- PPBI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Pacific Premier Bancorp (PPBI) 8-KFinancial statements and exhibits

Filed: 17 Mar 04, 12:00am

Nasdaq National Market (PPBI)

Regulation FD

This presentation may include forward-looking statements. The statements contained

herein that are not historical facts are forward-looking statements based on

management’s current expectations and beliefs concerning future developments and their

potential effects on the Company. There can be no assurance that future developments

affecting the Company will be the same as those anticipated by management. Actual

results may differ from those projected in the forward-looking statements. These

forward-looking statements involve risks and uncertainties. These include, but are not

limited to, the following risks: (1) changes in the performance of the financial markets,

(2) changes in the demand for and market acceptance of the Company’s products and

services, (3) changes in general economic conditions including interest rates, presence of

competitors with greater financial resources, and the impact of competitive projects and

pricing, (4) the effect of the Company’s policies, (5) the continued availability of

adequate funding sources, (6) actual prepayment rates and credit losses as compared to

prepayment rates and credit losses assumed by the Company for purposes of its valuation

of mortgage derivative securities (the “Participation Contract”), (7) the effect of

changes in market interest rates on the spread between the coupon rate and the pass

through rate and on the discount rate assumed by the Company in its valuation of its

Participation Contract, and (8) various legal, regulatory and litigation risks.

2

Overview

Community Bank based in Southern California

New management successfully repositioned company

2000 - 2001 poor asset quality, high cost deposits, regulatory

2001 - 2002 private placement, community banking model

2002 - 2003 secondary offering, turn-around complete

Exceptional growth opportunities in a vibrant market

Southern California – 3 retail offices

Income property lending

Earnings at inflection point

Substantial reduction of interest expense

Fixed costs in place, income tax benefits

3

Experienced Management Team

4

Years

Name (Age)

Position

Experience

_________________________________________________________________________________

Steven Gardner (43)

President & Chief Executive Officer

20

John Shindler (48)

Chief Financial Officer

27

Andrew Anderson (40)

Director of Retail Banking

21

Eddie Wilcox (37)

Chief Credit Officer

16

Kathi Duncan (47)

Director of Human Resources and Compliance

24

Jim Sanchez (41)

Director of Information Technology

20

Robert Johnson (60)

Director of Internal Audit

32

Growth and Operating Strategies

Increase origination of income property loans

Wholesale origination

New Account Managers hired – Q4 2003

Retail Originations

Grow retail branch deposit base

Relationship selling – small businesses, consumers

Introduce additional products and services

Grow organically or through strategic opportunities

5

Income Property Lending

Multi-family Markets

Excellent growth opportunities

Expansive Fragmented market

$16 billion of loans originated in So. California

Top 10 lenders represent less than 50% of the market

Over 900 various lenders in the state of California

Southern California #1 market in the country

Source:

- DataQuick Information Systems

- National Multi Housing Council, “Apartments: A $1.3 Trillion Market”, 2001

- Southern California consisting primarily of the counties of Los Angeles, Orange, San Diego, San Bernardino, Ventura, Santa Barbara, and Riverside.

6

Multi-family Lending Sector has

Superior Asset Quality

West Region

2001

2002

2003

4Q 03

Loan Type:

Multi-family

0.00%

0.00%

0.01%

0.01%

Commercial RE

0.19%

0.09%

0.08%

0.03%

SFR Construction

0.20%

0.18%

0.09%

-0.02%

Single Family

0.06%

0.07%

0.04%

0.03%

Source: Office of Thrift Supervision

National

Annualized Net Charge-Off Rates

7

Lending Strategy

Increase origination of income property loans

Focus on multi-family properties – higher risk adjusted rates

of return than other mortgage related asset classes

Asset quality directs all of our lending activities -

Underwriting focused on actual cash flow, borrower

liquidity and collateral marketability

Adjustable interest rates, floor rates and prepayment

penalties on virtually all loans

Results in overall lower collection costs, consistent revenue stream,

well positioned for rising interest rates and higher gains on excess production

8

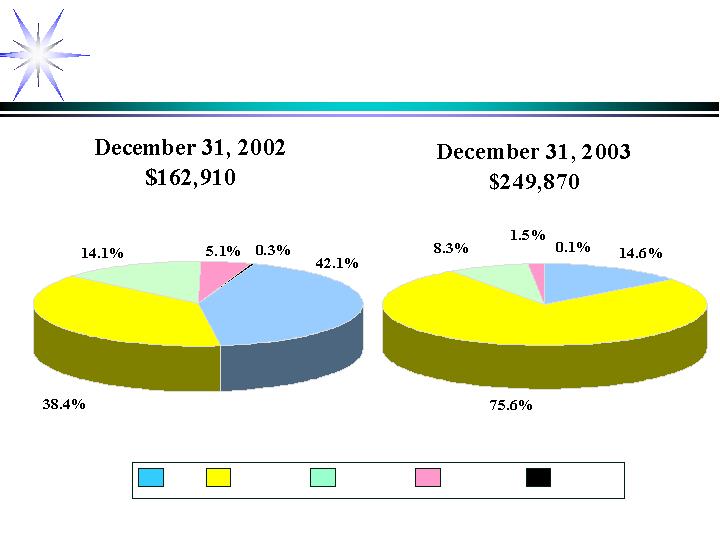

Loan Portfolio Composition

SFR

Multi-family

Commercial

Construction

Other

(dollars in thousands)

