UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month ofSeptember, 2012

Commission File Number001-31930

Atlatsa Resources Corporation

(Translation of registrant’s name into English)

15th Floor, 1040 West Georgia Street,

Vancouver, British Columbia, Canada, V6E 4H8

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40F:

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

DOCUMENTS INCLUDED AS PART OF THIS REPORT

| | |

Document | | Description |

| |

| 1. | | Material Change Report, dated September 26, 2012 |

| |

| 2. | | Amendment and Interim Implementation Agreement, dated September 28, 2012 |

Document 1

Form 51-102F3

Material Change Report

| 1. | Name and Address of Company |

Atlatsa Resources Corporation

4th Floor – 82 Grayston Drive

Sandton, 2146

South Africa

| 2. | Date of Material Change |

September 26, 2012

A news release was issued by Atlatsa Resources Corporation (“Atlatsa”) (TSXV:ATL; AMEX:ATL; JSE:ATL) through CNW Canada newswire on September 27, 2012. A copy of such news release is attached hereto as Schedule A and forms a part hereof.

| 4. | Summary of Material Change |

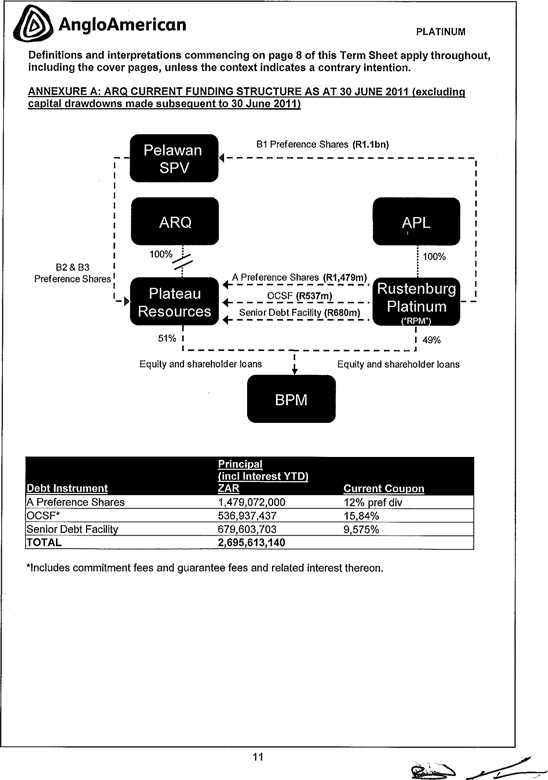

Atlatsa announced on September 27, 2012 that it has entered into an Amendment and Interim Implementation Agreement (the “Interim Implementation Agreement”) with, among others, a wholly-owned subsidiary of Anglo American Platinum Corporation (“Amplats”) pursuant to which Atlatsa will implement the first phase of a broader refinancing and restructuring transaction (the “Restructuring Transaction”), which was first announced by Atlatsa in a news release dated February 2, 2012.

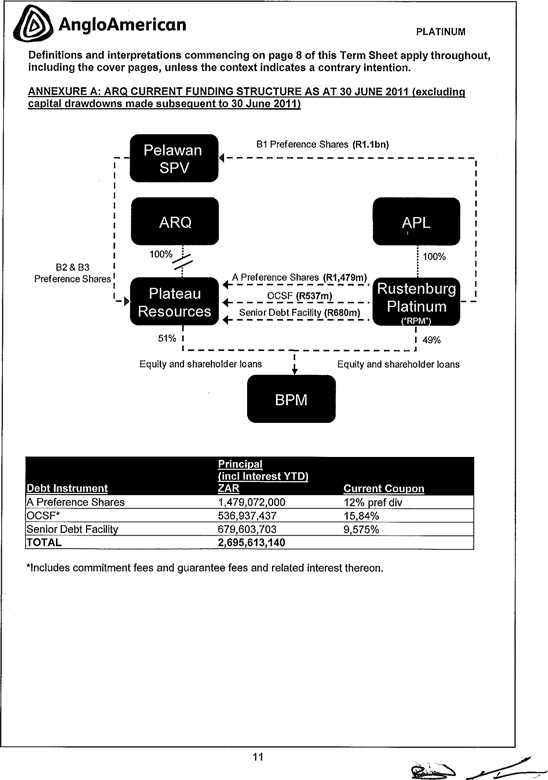

Pursuant to the terms of the Interim Implementation Agreement, the first phase of the Restructuring Transactions will involve: (i) an amendment to the terms of the Senior Term Loan Facilities Agreement dated June 12, 2009 between, among others, Atlatsa, Plateau Resources Proprietary Limited (“Plateau”), a wholly-owned subsidiary of Atlatsa, as borrower and Rustenburg Platinum Mines Limited (“RPM”), a wholly-owned subsidiary of Amplats, as lender (the “2009 Senior Facilities Agreement”) to increase the total loan facility available by approximately C$313 million (the “Loan Amendment”) and (ii) use of such additional loan proceeds to repay the existing operating cashflow shortfall facility (“OCSF”) and fund share subscriptions by Plateau into Bokoni Platinum Holdings Proprietary Limited (“Bokoni Holdco”) and by Bokoni Holdco into Bokoni Mine Proprietary Limited (“Bokoni Opco”) (the “Share Subscriptions”) for the purpose of repayment of certain existing loan facilities by Plateau, Bokoni Holdco and Bokoni Opco.

| 5. | Full Description of Material Change |

In addition to the information included in the news release attached hereto, the following disclosure is required under Multilateral Instrument 61-101 –Protection of Minority Security Holders in Special Transactions (“MI 61-101”).

| | (a) | A description of the transaction and its material terms |

Atlatsa announced on September 27, 2012 that it has entered into the Interim Implementation Agreement with, among others, RPM and Plateau, pursuant to which Atlatsa will implement the first phase of the Restructuring Transactions.

Pursuant to the terms of the Interim Implementation Agreement, the first phase will involve: (i) the Loan Amendment to the terms of the 2009 Senior Facilities Agreement to increase the total loan facility available by approximately C$313 million and (ii) the use of such additional loan proceeds to fund the Share Subscriptions by Plateau into Bokoni Holdco and by Bokoni Holdco into Bokoni Opco for the purpose of repaying certain existing loans, as described in further detail below.

| | (b) | The purpose and business reasons for the transaction |

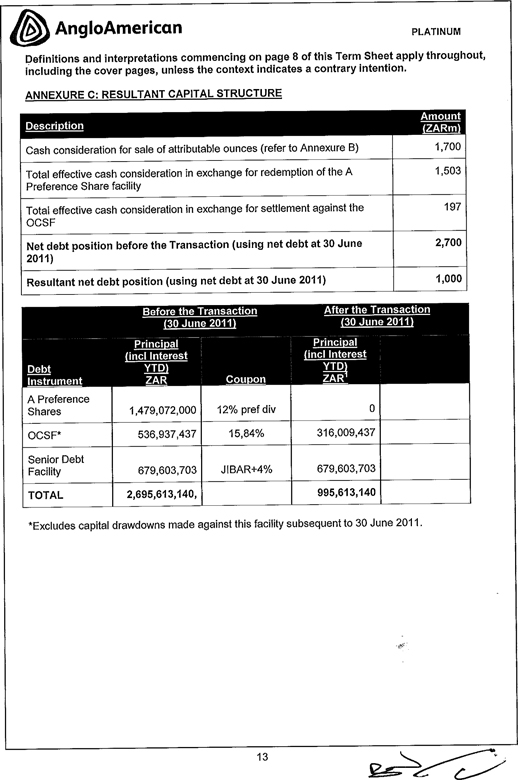

The purpose of the Loan Amendment and Share Subscription is to allow Plateau, Bokoni Holdco and Bokoni Opco to utilize the proceeds of the Loan Amendment to redeem and repay the “A” Preference Share Facility (the “A Preference Facility”) that is currently outstanding in the capital structure of each of Plateau, Bokoni Holdco and Bokoni Opco and the OCSF. Plateau will utilize the proceeds of the Loan Amendment to subscribe for shares in the capital of Bokoni Holdco. Upon receipt by Bokoni Holdco of the Share Subscription proceeds, Bokoni Holdco will make an equivalent share subscription into Bokoni Opco. Bokoni Opco will then use the proceeds of such share subscription to repay the accrued dividends and redemption amount on its outstanding A Preference Shares held by Bokoni Holdco and to redeem such shares. Upon receipt by Bokoni Holdco of such dividend and redemption payments, Bokoni Holdco will use such proceeds to pay the accrued dividends and redemption amount on its outstanding A Preference Shares held by each of Plateau and RPM, and to redeem such shares. Upon receipt of such payment, Plateau will use such proceeds to pay the accrued dividends and redemption amount on its outstanding A Preference Shares held by RPM, thereby fully repaying the amount owing to RPM under the A Preference Facility, totalling approximately C$203 million. The remainder of the additional proceeds from the Loan Amendment will be used by Plateau to fully repay the amount owing to RPM under the OCSF, totalling approximately C$110 million.

- 2 -

| | (c) | The anticipated effect of the transaction on the issuer’s business and affairs |

Upon implementation of the Loan Amendment and the Share Subscription and resulting repayment of the A Preference Facility and the OCSF (collectively, the “Interim Transactions”), the interest rate payable on the debt owing by Atlatsa to Amplats will be reduced to an annual effective rate of 6.23% (linked to the 3-month Johannesburg Interbank Rate) from the current annual effective rate of 12.31%. In addition, the transactions contemplated by the Interim Implementation Agreement will simplify Atlatsa’s balance sheet structure and will materially reduce its effective cost of borrowing, going forward.

