UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2006

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to ________

Commission File Number 0-29030

SUSSEX BANCORP

(Exact name of registrant as specified in its charter)

New Jersey | 22-3475473 |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) |

| incorporation or organization) | |

| | |

200 Munsonhurst Rd., Franklin, NJ | 07416 |

| (Address of principal executive offices) | (Zip Code) |

(973) 827-2914

(Registrant's telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

Common Stock, no par value | NASDAQ |

| (Title of each class) | (Name of exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

The aggregate market value of the voting stock held by non-affiliates of the Issuer as of June 30, 2006 was $40,838,589. The number of shares of the Issuer's Common Stock, no par value, outstanding as of March 7, 2007 was 3,162,640.

| 3 |

| | |

| 3 |

| 7 |

| 10 |

| 10 |

| 11 |

| 11 |

| | |

| 11 |

| | |

| 11 |

| 12 |

| 13 |

| 29 |

| 30 |

| 60 |

| 60 |

| 60 |

| | |

| 60 |

| | |

| 60 |

| 61 |

| 61 |

| 62 |

| 62 |

| | |

| 62 |

| | |

| 62 |

| 63 |

GENERAL

Sussex Bancorp (the "Company" or "Registrant") is a one-bank holding company incorporated under the laws of the State of New Jersey in January 1996 to serve as a holding company for Sussex Bank (the "Bank"). The Company was organized at the direction of the Board of Directors of the Bank for the purpose of acquiring all of the capital stock of the Bank (the "Acquisition"). Pursuant to the New Jersey Banking Act of 1948, as amended, (the "Banking Act"), and pursuant to approval of the shareholders of the Bank, the Company acquired the Bank and became its holding company on November 20, 1996. As part of the Acquisition, shareholders of the Bank received one share of common stock, no par value ("Common Stock") of the Company for each outstanding share of the common stock of the Bank, $2.50 per share par value ("Bank Common Stock"). The only significant asset of the Company is its investment in the Bank. The Company's principal executive offices are located at 200 Munsonhurst Road, Route 517, Franklin, Sussex County, New Jersey 07416.

The Bank is a commercial bank formed under the laws of the State of New Jersey in 1975. The Bank operates from its main office at 399 Route 23, Franklin, New Jersey, and its nine branch offices located at 7 Church Street, Vernon, New Jersey; 266 Clove Road, Montague, New Jersey; 33 Main Street, Sparta, New Jersey; 455 Route 23, Wantage, New Jersey; 15 Trinity Street, Newton, New Jersey; 100 Route 206, Augusta, New Jersey; 165 Route 206, Andover, New Jersey; 20-22 Fowler Street, Port Jervis, New York; and 67-67 Main Street, Warwick, New York. On November 7, 2005, the Bank entered into an agreement to purchase the Port Jervis, New York branch office of NBT Bank, N.A. and expand its branch network outside of Sussex County New Jersey for the first time. The transaction was consummated on March 24, 2006. As part of the transaction, the Bank assumed approximately $6.3 million in deposits and acquired approximately $3.4 million in loans. In December, 2006, the Company applied for regulatory approval to establish a branch in Westfall Township, Pennsylvania. It is anticipated that the branch will open in late 2007.

On October 1, 2001, the Company acquired all of the outstanding stock of Tri-State Insurance Agency, Inc. (“Tri-State”). Tri-State is a full service insurance agency located in Augusta, New Jersey. In 2003, the Company expanded its insurance operations through the acquisition of the Garrera Insurance Agency. The operations of the Garrera Insurance Agency have been consolidated with Tri-State.

The Company is subject to the supervision and regulation of the Board of Governors of the Federal Reserve System (the "FRB"). The Bank's deposits are insured by the Deposit Insurance Fund ("DIF") of the Federal Deposit Insurance Corporation ("FDIC") up to applicable limits. The operations of the Company and the Bank are subject to the supervision and regulation of the FRB, FDIC and the New Jersey Department of Banking and Insurance (the "Department"). The operations of Tri-State are also subject to supervision and regulation by Department. The principal executive offices of the Company are located at 200 Munsonhurst Road, Route 517, Franklin, New Jersey 07416, and the telephone number is (973) 827-2914.

The Company has two business segments, banking and financial services and insurance services. For Financial data on the segments see Part II, Item 8, “Financial Statements,” Note 3 of the consolidated financial statements.

BUSINESS OF THE COMPANY

The Company's primary business is ownership and supervision of the Bank and Tri-State, a subsidiary of the Bank. The Company, through the Bank, conducts a traditional commercial banking business, and offers services including personal and business checking accounts and time deposits, money market accounts and regular savings accounts. The Company structures its specific services and charges in a manner designed to attract the business of the small and medium sized business and professional community as well as that of individuals residing,

working and shopping in northwest New Jersey, northeast Pennsylvania and Orange County, New York trade areas serviced by the Company. The Company engages in a wide range of lending activities and offers commercial, consumer, mortgage, home equity and personal loans. In 2005, the Company formed a joint venture with National City Mortgage Inc., called SussexMortgage.com LLC to originate one to four family mortgage loans for funding by third party investors for sale into the secondary market. Servicing is released to the third party investors. The joint venture currently operates in New Jersey and four other states.

Through the Bank's subsidiary, Tri-State, the Company operates a full service general insurance agency, offering both commercial and personal lines of insurance. The Company considers this to be a separate business segment.

In order to augment its capital base, on December 15, 2004, the Company issued 1,131,150 shares of its common stock, no par value, pursuant to a public offering underwritten by Keefe, Bruyette & Woods, Inc. The offering raised approximately $15.1 million in net proceeds.

SERVICE AREA

The Company's service area primarily consists of the Sussex County, New Jersey; Orange County, New York; and Pike County, Pennsylvania markets; although the Company makes loans throughout New Jersey. The Company operates its main office in Franklin, New Jersey and nine branch offices in Vernon, Montague, Sparta, Wantage, Newton, Andover and Augusta, New Jersey and, Port Jervis and Warwick, New York. Our market area is among the most affluent in the nation.

COMPETITION

The Company operates in a highly competitive environment competing for deposits and loans with commercial banks, thrifts and other financial institutions, many of which have greater financial resources than the Company. Many large financial institutions in New York City and other parts of New Jersey compete for the business of customers located in the Company's service area. Many of these institutions have significantly higher lending limits than the Company and provide services to their customers which the Company does not offer.

Management believes the Company is able to compete on a substantially equal basis with its competitors because it provides responsive personalized services through management's knowledge and awareness of the Company's service area, customers and business.

PERSONNEL

At December 31, 2006, the Company employed 110 full-time employees and 24 part-time employees. None of these employees are covered by a collective bargaining agreement and the Company believes that its employee relations are good.

REGULATION AND SUPERVISION

Bank holding companies and banks are extensively regulated under both federal and state law. These laws and regulations are intended to protect depositors, not stockholders. Insurance agencies licensed in New Jersey are regulated under state law by the New Jersey Department of Banking and Insurance. To the extent that the following information describes statutory and regulatory provisions, it is qualified in its entirety by reference to the particular statutory and regulatory provisions. Any change in the applicable law or regulation may have a material effect on the business and prospects of the Company and the Bank.

BANK HOLDING COMPANY REGULATION

GENERAL

As a bank holding company registered under the Bank Holding Company Act of 1956, as amended, (the BHCA), we are subject to the regulation and supervision of the Federal Reserve Bank (FRB). We are required to file with the FRB annual reports and other information regarding our business operations and those of our subsidiaries.

The BHCA requires, among other things, the prior approval of the FRB in any case where a bank holding company proposes to (i) acquire all or substantially all of the assets of any other bank, (ii) acquire direct or indirect ownership or control or more than 5% of the outstanding voting stock of any bank (unless it owns a majority of such bank's voting shares) or (iii) merge or consolidate with any other bank holding company. The FRB will not approve any acquisition, merger, or consolidation that would have a substantially anti-competitive effect, unless the anti-competitive impact of the proposed transaction is clearly outweighed by a greater public interest in meeting the convenience and needs of the community to be served. The FRB also considers capital adequacy and other financial and managerial resources and future prospects of the companies and the banks concerned, together with the convenience and need of the community to be served when reviewing acquisitions or mergers.

