UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month ofJune, 2013

Commission File Number001-31930

ATLATSA RESOURCES CORPORATION

(Translation of registrant’s name into English)

15th Floor, 1040 West Georgia Street,

Vancouver, British Columbia, Canada, V6E 4H8

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40F:

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

DOCUMENTS INCLUDED AS PART OF THIS REPORT

| | |

Document | | Description |

| |

1. | | Notice of Annual General Meeting and Management Information Circular |

| |

2. | | Form of Proxy – Annual General Meeting |

| |

3 | | Voting Instruction Form – Annual General Meeting |

| |

4 | | Notice of Special Meeting and Management Information Circular |

| |

5 | | Form of Proxy – Special Meeting |

| |

6 | | Voting Instruction Form – Special Meeting |

| |

7 | | Financial Statement Request Form |

Document 1

ATLATSA RESOURCES CORPORATION

(formerly: Anooraq Resources Corporation)

NOTICE OF

ANNUAL GENERAL MEETING

and

MANAGEMENT INFORMATION CIRCULAR

Meeting to be held on June 28, 2013

The TSX Venture Exchange has not in any way passed judgment upon the merits of the

matters described herein and any representation to the contrary is an offence.

This document is important and requires your immediate attention.

If you are in any doubt as to the action you should take, please consult your broker, intermediary, Central Securities Depositary Participant, banker, accountant, attorney or other independent professional adviser immediately.

Copies of this document, which is only available in English, may be obtained on SEDAR atwww.sedar.com, on the Company’s website at www.atlatsaresources.co.za or from the offices of Atlatsa Resources Corporation in South Africa – 4th Floor, 82 Grayston Drive, Sandton, Johannesburg 2146

ATLATSA RESOURCES CORPORATION

(formerly Anooraq Resources Corporation)

Registered office in Canada: Suite 1300 – 777 Dunsmuir Street

Vancouver, British Columbia V7Y 1K2

Telephone (604) 643-7100 Fax (604) 643-7900

Head office in South Africa: 4th Floor, 82 Grayston Drive, Sandton, Johannesburg 2146

Telephone +27 11 883 0831

May 28, 2013

To the Shareholders of Atlatsa Resources Corporation:

You are invited to attend the annual general meeting (the “Meeting”) of the holders (“Shareholders”) of common shares without par value (“Common Shares”) in the capital of Atlatsa Resources Corporation (formerly Anooraq Resources Corporation) (“Atlatsa” or the “Company”) to be held at 4th Floor, 82 Grayston Drive, Sandton, Johannesburg, South Africa on June 28, 2013 at 4:15 p.m. (Central African Time) (7:15 a.m. Pacific Time), with a simulcast live by video conference to Atlatsa’s registered offices in Canada at Suite 1300, 777 Dunsmuir Street, Vancouver, British Columbia.

The following business of the Company will be dealt with at the Meeting:

| (i) | receipt of the audited annual financial statements of the Company for its fiscal year ended December 31, 2012, together with the auditor’s report thereon; |

| (ii) | the election of the directors of the Company for the ensuing year; |

| (iii) | the appointment of an auditor of the Company for the ensuing year and authorization for the directors to fix the auditor’s remuneration; and |

| (iv) | to transact such further business as may properly come before the Meeting or any adjournment or adjournments thereof. |

A brief summary of biographical information for each director nominee proposed for re-election at the Meeting is provided on pages 11 through 14 of the accompanying management information circular of the Company (the “Information Circular”).

To be represented at the Meeting, Registered Shareholders (being Shareholders whose names appear on Atlatsa’s central security register as a registered holder of Common Shares as of May 28, 2013), other than South African Shareholders, must either attend the Meeting in person or sign, date and send the enclosed form of proxy (yellow) (the “Proxy”) so as to be deposited with Computershare Trust Company of Canada by fax (1-866-249-7775) or by mail or by hand to 100 University Avenue, 9th Floor, Toronto, Ontario, M5J 2Y1 prior to 10:15 a.m. (Eastern Time) (7:15 a.m. Pacific Time) on June 26, 2013 or, if the Meeting is adjourned, not less than 48 hours (excluding Saturdays, Sundays and statutory holidays in the cities of Vancouver, British Columbia and Johannesburg, South Africa) prior to the time set for the adjournment thereof. Beneficial Shareholders (being Shareholders who beneficially own and hold Common Shares through a broker or other intermediary and who do not hold Common Shares in their own names) should refer to the accompanying Information Circular for further instructions.

South African Shareholders whose names appear on the South African register, who hold either certificated Common Shares or dematerialised Common Shares in their own name, and who wish to be represented at the Meeting, must either attend the Meeting in person or complete, sign, date and send the enclosed South African form of proxy (yellow) (the “South African Proxy”) so as to be deposited at the offices of the Company’s transfer agent (by mail at Computershare Investor Services (Pty) Limited, PO Box 61051, Marshalltown, 2107 or by hand at Computershare Investor Services (Pty) Limited, Ground Floor, 70 Marshall Street, Johannesburg, 2001) 4:15 p.m. (Central African Time) on June 26, 2013 if the Meeting is adjourned, not less than 48 hours (excluding Saturdays, Sundays and statutory holidays in the cities of Vancouver, British Columbia and Johannesburg, South Africa) prior to the time set for the adjournment thereof.

South African Shareholders registered on the Company’s South African securities register who have dematerialised their Common Shares through a South African Central Securities Depositary Participant (“CSDP”), or broker and have not elected “own-name” registration or who hold certificated Common Shares through a nominee, and who wish to be represented at the Meeting, must instruct their CSDP, broker or nominee to issue the necessary letter of representation to attend, or must provide their CSDP, broker or nominee with their voting instructions in terms of the custody agreement entered into between the South African Shareholder and their CSDP, broker or nominee.

|

| Yours truly, |

|

| (signed)“Harold Motaung” |

| Chief Executive Officer |

ATLATSA RESOURCES CORPORATION

(formerly Anooraq Resources Corporation)

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that an annual general meeting (the “Meeting”) of the holders (“Shareholders”) of common shares (“Common Shares”) in the capital of Atlatsa Resources Corporation (formerly Anooraq Resources Corporation) (“Atlatsa” or the “Company”) will be held at 4th Floor, 82 Grayston Drive, Sandton, Johannesburg, South Africa on June 28, 2013 at 4:15 p.m. (Central African Time) (7:15 a.m. Pacific Time), with a simulcast live by video conference to Atlatsa’s registered offices in Canada at Suite 1300, 777 Dunsmuir Street, Vancouver, British Columbia.

The following business of the Company will be dealt with at the Meeting:

��

| 1. | to receive the audited annual financial statements of the Company for its fiscal year ended December 31, 2012, together with the auditor’s report thereon; |

| 2. | to elect the directors for the ensuing year; |

| 3. | to appoint KPMG Inc. as the independent auditor of the Company for the ensuing year and to authorize the directors to fix the independent auditor’s remuneration; and |

| 4. | to transact such further business as may properly come before the Meeting or any adjournment or adjournments thereof. |

The audited annual financial statements of the Company for the fiscal year ended December 31, 2012, the Company’s annual report filed on Form 20-F for the year ended December 31, 2012 and the Company’s management discussion and analysis for the year ended December 31, 2012 are available on the System for Electronic Data Analysis and Retrieval at www.sedar.com.

The record date for the determination of Shareholders entitled to receive notice of and to vote at the Meeting is May 28, 2013 (the “Record Date”). Registered Shareholders of Atlatsa as of the close of business on the Record Date will be entitled to receive notice of and to vote at the Meeting.

Registered Shareholders other than South African Shareholders

A Registered Shareholder may attend the Meeting in person or may be represented by proxy. Registered Shareholders, other than South African Shareholders, who are unable to attend the Meeting or any adjournment thereof in person are requested to date, sign and return the accompanying form of proxy (yellow) (the “Proxy”) for use at the Meeting or any adjournment thereof. To be effective, the enclosed Proxy must be mailed so as to reach or be deposited with Computershare Trust Company of Canada by fax (1-866-249-7775) or by mail or by hand to 100 University Avenue, 9th Floor, Toronto, Ontario, M5J 2Y1 prior to 10:15 a.m. (Eastern Time) (7:15 a.m. Pacific Time) on June 26, 2013 or, if the Meeting is adjourned, not less than 48 hours (excluding Saturdays, Sundays and statutory holidays in the cities of Vancouver, British Columbia and Johannesburg, South Africa) before the commencement of the adjourned Meeting or may be deposited with the Chair of the Meeting prior to the commencement thereof.

Beneficial Shareholders (being Shareholders who beneficially own and hold Common Shares through a broker or other intermediary and who do not hold Common Shares in their own name) should refer to the accompanying management information circular of the Company for voting information.

South African Shareholders

South African Shareholders holding Common Share certificates in their own names and South African Shareholders who have dematerialised their Common Shares and have elected “own-name” registration in the sub-register through a Central Securities Depositary Participant (“CSDP”), may attend the Meeting in person or, if they are unable to attend the Meeting but wish to be represented thereat, must complete and return the attached South African form of proxy (yellow) (the “South African Proxy”), to the offices of the Company’s transfer agent (by mail at Computershare Investor Services (Pty) Limited, PO Box 61051, Marshalltown, 2107 or by hand at Computershare Investor Services (Pty) Limited, Ground Floor, 70 Marshall Street, Johannesburg, 2001 to be received prior to 4:15 p.m. (Central African Time) on June 26, 2013 or, if the Meeting is adjourned, not less than 48 hours (excluding Saturdays, Sundays and statutory holidays in the cities of Vancouver, British Columbia and Johannesburg, South Africa) before the commencement of the adjourned Meeting or may be deposited with the Chair of the Meeting prior to the commencement thereof.

South African Shareholders who have dematerialised their Common Shares through a CSDP or broker and who have not elected “own-name” registration in the sub-register maintained by a CSDP and South African Shareholders who hold certificated Common Shares through a nominee, who wish to attend the Meeting must instruct their CSDP, broker or nominee to issue them with the necessary letter of representation to attend, or, if they do not wish to attend the Meeting but wish to be represented thereat, they must provide their CSDP, broker or nominee with their voting instructions in terms of the custody agreement entered into between them and their CSDP, broker or nominee.

In respect of dematerialised Common Shares, it is important to ensure that the person or entity (such as a nominee) whose name has been entered into the relevant sub-register maintained by a CSDP completes the South African Proxy and appoints a proxy to vote at the Meeting.

