Exhibit 99.1

FIG Partners 7th Annual West Coast CEO Forum February 2016

2 FORWARD - LOOKING STATEMENT This confidential presentation, and the oral presentation that supplements it, have been developed by Sussex Bancorp (“Sussex” or the “Company”), were prepared exclusively for the benefit and internal use of the recipient and are not an offer or the solicitation of an offer to buy securities. Neither this presentation, nor the oral presentation that supplements it, nor any of their contents, may be used, reproduced, disseminated, quoted or referred to for any other purpose, in whole or in part, without the prior written consent of the Company. Some of the statements contained in this presentation are “forward - looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. When used in this presentation, words such as “may,” “plan,” “contemplate,” “anticipate,” “believe,” “intend,” “continue,” “expect,” “project,” “predict,” “estimate,” “target,” “could,” “is likely,” “should,” “would,” “will,” or similar expressions are intended to identify “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward - looking statements, which speak only as of the date made. These statements may relate to the Company’s future financial performance, strategic plans or objectives, revenue, expense or earnings projections, or other financial items. By their nature, these statements are subject to numerous uncertainties that could cause actual results to differ materially from those anticipated in the statements. Factors that could cause actual results to differ materially from the results anticipated or projected include, but are not limited to, the following: ( i ) competition in the industry and markets in which the Company operates; (ii) levels of non - performing assets; (iii) changes in general interest rates; (iv) loan demand; (v) rapid changes in technology affecting the financial services industry; (vi) real estate values; (vii) changes in government regulation; and (viii) general economic and business conditions.

Agenda 1 2 3 4 Building Franchise Value Financial Performance Growing Shareholder Value Company and Market Overview 3

1. Company and Market Overview

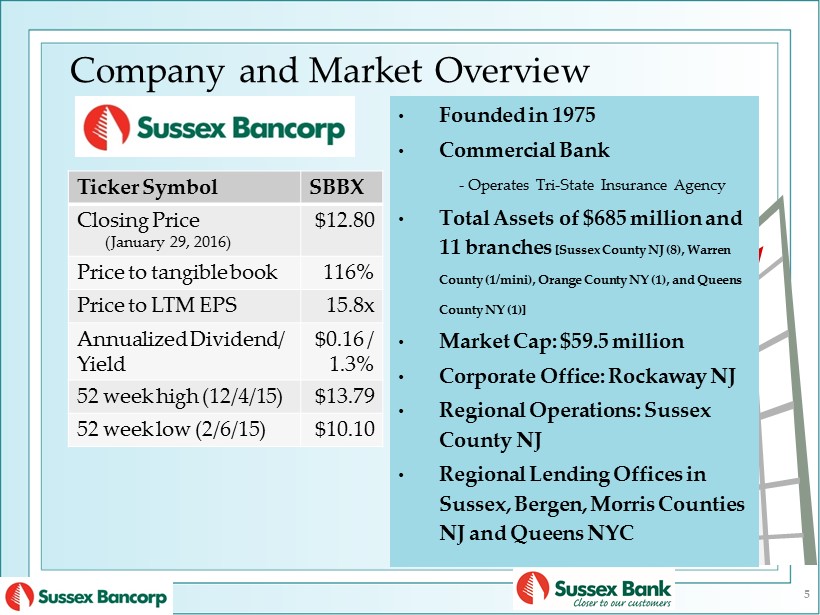

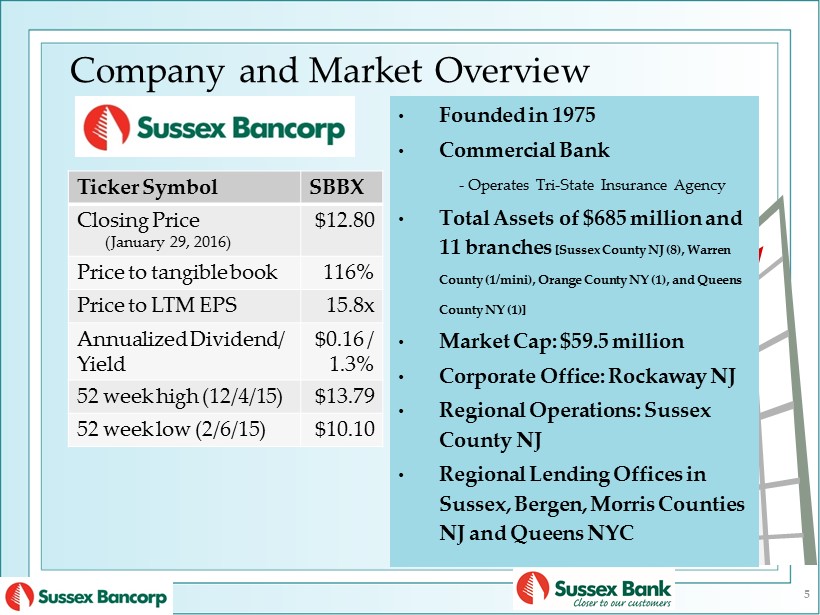

Ticker Symbol SBBX Closing Price (January 29, 2016) $12.80 Price to tangible book 116% Price to LTM EPS 15.8x Annualized Dividend/ Yield $0.16 / 1.3% 52 week high (12/4/15) $13.79 52 week low (2/6/15) $10.10 • Founded in 1975 • Commercial Bank - Operates Tri - State Insurance Agency • Total Assets of $685 million and 11 branches [Sussex County NJ (8), Warren County (1/mini), Orange County NY (1), and Queens County NY (1)] • Market Cap: $59.5 million • Corporate Office: Rockaway NJ • Regional Operations: Sussex County NJ • Regional Lending Offices in Sussex, Bergen, Morris Counties NJ and Queens NYC Company and Market Overview 5

