0000102816eatonvance:EATONVANCEIndexMSCIACWIIndex19220AdditionalIndexMember2021-09-300000102816eatonvance:EATONVANCEIndexMSCIWorldHealthCareIndex19122AdditionalIndexMember2018-04-300000102816eatonvance:C000081646Membereatonvance:ManagedHealthCareSectorMember2024-08-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-01241

Eaton Vance Growth Trust

(Exact Name of Registrant as Specified in Charter)

One Post Office Square, Boston, Massachusetts 02109

(Address of Principal Executive Offices)

Deidre E. Walsh

One Post Office Square, Boston, Massachusetts 02109

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

August 31

Date of Fiscal Year End

August 31, 2024

Date of Reporting Period

Item 1. Reports to Stockholders

(a)

Eaton Vance Greater China Growth Fund

Annual Shareholder Report August 31, 2024

This annual shareholder report contains important information about the Eaton Vance Greater China Growth Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $141 | 1.51% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the MSCI China Index (the Index):

↓ An overweight position in online retailer Meituan declined in value amid weak consumer spending, intensified competition, and reduced profit margins

↓ An overweight position in pharmaceutical firm Wuxi Biologics fell in value amid weak profits and potential lost sales if the U.S. Biosecure Act is passed

↓ An overweight position in online services provider NetEase fell in value as profits declined and the U.S. barred NetEase from buying Nvidia microchips

↓ On a sector basis, stock selections and an overweight in health care; an overweight in consumer staples; and stock selections in industrials hurt returns

↑ An overweight position in online gaming firm Tencent Holdings rose in value on higher gaming activity, stronger ad revenue, and more earnings visibility

↑ Not owning internet search engine and Index component Baidu helped returns as its stock price fell amid weak ad revenue and concern over China’s economy

↑ An overweight position in air conditioner maker Gree Electric Appliances rose in value after China announced measures supporting new A/C purchases

↑ On a sector basis, an overweight position in communication services helped Index-relative performance during the period

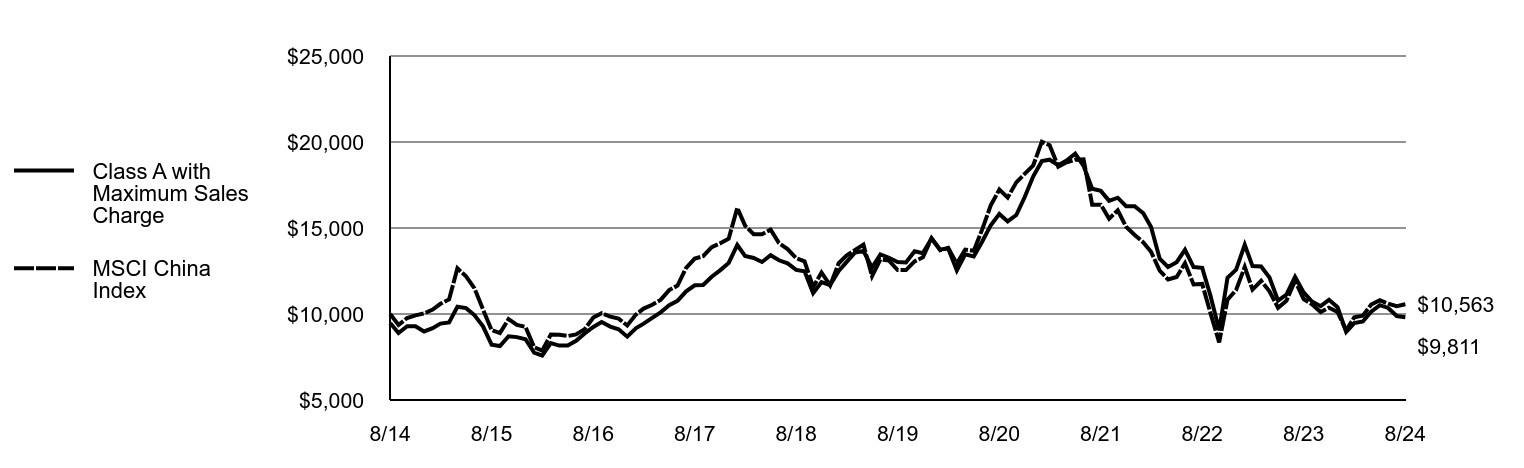

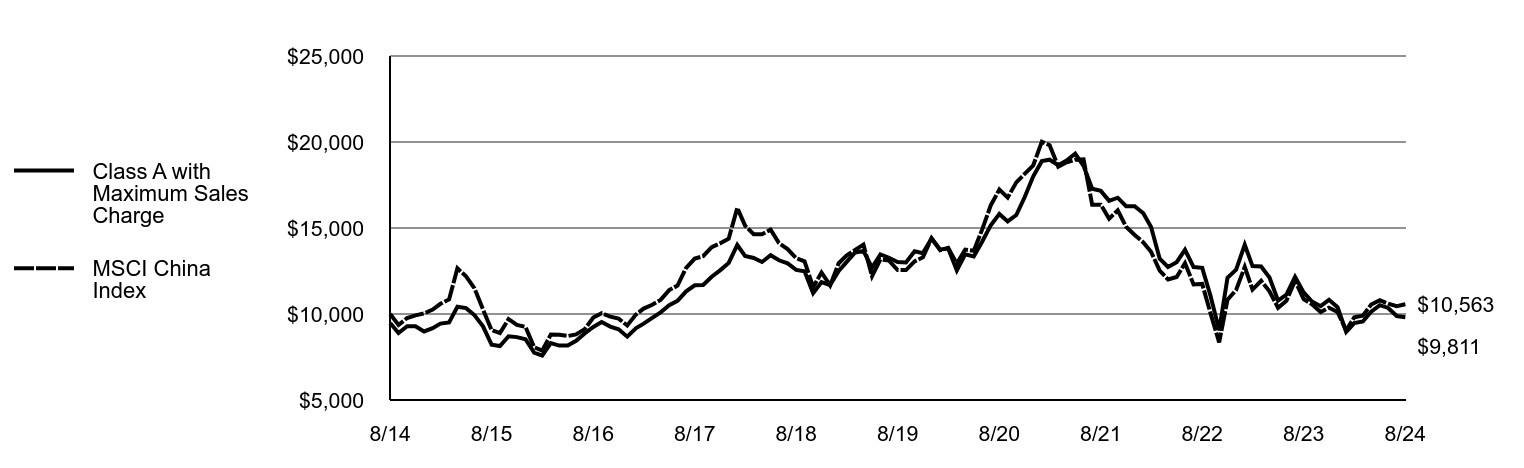

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class A with Maximum Sales Charge | MSCI China Index |

|---|

| 8/14 | $9,475 | $10,000 |

| 9/14 | $8,895 | $9,362 |

| 10/14 | $9,287 | $9,766 |

| 11/14 | $9,283 | $9,919 |

| 12/14 | $8,984 | $10,034 |

| 1/15 | $9,172 | $10,261 |

| 2/15 | $9,441 | $10,593 |

| 3/15 | $9,509 | $10,848 |

| 4/15 | $10,423 | $12,657 |

| 5/15 | $10,341 | $12,189 |

| 6/15 | $9,939 | $11,503 |

| 7/15 | $9,280 | $10,265 |

| 8/15 | $8,219 | $9,066 |

| 9/15 | $8,138 | $8,890 |

| 10/15 | $8,707 | $9,698 |

| 11/15 | $8,655 | $9,370 |

| 12/15 | $8,534 | $9,248 |

| 1/16 | $7,753 | $8,072 |

| 2/16 | $7,586 | $7,868 |

| 3/16 | $8,307 | $8,804 |

| 4/16 | $8,162 | $8,787 |

| 5/16 | $8,175 | $8,721 |

| 6/16 | $8,443 | $8,815 |

| 7/16 | $8,869 | $9,122 |

| 8/16 | $9,246 | $9,794 |

| 9/16 | $9,532 | $10,042 |

| 10/16 | $9,269 | $9,847 |

| 11/16 | $9,110 | $9,729 |

| 12/16 | $8,682 | $9,331 |

| 1/17 | $9,167 | $9,965 |

| 2/17 | $9,442 | $10,317 |

| 3/17 | $9,772 | $10,538 |

| 4/17 | $10,097 | $10,819 |

| 5/17 | $10,513 | $11,389 |

| 6/17 | $10,765 | $11,652 |

| 7/17 | $11,315 | $12,687 |

| 8/17 | $11,667 | $13,222 |

| 9/17 | $11,690 | $13,359 |

| 10/17 | $12,166 | $13,890 |

| 11/17 | $12,537 | $14,107 |

| 12/17 | $12,969 | $14,377 |

| 1/18 | $14,012 | $16,172 |

| 2/18 | $13,378 | $15,136 |

| 3/18 | $13,255 | $14,638 |

| 4/18 | $13,025 | $14,635 |

| 5/18 | $13,414 | $14,904 |

| 6/18 | $13,122 | $14,126 |

| 7/18 | $12,943 | $13,773 |

| 8/18 | $12,565 | $13,250 |

| 9/18 | $12,478 | $13,065 |

| 10/18 | $11,214 | $11,567 |

| 11/18 | $11,854 | $12,414 |

| 12/18 | $11,676 | $11,663 |

| 1/19 | $12,501 | $12,953 |

| 2/19 | $13,017 | $13,400 |

| 3/19 | $13,579 | $13,726 |

| 4/19 | $13,663 | $14,032 |

| 5/19 | $12,698 | $12,196 |

| 6/19 | $13,461 | $13,175 |

| 7/19 | $13,270 | $13,104 |

| 8/19 | $13,023 | $12,555 |

| 9/19 | $12,995 | $12,552 |

| 10/19 | $13,646 | $13,059 |

| 11/19 | $13,540 | $13,292 |

| 12/19 | $14,389 | $14,399 |

| 1/20 | $13,752 | $13,707 |

| 2/20 | $13,804 | $13,841 |

| 3/20 | $12,534 | $12,928 |

| 4/20 | $13,467 | $13,744 |

| 5/20 | $13,340 | $13,676 |

| 6/20 | $14,204 | $14,905 |

| 7/20 | $15,154 | $16,312 |

| 8/20 | $15,815 | $17,238 |

| 9/20 | $15,381 | $16,767 |

| 10/20 | $15,757 | $17,654 |

| 11/20 | $16,789 | $18,144 |

| 12/20 | $18,006 | $18,646 |

| 1/21 | $18,887 | $20,019 |

| 2/21 | $18,970 | $19,811 |

| 3/21 | $18,651 | $18,566 |

| 4/21 | $18,919 | $18,824 |

| 5/21 | $19,328 | $18,969 |

| 6/21 | $18,613 | $18,987 |

| 7/21 | $17,278 | $16,359 |

| 8/21 | $17,157 | $16,359 |

| 9/21 | $16,576 | $15,538 |

| 10/21 | $16,761 | $16,028 |

| 11/21 | $16,269 | $15,071 |

| 12/21 | $16,270 | $14,596 |

| 1/22 | $15,854 | $14,165 |

| 2/22 | $15,054 | $13,613 |

| 3/22 | $13,214 | $12,524 |

| 4/22 | $12,737 | $12,013 |

| 5/22 | $13,012 | $12,155 |

| 6/22 | $13,731 | $12,952 |

| 7/22 | $12,730 | $11,722 |

| 8/22 | $12,683 | $11,748 |

| 9/22 | $11,044 | $10,038 |

| 10/22 | $9,049 | $8,351 |

| 11/22 | $12,112 | $10,832 |

| 12/22 | $12,578 | $11,395 |

| 1/23 | $14,023 | $12,737 |

| 2/23 | $12,784 | $11,416 |

| 3/23 | $12,763 | $11,931 |

| 4/23 | $12,122 | $11,316 |

| 5/23 | $10,776 | $10,362 |

| 6/23 | $11,125 | $10,773 |

| 7/23 | $12,157 | $11,932 |

| 8/23 | $11,253 | $10,864 |

| 9/23 | $10,726 | $10,564 |

| 10/23 | $10,455 | $10,114 |

| 11/23 | $10,826 | $10,369 |

| 12/23 | $10,399 | $10,119 |

| 1/24 | $8,961 | $9,045 |

| 2/24 | $9,471 | $9,804 |

| 3/24 | $9,564 | $9,897 |

| 4/24 | $10,136 | $10,550 |

| 5/24 | $10,515 | $10,803 |

| 6/24 | $10,352 | $10,599 |

| 7/24 | $9,881 | $10,458 |

| 8/24 | $9,811 | $10,563 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class A | (12.81)% | (5.50)% | 0.35% |

| Class A with 5.25% Maximum Sales Charge | (17.41)% | (6.52)% | (0.19)% |

| MSCI China Index (net of foreign withholding taxes) | (2.77)% | (3.39)% | 0.55% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $32,112,625 |

| # of Portfolio Holdings | 35 |

| Portfolio Turnover Rate | 77% |

| Total Advisory Fees Paid | $124,295 |

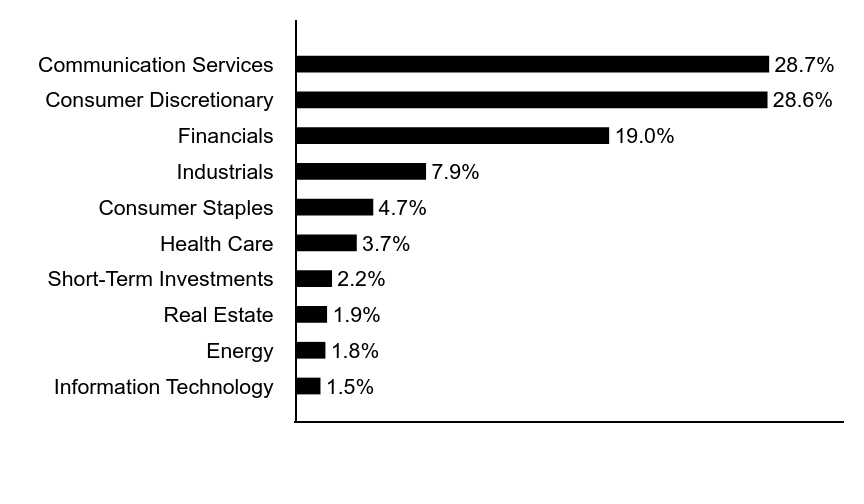

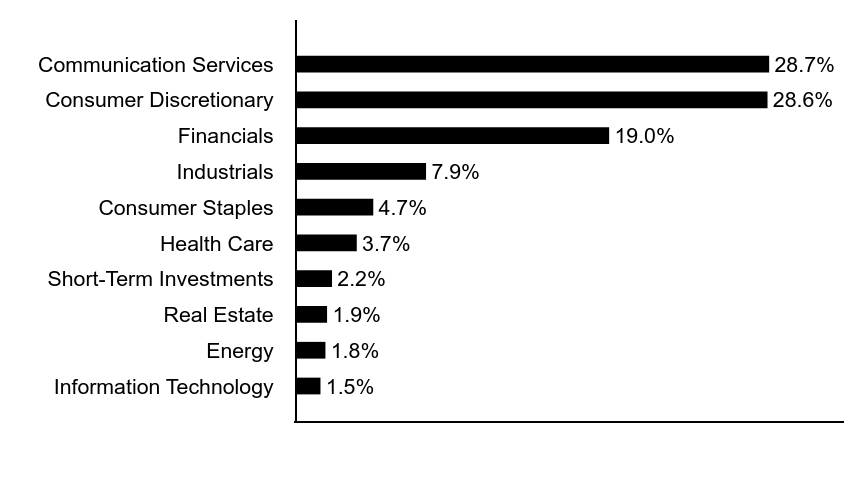

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Information Technology | 1.5% |

| Energy | 1.8% |

| Real Estate | 1.9% |

| Short-Term Investments | 2.2% |

| Health Care | 3.7% |

| Consumer Staples | 4.7% |

| Industrials | 7.9% |

| Financials | 19.0% |

| Consumer Discretionary | 28.6% |

| Communication Services | 28.7% |

Top Ten Holdings (% of total investments)Footnote Referencea

| Tencent Holdings Ltd. | 22.9% |

| China Construction Bank Corp., Class H | 12.1% |

| PDD Holdings, Inc., ADR | 6.1% |

| Meituan, Class B | 5.0% |

| NetEase, Inc. | 4.8% |

| China Merchants Bank Co. Ltd., Class H | 4.8% |

| Trip.com Group Ltd. | 4.6% |

| Kweichow Moutai Co. Ltd., Class A | 3.2% |

| BYD Co. Ltd., Class H | 2.2% |

| China State Construction International Holdings Ltd. | 2.0% |

| Total | 67.7% |

| Footnote | Description |

Footnotea | Excluding cash equivalents |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report August 31, 2024

