Investor Presentation Fourth Quarter 2024 January 23, 2025 Ronald J. Nicolas, Jr. Sr. EVP & Chief Financial Officer rnicolas@ppbi.com 949-864-8000 Steve Gardner Chairman, Chief Executive Officer, & President sgardner@ppbi.com 949-864-8000

2 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved FORWARD LOOKING STATEMENTS AND WHERE TO FIND MORE INFORMATION Forward Looking Statements This investor presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and the future performance of Pacific Premier Bancorp, Inc. (“PPBI” or the “Company”), including its wholly-owned subsidiary Pacific Premier Bank, N.A. (“Pacific Premier” or the “Bank”). Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “could,” “may,” “should,” “will” or other similar words and expressions are intended to identify these forward-looking statements. These forward-looking statements are based on PPBI’s current expectations and beliefs concerning future developments and their potential effects on the Company including, without limitation, the strength of the United States (“U.S.”) economy in general and the strength of the local economies in which we conduct operations; adverse developments in the banking industry and the potential impact of such developments on customer confidence, liquidity, and regulatory responses to these developments; the effects of, and changes in, trade, monetary, and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; interest rate, liquidity, economic, market, credit, operational, and inflation risks associated with our business, including the speed and predictability of changes in these risks; our ability to attract and retain deposits and access to other sources of liquidity, particularly in a rising or high interest rate environment, and the quality and composition of our deposits; business and economic conditions generally and in the financial services industry, nationally and within our current and future geographic markets, including the tight labor market, ineffective management of the U.S. Federal budget or debt, or turbulence or uncertainty in domestic or foreign financial markets; the effect of acquisitions we have made or may make, including, without limitation, the failure to achieve the expected revenue growth and/or expense savings from such acquisitions, and/or the failure to effectively integrate an acquisition target into our operations; the timely development of competitive new products and services and the acceptance of these products and services by new and existing customers; possible impairment charges to goodwill, including any impairment that may result from increased volatility in our stock price; the impact of changes in financial services policies, laws, and regulations, including those concerning taxes, banking, securities, and insurance, and the application thereof by regulatory bodies; compliance risks, including any increased costs of monitoring, testing, and maintaining compliance with complex laws and regulations; the effectiveness of our risk management framework and quantitative models; the effect of changes in accounting policies and practices or accounting standards, as may be adopted from time-to-time by bank regulatory agencies, the U.S. Securities and Exchange Commission (“SEC”), the Public Company Accounting Oversight Board, the Financial Accounting Standards Board or other accounting standards setters; possible credit-related impairments of securities held by us; changes in the level of our nonperforming assets and charge-offs; the impact of governmental efforts to restructure or adjust the U.S. financial regulatory system; the impact of recent or future changes in the FDIC insurance assessment rate or the rules and regulations related to the calculation of the FDIC insurance assessment amount, including any special assessments; changes in consumer spending, borrowing, and savings habits; the effects of concentrations in our loan portfolio, including commercial real estate and the risks of geographic and industry concentrations; the possibility that we may reduce or discontinue the payments of dividends on our common stock; the possibility that we may discontinue, reduce or otherwise limit the level of repurchases of our common stock we may make from time to time pursuant to our stock repurchase program; changes in the financial performance and/or condition of our borrowers; changes in the competitive environment among financial and bank holding companies and other financial service providers; geopolitical conditions, including acts or threats of terrorism, actions taken by the United States or other governments in response to acts or threats of terrorism, and/or military conflicts, including the war between Russia and Ukraine, conflict in the Middle East, and trade tensions, all of which could impact business and economic conditions in the United States and abroad; public health crises and pandemics, and their effects on the economic and business environments in which we operate, including on our credit quality and business operations, as well as the impact on general economic and financial market conditions; cybersecurity threats and the cost of defending against them; climate change, including the enhanced regulatory, compliance, credit, and reputational risks and costs; natural disasters, earthquakes, fires, and severe weather; direct and indirect costs and impacts on clients, the Company and its employees from the January 2025 Los Angeles County wildfires, including potential adverse changes to the level of our nonperforming assets and charge-offs; unanticipated regulatory or legal proceedings; and our ability to manage the risks involved in the foregoing. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in the Company's 2023 Annual Report on Form 10-K filed with the SEC and available at the SEC’s Internet site (http://www.sec.gov). The Company undertakes no obligation to revise or publicly release any revision or update to these forward-looking statements to reflect events or circumstances that occur after the date on which such statements were made. Non-U.S. GAAP Financial Measures This presentation contains non-U.S. GAAP financial measures. For purposes of Regulation G promulgated by the SEC, a non-U.S. GAAP financial measure is a numerical measure of the registrant’s historical or future financial performance, financial position or cash flows that excludes amounts or is subject to adjustments that have the effect of excluding amounts that are included in the most directly comparable measure calculated and presented in accordance with U.S. GAAP in the statement of income, statement of financial condition or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented in this regard. U.S. GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, PPBI has provided reconciliations within this presentation, as necessary, of the non-U.S GAAP financial measures to the most directly comparable U.S. GAAP financial measures. For more details on PPBI’s non-U.S. GAAP measures, refer to the Appendix in this presentation.

3 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved PRESENTATION CONTENTS Corporate Overview 4 Fourth Quarter Performance Highlights & 2025 Outlook 6 Balance Sheet Highlights 9 Asset Quality & Credit Risk Management 17 Loan Metrics 22 Strategy and Technology 31 Culture and Governance 34 Appendix: Non-GAAP Reconciliation 39

PPBI Corporate Overview

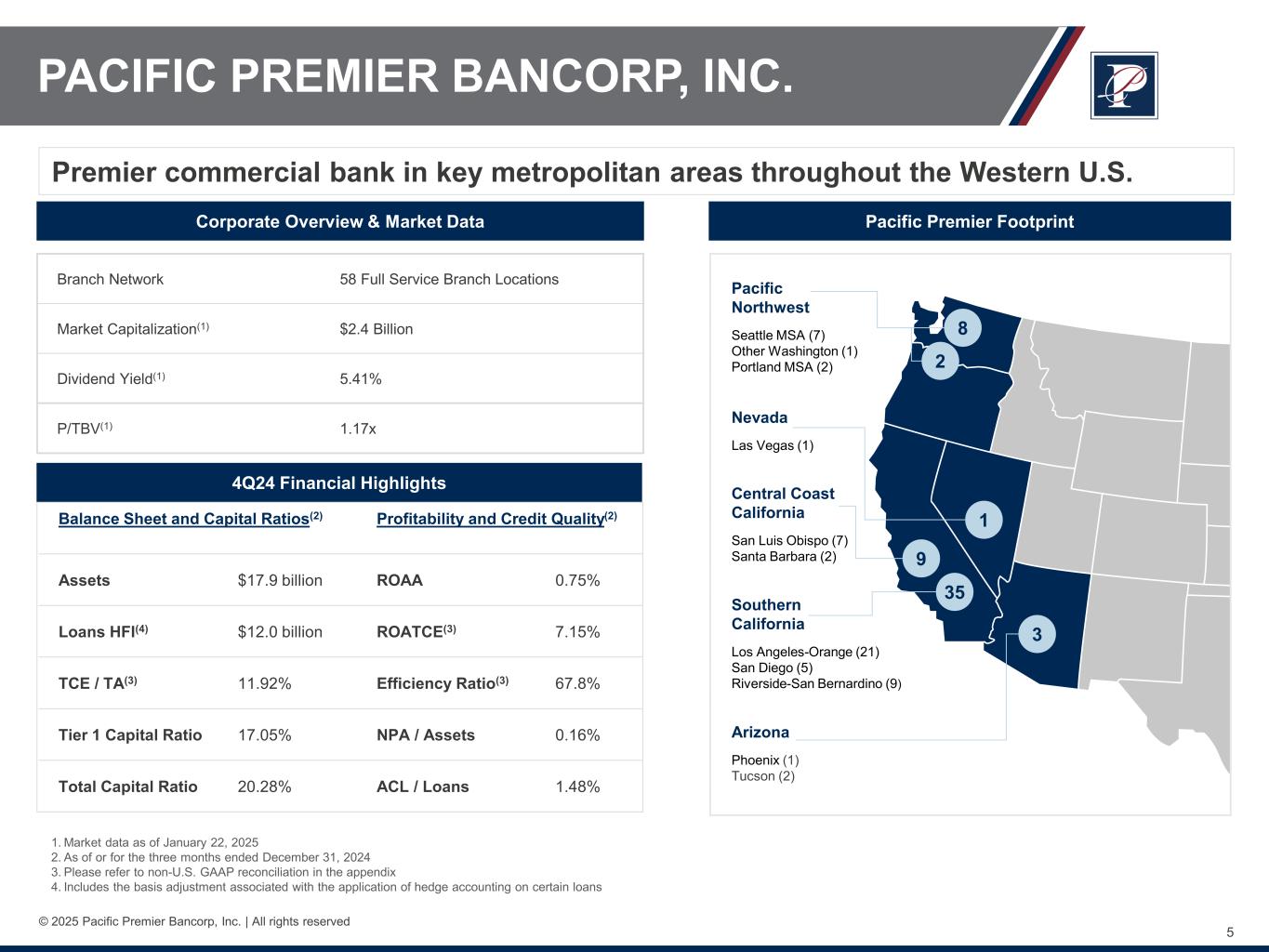

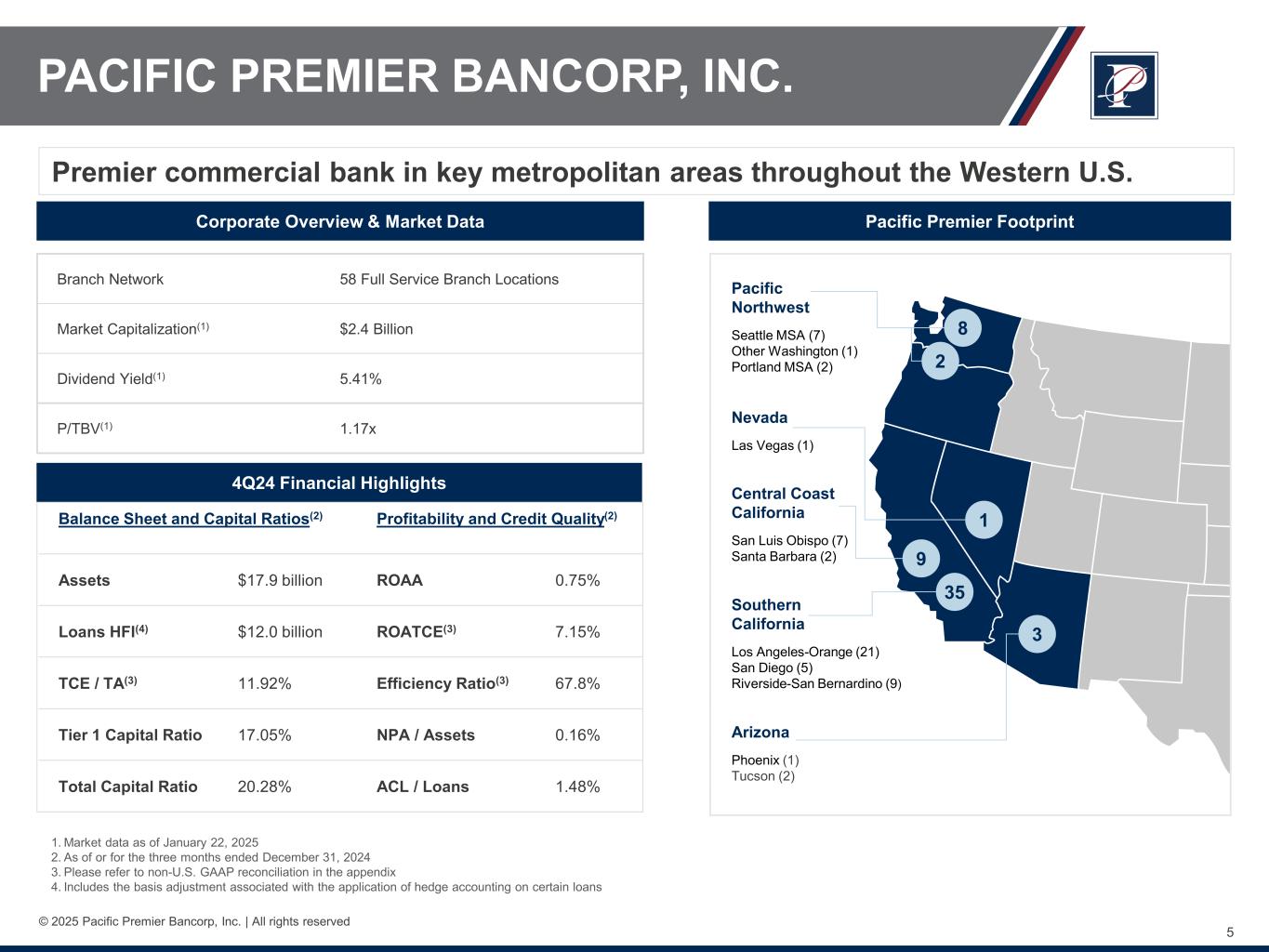

5 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved Balance Sheet and Capital Ratios(2) Profitability and Credit Quality(2) Assets $17.9 billion ROAA 0.75% Loans HFI(4) $12.0 billion ROATCE(3) 7.15% TCE / TA(3) 11.92% Efficiency Ratio(3) 67.8% Tier 1 Capital Ratio 17.05% NPA / Assets 0.16% Total Capital Ratio 20.28% ACL / Loans 1.48% Premier commercial bank in key metropolitan areas throughout the Western U.S. 1. Market data as of January 22, 2025 2. As of or for the three months ended December 31, 2024 3. Please refer to non-U.S. GAAP reconciliation in the appendix 4. Includes the basis adjustment associated with the application of hedge accounting on certain loans 4Q24 Financial Highlights PACIFIC PREMIER BANCORP, INC. Corporate Overview & Market Data Branch Network 58 Full Service Branch Locations Market Capitalization(1) $2.4 Billion Dividend Yield(1) 5.41% P/TBV(1) 1.17x Pacific Premier Footprint 8 2 Arizona Phoenix (1) Tucson (2) 3 Nevada Las Vegas (1) 1 Southern California Los Angeles-Orange (21) San Diego (5) Riverside-San Bernardino (9) 35 Central Coast California San Luis Obispo (7) Santa Barbara (2) 9 Pacific Northwest Seattle MSA (7) Other Washington (1) Portland MSA (2)

Fourth Quarter Performance Highlights & 2025 Outlook

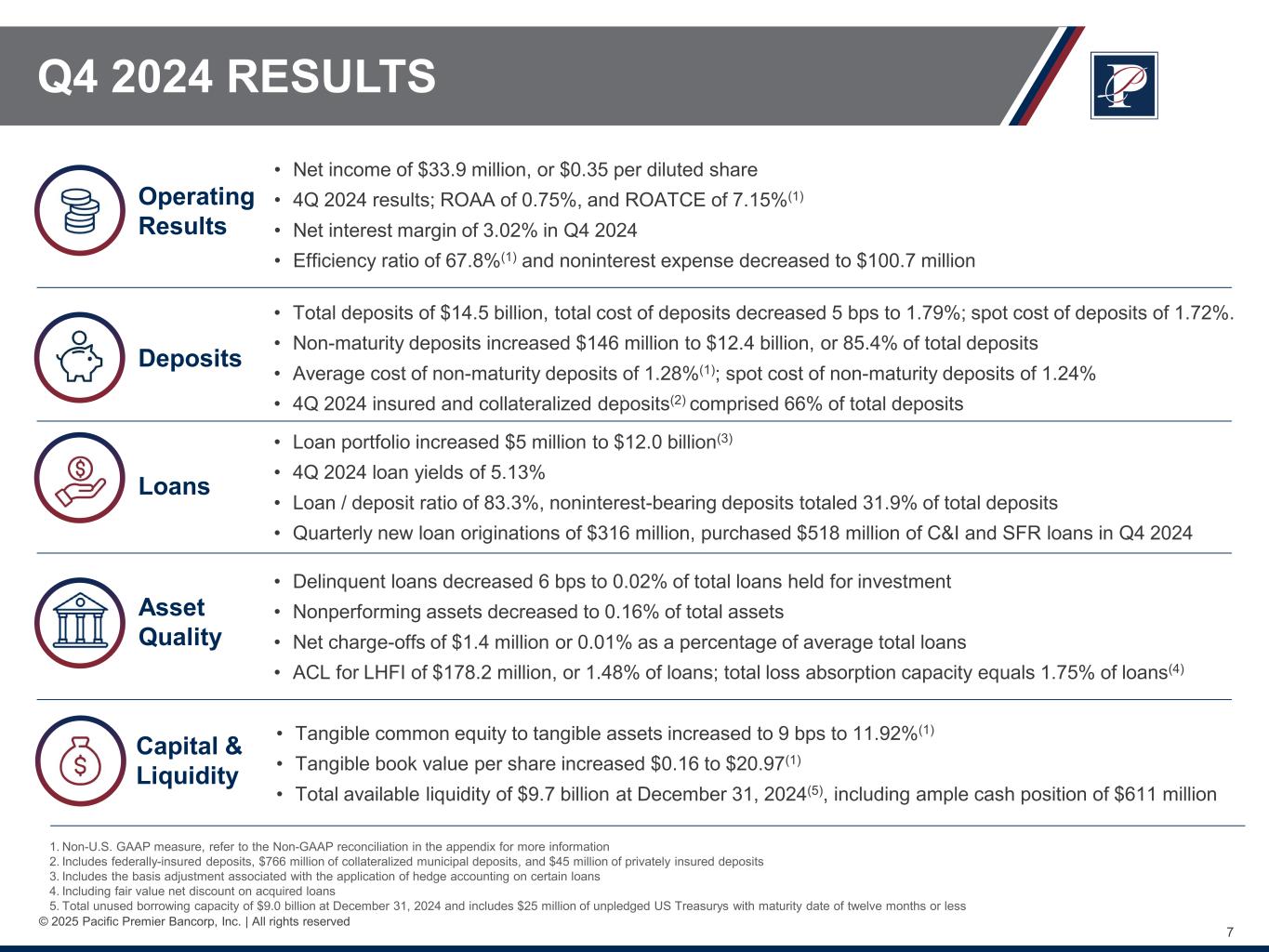

7 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved Q4 2024 RESULTS 1. Non-U.S. GAAP measure, refer to the Non-GAAP reconciliation in the appendix for more information 2. Includes federally-insured deposits, $766 million of collateralized municipal deposits, and $45 million of privately insured deposits 3. Includes the basis adjustment associated with the application of hedge accounting on certain loans 4. Including fair value net discount on acquired loans 5. Total unused borrowing capacity of $9.0 billion at December 31, 2024 and includes $25 million of unpledged US Treasurys with maturity date of twelve months or less Operating Results • Net income of $33.9 million, or $0.35 per diluted share • 4Q 2024 results; ROAA of 0.75%, and ROATCE of 7.15%(1) • Net interest margin of 3.02% in Q4 2024 • Efficiency ratio of 67.8%(1) and noninterest expense decreased to $100.7 million Loans • Loan portfolio increased $5 million to $12.0 billion(3) • 4Q 2024 loan yields of 5.13% • Loan / deposit ratio of 83.3%, noninterest-bearing deposits totaled 31.9% of total deposits • Quarterly new loan originations of $316 million, purchased $518 million of C&I and SFR loans in Q4 2024 Deposits • Total deposits of $14.5 billion, total cost of deposits decreased 5 bps to 1.79%; spot cost of deposits of 1.72%. • Non-maturity deposits increased $146 million to $12.4 billion, or 85.4% of total deposits • Average cost of non-maturity deposits of 1.28%(1); spot cost of non-maturity deposits of 1.24% • 4Q 2024 insured and collateralized deposits(2) comprised 66% of total deposits Capital & Liquidity • Tangible common equity to tangible assets increased to 9 bps to 11.92%(1) • Tangible book value per share increased $0.16 to $20.97(1) • Total available liquidity of $9.7 billion at December 31, 2024(5), including ample cash position of $611 million Asset Quality • Delinquent loans decreased 6 bps to 0.02% of total loans held for investment • Nonperforming assets decreased to 0.16% of total assets • Net charge-offs of $1.4 million or 0.01% as a percentage of average total loans • ACL for LHFI of $178.2 million, or 1.48% of loans; total loss absorption capacity equals 1.75% of loans(4)

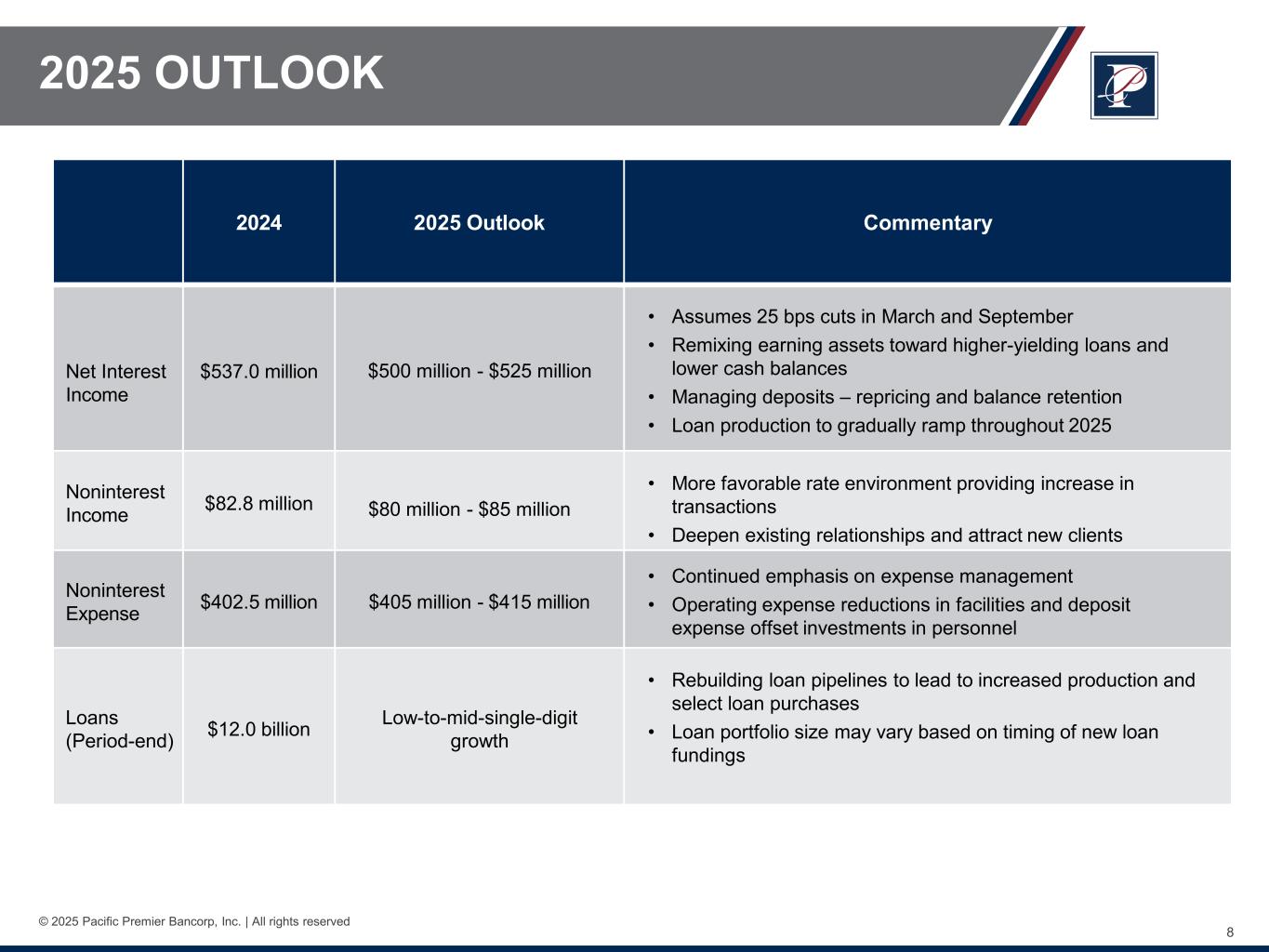

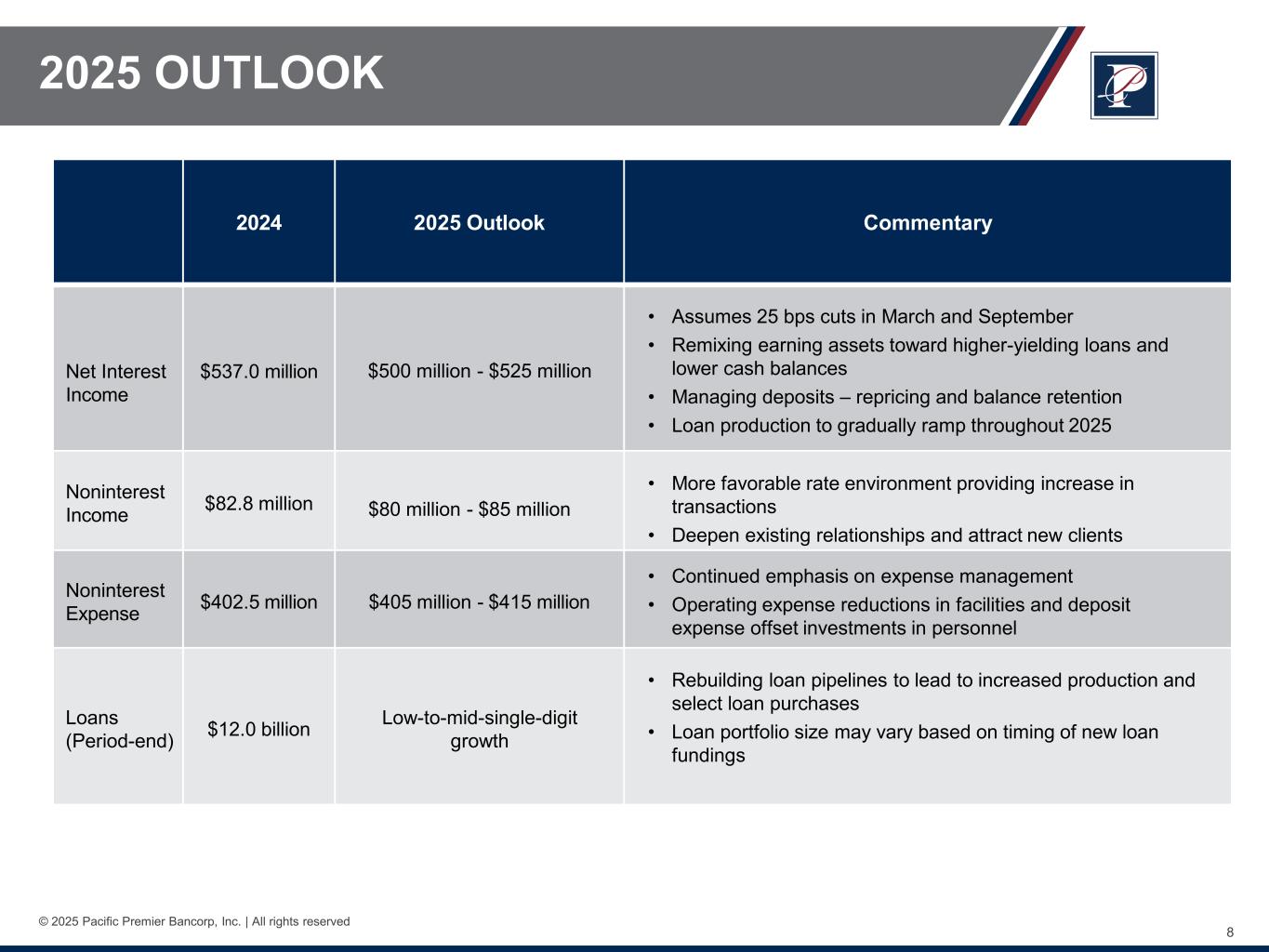

8 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved 2025 OUTLOOK 2024 2025 Outlook Commentary Net Interest Income $537.0 million $500 million - $525 million • Assumes 25 bps cuts in March and September • Remixing earning assets toward higher-yielding loans and lower cash balances • Managing deposits – repricing and balance retention • Loan production to gradually ramp throughout 2025 Noninterest Income $82.8 million $80 million - $85 million • More favorable rate environment providing increase in transactions • Deepen existing relationships and attract new clients Noninterest Expense $402.5 million $405 million - $415 million • Continued emphasis on expense management • Operating expense reductions in facilities and deposit expense offset investments in personnel Loans (Period-end) $12.0 billion Low-to-mid-single-digit growth • Rebuilding loan pipelines to lead to increased production and select loan purchases • Loan portfolio size may vary based on timing of new loan fundings

