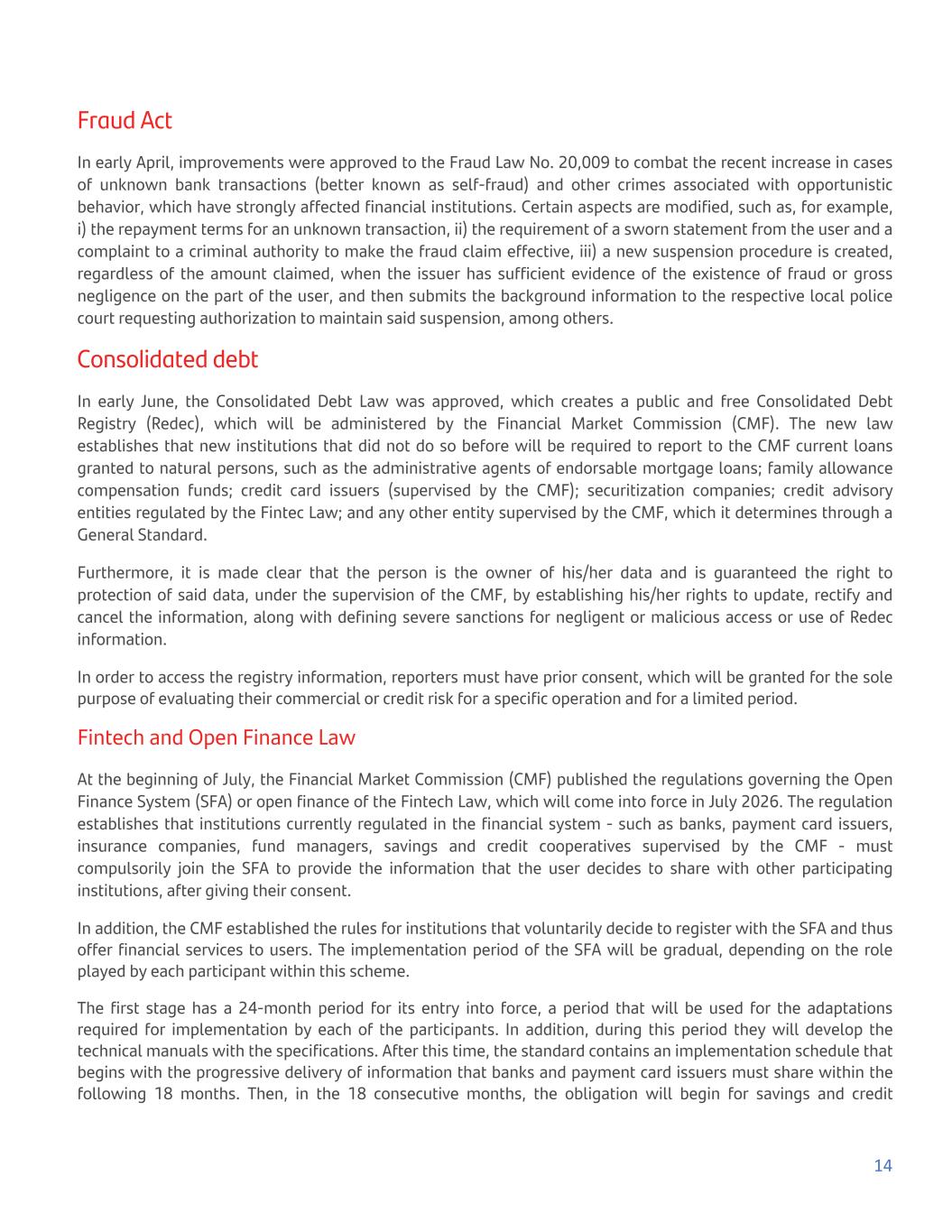

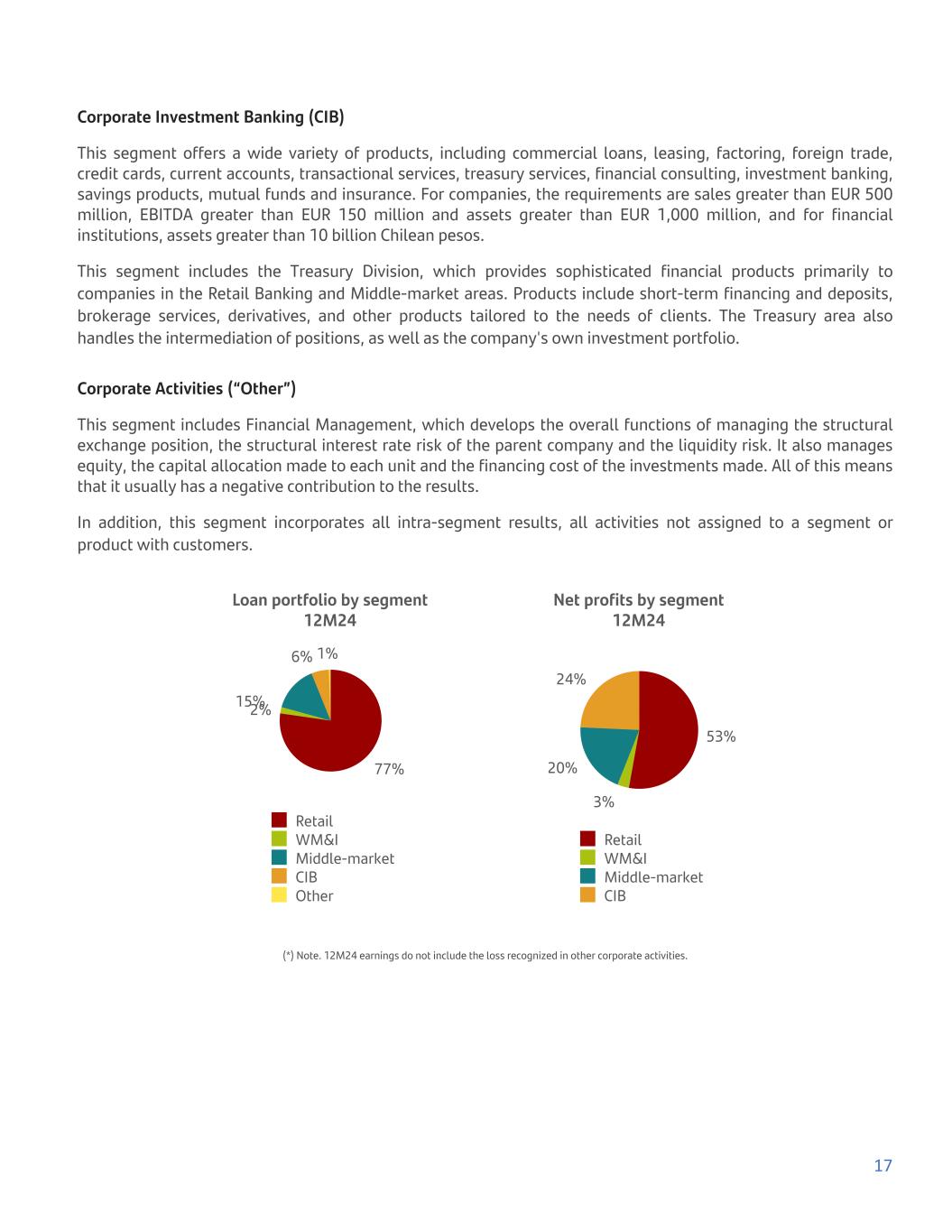

Corporate Investment Banking (CIB) This segment offers a wide variety of products, including commercial loans, leasing, factoring, foreign trade, credit cards, current accounts, transactional services, treasury services, financial consulting, investment banking, savings products, mutual funds and insurance. For companies, the requirements are sales greater than EUR 500 million, EBITDA greater than EUR 150 million and assets greater than EUR 1,000 million, and for financial institutions, assets greater than 10 billion Chilean pesos. This segment includes the Treasury Division, which provides sophisticated financial products primarily to companies in the Retail Banking and Middle-market areas. Products include short-term financing and deposits, brokerage services, derivatives, and other products tailored to the needs of clients. The Treasury area also handles the intermediation of positions, as well as the company's own investment portfolio. Corporate Activities (“Other”) This segment includes Financial Management, which develops the overall functions of managing the structural exchange position, the structural interest rate risk of the parent company and the liquidity risk. It also manages equity, the capital allocation made to each unit and the financing cost of the investments made. All of this means that it usually has a negative contribution to the results. In addition, this segment incorporates all intra-segment results, all activities not assigned to a segment or product with customers. Loan portfolio by segment 12M24 77% 2%15% 6% 1% Retail WM&I Middle-market CIB Other Net profits by segment 12M24 53% 3% 20% 24% Retail WM&I Middle-market CIB (*) Note. 12M24 earnings do not include the loss recognized in other corporate activities. 17

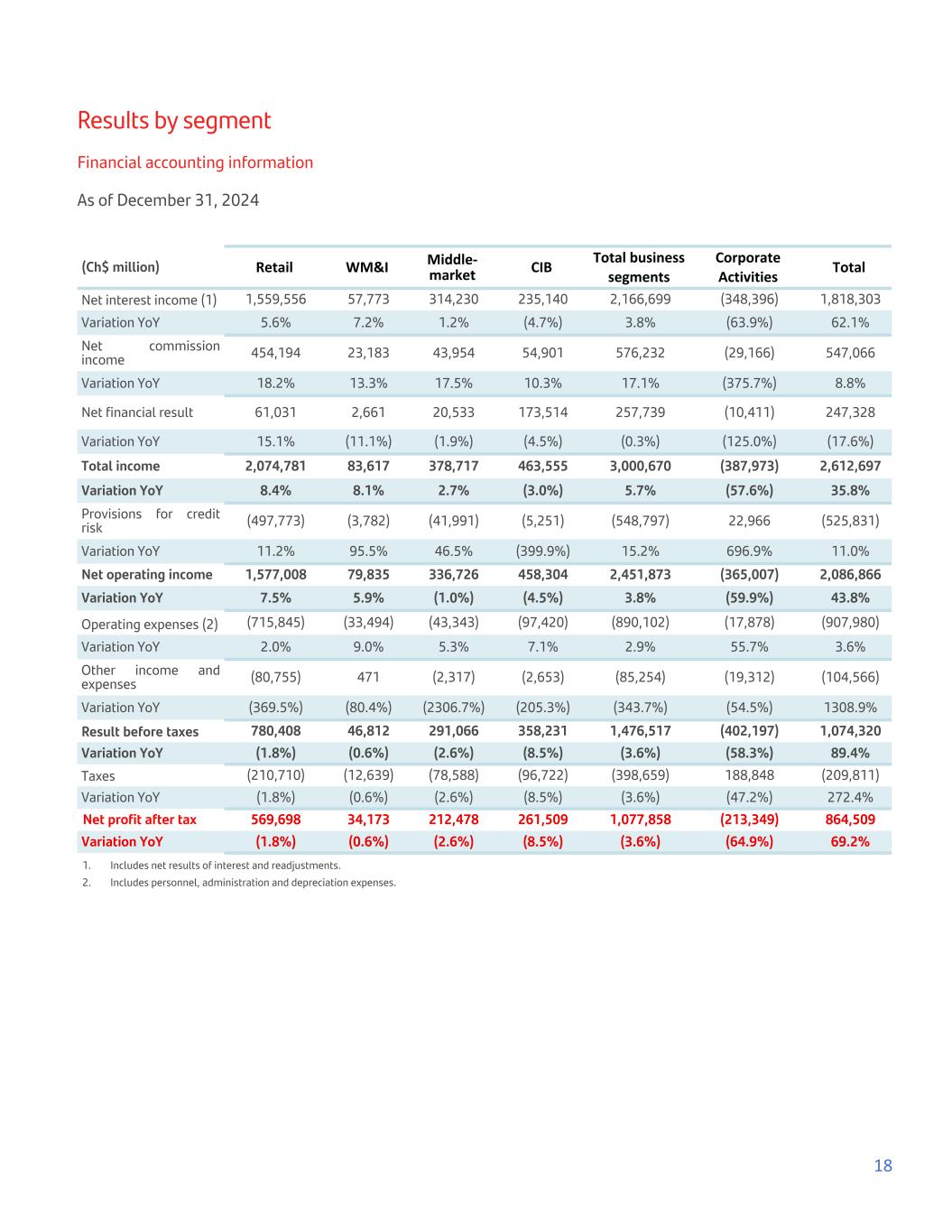

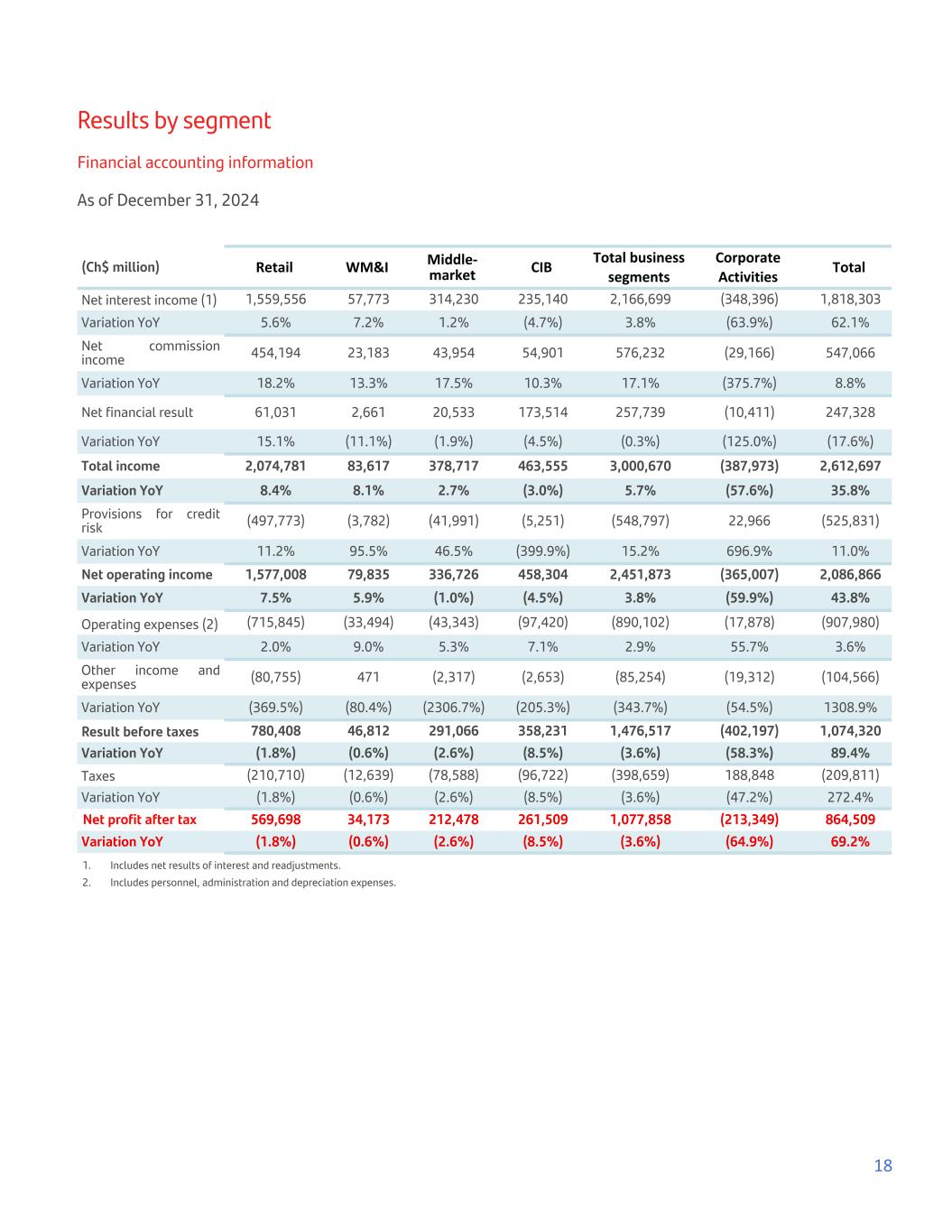

Results by segment Financial accounting information As of December 31, 2024 (Ch$ million) Retail WM&I Middle- market CIB Total business segments Corporate Activities Total Net interest income (1) 1,559,556 57,773 314,230 235,140 2,166,699 (348,396) 1,818,303 Variation YoY 5.6% 7.2% 1.2% (4.7%) 3.8% (63.9%) 62.1% Net commission income 454,194 23,183 43,954 54,901 576,232 (29,166) 547,066 Variation YoY 18.2% 13.3% 17.5% 10.3% 17.1% (375.7%) 8.8% Net financial result 61,031 2,661 20,533 173,514 257,739 (10,411) 247,328 Variation YoY 15.1% (11.1%) (1.9%) (4.5%) (0.3%) (125.0%) (17.6%) Total income 2,074,781 83,617 378,717 463,555 3,000,670 (387,973) 2,612,697 Variation YoY 8.4% 8.1% 2.7% (3.0%) 5.7% (57.6%) 35.8% Provisions for credit risk (497,773) (3,782) (41,991) (5,251) (548,797) 22,966 (525,831) Variation YoY 11.2% 95.5% 46.5% (399.9%) 15.2% 696.9% 11.0% Net operating income 1,577,008 79,835 336,726 458,304 2,451,873 (365,007) 2,086,866 Variation YoY 7.5% 5.9% (1.0%) (4.5%) 3.8% (59.9%) 43.8% Operating expenses (2) (715,845) (33,494) (43,343) (97,420) (890,102) (17,878) (907,980) Variation YoY 2.0% 9.0% 5.3% 7.1% 2.9% 55.7% 3.6% Other income and expenses (80,755) 471 (2,317) (2,653) (85,254) (19,312) (104,566) Variation YoY (369.5%) (80.4%) (2306.7%) (205.3%) (343.7%) (54.5%) 1308.9% Result before taxes 780,408 46,812 291,066 358,231 1,476,517 (402,197) 1,074,320 Variation YoY (1.8%) (0.6%) (2.6%) (8.5%) (3.6%) (58.3%) 89.4% Taxes (210,710) (12,639) (78,588) (96,722) (398,659) 188,848 (209,811) Variation YoY (1.8%) (0.6%) (2.6%) (8.5%) (3.6%) (47.2%) 272.4% Net profit after tax 569,698 34,173 212,478 261,509 1,077,858 (213,349) 864,509 Variation YoY (1.8%) (0.6%) (2.6%) (8.5%) (3.6%) (64.9%) 69.2% 1. Includes net results of interest and readjustments. 2. Includes personnel, administration and depreciation expenses. 18

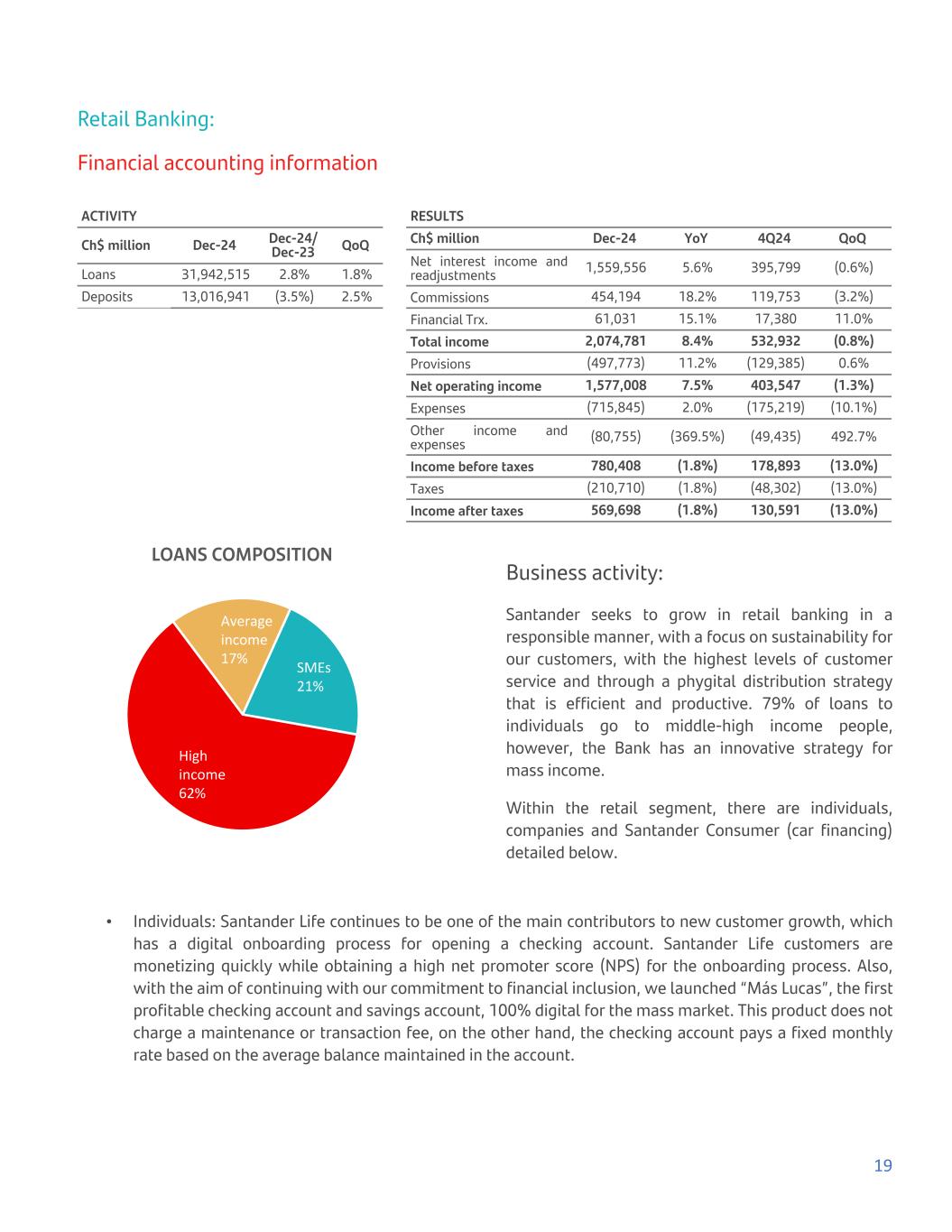

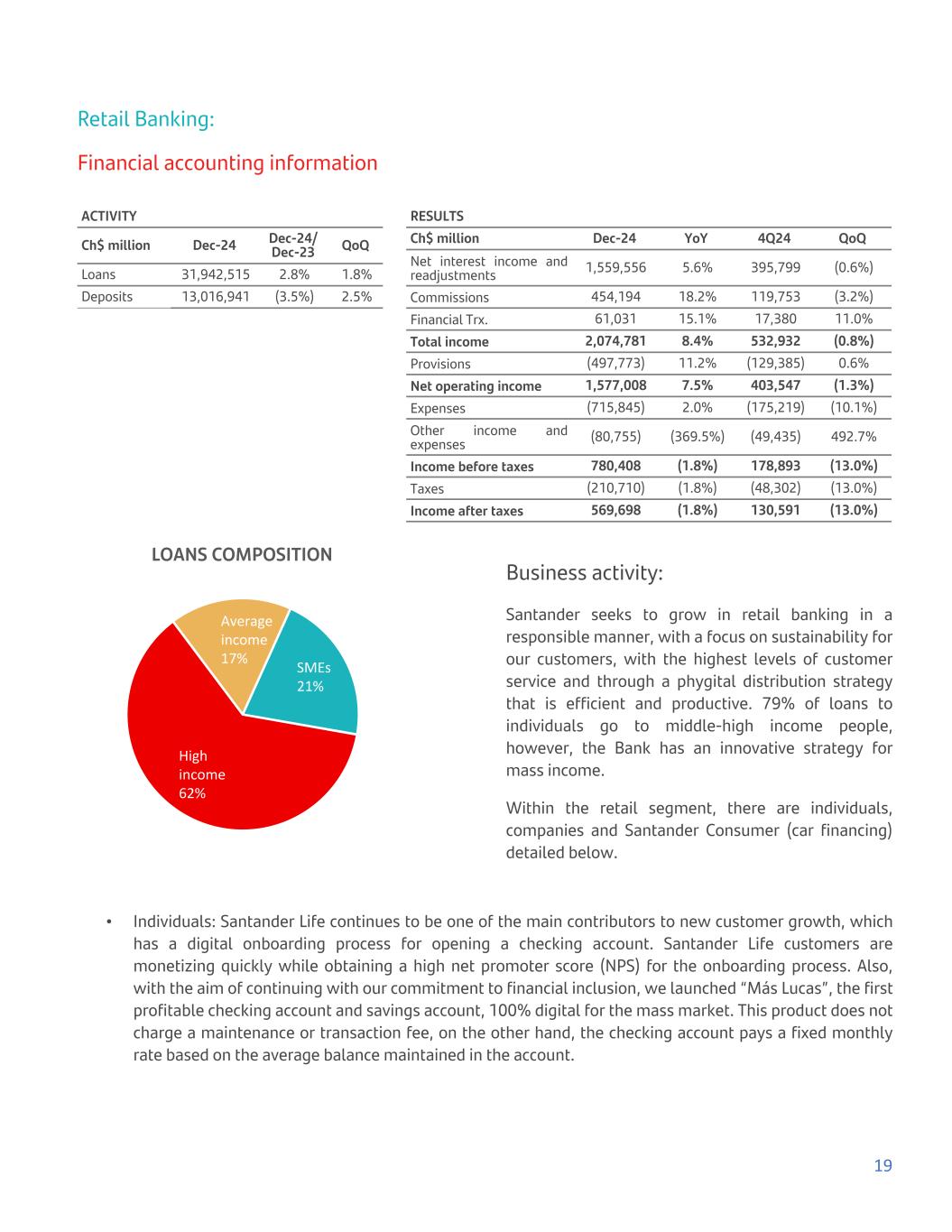

Retail Banking: Financial accounting information ACTIVITY Ch$ million Dec-24 Dec-24/ Dec-23 QoQ Loans 31,942,515 2.8% 1.8% Deposits 13,016,941 (3.5%) 2.5% RESULTS Ch$ million Dec-24 YoY 4Q24 QoQ Net interest income and readjustments 1,559,556 5.6% 395,799 (0.6%) Commissions 454,194 18.2% 119,753 (3.2%) Financial Trx. 61,031 15.1% 17,380 11.0% Total income 2,074,781 8.4% 532,932 (0.8%) Provisions (497,773) 11.2% (129,385) 0.6% Net operating income 1,577,008 7.5% 403,547 (1.3%) Expenses (715,845) 2.0% (175,219) (10.1%) Other income and expenses (80,755) (369.5%) (49,435) 492.7% Income before taxes 780,408 (1.8%) 178,893 (13.0%) Taxes (210,710) (1.8%) (48,302) (13.0%) Income after taxes 569,698 (1.8%) 130,591 (13.0%) LOANS COMPOSITION High income 62% Average income 17% SMEs 21% Business activity: Santander seeks to grow in retail banking in a responsible manner, with a focus on sustainability for our customers, with the highest levels of customer service and through a phygital distribution strategy that is efficient and productive. 79% of loans to individuals go to middle-high income people, however, the Bank has an innovative strategy for mass income. Within the retail segment, there are individuals, companies and Santander Consumer (car financing) detailed below. • Individuals: Santander Life continues to be one of the main contributors to new customer growth, which has a digital onboarding process for opening a checking account. Santander Life customers are monetizing quickly while obtaining a high net promoter score (NPS) for the onboarding process. Also, with the aim of continuing with our commitment to financial inclusion, we launched “Más Lucas”, the first profitable checking account and savings account, 100% digital for the mass market. This product does not charge a maintenance or transaction fee, on the other hand, the checking account pays a fixed monthly rate based on the average balance maintained in the account. 19

• Santander Consumer (auto financing): This business has been very proactive in increasing alliances with different car manufacturers. Also in March, the FNE approved the purchase of an auto loan portfolio with Servicios Financieros Mundo Crédito Spa (auto financing company). • Companies: We continue to open digital current accounts for these clients, which, together with the services offered by Getnet, complete the range of solutions for their businesses. Results: Retail banking net contribution decreased 1.8% YoY. Margin increased 5.6% YoY due to improved mix, with consumer loan growth and a higher spread due to a better funding mix. Fees in this segment increased strongly by 18.2% YoY, driven by card fees due to higher usage and the increase in the customer base, as well as by fees generated by Getnet. Provisions increased 11.2% YoY, excluding additional provisions, due to portfolio growth in the year, lower economic growth and the normalization of the asset quality of our retail loans after historically low levels of non-performing loans. Operating costs increased at a controlled rate of 2.0% YoY as the Bank continues its digital transformation, generating greater operating efficiencies. Compared to 3Q24, retail banking's net contribution decreased by 13.0% QoQ. The margin remained stable in the quarter. Commissions in this segment decreased by 3.2% in the quarter mainly as a result of a higher payment of Latam miles in the quarter. Provisions increased by 0.6% QoQ mainly due to higher write-offs compared to the previous quarter. Operating costs decreased by 10.1% QoQ, mainly due to lower salary expenses. Wealth Management & Insurance: This unit aims to unify the investment offering, allowing for greater consistency across all segments and communication of products and services. Its focus is on generating a specialized strategy for investments in each segment, establishing unique digital and communication development plans. The core businesses are insurance and the distribution of investment instruments for the Retail segment and Private Banking. Financial accounting information ACTIVITY Ch$ million Dec-24 Dec-24/ Dec-23 QoQ Loans 818,155 12.2% 4.9% Deposits 2,773,286 32.4% 4.0% 20

RESULTS Ch$ million Dec-24 YoY 4Q24 QoQ Net interest income and readjustments 314,230 1.2% 80,893 4.8% Commissions 43,954 17.5% 11,107 (5.9%) Financial Trx. 20,533 (1.9%) 5,768 26.8% Total income 378,717 2.7% 97,768 4.5% Provisions (41,991) 46.5% (19,158) 80.8% Net operating income 336,726 (1.0%) 78,610 (5.2%) Expenses (43,343) 5.3% (10,271) 4.2% Other income and expenses (2,317) (2306.7%) (2,565) (747.7%) Income before taxes 291,066 (2.6%) 65,774 (10.5%) Taxes (78,588) (2.6%) (17,759) (10.5%) Income after taxes 212,478 (2.6%) 48,015 (10.5%) Business activity: The loan portfolio of this segment increased by 12.2% YoY due to higher demand for commercial and mortgage loans and cards. Deposits increased by 4.0% QoQ and 32.4% YoY, mainly due to time deposits in CLP and demand deposits. Results: The net contribution of Wealth Management & Insurance decreased 2.6% YoY due to higher provisions due to loan growth and a worsening in customer behavior and higher consumer write-offs. This was offset by higher total revenues which increased 2.7% YoY explained by a higher spread and volume in cards and commercial loans in this segment and higher commissions of 17.5% related to investment funds and insurance. Operating expenses increased 5.3% YoY due to higher variable compensation and other administrative expenses. In the quarter, the net contribution of Wealth Management & Insurance was a gain of $48,015 million in 4Q24 mainly due to higher provisions in the quarter. In 3Q24, there was a release of provisions, which was not repeated in 4Q24. Middle-market: Financial accounting information ACTIVITY Ch$ million Dec-24 Dec-24/ Dec-23 QoQ Loans 6,044,799 0.3% 4.5% Deposits 4,299,293 12.9% 8.9% 21

RESULTS Ch$ million Dec-24 YoY 4Q24 QoQ Net interest income and readjustments 314,230 1.2% 80,893 4.8% Commissions 43,954 17.5% 11,107 (5.9%) Financial Trx. 20,533 (1.9%) 5,768 26.8% Total income 378,717 2.7% 97,768 4.5% Provisions (41,991) 46.5% (19,158) 80.8% Net operating income 336,726 (1.0%) 78,610 (5.2%) Expenses (43,343) 5.3% (10,271) 4.2% Other income and expenses (2,317) (2306.7%) (2,565) (747.7%) Income before taxes 291,066 (2.6%) 65,774 (10.5%) Taxes (78,588) (2.6%) (17,759) (10.5%) Income after taxes 212,478 (2.6%) 48,015 (10.5%) Business activity: This segment's loan portfolio increased 0.3% YoY as of December 31, 2024 and 4.5% QoQ, due to lower demand from companies during the year and partly offset in 4Q24 by the depreciation of the Chilean peso, which increases the peso value of US$-denominated loans from foreign trade companies. Deposits increased 12.9% as of December 31, 2023 and 8.9% QoQ due to higher balances seen at year-end. The main strategic objective of this segment is to focus on total customer profitability, in lending and non-lending activities. Results: The Middle-market's net contribution decreased by 2.6% YoY and 10.5% QoQ mainly due to higher provisions in the fourth quarter, related to client behavior and the effect of the economic cycle. During 2024, there was greater risk in sectors such as agriculture, which we saw affected by the intense rains and floods caused by the "El Niño phenomenon", which mainly affected the central regions of Chile where there is a lot of cultivation. This was partly offset by margin growth due to higher volumes. Additionally, commissions increased by 17.5% YoY in line with increased client activity in payments and other products. 22