9

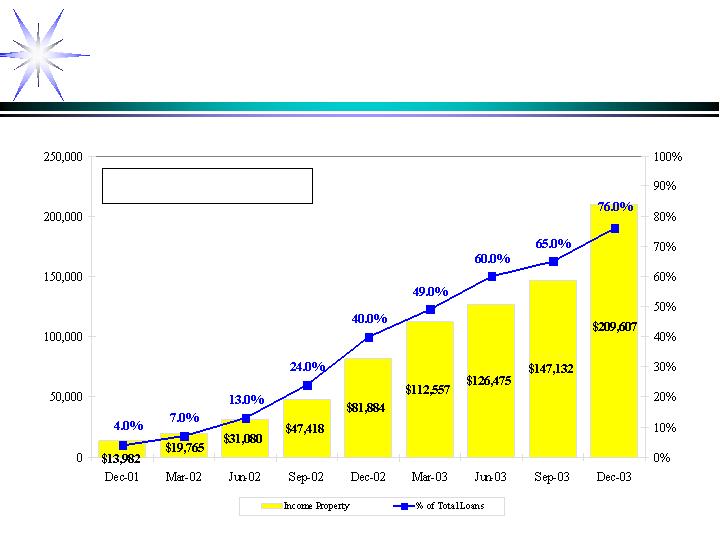

Income Property

(dollars in thousands)

CAGR 170.9%

10

Loan Portfolio Characteristics

11

At Origination through December 31, 2003

Multifamily

Average Loan to Value

66.7%

Average Debt Coverage Ratio

1.36:1

Average Balance

$728,000

Commercial Real Estate

Average Loan to Value

60.8%

Average Debt Coverage Ratio

1.52:1

Average Balance

$981,000

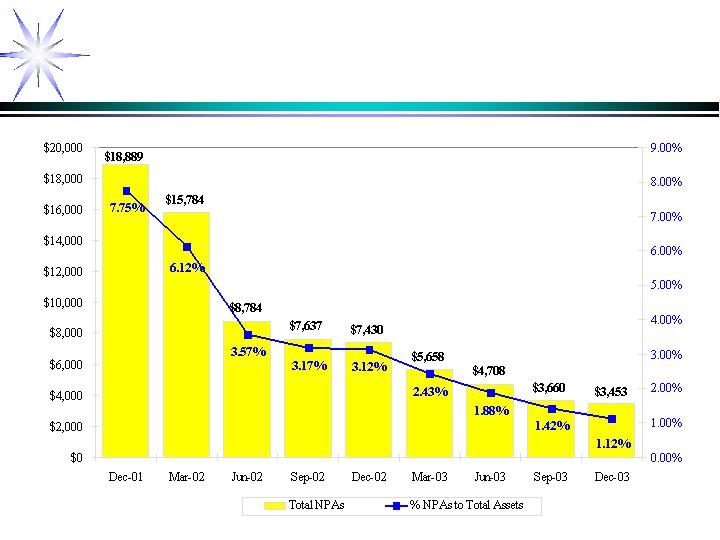

Improving Asset Quality Trends:

NPAs to Total Assets

(dollars in thousands)

12

Retail Branch Strategy

Grow retail branch deposit base

Increase transaction accounts with emphasis on relationship

banking with small business owners

Enhanced product offerings – community bank product

menu

Cross-sell of various products and services, multiple

accounts per customer to ensure they are “fully banked”

Results in stable deposit base, lower funding cost,

increased fee income and improved franchise value

13

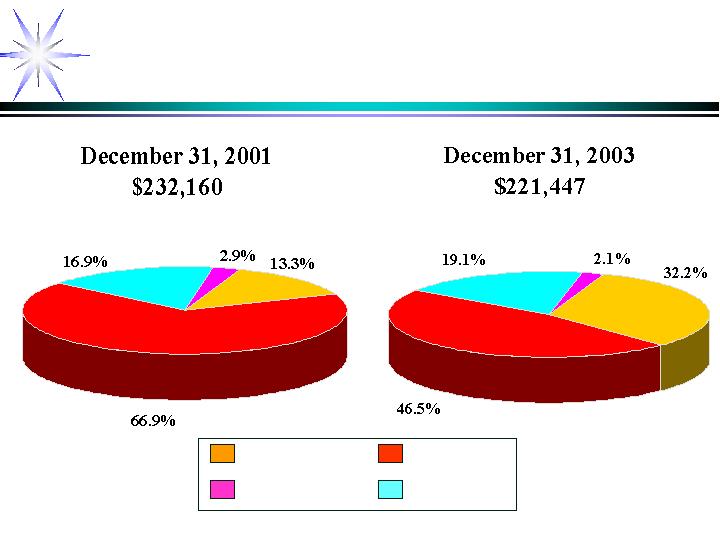

Deposit Portfolio Composition

(dollars in thousands)