If you are in any doubt as to the action you should take, please consult your broker or other intermediary through whom your Common Shares are held, CSDP, banker, accountant, attorney or other professional adviser immediately.

DATED at Vancouver, British Columbia this 28th day of May, 2013.

|

| BY ORDER OF THE BOARD OF DIRECTORS |

|

| (signed)“Harold Motaung” |

| Chief Executive Officer |

TABLE OF CONTENTS

MANAGEMENT INFORMATION CIRCULAR

ATLATSA RESOURCES CORPORATION

(formerly Anooraq Resources Corporation)

ANNUAL GENERAL MEETING OF SHAREHOLDERS

This management information circular (the “Information Circular”) is furnished in connection with the solicitation of proxies by the management of Atlatsa Resources Corporation (formerly Anooraq Resources Corporation) (the “Company” or “Atlatsa”) for use at the annual general meeting (the “Meeting”) of Shareholders of the Company to be held on June 28, 2013 at the time and place and for the purposes set forth in the accompanying notice of the Meeting.

No person has been authorized by the Company to give any information or make any representation in connection with any of the matters to be considered at the Meeting other than those contained in this Information Circular and, if given, any such information or representation must not be relied upon as having been authorized.

In this Information Circular, references to “the Company”, “Atlatsa”, “we” and “our” refer to Atlatsa Resources Corporation (formerly Anooraq Resources Corporation). All capitalized terms used herein but not otherwise defined have the meanings set out under “Glossary of Terms”. References in this Information Circular to dollar amounts are to Canadian dollars, unless otherwise indicated. Unless otherwise noted herein, all financial figures quoted in Canadian dollars in this Information Circular are converted at a rate of ZAR8.53 : $1. This represents the ZAR:$ exchange rate as of December 31, 2012, which such rate is used in the Company’s 2012 audited annual financial statements.

This Information Circular has been prepared in accordance with Form 51-102F5 –Information Circular of the Canadian securities administrators. In addition to the Company’s primary TSX-V listing, the Company has secondary listings on NYSE AMEX and the JSE and accordingly various additional disclosures have been included in this Information Circular in order to satisfy the JSE Listings Requirements. The Company has been conditionally approved for listing on the Toronto Stock Exchange (“TSX”). Migration to the TSX is conditional upon the completion of certain restructuring and refinancing transactions referred to in the Company’s News Release dated March 27, 2013,

The information given in this Information Circular is given as of May 28, 2013, unless otherwise indicated.

1

GLOSSARY OF TERMS

The following is a glossary of certain terms used in this Information Circular.

“affiliate” has the meaning ascribed thereto in theSecurities Act (British Columbia), as amended, except as otherwise provided herein;

“Alexander Forbes Retirement Fund” means a defined contribution provident and retirement fund for the directors, executive officers and full time employees at the Company’s head office managed by Alexander Forbes Equity Holdings and its subsidiaries;

“Anglo Platinum Group Provident Fund” means a defined contribution provident fund for Anglo Platinum employees and the Company’s employees;

“Anglo Platinum Mines Retirement Fund” means a defined contribution retirement fund for Anglo Platinum employees and the Company’s employees;

“Anglo Platinum” means Anglo American Platinum Limited, a public company incorporated under the laws of South Africa and whose common shares are listed on the JSE;

“Atlatsa” or the“Company” means Atlatsa Resources Corporation (formerly Anooraq Resources Corporation), a corporation incorporated under the laws of the Province of British Columbia and listed on the TSX-V, the JSE and the NYSE AMEX;

“associate” has the meaning ascribed thereto in theSecurities Act (British Columbia), as amended, except as otherwise provided herein;

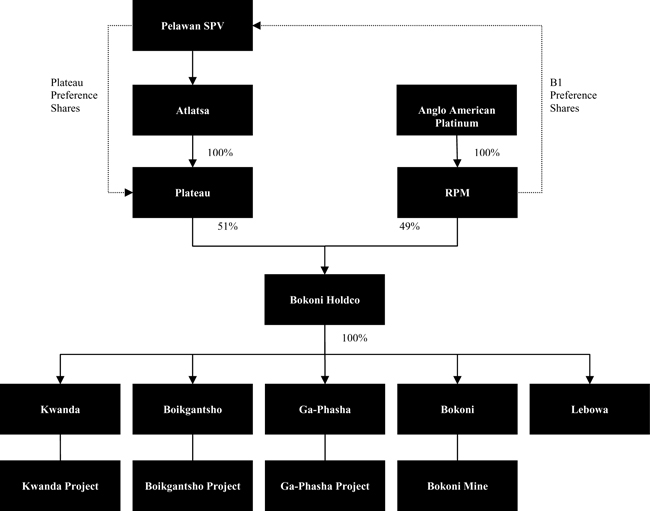

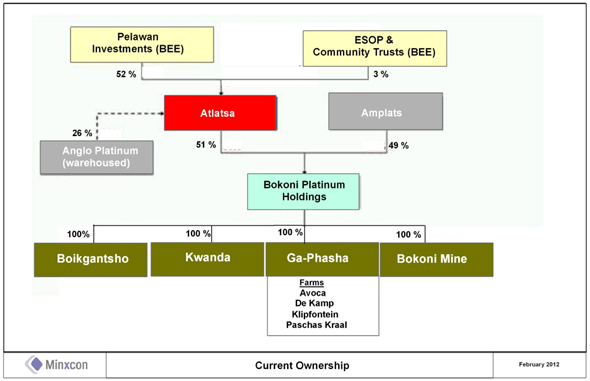

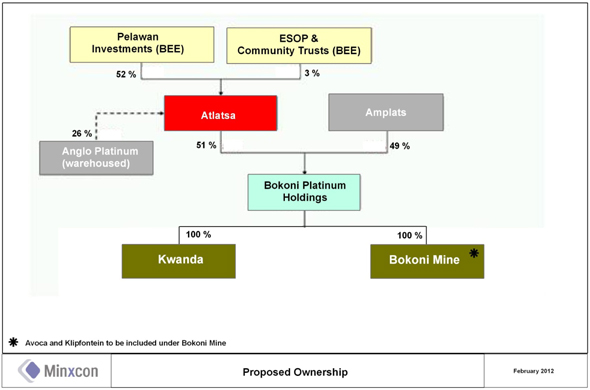

“Atlatsa Holdings” means Atlatsa Holdings (Proprietary) Ltd. (formerly Pelawan Investments (Proprietary) Limited), a private company incorporated under the laws of South Africa, with 15 BEE shareholders including Tumelo Motsisi and Harold Motaung and the sole beneficiary of the Pelawan Trust;

“B2 Preference Shares” means cumulative convertible redeemable preference shares in the capital of Plateau;

“B3 Preference Shares” means cumulative convertible redeemable preference shares in the capital of Plateau;

“BEE” means broad based black economic empowerment, as envisaged pursuant to the MPRD Act and related legislation and guidelines, being a strategy aimed at substantially increasing participation by HDSAs at all levels in the economy of South Africa;

“Beneficial Shareholder” means a Shareholder who beneficially owns and holds Common Shares through a broker (or some other Intermediary) and who does not hold Common Shares in his, her or its own name;

“Board of Directors” or “Board” means the board of directors of Atlatsa;

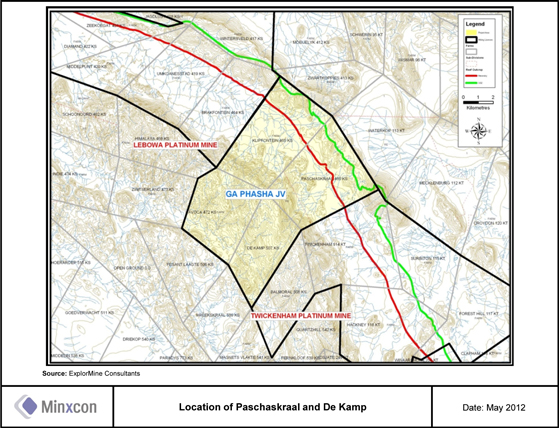

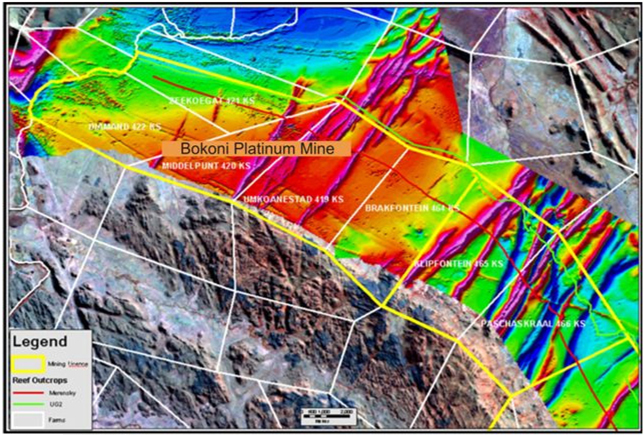

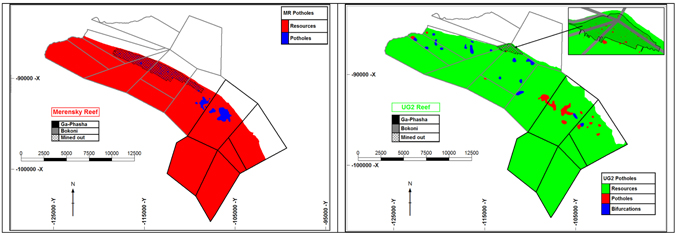

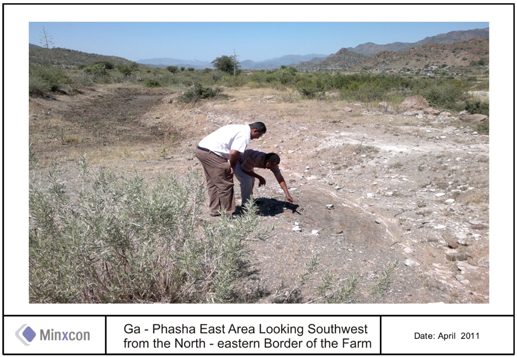

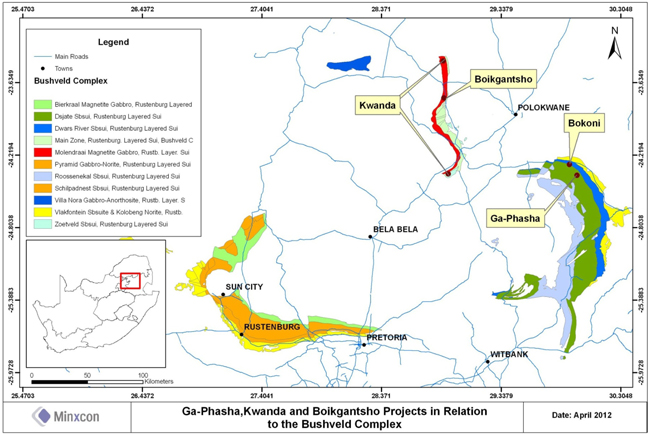

“Bokoni” means Bokoni Platinum Mines (Proprietary) Limited, a private company incorporated under the laws of South Africa which holds the mineral title in respect of Bokoni Mine;