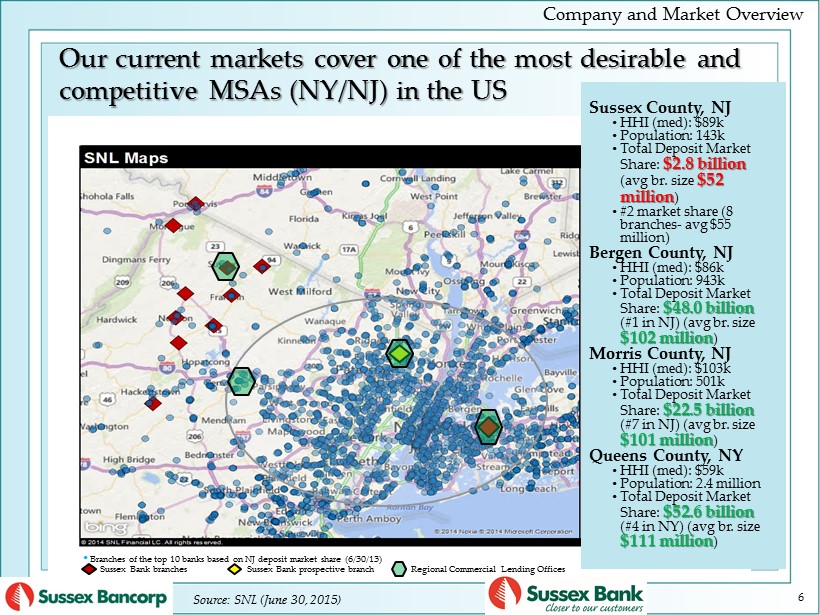

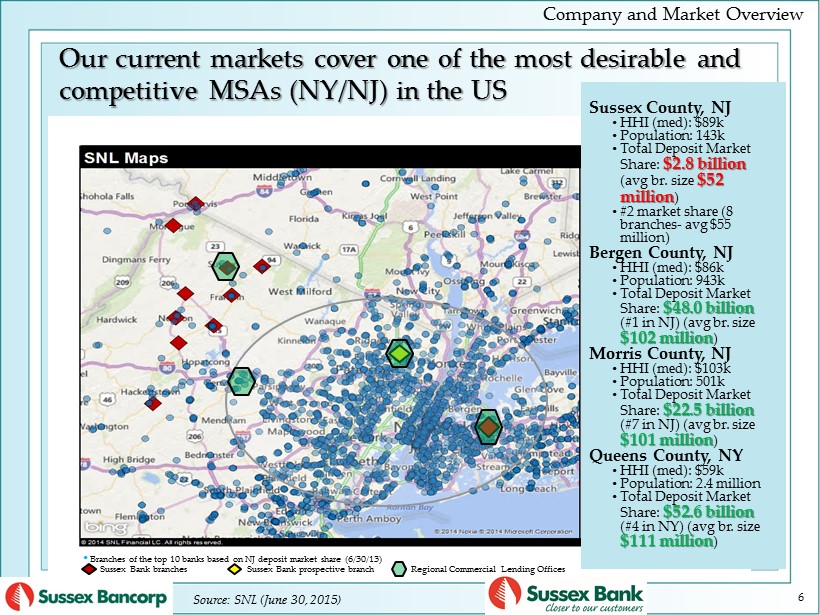

Our current markets cover one of the most desirable and competitive MSAs (NY/NJ) in the US 6 Sussex County, NJ • HHI (med): $ 89k • Population: 143k • Total Deposit Market Share: $ 2.8 billion ( avg br. size $52 million ) • #2 market share (8 branches - avg $ 55 million) Bergen County, NJ • HHI (med): $ 86k • Population: 943k • Total Deposit Market Share: $ 48.0 billion (#1 in NJ) ( avg br. size $102 million ) Morris County , NJ • HHI (med): $103k • Population: 501k • Total Deposit Market Share: $22.5 billion (#7 in NJ) ( avg br. size $101 million ) Queens County, NY • HHI (med): $59k • Population: 2.4 million • Total Deposit Market Share: $52.6 billion (#4 in NY) ( avg br. size $111 million ) • Branches of the top 10 banks based on NJ deposit market share (6/30/13) Sussex Bank branches Sussex Bank prospective branch Regional Commercial Lending Offices Source: SNL (June 30, 2015) Company and Market Overview