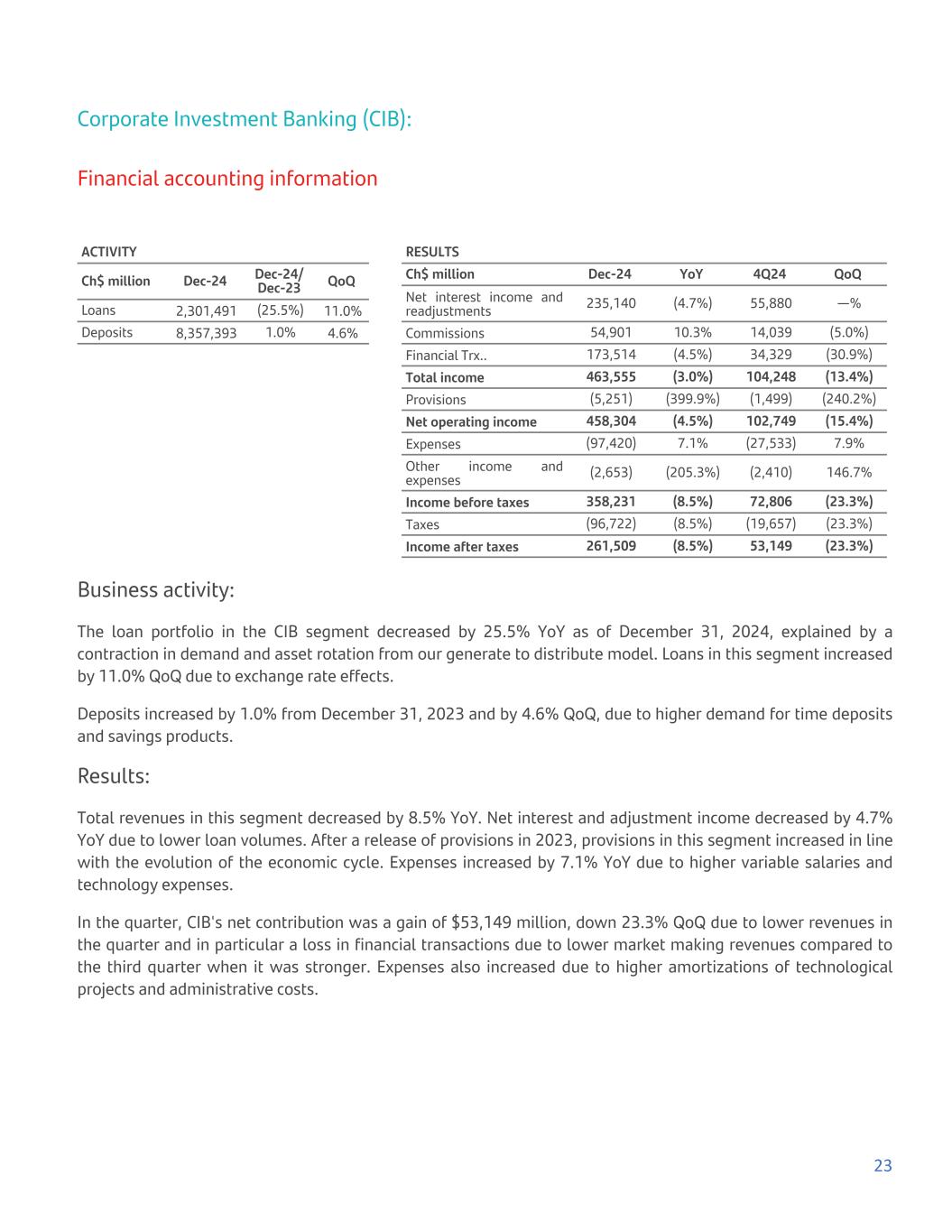

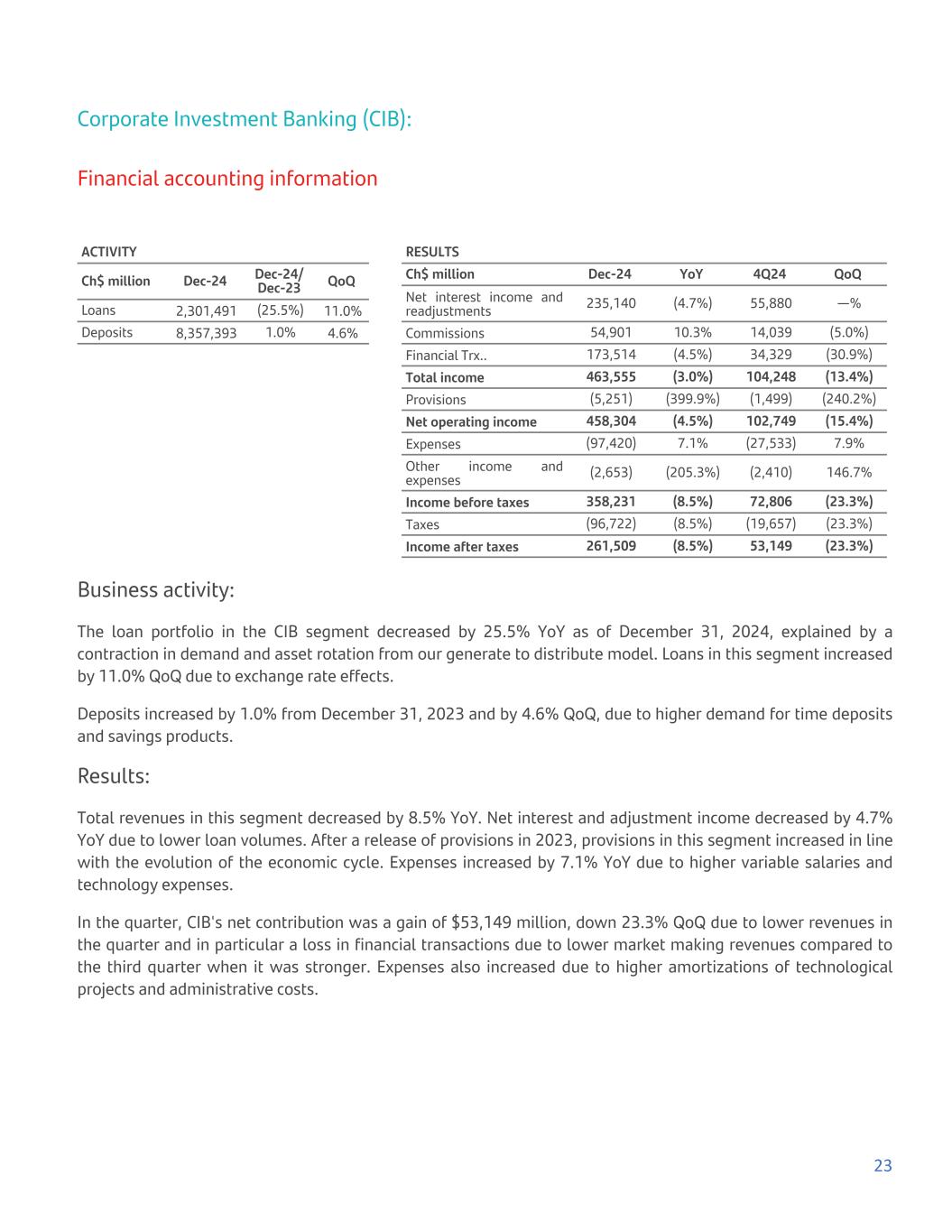

Corporate Investment Banking (CIB): Financial accounting information ACTIVITY Ch$ million Dec-24 Dec-24/ Dec-23 QoQ Loans 2,301,491 (25.5%) 11.0% Deposits 8,357,393 1.0% 4.6% RESULTS Ch$ million Dec-24 YoY 4Q24 QoQ Net interest income and readjustments 235,140 (4.7%) 55,880 —% Commissions 54,901 10.3% 14,039 (5.0%) Financial Trx.. 173,514 (4.5%) 34,329 (30.9%) Total income 463,555 (3.0%) 104,248 (13.4%) Provisions (5,251) (399.9%) (1,499) (240.2%) Net operating income 458,304 (4.5%) 102,749 (15.4%) Expenses (97,420) 7.1% (27,533) 7.9% Other income and expenses (2,653) (205.3%) (2,410) 146.7% Income before taxes 358,231 (8.5%) 72,806 (23.3%) Taxes (96,722) (8.5%) (19,657) (23.3%) Income after taxes 261,509 (8.5%) 53,149 (23.3%) Business activity: The loan portfolio in the CIB segment decreased by 25.5% YoY as of December 31, 2024, explained by a contraction in demand and asset rotation from our generate to distribute model. Loans in this segment increased by 11.0% QoQ due to exchange rate effects. Deposits increased by 1.0% from December 31, 2023 and by 4.6% QoQ, due to higher demand for time deposits and savings products. Results: Total revenues in this segment decreased by 8.5% YoY. Net interest and adjustment income decreased by 4.7% YoY due to lower loan volumes. After a release of provisions in 2023, provisions in this segment increased in line with the evolution of the economic cycle. Expenses increased by 7.1% YoY due to higher variable salaries and technology expenses. In the quarter, CIB's net contribution was a gain of $53,149 million, down 23.3% QoQ due to lower revenues in the quarter and in particular a loss in financial transactions due to lower market making revenues compared to the third quarter when it was stronger. Expenses also increased due to higher amortizations of technological projects and administrative costs. 23

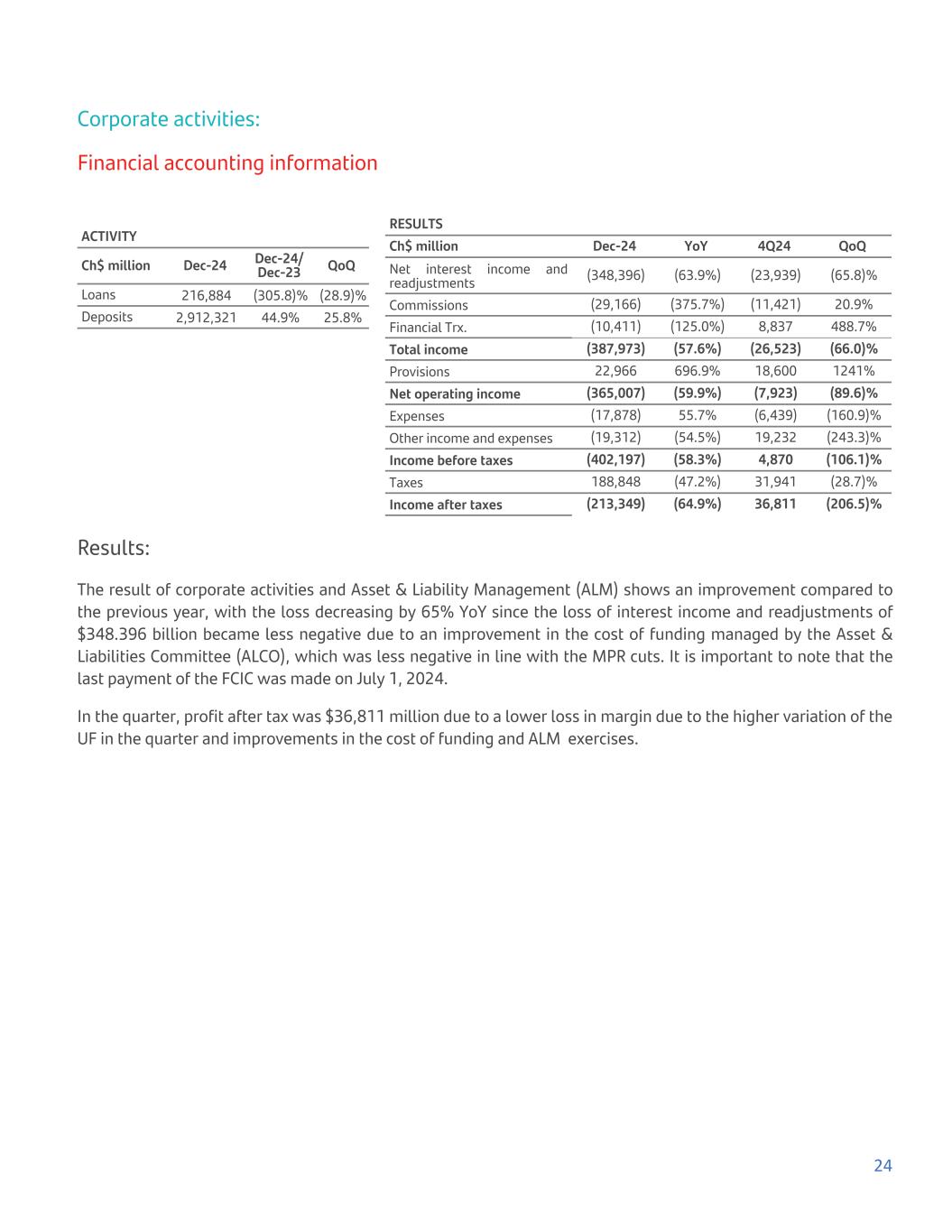

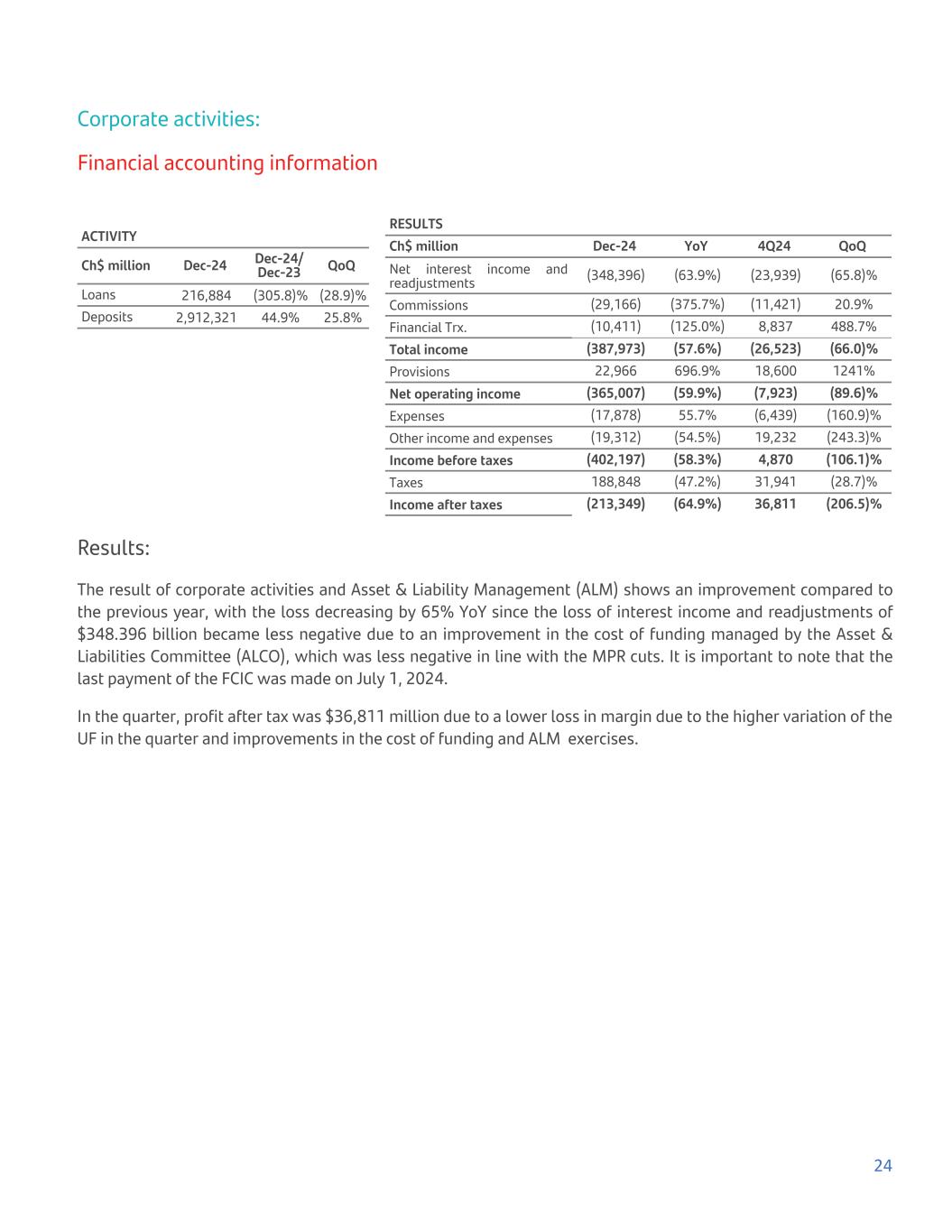

Corporate activities: Financial accounting information ACTIVITY Ch$ million Dec-24 Dec-24/ Dec-23 QoQ Loans 216,884 (305.8)% (28.9)% Deposits 2,912,321 44.9% 25.8% RESULTS Ch$ million Dec-24 YoY 4Q24 QoQ Net interest income and readjustments (348,396) (63.9%) (23,939) (65.8)% Commissions (29,166) (375.7%) (11,421) 20.9% Financial Trx. (10,411) (125.0%) 8,837 488.7% Total income (387,973) (57.6%) (26,523) (66.0)% Provisions 22,966 696.9% 18,600 1241% Net operating income (365,007) (59.9%) (7,923) (89.6)% Expenses (17,878) 55.7% (6,439) (160.9)% Other income and expenses (19,312) (54.5%) 19,232 (243.3)% Income before taxes (402,197) (58.3%) 4,870 (106.1)% Taxes 188,848 (47.2%) 31,941 (28.7)% Income after taxes (213,349) (64.9%) 36,811 (206.5)% Results: The result of corporate activities and Asset & Liability Management (ALM) shows an improvement compared to the previous year, with the loss decreasing by 65% YoY since the loss of interest income and readjustments of $348.396 billion became less negative due to an improvement in the cost of funding managed by the Asset & Liabilities Committee (ALCO), which was less negative in line with the MPR cuts. It is important to note that the last payment of the FCIC was made on July 1, 2024. In the quarter, profit after tax was $36,811 million due to a lower loss in margin due to the higher variation of the UF in the quarter and improvements in the cost of funding and ALM exercises. 24

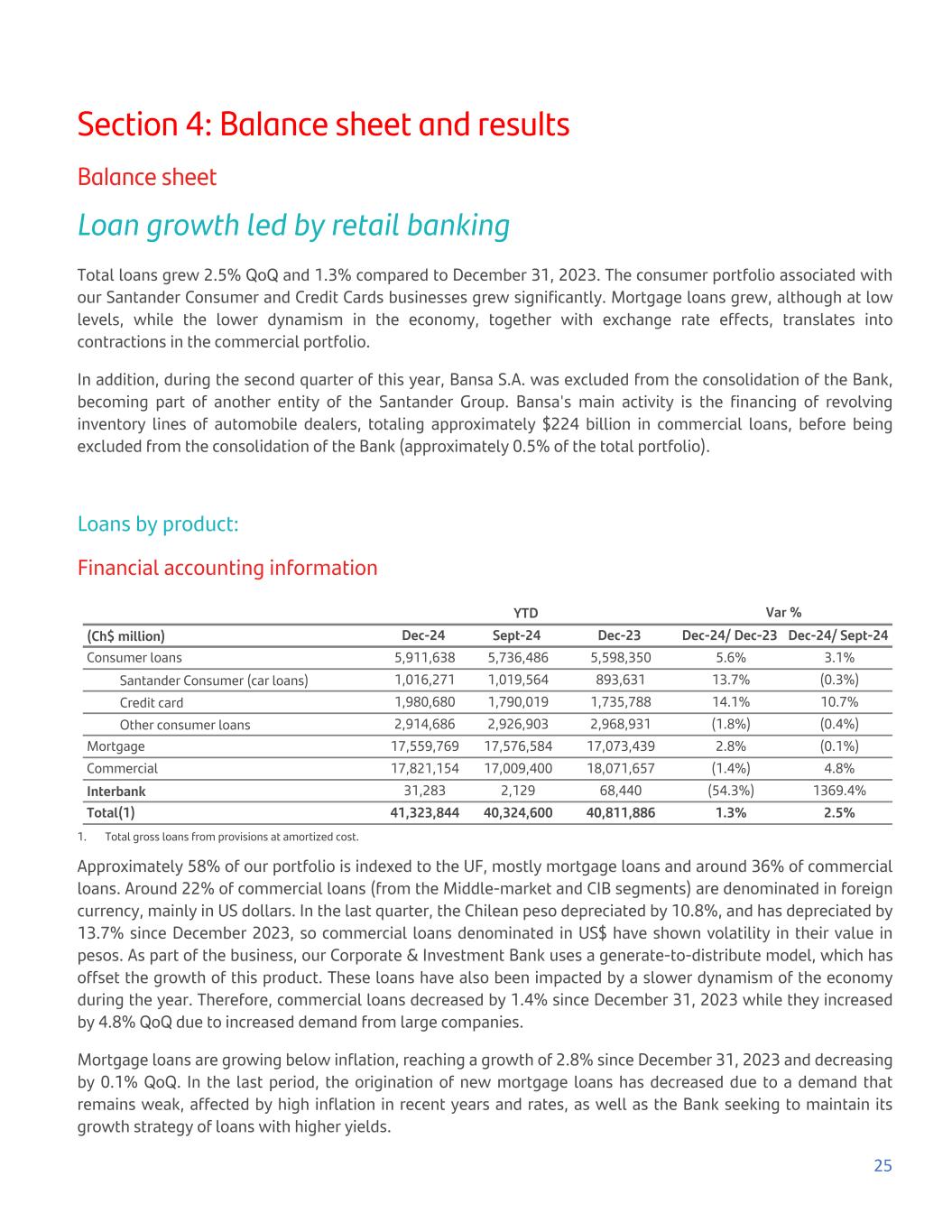

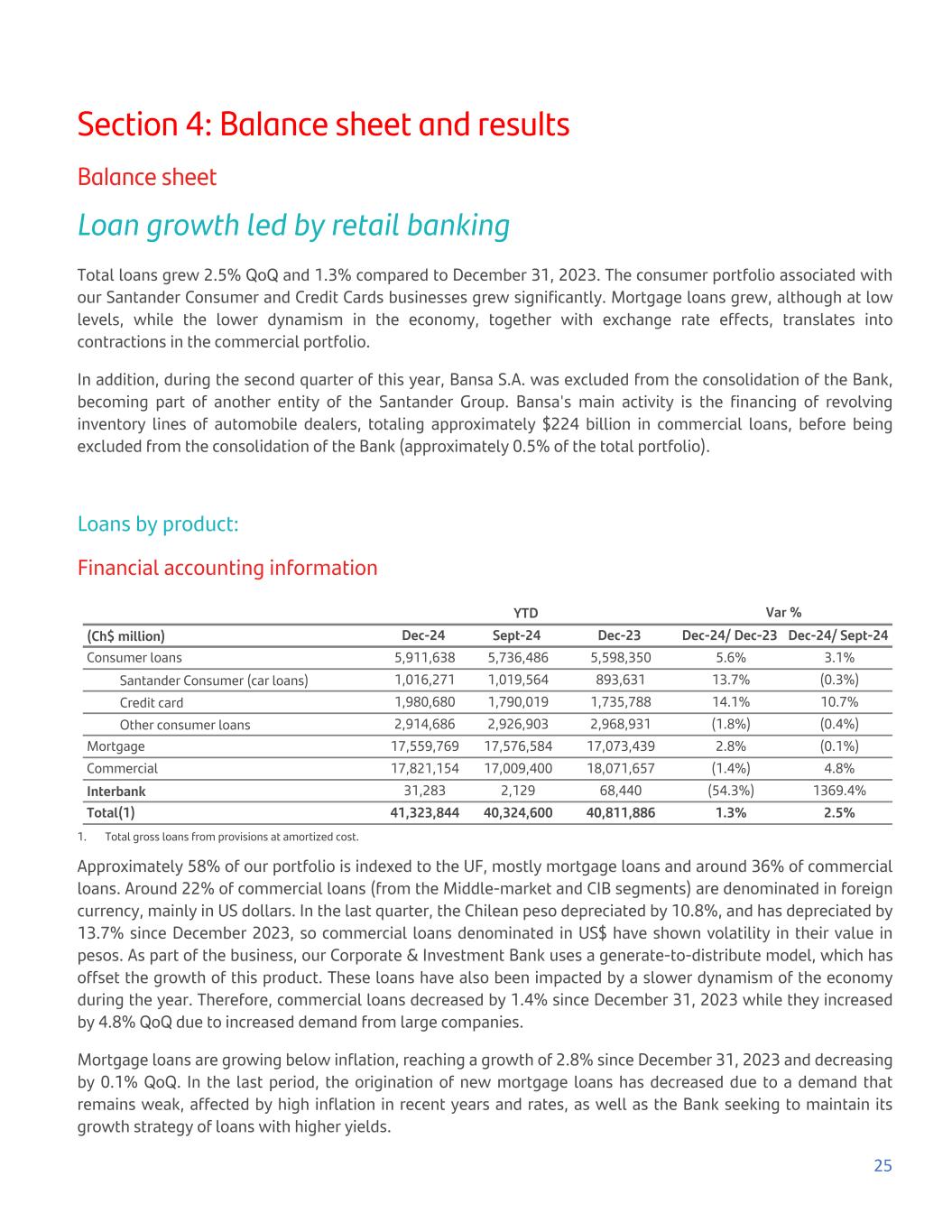

Section 4: Balance sheet and results Balance sheet Loan growth led by retail banking Total loans grew 2.5% QoQ and 1.3% compared to December 31, 2023. The consumer portfolio associated with our Santander Consumer and Credit Cards businesses grew significantly. Mortgage loans grew, although at low levels, while the lower dynamism in the economy, together with exchange rate effects, translates into contractions in the commercial portfolio. In addition, during the second quarter of this year, Bansa S.A. was excluded from the consolidation of the Bank, becoming part of another entity of the Santander Group. Bansa's main activity is the financing of revolving inventory lines of automobile dealers, totaling approximately $224 billion in commercial loans, before being excluded from the consolidation of the Bank (approximately 0.5% of the total portfolio). Loans by product: Financial accounting information YTD Var % (Ch$ million) Dec-24 Sept-24 Dec-23 Dec-24/ Dec-23 Dec-24/ Sept-24 Consumer loans 5,911,638 5,736,486 5,598,350 5.6% 3.1% Santander Consumer (car loans) 1,016,271 1,019,564 893,631 13.7% (0.3%) Credit card 1,980,680 1,790,019 1,735,788 14.1% 10.7% Other consumer loans 2,914,686 2,926,903 2,968,931 (1.8%) (0.4%) Mortgage 17,559,769 17,576,584 17,073,439 2.8% (0.1%) Commercial 17,821,154 17,009,400 18,071,657 (1.4%) 4.8% Interbank 31,283 2,129 68,440 (54.3%) 1369.4% Total(1) 41,323,844 40,324,600 40,811,886 1.3% 2.5% 1. Total gross loans from provisions at amortized cost. Approximately 58% of our portfolio is indexed to the UF, mostly mortgage loans and around 36% of commercial loans. Around 22% of commercial loans (from the Middle-market and CIB segments) are denominated in foreign currency, mainly in US dollars. In the last quarter, the Chilean peso depreciated by 10.8%, and has depreciated by 13.7% since December 2023, so commercial loans denominated in US$ have shown volatility in their value in pesos. As part of the business, our Corporate & Investment Bank uses a generate-to-distribute model, which has offset the growth of this product. These loans have also been impacted by a slower dynamism of the economy during the year. Therefore, commercial loans decreased by 1.4% since December 31, 2023 while they increased by 4.8% QoQ due to increased demand from large companies. Mortgage loans are growing below inflation, reaching a growth of 2.8% since December 31, 2023 and decreasing by 0.1% QoQ. In the last period, the origination of new mortgage loans has decreased due to a demand that remains weak, affected by high inflation in recent years and rates, as well as the Bank seeking to maintain its growth strategy of loans with higher yields. 25

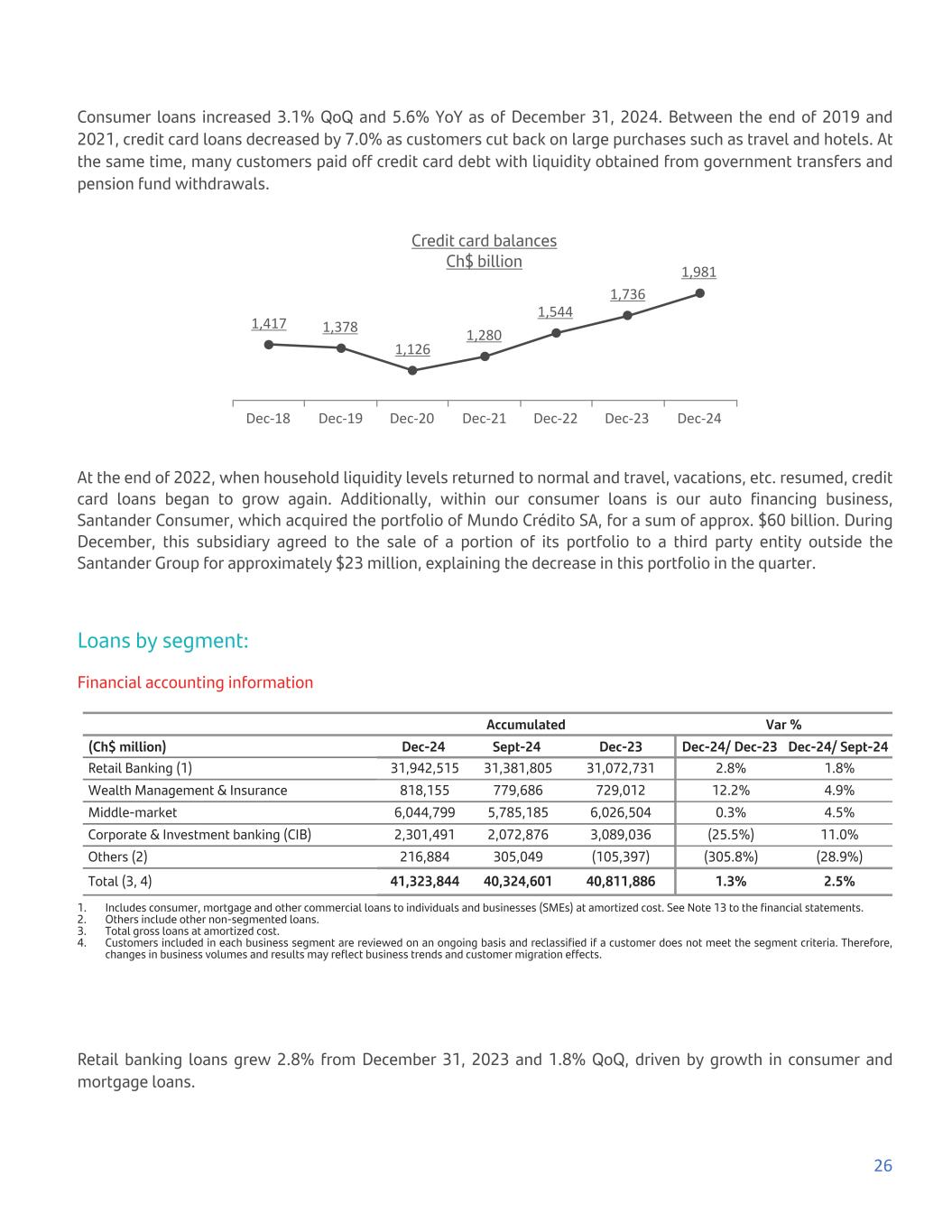

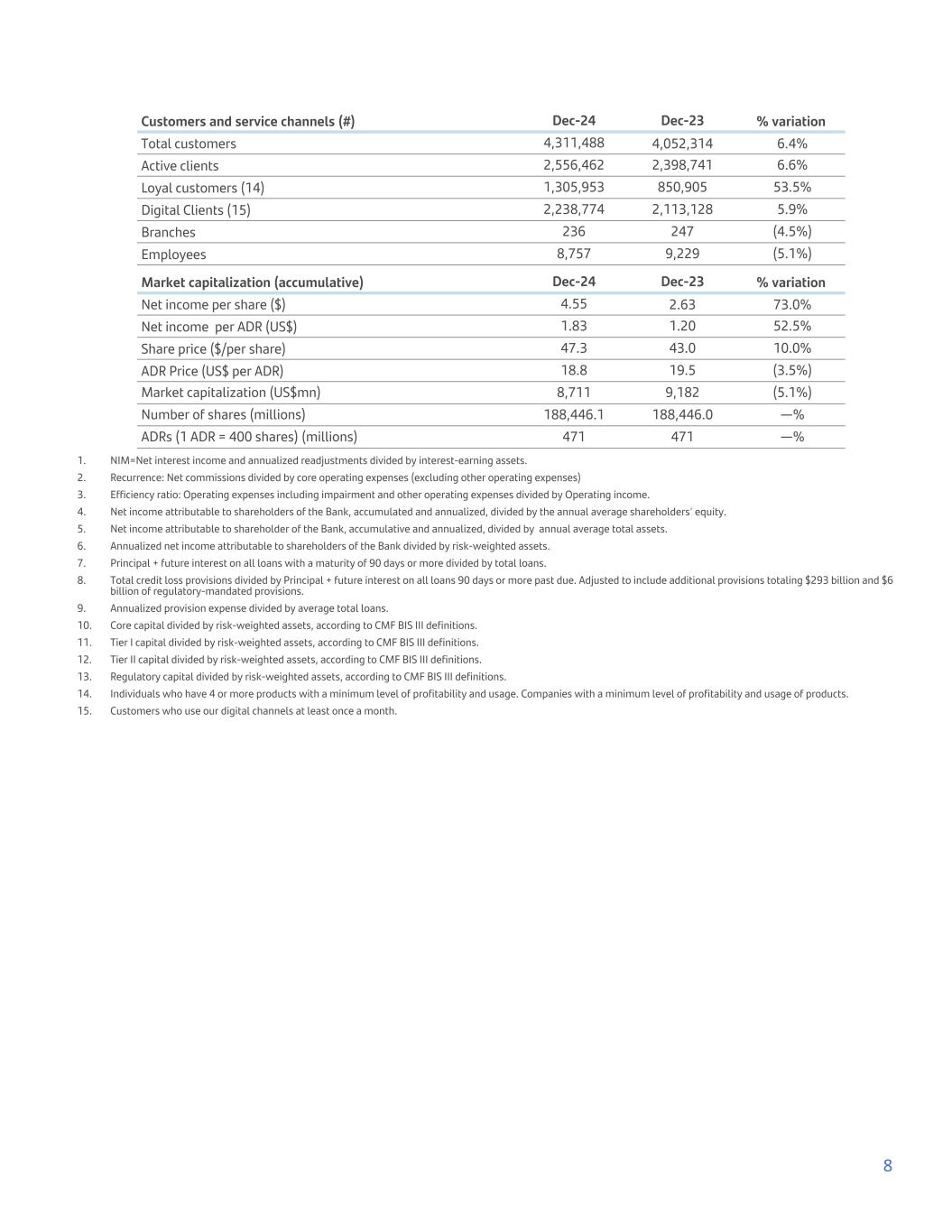

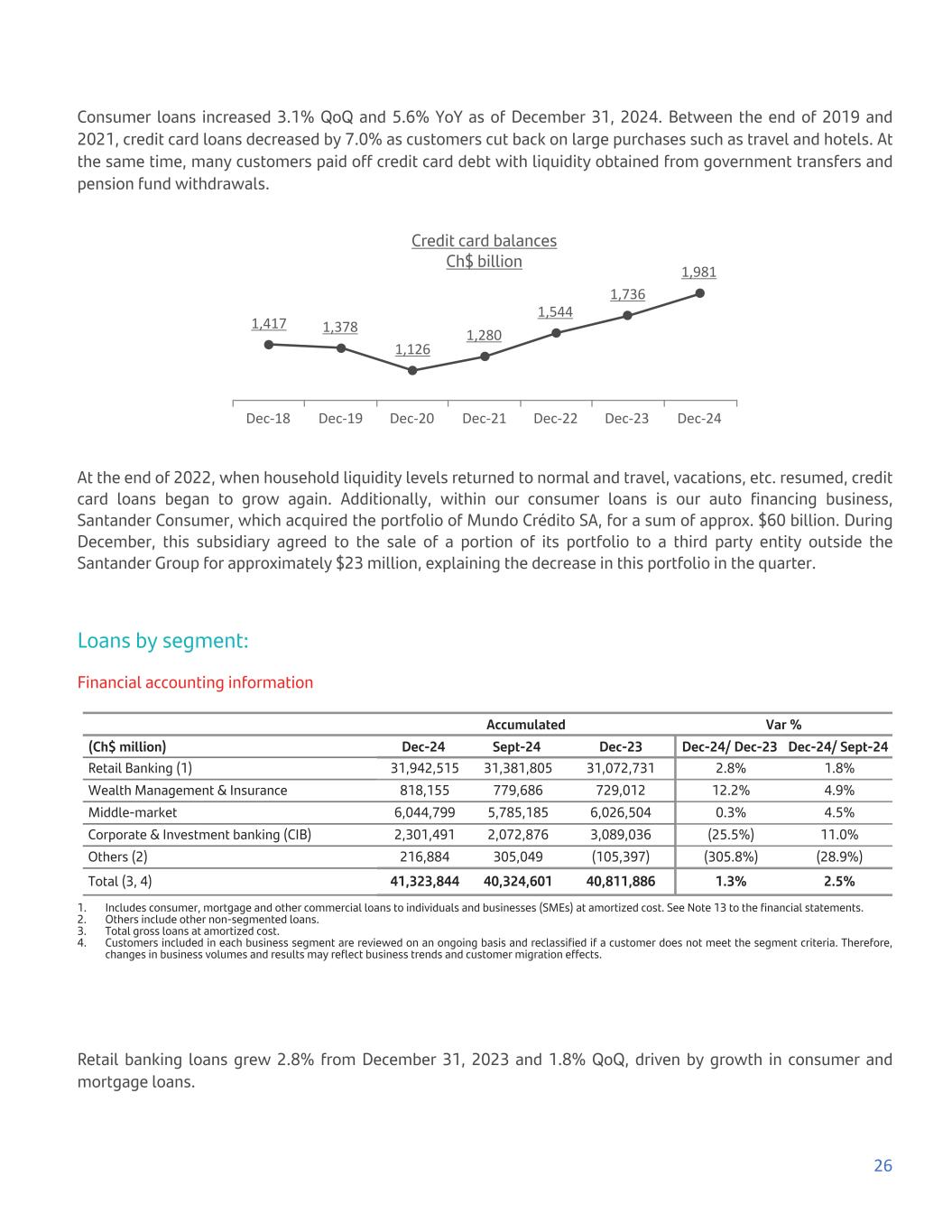

Consumer loans increased 3.1% QoQ and 5.6% YoY as of December 31, 2024. Between the end of 2019 and 2021, credit card loans decreased by 7.0% as customers cut back on large purchases such as travel and hotels. At the same time, many customers paid off credit card debt with liquidity obtained from government transfers and pension fund withdrawals. Credit card balances Ch$ billion 1,417 1,378 1,126 1,280 1,544 1,736 1,981 Dec-18 Dec-19 Dec-20 Dec-21 Dec-22 Dec-23 Dec-24 At the end of 2022, when household liquidity levels returned to normal and travel, vacations, etc. resumed, credit card loans began to grow again. Additionally, within our consumer loans is our auto financing business, Santander Consumer, which acquired the portfolio of Mundo Crédito SA, for a sum of approx. $60 billion. During December, this subsidiary agreed to the sale of a portion of its portfolio to a third party entity outside the Santander Group for approximately $23 million, explaining the decrease in this portfolio in the quarter. Loans by segment: Financial accounting information Accumulated Var % (Ch$ million) Dec-24 Sept-24 Dec-23 Dec-24/ Dec-23 Dec-24/ Sept-24 Retail Banking (1) 31,942,515 31,381,805 31,072,731 2.8% 1.8% Wealth Management & Insurance 818,155 779,686 729,012 12.2% 4.9% Middle-market 6,044,799 5,785,185 6,026,504 0.3% 4.5% Corporate & Investment banking (CIB) 2,301,491 2,072,876 3,089,036 (25.5%) 11.0% Others (2) 216,884 305,049 (105,397) (305.8%) (28.9%) Total (3, 4) 41,323,844 40,324,601 40,811,886 1.3% 2.5% 1. Includes consumer, mortgage and other commercial loans to individuals and businesses (SMEs) at amortized cost. See Note 13 to the financial statements. 2. Others include other non-segmented loans. 3. Total gross loans at amortized cost. 4. Customers included in each business segment are reviewed on an ongoing basis and reclassified if a customer does not meet the segment criteria. Therefore, changes in business volumes and results may reflect business trends and customer migration effects. Retail banking loans grew 2.8% from December 31, 2023 and 1.8% QoQ, driven by growth in consumer and mortgage loans. 26

