UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file Number 811-01807

Value Line Larger Companies Focused Fund, Inc.

(Exact name of registrant as specified in charter)

1605 Main Street, Sarasota, FL 34236

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: 212-907-1900

Date of fiscal year end: December 31, 2024

Date of reporting period: December 31, 2024

Item I. Reports to Stockholders.

| | (a) | A copy of the Tailored Shareholder Report to Stockholders for the period ended 12/31/24 is included with this Form. |

Value Line Larger Companies Focused Fund, Inc.

Institutional Class VLLIX

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about Value Line Larger Companies Focused Fund, Inc. (the "Fund") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.vlfunds.com. You can also request this information by contacting us at 1-800-243-2729 or investorservices@vlfunds.com.

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $101 | 0.89% |

|---|

How did the Fund perform last year?

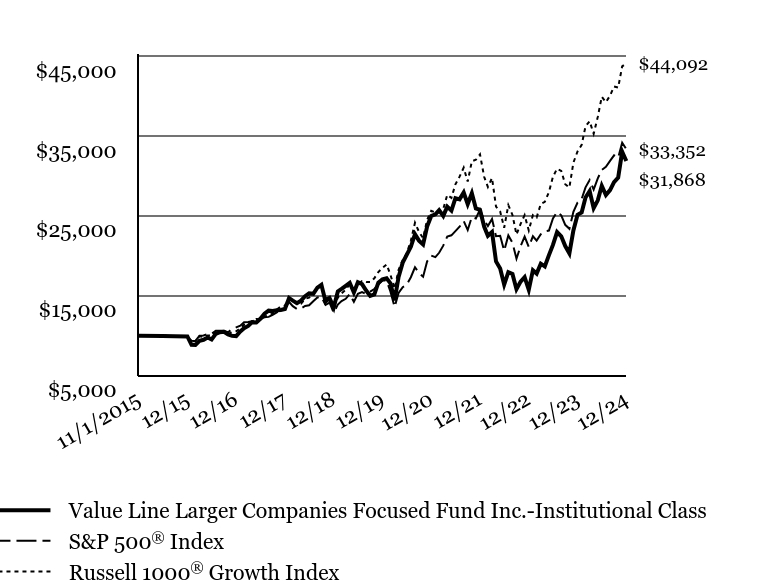

The Fund's Institutional Class generated a total return of 26.78% during the year ended December 31, 2024.

• The Fund outperformed the S&P 500® Index, attributable primarily to sector allocation. The Fund also benefited from its focus on growth companies, which outperformed value-oriented stocks, and from having positions in all of the Magnificent Seven, the mega-cap stocks that drove equity performance. Stock selection overall detracted, albeit modestly.

• An overweight to information technology and having no allocation to consumer staples contributed positively. Stock selection in information technology and financials also added value. Stock selection in health care, consumer discretionary and industrials detracted.

• Individual stocks contributing most positively to the Fund’s relative results were MicroStrategy, an AI-powered enterprise analytics software and Bitcoin treasury company; NVIDIA, a computer graphics processors maker; and Robinhood Markets, a financial services platform operator—each of which enjoyed a triple-digit share price gain. Out-of-Index holdings in new Fund position MicroStrategy and in Robinhood Markets advanced mostly on Bitcoin’s appreciation. An overweight in NVIDIA benefited from strong AI demand.

• Stocks that detracted most from the Fund’s relative performance were molecular diagnostics company Exact Sciences, semiconductor company Advanced Micro Devices and electric vehicle maker Rivian Automotive—each of which saw a double-digit share price decline. An out-of-Index position in Exact Sciences was negatively affected by execution issues and competitive pressures associated with the launch of its next-gen Cologuard screening test. An overweight to Advanced Micro Devices was impacted by weakness in the communications and industrials markets. An out-of-Index position in Rivian Automotive was volatile, as the company ramped up its production of electric trucks and SUVs while balancing profitability and market dynamics.

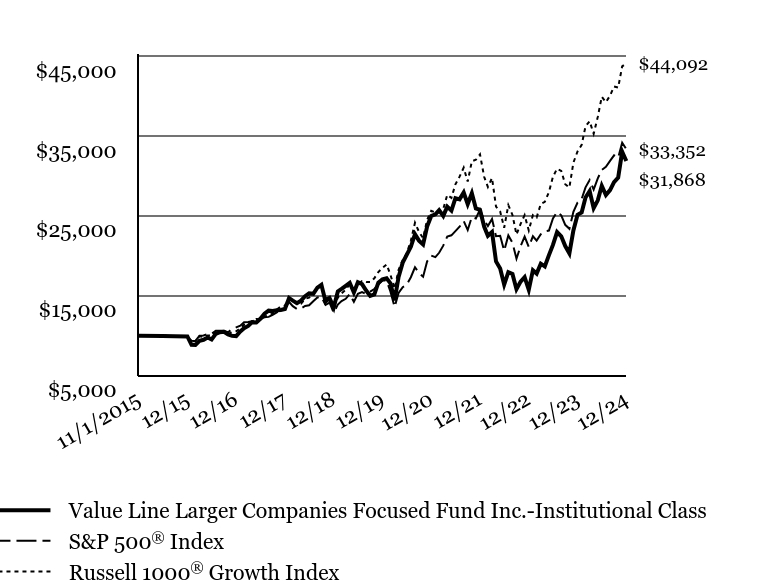

Total Return based on a $10,000 Investment

| Value Line Larger Companies Focused Fund Inc.-Institutional Class | S&P 500® Index | Russell 1000® Growth Index |

