UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-02589 |

|

Eaton Vance Series Trust |

(Exact name of registrant as specified in charter) |

|

The Eaton Vance Building, 255 State Street, Boston, Massachusetts | | 02109 |

(Address of principal executive offices) | | (Zip code) |

|

Alan R. Dynner The Eaton Vance Building, 255 State Street, Boston, Massachusetts 02109 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (617) 482-8260 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2006 | |

| | | | | | | | |

Item 1. Reports to Stockholders

Annual Report December 31, 2006

EATON VANCE

TAX-MANAGED

GROWTH

FUND

1.0

IMPORTANT NOTICES REGARDING PRIVACY,

DELIVERY OF SHAREHOLDER DOCUMENTS,

PORTFOLIO HOLDINGS, AND PROXY VOTING

Privacy. The Eaton Vance organization is committed to ensuring your financial privacy. Each of the financial institutions identified below has in effect the following policy ("Privacy Policy") with respect to nonpublic personal information about its customers:

• Only such information received from you, through application forms or otherwise, and information about your Eaton Vance fund transactions will be collected. This may include information such as name, address, social security number, tax status, account balances and transactions.

• None of such information about you (or former customers) will be disclosed to anyone, except as permitted by law (which includes disclosure to employees necessary to service your account). In the normal course of servicing a customer's account, Eaton Vance may share information with unaffiliated third parties that perform various required services such as transfer agents, custodians and broker/dealers.

• Policies and procedures (including physical, electronic and procedural safeguards) are in place that are designed to protect the confidentiality of such information.

• We reserve the right to change our Privacy Policy at any time upon proper notification to you. Customers may want to review our Policy periodically for changes by accessing the link on our homepage: www.eatonvance.com.

Our pledge of privacy applies to the following entities within the Eaton Vance organization: the Eaton Vance Family of Funds, Eaton Vance Management, Eaton Vance Investment Counsel, Boston Management and Research, and Eaton Vance Distributors, Inc.

In addition, our Privacy Policy only applies to those Eaton Vance customers who are individuals and who have a direct relationship with us. If a customer's account (i.e., fund shares) is held in the name of a third-party financial adviser/broker-dealer, it is likely that only such adviser's privacy policies apply to the customer. This notice supersedes all previously issued privacy disclosures.

For more information about Eaton Vance's Privacy Policy, please call 1-800-262-1122.

Delivery of Shareholder Documents. The Securities and Exchange Commission (the "SEC") permits funds to deliver only one copy of shareholder documents, including prospectuses, proxy statements and shareholder reports, to fund investors with multiple accounts at the same residential or post office box address. This practice is often called "householding" and it helps eliminate duplicate mailings to shareholders.

Eaton Vance, or your financial adviser, may household the mailing of your documents indefinitely unless you instruct Eaton Vance, or your financial adviser, otherwise.

If you would prefer that your Eaton Vance documents not be householded, please contact Eaton Vance at 1-800-262-1122, or contact your financial adviser.

Your instructions that householding not apply to delivery of your Eaton Vance documents will be effective within 30 days of receipt by Eaton Vance or your financial adviser.

Portfolio Holdings. Each Eaton Vance Fund and its underlying Portfolio (if applicable) will file a schedule of its portfolio holdings on Form N-Q with the SEC for the first and third quarters of each fiscal year. The Form N-Q will be available on the Eaton Vance website www.eatonvance.com, by calling Eaton Vance at 1-800-262-1122 or in the EDGAR database on the SEC's website at www.sec.gov. Form N-Q may also be reviewed and copied at the SEC's public reference room in Washington, D.C. (call 1-800-732-0330 for information on the operation of the public reference room).

Proxy Voting. From time to time, funds are required to vote proxies related to the securities held by the funds. The Eaton Vance Funds or their underlying Portfolios (if applicable) vote proxies according to a set of policies and procedures approved by the Funds' and Portfolios' Boards. You may obtain a description of these policies and procedures and information on how the Funds or Portfolios voted proxies relating to portfolio securities during the most recent 12 month period ended June 30, without charge, upon request, by calling 1-800-262-1122. This description is also available on the SEC's website at www.sec.gov.

Eaton Vance Tax-Managed Growth Fund 1.0 as of December 31, 2006

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

Lewis R. Piantedosi

Co-Portfolio Manager

Duncan W. Richardson, CFA

Co-Portfolio Manager

The Fund

Performance for the Past Year

· For the year ended December 31, 2006, Eaton Vance Tax-Managed Growth Fund 1.0 (the Fund) had a total return of 13.62%. This return was the result of an increase in net asset value per share to $603.37 on December 31, 2006, from $546.87 on December 31, 2005, and the reinvestment of $8.030 per share in dividend income and $9.5115 per share in capital gains.

· For comparison, the S&P 500 Index – a broad-based, unmanaged market index commonly used as a measure of overall U.S. stock market performance – had a total return of 15.78% for the same period. The Lipper Large-Cap Core Classification had a total return of 13.53% for the same period.(1)

See pages 3 and 4 for more performance information, including after-tax returns.

Management Discussion

· The year ended December 31, 2006 marked another impressive year for equities as broad U.S. markets locked in a fourth consecutive annual gain. Helping fuel the rally were easing inflation and housing concerns, as well as declining oil prices and a continued pause in interest rate increases. Record levels of mergers and private equity activity further supported higher stock prices during the year, as did better than expected earnings and profit results. Price gains for the year were broad-based, but of particular note were the double digit gains realized by the blue chip Dow Industrial Average and the S&P 500 Index.

· For the year ended December 31, 2006, each of the 10 major sectors included in the S&P 500 Index registered positive returns. Telecommunications, energy and utilities were top performing S&P 500 Index sectors during the year, while the health care and information technology sectors had the weakest performance. Market leading industries of 2006 included diversified telecommunications, real estate investment trusts and investment bank and brokerage. In contrast, internet and catalog retailers, biotechnology and educational service industries realized weaker returns for the year. During the course of the year, on average, small-cap stocks outperformed large-cap stocks and the value investment style continued to lead growth.

· The Fund invests its assets in Tax-Managed Growth Portfolio (the Portfolio), a separate registered investment company with the same objective and investment policies as the Fund. The Portfolio in turn invests primarily in common stocks of established growth companies. The Fund underperformed its benchmark due in part to differences in sector allocation and stock selection in the Portfolio versus the S&P 500 Index.

· During the year ended December 31, 2006, the Portfolio remained overweight in the industrials, consumer staples and consumer discretionary sectors, while continuing to underweight the technology, telecommunications and utilities sectors. The Portfolio benefited from its emphasis of the strong performing energy and consumer discretionary sectors and relatively stronger investment selection within commercial banks and metals and mining versus the S&P 500 Index. The Portfolio’s underweight of the technology sector was also helpful, particularly within the semiconductor and internet software industries, as stocks in those sectors experienced significant declines over the course of the year.

(1) It is not possible to invest directly in an Index or a Lipper Classification. The Index’s total return does not reflect commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index. The Lipper Classification return shown is the average total return, at net asset value, of the funds that are in the same Lipper Classification as the Fund.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to www.eatonvance.com.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

1

Eaton Vance Tax-Managed Growth Fund 1.0 as of December 31, 2006

Management’s Discussion of Fund Performance

· During the year ended December 31, 2006, the Portfolio’s de-emphasis of high dividend yielding stocks, such as those in the utilities and telecommunications sectors, hurt performance, as did the weak performance of certain Portfolio holdings in the health care and consumer staples sectors. Despite positive performance from holdings in the air freight and machinery stocks industries, the Portfolio’s overweight of the lagging industrials sector negatively impacted returns.

The views expressed throughout this report are those of the portfolio managers and are current only through the end of the period of the report as stated on the cover. These views are subject to change at any time based upon market or other conditions, and the investment adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on many factors, may not be relied on as an indication of trading intent on behalf of any Eaton Vance fund.

Ten Largest Holdings*

By net assets

Exxon Mobil Corp. | | 2.64 | % |

General Electric Co. | | 2.37 | % |

Procter & Gamble Co. | | 2.34 | % |

American International Group | | 2.22 | % |

ConocoPhillips | | 2.17 | % |

Pepsico Inc. | | 1.90 | % |

BP PLC Spons ADR | | 1.68 | % |

Deere & Co. | | 1.55 | % |

Amgen Inc. | | 1.47 | % |

Danaher Corp. | | 1.44 | % |

Common Stock Investments by Sector**

By net assets

* Ten Largest Holdings represented 19.78% of Portfolio net assets as of December 31, 2006. Holdings are subject to change due to active management.

**As a percentage of the Portfolio’s net assets as of December 31, 2006. Portfolio information may not be representative of current or future investments and may change due to active management.

2

Eaton Vance Tax-Managed Growth Fund 1.0 as of December 31, 2006

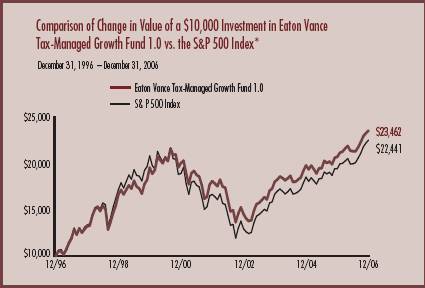

FUND PERFORMANCE

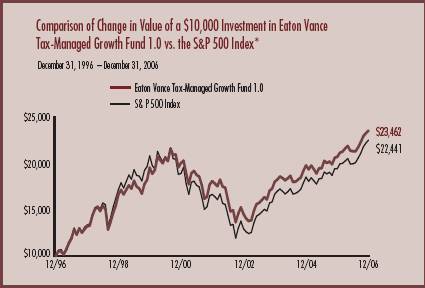

The line graph and table set forth below provide information about the Fund’s performance. The line graph compares the performance of the Fund with that of the S&P 500 Index, a broad-based, unmanaged market index commonly used as a measure of U.S. stock market performance. The lines on the graph represent the total returns of a hypothetical investment of $10,000 in each of the Fund and the S&P 500 Index. The table includes the total returns of the Fund. The performance presented below does not reflect the deduction of taxes, if any, that a shareholder would pay on distributions or redemptions of Fund shares.