In addition, the BHCA was amended through the Gramm-Leach-Bliley Financial Modernization Act of 1999 (the “GLBA”). Under the terms of the GLBA, bank holding companies whose subsidiary banks meet certain capital, management and Community Reinvestment Act standards are permitted to engage in a substantially broader range of non-banking activities than is permissible for bank holding companies under the BHCA. These activities include certain insurance, securities and merchant banking activities. In addition, the GLBA amendments to the BHCA remove the requirement for advance regulatory approval for a variety of activities and acquisitions by financial holding companies. As our business is currently limited to activities permissible for a bank, we have not elected to become a financial holding company.

There are a number of obligations and restrictions imposed on bank holding companies and their depository institution subsidiaries by law and regulatory policy that are designed to minimize potential loss to the depositors of such depository institutions and the FDIC insurance fund in the event the depository institution becomes in danger of default. Under a policy of the FRB with respect to bank holding company operations, a bank holding company is required to serve as a source of financial strength to its subsidiary depository institutions and to commit resources to support such institutions in circumstances where it might not do so absent such policy. The FRB also has the authority under the BHCA to require a bank holding company to terminate any activity or to relinquish control of a non-bank subsidiary upon the FRB's determination that such activity or control constitutes a serious risk to the financial soundness and stability of any bank subsidiary of the bank holding company.

CAPITAL ADEQUACY GUIDELINES FOR BANK HOLDING COMPANIES

The FRB has adopted risk-based capital guidelines for bank holding companies. The risk-based capital guidelines are designed to make regulatory capital requirements more sensitive to differences in risk profile among banks and bank holding companies, to account for off-balance sheet exposure and to minimize disincentives for holding liquid assets. Under these guidelines, assets and off-balance sheet items are assigned to broad risk categories each with appropriate weights. The resulting capital ratios represent capital as a percentage of total risk-weighted assets and off-balance sheet items.

The risk-based guidelines apply on a consolidated basis to bank holding companies with consolidated assets of $150 million or more. The minimum ratio of total capital to risk-weighted assets (including certain off-balance sheet activities, such as standby letters of credit) is 8%. At least 4% of the total capital is required to be "Tier I", consisting of common stockholders' equity, certain preferred stock and certain hybrid capital instruments, less certain goodwill items and other intangible assets. The remainder, "Tier II Capital", may consist of (a) the allowance for loan losses of up to 1.25% of risk-weighted assets, (b) excess of qualifying preferred stock, (c) excess of hybrid capital instruments, (d) debt, (e) mandatory convertible securities, and (f) qualifying

subordinated debt. Certain hybrid capital instruments, including specifically trust preferred securities may be included in Tier I capital up to a maximum of 25% of Tier I capital. In 2002, the Company raised $4.8 million in net proceeds through an offering of trust preferred securities, all of which is counted as Tier I Capital. Total capital is the sum of Tier I and Tier II capital less reciprocal holdings of other banking organizations' capital instruments, investments in unconsolidated subsidiaries and any other deductions as determined by the FRB (determined on a case-by-case basis or as a matter of policy after formal rule-making).

Bank holding company assets are given risk-weights of 0%, 20%, 50% and 100%. In addition, certain off-balance sheet items are given similar credit conversion factors to convert them to asset equivalent amounts to which an appropriate risk-weight will apply. These computations result in the total risk-weighted assets. Most loans are assigned to the 100% risk category, except for performing first mortgage loans fully secured by residential property which carry a 50% risk-weighting. Most investment securities (including, primarily, general obligation claims of states or other political subdivisions of the United States) are assigned to the 20% category, except for municipal or state revenue bonds, which have a 50% risk-weight, and direct obligations of the U.S. Treasury or obligations backed by the full faith and credit of the U.S. Government, which have a 0% risk-weight. In converting off-balance sheet items, direct credit substitutes including general guarantees and standby letters of credit backing financial obligations are given 100% risk-weighing. Transaction related contingencies such as bid bonds, standby letters of credit backing non-financial obligations, and undrawn commitments (including commercial credit lines with an initial maturity of more than one year) have a 50% risk-weighting. Short term commercial letters of credit have a 20% risk-weighting and certain short-term unconditionally cancelable commitments have a 0% risk-weighting.

In addition to the risk-based capital guidelines, the FRB has adopted a minimum Tier I capital (leverage) ratio, under which a bank holding company must maintain a minimum level of Tier I capital to average total consolidated assets of at least 3% in the case of a bank holding company that has the highest regulatory examination rating and is not contemplating significant growth or expansion. All other bank holding companies are expected to maintain a leverage ratio of at least 100 to 200 basis points above the stated minimum.

BANK REGULATION

As a New Jersey-chartered commercial bank, the Bank is subject to the regulation, supervision, and control of the Department. As an FDIC-insured institution, the Bank is subject to regulation, supervision and control of the FDIC, an agency of the federal government. The regulations of the FDIC and the Department impact virtually all activities of the Bank, including the minimum level of capital the Bank must maintain the ability of the Bank to pay dividends, the ability of the Bank to expand through new branches or acquisitions and various other matters.

INSURANCE OF DEPOSITS

The Bank's deposits are insured up to a maximum of $100,000 per depositor under the DIF. In addition, federal law provides for insurance coverage of up to $250,000 for "self-directed" retirement accounts. The FDIC has established a risk-based insurance premium assessment system under which the FDIC has developed a matrix that sets the assessment premium for a particular institution in accordance with its capital level and overall regulatory rating by the institutions' primary federal regulators. Under the matrix that is currently in effect, the assessment rate ranges from 5 to 43 basis points of assessed deposits. In 2006, the assessment for federal insurance totaled $33,000.

DIVIDEND RIGHTS

Under the Banking Act, a Bank may declare and pay dividends only if, after payment of the dividend, the capital stock of the Bank will be unimpaired and either the Bank will have a surplus of not less than 50% of its capital stock or the payment of the dividend will not reduce the Bank's surplus.

LEGISLATIVE AND REGULATORY CHANGES

On July 30, 2002, the Sarbanes-Oxley Act, or “SOX” was enacted. SOX is not a banking law, but applies to all public companies, including Sussex Bancorp. The stated goals of SOX are to increase corporate responsibility, to provide for enhanced penalties for accounting and auditing improprieties at publicly traded companies and to protect investors by improving the accuracy and reliability of corporate disclosures pursuant to the securities laws. SOX is the most far reaching U.S. securities legislation enacted in some time. SOX generally applies to all companies, both U.S. and non-U.S., that file or are required to file periodic reports with the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended.

SOX includes very specific additional disclosure requirements and new corporate government rules and requires the SEC and securities exchanges to adopt extensive additional disclosure, corporate governance and other related rules and mandates further studies of specific issues by the SEC. SOX represents significant federal involvement in matters traditionally left to state regulatory systems, such as the regulation of the accounting profession, and to state corporate law, such as the relationship between a board of directors and management and between a board of directors and its committees. SOX addresses, among other matters:

| | · | certification of financial statements by the chief executive officer and the chief financial officer; |

| | · | the forfeiture of bonuses or other incentive-based competition and profits from the sale of an issuer’s securities by directors and senior officers in the twelve month period following initial publication of any financial statements that later require restatement; |

| | · | a prohibition on insider trading during pension plan black out periods; |

| | · | disclosure of off-balance sheet transactions; |

| | · | a prohibition on personal loans to officers and directors, unless subject to Federal Reserve Regulation O; |

| | · | expedited filing requirements for Form 4 statements of changes of beneficial ownership of securities required to be filed by officers, directors and 10% shareholders; |

| | · | disclosure of whether or not a company has adopted a code of ethics; |

| | · | “real time” filing of periodic reports; |

| | · | auditor independence; and |

| | · | various increased criminal penalties for violations of securities laws. |

Complying with the requirements of SOX as implemented by the SEC will increase our compliance costs and could make it more difficult to attract and retain board members.

On October 26, 2001, a new anti-terrorism bill, the International Money Laundering Abatement and Anti-Terrorism Funding Act of 2001, was signed into law. This law restricts money laundering by terrorists in the United States and abroad. This act specifies new "know your customer" requirements that will obligate financial institutions to take actions to verify the identity of the account holders in connection with opening an account at any U.S. financial institution. Banking regulators will consider compliance with the act's money laundering provisions in making decisions regarding approval of acquisitions and mergers. In addition, sanctions for violations of the act can be imposed in an amount equal to twice the sum involved in the violating transaction, up to $1 million.