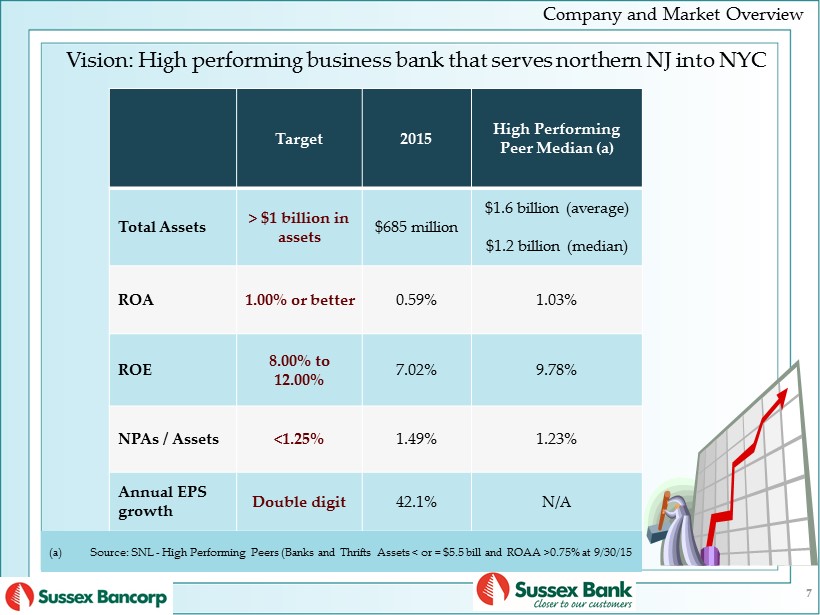

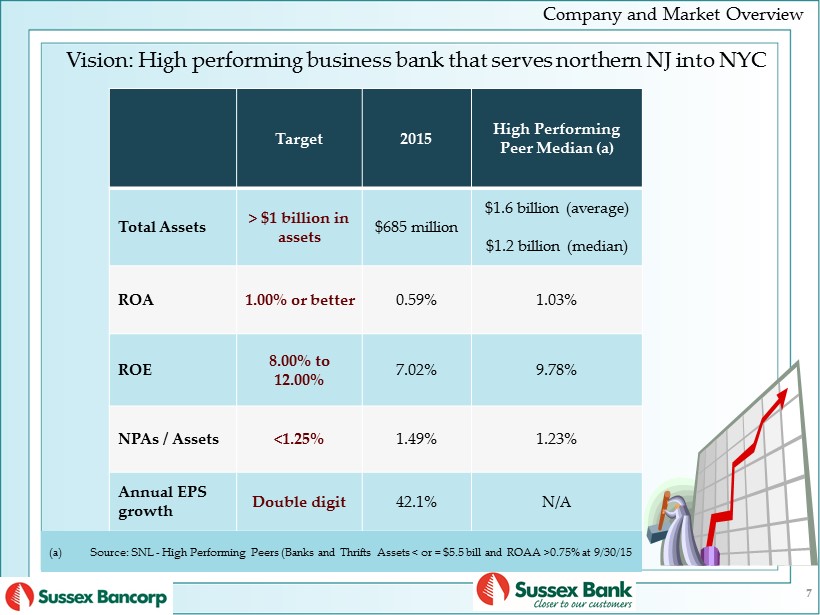

Vision: High performing business bank that serves northern NJ into NYC Target 2015 High Performing Peer Median (a) Total Assets > $1 billion in assets $685 million $1.6 billion (average) $1.2 billion (median) ROA 1.00% or better 0.59% 1.03% ROE 8.00% to 12.00% 7.02% 9.78% NPAs / Assets <1.25% 1.49% 1.23% Annual EPS growth Double digit 42.1% N/A (a) Source: SNL - High Performing Peers (Banks and Thrifts Assets < or = $5.5 bill and ROAA >0.75% at 9/30/15 7 Company and Market Overview

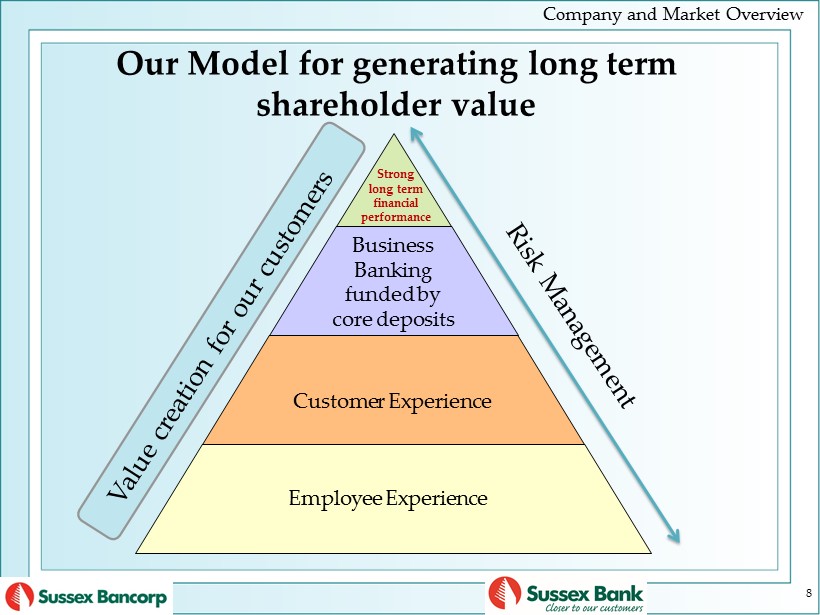

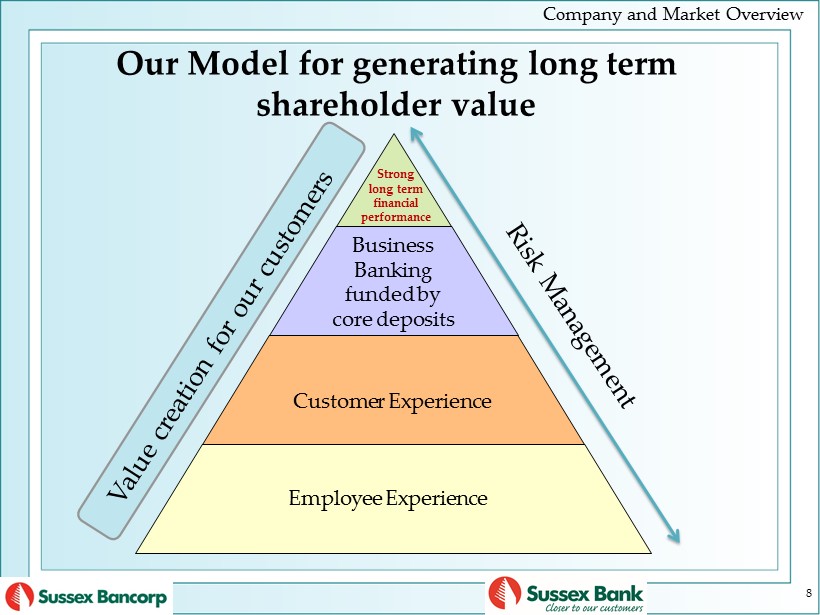

Employee Experience Customer Experience Business Banking funded by core deposits Strong long term financial performance 8 Our Model for generating long term shareholder value Company and Market Overview 8

