Exhibit 99.2 Investor Presentation First Quarter 2019 Steve Gardner Chairman, President & Chief Executive Officer sgardner@ppbi.com 949-864-8000 1

Forward Looking Statement The statements contained in this presentation that are not historical facts are forward-looking statements based on management’s current expectations and beliefs concerning future developments and their potential effects on Pacific Premier Bancorp, Inc. (the “Company” or “Pacific Premier”) including, without limitation, plans, strategies and goals, and statements about the Company’s expectations regarding revenue and asset growth, financial performance and profitability, loan and deposit growth, yields and returns, loan diversification and credit management, shareholder value creation and the impact of the Company’s acquisitions. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of the Company. There can be no assurance that future developments affecting the Company will be the same as those anticipated by management. The Company cautions readers that a number of important factors could cause actual results to differ materially from those expressed in, or implied or projected by, such forward-looking statements. These risks and uncertainties include, but are not limited to, the following: the expected cost savings, synergies and other financial benefits from the Grandpoint acquisition or any other acquisition the Company has made or may make might not be realized within the expected time frames or at all; the strength of the United States economy in general and the strength of the local economies in which the Company conducts operations; the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; inflation, interest rate, market and monetary fluctuations; the timely development of competitive new products and services and the acceptance of these products and services by new and existing customers; the willingness of users to substitute competitors’ products and services for the Company’s products and services; the impact of changes in financial services policies, laws and regulations and of governmental efforts to restructure the U.S. financial regulatory system; technological changes; changes in the level of the Company’s nonperforming assets and charge offs; any oversupply of inventory and deterioration in values of California real estate, both residential and commercial; the effect of changes in accounting policies and practices, as may be adopted from time-to-time by bank regulatory agencies, the Securities and Exchange Commission (“SEC”), the Public Company Accounting Oversight Board, the Financial Accounting Standards Board or other accounting standards setters; possible other-than-temporary impairment of securities held by us; changes in consumer spending, borrowing and savings habits; the effects of the Company’s lack of a diversified loan portfolio, including the risks of geographic and industry concentrations; ability to attract deposits and other sources of liquidity; changes in the financial performance and/or condition of our borrowers; changes in the competitive environment among financial and bank holding companies and other financial service providers; unanticipated regulatory or judicial proceedings; and the Company’s ability to manage the risks involved in the foregoing. Additional factors that could cause actual results to differ materially from those expressed in the forward- looking statements are discussed in the 2018 Annual Report on Form 10-K of Pacific Premier Bancorp, Inc. filed with the SEC and available at the SEC’s Internet site (http://www.sec.gov). Annualized, pro forma, projected and estimated numbers in this investor presentation are used for illustrative purposes only, are not forecasts and may not reflect actual results. Pacific Premier undertakes no obligation to revise or publicly release any revision or update to these forward‐looking statements to reflect events or circumstances that occur after the date on which such statements were made.

Corporate Overview Headquarters Irvine, Ca Exchange / Listing NASDAQ: PPBI Market Cap $1.82 Billion(1) Average Daily Volume 369,108 Shares(2) Outstanding Shares 62,773,828(1) Dividend Yield 3.03%(1)(3) # of Research Analysts 7 Analysts Focus Small & Mid-Market Businesses Total Assets $11.6 Billion Branch Network 42 Full-Service Branch Locations (1) Market data as of April 30, 2019 (2) 3-month average as of April 30, 2019 (3) Annualized 3

Geographic Footprint Premier banking franchise in the Western U.S. – well-positioned for further expansion . 37 branches in Southern California Franchise Footprint and Central Coast California . 3 branches in Arizona (Phoenix and Tucson) . 1 branch in Las Vegas, Nevada . 1 branch in Vancouver, Washington California Footprint 4

Highlights – Q1 2019 Strong financial returns while executing on a number of strategic projects . Net income of $38.7 million, which included $0.7 million in merger-related expense . Operating net income of $38.8(1) million or $0.62(1) per diluted share . Operating ROAA of 1.36%(1), and Operating ROATCE of 15.6%(1) Earnings . Efficiency ratio of 49.3%(1)(2) . Net interest margin of 4.37%, core net interest margin of 4.21%(2) . Loans totaled $8.9 billion, an increase of $29 million, or 1% annualized Loans and Asset . New loan commitments of $550 million, 5.67% weighted average rate Quality . Nonperforming assets as a percent of total assets of 0.11% . Loan yield of 5.56%, core loan yield of 5.38% . Deposits totaled $8.7 billion, an increase of $57 million, or 1%, from prior quarter . Noninterest-bearing deposits represent 39% of total deposits Deposits . Non-maturity deposits equal 82% of total deposits . Cost of deposits of 0.63% . Tangible book value per share of $17.56(1), compared to $16.97 as of 12/31/2018 Capital . Tangible common equity ratio of 10.32%, compared to 10.02% as of 12/31/2018 . Declared a quarterly cash dividend of $0.22 per share, payable in Q2 2019 (1) Please refer to non-U.S. GAAP reconciliation in appendix (2) Represents the ratio of noninterest expense less other real estate owned operations, core deposit intangible amortization and merger-related expenses to the sum of net interest income before provision for loan losses and total noninterest income, less gain / (loss) on sales of securities and gain / (loss) of other real estate owned (3) Core net interest margin excludes accretion 5

