UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2005. |

| ¨ | TRANSITION REPORTING PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO . |

COMMISSION FILE NO. 0-21911

SYNTROLEUM CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 73-1565725 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

4322 South 49thWest Avenue Tulsa, Oklahoma | | 74107 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (918) 592-7900

Securities registered pursuant to Section 12(b) of the Act: None

Securities Registered Pursuant to Section 12(g) of the Act:

Common Stock, par value $.01 per share

and

Preferred Share Purchase Rights

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes¨ Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yesx No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | |

| Large accelerated filer ¨ | | Accelerated filer x | | Non-accelerated filer ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes¨ Nox

At June 30, 2005, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $344,000,000 based on the closing price of such stock on such date of $10.26 per share (assuming solely for this purpose that all of the registrant’s directors, executive officers and 10 percent stockholders are its affiliates).

At March 1, 2006, the number of outstanding shares of the registrant’s common stock was 55,694,877.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission (“SEC”) within 120 days of December 31, 2005 for its 2006 annual meeting of stockholders are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes forward-looking statements as well as historical facts. These forward-looking statements include statements relating to the Syntroleum Process and related technologies including Synfining, gas-to-liquids (“GTL”) and coal-to-liquids (“CTL”) plants based on the Syntroleum Process, including our GTL Mobile Facilities, anticipated costs to design, construct and operate these plants, the timing of commencement and completion of the design and construction of these plants, expected production of ultra-clean diesel fuel, obtaining required financing for these plants and our other activities, the economic construction and operation of GTL or CTL plants, the value and markets for plant products, testing, certification, characteristics and use of plant products, the continued development of the Syntroleum Process (alone or with co-venturers) and the economic production of oil and gas reserves, anticipated capital expenditures, anticipated expense reductions, anticipated cash outflows, anticipated expenses, use of proceeds from our equity offerings, anticipated revenues, availability of catalyst materials, our support of and relationship with our licensees, and any other statements regarding future growth, cash needs, capital availability, operations, business plans and financial results. When used in this document, the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “should” and similar expressions are intended to be among the statements that identify forward-looking statements. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these kinds of statements involve risks and uncertainties. Actual results may not be consistent with these forward-looking statements. Important factors that could cause actual results to differ from these forward-looking statements are described under “Item 1A. Risk Factors” and elsewhere in this Annual Report on Form 10-K.

As used in this Annual Report on Form 10-K, the terms “Syntroleum,” “we,” “our” or “us” mean Syntroleum Corporation, a Delaware corporation, and its predecessors and subsidiaries, unless the context indicates otherwise.

Our GTL technology can be used for converting natural gas or synthesis gas from coal, into synthetic liquid hydrocarbons. Generally, any reference to GTL is also applicable to CTL unless the context indicates otherwise.

PART I

Overview

We are seeking to develop and employ innovative technology to acquire and cause the production of stranded energy assets in various regions of the world. We are focusing our efforts on:

| | • | | projects that will allow us to use our proprietary processes for converting natural gas, or synthesis gas from coal or other materials, into synthetic liquid hydrocarbons, a process generally known as gas-to-liquids (“GTL”) or coal-to-liquids (“CTL”) technology, utilizing Fischer-Tropsch synthesis; and |

| | • | | projects in which we are directly involved in the field development, production and processing of hydrocarbons, including projects that involve traditional methods of production and processing, projects that may later include the use of our GTL technology and projects that utilize other available technology. |

We seek to form joint ventures for projects and acquire equity interests in these projects. We also license our GTL technologies, which we refer to as the “Syntroleum Process” and the “Synfining Process,” to others. We believe that our use of air in the conversion process provides our technology with a competitive advantage compared to other technologies that use pure oxygen, thereby allowing us to build smaller footprint plants, like our designed barge- or ship-mounted GTL plant (“GTL Mobile Facility”), and avoid the inherent operating risks associated with using pure oxygen.

We are currently investing a significant amount of our resources into our designed GTL Mobile Facility and other potential international or domestic GTL or CTL projects. We believe that these projects offer the greatest potential to meet our objective of generating cash flow and utilizing the advantages of our processes. We also have projects ongoing and at varying stages of development with co-venturers and licensees in various geographical areas, including, Australia, Bolivia, Egypt, Nigeria, Papua New Guinea, Trinidad and the United States. We may obtain funding through joint ventures, license arrangements and other strategic alliances, as well as various other financing arrangements to meet our capital and operating needs for various projects. We are currently exploring alternatives for raising capital to fund the growth of our CTL business, including the development, and demonstration of effectiveness, of our technology with coal-derived synthesis gas. In January 2006, we entered into a memorandum of understanding with Sustec AG (“Sustec”) to form a joint venture to develop projects that will integrate Sustec’s coal gasification technology with our Fischer-Tropsch technology. We expect to incur increases in our costs as we continue to develop and commercialize our projects. Our longer-term survival will depend on our ability to obtain additional revenues or financing.

We are incurring substantial operating and research and development costs with respect to developing and commercializing the Syntroleum Process, our proprietary process of converting natural gas or gasified coal into synthetic liquid hydrocarbons, and the Synfining Process, our proprietary process for refining synthetic liquid hydrocarbons produced by the Syntroleum Process, and do not anticipate recognizing any significant revenues from licensing our technology or from production from either a GTL or CTL plant in which we own an interest in the near future. As a result, we expect to continue to operate at a loss until sufficient revenues are recognized from licensing activities, commercial operation of GTL or CTL plants or non-GTL projects we are developing.

During the past five years, we have been focusing on commercializing the Syntroleum Process and Synfining Process to develop our own GTL and, more recently, CTL projects and we have also pursued more traditional oil and gas development and processing activities. We began business as GTG, Inc. on November 15, 1984. On April 25, 1994, GTG, Inc. changed its name to Syntroleum Corporation. On August 7, 1998, Syntroleum Corporation merged into SLH Corporation. SLH Corporation was the surviving entity in the merger and was renamed Syntroleum Corporation. Syntroleum Corporation was later re-incorporated in Delaware on June 17, 1999 through its merger into a Delaware corporation that was organized on April 23, 1999.

2

GTL and CTL Projects

The Syntroleum Process produces synthetic liquid hydrocarbons that are substantially free of contaminants normally found in conventional products made from crude oil. These synthetic liquid hydrocarbons can be further processed into higher margin products through conventional refining processes and our Synfining Process. These products include:

| | • | | Ultra-clean liquid fuels for use in internal combustion engines, jet/turbine engines (subject to certification) and fuel cells; and |

| | • | | Specialty products, such as synthetic lubricants, process oils, high melting point waxes, liquid normal paraffins, drilling fluids, and chemical feedstocks. |

We believe the key advantages of our GTL technology over traditional GTL technologies are (1) the use of air in the conversion process, which is inherently safer than the requirement for pure oxygen in other GTL technologies, and (2) the use of our proprietary catalysts, which we believe will provide operating cost efficiencies through longer operating life than catalysts used in traditional or other GTL technologies. We believe these advantages will reduce capital and operating costs of GTL plants based on our GTL technologies and permit smaller plant sizes, including mobile plants that could be mounted on barges and ocean-going vessels. Based on demonstrated research, including the advancement of our technology from the laboratory to pilot plant and demonstration facility scales, and current market conditions, we believe that our single-train commercial design of 17,000 barrels per day (“b/d”) stand-alone facility can be economically developed. Increased economies of scale can be achieved with incremental trains resulting in throughput levels over 100,000 b/d depending upon the volume amount of oil, condensate, and liquefied petroleum gas or propane (“LPG”) that is produced along with the natural gas. Additionally, we believe that our single-train design could be increased to over 20,000 b/d. We also believe that, subject to our completion of additional engineering to implement improvements we have tested, a GTL or CTL plant smaller than our 17,000 b/d design can be effectively utilized at existing processing facilities. However, the economic application of our GTL technology at any particular plant will depend on the plant operating conditions, including among other things, the then-current market conditions and the volume amount of oil, condensate and liquefied petroleum gas or propane (“LPG”) that is produced along with the natural gas.

