Symbol: EEFT www.euronetworldwide.com 24, 2003 Investor Conference Call November Presenters Michael J. Brown, Chairman & CEO Rick Weller, EVP & CFO Platt, Co-Managing Director Transact Jeff B. Newman, EVP & General Counsel Welcome to Euronet Worldwide J Bernd Artinger, Co-Managing Director Transact

• 11/21/03 • the are of the the in for the from by concern or statements. anticipated number exchange described Exchange 10-Q for information unaudited differ obtained a affecting affecting and Form 10-K this may be those of foreign are which expectations, Form Financial while it may from result risks Securities Euronet’s its a services; regulations and filings forward-looking as developments other the to accurate, Statements and and Transact be presentation, are materially and 2003 unaudited; these . intentions, with limited to this vary laws risks 30, 2002. is of SEC in statements products in filings not the may These but 31, believed Copies or contained management’s performance, results technological Company’s changes periodic September presentation is Company future and including December this amounts. or of actual including: the business. ended the statements forward-looking for Company’s period ended in information audited Euronet’s such Forward-Looking Any Company’s predictions in factors, market fluctuations; Company’s the Commission, the year included financial final contacting • 2

11/21/03 Euronet Overview Michael Brown Chairman & CEO 3

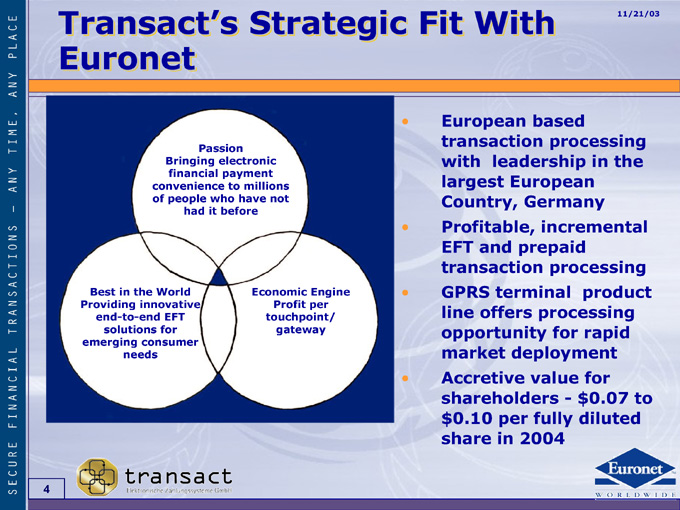

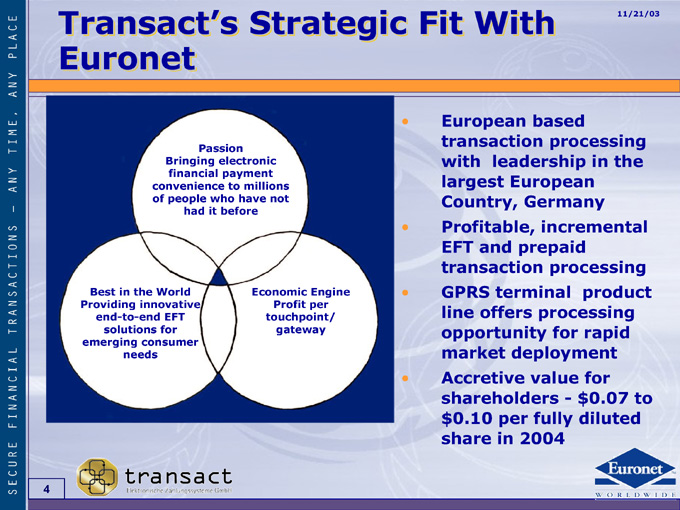

• 11/21/03 to • the in product rapid for $0.07 diluted based processing Germany incremental processing processing for value—fully European prepaid deployment 2004 leadership terminal offers per in With and transaction market Accretive European transaction with largest Country, Profitable, EFT GPRS line opportunity shareholders $0.10 share • Fit • • • • Engine per Strategic not Economic Profit touchpoint/ gateway millions have electronic payment to who before Passion it Bringing financial people had World EFT for convenience of innovative consumer the needs in end-to-end solutions Transact’sEuronet Best Providing emerging • 4

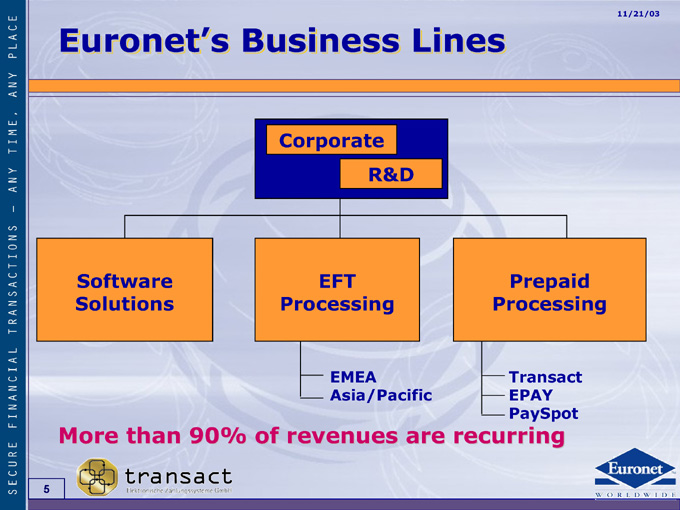

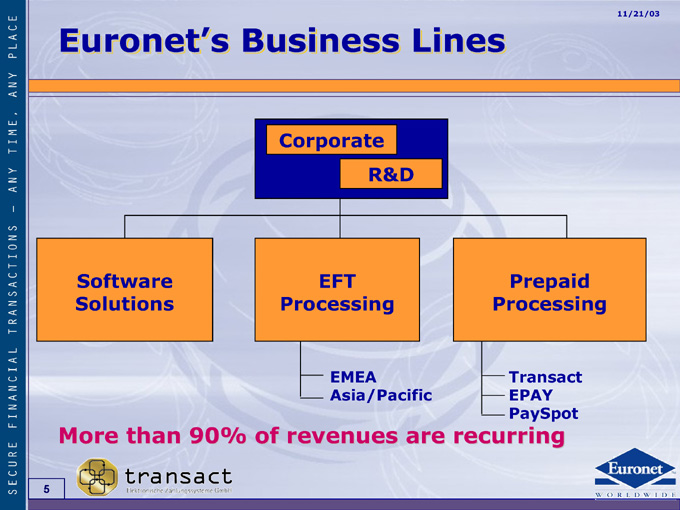

11/21/03 Prepaid Processing Transact EPAY PaySpot R&D Asia/Pacific Corporate EFT Processing EMEA Euronet’s Business Lines Software Solutions More than 90% of revenues are recurring 5

