GS Financial Corp.. |

| 2007 Annual Report |

| To our Shareholders: A Message from the President and CEO |

2007 – THE YEAR OF CHALLENGE

The year 2007 will be remembered as a challenging year for the banking industry and it was no different for GS Financial Corp.

Like the industry as a whole, our profitability was fettered by margin compression, a slow housing market, and increased competition for deposits. Our net income was impacted by the expenses of planned growth relating to new banking locations, additional personnel, and additional investment in technology.

We, nevertheless, made progress in the fulfillment of our strategic objectives related to increased loan growth, a better mix of fixed rate loans with shorter maturities, the introduction of variable rate loans and enhanced product offerings, the establishment of new banking locations, growth in low cost deposits and improved technology.

Some of our performance highlights include:

| | · | Gross loans grew by $24.1 million or 24.7% during 2007 to $121.9 million. |

| | · | We sold $15.2 million of residential loan originations in the secondary market in 2007 resulting in gains on loan sales of $189,000. |

| | · | Deposits grew by $6.8 million or 5.5% during 2007, including $2.3 million in non-interest bearing deposits. |

| | · | During 2007, the Bank re-opened its newly renovated Mid-City New Orleans office, which was flooded by Hurricane Katrina, converted its loan production office in Ponchatoula, Louisiana to a full service branch and opened a full service trailer branch on the Westbank of Jefferson Parish in Harvey, Louisiana. |

| | · | Stockholders’ equity at December 31, 2007 was $28.2 million, up $1.0 million from December 31, 2006. Stockholders’ equity as a percentage of total assets at December 31, 2007 was 15.10%. |

THE COMMUNITY BANK BUSINESS MODEL

In past communications to our shareholders, I have emphasized that we adopted a community bank business model, transitioning the Bank from the traditional savings and loan model. I would like to share with you the status of our transition.

Below is a summary of some of the progress we have made in critical areas:

Information technology – Management has focused much of its time and resources over the past two years on developing new banking products and services, increasing capacity for all business lines. We have made significant expenditures on hardware and software upgrades. Some of the software expenditures have included those for the implementation of corporate wide e-mail and Internet access, online banking, documentation scanning, mortgage loan origination and processing software and loan documentation software. This investment will be increasingly leveraged over the next several years as each department realizes operating efficiencies and expands existing product offerings as more customers take advantage of our convenience products, such as online banking, remote deposit and free bill payment services.

Mortgage Banking – Management knew that, for our mortgage lending process to be competitive, we had to evolve from a low volume long term fixed rate portfolio lender. To that end, we have added adjustable rate mortgage loan products and home equity loans, and we now originate loans for sale into the secondary market. A significant investment in personnel was made during the past two years in order to assemble a team of mortgage banking professionals who could serve an increased volume of mortgage loans and implement the secondary market program. Management believes that the significant changes we have made to mortgage lending will not only increase profitability and reduce interest rate risk (by retaining primarily adjustable rate loans in the portfolio), it will also allow us to both better serve our mortgage loan customers with the additional products and better pricing and permit us to be more competitive in our market area.

Commercial Banking – Management has completed the successful implementation of a new commercial lending philosophy founded on the principles of safety, soundness and profitability. We hired experienced commercial lenders with a successful business development track record and formal credit training in their backgrounds, and placed them in locations where they have a customer following. As a result of the investment in these new personnel, the commercial lending team has significantly increased the quality of our commercial loan portfolio. These new bankers are committed to a relationship banking approach to business development. They have been the driving force in the growth of our low cost commercial deposits and have already made a significant contribution through their efforts to cross-sell mortgage loans, home equity loans and retail deposits. Quarter by quarter these activities will continue to improve the profitability of our Bank.

Deposit Mix- Management recognized that our past reliance upon certificates of deposit and traditional passbook savings accounts to fund the community bank business model would be insufficient. We needed new and better deposit products in order to compete more effectively. Accordingly, we enhanced our deposit product offerings. We introduced tiered money market accounts for individuals and businesses; we implemented several new pricing options for certificates of deposit in an effort to move the high cost time deposit customer into longer or shorter terms based upon management’s anticipation of interest rate movements; and we placed increased emphasis on the sale of NOW checking accounts coupled with better online banking products.

2008 - WHAT ARE THE OPPORTUNITIES?

Guaranty Savings Bank has made great progress transitioning to a community bank business model. This model reaches more customers through the offering of more products, earns a higher interest margin and, in recent years, achieved more profits than if we had retained the savings and loan business model. Although the amount of time it will take to fully transform our pre-existing savings and loan balance sheet to one of a community bank is uncertain, we believe it will occur gradually over a period of several productive years. Currently, much of our deposit mix remains concentrated in time deposits as opposed to non-interest bearing and other transactional accounts. That is why we have placed emphasis and have demonstrated progress in the growth of transactional and non-interest bearing deposit products. In addition, much of the loan portfolio remains concentrated in 15-year and 30-year fixed rate residential portfolio loans as opposed to adjustable rate loans, home equity loans and higher yielding shorter term commercial loans. That is why we have aggressively revitalized both the mortgage lending and commercial banking teams. While the progress we have made has reduced our exposure to margin compression and interest rate risk, we still have more to accomplish.

The execution of our multi-year strategic plan will transition Guaranty Savings Bank to a community bank and is expected to improve our profitability over time. We have made great strides and see progress every day. We believe our fundamentals are strong and our growth strategy is sound. We have a good management team, a healthy capital position, minimal exposure to the sub-prime mortgage market, and, we believe, adequate loan loss reserves. In addition, we have diversified our revenue streams and we expect to capitalize on the recent big bank consolidation and acquisition activities in our market by attracting more customers.

Management and the Board of Directors of GS Financial Corp. and Guaranty Savings Bank appreciate the confidence that you have placed in us by investing in our Company.

Stephen Wessel

President and Chief Executive Officer

| Business Description | 4 |

| | |

| Shareholder Information | 4 |

| | |

| Selected Consolidated Financial Data | 5 |

| | |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | 6 |

| | |

| Management’s Report on Internal Control Over Financial Reporting | 27 |

| | |

| Report of Independent Registered Public Accounting Firm | 28 |

| | |

| Consolidated Balance Sheets | 29 |

| | |

| Consolidated Statements of Income | 31 |

| | |

| Consolidated Statements of Comprehensive Income | 32 |

| | |

| Consolidated Statements of Changes in Stockholders’ Equity | 33 |

| | |

| Consolidated Statements of Cash Flows | 34 |

| | |

| Notes to the Consolidated Financial Statements | 36 |

| | |

| Board of Directors | 64 |

| | |

| Executive Officers | 64 |

| | |

| Banking Locations | 65 |

| | |

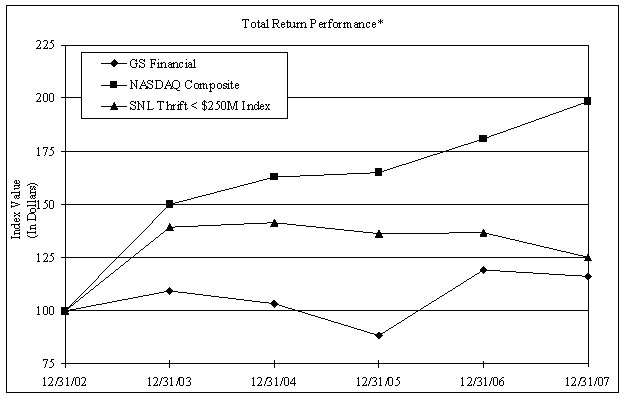

| GS Financial Corp. Stock Performance | 65 |

GS Financial Corp. (“GS Financial” or the “Company”) provides community banking services through its wholly-owned subsidiary, Guaranty Savings Bank, a Louisiana chartered savings bank, at its five banking locations and a loan production office in the metropolitan New Orleans area.

The Company, a thrift holding company organized and incorporated under the laws of the State of Louisiana, is subject to the supervision and regulation of the Office of Thrift Supervision as well as other federal and state agencies governing the banking industry and public companies.

TRANSFER AGENT, REGISTRAR, AND DIVIDEND PAYING AGENT FOR COMMON STOCK

Registered shareholder inquiries related to stock transfers, address changes, lost stock certificates, dividend payments or account consolidations should be directed to:

Registrar and Transfer Company

10 Commerce Drive

Cranford, New Jersey 07016

(800) 368-5948

www.rtco.com

FORM 10-K AND OTHER FINANCIAL INFORMATION

Shareholders are advised to review financial information and other disclosures about GS Financial contained in its Annual Report on Form 10-K. A copy of the Form 10-K for the year ended December 31, 2007 and other financial reports filed by GS Financial with the SEC is available on the Company’s web site at www.gsfinancialcorp.com or the SEC’s web site at www.sec.gov, or may be obtained without charge by calling Lettie Moll, Corporate Secretary, or Andrew Bower, Chief Financial Officer, at (504) 457-6220 or by writing to:

GS Financial Corp.

Investor Relations

3798 Veterans Boulevard

Metairie, Louisiana 70002

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

LaPorte, Sehrt, Romig and Hand

A Professional Accounting Corporation

110 Veterans Boulevard, Suite 200

Metairie, Louisiana 70005

COMMON STOCK

GS Financial’s common stock is traded on The Nasdaq Global Market under the ticker symbol GSLA. At December 31, 2007, the closing price was $18.94 per share and there were approximately 100 shareholders of record.