We believe the advantages afforded by the Syntroleum Process together with the large worldwide resource base of stranded natural gas provide market opportunities for the use of this technology by us and our licensees in the development of commercial GTL plants. These market opportunities include the application of our technology to natural gas reserves that have not yet been developed due to the limited markets available and those that are currently being flared, vented or re-injected or to coal reserves that are not currently being produced due to environmental concerns or their distance to market. These reserves are typically referred to as “stranded reserves”.

In addition to enabling monetization of stranded natural gas, we expect that our FT technology will be applied to coal. The largest coal reserves are located in the United States, Russia, India, China and Australia. Much of these reserves are difficult and expensive to utilize because of environmental concerns and distance to markets. By applying the Syntroleum Process, integrated with third party gasification and synthesis gas cleanup technology, these underused coal resources could be converted to ultra-clean transportation fuels, thus providing a new source of clean energy and reducing dependence on oil from politically unstable regions. In response to the growing demand for development and application of clean-coal technologies in the United States and availability of stranded coal at prices comparable to stranded natural gas internationally, we are undertaking a comprehensive evaluation of this opportunity.

While we have not yet built a commercial-scale GTL plant based on the Syntroleum Process, we have demonstrated numerous elements and variations of the major catalytic reactions that are part of the Syntroleum Process. These major catalytic reactions include the autothermal reforming of natural gas to Synthesis Gas, or Syngas, and the Fischer-Tropsch synthesis to convert the Syngas into paraffin-like synthetic crude. We have also demonstrated our Synfining Process, which involves the hydro-treating/hydro-cracking of the synthetic crude to produce finished products. We have completed numerous tests and observations on each of these reactions in demonstration plant operations, pilot plant operations and laboratory tests, including:

| | • | | operation of the demonstration plant located at the Tulsa Port of Catoosa (the “Catoosa Demonstration Facility” or “CDF”) since March 2004 as part of the Department of Energy (“DOE”) Ultra-Clean Fuels Production and Demonstration Project ( the “DOE Catoosa Project”) with Marathon Oil Company (“Marathon”) which was completed in 2005; |

3

| | • | | operation of the CDF since the completion of the DOE Catoosa Project for the production of additional fuels, extension of our operating experience and for our own research and development purposes; |

| | • | | operation of the Cherry Point Refinery demonstration facility in Blaine, Washington with Atlantic Richfield Company (“ARCO”) for approximately one year; |

| | • | | several years of operations at our Tulsa-based pilot plant under various operating conditions; and |

| | • | | preparation and testing of various concepts and designs in our laboratories. |

These reactions have produced synthetic liquid hydrocarbons in anticipated amounts. For a discussion of our intellectual property rights, see “ – Intellectual Property”.

We currently have a number of licensing agreements with oil companies plus the Commonwealth of Australia and have active projects under development with current licensees Ivanhoe Energy Inc. (“Ivanhoe”) and Marathon. These agreements are described under “ – Licensing Agreements”. In addition, we are pursuing the development of the GTL Mobile Facility and various projects in Australia, Bolivia, Egypt, Nigeria, Papua New Guinea, Trinidad and the United States. We also have strategic relationships with various companies in support of the Syntroleum Process, including AMEC Process and Energy Ltd. and Mustang Engineering, L.P., with which we have entered into agreements allowing access to our confidential engineering systems, technology and information.

Development, Production and Processing Projects

We are pursuing projects in which we intend to participate in the development, production and processing of hydrocarbons. These include projects that involve traditional methods of production and processing, projects that may later include the use of our GTL or CTL technologies and projects that utilize other technologies.

One of the projects we are pursuing is our Oil Mining Lease (“OML”) 113 project offshore Nigeria. The license covers approximately 413,000 acres, and we believe that areas in this lease have the potential to contain a significant amount of oil, condensate, natural gas liquids and natural gas. An appraisal well (“Aje-3”) was drilled in the third quarter of 2005. Test results were evaluated after drilling for consideration of commercial completion. The participants found the economics for commercial completion to be unfavorable and are evaluating further development in accordance with the participation agreement in 2006. If we successfully develop this project, we expect to begin to produce potential oil reserves that we believe may be contained in OML 113 while determining if gas reserves are sufficient to support a GTL facility.

Another project we are pursuing is with Brittania-U Nigeria Limited (“Brittania-U”) to acquire a 40 percent participating interest in the Ajapa field in OML 90 offshore Nigeria. We have entered into a Heads of Agreement, Participation Agreement, Joint Operating Agreement, and Deed of Assignment with Brittania-U regarding this project. Depending on receipt of the appropriate approvals, rig availability and the results of initial drilling, production from the Ajapa Field could commence by the end of 2007 or early 2008. Previously, we have also sought opportunities through natural gas monetization projects with prospects for short-term revenues to provide us with cash flows as we pursue our long lead-time GTL or CTL technologies and projects. These gas monetization projects were located in the United States and included leaseholds, completed wells, related equipment, and a gas processing plant. These operations have been discontinued and the assets have been or are in the process of being sold due to economic factors surrounding the projects and a realignment of all resources with strategic goals of the company.

4

Business Strategy

Our objective is to be the leading developer of small and medium sized stranded energy projects utilizing our GTL and CTL technologies and other technology resulting in the ownership of oil, gas and coal reserves and to be a recognized provider of GTL and CTL technology for the energy industry. Our business strategy to achieve this objective involves the following key elements:

Participate in Development Projects.We intend to establish equity participation in projects involving monetization of stranded natural gas and coal assets and associated activities. We are actively pursuing such projects involving natural gas development in Australia, Bolivia, Egypt, Nigeria, Papua New Guinea, Trinidad and the United States. Under this strategy, we will provide our GTL, CTL and related technologies to work with companies that have remote and/or stranded resources that can be economically monetized with our technology through individual site licenses for the specific GTL or CTL plant location. Such projects may involve conventional gas processing and/or GTL activities.

Develop and Own GTL and CTL Plants.We intend to develop projects and own equity interests in joint ventures with our licensees and other energy-industry and financial participants that will develop and own GTL and CTL plants for the production of fuels and specialty products. We are actively pursuing development of GTL and/or CTL plants in several locations, including potential projects in China, Egypt, Malaysia, Nigeria, Papua New Guinea, Trinidad and the United States. We are currently engaged in the study phase with respect to several joint ventures; however, at present no joint venture for the construction of a GTL or CTL plant is in place.