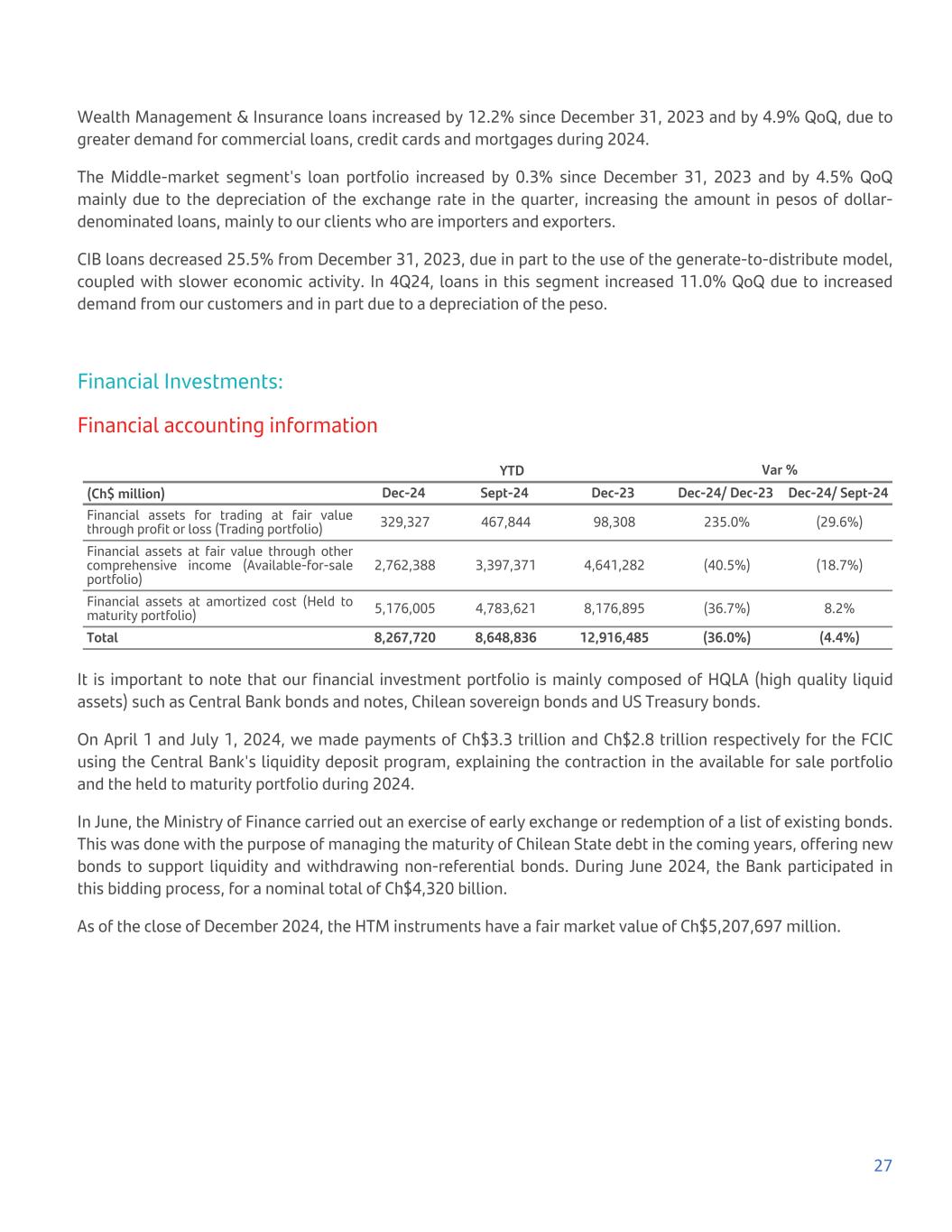

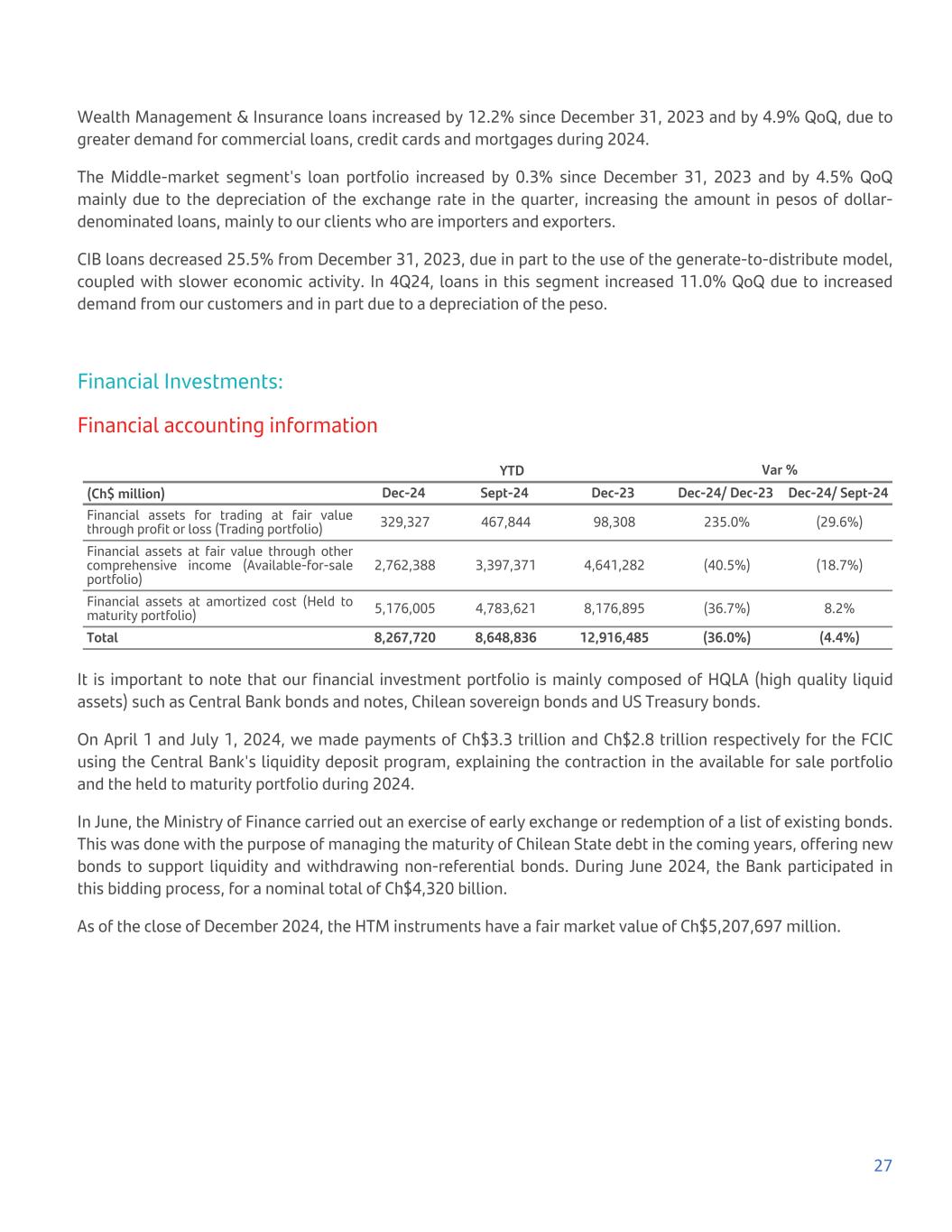

Wealth Management & Insurance loans increased by 12.2% since December 31, 2023 and by 4.9% QoQ, due to greater demand for commercial loans, credit cards and mortgages during 2024. The Middle-market segment's loan portfolio increased by 0.3% since December 31, 2023 and by 4.5% QoQ mainly due to the depreciation of the exchange rate in the quarter, increasing the amount in pesos of dollar- denominated loans, mainly to our clients who are importers and exporters. CIB loans decreased 25.5% from December 31, 2023, due in part to the use of the generate-to-distribute model, coupled with slower economic activity. In 4Q24, loans in this segment increased 11.0% QoQ due to increased demand from our customers and in part due to a depreciation of the peso. Financial Investments: Financial accounting information YTD Var % (Ch$ million) Dec-24 Sept-24 Dec-23 Dec-24/ Dec-23 Dec-24/ Sept-24 Financial assets for trading at fair value through profit or loss (Trading portfolio) 329,327 467,844 98,308 235.0% (29.6%) Financial assets at fair value through other comprehensive income (Available-for-sale portfolio) 2,762,388 3,397,371 4,641,282 (40.5%) (18.7%) Financial assets at amortized cost (Held to maturity portfolio) 5,176,005 4,783,621 8,176,895 (36.7%) 8.2% Total 8,267,720 8,648,836 12,916,485 (36.0%) (4.4%) It is important to note that our financial investment portfolio is mainly composed of HQLA (high quality liquid assets) such as Central Bank bonds and notes, Chilean sovereign bonds and US Treasury bonds. On April 1 and July 1, 2024, we made payments of Ch$3.3 trillion and Ch$2.8 trillion respectively for the FCIC using the Central Bank's liquidity deposit program, explaining the contraction in the available for sale portfolio and the held to maturity portfolio during 2024. In June, the Ministry of Finance carried out an exercise of early exchange or redemption of a list of existing bonds. This was done with the purpose of managing the maturity of Chilean State debt in the coming years, offering new bonds to support liquidity and withdrawing non-referential bonds. During June 2024, the Bank participated in this bidding process, for a nominal total of Ch$4,320 billion. As of the close of December 2024, the HTM instruments have a fair market value of Ch$5,207,697 million. 27

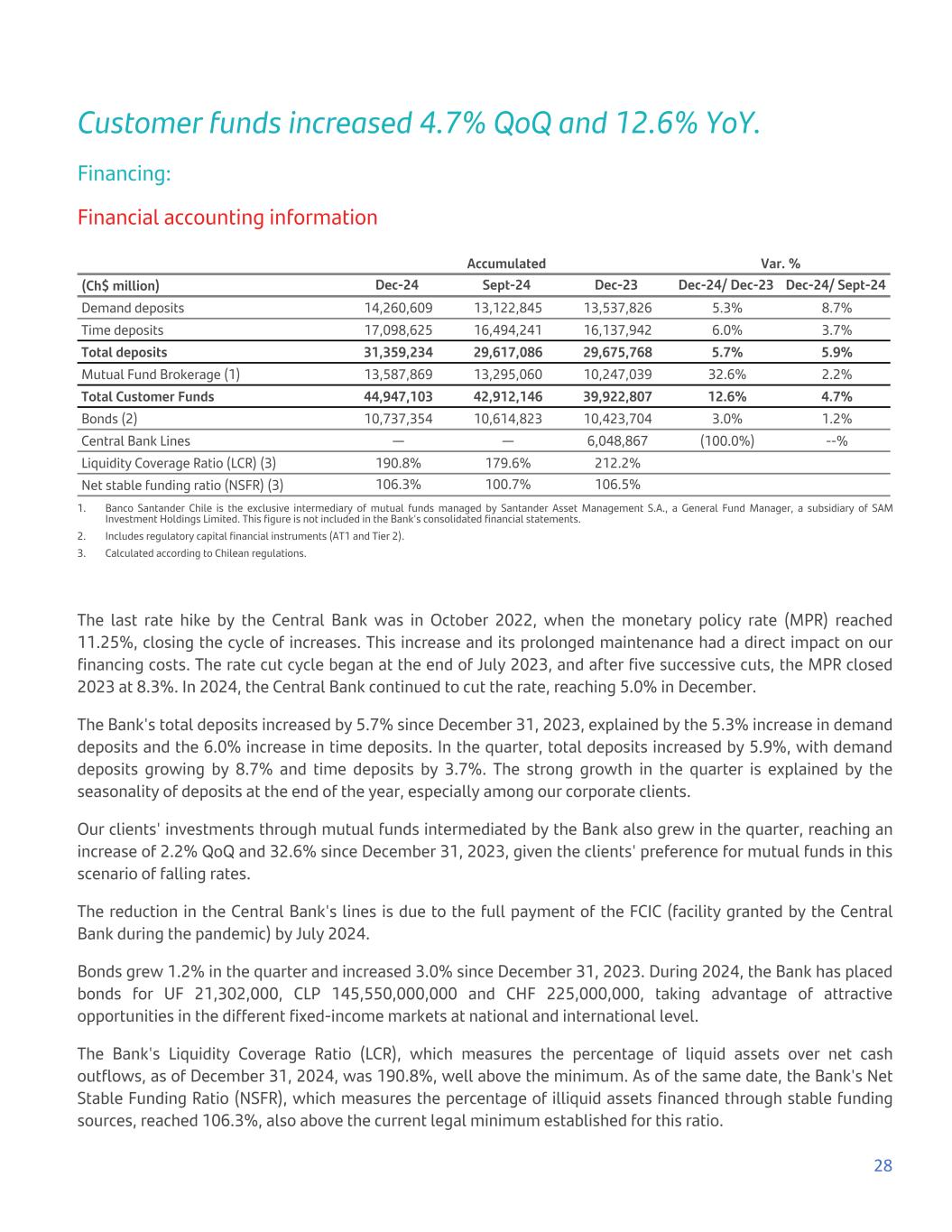

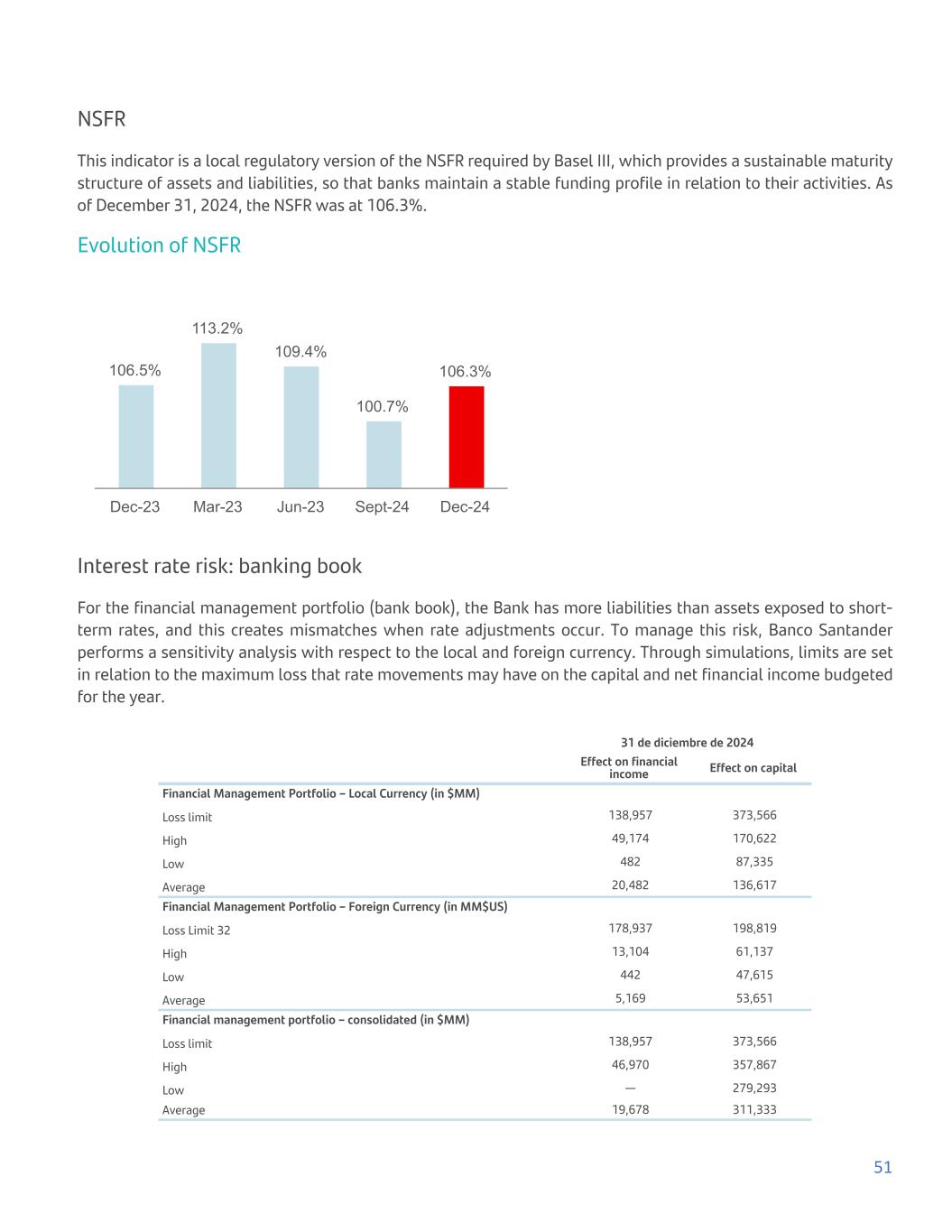

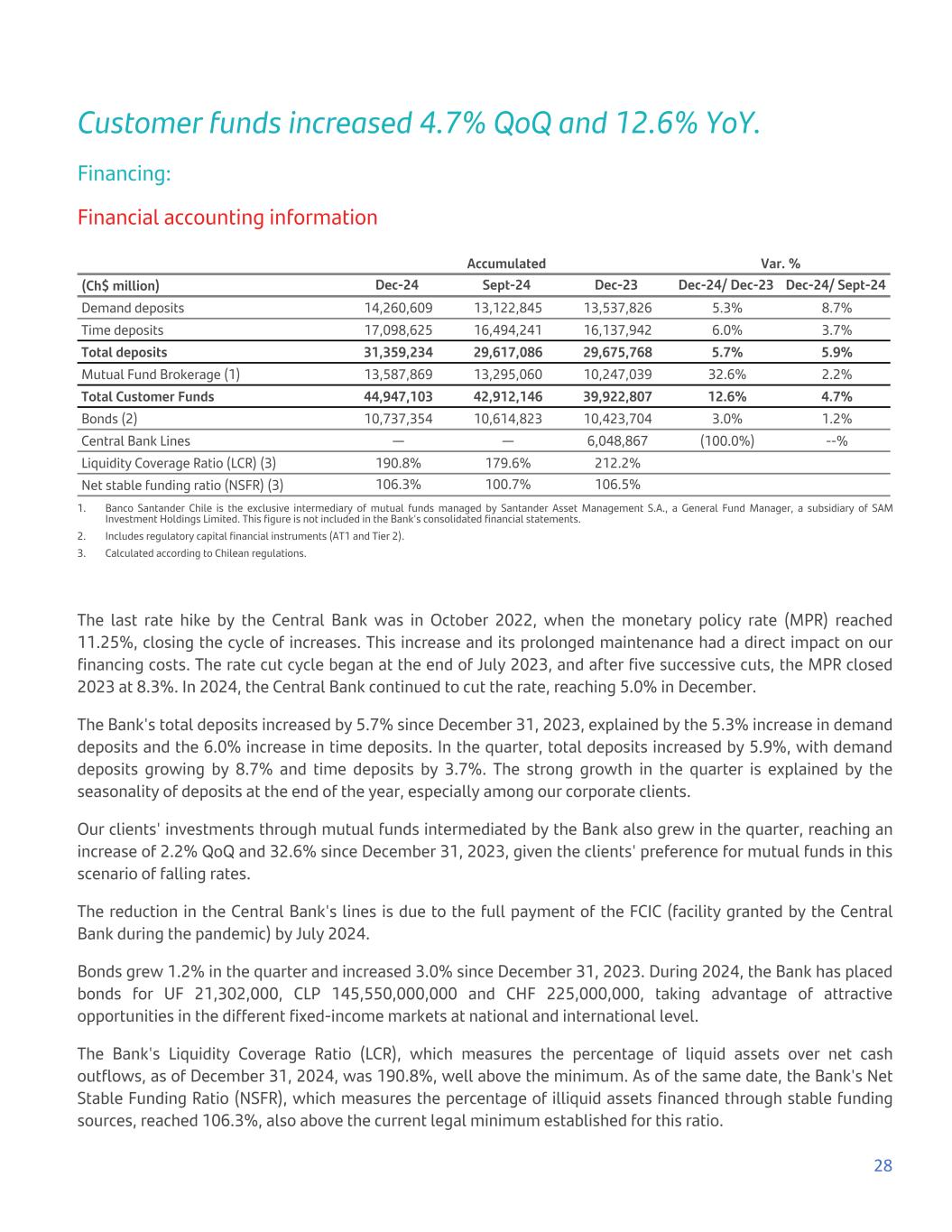

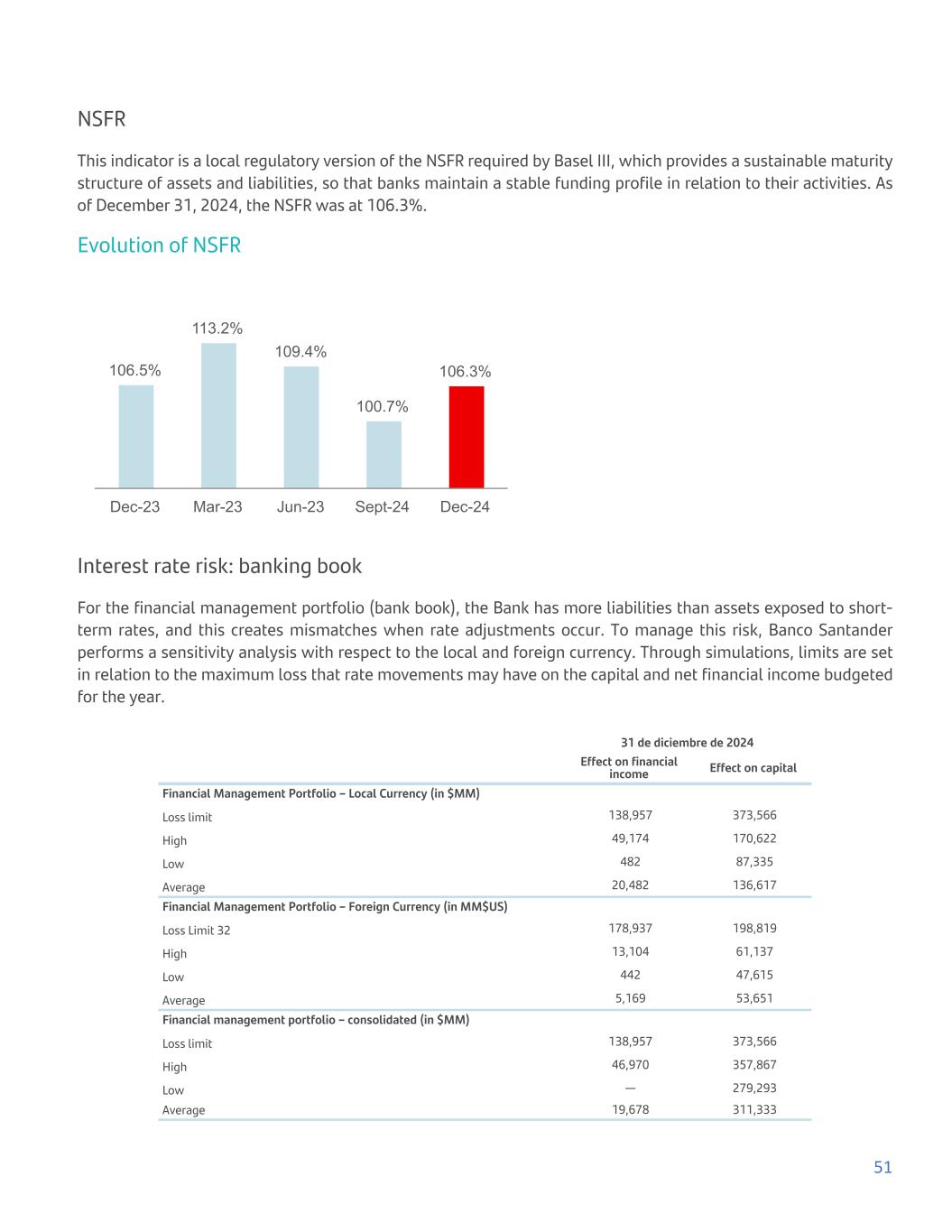

Customer funds increased 4.7% QoQ and 12.6% YoY. Financing: Financial accounting information Accumulated Var. % (Ch$ million) Dec-24 Sept-24 Dec-23 Dec-24/ Dec-23 Dec-24/ Sept-24 Demand deposits 14,260,609 13,122,845 13,537,826 5.3% 8.7% Time deposits 17,098,625 16,494,241 16,137,942 6.0% 3.7% Total deposits 31,359,234 29,617,086 29,675,768 5.7% 5.9% Mutual Fund Brokerage (1) 13,587,869 13,295,060 10,247,039 32.6% 2.2% Total Customer Funds 44,947,103 42,912,146 39,922,807 12.6% 4.7% Bonds (2) 10,737,354 10,614,823 10,423,704 3.0% 1.2% Central Bank Lines — — 6,048,867 (100.0%) --% Liquidity Coverage Ratio (LCR) (3) 190.8% 179.6% 212.2% Net stable funding ratio (NSFR) (3) 106.3% 100.7% 106.5% 1. Banco Santander Chile is the exclusive intermediary of mutual funds managed by Santander Asset Management S.A., a General Fund Manager, a subsidiary of SAM Investment Holdings Limited. This figure is not included in the Bank's consolidated financial statements. 2. Includes regulatory capital financial instruments (AT1 and Tier 2). 3. Calculated according to Chilean regulations. The last rate hike by the Central Bank was in October 2022, when the monetary policy rate (MPR) reached 11.25%, closing the cycle of increases. This increase and its prolonged maintenance had a direct impact on our financing costs. The rate cut cycle began at the end of July 2023, and after five successive cuts, the MPR closed 2023 at 8.3%. In 2024, the Central Bank continued to cut the rate, reaching 5.0% in December. The Bank's total deposits increased by 5.7% since December 31, 2023, explained by the 5.3% increase in demand deposits and the 6.0% increase in time deposits. In the quarter, total deposits increased by 5.9%, with demand deposits growing by 8.7% and time deposits by 3.7%. The strong growth in the quarter is explained by the seasonality of deposits at the end of the year, especially among our corporate clients. Our clients' investments through mutual funds intermediated by the Bank also grew in the quarter, reaching an increase of 2.2% QoQ and 32.6% since December 31, 2023, given the clients' preference for mutual funds in this scenario of falling rates. The reduction in the Central Bank's lines is due to the full payment of the FCIC (facility granted by the Central Bank during the pandemic) by July 2024. Bonds grew 1.2% in the quarter and increased 3.0% since December 31, 2023. During 2024, the Bank has placed bonds for UF 21,302,000, CLP 145,550,000,000 and CHF 225,000,000, taking advantage of attractive opportunities in the different fixed-income markets at national and international level. The Bank's Liquidity Coverage Ratio (LCR), which measures the percentage of liquid assets over net cash outflows, as of December 31, 2024, was 190.8%, well above the minimum. As of the same date, the Bank's Net Stable Funding Ratio (NSFR), which measures the percentage of illiquid assets financed through stable funding sources, reached 106.3%, also above the current legal minimum established for this ratio. 28

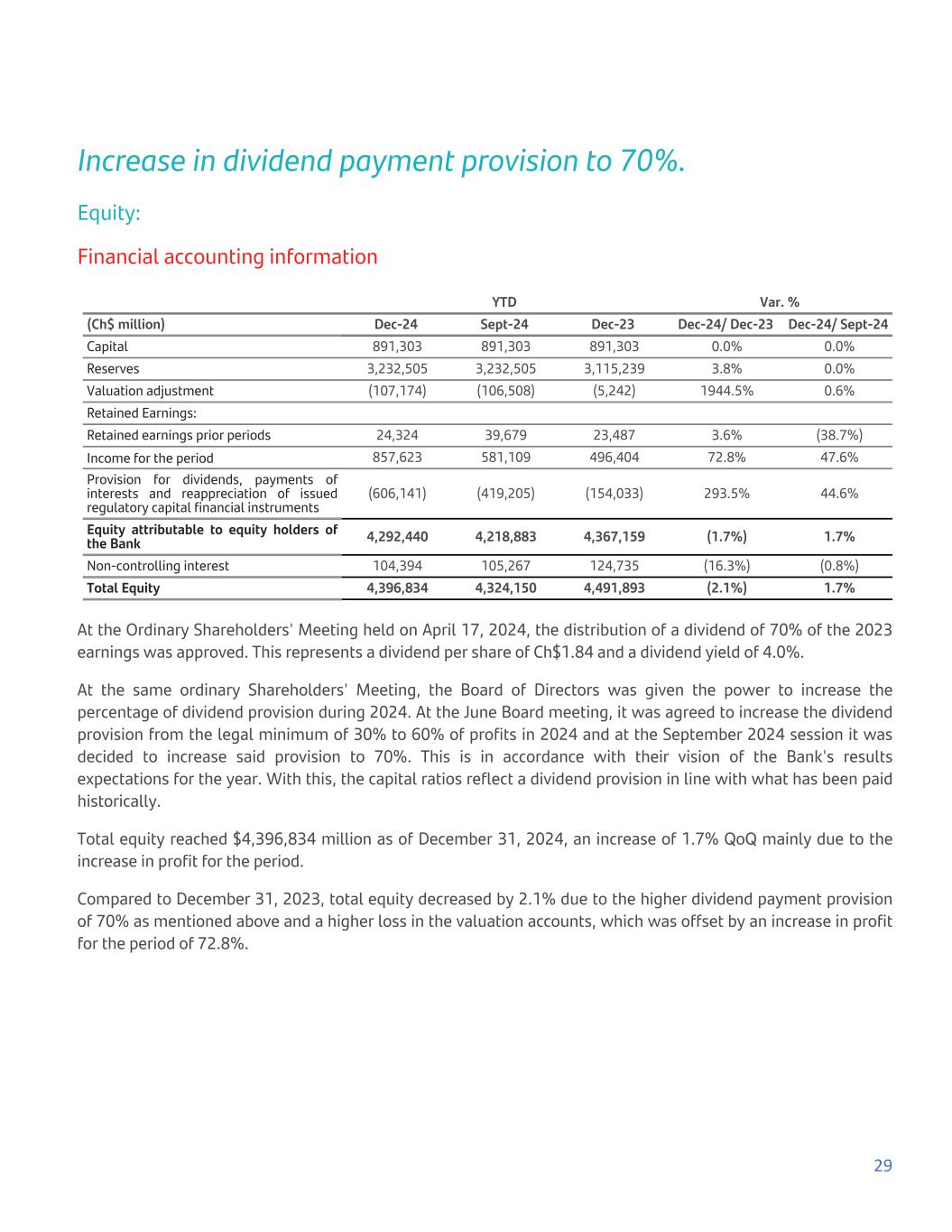

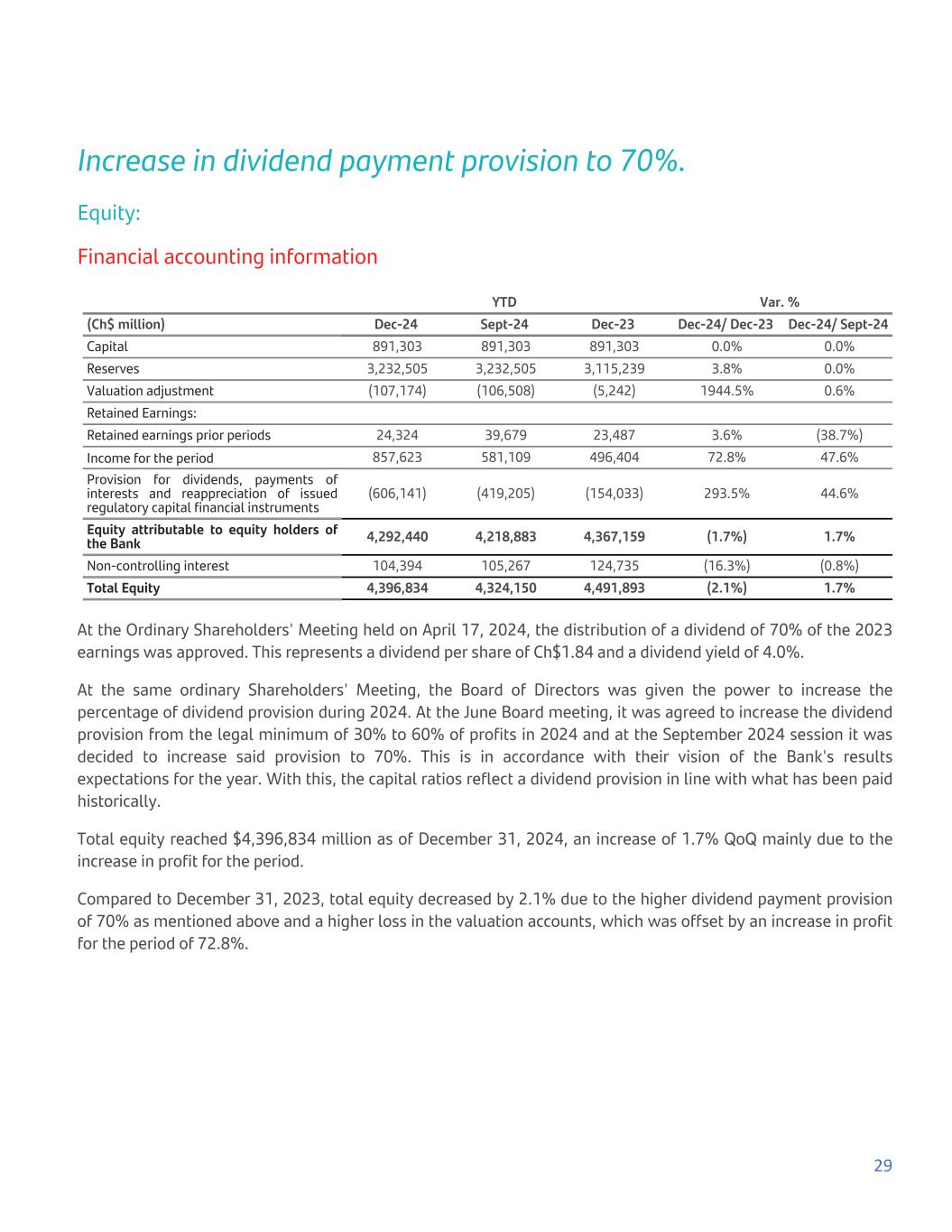

Increase in dividend payment provision to 70%. Equity: Financial accounting information YTD Var. % (Ch$ million) Dec-24 Sept-24 Dec-23 Dec-24/ Dec-23 Dec-24/ Sept-24 Capital 891,303 891,303 891,303 0.0% 0.0% Reserves 3,232,505 3,232,505 3,115,239 3.8% 0.0% Valuation adjustment (107,174) (106,508) (5,242) 1944.5% 0.6% Retained Earnings: Retained earnings prior periods 24,324 39,679 23,487 3.6% (38.7%) Income for the period 857,623 581,109 496,404 72.8% 47.6% Provision for dividends, payments of interests and reappreciation of issued regulatory capital financial instruments (606,141) (419,205) (154,033) 293.5% 44.6% Equity attributable to equity holders of the Bank 4,292,440 4,218,883 4,367,159 (1.7%) 1.7% Non-controlling interest 104,394 105,267 124,735 (16.3%) (0.8%) Total Equity 4,396,834 4,324,150 4,491,893 (2.1%) 1.7% At the Ordinary Shareholders' Meeting held on April 17, 2024, the distribution of a dividend of 70% of the 2023 earnings was approved. This represents a dividend per share of Ch$1.84 and a dividend yield of 4.0%. At the same ordinary Shareholders' Meeting, the Board of Directors was given the power to increase the percentage of dividend provision during 2024. At the June Board meeting, it was agreed to increase the dividend provision from the legal minimum of 30% to 60% of profits in 2024 and at the September 2024 session it was decided to increase said provision to 70%. This is in accordance with their vision of the Bank's results expectations for the year. With this, the capital ratios reflect a dividend provision in line with what has been paid historically. Total equity reached $4,396,834 million as of December 31, 2024, an increase of 1.7% QoQ mainly due to the increase in profit for the period. Compared to December 31, 2023, total equity decreased by 2.1% due to the higher dividend payment provision of 70% as mentioned above and a higher loss in the valuation accounts, which was offset by an increase in profit for the period of 72.8%. 29