Investors in the Company’s securities should consider the following factors before trading in the Company’s securities:

Risks Affecting our Business:

Our earnings could be negatively affected if we are unable to continue our growth. The Company has experienced significant growth, and our future business strategy is to continue to expand. Historically, the growth of our loans and deposits has been the principal factor in our increase in net interest income. In the event that we are unable to execute our business strategy of continued growth in loans and deposits, our earnings could be adversely impacted. Our ability to continue to grow depends, in part, upon our ability to expand our market share, successfully attract core deposits, and identify loan and investment opportunities as well as opportunities to generate fee-based income. Our ability to manage growth successfully will also depend on whether we can continue to efficiently fund asset growth and maintain asset quality and cost controls, as well as on factors beyond our control, such as economic conditions and interest rate trends.

Our future profitability depends upon our ability to manage our growth. The Company expects to continue to experience growth in the scope of our operations and correspondingly in the number of our employees and customers. Our ability to manage this growth will depend upon our ability to continue to attract, hire and retain skilled employees. This may be particularly critical as we expand out of our traditional Sussex County, New Jersey market into New York and Pennsylvania. Our success will also depend on the ability of our officers and key employees to continue to implement and improve our operational and other systems, to manage multiple, concurrent customer relationships and to hire, train and manage our employees.

Our ability to afford and adapt to changes in technology will affect our future profitability. Many of the Company’s competitors have substantially greater resources to invest in technological improvements and have more experience in managing technological change. Adoption of rapid technological changes by the banking industry or the bank's customers could put the bank at a competitive disadvantage if we do not have the capital or personnel necessary to implement such changes.

Our legal lending limits are relatively low and restrict our ability to compete for larger customers. At December 31, 2006, our lending limit per borrower was approximately $5.0 million, or 15% of our capital. Accordingly, the size of loans that we can offer to potential borrowers (without participation by other lenders) is less than the size of loans that many of our competitors with larger capitalization are able to offer. Our legal lending limit also impacts the efficiency of our lending operation because it tends to lower our average loan size, which means we have to generate a higher number of transactions to achieve the same portfolio volume. We may engage in loan participations with other banks for loans in excess of our legal lending limits. However, there can be no assurance that such participations will be available at all or on terms which are favorable to us and our customers.

Market conditions may adversely affect our fee based insurance business. The revenues of our fee based insurance business are derived primarily from commissions from the sale of insurance policies, which commissions are generally calculated as a percentage of the policy premium. These insurance policy commissions can fluctuate as insurance carriers from time to time increase or decrease the premiums on the insurance products we sell.

Our loan portfolio is concentrated in loans secured by commercial real estate. Any downturn in the commercial real estate market could adversely affect our results of operations. Our loan portfolio is concentrated in loans secured by real estate. Loans secured by commercial real estate account for 53.1% of our portfolio, and construction and land development loans account for another 11.5% of our loans. Majority of these properties are located in northwest New Jersey. Any sustained and material downturn in the commercial real estate market in northwest New Jersey could impair the value of our collateral and have an adverse effect on our results of operations. In addition, the federal regulatory agencies supervising our operations have adopted policies requiring institutions with substantial portfolios of commercial real estate loans to hold higher levels of capital. Although the Company is not currently subject to these requirements, it could become subject to them if it continues to increase its proportion of commercial real estate loans. Any requirement that the Company hold additional capital could restrict the Company’s growth and negatively affect its profitability.

Higher interest rates and a slowing real estate market have caused our non-performing assets to increase.

Continuation of these trends could adversely affect our results of operations. A substantial portion of our loans (65.7% of the portfolio) carry variable rates of interest which reset periodically. As these loans have reset to current higher rates of interest, it has negatively affected the cash flow of some of our borrowers. In addition, the slowing real estate market has made it more difficult for borrowers to lease or sell properties. As a result of these two trends, our non-performing assets have increased from $1.4 million at year end 2005 to $2.7 million at year end 2006. If these trends continue, our non-performing assets may continue to increase, which would adversely affect our results of operations.

Risks Affecting the Banking Industry:

Our operations are subject to extensive regulation. The Company is subject to extensive federal and state legislation, regulation and supervision that are intended primarily to protect depositors and the Federal Deposit Insurance Corporation's Deposit Insurance Fund, rather than investors. Legislative and regulatory changes may increase our cost of doing business or otherwise adversely affect the Company and create competitive advantages for non-bank competitors. The Company can give no assurance that future changes in laws and regulations or changes in their interpretation will not adversely affect our business. The federal and state laws and regulations applicable to our operations give regulatory authorities extensive discretion in connection with their supervisory and enforcement responsibilities, and generally have been promulgated to protect depositors and the deposit insurance funds and not for the purpose of protecting shareholders. These laws and regulations can materially affect our future business. Laws and regulations now affecting us may be changed at any time, and the interpretation of such laws and regulations by bank regulatory authorities is also subject to change.

We operate in a highly competitive environment. The banking industry within the New Jersey-New York metropolitan area is highly competitive. Although we believe that we have been and will continue to be able to compete effectively with our competition due to our experienced management and personalized service, if we are wrong, our ability to grow and operate profitably may be negatively affected. The bank's principal market area is served by branch offices of large commercial banks and thrift institutions. We also face competition from other companies that provide financial services, including consumer loan companies, credit unions, mortgage brokers, insurance companies, securities brokerage firms, money market mutual funds, internet banks and private lenders. In addition, in November of 1999, the Gramm-Leach-Bliley Financial Modernization Act of 1999 (the "GLB Act") was passed into law. Among other things, the GLB Act permits insurance companies and securities firms to acquire or form financial institutions, thereby further increasing the competition we face. A number of our competitors have substantially greater resources to expend on advertising and marketing than we do, and their substantially greater capitalization enables them to make much larger loans. Our success depends a great deal on our belief that large and mid-size financial institutions do not adequately serve individuals and small businesses in our principal market area and on our ability to compete favorably for such customers. In addition to competition from larger institutions, we also face competition for individuals and small businesses from recently formed banks seeking to compete as "home town" institutions. Most of these new institutions have focused their marketing efforts on the smaller end of the small business market we serve.

Our earnings may be adversely affected by changes in interest rates. The Company may not be able to effectively manage changes in interest rates that affect what we charge as interest on our earning assets and the expense we must pay on interest-bearing liabilities, which may significantly reduce our earnings. In addition, there are costs associated with our risk management techniques, and these costs could be material. Fluctuations in interest rates are not predictable or controllable and, therefore, there can be no assurances of our ability to continue to maintain a consistent positive spread between the interest earned on our earning assets and the interest paid on our interest-bearing liabilities.

Economic conditions may adversely affect our business. Deterioration in local, regional, national or global economic conditions could cause us to experience a reduction in deposits and new loans, an increase in the number of borrowers who default on their loans and a reduction in the value of the collateral securing their loans, all of which could adversely affect our performance and financial condition. Unlike larger banks that are more geographically diversified, we provide banking and financial services locally. Therefore, we are particularly vulnerable to adverse local economic conditions.

If the bank experiences greater loan losses than anticipated, it will have an adverse effect on our net income and our ability to fund our growth strategy. The risk of nonpayment of loans is inherent in banking. If we experience greater nonpayment levels than anticipated, our earnings and overall financial condition, as well as the value of our common stock, could be adversely affected. We cannot assure you that our monitoring procedures and policies will reduce certain lending risks or that our allowance for loan losses will be adequate to cover actual losses. Loan losses can cause insolvency and failure of a financial institution and, in such an event, our shareholders could lose their entire investment. In addition, future provisions for loan losses could materially and adversely affect our results of operation. Any loan losses will reduce the loan loss reserve. A reduction in the loan loss reserve will be restored by an increase in our provision for loan losses and will result in a decrease in our net income and, possibly, our capital, and may materially affect our results of operations in the period in which the allowance is increased.

