Filed Pursuant to Rule 424(b)(3)

Registration File No.: 333-124317

PROSPECTUS

AXION POWER INTERNATIONAL, INC.

Up to 6,856,904 Shares

Common Stock, par value $.0001 per share

This prospectus relates to the sale by selling stockholders of up to 6,856,904 shares of our common stock, including:

| · | 1,118,750 currently outstanding shares; |

| · | 2,019,704 shares that we will issue upon conversion of outstanding senior preferred stock; and |

| · | 3,718,450 shares that we will issue upon the exercise of outstanding warrants and options. |

We will receive proceeds of up to $7,951,450 in connection with the exercise of our outstanding warrants and options. We will not receive any additional proceeds when the selling stockholders resell the shares they hold or the additional shares they acquire upon conversion of senior preferred stock or the exercise of warrants and options.

We have agreed to pay all expenses incurred in connection with the registration of the shares of common stock covered by this prospectus, including the reasonable expenses of the selling stockholders (excluding transfer taxes and underwriters’ discounts, commissions and the like).

Our common stock is quoted on the OTC Bulletin Board under the symbol “AXPW.” On June 20, 2005, the closing bid and ask prices our common stock as reported on the OTC Bulletin Board were $4.00 and $4.50 per share, respectively.

Investing in our common stock involves a high degree of risk. Please carefully consider the “Risk Factors” beginning on page 8 of this prospectus before buying shares.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION, THE ONTARIO SECURITIES COMMISSION NOR ANY STATE OR PROVINCIAL SECURITIES REGULATORY AUTHORITY HAS APPROVED OR DISAPPROVED THE SHARES OF COMMON STOCK OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is June 21, 2005

WHERE OUR e3 Supercells FIT IN ENERGY STORAGE

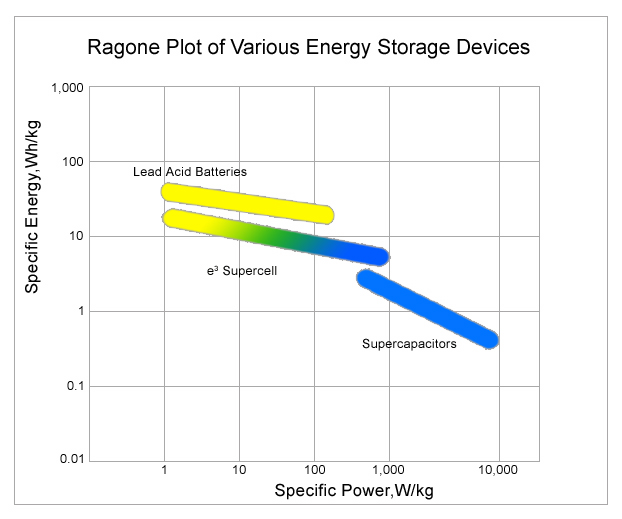

There are three basic classes of direct storage devices for electricity: batteries, supercapacitors and capacitors. Within these basic classes, individual devices are typically described in terms of “energy,” which refers to the ability or capacity to do work, and “power,” which refers to the rate at which electricity can be delivered and work can be performed. In the simple example of a camera, the battery provides the necessary energy for all of the camera systems for several hours, but it takes a capacitor or supercapacitor to power the flashbulb for a fraction of a second.

The following chart provides a simplified overview of the range of specific energy and specific power parameters that are typical for lead acid batteries and supercapacitors. It also shows the range of specific energy and specific power parameters that we believe we will be able to achieve with our e3 Supercell technology.

Our e3 Supercell technology is not a single product. Rather it is a technology platform with the versatility to accommodate a range of design alternatives for high performance storage devices for electricity. That means e3 Supercell devices can be configured to favor either supercapacitor or battery attributes and within the general configurations, individual e3 Supercell devices can be fine-tuned to the particular needs of a specific application.

There is no assurance that we will be able to develop a product based on our e3 Supercell technology or that we will have the ability to manufacture and market any products we develop. See “Risk Factors.”

PROSPECTUS SUMMARY

Introduction

We were incorporated in Delaware on January 9, 1997 as Tamboril Cigar Company. We operated a wholesale cigar business until 1998 and were inactive from January 1999 until December 2003 when we acquired Axion Power Corporation in a business combination that was structured as a reverse takeover. We changed our name to Axion Power International, Inc. in June 2004. Unless we tell you otherwise, as used in this prospectus:

| · | “Axion (Ontario)” refers to our wholly owned subsidiary Axion Power Corporation, a Canadian federal corporation, before the business combination; |

| · | “business combination” refers to the December 31, 2003 reverse takeover of Tamboril by the shareholders of Axion (Ontario); |

| · | “common stock” refers to our $.0001 par value common stock and gives effect to a reverse split that we implemented in June 2004; |

| · | “options” refers to an aggregate of 584,750 outstanding common stock purchase options that are presently exercisable or will become exercisable within 60 days of the date of this prospectus; |

| · | “selling stockholders” refers to the individuals identified in this prospectus who own shares of our common stock, shares of our preferred stock, warrants and options; |

| · | “senior preferred stock” refers to our 8% Convertible Senior Preferred Stock; |

| · | “Tamboril” refers to our company before the business combination; |

| · | “warrants” refers to an aggregate of 3,133,700 outstanding common stock purchase warrants that are presently exercisable or will become exercisable within 60 days of the date of this prospectus; and |

| · | “We,”“our,”“us” and “the company” refer collectively to our company and our wholly owned subsidiary on a consolidated basis after the business combination. |

Unless we tell you otherwise, all information in this prospectus assumes:

| · | the sale by each selling stockholder of all shares of common stock covered by this prospectus; |

| · | the full conversion our senior preferred stock at rate of 5.37 shares of common stock for each share of senior preferred stock; and |

| · | the full exercise of outstanding warrants and options and the receipt of $7,951,450 in cash proceeds from those exercises; and |

| · | an aggregate of 20,469,087 shares of common stock to be outstanding, which we refer to in this prospectus as the “fully-diluted” number of shares of common stock, and which represents the sum of the following: |

| · | 14,730,933 shares of common stock outstanding as of June 20, 2005; |

| · | 2,019,704 shares of common stock issuable upon the conversion of senior preferred stock; |

| · | 3,133,700 shares of common stock issuable upon the exercise of warrants; and |

| · | 584,750 shares of common stock issuable upon the exercise of options. |

Our company

We are a research and development company based in the Toronto metropolitan area. We are developing a platform technology for a family of asymmetrically supercapacitive lead-acid-carbon energy storage devices that we refer to as “e3 Supercells.” Our executive office is located at 100 Caster Avenue, Woodbridge, Ontario L4L 5Y9 Canada. Our telephone number is (905) 264-1991.

Historical Overview

Our principal founders were non-management investors in Mega-C Power Corporation (“Mega-C”), a former licensee of limited rights to our e3 Supercell technology that became embroiled in controversy in March 2003 when the Ontario Securities Commission began an investigation into Mega-C’s unregistered stock sales. After organizing an investors committee and conducting a detailed investigation, our founders concluded that Mega-C’s corporate, financial and regulatory problems were insoluble. In September 2003, they organized Axion (Ontario) for the purpose of acquiring the e3 Supercell patents from Mega-C’s licensor, continuing development work on the technology and protecting the interests of the people who had invested money in Mega-C. In connection with the business combination, we created a trust for the benefit of Mega-C’s creditors and shareholders (the “Mega-C Trust”), which presently owns 7,827,500 shares of our stock. The formation of Axion (Ontario), our acquisition of the e3 Supercell patents and our creation of the Mega-C Trust were vigorously opposed by one of Mega-C’s principal promoter groups, which filed a lawsuit against Tamboril, Axion (Ontario), the original developer of the e3 Supercell technology, Mega-C and 30 other defendants in February 2004. In April 2004, we filed an involuntary Chapter 11 petition against Mega-C in the U.S. Bankruptcy Court for the District of Nevada (the “Court”) for the purpose of obtaining a court-supervised resolution of all clams and interests in accordance with the Bankruptcy Code. In March 2005, the Court appointed a Chapter 11 trustee (the “bankruptcy trustee”) for the Mega-C case.