11/21/03 Euronet Financials Rick Weller EVP & CFO 6

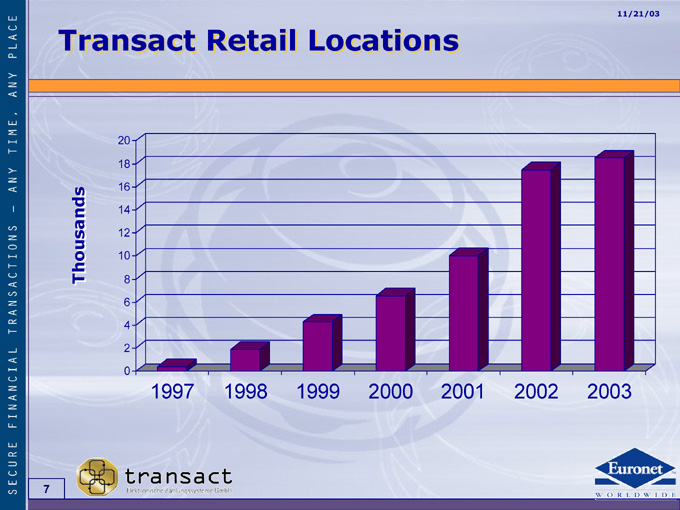

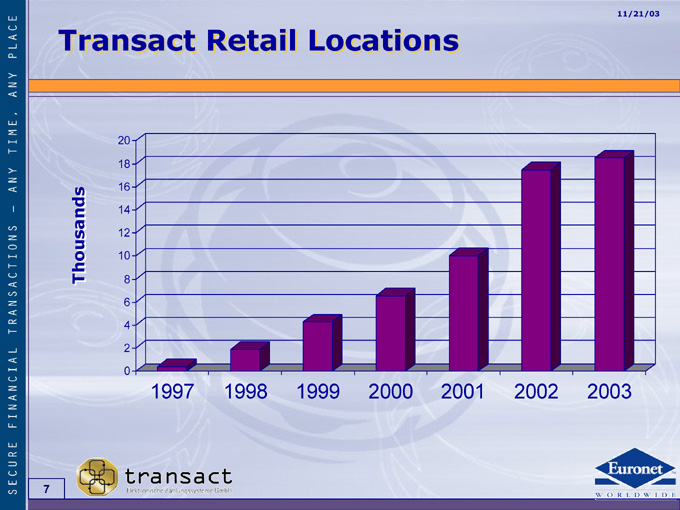

11/21/03 2003 2002 2001 2000 1999 1998 1997 20 18 16 14 12 10 8 6 4 2 0 Transact Retail Locations Thousands 7

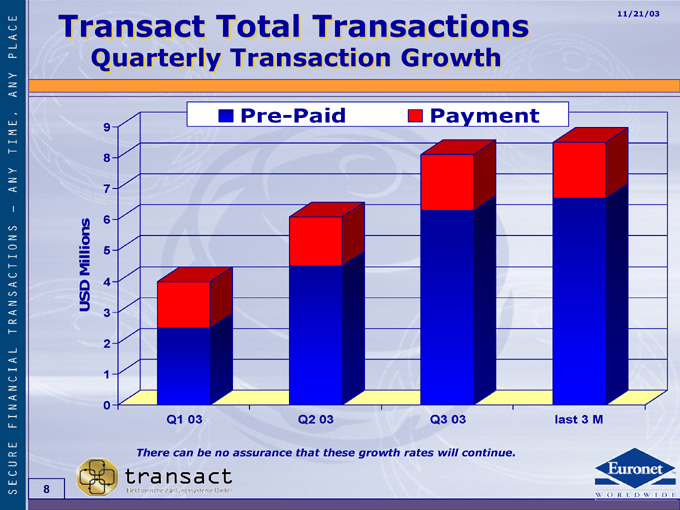

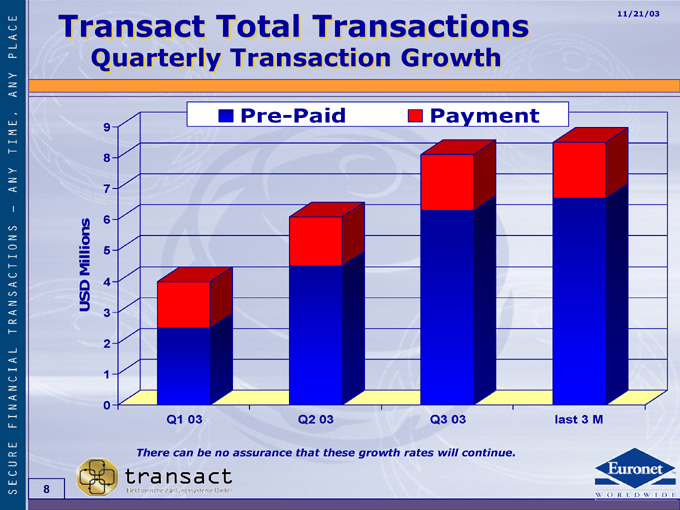

11/21/03 last 3 M Payment Q3 03 Pre-Paid Q2 03 Q1 03 There can be no assurance that these growth rates will continue. Quarterly Transaction Growth 9 8 7 6 5 4 3 2 1 0 Transact Total Transactions Millions USD 8

