UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Deltek, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

NOTICE OF

2010 ANNUAL MEETING OF STOCKHOLDERS

May 28, 2010

To Deltek Stockholders:

This is to notify you that the 2010 Annual Meeting of Stockholders (the “Annual Meeting”) of Deltek, Inc., a Delaware corporation (“Deltek” or the “Company”), will be held on Friday, May 28, 2010, at 8:00 a.m., Eastern Time, at Deltek’s principal executive offices located at 13880 Dulles Corner Lane, Herndon, Virginia 20171, for the following purposes:

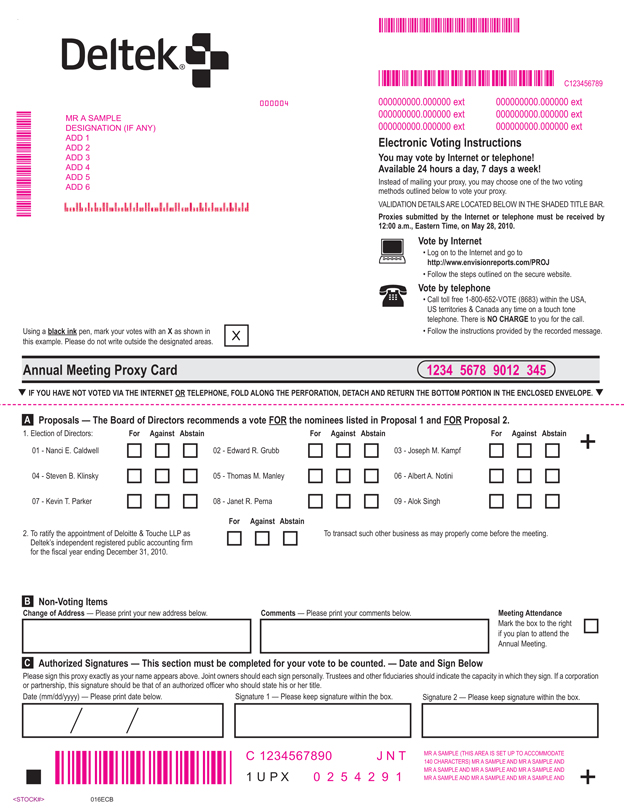

| | 1. | To elect nine directors to serve for the ensuing year and until their successors are duly elected and qualified. |

| | 2. | To ratify the appointment of Deloitte & Touche LLP as Deltek’s independent registered public accounting firm for the fiscal year ending December 31, 2010. |

| | 3. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

We are furnishing proxy materials to you via the Internet. Unless you have already requested to receive a printed set of proxy materials, you will receive a Notice of Availability of Proxy Materials (“Notice of Materials”). The Notice of Materials contains instructions on how to access proxy materials and vote your shares via the Internet or telephone or, if you prefer, to request a printed set of proxy materials, including the proxy statement for the Annual Meeting, our 2009 Annual Report on Form 10-K and a form of proxy card, at no additional cost to you.

The preceding items of business are more fully described in our proxy statement relating to the Annual Meeting. Any action on the items of business described above may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting is properly adjourned or postponed.

Only stockholders of record at the close of business on March 31, 2010 are entitled to notice of and to vote at the Annual Meeting. The Notice of Materials, our proxy materials and our 2009 Annual Report on Form 10-K are being made available to stockholders via the Internet on or about April 16, 2010.

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read our proxy statement and vote on the Internet or by telephone or submit your proxy card as soon as possible. For specific instructions on how to vote your shares, please refer to the section entitled “Questions and Answers About the 2010 Annual Meeting and Procedural Matters.”

All stockholders are cordially invited to attend the Annual Meeting in person. Any stockholder attending the Annual Meeting may vote in person even if such stockholder previously signed and returned a proxy card or voted on the Internet or by telephone.

Thank you for your ongoing support of Deltek.

|

| Sincerely, |

|

| Kevin T. Parker |

| Chairman, President and Chief Executive Officer |

PROXY STATEMENT

FOR

2010 ANNUAL MEETING OF STOCKHOLDERS

Table of Contents

DELTEK, INC.

13880 Dulles Corner Lane

Herndon, Virginia 20171

PROXY STATEMENT

FOR

2010 ANNUAL MEETING OF STOCKHOLDERS

QUESTIONS AND ANSWERS

ABOUT THE 2010 ANNUAL MEETING

AND PROCEDURAL MATTERS

| Q: | Why am I receiving a Notice of Availability of Proxy Materials? |

| A: | The Board of Directors of Deltek, Inc. is making available to you the Notice of Availability of Proxy Materials (the “Notice of Materials”), the proxy statement relating to our 2010 Annual Meeting of Stockholders (the “Annual Meeting”) and our 2009 Annual Report on Form 10-K (the “2009 Annual Report”) in connection with the solicitation of proxies for use at the Annual Meeting to be held on Friday, May 28, 2010, at 8:00 a.m., Eastern Time, and at any adjournment or postponement thereof, for the purpose of considering and acting upon the matters set forth in this proxy statement. The Notice of Materials, our proxy materials and our 2009 Annual Report are being made available to you via the Internet on or about April 16, 2010. |

The Annual Meeting will be held at Deltek’s principal executive offices, located at 13880 Dulles Corner Lane, Herndon, Virginia, 20171. The telephone number at that location is (703) 734-8606.

All holders of record at the close of business on the Record Date (as described below) are invited to attend the Annual Meeting and are requested to vote on the proposals described in this proxy statement.

| Q: | May I attend the Annual Meeting? |

| A: | You are invited to attend the Annual Meeting if you were a stockholder of record or a beneficial owner as of March 31, 2010 (the “Record Date”). You should bring photo identification for entrance to the Annual Meeting. You also must bring proof that you were a stockholder of record or a beneficial owner as of March 31, 2010. The meeting will begin promptly at 8:00 a.m., Eastern Time, and you should leave ample time for the check-in procedures. |

| Q: | Who is entitled to vote at the Annual Meeting? |

| A: | You may vote your shares of Deltek common stock if our records show that you owned your shares at the close of business on the Record Date. As of March 31, 2010, there were 67,257,000 shares of Deltek common stock outstanding and entitled to vote at the Annual Meeting. You may cast one vote for each share of common stock you hold as of the Record Date on all matters presented. |

| Q: | What is the difference between holding shares as a stockholder of record or as a beneficial owner? |

| A: | If your shares are registered directly in your name with Deltek’s transfer agent, Computershare Trust Company, N.A., you are considered, with respect to those shares, to be the “stockholder of record,” and these proxy materials are being made available directly to you by Deltek. As the stockholder of record, you have the right to grant your voting proxy directly to Deltek or to a third party, or to vote by internet, phone or mail as described below or you may vote in person at the Annual Meeting. Deltek has made available a proxy card for you to use. |

1

If your shares are held by a brokerage account or by another nominee, you are considered to be the “beneficial owner” of shares held in “street name,” and the proxy materials are being made available to you together with voting instructions on behalf of your broker, trustee or nominee. As the beneficial owner, you have the right to direct your broker, trustee or nominee how to vote and you are also invited to attend the Annual Meeting. Your broker, trustee or nominee has made available or provided voting instructions for you to use in directing the broker, trustee or nominee how to vote your shares. Since a beneficial owner is not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a “legal proxy” from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the Annual Meeting.

