Filed by National City Corporation

pursuant to Rule 425 under the

Securities Act of 1933 and deemed

filed pursuant to Rule 14a-12 under

the Securities Exchange Act of 1934

Subject Company: Fidelity Bankshares, Inc.

Commission File Number: 000-29040

TRANSITION NEWS

News about the Fidelity Federal/National City Merger

September 15, 2006

Getting to Know National City: Foundation of Success

National City is one of the most successful banks in the country. This success is based on its ethical standards and principles of doing business.

National City has long been known as a highly ethical company. Recently,Business Ethicsmagazine ranked National City among the “100 Best Corporate Citizens” in the country, based on its commitment to serving the needs of stakeholders such as shareholders, the community, employees and customers.

In addition, Institutional Shareholder Services, Inc. (ISS) awarded National City a corporate governance score of 100—the highest possible rating. No other S&P 500 member received a score of 100.

The company’s mission, management principles, brand promise and Code of Ethics are the foundation on which National City’s success is built.

Mission Statement

National City Corporation will be a premier diversified financial services company providing customers with advice, information and services to meet their financial needs. We will achieve superior levels of financial performance as compared to our peers and provide stockholders with an attractive return on their investment over time.

Fidelity Transition News, Page 1

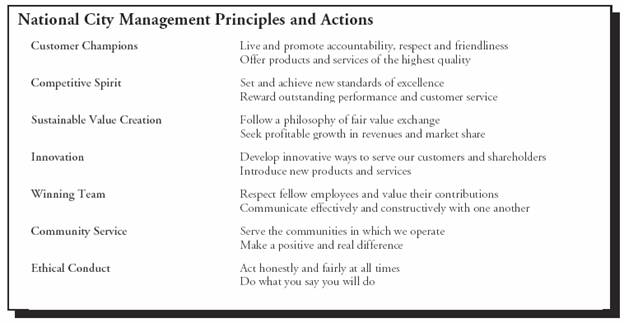

Management Principles

Brand Promise

At National City, we care about doing what’s right for our customers.

Code of Ethics

The final component of National City’s foundation, the Code of Ethics, will be provided to all employees upon the close of the transaction.

Educational Assistance Program at National City

National City supports the educational and professional development of employees and recognizes the importance of contributing financially to their development. The Educational Assistance Program demonstrates our support of employees’ educational goals by sharing in the cost of selected educational expenses.

Participation in the Educational Assistance Program is entirely voluntary, and employees are expected to manage their school schedule and workload in a manner that does not interfere with job performance.

Educational assistance will be approved by the employee’s manager within the established reimbursement limits if job performance and course completion requirements are met.

The reimbursement limits are different for undergraduate and graduate level education:

| • | | Undergraduate Program: Tuition will be reimbursed for courses taken to achieve a business or job-related bachelor’s degree up to an annual maximum of $4,000 for full-time employees. Part-time employees are eligible to receive reimbursement, up to an annual maximum of $1,200, after one year of service. |

| |

| • | | Graduate Program: Tuition will be reimbursed for graduate courses taken to receive a business or job-related master’s degree up to an annual maximum of $10,000 for exempt full-time employees. Part-time and non-exempt employees are not eligible for reimbursement of graduate courses. |

More specific information about eligibility and the provisions of the Educational Assistance Program will be shared in the coming months.

Fidelity Transition News, Page 2

Excel Award Recognizes Winning Behaviors

Living the National City brand promise and practicing the management principles are critical to National City’s success. As such, National City has a variety of programs to reward employees who, through their performance, behavior and attitude, exemplify the best of National City. Fidelity employees will be eligible for these programs beginning in 2007.

One of these programs is theExcel Award. The Excel Award is the highest National City honor for individual and team accomplishments. It recognizes and celebrates exceptional accomplishments and extraordinary people.

