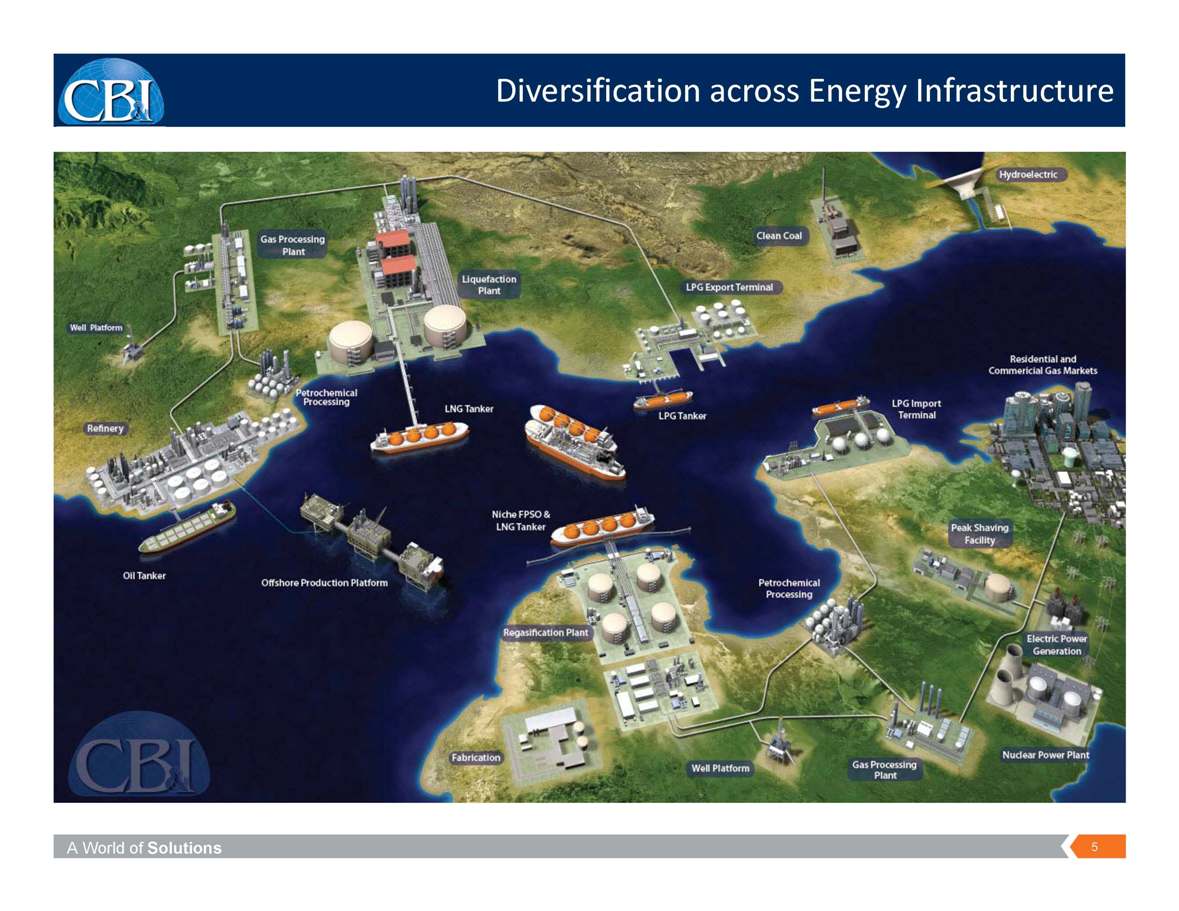

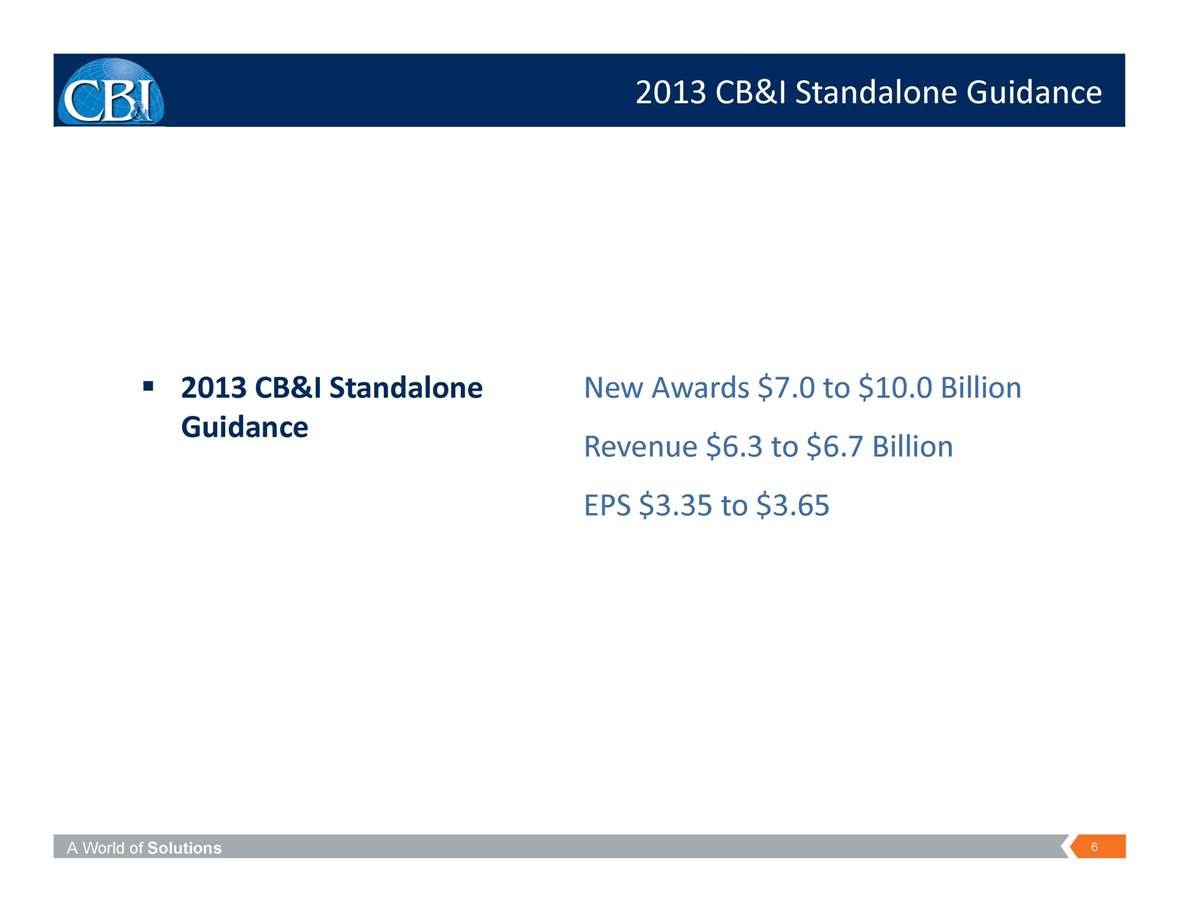

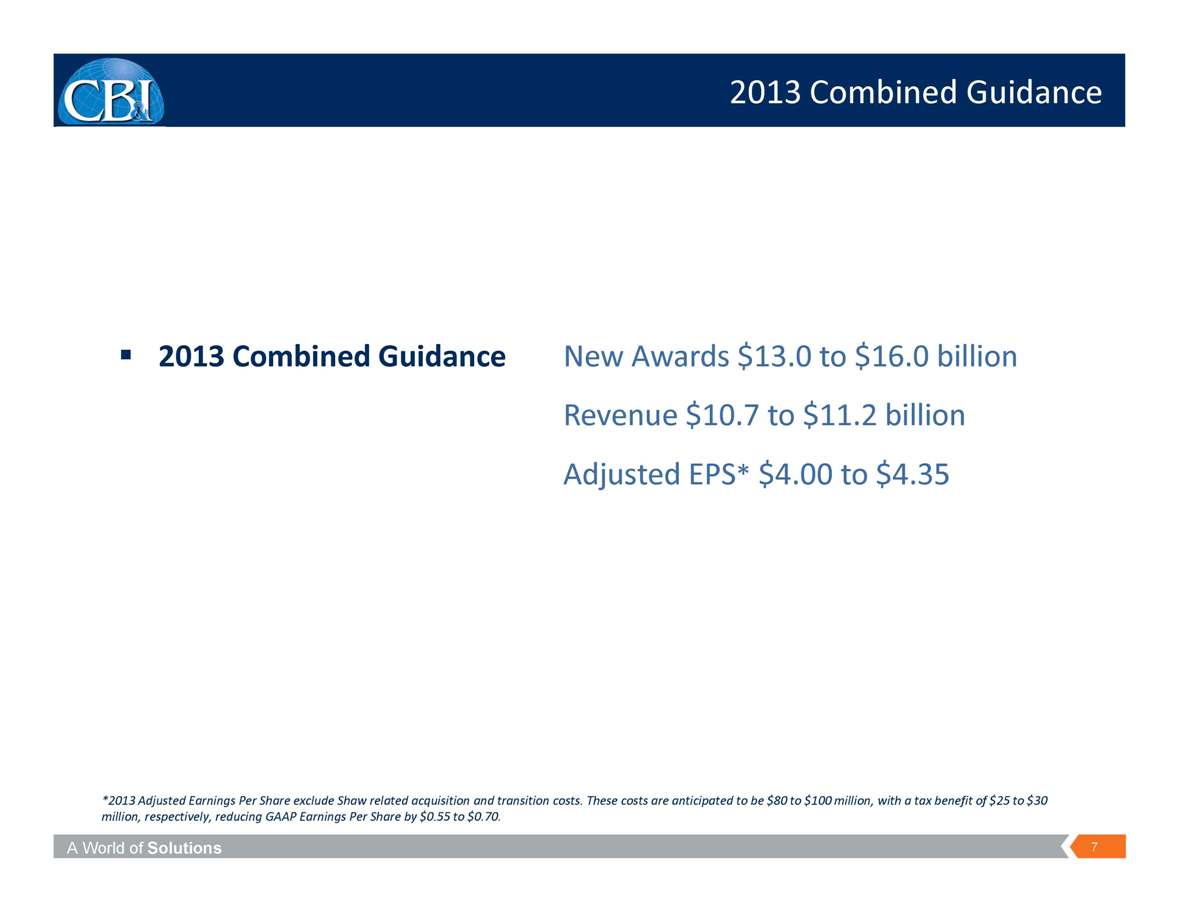

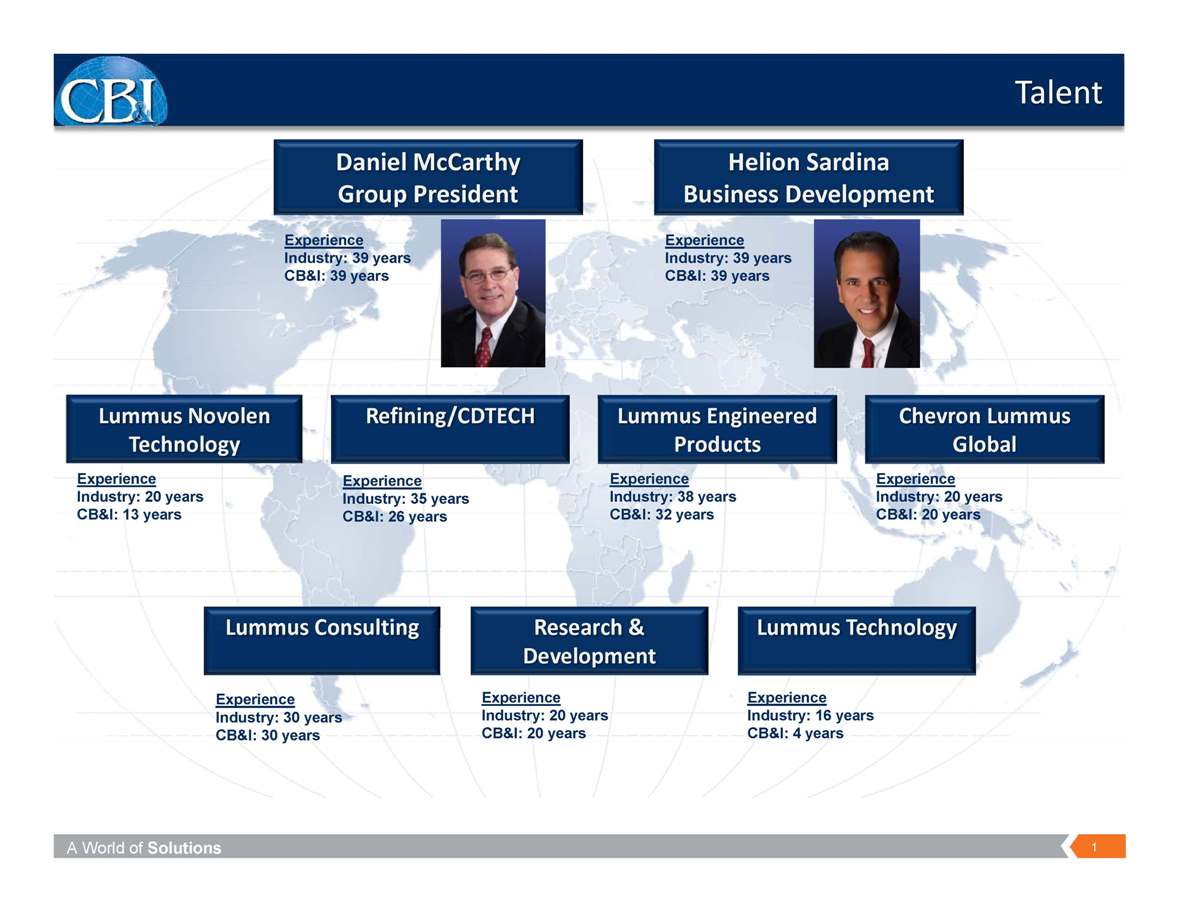

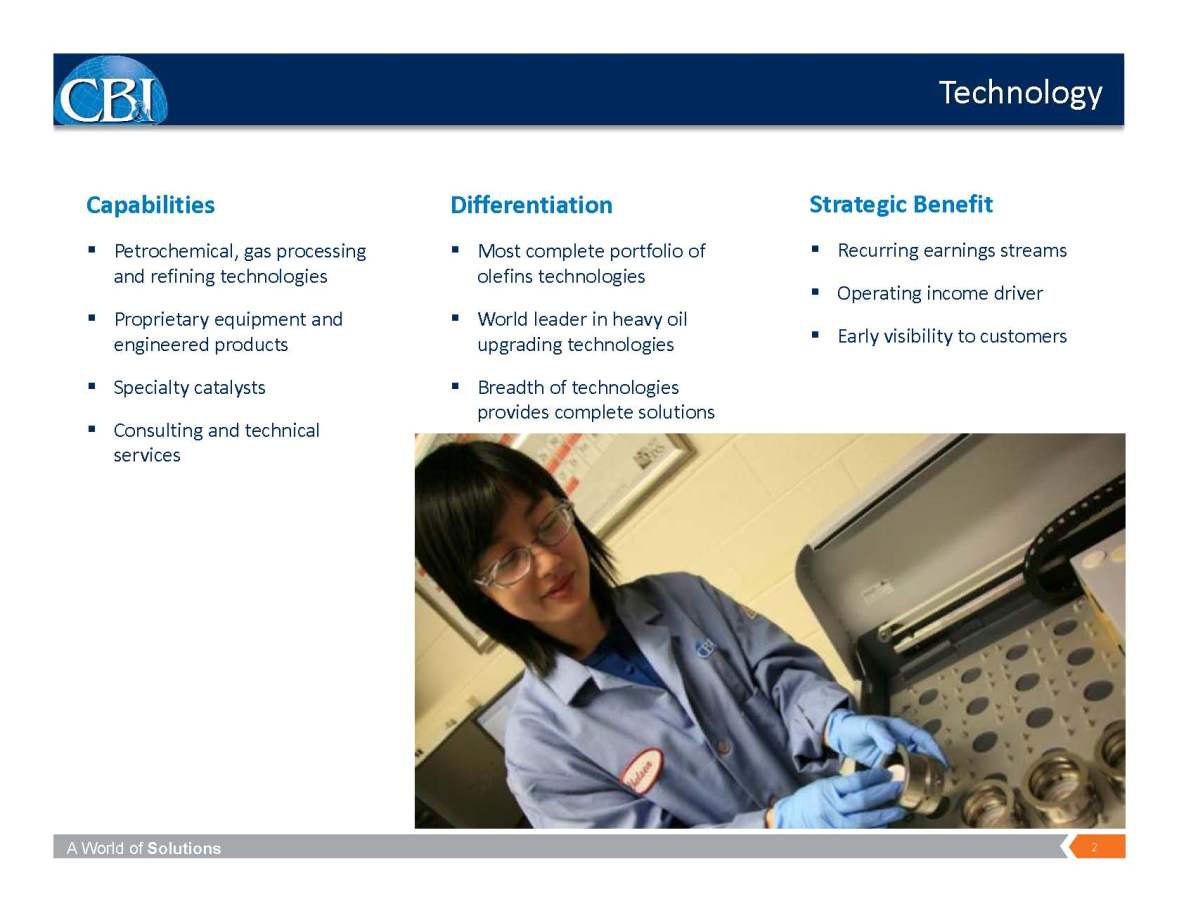

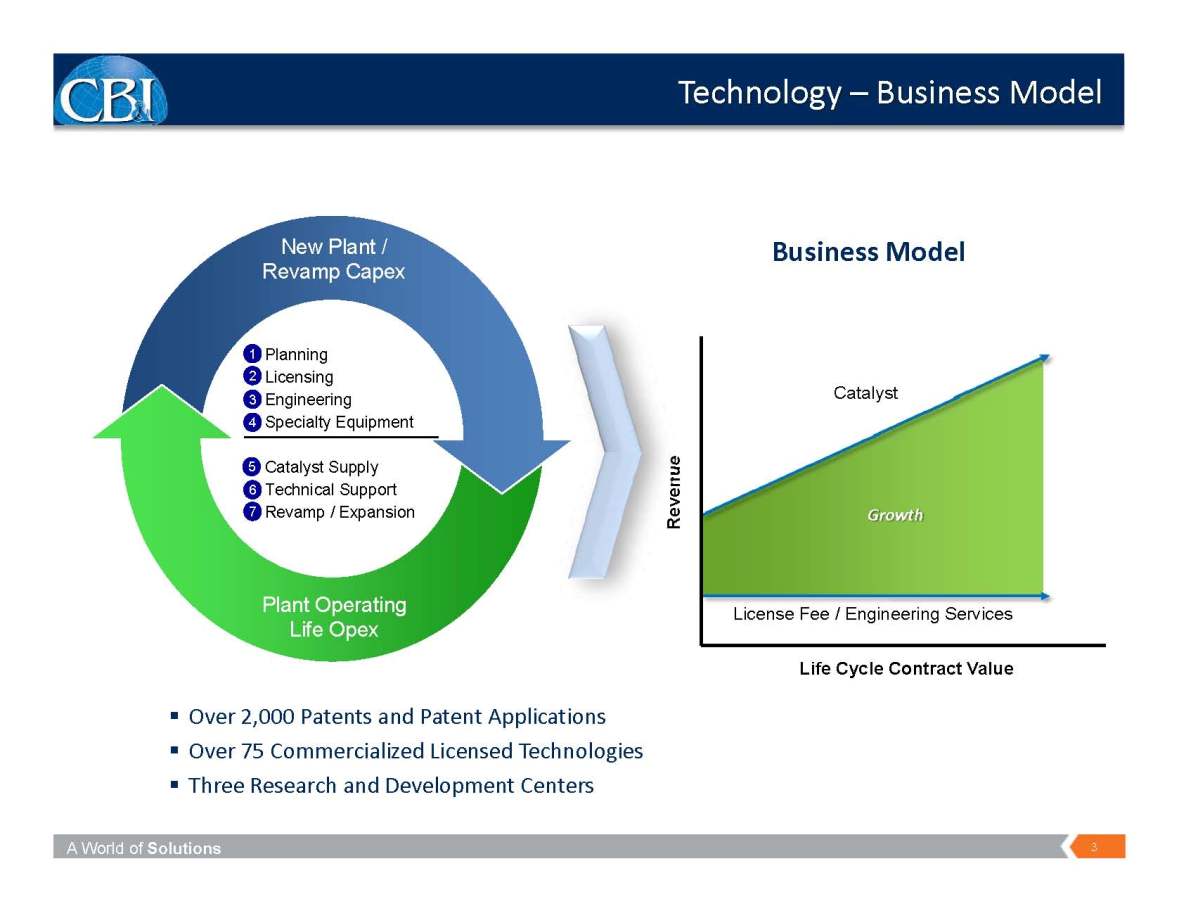

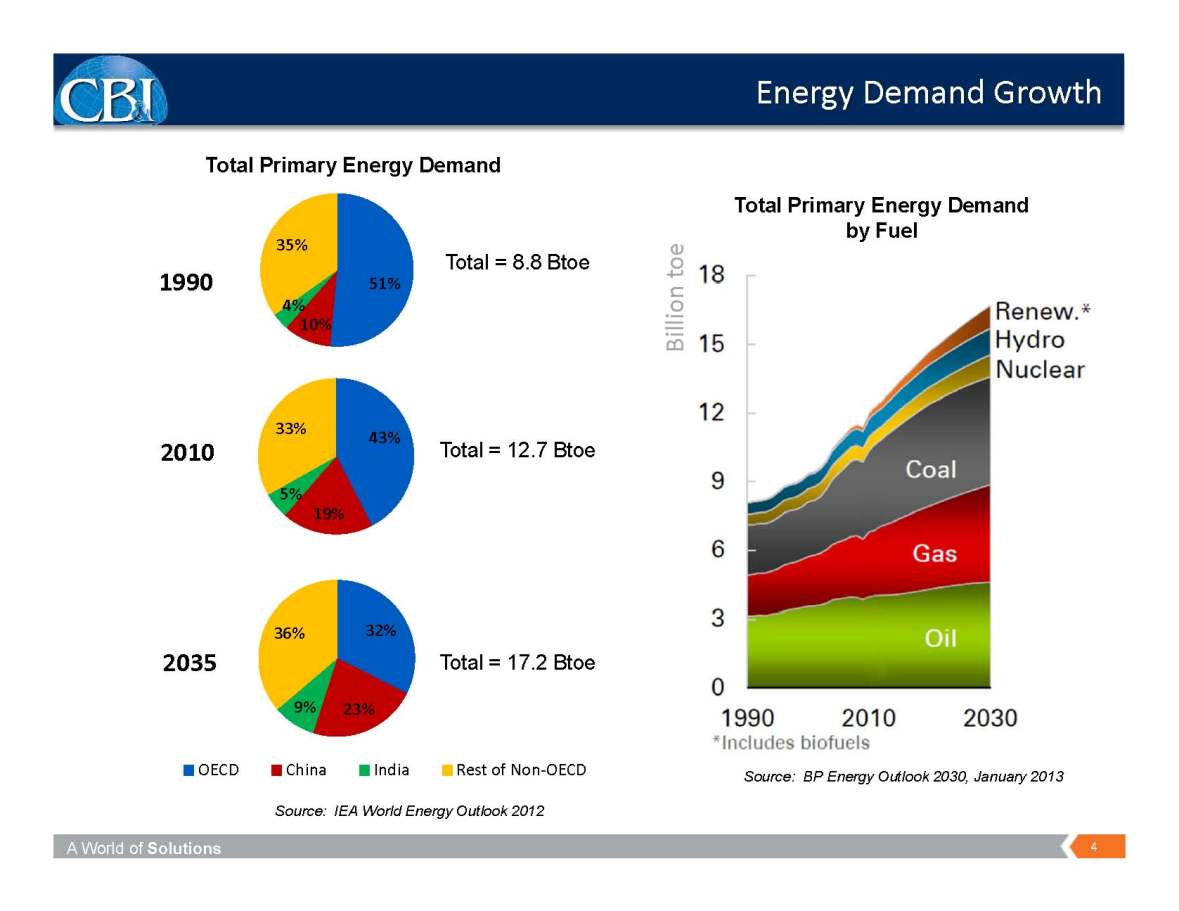

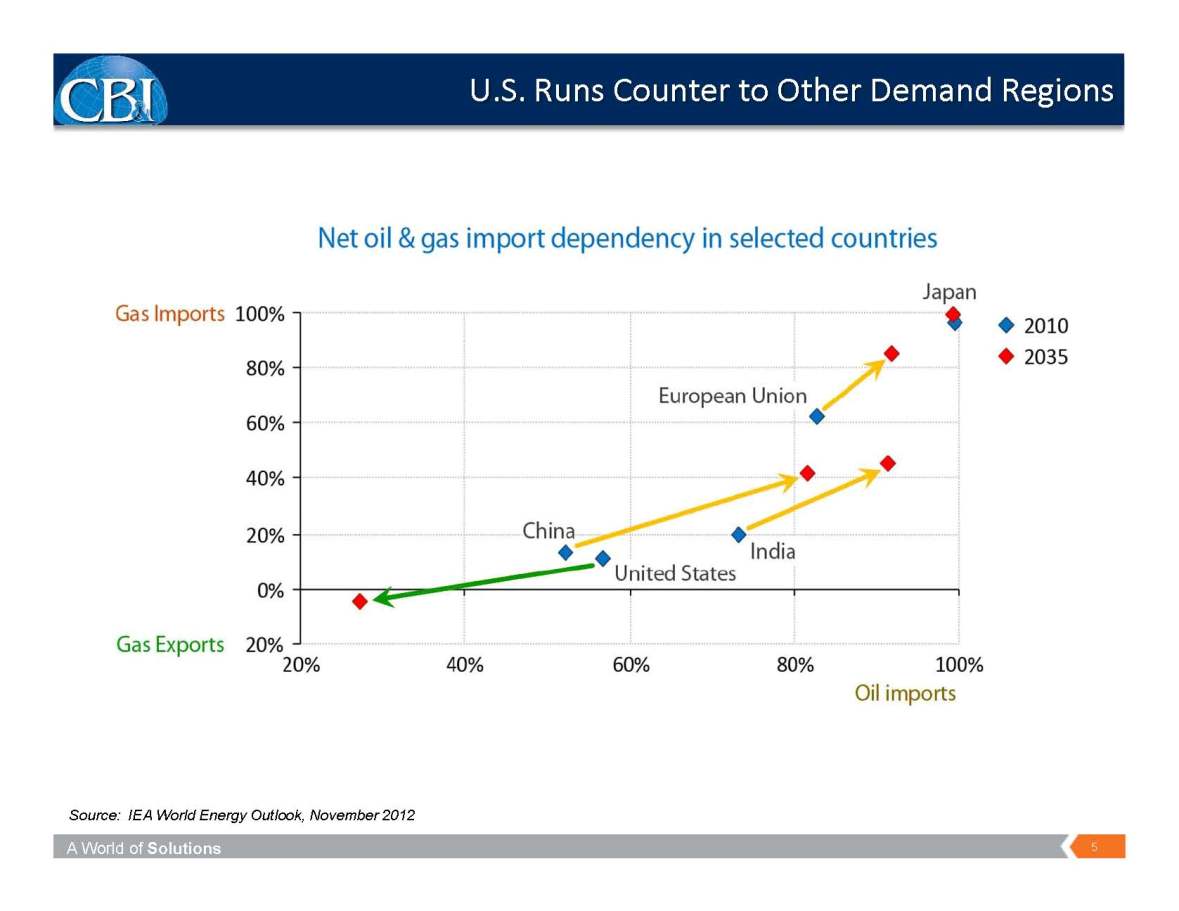

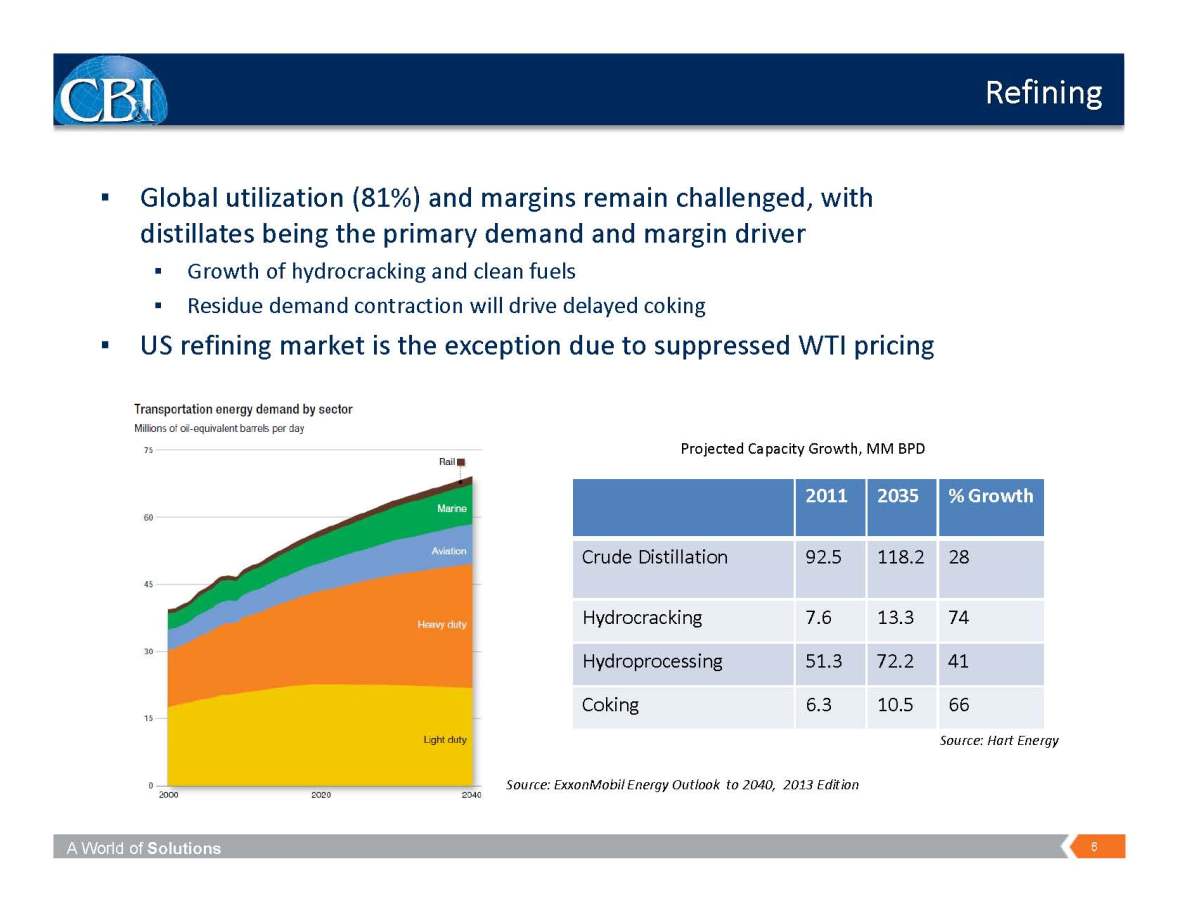

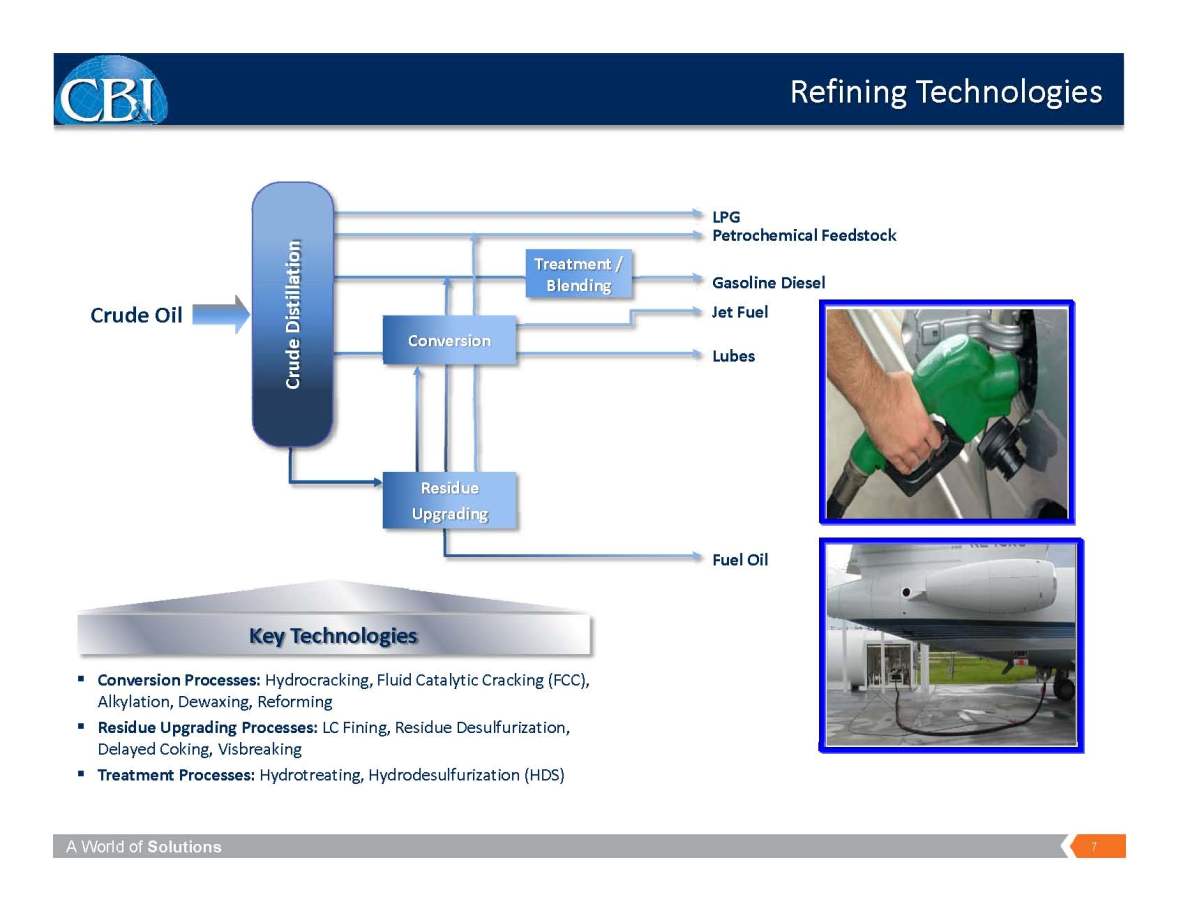

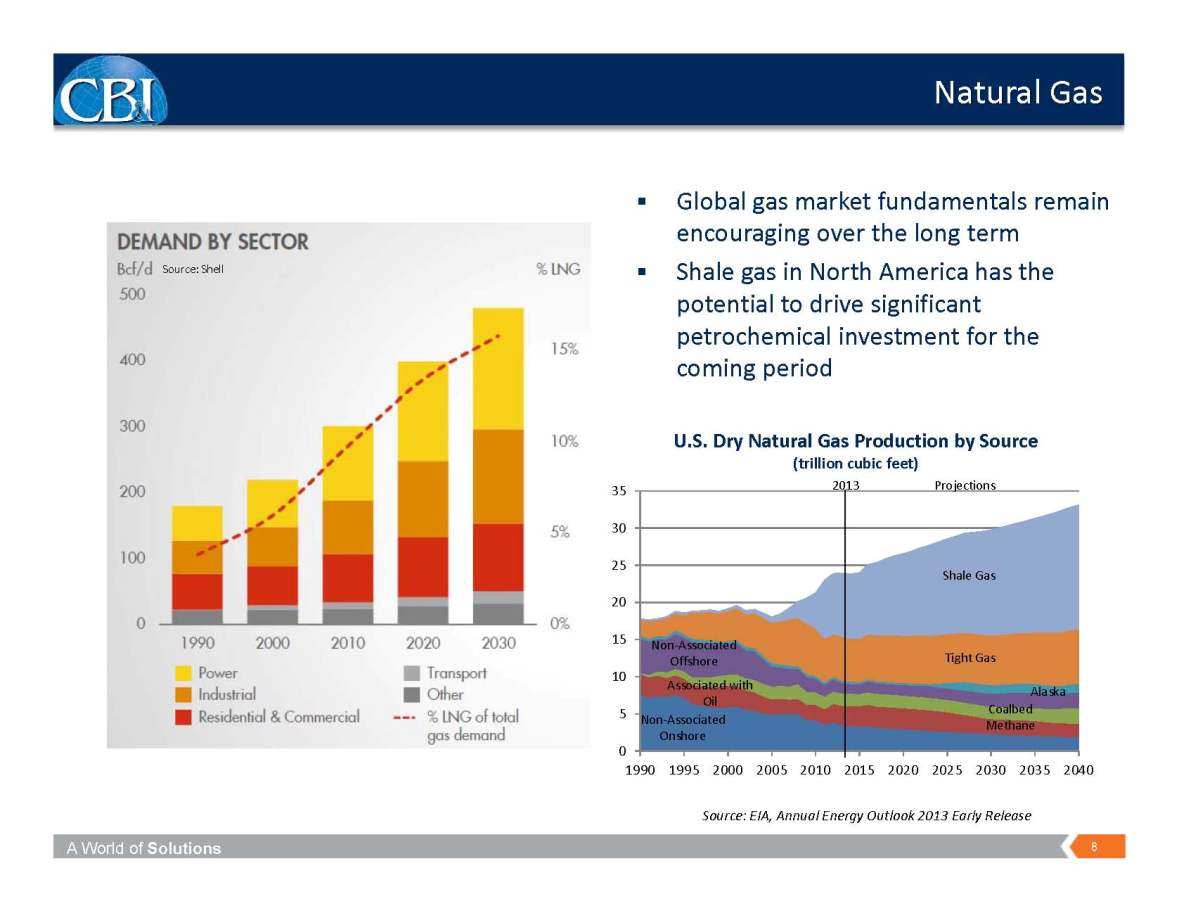

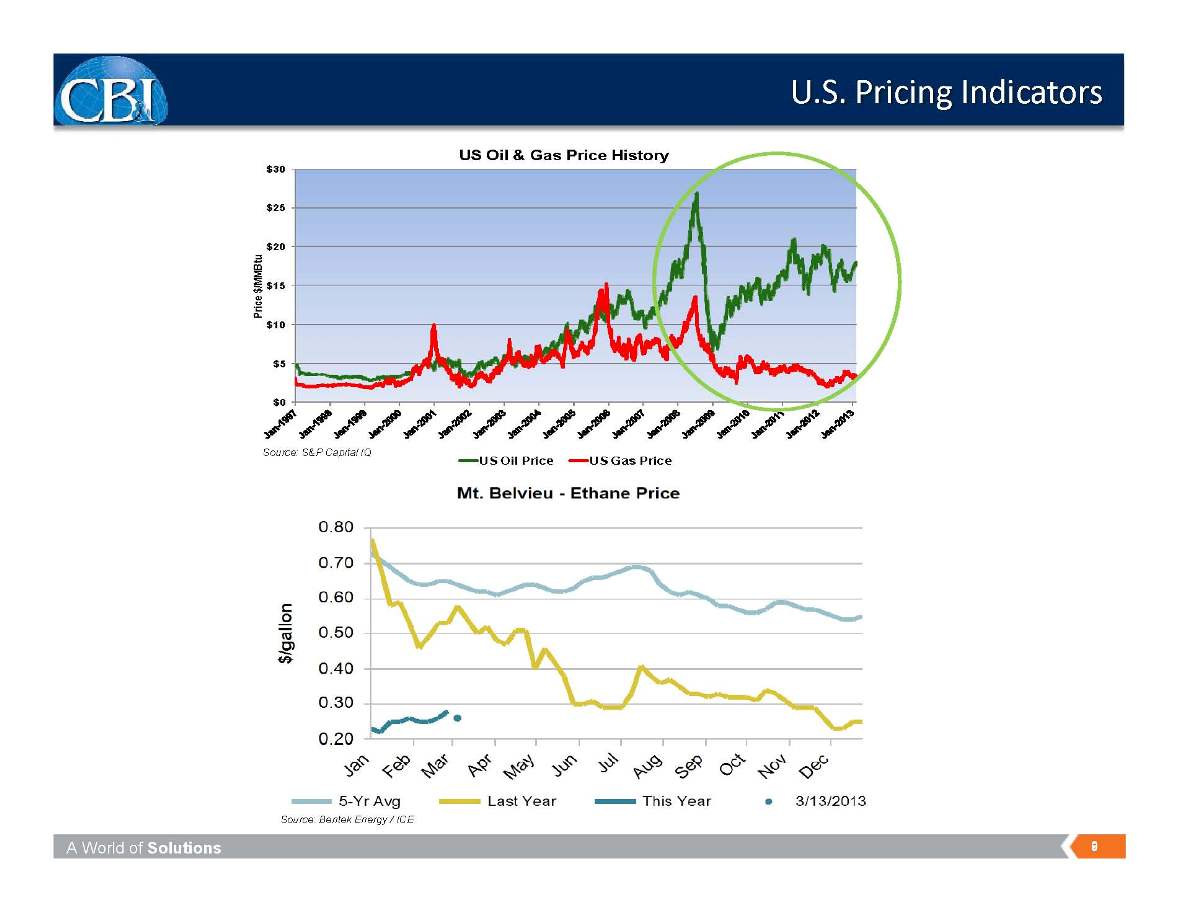

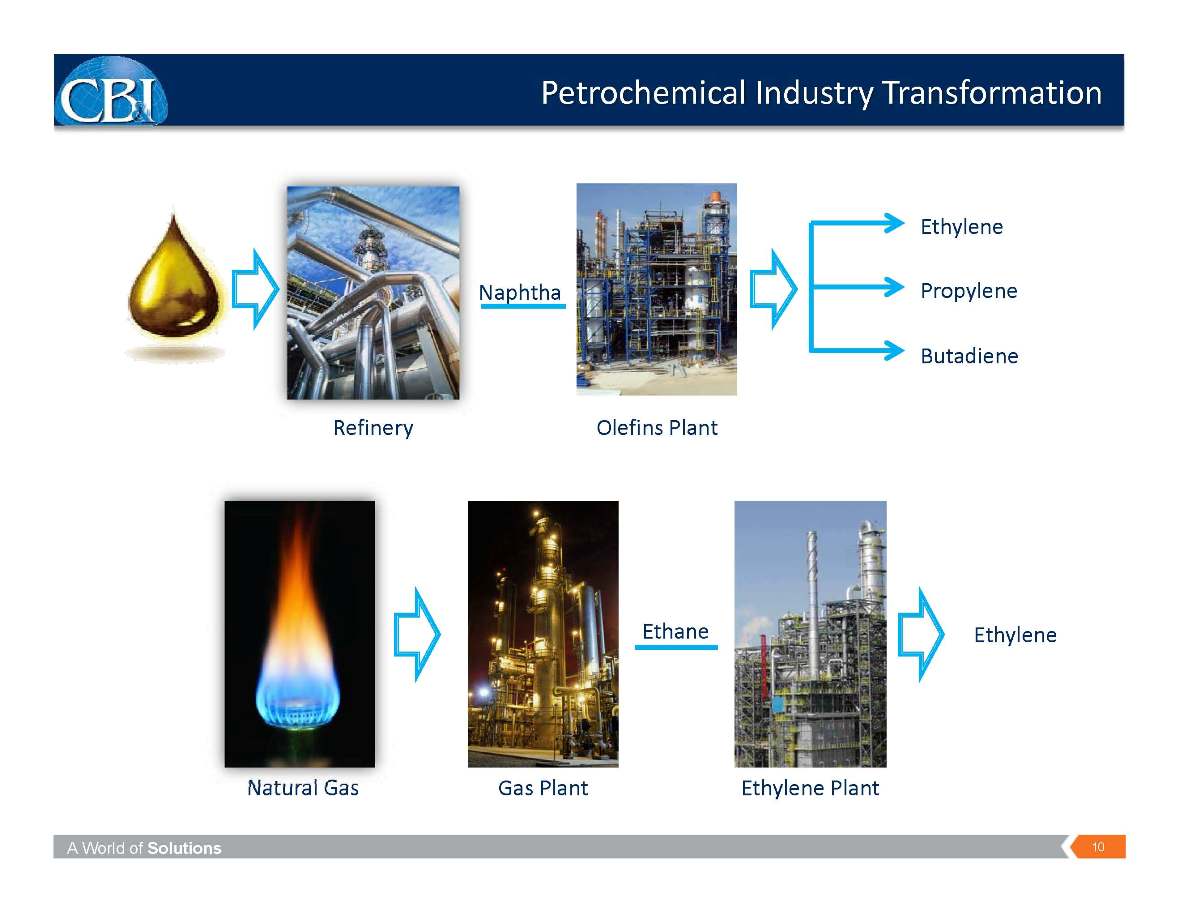

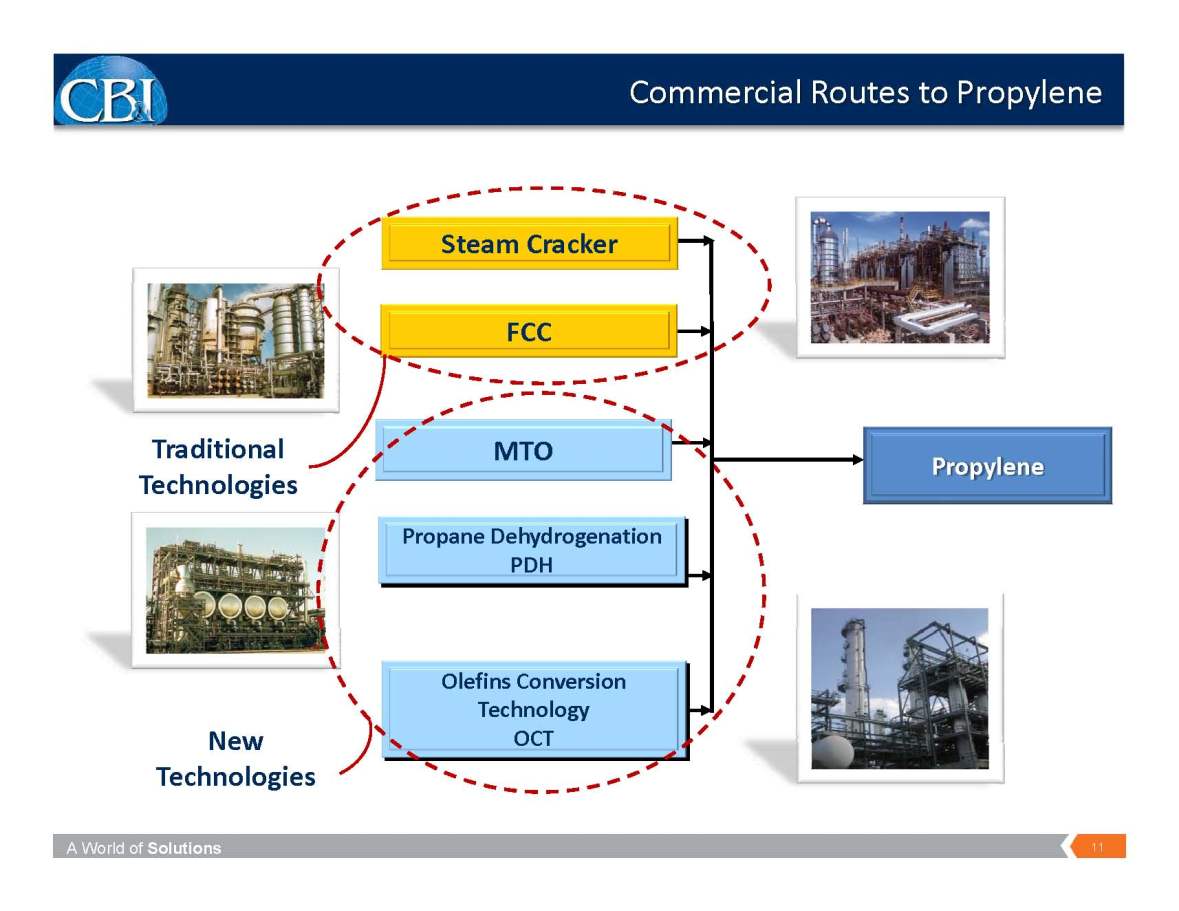

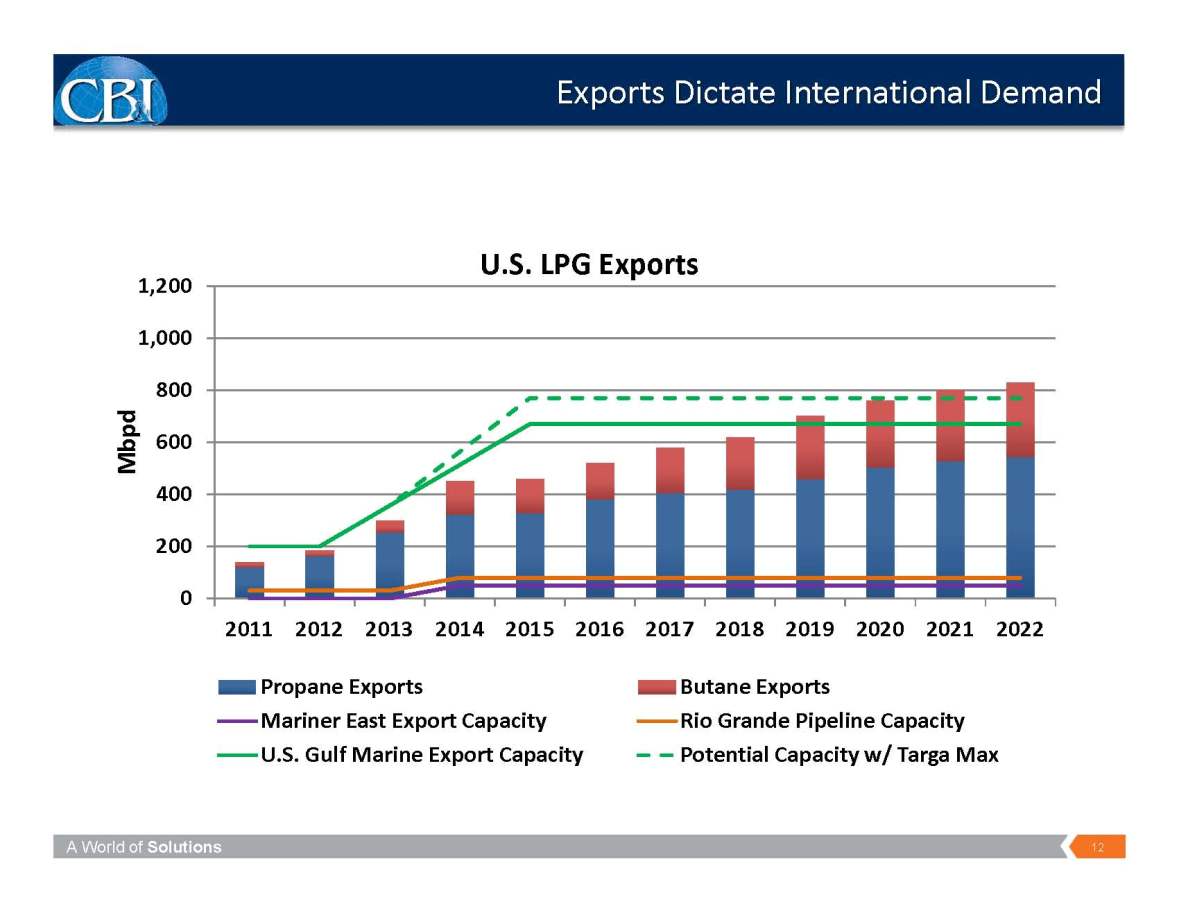

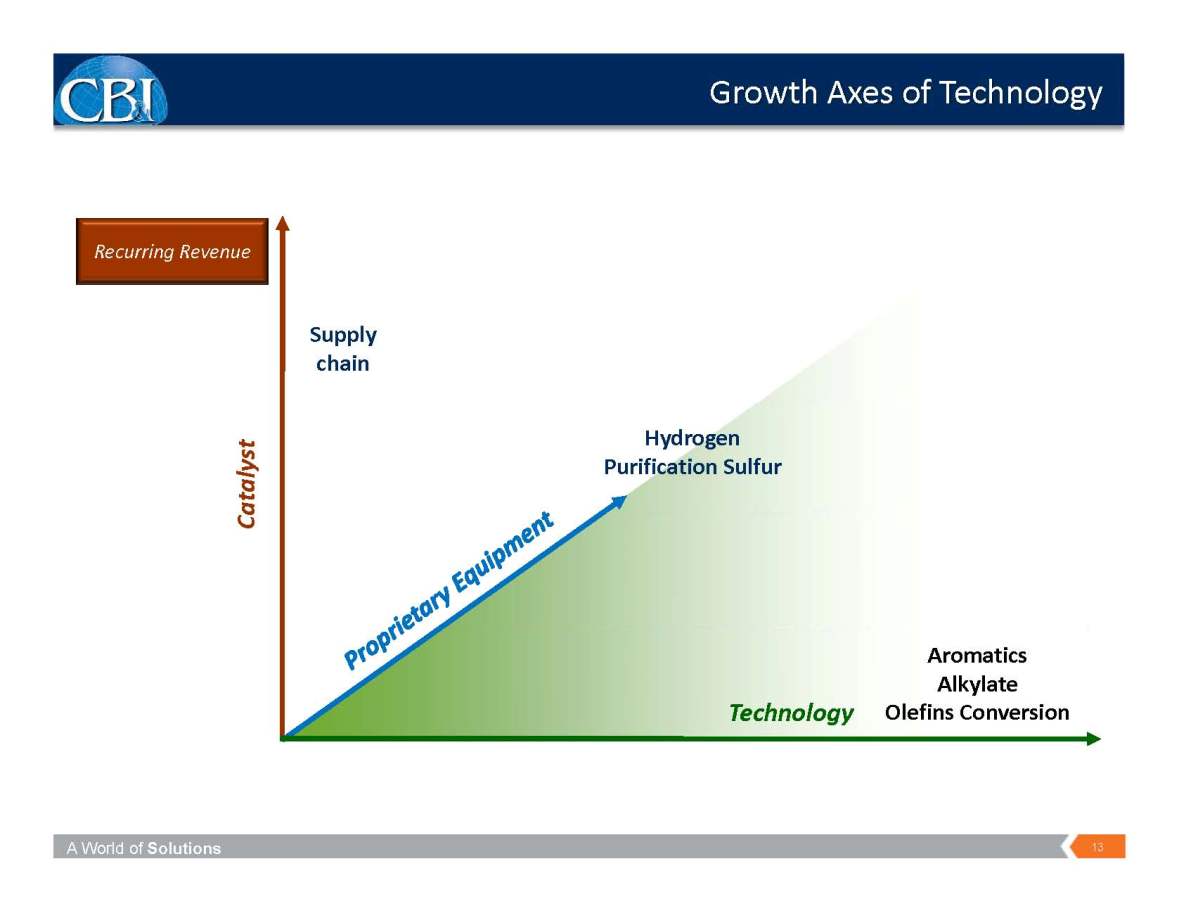

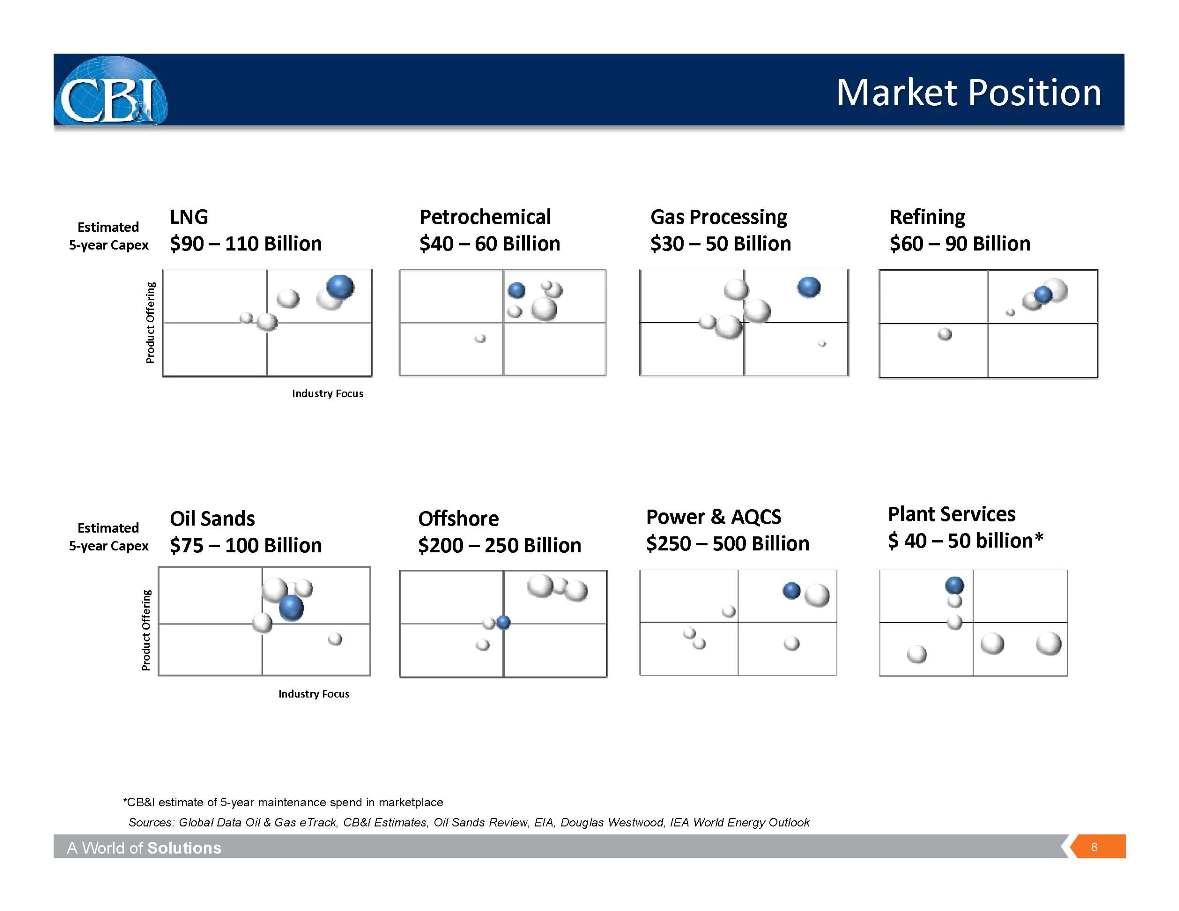

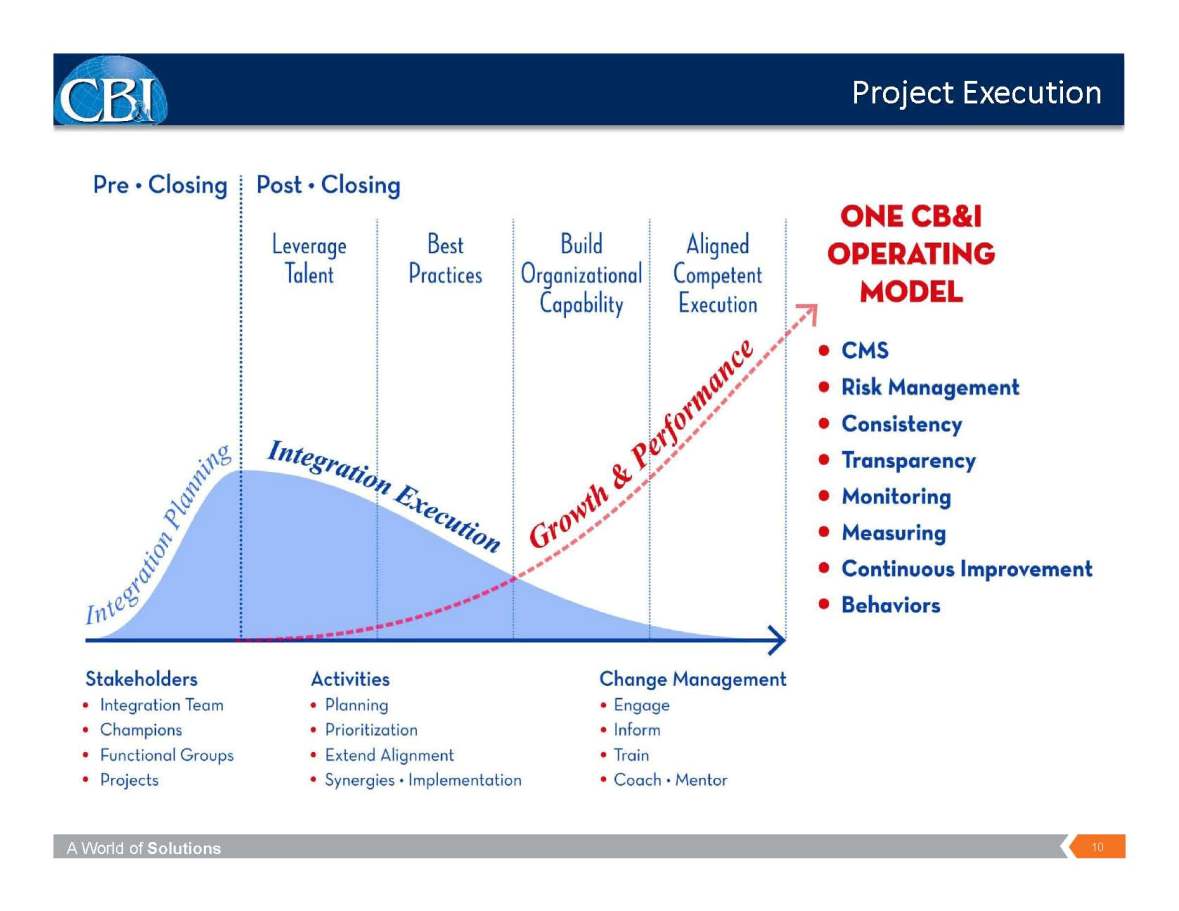

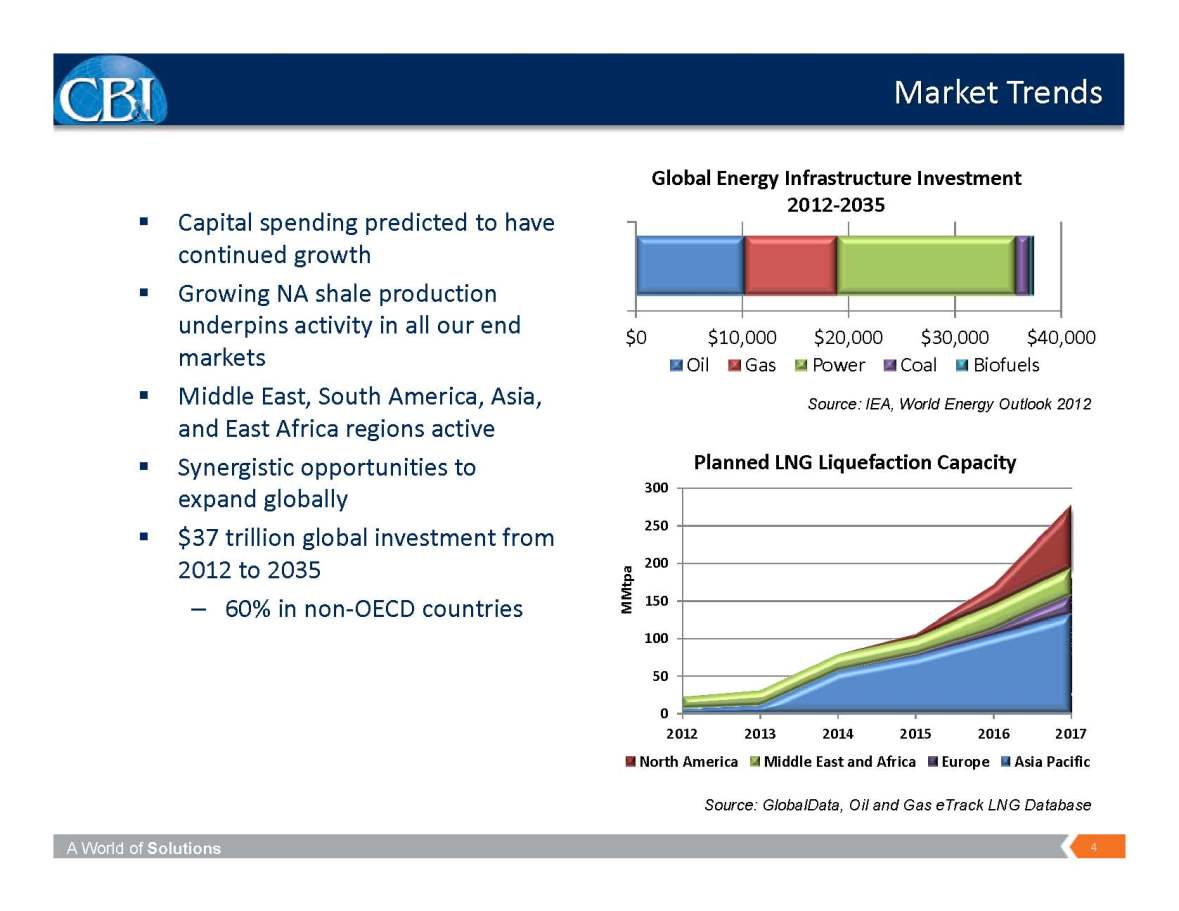

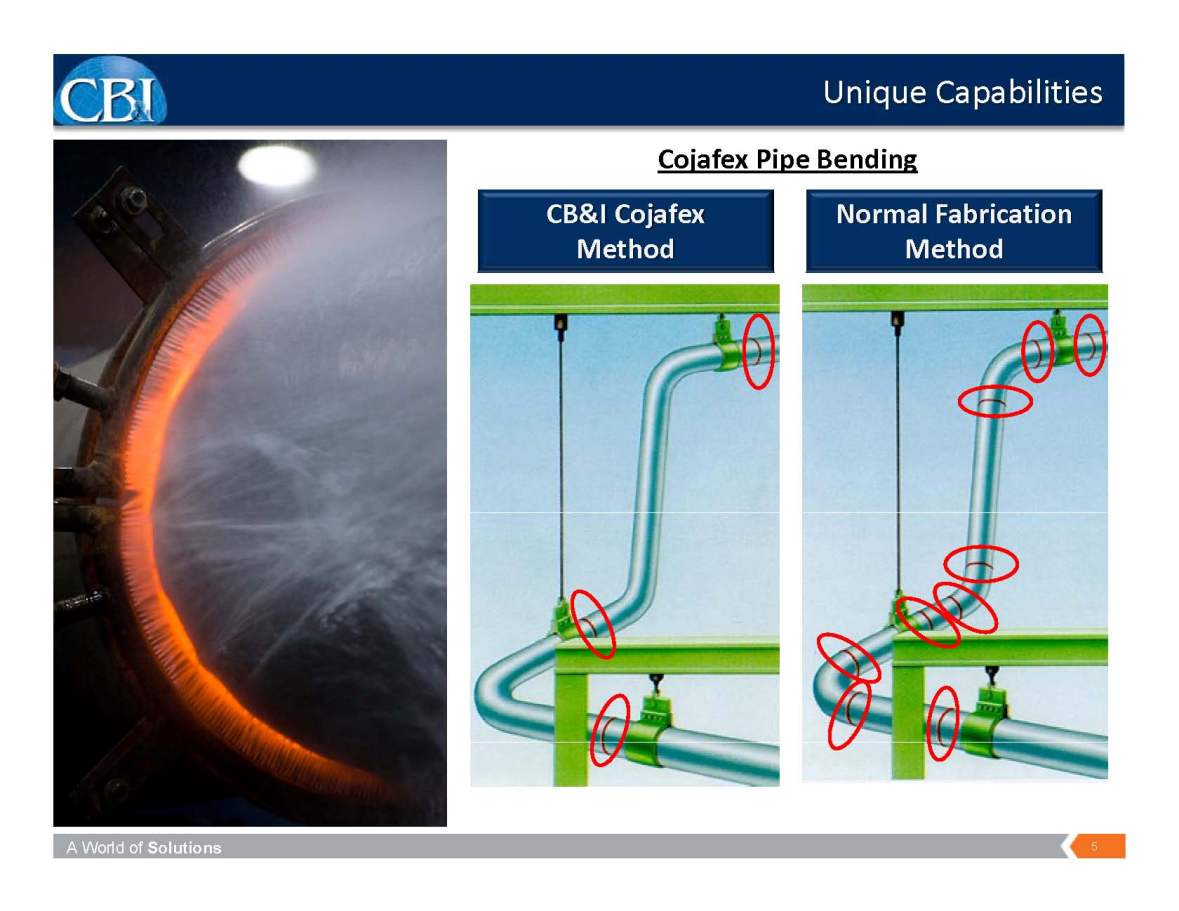

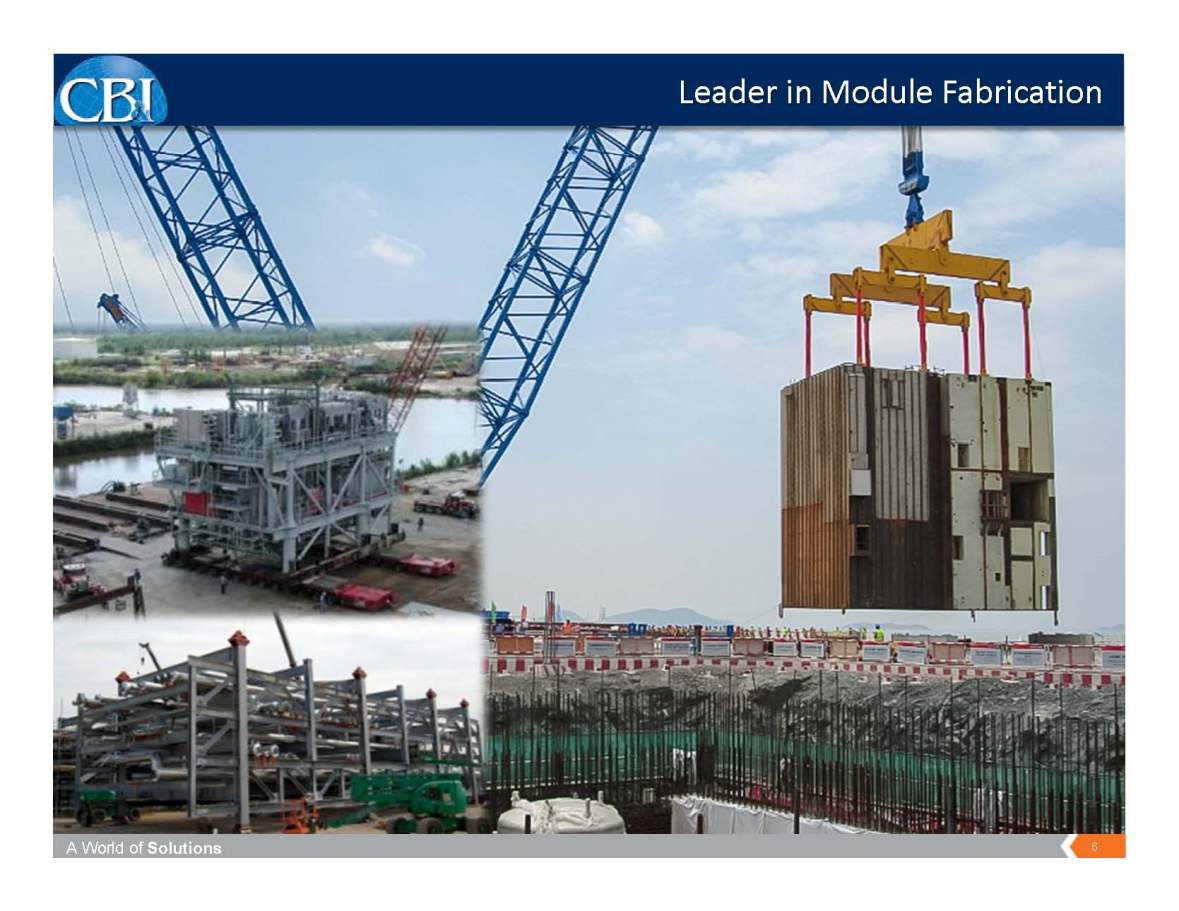

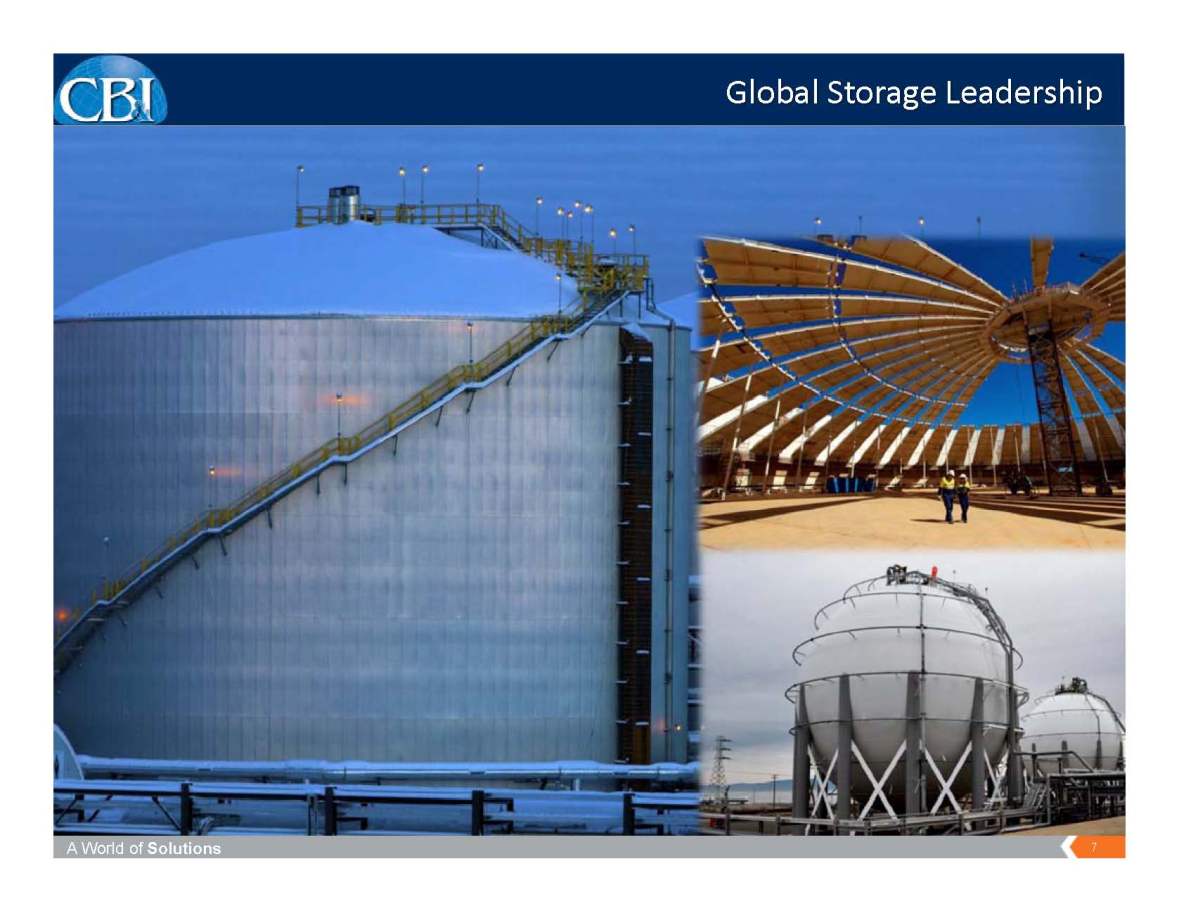

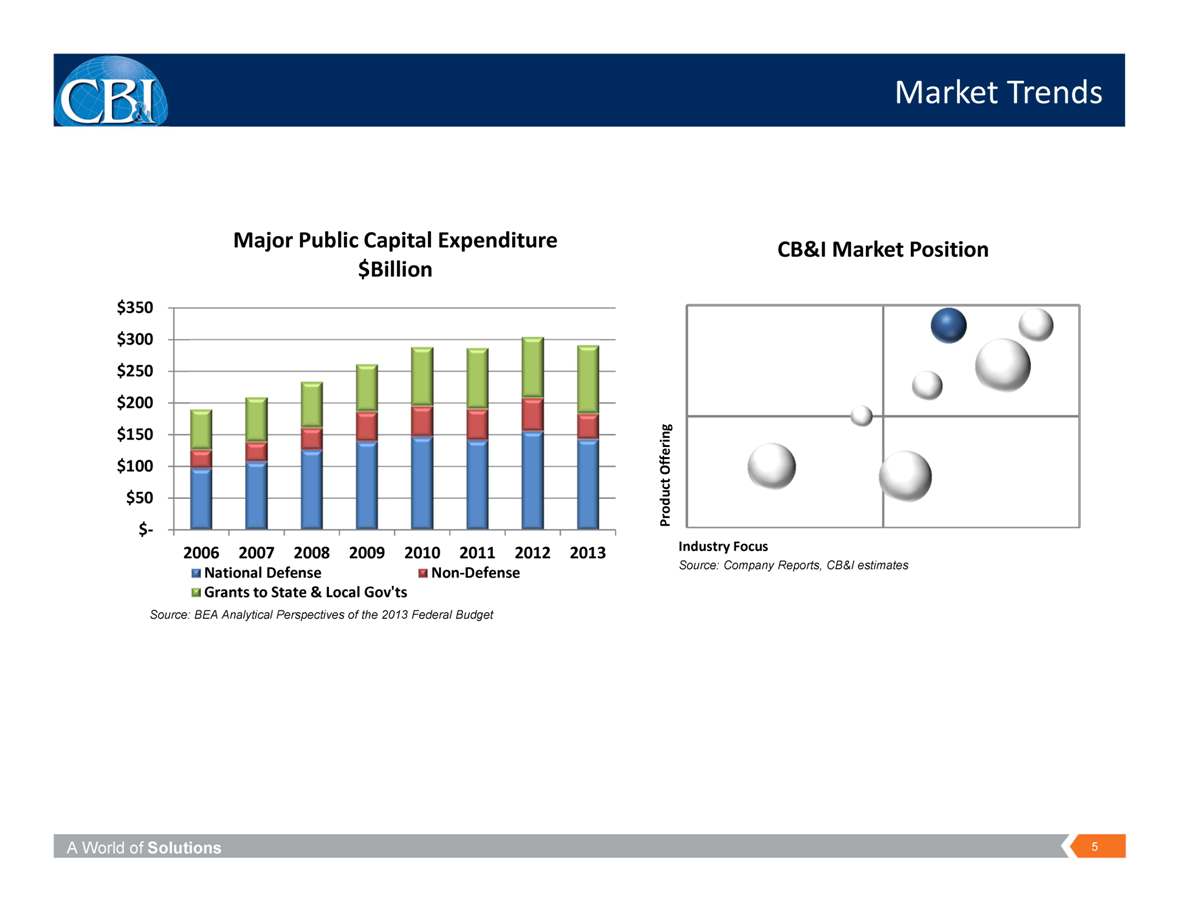

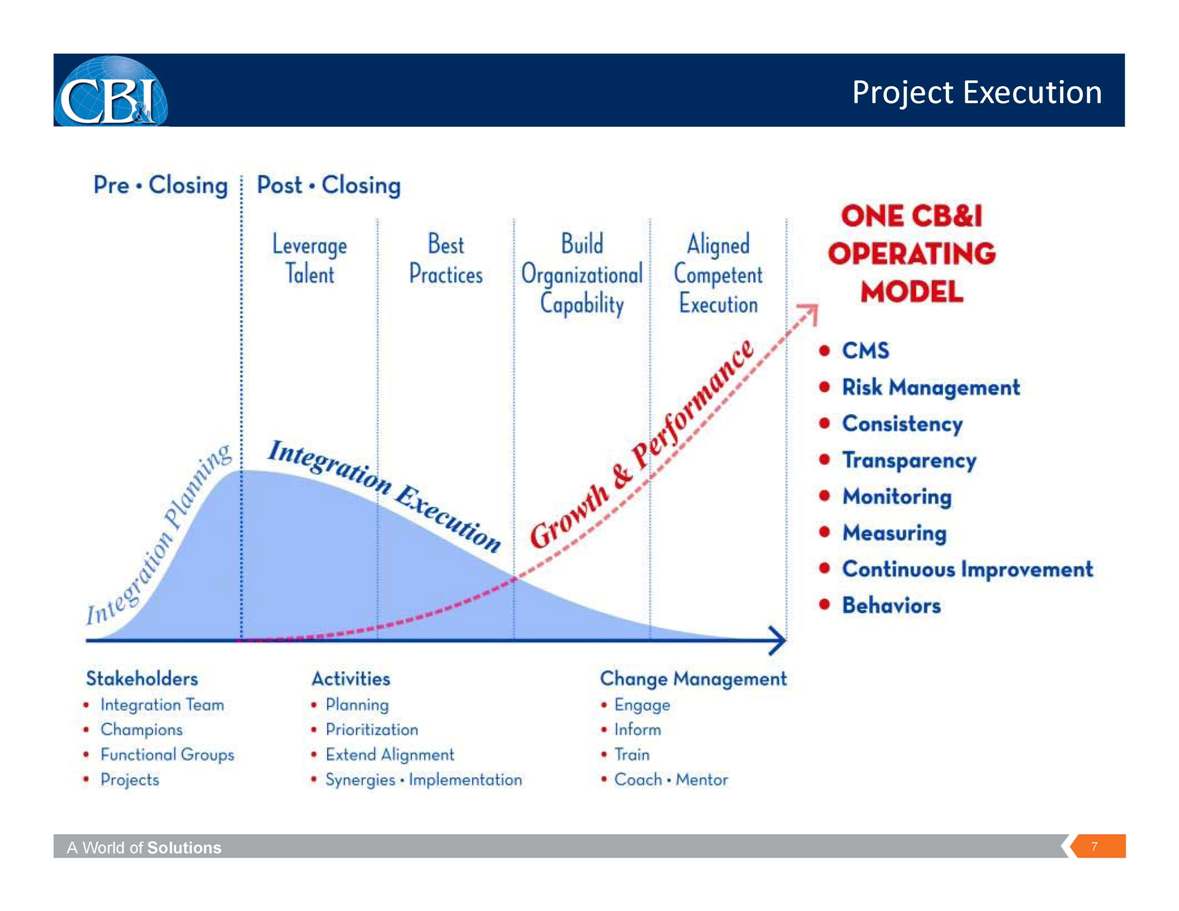

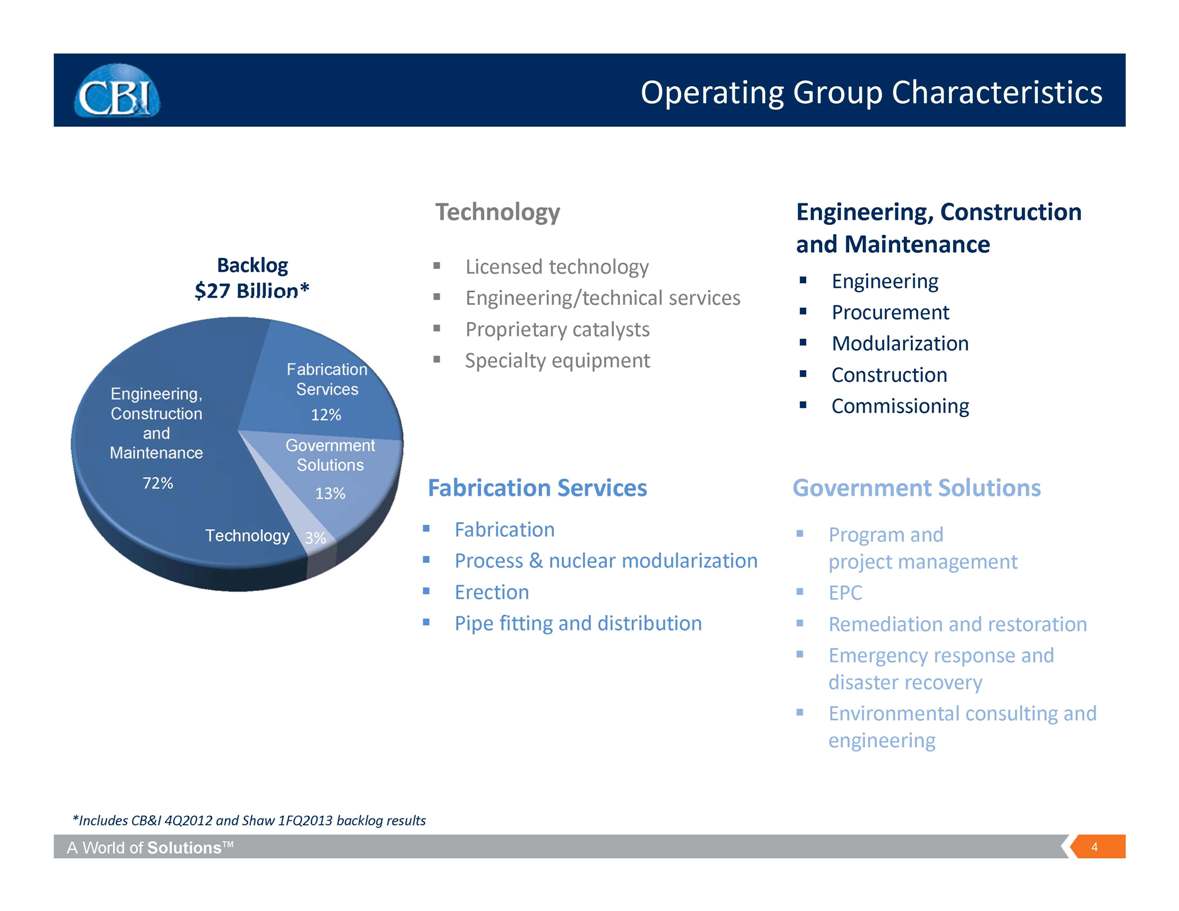

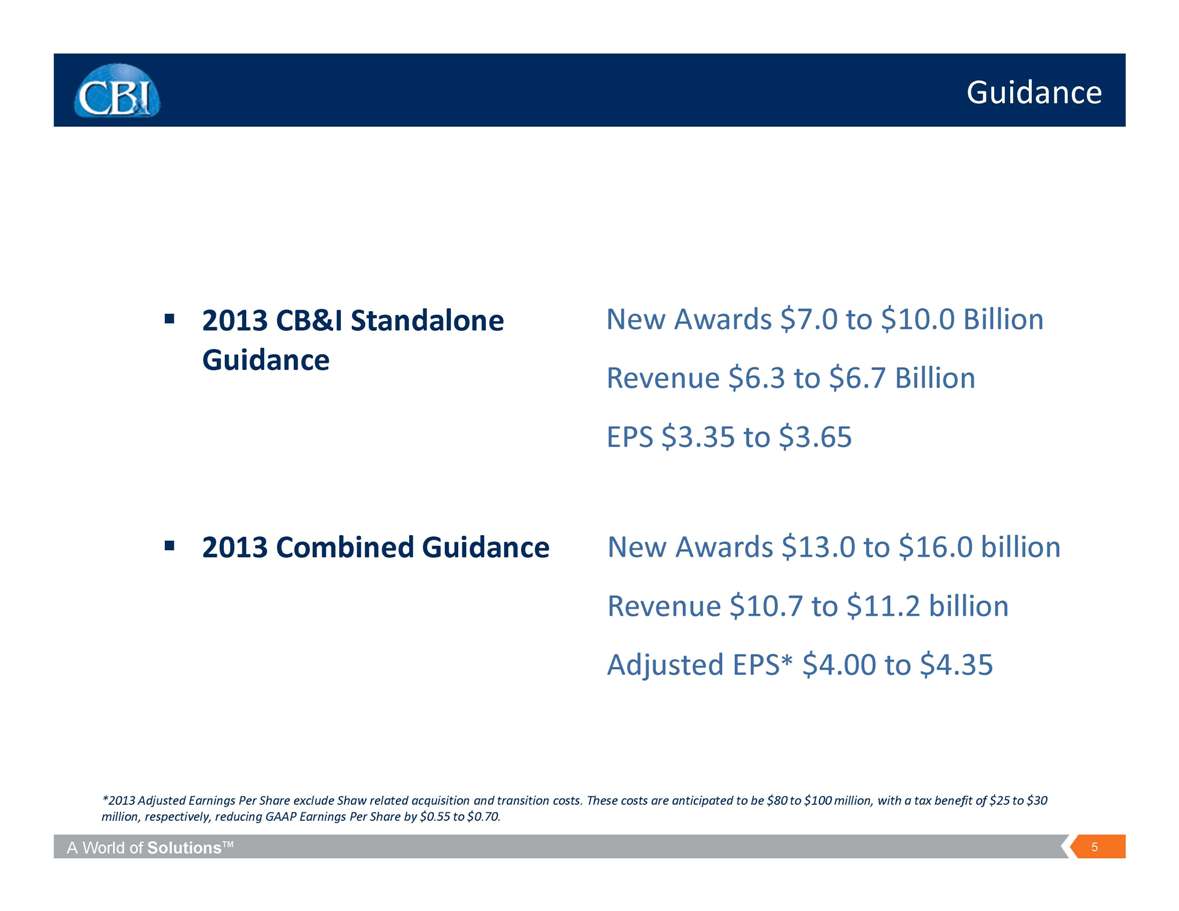

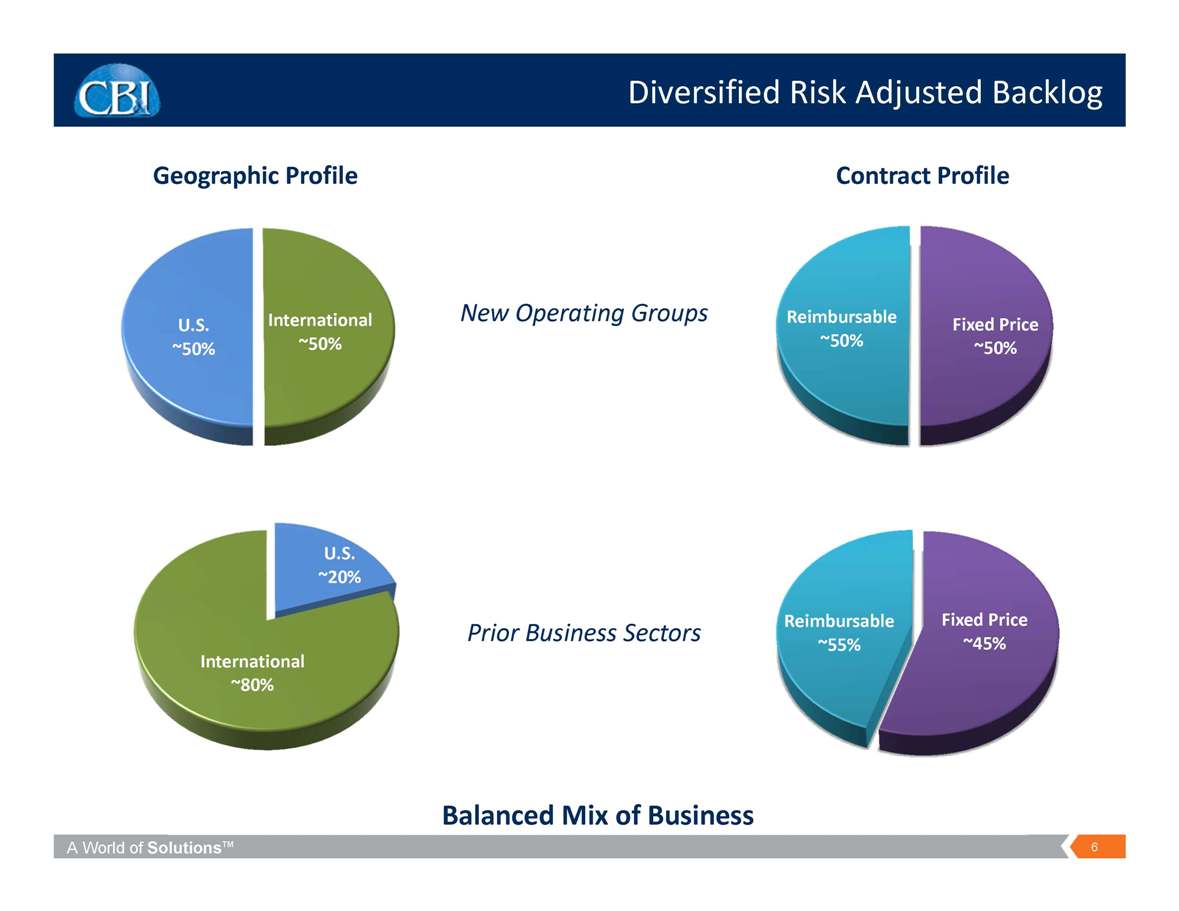

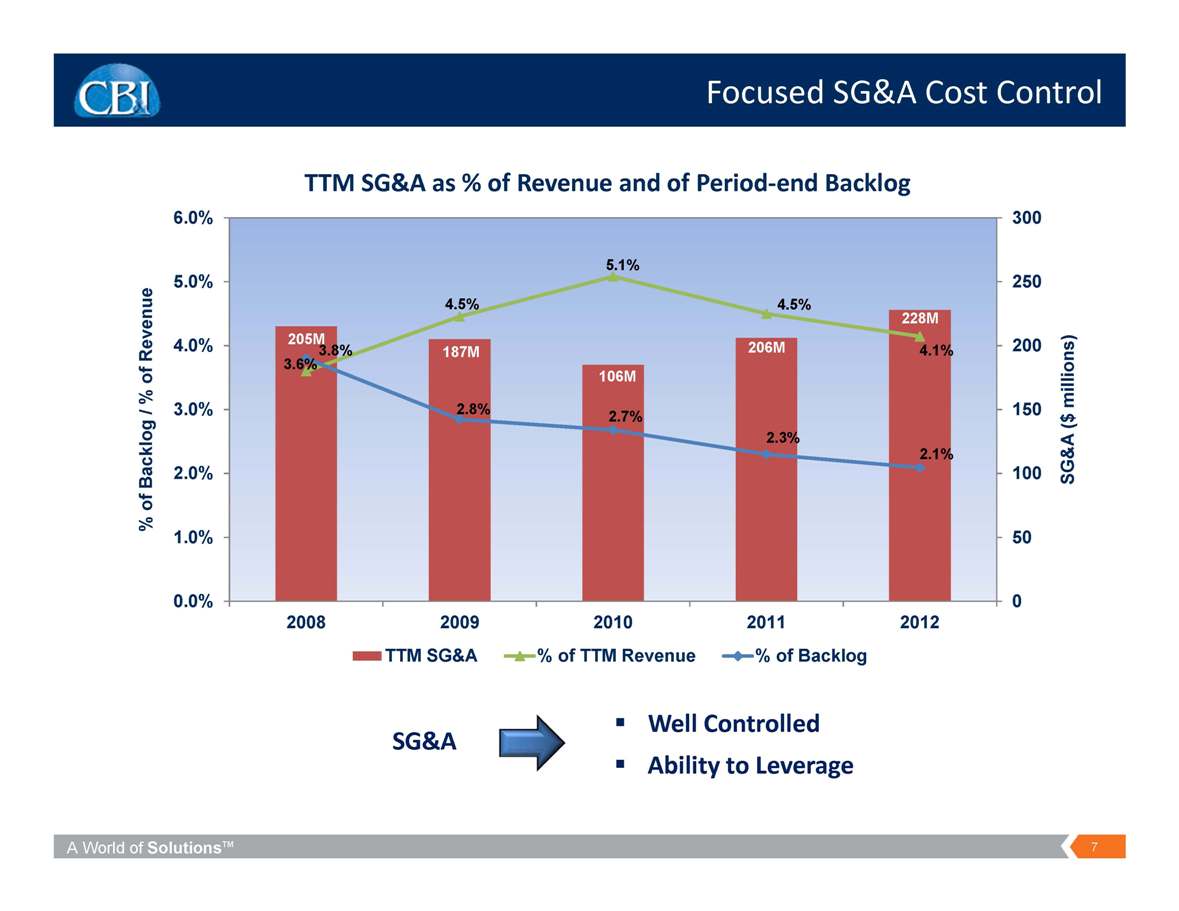

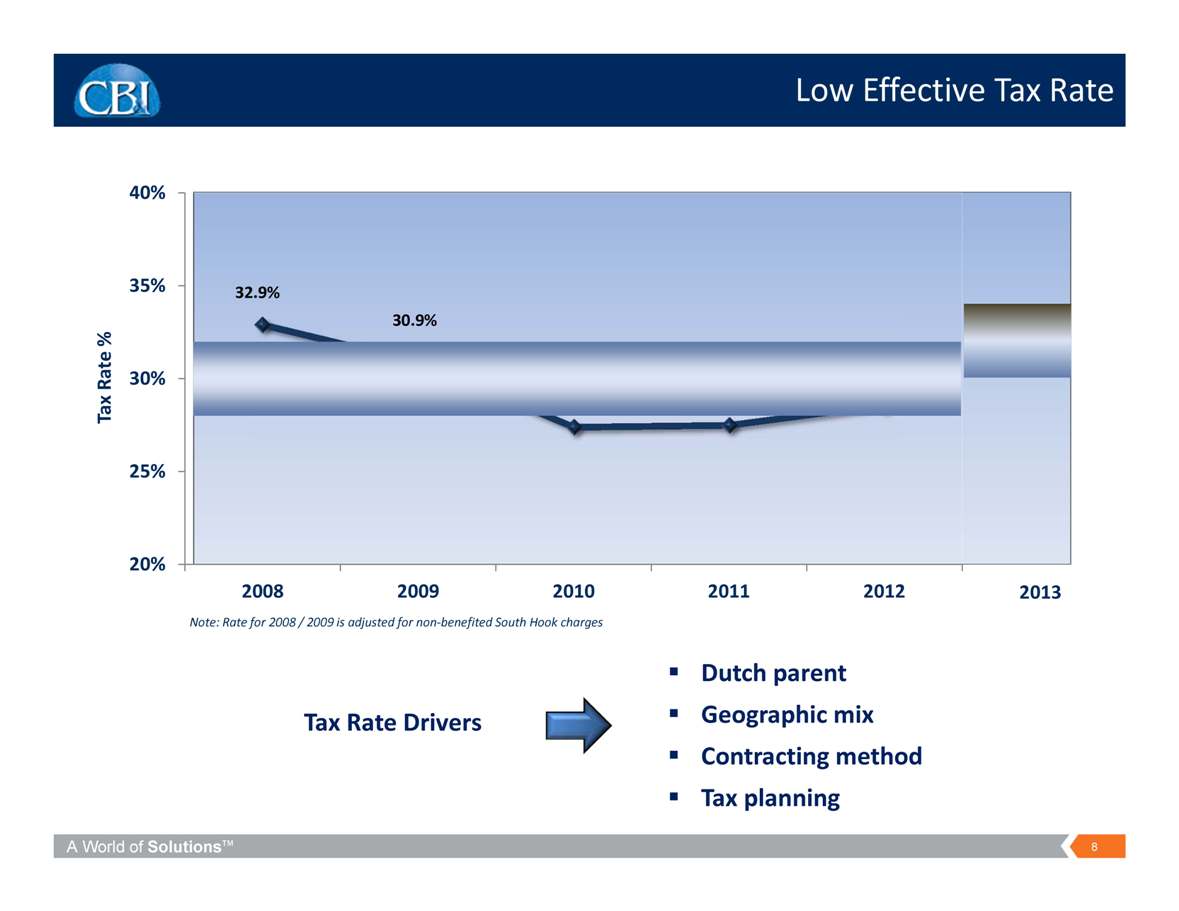

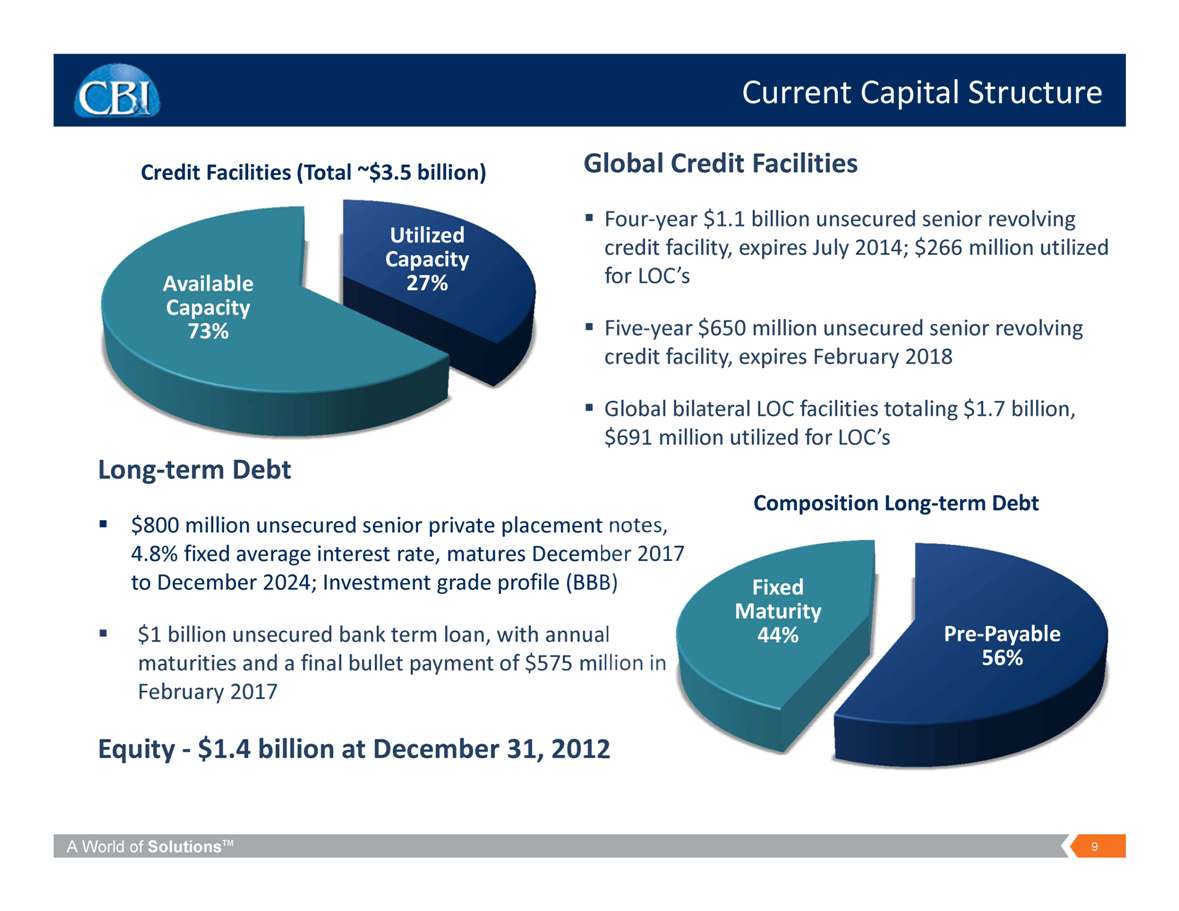

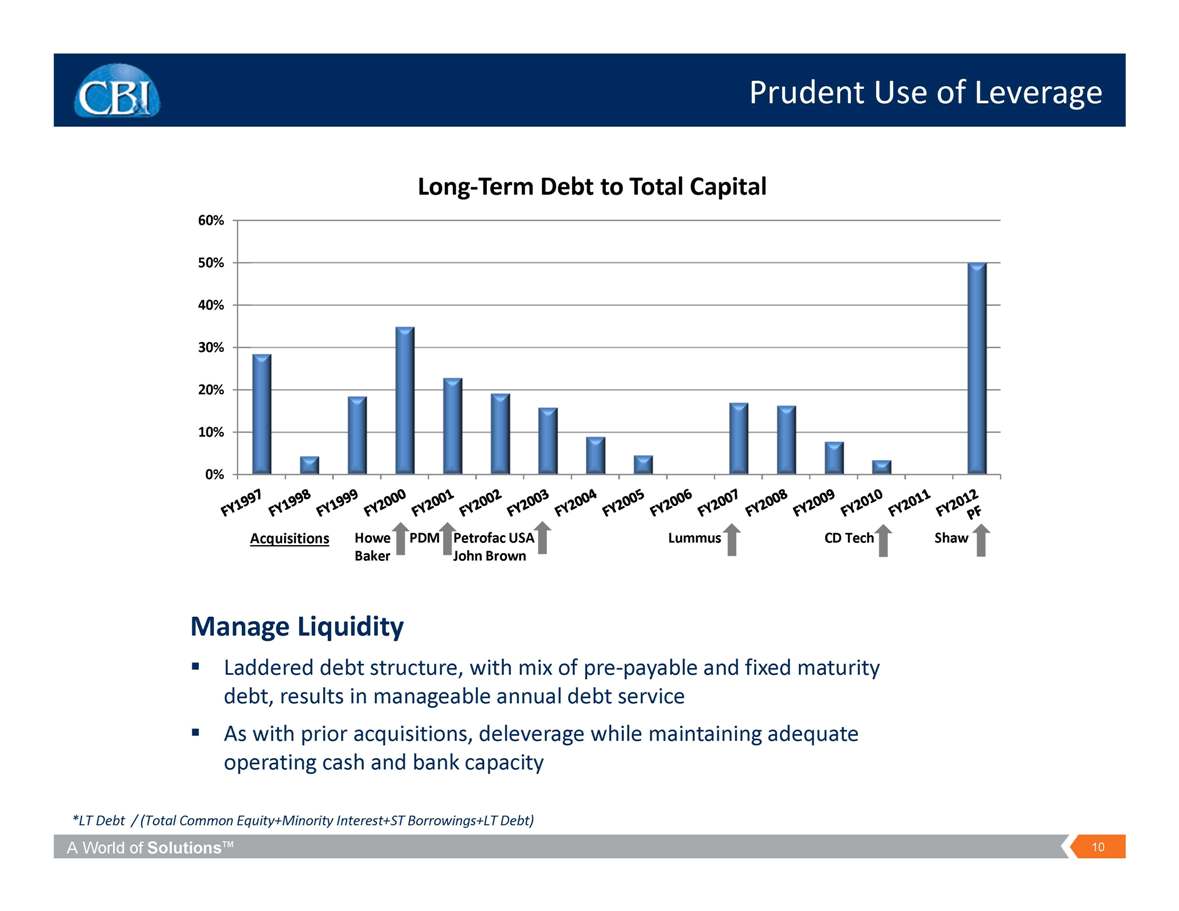

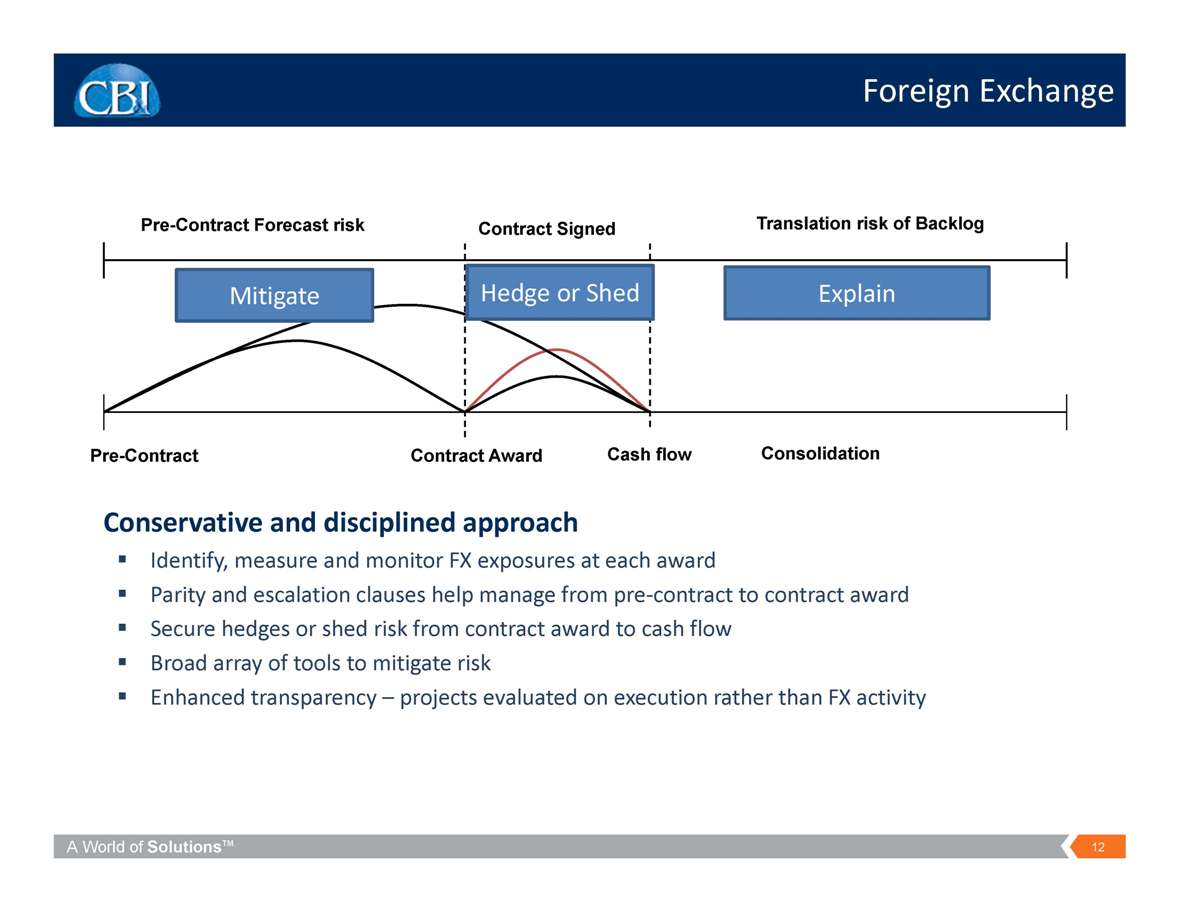

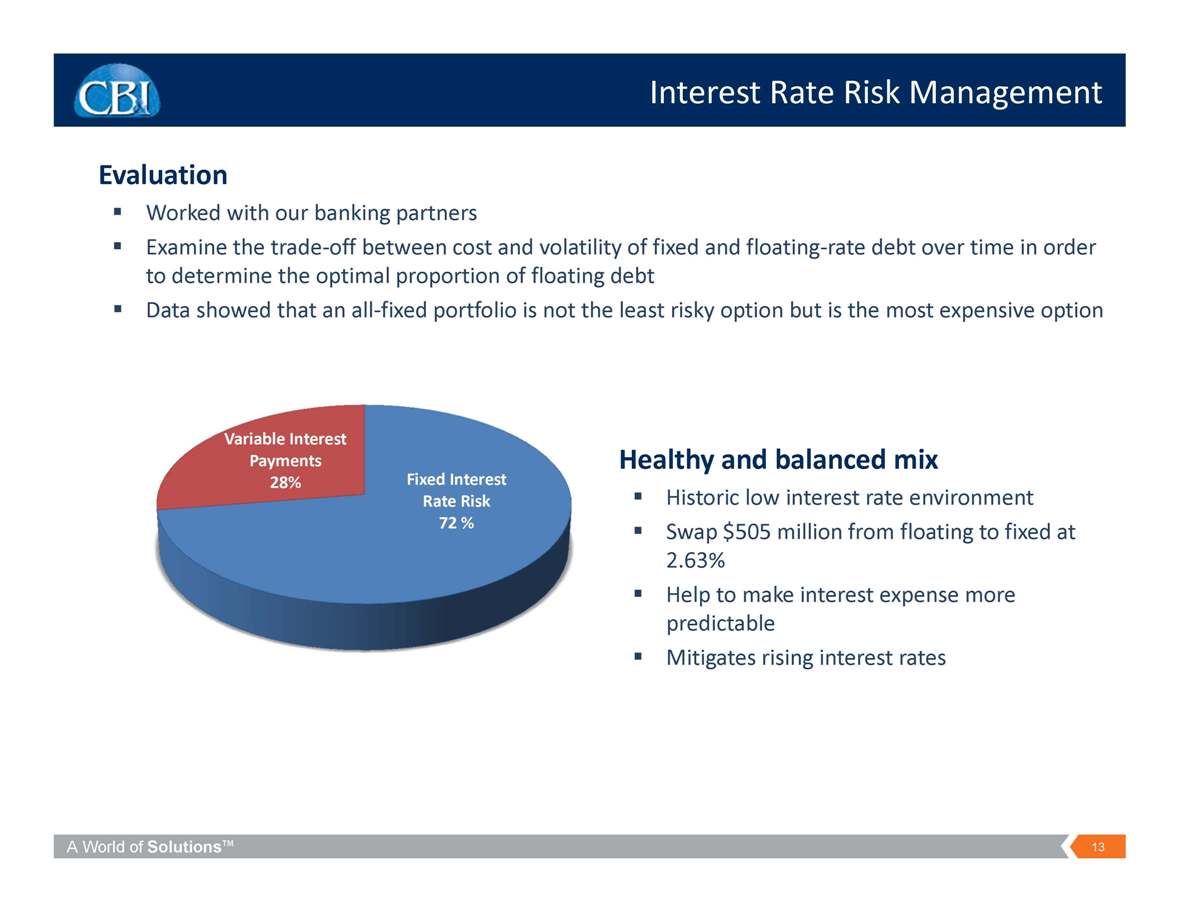

A World of Solutions CB&I Investor/Analyst Day March 2013 The Most Complete Energy Infrastructure Focused Company in the World A World of Solutions 2 Safe Harbor Statement This presentation contains forward-looking statements regarding CB&I and represents our expectations and beliefs concerning future events. These forward-looking statements are intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties. When considering any statements that are predictive in nature, depend upon or refer to future events or conditions, or use or contain words, terms, phrases, or expressions such as “achieve”, “forecast”, “plan”, “propose”, “strategy”, “envision”, “hope”, “will”, “continue”, “potential”, “expect”, “believe”, “anticipate”, “project”, “estimate”, “predict”, “intend”, “should”, “could”, “may”, “might”, or similar forward-looking statements, we refer you to the cautionary statements concerning risk factors and “Forward-Looking Statements” described under “Risk Factors” in Item 1A of our Annual Report filed on Form 10-K filed with the SEC for the year ended December 31, 2012, and any updates to those risk factors or “Forward-Looking Statements” included in our subsequent Quarterly Reports on Form 10-Q filed with the SEC, which cautionary statements are incorporated herein by reference. A World of Solutions 3 Confidence Government Solutions Engineering, Construction and Maintenance (EC&M) Fabrication Services Technology Powerful Combination ? Performance Excellence ? Positioned to Win A World of Solutions 4 Breadth of Services Engineering, Construction and Maintenance Fabrication Services Technology Government Solutions *Includes CB&I 4Q2012 and Shaw 1FQ2013 backlog results Backlog $27 Billion* 72% 12% 13% 3% Engineering, Construction and Maintenance Fabrication Services Technology Government Solutions Fabrication Services Fabrication Process & nuclear modularization Erection Pipe fitting and distribution Engineering Procurement Modularization Construction Commissioning Engineering, Construction and Maintenance Technology Licensed technology Engineering/technical services Proprietary catalysts Specialty equipment Government Solutions Program and project management EPC Remediation and restoration Emergency response and disaster recovery Environmental consulting and engineering A World