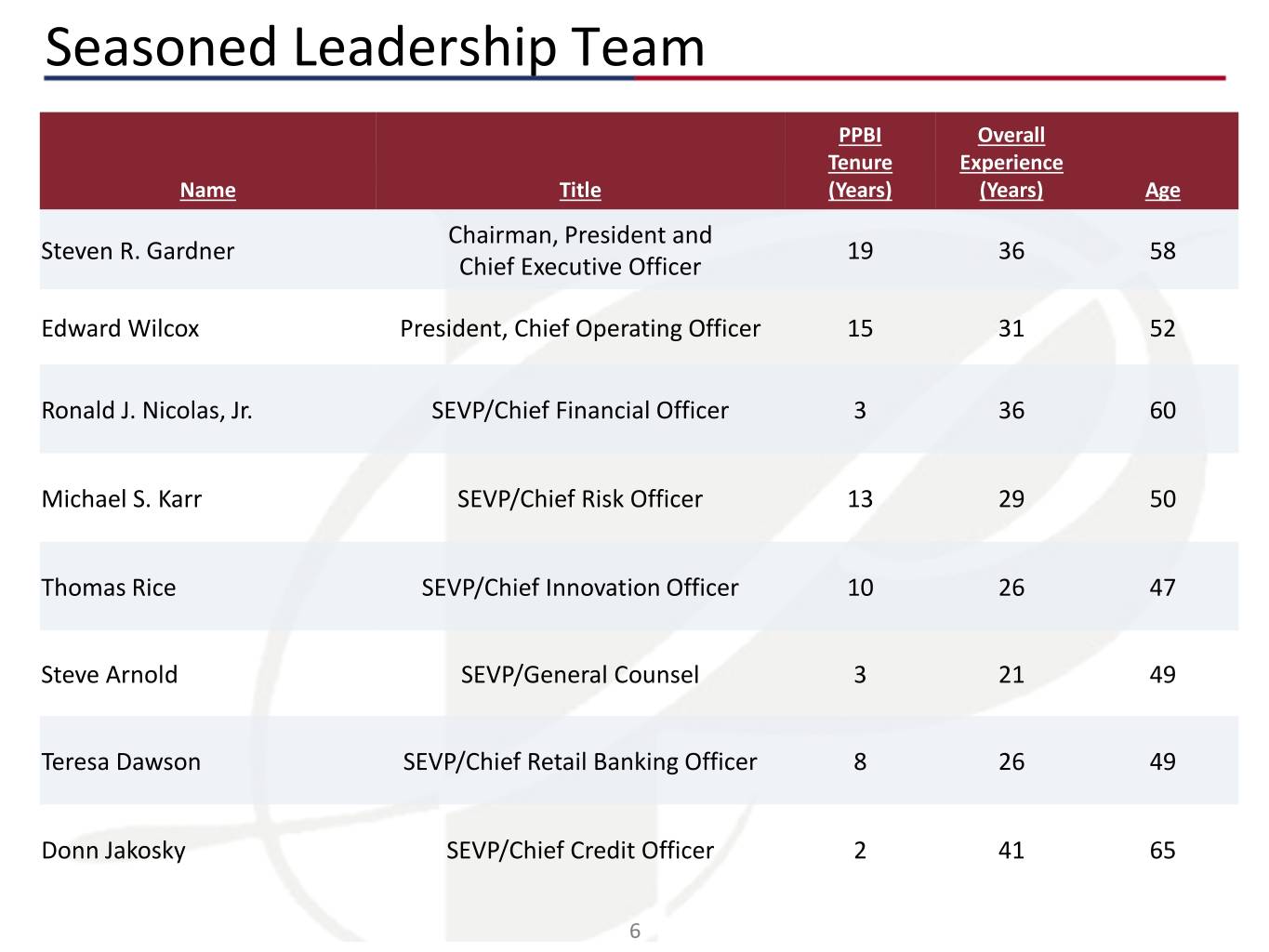

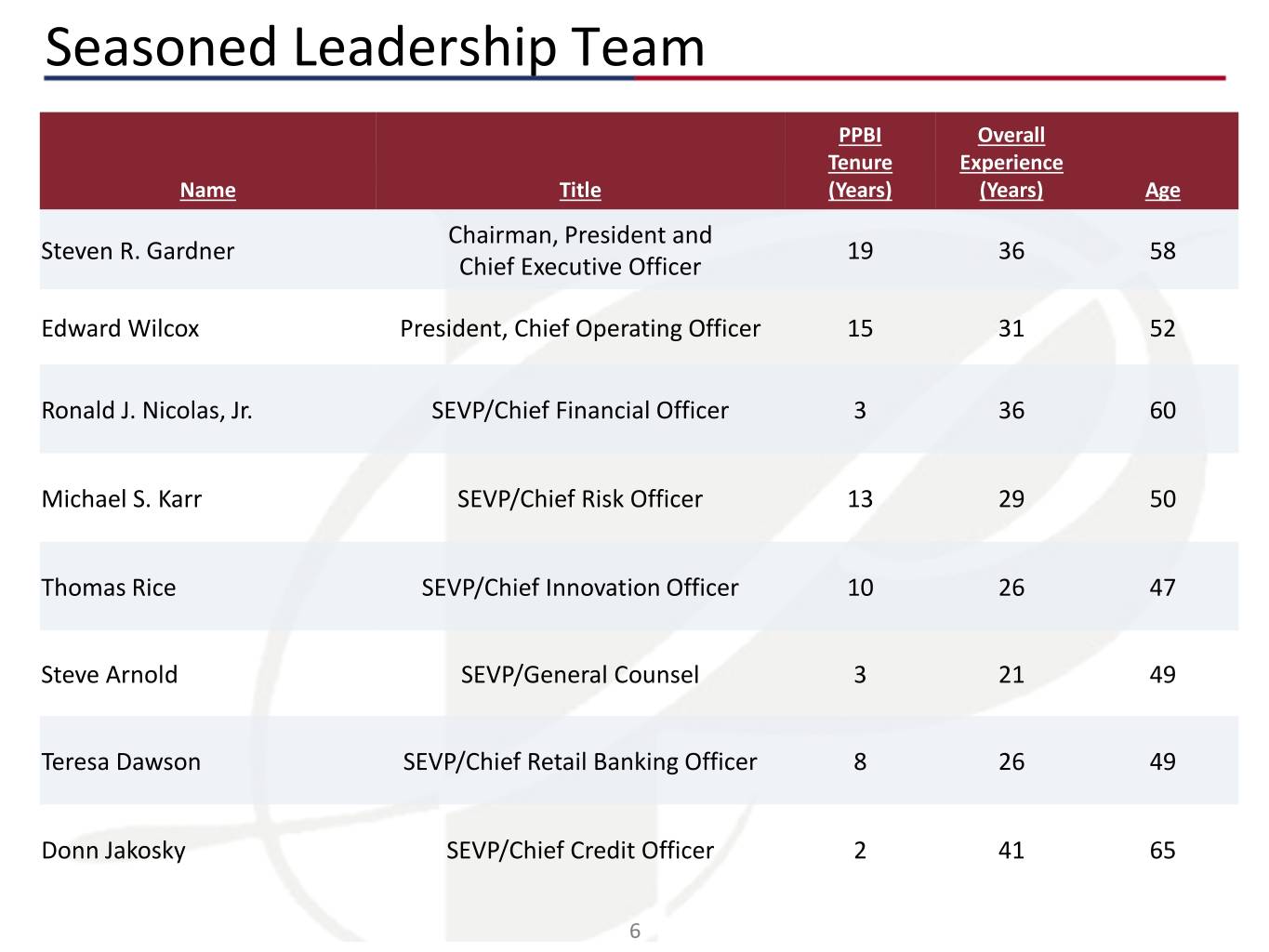

Seasoned Leadership Team PPBI Overall Tenure Experience Name Title (Years) (Years) Age Chairman, President and Steven R. Gardner 19 36 58 Chief Executive Officer Edward Wilcox President, Chief Operating Officer 15 31 52 Ronald J. Nicolas, Jr. SEVP/Chief Financial Officer 3 36 60 Michael S. Karr SEVP/Chief Risk Officer 13 29 50 Thomas Rice SEVP/Chief Innovation Officer 10 26 47 Steve Arnold SEVP/General Counsel 3 21 49 Teresa Dawson SEVP/Chief Retail Banking Officer 8 26 49 Donn Jakosky SEVP/Chief Credit Officer 2 41 65 6

Value Creation Strategy Increase EPS and TBV by growing scale and operating leverage Expand our market presence through disciplined organic and acquisitive growth . Target ROAA of 1.50% . Target ROATCE of 17% - 18% Focus on small and middle market commercial businesses . Revenues of $5 - $250 million . Emphasis on full banking relationships Organic Growth . Full suite of commercial and SMID business products and services . Complementary business centric nationwide lines of business: . HOA Management, QSR Franchise, SBA . Disciplined sales process utilizing our customized Salesforce technology Target commercial banks and specialized lines of business . Complementary geography / relationship focused / product expansion . Attractive deposit profile with emphasis on non-maturity deposits Acquisitive Growth . Disciplined acquisition criteria: . Accretive to EPS 1st full year . < 3 years TBV dilution payback . +15% IRR . Solid track record of delivering value for shareholders 7

Acquisition History PPBI acquisitions have consistently enhanced franchise value . Over the last 5 years, TBVPS has grown 13% compounded annually . Assets have grown 44% compounded annually since 2013 Acquisition Timeline Total Assets July 2018 TBV/Share $14,000 Acquired Grandpoint Capital, Inc. $17.56 $18.00 ($3.1B assets) April 2017 and November 2017 Acquired Heritage Oaks Bancorp ($2.0B assets) and Plaza Bancorp $12,000 $11,487 $11,580 February 2011 ($1.3B assets) Acquired Canyon National Bank ($192MM assets) in $15.50 $10,000 FDIC-assisted deal January 2016 Acquired Security California Bancorp ($715MM assets) April 2012 January 2014 $8,025 $8,000 Acquired Palm Acquired Infinity Desert National Franchise Holdings January 2015 Bank ($103MM ($80MM assets), a Acquired $13.00 assets) in FDIC- specialty finance Independence assisted deal $6,000 company Bank ($422MM assets) March 2013 and June 2013 Acquired First Associations $4,036 $4,000 Bank ($424MM assets) and San Diego Trust Bank $10.50 ($211MM assets) $2,790 $2,038 $1,714 $2,000 $- $8.00 2013 2014 2015 2016 2017 2018 1Q'19 Non-Acquired Acquired TBV/Share Note: All dollars in millions 8

Acquisition Execution The Company has a well established track record of executing on acquisitions . Organic growth driven by dynamic and disciplined sales culture . Geographic expansion through highly accretive FDIC-assisted acquisitions 2008 - 2012 ₋ Canyon National Bank (“CNB”) - $192 million in assets, closed on 2/11/2011 (FDIC-Assisted) ₋ Palm Desert National Bank (“PDNB”) - $103 million in assets, closed on 4/27/2012 (FDIC- Assisted) . Build out of commercial banking platform through acquisitions ₋ First Associations Bank (“FAB”) - $424 million in assets, closed on 3/15/2013 (151 days) ₋ San Diego Trust Bank (“SDTB”) - $211 million in assets, closed on 6/25/2013 (111 days) ₋ Infinity Franchise Holdings (“IFH”) - $80 million in assets, closed on 1/30/2014 (73 days) 2013 - 2018 ₋ Independence Bank (“IDPK”) - $422 million in assets, closed on 1/26/2015 (96 days) ₋ Security California Bancorp (“SCAF”) - $715 million in assets, closed 1/31/2016 (123 days) ₋ Heritage Oaks Bancorp (“HEOP”) – $2 billion in assets, closed on 4/1/2017 (109 days) ₋ Plaza Bancorp (“PLZZ”) - $1.3 billion in assets, closed on 11/1/2017 (84 days) ₋ Grandpoint Capital, Inc. (“GPNC”) - $3.2 billion in assets, closed on 7/1/2018 (142 days) . Focus on producing EPS growth from scale, efficiency and balance sheet leverage 2019 and . Target ROAA and ROATCE of 1.50% and 17%-18%, respectively Beyond . Continue disciplined organic and acquisitive growth, increasing scarcity value 9