Performance

Average Annual Total Returns (at net asset value) | | | |

One Year | | 13.62 | % |

Five Years | | 5.38 | % |

Ten Years | | 8.90 | % |

Life of Fund (3/29/66) | | 10.27 | % |

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to www.eatonvance.com.

* Source: Thomson Financial. The Fund commenced investment operations on 3/29/66.

It is not possible to invest directly in an Index. The Index’s total return does not reflect any commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

3

Eaton Vance Tax-Managed Growth Fund 1.0 as of December 31, 2006

FUND PERFORMANCE

“Return Before Taxes” does not take into consideration shareholder taxes. It is most relevant to tax-free or tax-deferred shareholder accounts. “Return After Taxes on Distributions” reflects the impact of federal income taxes due on Fund distributions of dividends and capital gains. It is most relevant to taxpaying shareholders who continue to hold their shares. “Return After Taxes on Distributions and Sale of Fund Shares” also reflects the impact of taxes on capital gain or loss realized upon a sale of shares. It is most relevant to taxpaying shareholders who sell their shares.

Average Annual Total Returns (For the periods ended December 31, 2006)

Returns at net asset Value (NAV)

| | One Year | | Five Years | | Ten Years | |

Return Before Taxes | | 13.62 | % | 5.38 | % | 8.90 | % |

Return After Taxes on Distributions | | 13.19 | % | 5.00 | % | 8.60 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | 9.54 | % | 4.53 | % | 7.83 | % |

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to www.eatonvance.com.

The Fund commenced investment operations 3/29/66.

After-tax returns are calculated using the highest historical individual federal income tax rate and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and may differ from those shown. After-tax returns are not relevant for shareholders who hold shares in tax-deferred accounts or to shares held by non-taxable entities. Return After Taxes on Distributions for a period may be the same as Return Before Taxes for that period because no distributions were paid during that period or because the taxable portion of distributions made during the period was insignificant. Also, Return After Taxes on Distributions and Sale of Fund Shares for a period may be greater than Return After Taxes on Distributions for the same period because of realized losses on the sale of Fund shares.

4

Eaton Vance Tax-Managed Growth Fund 1.0 as of December 31, 2006

FUND EXPENSES

Example: As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2006 – December 31, 2006).

Actual Expenses: The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual return of the Fund. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Eaton Vance Tax-Managed Growth Fund 1.0

| | | Beginning Account Value

(7/1/06) | | Ending Account Value

(12/31/06) | | Expenses Paid During Period*

(7/1/06 – 12/31/06) | |

| Actual | | $ | 1,000.00 | | | $ | 1,103.90 | | | $ | 2.44 | | |

| Hypothetical | |

| (5% return per year before expenses) | | $ | 1,000.00 | | | $ | 1,022.90 | | | $ | 2.35 | | |

* Expenses are equal to the Fund's annualized expense ratio of 0.46% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2006. The Example reflects the expenses of both the Fund and the Portfolio.

5

Eaton Vance Tax-Managed Growth Fund 1.0 as of December 31, 2006

FINANCIAL STATEMENTS

Statement of Assets and Liabilities

As of December 31, 2006

| Assets | |

Investment in Tax-Managed Growth Portfolio, at value

(identified cost, $289,570,032) | | $ | 1,032,844,274 | | |

| Total assets | | $ | 1,032,844,274 | | |

| Liabilities | |

| Payable for Fund shares redeemed | | $ | 202,872 | | |

| Payable to affiliate for Trustees' fees | | | 842 | | |

| Accrued expenses | | | 47,234 | | |

| Total liabilities | | $ | 250,948 | | |

| Net Assets for 1,711,376 shares of beneficial interest outstanding | | $ | 1,032,593,326 | | |

| Sources of Net Assets | |

| Paid-in capital | | $ | 334,782,664 | | |

Accumulated net realized loss from Portfolio (computed on

the basis of identified cost) | | | (26,080,944 | ) | |

| Accumulated undistributed net investment income | | | 126,536 | | |

Accumulated federal tax on undistributed net realized long-term

capital gain, paid on behalf of the shareholders | | | (19,509,172 | ) | |

Net unrealized appreciation from Portfolio (computed on the basis of

identified cost) | | | 743,274,242 | | |

| Total | | $ | 1,032,593,326 | | |

Net Asset Value and

Redemption Price Per Share | |

| ($1,032,593,326 ÷ 1,711,376 shares of beneficial interest outstanding) | | $ | 603.37 | | |

Statement of Operations

For the Year Ended

December 31, 2006

| Investment Income | |

| Dividends allocated from Portfolio (net of foreign taxes, $247,260) | | $ | 18,286,271 | | |

| Interest allocated from Portfolio | | | 137,182 | | |

| Security lending income allocated from Portfolio, net | | | 23,364 | | |

| Expenses allocated from Portfolio | | | (4,465,042 | ) | |

| Net investment income from Portfolio | | $ | 13,981,775 | | |

| Expenses | |

| Trustees' fees and expenses | | $ | 3,516 | | |

| Custodian fee | | | 36,654 | | |

| Transfer and dividend disbursing agent fees | | | 35,173 | | |

| Legal and accounting services | | | 28,399 | | |

| Printing and postage | | | 14,218 | | |

| Miscellaneous | | | 8,918 | | |

| Total expenses | | $ | 126,878 | | |

| Net investment income | | $ | 13,854,897 | | |

| Realized and Unrealized Gain (Loss) from Portfolio | |

Net realized gain (loss) —

Investment transactions (identified cost basis) | | $ | 52,037,170 | | |

| Foreign currency transactions | | | (1,219 | ) | |

| Net realized gain | | $ | 52,035,951 | | |

Change in unrealized appreciation (depreciation) —

Investments (identified cost basis) | | $ | 62,965,559 | | |

| Foreign currency | | | 5,239 | | |

| Net change in unrealized appreciation (depreciation) | | $ | 62,970,798 | | |

| Net realized and unrealized gain | | $ | 115,006,749 | | |

| Net increase in net assets from operations | | $ | 128,861,646 | | |

See notes to financial statements

6

Eaton Vance Tax-Managed Growth Fund 1.0 as of December 31, 2006

FINANCIAL STATEMENTS CONT'D

Statements of Changes in Net Assets

Increase (Decrease)

in Net Assets | | Year Ended

December 31, 2006 | | Year Ended

December 31, 2005* | |

From operations —

Net investment income | | $ | 13,854,897 | | | $ | 12,135,866 | | |

Net realized gain from investment

transactions, securities sold short and

foreign currency transactions | | | 52,035,951 | | | | 10,141,509 | | |

Net change in unrealized appreciation

(depreciation) of investments, securities

sold short and foreign currency | | | 62,970,798 | | | | 22,423,541 | | |

| Net increase in net assets from operations | | $ | 128,861,646 | | | $ | 44,700,916 | | |

Distributions to shareholders —

From net investment income | | $ | (13,878,065 | ) | | $ | (11,933,965 | ) | |

From net realized gain on investment

transactions | | | (16,167,277 | ) | | | (3,401,078 | ) | |

| Total distributions to shareholders | | $ | (30,045,342 | ) | | $ | (15,335,043 | ) | |

Transactions in shares of beneficial interest —

Net asset value of shares issued to

shareholders in payment of

distributions declared | | $ | 9,756,490 | | | $ | 4,352,380 | | |

| Cost of shares redeemed | | | (68,830,449 | ) | | | (44,505,867 | ) | |

Net decrease in net assets

from Fund share transactions | | $ | (59,073,959 | ) | | $ | (40,153,487 | ) | |

| Net increase (decrease) in net assets | | $ | 39,742,345 | | | $ | (10,787,614 | ) | |

| Net Assets | |

| At beginning of year | | $ | 992,850,981 | | | $ | 1,003,638,595 | | |

| At end of year | | $ | 1,032,593,326 | | | $ | 992,850,981 | | |

Accumulated undistributed

net investment income

included in net assets | |

| At end of year | | $ | 126,536 | | | $ | 183,287 | | |

* Amounts were reclassified for the year ended December 31, 2005 resulting in an increase in net realized gain (loss) and a decrease in net change in unrealized appreciation (depreciation) of $49,188,852. This amount was reclassified due to the correction of the allocation of realized gain (loss). These changes had no effect on the Fund's net asset value, net assets, net investment income, net increase in net assets from operations, financial highlights or total return.