If you are a beneficial owner of shares, your broker may have authority to vote shares for routine matters (including the ratification of the appointment of the independent registered public accounting firm) in the absence of voting instructions from the beneficial owner. You should be aware that in the absence of instructions from the beneficial owner, your broker will not have the authority to vote for the election of directors (which is considered a non-routine matter.)

| Q: | How can I vote my shares in person at the Annual Meeting? |

| A: | Shares held in your name as the stockholder of record may be voted in person at the Annual Meeting. Shares held beneficially in street name may be voted in person at the Annual Meeting only if you obtain a “legal proxy” from the broker, trustee or nominee that holds your shares giving you the right to vote the shares.Even if you plan to attend the Annual Meeting, we recommend that you also submit your voting instructions or, if applicable, your proxy card, as described below, so that your vote will be counted even if you later decide not to attend the meeting. |

| Q: | How can I vote my shares without attending the Annual Meeting? |

| A: | Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the Annual Meeting. If you are a stockholder of record, you may vote by submitting a proxy by mail, on the Internet or by telephone. If you hold shares beneficially in street name, you may vote by submitting voting instructions to your broker, trustee or nominee. For instructions on how to vote, please refer to the instructions below or, for shares held beneficially in street name, the voting instructions provided to you by your broker, trustee or nominee. |

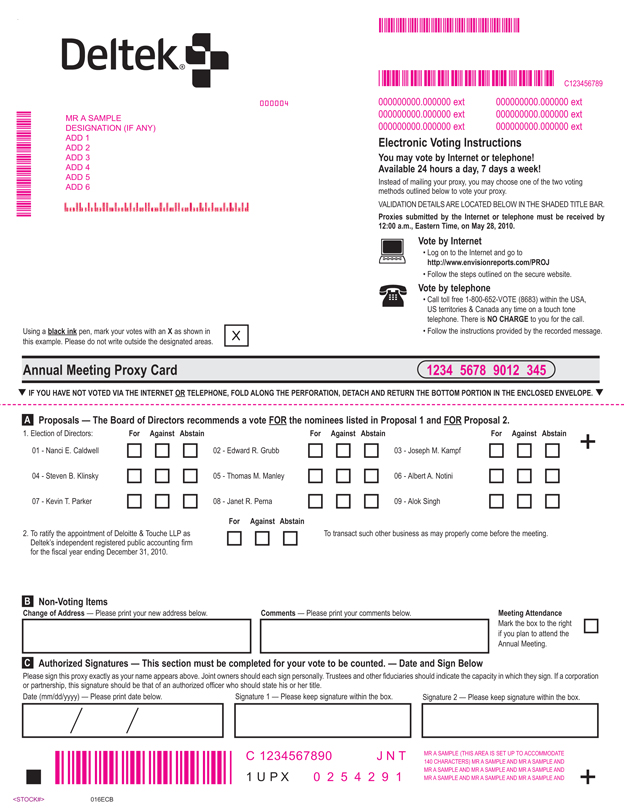

By Internet—Stockholders of record of Deltek common stock with Internet access may submit proxies by following the “Vote by Internet” instructions on the Notice of Materials until 12:00 a.m., Eastern Time, on May 28, 2010. Most Deltek stockholders who hold shares beneficially in street name may vote by accessing the web site specified in the voting instructions provided by their brokers, trustees or nominees. Please check the voting instructions for Internet voting availability.

By telephone—Stockholders of record of Deltek common stock who live in the United States or Canada and who have requested a printed copy of the proxy materials may submit proxies by following the “Vote by Telephone” instructions on the proxy card until 12:00 a.m., Eastern Time, on May 28, 2010. Most Deltek stockholders who hold shares beneficially in street name may vote by phone by calling the number specified in the voting instructions provided by their brokers, trustees or nominees. Please check the voting instructions for telephone voting availability.

By mail—Stockholders of record of Deltek common stock who received their proxy materials by mail may submit proxies by completing, signing and dating their proxy cards and mailing them in the accompanying pre-addressed envelopes. Proxy cards submitted by mail must be received by the time of the meeting in order for your shares to be voted.

2

| Q: | How many shares must be present or represented to conduct business at the Annual Meeting? |

| A: | The presence of the holders of a majority of the shares entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Such stockholders are counted as present at the meeting if (i) they are present in person at the Annual Meeting or (ii) have properly submitted a proxy. |

Under the General Corporation Law of the State of Delaware, abstentions and broker “non-votes” are counted as present and entitled to vote and are, therefore, included for the purposes of determining whether a quorum is present at the Annual Meeting.

A broker “non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner.

| Q: | What proposals will be voted on at the Annual Meeting? |

| A: | The proposals scheduled to be voted on at the Annual Meeting are: |

| | • | | The election of nine directors to serve for the ensuing year and until their successors are duly elected and qualified; |

| | • | | The ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2010; and |

| | • | | To transact such other business as may properly come before the meeting or any adjournment. |

| Q: | What is the voting requirement to approve each of the proposals? |

| A: | Election of Directors—Because this is an uncontested election, a nominee for director will be elected to the Board of Directors if the votes cast for such nominee’s election exceed the votes cast against such nominee’s election. |

Ratification of Independent Registered Public Accounting Firm—The affirmative vote of a majority of the voting power of our issued and outstanding stock present and entitled to vote is required to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2010.

Other Business to be Transacted—The affirmative vote of a majority of the voting power of our issued and outstanding stock present and entitled to vote is required to approve any other business transacted at the meeting or any adjournment.

| A: | You may vote “FOR” or “AGAINST” or “ABSTAIN” on each of the nominees for election as director. A nominee for director will be elected to the Board of Directors if the votes cast for such nominee’s election exceed the votes cast against such nominee’s election. Therefore, abstentions or broker non-votes will not affect the outcome of the election. The Board of Directors expects a director to tender his or her resignation if the director fails to receive the required number of votes for re-election. The Board of Directors will act on an expedited basis to determine whether or not to accept the director’s resignation in accordance with our Majority Voting Policy. See “Election of Directors—General.” |

You may vote “FOR,” “AGAINST” or “ABSTAIN” on the proposal to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2010.Abstentions are deemed to be votes cast and have the same effect as a vote against this proposal. However, broker non-votes have no effect and, therefore, are not included in the tabulation of the voting results on this proposal.

3

All shares entitled to vote and represented by properly executed proxy cards received prior to the Annual Meeting (and not revoked) will be voted at the Annual Meeting in accordance with the instructions indicated on the completed proxies. If no instructions are indicated on a properly executed proxy, the shares represented by that proxy will be voted as recommended by the Board of Directors.

| Q: | How does the Board of Directors recommend that I vote? |

| A: | The Board of Directors recommends that you vote your shares: |

| | • | | “FOR” the nine nominees for election as directors; and |

| | • | | “FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2010. |

| Q: | Do any stockholders have the ability to significantly impact the results of the matters to be voted on? |

| A: | As of March 22, 2010, New Mountain Partners II, L.P., New Mountain Affiliated Investors II, L.P. and Allegheny New Mountain Partners, L.P. (the “New Mountain Funds”) collectively owned approximately 61% of our common stock and are able to control all matters requiring stockholder approval, including the election of directors, as long as they continue to collectively own a majority of the outstanding shares of our common stock on the date of the Annual Meeting. New Mountain Capital Partners II, L.P. and certain shareholders referred to as the “deLaski Shareholders” also have the right, pursuant to an investor rights agreement, to designate a certain number of directors. The New Mountain Funds and the deLaski Shareholders are required to take action to effect the terms of the investor rights agreement, including voting for the election of the directors nominated by the other party. We are also required to take all necessary or desirable action within our control to cause the individuals designated by New Mountain Partners II, L.P. and the deLaski Shareholders to be elected as directors. |

| Q: | What happens if additional matters are presented at the Annual Meeting and I have given my proxy? |

| A: | If any other matters are properly presented for consideration at the Annual Meeting, the persons named as proxy holders, David Schwiesow and Salman Ahmad, or either of them, will have discretion to vote on those matters in accordance with their best judgment. As described below, Deltek’s bylaws specify the only business that may be conducted at an annual meeting. As a result, Deltek believes that no other matters will be properly raised at the Annual Meeting. |

| A: | Subject to any rules your broker, trustee or nominee may have, you may change your proxy instructions at any time before your proxy is voted at the Annual Meeting. |

If you are the stockholder of record, you may change your vote (1) by granting a new proxy bearing a later date (which automatically revokes the earlier proxy) using any of the methods described above (and until the applicable deadline for each method), (2) by providing a written notice of revocation to Deltek’s Corporate Secretary at Deltek, Inc., 13880 Dulles Corner Lane, Herndon, VA 20171 prior to your shares being voted, or (3) by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request.

