MANAGEMENT’S DISCUSSION AND ANALYSIS

This management’s discussion and analysis (“MD&A”) of ARC Resources Ltd. (“ARC” or the “Company”) is Management’s analysis of the financial performance and significant trends or external factors that may affect future performance. It is dated February 10, 2016 and should be read in conjunction with the audited consolidated financial statements as at and for the year ended December 31, 2015 (the "financial statements"), and the MD&A and unaudited condensed interim consolidated financial statements for the periods ended March 31, 2015, June 30, 2015 and September 30, 2015 as well as ARC’s Annual Information Form that is filed on SEDAR at www.sedar.com. All financial information is reported in Canadian dollars and all per share information is based on diluted weighted average shares, unless otherwise noted.

This MD&A contains additional generally accepted accounting principles ("GAAP") measures, non-GAAP measures and forward-looking statements. Readers are cautioned that the MD&A should be read in conjunction with ARC’s disclosure under the headings “Non-GAAP Measures,” “Additional GAAP Measures,” “Forward-looking Information and Statements” and "Glossary" included at the end of this MD&A.

ABOUT ARC RESOURCES LTD.

ARC is a dividend-paying Canadian oil and gas company headquartered in Calgary, Alberta. ARC’s activities relate to the exploration, development and production of conventional oil and natural gas in Canada with an emphasis on the development of properties with a large volume of hydrocarbons in place commonly referred to as “resource plays.”

ARC’s vision is to be a leading energy producer, focused on delivering results through its strategy of risk-managed value creation. ARC is committed to providing superior long-term financial returns for its shareholders, creating a culture where respect for the individual is paramount and action and passion are rewarded. ARC runs its business in a manner that protects the safety of employees, communities and the environment. ARC’s vision is realized through the four pillars of its strategy:

| |

| 1. | High quality, long-life assets – ARC’s unique suite of assets includes both Montney and other assets. ARC’s Montney assets consist of world-class resource play properties, concentrated in the Montney geological formation in northeast British Columbia and northern Alberta. The Montney assets provide substantial growth opportunities, which ARC will pursue to create value through long-term profitable development. Other assets are located in Alberta and Saskatchewan and include core assets in the Cardium formation in the Pembina area of Alberta. These assets deliver stable production and contribute cash flow to fund future development and support ARC's dividend. |

| |

| 2. | Operational excellence – ARC is focused on capital discipline and cost management to extract the maximum return on its investments while operating in a safe and environmentally responsible manner. Production from individual crude oil and natural gas wells naturally declines over time. In any one year, ARC approves a budget to drill new wells with the intent to first replace production declines and second to potentially increase production volumes and profitability. At times, ARC may also acquire strategic producing or undeveloped properties to enhance current production and reserves or to provide potential future drilling locations. Alternatively, it may strategically dispose of non-core assets that no longer meet its investment criteria. |

| |

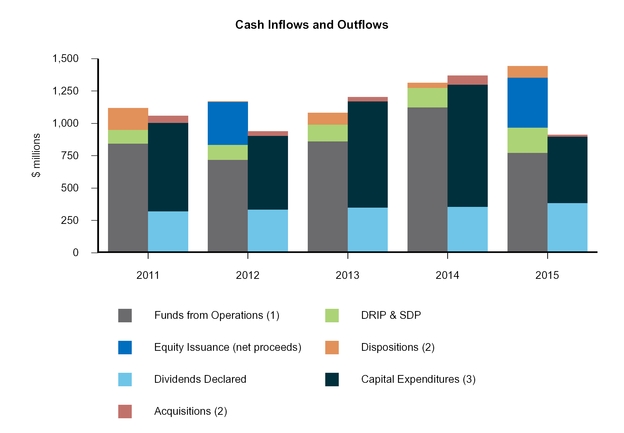

| 3. | Financial flexibility – ARC provides returns to shareholders through a combination of a monthly dividend, currently $0.05 per share outstanding per month, and the potential for capital appreciation. ARC’s long-term goal is to fund dividend payments and capital expenditures necessary for the replacement of production declines using funds from operations (1). ARC will finance value-creating activities through a combination of sources including funds from operations, proceeds from ARC’s Dividend Reinvestment Program (“DRIP”), reduced funding required under the Stock Dividend Program ("SDP"), proceeds from property dispositions, debt capacity, and when appropriate, equity issuance. ARC chooses to maintain prudent debt levels, targeting a maximum net debt to annualized funds from operations of less than two times during specific periods with a long-term target for net debt to be one to 1.5 times annualized funds from operations and less than 20 per cent of total capitalization over the long-term (1). |

| |

| 4. | Top talent and strong leadership culture – ARC is committed to the attraction, retention and development of the best and brightest people in the industry. ARC’s employees conduct business every day in a culture of trust, respect, integrity and accountability. Building leadership talent at all levels of the organization is a key focus. ARC is also committed to corporate leadership through community investment, environmental reporting practices and open communication with all stakeholders. As of February 10, 2016, ARC had 502 employees with 269 professional, technical and support staff in the Calgary office, and 233 individuals located across ARC’s operating areas in western Canada. |

| |

| (1) | Funds from operations, net debt, and total capitalization are additional GAAP measures which may not be comparable to similar additional GAAP measures used by other entities. Refer to the section entitled “Additional GAAP Measures” contained within this MD&A and to Note 15 "Capital Management" in the financial statements. Also refer to the "Funds from Operations" section within this MD&A for a reconciliation of ARC’s net income to funds from operations and cash flow from operating activities. |

Total Return to Shareholders

ARC's business plan has resulted in significant operational success and helped mitigate the headwinds of a challenging commodity price environment, resulting in a trailing five year annualized total return that exceeds the Standard & Poor's ("S&P")/Toronto Stock Exchange ("TSX") Exploration & Producers Index (Table 1).

Table 1 |

| | | | | | |

Total Returns (1) | Trailing One Year |

| Trailing Three Year |

| Trailing Five Year |

|

| Dividends per share outstanding ($) | 1.20 |

| 3.60 |

| 6.00 |

|

| Capital appreciation (depreciation) per share outstanding ($) | (8.46 | ) | (7.74 | ) | (8.71 | ) |

| Total return per share outstanding (%) | (29.6 | ) | (21.1 | ) | (16.3 | ) |

| Annualized total return per share outstanding (%) | (29.6 | ) | (7.6 | ) | (3.5 | ) |

| S&P/TSX Exploration & Producers Index annualized total return (%) | (32.1 | ) | (15.6 | ) | (15.2 | ) |

| |

| (1) | Non-GAAP measure which may not be comparable to similar non-GAAP measures used by other entities. Refer to the section entitled "Non-GAAP Measures" contained within this MD&A. Calculated as at December 31, 2015. |

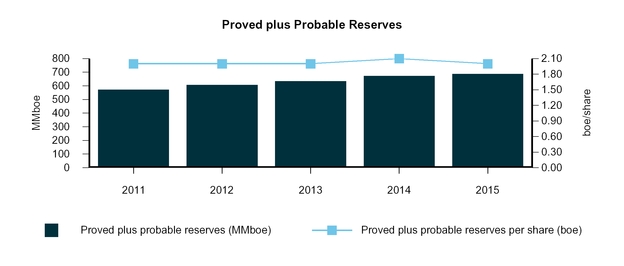

Since 2011, ARC’s production has grown by 30,751 boe per day, or 37 per cent, while its proved plus probable reserves have grown by 114.5 MMboe, or 20 per cent. Table 2 highlights ARC’s production and reserves for the last five years:

Table 2 |

| | | | | | | | | | |

| | 2015 |

| 2014 |

| 2013 |

| 2012 |

| 2011 |

|

Production (boe/d) (1) | 114,167 |

| 112,387 |

| 96,087 |

| 93,546 |

| 83,416 |

|

Daily production per thousand shares (2) | 0.34 |

| 0.35 |

| 0.31 |

| 0.31 |

| 0.29 |

|

Proved plus probable reserves (MMboe) (3)(4) | 686.9 |

| 672.7 |

| 633.9 |

| 607.0 |

| 572.4 |

|

| Proved plus probable reserves per share (boe) | 2.0 |

| 2.1 |

| 2.0 |

| 2.0 |

| 2.0 |

|

| |

| (1) | Reported production amount is based on company interest before royalty burdens. |

| |

| (2) | Daily production per thousand shares represents annual average daily production divided by the diluted weighted average common shares for the respective years ending December 31. |

| |

| (3) | As determined by ARC’s independent reserve evaluator solely at December 31. |

| |

| (4) | Company gross reserves are the gross interest reserves before deduction of royalties and without including any royalty interests. For more information, see ARC’s Annual Information Form as filed on SEDAR at www.sedar.com and the news release entitled “ARC Resources Ltd. Announces the 8th Consecutive Year of ~200% Reserves Replacement, 2015 Finding and Development Costs for 2P Reserves of $6.97 and a Significant Increase in Montney Resource Estimates in 2015” dated February 10, 2016. |

Exhibit 1

Exhibit 1a

ECONOMIC ENVIRONMENT

ARC’s 2015 financial and operating results were impacted by commodity prices and foreign exchange rates which are outlined in Table 3 below:

Table 3 |

| | | | | | | | | | | | |

Selected Benchmark Prices and Exchange Rates (1) | Three Months Ended | Twelve Months Ended |

| | December 31 | December 31 |

| | 2015 |

| 2014 |

| % Change |

| 2015 |

| 2014 |

| % Change |

|

| Brent (US$/bbl) | 44.69 |

| 77.07 |

| (42 | ) | 53.60 |

| 99.45 |

| (46 | ) |

| WTI oil (US$/bbl) | 42.16 |

| 73.20 |

| (42 | ) | 48.76 |

| 92.91 |

| (48 | ) |

| Edmonton Par (Cdn$/bbl) | 52.93 |

| 75.65 |

| (30 | ) | 57.20 |

| 94.46 |

| (39 | ) |

| Henry Hub NYMEX (US$/MMbtu) | 2.27 |

| 4.00 |

| (43 | ) | 2.66 |

| 4.41 |

| (40 | ) |

| AECO natural gas (Cdn$/Mcf) | 2.65 |

| 4.01 |

| (34 | ) | 2.77 |

| 4.42 |

| (37 | ) |

| Cdn$/US$ exchange rate | 1.34 |

| 1.14 |

| 18 |

| 1.28 |

| 1.10 |

| 16 |

|

| |

| (1) | The benchmark prices do not reflect ARC's realized sales prices. For average realized sales prices, refer to Table 13 in this MD&A. Prices and exchange rates presented above represent averages for the respective periods. |

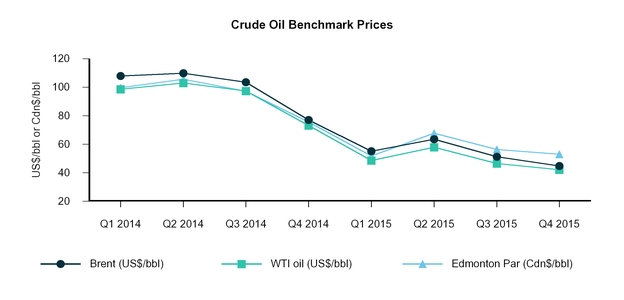

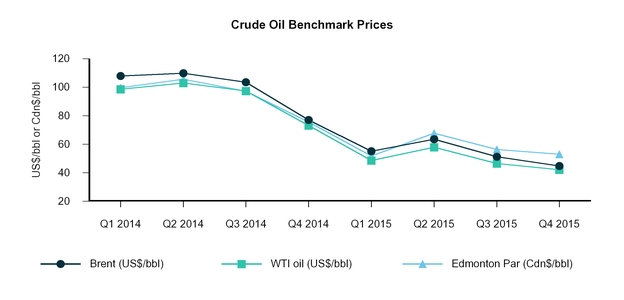

Global crude oil prices continued their decline throughout the fourth quarter of 2015, as persistent oversupply in the market was compounded by OPEC's decision to not reduce production quotas, as well as the anticipation of new Iranian production hitting the market and fears of economic slowdown in China and other emerging economies. The WTI benchmark price averaged 42 per cent lower than the fourth quarter of 2014 and nine per cent lower than the third quarter of 2015. ARC’s crude oil price is primarily referenced to the Edmonton Par benchmark price, which fared moderately better than WTI owing to the decline in the Canadian dollar during 2015. The Edmonton Par price decreased 30 per cent compared to the fourth quarter of 2014 and six per cent from the third quarter of 2015. The differential between WTI and Edmonton Par in the fourth quarter of 2015 narrowed to an average discount of US$2.52, 62 per cent less than the fourth quarter of 2014 and 28 per cent less than the third quarter of 2015. The narrowing of the differential was largely driven by increased local demand for Canadian crude with the initiation of the reversal of Enbridge's Line 9.