Our ability to pay dividends is limited by law and federal banking regulation. Our ability to pay dividends to our shareholders largely depends on our receipt of dividends from Sussex Bank. The amount of dividends that Sussex Bank may pay to us is limited by federal laws and regulations. We also may decide to limit the payment of dividends even when we have the legal ability to pay them in order to retain earnings for use in our business.

None

The Company conducts its business through its principal executive office located at 200 Munsonhurst Road, Route 517, Franklin, New Jersey, its ten branch offices, its loan production office in Milford, PA and its insurance agency office. The following table set forth certain information regarding the Company's properties as of December 31, 2006. All properties are adequately covered by insurance.

LOCATION | LEASED OR OWNED | DATE OF LEASE EXPIRATION |

399 Route 23 Franklin, New Jersey | Owned | N/A |

7 Church Street Vernon, New Jersey | Owned | N/A |

266 Clove Road Montague, New Jersey | Owned | N/A |

96 Route 206 Augusta, New Jersey | Leased | July, 2015 |

455 Route 23 Wantage, New Jersey | Owned (1) | N/A |

15 Trinity Street Newton, New Jersey | Owned | N/A |

165 Route 206 Andover, New Jersey | Owned | N/A |

100 Route 206 Augusta, New Jersey | Owned | N/A |

33 Main Street Sparta, New Jersey | Owned | N/A |

200 Munsonhurst Road Franklin, New Jersey | Leased | December, 2008 |

20-22 Fowler Street Port Jervis, New York | Leased (2) | June 30, 2008 |

65-67 Main Street Warwick, New York | Leased | December, 2007 |

104 Bennett Ave., Suite 2D Milford, Pennsylvania | Leased | March, 2007 |

| | (1) | The Company owns the building housing its Wantage branch. The land on which the building is located is leased pursuant to a ground lease which runs until December 31, 2020, and contains an option for the Company to extend the lease for an additional 25 year term. |

| | (2) | The Company assumed the lease on the Port Jervis, New York branch on March 24, 2006. |

The Company and the Bank are periodically parties to or otherwise involved in legal proceedings arising in the normal course of business, such as claims to enforce liens, claims involving the making and servicing of real property loans, and other issues incident to the Bank's business. Management does not believe that there is any pending or threatened proceeding against the Company or the Bank which, if determined adversely, would have a material effect on the business, financial position or results of operation of the Company or the Bank.

ITEM 4. SUBMISSIONS OF MATTERS TO A VOTE OF SECURITY HOLDERS No matters were submitted for a vote of the registrant's shareholders during the Fourth Quarter of fiscal 2006.

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS Our Common Stock traded on the American Stock Exchange until October 3, 2006. On October 4, our Common Stock began trading on the NASDAQ Global Market, under the symbol "SBBX". As of December 31, 2006, the Company had approximately 638 holders of record of its common stock.

The following table shows the high and low sales price, by quarter, for the common stock, for the period of time it traded on the American Stock Exchange and the high and low bid price for the fourth quarter since October 4, as well as dividends declared, for the last two fiscal years:

2006 | | High Closing Price: | | Low Closing Price: | | Dividends Declared: |

| | | | | | | |

4th Quarter (since October 4) | | $16.60 | | $14.43 | | $0.070 |

4th Quarter (through October 3) | | $15.12 | | $14.62 | | - |

3rd Quarter | | $14.80 | | $14.10 | | $0.070 |

2nd Quarter | | $14.85 | | $14.44 | | $0.070 |

1st Quarter | | $15.10 | | $14.63 | | $0.070 |

| | | | | | | |

2005 | | High Closing Price: | | Low Closing Price: | | Dividends Declared: |

| | | | | | | |

4th Quarter | | $15.35 | | $13.48 | | - |

3rd Quarter | | $13.81 | | $13.24 | | $0.067 |

2nd Quarter | | $14.05 | | $12.81 | | $0.067 |

1st Quarter | | $15.03 | | $13.33 | | $0.067 |

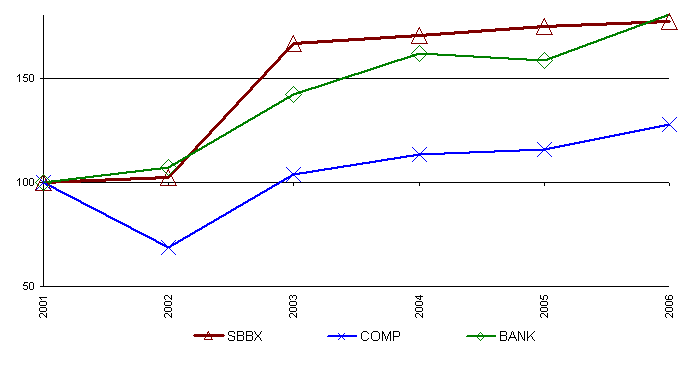

Comparison of Five-Year Cumulative Total Return Among Sussex Bancorp (SBBX), Nasdaq Composite (COMP) and Nasdaq Bank Index (BANK) Total Return Assumes $100 Invested on December 31, 2001 with Reinvestment of Dividends |

Five-Year Cumulative Total Return |

The following selected financial data as of December 31 for each of the five years should be read in conjunction with the Company's audited consolidated financial statements and the accompanying notes elsewhere herein.

| | As of and for the Year Ended December 31 | |

(Dollars in thousands, except per share data) | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| SUMMARY OF INCOME: | | | | | | | | | | | | | | | | |

| Interest income | | $ | 19,998 | | $ | 15,547 | | $ | 11,791 | | $ | 10,771 | | $ | 10,860 | |

| Interest expense | | | 8,249 | | | 4,328 | | | 2,814 | | | 2,860 | | | 3,536 | |

| Net interest income | | | 11,749 | | | 11,219 | | | 8,977 | | | 7,911 | | | 7,324 | |

| Provision for loan losses | | | 733 | | | 1,138 | | | 558 | | | 405 | | | 300 | |

| Net interest income after provision for loan losses | | | 11,016 | | | 10,081 | | | 8,419 | | | 7,506 | | | 7,024 | |

| Other income | | | 5,244 | | | 4,873 | | | 4,542 | | | 4,103 | | | 3,292 | |

| Other expenses | | | 12,648 | | | 11,603 | | | 10,789 | | | 9,663 | | | 8,634 | |

| Income before income taxes | | | 3,612 | | | 3,351 | | | 2,172 | | | 1,946 | | | 1,682 | |

| Income taxes | | | 1,148 | | | 952 | | | 581 | | | 505 | | | 526 | |

| Net income | | $ | 2,464 | | $ | 2,399 | | $ | 1,591 | | $ | 1,441 | | $ | 1,156 | |

| | | | | | | | | | | | | | | | | |

| WEIGHTED AVERAGE NUMBER OF SHARES: (a) | | | | | | | | | | | | | | | | |

| Basic | | | 3,154,487 | | | 3,163,182 | | | 1,965,745 | | | 1,879,649 | | | 1,835,507 | |

| Diluted | | | 3,188,620 | | | 3,200,876 | | | 2,046,568 | | | 1,952,379 | | | 1,911,760 | |

| | | | | | | | | | | | | | | | | |

| PER SHARE DATA: | | | | | | | | | | | | | | | | |

| Basic earnings per share | | $ | 0.78 | | $ | 0.76 | | $ | 0.81 | | $ | 0.77 | | $ | 0.63 | |

| Diluted earnings per share | | | 0.77 | | | 0.75 | | | 0.78 | | | 0.74 | | | 0.60 | |

| Cash dividends (b) | | | 0.28 | | | 0.20 | | | 0.27 | | | 0.19 | | | 0.23 | |

| Stock dividends | | | 0 | % | | 5 | % | | 0 | % | | 5 | % | | 0 | % |

| | | | | | | | | | | | | | | | | |

| BALANCE SHEET: | | | | | | | | | | | | | | | | |

| Loans, net | | $ | 258,936 | | $ | 208,720 | | $ | 154,642 | | $ | 132,640 | | $ | 112,069 | |

| Total assets | | | 356,297 | | | 313,182 | | | 278,275 | | | 240,617 | | | 225,904 | |

| Total deposits | | | 295,770 | | | 256,847 | | | 229,827 | | | 207,657 | | | 189,858 | |

| Total stockholders’ equity | | | 34,592 | | | 32,924 | | | 31,652 | | | 14,904 | | | 13,680 | |