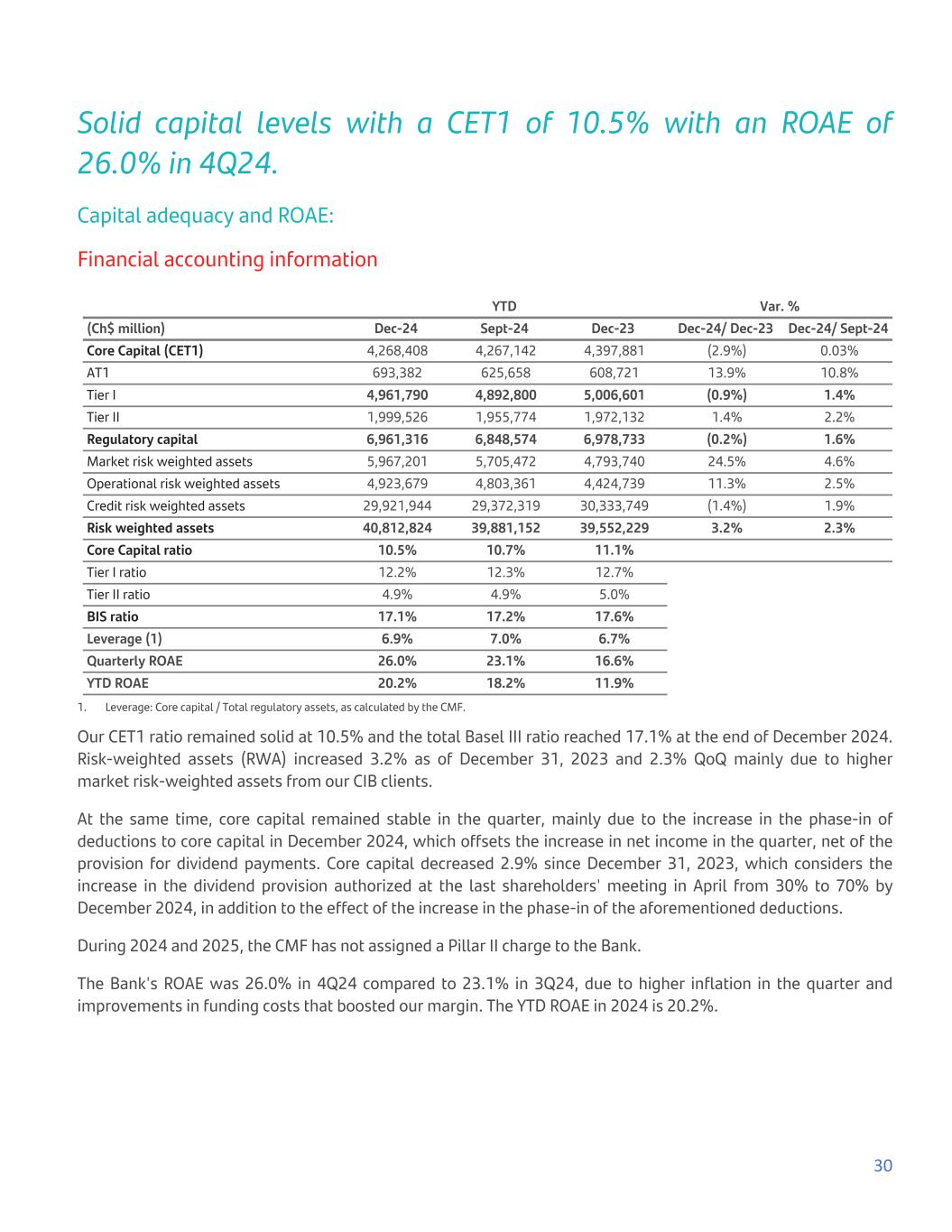

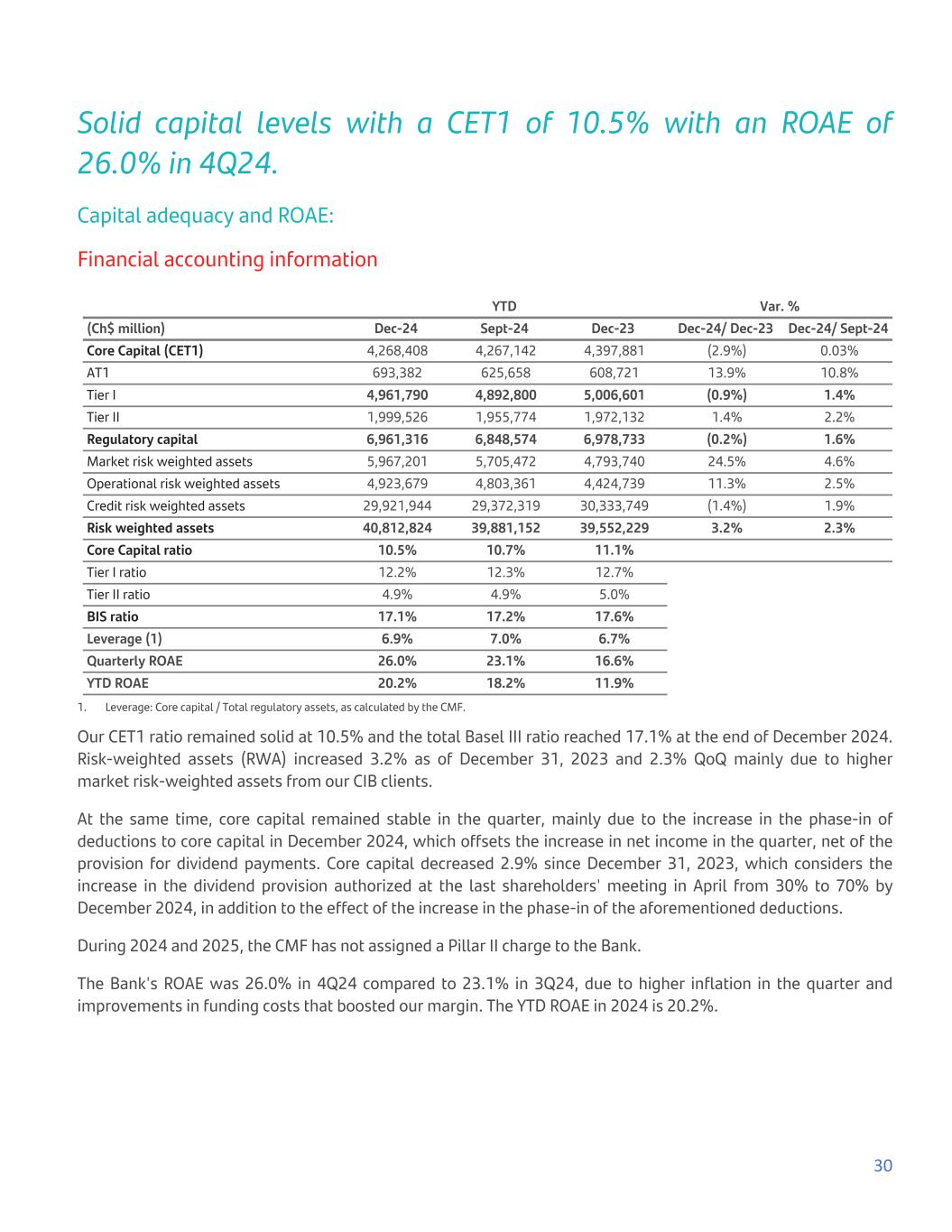

Solid capital levels with a CET1 of 10.5% with an ROAE of 26.0% in 4Q24. Capital adequacy and ROAE: Financial accounting information YTD Var. % (Ch$ million) Dec-24 Sept-24 Dec-23 Dec-24/ Dec-23 Dec-24/ Sept-24 Core Capital (CET1) 4,268,408 4,267,142 4,397,881 (2.9%) 0.03% AT1 693,382 625,658 608,721 13.9% 10.8% Tier I 4,961,790 4,892,800 5,006,601 (0.9%) 1.4% Tier II 1,999,526 1,955,774 1,972,132 1.4% 2.2% Regulatory capital 6,961,316 6,848,574 6,978,733 (0.2%) 1.6% Market risk weighted assets 5,967,201 5,705,472 4,793,740 24.5% 4.6% Operational risk weighted assets 4,923,679 4,803,361 4,424,739 11.3% 2.5% Credit risk weighted assets 29,921,944 29,372,319 30,333,749 (1.4%) 1.9% Risk weighted assets 40,812,824 39,881,152 39,552,229 3.2% 2.3% Core Capital ratio 10.5% 10.7% 11.1% Tier I ratio 12.2% 12.3% 12.7% Tier II ratio 4.9% 4.9% 5.0% BIS ratio 17.1% 17.2% 17.6% Leverage (1) 6.9% 7.0% 6.7% Quarterly ROAE 26.0% 23.1% 16.6% YTD ROAE 20.2% 18.2% 11.9% 1. Leverage: Core capital / Total regulatory assets, as calculated by the CMF. Our CET1 ratio remained solid at 10.5% and the total Basel III ratio reached 17.1% at the end of December 2024. Risk-weighted assets (RWA) increased 3.2% as of December 31, 2023 and 2.3% QoQ mainly due to higher market risk-weighted assets from our CIB clients. At the same time, core capital remained stable in the quarter, mainly due to the increase in the phase-in of deductions to core capital in December 2024, which offsets the increase in net income in the quarter, net of the provision for dividend payments. Core capital decreased 2.9% since December 31, 2023, which considers the increase in the dividend provision authorized at the last shareholders' meeting in April from 30% to 70% by December 2024, in addition to the effect of the increase in the phase-in of the aforementioned deductions. During 2024 and 2025, the CMF has not assigned a Pillar II charge to the Bank. The Bank's ROAE was 26.0% in 4Q24 compared to 23.1% in 3Q24, due to higher inflation in the quarter and improvements in funding costs that boosted our margin. The YTD ROAE in 2024 is 20.2%. 30

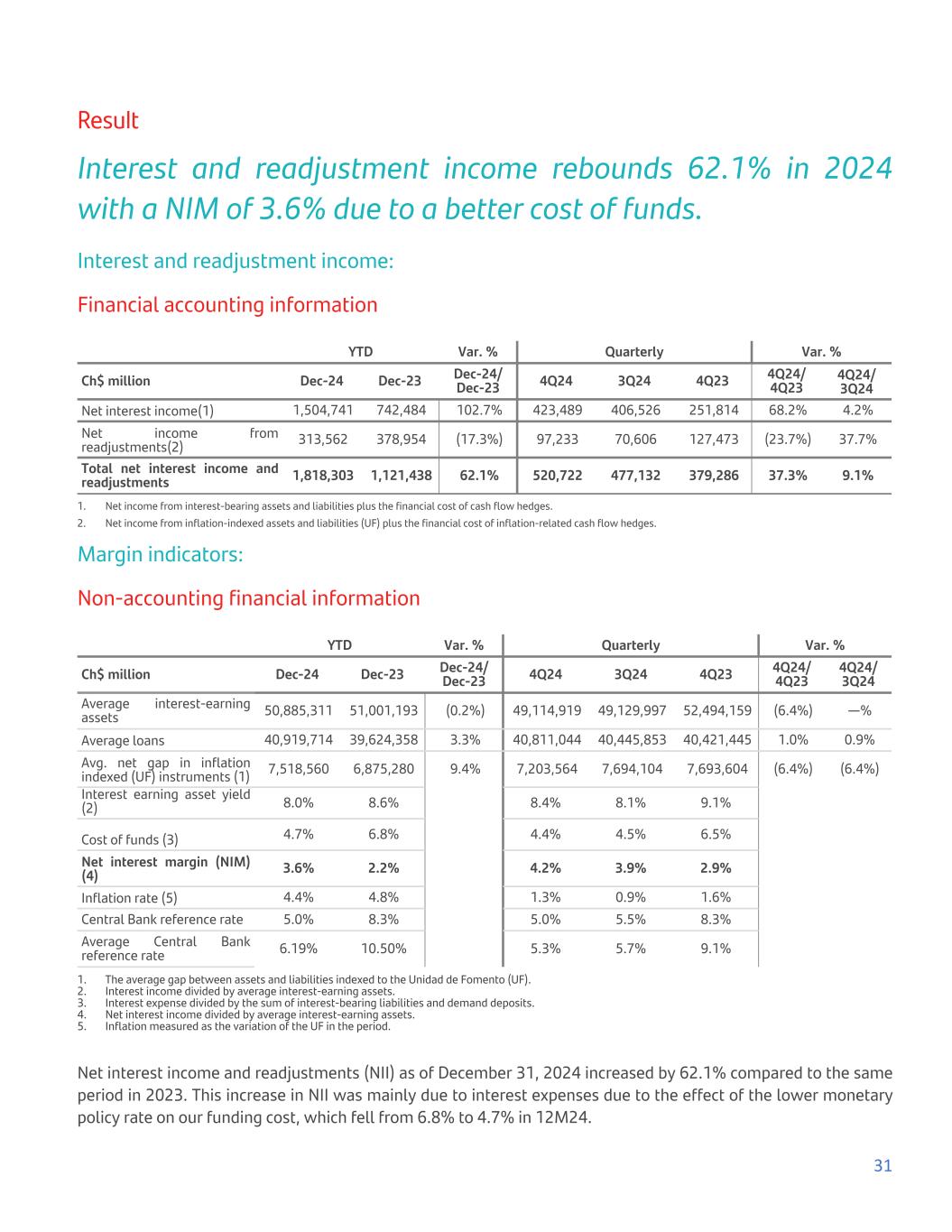

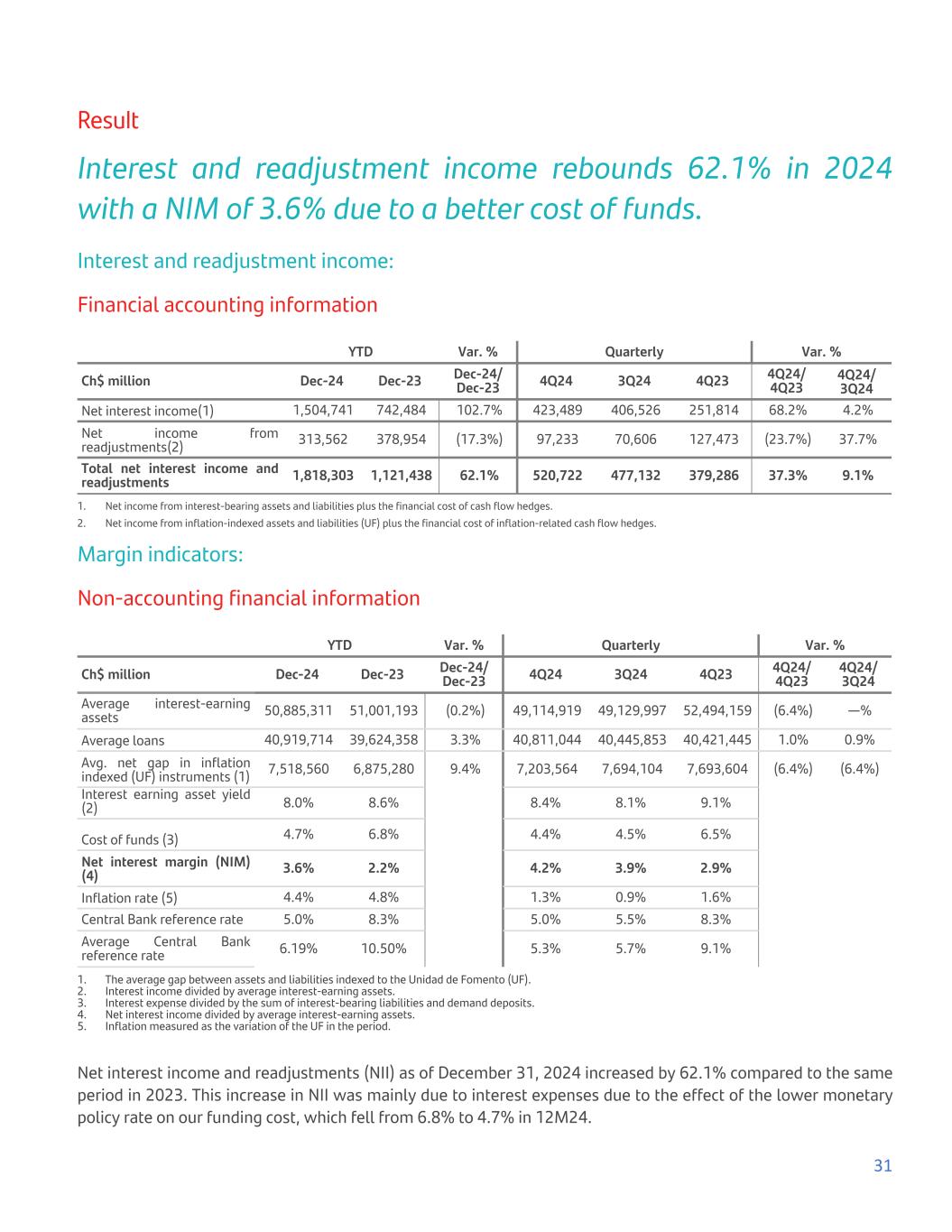

Result Interest and readjustment income rebounds 62.1% in 2024 with a NIM of 3.6% due to a better cost of funds. Interest and readjustment income: Financial accounting information YTD Var. % Quarterly Var. % Ch$ million Dec-24 Dec-23 Dec-24/ Dec-23 4Q24 3Q24 4Q23 4Q24/ 4Q23 4Q24/ 3Q24 Net interest income(1) 1,504,741 742,484 102.7% 423,489 406,526 251,814 68.2% 4.2% Net income from readjustments(2) 313,562 378,954 (17.3%) 97,233 70,606 127,473 (23.7%) 37.7% Total net interest income and readjustments 1,818,303 1,121,438 62.1% 520,722 477,132 379,286 37.3% 9.1% 1. Net income from interest-bearing assets and liabilities plus the financial cost of cash flow hedges. 2. Net income from inflation-indexed assets and liabilities (UF) plus the financial cost of inflation-related cash flow hedges. Margin indicators: Non-accounting financial information YTD Var. % Quarterly Var. % Ch$ million Dec-24 Dec-23 Dec-24/ Dec-23 4Q24 3Q24 4Q23 4Q24/ 4Q23 4Q24/ 3Q24 Average interest-earning assets 50,885,311 51,001,193 (0.2%) 49,114,919 49,129,997 52,494,159 (6.4%) —% Average loans 40,919,714 39,624,358 3.3% 40,811,044 40,445,853 40,421,445 1.0% 0.9% Avg. net gap in inflation indexed (UF) instruments (1) 7,518,560 6,875,280 9.4% 7,203,564 7,694,104 7,693,604 (6.4%) (6.4%) Interest earning asset yield (2) 8.0% 8.6% 8.4% 8.1% 9.1% Cost of funds (3) 4.7% 6.8% 4.4% 4.5% 6.5% Net interest margin (NIM) (4) 3.6% 2.2% 4.2% 3.9% 2.9% Inflation rate (5) 4.4% 4.8% 1.3% 0.9% 1.6% Central Bank reference rate 5.0% 8.3% 5.0% 5.5% 8.3% Average Central Bank reference rate 6.19% 10.50% 5.3% 5.7% 9.1% 1. The average gap between assets and liabilities indexed to the Unidad de Fomento (UF). 2. Interest income divided by average interest-earning assets. 3. Interest expense divided by the sum of interest-bearing liabilities and demand deposits. 4. Net interest income divided by average interest-earning assets. 5. Inflation measured as the variation of the UF in the period. Net interest income and readjustments (NII) as of December 31, 2024 increased by 62.1% compared to the same period in 2023. This increase in NII was mainly due to interest expenses due to the effect of the lower monetary policy rate on our funding cost, which fell from 6.8% to 4.7% in 12M24. 31

Net readjustment income decreased 17.3% in 12M24 compared to the same period in 2023, as the UF variation reached 4.4% in 12M24 compared to 4.8% in the same period in 2023. The UF GAP in 12M24 is larger than in 12M23, in line with a more stable UF variation for the coming periods vs. expectations of a decrease in inflation at the end of 2023. The Bank has a shorter duration of interest-bearing liabilities than interest-earning assets, so our liabilities recognize price changes more quickly than our assets. Following the rapid rise in the MPR that began in mid-2021 and continued through 2022, the Central Bank began cutting the MPR in July 2023 from its peak of 11.25%, with five successive cuts to reach 8.25% in December 2023 and continuing through 2024, reaching 5.0% in December 2024. Our time deposits represent 36.4% of our funding at the end of December, and in general these deposits have a duration of 30-60 days, so they are priced in at the new rate quickly. This has led to a rapid recovery in net interest income, increasing by 102.7% in 12M24 compared to 12M23. In 4Q24, total net interest and readjustment income increased 37.3% compared to 4Q23 and 9.1% compared to 3Q24. This is mainly due to higher interest income in 4Q24 compared to 3Q24 and 4Q23, which increased 4.2% and 68.2% respectively due to a lower average MPR in the quarter of 5.3% compared to 5.7% in 3Q24 and 9.1% in 4Q23. On the other hand, the UF variation was 1.3% in 4Q24, higher than the 0.9% in 3Q24 and lower than the 1.6% in 4Q23, explaining the 37.7% increase in net income from readjustments in 4Q24 compared to 3Q24 and the 23.7% decrease compared to 4Q23. With these funding cost and inflation dynamics, the NIM increased from 2.2% in 12M23 to 3.6% in 12M24 and from 2.9% in 4Q23 to 3.9% in 3Q24 and to 4.2% in 4Q24. Currently our economists are estimating a UF variation of 3.9% during 2025 and an average rate of 4.8%. Therefore we estimate that our NIM for 2025 could be around 4%. 32

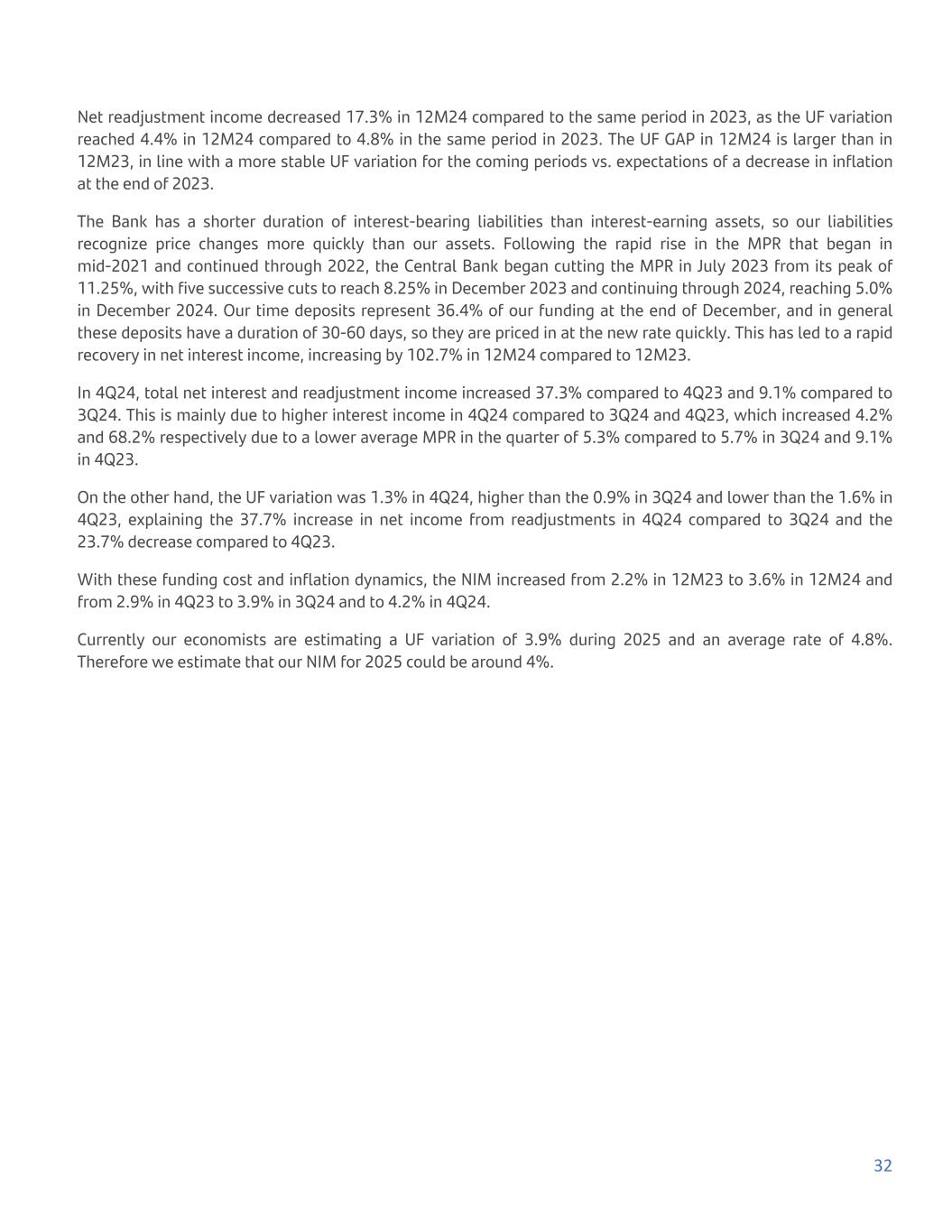

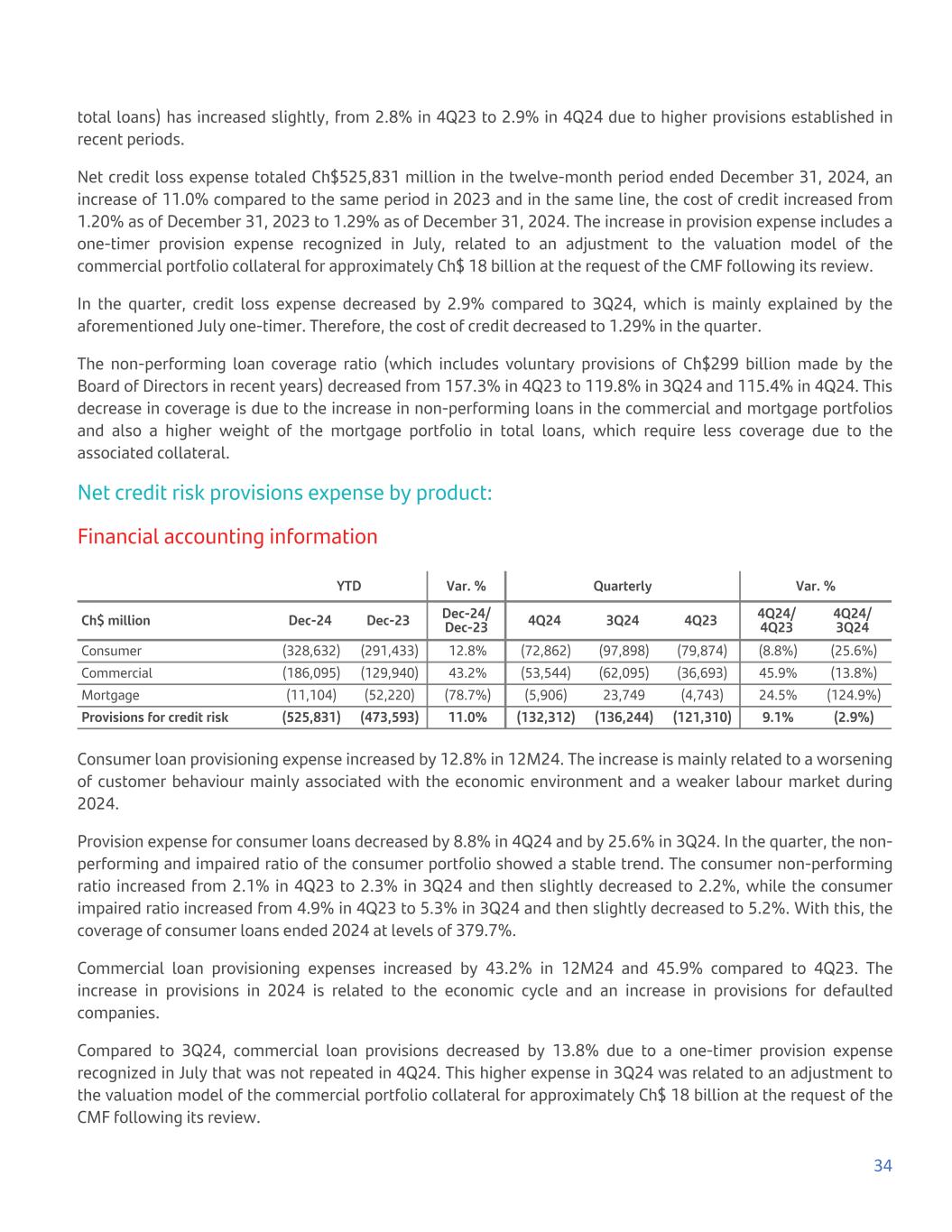

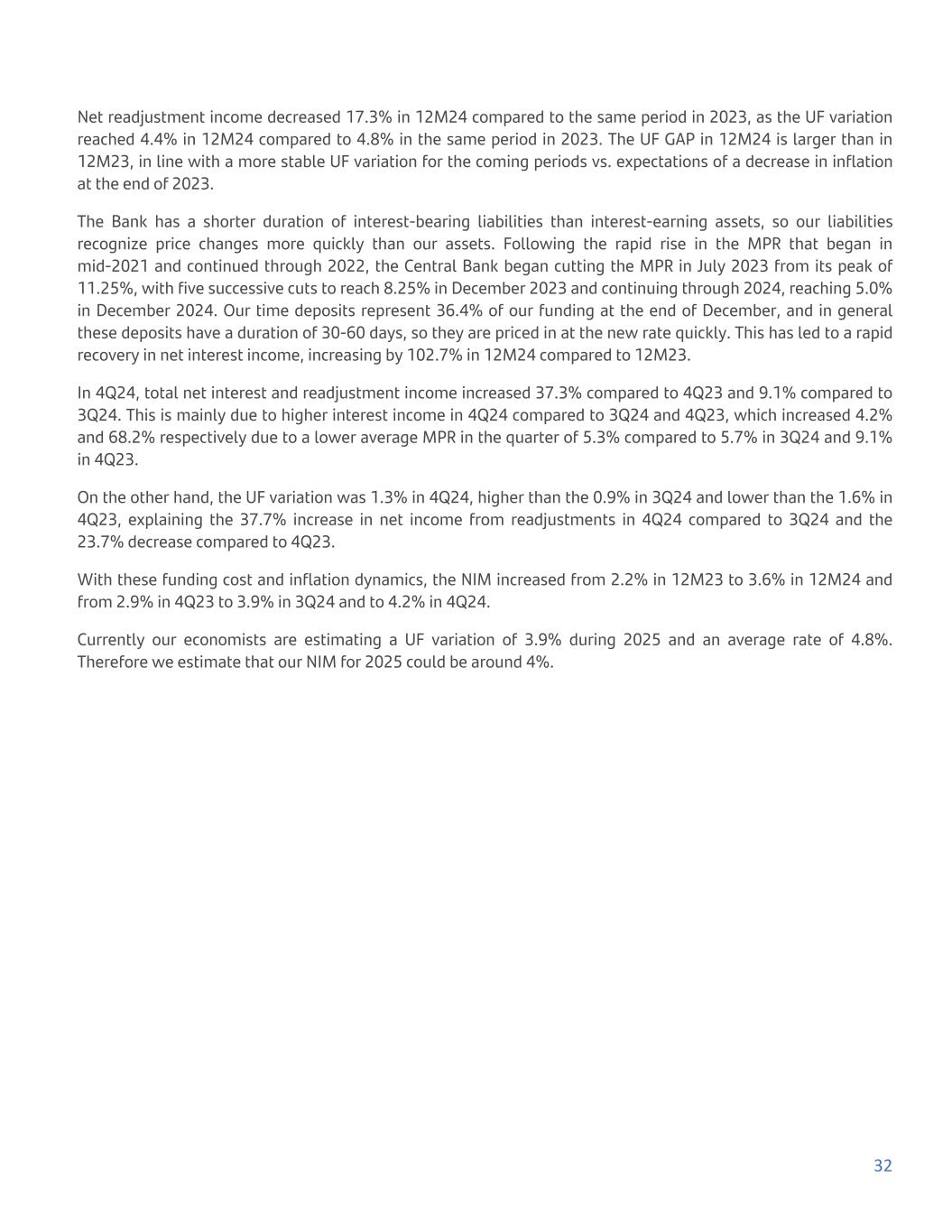

Cost of credit of 1.29% YTD and NPL coverage at 115.4% Provision expense: Financial accounting information YTD Var. % Quarterly Var. % Ch$ million Dec-24 Dec-23 Dec-24/ Dec-23 4Q24 3Q24 4Q23 4Q24/ 4Q23 4Q24/ 3Q24 Provisions for credit risk for interbank loans and loans and accounts receivable from clients (1) (675,794) (572,590) 18.0% (177,287) (170,893) (150,254) 18.0% 3.7% Special provisions for credit risk (2) (3,359) (7,312) (54.1%) (2,960) (68) (2,521) 17.4% 4252.9% Gross provisions (679,153) (579,902) 17.1% (180,247) (170,961) (152,775) 18.0% 5.4% Recovery of written-off loans 153,944 107,069 43.8% 49,011 34,027 31,643 54.9% 44.0% Impairment for credit risk for other financial assets at amortized cost and financial assets at fair value through other comprehensive income (622) (759) (18.1%) (1,076) 690 (178) 504.5% (255.9%) Provisions for credit risk (525,831) (473,592) 11.0% (132,311) (136,244) (121,310) 9.1% (2.9%) 1. Includes write-offs. 2. Includes additional provisions and provisions for contingent credits. Asset quality indicators and cost of credit: Non-accounting financial information YTD Quarterly Dec-24 Dec-23 4Q24 3Q24 4Q23 Cost of credit (1) 1.29% 1.20% 1.29% 1.35% 1.20% Expected loss ratio (LLA / total loans) 2.9% 2.8% 2.9% 3.0% 2.8% NPL ratio (90 days or more overdue/ total loans) 3.2% 2.3% 3.2% 3.1% 2.3% Impaired loan ratio (impaired loans / total loans) 6.7% 5.6% 6.7% 6.7% 5.6% Coverage of NPLs (2) 115.4% 157.3% 115.4% 119.8% 157.3% 1. Annualized credit loss expense divided by average loans. 2. Balance sheet provisions including additional provisions divided by non-performing loans. During the Covid-19 pandemic, asset quality benefited from state aid and pension fund withdrawals, which led to a positive performance of assets during that period, before normalizing in line with the evolution of the economy and the drainage of excess liquidity from households. Currently, our clients' performance is reflecting the state of the economy and the labor market, where non- performing loans are higher than the levels we saw before the pandemic. The non-performing loans (NPL) ratio increased from 2.3% in 4Q23 to 3.1% in 3Q24 and 3.2% in 4Q24. The impaired portfolio ratio increased from 5.6% in 4Q23 to 6.7% in 3Q24 and 6.7% in 4Q24. Finally, the expected loss ratio (credit risk provisions divided by 33

