UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-02589 |

|

Eaton Vance Series Trust |

(Exact name of registrant as specified in charter) |

|

The Eaton Vance Building, 255 State Street, Boston, Massachusetts | | 02109 |

(Address of principal executive offices) | | (Zip code) |

|

Alan R. Dynner

The Eaton Vance Building, 255 State Street, Boston, Massachusetts 02109 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (617) 482-8260 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | June 30, 2005 | |

| | | | | | | | |

Item 1. Reports to Stockholders

Semiannual Report June 30, 2005

EATON VANCE

TAX-MANAGED

GROWTH

FUND

1.0

IMPORTANT NOTICES REGARDING PRIVACY,

DELIVERY OF SHAREHOLDER DOCUMENTS,

PORTFOLIO HOLDINGS, AND PROXY VOTING

Privacy. The Eaton Vance organization is committed to ensuring your financial privacy. Each of the financial institutions identified below has in effect the following policy ("Privacy Policy") with respect to nonpublic personal information about its customers:

• Only such information received from you, through application forms or otherwise, and information about your Eaton Vance fund transactions will be collected. This may include information such as name, address, social security number, tax status, account balances and transactions.

• None of such information about you (or former customers) will be disclosed to anyone, except as permitted by law (which includes disclosure to employees necessary to service your account). In the normal course of servicing a customer's account, Eaton Vance may share information with unaffiliated third parties that perform various required services such as transfer agents, custodians and broker/dealers.

• Policies and procedures (including physical, electronic and procedural safeguards) are in place that are designed to protect the confidentiality of such information.

• We reserve the right to change our Privacy Policy at any time upon proper notification to you. Customers may want to review our Policy periodically for changes by accessing the link on our homepage: www.eatonvance.com.

Our pledge of privacy applies to the following entities within the Eaton Vance organization: the Eaton Vance Family of Funds, Eaton Vance Management, Eaton Vance Investment Counsel, Boston Management and Research, and Eaton Vance Distributors, Inc.

In addition, our Privacy Policy only applies to those Eaton Vance customers who are individuals and who have a direct relationship with us. If a customer's account (i.e., fund shares) is held in the name of a third-party financial adviser/broker-dealer, it is likely that only such adviser's privacy policies apply to the customer. This notice supersedes all previously issued privacy disclosures.

For more information about Eaton Vance's Privacy Policy, please call 1-800-262-1122.

Delivery of Shareholder Documents. The Securities and Exchange Commission (the "SEC") permits funds to deliver only one copy of shareholder documents, including prospectuses, proxy statements and shareholder reports, to fund investors with multiple accounts at the same residential or post office box address. This practice is often called "householding" and it helps eliminate duplicate mailings to shareholders.

Eaton Vance, or your financial adviser, may household the mailing of your documents indefinitely unless you instruct Eaton Vance, or your financial adviser, otherwise.

If you would prefer that your Eaton Vance documents not be householded, please contact Eaton Vance at 1-800-262-1122, or contact your financial adviser.

Your instructions that householding not apply to delivery of your Eaton Vance documents will be effective within 30 days of receipt by Eaton Vance or your financial adviser.

Portfolio Holdings. Each Eaton Vance Fund and its underlying Portfolio (if applicable) will file a schedule of its portfolio holdings on Form N-Q with the SEC for the first and third quarters of each fiscal year. The Form N-Q will be available on the Eaton Vance website www.eatonvance.com, by calling Eaton Vance at 1-800-262-1122 or in the EDGAR database on the SEC's website at www.sec.gov. Form N-Q may also be reviewed and copied at the SEC's public reference room in Washington, D.C. (call 1-800-732-0330 for information on the operation of the public reference room).

Proxy Voting. From time to time, funds are required to vote proxies related to the securities held by the funds. The Eaton Vance Funds or their underlying Portfolios (if applicable) vote proxies according to a set of policies and procedures approved by the Funds' and Portfolios' Boards. You may obtain a description of these policies and procedures and information on how the Funds or Portfolios voted proxies relating to portfolio securities during the most recent 12 month period ended June 30, without charge, upon request, by calling 1-800-262-1122. This description is also available on the SEC's website at www.sec.gov.

Eaton Vance Tax-Managed Growth Fund 1.0 as of June 30, 2005

INVESTMENT UPDATE

Duncan W. Richardson

Portfolio Manager

The Fund

Performance for the Past Six Months

• During the six months ended June 30, 2005, Eaton Vance Tax-Managed Growth Fund 1.0 (the Fund) shares had a total return of

- -1.55%. This return was the result of a decrease in net asset value per share to $519.63 on June 30, 2005, from $530.77 on December 31, 2004, and the distribution of $2.90 per share in income.

• For comparison, the S&P 500 Index – a broad-based, unmanaged market index commonly used as a measure of overall U.S. stock market performance – had a total return of -0.81% for the same period.(1)

See pages 3 and 4 for more performance information, including after-tax returns.

Management Discussion

• Although consumer spending, manufacturing activity and corporate earnings growth remained healthy during the first half of 2005, investor concerns about rising interest rates, a mounting trade deficit and record oil prices hampered stock market performance. Equity market leadership for the first half of 2005 can be characterized as defensive and interest-rate sensitive. Higher-yielding stocks generally outperformed more aggressive stocks, and small- and mid-cap stocks generally outperformed large-cap stocks. Energy, utilities and health care were the strongest performing sectors, while telecommunications and materials were the weakest performing sectors.

• The Fund invests in Tax-Managed Growth Portfolio (the Portfolio), which invests on a long-term basis in a broadly diversified portfolio of primarily large-cap stocks. During the first half of 2005, its large-cap orientation and growth emphasis were not consistent with a market environment that favored small-and mid-cap stocks and value-style investing. The Portfolio’s de-emphasis of the slower-growth, high-yielding sectors, such as utilities, hurt returns during the period. The Portfolio’s returns were also negatively affected by its overweight of airfreight logistics and machinery investments, and adverse stock selection within food and staples retailing industries.

• On the positive side, an overweighted position in the energy sector helped Portfolio performance, as investments in oil production, equipment and drilling companies advanced on record oil prices. The Portfolio’s underweight of the information technology and materials sectors was also helpful, as electronic equipment, computers and metal industries declined during the first half of 2005. The Portfolio also benefited from favorable stock selection within the diversified telecom, mortgage-thrifts and consumer service industries during the period.

The views expressed throughout this report are those of the portfolio manager and are current only through the end of the period of the report as stated on the cover. These views are subject to change at any time based upon market or other conditions, and the investment adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on many factors, may not be relied on as an indication of trading intent on behalf of any Eaton Vance fund.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. For performance as of the most recent month-end, please refer to www.eatonvance.com.

(1) It is not possible to invest directly in an Index. The Index’s total return does not reflect commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

2

Eaton Vance Tax-Managed Growth Fund 1.0 as of June 30, 2005

FUND PERFORMANCE

Performance

Average Annual Total Returns (at net asset value)

One Year | | 4.37 | % |

Five Years | | -1.11 | % |

Ten Years | | 10.51 | % |

Life of Fund (3/29/66) | | 10.15 | % |

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to www.eatonvance.com.

Ten Largest Holdings *

By net assets

General Electric Co. | | 2.33 | % |

Exxon Mobil Corp. | | 1.97 | |

Pepsico Inc. | | 1.85 | |

BP PLC Spons ADR | | 1.73 | |

American International Group | | 1.72 | |

Intel Corp. | | 1.44 | |

Amgen Inc. | | 1.33 | |

Burlington Resources, Inc. | | 1.31 | |

United Parcel Service, Inc. | | 1.25 | |

Bank of America Corp. | | 1.22 | |

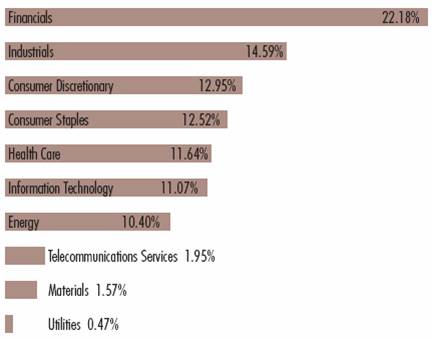

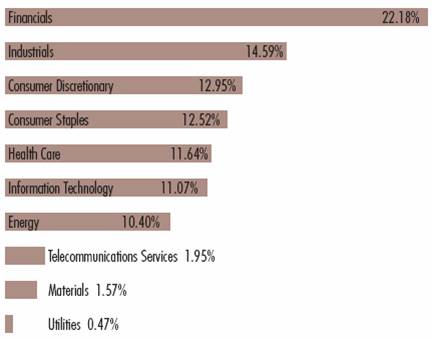

Common Stock Investments by Sector*

By net assets

* Portfolio information may not be representative of the Portfolio’s current or future investments and may change due to active management. Ten Largest Holdings represented 16.15% of Portfolio net assets as of June 30, 2005.

3

“Return Before Taxes” does not take into consideration shareholder taxes. It is most relevant to tax-free or tax-deferred shareholder accounts. “Return After Taxes on Distributions” reflects the impact of federal income taxes due on Fund distributions of dividends and capital gains. It is most relevant to taxpaying shareholders who continue to hold their shares. “Return After Taxes on Distributions and Sale of Fund Shares” also reflects the impact of taxes on capital gain or loss realized upon a sale of shares. It is most relevant to taxpaying shareholders who sell their shares.

Average Annual Total Returns

(For the periods ended June 30, 2005)

Returns at Net Asset Value (NAV)

| | One Year | | Five Years | | Ten Years | |

Return Before Taxes | | 4.37 | % | -1.11 | % | 10.51 | % |

Return After Taxes on Distributions | | 4.03 | % | -1.34 | % | 10.23 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | 3.28 | % | -0.93 | % | 9.33 | % |

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to www.eatonvance.com.

The Fund commenced operations on 3/29/66.

After-tax returns are calculated using the highest historical individual federal income tax rate and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and may differ from those shown. After-tax returns are not relevant for shareholders who hold shares in tax-deferred accounts or to shares held by non-taxable entities. Return After Taxes on Distributions for a period may be the same as Return Before Taxes for that period because no distributions were paid during that period or because the taxable portion of distributions made during the period was insignificant. Also,Return After Taxes on Distributions and Sale of Fund Shares for a period may be greater than Return After Taxes on Distributions for the same period because of realized losses on the sale of Fund shares.

4

Eaton Vance Tax-Managed Growth Fund 1.0 as of June 30, 2005

FUND EXPENSES

Example: As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2005 – June 30, 2005).