PPBI Balance Sheet Highlights

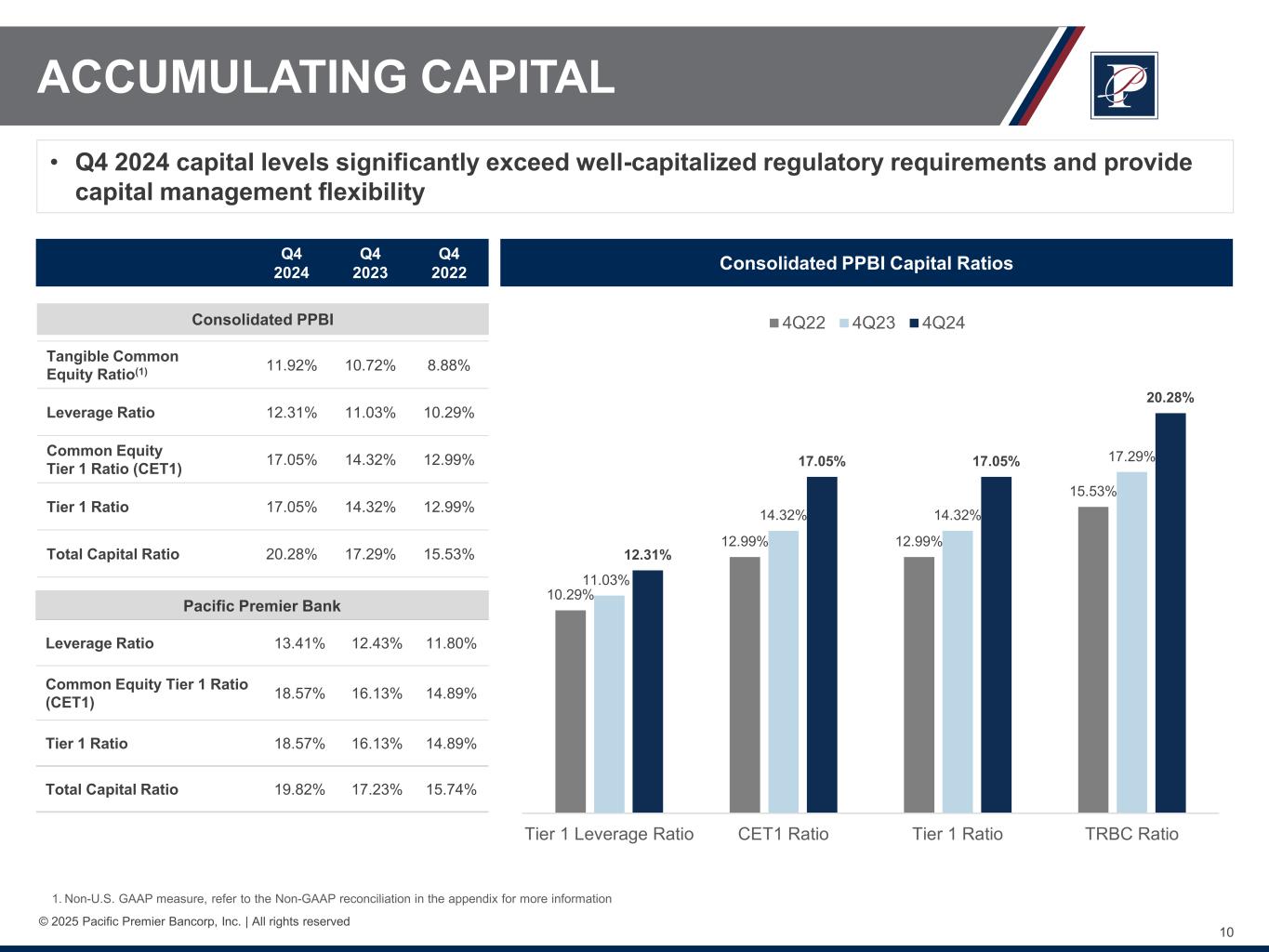

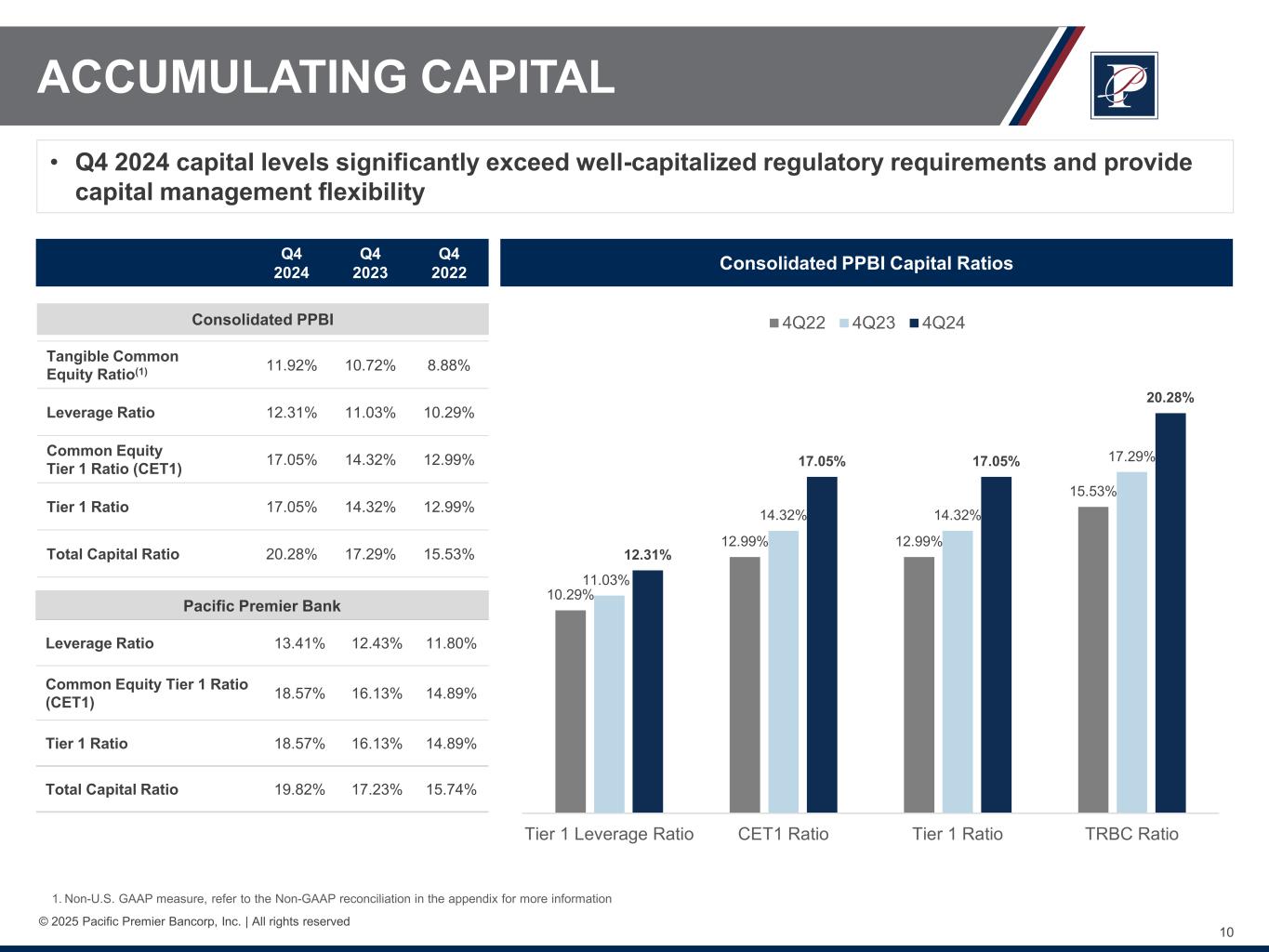

10 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved ACCUMULATING CAPITAL Consolidated PPBI Capital Ratios • Q4 2024 capital levels significantly exceed well-capitalized regulatory requirements and provide capital management flexibility 1. Non-U.S. GAAP measure, refer to the Non-GAAP reconciliation in the appendix for more information Consolidated PPBI Pacific Premier Bank Tangible Common Equity Ratio(1) 11.92% 10.72% 8.88% Leverage Ratio 12.31% 11.03% 10.29% Common Equity Tier 1 Ratio (CET1) 17.05% 14.32% 12.99% Tier 1 Ratio 17.05% 14.32% 12.99% Total Capital Ratio 20.28% 17.29% 15.53% Leverage Ratio 13.41% 12.43% 11.80% Common Equity Tier 1 Ratio (CET1) 18.57% 16.13% 14.89% Tier 1 Ratio 18.57% 16.13% 14.89% Total Capital Ratio 19.82% 17.23% 15.74% Q4 2024 Q4 2023 Q4 2022 10.29% 12.99% 12.99% 15.53% 11.03% 14.32% 14.32% 17.29% 12.31% 17.05% 17.05% 20.28% Tier 1 Leverage Ratio CET1 Ratio Tier 1 Ratio TRBC Ratio 4Q22 4Q23 4Q24

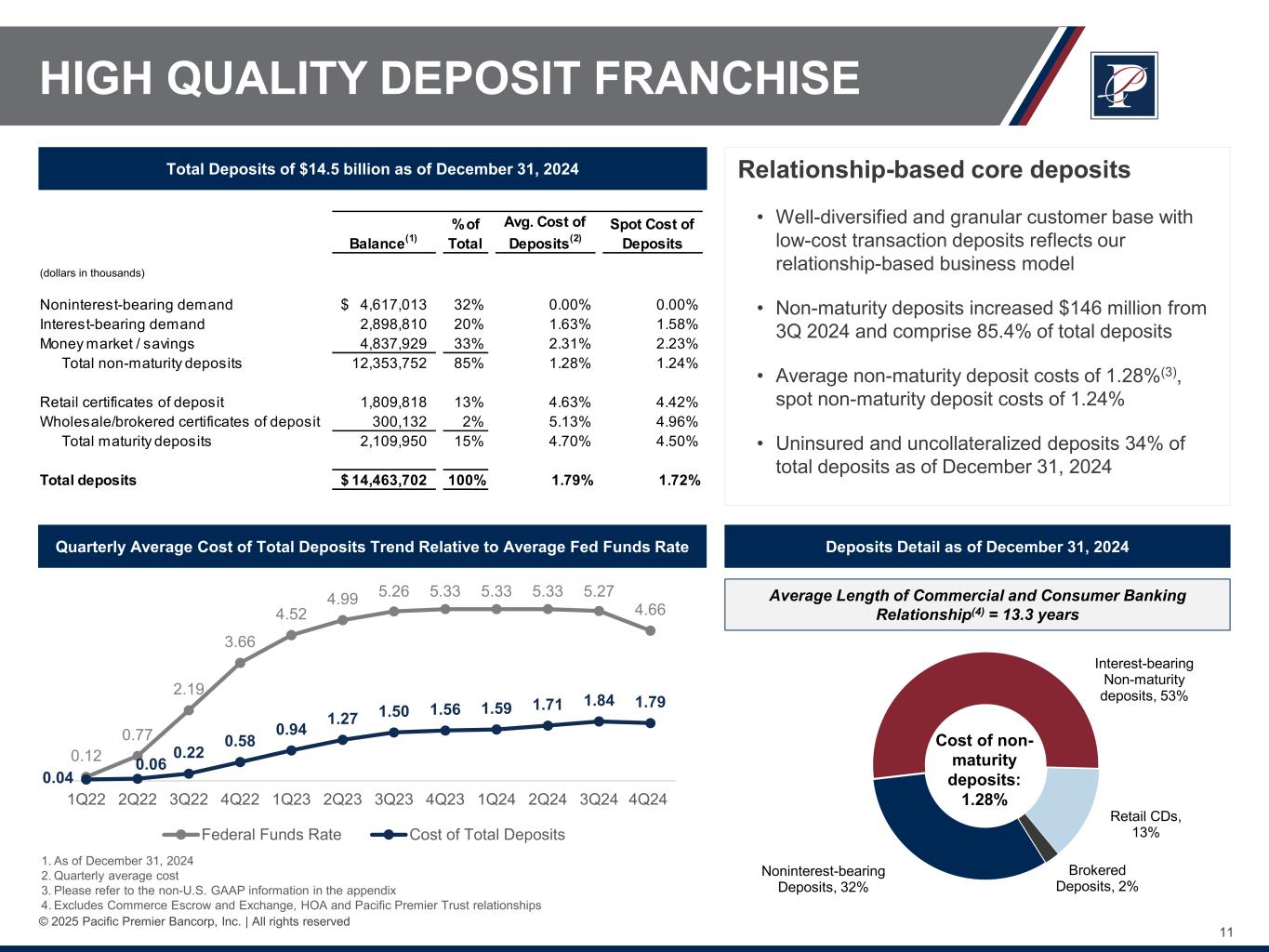

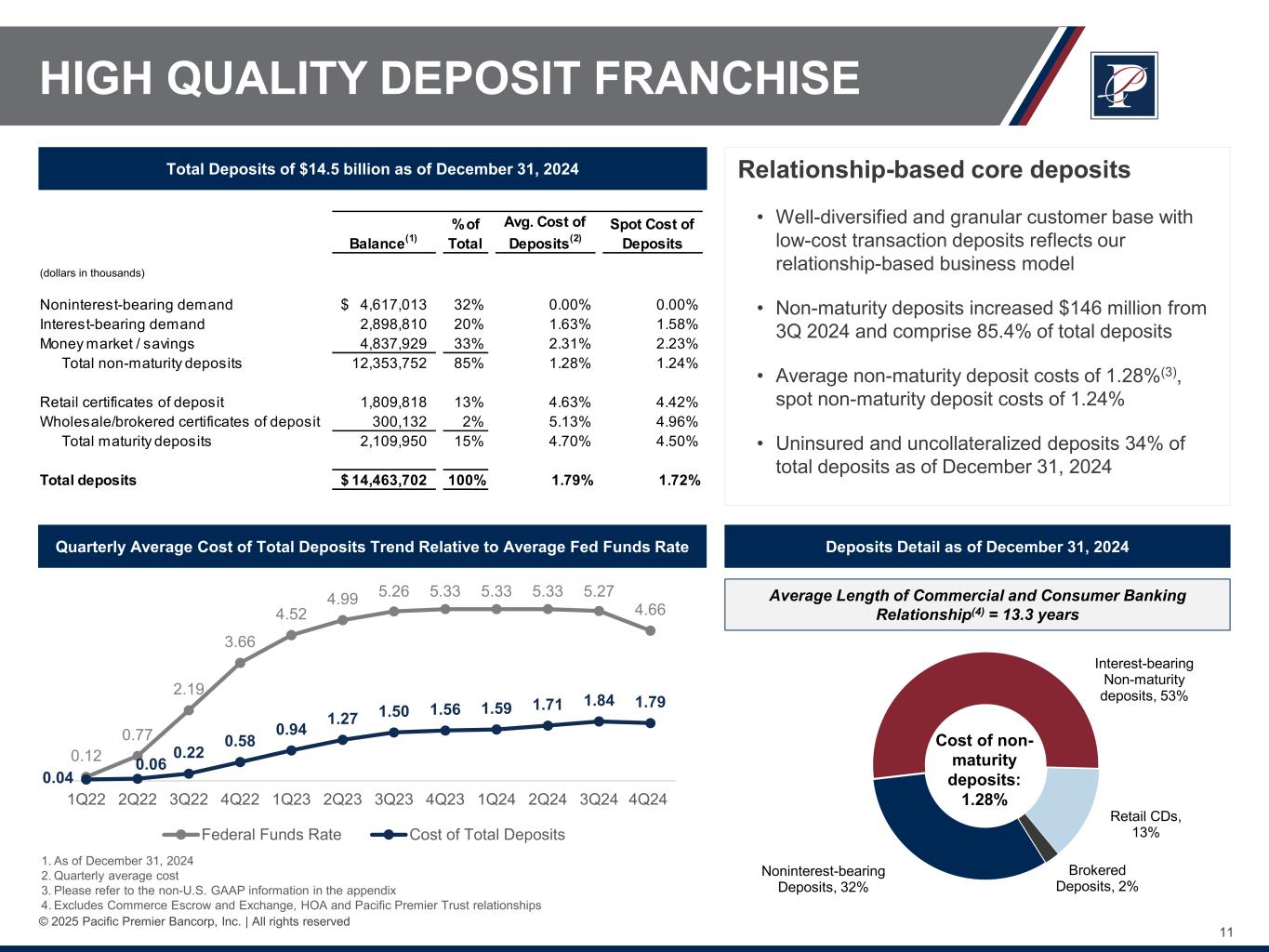

11 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved Noninterest-bearing Deposits, 32% Interest-bearing Non-maturity deposits, 53% Retail CDs, 13% Brokered Deposits, 2% Total Deposits of $14.5 billion as of December 31, 2024 Relationship-based core deposits • Well-diversified and granular customer base with low-cost transaction deposits reflects our relationship-based business model • Non-maturity deposits increased $146 million from 3Q 2024 and comprise 85.4% of total deposits • Average non-maturity deposit costs of 1.28%(3), spot non-maturity deposit costs of 1.24% • Uninsured and uncollateralized deposits 34% of total deposits as of December 31, 2024 HIGH QUALITY DEPOSIT FRANCHISE 1. As of December 31, 2024 2. Quarterly average cost 3. Please refer to the non-U.S. GAAP information in the appendix 4. Excludes Commerce Escrow and Exchange, HOA and Pacific Premier Trust relationships Quarterly Average Cost of Total Deposits Trend Relative to Average Fed Funds Rate Cost of non- maturity deposits: 1.28% Deposits Detail as of December 31, 2024 Average Length of Commercial and Consumer Banking Relationship(4) = 13.3 years Balance(1) % of Total Avg. Cost of Deposits(2) Spot Cost of Deposits (dollars in thousands) Noninterest-bearing demand 4,617,013$ 32% 0.00% 0.00% Interest-bearing demand 2,898,810 20% 1.63% 1.58% Money market / savings 4,837,929 33% 2.31% 2.23% Total non-maturity deposits 12,353,752 85% 1.28% 1.24% Retail certificates of deposit 1,809,818 13% 4.63% 4.42% Wholesale/brokered certificates of deposit 300,132 2% 5.13% 4.96% Total maturity deposits 2,109,950 15% 4.70% 4.50% Total deposits 14,463,702$ 100% 1.79% 1.72% 0.12 0.77 2.19 3.66 4.52 4.99 5.26 5.33 5.33 5.33 5.27 4.66 0.04 0.06 0.22 0.58 0.94 1.27 1.50 1.56 1.59 1.71 1.84 1.79 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 Federal Funds Rate Cost of Total Deposits

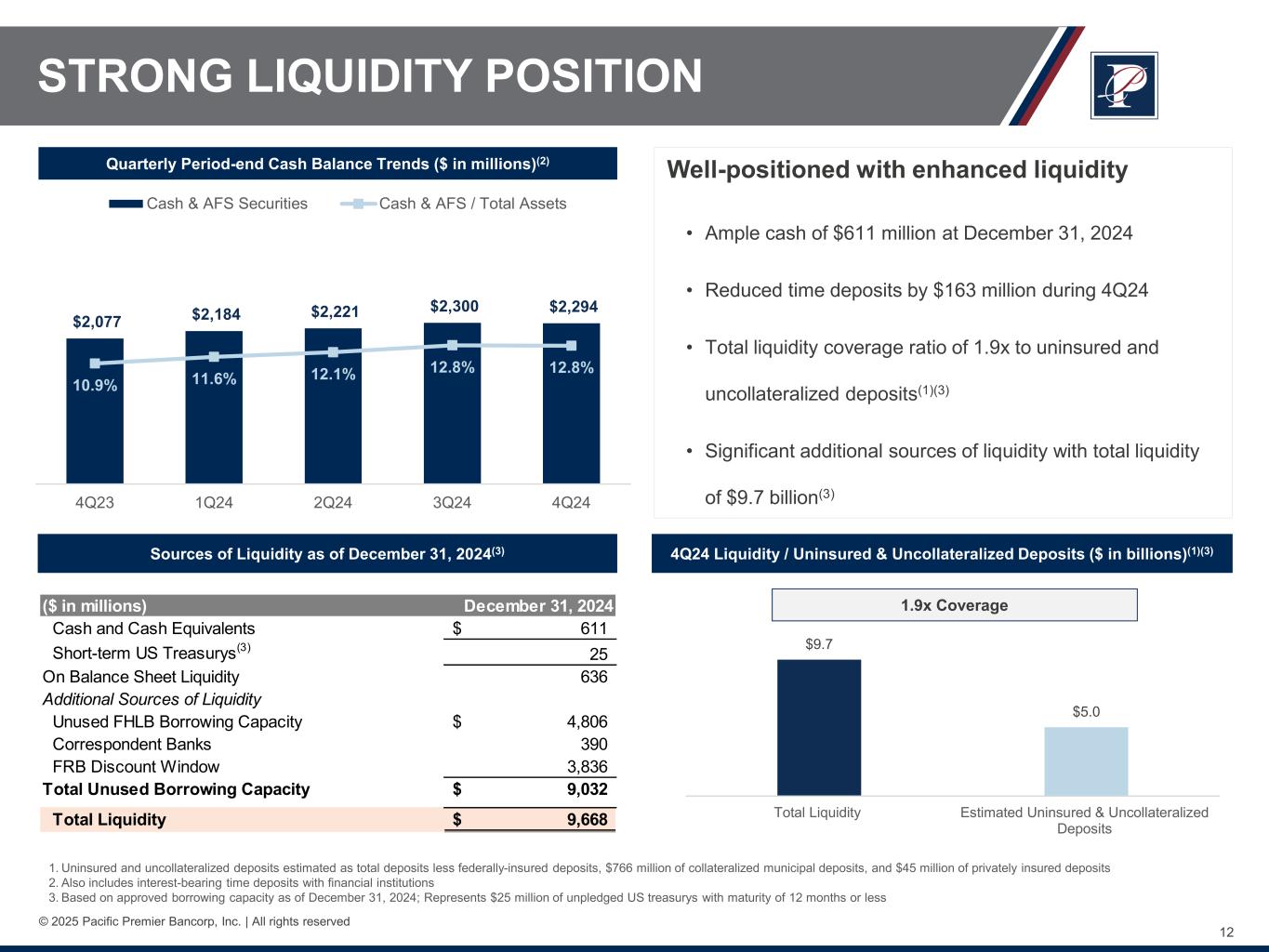

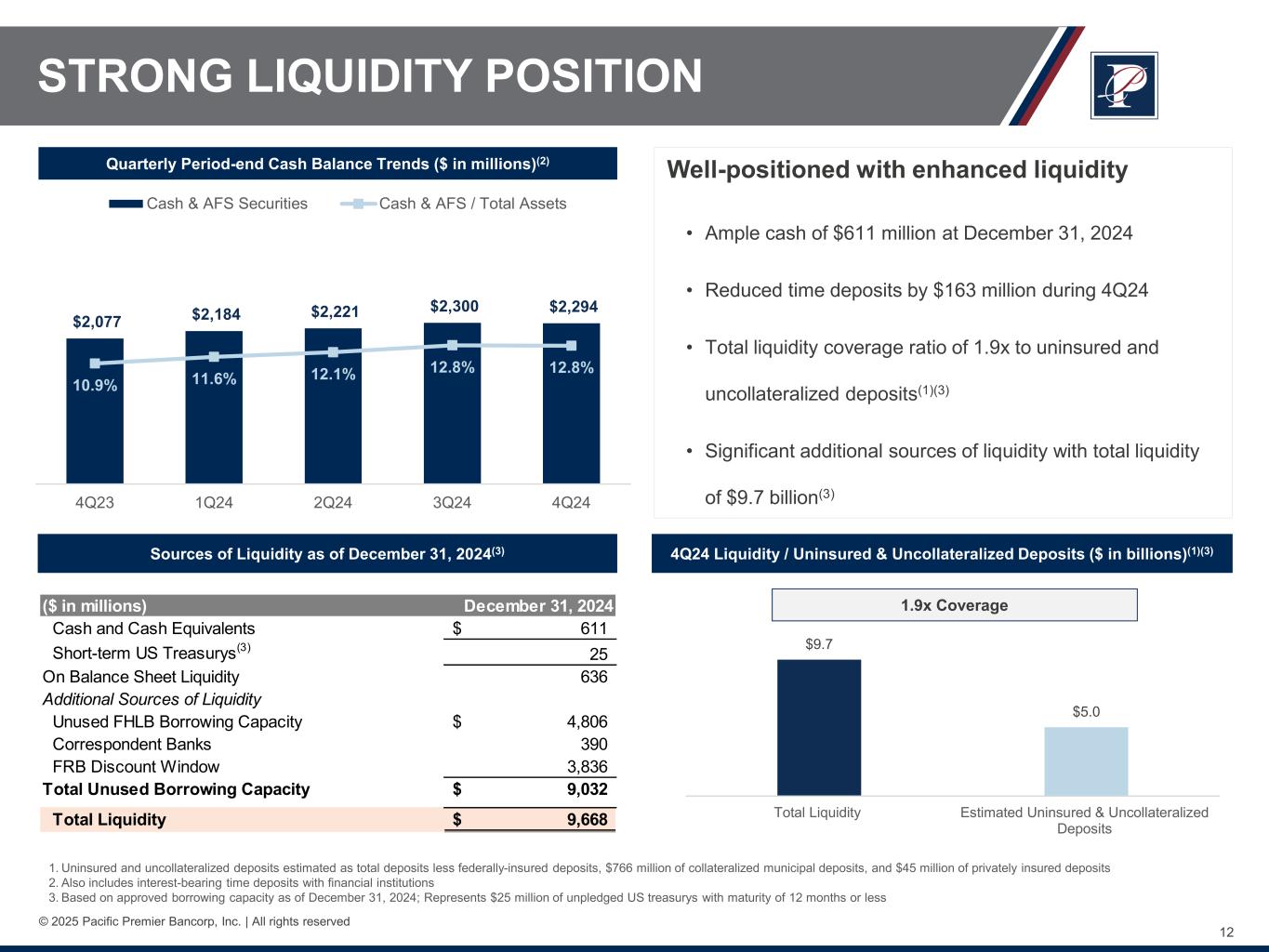

12 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved $9.7 $5.0 Total Liquidity Estimated Uninsured & Uncollateralized Deposits 1. Uninsured and uncollateralized deposits estimated as total deposits less federally-insured deposits, $766 million of collateralized municipal deposits, and $45 million of privately insured deposits 2. Also includes interest-bearing time deposits with financial institutions 3. Based on approved borrowing capacity as of December 31, 2024; Represents $25 million of unpledged US treasurys with maturity of 12 months or less STRONG LIQUIDITY POSITION Quarterly Period-end Cash Balance Trends ($ in millions)(2) Well-positioned with enhanced liquidity • Ample cash of $611 million at December 31, 2024 • Reduced time deposits by $163 million during 4Q24 • Total liquidity coverage ratio of 1.9x to uninsured and uncollateralized deposits(1)(3) • Significant additional sources of liquidity with total liquidity of $9.7 billion(3) Sources of Liquidity as of December 31, 2024(3) 4Q24 Liquidity / Uninsured & Uncollateralized Deposits ($ in billions)(1)(3) 1.9x Coverage $2,077 $2,184 $2,221 $2,300 $2,294 10.9% 11.6% 12.1% 12.8% 12.8% 4Q23 1Q24 2Q24 3Q24 4Q24 Cash & AFS Securities Cash & AFS / Total Assets ($ in millions) December 31, 2024 Cash and Cash Equivalents 611$ Short-term US Treasurys(3) 25 On Balance Sheet Liquidity 636 Additional Sources of Liquidity Unused FHLB Borrowing Capacity 4,806$ Correspondent Banks 390 FRB Discount Window 3,836 Total Unused Borrowing Capacity 9,032$ Total Liquidity 9,668$

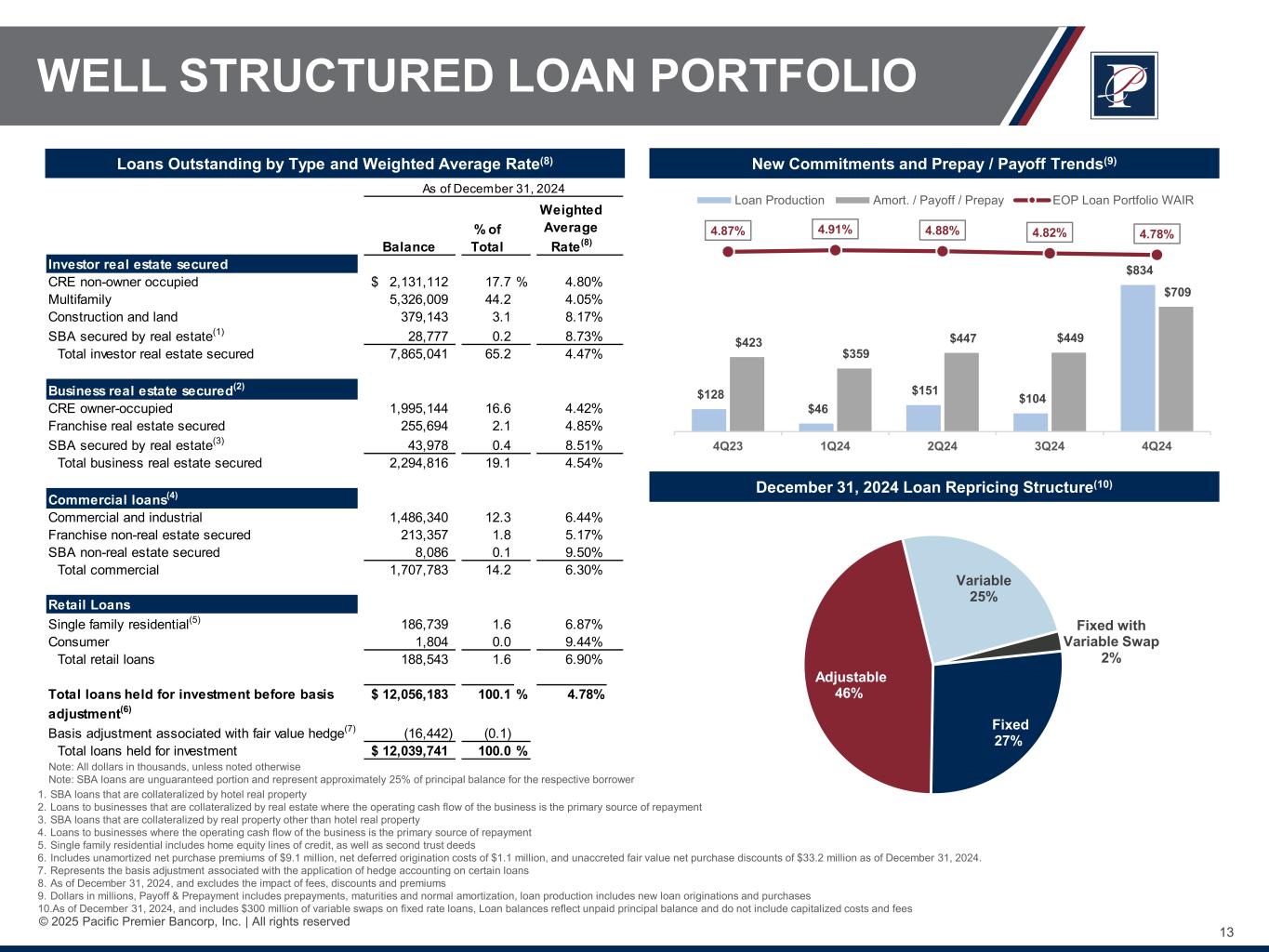

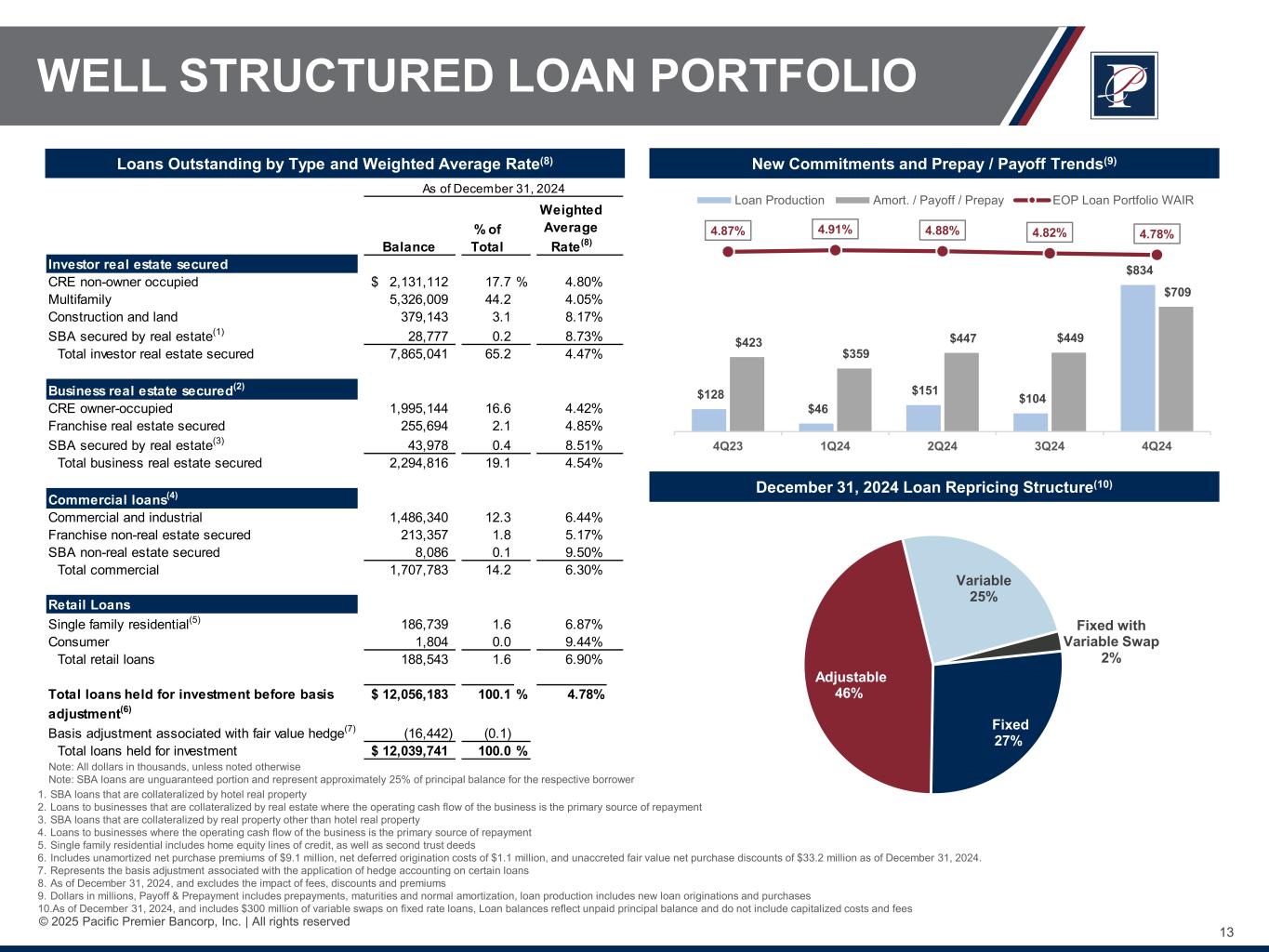

13 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved Note: All dollars in thousands, unless noted otherwise Note: SBA loans are unguaranteed portion and represent approximately 25% of principal balance for the respective borrower WELL STRUCTURED LOAN PORTFOLIO Loans Outstanding by Type and Weighted Average Rate(8) December 31, 2024 Loan Repricing Structure(10) New Commitments and Prepay / Payoff Trends(9) - 1. SBA loans that are collateralized by hotel real property 2. Loans to businesses that are collateralized by real estate where the operating cash flow of the business is the primary source of repayment 3. SBA loans that are collateralized by real property other than hotel real property 4. Loans to businesses where the operating cash flow of the business is the primary source of repayment 5. Single family residential includes home equity lines of credit, as well as second trust deeds 6. Includes unamortized net purchase premiums of $9.1 million, net deferred origination costs of $1.1 million, and unaccreted fair value net purchase discounts of $33.2 million as of December 31, 2024. 7. Represents the basis adjustment associated with the application of hedge accounting on certain loans 8. As of December 31, 2024, and excludes the impact of fees, discounts and premiums 9. Dollars in millions, Payoff & Prepayment includes prepayments, maturities and normal amortization, loan production includes new loan originations and purchases 10.As of December 31, 2024, and includes $300 million of variable swaps on fixed rate loans, Loan balances reflect unpaid principal balance and do not include capitalized costs and fees Fixed 27% Adjustable 46% Variable 25% Fixed with Variable Swap 2% $128 $46 $151 $104 $834 $423 $359 $447 $449 $709 4.87% 4.91% 4.88% 4.82% 4.78% 4Q23 1Q24 2Q24 3Q24 4Q24 Loan Production Amort. / Payoff / Prepay EOP Loan Portfolio WAIR Balance % of Total Weighted Average Rate(8) Investor real estate secured CRE non-owner occupied 2,131,112$ 17.7 % 4.80% Multifamily 5,326,009 44.2 4.05% Construction and land 379,143 3.1 8.17% SBA secured by real estate(1) 28,777 0.2 8.73% Total investor real estate secured 7,865,041 65.2 4.47% Business real estate secured(2) CRE owner-occupied 1,995,144 16.6 4.42% Franchise real estate secured 255,694 2.1 4.85% SBA secured by real estate(3) 43,978 0.4 8.51% Total business real estate secured 2,294,816 19.1 4.54% Commercial loans(4) Commercial and industrial 1,486,340 12.3 6.44% Franchise non-real estate secured 213,357 1.8 5.17% SBA non-real estate secured 8,086 0.1 9.50% Total commercial 1,707,783 14.2 6.30% Retail Loans Single family residential(5) 186,739 1.6 6.87% Consumer 1,804 0.0 9.44% Total retail loans 188,543 1.6 6.90% Total loans held for investment before basis adjustment(6) 12,056,183$ 100.1 % 4.78% Basis adjustment associated with fair value hedge(7) (16,442) (0.1) Total loans held for investment 12,039,741$ 100.0 % As of December 31, 2024