License the Syntroleum Process. Although we are not actively seeking to enter new master, regional or volume licensing agreements, we plan to support our existing licensees in their efforts to develop new GTL plants through both our research and development and our commercial and engineering support activities. Our license agreements obligate us to apprise licensees of upgrades and improvements in the Syntroleum Process and the Synfining Process and to assist in the plant construction process. We believe that our research and development capabilities combined with our demonstration and pilot plant testing facilities provide advantages over competing and alternative technologies. We also believe these advantages enable us to maintain strong relationships with existing licensees and gain project participation opportunities for us.

Expand and Develop Product Markets. We intend to continue developing markets for our synthetic fuels and specialty products in order to promote construction of GTL and CTL plants by us and our licensees, and to establish markets for GTL and CTL products from plants. Based on the results of our already-completed research and development activities, we believe that our technology can provide economic and environmentally superior transportation fuels, including diesel and JP-5/JP-8 jet fuels. These fuels when produced through the Syntroleum Process and Synfining Process are virtually free of sulfur and aromatics and can be transported to the end user through the existing distribution infrastructure. We also believe that availability of these fuels will foster the development and economic application of existing diesel engines, fuel cells and other clean combustion technologies.

The Syntroleum Process

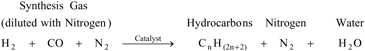

The Syntroleum Process involves two catalytic reactions: (1) conversion of natural gas into synthesis gas in our proprietary flameless autothermal reformer; and (2) conversion of the synthesis gas into hydrocarbons over our proprietary Fischer-Tropsch catalyst. These reactions are expressed in the following equations:

Step 1

Conversion of Natural Gas to Synthesis Gas

5

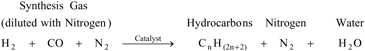

Step 2

Fischer - Tropsch Synthesis

The flameless autothermal reformer in the Syntroleum Process is similar to units used for over 30 years in the ammonia industry. Different generations of our ATR design have operated since November 2003 in our Catoosa Demonstration Facility and have been operating since 1995 as the sole source of synthesis gas for our two b/d pilot plant facility in Tulsa, Oklahoma. An earlier generation of this reformer design was also operated for over 6,500 hours at a 70 b/d demonstration facility with one of our licensees, ARCO, at its Cherry Point refinery in Washington State. The nitrogen in the gas entering the autothermal reformer passes through the reactor essentially unchanged, although very low levels of other nitrogen compounds are produced. These trace contaminants may be removed from the process stream and are not incorporated into the finished products in significant quantities.

Although our proprietary cobalt-based Fischer-Tropsch catalyst was originally developed for use with synthesis gas produced from natural gas, we believe it is capable of functioning with synthesis gas produced from other sources, such as coal or petroleum coke. These feedstocks are converted into synthesis gas using either an air-based or oxygen-based gasifier that is currently available from several third-party technology providers. The ratio of hydrogen to carbon monoxide in the synthesis gas from the gasifier is adjusted using a water gas shift reactor and sulfur and other contaminants are removed. We believe that once this process synthesis gas preparation has been completed, the synthesis gas produced from coal and other sources will react the same as synthesis gas produced in the Syntroleum Process from natural gas.

The Synfining Process

We have also developed refining technology – the Synfining Process – for conversion of the Fischer-Tropsch products into a variety of products including diesel fuels, jet fuels subject to certification, lubricants, and other materials. The high purity and highly paraffinic, or waxy, nature of the Fischer-Tropsch products generally require lower temperature processing conditions than conventional petroleum-derived feedstocks to obtain high yields of the desired products. This refining technology has been used to produce fuels for testing by the DOE in its Ultra-Clean Fuels Program, automobile manufacturers in the United States and Japan as well as by the U.S. Department of Defense (“DOD”) and U.S. Department of Transportation (“DOT”). This refining technology will be utilized in plants we construct and is available for license to our Syntroleum Process licensees and others.

Syntroleum Technology Implementation

The Catoosa Demonstration Facility has produced ultra-clean diesel fuel and jet fuel from natural gas using the Syntroleum Process and the Synfining Process. This is the first plant we have built that incorporates all of our proprietary GTL process technologies on a single site. We completed the DOE Catoosa Project fuel production commitment during 2004. We completed delivery of ultra-clean diesel fuel to other project participants during 2004 and 2005, including the Washington Metropolitan Area Transit Authority and the U.S. National Park Service at Denali National Park in Alaska for testing in bus fleets. We also operated the Catoosa Demonstration Facility during 2005 to support additional fuel testing programs including those of the DOD and the DOT, to demonstrate GTL process technology and catalyst enhancements, and to provide training for our operators.

6

Our goal in developing the Syntroleum Process and Synfining Process has been to substantially reduce both the capital and operating costs and the minimum economic size of a GTL or CTL plant. We have developed and continue to develop variations of our basic process design and make enhancements to our proprietary Fischer-Tropsch catalyst in an effort to further lower costs and increase the adaptability of the Syntroleum Process to a wide variety of potential applications. We are working with a number of engineering firms and manufacturers of catalysts with which we have entered into agreements allowing access to our confidential engineering systems, technologies and information.

Although we believe that the Syntroleum Process can be utilized in commercial-scale GTL and CTL plants, there can be no assurance that commercial-scale GTL or CTL plants based on the Syntroleum Process will be successfully constructed and operated or that these plants will yield the same economics and results as those demonstrated in a laboratory, pilot plant or demonstration plant. In addition, improvements to the Syntroleum Process currently under development may not prove to be commercially applicable. See “Item 1A. Risk Factors–Risks Relating to Our Technology.”

Syntroleum Advantage

We believe that the Syntroleum Process and the Synfining Process will be an attractive solution for companies that are unable to economically produce their natural gas or coal reserves using traditional methods. We believe that the Syntroleum Process will enable owners of stranded natural gas or coal reserves to monetize a significant portion of these resources by converting them into synthetic liquid hydrocarbons in the form of ultra-clean fuels, based on our belief that these products can be:

| | • | | produced substantially free of undesirable products normally found in fuels and specialty products made from crude oil; |

| | • | | used as blending stock to upgrade conventional fuels and specialty products made from crude oil; |

| | • | | used unblended in traditional internal combustion engines to reduce emissions; |

| | • | | used in advanced internal combustion engines and fuel-cells that require sulfur-free fuels; and |

| | • | | transported through existing distribution infrastructures for crude oil and refined products. |

Resource Base

Set forth below and elsewhere in this Annual Report on Form 10-K are estimates of identified reserves of oil, natural gas and coal. These estimates do not constitute proved reserves in accordance with the regulations of the SEC. Under SEC regulations, proved oil and gas reserves are the estimated quantities of crude oil, natural gas and natural gas liquids, which geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions (i.e., prices and costs as of the date the estimate is made). Under SEC regulations, proven coal reserves are the reserves for which (a) the quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes, and the grade and/or quality are computed from the results of detailed sampling, and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. We compiled these estimates of identified reserves from the referenced industry publications and other publicly available reports to identify the magnitude of the natural gas and coal resource base. We have not independently verified this information. Accordingly, we cannot provide assurance as to the existence or recoverability of the estimates of identified reserves of oil, natural gas and coal set forth in this Annual Report on Form 10-K. References below and elsewhere in this Annual Report on Form 10-K to the conversion of identified amounts of natural gas and coal into amounts of synthetic crude oil assume that all of the referenced natural gas and coal could be converted at anticipated conversion rates. Actual amounts of synthetic crude oil produced will vary based on the ability of the producer to extract the natural gas and coal, the composition of the natural gas and coal and process conditions selected for the plant, and this variance may be material.