If you are a beneficial owner of shares held in street name, you may change your vote by (1) submitting new voting instructions to your broker, trustee or nominee or (2) if you have obtained a legal proxy from the broker, trustee or nominee that holds your shares giving you the right to vote your shares, by attending the Annual Meeting and voting in person.

4

| Q: | What happens if I decide to attend the Annual Meeting but I have already voted or submitted a proxy covering my shares? |

| A: | Subject to any rules your broker, trustee or nominee may have, you may attend the Annual Meeting and vote in person even if you have already voted or submitted a proxy card. Any previous votes that were submitted by you will be superseded by the vote you cast at the Annual Meeting. Please be aware that attendance at the Annual Meeting will not, by itself, revoke a proxy. |

If a broker, trustee or nominee beneficially holds your shares in street name and you wish to attend the Annual Meeting and vote in person, you must obtain a legal proxy from the broker, trustee or nominee that holds your shares giving you the right to vote the shares.

| Q: | What should I do if I receive more than one set of voting materials? |

| A: | You may receive more than one Notice of Materials. For example, if you hold your shares in more than one brokerage account, you may receive separate voting instructions for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you will receive more than one Notice of Materials. Please complete the voting instructions in each Notice of Materials that you receive to ensure that all your shares are voted. |

| Q: | Is my vote confidential? |

| A: | Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within Deltek or to third parties, except: (i) as necessary to meet applicable legal requirements, (ii) to allow for the tabulation of votes and certification of the vote and (iii) to facilitate a successful proxy solicitation. |

| Q: | Who will serve as inspector of election? |

| A: | The inspector of election will be Computershare Trust Company, N.A. |

| Q: | Where can I find the voting results of the Annual Meeting? |

| A: | We intend to announce preliminary voting results at the Annual Meeting and will publish final results on a Form 8-K filed with the Securities and Exchange Commission within four business days of the date of completion of the Annual Meeting. |

| Q: | Who will bear the cost of soliciting votes for the Annual Meeting? |

| A: | Deltek is making this solicitation and will pay the entire cost of preparing and distributing the proxy materials and soliciting votes. We may reimburse brokerage firms, custodians, nominees, fiduciaries and other persons representing beneficial owners for their reasonable expenses in forwarding solicitation material to such beneficial owners. Our directors, officers and employees may also solicit proxies in person or by other means of communication. Such directors, officers and employees will not be additionally compensated but may be reimbursed for reasonable out-of-pocket expenses in connection with such solicitation. |

You are responsible for Internet access charges you may incur for accessing the proxy materials. If you choose to vote by telephone, you are responsible for telephone charges you may incur.

| Q: | What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors? |

| A: | You may submit proposals, including recommendations of director candidates, for consideration at future stockholder meetings. |

5

For inclusion in Deltek’s proxy materials—Stockholders of record may present proper proposals for inclusion in Deltek’s proxy statement and for consideration at the next annual meeting of its stockholders by submitting their proposals in writing to Deltek’s Corporate Secretary in a timely manner. In order to be included in the proxy statement for the 2011 annual meeting of stockholders, stockholder proposals must be received by Deltek’s Corporate Secretary no later than December 17, 2010, and must otherwise comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and any other applicable rules established by the Securities and Exchange Commission.

To be brought before the annual meeting—In addition, Deltek’s bylaws establish an advance notice procedure for stockholders of record who wish to present certain matters before an annual meeting of stockholders. In general, nominations for the election of directors may be made by the Board of Directors or any stockholder entitled to vote who has delivered written notice to Deltek’s Corporate Secretary no later than the Notice Deadline (as defined below), which notice must contain specified information concerning the nominees and concerning the stockholder proposing such nominations.

Deltek’s bylaws also provide that the only business that may be conducted at an annual meeting is business that is (i) specified in the notice of meeting given by or at the direction of the Board of Directors (or any duly authorized committee thereof), (ii) properly brought before the meeting by or at the direction of the Board of Directors (or any duly authorized committee thereof) or (iii) properly brought before the meeting by a stockholder who has delivered written notice to Deltek’s Corporate Secretary no later than the Notice Deadline (as defined below), which notice must contain specified information concerning the matters to be brought before such meeting and concerning the stockholder proposing such matters.

The “Notice Deadline” is generally defined as that date which is 90 days prior to the one year anniversary of the previous year’s annual meeting of stockholders. As a result, the Notice Deadline for the 2011 annual meeting of stockholders is February 27, 2011.

If a stockholder who has notified Deltek of his or her intention to present a proposal at an annual meeting does not appear, in person or by proxy, to present his or her proposal at such meeting or is no longer a stockholder of record on the record date applicable to such meeting, Deltek need not present the proposal for vote at such meeting.

A copy of the full text of the bylaw provisions discussed above may be obtained by writing to Deltek’s Corporate Secretary at our principal executive offices. All notices of proposals by stockholders, whether or not included in Deltek’s proxy materials, must be sent to Deltek’s Corporate Secretary at our principal executive offices.

| Q: | How may I obtain a separate set of proxy materials or the 2009 Annual Report on Form 10-K? |

| A: | If you share an address with another stockholder, each stockholder may not receive a separate Notice of Materials. Stockholders who do not receive a separate Notice of Materials and want to receive a separate copy may request to receive a separate copy of, or stockholders may request additional copies of, our Notice of Materials, proxy materials and 2009 Annual Report on Form 10-K by following the “Obtaining a Copy of the Proxy Materials” instructions on the Notice of Materials, by calling (703) 885-9768 or by writing to Deltek, Inc., 13880 Dulles Corner Lane, Herndon, VA 20171, Attention: Office of the General Counsel. Stockholders who share an address and receive multiple copies of our Notice of Materials may also request a single copy following the instructions above. |

We are able to distribute our proxy materials to stockholders in a fast and efficient manner via the Internet. You may elect to view all proxy materials on the Internet or to receive all proxy materials by mail. To make an election regarding how to receive these materials going forward, please log on towww.envisionreports.com/PROJ and follow the instructions on the screen to select your delivery preferences.

6

EXECUTIVE OFFICERS OF THE COMPANY

Set forth below is information concerning our executive officers as of March 22, 2010.

| | | | |

Name | | Age | | Position(s) |

Kevin T. Parker | | 50 | | Chairman of the Board, President and Chief Executive Officer |

Eric J. Brehm | | 51 | | Executive Vice President of Sustaining Engineering |

William D. Clark | | 49 | | Executive Vice President and Chief Marketing Officer |

Michael P. Corkery | | 47 | | Executive Vice President, Chief Financial Officer and Treasurer |

James J. Dellamore | | 52 | | Executive Vice President of Global Services |

Deborah K. Fitzgerald | | 38 | | Senior Vice President and Chief Information Officer |

Garland T. Hall | | 49 | | Senior Vice President of Customer Care |

Richard P. Lowrey | | 50 | | Executive Vice President of Deltek Engineering |

Carolyn J. Parent | | 43 | | Executive Vice President of Worldwide Sales |

Holly C. Kortright | | 43 | | Senior Vice President of Human Resources |

Michael L. Krone | | 41 | | Senior Vice President, Corporate Controller and Assistant Treasurer |

David R. Schwiesow | | 59 | | Senior Vice President, General Counsel and Secretary |

Kevin T. Parker has served as our President and Chief Executive Officer since June 2005 and as Chairman of the Board since April 2006. Prior to joining Deltek, Mr. Parker served as Co-President and Chief Financial Officer of PeopleSoft, Inc., an enterprise applications software company, from October 2004 to December 2004, and as Executive Vice President of Finance and Administration and Chief Financial Officer of PeopleSoft from January 2002 to October 2004. Prior to January 2002, Mr. Parker held various positions, including Senior Vice President and Chief Financial Officer of PeopleSoft, Senior Vice President and Chief Financial Officer of Aspect Communications Corporation, a customer relationship management software company, and Senior Vice President of Finance and Administration at Fujitsu Computer Products of America. He currently serves on the Boards of Directors of Polycom, Inc. and Camber Corporation. Mr. Parker received his B.S. in Accounting from Clarkson University, where he serves on the board of trustees.