Eaton Vance Greater China Growth Fund

Annual Shareholder Report August 31, 2024

This annual shareholder report contains important information about the Eaton Vance Greater China Growth Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $211 | 2.26% |

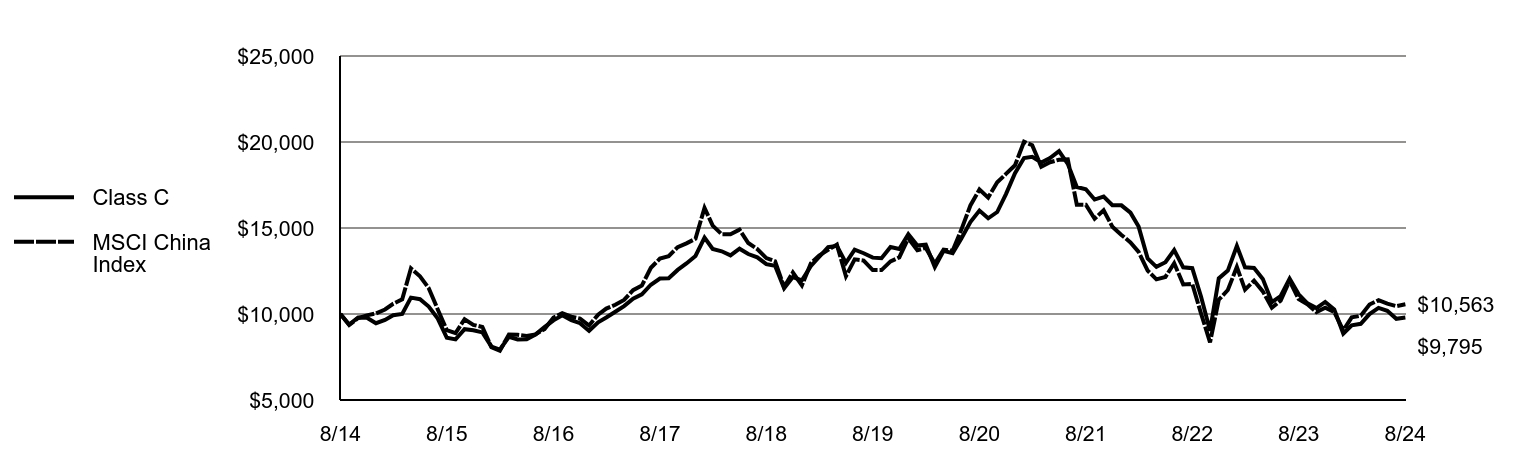

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the MSCI China Index (the Index):

↓ An overweight position in online retailer Meituan declined in value amid weak consumer spending, intensified competition, and reduced profit margins

↓ An overweight position in pharmaceutical firm Wuxi Biologics fell in value amid weak profits and potential lost sales if the U.S. Biosecure Act is passed

↓ An overweight position in online services provider NetEase fell in value as profits declined and the U.S. barred NetEase from buying Nvidia microchips

↓ On a sector basis, stock selections and an overweight in health care; an overweight in consumer staples; and stock selections in industrials hurt returns

↑ An overweight position in online gaming firm Tencent Holdings rose in value on higher gaming activity, stronger ad revenue, and more earnings visibility

↑ Not owning internet search engine and Index component Baidu helped returns as its stock price fell amid weak ad revenue and concern over China’s economy

↑ An overweight position in air conditioner maker Gree Electric Appliances rose in value after China announced measures supporting new A/C purchases

↑ On a sector basis, an overweight position in communication services helped Index-relative performance during the period

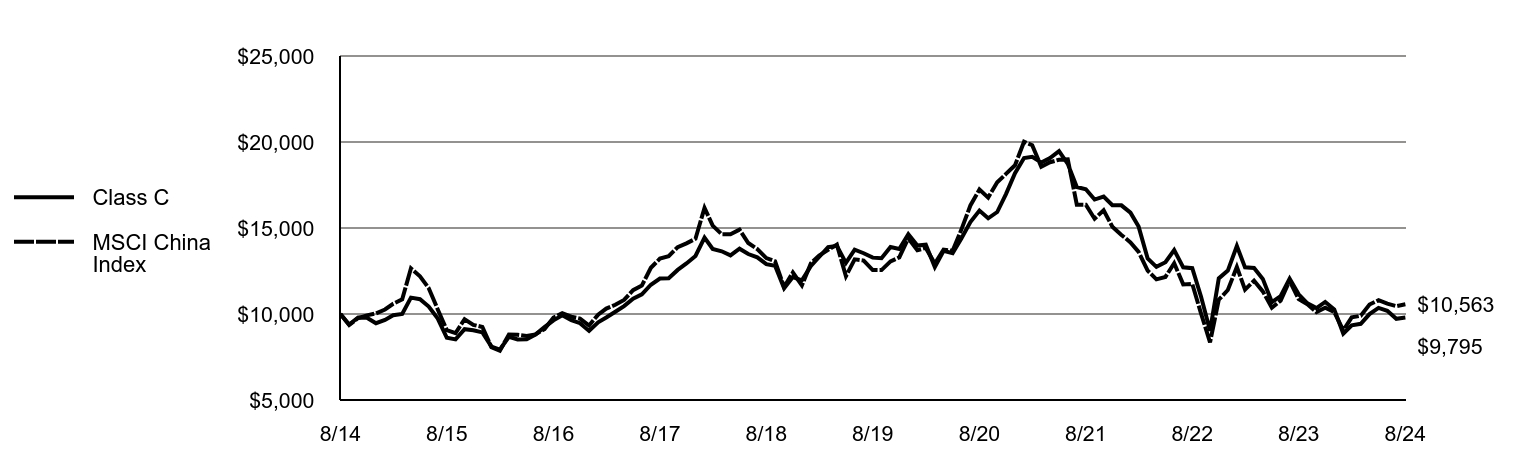

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class C | MSCI China Index |

|---|

| 8/14 | $10,000 | $10,000 |

| 9/14 | $9,384 | $9,362 |

| 10/14 | $9,795 | $9,766 |

| 11/14 | $9,785 | $9,919 |

| 12/14 | $9,463 | $10,034 |

| 1/15 | $9,655 | $10,261 |

| 2/15 | $9,930 | $10,593 |

| 3/15 | $10,000 | $10,848 |

| 4/15 | $10,952 | $12,657 |

| 5/15 | $10,859 | $12,189 |

| 6/15 | $10,434 | $11,503 |

| 7/15 | $9,734 | $10,265 |

| 8/15 | $8,618 | $9,066 |

| 9/15 | $8,525 | $8,890 |

| 10/15 | $9,118 | $9,698 |

| 11/15 | $9,057 | $9,370 |

| 12/15 | $8,929 | $9,248 |

| 1/16 | $8,105 | $8,072 |

| 2/16 | $7,926 | $7,868 |

| 3/16 | $8,671 | $8,804 |

| 4/16 | $8,517 | $8,787 |

| 5/16 | $8,527 | $8,721 |

| 6/16 | $8,800 | $8,815 |

| 7/16 | $9,242 | $9,122 |

| 8/16 | $9,629 | $9,794 |

| 9/16 | $9,922 | $10,042 |

| 10/16 | $9,639 | $9,847 |

| 11/16 | $9,465 | $9,729 |

| 12/16 | $9,017 | $9,331 |

| 1/17 | $9,517 | $9,965 |

| 2/17 | $9,797 | $10,317 |

| 3/17 | $10,132 | $10,538 |

| 4/17 | $10,462 | $10,819 |

| 5/17 | $10,887 | $11,389 |

| 6/17 | $11,142 | $11,652 |

| 7/17 | $11,702 | $12,687 |

| 8/17 | $12,062 | $13,222 |

| 9/17 | $12,077 | $13,359 |

| 10/17 | $12,563 | $13,890 |

| 11/17 | $12,938 | $14,107 |

| 12/17 | $13,373 | $14,377 |

| 1/18 | $14,440 | $16,172 |

| 2/18 | $13,781 | $15,136 |

| 3/18 | $13,647 | $14,638 |

| 4/18 | $13,407 | $14,635 |

| 5/18 | $13,798 | $14,904 |

| 6/18 | $13,485 | $14,126 |

| 7/18 | $13,295 | $13,773 |

| 8/18 | $12,898 | $13,250 |

| 9/18 | $12,803 | $13,065 |

| 10/18 | $11,496 | $11,567 |

| 11/18 | $12,144 | $12,414 |

| 12/18 | $11,961 | $11,663 |

| 1/19 | $12,793 | $12,953 |

| 2/19 | $13,314 | $13,400 |

| 3/19 | $13,883 | $13,726 |

| 4/19 | $13,963 | $14,032 |

| 5/19 | $12,971 | $12,196 |

| 6/19 | $13,736 | $13,175 |

| 7/19 | $13,534 | $13,104 |

| 8/19 | $13,277 | $12,555 |

| 9/19 | $13,240 | $12,552 |

| 10/19 | $13,895 | $13,059 |

| 11/19 | $13,779 | $13,292 |

| 12/19 | $14,634 | $14,399 |

| 1/20 | $13,977 | $13,707 |

| 2/20 | $14,028 | $13,841 |

| 3/20 | $12,727 | $12,928 |

| 4/20 | $13,668 | $13,744 |

| 5/20 | $13,529 | $13,676 |

| 6/20 | $14,394 | $14,905 |

| 7/20 | $15,348 | $16,312 |

| 8/20 | $16,011 | $17,238 |

| 9/20 | $15,563 | $16,767 |

| 10/20 | $15,929 | $17,654 |

| 11/20 | $16,971 | $18,144 |

| 12/20 | $18,184 | $18,646 |

| 1/21 | $19,070 | $20,019 |

| 2/21 | $19,139 | $19,811 |

| 3/21 | $18,807 | $18,566 |

| 4/21 | $19,063 | $18,824 |

| 5/21 | $19,465 | $18,969 |

| 6/21 | $18,731 | $18,987 |

| 7/21 | $17,382 | $16,359 |

| 8/21 | $17,250 | $16,359 |

| 9/21 | $16,655 | $15,538 |

| 10/21 | $16,828 | $16,028 |

| 11/21 | $16,323 | $15,071 |

| 12/21 | $16,317 | $14,596 |

| 1/22 | $15,893 | $14,165 |

| 2/22 | $15,081 | $13,613 |

| 3/22 | $13,225 | $12,524 |

| 4/22 | $12,742 | $12,013 |

| 5/22 | $13,013 | $12,155 |

| 6/22 | $13,722 | $12,952 |

| 7/22 | $12,713 | $11,722 |

| 8/22 | $12,662 | $11,748 |

| 9/22 | $11,017 | $10,038 |

| 10/22 | $9,021 | $8,351 |

| 11/22 | $12,069 | $10,832 |

| 12/22 | $12,524 | $11,395 |

| 1/23 | $13,951 | $12,737 |

| 2/23 | $12,712 | $11,416 |

| 3/23 | $12,680 | $11,931 |

| 4/23 | $12,041 | $11,316 |

| 5/23 | $10,693 | $10,362 |

| 6/23 | $11,036 | $10,773 |

| 7/23 | $12,049 | $11,932 |

| 8/23 | $11,145 | $10,864 |

| 9/23 | $10,623 | $10,564 |

| 10/23 | $10,342 | $10,114 |

| 11/23 | $10,701 | $10,369 |

| 12/23 | $10,266 | $10,119 |

| 1/24 | $8,852 | $9,045 |

| 2/24 | $9,346 | $9,804 |

| 3/24 | $9,431 | $9,897 |

| 4/24 | $9,994 | $10,550 |

| 5/24 | $10,351 | $10,803 |

| 6/24 | $10,190 | $10,599 |

| 7/24 | $9,721 | $10,458 |

| 8/24 | $9,795 | $10,563 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class C | (13.47)% | (6.19)% | (0.21)% |

| Class C with 1% Maximum Deferred Sales Charge | (14.26)% | (6.19)% | (0.21)% |

| MSCI China Index (net of foreign withholding taxes) | (2.77)% | (3.39)% | 0.55% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $32,112,625 |

| # of Portfolio Holdings | 35 |

| Portfolio Turnover Rate | 77% |

| Total Advisory Fees Paid | $124,295 |

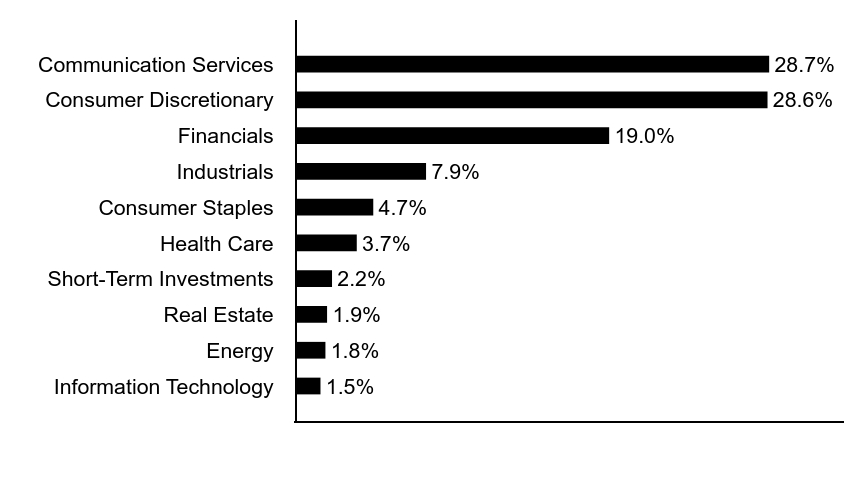

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Information Technology | 1.5% |

| Energy | 1.8% |

| Real Estate | 1.9% |

| Short-Term Investments | 2.2% |

| Health Care | 3.7% |

| Consumer Staples | 4.7% |

| Industrials | 7.9% |

| Financials | 19.0% |

| Consumer Discretionary | 28.6% |

| Communication Services | 28.7% |

Top Ten Holdings (% of total investments)Footnote Referencea

| Tencent Holdings Ltd. | 22.9% |

| China Construction Bank Corp., Class H | 12.1% |

| PDD Holdings, Inc., ADR | 6.1% |

| Meituan, Class B | 5.0% |

| NetEase, Inc. | 4.8% |

| China Merchants Bank Co. Ltd., Class H | 4.8% |

| Trip.com Group Ltd. | 4.6% |

| Kweichow Moutai Co. Ltd., Class A | 3.2% |

| BYD Co. Ltd., Class H | 2.2% |

| China State Construction International Holdings Ltd. | 2.0% |

| Total | 67.7% |

| Footnote | Description |

Footnotea | Excluding cash equivalents |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report August 31, 2024

Eaton Vance Greater China Growth Fund

Annual Shareholder Report August 31, 2024

This annual shareholder report contains important information about the Eaton Vance Greater China Growth Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $118 | 1.26% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the MSCI China Index (the Index):

↓ An overweight position in online retailer Meituan declined in value amid weak consumer spending, intensified competition, and reduced profit margins

↓ An overweight position in pharmaceutical firm Wuxi Biologics fell in value amid weak profits and potential lost sales if the U.S. Biosecure Act is passed

↓ An overweight position in online services provider NetEase fell in value as profits declined and the U.S. barred NetEase from buying Nvidia microchips

↓ On a sector basis, stock selections and an overweight in health care; an overweight in consumer staples; and stock selections in industrials hurt returns

↑ An overweight position in online gaming firm Tencent Holdings rose in value on higher gaming activity, stronger ad revenue, and more earnings visibility

↑ Not owning internet search engine and Index component Baidu helped returns as its stock price fell amid weak ad revenue and concern over China’s economy

↑ An overweight position in air conditioner maker Gree Electric Appliances rose in value after China announced measures supporting new A/C purchases

↑ On a sector basis, an overweight position in communication services helped Index-relative performance during the period

Comparison of the change in value of a $1,000,000 investment for the period indicated.

