SCHEDULE 14A

INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to Sec. 240.14a-11(c) or Sec. 240.14a-12

METROPOLITAN WEST FUNDS

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1. | Title of each class of securities to which transactions applies: |

| | 2. | Aggregate number of securities to which transaction applies: |

| | 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4. | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identity the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 6. | Amount Previously Paid: |

| | 7. | Form, Schedule or Registration Statement No.: |

| | |

| | Metropolitan West Funds 11766 Wilshire Boulevard Suite 1580 Los Angeles, CA 90025 |

| | |

| |

| Dear Shareholder: | | December 14, 2004 |

The enclosed Proxy Statement contains important information about changes we recommend for the Metropolitan West Strategic Income Fund and the Metropolitan West AlphaTrakSM 500 Fund (together, the “Funds”).

Shareholders are being asked to approve an amendment to each Fund’s Investment Management Agreement with Metropolitan West Asset Management, LLC, the Fund’s current investment adviser (the “Adviser”), and to pay escrowed advisory fees to the Adviser.The proposed amendments may seem highly technical, and they are, but they are intended to better conform the calculation of the performance portion of the advisory fee to applicable SEC rules and to clarify the method of calculation. There can be circumstances where higher advisory fees could result, as described in the scenarios listed on pages 9 and 20.However, overall, since inception of the Funds, the proposed amendment would have resulted in a lower advisory fee. While the proposal changes the way the fee is calculated—to meet SEC requirements—the proposal is not an attempt to change the fee rate itself.

In addition, shareholders of the Metropolitan West Strategic Income Fund are being asked to provide the Fund’s portfolio managers with more flexibility by approving a change in the classification of the Fund from a diversified to a non-diversified company.

The Board of Trustees has unanimously approved these recommendations and believes they are in the best interests of the Funds and their shareholders. The Trustees recommend that you vote in favor of each proposal in the Proxy Statement.

The Proxy Statement describes the voting process for shareholders.We ask you to read the Proxy Statement carefully and vote in favor of the approval of the proposals. The election returns will be reported at the Special Meeting of Shareholders scheduled for February 11, 2005. Please return your proxy in the postage-paid envelope as soon as possible.

Sincerely,

Scott B. Dubchansky

President and Chairman of the Board

METROPOLITAN WEST FUNDS

760 Moore Road

King of Prussia, PA 19406

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON FEBRUARY 11, 2005

To the Shareholders:

NOTICE IS HEREBY GIVEN that a SPECIAL MEETING OF SHAREHOLDERS (the “Meeting”) of the Metropolitan West Strategic Income Fund and the Metropolitan West AlphaTrak 500 Fund (each a “Fund” and together, the “Funds”), each a series of the Metropolitan West Funds (the “Trust”), will be held on February 11, 2005 at 1:00 p.m., Eastern Time, at the offices of the Trust’s Administrator, PFPC Inc., at 760 Moore Road, King of Prussia, Pennsylvania 19406 for the following purposes:

| | 1. | With respect to the Metropolitan West Strategic Income Fund, approve an amendment to the Investment Management Agreement with Metropolitan West Asset Management, LLC, the Fund’s current investment adviser (the “Adviser”), and approve the payment to the Adviser of advisory fees held in escrow; |

| | 2. | With respect to the Metropolitan West AlphaTrak 500 Fund, approve an amendment to the Investment Management Agreement with the Adviser, and approve the payment to the Adviser of advisory fees held in escrow; |

| | 3. | Approve a change in the classification of the Metropolitan West Strategic Income Fund from a diversified company to a non-diversified company; and |

| | 4. | To transact such other business as may properly come before the Meeting or any adjournments thereof. |

Shareholders of record of the Trust at the close of business on December 3, 2004 (the “Record Date”) are entitled to notice of, and to vote on, the proposals at the Meeting or any adjournment thereof.

Shareholders are invited to attend in person. If you plan to attend the Meeting, so indicate on the enclosed proxy card and return it promptly in the enclosed envelope. Whether you will be able to attend or not,PLEASE VOTE, SIGN AND DATE THE PROXY AND RETURN IT PROMPTLYso that a quorum will be present at the Meeting.

| | |

| By Order of the Board of Trustees |

|

|

Scott B. Dubchansky President and Chairman of the Board |

Dated: December 14, 2004

YOUR BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS THAT

YOU VOTE IN FAVOR OF THE PROPOSALS. YOUR VOTE IS IMPORTANT

REGARDLESS OF HOW MANY SHARES YOU OWN.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON FEBRUARY 11, 2005

This Proxy Statement is furnished in connection with the solicitation of proxies by or on behalf of the Board of Trustees of Metropolitan West Funds (the “Trust”) for use at the Special Meeting of Shareholders of the Trust (the “Meeting”) to be held on February 11, 2005 at 1:00 p.m. Eastern time at the offices of the Trust’s Administrator, PFPC Inc., 760 Moore Road, King of Prussia, Pennsylvania 19406, and at any adjournment thereof. This Proxy Statement and the accompanying proxy card were first mailed to shareholders on or about December 16, 2004.

The Trust is an open-end, management investment company, as defined in the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust offers shares of seven separate operational series or funds (each of which may offer more than one share class): Metropolitan West High Yield Bond Fund, Metropolitan West Intermediate Bond Fund, Metropolitan West Total Return Bond Fund, Metropolitan West Ultra Short Bond Fund, Metropolitan West Low Duration Bond Fund, Metropolitan West Strategic Income Fund (the “Strategic Income Fund”) and Metropolitan West AlphaTrak 500 Fund (the “AlphaTrak 500 Fund”). The Strategic Income Fund has two share classes, M and I; the AlphaTrak 500 Fund offers only one share class, which is undesignated.

As set forth in the attached notice, shareholders will be asked to vote on three (3) proposals at the Meeting. The following table shows the shareholders that are entitled to vote for each proposal.

| | |

Proposal 1 | | Shareholders of the Strategic Income Fund |

| |

Proposal 2 | | Shareholders of the AlphaTrak 500 Fund |

| |

Proposal 3 | | Shareholders of the Strategic Income Fund |

All proxies solicited by the Board of Trustees, which are properly executed and received by the Secretary before the Meeting, will be voted at the Meeting in accordance with the shareholders’ instructions thereon. A shareholder may revoke the accompanying proxy at any time before it is voted by written notification to the Trust or a duly executed proxy card bearing a later date. In addition, any shareholder who attends the Meeting in person may vote by ballot at the Meeting, thereby canceling any proxy previously given. If no instruction is given on a signed and returned proxy card, it will be voted “FOR” the proposals and the proxies may vote in their discretion with respect to other matters not now known

1

to the Board of Trustees of the Trust that may be properly presented at the Meeting. Any shareholder may vote part of the shares in favor of the proposal and refrain from voting the remaining shares or vote them against the proposal, but if the shareholder fails to specify the number of shares which the shareholder is voting affirmatively, it will be conclusively presumed that the shareholder’s approving vote is with respect to the total shares that the shareholder is entitled to vote on such proposal.

All proxies voted, including abstentions and broker non-votes (where the underlying holder has not voted and the broker does not vote the shares), will be counted toward establishing a quorum. Abstentions do not constitute a vote “for” and effectively result in a vote “against.” Broker non-votes do not represent a vote “for” or “against” and are disregarded in determining whether a Proposal has received enough votes.

Shareholders of record of the Funds on the Record Date are entitled to notice of, and to vote on, the proposals at the Meeting and any adjournment thereof. At the close of business on December 3, 2004, the Funds had the following outstanding shares:

| | |

| | | Shares

Outstanding

|

Metropolitan West Strategic Income Fund (Class I) | | 6,047,600.459 |

Metropolitan West Strategic Income Fund (Class M) | | 10,328,468.225 |

Total for Strategic Income Fund | | 16,376,068.684 |

| | |

|

Metropolitan West AlphaTrak 500 Fund | | 18,805,871.486 |

| | |

|

Forty percent (40%) of the outstanding shares of the applicable Fund on the Record Date, represented in person or by proxy, must be present to constitute a quorum with respect to the proposals presented for that Fund. If a quorum is not present or presented at the Meeting, the holders of a majority of the shares present in person or by proxy shall have the power to adjourn the Meeting to a later date, without notice other than announcement at the Meeting, until a quorum shall be present or represented. Votes cast by proxy or in person at the Meeting will be counted by persons appointed by the Trust to act as inspectors of election for the Meeting.