2. Financial Performance

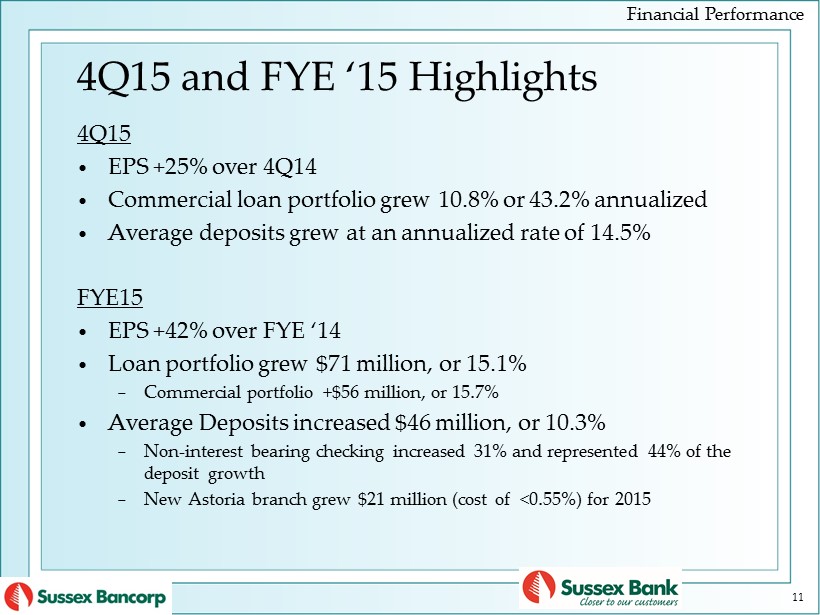

SUSSEX BANCORP ANNOUNCES A 42% INCREASE IN EPS DRIVEN BY LOAN AND DEPOSIT GROWTH FOR FISCAL 2015 AND DECLARES QUARTERLY CASH DIVIDEND ( Excerpt from earnings release) ROCKAWAY , NEW JERSEY – January 28, 2016 “Growing our business responsibly continues to be our focus. To that end, I am pleased to report that in the fourth quarter we were able to achieve our strongest business production of the year. Our commercial loan portfolio grew 10.8% or 43.2% annualized on $50.0 million of gross loan production, our average deposits grew at an annualized rate of 14.5%, predominately in non - interest bearing deposits and our insurance subsidiary had a strong year, increasing their pre - tax income by 33.7%,” said Anthony Labozzetta, President and Chief Executive Officer of Sussex Bank. Mr. Labozzetta also stated, “As I recently noted, spreads continue to tighten due in part to the present hyper - competitive environment, nevertheless our strong business line productivity continues to build our net interest income and other income, which enhances our operating leverage and improves our financial performance.” In addition, Mr. Labozzetta stated, “In the first quarter of 2016, we will open our next branch in Oradell, NJ. Comparable to our successful Astoria location, the Oradell branch will utilize our new model that includes more technology, a smaller footprint and a new approach to staffing. Furthermore, we are very excited about the advanced business activity surrounding the new location .” 10 Financial Performance

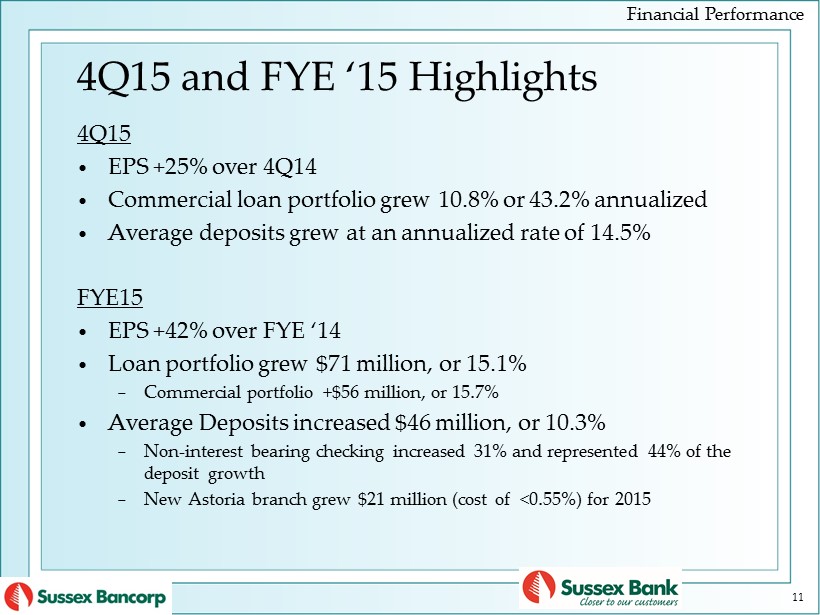

11 4Q15 • EPS +25% over 4Q14 • Commercial loan portfolio grew 10.8% or 43.2% annualized • Average deposits grew at an annualized rate of 14.5% FYE15 • EPS +42% over FYE ‘14 • Loan portfolio grew $71 million, or 15.1% − Commercial portfolio +$56 million, or 15.7% • Average Deposits increased $46 million, or 10.3% − Non - interest bearing checking increased 31% and represented 44% of the deposit growth − New Astoria branch grew $21 million (cost of <0.55%) for 2015 4Q15 and FYE ‘15 Highlights Financial Performance

