Exhibit 99.3

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

The Annual and Special Meeting (the “Meeting”) of the holders (“Shareholders”) of Common Shares (“Common Shares”) of ARC Resources Ltd. (the “Corporation”) will be held at the Ballroom in the Metropolitan Centre, 333 – 4th Avenue SW, Calgary, Alberta, on Friday, the 29th day of April, 2016, at 10:00 a.m. (mountain standard time) for the following purposes:

| 1. | To receive and consider the Consolidated Financial Statements of the Corporation for the year ended December 31, 2015 and the auditors’ report thereon. |

| 2. | To elect the Directors of the Corporation. |

| 3. | To appoint the auditors of the Corporation. |

| 4. | To consider and, if thought fit, approve a resolution to accept the Corporation’s approach to executive compensation. |

| 5. | To consider and, if thought fit, approve a special resolution to reduce the stated capital of our common shares. |

| 6. | To transact such other business as may properly be brought before the Meeting or any adjournment thereof. |

The specific details of the matters proposed to be put before the Meeting are set forth in the Information Circular - Proxy Statement accompanying and forming part of this Notice.

Registered Shareholders of the Corporation who are unable to attend the Meeting in person are requested to complete, date and sign the enclosed form of proxy and return it by mail, hand delivery or fax to our transfer agent, Computershare Trust Company of Canada, as follows:

| 1. | By mail to Computershare Trust Company of Canada, Proxy Department, 135 West Beaver Creek, P.O. Box 300, Richmond Hill, Ontario, L4B 4R5; |

| 2. | By hand delivery to Computershare Trust Company of Canada, 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1; or |

| 3. | By facsimile to (416) 263-9524 or 1-866-249-7775. |

Alternatively, you may vote through the internet atwww.investorvote.com or by telephone at 1-866-732-8683 (toll free).You will require your 15 digit control number found on your proxy form to vote through the internet or by telephone.

In order to be valid and acted upon at the Meeting, forms of proxy as well as votes by internet and telephone must be received in each case not less than 48 hours (excluding weekends and holidays) before the time set for the holding of the Meeting or any adjournment thereof.

Beneficial or non-Registered Shareholders should follow the instructions on the voting instruction form provided by their intermediaries with respect to the procedures to be followed for voting at the Meeting.

The Board of Directors of the Corporation has fixed the record date for the Meeting at the close of business on March 15, 2016.

DATED at Calgary, Alberta, this 9thday of March, 2016.

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | |

| |  |

| | |

| | Myron M. Stadnyk |

| | President and Chief Executive Officer |

| ARC Resources Ltd. | 2016 | Information Circular 1 |

LETTER TO SHAREHOLDERS

Dear Shareholders,

On behalf of ARC’s Board of Directors, I am pleased to invite you to our 2016 annual and special meeting (“Meeting”). I would like to start by introducing myself as the new Chairman of the Board of Directors. It is a great honour to succeed the founding Chairman, Mac Van Wielingen, who stepped down as Chair on December 31, 2015. Although I am new to the role of Chairman at ARC, I have been a member of ARC’s Board of Directors since 2009, and bring over 35 years of experience in the energy industry. The Chairman transition between Mr. Van Wielingen and myself has been long-planned and I look forward to serving you as the Board

Chair.

The 2016 Meeting will take place at 10:00 am on April 29th at the Metropolitan Centre in Calgary, Alberta. Matters to be discussed and voted on at the Meeting include the election of directors (page 7), appointment of auditors (page 7), the advisory vote on executive compensation (pages 7-8) and the reduction in stated capital (page 8-9).

Despite a challenging economic environment in 2015, ARC delivered strong performance. We continued to build our business for the long-term, staying focused on our founding principle of risk managed value creation. Underpinning this principle are the pillars of financial flexibility, high quality long life assets, operational excellence, and top talent and a strong leadership culture.

ARC’s strong leadership culture is well recognized within our industry and the communities in which we operate. Throughout the organization there is a deliberate approach to leadership and succession planning. The executive team and directors spend countless hours each year discussing the succession and development of our leaders. Candidates are rigorously evaluated on their ethics, integrity, trustworthiness and industry knowledge to ensure leadership sustainability and continuity. ARC’s deliberate focus on succession planning began 20 years ago by its founder, none more exemplary of those attributes, than Mac Van Wielingen.

I would like to take a moment to acknowledge the outstanding contributions made by Mr. Van Wielingen over his almost 20 years as Chairman of the Board. He has been instrumental in establishing ARC’s successful business model and culture. His leadership and guidance have been invaluable to our organization. Mr. Van Wielingen’s in-depth industry knowledge and pursuit of excellence have set the bar very high. On behalf of the Board and management, I thank Mac for his many contributions and leadership over the years.

In 2016, we have 10 candidates nominated for election to the Board, including myself. All candidates are returning directors with the exception of Nancy Smith. Ms. Smith embodies the skills, experience and characteristics that matter most to ARC and we look forward to welcoming her to the Board at our Meeting.

Please take some time to read through our Information Circular and Proxy Statement in determining your vote. On behalf of the Board and management, we thank you for your ongoing support and confidence in ARC and we look forward to seeing you on April 29th.

| Sincerely, | |

| | |

| |

| | |

| Harold Kvisle | |

| Chair of the Board of Directors | |

| ARC Resources Ltd. | 2016 | Information Circular 2 |

ARC RESOURCES LTD.

INFORMATION CIRCULAR – PROXY STATEMENT

FOR THE ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON FRIDAY, APRIL 29, 2016

SOLICITATION OF PROXIES

This Information Circular - Proxy Statement (“Information Circular”) is furnished in connection with the solicitation of proxies by Management of ARC Resources Ltd. (the “Corporation” or “ARC”), for use at the Annual and Special Meeting of the holders (the “Shareholders” or “shareholders”) of Common Shares (“Common Shares”) of the Corporation (the “Meeting”) to be held on the 29th day of April, 2016, at 10:00 a.m. (mountain standard time) in the Ballroom at the Metropolitan Centre, 333 – 4th Avenue SW, Calgary, Alberta, and at any adjournment thereof, for the purposes set forth in the Notice of Annual and Special Meeting.

The Board of Directors of the Corporation has fixed the record date for the Meeting to be the close of business on March 15, 2016 (the “Record Date”). Only shareholders whose names have been entered in the register of Common Shares on the close of business on the Record Date will be entitled to receive notice of and to vote at the Meeting provided, however, if any shareholder transfers Common Shares after the Record Date and the transferee of those shares, having produced properly endorsed certificates evidencing such shares or having otherwise established that such transferee owns such shares, demands, not later than 10 days before the Meeting, that the transferee’s name be included in the list of shareholders entitled to vote at the Meeting, such transferee shall be entitled to vote such Common Shares at the Meeting.

The instrument appointing a proxy shall be in writing and shall be executed by the shareholder or his attorney authorized in writing or, if the shareholder is a corporation, under its corporate seal or by an officer or attorney thereof duly authorized.

The persons named in the enclosed form of proxy are Directors or officers of the Corporation.Each shareholder has the right to appoint a proxy holder other than the nominees of management, who need not be a shareholder, to attend and to act for and on behalf of the shareholder at the Meeting.To exercise such right, the names of the nominees of management should be crossed out and the name of the shareholder’s appointee should be legibly printed in the blank space provided.

NOTICE-AND-ACCESS

The Corporation has elected to use the “notice-and-access” provisions under National Instrument 54-101Communications with Beneficial Owners of Securities of a Reporting Issuer(the “Notice-and-Access Provisions”) for the Meeting in respect of mailings to its Beneficial Shareholders (as defined below) but not in respect of mailings to its Registered Shareholders (as defined below). The Notice-and-Access Provisions are rules developed by the Canadian Securities Administrators that reduce the volume of materials that must be physically mailed to shareholders by allowing a reporting issuer to post an information circular in respect of a meeting of its shareholders and related materials online.

| ARC Resources Ltd. | 2016 | Information Circular 3 |

The Corporation has also elected to use procedures known as ‘stratification’ in relation to its use of the Notice-and-Access Provisions. Stratification occurs when a reporting issuer using the Notice-and-Access Provisions provides a paper copy of an Information Circular and, if applicable, a paper copy of financial statements and related Management’s Discussion and Analysis (“Financial Information”), to some shareholders together with a notice of a meeting of its shareholders. In relation to the Meeting, Registered Shareholders will receive a paper copy of each of a notice of the Meeting, this Information Circular and a form of proxy whereas Beneficial Shareholders will receive a Notice-and-Access Notification and a request for voting instructions. Furthermore, a paper copy of the Financial Information in respect of the most recent financial year of the Corporation will be mailed to Registered Shareholders as well as to those Beneficial Shareholders who have previously requested to receive them.

The Corporation will be delivering proxy-related materials directly to non-objecting beneficial owners of its Common Shares with the assistance of Broadridge (as defined below) and intends to pay for intermediaries to deliver proxy-related materials to objecting beneficial owners of its Common Shares.

VOTING INFORMATION

REGISTERED SHAREHOLDER VOTING INFORMATION

You are a Registered Shareholder (a “Registered Shareholder”) if your name appears on your share certificate.

Registered Shareholders who are eligible to vote can vote their Common Shares either in person at the Meeting or by proxy.