of Solutions 5 Diversification across Energy Infrastructure A World of Solutions 6 2013 CB&I Standalone Guidance New Awards $7.0 to $10.0 Billion Revenue $6.3 to $6.7 Billion EPS $3.35 to $3.65 2013 CB&I Standalone Guidance A World of Solutions 7 2013 Combined Guidance New Awards $13.0 to $16.0 billion Revenue $10.7 to $11.2 billion Adjusted EPS* $4.00 to $4.35 2013 Combined Guidance *2013 Adjusted Earnings Per Share exclude Shaw related acquisition and transition costs. These costs are anticipated to be $80 to $100 million, with a tax benefit of $25 to $30 million, respectively, reducing GAAP Earnings Per Share by $0.55 to $0.70. A World of Solutions 8 Agenda Overview Break?out Sessions Technology Engineering, Construction and Maintenance Fabrication Services Government Solutions Lunch / Finance / Panel Discussion 8:00 – 8:30 am 8:40 – 11:10 am 11:20 am – 1:00 pm CB&I Technology Group March 2013 h l f d h ld The Most Complete Energy Infrastructure Focused Company in the World A World of Solutions Talent Daniel Helion Sardina Experience Industry: 39 years CB&I: 39 years Experience Industry: 39 years CB&I: 39 years McCarthy Group President Business Development y y Lummus Novolen Technology Refining/CDTECH Lummus Engineered Products Experience Industry: 20 years Experience Industry: 35 years I Experience Industry: 38 years Chevron Lummus Global Experience Industry: 20 years CB&I: 13 years CB&I: 26 years CB&I: 32 years Lummus Consulting Research & Lummus Technology CB&I: 20 years Development Experience Industry: 30 years CB&I: 30 years Experience Industry: 20 years CB&I: 20 years Experience Industry: 16 years CB&I: 4 years A World of Solutions 1 y Technology Differentiation Most complete portfolio of olefins technologies Strategic Benefit Recurring earnings streams Capabilities Petrochemical, gas processing and refining technologies g World leader in heavy oil upgrading technologies Breadth of technologies Operating income driver Early visibility to customers g g Proprietary equipment and engineered products Specialty catalysts provides complete solutions Consulting and technical services A World of Solutions 2 Technology – Business Model Business Model New Plant / Revamp Capex Catalyst Planning Licensing Engineering 1 2 3 evenue Growth Specialty Equipment Catalyst Supply Technical Support Revamp / 4 5 6 7 Re License Fee / Engineering Services Expansion Plant Operating Over 2,000 Patents and Patent Applications i li di d h l i Life Cycle Contract Value Life Opex A World of Solutions 3 Over 75 Commercialized Licensed Technologies Three Research and Development Centers Energy Demand Growth Energy Demand Total Primary Energy Demand by Fuel toe 51% 35% 1990 Total Primary Total = 8.8 Btoe Billion 10% 4% 43% 19% 5% 33% 2010 Total = 12.7 Btoe 32% 36% 23% 9% 2035 Total = 17.2 Btoe A World of Solutions 4 Source: BP Energy Outlook 2030, January 2013 Source: IEA World Energy Outlook 2012 OECD China India Rest of Non?OECD U.S. Runs Counter to Other Demand Regions A World of Solutions 5 Source: IEA World Energy Outlook, November 2012 Refining ? Global utilization (81%) and margins remain challenged, with distillates being the primary demand and margin driver ? Growth of hydrocracking and clean fuels ? Residue demand contraction will drive delayed coking ? US refining market is the exception due to suppressed WTI pricing 2011 2035 % Growth Projected Capacity Growth, MM BPD Crude Distillation 92.5 118.2 28 Hydrocracking 7.6 13.3 74 Source: Hart Energy Hydroprocessing 51.3 72.2 41 Coking 6.3 10.5 66 A World of Solutions 6 Source: ExxonMobil Energy Outlook to 2040, 2013 Edition Refining Technologies ation Treatment / Blending LPG Petrochemical Feedstock