7

Natural Gas

The following table presents the 2004 worldwide identified natural gas reserves, consumption and ratio of reserves to consumption (i.e., reserve life) by region:

2004 Worldwide Natural Gas Reserves, Consumption and Reserve Life

| | | | | | |

Region | | Reserves | | Annual

Consumption | | Reserve

Life |

| | | (TCF) | | (TCF) | | (years) |

Central and South America | | 250.6 | | 4.2 | | 54.9 |

Africa and the Middle East | | 3,067.3 | | 10.9 | | 204.9 |

Asia Pacific | | 501.5 | | 12.9 | | 44.0 |

Europe and the Commonwealth of Independent States | | 2,259.7 | | 39.1 | | 61.0 |

North America | | 258.3 | | 27.6 | | 9.7 |

| | | | | | |

Total | | 6,337.4 | | 94.7 | | 67.1 |

Source: Information derived from BP Statistical Review of World Energy 2005.

World natural gas reserves have increased in recent years. Identified gas reserves in 1993 were estimated to be approximately 4,981 trillion cubic feet (“TCF”), according to the BP Statistical Review of World Energy 2005. However, by 2004, natural gas reserves were estimated to be approximately 6,337 TCF. This increase occurred while the demand for natural gas increased 25 percent over the same time period.

A significant amount of stranded gas also exists that is not included in the natural gas reserves indicated above. The term “stranded gas” generally refers to gas existing in reservoirs that have been discovered but no economic market can be found for the natural gas production, or production with associated oil would be too prolific for the limited markets available. Typically this low value gas is managed by either not producing the reservoir, flaring, venting, or re-injecting the natural gas into the geologic formation from which it is produced while producing the oil reserves.

We believe that energy companies with stranded natural gas reserves will be able to cost-effectively use our GTL technology to produce fuels that can be sold in well-developed global markets. As a result, we believe these companies would be able to generate a return on these already discovered reserves, which are currently undeveloped.

Coal

In addition to enabling monetization of stranded natural gas, we expect that our Fischer-Tropsch technology can be applied to coal as well. According to BP Statistical Review of World Energy 2005, identified world coal reserves in 2004 were approximately 909,064 million tons. The largest coal reserves are located in the United States, Russia, China, India and Australia. Much of these reserves are difficult and expensive to utilize because of environmental concerns and distance to traditional power markets. By applying the Syntroleum Process, these underused coal resources could be converted to ultra-clean transportation fuels, thus providing a new source of clean energy and reducing dependence on oil from politically unstable regions.

Market Demand

We believe significant market potential exists for Syntroleum GTL and CTL technologies and products because of steadily increasing demand for transportation fuels, the anticipated increased demand for ultra-clean fuels for both internal combustion engines and fuel cells, and the existing demand for high-quality specialty products—underpinned by the vast amounts of stranded natural gas and coal worldwide.

8

We expect demand for products created via Syntroleum technologies to result from the following factors:

The Large Market for Transportation Fuels. According to the Energy Information Administration, diesel fuel demand is estimated to be growing at a faster rate than the total demand for refined products due to superior fuel efficiency of the diesel engine. Based on a study completed by the National Energy Policy Development Group, oil consumption in the United States is expected to increase 32 percent b/d by 2020 primarily due to the growth in consumption of transportation fuels. Based on our belief that the Syntroleum Process can produce ultra-clean transportation fuels, we believe that a portion of the demand growth can be satisfied through our process, although the amount of this demand actually satisfied through our process will depend on the number of products from any commercial plants that are constructed.

Increasing Demand for Ultra-Clean Fuels. Market demand for ultra-clean fuels is increasing due to more stringent environmental standards in most of the world’s industrialized countries and the need for vehicle manufacturers to respond to the challenge of producing fuel-efficient engines that meet these standards. The burden of producing cleaner fuels from conventional crude oil is expected to substantially increase refining costs. We believe these factors will promote the creation of markets for premium, ultra-clean fuels produced by the Syntroleum Process. In addition, we believe that fuels produced by the Syntroleum Process, either alone or blended with conventional fuels, can be used in existing and new generation diesel engines on a cost-effective basis to meet or exceed current and scheduled fuel specifications and emissions standards.

Increasingly Restrictive Environmental Legislation. Key domestic and international environmental regulations and initiatives that affect the demand for ultra-clean fuels include the Clean Air Act of 1970, which establishes specific responsibilities for government and private industry to reduce emissions from vehicles, factories and other pollution sources. In December 1999, the U.S. Environmental Protection Agency (“EPA”) issued rules mandating that sulfur levels in highway diesel fuel be lowered from the then current level of 500 parts per million (“ppm”) to 15 ppm beginning in 2006.

The U.S. government passed the 2005 Energy Policy Act with incentives for innovative technologies, which allowed for the appropriation of funds to carry out research, development, demonstration and commercial application programs in fossil energy. In addition to the appropriations for fossil energy, specific funds will be dedicated to coal and related technologies programs, which will include programs to facilitate production and generation of coal-based power.

The U.S. government also passed the Safe, Accountable, Flexible, and Efficient Transportation Equity Act of 2005, which includes extensive tax incentives for alternative fuels. Alternative fuels include any liquid fuel derived from coal. The alternative fuel credit results in a credit of $0.50 per gallon for use as a motor fuel in a highway vehicle.

The European Union is also making sharp reductions in engine emissions. Sulfur content from the current 350 ppm to below 50 ppm is currently mandated for diesel fuel in 2005. In addition, the Commission of the European Communities requires diesel fuel with a maximum sulfur content of 10 ppm to be made available on a broad geographic basis within each member state of the European Union by January 1, 2005. Member states must also introduce a fuel quality monitoring system and present a fuel quality report. The Commission must publish an annual report on fuel quality and the geographical coverage of fuels with a maximum sulfur content of 10 ppm.

We believe that fuels produced by the Syntroleum Process are positioned to take advantage of the demand for ultra-clean fuels that we expect will develop as a result of these stringent emission standards. This belief is based on the characteristics of fuels produced by the Syntroleum Process, which are substantially free of contaminants – sulfur and aromatics – and demonstrate high operating efficiency. As a result, we believe that fuels produced by the Syntroleum Process, either alone or blended with conventional fuels, can be cost-effectively used to meet scheduled fuel specifications.

Increasing Demand for Fuel Cells. Fuel cells combine hydrogen – which can be derived from natural gas, propane, methanol, gasoline or diesel – with oxygen from the air to produce electric power without combustion. Fuel cell systems have advantages over conventional power systems, which include low or no pollution, higher fuel efficiency, greater flexibility in installation and operation, quiet operation, low vibration and potentially lower maintenance and capital costs. Fuel cells are being developed to support a variety of markets, including transportation and continuous stationary (residential and commercial) power.