MARKET PRICES AND DIVIDENDS

Set forth below are the high and low sales prices for GS Financial’s common stock on the Nasdaq Global Market and dividends paid for the periods presented.

| Year 2007 | | Stock Price | | | Dividends | |

| Quarter Ended | | High | | | Low | | | | |

| March 31 | | $ | 21.38 | | | $ | 19.00 | | | $ | 0.10 | |

| June 30 | | | 21.49 | | | | 18.26 | | | | 0.10 | |

| September 30 | | | 20.75 | | | | 17.04 | | | | 0.10 | |

| December 31 | | | 19.50 | | | | 17.59 | | | | 0.10 | |

| Year 2006 | | Stock Price | | | Dividends | |

| Quarter Ended | | High | | | Low | | | | | |

| March 31 | | $ | 17.68 | | | $ | 14.99 | | | $ | 0.10 | |

| June 30 | | | 18.15 | | | | 16.74 | | | | 0.10 | |

| September 30 | | | 18.50 | | | | 16.50 | | | | 0.10 | |

| December 31 | | | 21.76 | | | | 18.20 | | | | 0.10 | |

ANNUAL MEETING

The Annual Meeting of Shareholders of GS Financial Corp. will be held on Tuesday, April 22, 2008, at 10:00 a.m. CDT at its corporate office. The address is:

Guaranty Savings Bank

3798 Veterans Boulevard

Metairie, Louisiana 70002

| GS Financial Corp. and Subsidiary |

| Selected Consolidated Financial Data |

| | | At or For Years Ended December 31, | |

| ($ in thousands, except per share data) | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| BALANCE SHEET DATA | | | | | | | | | | | | | | | |

| Total assets | | $ | 186,487 | | | $ | 168,380 | | | $ | 177,614 | | | $ | 200,066 | | | $ | 214,714 | |

| Cash and cash equivalents | | | 9,462 | | | | 11,117 | | | | 22,555 | | | | 7,024 | | | | 11,371 | |

| Loans receivable, net | | | 118,477 | | | | 93,987 | | | | 69,657 | | | | 92,158 | | | | 77,367 | |

| Investment securities | | | 47,747 | | | | 55,090 | | | | 77,344 | | | | 94,557 | | | | 119,271 | |

| Deposit accounts | | | 129,510 | | | | 122,754 | | | | 118,866 | | | | 130,723 | | | | 142,108 | |

| Borrowings | | | 26,986 | | | | 17,042 | | | | 32,106 | | | | 39,689 | | | | 42,135 | |

| Stockholders' equity | | | 28,164 | | | | 27,164 | | | | 25,407 | | | | 28,944 | | | | 29,308 | |

| INCOME STATEMENT DATA | | | | | | | | | | | | | | | | | | | | |

| Interest income | | $ | 11,248 | | | $ | 11,000 | | | $ | 10,466 | | | $ | 10,989 | | | $ | 9,993 | |

| Interest expense | | | 5,547 | | | | 4,904 | | | | 4,856 | | | | 5,436 | | | | 6,178 | |

| Net interest income | | | 5,701 | | | | 6,096 | | | | 5,610 | | | | 5,553 | | | | 3,815 | |

| Provision (reversal) for loan losses | | | (300 | ) | | | (1,981 | ) | | | 4,793 | | | | 343 | | | | 118 | |

| Non-interest income (loss) | | | 424 | | | | 51 | | | | (1,294 | ) | | | (691 | ) | | | 1,476 | |

| Non-interest expense | | | 5,409 | | | | 4,926 | | | | 4,707 | | | | 4,483 | | | | 4,419 | |

| Net income (loss) before taxes | | | 1,016 | | | | 3,202 | | | | (5,184 | ) | | | 36 | | | | 754 | |

| Net income (loss) | | | 658 | | | | 2,114 | | | | (3,676 | ) | | | 199 | | | | 691 | |

| KEY RATIOS | | | | | | | | | | | | | | | | | | | | |

| Return on average assets | | | 0.38 | % | | | 1.21 | % | | | (1.96 | )% | | | 0.10 | % | | | 0.32 | % |

| Return on average shareholders' equity | | | 2.40 | | | | 8.15 | | | | (13.76 | ) | | | 0.70 | | | | 2.17 | |

| Net interest margin | | | 3.44 | | | | 3.58 | | | | 3.12 | | | | 2.73 | | | | 1.84 | |

| Average loans to average deposits | | | 88.35 | | | | 70.74 | | | | 71.74 | | | | 62.69 | | | | 60.15 | |

| Earning assets to interest-bearing liabilities | | | 118.86 | | | | 117.88 | | | | 115.04 | | | | 114.37 | | | | 115.53 | |

| Efficiency ratio | | | 88.27 | | | | 80.14 | | | | 109.06 | | | | 92.20 | | | | 83.52 | |

| Non-interest expense to average assets | | | 3.12 | | | | 2.82 | | | | 2.51 | | | | 2.12 | | | | 2.06 | |

| Allowance for loan losses to loans | | | 2.82 | | | | 3.82 | | | | 7.58 | | | | 0.99 | | | | 0.77 | |

| Stockholders' equity to total assets | | | 15.10 | | | | 16.16 | | | | 14.30 | | | | 14.47 | | | | 13.65 | |

| COMMON SHARE DATA | | | | | | | | | | | | | | | | | | | | |

| Earnings (loss) per share: | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.53 | | | $ | 1.74 | | | $ | (3.11 | ) | | $ | 0.17 | | | $ | 0.58 | |

| Diluted | | | 0.52 | | | | 1.73 | | | | (3.11 | ) | | | 0.17 | | | | 0.57 | |

| Dividends paid per share | | | 0.40 | | | | 0.40 | | | | 0.40 | | | | 0.40 | | | | 0.40 | |

| Dividend payout ratio | | | 76.44 | % | | | 22.99 | % | | | n/a | | | | 235.29 | % | | | 68.97 | % |

| Book value per share | | $ | 21.90 | | | $ | 22.00 | | | $ | 20.99 | | | $ | 22.47 | | | $ | 22.46 | |

| Trading data: | | | | | | | | | | | | | | | | | | | | |

| High closing price | | $ | 21.49 | | | $ | 21.76 | | | $ | 19.66 | | | $ | 19.90 | | | $ | 19.50 | |

| Low closing price | | | 17.04 | | | | 14.99 | | | | 12.86 | | | | 17.90 | | | | 18.00 | |

| End of period closing price | | | 18.94 | | | | 19.80 | | | | 15.00 | | | | 18.00 | | | | 19.44 | |

| Average shares outstanding: | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 1,243,655 | | | | 1,212,173 | | | | 1,181,313 | | | | 1,156,441 | | | | 1,194,296 | |

| Diluted | | | 1,268,995 | | | | 1,222,949 | | | | 1,181,313 | | | | 1,178,013 | | | | 1,214,443 | |

| GS Financial Corp. and Subsidiary |

| Management's Discussion and Analysis of Financial Condition and Results of Operations |

Presented below is a discussion of the financial condition of GS Financial Corp. (“GS Financial” or the “Company”), changes in financial condition and its results of operations during 2007, 2006 and 2005. Virtually all of the Company’s operations are dependent on the operations of its subsidiary, Guaranty Savings Bank (“Guaranty” or the “Bank”), formerly known as Guaranty Savings and Homestead Association. This discussion is presented to highlight and supplement information presented elsewhere in this Annual Report, particularly the consolidated audited financial statements and related notes. This discussion should be read in conjunction with the accompanying tables and our consolidated, audited financial statements. Certain financial information in prior years has been reclassified to conform to the current year’s presentation.

FORWARD-LOOKING STATEMENTS

In addition to the historical information, this annual report includes certain forward-looking statements as that term is defined by the Private Securities Litigation Reform Act of 1995. Such statements include, but may not be limited to comments regarding (a) the potential for earnings volatility from, among other factors, changes in the estimated allowance for loan losses over time, (b) the expected growth rate of the loan portfolio, (c) future changes in the mix of deposits, (d) the results of net interest income simulations run by the Company to measure interest rate sensitivity, (e) the performance of Guaranty’s net interest income and net interest margin assuming certain future conditions, (f) the future prospects of metropolitan New Orleans after Hurricane Katrina and (g) changes or trends in certain expense levels.

Forward-looking statements are based on numerous assumptions, certain of which may be referred to specifically in connection with a particular statement. Some of the more important assumptions include:

| | · | expectations about overall economic recovery in the Company’s market area, |

| | · | expectations about the ability of the Bank’s borrowers to make payments on outstanding loans and the sufficiency of the allowance for loan losses, |

| | · | expectations about the current values of collateral securing the Bank’s outstanding loans, |

| | · | expectations about the movement of interest rates, including actions that may be taken by the Federal Reserve Board in response to changing economic conditions, |

| | · | reliance on existing or anticipated changes in laws or regulations affecting the activities of the banking industry and other financial service providers, and |

| | · | expectations regarding the nature and level of competition, changes in customer behavior and preferences, and the Company’s ability to execute its plans to respond effectively. |

Because it is uncertain whether future conditions and events will confirm these assumptions, there is a risk that the Company’s future results will differ materially from what is stated or implied by such forward-looking statements. The Company cautions the reader to consider this risk.