Gasoline Diesel Crude Oil Crude DistillaBlending Conversion Jet Fuel Lubes Residue Upgrading h l i Fuel Oil Conversion Processes: Hydrocracking, Fluid Catalytic Cracking (FCC), Alkylation, Dewaxing, Reforming Residue Upgrading Processes: LC Fining, Residue Desulfurization, l d k b k Key Technologies 7 A World of Solutions Delayed Coking, Visbreaking Treatment Processes: Hydrotreating, Hydrodesulfurization (HDS) Natural Gas Global gas market fundamentals remain encouraging over the long term Shale gas in North America has the Source: Shell g potential to drive significant petrochemical investment for the coming period 35 U.S. Dry Natural Gas Production by Source (trillion cubic feet) 2013 Projections Shale Gas 20 25 30 Non?Associated Onshore Associated with Oil Coalbed Methane Non?Associated Offshore Alaska Tight Gas 5 10 15 A World of Solutions 88 Source: EIA, Annual Energy Outlook 2013 Early Release 0 1990 1995 2000 2005 2010 2015 2020 2025 2030 2035 2040 $30 US Oil & Gas Price History U.S. Pricing Indicators $15 $20 $25 MMBtu $5 $10 Price $/M $0 US Oil Price US Gas Price Source: S&P Capital IQ A World of Solutions 99 Source: Bentek Energy / ICE Petrochemical Industry Transformation Ethylene P l Naphtha Propylene Butadiene Olefins Plant Refinery Ethane E h l Ethylene A World of Solutions 10 Gas Plant Ethylene Plant Natural Gas Commercial Routes to Propylene Steam Cracker FCC Propylene MTO Traditional Technologies Propane Dehydrogenation PDH Olefins Conversion Technology OCT New A World of Solutions 11 Technologies Exports Dictate International Demand 1 200 U.S. LPG Exports 800 1,000 1,200 400 600 Mbpd 0 200 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Propane Exports Butane Exports Mariner East Export Capacity Rio Grande Pipeline Capacity 12 A World of Solutions U.S. Gulf Marine Export Capacity Potential Capacity w/ Targa Max Growth Axes of Technology Recurring Revenue Supply chain atalyst Hydrogen Purification Sulfur Ca Technology Aromatics Alkylate Olefins Conversion A World of Solutions 13 Continued Opportunity Positioned well in growing markets: Olefins Gas Processing Heavy Oil Upgrading Alkylate Mega Projects Proactive management of trends A World of Solutions 14 Conclusion A World of Solutions 15 Powerful Combination ? Performance Excellence ? Positioned to Win CB&I Engineering Engineering, Construction and Maintenance March 2013 The Most Complete Energy Infrastructure Focused Company in the World A World of Solutions Safe Harbor Statement This presentation contains forward-looking statements regarding CB&I and represents our expectations and beliefs concerning future events. These forward-looking statements are intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties. When considering any statements that are predictive in nature, depend upon or refer to future events or conditions, or use or contain words, terms, phrases, or expressions such as “achieve”, “forecast”, “plan”, “propose”, “strategy”, “envision”, “hope”, “will”, “continue”, “potential”, “expect”, “believe”, “anticipate”, “project”, “estimate”, “predict”, “intend”, “should”, “could”, “may”, “might”, or similar forward-looking statements, we refer you to the cautionary statements concerning risk factors and “Forward-Looking Statements” described under “Risk Factors” in Item 1A of our Annual Report filed on Form 10-K filed with the SEC for the year ended December 31, 2012, and any updates to those risk factors or “Forward-Looking Statements” included in our subsequent Quarterly Reports on Form 10-Q filed with the SEC, which cautionary statements are incorporated herein by reference. A World of Solutions 1 Talent Clarence Ray Lasse Petterson Experience Industry: 