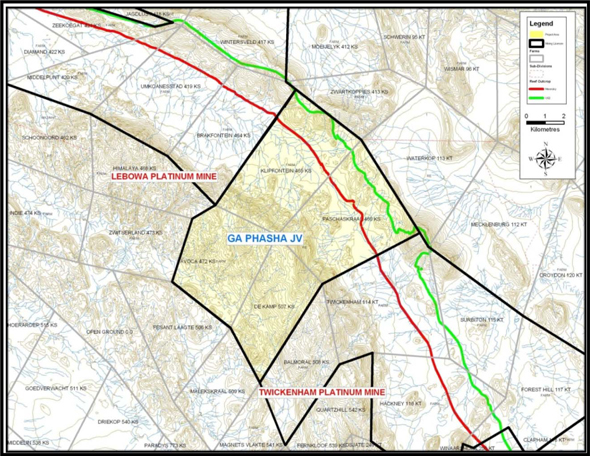

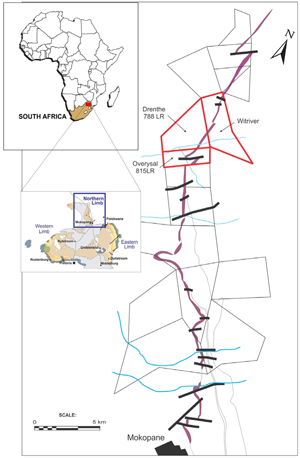

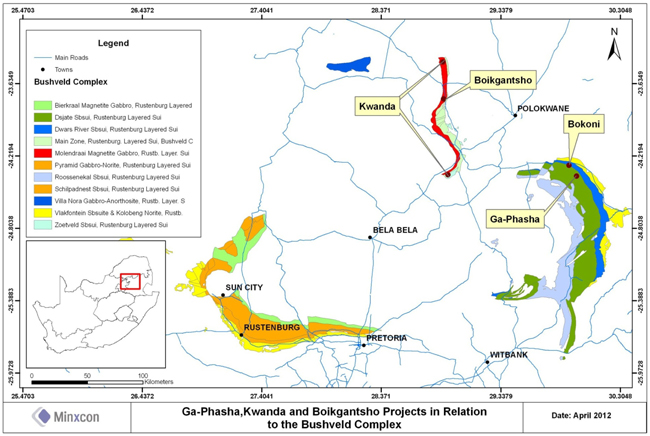

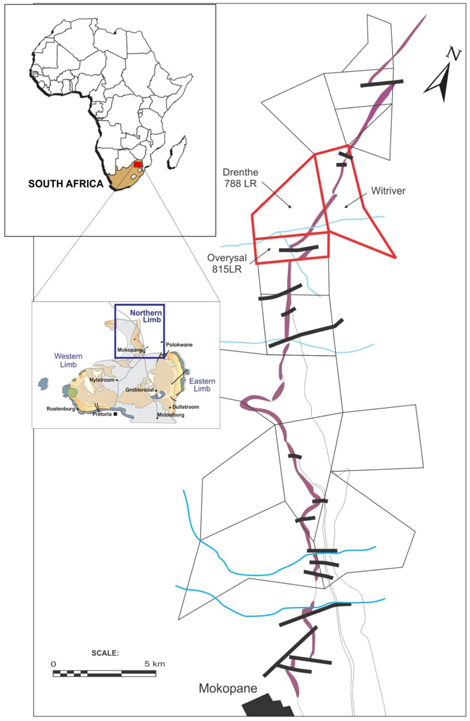

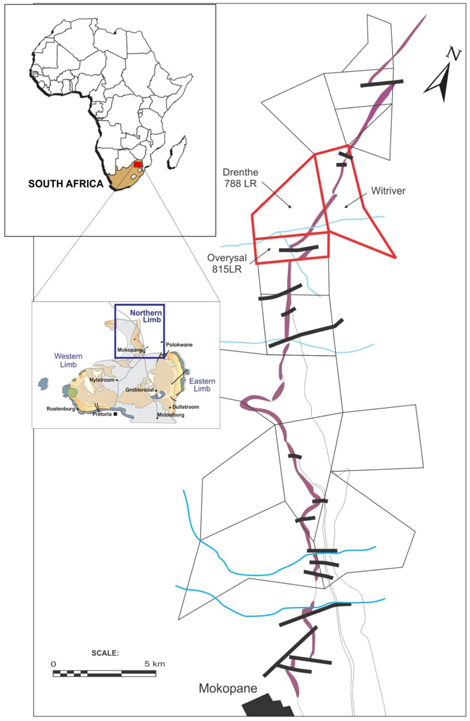

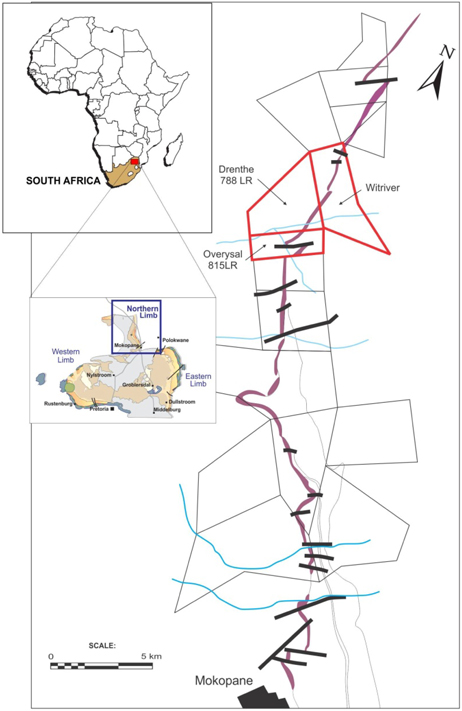

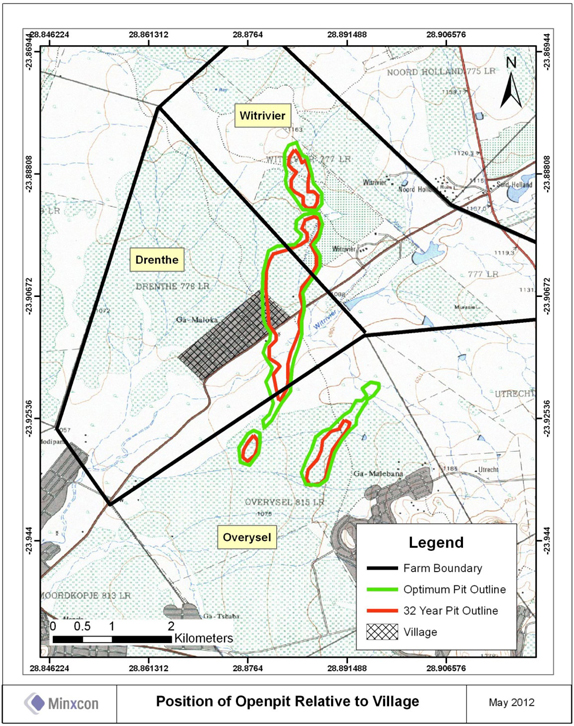

“Bokoni Mine” means Bokoni Platinum Mine, a PGM mine located on the Eastern Limb of the Bushveld Complex in South Africa (formerly referred to as the Lebowa Platinum Mine);

“Broadridge” means Broadridge Financial Solutions, Inc.;

“CAT” means Central African Time;

“CDS” means the Canadian Depository for Securities Inc.;

2

“Common Shares” means common shares without par value in the capital of the Company;

“CSA” means Canadian Securities Administrators;

“CSDP” means Central Securities Depository Participant in South Africa;

“DME” means the South African Department of Minerals and Energy;

“HDSA” means a “historically disadvantaged South African” as contemplated in the MPRD Act, being a person or group who has been discriminated against on the basis of race, gender and disability, and includes certain trusts and companies in which such persons have interests;

“Information Circular” means this management information circular dated May 28, 2013, together with all schedules hereto, distributed to Shareholders by Atlatsa in connection with the Meeting;

“Intermediaries” means brokers, investment firms, cleaning houses and similar entities that own and hold Common Shares on behalf of Beneficial Shareholders;

“JSE” means JSE Limited, a company incorporated in accordance with the laws of South Africa, licensed as an exchange under the South African Securities Services Act, 2004 which means operates the Johannesburg Stock Exchange;

“JSE Listings Requirements” means the JSE Listings Requirements as amended from time to time;

“KPMG” means KPMG Inc., registered auditors, the current auditors of the Company;

“Meeting” means the annual general and special meeting of the Shareholders to be held at 4:15 p.m. (CAT) (7:15 a.m. Pacific Time) on June 28, 2013 and any adjournment thereof;

“MPRD Act” means the South African Mineral and Petroleum Resources Development Act, No. 28 of 2002;

“NI 52-110” means National Instrument 52-110 - Audit Committees;

“NI 58-101” means National Instrument 58-101 - Disclosure of Corporate Governance Practices;

“NP 58-201” means National Policy 58-201 - Corporate Governance Guidelines;

“NYSE AMEX” means the NYSE AMEX Stock Exchange, the successor to the American Stock Exchange;

“Optionee” means any person who receives a grant of Options;

“Options” means the options to acquire Common Shares granted under and in accordance with the terms of the Stock Option Plan;

“Pelawan Trust” means the independent South African trust established in accordance with a trust deed dated September 2, 2004, the trustees of which are Andre Visser, Tumelo Motsisi (a director of the Company) and Harold Motaung (a director of the Company);

“PGM” means platinum group metals;

“Plateau” means Plateau Resources (Proprietary) Limited, a private company incorporated under the laws of South Africa, being an indirect wholly-owned subsidiary of Atlatsa;

“Plateau Preference Shares” means the B2 Preference Shares and the B3 Preference Shares;

3

“Proxy” means the form of proxy on yellow coloured paper which accompanies this Information Circular for use by Registered Shareholders other than South African Shareholders;

“Record Date” means May 28, 2013;

“Registered Shareholder” means a Shareholder whose name appears on the records of Atlatsa’s central security register as a registered holder of Common Shares as of the Record Date;

“SARs” means share appreciation rights;

“SEDAR” means the System for Electronic Document Analysis and Retrieval available on the Internet atwww.sedar.com;

“Shareholder” means a holder of Common Shares;

“South Africa” means the Republic of South Africa;

“South African Proxy” means the form of proxy printed on yellow coloured paper which accompanies this Information Circular and is to be completed by South African Shareholders;

“South African Shareholder” means a Shareholder whose Common Shares are registered on the Company’s South African register of Shareholders;

“Stock Option Plan” means the incentive stock option plan of the Company adopted on May 21, 2004, as amended on June 17, 2005 and as further amended as of June 15, 2009;

“TSX” means the Toronto Stock Exchange;

“TSX-V” means TSX Venture Exchange;

“ZAR” means the South African Rand, the currency of South Africa.