Any employee can nominate other employees or teams for the Excel Award. Last year, more than 6,000 employees were nominated as individuals or as part of teams. Cross-functional committees in each bank, region or subsidiary select local Excel Award winners. A second cross-functional committee then reviews local winners for a Corporate Excel Award. The Office of the Chairman makes the final decisions.

All local individual and team winners receive trophies and certificates. Local winners who go on to win the Corporate Excel Award also receive shares of National City stock.

The 2006 Excel Award winners will be announced on March 14, 2007, at the annual National City Videoconference, hosted by Chairman & CEO Dave Daberko. It will be broadcast to sites throughout National City markets, including a site for Fidelity employees.

Fidelity Transition News, Page 3

Blending Work and Life

Integrating your professional life with your personal life can be challenging. While things that happen at home may not directly affect your work, they can affect your personal well-being, which does affect your work. National City offers the following benefits and services to help employees better meet the ongoing challenge of this balancing act.

National City Employee Assistance Programs

The Employee Assistance Program (EAP) is available 24 hours a day, across the corporation, to help employees and their families deal with personal problems. Provided at no cost, the Employee Assistance Program offers the services of qualified professional counselors to assist you and your family to find solutions to a variety of issues, including stress, depression, mental conflict, divorce, financial difficulties and much more. Fidelity employees will begin to use Ceridian, the National City EAP provider, upon the close of the legal merger.

LifeWorks®

LifeWorks® is a service designed to give employees free information, advice and referrals to local and national resources to help make life a little easier. Whether your day-care provider quits, you are worried about your child’s declining grades, your parents can no longer live on their own, or you are working through times of significant change, the LifeWorks employee resource program can set you in the right direction. Complementing the resources available through the Employee Assistance Program, LifeWorks can help with things such as budgeting basics, learning time management skills and much more. Fidelity employees will be able to access LifeWorks upon the close of the legal merger.

FlexWork

FlexWork is a program that has been designed to help employees manage their commitments to work, family, education and community without jeopardizing career potential. FlexWork provides opportunities for employees to telecommute, job share or work flexible hours and days.

Childcare Discounts

Childcare discounts are available at various locations throughout the country. National City currently provides discounts with two national vendors: La Petite Academy and Children’s World Learning Centers. Fidelity employees will be eligible for these discounts upon the close of the legal merger.

Nursing Mother’s Station

Although the birth of a baby is an occasion for joy, new babies can create challenges—especially for working mothers who want to continue to nurse. By continuing to nurse your baby after returning to work, you will be able to balance the need to nurture your baby with the need to work. A private room is available in most of National City’s larger locations. National City will create nursing mother’s stations in the main locations and larger locations at Fidelity.

Community Involvement

National City firmly believes that its success depends on the vitality of the communities it serves. The company brings together many resources to help build solutions for individuals, businesses and community organizations as they pursue social, economic, educational and cultural goals. Together, we are ensuring that our communities are healthy places to live and work.

The comprehensive range of support by National City includes cash grants, loan assistance, in-kind donations, sponsorships of community events, the annual United Way and performing arts campaigns, volunteerism and more.

As one of our management principles, National City strongly encourages community involvement by all employees. Employees can make a real and positive difference in the community.

In the communities where National City does business, employees enjoy a reputation as active, involved volunteers. The decision to participate is an individual choice, however, and employees are not required to take part in volunteer activities.

Fidelity Transition News, Page 4

While most volunteer commitments take place after regular business hours, some may require time during the workday. National City managers are encouraged to organize work flow in such a way that volunteers are allowed to fulfill their commitments when possible and if work needs permit.

Matching Gifts to Educational Institutions

National City provides a match of employees’ gifts to eligible educational institutions. Employees at Fidelity will become eligible for the National City matching gift program upon the close of the legal merger.

Banking Services for Employees

National City offers competitive banking services delivered with excellent customer service. Employees of National City can use these services with pride and can help encourage their friends and families to bank with National City. Special discounts, including preferred pricing on a variety of retail banking and investment products and services, are offered exclusively to our employees through the Employee Privilege Banking program. Fidelity employees will be eligible for the Employee Privilege Banking program upon core conversion.