33 years CB&I: 4 years Experience Industry: 43 years CB&I: 6 years Power Chief Operating Officer Ron McCall Peter Hedges Plant Services Experience Industry: 30 years CB&I: 4 years Experience Industry: 40 years CB&I: 11 years Oil & Gas Jim Sabin Experience Industry: 32 years CB&I: 32 years Global Systems A World of Solutions 2 y Engineering, Construction and Maintenance Overview Differentiation Market position Strategic Benefit Critical mass Capabilities Engineering, procurement, and construction (EPC) Contracting flexibility Global footprint Self?perform capabilities Revenue driver Nuclear uprate opportunities Oil and Gas Power Plant services, including maintenance upgrades and maintenance, uprates, modifications and refueling Increasing use of modularization A World of Solutions 3 Oil & Gas Market Trends l b l il & $ $1 200 $1,400 Global Oil Gas CapEx, Bn 80 100 120 140 Global LNG Capacity, Bcfd $1,000 1,200 0 20 40 60 2000 2002 2004 2006 2008 2010 2012 2014 2016 $600 $800 Liquefaction Liq Forecast Regasification Regas Forecast Source: Global Data Oil & Gas eTrack, and CB&I estimates Estimated annual growth rate, LNG trade (2011-2020): ~8.5% Total LNG trade increase, 2011-2020 ? 59 “Peru-sized” LNG trains. Oil & Gas Total CapEx levels rising LNG $400 LNG trade now over 10% of global gas demand ?? And growing 5x faster List of import and export countries continues to $0 $200 A World of Solutions 4 grow 2008 2009 2010 2011 2012 2013E Source: Global Data Oil & Gas eTrack Power and Plant Services Market Trends Power Electric power demand 2x population growth All sources grow except oil 9,000 Global Power Generation Capacity, GW fuel Despite carbon concerns, coal maintains a substantial share Government regulations driving air quality control system shutdowns 6,000 7,000 8,000 4.1%/yr 2.4%/yr 1.9%/yr retrofits and plant 3,000 4,000 5,000 Plant Services C ti d i f l i t 0 1,000 2,000 Continued expansion of nuclear maintenance market as utilities: ?? Seek fleet?wide service arrangements ?? Recognize benefits of turnkey management model 2010 2015 2020 2025 Coal Gas Oil Nuclear Hydro Wind Other Renewable Increased capital spending within industrial sector promotes growth in process maintenance Source: IEA World Energy Outlook 2012 A World of Solutions 5 Flexible Workforce Consistent Execution LNG Flexible Talent Pool Broad Functional Expertise Union Workforce Development Across Diverse Markets Estimating Gas Processing Non-Union Direct-Hire Sales Project Mgmt. g Offshore Oil Sands Job Skills Training, Salaried Contract Project Controls Engineering Petrochemicals Refining g Organizational Training and Development Local International Procurement Information Tech. Fabrication Nuclear Expatriate Craft Commissioning Construction A World of Solutions 6 Other Power Professional Managed Maintenance Market Opportunities Gas Processing LNG Petrochemical Strategic Focus: Capitalize on non?conventional gas Strategic Focus: FEED to EPC using proven partnerships Strategic Focus: U.S. market development Refining Strategic Focus: Leverage Oil Sands Strategic Focus: Execution excellence using Strategic Focus: Growth through broader Offshore g g technology and global reach g g proven fabrication and EPC capabilities service offering and floating LNG Power Strategic Focus: Secure nuclear uprate Plant Services Strategic Focus: Expand nuclear Air Quality Control Systems Strategic Focus: Leverage opportunities Photo courtesy of Southern Company A World of Solutions 7 opportunities; expand global footprint; new gas?fired plants market share and leverage into US and international oil and gas sector created by new regulations Market Position Petrochemical $40 – 60 Billion