Words importing the singular, where the context requires, include the plural andvice versa and words importing any gender include all genders.

4

GENERAL PROXY INFORMATION

The following proxy information is applicable to all Shareholders,other than South African Shareholders who should refer to the section of this Information Circular entitled “Information for South African Shareholders” for proxy instructions.

Solicitation of Proxies

The solicitation of proxies is made by management on behalf of the Company, and will be primarily by mail, but proxies may be solicited personally or by telephone by directors, officers and employees of the Company. The Company will bear all costs of any solicitation. We have arranged for Intermediaries to forward the meeting materials to Beneficial Shareholders of record by those Intermediaries and we will reimburse the Intermediaries for their reasonable fees and disbursements in that regard. The cost of solicitation will be borne by the Company.

The following information respecting appointment of proxyholders and revocation of proxies is generally applicable only to Registered Shareholders. A significant number of Shareholders are Beneficial Shareholders. In almost all cases, a Beneficial Shareholder will not appear as the holder of record of such Common Shares on the Company’s central securities register of Shareholders. As Beneficial Shareholders do not have the same legal rights as Registered Shareholders in respect of shareholder meetings (including the rights described below to appoint a proxyholder and revoke a deposited proxy), Beneficial Shareholders are required to act indirectly through their Intermediary in order to vote their Common Shares or revoke a proxy, and Beneficial Shareholders should refer to the information set out under “General Proxy Information – Beneficial Shareholders” in this Information Circular.

Appointment of Proxyholders

A Shareholder may attend the Meeting in person or may be represented by a proxyholder. Registered Shareholders who are unable to attend the Meeting in person are asked to date, sign and return the accompanying yellow coloured Proxy, or other appropriate form of proxy, in accordance with the instructions set out in this Information Circular. If a Proxy is not dated, the proxyholder so appointed will date such Proxy as of the date on which it was mailed to such Registered Shareholder by the Company.A Proxy will not be valid unless it is deposited at the offices of Computershare Investor Services Inc., 100 University Avenue, 9th Floor, Toronto, Ontario, M5J 2Y1 prior to 10:15 a.m. (Eastern Time) (7:15 a.m. Pacific Time) on June 26, 2013 or, if the Meeting is adjourned, not less than 48 hours (excluding Saturdays, Sundays and holidays in the Cities of Vancouver, British Columbia and Johannesburg, South Africa) before the time of the Meeting. A person appointed as proxyholder need not be a Shareholder.

A Proxy must be signed by the Registered Shareholder or a duly appointed attorney authorized in writing or, if the Registered Shareholder is a corporation or other entity, by a duly authorized officer. A Proxy signed by a person acting as attorney or in some other representative capacity (including an officer or other duly appointed representative of a corporate Registered Shareholder) should clearly indicate that person’s capacity and should be accompanied by the original or a notarized copy of the instrument evidencing such qualification and authority to act, or such other documentation in support as is acceptable to the Chair of the Meeting.

The management designees named in the accompanying Proxy are senior officers and directors of Atlatsa.A Registered Shareholder has the right to appoint a person (who need not be a Shareholder), other than the management designees to represent such Registered Shareholder at the Meeting. To exercise this right, a Registered Shareholder should cross out the names of the management designees on the accompanying Proxy and insert the name of the other person in the blank space provided.

5

Voting by Proxyholders and Exercise of Discretion

The persons named in the Proxy will vote, or withhold from voting, the Common Shares represented thereby in accordance with your instructions on any ballot that may be called for. If you specify a choice with respect to any matter to be acted upon, your Common Shares will be voted accordingly. The Proxy confers discretionary authority on the persons named therein with respect to:

| | (a) | each matter or group of matters identified therein for which a choice is not specified; |

| | (b) | any amendment to or variation of any matter identified therein; and |

| | (c) | any other matter that properly comes before the Meeting. |

In respect of a matter for which a choice is not specified by the Registered Shareholder in the Proxy, the persons named in the Proxy will vote the Common Shares represented by the Proxy “FOR” the approval of such matter.

Registered Shareholders may wish to vote by Proxy whether or not they are able to attend the Meeting in person. Registered Shareholders electing to submit a Proxy may do so by:

| | (a) | completing, dating and signing the enclosed Proxy (yellow sheet) and returning it to the Company’s transfer agent, Computershare Investor Services Inc., by fax within North America at 1-866-249-7775, outside North America at 1-416-263-9524, or by mail or by hand to the 9th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1; |

| | (b) | using a touch-tone phone to transmit voting choices to a toll free number. Registered Shareholders must follow the instructions of the voice response system and refer to the enclosed form of Proxy (yellow sheet) for the toll free number, the holder’s account number and the control number; or |

| | (c) | using the internet through the website of the Company’s transfer agent at www.investorvote.com, Registered Shareholders must follow the instructions that appear on the screen and refer to the enclosed Proxy (yellow sheet) for the holder’s account number and the control number; |

in all cases ensuring that the Proxy is received prior to 10:15 a.m. (Eastern Time) (7:15 a.m. Pacific Time) on June 26, 2013, or, if the Meeting is adjourned, then not less than 48 hours (excluding Saturdays, Sundays and holidays in the Cities of Vancouver, British Columbia and Johannesburg, South Africa) before the commencement of the adjourned Meeting at which the Proxy is to be used.

Revocation of Proxies

In addition to revocation in any other manner permitted by law, a Registered Shareholder who has given a Proxy may revoke it by:

| | (a) | executing a Proxy bearing a later date or by executing a valid notice of revocation, either of the foregoing to be executed by the Registered Shareholder or the Registered Shareholder’s authorized attorney in writing, or, if the Shareholder is a corporation, under its corporate seal by an officer or attorney duly authorized, and by delivering the Proxy bearing a later date to Computershare Investor Services Inc. at 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1 at any time up to and including the last business day that precedes the day of the Meeting or, if the Meeting is adjourned, the last business day that precedes any reconvening thereof, or to the Chair of the Meeting on the day of the Meeting or any reconvening thereof, or in any other manner provided by law; or |

| | (b) | personally attending the Meeting and voting the Registered Shareholder’s Common Shares. |

6

A revocation of a Proxy will not affect a matter on which a vote is taken before the revocation.

Beneficial Shareholders

The following information is of significant importance to many Shareholders, as a substantial number of Shareholders are Beneficial Shareholders who do not hold Common Shares in their own name. Beneficial Shareholders should note that only Proxies deposited by Registered Shareholders can be recognized and acted upon at the Meeting.

If Common Shares are listed in an account statement provided to a Shareholder by a broker or other Intermediary, then, in almost all cases, those Common Shares will not be registered in the Shareholder’s name on the records of the Company. Such Common Shares will more likely be registered under the names of the Shareholder’s broker or an agent of that broker. In the United States, the vast majority of such Common Shares are registered under the name of Cede & Co. as nominee for The Depository Trust Company (which acts as depositary for many U.S. brokerage firms and custodian banks), and in Canada, under the name of CDS & Co. (the registration name for CDS, which acts as nominee for many Canadian brokerage firms).

Common Shares held by brokers or their agents or nominees can only be voted (for or against resolutions) upon the instructions of Beneficial Shareholders. Without specific instructions, brokers and their agents and nominees are prohibited from voting shares for the broker’s clients.Therefore, Beneficial Shareholders should ensure that instructions respecting the voting of their Common Shares are communicated to the appropriate person in advance of the Meeting.Intermediaries are required to seek voting instructions from Beneficial Shareholders in advance of shareholders’ meetings. Every Intermediary has its own mailing procedures and provides its own return instructions to clients.If you are a Beneficial Shareholder, you should carefully follow the instructions of your Intermediary in order to ensure that your Common Shares are voted at the Meeting.

The voting instruction form supplied to you by your broker will be similar to the Proxy provided to Registered Shareholders by the Company. However, its purpose is limited to instructing the Intermediary on how to vote on your behalf. Most brokers now delegate responsibility for obtaining instructions from clients to Broadridge. Broadridge typically provides a computer readable voting instruction form to Beneficial Shareholders and asks Beneficial Shareholders to complete this form and return to Broadridge. The voting instruction form will name the same persons as the Proxy to represent you at the Meeting. You have the right to appoint a person (who need not be a Shareholder of the Company), other than the persons designated in the voting instruction form, to represent you at the Meeting. To exercise this right, you should insert the name of the desired representative in the blank space provided in the voting instruction form. The completed voting instruction form must then be returned to Broadridge by mail or facsimile or voting instructions given to Broadridge by phone or over the internet, in accordance with Broadridge’s instructions. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Common Shares to be represented at the Meeting.If you receive a voting instruction form from Broadridge, you cannot use it to vote Common Shares directly at the Meeting. The voting instruction form must be completed and returned to Broadridge, in accordance with its instructions, well in advance of the Meeting in order to have the Common Shares voted.

These securityholder materials are being sent to both Registered Shareholders and Beneficial Shareholders. If you are a Beneficial Shareholder and the Company or its agent has sent these materials directly to you, your name, address and information about your holding of securities have been obtained in accordance with applicable securities regulatory requirements from the Intermediary holding Common Shares on your behalf. By choosing to send these materials to you directly, the Company (not the Intermediary holding Common Shares on your behalf) has assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the request for voting instructions.

