EXHIBIT 99.1

Spectrum Brands merger with Russell Hobbs

Important Information FORWARD-LOOKING STATEMENTS Certain matters discussed in this presentation, with the exception of historical matters, may be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are subject to a number of risks and uncertainties that could cause results to differ materially from those anticipated as of the date of this presentation. Actual results may differ materially as a result of (1) Spectrum Brands’ ability to manage and otherwise comply with its covenants with respect to its significant outstanding indebtedness, (2) Spectrum Brands’ ability to identify, develop and retain key employees, (3) risks that changes and developments in external competitive market factors, such as introduction of new product features or technological developments, development of new competitors or competitive brands or competitive promotional activity or spending, (4) changes in consumer demand for the various types of products Spectrum Brands offers, (5) unfavorable developments in the global credit markets, (6) the impact of overall economic conditions on consumer spending, (7) fluctuations in commodities prices, the costs or availability of raw materials or terms and conditions available from suppliers, (8) changes in the general economic conditions in countries and regions where Spectrum Brands does business, such as stock market prices, interest rates, currency exchange rates, inflation and consumer spending, (9) Spectrum Brands’ ability to successfully implement manufacturing, distribution and other cost efficiencies and to continue to benefit from its cost-cutting initiatives, (10) unfavorable weather conditions and various other risks and uncertainties, including those discussed herein and those set forth in Spectrum Brands’ securities filings, including the most recently filed Annual Report on Form 10-K or Quarterly Reports on Form 10-Q. Spectrum Brands also cautions the reader that its estimates of trends, market share, retail consumption of its products and reasons for changes in such consumption are based solely on limited data available to Spectrum Brands and management’s reasonable assumptions about market conditions, and consequently may be inaccurate, or may not reflect significant segments of the retail market.Spectrum Brands also cautions the reader that undue reliance should not be placed on any forward-looking statements, which speak only as of the date of this presentation. Spectrum Brands undertakes no duty or responsibility to update any of these forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect actual outcomes.In addition, the following factors, among others, could cause actual results to differ materially from those set forth in the forward-looking statements: the failure of Spectrum Brands stockholders and Russell Hobbs stockholders to approve this transaction; the risk that the businesses will not be integrated successfully; the risk that synergies will not be realized; the risk that required consents will not be obtained; the risk that the combined company following this transaction will not realize on its financing strategy litigation in respect of either company or this transaction; and disruption from this transaction making it more difficult to maintain certain strategic relationships. Additional factors that may affect future results and conditions are described in Spectrum Brands’ filings with the SEC, which are available at the SEC’s web site at www.sec.gov or at Spectrum Brands’ website at www.spectrumbrands.com.The following slides contain summaries of certain financial and statistical information about Spectrum Brands and Russell Hobbs. The information contained in this presentation is summary information that is intended to be considered in the context of Spectrum Brands’ and Russell Hobbs’ SEC filings, if any, and other public announcements that they may make, by press release or otherwise, from time to time. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of Spectrum Brands or Russell Hobbs, or information about the market, as indicative of Spectrum Brands’ or Russell Hobbs’ future results or the potential future results of the combined company following consummation of the Transaction. Further, performance information respecting investment returns on portfolio transactions is not directly equivalent to returns on an investment in Spectrum Brands’ or Russell Hobbs’ common stock.This presentation is not a solicitation of a proxy from any stockholders of Spectrum Brands or Russell Hobbs or an offer to sell or the solicitation of an offer to buy any securities of Spectrum Brands or Russell Hobbs. The following slides contain information in respect of each of Spectrum Brands and Russell Hobbs. Neither company makes any representation as to the accuracy of the other company’s information. Although the companies signed a merger agreement as previously reported and filed with the SEC, the companies remain independent as of the date hereof.IMPORTANT ADDITIONAL INFORMATION WILL BE FILED WITH THE SEC This Communication is being made in respect of the proposed business combination involving Spectrum Brands and Russell Hobbs. In connection with the proposed transaction, Spectrum Brands plans to file with the SEC a Registration Statement on Form S-4 that includes the proxy statement of Spectrum Brands and that also constitutes a prospectus of Spectrum Brands. The definitive Proxy Statement/Prospectus will be mailed to stockholders of Spectrum Brands. INVESTORS AND SECURITY HOLDERS OF SPECTRUM BRANDS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the Registration Statement and Proxy Statement/Prospectus (when available) and other documents filed with the SEC by Spectrum Brands through the web site maintained by the SEC at www.sec.gov. Free copies of the Registration Statement and Proxy Statement/Prospectus (when available) and other documents filed with the SEC can also be obtained on Spectrum Brands’ website at www.spectrumbrands.com. PROXY SOLICITATION Spectrum Brands, Russell Hobbs and their respective directors, executive officers and certain other members of management and employees may be soliciting proxies from Spectrum Brands and Russell Hobbs stockholders in favor of the acquisition. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the Spectrum Brands and Russell Hobbs stockholders in connection with the proposed acquisition will be set forth in the Proxy Statement/Prospectus when it is filed with the SEC. You can find information about Spectrum Brands’ executive officers and directors in its annual report on Form 10-K filed with the SEC on December 29, 2009. You can obtain free copies of these documents from Spectrum Brands in the manner set forth above.