The Company undertakes no obligation to update any forward-looking statement included in this annual report, whether as a result of new information, future events or developments, or for any other reason.

OVERVIEW

The Company reported net income of $658,000, or $0.53 per share, for the year ended December 31, 2007, compared with $2.1 million, or $1.74 per share, for the year ended December 31, 2006. The Company succeeded in its growth initiatives during the year, including continued strong loan growth during a year in which growth in the local market as a whole was minimal, deposit growth, particularly in transactional accounts, and the opening of a new banking location, re-opening of a banking location, and the conversion of our loan production office to a full service branch. The decline in profitability in 2007 compared with 2006 was due in large part to the $2.0 million reversal in the provision for loan losses in 2006 compared to a $300,000 reversal in 2007, as well as margin compression as the Bank’s cost of funds increased substantially during 2007. This adverse trend in funding costs began to reverse in the fourth quarter of 2007 and is continuing to trend favorably thus far in 2008.

Hurricane Katrina, which struck the Greater New Orleans area in August 2005, resulted in substantial property damage in the market area that the Company operates in and has displaced a significant number of people and businesses. Based upon its assessment of the property damage caused by Hurricane Katrina, and taking into consideration its estimates of the potential economic impact on its borrowers, the Company made provisions for loan losses of $4.8 million for the year ended December 31, 2005. In 2007 and 2006, $300,000 and $2.0 million, respectively, of these provisions were reversed as conditions in the Bank’s area improved and the level of actual loan impairment was less than what management expected at the end of 2005. The Bank re-opened its one location which suffered extensive damage from Hurricane Katrina in August 2007.

| GS Financial Corp. and Subsidiary |

| Management's Discussion and Analysis of Financial Condition and Results of Operations |

The Company’s net loan portfolio amounted to $118.5 million at December 31, 2007, compared with $94.0 million and $69.7 million at December 31, 2006 and 2005, respectively. The increase in net loans receivable was due to a substantial increase in the volume of new loan originations of both residential and commercial real estate loans. In December 2005, Stephen Wessel was hired as the Bank’s new President and Chief Executive Officer. In addition, in January 2006, two new commercial loan officers were hired and, in March 2006, a mortgage banking manager was hired. During 2006, the Bank was approved as an originator to sell loans to Fannie Mae and Freddie Mac and, in the fourth quarter of 2006, the Bank sold its first loans in the secondary market. During 2007, an additional experienced mortgage loan originator was hired, and the Bank was approved as an originator for two additional private investors. These factors contributed to the Bank increasing its residential loan production from $20.5 million in 2006 to $35.6 million in 2007. The Bank anticipates continuing to sell loans in the secondary market while retaining servicing on these loans to maintain customer relationships and earn servicing fee income. During 2007 and 2006, we sold an aggregate of $15.2 million and $1.4 million, respectively, of residential mortgage loans into the secondary market at a gain of $189,000 and $30,000, respectively.

CRITICAL ACCOUNTING POLICIES

The Company prepares its financial statements in accordance with accounting principles generally accepted in the United States of America. Note A to the consolidated financial statements discusses certain accounting principles and methods of applying those principles that are particularly important to this process. In applying these principles to determine the amounts and other disclosures that are presented in the financial statements and discussed in this section, the Company is required to make estimates and assumptions.

The Company believes that the determination of its estimate of the allowance for loan losses involves a higher degree of judgment and complexity than its application of other significant accounting policies. Factors considered in this determination and the processes used by management are discussed in Note A to the consolidated financial statements and in the discussion below under the headings “Loans” and “Allowance for Loan Losses.” Although management believes it has identified appropriate factors for review and designed and implemented adequate procedures to support the estimation process that are consistently followed, the allowance remains an estimate about the effect of matters that are inherently uncertain. Over time, changes in economic conditions or the actual or perceived financial condition of Guaranty’s credit customers or other factors can materially impact the allowance estimate, potentially subjecting the Company to significant earnings volatility.

One other estimate requiring a high degree of judgment is the valuation allowance on the deferred tax asset. As operating losses can be carried forward 15 years and the Company expects positive taxable income for each year going forward, no valuation allowance is deemed necessary on the portion of the deferred tax asset created by net operating losses. However, a portion of the deferred tax asset relates to capital losses. Tax rules only allow these losses to be offset against future capital gains for five years. As it is uncertain whether the Bank will be able to realize capital gains of the magnitude to fully offset these losses in the applicable five year period, we elected to establish an appropriate valuation allowance for the portion of the capital loss carryforward which we estimate may not be utilized. See Note I of the Consolidated Financial Statements for further discussion of the Company’s income tax accounting.

| GS Financial Corp. and Subsidiary |

| Management's Discussion and Analysis of Financial Condition and Results of Operations |

FINANCIAL CONDITION

At December 31, 2007, GS Financial reported total assets of $186.5 million compared to $168.4 million at the end of 2006. Average total assets were $172.6 million for the year ended December 31, 2007, a decrease of $1.5 million compared to the year ended December 31, 2006, or 0.9%.

LOANS AND ALLOWANCE FOR LOAN LOSSES

As with most savings institutions, a significant portion of the Company’s assets are comprised of loans made to its customers. The Company engages primarily in real estate lending, both residential and commercial.

In general, credit is extended based on the current market conditions, prevailing economic trends, the value of the underlying collateral and the borrower’s credit history. The lending activities of the Company are subject to written underwriting standards and loan origination procedures established by the Company's Board of Directors (the “Board”) and senior officers and are incorporated into the Company's Lending Policy which is reviewed as needed by the Board and senior officers. The underwriting standards establish the manner in which loan applications are accepted and processed. Such standards are written to comply with all applicable laws and regulations including but not limited to Truth-In-Lending (Regulation Z) and the Real Estate Settlement Procedures Act (“RESPA”). These standards pertain to such issues as maximum loan amounts, acceptable rates and terms, appraisal guidelines, disclosure requirements, credit criteria, debt-to-income ratios, complete applications, and title requirements. The Lending Policy establishes the overall direction of the Company's lending activities within the community and forms the basis for setting underwriting standards which limit the Company's exposure to credit risk.

The outstanding balance in total loans at December 31, 2007 was $121.9 million, an increase of $24.1 million, or 24.7%, from the year-end 2006 balance of $97.7 million. The 2006 balance was up 29.7%, or $22.3 million, from the end of 2005. Average loans for 2007 were $107.8 million, up $20.4 million, or 23.4% from the prior year’s average level. Table 1, which is based on regulatory reporting codes, shows loan balances at year-end of the most recent five years.

| TABLE 1. COMPOSITION OF LOAN PORTFOLIO | |

| | | At December 31, | |

| ($ in thousands) | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Real estate loans - residential | | $ | 62,481 | | | $ | 48,610 | | | $ | 36,800 | | | $ | 45,007 | | | $ | 44,021 | |

| Real estate loans - commercial and other | | | 45,757 | | | | 36,896 | | | | 24,794 | | | | 36,143 | | | | 26,460 | |

| Real estate loans - construction | | | 9,074 | | | | 9,089 | | | | 11,282 | | | | 8,233 | | | | 4,709 | |

| Consumer loans | | | 913 | | | | 677 | | | | 669 | | | | 629 | | | | 513 | |

| Commercial business loans | | | 3,625 | | | | 2,445 | | | | 1,819 | | | | 3,058 | | | | 2,257 | |

| Total loans at year-end | | $ | 121,850 | | | $ | 97,717 | | | $ | 75,364 | | | $ | 93,070 | | | $ | 77,960 | |

| Allowance for loan losses | | | (3,432 | ) | | | (3,732 | ) | | | (5,713 | ) | | | (920 | ) | | | (601 | ) |

| Deferred loan origination costs | | | 59 | | | | 2 | | | | 6 | | | | 8 | | | | 8 | |

| Net loans at year end | | | 118,477 | | | | 93,987 | | | | 69,657 | | | | 92,158 | | | | 77,367 | |

| Average total loans during year | | $ | 107,785 | | | $ | 87,360 | | | $ | 87,437 | | | $ | 87,185 | | | $ | 76,623 | |

The Company’s investment in residential real estate loans, which includes those loans secured by 1-4 family properties, increased 28.5%, or $13.9 million, between December 31, 2006 and 2007, after an increase of 32.1%, or $11.8 million, between 2005 and 2006. The increase in 2006 was due to concerted marketing efforts as well as rebuilding loans made subsequent to Hurricane Katrina converting to permanent mortgages. In 2007, residential real estate loans continued to increase as the Company added an experienced mortgage loan originator and additional loan products as well as continuing its marketing efforts.

| GS Financial Corp. and Subsidiary |

| Management's Discussion and Analysis of Financial Condition and Results of Operations |

Since 2000, the Company has been shifting its lending emphasis towards the commercial real estate market to diversify and enhance the products and services offered to its customers and add higher yielding loans to its overall portfolio. Commercial real estate loans typically carry higher yields and associated risk than loans on 1-4 family dwellings. The Company offers real estate loans on multifamily residential dwellings, commercial real estate and vacant land. The Company also offers commercial asset-based loans secured by non-real estate collateral such as inventory and accounts receivable, though it does not actively solicit non-real estate commercial loans. The Company has a commercial loan committee consisting of board members to evaluate commercial loan applications of significant size and complexity.