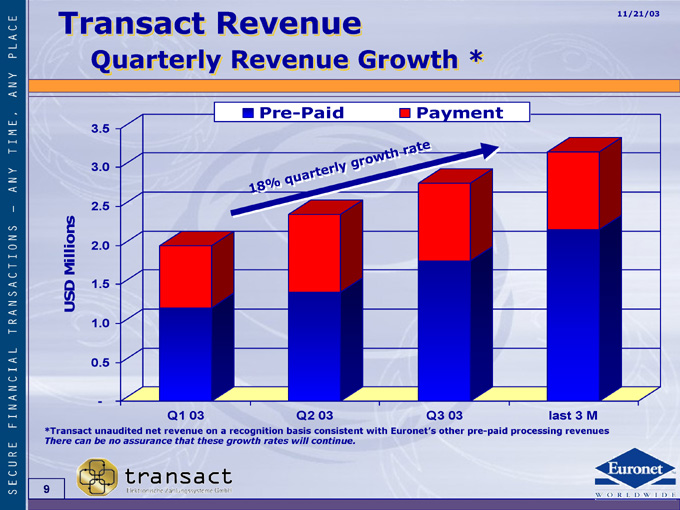

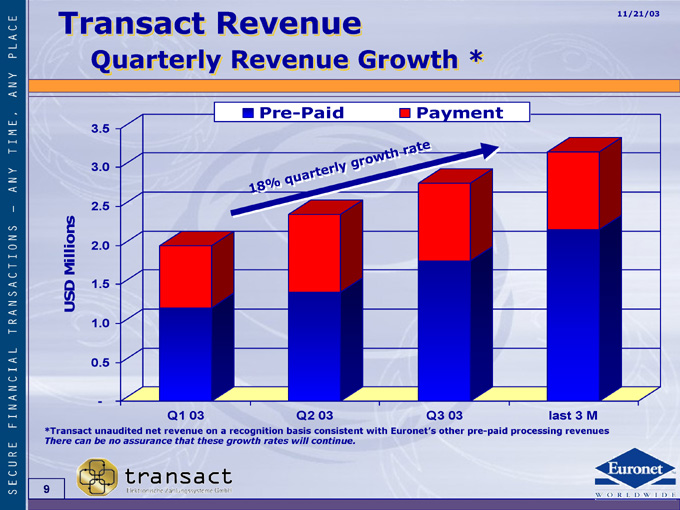

11/21/03 last 3 M Q3 03 Payment e t t a r h t t w o r g y l l r e t t r a u Q2 03 q % Pre-Paid 8 1 on a recognition basis consistent with Euronet’s other pre-paid processing revenues Q1 03 Quarterly Revenue Growth * 3.5 3.0 2.5 2.0 1.5 1.0 0.5 - Transact Revenue Millions USD *Transact unaudited net revenue There can be no assurance that these growth rates will continue. 9

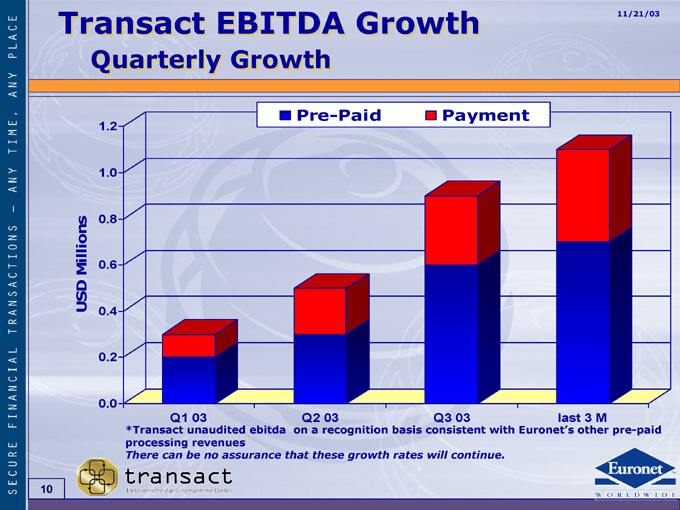

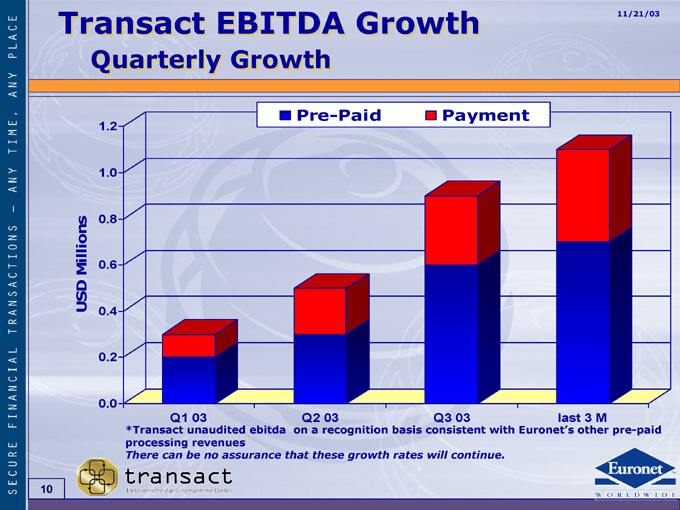

11/21/03 last 3 M Payment Q3 03 Pre-Paid Q2 03on a recognition basis consistent with Euronet’s other pre-paid Q1 03*Transact unaudited ebitda processing revenues There can be no assurance that these growth rates will continue. Quarterly Growth 1.2 1.0 0.8 0.6 0.4 0.2 0.0 Transact EBITDA Growth Millions USD 10

11/21/03 Euronet and Transact Michael Brown Chairman & CEO J Platt & Bernd Artinger Co-Managing Director Transact 11

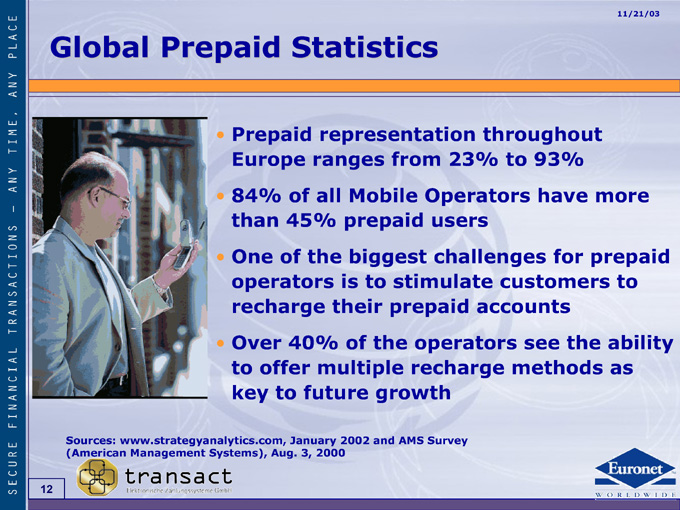

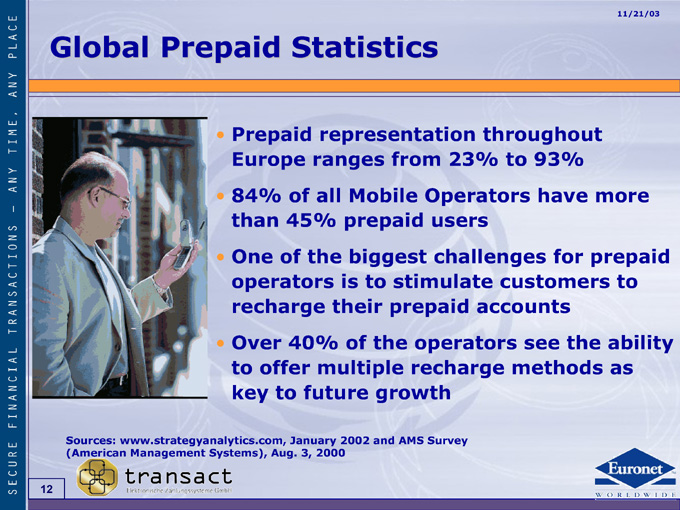

• 11/21/03 more prepaid to ability as 93% have for the see methods throughout to customers accounts 23% users challenges Operators operators recharge Survey from stimulate prepaid growth AMS • Mobile biggest to the and representation prepaid is their of multiple 2002 ranges all the future 2000 • Statistics of 45% 40% January 3, • Prepaid of operators offer to Aug. • Europe 84% than One recharge Over to key • Prepaid • • • Systems), www.strategyanalytics.com, Management Global Sources: (American • 12