|---|

| 11/1/2015 | $10,000 | $10,000 | $10,000 |

|---|

| 11/30/2015 | $9,975 | $10,030 | $10,028 |

|---|

| 12/31/2015 | $9,927 | $9,872 | $9,881 |

|---|

| 1/31/2016 | $8,880 | $9,382 | $9,329 |

|---|

| 2/29/2016 | $8,861 | $9,369 | $9,325 |

|---|

| 3/31/2016 | $9,373 | $10,005 | $9,954 |

|---|

| 4/30/2016 | $9,506 | $10,043 | $9,863 |

|---|

| 5/31/2016 | $9,798 | $10,224 | $10,055 |

|---|

| 6/30/2016 | $9,540 | $10,250 | $10,015 |

|---|

| 7/31/2016 | $10,241 | $10,628 | $10,488 |

|---|

| 8/31/2016 | $10,450 | $10,643 | $10,436 |

|---|

| 9/30/2016 | $10,496 | $10,645 | $10,474 |

|---|

| 10/31/2016 | $10,181 | $10,451 | $10,228 |

|---|

| 11/30/2016 | $9,995 | $10,838 | $10,451 |

|---|

| 12/31/2016 | $9,966 | $11,052 | $10,580 |

|---|

| 1/31/2017 | $10,546 | $11,262 | $10,937 |

|---|

| 2/28/2017 | $10,962 | $11,709 | $11,391 |

|---|

| 3/31/2017 | $11,239 | $11,723 | $11,523 |

|---|

| 4/30/2017 | $11,711 | $11,843 | $11,786 |

|---|

| 5/31/2017 | $11,667 | $12,010 | $12,093 |

|---|

| 6/30/2017 | $12,131 | $12,085 | $12,061 |

|---|

| 7/31/2017 | $12,767 | $12,333 | $12,381 |

|---|

| 8/31/2017 | $13,152 | $12,371 | $12,608 |

|---|

| 9/30/2017 | $13,122 | $12,626 | $12,772 |

|---|

| 10/31/2017 | $13,200 | $12,921 | $13,267 |

|---|

| 11/30/2017 | $13,243 | $13,317 | $13,670 |

|---|

| 12/31/2017 | $13,351 | $13,465 | $13,777 |

|---|

| 1/31/2018 | $14,721 | $14,236 | $14,752 |

|---|

| 2/28/2018 | $14,404 | $13,711 | $14,366 |

|---|

| 3/31/2018 | $14,092 | $13,363 | $13,972 |

|---|

| 4/30/2018 | $14,409 | $13,414 | $14,020 |

|---|

| 5/31/2018 | $14,954 | $13,737 | $14,635 |

|---|

| 6/30/2018 | $15,318 | $13,822 | $14,776 |

|---|

| 7/31/2018 | $15,257 | $14,336 | $15,210 |

|---|

| 8/31/2018 | $16,021 | $14,803 | $16,041 |

|---|

| 9/30/2018 | $16,375 | $14,887 | $16,131 |

|---|

| 10/31/2018 | $14,311 | $13,870 | $14,688 |

|---|

| 11/30/2018 | $14,716 | $14,153 | $14,844 |

|---|

| 12/31/2018 | $13,558 | $12,875 | $13,568 |

|---|

| 1/31/2019 | $15,549 | $13,906 | $14,788 |

|---|

| 2/28/2019 | $15,874 | $14,353 | $15,317 |

|---|

| 3/31/2019 | $16,258 | $14,632 | $15,753 |

|---|

| 4/30/2019 | $16,632 | $15,224 | $16,464 |

|---|

| 5/31/2019 | $15,426 | $14,257 | $15,424 |

|---|

| 6/30/2019 | $16,712 | $15,262 | $16,484 |

|---|

| 7/31/2019 | $16,477 | $15,481 | $16,856 |

|---|

| 8/31/2019 | $15,666 | $15,236 | $16,727 |

|---|

| 9/30/2019 | $15,004 | $15,521 | $16,729 |

|---|

| 10/31/2019 | $15,191 | $15,857 | $17,200 |

|---|

| 11/30/2019 | $16,653 | $16,433 | $17,964 |

|---|

| 12/31/2019 | $17,072 | $16,928 | $18,506 |

|---|

| 1/31/2020 | $17,207 | $16,922 | $18,919 |

|---|

| 2/29/2020 | $16,572 | $15,529 | $17,631 |

|---|

| 3/31/2020 | $14,438 | $13,611 | $15,896 |

|---|

| 4/30/2020 | $17,360 | $15,356 | $18,249 |

|---|

| 5/31/2020 | $19,160 | $16,087 | $19,474 |

|---|

| 6/30/2020 | $20,124 | $16,407 | $20,322 |

|---|

| 7/31/2020 | $21,130 | $17,332 | $21,885 |

|---|

| 8/31/2020 | $22,712 | $18,578 | $24,144 |

|---|

| 9/30/2020 | $21,906 | $17,872 | $23,008 |

|---|

| 10/31/2020 | $21,430 | $17,397 | $22,226 |

|---|

| 11/30/2020 | $23,665 | $19,301 | $24,502 |

|---|

| 12/31/2020 | $24,988 | $20,043 | $25,629 |

|---|

| 1/31/2021 | $25,201 | $19,841 | $25,439 |

|---|

| 2/28/2021 | $25,718 | $20,388 | $25,433 |

|---|

| 3/31/2021 | $25,001 | $21,281 | $25,870 |

|---|

| 4/30/2021 | $26,157 | $22,416 | $27,630 |

|---|

| 5/31/2021 | $25,659 | $22,573 | $27,248 |

|---|

| 6/30/2021 | $27,223 | $23,100 | $28,958 |

|---|

| 7/31/2021 | $27,074 | $23,649 | $29,912 |

|---|

| 8/31/2021 | $27,927 | $24,368 | $31,030 |

|---|

| 9/30/2021 | $26,480 | $23,234 | $29,293 |

|---|

| 10/31/2021 | $27,824 | $24,862 | $31,830 |

|---|

| 11/30/2021 | $25,924 | $24,690 | $32,024 |

|---|

| 12/31/2021 | $25,768 | $25,797 | $32,701 |

|---|

| 1/31/2022 | $23,672 | $24,462 | $29,895 |

|---|

| 2/28/2022 | $22,509 | $23,729 | $28,625 |

|---|

| 3/31/2022 | $22,990 | $24,610 | $29,745 |

|---|

| 4/30/2022 | $19,309 | $22,464 | $26,153 |

|---|

| 5/31/2022 | $18,435 | $22,505 | $25,545 |

|---|

| 6/30/2022 | $16,406 | $20,648 | $23,521 |

|---|

| 7/31/2022 | $17,969 | $22,552 | $26,344 |

|---|

| 8/31/2022 | $17,739 | $21,632 | $25,117 |

|---|

| 9/30/2022 | $15,836 | $19,640 | $22,675 |

|---|

| 10/31/2022 | $16,784 | $21,230 | $24,001 |

|---|

| 11/30/2022 | $17,339 | $22,416 | $25,094 |

|---|

| 12/31/2022 | $15,757 | $21,125 | $23,173 |

|---|

| 1/31/2023 | $18,213 | $22,452 | $25,105 |

|---|

| 2/28/2023 | $17,794 | $21,904 | $24,807 |

|---|

| 3/31/2023 | $19,026 | $22,708 | $26,502 |

|---|

| 4/30/2023 | $18,682 | $23,063 | $26,764 |

|---|

| 5/31/2023 | $20,099 | $23,163 | $27,984 |

|---|

| 6/30/2023 | $21,373 | $24,693 | $29,897 |

|---|

| 7/31/2023 | $22,982 | $25,487 | $30,904 |

|---|

| 8/31/2023 | $22,454 | $25,081 | $30,627 |

|---|

| 9/30/2023 | $21,230 | $23,885 | $28,961 |

|---|

| 10/31/2023 | $20,308 | $23,383 | $28,549 |

|---|

| 11/30/2023 | $23,192 | $25,518 | $31,661 |

|---|

| 12/31/2023 | $25,136 | $26,678 | $33,063 |

|---|

| 1/31/2024 | $25,430 | $27,126 | $33,888 |

|---|

| 2/29/2024 | $27,299 | $28,574 | $36,200 |

|---|

| 3/31/2024 | $28,112 | $29,494 | $36,837 |

|---|

| 4/30/2024 | $25,966 | $28,289 | $35,275 |

|---|

| 5/31/2024 | $26,947 | $29,692 | $37,386 |

|---|

| 6/30/2024 | $28,765 | $30,757 | $39,907 |

|---|

| 7/31/2024 | $27,617 | $31,132 | $39,229 |

|---|

| 8/31/2024 | $28,229 | $31,887 | $40,046 |

|---|

| 9/30/2024 | $29,226 | $32,568 | $41,180 |

|---|

| 10/31/2024 | $29,796 | $32,272 | $41,044 |

|---|

| 11/30/2024 | $33,032 | $34,167 | $43,706 |

|---|

| 12/31/2024 | $31,868 | $33,352 | $44,092 |

|---|

The S&P 500® Index is an unmanaged index that is representative of the larger-capitalization stocks traded in the United States.

The Russell 1000® Growth Index is an unmanaged index that is representative of the 1,000 top companies by market capitalization in the United States.

Average Annual Total Returns (%)

| 1 Year | 5 Years | Since InceptionFootnote Reference* |

|---|

| Institutional Class | 26.78% | 13.30% | 13.48% |

|---|

S&P 500® Index | 25.02% | 14.53% | 14.05% |

|---|

Russell 1000® Growth Index | 33.36% | 18.96% | 17.57% |

|---|

The performance data quoted represent past performance and are no guarantee of future performance. The investment return and principal value of an investment will fluctuate so that an investment, when redeemed, may be worth more or less than its original cost. The performance data includes reinvestments of all dividends and distributions but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| Footnote | Description |

Footnote* | 11/01/2015 |

Annual Shareholder Report - December 31, 2024

Value Line Larger Companies Focused Fund, Inc.

| Total Net Assets | $357,495,335 |

|---|

| # of Portfolio Holdings | 37 |

|---|

| Portfolio Turnover Rate | 23% |

|---|

| Total Advisory Fees Paid | $2,537,256 |

|---|

Ten Largest Holdings (% of Net Assets)*

| NVIDIA Corp. | 8.6% |

| Meta Platforms, Inc. | 7.7% |

| Amazon.com, Inc. | 6.0% |

| Uber Technologies, Inc. | 5.0% |

| Advanced Micro Devices, Inc. | 4.5% |

| Netflix, Inc. | 4.0% |

| Alphabet, Inc. | 3.8% |

| MicroStrategy, Inc. | 3.6% |

| Microsoft Corp. | 3.5% |

| Visa, Inc. | 3.4% |

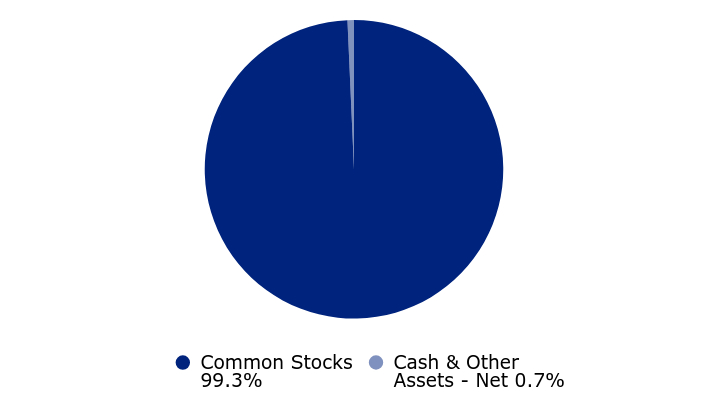

Asset Allocation (% of Net Assets)

| Value | Value |

|---|

| Common Stocks | 99.3% |

| Cash & Other Assets - Net | 0.7% |

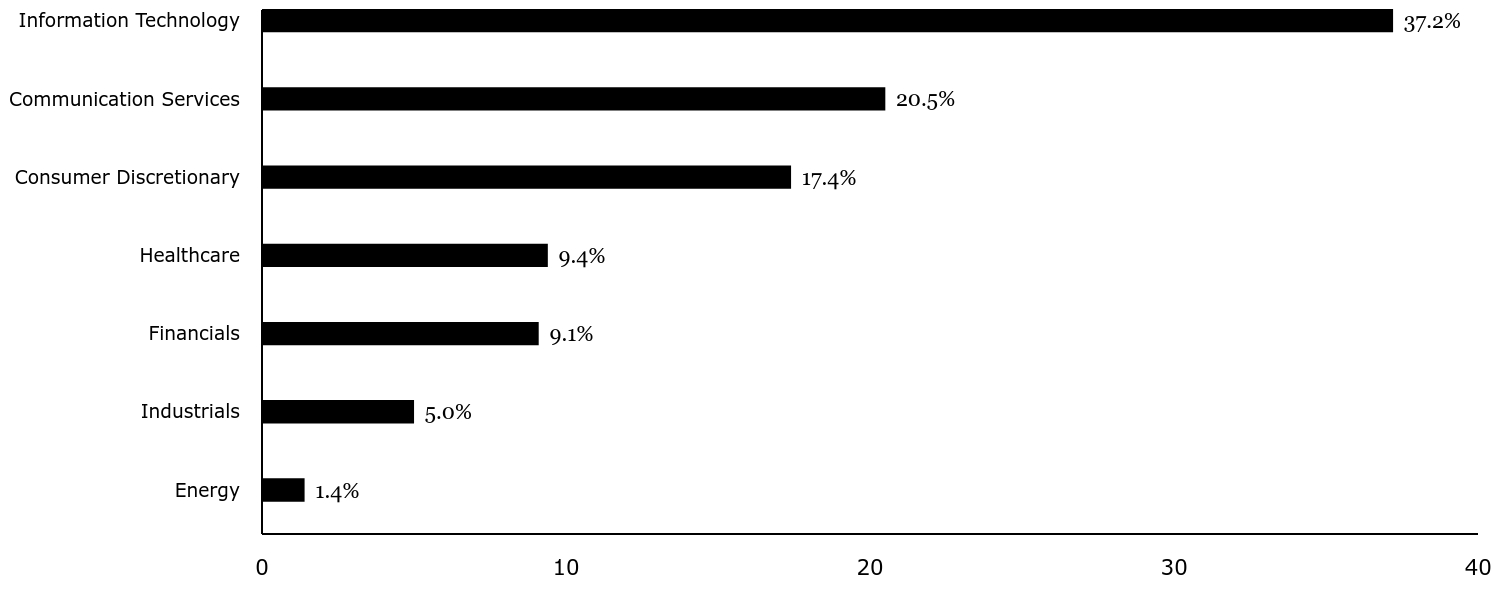

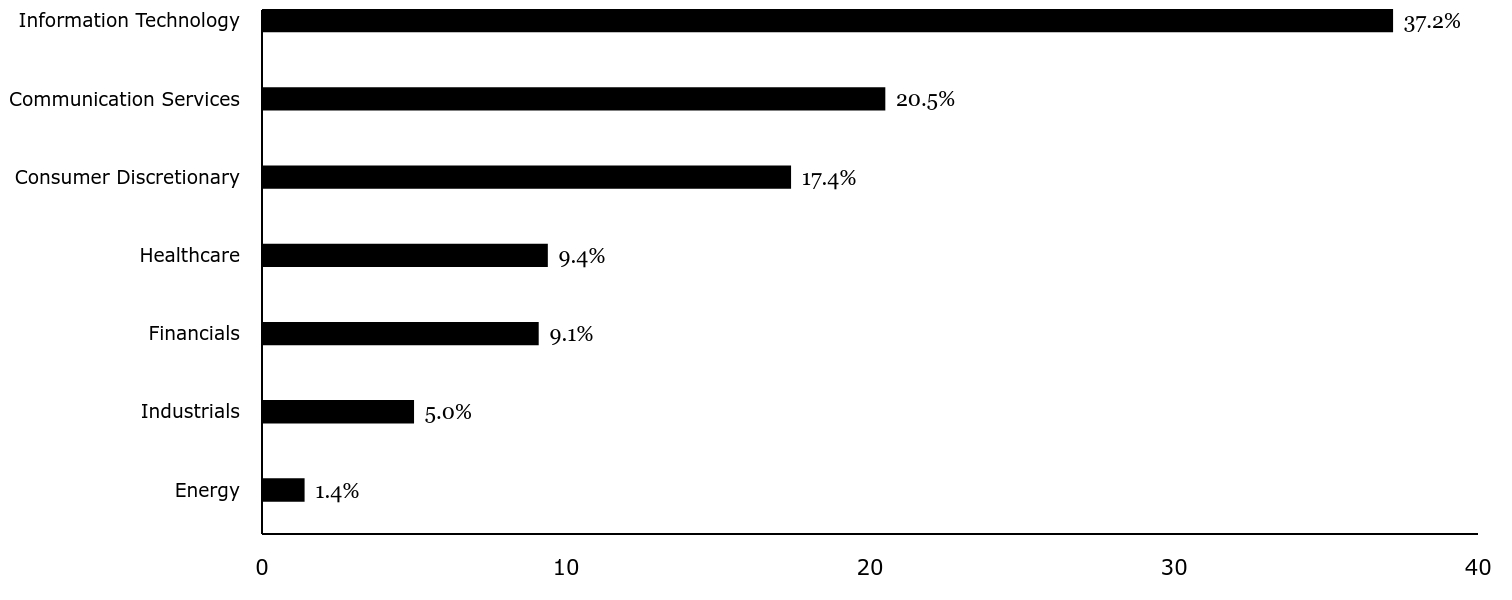

Sector Weightings (% of Total Investments In Securities)*

| Value | Value |

|---|

| Energy | 1.4% |

| Industrials | 5.0% |

| Financials | 9.1% |

| Healthcare | 9.4% |

| Consumer Discretionary | 17.4% |

| Communication Services | 20.5% |

| Information Technology | 37.2% |

* Excludes Short-term Investments, if any.

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please scan the QR code, visit www.vlfunds.com, email investorservices@vlfunds.com, or call us at 800-243-2729.

Value Line Larger Companies Focused Fund, Inc.

Annual Shareholder Report

December 31, 2024

Value Line Larger Companies Focused Fund, Inc.

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about Value Line Larger Companies Focused Fund, Inc. (the "Fund") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.vlfunds.com. You can also request this information by contacting us at 1-800-243-2729 or investorservices@vlfunds.com.

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $129 | 1.14% |

|---|

How did the Fund perform last year?

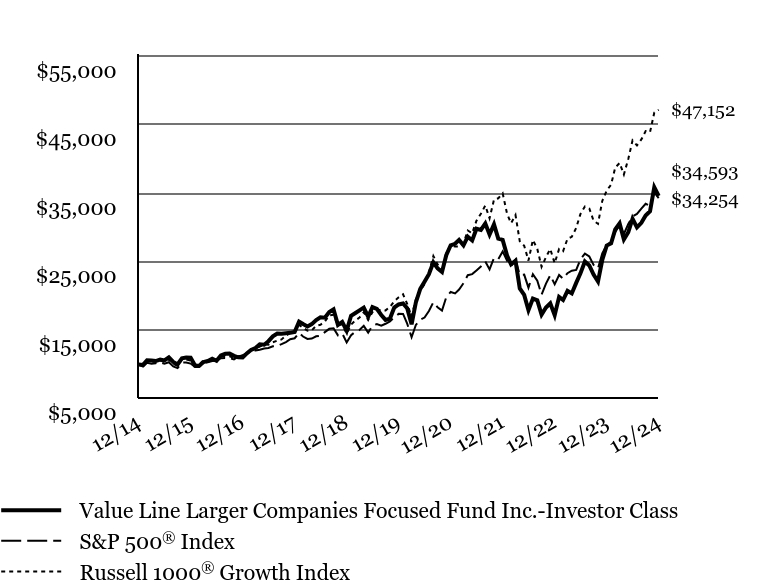

The Fund's Investor Class generated a total return of 26.49% during the year ended December 31, 2024.