The affirmative vote of a “majority of the outstanding voting securities” of the Strategic Income Fund present in person or by proxy and voting is necessary to approve the amendment to the Investment Management Agreement with respect to the Strategic Income Fund (Proposal 1). The affirmative vote of a “majority of the outstanding voting securities” of the AlphaTrak 500 Fund present in person or by proxy and voting is necessary to approve the amendment to the Investment

2

Management Agreement with respect to the AlphaTrak 500 Fund (Proposal 2). The affirmative vote of a “majority of the outstanding voting securities” is required for the approval of the reclassification of the Strategic Income Fund as a non-diversified company (Proposal 3).

A majority of the outstanding voting securities means the affirmative vote of the lesser of (i) more than 50% of the outstanding shares of the Fund or (ii) 67% or more of the shares of the Fund present at the Meeting if more than 50% of the outstanding shares of the Fund are represented at the Meeting in person or by proxy. The shares of each Fund will be counted using dollar-based voting. This means that each share of a Fund will represent the number of votes equal to that share’s net asset value on the record date.

If a quorum is present, but sufficient votes in favor of the Proposals are not received by the time scheduled for the Meeting, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of the shares present in person or by proxy at the session of the Meeting adjourned. The persons named as proxies will vote in favor of or against such adjournment in direct proportion to the proxies received for or against the Proposals.

The Board of Trustees knows of no business other than that specifically mentioned in the Notice of Special Meeting of Shareholders which will be presented for consideration at the Meeting. If other business should properly come before the Meeting, the proxy holders will vote thereon in accordance with their best judgment.

Audited financial statements of the Trust in the form of an Annual Report dated March 31, 2004 have been mailed before this proxy mailing. The Trust will furnish, without charge, a copy of the Annual Report to any shareholder who requests the Report. Shareholders may obtain the Annual Report by contacting the Trust at 11766 Wilshire Boulevard, Suite 1580, Los Angeles, California 90025 or by calling (800) 241-4671.

3

PROPOSAL 1 (FOR SHAREHOLDERS OF

METROPOLITAN WEST STRATEGIC INCOME FUND ONLY):

APPROVE AN AMENDMENT TO THE INVESTMENT MANAGEMENT

AGREEMENT WITH THE ADVISER AND PAY ESCROWED ADVISORY FEES

Shareholders are being asked to consider an amendment (the “Amendment”) to the Investment Management Agreement (“Agreement”) between Metropolitan West Funds (the “Trust”) and the Adviser, with respect to the Strategic Income Fund.

Under the Agreement, the Strategic Income Fund pays a management fee to the Adviser that is adjusted upward or downward based on the Fund’s performance in relation to a securities index.

The Agreement

The Agreement was originally approved by the Board, including a majority of the Independent Trustees, at a meeting held on April 1, 1997, and by the Trust’s initial shareholders on April 1, 1997. The Agreement has remained substantially unchanged since that time, except with respect to the addition of various series of the Trust. The Agreement was amended and restated on May 18, 1998 to make explicit the requirement that the Trust’s Independent Trustees must approve any recovery of contingent deferred expense reimbursements and any contingent deferred management fees permitted under the Agreement, and to eliminate obsolete references to expense limitations under state law. The addition of the Fund to the Agreement was approved by the Board, including a majority of the Independent Trustees, at a meeting held on May 19, 2003, and by the Fund’s initial shareholders in June, 2003. The Amendment, in the form being presented to shareholders under this proposal, was unanimously approved with respect to the Fund, by the full Board, and separately by the Independent Trustees (defined below), at an in-person meeting held on November 15, 2004 (the Agreement in its amended form, as approved by the Board and as presented to shareholders in this proxy statement, is referred to as the “Amended Agreement” or the “Amendment”).

Under the Agreement, the Trust has appointed the Adviser to provide investment advice and management services with respect to the assets of the Strategic Income Fund. In connection with these investment management services, the Adviser agrees to supervise the Fund’s investments in accordance with the investment objectives, programs and restrictions of the Fund as provided in the Trust’s governing documents, including the Trust’s Agreement and Declaration of Trust and By-Laws, and such other limitations as the Trustees may impose from time to time in writing to the Adviser. The Agreement requires that the Adviser

4

shall: (i) furnish the Fund with advice and recommendations with respect to the investment of the Fund’s assets and the purchase and sale of portfolio securities for the Fund, including the taking of such other steps as may be necessary to implement such advice and recommendations; (ii) furnish the Fund with reports, statements and other data on securities, economic conditions and other pertinent subjects which the Trust’s Board of Trustees may reasonably request; (iii) manage the investments of the Fund, subject to the ultimate supervision and direction of the Trust’s Board of Trustees; (iv) provide persons satisfactory to the Trust’s Board of Trustees to act as officers and employees of the Trust and the Fund (such officers and employees, as well as certain trustees, may be trustees, directors, officers, partners, or employees of the Adviser or its affiliates) but not including personnel to provide limited administrative services to the Fund not typically provided by the Fund’s administrator under separate agreement; and (v) render to the Trust’s Board of Trustees such periodic and special reports with respect to each Fund’s investment activities as the Board may reasonably request.

Under the Agreement, except as otherwise required under the 1940 Act, in the absence of willful misfeasance, bad faith, gross negligence, or reckless disregard of the obligations or duties on the part of the Adviser, the Adviser shall not be subject to liability to the Trust or the Fund or to any shareholder of the Fund for any act or omission in the course of, or connected with, rendering services hereunder or for any losses that may be sustained in the purchase, holding or sale of any security by the Fund. No change is proposed to the Adviser’s standard of care under the Agreement.

The Agreement provides that it continues from year to year so long as it is approved at least annually with respect to the Fund by a majority of the outstanding voting securities of the Fund or by a vote of a majority of the Trustees of the Fund, including a majority of the Trustees who are not “interested persons” of the Fund under the 1940 Act (the “Independent Trustees”) and who are not parties to the Agreement.

The Agreement may be terminated by either party upon notice to the other without penalty upon no less than 60 days’ notice by the Fund to the Adviser or 60 days’ notice by the Adviser to the Fund, and automatically terminates in the event of its assignment (as that term is defined in the 1940 Act).

The Management Fee Before the Amendment

The Adviser receives a management fee for the services it provides under the Agreement. Under the Agreement, the basic management fee is computed daily and payable monthly at an annual rate of 1.20% of the Fund’s average daily net assets. The basic fee may be adjusted upward or downward (by up to 0.70% of the Fund’s average daily net assets), depending on whether and to what extent the

5

investment performance of the Fund, for the relevant performance period, exceeds the investment record of a securities index plus a margin over the same period. Under the Agreement, that securities index is the Merrill Lynch 3-month U.S. Treasury Bill Index (the “Index”) plus a margin of 2.00%. The average monthly management fee for the period from inception through March 31, 2004 was equal to an annual rate of 1.90%. For the fiscal year ended March 31, 2004, the Fund paid $301,841 to the Adviser under the Agreement.

During the Fund’s first full year of operations, which began June 30, 2003 for the Class M shares, the performance period used for calculating the performance adjustment to the basic fee began with the commencement of the Fund’s operations and increased by each succeeding month until a total of 12 months was reached. Thus, the first performance period was one month, the second period was two months, the third period was three months, with each successive performance period increasing on a monthly basis until the Fund had operated for 12 months. After the Fund had operated for 12 months, it began using a rolling 12-month performance period. Each 0.10% of difference of the Fund’s investment performance compared to the investment record of the Index plus 2.00% is multiplied by a performance adjustment of 0.035%, up to a maximum adjustment of 0.70% (as an annual rate). Thus, an annual excess performance difference of 2.00% or more between the Fund and the Index plus 2.00% would result in an annual maximum performance adjustment of 0.70%. This formula requires that the Fund’s investment performance exceed the investment record of the Index plus 2.00% before any upward adjustment is made to the basic fee. If the Fund’s investment performance is below the investment record of the Index plus 2.00%, the management fee would be adjusted downward. Stated another way, the net performance of the Fund after the maximum possible management fee needs to exceed the investment record of the Index by at least 0.10% before any upward adjustment of the management fee rate.