Powerful combination: $3B global consumer products companyExtends global reach and market leading brandsAttractive economics for shareholdersStrengthens capital structure and reduces financial riskReduces and lowers cost of combined debtImproves leverageExtends debt maturitiesEnhances liquidity and increases capital available for growth

Powerful Combination Creates new global consumer products company $3B in revenues: $2.2B Spectrum Brands, $0.8B Russell Hobbs Carried in over 1 million retail outlets by key retailers globally $430 million to $440 million of fiscal 2010 estimated adjusted EBITDA Combined portfolio includes widely respected global brands including: Remington, Rayovac, VARTA, Spectracide, Cutter, Hot Shot, Tetra, 8 in 1, Dingo Russell Hobbs, George Foreman, Black & Decker, Littermaid, Toastmaster Creates a premier personal care and kitchen electric appliance company Expands product portfolio, new product pipeline and brands Provides greater scale and builds stronger, more efficient global supply chain Leverages global infrastructure including sales, distribution, and admin Expand global sales within and across business units of each company Expected to generate $25-30 million of synergies

Like Spectrum, Russell Hobbs Has Strong, Long-Standing Global Customer Relationships

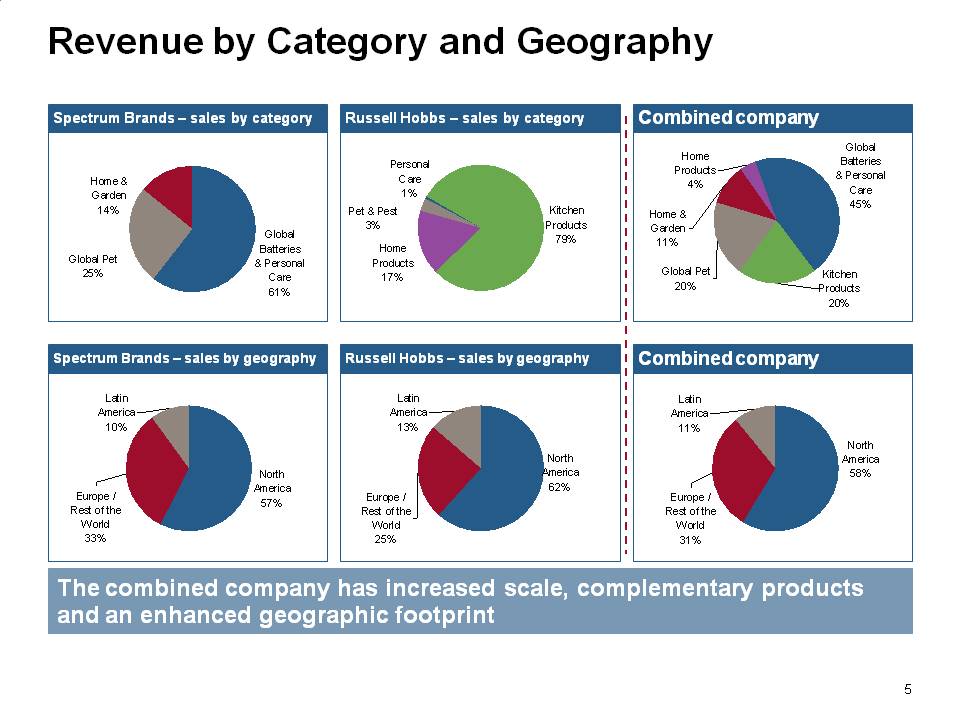