| Average assets | | | 332,912 | | | 291,368 | | | 251,338 | | | 233,027 | | | 214,897 | |

| Average stockholders’ equity | | | 33,710 | | | 32,368 | | | 16,067 | | | 14,035 | | | 12,766 | |

| | | | | | | | | | | | | | | | | |

| PERFORMANCE RATIOS: | | | | | | | | | | | | | | | | |

| Return on average assets | | | 0.74 | % | | 0.82 | % | | 0.63 | % | | 0.62 | % | | 0.54 | % |

| Return on average stockholders’ equity | | | 7.31 | % | | 7.41 | % | | 9.90 | % | | 10.27 | % | | 9.06 | % |

| Net interest margin | | | 3.91 | % | | 4.34 | % | | 4.10 | % | | 3.86 | % | | 3.82 | % |

| Efficiency ratio (c) | | | 74.43 | % | | 72.10 | % | | 79.81 | % | | 80.43 | % | | 81.33 | % |

| Other income to net interest income plus other income | | | 30.86 | % | | 30.28 | % | | 33.60 | % | | 34.15 | % | | 31.01 | % |

| Dividend payout ratio | | | 36 | % | | 26 | % | | 33 | % | | 25 | % | | 36 | % |

| | | | | | | | | | | | | | | | | |

| CAPITAL RATIOS: | | | | | | | | | | | | | | | | |

| Tier I capital to average assets | | | 10.48 | % | | 11.45 | % | | 12.86 | % | | 7.15 | % | | 6.66 | % |

| Tier I capital to total risk-weighted assets | | | 12.84 | % | | 15.42 | % | | 18.84 | % | | 11.14 | % | | 11.77 | % |

| Total capital to total risk-weighted assets | | | 14.00 | % | | 16.55 | % | | 20.09 | % | | 12.37 | % | | 13.36 | % |

| Average equity/average assets | | | 10.13 | % | | 11.11 | % | | 6.39 | % | | 6.02 | % | | 5.94 | % |

| | | | | | | | | | | | | | | | | |

| ASSET QUALITY RATIOS: | | | | | | | | | | | | | | | | |

| Non-performing loans to total gross loans | | | 1.01 | % | | 0.65 | % | | 0.85 | % | | 0.99 | % | | 1.14 | % |

| Non-performing assets to total assets | | | 0.75 | % | | 0.44 | % | | 0.48 | % | | 0.64 | % | | 0.66 | % |

| Net loan charge-offs to average total loans | | | 0.00 | % | | 0.43 | % | | 0.01 | % | | 0.05 | % | | 0.05 | % |

| Allowance for loan losses to total gross loans at period end | | | 1.27 | % | | 1.24 | % | | 1.45 | % | | 1.29 | % | | 1.22 | % |

| Allowance for loan losses to non-performing loans | | | 125.61 | % | | 190.04 | % | | 169.96 | % | | 130.67 | % | | 107.11 | % |

| | | | | | | | | | | | | | | | | |

(a) The weighted average number of shares outstanding was computed based on the average number of shares outstanding during each period as adjusted for subsequent stock dividends. (b) Cash dividends per common share are based on the actual number of common shares outstanding on the dates of record as adjusted for subsequent stock dividends. (c) Efficiency ratio is total other expenses divided by net interest income and total other income. |

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

GENERAL

This discussion is intended to assist in understanding the financial condition and results of operations of the Company. This discussion should be read in conjunction with the Consolidated Financial Statements and accompanying Notes contained in this report.

MANAGEMENT STRATEGY

The Company's goal is to serve as community-oriented financial institution serving the northwestern New Jersey, northeastern Pennsylvania and Orange County, New York marketplace. Our market presence has expanded by opening branch offices in Port Jervis and Warwick, New York. In addition, in December 2006 the Company filed applications for regulatory approval to open an office in Westfall Township, Pennsylvania. The Company plans to open the branch in the third quarter of 2007. Also during 2007, we intend to move the Wantage branch to its new location site. While offering traditional community bank loan and deposit products and services, the Company obtains significant non-interest income through its Tri-State Insurance Agency, Inc. ("Tri-State") insurance brokerage operations and the sale of non-deposit products. We report the operations of Tri-State as a separate segment from our commercial banking operations. See Note 3 to the Consolidated Financial Statements for December 31, 2006 included herein for more financial data regarding our two segments.

FORWARD LOOKING STATEMENTS

When used in this discussion the words: “believes”, “anticipates”, “contemplated”, “expects” or similar expressions are intended to identify forward looking statements. Such statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. Those risks and uncertainties include those discussed under Item 1A - Risk Factors as well as changes to interest rates, the ability to control costs and expenses, general economic conditions, the success of the Company’s efforts to diversify its revenue base by developing additional sources of non-interest income while continuing to manage its existing fee based business and the risks inherent in integrating acquisitions into the Company and commencing operations in new markets. The Company undertakes no obligation to publicly release the results of any revisions to those forward looking statements that may be made to reflect events or circumstances after this date or to reflect the occurrence of unanticipated events.

CRITICAL ACCOUNTING POLICIES

Our accounting policies are fundamental to understanding Management's Discussion and Analysis of Financial Condition and Results of Operations. Our accounting policies are more fully described in Note 1 of the Notes to the Consolidated Financial Statements for December 31, 2006 included herein. The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions about future events that affect the amounts reported in our Consolidated Financial Statements and accompanying Notes. Since future events and their effect cannot be determined with absolute certainty, actual results may differ from those estimates. Management makes adjustments to its assumptions and judgments when facts and circumstances dictate. The amounts currently estimated by us are subject to change if different assumptions as to the outcome of future events were made. We evaluate our estimates and judgments on historical experience and on various other factors that are believed to be reasonable under the circumstances. Management believes the following critical accounting policies encompass the more significant judgments and estimates used in preparation of our consolidated financial statements.

Allowance for Loan Losses. The provision for loan losses charged to operating expense reflects the amount deemed appropriate by management to provide for known and inherent losses in the existing loan portfolio. Management's judgment is based on the evaluation of the past experience of individual loans, the assessment of current economic conditions, and other relevant factors. Loan losses are charged directly against the allowance for loan losses and recoveries on previously charged-off loans are added to the allowance.

Management uses significant estimates to determine the allowance for loan losses. Consideration is given to a variety of factors in establishing these estimates including current economic conditions, diversification of the loan portfolio, delinquency statistics, borrowers' perceived financial and managerial strengths, the adequacy of underlying collateral, if collateral dependent, or present value of future cash flows, and other relevant factors. Since the sufficiency of the allowance for loan losses is dependent to a great extent on conditions that may be beyond our control, it is possible that management's estimates of the allowance for loan losses and actual results could differ in the near term. Although we believe that we use the best information available to establish the allowance for loan losses, future additions to the allowance may be necessary if certain future events occur that cause actual results to differ from the assumptions used in making the evaluation. For example, a downturn in the local economy could cause increases in non-performing loans. Additionally, a decline in real estate values could cause some of our loans to become inadequately collateralized. In either case, this may require us to increase our provisions for loan losses, which would negatively impact earnings. Additionally, a large loss could deplete the allowance and require increased provisions to replenish the allowance, which would negatively impact earnings. In addition, regulatory authorities, as an integral part of their examination, periodically review the allowance for loan losses. They may require additions to the allowance for loan losses based upon their judgments about information available to them at the time of examination. Future increases to our allowance for loan losses, whether due to unexpected changes in economic conditions or otherwise, could adversely affect our future results of operations.

Stock-Based Compensation. The Company currently has several stock option plans in place for employees and directors of the Company. Prior to January 1, 2006, the Company accounted for its stock option plans, under the recognition and measurement provision of APB Opinion No 25, "Accounting for Stock Issued to Employees," and related Interpretations, as permitted by FASB Statement No. 123, "Accounting for Stock-Based Compensation". No stock-based employee compensation cost was recognized in the Company's consolidated statements of income through December 31, 2005, as all options granted under the Company’s plans had an exercise price equal to the market value of the underlying common stock on the date of grant.