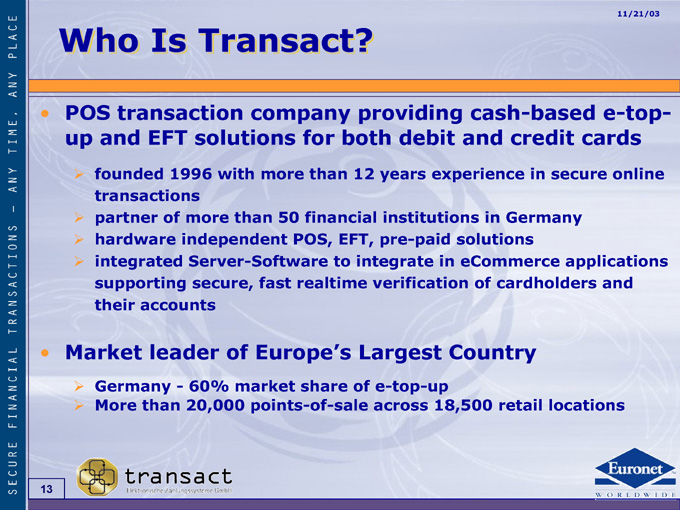

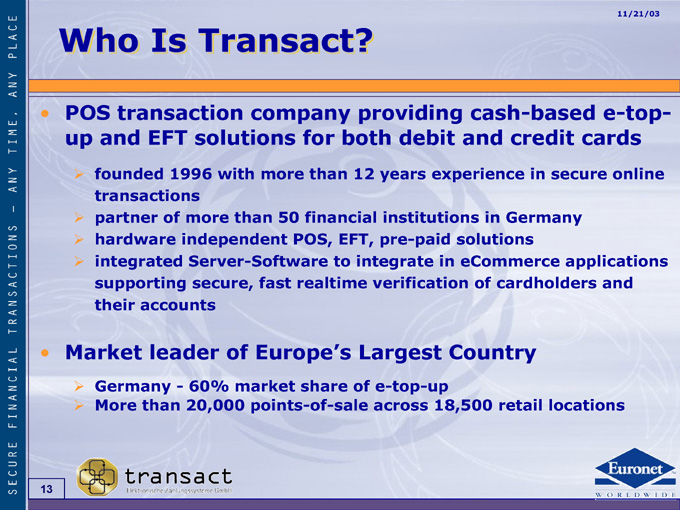

• 11/21/03 e-top- cards online applications and secure locations credit in Germany cardholders retail in • cash-based and solutions eCommerce of Country • debit experience institutions in 18,500 providing years pre-paid integrate verification Largest e-top-up across both 12 EFT, of than financial to for POS, realtime share company more 50 fast Europe’s market points-of-sale Transact? solutions with than secure, of more independent Server-Software 60% 20,000 • Is transaction EFT 1996 of accounts leader—than • and founded transactions partner hardware integrated supporting their Germany More • Who POS up Market • 13

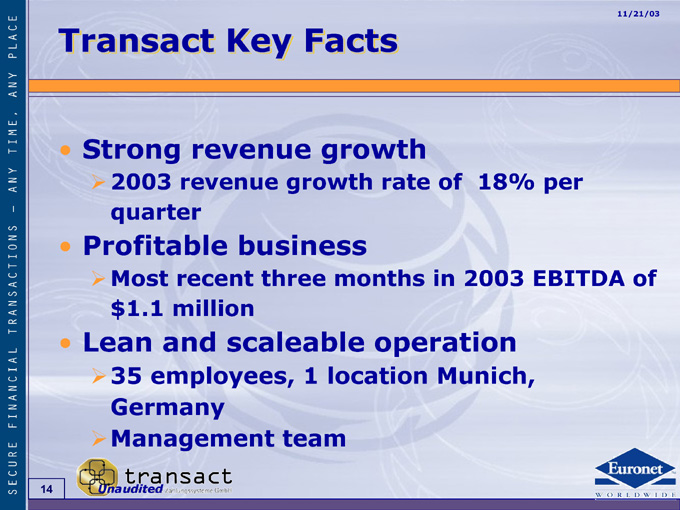

• 11/21/03 of • per EBITDA 18% 2003 of in Munich, • growth rate months operation location • Facts growth 1 team • business three scaleable Key revenue revenue • recent million and employees, • 2003 quarter Most $1.1 35 Germany Management Unaudited • Transact Strong Profitable Lean • • • 14

11/21/03 1,000 Small Retailers Retailers and Airtime Suppliers Major Multiple Retailers All Major German Operators, 20,000 Points of Sale, 18,500 Retail Outlets Transact 15