Actual Expenses: The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual return of the Fund. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Eaton Vance Tax-Managed Growth Fund 1.0

| | Beginning Account Value

(1/1/05) | | Ending Account Value

(6/30/05) | | Expenses Paid During Period*

(1/1/05 – 6/30/05) | |

Actual | | $ | 1,000.00 | | $ | 984.50 | | $ | 2.26 | |

Hypothetical (5% return per year before expenses) | | $ | 1,000.00 | | $ | 1,022.50 | | $ | 2.31 | |

* Expenses are equal to the Fund’s annualized expense ratio of 0.46% multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on December 31, 2004. The Example reflects the expenses of both the Fund and the Portfolio.

5

Eaton Vance Tax-Managed Growth Fund 1.0 as of June 30, 2005

FINANCIAL STATEMENTS (Unaudited)

Statement of Assets and Liabilities

As of June 30, 2005

| Assets | | | |

Investment in Tax-Managed Growth Portfolio, at value

(identified cost, $152,318,437) | | $ | 967,378,401 | | |

| Total assets | | $ | 967,378,401 | | |

| Liabilities | | | |

| Payable for Fund shares redeemed | | $ | 677,632 | | |

| Payable to affiliate for Trustees' fees | | | 987 | | |

| Accrued expenses | | | 34,494 | | |

| Total liabilities | | $ | 713,113 | | |

| Net Assets for 1,860,313 shares of beneficial interest outstanding | | $ | 966,665,288 | | |

| Sources of Net Assets | | | |

| Paid-in capital | | $ | 156,999,008 | | |

Accumulated net realized gain from Portfolio (computed on

the basis of identified cost) | | | 13,342,834 | | |

| Accumulated undistributed net investment income | | | 772,654 | | |

Federal tax on undistributed net realized long-term capital gain,

paid on behalf of the shareholders | | | (19,509,172 | ) | |

Net unrealized appreciation from Portfolio (computed on

the basis of identified cost) | | | 815,059,964 | | |

| Total | | $ | 966,665,288 | | |

Net Asset Value and Redemption Price Per Share

($966,665,288 ÷ 1,860,313 shares of beneficial interest outstanding) | | $ | 519.63 | | |

Statement of Operations

For the Six Months Ended

June 30, 2005

| Investment Income | | | |

| Dividends allocated from Portfolio (net of foreign taxes, $139,933) | | $ | 8,373,227 | | |

| Interest allocated from Portfolio | | | 46,180 | | |

| Expenses allocated from Portfolio | | | (2,165,010 | ) | |

| Net investment income from Portfolio | | $ | 6,254,397 | | |

| Expenses | | | |

| Trustees' fees and expenses | | $ | 1,629 | | |

| Transfer and dividend disbursing agent fees | | | 25,702 | | |

| Custodian fee | | | 19,070 | | |

| Legal and accounting services | | | 15,437 | | |

| Printing and postage | | | 7,473 | | |

| Miscellaneous | | | 7,681 | | |

| Total expenses | | $ | 76,992 | | |

| Net investment income | | $ | 6,177,405 | | |

| Realized and Unrealized Gain (Loss) from Portfolio | | | |

Net realized gain (loss) -

Investment transactions (identified cost basis) | | $ | 2,268,284 | | |

| Securities sold short | | | (1,588,182 | ) | |

| Foreign currency transactions | | | (3,556 | ) | |

| Net realized gain | | $ | 676,546 | | |

Change in unrealized appreciation (depreciation) -

Investments (identified cost basis) | | $ | (23,450,397 | ) | |

| Securities sold short | | | 986,152 | | |

| Foreign currency | | | (7,100 | ) | |

| Net change in unrealized appreciation (depreciation) | | $ | (22,471,345 | ) | |

| Net realized and unrealized loss | | $ | (21,794,799 | ) | |

| Net decrease in net assets from operations | | $ | (15,617,394 | ) | |

See notes to financial statements

6

Eaton Vance Tax-Managed Growth Fund 1.0 as of June 30, 2005

FINANCIAL STATEMENTS CONT'D

Statements of Changes in Net Assets

Increase (Decrease)

in Net Assets | | Six Months Ended

June 30, 2005

(Unaudited) | | Year Ended

December 31, 2004 | |

From operations -

Net investment income | | $ | 6,177,405 | | | $ | 11,419,350 | | |

Net realized gain from investment

transactions, securities sold short

and foreign currency transactions | | | 676,546 | | | | 61,131,903 | | |

Net change in unrealized

appreciation (depreciation) of

investments, securities sold short

and foreign currency | | | (22,471,345 | ) | | | 18,441,167 | | |

Net increase (decrease) in net assets

from operations | | $ | (15,617,394 | ) | | $ | 90,992,420 | | |

Distributions to shareholders -

From net investment income | | $ | (5,404,751 | ) | | $ | (11,422,655 | ) | |

From net realized gain on

investment transactions | | | - | | | | (8,755,776 | ) | |

| Total distributions to shareholders | | $ | (5,404,751 | ) | | $ | (20,178,431 | ) | |

Transactions in shares of beneficial interest -

Net asset value of shares issued to

shareholders in payment of

distributions declared | | $ | 1,339,998 | | | $ | 5,937,571 | | |

| Cost of shares redeemed | | | (17,291,160 | ) | | | (52,296,005 | ) | |

Net decrease in net assets from Fund

share transactions | | $ | (15,951,162 | ) | | $ | (46,358,434 | ) | |

| Net increase (decrease) in net assets | | $ | (36,973,307 | ) | | $ | 24,455,555 | | |

| Net Assets | |

| At beginning of period | | $ | 1,003,638,595 | | | $ | 979,183,040 | | |

| At end of period | | $ | 966,665,288 | | | $ | 1,003,638,595 | | |

Accumulated undistributed

net investment income

included in net assets | |

| At end of period | | $ | 772,654 | | | $ | - | | |

See notes to financial statements

7

Eaton Vance Tax-Managed Growth Fund 1.0 as of June 30, 2005

FINANCIAL STATEMENTS CONT'D

Financial Highlights

| | | Six Months Ended

June 30, 2005 | | Year Ended December 31, | |

| | | (Unaudited) | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | |

| Net asset value - Beginning of period | | $ | 530.770 | | | $ | 493.870 | | | $ | 410.040 | | | $ | 514.030 | | | $ | 572.920 | | | $ | 562.030 | | |

| Income (loss) from operations | |

| Net investment income | | $ | 3.315 | | | $ | 5.964 | | | $ | 4.627 | | | $ | 3.840 | | | $ | 3.292 | | | $ | 3.880 | | |

| Net realized and unrealized gain (loss) | | | (11.555 | ) | | | 41.533 | | | | 92.657 | | | | (104.030 | ) | | | (58.932 | ) | | | 15.106 | | |

| Total income (loss) from operations | | $ | (8.240 | ) | | $ | 47.497 | | | $ | 97.284 | | | $ | (100.190 | ) | | $ | (55.640 | ) | | $ | 18.986 | | |

| Less distributions | |

| From net investment income | | $ | (2.900 | ) | | $ | (5.950 | ) | | $ | (4.550 | ) | | $ | (3.800 | ) | | $ | (3.250 | ) | | $ | (3.740 | ) | |

| From net realized gain | | | - | | | | (4.647 | ) | | | (8.904 | ) | | | - | | | | - | | | | - | | |

| Total distributions | | $ | (2.900 | ) | | $ | (10.597 | ) | | $ | (13.454 | ) | | $ | (3.800 | ) | | $ | (3.250 | ) | | $ | (3.740 | ) | |

| Provision for federal tax on undistributed net realized long-term gain | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | (4.356 | ) | |

| Net asset value - End of period | | $ | 519.630 | | | $ | 530.770 | | | $ | 493.870 | | | $ | 410.040 | | | $ | 514.030 | | | $ | 572.920 | | |

| Total Return(1) | | | (1.55 | )% | | | 9.68 | % | | | 23.86 | % | | | (19.54 | )% | | | (9.71 | )% | | | 2.58 | % | |

| Ratios/Supplemental Data† | |

| Net assets, end of period (000's omitted) | | $ | 966,665 | | | $ | 1,003,639 | | | $ | 979,183 | | | $ | 863,009 | | | $ | 1,138,791 | | | $ | 1,322,820 | | |

| Ratios (As a percentage of average daily net assets): | |

| Net expenses(2) | | | 0.46 | %(3) | | | 0.46 | % | | | 0.47 | % | | | 0.47 | % | | | 0.46 | % | | | 0.46 | % | |

| Net expenses after custodian fee reduction(2) | | | 0.46 | %(3) | | | 0.46 | % | | | - | | | | - | | | | - | | | | - | | |

| Net investment income | | | 1.28 | %(3) | | | 1.17 | % | | | 1.04 | % | | | 0.83 | % | | | 0.63 | % | | | 0.66 | % | |

| Portfolio Turnover of the Portfolio | | | 0.12 | % | | | 3 | % | | | 15 | % | | | 23 | % | | | 18 | % | | | 13 | % | |

| † The operating expenses of the Portfolio reflect a reduction of the investment adviser fee. Had such action not been taken, the ratios and net investment income per share would have been as follows: | |

| Ratios (As a percentage of average daily net assets): | |

| Expenses(2) | | | 0.47 | %(3) | | | 0.46 | % | | | | | | | | | | | | | | | | | |

| Expenses after custodian fee reduction(2) | | | 0.47 | %(3) | | | 0.46 | % | | | | | | | | | | | | | | | | | |

| Net investment income | | | 1.28 | %(3) | | | 1.17 | % | | | | | | | | | | | | | | | | | |

| Net investment income per share | | $ | 3.313 | | | $ | 5.964 | | | | | | | | | | | | | | | | | | |

(1) Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. Total return is not computed on an annualized basis.

(2) Includes the Fund's share of the Portfolio's allocated expenses.

(3) Annualized.

See notes to financial statements

8

Eaton Vance Tax-Managed Growth Fund 1.0 as of June 30, 2005

NOTES TO FINANCIAL STATEMENTS (Unaudited)

1 Significant Accounting Policies

Eaton Vance Tax-Managed Growth Fund 1.0 (the Fund), is a diversified series of Eaton Vance Series Trust (the Trust). The Trust is an entity of the type commonly known as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Fund invests all of its investable assets in interests of Tax-Managed Growth Portfolio (the Portfolio), a New York trust, having the same investment objective as the Fund. The value of the Fund's investment in the Portfolio reflects the Fund's proportionate interest in the net assets of the Portfolio (5.3% at June 30, 2005). The performance of the Fund is directly affected by the performance of the Portfolio. The financial statements of the Portfolio, including the Portfolio of Investments, are included elsewhere in this report and should be read in conjunction with the Fun d's financial statements.