Diversity at National City

National City believes that the delivery of its brand promise to every customer is enhanced when the work force reflects the values and diversity of the communities where they do business. Brand behavior contributes to exceptional customer experiences that build brand loyalty. Inclusion is a crucial component of delivering the Customer Champion brand promise.

At National City, an inclusive approach to work force development is essential to establishing new customer relationships and delivering long-term sustainable growth to shareholders. Diversity initiatives position employees and the organization to implement business strategies based on values that treat everyone as an integral part of the team and empower everyone to utilize their full potential.

Inclusion is embracing differences and similarities to fully leverage the talents of all for organizational success. Diversity supports the company’s business agenda and promotes market growth by building a pathway to inclusive relationships. The business strategy of providing service excellence and strong returns through sustained market growth is integrally linked to the effective delivery of the National City Customer Champion brand promise. Inclusive practices enhance perspectives, products, team spirit and, ultimately, the ability to deliver superb performance.

Everyone at National City is responsible for creating an environment that embraces corporate diversity and inclusion and exemplifies the brand promise behaviors of accountability, respect and friendliness.

What’s On Your Mind?

Human Resources Questions

When will we find out more about our vacation / sick time and other time off policies?

We plan to communicate the National City Time Away from Work policies in late September.

Will part-timers be eligible for benefits?

Yes, part-time employees are eligible for many benefit programs at National City. WatchTransition Newsin the coming months for more information about benefit programs, including eligibility.

What kind of other benefits do you have; is there a list?

You can read an overview about National City benefits online. Just go to www.NationalCity.com and click on About National City, then Careers, then Working at National City, then Benefits and other programs. More details about benefits will be shared in upcoming issues ofTransition News.

What will happen with the two types of life insurance the bank offers (supplemental and regular)?

Our benefits staff met with the National City benefits team last week to begin the process of mapping Fidelity and National City benefits. At this time, we do not have details about specific benefit offerings.

Fidelity Transition News, Page 5

WatchTransition Newsfor more information as we determine when we will move to National City benefits and what those benefits will be.

Once the transaction closes, will employees be able to view job openings with National City for all markets in Florida, including markets operated by Harbor and Fidelity?

All National City positions can be viewed onwww.NationalCity.com. The job posting system is tied to the HR system, and open positions at Fidelity and Harbor will be live in the National City system upon each company’s HR conversion. In the meantime, you can find information about open positions at Harbor and Fidelity on each company’s Web sites. However, as a reminder, you cannot transfer until after the legal close.

What will happen with our retirement benefits? Will the 401(k), ESOP & pension money will be paid out to all who are vested at the time of the merger with National City? Will future contributions by National City be comparable to Fidelity’s?

National City believes in offering employees the opportunity to save for a secure financial future. Through the National City Savings and Investment Plan (SIP), employees have the ability to accumulate wealth for retirement through their own contributions, a generous employer match and investment returns. Employees are encouraged to take advantage of the SIP to help build their retirement savings. At this time, National City does not offer an ESOP. Also National City is no longer accepting new employees into its Pension Plan.

401(k) Plan

Following the merger, Fidelity employees will have the opportunity to participate in the National City Savings and Investment Plan (SIP). The SIP allows participants to defer up to 20% of their eligible cash compensation, and provides an employer matching contribution equal to 115% of the first 6% of a participant’s deferral. More information about the National City 401(k) program, including information about eligibility, will be shared in the coming months.

Following the merger, participants’ vested benefits in the Fidelity 401(k) plan will continue to be maintained in the Fidelity Plan. Distribution rules will not be changed.

Although all vested benefits under the Fidelity 401(k) will be honored, additional employee deferrals and employer contributions will not be permitted in the Fidelity Plan once the SIP becomes available.