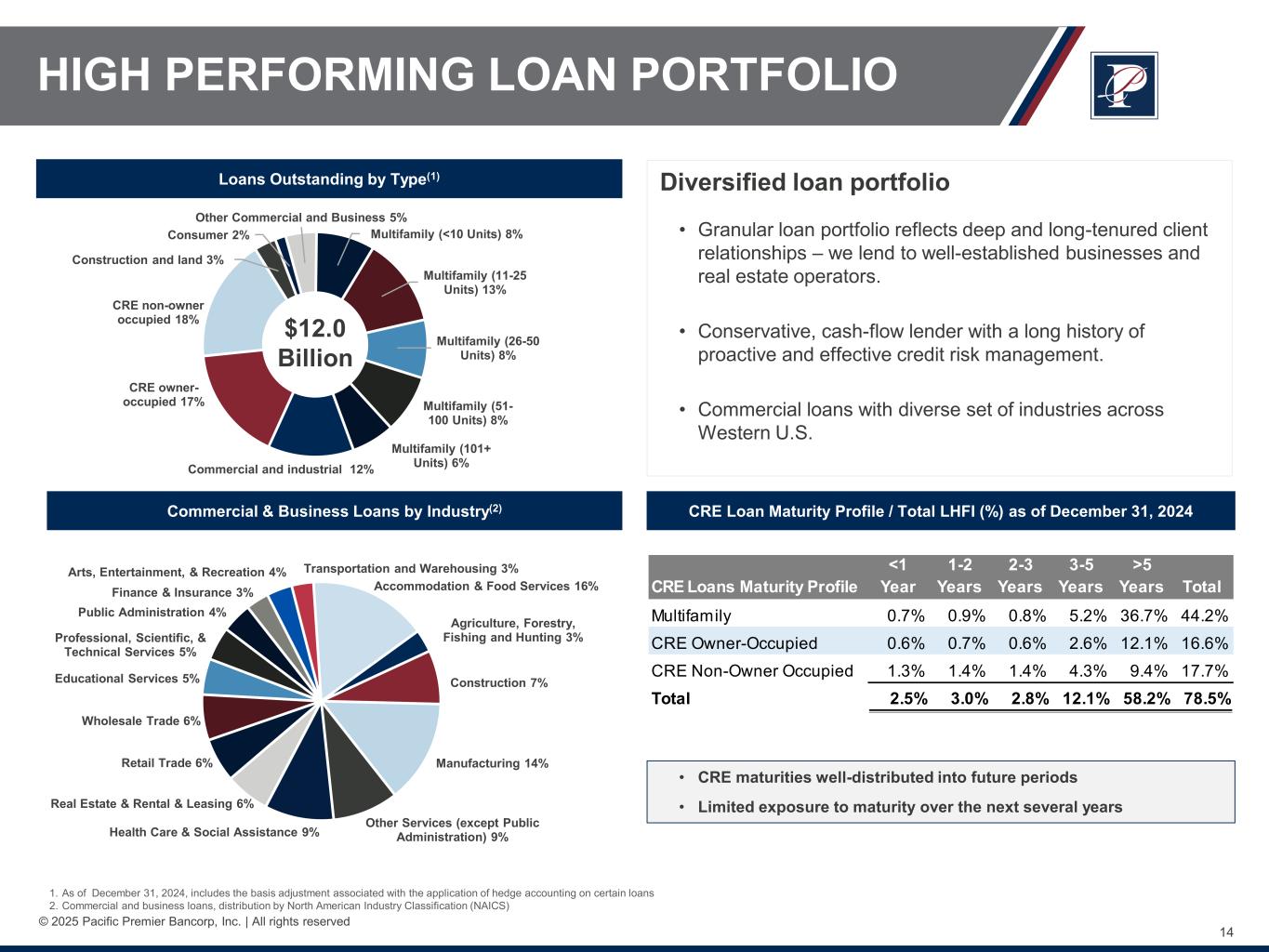

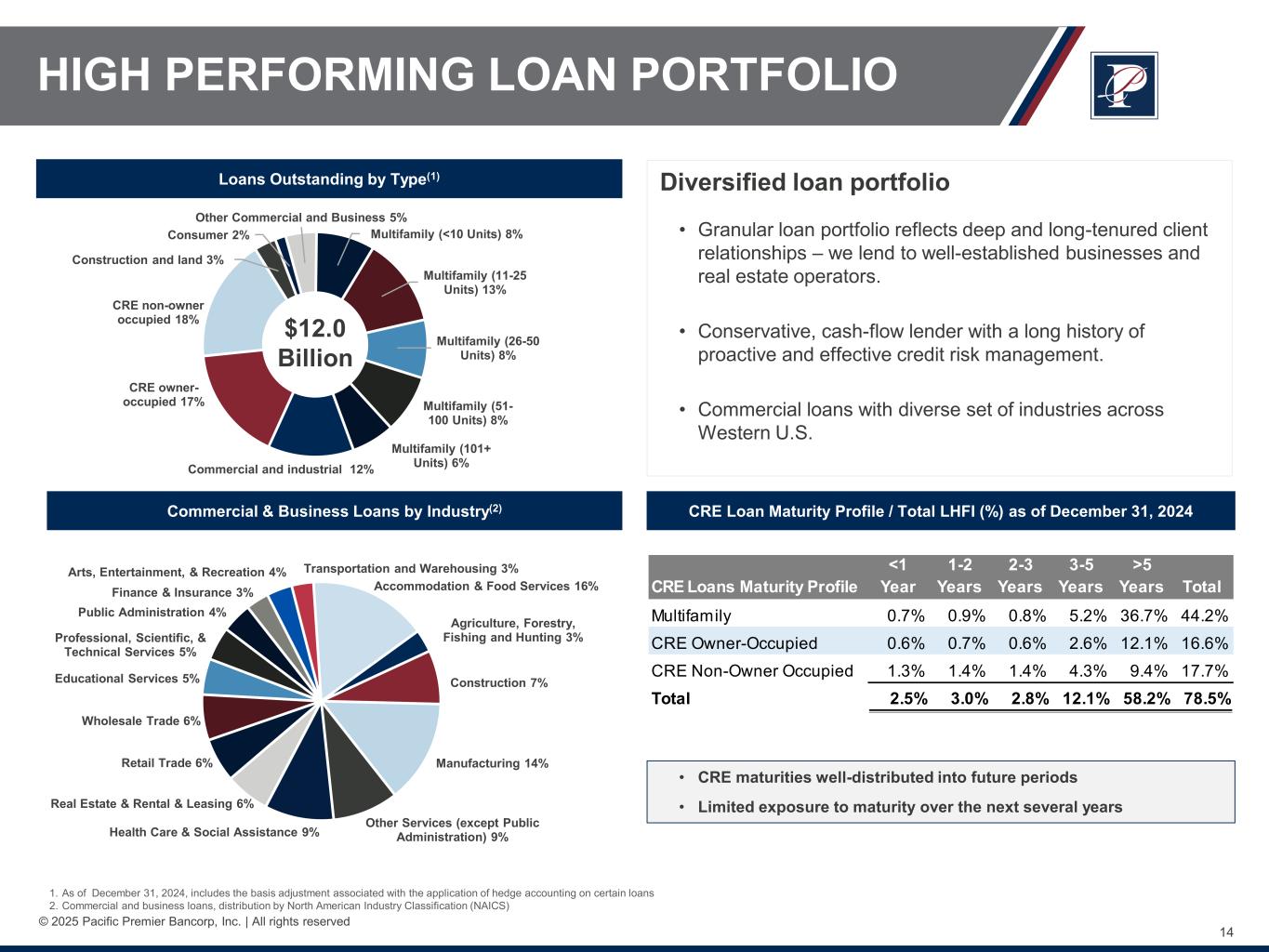

14 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved 1. As of December 31, 2024, includes the basis adjustment associated with the application of hedge accounting on certain loans 2. Commercial and business loans, distribution by North American Industry Classification (NAICS) Loans Outstanding by Type(1) Commercial & Business Loans by Industry(2) HIGH PERFORMING LOAN PORTFOLIO $12.0 Billion Diversified loan portfolio • Granular loan portfolio reflects deep and long-tenured client relationships – we lend to well-established businesses and real estate operators. • Conservative, cash-flow lender with a long history of proactive and effective credit risk management. • Commercial loans with diverse set of industries across Western U.S. CRE Loan Maturity Profile / Total LHFI (%) as of December 31, 2024 • CRE maturities well-distributed into future periods • Limited exposure to maturity over the next several years CRE Loans Maturity Profile <1 Year 1-2 Years 2-3 Years 3-5 Years >5 Years Total Multifamily 0.7% 0.9% 0.8% 5.2% 36.7% 44.2% CRE Owner-Occupied 0.6% 0.7% 0.6% 2.6% 12.1% 16.6% CRE Non-Owner Occupied 1.3% 1.4% 1.4% 4.3% 9.4% 17.7% Total 2.5% 3.0% 2.8% 12.1% 58.2% 78.5% Agriculture, Forestry, Fishing and Hunting 3% Construction 7% Manufacturing 14% Other Services (except Public Administration) 9%Health Care & Social Assistance 9% Real Estate & Rental & Leasing 6% Retail Trade 6% Wholesale Trade 6% Educational Services 5% Professional, Scientific, & Technical Services 5% Public Administration 4% Finance & Insurance 3% Arts, Entertainment, & Recreation 4% Transportation and Warehousing 3% Accommodation & Food Services 16% Commercial and industrial 12% CRE owner- occupied 17% CRE non-owner occupied 18% Construction and land 3% Consumer 2% Other Commercial and Business 5% Multifamily (<10 Units) 8% Multifamily (11-25 Units) 13% Multifamily (26-50 Units) 8% Multifamily (51- 100 Units) 8% Multifamily (101+ Units) 6%

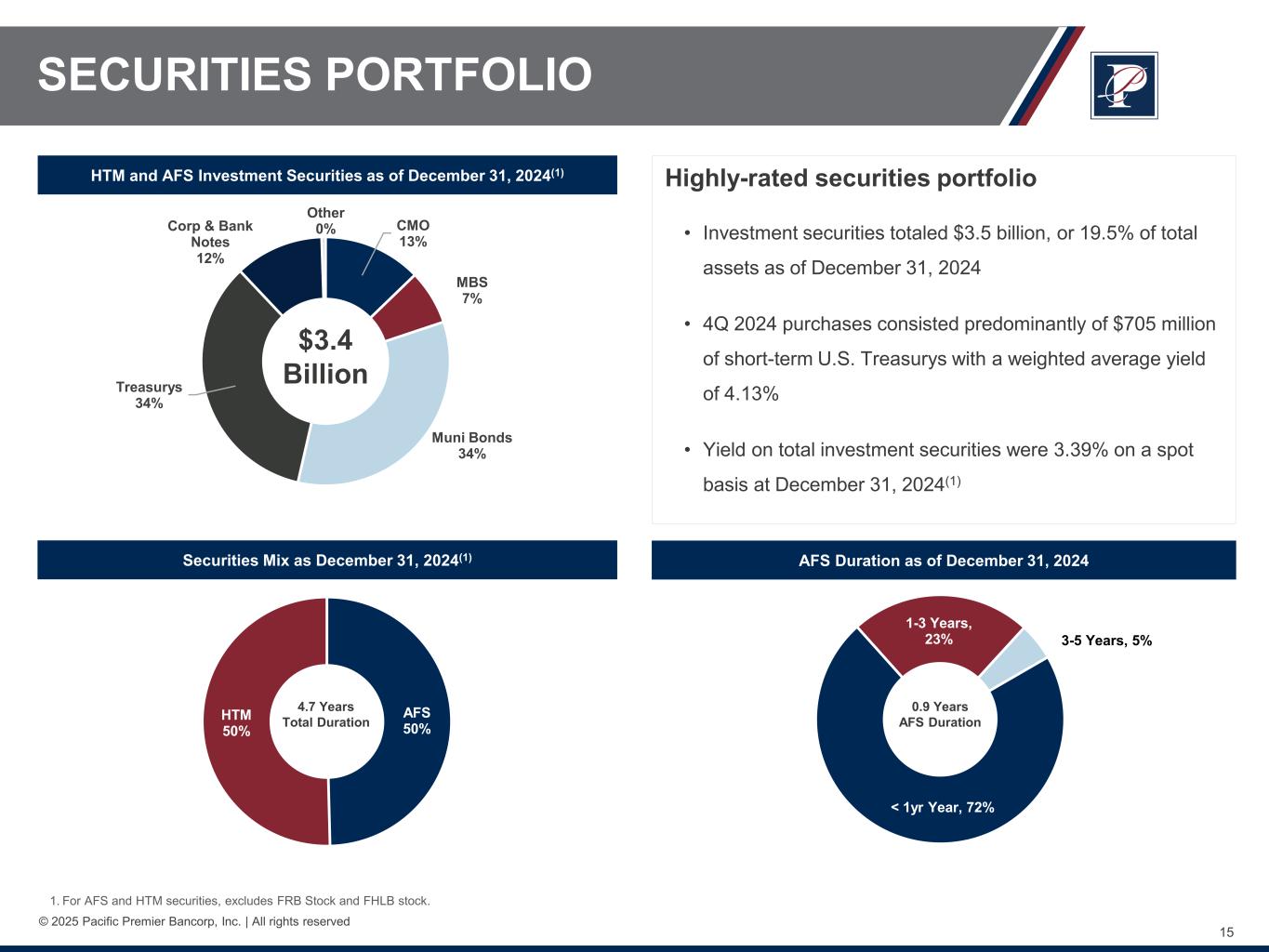

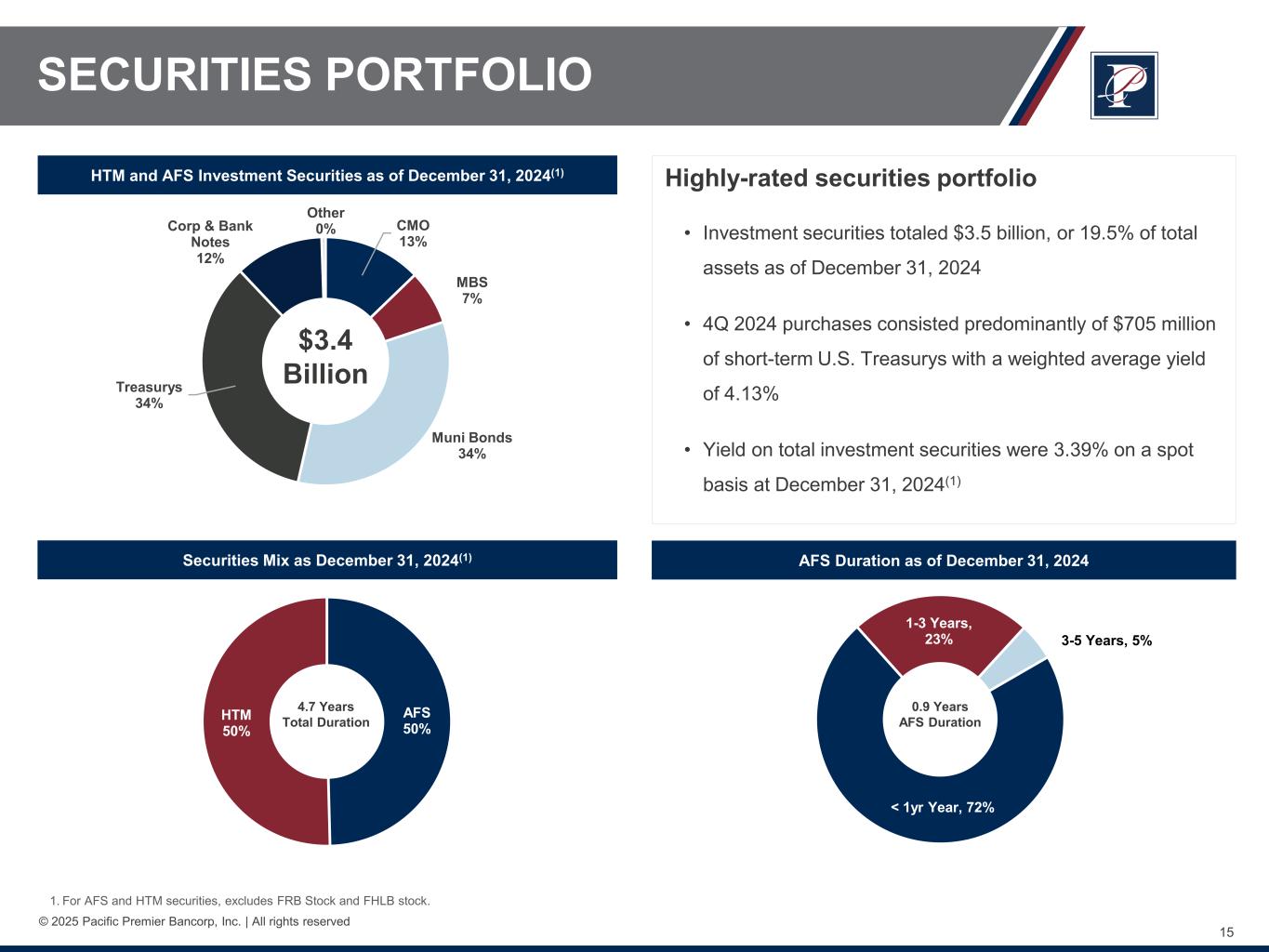

15 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved CMO 13% MBS 7% Muni Bonds 34% Treasurys 34% Corp & Bank Notes 12% Other 0% AFS 50% HTM 50% 4.7 Years Total Duration SECURITIES PORTFOLIO HTM and AFS Investment Securities as of December 31, 2024(1) Highly-rated securities portfolio • Investment securities totaled $3.5 billion, or 19.5% of total assets as of December 31, 2024 • 4Q 2024 purchases consisted predominantly of $705 million of short-term U.S. Treasurys with a weighted average yield of 4.13% • Yield on total investment securities were 3.39% on a spot basis at December 31, 2024(1) $3.4 Billion 1. For AFS and HTM securities, excludes FRB Stock and FHLB stock. AFS Duration as of December 31, 2024 0.9 Years AFS Duration Securities Mix as December 31, 2024(1) < 1yr Year, 72% 1-3 Years, 23% 3-5 Years, 5%

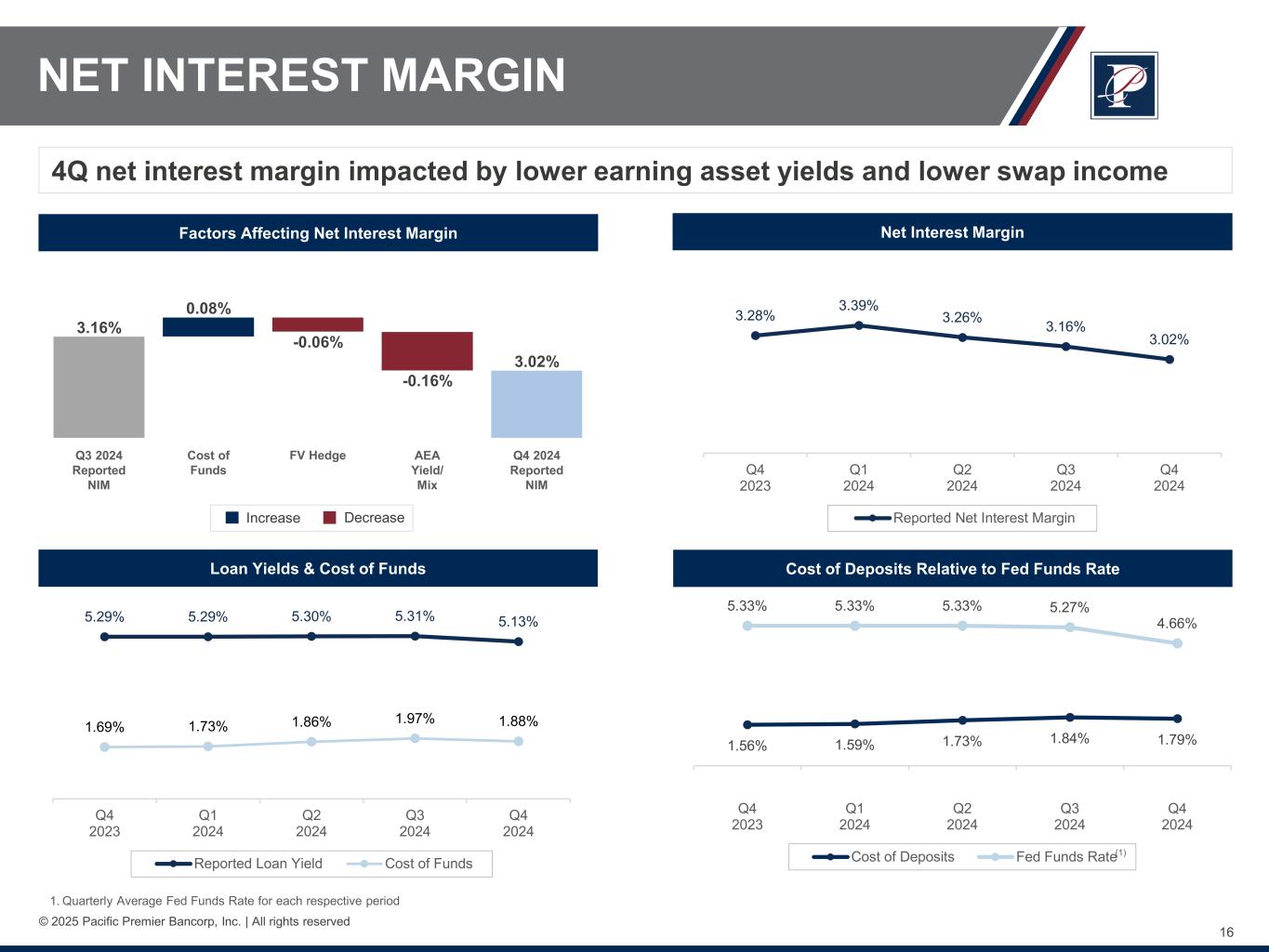

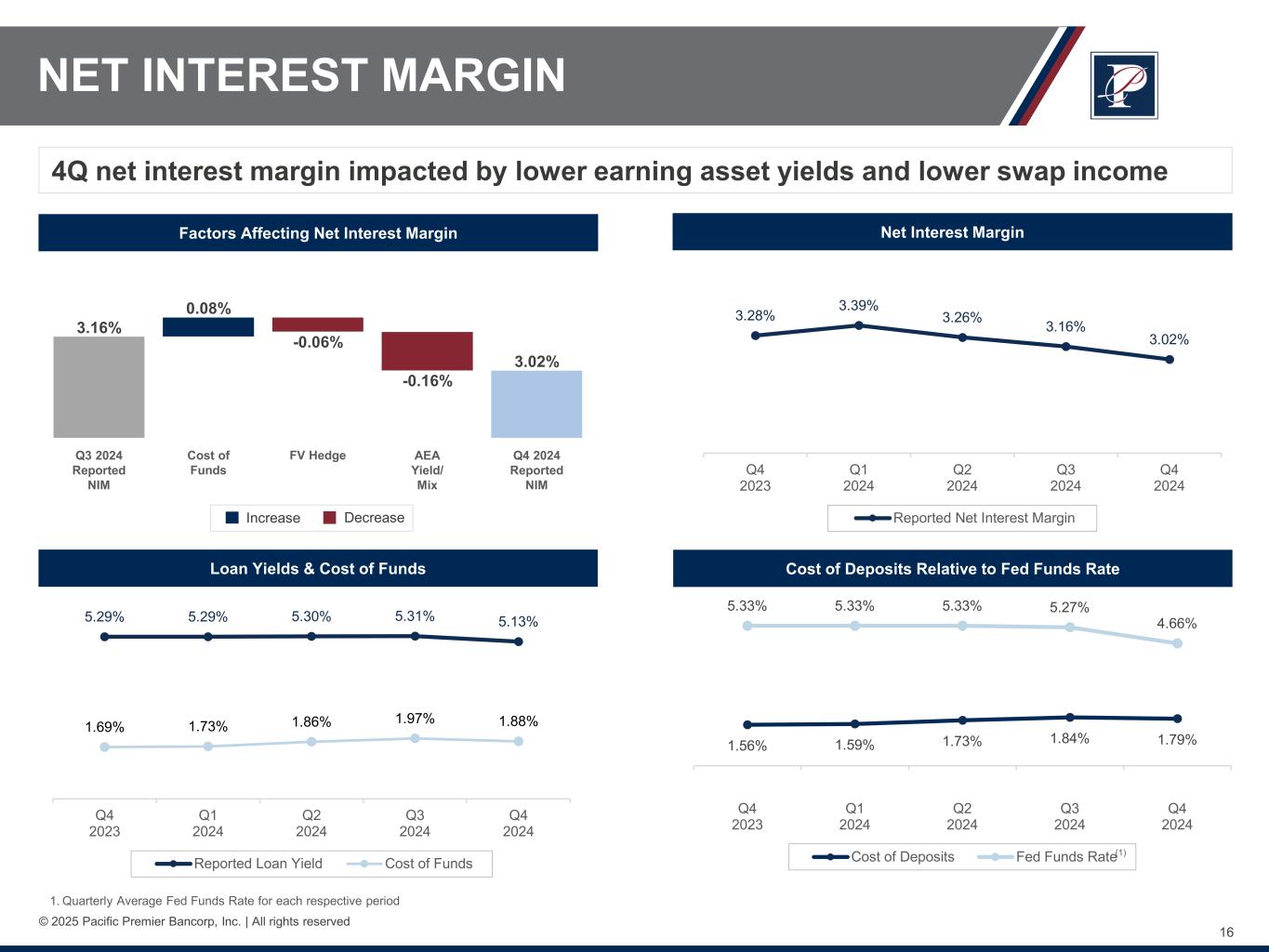

16 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved NET INTEREST MARGIN Net Interest Margin 4Q net interest margin impacted by lower earning asset yields and lower swap income Loan Yields & Cost of Funds Cost of Deposits Relative to Fed Funds Rate Factors Affecting Net Interest Margin Increase Decrease (1) 1. Quarterly Average Fed Funds Rate for each respective period 1.56% 1.59% 1.73% 1.84% 1.79% 5.33% 5.33% 5.33% 5.27% 4.66% Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Cost of Deposits Fed Funds Rate 5.29% 5.29% 5.30% 5.31% 5.13% 1.69% 1.73% 1.86% 1.97% 1.88% Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Reported Loan Yield Cost of Funds 3.28% 3.39% 3.26% 3.16% 3.02% Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Reported Net Interest Margin 3.16% 0.08% -0.06% -0.16% 3.02% Q3 2024 Reported NIM Cost of Funds FV Hedge AEA Yield/ Mix Q4 2024 Reported NIM