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America.

A Investment Valuation - Valuation of securities by the Portfolio is discussed in Note 1A of the Portfolio's Notes to Financial Statements which are included elsewhere in this report.

B Income - The Fund's net investment income consists of the Fund's pro rata share of the net investment income of the Portfolio, less all actual and accrued expenses of the Fund determined in accordance with accounting principles generally accepted in the United States of America.

C Expenses - The majority of expenses of the Trust are directly identifiable to an individual fund. Expenses which are not readily identifiable to a specific fund are allocated taking into consideration, among other things, the nature and type of expense and the relative size of the funds.

D Federal Taxes - The Fund's policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute to shareholders each year substantially all of its net investment income and all or substantially all of its net realized capital gains. Accordingly, no provision for federal income or excise tax is necessary. Although the Fund intends to distribute net realized long-term gains to shareholders each year, the Fund reserves the right to designate such gains as undistributed and pay the federal tax thereon on behalf of shareholders. Provision for such tax is recorded on the Fund's records on the last business day of the Fund's fiscal year because the Internal Revenue Code provides that such tax is allocated among shareholders of record on that date.

E Expense Reduction - Investors Bank & Trust Company (IBT) serves as a custodian to the Fund and the Portfolio. Pursuant to the respective custodian agreements, IBT receives a fee reduced by credits which are determined based on average daily cash balances the Fund or the Portfolio maintains with IBT. For the six months ended June 30, 2005, there were no credit balances used to reduce the Fund's custodian fee.

F Indemnifications - Under the Trust's organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund and shareholders are indemnified against personal liability for the obligations of the Trust. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made agains t the Fund that have not yet occurred.

G Other - Investment transactions are accounted for on a trade-date basis. Dividends to shareholders are recorded on the ex-dividend date.

H Use of Estimates - The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

I Interim Financial Statements - The interim financial statements relating to June 30, 2005 and for the six months then ended have not been audited by an Independent Registered Public Accounting Firm, but in the opinion of the Fund's management reflect all adjustments, consisting only of normal recurring adjustments, necessary for the fair presentation of the financial statements.

9

Eaton Vance Tax-Managed Growth Fund 1.0 as of June 30, 2005

NOTES TO FINANCIAL STATEMENTS (Unaudited) CONT'D

2 Distributions to Shareholders

The Fund's policy is to distribute all or substantially all of the net investment income allocated to the Fund by the Portfolio (less the Fund's direct expenses) and to distribute all or substantially all of its net realized capital gains (reduced by any available capital loss carryforwards from prior years) allocated by the Portfolio to the Fund, if any. Distributions are paid in the form of additional shares of the Fund or, at the election of the shareholder, in cash. Shareholders may reinvest all distributions in additional shares of the Fund at net asset value as of the close of business on the ex-dividend date. The Fund distinguishes between distributions on a tax basis and a financial reporting basis. Accounting principles generally accepted in the United States of America require that only distributions in excess of tax basis earnings and profits be reported in the financial statements as a return of capital. Permanent differences between book and tax accounting relating to distributions are re-classified to paid-in capital.

3 Shares of Beneficial Interest

The Fund's Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest (without par value). Transactions in Fund shares were as follows:

| | | Six Months Ended

June 30, 2005

(Unaudited) | | Year Ended

December 31, 2004 | |

Issued to shareholders electing to

receive payments of distributions

in Fund shares | | | 2,569 | | | | 11,439 | | |

| Redemptions | | | (33,167 | ) | | | (103,202 | ) | |

| Net decrease | | | (30,598 | ) | | | (91,763 | ) | |

4 Investment Transactions

Decreases in the Fund's investment in the Portfolio aggregated $21,073,166 for the six months ended June 30, 2005.

5 Transactions with Affiliates

Eaton Vance Management (EVM) serves as the administrator of the Fund, but receives no compensation. The Portfolio has engaged Boston Management and Research (BMR), a subsidiary of EVM, to render investment advisory services. See Note 2 of the Portfolio's Notes to Financial Statements which are included elsewhere in this report. EVM serves as the sub-transfer agent of the Fund and receives an aggregate fee based upon the actual expenses incurred by EVM in the performance of those services. For the six months ended June 30, 2005, EVM earned $2,078 in sub-transfer agent fees.

Except for Trustees of the Fund and the Portfolio who are not members of EVM's or BMR's organization, officers and Trustees receive remuneration for their services to the Fund out of the investment adviser fee earned by BMR. Trustees of the Fund who are not affiliated with EVM or BMR may elect to defer receipt of all or a percentage of these annual fees in accordance with terms of the Trustees Deferred Compensation Plan. For the six months ended June 30, 2005, no significant amounts have been deferred.

Certain officers and Trustees of the Fund are officers of the above organizations.

6 Shareholder Meeting

The Fund held a Special Meeting of Shareholders on April 29, 2005 to elect Trustees. The results of the vote were as follows:

| | | Number of Shares | |

| Nominee for Trustee | | Affirmative | | Withhold | |

| Benjamin C. Esty | | | 1,037,918 | | | | 5,443 | | |

| James B. Hawkes | | | 1,041,060 | | | | 2,300 | | |

| Samuel L. Hayes, III | | | 1,030,407 | | | | 12,953 | | |

| William H. Park | | | 1,037,918 | | | | 5,443 | | |

| Ronald A. Pearlman | | | 1,037,869 | | | | 5,492 | | |

| Norton H. Reamer | | | 1,027,018 | | | | 16,342 | | |

| Lynn A. Stout | | | 1,037,918 | | | | 5,443 | | |

| Ralph F. Verni | | | 1,037,889 | | | | 5,472 | | |

Each nominee was also elected a Trustee of the Portfolio.

10

Tax-Managed Growth Portfolio as of June 30, 2005

PORTFOLIO OF INVESTMENTS (Unaudited)

