August 29, 2011

ConAgra Foods, Inc.

One ConAgra Drive, 1-220

Omaha, NE 68102-5001

| Attention: | John F. Gehring - Executive Vice President & Chief Financial Officer |

HIGHLY CONFIDENT LETTER

Dear Mr. Gehring:

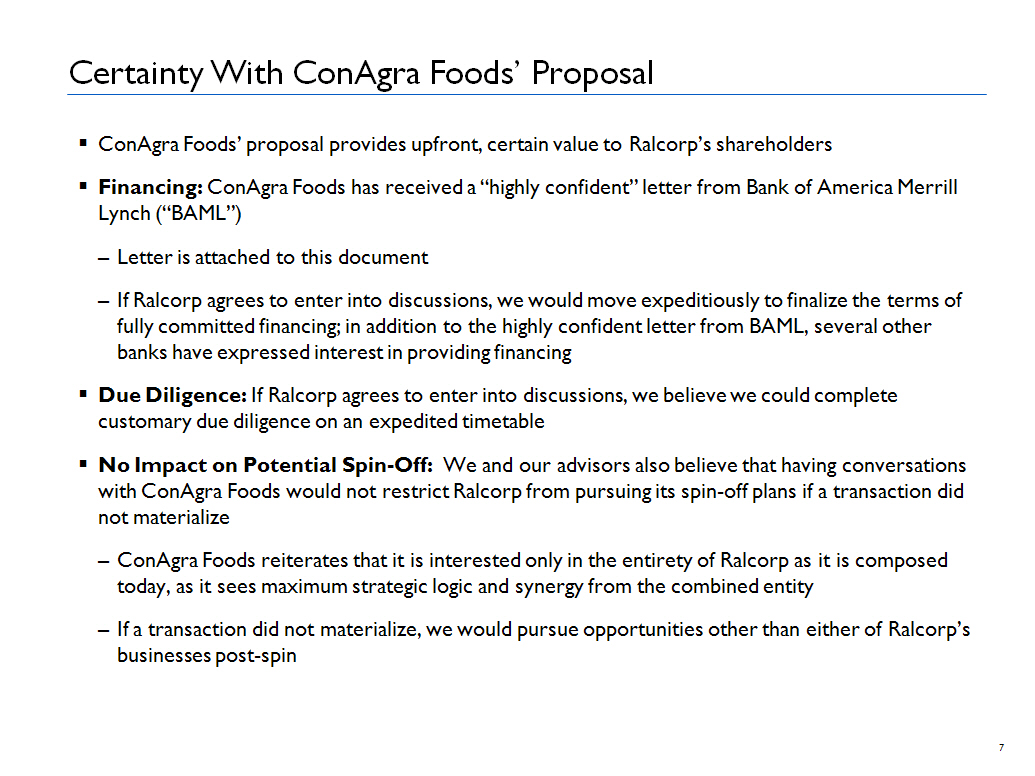

You have advised Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPFS”) that ConAgra Foods, Inc. (“ConAgra” or the “Purchaser”) intends to acquire Ralcorp Holdings, Inc. (the “Subject Company”) through the purchase, directly or indirectly, of all of the outstanding capital stock of the Subject Company not currently owned by the Purchaser, including, if appropriate, refinancing the Subject Company’s existing debt (collectively, the “Acquisition”). You have further advised us that you propose to finance the Acquisition (including the refinancing of existing indebtedness of the Subject Company) and related fees and expenses from the following sources: up to $8.5 billion of senior indebtedness composed of (a) a term loan facility (the “Credit Facility”), and (b) unsecured senior notes (the “Securities”) upon the terms and conditions satisfactory to MLPFS.

We are pleased to inform you that based upon our understanding of the Acquisition and current market conditions and subject to the conditions set forth below, we are highly confident of our ability, (i) to sell or place the Securities in connection with the Acquisition and (ii) to arrange and syndicate the Credit Facility in connection with the Acquisition. The structure, interest rate and yield, covenants and terms of, and the documentation for, the Securities and the Credit Facility will be based on market conditions at the time of the sale or placement and the arrangement and on the structure and documentation of the Acquisition and all the financing therefor.