The Interim Transactions will be completed pursuant to the terms of the Interim Implementation Agreement on or about September 28, 2012.

The Interim Transactions are interim steps of the Restructuring Transaction. The completion of the remaining steps of the Restructuring Transaction remain subject to finalization of definitive transaction agreements with respect to such transactions, as well as necessary shareholder and regulatory approvals including approval of the TSX Venture Exchange, the Department of Mineral Resources, South Africa. On the closing of the Restructuring Transaction, the amount owing by Plateau under the 2009 Senior Facilities Agreement, as amended, is expected to be materially reduced, in part through the proceeds of the sale of certain assets of the Bokoni group, as more particularly described in Atlatsa’s news release dated February 2, 2012.

| | (i) | The interest in the transaction of every interested party and of the related parties and associated entities of the interested parties |

Pursuant to financing arrangements implemented at the time of the 2009 Senior Facilities Agreement, RPM, a wholly-owned subsidiary of Amplats, is the indirect holder of “B” preference shares in the capital of Plateau that are convertible, indirectly, into 115.8 million common shares of Atlatsa. RPM is also a creditor of Atlatsa and Plateau under the A Preference Facility, the OCSF and the 2009 Senior Facilities Agreement. RPM is a party to the Interim Implementation Agreement, the 2009 Senior Facilities Agreement which will be amended pursuant to the Loan Amendment, and certain of the agreements with respect to the Share Subscription, pursuant to which it will issue shares to Plateau.

- 3 -

Atlatsa holds a 51% indirect interest in Bokoni Holdco, and is a control person of Bokoni Holdco. Bokoni Holdco is a party to certain of the agreements with respect to the Interim Transactions.

Harold Motaung and Tumelo Motsisi, both of whom are directors and officers of Atlatsa, have beneficial interests in the Pelawan Trust and the Pelawan Dividend Trust (collectively, “Pelawan”) and Pelawan is a significant shareholder of Atlatsa. Pelawan is a party to the Interim Implementation Agreement, though is not involved directly in the Interim Transactions.

| | (ii) | The anticipated effect of the transaction on the percentage of securities of the issuer, or of an affiliated entity of the issuer, beneficially owned or controlled by each person referred to in subparagraph (i) for which there would be a material change in that percentage |

The Interim Transactions will not result in any material change in the percentage of securities of Atlatsa, Plateau or any other affiliated entity of Atlatsa, beneficially owned or controlled by Amplats, RPM, Bokoni Holdco or Pelawan or its trustees or beneficiaries. Pursuant to the Interim Transactions, the A Preference Shares will be redeemed and the Share Subscriptions will be completed in the capital of Plateau, Bokoni Holdco and Bokoni Opco, as described above, but the relative percentage shareholdings of the parties will remain the same.

| | (e) | A discussion of the review and approval process adopted by the board of directors and the special committee, if any, of the issuer for the transaction, including a discussion of any materially contrary view or abstention by a director and any material disagreement between the board and the special committee |

On September 21, 2012, the independent committee comprised of independent members of the board of directors, being Patrick Cooke, Anu Dhir and Fikile Tebogo De Buck (the “Independent Committee”) met to consider the Interim Implementation Agreement and the Interim Transactions. The Independent Committee determined that the Interim Implementation Agreement and Interim Transactions are reasonable and in the best interests of Atlatsa, given Atlatsa’s current financial situation. The Independent Committee further determined that Atlatsa satisfies the requirements of, and ought to rely on, certain exemptions available under MI 61-101 with respect to minority shareholder approval and valuation requirements, as described in more detail in section (i) below. The Independent Committee approved and recommended to the board of directors that the board approve the Interim Implementation Agreement and the Interim Transactions, that Atlatsa proceed with the transactions

- 4 -

contemplated thereby and that Atlatsa rely on the applicable exemptions available under MI 61-101.

On September 21, 2012, the audit committee of the board of directors comprised of Fikile Tebogo De Buck, Anu Dhir and Patrick Cooke (the “Audit Committee”) met to consider the Interim Implementation Agreement and the Interim Transactions and their impact on Atlatsa as a going concern. The Audit Committee determined that the Interim Implementation Agreement and the Interim Transactions are reasonable given Atlatsa’s current financial situation. The Audit Committee approved and recommended to the board of directors that the board approve the Interim Implementation Agreement and the Interim Transactions and that Atlatsa proceed with the transactions contemplated thereby.

On September 21, 2012, the board of directors of Atlatsa met to consider the Interim Implementation Agreement and the Interim Transactions. Upon receiving the recommendations of the Independent Committee and the Audit Committee and having considered the terms of the Interim Implementation Agreement and the Interim Transactions, on September 26, 2012, the board of directors approved the Interim Implementation Agreement and the Interim Transactions, authorized Atlatsa to proceed with the Interim Transactions and found that Atlatsa met the requirements of, and authorized Atlatsa to rely on, certain exemptions available under MI 61-101 with respect to minority shareholder approval and valuation requirements, as described in more detail in section (i) below. In doing so, the board of directors determined that the Interim Implementation Agreement and the Interim Transactions are in the best interests of Atlatsa given Atlatsa’s current financial situation. Harold Motaung and Tumelo Motsisi abstained, as each have a disclosable interest in the Interim Implementation Agreement, as the Pelawan Trust and the Pelawan Dividend Trust are parties to the Interim Implementation Agreement and Mr. Motaung and Mr. Motsisi have beneficial interests in the Pelawan Trust and the Pelawan Dividend Trust.

| | (f) | A summary, in accordance with section 6.5 of MI 61-101, of the formal valuation, if any, obtained for the transaction, unless the formal valuation is included in its entirety in the material change report or will be included in its entirety in another disclosure document for the transaction |

Not applicable, see section (i) below.

| | (g) | Disclosure, in accordance with section 6.8 of MI 61-101, of every prior valuation in respect of the issuer that relates to the subject matter or is otherwise to the transaction: |

| | (i) | That has been made in the 24 months before the date of the material change report, and |

- 5 -

| | (ii) | The existence of which is known, after reasonable inquiry, to the issuer or to any director or senior officer of the issuer |

Not applicable.

| | (h) | The general nature and material terms of any agreement entered into by the issuer, or a related party of the issuer, with an interested party or a joint actor with an interested party, in connection with the transaction |

Atlatsa, Plateau and RPM, among others, have entered into the Interim Implementation Agreement, which sets out various terms with respect to the Interim Transactions and Plateau, Bokoni Holdco, Bokoni Opco and RPM have entered into subscription agreements with respect to the Share Subscriptions, as described below.

Pursuant to the Interim Implementation Agreement the amount advanced to Atlatsa pursuant to the Loan Amendment of approximately C$313 million is restricted in its use to only those purposes as set out in the Interim Implementation Agreement, namely for Plateau, Bokoni Holdco and Bokoni Opco to implement the Share Subscription in order to repay the A Preference Facility and for the repayment of the OCSF. Subject to the Loan Amendment pursuant to the Interim Implementation Agreement, the terms and conditions of the 2009 Senior Facilities Agreement remain in effect.

In connection with the Interim Implementation Agreement and the Share Subscription, Plateau and Holdco have entered into a subscription agreement pursuant to which Plateau will subscribe for ordinary shares in the capital of Bokoni Holdco for a subscription price of approximately C$203 million. Bokoni Holdco will utilize these subscription proceeds to subscribe for ordinary shares in the capital of Bokoni Opco. Bokoni Opco will then use these subscription proceeds to repay the accrued dividends and redemption amount on its outstanding A Preference Shares held by Bokoni Holdco and to redeem such shares. Upon receipt of such dividend and redemption payments, Holdco will use such proceeds to pay the accrued dividends and redemption amount on its outstanding A Preference Shares held by Plateau and RPM and to redeem such shares. Upon receipt of such payment, Plateau will use such proceeds to pay the accrued dividends and redemption amount on its outstanding A Preference Shares held by RPM, thereby fully repaying the amount owing to RPM under the A Preference Facility, totaling approximately C$203 million.

The Interim Implementation Agreement contemplates that the remaining amount available under the Loan Amendment of approximately C$110 million will be utilized to repay in full the OCSF.

| | (i) | Disclosure of the formal valuation and minority approval exemptions, if any, on which the issuer is relying under sections 5.5 and 5.7, |

- 6 -

| | respectively, of MI 61-101, and the facts supporting reliance on the exemptions |

Pursuant to financing arrangements implemented at the time of the 2009 Senior Facilities Agreement, RPM is the indirect holder of “B” preference shares in the capital of Plateau that are convertible, indirectly, into 115.8 million common shares of Atlatsa (representing approximately 26% of the issued and outstanding common shares of Atlatsa on a fully-diluted basis). As a result, RPM is a related party to the Company. Bokoni Holdco is also a related party to the Company as Atlatsa is a control person of Bokoni Holdco. As a result, the Loan Amendment and the Share Subscription are “related party transactions” pursuant to MI 61-101.

As related party transactions, MI 61-101 requires Atlatsa to obtain minority shareholder approval (the “Shareholder Approval Requirement”) with respect to the Loan Amendment and the Share Subscription and a formal valuation (the “Valuation Requirement”) with respect to the Share Subscription.