On April 14, 2005, the bankruptcy trustee filed a preliminary report with the Court that concluded:

| · | Mega-C is not a viable candidate for reorganization and we appear to be the entity best capable of exploiting the e3 Supercell technology; |

| · | the 7,327,500 shares we initially deposited in the Mega-C Trust are property of the bankruptcy estate and should be turned over to the bankruptcy trustee; and |

| · | the potential disputes between Mega-C and our company should, if possible, be settled through negotiation rather than litigation. |

On May 6, 2005, the bankruptcy trustee filed a declaration in support of an application for an order limiting notice in the Chapter 11 case that appears to generally agree with our understanding of the facts.

We commenced the Chapter 11 case because we believe the Court is well equipped to resolve the complex factual and legal issues in the Mega-C case. We do not agree with all of the bankruptcy trustee’s factual and legal conclusions. However we believe compromise is preferable to litigation and we have embarked on a course of discussions and negotiations with the bankruptcy trustee. Without acknowledging any liability or conceding any of the bankruptcy trustee’s factual or legal assertions, we hope to negotiate a settlement that will:

| · | facilitate the transfer of all or part of the trust assets to the bankruptcy trustee while establishing procedures to protect our company, Mega-C’s creditors and the people who invested money in Mega-C; |

| · | eliminate the bulk of the restrictions and limitations in the trust agreement and rely on the Court and the Chapter 11 process to sort out the rights and obligations of Mega-C’s investors and promoters; and |

| · | settle all potential disputes between our company and Mega-C, its creditors and its shareholders with respect to the ownership and commercialization of the e3 Supercell technology. |

Since our powers under the trust agreement are limited, we cannot negotiate a settlement without the consent of trustee for the Mega-C Trust. Accordingly, there is no assurance that we can or will negotiate a settlement with

both the Mega-C Trust and the bankruptcy trustee. Since the Mega-C Trust currently owns 7,827,500 shares, we do not believe a future settlement or the subsequent resale of shares in connection with the Chapter 11 case will be likely to have an adverse impact on our financial condition or result in dilution to our other stockholders.

Our e3 Supercell technology

Our e3 Supercells replace the lead-based negative electrodes in conventional lead-acid batteries with nanoporous carbon electrodes similar to those found in advanced supercapacitors. The result is a new class of hybrid energy storage device that offers both battery and supercapacitor performance characteristics and has a much longer service life than lead acid batteries. If ongoing development and testing continue to confirm our laboratory results, we believe e3 Supercells may offer a cost-effective alternative to conventional lead-acid batteries that:

| · | Charges three to five times faster; |

| · | Offers three to four times as many charge/discharge cycles in deep discharge applications; |

| · | Withstands repetitive 90% depth of discharge without significant loss of performance; and |

| · | Requires minimal maintenance. |

We have no products and no revenue. Initially, we plan to focus on developing e3 Supercells for use in uninterruptible power supplies, which are also known as UPS systems, and DC power systems for communications networks. We selected these markets because worldwide sales of batteries for UPS and communications power systems exceed $1 billion per year, our current prototypes have a form factor that approximates prevailing industry standards and our president and chief operating officer has substantial experience and contacts in these markets. Our second target market will be short-term energy storage and buffering systems for grid-connected wind and solar power generating facilities and conventional electric utilities. Our third target market will be power systems for hybrid automobiles. We may also develop specialized e3 Supercells for a variety of industrial and consumer products including forklifts, wheelchairs and golf carts. There is no assurance that we will be able to develop a product based on our e3 Supercell technology or that we will have the ability to manufacture and market any products we develop.

Our commercialization path

Since early 2004, we have focused on fabricating and testing material and design evaluation prototypes that range from single cells to complete laboratory prototype multi-cell assemblies. The purpose of these “Laboratory Prototypes” has been to refine our electrochemistry, optimize our production techniques and provide a series of standardized e3 Supercells that can be used for comprehensive performance analysis. Our Laboratory Prototypes cannot be used outside a laboratory setting. However, they are suitable for characterization and performance testing by our principal development collaborators.

We have begun preparing detailed drawings and design specifications for a series of application evaluation prototypes that will be tailored to specific uses. We do not expect to begin production of “Application Prototypes” until the second half of 2005. Our Application Prototypes will not be suitable for sale to end-users. However we expect them to be suitable for performance testing by a wide variety of third parties, including UPS manufacturers, communication network operators, wind and solar power generation facilities, motive power companies and other end-users. We are devoting substantial time, effort and attention to forging strategic alliances with leading manufacturers in each of these fields, however there is no assurance that our efforts will ultimately be successful.

Our third development stage will involve producing commercial products in limited quantities for sale to end-users. We plan to develop our “Pilot e3 Supercells” in cooperation with established manufacturers and intend to produce power systems in sufficient quantities to allow an analysis of each product’s commercial potential. Based on the relative success of our Pilot e3 Supercells, we will either enter into manufacturing relationships with others or establish our own facilities for the full-scale commercial production of our products.

We do not expect to generate revenue from the sale of Pilot e3 Supercells for a period of 12 to 18 months. We do not expect to generate material income from product sales until our Pilot e3 Supercells have been introduced to

the market and we have made arrangements for full-scale commercial production. Our development plan currently contemplates the following market entry schedule for our proposed Pilot e3 Supercell power systems:

June 2006 | UPS and DC Power for communications networks. |

| | |

September 2006 | Storage and buffering for conventional electric utilities. |

| | |

November 2006 | Storage for wind and solar power generating facilities. |

| | |

First Quarter 2007 | Power systems for hybrid automobiles. |

There is no assurance that we will be able to resolve the known and unknown technical issues and complete the development of our proposed products in a timely manner; or that the cost of future development work will not exceed current budget estimates. Moreover, there is no assurance that power systems based on our e3 Supercell technology will offer the competitive advantages we presently anticipate. Accordingly, there is no assurance that we will ever produce Pilot e3 Supercells or that our proposed products will ultimately be competitive.

The offering

Shares currently outstanding | | 14,730,933 |

| | | |

Issued and outstanding shares offered by selling stockholders | | 1,118,750 |

| | | |

Shares issuable upon conversion of senior preferred stock held by selling stockholders | | 2,019,704 |

| | | |

Shares of common stock offered by us to selling stockholders who hold warrants exercisable within 60 days | | 3,133,700 |

| | | |

Shares of common stock offered by us to selling stockholders who hold options exercisable within 60 days | | 584,750 |

| | | |

Fully diluted shares of common stock to be outstanding after this offering | | 20,469,087 |

| | | |

Use of Proceeds | | We will receive proceeds of up to $7,951,450 if all holders of warrants and options elect to exercise their stock purchase rights. We will not receive any proceeds from the sale of shares held by or issued to the selling stockholders. We intend to use all available proceeds for general corporate purposes, including general and administrative expenses and working capital. |

| | | |

Risk Factors | | Our business involves litigation and other risks that are not typical in development stage companies. You should carefully consider the information in the “Risk Factors” and “Pending Litigation” sections of this prospectus. Investing in our common stock is highly speculative. You should not purchase our shares unless you can afford to lose your entire investment. |

| | | |

OTC Bulletin Board Symbol | | AXPW |

SUMMARY CONSOLIDATED FINANCIAL DATA

The following summary consolidated financial data is derived from the consolidated financial statements appearing elsewhere in this prospectus and should be read in conjunction with the information contained under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The following summary consolidated financial data should be reviewed in conjunction with our consolidated financial statements and the notes thereto included elsewhere in this prospectus. The summary statement of operations data for the years ended December 31, 2004 and 2003, and the summary balance sheet data at December 31, 2004 and 2003 have been derived from our audited consolidated financial statements for those years. The summary statement of operations data for the three months ended March 31, 2005 and 2004 and the 18-month period from September 30, 2003 (Inception) through March 31, 2005, together with the summary balance sheet data at March 31, 2005 and 2004, have been derived from our unaudited condensed consolidated financial statements for those periods. Although the data for the three months ended March 31, 2005 and 2004 is unaudited, it contains (in the opinion of management) all adjustments necessary for a fair presentation of the results for those periods..