For your Common Shares to be voted by proxy, you must complete, date and sign the enclosed form of proxy and return it by mail, hand delivery or fax to our transfer agent, Computershare Trust Company of Canada. Registered Shareholders are also entitled to vote their Common Shares through the internet atwww.investorvote.comor by telephone at 1-866-732-8683 (toll free). For internet and telephone voting, you will require your 15-digit control number found on your proxy form.

In order to be valid and acted upon at the Meeting, forms of proxy as well as votes by internet and telephone must be received in each case not less than 48 hours (excluding weekends and holidays) before the time set for the holding of the Meeting or any adjournment thereof.

BENEFICIAL SHAREHOLDER VOTING INFORMATION

Most shareholders of the Corporation are "beneficial owners" who are non-registered Shareholders. You are a beneficial shareholder (a "Beneficial Shareholder") if you beneficially own Common Shares that are held in the name of an intermediary such as a bank, a trust company, a securities broker, a trustee or other nominee, and therefore do not have the shares registered in your own name. As required by Canadian securities laws, you will receive a request for voting instructions for the number of Common Shares held.

Beneficial Shareholders may vote their Common Shares either in person at the Meeting or by proxy.

For your Common Shares to be voted by proxy, you must carefully follow the instructions on the request for voting instructions that is provided to you including completing, dating and signing the request for voting instructions and returning it by mail, hand delivery or fax as directed. Beneficial Shareholders are also entitled to vote their Common Shares through the internet or by telephone by carefully following the instructions on the voting instruction form.

| ARC Resources Ltd. | 2016 | Information Circular 4 |

In order to be valid and acted upon at the Meeting, voting instructions as well as votes by internet and telephone must be received in each case not less than 72 hours (excluding weekends and holidays) before the time set for the holding of the Meeting or any adjournment thereof.

Beneficial Shareholders may also vote in person at the Meeting by completing the following steps: (a) insert your own name in the space provided in the request for voting instructions or mark the appropriate box on the request for voting instructions to appoint yourself as the proxy holder; and (b) return the document in the envelope provided or as otherwise permitted by your intermediary. No other part of the form should be completed. In some cases, your intermediary may send you additional documentation that must also be completed in order for you to vote in person at the Meeting.

REVOCABILITY OF PROXY

A Registered Shareholder who has submitted a proxy may revoke it at any time prior to the exercise thereof. If a Registered Shareholder who has given a proxy attends the Meeting in person at which such proxy is to be voted, such person may revoke the proxy and vote in person. In addition to revocation in any other manner permitted by law, a proxy may be revoked by instrument in writing executed by the Registered Shareholder or his attorney authorized in writing or, if the Registered Shareholder is a corporation, under its corporate seal or by an officer or attorney thereof duly authorized and deposited either at the head office of the Corporation at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof, at which the proxy is to be used, or with the Chairman of the Meeting on the day of the Meeting, or any adjournment thereof, and upon either of such deposits, the proxy is revoked.

If you are a Beneficial Shareholder, please contact your intermediary for instructions on how to revoke your voting instructions.

PERSONS MAKING THE SOLICITATION

The solicitation is made on behalf of management of the Corporation. The costs incurred in the preparation and mailing of the proxy-related materials for the Meeting will be borne by the Corporation. In addition to solicitation by mail, proxies may be solicited by personal interviews, telephone or other means of communication and by officers and employees of the Corporation, who will not be specifically remunerated therefor.

EXERCISE OF DISCRETION BY PROXY

The Common Shares represented by proxy by the management nominees shall be voted at the Meeting in respect of the matters to be acted upon and, where the shareholder specifies a choice with respect to any matter to be acted upon, the Common Shares shall be voted in accordance with the specification so made.In the absence of such specification, the Common Shares will be voted in favour of the matters to be acted upon. The persons appointed under the enclosed form of proxy furnished by the Corporation are conferred with discretionary authority with respect to the amendments or variations of those matters specified therein and in the Notice of Annual and Special Meeting. At the time of printing this Information Circular, management of the Corporation knows of no such amendment, variation or other matter.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

The Corporation is authorized to issue an unlimited number of Common Shares without nominal or par value (defined in this Information Circular as “Common Shares”). As at March 9, 2016, there were 349,405,246 Common Shares issued and outstanding. At the Meeting, upon a show of hands, every shareholder present in person or represented by proxy and entitled to vote shall have one vote. On a poll or ballot, every shareholder present in person or by proxy has one vote for each Common Share of which such shareholder is the registered holder.

| ARC Resources Ltd. | 2016 | Information Circular 5 |

The Corporation is also authorized to issue 50 million preferred shares without nominal or par value issuable in series. As at March 9, 2016, there were no preferred shares issued and outstanding.

When any Common Share is held jointly by several persons, one of those holders present at the Meeting may, in the absence of the others, vote such Common Share but if two or more of those persons are present at the Meeting, in person or by proxy, vote, they shall vote as one on the Common Share jointly held by them.

To the knowledge of the Directors and executive officers of the Corporation, there is no person or corporation which beneficially owns, or controls or directs, directly or indirectly, Common Shares carrying more than 10 per cent of the voting rights attached to the issued and outstanding Common Shares of the Corporation which may be voted at the Meeting.

As at March 9, 2016, the percentage of Common Shares of the Corporation that are beneficially owned, or controlled or directed, directly or indirectly, by all Directors and officers of the Corporation as a group is 0.9 per cent (3,054,608 Common Shares).

QUORUM FOR MEETING AND APPROVAL REQUIREMENTS

At the Meeting, a quorum shall consist of two (2) or more persons present and holding or representing by proxy not less than 25 per cent of the outstanding Common Shares. If a quorum is not present at the opening of the Meeting, the shareholders present may adjourn the Meeting to a fixed time and place but may not transact any other business.

All of the matters to be considered at the Meeting are ordinary resolutions requiring approval by more than 50 per cent of the votes cast in respect of the resolution at the Meeting, with the exception of the special resolution to reduce stated capital which requires approval by 662/3per cent or more of the votes cast at the Meeting.

REQUEST FOR MATERIALS

Beneficial Shareholders who wish to receive a paper copy of the Information Circular and/or the Financial Information should contact Broadridge Investor Communications Corporation (“Broadridge”) at the toll-free number 1-877-907-7643 at any time up to and including the date of Meeting or any adjournment thereof. In order to allow Beneficial Shareholders a reasonable time to receive paper copies of the Information Circular and related materials and to vote their Common Shares, any Beneficial Shareholders wishing to request paper copies as described above should ensure that such request is made by 5:00 p.m. (mountain standard time) on April 19, 2016. A Beneficial Shareholder may also call the Corporation at 1-888-272-4900 (toll free) to obtain additional information about the Notice-and-Access Provisions.

| ARC Resources Ltd. | 2016 | Information Circular 6 |

MATTERS TO BE ACTED UPON AT THE MEETING

ELECTION OF DIRECTORS

The Articles of the Corporation provide for a minimum of three (3) Directors and a maximum of twelve (12) Directors. All of the current Directors have been elected or appointed for a term ending immediately prior to the Meeting or any adjournment thereof. The ten (10) nominees for election as Directors of the Corporation by shareholders (“Director Nominees”) are as follows:

| Harold N. Kvisle | Kathleen M. O’Neill |

| John P. Dielwart | Herbert C. Pinder, Jr. |

| Fred J. Dyment | William G. Sembo |

| Timothy J. Hearn | Nancy L. Smith |

| James C. Houck | Myron M. Stadnyk |

If, for any reason, any of the proposed nominees does not stand for election or is unable to serve as such, the management designees named in the enclosed form of proxy reserve the right to vote for any other nominee in their sole discretion unless the shareholder has specified therein that its Common Shares are to be withheld from voting on the election of Directors. At the 2015 Annual and Special Meeting of Shareholders, this resolution was approved with shares voted in favour for the individual Directors ranging from 90.72 per cent to 99.92 per cent.

The term of office of each Director Nominee will be from the date of the Meeting until the next annual meeting or until his or her successor is elected or appointed.

See“Director Nominees”in this Information Circular for additional information on the Director Nominees.

The Board of Directors unanimously recommends that the shareholders vote FOR the election of each of the Director Nominees and unless instructed otherwise, the persons named in the enclosed form of proxy will vote FOR the election of each of the Director Nominees.

APPOINTMENT OF AUDITORS

At the Meeting, shareholders will consider an ordinary resolution to appoint the firm of Deloitte LLP, Independent Registered Chartered Accountants, Calgary, Alberta, to serve as auditors of the Corporation until the next annual meeting of the shareholders. At the 2015 Annual and Special Meeting of Shareholders, this resolution was approved with 99.68 per cent of shares voted in favour.

See“Corporate Governance Disclosures - Committee Mandates and Responsibilities - Audit Committee” in this Information Circular for additional information regarding the fees paid to our external auditors in 2015.

The Board of Directors unanimously recommends that the shareholders vote FOR the appointment of auditors and unless instructed otherwise, the persons named in the enclosed form of proxy will vote FOR the appointment of auditors.