With respect to the Loan Amendment, Atlatsa is relying on the loan to issuer exemption from the Shareholder Approval Requirement contained in subsection 5.7(f) of MI 61-101 on the basis that: (i) the Loan Amendment, as well as the 2009 Senior Facilities Agreement, are on commercially reasonable terms that are more advantageous to Plateau as compared to terms that may have been obtained from a person dealing at arm’s length, and (ii) the advance under the Loan Amendment is not convertible, directly or indirectly, into equity or voting securities of the Atlatsa, Plateau or any other subsidiary of Atlatsa, or otherwise participating in nature, nor is the advance repayable as to principal or interest, directly or indirectly, in equity or voting securities of Atlatsa, Plateau or any other subsidiary of Atlatsa.

With respect to the Share Subscription, Atlatsa is relying on the financial hardship exemption from the Shareholder Approval Requirement and Valuation Requirement contained in subsections 5.5(g) and 5.7(1)(e) of MI 61-101, on the basis that:

| | i. | Atlatsa is in serious financial difficulty; |

| | ii. | The Share Subscription, as part of the Restructuring Transaction, is designed to improve the financial position of Atlatsa; |

| | iii. | The Share Subscription is not subject to court approval and a court has not ordered that the Share Subscription be effected, pursuant to bankruptcy, insolvency or similar proceedings; and |

| | iv. | Atlatsa’s board of directors and the Independent Committee, representing greater than two-thirds of Atlatsa’s independent |

- 7 -

| | directors in respect of the Interim Transactions, and each acting in good faith, have determined that sub paragraphs (i) and (ii) above apply, and the terms of the Share Subscription are reasonable in the circumstances of Atlatsa. |

| | (j) | If the issuer files a material change report less than 21 days before the expected date of the closing of the transaction, the issuer shall explain in the news release required to be issued under National Instrument 51-102Continuous Disclosure and in the material change report why the shorter period is reasonable or necessary in the circumstances. |

This report was filed as soon as possible after the execution of the Interim Implementation Agreement, but less than 21 days before the anticipated closing of the Interim Transactions, as Atlatsa wished to negotiate and complete the transactions on an expedited basis with a view to simplifying its balance sheet structure, reducing its debt and interest payment obligations and for other sound business reasons. Atlatsa believes this decision is reasonable given Atlatsa’s financial condition. The Interim Transactions are the first phase of the Restructuring Transaction, certain aspects of which will be subject to minority shareholder approval at a subsequent shareholders meeting.

| 6. | Reliance on subsection 7.1(2) or (3) of National Instrument 51-102 |

Not applicable.

Not applicable.

Joel Kesler

Executive, Corporate Development

+27 11 779 6800

| 9. | Date of Material Change Report |

September 27, 2012.

A copy of this material change report will be sent to any shareholder upon request at no charge.

- 8 -

SCHEDULE A

NEWS RELEASE

ATLATSA AND ANGLO PLATINUM AGREE TO FIRST PHASE OF RESTRUCTURE PLAN

Significant reduction in Atlatsa’s cost of borrowing going forward

September 27, 2012 Atlatsa Resources Corporation (“Atlatsa” or the “Company”) (TSXV: ATL; NYSE MKT: ATL; JSE: ATL) announces it has concluded an interim implementation agreement (“the first phase agreement”) with Anglo American Platinum Limited (“Anglo Platinum”), comprising the first phase of its restructuring, recapitalization and refinancing plan (“the Restructure Plan”) for the Company, its wholly owned subsidiary, Plateau Resources Proprietary Limited (“Plateau”) and the Bokoni group of companies (“Bokoni group”), which Restructure Plan was described in greater detail in the Company’s news release dated February 2, 2012 and its subsequent market update announcements.

The effect of the first phase agreement will be as follows:

| | • | | Atlatsa, Plateau and the Bokoni group will consolidate outstanding debt and preference shares into its existing senior term loan facility with Anglo Platinum (“the Senior Loan”) on terms and conditions agreed between the parties in the first phase agreement. This will result in the repayment of preference shares through the redemption of all “A” preference shares outstanding in the share capital of Plateau and the Bokoni group, together with repayment of the Operating Cash Shortfall Facility loan within the Plateau and Bokoni group structures, which debt and preference shares will be consolidated into the Senior Loan going forward; |

| | • | | The Senior Loan, as consolidated, will bear an effective annual interest rate of 6.23% (linked to the 3 month JIBAR rate), as opposed to the annual effective interest rate of 12.31% currently charged on the various Atlatsa and Bokoni group debt owing to Anglo Platinum. |

Conclusion of the first phase agreement will simplify Atlatsa’s balance sheet structure and materially reduce its effective cost of borrowing. Closing of the above-mentioned transaction is expected to occur on or about September 28, 2012 and is subject to satisfaction of certain customary terms and conditions.

For further information regarding the first phase agreement, which constitutes a “related party transaction” for purposes of Multilateral Instrument 61-101 – Protection of Minority Securityholders in Special Transactions, shareholders are referred to the material change report dated September 26, 2012 which will be available on SEDAR at www.sedar.com. This news release was issued as soon as possible following execution of the first phase agreement but less than 21 days before the implementation of the transactions contemplated by the first phase agreement, as Atlatsa considered it to be in the Company’s best interests to negotiate and complete the transactions on an expedited basis with a view to reducing interest payment obligations and for other sound business reasons.

| | | | |

| For further information: | | | | |

| | |

| On behalf of Atlatsa Resources | | Russell and Associates | | Macquarie First South Capital |

| | |

| Joel Kesler, Chief Commercial Officer | | Charmane Russell | | Annerie Britz / Yvette Labuschagne |

| | |

| Office: +27 11 779 6800 | | Office: +27 11 880 3924 | | Office: +27 11 583 2000 |

| | |

| Mobile: +27 82 454 5556 | | Mobile: +27 82 3725816 | | |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. The NYSE MKT LLC has neither approved nor disapproved the contents of this press release.

A-1

The Company anticipates that the Atlatsa and Bokoni group debt will be further reduced on implementation of the transactions to be completed as part of the second phase of the Restructure Plan. The second phase of the Restructure Plan remains subject to finalization of definitive agreements with respect to such transactions, as well as obtaining the necessary regulatory approvals from the Department of Mineral Resources, South Africa and other regulatory bodies.

Shareholders are reminded that the Company remains under cautionary until the definitive agreements relating to the second phase of the Restructure Plan have been executed and its financial effects have been finalized.

Cautionary and forward-looking information

This news release contains “forward-looking statements” that are based on management’s expectations, estimates and projections as of the current date, including statements relating to the Bokoni group Restructure Plan and anticipated financial or operational performance. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “may”, “will”, “outlook”, “anticipate”, “project”, “target”, “believe”, “estimate”, “expect”, “intend”, “should” and similar expressions.

Atlatsa believes that such forward-looking statements are based on material factors and reasonable assumptions, including the following assumptions: the Restructure Plan will be implemented on the terms favourable to the Company and on a timely basis, the Bokoni Mine achieve targeted production levels; the Company’s exploration project results will continue to be positive; contracted parties provide goods and/or services on the agreed timeframes; equipment necessary for construction and development is available as scheduled and does not incur unforeseen breakdowns; no material labour slowdowns or strikes are incurred; plant and equipment functions as specified; geological or financial parameters do not necessitate future mine plan changes; and no geological or technical problems occur.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking statements. These include but are not limited to:

| • | | uncertainties related to the completion of the Bokoni group Restructure Plan on a timely basis, if at all; |

| • | | uncertainties and costs related to the Company’s exploration and development activities, such as those associated with determining whether mineral resources or reserves exist on a property; |

| • | | uncertainties related to feasibility studies that provide estimates of expected or anticipated costs, expenditures and economic returns from a mining project; |

| • | | uncertainties related to expected production rates, timing of production and the cash and total costs of production and milling; |

| • | | uncertainties related to the ability to obtain necessary approvals, licenses, permits, electricity, surface rights and title for projects; |

| • | | operating and technical difficulties in connection with mining development activities; |

| • | | uncertainties related to the accuracy of our mineral reserve and mineral resource estimates and our estimates of future production and future cash and total costs of production, and the geotechnical or hydrogeological nature of ore deposits, and diminishing quantities or grades of mineral reserves; |

| • | | uncertainties related to unexpected judicial or regulatory proceedings; |

| • | | changes in, and the effects of, the laws, regulations and government policies affecting our mining operations, particularly laws, regulations and policies relating to: |

| | • | | mine expansions, environmental protection and associated compliance costs arising from exploration, mine development, mine operations and mine closures; |

| | • | | expected effective future tax rates in jurisdictions in which our operations are located; |

| | • | | the protection of the health and safety of mine workers; and |

| | • | | mineral rights ownership in countries where our mineral deposits are located, including the effect of the Mineral and Petroleum Resources Development Act (South Africa); |

| • | | changes in general economic conditions, the financial markets and in the demand and market price for gold, copper and other minerals and commodities, such as diesel fuel, coal, petroleum coke, steel, concrete, electricity and other forms of energy, mining equipment, and fluctuations in exchange rates, particularly with respect to the value of the U.S. dollar, Canadian dollar and South African rand; |

| • | | unusual or unexpected formation, cave-ins, flooding, pressures, and precious metals losses (and the risk of inadequate insurance or inability to obtain insurance to cover these risks); |

| • | | changes in accounting policies and methods we use to report our financial condition, including uncertainties associated with critical accounting assumptions and estimates; environmental issues and liabilities associated with mining including processing and stock piling ore; |

| • | | geopolitical uncertainty and political and economic instability in countries which we operate; and |

A-2

| • | | labour strikes, work stoppages, or other interruptions to, or difficulties in, the employment of labour in markets in which we operate mines, or environmental hazards, industrial accidents or other events or occurrences, including third party interference that interrupt the production of minerals in our mines. |

For further information on Atlatsa, investors should review the Company’s Annual Report disclosed in the Form 20-F for the year ended December 31, 2011 filed on SEDAR at www.sedar.com and with the United States Securities and Exchange Commission www.sec.gov and other disclosure documents that are available on SEDAR at www.sedar.com.