• The Fund outperformed the S&P 500® Index, attributable primarily to sector allocation. The Fund also benefited from its focus on growth companies, which outperformed value-oriented stocks, and from having positions in all of the Magnificent Seven, the mega-cap stocks that drove equity performance. Stock selection overall detracted, albeit modestly.

• An overweight to information technology and having no allocation to consumer staples contributed positively. Stock selection in information technology and financials also added value. Stock selection in health care, consumer discretionary and industrials detracted.

• Individual stocks contributing most positively to the Fund’s relative results were MicroStrategy, an AI-powered enterprise analytics software and Bitcoin treasury company; NVIDIA, a computer graphics processors maker; and Robinhood Markets, a financial services platform operator—each of which enjoyed a triple-digit share price gain. Out-of-Index holdings in new Fund position MicroStrategy and in Robinhood Markets advanced mostly on Bitcoin’s appreciation. An overweight in NVIDIA benefited from strong AI demand.

• Stocks that detracted most from the Fund’s relative performance were molecular diagnostics company Exact Sciences, semiconductor company Advanced Micro Devices and electric vehicle maker Rivian Automotive—each of which saw a double-digit share price decline. An out-of-Index position in Exact Sciences was negatively affected by execution issues and competitive pressures associated with the launch of its next-gen Cologuard screening test. An overweight to Advanced Micro Devices was impacted by weakness in the communications and industrials markets. An out-of-Index position in Rivian Automotive was volatile, as the company ramped up its production of electric trucks and SUVs while balancing profitability and market dynamics.

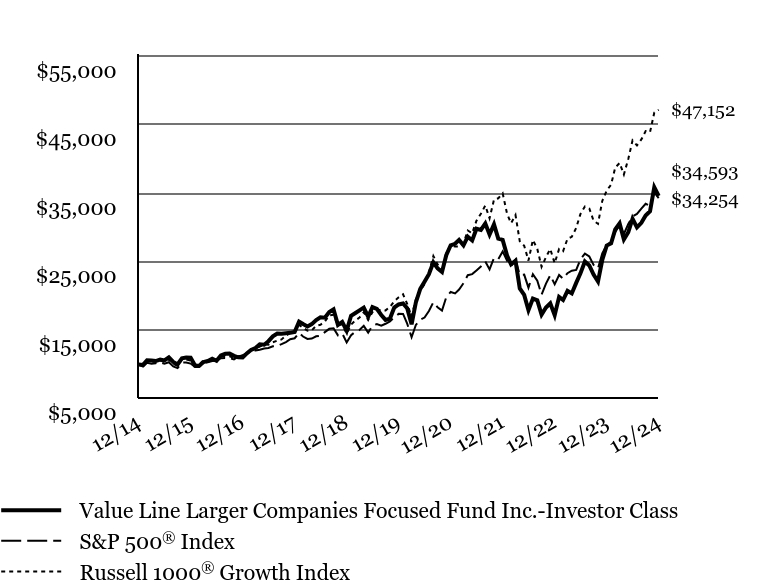

Total Return based on a $10,000 Investment

| Value Line Larger Companies Focused Fund Inc.-Investor Class | S&P 500® Index | Russell 1000® Growth Index |

|---|

| 12/14 | $10,000 | $10,000 | $10,000 |

|---|

| 01/15 | $9,941 | $9,700 | $9,847 |

|---|

| 02/15 | $10,609 | $10,257 | $10,503 |

|---|

| 03/15 | $10,578 | $10,095 | $10,384 |

|---|

| 04/15 | $10,498 | $10,192 | $10,436 |

|---|

| 05/15 | $10,724 | $10,323 | $10,583 |

|---|

| 06/15 | $10,597 | $10,123 | $10,396 |

|---|

| 07/15 | $11,044 | $10,335 | $10,749 |

|---|

| 08/15 | $10,364 | $9,712 | $10,096 |

|---|

| 09/15 | $9,996 | $9,471 | $9,846 |

|---|

| 10/15 | $10,894 | $10,270 | $10,694 |

|---|

| 11/15 | $11,013 | $10,301 | $10,724 |

|---|

| 12/15 | $10,988 | $10,138 | $10,567 |

|---|

| 01/16 | $9,845 | $9,635 | $9,977 |

|---|

| 02/16 | $9,807 | $9,622 | $9,973 |

|---|

| 03/16 | $10,368 | $10,275 | $10,645 |

|---|

| 04/16 | $10,515 | $10,315 | $10,548 |

|---|

| 05/16 | $10,841 | $10,500 | $10,753 |

|---|

| 06/16 | $10,553 | $10,527 | $10,711 |

|---|

| 07/16 | $11,323 | $10,915 | $11,216 |

|---|

| 08/16 | $11,557 | $10,931 | $11,160 |

|---|

| 09/16 | $11,603 | $10,933 | $11,201 |

|---|

| 10/16 | $11,256 | $10,733 | $10,938 |

|---|

| 11/16 | $11,046 | $11,131 | $11,176 |

|---|

| 12/16 | $11,015 | $11,351 | $11,314 |

|---|

| 01/17 | $11,655 | $11,566 | $11,696 |

|---|

| 02/17 | $12,109 | $12,025 | $12,182 |

|---|

| 03/17 | $12,415 | $12,039 | $12,322 |

|---|

| 04/17 | $12,935 | $12,163 | $12,604 |

|---|

| 05/17 | $12,888 | $12,334 | $12,932 |

|---|

| 06/17 | $13,399 | $12,411 | $12,898 |

|---|

| 07/17 | $14,097 | $12,666 | $13,241 |

|---|

| 08/17 | $14,522 | $12,705 | $13,483 |

|---|

| 09/17 | $14,484 | $12,967 | $13,659 |

|---|

| 10/17 | $14,570 | $13,270 | $14,188 |

|---|

| 11/17 | $14,613 | $13,677 | $14,619 |

|---|

| 12/17 | $14,737 | $13,829 | $14,733 |

|---|

| 01/18 | $16,239 | $14,621 | $15,776 |

|---|

| 02/18 | $15,894 | $14,082 | $15,363 |

|---|

| 03/18 | $15,549 | $13,724 | $14,941 |

|---|

| 04/18 | $15,889 | $13,777 | $14,994 |

|---|

| 05/18 | $16,491 | $14,108 | $15,651 |

|---|

| 06/18 | $16,887 | $14,195 | $15,801 |

|---|

| 07/18 | $16,820 | $14,724 | $16,265 |

|---|

| 08/18 | $17,658 | $15,203 | $17,155 |

|---|

| 09/18 | $18,044 | $15,290 | $17,251 |

|---|

| 10/18 | $15,771 | $14,245 | $15,708 |

|---|

| 11/18 | $16,213 | $14,535 | $15,875 |

|---|

| 12/18 | $14,929 | $13,223 | $14,510 |

|---|

| 01/19 | $17,120 | $14,282 | $15,814 |

|---|

| 02/19 | $17,480 | $14,741 | $16,380 |

|---|

| 03/19 | $17,898 | $15,027 | $16,846 |

|---|

| 04/19 | $18,305 | $15,636 | $17,607 |

|---|

| 05/19 | $16,973 | $14,642 | $16,495 |

|---|

| 06/19 | $18,381 | $15,674 | $17,628 |

|---|

| 07/19 | $18,122 | $15,899 | $18,026 |

|---|

| 08/19 | $17,226 | $15,648 | $17,888 |

|---|

| 09/19 | $16,502 | $15,940 | $17,890 |

|---|

| 10/19 | $16,696 | $16,286 | $18,394 |

|---|

| 11/19 | $18,305 | $16,877 | $19,210 |

|---|

| 12/19 | $18,762 | $17,386 | $19,790 |

|---|

| 01/20 | $18,905 | $17,379 | $20,232 |

|---|

| 02/20 | $18,203 | $15,949 | $18,854 |

|---|

| 03/20 | $15,858 | $13,979 | $17,000 |

|---|

| 04/20 | $19,054 | $15,771 | $19,515 |

|---|

| 05/20 | $21,029 | $16,522 | $20,825 |

|---|

| 06/20 | $22,081 | $16,850 | $21,732 |

|---|

| 07/20 | $23,179 | $17,801 | $23,404 |

|---|

| 08/20 | $24,914 | $19,080 | $25,819 |

|---|

| 09/20 | $24,024 | $18,355 | $24,604 |

|---|

| 10/20 | $23,498 | $17,867 | $23,769 |

|---|

| 11/20 | $25,947 | $19,823 | $26,203 |

|---|

| 12/20 | $27,389 | $20,585 | $27,408 |

|---|

| 01/21 | $27,610 | $20,377 | $27,205 |

|---|

| 02/21 | $28,175 | $20,939 | $27,199 |

|---|

| 03/21 | $27,389 | $21,856 | $27,666 |

|---|

| 04/21 | $28,646 | $23,022 | $29,548 |

|---|

| 05/21 | $28,096 | $23,183 | $29,140 |

|---|

| 06/21 | $29,803 | $23,724 | $30,968 |

|---|

| 07/21 | $29,631 | $24,288 | $31,988 |

|---|

| 08/21 | $30,567 | $25,026 | $33,184 |

|---|

| 09/21 | $28,967 | $23,863 | $31,326 |

|---|

| 10/21 | $30,439 | $25,534 | $34,039 |

|---|

| 11/21 | $28,353 | $25,357 | $34,247 |

|---|

| 12/21 | $28,180 | $26,494 | $34,971 |

|---|

| 01/22 | $25,883 | $25,123 | $31,970 |

|---|

| 02/22 | $24,612 | $24,371 | $30,612 |

|---|

| 03/22 | $25,129 | $25,276 | $31,809 |

|---|

| 04/22 | $21,094 | $23,071 | $27,968 |

|---|

| 05/22 | $20,142 | $23,114 | $27,318 |

|---|

| 06/22 | $17,920 | $21,206 | $25,154 |

|---|

| 07/22 | $19,617 | $23,161 | $28,173 |

|---|

| 08/22 | $19,363 | $22,217 | $26,861 |

|---|

| 09/22 | $17,280 | $20,170 | $24,249 |

|---|

| 10/22 | $18,313 | $21,804 | $25,667 |

|---|

| 11/22 | $18,920 | $23,022 | $26,836 |

|---|

| 12/22 | $17,194 | $21,696 | $24,782 |

|---|

| 01/23 | $19,862 | $23,059 | $26,847 |

|---|

| 02/23 | $19,407 | $22,496 | $26,528 |

|---|

| 03/23 | $20,746 | $23,322 | $28,342 |

|---|

| 04/23 | $20,364 | $23,686 | $28,621 |

|---|

| 05/23 | $21,908 | $23,789 | $29,926 |

|---|

| 06/23 | $23,294 | $25,361 | $31,972 |

|---|

| 07/23 | $25,032 | $26,176 | $33,050 |

|---|

| 08/23 | $24,447 | $25,759 | $32,753 |

|---|

| 09/23 | $23,117 | $24,531 | $30,972 |

|---|

| 10/23 | $22,103 | $24,015 | $30,531 |

|---|

| 11/23 | $25,237 | $26,208 | $33,859 |

|---|

| 12/23 | $27,348 | $27,399 | $35,358 |

|---|

| 01/24 | $27,664 | $27,859 | $36,240 |

|---|

| 02/24 | $29,691 | $29,347 | $38,713 |

|---|

| 03/24 | $30,575 | $30,291 | $39,394 |

|---|

| 04/24 | $28,231 | $29,054 | $37,723 |

|---|

| 05/24 | $29,291 | $30,494 | $39,981 |

|---|

| 06/24 | $31,263 | $31,589 | $42,677 |

|---|

| 07/24 | $30,007 | $31,973 | $41,951 |

|---|

| 08/24 | $30,668 | $32,749 | $42,825 |

|---|

| 09/24 | $31,737 | $33,448 | $44,038 |

|---|

| 10/24 | $32,351 | $33,145 | $43,893 |

|---|

| 11/24 | $35,856 | $35,090 | $46,740 |

|---|

| 12/24 | $34,593 | $34,254 | $47,152 |

|---|

The S&P 500® Index is an unmanaged index that is representative of the larger-capitalization stocks traded in the United States.

The Russell 1000® Growth Index is an unmanaged index that is representative of the 1,000 top companies by market capitalization in the United States.