Eric J. Brehm has served as our Executive Vice President of Sustaining Engineering (previously, Product Development) since June 2006. From November 2001 to June 2006, Mr. Brehm served as our Executive Vice President and General Manager of the Professional Services Market Group. Previously, Mr. Brehm served as Vice President of Development for Harper and Shuman, Inc., a software company that we acquired in 1998. Mr. Brehm received his B.A. in Economics from Brandeis University and his Master of Information Sciences from Northeastern University.

William D. Clark has served as our Executive Vice President and Chief Marketing Officer since October 2005. From February 2005 to October 2005, Mr. Clark served as Vice President of Global Product Marketing at Novell, Inc., an enterprise applications software developer. Prior to joining Novell, from May 2003 to September 2004, Mr. Clark served as Executive Vice President and Chief Marketing Officer of Mantas, Inc., a financial services software developer, and, from December 2001 to May 2003, he served as Vice President of Marketing of Bang Networks, Inc., a computer technology and service firm. Mr. Clark also has held various positions at IBM Corporation and JP Morgan & Co. Mr. Clark received his B.S. in Business Administration from Drexel University.

Michael P. Corkery has served as our Executive Vice President, Chief Financial Officer and Treasurer since January 2010. From November 2007 to December 2009, Mr. Corkery served as Executive Vice President and Chief Financial Officer of ICO Global Communications, a global satellite communications company, and from February 2009 to December 2009 also served as acting Chief Executive Officer. From January 2006 to November 2007, Mr. Corkery was the Chief Financial Officer of Current Group, LLC, a company providing smart grid solutions to utility companies worldwide. From August 2002 to August 2005, Mr. Corkery served as Vice President, Operations Finance at Nextel Communications. Mr. Corkery received his B.S. in Accounting from St. Bonaventure University.

7

James J. Dellamore has served as our Executive Vice President of Global Services since September 2009. From February 2007 to September 2009, Mr. Dellamore served as the Senior Vice President of Global Solutions Delivery of GXS, a worldwide provider of business-to-business electronic data interchange and supply chain integration. From October 2005 to August 2006, Mr. Dellamore was the Chief Operating Officer of Razorsight, a provider of outsourcing and on-demand services for invoice automation, auditing, and business intelligence in the telecommunications industry. Mr. Dellamore was the Group Vice President, Consulting for Oracle Corporation from September 2001 to October 2005. Mr. Dellamore received his B.S. in Business Administration from the Rochester Institute of Technology.

Deborah K. Fitzgerald has served as our Senior Vice President and Chief Information Officer since November 2009. Previously, Ms. Fitzgerald served in several capacities at VeriSign, a provider of Internet infrastructure services, including from November 2008 to October 2009, as Vice President of Information Technologies, from September 2007 to November 2008, as Vice President of Product Development and Shared Services, and from November 2005 to September 2007, as Director of Product Development. Ms. Fitzgerald was Director, Professional Services at Open Text, a provider of Enterprise Content Management software, from 2003 to November 2005. Ms. Fitzgerald received her B.S. in Computer Science and Business from Alma College.

Garland T. Hall has served as our Senior Vice President of Customer Care (previously, Global Support) since October 2008. Prior to joining Deltek, Mr. Hall served as Chief Customer Officer of Enterprise DB, a provider of enterprise-class database products and services, from 2006 to September 2008. From 2005 to 2006, Mr. Hall served as Vice President of Strategic Alliances for Composite Software, a data services company. From 2001 to 2004, Mr. Hall was Chief Customer Officer at webMethods, Inc., a provider of business integration and optimization software. Mr. Hall received his B.S. in Clinical Psychology from Liberty University.

Richard P. Lowrey has served as our Executive Vice President of Deltek Engineering (previously, Products and Strategy) since June 2006. Mr. Lowrey joined us as a systems consultant in 1995 and has since served as Managing Consultant, Director of Training, Director of Time Collection Product Group, Business Development Director, Vice President of Strategy and Business Development and, most recently, as Executive Vice President and General Manager of the Enterprise Solutions Group for the Company. Prior to joining our Company, Mr. Lowrey held financial positions at Titan Corporation, Digicon Corporation and SRA International. Mr. Lowrey received his B.S. in Public Administration from George Mason University.

Carolyn J. Parent has served as our Executive Vice President of Worldwide Sales since March 2006. From March 2004 to March 2006, Ms. Parent served as National Sales Director at BearingPoint, Inc., a management and technology consulting firm. From January 2002 to March 2004, Ms. Parent served as Executive Vice President of Sales at Sequation, Inc., a software company. Prior to joining Sequation, Ms. Parent held various executive positions at Enterworks, Inc. and Xacta Corporation, a division of Telos Corporation, a software company. Ms. Parent received her B.A. in English from Villanova University.

Holly C. Kortright has served as our Senior Vice President of Human Resources since October 2006. From March 2006 to October 2006, Ms. Kortright was Vice President of Human Resources for Capital One Financial Corporation, a global diversified financial services provider. From August 1999 through March 2006, she held various positions at Capital One, including Director of Human Resources, Director of Leadership Development and Senior Management Development Consultant. Ms. Kortright received her B.S. in Industrial Engineering from Lehigh University and her M.B.A. from Indiana University.

Michael L. Krone has served as Senior Vice President and Corporate Controller since July 2009. He also has been our Assistant Treasurer since February 2009, and he joined Deltek as Vice President, Finance and Corporate Controller in August 2008. Mr. Krone has also been designated as our principal accounting officer since August 2009. From August 2007 to July 2008, Mr. Krone provided independent financial consulting services. Mr. Krone served as Vice President of Finance and Chief Accounting Officer at webMethods, Inc., a leading provider of business integration and optimization software, from June 2006 to August 2007. Prior to

8

joining webMethods, Mr. Krone served as Public Services Industry Controller at BearingPoint, Inc., a management and technology consulting firm, from March 2004 to June 2006. Mr. Krone received his B.S. in Accounting from Shepherd University.

David R. Schwiesow has served as our Senior Vice President and General Counsel since May 2006. From December 2000 to May 2006, Mr. Schwiesow, at different times, served as Deputy General Counsel, Managing Director and Vice President of BearingPoint, Inc., a management and technology consulting firm. Prior to December 2000, Mr. Schwiesow served as Vice President and Associate General Counsel for The Rouse Company. He received his B.S. in Economics from The Wharton School of the University of Pennsylvania and his J.D. from Stanford Law School.

9

PROPOSAL ONE

ELECTION OF DIRECTORS

General

Deltek’s Board of Directors currently has ten authorized directors. Michael Ajouz, a current director designated by our majority stockholders, the New Mountain Funds, informed us that he would not stand for re-election to the Board of Directors at the 2010 Annual Meeting of Stockholders. The New Mountain Funds informed us that they would not be designating a candidate to fill the vacancy created by Mr. Ajouz’s departure. Based on this information, the Board of Directors determined to decrease the size of the Board of Directors and fix the number of directors at nine, effective at the end of Mr. Ajouz’s term on May 28, 2010. The Board of Directors has selected nine nominees for election to the Board of Directors at the 2010 Annual Meeting of Stockholders. Eight of the nominees were elected directors at our 2009 Annual Meeting of Stockholders held on May 22, 2009. Kathleen deLaski, a current director designated by the deLaski stockholders, also informed us that she would not stand for re-election at our 2010 Annual Meeting of Stockholders. The deLaski stockholders have designated Edward R. Grubb to fill the vacancy created by Ms. deLaski’s departure, subject to shareholder approval at the 2010 Annual Meeting of Stockholders. Mr. Grubb is the husband of Ms. deLaski.