The Fund’s investment performance is calculated based on its net asset value per share after expenses but before the management fee. For purposes of calculating the performance adjustment, any dividends or capital gains distributions paid by the Fund are treated as if those distributions were reinvested in Fund shares at the net asset value per share as of the record date for payment. The investment record for the Index is based on the change in value of the Index.

6

Here are examples of how the pre-Amendment performance adjustment worked (using annual rates):

| | | | | | | | | | | | |

Performance of Strategic

Income Fund (before

payment of management fee)

| | Index plus 2.00%

| | | Basic Fee

| | | Performance

Adjustment to

Basic Fee

| | | Total

Management

Fee

| |

8.00% | | 6.00 | % | | 1.20 | % | | 0.70 | % | | 1.90 | % |

7.00% | | 6.00 | % | | 1.20 | % | | 0.35 | % | | 1.55 | % |

6.00% | | 6.00 | % | | 1.20 | % | | 0.00 | % | | 1.20 | % |

5.00% | | 6.00 | % | | 1.20 | % | | (0.35 | )% | | 0.85 | % |

4.00% | | 6.00 | % | | 1.20 | % | | (0.70 | )% | | 0.50 | % |

Other Fees Paid to or Reimbursed by the Adviser

With respect to the Class M shares only, the Fund has adopted a Rule 12b-1 Distribution Plan which allows for payments of up to 0.25% of the Fund’s average daily net assets. For the fiscal year ended March 31, 2004, the Fund paid fees under the Rule 12b-1 Plan consisting of approximately $16,328 as compensation and shareholder servicing fees to broker/dealers, recordkeepers and other intermediaries that provide shareholder services.

In addition, the Adviser has contractually agreed to reduce its fees and/or absorb expenses, and to pay a portion of the Fund’s distribution expenses, to limit the Class M shares’ total annual operating expense rate to 2.35%, and the Class I shares’ total annual operating expense rate to 2.10% by limiting the Fund’s “Other Expenses” to 0.20% of the Fund’s average daily net assets assuming the maximum management fee. Due to this expense limitation, for the fiscal year ended March 31, 2004, the Adviser reduced its fees and absorbed certain Fund expenses totaling $42,378. For purposes of the expense limitation, “Other Expenses” does not include interest, taxes, Rule 12b-1 fees, brokerage commissions, short sale dividend expenses, swap interest expenses, and any expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation. The expense limitation contract has a one-year term, renewable at the end of each fiscal year, but is expected to be terminated at the end of the fiscal year in which the Fund’s total assets reach $100 million. As of September 30, 2004, the Fund’s total assets were approximately $175 million. Therefore, it is expected that the expense limitation contract will be terminated at the end of the Fund’s current fiscal year, which is March 31, 2005.

For the fiscal year ended March 31, 2004, the Fund paid no commissions on securities transactions to any broker affiliated with the Adviser. The Adviser has not obtained any soft dollar benefits from transactions by the Fund since its inception date.

7

Background Regarding the Proposed Amendment

The Adviser and the Board are proposing to amend the method of calculation of the management fee paid by the Fund to the Adviser. The formula for the performance adjustment has been in use since the Fund’s inception and has been disclosed in the Fund’s prospectus and required SEC filings. The Fund has calculated the performance adjustment in conformity with the method that has been disclosed to shareholders. However, in late September, 2004, the Adviser identified that the performance adjustment to the management fee had been calculated in a manner that could be considered to be inconsistent with Rule 205-2 under the Investment Advisers Act of 1940. Rule 205-2 specifies that the performance rate portion of the management fee be applied to the average of net assets over the full performance period (in the Fund’s case, 12 months) rather than at the end of a different period. In the Fund’s case, the performance rate portion was applied to the average net assets for the current month. Because the Fund’s average net assets were generally increasing over time and the investment performance of the Fund had exceeded the investment record of the Index plus 2.00% over most time periods, the Fund overpaid advisory fees in the amount of $335,633. On October 5 and November 15, 2004, the Board met to discuss the overpayment, proposed correction, the proposed Amendment and related matters. By November 15, 2004, the Adviser reimbursed the Fund in full plus interest for that overpayment.

Between September 30, 2004 and November 30, 2004, the Adviser charged the Fund thelesser of (1) the contractual fee and the related performance adjustment using the calculation methodology shown in the Fund’s prospectus and (2) the contractual fee and the related performance adjustment using the new calculation methodology specified in the Amendment.

The Amendment’s Proposed Changes to the Agreement

The purpose of the Amendment is to correct and improve the Fund’s method of calculating the performance adjustment to the management fee. Specifically, it is proposed that the Agreement be amended as follows:

| | • | The performance adjustment portion of the management fee will be applied to the average assets over the rolling 12-month performance period. |

| | • | The performance adjustment will be calculated on a continuous scale rather than a stepped scale. |

| | • | The performance adjustment formula will be clarified to compare the investment performance of the Fund (calculated assuming deduction of the maximum possible management fee) to the Index plus 0.10% rather than the mathematically equivalent former method of comparing the investment performance of the Fund (calculated after expenses but before the advisory fee) to the Index plus 2.00%. |

8

Calculation Based on Average Assets

As noted above, SEC rules require performance adjustments to be accrued based on the average assets of the Fund during the performance period. Because the Fund’s performance period is 12 months, the performance adjustment will be calculated and accrued daily based on the average daily net assets during the prior 12 months, the same period over which the Fund’s investment performance is measured.

Effect on the Management Fee. The Amendment’s effect on the management fee will differ depending on the Fund’s future performance and changes in asset size. As hypothetical examples only, here are four potential scenarios:

Scenario 1—In a 12-month period where Fund performance exceeds the Index plus the margin and where Fund assets have increased, the new calculation will likely result in a lower total management fee than would have been paid under the prior calculation methodology.

Scenario 2—In a 12-month period where Fund performance exceeds the Index plus the margin and where Fund assets have decreased, the new calculation could result in a higher total management fee than would have been paid under the prior calculation methodology.

Scenario 3—In a 12-month period where Fund performance is below the Index plus the margin and where Fund assets have increased, the new calculation could result in a higher total management fee than would have been paid under the prior calculation methodology.

Scenario 4—In a 12-month period where Fund performance is below the Index plus the margin and where Fund assets have decreased, the new calculation could result in a lower total management fee than would have been paid under the prior calculation methodology.

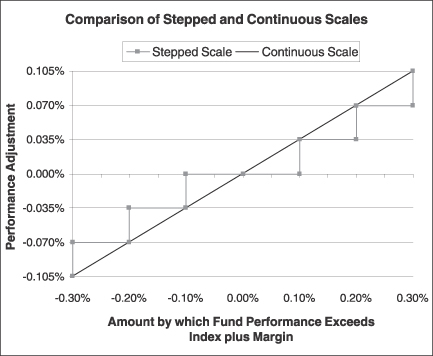

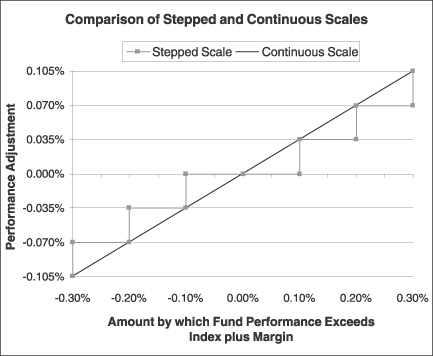

Use of Continuous Scale

Under the old Agreement, each 0.10% of difference of the Fund’s performance compared to the investment record of the Index plus the margin was multiplied by a performance adjustment of 0.035%, up to a maximum adjustment of 0.70% (as an annual rate). Under the Amendment, any percentage amount of difference (positive or negative) of the Fund’s performance compared to the investment record of the Index plus the margin is multiplied by 35%, up to a maximum adjustment of 0.70%.

The scale used in the old Agreement resulted in a stepped scale, where the Adviser’s fee would increase or decrease in 3.5 basis point increments (0.035%).

9

The scale used in the new Agreement results in a performance adjustment that is continuously adjusted and thus more closely correlated to relatively small changes in Fund performance, but also can make smaller adjustments in the management fee.