| Common Stocks - 99.3% | |

| Security | | Shares | | Value | |

| Aerospace & Defense - 3.0% | |

| Boeing Company (The) | | | 796,801 | | | $ | 52,588,866 | | |

| General Dynamics Corp. | | | 735,000 | | | | 80,511,900 | | |

| Honeywell International, Inc. | | | 277,798 | | | | 10,175,741 | | |

| Northrop Grumman Corp. | | | 3,489,713 | | | | 192,806,643 | | |

| Raytheon Company | | | 340,663 | | | | 13,326,737 | | |

| Rockwell Collins, Inc. | | | 109,067 | | | | 5,200,315 | | |

| Teledyne Technologies, Inc.(1) | | | 6,117 | | | | 199,292 | | |

| United Technologies Corp. | | | 3,658,876 | | | | 187,883,283 | | |

| | | $ | 542,692,777 | | |

| Air Freight & Logistics - 2.5% | | | |

| FedEx Corp. | | | 2,106,578 | | | $ | 170,653,884 | | |

| Robinson (C.H.) Worldwide, Inc. | | | 1,039,952 | | | | 60,525,206 | | |

| United Parcel Service, Inc. Class B | | | 3,324,281 | | | | 229,907,274 | | |

| | | $ | 461,086,364 | | |

| Airlines - 0.0% | | | |

| Southwest Airlines, Inc. | | | 379,642 | | | $ | 5,288,413 | | |

| | | $ | 5,288,413 | | |

| Auto Components - 0.1% | | | |

| ArvinMeritor, Inc. | | | 8,000 | | | $ | 142,320 | | |

| BorgWarner, Inc. | | | 186,738 | | | | 10,022,228 | | |

| Dana Corp. | | | 25,000 | | | | 375,250 | | |

| Delphi Corp. | | | 5,361 | | | | 24,929 | | |

| Johnson Controls, Inc. | | | 234,164 | | | | 13,190,458 | | |

| Visteon Corp. | | | 9,828 | | | | 59,263 | | |

| | | $ | 23,814,448 | | |

| Automobiles - 0.0% | | | |

| DaimlerChrysler AG | | | 7,000 | | | $ | 283,570 | | |

| Ford Motor Co. | | | 85,182 | | | | 872,264 | | |

| General Motors Corp. | | | 9,023 | | | | 306,782 | | |

| Harley-Davidson, Inc. | | | 140,700 | | | | 6,978,720 | | |

| Honda Motor Co. Ltd. ADR | | | 20,000 | | | | 492,200 | | |

| | | $ | 8,933,536 | | |

| Beverages - 4.2% | | | |

| Anheuser-Busch Companies, Inc. | | | 4,401,266 | | | $ | 201,357,919 | | |

| Brown-Forman Corp. Class A | | | 547,732 | | | | 35,054,848 | | |

| Security | | Shares | | Value | |

| Beverages (continued) | |

| Brown-Forman Corp. Class B | | | 45,820 | | | $ | 2,770,277 | | |

| Coca-Cola Company (The) | | | 3,550,659 | | | | 148,240,013 | | |

| Coca-Cola Enterprises, Inc. | | | 1,756,930 | | | | 38,670,029 | | |

| PepsiCo., Inc. | | | 6,274,023 | | | | 338,358,060 | | |

| | | $ | 764,451,146 | | |

| Biotechnology - 1.7% | | | |

| Amgen, Inc.(1) | | | 4,048,249 | | | $ | 244,757,135 | | |

| Applera Corp. - Celera Genomics Group(1) | | | 26,000 | | | | 285,220 | | |

| Biogen Idec, Inc.(1) | | | 11,200 | | | | 385,840 | | |

| Genzyme Corp.(1) | | | 564,926 | | | | 33,946,403 | | |

| Gilead Sciences, Inc.(1) | | | 115,482 | | | | 5,080,053 | | |

| Incyte Corp.(1) | | | 14,294 | | | | 102,202 | | |

| Invitrogen Corp.(1) | | | 429,910 | | | | 35,807,204 | | |

| Vertex Pharmaceuticals, Inc.(1) | | | 13,000 | | | | 218,920 | | |

| | | $ | 320,582,977 | | |

| Building Products - 0.9% | | | |

| American Standard Companies, Inc. | | | 975,691 | | | $ | 40,900,967 | | |

| Masco Corp. | | | 4,157,854 | | | | 132,053,443 | | |

| Water Pik Technologies, Inc.(1) | | | 2,141 | | | | 40,786 | | |

| | | $ | 172,995,196 | | |

| Capital Markets - 3.9% | | | |

| Affiliated Managers Group(1) | | | 20,520 | | | $ | 1,402,132 | | |

| Bank of New York Co., Inc. (The) | | | 398,470 | | | | 11,467,967 | | |

| Bear Stearns Companies, Inc. | | | 88,001 | | | | 9,146,824 | | |

| Credit Suisse Group | | | 155,136 | | | | 6,082,862 | | |

| Federated Investors, Inc. | | | 1,666,768 | | | | 50,019,708 | | |

| Franklin Resources, Inc. | | | 1,462,116 | | | | 112,553,690 | | |

| Goldman Sachs Group, Inc. | | | 948,077 | | | | 96,722,816 | | |

| Investors Financial Services Corp. | | | 453,428 | | | | 17,148,647 | | |

| Knight Capital Group, Inc.(1) | | | 1,750,000 | | | | 13,335,000 | | |

| Legg Mason, Inc. | | | 26,461 | | | | 2,754,855 | | |

| Lehman Brothers Holdings, Inc. | | | 96,237 | | | | 9,554,409 | | |

| Mellon Financial Corp. | | | 235,337 | | | | 6,751,819 | | |

| Merrill Lynch & Co., Inc. | | | 2,041,332 | | | | 112,293,673 | | |

| Morgan Stanley | | | 3,744,289 | | | | 196,462,844 | | |

| Northern Trust Corp. | | | 429,252 | | | | 19,569,599 | | |

| Nuveen Investments Class A | | | 150,000 | | | | 5,643,000 | | |

| Piper Jaffray Companies, Inc.(1) | | | 40,992 | | | | 1,247,387 | | |

| Price (T. Rowe) Group, Inc. | | | 163,648 | | | | 10,244,365 | | |

See notes to financial statements

11

Tax-Managed Growth Portfolio as of June 30, 2005

PORTFOLIO OF INVESTMENTS (Unaudited) CONT'D

| Security | | Shares | | Value | |

| Capital Markets (continued) | |

| Raymond James Financial, Inc. | | | 147,337 | | | $ | 4,162,270 | | |

| Schwab (Charles) & Co. | | | 857,261 | | | | 9,669,904 | | |

| State Street Corp. | | | 132,670 | | | | 6,401,327 | | |

| UBS AG | | | 63,392 | | | | 4,935,067 | | |

| Waddell & Reed Financial, Inc., Class A | | | 273,635 | | | | 5,062,247 | | |

| | | $ | 712,632,412 | | |

| Chemicals - 0.9% | | | |

| Airgas, Inc. | | | 264,027 | | | $ | 6,513,546 | | |

| Arch Chemicals, Inc. | | | 4,950 | | | | 123,552 | | |

| Ashland, Inc.(1) | | | 116,107 | | | | 8,344,610 | | |

| Bayer AG ADR | | | 40,000 | | | | 1,331,200 | | |

| Dow Chemical Co. (The) | | | 266,675 | | | | 11,875,038 | | |

| DuPont (E.I.) de Nemours & Co. | | | 1,133,572 | | | | 48,754,932 | | |

| Ecolab, Inc. | | | 258,423 | | | | 8,362,568 | | |

| MacDermid, Inc. | | | 61,937 | | | | 1,929,957 | | |

| Monsanto Company | | | 19,181 | | | | 1,205,909 | | |

| Olin Corp. | | | 9,900 | | | | 180,576 | | |

| PPG Industries, Inc. | | | 23,542 | | | | 1,477,496 | | |

| Rohm and Haas Co. | | | 2,601 | | | | 120,530 | | |

| RPM, Inc. | | | 70,138 | | | | 1,280,720 | | |

| Sigma-Aldrich Corp. | | | 630,897 | | | | 35,355,468 | | |

| Solutia, Inc.(1) | | | 20,293 | | | | 11,871 | | |

| Valspar Corp. | | | 731,155 | | | | 35,307,475 | | |

| | | $ | 162,175,448 | | |

| Commercial Banks - 8.7% | | | |

| Amegy Bancorp, Inc. | | | 1,255,140 | | | $ | 28,090,033 | | |

| AmSouth Bancorporation | | | 586,767 | | | | 15,255,942 | | |