A-3

Document 2

EXECUTION VERSION

AMENDMENT AND INTERIM IMPLEMENTATION AGREEMENT

amongst

ATLATSA RESOURCES CORPORATION

and

N1C RESOURCES INC.

and

N2C RESOURCES INC

and

RUSTENBURG PLATINUM MINES LIMITED

(in its capacity as co-shareholder and preference shareholder of Holdco,

Senior Agent, Senior Facilities Lender and OCSF Lender)

and

PLATEAU RESOURCES PROPRIETARY LIMITED

and

BOKONI PLATINUM HOLDINGS PROPRIETARY LIMITED

and

BOKONI PLATINUM MINE PROPRIETARY LIMITED

and

MICAWBER 634 PROPRIETARY LIMITED

and

MICAWBER 603 PROPRIETARY LIMITED

and

PELAWAN FINANCE SPV PROPRIETARY LIMITED

and

THE TRUSTEES FOR THE TIME BEING OF THE PELAWAN TRUST

and

THE TRUSTEES FOR THE TIME BEING OF THE PELAWAN DIVIDEND TRUST

Table of Contents

| | |

| | 1 |

| | |

| 1. | PART 1: DEFINITIONS AND INTERPRETATION |

| 1.1 | Words and expressions not otherwise defined in this Agreement shall bear the meaning given to them in the June 2009 Senior Facilities Agreement (as defined below). In addition, unless otherwise stated or inconsistent with the context in which they appear, the following words and expressions used in this Agreement (including without limitation, in clauses 4.1 to 4.7) bear the following meanings and other words derived from the same origins as such words (that is, cognate words) shall bear corresponding meanings: |

| | | | |

| 1.1.1 | | “Accrued Notional | | |

| | Interest Amount” | | on the date of calculation, the aggregate notional interest amount on the Loans, calculated in accordance with clauses 4.1.2.6.4 and 4.1.2.6.5; |

| | |

| 1.1.2 | | “Accrued Notional | | |

| | Interest Reference | | |

| | Amount” | | an amount of R226,532,264.58; |

| | |

| 1.1.3 | | “Additional | | |

| | Advance Amounts” | | the aggregate of the Subscription Advance Amount, the OSCF Settlement Advance Amount and the Additional SFA Advance Amounts; |

| | |

| 1.1.4 | | “Additional SFA | | |

| | Advance Amounts” | | the amount of R295 870 924.16; |

| | |

| 1.1.5 | | “AFSA” | | Arbitration Foundation of Southern Africa; |

| | |

| 1.1.6 | | “Agreement” | | this amendment and interim implementation agreement, including all Schedules, as amended from time to time; |

| | |

| 1.1.7 | | “Atlatsa” | | Atlatsa Resources Corporation (previously known as Anooraq Resources Corporation), registration number 10022-2033, a public company incorporated in accordance with the laws of British Columbia, Canada; |

| | |

| | 2 |

| | |

| | | | |

| 1.1.8 | | “Business Day” | | any day which is not a Saturday, Sunday or gazetted public holiday in South Africa; |

| | |

| 1.1.9 | | “Companies Act” | | the Companies Act, 71 of 2008; |

| | |

| 1.1.10 | | “Conditions | | |

| | Precedent” | | the conditions precedent set out in clause 3; |

| | |

| 1.1.11 | | “First Holdco | | |

| | Opco Subscription | | |

| | Agreement” | | the first subscription agreement entered into, or to be entered into, between Holdco and Opco, on or about the Signature Date, in terms of which Holdco subscribes for and Opco issues and allots the First Holdco Opco Subscription Shares; |

| | |

| 1.1.12 | | “First Holdco Opco | | |

| | Subscription Price” | | the aggregate subscription price for the First Holdco Opco Subscription Shares, being R3,398,107,403.92; |

| | |

| 1.1.13 | | “First Holdco Opco | | |

| | Subscription | | |

| | Shares” | | 100 ordinary shares of R1,00 each in the authorised share capital of Opco, to be issued and allotted to Holdco pursuant to the First Holdco Opco Subscription Agreement; |

| | |

| 1.1.14 | | “First Plateau | | |

| | Holdco Subscription | | |

| | Agreement” | | the first subscription agreement entered into, or to be entered into, between Plateau and Holdco, on or about the Signature Date, in terms of which Plateau subscribes for and Holdco issues and allots the Plateau Holdco Subscription Shares; |

| | |

| 1.1.15 | | “First Plateau Holdco | | |

| | Subscription Price” | | the aggregate subscription price for the First Plateau Holdco Subscription Shares, being the Subscription Advance Amount; |

| | |

| | 3 |

| | |

| | | | |

| 1.1.16 | | “First Plateau Holdco | | |

| | Subscription | | |

| | Shares” | | 51 ordinary shares of R1,00 each in the authorised share capital of Holdco, to be issued and allotted to Plateau pursuant to the First Plateau Holdco Subscription Agreement; |

| | |

| 1.1.17 | | “First RPM | | |

| | Holdco Subscription | | |

| | Agreement” | | the first subscription agreement entered into, or to be entered into, between RPM and Holdco, on or about the Signature Date, in terms of which RPM subscribes for and Holdco issues and allots the First RPM Holdco Subscription Shares; |

| | |

| 1.1.18 | | “First RPM Holdco | | |

| | Subscription Price” | | the aggregate subscription price for the First RPM Holdco Subscription Shares, being R1,665,072,628.31; |

| | |

| 1.1.19 | | “First RPM Holdco | | |

| | Subscription | | |

| | Shares” | | 49 ordinary shares of R1,00 each in the authorised share capital of Holdco, to be issued and allotted to RPM pursuant to the First RPM Holdco Subscription Agreement; |

| | |

| 1.1.20 | | “Holdco” | | Bokoni Platinum Holdings Proprietary Limited, registration number 2007/016711/07, a private company incorporated in accordance with the laws of South Africa; |

| | |

| 1.1.21 | | “Holdco Opco | | |

| | A Preference Share | | |

| | Subscription | | |

| | Agreement” | | the subscription agreement entered into between Holdco and Opco on or about 12 June 2009, in terms of which Holdco subscribed for and Opco issued and alloted the Holdco Opco A Preference Shares; |

| | |

| | 4 |

| | |

| | | | |

| 1.1.22 | | “Holdco Opco | | |

| | A Preference | | |

| | Dividend” | | the A Preference Dividend, as defined in Schedule 2 of the Holdco Opco A Preference Share Subscription Agreement; |

| | |

| 1.1.23 | | “Holdco Opco | | |

| | A Preference | | |

| | Shares” | | the A Preference Shares, as defined in Schedule 2 of the Holdco Opco A Preference Share Subscription Agreement; |

| | |

| 1.1.24 | | “Holdco Opco | | |

| | Redemption | | |

| | Amount” | | the Redemption Amount, as defined in Schedule 2 of the Holdco Opco A Preference Share Subscription Agreement; |

| | |

| 1.1.25 | | “Implementation | | |

| | Bank” | | The Standard Bank of South Africa Limited; |

| | |

| 1.1.26 | | Income Tax Act” | | the Income Tax Act, 58 of 1962; |

| | |

| 1.1.27 | | “Insolvency Act” | | the Insolvency Act, 24 of 1936; |

| | |

| 1.1.28 | | “Interim Closing | | |

| | Date” | | 28 September 2012 or such other date as RPM and Plateau may agree to in writing; |

| | |

| 1.1.29 | | “Interim Funds | | |

| | Flow Statement” | | the Interim Funds Flow Statement attached as Schedule 1 to this Agreement; |

| | |

| 1.1.30 | | “Interim | | |

| | Implementation | | |

| | Steps” | | the steps set out in clause 5.2, in the sequence reflected in such clause; |

| | |

| 1.1.31 | | “June 2009 | | |

| | Senior Facilities | | |

| | Agreement” | | the ZAR750,000,000 (inclusive of capitalised interest) term facility agreement dated 12 June 2009, between (as at the Signature Date), amongst |

| | |

| | 5 |

| | |

| | | | |

| | | | others, Atlatsa, N1C Resources, N2C Resources, the Borrower and RPM in its capacity as lender, senior agent and security agent, as amended from time to time; |

| | |

| 1.1.32 | | “Lender” | | the Lender, as defined in the Senior Facilities Agreement; |

| | |

| 1.1.33 | | “N1C Resources” | | N1C Resources Inc., registration number CR-94610, a limited liability company incorporated in accordance with the laws of the Cayman Islands; |

| | |

| 1.1.34 | | “N2C Resources” | | N2C Resources Inc., registration number CR-94611, a limited liability company incorporated in accordance with the laws of the Cayman Islands; |