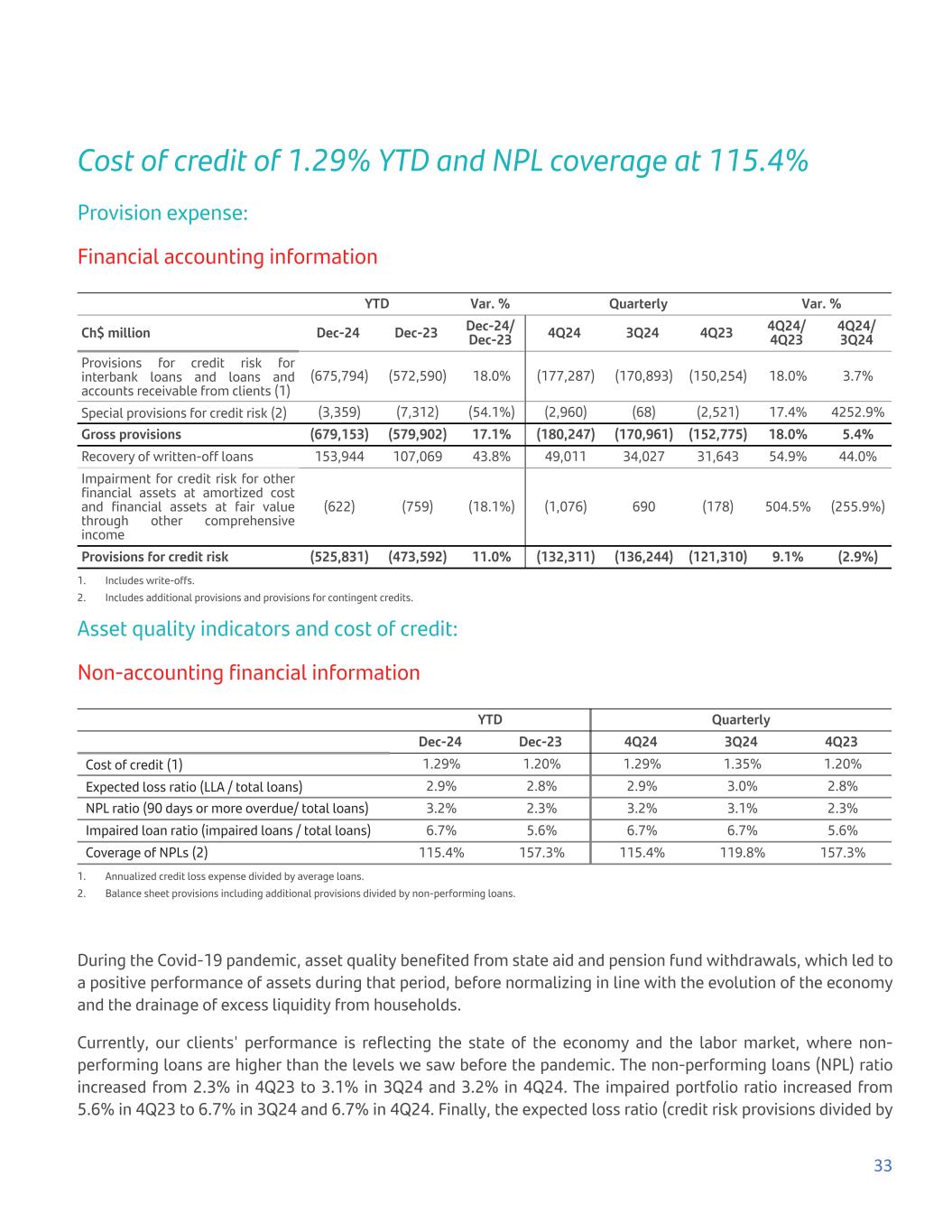

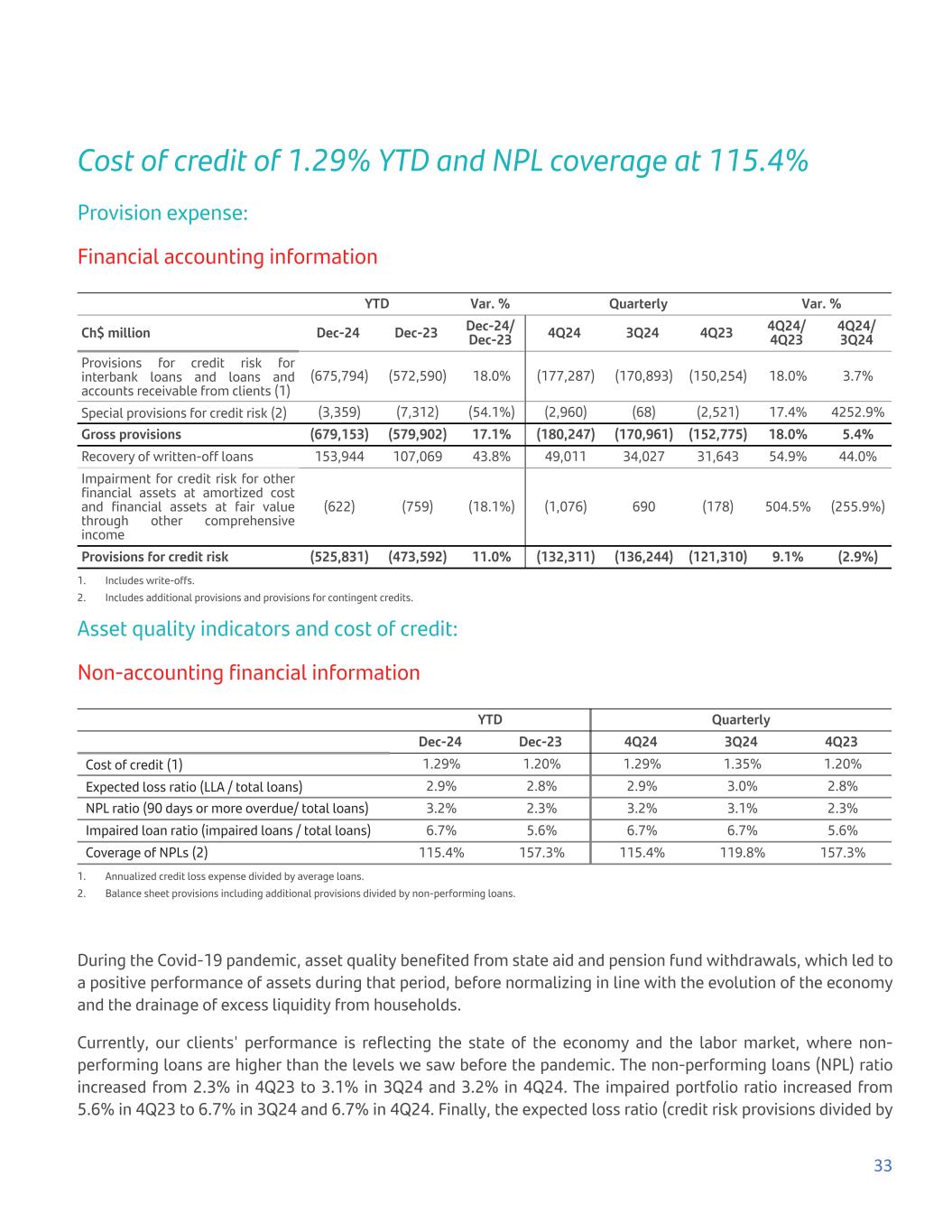

total loans) has increased slightly, from 2.8% in 4Q23 to 2.9% in 4Q24 due to higher provisions established in recent periods. Net credit loss expense totaled Ch$525,831 million in the twelve-month period ended December 31, 2024, an increase of 11.0% compared to the same period in 2023 and in the same line, the cost of credit increased from 1.20% as of December 31, 2023 to 1.29% as of December 31, 2024. The increase in provision expense includes a one-timer provision expense recognized in July, related to an adjustment to the valuation model of the commercial portfolio collateral for approximately Ch$ 18 billion at the request of the CMF following its review. In the quarter, credit loss expense decreased by 2.9% compared to 3Q24, which is mainly explained by the aforementioned July one-timer. Therefore, the cost of credit decreased to 1.29% in the quarter. The non-performing loan coverage ratio (which includes voluntary provisions of Ch$299 billion made by the Board of Directors in recent years) decreased from 157.3% in 4Q23 to 119.8% in 3Q24 and 115.4% in 4Q24. This decrease in coverage is due to the increase in non-performing loans in the commercial and mortgage portfolios and also a higher weight of the mortgage portfolio in total loans, which require less coverage due to the associated collateral. Net credit risk provisions expense by product: Financial accounting information YTD Var. % Quarterly Var. % Ch$ million Dec-24 Dec-23 Dec-24/ Dec-23 4Q24 3Q24 4Q23 4Q24/ 4Q23 4Q24/ 3Q24 Consumer (328,632) (291,433) 12.8% (72,862) (97,898) (79,874) (8.8%) (25.6%) Commercial (186,095) (129,940) 43.2% (53,544) (62,095) (36,693) 45.9% (13.8%) Mortgage (11,104) (52,220) (78.7%) (5,906) 23,749 (4,743) 24.5% (124.9%) Provisions for credit risk (525,831) (473,593) 11.0% (132,312) (136,244) (121,310) 9.1% (2.9%) Consumer loan provisioning expense increased by 12.8% in 12M24. The increase is mainly related to a worsening of customer behaviour mainly associated with the economic environment and a weaker labour market during 2024. Provision expense for consumer loans decreased by 8.8% in 4Q24 and by 25.6% in 3Q24. In the quarter, the non- performing and impaired ratio of the consumer portfolio showed a stable trend. The consumer non-performing ratio increased from 2.1% in 4Q23 to 2.3% in 3Q24 and then slightly decreased to 2.2%, while the consumer impaired ratio increased from 4.9% in 4Q23 to 5.3% in 3Q24 and then slightly decreased to 5.2%. With this, the coverage of consumer loans ended 2024 at levels of 379.7%. Commercial loan provisioning expenses increased by 43.2% in 12M24 and 45.9% compared to 4Q23. The increase in provisions in 2024 is related to the economic cycle and an increase in provisions for defaulted companies. Compared to 3Q24, commercial loan provisions decreased by 13.8% due to a one-timer provision expense recognized in July that was not repeated in 4Q24. This higher expense in 3Q24 was related to an adjustment to the valuation model of the commercial portfolio collateral for approximately Ch$ 18 billion at the request of the CMF following its review. 34

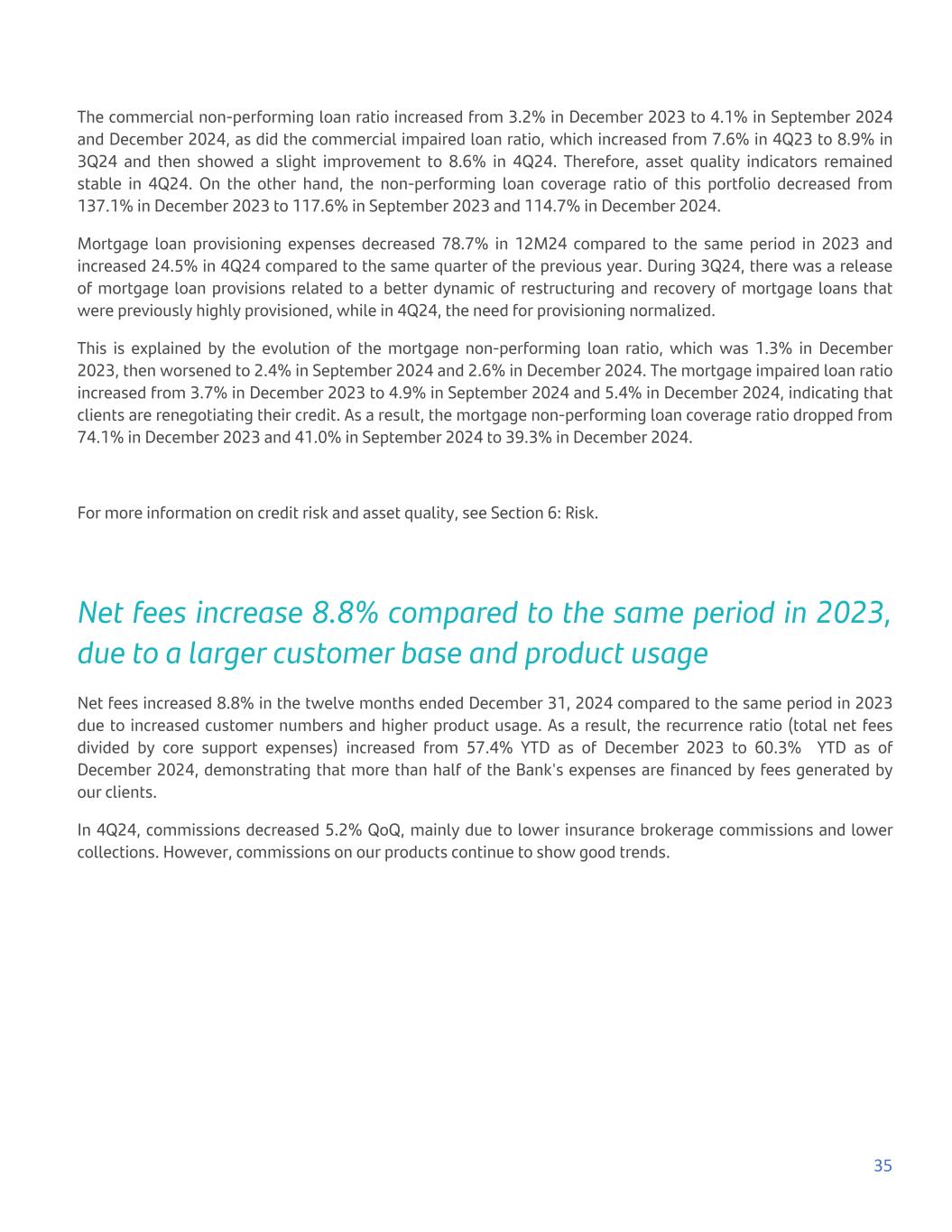

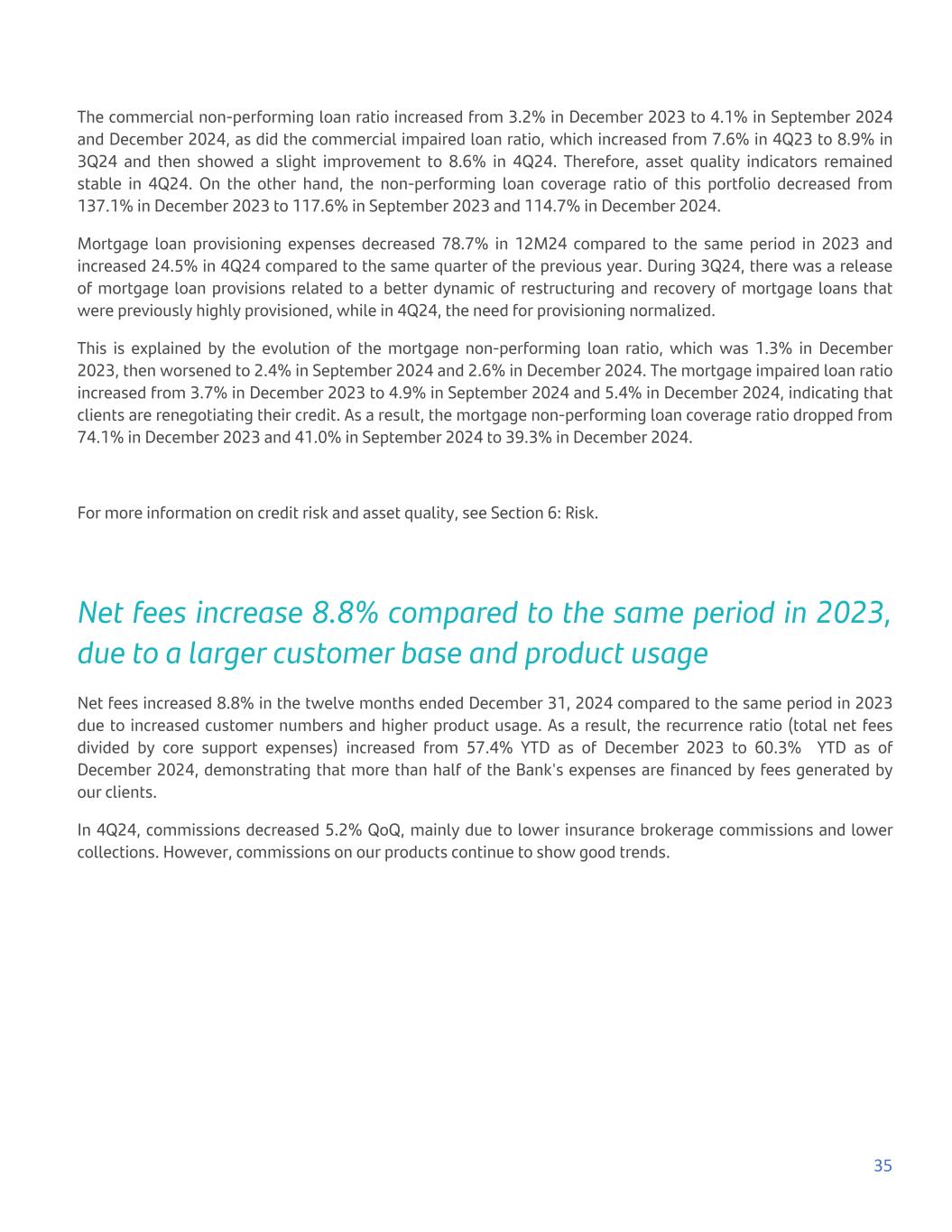

The commercial non-performing loan ratio increased from 3.2% in December 2023 to 4.1% in September 2024 and December 2024, as did the commercial impaired loan ratio, which increased from 7.6% in 4Q23 to 8.9% in 3Q24 and then showed a slight improvement to 8.6% in 4Q24. Therefore, asset quality indicators remained stable in 4Q24. On the other hand, the non-performing loan coverage ratio of this portfolio decreased from 137.1% in December 2023 to 117.6% in September 2023 and 114.7% in December 2024. Mortgage loan provisioning expenses decreased 78.7% in 12M24 compared to the same period in 2023 and increased 24.5% in 4Q24 compared to the same quarter of the previous year. During 3Q24, there was a release of mortgage loan provisions related to a better dynamic of restructuring and recovery of mortgage loans that were previously highly provisioned, while in 4Q24, the need for provisioning normalized. This is explained by the evolution of the mortgage non-performing loan ratio, which was 1.3% in December 2023, then worsened to 2.4% in September 2024 and 2.6% in December 2024. The mortgage impaired loan ratio increased from 3.7% in December 2023 to 4.9% in September 2024 and 5.4% in December 2024, indicating that clients are renegotiating their credit. As a result, the mortgage non-performing loan coverage ratio dropped from 74.1% in December 2023 and 41.0% in September 2024 to 39.3% in December 2024. For more information on credit risk and asset quality, see Section 6: Risk. Net fees increase 8.8% compared to the same period in 2023, due to a larger customer base and product usage Net fees increased 8.8% in the twelve months ended December 31, 2024 compared to the same period in 2023 due to increased customer numbers and higher product usage. As a result, the recurrence ratio (total net fees divided by core support expenses) increased from 57.4% YTD as of December 2023 to 60.3% YTD as of December 2024, demonstrating that more than half of the Bank's expenses are financed by fees generated by our clients. In 4Q24, commissions decreased 5.2% QoQ, mainly due to lower insurance brokerage commissions and lower collections. However, commissions on our products continue to show good trends. 35