| Associated Banc-Corp. | | | 1,056,688 | | | | 35,568,118 | | |

| Bank of America Corp. | | | 4,884,245 | | | | 222,770,414 | | |

| Bank of Hawaii Corp. | | | 69,735 | | | | 3,539,051 | | |

| Bank of Montreal | | | 266,320 | | | | 12,391,870 | | |

| BB&T Corp. | | | 1,804,226 | | | | 72,114,913 | | |

| Canadian Imperial Bank of Commerce | | | 100,000 | | | | 6,197,000 | | |

| City National Corp. | | | 184,221 | | | | 13,210,488 | | |

| Colonial Bancgroup, Inc. (The) | | | 253,936 | | | | 5,601,828 | | |

| Comerica, Inc. | | | 331,589 | | | | 19,165,844 | | |

| Commerce Bancshares, Inc. | | | 155,154 | | | | 7,821,313 | | |

| Compass Bancshares, Inc. | | | 299,160 | | | | 13,462,200 | | |

| Fifth Third Bancorp | | | 1,720,472 | | | | 70,900,651 | | |

| First Citizens BancShares, Inc. | | | 30,600 | | | | 4,423,230 | | |

| First Financial Bancorp. | | | 47,933 | | | | 905,934 | | |

| Security | | Shares | | Value | |

| Commercial Banks (continued) | |

| First Horizon National Corp. | | | 153,987 | | | $ | 6,498,251 | | |

| First Midwest Bancorp, Inc. | | | 815,329 | | | | 28,675,121 | | |

| Hibernia Corp. Class A | | | 187,345 | | | | 6,216,107 | | |

| HSBC Holdings PLC ADR | | | 608,805 | | | | 48,491,318 | | |

| Huntington Bancshares, Inc. | | | 630,239 | | | | 15,213,969 | | |

| KeyCorp | | | 835,217 | | | | 27,687,444 | | |

| M&T Bank Corp. | | | 54,058 | | | | 5,684,739 | | |

| Marshall & Ilsley Corp. | | | 629,932 | | | | 28,000,477 | | |

| National City Corp. | | | 1,652,359 | | | | 56,378,489 | | |

| North Fork Bancorporation, Inc. | | | 1,825,892 | | | | 51,289,306 | | |

| PNC Bank Corp. | | | 149,958 | | | | 8,166,713 | | |

| Popular, Inc. | | | 1,432 | | | | 36,072 | | |

| Regions Financial Corp. | | | 1,883,666 | | | | 63,818,604 | | |

| Royal Bank of Canada | | | 353,553 | | | | 21,906,144 | | |

| Royal Bank of Scotland Group PLC | | | 50,837 | | | | 1,531,287 | | |

| S&T Bancorp, Inc. | | | 100,000 | | | | 3,610,000 | | |

| Societe Generale | | | 859,825 | | | | 87,225,032 | | |

| SunTrust Banks, Inc. | | | 1,388,437 | | | | 100,300,689 | | |

| Synovus Financial Corp. | | | 1,369,351 | | | | 39,259,293 | | |

| TCF Financial Corp. | | | 72,500 | | | | 1,876,300 | | |

| Trustmark Corp. | | | 205,425 | | | | 6,010,735 | | |

| U.S. Bancorp | | | 5,086,973 | | | | 148,539,612 | | |

| Valley National Bancorp. | | | 104,601 | | | | 2,445,571 | | |

| Wachovia Corp. | | | 2,071,982 | | | | 102,770,307 | | |

| Wells Fargo & Co. | | | 2,396,974 | | | | 147,605,659 | | |

| Westamerica Bancorporation | | | 268,474 | | | | 14,178,112 | | |

| Whitney Holding Corp. | | | 516,858 | | | | 16,865,060 | | |

| Zions Bancorporation | | | 231,190 | | | | 16,999,401 | | |

| | | $ | 1,588,698,641 | | |

| Commercial Services & Supplies - 1.5% | | | |

| Allied Waste Industries, Inc.(1) | | | 1,674,390 | | | $ | 13,277,913 | | |

| Avery Dennison Corp. | | | 1,004,475 | | | | 53,196,996 | | |

| Banta Corp. | | | 42,341 | | | | 1,920,588 | | |

| Cendant Corp. | | | 784,731 | | | | 17,554,432 | | |

| Century Business Services, Inc.(1) | | | 185,000 | | | | 749,250 | | |

| Cintas Corp. | | | 1,568,941 | | | | 60,561,123 | | |

| Consolidated Graphics, Inc.(1) | | | 70,215 | | | | 2,862,666 | | |

| Deluxe Corp. | | | 32,000 | | | | 1,299,200 | | |

| Donnelley (R.R.) & Sons Co. | | | 91,260 | | | | 3,149,383 | | |

| Equifax, Inc. | | | 80,000 | | | | 2,856,800 | | |

| HNI Corp. | | | 1,331,533 | | | | 68,107,913 | | |

| Hudson Highland Group, Inc.(1) | | | 10,262 | | | | 159,985 | | |

See notes to financial statements

12

Tax-Managed Growth Portfolio as of June 30, 2005

PORTFOLIO OF INVESTMENTS (Unaudited) CONT'D

| Security | | Shares | | Value | |

| Commercial Services & Supplies (continued) | |

| Ikon Office Solutions, Inc. | | | 56,287 | | | $ | 535,289 | | |

| Imagistics International, Inc.(1) | | | 809 | | | | 22,652 | | |

| Manpower, Inc. | | | 2,000 | | | | 79,560 | | |

| Miller (Herman), Inc. | | | 541,800 | | | | 16,709,112 | | |

| Monster Worldwide, Inc.(1) | | | 68,426 | | | | 1,962,458 | | |

| Navigant Consulting, Inc.(1) | | | 273,137 | | | | 4,823,599 | | |

| PHH Corp.(1) | | | 27,467 | | | | 706,451 | | |

| Pitney Bowes, Inc. | | | 22,857 | | | | 995,422 | | |

| School Specialty Corp.(1) | | | 49,197 | | | | 2,287,660 | | |

| Steelcase, Inc. | | | 123,000 | | | | 1,703,550 | | |

| Waste Management, Inc. | | | 1,014,367 | | | | 28,747,161 | | |

| | | $ | 284,269,163 | | |

| Communications Equipment - 1.4% | | | |

| 3Com Corp.(1) | | | 869,674 | | | $ | 3,165,613 | | |

| ADC Telecommunications, Inc.(1) | | | 41,693 | | | | 907,656 | | |

| Alcatel S.A. ADR(1) | | | 43,728 | | | | 477,072 | | |

| Avaya, Inc.(1) | | | 56,571 | | | | 470,671 | | |

| Ciena Corp.(1) | | | 380,378 | | | | 794,990 | | |

| Cisco Systems, Inc.(1) | | | 4,918,086 | | | | 93,984,623 | | |

| Comverse Technology, Inc.(1) | | | 340,508 | | | | 8,053,014 | | |

| Corning, Inc.(1) | | | 3,636,520 | | | | 60,438,962 | | |

| Enterasys Networks, Inc.(1) | | | 98,848 | | | | 88,963 | | |

| JDS Uniphase Corp.(1) | | | 52,451 | | | | 79,726 | | |

| Lucent Technologies, Inc.(1) | | | 555,464 | | | | 1,616,400 | | |

| Motorola, Inc. | | | 1,335,456 | | | | 24,385,427 | | |

| Nokia Corp., Class A, ADR | | | 2,042,478 | | | | 33,986,834 | | |

| Nortel Networks Corp.(1) | | | 996,447 | | | | 2,600,727 | | |

| Qualcomm, Inc. | | | 534,846 | | | | 17,655,266 | | |

| Riverstone Networks, Inc.(1) | | | 28,706 | | | | 17,941 | | |

| Tellabs, Inc.(1) | | | 110,405 | | | | 960,523 | | |

| | | $ | 249,684,408 | | |

| Computers & Peripherals - 2.5% | | | |

| Dell, Inc.(1) | | | 4,420,850 | | | $ | 174,667,783 | | |

| EMC Corp.(1) | | | 1,377,291 | | | | 18,882,660 | | |

| Gateway, Inc.(1) | | | 86,345 | | | | 284,938 | | |

| Hewlett-Packard Co. | | | 913,405 | | | | 21,474,152 | | |

| International Business Machines Corp. | | | 1,689,360 | | | | 125,350,512 | | |

| Lexmark International, Inc., Class A(1) | | | 1,709,509 | | | | 110,827,468 | | |