See notes to financial statements

7

Eaton Vance Tax-Managed Growth Fund 1.0 as of December 31, 2006

FINANCIAL STATEMENTS CONT'D

Financial Highlights

| | | Year Ended December 31, | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| Net asset value — Beginning of year | | $ | 546.870 | | | $ | 530.770 | | | $ | 493.870 | | | $ | 410.040 | | | $ | 514.030 | | |

| Income (loss) from operations | |

| Net investment income | | $ | 8.023 | | | $ | 6.586 | | | $ | 5.964 | | | $ | 4.627 | | | $ | 3.840 | | |

| Net realized and unrealized gain (loss) | | | 66.019 | | | | 17.864 | | | | 41.533 | | | | 92.657 | | | | (104.030 | ) | |

| Total income (loss) from operations | | $ | 74.042 | | | $ | 24.450 | | | $ | 47.497 | | | $ | 97.284 | | | $ | (100.190 | ) | |

| Less distributions | |

| From net investment income | | $ | (8.030 | ) | | $ | (6.475 | ) | | $ | (5.950 | ) | | $ | (4.550 | ) | | $ | (3.800 | ) | |

| From net realized gain | | | (9.512 | ) | | | (1.875 | ) | | | (4.647 | ) | | | (8.904 | ) | | | — | | |

| Total distributions | | $ | (17.542 | ) | | $ | (8.350 | ) | | $ | (10.597 | ) | | $ | (13.454 | ) | | $ | (3.800 | ) | |

| Net asset value — End of year | | $ | 603.370 | | | $ | 546.870 | | | $ | 530.770 | | | $ | 493.870 | | | $ | 410.040 | | |

| Total Return(1) | | | 13.62 | % | | | 4.64 | % | | | 9.68 | % | | | 23.86 | % | | | (19.54 | )% | |

| Ratios/Supplemental Data | |

| Net assets, end of year (000's omitted) | | $ | 1,032,593 | | | $ | 992,851 | | | $ | 1,003,639 | | | $ | 979,183 | | | $ | 863,009 | | |

| Ratios (As a percentage of average daily net assets): | |

| Expenses before custodian fee reduction(2) | | | 0.46 | % | | | 0.46 | %† | | | 0.46 | %† | | | 0.47 | % | | | 0.47 | % | |

| Expenses after custodian fee reduction(2) | | | 0.46 | % | | | 0.46 | %† | | | 0.46 | %† | | | 0.47 | % | | | 0.47 | % | |

| Net investment income | | | 1.38 | % | | | 1.24 | %† | | | 1.17 | %† | | | 1.04 | % | | | 0.83 | % | |

| Portfolio Turnover of the Portfolio(3) | | | 1 | % | | | 0 | %(4) | | | 3 | % | | | 15 | % | | | 23 | % | |

† The operating expenses of the Portfolio reflect a reduction of the investment adviser fee. Had such action not been taken, the ratios and net investment income per share would have changed by less than 0.005% and $0.0005, respectively.

(1) Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested.

(2) Includes the Fund's share of the Portfolio's allocated expenses.

(3) Excludes the value of the portfolio securities contributed or distributed as a result of in-kind shareholder transactions. The total turnover rate of the Portfolio including in-kind contributions and distributions of securities was 7%, 6%, 10%, 21%, and 30% for 2006, 2005, 2004, 2003, and 2002, respectively.

(4) Amounts to less than 1%.

See notes to financial statements

8

Eaton Vance Tax-Managed Growth Fund 1.0 as of December 31, 2006

NOTES TO FINANCIAL STATEMENTS

1 Significant Accounting Policies

Eaton Vance Tax-Managed Growth Fund 1.0 (the Fund), is a diversified series of Eaton Vance Series Trust (the Trust). The Trust is an entity of the type commonly known as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Fund invests all of its investable assets in interests of Tax-Managed Growth Portfolio (the Portfolio), a New York trust, having the same investment objective as the Fund. The value of the Fund's investment in the Portfolio reflects the Fund's proportionate interest in the net assets of the Portfolio (5.1% at December 31, 2006). The performance of the Fund is directly affected by the performance of the Portfolio. The financial statements of the Portfolio, including the Portfolio of Investments, are included elsewhere in this report and should be read in conjunction with the Fund's financial statements.

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America.

A Investment Valuation — Valuation of securities by the Portfolio is discussed in Note 1A of the Portfolio's Notes to Financial Statements, which are included elsewhere in this report.

B Income — The Fund's net investment income or loss consists of the Fund's pro rata share of the net investment income or loss of the Portfolio, less all actual and accrued expenses of the Fund.

C Expenses — The majority of expenses of the Trust are directly identifiable to an individual fund. Expenses which are not readily identifiable to a specific fund are allocated taking into consideration, among other things, the nature and type of expense and the relative size of the funds.

D Federal Taxes — The Fund's policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute to shareholders, each year, substantially all of its net investment income and all or substantially all of its net realized capital gains. Accordingly, no provision for federal income or excise tax is necessary. Although the Fund intends to distribute net realized long-term gains to shareholders each year, the Fund reserves the right to designate such gains as undistributed and pay the federal

tax thereon on behalf of shareholders. Provision for such tax is recorded on the Fund's records on the last business day of the Fund's fiscal year because the Internal Revenue Code provides that such tax is allocated among shareholders of record on that date.

At December 31, 2006, net losses of $371 attributable to currency transactions incurred after October 31, 2006 are treated as arising on the first day of the Fund's taxable year ending December 31, 2007.

E Expense Reduction — Investors Bank & Trust Company (IBT) serves as custodian of the Fund. Pursuant to the custodian agreement, IBT receives a fee reduced by credits which are determined based on the average daily cash balance the Fund maintains with IBT. All credit balances used to reduce the Fund's custodian fees are reported as a reduction of expenses in the Statement of Operations. For the year ended December 31, 2006, there were no credit balances used to reduce the Fund's custodian fee.

F Indemnifications — Under the Trust's organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund, and shareholders are indemnified against personal liability for the obligations of the Trust. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

G Other — Investment transactions are accounted for on the date the securities are purchased or sold. Dividends to shareholders are recorded on the ex-dividend date.

H Use of Estimates — The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

9

Eaton Vance Tax-Managed Growth Fund 1.0 as of December 31, 2006

NOTES TO FINANCIAL STATEMENTS CONT'D

2 Distributions to Shareholders

The Fund's policy is to distribute all or substantially all of the net investment income allocated by the Portfolio to the Fund (less the Fund's direct expenses) and to distribute all or substantially all of its net realized capital gains (reduced by any available capital loss carryforwards from prior years) allocated by the Portfolio to the Fund, if any. Distributions are paid in the form of additional shares of the Fund or, at the election of the shareholder, in cash. Shareholders may reinvest all distributions in additional shares of the Fund at net asset value as of the close of business on the ex-dividend date. The Fund distinguishes between distributions on a tax basis and a financial reporting basis. Accounting principles generally accepted in the United States of America require that only distributions in excess of tax basis earnings and profits be reported in the financial statements as a return of capital. Permanent di fferences between book and tax accounting relating to distributions are re-classified to paid-in capital.

The tax character of distributions paid for the years ended December 31, 2006 and December 31, 2005 was as follows:

| | | Year Ended December 31, | |

| | | 2006 | | 2005 | |

| Distributions declared from: | |

| Ordinary income | | $ | 13,878,065 | | | $ | 11,934,174 | | |

| Long-term capital gain | | $ | 16,167,277 | | | $ | 3,400,869 | | |

During the year ended December 31, 2006, accumulated paid-in capital was increased by $49,490,104, accumulated undistributed net investment income was decreased by $33,583, and accumulated net realized gain was decreased by $49,456,521 primarily due to differences between book and tax accounting treatment of foreign currency gain (loss) and redemptions in-kind. Additionally, amounts were reclassified resulting in an increase in accumulated paid-in capital and a decrease in accumulated net realized gains of $229,220,496 due to the correction of the allocation of realized gain (loss). These changes had no effect on the Fund's net assets or net asset value per share.

As of December 31, 2006, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

| Accumulated undistributed income | | $ | 121,715 | | |

| Unrealized appreciation | | $ | 714,657,964 | | |

| Undistributed long-term capital gain | | $ | 2,540,526 | | |

| Other temporary differences | | $ | (371 | ) | |

3 Shares of Beneficial Interest

The Fund's Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest (without par value). Such shares may be issued in a number of different series (such as the Fund) and classes. Transactions in Fund shares were as follows:

| | | Year Ended December 31, | |

| | | 2006 | | 2005 | |

Issued to shareholders electing to

receive payments of distributions

in Fund shares | | | 16,401 | | | | 8,074 | | |

| Redemptions | | | (120,554 | ) | | | (83,456 | ) | |

| Net decrease | | | (104,153 | ) | | | (75,382 | ) | |

4 Investment Transactions

Decreases in the Fund's investment in the Portfolio aggregated $89,368,871 for the year ended December 31, 2006. Decreases in the Fund's investment in the Portfolio include the distribution of common stock as the result of redemptions in-kind of $67,426,991 for the year ended December 31, 2006.

5 Transactions with Affiliates

Eaton Vance Management (EVM) serves as the administrator of the Fund, but receives no compensation. The Portfolio has engaged Boston Management and Research (BMR), a subsidiary of EVM, to render investment advisory services. See Note 2 of the Portfolio's Notes to Financial Statements which are included elsewhere in this report. EVM serves as the sub-transfer agent of the Fund and receives an aggregate fee based upon the actual expenses incurred by EVM in the performance of those services. For the year ended December 31, 2006, EVM received $3,541 in sub-transfer agent fees.

Except for Trustees of the Fund and the Portfolio who are not members of EVM's or BMR's organization, officers and Trustees receive remuneration for their services to the Fund out of the investment adviser fee earned by BMR. Trustees of the Fund who are not affiliated with EVM or BMR may elect to defer receipt of all or a percentage of these annual fees in accordance with terms of the Trustees Deferred Compensation Plan. For the year ended December 31, 2006, no significant amounts have been deferred.

Certain officers and Trustees of the Fund are officers of the above organizations.

10

Eaton Vance Tax-Managed Growth Fund 1.0 as of December 31, 2006

NOTES TO FINANCIAL STATEMENTS CONT'D

6 Recently Issued Accounting Pronouncements

In June 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 48, (FIN 48) "Accounting for Uncertainty in Income Taxes – an interpretation of FASB Statement No. 109". FIN 48 clarifies the accounting for uncertainty in income taxes recognized in accordance with FASB Statement No. 109, "Accounting for Income Taxes." This interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. It also provides guidance on de-recognition, classification, interest and penalties, accounting in interim periods, disclosure and transition. FIN 48 is effective during the first required financial reporting period for fiscal years beginning after December 15, 2006. Management is currently evaluating the impact of applying the various provisions of FIN 48.