ADVISORY VOTE ON EXECUTIVE COMPENSATION

The underlying principle for executive pay throughout the Corporation is “pay-for-performance”. We believe that this philosophy achieves the goal of attracting and retaining excellent employees and executive officers, while rewarding the demonstrated behaviors that reinforce the Corporation’s values and help to deliver on its corporate objectives. A detailed discussion of our executive compensation program is provided in the “Compensation Discussion and Analysis” section of this Information Circular.

| ARC Resources Ltd. | 2016 | Information Circular 7 |

After monitoring recent developments and emerging trends in the practice of holding advisory votes on executive compensation (commonly referred to as “Say on Pay”), the Board of Directors has determined to continue to provide shareholders with a “Say on Pay” advisory vote at the Meeting. This non-binding advisory vote on executive compensation will provide you as a shareholder with the opportunity to vote “For” or “Against” our approach to executive compensation through the following resolution:

“Resolved, on an advisory basis and not to diminish the role and responsibilities of the Board of Directors, that the shareholders accept the approach to executive compensation disclosed in the Information Circular delivered in advance of the 2016 Annual Meeting of shareholders of the Corporation.”

As this is an advisory vote, the results will not be binding upon the Board of Directors. However, the Board of Directors will consider the outcome of the vote as part of its ongoing review of executive compensation. The Board of Directors believes that it is essential for the shareholders to be well informed of the Corporation’s approach to executive compensation and considers this advisory vote to be an important part of the ongoing process of engagement between the shareholders and the Board of Directors. At the 2015 Annual and Special Meeting of Shareholders, this resolution was approved with 97.57 per cent of shares voted in favour.

The Board of Directors unanimously recommends that the shareholders vote FOR the advisory vote on executive compensation and unless instructed otherwise, the persons named in the enclosed form of proxy will vote FOR the advisory vote on executive compensation.

REDUCTION OF STATED CAPITAL

At the meeting, holders of our common shares will be asked to consider and, if deemed advisable, to approve by way of special resolution, a reduction of the stated capital account of our common shares by $1 billion dollars (the “Stated Capital Reduction”). If approved, the Stated Capital Reduction will be effective as of April 29, 2016.

A corporation is required to maintain a stated capital account for each class of shares that it issues and to add to that account the full amount of consideration that it receives for the shares that it has issued. In addition, a corporation is restricted from declaring and paying dividends on its shares unless it can meet certain financial tests including that there are reasonable grounds for believing that, after giving effect to the payment of the dividend, the realizable value of the corporation's assets would be more than the aggregate of its liabilities and stated capital. The Stated Capital Reduction will not result in any change to shareholders’ equity as presented in ARC’s financial statements and therefore will not affect our book value.

Our Board of Directors believes that the Stated Capital Reduction will benefit ARC on a go-forward basis by providing more flexibility in managing our capital structure, including our ability to pay dividends on our common shares. Accordingly, at the meeting, holders of common shares will be asked to consider and, if deemed appropriate, to approve a special resolution, with or without variation, as follows:

“BE IT RESOLVED, AS A SPECIAL RESOLUTION THAT:

| 1) | the stated capital account of the common shares of ARC Resources Ltd. (the “Corporation”) be reduced by $1 billion dollars, all as more particularly described in the Corporations information circular-proxy statement dated March 9, 2016; |

| 2) | any one Director or officer of the Corporation be and is hereby authorized and empowered on behalf of the Corporation to do and perform all such acts and things and to execute and deliver or cause to be executed and delivered for, in the name of and on behalf of the Corporation (whether under corporate seal or otherwise), all such deeds, documents or other instruments as in his opinion may be necessary and desirable in order to perform the terms of this resolution; and; |

| 3) | notwithstanding that this resolution has been passed by the shareholders of the Corporation, the directors of the Corporation are hereby authorized to and empowered to revoke this resolution, without any further approval of the Corporation’s shareholders, at any time if such revocation is considered necessary or desirable by the Directors.” |

Pursuant to the provisions of theBusiness Corporations Act (Alberta), the foregoing special resolution must be approved by not less than two-thirds of the votes cast by the holders of our common shares at the Meeting, in person or by proxy, on the special resolution.

| ARC Resources Ltd. | 2016 | Information Circular 8 |

The Stated Capital Reduction will have no immediate income tax consequences to a holder of common shares. The Stated Capital Reduction may have an effect in the future, in certain circumstances, if we are wound up or make a distribution to our shareholders, or if we redeem, cancel or acquire our common shares. As a general rule, upon such transactions, a holder of common shares will be deemed to have received a dividend to the extent that the amount paid or distributed exceeds the stated capital of the common shares.

Our Board of Directors recommends that holders of our common shares vote in favour of the Stated Capital Reduction. Unless otherwise directed, our management nominees in the enclosed form of proxy will vote FOR the foregoing special resolution approving the Stated Capital Reduction.

2015 VOTING RESULTS

| Motions | | Votes in

Favour | | | Percentage of

Votes in

Favour | | | Votes Withheld | | | Percentage of

Votes Withheld | | | Votes

Against | | | Percentage

of Votes

Against | |

| Elect Wielingen | | | 193,087,076 | | | | 97.84 | | | | 4,264,367 | | | | 2.16 | | | | 0 | | | | 0.00 | |

| Elect Dielwart | | | 196,282,338 | | | | 99.46 | | | | 1,069,105 | | | | 0.54 | | | | 0 | | | | 0.00 | |

| Elect Dyment | | | 179,027,595 | | | | 90.72 | | | | 18,323,848 | | | | 9.28 | | | | 0 | | | | 0.00 | |

| Elect Hearn | | | 196,658,191 | | | | 99.65 | | | | 693,252 | | | | 0.35 | | | | 0 | | | | 0.00 | |

| Elect Houck | | | 197,170,939 | | | | 99.91 | | | | 180,504 | | | | 0.09 | | | | 0 | | | | 0.00 | |

| Elect Kvisle | | | 195,453,808 | | | | 99.04 | | | | 1,897,635 | | | | 0.96 | | | | 0 | | | | 0.00 | |

| Elect O’Neill | | | 197,174,787 | | | | 99.91 | | | | 176,656 | | | | 0.09 | | | | 0 | | | | 0.00 | |

| Elect Pinder | | | 196,513,493 | | | | 99.58 | | | | 837,950 | | | | 0.42 | | | | 0 | | | | 0.00 | |

| Elect Sembo | | | 197,184,809 | | | | 99.92 | | | | 166,634 | | | | 0.08 | | | | 0 | | | | 0.00 | |

| Elect Stadnyk | | | 196,821,913 | | | | 99.73 | | | | 529,530 | | | | 0.27 | | | | 0 | | | | 0.00 | |

| Appointment of Auditors | | | 202,720,161 | | | | 99.68 | | | | 647,266 | | | | 0.32 | | | | 0 | | | | 0.00 | |

| Advisory Vote on Executive Compensation | | | 192,264,660 | | | | 97.57 | | | | 0 | | | | 0.00 | | | | 4,788,356 | | | | 2.43 | |

| Long-term Restricted Share Award Plan | | | 156,016,588 | | | | 79.17 | | | | 0 | | | | 0.00 | | | | 41,039,428 | | | | 20.83 | |

| ARC Resources Ltd. | 2016 | Information Circular 9 |

DIRECTOR NOMINEES

The following pages set out the names of the proposed nominees for election as Directors, defined earlier in this Information Circular as “Director Nominees”, together with their age, place of primary residence, principal occupation, year first elected or appointed as a Director, membership on Committees of the Board of Directors as at December 31, 2015, attendance at Board and Committee meetings during 2015, Directorships of other public and private entities and votes for and withheld at the 2015 Annual and Special Meeting of Shareholders (the “2015 AGM”). Also indicated for each Director Nominee is the number of Common Shares and share equivalents beneficially owned, or controlled or directed, directly or indirectly, on December 31, 2015 and, as at such date, the value of such Common Shares and share equivalents.

The Board of Directors has determined that all of the Director Nominees with the exception of John P. Dielwart and Myron M. Stadnyk are independent within the meaning of National Instrument 58-101Disclosure of Corporate Governance Practice of the Canadian Securities Administrators (“NI 58-101”).

| Harold N. Kvisle, B.Sc., P.Eng., MBA |

Independent Businessman Calgary, Alberta, Canada Age: 63 Director Since: 2009 Independent | Mr. Kvisle has over 35 years of experience as a leader in the oil and gas, utilities and power generation industries. Most recently he held the position of President and Chief Executive Officer of Talisman Energy Inc., from September 2012 to May 2015. From 2001 to 2010, Mr. Kvisle was President and Chief Executive Officer of TransCanada Corporation and its predecessor, TransCanada PipeLines Ltd. Prior to joining TransCanada in 1999, Mr. Kvisle was President of Fletcher Challenge Energy Canada from 1990 to 1999 and he held engineering, finance and management positions with Dome Petroleum Limited from 1975 to 1988. Mr. Kvisle holds a Bachelor of Science in Engineering from the University of Alberta and a Masters in Business Administration from the University of Calgary. |

| Board Committee Membership(1) | Membership | Meeting Attendance |

| | Board(4) | (9/10) 90% |

| | Human Resources and Compensation | (6/6) 100% |

| | Policy and Board Governance | (4/5) 80% |

| | Total | (19/21) 90% |

| Current Board Directorships | Public Boards | Private Boards |

| | ARC Resources Ltd. | Nil |

| | Northern Blizzard Resources Inc. | |

| Voting Results of 2015 AGM | Number of Votes | % of Votes |

| Votes For | 195,453,808 | 99.04 |

| Votes Withheld | 1,897,635 | 0.96 |

| | | |

| Common Share and Share Equivalents(2) | Number | Total Value |

| | 122,812 | $ 2,050,960 |

| | | |

| Shareholding Requirements(3) | % of Shareholding Requirements | Target Date to Meet Requirement |