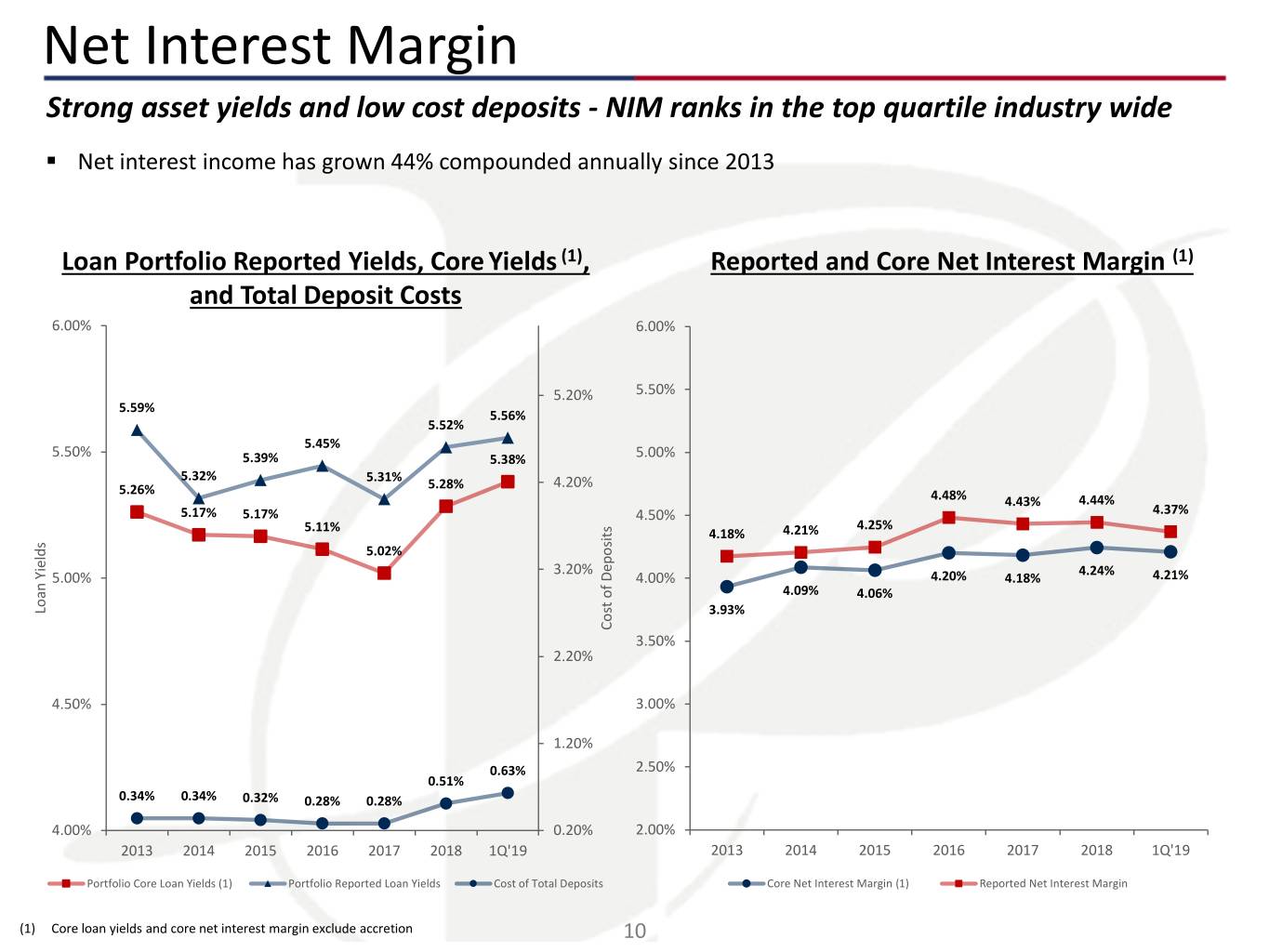

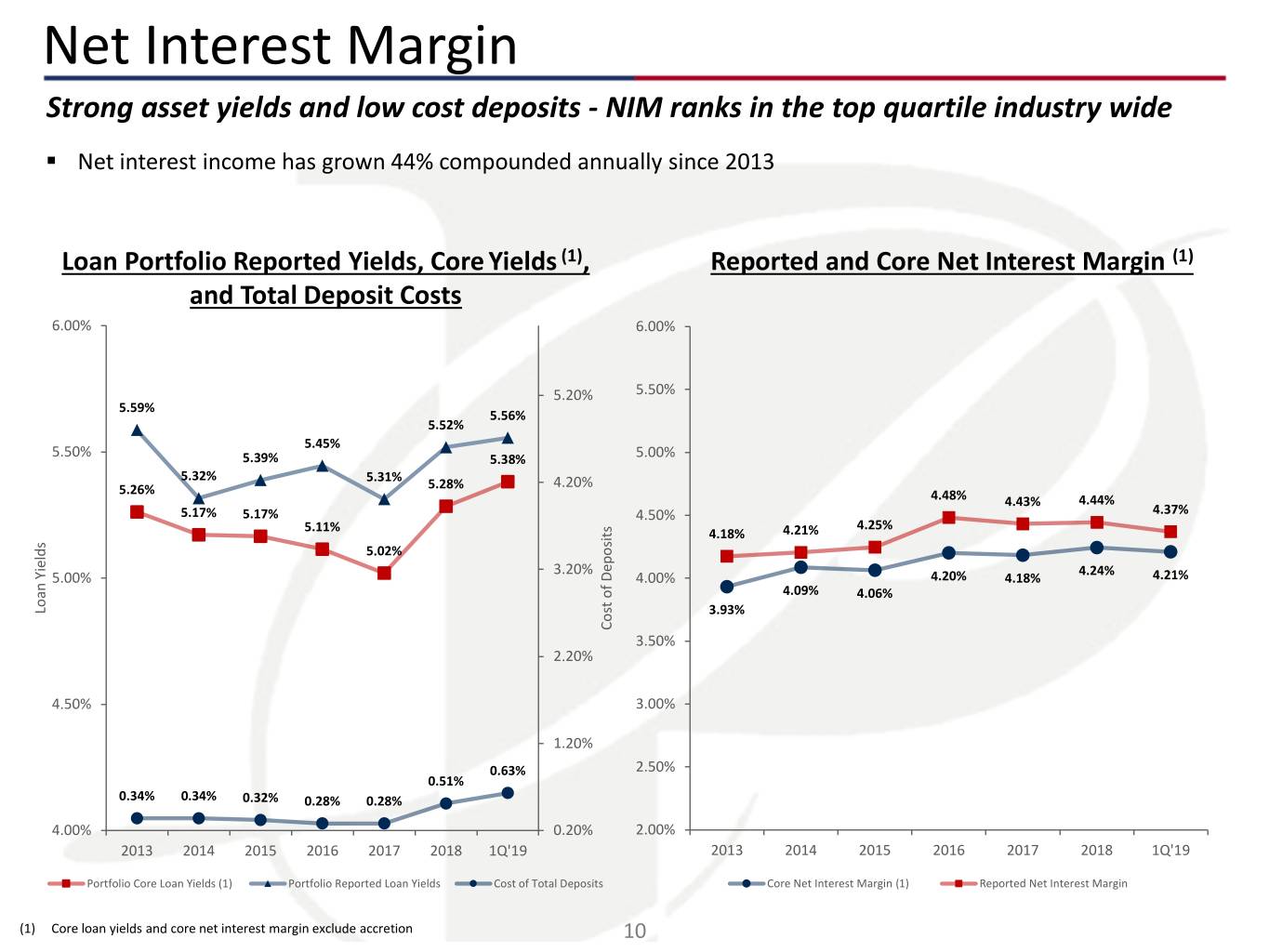

Net Interest Margin Strong asset yields and low cost deposits - NIM ranks in the top quartile industry wide . Net interest income has grown 44% compounded annually since 2013 Loan Portfolio Reported Yields, Core Yields (1), Reported and Core Net Interest Margin (1) and Total Deposit Costs 6.00% 6.00% 5.20% 5.50% 5.59% 5.56% 5.52% 5.50% 5.45% 5.39% 5.38% 5.00% 5.32% 5.31% 5.26% 5.28% 4.20% 4.48% 4.43% 4.44% 5.17% 5.17% 4.50% 4.37% 4.25% 5.11% 4.18% 4.21% 5.02% 3.20% 4.24% 5.00% 4.00% 4.20% 4.18% 4.21% 4.09% 4.06% Loan Yields Loan 3.93% Cost of Deposits 3.50% 2.20% 4.50% 3.00% 1.20% 0.63% 2.50% 0.51% 0.34% 0.34% 0.32% 0.28% 0.28% 4.00% 0.20% 2.00% 2013 2014 2015 2016 2017 2018 1Q'19 2013 2014 2015 2016 2017 2018 1Q'19 Portfolio Core Loan Yields (1) Portfolio Reported Loan Yields Cost of Total Deposits Core Net Interest Margin (1) Reported Net Interest Margin (1) Core loan yields and core net interest margin exclude accretion 10

Strong Earnings Performance The Company has consistently delivered leading earnings growth and shareholder value Total Revenue and Efficiency Ratio Net Income and Earnings Per Share $600.0 $200.0 $2.70 $2.50 $2.49 75% $180.0 $2.26 $2.49 $500.0 $476.3 $2.05 $2.20 $160.0 $154.9$155.3 $423.7 64.7% $140.0 $136.4 $400.0 65% $1.58 $1.56 $1.70 61.3% $123.3 $120.0 $1.34 $1.46 $300.0 55.9% $278.6 $100.0 $1.04 $1.20 53.6% 55% $1.19 $79.0 $0.80 Net Net Income ($MM) $80.0 $0.96 Earnings per Share ($) $200.0 51.6% $0.70 $172.7 50.9% $60.1 $60.0 49.3% $43.3 $120.7 45% $0.54 $40.1 $40.0 $100.0 $87.0 $28.8 $25.5 $0.20 $67.3 $18.0 $16.6 $20.0 $13.4 $9.0 $0.0 35% $0.0 -$0.30 2013 2014 2015 2016 2017 2018 Q1'19 * 2013 2014 2015 2016 2017 2018 Q1'19* Total Revenue Efficiency Ratio Reported Net Income Operating Net Income (1) Note: All dollars in millions (1) (1) Please refer to non-U.S. GAAP reconciliation in appendix Reported EPS (Diluted) Operating EPS (Diluted) * Annualized 11

Capital Ratios Capital management is a key focus of the board and management Holding Company Capital Ratios Q1 2019 Q4 2018 Leverage Ratio 10.69% 10.38% Common Equity Tier-1 Ratio (CET-1) 11.08% 10.88% Tier-1 Ratio 11.32% 11.13% Risk Based Capital Ratio 12.58% 12.39% Bank Level Capital Ratios Q1 2019 Q4 2018 Leverage Ratio 11.39% 11.06% Common Equity Tier-1 Ratio (CET-1) 12.07% 11.87% Tier-1 Ratio 12.07% 11.87% Risk Based Capital Ratio 12.49% 12.28% 12

Attractive Deposit Portfolio 82% non-maturity deposits with 39% in non-interest bearing reflects our client relationship based business model As of Cost of (dollars in thousands) 3/31/2019 Deposits Certificates of Deposits Deposit 18% Non-interest bearing checking $ 3,423,893 N/A Non-interest Interest-bearing checking 560,274 0.36% Bearing Demand Money market and savings 3,138,875 0.85% 39% Total non-maturity deposits 7,123,042 0.40% Money Market and Retail certificates of deposit 1,007,559 1.64% Savings 36% Wholesale brokered certificates of deposit 584,574 2.31% Total certificates of deposit 1,592,133 1.83% Interest-Bearing Total deposits $ 8,715,175 0.63% Demand 7% 13