Asset Quality & Credit Risk Management

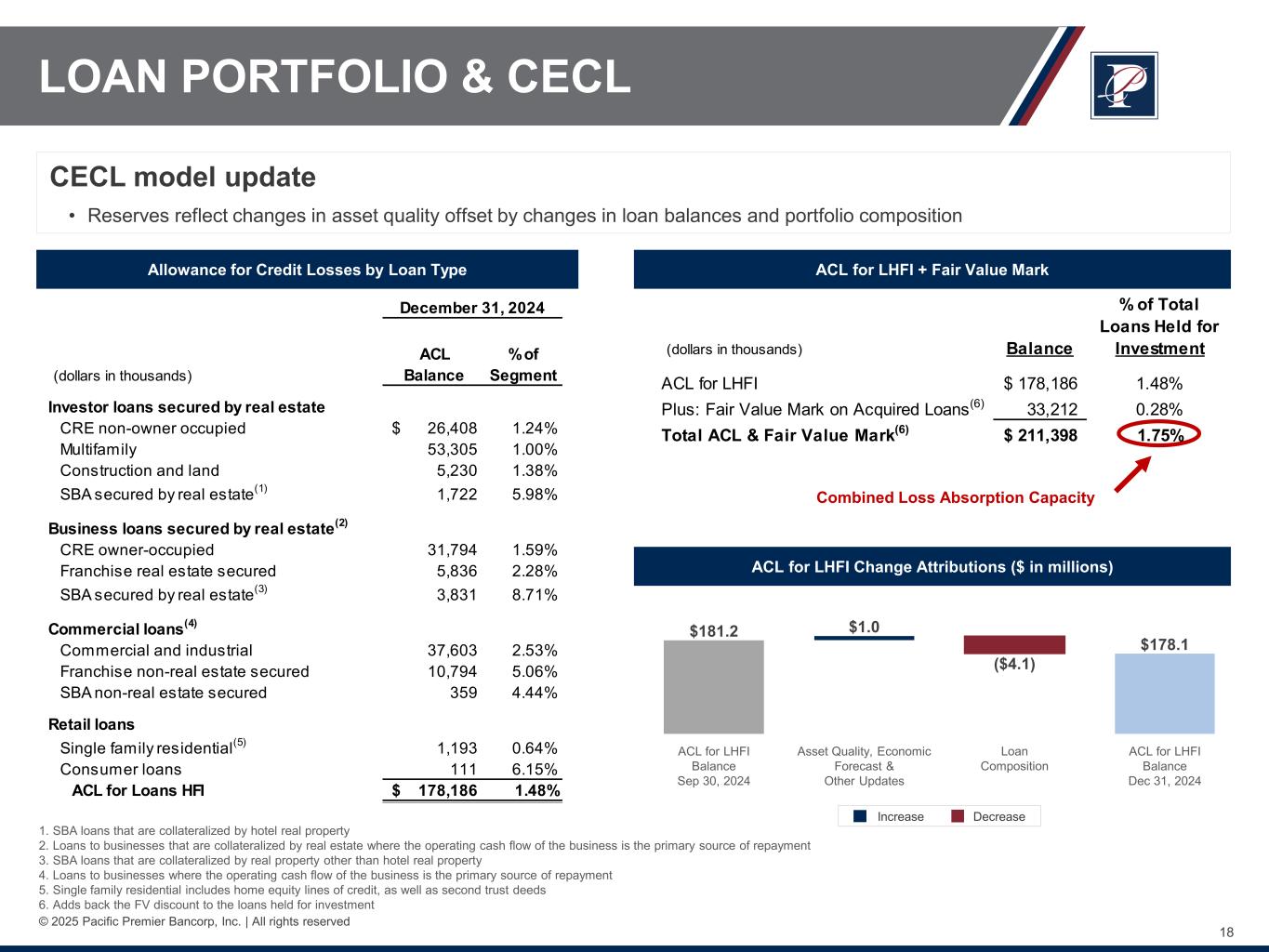

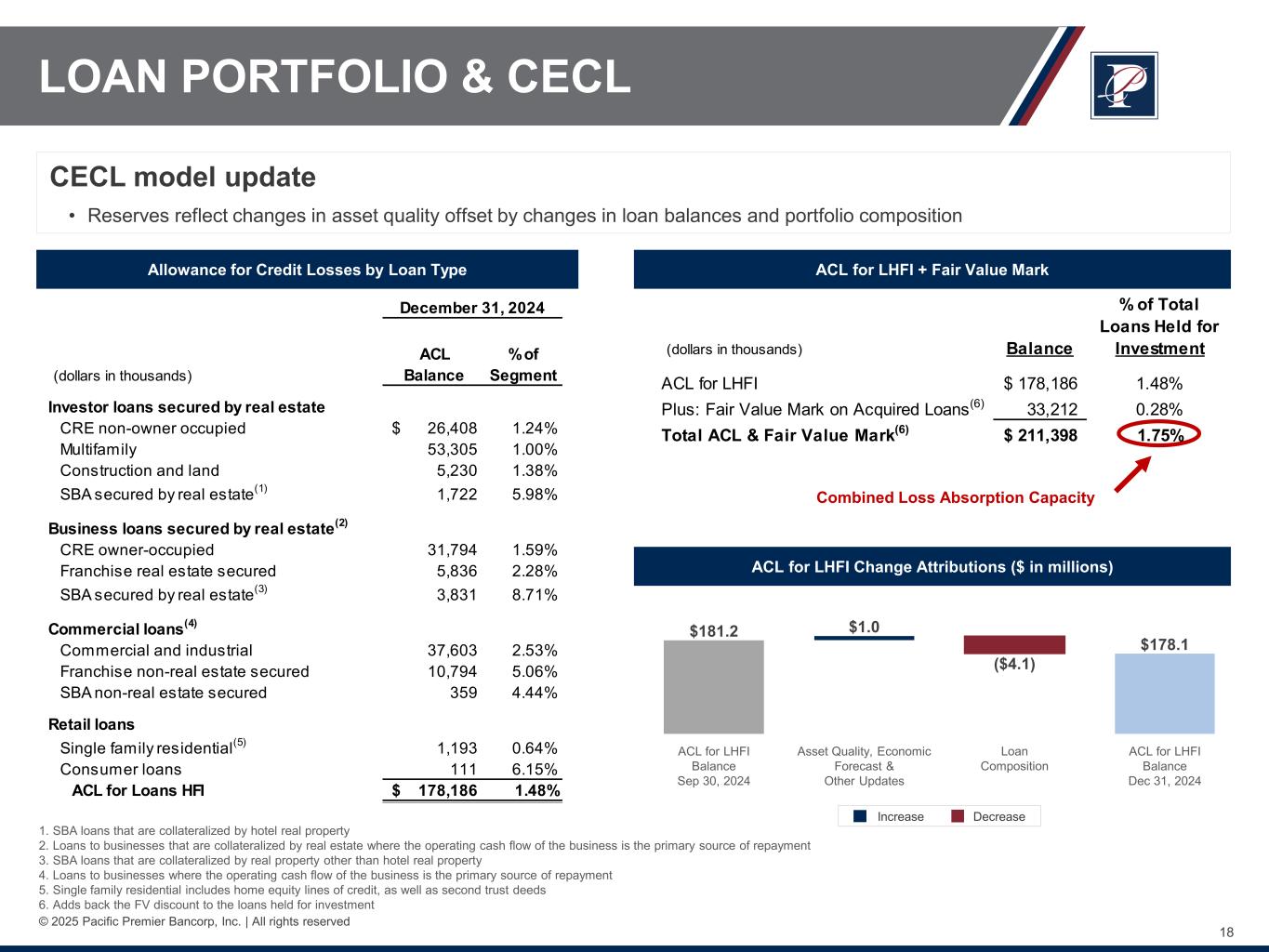

18 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved LOAN PORTFOLIO & CECL ACL for LHFI + Fair Value MarkAllowance for Credit Losses by Loan Type 1. SBA loans that are collateralized by hotel real property 2. Loans to businesses that are collateralized by real estate where the operating cash flow of the business is the primary source of repayment 3. SBA loans that are collateralized by real property other than hotel real property 4. Loans to businesses where the operating cash flow of the business is the primary source of repayment 5. Single family residential includes home equity lines of credit, as well as second trust deeds 6. Adds back the FV discount to the loans held for investment Increase Decrease Combined Loss Absorption Capacity CECL model update • Reserves reflect changes in asset quality offset by changes in loan balances and portfolio composition ACL for LHFI Change Attributions ($ in millions) $181.2 $1.0 ($4.1) $178.1 ACL for LHFI Balance Sep 30, 2024 Asset Quality, Economic Forecast & Other Updates Loan Composition ACL for LHFI Balance Dec 31, 2024 (dollars in thousands) Balance % of Total Loans Held for Investment ACL for LHFI 178,186$ 1.48% Plus: Fair Value Mark on Acquired Loans(6) 33,212 0.28% Total ACL & Fair Value Mark(6) 211,398$ 1.75% (dollars in thousands) ACL Balance % of Segment Investor loans secured by real estate CRE non-owner occupied 26,408$ 1.24% Multifamily 53,305 1.00% Construction and land 5,230 1.38% SBA secured by real estate(1) 1,722 5.98% Business loans secured by real estate(2) CRE owner-occupied 31,794 1.59% Franchise real estate secured 5,836 2.28% SBA secured by real estate(3) 3,831 8.71% Commercial loans(4) Commercial and industrial 37,603 2.53% Franchise non-real estate secured 10,794 5.06% SBA non-real estate secured 359 4.44% Retail loans Single family residential(5) 1,193 0.64% Consumer loans 111 6.15% ACL for Loans HFI 178,186$ 1.48% December 31, 2024

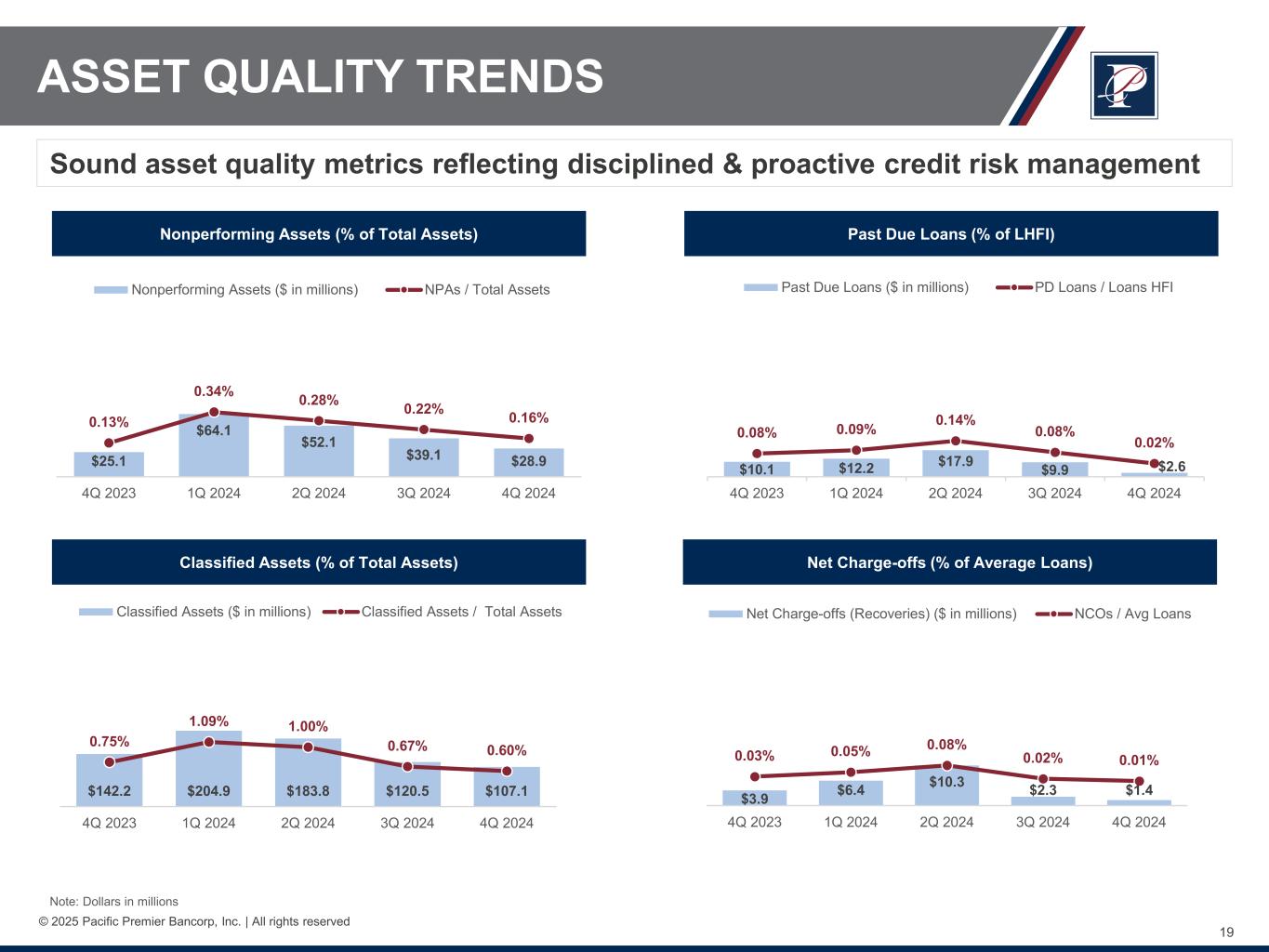

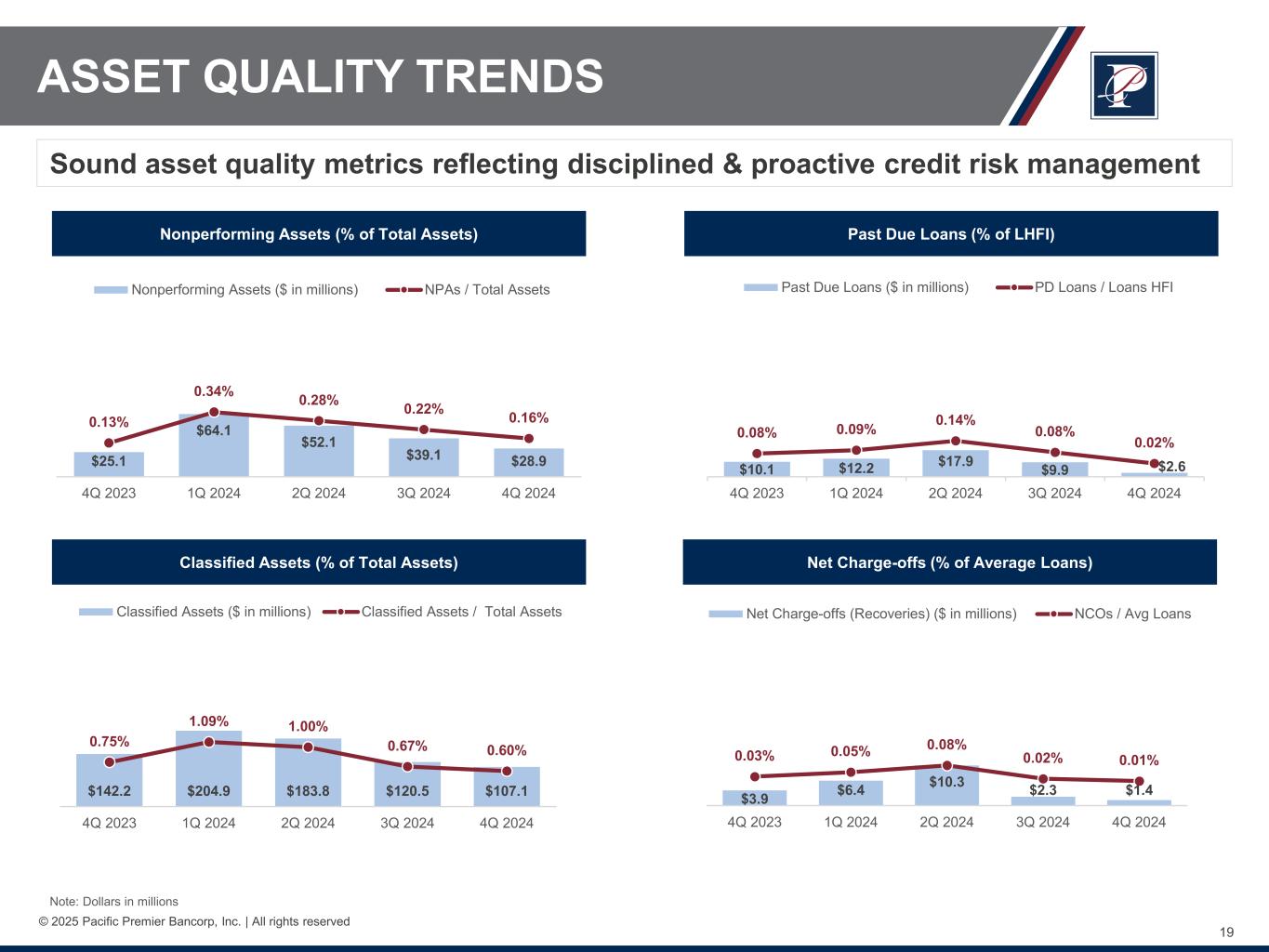

19 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved ASSET QUALITY TRENDS Nonperforming Assets (% of Total Assets) Past Due Loans (% of LHFI) Classified Assets (% of Total Assets) Net Charge-offs (% of Average Loans) Sound asset quality metrics reflecting disciplined & proactive credit risk management Note: Dollars in millions $25.1 $64.1 $52.1 $39.1 $28.9 0.13% 0.34% 0.28% 0.22% 0.16% 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 Nonperforming Assets ($ in millions) NPAs / Total Assets $142.2 $204.9 $183.8 $120.5 $107.1 0.75% 1.09% 1.00% 0.67% 0.60% 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 Classified Assets ($ in millions) Classified Assets / Total Assets $10.1 $12.2 $17.9 $9.9 $2.6 0.08% 0.09% 0.14% 0.08% 0.02% 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 Past Due Loans ($ in millions) PD Loans / Loans HFI $3.9 $6.4 $10.3 $2.3 $1.4 0.03% 0.05% 0.08% 0.02% 0.01% 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 Net Charge-offs (Recoveries) ($ in millions) NCOs / Avg Loans

20 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved 0.16% 3.84% Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 PPBI Peer Median PDNB Failed- Bank Acquisition 4/27/12 CREDIT RISK MANAGEMENT Credit quality has historically outperformed peers throughout varying cycles Nonperforming Assets to Total Assets Comparison CNB Failed- Bank Acquisition 2/11/11 Note: Peer group consists of Western region banks and thrifts with total assets between $5 billion and $81 billion as of September 30, 2024

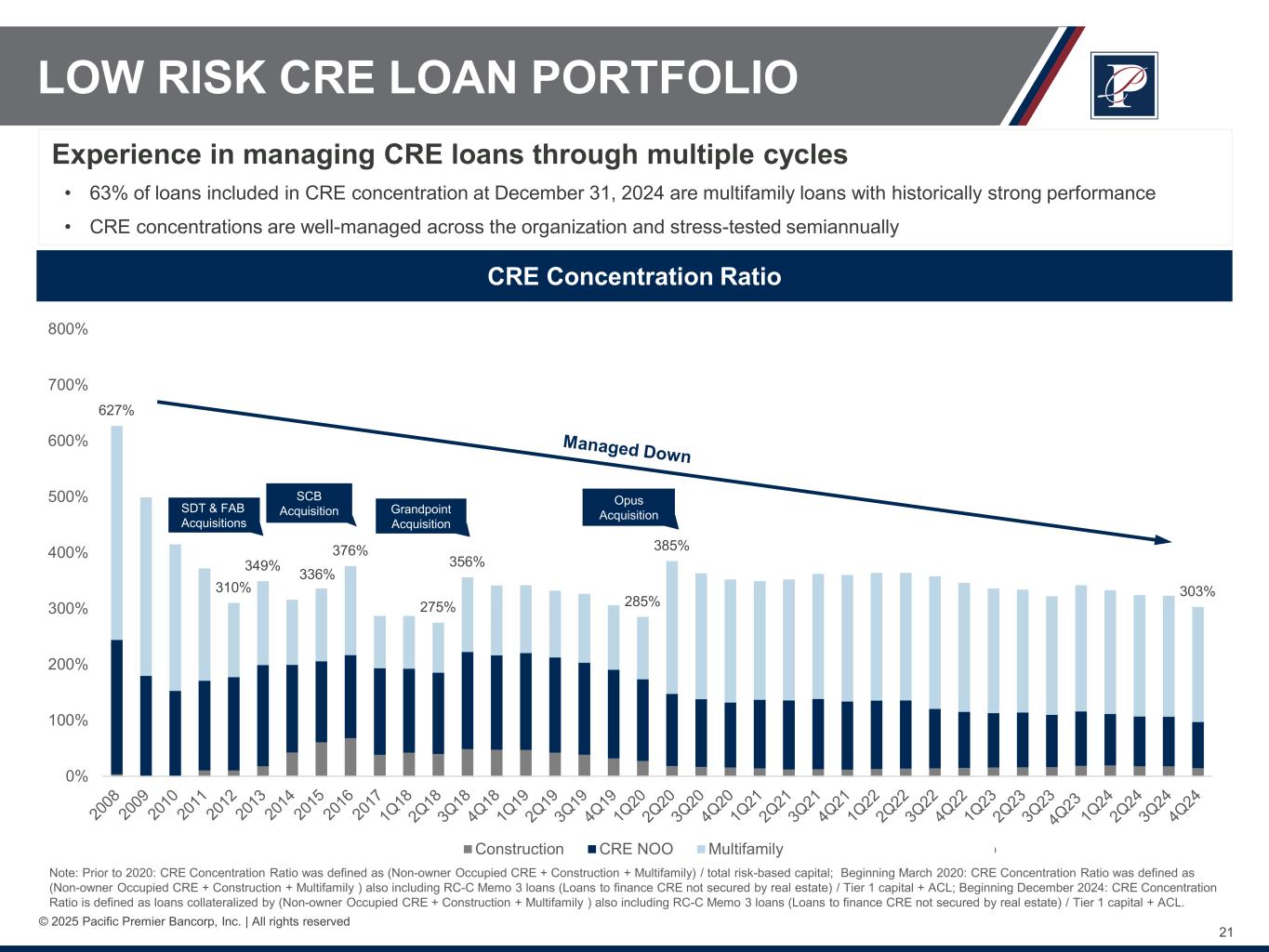

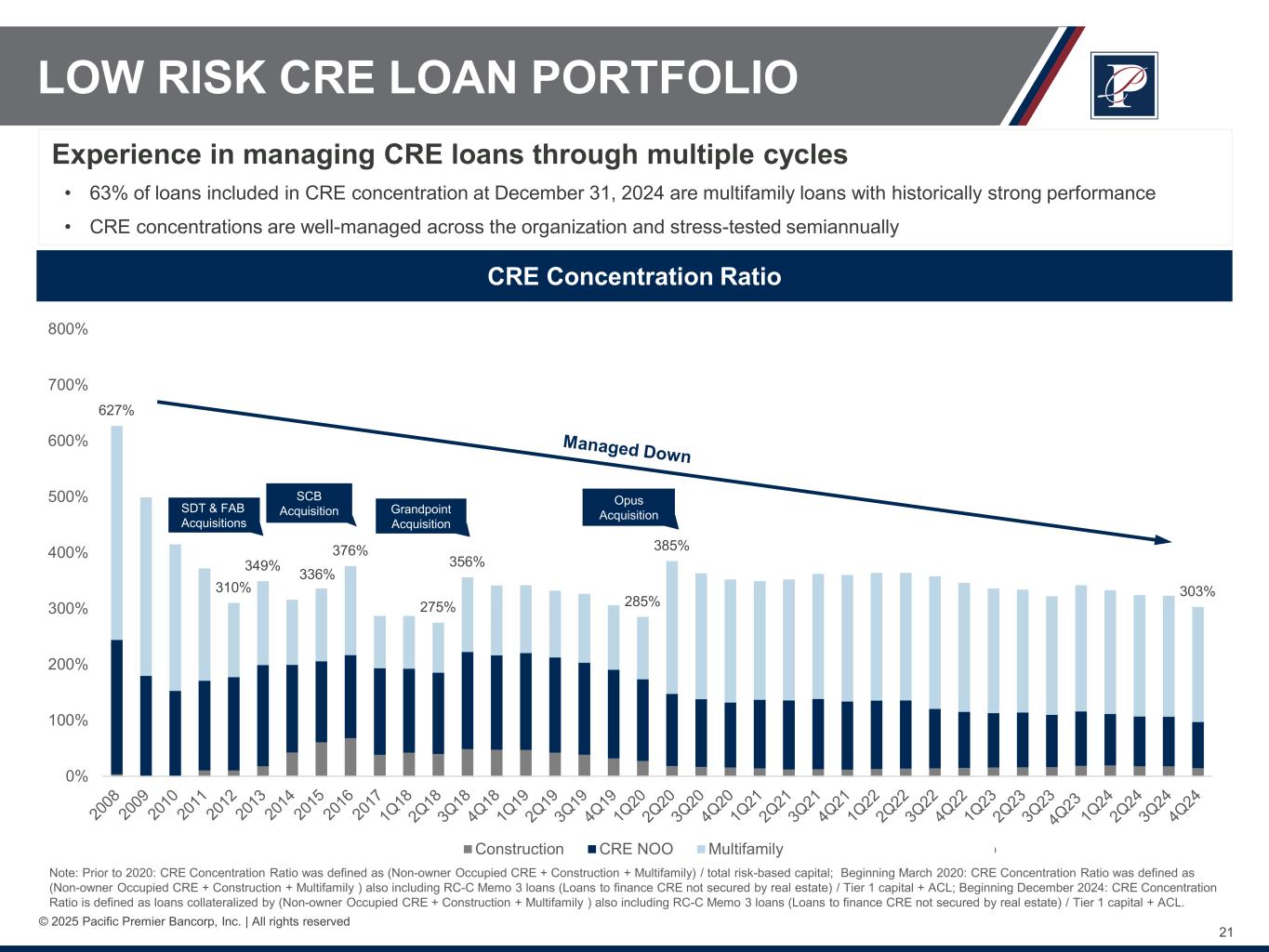

21 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved 627% 310% 349% 336% 376% 275% 356% 285% 385% 303% 0% 100% 200% 300% 400% 500% 600% 700% 800% Construction CRE NOO Multifamily CRE Concentration Ratio Note: Prior to 2020: CRE Concentration Ratio was defined as (Non-owner Occupied CRE + Construction + Multifamily) / total risk-based capital; Beginning March 2020: CRE Concentration Ratio was defined as (Non-owner Occupied CRE + Construction + Multifamily ) also including RC-C Memo 3 loans (Loans to finance CRE not secured by real estate) / Tier 1 capital + ACL; Beginning December 2024: CRE Concentration Ratio is defined as loans collateralized by (Non-owner Occupied CRE + Construction + Multifamily ) also including RC-C Memo 3 loans (Loans to finance CRE not secured by real estate) / Tier 1 capital + ACL. CRE Concentration Ratio Grandpoint Acquisition Experience in managing CRE loans through multiple cycles • 63% of loans included in CRE concentration at December 31, 2024 are multifamily loans with historically strong performance • CRE concentrations are well-managed across the organization and stress-tested semiannually Opus Acquisition LOW RISK CRE LOAN PORTFOLIO SCB Acquisition SDT & FAB Acquisitions

Selected Loan Metrics Fourth Quarter 2024

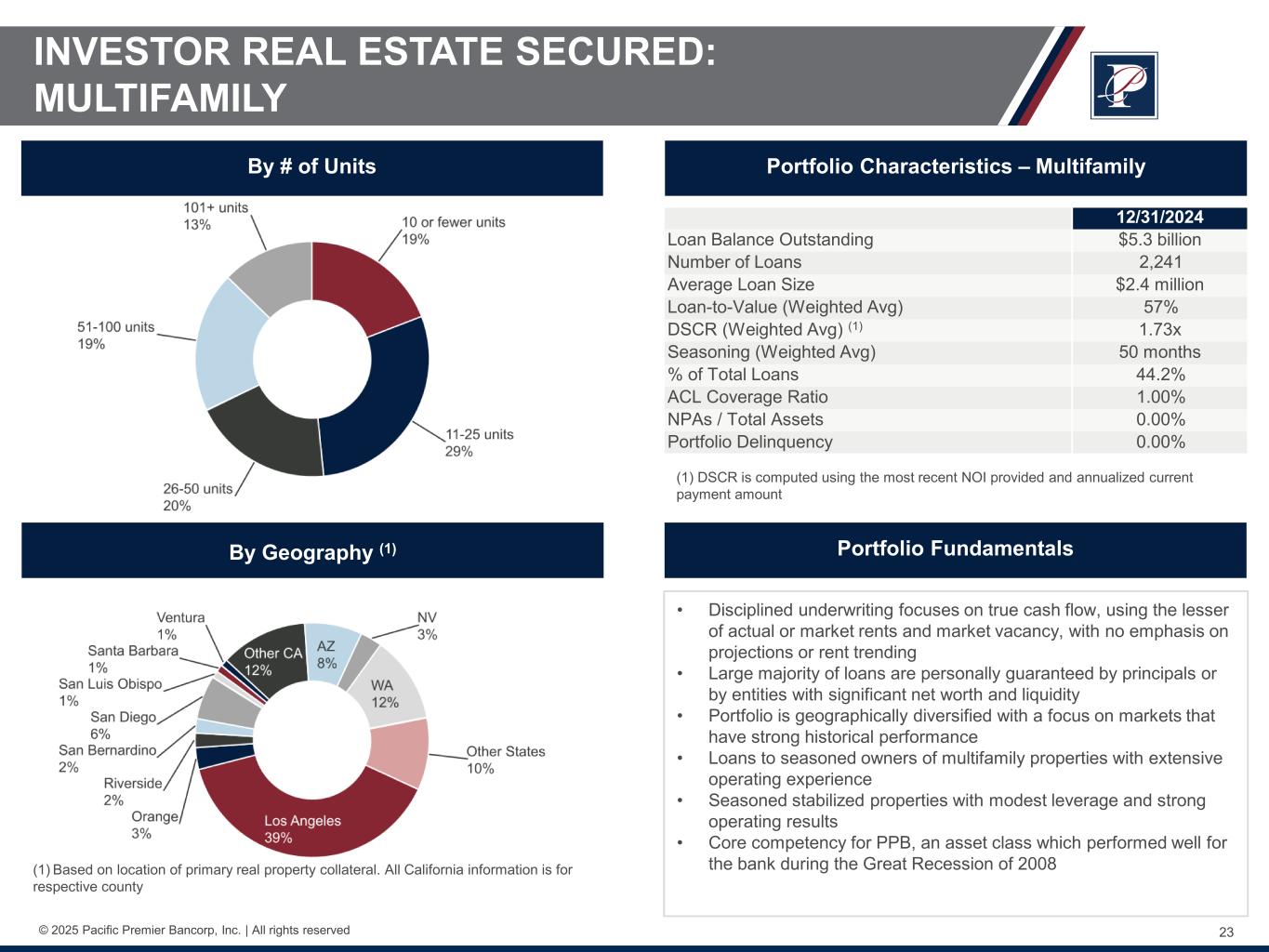

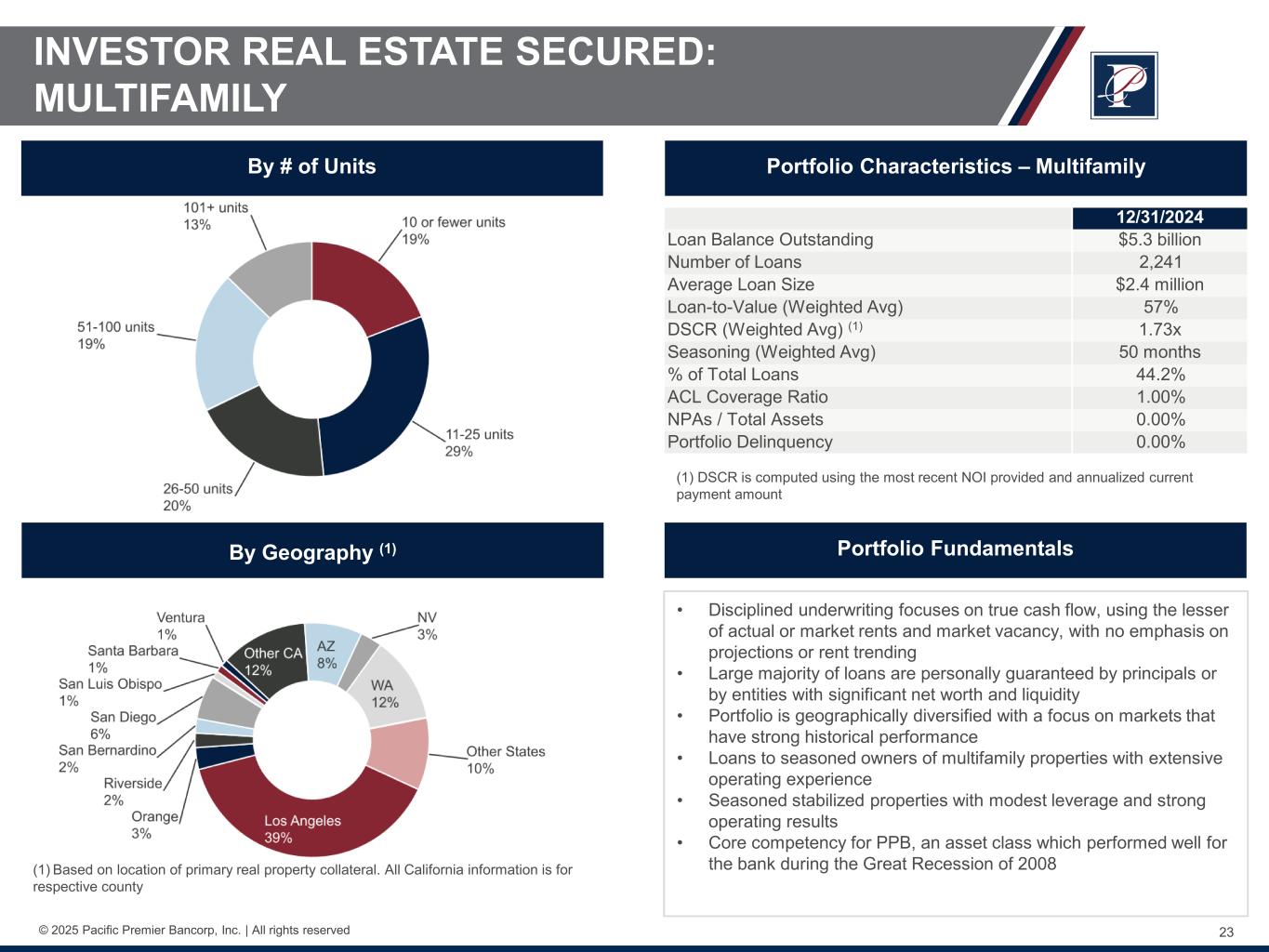

23© 2025 Pacific Premier Bancorp, Inc. | All rights reserved Portfolio Fundamentals • Disciplined underwriting focuses on true cash flow, using the lesser of actual or market rents and market vacancy, with no emphasis on projections or rent trending • Large majority of loans are personally guaranteed by principals or by entities with significant net worth and liquidity • Portfolio is geographically diversified with a focus on markets that have strong historical performance • Loans to seasoned owners of multifamily properties with extensive operating experience • Seasoned stabilized properties with modest leverage and strong operating results • Core competency for PPB, an asset class which performed well for the bank during the Great Recession of 2008 (1) DSCR is computed using the most recent NOI provided and annualized current payment amount By Geography (1) Portfolio Characteristics – MultifamilyBy # of Units (1) Based on location of primary real property collateral. All California information is for respective county INVESTOR REAL ESTATE SECURED: MULTIFAMILY 12/31/2024 Loan Balance Outstanding $5.3 billion Number of Loans 2,241 Average Loan Size $2.4 million Loan-to-Value (Weighted Avg) 57% DSCR (Weighted Avg) (1) 1.73x Seasoning (Weighted Avg) 50 months % of Total Loans 44.2% ACL Coverage Ratio 1.00% NPAs / Total Assets 0.00% Portfolio Delinquency 0.00%