| | 614 | Met |

| ARC Resources Ltd. | 2016 | Information Circular 10 |

| John P. Dielwart, B.Sc., P.Eng. |

Vice-Chairman of ARC Financial Corp. Calgary, Alberta, Canada Age: 63 Director Since: 1996 Non-Independent | Mr. Dielwart is a founding member of ARC Resources and held the position of Chief Executive Officer until January 1, 2013. Currently, he is Vice-Chairman and Director of ARC Financial Corp., Canada's leading energy-focused private equity manager. Prior to joining ARC in 1994, Mr. Dielwart spent 12 years with a major Calgary based oil and natural gas engineering consulting firm, as senior Vice-President and director, where he gained extensive technical knowledge of oil and natural gas properties in Western Canada. He began his career with a major oil and natural gas company in Calgary. Mr. Dielwart received a Bachelor of Science with Distinction (Civil Engineering) degree from the University of Calgary and is a member of the Association of Professional Engineers and Geoscientists of Alberta (APEGA). Mr. Dielwart is a Past-Chairman of the Board of Governors for the Canadian Association of Petroleum Producers (CAPP) and is the Board Co-Chair at the Sheldon Kennedy Child Advocacy Centre. |

| Board Committee Membership(1) | Membership | Meeting Attendance |

| | Board | (10/10) 100% |

| | Health, Safety and Environment (Chair) | (4/4) 100% |

| | Risk | (5/5) 100% |

| | Total | (19/19) 100% |

| Current Board Membership Directorships | Public Boards | Private Boards |

| | ARC Resources Ltd. | ARC Financial Corp. |

| | Denbury Resources Inc. | Modern Resources Ltd. |

| | Tesco Corporation | Aspenleaf Energy Limited |

| | TransAlta Corporation | |

| Voting Results of 2015 AGM | Number of Votes | % of Votes |

| Votes For | 196,282,338 | 99.46 |

| Votes Withheld | 1,069,105 | 0.54 |

| Common Shares and Share Equivalents(2) | Number | Total Value |

| | 405,732 | $ 6,775,724 |

| Shareholding Requirements(3) | % of Shareholding Requirements | Target Date to Meet Requirements |

| | 2029 | Met |

| ARC Resources Ltd. | 2016 | Information Circular 11 |

| Fred J. Dyment, CPA, CA |

Independent Businessman Calgary, Alberta, Canada Age: 67 Director Since: 2003 Independent | Mr. Dyment has over 40 years of extensive experience in the oil and gas industry and is currently an independent businessman. From 1978 to 2000, Mr. Dyment has held various positions with Ranger Oil Limited, including as Chief Financial Officer, President and Chief Executive Officer. From 2000 to 2001, Mr. Dyment served as President and Chief Executive Officer of Maxx Petroleum Company. Mr. Dyment has also served as Governor of the Canadian Association of Petroleum Producers (“CAPP”) from 1995 to 1997 and holds a Chartered Accountant designation from the Province of Ontario. |

| Board Committee Membership(1) | Membership | Meeting Attendance |

| | Board | (9/10) 90% |

| | Policy and Board Governance | (4/4) 100% |

| | Reserves | (4/4) 100% |

| | Risk (Chair) | (5/5) 100% |

| | Total | (22/23) 96% |

| Current Board Directorships | Public Boards | Private Boards |

| | ARC Resources Ltd. | Avalon Oil & Gas Ltd. |

| | Tesco Corporation | |

| | Transglobe Energy Corporation | |

| | WesternZagros Resources Ltd. | |

| | Major Drilling Group International Inc. | |

| Voting Results of 2015 AGM | Number of Votes | % of Votes |

| Votes For | 179,027,595 | 90.72 |

| Votes Withheld | 18,323,848 | 9.28 |

| Common Shares and Share Equivalents(2) | Number | Total Value |

| | 77,881 | $ 1,300,613 |

| Shareholding Requirements(3) | % of Shareholding Requirements | Target Date to Meet Requirements |

| | 389 | Met |

| ARC Resources Ltd. | 2016 | Information Circular 12 |

| Timothy J. Hearn, B.Sc. |

Independent Businessman Calgary, Alberta, Canada Age: 71 Director Since: 2011 Independent | Mr. Hearn is a retired Chairman, President and Chief Executive Officer of Imperial Oil Limited. He has over 40 years of experience in oil and gas with Imperial Oil. During his time with Imperial Oil he held increasingly senior positions, including President of Exxon Mobil Chemicals, Asia Pacific, and Vice President of Human Resources for Exxon Mobil Corporation. Mr. Hearn holds a Bachelor of Science from the University of Manitoba. He brings extensive corporate board experience to ARC. In addition to his work on corporate boards, Mr. Hearn is a member of the Advisory Board of the Public Policy School at the University of Calgary. Previously, he has served as the Chairman of the board of directors of the C.D. Howe Institute and the Calgary Homeless Foundation and was a member of the Canada Council of Chief Executives. |

| Board Committee Membership(1) | Membership | Meeting Attendance |

| | Board | (10/10) 100% |

| | Health, Safety and Environment | (4/4) 100% |

| | Human Resources and Compensation (Chair) | (6/6) 100% |

| | Policy and Board Governance | (5/5) 100% |

| | Total | (25/25) 100% |

| Current Board Directorships | Public Boards | Private Boards |

| | ARC Resources Ltd. | Nil |

| | CGI Group Inc. | |

| Voting Results of 2015 AGM | Number of Votes | % of Votes |

| Votes For | 196,658,191 | 99.65 |

| Votes Withheld | 693,252 | 0.35 |

| Common Shares and Share Equivalents(2) | Number | Total Value |

| | 126,118 | $ 2,106,171 |

| Shareholding Requirements(3) | % of Shareholding Requirements | Target Date to Meet Requirements |

| | 631 | Met |

| ARC Resources Ltd. | 2016 | Information Circular 13 |

| James C. Houck, B.Sc., MBA |

Independent Businessman Calgary, Alberta, Canada Age: 68 Director Since: 2008 Independent | Mr. Houck has over 40 years of diversified experience in the oil and gas industry. Most recently, he held the position as President and Chief Executive Officer of the Churchill Corporation, a construction and industrial services company. Previously he was President and Chief Executive Officer of Western Oil Sands. The greater part of his career was spent with ChevronTexaco Inc., where he held a number of senior management and officer positions, including President, Worldwide Power and Gasification Inc., and Vice President and General Manager, Alternate Energy Department. Earlier in his career, Mr. Houck held various positions of increasing responsibility in Texaco’s conventional oil and gas operations. Mr. Houck has a Bachelor of Engineering Science from Trinity University in San Antonio and a Masters in Business Administration from the University of Houston. |

| Board Committee Membership(1) | Membership | Meeting Attendance |

| | Board | (10/10) 100% |

| | Audit | (6/6) 100% |

| | Reserves (Chair) | (4/4) 100% |

| | Risk | (5/5) 100% |

| | Total | (25/25) 100% |

| Current Board Directorships | Public Boards | Private Boards |

| | ARC Resources Ltd. | Nil |

| | WesternZagros Resources Ltd. | |

| Voting Results of 2015 AGM | Number of Votes | % of Votes |

| Votes For | 197,170,939 | 99.91 |

| Votes Withheld | 180,504 | 0.09 |

| Common Shares and Share Equivalents(2) | Number | Total Value |

| | 57,822 | $ 956,627 |

| Shareholding Requirements(3) | % of Shareholding Requirements | Target Date to Meet Requirements |

| | 289 | Met |

| ARC Resources Ltd. | 2016 | Information Circular 14 |

| Kathleen M. O’Neill, B.Comm, FCPA, FCA |

Independent Business Person Toronto, Ontario, Canada Age: 62 Director Since: 2009 Independent | Ms. O’Neill is a Corporate Director and has extensive experience in accounting and financial services. Previously, she was an Executive Vice-President of the Bank of Montreal (BMO) Financial Group with accountability for a number of major business units. Prior to joining BMO Financial Group in 1994, she was a partner with PricewaterhouseCoopers. Ms. O'Neill is a FCPA, FCA (Fellow of Institute of Chartered Accountants) and has an ICD.D designation from the Institute of Corporate Directors. Ms. O'Neill was a member of the Steering Committee on Enhancing Audit Quality sponsored by the CPA (Chartered Professional Accountants of Canada) and the Canadian Public Accountability Board. Ms. O’Neill is the past Chair of St Joseph’s Health Centre and St Joseph’s Health Centre Foundation of Toronto. In 2014 and 2015, Ms. O’Neill was awarded Canada's Most Powerful Women: Top 100 Award by the Women's Executive Network. |

| Board Committee Membership(1) | Membership | Meeting Attendance |

| | Board | (10/10) 100% |

| | Audit (Chair) | (6/6) 100% |

| | Health, Safety and Environment | (4/4) 100% |

| | Risk | (5/5) 100% |

| | Total | (25/25) 100% |

| Current Board Directorships | Public Boards | Private Boards |

| | ARC Resources Ltd. | Cadillac Fairview |

| | Finning International Inc. | Ontario Teachers’ Pension Plan |

| | Invesco Canada Funds (Invesco Canada Fund Inc. and Invesco Corporate Class Inc.) | |