Statement of operations data

| | | Three-months ended March 31, | | Years ended December 31, | | Inception (September 30, 2003) through March 31, 2005 | |

| | | | 2005 | | | 2004 | | | 2004 | | | 2003 | |

| Selling, general and administrative expense | | | 1,559,995 | | | 284,427 | | | 1,376,031 | | | 252,865 | | | 3,188,891 | |

| Research and development expense | | | 650,319 | | | 281,629 | | | 1,551,790 | | | 253,435 | | | 2,455,544 | |

| Other expense (income) | | | (1,099 | ) | | 26,924 | | | (19,703 | ) | | 0 | | | (20,802 | ) |

| Net loss | | | (2,209,214 | ) | | (592,980 | ) | | (2,908,118 | ) | | (506,300 | ) | | (5,623,632 | ) |

Balance sheet data

The following table provides summary information on our consolidated financial position at March 31, 2005 and 2004, and at December 31, 2004 and 2003.

| | March 31, | | December 31, |

| | 2005 | | 2004 | | 2004 | | 2003 |

| Current assets | $1,728,174 | | $ 287,874 | | $61,478 | | $455,369 |

| Property and equipment | 88,394 | | 5,032 | | 97,606 | | |

| Notes receivable | 1,239,320 | | 570,360 | | 958,523 | | $388,148 |

| Intangible assets | 1,920,522 | | 1,794,000 | | 1,920,522 | | $1,794,000 |

| Total | $4,976,410 | | $2,657,266 | | $3,038,129 | | $2,637,517 |

| | | | | | | | |

| Current liabilities | $ 369,975 | | $1,378,226 | | $1,744,258 | | $1,247,000 |

| Liability to issue equity instruments | 533,750 | | | | | | |

| Shareholders' equity | 4,072,685 | | $1,279,040 | | 1,293,871 | | $1,390,518 |

| | | | | | | | |

| Total | $4,976,410 | | $2,657,266 | | $3,038,129 | | $2,637,517 |

| | | | | | | | |

| Common stock outstanding | 14,462,933 | | 13,961,933 | | 13,962,933 | | 12,614,152 |

| Senior preferred stock outstanding (1) | 381,000 | | | | | | |

| (1) | After giving effect to the sale of 4,000 additional shares of senior preferred stock, the conversion of 10,000 shares into common stock and the conversion price adjustments specified in the certificate of rights, powers and designations, the 375,000 presently outstanding shares of senior preferred stock are convertible into 2,019,704 shares of common stock. |

RISK FACTORS

Investing in our common stock is very speculative and involves a high degree of risk. You should carefully consider all of the information in this prospectus before making an investment in our common stock. The following are among the risks we face related to our business, assets and operations. They are not the only risks we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also arise. Any of these risks could materially and adversely affect our business, results of operations and financial condition, which in turn could materially and adversely affect the trading price of our common stock and you might lose all or part of your investment.

Risks related to our business

We are an early stage company and our business and prospects are extremely difficult to evaluate.

Axion (Ontario) commenced operations in September 2003 and then entered into a business combination with Tamboril that closed on December 31, 2003. We do not have a substantial or stable operating history that you can rely on in connection with your evaluation of our business and prospects. Our business and prospects must be carefully considered in light of the history of the e3 Supercell technology, the origins of our company and the many business risks, uncertainties and difficulties that are typically encountered by development stage companies that have no revenues and intend to focus on research, development and product testing for an extended period of time. Some of the principal risks and difficulties we expect to encounter include our ability to:

| · | Raise the necessary capital to finance the continuation of our business until we can introduce a product; |

| · | Maintain effective control over the cost of our research, development and product testing activities; |

| · | Develop cost effective manufacturing methods for essential components of our proposed products; |

| · | Improve the performance of our Laboratory Prototypes and develop Application Prototypes; |

| · | Produce Application Prototypes in sufficient quantities to support our planned testing activities; |

| · | Establish facilities and relationships for the manufacturing of our proposed Pilot e3 Supercells; |

| · | Adapt and successfully execute our rapidly evolving and inherently unpredictable business plan; |

| · | Implement and improve operational, financial and management control systems and processes; |

| · | License complementary technologies and defend our intellectual property rights against potential claims; |

| · | Respond effectively to competitive developments and changing market conditions; |

| · | Attract, retain and motivate qualified personnel; and |

| · | Manage each of the other risks set forth below. |

Because of our brief operating history and our early stage of development, we have limited insight into trends and conditions that may exist or might emerge and affect our business. There is no assurance that our business strategy will be successful or that we will successfully address the risks identified in this prospectus.

We have no revenue, have incurred net losses since inception and do not expect to introduce our first products for 12 to 18 months.

We are engaged in research and development. We have incurred losses since inception and expect to continue to incur substantial and increasing losses for the foreseeable future as we increase our spending to finance the development of our e3 Supercell technology, our administrative activities, and the costs associated with being a

public company. Our operating losses have had, and will continue to have, an adverse impact on our working capital, total assets and stockholders’ equity. We incurred a net loss of ($2,908,118) for the year ended December 31, 2004 and a net loss ($506,300) for the year ended December 31, 2003. For the three months ended March 31, 2005, we incurred a net loss of ($2,209,214), which included $1,000,000 in costs associated with the augmentation of the Mega-C Trust and $852,708 in expense associated with equity compensation awards to employees. While the bulk of our first quarter costs were non-recurring, we expect our net losses for 2005 and 2006 to be significantly higher than our historical losses. Our e3 Supercell technology has not reached a point where we can offer products based on the technology and we will not be in a position to commercialize products based on our e3 Supercell technology until we complete the development and testing activities described in this prospectus. We believe the development and testing process will require a minimum of 12 to 18 months. There can be no assurance that our development and testing activities will be successful or that our proposed products will achieve market acceptance or be sold in sufficient quantities and at prices necessary to make them commercially successful. If we do not realize sufficient revenue to achieve profitability, our business could be harmed.

Our business will not succeed if we are not able to raise substantial additional capital.

During our first 18 months of operations, our financing activities kept pace with our operating expenditures but our working capital was very limited. We recently received $3,840,000 in net proceeds from a private placement of 385,000 shares of senior preferred stock that gave investors rights, privileges and preferences that are senior to the rights of common stockholders. We believe our available financial resources and the anticipated proceeds from the exercise of warrants and options will be sufficient to finance our operations for a period of 9 to 12 months from the date of this prospectus. We will probably not be able to complete the development of Application Prototypes or begin production of Pilot e3 Supercells without substantial additional financing. We cannot assure you that additional capital will be available to us on favorable terms, or at all. If we are unable to obtain additional capital when needed, our research, development and testing activities will be materially and adversely affected and we may be unable to take advantage of future opportunities or respond to competitive pressures. Any inability to raise additional capital when we require it would seriously harm our business.

Mega-C’s Chapter 11 case could be dismissed.