In December 2004, the Financial Accounting Standards Board ("FASB") issued Statement No. 123(R), "Share-Based Payments." Statement No. 123(R) addresses the accounting for share-based payment transactions in which an enterprise receives employee services in exchange for (a) equity instruments of the enterprise, or (b) liabilities that are based on the fair value of the enterprise's equity instruments or that may be settled by the issuance of such equity instruments. Statement 123(R) requires an entity to recognize the grant-date fair-value of stock options and other equity-based compensation issued to the employees in the income statement. The revised Statement generally requires that an entity account for these transactions using the fair-value-based method, and eliminates the intrinsic-value method of accounting as of January 1, 2006.

Statement No. 123(R) was effective for periods beginning after December 15, 2005; all public companies must use either the modified prospective or the modified retrospective transition method. The Company adopted the modified prospective method. Using the modified prospective method, the Company's expense for stock-based compensation related to stock options, net of related tax effect, was $31,000 for the year ending December 31, 2006.

Goodwill and Other Intangible Assets. The Company has recorded goodwill of $2.3 million at December 31, 2006 related to the acquisition of Tri-State Insurance Agency on October 1, 2001 and $486 thousand from the acquisition of the Port Jervis, New York branch office on March 24, 2006. SFAS No. 142, “Goodwill and Other Intangible Assets.” requires that goodwill is not amortized to expense, but rather that it be tested for impairment at least annually. The Company periodically assesses whether events or changes in circumstances indicate that the carrying amounts of goodwill will require impairment testing. The Company performs its annual impairment test on the goodwill of Tri-State in the fourth quarter of each calendar year. If the fair value of the reporting unit

exceeds the book value, no write-downs of goodwill are necessary. If the fair value is less than the book value, an additional test is necessary to assess the proper carrying value of goodwill. The Company determined that no impairment write-offs were necessary during 2006, 2005 and 2004.

Business unit valuation is inherently subjective, with a number of factors based on assumption and management judgments. Among these are future growth rates, discount rates and earnings capitalization rates. Changes in assumptions and results due to economic conditions, industry factors and reporting unit performance could result in different assessments of the fair value and could result in impairment charges in the future.

Investment Securities Impairment Evaluation. Management evaluates securities for other-than-temporary impairment at least on a quarterly basis, and more frequently when economic or market concerns warrant such evaluation. Consideration is given to (1) length of time and the extent to which the fair value has been less than cost, (2) the financial condition and near-term prospects of the issuer, and (3) the intent and ability of the Company to retain its investments in the issuer for a period of time sufficient to allow for any anticipated recovery in fair value.

COMPARISION OF OPERATING RESULTS AT YEAR-END DECEMBER 31, 2006 and 2005

Overview: Total assets were $356.3 million at year-end 2006 compared to $313.2 million at year-end 2005, an increase of $43.1 million, or 13.6%. Total loans, net of the allowance for loan losses, increased $50.2 million, or 24.1%, to $258.9 million at December 31, 2006 from $208.7 million at December 31, 2005. Total deposits increased by $38.9 million, or 15.2% to $295.8 million at December 31, 2006 from $256.8 million at December 31, 2005. In keeping with our market expansion plans, in March of 2006 the Port Jervis branch was acquired with $6.3 million in deposits. As of December 31, 2006 the Port Jervis branch deposits have grown 86.6% to $11.8 million.

Results of Operations. For the year ended December 31, 2006, net income was $2.5 million, an increase of $65 thousand, or 2.7%, from the $2.4 million for the same period in 2005. Basic earnings per share were $0.78 for the year ended December 31, 2006 compared to $0.76 for the same period last year. Diluted earnings per share were $0.77 for the year ended December 31, 2006 compared to $0.75 for the same period last year. For the year ended December 31, 2006 the Company had 3,154,487 average basic shares outstanding, compared to 3,163,182 average basic shares for the year ended December 31, 2005.

The results reflect an increase in net interest income, an outcome of both increasing interest income and interest expense, coupled with increases in non-interest income, primarily due to increases in service fees on deposit accounts and insurance commissions and fees, offset by increases in non-interest expense associated with additional professional fees related to Section 404 requirements of the Sarbanes Oxley Act of 2002.

Comparative Average Balance and Average Interest Rates

The following table presents, on a fully taxable equivalent basis, a summary of the Company’s interest-earning assets and their average yields, and interest-bearing liabilities and their average costs for each of the years ended December 31, 2006, 2005 and 2004. The average balances of loans include non-accrual loans, and associated yields include loan fees, which are considered adjustment to yields.

| | | Years Ended December 31. | |

(Dollars in thousands) | 2006 | | 2005 | | 2004 | |

| | | Average | | | | Average | | Average | | | | Average | | Average | | | | Average | |

| Earning Assets: | | Balance | Interest (1) | Rate (2) | | Balance | Interest (1) | Rate (2) | | Balance | Interest (1) | Rate (2) | |

| Securities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tax exempt (3) | | $ | 24,018 | | $ | 1,383 | | | 5.76 | % | $ | 26,716 | | $ | 1,614 | | | 6.04 | % | $ | 22,176 | | $ | 1,241 | | | 5.60 | % |

| Taxable | | | 35,687 | | | 1,455 | | | 4.08 | % | | 44,849 | | | 1,650 | | | 3.68 | % | | 51,684 | | | 1,812 | | | 3.51 | % |

| Total securities | | | 59,705 | | | 2,838 | | | 4.75 | % | | 71,565 | | | 3,264 | | | 4.56 | % | | 73,860 | | | 3,053 | | | 4.13 | % |

| Total loans receivable (4) | | | 239,831 | | | 17,009 | | | 7.09 | % | | 185,287 | | | 12,331 | | | 6.66 | % | | 143,916 | | | 8,954 | | | 6.22 | % |

| Other interest-earning assets | | | 10,244 | | | 502 | | | 4.90 | % | | 12,600 | | | 421 | | | 3.34 | % | | 10,409 | | | 156 | | | 1.50 | % |

| Total earning assets | | | 309,780 | | $ | 20,349 | | | 6.57 | % | | 269,452 | | $ | 16,016 | | | 5.94 | % | | 228,185 | | $ | 12,163 | | | 5.33 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-interest earning assets | | | 26,126 | | | | | | | | | 24,146 | | | | | | | | | 25,311 | | | | | | | |

| Allowance for loan losses | | | (2,994 | ) | | | | | | | | (2,230 | ) | | | | | | | | (1,958 | ) | | | | | | |

| Total Assets | | $ | 332,912 | | | | | | | | $ | 291,368 | | | | | | | | $ | 251,538 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sources of Funds: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest bearing deposits: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NOW | | $ | 57,974 | | $ | 1,306 | | | 2.25 | % | $ | 43,939 | | $ | 299 | | | 0.68 | % | $ | 42,412 | | $ | 196 | | | 0.46 | % |

| Money market | | | 30,773 | | | 1,200 | | | 3.90 | % | | 22,083 | | | 534 | | | 2.42 | % | | 16,878 | | | 184 | | | 1.09 | % |

| Savings | | | 45,916 | | | 401 | | | 0.87 | % | | 62,025 | | | 456 | | | 0.74 | % | | 66,322 | | | 439 | | | 0.66 | % |

| Time | | | 100,061 | | | 4,190 | | | 4.19 | % | | 71,174 | | | 1,997 | | | 2.81 | % | | 58,443 | | | 1,213 | | | 2.08 | % |

| Total interest bearing deposits | | | 234,724 | | | 7,097 | | | 3.02 | % | | 199,221 | | | 3,286 | | | 1.65 | % | | 184,055 | | | 2,032 | | | 1.10 | % |

| Borrowed funds | | | 14,359 | | | 707 | | | 4.92 | % | | 14,771 | | | 686 | | | 4.64 | % | | 10,630 | | | 522 | | | 4.91 | % |

| Junior subordinated debentures | | | 5,155 | | | 445 | | | 8.63 | % | | 5,155 | | | 356 | | | 6.91 | % | | 5,155 | | | 260 | | | 5.05 | % |

| Total interest bearing liabilities | | | 254,238 | | $ | 8,249 | | | 3.24 | % | | 219,147 | | $ | 4,328 | | | 1.97 | % | | 199,840 | | $ | 2,814 | | | 1.41 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-interest bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Demand deposits | | | 43,036 | | | | | | | | | 38,068 | | | | | | | | | 33,627 | | | | | | | |