10

Clarification of Performance Formula

The final proposed change to the performance adjustment to the Fund’s management fee will result in a mathematically equivalent management fee. The purpose of the proposed formula is to ensure that the Fund’s calculation methodology fully complies with the applicable SEC rule. Both formulas are calculated on a per share basis.

| | |

Old Agreement |

Performance Formula | | Fund performance = change in net asset value + accrued basic management fee + accrued performance adjustment + accumulated cash distributions + capital gain taxes paid or payable on undistributable realized long-term capital gains accumulated during period |

Index | | Merrill Lynch 3-month U.S. Treasury Bill Index |

Base Management Fee | | 1.20% |

Performance Adjustment | | Each 0.10% of difference of the Fund’s performance compared to the performance of the Index plus 2.00% is multiplied by a performance adjustment of 0.035%, up to a maximum adjustment of 0.70% |

| | |

Proposed Amendment |

Performance Formula | | Fund performance = change in net asset value + accrued basic management fee + accrued performance adjustment –(maximum possible basic management fee and performance adjustment) + accumulated cash distributions + capital gain taxes paid or payable on undistributable realized long-term capital gains accumulated during period [change to formula is underlined and italicized] |

Index | | Merrill Lynch 3-month U.S. Treasury Bill Index |

Base Management Fee | | 1.20% |

Performance Adjustment | | Any percentage amount of difference (positive or negative) of the Fund’s performance compared to the investment record of the Indexplus 0.10% is multiplied by 35% up to a maximum adjustment of 0.70%. |

Here is a comparison of the former and proposed performance adjustment formulas (using annual rates):

| | | | | | | | | | | | | | |

| | | Change in

Net Asset

Value

| | Index

| | Index + Margin

| | Fund

Perf.

| | Basic

Fee

| | Performance

Adjustment

| | Total

Mgmt.

Fee

|

Former Performance Adjustment Formula | | 10.00% | | 7.00% | | 9.00% [Index + 2.00%] | | 11.90% | | 1.20% | | 0.70% | | 1.90% |

| | | | | | | |

Proposed Performance Adjustment Formula | | 10.00% | | 7.00% | | 7.10% [Index + 0.10%] | | 10.00% | | 1.20% | | 0.70% | | 1.90% |

11

As the two examples show, the total management fee paid to the Adviser would be 1.90% under both formulas.

| | | | |

| | | Old | | New |

| Fund Performance for Purposes of Calculating the Performance Adjustment (assuming past actual total management fee of 1.90%) | | Fund performance = change in net asset value + accrued basic management fee + accrued performance adjustment + accumulated cash distributions + capital gain taxes paid or payable on undistributable realized long-term capital gains accumulated during period | | Fund performance = change in net asset value + accrued basic management fee + accrued performance adjustment –(maximum possible basic management fee and performance adjustment)+ accumulated cash distributions + capital gain taxes paid or payable on undistributable realized long-term capital gains accumulated during period |

| | | = 10% + 1.20% + 0.70% = 11.90% | | = 10% + 1.20% + 0.70% -1.90% = 10% |

| | | | |

| | | Old | | New |

| Performance Adjustment | | Each 0.10% of difference of the Fund’s performance compared to the investment record of the Index plus 2.00% is multiplied by a performance adjustment of 0.035%, up to a maximum adjustment of 0.70% | | Any percentage amount of difference of the Fund’s performance compared to the investment record of the Index plus 0.10% is multiplied by 35% up to a maximum adjustment of 0.70% |

| | | = ((11.90% - 9.00%/.10%)*0.035% = 1.015% (decrease to maximum amount of 0.70%)= 0.70% | | = 35% * (10.0% - 7.1%) = 1.015% (decrease to maximum amount of 0.70%)= 0.70% |

If approved by shareholders, the final clarification described above would not increase the effective investment management fee rates charged by the Adviser with respect to the management of the assets of the Fund under the Agreement.

Consideration of the Board of Trustees

At an in-person meeting of the Board held on November 15, 2004, the Trustees, including the Independent Trustees, unanimously approved the proposed Amendment and found that the Amendment is in the best interests of the Fund and its shareholders. The Board considered, among other factors:

| | 1. | That the Amendment better reflects the wording of SEC rules that apply to performance adjustments to mutual fund advisory fees. |

| | 2. | That the Amendment retains the fundamental character of the management fee that the Fund’s net performance must exceed the Index on a full net basis. |

12

| | 3. | That the Board and Independent Trustees at a meeting on May 17, 2004 approved a renewal of the Agreement with respect to the Fund by finding that the management fee is fair and reasonable for the services provided by the Adviser. |

| | 4. | That the Adviser did not intend to mislead shareholders or otherwise charge an improper or excessive fee, and that the Adviser relied on professional advisers in previously and currently devising the fee calculation. |

| | 5. | That the Fund’s prospectus at all relevant times accurately described the manner in which the management fee was calculated. |

| | 6. | That the Adviser detected and voluntarily reimbursed the excess management fee plus interest. |

| | 7. | That the Adviser voluntarily agreed to have the Fund pay its management fee (as determined under the Amendment) into an escrow account for the periods beginning after November 30, 2004. |

The Board considered the fact that the Amendment does not increase the effective investment management fee rates charged by the Adviser with respect to the management of the assets of the Fund under the Agreement (assuming no change in assets or increasing assets during the rolling 12-month performance period).

A copy of the Amendment with respect to the Strategic Income Fund is included asAppendix B.

Payment of Escrowed Management Fees

On November 15, 2004, the Board approved the proposed Amendment. Because the Amendment had not yet been approved by shareholders, the Board decided to treat the Amendment as an interim Amendment to the Agreement, and the management fees due under the Agreement will be placed in an escrow account for the periods beginning after November 30, 2004, recoverable upon shareholder approval of the Amendment.

If shareholders approve the Amendment set forth in this proposal, the management fees will be released from escrow and paid to the Adviser. If shareholders do not approve this proposal, the Board will consider possible alternative actions, including revisions to the Amendment or re-solicitation of shareholder approval. The Adviser may also seek compensation from the Fund for the costs incurred by the Adviser to manage the Fund during the period in which the management fees were held in escrow.

13

Vote Required and Recommendation

The affirmative vote of a majority of the Fund’s outstanding voting securities (as defined in the Investment Company Act) is required to approve the amendment to the Agreement with respect to the Fund. The Investment Company Act defines a vote of a majority of a fund’s outstanding voting securities as the lesser of (a) 67% or more of the shares represented at the meeting if more than 50% of the shares entitled to vote are so represented, or (b) more than 50% of the shares entitled to vote. If approved by shareholders this proposal will take effect on the date of the shareholder meeting.

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, BELIEVES THAT THE PROPOSAL TO AMEND THE AGREEMENT IS IN THE BEST INTERESTS OF THE FUND AND ITS SHAREHOLDERS. THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THIS PROPOSAL.

14

PROPOSAL 2 (FOR SHAREHOLDERS OF

METROPOLITAN WEST ALPHATRAK 500 FUND ONLY):

APPROVE AN AMENDMENT TO THE INVESTMENT MANAGEMENT

AGREEMENT WITH THE ADVISER AND PAY ESCROWED ADVISORY FEES

Shareholders are being asked to consider an amendment (the “Amendment”) to the Investment Management Agreement (“Agreement”) between Metropolitan West Funds (the “Trust”) and the Adviser, with respect to the AlphaTrak 500 Fund.

Under the Agreement, the AlphaTrak 500 Fund pays a management fee to the Adviser that is adjusted upward or downward based on the Fund’s performance in relation to a securities index.

The Agreement

The Agreement was originally approved by the Board, including a majority of the Independent Trustees, at a meeting held on April 1, 1997, and by the Trust’s initial shareholders on April 1, 1997. The Agreement was entered into between the Trust and the Adviser in March 31, 1997, and has remained substantially unchanged since that time, except with respect to the addition of various series of the Trust. The Agreement was amended and restated on May 18, 1998 to make explicit the requirement that the Trust’s Independent Trustees must approve any recoupment of contingent deferred expense reimbursements and any contingent deferred management fees permitted under the Agreement, and to eliminate obsolete references to expense limitations under state law. The addition of the Fund to the Agreement was approved by the Board, including a majority of the Independent Trustees, at a meeting held on May 18, 1998, and by the Fund’s initial shareholders in June, 1998. The Amendment, in the form being presented to shareholders under this proposal, was unanimously approved with respect to the Fund, by the full Board, and separately by the Independent Trustees (defined below), at an in-person meeting held on November 15, 2004 (the Agreement in its amended form, as approved by the Board and as presented to shareholders in this proxy statement, is referred to as the “Amended Agreement” or the “Amendment”).