We created the Mega-C Trust for the purpose of protecting Mega-C’s creditors and the people who invested money in Mega-C. We subsequently filed an involuntary Chapter 11 petition against Mega-C for the purpose of obtaining a court-supervised resolution of all clams and interests in accordance with the Bankruptcy Code. It is anticipated that the shares of our stock that are currently held by the Mega-C Trust may be a primary source of funding to pay the costs of the Chapter 11 case and the claims of Mega-C’s creditors and shareholders. The bankruptcy trustee or other parties in interest could move to dismiss the Chapter 11 case for a variety of reasons, including the speculative value of our shares. If the Chapter 11 case is dismissed, we could be compelled to litigate in other courts. While we believe the information developed in connection with the Chapter 11 case will simplify any future litigation, the cost of litigation in other courts could have a material adverse impact on our company and the value of our common stock.

A controlling interest in our company may be transferred to the bankruptcy trustee.

We do not control the Mega-C Trust and our rights under the trust agreement are limited. There is no assurance that we will be able to negotiate a three-party settlement with the bankruptcy trustee and the Mega-C Trust, or that the Court will approve any proposed settlement. If we cannot negotiate a settlement, we may become involved in litigation with the bankruptcy trustee that would have a material adverse impact on our company and value of our common stock. If we negotiate a settlement that is approved by the Court, the disposition of our shares will ultimately be governed by Mega-C’s plan of reorganization. Accordingly, there is no assurance that:

| · | the bankruptcy trustee will not exert operational control over our company during the reorganization; |

| · | the people who invested money in Mega-C will receive the treatment that we intended; |

| · | the bankruptcy trustee will not distribute shares of our stock to Mega-C’s promoters, their associates and other persons that we would exclude from share ownership if we had the power to do so; or |

| · | the bankruptcy trustee will not sell all or a substantial portion of the shares to fund the Chapter 11 case. |

If our shares are transferred to the bankruptcy trustee and he decides to sell our shares to a third-party instead of distributing our shares to Mega-C’s shareholders, a block purchaser could obtain effective control of our company.

The growth we seek is rare and inherently problematic.

The realization of our business objectives will require substantial future growth. Growth of this magnitude is rare. If we are able to complete the development of our Application Prototypes, develop Pilot e3 Supercells, introduce our products to the market and grow our business, we expect that rapid growth will place a significant strain on our managerial, operational and financial resources. We must manage our growth, if any, through appropriate systems and controls. We must also establish, train and manage a much larger work force. If we do not manage the growth of our business effectively, our potential could be materially and adversely affected.

Being a public company has increased our administrative costs.

As a public company, we incur significant legal, accounting and other expenses that would not be incurred by a comparable private company. SEC rules and regulations have made some activities more time consuming and expensive and required us to implement corporate governance and internal control procedures that are not typical for development stage companies. We also incur a variety of internal and external costs associated with the preparation, filing and distribution of the periodic public reports and proxy statements required by the Exchange Act. During the year ended December 31, 2004, we spent approximately $289,000 for the legal and accounting fees and other costs associated with Exchange Act compliance. We expect SEC rules and regulations to make it more difficult and expensive for us to attract and retain qualified directors and executive officers.

We depend on key personnel and our business may be severely disrupted if we lose the services of our key executives and employees.

Our business is dependent upon the knowledge and experience of our key scientists and engineers, many of whom are Russian nationals who are living in Canada under renewable work permits. Given the competitive nature of our industry and our reliance on expatriates, the risk that one or more of our key scientists and engineers will resign their positions is high and could have a disruptive impact on our operations. If any of our key scientists or engineers is unable or unwilling to continue in their present positions, we may not be able to easily replace them and our business may be severely disrupted. If any of our key scientists or engineers joins a competitor or forms a competing company, we could lose important know-how and experience and incur substantial expense to recruit and train suitable replacements. We do not maintain key-man insurance for any of our key employees.

Our directors and officers effectively control management and the outcome of any stockholder vote.

We had 14,730,933 common shares outstanding on the date of this prospectus, including 7,827,500 shares held by the Mega-C Trust. The Mega-C Trust is required to vote its shares proportionally with the votes cast by our other stockholders. Therefore, the holders of 6,903,433 shares that are not owned by the Mega-C Trust will decide all matters that are submitted for a stockholder vote. Since our directors and officers own or control 2,888,400 shares of common stock, 82,000 shares of senior preferred stock that are presently convertible into 445,068 shares of common stock, and warrants and options to purchase 1,942,150 additional shares of common stock, they will have the effective power to control management and the outcome of any stockholder vote until a substantial number of shares are sold or distributed by the trustee.

Our certificate of incorporation and by-laws provide for indemnification and exculpation of our officers and directors.

Our Certificate of Incorporation provides for indemnification our officers, directors and employees to the fullest extent permitted by Delaware law. It also provides exculpation of our directors for monetary damages arising from breach of their fiduciary duties in cases that do not involve fraud or willful misconduct. We have been advised that the SEC believes that indemnification for liabilities arising under the securities laws is against public policy as expressed in the securities laws and is therefore unenforceable.

Risks related to our e3 Supercell technology

We need to improve the performance of our Laboratory Prototypes.

Our Laboratory Prototypes do not satisfy all our performance expectations and we need to improve various aspects of our e3 Supercell technology before we can begin production of Application Prototypes. In particular, we need to increase our energy densities and further refine our electrochemistry. There is no assurance that we will be able to resolve the known technical issues. Future testing of our existing Laboratory Prototypes and our proposed Application Prototypes may reveal additional technical issues that are not currently recognized as obstacles. If we cannot improve the performance of our Laboratory Prototypes in a timely manner, we may be forced to redesign or delay the production of Application Prototypes, reconsider our plans to introduce Pilot e3 Supercell power systems or abandon our product development efforts altogether.

We may be unable to develop cost effective manufacturing methods for our carbon electrodes.

The nanoporous carbon electrodes that are the foundation of our e3 Supercell technology are more complex than the lead-based negative electrodes used in conventional batteries. The production of nanoporous carbon electrodes requires extensive processing of carefully selected raw materials and precision fabrication of the finished electrodes. Minor variations in processing and fabrication methods can have a major impact on the performance of the finished electrodes. There is no assurance that we will be able to develop cost effective fabrication methods for our carbon electrodes or manufacture commercial quantities of carbon electrodes that exhibit the performance characteristics of our Laboratory Prototypes. Moreover, there is no assurance that our nanoporous carbon electrodes can be produced at a cost that is reasonably competitive with conventional lead electrodes. If we are unable to develop manufacturing methods that allow us to consistently produce quality carbon electrodes at a competitive cost we will be unable to develop a competitive product based on our technology.

We cannot begin production of Pilot e3 Supercells for 12 to 18 months.

We will not be able to begin production of power systems based on our e3 Supercell technology until we complete our current material and design evaluation, our planned application evaluation and our planned product development. We believe our commercialization path will require a minimum of 12 to 18 months. Even if our material and design evaluation and application evaluation activities are successful, there can be no assurance that we will be able to establish facilities and relationships for the manufacturing, distribution and sale of our proposed Pilot e3 Supercells or that any future products will achieve market acceptance and be sold in sufficient quantities and at prices necessary to make them commercially successful. Even if our proposed products are commercially successful there can be no assurance that we will realize enough revenue from the sale of products to achieve profitability.

We do not have any vendor contracts.

We currently purchase the raw materials for our carbon electrodes and a variety of other components from third parties. We then fabricate our carbon electrodes and build our Laboratory Prototypes in-house. We do not have any long-term contracts with suppliers of raw materials and components and our current suppliers may be unable to satisfy our future requirements on a timely basis. Moreover, the price of purchased raw materials and components could fluctuate significantly due to circumstances beyond our control. If our current suppliers are unable to satisfy our long-term requirements on a timely basis, we may be required to seek alternative sources for necessary materials and components, or redesign our proposed products to accommodate available substitutes.