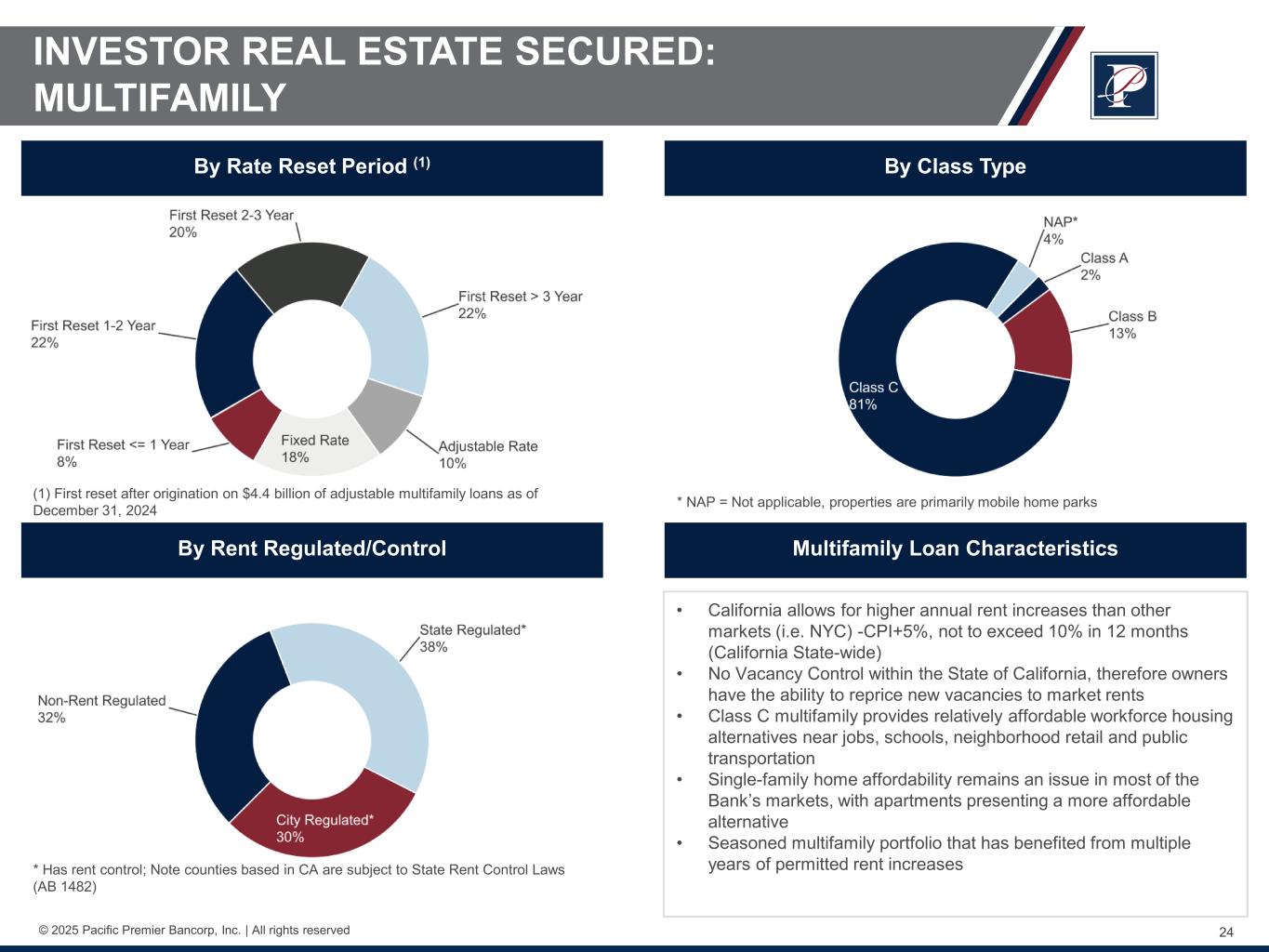

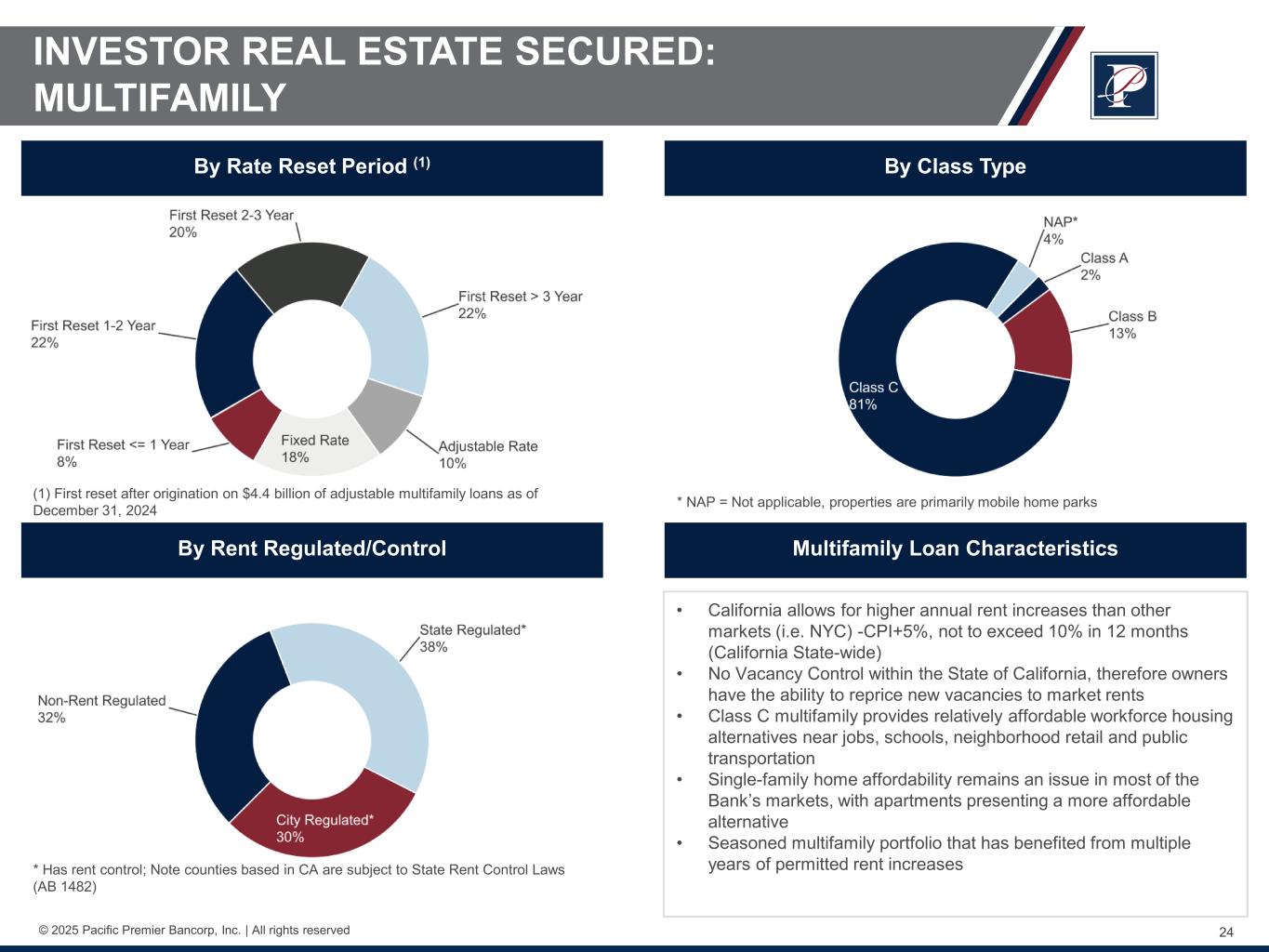

24© 2025 Pacific Premier Bancorp, Inc. | All rights reserved Multifamily Loan Characteristics • California allows for higher annual rent increases than other markets (i.e. NYC) -CPI+5%, not to exceed 10% in 12 months (California State-wide) • No Vacancy Control within the State of California, therefore owners have the ability to reprice new vacancies to market rents • Class C multifamily provides relatively affordable workforce housing alternatives near jobs, schools, neighborhood retail and public transportation • Single-family home affordability remains an issue in most of the Bank’s markets, with apartments presenting a more affordable alternative • Seasoned multifamily portfolio that has benefited from multiple years of permitted rent increases By Rent Regulated/Control By Class TypeBy Rate Reset Period (1) INVESTOR REAL ESTATE SECURED: MULTIFAMILY * NAP = Not applicable, properties are primarily mobile home parks * Has rent control; Note counties based in CA are subject to State Rent Control Laws (AB 1482) (1) First reset after origination on $4.4 billion of adjustable multifamily loans as of December 31, 2024

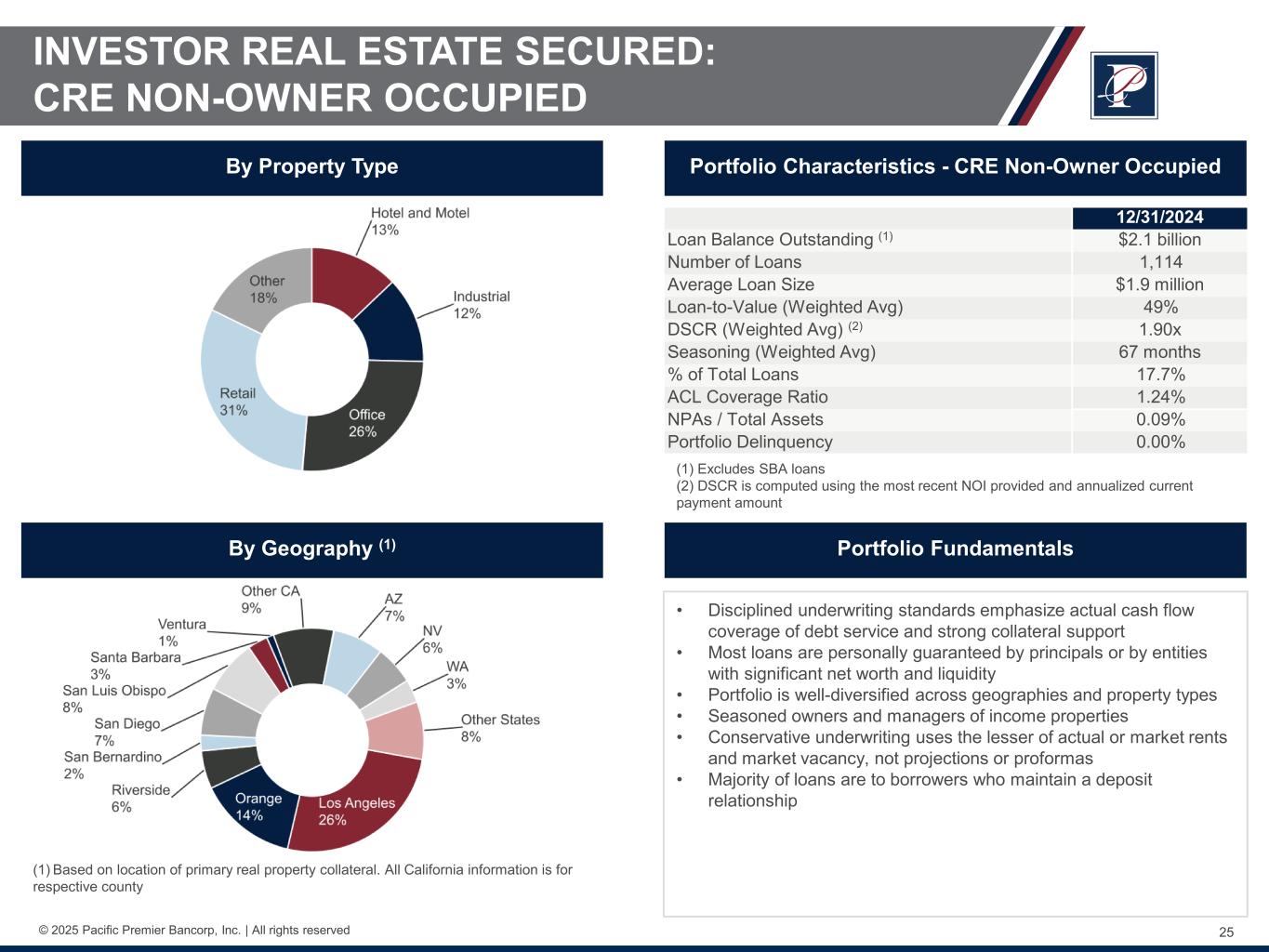

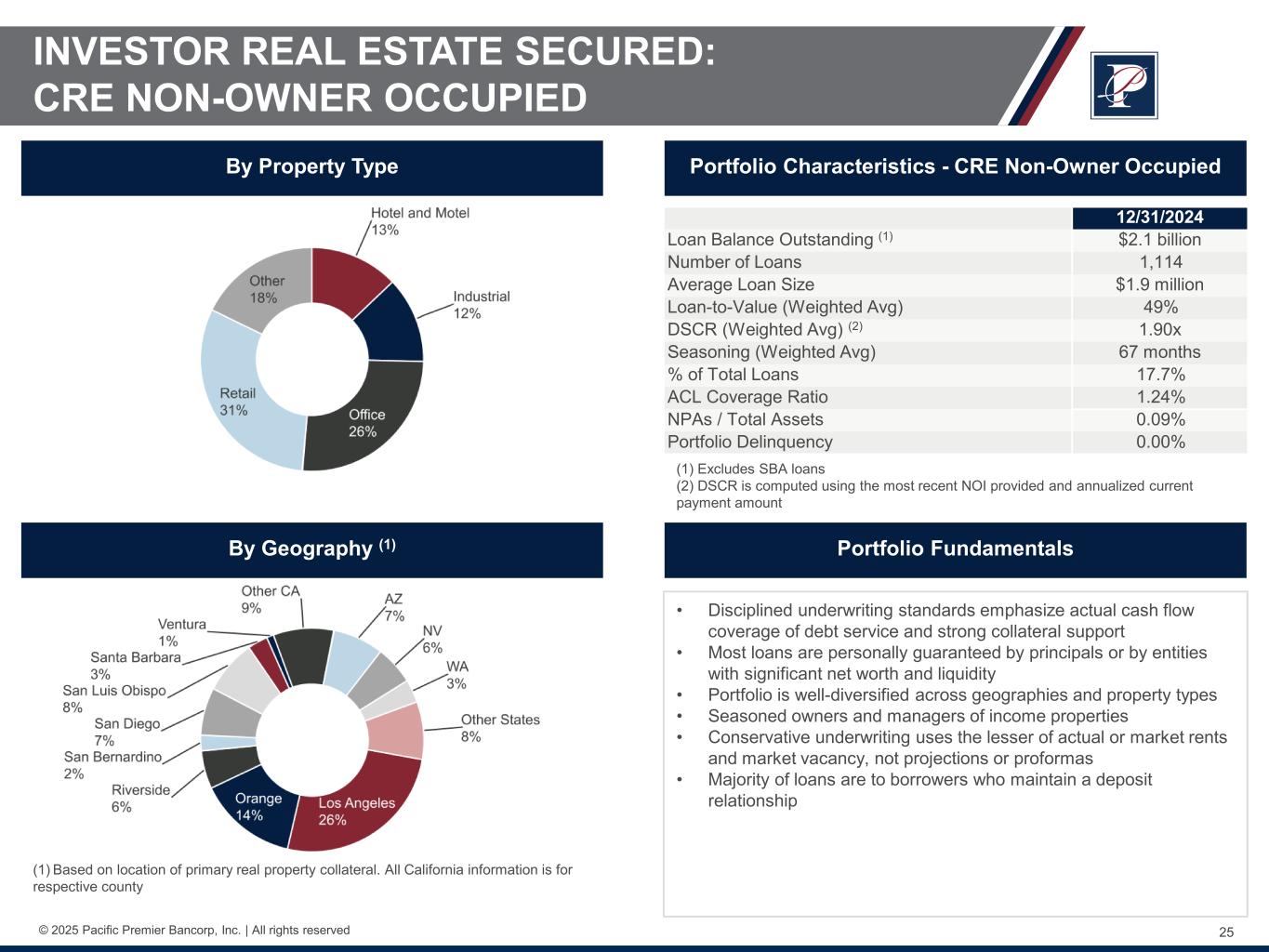

25© 2025 Pacific Premier Bancorp, Inc. | All rights reserved 12/31/2024 Loan Balance Outstanding (1) $2.1 billion Number of Loans 1,114 Average Loan Size $1.9 million Loan-to-Value (Weighted Avg) 49% DSCR (Weighted Avg) (2) 1.90x Seasoning (Weighted Avg) 67 months % of Total Loans 17.7% ACL Coverage Ratio 1.24% NPAs / Total Assets 0.09% Portfolio Delinquency 0.00% Portfolio Fundamentals • Disciplined underwriting standards emphasize actual cash flow coverage of debt service and strong collateral support • Most loans are personally guaranteed by principals or by entities with significant net worth and liquidity • Portfolio is well-diversified across geographies and property types • Seasoned owners and managers of income properties • Conservative underwriting uses the lesser of actual or market rents and market vacancy, not projections or proformas • Majority of loans are to borrowers who maintain a deposit relationship (1) Excludes SBA loans (2) DSCR is computed using the most recent NOI provided and annualized current payment amount By Geography (1) Portfolio Characteristics - CRE Non-Owner OccupiedBy Property Type (1) Based on location of primary real property collateral. All California information is for respective county INVESTOR REAL ESTATE SECURED: CRE NON-OWNER OCCUPIED

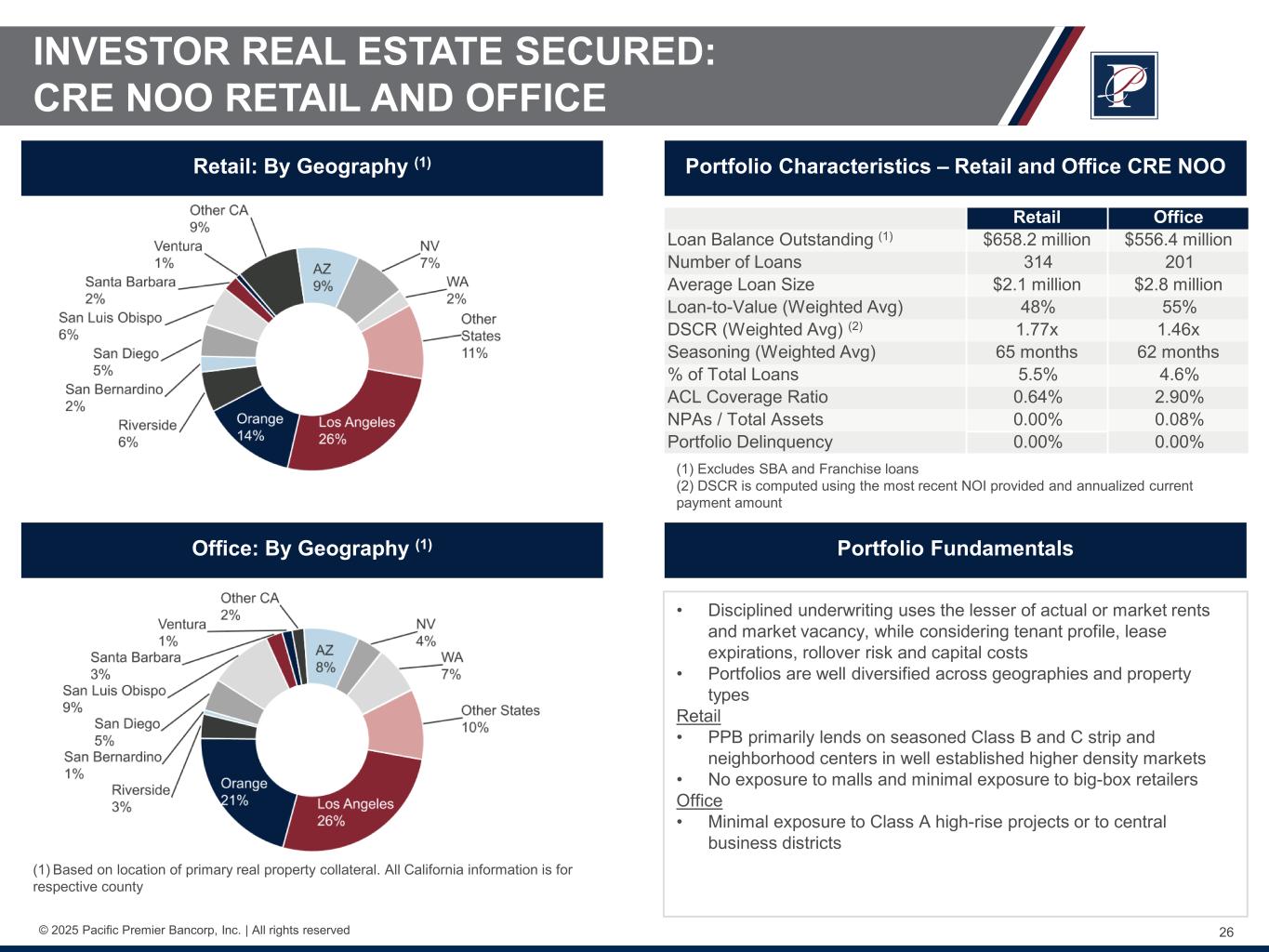

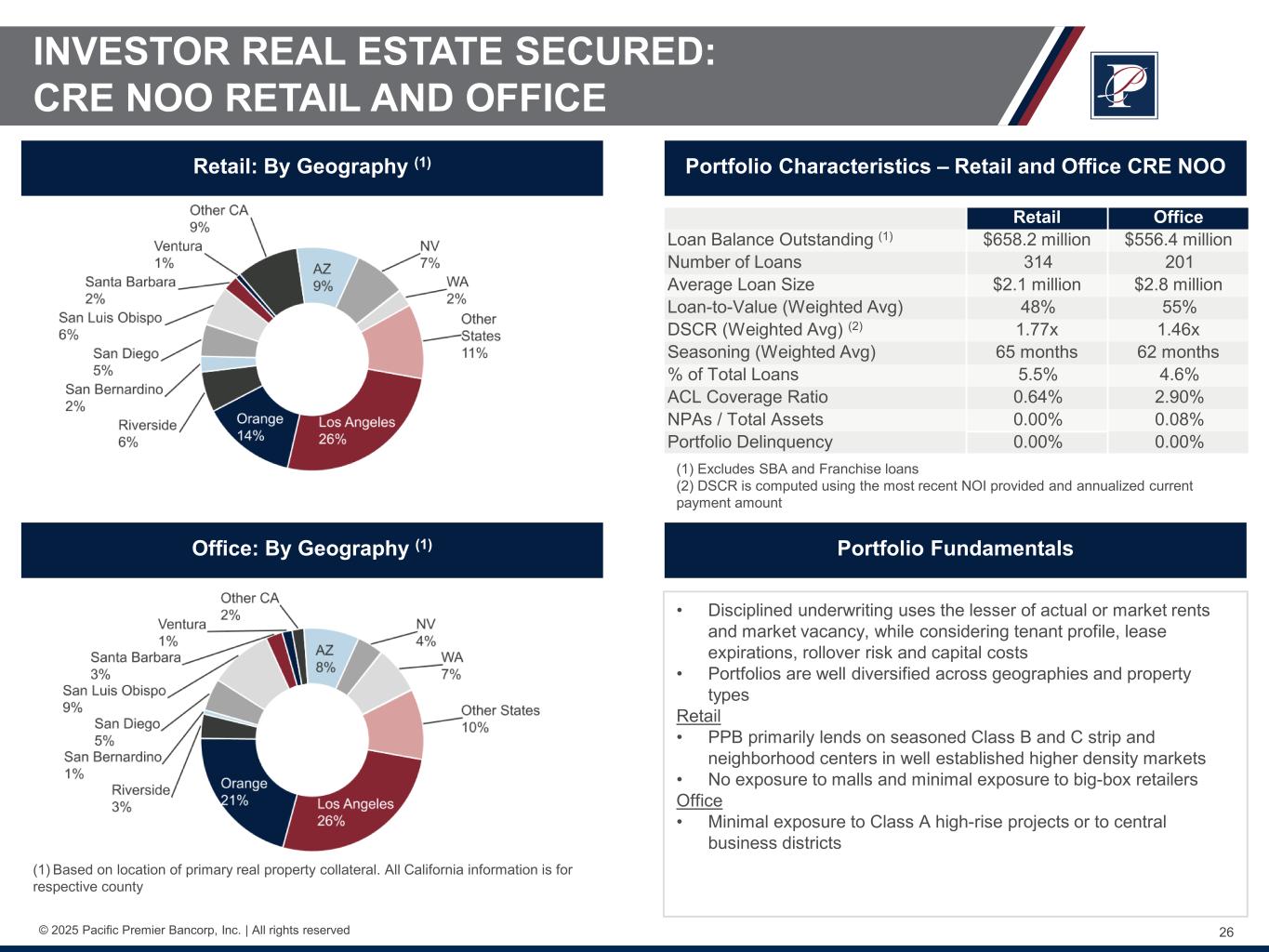

26© 2025 Pacific Premier Bancorp, Inc. | All rights reserved Retail Office Loan Balance Outstanding (1) $658.2 million $556.4 million Number of Loans 314 201 Average Loan Size $2.1 million $2.8 million Loan-to-Value (Weighted Avg) 48% 55% DSCR (Weighted Avg) (2) 1.77x 1.46x Seasoning (Weighted Avg) 65 months 62 months % of Total Loans 5.5% 4.6% ACL Coverage Ratio 0.64% 2.90% NPAs / Total Assets 0.00% 0.08% Portfolio Delinquency 0.00% 0.00% Portfolio Fundamentals • Disciplined underwriting uses the lesser of actual or market rents and market vacancy, while considering tenant profile, lease expirations, rollover risk and capital costs • Portfolios are well diversified across geographies and property types Retail • PPB primarily lends on seasoned Class B and C strip and neighborhood centers in well established higher density markets • No exposure to malls and minimal exposure to big-box retailers Office • Minimal exposure to Class A high-rise projects or to central business districts (1) Excludes SBA and Franchise loans (2) DSCR is computed using the most recent NOI provided and annualized current payment amount Office: By Geography (1) Portfolio Characteristics – Retail and Office CRE NOORetail: By Geography (1) (1) Based on location of primary real property collateral. All California information is for respective county INVESTOR REAL ESTATE SECURED: CRE NOO RETAIL AND OFFICE

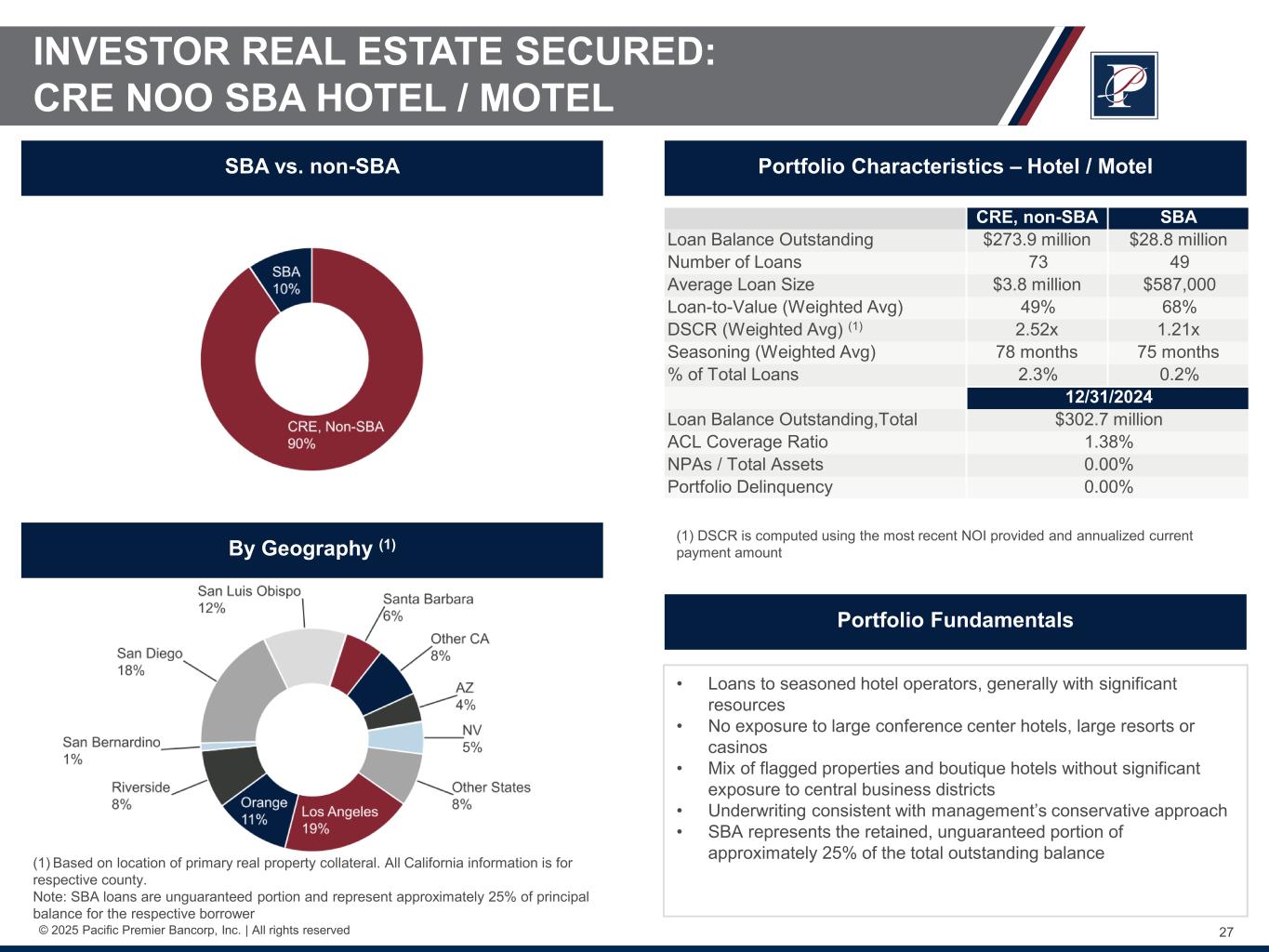

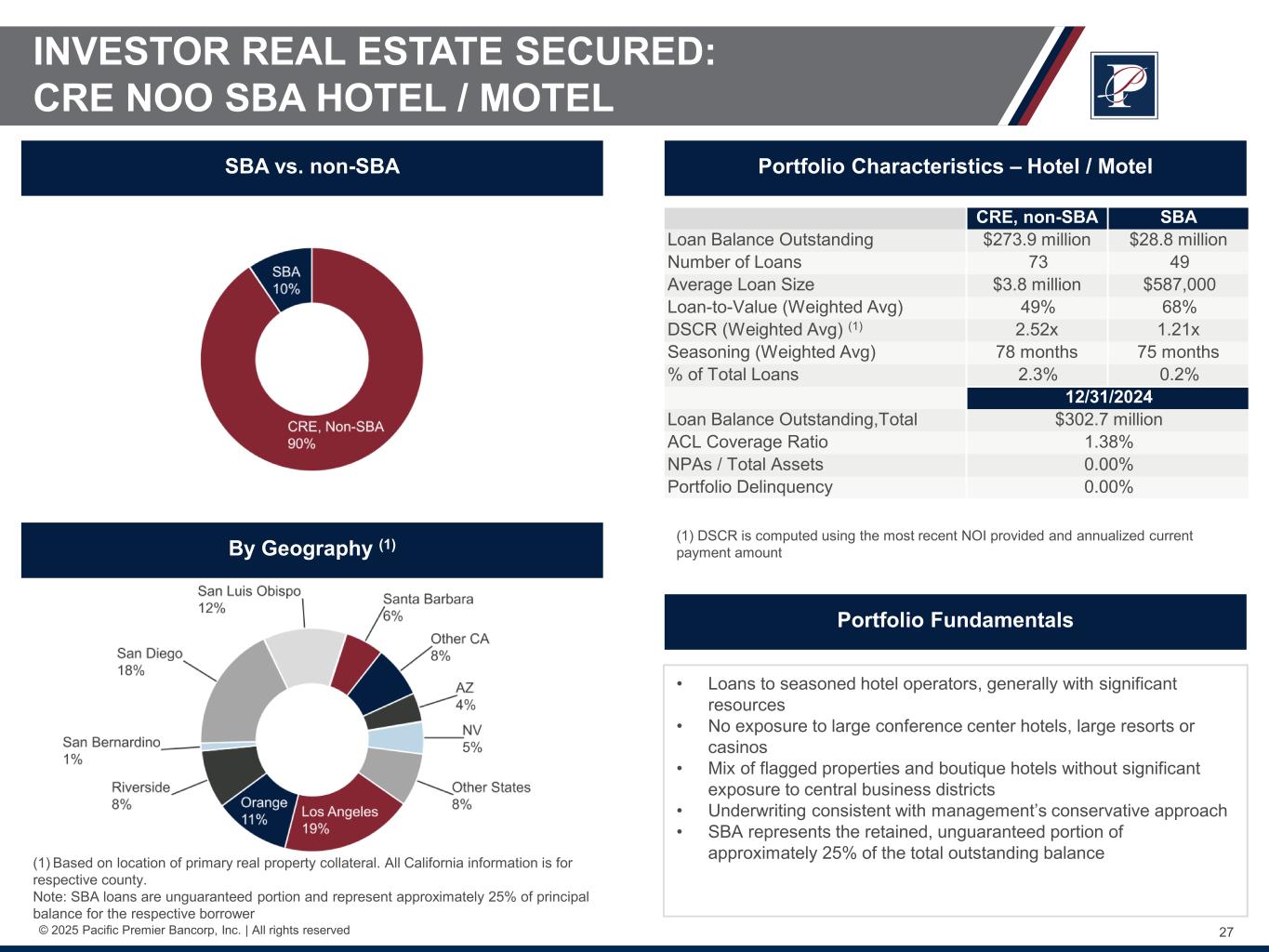

27© 2025 Pacific Premier Bancorp, Inc. | All rights reserved CRE, non-SBA SBA Loan Balance Outstanding $273.9 million $28.8 million Number of Loans 73 49 Average Loan Size $3.8 million $587,000 Loan-to-Value (Weighted Avg) 49% 68% DSCR (Weighted Avg) (1) 2.52x 1.21x Seasoning (Weighted Avg) 78 months 75 months % of Total Loans 2.3% 0.2% 12/31/2024 Loan Balance Outstanding,Total $302.7 million ACL Coverage Ratio 1.38% NPAs / Total Assets 0.00% Portfolio Delinquency 0.00% Portfolio Fundamentals • Loans to seasoned hotel operators, generally with significant resources • No exposure to large conference center hotels, large resorts or casinos • Mix of flagged properties and boutique hotels without significant exposure to central business districts • Underwriting consistent with management’s conservative approach • SBA represents the retained, unguaranteed portion of approximately 25% of the total outstanding balance By Geography (1) Portfolio Characteristics – Hotel / MotelSBA vs. non-SBA (1) Based on location of primary real property collateral. All California information is for respective county. Note: SBA loans are unguaranteed portion and represent approximately 25% of principal balance for the respective borrower INVESTOR REAL ESTATE SECURED: CRE NOO SBA HOTEL / MOTEL (1) DSCR is computed using the most recent NOI provided and annualized current payment amount