Because this is an uncontested election, a majority of the votes cast is required for the election of directors, meaning that the number of votes cast “FOR” a director nominee must exceed the number of votes cast “AGAINST” that director nominee.

In accordance with our Majority Voting Policy, the Board of Directors will nominate for election or re-election as a director only candidates who agree to tender promptly following the annual meeting at which he or she is elected or re-elected as director, an irrevocable resignation that will be effective upon (i) the failure to receive the required vote at the next annual meeting at which he or she faces re-election and (ii) acceptance by the Board of Directors of such resignation. In addition, the Board of Directors will fill director vacancies and new directorships only with candidates who agree to tender the same form of resignation promptly following their appointment to the Board of Directors.

If an incumbent director fails to receive the required vote for re-election, the Board of Directors will act on an expedited basis to determine whether or not to accept the director’s resignation. Any director who tenders his or her resignation pursuant to this Majority Voting Policy may not participate in any decision by the Board of Directors regarding such resignation.

Each director holds office until the next annual meeting of stockholders or until that director’s successor is duly elected and qualified. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unavailable to serve. In the event any nominee is unable or declines to serve as a director at the time of the annual meeting of stockholders, the proxies will be voted for any nominee who may be designated by the present Board of Directors to fill the vacancy. Unless otherwise instructed, the proxy holders will vote the proxies received by them “FOR” the nominees named below. Your proxies cannot be voted for a greater number of persons than the number of nominees named in this proxy statement.

As of March 31, 2010, the New Mountain Funds owned approximately 61% of our common stock and 100% of our outstanding Class A common stock and, together with agreements with other stockholders (including an investor rights agreement), are entitled to designate a majority of the members of the Board of Directors and are able to control all other matters requiring stockholder approval, including any transaction subject to stockholder approval, as long as they collectively own a majority of the outstanding shares of our Class A common stock and at least one-third of the outstanding shares of our common stock. The Class A common stock does not otherwise carry any general voting rights, dividend entitlement or liquidation preference. The New Mountain Funds have designated Steven B. Klinsky and Alok Singh for election as directors. The deLaski stockholders have designated Edward R. Grubb for election as a director. We are required to take the necessary action within our control to cause the designated individuals to be elected as members of our Board of Directors. See “Certain Relationships and Related Transactions—Investor Rights Agreement.”

10

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FORTHE ELECTION OF THE NOMINEES LISTED BELOW.

Information Regarding the Nominees for Director

All of our directors have demonstrated business experience and acumen and a commitment of service to our Board of Directors. Our directors also possess significant executive leadership experience, knowledge and expertise derived from their service as executives of various businesses and, in many instances, as members of the Boards of Directors of public and private companies. In their conduct, our directors display integrity, honesty and adherence to high ethical standards.

In evaluating each director and director nominee’s qualifications, we consider a variety of experience and qualifications, including:

| | • | | Management Experience. We believe that directors who have prior experience in senior management positions at public or private companies possess the leadership, knowledge and experience to serve as a director of a public company. Directors with this type of experience also provide valuable insight into the management and oversight of our Company. |

| | • | | Director Experience. We believe that directors who have prior experience as directors of other companies possess additional insight into the oversight of our management and operations and the proper functioning of a board of directors. |

| | • | | Finance Experience. We believe that directors with a finance background or prior financial experience play a key role in the oversight of our operational and financial performance. |

| | • | | Industry Experience. We believe that directors with prior software or other technology industry experience are better able to understand the industry in which we operate and the particular market conditions or challenges faced in our industry. |

| | • | | Experience with Deltek. Many of our current directors have served on our Board of Directors or as an executive of Deltek for several years. We believe this continuity of service is useful in understanding our historical performance and improves our Board’s oversight of the strategic focus of our Company. |

There are no family relationships among any of Deltek’s directors, director nominees or executive officers, except that Mr. Grubb is the husband of Ms. Kathleen deLaski, who will cease to serve as a director upon the conclusion of the 2010 Annual Meeting of Stockholders.

Set forth below is each director nominee’s biographical information and a description of the nature of each director nominee’s experience and qualifications that the Board believes supports his or her service as a director.

| | | | |

Name | | Age | | Position |

Kevin T. Parker | | 50 | | Chairman of the Board, Chief Executive Officer and President |

Alok Singh (1) | | 55 | | Lead Director |

Nanci E. Caldwell (1)(2) | | 52 | | Director |

Edward R. Grubb | | 52 | | Director Nominee |

Joseph M. Kampf (1) | | 65 | | Director |

Steven B. Klinsky | | 53 | | Director |

Thomas M. Manley (2) | | 51 | | Director |

Albert A. Notini | | 53 | | Director |

Janet R. Perna (2) | | 61 | | Director |

| (1) | Member of Compensation Committee |

| (2) | Member of Audit Committee |

11

Kevin T. Parkerhas served as our President and Chief Executive Officer since June 2005 and as Chairman of the Board since April 2006. Prior to joining Deltek, Mr. Parker served as Co-President and Chief Financial Officer of PeopleSoft, Inc., an enterprise applications software company, from October 2004 to December 2004, and as Executive Vice President of Finance and Administration and Chief Financial Officer of PeopleSoft from January 2002 to October 2004. Prior to January 2002, Mr. Parker held various positions, including Senior Vice President and Chief Financial Officer of PeopleSoft, Senior Vice President and Chief Financial Officer of Aspect Communications Corporation, a customer relationship management software company, and Senior Vice President of Finance and Administration at Fujitsu Computer Products of America. He currently serves on the Boards of Directors of Polycom, Inc. and Camber Corporation. Mr. Parker received his B.S. in Accounting from Clarkson University, where he serves on the board of trustees.

Mr. Parker brings to our Board of Directors extensive senior management, finance and industry experience, in addition to having served on our Board of Directors since 2006. In particular, having served both as our President and Chief Executive Officer and previously as Co-President and Chief Financial Officer of PeopleSoft, Mr. Parker possesses the operational, financial, strategic and governance experience needed to make significant contributions to our Board of Directors.

Alok Singh has served as a director since April 2005, and as lead director since April 2006. Mr. Singh’s duties as lead director are to assist the Chairman of the Board in establishing the agenda for meetings of the Board of Directors, to preside, in the absence of the Chairman of the Board, at meetings consisting solely of the non-executive members of the Board of Directors and to act as a liaison between the Board of Directors and stockholders or other third parties who request direct communications with the Board of Directors. Mr. Singh is a Managing Director of New Mountain Capital, a private equity investment firm based in New York. Prior to joining New Mountain Capital in September 2002, Mr. Singh served as a Partner and Managing Director of Bankers Trust. He also established and led the Corporate Financial Advisory Group for the Americas for Barclays Capital. Mr. Singh is non-executive Chairman of Overland Solutions, Inc., lead director of Camber Corporation and serves on the Boards of Directors of Apptis, Inc., Ikaria Holdings, Inc., RedPrairie Holding, Inc., Tygris Commercial Finance Group, Inc. and Validus Holdings, Ltd. He also serves on the advisory board of Sonenshine Partners, an investment bank. Mr. Singh received both his B.A. in Economics and History and his M.B.A. in Finance from New York University.

Mr. Singh brings to our Board of Directors significant financial and senior management experience, having served as an executive at both a private equity investment firm and several investment banks. Mr. Singh’s experience as a lead director or director at other companies also enables him to understand the role of the Board of Directors in the oversight of our Company. In addition, Mr. Singh has served as our lead director since our initial public offering and has been a director since 2005.

Nanci E. Caldwell has served as a director since August 2005. Ms. Caldwell has been a technology consultant since January 2005. From April 2001 to December 2004, Ms. Caldwell worked at PeopleSoft, Inc., serving as Senior Vice President and Chief Marketing Officer from April 2001 to January 2002, and as Executive Vice President and Chief Marketing Officer from January 2002 to December 2004. Prior to joining PeopleSoft in 2001, Ms. Caldwell held various senior management positions at Hewlett-Packard Company. Ms. Caldwell serves on the Boards of Directors of Citrix Systems, Inc., Live Ops, Inc., RedPrairie Holding, Inc., Sophos Plc, and Tibco Software, Inc. Ms. Caldwell received her B.A. in Psychology from Queen’s University, Kingston, Canada, and completed the University of Western Ontario’s Executive Marketing Management Program.