Although as a Beneficial Shareholder you may not be recognized directly at the Meeting for the purposes of voting Common Shares registered in the name of your Intermediary, you, or a person designated by you, may attend at the Meeting as proxyholder for your Intermediary and vote your Common Shares in that capacity. If you wish to attend at the Meeting and indirectly vote your Common Shares as proxyholder for your Intermediary, or have a person designated by you do so, you should enter your own name, or the name of the person you wish to designate, in the blank space on the voting instruction form provided to you and return the same to your Intermediary in accordance with the instructions provided by such Intermediary, well in advance of the Meeting.

7

Atlatsa will send proxy-related materials directly to non-objecting Beneficial Shareholders in accordance with NI 54-101 –Communication with Beneficial Owners.

Electronic Participation

This year, the Company is excited to provide the opportunity for Registered Shareholders to participate electronically in the meeting from Vancouver, British Columbia. The Meeting will be held in Sandton, Johannesburg, South Africa at the Company’s head offices with a simulcast live by video conference to Atlatsa’s registered offices in Canada at Suite 1300, 777 Dunsmuir Street, Vancouver, British Columbia. If you attend the Meeting in Sandton, Johannesburg, South Africa or participate from the Company’s satellite location in Vancouver, British Columbia, you will be able to see and hear the individuals at the other location by way of large screens and will also be able to vote and ask questions at the relevant times during the Meeting. Although the Company’s goal is seamless electronic participation from Vancouver, British Columbia, if you are concerned with ensuring that any votes you wish to cast at the Meeting are counted and you are not able to attend the Meeting in person in Sandton, Johannesburg, South Africa, you should vote in advance by proxy.

INFORMATION FOR SOUTH AFRICAN SHAREHOLDERS

This Information Circular will be distributed to all Shareholders on the South Africa register who have elected to receive such documentation.

South African Proxy Instructions

Voting by Proxyholders

The persons named in the South African Proxy will vote or withhold from voting the Common Shares represented thereby in accordance with your instructions on any ballot that may be called for. If you specify a choice with respect to any matter to be acted upon, your Common Shares will be voted accordingly. The South African Proxy confers discretionary authority on the persons named therein with respect to:

| | (a) | each matter or group of matters identified therein for which a choice is not specified, |

| | (b) | any amendment to or variation of any matter identified therein, and |

| | (c) | any other matter that properly comes before the Meeting. |

In respect of a matter for which a choice is not specified in the South African Proxy, the persons named in the South African Proxy will vote the Common Shares represented by the South African Proxy for the approval of such matter.

Shareholders holding Common Share certificates in their own names and shareholders who have dematerialised their Common Shares and have elected “own-name” registration in the sub-register through a CSDP and who are unable to attend the Meeting but wish to be represented thereat may complete and return the attached form of South African Proxy (yellow), in accordance with the instructions contained therein, to be received by Computershare Investor Services (Pty) Limited by mail at PO Box 61051, Marshalltown, 2107 or by hand at Ground Floor, 70 Marshall Street, Johannesburg, 2001 prior to 4:15 p.m. (CAT) on June 26, 2013 or, if the Meeting is adjourned, not less than 48 hours (excluding Saturdays, Sundays and statutory holidays in the Cities of Vancouver, British Columbia and Johannesburg, South Africa) prior to the time set for the adjournment thereof.

Shareholders who have dematerialised their Common Shares through a CSDP or broker and who have not elected “own-name” registration in the sub-register maintained by a CSDP and Shareholders who hold certificated Common Shares through a nominee and who wish to attend the Meeting must instruct their CSDP, broker or nominee to issue them with the necessary letter of representation to attend. If such Shareholders do not wish to attend the general meeting but wish to be represented thereat, they must provide their CSDP, broker or nominee with their voting instructions in terms of the custody agreement entered into between them and their CSDP, broker or nominee.

8

Shareholders who hold dematerialised Common Shares must ensure that the person or entity (such as a nominee) whose name has been entered into the relevant sub-register maintained by a CSDP completes the form of South African Proxy and appoints a proxy to vote at the Meeting.

The Company does not take responsibility and will not be held liable for any failure on the part of a CSDP, nominee or broker of a Shareholder holding dematerialised Common Shares to notify such Shareholder of the Meeting or any business to be conducted thereat, or to validly authorize a Shareholder to attend or vote thereat.

Shareholders are advised to consult their professional adviser if they have any questions regarding the above.

The Company’s sponsor in South Africa is Macquarie First South Capital (Pty) Limited (tel: +27 11 583 2000).

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

Tumelo Motsisi, a director and Executive Chair of the Company, and Harold Motaung, a director and Chief Executive Officer of the Company, hold a 14.1% and 9.8% interest, respectively, in the issued and outstanding share capital of Atlatsa Holdings, the indirect beneficial owner of 57.2% of the issued and outstanding Common Shares in the capital of the Company.

Except as described above, no director or executive officer of the Company, nor any person who has held such a position since the beginning of the last completed financial year of the Company, nor any nominee for election as a director of the Company, nor any associate or affiliate of the foregoing persons, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted on at the Meeting.

RECORD DATE, VOTING SECURITIES AND PRINCIPAL HOLDERS

OF VOTING SECURITIES

The Board of Directors has fixed May 28, 2013 as the Record Date for determination of persons entitled to receive notice of and to vote at the Meeting. Only Shareholders of record at the close of business on the Record Date who either attend the Meeting personally or complete, sign and deliver a form of proxy, in the manner and subject to the provisions described above or under the heading “General Proxy Information”, will be entitled to vote or to have their Common Shares voted at the Meeting. Quorum for the transaction of business at the Meeting is two persons present in person or by proxy, holding not less than 5% of the issued and outstanding Common Shares at the Record Date.

As of the Record Date, there were 201,888,473 Common Shares issued and outstanding, each such Common Share carrying the right to one vote. The Company is authorized to issue an unlimited number of Common Shares. As of the Record Date, there are 227,400 Plateau Preference Shares (comprised of 115,800 B2 Preference Shares and 111,600 B3 Preference Shares) issued in the capital of Plateau which when duly converted into Plateau common shares will, through a series of transactions, be exchanged for 227.4 million Common Shares in the Company. The Plateau Preference Shares have not been converted as of the Record Date and therefore the holders thereof are not entitled to vote at the Meeting. Refer to the Company’s news release dated March 27, 2013 for details of the proposed conversion of the Plateau Preference Shares.

9

To the knowledge of the directors and executive officers of the Company, the only persons or corporations that beneficially owned or exercised control or direction over, directly or indirectly, Common Shares carrying more than 10% of the voting rights attached to all issued and outstanding Common Shares of the Company as at the Record Date are:

| | | | | | | | |

Shareholder Name and Address | | Number of

Common Shares Held | | | Percentage

of

Issued

Common

Shares | |

The Pelawan Trust, as Trustee(1) Atlatsa Holdings, as Beneficiary 4th Floor, 82 Grayston Drive Sandton, 2196, South Africa | | | 115,496,438 | | | | 57.2 | % |

Mr. Tumelo M. Motsisi(2)(3) 4th Floor, 82 Grayston Drive Sandton, 2196, South Africa | | | 28,535,153 | | | | 14.1 | % |

| (1) | These Common Shares are registered in the name of Pelawan Trust, which holds such Common Shares in trust for Atlatsa pursuant to escrow arrangements described in Item 9.G. “Escrow Securities” of Atlatsa’s annual report prepared on Form 20-F available on the Company’s profile on SEDAR atwww.sedar.com. |

| (2) | Attributable indirect holdings based on 240 of the 1,000 ordinary shares in the issued and outstanding share capital of Atlatsa Holdings, multiplied by the number of Common Shares of the Company (115,496,438) held by the Pelawan Trust for a total attributable indirect holdings of 13.7% Common Shares. |

| (3) | Direct holding of 815,998 Common Shares in the Company. |

FINANCIAL STATEMENTS

The audited annual financial statements of the Company for the year ended December 31, 2012, and the auditors’ report thereon, together with the related management discussion and analysis, will be placed before the Meeting. These documents have been filed with the securities commissions or similar regulatory authorities in Alberta, British Columbia and Quebec.

Copies of the documents may be obtained by a Shareholder upon request and without charge from Investor Relations, Atlatsa Resources Corporation, 15th floor, 1040 West Georgia Street, Vancouver, British Columbia, V6E 4H1, telephone: 604-684-6365. These documents are also available through the Company’s profile on SEDAR available on the Internet at www.sedar.com and on the Company’s website at www.atlatsaresources.co.za.

VOTES NECESSARY TO PASS RESOLUTIONS

If there are more nominees for election as directors or appointment of the Company’s auditor than there are vacancies to fill as a consequence of additional nominations from the floor of the Meeting, those nominees receiving the greatest number of votes will be elected or appointed, as the case may be, until all such vacancies have been filled. If the number of nominees for election or appointment is equal to the number of vacancies to be filled, all such nominees will be declared elected or appointed by acclamation.

The Company has a majority voting policy, which provides that if the votes “for” the election of a director nominee at a meeting of Shareholders are fewer than the number voted “withheld”, the nominee is expected to submit his or her resignation promptly after the meeting for consideration by the Nomination and Governance Committee. The Nominating and Governance Committee will make a recommendation to the Board after reviewing the matter, and the Board will then decide whether to accept or reject the resignation. The Board’s decision to accept or reject the resignation will be disclosed to Shareholders. The nominee will not participate in any Nomination and Governance Committee deliberations whether to accept or reject the resignation. This policy does not apply in circumstances involved contested director elections.