In September 2006, FASB issued Statement of Financial Accounting Standards No. 157, (FAS 157) "Fair Value Measurements". FAS 157 defines fair value, establishes a framework for measuring fair value in accordance with generally accepted accounting principles and expands disclosure about fair value measurements. FAS 157 is effective for fiscal years beginning after November 15, 2007. Management is currently evaluating the impact the adoption of FAS 157 will have on the Fund's financial statement disclosures.

11

Eaton Vance Tax-Managed Growth Fund 1.0 as of December 31, 2006

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Trustees of Eaton Vance Series Trust and

Shareholders of Eaton Vance Tax-Managed

Growth Fund 1.0:

We have audited the accompanying statement of assets and liabilities of Eaton Vance Tax-Managed Growth Fund 1.0 (the Fund) (one of the series of Eaton Vance Series Trust) as of December 31, 2006, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates ma de by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Eaton Vance Tax-Managed Growth Fund 1.0 as of December 31, 2006, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

Boston, Massachusetts

February 20, 2007

12

Eaton Vance Tax-Managed Growth Fund 1.0 as of December 31, 2006

FEDERAL TAX INFORMATION (Unaudited)

The Form 1099-DIV you received in January 2007 showed the tax status of all distributions paid to your account in calendar 2006. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code regulations, shareholders must be notified within 60 days of the Fund's fiscal year end regarding the status of qualified dividend income for individuals, the dividends received deduction for corporations, and capital gains dividends.

Qualified Dividend Income. The Fund designates $14,528,003 or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for the reduced tax rate of 15%.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund's dividend distribution that qualified under tax law. For the Fund's fiscal 2006 ordinary income dividends, 100% qualified for the corporate dividends received deduction.

Capital Gains Dividends. The Fund designates $16,167,277 as a capital gain dividend.

13

Tax-Managed Growth Portfolio as of December 31, 2006

PORTFOLIO OF INVESTMENTS

| Common Stocks — 99.7% | |

| Security | | Shares | | Value | |

| Aerospace & Defense — 3.3% | |

| Boeing Company (The) | | | 948,774 | | | $ | 84,289,082 | | |

| General Dynamics Corp. | | | 1,470,000 | | | | 109,294,500 | | |

| Honeywell International, Inc. | | | 293,060 | | | | 13,258,034 | | |

| Northrop Grumman Corp. | | | 3,106,377 | | | | 210,301,723 | | |

| Raytheon Co. | | | 350,050 | | | | 18,482,640 | | |

| Rockwell Collins, Inc. | | | 129,632 | | | | 8,204,409 | | |

| United Technologies Corp. | | | 3,693,938 | | | | 230,945,004 | | |

| | | $ | 674,775,392 | | |

| Air Freight & Logistics — 2.7% | |

| C.H. Robinson Worldwide, Inc. | | | 2,078,589 | | | $ | 84,993,504 | | |

| FedEx Corp. | | | 2,219,776 | | | | 241,112,069 | | |

| United Parcel Service, Inc., Class B | | | 2,979,416 | | | | 223,396,612 | | |

| | | $ | 549,502,185 | | |

| Airlines — 0.0% | |

| Southwest Airlines Co. | | | 386,112 | | | $ | 5,915,236 | | |

| | | $ | 5,915,236 | | |

| Auto Components — 0.1% | |

| BorgWarner, Inc. | | | 95,849 | | | $ | 5,657,008 | | |

| Delphi Corp.(1) | | | 5,361 | | | | 20,479 | | |

| Johnson Controls, Inc. | | | 213,523 | | | | 18,345,896 | | |

| Visteon Corp.(1) | | | 4,426 | | | | 37,532 | | |

| | | $ | 24,060,915 | | |

| Automobiles — 0.1% | |

| DaimlerChrysler AG(2) | | | 24,284 | | | $ | 1,491,280 | | |

| Ford Motor Co. | | | 83,266 | | | | 625,328 | | |

| General Motors Corp. | | | 33,939 | | | | 1,042,606 | | |

| Harley-Davidson, Inc. | | | 141,140 | | | | 9,946,136 | | |

| | | $ | 13,105,350 | | |

| Beverages — 4.5% | |

| Anheuser-Busch Companies, Inc. | | | 4,881,907 | | | $ | 240,189,824 | | |

| Brown-Forman Corp., Class A | | | 479,732 | | | | 32,348,329 | | |

| Brown-Forman Corp., Class B | | | 45,820 | | | | 3,035,117 | | |

| Coca Cola Co. (The) | | | 4,721,933 | | | | 227,833,267 | | |

| Coca-Cola Enterprises, Inc. | | | 1,606,930 | | | | 32,813,511 | | |

| PepsiCo, Inc. | | | 6,177,920 | | | | 386,428,896 | | |

| | | $ | 922,648,944 | | |

| Security | | Shares | | Value | |

| Biotechnology — 1.7% | |

| Amgen, Inc.(1) | | | 4,383,782 | | | $ | 299,456,148 | | |

| Biogen Idec, Inc.(1) | | | 211,200 | | | | 10,388,928 | | |

| Celera Group(1) | | | 8,870 | | | | 124,091 | | |

| Genzyme Corp.(1) | | | 501,099 | | | | 30,857,676 | | |

| Gilead Sciences, Inc.(1) | | | 115,482 | | | | 7,498,246 | | |

| Vertex Pharmaceuticals, Inc.(1) | | | 13,000 | | | | 486,460 | | |

| | | $ | 348,811,549 | | |

| Building Products — 0.7% | |

| American Standard Companies, Inc. | | | 868,699 | | | $ | 39,829,849 | | |

| Masco Corp. | | | 3,420,182 | | | | 102,160,836 | | |

| | | $ | 141,990,685 | | |

| Capital Markets — 5.4% | |

| Affiliated Managers Group, Inc.(1) | | | 20,520 | | | $ | 2,157,268 | | |

| Ameriprise Financial, Inc. | | | 67,969 | | | | 3,704,311 | | |

| Bank of New York Co., Inc. | | | 426,888 | | | | 16,806,581 | | |

| Bear Stearns Companies, Inc. | | | 95,736 | | | | 15,583,906 | | |

| Charles Schwab Corp. (The) | | | 847,738 | | | | 16,395,253 | | |

| Credit Suisse Group(2) | | | 155,136 | | | | 10,796,273 | | |

| Federated Investors, Inc., Class B | | | 1,599,819 | | | | 54,041,886 | | |

| Franklin Resources, Inc. | | | 797,053 | | | | 87,811,329 | | |

| Goldman Sachs Group, Inc. | | | 1,115,548 | | | | 222,384,494 | | |

| Investors Financial Services Corp. | | | 450,386 | | | | 19,217,971 | | |

| Knight Capital Group, Inc., Class A(1) | | | 1,750,000 | | | | 33,547,500 | | |