| McData Corp., Class A(1) | | | 17,982 | | | | 71,928 | | |

| Network Appliance, Inc.(1) | | | 488,000 | | | | 13,795,760 | | |

| Security | | Shares | | Value | |

| Computers & Peripherals (continued) | |

| PalmOne, Inc.(1) | | | 64,913 | | | $ | 1,932,460 | | |

| Sun Microsystems, Inc.(1) | | | 319,180 | | | | 1,190,541 | | |

| | | $ | 468,478,202 | | |

| Construction & Engineering - 0.1% | | | |

| Dycom Industries, Inc.(1) | | | 143,116 | | | $ | 2,835,128 | | |

| Jacobs Engineering Group, Inc.(1) | | | 162,719 | | | | 9,154,571 | | |

| | | $ | 11,989,699 | | |

| Construction Materials - 0.1% | | | |

| CRH PLC | | | 329,450 | | | $ | 8,666,264 | | |

| Vulcan Materials Co. | | | 184,512 | | | | 11,991,435 | | |

| | | $ | 20,657,699 | | |

| Consumer Finance - 1.1% | | | |

| American Express Co. | | | 613,160 | | | $ | 32,638,507 | | |

| Capital One Financial Corp. | | | 1,409,490 | | | | 112,773,295 | | |

| MBNA Corp. | | | 496,474 | | | | 12,987,760 | | |

| Providian Financial Corp.(1) | | | 457,296 | | | | 8,062,128 | | |

| SLM Corp. | | | 905,499 | | | | 45,999,349 | | |

| | | $ | 212,461,039 | | |

| Containers & Packaging - 0.1% | | | |

| Bemis Co. | | | 295,186 | | | $ | 7,834,236 | | |

| Caraustar Industries, Inc.(1) | | | 167,599 | | | | 1,759,789 | | |

| Sealed Air Corp.(1) | | | 37,014 | | | | 1,842,927 | | |

| Sonoco Products Co. | | | 148,033 | | | | 3,922,874 | | |

| Temple-Inland, Inc. | | | 115,924 | | | | 4,306,577 | | |

| | | $ | 19,666,403 | | |

| Department Stores - 0.0% | | | |

| Neiman Marcus Group, Inc. (The) | | | 6 | | | $ | 580 | | |

| | | $ | 580 | | |

| Distributors - 0.1% | | | |

| Genuine Parts Company | | | 314,107 | | | $ | 12,906,657 | | |

| | | $ | 12,906,657 | | |

| Diversified Consumer Services - 0.5% | | | |

| Apollo Group, Inc. Class A(1) | | | 47,312 | | | $ | 3,700,745 | | |

| Block (H&R), Inc. | | | 787,622 | | | | 45,957,744 | | |

See notes to financial statements

13

Tax-Managed Growth Portfolio as of June 30, 2005

PORTFOLIO OF INVESTMENTS (Unaudited) CONT'D

| Security | | Shares | | Value | |

| Diversified Consumer Services (continued) | |

| Laureate Education, Inc.(1) | | | 520,213 | | | $ | 24,897,394 | | |

| Service Corp. International | | | 142,389 | | | | 1,141,960 | | |

| ServiceMaster Co. | | | 1,156,537 | | | | 15,486,030 | | |

| Stewart Enterprises, Inc. | | | 114,000 | | | | 745,560 | | |

| | | $ | 91,929,433 | | |

| Diversified Financial Services - 1.7% | | | |

| Citigroup, Inc. | | | 4,109,506 | | | $ | 189,982,462 | | |

| Finova Group, Inc.(1) | | | 175,587 | | | | 14,925 | | |

| ING Groep NV ADR | | | 257,281 | | | | 7,216,732 | | |

| JPMorgan Chase & Co. | | | 3,128,352 | | | | 110,493,393 | | |

| Moody's Corp. | | | 135,086 | | | | 6,073,467 | | |

| | | $ | 313,780,979 | | |

| Diversified Telecommunication Services - 1.9% | | | |

| Alltel Corp. | | | 1,598,689 | | | $ | 99,566,351 | | |

| AT&T Corp. | | | 502,314 | | | | 9,564,059 | | |

| BCE, Inc. | | | 3,400,000 | | | | 80,512,000 | | |

| BellSouth Corp. | | | 185,784 | | | | 4,936,281 | | |

| Cincinnati Bell, Inc.(1) | | | 169,013 | | | | 726,756 | | |

| Citizens Communications Co. | | | 13,568 | | | | 182,354 | | |

| Deutsche Telekom AG ADR | | | 2,006,790 | | | | 36,965,072 | | |

| McLeodUSA, Inc.(1) | | | 947 | | | | 48 | | |

| Qwest Communications International, Inc.(1) | | | 47,762 | | | | 177,197 | | |

| RSL Communications Ltd.(1)(2) | | | 247,161 | | | | 0 | | |

| SBC Communications, Inc. | | | 1,285,015 | | | | 30,519,106 | | |

| Sprint Corp. | | | 101,903 | | | | 2,556,746 | | |

| Telefonos de Mexico SA ADR | | | 3,251,574 | | | | 61,422,233 | | |

| Verizon Communications, Inc. | | | 450,014 | | | | 15,547,984 | | |

| | | $ | 342,676,187 | | |

| Electric Utilities - 0.3% | | | |

| Ameren Corp. | | | 5,000 | | | $ | 276,500 | | |

| American Electric Power Co., Inc. | | | 960 | | | | 35,395 | | |

| Exelon Corp. | | | 1,002,000 | | | | 51,432,660 | | |

| PG&E Corp. | | | 47,705 | | | | 1,790,846 | | |

| Southern Co. (The) | | | 65,985 | | | | 2,287,700 | | |

| Teco Energy, Inc. | | | 34,145 | | | | 645,682 | | |

| | | $ | 56,468,783 | | |

| Electrical Equipment - 0.5% | | | |

| American Power Conversion Corp. | | | 34,704 | | | $ | 818,667 | | |

| Baldor Electric Co. | | | 149,060 | | | | 3,625,139 | | |

| Security | | Shares | | Value | |

| Electrical Equipment (continued) | | | |

| Emerson Electric Co. | | | 1,147,739 | | | $ | 71,882,894 | | |

| Rockwell International Corp. | | | 159,099 | | | | 7,749,712 | | |

| Roper Industries, Inc. | | | 23,122 | | | | 1,650,217 | | |

| Thomas and Betts Corp.(1) | | | 114,600 | | | | 3,236,304 | | |

| | | $ | 88,962,933 | | |

| Electronic Equipment & Instruments - 0.6% | | | |

| Agilent Technologies, Inc.(1) | | | 461,232 | | | $ | 10,617,561 | | |

| Arrow Electronics, Inc.(1) | | | 8,750 | | | | 237,650 | | |

| Flextronics International, Ltd.(1) | | | 441,607 | | | | 5,833,628 | | |

| Jabil Circuit, Inc.(1) | | | 2,127,971 | | | | 65,392,549 | | |

| Molex, Inc., Class A | | | 62,131 | | | | 1,458,836 | | |

| National Instruments Corp. | | | 735,687 | | | | 15,596,564 | | |

| Plexus Corp.(1) | | | 153,745 | | | | 2,187,791 | | |

| Sanmina Corp.(1) | | | 1,140,602 | | | | 6,239,093 | | |

| Solectron Corp.(1) | | | 1,752,794 | | | | 6,643,089 | | |

| | | $ | 114,206,761 | | |

| Energy Equipment & Services - 0.7% | | | |

| Baker Hughes, Inc. | | | 455,117 | | | $ | 23,283,786 | | |

| Core Laboratories NV(1) | | | 31,290 | | | | 839,198 | | |

| Grant Prideco, Inc.(1) | | | 11,694 | | | | 309,306 | | |

| Halliburton Co. | | | 706,778 | | | | 33,798,124 | | |

| National-Oilwell, Inc.(1) | | | 427,772 | | | | 20,336,281 | | |

| Schlumberger Ltd. | | | 553,812 | | | | 42,056,483 | | |

| Smith International, Inc. | | | 140,000 | | | | 8,918,000 | | |

| Transocean Sedco Forex, Inc.(1) | | | 103,602 | | | | 5,591,400 | | |

| | | $ | 135,132,578 | | |

| Food & Staples Retailing - 2.1% | | | |

| Albertson's, Inc. | | | 981,818 | | | $ | 20,303,996 | | |

| Casey's General Stores, Inc. | | | 35,260 | | | | 698,853 | | |

| Costco Wholesale Corp. | | | 927,132 | | | | 41,554,056 | | |

| CVS Corp. | | | 263,610 | | | | 7,663,143 | | |

| Kroger Co. (The)(1) | | | 1,354,998 | | | | 25,785,612 | | |

| Safeway, Inc. | | | 1,191,841 | | | | 26,923,688 | | |

| Sysco Corp.(2)(3) | | | 30,000 | | | | 1,084,886 | | |

| Sysco Corp. | | | 1,810,217 | | | | 65,511,753 | | |

| Sysco Corp.(2)(3) | | | 60,000 | | | | 2,169,410 | | |

| Walgreen Co. | | | 912,719 | | | | 41,975,947 | | |

| Wal-Mart Stores, Inc. | | | 2,991,799 | | | | 144,204,712 | | |

| Winn-Dixie Stores, Inc.(1) | | | 137,447 | | | | 149,817 | | |

| | | $ | 378,025,873 | | |

See notes to financial statements

14

Tax-Managed Growth Portfolio as of June 30, 2005

PORTFOLIO OF INVESTMENTS (Unaudited) CONT'D

| Security | | Shares | | Value | |

| Food Products - 2.7% | | | |

| Archer-Daniels-Midland Co. | | | 977,204 | | | $ | 20,892,622 | | |

| Campbell Soup Co. | | | 1,276,023 | | | | 39,263,228 | | |

| ConAgra Foods, Inc. | | | 1,598,140 | | | | 37,012,922 | | |

| Dean Foods Co.(1) | | | 362,189 | | | | 12,763,540 | | |

| Del Monte Foods Co.(1) | | | 99,492 | | | | 1,071,529 | | |

| General Mills, Inc. | | | 159,029 | | | | 7,440,967 | | |

| Heinz (H.J.) Co. | | | 299,708 | | | | 10,615,657 | | |

| Hershey Foods Corp. | | | 506,511 | | | | 31,454,333 | | |

| JM Smucker Co. | | | 12,138 | | | | 569,758 | | |

| Kellogg Co. | | | 58,538 | | | | 2,601,429 | | |

| Kraft Foods, Inc. | | | 465 | | | | 14,792 | | |

| Nestle SA | | | 275,000 | | | | 70,274,200 | | |

| Sara Lee Corp. | | | 4,785,008 | | | | 94,791,008 | | |

| Smithfield Foods, Inc.(1) | | | 3,845,278 | | | | 104,860,731 | | |

| TreeHouse Foods, Inc.(1) | | | 72,438 | | | | 2,065,202 | | |

| Tyson Foods, Inc. | | | 315,272 | | | | 5,611,842 | | |

| Wrigley (Wm.) Jr. Co. | | | 857,367 | | | | 59,021,144 | | |

| | | $ | 500,324,904 | | |

| Gas Utilities - 0.0% | | | |

| National Fuel Gas Co. | | | 4,000 | | | $ | 115,640 | | |

| | | $ | 115,640 | | |

| Health Care Equipment & Supplies - 1.3% | | | |

| Advanced Medical Optics, Inc.(1) | | | 31,158 | | | $ | 1,238,530 | | |

| Bausch & Lomb, Inc. | | | 29,250 | | | | 2,427,750 | | |

| Baxter International, Inc. | | | 229,317 | | | | 8,507,661 | | |

| Becton, Dickinson and Co. | | | 64,173 | | | | 3,367,157 | | |

| Biomet, Inc. | | | 419,890 | | | | 14,544,990 | | |

| Boston Scientific Corp.(1) | | | 1,109,134 | | | | 29,946,618 | | |

| Dentsply International, Inc. | | | 7,705 | | | | 416,070 | | |

| Dionex Corp.(1) | | | 139,750 | | | | 6,094,497 | | |

| Edwards Lifesciences Corp.(1) | | | 10,353 | | | | 445,386 | | |

| Guidant Corp. | | | 57,206 | | | | 3,849,964 | | |

| Hillenbrand Industries, Inc. | | | 489,188 | | | | 24,728,453 | | |

| Hospira, Inc.(1) | | | 192,411 | | | | 7,504,029 | | |

| Lumenis Ltd.(1) | | | 100,000 | | | | 150,000 | | |

| Medtronic, Inc. | | | 2,066,441 | | | | 107,020,979 | | |

| PerkinElmer, Inc. | | | 254,526 | | | | 4,810,541 | | |

| St. Jude Medical, Inc.(1) | | | 48,028 | | | | 2,094,501 | | |

| Steris Corp. | | | 6,145 | | | | 158,357 | | |

| Stryker Corp. | | | 36,741 | | | | 1,747,402 | | |

| Security | | Shares | | Value | |

| Health Care Equipment & Supplies (continued) | |

| Waters Corp.(1) | | | 165,841 | | | $ | 6,164,310 | | |

| Zimmer Holdings, Inc.(1) | | | 290,489 | | | | 22,126,547 | | |

| | | $ | 247,343,742 | | |

| Health Care Providers & Services - 2.0% | | | |

| AmerisourceBergen Corp. | | | 174,177 | | | $ | 12,044,340 | | |

| Beverly Enterprises, Inc.(1) | | | 50,586 | | | | 644,466 | | |

| Cardinal Health, Inc. | | | 1,784,669 | | | | 102,761,241 | | |

| Caremark Rx, Inc.(1) | | | 701,471 | | | | 31,229,489 | | |

| Cigna Corp. | | | 11,836 | | | | 1,266,807 | | |

| Express Scripts, Inc.(1) | | | 53,316 | | | | 2,664,734 | | |

| HCA, Inc. | | | 140 | | | | 7,934 | | |

| Health Management Associates, Inc., Class A | | | 242,438 | | | | 6,347,027 | | |