During 2007 and 2006, the Company was able to develop significant new business in commercial real estate loans. Commercial real estate loans, including owner-occupied buildings multi-family and retail property, increased 24.0%, or $8.9 million between December 31, 2006 and 2007, which follow an increase of 48.8%, or $12.1 million, between December 31, 2005 and 2006. At December 31, 2007, commercial real estate and construction loans made up 45.0% of the total loan portfolio compared to 47.1% and 47.9% at December 31, 2006 and 2005, respectively.

For the year ended December 31, 2007, the Bank’s total loan origination’s amounted to $56.2 million compared to $42.0 million and $14.7 million for the years ended December 31, 2006 and 2005, respectively. The increases in both residential and commercial lending in 2007 and 2006 were due to the Bank hiring experienced lending professionals in each area of expertise.

Table 2 reflects the Company’s total loan origination and repayment experience during the periods indicated.

| TABLE 2. LOAN ORIGINATIONS BY TYPE | |

| | | Year Ended December 31, | |

| ($ in thousands) | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Real estate loans - residential | | $ | 35,575 | | | $ | 20,487 | | | $ | 8,339 | | | $ | 13,452 | | | $ | 12,469 | |

| Real estate loans - commercial and other | | | 15,447 | | | | 16,398 | | | | 1,143 | | | | 18,733 | | | | 15,103 | |

| Real estate loans - construction | | | 3,684 | | | | 2,432 | | | | 4,896 | | | | 6,550 | | | | 3,152 | |

| Consumer loans | | | 547 | | | | 345 | | | | 366 | | | | 269 | | | | 338 | |

| Commercial loans | | | 949 | | | | 2,332 | | | | - | | | | 2,003 | | | | 3,153 | |

| Total originations | | | 56,202 | | | | 41,994 | | | | 14,744 | | | | 41,007 | | | | 34,215 | |

| Loan principal repayments | | | (16,963 | ) | | | (18,108 | ) | | | (32,204 | ) | | | (25,897 | ) | | | (35,062 | ) |

| Loans sold | | | (15,182 | ) | | | (1,353 | ) | | | - | | | | - | | | | - | |

| Net portfolio activity | | $ | 24,057 | | | $ | 22,533 | | | $ | (17,460 | ) | | $ | 15,110 | | | $ | (847 | ) |

| GS Financial Corp. and Subsidiary |

| Management's Discussion and Analysis of Financial Condition and Results of Operations |

Table 3 reflects contractual loan maturities, unadjusted for scheduled principal reductions, prepayments or re-pricing opportunities. Demand loans and loans having no stated maturity are reported as due in one year or less. Most of the Bank’s outstanding loans carry a fixed rate of interest, though certain commercial loans are tied to the Guaranty Savings Bank Prime rate and home equity lines of credit have floating interest rates which are tied to the Wall Street Prime rate.

| TABLE 3. LOAN MATURITIES BY TYPE | |

| At December 31, 2007, Loans Maturing In | |

| ($ in thousands) | | One year or less | | | One through five years | | | More than five years | | | Total | |

| Real estate loans – residential | | $ | 4,041 | | | $ | 7,563 | | | $ | 56,940 | | | $ | 68,544 | |

| Other real estate loans | | | 10,340 | | | | 20,639 | | | | 15,408 | | | | 46,387 | |

| Consumer loans | | | - | | | | 197 | | | | 3,882 | | | | 4,079 | |

| Commercial loans | | | 1,693 | | | | 1,147 | | | | - | | | | 2,840 | |

| Total | | $ | 16,074 | | | $ | 29,546 | | | $ | 76,230 | | | $ | 121,850 | |

| Percentage | | | 13.2 | % | | | 24.2 | % | | | 62.6 | % | | | 100.0 | % |

Of the Bank’s loans outstanding at December 31, 2007 with maturities greater than one year, $101,036,000 have a fixed rate of interest and $4,740,000 have a variable interest rate.

All loans carry a degree of credit risk. Management’s evaluation of this risk ultimately is reflected in the estimate of probable loan losses that is reported in the Company’s financial statements as the allowance for loan losses. Additions to the allowance for loan losses as a result of this ongoing evaluation are reflected in the provision for loan losses charged to operating expense.

The Company has adopted an asset classification policy which is designed to draw attention to assets before collection becomes a problem, thus maintaining the quality of the Company’s investment as an interest-earning asset. The policy also helps ensure the accurate reporting of the Company’s assets from a valuation standpoint. As part of this policy, all of the Company’s loans are reviewed on a regular basis. Payment histories as well as the value of the underlying collateral are reviewed and assessed in light of several risk factors. The evaluation process considers the state of the local economy as well as current interest rates and expectations of the movement thereof. Other risk factors include the level of credit concentration the customer has with the Company, environmental factors which could impair the value of the underlying collateral of an asset, or other factors which might reduce the ability of the Company to collect all of the principal and interest owed to the Company.

The Company maintains a “Watch List” of loans, which is part of management’s internal asset classification system. The Watch List identifies assets classified as “substandard,” “doubtful” or “loss,” pursuant to OTS regulations. Assets displaying tendencies which might hinder full collection of principal are classified as substandard. Such tendencies include but are not limited to late payments on loans or deterioration of the underlying collateral.

Loan collection efforts in the form of past due notices commence when loan payments are more than 15 days past due. Once a loan reaches 15 days past due status, the Company’s collection manager initiates personal contact with the borrower. When a loan becomes 90 days past due, the Company initiates foreclosure proceedings. At this point, loans are placed on non-accrual status. All interest and late charges due on such loans are reversed in the form of reserves for uncollectible interest and late charges.

In making its risk evaluation and establishing an allowance for loan loss level that it believes is adequate to absorb probable losses in the portfolio, management considers various sources of information. Some of the more significant sources include analyses prepared on specific loans reviewed for impairment, statistics on balances of loans assigned to internal risk rating categories, reports on the composition and repayment portion of loan portfolios not subject to individual risk ratings, and factors derived from historical loss experience. In addition to this more objective and quantitative information, management’s evaluation must take into consideration its assessment of general economic conditions and how current conditions affect segments of borrowers. Management must also make judgments regarding the level of accuracy inherent in the loss allowance estimation process. Management’s Asset Quality Committee, consisting of executive, lending and collections personnel, meets at least quarterly to discuss the status of all potentially impaired loans. Based on these evaluations, an allowance analysis is prepared at least quarterly that summarizes the results of the evaluation process and helps ensure a consistent process over time.

| GS Financial Corp. and Subsidiary |

| Management's Discussion and Analysis of Financial Condition and Results of Operations |

At December 31, 2007, the allowance for loan losses was $3.4 million, or 2.82% of total loans, compared to $3.7 million, or 3.82% of total loans at the end of 2006. No loans were charged off during the year ended December 31, 2007. As a result of credit quality in 2007 and 2006 being better than expectations at the time the Hurricane Katrina-related provision was recorded, reversals of the provision for loan losses of $300,000 and $2.0 million were recorded in 2007 and 2006, respectively. Table 4 presents an analysis of the activity in the allowance for loan losses for the past five years.

| TABLE 4. SUMMARY OF ACTIVITY IN THE ALLOWANCE FOR LOSSES | |

| | | Year Ended December 31, | |

| ($ in thousands) | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Balance at the beginning of year | | $ | 3,732 | | | $ | 5,713 | | | $ | 920 | | | $ | 601 | | | $ | 483 | |

| Provision (reversal) for loan losses charged to operations | | | (300 | ) | | | (1,981 | ) | | | 4,793 | | | | 343 | | | | 118 | |

| Loans charged to the allowance | | | - | | | | - | | | | - | | | | (24 | ) | | | - | |

| Recoveries of loans previously charged off | | | - | | | | - | | | | - | | | | - | | | | - | |

| Balance at the end of year | | $ | 3,432 | | | $ | 3,732 | | | $ | 5,713 | | | $ | 920 | | | $ | 601 | |

| Ratios | | | | | | | | | | | | | | | | | | | | |

| Charge-offs to average loans | | | - | | | | - | | | | - | | | | 0.03 | % | | | - | |

| Provision for loan losses to charge-offs | | | n/a | | | | n/a | | | | n/a | | | | 1,429.17 | % | | | n/a | |

| Allowance for loan losses to loans at end of year | | | 2.82 | % | | | 3.82 | % | | | 7.58 | % | | | 0.99 | % | | | 0.77 | % |

The allowance for loan losses is comprised of specific reserves for each loan that is reviewed for impairment or for which a probable loss has been identified and general reserves for groups of homogenous loans. Reserves for impaired loans are based on discounted cash flows using the loan’s initial effective interest rate, the observable market value of the loan or the fair value of the underlying collateral. General reserves are established based on historic charge-offs, and based upon consideration of various other factors including risk rating, industry concentration and loan type.