Subsequent to December 31, 2015, global crude oil prices have continued to deteriorate, with the WTI crude oil price dropping by approximately 25 per cent from the average realized price in the fourth quarter of 2015. Oversupply continues to be a concern as inventories remain high, delaying the effect of any supply/demand rebalancing.

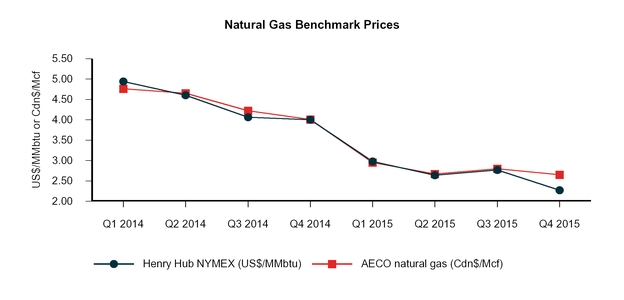

Exhibit 2

North American natural gas prices, referenced by the average Henry Hub NYMEX price, experienced a pullback of 18 per cent in the fourth quarter of 2015 compared to the third quarter, and were markedly lower in the fourth quarter of 2015 relative to the same period in 2014, decreasing 43 per cent. ARC’s realized natural gas price is primarily referenced to the AECO hub, which was 34 per cent lower in the fourth quarter of 2015 compared to the fourth quarter of 2014 and five per cent lower compared to the third quarter of 2015. The lower prices were impacted by continued oversupply throughout the quarter, resulting in record storage levels at the close of injection season and warmer continental weather reducing normal seasonal demand. The oversupply was slightly alleviated by strong demand for Mexican exports and increased natural gas-fired power generation. Looking ahead to 2016, natural gas pricing is expected to experience continued weakness as a result of a relatively mild winter in the eastern half of North America to-date, and continued strong supply.

Exhibit 2a

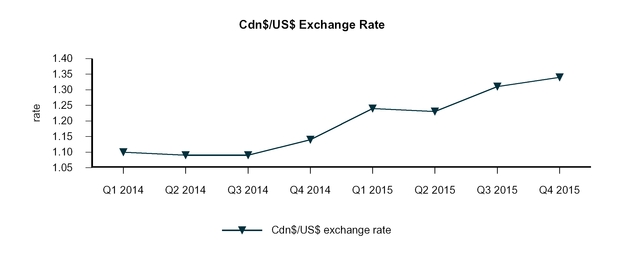

The Canadian dollar continued to weaken relative to the US dollar during the fourth quarter of 2015, averaging US$0.75 (Cdn$/US$1.34), as crude oil prices moved lower and the US Federal Reserve raised its interest rates for the first time in almost 10 years, signaling the continued economic recovery in the United States. The devaluation of the Canadian dollar relative to the US dollar serves to partially offset the impact of lower US dollar-denominated crude oil and natural gas prices for Canadian producers.

Exhibit 2b

ANNUAL GUIDANCE AND FINANCIAL HIGHLIGHTS

Table 4 is a summary of ARC’s 2016 and 2015 guidance and a review of 2015 actual results. During this period of prolonged low commodity prices, ARC's strategy and principles remain unchanged; the Company is focused on balance sheet strength, value creation from the development of its high-quality asset base and long-term sustainability of its business. In response to the continued deterioration of commodity prices in late 2015 and early 2016, ARC is reducing its 2016 capital program to $390 million, down from the $550 million previously announced.

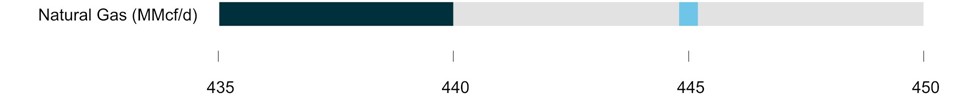

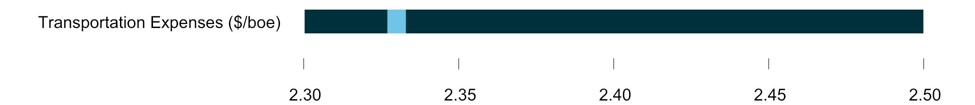

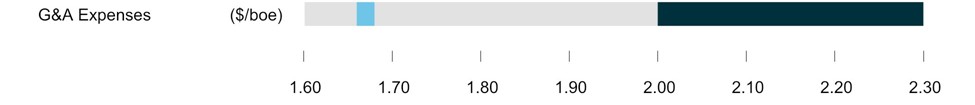

ARC's 2016 full-year guidance has been revised to incorporate reduced 2016 capital spending of approximately $390 million. Reflecting the 30 per cent reduction in capital spending, ARC's full-year average production guidance has been revised downward to a range of 116,000 to 120,000 boe per day from the previously guided range of 119,000 to 124,000 boe per day. ARC's full-year guidance for per boe operating costs was lowered to a range of $7.40 to $7.80 per boe to reflect the deferral of certain discretionary expenditures to future periods, and to reflect the continued focus on ARC's northeast British Columbia Montney assets, which have lower relative costs to operate. Lower power prices and the revision of estimates for prior periods benefited 2015 operating costs on a per boe basis; these items are not expected to impact 2016 operating costs, and as such, the guidance for 2016 operating costs on a per boe basis is higher relative to 2015 actual results. All other 2016 per boe guidance estimates that have changed from the original guidance announced on November 4, 2015 reflect revised production guidance for 2016.

Table 4

|

| | | | | | | | | | |

| | 2016 Original

Guidance (1) | 2016 Revised

Guidance (1) | 2015

Guidance (2) | 2015 Actuals | % Variance from Guidance |

|

| Production | | | | | |

| Crude oil (bbl/d) | 34,500 - 36,500 |

| 32,000 - 34,000 |

| 33,500 - 34,500 |

| 32,762 |

| (2 | ) |

| Condensate (bbl/d) | 3,200 - 3,600 |

| 3,000 - 3,400 |

| 3,400 - 3,800 |

| 3,430 |

| — |

|

| Natural gas (MMcf/d) | 465 - 475 |

| 460 - 470 |

| 435 - 440 |

| 444.9 |

| 1 |

|

| NGLs (bbl/d) | 4,000 - 4,500 |

| 3,800 - 4,200 |

| 3,700 - 3,900 |

| 3,819 |

| — |

|

| Total (boe/d) | 119,000 - 124,000 |

| 116,000 - 120,000 |

| 113,000 - 115,000 |

| 114,167 |

| — |

|

| Expenses ($/boe) | | | | | |

Operating (3) | 7.70 - 8.10 |

| 7.40 - 7.80 |

| 7.50 - 7.70 |

| 7.15 |

| (5 | ) |

| Transportation | 2.40 - 2.70 |

| 2.40 - 2.70 |

| 2.30 - 2.50 |

| 2.33 |

| — |

|

| G&A expenses before share-based compensation plans | 1.45 - 1.55 |

| 1.55 - 1.65 |

| 1.65 - 1.70 |

| 1.48 |

| (10 | ) |

G&A - share-based compensation plans (4) | 0.55 - 0.75 |

| 0.45 - 0.65 |

| 0.35 - 0.60 |

| 0.17 |

| (51 | ) |

| Interest | 1.00 - 1.20 |

| 1.10 - 1.30 |

| 1.10 - 1.30 |

| 1.22 |

| — |

|

Current income tax (per cent of funds from operations) (5) | 0 - 5 |

| 0 - 5 |

| 0 - 2 |

| — |

| — |

|

| Capital expenditures before land purchases and net property acquisitions (dispositions) ($ millions) | 550 |

| 390 |

| 550 |

| 541.6 |

| (2 | ) |

| Land purchases and net property acquisitions (dispositions) ($ millions) | — |

| — |

| — |

| (67.7 | ) | N/A |

|

| Weighted average shares, diluted (millions) | 351 |

| 351 |

| 339 |

| 341 |

| 1 |

|

| |

| (1) | 2016 revised production guidance incorporates impact of approximately 1,300 boe per day of divested non-core crude oil assets at the end of 2015 and does not take into account the impact of any dispositions that may occur during 2016. |

| |

| (2) | Incorporates impact of approximately 3,600 boe per day of divested non-core assets throughout the first nine months of 2015 (75 per cent natural gas), which resulted in an annual volume impact of approximately 2,200 boe per day of production. |

| |

| (3) | Actual results for the year ended December 31, 2015 include a reduction of approximately $0.40 per boe due to a revision of estimates for prior period operating costs. |

| |

| (4) | Comprises expenses recognized under the RSU and PSU, Share Option and LTRSA Plans. In periods where substantial share price fluctuation occurs, ARC’s G&A expenses are subject to greater volatility. |

| |

| (5) | The 2015 and 2016 corporate tax estimates vary depending on level of commodity prices. |

2015 annual production fell within the guidance range. Crude oil production was two per cent below the guidance range, reflecting the disposition of non-core properties producing approximately 500 barrels per day during the third quarter while natural gas production averaged slightly above the guidance range as a result of exceptional performance from ARC’s newest gas processing facility at Sunrise throughout the fourth quarter.

Exhibit 3

2015 Production Guidance

On a per boe basis, operating costs were below the guidance range during 2015 with higher than expected production volumes for the first half of the year coupled with lower average electricity rates and diligent cost control over turnaround and maintenance activities completed during the year. In 2015, ARC’s G&A expenses averaged lower than the guidance range primarily due to decreased expenses under ARC’s share-based compensation plans. ARC recorded an income tax recovery for 2015, reflecting lower than anticipated taxable income related to decreased commodity prices.

Exhibit 3a

2015 Expenses Guidance

ARC incurred $541.6 million of capital expenditures during 2015. In addition, ARC spent $6.7 million on land purchases during the year and completed net dispositions of assets resulting in net proceeds of $74.4 million.