Ms. Caldwell has been involved in the technology industry for many years and has particular experience with software companies. In addition to her industry experience, Ms. Caldwell’s experience as a senior officer at PeopleSoft and Hewlett Packard provides her with the management experience to assist in the oversight of our operations and strategic objectives. She has served on the Boards of Directors of a number of companies, including software companies, such as Citrix Systems and Tibco Software. Ms. Caldwell has also been involved with Deltek since 2005 and is familiar with our operations and history.

12

Edward R. Grubb has been nominated for election as a director at the 2010 Annual Meeting of Stockholders. Mr. Grubb has been a private investor since 2002. From 2000 to 2002, Mr. Grubb was President and Chief Executive Officer of Control Risks Group LLC, a subsidiary of Control Risks Group Limited, an international political risk and crisis management firm. Prior to that, Mr. Grubb spent 18 years with Control Risks Group Limited and held various senior management positions. Mr. Grubb received his B.A. in Oriental Studies from the University of Cambridge in Cambridge, England and is currently a Teaching Fellow and Ph.D. candidate at Catholic University.

Mr. Grubb’s experience in risk and crisis management provides our Board of Directors with an additional dimension in the oversight of a growing international company. In addition, Mr. Grubb’s senior management experience, including as President and Chief Executive Officer of Control Risks Group LLC, gives him the management skills to provide oversight of our operations and strategic initiatives. As a member of the deLaski family, Mr. Grubb is familiar with Deltek, our history and our operations.

Joseph M. Kampf has served as a director since April 2006. Mr. Kampf has served as Chairman and Chief Executive Officer of CoVant Management, Inc., a technology investment company, since July 2006. From 1996 until June 2006, Mr. Kampf served as President and Chief Executive Officer of Anteon International Corporation, an information technology and engineering service company. Prior to 1996, Mr. Kampf served as a senior partner of Avenac Corporation, a consulting firm providing management and strategic planning advice to middle market companies. He served as Chairman of the Professional Services Council from 2003 to 2004 and as a member of its Executive Committee. Mr. Kampf serves on the Board of Directors of CoVant Management, Inc., CoVant Technologies, LLC, A-T Solutions, Inc. and A-T Solutions Holdings Inc. Mr. Kampf previously served on the board of directors of Anteon International Corporation. He received his B.A. in Economics from the University of North Carolina, Chapel Hill.

Mr. Kampf provides our Board of Directors with valuable insight into the management and oversight of a technology company, having served as the Chief Executive Officer of a technology investment company since 2006 and as the Chief Executive Officer of a major public company prior to that. In addition to his industry and executive experience, Mr. Kampf has experience providing strategic advice to growing companies. He also has served on the Boards of Directors of several technology companies, including Anteon International and CoVant Technologies. This background, along with his familiarity with our Company, allows Mr. Kampf to make important contributions to our Board of Directors.

Steven B. Klinsky has served as a director since April 2005. Mr. Klinsky is a Managing Director of New Mountain Capital and has served as its Founder and Chief Executive Officer since its inception in 1999. Prior to 1999, Mr. Klinsky served as a General Partner and an Associate Partner with Forstmann Little & Co. and co-founded Goldman, Sachs & Co.’s Leveraged Buyout Group. He serves on the Boards of Directors of MailSouth, Inc., Overland Solutions, Inc., Apptis, Inc., Inmar, Inc., Connextions, Inc., National Medical Health Card Systems, Inc. Oakleaf Global Holdings, Inc., and RedPrairie Holding, Inc. Mr. Klinsky received his B.A. in Economics and Political Philosophy from the University of Michigan. He received his M.B.A. from Harvard Business School and his J.D. from Harvard Law School.

Mr. Klinsky’s experience in investment banking and private equity investment gives him the financial experience necessary to understand and offer guidance regarding our financial performance. In addition, his experience as the Chief Executive Officer of New Mountain Capital provides Mr. Klinsky with an understanding of the essential elements for the management of a company. Finally, Mr. Klinsky’s legal background provides him with additional insight into balancing the risks and benefits associated with various strategic objectives. Mr. Klinsky has served on our Board of Directors since 2005 and is the Founder of the New Mountain Funds, our controlling stockholders.

Thomas M. Manley has served as a director since August 2008. Mr. Manley has been a private investor since April 2009. From July 2008 to April 2009, Mr. Manley served as Chief Financial Officer of Avaya Inc., a leading global provider of business communications applications, systems and services. From 2001 to July 2008,

13

Mr. Manley was the Chief Financial Officer and Senior Vice President of Administration for Cognos, Inc. (an IBM company), a leader in business intelligence and performance management solutions. Prior to 2001, Mr. Manley spent 18 years with Nortel Networks and held various positions, including Chief Financial Officer for the High Performance Optical Component Solutions Group. He serves on the Board of Directors of DragonWave Inc. and RedPrairie Holding, Inc., Mr. Manley received his B.S. in Engineering from Carleton University in Ottawa, Canada and his M.B.A. from Queen’s University in Kingston, Canada.

As a senior finance executive for several large public and private companies, Mr. Manley possesses significant finance experience that qualifies him to serve as a director of our Company and as the Chairman of our Audit Committee. In addition to being a financial expert, Mr. Manley is familiar with the software and technology industries, having served as a senior executive at Avaya, Cognos and Nortel Networks. This experience as a senior executive also gives Mr. Manley the management background necessary for the oversight of our financial and operational performance.

Albert A. Notini has served as a director since August 2005. Mr. Notini has served as Chief Executive Officer of Apptis, Inc., a provider of information technology solutions and services, since August 2007 and is the Chairman of its Board of Directors. Mr. Notini also serves as a senior advisor to New Mountain Capital. Prior to August 2007, he served as President and Chief Operating Officer and as a member of the Board of Directors of Sonus Networks, Inc., a voice infrastructure product provider, since April 2004. From May 2000 to March 2004, Mr. Notini served as the Chief Financial Officer and a member of the Board of Directors of Manufacturers’ Services Limited, a global electronics and supply chain services company. Prior to May 2000, Mr. Notini served as Executive Vice President of information technology services provider Getronics NV, following its acquisition of technology services provider Wang Global, Inc., where Mr. Notini had served as Executive Vice President of Corporate Development and Administration and General Counsel. Mr. Notini serves on the Boards of Directors of Apptis, Inc. and Camber Corporation. Mr. Notini previously served on the board of directors of Sonus Networks. He received his A.B. from Boston College, his M.A. from Boston University and his J.D. from Boston College Law School.

Having been the Chief Executive Officer, Chief Operating Officer and a senior executive at several technology companies, Mr. Notini possesses management, industry and financial experience that is valuable for the oversight of a public software company. Mr. Notini is currently the Chief Executive Officer of an information technology solutions company and has served as the Chief Operating Officer of a public company. In addition, Mr. Notini has served as a Chief Financial Officer and was previously a member of the Boards of Directors of several public and private companies. He is very familiar with our business and operations, having served as a director since 2005 and as a member of our Audit Committee until 2008.

Janet R. Perna has served as a director since June 2006. Ms. Perna has been a private investor since January 2006. She served as General Manager of Information Management for IBM’s Software Group from November 1996 until January 2006. Prior to November 1996, she held various executive positions within the IBM Software Group. Ms. Perna serves on the Boards of Directors of Flexera Software, Varicent Software Incorporated and RedPrairie Holding, Inc. Ms. Perna previously served on the board of directors of Cognos, Inc., which was acquired by IBM in 2007. She also serves on the Foundation Board of the State University of New York at Oneonta where she received her B.S. degree in Mathematics.