| Legg Mason, Inc. | | | 46,784 | | | | 4,446,819 | | |

| Lehman Brothers Holdings, Inc. | | | 192,474 | | | | 15,036,069 | | |

| Mellon Financial Corp. | | | 321,392 | | | | 13,546,673 | | |

| Merrill Lynch & Co., Inc. | | | 2,472,803 | | | | 230,217,959 | | |

| Morgan Stanley | | | 3,053,604 | | | | 248,654,974 | | |

| Northern Trust Corp. | | | 725,484 | | | | 44,029,624 | | |

| Nuveen Investments, Class A | | | 110,000 | | | | 5,706,800 | | |

| Piper Jaffray Cos., Inc.(1) | | | 27,517 | | | | 1,792,733 | | |

| Raymond James Financial, Inc. | | | 221,005 | | | | 6,698,662 | | |

| State Street Corp. | | | 146,764 | | | | 9,897,764 | | |

| T. Rowe Price Group, Inc. | | | 341,862 | | | | 14,963,300 | | |

| UBS AG(2) | | | 192,683 | | | | 11,624,565 | | |

| Waddell & Reed Financial, Inc., Class A | | | 273,635 | | | | 7,486,654 | | |

| | | $ | 1,096,549,368 | | |

See notes to financial statements

14

Tax-Managed Growth Portfolio as of December 31, 2006

PORTFOLIO OF INVESTMENTS CONT'D

| Security | | Shares | | Value | |

| Chemicals — 0.8% | |

| Arch Chemicals, Inc. | | | 4,950 | | | $ | 164,885 | | |

| Arkema (ADR)(1) | | | 20,000 | | | | 1,026,702 | | |

| Ashland, Inc. | | | 46,969 | | | | 3,249,315 | | |

| Dow Chemical Co. (The) | | | 250,250 | | | | 9,994,985 | | |

| E.I. du Pont de Nemours and Co. | | | 1,031,498 | | | | 50,244,268 | | |

| Ecolab, Inc. | | | 407,411 | | | | 18,414,977 | | |

| MacDermid, Inc. | | | 41,355 | | | | 1,410,206 | | |

| Monsanto Co. | | | 39,066 | | | | 2,052,137 | | |

| Olin Corp. | | | 9,900 | | | | 163,548 | | |

| PPG Industries, Inc. | | | 27,142 | | | | 1,742,788 | | |

| Rohm and Haas Co. | | | 2,601 | | | | 132,963 | | |

| Sigma-Aldrich Corp. | | | 630,897 | | | | 49,033,315 | | |

| Tronox, Inc., Class B | | | 37,854 | | | | 597,715 | | |

| Valspar Corp. (The) | | | 1,219,107 | | | | 33,696,117 | | |

| | | $ | 171,923,921 | | |

| Commercial Banks — 7.8% | |

| Associated Banc-Corp. | | | 991,726 | | | $ | 34,591,403 | | |

| Bank of Hawaii Corp. | | | 69,735 | | | | 3,762,203 | | |

| Bank of Montreal(2) | | | 255,949 | | | | 15,149,621 | | |

| BB&T Corp. | | | 1,867,960 | | | | 82,059,483 | | |

| City National Corp. | | | 184,221 | | | | 13,116,535 | | |

| Colonial BancGroup, Inc. (The) | | | 52,095 | | | | 1,340,925 | | |

| Comerica, Inc. | | | 466,015 | | | | 27,345,760 | | |

| Commerce Bancshares, Inc. | | | 171,056 | | | | 8,280,821 | | |

| Compass Bancshares, Inc. | | | 54,254 | | | | 3,236,251 | | |

| Fifth Third Bancorp | | | 2,711,753 | | | | 110,992,050 | | |

| First Citizens BancShares, Inc., Class A | | | 22,480 | | | | 4,555,347 | | |

| First Horizon National Corp. | | | 148,868 | | | | 6,219,705 | | |

| First Midwest Bancorp, Inc. | | | 523,358 | | | | 20,243,487 | | |

| HSBC Holdings PLC (Hungary) (ADR) | | | 220,592 | | | | 4,037,864 | | |

| HSBC Holdings PLC (UK) (ADR) | | | 580,708 | | | | 53,221,888 | | |

| Huntington Bancshares, Inc. | | | 583,001 | | | | 13,846,274 | | |

| KeyCorp | | | 663,862 | | | | 25,246,672 | | |

| M&T Bank Corp. | | | 81,234 | | | | 9,923,545 | | |

| Marshall & Ilsley Corp. | | | 663,221 | | | | 31,907,562 | | |

| National City Corp. | | | 1,511,282 | | | | 55,252,470 | | |

| PNC Financial Services Group, Inc. | | | 166,675 | | | | 12,340,617 | | |

| Popular, Inc.(2) | | | 1,432 | | | | 25,704 | | |

| Regions Financial Corp. | | | 2,294,230 | | | | 85,804,202 | | |

| Royal Bank of Canada(2) | | | 574,109 | | | | 27,356,294 | | |

| Societe Generale(2) | | | 1,606,685 | | | | 271,515,830 | | |

| SunTrust Banks, Inc. | | | 1,252,412 | | | | 105,766,193 | | |

| Security | | Shares | | Value | |

| Commercial Banks (continued) | |

| Synovus Financial Corp. | | | 1,065,458 | | | $ | 32,848,070 | | |

| Toronto-Dominion Bank (The)(2) | | | 17,915 | | | | 1,072,571 | | |

| Trustmark Corp. | | | 205,425 | | | | 6,719,452 | | |

| U.S. Bancorp | | | 4,831,496 | | | | 174,851,840 | | |

| Valley National Bancorp. | | | 109,831 | | | | 2,911,620 | | |

| Wachovia Corp. | | | 2,539,881 | | | | 144,646,223 | | |

| Wells Fargo & Co. | | | 4,253,936 | | | | 151,269,964 | | |

| Westamerica Bancorporation | | | 258,826 | | | | 13,104,360 | | |

| Whitney Holding Corp. | | | 117,128 | | | | 3,820,715 | | |

| Zions Bancorporation | | | 454,096 | | | | 37,435,674 | | |

| | | $ | 1,595,819,195 | | |

| Commercial Services & Supplies — 0.8% | |

| Acco Brands Corp.(1) | | | 15,490 | | | $ | 410,020 | | |

| Allied Waste Industries, Inc.(1) | | | 1,240,437 | | | | 15,244,971 | | |

| Avery Dennison Corp. | | | 65,769 | | | | 4,467,688 | | |

| Cintas Corp. | | | 1,251,060 | | | | 49,679,593 | | |

| Donnelley (R.R.) & Sons Co. | | | 60,262 | | | | 2,141,711 | | |

| Herman Miller, Inc. | | | 541,800 | | | | 19,699,848 | | |

| HNI Corp. | | | 765,839 | | | | 34,010,910 | | |

| Hudson Highland Group, Inc.(1) | | | 5,226 | | | | 87,170 | | |

| Manpower, Inc. | | | 706 | | | | 52,901 | | |

| Monster Worldwide, Inc.(1) | | | 39,395 | | | | 1,837,383 | | |

| PHH Corp.(1) | | | 27,409 | | | | 791,298 | | |

| Pitney Bowes, Inc. | | | 31,857 | | | | 1,471,475 | | |

| School Specialty, Inc.(1) | | | 12,603 | | | | 472,486 | | |

| Waste Management, Inc. | | | 671,011 | | | | 24,673,074 | | |

| | | $ | 155,040,528 | | |

| Communications Equipment — 1.6% | |

| 3Com Corp.(1) | | | 472,985 | | | $ | 1,943,968 | | |

| ADC Telecommunications, Inc.(1) | | | 21,341 | | | | 310,084 | | |

| Alcatel SA (ADR) | | | 89,240 | | | | 1,268,993 | | |

| Avaya, Inc.(1) | | | 20,404 | | | | 285,248 | | |

| Cisco Systems, Inc.(1) | | | 6,198,467 | | | | 169,404,103 | | |

| Comverse Technology, Inc.(1) | | | 165,755 | | | | 3,499,088 | | |

| Corning, Inc.(1) | | | 3,671,953 | | | | 68,702,241 | | |

| Dycom Industries, Inc.(1) | | | 61,019 | | | | 1,288,721 | | |

| Juniper Networks, Inc.(1) | | | 35,691 | | | | 675,988 | | |

| Motorola, Inc. | | | 1,266,823 | | | | 26,045,881 | | |

| Nokia Oyj (ADR) | | | 2,042,478 | | | | 41,503,153 | | |

| Nortel Networks Corp.(1)(2) | | | 72,544 | | | | 1,939,101 | | |

See notes to financial statements

15

Tax-Managed Growth Portfolio as of December 31, 2006

PORTFOLIO OF INVESTMENTS CONT'D

| Security | | Shares | | Value | |

| Communications Equipment (continued) | |

| QUALCOMM, Inc. | | | 347,456 | | | $ | 13,130,362 | | |

| Riverstone Networks, Inc.(3) | | | 28,706 | | | | 0 | | |

| Tellabs, Inc.(1) | | | 32,678 | | | | 335,276 | | |

| | | $ | 330,332,207 | | |

| Computer Peripherals — 2.3% | |

| Dell, Inc.(1) | | | 4,406,741 | | | $ | 110,565,132 | | |

| EMC Corp.(1) | | | 1,747,812 | | | | 23,071,118 | | |

| Gateway, Inc.(1) | | | 65,556 | | | | 131,768 | | |

| Hewlett-Packard Co. | | | 887,799 | | | | 36,568,441 | | |

| International Business Machines Corp. | | | 1,575,883 | | | | 153,097,033 | | |

| Lexmark International, Inc., Class A(1) | | | 1,714,509 | | | | 125,502,059 | | |

| McDATA Corp., Class A(1) | | | 7,666 | | | | 42,546 | | |

| Network Appliance, Inc.(1) | | | 364,967 | | | | 14,335,904 | | |

| Palm, Inc.(1) | | | 68,379 | | | | 963,460 | | |

| Sun Microsystems, Inc.(1) | | | 319,180 | | | | 1,729,956 | | |

| | | $ | 466,007,417 | | |

| Construction & Engineering — 0.1% | |

| Jacobs Engineering Group, Inc.(1) | | | 157,319 | | | $ | 12,827,791 | | |

| | | $ | 12,827,791 | | |

| Construction Materials — 0.1% | |

| CRH PLC(2) | | | 207,894 | | | $ | 8,634,999 | | |

| Vulcan Materials Co. | | | 206,614 | | | | 18,568,400 | | |

| | | $ | 27,203,399 | | |

| Consumer Finance — 1.0% | |

| American Express Co. | | | 618,260 | | | $ | 37,509,834 | | |

| Capital One Financial Corp. | | | 1,705,714 | | | | 131,032,949 | | |

| SLM Corp. | | | 916,399 | | | | 44,692,779 | | |

| | | $ | 213,235,562 | | |

| Containers & Packaging — 0.1% | |

| Bemis Co., Inc. | | | 295,186 | | | $ | 10,030,420 | | |

| Sealed Air Corp. | | | 21,264 | | | | 1,380,459 | | |

| Sonoco Products Co. | | | 128,617 | | | | 4,895,163 | | |

| Temple-Inland, Inc. | | | 115,924 | | | | 5,335,982 | | |

| | | $ | 21,642,024 | | |

| Distributors — 0.0% | |

| Genuine Parts Co. | | | 190,459 | | | $ | 9,033,470 | | |

| | | $ | 9,033,470 | | |

| Security | | Shares | | Value | |

| Diversified Consumer Services — 0.3% | |

| Apollo Group, Inc., Class A(1) | | | 31,893 | | | $ | 1,242,870 | | |

| H&R Block, Inc. | | | 1,599,312 | | | | 36,848,148 | | |

| Laureate Education, Inc.(1) | | | 302,518 | | | | 14,711,450 | | |

| ServiceMaster Co. (The) | | | 1,156,537 | | | | 15,162,200 | | |

| | | $ | 67,964,668 | | |

| Diversified Financial Services — 3.1% | |

| Bank of America Corp. | | | 4,074,755 | | | $ | 217,551,169 | | |

| Citigroup, Inc. | | | 4,486,846 | | | | 249,917,322 | | |

| ING Groep N.V. (ADR) | | | 257,281 | | | | 11,364,102 | | |

| JPMorgan Chase & Co. | | | 2,748,807 | | | | 132,767,378 | | |

| Moody's Corp. | | | 309,906 | | | | 21,402,108 | | |

| | | $ | 633,002,079 | | |

| Diversified Telecommunication Services — 1.4% | |

| AT&T, Inc. | | | 1,201,387 | | | $ | 42,949,585 | | |

| BCE, Inc.(2) | | | 2,653,500 | | | | 71,644,500 | | |

| Bell Aliant Regional Communications, Inc.(1)(2)(3)(5) | | | 210,251 | | | | 4,870,986 | | |