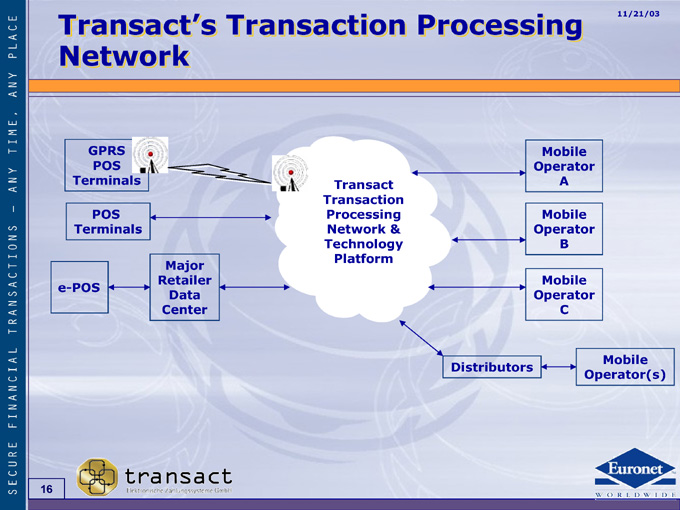

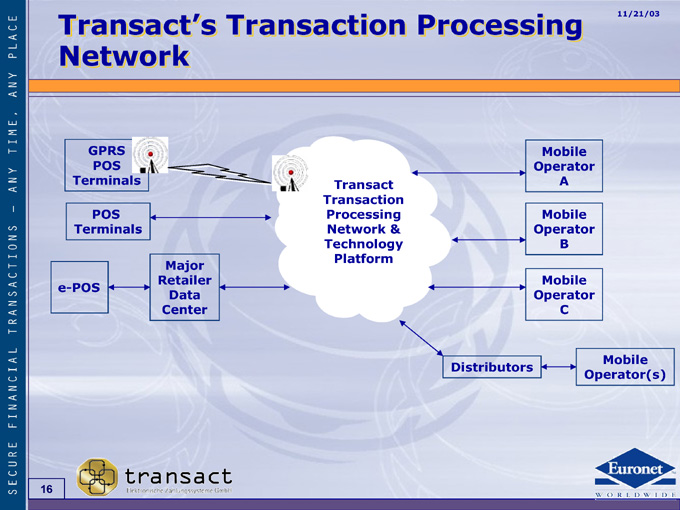

11/21/03 Mobile Operator(s) Mobile Operator A Mobile Operator B Mobile Operator C Distributors Transact Transaction Processing Network & Technology Platform Major Retailer Data Center Transact’s Transaction Processing Network GPRS POS Terminals POS Terminals e-POS 16

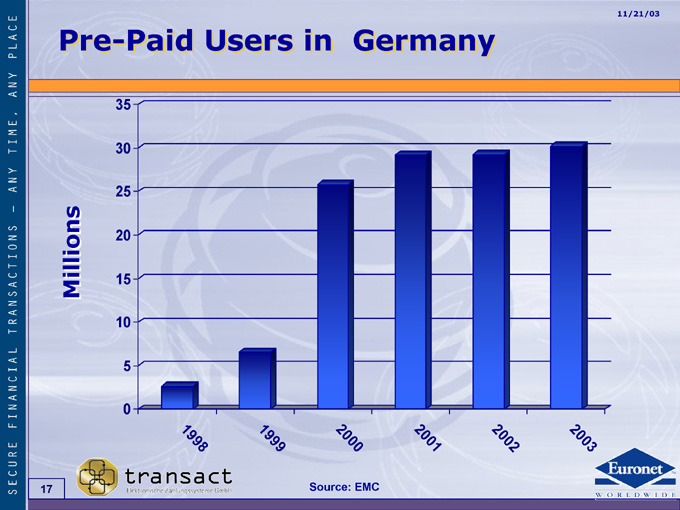

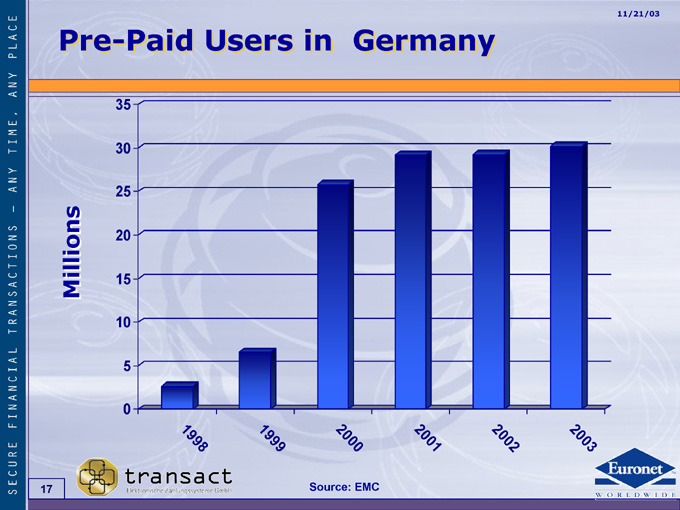

11/21/03 0 3 2 0 0 2 2 0 0 1 Germany Germany 2 0 0 0 2 0 Source: EMC in 9 9 1 9 9 8 1 9 35 30 25 20 15 10 5 0 Pre-Paid Users Pre Millions 17

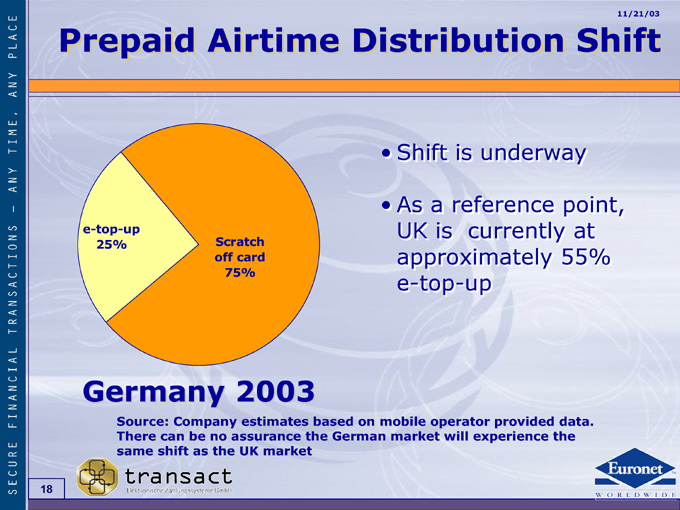

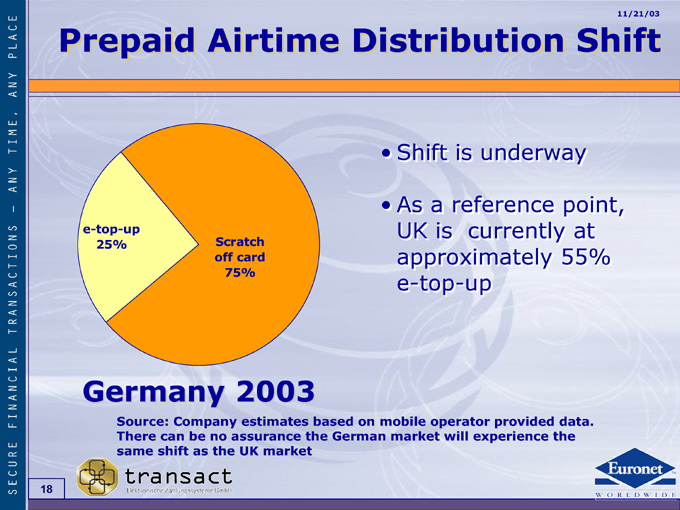

• 11/21/03 Shift • point, at 55% data. • the underway currently provided experience • is reference will • a is operator • Shift As UK approximately e-top-up market • • mobile • Distribution on German • based the estimates market • Scratch card 75% 2003 assurance UK • Airtime off no the • Company be as can shift Source: There same • Prepaid e-top-up 25% Germany • 18