| Class I | MSCI China Index |

|---|

| 8/14 | $1,000,000 | $1,000,000 |

| 9/14 | $938,849 | $936,219 |

| 10/14 | $980,665 | $976,570 |

| 11/14 | $980,665 | $991,870 |

| 12/14 | $949,191 | $1,003,351 |

| 1/15 | $969,424 | $1,026,060 |

| 2/15 | $997,752 | $1,059,305 |

| 3/15 | $1,005,396 | $1,084,802 |

| 4/15 | $1,102,068 | $1,265,709 |

| 5/15 | $1,094,012 | $1,218,863 |

| 6/15 | $1,051,552 | $1,150,335 |

| 7/15 | $981,991 | $1,026,492 |

| 8/15 | $869,970 | $906,558 |

| 9/15 | $861,388 | $889,046 |

| 10/15 | $922,367 | $969,765 |

| 11/15 | $916,946 | $937,050 |

| 12/15 | $904,584 | $924,846 |

| 1/16 | $821,740 | $807,211 |

| 2/16 | $804,021 | $786,802 |

| 3/16 | $880,640 | $880,443 |

| 4/16 | $865,796 | $878,705 |

| 5/16 | $867,232 | $872,103 |

| 6/16 | $895,964 | $881,450 |

| 7/16 | $941,936 | $912,206 |

| 8/16 | $982,161 | $979,424 |

| 9/16 | $1,012,330 | $1,004,177 |

| 10/16 | $984,555 | $984,730 |

| 11/16 | $967,795 | $972,943 |

| 12/16 | $922,491 | $933,136 |

| 1/17 | $974,735 | $996,473 |

| 2/17 | $1,004,243 | $1,031,733 |

| 3/17 | $1,039,556 | $1,053,759 |

| 4/17 | $1,073,902 | $1,081,862 |

| 5/17 | $1,118,890 | $1,138,940 |

| 6/17 | $1,145,979 | $1,165,156 |

| 7/17 | $1,204,995 | $1,268,686 |

| 8/17 | $1,242,243 | $1,322,185 |

| 9/17 | $1,245,629 | $1,335,924 |

| 10/17 | $1,296,422 | $1,389,019 |

| 11/17 | $1,336,089 | $1,410,671 |

| 12/17 | $1,382,425 | $1,437,675 |

| 1/18 | $1,493,972 | $1,617,214 |

| 2/18 | $1,426,827 | $1,513,646 |

| 3/18 | $1,414,373 | $1,463,826 |

| 4/18 | $1,390,006 | $1,463,479 |

| 5/18 | $1,431,701 | $1,490,357 |

| 6/18 | $1,400,836 | $1,412,561 |

| 7/18 | $1,382,425 | $1,377,328 |

| 8/18 | $1,342,355 | $1,325,042 |

| 9/18 | $1,333,149 | $1,306,505 |

| 10/18 | $1,198,318 | $1,156,658 |

| 11/18 | $1,267,088 | $1,241,438 |

| 12/18 | $1,248,748 | $1,166,303 |

| 1/19 | $1,336,923 | $1,295,283 |

| 2/19 | $1,392,330 | $1,339,995 |

| 3/19 | $1,453,099 | $1,372,636 |

| 4/19 | $1,462,036 | $1,403,213 |

| 5/19 | $1,359,562 | $1,219,573 |

| 6/19 | $1,441,184 | $1,317,515 |

| 7/19 | $1,420,927 | $1,310,374 |

| 8/19 | $1,395,309 | $1,255,527 |

| 9/19 | $1,392,330 | $1,255,208 |

| 10/19 | $1,462,632 | $1,305,877 |

| 11/19 | $1,451,312 | $1,329,162 |

| 12/19 | $1,542,850 | $1,439,884 |

| 1/20 | $1,474,992 | $1,370,724 |

| 2/20 | $1,481,161 | $1,384,053 |

| 3/20 | $1,344,827 | $1,292,791 |

| 4/20 | $1,445,381 | $1,374,421 |

| 5/20 | $1,432,426 | $1,367,636 |

| 6/20 | $1,525,577 | $1,490,475 |

| 7/20 | $1,627,982 | $1,631,236 |

| 8/20 | $1,699,541 | $1,723,816 |

| 9/20 | $1,653,274 | $1,676,712 |

| 10/20 | $1,693,989 | $1,765,397 |

| 11/20 | $1,805,647 | $1,814,353 |

| 12/20 | $1,937,075 | $1,864,563 |

| 1/21 | $2,032,364 | $2,001,852 |

| 2/21 | $2,041,892 | $1,981,123 |

| 3/21 | $2,007,861 | $1,856,615 |

| 4/21 | $2,037,128 | $1,882,382 |

| 5/21 | $2,081,369 | $1,896,862 |

| 6/21 | $2,005,138 | $1,898,718 |

| 7/21 | $1,862,206 | $1,635,874 |

| 8/21 | $1,849,274 | $1,635,939 |

| 9/21 | $1,786,656 | $1,553,770 |

| 10/21 | $1,807,075 | $1,602,800 |

| 11/21 | $1,754,666 | $1,507,083 |

| 12/21 | $1,754,743 | $1,459,592 |

| 1/22 | $1,710,373 | $1,416,533 |

| 2/22 | $1,624,497 | $1,361,291 |

| 3/22 | $1,426,265 | $1,252,440 |

| 4/22 | $1,374,739 | $1,201,294 |

| 5/22 | $1,404,796 | $1,215,453 |

| 6/22 | $1,482,801 | $1,295,184 |

| 7/22 | $1,374,739 | $1,172,179 |

| 8/22 | $1,370,445 | $1,174,797 |

| 9/22 | $1,193,683 | $1,003,813 |

| 10/22 | $978,276 | $835,074 |

| 11/22 | $1,309,616 | $1,083,160 |

| 12/22 | $1,360,653 | $1,139,496 |

| 1/23 | $1,516,806 | $1,273,736 |

| 2/23 | $1,383,394 | $1,141,587 |

| 3/23 | $1,381,119 | $1,193,142 |

| 4/23 | $1,312,139 | $1,131,610 |

| 5/23 | $1,166,599 | $1,036,195 |

| 6/23 | $1,204,500 | $1,077,307 |

| 7/23 | $1,316,687 | $1,193,211 |

| 8/23 | $1,219,660 | $1,086,354 |

| 9/23 | $1,162,809 | $1,056,439 |

| 10/23 | $1,134,004 | $1,011,408 |

| 11/23 | $1,174,179 | $1,036,899 |

| 12/23 | $1,127,142 | $1,011,901 |

| 1/24 | $972,129 | $904,519 |

| 2/24 | $1,027,373 | $980,446 |

| 3/24 | $1,038,092 | $989,693 |

| 4/24 | $1,099,933 | $1,054,973 |

| 5/24 | $1,141,160 | $1,080,278 |

| 6/24 | $1,123,844 | $1,059,866 |

| 7/24 | $1,073,547 | $1,045,786 |

| 8/24 | $1,066,127 | $1,056,292 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class I | (12.59)% | (5.23)% | 0.64% |

| MSCI China Index (net of foreign withholding taxes) | (2.77)% | (3.39)% | 0.55% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $32,112,625 |

| # of Portfolio Holdings | 35 |

| Portfolio Turnover Rate | 77% |

| Total Advisory Fees Paid | $124,295 |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Information Technology | 1.5% |

| Energy | 1.8% |

| Real Estate | 1.9% |

| Short-Term Investments | 2.2% |

| Health Care | 3.7% |

| Consumer Staples | 4.7% |

| Industrials | 7.9% |

| Financials | 19.0% |

| Consumer Discretionary | 28.6% |

| Communication Services | 28.7% |

Top Ten Holdings (% of total investments)Footnote Referencea

| Tencent Holdings Ltd. | 22.9% |

| China Construction Bank Corp., Class H | 12.1% |

| PDD Holdings, Inc., ADR | 6.1% |

| Meituan, Class B | 5.0% |

| NetEase, Inc. | 4.8% |

| China Merchants Bank Co. Ltd., Class H | 4.8% |

| Trip.com Group Ltd. | 4.6% |

| Kweichow Moutai Co. Ltd., Class A | 3.2% |

| BYD Co. Ltd., Class H | 2.2% |

| China State Construction International Holdings Ltd. | 2.0% |

| Total | 67.7% |

| Footnote | Description |

Footnotea | Excluding cash equivalents |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report August 31, 2024

Eaton Vance Richard Bernstein All Asset Strategy Fund

Annual Shareholder Report August 31, 2024

This annual shareholder report contains important information about the Eaton Vance Richard Bernstein All Asset Strategy Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $130 | 1.23% |

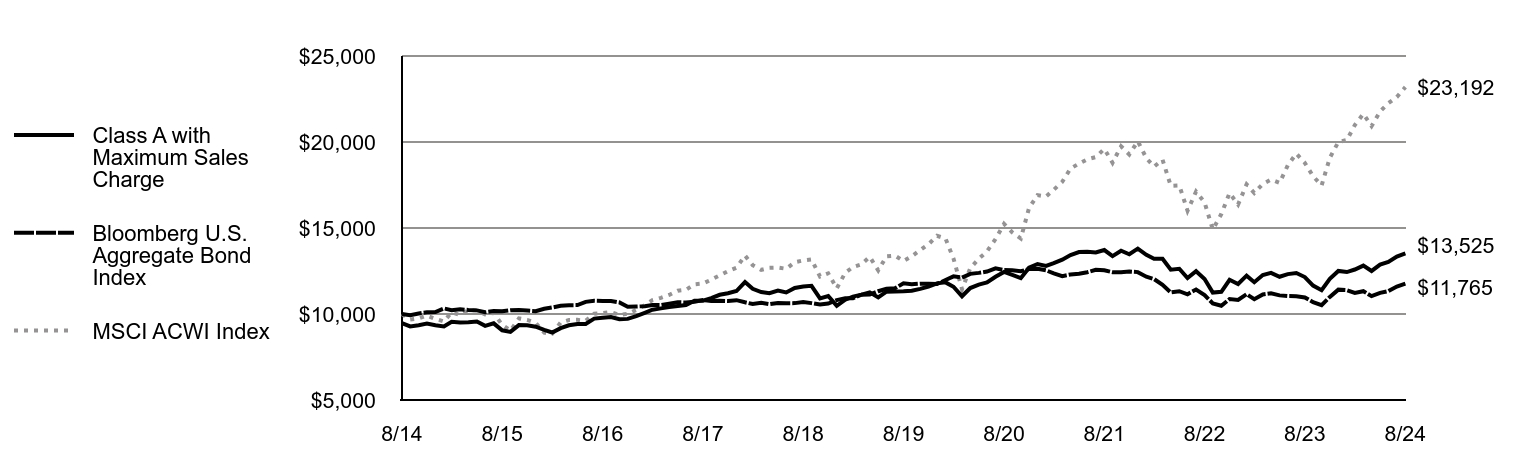

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to 60% Bloomberg U.S. Aggregate Bond Index/40% MSCI ACWI Index (the Blended Index):

↓ An underweight position in the information technology sector -- mainly in the semiconductors & semiconductor equipment industry -- detracted from returns

↓ Despite small-cap stocks having low valuations relative to large-cap stocks, an overweight position in global small-cap stocks detracted from returns

↓ An overweight position in short-term and long-term U.S. Treasurys, which underperformed the Blended Index, detracted from relative returns

↓ Overweight positions in U.S. energy and consumer staples -- two of the weaker-performing equity sectors within the Blended Index -- hurt returns

↓ An overweight position in China -- through investments in the MSCI China ETF -- hampered returns relative to the Blended Index, and was sold in July 2024

↑ An overweight position in equities and an underweight position in fixed-income assets helped relative returns as stocks generally outperformed bonds

↑ Stock selections in the financials and health care sectors contributed to performance relative to the Blended Index during the period

↑ An overweight position in securitized mortgages -- through investments in the Janus Henderson Mortgage-Backed Securities ETF -- helped relative returns

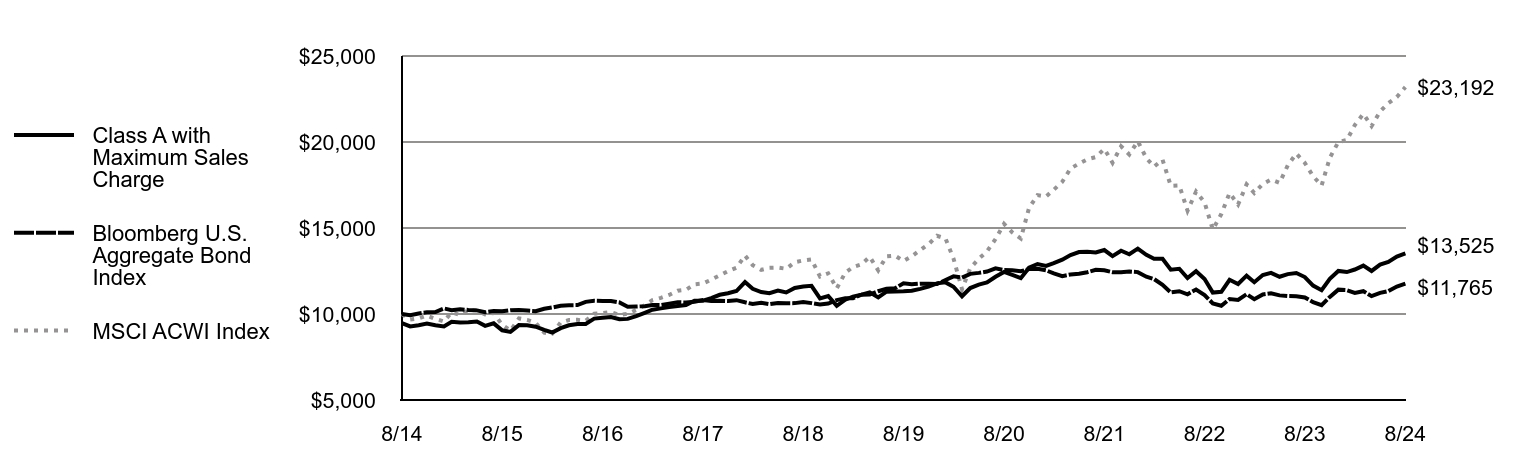

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class A with Maximum Sales Charge | Bloomberg U.S. Aggregate Bond Index | MSCI ACWI Index |