| BellSouth Corp. | | | 165,981 | | | | 7,819,365 | | |

| Cincinnati Bell, Inc.(1) | | | 169,013 | | | | 772,389 | | |

| Citizens Communications Co. | | | 6,949 | | | | 99,857 | | |

| Deutsche Telekom AG (ADR) | | | 1,843,732 | | | | 33,555,922 | | |

| Embarq Corp. | | | 16,420 | | | | 863,035 | | |

| McLeod USA, Inc., Class A(1)(3) | | | 947 | | | | 0 | | |

| Qwest Communications International, Inc.(1) | | | 38,011 | | | | 318,152 | | |

| RSL Communications, Ltd., Class A(1)(2)(3) | | | 247,161 | | | | 0 | | |

| Telefonos de Mexico SA de CV (ADR) | | | 2,883,026 | | | | 81,416,654 | | |

| Verizon Communications, Inc. | | | 462,191 | | | | 17,211,993 | | |

| Windstream Corp. | | | 1,105,386 | | | | 15,718,589 | | |

| | | $ | 277,241,027 | | |

| Electric Utilities — 0.4% | |

| American Electric Power Co., Inc. | | | 960 | | | $ | 40,877 | | |

| Duke Energy Corp. | | | 417,250 | | | | 13,856,873 | | |

| Exelon Corp. | | | 1,003,134 | | | | 62,083,963 | | |

| Southern Co. (The) | | | 65,985 | | | | 2,432,207 | | |

| | | $ | 78,413,920 | | |

| Electrical Equipment — 0.6% | |

| American Power Conversion Corp. | | | 15,654 | | | $ | 478,856 | | |

| Emerson Electric Co. | | | 2,533,434 | | | | 111,648,436 | | |

| Rockwell Automation, Inc. | | | 160,084 | | | | 9,777,931 | | |

| Roper Industries, Inc. | | | 46,244 | | | | 2,323,299 | | |

| Thomas & Betts Corp.(1) | | | 106,648 | | | | 5,042,317 | | |

| | | $ | 129,270,839 | | |

See notes to financial statements

16

Tax-Managed Growth Portfolio as of December 31, 2006

PORTFOLIO OF INVESTMENTS CONT'D

| Security | | Shares | | Value | |

| Electronic Equipment & Instruments — 0.4% | |

| Agilent Technologies, Inc.(1) | | | 451,772 | | | $ | 15,744,254 | | |

| Arrow Electronics, Inc.(1) | | | 8,750 | | | | 276,063 | | |

| Flextronics International, Ltd.(1)(2) | | | 441,607 | | | | 5,069,648 | | |

| Jabil Circuit, Inc. | | | 2,082,013 | | | | 51,113,419 | | |

| National Instruments Corp. | | | 278,794 | | | | 7,594,349 | | |

| Plexus Corp.(1) | | | 146,273 | | | | 3,492,999 | | |

| Sanmina-SCI Corp.(1) | | | 540,602 | | | | 1,865,077 | | |

| Solectron Corp.(1) | | | 1,670,613 | | | | 5,379,374 | | |

| | | $ | 90,535,183 | | |

| Energy Equipment & Services — 0.7% | |

| Baker Hughes, Inc. | | | 194,687 | | | $ | 14,535,331 | | |

| GlobalSantaFe Corp.(2) | | | 20,000 | | | | 1,175,600 | | |

| Grant Prideco, Inc.(1) | | | 11,694 | | | | 465,070 | | |

| Halliburton Co. | | | 1,251,578 | | | | 38,861,497 | | |

| Schlumberger, Ltd.(2) | | | 1,178,674 | | | | 74,445,050 | | |

| Smith International, Inc. | | | 120,165 | | | | 4,935,177 | | |

| Transocean, Inc.(1)(2) | | | 103,602 | | | | 8,380,366 | | |

| | | $ | 142,798,091 | | |

| Food & Staples Retailing — 1.8% | |

| Casey's General Stores, Inc. | | | 12,551 | | | $ | 295,576 | | |

| Costco Wholesale Corp. | | | 928,292 | | | | 49,078,798 | | |

| CVS Corp. | | | 365,636 | | | | 11,301,809 | | |

| Kroger Co. (The) | | | 1,344,295 | | | | 31,012,886 | | |

| Safeway, Inc. | | | 1,135,280 | | | | 39,235,277 | | |

| SUPERVALU, Inc. | | | 98,710 | | | | 3,528,883 | | |

| Sysco Corp. | | | 2,229,368 | | | | 81,951,568 | | |

| Walgreen Co. | | | 1,063,420 | | | | 48,800,344 | | |

| Wal-Mart Stores, Inc. | | | 2,141,995 | | | | 98,917,329 | | |

| | | $ | 364,122,470 | | |

| Food Products — 2.5% | |

| Archer-Daniels-Midland Co. | | | 1,376,641 | | | $ | 43,997,446 | | |

| Campbell Soup Co. | | | 1,295,515 | | | | 50,382,578 | | |

| ConAgra Foods, Inc. | | | 954,451 | | | | 25,770,177 | | |

| Dean Foods Co.(1) | | | 286,449 | | | | 12,111,064 | | |

| Del Monte Foods Co. | | | 99,492 | | | | 1,097,397 | | |

| General Mills, Inc. | | | 151,524 | | | | 8,727,782 | | |

| H.J. Heinz Co. | | | 292,513 | | | | 13,166,010 | | |

| Hershey Co. (The) | | | 497,578 | | | | 24,779,384 | | |

| J.M. Smucker Co. (The) | | | 7,152 | | | | 346,657 | | |

| Security | | Shares | | Value | |

| Food Products (continued) | |

| Kellogg Co. | | | 54,076 | | | $ | 2,707,045 | | |

| Kraft Foods, Inc. | | | 465 | | | | 16,601 | | |

| Nestle SA(2) | | | 275,000 | | | | 97,368,672 | | |

| Sara Lee Corp. | | | 4,504,598 | | | | 76,713,304 | | |

| Smithfield Foods, Inc.(1) | | | 3,650,830 | | | | 93,680,298 | | |

| TreeHouse Foods, Inc.(1) | | | 64,797 | | | | 2,021,666 | | |

| Tyson Foods, Inc., Class A | | | 265,272 | | | | 4,363,724 | | |

| William Wrigley Jr. Co. | | | 996,034 | | | | 51,514,878 | | |

| | | $ | 508,764,683 | | |

| Gas Utilities — 0.0% | |

| National Fuel Gas Co. | | | 4,000 | | | $ | 154,160 | | |

| | | $ | 154,160 | | |

| Health Care Equipment & Supplies — 1.0% | |

| Advanced Medical Optics, Inc.(1) | | | 9,834 | | | $ | 346,157 | | |

| Baxter International, Inc. | | | 241,562 | | | | 11,206,061 | | |

| Becton, Dickinson and Co. | | | 63,708 | | | | 4,469,116 | | |

| Biomet, Inc. | | | 419,890 | | | | 17,328,860 | | |

| Boston Scientific Corp.(1) | | | 1,138,837 | | | | 19,565,220 | | |

| DENTSPLY International, Inc. | | | 7,701 | | | | 229,875 | | |

| Edwards Lifesciences Corp.(1) | | | 3,070 | | | | 144,413 | | |

| Hillenbrand Industries, Inc. | | | 188,606 | | | | 10,737,340 | | |

| Hospira, Inc.(1) | | | 114,611 | | | | 3,848,637 | | |

| Medtronic, Inc. | | | 1,886,733 | | | | 100,959,083 | | |

| Medtronic, Inc.(3)(4) | | | 7,500 | | | | 401,074 | | |

| St. Jude Medical, Inc.(1) | | | 84,585 | | | | 3,092,428 | | |

| Stryker Corp. | | | 151,918 | | | | 8,372,201 | | |

| Zimmer Holdings, Inc.(1) | | | 302,863 | | | | 23,738,402 | | |

| | | $ | 204,438,867 | | |

| Health Care Providers & Services — 1.9% | |

| AmerisourceBergen Corp. | | | 369,925 | | | $ | 16,631,828 | | |

| Cardinal Health, Inc. | | | 2,189,814 | | | | 141,089,716 | | |

| Caremark Rx, Inc. | | | 1,087,504 | | | | 62,107,353 | | |

| CIGNA Corp. | | | 15,036 | | | | 1,978,287 | | |

| Express Scripts, Inc.(1) | | | 74,800 | | | | 5,355,680 | | |

| Health Management Associates, Inc., Class A | | | 124,425 | | | | 2,626,612 | | |