| Voting Results of 2015 AGM | Number of Votes | % of Votes |

| Votes For | 197,174,787 | 99.91 |

| Votes Withheld | 176,656 | 0.09 |

| Common Shares and Share Equivalents(2) | Number | Total Value |

| | 57,882 | $ 966,629 |

| Shareholding Requirements(3) | % of Shareholding Requirements | Target Date to Meet Requirements |

| | 289 | Met |

| ARC Resources Ltd. | 2016 | Information Circular 15 |

| Herbert C. Pinder, Jr., B.A., L.L.B., MBA |

Independent Businessman Saskatoon, Saskatchewan, Canada Age: 69 Director Since: 2006 Independent | Mr. Pinder is the President of Goal Group, a private equity management firm located in Saskatoon, Saskatchewan. Previously, he managed a family business as President of Pinder Drugs. He is an experienced corporate director and brings a varied business background to ARC. Mr. Pinder has a Bachelor of Arts degree from the University of Saskatchewan, a Bachelor of Law degree from the University of Manitoba and Masters in Business Administration degree from Harvard University Graduate School of Business. Mr. Pinder is a Director on the Board of the Fraser Institute and the Chairman of the Business of Hockey Institute. |

| Board and Committee Membership(1) | Membership | Meeting Attendance |

| | Board | (10/10) 100% |

| | Human Resources and Compensation | (6/6) 100% |

| | Policy and Board Governance (Chair) | (5/5) 100% |

| | Reserves | (4/4) 100% |

| | Total | (25/25) 100% |

| Current Board Directorships | Public Boards | Private Boards |

| | ARC Resources Ltd. | Cavalier Enterprises Ltd. |

| | | Tournament Exploration Ltd. |

| | | Astra Oil Corp. |

| Voting Results of 2015 AGM | Number of Votes | % of Votes |

| Votes For | 196,513,493 | 99.58 |

| Votes Withheld | 837,950 | 0.42 |

| Common Shares and Share Equivalents(2) | Number | Total Value |

| | 146,451 | $ 2,445,732 |

| Shareholding Requirements(3) | % of Shareholding Requirements | Target Date to Meet Requirements |

| | 778 | Met |

| ARC Resources Ltd. | 2016 | Information Circular 16 |

| Nancy L. Smith, B.A., MBA |

Managing Director ARC Financial Corp. Calgary, Alberta, Canada Age: 53 Director Since: 2016 Independent | Ms. Smith is a Managing Director of ARC Financial Corp., Canada’s largest energy focused private equity manager. Prior to joining ARC Financial in 1999, she held executive positions in finance and upstream marketing at a Canadian integrated energy company and spent the first five years of her career in corporate banking. Ms. Smith received a Masters of Business Administration and a Bachelor of Arts (Economics) from the University of Alberta and has an ICD.D designation from the Institute of Corporate Directors. |

| Board and Committee Membership(1) | Membership(5) | Meeting Attendance |

| | N/A | N/A |

| Current Public Board Membership | Public Boards | Private Boards |

| | ARC Resources Ltd. | ARC Financial Corp.(7) |

| | | Canbriam Energy Inc. |

| | | Corinthian Oil Corp. |

| | | Spur Management Ltd. |

| Common Shares and Share Equivalents(2) (6) | Number | Total Value |

| | 0 | $ 0 |

| Shareholding Requirements(3) | % of Shareholding Requirements | Target Date to Meet Requirements |

| | 0 | February 2021 |

| ARC Resources Ltd. | 2016 | Information Circular 17 |

| William G. Sembo, B.A. |

Independent Businessman Calgary, Alberta, Canada Age: 62 Director Since: 2013 Independent | Mr. Sembo has over 40 years of industry experience. He retired from his role as Vice Chairman at RBC Capital Markets LLC in 2013. Mr. Sembo has spent the majority of his career in energy investment banking and has expertise in investment banking, corporate credit and mergers and acquisitions. Prior to joining RBC in 1986, Mr. Sembo held Corporate Finance and Financial Planning positions with Toronto Dominion Bank and Asamera Inc., respectively. Mr. Sembo has a Bachelor of Arts in Economics from the University of Calgary. He brings extensive capital markets expertise as well as a broad base of corporate governance experience to ARC, having served as a director for both private and public boards as well as numerous not-for-profit organizations. |

| Board and Committee Membership(1) | Membership | Meeting Attendance |

| | Board | (10/10) 100% |

| | Audit | (6/6) 100% |

| | Reserves | (4/4) 100% |

| | Total | (20/20) 100% |

| Current Public Board Membership | Public Boards | Private Boards |

| | ARC Resources Ltd. | OMERS Energy Services LP |

| | Canadian Utilities Ltd. | CEDA International Corporation |

| | | Calgary Scientific Inc. |

| Voting Results of 2015 AGM | Number of Votes | % of Votes |

| Votes For | 197,184,809 | 99.92 |

| Votes Withheld | 166,634 | 0.08 |

| Common Shares and Share Equivalents(2) | Number | Total Value |

| | 26,910 | $ 449,397 |

| Shareholding Requirements(3) | % of Shareholding Requirements | Target Date to Meet Requirements |

| | 269 | Met |

| ARC Resources Ltd. | 2016 | Information Circular 18 |

| Myron M. Stadnyk, B.Sc., P.Eng. |

President and Chief Executive Officer ARC Resources Ltd. Calgary, Alberta, Canada Age: 53 Director Since: 2013 Management Director | Mr. Stadnyk is President and Chief Executive Officer of ARC and has overall Management responsibility for the Corporation. Mr. Stadnyk joined ARC in 1997, as the Corporation’s first operations employee and has been President since 2009 and CEO since 2013. Prior to joining ARC, Mr. Stadnyk worked with a major oil and gas company in both domestic and international operations. He holds a Bachelor of Science in Mechanical Engineering from the University of Saskatchewan and is a graduate of the Harvard Business School Advanced Management program. Mr. Stadnyk joined ARC’s Board of Directors in 2013. He is a member of the Association of Professional Engineers and Geoscientists (APEGA) and currently sits on the Canadian Association of Petroleum Producers (CAPP) Board of Governors and is the current Chair of the British Columbia Executive Policy Group. Mr. Stadnyk is a board member of the University of Saskatchewan Engineering Advancement Trust, STARS (Shock Trauma Air Rescue Society) Air Ambulance and is active with various charitable organizations. |

| Board and Committee Membership(1) | Membership | Meeting Attendance |

| | Board | (10/10) 100% |

| | Mr. Stadnyk is not a member of any Committees, however he attended substantially all of the Committee meetings during 2015. |

| Current Board Directorships | Public Boards | Private Boards |

| | ARC Resources Ltd. | Nil |

| Voting Results of 2015 AGM | Number of Votes | % of Votes |

| Votes For | 196,821,913 | 99.73 |

| Votes Withheld | 529,530 | 0.27 |

| Common Shares and Share Equivalents(2) | Number | Total Value |

| | 403,428 | $6,737,248 |

| Shareholding Requirements(3) | % of Shareholding Requirement | Target Date to Meet Requirements |

| | 1180 | Met |

| (1) | Committee membership as at December 31, 2015. |

| (2) | See“Share Ownership Requirements”for detailed breakdown of Common Shares and share equivalents for 2015 and 2014. Share equivalents includes DSUs issued under the Directors Deferred Share Unit Plan as at December 31, 2015. Share equivalents does not include PSUs issued under the RSU and PSU Plan and options issued under the Share Option Plan to Mr. Dielwart and Mr. Stadnyk or Restricted Shares issued under the Long Term Restricted Share Award Plan to Mr. Stadnyk. |

| (3) | Information on share ownership requirements for Directors can be found under “Share Ownership Requirements” on pages 22 to 23. |

| (4) | Mr. Kvisle was appointed Chair of the Board of Directors effective January 1, 2016 following the resignation of Mr. Wielingen. |

| (5) | Ms. Smith was appointed to the Board of Directors and the Audit Committee on February 10, 2016. |

| (6) | Ms. Smith acquired 5000 common shares on February 17, 2016 and has until February 10, 2021 to accumulate a minimum share ownership of 20,000 Common Shares and share equivalents within five years on the Board. |

| (7) | Related to her role at ARC Financial Corp. and the investment funds managed by ARC Financial Corp., Ms. Smith also serves on the boards of a number of private companies which are affiliates of these entities. |

MAJORITY VOTING FOR DIRECTORS

The Board has adopted a policy stipulating that if the votes in favour of the election of a Director Nominee at a Shareholders' Meeting represent less than a majority of the Common Shares voted and withheld, the nominee will submit his or her resignation promptly after the Meeting for the Policy and Board Governance Committee's consideration. The Committee will make a recommendation to the Board after reviewing the matter, and the Board's decision to accept or reject the resignation offer will be disclosed to the public within 90 days of the applicable shareholders’ meeting. Resignations will be accepted except in situations where special circumstances would warrant the applicable Director’s continuation as a Board member. The nominee will not participate in any Committee or Board deliberations on the resignation offer. The policy does not apply in circumstances involving contested Director elections.

| ARC Resources Ltd. | 2016 | Information Circular 19 |

REMUNERATION OF DIRECTORS

DIRECTOR COMPENSATION PHILOSOPHY AND OBJECTIVES

The compensation program for ARC’s non-management Directors is designed to attract and retain high quality individuals with the experience and capability to meet the responsibilities of a Board member and to align the interests of Directors with the interests of shareholders. The Board reviews Directors’ compensation on a biennial basis through an analysis of the proxy circulars of other oil and gas companies together with a review of director compensation surveys performed by third parties, to ensure that the composition of ARC’s compensation program is appropriate and that total compensation is competitive in order to attract well qualified board members.