| Other liabilities | | | 1,928 | | | | | | | | | 1,785 | | | | | | | | | 2,004 | | | | | | | |

| Total non-interest bearing liabilities | | | 44,964 | | | | | | | | | 39,853 | | | | | | | | | 35,631 | | | | | | | |

| Stockholders' equity | | | 33,710 | | | | | | | | | 32,368 | | | | | | | | | 16,067 | | | | | | | |

| Total Liabilities and Stockholders' Equity | | $ | 332,912 | | | | | | | | $ | 291,368 | | | | | | | | $ | 251,538 | | | | | | | |

| | | | | | | | | | | | | |

| Net Interest Income and Margin (5) | | | | | $ | 12,100 | | | 3.91 | % | | | | $ | 11,688 | | | 4.34 | % | | | | $ | 9,349 | | | 4.10 | % |

| (1) Includes loan fee income |

| (2) Average rates on securities are calculated on amortized costs |

| (3) Full taxable equivalent basis, using a 39% effective tax rate and adjusted for TEFRA (Tax and Equity Fiscal Responsibility Act) interest expense disallowance |

| (4) Loans outstanding include non-accrual loans |

| (5) Represents the difference between interest earned and interest paid, divided by average total interest-earning assets |

Net Interest Income. Net interest income is the difference between interest and fees on loans and other interest-earning assets and interest paid on interest-bearing liabilities. Changes in volume and mix of interest-earning assets and interest-bearing liabilities that support those assets, as well as changing interest rates when differences exist in repricing dates of assets and liabilities, directly affect net interest income.

Net interest income, on a fully taxable equivalent basis (a 39% tax rate), increased $412 thousand, or 3.5%, to $12.1 million for the year ended December 31, 2006 compared to $11.7 million in 2005. Total interest income, on a fully taxable equivalent basis, increased by $4.3 million to $20.3 million for the year ended December 31, 2006 compared to $16.0 million in 2005. The increase in total interest income reflects both increases on the volume of interest earning assets and the average rate earned on those assets. Total average earning assets increased by $40.3 million to $309.8 million from $269.5 million for the year ended December 31, 2005. The majority of the increase in average earning assets was in the loan portfolio. The average loan portfolio balance increased by $54.5 million, to $239.8 million in the current year from $185.3 million in 2005. Higher market rates of interest and the increase in the average balance in loans increased the average rate earned on earning assets 63 basis points from 5.94% for 2005 to 6.57% in 2006.

Interest expense increased by $3.9 million to $8.2 million for the year ended December 31, 2006 from $4.3 million for the year ago period as a result of increases in market rates of interest, as the average balance interest

bearing liabilities increased $35.1million, to $254.2 million for the year ended December 31, 2006 from $219.1 million the year earlier. The average rate paid on interest bearing liabilities increased by 127 basis points to 3.24% for the current year from 1.97% for the year ended December 31, 2005.

The net interest margin decreased, on a fully taxable equivalent basis, by 43 basis points to 3.91% in the year ended December 31, 2006 compared to 4.34% for the same period in 2005.

Interest Income. Total interest income, on a fully taxable equivalent basis, increased by $4.3 million to $20.3 million for the year ended December 31, 2006 compared to $16.0 million in 2005. The largest component of the increase was in federal funds sold and the loan portfolio.

Total interest income on the loan portfolio increased by $4.7 million to $17.0 million for the current year from $12.3 million in 2005. Comparing the average balance in the loan portfolio for the year ended December 31, 2006 to the same period in 2005, the average balance in loans increased $54.5 million, or 29.4%. The increase in our loan portfolio reflects our continuing efforts to enhance our loan origination capacity. The average rate earned on loans increased 43 basis points from 6.66% for the period ended December 31, 2005 to 7.09% for the same period in 2006. This was due to competitive pricing in a competitive market rate environment.

Total interest income on securities, on a fully taxable equivalent basis, decreased $426 thousand, or 13.1%, from the year ended December 31, 2005 to the same period in 2006. The average balance of securities decreased $11.9 million, as cash flow from repayments and prepayments was primarily used to fund new loan origination. The average rate increased 19 basis points, from 4.56% in 2005 to 4.75% for 2006. The increase in yield reflects the repricing of rates on the mortgage-backed securities held in the portfolio.

Interest Expense. The Company’s interest expense for the year ended December 31, 2006 increased $3.9 million, or 90.6%, to $8.2 million from $4.3 million for the same period in 2005, as the average interest-bearing liabilities increased $35.1 million, or 16.0%, to $254.2 million from $219.1 million between the same two periods. The average rate paid on total interest-bearing liabilities has increased by 127 basis points from 1.97% for the year ended December 31, 2005 to 3.24% for the same period in 2006. The increase in interest expense reflects continued competition for deposits in our primary market. In order to attract and retain deposits to fund our growing loan portfolio, the Company has had to offer higher rates and emphasize more expensive accounts, such as time deposits and money market accounts, which typically bear higher rates than transactional or savings accounts. The average balance of time deposits has increased by $28.9 million, or 40.6%, to $100.1 million for the year ended December 31, 2006 compared to $71.2 million the prior year. The average rate paid on time deposits increased 138 basis points from 2.81% for the period ended December 31, 2005 to 4.19% for the same period in 2006. The average balance in money market accounts has increased $8.7 million, or 39.4%, to $30.8 million for the year ended December 31, 2006 from $22.1 million for the same period in 2005. The average rate paid on money market deposits has increased 148 basis points from 2.42% to 3.90% between year end 2005 to year end 2006, as the Company has promoted a business money market sweep product with its interest rate based on economic market conditions and a tiered personal money market product which offers higher rates of interest on larger average balances.

At December 31, 2006, the Company’s borrowed funds consisted of four convertible notes and one amortizing advance from the Federal Home Loan Bank totaling $18.3 million. The Company also has $5.2 million in junior subordinated debentures. The debentures bear a floating rate of interest, which averaged 8.63% for the year ended December 31, 2006, up 172 basis points from 6.91% in the same period in 2005.

The following table reflects the impact on net interest income of changes in the volume of earnings assets and interest bearing liabilities and changes in rates earned and paid by the Company on such assets and liabilities. For purposes of this table, nonaccrual loans have been included in the average loan balance. Changes due to both volume and rate have been allocated in proportion to the relationship of the dollar amount change in each.

| | | December 31, 2006 v. 2005 | | December 31, 2005 v. 2004 | |

| | | Increase (decrease) | | Increase (decrease) | |

| | | Due to changes in: | | Due to changes in: | |

(Dollars in thousands) | | Volume | | Rate | | Total | | Volume | | Rate | | Total | |

| Securities: | | | | | | | | | | | | | | | | | | | |

| Tax exempt | | | ($158 | ) | | ($73 | ) | | ($231 | ) | $ | 269 | | $ | 104 | | $ | 373 | |

| Taxable | | | (361 | ) | | 166 | | | (195 | ) | | (249 | ) | | 87 | | | (162 | ) |

| Total securities (1) | | | (519 | ) | | 93 | | | (426 | ) | | 20 | | | 191 | | | 211 | |

| Total loans receivable (2) | | | 3,825 | | | 853 | | | 4,678 | | | 2,718 | | | 659 | | | 3,377 | |

| Other interest-earning assets | | | (89 | ) | | 170 | | | 81 | | | 39 | | | 226 | | | 265 | |

Total net change in income on interest-earning assets | | | 3,217 | | | 1,116 | | | 4,333 | | | 2,777 | �� | | 1,076 | | | 3,853 | |

| Interest bearing deposits: | | | | | | | | | | | | | | | | | | | |

| NOW | | | 122 | | | 885 | | | 1,007 | | | 7 | | | 96 | | | 103 | |

| Money Market | | | 260 | | | 406 | | | 666 | | | 71 | | | 279 | | | 350 | |

| Savings | | | (131 | ) | | 76 | | | (55 | ) | | (30 | ) | | 47 | | | 17 | |

| Time | | | 991 | | | 1,202 | | | 2,193 | | | 300 | | | 484 | | | 784 | |

| Interest bearing deposits | | | 1,242 | | | 2,569 | | | 3,811 | | | 348 | | | 906 | | | 1,254 | |

| Borrowed funds | | | (19 | ) | | 40 | | | 21 | | | 194 | | | (30 | ) | | 164 | |

| Junior subordinated debentures | | | - | | | 89 | | | 89 | | | - | | | 96 | | | 96 | |