ARC's 2016 reduced capital program of $390 million will remain focused on balance sheet preservation and long-term value creation through continued development of ARC's low-cost, high-value northeast British Columbia Montney assets. The budget will allow ARC to hold northeast British Columbia facilities at capacity, progress the key infrastructure project at Dawson Phase III, and continue to delineate ARC's highly prospective Attachie asset. Capital allocation to ARC’s assets in Ante Creek, Pembina and Southeast Saskatchewan has been deferred while ARC concentrates investment in larger-scale projects that deliver superior rates of return in the current commodity price environment; ARC also awaits final details on the MRF (1) from the Alberta Government for its Alberta assets. Full-year 2016 annual average production is expected to be in the range of 116,000 to 120,000 boe per day.

Ongoing commodity price volatility may affect ARC's funds from operations and profitability on capital programs. As continued volatility is expected, ARC will continue to take steps to mitigate these risks, focus on capital discipline and cost control, and protect its strong financial position. ARC will adjust spending and the pace of development, if required, to ensure balance sheet strength is protected.

The guidance information presented is intended to provide shareholders with information on Management’s expectations for results from operations. Readers are cautioned that the guidance may not be appropriate for other purposes.

| |

| (1) | Modernized Royalty Framework. Refer to the section entitled “Royalties” contained within this MD&A. |

2015 FOURTH QUARTER FINANCIAL AND OPERATING RESULTS

Financial Highlights

Table 5 |

| | | | | | | | | | | | |

| | Three Months Ended | Twelve Months Ended |

| | December 31 | December 31 |

| ($ millions, except per share and volume data) | 2015 |

| 2014 |

| % Change |

| 2015 |

| 2014 |

| % Change |

|

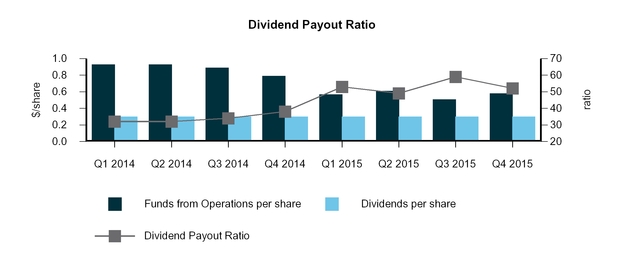

Funds from operations (1) | 200.7 |

| 251.7 |

| (20 | ) | 773.4 |

| 1,124.0 |

| (31 | ) |

Funds from operations per share (1) | 0.58 |

| 0.79 |

| (27 | ) | 2.27 |

| 3.54 |

| (36 | ) |

| Net income (loss) | (55.0 | ) | 113.7 |

| (148 | ) | (342.7 | ) | 380.8 |

| (190 | ) |

| Net income (loss) per share | (0.16 | ) | 0.36 |

| (144 | ) | (1.01 | ) | 1.20 |

| (184 | ) |

Dividends per share (2) | 0.30 |

| 0.30 |

| — |

| 1.20 |

| 1.20 |

| — |

|

| Average daily production (boe/d) | 119,243 |

| 117,986 |

| 1 |

| 114,167 |

| 112,387 |

| 2 |

|

| |

| (1) | Refer to the sections entitled "Funds from Operations" and “Additional GAAP Measures” contained within this MD&A. |

| |

| (2) | Dividends per share are based on the number of shares outstanding at each dividend record date. |

Funds from Operations

ARC reports funds from operations in total and on a per share basis. Funds from operations does not have a standardized meaning prescribed by Canadian GAAP. Refer to the section entitled “Additional GAAP Measures” contained within this MD&A.

Table 6 is a reconciliation of ARC’s net income (loss) to funds from operations and cash flow from operating activities:

Table 6 |

| | | | | | | | |

| | Three Months Ended | Twelve Months Ended |

| | December 31 | December 31 |

| ($ millions) | 2015 |

| 2014 |

| 2015 |

| 2014 |

|

| Net income (loss) | (55.0 | ) | 113.7 |

| (342.7 | ) | 380.8 |

|

| Adjusted for the following non-cash items: | | | | |

| DD&A and impairment | 263.0 |

| 279.4 |

| 1,065.4 |

| 758.5 |

|

| Accretion of ARO | 3.3 |

| 3.7 |

| 13.4 |

| 14.9 |

|

| E&E expenses | — |

| 9.5 |

| 46.9 |

| 39.4 |

|

| Deferred tax expense (recovery) | 3.2 |

| 23.5 |

| (6.8 | ) | 59.1 |

|

| Unrealized gain on risk management contracts | (41.6 | ) | (212.6 | ) | (152.0 | ) | (205.3 | ) |

| Unrealized loss on foreign exchange | 34.9 |

| 32.7 |

| 178.5 |

| 73.8 |

|

| Loss (gain) on disposal of petroleum and natural gas properties | (8.3 | ) | (0.1 | ) | (31.6 | ) | 1.8 |

|

| Other | 1.2 |

| 1.9 |

| 2.3 |

| 1.0 |

|

| Funds from operations | 200.7 |

| 251.7 |

| 773.4 |

| 1,124.0 |

|

| Net change in other liabilities | (4.0 | ) | 0.4 |

| (22.0 | ) | (20.4 | ) |

| Change in non-cash working capital | (20.9 | ) | 39.1 |

| (62.4 | ) | 49.4 |

|

| Cash flow from operating activities | 175.8 |

| 291.2 |

| 689.0 |

| 1,153.0 |

|

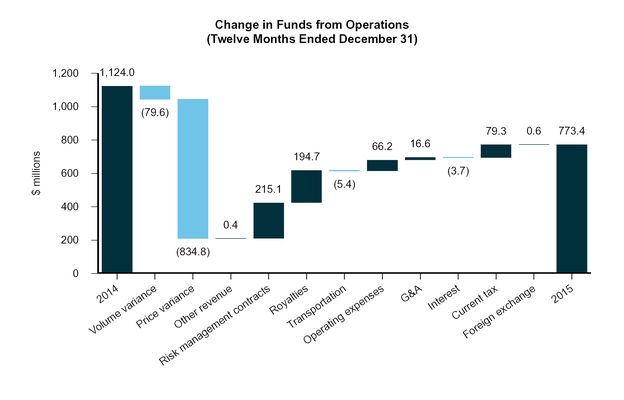

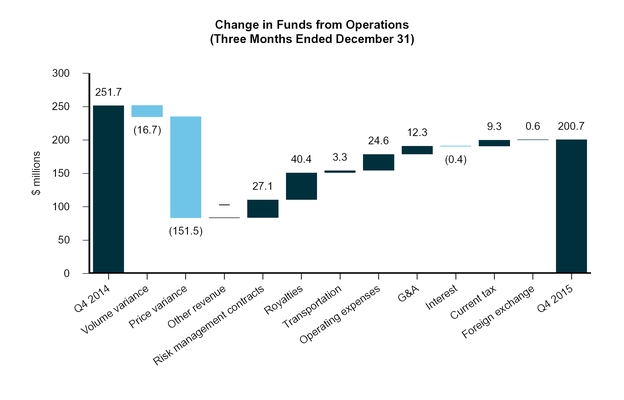

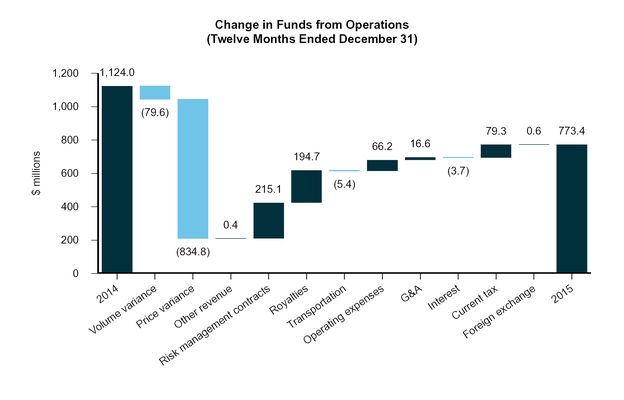

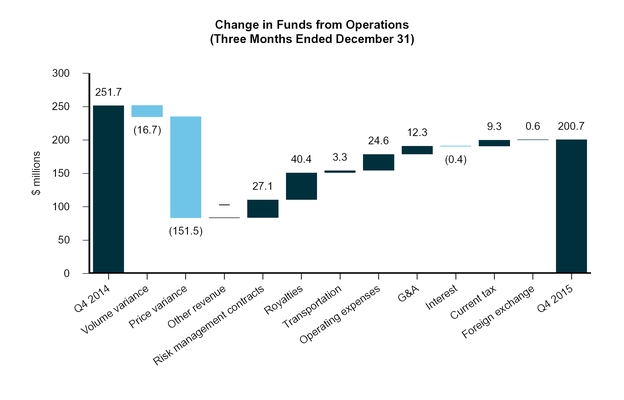

Details of the change in funds from operations from the three and twelve months ended December 31, 2014 to the three and twelve months ended December 31, 2015 are included in Table 7 below:

Table 7 |

| | | | | | | | |

| | Three Months Ended | Twelve Months Ended |

| | December 31 | December 31 |

| | $ millions |

| $/Share |

| $ millions |

| $/Share |

|

| Funds from operations – 2014 | 251.7 |

| 0.79 |

| 1,124.0 |

| 3.54 |

|

| Volume variance | | | | |

| Crude oil and liquids | (30.8 | ) | (0.10 | ) | (147.0 | ) | (0.46 | ) |

| Natural gas | 14.1 |

| 0.04 |

| 67.4 |

| 0.21 |

|

| Price variance | | | | |

| Crude oil and liquids | (84.1 | ) | (0.26 | ) | (529.7 | ) | (1.67 | ) |

| Natural gas | (67.4 | ) | (0.21 | ) | (305.1 | ) | (0.96 | ) |

| Other Revenue | — |

| — |

| 0.4 |

| — |

|

| Realized gain on risk management contracts | 27.1 |

| 0.08 |

| 215.1 |

| 0.68 |

|

| Royalties | 40.4 |

| 0.13 |

| 194.7 |

| 0.62 |

|

| Expenses (recoveries) | | | | |

| Transportation | 3.3 |

| 0.01 |

| (5.4 | ) | (0.02 | ) |

| Operating | 24.6 |

| 0.08 |

| 66.2 |

| 0.21 |

|

| G&A | 12.3 |

| 0.04 |

| 16.6 |

| 0.05 |

|

| Interest | (0.4 | ) | — |

| (3.7 | ) | (0.01 | ) |

| Current tax | 9.3 |

| 0.03 |

| 79.3 |

| 0.25 |

|

| Realized gain on foreign exchange | 0.6 |

| — |

| 0.6 |

| — |

|

| Diluted shares | — |

| (0.05 | ) | — |

| (0.17 | ) |

| Funds from operations – 2015 | 200.7 |

| 0.58 |

| 773.4 |

| 2.27 |

|

Funds from operations decreased by 20 per cent in the fourth quarter of 2015 to $200.7 million from $251.7 million generated in the fourth quarter of 2014. The decrease reflects lower revenue due primarily to significantly lower realized commodity prices and reduced crude oil and liquids production in the fourth quarter of 2015 as compared to the fourth quarter of 2014. Increased natural gas production and realized gains on risk management contracts relative to the fourth quarter of the prior year along with lower royalties, operating costs, G&A expenses and current taxes partially offset the impact of the reduction in commodity prices.