Refining $60 – 90 Billion Gas Processing $30 – 50 Billion LNG $90 – 110 Billion g Estimated 5?year Capex Industry Focus Product Offering OilS d y Power & AQCS Off h Plant Services Oil Sands $75 – 100 Billion Offering $250 – 500 Billion Offshore $200 – 250 Billion $ 40 – 50 billion* Estimated 5?year Capex Industry Focus Product O A World of Solutions 8 *CB&I estimate of 5-year maintenance spend in marketplace Sources: Global Data Oil & Gas eTrack, CB&I Estimates, Oil Sands Review, EIA, Douglas Westwood, IEA World Energy Outlook Unique Capabilities Project Execution A World of Solutions 10 Conclusion A World of Solutions 11 Powerful Combination ? Performance Excellence ? Positioned to Win CB&I Fabrication Services March 2013 The Most Complete Energy Infrastructure Focused Company in the World A World of Solutions Safe Harbor Statement This presentation contains forward-looking statements regarding CB&I and represents our expectations and beliefs concerning future events. These forward-looking statements are intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties. When considering any statements that are predictive in nature, depend upon or refer to future events or conditions, or use or contain words, terms, phrases, or expressions such as “achieve”, “forecast”, “plan”, “propose”, “strategy”, “envision”, “hope”, “will”, “continue”, “potential”, “expect”, “believe”, “anticipate”, “project”, “estimate”, “predict”, “intend”, “should”, “could”, “may”, “might”, or similar forward-looking statements, we refer you to the cautionary statements concerning risk factors and “Forward-Looking Statements” described under “Risk Factors” in Item 1A of our Annual Report filed on Form 10-K filed with the SEC for the year ended December 31, 2012, and any updates to those risk factors or “Forward-Looking Statements” included in our subsequent Quarterly Reports on Form 10-Q filed with the SEC, which cautionary statements are incorporated herein by reference. A World of Solutions 1 Talent Cesar Canals Steel Plate Structures Remi Bonnecaze Fabrication & Manufacturing Luke Scorsone Group President Experience Industry: 35 years CB&I: 34 years Experience Industry: 31 years CB&I: 31 years Experience Industry: 26 years CB&I: 19 years Steel Plate Structures Experience * Industry: 29 Experience * Industry: 25 Fabrication & Manufacturing years CB&I: 26 years years CB&I: 12 years A World of Solutions 2 *Reflects average of management teams Fabrication Services Overview Differentiation Brand leadership; mega project capability in plate structures, pipe fabrication, Strategic Benefit Stable business underpinning Client access Capabilities Engineering, procurement, fabrication, and erection of bulk liquid and gas storage modules Large?scale fabrication facilities and yards throughout the world q g g structures and terminals, nuclear containment and other specialty structures Pipe and structural fabrication; g Induction bending technology drives quality and savings p ; process & nuclear modules; pipe & fitting distribution Self?perform fabrication and erection capabilities p worldwide A World of Solutions 3 Market Trends Capital spending predicted to have continued growth h l d Global Energy Infrastructure Investment 2012?2035 Growing NA shale production underpins activity in all our end markets Middle East America Asia $0 $10,000 $20,000 $30,000 $40,000 Oil Gas Power Coal Biofuels East, South America, Asia, and East Africa regions active Synergistic opportunities to expand globally Source: IEA, World Energy Outlook 2012 300 Planned LNG Liquefaction Capacity $37 trillion global investment from 2012 to 2035 – 60% in non?OECD countries 150 200 250 MMtpa 0 50 100 2012 2013 