|---|

| 8/14 | $9,475 | $10,000 | $10,000 |

| 9/14 | $9,278 | $9,932 | $9,676 |

| 10/14 | $9,351 | $10,030 | $9,744 |

| 11/14 | $9,439 | $10,101 | $9,907 |

| 12/14 | $9,346 | $10,110 | $9,716 |

| 1/15 | $9,279 | $10,322 | $9,564 |

| 2/15 | $9,553 | $10,225 | $10,096 |

| 3/15 | $9,508 | $10,273 | $9,940 |

| 4/15 | $9,523 | $10,236 | $10,228 |

| 5/15 | $9,567 | $10,211 | $10,215 |

| 6/15 | $9,309 | $10,100 | $9,974 |

| 7/15 | $9,457 | $10,170 | $10,061 |

| 8/15 | $9,050 | $10,156 | $9,371 |

| 9/15 | $8,962 | $10,224 | $9,032 |

| 10/15 | $9,353 | $10,226 | $9,741 |

| 11/15 | $9,346 | $10,199 | $9,660 |

| 12/15 | $9,259 | $10,166 | $9,486 |

| 1/16 | $9,072 | $10,306 | $8,914 |

| 2/16 | $8,923 | $10,379 | $8,853 |

| 3/16 | $9,177 | $10,474 | $9,509 |

| 4/16 | $9,342 | $10,514 | $9,649 |

| 5/16 | $9,424 | $10,517 | $9,661 |

| 6/16 | $9,417 | $10,706 | $9,603 |

| 7/16 | $9,731 | $10,774 | $10,016 |

| 8/16 | $9,776 | $10,761 | $10,050 |

| 9/16 | $9,828 | $10,755 | $10,112 |

| 10/16 | $9,693 | $10,673 | $9,940 |

| 11/16 | $9,716 | $10,420 | $10,016 |

| 12/16 | $9,882 | $10,435 | $10,232 |

| 1/17 | $10,070 | $10,456 | $10,512 |

| 2/17 | $10,251 | $10,526 | $10,807 |

| 3/17 | $10,326 | $10,520 | $10,939 |

| 4/17 | $10,401 | $10,601 | $11,109 |

| 5/17 | $10,469 | $10,683 | $11,355 |

| 6/17 | $10,522 | $10,672 | $11,406 |

| 7/17 | $10,770 | $10,718 | $11,725 |

| 8/17 | $10,777 | $10,814 | $11,770 |

| 9/17 | $10,920 | $10,763 | $11,997 |

| 10/17 | $11,116 | $10,769 | $12,246 |

| 11/17 | $11,206 | $10,755 | $12,484 |

| 12/17 | $11,335 | $10,805 | $12,685 |

| 1/18 | $11,857 | $10,680 | $13,400 |

| 2/18 | $11,466 | $10,579 | $12,838 |

| 3/18 | $11,274 | $10,647 | $12,563 |

| 4/18 | $11,205 | $10,568 | $12,683 |

| 5/18 | $11,366 | $10,643 | $12,699 |

| 6/18 | $11,251 | $10,630 | $12,630 |

| 7/18 | $11,512 | $10,633 | $13,011 |

| 8/18 | $11,604 | $10,701 | $13,113 |

| 9/18 | $11,635 | $10,632 | $13,170 |

| 10/18 | $10,905 | $10,548 | $12,183 |

| 11/18 | $11,043 | $10,611 | $12,361 |

| 12/18 | $10,471 | $10,806 | $11,491 |

| 1/19 | $10,833 | $10,921 | $12,398 |

| 2/19 | $11,014 | $10,914 | $12,729 |

| 3/19 | $11,125 | $11,124 | $12,890 |

| 4/19 | $11,259 | $11,127 | $13,325 |

| 5/19 | $10,967 | $11,324 | $12,534 |

| 6/19 | $11,298 | $11,466 | $13,355 |

| 7/19 | $11,306 | $11,492 | $13,394 |

| 8/19 | $11,322 | $11,789 | $13,077 |

| 9/19 | $11,353 | $11,727 | $13,352 |

| 10/19 | $11,463 | $11,762 | $13,717 |

| 11/19 | $11,597 | $11,756 | $14,052 |

| 12/19 | $11,780 | $11,748 | $14,547 |

| 1/20 | $11,838 | $11,974 | $14,386 |

| 2/20 | $11,583 | $12,189 | $13,224 |

| 3/20 | $11,032 | $12,118 | $11,439 |

| 4/20 | $11,509 | $12,333 | $12,664 |

| 5/20 | $11,706 | $12,391 | $13,215 |

| 6/20 | $11,830 | $12,469 | $13,637 |

| 7/20 | $12,167 | $12,655 | $14,358 |

| 8/20 | $12,446 | $12,553 | $15,237 |

| 9/20 | $12,274 | $12,546 | $14,746 |

| 10/20 | $12,084 | $12,490 | $14,388 |

| 11/20 | $12,693 | $12,612 | $16,161 |

| 12/20 | $12,907 | $12,630 | $16,911 |

| 1/21 | $12,797 | $12,539 | $16,834 |

| 2/21 | $12,957 | $12,358 | $17,224 |

| 3/21 | $13,161 | $12,204 | $17,684 |

| 4/21 | $13,431 | $12,300 | $18,458 |

| 5/21 | $13,601 | $12,340 | $18,745 |

| 6/21 | $13,618 | $12,427 | $18,992 |

| 7/21 | $13,575 | $12,566 | $19,123 |

| 8/21 | $13,719 | $12,542 | $19,601 |

| 9/21 | $13,364 | $12,433 | $18,792 |

| 10/21 | $13,677 | $12,430 | $19,751 |

| 11/21 | $13,474 | $12,467 | $19,275 |

| 12/21 | $13,801 | $12,435 | $20,046 |

| 1/22 | $13,444 | $12,167 | $19,062 |

| 2/22 | $13,212 | $12,031 | $18,569 |

| 3/22 | $13,212 | $11,697 | $18,972 |

| 4/22 | $12,578 | $11,253 | $17,453 |

| 5/22 | $12,632 | $11,326 | $17,474 |

| 6/22 | $12,087 | $11,148 | $16,001 |

| 7/22 | $12,489 | $11,420 | $17,118 |

| 8/22 | $12,034 | $11,098 | $16,488 |

| 9/22 | $11,248 | $10,618 | $14,909 |

| 10/22 | $11,293 | $10,481 | $15,809 |

| 11/22 | $11,989 | $10,866 | $17,035 |

| 12/22 | $11,743 | $10,817 | $16,365 |

| 1/23 | $12,229 | $11,150 | $17,538 |

| 2/23 | $11,851 | $10,862 | $17,035 |

| 3/23 | $12,265 | $11,138 | $17,561 |

| 4/23 | $12,391 | $11,205 | $17,813 |

| 5/23 | $12,166 | $11,083 | $17,622 |

| 6/23 | $12,319 | $11,044 | $18,645 |

| 7/23 | $12,382 | $11,036 | $19,328 |

| 8/23 | $12,148 | $10,965 | $18,788 |

| 9/23 | $11,653 | $10,687 | $18,011 |

| 10/23 | $11,383 | $10,518 | $17,469 |

| 11/23 | $12,040 | $10,994 | $19,082 |

| 12/23 | $12,503 | $11,415 | $19,998 |

| 1/24 | $12,439 | $11,384 | $20,116 |

| 2/24 | $12,586 | $11,223 | $20,979 |

| 3/24 | $12,816 | $11,327 | $21,637 |

| 4/24 | $12,503 | $11,041 | $20,924 |

| 5/24 | $12,872 | $11,228 | $21,773 |

| 6/24 | $13,028 | $11,334 | $22,258 |

| 7/24 | $13,341 | $11,599 | $22,617 |

| 8/24 | $13,525 | $11,765 | $23,192 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class A | 11.34% | 3.62% | 3.62% |

| Class A with 5.25% Maximum Sales Charge | 5.48% | 2.50% | 3.06% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.64% |

| MSCI ACWI Index (net of foreign withholding taxes) | 23.44% | 12.13% | 8.77% |

| Blended Index | 13.58% | 4.94% | 4.67% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $425,009,041 |

| # of Portfolio Holdings | 272 |

| Portfolio Turnover Rate | 49% |

| Total Advisory Fees Paid | $3,892,902 |

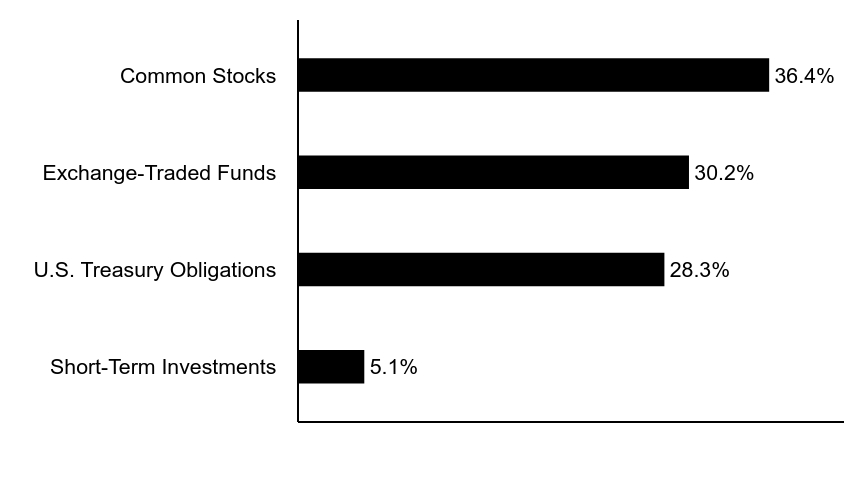

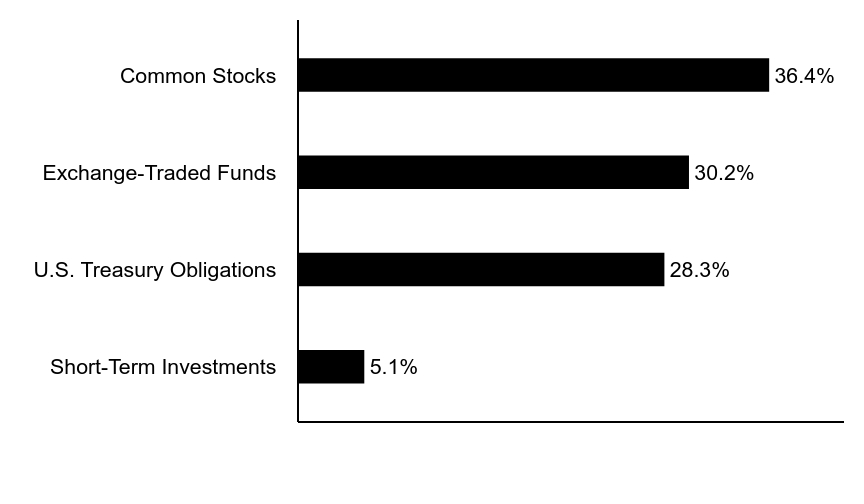

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Asset Allocation (% of total investments)

| Value | Value |

|---|

| Short-Term Investments | 5.1% |

| U.S. Treasury Obligations | 28.3% |

| Exchange-Traded Funds | 30.2% |

| Common Stocks | 36.4% |

Top Ten Holdings (% of total investments)Footnote Referencea

| Janus Henderson Mortgage-Backed Securities ETF | 22.1% |

| iShares MSCI Taiwan ETF | 3.1% |

| iShares MSCI India ETF | 3.1% |

| U.S. Treasury Notes, 4.50%, 11/15/25 | 2.3% |

| U.S. Treasury Notes, 4.00%, 2/15/26 | 2.2% |

| U.S. Treasury Bonds, 2.25%, 5/15/41 | 2.0% |

| Apple, Inc. | 2.0% |

| iShares MSCI South Korea ETF | 1.9% |

| NVIDIA Corp. | 1.8% |

| Microsoft Corp. | 1.8% |

| Total | 42.3% |

| Footnote | Description |

Footnotea | Excluding cash equivalents |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report August 31, 2024

Eaton Vance Richard Bernstein All Asset Strategy Fund

Annual Shareholder Report August 31, 2024

This annual shareholder report contains important information about the Eaton Vance Richard Bernstein All Asset Strategy Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $208 | 1.98% |

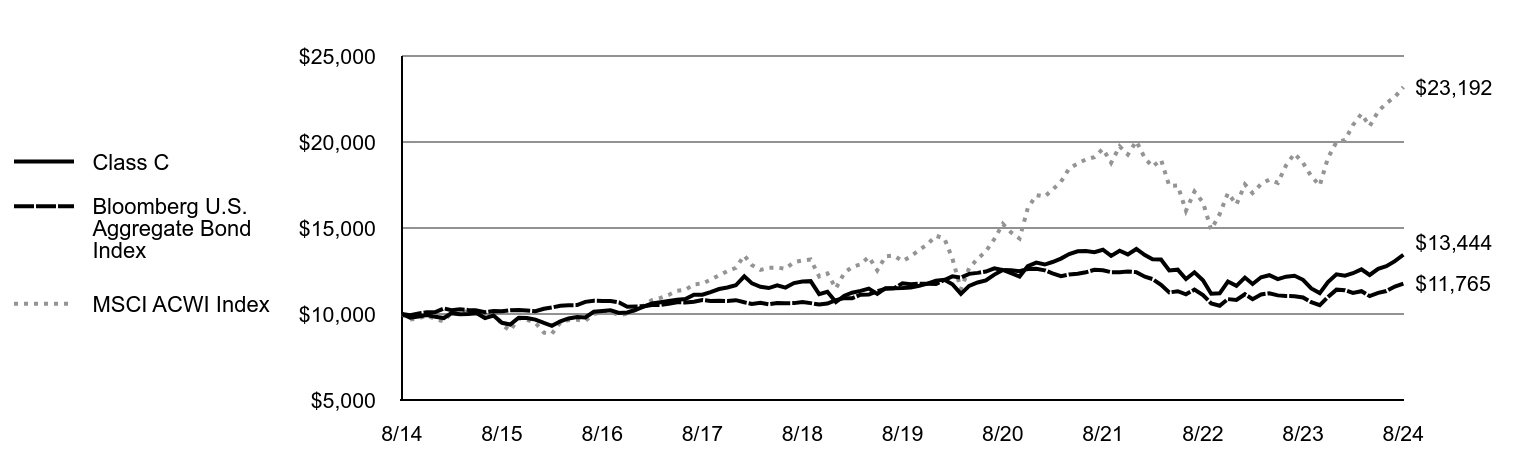

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to 60% Bloomberg U.S. Aggregate Bond Index/40% MSCI ACWI Index (the Blended Index):

↓ An underweight position in the information technology sector -- mainly in the semiconductors & semiconductor equipment industry -- detracted from returns

↓ Despite small-cap stocks having low valuations relative to large-cap stocks, an overweight position in global small-cap stocks detracted from returns

↓ An overweight position in short-term and long-term U.S. Treasurys, which underperformed the Blended Index, detracted from relative returns

↓ Overweight positions in U.S. energy and consumer staples -- two of the weaker-performing equity sectors within the Blended Index -- hurt returns

↓ An overweight position in China -- through investments in the MSCI China ETF -- hampered returns relative to the Blended Index, and was sold in July 2024

↑ An overweight position in equities and an underweight position in fixed-income assets helped relative returns as stocks generally outperformed bonds

↑ Stock selections in the financials and health care sectors contributed to performance relative to the Blended Index during the period

↑ An overweight position in securitized mortgages -- through investments in the Janus Henderson Mortgage-Backed Securities ETF -- helped relative returns

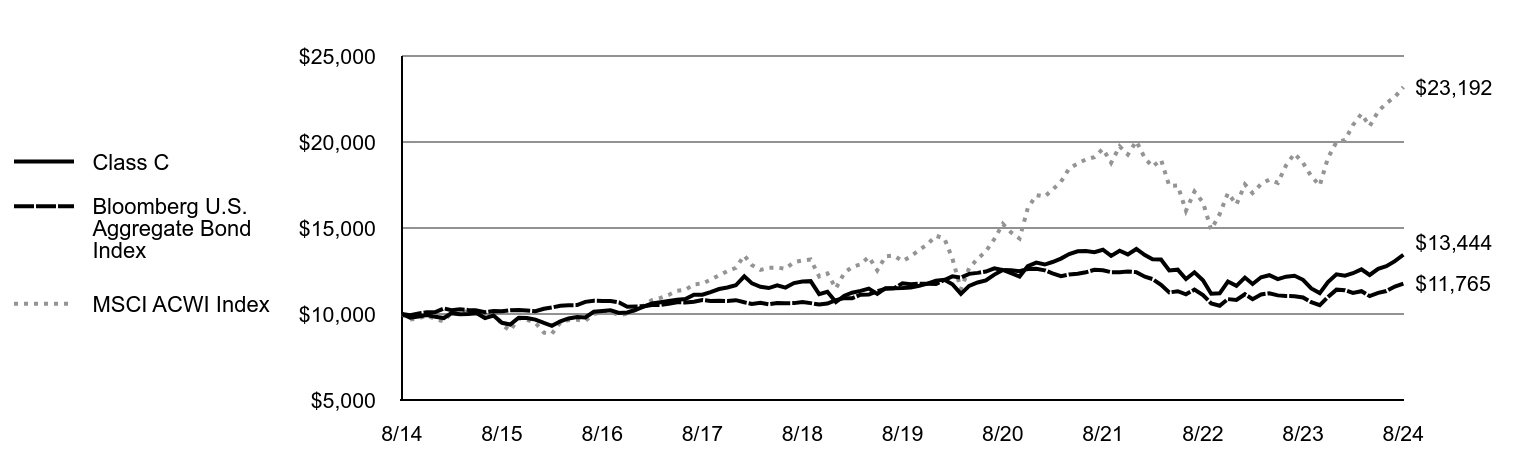

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class C | Bloomberg U.S. Aggregate Bond Index | MSCI ACWI Index |