For the year ended December 31, 2015, funds from operations decreased by $350.6 million to $773.4 million from $1,124 million in the prior year. This decrease reflects lower revenue net of royalties, partially offset by increased realized gains on risk management contracts, operating costs, G&A expenses and current taxes.

|

| | |

| ARC Resources Ltd. | Page 10 |

Exhibit 4  Exhibit 4a

Exhibit 4a

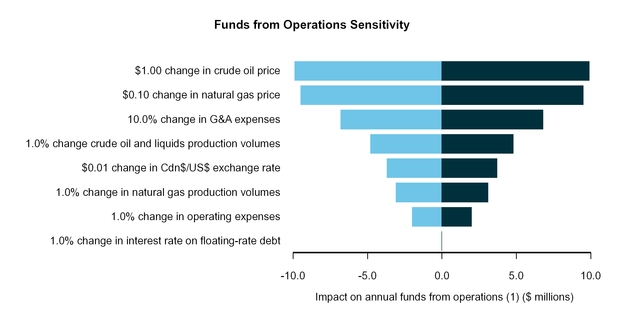

2015 Funds from Operations Sensitivity

Table 8 illustrates sensitivities of pre-hedged operating items to operational and business environment changes and the resulting impact on funds from operations per share:

Table 8 |

| | | | | | |

| | Impact on Annual Funds from Operations (6) |

|

| | Assumption |

| Change |

| $/Share |

|

Business Environment (1) | | | |

Crude oil price (US$ WTI/bbl) (2)(3) | 48.76 |

| 1.00 |

| 0.029 |

|

Natural gas price (Cdn$ AECO/Mcf) (2)(3) | 2.77 |

| 0.10 |

| 0.028 |

|

Cdn$/US$ exchange rate (2)(3)(4) | 1.28 |

| 0.01 |

| 0.011 |

|

Interest rate on floating-rate debt (2) | 2.8 | % | 1.0 | % | — |

|

| Operational | | | |

Crude oil and liquids production volumes (bbl/d) (5) | 40,011 |

| 1.0 | % | 0.014 |

|

Natural gas production volumes (MMcf/d) (5) | 444.9 |

| 1.0 | % | 0.009 |

|

Operating expenses ($/boe) (5) | 7.15 |

| 1.0 | % | 0.006 |

|

G&A expenses ($/boe) (5) | 1.65 |

| 10.0 | % | 0.020 |

|

| |

| (1) | Calculations are performed independently and may not be indicative of actual results that would occur when multiple variables change at the same time. |

| |

| (2) | Prices and rates are indicative of published prices for the year ended December 31, 2015. See Table 13 of this MD&A for additional details. The calculated impact on funds from operations would only be applicable within a limited range of these amounts. |

| |

| (3) | Analysis does not include the effect of risk management contracts. |

| |

| (4) | Includes impact of foreign exchange on crude oil, condensate, and NGLs prices that are presented in US dollars. |

| |

| (5) | Operational assumptions are based upon results for the year ended December 31, 2015. |

| |

| (6) | Refer to the sections entitled "Funds from Operations" and “Additional GAAP Measures” contained within this MD&A. |

Exhibit 5

| |

| (1) | Refer to the sections entitled "Funds from Operations" and “Additional GAAP Measures” contained within this MD&A. |

|

| | |

| ARC Resources Ltd. | Page 11 |

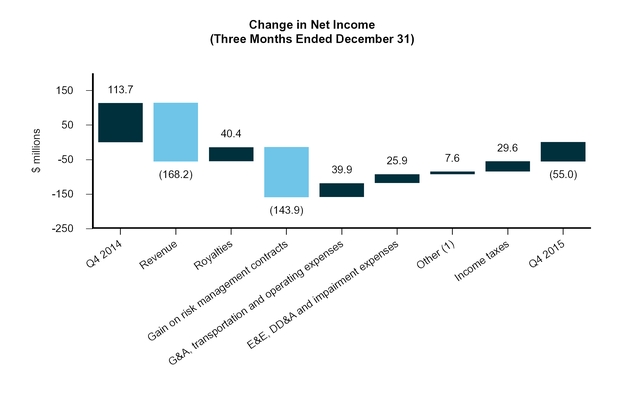

Net Income (Loss)

A net loss of $55 million (loss of $0.16 per share) was incurred in the fourth quarter of 2015, a $168.7 million ($0.52 per share) decrease compared to net income of $113.7 million (income of $0.36 per share) in the fourth quarter of 2014. Lower revenue net of royalties and decreased gains on risk management contracts reduced net income while lower operating costs, G&A expenses and income taxes, as well as higher gains on disposal of petroleum and natural gas properties served to partially offset the decrease. ARC also recorded lower DD&A charges in the fourth quarter of 2015 as compared to the same period in the prior year, which were partially offset by increased impairment charges.

Exhibit 6

| |

| (1) | Includes loss on foreign exchange, loss on short-term investments, and gain on disposal of PP&E. |

During the year ended December 31, 2015, ARC incurred a net loss of $342.7 million (loss of $1.01 per share), compared to net income of $380.8 million (income of $1.20 per share) earned during the prior year. Lower commodity prices during 2015 resulted in lower revenue net of royalties, however, the impact of falling prices was partially offset by increased gains on risk management contracts. ARC also recognized lower operating costs, lower G&A expenses, higher gains on disposal of petroleum and natural gas properties, and lower current and deferred taxes during the year. While ARC's DD&A charges were lower in 2015 as compared to the prior year, higher impairment charges were recognized in 2015. Additionally, increased foreign exchange losses were recognized in the current year relating to the revaluation of ARC’s U.S. dollar denominated long-term debt outstanding.

|

| | |

| ARC Resources Ltd. | Page 12 |

Exhibit 6a

| |

| (1) | Includes accretion, interest and financing expenses, loss on short-term investments, and gain on disposal of PP&E. |

Production

Table 9 |

| | | | | | | | | | | | |

| | Three Months Ended | Twelve Months Ended |

| | December 31 | December 31 |

| Production | 2015 |

| 2014 |

| % Change |

| 2015 |

| 2014 |

| % Change |

|

| Light and medium crude oil (bbl/d) | 33,124 |

| 36,276 |

| (9 | ) | 31,827 |

| 35,467 |

| (10 | ) |

| Heavy oil (bbl/d) | 775 |

| 1,166 |

| (34 | ) | 935 |

| 1,058 |

| (12 | ) |

| Condensate (bbl/d) | 3,631 |

| 3,448 |

| 5 |

| 3,430 |

| 3,667 |

| (6 | ) |

| Natural gas (MMcf/d) | 469.1 |

| 432.1 |

| 9 |

| 444.9 |

| 406.1 |

| 10 |

|

| NGLs (bbl/d) | 3,523 |

| 5,075 |

| (31 | ) | 3,819 |

| 4,518 |

| (15 | ) |

| Total production (boe/d) | 119,243 |

| 117,986 |

| 1 |

| 114,167 |

| 112,387 |

| 2 |

|

| % Natural gas production | 66 |

| 61 |

| 8 |

| 65 |

| 60 |

| 8 |

|

| % Crude oil and liquids production | 34 |

| 39 |

| (13 | ) | 35 |

| 40 |

| (13 | ) |

During both the three months and year ended December 31, 2015, crude oil and liquids production decreased 11 per cent from the same periods of the prior year. The decrease in crude oil and liquids production primarily reflects natural declines associated with reduced drilling activity and the disposition of certain non-core assets in Southwestern Saskatchewan in the third quarter of 2015 which had been producing approximately 500 boe per day prior to disposal. The decrease was partially offset by additional production at Tower following the battery expansion that was completed during the fourth quarter.

|

| | |

| ARC Resources Ltd. | Page 13 |

Natural gas production was 469.1 MMcf per day in the fourth quarter of 2015, an increase of nine per cent from the 432.1 MMcf per day produced in the fourth quarter of 2014. The increase is mainly attributed to new production from drilling throughout 2015 in northeastern British Columbia, particularly at Sunrise to fill ARC's new 60 MMcf per day natural gas processing facility which was commissioned during the third quarter of 2015. The increase in natural gas production was partially offset by the disposition of certain non-core assets in South Central Alberta in the second quarter of 2015 which had been producing approximately 14.4 MMcf per day prior to disposal. For the year ended December 31, 2015, natural gas production increased by 10 per cent as new production was brought on throughout 2015 at Sunrise and Parkland which served to offset the impact of lost production due to turnarounds during the year and the second quarter disposition.

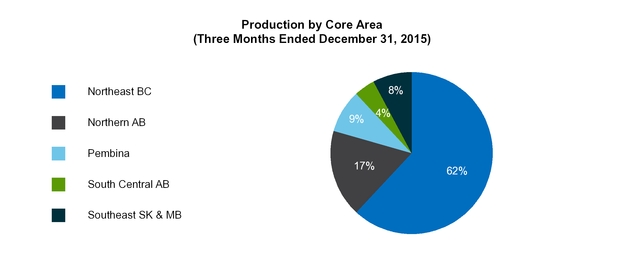

Exhibit 7

|

| | |

| ARC Resources Ltd. | Page 14 |

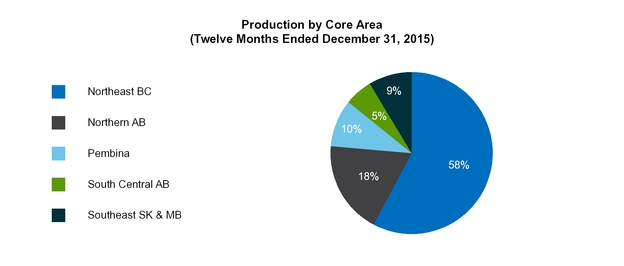

During the fourth quarter of 2015, ARC drilled five natural gas wells (100 per cent ARC) on operated properties. For the year ended December 31, 2015, ARC drilled 60 gross wells (59 net wells) on operated properties consisting of 33 gross (32 net) oil wells, 21 gross (21 net) natural gas wells, five gross (five net) liquids-rich natural gas wells, and one gross (one net) service well. Table 10 summarizes ARC’s production by core area for the fourth quarter of 2015 and 2014:

Table 10

|

| | | | | | | | | | |

| | Three Months Ended December 31, 2015 |

| Production | Total |

| Crude Oil |

| Condensate |

| Natural Gas |

| NGLs |

|

Core Area (1) | (boe/d) |

| (bbl/d) |

| (bbl/d) |

| (MMcf/d) |

| (bbl/d) |

|

| Northeast BC | 73,964 |

| 6,344 |

| 2,677 |

| 379.8 |

| 1,637 |

|

| Northern AB | 20,780 |

| 7,394 |

| 703 |

| 68.9 |

| 1,194 |

|

| Pembina | 10,368 |

| 7,618 |

| 195 |

| 12.8 |

| 432 |

|

South Central AB (2) | 4,821 |

| 3,593 |

| 6 |

| 6.4 |

| 150 |

|

Southeast SK & MB (3) | 9,310 |

| 8,950 |

| 50 |

| 1.2 |

| 110 |

|

| Total | 119,243 |

| 33,899 |

| 3,631 |

| 469.1 |

| 3,523 |

|

|

| | | | | | | | | | |

| | Three Months Ended December 31, 2014 |

| Production | Total |

| Crude Oil |

| Condensate |

| Natural Gas |

| NGLs |

|

Core Area (1) | (boe/d) |

| (bbl/d) |

| (bbl/d) |

| (MMcf/d) |

| (bbl/d) |

|

| Northeast BC | 63,675 |

| 4,372 |

| 2,420 |

| 325.0 |

| 2,704 |

|

| Northern AB | 22,583 |

| 8,496 |

| 748 |

| 70.3 |

| 1,626 |

|

| Pembina | 12,068 |

| 9,331 |

| 167 |

| 12.8 |

| 444 |

|

South Central AB (2) | 8,645 |

| 4,542 |

| 60 |

| 23.0 |

| 213 |

|

Southeast SK & MB (3) | 11,015 |

| 10,701 |

| 53 |

| 1.0 |

| 88 |

|

| Total | 117,986 |

| 37,442 |

| 3,448 |

| 432.1 |

| 5,075 |

|

| |

| (1) | Provincial references: "AB" is Alberta, "BC" is British Columbia, "SK" is Saskatchewan, "MB" is Manitoba. |

| |

| (2) | During the second quarters of 2015 and 2014, ARC disposed of certain non-core assets in this district. Each disposition included assets that had been producing approximately 2,400 boe per day prior to disposal. An additional 500 boe per day were disposed from this district toward the end of the third quarter of 2015. |

| |

| (3) | In December 2015, ARC disposed of certain non-core assets in this district that had been producing approximately 1,300 boe per day prior to disposal. |

Exhibit 8

|

| | |

| ARC Resources Ltd. | Page 15 |

Table 10a summarizes ARC’s production by core area for the twelve months ended December 31, 2015 and 2014:

Table 10a |

| | | | | | | | | | |

| | Twelve Months Ended December 31, 2015 |

| Production | Total |

| Crude Oil |

| Condensate |

| Natural Gas |

| NGLs |

|

Core Area (1) | (boe/d) |

| (bbl/d) |

| (bbl/d) |

| (MMcf/d) |

| (bbl/d) |

|

| Northeast BC | 66,022 |

| 3,406 |

| 2,461 |

| 350.8 |

| 1,687 |

|

| Northern AB | 21,035 |

| 7,497 |

| 710 |

| 68.5 |

| 1,402 |

|

| Pembina | 10,992 |

| 8,227 |

| 175 |

| 12.9 |

| 446 |

|

South Central AB (2) | 6,166 |

| 3,996 |

| 33 |

| 11.6 |

| 196 |

|

Southeast SK & MB (3) | 9,952 |

| 9,636 |

| 51 |

| 1.1 |

| 88 |

|

| Total | 114,167 |

| 32,762 |

| 3,430 |

| 444.9 |

| 3,819 |

|

|

| | | | | | | | | | |

| | Twelve Months Ended December 31, 2014 |

| Production | Total |

| Crude Oil |

| Condensate |

| Natural Gas |

| NGLs |

|

Core Area (1) | (boe/d) |

| (bbl/d) |

| (bbl/d) |

| (MMcf/d) |

| (bbl/d) |

|

| Northeast BC | 57,669 |

| 3,384 |

| 2,580 |

| 296.4 |

| 2,302 |

|

| Northern AB | 23,339 |

| 9,547 |

| 811 |

| 68.8 |

| 1,511 |

|

| Pembina | 11,391 |

| 8,779 |

| 163 |

| 12.3 |

| 405 |

|

South Central AB (2) | 9,190 |

| 4,321 |

| 70 |

| 27.5 |

| 220 |

|

Southeast SK & MB (3) | 10,798 |

| 10,494 |

| 43 |

| 1.1 |

| 80 |

|

| Total | 112,387 |

| 36,525 |

| 3,667 |

| 406.1 |

| 4,518 |

|

| |

| (1) | Provincial references: "AB" is Alberta, "BC" is British Columbia, "SK" is Saskatchewan, "MB" is Manitoba. |

| |

| (2) | During the second quarters of 2015 and 2014, ARC disposed of certain non-core assets in this district. Each disposition included assets that had been producing approximately 2,400 boe per day prior to disposal. An additional 500 boe per day were disposed from this district toward the end of the third quarter of 2015. |

| |

| (3) | In December 2015, ARC disposed of certain non-core assets in this district that had been producing approximately 1,300 boe per day prior to disposal. |

Exhibit 8a

|

| | |

| ARC Resources Ltd. | Page 16 |

Sales of Crude Oil, Natural Gas, Condensate, NGLs and Other Income

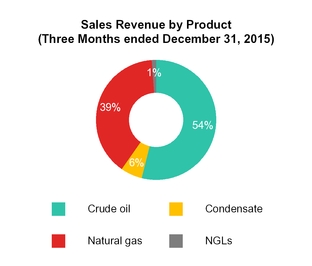

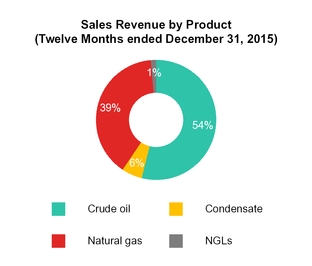

Sales revenue from crude oil, natural gas, condensate, NGLs and other income decreased significantly in both the fourth quarter of 2015 and for the full year as compared to the same periods in 2014. The decreases reflect lower average realized commodity prices for all products in 2015 compared to 2014 as well as decreased crude oil and liquids production volumes.

A breakdown of sales revenue by product is outlined in Table 11:

Table 11 |

| | | | | | | | | | | | |

| | Three Months Ended | Twelve Months Ended |

| | December 31 | December 31 |

Sales revenue by product ($ millions) | 2015 |

| 2014 |

| % Change |

| 2015 |

| 2014 |

| % Change |

|

| Crude oil | 153.5 |

| 249.7 |

| (39 | ) | 640.1 |

| 1,208.4 |

| (47 | ) |

| Condensate | 16.6 |

| 23.5 |

| (29 | ) | 67.4 |

| 125.6 |

| (46 | ) |

| Natural gas | 111.7 |

| 165.0 |

| (32 | ) | 467.9 |

| 705.6 |

| (34 | ) |

| NGLs | 3.5 |

| 15.3 |

| (77 | ) | 14.9 |

| 65.1 |

| (77 | ) |

| Total sales revenue from crude oil, natural gas, condensate and NGLs | 285.3 |

| 453.5 |

| (37 | ) | 1,190.3 |

| 2,104.7 |

| (43 | ) |

| Other income | 0.6 |

| 0.6 |

| — |

| 3.4 |

| 3.0 |

| 13 |

|

| Total sales revenue | 285.9 |

| 454.1 |

| (37 | ) | 1,193.7 |

| 2,107.7 |

| (43 | ) |

Exhibit 9

While ARC’s production mix on a per boe basis is weighted more heavily to natural gas than to crude oil and liquids, ARC's revenue contribution is more heavily weighted to crude oil and liquids production as shown by the table below:

Table 12

|

| | | | |

| | Three Months Ended | Twelve Months Ended |

| | December 31 | December 31 |

| Revenue by Product Type | 2015 | 2014 | 2015 | 2014 |

| | % of Total Revenue | % of Total Revenue | % of Total Revenue | % of Total Revenue |

| Crude oil and liquids | 61 | 64 | 61 | 66 |

| Natural gas | 39 | 36 | 39 | 34 |

| Total sales revenue | 100 | 100 | 100 | 100 |

|

| | |

| ARC Resources Ltd. | Page 17 |

Commodity Prices Prior to Hedging

Table 13 |

| | | | | | | | | | | | |

| | Three Months Ended | Twelve Months Ended |

| | December 31 | December 31 |

| | 2015 |

| 2014 |

| % Change |

| 2015 |

| 2014 |

| % Change |

|

| Average Benchmark Prices | | | | | | |

| AECO natural gas (Cdn$/Mcf) | 2.65 |

| 4.01 |

| (34 | ) | 2.77 |

| 4.42 |

| (37 | ) |

| WTI oil (US$/bbl) | 42.16 |

| 73.20 |

| (42 | ) | 48.76 |

| 92.91 |

| (48 | ) |

| Cdn$/US$ exchange rate | 1.34 |

| 1.14 |

| 18 |

| 1.28 |

| 1.10 |

| 16 |

|

| WTI oil (Cdn$/bbl) | 56.49 |

| 83.45 |

| (32 | ) | 62.41 |

| 102.20 |

| (39 | ) |

| Edmonton Par (Cdn$/bbl) | 52.93 |

| 75.65 |

| (30 | ) | 57.20 |

| 94.46 |

| (39 | ) |

| ARC Average Realized Prices Prior to Hedging | | | | | | |

| Crude oil ($/bbl) | 49.24 |

| 72.49 |

| (32 | ) | 53.53 |

| 90.64 |

| (41 | ) |

| Condensate ($/bbl) | 49.80 |

| 74.04 |

| (33 | ) | 53.84 |

| 93.81 |

| (43 | ) |

| Natural gas ($/Mcf) | 2.59 |

| 4.15 |

| (38 | ) | 2.88 |

| 4.76 |

| (39 | ) |

| NGLs ($/bbl) | 10.73 |

| 32.69 |

| (67 | ) | 10.70 |

| 39.45 |

| (73 | ) |

| Total average realized commodity price prior to other income and hedging ($/boe) | 26.01 |

| 41.78 |

| (38 | ) | 28.57 |

| 51.31 |

| (44 | ) |

| Other income ($/boe) | 0.05 |

| 0.05 |

| — |

| 0.08 |

| 0.07 |

| 14 |

|

| Total average realized price prior to hedging ($/boe) | 26.06 |

| 41.83 |

| (38 | ) | 28.65 |

| 51.38 |

| (44 | ) |

In the fourth quarter of 2015, WTI decreased 42 per cent to US$42.16 per barrel as compared to US$73.20 per barrel in the same period in 2014. Similarly, ARC’s realized crude oil price decreased by 32 per cent over the same time period, averaging $49.24 per barrel. During the fourth quarter of 2015, the differential between WTI and Edmonton posted prices narrowed to an average discount of US$2.52 per barrel compared to US$6.58 per barrel in the same period in 2014. During the same period, the average exchange rate for the Canadian dollar as compared to the US dollar weakened from $1.14 to $1.34. The narrowing of the differential combined with a weaker Canadian dollar served to partially mitigate the overall impact of the decrease in WTI on ARC's average realized prices.

For the year ended December 31, 2015, ARC's average realized crude oil price fell by 41 per cent as compared to the year ended December 31, 2014. This price decrease is primarily attributed to the 48 per cent decrease in WTI over the same time period, partially offset by the effect of a narrowed differential between WTI and Edmonton Par crude oil prices and a weakened Canadian dollar.