2014 2015 2016 2017 A World of Solutions 4 North America Middle East and Africa Europe Asia Pacific Source: GlobalData, Oil and Gas eTrack LNG Database Unique Capabilities Cojafex Pipe Bending Normal Fabrication Method CB&I Cojafex Method j p g A World of Solutions 5 Leader in Module Fabrication A World of Solutions 6 Global Storage Leadership A World of Solutions 7 Project Execution A World of Solutions 8 Conclusion A World of Solutions 9 Powerful Combination ? Performance Excellence ? Positioned to Win A World of Solutions CB&I Government Solutions March 2013 The Most Complete Energy Infrastructure Focused Company in the World A World of Solutions 2 This presentation contains forward-looking statements regarding CB&I and represents our expectations and beliefs concerning future events. These forward-looking statements are intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties. When considering any statements that are predictive in nature, depend upon or refer to future events or conditions, or use or contain words, terms, phrases, or expressions such as “achieve”, “forecast”, “plan”, “propose”, “strategy”, “envision”, “hope”, “will”, “continue”, “potential”, “expect”, “believe”, “anticipate”, “project”, “estimate”, “predict”, “intend”, “should”, “could”, “may”, “might”, or similar forward-looking statements, we refer you to the cautionary statements concerning risk factors and “Forward-Looking Statements” described under “Risk Factors” in Item 1A of our Annual Report filed on Form 10-K filed with the SEC for the year ended December 31, 2012, and any updates to those risk factors or “Forward-Looking Statements” included in our subsequent Quarterly Reports on Form 10-Q filed with the SEC, which cautionary statements are incorporated herein by reference. Safe Harbor Statement A World of Solutions 3 Kelly Trice MOX Chip Ray Group President Mike Dillman Environmental & Infrastructure Talent Experience Industry: 30 years CB&I: 10 years Experience Industry: 24 years CB&I: 12 years Experience Industry: 28 years CB&I: 4 years Robert Cochran Federal Experience Industry: 35 years CB&I: <1 year A World of Solutions 4 Differentiation Most comprehensive provider of products and services 4,500 experts providing environmental solutions Proprietary programs and products for waste clean?up Rapid mobilization of qualified early responders Government Solutions Overview Strategic Benefit Diversification reduces impact of market cyclicality Stable business underpinning Broadens offering to existing CB&I clients (synergy) Worldwide governmental relationships Capabilities Remediation of waste sites – radiation, toxins, etc. Program management (e.g., M&O of military installations, energy efficiency) EPC of infrastructure for government related projects Environmental consulting and engineering: ? Development / management of regulatory compliance programs ? Methods development and testing for pollutants ? Coastal restoration and engineering Support for emergency response and disaster recovery A World of Solutions 5 Market Trends $? $50 $100 $150 $200 $250 $300 $350 2006 2007 2008 2009 2010 2011 2012 2013 Major Public Capital Expenditure $Billion National Defense Non?Defense Grants to State & Local Gov'ts Source: BEA Analytical Perspectives of the 2013 Federal Budget Source: Company Reports, CB&I estimates CB&I Market Position Industry Focus Product Offering A World of Solutions 6 Remediation and restoration Program and project management Engineering Procurement Construction Environmental consulting and engineering Emergency response and disaster recovery Government Solutions – Primary Services A World of Solutions 7 Project Execution A World of Solutions 