| | |

| 1.1.35 | | “New Senior Facilities | | |

| | Agreement” | | the new senior facilities agreement to be entered into between, amongst others, the parties to the June 2009 Senior Facilities Agreement after the Signature Date, in terms of which RPM, as original lender, will advance to Plateau, as borrower, an amount of up to R2,300,000,000, including capitalised interest, (plus a further amount, to be agreed between the parties to this agreement, to facilitate the capitalisation of the Holdco Group), on the terms set out in that agreement; |

| | |

| 1.1.36 | | “New Senior Facilities | | |

| | Utilisation Date” | | the date on which the first amount is advanced to Plateau under the New Senior Facilities Agreement; |

| | |

| 1.1.37 | | “OCSF Agreement” | | the OCSF Agreement, as defined in the RPM Funding Common Terms Agreement; |

| | |

| 1.1.38 | | “OCSF Facility” | | the OCSF Facility, as defined in the RPM Funding Common Terms Agreement; |

| | |

| | 6 |

| | |

| | | | |

| 1.1.39 | | “OCSF Lender” | | RPM, in its capacity as lender under the OCSF Facility; |

| | |

| 1.1.40 | | “OCSF Settlement | | |

| | Advance Amount” | | an amount equivalent to the OCSF Settlement Amount; |

| | |

| 1.1.41 | | “OCSF Settlement | | |

| | Amount” | | the amount required to be repaid by Plateau to the OSCF Lender to settle all amounts outstanding under the OSCF Facility on the Interim Closing Date, being the amount referred to in clause 4.2.2.1.2; |

| | |

| 1.1.42 | | “Opco” | | Bokoni Platinum Mines Proprietary Limited, registration number 2007/016001/07, a private company incorporated in accordance with the laws of South Africa; |

| | |

| 1.1.43 | | “Opco | | |

| | Security SPV” | | Micawber 603 Proprietary Limited, registration number 2007/019599/07, a private company incorporated in accordance with the laws of South Africa; |

| | |

| 1.1.44 | | “Parties” | | collectively, Atlatsa, Plateau, N1C Resources, N2C Resources, RPM, the Lender, the OSCF Lender, the Senior Agent, Opco Security SPV, Plateau Security SPV, Holdco, Opco, Pelawan SPV, Pelawan Dividend Trust, Pelawan Trust and a “Party” shall mean each or any of them, as the context requires; |

| | |

| 1.1.45 | | “Pelawan SPV” | | Pelawan Finance SPV Proprietary Limited (formerly Central Plaza Investments 78 Proprietary Limited), registration number 2006/032879/07, a private company incorporated in accordance with the laws of South Africa; |

| | |

| | 7 |

| | |

| | | | |

| 1.1.46 | | “Pelawan | | |

| | Dividend Trust” | | the trustees for the time being of the Pelawan Dividend Trust, established in accordance with the trust deed with Master’s reference number IT8410/2004; |

| | |

| 1.1.47 | | “Pelawan Trust” | | the trustees for the time being of the Pelawan Trust, established in accordance with the trust deed dated 2 September 2004, Master’s reference number IT8411/2004; |

| | |

| 1.1.48 | | “Plateau” | | Plateau Resources Proprietary Limited, registration number 1996/013879/07, a private company incorporated in accordance with the laws of South Africa; |

| | |

| 1.1.49 | | “Plateau Holdco | | |

| | A Preference Share | | |

| | Subscription | | |

| | Agreement” | | the subscription agreement entered into between Plateau and Holdco on or about 12 June 2009, in terms of which Plateau subscribes for and Holdco issues and allots the Plateau Holdco A Preference Shares; |

| | |

| 1.1.50 | | “Plateau Holdco | | |

| | A Preference | | |

| | Dividend” | | the A Preference Dividend, as defined in Schedule 2 of the Plateau Holdco A Preference Share Subscription Agreement; |

| | |

| 1.1.51 | | “Plateau Holdco | | |

| | A Preference | | |

| | Shares” | | the A Preference Shares, as defined in the Plateau Holdco A Preference Share Subscription Agreement; |

| | |

| | 8 |

| | |

| | | | |

| 1.1.52 | | “Plateau Holdco | | |

| | Redemption | | |

| | Amount” | | the Redemption Amount, as defined in the Plateau Holdco A Preference Share Subscription Agreement; |

| | |

| 1.1.53 | | “Plateau | | |

| | Security SPV” | | Micawber 634 Proprietary Limited, registration number 2007/025445/07, a private company incorporated in accordance with the laws of South Africa; |

| | |

| 1.1.54 | | “RPM” | | Rustenburg Platinum Mines Limited, registration number 1931/003380/06, a public company incorporated in accordance with the laws of South Africa; |

| | |

| 1.1.55 | | “RPM Funding | | |

| | Common Terms | | |

| | Agreement” | | the RPM Funding Common Terms Agreement dated 12 June 2009 between, amongst RPM, Plateau, Atlatsa, Pelawan SPV, N1C Resources, N2C Resources, Pelawan, Pelawan Trust, Opco Security SPV and Plateau Security SPV; |

| | |

| 1.1.56 | | “RPM Holdco | | |

| | A Preference Share | | |

| | Subscription | | |

| | Agreement” | | the subscription agreement entered into between RPM and Holdco on or about 12 June 2009, in terms of which RPM subscribed for and Holdco issued and allotted the RPM Holdco A Preference Shares; |

| | |

| 1.1.57 | | “RPM Holdco | | |

| | A Preference | | |

| | Dividend” | | the A Preference Dividend, as defined in Schedule 2 of the RPM Holdco A Preference Share Subscription Agreement; |

| | |

| | 9 |

| | |

| | | | |

| 1.1.58 | | “RPM Holdco | | |

| | A Preference | | |

| | Shares” | | the A Preference Shares, as defined in Schedule 2 of the RPM Holdco A Preference Share Subscription Agreement; |

| | |

| 1.1.59 | | “RPM Holdco | | |

| | Redemption | | |

| | Amount” | | the Redemption Amount, as defined in Schedule 2 of the RPM Holdco A Preference Share Subscription Agreement; |

| | |

| 1.1.60 | | “RPM Plateau | | |

| | A Preference Share | | |

| | Subscription | | |

| | Agreement” | | the subscription agreement entered into between RPM and Plateau on or about 12 June 2009, in terms of which RPM subscribed for and Holdco issued and allotted the RPM Plateau A Preference Shares; |

| | |

| 1.1.61 | | “RPM Plateau | | |

| | A Preference | | |

| | Dividend” | | the A Preference Dividend, as defined in Schedule 2 of the RPM Plateau A Preference Share Subscription Agreement; |

| | |

| 1.1.62 | | “RPM Plateau | | |

| | A Preference | | |

| | Shares” | | the A Preference Shares, as defined in Schedule 2 of the RPM Plateau A Preference Share Subscription Agreement; |

| | |

| 1.1.63 | | “RPM Plateau | | |

| | Redemption | | |

| | Amount” | | the Redemption Amount, as defined in Schedule 2 of the RPM Plateau A Preference Share Subscription Agreement; |

| | |

| 1.1.64 | | “Schedule” | | a schedule to this Agreement; |

| | |

| | 10 |

| | |

| | | | |

| 1.1.65 | | “Security Agent” | | the Security Agent, as defined in the June 2009 Senior Facilities Agreement; |

| | |

| 1.1.66 | | “Senior Agent” | | the Senior Agent, as defined in the June 2009 Senior Facilities Agreement; |

| | |

| 1.1.67 | | “Signature Date” | | the date on which this Agreement is signed (whether or not in counterpart) by the last signing of the Parties; |

| | |

| 1.1.68 | | “South Africa” | | the Republic of South Africa; |

| | |

| 1.1.69 | | “Subscription | | |

| | Advance Amount” | | the amount of R1,733,034,775.61; |

| | |

| 1.1.70 | | “Term Sheet” | | the term sheet entitled ‘Project Kingpin’, initialled by AAPL and Atlatsa on or about December 2011, attached hereto as Schedule 2; |

| | |

| 1.1.71 | | “Total Facility | | |

| | Outstandings” | | mean, at any time, and in relation to the June 2009 Senior Facility Agreement, the aggregate of all amounts of principal (including capitalised interest), accrued and unpaid interest and all and any other amounts due and payable to the Senior Finance Parties by Plateau under the June 2009 Senior Facilities Agreement including, without limitation, any bona fide claim for direct damages or restitution and any claim as a result of any recovery by Plateau of a payment or discharge on the grounds of preference, and any amounts which would be included in any of the above but for any discharge, non-provability or unenforceability of those amounts in any insolvency or other proceedings; |

| | |

| 1.1.72 | | “VAT” | | value-added tax in terms of the VAT Act; |

| | |

| 1.1.73 | | “VAT Act” | | the Value Added Tax Act, 89 of 1991; |

| | |

| | 11 |

| | |

| 1.2 | If any provision in a definition is a substantive provision conferring rights or imposing obligations on any Party, notwithstanding that it is only in the definition clause, effect shall be given to it as if it were a substantive provision of this Agreement. |

| 1.3 | Any reference to an enactment is to that enactment as at the Signature Date and, in the event that any right and/or obligation shall arise in terms of this Agreement, in respect of and/or in connection with such enactment after the Signature Date, such reference shall be to that enactment as amended and/or replaced as at the date for performance of such right and/or obligation. |