The $4.8 million provision for loan losses made in 2005 and subsequent $2.0 million and $300,000 reversals in 2006 and 2007, respectively, reflect management’s assessment, based on the information available at the time, of the inherent level of losses in the Bank’s portfolio. In its assessment for year-end 2005, management attempted to contact all borrowers with loans over $200,000 and evaluated the collateral value for all loans where the Bank did not receive either a loan payment or insurance proceeds for December 2005. Of the $4.8 million provision, $3.3 million was recorded specifically on an aggregate of $8.2 million of loans deemed impaired and on which no loan payments had been received and the Company knew the collateral had suffered property damage as a result of the hurricane. The remaining $1.5 million of the provision was applied to the general allowance for loan losses. Because significant uncertainties remain regarding the performance of the Company’s loan portfolio after Hurricane Katrina, such as the ultimate disposition of property insurance claims and the ultimate economic recovery of greater New Orleans in a stressed national economy, the Company maintained this general allowance for loan losses at $1.5 million at December 31, 2007 and 2006. We will continue to assess the allowance for loan losses and adjust it as appropriate for changes subsequent to December 31, 2007.

| GS Financial Corp. and Subsidiary |

| Management's Discussion and Analysis of Financial Condition and Results of Operations |

| TABLE 5. ALLOCATION OF THE ALLOWANCE FOR LOAN LOSSES | |

| | | At December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| ($ in thousands) | | Allowance for Loan Losses | | | % of Total Reserve | | | Allowance for Loan Losses | | | % of Total Reserve | | | Allowance for Loan Losses | | | % of Total Reserve | | | Allowance for Loan Losses | | | % of Total Reserve | | | Allowance for Loan Losses | | | % of Total Reserve | |

| Real estate loans - residential | | $ | 1,169 | | | | 34.1 | % | | $ | 1,177 | | | | 31.5 | % | | $ | 3,332 | | | | 58.3 | % | | $ | 239 | | | | 26.0 | % | | $ | 147 | | | | 24.5 | % |

| Real estate loans - commercial and other | | | 1,802 | | | | 52.5 | % | | | 1,963 | | | | 52.6 | % | | | 1,805 | | | | 31.6 | % | | | 591 | | | | 64.2 | % | | | 410 | | | | 68.2 | % |

| Real estate loans - construction | | | 189 | | | | 5.5 | % | | | 360 | | | | 9.7 | % | | | 292 | | | | 5.1 | % | | | 4 | | | | 0.4 | % | | | 10 | | | | 1.7 | % |

| Commercial loans | | | 272 | | | | 7.9 | % | | | 232 | | | | 6.2 | % | | | 284 | | | | 5.0 | % | | | 87 | | | | 9.4 | % | | | 34 | | | | 5.6 | % |

| Total | | $ | 3,432 | | | | 100.0 | % | | $ | 3,732 | | | | 100.0 | % | | $ | 5,713 | | | | 100.0 | % | | $ | 921 | | | | 100.0 | % | | $ | 601 | | | | 100.0 | % |

Tables 6 and 7 set forth the Company’s delinquent loans and nonperforming assets for each of the prior three and five years, respectively. The balances presented in Table 6 are total principal balances outstanding on the loans rather than the actual principal past due. Nonperforming assets consist of loans on nonaccrual status and foreclosed assets. There were no loans 90 days delinquent and still accruing interest at any of the five previous year ends.

| TABLE 6. DELINQUENT LOANS | |

| | | At December 31, | |

| ($ in thousands) | | 2007 | | | 2006 | | | 2005 | |

| 30-89 Days | | $ | 3,305 | | | $ | 1,379 | | | $ | 9,296 | |

| 90+ Days | | | 1,438 | | | | 179 | | | | 931 | |

| Total | | $ | 4,743 | | | $ | 1,558 | | | $ | 10,227 | |

| Ratios | | | | | | | | | | | | |

| Loans delinquent 90 days to total loans | | | 1.18 | % | | | 0.18 | % | | | 1.24 | % |

| Total delinquent loans to total loans | | | 3.89 | % | | | 1.59 | % | | | 13.57 | % |

| Allowance for loan losses to non-accrual loans | | | 238.66 | % | | | 2,084.92 | % | | | 613.64 | % |

| Allowance for loan losses to total delinquent loans | | | 72.36 | % | | | 239.54 | % | | | 55.86 | % |

| TABLE 7. NONPERFORMING ASSETS | |

| | | At December 31, | |

| ($ in thousands) | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Loans accounted for on a nonaccrual basis | | $ | 1,438 | | | $ | 179 | | | $ | 3,582 | | | $ | 894 | | | $ | 929 | |

| Foreclosed assets | | | - | | | | - | | | | - | | | | - | | | | 52 | |

| Total nonperforming assets | | $ | 1,438 | | | $ | 179 | | | $ | 3,582 | | | $ | 894 | | | $ | 981 | |

| Ratios | | | | | | | | | | | | | | | | | | | | |

| Nonperforming assets to loans plus foreclosed assets | | | 1.18 | % | | | 0.18 | % | | | 4.75 | % | | | 0.96 | % | | | 1.26 | % |

| Nonperforming assets to total assets | | | 0.77 | % | | | 0.11 | % | | | 2.02 | % | | | 0.45 | % | | | 0.46 | % |

| Allowance for loan losses to nonperforming loans | | | 238.66 | % | | | 2,084.92 | % | | | 159.49 | % | | | 102.91 | % | | | 64.69 | % |

During the fourth quarter of 2005, the Bank unilaterally agreed to defer all loan payments. As a result, no loans other than those that were delinquent prior to the deferral period were deemed to be delinquent, non-performing or non-accrual during the three-month deferral period.

| GS Financial Corp. and Subsidiary |

| Management's Discussion and Analysis of Financial Condition and Results of Operations |

INVESTMENT IN SECURITIES

Interest rates dictate many of the investment decisions and policies of the Company. It is the policy of the Company not to engage in speculative purchasing, selling or trading of investments; however, certain profits may be taken from time to time on the sale of investments. When interest rate spreads reach acceptable levels, the Company may utilize leveraged purchasing of investment securities, as has been done in the past. Also, when anticipated earnings permit, certain portfolio adjustments may be made to enhance overall portfolio yield even though losses may be recognized in doing so.

Liquidity was reduced in 2005 as the result of a decline in deposits, caused in part by Hurricane Katrina, and by contractual paydowns on FHLB borrowings. Significant loan growth in 2007 and 2006 further reduced liquidity. However, the Company still has substantial liquidity and is in compliance with all regulatory requirements regarding liquidity. Information on changes in deposits and liquidity sources are presented in later sections of this Management’s Discussion and Analysis. Management routinely places much of the Company’s liquid assets into its investment portfolio to balance its need for liquidity with the need to earn a competitive yield. To allow for the investment portfolio to fund liquidity needs as necessary, all investment securities have been classified as available-for-sale during the past three years.

At December 31, 2007, total securities were $47.7 million, down 13.3%, or $7.3 million, from December 31, 2006. Mutual fund investments were 12.1% of the total portfolio at December 31, 2007 compared with 19.6% at the prior year-end. Mortgage-backed securities, consisting of fixed-rate and hybrid ARM securities issued by Fannie Mae and Freddie Mac, increased by $5.1 million, or 135.1%

During the year ended December 31, 2005, the Company recognized charges of $1.3 million, respectively, for other-than-temporary impairments of available-for-sale securities. The $1.3 million charge recognized in 2005 relates to the Company’s then $49 million investment in an ARM mutual fund which, based on then current rates and market conditions, was deemed to be other-than-temporarily impaired. Approximately $5.0 million and $39.0 million of the holdings in this fund were sold in 2007 and 2006, respectively. Table 8 shows the book value of the Company’s investment portfolio at December 31, 2007, 2006 and 2005.

| TABLE 8. COMPOSITION OF INVESTMENT PORTFOLIO | |

| | | At December 31, | |

| | | 2007 | | | 2006 | | | 2005 | |

| ($ in thousands) | | Balance | | | Percent | | | Balance | | | Percent | | | Balance | | | Percent | |

| U.S. Treasury and agency securities | | $ | 18,421 | | | | 38.6 | % | | $ | 23,326 | | | | 42.3 | % | | $ | 5,449 | | | | 7.1 | % |

| Mortgage-backed securities | | | 8,912 | | | | 18.7 | | | | 3,791 | | | | 6.9 | | | | 100 | | | | 0.1 | |

| Collateralized mortgage obligations | | | 14,633 | | | | 30.6 | | | | 17,173 | | | | 31.2 | | | | 22,496 | | | | 29.1 | |

| Mutual funds | | | 5,781 | | | | 12.1 | | | | 10,800 | | | | 19.6 | | | | 49,299 | | | | 63.7 | |

| Total investments at year end | | $ | 47,747 | | | | 100.0 | % | | $ | 55,090 | | | | 100.0 | % | | $ | 77,344 | | | | 100.0 | % |

| Average investments during year | | $ | 50,452 | | | | | | | $ | 68,469 | | | | | | | $ | 78,516 | | | | | |

Information about the contractual maturity and weighted-average yield of the Company’s investment securities at December 31, 2007 is shown in Table 9 below. At December 31, 2007, 12.1% of the investment portfolio consisted of mutual fund or equity investments carrying no stated maturity. These investments are redeemable immediately at their current market value. Scheduled principal reductions and principal repayments on mortgage-backed securities and collateralized mortgage obligations are not reflected in Table 9. If these expected principal reductions were taken into consideration, the weighted-average maturity of the Company’s overall securities portfolio would be approximately 33 months at December 31, 2007. As the Company owned no tax-exempt securities during the periods presented, no yield adjustments were necessary.