We do not have any manufacturing facilities or manufacturing experience.

Our research and prototype development facility can only accommodate limited production of Laboratory and Application Prototypes. Our current facility will not be able to produce our proposed Pilot e3 Supercells. We will not be able to manufacture Pilot e3 Supercells or successfully commercialize our proposed products unless we establish dedicated manufacturing facilities or enter into agreements for the outsourcing of the manufacturing function. Each of our manufacturing alternatives has a unique risk profile and different financial and managerial requirements. There can be no assurance that we will have the necessary financial resources to establish or acquire suitable manufacturing facilities if and when needed; or that we can negotiate suitable arrangements for the outsourcing of

our manufacturing functions. We do not have any manufacturing experience and there is no assurance that we will be able to retain a qualified manufacturing staff or effectively manage the manufacturing of our proposed products.

We will be a small player in an intensely competitive market and may be unable to compete.

The lead-acid battery industry is large, intensely competitive and resistant to technological change. If our product development efforts are successful, we will have to compete or enter into strategic relationships with well-established companies that are much larger and have greater financial, capital and other resources than we do. We may be unable to convince end users that products based on our e3 Supercell technology are superior to available alternatives. Moreover, if competitors introduce similar products, they may have a greater ability to withstand price competition and finance their marketing programs. There is no assurance that we will be able to compete effectively.

To the extent we enter into strategic relationships, we will be dependent upon our partners.

Our products are not intended for direct sale to end users and our business strategy will likely require us to enter into strategic relationships with manufacturers of UPS systems, DC Power systems, motive power systems and other power industry participants that use batteries and other energy storage devices as important components of their finished products. The agreements governing any future strategic relationships are unlikely to provide us with control over the activities of any strategic relationship we negotiate and our future partners, if any, will likely retain the right to terminate the strategic relationship at their option. Our future partners will have significant discretion in determining the efforts and level of resources that they dedicate to our products and may be unwilling or unable to fulfill their obligations to us. In addition, our future partners may develop and commercialize, either alone or with others, products that are similar to or competitive with the products that we intend to produce.

Risks relating to our intellectual property

We may require licenses of third-party technology that may not be available to us or may be very expensive and could prevent us from pursuing a particular development path.

The fields of energy storage and nanotechnology enhanced materials have seen a proliferation of patents and patent applications in recent years and we may find that third party patents would be useful in the development of our e3 Supercell technology or the manufacturing of products based on our technology. In such an event, the preferred choice may be to obtain a license to the third-party patent. Such licenses may not be available to us on reasonable terms, or at all. The inability to obtain any necessary third-party licenses could cause us to abandon a particular development path, which could seriously harm our business, financial condition and results of operations.

We may be unable to enforce or defend our ownership of proprietary technology.

Our ability to compete effectively will depend in part on our ability to maintain the proprietary nature of our e3 Supercell technology. The intellectual property we purchased from C&T includes three issued patents that cover various aspects of the e3 Supercell technology. We plan to file additional patent applications in the future. However the degree of protection offered by our existing patents or the likelihood that our future applications will be granted is uncertain. Competitors in both the U.S. and foreign countries, many of which have substantially greater resources and have made substantial investment in competing technologies, may have, or may apply for and obtain patents that will prevent, limit or interfere with our ability to make and sell products based on our e3 Supercell technology. Competitors may also intentionally infringe on our patents. The defense and prosecution of patent litigation is both costly and time-consuming, even if the outcome is favorable to us. An adverse outcome in the defense of a patent infringement suit could subject us to significant liabilities to third parties. Although third parties have not asserted any infringement claims against us, there is no assurance that third parties will not assert such claims in the future.

New technology may lead to the development of superior competitive products.

Research into the electrochemical applications for carbon nanotechnology is proceeding at a rapid pace and many private and public companies and research institutions are actively engaged in the development of new battery technologies based on carbon nanotubes, nanostructured carbon materials and other non-carbon materials. These new technologies may, if successfully developed, offer significant performance or price advantages when compared

with our e3 Supercell technology. There is no assurance that our existing patents or our pending and proposed patent applications will offer meaningful protection if a competitor develops a novel product based on a new technology.

Risks relating to the offering and our common stock

The number of shares of common stock we are registering and have previously registered for sale could depress our stock price

This prospectus relates to 6,856,904 shares of our common stock that have been registered for resale by the selling shareholders. These shares represent approximately 33.5% of our fully diluted capitalization. The potential sale of a significant number of these shares may cause the market price of our common stock to decline.

We have issued a large number of convertible securities, warrants and options that may significantly increase the number of common shares outstanding.

We had 14,730,933 shares of common stock outstanding on the date of this prospectus and our senior preferred stock is presently convertible into 2,019,704 shares of common stock. We have also issued:

| · | 3,133,700 warrants that entitle the holders to purchase common stock at prices that range from $1.00 to $4.00 per share and average $2.14 per share; and |

| · | 584,750 vested stock options that entitle the holders to purchase common stock at prices that range from $1.00 to $5.60 per share and average $2.14 per share. |

If all holders of our vested derivative securities immediately exercised their conversion and stock purchase rights, we would receive $7,951,450 in cash proceeds and have a total of 20,469,087 shares of common stock outstanding.

We have provided and intend to continue offering compensation packages to our management and employees that emphasize equity-based compensation.

As a key component of our growth strategy, we have provided and intend to continue offering compensation packages to our management and employees that emphasize equity-based compensation. In particular:

| · | Our incentive stock plan authorized incentive awards for up to 2,000,000 shares of our common stock; we have issued incentive awards for an aggregate of 999,450 shares at the date of this prospectus; and we have the power to issue incentive awards for an additional 1,000,550 shares without stockholder approval; |

| · | Our independent directors’ stock option plan authorized options for up to 500,000 shares of our common stock; we have issued options for an aggregate of 109,600 shares at the date of this prospectus; and have the power to issue options for an additional 391,400 shares without stockholder approval; |

| · | We have issued contractual options for an aggregate of 620,000 shares of our common stock to executive officers under the terms of their employment agreements with us; and |

| · | We have issued contractual options for an aggregate of 369,200 shares of our common stock to certain attorneys and consultants under the terms of their agreements with us; |

We believe our equity compensation policies will allow us to provide substantial incentives while minimizing our cash outflow. Nevertheless, we will be required to account for the fair market value of equity compensation awards as operating expenses. As our business matures and expands, we expect to incur increasing amounts of non-cash compensation expense, which may materially and adversely affect our future operating results.

We may issue stock to finance acquisitions.

As a key component of our growth strategy, we intend to acquire complimentary technologies, facilities and other assets. Whenever possible, we will try to use our stock as an acquisition currency in order to conserve our

available cash for operations. Future acquisitions may give rise to substantial charges for the impairment of goodwill and other intangible assets that would materially and adversely affect our reported operating results. Any future acquisitions will involve numerous business and financial risks, including:

| · | difficulties in integrating new operations, technologies, products and staff; |

| · | diversion of management attention from other business concerns; and |

| · | cost and availability of acquisition financing. |

We will need to be able to successfully integrate any businesses we may acquire in the future, and the failure to do so could have a material adverse effect on our business, results of operations and financial condition.

Because of factors unique to us, the market price of our common stock is likely to be volatile.