Revenue by Category and Geography Spectrum Brands – sales by category Russell Hobbs – sales by category Combined company Spectrum Brands – sales by geography Russell Hobbs – sales by geography Combined company The combined company has increased scale, complementary products and an enhanced geographic footprint Home & Garden 14% Global Pet 25% Global Batteries & Personal Care 61% Personal Care 1% Pet & Pest 3% Home Products 17% Kitchen Products 79% Home Products 4% Home & Garden 11% Global Pet 20% Global Batteries & Personal Care 45% Kitchen Products 20% Latin America 10% Europe Rest of the World 33% North America 57% Latin America 13% Europe Rest of the World 25% North America 62% Latin America 11% Europe Rest of the World 31% North America 58%

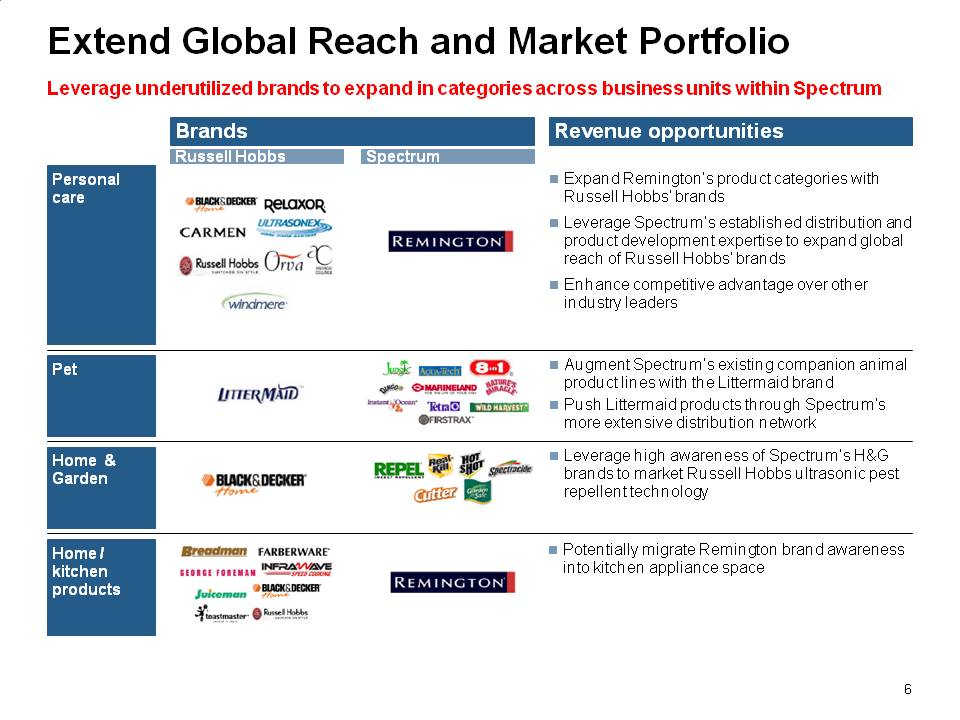

Extend Global Reach and Market Portfolio Leverage underutilized brands to expand in categories across business units within Spectrum Personal care Pet Home & Garden Home / kitchen products Revenue opportunities Brands Expand Remington’s product categories with Russell Hobbs’ brandsLeverage Spectrum’s established distribution and product development expertise to expand global reach of Russell Hobbs’ brandsEnhance competitive advantage over other industry leaders Augment Spectrum’s existing companion animal product lines with the Littermaid brandPush Littermaid products through Spectrum’s more extensive distribution network Leverage high awareness of Spectrum’s H&G brands to market Russell Hobbs ultrasonic pest repellent technology Potentially migrate Remington brand awareness into kitchen appliance space Russell Hobbs Spectrum