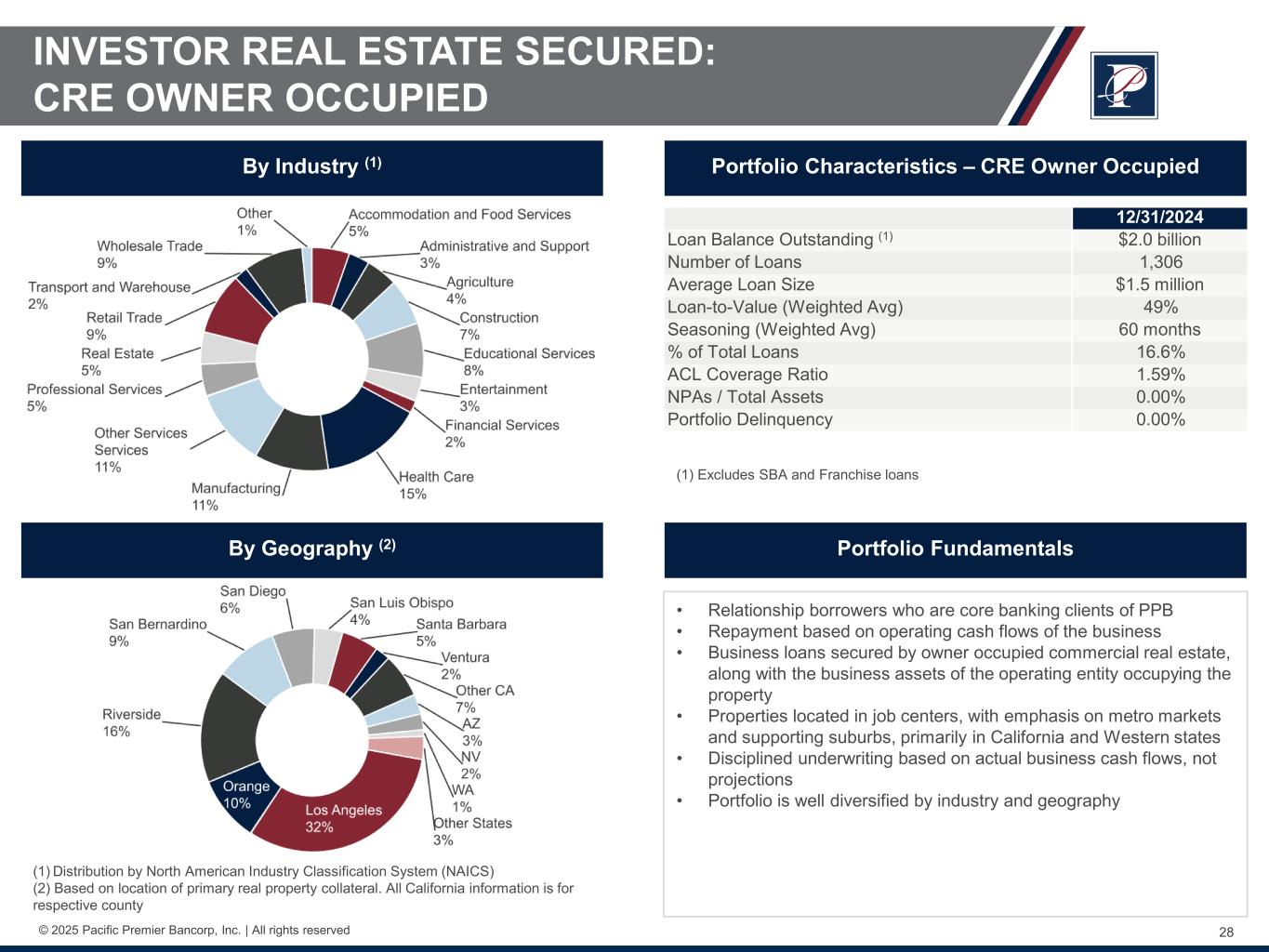

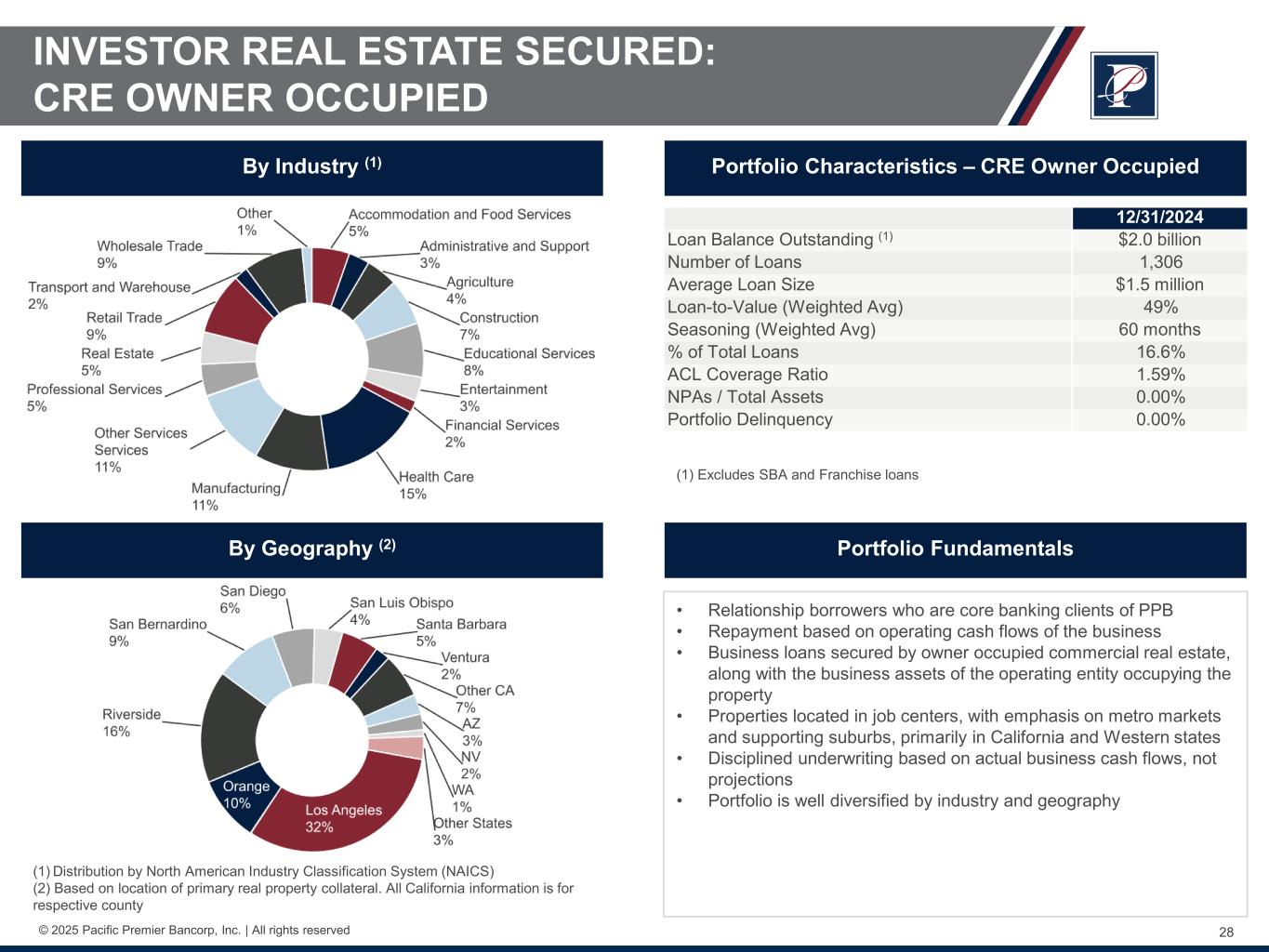

28© 2025 Pacific Premier Bancorp, Inc. | All rights reserved Portfolio Fundamentals • Relationship borrowers who are core banking clients of PPB • Repayment based on operating cash flows of the business • Business loans secured by owner occupied commercial real estate, along with the business assets of the operating entity occupying the property • Properties located in job centers, with emphasis on metro markets and supporting suburbs, primarily in California and Western states • Disciplined underwriting based on actual business cash flows, not projections • Portfolio is well diversified by industry and geography (1) Excludes SBA and Franchise loans By Geography (2) Portfolio Characteristics – CRE Owner OccupiedBy Industry (1) (1) Distribution by North American Industry Classification System (NAICS) (2) Based on location of primary real property collateral. All California information is for respective county 12/31/2024 Loan Balance Outstanding (1) $2.0 billion Number of Loans 1,306 Average Loan Size $1.5 million Loan-to-Value (Weighted Avg) 49% Seasoning (Weighted Avg) 60 months % of Total Loans 16.6% ACL Coverage Ratio 1.59% NPAs / Total Assets 0.00% Portfolio Delinquency 0.00% INVESTOR REAL ESTATE SECURED: CRE OWNER OCCUPIED

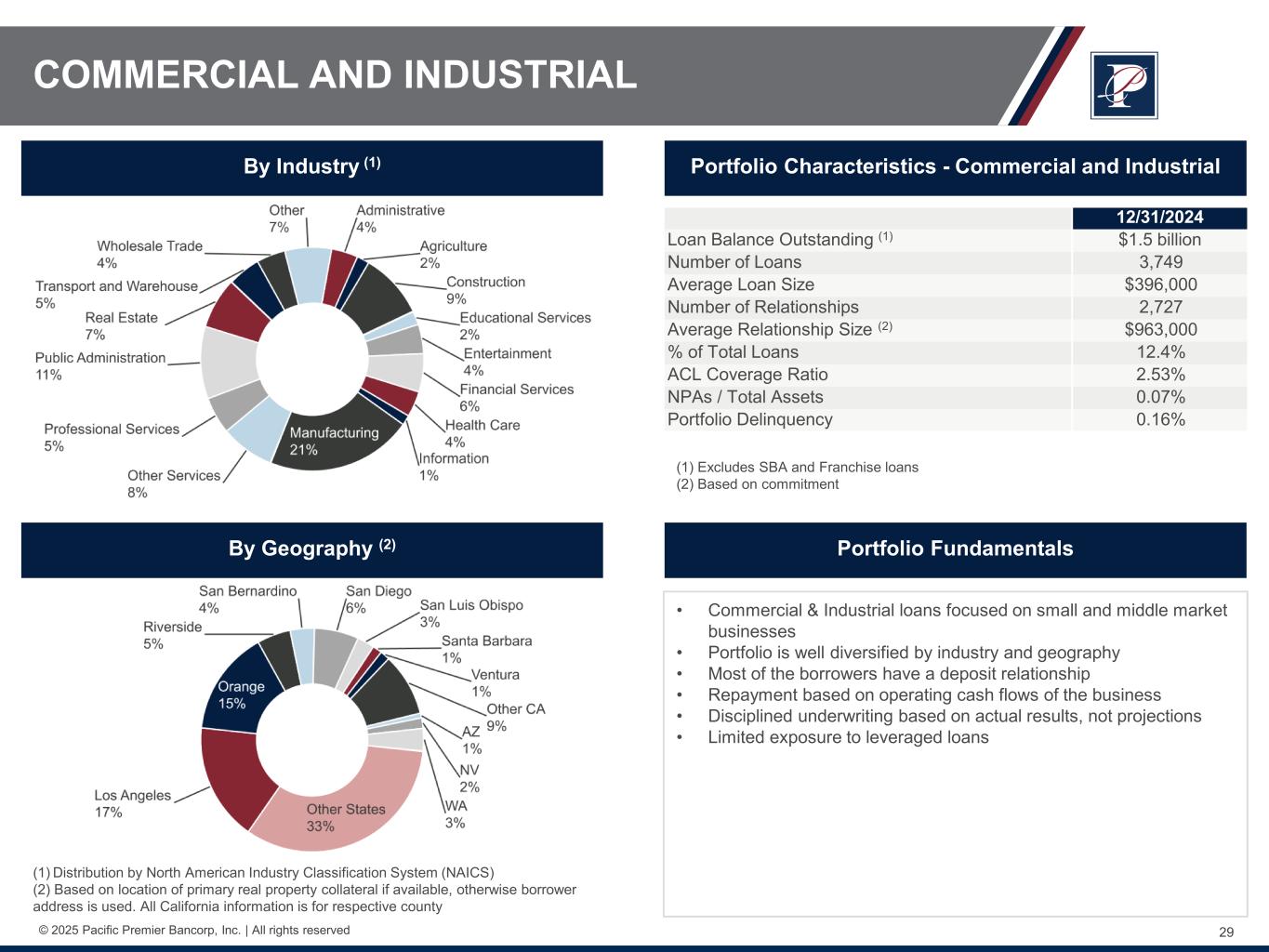

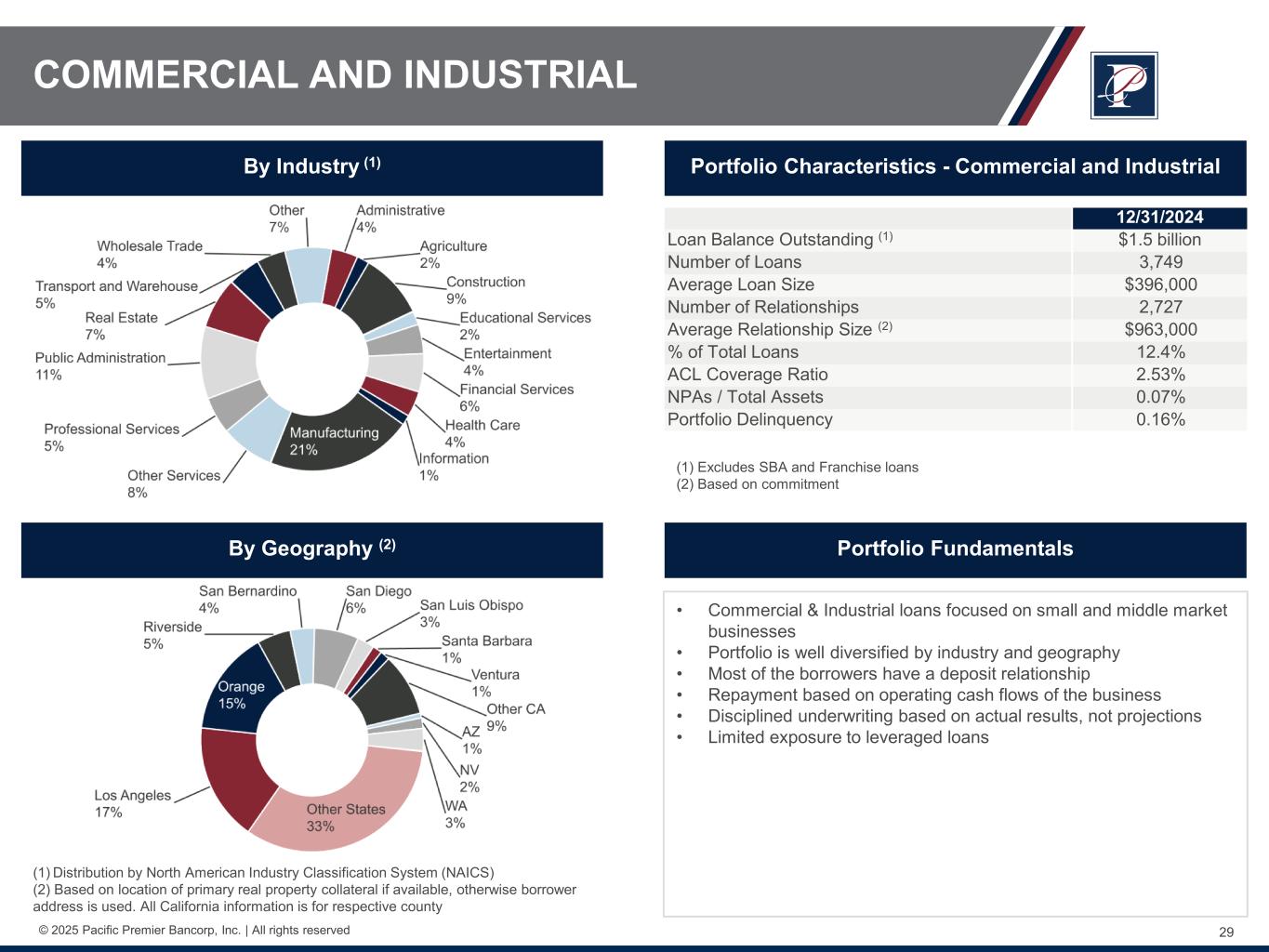

29© 2025 Pacific Premier Bancorp, Inc. | All rights reserved Portfolio Fundamentals • Commercial & Industrial loans focused on small and middle market businesses • Portfolio is well diversified by industry and geography • Most of the borrowers have a deposit relationship • Repayment based on operating cash flows of the business • Disciplined underwriting based on actual results, not projections • Limited exposure to leveraged loans (1) Excludes SBA and Franchise loans (2) Based on commitment By Geography (2) Portfolio Characteristics - Commercial and IndustrialBy Industry (1) (1) Distribution by North American Industry Classification System (NAICS) (2) Based on location of primary real property collateral if available, otherwise borrower address is used. All California information is for respective county 12/31/2024 Loan Balance Outstanding (1) $1.5 billion Number of Loans 3,749 Average Loan Size $396,000 Number of Relationships 2,727 Average Relationship Size (2) $963,000 % of Total Loans 12.4% ACL Coverage Ratio 2.53% NPAs / Total Assets 0.07% Portfolio Delinquency 0.16% COMMERCIAL AND INDUSTRIAL

30© 2025 Pacific Premier Bancorp, Inc. | All rights reserved Portfolio Fundamentals • Majority of Franchise portfolio are Quick Service Restaurant (“QSR”) brands and fast food with national scale with the resources to innovate and command market share • Well diversified by brand, guarantors, geography and collateral type (CRE and C&I) • 100% of the QSR franchise concepts in our portfolio profile have drive-thru, takeout and/or delivery capabilities, with this component expected to remain higher than pre-pandemic levels and thus bring added strength to our portfolio • Borrowers have over 24 years of operating experience on average • Principals provide personal guarantees and all related loans are cross collateralized and cross defaulted • Highly disciplined approach, maintain well-defined market niche with minimal exceptions (1) Based on commitment (2) Fixed Charge Coverage Ratio includes certain fixed expenses in the denominator and is a more conservative measure than DSCR By Geography (2) Portfolio Characteristics - FranchiseBy Concept (1) (1) Other category includes 12 different concepts, none of which is more than 3% (2) Based on state of primary real property collateral if available, otherwise borrower address. Other category includes 24 different states, none of which is more than 4%. 12/31/2024 Loan Balance Outstanding $469.1 million % of Loans Secured by Real Estate Collateral 55% Number of Relationships 126 Average Relationship Size (1) $3.7 million Average Length of Relationship 73 Number of Loans 472 Average Loan Size $994,000 FCCR (Weighted Avg) (2) 1.70 % of Total Loans 3.9% ACL Coverage Ratio 3.55% NPAs / Total Assets 0.00% Portfolio Delinquency 0.00% FRANCHISE LOANS

Strategy and Technology Overview

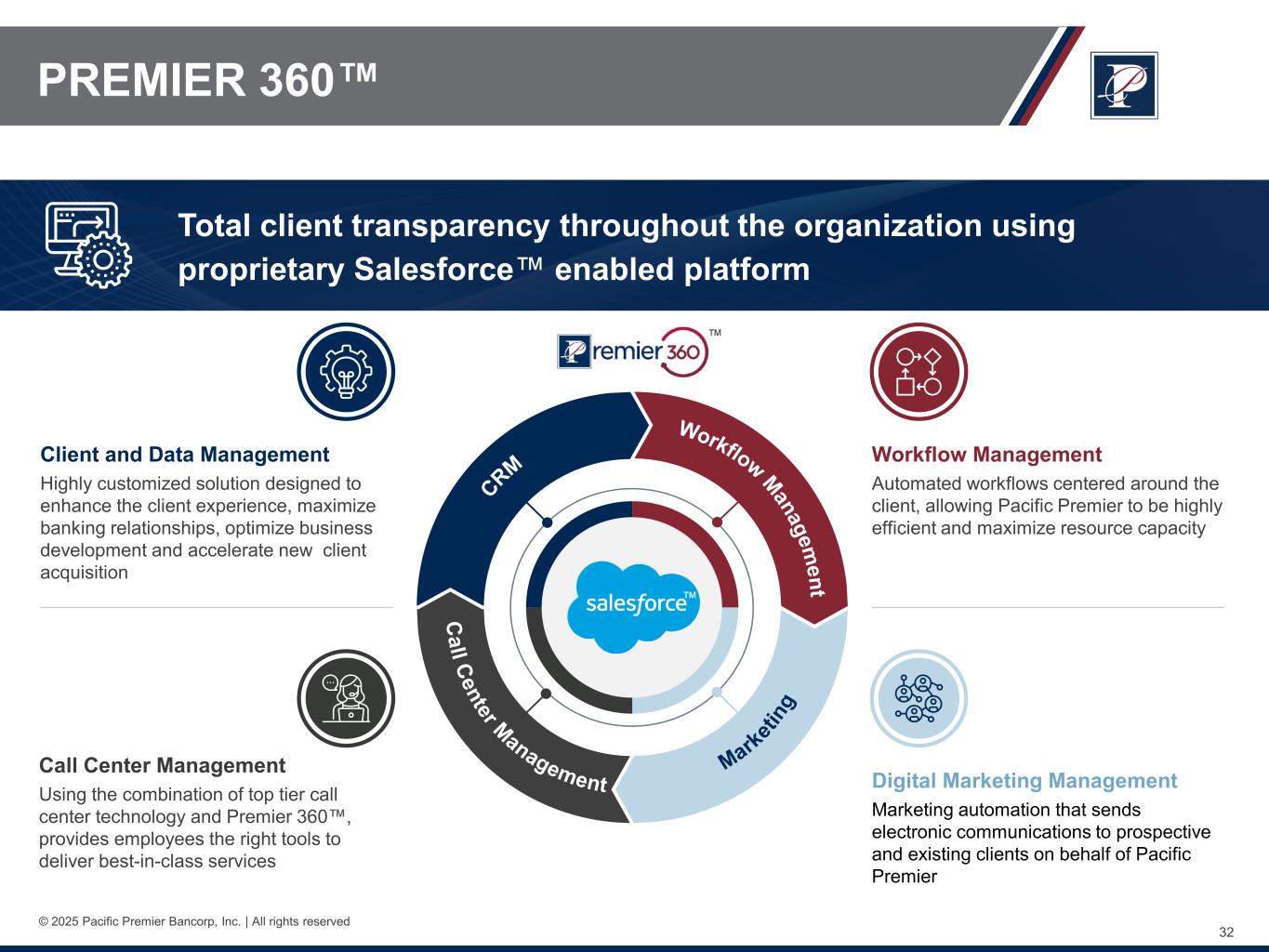

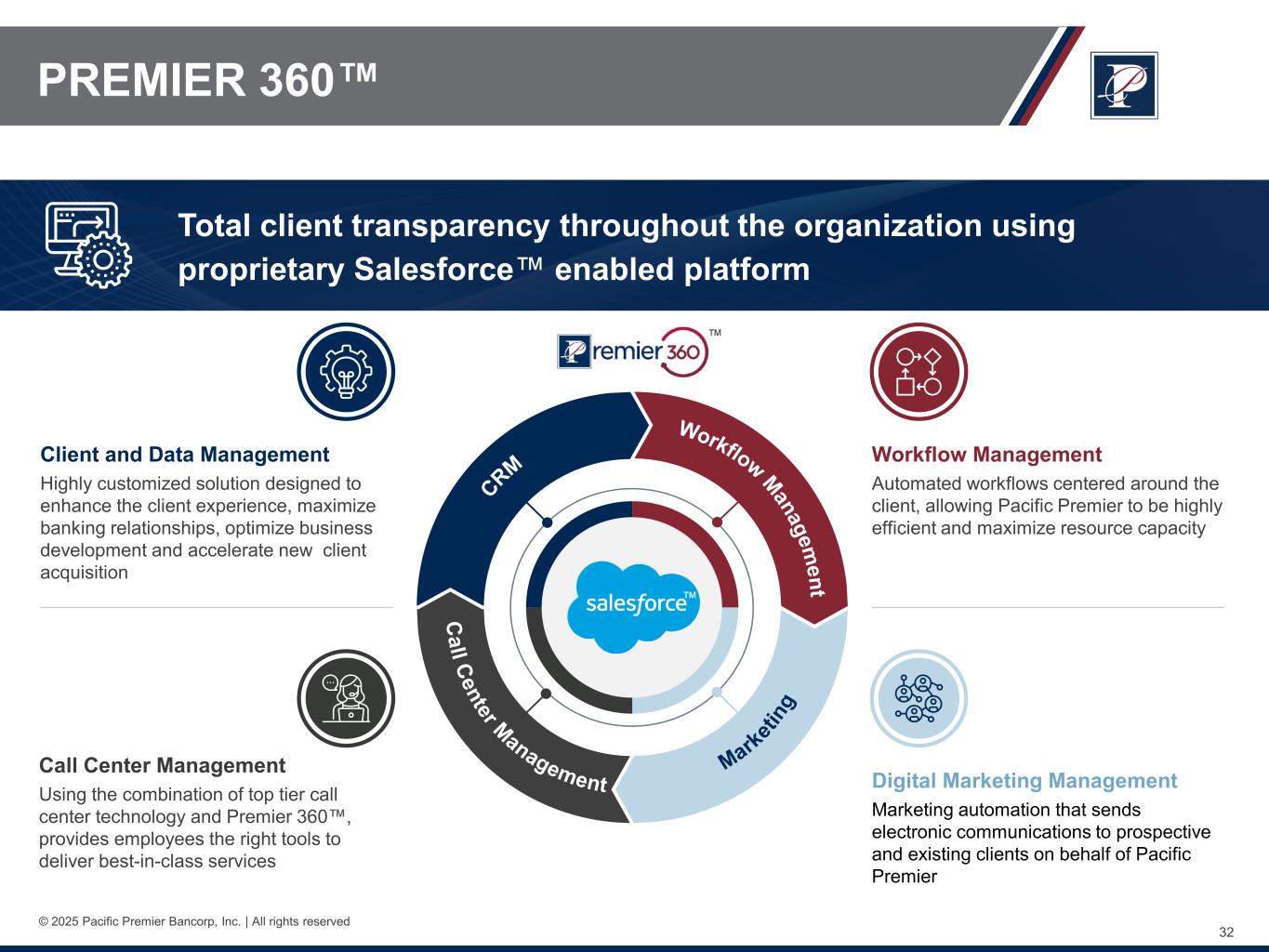

32 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved PREMIER 360 Total client transparency throughout the organization using proprietary Salesforce enabled platform Client and Data Management Highly customized solution designed to enhance the client experience, maximize banking relationships, optimize business development and accelerate new client acquisition Workflow Management Automated workflows centered around the client, allowing Pacific Premier to be highly efficient and maximize resource capacity Call Center Management Using the combination of top tier call center technology and Premier 360 , provides employees the right tools to deliver best-in-class services Digital Marketing Management Marketing automation that sends electronic communications to prospective and existing clients on behalf of Pacific Premier

33 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved CLIENT ACQUISITION - PREMIER 360 New Client Acquisition Onboarding Clients Premier360 Reporting Premier360 is the central database of all potential banking clients and referral sources Each relationship manager owns a targeted number of prospects and referral sources which they call regularly Marketing campaigns are customized, targeted and delivered digitally to prospective clients enabling better call penetration All client onboarding starts and finishes through Premier360 – universal client view as every business unit has visibility of each prospective and existing client Each potential banking relationship is customized to the current and future banking needs of the client Clients have a dedicated relationship manager that owns the relationship All potential client and referral source calls and appointments are tracked with activity reports in Premier360 All business units have access to onboarding pipeline to track progress to ensure client expectations are met All existing client calls and appointments are tracked in Premier360 to foster stronger relationships

PPBI Culture and ESG

35 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved CULTURE AT PACIFIC PREMIER Our culture is defined by our Success Attributes, and they are the foundation of our “one bank, one culture” approach Organizational Culture Integrity • Do the right thing, every time. • Conduct business with the highest ethical standards. • Take responsibility for your actions. Improve • Improvement is incremental. Small changes over time have a significant impact. • Mistakes happen. Learn from them and don’t repeat them. • Be responsible for your personal and professional development. Communicate • Over-communicate. • Provide timely and complete information to all stakeholders. • Collaborate to make better decisions. Achieve • Results matter. • Be open to achieving results in new ways. • A winning attitude is contagious. Urgency • Operate with a sense of urgency. • Be thoughtful, making decisions in a timely manner. • Act today, not tomorrow.