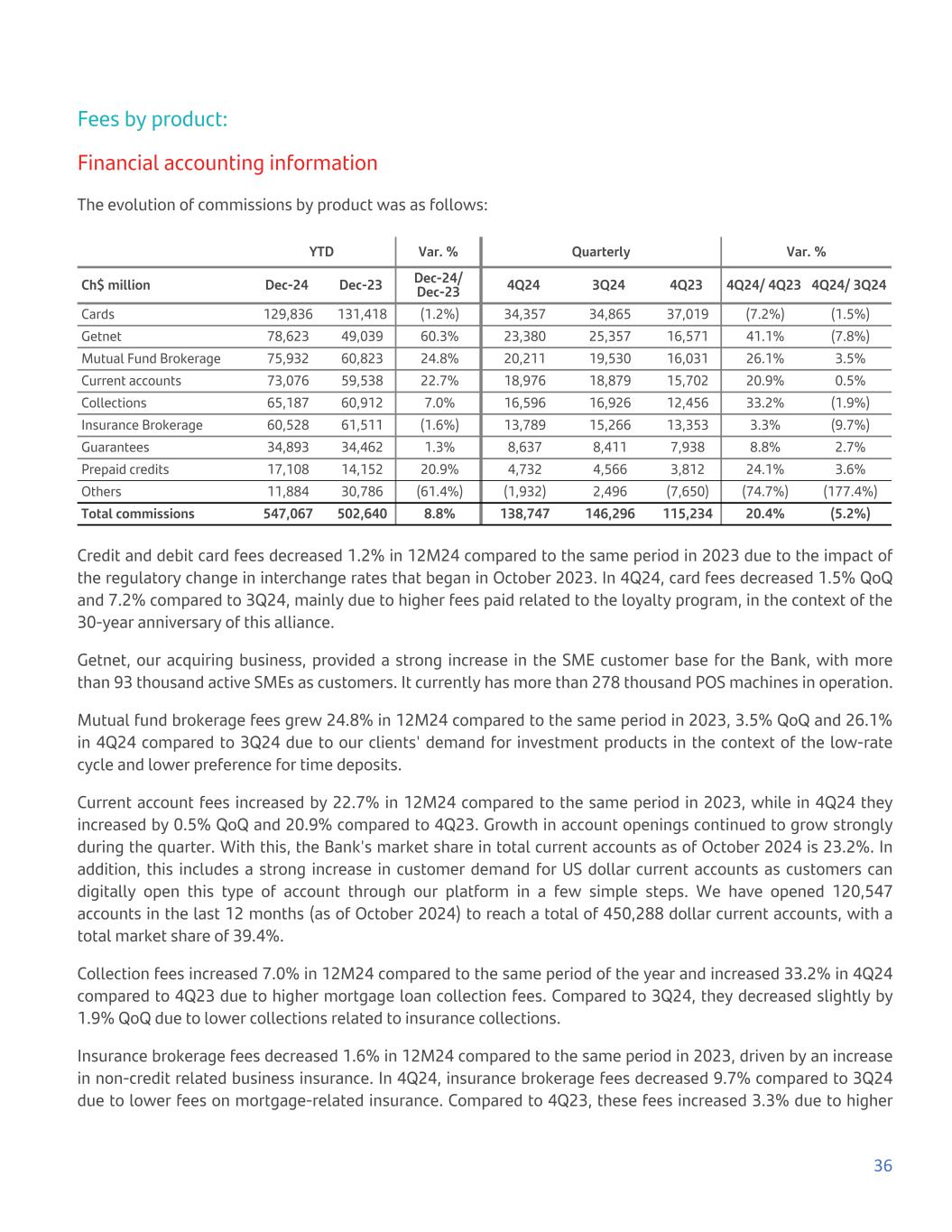

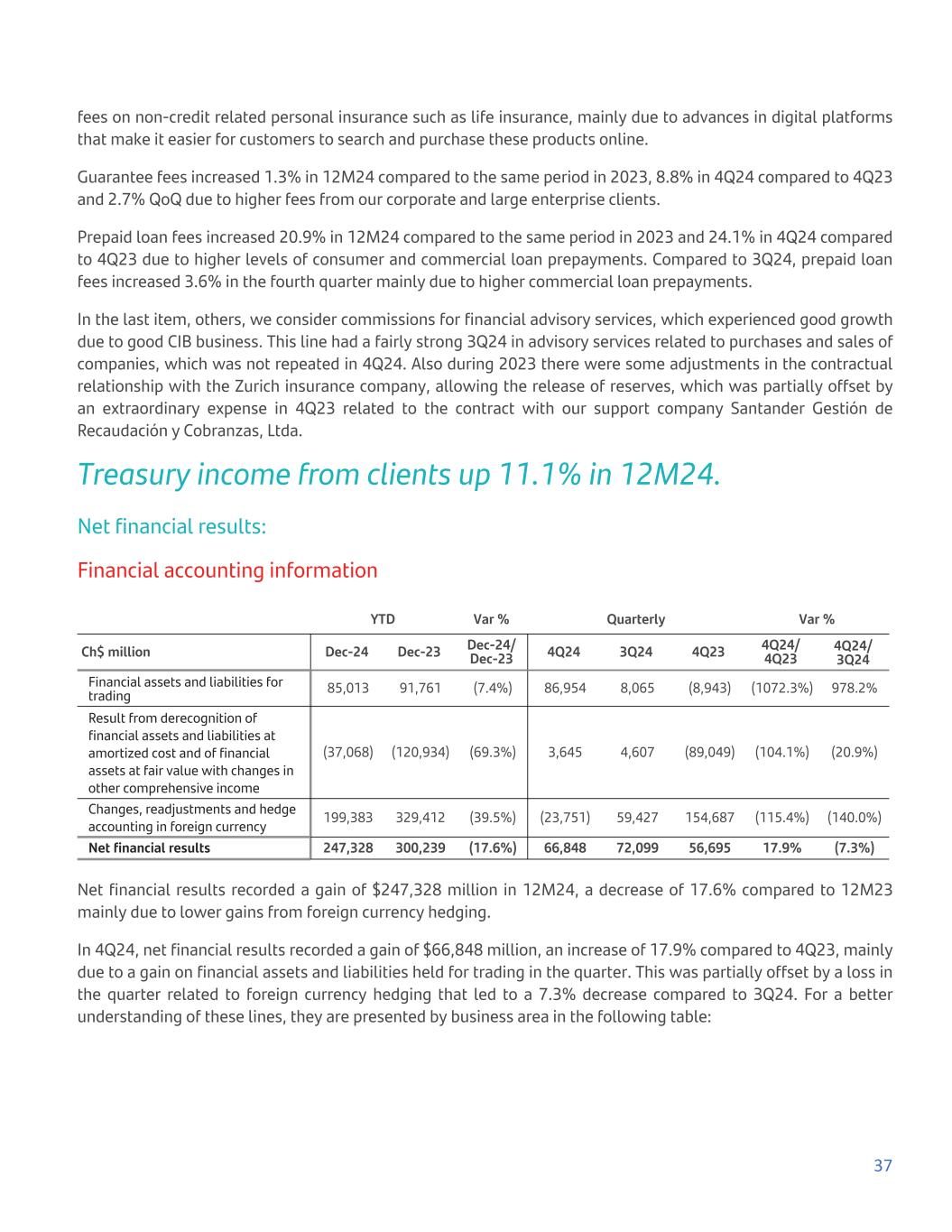

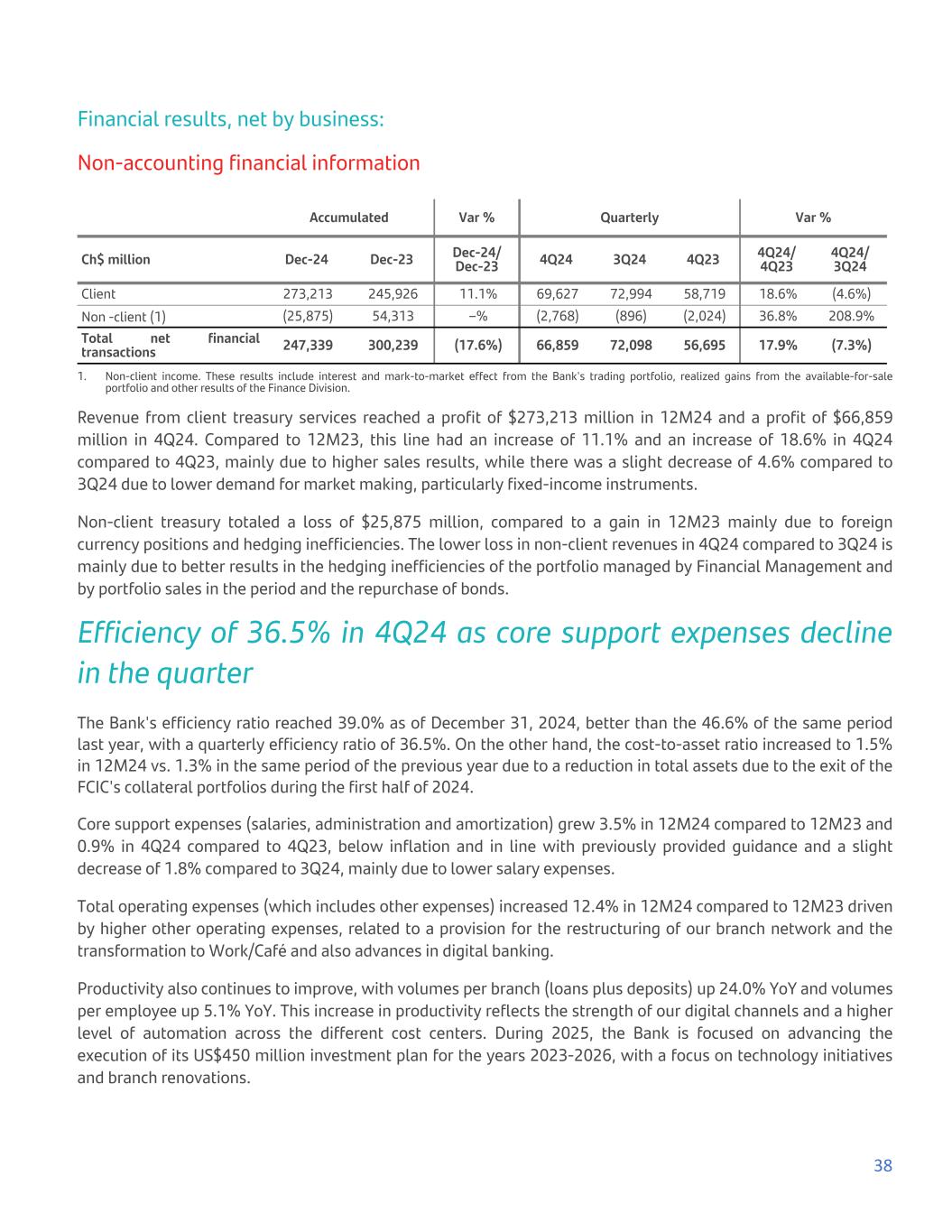

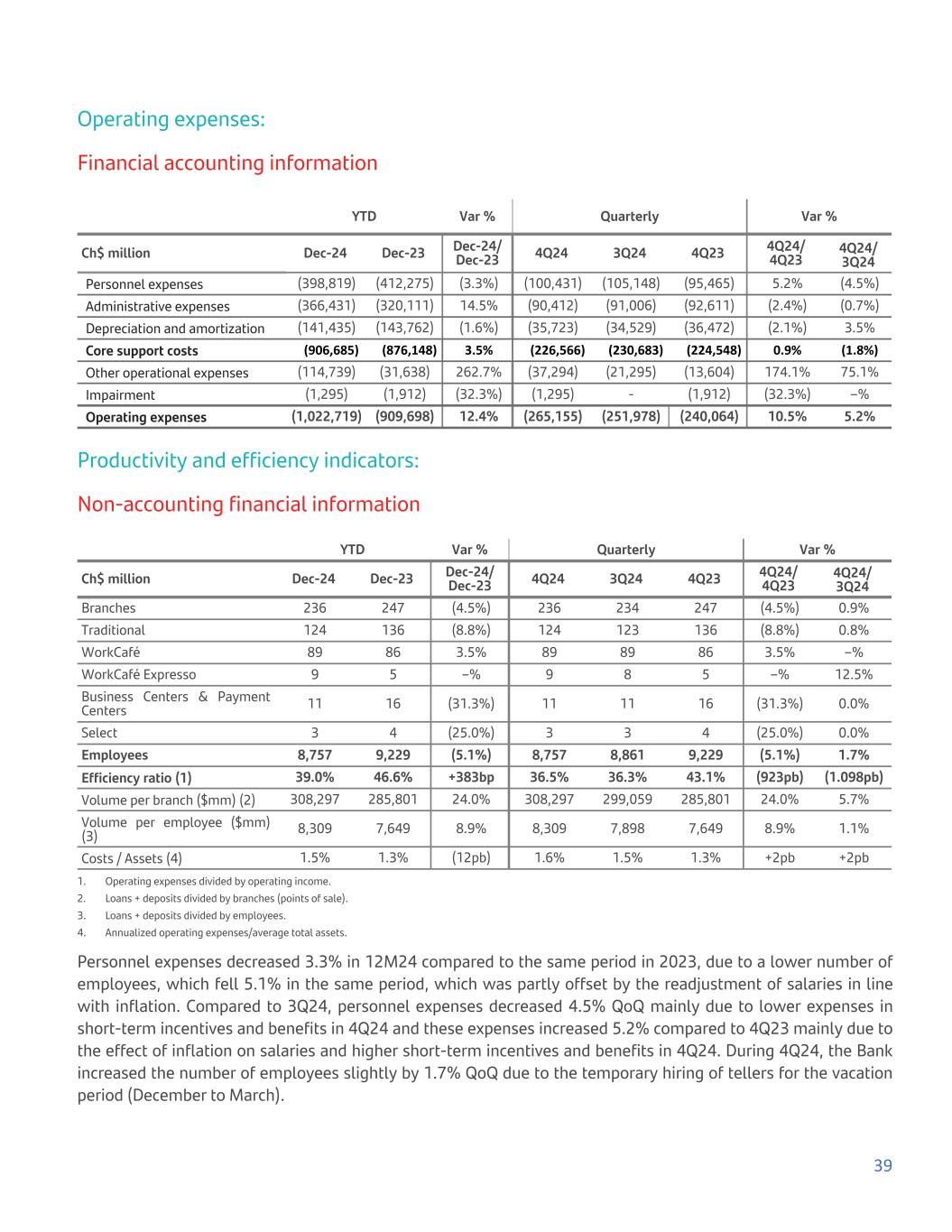

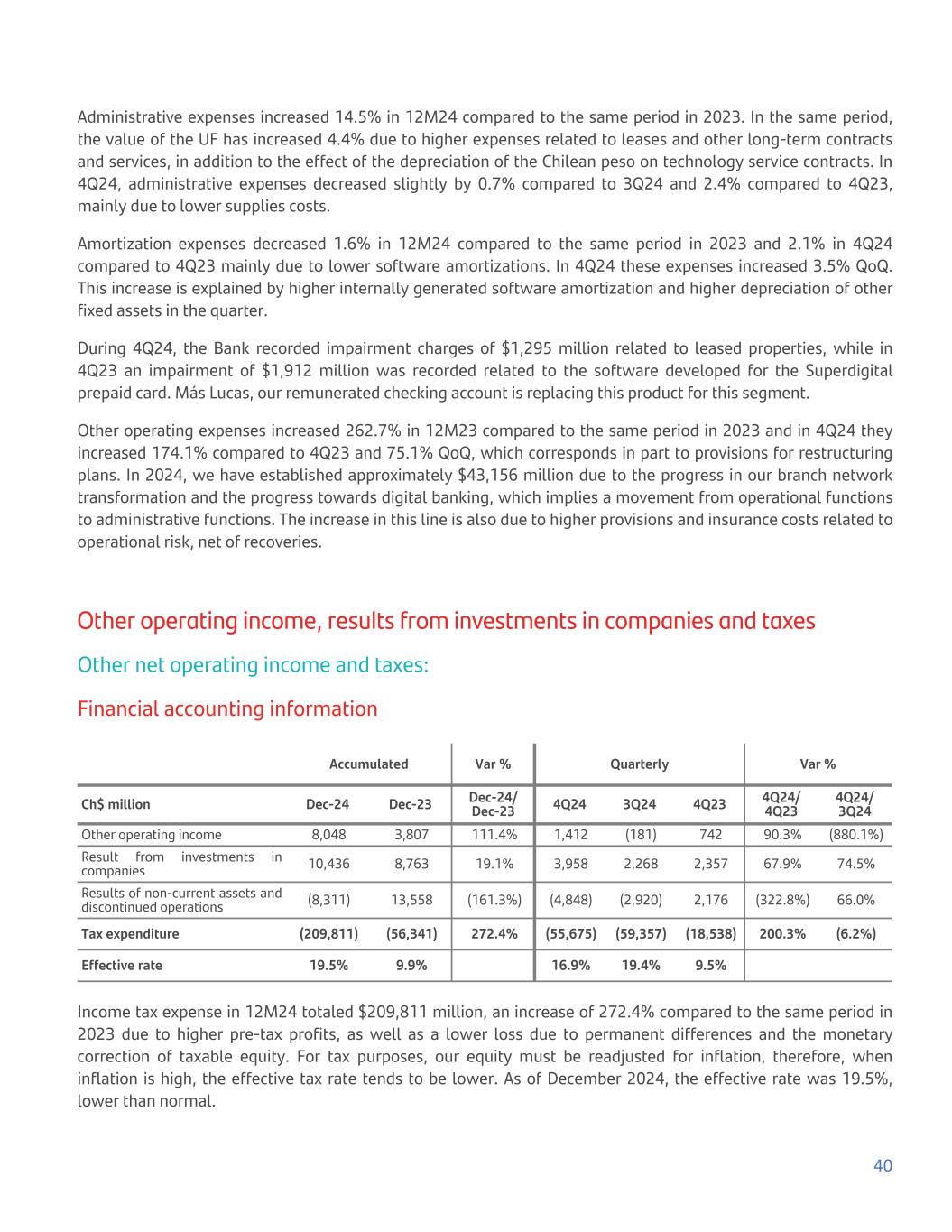

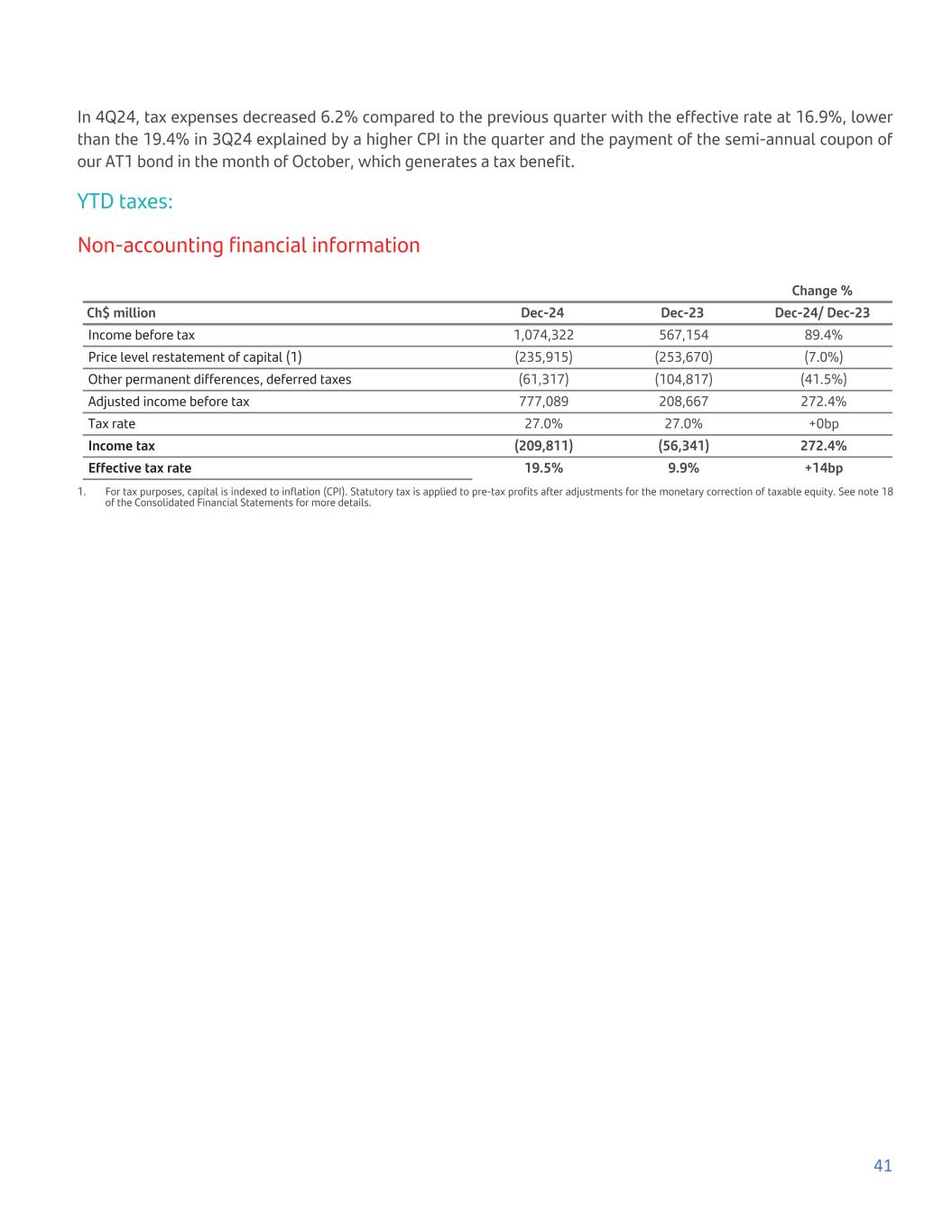

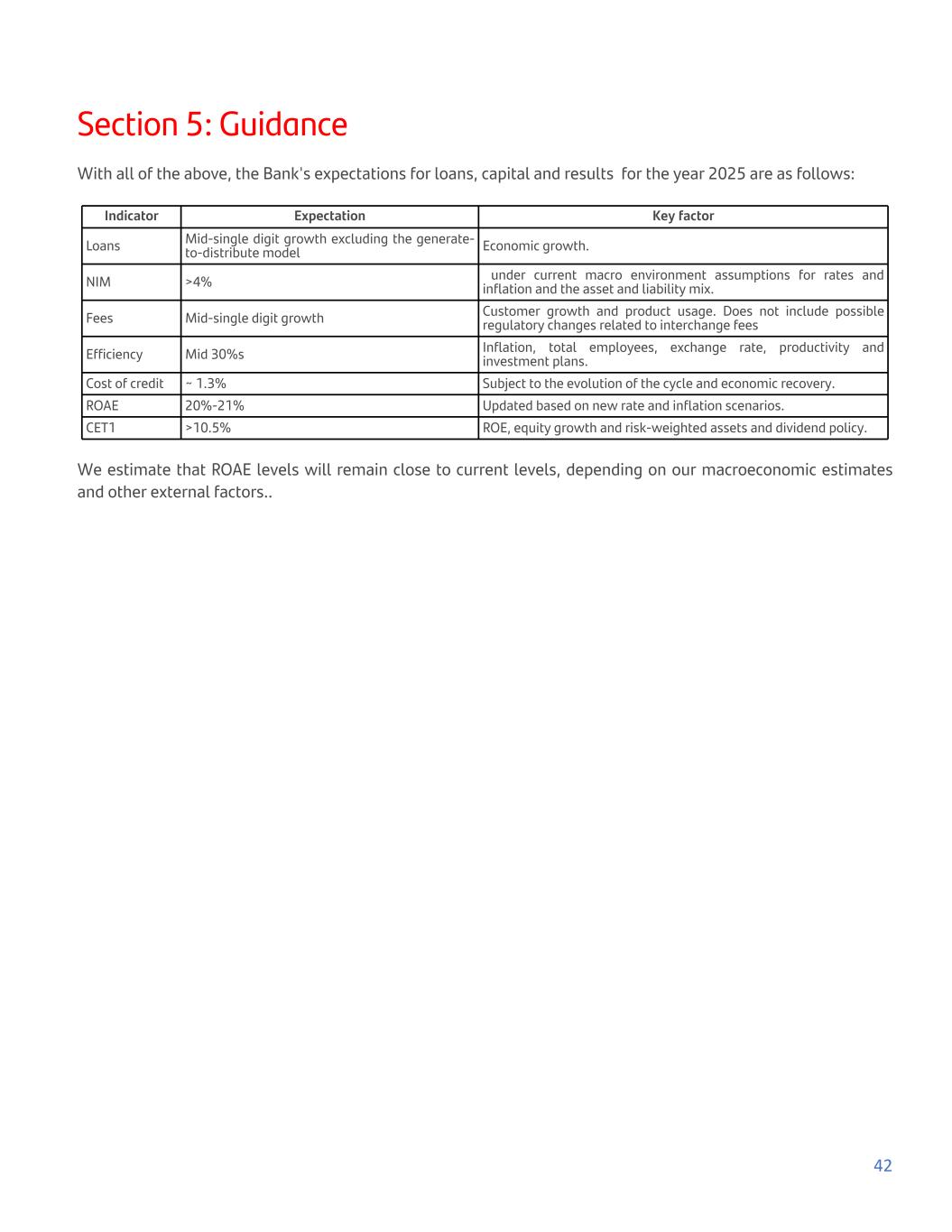

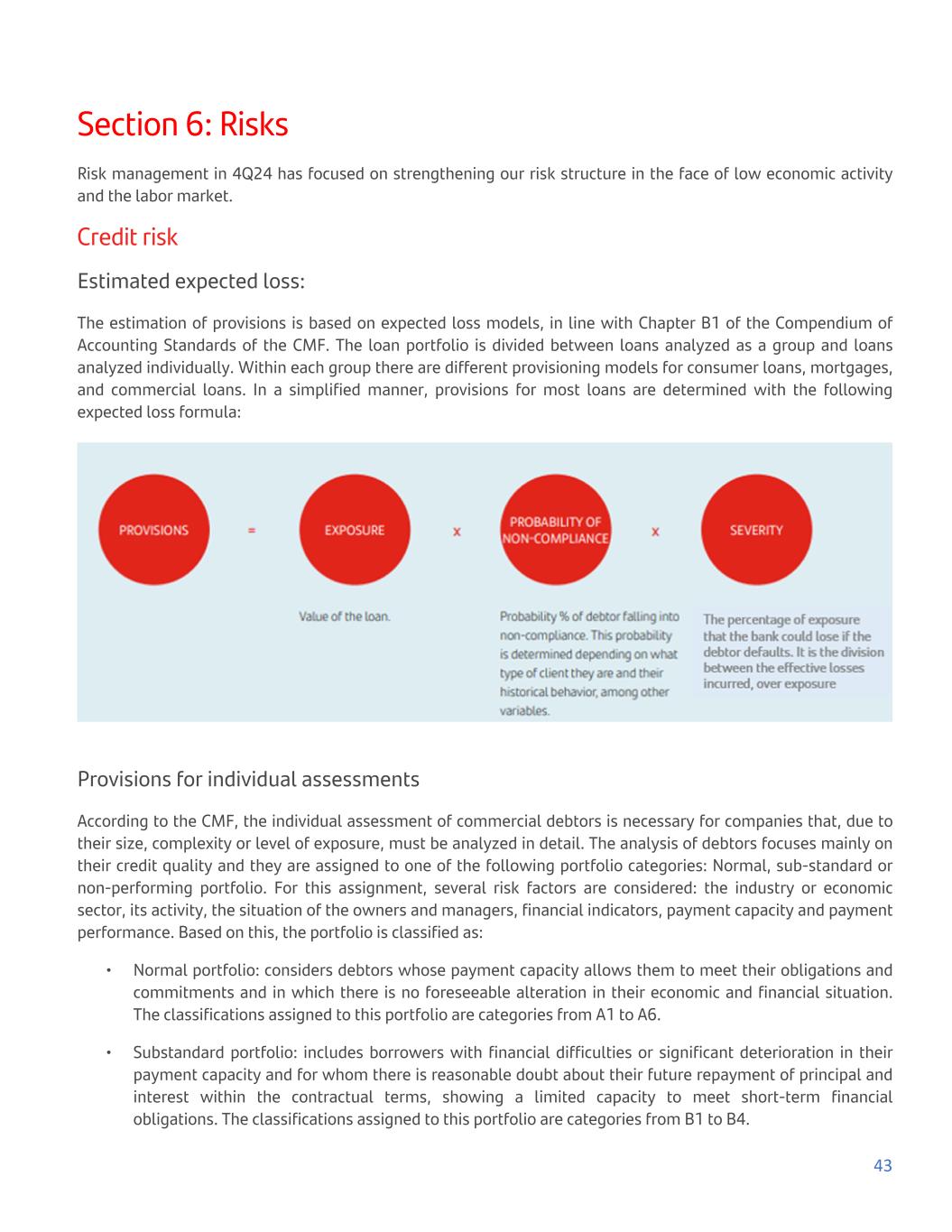

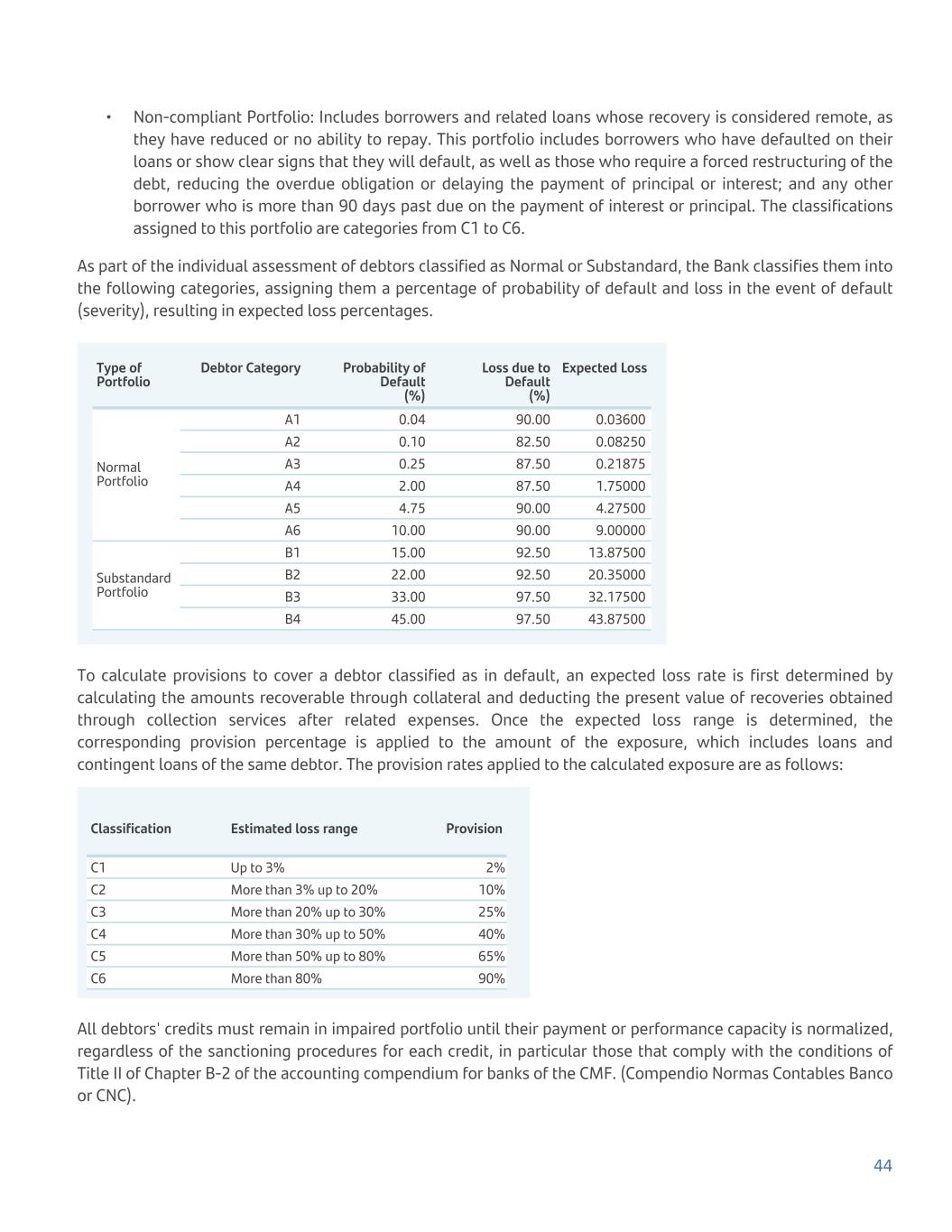

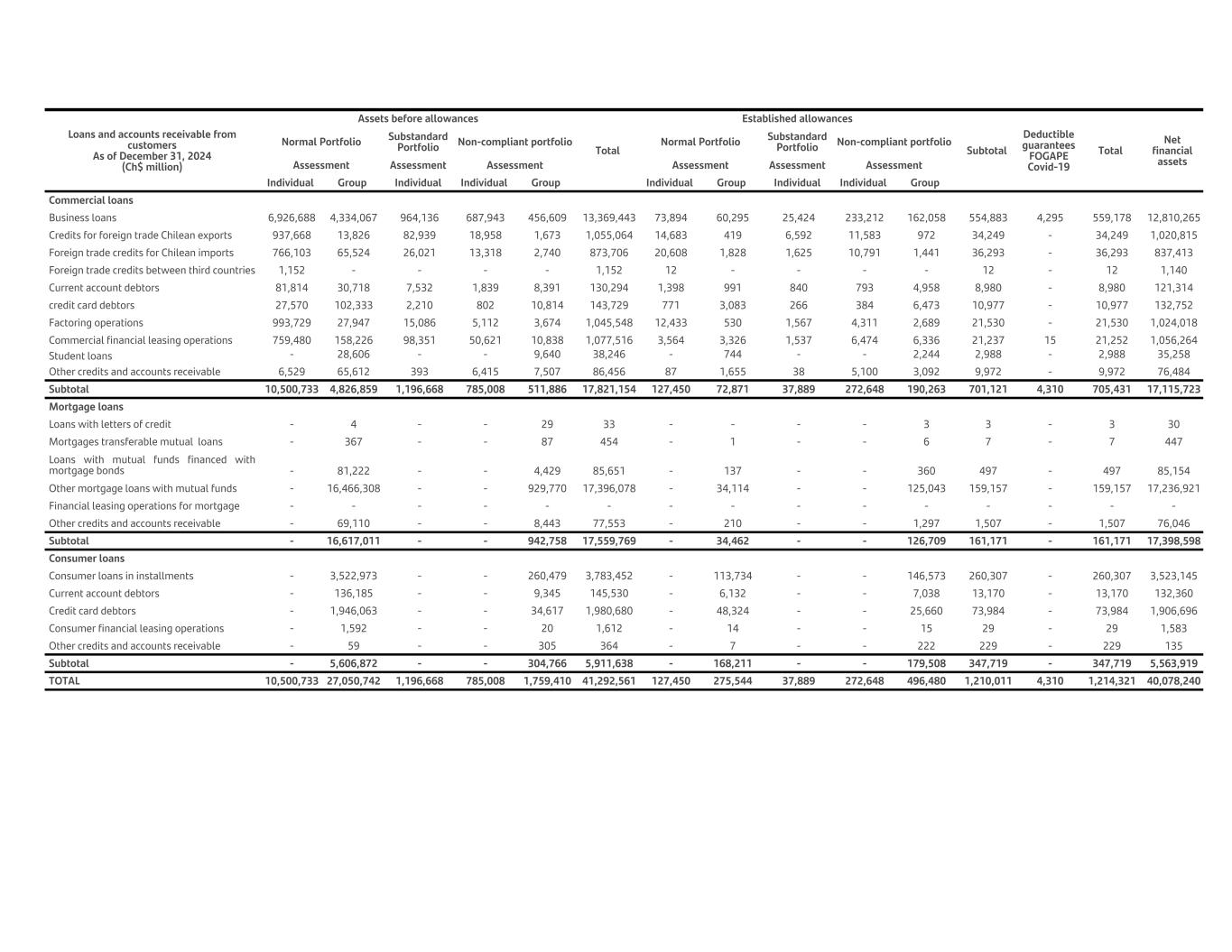

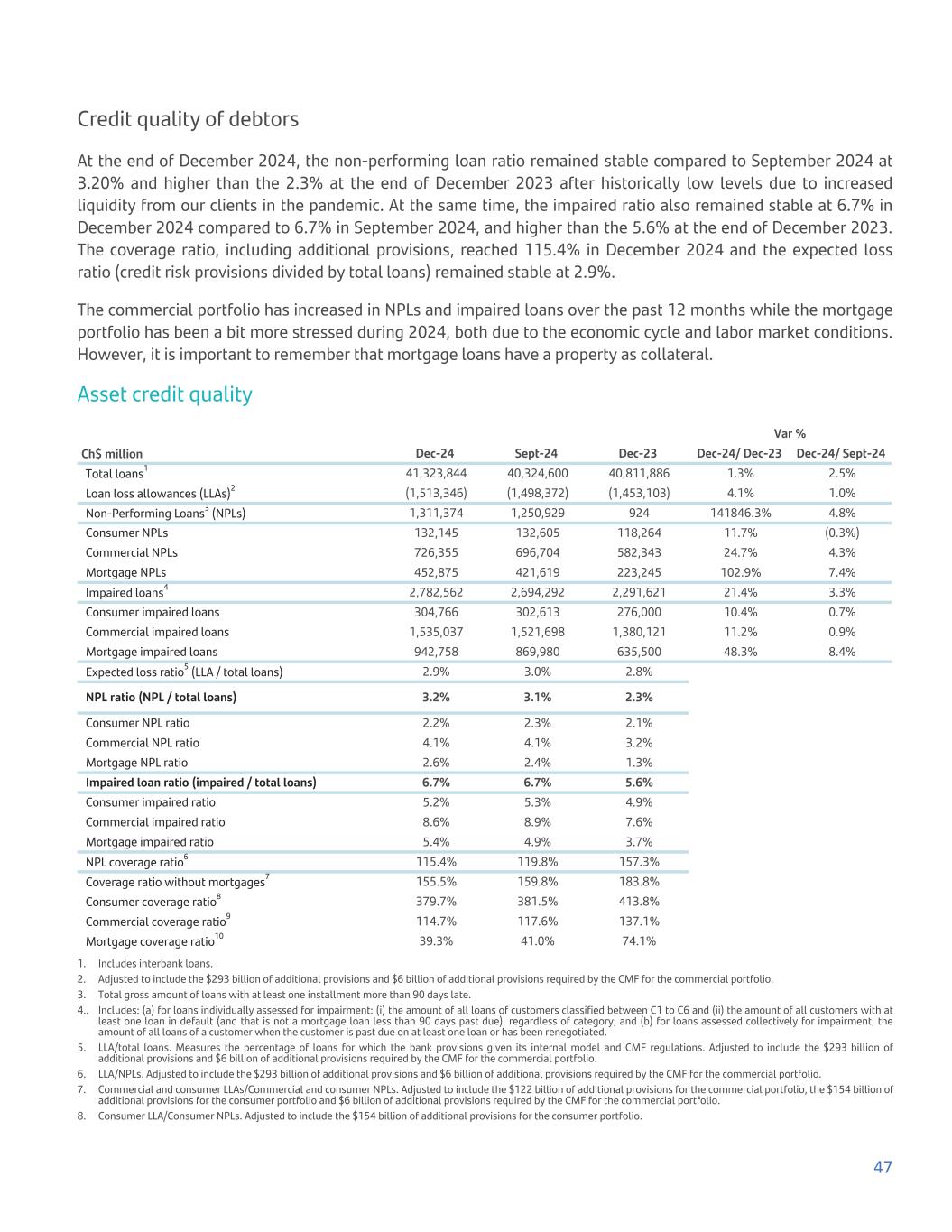

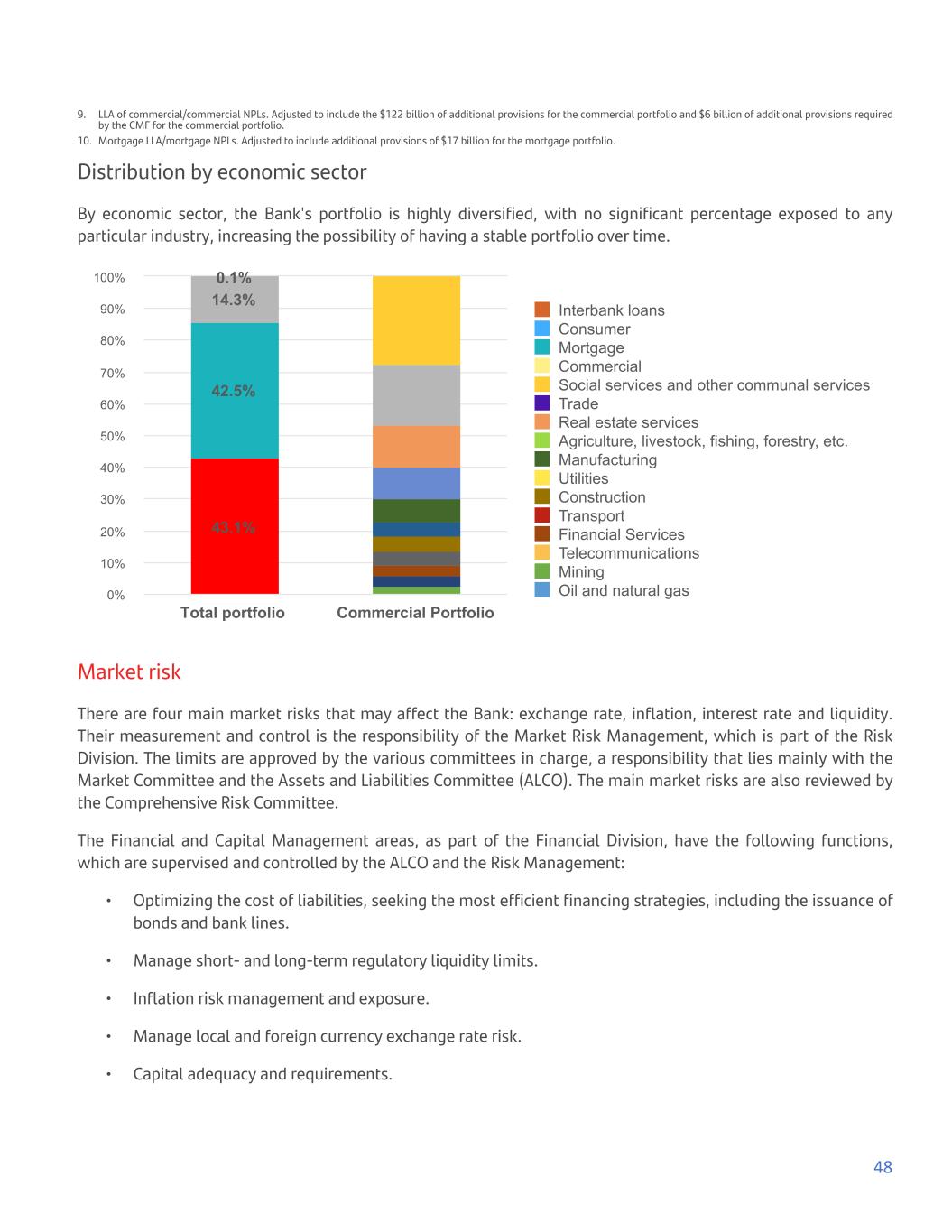

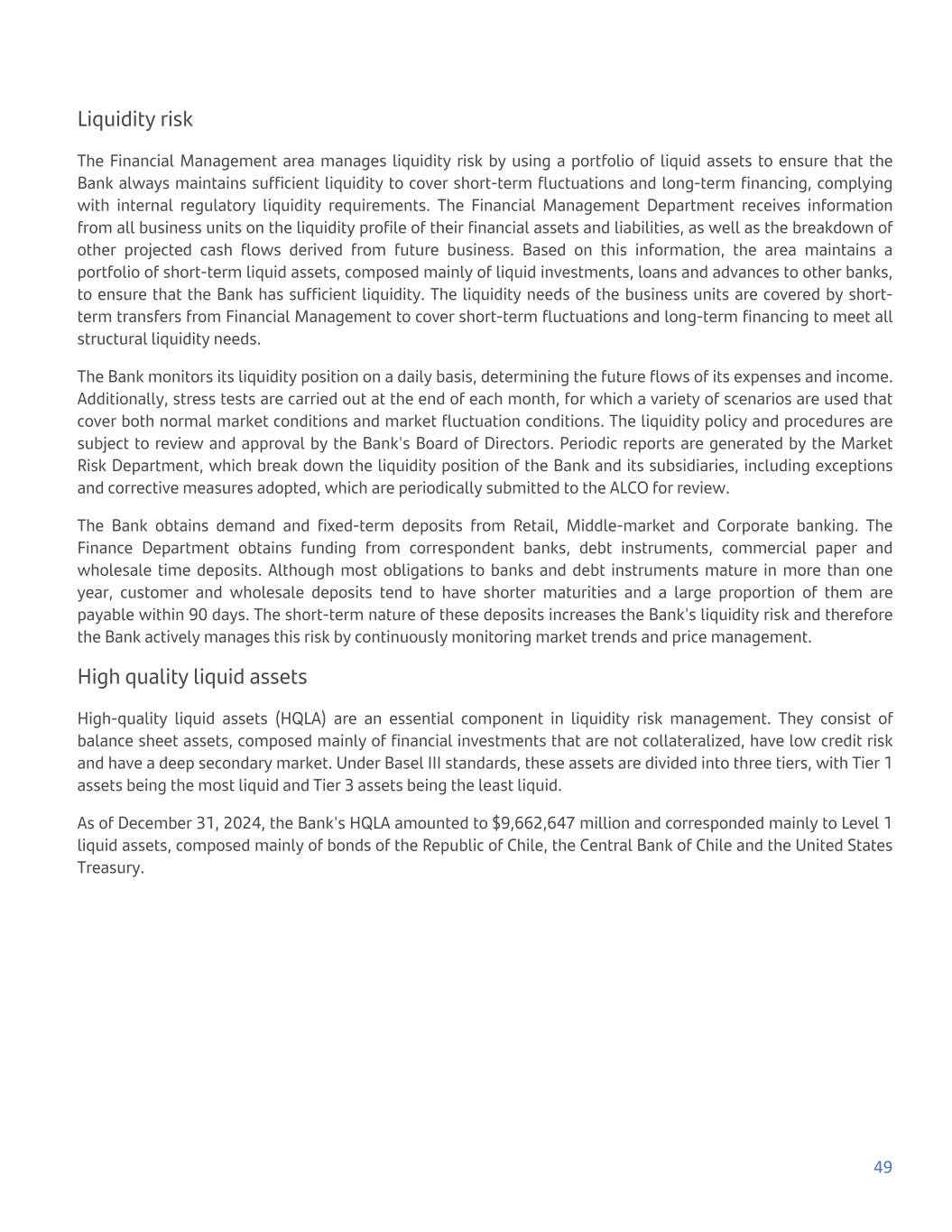

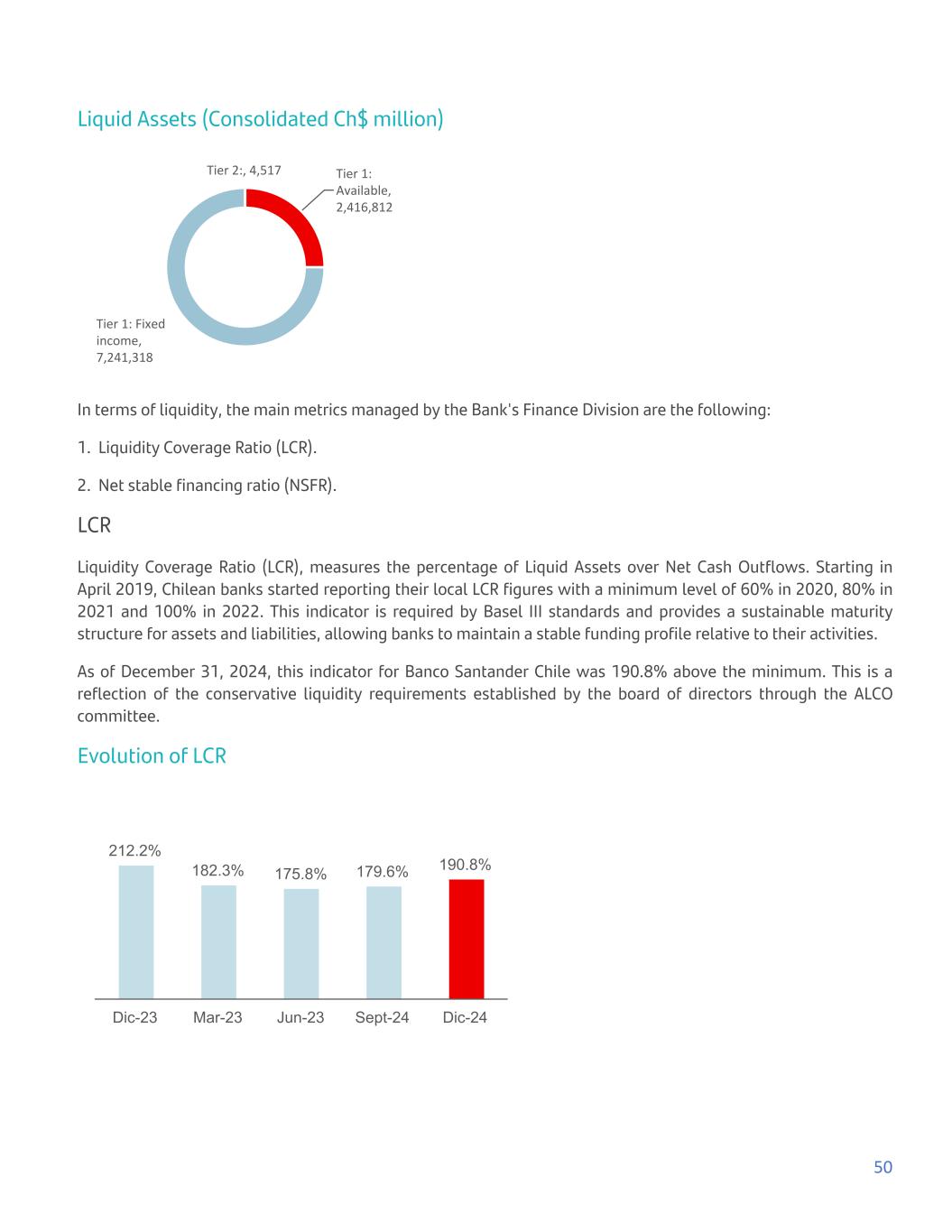

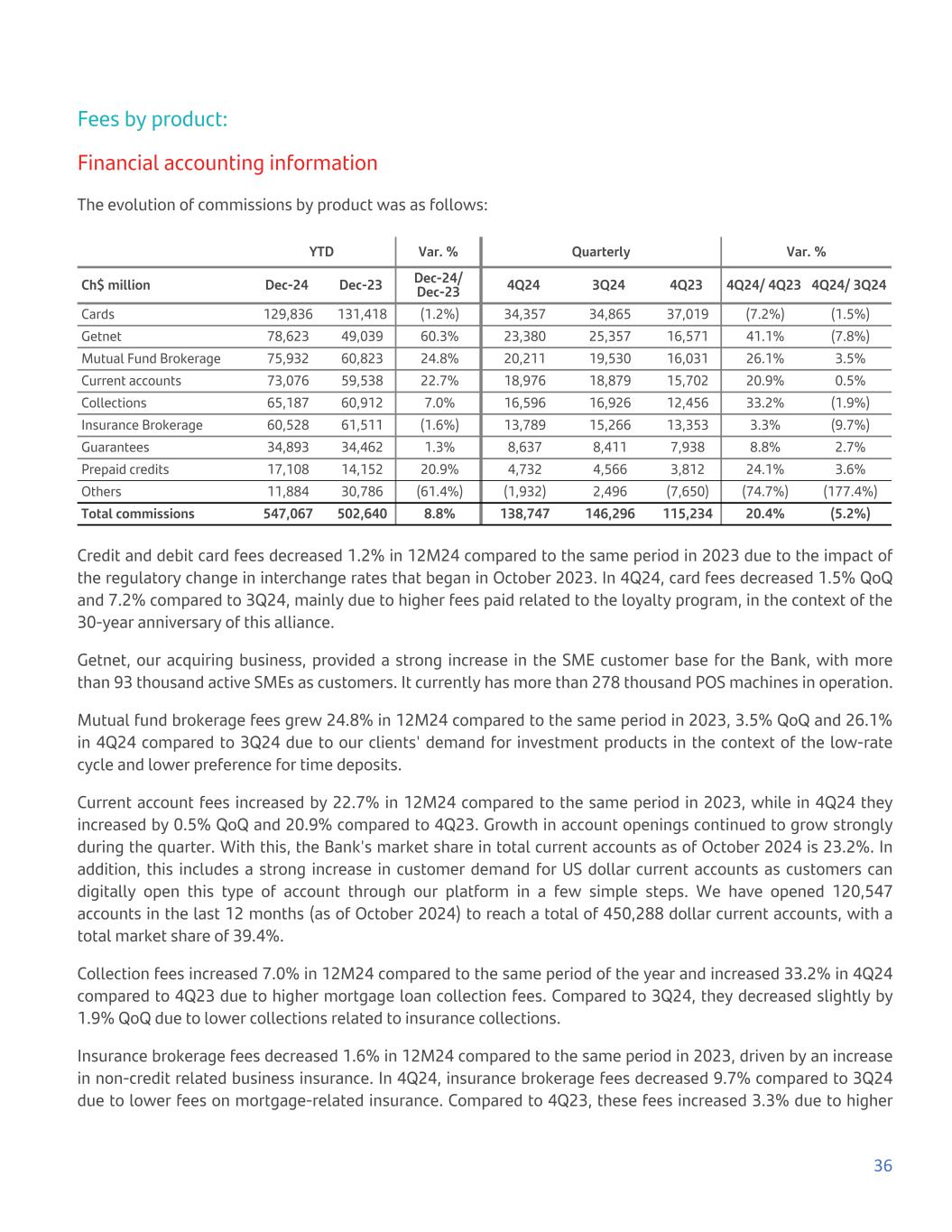

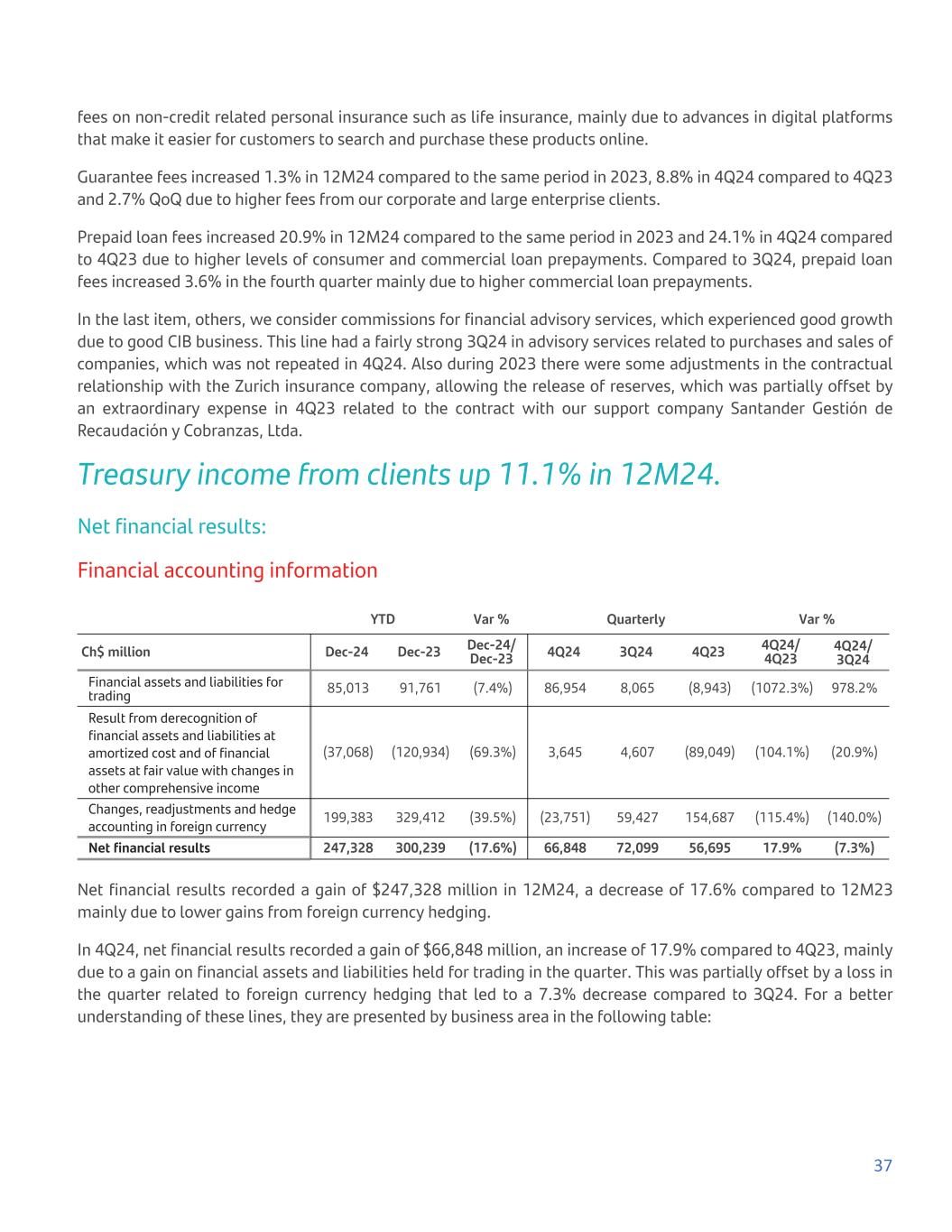

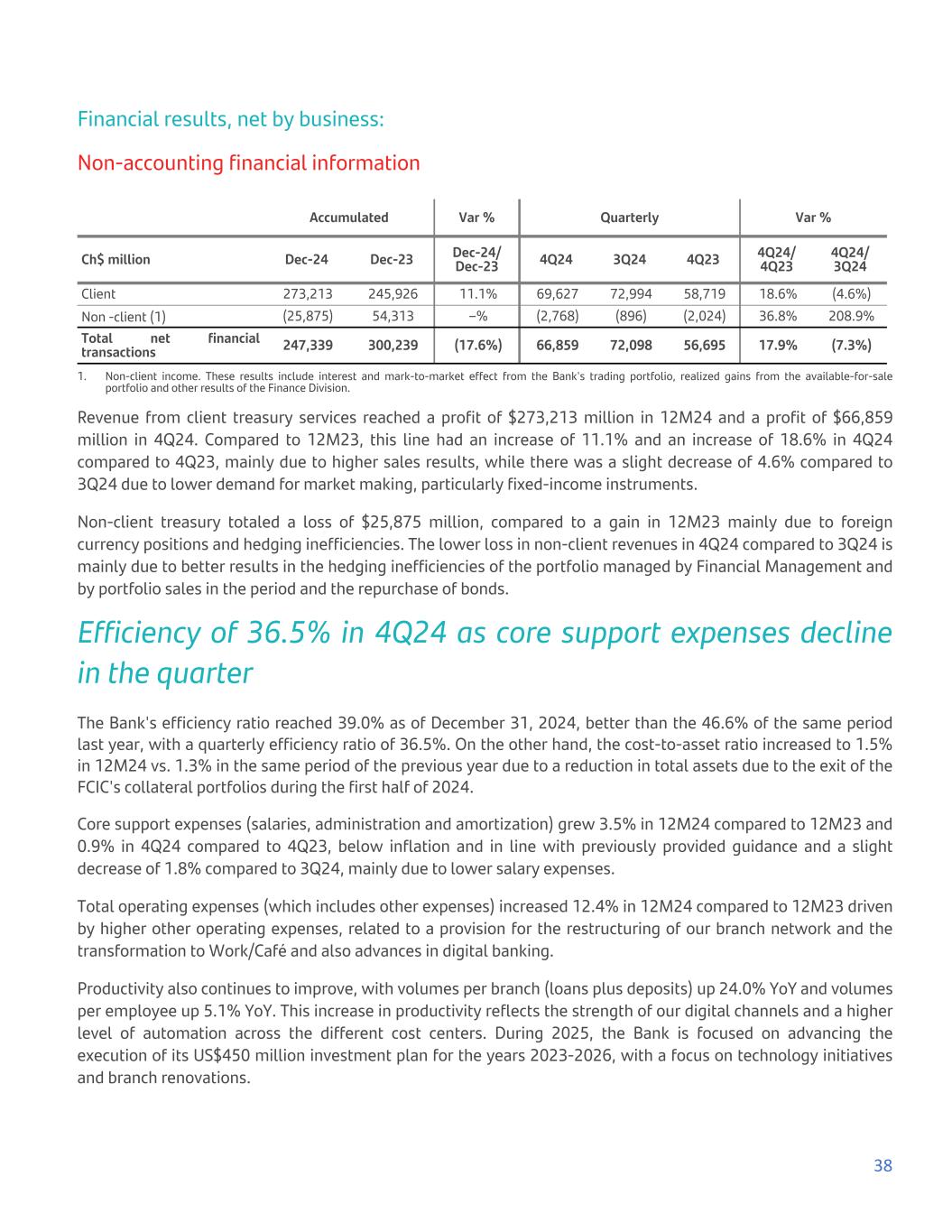

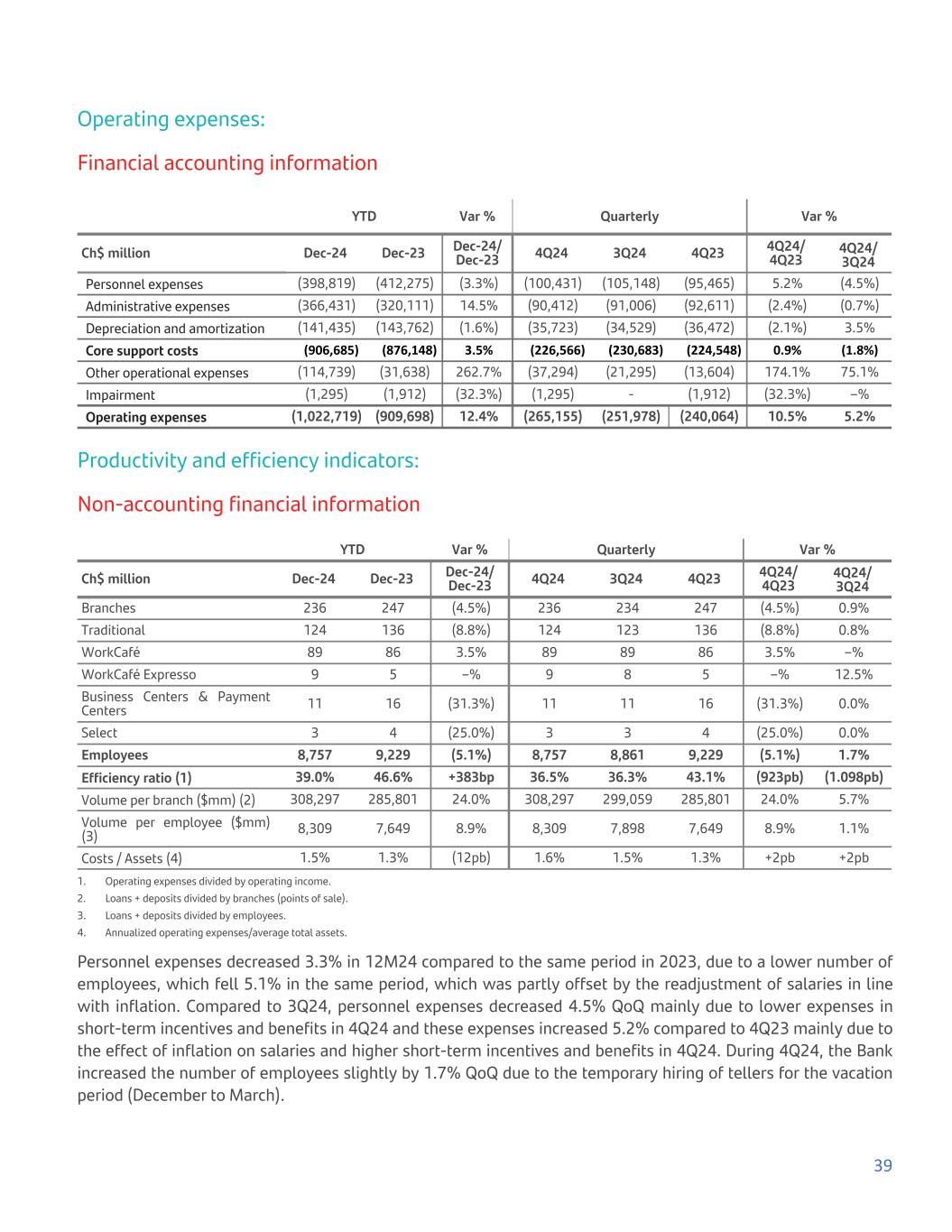

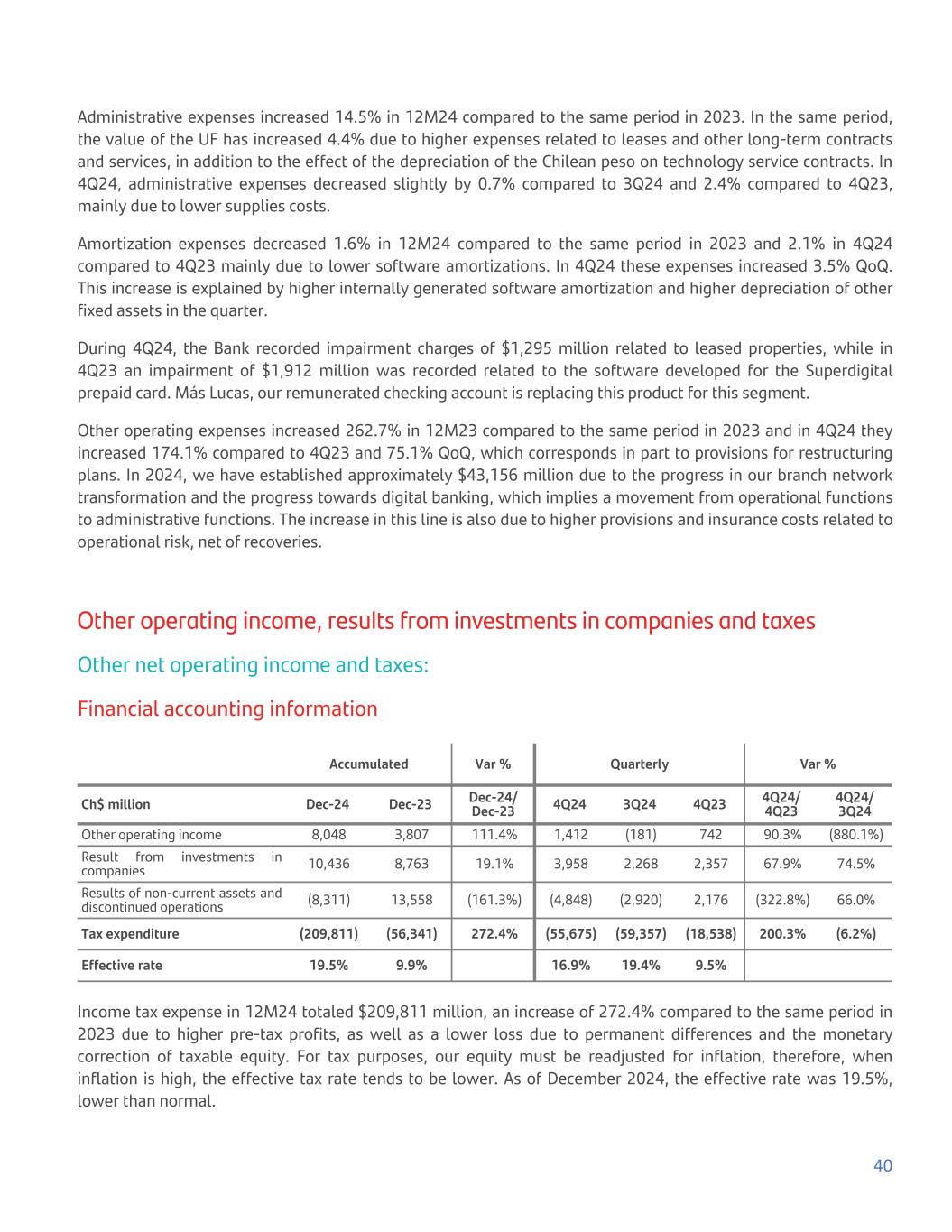

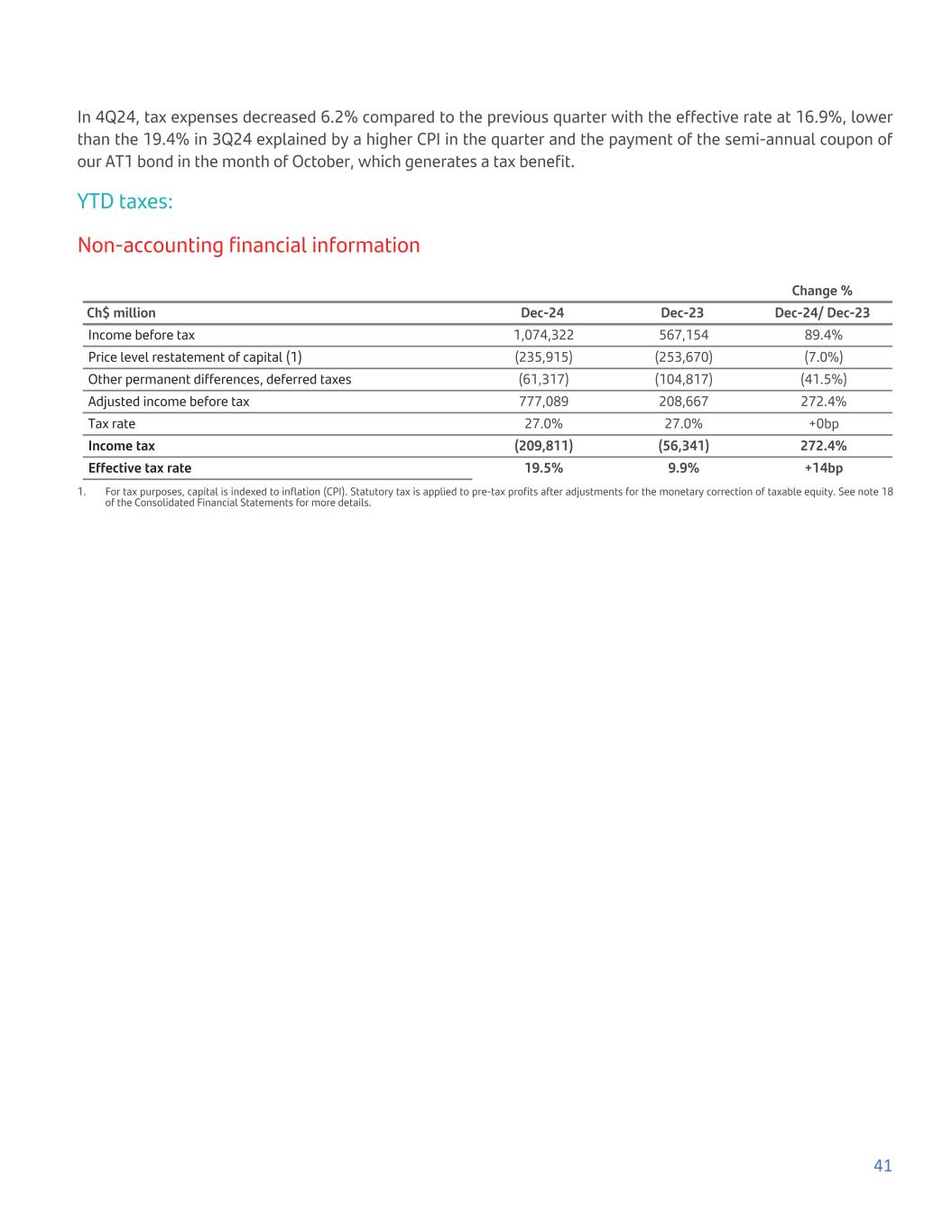

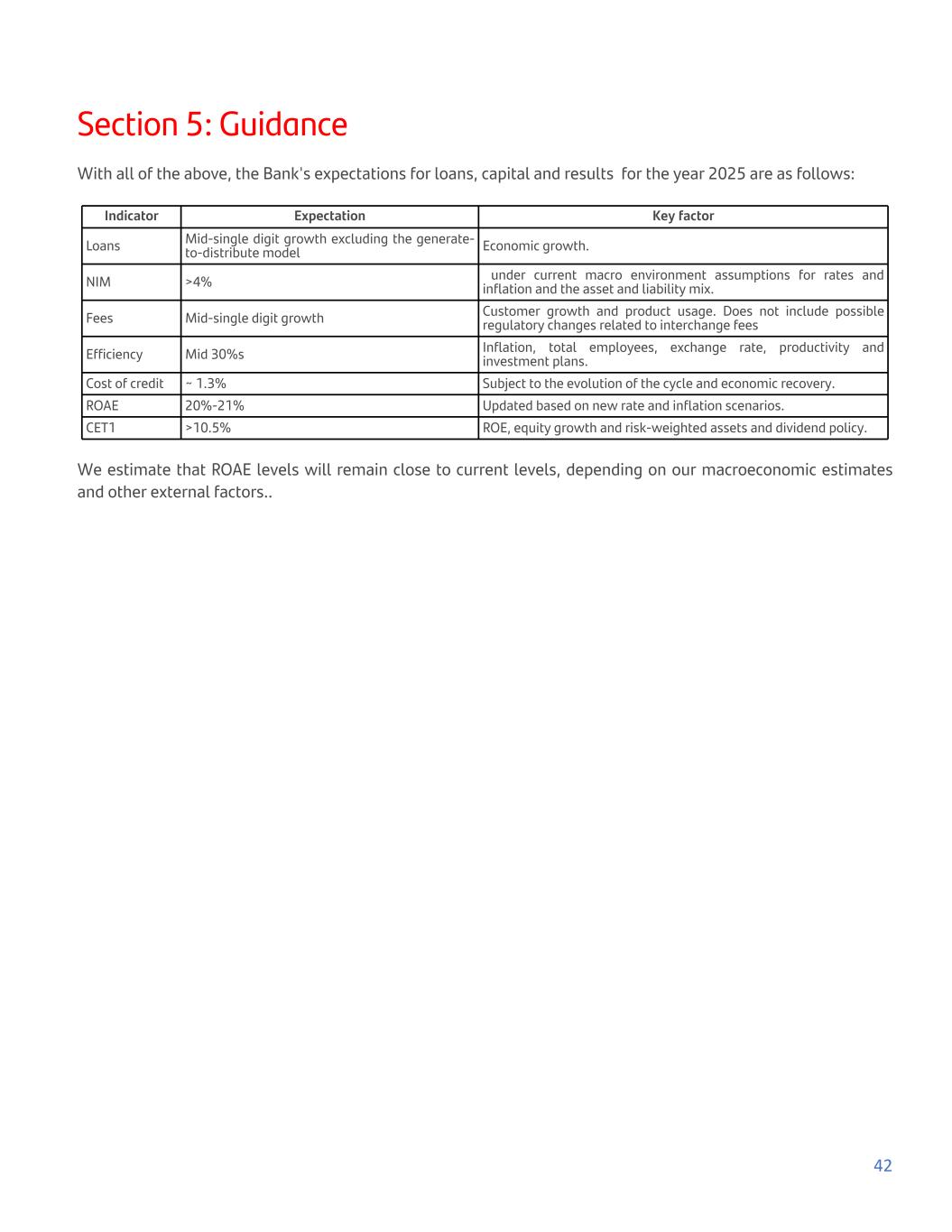

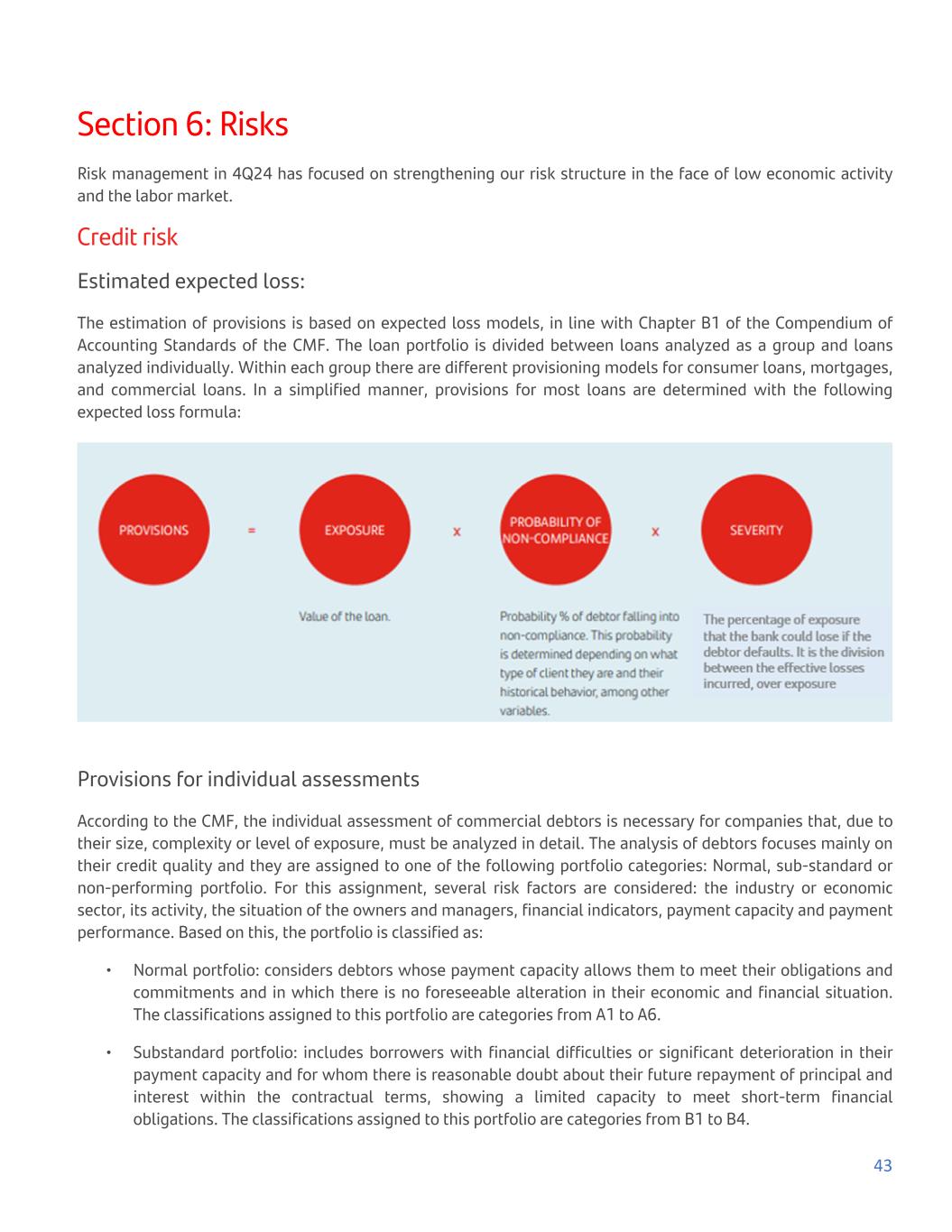

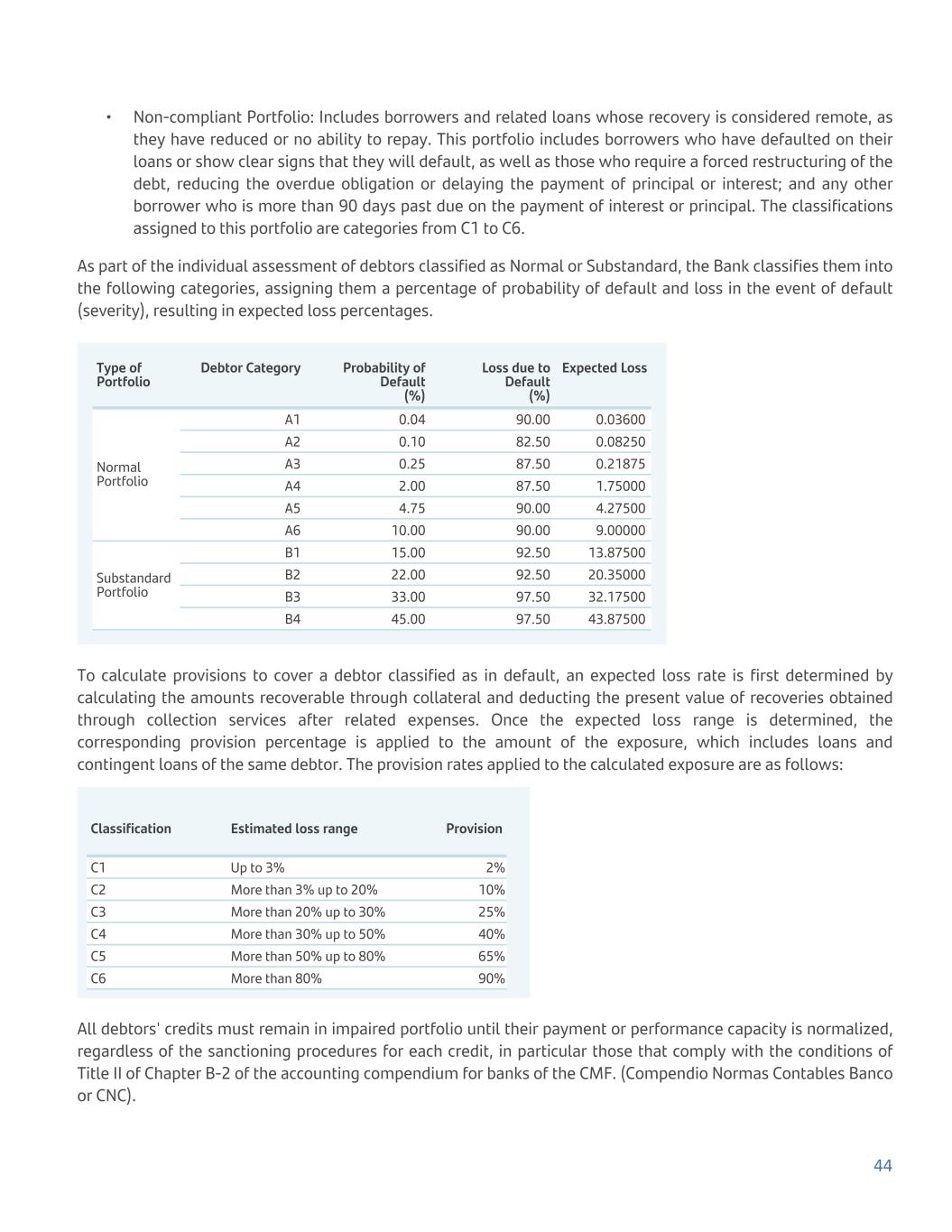

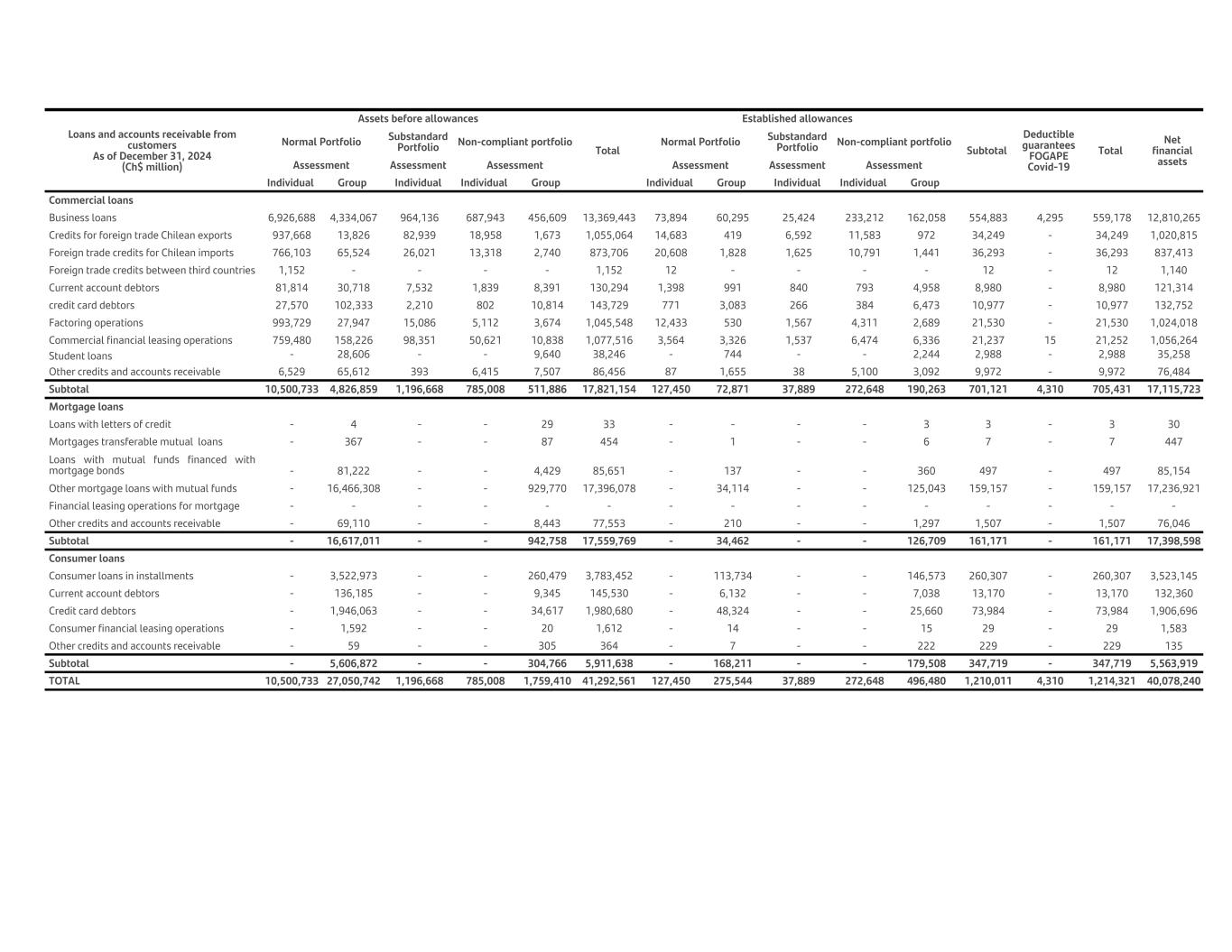

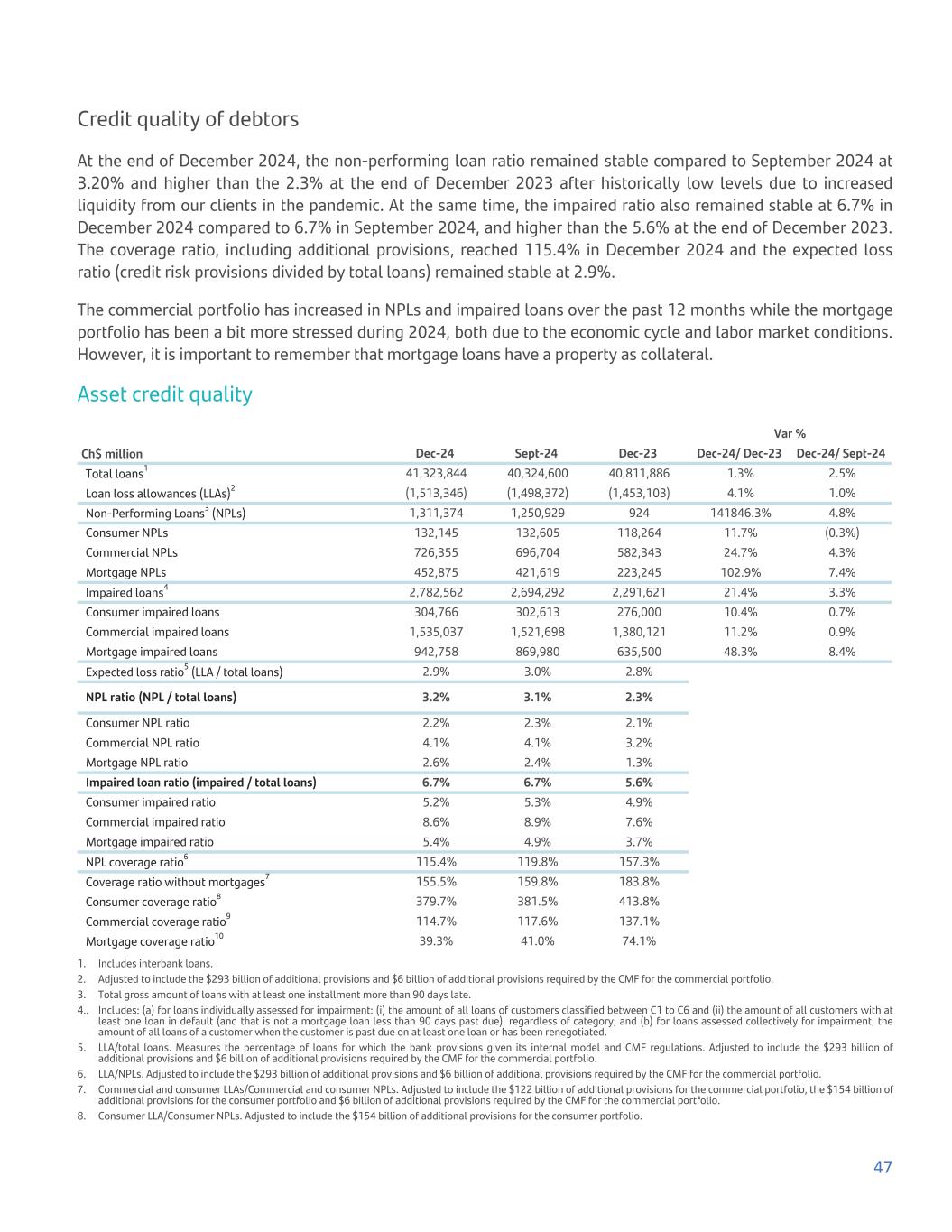

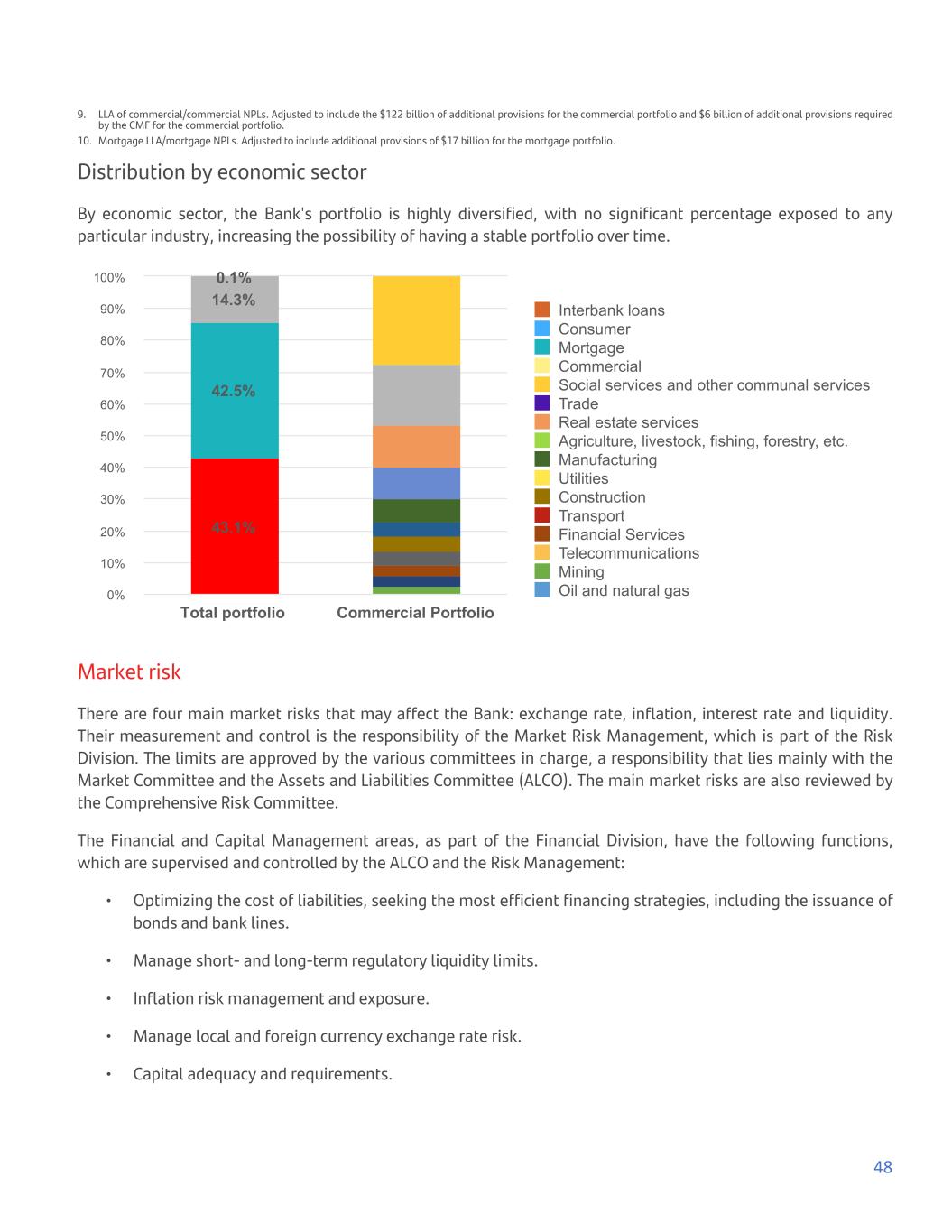

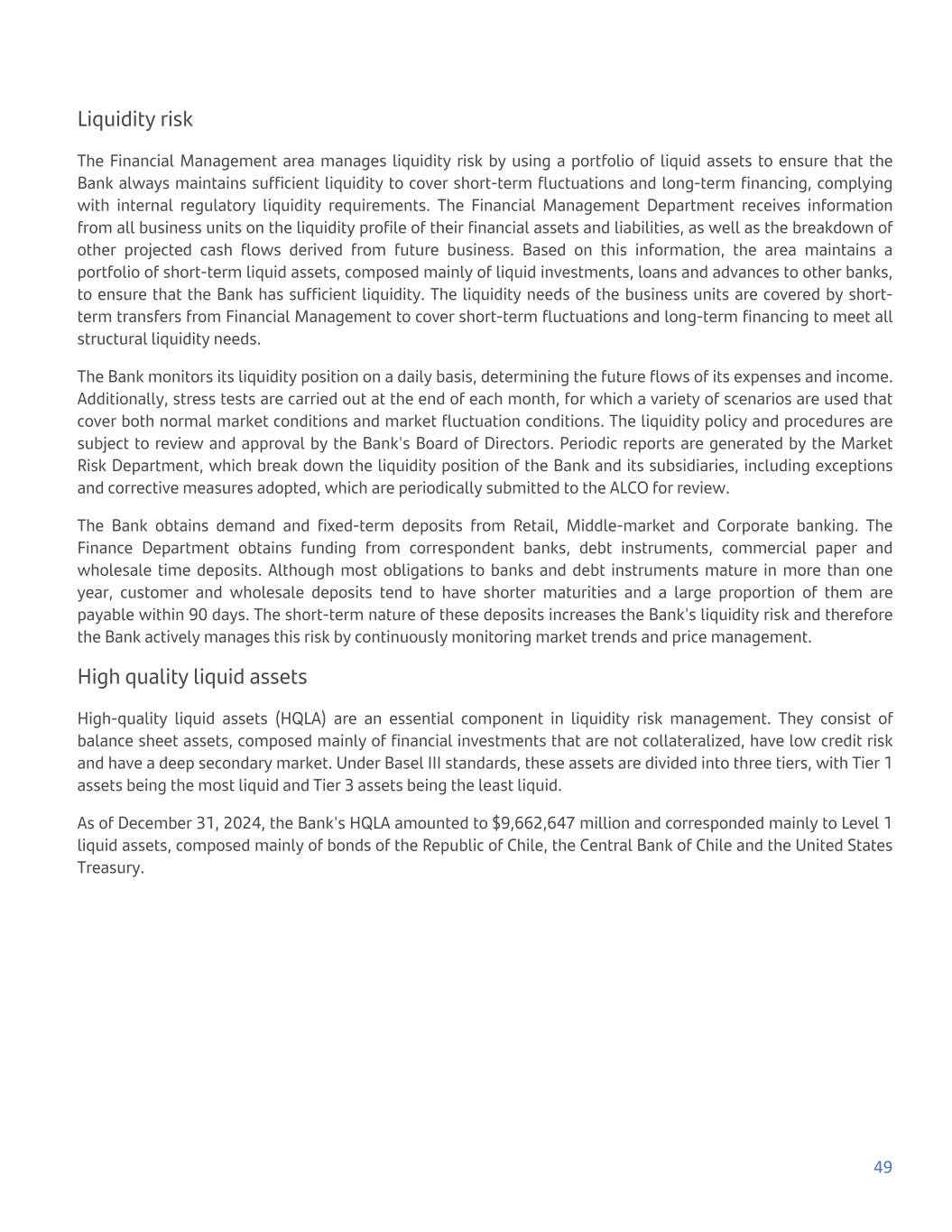

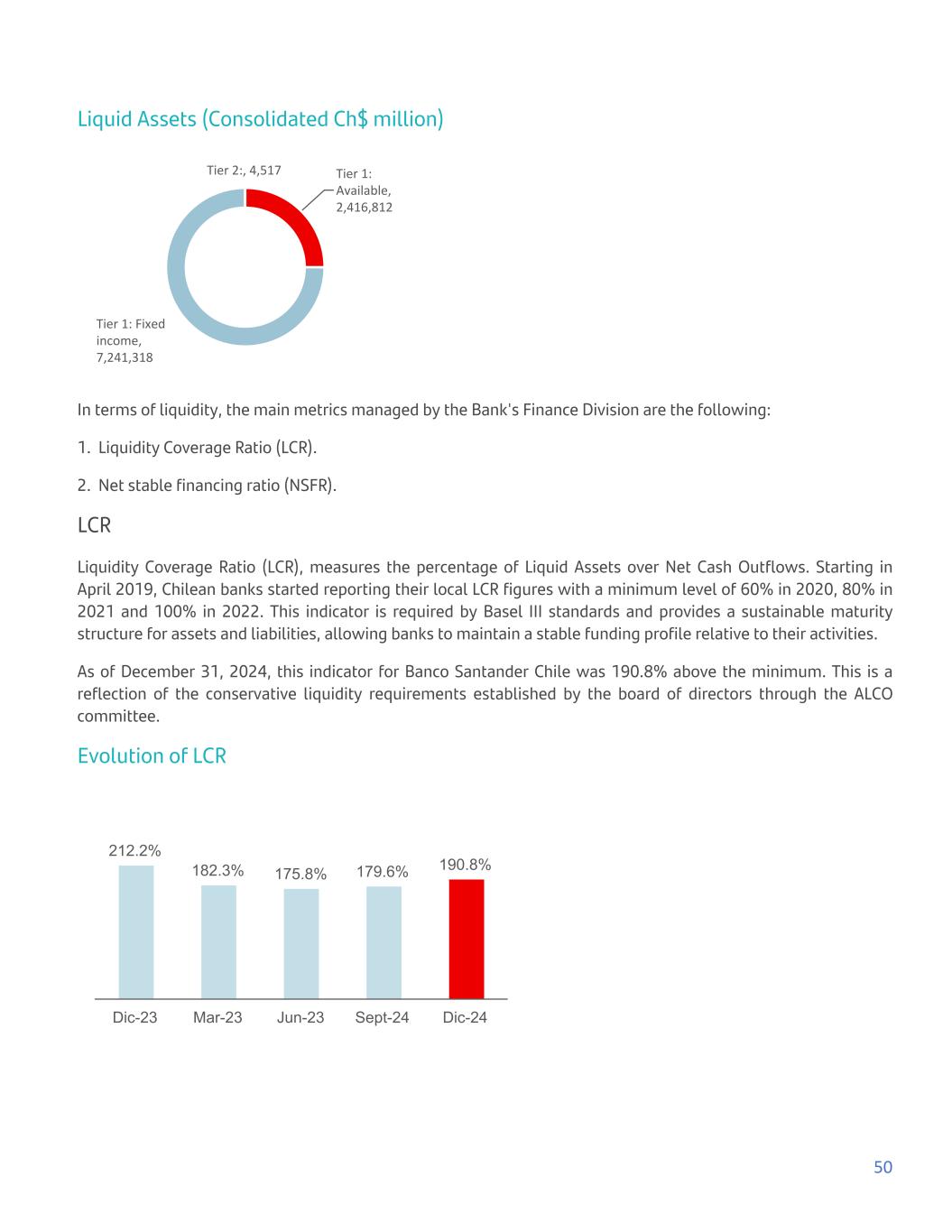

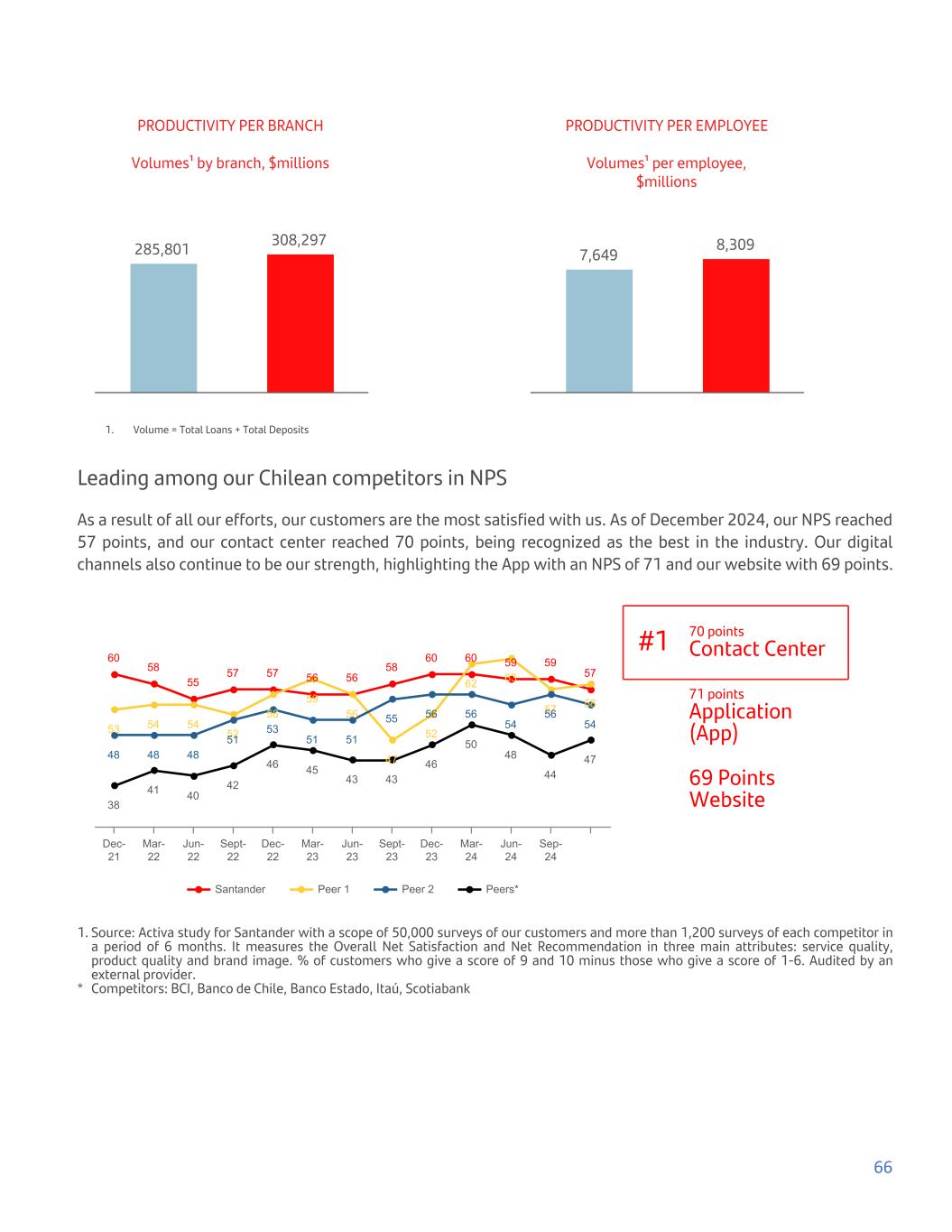

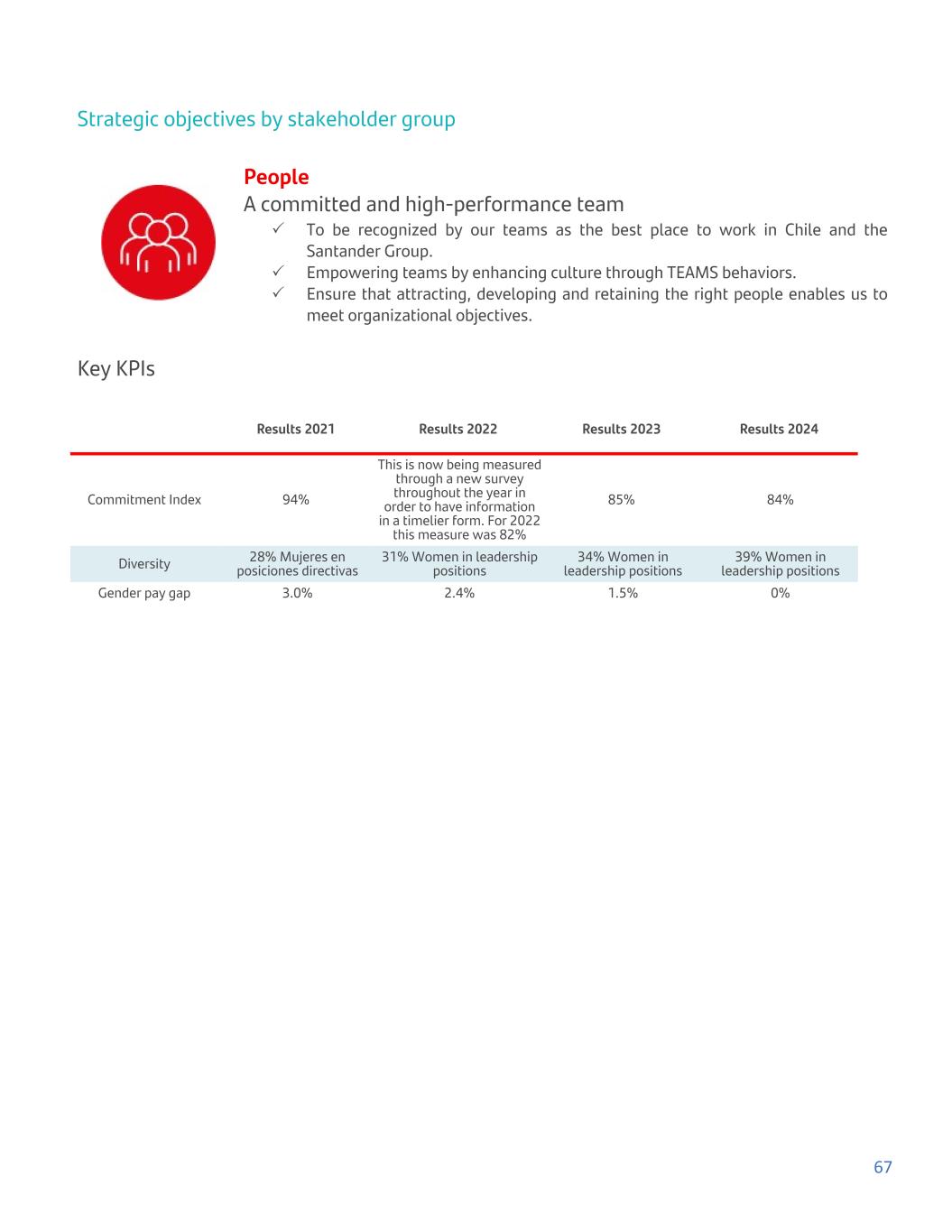

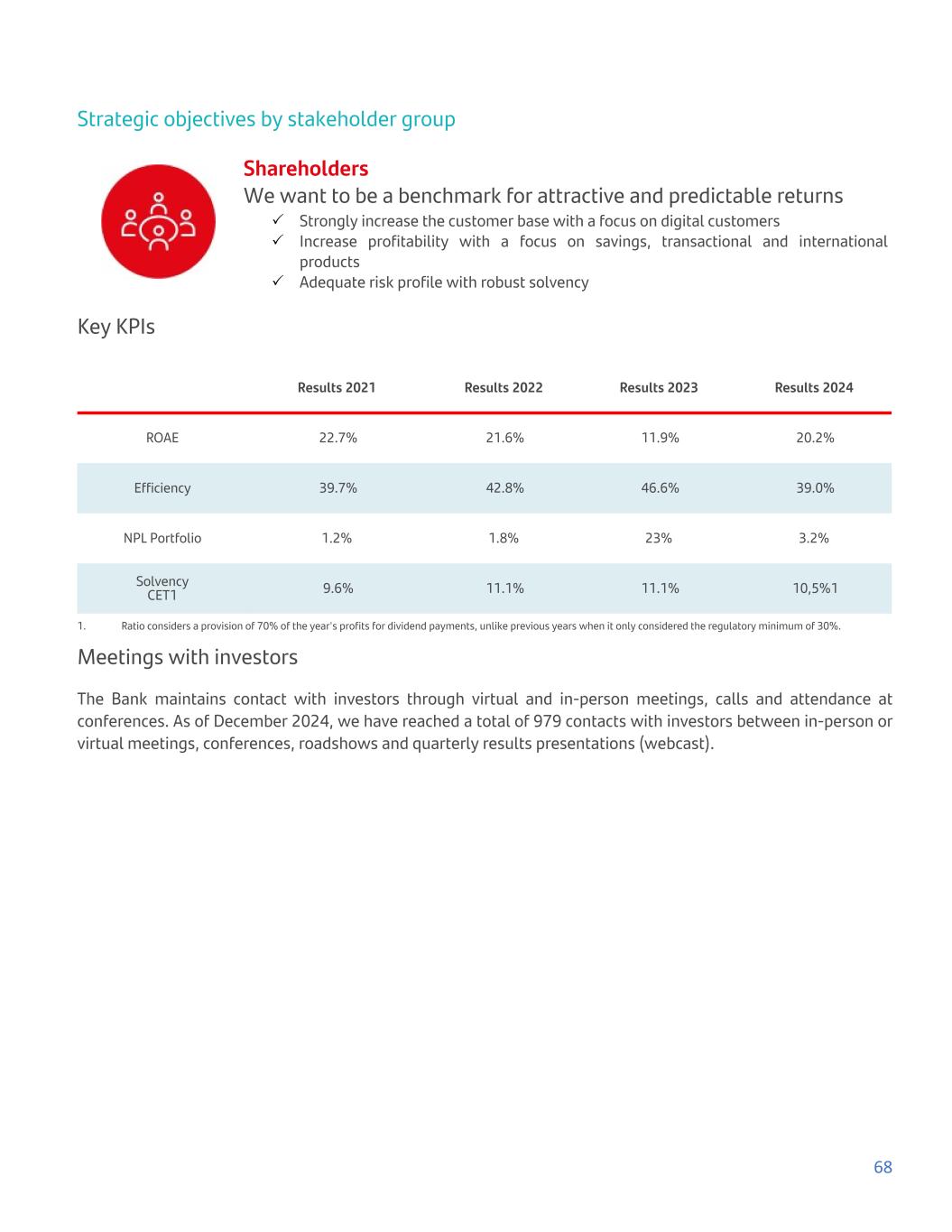

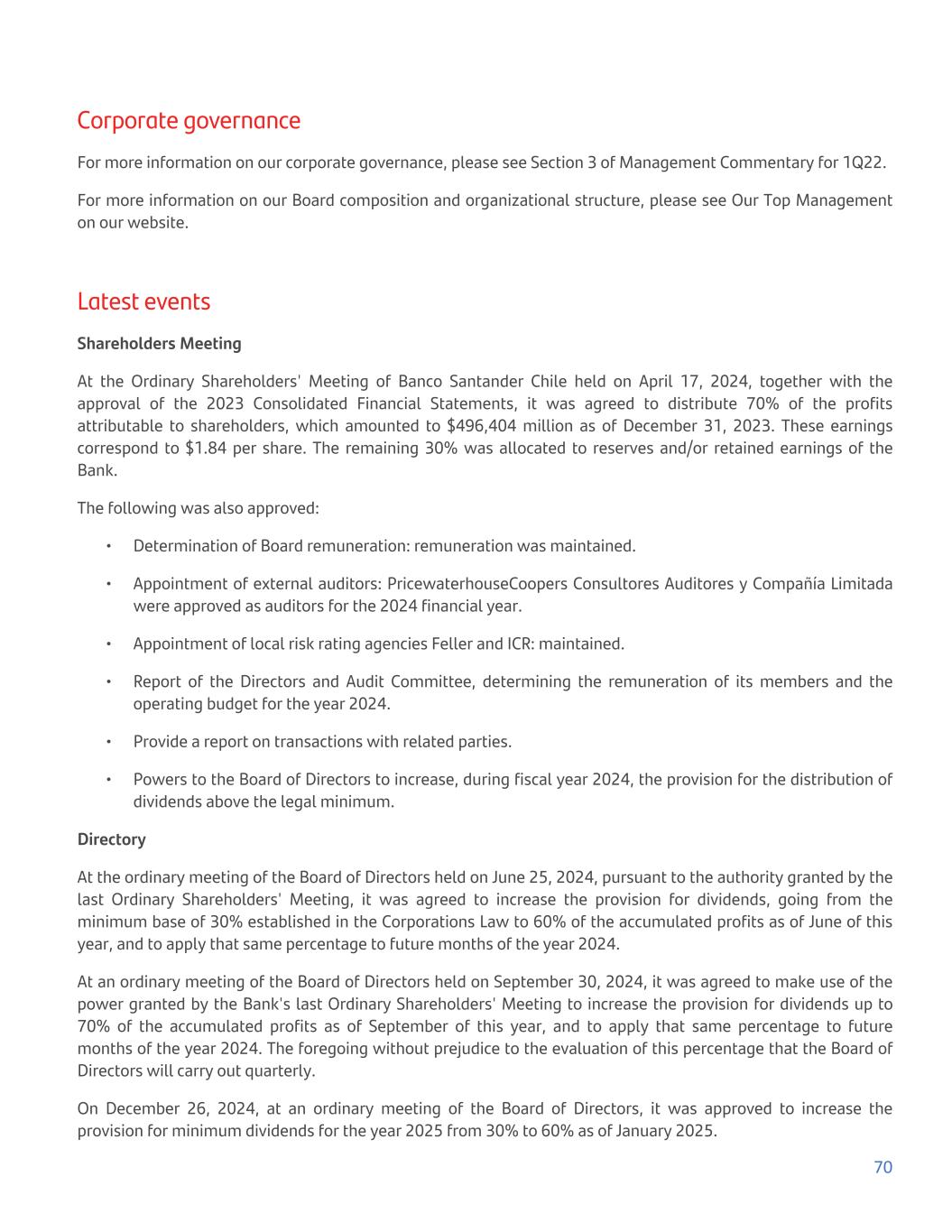

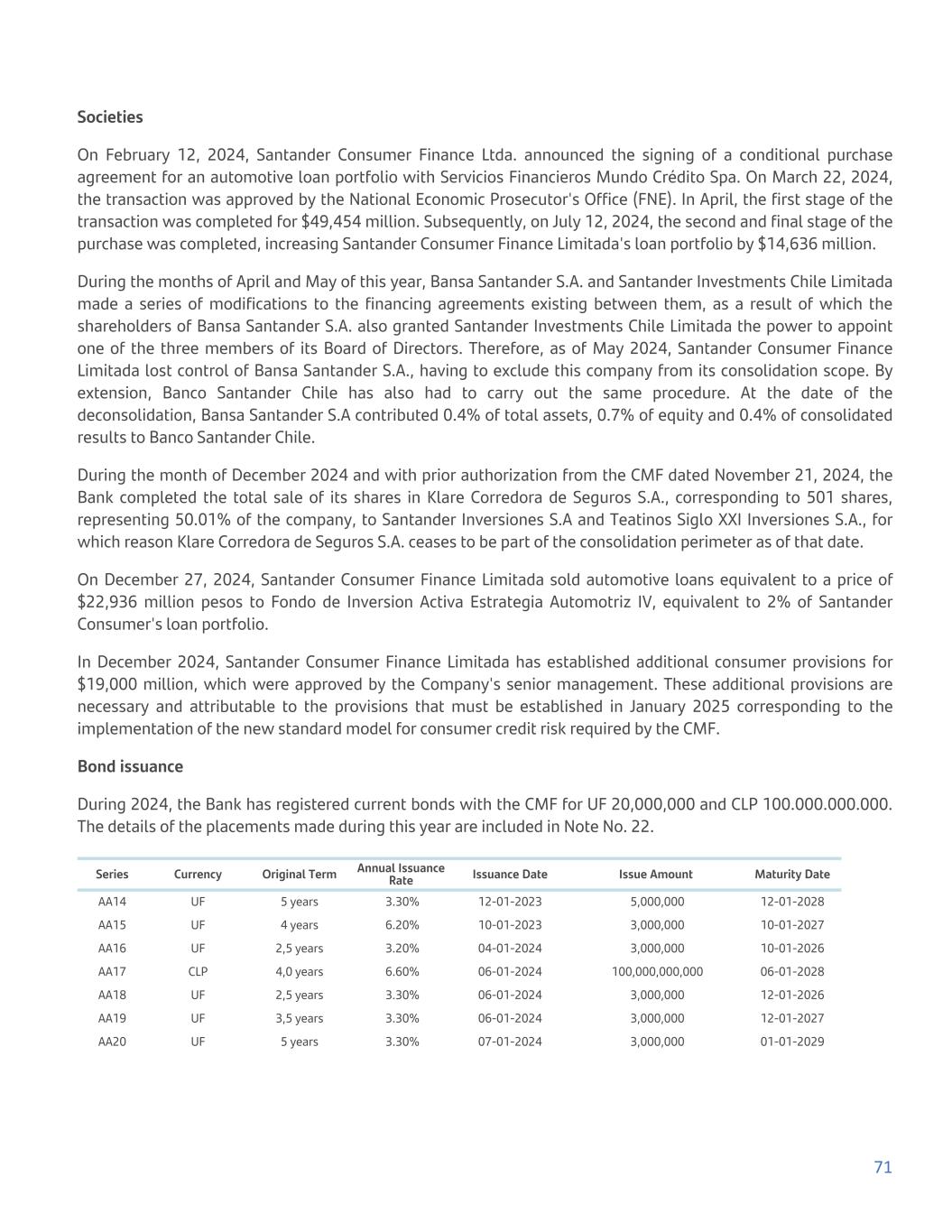