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Investor Class | 26.49% | 13.02% | 13.21% |

|---|

S&P 500® Index | 25.02% | 14.53% | 13.10% |

|---|

Russell 1000® Growth Index | 33.36% | 18.96% | 16.78% |

|---|

The performance data quoted represent past performance and are no guarantee of future performance. The investment return and principal value of an investment will fluctuate so that an investment, when redeemed, may be worth more or less than its original cost. The performance data includes reinvestments of all dividends and distributions but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Annual Shareholder Report - December 31, 2024

Value Line Larger Companies Focused Fund, Inc.

| Total Net Assets | $357,495,335 |

|---|

| # of Portfolio Holdings | 37 |

|---|

| Portfolio Turnover Rate | 23% |

|---|

| Total Advisory Fees Paid | $2,537,256 |

|---|

Ten Largest Holdings (% of Net Assets)*

| NVIDIA Corp. | 8.6% |

| Meta Platforms, Inc. | 7.7% |

| Amazon.com, Inc. | 6.0% |

| Uber Technologies, Inc. | 5.0% |

| Advanced Micro Devices, Inc. | 4.5% |

| Netflix, Inc. | 4.0% |

| Alphabet, Inc. | 3.8% |

| MicroStrategy, Inc. | 3.6% |

| Microsoft Corp. | 3.5% |

| Visa, Inc. | 3.4% |

Asset Allocation (% of Net Assets)

| Value | Value |

|---|

| Common Stocks | 99.3% |

| Cash & Other Assets - Net | 0.7% |

Sector Weightings (% of Total Investments In Securities)*

| Value | Value |

|---|

| Energy | 1.4% |

| Industrials | 5.0% |

| Financials | 9.1% |

| Healthcare | 9.4% |

| Consumer Discretionary | 17.4% |

| Communication Services | 20.5% |

| Information Technology | 37.2% |

* Excludes Short-term Investments, if any.

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please scan the QR code, visit www.vlfunds.com, email investorservices@vlfunds.com, or call us at 800-243-2729.

Value Line Larger Companies Focused Fund, Inc.

Annual Shareholder Report

December 31, 2024

(b) Not Applicable

Item 2 Code of Ethics

(a) The Registrant has adopted a Code of Ethics that applies to its principal executive officer and principal financial officer.

(f) Pursuant to item 12(a), the Registrant is attaching as an exhibit a copy of its Code of Ethics that applies to its principal executive officer and principal financial officer.

Item 3. Audit Committee Financial Expert

(a)(1)The Registrant has an Audit Committee Financial Expert serving on its Audit Committee.

(2) The Registrant’s Board has designated James Hillman, member of the Registrant’s Audit Committee, as the Registrant’s Audit Committee Financial Expert. Mr. Hillman is an independent director.

A person who is designated as an “audit committee financial expert” shall not make such person an “expert” for any purpose, including without limitation under Section 11 of the Securities Act of 1933 or under applicable fiduciary laws, as a result of being designated or identified as an audit committee financial expert. The designation or identification of a person as an audit committee financial expert does not impose on such person any duties, obligations, or liabilities that are greater than the duties, obligations, and liabilities imposed on such person as a member of the audit committee and Board of Trustees in the absence of such designation or identification.

Item 4. Principal Accountant Fees and Services

(a) Audit Fees 2024 - $29,315

Audit Fees 2023 - $27,727

(b) Audit-Related fees – None.

(c) Tax Preparation Fees 2024 - $0

Tax Preparation Fees 2023 - $0

(d) All Other Fees – None

(e) (1) Disclose the audit committee’s pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X

The Value Line Larger Companies Focused Fund, Inc. (the “Fund”) Board has adopted policies and procedures with regard to the pre-approval of services provided by the Audit firm. Audit, audit-related and tax compliance services provided to the Fund on an annual basis require specific pre-approval by the Board. As noted above, the Board must also approve other non-audit services provided to the Fund and those non-audit services provided to the Fund’s Affiliate Service Providers that related directly to the operations and financial reporting of the Fund. Certain of these non-audit services that the Board believes are a) consistent with the SEC’s auditor independence rules and b) routine and recurring services that will not impair the independence of the independent auditors may be approved by the Board.

General Audit Committee Approval Policy:

Potential services by the auditors will be classified by officers of the Fund and the auditors into the four non-restricted service categories denoted above and this “Approval of Audit, Audit-Related, Tax and Other Services” Policy above will be applied. Any services outside the specific pre-approved service subcategories set forth in this Policy must be specifically approved by the Audit Committee (or such member or members of the Audit Committee as the Audit Committee may authorize to grant such approval).

At least sem-annually, the Audit Committee shall review a report summarizing the services by service category, including fees, provided by the Audit firm as set forth in the above policy.

(e) (2) Not applicable.

(f) Not applicable.

(g) Aggregate Non-Audit Fees 2024 -$0

Aggregate Non-Audit Fees 2023 -$0

(h) Not applicable.

Item 5. Audit Committee of Listed Registrants

Not Applicable.

Item 6. Investments

Not Applicable

Item 7. Financial Statements

| | (a) | A copy of the Annual Financial Statements and Other Information for the period ended 12/31/24 is included with this Form. |

Annual Financial Statements and Other Information |

|

|

Value Line Small Cap Opportunities Fund, Inc. |

|

Institutional Class (VLEIX) |

Value Line Mid Cap Focused Fund, Inc. |

|

Institutional Class (VLMIX) |

Value Line Select Growth Fund, Inc. |

|

Institutional Class (VILSX) |

Value Line Larger Companies Focused Fund, Inc. |

|

Institutional Class (VLLIX) |

Value Line Asset Allocation Fund, Inc. |

|

Institutional Class (VLAIX) |

Value Line Capital Appreciation Fund, Inc. |

|

Institutional Class (VLIIX) |

Value Line Core Bond Fund |

|

Go Paperless

VLFunds.com/edelivery

This audited report is issued for information to shareholders. It is not authorized for distribution to prospective investors unless preceded or accompanied by a currently effective prospectus of the Fund (obtainable from the Distributor).

Value Line Small Cap Opportunities Fund, Inc.

| | |

|

CONSUMER DISCRETIONARY 8.6% |

| |

| | |

| ENGINEERING & CONSTRUCTION 1.0% |

| | |

| |

| | |

| |

| Cavco Industries, Inc.(1) | |

| |

| Group 1 Automotive, Inc.(2) | |

| | |

| | |

| | |

| | |

|

| |

| J & J Snack Foods Corp.(2) | |

| | |

| | |

|

| |

| First Financial Bankshares, Inc. | |

| | |

| | |

| DIVERSIFIED FINANCIALS 1.5% |

| | |

| |

| | |

| | |

| | |

| Selective Insurance Group, Inc. | |

| | |

| | |

|

| |

| Merit Medical Systems, Inc.(1) | |

| |

| | |

| | |

| Medpace Holdings, Inc.(1) | |

| U.S. Physical Therapy, Inc. | |

| | |

| | |

|

| |

| | |

| Lennox International, Inc. | |

| | |

| | |

| | |

COMMON STOCKS 96.9% (continued) |

INDUSTRIALS 46.2% (continued) |

| |

| | |

| | |

| | |

| | |

| |

| CACI International, Inc. Class A(1) | |

| ExlService Holdings, Inc.(1) | |

| Science Applications International Corp. | |

| | |

| DISTRIBUTION/WHOLESALE 2.2% |

| Rush Enterprises, Inc. Class A | |

| SiteOne Landscape Supply, Inc.(1) | |

| | |

| ELECTRICAL EQUIPMENT 1.5% |

| | |

| |

| | |

| ENGINEERING & CONSTRUCTION 8.9% |

| Comfort Systems USA, Inc. | |

| | |

| | |

| | |

| |

| Franklin Electric Co., Inc. | |

| | |

| | |

| MACHINERY - DIVERSIFIED 5.6% |

| Applied Industrial Technologies, Inc. | |

| | |

| Watts Water Technologies, Inc. Class A | |

| | |

| METAL FABRICATE/HARDWARE 2.2% |

| | |

| MISCELLANEOUS MANUFACTURERS 4.4% |

| | |

| | |

| | |

| | |

| |

| | |

| |

| | |

| | |

INFORMATION TECHNOLOGY 16.4% |

| |

| | |

| | |

| Insight Enterprises, Inc.(1)(2) | |

See Notes to Financial Statements.

Schedule of Investments (continued)

| | |

COMMON STOCKS 96.9% (continued) |

INFORMATION TECHNOLOGY 16.4% (continued) |

| COMPUTERS 2.2% (continued) |

| | |

| | |

| ELECTRICAL EQUIPMENT 0.1% |

| | |

| |

| | |

| | |

| | |

| |

| | |

| MISCELLANEOUS MANUFACTURERS 2.1% |

| | |

| |

| MACOM Technology Solutions Holdings, Inc.(1) | |

| |

| | |

| Appfolio, Inc. Class A(1) | |

| | |

| | |

| | |

| | |

|

| |

| | |

| |

| Carpenter Technology Corp. | |

| PACKAGING & CONTAINERS 1.8% |

| | |

| | |

| | |

| | |

| | |

COMMON STOCKS 96.9% (continued) |

|

| |

| American States Water Co. | |

TOTAL COMMON STOCKS

(Cost $382,974,739) | |

SHORT-TERM INVESTMENTS 4.0% |

| |

| State Street Institutional U.S. Government Money Market Fund, Premier Class, 4.43%(3) | |

| State Street Navigator Securities Lending Government Money Market Portfolio(4) | |

| | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $28,837,794) | |

TOTAL INVESTMENTS IN SECURITIES 100.9%

(Cost $411,812,533) | |

EXCESS OF LIABILITIES OVER CASH AND OTHER ASSETS (0.9)% | |

| |

| |

| A portion or all of the security was held on loan. As of December 31, 2024, the market value of the securities on loan was $41,543,670. |

| Rate reflects 7 day yield as of December 31, 2024. |

| Securities with an aggregate market value of $41,543,670 were out on loan in exchange for collateral including $6,383,124 of cash collateral as of December 31, 2024. The collateral was invested in a cash collateral reinvestment vehicle. See Note 1(K). |

The following table summarizes the inputs used to value the Fund's investments in securities as of December 31, 2024 (See Note 1(B)):

Investments in Securities: | | | | |

| | | | |

| | | | |

| | | | |

Total Investments in Securities | | | | |

| See Schedule of Investments for further breakdown by category. |

See Notes to Financial Statements.

Value Line Mid Cap Focused Fund, Inc.

| | |

|

CONSUMER DISCRETIONARY 4.0% |

| DISTRIBUTION/WHOLESALE 2.7% |

| | |

| |

| | |

| | |

|

| |

| | |

| |

| Casey's General Stores, Inc. | |

| | |

|

| |

| American Financial Group, Inc. | |

| | |

| | |

| | |

| |

| Jack Henry & Associates, Inc. | |

| | |

| | |

| | |

|

| |

| Mettler-Toledo International, Inc.(1) | |

| |

| IDEXX Laboratories, Inc.(1) | |

| | |

| West Pharmaceutical Services, Inc. | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

|

| |

| | |

| | |

| | |

| |

| Lennox International, Inc.(2) | |

| |

| | |

| | |

| | |

| |

| CACI International, Inc. Class A(1) | |

| | |

COMMON STOCKS 97.1% (continued) |

INDUSTRIALS 28.4% (continued) |

| DISTRIBUTION/WHOLESALE 1.2% |

| | |

| ENGINEERING & CONSTRUCTION 2.3% |

| Comfort Systems USA, Inc. | |

| | |

| | |

| ENVIRONMENTAL CONTROL 6.3% |

| | |

| | |

| | |

| | |

INFORMATION TECHNOLOGY 29.8% |

| |

| | |

| | |

| | |

| | |

| |

| | |

| MISCELLANEOUS MANUFACTURERS 1.0% |

| Teledyne Technologies, Inc.(1) | |

| |

| Monolithic Power Systems, Inc. | |

| |

| | |

| Cadence Design Systems, Inc.(1) | |

| | |

| | |

| Tyler Technologies, Inc.(1) | |

| | |

| |

| | |

| | |

| | |

| | |

|

| PACKAGING & CONTAINERS 2.1% |

| | |

TOTAL COMMON STOCKS

(Cost $1,481,623,667) | |

SHORT-TERM INVESTMENTS 3.2% |

| |

| State Street Institutional U.S. Government Money Market Fund, Premier Class, 4.43%(3) | |

See Notes to Financial Statements.