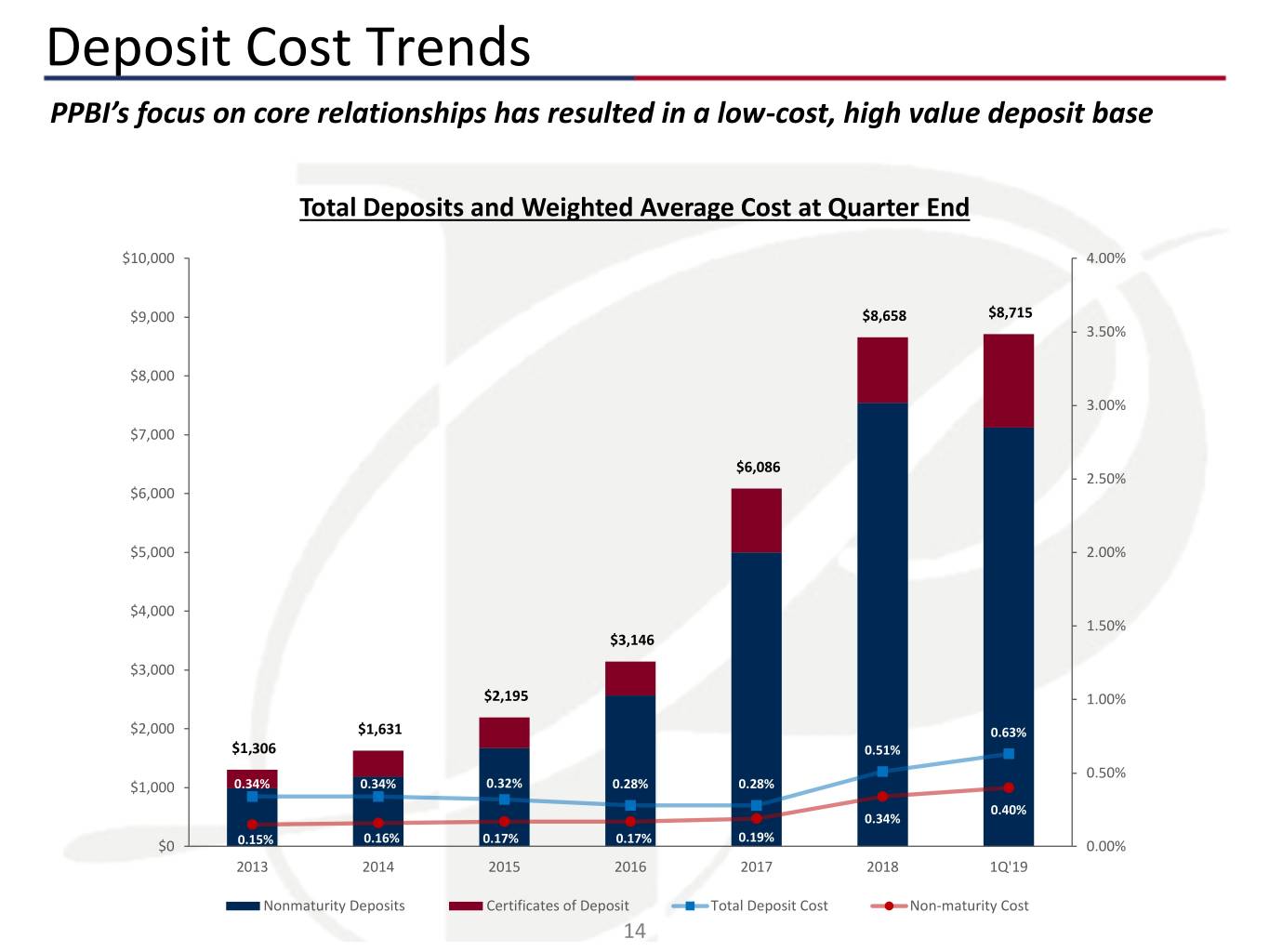

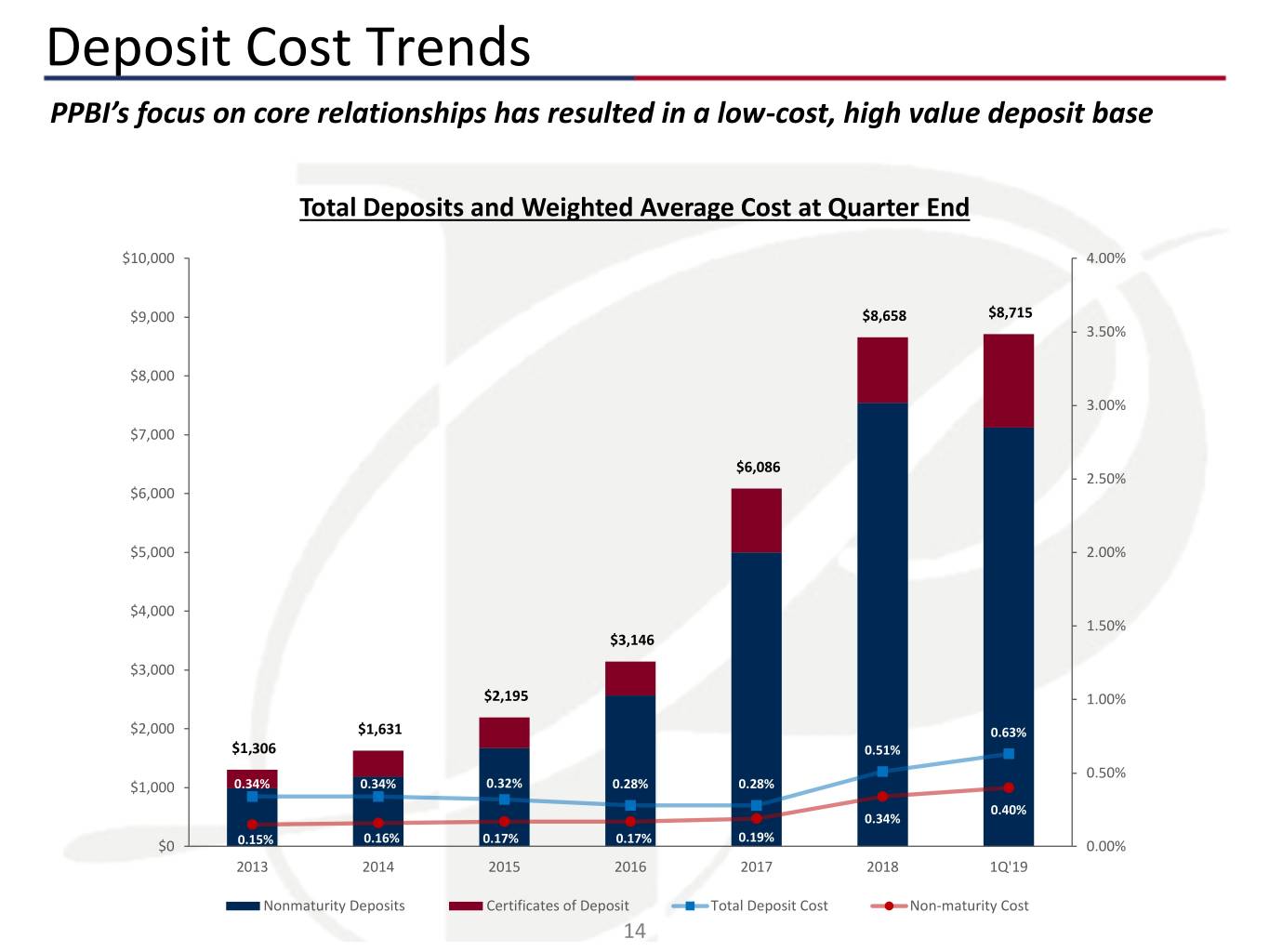

Deposit Cost Trends PPBI’s focus on core relationships has resulted in a low-cost, high value deposit base Total Deposits and Weighted Average Cost at Quarter End $10,000 4.00% $9,000 $8,658 $8,715 3.50% $8,000 3.00% $7,000 $6,086 2.50% $6,000 $5,000 2.00% $4,000 1.50% $3,146 $3,000 $2,195 1.00% $2,000 $1,631 0.63% $1,306 0.51% 0.50% $1,000 0.34% 0.34% 0.32% 0.28% 0.28% 0.40% 0.34% 0.19% $0 0.15% 0.16% 0.17% 0.17% 0.00% 2013 2014 2015 2016 2017 2018 1Q'19 Nonmaturity Deposits Certificates of Deposit Total Deposit Cost Non-maturity Cost 14

Loan Portfolio Well diversified commercial loan portfolio Farmland As of 3/31/2019 Average Loan 2% (dollars in thousands) Loans Outstanding Loan Yield Balance Other Business loans 4% Const. & Commercial and industrial $ 1,336,520 5.75% $ 330 land Franchise 813,057 5.43% 1,004 7% Commercial owner occupied 1,648,762 4.97% 1,055 SBA 188,757 7.39% 292 Commercial and industrial Agribusiness 134,603 5.50% 1,068 Multi-family 24% Total business loans 4,121,699 5.44% 572 17% Real estate loans Commercial owner occupied Commercial non-owner occupied 2,124,250 4.69% 1,589 19% Multi-family 1,511,942 4.37% 1,682 One-to-four family 279,467 5.09% 250 Commercial non-owner Construction 538,197 6.67% 2,403 occupied Farmland 167,345 4.81% 1,780 23% Land 46,848 5.49% 732 Total real estate loans 4,668,049 4.85% 1,249 Agribusiness Consumer loans 85,302 5.56% 37 SBA 2% 2% Gross loans held for investment $ 8,875,050 5.13% $ 670 15

Loan Portfolio Trends Prudent loan portfolio growth with increasing yields and pricing discipline 6.00% Loan Portfolio and Weighted Average Rates 5.67% $12,000 5.50% 5.30% 5.02% 5.00% 4.97% 4.88% 4.89% $10,000 5.13% 5.13% 5.00% 4.90% 4.91% 4.95% $8,846 $8,875 4.81% 4.73% 4.50% $8,000 $6,199 4.00% $6,000 3.50% $4,000 $3,238 3.00% $2,254 $2,000 $1,628 $1,240 2.50% $0 2.00% 2013 2014 2015 2016 2017 2018 1Q'19 Business Loans Real Estate Loans Other Loans Originations - WAR Portfolio - WAR Note: All dollars in millions 16

High Quality Loan Portfolio Distribution of C&I Portfolio By Industry1 CRE Property Type as a Percent of Total CRE Manufacturing, 10% Construction, 10% 15% 11% Other Services (except Public Administration), 9% 10% 6% Real Estate, and Rental and Leasing, 9% Health Care and Social Assistance, 9% 7% 9% Retail Trade, 9% Accommodation and Food Services, 8% 7% 9% Finance and Insurance, 7% 8% Professional, Scientific, and Technical Services, 7% 9% 9% Wholesale Trade, 6% All Other, 15% Loan Balance by State Distribution of Franchise Concepts 2% 20% California, 76% Burger King, 20% 6% Texas, 2% Dunkin Donuts, 15% 1% Arizona, 6% 43% Sonic Drive-In, 14% 4% Nevada, 2% KFC, 8% 1% 76% 15% 1% Washington/Oregon, 4% Other, 43% 9% New York, 1% New Jersey, 1% Other, 9% 14% 8% *Based on state of primary real property collateral. If primary collateral is not real property, borrower *Other category includes 24 different concepts, none of which represents more than 4% address is used. 17

CRE to Capital Concentration Ratio Experience in managing CRE concentrations in excess of 300% . CRE concentrations are well-managed across the organization, and are semi-annually stress tested CRE as a Percent of Total Capital 1000% Annualized Net Charge-Offs(1) Commercial Real Estate 0.10% Multi-family 0.05% 800% 627% 600% Managed Growth 499% Grandpoint 415% Acquisition 389% 400% 372% 376% 362% 352% 365% 356% 349% 336% 340% 336% 341% 342% 310% 316% 287% 287% 275% 200% 0% 2008 2009 2010 2011 2012 2013 2014 2015 1Q'16 2Q'16 3Q'16 4Q'16 1Q'17 2Q'17 3Q'17 4Q'17 1Q'18 2Q'18 3Q'18 4Q'18 1Q'19 (1) January 1, 2009 – December 31, 2018 18

Credit Risk Management The Company has a long running history of outperforming peers on asset quality . Loan delinquencies to loans held for investment of 0.18% as of 3/31/2019 . Nonperforming assets to total assets of 0.11% at 3/31/2019 Nonperforming Assets to Total Assets Comparison PPBI Peers * 5.00 4.39 4.50 4.26 4.30 4.24 4.23 4.29 4.11 4.06 3.96 4.04 4.00 3.77 3.62 3.48 3.39 3.50 3.26 3.21 2.93 CNB 2.96 PDNB 3.00 Acquisition Acquisition 2/11/11 2.50 4/27/12 2.00 1.70 1.66 1.67 1.58 1.62 1.56 1.36 1.31 1.50 1.24 1.18 1.04 1.08 1.10 1.05 0.91 0.80 1.00 0.76 0.74 0.69 0.74 0.58 0.59 0.58 0.53 0.48 0.48 0.50 0.49 0.46 0.44 0.38 0.33 0.42 0.41 0.42 0.41 0.36 0.21 0.20 0.20 0.21 0.19 0.50 0.40 0.55 0.15 0.14 0.12 0.12 0.18 0.18 0.17 0.11 0.13 0.17 0.04 0.11 0.08 0.07 0.02 0.01 0.01 0.04 0.04 - 1Q'16 2Q'16 3Q'16 4Q'16 1Q'17 2Q'17 3Q'17 4Q'17 1Q'18 2Q'18 3Q'18 4Q'18 1Q'19 1Q '09 1Q '09 2Q '09 3Q '09 4Q '10 1Q '10 2Q '10 3Q '10 4Q '11 1Q '11 2Q '11 3Q '11 4Q '12 1Q '12 2Q '12 3Q '12 4Q '13 1Q '13 2Q '13 3Q '13 4Q '14 1Q '14 2Q '14 3Q '14 4Q '15 1Q '15 2Q '15 3Q '15 4Q * California peer group consists of all insured California institutions, from SNL Financial. 19