Fees by product: Financial accounting information The evolution of commissions by product was as follows: YTD Var. % Quarterly Var. % Ch$ million Dec-24 Dec-23 Dec-24/ Dec-23 4Q24 3Q24 4Q23 4Q24/ 4Q23 4Q24/ 3Q24 Cards 129,836 131,418 (1.2%) 34,357 34,865 37,019 (7.2%) (1.5%) Getnet 78,623 49,039 60.3% 23,380 25,357 16,571 41.1% (7.8%) Mutual Fund Brokerage 75,932 60,823 24.8% 20,211 19,530 16,031 26.1% 3.5% Current accounts 73,076 59,538 22.7% 18,976 18,879 15,702 20.9% 0.5% Collections 65,187 60,912 7.0% 16,596 16,926 12,456 33.2% (1.9%) Insurance Brokerage 60,528 61,511 (1.6%) 13,789 15,266 13,353 3.3% (9.7%) Guarantees 34,893 34,462 1.3% 8,637 8,411 7,938 8.8% 2.7% Prepaid credits 17,108 14,152 20.9% 4,732 4,566 3,812 24.1% 3.6% Others 11,884 30,786 (61.4%) (1,932) 2,496 (7,650) (74.7%) (177.4%) Total commissions 547,067 502,640 8.8% 138,747 146,296 115,234 20.4% (5.2%) Credit and debit card fees decreased 1.2% in 12M24 compared to the same period in 2023 due to the impact of the regulatory change in interchange rates that began in October 2023. In 4Q24, card fees decreased 1.5% QoQ and 7.2% compared to 3Q24, mainly due to higher fees paid related to the loyalty program, in the context of the 30-year anniversary of this alliance. Getnet, our acquiring business, provided a strong increase in the SME customer base for the Bank, with more than 93 thousand active SMEs as customers. It currently has more than 278 thousand POS machines in operation. Mutual fund brokerage fees grew 24.8% in 12M24 compared to the same period