Under the Agreement, the Trust has appointed the Adviser to provide investment advice and management services with respect to the assets of the AlphaTrak 500 Fund. In connection with these investment management services, the Adviser agrees to supervise the Fund’s investments in accordance with the investment objectives, programs and restrictions of the Fund as provided in the Trust’s governing documents, including the Trust’s Agreement and Declaration of Trust and By-Laws, and such other limitations as the Trustees may impose from time to time in writing to the Adviser. The Agreement requires that the Adviser shall: (i) furnish the Fund with advice and recommendations with respect to the

15

investment of the Fund’s assets and the purchase and sale of portfolio securities for the Fund, including the taking of such other steps as may be necessary to implement such advice and recommendations; (ii) furnish the Fund with reports, statements and other data on securities, economic conditions and other pertinent subjects which the Trust’s Board of Trustees may reasonably request; (iii) manage the investments of the Fund, subject to the ultimate supervision and direction of the Trust’s Board of Trustees; (iv) provide persons satisfactory to the Trust’s Board of Trustees to act as officers and employees of the Trust and the Fund (such officers and employees, as well as certain trustees, may be trustees, directors, officers, partners, or employees of the Adviser or its affiliates) but not including personnel to provide limited administrative services to the Fund not typically provided by the Fund’s administrator under separate agreement; and (v) render to the Trust’s Board of Trustees such periodic and special reports with respect to each Fund’s investment activities as the Board may reasonably request.

Under the Agreement, except as otherwise required under the 1940 Act, in the absence of willful misfeasance, bad faith, gross negligence, or reckless disregard of the obligations or duties on the part of the Adviser, the Adviser shall not be subject to liability to the Trust or the Fund or to any shareholder of the Fund for any act or omission in the course of, or connected with, rendering services hereunder or for any losses that may be sustained in the purchase, holding or sale of any security by the Fund. No change is proposed to the Adviser’s standard of care under the Agreement.

The Agreement provides that it continues from year to year so long as it is approved at least annually with respect to the Fund by a majority of the outstanding voting securities of the Fund or by a vote of a majority of the Trustees of the fund, including a majority of the Trustees who are not “interested persons” of the Fund under the 1940 Act (the “Independent Trustees”) and who are not parties to the Agreement.

The Agreement may be terminated by either party upon notice to the other without penalty upon no less than 60 days’ notice by the Fund to the Adviser or 60 days’ notice by the Adviser to the Fund, and automatically terminates in the event of its assignment (as that term is defined in the 1940 Act).

The Agreement was most recently unanimously approved with respect to all series of the Trust, including the Fund, by the Board, including a majority of the Independent Trustees, at a meeting held on May 17, 2004.

The Management Fee Before the Amendment

The Adviser receives a management fee for the services it provides under the Agreement. Under the current Agreement, the basic management fee is computed

16

daily and payable monthly at an annual rate of 0.35% of the Fund’s average daily net assets. The basic fee may be adjusted upward or downward (by up to 0.35% of the Fund’s average daily net assets), depending on whether and to what extent the investment performance of the Fund, for the relevant performance period, exceeds the investment record of a securities index plus a margin over the same period. That securities index is the S&P 500®Stock Index (the “Index”) plus a margin of 1.00%. The average monthly management fee for the period from March 31, 2003 through March 31, 2004 was equal to an annual rate of 0.69%. For the fiscal year ended March 31, 2004, the Fund paid $817,525 to the Adviser under the Agreement.

During the Fund’s first full year of operations, which began June 29, 1998, the performance period used for calculating the performance adjustment to the basic fee began with the commencement of the Fund’s operations and increased by each succeeding month until a total of 3 months was reached. Thus, the first performance period was one month, the second period was two months, and the third period was three months. After the Fund had operated for 3 months, it began using a rolling 3-month performance period. Each 0.10% of difference of the Fund’s investment performance compared to the investment record of the Index plus 1.00% is multiplied by a performance adjustment of 0.035%, up to a maximum adjustment of 0.35% (as an annual rate). Thus, an annual excess performance difference of 1.00% or more between the Fund and the Index plus 1.00% would result in an annual maximum performance adjustment of 0.35%. This formula requires that the Fund’s investment performance exceed the investment record of the Index plus 1.00% before any upward adjustment is made to the basic fee. If the Fund’s investment performance is below the investment record of the Index plus 1.00%, the management fee would be adjusted downward. Stated another way, the net performance of the Fund after the maximum possible management fee needs to exceed the investment record of the Index by at least 0.30% before any upward adjustment of the management fee rate.

The Fund’s investment performance is calculated based on its net asset value per share after expenses but before the management fee. For purposes of calculating the performance adjustment, any dividends or capital gains distributions paid by the Fund are treated as if those distributions were reinvested in Fund shares at the net asset value per share as of the record date for payment. The investment record for the Index is based on the change in value of the Index.

17

Other Fees Paid to or Reimbursed by the Adviser

Here are examples of how the pre-Amendment performance adjustment worked (using annual rates):

| | | | | | | | | | | | |

Performance of AlphaTrak 500

Fund (before payment of

management fee)

| | Index plus

1.00%

| | | Basic Fee

| | | Performance

Adjustment to

Basic Fee

| | | Total

Management Fee

| |

9.00% | | 8.00 | % | | 0.35 | % | | 0.35 | % | | 0.70 | % |

8.50% | | 8.00 | % | | 0.35 | % | | 0.18 | % | | 0.53 | % |

8.00% | | 8.00 | % | | 0.35 | % | | 0.00 | % | | 0.35 | % |

7.50% | | 8.00 | % | | 0.35 | % | | (0.18 | )% | | 0.18 | % |

7.00% | | 8.00 | % | | 0.35 | % | | (0.35 | )% | | 0.00 | % |

The Trust’s Rule 12b-1 Distribution Plan does not apply to the Fund and, therefore, no Rule 12b-1 fee is charged.

In addition, the Adviser has contractually agreed to reduce its fees and/or absorb expenses to limit the Fund’s total annual operating expense rate to 0.90% by limiting the Fund’s “Other Expenses” to 0.20% of the Fund’s average daily net assets assuming the maximum management fee. Under this expense limitation, for the fiscal year ended March 31, 2004, the Adviser was not required to reduce its fees or absorb any Fund expenses. For purposes of the expense limitation, “Other Expenses” does not include interest, taxes, Rule 12b-1 fees, brokerage commissions, short sale dividend expenses, swap interest expenses, and any expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation.

For the fiscal year ended March 31, 2004, the Fund paid no commissions on securities transactions to any broker affiliated with the Adviser. The Adviser has not obtained any soft dollar benefits from transactions by the Fund since its inception date.

Background Regarding the Amended Agreement

The Adviser and the Board are proposing to amend the method of calculation of the management fee paid by the Fund to the Adviser. The formula for the performance adjustment has been in use since the Fund’s inception and has been disclosed in the Fund’s prospectus and required SEC filings. The Fund has calculated the performance adjustment in conformity with the method that has been disclosed to shareholders. However, in late September, 2004, the Adviser identified that the performance adjustment to the management fee had been calculated in a manner that could be considered to be inconsistent with Rule 205-2 under the Investment Advisers Act of 1940. Rule 205-2 specifies that the performance rate portion of the management fee be applied to the average of net

18

assets over the full performance period (in the Fund’s case, 3 months) rather than at the end of a different period. In the Fund’s case, the performance rate portion was applied to the average net assets for the current month. Because the Fund’s average net assets increased by more than they decreased when the investment performance of the Fund had exceeded the investment record of the Index plus 1.00% over most time periods, the Fund overpaid advisory fees in the amount of $95,582. On October 5 and November 15, 2004, the Board met to discuss the overpayment, proposed correction, the proposed Amendment and related matters. By November 15, 2004, the Adviser reimbursed the Fund in full plus interest for this overpayment.