Fidelity ESOP

The Fidelity ESOP will be terminated following the close of the acquisition. As part of termination, participant balances will be vested and distributed. Recipients will have the ability to roll over their distributions into the National City Savings and Investment Plan (if they are active participants at the time of distribution) or another qualified vehicle of their choice.

Although all vested benefits under the Fidelity ESOP will be honored, future contributions will be eliminated following close of the merger.

Fidelity Pension

Participant’s vested benefits in the Fidelity pension will be maintained and are generally distributable following retirement or termination of employment.

Although vested benefits under the Fidelity pension plan will be honored, participants will not earn additional benefits following the close of the merger.

When you start the payout for the ESOP, what is the wait time to receive the funds?

The Fidelity ESOP will be terminated when the acquisition is closed. Distributions following termination will be made once IRS approval of the termination event is received. Although we are unable to determine specifically when the IRS will respond, the customary time frame is six months or more.

Will we have the option of having the funds for ESOP moved into a different stock vs. the cash payout (which will be taxed immediately)?

Following close, the Fidelity ESOP may hold shares of National City Common Stock or cash (i.e., money market equivalent). Other investment choices will not be available prior to formal termination and distribution of participant accounts.

Fidelity Transition News, Page 6

Will the 401(k) roll-over to National City? Will they base their decisions on our years of service, age / gender, or experience and knowledge?

One aim of integration is to consolidate balances from the Fidelity 401(k) plan into the National City Savings and Investment Plan (SIP). This will happen in a two-step process.

First, shortly following the close of the acquisition, participants will stop participating in the Fidelity 401(k) plan and start participating in the SIP. At that time, a Fidelity employee will have two accounts: one in the Fidelity 401(k) plan, representing the value of accumulated contributions from Fidelity, and another in SIP, representing the value of accumulated contributions from National City.

Next, the balances in the Fidelity 401(k) plan will be transferred into the SIP. This type of consolidation activity occurs late in the conversion process and may take a year or more following close to complete.

As a result, during the conversion process, participants will have to access both their accounts under the Fidelity 401(k) and the SIP in order to view their entire retirement savings.

I would like to ask, what is going to happen to 401(k) loans, which some of us have taken from it?

Plan loans from the Fidelity 401(k) plan will be maintained according to the terms of the loan agreement for the duration of an individual’s period of employment, and will be called or deemed distributed if unpaid following termination of employment.

How will the ESOP work for the Fidelity Federal employees who are not 100% vested?

All Fidelity ESOP participants will be 100% vested in connection with the termination of the Fidelity ESOP.

When can we start buying and selling vacation days? Will our Fidelity Federal start date be considered for qualifying for this program?

We expect to be able to communicate more information about the National City vacation buy-sell program and eligibility requirements in late September.

Will there be a pay increase, besides our annual raise, to the current Fidelity employees who are not being displaced?

No, employees will not receive a pay increase as a result of the merger.

Miscellaneous Questions

Are there any National City branches in Virginia? If so, what cities?

No, National City does not have retail branch offices in Virginia. However, National City does have retail mortgage offices in Alexandria, Annandale, Bedford, Blacksburg, Charlottesville, Chesapeake, Chester, Colonial Heights, Fairfax, Farmville, Fredericksburg, Glen Allen, McLean, Newport News, Orange, Richmond, Roanoke, Staunton, Vienna, Virginia Beach, Williamsburg and Woodbridge. National City also has a wholesale banking office in Reston.

In regard to a tentative training schedule based on previous acquisitions, when do you estimate training to begin? How long is the training? Is it classroom or Web training?

As each integration area begins to proceed with the integration process, plans for training will be fully discussed and developed based on the specific needs of each group. A timetable for training has not yet been set.

What will happen to the training centers?

Clearly, training will be critical during the integration process and going forward. During the integration process each of our integration teams are working to identify the training needs for the company. We will communicate decisions as soon as we can.

When are we going to start getting information on mortgage programs we are going to be able to offer?