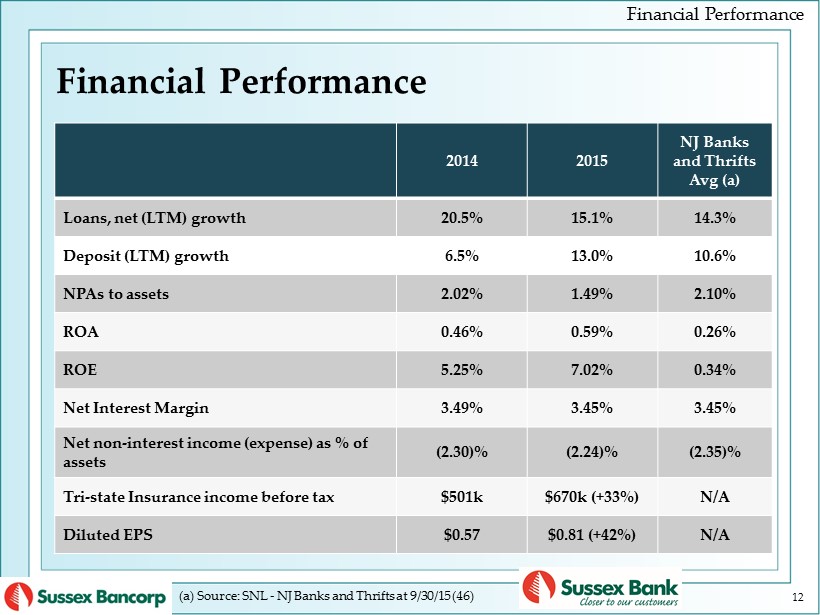

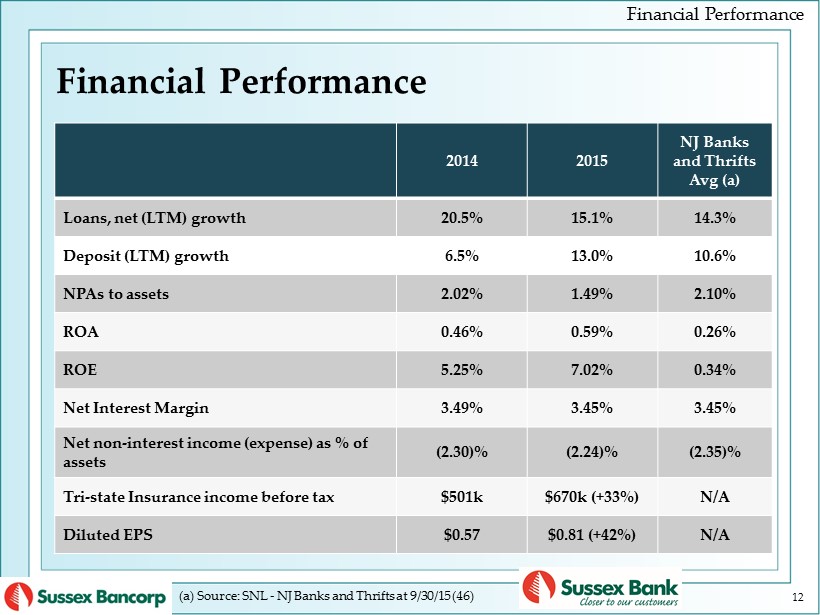

2014 2015 NJ Banks and Thrifts Avg (a) Loans, net (LTM) growth 20.5% 15.1% 14.3% Deposit (LTM) growth 6.5% 13.0% 10.6% NPAs to assets 2.02% 1.49% 2.10% ROA 0.46% 0.59% 0.26% ROE 5.25% 7.02% 0.34% Net Interest Margin 3.49% 3.45% 3.45% Net non - interest income (expense) as % of assets (2.30)% (2.24)% (2.35)% Tri - state Insurance income before tax $501k $670k (+33%) N/A Diluted EPS $0.57 $0.81 (+42%) N/A Financial Performance 12 (a) Source : SNL - NJ Banks and Thrifts at 9/30/15 (46) Financial Performance

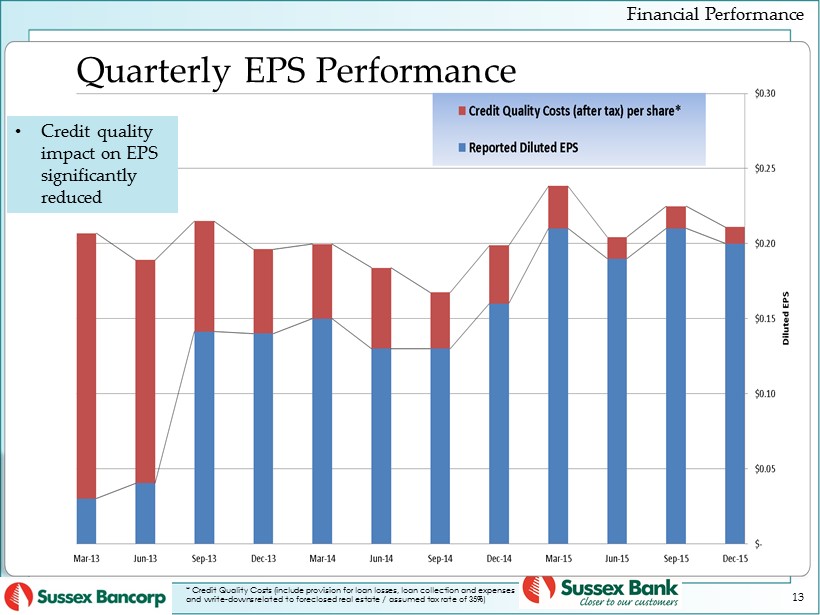

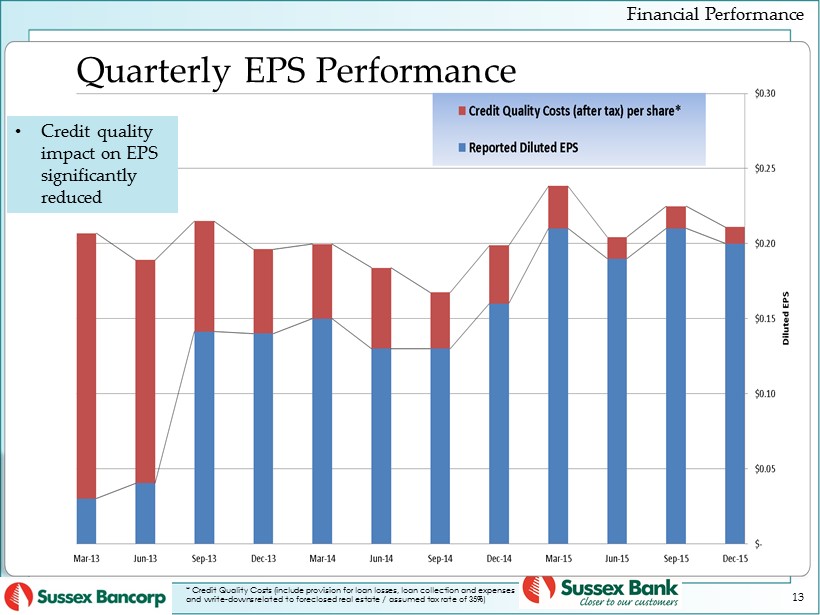

Quarterly EPS Performance • Credit quality impact on EPS significantly reduced * Credit Quality Costs (include provision for loan losses, loan collection and expenses and write - downs related to foreclosed real estate / assumed tax rate of 35%) 13 Financial Performance

3 . Building Franchise Value

1. Strong Leadership − CEO and Executive Team with strong banking and leadership experience − Executive and Senior Management Teams are from much larger and successful financial institutions − Innovative Approach to Leadership − Talent Management • A great employee experience culture is critical • Ability to attract and retain talent • Growth and development • Reward and recognition 15 Building Franchise Value

Building Franchise Value 2. Grow our business − Relationship banking driven by great customer experience − Expand into markets that support long - term growth objectives • Hub and spoke model − Hub: De - novo branch and a regional commercial lending team − Spoke: smaller retail branches within the Hub region • Next de - novo branches (“spokes”) around Oradell (Bergen County, NJ) and Astoria NY locations (Oradell branch / regional lending location scheduled to open in March 2016) • Establish Hubs in Morris and Hudson counties (NJ) and NY markets adjacent to our current Hubs. − Continue to target existing markets within Sussex County 16