in 2023, 3.5% QoQ and 26.1% in 4Q24 compared to 3Q24 due to our clients' demand for investment products in the context of the low-rate cycle and lower preference for time deposits. Current account fees increased by 22.7% in 12M24 compared to the same period in 2023, while in 4Q24 they increased by 0.5% QoQ and 20.9% compared to 4Q23. Growth in account openings continued to grow strongly during the quarter. With this, the Bank's market share in total current accounts as of October 2024 is 23.2%. In addition, this includes a strong increase in customer demand for US dollar current accounts as customers can digitally open this type of account through our platform in a few simple steps. We have opened 120,547 accounts in the last 12 months (as of October 2024) to reach a total of 450,288 dollar current accounts, with a total market share of 39.4%. Collection fees increased 7.0% in 12M24 compared to the same period of the year and increased 33.2% in 4Q24 compared to 4Q23 due to higher mortgage loan collection fees. Compared to 3Q24, they decreased slightly by 1.9% QoQ due to lower collections related to insurance collections. Insurance brokerage fees decreased 1.6% in 12M24 compared to the same period in 2023, driven by an increase in non-credit related business insurance. In 4Q24, insurance brokerage fees decreased 9.7% compared to 3Q24 due to lower fees on mortgage-related insurance. Compared to 4Q23, these fees increased 3.3% due to higher 36