We just have begun working with the National City Mortgage integration leader to plan out the integration process, which will include the timing of product launch, employee training and systems conversion. Part of that process will entail looking at potential early product roll-outs.

Fidelity Transition News, Page 7

What will happen to the mortgage loan processing center?

Integration leaders from Fidelity and National City Mortgage have begun discovery in the past week or so. At this time, we have not made decisions about specific functions or locations. Please be patient during this process—we will communicate decisions as soon as we can.

What will happen to the Fidelity insurance companies? Why wasn’t there an integration leader assigned for this business line?

Bob Heatwole, president of Fidelity Insurance, has been assigned as integration leader for Insurance. Because we are just getting started with the integration process, we have not yet made any decisions about the insurance business.

Our (fraud prevention) department is not a typical revenue maker; however we prevent the bank’s revenue from being lost. As South Florida is #2 in the nation for fraud, will National City take our successes into consideration? Will they consider that Florida has different types of fraud than Ohio, Indiana etc. and that we are highly skilled in this area? Will your current staff be able to assimilate the fraud case load that is handled by Fidelity Federal?

Integration leaders from Fidelity and National City have begun discovery in the past week or so. At this time, we have not made decisions about specific functions or locations. Please be patient during this process—we will communicate decisions as soon as we can.

I read in the business section of yesterday’s paper that National City is selling its Loan Division to Merrill Lynch. I am assuming that is just their brokerage companies. I was just wondering if the sale will affect our Loan Servicing, Processing, & Closing areas in any way when the conversion is complete.

National City Corporation announced an agreement for Merrill Lynch & Co. to acquire the First Franklin origination franchise and related servicing platform from National City. First Franklin is a leading originator of non-prime residential mortgage loans through a nationwide wholesale network.

Merrill Lynch will purchase the San Jose, Calif.-based First Franklin, and affiliated business units National City Home Loan Services and NationPoint. Home Loan Services, headquartered in Pittsburgh, services First Franklin loans for National City as well as third parties. Lake Forest, Calif.-based NationPoint is engaged in direct-to-consumer mortgage lending. In a separate transaction, National City also expects to sell to Merrill Lynch’s whole loan trading unit approximately $5.6 billion of First Franklin-originated mortgage loans from National City’s loan portfolio.

The sale involves specific business units involved in non-prime lending. At this time, we do not see any cross-over with Fidelity’s mortgage business.

Severance Allowance/Retention Bonus Questions

Are part-time employees eligible for severance?

Yes. As stated in the August 17 issue ofTransition News, full-time and part-time employees whose positions are eliminated as a result of the merger, and for whom no positions have been offered for which they are qualified, are eligible for severance benefits. See the August 17 issue for additional eligibility information.

How will the retention bonus be calculated (base salary or another amount)?

Retention bonus payments for displaced Fidelity employees as a result of the merger are calculated as follows:

For full-time employees: 40 hours (x) retention bonus weeks (x) compensation rate

Full part-time employees: Average hours worked (x) retention bonus weeks (x) compensation rate

How will the severance allowance/retention bonus be calculated for employees working on commission?

If a Fidelity employee working on commission is displaced, the benefit is based on the average commissions paid for the 12 months preceding the displacement date, or during the period of time the employee was paid by commission, if shorter.

Fidelity Transition News, Page 8

When notifications about positions begin in mid-November, how will employees who are out on leave find out about their positions?

In the event an employee being displaced is out on leave, the manager would call the employee at home to let him / her know what decisions have been made. If the employee is displaced, a representative from Human Resources would contact the employee to discuss any severance information.

Will all affected employees be given an opportunity to transfer somewhere within the company if they would like to? If not, how will it be determined which employees are given that opportunity—e.g., annual reviews, experience, manager recommendation, other?

At any given time, National City has approximately 1,500 open positions, and they welcome the opportunity to consider anyone interested in those positions. Fidelity employees will be given urgent consideration if they apply for an opportunity. This means that we will commit to responding to your application within three days.