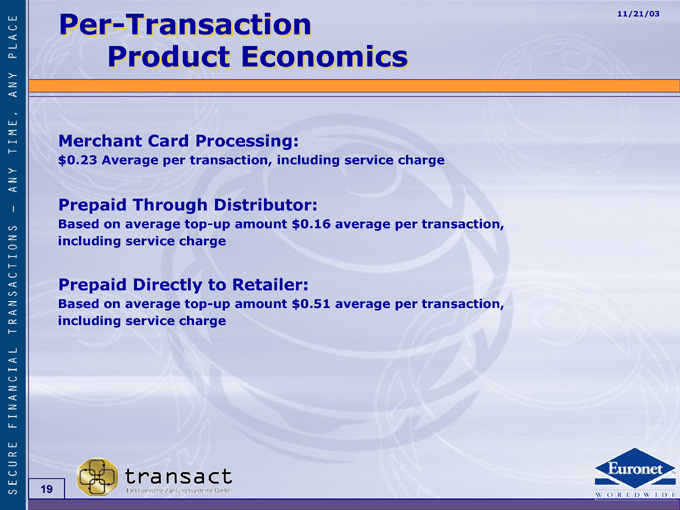

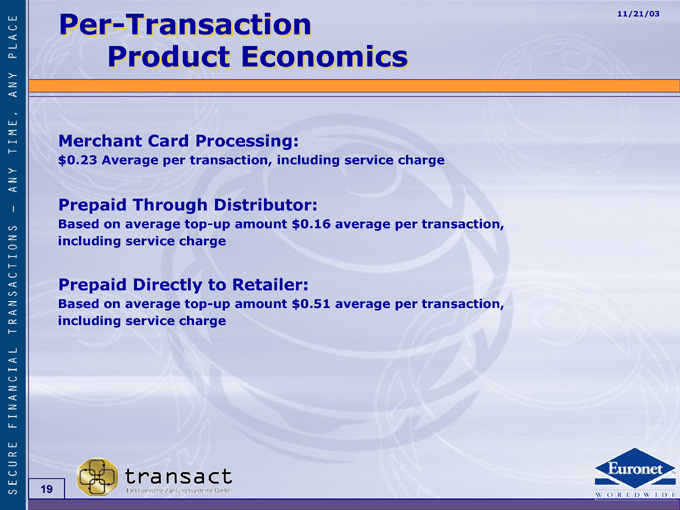

11/21/03 Per-Transaction Product Economics Merchant Card Processing: $0.23 Average per transaction, including service charge Prepaid Through Distributor: Based on average top-up amount $0.16 average per transaction, including service charge Prepaid Directly to Retailer: Based on average top-up amount $0.51 average per transaction, including service charge 19

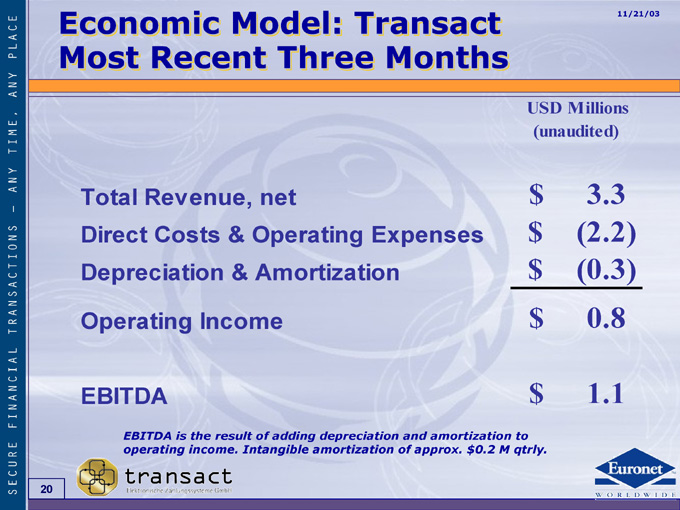

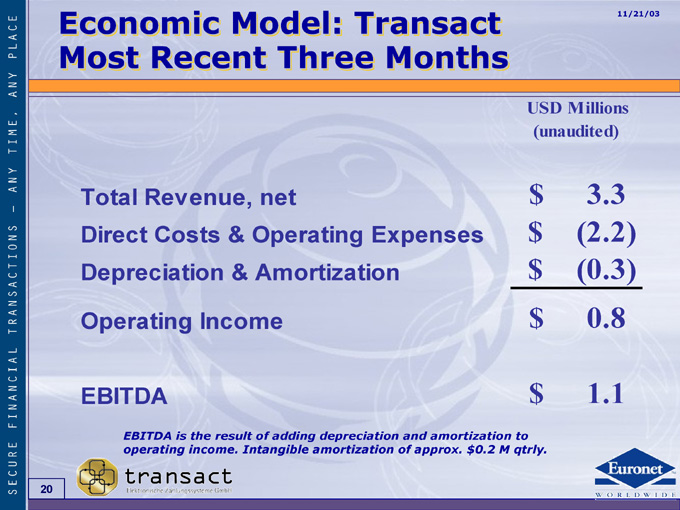

11/21/03 (unaudited) 3.3 (2.2) (0.3) 0.8 1.1 USD Millions $ $ $ $ $ Economic Model: TransactMost Recent Three Months Total Revenue, net Direct Costs & Operating Expenses Depreciation & Amortization Operating Income EBITDA EBITDA is the result of adding depreciation and amortization to operating income. Intangible amortization of approx. $0.2 M qtrly. 20