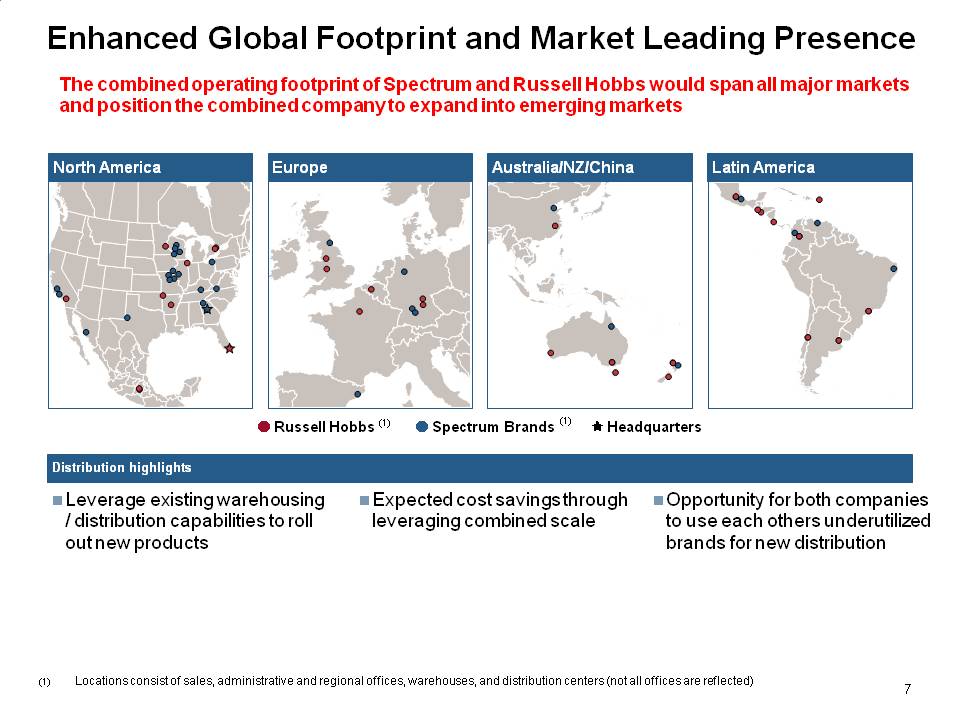

Enhanced Global Footprint and Market Leading Presence North America Distribution highlights Europe Australia/NZ/China Latin America Leverage existing warehousing / distribution capabilities to roll out new products Expected cost savings through leveraging combined scale Opportunity for both companies to use each others underutilized brands for new distribution The combined operating footprint of Spectrum and Russell Hobbs would span all major markets and position the combined company to expand into emerging markets Russell Hobbs Spectrum Brands Headquarters Locations consist of sales, administrative and regional offices, warehouses, and distribution centers (not all offices are reflected)