|---|

| 8/14 | $10,000 | $10,000 | $10,000 |

| 9/14 | $9,789 | $9,932 | $9,676 |

| 10/14 | $9,859 | $10,030 | $9,744 |

| 11/14 | $9,945 | $10,101 | $9,907 |

| 12/14 | $9,835 | $10,110 | $9,716 |

| 1/15 | $9,764 | $10,322 | $9,564 |

| 2/15 | $10,048 | $10,225 | $10,096 |

| 3/15 | $9,992 | $10,273 | $9,940 |

| 4/15 | $10,000 | $10,236 | $10,228 |

| 5/15 | $10,048 | $10,211 | $10,215 |

| 6/15 | $9,764 | $10,100 | $9,974 |

| 7/15 | $9,914 | $10,170 | $10,061 |

| 8/15 | $9,488 | $10,156 | $9,371 |

| 9/15 | $9,385 | $10,224 | $9,032 |

| 10/15 | $9,787 | $10,226 | $9,741 |

| 11/15 | $9,772 | $10,199 | $9,660 |

| 12/15 | $9,676 | $10,166 | $9,486 |

| 1/16 | $9,478 | $10,306 | $8,914 |

| 2/16 | $9,312 | $10,379 | $8,853 |

| 3/16 | $9,573 | $10,474 | $9,509 |

| 4/16 | $9,740 | $10,514 | $9,649 |

| 5/16 | $9,819 | $10,517 | $9,661 |

| 6/16 | $9,803 | $10,706 | $9,603 |

| 7/16 | $10,128 | $10,774 | $10,016 |

| 8/16 | $10,168 | $10,761 | $10,050 |

| 9/16 | $10,215 | $10,755 | $10,112 |

| 10/16 | $10,065 | $10,673 | $9,940 |

| 11/16 | $10,088 | $10,420 | $10,016 |

| 12/16 | $10,247 | $10,435 | $10,232 |

| 1/17 | $10,437 | $10,456 | $10,512 |

| 2/17 | $10,619 | $10,526 | $10,807 |

| 3/17 | $10,683 | $10,520 | $10,939 |

| 4/17 | $10,754 | $10,601 | $11,109 |

| 5/17 | $10,826 | $10,683 | $11,355 |

| 6/17 | $10,873 | $10,672 | $11,406 |

| 7/17 | $11,119 | $10,718 | $11,725 |

| 8/17 | $11,119 | $10,814 | $11,770 |

| 9/17 | $11,269 | $10,763 | $11,997 |

| 10/17 | $11,451 | $10,769 | $12,246 |

| 11/17 | $11,539 | $10,755 | $12,484 |

| 12/17 | $11,669 | $10,805 | $12,685 |

| 1/18 | $12,192 | $10,680 | $13,400 |

| 2/18 | $11,782 | $10,579 | $12,838 |

| 3/18 | $11,581 | $10,647 | $12,563 |

| 4/18 | $11,509 | $10,568 | $12,683 |

| 5/18 | $11,661 | $10,643 | $12,699 |

| 6/18 | $11,533 | $10,630 | $12,630 |

| 7/18 | $11,798 | $10,633 | $13,011 |

| 8/18 | $11,886 | $10,701 | $13,113 |

| 9/18 | $11,910 | $10,632 | $13,170 |

| 10/18 | $11,155 | $10,548 | $12,183 |

| 11/18 | $11,291 | $10,611 | $12,361 |

| 12/18 | $10,698 | $10,806 | $11,491 |

| 1/19 | $11,067 | $10,921 | $12,398 |

| 2/19 | $11,239 | $10,914 | $12,729 |

| 3/19 | $11,346 | $11,124 | $12,890 |

| 4/19 | $11,477 | $11,127 | $13,325 |

| 5/19 | $11,166 | $11,324 | $12,534 |

| 6/19 | $11,502 | $11,466 | $13,355 |

| 7/19 | $11,502 | $11,492 | $13,394 |

| 8/19 | $11,510 | $11,789 | $13,077 |

| 9/19 | $11,535 | $11,727 | $13,352 |

| 10/19 | $11,642 | $11,762 | $13,717 |

| 11/19 | $11,765 | $11,756 | $14,052 |

| 12/19 | $11,942 | $11,748 | $14,547 |

| 1/20 | $11,993 | $11,974 | $14,386 |

| 2/20 | $11,730 | $12,189 | $13,224 |

| 3/20 | $11,169 | $12,118 | $11,439 |

| 4/20 | $11,636 | $12,333 | $12,664 |

| 5/20 | $11,832 | $12,391 | $13,215 |

| 6/20 | $11,951 | $12,469 | $13,637 |

| 7/20 | $12,291 | $12,655 | $14,358 |

| 8/20 | $12,563 | $12,553 | $15,237 |

| 9/20 | $12,376 | $12,546 | $14,746 |

| 10/20 | $12,180 | $12,490 | $14,388 |

| 11/20 | $12,784 | $12,612 | $16,161 |

| 12/20 | $12,989 | $12,630 | $16,911 |

| 1/21 | $12,876 | $12,539 | $16,834 |

| 2/21 | $13,023 | $12,358 | $17,224 |

| 3/21 | $13,223 | $12,204 | $17,684 |

| 4/21 | $13,484 | $12,300 | $18,458 |

| 5/21 | $13,649 | $12,340 | $18,745 |

| 6/21 | $13,658 | $12,427 | $18,992 |

| 7/21 | $13,597 | $12,566 | $19,123 |

| 8/21 | $13,736 | $12,542 | $19,601 |

| 9/21 | $13,380 | $12,433 | $18,792 |

| 10/21 | $13,675 | $12,430 | $19,751 |

| 11/21 | $13,466 | $12,467 | $19,275 |

| 12/21 | $13,781 | $12,435 | $20,046 |

| 1/22 | $13,426 | $12,167 | $19,062 |

| 2/22 | $13,180 | $12,031 | $18,569 |

| 3/22 | $13,171 | $11,697 | $18,972 |

| 4/22 | $12,534 | $11,253 | $17,453 |

| 5/22 | $12,579 | $11,326 | $17,474 |

| 6/22 | $12,033 | $11,148 | $16,001 |

| 7/22 | $12,425 | $11,420 | $17,118 |

| 8/22 | $11,960 | $11,098 | $16,488 |

| 9/22 | $11,178 | $10,618 | $14,909 |

| 10/22 | $11,205 | $10,481 | $15,809 |

| 11/22 | $11,888 | $10,866 | $17,035 |

| 12/22 | $11,635 | $10,817 | $16,365 |

| 1/23 | $12,117 | $11,150 | $17,538 |

| 2/23 | $11,744 | $10,862 | $17,035 |

| 3/23 | $12,135 | $11,138 | $17,561 |

| 4/23 | $12,254 | $11,205 | $17,813 |

| 5/23 | $12,026 | $11,083 | $17,622 |

| 6/23 | $12,172 | $11,044 | $18,645 |

| 7/23 | $12,226 | $11,036 | $19,328 |

| 8/23 | $11,990 | $10,965 | $18,788 |

| 9/23 | $11,489 | $10,687 | $18,011 |

| 10/23 | $11,216 | $10,518 | $17,469 |

| 11/23 | $11,853 | $10,994 | $19,082 |

| 12/23 | $12,306 | $11,415 | $19,998 |

| 1/24 | $12,232 | $11,384 | $20,116 |

| 2/24 | $12,371 | $11,223 | $20,979 |

| 3/24 | $12,593 | $11,327 | $21,637 |

| 4/24 | $12,269 | $11,041 | $20,924 |

| 5/24 | $12,629 | $11,228 | $21,773 |

| 6/24 | $12,777 | $11,334 | $22,258 |

| 7/24 | $13,073 | $11,599 | $22,617 |

| 8/24 | $13,444 | $11,765 | $23,192 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class C | 10.50% | 2.85% | 3.00% |

| Class C with 1% Maximum Deferred Sales Charge | 9.50% | 2.85% | 3.00% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.64% |

| MSCI ACWI Index (net of foreign withholding taxes) | 23.44% | 12.13% | 8.77% |

| Blended Index | 13.58% | 4.94% | 4.67% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $425,009,041 |

| # of Portfolio Holdings | 272 |

| Portfolio Turnover Rate | 49% |

| Total Advisory Fees Paid | $3,892,902 |

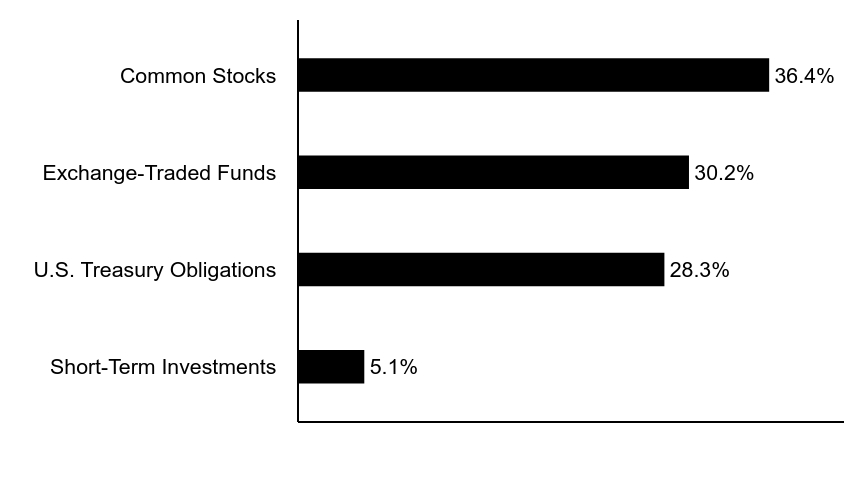

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Asset Allocation (% of total investments)

| Value | Value |

|---|

| Short-Term Investments | 5.1% |

| U.S. Treasury Obligations | 28.3% |

| Exchange-Traded Funds | 30.2% |

| Common Stocks | 36.4% |

Top Ten Holdings (% of total investments)Footnote Referencea

| Janus Henderson Mortgage-Backed Securities ETF | 22.1% |

| iShares MSCI Taiwan ETF | 3.1% |

| iShares MSCI India ETF | 3.1% |

| U.S. Treasury Notes, 4.50%, 11/15/25 | 2.3% |

| U.S. Treasury Notes, 4.00%, 2/15/26 | 2.2% |

| U.S. Treasury Bonds, 2.25%, 5/15/41 | 2.0% |

| Apple, Inc. | 2.0% |

| iShares MSCI South Korea ETF | 1.9% |

| NVIDIA Corp. | 1.8% |

| Microsoft Corp. | 1.8% |

| Total | 42.3% |

| Footnote | Description |

Footnotea | Excluding cash equivalents |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report August 31, 2024

Eaton Vance Richard Bernstein All Asset Strategy Fund

Annual Shareholder Report August 31, 2024

This annual shareholder report contains important information about the Eaton Vance Richard Bernstein All Asset Strategy Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $104 | 0.98% |

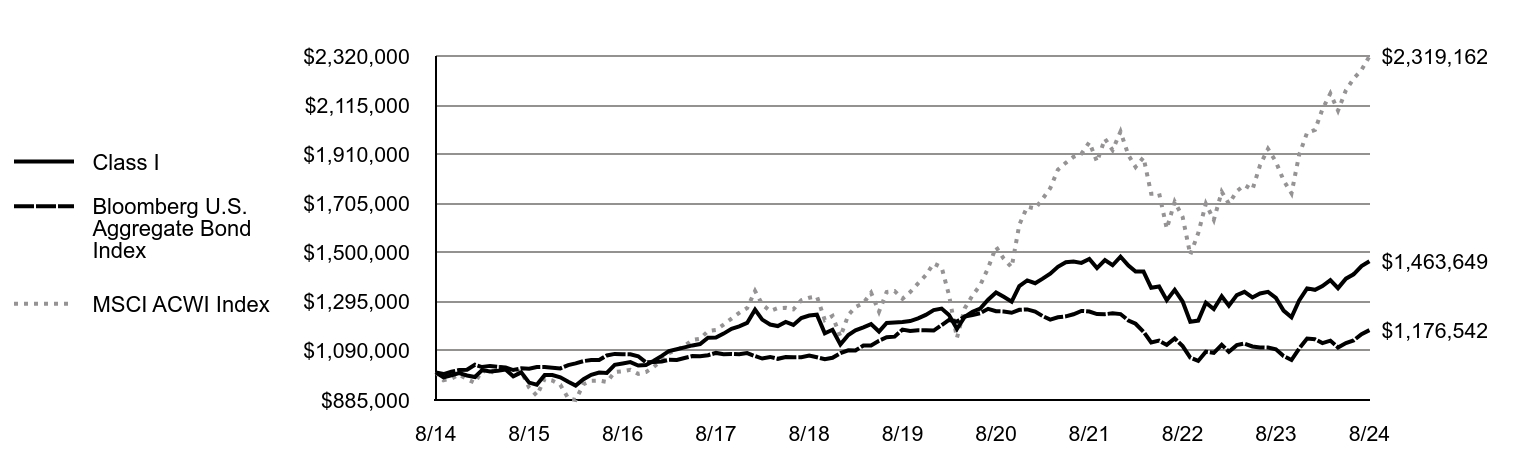

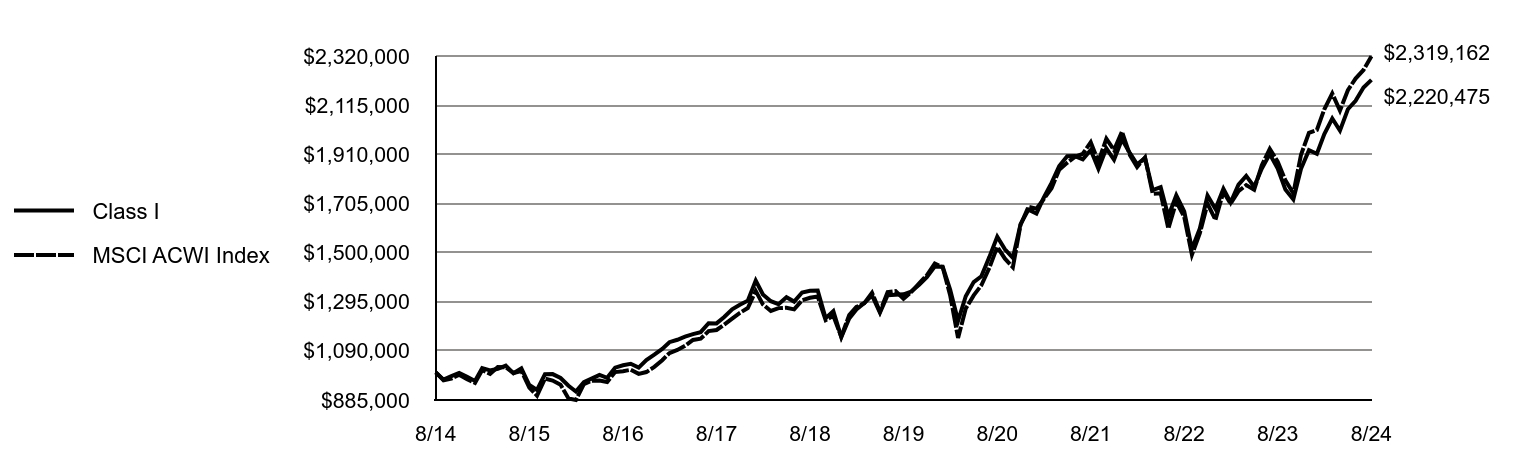

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to 60% Bloomberg U.S. Aggregate Bond Index/40% MSCI ACWI Index (the Blended Index):

↓ An underweight position in the information technology sector -- mainly in the semiconductors & semiconductor equipment industry -- detracted from returns

↓ Despite small-cap stocks having low valuations relative to large-cap stocks, an overweight position in global small-cap stocks detracted from returns

↓ An overweight position in short-term and long-term U.S. Treasurys, which underperformed the Blended Index, detracted from relative returns

↓ Overweight positions in U.S. energy and consumer staples -- two of the weaker-performing equity sectors within the Blended Index -- hurt returns

↓ An overweight position in China -- through investments in the MSCI China ETF -- hampered returns relative to the Blended Index, and was sold in July 2024

↑ An overweight position in equities and an underweight position in fixed-income assets helped relative returns as stocks generally outperformed bonds

↑ Stock selections in the financials and health care sectors contributed to performance relative to the Blended Index during the period

↑ An overweight position in securitized mortgages -- through investments in the Janus Henderson Mortgage-Backed Securities ETF -- helped relative returns