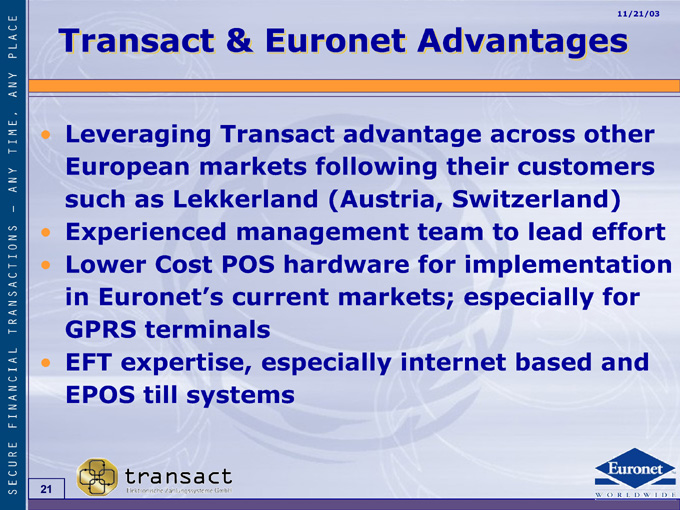

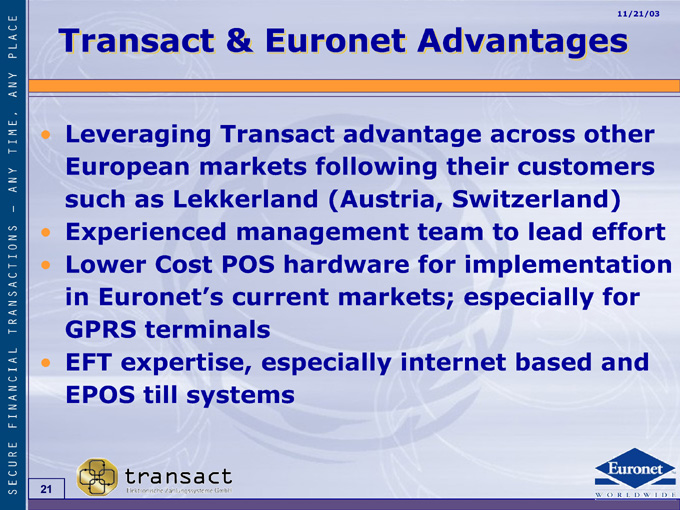

• 11/21/03 other effort for and customers lead based across their Switzerland) to implementation especially Advantages advantage following (Austria, team for markets; internet Euronet management hardware especially • Transact markets Lekkerland POS current systems Cost terminals till as Euronet’s expertise, Transact Leveraging European such Experienced Lower in GPRS EFT EPOS • • • 21

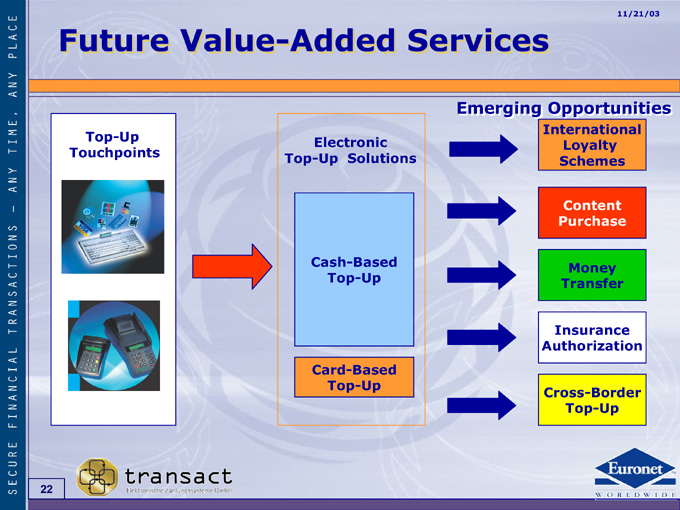

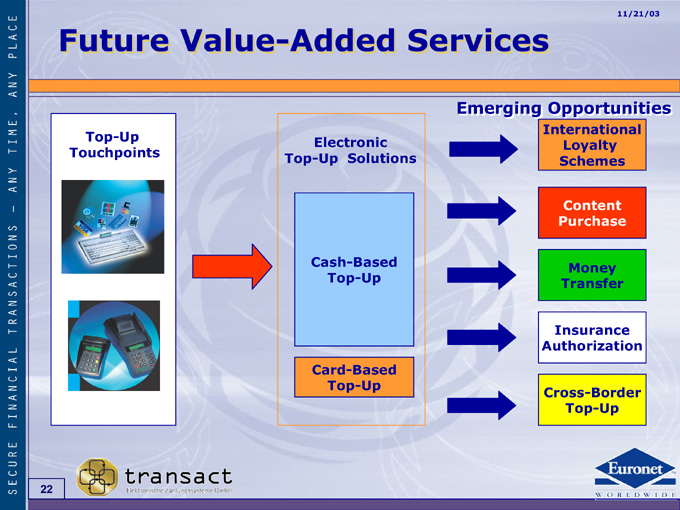

11/21/03 Loyalty Schemes Content Purchase Money Transfer Insurance Top-Up Emerging Opportunities International Authorization Cross-Border Electronic Solutions Cash-Based Top-Up Card-Based Top-Up Top-Up Future Value-Added Services Top-Up Touchpoints 22

11/21/03 Transaction Summaries Rick Weller EVP and CFO 23

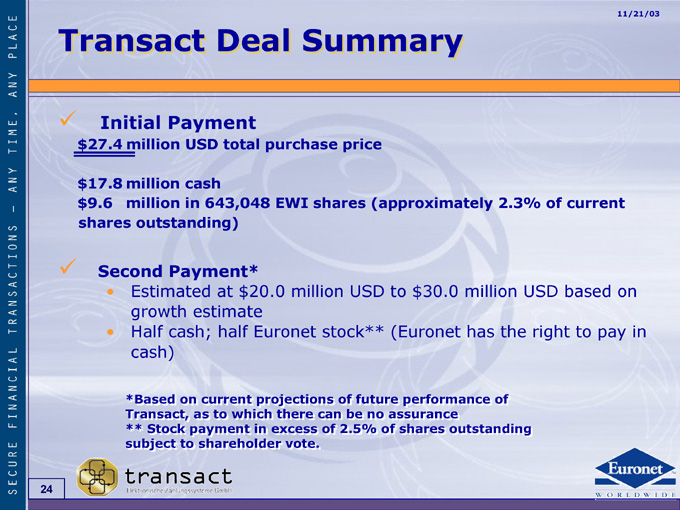

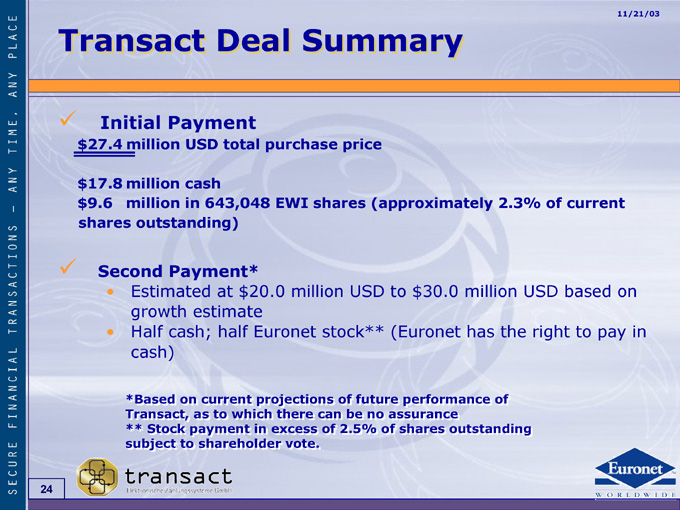

11/21/03 . . million USD total purchase price million cash million in 643,048 EWI shares (approximately 2.3% of current Estimated at $20.0 million USD to $30.0 million USD based on growth estimate Half cash; half Euronet stock** (Euronet has the right to pay in cash) *Based on current projections of future performance of Transact, as to which there can be no assurance ** Stock payment in excess of 2.5% of shares outstanding subject to shareholder vote. Transact Deal Summary Initial Payment $27.4 $17.8 $9.6 shares outstanding) Second Payment* • • 9 9 24