Between September 30, 2004 and November 30, 2004, the Adviser charged the Fund thelesser of (1) the contractual fee and the related performance adjustment using the calculation methodology shown in the Fund’s prospectus and (2) the contractual fee and the related performance adjustment using the new calculation methodology specified in the Amendment.

The Amendment’s Proposed Changes to the Agreement

The purpose of the Amendment is to correct and improve the Fund’s method of calculating the performance adjustment to the management fee. Specifically, it is proposed that the Agreement be amended as follows:

| | • | The performance adjustment portion of the management fee will be applied to the average assets over the rolling 3-month performance period. |

| | • | The performance adjustment will be calculated on a continuous scale rather than a stepped scale. |

| | • | The performance adjustment formula will be clarified to compare the investment performance of the Fund (calculated assuming deduction of the maximum possible management fee) to the Index plus 0.30% rather than the mathematically equivalent former method of comparing the investment performance of the Fund (calculated after expenses but before the advisory fee) to the Index plus 1.00%. |

Calculation Based on Average Assets

As noted above, SEC rules require performance adjustments to be accrued based on the average assets of the Fund during the performance period. Because the Fund’s performance period is 3 months, the performance adjustment will be calculated and accrued daily based on the average daily net assets during the prior 3 months, the same period over which the Fund’s investment performance is measured.

19

Effect on the Management Fee. The Amendment’s effect on the management fee will differ depending on the Fund’s future performance and changes in asset size. As hypothetical examples only, here are four potential scenarios:

Scenario 1—In a 3-month period where Fund performance exceeds the Index plus the margin and where Fund assets have increased, the new calculation will likely result in a lower total management fee than would have been paid under the prior calculation methodology.

Scenario 2—In a 3-month period where Fund performance exceeds the Index plus the margin and where Fund assets have decreased, the new calculation could result in a higher total management fee than would have been paid under the prior calculation methodology.

Scenario 3—In a 3-month period where Fund performance is below the Index plus the margin and where Fund assets have increased, the new calculation could result in a higher total management fee than would have been paid under the prior calculation methodology.

Scenario 4—In a 3-month period where Fund performance is below the Index plus the margin and where Fund assets have decreased, the new calculation could result in a lower total management fee than would have been paid under the prior calculation methodology.

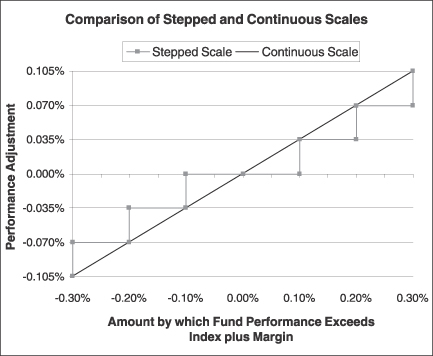

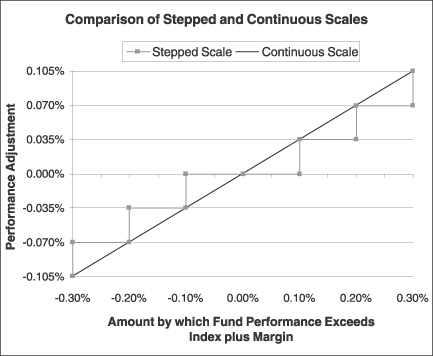

Use of Continuous Scale

Under the old Agreement, each 0.10% of difference of the Fund’s performance compared to the performance of the Index plus the margin was multiplied by a performance adjustment of 0.035%, up to a maximum adjustment of 0.35% (as an annual rate). Under the Amendment, any percentage amount of difference (positive or negative) of the Fund’s performance compared to the performance of the Index plus the margin is multiplied by 35%, up to a maximum adjustment of 0.35%.

The scale used in the old Agreement resulted in a stepped scale, where the Adviser’s fee would increase or decrease in 3.5 basis point increments (0.035%). The scale used in the new Agreement results in a performance adjustment that is continuously adjusted and thus more closely correlated to relatively small changes in Fund performance, but also can make smaller adjustments in the management fee.

20

Clarification of Performance Formula

The final proposed change to the performance adjustment to the Fund’s management fee will result in a mathematically equivalent management fee. The purpose of the proposed formula is to ensure that the Fund’s calculation methodology fully complies with the applicable SEC rule. Both formulas are calculated on a per share basis.

| | |

Old Agreement |

Performance Formula | | Fund performance = change in net asset value + accrued basic management fee + accrued performance adjustment + accumulated cash distributions + capital gain taxes paid or payable on undistributable realized long-term capital gains accumulated during period |

Index | | Standard & Poors 500® Stock Index |

Base Management Fee | | 0.35% |

Performance Adjustment | | Each 0.10% of difference of the Fund’s performance compared to the investment record of the Index plus 1.00% is multiplied by a performance adjustment of 0.035%, up to a maximum adjustment of 0.35% |

21

| | |

Proposed Amendment |

Performance Formula | | Fund performance = change in net asset value + accrued basic management fee + accrued performance adjustment –(maximum possible basic management fee and performance adjustment) + accumulated cash distributions + capital gain taxes paid or payable on undistributable realized long-term capital gains accumulated during period [change to formula is underlined and italicized] |

Index | | Standard & Poors 500 Stock Index |

Base Management Fee | | 0.35% |

Performance Adjustment | | Any percentage amount of difference (positive or negative) of the Fund’s performance compared to the investment record of the Indexplus 0.30% is multiplied by 35% up to a maximum adjustment of 0.35%. |

Here is a comparison of the former and proposed performance adjustment formulas (using annual rates):

| | | | | | | | | | | | | | |

| | | Change in

Net Asset

Value

| | Index

| | Index + Margin

| | Fund

Perf.

| | Basic

Fee

| | Performance

Adjustment

| | Total

Mgmt

.Fee

|

Former Performance Adjustment Formula | | 10.00% | | 7.00% | | 8.00% [Index + 1.00%] | | 10.70% | | 0.35% | | 0.35% | | 0.70% |

| | | | | | | |

Proposed Performance Adjustment Formula | | 10.00% | | 7.00% | | 7.30% [Index + 0.30%] | | 10.00% | | 0.35% | | 0.35% | | 0.70% |

As the two examples show, the total management fee paid to the Adviser would be 0.70% under both formulas.

| | | | |

| | | Old | | New |

| Fund Performance for Purposes of Calculating the Performance Adjustment (assuming past actual total management fee of 0.70%) | | Fund performance = change in net asset value + accrued basic management fee + accrued performance adjustment + accumulated cash distributions + capital gain taxes paid or payable on undistributable realized long-term capital gains accumulated during period | | Fund performance = change in net asset value + accrued basic management fee + accrued performance adjustment –(maximum possible basic management fee and performance adjustment) + accumulated cash distributions + capital gain taxes paid or payable on undistributable realized long-term capital gains accumulated during period |

| | | = 10% + 0.35% + 0.35%= 10.70% | | = 10% + 0.35% + 0.35% - 0.70% = 10% |

| | | | |

| | | Old | | New |

| Performance Adjustment | | Each 0.10% of difference of the Fund’s performance compared to the investment record of the Index plus 1.00% is multiplied by a performance adjustment of 0.035%, up to a maximum adjustment of 0.70% | | Any percentage amount of difference of the Fund’s performance compared to the investment record of the Index plus 0.30% is multiplied by 35% up to a maximum adjustment of 0.35%. |

| | | = ((10.70% - 8.00%)/.10%)*0.035% = 0.945% (decrease to maximum amount of 0.35%)= 0.35% | | = 35% * (10.0% - 7.3%) = 0.945% (decrease to maximum amount of 0.35%)= 0.35% |

22

If approved by shareholders, the final clarification described above would not increase the effective investment management fee rates charged by the Adviser with respect to the management of the assets of the Fund under the Agreement.