Schedule of Investments (continued)

| | |

SHORT-TERM INVESTMENTS 3.2% (continued) |

| MONEY MARKET FUNDS 3.2% (continued) |

| State Street Navigator Securities Lending Government Money Market Portfolio(4) | |

| | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $61,061,149) | |

TOTAL INVESTMENTS IN SECURITIES 100.3%

(Cost $1,542,684,816) | |

EXCESS OF LIABILITIES OVER CASH AND OTHER ASSETS (0.3)% | |

| |

| |

| A portion or all of the security was held on loan. As of December 31, 2024, the market value of the securities on loan was $4,508,537. |

| Rate reflects 7 day yield as of December 31, 2024. |

| Securities with an aggregate market value of $4,508,537 were out on loan in exchange for collateral including $1,394,942 of cash collateral as of December 31, 2024. The collateral was invested in a cash collateral reinvestment vehicle. See Note 1(K). |

| American Depositary Receipt. |

The following table summarizes the inputs used to value the Fund's investments in securities as of December 31, 2024 (See Note 1(B)):

Investments in Securities: | | | | |

| | | | |

| | | | |

| | | | |

Total Investments in Securities | | | | |

| See Schedule of Investments for further breakdown by category. |

See Notes to Financial Statements.

Value Line Select Growth Fund, Inc.

| | |

|

|

| |

| | |

|

| |

| | |

| DIVERSIFIED FINANCIALS 6.8% |

| Intercontinental Exchange, Inc. | |

| | |

| | |

| |

| | |

| Marsh & McLennan Cos., Inc. | |

| | |

| | |

| |

| | |

| | |

|

| HEALTHCARE PRODUCTS 13.1% |

| | |

| IDEXX Laboratories, Inc.(1) | |

| | |

| Thermo Fisher Scientific, Inc. | |

| | |

| |

| | |

| | |

|

| |

| | |

| |

| | |

| |

| | |

| ENVIRONMENTAL CONTROL 7.4% |

| | |

| | |

COMMON STOCKS 98.4% (continued) |

INDUSTRIALS 25.1% (continued) |

| ENVIRONMENTAL CONTROL 7.4% (continued) |

| | |

| | |

| | |

INFORMATION TECHNOLOGY 32.7% |

| |

| | |

| |

| | |

| Cadence Design Systems, Inc.(1) | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

|

| |

| | |

TOTAL COMMON STOCKS

(Cost $187,634,705) | |

SHORT-TERM INVESTMENTS 1.7% |

| |

| State Street Institutional U.S. Government Money Market Fund, Premier Class, 4.43%(2) | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $7,253,422) | |

TOTAL INVESTMENTS IN SECURITIES 100.1%

(Cost $194,888,127) | |

EXCESS OF LIABILITIES OVER CASH AND OTHER ASSETS (0.1)% | |

| |

| |

| Rate reflects 7 day yield as of December 31, 2024. |

The following table summarizes the inputs used to value the Fund's investments in securities as of December 31, 2024 (See Note 1(B)):

Investments in Securities: | | | | |

| | | | |

| | | | |

| | | | |

Total Investments in Securities | | | | |

| See Schedule of Investments for further breakdown by category. |

See Notes to Financial Statements.

Value Line Larger Companies Focused Fund, Inc.

| | |

|

COMMUNICATION SERVICES 20.3% |

| |

| | |

| | |

| Meta Platforms, Inc. Class A | |

| | |

| | |

| | |

| | |

CONSUMER DISCRETIONARY 17.3% |

| |

| Rivian Automotive, Inc. Class A(1)(2) | |

| | |

| | |

| |

| DraftKings, Inc. Class A(1) | |

| |

| | |

| | |

| | |

| |

| Chipotle Mexican Grill, Inc.(1) | |

| Lululemon Athletica, Inc.(1) | |

| | |

| | |

|

| |

| | |

|

| DIVERSIFIED FINANCIALS 6.0% |

| Coinbase Global, Inc. Class A(1) | |

| | |

| | |

| |

| Robinhood Markets, Inc. Class A(1) | |

| | |

|

| |

| BioMarin Pharmaceutical, Inc.(1) | |

| | |

| Vertex Pharmaceuticals, Inc.(1) | |

| | |

| |

| Exact Sciences Corp.(1)(2) | |

| |

| | |

| | |

|

| |

| Uber Technologies, Inc.(1) | |

| | |

COMMON STOCKS 99.3% (continued) |

INFORMATION TECHNOLOGY 36.9% |

| |

| | |

| Crowdstrike Holdings, Inc. Class A(1) | |

| | |

| |

| | |

| |

| Advanced Micro Devices, Inc.(1) | |

| | |

| | |

| | |

| |

| | |

| | |

| MicroStrategy, Inc. Class A(1)(2) | |

| | |

| | |

| | |

| | |

| | |

TOTAL COMMON STOCKS

(Cost $175,532,333) | |

SHORT-TERM INVESTMENTS 1.0% |

| |

| State Street Institutional U.S. Government Money Market Fund, Premier Class, 4.43%(3) | |

| State Street Navigator Securities Lending Government Money Market Portfolio(4) | |

| | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $3,447,393) | |

TOTAL INVESTMENTS IN SECURITIES 100.3%

(Cost $178,979,726) | |

EXCESS OF LIABILITIES OVER CASH AND OTHER ASSETS (0.3)% | |

| |

| |

| A portion or all of the security was held on loan. As of December 31, 2024, the market value of the securities on loan was $30,376,646. |

| Rate reflects 7 day yield as of December 31, 2024. |

| Securities with an aggregate market value of $30,376,646 were out on loan in exchange for collateral including $196,448 of cash collateral as of December 31, 2024. The collateral was invested in a cash collateral reinvestment vehicle. See Note 1(K). |

See Notes to Financial Statements.

The following table summarizes the inputs used to value the Fund's investments in securities as of December 31, 2024 (See Note 1(B)):

Investments in Securities: | | | | |

| | | | |

| | | | |

| | | | |

Total Investments in Securities | | | | |

| See Schedule of Investments for further breakdown by category. |

See Notes to Financial Statements.

Value Line Asset Allocation Fund, Inc.

| | |

|

CONSUMER DISCRETIONARY 1.3% |

| DISTRIBUTION/WHOLESALE 1.3% |

| | |

|

| |

| | |

|

| |

| | |

| DIVERSIFIED FINANCIALS 3.0% |

| Intercontinental Exchange, Inc. | |

| |

| American Financial Group, Inc. | |

| Marsh & McLennan Cos., Inc. | |

| | |

| | |

| | |

| |

| | |

| | |

|

| |

| IDEXX Laboratories, Inc.(1) | |

| | |

| | |

| |

| | |

| |

| | |

| | |

|

| |

| | |

| | |

| | |

| |

| Lennox International, Inc. | |

| |

| | |

| DISTRIBUTION/WHOLESALE 0.3% |

| | |

| ENGINEERING & CONSTRUCTION 0.4% |

| | |

| ENVIRONMENTAL CONTROL 4.3% |

| | |

| | |

| | |

| | |

INFORMATION TECHNOLOGY 27.1% |

| |

| | |

| | |

COMMON STOCKS 65.0% (continued) |

INFORMATION TECHNOLOGY 27.1% (continued) |

| COMPUTERS 5.3% (continued) |

| | |

| | |

| | |

| | |

| |

| | |

| |

| | |

| Cadence Design Systems, Inc.(1) | |

| | |

| | |

| | |

| | |

| | |

| Tyler Technologies, Inc.(1) | |

| | |

| |

| | |

| | |

TOTAL COMMON STOCKS

(Cost $284,653,328) | |

| | |

COLLATERALIZED MORTGAGE OBLIGATIONS 0.6% |

| FHLMC, Series 2023-DNA1, Class M1A, REMIC, (30 day USD SOFR Average + 2.10%), 6.66%, 3/25/43(3)(4) | |

| FNMA, Series 2023-R02, Class 1M1, (30 day USD SOFR Average + 2.30%), 6.87%, 1/25/43(3)(4) | |

| FNMA, Series 2023-R04, Class 1M1, (30 day USD SOFR Average + 2.30%), 6.86%, 5/25/43(3)(4) | |

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS

(Cost $5,009,723) | |

COMMERCIAL MORTGAGE-BACKED SECURITIES 0.6% |

| FHLMC Multifamily Structured Pass-Through Certificates, Series K055, Class A2, 2.67%, 3/25/26 | |

| FHLMC Multifamily Structured Pass-Through Certificates, Series K064, Class A2, 3.22%, 3/25/27 | |

| FHLMC Multifamily Structured Pass-Through Certificates, Series K084, Class A2, 3.78%, 10/25/28(4) | |

| FHLMC Multifamily Structured Pass-Through Certificates, Series K089, Class A1, 3.34%, 10/25/28 | |

| GNMA, Series 2013-12, Class B, 2.07%, 11/16/52(4) | |

See Notes to Financial Statements.

| | |

COMMERCIAL MORTGAGE-BACKED SECURITIES 0.6% (continued) |

| Morgan Stanley Capital I Trust, Series 2021-L7, Class A4, 2.32%, 10/15/54 | |

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(Cost $6,392,920) | |

CORPORATE BONDS & NOTES 11.7% |

|

| |

| Eastman Chemical Co., Senior Unsecured Notes, 5.63%, 2/20/34 | |

| |

| ArcelorMittal SA, Senior Unsecured Notes, 4.25%, 7/16/29(2) | |

| |

| Freeport-McMoRan, Inc., Guaranteed Notes, 4.63%, 8/1/30(2) | |

| Newmont Corp., Guaranteed Notes, 2.60%, 7/15/32(2) | |

| | |

| | |

|

| |

| Expedia Group, Inc., Guaranteed Notes, 3.25%, 2/15/30(2) | |

| Netflix, Inc., Senior Unsecured Notes, 4.90%, 8/15/34(2) | |

| | |

| |

| Comcast Corp., Guaranteed Notes, 4.15%, 10/15/28 | |

| |

| AT&T, Inc., Senior Unsecured Notes, 2.55%, 12/1/33 | |

| Motorola Solutions, Inc., Senior Unsecured Notes, 2.30%, 11/15/30 | |

| T-Mobile USA, Inc., Guaranteed Notes, 3.50%, 4/15/31 | |

| Verizon Communications, Inc., Senior Unsecured Notes, 4.13%, 3/16/27 | |

| Vodafone Group PLC, Senior Unsecured Notes, 4.25%, 9/17/50 | |

| | |

| | |

|

| |

| Tapestry, Inc., Senior Unsecured Notes, 5.10%, 3/11/30 | |

| |

| Ford Motor Credit Co. LLC, Senior Unsecured Notes, 6.05%, 3/5/31 | |

| General Motors Financial Co., Inc., Senior Unsecured Notes, 5.45%, 9/6/34(2) | |

| | |

| AUTO PARTS & EQUIPMENT 0.1% |

| BorgWarner, Inc., Senior Unsecured Notes, 5.40%, 8/15/34(2) | |

| | |

CORPORATE BONDS & NOTES 11.7% (continued) |

CONSUMER, CYCLICAL 1.2% (continued) |

| |

| Lennar Corp., Guaranteed Notes, 4.75%, 5/30/25 | |

| |

| Hyatt Hotels Corp., Senior Unsecured Notes, 5.38%, 12/15/31 | |

| Marriott International, Inc., 4.90%, 4/15/29(2) | |

| | |

| |

| Costco Wholesale Corp., Senior Unsecured Notes, 1.75%, 4/20/32(2) | |

| TJX Cos., Inc., 2.25%, 9/15/26 | |

| | |

| | |

CONSUMER, NON-CYCLICAL 1.6% |

| |

| Constellation Brands, Inc., Guaranteed Notes, 5.25%, 11/15/48 | |

| |

| Amgen, Inc., Senior Unsecured Notes, 2.20%, 2/21/27 | |

| Gilead Sciences, Inc., 4.60%, 9/1/35 | |

| Regeneron Pharmaceuticals, Inc., Senior Unsecured Notes, 1.75%, 9/15/30(2) | |

| | |

| |

| PayPal Holdings, Inc., Senior Unsecured Notes, 2.65%, 10/1/26 | |

| |

| GE HealthCare Technologies, Inc., Senior Unsecured Notes, 4.80%, 8/14/29 | |

| Smith & Nephew PLC, Senior Unsecured Notes, 2.03%, 10/14/30 | |

| Stryker Corp., 3.38%, 11/1/25 | |

| | |

| |

| HCA, Inc., Guaranteed Notes, 5.38%, 2/1/25 | |

| |

| AbbVie, Inc., Senior Unsecured Notes, 2.95%, 11/21/26 | |

| Eli Lilly & Co., Senior Unsecured Notes, 5.00%, 2/9/54 | |

| Pfizer Investment Enterprises Pte. Ltd., Guaranteed Notes, 5.30%, 5/19/53 | |

| | |

| | |

|

| |

| Devon Energy Corp., Senior Unsecured Notes, 5.20%, 9/15/34(2) | |

| Diamondback Energy, Inc., Guaranteed Notes, 5.15%, 1/30/30(2) | |

See Notes to Financial Statements.