9

Because fuels produced by the Syntroleum Process are substantially free of contaminants and have greater hydrogen content than other liquid fuels, we believe that fuels produced by the Syntroleum Process have the potential to become preferable fuel cell fuels and to significantly enhance commercial opportunities for many fuel-cell applications. The absence of contaminants from fuels produced by the Syntroleum Process allows for simplified fuel cell processor design, construction and operation. As the storage and processing of the fuel for a fuel cell are simplified, the physical size of fuel-cell components can be reduced. Because fuels produced by the Syntroleum Process have almost twice the hydrogen content per volume of other commonly proposed fuel cell fuels, primarily methane, methanol and liquid hydrogen, they enable greater utility and wider application of fuel-cell power for vehicles. We also believe that fuels produced by the Syntroleum Process have lower toxicity and similar solubility compared to conventional fuels, and can be distributed via existing conventional fuel distribution infrastructure.

The Existing Market for High-Quality Specialty Products. Synthetic crude oil produced by the Syntroleum Process can be further refined into specialty products using conventional refining processes that can be simplified to take advantage of the ultra-clean nature of the synthetic feedstock. We intend to develop and own significant equity interests in GTL and CTL plants designed to produce these specialty products. We believe that specialty products produced by the Syntroleum Process have environmental and performance characteristics that are superior to comparable conventional crude oil products.

Sales and Marketing

We intend to maintain an active marketing and sales effort to promote the Syntroleum Process, working to further develop current projects as well as to look for additional project opportunities. We also intend to continue efforts to establish brand recognition for “Syntroleum” through participation in conferences, press releases, providing fuels for testing with automobile and engine manufacturers, and our work with the DOE, the DOD, DOT and other governmental agencies. “Syntroleum” is a registered trademark and service mark in Argentina, Australia, Bolivia, Chile, the European Union, Japan, Peru and the United States, with an application pending in Brazil.

Licensing Agreements

GTL Licenses.We currently have four types of GTL license agreements. Our master GTL license agreement generally grants to the licensee the non-exclusive right to enter into an unlimited number of site license agreements to construct GTL plants based on the Syntroleum Process to produce fuels worldwide. Our volume GTL license agreement generally grants to the licensee the non-exclusive right to enter into an unlimited number of site license agreements to construct GTL plants based on the Syntroleum Process, subject to specified aggregate production capacity limits. Our regional GTL license agreement generally grants to the licensee the non-exclusive right to enter into an unlimited number of site license agreements to construct GTL plants based on the Syntroleum Process within a designated region. Finally, our site GTL license agreement generally grants to the licensee the non-exclusive right to use the Syntroleum Process in a GTL plant at a single, specified location for the life of the plant. This type of license may be granted under our master, regional or volume license agreements or may be granted to licensees for a specific site who have not otherwise entered into a master, regional or volume license agreement. The licenses may exclude the right to use the Syntroleum Process in areas of the world with which we have intellectual property protection concerns; these areas may vary over time as countries change their laws and enforcement practices.

Under three different licensing programs that include prepaid deposits, a licensee receives pricing terms for future project site licenses and secures (1) the right to use the Syntroleum Process, (2) the right to acquire catalysts from us for which we charge a fixed mark-up over our cost and (3) the right to future improvements in our GTL technology. Current GTL licensees include BP, the Commonwealth of Australia, Ivanhoe, Kerr-McGee Corporation, Marathon, and Repsol-YPF, S.A. We have received an aggregate of $39.5 million in connection with our licensing agreements, which generally begin to expire in 2011.

The following description summarizes the principal terms and conditions of the forms of our GTL license agreements. This summary is not complete and is qualified in its entirety by reference to the form of our master license agreement, a copy of which has been filed as an exhibit to this Annual Report on Form 10-K. Agreements entered into with specific licensees may differ in material respects from the current forms of our various license agreements.

10

CTL Licenses. While we have had discussions with potential CTL licensees, we have not executed any CTL license agreements that grant rights to any licensee to construct CTL plants based on the Syntroleum Process. We are focusing our efforts on CTL site licenses where we have the option to participate in the project as well as collect license fees. We will also consider exchanging license fees for equity in CTL projects. The license fees structure for CTL licenses will more than likely be different than GTL licenses and reflect market demand for the technology, as well as consideration for technology development support and options for equity participation by us.

Initial Deposits and GTL License Fees. At the inception of a master, volume or regional GTL license agreement, the licensee is generally required to make an initial deposit to us, which is credited against future site-specific license fees. The amount of the initial deposit depends on market conditions and, in the case of volume and regional GTL license agreements, the volume limitation and the size and location of the region covered. In some cases, we have acquired technologies or commitments to provide funding for future development activities in lieu of initial cash deposits in cases where we viewed these technologies or commitments as being more valuable than the initial cash deposit.

Generally, the amount of the license fee for site licenses under our master, volume and regional GTL license agreements is determined pursuant to a formula based on the discounted present value of the product of (1) the annual maximum design capacity of the plant, (2) an assumed life of the plant and (3) an agreed royalty rate. Our license fees for new plants may change from time to time based on the size of the plant, improvements that reduce plant capital cost and competitive market conditions. Our existing master and volume license agreements allow for the adjustment of fees for new site licenses under certain circumstances. We expect that license fees under existing GTL licensing agreements will be paid in increments when certain milestones during the plant design and construction process are achieved.

Catalyst Sales and Process Design Packages. Our license agreements grant the licensee the right to acquire from us or from vendors designated by us any proprietary catalyst used in either the synthesis gas reaction or the Fischer-Tropsch reaction, in each case at prices based on our costs plus a specified margin. We currently estimate that these catalysts will be required to be replaced every three to five years. Licensees also have the right to acquire proprietary reactors used in the Syntroleum Process from vendors approved by us. In addition, under our license agreements, licensees are required to purchase from us a process design package for plants covered by the license at a fee based on our costs plus a specified margin. We may, however, develop the process design package with the assistance of a third party. We are also required to provide certain technical support to licensees at specified fees.

Other License Terms.As part of our network model for improving our GTL and CTL technologies, we generally acquire a royalty-free, non-exclusive license to any invention or improvement to the Syntroleum Process that is developed by the licensee, together with the right to grant corresponding sublicenses to our other licensees who have granted us similar rights. Licensees also generally acquire the right to use subsequent inventions or improvements to the Syntroleum Process that we acquire from other licensees. Licensees may, but are not required to, develop improvements to the Syntroleum Process and may seek to obtain a patent on the improvements, either independently or jointly with us, and to license those improvements. Our license agreements may be terminated by the licensee, with or without cause, and without penalty, upon 90 days notice to us. For a further discussion of our license agreements and license fees, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations-Operating Revenues-License Revenues” in Item 7 of this Annual Report on Form 10-K.

Agreement with ExxonMobil.In December 2004, we signed an agreement with ExxonMobil Research and Engineering Company (“ExxonMobil”) whereby we were granted a worldwide license to use ExxonMobil’s patented processes to produce and sell fuels from natural gas or other substances such as coal. In addition, we have the right to extend the terms of this agreement to our licensees. The scope of this agreement includes the fields of syngas production, Fischer-Tropsch synthesis and product upgrading to make fuels and various processes that relate to these areas. It includes all existing ExxonMobil patents (which number over 3,000 worldwide) and future improvement patents in these areas over the next several years. This agreement does not include patents covering certain specific catalyst formulations and manufacturing steps. We have agreed that we will not enforce against ExxonMobil and its affiliates any patents that we obtain after the date of the license agreement, to the extent that those patents overlap with any of ExxonMobil’s patents.