Consideration of the Board of Trustees

At an in-person meeting of the Board held on November 15, 2004, the Trustees, including the Independent Trustees, unanimously approved the proposed Amendment and found that the Amendment is in the best interests of the Fund and its shareholders. The Board considered, among other factors:

| | 1. | That the Amendment better reflects the wording of SEC rules that apply to performance adjustments to mutual fund advisory fees. |

| | 2. | That the Amendment retains the fundamental character of the management fee that the Fund’s net performance must exceed the Index on a full net basis. |

| | 3. | That the Board and Independent Trustees at a meeting on May 17, 2004 approved a renewal of the Agreement with respect to the Fund by finding that the management fee is fair and reasonable for the services provided by the Adviser. |

| | 4. | That the Adviser did not intend to mislead shareholders or otherwise charge an improper or excessive fee, and that the Adviser relied on professional advisers in previously and currently devising the fee calculation. |

| | 5. | That the Fund’s prospectus at all relevant times accurately described the manner in which the management fee was calculated. |

| | 6. | That the Adviser detected and voluntarily reimbursed the excess management fee plus interest. |

| | 7. | That the Adviser voluntarily agreed to have the Fund pay its management fee (as determined under the Amendment) into an escrow account for the periods beginning after November 30, 2004. |

The Board considered the fact that the Amendment does not increase the effective investment management fee rates charged by the Adviser with respect to the management of the assets of the Fund under the Agreement (assuming no change in assets or increasing assets during the rolling 3-month performance period).

A copy of the Amendment with respect to the AlphaTrak 500 Fund, is included asAppendix B.

23

Payment of Escrowed Management Fees

On November 15, 2004, the Board approved the proposed Amendment. Because the Amendment had not yet been approved by shareholders, the Board decided to treat the Amendment as an interim Amendment to the Agreement, and the management fees due under the Agreement will be placed in an escrow account for the periods beginning after November 30, 2004, recoverable upon shareholder approval of the Amendment.

If shareholders approve the Amendment set forth in this proposal, the management fees will be released from escrow and paid to the Adviser. If shareholders do not approve this proposal, the Board will consider possible alternative actions, including revisions to the Amendment or resolicitation of shareholder approval. Adviser may also seek compensation from the Fund for the costs incurred by the Adviser to manage the Fund during the period in which the management fees were held in escrow.

Vote Required and Recommendation

The affirmative vote of a majority of the Fund’s outstanding voting securities (as defined in the Investment Company Act) is required to approve the amendment to the Agreement with respect to the Fund. The Investment Company Act defines a vote of a majority of a fund’s outstanding voting securities as the lesser of (a) 67% or more of the shares represented at the meeting if more than 50% of the shares entitled to vote are so represented, or (b) more than 50% of the shares entitled to vote. If approved by shareholders this proposal will take effect on the date of the shareholder meeting.

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, BELIEVES THAT THE PROPOSAL TO AMEND THE AGREEMENT IS IN THE BEST INTERESTS OF THE FUND AND ITS SHAREHOLDERS. THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THIS PROPOSAL.

24

PROPOSAL 3 APPROVE CHANGE IN THE CLASSIFICATION OF THE

METROPOLITAN WEST STRATEGIC INCOME FUND FROM

DIVERSIFIED TO NON-DIVERSIFIED

The Strategic Income Fund is currently a diversified investment company under Section 5(b)(1) of the 1940 Act. This means that, with respect to 75% of its total assets, the Strategic Income Fund is limited in its investment in any one issuer (other than government securities or securities of other investment companies) to an amount not greater in value than 5% of the value of the Strategic Income Fund’s total assets and to not more than 10% of the outstanding voting securities of that issuer. The Fund has also adopted this requirement as one of its fundamental investment policies. A non-diversified fund is not subject to this requirement. By law, the diversified status of the Strategic Income Fund may be changed only with shareholder approval. If this proposal is approved by shareholders, the Strategic Income Fund will no longer be subject to the diversification limits described above and will thus be afforded greater flexibility to invest a higher percentage of its assets in the securities of a smaller number of companies than would currently be permissible. This flexibility would provide the current or future portfolio managers of the Fund with increased ability to take larger investment positions in companies that are consistent with the Fund’s investment objective, based on the merits of the relevant companies and without regard to meeting the specific diversification standards of the 1940 Act.

The proposed change to the Fund’s classification will not change the Fund’s investment objective. The Board does not believe that the proposed change to the Fund’s classification will result in more than modest restructuring of the Fund’s investment portfolio. The change simply allows the portfolio managers greater flexibility in pursuing the Fund’s current investment objectives.

If shareholders approve the proposed change in classification, the Fund will also conform its fundamental investment policies by removing the current policy that the Fund will meet the diversification requirements.

If shareholders approve this proposal, the Strategic Income Fund would be permitted to invest a higher percentage of its assets in the securities of a smaller number of issuers. Accordingly, the Fund’s investment risk may increase, and an investment in the Fund may, under certain circumstances, present greater risk to an investor than an investment in a diversified investment company. This risk includes greater exposure to potential poor earnings results or defaults than would be the case for a more diversified portfolio, which could result in greater net asset value volatility for the Fund and an increase in the risk of loss of net asset value, and therefore the value of your investment. Being classified as a non-diversified portfolio does not prevent the portfolio manager from managing the Strategic Income Fund as though it were a diversified investment company.

25

Although the Strategic Income Fund will no longer be subject to the Investment Company Act diversification limits if shareholders approve this proposal, the Fund must still adhere to certain federal tax diversification requirements. For purposes of Subchapter M of the Internal Revenue Code of 1986, as amended, the Strategic Income Fund operates, and will continue to operate, as a “regulated investment company.” As such, the Strategic Income Fund must meet certain other diversification requirements, including the requirement that at the end of each tax year quarter, at least 50% of the market value of its total assets must be invested in cash, cash equivalents, U.S. government securities and securities of issuers (including foreign governments), in which it has invested not more than 5% of its assets. The Strategic Income Fund will further be limited in its purchases of voting securities of any issuer and may invest no more than 25% of the value of its total assets in securities (other than U.S. government securities) of any one issuer or of two or more issuers that the Strategic Income Fund controls and are engaged in the same, similar or related trades or businesses.

On November 15, 2004, the Trustees of the Funds, including the Independent Trustees, unanimously approved a change in the Fund’s classification from diversified to non-diversified, subject to approval by shareholders.

Vote Required and Recommendation

Approval of this proposal on behalf of each Fund requires the affirmative vote of a “majority of the outstanding voting securities” of the Funds, which for this purpose means the affirmative vote of the lesser of (i) more than 50% of the outstanding shares of the Funds or (ii) 67% or more of the shares of the Funds present at the Meeting if more than 50% of the outstanding shares of the Funds are represented at the Meeting.

THE BOARD OF TRUSTEES OF THE TRUST, INCLUDING THE INDEPENDENT TRUSTEES, BELIEVES THAT THE PROPOSAL TO CHANGE THE CLASSIFICATION OF THE FUND FOR PURPOSES OF THE 1940 ACT FROM DIVERSIFIED TO NON-DIVERSIFIED IS IN THE BEST INTERESTS OF THE FUND AND ITS SHAREHOLDERS. THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THIS PROPOSAL.

26

GENERAL INFORMATION

Other Matters to Come Before the Meeting

Management of the Trust does not know of any matters to be presented at the Meeting other than those described in this Proxy Statement. If other business should properly come before the Meeting, the proxy holders will vote thereon in accordance with their best judgment.

Expenses

The expenses incurred in connection with the Meeting, including printing, mailing, solicitation and vote tabulation and proxy soliciting expenses, legal fees, and out-of-pocket expenses will be borne exclusively by the Adviser.

Solicitation of Proxies

Solicitation will be primarily by mail, but officers of the Funds or regular employees of the Adviser may also solicit without compensation by telephone or personal contact. The Funds may also retain a service to assist in the solicitation process.

Adviser

Metropolitan West Asset Management, LLC, with principal offices at 11766 Wilshire Boulevard, Suite 1580, Los Angeles, California 90025, acts as the investment adviser to the Funds and generally administers the affairs of the Trust. The Adviser’s website iswww.mwamllc.com. Subject to the direction and control of the Board of Trustees, the Adviser supervises and arranges the purchase and sale of securities and other assets held in the portfolios of the Funds. The Adviser is a registered investment adviser organized in 1996. The Adviser managed approximately $14 billion of fixed-income investments as of September 30, 2004 on behalf of institutional clients and the Funds.