For the purposes of benchmarking director compensation, ARC reviews and considers data from a group of Canadian energy industry peers. The peer group is determined based on production levels, total enterprise value, nature and location of operations to ensure consistency and relevancy of the comparison. The following table lists the companies which were included in ARC’s peer group for purposes of benchmarking director compensation when last performed in August 2014.

| Proxy Peer Group - Canadian Oil and Gas Production Companies |

| Baytex Energy Corporation | Penn West Petroleum Ltd. |

| Bonavista Energy Corporation | Pengrowth Energy Corporation |

| Canadian Oil Sands Limited | Peyto Exploration & Development Corporation |

| Crescent Point Energy Corporation | Talisman Energy |

| Enerplus Corporation | Tourmaline Oil Corporation |

| MEG Energy Corporation | Trilogy Energy Corporation |

| Paramount Resources Ltd. | Vermilion Energy Inc. |

ARC's compensation program for non-management Directors consists of both a cash component and an equity component paid in the form of Deferred Share Units ("DSUs"). The maximum cash component received is 40 per cent of a non-management Director’s total compensation, with the remaining compensation received in the form of the DSUs.

A non-management Director may elect to receive all of his or her compensation in the form of DSUs, therefore, a Director may receive up to 100 per cent of his or her total compensation in the form of DSUs. DSUs vest immediately upon grant but cannot be redeemed until the holder ceases to be a Director. For additional information on the DSU Plan and the terms of the DSUs, see“Equity Based Compensation”below as well asSchedule F to this Information Circular.

The payment of Board and Committee cash retainers and granting of DSUs occurs on a quarterly basis.The two elements of ARC's compensation program for non-management Directors are described below.

| ARC Resources Ltd. | 2016 | Information Circular 20 |

BOARD AND COMMITTEE RETAINERS

The following table outlines the Board and Committee retainer fee schedule for non-management directors for 2015. There were no changes to the fee schedule during 2015.

| 2015 Directors Fees | | | |

| Cash Retainer: | | | | |

| Board Chair | | $ | 166,000 | |

| Board Member | | $ | 88,000 | |

| Audit Committee Chair | | $ | 10,000 | |

| Other Committee Chair | | $ | 6,000 | |

| Equity Compensation | | | 150% of Cash Retainer | |

| Total Director Compensation (1) | | | 40% Cash / 60% Equity | |

| (1) | A non-management Director may elect to receive all of his or her total compensation in the form of DSUs, therefore, a Director may receive up to 100% of his or her total compensation in the form of DSUs. |

EQUITY BASED COMPENSATION

ARC believes that equity based compensation for Directors provides for greater alignment of the interests of Directors and shareholders. ARC’s non-management Directors receive equity based compensation in the form of DSUs which are notional shares granted to the Director and are linked directly to the share price performance from the grant date to the date on which the DSUs are redeemed. DSUs vest immediately upon grant but cannot be redeemed until the holder ceases to be a Director. In addition, each time that dividends are paid on the Common Shares, the number of DSUs in the Directors’ DSU account is increased to reflect the value of dividends that are paid on the notional underlying Common Shares.

The number of DSUs awarded to non-management Directors from time-to-time is calculated by dividing the value of the award by the weighted average trading price of the Common Shares on the TSX for the five trading days prior to the date of grant. On the date that a holder of DSUs ceases to be a Director of ARC, he or she has until December 1st in the calendar year following the date on which the holder ceases to be a Director to redeem his or her awards in exchange for a cash payment equal to the number of DSUs held multiplied by the weighted average trading price of the Common Shares on the TSX for the five trading days prior to the date of settlement.

Non-management Directors are not eligible to participate in the RSU and PSU Plan, the Share Option Plan or the Long Term Restricted Share Award Plan.

| ARC Resources Ltd. | 2016 | Information Circular 21 |

TOTAL DIRECTOR COMPENSATION

The following table details total compensation paid to each non-management Director during 2015.

| Director(1) | | Board

Chair or

Member

Retainer | | | Committee

Chair

Retainer | | | Total Cash

Retainer

Fees

Earned | | | Equity

(DSUs)(2) | | | Total

Compensation | | | Portion

taken as

Cash | | | Portion

taken as

DSUs(3) | |

| Van Wielingen | | $ | 166,000 | | | $ | - | | | $ | 166,000 | | | $ | 249,056 | | | $ | 415,056 | | | $ | - | | | $ | 415,056 | |

| Dielwart | | $ | 88,000 | | | $ | 6,000 | | | $ | 94,000 | | | $ | 141,032 | | | $ | 235,032 | | | $ | - | | | $ | 235,032 | |

| Dyment | | $ | 88,000 | | | $ | 6,000 | | | $ | 94,000 | | | $ | 141,025 | | | $ | 235,025 | | | $ | 93,975 | | | $ | 141,025 | |

| Hearn | | $ | 88,000 | | | $ | 6,000 | | | $ | 94,000 | | | $ | 141,025 | | | $ | 235,025 | | | $ | 93,975 | | | $ | 141,025 | |

| Houck | | $ | 88,000 | | | $ | 6,000 | | | $ | 94,000 | | | $ | 141,025 | | | $ | 235,025 | | | $ | 70,450 | | | $ | 164,550 | |

| Kvisle | | $ | 88,000 | | | $ | - | | | $ | 88,000 | | | $ | 132,047 | | | $ | 220,047 | | | $ | - | | | $ | 220,047 | |

| O’Neill | | $ | 88,000 | | | $ | 10,000 | | | $ | 98,000 | | | $ | 147,041 | | | $ | 245,041 | | | $ | 48,959 | | | $ | 196,041 | |

| Pinder | | $ | 88,000 | | | $ | 6,000 | | | $ | 94,000 | | | $ | 141,032 | | | $ | 235,032 | | | $ | - | | | $ | 235,032 | |

| Sembo | | $ | 88,000 | | | $ | - | | | $ | 88,000 | | | $ | 132,024 | | | $ | 220,024 | | | $ | 87,976 | | | $ | 132,024 | |

| Total | | $ | 870,000 | | | $ | 40,000 | | | $ | 910,000 | | | $ | 1,356,307 | | | $ | 2,275,307 | | | $ | 395,335 | | | $ | 1,879,832 | |

| (1) | Excludes Mr. Stadnyk as he was a management Director during 2015. |

| (2) | This amount is equal to approximately 150% of the amount of Total Cash Retainer Fees Earned, and must be taken as DSUs. |

| (3) | Approximately 60% of a Director's Total Compensation is paid in DSU’s, the remaining portion of approximately 40% may be paid in cash or the Director may elect to increase the percentage of DSUs. |

EQUITY BASED AWARDS – OUTSTANDING AND VESTED DURING 2015

The following table sets forth information in respect of the number and value of DSU awards held by non-management Directors which were outstanding and were fully vested as at December 31, 2015.

| Director(1) | | Number of DSUs | | | Estimated Payout Value of DSUs(2) | |

| Van Wielingen | | | 94,871 | | | $ | 1,584,346 | |

| Dielwart | | | 25,163 | | | $ | 420,222 | |

| Dyment | | | 29,625 | | | $ | 494,738 | |

| Hearn | | | 24,568 | | | $ | 410,286 | |

| Houck | | | 33,062 | | | $ | 552,135 | |

| Kvisle | | | 42,312 | | | $ | 706,610 | |

| O’Neill | | | 38,096 | | | $ | 636,203 | |

| Pinder | | | 51,143 | | | $ | 854,088 | |

| Sembo | | | 11,610 | | | $ | 193,887 | |

| (1) | Excludes Mr. Stadnyk as he was a management Director during 2015. |

| (2) | Calculated based on the closing price of the Common Shares on December 31, 2015 of $16.70 multiplied by the number of DSUs on such date adjusted to reflect cash dividends on the underlying Common Shares for the period from the grant date to December 31, 2015. DSUs vest immediately upon grant but cannot be redeemed until death or retirement of the Director. |

The table above does not include any share based compensation which was outstanding and held by Mr. Dielwart, as at December 31, 2015, other than DSUs which were awarded to him in his capacity as a non-management Director. Mr. Dielwart however does continue to hold PSUs and stock options which were awarded to him in relation to his former role as Chief Executive Officer (“CEO”). As at December 31, 2015, Mr. Dielwart held an aggregate 27,788 unvested PSUs which had a median value of approximately $464,060 (range of $nil to $928,119 subject to a performance multiplier that may vary from zero to two). Mr. Dielwart also held an aggregate 148,748 unvested stock options which had a value of approximately $66,641. These values have been calculated in the same manner that ARC has valued the unvested PSUs and unvested stock options held by its Named Executive Officers as described later in this Information Circular under"2015 Executive Compensation".As a Director, Mr. Dielwart is no longer eligible to receive PSUs and options, but the PSUs and options he received during his tenure as CEO continue to vest under the terms and conditions of those plans.

| ARC Resources Ltd. | 2016 | Information Circular 22 |

The table above also does not include any share based compensation held by Mr. Dielwart which vested during 2015 other than DSUs which were awarded to him in his capacity as a non-management Director. Mr. Dielwart held PSU’s which vested during 2015 and which were awarded to him during his tenure as CEO. During 2015, 62,668 PSUs held by Mr. Dielwart vested with a value of $2,086,091 as calculated in the same manner that ARC has valued the PSUs which vested during 2015 and were held by its Named Executive Officers as described under“2015 Executive Compensation”.