| Henry Schein, Inc.(1) | | | 1,143,408 | | | | 56,004,124 | | |

| McKesson Corp. | | | 2,631 | | | | 133,392 | | |

| Medco Health Solutions, Inc.(1) | | | 174,081 | | | | 9,302,889 | | |

| Sunrise Senior Living, Inc.(1) | | | 8,000 | | | | 245,760 | | |

See notes to financial statements

17

Tax-Managed Growth Portfolio as of December 31, 2006

PORTFOLIO OF INVESTMENTS CONT'D

| Security | | Shares | | Value | |

| Health Care Providers & Services (continued) | |

| Tenet Healthcare Corp.(1) | | | 3,478 | | | $ | 24,242 | | |

| Unitedhealth Group | | | 453,594 | | | | 24,371,606 | | |

| WellPoint, Inc.(1) | | | 834,692 | | | | 65,681,913 | | |

| | | $ | 385,553,402 | | |

| Health Care Technology — 0.0% | |

| IMS Health, Inc. | | | 120,055 | | | $ | 3,299,111 | | |

| | | $ | 3,299,111 | | |

| Hotels, Restaurants & Leisure — 1.5% | |

| Bob Evans Farms, Inc. | | | 49,985 | | | $ | 1,710,487 | | |

| Brinker International, Inc. | | | 185,881 | | | | 5,606,171 | | |

| Carnival Corp.(2) | | | 550,082 | | | | 26,981,522 | | |

| Darden Restaurants, Inc. | | | 184,714 | | | | 7,419,961 | | |

| Gaylord Entertainment Co.(1) | | | 428,482 | | | | 21,822,588 | | |

| International Game Technology | | | 409,904 | | | | 18,937,565 | | |

| International Speedway Corp., Class A | | | 118,344 | | | | 6,040,278 | | |

| Jack in the Box, Inc.(1) | | | 74,400 | | | | 4,541,376 | | |

| Marriott International, Inc., Class A | | | 395,881 | | | | 18,891,441 | | |

| McDonald's Corp. | | | 915,891 | | | | 40,601,448 | | |

| MGM MIRAGE(1) | | | 188,890 | | | | 10,832,842 | | |

| OSI Restaurant Partners, Inc. | | | 1,034,548 | | | | 40,554,282 | | |

| Papa John's International, Inc.(1) | | | 157,179 | | | | 4,559,763 | | |

| Sonic Corp.(1) | | | 43,809 | | | | 1,049,226 | | |

| Starbucks Corp.(1) | | | 2,254,271 | | | | 79,846,279 | | |

| Wyndham Worldwide Corp.(1) | | | 128,223 | | | | 4,105,700 | | |

| Yum! Brands, Inc. | | | 247,333 | | | | 14,543,180 | | |

| | | $ | 308,044,109 | | |

| Household Durables — 0.4% | |

| Blyth, Inc. | | | 583,297 | | | $ | 12,103,413 | | |

| D.R. Horton, Inc. | | | 637,557 | | | | 16,888,885 | | |

| Fortune Brands, Inc. | | | 115,429 | | | | 9,856,482 | | |

| Leggett & Platt, Inc. | | | 1,794,941 | | | | 42,899,090 | | |

| Newell Rubbermaid, Inc. | | | 291,589 | | | | 8,441,502 | | |

| | | $ | 90,189,372 | | |

| Household Products — 3.1% | |

| Clorox Co. (The) | | | 14,873 | | | $ | 954,103 | | |

| Colgate-Palmolive Co. | | | 702,684 | | | | 45,843,104 | | |

| Energizer Holdings, Inc.(1) | | | 168,981 | | | | 11,995,961 | | |

| Kimberly-Clark Corp. | | | 1,398,706 | | | | 95,042,073 | | |

| Procter & Gamble Co. (The) | | | 7,412,101 | | | | 476,375,731 | | |

| | | $ | 630,210,972 | | |

| Security | | Shares | | Value | |

Independent Power Producers &

Energy Traders — 0.1% | |

| AES Corp. (The)(1) | | | 40,339 | | | $ | 889,072 | | |

| Dynegy, Inc., Class A(1) | | | 22,688 | | | | 164,261 | | |

| TXU Corp. | | | 196,092 | | | | 10,630,147 | | |

| | | $ | 11,683,480 | | |

| Industrial Conglomerates — 2.9% | |

| 3M Co. | | | 911,246 | | | $ | 71,013,401 | | |

| General Electric Co. | | | 12,987,699 | | | | 483,272,280 | | |

| Teleflex, Inc. | | | 14,497 | | | | 935,926 | | |

| Textron, Inc. | | | 12,838 | | | | 1,203,819 | | |

| Tyco International, Ltd.(2) | | | 1,125,841 | | | | 34,225,566 | | |

| | | $ | 590,650,992 | | |

| Insurance — 5.8% | |

| Aegon, N.V. (ADR) | | | 5,182,849 | | | $ | 98,214,989 | | |

| AFLAC, Inc. | | | 2,198,053 | | | | 101,110,438 | | |

| Allstate Corp. (The) | | | 191,646 | | | | 12,478,071 | | |

| American International Group, Inc. | | | 6,322,481 | | | | 453,068,988 | | |

| AON Corp. | | | 517,325 | | | | 18,282,266 | | |

| Arthur J. Gallagher & Co. | | | 557,196 | | | | 16,465,142 | | |

| Berkshire Hathaway, Inc., Class A(1) | | | 641 | | | | 70,503,590 | | |

| Berkshire Hathaway, Inc., Class B(1) | | | 40,436 | | | | 148,238,376 | | |

| Chubb Corp. (The) | | | 30,869 | | | | 1,633,279 | | |

| Commerce Group, Inc. (The) | | | 84,309 | | | | 2,508,193 | | |

| Hartford Financial Services Group, Inc. (The) | | | 45,700 | | | | 4,264,267 | | |

| Lincoln National Corp. | | | 224,854 | | | | 14,930,306 | | |

| Manulife Financial Corp.(2) | | | 210,896 | | | | 7,126,176 | | |

| Marsh & McLennan Cos., Inc. | | | 478,800 | | | | 14,680,008 | | |

| MetLife, Inc. | | | 803,028 | | | | 47,386,682 | | |

| Old Republic International Corp. | | | 300,685 | | | | 6,999,947 | | |

| Principal Financial Group, Inc. | | | 113,328 | | | | 6,652,354 | | |

| Progressive Corp. (The) | | | 3,784,948 | | | | 91,671,441 | | |

| SAFECO Corp. | | | 161,000 | | | | 10,070,550 | | |

| St. Paul Travelers Cos., Inc. (The) | | | 349,428 | | | | 18,760,789 | | |

| Torchmark Corp. | | | 318,929 | | | | 20,334,913 | | |

| UnumProvident Corp. | | | 53,710 | | | | 1,116,094 | | |

| XL Capital Ltd., Class A(2) | | | 187,100 | | | | 13,474,942 | | |

| | | $ | 1,179,971,801 | | |

See notes to financial statements

18

Tax-Managed Growth Portfolio as of December 31, 2006

PORTFOLIO OF INVESTMENTS CONT'D

| Security | | Shares | | Value | |

| Internet & Catalog Retail — 0.2% | |

| Amazon.com, Inc.(1) | | | 42,476 | | | $ | 1,676,103 | | |

| Expedia, Inc.(1) | | | 403,096 | | | | 8,456,954 | | |

| IAC/InterActiveCorp(1) | | | 429,832 | | | | 15,972,557 | | |

| Liberty Media Corp. - Interactive(1) | | | 275,760 | | | | 5,948,143 | | |

| | | $ | 32,053,757 | | |

| Internet Software & Services — 0.4% | |

| eBay, Inc.(1) | | | 1,257,244 | | | $ | 37,805,327 | | |

| Google, Inc., Class A(1) | | | 91,634 | | | | 42,195,624 | | |

| | | $ | 80,000,951 | | |

| IT Services — 2.5% | |

| Accenture Ltd., Class A(2) | | | 2,739,520 | | | $ | 101,170,474 | | |

| Acxiom Corp. | | | 455,893 | | | | 11,693,655 | | |

| Affiliated Computer Services, Inc.(1) | | | 183,730 | | | | 8,973,373 | | |

| Automatic Data Processing, Inc. | | | 1,491,647 | | | | 73,463,615 | | |

| BISYS Group, Inc. (The)(1) | | | 65,000 | | | | 839,150 | | |

| Computer Sciences Corp.(1) | | | 226,702 | | | | 12,099,086 | | |

| DST Systems, Inc.(1) | | | 72,199 | | | | 4,521,823 | | |

| Electronic Data Systems Corp. | | | 1,252 | | | | 34,493 | | |

| Fidelity National Information Services, Inc. | | | 42,862 | | | | 1,718,338 | | |