2. Grow our business − Continue growing commercial loans • Target Commercial Loan annual growth of 15 - 20% • Absorb unused lender capacity • Regional lending office model • Attracting and retaining talent • Relationships, not transactions • Commercial lending relationships include deposits • Evaluating other specialty lines 17 Building Franchise Value

Lending 18 Building Franchise Value

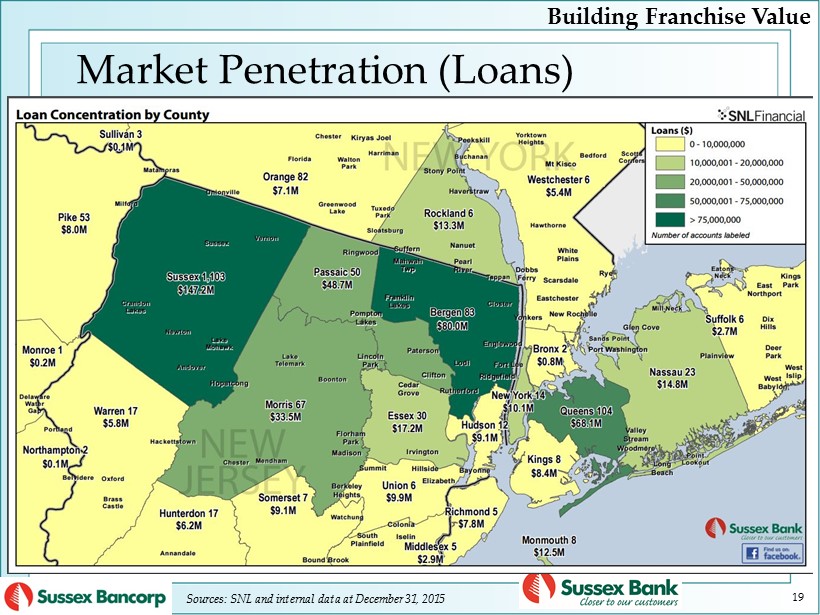

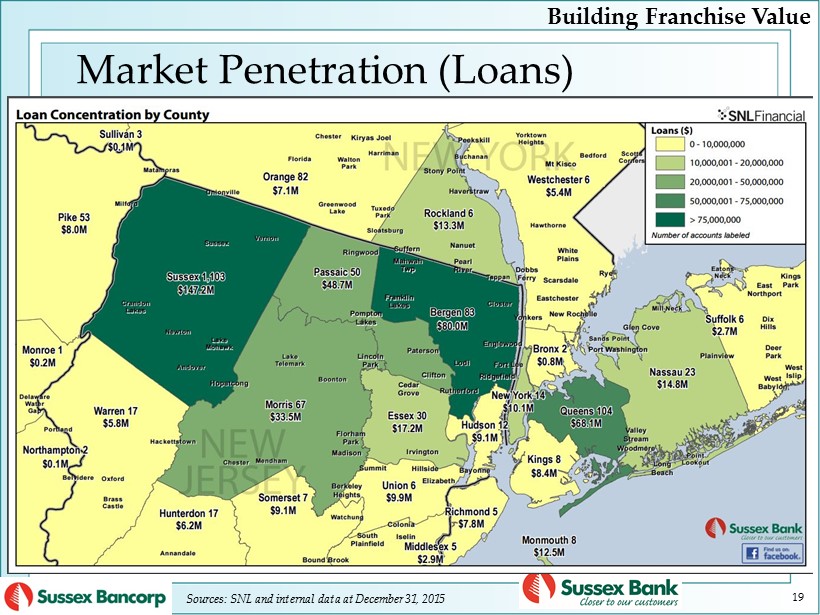

Market Penetration (Loans) Sources: SNL and internal data at December 31, 2015 Building Franchise Value 19

Commercial Lending • Originated over $365 million in new commercial loans in the last 11 quarters • Commercial loans grew 16% LTM and CAGR 20% for last 11 quarters • First half of 2015 impacted by higher prepayments/participations and lower production • Second half of 2015 growth of 16% or 32% annualized • Loan pipeline (approx. $120 million): principally in higher growth markets $ in thousands 20 Building Franchise Value

21 Commercial Loans/Mortgages Originated in 2015 Rate: 4.10% Term: 4.1 yrs Avg. Bal: $290k Rate: 3.98% Term: 5.6 yrs Avg Bal: $3.3M DSCR: 1.75 LTV: <60% • Net funded $115 million (balances at December 31, 2015) o Associated unfunded commitments +$21 million (total exposure $136 million) • Rate 4.03% • Term 5 yrs All other 42% Top 20 CML loans orig. ‘15 58% • Term: lower of remaining repricing or maturity term. • Weighted average rates, terms, DSCR and LTV. Building Franchise Value

Retail Banking 22 Building Franchise Value

• Total deposits are up 31% (CAGR 5%) since 12/31/09 • Shift in mix (non - interest bearing up 165% CAGR 19%) • Continued market penetration into Northeastern NJ and NYC 23 Market Penetration (Deposits) Sources: SNL and internal data at December 31, 2015 Building Franchise Value

24 Deposit Mix and Cost of Deposits Overall cost of deposits 0.38% (4Q15) Y/E Dec 31, 2015: (Cost of deposits in parenthesis) Building Franchise Value