11

Projects

We continue to develop several projects that would utilize the Syntroleum Process; however, we can provide no assurance that GTL or CTL plants will be constructed using this technology, that financing will be attained for projects being developed by us and others, that the design and construction of any of these plants will be successfully completed, that any of these plants will be commercially successful, or that these plants will be constructed or utilized on a cost-effective basis. See “Item 1A. Risk Factors.”

Commercial and Licensee Projects

During 2005 and early 2006, we made progress on various projects including the acquisition of interests in OML 113 offshore Nigeria, the acquisition of interests, subject to various government and other approvals, in OML 90 offshore Nigeria, the GTL Mobile Facility, and projects in Papua New Guinea, and the Commonwealth of Independent States. During 2005 and early 2006, we and our licensees had projects in Egypt and Qatar. For a discussion of these projects, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Significant Developments During 2005 and Early 2006” in Item 7 of this Annual Report on Form 10-K.

Demonstration and Scale-Up Projects

Our Demonstration and Scale-Up Projects during 2005 consisted primarily of our Catoosa Demonstration Facility for the DOE Ultra-Clean Fuels Project, including increasing the capacity of a single-train GTL facility, the testing of our new Fischer-Tropsch catalyst and the design, construction and operation of our Modified Reformer Unit. For a discussion of these projects, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Significant Developments During 2005 and Early 2006” in Item 7 of this Annual Report on Form 10-K.

Oil and Gas Properties

In connection with our development, production and processing projects, we have acquired interests in oil and gas properties in the Central Kansas Uplift area, and in OML 113 offshore Nigeria. During the year ended 2005, we drilled on these leases in both properties, with limited production from the Central Kansas Uplift leases and have subsequently discontinued operations and sold leases and assets associated with the Central Kansas Uplift area. “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Significant Developments during 2005 and Early 2006” in Item 7 of this Annual Report on Form 10-K for future development plans for these leases. The following information provides drilling activity and acreage data for our oil and gas properties. We had no productive wells as of December 31, 2005. No reserve estimates were provided to any federal authority or agency since the beginning of 2005.

Drilling Activity

During 2005, we drilled nine exploratory gross (nine net) wells and reentered three wells in the Central Kansas Uplift. Nominal production from one of these wells began in the first quarter of 2005. Evaluation of commercial completion and economics was performed and completed on all wells and management made the determination that these properties would be liquidated. We also drilled one exploratory well, Aje-3, on OML 113 offshore Nigeria during 2005. This well was plugged and abandoned. For discussion of this wells and wells that may be drilled in the future, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Significant Developments during 2005 and Early 2006” in Item 7 of this Annual Report on Form 10-K.

12

Acreage Data

The following table sets forth certain information regarding our developed and undeveloped lease acreage as of December 31, 2005. Developed acres refer to acreage within producing units and undeveloped acres refer to acreage that has not been placed in producing units. All remaining oil and gas leases in Kansas were sold subsequent to December 31, 2005. These leases were acquired during 2004 and generally had three year terms and options to extend for an additional three years. The lease for OML 113 offshore Nigeria expires in 13 years. In general, our leases will continue past their primary terms if oil or natural gas in commercial quantities is being produced from a well on such leases.

| | | | | | | | | | | | |

| | | Developed Acreage | | Undeveloped Acreage | | Total |

| | | Gross | | Net | | Gross | | Net | | Gross | | Net |

Kansas | | 1,800 | | 1,800 | | 58,700 | | 58,700 | | 60,500 | | 60,500 |

Offshore Nigeria | | — | | — | | 412,650 | | 100,580 | | 412,650 | | 100,580 |

| | | | | | | | | | | | |

Total | | 1,800 | | 1,800 | | 471,350 | | 159,280 | | 473,150 | | 161,080 |

| | | | | | | | | | | | |

Research and Development

Our ongoing research and development strategy includes continuing to lower GTL and CTL capital and operating costs and improving the efficiency of the Syntroleum Process. Our expenditures for research and development activities, including pilot plant, engineering and construction and operation of the Catoosa Demonstration Facility, totaled approximately $22.4 million, $22.3 million, and $30.1 million in 2005, 2004, and 2003, respectively. The current 2006 budget for these activities is approximately $24 million, a significant amount of which relates to operations of the Catoosa Demonstration Facility and the Tulsa pilot plant, engineering and design of our GTL Mobile Facility, and ongoing research and development efforts focusing primarily on commercialization of the technology we previously have developed.

Our research and development facilities include the following locations:

| | • | | Catoosa Demonstration Facility - This facility houses a 70 b/d plant that initially produced products for the DOE and other governmental agencies. This facility has operated since March 2004 to complete our commitment for delivery of fuels to the DOE as well as for research and development and demonstrations for licensees or other customers. |

| | • | | Syntroleum Corporate Office and Technology Center - This facility houses our corporate offices and much of our research and development equipment, including our Synfining Product Upgrading Unit. This unit manufactures finished fuels and specialty products to specifications for testing by our customers and us, which have included the DOD, DOE, and DOT, and a consortium of Japanese automobile manufacturers. This facility is also home to our catalyst development and characterization, products, and gas chromatography laboratories. |

| | • | | Syntroleum Fischer-Tropsch Performance Laboratory - This laboratory houses six fixed bed, four fluid bed and eleven continuously stirred-tank reactors, as well as a particle size analysis instrument and supporting accessories. |

| | • | | Syntroleum Pilot Plant - The plant includes our Advanced Fischer-Tropsch Slurry Reactor Unit, which is utilized in demonstrating process performance and conducting parametric studies requested by clients and engineering contractors involved in developing commercial GTL plants. In support of the Advanced Reactor Unit, we have a syngas generation process (ATR), steam generation facilities, and a Fischer-Tropsch laboratory located at this facility that includes three continuous stirred tank reactors. |

Intellectual Property

Our success depends on our ability to obtain, protect, and enforce our intellectual property rights, to successfully avoid infringing the valid and enforceable intellectual property rights of others and, if necessary, to defend against any alleged infringements. We regard the protection of our proprietary technologies as critical to our future success and we rely on a combination of patent, copyright, trademark and trade secret law and contractual restrictions to protect our proprietary rights. We pursue protection of the Syntroleum Process and the Synfining Process primarily through patents and trade secrets. It is our policy to seek, when appropriate, protection for our proprietary products and processes by filing patent applications in the United States and selected foreign countries and to encourage or further the efforts of others who have licensed technology to us to file patent applications. Our

13

ability to protect and enforce these rights involves complex legal, scientific and factual questions and uncertainties. Our policy is to honor the valid, enforceable intellectual property rights of others. While we have made efforts to avoid any such infringement, commercialization of our GTL and CTL technologies may give rise to claims that the technologies infringe upon the patents or other proprietary rights of others. We have not been notified of any claim that our GTL or CTL technologies infringes on the proprietary rights of any third party. However, we can provide no assurance that third parties will not claim infringement by us with respect to past, present or future GTL or CTL technologies.