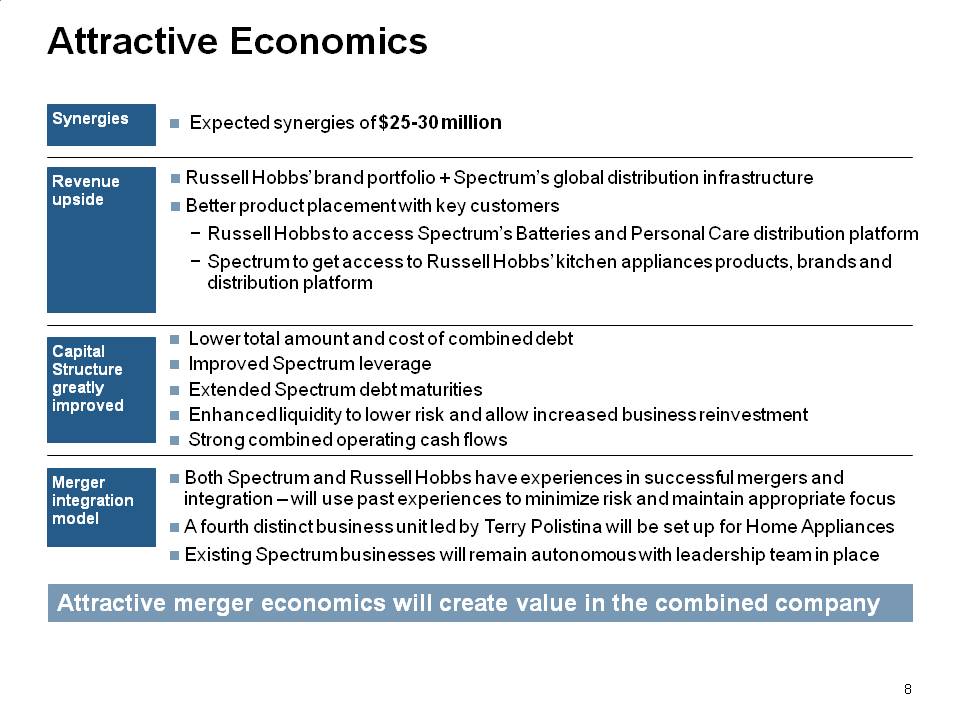

Attractive Economics Attractive merger economics will create value in the combined company Synergies Revenue upside Capital Structure greatly improved Merger integration model Expected synergies of $25-30 million Russell Hobbs’ brand portfolio + Spectrum’s global distribution infrastructureBetter product placement with key customersRussell Hobbs to access Spectrum’s Batteries and Personal Care distribution platformSpectrum to get access to Russell Hobbs’ kitchen appliances products, brands and distribution platform Lower total amount and cost of combined debt Improved Spectrum leverage Extended Spectrum debt maturities Enhanced liquidity to lower risk and allow increased business reinvestment Strong combined operating cash flows Both Spectrum and Russell Hobbs have experiences in successful mergers and integration – will use past experiences to minimize risk and maintain appropriate focusA fourth distinct business unit led by Terry Polistina will be set up for Home AppliancesExisting Spectrum businesses will remain autonomous with leadership team in place

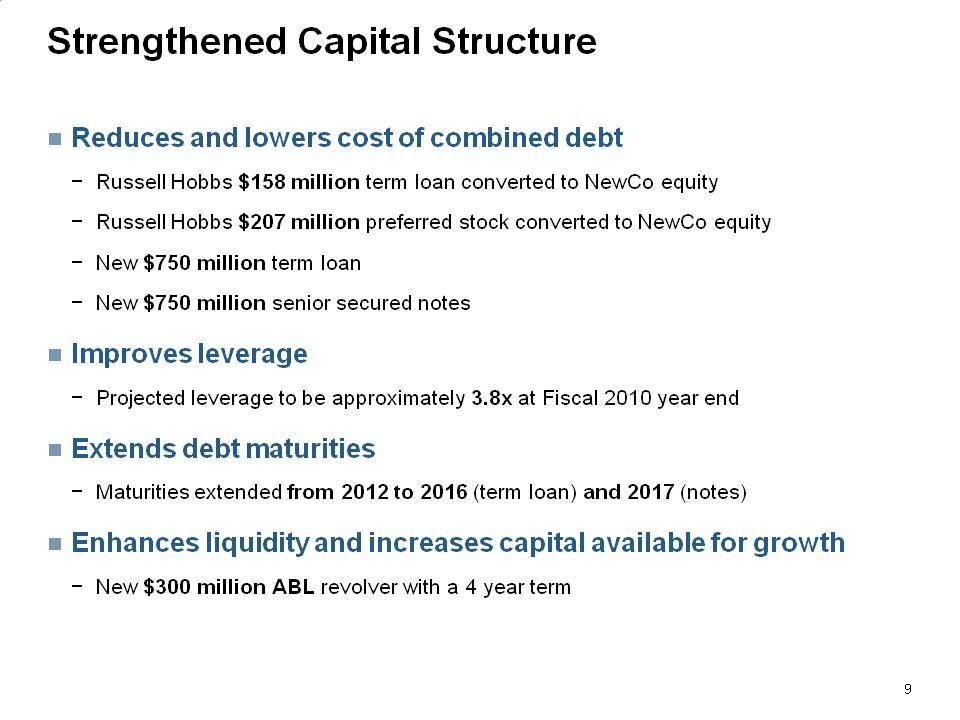

Strengthened Capital Structure Reduces and lowers cost of combined debt Russell Hobbs $158 million term loan converted to NewCo equity Russell Hobbs $207 million preferred stock converted to NewCo equity New $750 million term loan New $750 million senior secured notes Improves leverage Projected leverage to be approximately 3.8x at Fiscal 2010 year end Extends debt maturities Maturities extended from 2012 to 2016 (term loan) and 2017 (notes) Enhances liquidity and increases capital available for growth New $300 million ABL revolver with a 4 year term:

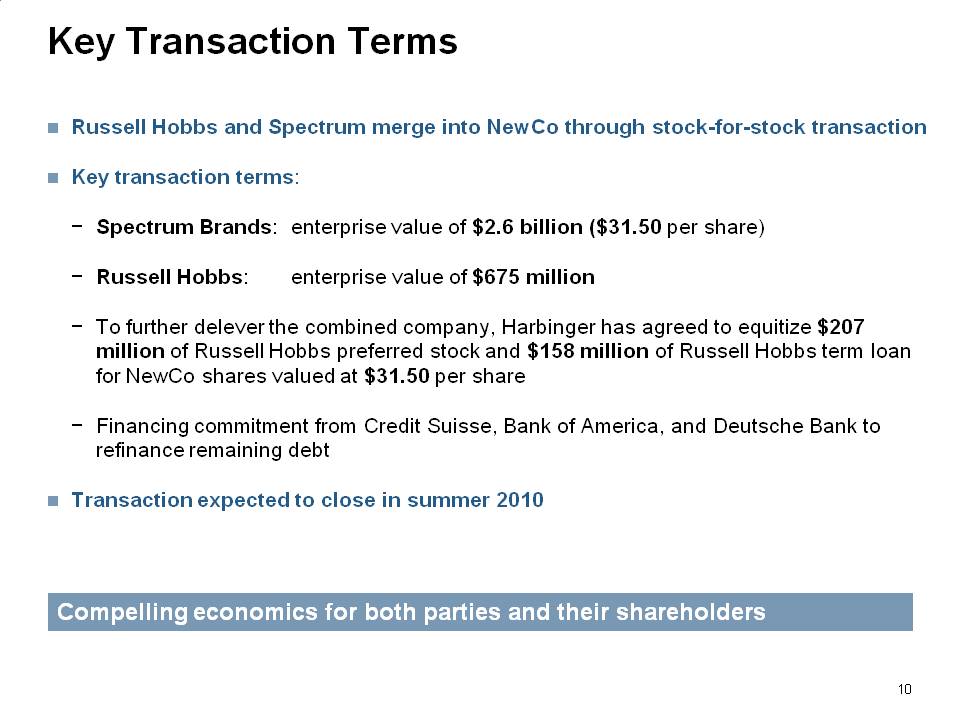

Key Transaction Terms Russell Hobbs and Spectrum merge into NewCo through stock-for-stock transactionKey transaction terms:Spectrum Brands: enterprise value of $2.6 billion ($31.50 per share)Russell Hobbs: enterprise value of $675 millionTo further delever the combined company, Harbinger has agreed to equitize $207 million of Russell Hobbs preferred stock and $158 million of Russell Hobbs term loan for NewCo shares valued at $31.50 per shareFinancing commitment from Credit Suisse, Bank of America, and Deutsche Bank to refinance remaining debtTransaction expected to close in summer 2010 Compelling economics for both parties and their shareholders