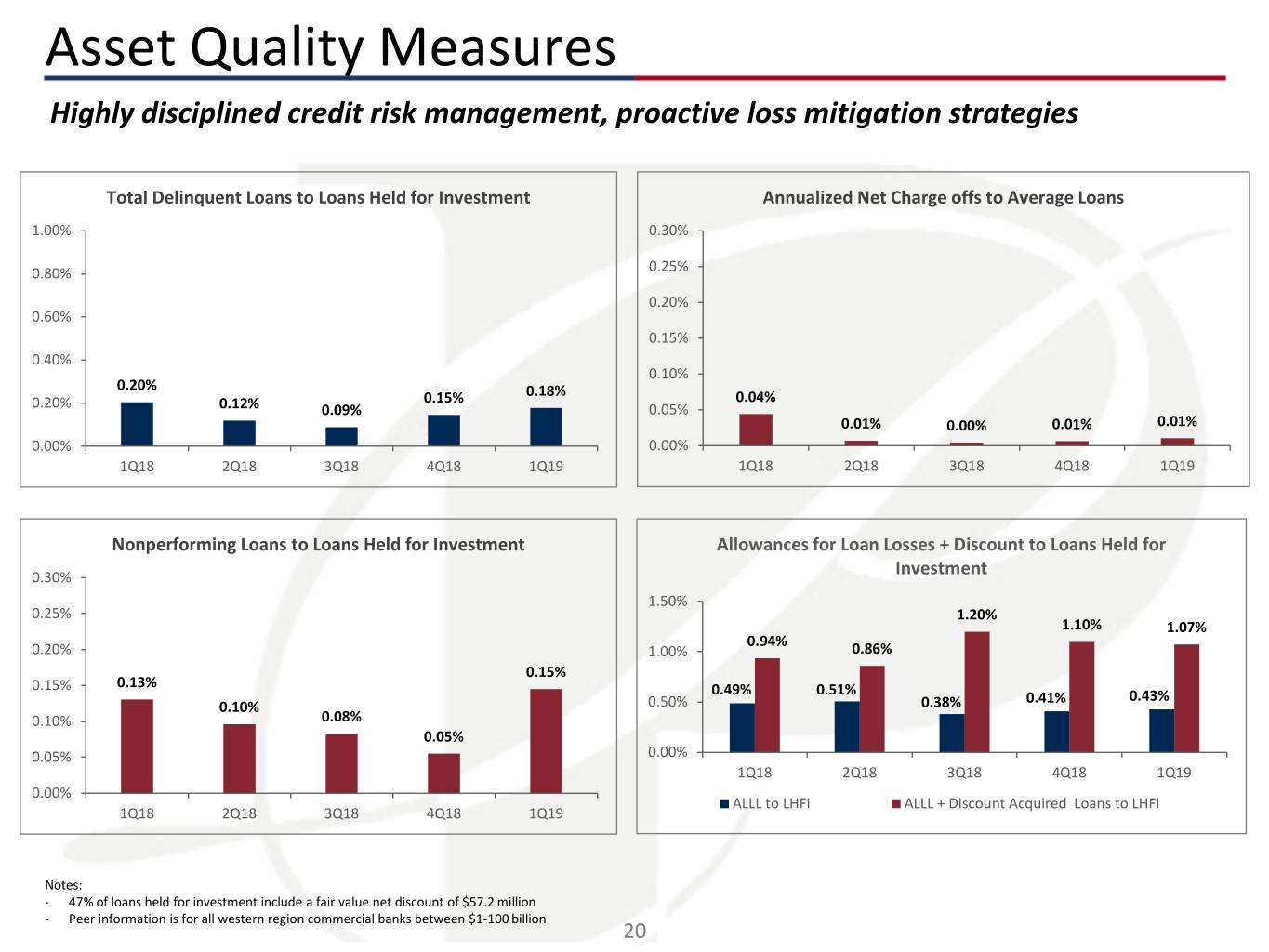

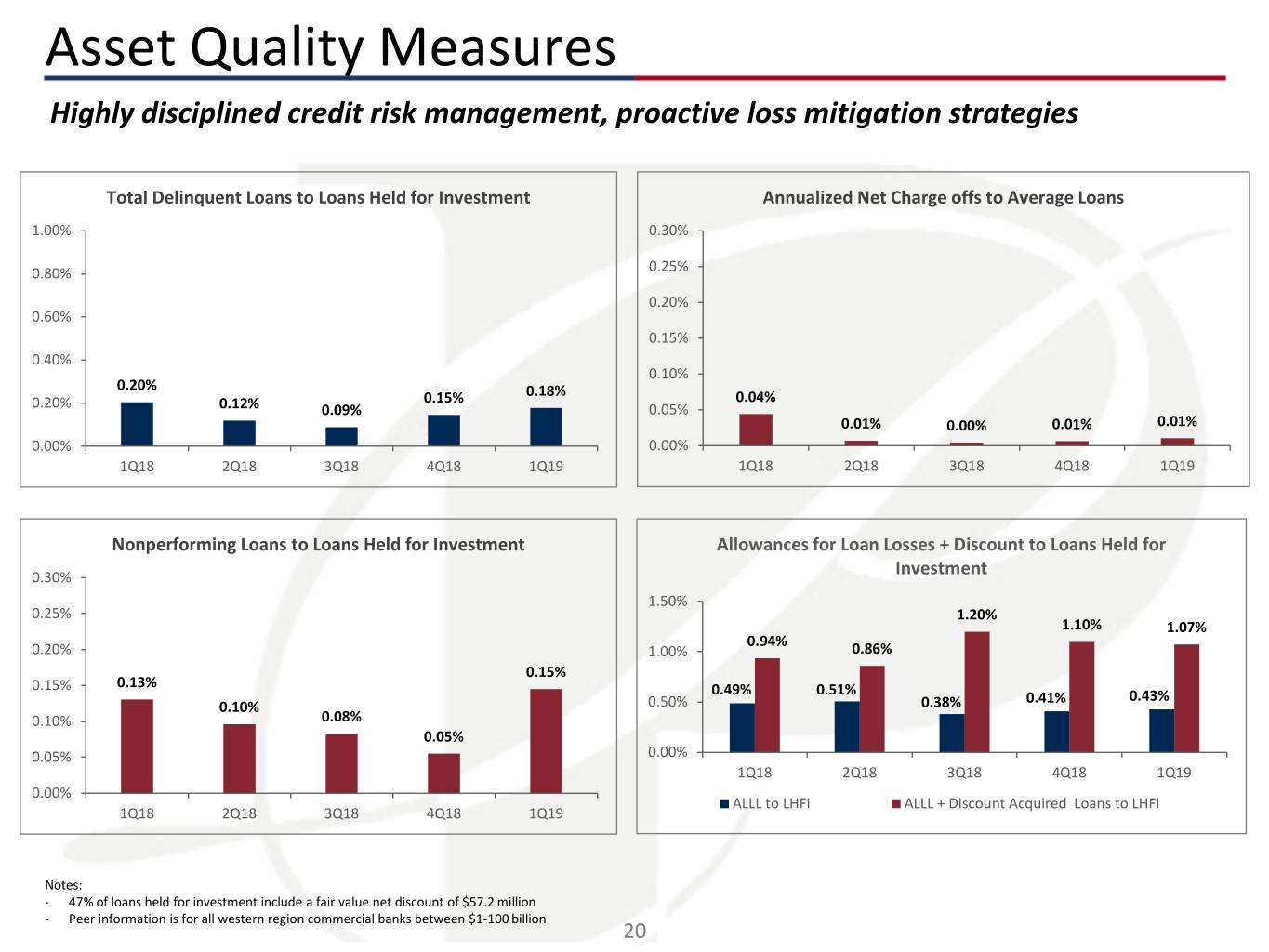

Asset Quality Measures Highly disciplined credit risk management, proactive loss mitigation strategies Total Delinquent Loans to Loans Held for Investment Annualized Net Charge offs to Average Loans 1.00% 0.30% 0.80% 0.25% 0.20% 0.60% 0.15% 0.40% 0.10% 0.20% 0.15% 0.18% 0.04% 0.20% 0.12% 0.09% 0.05% 0.01% 0.00% 0.01% 0.01% 0.00% 0.00% 1Q18 2Q18 3Q18 4Q18 1Q19 1Q18 2Q18 3Q18 4Q18 1Q19 Nonperforming Loans to Loans Held for Investment Allowances for Loan Losses + Discount to Loans Held for 0.30% Investment 1.50% 0.25% 1.20% 1.10% 1.07% 0.94% 0.20% 1.00% 0.86% 0.15% 0.15% 0.13% 0.49% 0.51% 0.41% 0.43% 0.10% 0.50% 0.38% 0.10% 0.08% 0.05% 0.05% 0.00% 1Q18 2Q18 3Q18 4Q18 1Q19 0.00% ALLL to LHFI ALLL + Discount Acquired Loans to LHFI 1Q18 2Q18 3Q18 4Q18 1Q19 Notes: - 47% of loans held for investment include a fair value net discount of $57.2 million - Peer information is for all western region commercial banks between $1-100 billion 20

High Performing Culture & Strong Internal Controls Continue to Evolve and Strive for Superior Performance PPBI’s management team operates the Bank in a disciplined and dynamic fashion • Our business model is always evolving, transforming, and improving • Ongoing investments in technology and people • Continuously strengthening our leadership team Operational Integrity Leads to Strong Internal Controls and Risk Management PPBI’s operating environment and culture have been built over the years to be scalable • Disciplined credit culture remains a fundamental underpinning • Controls over ERM, DFAST, Compliance, BSA/AML and CRA are implemented ahead of our growth Keen Focus on Creating Maximum Shareholder Value Management consistently communicates and executes on its strategic plan • Our Board regularly evaluates capital management, strategic direction and the alternatives to maximize shareholder value • Focused on increasing earnings and building TBV through disciplined, profitable growth strategies • Our goal is to create a fundamentally sound franchise with strong operating leverage, earnings and risk management 21