Natural gas prices decreased in the fourth quarter and for the year ended December 31, 2015 as compared to the same periods in 2014. Year-over-year North American supply exceeded demand, leaving inventory levels much higher than in the prior year. ARC's average realized natural gas price for the year ended December 31, 2015 of $2.88 per Mcf was higher than the 2014 average AECO monthly index price due in part to ARC's higher than average heat content in its natural gas. Approximately 20 per cent of ARC's natural gas production is sold at Station 2 in British Columbia which has experienced volatile pricing throughout the second half of the year, primarily as a result of maintenance activities on all western Canadian pipelines, leading to insufficient take-away capacity. As a result, ARC's average realized natural gas price for the fourth quarter of 2015 of $2.59 per Mcf was modestly lower than the average AECO monthly index price during the period. ARC has been able to partially mitigate the impact of Station 2 pricing through the physical diversification of its sales points. ARC maintains a diversified sales portfolio that allows some flexibility on a portion of its natural gas sales between monthly average and daily spot pricing at sales hubs in western Canada and the mid-western United States.

|

| | |

| ARC Resources Ltd. | Page 18 |

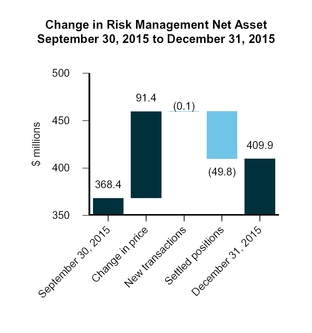

Risk Management

ARC maintains a risk management program to reduce the volatility of revenues, increase the certainty of funds from operations, and to protect acquisition and development economics. ARC’s risk management program is governed by certain guidelines approved by the Board of Directors (the "Board"). These guidelines currently restrict risk management contracts to a maximum of 55 per cent of total forecast production where a specific commodity (crude oil or natural gas) cannot exceed a maximum of 70 per cent of forecast production for that commodity over the next two years, and with a maximum of 25 per cent of forecast natural gas production in risk management contracts beyond two years and up to five years. ARC’s risk management program guidelines allow for further risk management contracts on anticipated volumes associated with new production arising from specific capital projects and acquisitions or to further protect cash flows for a specific period with approval of the Board.

Gains and losses on risk management contracts are composed of both realized gains and losses, representing the portion of risk management contracts that have settled in cash during the period, and unrealized gains or losses that represent the change in the mark-to-market position of those contracts throughout the period. ARC does not employ hedge accounting for any of its risk management contracts currently in place. ARC considers all of its risk management contracts to be effective economic hedges of its underlying business transactions.

Table 14 summarizes the total gain or loss on risk management contracts for the fourth quarter of 2015 compared to the same period in 2014:

Table 14 |

| | | | | | | | | | | | |

Risk Management Contracts ($ millions) | Crude Oil & Liquids |

| Natural Gas |

| Foreign Currency |

| Power |

| Q4 2015 Total |

| Q4 2014 Total |

|

Realized gain (loss) on contracts (1) | 12.7 |

| 43.2 |

| (3.2 | ) | (0.8 | ) | 51.9 |

| 24.8 |

|

Unrealized gain (loss) on contracts (2) | 20.0 |

| 18.5 |

| 3.9 |

| (0.8 | ) | 41.6 |

| 212.6 |

|

| Gain (loss) on risk management contracts | 32.7 |

| 61.7 |

| 0.7 |

| (1.6 | ) | 93.5 |

| 237.4 |

|

| |

| (1) | Represents actual cash settlements or receipts under the respective contracts. |

| |

| (2) | Represents the change in fair value of the contracts during the period. |

Table 14a summarizes the total gain or loss on risk management contracts for the year ended December 31, 2015 compared to the same period in 2014:

Table 14a |

| | | | | | | | | | | | |

Risk Management Contracts ($ millions) | Crude Oil & Liquids |

| Natural Gas |

| Foreign Currency |

| Power |

| 2015 Total |

| 2014 Total |

|

Realized gain (loss) on contracts (1) | 55.8 |

| 141.2 |

| (9.9 | ) | (1.1 | ) | 186.0 |

| (29.1 | ) |

Unrealized gain (loss) on contracts (2) | 39.4 |

| 109.5 |

| 4.1 |

| (1.0 | ) | 152.0 |

| 205.3 |

|

| Gain (loss) on risk management contracts | 95.2 |

| 250.7 |

| (5.8 | ) | (2.1 | ) | 338.0 |

| 176.2 |

|

| |

| (1) | Represents actual cash settlements or receipts under the respective contracts. |

| |

| (2) | Represents the change in fair value of the contracts during the period. |

During the three and twelve months ended December 31, 2015, ARC recorded gains of $93.5 million and $338 million, respectively, on its risk management contracts. These gains comprised realized gains of $51.9 million and unrealized gains of $41.6 million for the fourth quarter and realized gains of $186 million and unrealized gains of $152 million for the year ended December 31, 2015. The realized gains reflect positive cash settlements received on crude oil contracts with an average floor price of US$90/bbl for the first and second quarters of 2015, crude oil swaps with an average price of $74.77 in the third and fourth quarters, crude oil contracts with an average floor price of $61.80 in the fourth quarter, and on natural gas contracts with an average floor price of $3.94/MMbtu throughout the year. These realized gains are partially offset by realized losses on forward foreign currency and power contracts.

ARC's fourth quarter 2015 unrealized gains on crude oil contracts reflect lower Canadian WTI prices in the forward price curve. During the same period, unrealized gains on natural gas contracts reflect lower forward NYMEX Henry Hub prices, offset by slightly narrower AECO basis through 2019. For the year ended December 31, 2015, ARC's unrealized gains on natural gas contracts primarily reflect lower forward NYMEX Henry Hub prices. Losses for the three months and year ended December 31, 2015 on electricity contracts reflect lower power prices in the forward price curve.

ARC’s risk management contracts provide protection from natural gas prices on 173,400 MMbtu per day for 2016. ARC has also executed long-term natural gas contracts on 154,500 MMbtu per day for 2017, 127,900 MMbtu per day for 2018, 68,400 MMbtu per day for 2019, and 56,800 for 2020. In addition, ARC has AECO basis swap contracts in place,

|

| | |

| ARC Resources Ltd. | Page 19 |

fixing the AECO price received on 140,000 MMbtu per day for 2016, 150,000 MMbtu per day for 2017, 95,000 MMbtu per day for 2018, 60,000 MMbtu per day for 2019, and 10,000 MMbtu per day for 2020.

For crude oil, ARC has 10,000 barrels per day of crude oil production hedged for 2016. In addition, ARC has hedged 3,000 barrels per day of production for the first half of 2017. ARC also has MSW basis swap contracts in place for 2016, fixing the discount between WTI and the mixed sweet crude grade price at Edmonton.

Table 15 summarizes ARC’s average crude oil and natural gas hedged volumes for 2016 through 2020 as at the date of this MD&A. For a complete listing and terms of ARC’s hedging contracts at December 31, 2015, see Note 16 “Financial Instruments and Market Risk Management” in the financial statements.

Table 15

|

| | | | | | | | | | | | | | | | | | | | |

Hedge Positions Summary (1) | | | | | | | | | | |

| As at February 10, 2016 | 2016 | 2017 | 2018 | 2019 | 2020 |

Crude Oil - Cdn$ WTI (2) | Cdn$/bbl |

| bbl/d |

| Cdn$/bbl |

| bbl/d |

| Cdn$/bbl |

| bbl/d |

| Cdn$/bbl |

| bbl/d |

| Cdn$/bbl |

| bbl/d |

|

| Ceiling | 83.38 |

| 3,000 |

| 83.38 |

| 1,488 |

| — |

| — |

| — |

| — |

| — |

| — |

|

| Floor | 70.00 |

| 3,000 |

| 70.00 |

| 1,488 |

| — |

| — |

| — |

| — |

| — |

| — |

|

| Swap | 77.20 |

| 7,000 |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

|

Crude Oil - MSW (Differential to WTI) (3) | US$/bbl |

| bbl/d |

| US$/bbl |

| bbl/d |

| US$/bbl |

| bbl/d |

| US$/bbl |

| bbl/d |

| US$/bbl |

| bbl/d |

|

| Swap | (3.75 | ) | 9,500 |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

|

Natural Gas - NYMEX (4) | US$/MMbtu |

| MMbtu/d |

| US$/MMbtu |

| MMbtu/d |

| US$/MMbtu |

| MMbtu/d |

| US$/MMbtu |

| MMbtu/d |

| US$/MMbtu |

| MMbtu/d |

|

| Ceiling | 4.79 |

| 105,000 |

| 4.81 |

| 145,000 |

| 4.92 |

| 90,000 |

| 5.00 |

| 40,000 |

| — |

| — |

|

| Floor | 4.00 |

| 105,000 |

| 4.00 |

| 145,000 |

| 4.00 |

| 90,000 |

| 4.00 |

| 40,000 |

| — |

| — |

|

| Swap | 4.00 |

| 40,000 |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

| — |

|

Natural Gas - AECO (5) | Cdn$/GJ |

| GJ/d |

| Cdn$/GJ |

| GJ/d |

| Cdn$/GJ |

| GJ/d |

| Cdn$/GJ |

| GJ/d |

| Cdn$/GJ |

| GJ/d |

|

| Ceiling | — |

| — |

| — |

| — |

| — |

| — |

| 3.30 |

| 10,000 |

| 3.60 |

| 30,000 |

|

| Floor | — |

| — |

| — |

| — |

| — |

| — |

| 3.00 |

| 10,000 |

| 3.08 |

| 30,000 |

|

| Swap | 2.99 |

| 30,000 |

| 2.75 |

| 10,000 |

| 2.96 |

| 40,000 |

| 3.16 |

| 20,000 |

| 3.35 |

| 30,000 |

|

Natural Gas - AECO Basis (6) | AECO/NYMEX |

| MMbtu/d |

| AECO/NYMEX |

| MMbtu/d |

| AECO/NYMEX |

| MMbtu/d |

| AECO/NYMEX |

| MMbtu/d |

| AECO/NYMEX |

| MMbtu/d |

|

| Swap (percentage of NYMEX) | 90.3 |

| 140,000 |

| 89.3 |

| 150,000 |

| 84.5 |

| 95,000 |

| 82.6 |

| 60,000 |

| 82.5 |

| 10,000 |

|

| |

| (1) | The prices and volumes in this table represent averages for several contracts representing different periods. The average price for the portfolio of options listed above does not have the same payoff profile as the individual option contracts. Viewing the average price of a group of options is purely for indicative purposes. All positions are financially settled against the benchmark prices disclosed in Note 16 “Financial Instruments and Market Risk Management” in the financial statements. |

| |

| (2) | Crude oil prices referenced to WTI, multiplied by the Bank of Canada monthly average noon day rate. |

| |

| (3) | MSW differential refers to the discount between WTI and the mixed sweet crude grade at Edmonton, calculated on a monthly weighted average basis in US$. |

| |

| (4) | Natural gas prices referenced to NYMEX Henry Hub. |

| |

| (5) | Natural gas prices referenced to AECO 7(a) index. |

| |

| (6) | ARC sells the majority of its natural gas production based on AECO pricing. To reduce the risk of weak basis pricing (AECO relative to NYMEX Henry Hub), ARC has hedged a portion of production by tying ARC's price to a percentage of the NYMEX Henry Hub natural gas price. |

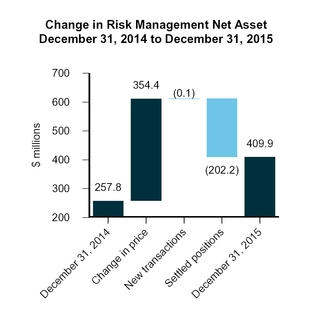

The fair value of ARC’s risk management contracts at December 31, 2015 was a net asset of $409.9 million, representing the expected market price to settle ARC’s contracts at the balance sheet date after any adjustments for credit risk. This may differ from what will eventually be settled in future periods.

|

| | |

| ARC Resources Ltd. | Page 20 |

Exhibit 10

Operating Netbacks

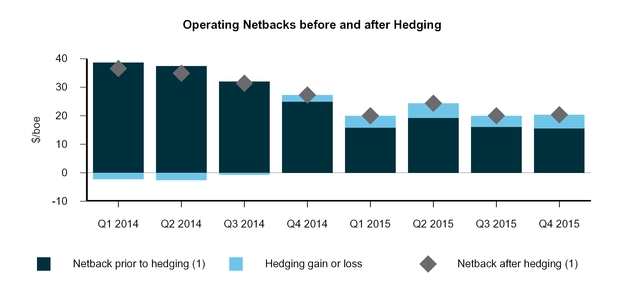

ARC’s fourth quarter and 2015 netbacks prior to hedging were $15.63 per boe and $16.69 per boe, respectively, representing decreases of 37 per cent and 49 per cent as compared to the same periods in 2014.