SHARE OWNERSHIP REQUIREMENTS

In order to align the interests of Directors with those of the shareholders, each non-management Director is required to own a minimum of 20,000 Common Shares or share equivalents of the Corporation after having been on the Board for five years. A minimum of 10,000 Common Shares or share equivalents must be held after three years on the Board. The Board of Directors considered an ownership requirement based on a multiple of fees received but determined that setting a numeric threshold of 20,000 Common Shares or share equivalents, that at the time was approximately equal to three times the cash retainer fees for the Chairman of the Board and in excess of four times the cash retainer fees for other Board members, was appropriate. As at December 31, 2015, and as outlined in the following page, all non-management Directors meet or exceed the minimum share ownership requirement. Management Directors are subject to separate share ownership requirements which are outlined in the“Compensation Discussion and Analysis” section of this Information Circular.

| Director | | Year Ended

December

31 | | Common

Shares | | | DSUs(1) | | | Total

Common

Shares and

share

equivalents | | | Total Market

value of

Common

Shares and

share

equivalents(2) | | | Value at risk

as multiple

of Cash

Retainer

Fees

Earned(3) | | | Meets

Minimum

Share

Ownership

Guidelines(3) |

| Van Wielingen | | 2015 | | | 868,440 | | | | 94,871 | | | | 963,311 | | | $ | 16,087,294 | | | | 97 | | | yes |

| | | 2014 | | | 718,440 | | | | 69,081 | | | | 787,521 | | | $ | 19,814,028 | | | | 112 | | | yes |

| Dielwart(4) | | 2015 | | | 380,570 | | | | 25,163 | | | | 405,733 | | | $ | 6,775,741 | | | | 72 | | | yes |

| | | 2014 | | | 400,922 | | | | 12,134 | | | | 413,056 | | | $ | 10,392,489 | | | | 116 | | | yes |

| Dyment | | 2015 | | | 48,256 | | | | 29,625 | | | | 77,881 | | | $ | 1,300,613 | | | | 14 | | | yes |

| | | 2014 | | | 47,187 | | | | 21,006 | | | | 68,193 | | | $ | 1,715,736 | | | | 18 | | | yes |

| Hearn | | 2015 | | | 101,550 | | | | 24,568 | | | | 126,118 | | | $ | 2,106,171 | | | | 22 | | | yes |

| | | 2014 | | | 100,750 | | | | 16,228 | | | | 116,978 | | | $ | 2,943,166 | | | | 30 | | | yes |

| Houck | | 2015 | | | 24,760 | | | | 33,062 | | | | 57,822 | | | $ | 965,627 | | | | 10 | | | yes |

| | | 2014 | | | 19,760 | | | | 23,089 | | | | 42,849 | | | $ | 1,078,081 | | | | 11 | | | yes |

| Kvisle | | 2015 | | | 80,500 | | | | 42,312 | | | | 122,812 | | | $ | 2,050,960 | | | | 23 | | | yes |

| | | 2014 | | | 38,500 | | | | 29,080 | | | | 67,580 | | | $ | 1,700,313 | | | | 21 | | | yes |

| O’Neill | | 2015 | | | 19,786 | | | | 38,096 | | | | 57,882 | | | $ | 966,629 | | | | 10 | | | yes |

| | | 2014 | | | 18,646 | | | | 26,285 | | | | 44,931 | | | $ | 1,130,464 | | | | 11 | | | yes |

| Pinder | | 2015 | | | 95,308 | | | | 51,143 | | | | 146,451 | | | $ | 2,445,682 | | | | 26 | | | yes |

| | | 2014 | | | 84,443 | | | | 36,681 | | | | 121,124 | | | $ | 3,047,480 | | | | 32 | | | yes |

| Sembo | | 2015 | | | 15,300 | | | | 11,610 | | | | 26,910 | | | $ | 449,397 | | | | 5 | | | yes |

| | | 2014 | | | 10,000 | | | | 4,431 | | | | 14,431 | | | $ | 363,084 | | | | 4 | | | yes |

| (1) | The number of DSUs reflects dividends paid on Common Shares to December 31, 2015 or 2014, as applicable. |

| (2) | Value based on closing share price of Common Shares of $16.70 at December 31, 2015 ($25.16 at December 31, 2014). |

| (3) | Based on total market value of Common Shares and share equivalents including DSUs. |

| (4) | Mr. Dielwart was the CEO of ARC until December 31, 2012 and became a non-management Director on May 16, 2013. |

| ARC Resources Ltd. | 2016 | Information Circular 23 |

CORPORATE GOVERNANCE DISCLOSURE

National Instrument 58-101Disclosure of Corporate Governance Practicesrequires that if management of an issuer solicits proxies from its security holders for the purpose of electing Directors that certain prescribed disclosure respecting corporate governance matters be included in its management Information Circular. The TSX also requires listed companies to provide, on an annual basis, the corporate governance disclosure which is prescribed by NI 58-101. The prescribed corporate governance disclosure for the Corporation is that contained in Form 58-101F1 which is attached to NI 58-101.

ABOUT THE BOARD

The Board is responsible for the stewardship of ARC with oversight in several key areas including vision, strategy and leadership, risk management, succession planning, and corporate governance practices. The Board’s duties are set out in the Board Mandate which is reviewed each year and found inSchedule B.

The Board of Directors, in part, performs its mandated responsibilities through the activities of its six Committees outlined below. Each of the six Committees has their own mandate which is reviewed and approved each year. The Audit, Human Resources and Compensation, Policy and Board Governance and Reserves Committees are comprised entirely of independent Directors. The Board of Directors has determined that with the exception of Mr. Dielwart, the former CEO of ARC, none of the Directors who serve on any Board Committees have a material relationship with ARC that could reasonably interfere with the exercise of a Director’s independent judgment.

| Audit Committee |

| Human Resources and Compensation Committee(1) |

| Policy and Board Governance Committee(2) |

| Health, Safety and Environment Committee(3) |

| Reserves Committee |

| Risk Committee |

| (1) | Referred to as “HRC Committee” or “HRCC”. |

| (2) | Referred to as “Governance Committee”. |

| (3) | Referred to as “HSE Committee”. |

The Board of Directors hold regularly scheduled meetings at least quarterly to perform its responsibilities. The Board of Directors and members of management hold strategic planning sessions at least annually and revisit strategic planning at each quarterly meeting of the Board of Directors. Significant operational decisions and all decisions relating to the following are made by the Board of Directors:

| · | the acquisition and disposition of properties for a purchase price or proceeds in excess of an amount established by the Board of Directors from time-to-time; |

| · | the approval of capital expenditure budgets |

| · | the establishment of credit facilities |

| · | issuances of additional Common Shares |

| · | the determination of the amount of dividends paid on Common Shares |

| · | long term marketing, transportation and hedging arrangements in excess of an amount established by the Board of Directors from time-to-time |

| ARC Resources Ltd. | 2016 | Information Circular 24 |

The Board of Directors and the Policy and Board Governance Committee have developed position descriptions for the Chair of the Board and the CEO with a view of ensuring that the Board of Directors can operate efficiently on a fully informed basis independent of management. As such, the CEO reports directly to the Board of Directors. The Chair of the Board is an Independent Director and is responsible for managing the affairs of the Board and its Committees, including ensuring the Board of Directors is organized properly, functions effectively and independently of management and meets its obligations and responsibilities.

Strategic Planning Oversight

The Board oversees the development and execution of a longer range strategic plan and a shorter range business plan for ARC’s business which are designed to achieve ARC’s principal objectives and identify the principal strategic and operational opportunities and risks of ARC’s business. To assist the Board of Directors in meeting this responsibility, the agenda for every regularly scheduled board meeting includes a discussion of the progress of the short-term business plan and quarterly results as well as a “Strategy Update” where management provides a review of business development, exploration, financial forecasts, human resources and emerging trends and opportunities so as to provide the Board the information required for them to discuss and analyze the main risks associated with our business plan and make recommendations to adjust the plan if necessary. In addition, the Board sets aside two days every year for a strategic planning session where they discuss the long-term plan for the organization in detail.