Expanding Our Capabilities Enhancing products and streamlining processes to drive additional income. Product Enhancements Foreign Third Party Treasury Management Currency Escrow • Expanded International Banking • M&A transactions • Enhanced Account Analysis Platform Department • Capital Investments • Expanded Lockbox Services • Streamlined Foreign Currency • Contractor Retention • Improved ACH Capabilities Processing • Disbursement/Fund Control • Invoice to Pay • Improved Client Experience • Qualified Escrow Accounts • Check Printing Service • Large Asset Acquisition • Dissolution of Assets Technology enabled Business Development Significant investment in customizing the Salesforce platform. • Manage and monitor all facets of client relationship • Analytics to consistently drive lead generation and new client acquisition • Robust monitoring and reporting capabilities • Productivity Tracking 22

Premier API Banking & DataVault® Modernizing the exchange of data between clients and the Bank. Premier API Banking allows software developers, corporate clients and FinTechs to partner with Pacific Premier to create powerful applications and long lasting relationships Technology Advancements Industry Accounting Pacific Premier Bank Platforms Expanded Market Data Services Opportunities • HOA Software Partners • Core Banking Services • FinTech Partners • Check Images • Accounting Software Partners • Statement Images DataVault® FinTech • Subscription Companies • Transaction Details API Application • Healthcare • Account Transfers • Alternate lending models • Electronic Payments Corporate Clients Data flows through Bank systems to reach the client securely and directly. 23

Enhanced Scarcity Value in Southern California PPBI is the 2nd largest publicly traded bank headquartered in Southern California(1) Total Market Price to Price to Assets Cap. Earnings TBV Company Name State Ticker Exchange ($M) ($M) (x) (%) 1 PacWest Bancorp CA PACW NASDAQ 26,324 4,754 10.7 217.1 2 Pacific Premier Bancorp, Inc. CA PPBI NASDAQ 11,580 1,825 11.5 165.6 3 CVB Financial Corp. CA CVBF NASDAQ 11,305 3,038 16.7 (2) 258.9(2) 4 Banc of California, Inc. CA BANC NYSE 9,887 731 33.7 109.8 5 Axos Financial Inc. CA AX NYSE 9,810 2,003 12.7 220.2 6 Opus Bank CA OPB NASDAQ 7,688 791 30.0 121.8 7 Farmers & Merchants Bank of Long Beach CA FMBL OTCQB 7,375 1,071 12.4 102.8 8 First Foundation Inc. CA FFWM NASDAQ 6,001 634 14.1 135.1 9 American Business Bank CA AMBZ OTC Pink 2,191 281 14.8 161.5 10 Pacific Mercantile Bancorp CA PMBC NASDAQ 1,399 172 7.5 - 11 Provident Financial Holdings, Inc. CA PROV NASDAQ 1,119 152 30.7 125.3 12 Malaga Financial Corporation CA MLGF OTC Pink 1,117 167 11.2 122.3 Median 7,531 761 13.4 135.1 Market data as of April 30, 2019. Financial data for the most recently reported quarter. Peer P/E ratio uses LTM EPS. Source: SNL Financial (1) Defined as banks with shares listed on the NYSE, NASDAQ or OTC exchanges, excludes ethnically focused banking institutions, sorted by total assets 24

Enhanced Scarcity Value in the Western U.S. Listed below are banks headquartered in the West with assets between $5B and $25B (1) . PPBI ranks 2nd when measured by total assets for banks headquartered in Southern California… and 8th more broadly across the continental Western U.S. Total Market Price to Price to Assets Cap. Earnings TBV Company Name State Ticker Exchange ($M) ($M) (x) (%) 1 PacWest Bancorp CA PACW NASDAQ 26,324 4,754 10.7 217.1 2 Western Alliance Bancorporation AZ WAL NYSE 23,793 4,943 11.0 206.1 (2) (2) 3 Washington Federal, Inc. WA WAFD NASDAQ 16,435 2,666 13.2 157.4 4 First Interstate BancSystem, Inc. MT FIBK NASDAQ 13,498 1,808 15.0 232.0 5 Columbia Banking System, Inc. WA COLB NASDAQ 13,064 2,731 15.4 215.8 6 Glacier Bancorp, Inc. MT GBCI NASDAQ 12,074 3,602 18.8 296.8 7 Banner Corporation WA BANR NASDAQ 11,730 1,862 12.6 163.3 8 Pacific Premier Bancorp, Inc. CA PPBI NASDAQ 11,580 1,825 11.5 165.6 9 CVB Financial Corp. CA CVBF NASDAQ 11,305 3,038 16.7 258.9 10 Banc of California, Inc. CA BANC NYSE 9,887 731 33.7 109.8 11 Axos Financial Inc. CA AX NYSE 9,810 2,003 12.7 220.2 12 Opus Bank CA OPB NASDAQ 7,688 791 30.0 121.8 13 HomeStreet, Inc. WA HMST NASDAQ 7,042 761 19.1 106.8 14 Westamerica Bancorporation CA WABC NASDAQ 5,556 1,727 23.4 323.8 Median 11,655 1,932 15.2 211.0 Market data as of April 30, 2019. Financial data for the most recently reported quarter. Peer P/E ratio uses LTM EPS. Source: SNL Financial (1) Defined as banks headquartered in AZ, CA, ID, OR, MT, WA and WY with shares listed on the NYSE or NASDAQ exchanges, excludes ethnically focused banking institutions, sorted by total assets 25

Key Investment Highlights Building Long-term Franchise Value . Proven track record of executing on acquisitions and organic growth . Well-positioned to evaluate attractive acquisition opportunities . Continue to drive economies of scale and operating leverage . Strong profitability drives capital return to shareholders . Ability to integrate business lines that generate higher risk adjusted returns 26