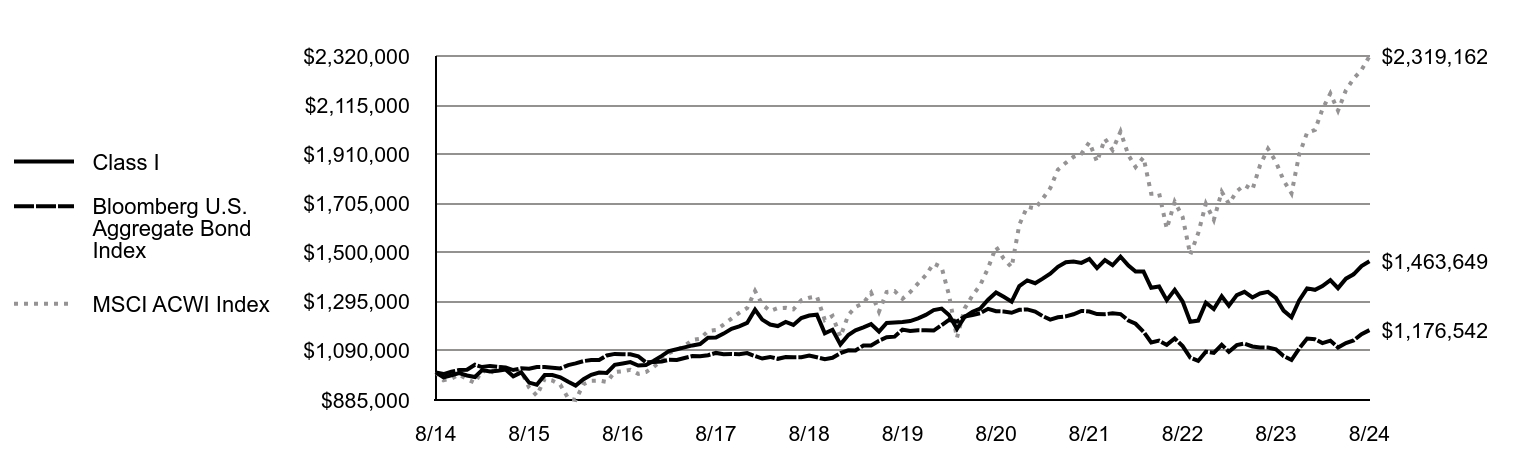

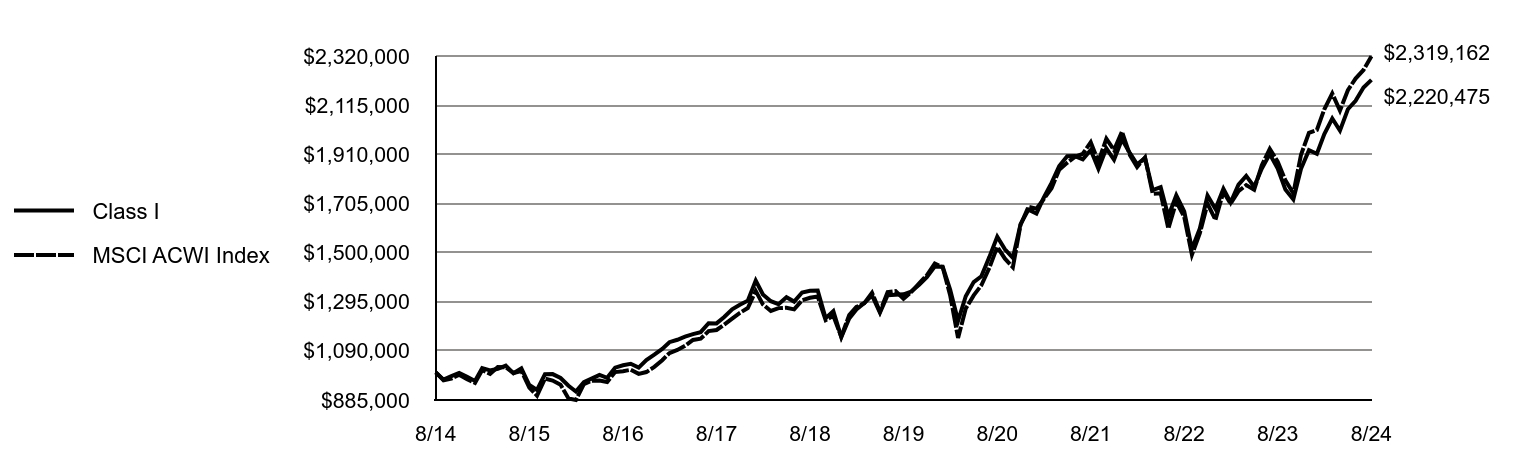

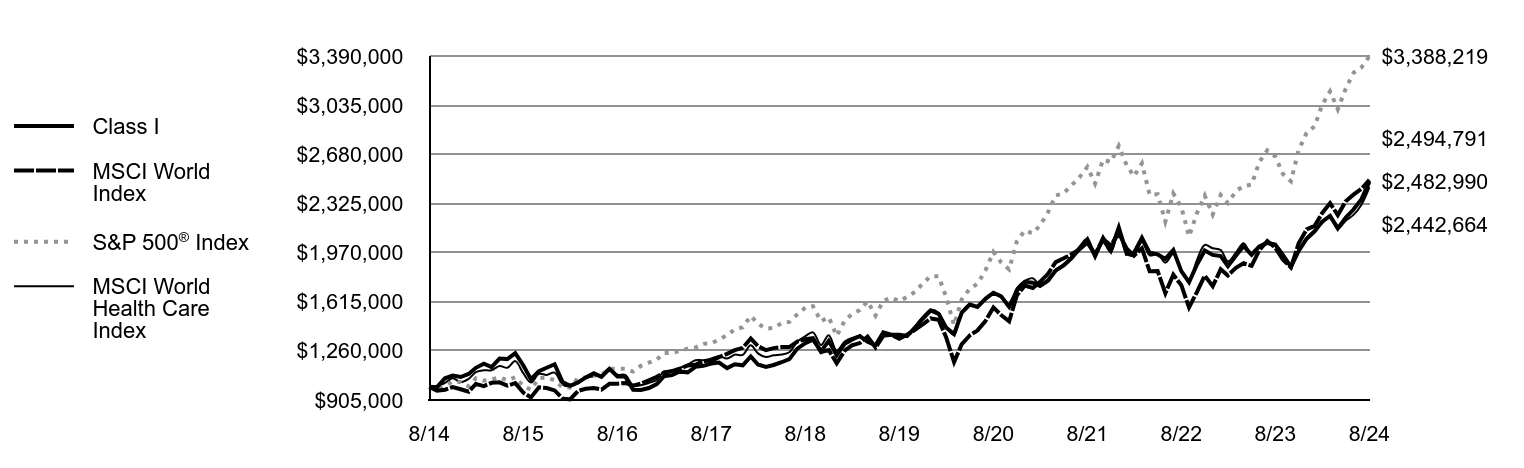

Comparison of the change in value of a $1,000,000 investment for the period indicated.

| Class I | Bloomberg U.S. Aggregate Bond Index | MSCI ACWI Index |

|---|

| 8/14 | $1,000,000 | $1,000,000 | $1,000,000 |

| 9/14 | $979,330 | $993,213 | $967,570 |

| 10/14 | $987,752 | $1,002,974 | $974,384 |

| 11/14 | $996,935 | $1,010,089 | $990,684 |

| 12/14 | $987,116 | $1,011,034 | $971,563 |

| 1/15 | $980,890 | $1,032,235 | $956,377 |

| 2/15 | $1,009,669 | $1,022,529 | $1,009,620 |

| 3/15 | $1,004,229 | $1,027,277 | $993,973 |

| 4/15 | $1,006,559 | $1,023,591 | $1,022,816 |

| 5/15 | $1,012,007 | $1,021,126 | $1,021,481 |

| 6/15 | $984,004 | $1,009,992 | $997,432 |

| 7/15 | $1,000,335 | $1,017,013 | $1,006,095 |

| 8/15 | $957,546 | $1,015,552 | $937,126 |

| 9/15 | $948,992 | $1,022,422 | $903,176 |

| 10/15 | $989,439 | $1,022,592 | $974,058 |

| 11/15 | $989,434 | $1,019,890 | $966,016 |

| 12/15 | $979,764 | $1,016,594 | $948,596 |

| 1/16 | $960,799 | $1,030,584 | $891,386 |

| 2/16 | $944,998 | $1,037,895 | $885,250 |

| 3/16 | $971,862 | $1,047,417 | $950,856 |

| 4/16 | $990,038 | $1,051,438 | $964,891 |

| 5/16 | $999,514 | $1,051,707 | $966,110 |

| 6/16 | $997,928 | $1,070,604 | $960,258 |

| 7/16 | $1,031,909 | $1,077,373 | $1,001,642 |

| 8/16 | $1,037,445 | $1,076,141 | $1,005,010 |

| 9/16 | $1,042,969 | $1,075,510 | $1,011,169 |

| 10/16 | $1,028,753 | $1,067,284 | $994,007 |

| 11/16 | $1,031,124 | $1,042,039 | $1,001,561 |

| 12/16 | $1,049,002 | $1,043,508 | $1,023,197 |

| 1/17 | $1,068,906 | $1,045,556 | $1,051,174 |

| 2/17 | $1,088,801 | $1,052,583 | $1,080,661 |

| 3/17 | $1,096,754 | $1,052,031 | $1,093,881 |

| 4/17 | $1,104,714 | $1,060,150 | $1,110,929 |

| 5/17 | $1,112,671 | $1,068,310 | $1,135,461 |

| 6/17 | $1,118,247 | $1,067,234 | $1,140,625 |

| 7/17 | $1,144,505 | $1,071,827 | $1,172,501 |

| 8/17 | $1,145,301 | $1,081,441 | $1,176,993 |

| 9/17 | $1,162,020 | $1,076,290 | $1,199,733 |

| 10/17 | $1,181,915 | $1,076,914 | $1,224,646 |

| 11/17 | $1,192,260 | $1,075,531 | $1,248,353 |

| 12/17 | $1,206,440 | $1,080,468 | $1,268,478 |

| 1/18 | $1,261,835 | $1,068,024 | $1,340,042 |

| 2/18 | $1,220,294 | $1,057,900 | $1,283,762 |

| 3/18 | $1,199,934 | $1,064,684 | $1,256,281 |

| 4/18 | $1,193,423 | $1,056,765 | $1,268,278 |

| 5/18 | $1,210,523 | $1,064,307 | $1,269,861 |

| 6/18 | $1,198,308 | $1,062,998 | $1,262,985 |

| 7/18 | $1,226,821 | $1,063,251 | $1,301,072 |

| 8/18 | $1,237,410 | $1,070,093 | $1,311,294 |

| 9/18 | $1,240,672 | $1,063,202 | $1,317,001 |

| 10/18 | $1,163,285 | $1,054,800 | $1,218,306 |

| 11/18 | $1,177,948 | $1,061,097 | $1,236,124 |

| 12/18 | $1,116,918 | $1,080,590 | $1,149,059 |

| 1/19 | $1,156,303 | $1,092,066 | $1,239,788 |

| 2/19 | $1,175,579 | $1,091,433 | $1,272,949 |

| 3/19 | $1,188,150 | $1,112,391 | $1,288,957 |

| 4/19 | $1,201,559 | $1,112,675 | $1,332,480 |

| 5/19 | $1,170,556 | $1,132,427 | $1,253,438 |

| 6/19 | $1,206,587 | $1,146,648 | $1,335,513 |

| 7/19 | $1,208,255 | $1,149,170 | $1,339,426 |

| 8/19 | $1,209,928 | $1,178,947 | $1,307,652 |

| 9/19 | $1,214,117 | $1,172,668 | $1,335,167 |

| 10/19 | $1,225,845 | $1,176,201 | $1,371,709 |

| 11/19 | $1,240,095 | $1,175,602 | $1,405,194 |

| 12/19 | $1,260,156 | $1,174,782 | $1,454,678 |

| 1/20 | $1,266,290 | $1,197,390 | $1,438,610 |

| 2/20 | $1,239,121 | $1,218,942 | $1,322,414 |

| 3/20 | $1,181,278 | $1,211,768 | $1,143,884 |

| 4/20 | $1,231,228 | $1,233,309 | $1,266,422 |

| 5/20 | $1,253,129 | $1,239,051 | $1,321,500 |

| 6/20 | $1,266,273 | $1,246,856 | $1,363,725 |

| 7/20 | $1,303,075 | $1,265,481 | $1,435,849 |

| 8/20 | $1,333,736 | $1,255,266 | $1,523,730 |

| 9/20 | $1,315,333 | $1,254,578 | $1,474,600 |

| 10/20 | $1,295,174 | $1,248,976 | $1,438,755 |

| 11/20 | $1,360,020 | $1,261,231 | $1,616,100 |

| 12/20 | $1,383,886 | $1,262,969 | $1,691,134 |

| 1/21 | $1,372,140 | $1,253,914 | $1,683,443 |

| 2/21 | $1,390,215 | $1,235,806 | $1,722,437 |

| 3/21 | $1,411,919 | $1,220,375 | $1,768,443 |

| 4/21 | $1,440,834 | $1,230,016 | $1,845,763 |

| 5/21 | $1,459,810 | $1,234,035 | $1,874,488 |

| 6/21 | $1,462,533 | $1,242,705 | $1,899,192 |

| 7/21 | $1,457,117 | $1,256,600 | $1,912,276 |

| 8/21 | $1,473,388 | $1,254,207 | $1,960,139 |

| 9/21 | $1,435,423 | $1,243,349 | $1,879,166 |

| 10/21 | $1,468,868 | $1,243,006 | $1,975,085 |

| 11/21 | $1,447,174 | $1,246,683 | $1,927,524 |

| 12/21 | $1,482,957 | $1,243,493 | $2,004,626 |

| 1/22 | $1,445,692 | $1,216,703 | $1,906,174 |

| 2/22 | $1,420,849 | $1,203,129 | $1,856,943 |

| 3/22 | $1,420,849 | $1,169,704 | $1,897,162 |

| 4/22 | $1,353,007 | $1,125,316 | $1,745,310 |

| 5/22 | $1,358,740 | $1,132,572 | $1,747,352 |

| 6/22 | $1,301,410 | $1,114,804 | $1,600,057 |

| 7/22 | $1,344,408 | $1,142,044 | $1,711,793 |

| 8/22 | $1,295,676 | $1,109,774 | $1,648,773 |

| 9/22 | $1,211,591 | $1,061,824 | $1,490,938 |

| 10/22 | $1,216,369 | $1,048,071 | $1,580,911 |

| 11/22 | $1,290,899 | $1,086,615 | $1,703,532 |

| 12/22 | $1,264,571 | $1,081,713 | $1,636,496 |

| 1/23 | $1,317,704 | $1,114,991 | $1,753,795 |

| 2/23 | $1,278,095 | $1,086,163 | $1,703,532 |

| 3/23 | $1,322,534 | $1,113,754 | $1,756,056 |

| 4/23 | $1,336,059 | $1,120,504 | $1,781,295 |

| 5/23 | $1,312,873 | $1,108,303 | $1,762,216 |

| 6/23 | $1,329,296 | $1,104,350 | $1,864,532 |

| 7/23 | $1,336,059 | $1,103,580 | $1,932,789 |

| 8/23 | $1,310,941 | $1,096,532 | $1,878,779 |

| 9/23 | $1,257,808 | $1,068,667 | $1,801,090 |

| 10/23 | $1,229,792 | $1,051,802 | $1,746,937 |

| 11/23 | $1,300,315 | $1,099,434 | $1,908,172 |

| 12/23 | $1,350,626 | $1,141,519 | $1,999,829 |

| 1/24 | $1,344,680 | $1,138,385 | $2,011,553 |

| 2/24 | $1,360,535 | $1,122,301 | $2,097,875 |

| 3/24 | $1,385,308 | $1,132,664 | $2,163,742 |

| 4/24 | $1,351,617 | $1,104,055 | $2,092,353 |

| 5/24 | $1,391,253 | $1,122,772 | $2,177,331 |

| 6/24 | $1,409,090 | $1,133,402 | $2,225,825 |

| 7/24 | $1,443,772 | $1,159,875 | $2,261,722 |

| 8/24 | $1,463,649 | $1,176,542 | $2,319,162 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class I | 11.64% | 3.88% | 3.88% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.64% |

| MSCI ACWI Index (net of foreign withholding taxes) | 23.44% | 12.13% | 8.77% |

| Blended Index | 13.58% | 4.94% | 4.67% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $425,009,041 |

| # of Portfolio Holdings | 272 |

| Portfolio Turnover Rate | 49% |

| Total Advisory Fees Paid | $3,892,902 |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Asset Allocation (% of total investments)

| Value | Value |

|---|

| Short-Term Investments | 5.1% |

| U.S. Treasury Obligations | 28.3% |

| Exchange-Traded Funds | 30.2% |

| Common Stocks | 36.4% |

Top Ten Holdings (% of total investments)Footnote Referencea

| Janus Henderson Mortgage-Backed Securities ETF | 22.1% |

| iShares MSCI Taiwan ETF | 3.1% |

| iShares MSCI India ETF | 3.1% |

| U.S. Treasury Notes, 4.50%, 11/15/25 | 2.3% |

| U.S. Treasury Notes, 4.00%, 2/15/26 | 2.2% |

| U.S. Treasury Bonds, 2.25%, 5/15/41 | 2.0% |

| Apple, Inc. | 2.0% |

| iShares MSCI South Korea ETF | 1.9% |

| NVIDIA Corp. | 1.8% |

| Microsoft Corp. | 1.8% |

| Total | 42.3% |

| Footnote | Description |

Footnotea | Excluding cash equivalents |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report August 31, 2024