| GS Financial Corp. and Subsidiary |

| Management's Discussion and Analysis of Financial Condition and Results of Operations |

| TABLE 9. DISTRIBUTION OF INVESTMENT MATURITIES | |

| At December 31, 2007 | |

| ($ in thousands) | | One year or less | | | Over one through five years | | | Over five through ten years | | | Over ten years | | | Total | |

| | | Amount | | | Yield | | | Amount | | | Yield | | | Amount | | | Yield | | | Amount | | | Yield | | | Amount | | | Yield | |

| U.S. Treasury and Agency securities | | $ | - | | | | - | | | $ | 5,015 | | | | 5.13 | % | | $ | 3,002 | | | | 6.00 | % | | $ | 10,404 | | | | 6.48 | % | | $ | 18,421 | | | | 5.67 | % |

| Mortgage-backed securities | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 8,912 | | | | 5.68 | % | | | 8,912 | | | | 5.68 | % |

| Collateralized Mortgage Obligations | | | - | | | | - | | | | - | | | | - | | | | 408 | | | | 5.65 | % | | | 14,225 | | | | 5.35 | % | | | 14,633 | | | | 5.36 | % |

| Mutual funds | | | 5,781 | | | | 5.02 | % | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 5,781 | | | | 5.02 | % |

| Total | | $ | 5,781 | | | | 5.02 | % | | $ | 5,015 | | | | 5.13 | % | | $ | 3,410 | | | | 6.00 | % | | $ | 33,541 | | | | 5.79 | % | | $ | 47,747 | | | | 5.50 | % |

| Percentage of Total | | | 12.11 | % | | | | | | | 10.50 | % | | | | | | | 7.14 | % | | | | | | | 70.25 | % | | | | | | | 100.0 | % | | | | |

All of the Company’s investments in marketable securities are classified as available for sale. The net unrealized losses on these investments totaled $167,000, or 0.35%, of amortized cost at December 31, 2007. At year-end 2006, there was a net unrealized loss of $477,000, or 0.90% of amortized cost. The reported amount of net unrealized gain or loss varies based on the overall changes in market rates, shifts in the slope of the yield curve, and movement in spreads to the yield curve for different types of securities.

At December 31, 2007, the Company had certain investment concentrations exceeding 10% of stockholders’ equity. While these were significant in amount, they were limited to “AAA” rated securities and management feels that they present a limited risk of default, though the mutual funds do have a risk of share price fluctuation. Investments of the Company that exceed 10% of stockholders’ equity at December 31, 2007 are shown in Table 10 below.

| TABLE 10. INVESTMENTS GREATER THAN 10% OF STOCKHOLDERS' EQUITY | |

| At December 31, 2006 | |

| ($ in thousands) | Type | | Total Investment | | | % of Total Assets | | | % of Stockholders' Equity | |

| Federal National Mortgage Association | Agency Bond and Mortgage-Backed Securities | | $ | 15,060 | | | | 8.08 | % | | | 53.47 | % |

| Shay Mutual Funds | Mutual Fund | | | 5,781 | | | | 3.10 | % | | | 20.53 | % |

| Federal Home Loan Mortgage Corporation | Mortgage-Backed Securities | | | 5,461 | | | | 2.93 | % | | | 19.39 | % |

| Federal Home Loan Bank | Agency Bond | | | 8,530 | | | | 4.57 | % | | | 30.29 | % |

| Total | | | $ | 34,832 | | | | 18.68 | % | | | 123.68 | % |

At December 31, 2007 the Company had $3.5 million in investments in financial instruments or participated in agreements with values that are linked to or derived from changes in some underlying asset or index. These financial instruments or agreements are commonly referred to as derivatives and include such instruments as futures, forward contracts, option contracts, interest rate swap agreements and other financial arrangements with similar characteristics. The Company’s investments in derivatives consist of two “range notes” issued by the Federal Home Loan Bank. These notes are long-term agency bonds which pay interest so long as LIBOR falls within a certain range. Since inception LIBOR has been within the required range and interest has been paid. These instruments are classified as agency securities and as securities available for sale. The impact of SFAS 133, which requires marking these securities to market value through operations, was not material in 2007.

DEPOSITS

Deposits are the Company’s primary source of funding for earning assets. The Company offers a variety of products designed to attract and retain customers. The principal methods used by the Company to attract deposits include its emphasis on personal service, competitive interest rates and convenient office locations. The Company does not actively solicit or pay higher rates for “jumbo” (amounts over $100,000) certificates of deposit. The Company had no deposits that were obtained through outside deposit brokers at December 31, 2007 or 2006.

| GS Financial Corp. and Subsidiary |

| Management's Discussion and Analysis of Financial Condition and Results of Operations |

At December 31, 2007, deposits were up 5.5%, or $6.8 million, from the level at December 31, 2006. Average deposits for fiscal 2007 increased 2.3%, or $2.9 million over 2006 and increased 1.5%, or $1.9 million, in 2006 from 2005. The increase in deposits in 2006 was due to the addition of a money market account in 2006 which attracted substantial balances (included in Table 11 in NOW account deposits) and the stabilization in the area’s population base as it recovers from the impact of Hurricane Katrina. Those factors also impacted the increase in 2007, as did the opening of new banking locations.

| TABLE 11. DEPOSIT COMPOSITION | |

| | | At December 31, | |

| | | 2007 | | | 2006 | | | 2005 | |

| ($ in thousands) | | Average Balances | | | % of Deposits | | | Average Balances | | | % of Deposits | | | Average Balances | | | % of Deposits | |

| Noninterest bearing demand deposits | | $ | 4,380 | | | | 3.5 | % | | $ | 2,367 | | | | 1.9 | % | | $ | 895 | | | | 0.7 | % |

| NOW account deposits | | | 21,576 | | | | 17.1 | | | | 17,186 | | | | 13.9 | | | | 7,778 | | | | 6.4 | |

| Savings deposits | | | 20,511 | | | | 16.2 | | | | 27,103 | | | | 22.0 | | | | 30,551 | | | | 25.1 | |

| Certificates of deposit | | | 79,911 | | | | 63.2 | | | | 76,841 | | | | 62.2 | | | | 82,409 | | | | 67.8 | |

| Total | | $ | 126,378 | | | | 100.0 | % | | $ | 123,497 | | | | 100.0 | % | | $ | 121,633 | | | | 100.0 | % |

Average certificates of deposit (or “time deposits”) totaled $79.9 million, or 63.2% of total average deposits during 2007, up $3.1 million, or 4.0%, compared to 2006. Average savings deposits made up 16.2% of total average deposits during 2007, down from 22.0% in the previous year. During 2007, the average balance of transaction accounts increased from 15.8% to 20.6% of total deposits, with money market accounts contributing to the $4.4 million increase in NOW accounts. Non-interest bearing demand deposits increased by $2.0 million as the Bank continued to increase its volume of activity with commercial customers. Table 12 shows the maturity structure of time deposits over and under $100,000 at December 31, 2007.

| TABLE 12. MATURITIES OF TIME DEPOSITS | |

| At December 31, 2007 | |

| ($ in thousands) | | Less than $100,000 | | | $100,000 or more | | | Total | |

| | | | | | | | | Amount | | | Percentage | |

| Three months or less | | $ | 18,889 | | | $ | 5,357 | | | $ | 24,246 | | | | 29.95 | % |

| Over three months through twelve months | | | 30,808 | | | | 8,899 | | | | 39,707 | | | | 49.05 | % |

| Over twelve months | | | 12,935 | | | | 4,060 | | | | 16,995 | | | | 21.00 | % |

| Total | | $ | 62,632 | | | $ | 18,316 | | | $ | 80,948 | | | | 100.00 | % |

BORROWINGS

The Association is a member of the Federal Home Loan Bank. This membership provides access to a variety of Federal Home Loan Bank advance products as an alternative source of funds. At December 31, 2007, the Company had outstanding advances totaling $27.0 million, compared to $17.0 million at year-end 2006. Average advances outstanding during 2007 were $17.6 million, compared with $23.4 million for 2006. The average rate paid on FHLB advances during 2007 was 5.47%, compared to 5.30% in 2006. FHLB advances increased $10.0 million, or 58.4%, at December 31, 2007 compared to December 31, 2006. This increase was due to new borrowings in 2007 to fund loan growth. The Company’s reliance on borrowings continues to be within the parameters determined by management to be prudent in terms of liquidity and interest rate sensitivity, though the Company has significant additional borrowing capacity should borrowing needs arise. Table 13 shows the scheduled maturities of FHLB advances at December 31, 2007.

| GS Financial Corp. and Subsidiary |

| Management's Discussion and Analysis of Financial Condition and Results of Operations |

| TABLE 13. MATURITIES OF ADVANCES | |

| At December 31, 2007 | |

| ($ in thousands) | | Amount | | | % of Total Advances | | | Weighted Average Rate | |

| 2008 | | $ | 11,514 | | | | 42.67 | % | | | 5.44 | % |

| 2009 | | | - | | | | - | | | | - | |

| 2010 | | | 13,000 | | | | 48.17 | % | | | 4.51 | % |

| 2011 | | | - | | | | - | | | | - | |

| 2012 | | | 2,472 | | | | 9.16 | % | | | 5.81 | % |

| Total Advances | | $ | 26,986 | | | | 100.00 | % | | | 5.07 | % |

STOCKHOLDERS’ EQUITY AND CAPITAL ADEQUACY

At December 31, 2007, stockholders’ equity totaled $28.2 million, compared to $27.2 million at the end of 2006. The major factors in the $1 million increase in 2007 were the net income of $658,000, issuances of additional shares of common stock upon the exercise of stock options of $516,000, and a reduction in the accumulated other comprehensive loss of $204,000, partially offset by dividends paid of $503,000. The dividend payout was 76.4% and 23.0% of net income in 2007 and 2006, respectively. As the Company incurred a net loss in 2005 the dividend payout ratio was not a meaningful measure.