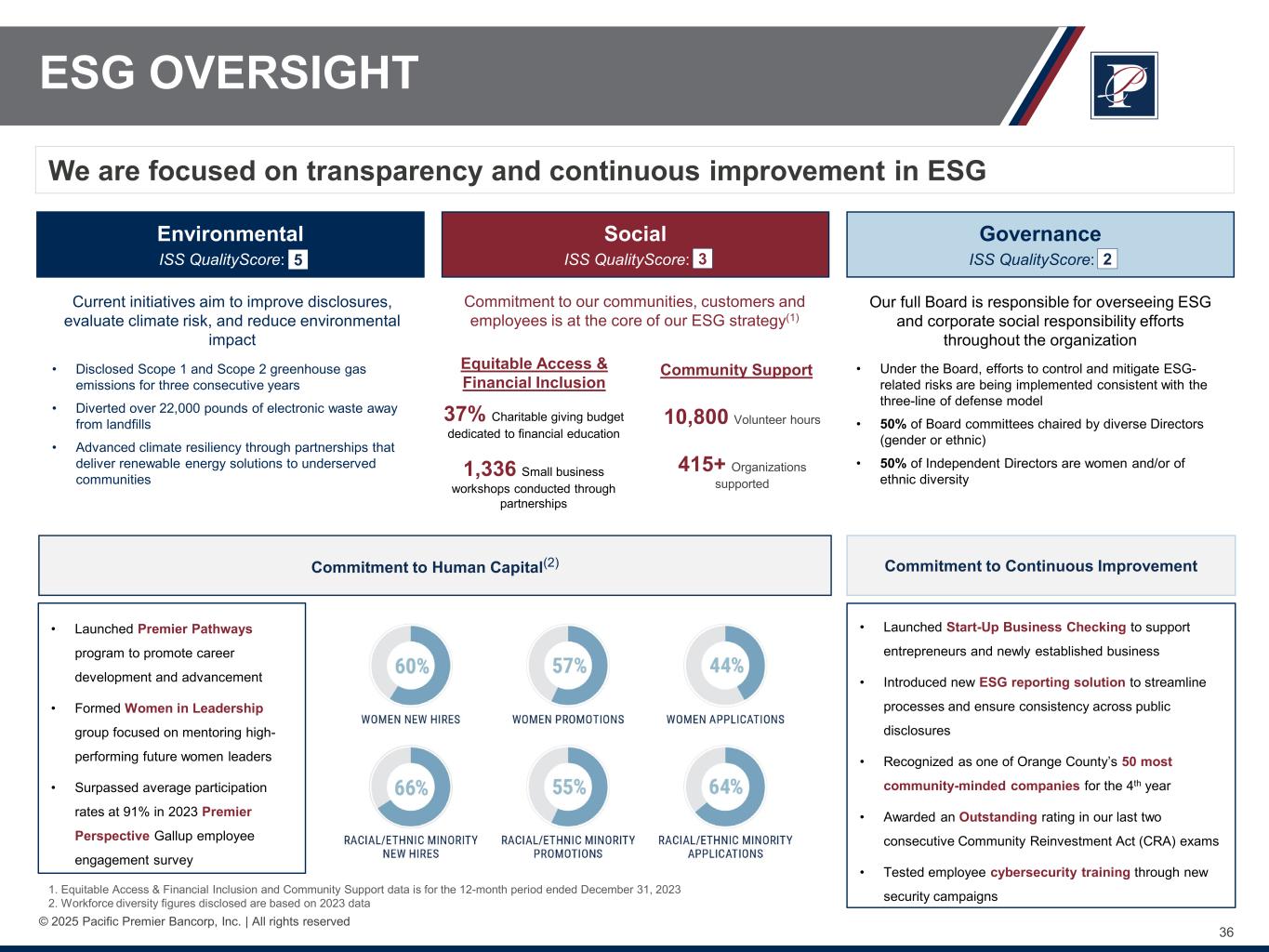

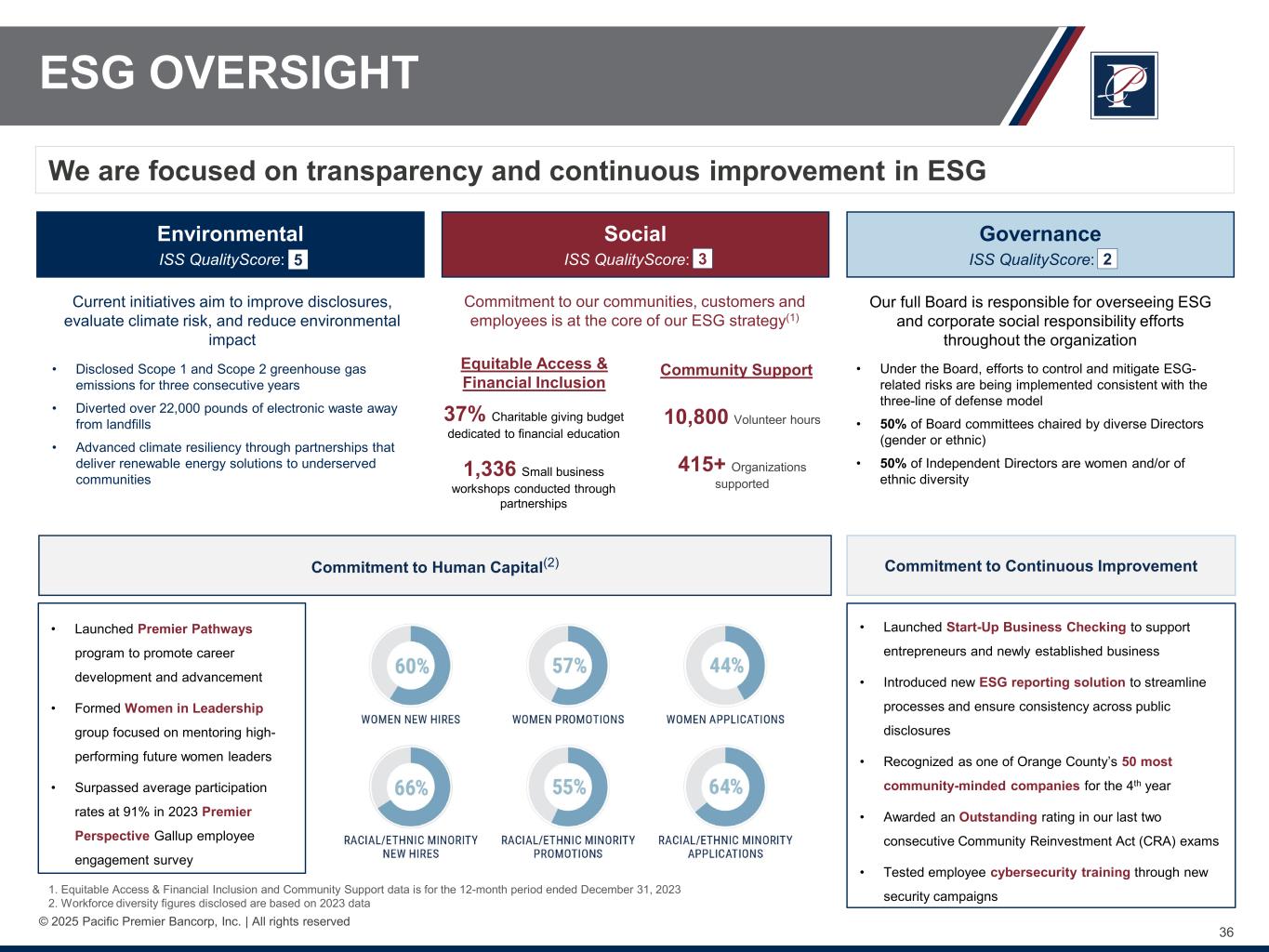

36 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved We are focused on transparency and continuous improvement in ESG Environmental ISS QualityScore: 4 Social ISS QualityScore: 3 Governance ISS QualityScore: 1 • Launched Start-Up Business Checking to support entrepreneurs and newly established business • Introduced new ESG reporting solution to streamline processes and ensure consistency across public disclosures • Recognized as one of Orange County’s 50 most community-minded companies for the 4th year • Awarded an Outstanding rating in our last two consecutive Community Reinvestment Act (CRA) exams • Tested employee cybersecurity training through new security campaigns Current initiatives aim to improve disclosures, evaluate climate risk, and reduce environmental impact Commitment to our communities, customers and employees is at the core of our ESG strategy(1) Community Support 10,800 Volunteer hours 415+ Organizations supported Our full Board is responsible for overseeing ESG and corporate social responsibility efforts throughout the organization 37% Charitable giving budget dedicated to financial education 1,336 Small business workshops conducted through partnerships • Disclosed Scope 1 and Scope 2 greenhouse gas emissions for three consecutive years • Diverted over 22,000 pounds of electronic waste away from landfills • Advanced climate resiliency through partnerships that deliver renewable energy solutions to underserved communities 1. Equitable Access & Financial Inclusion and Community Support data is for the 12-month period ended December 31, 2023 2. Workforce diversity figures disclosed are based on 2023 data Equitable Access & Financial Inclusion ESG OVERSIGHT • Under the Board, efforts to control and mitigate ESG- related risks are being implemented consistent with the three-line of defense model • 50% of Board committees chaired by diverse Directors (gender or ethnic) • 50% of Independent Directors are women and/or of ethnic diversity 5 2 Employee HighlightsCommitment to Human Capital(2) Commitment to Continuous Improvement • Launched Premier Pathways program to promote career development and advancement • Formed Women in Leadership group focused on mentoring high- performing future women leaders • Surpassed average participation rates at 91% in 2023 Premier Perspective Gallup employee engagement survey

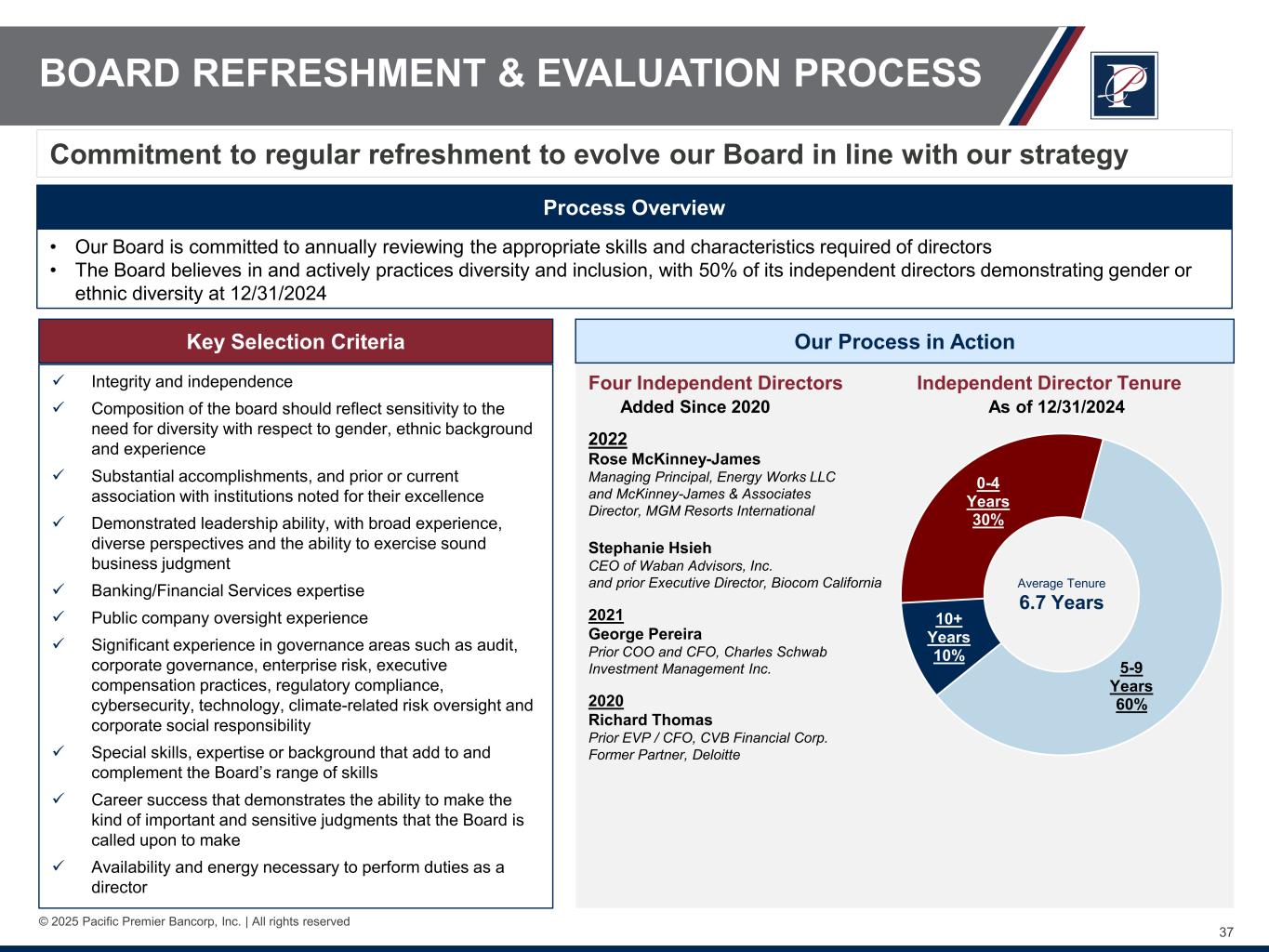

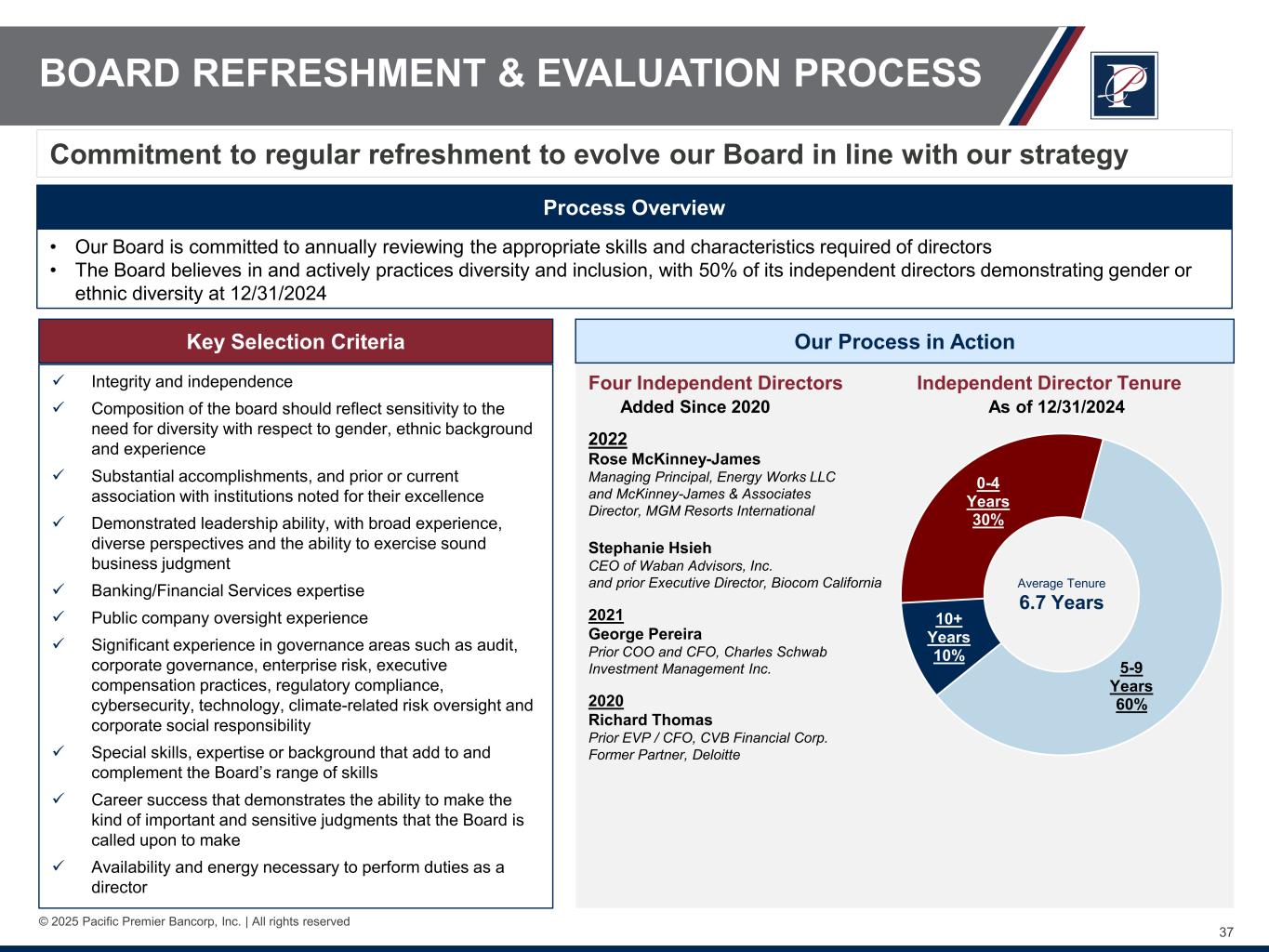

37 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved Four Independent Directors Independent Director Tenure Added Since 2020 As of 12/31/2024 2022 Rose McKinney-James Managing Principal, Energy Works LLC and McKinney-James & Associates Director, MGM Resorts International Stephanie Hsieh CEO of Waban Advisors, Inc. and prior Executive Director, Biocom California 2021 George Pereira Prior COO and CFO, Charles Schwab Investment Management Inc. 2020 Richard Thomas Prior EVP / CFO, CVB Financial Corp. Former Partner, Deloitte Commitment to regular refreshment to evolve our Board in line with our strategy Process Overview • Our Board is committed to annually reviewing the appropriate skills and characteristics required of directors • The Board believes in and actively practices diversity and inclusion, with 50% of its independent directors demonstrating gender or ethnic diversity at 12/31/2024 Key Selection Criteria Integrity and independence Composition of the board should reflect sensitivity to the need for diversity with respect to gender, ethnic background and experience Substantial accomplishments, and prior or current association with institutions noted for their excellence Demonstrated leadership ability, with broad experience, diverse perspectives and the ability to exercise sound business judgment Banking/Financial Services expertise Public company oversight experience Significant experience in governance areas such as audit, corporate governance, enterprise risk, executive compensation practices, regulatory compliance, cybersecurity, technology, climate-related risk oversight and corporate social responsibility Special skills, expertise or background that add to and complement the Board’s range of skills Career success that demonstrates the ability to make the kind of important and sensitive judgments that the Board is called upon to make Availability and energy necessary to perform duties as a director Our Process in Action Average Tenure 6.7 Years BOARD REFRESHMENT & EVALUATION PROCESS 10+ Years 10% 0-4 Years 30% 5-9 Years 60%

38 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved PPBI INVESTMENT THESIS Shareholder value is our key focus – building long-term value for our owners Our culture differentiates us and drives fundamentals for all stakeholders Diverse Board advising on strategy, overseeing risk and ESG, and supporting long-term value creation Financial results remain solid – strong capital ratios and core earnings Emphasis on risk management is a key strength of our organization We have maintained a strong credit culture in both good times and bad Highly experienced and respected bank acquirer – 11 successful acquisitions since 2011

Appendix: Information - Non-GAAP Reconciliation

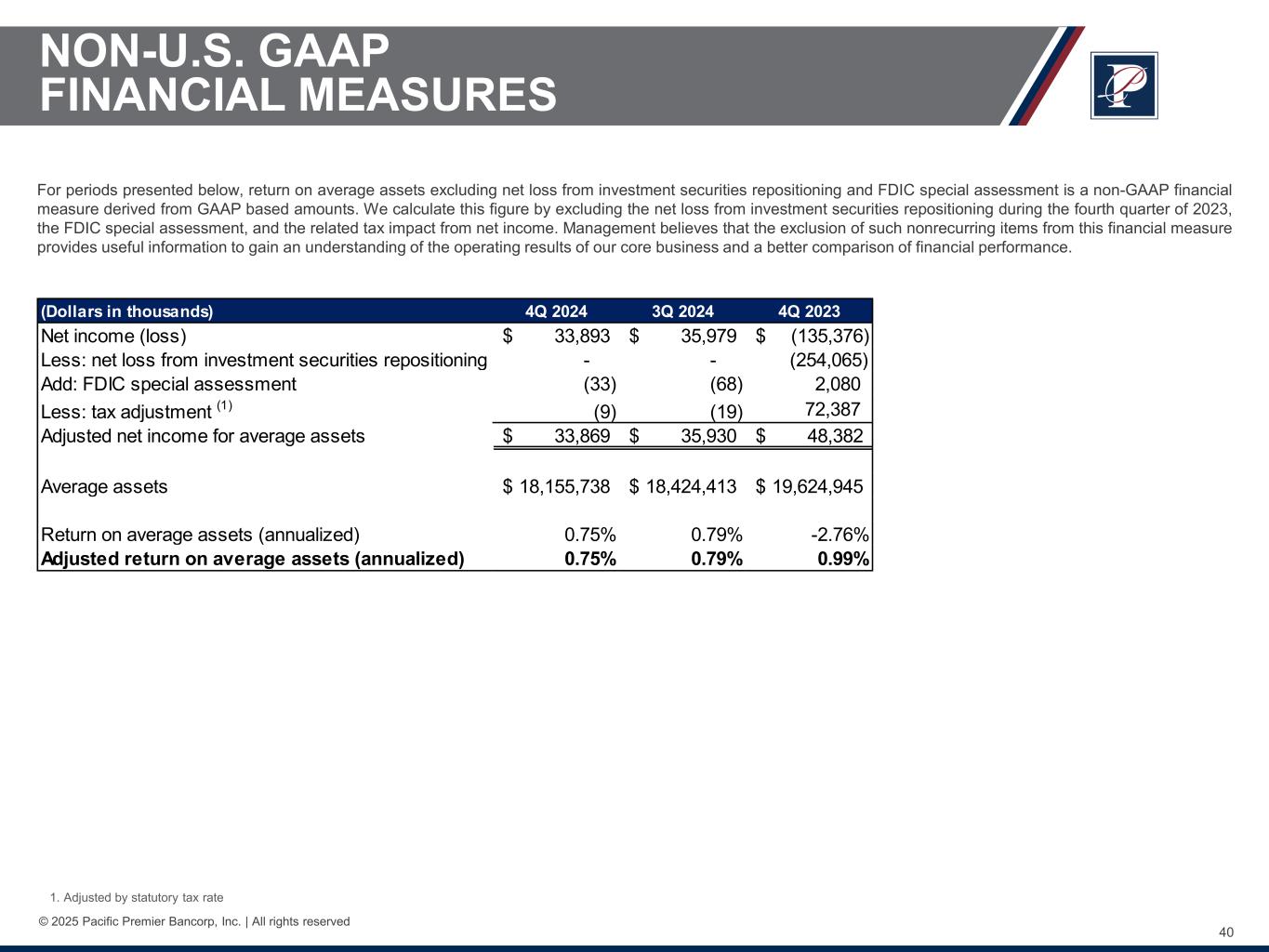

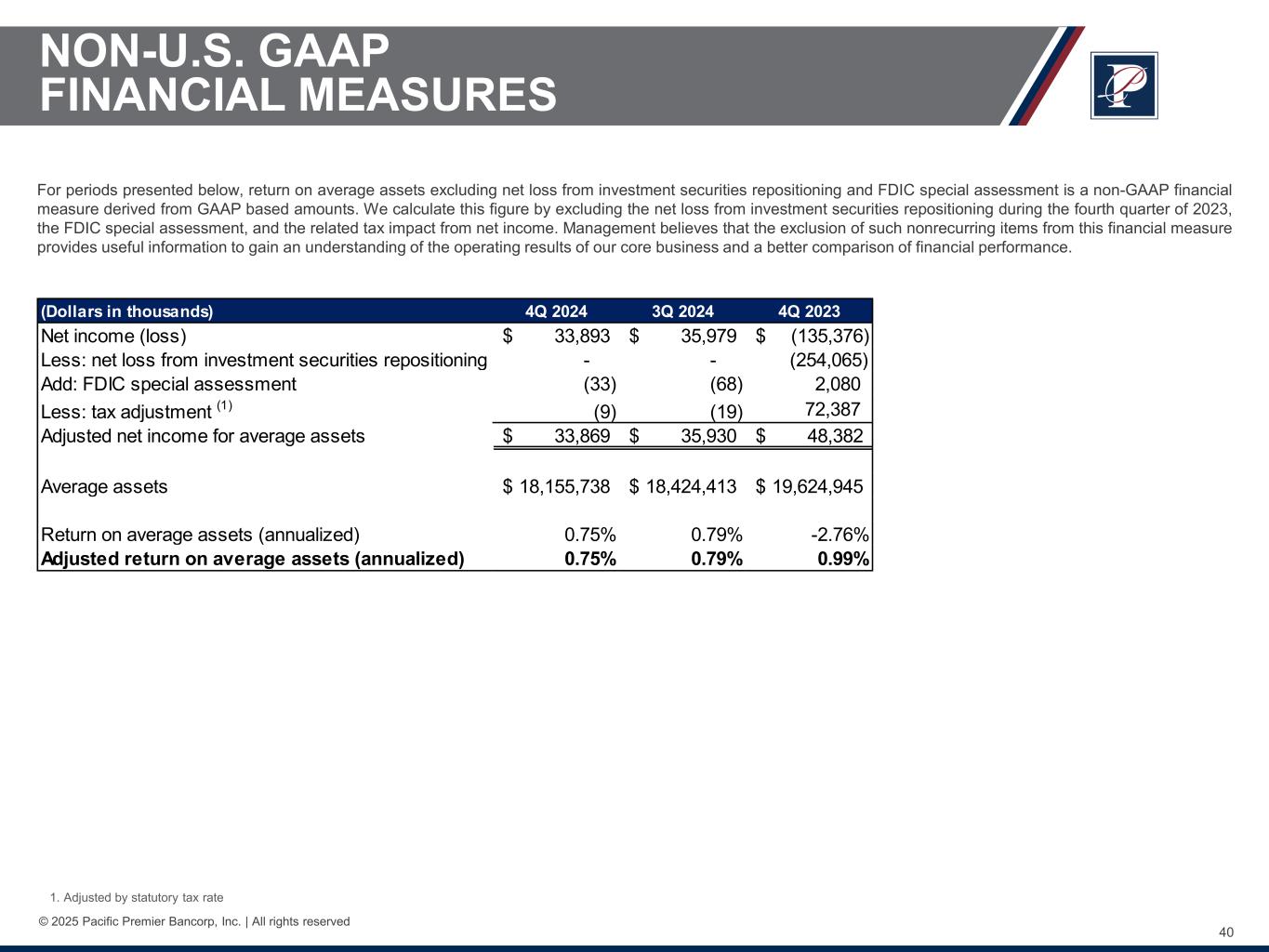

40 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved NON-U.S. GAAP FINANCIAL MEASURES 1. Adjusted by statutory tax rate For periods presented below, return on average assets excluding net loss from investment securities repositioning and FDIC special assessment is a non-GAAP financial measure derived from GAAP based amounts. We calculate this figure by excluding the net loss from investment securities repositioning during the fourth quarter of 2023, the FDIC special assessment, and the related tax impact from net income. Management believes that the exclusion of such nonrecurring items from this financial measure provides useful information to gain an understanding of the operating results of our core business and a better comparison of financial performance. (Dollars in thousands) 4Q 2024 3Q 2024 4Q 2023 Net income (loss) 33,893$ 35,979$ (135,376)$ Less: net loss from investment securities repositioning - - (254,065) Add: FDIC special assessment (33) (68) 2,080 Less: tax adjustment (1) (9) (19) 72,387 Adjusted net income for average assets 33,869$ 35,930$ 48,382$ Average assets 18,155,738$ 18,424,413$ 19,624,945$ Return on average assets (annualized) 0.75% 0.79% -2.76% Adjusted return on average assets (annualized) 0.75% 0.79% 0.99%