8 Positioned for Growth Market Opportunity Comprehensive Offering Strong Brand Growth A World of Solutions 9 Conclusion Powerful Combination ? Performance Excellence ? Positioned to Win A World of SolutionsTM CB&I Finance March 2013 The Most Complete Energy Infrastructure Focused Company in the World A World of SolutionsTM 2 Safe Harbor Statement This presentation contains forward-looking statements regarding CB&I and represents our expectations and beliefs concerning future events. These forward-looking statements are intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties. When considering any statements that are predictive in nature, depend upon or refer to future events or conditions, or use or contain words, terms, phrases, or expressions such as “achieve”, “forecast”, “plan”, “propose”, “strategy”, “envision”, “hope”, “will”, “continue”, “potential”, “expect”, “believe”, “anticipate”, “project”, “estimate”, “predict”, “intend”, “should”, “could”, “may”, “might”, or similar forward-looking statements, we refer you to the cautionary statements concerning risk factors and “Forward-Looking Statements” described under “Risk Factors” in Item 1A of our Annual Report filed on Form 10-K filed with the SEC for the year ended December 31, 2012, and any updates to those risk factors or “Forward-Looking Statements” included in our subsequent Quarterly Reports on Form 10-Q filed with the SEC, which cautionary statements are incorporated herein by reference. A World of SolutionsTM 3 Talent Internal Audit Tax Controller Financial Operations ? EC&M Financial Operations ? Fabrication Services Financial Operations ? Technology and Government Solutions Experience Industry: 20 years CB&I: 11 years Experience Industry: 25 years CB&I: 9 years Experience Industry: 15 years CB&I: 11 years Experience Industry: 15 years CB&I: 12 years Experience Industry: 25 years CB&I: 19 years Experience Industry: 40 years CB&I: 40 years Experience Industry: 20 years CB&I: 6 years Experience Industry: 20 years CB&I: 15 years Experience Industry: 35 years CB&I: 8 years John Masterson Derivatives Ron Ballschmiede Chief Financial Officer Luciano Reyes Treasurer A World of SolutionsTM 4 Operating Group Characteristics Fabrication Services Fabrication Process & nuclear modularization Erection Pipe fitting and distribution Engineering Procurement Modularization Construction Commissioning Engineering, Construction and Maintenance Technology Licensed technology Engineering/technical services Proprietary catalysts Specialty equipment Backlog $27 Billion* 72% 12% 13% 3% Engineering, Construction and Maintenance Fabrication Services Technology Government Solutions *Includes CB&I 4Q2012 and Shaw 1FQ2013 backlog results Government Solutions Program and project management EPC Remediation and restoration Emergency response and disaster recovery Environmental consulting and engineering A World of SolutionsTM 5 Guidance 2013 CB&I Standalone Guidance New Awards $7.0 to $10.0 Billion Revenue $6.3 to $6.7 Billion EPS $3.35 to $3.65 New Awards $13.0 to $16.0 billion Revenue $10.7 to $11.2 billion Adjusted EPS* $4.00 to $4.35 2013 Combined Guidance *2013 Adjusted Earnings Per Share exclude Shaw related acquisition and transition costs. These costs are anticipated to be $80 to $100 million, with a tax benefit of $25 to $30 million, respectively, reducing GAAP Earnings Per Share by $0.55 to $0.70. A World of SolutionsTM 6 Reimbursable ~50% Fixed Price ~50% Diversified Risk Adjusted Backlog International ~50% U.S. ~50% Geographic Profile Contract Profile Balanced Mix of Business New Operating Groups International ~80% U.S. ~20% Reimbursable ~55% Fixed Price ~45% Prior Business Sectors A World