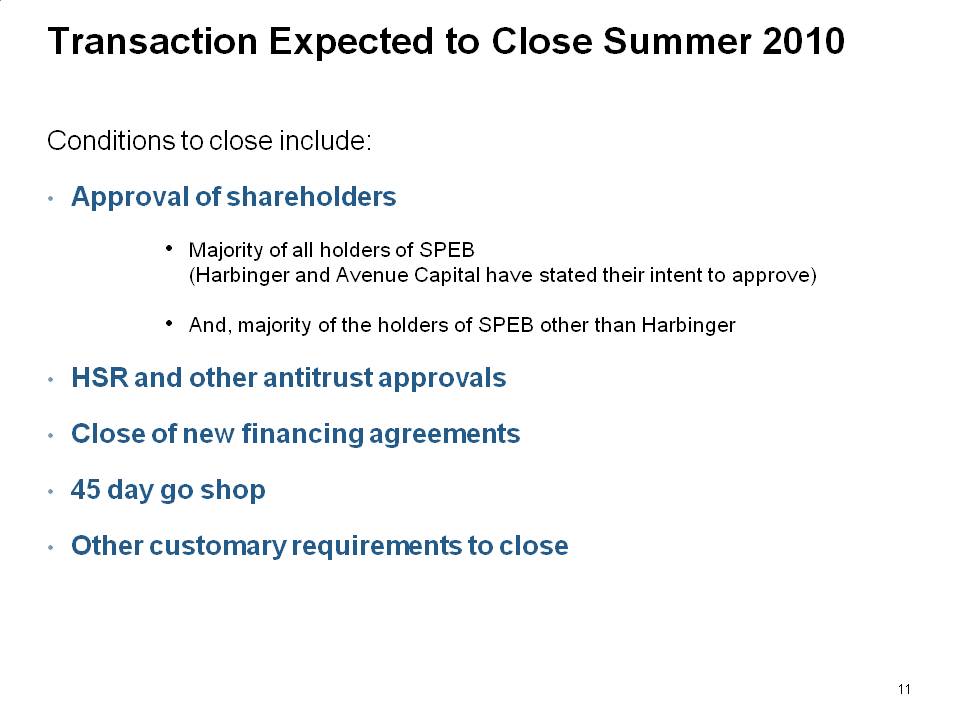

Transaction Expected to Close Summer 2010 Conditions to close include: Approval of shareholders Majority of all holders of SPEB (Harbinger and Avenue Capital have stated their intent to approve) And, majority of the holders of SPEB other than Harbinger HSR and other antitrust approvals Close of new financing agreements 45 day go shop Other customary requirements to close

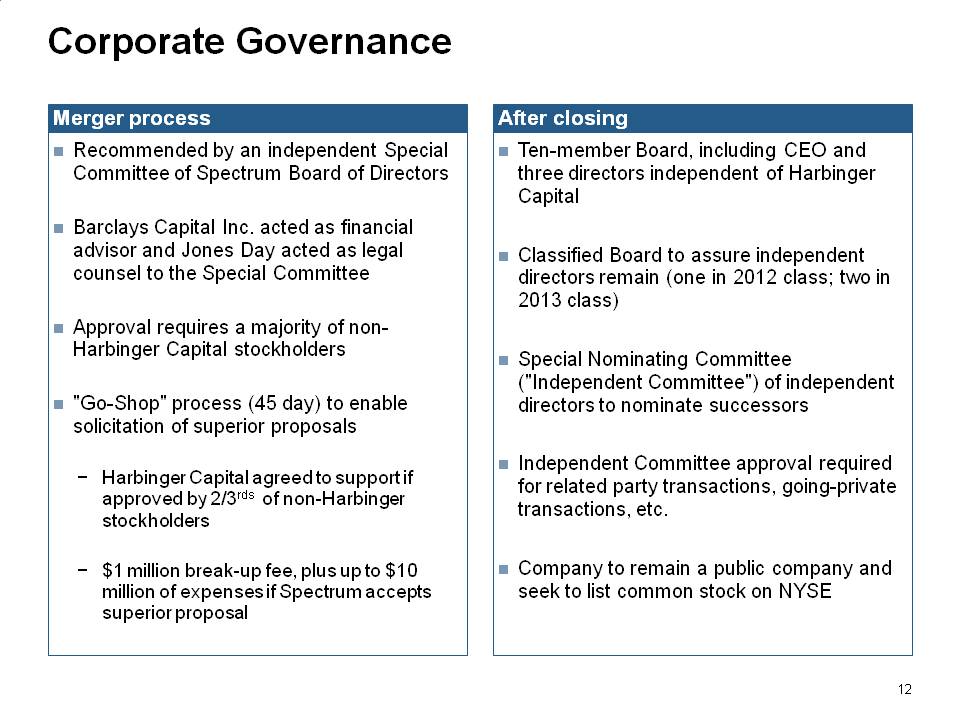

Corporate Governance Merger process Recommended by an independent Special Committee of Spectrum Board of DirectorsBarclays Capital Inc. acted as financial advisor and Jones Day acted as legal counsel to the Special CommitteeApproval requires a majority of non-Harbinger Capital stockholders"Go-Shop" process (45 day) to enable solicitation of superior proposalsHarbinger Capital agreed to support if approved by 2/3rds of non-Harbinger stockholders$1 million break-up fee, plus up to $10 million of expenses if Spectrum accepts superior proposal After closing Ten-member Board, including CEO and three directors independent of Harbinger CapitalClassified Board to assure independent directors remain (one in 2012 class; two in 2013 class)Special Nominating Committee ("Independent Committee") of independent directors to nominate successorsIndependent Committee approval required for related party transactions, going-private transactions, etc.Company to remain a public company and seek to list common stock on NYSE

Powerful combination: $3B global consumer products company Extends global reach and market leading brands Attractive economics for shareholders Strengthens capital structure and reduces financial risk Reduces and lowers cost of combined debt Improves leverage Extends debt maturities Enhances liquidity and increases capital available for growth