Schedule of Investments (continued)

| | |

CORPORATE BONDS & NOTES 11.7% (continued) |

|

| OIL & GAS 0.8% (continued) |

| Hess Corp., Senior Unsecured Notes, 4.30%, 4/1/27 | |

| Murphy Oil Corp., Senior Unsecured Notes, 6.00%, 10/1/32 | |

| Occidental Petroleum Corp., Senior Unsecured Notes, 5.55%, 10/1/34(2) | |

| Phillips 66 Co., Guaranteed Notes, 5.25%, 6/15/31 | |

| | |

| |

| Enbridge, Inc., Guaranteed Notes, 2.50%, 8/1/33 | |

| Kinder Morgan, Inc., 5.20%, 6/1/33 | |

| Targa Resources Corp., 6.50%, 3/30/34 | |

| | |

| | |

|

| |

| Bank of America Corp., (1 day USD SOFR + 2.16%), 5.02%, 7/22/33(4) | |

| Bank of New York Mellon Corp., (1 day USD SOFR + 1.51%), 4.71%, 2/1/34(4) | |

| Citigroup, Inc., Senior Unsecured Notes, (1 day USD SOFR + 1.34%), 4.54%, 9/19/30(2)(4) | |

| Citigroup, Inc., Senior Unsecured Notes, (1 day USD SOFR + 2.09%), 4.91%, 5/24/33(4) | |

| Citigroup, Inc., Subordinated Notes, 5.30%, 5/6/44 | |

| Goldman Sachs Group, Inc., Senior Unsecured Notes, 3.75%, 2/25/26 | |

| HSBC Holdings PLC, Senior Unsecured Notes, (3 mo. USD Term SOFR + 1.80%), 4.58%, 6/19/29(4) | |

| JPMorgan Chase & Co., Subordinated Notes, 4.13%, 12/15/26 | |

| JPMorgan Chase & Co., Senior Unsecured Notes, (3 mo. USD Term SOFR + 1.64%), 3.96%, 11/15/48(4) | |

| KeyCorp, Senior Unsecured Notes, 4.10%, 4/30/28(2) | |

| M&T Bank Corp., Senior Unsecured Notes, (1 day USD SOFR Index + 1.78%), 4.55%, 8/16/28(4) | |

| Morgan Stanley, (1 day USD SOFR + 2.56%), 6.34%, 10/18/33(4) | |

| NatWest Group PLC, (1 yr. CMT + 1.35%), 5.85%, 3/2/27(4) | |

| Regions Financial Corp., Senior Unsecured Notes, (1 day USD SOFR + 2.06%), 5.50%, 9/6/35(2)(4) | |

| Wells Fargo & Co., Senior Unsecured Notes, (1 day USD SOFR + 1.07%), 5.71%, 4/22/28(4) | |

| | |

CORPORATE BONDS & NOTES 11.7% (continued) |

FINANCIAL 4.2% (continued) |

| |

| Wells Fargo & Co., (1 day USD SOFR + 2.13%), 4.61%, 4/25/53(4) | |

| | |

| DIVERSIFIED FINANCIALS 0.7% |

| AerCap Ireland Capital DAC/AerCap Global Aviation Trust, Guaranteed Notes, 3.30%, 1/30/32 | |

| Ally Financial, Inc., Senior Unsecured Notes, 4.75%, 6/9/27(2) | |

| American Express Co., Senior Unsecured Notes, (1 day USD SOFR Index + 1.28%), 5.28%, 7/27/29(4) | |

| Discover Financial Services, Senior Unsecured Notes, 4.10%, 2/9/27 | |

| Synchrony Financial, 4.88%, 6/13/25 | |

| | |

| |

| Aflac, Inc., Senior Unsecured Notes, 3.60%, 4/1/30 | |

| |

| Alexandria Real Estate Equities, Inc., Guaranteed Notes, 4.90%, 12/15/30(2) | |

| American Tower Corp., 5.50%, 3/15/28 | |

| Crown Castle, Inc., Senior Unsecured Notes, 3.80%, 2/15/28 | |

| Equinix, Inc., Senior Unsecured Notes, 2.50%, 5/15/31 | |

| Extra Space Storage LP, Guaranteed Notes, 5.40%, 2/1/34(2) | |

| Host Hotels & Resorts LP, Senior Unsecured Notes, 3.50%, 9/15/30 | |

| Kimco Realty OP LLC, Senior Unsecured Notes, 2.25%, 12/1/31 | |

| Sabra Health Care LP, Guaranteed Notes, 3.20%, 12/1/31 | |

| Welltower OP LLC, Senior Unsecured Notes, 4.25%, 4/15/28 | |

| Weyerhaeuser Co., 4.75%, 5/15/26 | |

| | |

| | |

|

| |

| | |

| |

| Amphenol Corp., Senior Unsecured Notes, 2.20%, 9/15/31 | |

| Flex Ltd., Senior Unsecured Notes, 4.75%, 6/15/25 | |

| | |

| MISCELLANEOUS MANUFACTURERS 0.1% |

| Teledyne Technologies, Inc., 2.25%, 4/1/28 | |

| | |

See Notes to Financial Statements.

| | |

CORPORATE BONDS & NOTES 11.7% (continued) |

|

| |

| Dell International LLC/EMC Corp., Guaranteed Notes, 5.40%, 4/15/34(2) | |

| Hewlett Packard Enterprise Co., Senior Unsecured Notes, 5.00%, 10/15/34 | |

| Kyndryl Holdings, Inc., Senior Unsecured Notes, 3.15%, 10/15/31(2) | |

| | |

| |

| Analog Devices, Inc., Senior Unsecured Notes, 2.80%, 10/1/41(2) | |

| Broadcom, Inc., 4.30%, 11/15/32 | |

| Microchip Technology, Inc., Guaranteed Notes, 5.05%, 2/15/30 | |

| Micron Technology, Inc., Senior Unsecured Notes, 5.30%, 1/15/31 | |

| | |

| |

| Oracle Corp., 6.25%, 11/9/32 | |

| | |

|

| |

| Duke Energy Corp., Senior Unsecured Notes, 4.50%, 8/15/32(2) | |

| National Grid PLC, Senior Unsecured Notes, 5.42%, 1/11/34(2) | |

| Public Service Enterprise Group, Inc., Senior Unsecured Notes, 5.20%, 4/1/29 | |

| Southern Co., 5.70%, 3/15/34(2) | |

| | |

TOTAL CORPORATE BONDS & NOTES

(Cost $108,746,994) | |

LONG-TERM MUNICIPAL SECURITIES 1.0% |

| |

| Regents of the University of California Medical Center Pooled Revenue, Series Q, 4.13%, 5/15/32 | |

| State of California, GO, 5.70%, 10/1/32 | |

| | |

| |

| Town of Andover, GO, 2.17%, 11/1/32 | |

| |

| University of Michigan, 5.18%, 4/1/35 | |

| |

| Minnesota Housing Finance Agency, Series J, 5.85%, 7/1/44 | |

| |

| New York City Transitional Finance Authority Building Aid Revenue, (ST AID WITHHLDG), 4.80%, 7/15/26 | |

| |

| State of Oregon, Series C, GO, 2.38%, 5/1/36 | |

| | |

LONG-TERM MUNICIPAL SECURITIES 1.0% (continued) |

| |

| City of Austin Electric Utility Revenue, Series A, 2.84%, 11/15/27 | |

TOTAL LONG-TERM MUNICIPAL SECURITIES

(Cost $9,367,686) | |

RESIDENTIAL MORTGAGE-BACKED SECURITIES 8.8% |

| FHLMC, Series 4151, Class PA, 2.00%, 1/15/33 | |

| FHLMC Gold PC Pool #G08488, 3.50%, 4/1/42 | |

| FHLMC Pool #QB2462, 3.00%, 8/1/50 | |

| FHLMC Pool #QB2958, 3.00%, 9/1/50 | |

| FHLMC Pool #QF1236, 4.50%, 10/1/52 | |

| FHLMC Pool #QG6306, 5.00%, 7/1/53 | |

| FHLMC Pool #RA6817, 2.50%, 2/1/52 | |

| FHLMC Pool #RB5022, 3.00%, 11/1/39 | |

| FHLMC Pool #SD7514, 3.50%, 4/1/50 | |

| FHLMC Pool #SD8108, 3.00%, 11/1/50 | |

| FHLMC Pool #SD8196, 3.50%, 2/1/52 | |

| FHLMC Pool #SD8256, 4.00%, 10/1/52 | |

| FHLMC Pool #ZS4647, 3.50%, 1/1/46 | |

| FNMA Pool #AS0516, 3.00%, 9/1/43 | |

| FNMA Pool #AX9528, 3.50%, 2/1/45 | |

| FNMA Pool #AZ6194, 3.50%, 10/1/45 | |

| FNMA Pool #BM3634, 3.50%, 5/1/47 | |

| FNMA Pool #BP5709, 2.50%, 5/1/50 | |

| FNMA Pool #CA5540, 3.00%, 4/1/50 | |

| FNMA Pool #CB2403, 2.50%, 12/1/51 | |

| FNMA Pool #CB5892, 4.50%, 3/1/53 | |

| FNMA Pool #FM2202, 4.00%, 12/1/48 | |

| FNMA Pool #FM3254, 3.50%, 5/1/49 | |

| FNMA Pool #FM4140, 2.50%, 9/1/50 | |

| FNMA Pool #FM9509, 3.00%, 11/1/36 | |

| FNMA Pool #FM9760, 3.50%, 11/1/51 | |

| FNMA Pool #FM9834, 3.50%, 6/1/49 | |

| FNMA Pool #FM9939, 4.00%, 1/1/52 | |

| FNMA Pool #MA4055, 2.50%, 6/1/50 | |

| FNMA Pool #MA4078, 2.50%, 7/1/50 | |

| FNMA Pool #MA4222, 3.50%, 12/1/50 | |

| FNMA Pool #MA4494, 3.00%, 12/1/51 | |

| FNMA Pool #MA4495, 3.50%, 12/1/51 | |

| FNMA Pool #MA5283, MBS, 4.00%, 2/1/54 | |

| FNMA REMIC Trust Series 2013-18, Series 2013-18, Class AE, 2.00%, 3/25/28 | |

| FNMA REMIC Trust Series 2013-41, Series 2013-41, Class WD, 2.00%, 11/25/42 | |

| GNMA, Series 2021-98, Class IG, IO, 3.00%, 6/20/51 | |

| GNMA II Pool #MA3937, 3.50%, 9/20/46 | |

| GNMA II Pool #MA7054, 3.50%, 12/20/50 | |

| GNMA II Pool #MA7651, 3.50%, 10/20/51 | |

| GNMA II Pool #MA7705, MBS, 2.50%, 11/20/51 | |

See Notes to Financial Statements.