Since 1998, the Company has repurchased shares of its common stock when shares have been available at prices and amounts deemed prudent by management. Table 14 summarizes the repurchase of the shares of its common stock by year. All of the purchases were open market transactions and most were at a discount to book value.

| TABLE 14. SUMMARY OF STOCK REPURCHASES | |

| Year Ended December 31, | | Shares | | | Cost ($000) | | | Average Price Per Share | |

| 1998 | | | 491,054 | | | $ | 8,324 | | | $ | 16.95 | |

| 1999 | | | 299,000 | | | | 3,653 | | | | 12.22 | |

| 2000 | | | 679,600 | | | | 8,590 | | | | 12.64 | |

| 2001 | | | 305,684 | | | | 4,612 | | | | 15.09 | |

| 2002 | | | 142,201 | | | | 2,516 | | | | 17.69 | |

| 2003 | | | 216,181 | | | | 4,109 | | | | 19.01 | |

| 2004 | | | 16,842 | | | | 315 | | | | 18.70 | |

| 2005 | | | 3,907 | | | | 74 | | | | 19.06 | |

| 2006 | | | 17,763 | | | | 300 | | | | 16.87 | |

| 2007 | | | 10,468 | | | | 188 | | | | 18.00 | |

| Total Stock Repurchases | | | 2,182,700 | | | $ | 32,681 | | | $ | 14.97 | |

The ratios in Table 15 indicate that the Bank was well capitalized at December 31, 2007. Risk-based capital ratios declined in 2006 as there was a $15.6 million increase in risk-weighted assets, attributable primarily to growth in the loan portfolio. The regulatory capital ratios of Guaranty Savings Bank exceed the minimum required ratios, and the Bank has been categorized as “well-capitalized” in the most recent notice received from its primary regulatory agency.

| GS Financial Corp. and Subsidiary |

| Management's Discussion and Analysis of Financial Condition and Results of Operations |

| TABLE 15. CAPITAL AND RISK BASED CAPITAL RATIOS | |

December 31, | |

| ($ in thousands) | | 2007 | | | 2006 | | | 2005 | |

| Tier 1 regulatory capital | | $ | 27,197 | | | $ | 26,580 | | | $ | 23,772 | |

| Tier 2 regulatory capital | | | 1,260 | | | | 1,096 | | | | 905 | |

| Total regulatory capital | | $ | 28,457 | | | $ | 27,676 | | | $ | 24,677 | |

| Adjusted total assets | | $ | 184,285 | | | $ | 167,126 | | | $ | 176,444 | |

| Risk-weighted assets | | $ | 103,236 | | | $ | 87,645 | | | $ | 72,399 | |

| Ratios | | | | | | | | | | | | |

| Tier 1 capital to total assets | | | 14.76 | % | | | 15.90 | % | | | 13.47 | % |

| Tier 1 capital to risk-weighted assets | | | 26.34 | % | | | 30.33 | % | | | 32.83 | % |

| Total capital to risk-weighted assets | | | 27.57 | % | | | 31.58 | % | | | 34.08 | % |

| Stockholders' equity to total assets | | | 15.10 | % | | | 16.14 | % | | | 14.30 | % |

LIQUIDITY AND CAPITAL RESOURCES

The objective of liquidity management is to ensure that funds are available to meet cash flow requirements of depositors and borrowers, while at the same time meeting the operating, capital and strategic cash flow needs of the Company and the Bank, all in the most cost-effective manner. The Company develops its liquidity management strategies and measures and monitors liquidity risk as part of its overall asset/liability management process, making use of the quantitative modeling tools to project cash flows under a variety of possible scenarios.

On the liability side, liquidity management focuses on growing the base of more stable core deposits at competitive rates, while at the same time ensuring access to economical wholesale funding sources. The sections above on deposits and borrowings discuss changes in these liability-funding sources in 2007.

Liquidity management on the asset side primarily addresses the composition and maturity structure of the loan and investment securities portfolios and their impact on the Company’s ability to generate cash flows from scheduled payments, contractual maturities and prepayments, their use as collateral for borrowings and possible outright sales on the secondary market. Tables 3 and 9 above present the contractual maturities of the loan portfolio and the Company’s investment in securities.

Table 16 illustrates some the factors that the Company uses to measure liquidity. Cash and cash equivalents decreased somewhat during 2007 after decreasing substantially during 2006 compared to 2005. Cash balances were unusually high at the end of 2005 primarily resulting from significant loan paydowns occurring subsequent to Hurricane Katrina. This excess cash was used to fund loans and pay down FHLB advances in 2006. Deposits increased in 2007 as the Bank continued to attract both commercial and personal transaction accounts. Deposits increased slightly in 2006 as the area’s population stabilized as people returned to the city following Hurricane Katrina and the Bank introduced money market accounts, which attracted over $11 million in new deposits in 2006.

The Company has made investment allocation decisions and developed loan and deposit pricing strategies consistent with its assessment of current and future economic conditions. Management feels that these higher liquidity levels of the past three years will continue to move toward more normal levels with liquidity being used to pay down maturing FHLB debt and to take advantage of anticipated significant new lending opportunities resulting from both post-Hurricane Katrina rebuilding and the hiring of experienced commercial and residential lenders.

| GS Financial Corp. and Subsidiary |

| Management's Discussion and Analysis of Financial Condition and Results of Operations |

| TABLE 16. KEY LIQUIDITY INDICATORS | |

| | | December 31, | |

| ($ in thousands) | | 2007 | | | 2006 | | | 2005 | |

| Cash and cash equivalents | | $ | 9,462 | | | $ | 11,117 | | | $ | 22,555 | |

| Total loans | | | 121,850 | | | | 97,717 | | | | 75,364 | |

| Total deposits | | | 129,510 | | | | 122,754 | | | | 118,866 | |

| Deposits $100,000 and over | | | 35,586 | | | | 27,285 | | | | 16,301 | |

| Ratios | | | | | | | | | | | | |

| Total loans to total deposits | | | 94.09 | % | | | 79.60 | % | | | 63.40 | % |

| Deposits $100,000 and over to total deposits | | | 27.48 | % | | | 22.23 | % | | | 13.71 | % |

ASSET/LIABILITY MANAGEMENT

The objective of the Company’s asset/liability management is to implement strategies for the funding and deployment of its financial resources that are expected to maximize profitability over time at acceptable levels of risk.

Interest rate sensitivity is the potential impact of changing rate environments on both net interest income and cash flows. The Bank monitors its interest rate sensitivity on a quarterly basis by reviewing net interest income simulations, monitoring the economic value of equity and preparing interest rate gap analyses.

The simplest method of measuring interest rate sensitivity is gap analysis, which identifies the difference between the dollar volume of assets and liabilities that reprice within specific time periods. A gap is considered positive when the amount of interest-rate sensitive assets exceeds the amount of interest-rate sensitive liabilities, and is considered negative when the amount of interest-rate sensitive liabilities exceeds the amount of interest-rate sensitive assets. In general, during a period of rising interest rates, a negative gap within shorter maturities would adversely affect net interest income, while a positive gap within shorter maturities would result in an increase in net interest income. A cycle of falling interest rates would have the opposite effect.

Since thrift organizations are traditionally invested primarily in home mortgage loans varying in contractual terms to maturity usually from 15 to 30 years while their longest term interest-bearing liabilities are typically five-year certificates of deposit, they tend to create negative gaps over the short term. Guaranty Savings Bank is no different; therefore, it is vital that the Bank utilize its other investments to offset in the short-term (12-months or less) horizon, the substantial negative re-pricing gap which arises from one to five years, while at the same time maximizing net interest income. The Company has placed some of its ready cash in short-term investments such as mortgage-based mutual funds that provide the benefit of overnight availability. The Bank also places a high emphasis on cash flows in its portfolio of CMOs and mortgage-backed securities. The duration of the Bank’s CMOs varies from two to 15 years. Table 17 shows the Company’s static gap position as of December 31, 2007.