Transaction accounts

Jumbo CDs

Wholesale CDs

Retail CDs

14

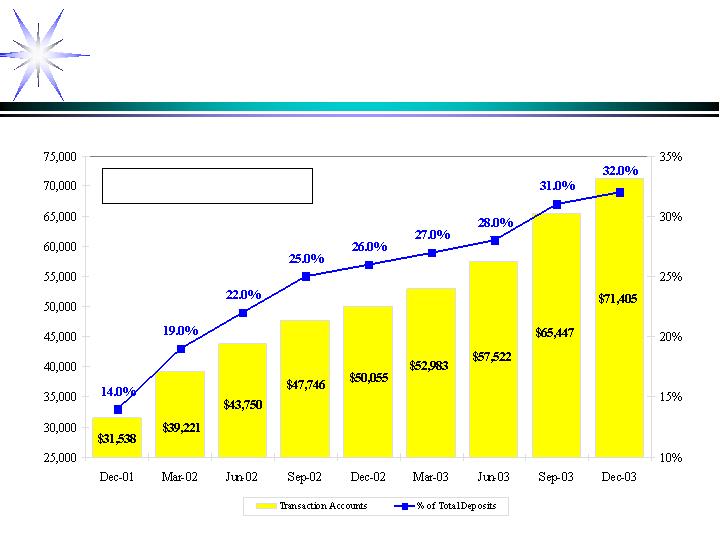

Deposit Transaction Accounts

(dollars in thousands)

CAGR 45.4%

15

Financial Performance

Balance Sheet

As of

12/31/2003

12/31/2002

12/31/2001

12/31/2000

12/31/1999

Assets:

Cash and Investments

44,715

61,833

42,365

75,910

53,148

Loans, net

247,600

158,231

187,176

316,724

434,328

Participation Contract

5,977

4,869

4,428

4,429

9,288

Other Assets

11,076

13,345

9,698

17,358

55,137

Total Assets

309,368

$

238,278

$

243,667

$

414,421

$

551,901

$

Liabilities:

Deposits

221,447

191,170

232,160

345,093

468,859

FHLB Advances

48,600

20,000

-

47,120

17,873

Notes Payable

-

11,440

-

-

-

Subordinated Debt

-

1,500

1,500

1,500

1,500

Other Liabilities

1,989

2,545

2,359

6,808

29,207

Total Liabilities

272,036

226,655

236,019

400,521

517,439

Stockholders' Equity

Common Stock

53

13

13

13

13

Additional Paid-in Capital

67,546

43,328

42,628

42,629

42,579

Accumulated Deficit

(30,021)

(32,086)

(34,964)

(28,912)

(8,130)

Accumulated Other Comprehensive Income

(246)

368

(29)

170

-

Total Stockholders' Equity

37,332

11,623

7,648

13,900

34,462

Total Liabilities and Stockholders' Equity

309,368

$

238,278

$

243,667

$

414,421

$

551,901

$

Fully Diluted Book Value per share

5.98

$

4.98

$

5.73

$

10.42

$

25.90

$

17

(in thousands)

Income Statement

12 Months Ended

12/31/2003

12/31/2002

12/31/2001

12/31/2000

12/31/1999

Interest Income

Loans

12,366

$

12,345

$

21,973

$

38,298

$

40,991

$

Other Int. Earning Assets

4,882

6,527

2,469

3,221

5,387

Total Interest Income

17,248

18,872

24,442

41,519

46,378

Interest Expense

Deposits

4,954

6,314

14,989

25,572

22,000

FHLB Advances

541

535

992

2,664

3,367

Notes and Debentures

2,162

2,061

210

210

210

Total Interest Expense

7,657

8,910

16,191

28,446

25,577

Net Int. Inc. Before Provision

9,591

9,962

8,251

13,073

20,801

Provision for Loan Losses

655

1,133

3,313

2,910

5,382

Non Interest Income

2,315

1,869

3,992

(2,136)

(15,020)

Non Interest Expense

9,783

10,165

14,340

25,806

29,643

Income Before Taxes

1,468

533

(5,410)

(17,779)

(29,244)

Inc. Tax (Benefit)/Provision

(597)

(2,345)

642

3,003

(11,405)

Net Income

2,065

$

2,878

$

(6,052)

$

(20,782)

$

(17,839)

$

Diluted Earnings/(Loss) per Share

0.61

$

1.16

$

(4.54)

$

(15.58)

$

(13.57)

$

18

(dollars in thousands)

Summary

Management repositioned company

Successful Community Banking business model

Exceptional growth opportunities

Southern California

Earnings at inflection point

Substantial reduction of interest expense

Fixed costs in place, income tax benefits

19