Daily trading in our common stock commenced in January 2004. Because of the manner in which we became a public company; the relatively small number of shares currently available for resale; the large number of shares that we have registered on behalf of selling stockholders; the early stage of our business and numerous other factors, the trading price of our common stock is likely to be highly volatile. In addition, actual or anticipated variations in our quarterly operating results; the introduction of new products by competitors; changes in competitive conditions or trends in the battery industry; changes in governmental regulation and changes in securities analysts' estimates of our future performance or that of our competitors or our industry in general, could adversely affect our future stock price. Investors should not purchase our shares if they are unable to suffer a complete loss of their investment.

Our current “bid” and “asked” prices may not stabilize at current levels

During our first year of operations, our stock was quoted on the OTC Pink Sheets. While our stock has been quoted on the OTC Bulletin Board since January 20, 2005, trading has been sporadic, trading volumes have been low and the market price has been volatile. The closing bid and asked prices were $4.00 and $4.50 per share, respectively, on June 20, 2005. The current quotations are not necessarily a reliable indicator of value and there is no assurance that the market price of our stock will stabilize at or near current levels.

We may not qualify for an Amex listing.

We have filed an application to list our common stock on the American Stock Exchange (“Amex”), which requires $4 million in stockholders’ equity; 400 public stockholders; 1 million publicly held shares; a market price of $3 per share; a market capitalization of $50 million; a market value of $15 million for shares in the public float; and the implementation of certain corporate governance standards. While we presently satisfy the qualitative and corporate governance standards established by the Amex, the Amex retains substantial discretion in matters relating to listing applications and they may conclude our business is not sufficiently developed to qualify for a listing. Until our common stock is approved for listing on the Amex, the only available market will be the OTC Bulletin Board.

Our common stock may become subject to the “penny stock” rules, which would make it a less attractive investment.

SEC rule 3a51-1 defines a “penny stock” as any equity security that is not listed on a national securities exchange or the Nasdaq system and has a bid price of less than $5 per share. We are presently subject to the penny stock rules. Our market price has been highly volatile since January 2004 and there is no assurance that the penny stock rules will not continue to apply to our shares for an indefinite period of time. Before a effecting a transaction that is subject to the penny stock rules, a broker-dealer must make a decision respecting the suitability of the purchaser; deliver certain disclosure materials to the purchaser and receive the purchaser's written approval of the transaction. Because of these restrictions, most broker-dealers refrain from effecting transactions in penny stocks and many actively discourage their clients from purchasing penny stocks. Therefore, both the ability of broker-dealers to recommend our common stock and the ability of our stockholders to sell their shares in the secondary market could be adversely affected by the penny stock rules.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the sections entitled “Prospectus Summary,”“Risk Factors,”“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Description of Our Business,” contains forward-looking statements. These statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to be materially different from the anticipated future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as “may,”“could,”“expect,”“intend,”“plan,”“seek,”“anticipate,”“believe,”“estimate,”“predict,”“potential,”“continue,” or the negative of these terms or other comparable terminology. Any statements contained in this prospectus that are not statements of historical fact may be deemed to be forward-looking statements.

You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties and other factors which are, in many cases, beyond our control and which could materially affect actual results, levels of activity, performance or achievements.

Any forward-looking statement you read in this prospectus reflects our current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our operations, results of operations, growth strategy and liquidity. We assume no obligation to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future. The Private Securities Litigation Reform Act of 1995 and Section 27A of the Securities Act, each of which provide safe harbor protection for certain forward-looking statements, do not apply in connection with this offering.

USE OF PROCEEDS

This prospectus relates to the sale of up to 6,856,904 shares of our common stock by the selling stockholders identified in this prospectus. The shares offered hereby include:

| · | 1,118,750 currently outstanding shares; |

| · | 2,019,704 shares that we will issue upon conversion of outstanding senior preferred stock; and |

| · | 3,718,450 shares that we will issue upon the exercise of outstanding warrants and options. |

We will receive proceeds of up to $7,951,450 in connection with the exercise of our outstanding warrants and options. We will not receive any additional proceeds when the selling stockholders resell the shares they currently hold or the additional shares they acquire upon conversion of senior preferred stock or the exercise of warrants and options. We intend to use any proceeds from the exercise of warrants and options for general corporate purposes, including working capital and other general and administrative expenses. We have not identified the amounts we plan to spend on each of these areas or the timing of expenditures. Pending specific application of the net proceeds, we plan to invest the net proceeds in short-term, investment grade securities.

DETERMINATION OF OFFERING PRICE

The selling stockholders have informed us that they may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of common stock or interests in shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale or at negotiated prices. No independent third party has been consulted concerning the offering price for the shares or the fairness of the offering price used for the shares.

MARKET FOR COMMON STOCK AND RELATED MATTERS

Market information

During the year ended December 31, 2004, our stock was quoted on the OTC Pink Sheets. While our stock has been quoted on the OTC Bulletin Board since January 20, 2005 (Symbol: AXPW), trading has been sporadic, trading volumes have been low and the market price has been volatile. The following table shows the range of high and low bid prices for our common stock as reported by the OTC Pink Sheets and the OTC Bulletin Board for each quarter since the date of the business combination. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

Period | | High | Low |

| First Quarter 2004 | | $7.20 | $1.28 |

| Second Quarter 2004 | | $7.20 | $3.84 |

| Third Quarter 2004 | | $7.00 | $4.00 |

| Fourth Quarter 2004 | | $4.50 | $2.95 |

| | | | |

| First Quarter 2005 | | $4.25 | $2.58 |

| Second Quarter 2005 | (through June 20, 2005) | $6.00 | $2.30 |

The market for our shares remains volatile and both prices and trading volumes vary significantly from day to day. On June 20, 2005, the closing bid and asked prices were $4.00 and $4.50 per share, respectively.

Information respecting holders

On May 9, 2005, we had 394 record holders of common stock and 19 record holders of senior preferred stock. According to information provided by the Depository Trust Company, a total of 316,600 shares are held in street name accounts by brokerage firms and other nominees for approximately 400 beneficial owners.

Information respecting dividend policies

We have not in the past paid, and do not expect for the foreseeable future to pay, dividends on our common stock. We are not obligated to pay cash dividends on our senior preferred stock in any quarter where we report a net loss for the quarter or the year-to-date then ended. We expect to incur operating losses in 2005 and 2006 and are unable to predict whether or when we might have reportable net income. Any future determination to pay dividends on our common stock and senior preferred stock will be at the discretion of our board and will depend upon, among other factors, our results of operations, financial condition, capital requirements and contractual restrictions.

Information respecting contractual stock options

In January 2004, members of the law firm of Petersen & Fefer were granted a contractual option to purchase 189,300 shares of our common stock at a price of $2.00 per share as partial compensation for services rendered. In August 2004, the exercise price of the options was reduced to $1.00 per share for their remaining term. The options are fully vested and may be exercised at any time prior to December 31, 2005.

In February 2004 Canadian Consultants Bureau Ltd., an advisor to our board, was granted a contractual option to purchase 6,300 shares of our common stock at a price of $3.20 per share as partial compensation for services. In June 2005, Canadian Consultants Bureau was granted similar option to purchase 3,600 shares of our common stock at a price of $5.60 per share. The options are fully vested and may be exercised at any time during the four-year period commencing one year after the date of grant.

In July 2004, our president and chief operating officer Charles Mazzacato was granted a contractual option to purchase 240,000 shares of our common stock at a price of $4.00 per share. This option will vest at the rate of 60,000 shares per year commencing July 31, 2005 and be exercisable for five years after each vesting date.

In July 2004, our chief financial officer Peter Roston was granted a contractual option to purchase 200,000 shares of our common stock at a price of $4.00 per share. This option will vest at the rate of 50,000 shares per year commencing July 31, 2005 and be exercisable for five years after each vesting date.