Gap analysis has several limitations, including the fact that it is a point-in-time measurement that ignores the dynamic nature of the Company’s assets and liabilities, and it does not take into consideration actions that management can and will take to maximize net interest income over time.

| GS Financial Corp. and Subsidiary |

| Management's Discussion and Analysis of Financial Condition and Results of Operations |

| TABLE 17. INTEREST RATE SENSITIVITY | |

| | | By Maturity or Re-pricing at December 31, 2007 | |

| ($ in thousands) | | 0-90 Days | | | 91-365 Days | | | After 1 through 3 Years | | | After 3 Years | | | Non-interest earning/ bearing | | | Total | |

| ASSETS | | | | | | | | | | | | | | | | | | |

| Loans | | $ | 10,477 | | | $ | 4,192 | | | $ | 9,050 | | | $ | 94,758 | | | $ | - | | | $ | 118,477 | |

| Securities available for sale | | | 5,781 | | | | - | | | | - | | | | 41,966 | | | | - | | | | 47,747 | |

| Cash and cash equivalents | | | 9,462 | | | | - | | | | - | | | | - | | | | - | | | | 9,462 | |

| Other assets | | | - | | | | - | | | | - | | | | - | | | | 10,801 | | | | 10,801 | |

| Total assets | | | 25,720 | | | | 4,192 | | | | 9,050 | | | | 136,724 | | | | 10,801 | | | | 186,487 | |

| SOURCES OF FUNDS | | | | | | | | | | | | | | | | | | | | | | | | |

| Noninterest bearing deposits | | | - | | | | - | | | | - | | | | - | | | | 5,685 | | | | 5,685 | |

| NOW account deposits | | | 23,968 | | | | - | | | | - | | | | - | | | | - | | | | 23,968 | |

| Savings deposits | | | 19,245 | | | | - | | | | - | | | | - | | | | - | | | | 19,245 | |

| Time deposits | | | 24,246 | | | | 39,706 | | | | 14,843 | | | | 2,153 | | | | - | | | | 80,948 | |

| Advances | | | 1,350 | | | | 10,164 | | | | 13,000 | | | | 2,472 | | | | - | | | | 26,986 | |

| Other liabilities | | | - | | | | - | | | | - | | | | - | | | | 1,491 | | | | 1,491 | |

| Stockholders' equity | | | - | | | | - | | | | - | | | | - | | | | 28,164 | | | | 28,164 | |

| Total sources of funds | | | 68,809 | | | | 49,870 | | | | 27,843 | | | | 4,625 | | | | 35,340 | | | | 186,487 | |

| Interest rate sensitivity gap | | | | | | | | | | | | | | | | | | | | | | | | |

| Period | | $ | (43,089 | ) | | $ | (45,678 | ) | | $ | (18,793 | ) | | $ | 132,099 | | | $ | (24,539 | ) | | | | |

| Cumulative | | $ | (43,089 | ) | | $ | (88,767 | ) | | $ | (107,560 | ) | | $ | 24,539 | | | $ | - | | | | | |

| Gap/total earning assets | | | | | | | | | | | | | | | | | | | | | | | | |

| Period | | | (26.0 | )% | | | (27.6 | )% | | | (11.3 | )% | | | 79.7 | % | | | (14.8 | )% | | | | |

| Cumulative | | | (26.0 | )% | | | (53.6 | )% | | | (64.9 | )% | | | 14.8 | % | | | - | | | | | |

Another tool used by management is a net portfolio value (“NPV”) model. The NPV is the difference between the market value of the Bank’s assets and the market value of the Bank’s liabilities and off balance sheet commitments. At least quarterly, the Board reviews an internal model and a standard thrift industry model prepared by the OTS from the Bank’s quarterly Consolidated Maturity and Rate Report.

Table 18 presented below is an analysis of the Bank’s interest rate risk as measured by changes in NPV for instantaneous and sustained parallel shifts in the yield curve, in 100 basis point increments, up and down 300 basis points in accordance with OTS regulations. Currently, due to the low level of interest rates, the only downward shocks capable of being applied realistically are 100 and 200 basis points. As illustrated in the tables below, NPV is currently more sensitive to and may be more negatively impacted by rising rates than falling rates.

| GS Financial Corp. and Subsidiary |

| Management's Discussion and Analysis of Financial Condition and Results of Operations |

| TABLE 18. NET PORTFOLIO VALUE | |

| | | | At December 31, | |

| ($ in thousands) | | 2007 | | | 2006 | |

| Change (Basis Point) in Interest Rates | | $ Value | | | $ Change | | | % Change | | | $ Value | | | $ Change | | | % Change | |

| | +300 | | | $ | 23,861 | | | $ | (11,632 | ) | | | (33 | )% | | $ | 24,026 | | | $ | (10,821 | ) | | | (31 | )% |

| | +200 | | | | 27,686 | | | | (7,807 | ) | | | (22 | )% | | | 27,705 | | | | (7,142 | ) | | | (20 | )% |

| | +100 | | | | 31,396 | | | | (4,097 | ) | | | (12 | )% | | | 31,189 | | | | (3,658 | ) | | | (10 | )% |

| | 0 | | | | 35,493 | | | | - | | | | - | | | | 34,847 | | | | - | | | | - | |

| | -100 | | | | 37,876 | | | | 2,383 | | | | 7 | % | | | 36,662 | | | | 1,815 | | | | 5 | % |

| | -200 | | | | 40,123 | | | | 4,630 | | | | 13 | % | | | 38,159 | | | | 3,312 | | | | 10 | % |

| | -300 | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | |

IMPACT OF INFLATION AND CHANGING PRICES

The great majority of assets and liabilities of a financial institution are monetary in nature. Management believes the most significant potential impact of inflationary or deflationary economic cycles on the Company’s financial results is its ability to react to changes in interest rates. Interest rates do not necessarily move in the same direction, or at the same magnitude, as the prices of goods and services. As discussed above, the Company employs asset/liability management strategies in its attempt to minimize the effects of economic cycles on its net interest income.

Inflation and changing prices also have an impact on the growth of total assets in the banking industry and the resulting need to increase capital at higher than normal rates in order to maintain an appropriate equity to assets ratio. Changing prices will also affect trends in noninterest operating expenses and noninterest income.

RESULTS OF OPERATIONS

The Company reported net income of $658,000, or $0.53 per share in 2007, compared with $2.1 million, or $1.74 per share, during 2006, and a loss of $3.7 million, or $3.11 per share in 2005. Earnings in 2007 and 2006 included reversals of $300,000 ($198,000 after tax) and $2.0 million ($1.3 million after tax) of the loan loss reserves established in 2005 due to the uncertainties in the loan portfolio subsequent to Hurricane Katrina. The losses in 2005 resulted primarily from a substantial loan loss provision of $4.8 million to cover potential loan losses resulting from the impact of Hurricane Katrina and a $1.3 million recognition of losses on available-for-sale investment securities as other-than-temporary.

NET INTEREST INCOME

The Company’s net interest income decreased 6.5%, or $395,000, in 2007 compared to 2006, due primarily to a 2.7% decline in average interest-earning assets. This followed an 8.7%, or $486,000 increase in net interest income for 2006 over 2005, when a 64 basis point increase in the average yield earned on interest earning assets more than offset a decrease in the average balance of interest-earning assets of 5.3%. Net interest margin is net interest income expressed as a percent of average interest-earning assets. In 2007 compared to 2006, the Company’s net interest margin fell 14 basis points from 3.58% to 3.44% with a 33 basis point increase in the average yield on earning assets being offset by a 58 basis point increase in the cost of interest-bearing liabilities. This increase in cost of funds, which was driven in large part by lower-yield certificates of deposit renewing into higher-yielding certificates, was experienced throughout the banking industry. In 2006, the Company’s net interest margin increased by 46 basis points compared to 2005.

During 2007, loans constituted 65% of average interest-earning assets, up from 51% in 2006 and 49% in 2005. Collateralized mortgage obligation investments made up 10% of average interest-earning assets during 2007, down from 11% in 2006 and 13% in 2005. Mutual fund investments, consisting primarily of investments in funds secured by short-term mortgage instruments, were 4% of average interest-earning assets in 2007, down from 17% in 2006 and 28% in 2005. A substantial portion of the mutual fund investments were liquidated during the past three years to diversify the investment portfolio and to fund loan growth.

| GS Financial Corp. and Subsidiary |

| Management's Discussion and Analysis of Financial Condition and Results of Operations |

The Company’s funding mix, though improving, continues to have a negative impact on interest margins. The percentage of average interest-earning assets funded by higher-cost sources of funds, including certificates of deposit and FHLB borrowings, was 59% in both 2007 and 2006, compared to 66% in 2005. This is expected to further improve in 2008 as the Bank continues to emphasize attracting lower-cost transaction accounts. During 2007, lower-cost core deposits totaled 28% of average interest earning assets, up from 26% of average interest-earning assets in 2006 and 21% in 2005. The improved funding mix was more than offset by an increase in the cost of funds, as the cost of interest-bearing deposits increased by 73 basis points in 2007 compared to 2006 and 56 basis points in 2006 compared to 2005, and the total cost of interest-bearing liabilities increased by 58 basis points in 2007 compared to 2006, following a 28 basis point increase in 2006 compared to 2005. These increases primarily reflect changes in market rates of interest, though the sharp upward trend in funding costs, which was experienced most heavily by savings institutions such as Guaranty Savings Bank which had high volumes of time deposits re-pricing at higher rates, reversed in the fourth quarter of 2007 and rates continue to decrease early in 2008.

| GS Financial Corp. and Subsidiary |

| Management's Discussion and Analysis of Financial Condition and Results of Operations |