InvestorAppendix Presentation Material

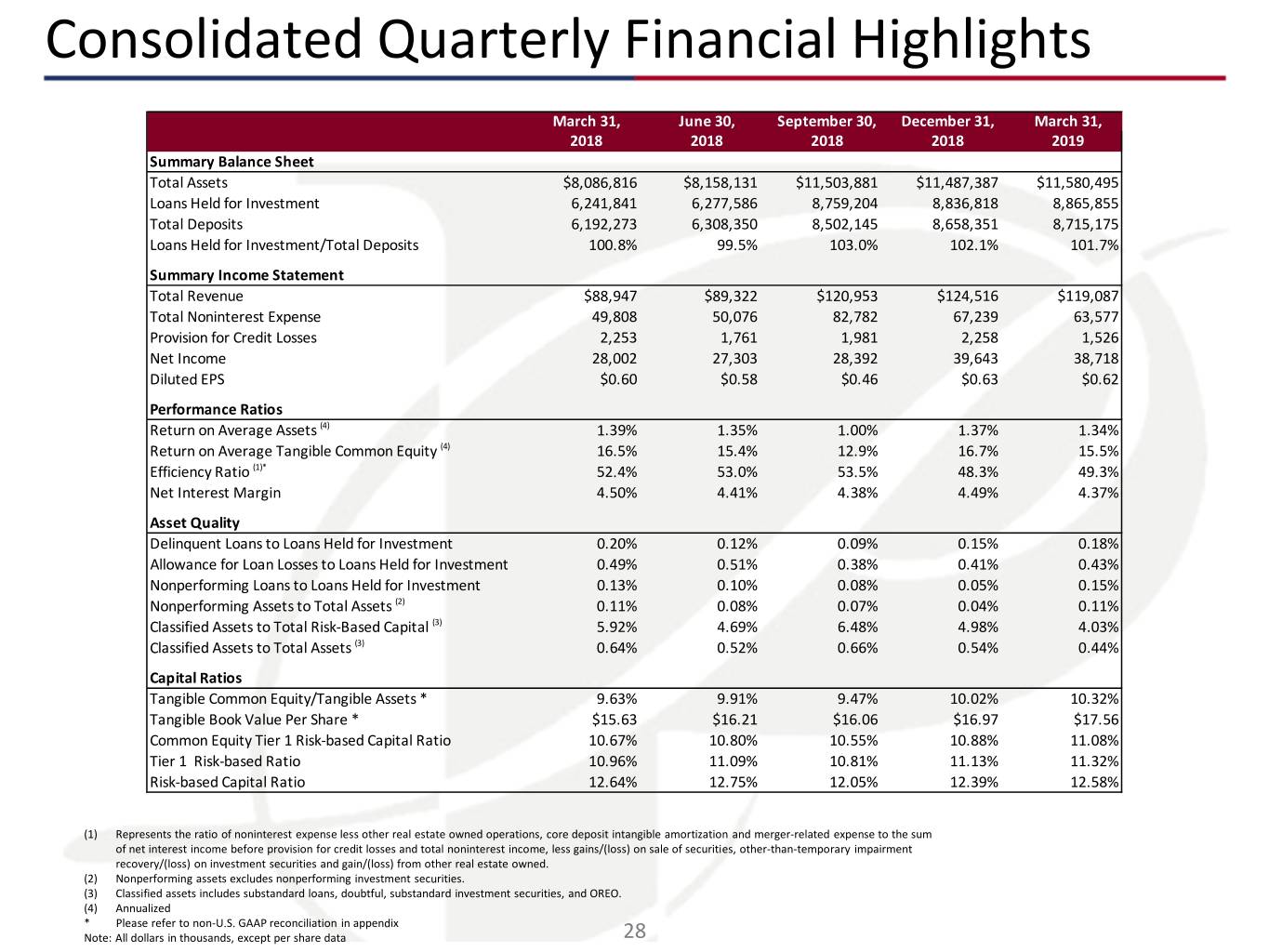

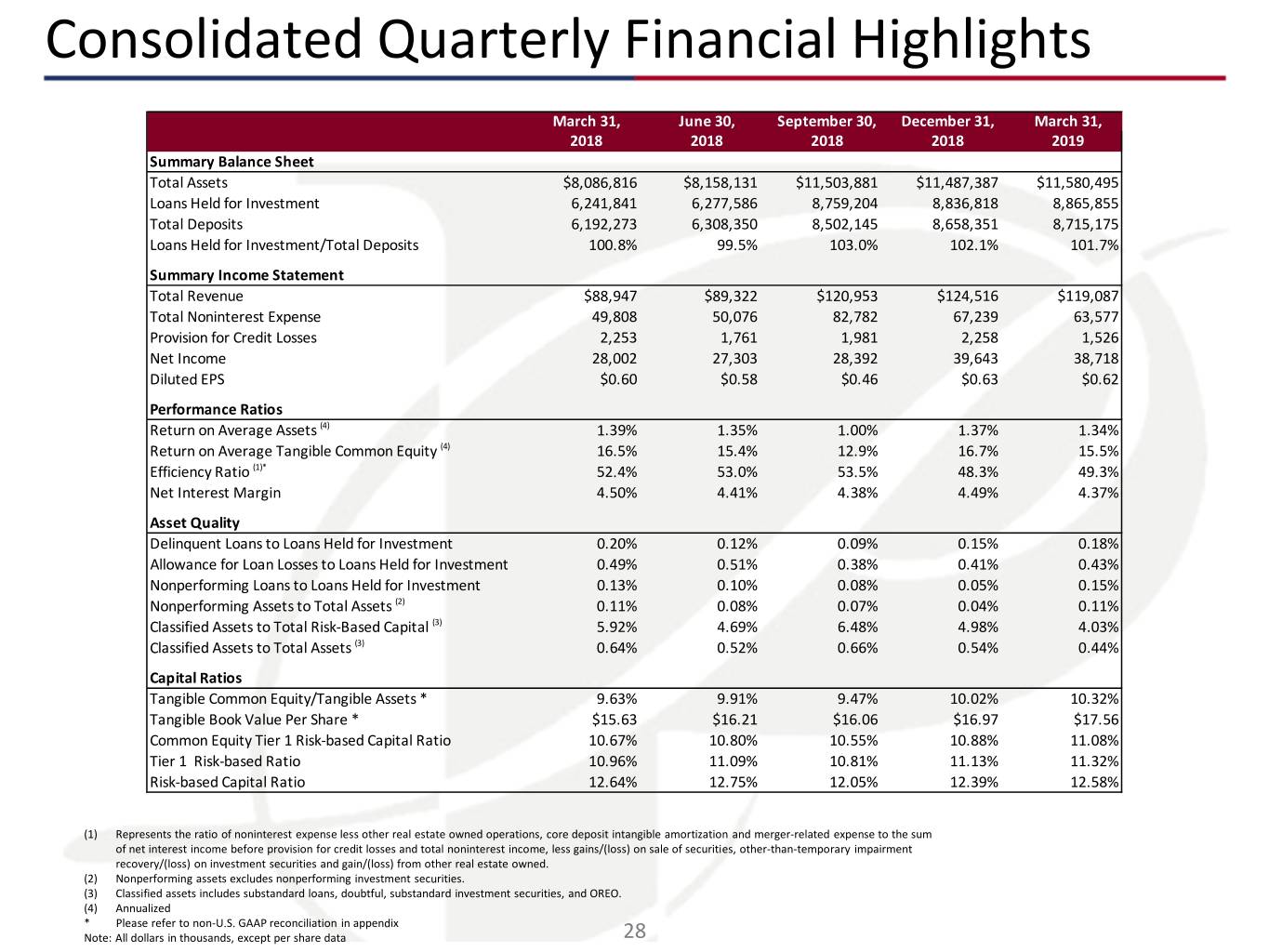

Consolidated Quarterly Financial Highlights March 31, June 30, September 30, December 31, March 31, 2018 2018 2018 2018 2019 Summary Balance Sheet Total Assets $8,086,816 $8,158,131 $11,503,881 $11,487,387 $11,580,495 Loans Held for Investment 6,241,841 6,277,586 8,759,204 8,836,818 8,865,855 Total Deposits 6,192,273 6,308,350 8,502,145 8,658,351 8,715,175 Loans Held for Investment/Total Deposits 100.8% 99.5% 103.0% 102.1% 101.7% Summary Income Statement Total Revenue $88,947 $89,322 $120,953 $124,516 $119,087 Total Noninterest Expense 49,808 50,076 82,782 67,239 63,577 Provision for Credit Losses 2,253 1,761 1,981 2,258 1,526 Net Income 28,002 27,303 28,392 39,643 38,718 Diluted EPS $0.60 $0.58 $0.46 $0.63 $0.62 Performance Ratios Return on Average Assets (4) 1.39% 1.35% 1.00% 1.37% 1.34% Return on Average Tangible Common Equity (4) 16.5% 15.4% 12.9% 16.7% 15.5% Efficiency Ratio (1)* 52.4% 53.0% 53.5% 48.3% 49.3% Net Interest Margin 4.50% 4.41% 4.38% 4.49% 4.37% Asset Quality Delinquent Loans to Loans Held for Investment 0.20% 0.12% 0.09% 0.15% 0.18% Allowance for Loan Losses to Loans Held for Investment 0.49% 0.51% 0.38% 0.41% 0.43% Nonperforming Loans to Loans Held for Investment 0.13% 0.10% 0.08% 0.05% 0.15% Nonperforming Assets to Total Assets (2) 0.11% 0.08% 0.07% 0.04% 0.11% Classified Assets to Total Risk-Based Capital (3) 5.92% 4.69% 6.48% 4.98% 4.03% Classified Assets to Total Assets (3) 0.64% 0.52% 0.66% 0.54% 0.44% Capital Ratios Tangible Common Equity/Tangible Assets * 9.63% 9.91% 9.47% 10.02% 10.32% Tangible Book Value Per Share * $15.63 $16.21 $16.06 $16.97 $17.56 Common Equity Tier 1 Risk-based Capital Ratio 10.67% 10.80% 10.55% 10.88% 11.08% Tier 1 Risk-based Ratio 10.96% 11.09% 10.81% 11.13% 11.32% Risk-based Capital Ratio 12.64% 12.75% 12.05% 12.39% 12.58% (1) Represents the ratio of noninterest expense less other real estate owned operations, core deposit intangible amortization and merger-related expense to the sum of net interest income before provision for credit losses and total noninterest income, less gains/(loss) on sale of securities, other-than-temporary impairment recovery/(loss) on investment securities and gain/(loss) from other real estate owned. (2) Nonperforming assets excludes nonperforming investment securities. (3) Classified assets includes substandard loans, doubtful, substandard investment securities, and OREO. (4) Annualized * Please refer to non-U.S. GAAP reconciliation in appendix Note: All dollars in thousands, except per share data 28

Non-U.S. GAAP Financial Measures Tangible common equity to tangible assets (the "tangible common equity ratio") and tangible book value per share are a non-U.S. GAAP financial measures derived from U.S. GAAP-based amounts. We calculate the tangible common equity ratio by excluding the balance of intangible assets from common stockholders' equity and dividing by tangible assets. We calculate tangible book value per share by dividing tangible common equity by common shares outstanding, as compared to book value per common share, which we calculate by dividing common stockholders’ equity by common shares outstanding. We believe that this information is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of risk-based capital ratios. Accordingly, we believe that these non-U.S. GAAP financial measures provide information that is important to investors and that is useful in understanding our capital position and ratios. However, these non-U.S. GAAP financial measures are supplemental and are not a substitute for an analysis based on U.S. GAAP measures. As other companies may use different calculations for these measures, this presentation may not be comparable to other similarly titled measures reported by other companies. A reconciliation of the non-U.S. GAAP measure of tangible common equity ratio to the U.S. GAAP measure of common equity ratio and tangible book value per share to the U.S. GAAP measure of book value per share are set forth below. December 31, December 31, December 31, December 31, December 31, December 31, March 31, 2013 2014 2015 2016 2017 2018 2019 Total stockholders' equity $ 175,226 $ 199,592 $ 298,980 $ 459,740 $ 1,241,996 $ 1,969,697 $ 2,007,064 Less: Intangible assets (24,056) (28,564) (58,002) (111,941) (536,343) (909,282) (904,846) Tangible common equity $ 151,170 $ 171,028 $ 240,978 $ 347,799 $ 705,653 $ 1,060,415 $ 1,102,218 Total assets $ 1,714,187 $ 2,037,731 $ 2,789,599 $ 4,036,311 $ 8,024,501 $ 11,487,387 $ 11,580,495 Less: Intangible assets (24,056) (28,564) (58,002) (111,941) (536,343) (909,282) (904,846) Tangible assets $ 1,690,131 $ 2,009,167 $ 2,731,597 $ 3,924,370 $ 7,488,158 $ 10,578,105 $ 10,675,649 Common Equity ratio 10.22% 9.79% 10.72% 11.39% 15.48% 17.15% 17.33% Less: Intangible equity ratio (1.28%) (1.28%) (1.90%) (2.53%) (6.06%) (7.13%) (7.01%) Tangible common equity ratio 8.94% 8.51% 8.82% 8.86% 9.42% 10.02% 10.32% Basic shares outstanding 16,656,279 16,903,884 21,570,746 27,798,283 46,245,050 62,480,755 62,773,299 Book value per share $ 10.52 $ 11.81 $ 13.86 $ 16.54 $ 26.86 $ 31.52 $ 31.97 Less: Intangible book value per share (1.44) (1.69) (2.69) (4.03) (11.60) (14.55) (14.41) Tangible book value per share $ 9.08 $ 10.12 $ 11.17 $ 12.51 $ 15.26 $ 16.97 $ 17.56 Note: All dollars in thousands, except per share data 29

Non-U.S. GAAP Financial Measures For quarter period presented below, adjusted net income and adjusted diluted earnings per share are non-U.S. GAAP financial measures derived from U.S. GAAP-based amounts. We calculate these figures by excluding merger related expenses and DTA revaluations in the period results. Management believes that the exclusion of such items from these financial measures provides useful information to an understanding of the operating results of our core business. For the quarter period presented below, adjusted net income for return on average tangible common equity and average tangible common equity are non-U.S. GAAP financial measures derived from U.S. GAAP-based amounts. We calculate return on average tangible common equity by adjusting net income for the effect of CDI amortization and exclude the average CDI and average goodwill from the average stockholders' equity during the period. We calculate adjusted return on average tangible common equity by adjusting net income for the effect of CDI amortization and merger related expense and exclude the average CDI and average goodwill from the average stockholders' equity during the period. We believe that this is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of risk-based capital ratios. Accordingly, we believe that these non-U.S. GAAP financial measures provide information that is important to investors and that is useful in understanding our capital position and ratios. However, these non-U.S. GAAP financial measures are supplemental and are not a substitute for an analysis based on U.S. GAAP measures. As other companies may use different calculations for these adjusted measures, this presentation may not be comparable to other similarly titled adjusted measures reported by other companies. A reconciliation of the non-U.S. GAAP measures of return on average tangible common equity and adjusted return on average tangible common equity to the U.S. GAAP measure of return on common stockholders’ equity is set forth below. March 31, 2019 Net Income $38,718 Add: DTA revaluation - Add: Merger-related expense 655 Less: Merger-related expense tax adjustment (190) Operating net income $39,183 Less: Net income allocated to participating securities (347) Operating net income for earnings per share(2) $38,836 Weighted average shares outstanding - diluted 62,285,783 Diluted earnings per share $0.62 Average assets $11,563,529 Operating return on average assets(1) 1.36% Operating net income $39,183 Add: CDI amortization 4,436 Less: CDI amortization expense tax adjustment (1,288) Operating net income for return on average tangible common equity $42,331 Average stockholders' equity $1,991,861 Less: Average core deposit intangible 98,984 Less: Average goodwill 808,726 Average tangible common equity $1,084,151 Operating return on average tangible common equity(1) 15.62% Note: All dollars in thousands, except per share data (1) Annualized (2) EPS presented using the two-class method beginning Q1 2019 30