Schedule of Investments (continued)

| | |

RESIDENTIAL MORTGAGE-BACKED SECURITIES 8.8% (continued) |

| GNMA II Pool #MA8043, POOL #MA8043, 3.00%, 5/20/52 | |

| GNMA II Pool #MA8945, 4.00%, 6/20/53 | |

| GNMA II Pool #MA9527, 5.00%, 3/20/54 | |

TOTAL RESIDENTIAL MORTGAGE-BACKED SECURITIES

(Cost $86,088,339) | |

U.S. TREASURY OBLIGATIONS 9.8% |

| U.S. Treasury Bonds, 5.38%, 2/15/31 | |

| U.S. Treasury Bonds, 3.50%, 2/15/39 | |

| U.S. Treasury Bonds, 3.88%, 5/15/43 | |

| U.S. Treasury Bonds, 3.00%, 2/15/48 | |

| U.S. Treasury Bonds, 3.63%, 5/15/53 | |

| U.S. Treasury Bonds, 4.25%, 8/15/54(2) | |

| U.S. Treasury Notes, 3.00%, 9/30/25(2) | |

| U.S. Treasury Notes, 4.63%, 2/28/26 | |

| U.S. Treasury Notes, 1.63%, 5/15/26 | |

| U.S. Treasury Notes, 4.50%, 7/15/26 | |

| U.S. Treasury Notes, 2.25%, 8/15/27 | |

| U.S. Treasury Notes, 2.75%, 2/15/28 | |

| U.S. Treasury Notes, 1.63%, 8/15/29 | |

| U.S. Treasury Notes, 3.63%, 8/31/29 | |

| U.S. Treasury Notes, 1.50%, 2/15/30 | |

| U.S. Treasury Notes, 3.88%, 8/15/33 | |

| U.S. Treasury Notes, 4.00%, 2/15/34 | |

TOTAL U.S. TREASURY OBLIGATIONS

(Cost $89,923,700) | |

| | |

SHORT-TERM INVESTMENTS 4.6% |

| |

| State Street Institutional U.S. Government Money Market Fund, Premier Class, 4.43%(5) | |

| State Street Navigator Securities Lending Government Money Market Portfolio(6) | |

| | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $41,619,401) | |

TOTAL INVESTMENTS IN SECURITIES 102.1%

(Cost $631,802,091) | |

EXCESS OF LIABILITIES OVER CASH AND OTHER ASSETS (2.1)% | |

| |

| |

| A portion or all of the security was held on loan. As of December 31, 2024, the market value of the securities on loan was $40,656,514. |

| Pursuant to Rule 144A under the Securities Act of 1933, this security can only be sold to qualified institutional investors. |

| Floating or variable rate security. The rate disclosed is the rate in effect as of December 31, 2024. The information in parentheses represents the benchmark and reference rate for each relevant security and the rate adjusts based upon the reference rate and spread. The security may be further subject to interest rate floor and caps. For securities which do not indicate a reference rate and spread in their descriptions, the interest rate adjusts periodically based on current interest rates and, for mortgage-backed securities, prepayments in the underlying pool of assets. |

| Rate reflects 7 day yield as of December 31, 2024. |

| Securities with an aggregate market value of $40,656,514 were out on loan in exchange for collateral including $20,474,643 of cash collateral as of December 31, 2024. The collateral was invested in a cash collateral reinvestment vehicle. See Note 1(K). |

| Constant Maturity Treasury. |

| Federal Home Loan Mortgage Corp. |

| Federal National Mortgage Association. |

| Government National Mortgage Association. |

| Real Estate Investment Trusts. |

| Real Estate Mortgage Investment Conduit. |

| Secured Overnight Financing Rate. |

| |

The following table summarizes the inputs used to value the Fund's investments in securities as of December 31, 2024 (See Note 1(B)):

Investments in Securities: | | | | |

| | | | |

| | | | |

Collateralized Mortgage Obligations | | | | |

Commercial Mortgage-Backed Securities | | | | |

| | | | |

See Notes to Financial Statements.

Investments in Securities: | | | | |

Long-Term Municipal Securities* | | | | |

Residential Mortgage-Backed Securities | | | | |

U.S. Treasury Obligations | | | | |

| | | | |

Total Investments in Securities | | | | |

| See Schedule of Investments for further breakdown by category. |

See Notes to Financial Statements.

Value Line Capital Appreciation Fund, Inc.

| | |

|

COMMUNICATION SERVICES 11.5% |

| |

| | |

| | |

| Meta Platforms, Inc. Class A | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

CONSUMER DISCRETIONARY 10.5% |

| |

| Rivian Automotive, Inc. Class A(1)(2) | |

| | |

| | |

| |

| DraftKings, Inc. Class A(1) | |

| |

| Alibaba Group Holding Ltd. ADR | |

| | |

| | |

| | |

| |

| Hilton Worldwide Holdings, Inc. | |

| |

| Chipotle Mexican Grill, Inc.(1) | |

| Lululemon Athletica, Inc.(1) | |

| | |

| | |

|

| |

| Constellation Brands, Inc. Class A | |

|

| |

| | |

|

| |

| | |

| |

| | |

| Goldman Sachs Group, Inc. | |

| | |

| | |

| |

| | |

| DIVERSIFIED FINANCIALS 3.9% |

| Coinbase Global, Inc. Class A(1) | |

| Interactive Brokers Group, Inc. Class A | |

| | |

COMMON STOCKS 65.2% (continued) |

FINANCIALS 8.8% (continued) |

| DIVERSIFIED FINANCIALS 3.9% (continued) |

| | |

| | |

| |

| Robinhood Markets, Inc. Class A(1) | |

| | |

|

| |

| BioMarin Pharmaceutical, Inc.(1) | |

| | |

| Vertex Pharmaceuticals, Inc.(1) | |

| | |

| |

| Exact Sciences Corp.(1)(2) | |

| |

| | |

| Madrigal Pharmaceuticals, Inc.(1)(2) | |

| | |

| | |

| | |

|

| |

| | |

| |

| | |

| Uber Technologies, Inc.(1) | |

| | |

| | |

INFORMATION TECHNOLOGY 23.7% |

| |

| | |

| Crowdstrike Holdings, Inc. Class A(1) | |

| | |

| |

| | |

| |

| Advanced Micro Devices, Inc.(1) | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| MicroStrategy, Inc. Class A(1)(2) | |

| | |

| | |

See Notes to Financial Statements.

| | |

COMMON STOCKS 65.2% (continued) |

INFORMATION TECHNOLOGY 23.7% (continued) |

| SOFTWARE 8.7% (continued) |

| | |

| | |

| | |

TOTAL COMMON STOCKS

(Cost $140,749,198) | |

| | |

COLLATERALIZED MORTGAGE OBLIGATIONS 0.3% |

| FHLMC, Series 2023-DNA1, Class M1A, REMIC, (30 day USD SOFR Average + 2.10%), 6.66%, 3/25/43(3)(4) | |

| FNMA, Series 2023-R02, Class 1M1, (30 day USD SOFR Average + 2.30%), 6.87%, 1/25/43(3)(4) | |

| FNMA, Series 2023-R04, Class 1M1, (30 day USD SOFR Average + 2.30%), 6.86%, 5/25/43(3)(4) | |

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS

(Cost $1,507,766) | |

COMMERCIAL MORTGAGE-BACKED SECURITIES 0.3% |

| FHLMC Multifamily Structured Pass-Through Certificates, Series K052, Class A2, 3.15%, 11/25/25 | |

| FHLMC Multifamily Structured Pass-Through Certificates, Series K055, Class A2, 2.67%, 3/25/26 | |

| FHLMC Multifamily Structured Pass-Through Certificates, Series K064, Class A2, 3.22%, 3/25/27 | |

| FHLMC Multifamily Structured Pass-Through Certificates, Series K074, Class A2, 3.60%, 1/25/28 | |

| FHLMC Multifamily Structured Pass-Through Certificates, Series K084, Class A2, 3.78%, 10/25/28(4) | |

| GNMA, Series 2013-12, Class AB, 1.83%, 11/16/52 | |

| GNMA, Series 2013-12, Class B, 2.07%, 11/16/52(4) | |

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(Cost $1,606,931) | |

CORPORATE BONDS & NOTES 9.6% |

|

| |

| Eastman Chemical Co., Senior Unsecured Notes, 5.63%, 2/20/34 | |

| |

| ArcelorMittal SA, Senior Unsecured Notes, 4.25%, 7/16/29(2) | |

| |

| Freeport-McMoRan, Inc., Guaranteed Notes, 4.63%, 8/1/30(2) | |

| | |

CORPORATE BONDS & NOTES 9.6% (continued) |

BASIC MATERIALS 0.4% (continued) |

| |

| Newmont Corp., Guaranteed Notes, 2.60%, 7/15/32(2) | |

| | |

| | |

|

| |

| Expedia Group, Inc., Guaranteed Notes, 3.25%, 2/15/30(2) | |

| Netflix, Inc., Senior Unsecured Notes, 4.90%, 8/15/34(2) | |

| | |

| |

| Comcast Corp., Guaranteed Notes, 3.95%, 10/15/25 | |

| |

| AT&T, Inc., Senior Unsecured Notes, 2.55%, 12/1/33 | |

| Motorola Solutions, Inc., Senior Unsecured Notes, 2.30%, 11/15/30 | |

| T-Mobile USA, Inc., Guaranteed Notes, 3.50%, 4/15/31 | |

| Verizon Communications, Inc., Senior Unsecured Notes, 4.13%, 3/16/27(2) | |

| Vodafone Group PLC, Senior Unsecured Notes, 4.25%, 9/17/50 | |

| | |

| | |

|

| |

| Tapestry, Inc., Senior Unsecured Notes, 5.10%, 3/11/30 | |

| |

| Ford Motor Credit Co. LLC, Senior Unsecured Notes, 6.05%, 3/5/31 | |

| General Motors Financial Co., Inc., Senior Unsecured Notes, 5.45%, 9/6/34(2) | |

| | |

| AUTO PARTS & EQUIPMENT 0.1% |

| BorgWarner, Inc., Senior Unsecured Notes, 5.40%, 8/15/34(2) | |

| |

| Lennar Corp., Guaranteed Notes, 4.75%, 5/30/25 | |

| |

| Hyatt Hotels Corp., Senior Unsecured Notes, 5.38%, 12/15/31 | |

| Marriott International, Inc., 4.90%, 4/15/29(2) | |

| | |

| |

| Costco Wholesale Corp., Senior Unsecured Notes, 1.75%, 4/20/32(2) | |

See Notes to Financial Statements.

Schedule of Investments (continued)

| | |

CORPORATE BONDS & NOTES 9.6% (continued) |

CONSUMER, CYCLICAL 1.0% (continued) |

| |

| TJX Cos., Inc., 2.25%, 9/15/26 | |

| | |

| | |

CONSUMER, NON-CYCLICAL 1.4% |

| |

| Constellation Brands, Inc., 2.25%, 8/1/31 | |

| Constellation Brands, Inc., Guaranteed Notes, 5.25%, 11/15/48 | |

| | |

| |

| Amgen, Inc., Senior Unsecured Notes, 2.20%, 2/21/27 | |

| Gilead Sciences, Inc., 4.60%, 9/1/35 | |

| Regeneron Pharmaceuticals, Inc., Senior Unsecured Notes, 1.75%, 9/15/30(2) | |

| | |

| |

| PayPal Holdings, Inc., Senior Unsecured Notes, 2.65%, 10/1/26(2) | |

| Service Corp. International, Senior Unsecured Notes, 4.00%, 5/15/31 | |

| | |

| |

| GE HealthCare Technologies, Inc., Senior Unsecured Notes, 4.80%, 8/14/29 | |

| Smith & Nephew PLC, Senior Unsecured Notes, 2.03%, 10/14/30 | |

| Stryker Corp., 3.38%, 11/1/25(2) | |

| | |

| |

| HCA, Inc., Guaranteed Notes, 5.38%, 2/1/25 | |

| |

| AbbVie, Inc., Senior Unsecured Notes, 2.95%, 11/21/26 | |

| Eli Lilly & Co., Senior Unsecured Notes, 5.00%, 2/9/54 | |

| Pfizer Investment Enterprises Pte. Ltd., Guaranteed Notes, 5.30%, 5/19/53(2) | |

| | |

| | |

|

| |

| Devon Energy Corp., Senior Unsecured Notes, 5.20%, 9/15/34(2) | |

| Diamondback Energy, Inc., Guaranteed Notes, 5.15%, 1/30/30(2) | |

| Hess Corp., Senior Unsecured Notes, 4.30%, 4/1/27 | |

| Murphy Oil Corp., Senior Unsecured Notes, 6.00%, 10/1/32 | |

| Occidental Petroleum Corp., Senior Unsecured Notes, 5.55%, 10/1/34(2) | |

| | |

CORPORATE BONDS & NOTES 9.6% (continued) |

|

| OIL & GAS 0.7% (continued) |

| Phillips 66 Co., Guaranteed Notes, 5.25%, 6/15/31 | |

| | |

| |

| Enbridge, Inc., Guaranteed Notes, 2.50%, 8/1/33 | |

| Kinder Morgan, Inc., 5.20%, 6/1/33(2) | |

| Targa Resources Corp., 6.50%, 3/30/34 | |

| | |

| | |

|

| |

| Bank of America Corp., (1 day USD SOFR + 2.16%), 5.02%, 7/22/33(2)(4) | |

| Bank of New York Mellon Corp., (1 day USD SOFR + 1.51%), 4.71%, 2/1/34(4) | |

| Citigroup, Inc., Senior Unsecured Notes, (1 day USD SOFR + 1.34%), 4.54%, 9/19/30(2)(4) | |

| Citigroup, Inc., Senior Unsecured Notes, (1 day USD SOFR + 2.09%), 4.91%, 5/24/33(2)(4) | |

| Citigroup, Inc., Subordinated Notes, 5.30%, 5/6/44 | |

| Goldman Sachs Group, Inc., Senior Unsecured Notes, 3.75%, 2/25/26(2) | |

| HSBC Holdings PLC, Senior Unsecured Notes, (3 mo. USD Term SOFR + 1.80%), 4.58%, 6/19/29(4) | |

| JPMorgan Chase & Co., Subordinated Notes, 4.13%, 12/15/26 | |

| JPMorgan Chase & Co., Senior Unsecured Notes, (3 mo. USD Term SOFR + 1.64%), 3.96%, 11/15/48(4) | |

| KeyCorp, Senior Unsecured Notes, 4.10%, 4/30/28(2) | |

| M&T Bank Corp., Senior Unsecured Notes, (1 day USD SOFR Index + 1.78%), 4.55%, 8/16/28(2)(4) | |

| Morgan Stanley, (1 day USD SOFR + 2.56%), 6.34%, 10/18/33(4) | |

| NatWest Group PLC, (1 yr. CMT + 1.35%), 5.85%, 3/2/27(4) | |

| Regions Financial Corp., Senior Unsecured Notes, (1 day USD SOFR + 2.06%), 5.50%, 9/6/35(2)(4) | |

| Royal Bank of Canada, 5.00%, 2/1/33 | |

| Wells Fargo & Co., Senior Unsecured Notes, (1 day USD SOFR + 1.07%), 5.71%, 4/22/28(4) | |

| Wells Fargo & Co., (1 day USD SOFR + 2.13%), 4.61%, 4/25/53(4) | |

| | |

See Notes to Financial Statements.