Risk Oversight

Over the past several years, there has been increasing focus on identification, management, mitigation and reporting of risks. The Board is responsible for the identification of principal risks of the business and to ensure that all reasonable steps are taken to ensure the implementation of appropriate systems and procedures to manage such risks. The Board established a Risk Committee in 2008 to assist the Board of Directors in meeting its responsibilities with respect to risk identification, oversight and mitigation. The Risk Committee maintains a “Business Risk Matrix” which identifies risks to the organization along with a ranking of severity of such risks. The Business Risk Matrix is reviewed at least annually by the Board. ARC has categorized the organizational risks as follows:

| Strategic |

| Financial |

| Governance, Regulatory/Legal, Compliance |

| Operational |

| Culture, Organizational |

| ARC Resources Ltd. | 2016 | Information Circular 25 |

The Board has assigned responsibility for specific risk oversight and mitigation to the appropriate committees as outlined below:

| Committee | Risk Oversight Responsibility | Specific Risk Oversight |

| Risk | Identify the principal business, financial, organizational and other risks of the Corporation Ensure that management, the Board or a Committee takes adequate steps to mitigate risks Establish accountability for such mitigation | Business environment, commodity price risk, hedging program, credit risk monitoring and mitigation, insurance |

| Audit | Financial reporting risk oversight Financial compliance risk oversight | Internal Controls, integrity of reporting systems, compliance with financial and regulatory requirements, compliance with financial contractual requirements |

| HRCC | Talent management and succession risk oversight Compensation risk oversight | Succession planning, compliance with contractual requirements |

| Governance | Governance and regulatory risk oversight | Compliance with Corporate Governance, legal and regulatory requirements |

| Reserves | Reserves evaluation and reserves reporting risk oversight | Accuracy and Integrity of Reserves evaluation and reporting, compliance with regulatory requirements |

| HSE | Health, safety and environment risk oversight Infrastructure integrity and security risk oversight Operational risk oversight | Operational performance monitoring and reporting, compliance with operational regulatory requirements |

See “Committee Membership, Mandates, Responsibilities and Other Information”for additional information with respect to the Committee mandates and responsibilities.

Succession Planning

The Board of Directors takes responsibility for senior officer succession planning and specifically, succession planning for the CEO. Succession planning is an agenda item at all quarterly Human Resources and Compensation Committee (“HRCC”) meetings where the President and CEO provide regular updates on the progression and development of individual executives. Succession planning is a frequent part of the Board agenda, in-camera discussions and is discussed formally at a separate succession, progression and development meeting held in conjunction with the third quarter Board and committee meetings, where the CEO, without other members of senior management present, discusses his views on the executive leadership team in general and his potential successors. At these sessions, the Board of Directors and the President and CEO discuss succession plans and candidates for all senior officer positions, including the CEO role.

The Board of Directors meet for an informal dinner session the evening prior to every regularly scheduled Board meeting. This provides the Board the opportunity to meet in a less formal atmosphere to discuss succession planning, corporate culture and a variety of other topics as well as strengthening the collegial working relationship of the Directors.

| ARC Resources Ltd. | 2016 | Information Circular 26 |

The Board of Directors and its Committees have access to senior management on a regular basis as Mr. Stadnyk, the President and CEO, is a Director and attends all meetings of the Board of Directors and its Committees, along with other executive officers who are invited to attend Directors meetings and Committee meetings to provide necessary information to facilitate decision making activities. All executive officers of the Corporation attend the annual strategic planning session providing additional opportunity for the Board to interact with management. An annual luncheon is also held with the Directors where the next level of management below the executive level are in attendance, providing the opportunity for the Board to meet this group of individuals.

The HRCC has become increasingly more detailed and formalized in its succession planning process for the CEO, senior management and other strategic positions considered critical to the success of ARC. The HRCC’s succession planning process involves working with the CEO to review the internal talent pool on a regular basis, and identifying potential candidates, selecting executive development opportunities and evaluating performance and progress, as well as planning for illness, disability and other unscheduled absences. This includes long range planning for executive development and succession to ensure leadership sustainability and continuity. The HRCC is responsible for ensuring ARC has appropriate programs for succession planning, overseeing human capital risk to ensure ARCs’ management programs (including those for officers) effectively address succession planning and reporting and recommending to the Board of Directors on succession planning matters.

The Charter of the Board of Directors and the Mandate of the Board of Directors are attached asSchedules A and B, respectively, and describe in more detail the general duties of the Board, its composition, retirement policies and other matters.

DIRECTOR INDEPENDENCE

The Board of Directors has determined that a majority of the Directors (eight of the ten Directors) standing for election are considered to be independent within the meaning of NI 58-101 (“Independent”), which prescribes that such Director is independent if he or she has no material relationship with the Corporation. A material relationship is a relationship which could in the view of the Board of Directors be reasonably expected to interfere with the exercise of a member’s independent judgment.

The Board of Directors has determined that all of its current Directors, with the exception of Mr. Dielwart and Mr. Stadnyk, are independent. Mr. Dielwart retired as CEO of the Corporation on December 31, 2012 and is not considered to beindependent. Mr. Stadnyk is the current President and CEO of the Corporation and is not independent.

INDEPENDENCE OF BOARD CHAIR

The Board of Directors has determined that the Chair of the Board, Mr. Kvisle, is an Independent Director within the meaning of NI 58-101. The Board of Directors, in conjunction with the Policy and Board Governance Committee and Mr. Kvisle, have developed broad terms of reference for the Chair of the Board of Directors which includes managing and developing a more effective Board, ensuring that such Board of Directors can function independently of management and working with management to monitor and influence strategic management and shareholder and other party relations. ARC believes that having an independent Board Chair fosters strong leadership, robust discussion and effective decisions while avoiding potential conflicts of interest.

| ARC Resources Ltd. | 2016 | Information Circular 27 |

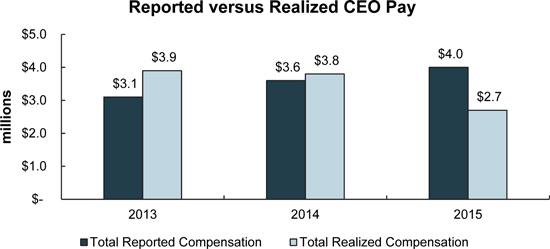

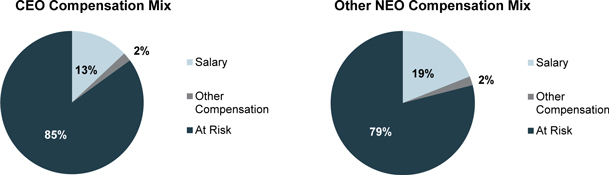

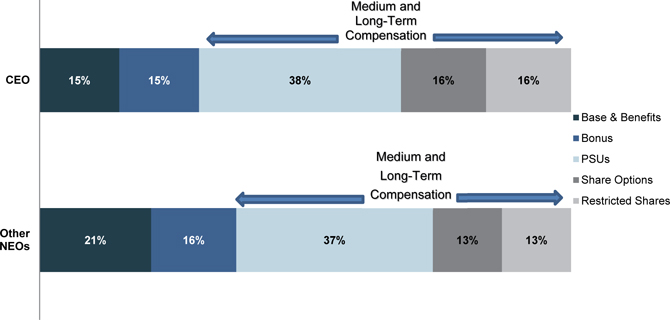

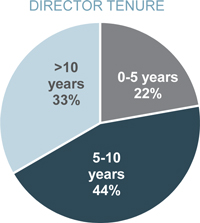

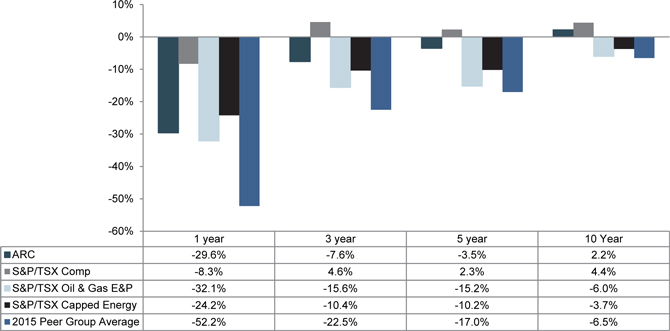

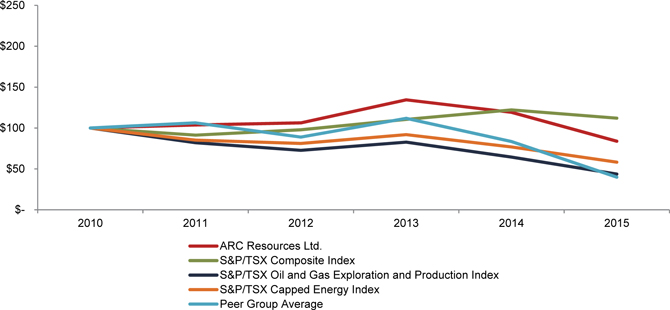

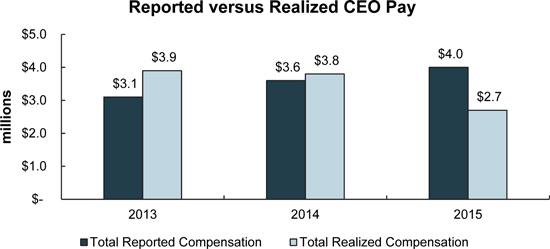

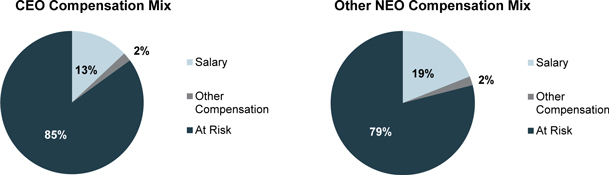

INTERLOCKING BOARDS