ARC’s fourth quarter and 2015 netbacks, including realized hedging gains and losses, were $20.36 per boe and $21.15 per boe, respectively, representing decreases of 25 per cent and 35 per cent as compared to the same periods in 2014.

The components of operating netbacks for the fourth quarter of 2015 compared to the same period in 2014 are summarized in Table 16:

Table 16 |

| | | | | | | | | | | | | | |

Netbacks (1) | Crude Oil |

| Heavy Oil |

| Condensate |

| Natural Gas |

| NGLs |

| Q4 2015 Total |

| Q4 2014 Total |

|

| | ($/bbl) |

| ($/bbl) |

| ($/bbl) |

| ($/Mcf) |

| ($/bbl) |

| ($/boe) |

| ($/boe) |

|

| Average sales price | 49.66 |

| 31.26 |

| 49.80 |

| 2.59 |

| 10.73 |

| 26.01 |

| 41.78 |

|

| Other income | — |

| — |

| — |

| — |

| — |

| 0.05 |

| 0.05 |

|

| Total sales | 49.66 |

| 31.26 |

| 49.80 |

| 2.59 |

| 10.73 |

| 26.06 |

| 41.83 |

|

| Royalties | (5.65 | ) | (1.03 | ) | (7.95 | ) | (0.04 | ) | (1.91 | ) | (2.03 | ) | (5.77 | ) |

| Transportation | (2.54 | ) | (0.48 | ) | (3.10 | ) | (0.30 | ) | (7.49 | ) | (2.19 | ) | (2.51 | ) |

Operating expenses (2) | (11.45 | ) | (13.03 | ) | (5.19 | ) | (0.66 | ) | (6.15 | ) | (6.21 | ) | (8.55 | ) |

| Netback prior to hedging | 30.02 |

| 16.72 |

| 33.56 |

| 1.59 |

| (4.82 | ) | 15.63 |

| 25.00 |

|

Hedging gain (3) | 3.89 |

| — |

| — |

| 0.93 |

| — |

| 4.73 |

| 2.29 |

|

| Netback after hedging | 33.91 |

| 16.72 |

| 33.56 |

| 2.52 |

| (4.82 | ) | 20.36 |

| 27.29 |

|

| % of total netback | 46 |

| 1 |

| 5 |

| 49 |

| (1 | ) | 100 |

| 100 |

|

| |

| (1) | Non-GAAP measure which may not be comparable to similar non-GAAP measures used by other entities. Refer to the section entitled "Non-GAAP Measures" contained within this MD&A. |

| |

| (2) | Composed of direct costs incurred to operate crude oil and natural gas wells. A number of assumptions have been made in allocating these costs between crude oil, heavy oil, condensate, natural gas and NGLs production. |

| |

| (3) | Includes realized cash gains and losses on risk management contracts. |

|

| | |

| ARC Resources Ltd. | Page 21 |

Exhibit 11

| |

| (1) | Non-GAAP measure which may not be comparable to similar non-GAAP measures used by other entities. Refer to the section entitled "Non-GAAP Measures" contained within this MD&A. |

The components of operating netbacks for the year ended December 31, 2015 compared to the same period in 2014 are summarized in Table 16a:

Table 16a

|

| | | | | | | | | | | | | | |

Netbacks (1) | Crude Oil |

| Heavy Oil |

| Condensate |

| Natural Gas |

| NGLs |

| 2015 Total |

| 2014 Total |

|

| | ($/bbl) |

| ($/bbl) |

| ($/bbl) |

| ($/Mcf) |

| ($/bbl) |

| ($/boe) |

| ($/boe) |

|

| Average sales price | 53.94 |

| 39.70 |

| 53.84 |

| 2.88 |

| 10.70 |

| 28.57 |

| 51.31 |

|

| Other income | — |

| — |

| — |

| — |

| — |

| 0.08 |

| 0.07 |

|

| Total sales | 53.94 |

| 39.70 |

| 53.84 |

| 2.88 |

| 10.70 |

| 28.65 |

| 51.38 |

|

| Royalties | (5.72 | ) | (0.87 | ) | (9.03 | ) | (0.14 | ) | (2.12 | ) | (2.48 | ) | (7.26 | ) |

| Transportation | (2.57 | ) | (0.52 | ) | (3.00 | ) | (0.32 | ) | (7.81 | ) | (2.33 | ) | (2.23 | ) |

Operating expenses (2) | (12.78 | ) | (10.38 | ) | (5.78 | ) | (0.80 | ) | (6.05 | ) | (7.15 | ) | (8.88 | ) |

| Netback prior to hedging | 32.87 |

| 27.93 |

| 36.03 |

| 1.62 |

| (5.28 | ) | 16.69 |

| 33.01 |

|

Hedging gain (loss) (3) | 4.59 |

| — |

| — |

| 0.82 |

| — |

| 4.46 |

| (0.65 | ) |

| Netback after hedging | 37.46 |

| 27.93 |

| 36.03 |

| 2.44 |

| (5.28 | ) | 21.15 |

| 32.36 |

|

| % of total netback | 50 |

| 1 |

| 5 |

| 45 |

| (1 | ) | 100 |

| 100 |

|

| |

| (1) | Non-GAAP measure which may not be comparable to similar non-GAAP measures used by other entities. Refer to the section entitled "Non-GAAP Measures" contained within this MD&A. |

| |

| (2) | Composed of direct costs incurred to operate crude oil and natural gas wells. A number of assumptions have been made in allocating these costs between crude oil, heavy oil, condensate, natural gas and NGLs production. |

| |

| (3) | Includes realized cash gains and losses on risk management contracts. |

Royalties

ARC pays royalties to the respective provincial governments and landowners of the four western Canadian provinces in which it operates. Approximately 79 per cent of these royalties are Crown royalties. Each province that ARC operates in has established a separate and distinct royalty regime which impacts ARC’s average corporate royalty rate.

In British Columbia, the majority of ARC’s royalty expense stems from production of natural gas and associated liquids. While condensate and NGLs have a flat royalty rate of 20 per cent of sales revenue, the royalty rates for natural gas

|

| | |

| ARC Resources Ltd. | Page 22 |

are based on the drill date of a well and a producer price. All wells spud on or after April 1, 2014 receive a minimum six per cent royalty with additional royalty credits available for horizontal wells drilled to depths greater than 1,900 meters. Wells drilled prior to that date receive a minimum three per cent royalty.

In Alberta, the majority of ARC’s royalties are related to oil production where royalty rates are based on reference prices, production levels and well depths. Similarly, most royalties remitted in Saskatchewan and Manitoba relate to oil production. Royalty calculations in these provinces are based on the classification of the oil product and well productivity.

Each province has various incentive programs in place to promote drilling by reducing the overall royalty expense for producers and offsetting gathering and processing costs. In most cases, the incentive period lasts for a finite period of time (usually twelve months upon commencement of production), after which point the royalty rate usually increases depending on the production rate of the well and prevailing market commodity prices.

In 2016, the provincial government of Alberta announced the key highlights of a proposed Modernized Royalty Framework ("MRF") that will be effective on January 1, 2017. These highlights include providing royalty incentives for the efficient development of conventional crude oil, natural gas, and NGL resources, no changes to the royalty structure of wells drilled prior to 2017 for a 10-year period from the royalty program's implementation date, the replacement of royalty credits/holidays on conventional wells by a revenue minus cost framework with a post-payout royalty rate based on commodity prices, the reduction of royalty rates for mature wells, and a neutral internal rate of return for any given play compared to the current royalty framework. While the provincial government of Alberta has not yet released all of the details of the MRF, the changes are not currently expected to have a material impact on ARC's results of operations. ARC will evaluate the impact of the MRF on the Company’s expected results of operations and cash flows as more details are released.

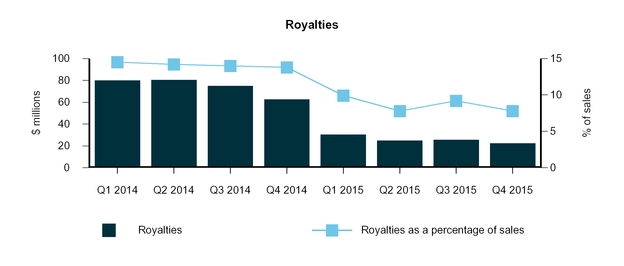

Total royalties as a percentage of pre-hedged commodity product sales revenue decreased from 13.8 per cent ($5.77 per boe) in the fourth quarter of 2014 to 7.8 per cent ($2.03 per boe) in the fourth quarter of 2015 reflecting the "sliding scale" effect of royalty rates with the decrease in average commodity prices during that time period. Similarly, total royalties decreased from $62.7 million in the fourth quarter of 2014 to $22.3 million in the fourth quarter of 2015. For the year ended December 31, 2015, total royalties represented 8.7 per cent of pre-hedged commodity product sales ($2.48 per boe) as compared to 14.1 per cent ($7.26 per boe) for the same period in 2014. The decrease in the royalty rate during the year ended December 31, 2015 as compared to the same period of the prior year also reflects the impact of the decrease in commodity prices on royalties over the same periods.