| 1.4 | Any reference in this Agreement to this Agreement or to any other agreement shall be construed as a reference to this Agreement or such other agreement as the same may have been (including at any time prior to the Signature Date), or may from time to time be, amended, varied, novated or supplemented. |

| 1.5 | Unless inconsistent with the context, an expression which denotes: |

| 1.5.1 | any gender includes the other genders; |

| 1.5.2 | a natural person includes an artificial person andvice versa; |

| 1.5.3 | the singular includes the plural andvice versa. |

| 1.6 | Where any term is defined within the context of any particular clause in this Agreement, the term so defined, unless it is clear from the clause in question that the term so defined has limited application to the relevant clause, shall bear the meaning ascribed to it for all purposes in terms of this Agreement, notwithstanding that that term has not been defined in this interpretation clause. |

| 1.7 | The rule of construction that, in the event of ambiguity, a contract shall be interpreted against the Party responsible for the drafting or preparation of such contract, shall not apply. |

| 1.8 | Where any number of days is prescribed, those days shall be reckoned exclusively of the first and inclusively of the last day unless the last day falls on a day which is not a Business Day, in which event the last day shall be the next succeeding Business Day. |

| | |

| | 12 |

| | |

| 1.9 | The Schedules to this Agreement forms an integral part hereof and words and expressions defined in this Agreement shall bear, unless the context otherwise requires, the same meaning in such Schedules. |

| 1.10 | If any words and expressions defined in clause 1.1 above are used in any clause in this Agreement which contains amendments to any Finance Document or RPM Finance Document (“Amended Finance Document”), such words and expressions shall be deemed to be included by reference, as defined terms, into such Amended Finance Document. |

| 2.1 | As part of a broader restructure of the funding arrangements in relation to the Borrower and the Holdco Group, and as interim implementation steps, the Parties wish to: |

| 2.1.1 | declare dividends in respect of the preference shares issued by each of Plateau, Holdco and Opco and redeem such preference shares; |

| 2.1.2 | record certain amendments to the interest rate applicable to the amounts outstanding under the OCSF Facility and under the June 2009 Senior Facilities Agreement; |

| 2.1.3 | repay the amounts outstanding under the OCSF Facility and terminate the OCSF Facility; and |

| 2.1.4 | enable utilisations of the Additional SFA Advance Amount, for the same purposes as utilisations under the OCSF Facility were permitted prior to its termination. |

| 2.2 | In order to give effect to the redemption of the preference shares, repayment of the amounts outstanding under the OCSF Facility and replacement of the terminated OCSF Facility on the Interim Closing Date in accordance with this Agreement, including the Interim Implementation Steps, read with the Interim Funds Flow Statement, Plateau has requested the Lender to amend the June 2009 Senior Facilities Agreement to increase the amount available for utilisation by Plateau under the June 2009 Senior Facilities Agreement in order to (i) enable the advance of the Subscription Advance Amount and the OCSF Settlement |

| | |

| | 13 |

| | |

| | Advance Amount and use of such amounts in accordance with the Interim Implementation Steps and (ii) allow further utilisations under the June 2009 Senior Facilities Agreement in order to replace the amounts which would have been available under the OCSF Facility prior to its termination in accordance with this Agreement. |

| 2.3 | The Parties accordingly wish to enter into this Agreement on the terms set out below. |

| 3. | PART 3: CONDITIONS PRECEDENT |

| 3.1 | This entire Agreement (save in respect of clauses 1 to 3 (both inclusive) and clause 6, which shall be of immediate force and effect) shall be subject to the fulfilment of the Conditions Precedent by not later than 26 September 2012, or such later date as the Parties may agree in writing, that: |

| 3.1.1 | the Parties shall respectively have obtained all necessary corporate authorisations (including all board and shareholder resolutions, including all required resolutions under sections 44, 45 and 46 of the Companies Act) required to enter into this Agreement and to give effect to the Interim Implementation Steps; |

| 3.1.2 | Plateau has delivered a copy of the constitutional documents of Plateau or, if the Senior Agent already has a copy, a certificate of an authorised signatory of the Company confirming that the copy in the Senior Agent’s possession is still correct, complete and in full force and effect as at a date no earlier than the Signature Date; |

| 3.1.3 | a specimen of the signature of each person authorised on behalf of Plateau to sign this Agreement; |

| 3.1.4 | a certificate of an authorised signatory of Plateau certifying that each copy document specified in this clause 3.1 is correct, complete and in full force and effect as at a date no earlier than the Signature Date; |

| 3.1.5 | a copy of any other authorisation or other document, opinion or assurance which the Senior Agent has notified Plateau is necessary or desirable in connection with the entry into and performance of, and the transactions |

| | |

| | 14 |

| | |

| | contemplated by, this Agreement or for the validity and enforceability of this Agreement; |

| 3.1.6 | RPM, Plateau, Holdco and Opco have instructed the Implementation Bank to give effect to the Interim Implementation Steps in accordance with the Interim Funds Flow Statement, and the Implementation Bank has agreed to do so, on terms acceptable to RPM; and |

| 3.1.7 | RPM and Plateau have received a copy of this Agreement, signed by each Party. |

| 3.2 | The Conditions Precedent above are imposed for the benefit of all the Parties, and may not be waived except by unanimous written agreement amongst the Parties at any time prior to the dates respectively specified for their fulfilment. |

| 3.3 | The Parties shall use their respective reasonable commercial endeavours to procure the fulfilment of the Conditions Precedent as soon as reasonably possible after the Signature Date. |

| 3.4 | If any Condition Precedent shall not have been fulfilled, or waived by the Party, or Parties, entitled to effect such waiver, as the case may be, by the date specified in clause 3.1 for its fulfilment (or such later date as the Parties may have in writing agreed), this Agreement (save in respect of clauses 1 to 3 (both inclusive) and clause 6, which shall remain of full force and effect, shall lapse and shall be of no force and effect and none of the Parties shall have any claim against the others of them in terms hereof or arising from the failure of the Conditions Precedent, save for a claim arising as a result of a Party’s failure to fulfil-comply with its obligations under this clause 3. |

| 4. | PART 4: AMENDMENTS TO THE FINANCE DOCUMENTS AND RPM FINANCE DOCUMENTS AND TERMINATION OF THE OCSF AGREEMENT |

| 4.1 | AMENDMENTS TO THE JUNE 2009 SENIOR FACILITIES AGREEMENT |

| 4.1.1.1 | Pursuant to clause 40 (Amendments and waivers) of the June 2009 Senior Facilities Agreement, the Lenders have consented to the |

| | |

| | 15 |

| | |

| | amendments to the June 2009 Senior Facilities Agreement contemplated by this Agreement. Accordingly, RPM in its capacity as Senior Agent is authorised to execute this Agreement on behalf of the Finance Parties. |

| 4.1.1.2 | The amendments set out in this clause 4.1 will amend the June 2009 Senior Facilities Agreement on and with effect from the Interim Closing Date. |

| 4.1.2 | Amendments and terms applicable to the Additional Advance Amount |

The June 2009 Senior Facilities Agreement and, to the extent applicable, each other Finance Document and each other RPM Finance Document shall be deemed to be amended, in all respects, as specifically set out in this clause 4.1.2 below and to give effect to the principles set out in this clause 4.1.2 below.

| 4.1.2.1 | Increase of the Total Commitments |

| 4.1.2.1.1 | The definition of “Commitments” is amended by adding the following sub-paragraph as sub-paragraph (a)(i) immediately after sub-paragraph (a) of this definition: |

(a)(i) in relation to RPM, as the sole Lender as at 28 September 2012, an amount equal to the Additional Advance Amounts; and”.

| 4.1.2.1.2 | The definition of “Total Commitments” is deleted and replaced with the following: |

“Total Commitments” means the aggregate of the Commitments, being R 525,725,465.76 plus the Additional Advance Amounts.”

| 4.1.2.2 | Availability Period |

| 4.1.2.2.1 | In relation to the Subscription Advance Amount and the OCSF Settlement Advance Amount, the Availability Period shall be a |

| | |

| | 16 |

| | |

| | period commencing at 07h00 on the Interim Closing Date and terminating at 17h00 on the Interim Closing Date. |

| 4.1.2.2.2 | In relation to the Additional SFA Advance Amounts, the Availability Period shall be the period commencing on the Interim Closing Date and terminating on the earlier of (i) the New Senior Facilities Utilisation Date and (ii) 31 August 2013. |

| 4.1.2.3.1 | The Subscription Advance Amount and the OCSF Settlement Advance Amount may be drawn down on the Interim Closing Date and, notwithstanding any provision to the contrary in the June 2009 Senior Facilities Agreement or any other Finance Document: |

| 4.1.2.3.1.1 | the OCSF Settlement Advance Amount may be used only for the purposes of implementing step 2 of the Interim Implementation Steps set out below (Payment of the OCSF Settlement Amount); and |

| 4.1.2.3.1.2 | the Subscription Advance Amount may be used for only for the purposes of implementing step 4 of the Interim Implementation Steps set out below (Subscription for ordinary shares in Holdco). |

| 4.1.2.3.2 | The Additional SFA Advance Amount is intended to replace amounts that were available for utilisation under the OSCF Facility immediately prior to its termination in accordance with clause 4.3 below. As such: |

| 4.1.2.3.2.1 | an amount of R267,870,824.16 of the Additional SFA Advance Amount may be utilised at any time during the Availability Period referred to in clause 4.1.2.2.2 and, notwithstanding any provision to the contrary in the June 2009 Senior Facilities Agreement, any other Finance Document or any other RPM Finance Document, may be |