| IDX Systems Corp.(1) | | | 60,000 | | | | 1,808,400 | | |

| IMS Health, Inc. | | | 280,530 | | | | 6,948,728 | | |

| McKesson Corp. | | | 2,631 | | | | 117,842 | | |

| Medco Health Solutions, Inc.(1) | | | 175,584 | | | | 9,369,162 | | |

| Parexel International Corp.(1) | | | 27,837 | | | | 552,564 | | |

| Renal Care Group, Inc.(1) | | | 372,577 | | | | 17,175,800 | | |

| Schein (Henry) Corp.(1) | | | 2,189,855 | | | | 90,922,780 | | |

| Sunrise Assisted Living, Inc.(1) | | | 144,000 | | | | 7,773,120 | | |

| Tenet Healthcare Corp.(1) | | | 3,961 | | | | 48,483 | | |

| UnitedHealth Group, Inc. | | | 403,952 | | | | 21,062,057 | | |

| Ventiv Health, Inc.(1) | | | 13,170 | | | | 253,918 | | |

| WellPoint, Inc.(1) | | | 808,000 | | | | 56,269,120 | | |

| | | $ | 369,268,012 | | |

| Hotels, Restaurants & Leisure - 1.9% | | | |

| Brinker International, Inc.(1) | | | 236,211 | | | $ | 9,460,251 | | |

| Carnival Corp. | | | 561,335 | | | | 30,620,824 | | |

| CBRL Group, Inc. | | | 62,047 | | | | 2,411,146 | | |

| Darden Restaurants, Inc. | | | 184,714 | | | | 6,091,868 | | |

| Evans (Bob) Farms, Inc. | | | 50,957 | | | | 1,188,317 | | |

| Gaylord Entertainment Co.(1) | | | 428,482 | | | | 19,920,128 | | |

| International Game Technology | | | 400,000 | | | | 11,260,000 | | |

| International Speedway Corp. | | | 118,344 | | | | 6,658,033 | | |

| Jack in the Box, Inc.(1) | | | 500,000 | | | | 18,960,000 | | |

| Lone Star Steakhouse & Saloon, Inc. | | | 145,981 | | | | 4,439,282 | | |

| Marriott International, Inc. | | | 272,535 | | | | 18,592,338 | | |

| McDonald's Corp. | | | 863,972 | | | | 23,975,223 | | |

| MGM Grand, Inc.(1) | | | 188,890 | | | | 7,476,266 | | |

| Navigant International, Inc.(1) | | | 38,258 | | | | 562,010 | | |

See notes to financial statements

15

Tax-Managed Growth Portfolio as of June 30, 2005

PORTFOLIO OF INVESTMENTS (Unaudited) CONT'D

| Security | | Shares | | Value | |

| Hotels, Restaurants & Leisure (continued) | | | |

| Outback Steakhouse, Inc. | | | 1,534,369 | | | $ | 69,414,854 | | |

| Papa John's International, Inc.(1) | | | 190,361 | | | | 7,608,729 | | |

| Royal Caribbean Cruises Ltd. | | | 500,000 | | | | 24,180,000 | | |

| Sonic Corp.(1) | | | 159,765 | | | | 4,877,625 | | |

| Starbucks Corp.(1) | | | 1,199,709 | | | | 61,976,967 | | |

| Yum! Brands, Inc. | | | 236,553 | | | | 12,319,680 | | |

| | | $ | 341,993,541 | | |

| Household Durables - 0.6% | | | |

| Blyth Industries, Inc. | | | 705,171 | | | $ | 19,780,047 | | |

| D.R. Horton, Inc. | | | 625,255 | | | | 23,515,841 | | |

| Department 56, Inc.(1) | | | 5,455 | | | | 55,914 | | |

| Fortune Brands, Inc. | | | 128,148 | | | | 11,379,542 | | |

| Helen of Troy Ltd.(1) | | | 20,000 | | | | 509,200 | | |

| Interface, Inc., Class A(1) | | | 75,467 | | | | 607,509 | | |

| Leggett & Platt, Inc. | | | 1,813,805 | | | | 48,210,937 | | |

| Maytag Corp. | | | 27,073 | | | | 423,963 | | |

| Newell Rubbermaid, Inc. | | | 411,393 | | | | 9,807,609 | | |

| Snap-On, Inc. | | | 42,453 | | | | 1,456,138 | | |

| | | $ | 115,746,700 | | |

| Household Products - 1.7% | | | |

| Clorox Co. (The) | | | 53,688 | | | $ | 2,991,495 | | |

| Colgate-Palmolive Co. | | | 714,888 | | | | 35,680,060 | | |

| Energizer Holdings, Inc.(1) | | | 168,981 | | | | 10,505,549 | | |

| Kimberly-Clark Corp. | | | 1,555,480 | | | | 97,357,493 | | |

| Procter & Gamble Co. | | | 3,183,122 | | | | 167,909,686 | | |

| | | $ | 314,444,283 | | |

Independent Power Producers & Energy

Traders - 0.2% | | | |

| AES Corp.(1) | | | 49,542 | | | $ | 811,498 | | |

| Duke Energy Corp. | | | 417,416 | | | | 12,409,778 | | |

| Dynegy, Inc.(1) | | | 22,688 | | | | 110,264 | | |

| TXU Corp. | | | 199,013 | | | | 16,535,990 | | |

| | | $ | 29,867,530 | | |

| Industrial Conglomerates - 2.9% | | | |

| 3M Co. | | | 745,287 | | | $ | 53,884,250 | | |

| General Electric Co. | | | 12,324,290 | | | | 427,036,649 | | |

| Teleflex, Inc. | | | 33,700 | | | | 2,000,769 | | |

| Tyco International, Ltd. | | | 1,715,944 | | | | 50,105,565 | | |

| | | $ | 533,027,233 | | |

| Security | | Shares | | Value | |

| Insurance - 5.9% | |

| 21st Century Insurance Group | | | 70,700 | | | $ | 1,049,188 | | |

| Aegon N.V. ADR | | | 5,311,829 | | | | 68,363,239 | | |

| AFLAC, Inc. | | | 2,162,527 | | | | 93,594,169 | | |

| Allstate Corp. (The) | | | 191,610 | | | | 11,448,698 | | |

| American International Group, Inc. | | | 5,411,957 | | | | 314,434,702 | | |

| AON Corp. | | | 786,684 | | | | 19,698,567 | | |

| Berkshire Hathaway, Inc., Class A(1) | | | 487 | | | | 40,664,500 | | |

| Berkshire Hathaway, Inc., Class B(1) | | | 41,316 | | | | 115,003,086 | | |

| Chubb Corp. | | | 6,077 | | | | 520,252 | | |

| Commerce Group, Inc. | | | 120,000 | | | | 7,453,200 | | |

| Gallagher (Arthur J.) and Co. | | | 726,310 | | | | 19,704,790 | | |

| Hartford Financial Services Group, Inc. | | | 11,094 | | | | 829,609 | | |

| Jefferson-Pilot Corp. | | | 186,756 | | | | 9,416,238 | | |

| Lincoln National Corp. | | | 52,903 | | | | 2,482,209 | | |

| Manulife Financial Corp. | | | 74,958 | | | | 3,583,742 | | |

| Marsh & McLennan Cos., Inc. | | | 837,113 | | | | 23,188,030 | | |

| MetLife, Inc. | | | 1,869,700 | | | | 84,024,318 | | |

| Old Republic International Corp. | | | 240,548 | | | | 6,083,459 | | |

| Progressive Corp.(2)(3) | | | 10,900 | | | | 1,076,221 | | |

| Progressive Corp. | | | 1,995,408 | | | | 197,166,264 | | |

| Safeco Corp. | | | 161,000 | | | | 8,748,740 | | |

| St. Paul Companies, Inc. (The) | | | 291,677 | | | | 11,529,992 | | |

| Torchmark Corp. | | | 345,335 | | | | 18,026,487 | | |

| UICI | | | 43,597 | | | | 1,297,883 | | |

| UnumProvident Corp. | | | 53,710 | | | | 983,967 | | |

| XL Capital Ltd., Class A | | | 187,100 | | | | 13,923,982 | | |

| | | $ | 1,074,295,532 | | |

| Internet & Catalog Retail - 0.3% | | | |

| Amazon.com Inc.(1) | | | 23,500 | | | $ | 777,380 | | |

| eBay, Inc.(1) | | | 1,257,244 | | | | 41,501,624 | | |

| IAC/InterActiveCorp(1) | | | 806,192 | | | | 19,388,918 | | |

| | | $ | 61,667,922 | | |

| IT Services - 2.4% | | | |

| Accenture Ltd.(1) | | | 3,138,000 | | | $ | 71,138,460 | | |

| Acxiom Corp. | | | 647,804 | | | | 13,526,148 | | |

| Affiliated Computer Services, Inc.(1) | | | 183,730 | | | | 9,388,603 | | |

| Automatic Data Processing, Inc. | | | 1,554,446 | | | | 65,240,099 | | |

| BISYS Group, Inc. (The)(1) | | | 65,000 | | | | 971,100 | | |

| Ceridian Corp.(1) | | | 26,632 | | | | 518,791 | | |

| Certegy, Inc. | | | 42,862 | | | | 1,638,186 | | |

| Computer Sciences Corp.(1) | | | 268,947 | | | | 11,752,984 | | |

See notes to financial statements

16

Tax-Managed Growth Portfolio as of June 30, 2005

PORTFOLIO OF INVESTMENTS (Unaudited) CONT'D

| Security | | Shares | | Value | |

| IT Services (continued) | |

| CSG Systems International, Inc.(1) | | | 25,200 | | | $ | 478,296 | | |

| DST Systems, Inc.(1) | | | 309,105 | | | | 14,466,114 | | |

| eFunds, Corp.(1) | | | 1 | | | | 18 | | |

| Electronic Data Systems Corp. | | | 2,752 | | | | 52,976 | | |

| First Data Corp. | | | 3,813,208 | | | | 153,062,169 | | |

| Fiserv, Inc.(1) | | | 300,000 | | | | 12,885,000 | | |

| Gartner Group, Inc., Class A(1) | | | 3,000 | | | | 31,860 | | |

| Gartner Group, Inc., Class B(1) | | | 27,576 | | | | 292,030 | | |

| Keane, Inc.(1) | | | 38,193 | | | | 523,244 | | |

| Paychex, Inc. | | | 1,598,101 | | | | 52,002,207 | | |

| Perot Systems Corp.(1) | | | 689,196 | | | | 9,800,367 | | |

| Safeguard Scientific, Inc.(1) | | | 26,579 | | | | 34,021 | | |

| SunGard Data Systems, Inc.(1) | | | 627,684 | | | | 22,075,646 | | |

| | | $ | 439,878,319 | | |

| Leisure Equipment & Products - 0.0% | | | |

| Eastman Kodak Co. | | | 91,016 | | | $ | 2,443,780 | | |

| Mattel, Inc. | | | 30,514 | | | | 558,406 | | |

| | | $ | 3,002,186 | | |

| Machinery - 2.9% | | | |

| Caterpillar, Inc.(2)(3) | | | 17,093 | | | $ | 1,628,265 | | |

| Caterpillar, Inc. | | | 54,360 | | | | 5,181,052 | | |

| Danaher Corp. | | | 4,031,970 | | | | 211,033,310 | | |

| Deere & Co. | | | 3,350,000 | | | | 219,391,500 | | |

| Donaldson Co., Inc. | | | 79,326 | | | | 2,405,958 | | |

| Dover Corp. | | | 343,717 | | | | 12,504,424 | | |

| Federal Signal Corp. | | | 218,345 | | | | 3,406,182 | | |

| Illinois Tool Works, Inc. | | | 851,632 | | | | 67,858,038 | | |

| ITT Industries, Inc. | | | 4,214 | | | | 411,413 | | |

| Nordson Corp. | | | 163,978 | | | | 5,621,166 | | |

| Parker-Hannifin Corp. | | | 45,353 | | | | 2,812,340 | | |

| Tecumseh Products Co., Class A | | | 125,700 | | | | 3,449,208 | | |

| Wabtec | | | 94,504 | | | | 2,029,946 | | |

| | | $ | 537,732,802 | | |

| Media - 4.8% | | | |

| ADVO, Inc. | | | 750,000 | | | $ | 23,887,500 | | |

| Arbitron, Inc. | | | 11,555 | | | | 495,710 | | |

| Belo (A.H.) Corp. | | | 542,924 | | | | 13,013,888 | | |

| Cablevision Systems Corp.(1) | | | 207,410 | | | | 6,678,602 | | |

| Catalina Marketing Corp. | | | 88,490 | | | | 2,248,531 | | |

| Clear Channel Communications, Inc. | | | 132,517 | | | | 4,098,751 | | |

| Security | | Shares | | Value | |

| Media (continued) | | | |

| Comcast Corp. Class A(1) | | | 1,979,071 | | | $ | 60,757,480 | | |

| Comcast Corp. Class A Special(1) | | | 1,280,622 | | | | 38,354,629 | | |

| EchoStar Communications, Class A | | | 35,150 | | | | 1,059,773 | | |