Our confidence in our ability to consummate the sale or placement of the Securities and to arrange and syndicate the Credit Facility is subject to: (i) the principal economic terms and

structure of the Acquisition and the related financing components being on the terms as described to MLPFS on the date hereof with such other terms and conditions acceptable to MLPFS and the execution of documentation relating thereto satisfactory in form and substance to MLPFS, and the Acquisition having been consummated; (ii) the receipt of all required governmental, regulatory or third party approvals or consents in connection with the Acquisition; (iii) the completion, to the satisfaction of MLPFS, of an offering memorandum or prospectus with respect to the sale of the Securities and an offering memorandum with respect to the syndication of the Credit Facility; (iv) the availability of audited and unaudited historical financial statements of the Purchaser and the Subject Company and its subsidiaries and pro forma financial statements of the Purchaser and the Subject Company and their respective subsidiaries assuming consummation of the Acquisition, in each case, satisfactory to MLPFS and in form and presentation as required by the Securities Act of 1933, as amended, and the rules and regulations thereunder applicable to registration statements; (v) there not having occurred any change or development that either individually or in the aggregate could reasonably be expected to have a material adverse effect on the business, operations, assets, properties, liabilities (actual and contingent), results of operations, condition (financial or otherwise) of the Purchaser and its subsidiaries, taken as a whole, since the date of the most recent audited financial statements of the Purchaser, in each case, in MLPFS’s sole judgment; (vi) there not having been any disruption or change or development in the market for new issues of high grade securities, the market for syndicated fully underwritten bank credit facilities or the financial, capital or syndication markets in general, in the sole judgment of MLPFS; (vii) MLPFS and its representatives being satisfied with the results of their continuing business and legal due diligence (and no new fact, circumstance or development shall have occurred or been discovered which MLPFS believes is inconsistent in any material respect with any information previously provided to it) and your full cooperation with respect to the marketing of the Securities and the syndication of the Credit Facility; (viii) MLPFS having a reasonable time to market the Securities and to syndicate the Credit Facilities based on MLPFS’s experience in comparable transactions; and (ix) no change or proposed change in law or regulation, including regulations that could reasonably be expected to materially and adversely affect the economic consequences, including the tax treatments, that the Purchaser contemplates deriving from the Acquisition.

You acknowledge that MLPFS and its affiliates may share with each other any information related to you, the Subject Company or its affiliates (including information relating to creditworthiness), or the Acquisition or the financing therefor; provided that MLPFS and such affiliates agree to hold any non-public information confidential in accordance with their respective customary policies related to non-public information.

This letter is not intended to be and should not be construed as (or relied upon as) an offer or commitment by MLPFS or any of its affiliates with respect to the extension of credit or the underwriting, sale, arrangement or placement of the Securities, the Credit Facility or any of the other financings referenced herein and creates no obligations or liability on our part or your part, or on the part of any of our respective affiliates, in connection therewith. Obtaining financing for

the Acquisition is inherently subject to uncertainties and contingencies beyond our control; accordingly there can be no assurance that the public offering or private placement of the Securities or the arrangement of the Credit Facility will in fact be accomplished.

Except as otherwise required by law or unless MLPFS has otherwise consented in writing, you are not authorized to show or circulate this letter to any other person or entity (other than your advisors and to the Subject Company, its board of directors and its advisors with a need to know). Nothing herein, express or implied, is intended or shall confer upon any third party any legal or equitable right, benefit or remedy of any nature whatsoever under or by reason of this letter.

| Very truly yours, | |

| MERRILL LYNCH, PIERCE, FENNER & SMITH INCORPORATED | |

| By: | /s/ Peter C. Hall | |

| | Peter C. Hall | |

| | Managing Director | |