| | |

| | 17 |

| | |

| | used for any purpose for which the amounts drawn down under the OSCF Facility (as defined in the OCSF Agreement) were permitted to be used; |

| 4.1.2.3.2.2 | an amount of R28,000,000 of the Additional SFA Advance Amount (“Guarantee Facility Portion”) may be utilised at any time during the Availability Period referred to in clause 4.1.2.2.2 and, notwithstanding any provision to the contrary in the June 2009 Senior Facilities Agreement, any other Finance Document or any other RPM Finance Document, may be used for any purpose for which the amounts drawn down under the Guarantee Facility (as defined in the OCSF Facility Agreement) were permitted to be used. |

| 4.1.2.4 | Utilisation Request and utilisation conditions |

| 4.1.2.4.1 | Notwithstanding any provision to the contrary in the June 2009 Senior Facilities Agreement Plateau shall only be entitled to deliver a Utilisation Request in relation to the advance of the Subscription Advance Amount and the OCSF Settlement Advance Amount (in substantially the form attached as Schedule 3 to the June 2009 Senior Facilities Agreement) provided that such delivery is made to the Senior Agent by no later than 11h00 on the Business Day immediately preceding the Interim Closing Date (or such later time as the Agent may agree to in writing). |

| 4.1.2.4.2 | In addition and notwithstanding any provision to the contrary in the June 2009 Senior Facilities Agreement, Plateau shall only be entitled to deliver a Utilisation Request in relation to each advance of the Additional SFA Advance Amount (or any part thereof), which Utilisation Request must be substantially the form of Schedule 3 to the June 2009 Senior Facilities Agreement and must be delivered by no later than 10 Business Days prior to the proposed Utilisation Date (or such other period |

| | |

| | 18 |

| | |

| | as the Lender and Plateau may agree in writing); provided that such Utilisation Request must also (i) specify the amount of the Additional SFA Advance Amount requested for utilization, (ii) specify if any Guarantee Facility Portion is requested, (iii) specify the purpose for which the Additional SFA Advance Amount will be used and (iv) confirm that each of the conditions of clause 6 of the OCSF Agreement (and incorporated into the June 2009 Senior Facilities Agreement by reference in terms of clause 4.1.2.4.3 below) have been complied with. |

| 4.1.2.4.3 | The provisions of clause 6 of the OCSF Agreement (Drawdowns) shall apply (mutatis mutandis) to any utilization of the Additional SFA Advance Amount (or any part thereof); provided that the provisions of such clause 6 which relate specifically to the Guarantee Facility (as defined in the OCSF Agreement) shall apply (mutatis mutandis) to the Guarantee Facility Portion. |

| 4.1.2.5.1 | On the Interim Closing Date, the Lender will advance and lend to Plateau, who shall borrow from the Lender an amount equal to the aggregate of the Subscription Advance Amount and the OCSF Settlement Advance Amount. |

| 4.1.2.5.2 | Utilisations under of the Additional SFA Advance Amount shall be made in accordance with the provisions of clause 4.1.2.4 above. |

| 4.1.2.5.3 | Save as otherwise expressly set out in this Agreement, the Lender will advance and Plateau shall borrow and repay the Additional Advance Amounts advanced by the Lender on the same terms and conditions as the other amounts advanced to Plateau under the June 2009 Senior Facilities Agreement as at the Signature Date. |

| | |

| | 19 |

| | |

| 4.1.2.5.4 | The Additional Advance Amounts advanced by the Lender shall be added to the principal amount of the Loan, a portion of which will be repaid by Plateau to the Senior Agent on the Interim Closing Date in accordance with Step 9 of the Interim Implementation Steps (Repayment of a portion of the Total Facility Outstandings) and the balance of which will be repaid by Plateau to the Senior Agent on the dates referred to in clause 10.1(a) of the June 2009 Senior Facilities Agreement (as amended, including pursuant to an amendment dated 11 August 2011). For this purpose the amount of each payment made by Plateau on such dates shall be increased pro rata by the Additional Advance Amounts which are outstanding as at the relevant payment date. |

| 4.1.2.5.5 | Interest on the Additional Advance Amounts advanced by the Lender shall accrue at the rate referred to in clause 4.1.2.6 and shall be repaid on the same dates specified in the June 2009 Senior Facilities Agreement (as amended, including pursuant to an amendment dated 11 August 2011). |

| 4.1.2.6.1 | Clauses 14.1 and 14.2 of the June 2009 Senior Facilities Agreement are amended as set out below. |

| 4.1.2.6.2 | Having regard to the interest rate principles agreed in the Term Sheet, the Parties agree that: |

| 4.1.2.6.2.1 | for the period commencing on 1 July 2011 up to and including 30 April 2012, the aggregate accrued interest in relation to the Loans is nil; and |

| 4.1.2.6.2.2 | for the period commencing on 1 May 2012 to 27 September 2012, the aggregate accrued interest in relation to the Loans is an amount of R81,007,438.94, which amount shall be capitalised to the Loans outstandings on 27 September 2012. |

| | |

| | 20 |

| | |

| 4.1.2.6.3 | From the period commencing on 28 September 2012 to the earlier of (i) the New Senior Facilities Utilisation Date; and (ii) the Termination Date, being (as at the Signature Date) 30 June 2018 (“the Interest Adjustment Period”), interest on each Loan for each Interest Period shall be calculated as set out below. |

| 4.1.2.6.4 | A notional calculation will be made, in terms of which a notional interest rate is calculated to be the percentage rate per annum which is (unless stated to be zero in clause 4.1.2.6.5): |

| 4.1.2.6.4.1 | the applicable JIBAR, plus or minus (as the case may be) |

| 4.1.2.6.4.2 | the applicable Margin, |

which notional interest shall be notionally applied to the Loans as if it accrues on the Loans, in each case, on a day to day basis at a notional interest rate, is calculated, in arrears, and compounded at the end of each Interest Period.

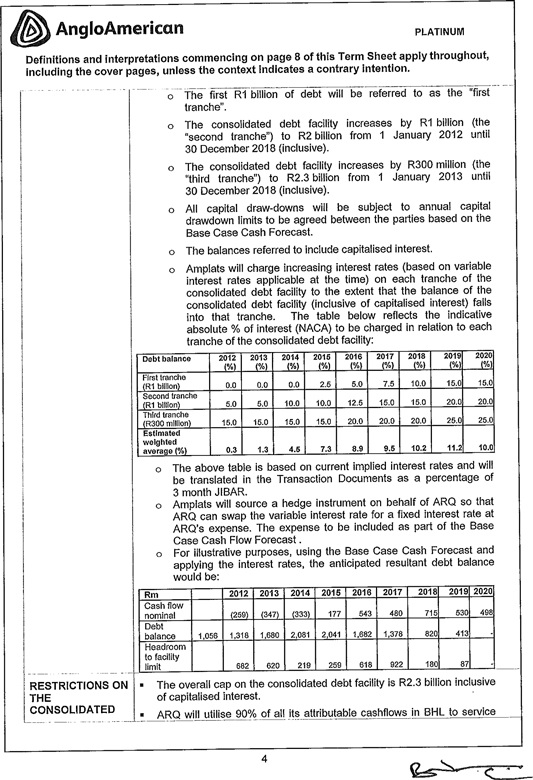

| 4.1.2.6.5 | The above notional interest rate and Margin in relation to each Loan will be calculated on a sliding scale with reference to the Total Facility Outstandings, in accordance with the following matrix (provided that the notional interest rate and Margin in relation to any Loan shall never be less than zero): |

| | | | | | | | | | | | | | |

Total Facility Outstandings | | 2012 | | 2013 | | 2014 | | 2015 | | 2016 | | 2017 | | 2018 |

| | | | | | | |

Up to ZAR1,000,000,000 | | zero

interest | | zero

interest | | zero

interest | | JIBAR

minus

5.14% | | JIBAR

minus

3.11% | | JIBAR

minus

0.96% | | JIBAR

plus

1.30% |

| | | | | | | |

From (and including) ZAR1,000,000,000 up to ZAR2,000,000,000 | | JIBAR

minus

0.73% | | JIBAR

minus

1.25% | | JIBAR

plus

3.02% | | JIBAR

plus

2.36% | | JIBAR

plus

4.39% | | JIBAR

plus

6.54% | | JIBAR

plus

6.30% |

| | | | | | | |

From (and including) ZAR2,000,000,000 | | JIBAR

plus

9.27% | | JIBAR

plus

8.75% | | JIBAR

plus

8.02% | | JIBAR

plus

7.36% | | JIBAR

plus

11.89% | | JIBAR

plus

11.54% | | JIBAR

plus

11.30% |

| | |

| | 21 |

| | |

| 4.1.2.7 | On the date upon which the Accrued Notional Interest Amount has reached an aggregate amount equal to the Accrued Notional Interest Reference Amount, interest shall begin to accrue on (and shall be due and payable in respect of) the Loans at the same rate of interest as the notional rate of interest set out in clauses 4.1.2.6.4 and 4.1.2.6.5, which interest shall be calculated on the same basis as the notional interest calculations set out in such clauses above. |

| 4.1.2.8 | If on the New Senior Facilities Agreement Utilisation Date, the Accrued Notional Interest Amount (ie the “Actual Notional Interest Amount”) is less than an amount equal to the Accrued Notional Interest Reference Amount, the notional interest rate and principles referred to in clauses 4.1.2.6.4 and 4.1.2.6.5 shall apply (mutatis mutandis) to the loans advanced under the New Senior Facilities Agreement (“New Senior Facilities Loans”) and other amounts outstanding under the New Senior Facilities Agreement, until the aggregate of the notional interest amount on the New Senior Facilities Loans plus the Actual Notional Interest Amount is equal to the Accrued Notional Interest Reference Amount, following which the provisions of clause 9 of the New Senior Facilities Agreement shall apply to the New Senior Facilities Loans and other amounts outstanding under the New Senior Facilities Agreement. |