Ms. Perna brings to Deltek unique insight into the management of a software company, having been a General Manager for IBM’s software group for almost 10 years. In addition, Ms. Perna has served as a member of the Board of Directors of other software companies, including Flexera Software and Varicent Software. This combination of experiences allows Ms. Perna to contribute to the oversight of our management and its corporate strategy.

See “Corporate Governance” and “Executive Compensation—Compensation of Directors” below for additional information regarding the Board of Directors.

14

PROPOSAL TWO

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

General

The Audit Committee has selected Deloitte & Touche LLP as Deltek’s independent registered public accounting firm for the fiscal year ending December 31, 2010, which will include an audit of the full-year financial statements and of the effectiveness of Deltek’s internal control over financial reporting. Deloitte & Touche LLP has audited Deltek’s financial statements since fiscal year 2004. A representative of Deloitte & Touche LLP is expected to be present at the annual meeting, and will have the opportunity to make a statement if he or she desires to do so, and is expected to be available to respond to appropriate questions.

Stockholder ratification of the selection of Deloitte & Touche LLP is not required by our bylaws or other applicable legal requirements. However, the Board of Directors is submitting the selection of Deloitte & Touche LLP to the stockholders for ratification as a matter of good corporate practice. If this selection of an independent registered public accounting firm is not ratified by the affirmative vote of a majority of the shares present and voting at the meeting in person or by proxy, the appointment of the independent registered public accounting firm will be reconsidered by the Audit Committee. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of Deltek and its stockholders.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR

THE RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP

AS DELTEK’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

FOR THE FISCAL YEAR ENDING DECEMBER 31, 2010.

Principal Accounting Fees and Services

The following table presents fees billed for professional audit services and other services rendered to Deltek by Deloitte & Touche LLP for the years ended December 31, 2008 and December 31, 2009.

| | | | | | |

| | | 2008 | | 2009 |

Audit Fees (1) | | $ | 1,858,000 | | $ | 1,474,000 |

Audit-Related Fees (2) | | | — | | | — |

Tax Fees (3) | | | — | | | — |

All Other Fees (4) | | | — | | | — |

| | | | | | |

Total | | $ | 1,858,000 | | $ | 1,474,000 |

| | | | | | |

| (1) | Audit fees include audits of consolidated financial statements, quarterly reviews, statutory audits, reviews of registration statement filings, comment letters, comfort letters, consents and correspondence related to SEC filings. |

| (2) | There were no fees billed to us by the Deloitte entities for audit-related services for the years ended December 31, 2009 and December 31, 2008. |

| (3) | There were no fees billed to us by the Deloitte entities for tax services for the years ended December 31, 2009 and December 31, 2008. |

| (4) | We did not engage the Deloitte entities for any services other than those listed above during 2009 or 2008. |

15

Pre-Approval of Audit and Non-Audit Services

Deltek’s Audit Committee Charter requires that the Audit Committee approve in advance any significant audit or non-audit engagement or relationship between the Company and its independent auditor, which is not prohibited by law, and approve the fees for such services. Deltek’s Audit Committee Charter is available on Deltek’s website at http://www.deltek.com—“Investor Relations”—“Corporate Governance.”

All significant Deloitte & Touche LLP services and fees in fiscal year 2008 and fiscal year 2009 were pre-approved by the Audit Committee.

16

CORPORATE GOVERNANCE

Code of Business Conduct and Ethics

Deltek has adopted a Code of Business Conduct and Ethics, which is applicable to our directors and employees, including our principal executive officer, principal financial officer, principal accounting officer and controller or persons performing similar functions. The Code of Business Conduct and Ethics is available on Deltek’s website at http://www.deltek.com—“Investor Relations”—“Corporate Governance.” Deltek will disclose on its website any amendment to the Code of Business Conduct and Ethics, as well as any waivers of the Code of Business Conduct and Ethics, that are required to be disclosed by the rules of the Securities and Exchange Commission (the “SEC”) or The Nasdaq Global Select Market (“Nasdaq”).

Composition and Leadership Structure of the Board of Directors

Our Board of Directors is led by Kevin Parker, who has served as our President and Chief Executive Officer since 2005 and as Chairman of our Board of Directors since 2006. In addition, Alok Singh serves as our lead director and works closely with Mr. Parker to promote effective governance in managing the affairs of our Board of Directors in its oversight of our Company. Mr. Singh is active in multiple facets of the business, including reviewing the operational, financial and strategic performance of the Company. In addition, as lead director, Mr. Singh works closely with Mr. Parker and our senior management on key strategic initiatives, such as our common stock rights offering, the amendment and extension of our existing credit facility, as well as on our acquisition activities.

Our Board of Directors currently consists of ten members, nine of whom are non-management members. Each director holds office until the election and qualification of his or her successor, or his or her earlier death, resignation or removal. The Board of Directors has determined that Ms. Caldwell, Ms. Perna, Mr. Kampf and Mr. Manley meet the independence requirements under the applicable listing standards of Nasdaq.

Messrs. Ajouz, Klinsky and Singh, each a Managing Director of New Mountain Capital, L.L.C., were appointed to our Board of Directors pursuant to an investor rights agreement under which New Mountain Partners II, L.P. has a right to designate a certain number of the members of our Board of Directors (ranging from a majority of the Board of Directors to one director, depending on the collective stock ownership percentage of the New Mountain Funds). Ms. deLaski was appointed to our Board of Directors pursuant to the investor rights agreement under which the deLaski stockholders, who include Kenneth E. deLaski and Donald deLaski, have a right to designate a certain number of the members of our Board of Directors (either two directors or one director, depending on their stock ownership percentage). See “Certain Relationships and Related Transactions.” Mr. Ajouz and Ms. deLaski have notified us that they will not stand for re-election at the 2010 Annual Meeting of Stockholders and, as a result, their respective terms as directors will expire upon completion of the 2010 Annual Meeting of Stockholders. The size of the Board of Directors will decrease from ten to nine members effective at the end of Mr. Ajouz’s term.

As more than 50% of our voting power is held by the New Mountain Funds, we are deemed to be a “controlled company” under the rules established by Nasdaq, and qualify for, and rely on, the “controlled company” exception to the Board of Directors and committee composition requirements under the rules of The Nasdaq Global Select Market. Pursuant to this exception, we are exempt from the rule that requires our Board of Directors to be comprised of a majority of “independent directors” and our Compensation Committee to be comprised solely of “independent directors,” as defined under the rules of Nasdaq. The “controlled company” exception does not modify the independence requirements for the Audit Committee, and we have complied with the requirements of the Sarbanes-Oxley Act and Nasdaq rules, which require that our Audit Committee be composed of at least three members, each of whom is independent. See “Certain Relationships and Related Transactions.”

17

We believe that having our President and Chief Executive Officer also serve as Chairman of the Board of Directors, together with an independent Audit Committee and a Compensation Committee that includes a Subcommittee composed of independent members, provides the most appropriate leadership structure for us. As President and Chief Executive Officer, Mr. Parker possesses in-depth knowledge and experience regarding our performance and strategy that he applies in serving as Chairman of the Board of Directors. Our Board of Directors and the committees of the Board of Directors are composed of experienced directors who possess the insight, experience and sound business judgment necessary for the oversight of our operations, risks, performance and strategy. In addition to his duties as President and Chief Executive Officer, as Chairman of our Board of Directors, Mr. Parker, in conjunction with our lead director:

| | • | | presides over executive sessions of the Board of Directors; |

| | • | | serves as a conduit for the consideration of the views, concerns or other matters raised by our directors; |

| | • | | provides topics for inclusion on the Board’s meeting agendas; and |

| | • | | works with the Compensation Committee and senior management on performance assessments of senior management and on matters relating to succession planning. |

The Role of the Board of Directors in Risk Oversight

We believe that effective risk management is necessary for the success of our business. In addition, our Board of Directors believes that it is critical that controls and procedures are established and followed so that risks and challenges can be understood, balanced and managed. Our management team is responsible for designing and implementing appropriate controls and procedures to mitigate risks and for reporting to our Board of Directors on those processes and how those risks have been managed. Our Board of Directors, both directly and through its committees, is responsible for oversight of management’s risk functions.