In March 2005, members of the law firm of Petersen & Fefer were granted an additional contractual option to purchase 140,000 shares of our common stock at a price of $1.00 per share as partial compensation for services rendered. The options are fully vested and may be exercised at any time prior to March 31, 2007.

In April 2005, our chief executive officer Thomas Granville was granted a contractual option to purchase 180,000 shares of our common stock at a price of $2.50 per share. This option will vest at the rate of 7,500 shares per month commencing May 1, 2005 and be exercisable for five years after each vesting date.

In April 2005, Auric Trading Ltd., our European financial advisor was granted a contractual option to purchase 30,000 shares of our common stock at a price of $2.50 per share. This option will vest at the rate of 2,500 shares per month commencing May 1, 2005 and be exercisable for two years after each vesting date.

Information respecting equity compensation plans

In April 2005, we issued 219,000 shares of common stock to employees as bonuses under our incentive stock plan. The following table provides summary information on our equity compensation plans as of June 20, 2005.

Plan category | | Number of shares to be issued upon exercise of outstanding options, warrants and rights | | Weighted-average exercise price of outstanding options, warrants and rights | | Number of shares available for future issuance under equity compensation plans | |

Equity compensation plans approved by stockholders | | | | | | | | | | | | | | | | | | | |

| 2004 Incentive Stock Plan | | | | | | 780,450 | | | | | $ | 2.57 | | | | | | 1,000,550 | |

| 2004 Directors' Option Plan | | | | | | 109,600 | | | | | $ | 3.48 | | | | | | 390,400 | |

Equity compensation plans not approved by stockholders | | | | | | | | | | | | | | | | | | | |

| Contractual stock options granted to officers, attorneys and consultants | | | | | | 989,200 | | | | | $ | 2.68 | | | | | | | |

Total equity awards | | | | | | 1,879,250 | | | | | $ | 2.68 | | | | | | 1,390,950 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATION

The following discussion of the financial condition and results of operations of our company should be read in conjunction with the financial statements and the notes to those statements included elsewhere in this prospectus. This discussion contains forward-looking statements that involve risks and uncertainties. Please see “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” elsewhere in this prospectus.

Overview

We had no revenues and incurred net losses of ($2,908,118) and ($506,300) respectively, during the years ended December 31, 2004 and 2003. For the three months ended March 31, 2005, we incurred a net loss of ($2,209,214). We do not expect to generate revenue for a period of 12 to 18 months from the date of this prospectus.

We had $4,072,685 in stockholders’ equity and $1,3581,199 in working capital at March 31, 2005. We believe our available financial resources and the anticipated proceeds from the exercise of outstanding warrants and options will be sufficient to finance our operations for a period of 9 to 12 months. We will probably not be able to complete the development of Application Prototypes or begin production of Pilot e3 Supercell power systems

without substantial additional funds from the sale of securities or other sources. We believe we will need at least $10 million in additional capital before we can begin production of Pilot e3 Supercells; however, capital requirements are difficult to plan in companies that are developing new products. We expect that we will need additional capital to pay the expenses of our research and testing activities, pay our day-to-day operating costs, finance additions to our infrastructure, pay for the development of manufacturing capabilities and the testing of our proposed products, pay for the development of a sales and marketing organization and finance the acquisition of complimentary assets, technologies and businesses. We intend to pursue additional financing as opportunities arise.

Results of operations

No revenue We have no revenue generating assets or business activities. We will not generate revenue from the sale of products until we complete the development and testing activities described in this prospectus. While we expect to generate modest revenues from the sale of Pilot e3 Supercells, the amount and timing of future revenues are uncertain. We do not expect to generate revenue from the sale of products for 12 to 18 months.

Increasing net losses We commenced operations in September 2003 and have received no revenue since inception. During the last six calendar quarters we incurred net losses, selling general and administrative expenses and research and development expenses as follows:

| | | 2003 | | 2004 | | 2005 | |

| | | Fourth Quarter | | First Quarter | | Second Quarter | | Third Quarter | | Fourth Quarter | | First Quarter | |

| Selling, general and administrative | | $ | 252,865 | | $ | 311,350 | | $ | 400,857 | | $ | 356,191 | | $ | 307,663 | | $ | 1,558,896 | |

| Research and development | | $ | 253,435 | | $ | 281,629 | | $ | 365,736 | | $ | 428,591 | | $ | 475,834 | | $ | 650,319 | |

| Net loss | | | ($506,300 | ) | | ($592,979 | ) | | ($766,592 | ) | | ($784,782 | ) | | ($763,765 | ) | | ($2,209,214 | ) |

Our reported net loss for the first quarter of 2005 is substantially greater than the reported loss for all previous quarterly periods. The principal reasons for the inordinately high first quarter loss were $1,000,000 in non-recurring costs associated with the augmentation of the Mega-C Trust and $852,708 in non-recurring costs associated with equity compensation awards to employees. After adjusting for non-cash portion of the non-recurring expenses, our net cash loss for the period was $383,506, an amount that is significantly less than our net loss in previous quarterly periods and is primarily attributable to a temporary contraction of our operations that we implemented during the first quarter of 2005 pending the sale of the senior preferred stock.

A detailed breakdown of our selling, general and administrative expenses over the last six fiscal quarters is set forth in the following table:

| | | 2003 | | 2004 | | 2005 | |

| | | Fourth Quarter | | First Quarter | | Second Quarter | | Third Quarter | | Fourth Quarter | | First Quarter | |

| Legal fees and expenses | | $ | 252,865 | | $ | 118,116 | | $ | 55,560 | | $ | 82,416 | | $ | 114,723 | | $ | 143,051 | |

| Directors and officers compensation | | | 0 | | | 36,776 | | | 168,541 | | | 84,639 | | | 79,820 | | | 113,835 | |

| Administrative staff expenses | | | 0 | | | 78,225 | | | 91,438 | | | 34,536 | | | 119,801 | | | 165,866 | |

| Exchange Act compliance and reporting | | | 0 | | | 45,749 | | | 54,475 | | | 123,911 | | | 64,629 | | | 9,091 | |

| Facilities, utilities and maintenance | | | 0 | | | 32,484 | | | 30,843 | | | 30,689 | | | 31,755 | | | 34,958 | |

Litigation costs Over the last 18 months, we have spent over $600,000 on legal fees to defend litigation that was instituted by a group of Mega-C’s promoters. In March 2005, the Court stayed all litigation pending a report from the bankruptcy trustee respecting various issues arising in connection with the case. On April 14, 2005, the bankruptcy trustee filed a preliminary report that concluded the potential disputes between Mega-C and our company should, if possible, be settled through negotiation rather than litigation. On May 6, 2005, the bankruptcy trustee filed a declaration in support of an application for an order limiting notice in the Chapter 11 case that appears to generally agree with our understanding of the facts

Notwithstanding our desire to negotiate a settlement agreement, the bankruptcy trustee or other parties in interest could move to dismiss the Chapter 11 case for a variety of reasons, including the speculative value of our

shares. If the Chapter 11 case is dismissed, we could be compelled to litigate collateral issues in other courts. While we believe the information developed in connection with the Chapter 11 case would simplify future litigation, the cost of future litigation could have a material adverse impact on our company and the value of our common stock.

Non-cash compensation We expect to incur substantial non-cash expenses for equity compensation awards to our officers, employees and others. In August 2004 we signed employment agreements with Charles Mazzacato and Peter Roston. In connection with these agreements, we granted Mr. Mazzacato an option to purchase 240,000 shares and we granted Mr. Roston an option to purchase 200,000 shares. Both options provide for an exercise price of $4.00 per share and vest over a period of four years. In April 2005, we signed an employment agreement with Thomas Granville that included an option to purchase 180,000 shares, which is exercisable at $2.50 per share and vests over a period of two years. We also issued 219,000 shares of common stock to directors, officers, employees and consultants as bonuses under our incentive stock plan. Future non-cash charges for equity compensation awards are likely to significantly increase our reported operating expenses and losses for an extended period of time.