of SolutionsTM 7 Focused SG&A Cost Control SG&A Well Controlled Ability to Leverage 205M 187M 106M 206M 228M 3.6% 4.5% 5.1% 4.5% 4.1% 3.8% 2.8% 2.7% 2.3% 2.1% 0 50 100 150 200 250 300 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 2008 2009 2010 2011 2012 SG&A ($ millions) % of Backlog / % of Revenue TTM SG&A as % of Revenue and of Period?end Backlog TTM SG&A % of TTM Revenue % of Backlog 8 A World of SolutionsTM 32.9% 30.9% 27.4% 27.5% 28.6% 20% 25% 30% 35% 40% 2008 2009 2010 2011 2012 Tax Rate % Low Effective Tax Rate Note: Rate for 2008 / 2009 is adjusted for non?benefited South Hook charges Tax Rate Drivers Dutch parent Geographic mix Contracting method Tax planning 2013 9 A World of SolutionsTM Utilized Capacity 27% Available Capacity 73% Credit Facilities (Total ~$3.5 billion) Global Credit Facilities Four?year $1.1 billion unsecured senior revolving credit facility, expires July 2014; $266 million utilized for LOC’s Five?year $650 million unsecured senior revolving credit facility, expires February 2018 Global bilateral LOC facilities totaling $1.7 billion, $691 million utilized for LOC’s Current Capital Structure Long?term Debt $800 million unsecured senior private placement notes, 4.8% fixed average interest rate, matures December 2017 to December 2024; Investment grade profile (BBB) $1 billion unsecured bank term loan, with annual maturities and a final bullet payment of $575 million in February 2017 Equity ? $1.4 billion at December 31, 2012 Pre?Payable 56% Fixed Maturity 44% Composition Long?term Debt A World of SolutionsTM 10 Prudent Use of Leverage Manage Liquidity Laddered debt structure, with mix of pre?payable and fixed maturity debt, results in manageable annual debt service As with prior acquisitions, deleverage while maintaining adequate operating cash and bank capacity *LT Debt / (Total Common Equity+Minority Interest+ST Borrowings+LT Debt) Howe Baker PDM Acquisitions Petrofac USA John Brown Lummus CD Tech Shaw 0% 10% 20% 30% 40% 50% 60% Long?Term Debt to Total Capital 11 A World of SolutionsTM Five Year Capital Strategy Maintain a conservative and flexible capital structure Adequate bank facility capacity Manageable debt service, with flexibility to substantially reduce debt Minimal interest rate risk Support strategic growth opportunities Deliver value to shareholders Significant flexibility and availability for share repurchase activity Continue quarterly cash dividends 12 A World of SolutionsTM Foreign Exchange Conservative and disciplined approach Identify, measure and monitor FX exposures at each award Parity and escalation clauses help manage from pre?contract to contract award Secure hedges or shed risk from contract award to cash flow Broad array of tools to mitigate risk Enhanced transparency – projects evaluated on execution rather than FX activity Pre-Contract Forecast risk Contract Signed Translation risk of Backlog Pre-Contract Contract Award Cash flow Consolidation Mitigate Hedge or Shed Explain 13 A World of SolutionsTM Interest Rate Risk Management Fixed Interest Rate Risk 72 % Variable Interest Payments 28% Healthy and balanced mix Historic low interest rate environment Swap $505 million from floating to fixed at 2.63% Help to make interest expense more predictable Mitigates rising interest rates Evaluation Worked with our banking partners Examine the trade?off between cost and volatility of fixed and floating?rate debt over time in order to determine the optimal proportion of floating debt Data showed that an all?fixed portfolio is not the least risky option but is the most expensive option A World of SolutionsTM 14 Conclusion Powerful Combination ? Performance Excellence ? Positioned to Win