Plateau (for itself and on behalf of each Obligor) confirms to the Lender that on the Signature Date and the Interim Closing Date, the Repeating Representations:

| 4.1.2.9.2 | would also be true if references to the June 2009 Senior Facilities Agreement were construed as references to such agreement, as amended by this Agreement. |

Each Repeating Representation is applied to the circumstances existing at the time the Repeating Representation is made.

| | |

| | 22 |

| | |

On the Interim Closing Date, Plateau (for itself and as agent for each other Obligor) confirms that:

| 4.1.2.10.1 | any Security created by it under the Transaction Security Documents extends to the obligations of the Obligors under the Finance Documents (including the June 2009 Senior Facilities Agreement and each other Finance Document or RPM Finance Document, as amended by this Agreement), subject to any limitations set out in the Transaction Security Documents; |

| 4.1.2.10.2 | the obligations of the Obligors arising under the June 2009 Senior Facilities Agreement as amended by this Agreement (and arising under any other Finance Document or RPM Finance Document, as amended by this Agreement) are included in the secured obligations (as the same may be defined in the respective Transaction Security Documents) subject to any limitations set out in the Transaction Security Documents; and |

| 4.1.2.10.3 | the Security created under the Transaction Security Documents continues in full force and effect on the terms of the respective Transaction Security Documents. |

| 4.1.2.11.1 | This Agreement is a Finance Document. |

| 4.1.2.11.2 | Except as expressly otherwise provided in this Agreement, no amendment, variation or change is made to any Finance Document and all the Finance Documents remain in full force and effect in accordance with their terms. |

| 4.1.2.11.3 | Except to the extent expressly waived in this Agreement, no waiver of any provision of any Finance Document is given by the terms of this Agreement and the Finance Parties expressly |

| | |

| | 23 |

| | |

| | reserve all their rights and remedies in respect of any breach of, or other Default under, the Finance Documents. |

| 4.2 | AMENDMENTS TO THE OCSF AGREEMENT |

| 4.2.1.1 | The provisions of this clause 4.2 are supplemental to and amend the OCSF Agreement pursuant to clause 23.3 (General) of the RPM Funding Common Terms Agreement. |

| 4.2.1.2 | The amendments set out in this clause 4.1 will amend the OCSF Agreement on and with effect from the Interim Closing Date. |

The OCSF Agreement and, to the extent applicable, each of the other Finance Document and RPM Finance Document shall be deemed to be amended, in all respects, as specifically set out in this clause 4.2.2 below and to give effect to the principles set out in this clause 4.2.2 below.

| 4.2.2.1 | Interest Rate and OCSF Settlement Amount |

| 4.2.2.1.1 | The Interest Rate applicable to the capital amounts outstanding under the OCSF Facility shall be calculated in accordance with clause 4.1.2.6 and for the periods referred to in clause 4.1.2.6, as if all capital amounts outstanding under the OCSF Facility constituted a Loan under the June 2009 Senior Facilities Agreement during such periods. Therefore (and having regard to the interest rate principles agreed in the Term Sheet), the Parties agree: |

| 4.2.2.1.1.1 | for the period commencing on 1 July 2011 up to and including 30 April 2012, the aggregate accrued interest in relation to the amounts outstanding under the OCSF Facility is nil; and |

| 4.2.2.1.1.2 | for the period commencing on 1 May 2012 to 27 September 2012, the aggregate accrued interest in |

| | |

| | 24 |

| | |

| | relation to amounts outstanding under the OCSF Facility is capitalized to the capital amounts outstanding under the OCSF Facility on 27 September 2012. |

| 4.2.2.1.2 | Having regard to the amendment referred to in clause 4.2.2.1.1 above, the OCSF Settlement Amount as at 27 September 2012 is an amount of R928,113,717.73. |

| 4.3 | TERMINATION OF THE OCSF AGREEMENT |

| 4.3.1 | On the Interim Closing Date and immediately after implementation of Step 2 of the Interim Implementation Steps, the Parties agree that the OCSF Agreement shall be terminated. |

| 4.3.2 | The termination of the OCSF Agreement referred to above shall be without prejudice to any Parties rights, remedies or obligations which have arisen under any the OCSF Agreement (or any other Finance Document or RPM Finance Document) or by operation of law, on or before the Interim Closing Date, including in relation to the amendments to the OCSF Facility Agreement set out in clause 4.2 above. |

| 4.4 | AMENDMENTS TO THE RPM FUNDING LOAN AGREEMENT |

| 4.4.1 | In this clause 4.4, references to “Loans” and “RPM OCSF Tranches” shall be to those terms, as defined in the RPM Funding Loan Agreement. |

| 4.4.2 | Having regard to the interest rate principles agreed in the Term Sheet, the Parties agree that: |

| 4.4.2.1 | for the period commencing on 1 July 2011 up to and including 30 April 2012, the aggregate accrued interest in relation to the Loans and the RPM OCSF Tranches is nil; and |

| 4.4.2.2 | for the period commencing on 1 May 2012 to 27 September 2012, the aggregate accrued interest in relation to the Loans and the RPM OCSF Tranches is an amount of R76,100,437.19, which amount shall be capitalized to the Loans and RPM OCSF Tranche outstandings on 27 September 2012. |

| | |

| | 25 |

| | |

| 4.4.3 | From the period commencing on 28 September 2012 to the date of repayment, the interest rate applicable to the Loans and the RPM OCSF Tranches (as amended by the provisions of this clause 4.4) shall be zero. |

| 4.4.4 | The Additional SFA Advance Amount available for utilisation under the June 2009 Senior Facilities Agreement is intended to replace amounts that were available for utilisation under the OSCF Facility immediately prior to its termination in accordance with clause 4.3. In addition, the advance of the OCSF Settlement Advance Amount creates a Loan under the June 2009 Senior Facilities Agreement which replace the advances under the OCSF Facility. As such, references in (i) the Opco Funding Loan Agreement, (ii) the Global Intercreditor Agreement, (iii) the RPM Funding Common Terms Agreement (iv) any other Finance Document or (v) any other RPM Finance Document to the OCSF Facility and amounts utilised under the OCSF Facility (including references to the OCSF Tranches, and all derivative and related definitions and concepts) shall (mutatis mutandis) be construed and implemented in all respects as references to the June 2009 Senior Facilities Agreement and the Additional Advance Amounts (or relevant part thereof) advanced by RPM under the June 2009 Senior Facilities Agreement. |

| 4.4.5 | Notwithstanding any provision to the contrary in the RPM Funding Loan Agreement, all references to Senior Debt Payment Dates shall be construed as references to the Senior Debt Payment Dates in the June 2009 Senior Facilities Agreement (as amended) and not to Schedule 1 to the RPM Funding Loan Agreement. |

| 4.5 | AMENDMENTS TO THE PLATEAU FUNDING LOAN AGREEMENT |

| 4.5.1 | In this clause 4.5, references to “Loans” and “Plateau OCSF Tranches” shall be to those terms, as defined in the Plateau Funding Loan Agreement. |

| 4.5.2 | Having regard to the interest rate principles agreed in the Term Sheet, the Parties agree that: |

| | |

| | 26 |

| | |

| 4.5.2.1 | for the period commencing on 1 July 2011 up to and including 30 April 2012, the aggregate accrued interest in relation to the Loans and the Plateau OCSF Tranches is nil; and |

| 4.5.2.2 | for the period commencing on 1 May 2012 to 27 September 2012, the aggregate accrued interest in relation to the Loans and the Plateau OCSF Tranches is an amount of R79,206,569.26, which amount shall be capitalized to the Loans and Plateau OCSF Tranche outstandings on 27 September 2012. |

| 4.5.3 | From the period commencing on 28 September 2012 to the date of repayment, the interest rate applicable to the Loans and the Plateau OCSF Tranches (as amended by the provisions of this clause 4.5) shall be zero. |

| 4.5.4 | The Additional SFA Advance Amount available for utilisation under the June 2009 Senior Facilities Agreement is intended to replace amounts that were available for utilisation under the OSCF Facility immediately prior to its termination in accordance with clause 4.3 above. In addition, the advance of the OCSF Settlement Advance Amount creates a Loan under the June 2009 Senior Facilities Agreement which replace the advances under the OCSF Facility. As such, references in (i) the Opco Funding Loan Agreement, (ii) the Global Intercreditor Agreement, (iii) the RPM Funding Common Terms Agreement (iv) any other Finance Document or (v) any other RPM Finance Document to the OCSF Facility and amounts utilised under the OCSF Facility (including references to the OCSF Tranches, and all derivative and related definitions and concepts) shall (mutatis mutandis) be construed and implemented in all respects as references to the June 2009 Senior Facilities Agreement, the Additional Advance Amounts (or relevant part thereof) advanced by RPM under the June 2009 Senior Facilities Agreement. |