10

ELECTION OF DIRECTORS

The Board is currently comprised of six (6) directors. It is proposed that six directors be elected until the next annual meeting of Shareholders or until their successors are elected or appointed. The following section sets out the names of the persons nominated for election as a director at the Meeting, all major offices and positions with the Company each now holds, the period of time during which each has been a director of the Company and the number of Common Shares beneficially owned by each, directly or indirectly, or over which each exercised control or direction, as at the Record Date. Unless reelected, the current directors of the Company will cease to hold office at the close of the Meeting. The persons named in the Proxy intend to vote “For” the resolution electing each of the following nominees, unless otherwise instructed by a Shareholder.

| | | | | | |

Name, position with the Company and province or

state and country of residence | | Period(s) as a Director of the

Company | | Common Shares

beneficially

owned, controlled

or directed(1)(2) | | B3 Preference

Shares(1)(3) |

Patrick COOKE(4)(5)(6) Non-Executive Director Gauteng, South Africa | | Since February 2012 | | 3,500 | | — |

Fikile Tebogo DE BUCK(4)(5)(7) Non-Executive Director Gauteng, South Africa | | November 2008 | | Nil | | — |

Anu DHIR(4)(6)(7)(8) Lead Independent Non-Executive Director Ontario, Canada | | Since July 2008 | | Nil | | — |

Harold MOTAUNG Director and Chief Executive Officer Gauteng, South Africa | | Director since September 2004 Chief Executive Officer since April 2011 | | 19,764,462(9) | | 18,972,000(9) |

Tumelo MOTSISI(8) Director and Executive Chair Gauteng, South Africa | | Since September 2004 | | 28,535,153(10) | | 26,784,000(10) |

Rizelle SAMPSON(7) Non-Executive Director Gauteng, South Africa | | Since September 2004 | | Nil | | — |

Notes:

| (1) | The information as to number of Common Shares beneficially owned controlled or directed is not within the knowledge of the management of the Company and has been furnished by the respective nominees as reported in their filings at www.sedi.ca. |

| (2) | Directors personally own or control a total of 48,303,115 Common Shares, which represent approximately 23.9% of the current outstanding Common Shares. The directors also hold 2,595,000 Options (see “Incentive Plan Awards – Option-based Awards). |

| (3) | Directors indirectly own or control a total of 45,756,000 B3 Preference Shares of the total 115,496,438 B3 Preference Shares, which represent approximately 22.1% of the current outstanding Common Shares on an as converted basis. |

| (4) | Member of the Audit Committee. |

| (5) | Member of Nominating and Governance Committee. |

| (6) | Member of Compensation Committee. |

| (7) | Member of the Sustainable Development and Health and Safety Committee. |

| (8) | Member of the Investment Committee. |

| (9) | Indirect holdings being 170 of the 1,000 ordinary shares in the issued and outstanding share capital of Atlatsa Holdings, multiplied by the number of Common Shares (115,496,438) held by the Pelawan Trust and direct holdings of 130,368 Common Shares. |

| (10) | Indirect holdings being 240 of the 1,000 ordinary shares in the issued and outstanding share capital of Atlatsa Holdings, multiplied by the number of Common Shares (115,496,438) held by the Pelawan Trust and direct holdings of 815,998 Common Shares. |

There have been no changes in the directors’ holdings of Common Shares as set out above between the Record Date and the date of this Information Circular. The following are biographies for the directors of Atlatsa nominated for election.

11

PATRICK COOKE, B.Com (Wits), CA(SA) – Director

Patrick Cooke has over 35 years’ professional experience as a chartered accountant and management consultant. Mr. Cooke was responsible for listing two companies on the main board of the JSE and was the financial director of a third JSE-listed company. His industry experience is wide, having been involved in mineral resources, information technology, wholesale fast moving consumer goods, financial services and professional services companies. He was appointed a non-executive director of Sallies Limited in October 2009 and, with effect from February 1, 2010, was appointed Financial Director, Chief Operating Officer and Acting Chief Executive Officer. He resigned from all positions at Sallies Limited with effect from January 2012.

Mr. Cooke is, or was within the past five years, an officer and/or director of the following public companies:

| | | | | | |

Company | | Positions Held | | From | | To |

| Atlatsa Resources Corporation | | Director | | February 2012 | | Current |

| Great Basin Gold Limited | | Director | | March 2006 | | Current |

| Sallies Limited | | Director | | August 2009 | | January 2012 |

| Pangea Diamondfields PLC | | Director | | January 2006 | | January 2009 |

FIKILE TEBOGO DE BUCK, BA, FCCA – Director

Fikile Tebogo De Buck is a Fellow of the Association of Chartered Certified Accountants FCCA (UK) and has extensive experience in business operations and financial affairs with companies in the mining sector. She holds a Bachelor of Arts degree in Economics and Accounting from the University of Swaziland. Ms. De Buck is currently a non-executive director and the lead independent director of Harmony Gold Mining Company Limited. (“Harmony”) and is a member of various board committees of Harmony including the audit committee. She is also a non-executive director of Clientele Limited. She has also served in various positions at the Council for Medical Schemes in South Africa.

Ms. De Buck is, or was within the past five years, an officer and/or director of the following public companies:

| | | | | | |

Company | | Positions Held | | From | | To |

| Atlatsa Resources Corporation | | Director | | November 2008 | | Present |

| Harmony Gold Mining Company Limited | | Director | | April 2006 | | Present |

| Clientele Limited | | Director | | November 2012 | | Present |

| Clientele Life | | Director | | November 2012 | | Present |

ANU DHIR, BA, JD - Director

Anu Dhir holds a Bachelor of Arts degree from the University of Toronto and a law degree (Juris Doctor) from Quinnipiac University, Connecticut, United States. Ms. Dhir has extensive experience in international business, operations and legal affairs in private equity and publicly-held companies in the mining, oil and gas and technology sectors. Ms. Dhir served as Vice President, Corporate Development and Company Secretary at Katanga Mining Limited, a TSX-listed company and is currently Managing Director of Miniqs Limited, a private group primarily interested in resource projects that have the capability to grow into major producing operations. Ms. Dhir is a non-executive director of Great Basin Gold Limited, a TSX-listed company engaged in gold mining and Frontier Rare Earths Limited, a TSX-listed company that is focused on rare earth elements.

12

Ms. Dhir is, or was within the past five years, an officer and/or director of the following public companies:

| | | | | | |

Company | | Positions Held | | From | | To |

| Atlatsa Resources Corporation | | Director | | July 2008 | | Present |

| Katanga Mining Limited | | Director | | March 2004 | | November 2004 |

| | Vice President, Corporate Development | | January 2006 | | October 2009 |

| Compass Asset Management | | Director | | June 2009 | | December 2012 |

| Miniqs Limited | | Director and Officer | | March 2010 | | Present |

| Frontier Rare Earths Limited | | Director | | November 2010 | | Present |

| Great Basin Gold Limited | | Director | | June 2011 | | Present |

A. H. C. (HAROLD) MOTAUNG, BSc, MBA – Chief Executive Officer and Director

Harold Motaung was previously employed at the Free State and Vaal River operations of Anglo American Corporation of South Africa Limited for six years as a mining engineer and as a production supervisor. Mr. Motaung then moved to the DME as a director within the Mine Inspectorate. As a Deputy Chief Inspector, he was responsible for implementing the Mine, Health and Safety Act. Subsequently he was appointed Chief Director within the Mine Inspectorate. His portfolio included the gold, platinum and coal regions of South Africa.

In Mr. Motaung’s capacity as a Chief Director of the Mine Inspectorate, he was appointed on numerous boards of government–associated institutions including the National Nuclear Reactor, the Deep Mining Board and the Mining Qualifications Authority. Mr. Motaung also chaired the Mines Research Board, which administered a mining safety fund. Mr. Motaung also represented the South African government in a number of international and bi-national engagements with foreign countries, and was a member of the DME executive team responsible for the briefs and presentations at the Parliamentary Portfolio Committee on the status of minerals and energy within the country, which culminated in the enactment of the Minerals & Petroleum Development Act. Mr. Motaung left the DME to establish a mining and geological consultancy, African Minerals Professionals (Pty) Limited. Mr. Motaung has been a director of Atlatsa since September 2004 and is not a director of any other public companies. Mr. Motaung is a founding member of Atlatsa Holdings, the controlling shareholder of Atlatsa. Recently, he was appointed and served on the board of Mintek as the non-executive Chair.

Mr. Motaung has been a director of the Company since September 2004, and the CEO of the Company since April 2011.

Mr. Motaung is, or was within the past five years, an officer and/or director of the following public company:

| | | | | | |

Company | | Positions Held | | From | | To |

| Atlatsa Resources Corporation | | Director | | September 2004 | | Present |

TUMELO M. MOTSISI, BA, LLM, MBA – Executive Chair and Director

Tumelo Motsisi is a prominent South African businessperson with experience in the South African financial services, mining and energy sectors. Between 1994 and 1998 he was employed first as a senior manager and then as a director within the Negotiated Benefits Consultants division of Alexander Forbes, a South African financial services company.

In 1998 he established Kopano Ke Matla Investment Company (“KKM”), the investment arm of South Africa’s largest trade union federation, the Congress of South African Trade Unions. He was subsequently appointed as the Chief Executive Officer of KKM. Mr. Motsisi also served as Executive Chair of Prosperity Holdings, a financial services company established between KKM, NBC Financial Services and Peregrine Holdings. Mr. Motsisi is a member and

13

director of several South African companies. Mr. Motsisi is a founding member of Atlatsa Holdings, the controlling shareholder of Atlatsa. Mr. Motsisi has been a director of Atlatsa since September 2004 and is not a director of any other public companies.

Mr. Motsisi is, or was within the past five years, an officer and/or director of the following public company:

| | | | | | |

Company | | Positions Held | | From | | To |

| Atlatsa Resources Corporation | | Director | | September 2004 | | Present |

RIZELLE M. SAMPSON, H. Dip Education – Director

Ms. Sampson is a South African citizen and holds a Certificate in Corporate Finance from the University of London (School of Economics), a Certificate in Telecommunications Policy, Regulation and Management from the University of Witwatersrand and a Higher Diploma in Education from the University of the Western Cape.

Following positions as a Portfolio Administrator (Institutional Clients) at Investec Asset Managers, Chief of Staff at the Ministry of Communications and Manager (Office of the CEO) at Sentech Ltd, she co-founded African Footprint Investment Holdings (Pty) Ltd (“AFIH”), an investment holding company that is mainly black woman owned and managed. Ms. Sampson represents AFIH on the board of Tellumat (Pty) Ltd. She is also a trustee of the Sentech Educational Fund Advisory Board and a non-executive director of IPSA Group Plc.

Ms. Sampson is, or was within the past five years, an officer and/or director of the following public companies:

| | | | | | |

Company | | Positions Held | | From | | To |

| Diesel Power Open Cast Mining (Pty) Ltd. | | Director | | June 2010 | | 2012 |

| Independent Power Southern Africa (IPSA) Group PLC | | Director | | January 2009 | | Present |

| Atlatsa Resources Corporation | | Director | | September 2004 | | Present |

Cease Trade Orders, Bankruptcies, Penalties and Sanctions

Corporate Cease Trade Orders

To the knowledge of the Board of Directors, no director or executive officer of the Company is, at the date hereof, or was within the ten years before the date hereof, a director, chief executive officer or chief financial officer of any company that: (i) was subject to a cease trade order or similar order, or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, that was issued while that person was acting in the capacity as director, chief executive officer or chief financial officer; or (ii) was subject to a cease trade or similar order, or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, that was issued after that person ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer.