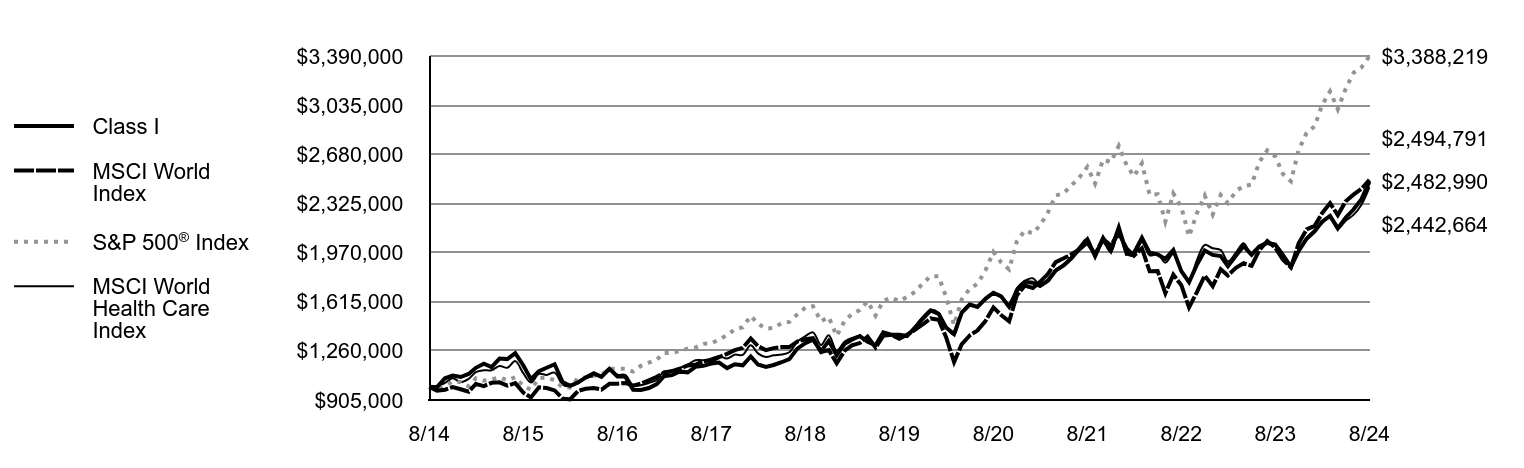

Eaton Vance Richard Bernstein Equity Strategy Fund

Annual Shareholder Report August 31, 2024

This annual shareholder report contains important information about the Eaton Vance Richard Bernstein Equity Strategy Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $131 | 1.19% |

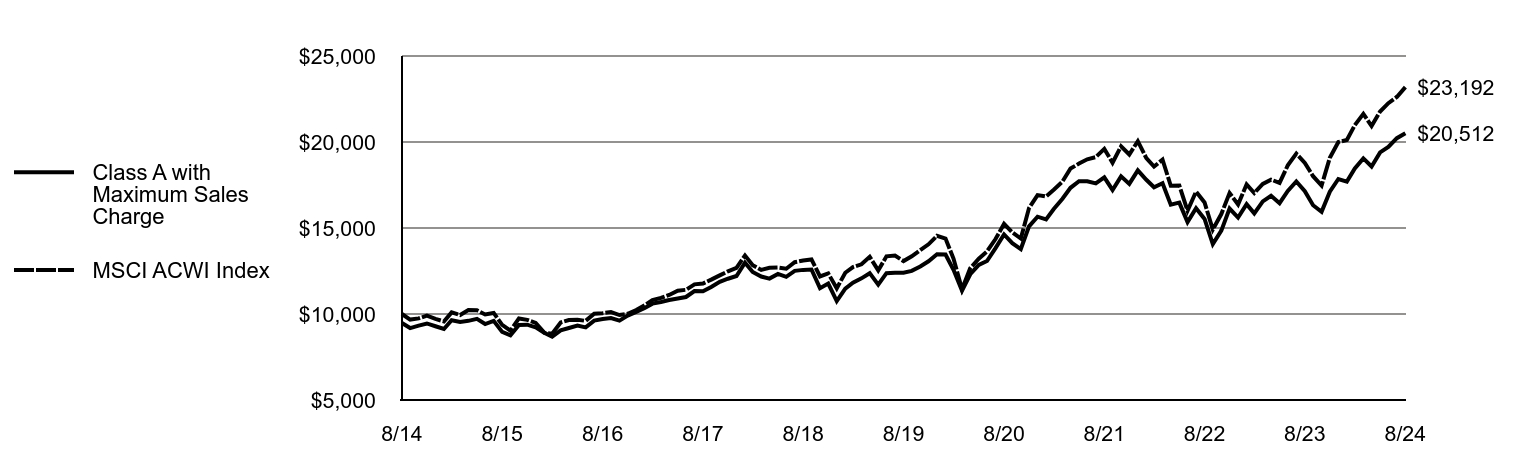

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the MSCI ACWI Index (the Index):

↓ An underweight position in the information technology sector -- mainly in the semiconductors & semiconductor equipment industry -- detracted from returns

↓ An overweight position in China -- through investments in the MSCI China ETF -- detracted from Index-relative performance, and was sold in July 2024

↓ Despite small-cap stocks having low valuations relative to large-cap stocks, an overweight position in global small-cap stocks detracted from returns

↓ An overweight position in the U.S. energy sector -- particularly in the oil, gas & consumable fuels industry -- detracted from Index-relative performance

↑ In the consumer discretionary sector, underweight positions in the hotels, restaurants & leisure industry; and the textiles, apparel & luxury goods industry contributed to Index-relative returns. Stock selections in the household durables and specialty retail industries also helped relative returns

↑ Stock selections in the financials sector -- most notably in the capital markets, banks, and financial services industries -- contributed to returns

↑ In the health care sector, stock selections in the health care equipment & supplies industry, and biotechnology industry contributed to relative returns

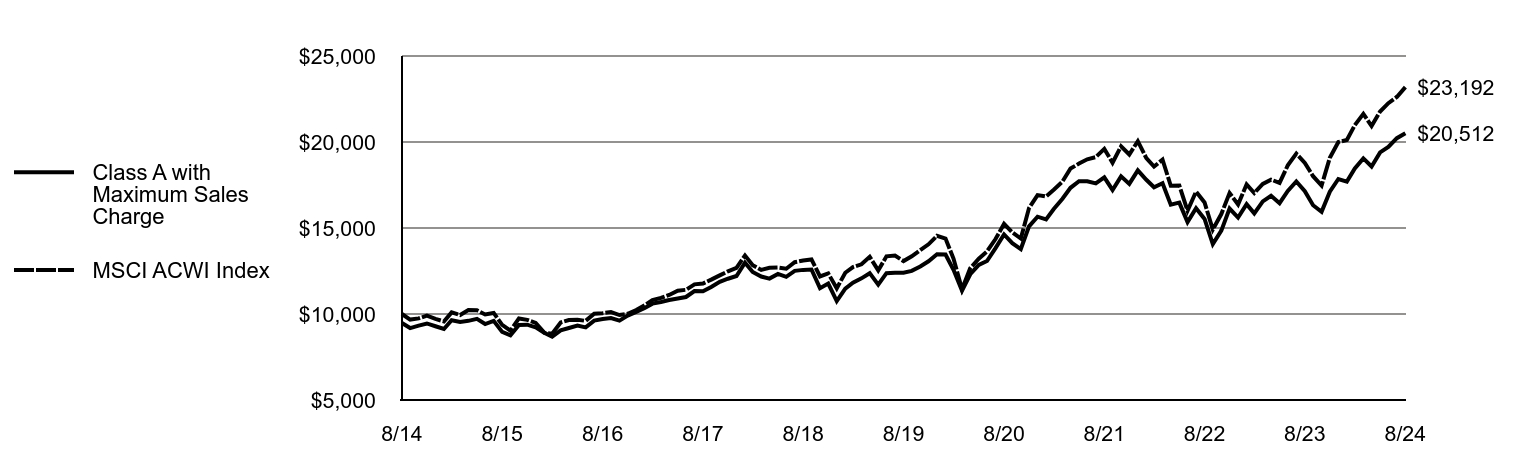

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class A with Maximum Sales Charge | MSCI ACWI Index |

|---|

| 8/14 | $9,475 | $10,000 |

| 9/14 | $9,182 | $9,676 |

| 10/14 | $9,322 | $9,744 |

| 11/14 | $9,450 | $9,907 |

| 12/14 | $9,289 | $9,716 |

| 1/15 | $9,128 | $9,564 |

| 2/15 | $9,635 | $10,096 |

| 3/15 | $9,539 | $9,940 |

| 4/15 | $9,603 | $10,228 |

| 5/15 | $9,719 | $10,215 |

| 6/15 | $9,417 | $9,974 |

| 7/15 | $9,603 | $10,061 |

| 8/15 | $8,955 | $9,371 |

| 9/15 | $8,762 | $9,032 |

| 10/15 | $9,366 | $9,741 |

| 11/15 | $9,379 | $9,660 |

| 12/15 | $9,220 | $9,486 |

| 1/16 | $8,912 | $8,914 |

| 2/16 | $8,683 | $8,853 |

| 3/16 | $9,050 | $9,509 |

| 4/16 | $9,188 | $9,649 |

| 5/16 | $9,332 | $9,661 |

| 6/16 | $9,220 | $9,603 |

| 7/16 | $9,614 | $10,016 |

| 8/16 | $9,705 | $10,050 |

| 9/16 | $9,764 | $10,112 |

| 10/16 | $9,614 | $9,940 |

| 11/16 | $9,908 | $10,016 |

| 12/16 | $10,115 | $10,232 |

| 1/17 | $10,345 | $10,512 |

| 2/17 | $10,602 | $10,807 |

| 3/17 | $10,697 | $10,939 |

| 4/17 | $10,812 | $11,109 |

| 5/17 | $10,906 | $11,355 |

| 6/17 | $10,988 | $11,406 |

| 7/17 | $11,333 | $11,725 |

| 8/17 | $11,319 | $11,770 |

| 9/17 | $11,570 | $11,997 |

| 10/17 | $11,875 | $12,246 |

| 11/17 | $12,051 | $12,484 |

| 12/17 | $12,208 | $12,685 |

| 1/18 | $12,987 | $13,400 |

| 2/18 | $12,444 | $12,838 |

| 3/18 | $12,180 | $12,563 |

| 4/18 | $12,058 | $12,683 |

| 5/18 | $12,330 | $12,699 |

| 6/18 | $12,158 | $12,630 |

| 7/18 | $12,508 | $13,011 |

| 8/18 | $12,565 | $13,113 |

| 9/18 | $12,586 | $13,170 |

| 10/18 | $11,501 | $12,183 |

| 11/18 | $11,772 | $12,361 |

| 12/18 | $10,750 | $11,491 |

| 1/19 | $11,479 | $12,398 |

| 2/19 | $11,825 | $12,729 |

| 3/19 | $12,073 | $12,890 |

| 4/19 | $12,373 | $13,325 |

| 5/19 | $11,704 | $12,534 |

| 6/19 | $12,373 | $13,355 |

| 7/19 | $12,396 | $13,394 |

| 8/19 | $12,403 | $13,077 |

| 9/19 | $12,509 | $13,352 |

| 10/19 | $12,764 | $13,717 |

| 11/19 | $13,065 | $14,052 |

| 12/19 | $13,475 | $14,547 |

| 1/20 | $13,458 | $14,386 |

| 2/20 | $12,572 | $13,224 |

| 3/20 | $11,359 | $11,439 |

| 4/20 | $12,310 | $12,664 |

| 5/20 | $12,851 | $13,215 |

| 6/20 | $13,081 | $13,637 |

| 7/20 | $13,827 | $14,358 |

| 8/20 | $14,623 | $15,237 |

| 9/20 | $14,122 | $14,746 |

| 10/20 | $13,778 | $14,388 |

| 11/20 | $15,098 | $16,161 |

| 12/20 | $15,657 | $16,911 |

| 1/21 | $15,498 | $16,834 |

| 2/21 | $16,103 | $17,224 |

| 3/21 | $16,691 | $17,684 |

| 4/21 | $17,338 | $18,458 |

| 5/21 | $17,716 | $18,745 |

| 6/21 | $17,716 | $18,992 |

| 7/21 | $17,590 | $19,123 |

| 8/21 | $17,943 | $19,601 |

| 9/21 | $17,212 | $18,792 |

| 10/21 | $18,002 | $19,751 |

| 11/21 | $17,565 | $19,275 |

| 12/21 | $18,353 | $20,046 |

| 1/22 | $17,803 | $19,062 |

| 2/22 | $17,366 | $18,569 |

| 3/22 | $17,603 | $18,972 |

| 4/22 | $16,359 | $17,453 |

| 5/22 | $16,473 | $17,474 |

| 6/22 | $15,344 | $16,001 |

| 7/22 | $16,151 | $17,118 |

| 8/22 | $15,524 | $16,488 |

| 9/22 | $14,062 | $14,909 |

| 10/22 | $14,850 | $15,809 |

| 11/22 | $16,132 | $17,035 |

| 12/22 | $15,610 | $16,365 |

| 1/23 | $16,382 | $17,538 |

| 2/23 | $15,850 | $17,035 |

| 3/23 | $16,543 | $17,561 |

| 4/23 | $16,874 | $17,813 |

| 5/23 | $16,442 | $17,622 |

| 6/23 | $17,154 | $18,645 |

| 7/23 | $17,706 | $19,328 |

| 8/23 | $17,144 | $18,788 |

| 9/23 | $16,322 | $18,011 |

| 10/23 | $15,941 | $17,469 |

| 11/23 | $17,114 | $19,082 |

| 12/23 | $17,849 | $19,998 |

| 1/24 | $17,696 | $20,116 |

| 2/24 | $18,458 | $20,979 |

| 3/24 | $19,046 | $21,637 |

| 4/24 | $18,578 | $20,924 |

| 5/24 | $19,395 | $21,773 |

| 6/24 | $19,711 | $22,258 |

| 7/24 | $20,223 | $22,617 |

| 8/24 | $20,512 | $23,192 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class A | 19.67% | 10.58% | 8.03% |

| Class A with 5.25% Maximum Sales Charge | 13.37% | 9.40% | 7.44% |

| MSCI ACWI Index (net of foreign withholding taxes) | 23.44% | 12.13% | 8.77% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $721,658,889 |