Exhibit 12

|

| | |

| ARC Resources Ltd. | Page 23 |

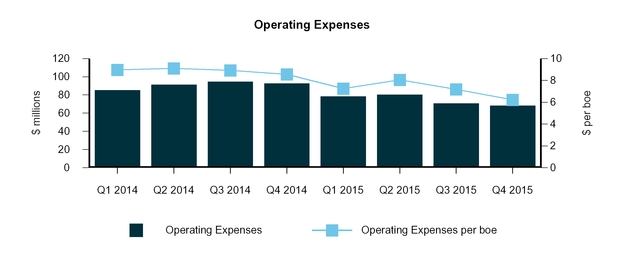

Operating and Transportation Expenses

Operating expenses decreased $2.34 per boe to $6.21 per boe in the fourth quarter of 2015 compared to $8.55 per boe in the fourth quarter of 2014. On an absolute dollar basis, operating expenses have also decreased by $24.6 million or 27 per cent in the fourth quarter of 2015 as compared to the fourth quarter of 2014. For the year ended December 31, 2015 operating expenses decreased by $66.2 million or $1.73 per boe compared to the prior year. The decrease in operating costs for both the three months and year ended December 31, 2015 is mainly a result of reduced maintenance activity levels, the disposition of certain non-core assets throughout the year, increased production volumes from new wells with relatively lower average operating costs, and diligent cost control efforts including negotiating service cost decreases with many of ARC's suppliers throughout 2015. Additionally, electricity costs were lower in 2015 than 2014 with an average Alberta Power Pool Rate of $33.41 per megawatt hour in 2015 as compared to an average of $49.63 per megawatt hour in 2014, further reducing operating costs year-over-year.

ARC hedges a portion of its electricity costs using financial risk management contracts that do not qualify for hedge accounting. The gains and losses associated with these contracts are included within gains and losses on risk management contracts on the consolidated statements of income (the "statements of income"). Had these contracts been recognized within operating expenses, ARC’s operating expenses would have been increased by $0.07 per boe for the three months ended December 31, 2015 (increased $0.03 per boe for the year ended December 31, 2015) as a result of a realized loss of $0.8 million during the period (realized loss of $1.1 million for the year ended December 31, 2015).

Exhibit 13

|

| | |

| ARC Resources Ltd. | Page 24 |

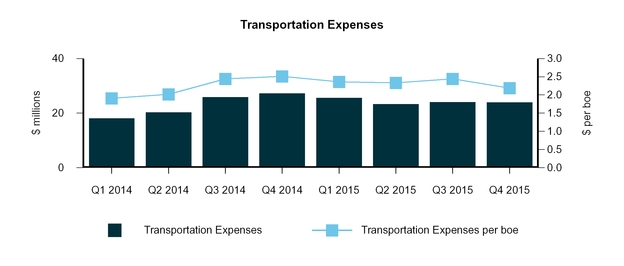

Transportation expenses were $2.19 per boe during the fourth quarter of 2015 ($2.33 per boe for the year ended December 31, 2015) as compared to $2.51 per boe in the fourth quarter of 2014 ($2.23 per boe for the year ended December 31, 2014). Due to reduced trucking costs at the Parkland/Tower area, which became pipeline-connected for its crude oil volumes over the course of 2015, transportation per boe was 13 per cent lower for the fourth quarter of 2015 compared to 2014. The increase in transportation charges for the year ended December 31, 2015 relative to the same period in 2014 is primarily related to transportation arrangements for new production at Sunrise as well as ARC having to secure supplementary takeaway capacity in the second quarter of 2015 due to maintenance and turnaround activity at a third-party facility.

Exhibit 14

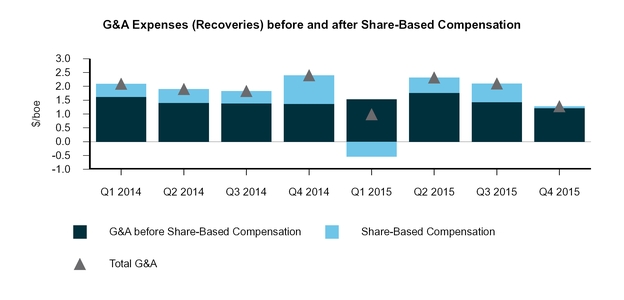

G&A Expenses and Share-Based Compensation

G&A, prior to share-based compensation expense and net of capitalized G&A and overhead recoveries on operated properties, decreased by nine per cent to $13.4 million in the fourth quarter of 2015 from $14.8 million in the fourth quarter of 2014. While G&A expenses before the impact of capitalized G&A and overhead recoveries decreased by 15 per cent from the fourth quarter of 2014 to the fourth quarter of 2015, capitalized G&A and overhead recoveries decreased by 21 per cent during the same period. The reduction in G&A prior to capitalized G&A and overhead recoveries was primarily the result of a significant reduction in cash bonus payments and other discretionary G&A spending in the last half of 2015 relative to 2014. The reduction in capitalized G&A is related to reduced capital spending in the fourth quarter compared to the same period in 2014.

For the year ended December 31, 2015, ARC's G&A prior to share-based compensation expense and net of capitalized G&A and overhead recoveries on operated properties was $61.7 million, a $2.7 million increase from the same period in 2014. The increase reflects decreased capitalized G&A and overhead recoveries from partners associated with lower capital spending, partially offset by lower compensation and bonus expenses.

|

| | |

| ARC Resources Ltd. | Page 25 |

Table 17 is a breakdown of G&A and share-based compensation expenses:

Table 17 |

| | | | | | | | | | | | |

| | Three Months Ended | Twelve Months Ended |

| | December 31 | December 31 |

| G&A and Share-Based Compensation | 2015 |

| 2014 |

| % Change |

| 2015 |

| 2014 |

| % Change |

|

| ($ millions, except per boe) |

G&A expenses (1) | 23.1 |

| 27.1 |

| (15 | ) | 98.5 |

| 107.1 |

| (8 | ) |

| Capitalized G&A and overhead recoveries | (9.7 | ) | (12.3 | ) | (21 | ) | (36.8 | ) | (48.1 | ) | (23 | ) |

| G&A expenses before share-based compensation plans | 13.4 |

| 14.8 |

| (9 | ) | 61.7 |

| 59.0 |

| 5 |

|

G&A – share-based compensation plans (2) | 0.6 |

| 11.2 |

| (95 | ) | 6.9 |

| 25.3 |

| (73 | ) |

| Total G&A and share-based compensation expenses | 14.0 |

| 26.0 |

| (46 | ) | 68.6 |

| 84.3 |

| (19 | ) |

| Total G&A and share-based compensation expenses per boe | 1.28 |

| 2.40 |

| (47 | ) | 1.65 |

| 2.06 |

| (20 | ) |

| |

| (1) | Includes expenses recognized under the DSU Plan. |

| |

| (2) | Comprises expenses recognized under the RSU and PSU, Share Option and LTRSA Plans. |

Exhibit 15

Share-Based Compensation Plans – Restricted Share Unit and Performance Share Unit Plan, Share Option Plan, Deferred Share Unit Plan, and Long-term Restricted Share Award Plan

Restricted Share Unit and Performance Share Unit Plan

The RSU and PSU Plan is designed to offer each eligible employee and officer (the “plan participants”) cash compensation in relation to the underlying value of a specified number of share units. The RSU and PSU Plan consists of RSUs for which the number of units is fixed and will vest over a period of three years and PSUs for which the number of units is variable and will vest at the end of three years.

Upon vesting, the plan participant is entitled to receive a cash payment based on the underlying value of the share units plus accrued dividends. The cash compensation issued upon vesting of the PSUs is dependent upon the total return performance of ARC compared to its peers. Total return is calculated as a sum of the change in the market price of the common shares in the period plus the amount of dividends in the period. A performance multiplier is applied to the PSUs based on the percentile rank of ARC’s total shareholder return compared to its peers. The performance multiplier ranges from zero if ARC’s performance ranks in the bottom quartile, to two for top quartile performance.

ARC recorded a G&A recovery of $0.5 million during the fourth quarter of 2015 in accordance with the RSU and PSU Plan, as compared to an expense of $10.4 million during the fourth quarter of 2014. For the year ended December 31, 2015, ARC recorded an expense in G&A related to the RSU and PSU Plan of $2.6 million, a decrease of $20 million or

|

| | |

| ARC Resources Ltd. | Page 26 |

88 per cent from the year ended December 31, 2014. ARC recognized a decrease in compensation charges for the fourth quarter of 2015 as compared to the fourth quarter of 2014 due to a reduction to the valuation of awards at December 31, 2015 as ARC's share price decreased from $25.16 per share outstanding at December 31, 2014 to $16.70 at December 31, 2015.

During the year ended December 31, 2015, ARC made cash payments of $25.3 million in respect of the RSU and PSU Plan ($39.4 million for the year ended December 31, 2014). Of these payments, $19.5 million were in respect of amounts recorded to G&A expenses ($28.9 million for the year ended December 31, 2014) and $5.8 million were in respect of amounts recorded to operating expenses and capitalized as PP&E and E&E assets ($10.5 million for the year ended December 31, 2014). These amounts were accrued in prior periods.

Table 18 shows the changes to the RSU and PSU Plan during 2015:

Table 18 |

| | | |

RSU and PSU Plan

(number of units, thousands) |

RSUs | PSUs (1) | Total RSUs and PSUs |

| Balance, December 31, 2014 | 625 | 1,513 | 2,138 |

| Granted | 464 | 702 | 1,166 |

| Distributed | (294) | (493) | (787) |

| Forfeited | (65) | (145) | (210) |

| Balance, December 31, 2015 | 730 | 1,577 | 2,307 |

| |

| (1) | Based on underlying units before any effect of the performance multiplier. |

The liability associated with the RSUs and PSUs granted is recognized in the statements of income over the vesting period while being adjusted each period for changes in the underlying share price, accrued dividends and the number of PSUs expected to be issued on vesting. In periods where substantial share price fluctuation occurs, ARC’s G&A expenses are subject to greater volatility.

Due to the variability in the future payments under the plan, ARC estimates that between $12.6 million and $68 million will be paid out in 2016 through 2018 based on the current share price, accrued dividends, and ARC’s market performance relative to its peers. Table 19 is a summary of the range of future expected payments under the RSU and PSU Plan based on variability of the performance multiplier and units outstanding under the RSU and PSU Plan as at December 31, 2015:

Table 19 |

| | | | | | |

| Value of RSU and PSU Plan as at | | | |

| December 31, 2015 | Performance multiplier |

| (units thousands and $ millions, except per share) | — |

| 1.0 |

| 2.0 |

|

| Estimated units to vest | | | |

| RSUs | 754 |

| 754 |

| 754 |

|

| PSUs | — |

| 1,659 |

| 3,318 |

|

Total units (1) | 754 |

| 2,413 |

| 4,072 |

|

Share price (2) | 16.70 |

| 16.70 |

| 16.70 |

|

| Value of RSU and PSU Plan upon vesting | 12.6 |

| 40.3 |

| 68.0 |

|

| 2016 | 5.9 |

| 14.8 |

| 23.7 |

|

| 2017 | 4.2 |

| 11.9 |

| 19.5 |

|

| 2018 | 2.5 |

| 13.6 |

| 24.8 |

|

| |

| (1) | Includes additional estimated units to be issued under the RSU and PSU Plan for dividends accrued to date. |

| |

| (2) | Per share outstanding. Values will fluctuate over the vesting period based on the volatility of the underlying share price. Assumes a future share price of $16.70, which is based on the closing share price at December 31, 2015. |

Share Option Plan

Share options are granted to employees and consultants of ARC, vesting evenly on the fourth and fifth anniversaries of their respective grant dates, and have a maximum term of seven years. The option holder has the right to exercise the options at the original exercise price or at a reduced exercise price, equal to the exercise price at grant date less all dividends paid subsequent to the grant date and prior to the exercise date. On June 24, 2015, ARC granted 998,545 options to officers and certain employees at ARC.

|

| | |

| ARC Resources Ltd. | Page 27 |