Hiring managers use a variety of tools to help them select the best candidate for a position. Past performance, skills and experience are important considerations, along with the interview process. We encourage employees to review all job postings frequently to determine if there are opportunities to post.

Does the displacement date differ for each employee? And if not, what is the most likely date—January or after conversion?

Displacement dates are determined by business unit and business need, therefore, the dates will differ. At this point, decisions have not been made as to the retention status of employees.

If you are offered a position, but decline the position, when will your separation occur (for example, immediately, 60 days thereafter, after the closing date in January 2007 or after the conversion in the spring)?

Displaced employees are expected to stay until their displacement date. Again, those dates may vary by department.

Will counselors be brought in to help displaced employees?

Yes, the outplacement firm Challenger, Gray & Christmas will have representatives on site to speak with displaced employees. Employees will also have access to the Employee Assistance Program for additional support.

If a full-time employee moves to part-time within the realm of his or her current position, will this hinder the possibility of receiving a severance package if offered?

If you are asking if a full-time employee can accept a part-time position and still receive severance the answer is no. Severance is available only to those employees whose positions are eliminated and who are not redeployed to a different position. If an employee chooses to accept a position, regardless of the status, full-time or part-time, then the employee is working and therefore would not be eligible for severance.

Have a question? You can call the toll-free “What’s on Your Mind” voicemail box at 866/405-0846 and leave a message with your question or email your question toCorpComm@NationalCity.com. We’ll respond to questions of general interest in future issues ofTransition News.

Fidelity Transition News, Page 9

In connection with the proposed transaction, a registration statement on Form S-4 will be filed with the United States Securities and Exchange Commission (SEC). Stockholders are encouraged to read the registration statement, including the final proxy statement/prospectus that will be a part of the registration statement, because it will contain important information about the proposed transaction. Stockholders will be able to obtain a free copy of the proxy statement/prospectus, as well as other filings containing information about National City Corporation and Fidelity Bankshares, Inc., without charge, at the SEC’s Web site,http://www.sec.gov, and the companies’ respective Web sites,www.nationalcity.comandwww.fidelityfederal.com. Copies of the proxy statement/prospectus and the SEC filings that will be incorporated by reference in the proxy statement/prospectus can also be obtained, without charge, by directing a request to National City Corporation at 1900 East Ninth Street, Locator 01-2229, Cleveland, OH 44114 Attention: Investor Relations, 1-800-622-4204, or to Fidelity Bankshares at 205 Datura Street, West Palm Beach, Florida 33401, Attention: Investor Relations, 561-803-9980.

The respective directors and executive officers of National City and Fidelity Bankshares and other persons may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding National City’s directors and executive officers is available in its proxy statement filed with the SEC on March 8, 2006, and information regarding Fidelity Bankshares directors and executive officers is available in its proxy statement filed with the SEC on March 24, 2006. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

This document contains forward-looking statements. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance, nor should they be relied upon as representing management’s views as of any subsequent date. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements.

The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: the ability to obtain governmental approvals of the merger on the proposed terms and schedule; the failure of Fidelity Bankshares’ stockholders to approve the merger; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the merger may not be fully realized or may take longer to realize than expected; disruption from the merger making it more difficult to maintain relationships with clients, employees or suppliers; increased competition and its effect on pricing, spending, third-party relationships and revenues; the risk of new and changing regulation in the U.S. and internationally. Additional factors that could cause National City’s and Fidelity Bankshares’ results to differ materially from those described in the forward-looking statements can be found in the 2006 Quarterly Reports on Form 10-Q, as they are filed, and the 2005 Annual Report on Form 10-K of National City and Fidelity Bankshares filed with the SEC. Copies of these filings are available at no cost on the SEC’s Web site,www.sec.gov, and on the companies’ respective Web sites,www.nationalcity.comandwww.fidelityfederal.com. Management may elect to update forward-looking statements at some future point; however, it specifically disclaims any obligation to do so.

Fidelity Transition News, Page 10