Bankruptcies

To the knowledge of the Board of Directors, no director or executive officer of the Company, or Shareholder holding a sufficient number of securities of the Company to effect materially the control of the Company: (i) is, at the date hereof, or has been within the ten years before the date hereof, a director or executive officer of any company that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings,

14

arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or (ii) has, within the ten years before the date hereof, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or became subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold such persons assets.

Penalties or Sanctions

To the knowledge of the Board of Directors, no director of executive officer of the Company, or a Shareholder holding a sufficient number of securities of the Company to affect materially the control of the Company has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities authority or any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable shareholder in deciding whether to vote for a proposed director.

APPOINTMENT OF AUDITOR

The auditors of the Company are currently KPMG Inc., Registered Auditors, 85 Empire Road, Parktown, Johannesburg, South Africa (“KPMG”). KPMG will be nominated at the Meeting for reappointment as auditors of the Company at remuneration to be fixed by the Board of Directors. KPMG was first appointed auditor of the Company on May 21, 2004. The persons named in the Proxy intend to vote “For” the resolution reappointing KPMG as the auditor of the Company at remuneration to be fixed by the Board, unless otherwise instructed by a Shareholder.

STATEMENT OF EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

In this section “Named Executive Officer” (or “NEO”) means each of the following individuals:

| | (c) | each of the three most highly compensated executive officers, or the three most highly compensated individuals acting in a similar capacity, other than the CEO and CFO, at the end of the most recently completed financial year whose total compensation was, individually, more than $150,000 for that financial year; and |

| | (d) | each individual who would be a NEO under paragraph (c) but for the fact that the individual was neither an executive officer of the company, nor acting in a similar capacity, at December 31, 2012. |

For the purposes of the executive compensation disclosure in this Circular, Bava Reddy (Business Development Officer), Joel Kesler (Chief Commercial Officer), Harold Motaung (Chief Executive Officer), Tumelo Motsisi (Executive Chair), and DeWet Schutte (Chief Financial Officer) are considered NEOs of Atlatsa.

Compensation Committee

The Company has a Compensation Committee to assist the Board of Directors in carrying out its responsibilities relating to executive and director compensation. The Compensation Committee has the following duties, responsibilities and authority:

| | (a) | to recommend to the Board of Directors the form and amount of compensation to be paid by the Company to the Directors, including compensation to be paid in consideration of a director acting on a committee of the Board of Directors; |

15

| | (b) | to review and approve corporate goals and objectives relating to the compensation of the Company’s executive officers, including the Executive Chair, CEO, CFO and other senior officers (collectively, the “Officers”) if applicable. The Compensation Committee evaluates the performance of the Officers in light of those goals and recommends to the Board the Officers’ annual compensation and incentive or equity plan participation levels and bases of participation. Recommendations of compensation include salary, bonus, and other incentive compensation; |

| | (c) | to review and recommend to the Board on an annual basis the evaluation process and compensation structure for the Company’s other employees; |

| | (d) | based upon input and recommendations from the Officers, to review the Company’s incentive compensation plans and recommend changes in such plans to the Board of Directors as needed and to review and submit to the Board of Directors recommendations concerning new incentive compensation plans; |

| | (e) | to administer the Company’s Stock Option Plan and other equity based compensation plans and determine the grants of Options and other equity based compensation; and |

| | (f) | to prepare and publish any annual executive compensation report in the Company’s annual information form or proxy statement. |

The Compensation Committee is composed of Anu Dhir (the Compensation Committee Chairperson) and Patrick Cooke (appointed May 3, 2012), both of whom are independent directors. Both Ms. Dhir and Mr. Cooke have experience participating in compensation committees of other publicly listed companies. During the 2012 financial year, the Compensation Committee met three times and the proceedings at such meetings were documented in the form of meeting minutes. Ms. Dhir and Mr. Cooke have relevant experience with respect to compensation matters on the basis of previous roles as directors of public companies and the compensation committees thereof. Additional information regarding the Compensation Committee is provided under “Corporate Governance - Board Committees – Compensation Committee”.

Report on Executive Compensation

The Board assumes responsibility for reviewing and monitoring the long-range compensation strategy for the senior management of the Company although the Compensation Committee guides it in this role. As part of its mandate, the Board determines the type and amount of compensation for the Company’s executive officers. In addition, the Board reviews the methodology utilized by the Company for setting salaries of employees throughout the organization.

The Company’s Compensation Committee receives competitive market information on compensation levels for executives. The Company’s compensation policies and programs are designed to be competitive with similar mining companies and to recognize and reward executive performance consistent with the success of the Company’s business.

Philosophy and Objectives

The Company’s reward philosophy is to consider the total reward package needed to meet the differing roles within the Company whilst ensuring external competitiveness and internal relativity. The purpose is to engage all employees to such a degree that they prefer to work for Atlatsa rather than another organization. To this end we regularly re-evaluate our reward programs, recognizing both where we are as an organization from a maturity life-cycle perspective as well relevant competitive factors that may affect achieving responsible delivery towards corporate objectives.

16

The compensation program for the senior management of the Company is designed to ensure that the level and form of compensation achieves certain objectives, including:

| | (a) | attracting and retaining talented, qualified and effective Officers; |

| | (b) | motivating the short and long-term performance of these Officers; and |

| | (c) | better aligning their interests with those of the Company’s Shareholders. |

In compensating its Officers, the Company has employed a combination of base salary, bonus compensation and equity participation through its Stock Option Plan. For the current year, no bonuses have been proposed or paid to any NEO.

Historically the Company has not had a formalized performance management system for the Officers. With effect from the commencement of the 2013 financial year, the Company is developing the Corporate Scorecard to enable the performance of the Officers to be evaluated on an annual basis.

The Corporate Scorecard

The Corporate Scorecard defines the Company’s primary success indicators and focus management effort. The Corporate Scorecard will be used to:

| | • | | pre-determine objectives and measurements which reflect critical success factors; |

| | • | | track critical performance variables over time and value; and |

| | • | | ring-fence deliverables and ascribe weightings of potential contribution to business success. |

| | | | |

Corporate Scorecard – Objectives 2013 | | Weighting | |

Safely Achieving Production Targets | | | 30 | |

Zero Harm to People, Property and the Environment | | | 25 | |

Sustaining the Company’s Social License to Operate | | | 15 | |

Maintaining a Reliable Information Management System | | | 10 | |

Financial Management | | | 10 | |

Positioning/Marketing | | | 10 | |

| | | | |

Total | | | 100 | |

| | | | |

The Officers will be evaluated against the Corporate Scorecard by the Compensation Committee with input from the Board of Directors. The actual evaluation will be used to quantify any annual base salary adjustment, bonus compensation and equity participation elements for each Officer.

Base Salary

In the Board’s view, paying base salaries that are competitive in the markets in which the Company operates is a first step to attracting and retaining talented, qualified and effective executives. The NEOs are paid a salary in order to ensure that the compensation package offered by the Company is in line with that offered by other companies in our industry, and as an immediate means of rewarding the NEO for efforts expended on behalf of the company.

17

The salary to be paid to a particular NEO is determined by gathering competitive salary information on comparable companies within the industry from a variety of sources, including surveys conducted by independent consultants and national and international sources of such listed information. Currently, the Company relies on Anglo Platinum to provide this information. Anglo Platinum uses PE Corporate Services (Pty) Ltd. and Global Remuneration Solutions (Pty) Ltd. to provide this information at no cost to the Company. Payment of a cash salary fits within the objective of the compensation program since it rewards the NEO for performance of his or her duties and responsibilities. Salaries of Officers are reviewed annually by the Board of Directors.

Bonus Compensation

No bonus arrangements with NEOs or directors have been agreed for the most recently completed financial year, although certain NEOs may be awarded bonus compensation in 2013 as discussed under the section entitled “The Corporate Scorecard” above.

Equity Participation

The Company’s Stock Option Plan is dated for reference May 21, 2004 and was amended on June 17, 2005 and June 15, 2009. The terms of the Stock Option Plan are described below under “Stock Option Plan”. The Stock Option Plan is designed to foster and promote the long-term financial success of the Company by strengthening the ability of the Company to attract and retain highly competent directors, employees and consultants, motivate performance through incentive compensation, promote greater alignment of interests between employees and Shareholders in creating long-term Shareholder value, and enable employees to participate in the long-term growth and financial success of the Company. Options are granted taking into account a number of factors, including the amount and term of Options previously granted, base salary, bonuses and competitive factors. The Compensation Committee administers the Stock Option Plan, generally granting Options annually to directors, management, employees and consultants and to individuals commencing employment with the Company. Previous grants are taken into account when considering new grants.

The Company also provides compensation to certain members of management through awards of SARs. See “Share Appreciation Rights” below.

General

Given the evolving nature of the Company’s business, the Board continues to review and redesign the overall compensation plan for NEOs so as to continue to address the objectives identified herein. The Board has not considered the implications of the risks associated with the Company’s current compensation program; however, the Company will review and consider the implications of any risks associated with the Company’s compensation program and design such compensation policies and practices in order to mitigate such risks.

There is no restriction on NEOs or directors regarding the purchase of financial instruments including prepaid variable forward contracts, equity swaps, collars, or units of exchange funds that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by an NEO or a director. For the year ended December 31, 2012, no NEO or director, directly or indirectly, employed a strategy to hedge or offset a decrease in market value of equity securities granted as compensation or held.

18

Performance Graph

The following graph compares the total cumulative Shareholder return for $100 invested in Common Shares on December 31, 2007 with the cumulative total return of the TSX Venture Composite Index and the Toronto Stock Exchange 300 Index, for the five most recently completed financial years.

To evaluate the trend in the Company’s compensation levels in relation to the Company’s performance as measured in the graph above, the Company relied on total annual compensation awarded for 2008 through 2012 on the same basis as is currently disclosed in the “Summary Compensation Table” for the NEOs below. As at December 31, 2012 total annual compensation for NEOs had decreased approximately 35% compared to December 31, 2007. The Company’s share price performance from December 31, 2007 through to December 31, 2012 decreased by approximately 97%. The trend in compensation levels of NEOs for 2008 through 2012 each year generally tracked the Company’s share price performance.

