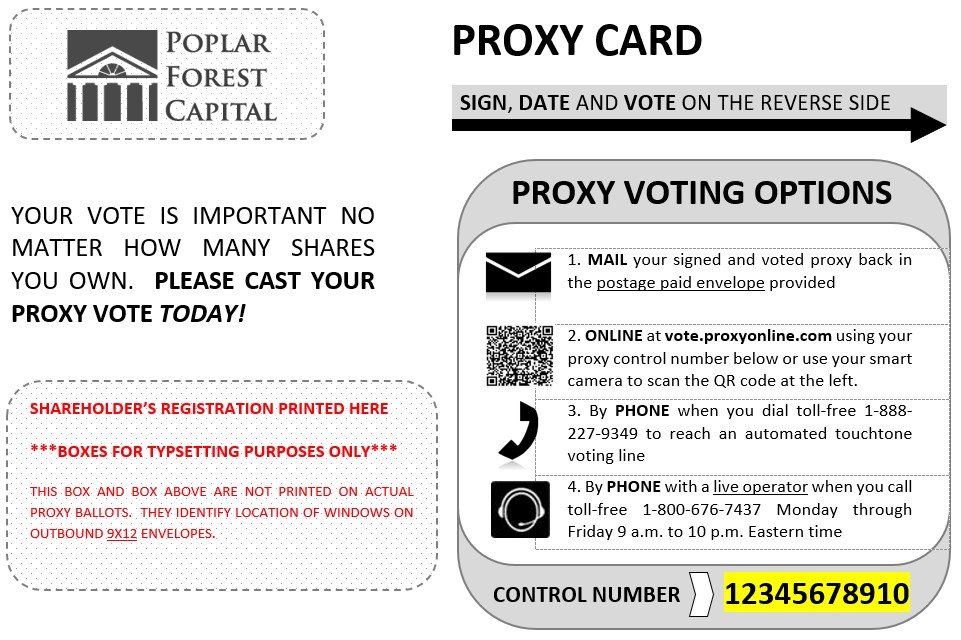

internet may be revoked at any time before they are voted by proxy voting again through the website or toll-free number

listed in the enclosed proxy card. Properly executed proxies will be voted, as you instruct, by the persons named in the

accompanying proxy card. In the absence of such direction, however, the persons named in the accompanying proxy card

intend to vote “FOR” the Proposal and may vote at their discretion with respect to other matters not now known to the Board

that may be presented at the Special Meeting. Attendance by a shareholder at the Special Meeting does not, in itself, revoke a

proxy.

If sufficient votes are not received by the date of the Special Meeting, the Special Meeting may be adjourned, once

or more, by either the chairman of the Special Meeting or by the vote of the holders of a majority of the Fund shares present

at the Special Meeting in person or by proxy to permit further solicitation of proxies. If there is a vote to adjourn, persons

named as proxies will vote all proxies in favor of adjournment that voted in favor of the Proposal and vote against

adjournment all proxies that voted against the Proposal.

Quorum Required. Each Fund must have a quorum of shares represented at the Special Meeting, in person or by

proxy, to take action on any matter relating to that Fund. Under the Trust’s Agreement and Declaration of Trust, as amended,

a quorum is constituted by the presence in person or by proxy of at least 40% of the outstanding shares of the Fund entitled to

vote at the Special Meeting.

Abstentions do not represent votes cast for a proposal but will be counted for purposes of determining whether a

quorum is present. “Broker non-votes” are shares held by a broker or nominee as to which instructions have not been

received from the beneficial owners or persons entitled to vote, and the broker or nominee does not have discretionary voting

power but for which a broker or nominee returns the proxy card or otherwise votes without actually voting on a proposal.

However, it is the Trust’s understanding that because broker-dealers, in the absence of specific authorization from their

customers, will not have discretionary authority to vote any shares held beneficially by their customers on the matters

expected to be presented at the Special Meeting, and accordingly, such shares will not count as present for quorum purposes

or for purposes of 2(a)(42) of the 1940 Act..

If a quorum is not present at the Special Meeting, or a quorum is present at the Special Meeting but sufficient votes

to approve a proposal are not received, the chairman of the Special Meeting or the holders of a majority of the Fund shares

present at the Special Meeting, in person or by proxy, may adjourn the Special Meeting with respect to such proposal and

such fund or funds, as necessary, to permit further solicitation of proxies.

Method and Cost of Proxy Solicitation. Proxies will be solicited by the Trust primarily by mail. The solicitation

may also include telephone, facsimile, electronic or oral communications by certain officers or employees of the Trust or

Poplar Forest or TAM, none of whom will be paid for these services, or by a third-party proxy solicitation firm. Poplar Forest

and TAM or its affiliates are bearing the costs of this proxy solicitation, including the printing and mailing of the Proxy

Statement and related materials. The expenses connected with the Proposal, the Special Meeting and the solicitation of

proxies are estimated to be $50,000. The Trust may also request broker-dealer firms, custodians, nominees and fiduciaries to

forward proxy materials to the beneficial owners of the shares of a Fund held of record by such persons. Poplar Forest may

reimburse such broker-dealer firms, custodians, nominees, and fiduciaries for their reasonable expenses incurred in

connection with such proxy solicitation, including reasonable expenses in communicating with persons for whom they hold

shares of a Fund.

Other Information. The Funds’ distributor and principal underwriter is Quasar Distributors, LLC, 111 E. Kilbourn

Ave., Suite 2200, Milwaukee, Wisconsin 53202. U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global

Fund Services, located at 615 East Michigan Street, Milwaukee, Wisconsin 53202, serves as the Funds’transfer agent and

administrator.

Share Ownership. To the knowledge of the Trust’s management, as of the close of business on February 14, 2025

(the Record Date), the officers and Trustees of the Trust, as a group, beneficially owned less than one percent of each Fund’s

outstanding shares and less than one percent of the Trust’s outstanding shares. To the knowledge of the Trust’s management,

as of the close of business on February 14, 2025, persons owning of record more than 5% of the outstanding shares of each

Fund are as listed in the table below. The Trust believes that most of the shares referred to below were held by the persons

indicated in accounts for their fiduciary, agency or custodial customers. Any shareholder listed below who beneficially owns

25% or more of the outstanding shares of a Fund may be presumed to “control” (as that term is defined in the 1940 Act) the