| Entercom Communications Corp.(1) | | | 220,000 | | | | 7,323,800 | | |

| Gannett Co., Inc. | | | 1,070,142 | | | | 76,119,200 | | |

| Havas Advertising, S.A. ADR | | | 3,142,938 | | | | 17,034,724 | | |

| Interpublic Group of Cos., Inc.(1) | | | 1,130,574 | | | | 13,770,391 | | |

| Knight Ridder, Inc. | | | 18,123 | | | | 1,111,665 | | |

| Lamar Advertising Co.(1) | | | 241,409 | | | | 10,325,063 | | |

| Liberty Global, Inc. Class A(1) | | | 50,655 | | | | 2,364,069 | | |

| Liberty Global, Inc. Class B(1) | | | 1,643 | | | | 79,751 | | |

| Liberty Media Corp. Class A(1) | | | 1,326,604 | | | | 13,518,095 | | |

| Liberty Media Corp. Class B(1) | | | 32,876 | | | | 347,828 | | |

| McClatchy Co. (The) | | | 48,066 | | | | 3,145,439 | | |

| McGraw-Hill Companies, Inc. (The) | | | 693,928 | | | | 30,706,314 | | |

| Meredith Corp. | | | 78,054 | | | | 3,829,329 | | |

| New York Times Co. (The), Class A | | | 303,168 | | | | 9,443,683 | | |

| News Corp. Inc. Class A | | | 187,934 | | | | 3,040,772 | | |

| Omnicom Group, Inc. | | | 2,322,646 | | | | 185,486,510 | | |

| Proquest Company(1) | | | 115,000 | | | | 3,770,850 | | |

| Publicis Groupe SA | | | 329,132 | | | | 9,686,087 | | |

| Reuters Holdings PLC ADR | | | 1,431 | | | | 60,666 | | |

| Scripps (The E.W.) Company | | | 51,066 | | | | 2,492,021 | | |

| Time Warner, Inc.(1) | | | 4,154,531 | | | | 69,422,213 | | |

| Tribune Co. | | | 1,440,457 | | | | 50,675,277 | | |

| Univision Communications, Inc.(1) | | | 401,298 | | | | 11,055,760 | | |

| Viacom, Inc., Class A | | | 29,774 | | | | 959,318 | | |

| Viacom, Inc., Class B | | | 948,871 | | | | 30,382,849 | | |

| Vivendi Universal SA ADR | | | 490,725 | | | | 15,374,414 | | |

| Walt Disney Co. (The) | | | 4,887,954 | | | | 123,078,682 | | |

| Washington Post Co. (The) | | | 16,470 | | | | 13,752,944 | | |

| Westwood One, Inc. | | | 122,400 | | | | 2,500,632 | | |

| WPP Group PLC | | | 139,450 | | | | 1,428,968 | | |

| WPP Group PLC ADR | | | 256,051 | | | | 13,071,404 | | |

| | | $ | 875,953,582 | | |

| Metals & Mining - 0.3% | | | |

| Alcoa, Inc. | | | 697,947 | | | $ | 18,237,355 | | |

| Allegheny Technologies, Inc. | | | 21,408 | | | | 472,260 | | |

| Inco, Ltd. | | | 200,000 | | | | 7,550,000 | | |

| Nucor Corp. | | | 421,662 | | | | 19,236,220 | | |

| Phelps Dodge Corp. | | | 14,862 | | | | 1,374,735 | | |

| Steel Dynamics, Inc. | | | 311,800 | | | | 8,184,750 | | |

| | | $ | 55,055,320 | | |

See notes to financial statements

17

Tax-Managed Growth Portfolio as of June 30, 2005

PORTFOLIO OF INVESTMENTS (Unaudited) CONT'D

| Security | | Shares | | Value | |

| Multiline Retail - 1.8% | | | |

| 99 Cents Only Stores(1) | | | 1,142,232 | | | $ | 14,517,769 | | |

| Dollar General Corp. | | | 101,456 | | | | 2,065,644 | | |

| Dollar Tree Stores, Inc.(1) | | | 659,218 | | | | 15,821,232 | | |

| Family Dollar Stores, Inc. | | | 2,618,411 | | | | 68,340,527 | | |

| Kohl's Corp.(1) | | | 55 | | | | 3,075 | | |

| May Department Stores Co. (The) | | | 437,780 | | | | 17,581,245 | | |

| Nordstrom, Inc. | | | 65,692 | | | | 4,465,085 | | |

| Penney (J.C.) Company, Inc. | | | 130,816 | | | | 6,878,305 | | |

| Sears Holdings Corp.(1) | | | 6,230 | | | | 933,690 | | |

| Target Corp. | | | 3,549,371 | | | | 193,121,276 | | |

| | | $ | 323,727,848 | | |

| Multi-Utilities - 0.0% | | | |

| Dominion Resources, Inc. | | | 3,249 | | | $ | 238,444 | | |

| Wisconsin Energy Corp. | | | 9,576 | | | | 373,464 | | |

| | | $ | 611,908 | | |

| Office Electronics - 0.0% | | | |

| Xerox Corp.(1) | | | 42,878 | | | $ | 591,288 | | |

| Zebra Technologies Corp., Class A(1) | | | 13,500 | | | | 591,165 | | |

| | | $ | 1,182,453 | | |

| Oil, Gas & Consumable Fuels - 9.7% | | | |

| Amerada Hess Corp. | | | 18,947 | | | $ | 2,018,045 | | |

| Anadarko Petroleum Corp. | | | 2,556,996 | | | | 210,057,221 | | |

| Apache Corp. | | | 2,074,432 | | | | 134,008,307 | | |

| BP PLC ADR | | | 5,083,828 | | | | 317,129,191 | | |

| Burlington Resources, Inc. | | | 4,339,822 | | | | 239,731,767 | | |

| Chevron Corp. | | | 351,610 | | | | 19,662,031 | | |

| ConocoPhillips | | | 3,326,290 | | | | 191,228,412 | | |

| Devon Energy Corp. | | | 1,015,400 | | | | 51,460,472 | | |

| El Paso Corp. | | | 148,709 | | | | 1,713,128 | | |

| Exxon Mobil Corp. | | | 6,294,824 | | | | 361,763,535 | | |

| Kerr-McGee Corp. | | | 267,327 | | | | 20,399,723 | | |

| Kinder Morgan, Inc. | | | 1,781,672 | | | | 148,235,110 | | |

| Marathon Oil Corp. | | | 1,450 | | | | 77,387 | | |

| Murphy Oil Corp. | | | 39,036 | | | | 2,038,850 | | |

| Newfield Exploration Co.(1) | | | 120,000 | | | | 4,786,800 | | |

| Royal Dutch Petroleum Co. | | | 118,194 | | | | 7,670,791 | | |

| Total SA ADR | | | 400,000 | | | | 46,740,000 | | |

| Valero Energy Corp. | | | 103,020 | | | | 8,149,912 | | |

| Williams Companies, Inc. (The) | | | 219,065 | | | | 4,162,235 | | |

| | | $ | 1,771,032,917 | | |

| Security | | Shares | | Value | |

| Paper and Forest Products - 0.2% | | | |

| Georgia-Pacific Corp. | | | 488,939 | | | $ | 15,548,260 | | |

| International Paper Co. | | | 112,154 | | | | 3,388,172 | | |

| Louisiana-Pacific Corp. | | | 70,750 | | | | 1,739,035 | | |

| MeadWestvaco Corp. | | | 84,358 | | | | 2,365,398 | | |

| Neenah Paper, Inc. | | | 41,453 | | | | 1,283,799 | | |

| Weyerhaeuser Co. | | | 89,778 | | | | 5,714,370 | | |

| | | $ | 30,039,034 | | |

| Personal Products - 1.6% | | | |

| Avon Products, Inc. | | | 173,400 | | | $ | 6,563,190 | | |

| Gillette Company | | | 3,966,764 | | | | 200,837,261 | | |

| Lauder (Estee) Companies, Inc. | | | 2,092,312 | | | | 81,872,169 | | |

| | | $ | 289,272,620 | | |

| Pharmaceuticals - 6.5% | | | |

| Abbott Laboratories | | | 3,015,317 | | | $ | 147,780,686 | | |

| Allergan, Inc. | | | 38,300 | | | | 3,264,692 | | |

| Andrx Corp.(1) | | | 180,170 | | | | 3,659,253 | | |

| Bristol-Myers Squibb Co. | | | 4,659,347 | | | | 116,390,488 | | |

| Elan Corp. PLC ADR(1) | | | 31,838 | | | | 217,135 | | |

| Forest Laboratories, Inc.(1) | | | 56,800 | | | | 2,206,680 | | |

| GlaxoSmithKline PLC ADR | | | 434,293 | | | | 21,067,553 | | |

| Johnson & Johnson | | | 3,276,675 | | | | 212,983,875 | | |

| King Pharmaceuticals, Inc.(1) | | | 505,637 | | | | 5,268,738 | | |

| Lilly (Eli) & Co. | | | 3,780,716 | | | | 210,623,688 | | |

| Merck & Co., Inc. | | | 2,536,057 | | | | 78,110,556 | | |

| Mylan Laboratories, Inc. | | | 27,992 | | | | 538,566 | | |

| Novo Nordisk ADR | | | 292,277 | | | | 14,897,359 | | |

| Pfizer, Inc. | | | 7,713,548 | | | | 212,739,654 | | |

| Schering AG ADR | | | 25,000 | | | | 1,542,250 | | |

| Schering-Plough Corp. | | | 2,481,743 | | | | 47,302,022 | | |

| Sepracor, Inc.(1) | | | 4,000 | | | | 240,040 | | |

| Teva Pharmaceutical Industries Ltd. ADR | | | 1,960,008 | | | | 61,034,649 | | |

| Watson Pharmaceuticals, Inc.(1) | | | 682,822 | | | | 20,184,218 | | |

| Wyeth Corp. | | | 840,705 | | | | 37,411,373 | | |

| | | $ | 1,197,463,475 | | |

| Real Estate - 0.2% | | | |

| AvalonBay Communities, Inc. | | | 28,867 | | | $ | 2,332,454 | | |

| Catellus Development Corp. | | | 398,165 | | | | 13,059,812 | | |

| Forest City Enterprises, Class A | | | 38,663 | | | | 2,745,073 | | |

| Jones Lang LaSalle, Inc.(1) | | | 1,835 | | | | 81,162 | | |

See notes to financial statements

18

Tax-Managed Growth Portfolio as of June 30, 2005

PORTFOLIO OF INVESTMENTS (Unaudited) CONT'D

| Security | | Shares | | Value | |

| Real Estate (continued) | | | |

| Plum Creek Timber Co., Inc. | | | 198,791 | | | $ | 7,216,113 | | |

| Trammell Crow Co.(1) | | | 473,932 | | | | 11,488,112 | | |

| | | $ | 36,922,726 | | |

| Road & Rail - 0.2% | | | |

| ANC Rental Corp.(1) | | | 389,417 | | | $ | 39 | | |

| Burlington Northern Santa Fe Corp. | | | 192,065 | | | | 9,042,420 | | |

| CSX Corporation | | | 38,134 | | | | 1,626,796 | | |

| Florida East Coast Industries, Inc. | | | 121,978 | | | | 5,281,647 | | |

| Heartland Express, Inc. | | | 653,154 | | | | 12,690,782 | | |

| Kansas City Southern Industries, Inc.(1) | | | 15,215 | | | | 307,039 | | |

| Norfolk Southern Corp. | | | 3,990 | | | | 123,530 | | |

| Union Pacific Corp. | | | 10,453 | | | | 677,354 | | |

| | | $ | 29,749,607 | | |

Semiconductors & Semiconductor

Equipment - 2.3% | | | |

| Agere Systems, Inc.(1) | | | 16,588 | | | $ | 199,056 | | |

| Altera Corp.(1) | | | 66,116 | | | | 1,310,419 | | |

| Analog Devices, Inc. | | | 574,160 | | | | 21,421,910 | | |

| Applied Materials, Inc. | | | 1,441,642 | | | | 23,325,768 | | |

| Broadcom Corp., Class A(1) | | | 541,281 | | | | 19,220,888 | | |

| Broadcom Corp., Class A(1)(2)(3) | | | 35,000 | | | | 1,241,918 | | |

| Conexant Systems, Inc.(1) | | | 134,174 | | | | 216,020 | | |

| Cypress Semiconductor Corporation(1) | | | 152,742 | | | | 1,923,022 | | |

| Freescale Semiconductor, Class B(1) | | | 101,704 | | | | 2,154,091 | | |

| Intel Corp. | | | 10,106,487 | | | | 263,375,051 | | |

| KLA-Tencor Corp. | | | 148,373 | | | | 6,483,900 | | |

| Linear Technology Corp. | | | 187,760 | | | | 6,888,914 | | |

| LSI Logic Corp.(1) | | | 132,810 | | | | 1,127,557 | | |

| Maxim Integrated Products Co. | | | 274,351 | | | | 10,482,952 | | |

| Mindspeed Technologies, Inc.(1) | | | 44,724 | | | | 54,563 | | |

| Skyworks Solutions, Inc.(1) | | | 98,685 | | | | 727,308 | | |