The Adviser is majority-owned by its key executives, with a minority ownership stake held by Metropolitan West Financial, LLC (“MWF”), an unregistered financial holding company. The following table provides the name, and principal occupation of each member (owner) and the Chief Executive Officer of the Adviser. The address of each director and the Chief Executive Officer of the Adviser is c/o Metropolitan West Asset Management, LLC, with principal offices at 11766 Wilshire Boulevard, Suite 1580, Los Angeles, California 90025.

| | |

Member

| | Principal Occupation with the Adviser (and office with the Trust, if applicable)

|

Scott B. Dubchansky | | Chief Executive Officer of the Adviser; Chairman of the Board of Trustees, President and Chief Executive Officer of the Trust |

Richard S. Hollander | | Director |

27

| | |

Member

| | Principal Occupation with the Adviser (and office with the Trust, if applicable)

|

Tad Rivelle | | Chief Investment Officer and Portfolio Manager |

Laird R. Landmann | | Managing Director and Portfolio Manager |

David B. Lippman | | Managing Director and Portfolio Manager of the Adviser; Trustee of the Trust |

Chris Scibelli | | Marketing Director |

Stephen M .Kane | | Managing Director and Portfolio Manager |

Patrick A. Moore | | Client Services Director |

Interested Persons of the Trust and the Funds

Certain Trustees and officers are deemed to be “interested persons” of the Trust, the Strategic Income Fund and the AlphaTrak 500 Fund because of their positions with the Adviser. Mr. Dubchansky, President and Chief Executive Officer of the Trust and Chairman of the Board; Mr. Lippman, Trustee of the Fund; and Mr. Holmes, Trustee of the Fund, performs legal services for the Adviser and MWF. Accordingly, they may be considered to have an indirect interest with respect to proposals 1 and 2.

Control Persons and Principal Holders of Securities

To the knowledge of the Trust, as of the Record Date, no current Trustee of the Trust owned 1% or more of the outstanding shares of any Fund, and the officers and Trustees of the Trust owned, as a group, less than 1% of the shares of each Fund.

Appendix A to this Proxy Statement lists the persons that, to the knowledge of the Trust, owned beneficially 5% or more of the outstanding shares of any class of a Fund as of the Record Date. A shareholder who beneficially owns, directly or indirectly, more than 25% of the Funds’ voting securities may be deemed a “control person” (as defined in the 1940 Act) of the Fund.

Principal Underwriter

The principal underwriter of the Funds’ shares is PFPC Distributors, Inc. (the “Distributor”). The Distributor offers the Funds’ shares to the public on a continuous basis. The address of the Distributor is 760 Moore Road, King of Prussia, Pennsylvania 19406.

28

Administrator

PFPC Inc. (“PFPC”) serves as Administrator of the Funds. The Administrator provides management and administrative services necessary for the operation of the Funds. The Administrator’s main office is located at 760 Moore Road, King of Prussia, PA 19406.

Independent Auditors

Deloitte & Touche LLP, 1700 Market Street, Philadelphia, PA 19103, serves as the Funds’ independent auditor.

Shareholder Proposals

The Trust is not required to hold annual meetings of shareholders and currently does not intend to hold such meetings unless shareholder action is required in accordance with the 1940 Act. A shareholder proposal to be considered for inclusion in the proxy statement at any subsequent meeting of shareholders must be submitted a reasonable time before the proxy statement for that meeting is mailed. Whether a proposal is submitted in the proxy statement will be determined in accordance with applicable federal and state laws.

PROMPT EXECUTION AND RETURN OF THE ENCLOSED PROXY IS REQUESTED. A SELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE.

Lara Mulpagano, Secretary

December 14, 2004

29

APPENDIX A

As of December 3, 2004, to the knowledge of management, no person owned beneficially or of record more than 5% of the outstanding shares of any class of the Funds, except as follows:

| | | | | |

| | | Shares Beneficially Owned

| |

Name of Beneficial Owner

| | Number

| | Percent of Fund

| |

AlphaTrak 500 Fund | | | | | |

Northern Trust Co FBO Our Customer PO Box 92994 Chicago, IL 60675 | | 3,205,194.670 | | 17.04 | % |

| | |

Trinity Health Holy Cross Employees Retirement Trust Attn: Treasury Department 27870 Cabot Drive Novi, MI 48377-2920 | | 2,491,735.247 | | 13.25 | % |

| | |

Memorial Hospital of South Bend, Inc. 615 North Michigan Street South Bend, IN 46601 | | 2,459,314.299 | | 13.08 | % |

| | |

Gettysburg College 300 North Washington St Gettysburg, PA 17325 | | 1,791,719.956 | | 9.53 | % |

| | |

Saxon & Co Trust FBO Our Customer PO Box 7780-1888 Philadelphia, PA 19182 | | 1,789,676.184 | | 9.52 | % |

| | |

First Source Bank Cust FBO Our Customer 615 North Michigan South Bend, IN 46601 | | 1,144,723.843 | | 6.09 | % |

| | |

New York Eye and Ear Infirmary 310 East 14th Street New York, NY 10003 | | 1,075,847.008 | | 5.72 | % |

A-1

| | | | | |

| | | Shares Beneficially Owned

| |

Name of Beneficial Owner

| | Number

| | Percent of Fund

| |

Strategic Income Fund—Class M | | | | | |

National Financial Services, LLC FBO Our Customers 200 Liberty Street One World Financial Center New York, NY 10281 | | 6,033,269.308 | | 58.41 | %* |

| | |

Charles Schwab & Co, Inc. Special Custody Account FBO Customers 101 Montgomery Street San Francisco, CA 94104-4122 | | 2,907,351.879 | | 28.15 | %* |

| | |

Strategic Income Fund—Class I | | | | | |

Charles Schwab & Co, Inc. Special Custody Account FBO Customers 101 Montgomery Street San Francisco, CA 94104-4122 | | 4,786,482.285 | | 79.15 | %* |

| | |

Merfarm & Co C/O Merchants Trust Company 275 Kennedy Dr South Burlington, VT 05403-6785 | | 934,254.030 | | 15.45 | % |

* Pursuant to the definition set forth in the 1940 Act, these persons are deemed “control persons” by nature of their ownership of 25% or more of the outstanding voting securities of a Fund. This does not mean, however, that these persons manage the affairs of the Trust. Principal holders own of record or beneficially 5% or more of a Fund’s outstanding voting securities.

A-2

Exhibit B

METROPOLITAN WEST FUNDS

Amended Investment Management Agreement

THIS INVESTMENT MANAGEMENT AGREEMENT (this “Agreement”) is made as of the 31st day of March, 1997, as amended and restated on May 18, 1998 and further amended on March 27, 2000 and May 19, 2003, by and between Metropolitan West Funds a Delaware business trust (hereinafter called the “Trust”), on behalf of each series of the Trust listed in Appendix A hereto, as may be amended from time to time (hereinafter referred to individually as a “Fund” and collectively as the “Funds”) and Metropolitan West Asset Management LLC, a California limited liability company (hereinafter called the “Manager”).

WITNESSETH:

WHEREAS, the Trust is an open-end management investment company, registered as such under the Investment Company Act of 1940, as amended (the “1940 Act”); and

WHEREAS, the Manager is registered as an investment adviser under the Investment Advisers Act of 1940, as amended, and is engaged in the business of supplying investment advice, investment management and administrative services, as an independent contractor; and

WHEREAS, the Trust desires to retain the Manager to render advice and services to the Funds pursuant to the terms and provisions of this Agreement, and the Manager is interested in furnishing said advice and services; and

WHEREAS, this Agreement has been amended and restated in order to (i) make explicit the requirement that the disinterested Trustees of the Trust must approve any recoupment of contingent deferred expense reimbursements and any contingent deferred management fees now permitted under Section 8(d) of the Agreement, and (ii) eliminate obsolete references to expense limitations under state law;

NOW, THEREFORE, in consideration of the covenants and the mutual promises hereinafter set forth, the parties hereto, intending to be legally bound hereby, mutually agree as follows:

1.Appointment of Manager. The Trust hereby employs the Manager and the Manager hereby accepts such employment, to render investment advice and

A-3

management services with respect to the assets of the Funds for the period and on the terms set forth in this Agreement, subject to the supervision and direction of the Trust’s Board of Trustees.

2.Duties of Manager.