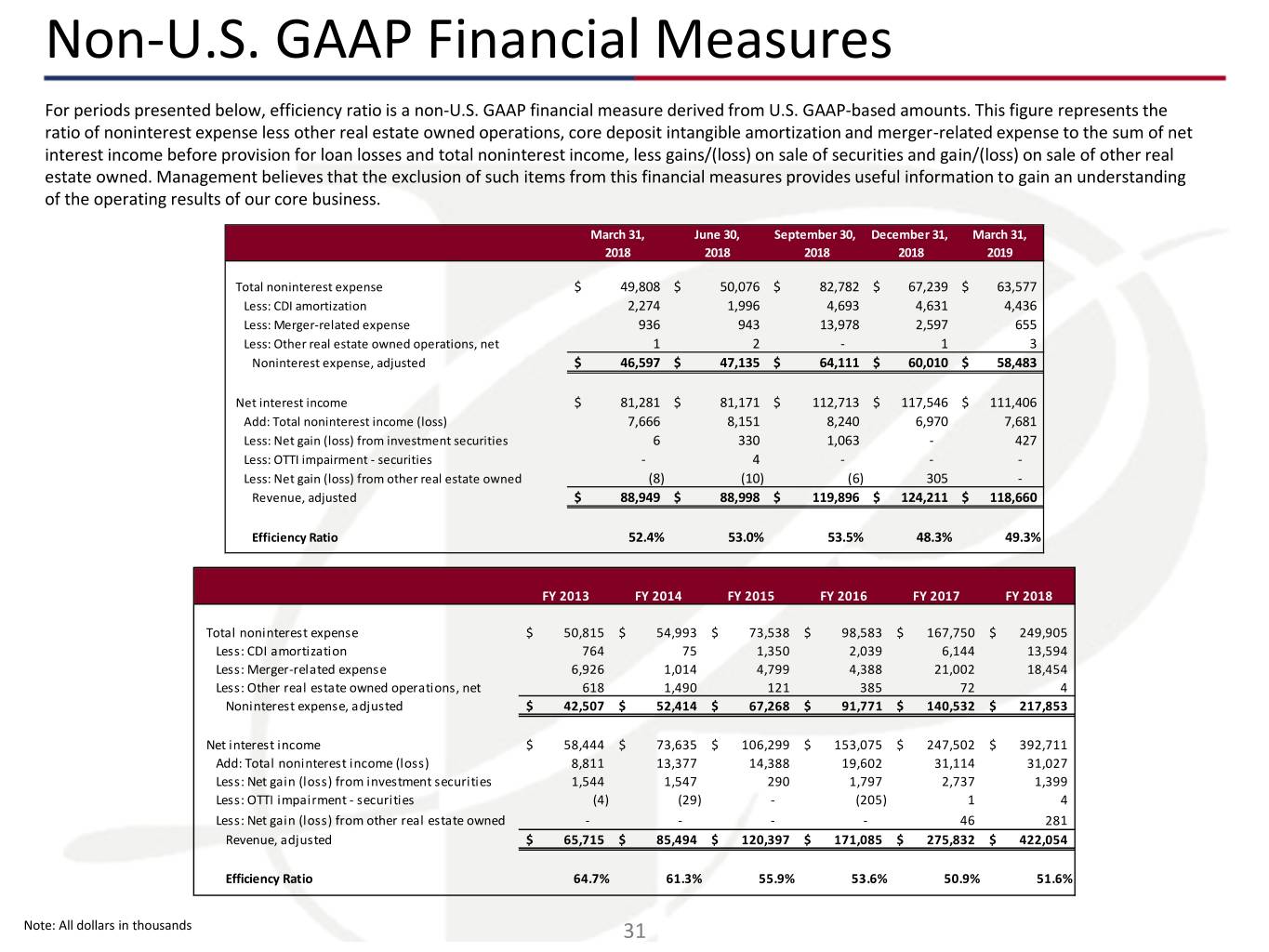

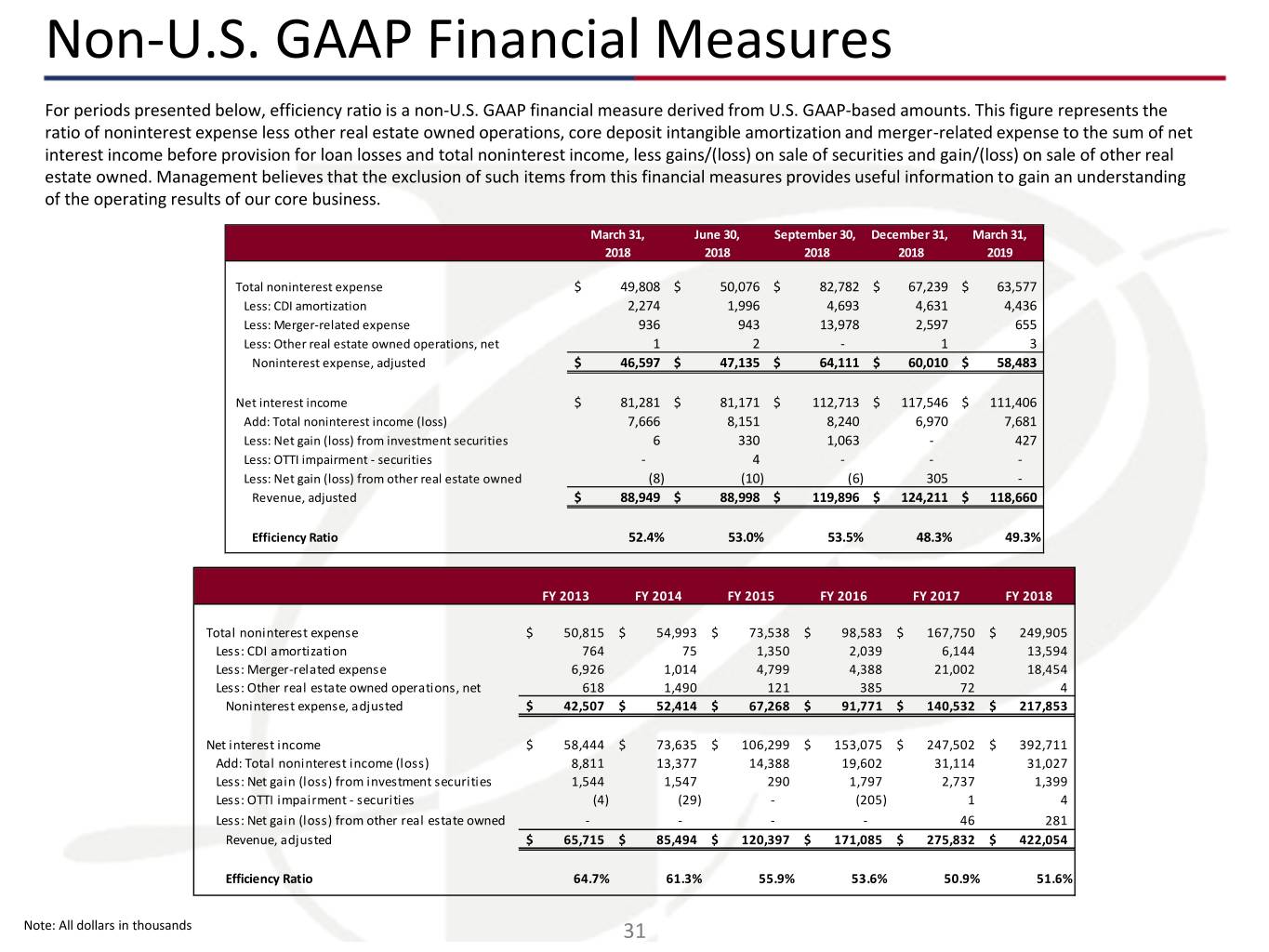

Non-U.S. GAAP Financial Measures For periods presented below, efficiency ratio is a non-U.S. GAAP financial measure derived from U.S. GAAP-based amounts. This figure represents the ratio of noninterest expense less other real estate owned operations, core deposit intangible amortization and merger-related expense to the sum of net interest income before provision for loan losses and total noninterest income, less gains/(loss) on sale of securities and gain/(loss) on sale of other real estate owned. Management believes that the exclusion of such items from this financial measures provides useful information to gain an understanding of the operating results of our core business. March 31, June 30, September 30, December 31, March 31, 2018 2018 2018 2018 2019 Total noninterest expense $ 49,808 $ 50,076 $ 82,782 $ 67,239 $ 63,577 Less: CDI amortization 2,274 1,996 4,693 4,631 4,436 Less: Merger-related expense 936 943 13,978 2,597 655 Less: Other real estate owned operations, net 1 2 - 1 3 Noninterest expense, adjusted $ 46,597 $ 47,135 $ 64,111 $ 60,010 $ 58,483 Net interest income $ 81,281 $ 81,171 $ 112,713 $ 117,546 $ 111,406 Add: Total noninterest income (loss) 7,666 8,151 8,240 6,970 7,681 Less: Net gain (loss) from investment securities 6 330 1,063 - 427 Less: OTTI impairment - securities - 4 - - - Less: Net gain (loss) from other real estate owned (8) (10) (6) 305 - Revenue, adjusted $ 88,949 $ 88,998 $ 119,896 $ 124,211 $ 118,660 Efficiency Ratio 52.4% 53.0% 53.5% 48.3% 49.3% FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 Total noninterest expense $ 50,815 $ 54,993 $ 73,538 $ 98,583 $ 167,750 $ 249,905 Less: CDI amortization 764 75 1,350 2,039 6,144 13,594 Less: Merger-related expense 6,926 1,014 4,799 4,388 21,002 18,454 Less: Other real estate owned operations, net 618 1,490 121 385 72 4 Noninterest expense, adjusted $ 42,507 $ 52,414 $ 67,268 $ 91,771 $ 140,532 $ 217,853 Net interest income $ 58,444 $ 73,635 $ 106,299 $ 153,075 $ 247,502 $ 392,711 Add: Total noninterest income (loss) 8,811 13,377 14,388 19,602 31,114 31,027 Less: Net gain (loss) from investment securities 1,544 1,547 290 1,797 2,737 1,399 Less: OTTI impairment - securities (4) (29) - (205) 1 4 Less: Net gain (loss) from other real estate owned - - - - 46 281 Revenue, adjusted $ 65,715 $ 85,494 $ 120,397 $ 171,085 $ 275,832 $ 422,054 Efficiency Ratio 64.7% 61.3% 55.9% 53.6% 50.9% 51.6% Note: All dollars in thousands 31