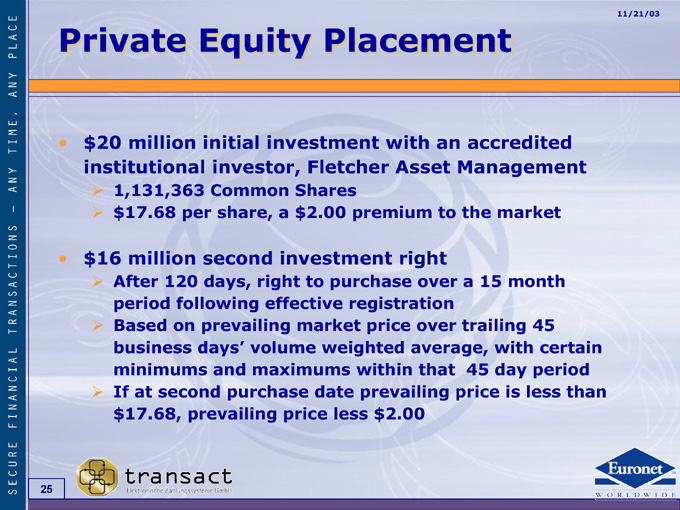

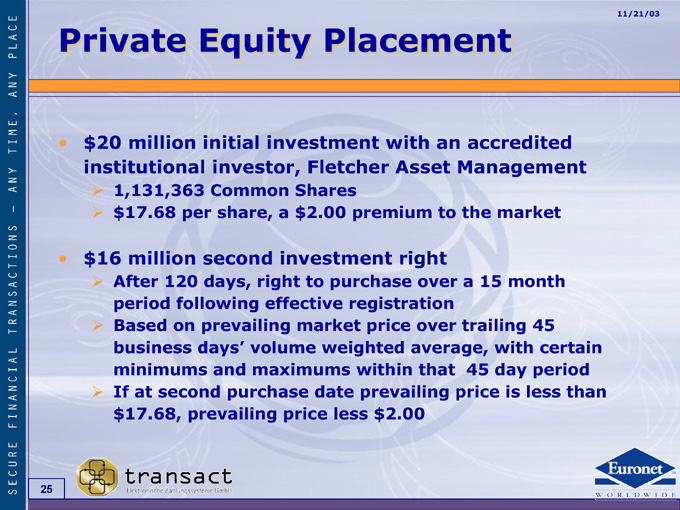

• 11/21/03 • certain period than month 45 less market with day is • accredited 15 • Management the a trailing 45 price an to over over average, that • with Asset right $2.00 • premium registration price within prevailing Placement Fletcher purchase weighted date less Shares $2.00 investment to market price investment a right effective volume maximums purchase Equity initial investor, Common share, second days, prevailing days’ and prevailing per 120 following on second • million million at • 1,131,363 $17.68 After period Based business minimums If $17.68, • Private $20 institutional $16 • • • 25

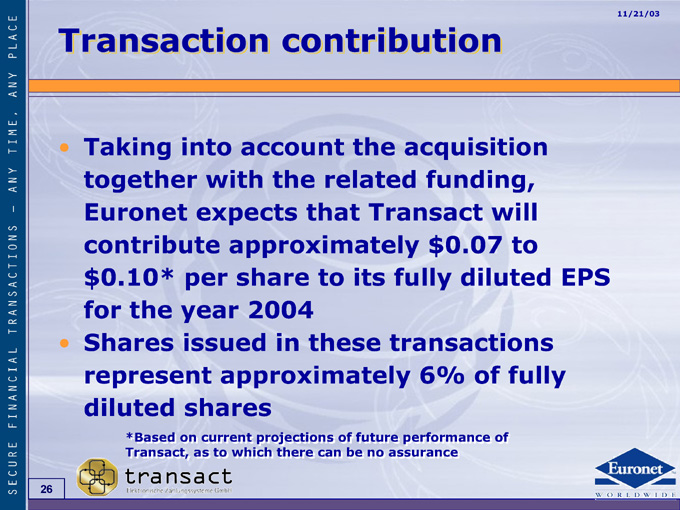

• 11/21/03 • EPS to fully will of funding, $0.07 diluted of acquisition Transact fully transactions 6% performance assurance • the its future no be • related of • contribution that to these can • account the share 2004 in projections there approximately approximately which with expects current to into per year issued shares as • on the *Based Transact, • Transaction Taking together Euronet contribute $0.10* for Shares represent diluted • • • 26

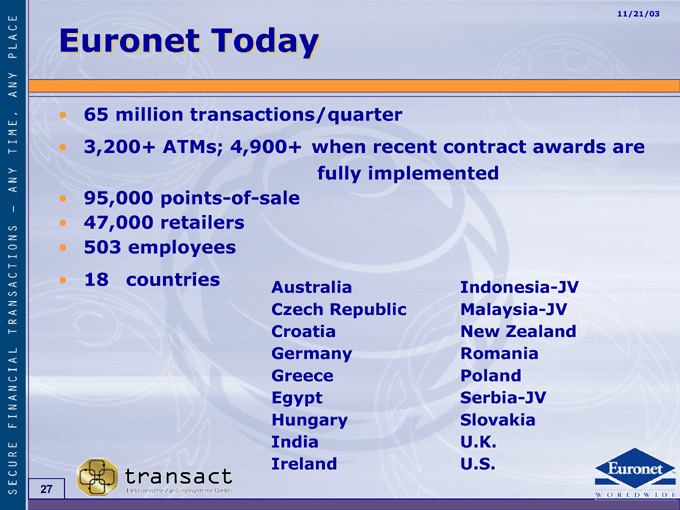

• 11/21/03 are • awards Zealand contract Indonesia-JV Malaysia-JV New Romania Poland Serbia-JV Slovakia U.K. U.S. • recent implemented Republic when fully • Today transactions/quarter 4,900+ Australia Czech Croatia Germany Greece Egypt Hungary India Ireland • ATMs; points-of-sale retailers employees countries million 3,200+ Euronet 65 95,000 47,000 503 18 • • • • • • 27

• 11/21/03 • Leadership • Market Australia Germany • UK • PrepaidPositions • • • 28

11/21/03 Daniel Henry President & COO Rick Weller EVP & CFO Jeff Newman EVP & Corporate Counsel Platt Transact Questions? Michael Brown Chairman & CEO J Bernd Artinger Co-Managing Directors 29