| First Data Corp. | | | 3,488,152 | | | | 89,017,639 | | |

| Fiserv, Inc.(1) | | | 832,355 | | | | 43,632,049 | | |

| Gartner, Inc., Class A(1) | | | 30,576 | | | | 605,099 | | |

| Paychex, Inc. | | | 1,623,499 | | | | 64,193,150 | | |

| Perot Systems Corp.(1) | | | 649,037 | | | | 10,637,716 | | |

| Safeguard Scientifics, Inc.(1) | | | 26,579 | | | | 64,321 | | |

| Western Union Co. | | | 3,488,152 | | | | 78,204,368 | | |

| | | $ | 500,868,349 | | |

| Leisure Equipment & Products — 0.0% | |

| Eastman Kodak Co. | | | 90,761 | | | $ | 2,341,634 | | |

| Mattel, Inc. | | | 30,514 | | | | 691,447 | | |

| | | $ | 3,033,081 | | |

| Life Sciences Tools & Services — 0.2% | |

| Dionex Corp.(1) | | | 37,300 | | | $ | 2,115,283 | | |

| Invitrogen Corp.(1) | | | 429,910 | | | | 24,328,607 | | |

| PerkinElmer, Inc. | | | 254,526 | | | | 5,658,113 | | |

| Waters Corp.(1) | | | 97,439 | | | | 4,771,588 | | |

| | | $ | 36,873,591 | | |

| Security | | Shares | | Value | |

| Machinery — 3.6% | |

| Caterpillar, Inc. | | | 185,437 | | | $ | 11,372,851 | | |

| Danaher Corp. | | | 4,060,343 | | | | 294,131,247 | | |

| Deere & Co. | | | 3,312,500 | | | | 314,919,375 | | |

| Donaldson Co., Inc. | | | 77,792 | | | | 2,700,160 | | |

| Dover Corp. | | | 532,425 | | | | 26,099,474 | | |

| Illinois Tool Works, Inc. | | | 1,656,572 | | | | 76,517,061 | | |

| ITT Industries, Inc. | | | 8,428 | | | | 478,879 | | |

| Nordson Corp. | | | 72,383 | | | | 3,606,845 | | |

| Parker Hannifin Corp. | | | 35,571 | | | | 2,734,698 | | |

| | | $ | 732,560,590 | | |

| Media — 4.9% | |

| ADVO, Inc. | | | 750,000 | | | $ | 24,450,000 | | |

| Belo Corp., Class A | | | 330,817 | | | | 6,080,416 | | |

| Cablevision Systems Corp., Class A | | | 4 | | | | 114 | | |

| Catalina Marketing Corp. | | | 79,803 | | | | 2,194,583 | | |

| CBS Corp., Class A | | | 14,887 | | | | 464,772 | | |

| CBS Corp., Class B | | | 556,629 | | | | 17,355,692 | | |

| Clear Channel Communications, Inc. | | | 129,887 | | | | 4,616,184 | | |

| Comcast Corp., Class A(1) | | | 1,895,538 | | | | 80,238,124 | | |

| Comcast Corp., Class A Special(1) | | | 2,367,010 | | | | 99,130,379 | | |

| Discovery Holding Co., Class A(1) | | | 102,540 | | | | 1,649,869 | | |

| E.W. Scripps Co. (The), Class A | | | 51,066 | | | | 2,550,236 | | |

| EchoStar Communications Corp., Class A(1) | | | 35,150 | | | | 1,336,755 | | |

| Entercom Communications Corp. | | | 220,000 | | | | 6,199,600 | | |

| Gannett Co., Inc. | | | 423,389 | | | | 25,598,099 | | |

| Havas SA (ADR) | | | 3,142,938 | | | | 17,367,670 | | |

| Idearc, Inc.(1) | | | 23,103 | | | | 661,901 | | |

| Interpublic Group of Companies, Inc., (The)(1) | | | 932,692 | | | | 11,416,150 | | |

| Lamar Advertising Co.(1) | | | 241,409 | | | | 15,785,735 | | |

| Liberty Global, Inc., Class A(1) | | | 46,731 | | | | 1,362,209 | | |

| Liberty Global, Inc., Class C(1) | | | 48,416 | | | | 1,355,648 | | |

| Liberty Media Holding Corp.-Capital, Series A(1) | | | 55,152 | | | | 5,403,793 | | |

| Liberty Media Holding Corp.-Capital, Series B(1) | | | 526 | | | | 51,614 | | |

| Live Nation, Inc.(1) | | | 16,410 | | | | 367,584 | | |

| McClatchy Co., (The), Class A | | | 9,394 | | | | 406,760 | | |

| McGraw-Hill Companies, Inc., (The) | | | 482,884 | | | | 32,845,770 | | |

| New York Times Co. (The), Class A | | | 300,468 | | | | 7,319,400 | | |

| News Corp., Class A | | | 187,934 | | | | 4,036,822 | | |

| Omnicom Group, Inc. | | | 2,410,418 | | | | 251,985,098 | | |

| Publicis Groupe(1) | | | 329,132 | | | | 13,849,518 | | |

| Time Warner, Inc. | | | 4,059,654 | | | | 88,419,264 | | |

| Tribune Co. | | | 1,694,658 | | | | 52,161,573 | | |

See notes to financial statements

19

Tax-Managed Growth Portfolio as of December 31, 2006

PORTFOLIO OF INVESTMENTS CONT'D

| Security | | Shares | | Value | |

| Media (continued) | |

| Univision Communications, Inc., Class A(1) | | | 27,009 | | | $ | 956,659 | | |

| Viacom, Inc., Class A(1) | | | 13,791 | | | | 565,569 | | |

| Viacom, Inc., Class B(1) | | | 524,573 | | | | 21,523,230 | | |

| Vivendi SA (ADR) | | | 174,913 | | | | 6,815,149 | | |

| Walt Disney Co. (The) | | | 4,955,298 | | | | 169,818,062 | | |

| Washington Post Co. (The), Class B | | | 16,470 | | | | 12,280,032 | | |

| WPP Group PLC(2) | | | 139,450 | | | | 1,881,113 | | |

| WPP Group PLC (ADR) | | | 256,051 | | | | 17,344,895 | | |

| | | $ | 1,007,846,041 | | |

| Metals & Mining — 0.3% | |

| Alcoa, Inc. | | | 85,947 | | | $ | 2,579,269 | | |

| Nucor Corp. | | | 741,928 | | | | 40,553,784 | | |

| Phelps Dodge Corp. | | | 29,724 | | | | 3,558,557 | | |

| Steel Dynamics, Inc. | | | 623,600 | | | | 20,235,820 | | |

| | | $ | 66,927,430 | | |

| Multiline Retail — 1.6% | |

| 99 Cents Only Stores(1) | | | 807,619 | | | $ | 9,828,723 | | |

| Dollar General Corp. | | | 52,668 | | | | 845,848 | | |

| Dollar Tree Stores, Inc.(1) | | | 646,996 | | | | 19,474,580 | | |

| Family Dollar Stores, Inc. | | | 2,249,176 | | | | 65,968,332 | | |

| Federated Department Stores, Inc. | | | 231,607 | | | | 8,831,175 | | |

| J.C. Penney Company, Inc. | | | 130,349 | | | | 10,083,799 | | |

| Nordstrom, Inc. | | | 131,384 | | | | 6,482,487 | | |

| Sears Holdings Corp.(1) | | | 4,563 | | | | 766,265 | | |

| Target Corp. | | | 3,504,497 | | | | 199,931,554 | | |

| | | $ | 322,212,763 | | |

| Multi-Utilities — 0.0% | |

| Ameren Corp. | | | 5,000 | | | $ | 268,650 | | |

| Dominion Resources, Inc. | | | 3,249 | | | | 272,396 | | |

| PG&E Corp. | | | 3,000 | | | | 141,990 | | |

| TECO Energy, Inc. | | | 20,354 | | | | 350,699 | | |

| Wisconsin Energy Corp. | | | 9,576 | | | | 454,477 | | |

| | | $ | 1,488,212 | | |

| Office Electronics — 0.0% | |

| Xerox Corp.(1) | | | 22,878 | | | $ | 387,782 | | |

| Zebra Technologies Corp., Class A(1) | | | 13,500 | | | | 469,665 | | |

| | | $ | 857,447 | | |

| Security | | Shares | | Value | |

| Oil, Gas & Consumable Fuels — 10.1% | |

| Anadarko Petroleum Corp. | | | 5,118,262 | | | $ | 222,746,762 | | |

| Apache Corp. | | | 2,145,450 | | | | 142,693,880 | | |

| BP PLC (ADR) | | | 5,110,159 | | | | 342,891,669 | | |

| Chevron Corp. | | | 545,679 | | | | 40,123,777 | | |

| ConocoPhillips | | | 6,155,436 | | | | 442,883,620 | | |

| Devon Energy Corp. | | | 818,602 | | | | 54,911,822 | | |

| El Paso Corp. | | | 97,665 | | | | 1,492,321 | | |

| Exxon Mobil Corp. | | | 7,018,803 | | | | 537,850,874 | | |

| Hess Corp. | | | 56,192 | | | | 2,785,437 | | |

| Kinder Morgan, Inc. | | | 1,762,113 | | | | 186,343,450 | | |

| Marathon Oil Corp. | | | 19,294 | | | | 1,784,695 | | |

| Murphy Oil Corp. | | | 39,036 | | | | 1,984,981 | | |

| Newfield Exploration Co.(1) | | | 30,851 | | | | 1,417,603 | | |

| Royal Dutch Shell PLC (ADR) | | | 116,941 | | | | 8,278,253 | | |

| Total SA (ADR) | | | 762,250 | | | | 54,821,020 | | |

| Valero Energy Corp. | | | 11,481 | | | | 587,368 | | |

| Williams Cos., Inc. (The) | | | 223,515 | | | | 5,838,212 | | |

| | | $ | 2,049,435,744 | | |

| Paper and Forest Products — 0.1% | |

| International Paper Co. | | | 150,301 | | | $ | 5,125,264 | | |

| MeadWestvaco Corp. | | | 45,590 | | | | 1,370,435 | | |

| Neenah Paper, Inc. | | | 33,028 | | | | 1,166,549 | | |

| Weyerhaeuser Co. | | | 85,020 | | | | 6,006,663 | | |

| | | $ | 13,668,911 | | |

| Personal Products — 0.3% | |

| Avon Products, Inc. | | | 173,400 | | | $ | 5,729,136 | | |

| Estee Lauder Cos., Inc., (The) Class A | | | 1,160,940 | | | | 47,389,571 | | |

| | | $ | 53,118,707 | | |

| Pharmaceuticals — 6.6% | |

| Abbott Laboratories | | | 3,244,908 | | | $ | 158,059,469 | | |

| Allergan, Inc. | | | 138,300 | | | | 16,560,042 | | |

| Bristol-Myers Squibb Co. | | | 4,735,992 | | | | 124,651,309 | | |

| Eli Lilly & Co. | | | 3,934,161 | | | | 204,969,788 | | |