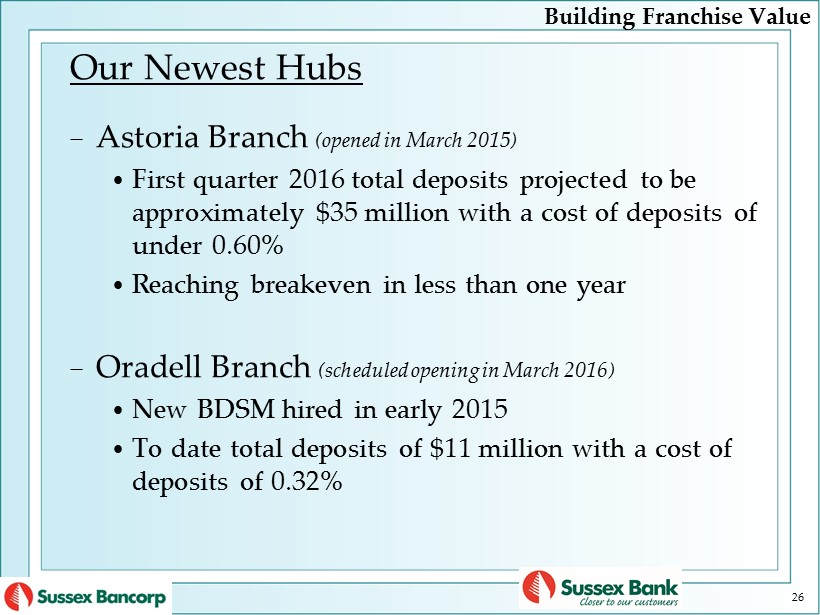

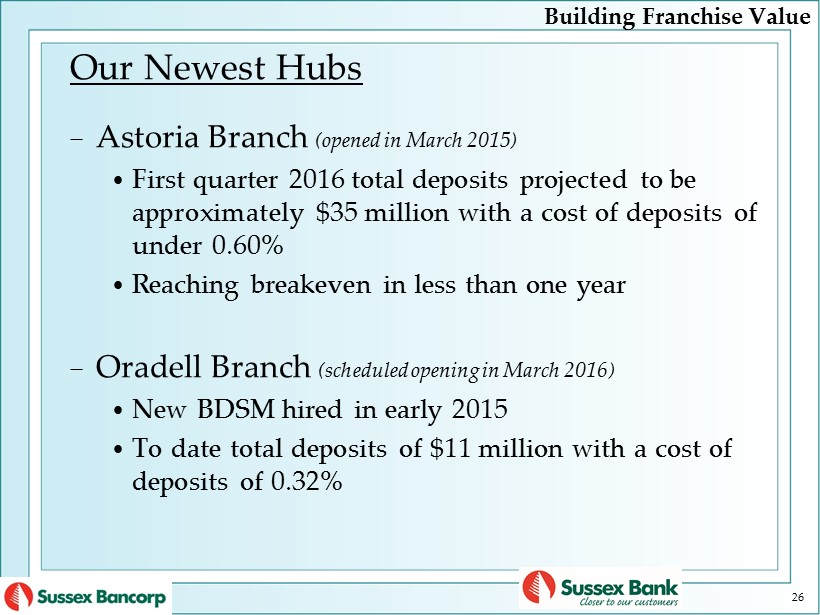

25 • New de - novo branch model − Approx. 1,200 sf and technology driven − New staffing model (BDSM and Universal Bankers) − Advisory board and centers of influence referrals − Continued focus on true core deposits and relationships Building Franchise Value

26 Our Newest Hubs − Astoria Branch (opened in March 2015) • First quarter 2016 total deposits projected to be approximately $35 million with a cost of deposits of under 0.60% • Reaching breakeven in less than one year − Oradell Branch (scheduled opening in March 2016) • New BDSM hired in early 2015 • To date total deposits of $11 million with a cost of deposits of 0.32% Building Franchise Value

27 • Existing Branches − Initial phase of New Branch Model in Sussex County • Initial phase (1): a 3 branch cluster with a BDSM generated year over year deposit growth of 16% vs. - 2% for all other branches in Sussex County − Phase 2: Physical and new staffing model to be implemented − Evaluating existing branch network profitability and applying New Branch Model (if financially feasible ) • (3) Less than 1,500sf ( avg deposits $30M) • (2) Between 2,100sf and 2,400sf ( avg deposits $48M) • (3) Between 3,100sf and 3,900sf ( avg deposits $82M) • (1) Announced the closure of one of our largest physical branches [Port Jervis NY] ($20M in deposits, which will be consolidated into an existing branch in Sussex County) − Operating cost savings of approx. $300k per year [beginning in July 2016] Building Franchise Value

Digital Banking and Technology Platform 28 Building Franchise Value x New leadership x Provide superior customer experience “digitally” through personal interactions x Omni - channel delivery model ▪ Supporting mobile and on - line banking x Investing and enhancing the current overall technology structure and platform x Scalable and efficient x Customer and revenue focused

3. Continue to strengthen profitability − Positive operating leverage • Added capacity for loan and deposit growth − Operational efficiencies excellence • Evaluate and restructure business processes to be operationally flexible and scalable to improve profitability • Evaluate existing branch network profitability and strategies − Growing fee income • Our insurance subsidiary (TSIA) • Expanding wealth management services • Strategies to improve bank fee income 29 Building Franchise Value