Non-financial metrics We do not presently use any non-financial metrics as indicators of our current and future financial condition and operating performance.

Outlook for remainder of 2005 After giving effect to known and anticipated operating conditions and our current operating plans, the following table summarizes our anticipated cash outlays, anticipated non-cash expenses and anticipated operating losses for each of the next three fiscal quarters.

| | | Second Quarter | | Third Quarter | | Fourth Quarter | |

| Anticipated cash expenses | | $ | 990,000 | | $ | 1,089,000 | | $ | 1,197,900 | |

| Anticipated non-cash expenses | | | 56,250 | | | 56,250 | | | 56,250 | |

| Anticipated net loss | | | ($1,046,240 | ) | | ($1,145,250 | ) | | ($1,254,150 | ) |

Our cash outlays and operating losses over the next four quarters may be significantly higher than current estimates because of unforeseen developments. While our limited operating history makes it difficult for us to predict future operating results, we expect to incur ongoing losses of increasing magnitude for the foreseeable future.

Liquidity and capital resources

Since inception, we have financed our operations through private sales of equity securities. We raised $1.9 million in capital during 2003 and $2.6 million in capital during 2004. In March and April 2005, we sold 385,000 shares of senior preferred stock and 507,500 warrants for net proceeds that included $2,840,000 in cash and a $1 million settlement of an obligation payable to C&T. We had $4,072,685 in stockholders’ equity and $1,3581,199 in working capital at March 31, 2005.

Short-term warrants and options In connection with our prior financing activities, we issued 1,305,100 short-term warrants that were initially exercisable for a period of one year from their respective issue dates. A total of 829,900 short-term warrants remain outstanding at the date of this prospectus. The following table provides summary information on our outstanding short-term warrants.

Warrant | | Number of | | Until Step-Up Date | | After Step-Up Date | |

Series | | Warrants | | Price | | Proceeds | | Price | | Proceeds | |

| Series I | | | 350,300 | | $ | 1.50 | | $ | 525,450 | | $ | 2.00 | | $ | 700,600 | |

| Series II | | | 225,000 | | $ | 3.00 | | | 675,000 | | $ | 4.00 | | | 900,000 | |

| Series III | | | 254,600 | | $ | 4.00 | | | 1,018,400 | | $ | 5.00 | | | 1,273,000 | |

| Totals | | | 829,900 | | $ | 2.67 | | $ | 2,218,850 | | $ | 3.46 | | $ | 2,873,600 | |

The exercise prices of our three classes of short-term warrants will increase on July 21, 2005 and all of the short-term warrants will expire at the close of business on January 21, 2006. Therefore, we believe those warrants are likely to be a material short-term source of liquidity for us.

Medium-term warrants and options We have issued 2,606,100 medium-term warrants and options that were initially exercisable for a period of two years from their respective issue dates. The following table provides summary information on our outstanding medium-term warrants and options:

Description | | Number | | Price | | Proceeds | | Expiration Date | |

| First stock option to counsel | | | 189,300 | | $ | 1.00 | | $ | 189,300 | | | December 31, 2005 | |

| Capital warrants | | | 1,769,300 | | $ | 1.94 | | | 3,475,900 | | | January 21, 2007 | |

| Preferred stock warrants | | | 507,500 | | $ | 2.00 | | | 1,007,000 | | | March 18, 2007 | |

| Second stock option to counsel | | | 140,000 | | $ | 1.00 | | | 140,000 | | | March 31, 2007 | |

| Totals | | | 2,606,100 | | $ | 1.85 | | $ | 4,812,200 | | | | |

The holders of medium-term warrants and options are not required to exercise their stock purchase rights at any time prior to the expiration date and we are unable to predict the amount and timing of any future warrant exercises. We reserve the right to temporarily reduce the exercise prices of our medium-term warrants and options from time to time in order to encourage the early exercise of those stock purchase rights.

Outlook for 2005 We believe our available financial resources and the anticipated proceeds from the exercise of our short-term warrants and options will be sufficient to finance our operations for a period of 9 to 12 months from the date of this prospectus. We will probably not be able to complete the development of Application Prototypes or begin production of Pilot e3 Supercell power systems without substantial additional funds from the sale of securities or other sources. We are presently seeking additional capital.

Contractual obligations

We have contractual obligations that may affect our financial condition. The following table summarizes our significant contractual obligations as of the date of this prospectus:

| | | Total | | Less than 1 year | | 1 to 3 years | | 3 to 5 years | | More than 5 years | |

| Long term debt, capital lease and operating lease obligations | | $ | 0 | | $ | 0 | | $ | 0 | | $ | 0 | | $ | 0 | |

| Employment contracts | | | 1,200,000 | | | 425,000 | | | 600,000 | | | 175,000 | | | | |

| Total | | $ | 1,200,000 | | $ | 425,000 | | $ | 600,000 | | $ | 175,000 | | $ | 0 | |

Off-balance sheet arrangements

We do not have any off-balance sheet arrangements that have, or are reasonably likely to have, an effect on our financial condition, financial statements, revenues or expenses

Critical accounting policies and estimates

Our discussion and analysis of our financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with accounting principles generally accepted in the U.S. The preparation of our financial statements requires us to make certain estimates, judgments and assumptions that affect the reported amounts of assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Our estimates, judgments and assumptions are continually re-evaluated based upon available information and experience. Because of the use of estimates inherent in the financial reporting process, actual results could differ from those estimates. Areas in which significant judgment and estimates are used include, but are not limited to, notes receivable and equity-based compensation.

Technology acquisition We purchased the e3 Supercell technology from C&T for 1,562,900 capital warrants and $1.8 million in cash and deferred payments. To insulate our company and protect the e3 Supercell technology from potential claims by Mega-C’s creditors and shareholders, we contributed 7,327,500 shares of common stock to the Mega-C Trust. A group of Mega-C promoters vigorously opposed these actions and filed a lawsuit against Mega-C, our company and 31 other named defendants in February 2004. Over the last 16 months, we have spent over $600,000 on legal fees and advanced over $1,200,000 to Mega-C for administrative and litigation expenses. In

connection with recent amendments to the trust agreement, we contributed 500,000 additional shares and $100,000 in cash to the Mega-C Trust. While we expect to recover the bulk of our cash advances in connection with Mega-C’s Chapter 11 case, the total cost of buying and defending the e3 Supercell technology has been far greater than the amount shown in our financial statements.

Equity-based compensation We account for stock-based compensation using the intrinsic value method prescribed in APB, Opinion No. 25, “Accounting for Stock Issued to Employees.” Under APB 25, the value of an equity incentive is calculated by subtracting the exercise price of the incentive from the closing market price of our stock at the date of grant. The calculated value is then charged to expense ratably over the vesting period. We also pro forma disclosures as required under SFAS No. 123, “Accounting for Stock-Based Compensation,” using the Black-Scholes pricing model. We intend to adopt SFAS 123(R) using the “modified prospective” transition method beginning with the first quarter of 2006. Under this method, awards that are granted, modified, or settled after December 15, 2005, will be measured and accounted for in accordance with SFAS 123(R). In addition, beginning in our first quarter of 2006, expense must be recognized in the income statement for unvested awards that were granted prior to the adoption of SFAS 123(R). The expense will be based on the fair value determined at grant date under SFAS 123, “Accounting for Stock-Based Compensation.” The following table summarizes our existing agreements and their expected impact on earnings:

| | | Current Accounting Method | | After Effective Date of Planned Change to SFAS 123(R) Option Accounting | |

| | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 | | 2010 | |