Total net change in expense on interest-bearing liabilities | | | 1,223 | | | 2,698 | | | 3,921 | | | 542 | | | 972 | | | 1,514 | |

| Change in net interest income | | $ | 1,994 | | | ($1,582 | ) | $ | 412 | | $ | 2,235 | | $ | 104 | | $ | 2,339 | |

| (1) Fully taxable equivalent basis, using 39% effective tax rate and adjusted for TEFRA (Tax and Equity Fiscal Responsibility Act) interest expense disallowance. |

| (2) Includes loan fee income |

Provision for Loan Losses. The provision for loan losses in 2006 was $733 thousand compared to a provision of $1.1 million in 2005, a decrease of $405 thousand or 35.6%. During 2005 the Company experienced approximately $1.0 million in charge-offs, compared with $94 thousand in 2006 and $35 thousand in 2004, which required additional provisions in 2005 to replenish the allowance due to these charge-offs. The provision for loan losses reflects management’s judgment concerning the risks inherent in the Company’s existing loan portfolio and the size of the allowance necessary to absorb the risks, as well as the activity in the allowance during the periods. Management reviews the adequacy of its allowance on an ongoing basis and will provide additional provisions, as management may deem necessary.

Non-Interest Income. The Company’s non-interest income is primarily generated through insurance commissions earned through the operation of Tri-State and service charges on deposit accounts.

The Company’s non-interest income increased by $371 thousand, or 7.6%, to $5.2 million for the year ended December 31, 2006 from $4.9 million for the same period in 2005. The increase is primarily attributable to the Company’s service fees on deposit accounts increasing $145 thousand or 11.8%, to $1.4 million for the year ended December 31, 2006 from $1.2 million in the previous year and the increase in insurance commission income of $249 thousand to $2.6 million in 2006 from $2.3 million in 2005. Net gain on the sale of securities was $90 thousand for the year ended December 31, 2006 compared to $35 thousand for the year ended December 31, 2005. These increases were partially offset by a decline in investment brokerage fees and mortgage brokerage fee income.

Non-Interest Expense. Total non-interest expense increased from $11.6 million in 2005 to $12.6 million in 2006, an increase of $1.0 million, or 9.0%. Salaries and employee benefits, the largest component of non-interest expense, increased $532 thousand, or 8.4%. The increase reflects both the additions to staff due to the Company’s continued growth and expansion and customary annual salary increases for the Bank’s and Tri-State’s existing staff. Occupancy expenses and furniture, fixtures and data processing expenses have increased, 8.9% and 12.2% respectively, in 2006 over 2005 due to the Company’s expansion into New York and renovations to the Company’s data operations area in Newton. The largest increase in non-interest expense was an increase of $123 thousand, or 22.6%, in professional fees. This increase was due to the continued costs associated with the

implementation of internal control requirements of Section 404 of the Sarbanes Oxley Act of 2002 and increased legal fees as a result of the Company’s expansion. Other expenses increased $175 thousand, or 12.7%, to $1.5 million in 2006 largely due to check and ATM losses increasing $45 thousand and auto and travel expenses increasing $32 thousand, as several Directors attended conferences as now required by the Sarbanes Oxley Act of 2002.

Income Taxes. The Company’s income tax provision, which includes both federal and state taxes, was $1.1 million and $952 thousand for the years ended December 31, 2006 and 2005, respectively. This 20.6% increase in income taxes resulted from an increase in income before taxes of $261 thousand, or 7.8%, and the decrease in tax-exempt securities income for the year ended December 31, 2006 compared to the same period in 2005. The Company’s effective tax rate of 31.8% and 28.4% for the years ended December 31, 2006 and 2005, respectively, is below the statutory tax rate due to tax-exempt interest on securities and earnings on the Company’s investment in life insurance on two of our executive officers.

COMPARISION OF OPERATING RESULTS AT YEAR-END DECEMBER 31, 2005 AND 2004

Overview. For the year ended December 31, 2005, net income was $2.4 million, an increase of $808 thousand, or 50.8%, from the $1.6 million for the same period in 2004. Basic earnings per share were $0.76 for the year ended December 31, 2005 compared to $0.81 for the same period last year, a decrease of 6.2%. Diluted earnings per share were $0.75 for the year ended December 31, 2005 compared to $0.78 for the same period last year, a decrease of 3.9 %. The decreased earnings per share reflects the issuance of an additional 1,131,150 shares of the Company’s stock from a public offering in December of 2004. For the year ended December 31, 2005, the Company had 3,163,189 average basic shares outstanding, compared to 1,965,745 average basic shares outstanding for the year ended December 31, 2004.

The results reflect an increase in net interest income, an outcome of both increasing interest income and interest expense, coupled with increases in non-interest income, primarily due to an increase in service fees on deposit accounts, offset by increases in non-interest expenses associated with additional professional fees related to the preliminary implementation of Section 404 requirements of the Sarbanes Oxley Act of 2002.

Net Interest Income. Net interest income is the difference between interest and fees on loans and other interest-earning assets and interest paid on interest-bearing liabilities. Changes in volume and mix of interest-earning assets and interest-bearing liabilities that support those assets, as well as changing interest rates when differences exist in repricing dates of assets and liabilities, directly affect net interest income.

Net interest income, on a fully taxable equivalent basis (a 39% tax rate), increased $2.3 million, or 25.0%, to $11.7 million for the year ended December 31, 2005 compared to $9.3 million in 2004. Total interest income, on a fully taxable equivalent basis, increased by $3.9 million to $16.0 million for the year ended December 31, 2005 compared to $12.2 million in 2004. Total average earning assets increased by $41.3 million to $269.5 million from $228.2 million for the year ended December 31, 2004. The majority of the increase in average earning assets was in the loan portfolio. The average loan portfolio balance increased by $41.4 million, to $185.3 million in the current year from $143.9 million in 2004. Higher market rates of interest and the increase in the average balance in loans increased the average rate earned on earning assets 61 basis points from 5.33% for 2004 to 5.94% in 2005.

Interest expense increased by $1.5 million to $4.3 million from $2.8 million for the year ended December 31, 2005 as a result of increases in market rates of interest, as the average balance in interest bearing liabilities increased $19.3 million, to $219.1 million for the year ended December 31, 2005 from $199.8 million the year earlier. The average rate paid on interest bearing liabilities increased by 56 basis points to 1.97% for the current year from 1.41% for the year ended December 31, 2004.

The net interest margin increased, on a fully taxable equivalent basis, by 24 basis points to 4.34% in the year ended December 31, 2005 compared to 4.10% for the same period in 2004.

Interest Income. Total interest income, on a fully taxable equivalent basis, increased by $3.9 million to $16.0 million for the year ended December 31, 2005 compared to $12.2 million in 2004. The largest components of the increase were on tax-exempt investment securities and on the loan portfolio.

Total interest income on the loan portfolio increased by $3.4 million to $12.3 million for the current year from $9.0 million in 2004. Comparing the average balance in the loan portfolio for the year ended December 31, 2005 to the same period in 2004, the average balance in loans increased $41.4 million, or 28.8%. The increase in our loan portfolio reflects our continuing efforts to enhance our loan origination capacity. In particular, we have enhanced our loan department through the hiring of additional lending staff and originators. The average rate earned on loans increased 44 basis points from 6.22% for the period ended December 31, 2004 to 6.66% for the same period in 2005. This was due to competitive pricing in an increasing market rate environment.

Total interest income on securities, on a fully taxable equivalent basis, increased $211 thousand, or 6.9%, from the year ended December 31, 2004 to the same period in 2005. While the average balance of securities decreased $2.3 million, the average rate earned increased 43 basis points, from 4.13% in 2004 to 4.56% for 2005. The decrease in the total securities portfolio reflects the reallocation of funds to meet increasing loan demand. The increase in yield was accomplished through increasing the tax-exempt securities portfolio by $4.5 million and increasing the tax equivalent yield by 44 basis points to 6.04% for the year ended December 31, 2005 from 5.60% the year earlier.