Our Audit Committee actively monitors the processes by which management assesses and manages risks. Our Chief Financial Officer, our General Counsel and our Senior Director for Internal Audit and Sarbanes-Oxley Compliance meet regularly with our Audit Committee and with our independent registered public accounting firm to discuss matters relating to risk management. The Board of Directors and the Audit Committee receive periodic reports from the Company detailing the key risks and challenges facing the Company, whether financial, operational, legal, reputational or otherwise. Those reports include a description of the steps taken to mitigate any such risks and the internal plan for future mitigation of those risks. The Board of Directors and the Audit Committee review and discuss these reports with our senior management.

In addition, our General Counsel provides a quarterly report to our Audit Committee and our Board of Directors with regard to any material legal matters. Similarly, our Senior Director for Internal Audit and Sarbanes-Oxley Compliance provides a quarterly report to our Audit Committee with respect to our internal audit process. Our Board of Directors and Audit Committee also receive periodic reports and updates from our senior management detailing our financial and operational performance, the principal factors underlying those results and our expectations with respect to future challenges and results.

Board Meetings and Committees

During the 2009 fiscal year, the Board of Directors held seven meetings. Except for Ms. deLaski and Mr. Klinsky, each of the directors attended or participated in 75% or more of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings held by all committees of the Board of Directors on which he or she served during the past fiscal year. Ms. deLaski and Mr. Klinsky attended 62% and 71%, respectively, of those meetings in 2009. The Board of Directors has two standing committees: an Audit Committee and a Compensation Committee.

18

Our Board of Directors has established an Audit Committee and a Compensation Committee. The members of each committee are appointed by the Board of Directors and serve until their successor is elected and qualified, unless they are earlier removed or resign.

As a controlled company we are not required under the applicable listing standards of Nasdaq to have a standing nominating committee. The functions of evaluating and selecting directors have been performed by our Board of Directors as a whole. The Board of Directors has not adopted a formal written charter or policy addressing the process for the nomination of directors and does not have a formal policy on Board diversity. Our Board of Directors, however is committed to maintaining a Board of Directors that is diverse in experience and background. We are also party to an investor rights agreement with certain of our stockholders that provides the New Mountain Funds and the deLaski stockholders the right to designate a certain number of members of the Board of Directors. See “Certain Relationships and Related Transactions.”

We do not have a policy with regard to the consideration of director candidates recommended by stockholders. Our Board of Directors does not believe that such a policy is necessary because, as described above, our controlling stockholders are entitled to designate a certain number of members of the Board of Directors. Our Board of Directors believes that our controlling stockholders will designate candidates that have the leadership, knowledge and experience to serve as a director of a large public company. Stockholder recommendations relating to director nominees may be submitted in accordance with the procedures set forth under the heading “Questions and Answers About the 2010 Annual Meeting and Procedural Matters.”

Audit Committee

We have an Audit Committee consisting of Ms. Caldwell, Ms. Perna and Mr. Manley. Mr. Manley chairs the committee, and the Board of Directors has determined that Mr. Manley satisfies the applicable requirements as an “audit committee financial expert” as defined in Item 407 of Regulation S-K. In addition, the Board of Directors has determined that Ms. Caldwell, Ms. Perna and Mr. Manley meet the independence requirements under the applicable listing standards of Nasdaq, including meeting the definition of “independent director” set forth in Nasdaq Rule 5605(a)(2) and the criteria for independence set forth in Rule 10A-3(b)(1) under the Exchange Act.

During 2009, our Audit Committee was comprised of Ms. Caldwell, Ms. Perna, and Mr. Manley. No other person served as a member of the Audit Committee during 2009.

The Audit Committee assists our Board of Directors in fulfilling its responsibility to stockholders, the investment community and governmental agencies that regulate our activities in its oversight of, among other things:

| | • | | the integrity of our financial reporting process and financial statements and systems of internal controls; |

| | • | | our compliance with legal and regulatory requirements; |

| | • | | the independent registered public accounting firm’s selection, qualifications and independence and performance; and |

| | • | | the performance of our internal audit function. |

The Audit Committee may study or investigate any matter of interest or concern that the committee determines is appropriate and may retain outside legal, accounting or other advisors for this purpose.

The Audit Committee held nine meetings during the last fiscal year. The Audit Committee has adopted a written charter approved by the Board of Directors, which is available on Deltek’s website at http://www.deltek.com—“Investor Relations”—“Corporate Governance.” The Audit Committee confirms on an annual basis that it has reviewed, assessed and adopted a formal written charter.

19

The Audit Committee Report is included in this proxy statement on page 59.

Compensation Committee

We have a Compensation Committee consisting of Ms. Caldwell, Ms. deLaski and Messrs. Kampf and Singh. Mr. Singh chairs the committee. The Board of Directors has determined that Ms. Caldwell and Mr. Kampf meet the independence requirements under the applicable listing standards of Nasdaq. Mr. Singh and Ms. deLaski do not meet the independence requirements under the applicable listing standards of Nasdaq. Ms. deLaski has notified us that she will not stand for re-election at our 2010 Annual Meeting of Stockholders. The Board of Directors has not determined who, if anybody, will replace Ms. deLaski as a member of the Compensation Committee following her departure.

The purpose of the Compensation Committee is to, among other things:

| | • | | discharge the responsibilities of our Board of Directors relating to compensation of our officers and certain employees, including our incentive compensation and equity-based plans, policies and programs; and |

| | • | | review the compensation discussion and analysis to be included in our filings with the Securities and Exchange Commission, discuss the compensation discussion and analysis with management and approve a report of the committee for inclusion in our annual report or annual proxy statement. |

The Compensation Committee has a subcommittee consisting of Ms. Caldwell and Mr. Kampf for purposes of complying with the requirements of Section 162(m) of the Internal Revenue Code (the “Code”) and Section 16 of the Exchange Act.

The Compensation Committee held six meetings during the last fiscal year. The Compensation Committee has adopted a written charter approved by the Board of Directors, which is available on Deltek’s website at http://www.deltek.com—“Investor Relations”—“Corporate Governance.”

The Compensation Committee Report is included in this proxy statement on page 41.

Compensation Committee Interlocks and Insider Participation

During 2009, our Board of Directors or our Compensation Committee determined the compensation of our executive officers. None of our executive officers currently serves, or in the past year has served, as a member of the Board of Directors or Compensation Committee of any entity that has one or more executive officers serving on our Board of Directors or Compensation Committee.

During 2009, our Compensation Committee was comprised of Ms. Caldwell, Ms. deLaski and Messrs. Kampf and Singh. No other person served as a member of the Compensation Committee during 2009.

Attendance at Annual Meetings of Stockholders by the Board of Directors

We do not have a formal policy regarding attendance by members of the Board of Directors at Deltek’s annual meeting of stockholders. One member of our Board of Directors attended our 2009 Annual Meeting of Stockholders.

Contacting the Board of Directors

Deltek has adopted a Policy Regarding Communications from Shareholders to enable stockholders to submit communications to the Board of Directors or individual members of the Board of Directors. These

20

communications may be submitted, addressed to the Board of Directors or the individual member, as appropriate, in either of the following ways:

Deltek, Inc.

Attn: General Counsel/Board of Directors

13880 Dulles Corner Lane

Herndon, VA 20171

www.ethicspoint.com (click on “File a New Report” and enter “Deltek” as the Organization Name)

Stockholders may submit their communications to the Board of Directors or individual directors on a confidential or anonymous basis by sending the communication in a sealed envelope marked “Confidential—To be opened only by [the Chairman of the Audit Committee or Appropriate Director].”

The Policy Regarding Communications from Shareholders is available on Deltek’s website at http://www.deltek.com—“Investor Relations”—“Corporate Governance.”

Risk Assessment of Compensation Policies and Practices