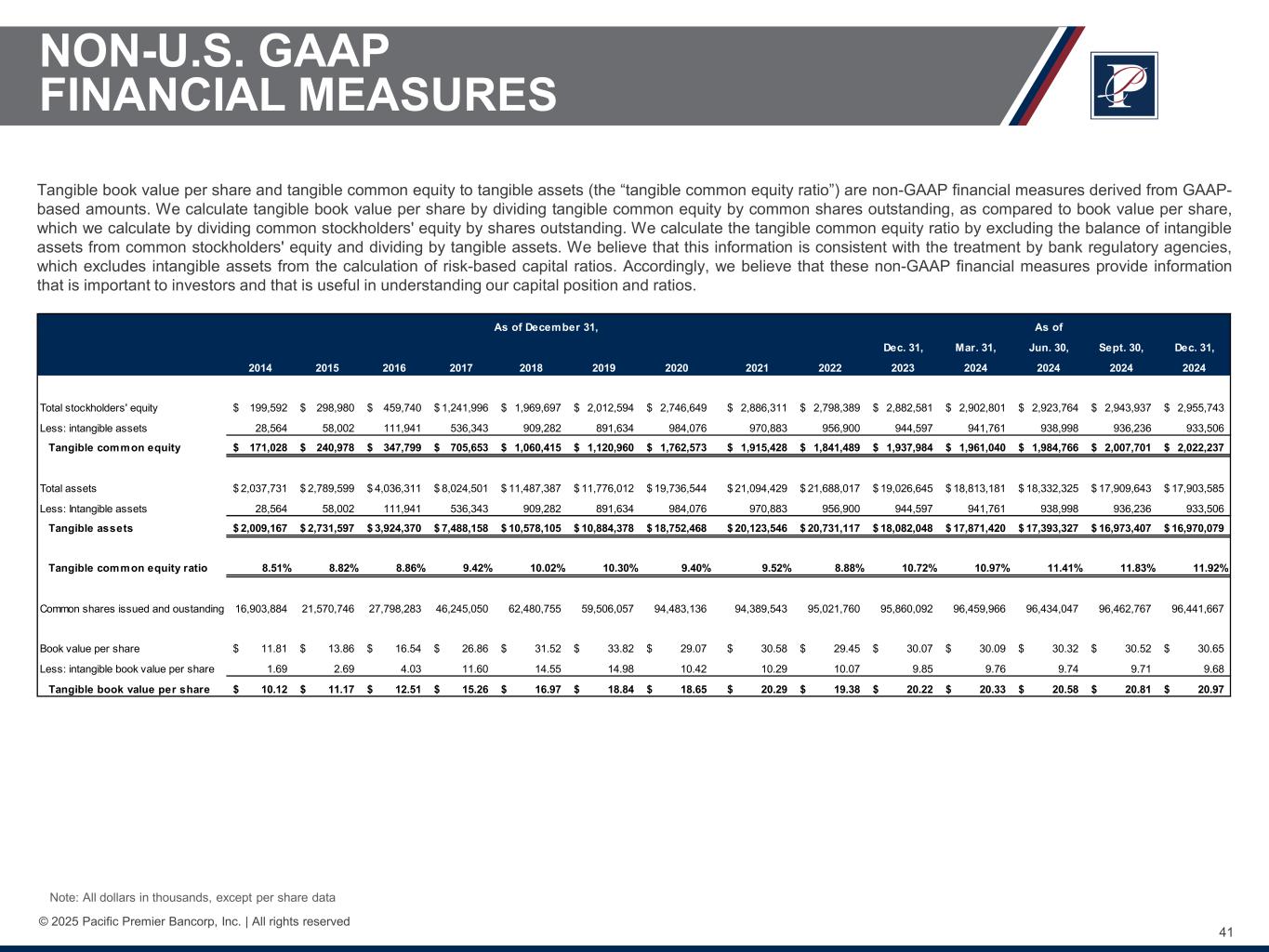

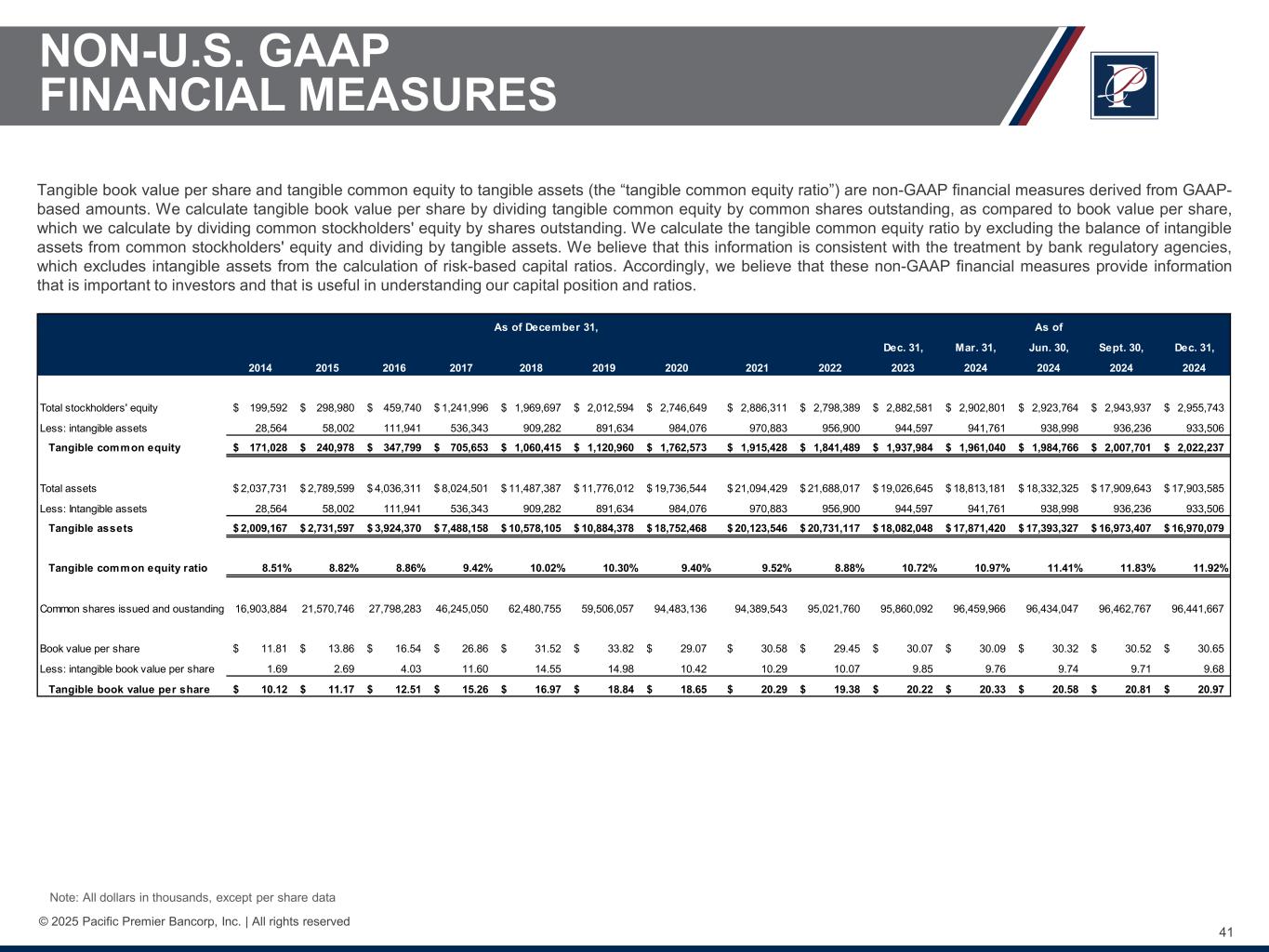

41 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved NON-U.S. GAAP FINANCIAL MEASURES Note: All dollars in thousands, except per share data Tangible book value per share and tangible common equity to tangible assets (the “tangible common equity ratio”) are non-GAAP financial measures derived from GAAP- based amounts. We calculate tangible book value per share by dividing tangible common equity by common shares outstanding, as compared to book value per share, which we calculate by dividing common stockholders' equity by shares outstanding. We calculate the tangible common equity ratio by excluding the balance of intangible assets from common stockholders' equity and dividing by tangible assets. We believe that this information is consistent with the treatment by bank regulatory agencies, which excludes intangible assets from the calculation of risk-based capital ratios. Accordingly, we believe that these non-GAAP financial measures provide information that is important to investors and that is useful in understanding our capital position and ratios. Dec. 31, Mar. 31, Jun. 30, Sept. 30, Dec. 31, 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2024 2024 2024 Total stockholders' equity 199,592$ 298,980$ 459,740$ 1,241,996$ 1,969,697$ 2,012,594$ 2,746,649$ 2,886,311$ 2,798,389$ 2,882,581$ 2,902,801$ 2,923,764$ 2,943,937$ 2,955,743$ Less: intangible assets 28,564 58,002 111,941 536,343 909,282 891,634 984,076 970,883 956,900 944,597 941,761 938,998 936,236 933,506 Tangible common equity 171,028$ 240,978$ 347,799$ 705,653$ 1,060,415$ 1,120,960$ 1,762,573$ 1,915,428$ 1,841,489$ 1,937,984$ 1,961,040$ 1,984,766$ 2,007,701$ 2,022,237$ Total assets 2,037,731$ 2,789,599$ 4,036,311$ 8,024,501$ 11,487,387$ 11,776,012$ 19,736,544$ 21,094,429$ 21,688,017$ 19,026,645$ 18,813,181$ 18,332,325$ 17,909,643$ 17,903,585$ Less: Intangible assets 28,564 58,002 111,941 536,343 909,282 891,634 984,076 970,883 956,900 944,597 941,761 938,998 936,236 933,506 Tangible assets 2,009,167$ 2,731,597$ 3,924,370$ 7,488,158$ 10,578,105$ 10,884,378$ 18,752,468$ 20,123,546$ 20,731,117$ 18,082,048$ 17,871,420$ 17,393,327$ 16,973,407$ 16,970,079$ Tangible common equity ratio 8.51% 8.82% 8.86% 9.42% 10.02% 10.30% 9.40% 9.52% 8.88% 10.72% 10.97% 11.41% 11.83% 11.92% Common shares issued and oustanding 16,903,884 21,570,746 27,798,283 46,245,050 62,480,755 59,506,057 94,483,136 94,389,543 95,021,760 95,860,092 96,459,966 96,434,047 96,462,767 96,441,667 Book value per share 11.81$ 13.86$ 16.54$ 26.86$ 31.52$ 33.82$ 29.07$ 30.58$ 29.45$ 30.07$ 30.09$ 30.32$ 30.52$ 30.65$ Less: intangible book value per share 1.69 2.69 4.03 11.60 14.55 14.98 10.42 10.29 10.07 9.85 9.76 9.74 9.71 9.68 Tangible book value per share 10.12$ 11.17$ 12.51$ 15.26$ 16.97$ 18.84$ 18.65$ 20.29$ 19.38$ 20.22$ 20.33$ 20.58$ 20.81$ 20.97$ As ofAs of December 31,

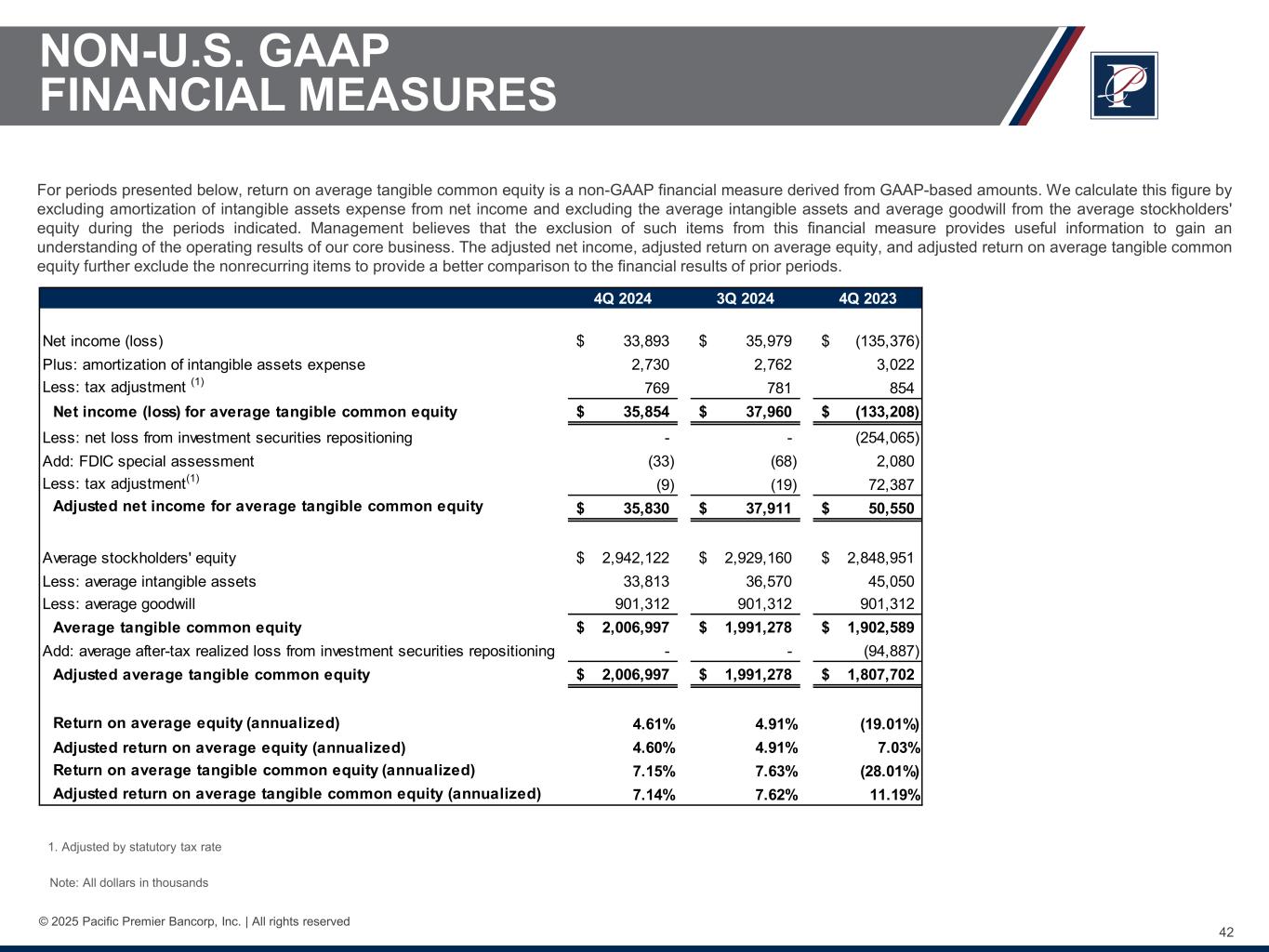

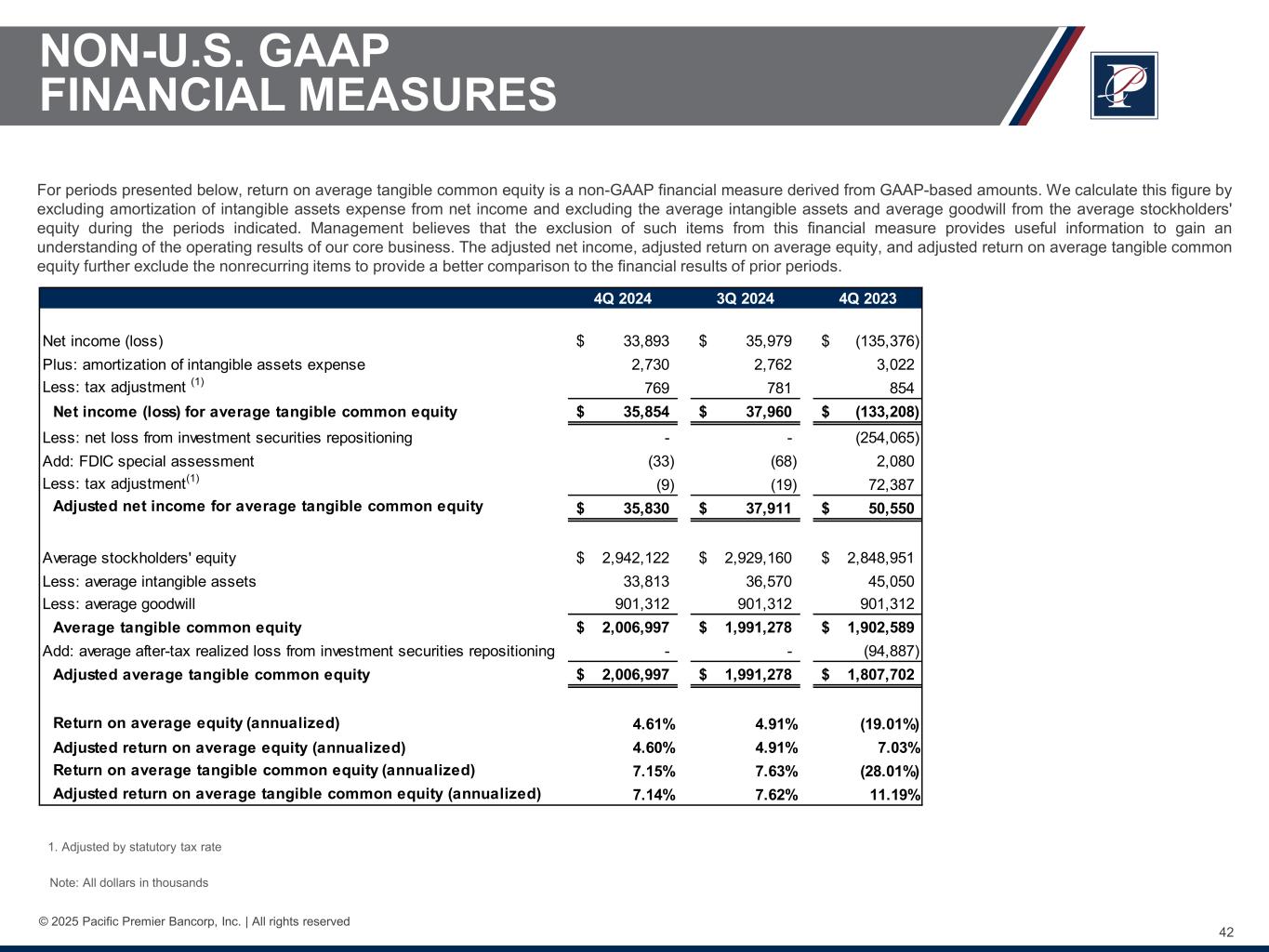

42 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved NON-U.S. GAAP FINANCIAL MEASURES Note: All dollars in thousands For periods presented below, return on average tangible common equity is a non-GAAP financial measure derived from GAAP-based amounts. We calculate this figure by excluding amortization of intangible assets expense from net income and excluding the average intangible assets and average goodwill from the average stockholders' equity during the periods indicated. Management believes that the exclusion of such items from this financial measure provides useful information to gain an understanding of the operating results of our core business. The adjusted net income, adjusted return on average equity, and adjusted return on average tangible common equity further exclude the nonrecurring items to provide a better comparison to the financial results of prior periods. 1. Adjusted by statutory tax rate 4Q 2024 3Q 2024 4Q 2023 Net income (loss) 33,893$ 35,979$ (135,376)$ Plus: amortization of intangible assets expense 2,730 2,762 3,022 Less: tax adjustment (1) 769 781 854 Net income (loss) for average tangible common equity 35,854$ 37,960$ (133,208)$ Less: net loss from investment securities repositioning - - (254,065) Add: FDIC special assessment (33) (68) 2,080 Less: tax adjustment(1) (9) (19) 72,387 Adjusted net income for average tangible common equity 35,830$ 37,911$ 50,550$ Average stockholders' equity 2,942,122$ 2,929,160$ 2,848,951$ Less: average intangible assets 33,813 36,570 45,050 Less: average goodwill 901,312 901,312 901,312 Average tangible common equity 2,006,997$ 1,991,278$ 1,902,589$ Add: average after-tax realized loss from investment securities repositioning - - (94,887) Adjusted average tangible common equity 2,006,997$ 1,991,278$ 1,807,702$ Return on average equity (annualized) 4.61% 4.91% (19.01%) Adjusted return on average equity (annualized) 4.60% 4.91% 7.03% Return on average tangible common equity (annualized) 7.15% 7.63% (28.01%) Adjusted return on average tangible common equity (annualized) 7.14% 7.62% 11.19%

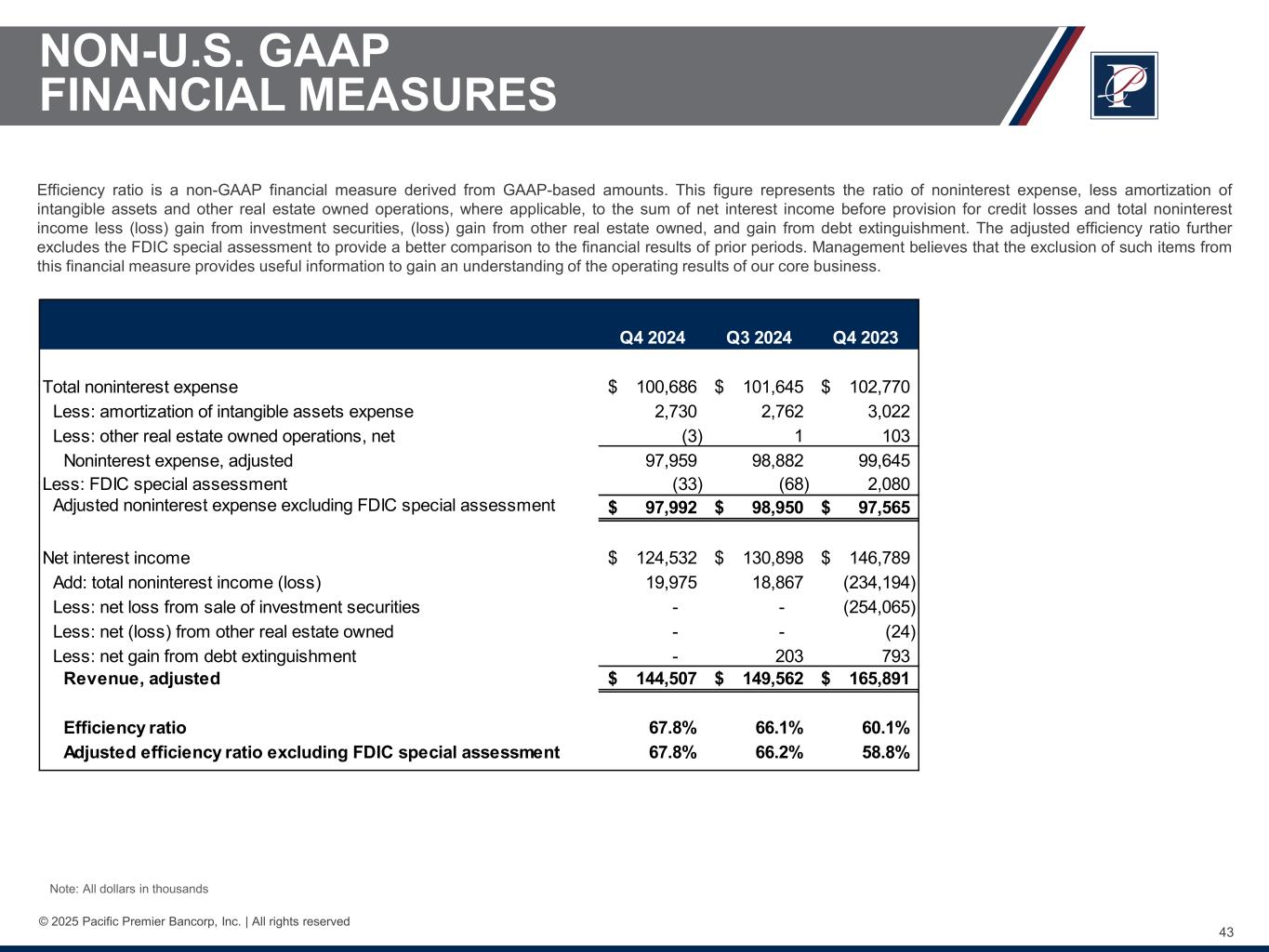

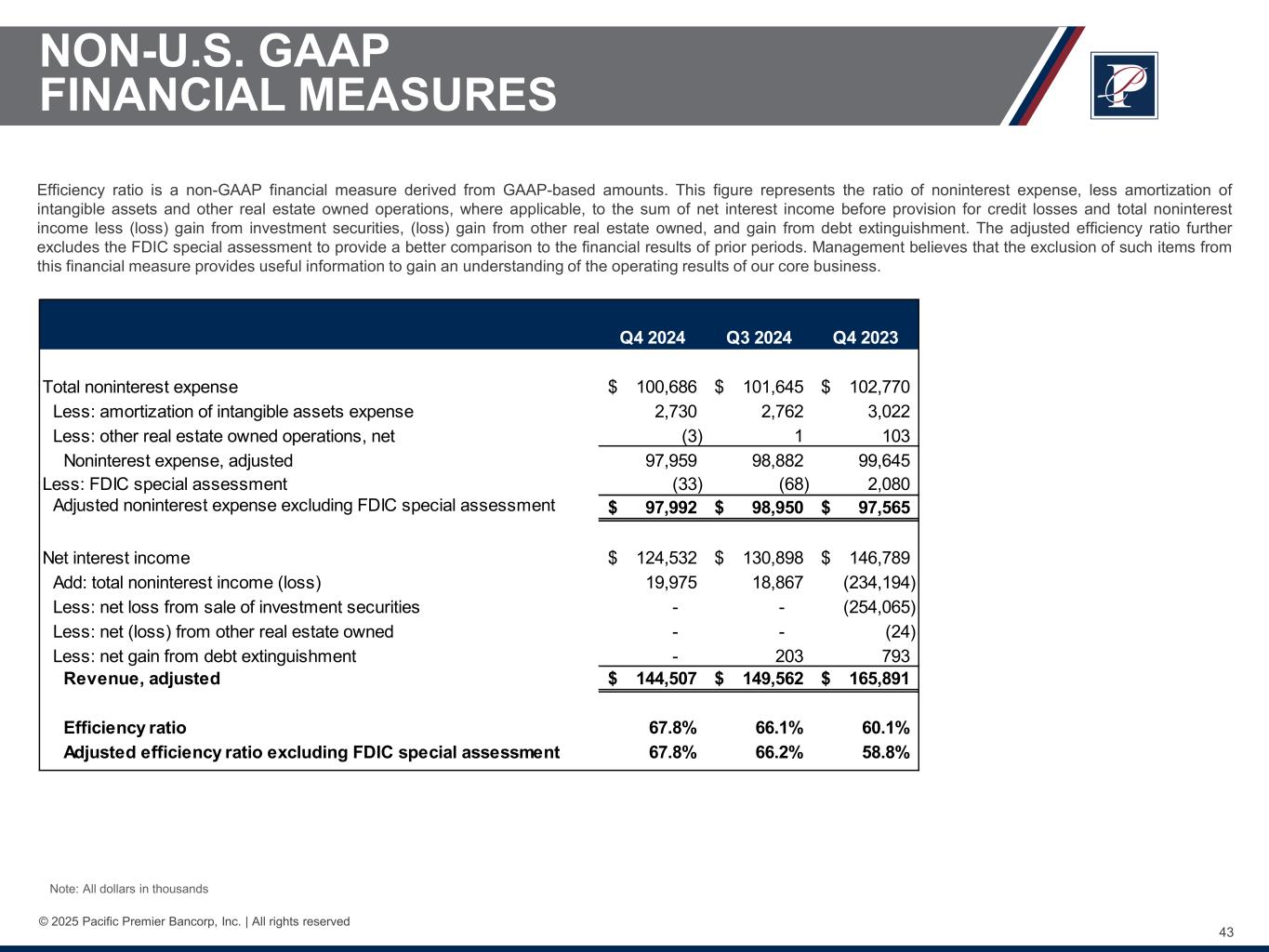

43 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved NON-U.S. GAAP FINANCIAL MEASURES Note: All dollars in thousands Efficiency ratio is a non-GAAP financial measure derived from GAAP-based amounts. This figure represents the ratio of noninterest expense, less amortization of intangible assets and other real estate owned operations, where applicable, to the sum of net interest income before provision for credit losses and total noninterest income less (loss) gain from investment securities, (loss) gain from other real estate owned, and gain from debt extinguishment. The adjusted efficiency ratio further excludes the FDIC special assessment to provide a better comparison to the financial results of prior periods. Management believes that the exclusion of such items from this financial measure provides useful information to gain an understanding of the operating results of our core business. Q4 2024 Q3 2024 Q4 2023 Total noninterest expense 100,686$ 101,645$ 102,770$ Less: amortization of intangible assets expense 2,730 2,762 3,022 Less: other real estate owned operations, net (3) 1 103 Noninterest expense, adjusted 97,959 98,882 99,645 Less: FDIC special assessment (33) (68) 2,080 Adjusted noninterest expense excluding FDIC special assessment 97,992$ 98,950$ 97,565$ Net interest income 124,532$ 130,898$ 146,789$ Add: total noninterest income (loss) 19,975 18,867 (234,194) Less: net loss from sale of investment securities - - (254,065) Less: net (loss) from other real estate owned - - (24) Less: net gain from debt extinguishment - 203 793 Revenue, adjusted 144,507$ 149,562$ 165,891$ Efficiency ratio 67.8% 66.1% 60.1% Adjusted efficiency ratio excluding FDIC special assessment 67.8% 66.2% 58.8%

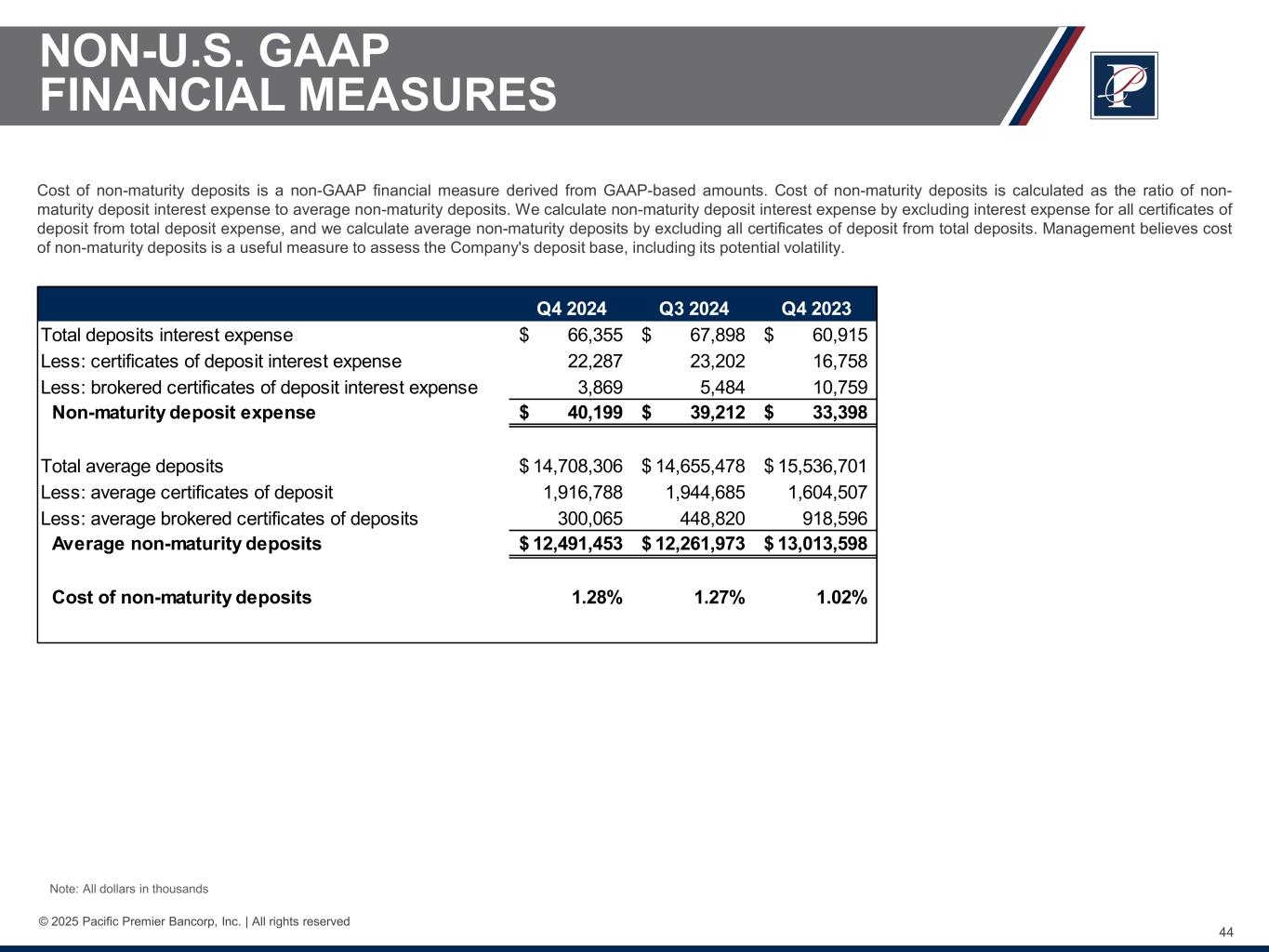

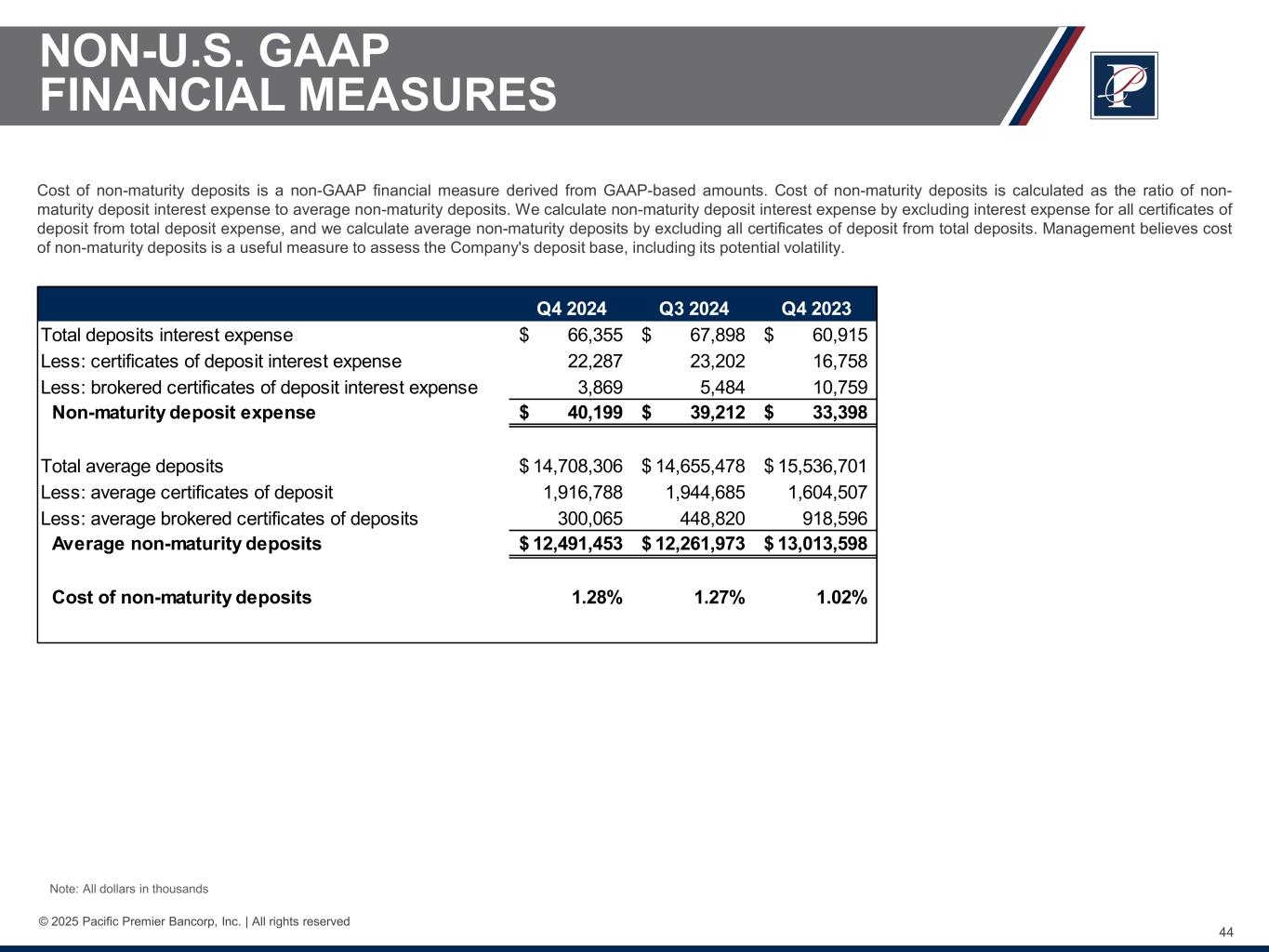

44 © 2025 Pacific Premier Bancorp, Inc. | All rights reserved NON-U.S. GAAP FINANCIAL MEASURES Cost of non-maturity deposits is a non-GAAP financial measure derived from GAAP-based amounts. Cost of non-maturity deposits is calculated as the ratio of non- maturity deposit interest expense to average non-maturity deposits. We calculate non-maturity deposit interest expense by excluding interest expense for all certificates of deposit from total deposit expense, and we calculate average non-maturity deposits by excluding all certificates of deposit from total deposits. Management believes cost of non-maturity deposits is a useful measure to assess the Company's deposit base, including its potential volatility. Note: All dollars in thousands Q4 2024 Q3 2024 Q4 2023 Total deposits interest expense 66,355$ 67,898$ 60,915$ Less: certificates of deposit interest expense 22,287 23,202 16,758 Less: brokered certificates of deposit interest expense 3,869 5,484 10,759 Non-maturity deposit expense 40,199$ 39,212$ 33,398$ Total average deposits 14,708,306$ 14,655,478$ 15,536,701$ Less: average certificates of deposit 1,916,788 1,944,685 1,604,507 Less: average brokered certificates of deposits 300,065 448,820 918,596 Average non-maturity deposits 12,491,453$ 12,261,973$ 13,013,598$ Cost of non-maturity deposits 1.28% 1.27% 1.02%