We currently own, or have licensed rights to, more than 140 patents or patent applications pending in the United States and various foreign countries that relate to one or more embodiments of Syntroleum technology. Our patents generally begin to expire in 2009 for the initial patents, which were issued in the late 1980s, and in 2017 for most of our patents that have been issued since the late 1990s. These patents are not renewable in the United States, and the cost of renewing our foreign patents is not material. In addition to patent protection, we also rely significantly on trade secrets, know-how and technological advances, which we seek to protect, in part, through confidentiality agreements with our collaborators, licensees, employees and consultants. If these agreements are breached, we might not have adequate remedies for the breach. In addition, our trade secrets and proprietary know-how might otherwise become known or be independently discovered by others.

In December 2004, we signed an agreement with ExxonMobil whereby we were granted a worldwide license to use ExxonMobil’s patented processes to produce and sell fuels from natural gas or other substances such as coal. In addition we have the right to extend the terms of this agreement to our licensees. The scope of this agreement includes the fields of syngas production, Fischer-Tropsch synthesis, product upgrading to make fuels and various processes that relate to these areas. It includes all existing ExxonMobil patents (which number over 3,000 worldwide) and future improvement patents in these areas over the next several years. This agreement does not include patents covering certain specific catalyst formulations and manufacturing steps. We have agreed that we will not enforce against ExxonMobil and its affiliates any patents that we obtain after the date of the license agreement, to the extent that those patents overlap with any of ExxonMobil’s patents.

As part of our intellectual property program, we have reviewed a large amount of Fischer-Tropsch patents and prior art literature. In conjunction with outside patent counsel, our technical staff and management have reviewed thousands of existing patents with respect to our own proprietary position and for patent clearance related to specific projects. Together with licensees, we have spent more than $2.0 million to establish a strong patent position, and we do not believe our technology infringes on the valid enforceable patents of others. As a result of these efforts, we are able to provide easy access to this literature for the entire industry through our website, http://www.fischer-tropsch.org. This growing site now includes over 6,000 patents, 12,650 literature document references, 2,180 government reports, and approximately 225 of the U.S. Technical Oil Mission microfilm reels. Recently, this website has had over 10,000 users and 100,000 hits per month from all parts of the world.

In any potential intellectual property dispute involving us, our licensees could also become the target of litigation. Our license agreements require us to indemnify the licensees against specified losses, including the losses resulting from patent and trade secret infringement claims, subject to a cap of 50 percent of the license fees received. Our indemnification and support obligations could result in substantial expenses and liabilities to us. These expenses or liabilities could have a material adverse effect on our business, operating results and financial condition. See “Item 1A. Risk Factors-Risks Relating to Our Technology.”

Employees

As of March 1, 2006, we had 125 employees, none of which is represented by a labor union. We have experienced no work stoppages and believe that our relations with our employees are excellent.

Government Regulation

We are subject to extensive federal, state and local laws and regulations relating to the protection of the environment, including laws and regulations relating to the release, emission, use, storage, handling, cleanup, transportation and disposal of hazardous materials, as well as to employee health and safety. Additionally, our GTL and CTL plants will be subject to environmental, health and safety laws and regulations of any foreign countries in

14

which these plants are located. Any GTL Mobile Facility may also be subject to the international treaties and laws relating to activities on the high seas. Violators of these laws and regulations may be subject to substantial fines, criminal sanctions or third-party lawsuits. We may be required to install costly pollution control equipment or, in some extreme cases, curtail operations to comply with these laws. These laws and regulations may also limit or prohibit activities on lands lying within wilderness areas, wetlands or other protected areas.

Our operations in the United States are also subject to the federal Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), also know as the “Superfund” law, and similar state laws, which can impose joint and several liability for site cleanup, regardless of fault, upon statutory classes of persons, including our company, with respect to the release into the environment of substances designated under CERCLA as hazardous substances (“Hazardous Substances”). These classes of persons, or so-called potentially responsible parties (“PRPs”), include the current and certain past owners and operators of a facility where there has been a release or threat of release of a Hazardous Substance and persons who disposed of or arranged for the disposal of Hazardous Substances found at a site. CERCLA also authorizes the EPA and, in some cases, third parties to take actions in response to threats to the public health or the environment and to seek to recover from the PRPs the costs of such action. In the course of our operations, we have generated and will generate wastes that may fall within CERCLA’s definition of Hazardous Substance. We may also be the owner or operator of sites on which Hazardous Substances have been released. To our knowledge, neither we nor our predecessors have been designated as a PRP by the EPA under CERCLA. We also do not know of any prior owners or operators of our properties that are named as PRPs related to their ownership or operation of such properties.

Environmental laws and regulations often require acquisition of a permit or other authorization before activities may be conducted, and compliance with laws, regulations and any requisite permits can increase the costs of designing, installing and operating our GTL and CTL plants. GTL and CTL plants generally will be required to obtain permits under applicable environmental laws of the country in which it is situated, as well as various permits for industrial siting and construction. Emissions from a GTL or CTL plant, primarily from the gas turbine, will contain nitrous oxides and may require the installation of abatement equipment in order to meet applicable permit requirements. Additionally, GTL or CTL plants will be required to adhere to laws applicable to the disposal of byproducts produced, including waste water and spent catalyst.

Operation of our Tulsa-based pilot plant requires two annual permits regarding air emissions and industrial wastewater discharge to a sanitation sewer. We do not expect the costs to renew these permits to be material.

Operation of our Catoosa Demonstration Facility requires the following permits: air emissions; air quality construction; air quality minor operating; industrial wastewater discharge; and storm water general. Each of these permits is renewed annually, with the exception of the storm water general permit, which expires on September 12, 2007. We do not expect the costs to renew these permits to be material.

The following environmental regulations are applicable to the Catoosa Demonstration Facility: Clean Air Act; Clean Water Act; Superfund Amendments and Reauthorization Act; Toxic Substance Control Agency; and Chemical Accident Prevention. We believe we are in substantial compliance with all of these regulations. We currently maintain a risk management plan addressing these regulations. We do not expect the costs associated with this plan to be material.

Although we do not believe that compliance with environmental and health and safety laws in connection with our current operations will have a material adverse effect on us, we cannot predict with certainty the future costs of complying with environmental laws and regulations and containing or remediating contamination. In the future we could incur material liabilities or costs related to environmental matters, and these environmental liabilities or costs (including fines or other sanctions) could have a material adverse effect on our business, operating results and financial condition. We currently carry environmental impairment liability insurance to protect us against these contingencies and may, in the future, seek to obtain additional insurance in connection with our participation in the construction and operation of GTL and CTL plants, if coverage is available at reasonable cost and without unreasonably broad exclusions.

Our subsidiary, Scout Development Corporation (“Scout”), which owned our real estate assets sold in 2003, is subject to several U.S. environmental laws, including the Clean Air Act, CERCLA, the Emergency Planning and Community Right-to-Know Act, the Federal Water Pollution Control Act, the Oil Pollution Act of

15

1990, the Resource Conservation and Recovery Act, the Safe Drinking Water Act and the Toxic Substances Control Act. Scout is also subject to U.S. environmental regulations promulgated under these acts, as well as state and local environmental regulations that have their foundation in the foregoing U.S. environmental laws. As is the case with many companies, Scout may face exposure to actual or potential claims and lawsuits involving environmental matters with respect to real estate that it has sold. However, no such claims are presently pending. Scout has not suffered and does not anticipate that it will suffer a material adverse effect as a result of any past action by any governmental agency or other party, or as a result of noncompliance with such environmental laws and regulations.