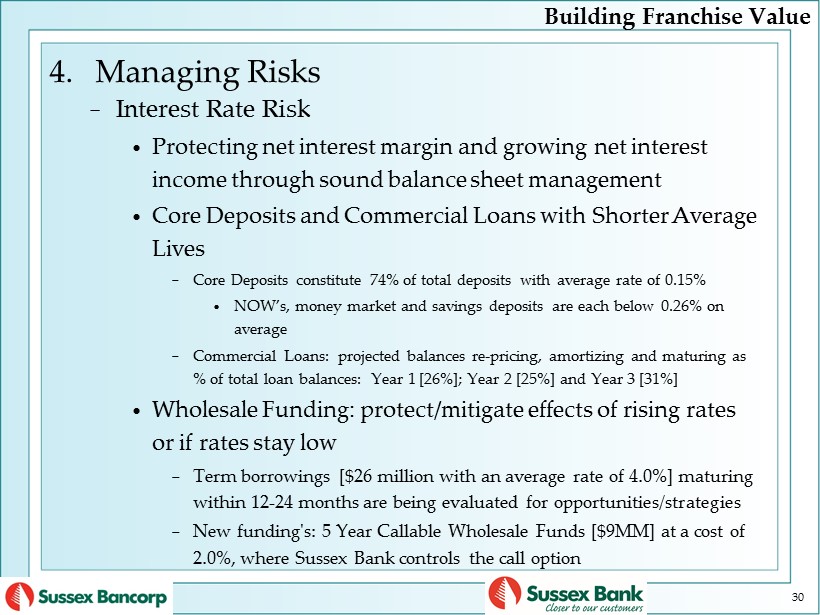

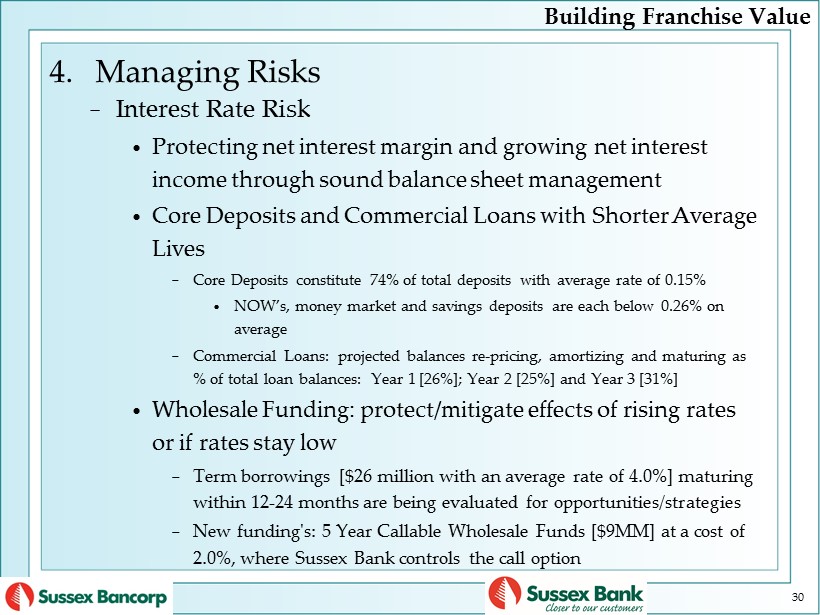

4. Managing Risks − Interest Rate Risk • Protecting net interest margin and growing net interest income through sound balance sheet management • Core Deposits and Commercial Loans with Shorter Average Lives − Core Deposits constitute 74% of total deposits with average rate of 0.15% • NOW’s, money market and savings deposits are each below 0.26% on average − Commercial Loans: projected balances re - pricing, amortizing and maturing as % of total loan balances: Year 1 [26%]; Year 2 [25%] and Year 3 [31%] • Wholesale Funding: protect/mitigate effects of rising rates or if rates stay low − Term borrowings [$26 million with an average rate of 4.0%] maturing within 12 - 24 months are being evaluated for opportunities/strategies − New funding's: 5 Year Callable Wholesale Funds [$9MM] at a cost of 2.0%, where Sussex Bank controls the call option 30 Building Franchise Value

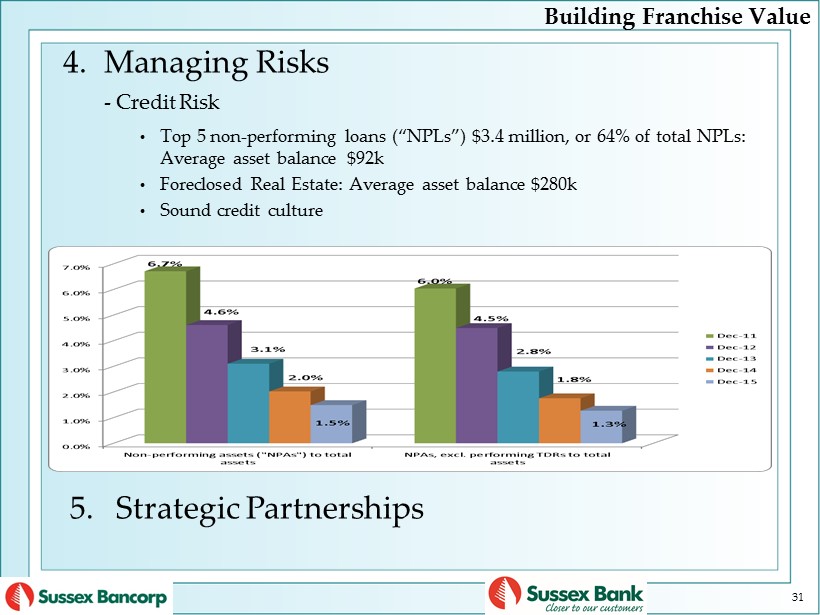

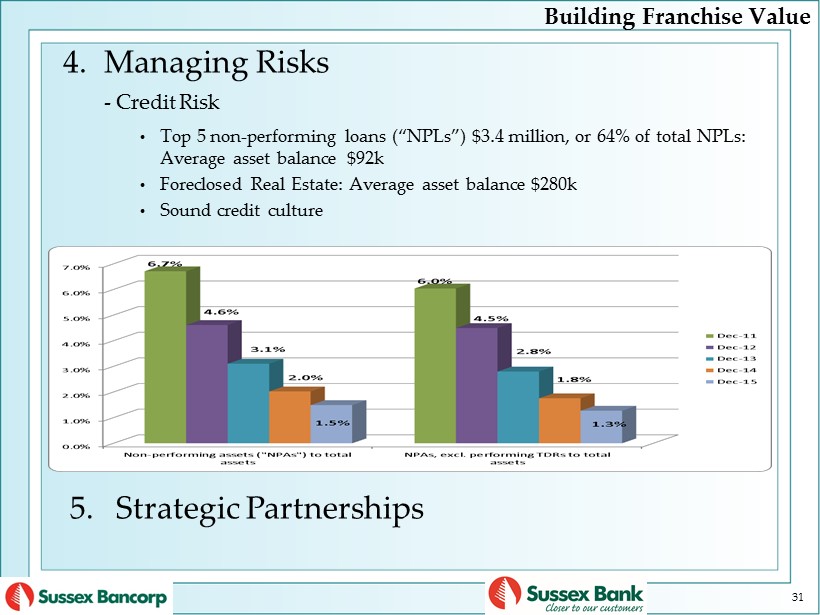

4. Managing Risks - Credit Risk • Top 5 non - performing loans (“NPLs”) $3.4 million, or 64% of total NPLs: Average asset balance $92k • Foreclosed Real Estate: Average asset balance $ 280k • Sound credit culture 31 Building Franchise Value 5. Strategic Partnerships

4. Growing Shareholder Value

Stock Performance One Year Total Return 33 Source: SNL Growing Shareholder Value

34 Source: SNL Stock Performance Five Year Total Return Growing Shareholder Value

Growing Shareholder Value 1. Strategic talent management 2. Grow our business and evaluate capital needs 3. Continue to strengthen profitability (being operationally excellent) Resulting in: − Higher EPS and tangible book value growth − Outperforming the total returns of the broader market and bank indices over the long run 35

36