| | |

CORPORATE BONDS & NOTES 9.6% (continued) |

FINANCIAL 3.4% (continued) |

| DIVERSIFIED FINANCIALS 0.5% |

| AerCap Ireland Capital DAC/AerCap Global Aviation Trust, Guaranteed Notes, 3.30%, 1/30/32 | |

| Ally Financial, Inc., Senior Unsecured Notes, 4.75%, 6/9/27(2) | |

| American Express Co., Senior Unsecured Notes, (1 day USD SOFR Index + 1.28%), 5.28%, 7/27/29(4) | |

| Discover Financial Services, Senior Unsecured Notes, 4.10%, 2/9/27 | |

| Synchrony Financial, 4.88%, 6/13/25 | |

| | |

| |

| Aflac, Inc., Senior Unsecured Notes, 3.60%, 4/1/30(2) | |

| |

| Alexandria Real Estate Equities, Inc., Guaranteed Notes, 4.90%, 12/15/30(2) | |

| American Tower Corp., 5.50%, 3/15/28 | |

| Crown Castle, Inc., Senior Unsecured Notes, 3.80%, 2/15/28(2) | |

| Equinix, Inc., Senior Unsecured Notes, 2.50%, 5/15/31 | |

| Extra Space Storage LP, Guaranteed Notes, 5.40%, 2/1/34(2) | |

| Host Hotels & Resorts LP, Senior Unsecured Notes, 3.50%, 9/15/30 | |

| Kimco Realty OP LLC, Senior Unsecured Notes, 2.25%, 12/1/31 | |

| Sabra Health Care LP, Guaranteed Notes, 3.20%, 12/1/31 | |

| Welltower OP LLC, Senior Unsecured Notes, 4.25%, 4/15/28 | |

| Weyerhaeuser Co., 4.75%, 5/15/26 | |

| | |

| | |

|

| |

| | |

| |

| Amphenol Corp., Senior Unsecured Notes, 2.20%, 9/15/31 | |

| Flex Ltd., Senior Unsecured Notes, 4.75%, 6/15/25(2) | |

| | |

| MISCELLANEOUS MANUFACTURERS 0.1% |

| Teledyne Technologies, Inc., 2.25%, 4/1/28 | |

| | |

|

| |

| Dell International LLC/EMC Corp., Guaranteed Notes, 5.40%, 4/15/34(2) | |

| Hewlett Packard Enterprise Co., Senior Unsecured Notes, 5.00%, 10/15/34 | |

| | |

CORPORATE BONDS & NOTES 9.6% (continued) |

TECHNOLOGY 0.8% (continued) |

| COMPUTERS 0.3% (continued) |

| Kyndryl Holdings, Inc., Senior Unsecured Notes, 3.15%, 10/15/31(2) | |

| | |

| |

| Analog Devices, Inc., Senior Unsecured Notes, 2.80%, 10/1/41(2) | |

| Broadcom, Inc., 4.30%, 11/15/32 | |

| Microchip Technology, Inc., Guaranteed Notes, 5.05%, 2/15/30(2) | |

| Micron Technology, Inc., Senior Unsecured Notes, 5.30%, 1/15/31(2) | |

| | |

| |

| Oracle Corp., 6.25%, 11/9/32 | |

| | |

|

| |

| Duke Energy Corp., Senior Unsecured Notes, 4.50%, 8/15/32(2) | |

| National Grid PLC, Senior Unsecured Notes, 5.42%, 1/11/34(2) | |

| Public Service Enterprise Group, Inc., Senior Unsecured Notes, 5.20%, 4/1/29(2) | |

| Southern Co., 5.70%, 3/15/34(2) | |

| | |

TOTAL CORPORATE BONDS & NOTES

(Cost $45,085,314) | |

LONG-TERM MUNICIPAL SECURITIES 0.9% |

| |

| Regents of the University of California Medical Center Pooled Revenue, Series Q, 4.13%, 5/15/32 | |

| State of California, GO, 5.70%, 10/1/32 | |

| | |

| |

| City & County Honolulu Wastewater System Revenue, Series B, 2.50%, 7/1/27 | |

| |

| Illinois State Toll Highway Authority, Series B, 5.85%, 12/1/34 | |

| |

| Commonwealth of Massachusetts, Series A, 3.77%, 7/15/29 | |

| |

| University of Michigan, 5.18%, 4/1/35 | |

| |

| Minnesota Housing Finance Agency, Series J, 5.85%, 7/1/44 | |

See Notes to Financial Statements.

Schedule of Investments (continued)

| | |

LONG-TERM MUNICIPAL SECURITIES 0.9% (continued) |

| |

| New York City Transitional Finance Authority Future Tax Secured Revenue, Series D-3, 2.25%, 11/1/31 | |

TOTAL LONG-TERM MUNICIPAL SECURITIES

(Cost $3,903,673) | |

RESIDENTIAL MORTGAGE-BACKED SECURITIES 7.2% |

| FHLMC, Series 4151, Class PA, 2.00%, 1/15/33 | |

| FHLMC Gold PC Pool #A47613, 5.00%, 11/1/35 | |

| FHLMC Gold Pool #C09027, 3.00%, 2/1/43 | |

| FHLMC Pool #QB9661, 2.50%, 3/1/51 | |

| FHLMC Pool #QD2419, 3.00%, 12/1/51 | |

| FHLMC Pool #QE8017, 3.50%, 8/1/52 | |

| FHLMC Pool #QF1236, 4.50%, 10/1/52 | |

| FHLMC Pool #QG6306, 5.00%, 7/1/53 | |

| FHLMC Pool #RA6817, 2.50%, 2/1/52 | |

| FHLMC Pool #SB8215, 4.00%, 3/1/38 | |

| FHLMC Pool #SD4553, 3.00%, 9/1/53 | |

| FHLMC Pool #SD8093, 3.50%, 9/1/50 | |

| FHLMC Pool #SD8108, 3.00%, 11/1/50 | |

| FHLMC Pool #SD8255, 3.50%, 10/1/52 | |

| FHLMC Pool #SD8256, 4.00%, 10/1/52 | |

| FHLMC Pool #SD8266, MBS, 4.50%, 11/1/52 | |

| FHLMC Pool #SD8328, 4.50%, 6/1/53 | |

| FNMA Pool #AH3226, 5.00%, 2/1/41 | |

| FNMA Pool #AL0657, 5.00%, 8/1/41 | |

| FNMA Pool #AQ1853, 3.00%, 11/1/42 | |

| FNMA Pool #AU5409, 3.00%, 8/1/43 | |

| FNMA Pool #CA5540, 3.00%, 4/1/50 | |

| FNMA Pool #CB5892, 4.50%, 3/1/53 | |

| FNMA Pool #FM2202, 4.00%, 12/1/48 | |

| FNMA Pool #FM4140, 2.50%, 9/1/50 | |

| FNMA Pool #FM9760, 3.50%, 11/1/51 | |

| FNMA Pool #FM9834, 3.50%, 6/1/49 | |

| FNMA Pool #FS3526, 4.00%, 12/1/52 | |

| FNMA Pool #MA4222, 3.50%, 12/1/50 | |

| FNMA Pool #MA4512, 2.50%, 1/1/52 | |

| FNMA Pool #MA5131, 3.50%, 7/1/53 | |

| FNMA Pool #MA5283, MBS, 4.00%, 2/1/54 | |

| FNMA REMIC Trust Series 2013-18, Series 2013-18, Class AE, 2.00%, 3/25/28 | |

| GNMA, Series 2021-98, Class IG, IO, 3.00%, 6/20/51 | |

| GNMA II Pool #MA1521, 3.50%, 12/20/43 | |

| GNMA II Pool #MA1839, 4.00%, 4/20/44 | |

| GNMA II Pool #MA4836, 3.00%, 11/20/47 | |

| GNMA II Pool #MA7054, 3.50%, 12/20/50 | |

| GNMA II Pool #MA7651, 3.50%, 10/20/51 | |

| GNMA II Pool #MA7705, MBS, 2.50%, 11/20/51 | |

| | |

RESIDENTIAL MORTGAGE-BACKED SECURITIES 7.2% (continued) |

| GNMA II Pool #MA8043, POOL #MA8043, 3.00%, 5/20/52 | |

| GNMA II Pool #MA8945, 4.00%, 6/20/53 | |

| GNMA II Pool #MA9527, 5.00%, 3/20/54 | |

TOTAL RESIDENTIAL MORTGAGE-BACKED SECURITIES

(Cost $35,135,263) | |

U.S. TREASURY OBLIGATIONS 9.2% |

| U.S. Treasury Bonds, 3.50%, 2/15/39 | |

| U.S. Treasury Bonds, 1.13%, 5/15/40 | |

| U.S. Treasury Bonds, 3.88%, 5/15/43 | |

| U.S. Treasury Bonds, 3.00%, 2/15/48 | |

| U.S. Treasury Bonds, 4.25%, 8/15/54(2) | |

| U.S. Treasury Notes, 3.00%, 9/30/25(2) | |

| U.S. Treasury Notes, 4.50%, 7/15/26 | |

| U.S. Treasury Notes, 2.25%, 8/15/27 | |

| U.S. Treasury Notes, 2.75%, 2/15/28 | |

| U.S. Treasury Notes, 1.63%, 8/15/29(2) | |

| U.S. Treasury Notes, 3.63%, 8/31/29 | |

| U.S. Treasury Notes, 1.50%, 2/15/30 | |

| U.S. Treasury Notes, 2.75%, 8/15/32 | |

| U.S. Treasury Notes, 3.38%, 5/15/33 | |

| U.S. Treasury Notes, 4.00%, 2/15/34 | |

TOTAL U.S. TREASURY OBLIGATIONS

(Cost $43,506,332) | |

| | |

SHORT-TERM INVESTMENTS 8.4% |

| |

| State Street Institutional U.S. Government Money Market Fund, Premier Class, 4.43%(5) | |

| State Street Navigator Securities Lending Government Money Market Portfolio(6) | |

| | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $39,036,189) | |

TOTAL INVESTMENTS IN SECURITIES 101.1%

(Cost $310,530,666) | |

EXCESS OF LIABILITIES OVER CASH AND OTHER ASSETS (1.1)% | |

| |

See Notes to Financial Statements.

| |

| A portion or all of the security was held on loan. As of December 31, 2024, the market value of the securities on loan was $44,989,932. |

| Pursuant to Rule 144A under the Securities Act of 1933, this security can only be sold to qualified institutional investors. |

| Floating or variable rate security. The rate disclosed is the rate in effect as of December 31, 2024. The information in parentheses represents the benchmark and reference rate for each relevant security and the rate adjusts based upon the reference rate and spread. The security may be further subject to interest rate floor and caps. For securities which do not indicate a reference rate and spread in their descriptions, the interest rate adjusts periodically based on current interest rates and, for mortgage-backed securities, prepayments in the underlying pool of assets. |

| Rate reflects 7 day yield as of December 31, 2024. |

| Securities with an aggregate market value of $44,989,932 were out on loan in exchange for collateral including $10,973,608 of cash collateral as of December 31, 2024. The collateral was invested in a cash collateral reinvestment vehicle. See Note 1(K). |

| American Depositary Receipt. |

| Constant Maturity Treasury. |

| Federal Home Loan Mortgage Corp. |

| Federal National Mortgage Association. |

| Government National Mortgage Association. |

| Real Estate Investment Trusts. |