Operating Hazards

Operations at our GTL and CTL plants will involve a risk of incidents involving personal injury and property damage due to the operation of machinery in close proximity to individuals and the highly flammable nature of natural gas and the materials produced at these plants. Depending on the frequency and severity of personal injury and property damage incidents, such incidents could affect our operating costs, insurability and relationships with customers, employees and regulators. Any significant frequency or severity of these incidents, or the general level of compensation awards, could affect our ability to obtain insurance and could have a material adverse effect on our business, operating results and financial condition.

Available Information

Our website address iswww.syntroleum.com. We make our website content available for information purposes only. It should not be relied upon for investment purposes, nor is it incorporated by reference in this Annual Report on Form 10-K. We make available on this website under “Investor Relations-Financial Information –Filings,” free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file those materials with, or furnish those materials to, the SEC. The SEC also maintains a website atwww.sec.gov that contains reports, proxy statements and other information regarding SEC registrants, including us.

You should carefully consider the risks described below. The risks and uncertainties described below encompass all risks that could affect our company. If any of the following risks actually occur, our business, financial condition or results of operations could be materially and adversely affected. In that case, the trading price of our common stock could decline and you may lose all or part of your investment in us.

Risks Relating to Our Technology

We might not successfully commercialize our technology, and commercial-scale GTL or CTL plants based on the Syntroleum Process may never be successfully constructed or operated.

We do not have significant experience managing the financing, design, construction or operation of commercial-scale GTL or CTL plants, and we may not be successful in doing so. No commercial-scale GTL or CTL plant based on the Syntroleum Process has been constructed to date. A commercial-scale GTL or CTL plant based on the Syntroleum Process may never be successfully built either by us or by our licensees. Success depends on our ability and the ability of our licensees to economically design, construct and operate commercial-scale GTL or CTL plants based on the Syntroleum Process. Successful commercial construction and operation of a GTL or CTL plant based on the Syntroleum Process depends on a variety of factors, many of which are outside our control.

Commercial-scale GTL or CTL plants based on the Syntroleum Process might not produce results necessary for success, including results demonstrated on a laboratory, demonstration and pilot plant basis.

A variety of results necessary for successful operation of the Syntroleum Process could fail to occur at a commercial plant, including reactions successfully tested on a laboratory, demonstration plant and pilot plant basis. Results that could cause commercial-scale GTL or CTL plants to be unsuccessful include:

| | • | | lower reaction activity than that demonstrated in laboratory, pilot plant and demonstration plant operations, which would increase the amount of catalyst or number of reactors required to convert synthesis gas into liquid hydrocarbons and increase capital and operating costs; |

16

| | • | | shorter than anticipated catalyst life, which would require more frequent catalyst regeneration, catalyst purchases, or both, thereby increasing operating costs; |

| | • | | excessive production of gaseous light hydrocarbons from the Fischer-Tropsch reaction compared to design conditions, which would lower the anticipated amount of liquid hydrocarbons produced and would lower revenues and margins from plant operations; |

| | • | | inability of the gas turbines or heaters integrated into the Syntroleum Process to burn the low-heating-value tail gas produced by the process, which would result in the need to incorporate other methods to generate horsepower for the compression process that may increase capital and operating costs; |

| | • | | inability of third-party gasification and synthesis gas clean-up technology integrated into the Syntroleum Process to produce quantities of quality synthesis gas adequate for economic operation of a CTL plant; and |

| | • | | higher than anticipated capital and operating costs to design, construct and operate a GTL or CTL plant. |

In addition, these plants could experience mechanical difficulties related or unrelated to elements of the Syntroleum Process.

Many of our competitors have significantly more resources than we do, and GTL and CTL technologies developed by competitors could become more commercially successful than ours or render our technology obsolete.

Development of GTL and CTL technology is highly competitive, and other GTL and CTL technologies could become more commercially successful than ours. The Syntroleum Process is based on chemistry that has been used by several companies in synthetic fuel projects over the past 60 years. Our competitors include major integrated oil companies that have developed or are developing competing GTL and CTL technologies, including BP, ConocoPhillips, ExxonMobil, Sasol (including its participation in a joint venture with Chevron) and Shell. Each of these companies has significantly more financial and other resources than we do to spend for research and development of their technologies and for funding construction and operation of commercial-scale GTL or CTL plants. In addition to using their own GTL technologies in competition with us, these competitors could also offer to license their technology to others. Additionally, several small companies have developed and are continuing to develop competing GTL and CTL technologies. The DOE has also sponsored a number of research programs relating to GTL and CTL technology that could potentially lower the cost of competitive processes.

As our competitors continue to develop GTL and CTL technologies, one or more of our current technologies could become obsolete. Our ability to create and maintain technological advantages is critical to our future success. As new technologies develop, we may be placed at a competitive disadvantage, and competitive pressures may force us to implement new technologies at a substantial cost. We may not be able to successfully develop or expend the financial resources necessary to acquire new technology.

Our ability to protect our intellectual property rights involves complexities and uncertainties and commercialization of the Syntroleum Process could give rise to claims that our technology infringes upon the rights of others.

Our success depends on our ability to protect our intellectual property rights, which involves complex legal, scientific and factual questions and uncertainties. We rely on a combination of patents, copyrights, trademarks, trade secrets and contractual restrictions to protect our proprietary rights. Additional patents may not be granted, and our existing patents might not provide us with commercial benefit or might be infringed upon, invalidated or circumvented by others. In addition, the availability of patents in foreign markets, and the nature of any protection against competition that may be afforded by those patents, are often difficult to predict and vary significantly from country to country. We, our licensors, or our licensees may choose not to seek, or may be unable to obtain, patent protection in a country that could potentially be an important market for our GTL or CTL technology. The

17

confidentiality agreements that are designed to protect our trade secrets could be breached, and we might not have adequate remedies for the breach. Additionally, our trade secrets and proprietary know-how might otherwise become known or be independently discovered by others.

Commercialization of the Syntroleum Process may give rise to claims that our technologies infringe upon the patents or proprietary rights of others. We may not become aware of patents or rights that may have applicability in the GTL or CTL industry until after we have made a substantial investment in the development and commercialization of those technologies. Third parties may claim that we have infringed upon past, present or future GTL or CTL technologies. Legal actions could be brought against us, our co-venturers or our licensees claiming damages and seeking an injunction that would prevent us, our co-venturers or our licensees from testing, marketing or commercializing the affected technologies. If an infringement action were successful, in addition to potential liability for damages, our co-venturers, our licensees or we could be required to obtain a license in order to continue to test, market or commercialize the affected technologies. Any required license might not be made available or, if available, might not be available on acceptable terms, and we could be prevented entirely from testing, marketing or commercializing the affected technology. We may have to expend substantial resources in litigation, either in enforcing our patents, defending against the infringement claims of others, or both. Many possible claimants, such as the major energy companies that have or may be developing proprietary GTL or CTL technologies competitive with the Syntroleum Process, have significantly more resources to spend on litigation.

We could have potential indemnification liabilities to licensees relating to the operation of GTL and CTL plants based on the Syntroleum Process or intellectual property disputes.