| # of Portfolio Holdings | 248 |

| Portfolio Turnover Rate | 35% |

| Total Advisory Fees Paid | $5,831,235 |

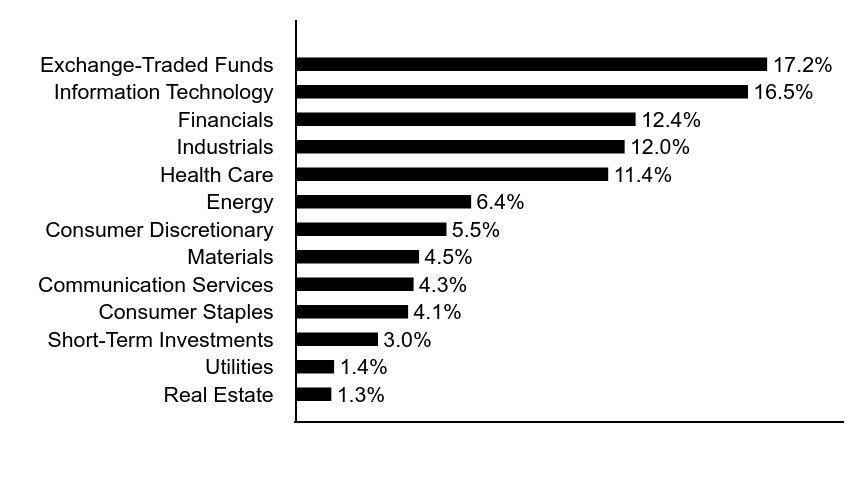

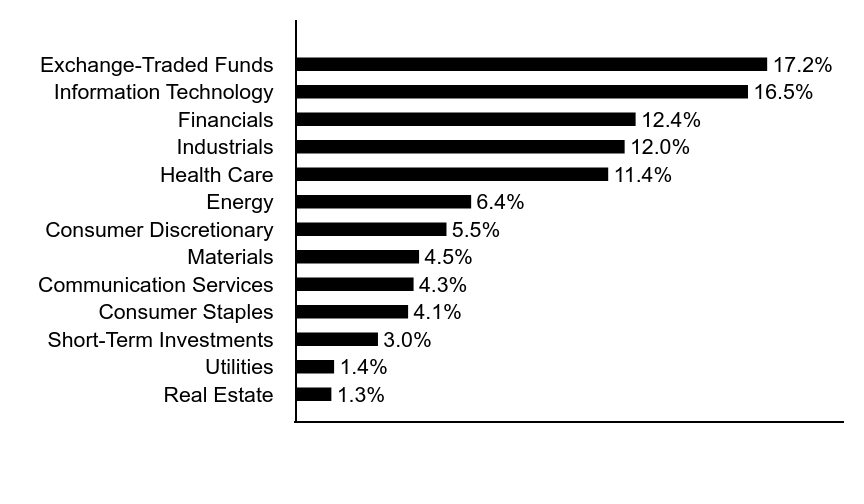

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

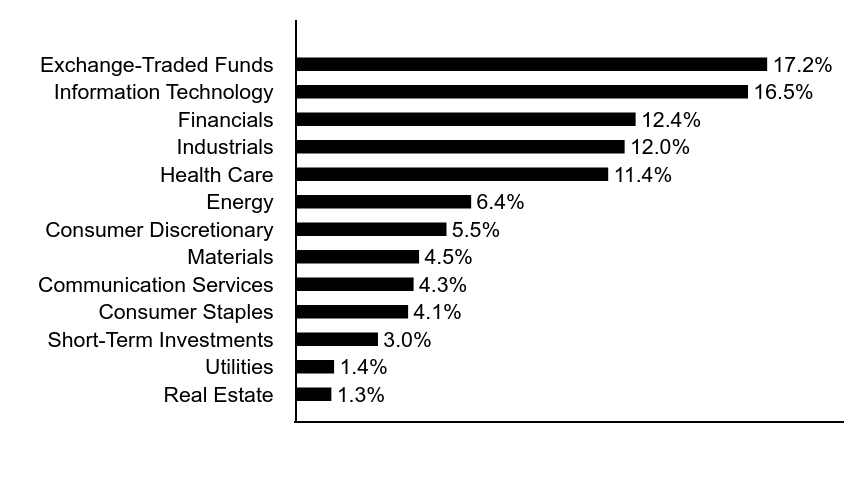

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Real Estate | 1.3% |

| Utilities | 1.4% |

| Short-Term Investments | 3.0% |

| Consumer Staples | 4.1% |

| Communication Services | 4.3% |

| Materials | 4.5% |

| Consumer Discretionary | 5.5% |

| Energy | 6.4% |

| Health Care | 11.4% |

| Industrials | 12.0% |

| Financials | 12.4% |

| Information Technology | 16.5% |

| Exchange-Traded Funds | 17.2% |

Top Ten Holdings (% of total investments)Footnote Referencea

| iShares MSCI Taiwan ETF | 6.6% |

| iShares MSCI India ETF | 6.5% |

| Apple, Inc. | 4.3% |

| iShares MSCI South Korea ETF | 4.1% |

| NVIDIA Corp. | 3.9% |

| Microsoft Corp. | 3.8% |

| Amazon.com, Inc. | 2.1% |

| Meta Platforms, Inc., Class A | 1.4% |

| Alphabet, Inc., Class A | 1.2% |

| Alphabet, Inc., Class C | 1.0% |

| Total | 34.9% |

| Footnote | Description |

Footnotea | Excluding cash equivalents |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report August 31, 2024

Eaton Vance Richard Bernstein Equity Strategy Fund

Annual Shareholder Report August 31, 2024

This annual shareholder report contains important information about the Eaton Vance Richard Bernstein Equity Strategy Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $212 | 1.94% |

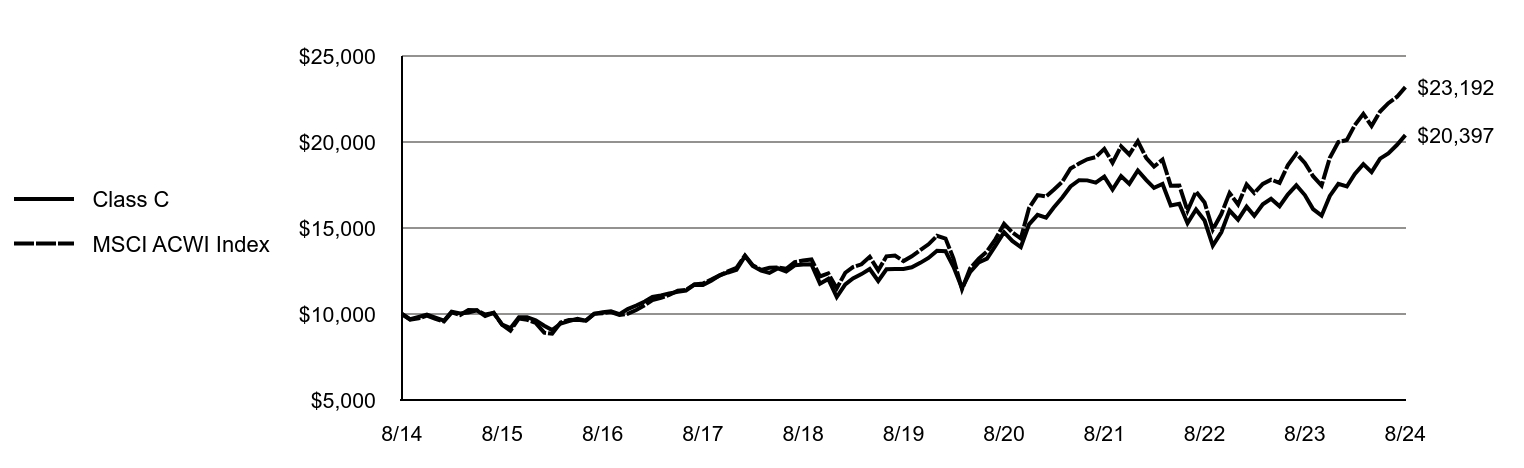

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the MSCI ACWI Index (the Index):

↓ An underweight position in the information technology sector -- mainly in the semiconductors & semiconductor equipment industry -- detracted from returns

↓ An overweight position in China -- through investments in the MSCI China ETF -- detracted from Index-relative performance, and was sold in July 2024

↓ Despite small-cap stocks having low valuations relative to large-cap stocks, an overweight position in global small-cap stocks detracted from returns

↓ An overweight position in the U.S. energy sector -- particularly in the oil, gas & consumable fuels industry -- detracted from Index-relative performance

↑ In the consumer discretionary sector, underweight positions in the hotels, restaurants & leisure industry; and the textiles, apparel & luxury goods industry contributed to Index-relative returns. Stock selections in the household durables and specialty retail industries also helped relative returns

↑ Stock selections in the financials sector -- most notably in the capital markets, banks, and financial services industries -- contributed to returns

↑ In the health care sector, stock selections in the health care equipment & supplies industry, and biotechnology industry contributed to relative returns

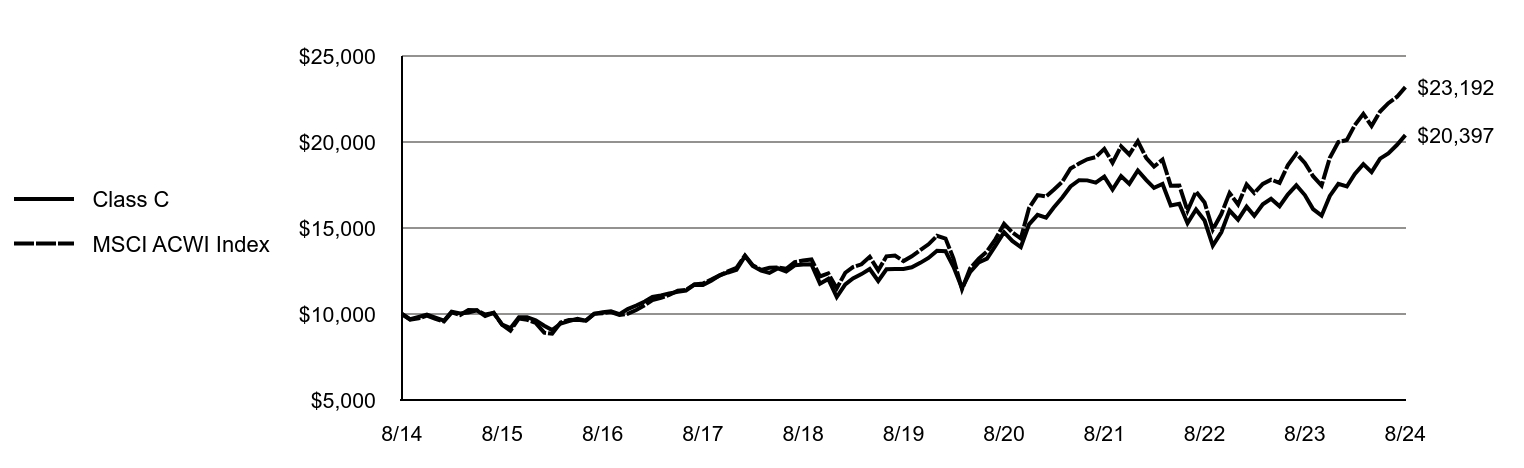

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class C | MSCI ACWI Index |

|---|

| 8/14 | $10,000 | $10,000 |

| 9/14 | $9,694 | $9,676 |

| 10/14 | $9,830 | $9,744 |

| 11/14 | $9,959 | $9,907 |

| 12/14 | $9,785 | $9,716 |

| 1/15 | $9,608 | $9,564 |

| 2/15 | $10,133 | $10,096 |

| 3/15 | $10,031 | $9,940 |

| 4/15 | $10,086 | $10,228 |

| 5/15 | $10,208 | $10,215 |

| 6/15 | $9,881 | $9,974 |

| 7/15 | $10,072 | $10,061 |

| 8/15 | $9,383 | $9,371 |

| 9/15 | $9,178 | $9,032 |

| 10/15 | $9,806 | $9,741 |

| 11/15 | $9,806 | $9,660 |

| 12/15 | $9,640 | $9,486 |

| 1/16 | $9,315 | $8,914 |

| 2/16 | $9,066 | $8,853 |

| 3/16 | $9,446 | $9,509 |

| 4/16 | $9,584 | $9,649 |

| 5/16 | $9,723 | $9,661 |

| 6/16 | $9,605 | $9,603 |

| 7/16 | $10,006 | $10,016 |

| 8/16 | $10,096 | $10,050 |

| 9/16 | $10,151 | $10,112 |

| 10/16 | $9,985 | $9,940 |

| 11/16 | $10,289 | $10,016 |

| 12/16 | $10,494 | $10,232 |

| 1/17 | $10,728 | $10,512 |

| 2/17 | $10,990 | $10,807 |

| 3/17 | $11,082 | $10,939 |

| 4/17 | $11,195 | $11,109 |

| 5/17 | $11,287 | $11,355 |

| 6/17 | $11,358 | $11,406 |

| 7/17 | $11,713 | $11,725 |

| 8/17 | $11,691 | $11,770 |

| 9/17 | $11,939 | $11,997 |

| 10/17 | $12,244 | $12,246 |

| 11/17 | $12,414 | $12,484 |

| 12/17 | $12,574 | $12,685 |

| 1/18 | $13,368 | $13,400 |

| 2/18 | $12,797 | $12,838 |

| 3/18 | $12,522 | $12,563 |

| 4/18 | $12,389 | $12,683 |

| 5/18 | $12,656 | $12,699 |

| 6/18 | $12,470 | $12,630 |

| 7/18 | $12,827 | $13,011 |

| 8/18 | $12,879 | $13,113 |

| 9/18 | $12,886 | $13,170 |

| 10/18 | $11,765 | $12,183 |

| 11/18 | $12,040 | $12,361 |

| 12/18 | $10,988 | $11,491 |

| 1/19 | $11,720 | $12,398 |

| 2/19 | $12,070 | $12,729 |

| 3/19 | $12,319 | $12,890 |

| 4/19 | $12,615 | $13,325 |

| 5/19 | $11,922 | $12,534 |

| 6/19 | $12,599 | $13,355 |

| 7/19 | $12,615 | $13,394 |

| 8/19 | $12,615 | $13,077 |

| 9/19 | $12,716 | $13,352 |

| 10/19 | $12,973 | $13,717 |

| 11/19 | $13,261 | $14,052 |

| 12/19 | $13,676 | $14,547 |

| 1/20 | $13,650 | $14,386 |

| 2/20 | $12,740 | $13,224 |

| 3/20 | $11,500 | $11,439 |

| 4/20 | $12,453 | $12,664 |

| 5/20 | $13,001 | $13,215 |

| 6/20 | $13,220 | $13,637 |

| 7/20 | $13,971 | $14,358 |

| 8/20 | $14,755 | $15,237 |

| 9/20 | $14,249 | $14,746 |

| 10/20 | $13,895 | $14,388 |

| 11/20 | $15,210 | $16,161 |

| 12/20 | $15,764 | $16,911 |

| 1/21 | $15,601 | $16,834 |

| 2/21 | $16,194 | $17,224 |

| 3/21 | $16,771 | $17,684 |

| 4/21 | $17,416 | $18,458 |

| 5/21 | $17,777 | $18,745 |

| 6/21 | $17,769 | $18,992 |

| 7/21 | $17,640 | $19,123 |

| 8/21 | $17,984 | $19,601 |

| 9/21 | $17,235 | $18,792 |

| 10/21 | $18,018 | $19,751 |

| 11/21 | $17,562 | $19,275 |

| 12/21 | $18,342 | $20,046 |

| 1/22 | $17,782 | $19,062 |

| 2/22 | $17,337 | $18,569 |

| 3/22 | $17,560 | $18,972 |

| 4/22 | $16,314 | $17,453 |

| 5/22 | $16,410 | $17,474 |

| 6/22 | $15,280 | $16,001 |

| 7/22 | $16,072 | $17,118 |

| 8/22 | $15,435 | $16,488 |

| 9/22 | $13,976 | $14,909 |

| 10/22 | $14,749 | $15,809 |

| 11/22 | $16,014 | $17,035 |

| 12/22 | $15,482 | $16,365 |

| 1/23 | $16,244 | $17,538 |

| 2/23 | $15,706 | $17,035 |

| 3/23 | $16,376 | $17,561 |

| 4/23 | $16,701 | $17,813 |

| 5/23 | $16,265 | $17,622 |

| 6/23 | $16,945 | $18,645 |

| 7/23 | $17,484 | $19,328 |

| 8/23 | $16,915 | $18,788 |

| 9/23 | $16,102 | $18,011 |

| 10/23 | $15,716 | $17,469 |

| 11/23 | $16,864 | $19,082 |

| 12/23 | $17,567 | $19,998 |

| 1/24 | $17,414 | $20,116 |

| 2/24 | $18,148 | $20,979 |

| 3/24 | $18,717 | $21,637 |

| 4/24 | $18,246 | $20,924 |

| 5/24 | $19,035 | $21,773 |

| 6/24 | $19,342 | $22,258 |

| 7/24 | $19,824 | $22,617 |

| 8/24 | $20,397 | $23,192 |

Average Annual Total Returns (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class C | 18.82% | 9.75% | 7.38% |

| Class C with 1% Maximum Deferred Sales Charge | 17.82% | 9.75% | 7.38% |

| MSCI ACWI Index (net of foreign withholding taxes) | 23.44% | 12.13% | 8.77% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $721,658,889 |

| # of Portfolio Holdings | 248 |

| Portfolio Turnover Rate | 35% |

| Total Advisory Fees Paid | $5,831,235 |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|