19

SUMMARY COMPENSATION TABLE

The compensation provided to NEOs of the Company during the financial year ended December 31, 2012, for each of the Company’s three most recently completed financial years, is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Non-equity

incentive

plan

compensation | | | | | | | | | | |

Name | | Year | | | Salary

($) | | | Option

based

awards(1)

($) | | | Annual

incentive

plans

($) | | | Long-

term

incentive

plans

($) | | | Pension,

provident

and

medical

value

($) | | | All other

Compensation

($) | | | Total

Compensation

($) | |

Tumelo Motsisi(2) (3)

Director

Executive Chair | | | 2012 | | | | 428,297 | | | | Nil | | | | Nil | | | | Nil | | | | 97,315 | | | | 21,311 | | | | 546,923 | |

| | | 2011 | | | | 412,648 | | | | Nil | | | | Nil | | | | Nil | | | | 60,643 | | | | 24,025 | | | | 497,316 | |

| | | 2010 | | | | 373,384 | | | | Nil | | | | Nil | | | | Nil | | | | 55,233 | | | | 21,699 | | | | 450,316 | |

| | | | | | | | |

Harold Motaung(2) (3)(4)

Director

CEO | | | 2012 | | | | 436,526 | | | | Nil | | | | Nil | | | | Nil | | | | 101,527 | | | | 29,256 | | | | 567,309 | |

| | | 2011 | | | | 403,644 | | | | Nil | | | | Nil | | | | Nil | | | | 59,383 | | | | 37,979 | | | | 501,006 | |

| | | 2010 | | | | 294,023 | | | | Nil | | | | Nil | | | | Nil | | | | 44,122 | | | | 23,351 | | | | 361,496 | |

| | | | | | | | |

DeWet Schutte(2) (5)

CFO | | | 2012 | | | | 362,914 | | | | Nil | | | | Nil | | | | Nil | | | | 81,527 | | | | 3,587 | | | | 448,028 | |

| | | 2011 | | | | 350,716 | | | | Nil | | | | Nil | | | | Nil | | | | 49,103 | | | | 7,825 | | | | 407,644 | |

| | | 2010 | | | | 310,288 | | | | 610,491 | | | | Nil | | | | Nil | | | | 29,687 | | | | 689 | | | | 951,155 | |

| | | | | | | | |

Joel Kesler(2)

Corporate Finance and Business Development | | | 2012 | | | | 326,510 | | | | Nil | | | | Nil | | | | Nil | | | | 79,501 | | | | 36,721 | | | | 442,732 | |

| | | 2011 | | | | 291,135 | | | | Nil | | | | Nil | | | | Nil | | | | 43,632 | | | | 34,214 | | | | 368,981 | |

| | | 2010 | | | | 267,658 | | | | Nil | | | | Nil | | | | Nil | | | | 40,431 | | | | 26,429 | | | | 334,518 | |

| | | | | | | | |

Bava Reddy(6)

Executive: Mineral Strategy and Exploration | | | 2012 | | | | 219,589 | | | | Nil | | | | Nil | | | | Nil | | | | 58,081 | | | | 22,336 | | | | 300,006 | |

| | | 2011 | | | | 226,979 | | | | Nil | | | | Nil | | | | Nil | | | | 34,075 | | | | 25,711 | | | | 286,765 | |

| | | 2010 | | | | 214,732 | | | | Nil | | | | Nil | | | | Nil | | | | 32,429 | | | | 19,436 | | | | 266,597 | |

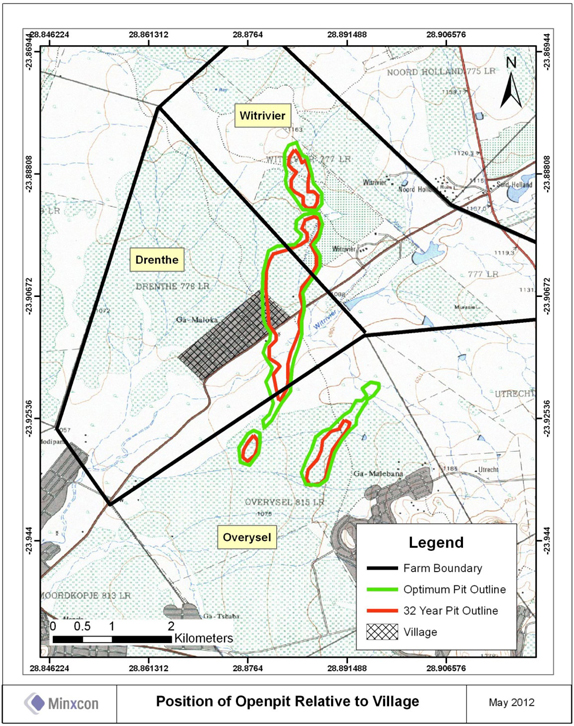

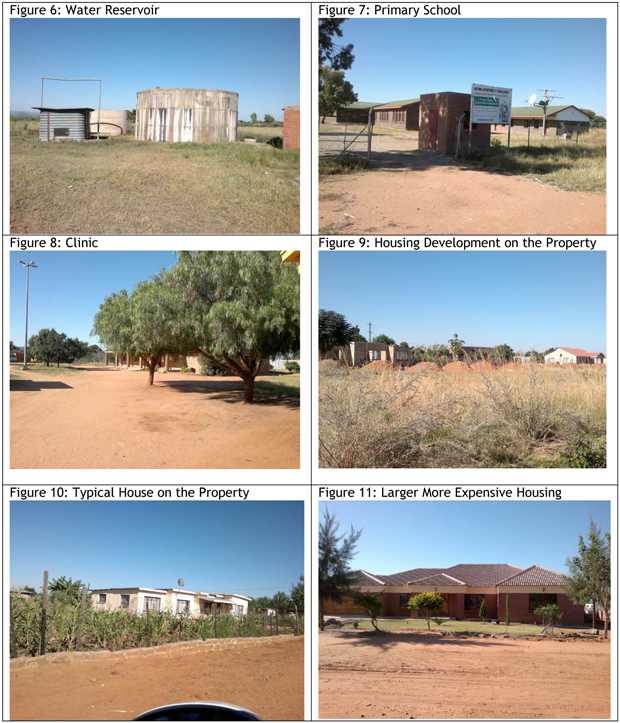

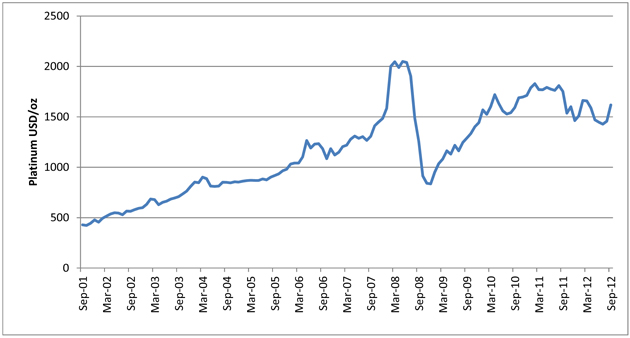

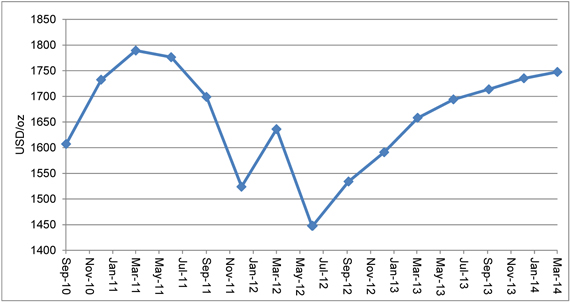

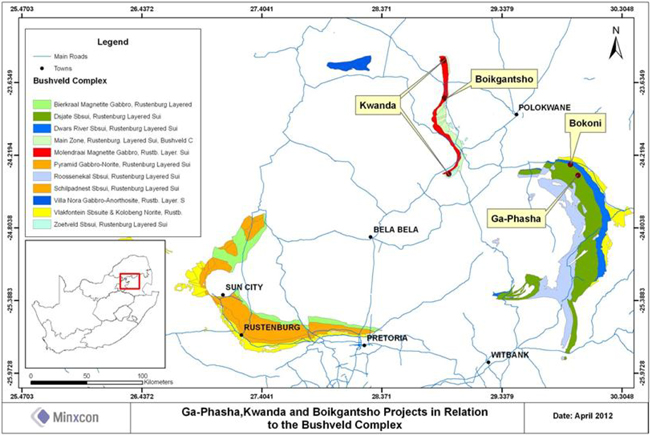

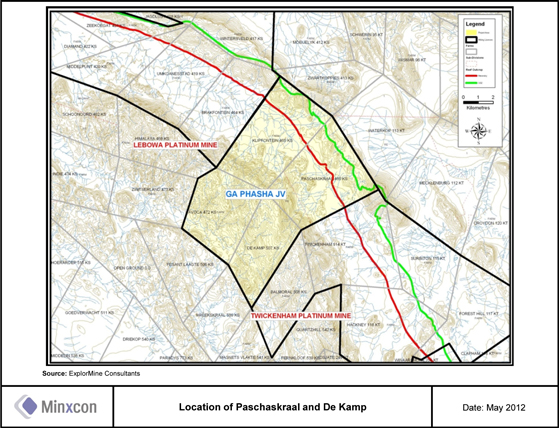

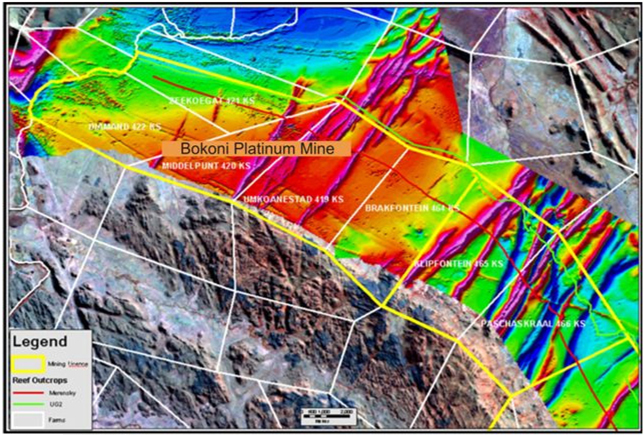

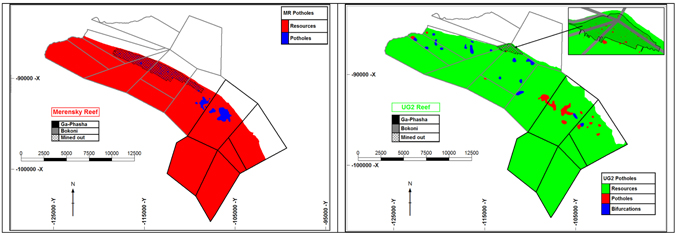

Notes: